The Daily Shot: 02-Dec-21

• Equities

• Credit

• Rates

• Commodities

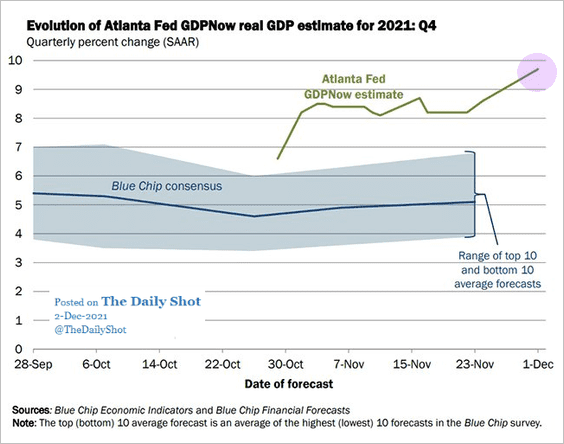

• Energy

• Cryptocurrency

• Emerging Markets

• China

• Asia – Pacific

• Japan

• The Eurozone

• Europe

• The United Kingdom

• Canada

• The United States

• Global Developments

• Food for Thought

Equities

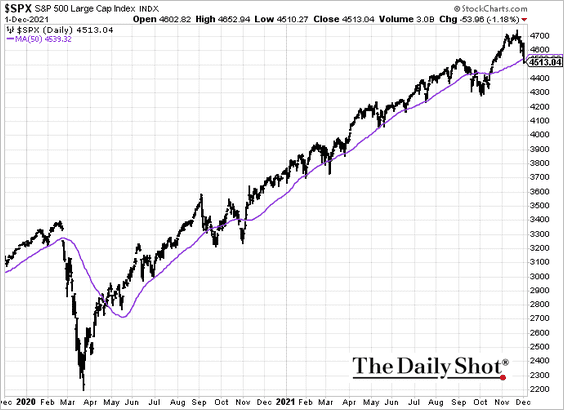

1. The first omicron case in the US spooked investors,…

Source: AP Read full article

Source: AP Read full article

… sending the S&P 500 below its 50-day moving average.

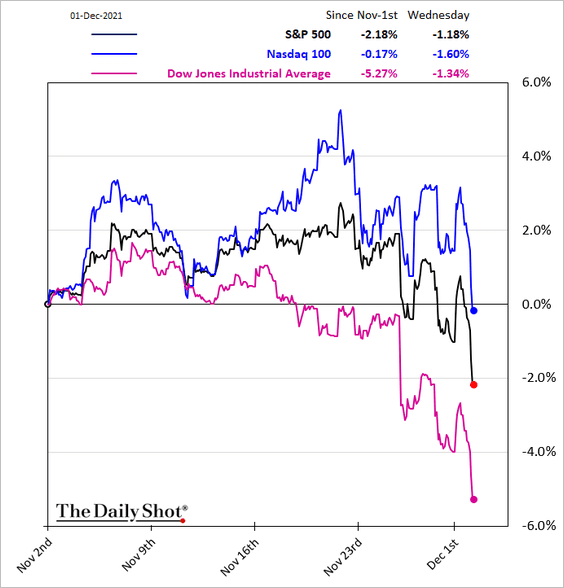

• Major US indices have diverged, with the Dow slumping by over 5% in recent weeks.

• The share of NYSE stocks closing above their 200-day moving average dipped below 50%.

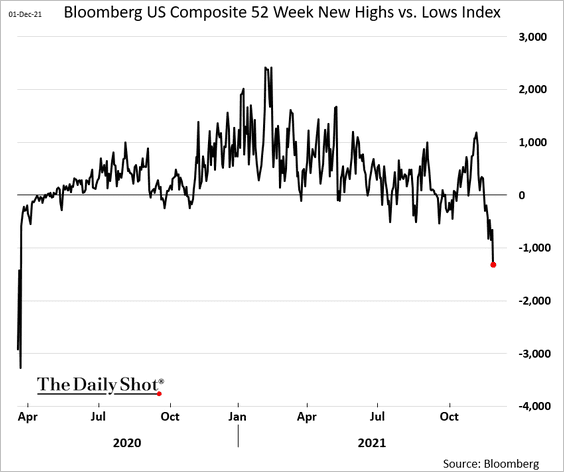

• The selloff has been broad. This chart shows the number of stocks hitting 52-week highs vs. those at 52-week lows.

h/t Cormac Mullen

h/t Cormac Mullen

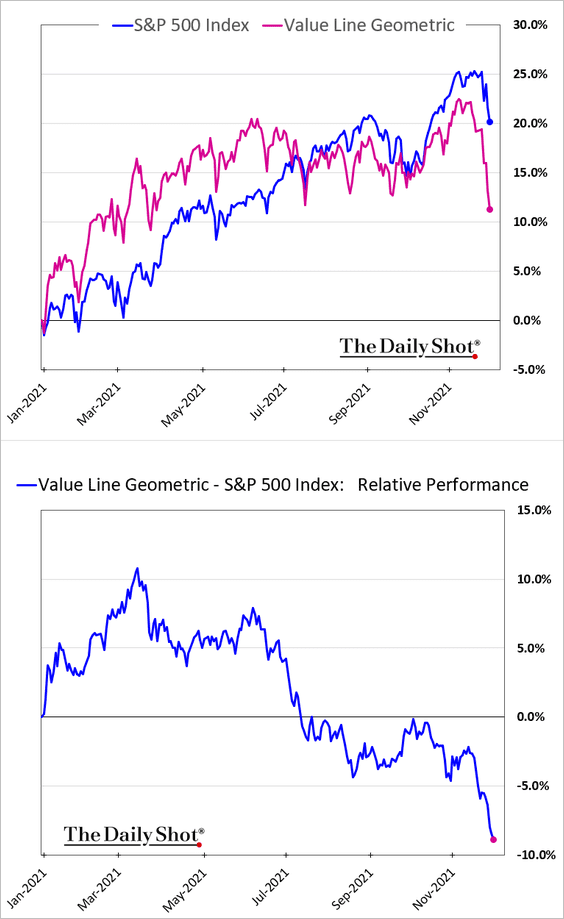

• The median stock price has sharply underperformed the S&P 500.

——————–

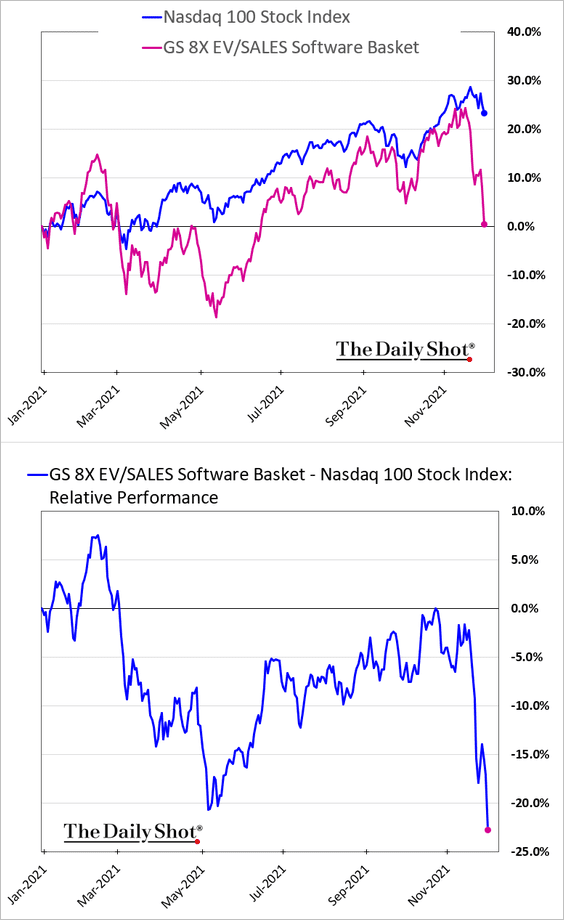

2. Funds have been dumping the most expensive tech shares.

Further reading

Further reading

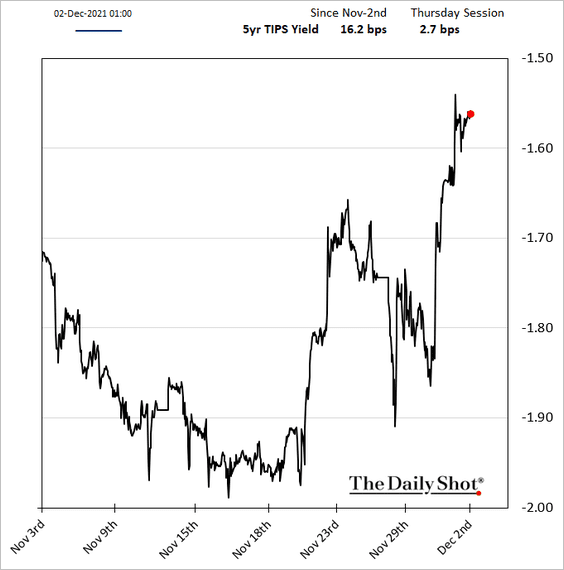

High-multiple stocks are vulnerable to real rates, which have been rising.

——————–

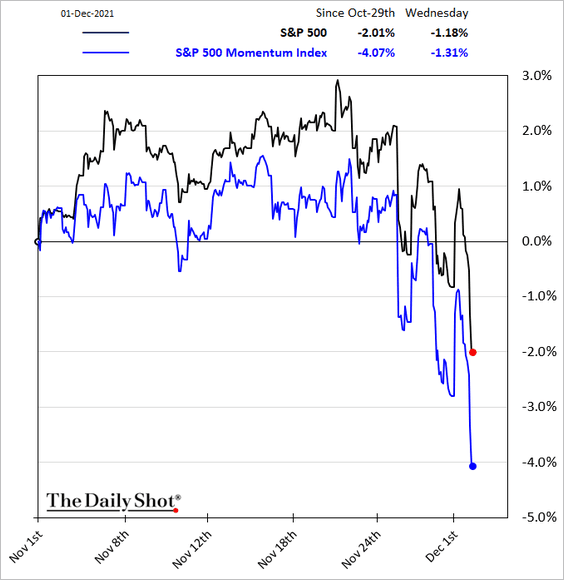

3. Momentum stocks continue to underperform.

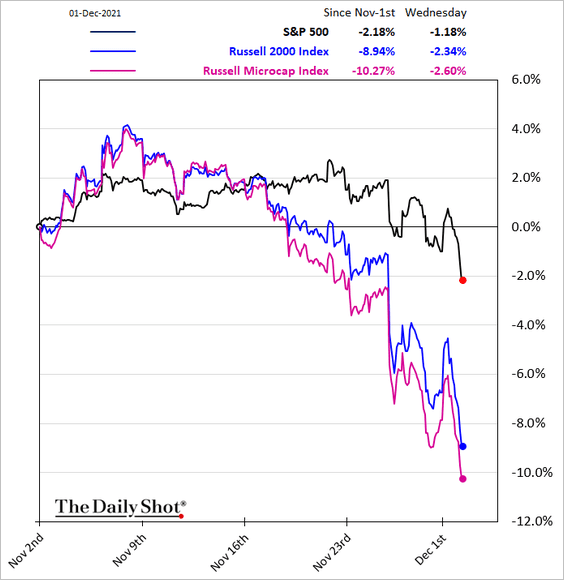

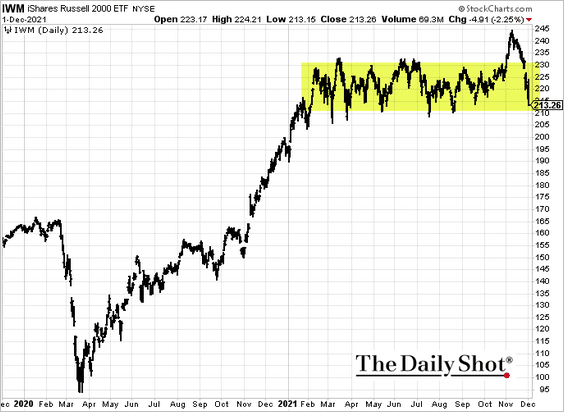

4. Small caps are down sharply, with microcaps now in correction territory.

The Russell 2000 index is back at the low end of its trading range.

——————–

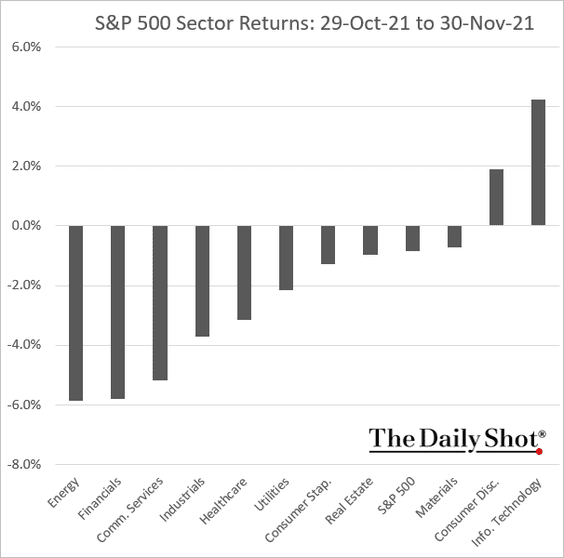

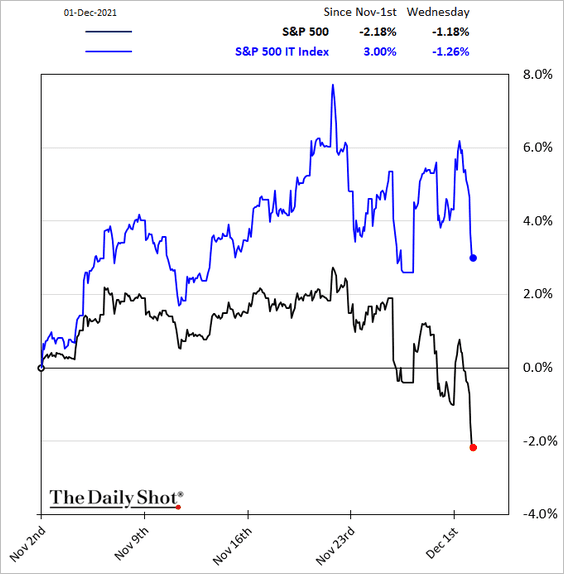

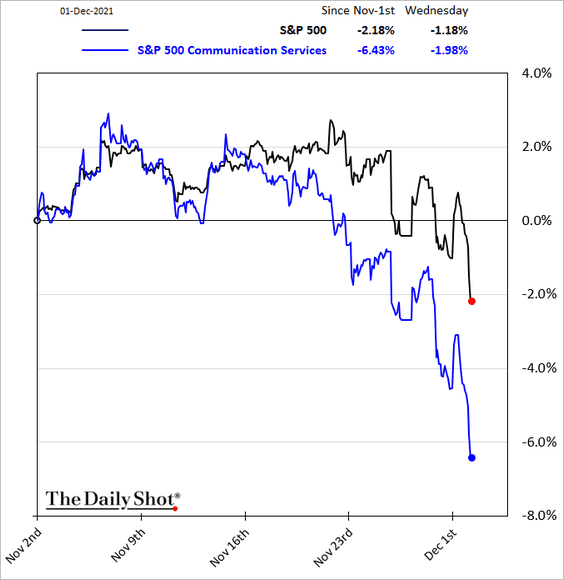

5. Next, we have some sector performance charts (over the past month).

• November returns:

• Tech and semiconductors:

![]()

• Communication Services:

• Banks:

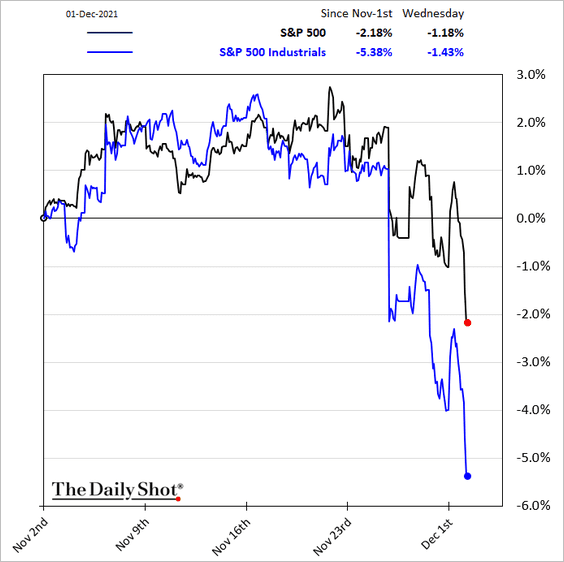

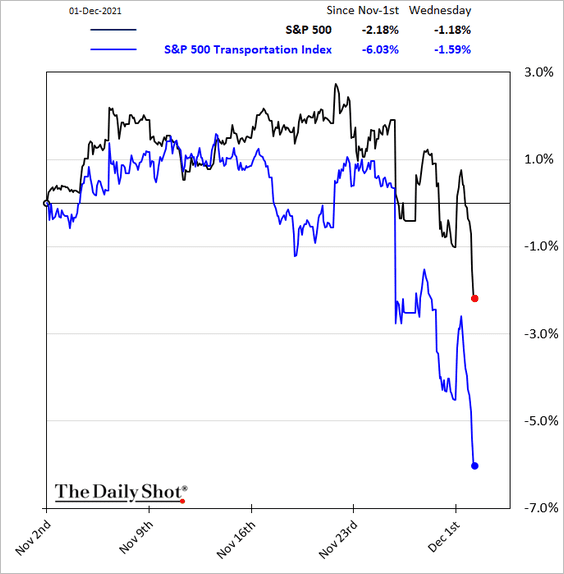

• Industrials:

• Transportation:

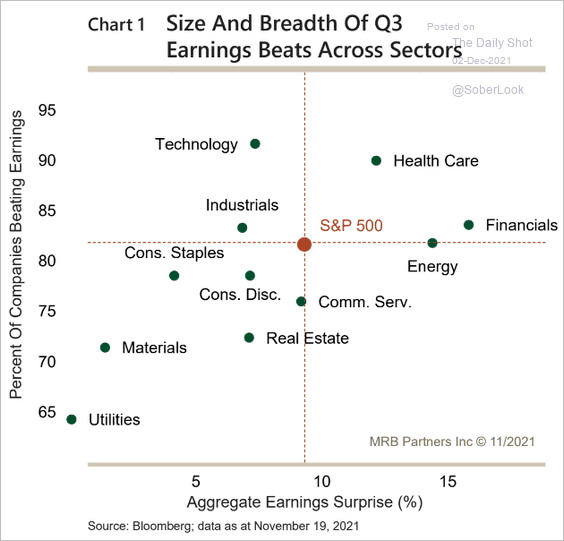

• Separately, here is the size and breadth of earning beats by sector.

Source: MRB Partners

Source: MRB Partners

——————–

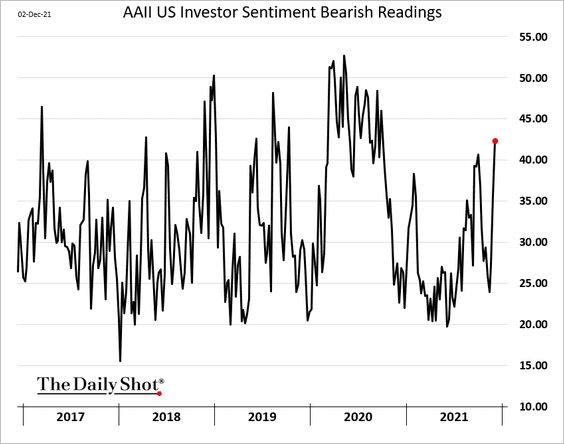

6. The percentage of bearish investors hit the highest level in over a year, according to AAII.

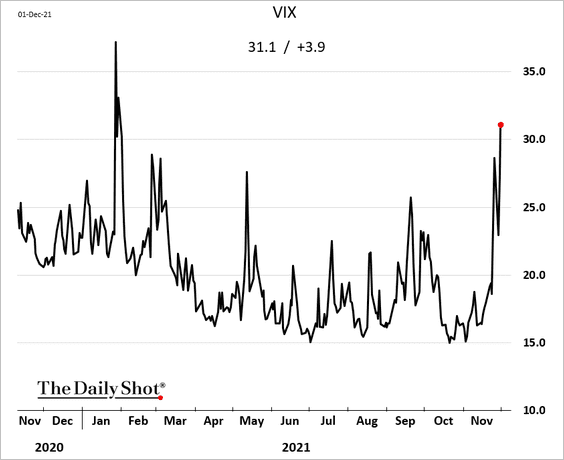

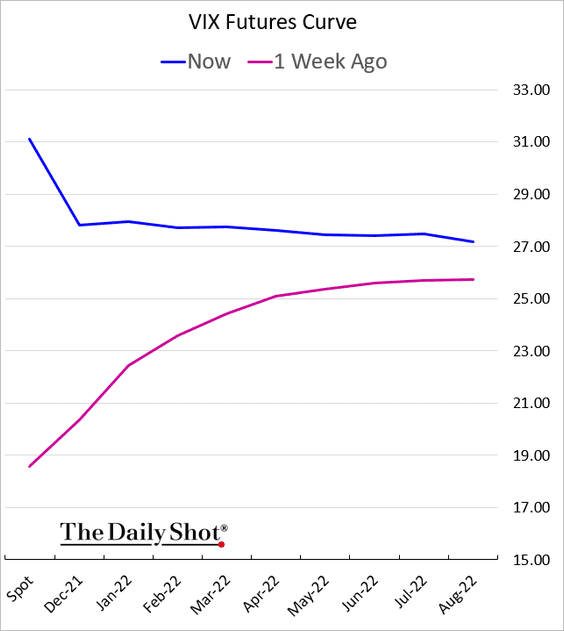

7. VIX climbed above 30 …

… and the vol curve shifted into backwardation (inverted).

——————–

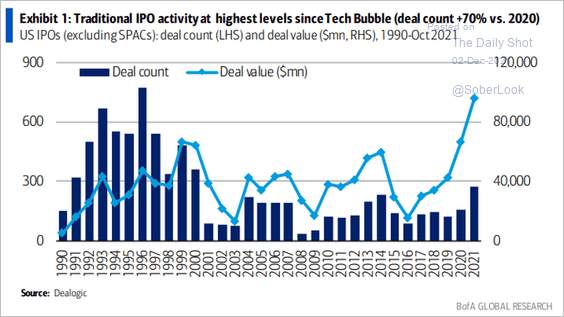

8. The volume of traditional IPOs hit a record this year in dollar terms.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

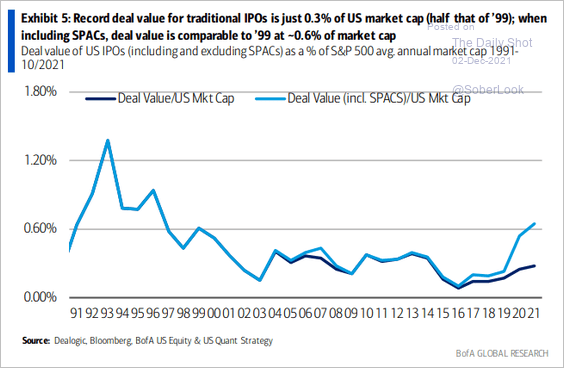

But here is the IPO deal value relative to the US market cap (with and without SPACs).

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

Back to Index

Credit

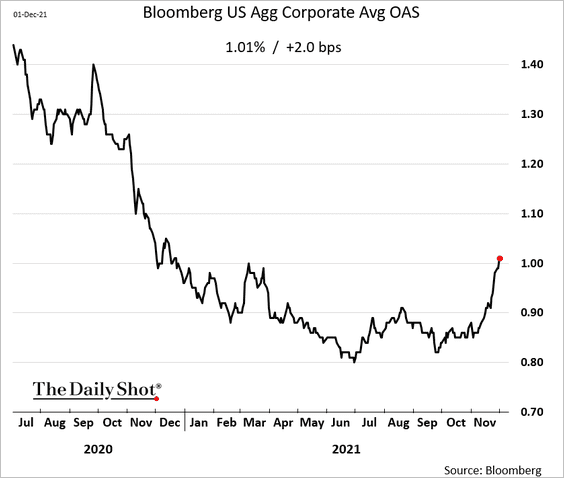

The spread on Bloomberg’s investment-grade bond index is back above 1%.

Back to Index

Rates

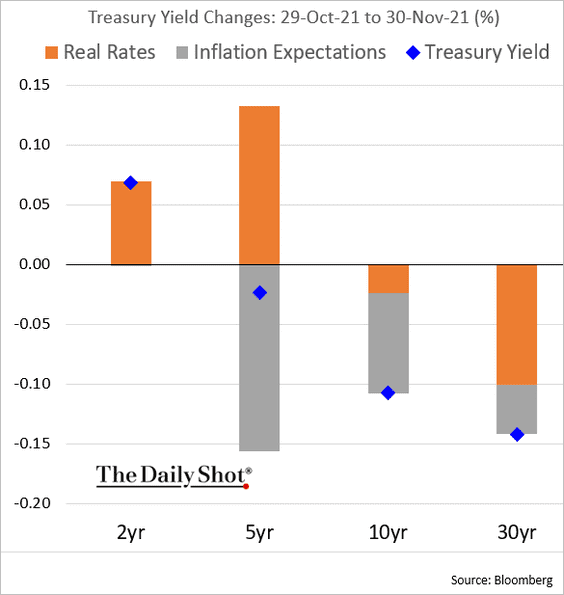

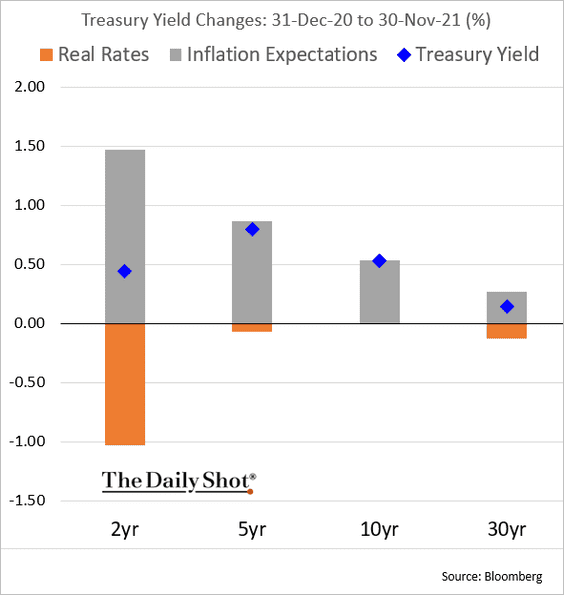

1. Here is the attribution of changes in Treasury yields.

• November:

• Year-to-date:

——————–

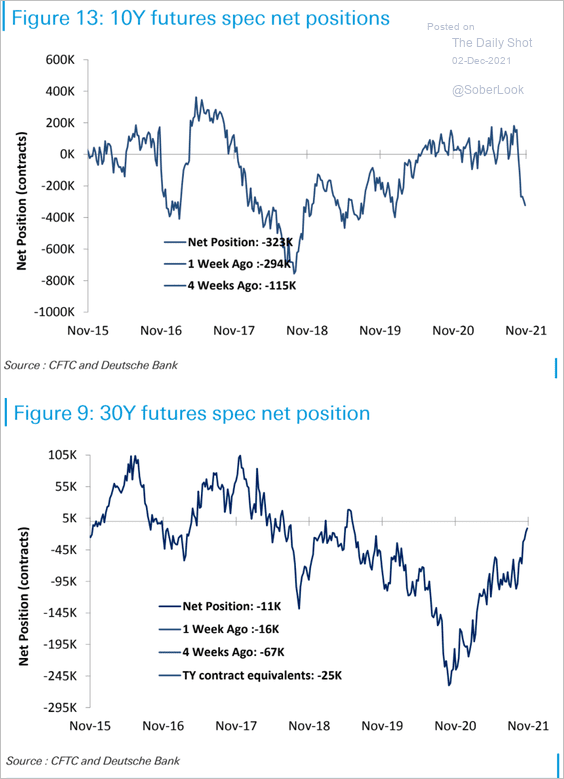

2. Speculative accounts are betting on further flattening in the 10yr – 30yr part of the curve.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Commodities

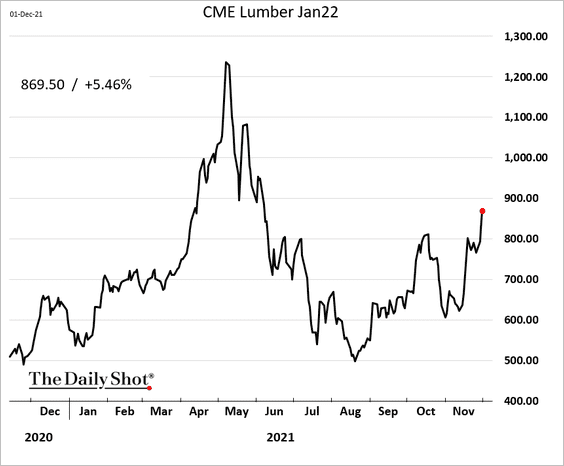

1. US lumber futures are rebounding.

Source: North Bay Business Journal Read full article

Source: North Bay Business Journal Read full article

——————–

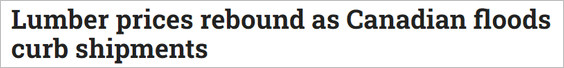

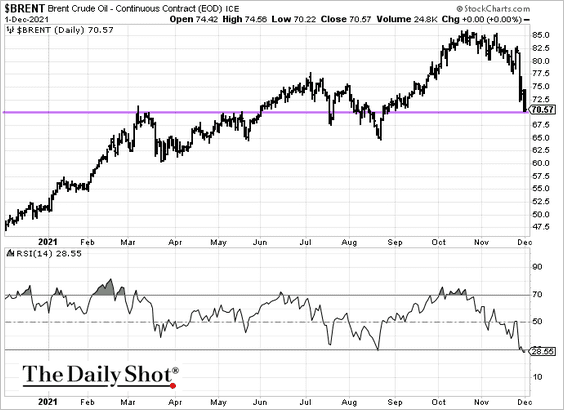

2. Materials stocks have been underperforming despite higher commodity prices.

Source: Acorn Macro Consulting Ltd.

Source: Acorn Macro Consulting Ltd.

Back to Index

Energy

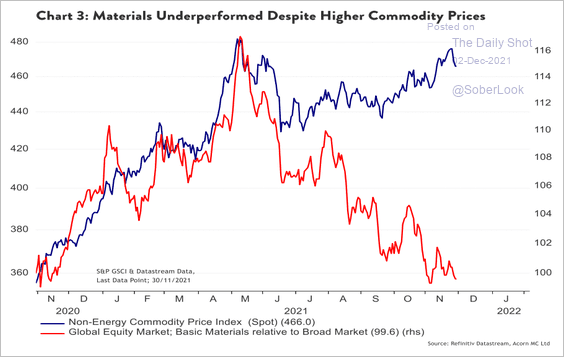

1. Brent is testing support at $70/bbl.

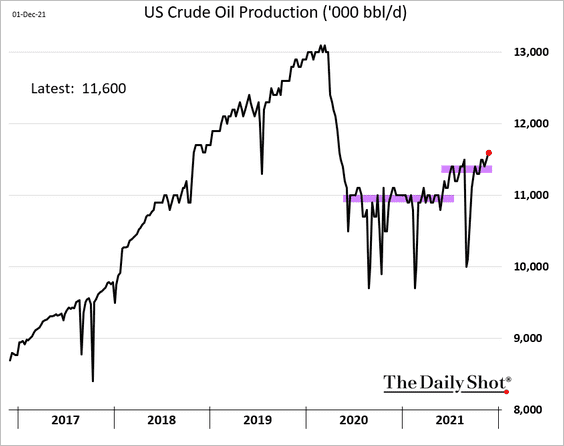

2. US crude oil production hit the highest level since the spring of 2020.

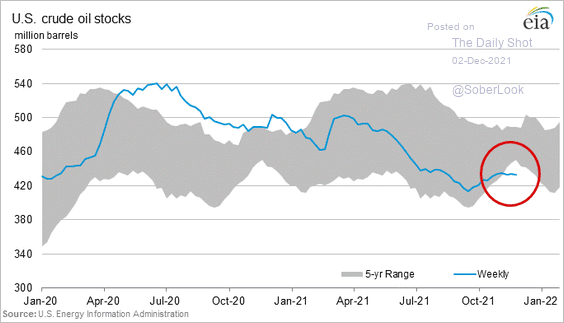

3. US oil inventories are well below the 5-year range.

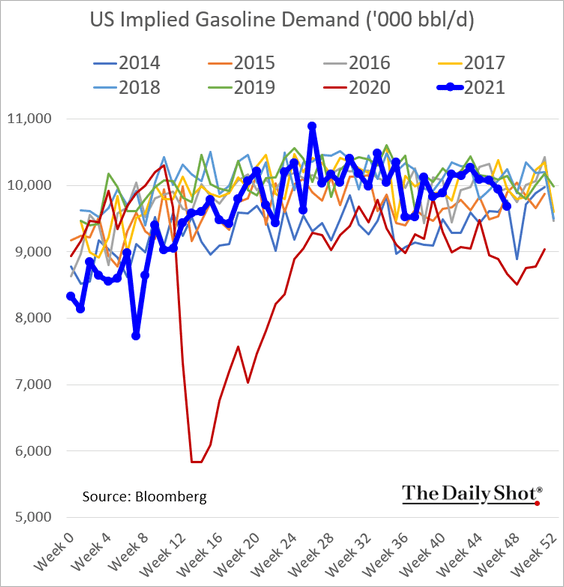

4. Gasoline demand has softened in recent weeks.

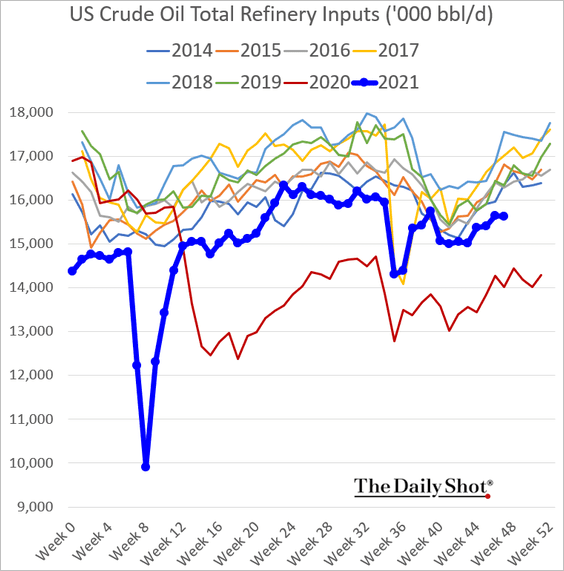

Refinery runs remain weak for this time of the year.

——————–

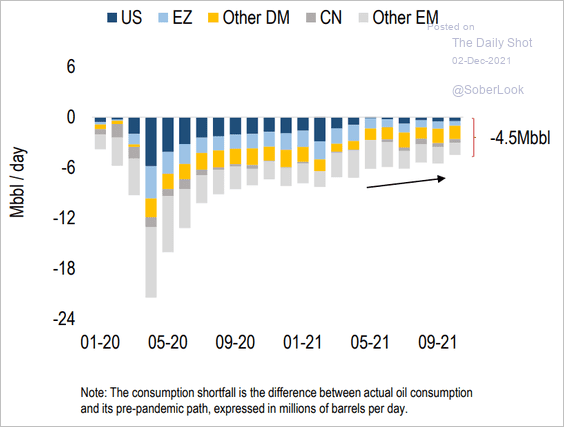

5. This chart shows the drivers of crude oil demand deviation from the pre-COVID path.

Source: Numera Analytics

Source: Numera Analytics

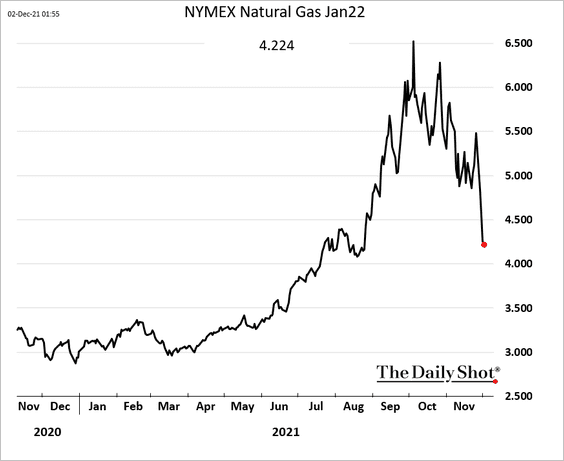

6. US natural gas futures continue to slump.

Back to Index

Cryptocurrency

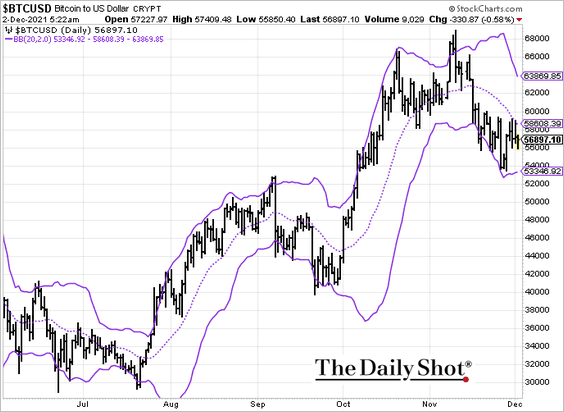

1. Bitcoin remains range-bound in the lower end of its Bollinger Band.

2. Litecoin (LTC) and ether (ETH) outperformed other large cryptocurrencies in November.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

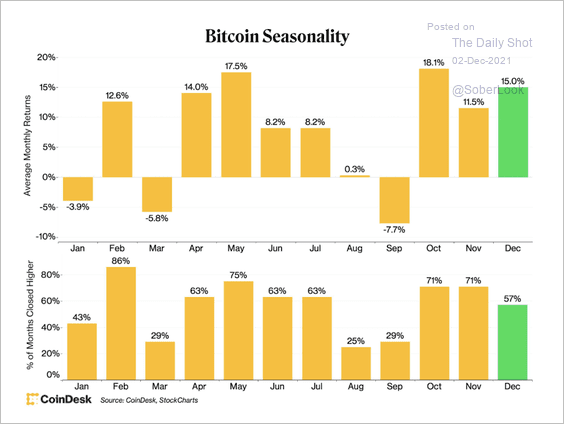

3. Typically, bitcoin has positive returns in the fourth quarter. Will we see a strong December before a January decline?

Source: CoinDesk Read full article

Source: CoinDesk Read full article

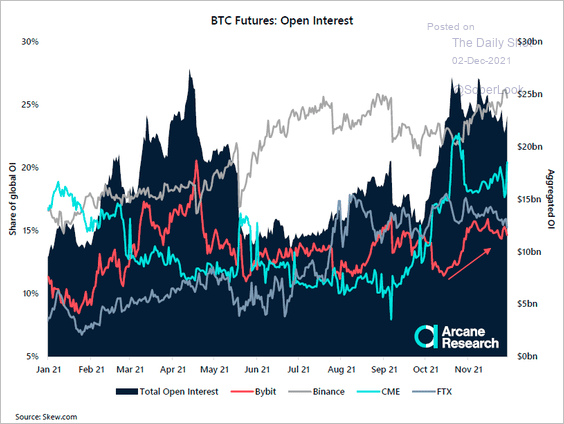

4. Open interest in bitcoin’s futures market remains high despite last week’s sell-off.

Source: @ArcaneResearch

Source: @ArcaneResearch

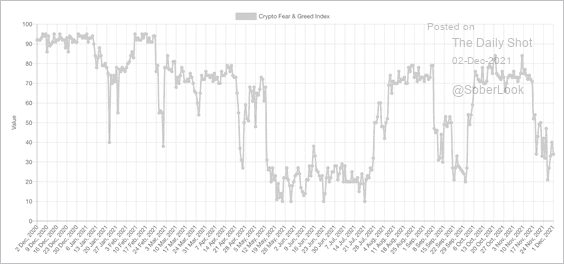

5. Bitcoin’s Fear & Greed Index is at the lowest level since late September, which preceded a price recovery.

Source: Alternative.me

Source: Alternative.me

Back to Index

Emerging Markets

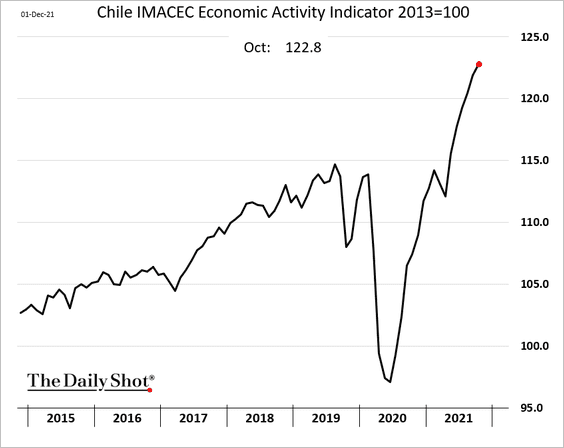

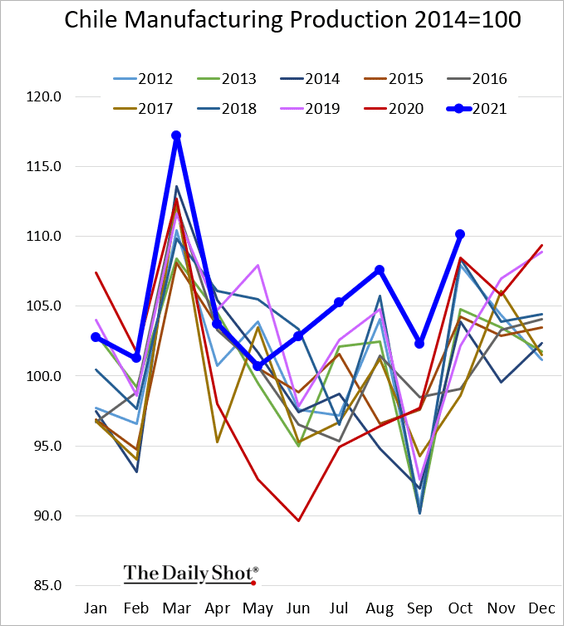

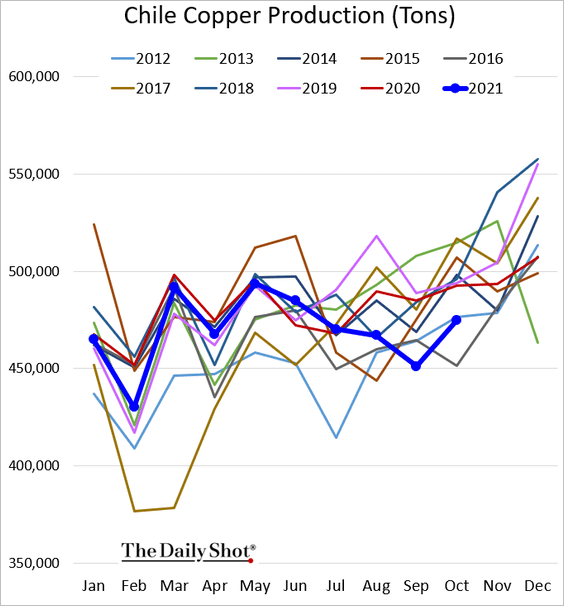

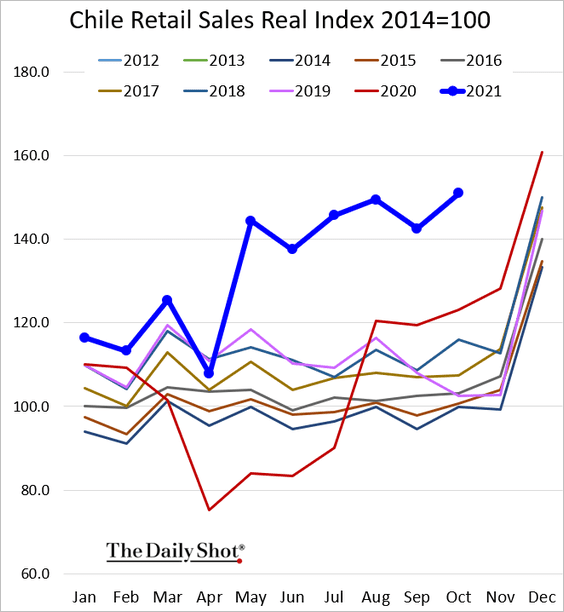

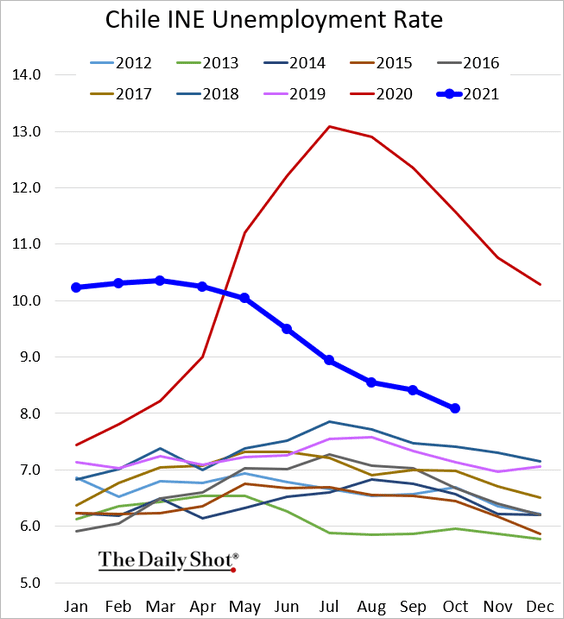

1. Chile’s economy continues to surge ahead despite the politics.

• Economic activity:

• Manufacturing output:

• Copper output (rebounding):

• Retail sales:

• The unemployment rate:

——————–

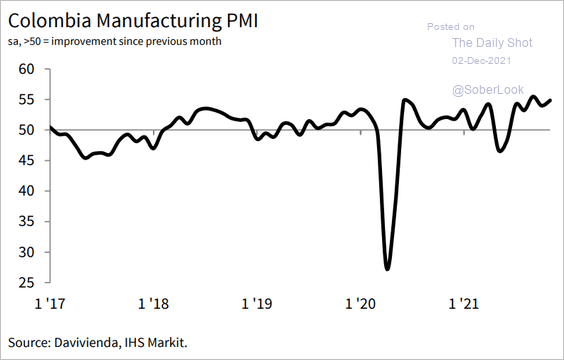

2. Colombia’s factory activity remains robust.

Source: IHS Markit

Source: IHS Markit

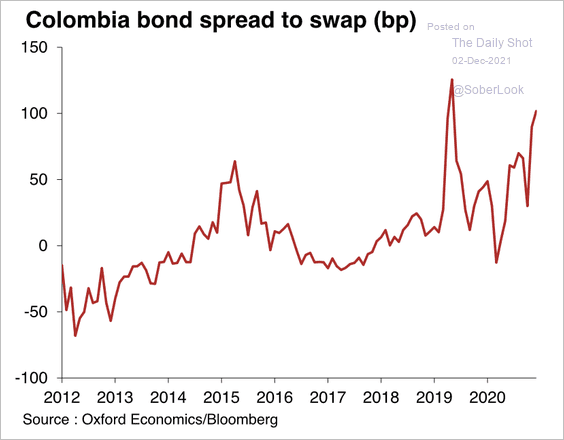

However, Columbia’s bond risk premium is at the highest level since the first wave of the pandemic.

Source: Oxford Economics

Source: Oxford Economics

——————–

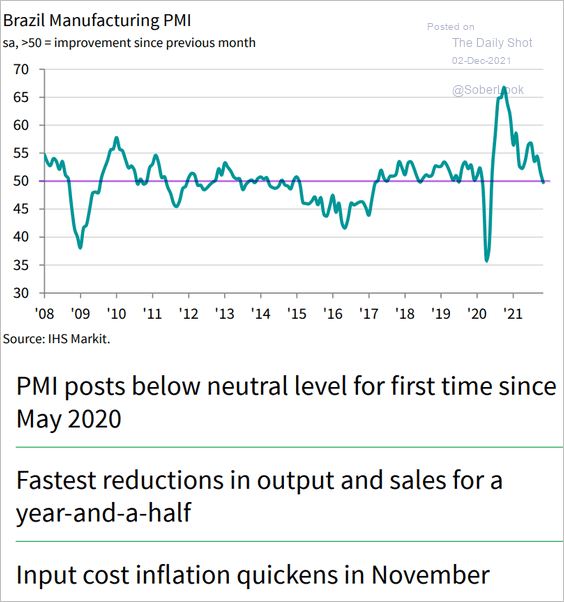

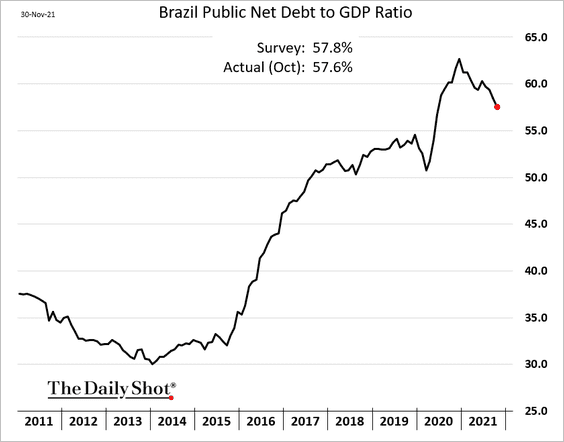

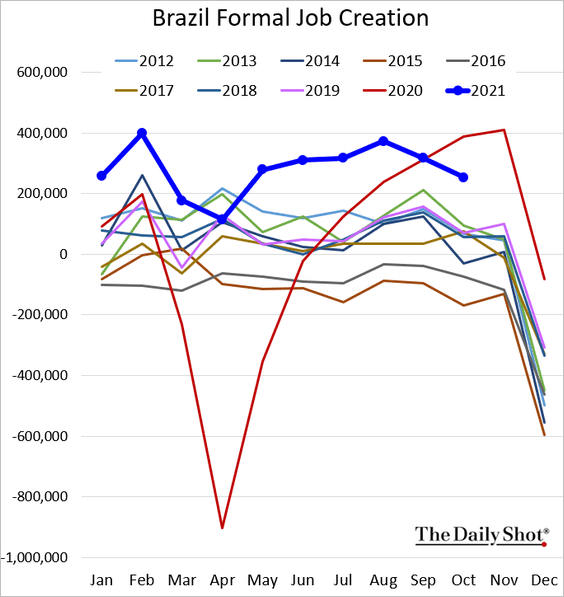

3. Next, we have some updates on Brazil.

• Manufacturing activity (now in contraction territory):

Source: IHS Markit

Source: IHS Markit

• The debt-to-GDP ratio:

• Bond spreads (low despite potential fiscal deterioration and recent economic weakness):

Source: Oxford Economics

Source: Oxford Economics

• Formal job creation:

——————–

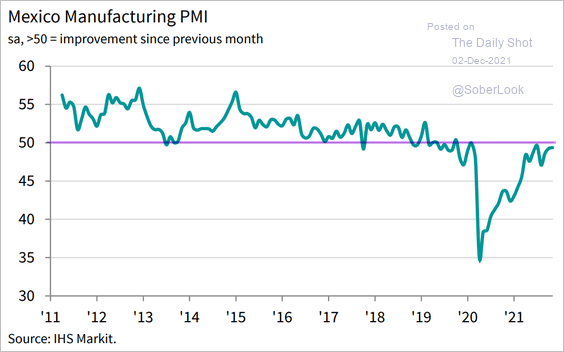

4. Mexico’s manufacturing sector can’t quite shift into growth mode, partially due to weak vehicle production.

Source: IHS Markit

Source: IHS Markit

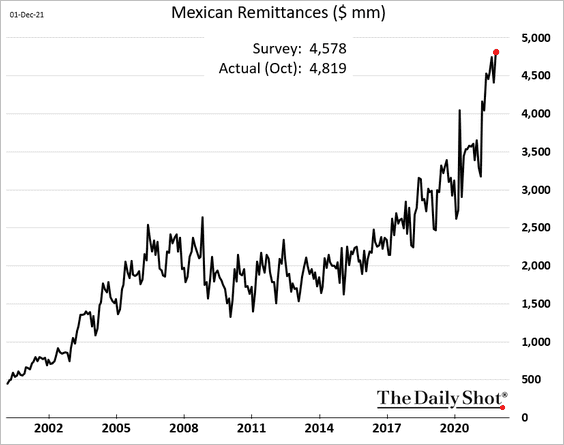

Remittances hit a record high.

——————–

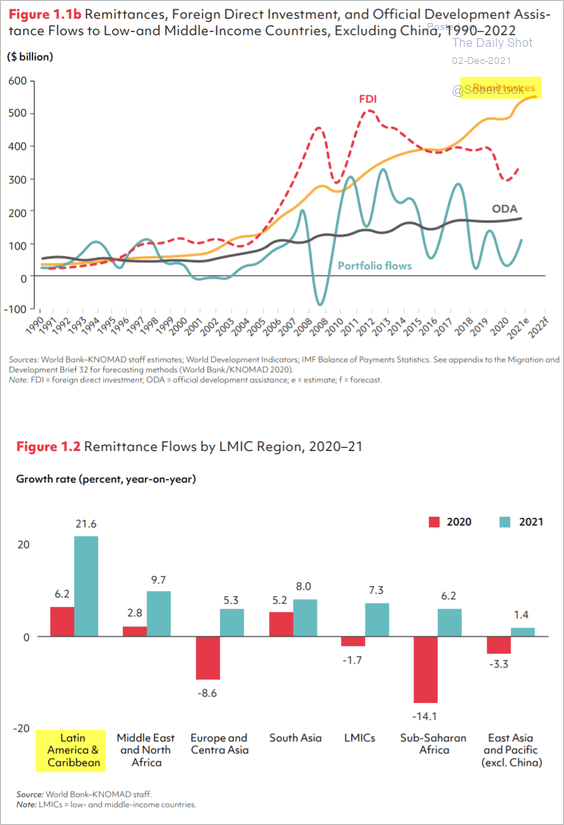

5. By the way, sending people to wealthy countries (legally or illegally) is a massive source of capital inflows for many EM economies. There is no incentive for governments to “stem” the flow of migrants.

Source: Knomad Read full article

Source: Knomad Read full article

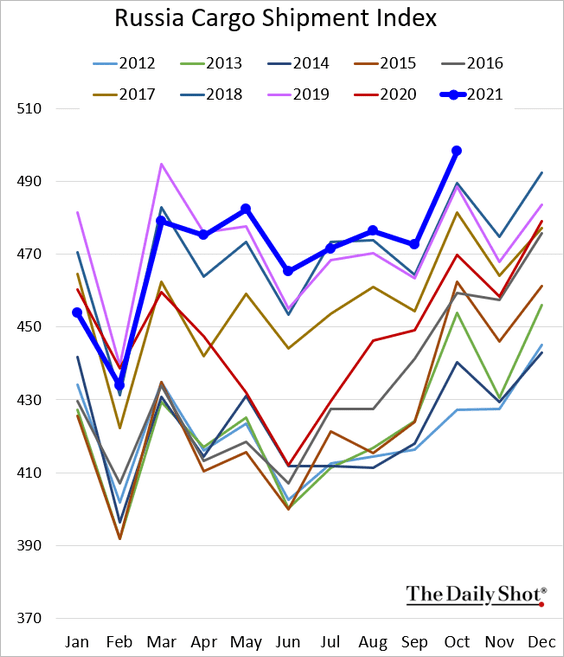

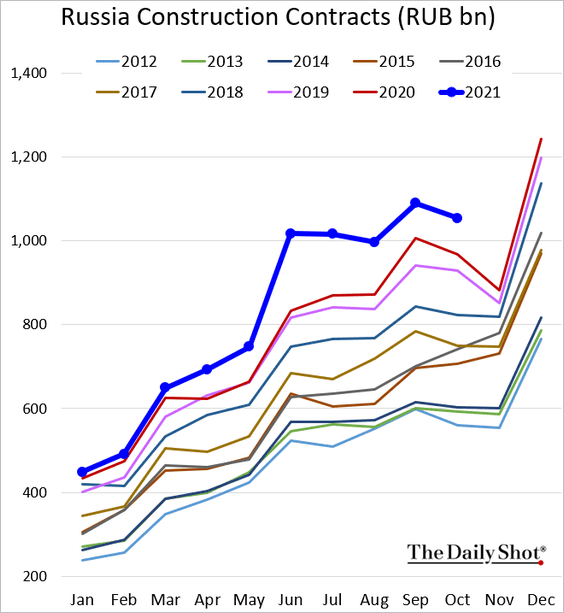

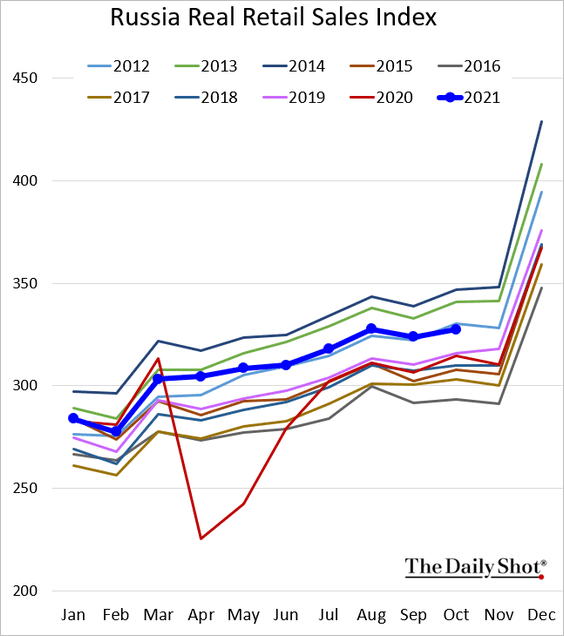

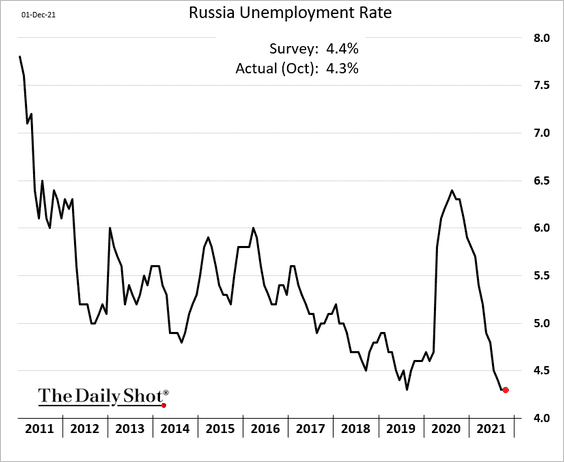

6. Next, let’s take a look at some trends in Russia which point to stronger economic activity.

• Cargo shipments:

• Construction:

• Retail sales (holding above 2019 levels despite high inflation):

• The unemployment rate:

——————–

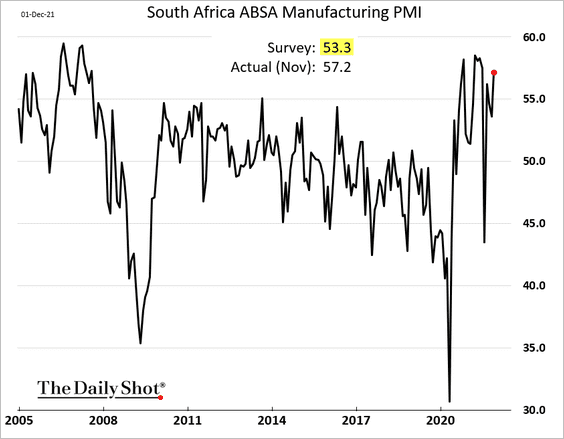

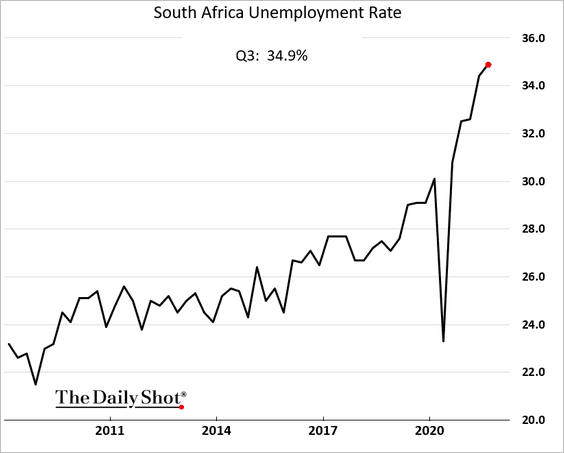

7. South Africa’s manufacturing PMI topped economists’ forecasts.

However, over a third of the workforce is now “officially” unemployed.

——————–

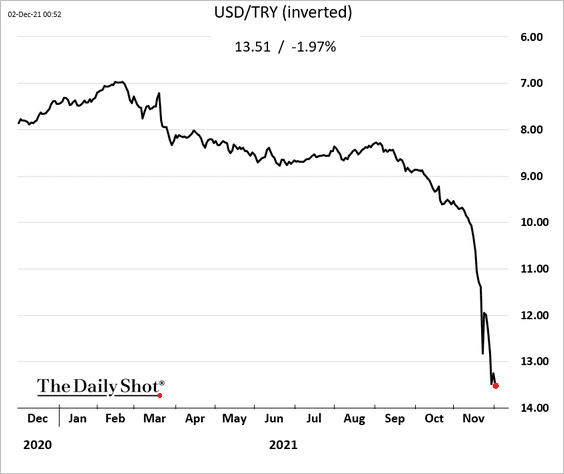

8. Turkey intervened in the F/X market, halting the lira’s crash.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

But then, the finance minister got replaced, …

Source: @financialtimes Read full article

Source: @financialtimes Read full article

… sending the lira to new lows.

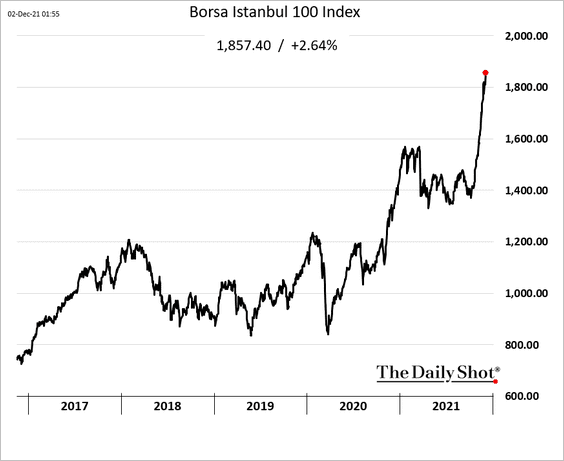

The stock market often becomes a “safe haven” in a collapsing currency regime.

Back to Index

China

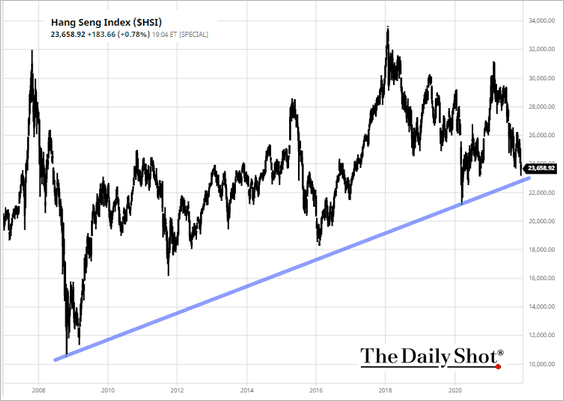

1. Stocks are testing long-term support in Hong Kong.

Source: barchart.com

Source: barchart.com

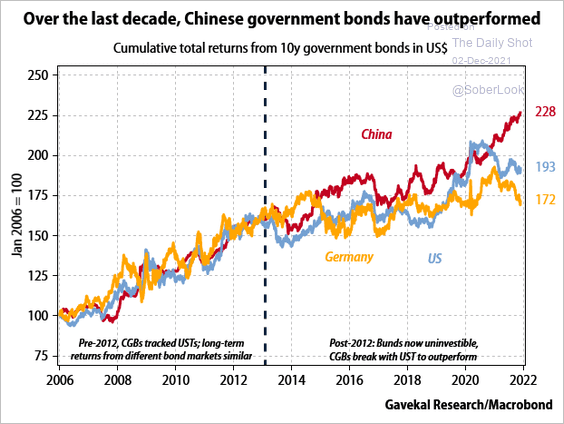

2. China’s government bonds have outperformed over the past decade.

Source: Gavekal Research

Source: Gavekal Research

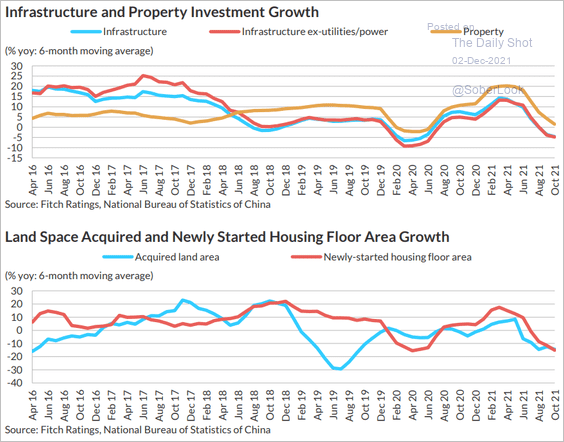

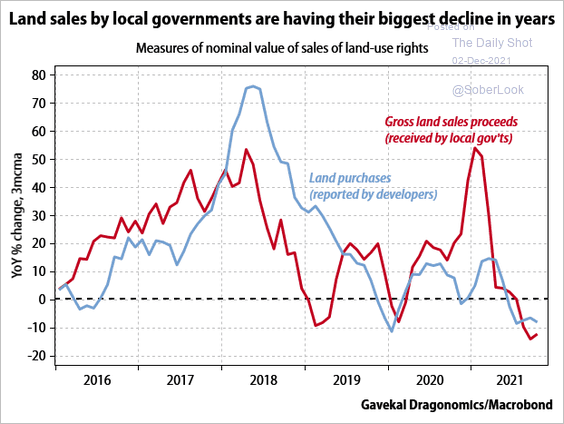

3. The charts below show China’s infrastructure and housing trends.

Source: Fitch Ratings

Source: Fitch Ratings

Source: Gavekal Research

Source: Gavekal Research

——————–

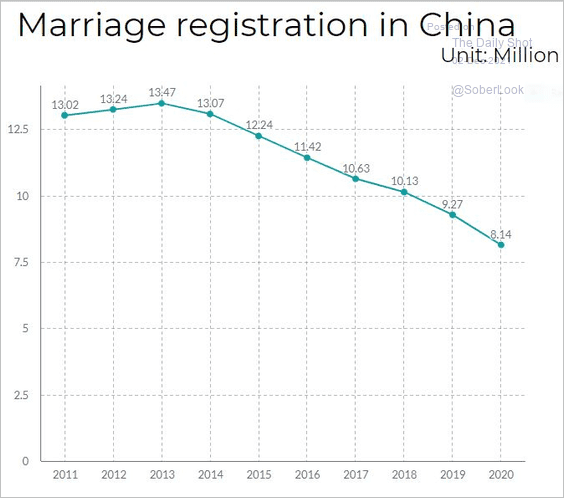

4. China’s marriages continue to decline.

Source: @BrankoMilan Read full article

Source: @BrankoMilan Read full article

Back to Index

Asia – Pacific

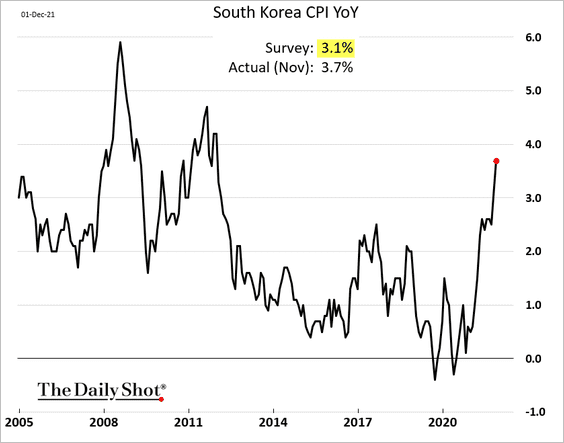

1. South Korea’s CPI surprised to the upside, pointing to more rate hikes ahead.

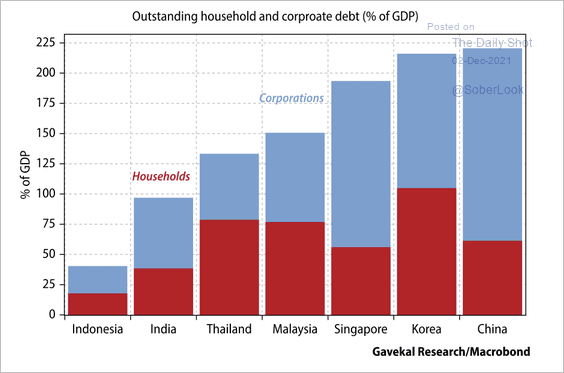

Separately, a high debt burden makes South Korea especially sensitive to rising interest rates.

Source: Gavekal Research

Source: Gavekal Research

——————–

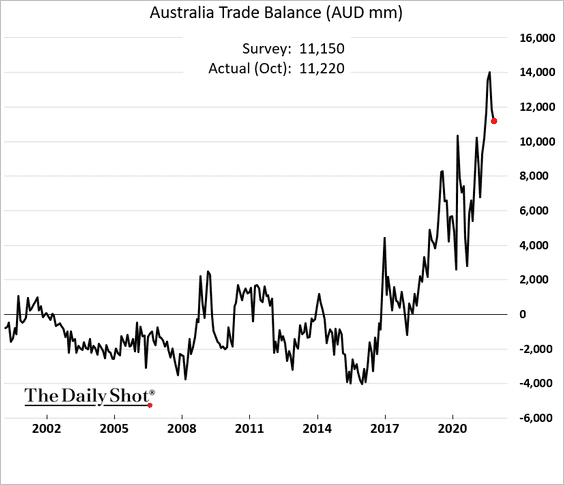

2. Australia’s trade surplus is off the highs but remains impressive.

Back to Index

Japan

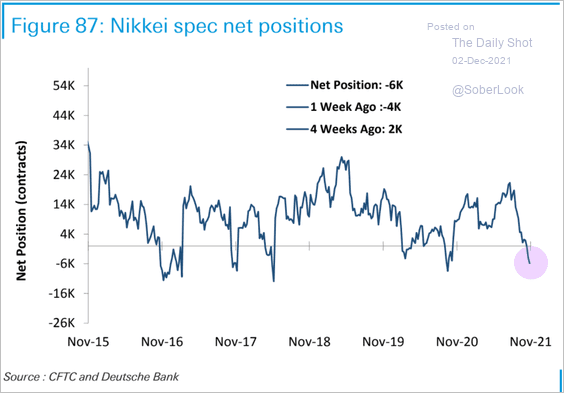

1. Traders have soured on Japanese equities.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

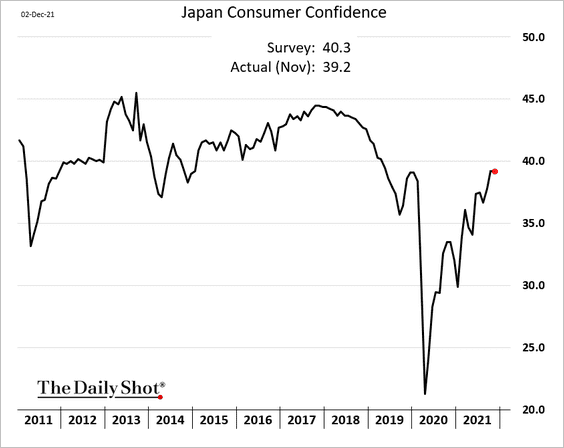

2. Consumer sentiment held up in November.

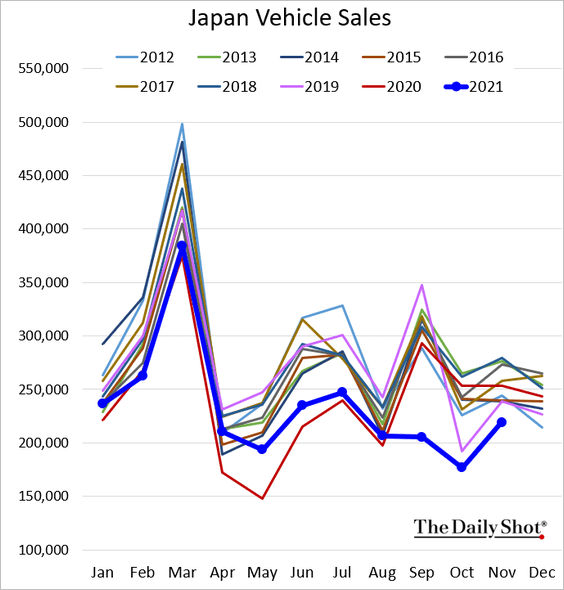

3. Vehicle sales are still soft for this time of the year.

Back to Index

The Eurozone

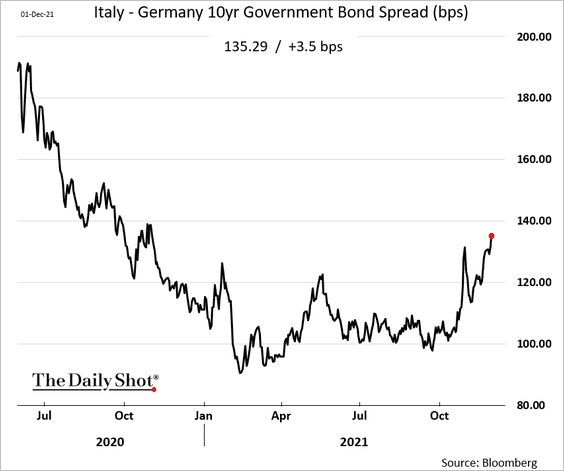

1. Italian spreads to Germany have been widening amid increased risk aversion.

2. Italian manufacturing PMI hit a new high, as the nation’s factory sector diverges from the rest of the Eurozone.

Source: IHS Markit

Source: IHS Markit

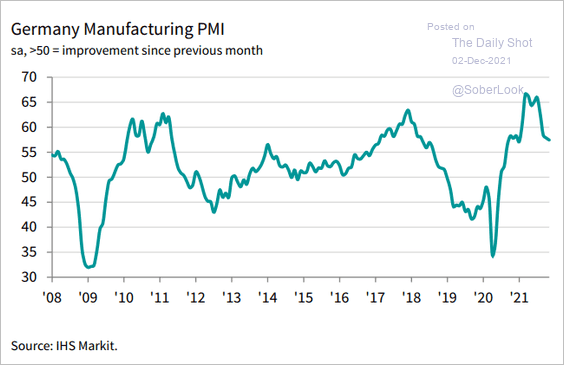

As a comparison, here is Germany’s PMI.

Source: IHS Markit

Source: IHS Markit

——————–

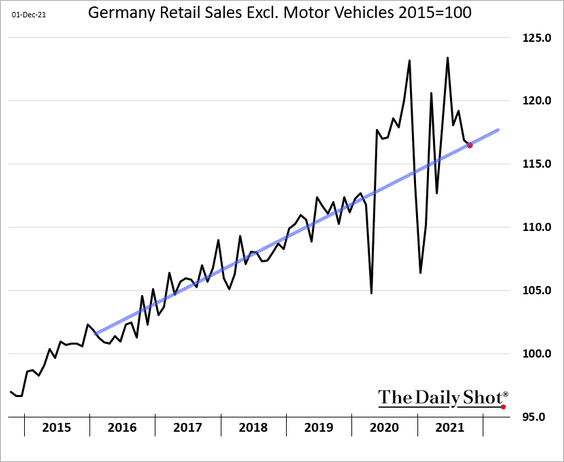

3. Germany’s retail sales were back on the pre-COVID trend in October.

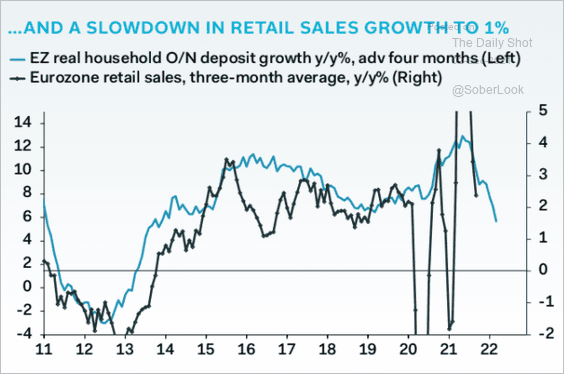

4. Euro-area deposit growth points to softer retail sales ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

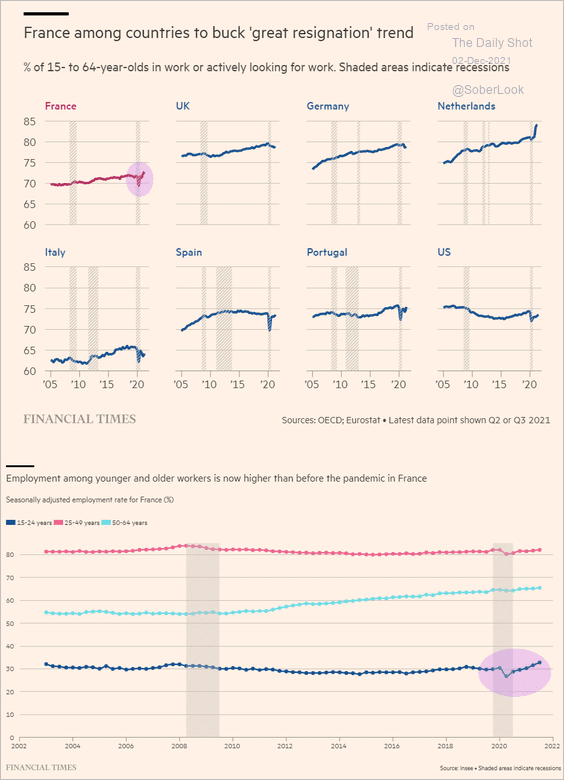

5. France is bucking the trend on labor force participation.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Europe

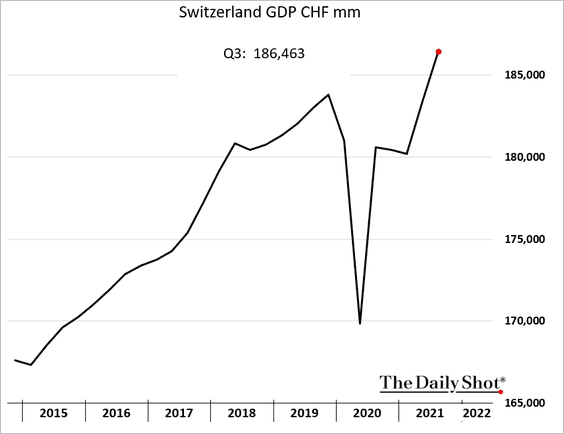

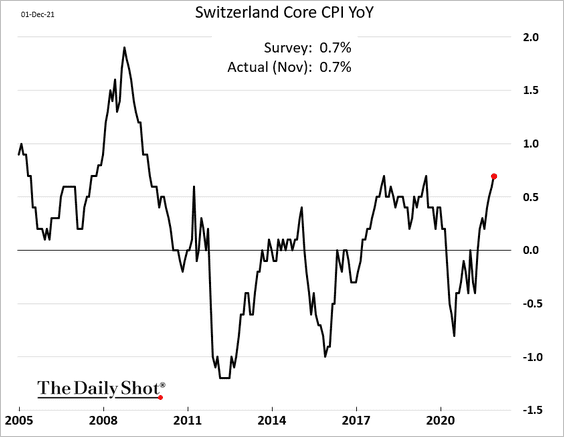

1. Swiss GDP growth has been outperforming the Eurozone.

Swiss inflation is grinding higher.

——————–

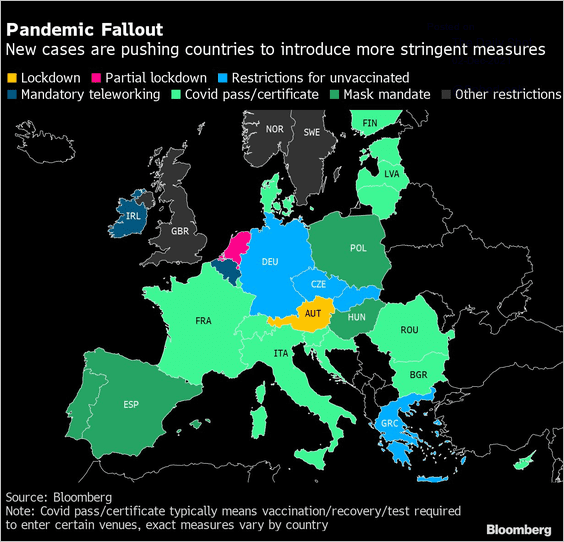

2. Here are the COVID measures across Western and Central Europe.

Source: @StuartLWallace, @CraigStirling Read full article

Source: @StuartLWallace, @CraigStirling Read full article

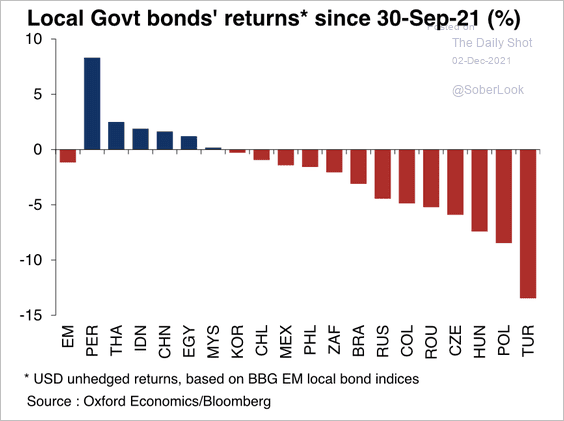

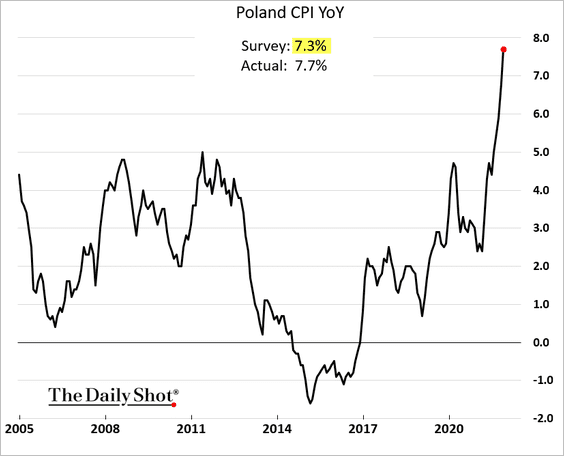

3. Central and Eastern European local bonds have underperformed since late September as inflation surges and central banks hike rates.

Source: Oxford Economics

Source: Oxford Economics

Here is Poland’s CPI, for example.

Back to Index

The United Kingdom

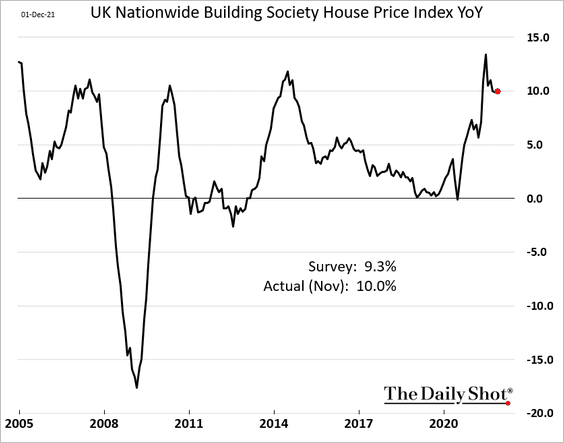

1. Home price appreciation held up well in November.

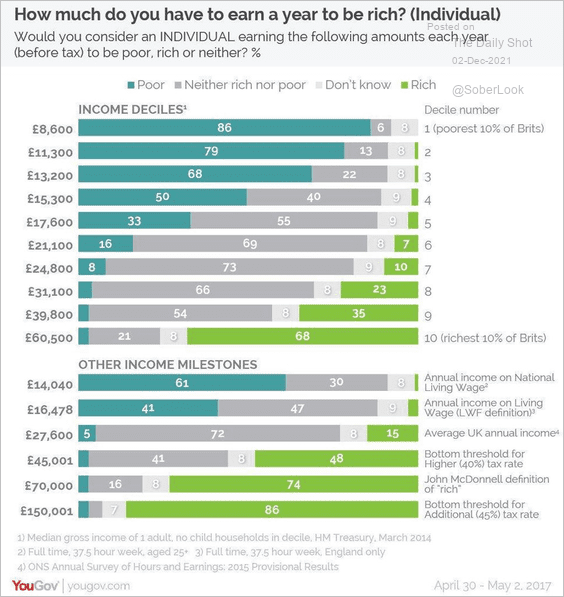

2. How much do you have to earn to be rich in the UK?

Source: YouGov Read full article

Source: YouGov Read full article

Back to Index

Canada

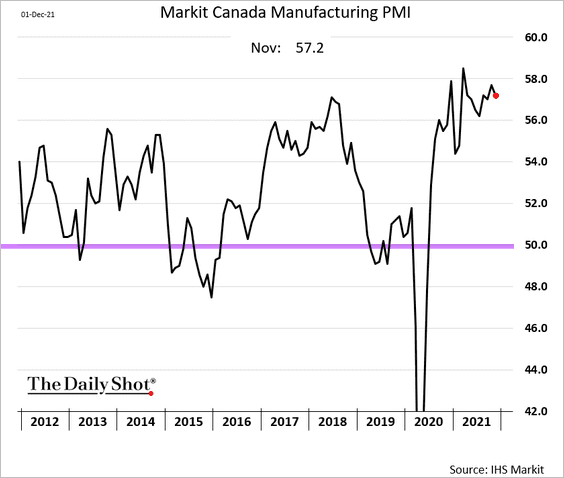

1. Manufacturing growth remains very strong.

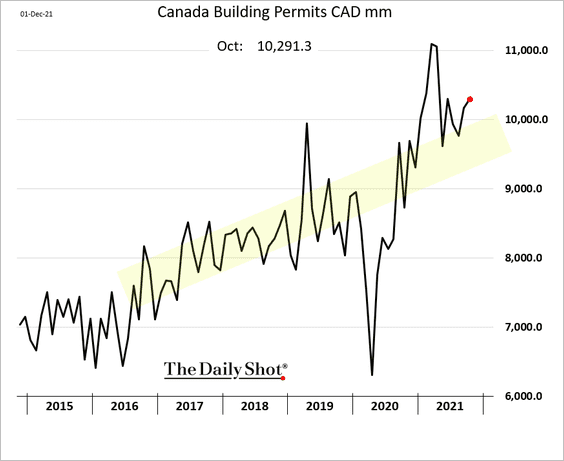

2. Building permits continue to trend higher.

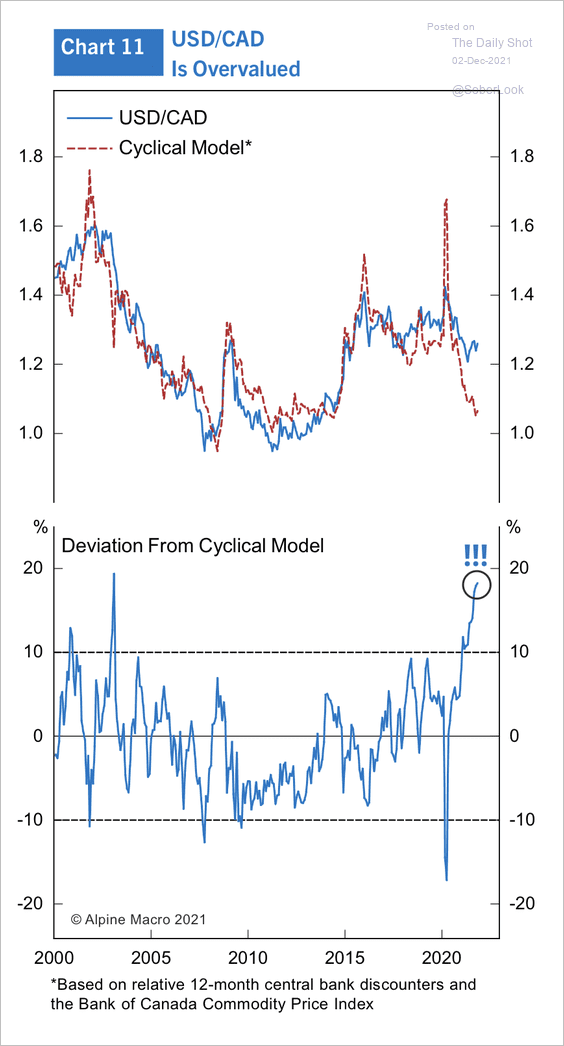

3. USD/CAD appears overvalued.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

The United States

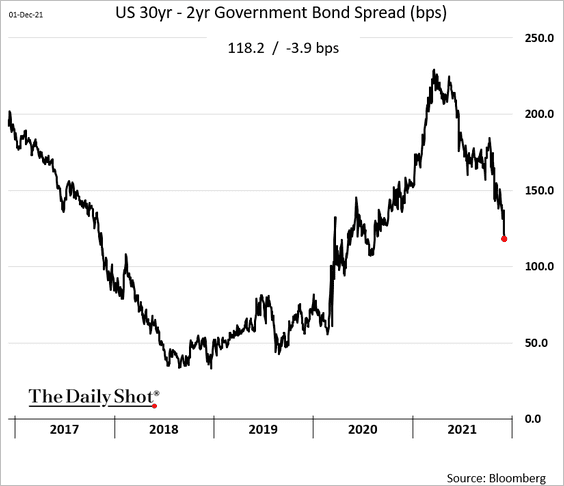

1. The Treasury curve continues to flatten.

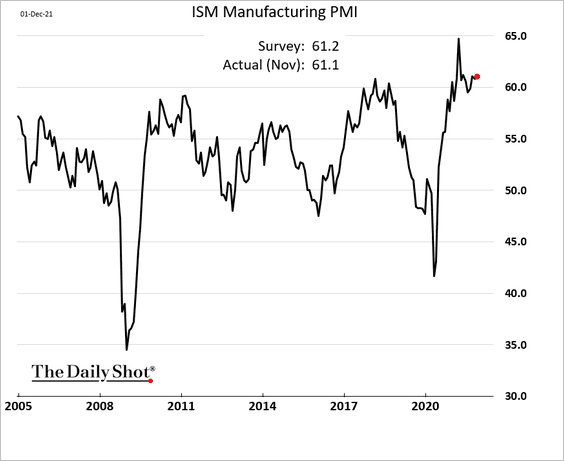

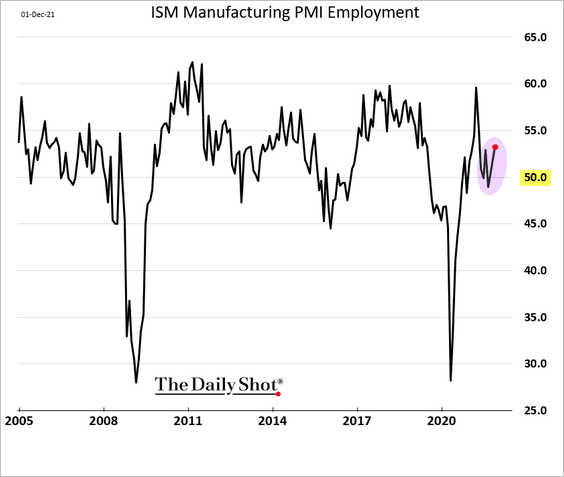

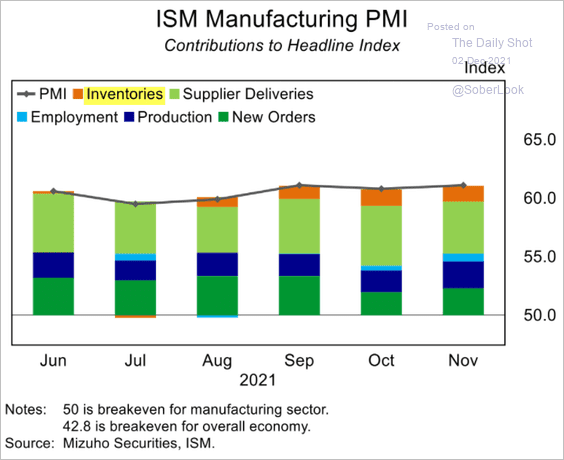

2. The ISM Manufacturing report was in line with expectations.

• Hiring picked up.

• Businesses continue to build inventories.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

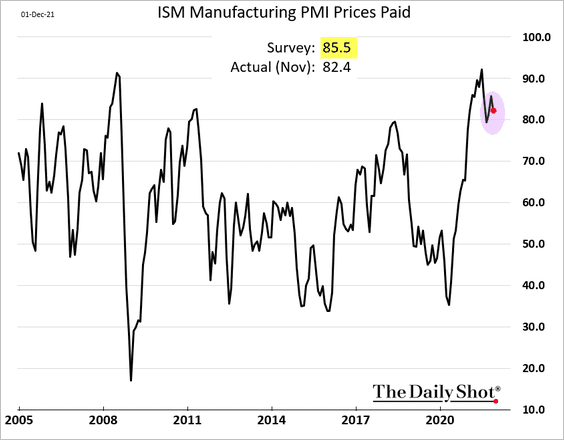

• The index measuring input prices surprised to the downside.

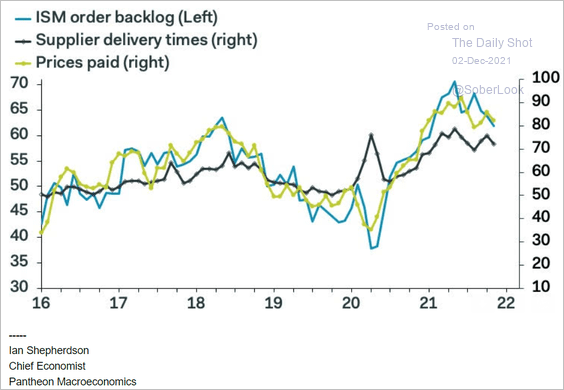

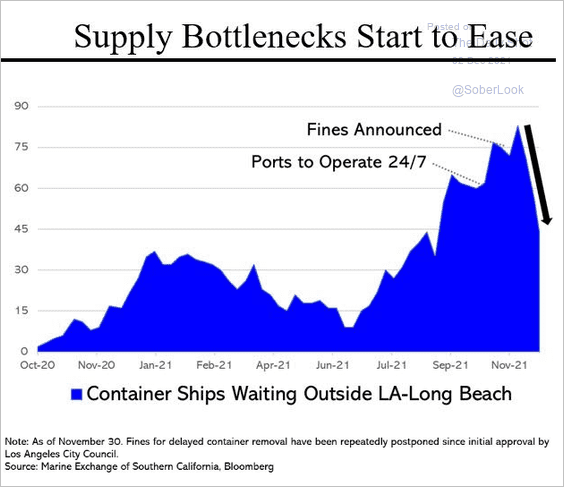

There are signs that supply-chain bottlenecks are starting to ease.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: @SteveRattner

Source: @SteveRattner

Source: Reuters Read full article

Source: Reuters Read full article

——————–

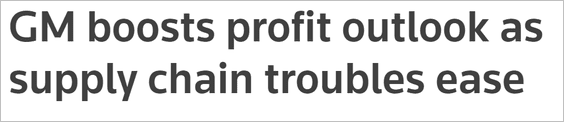

3. The ADP employment report showed over half a million new private-sector jobs created in November.

Source: ADP Research Institute

Source: ADP Research Institute

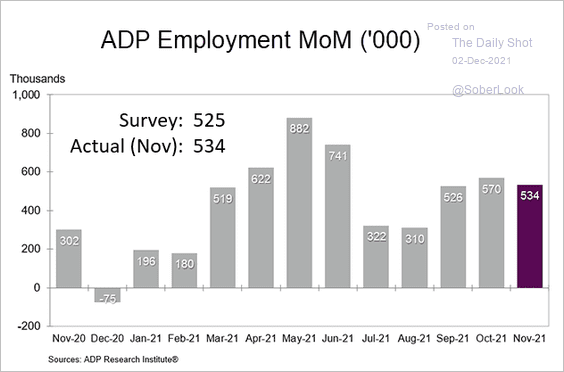

Once again, hiring was broad, with all major sectors showing gains.

Source: ADP Research Institute

Source: ADP Research Institute

——————–

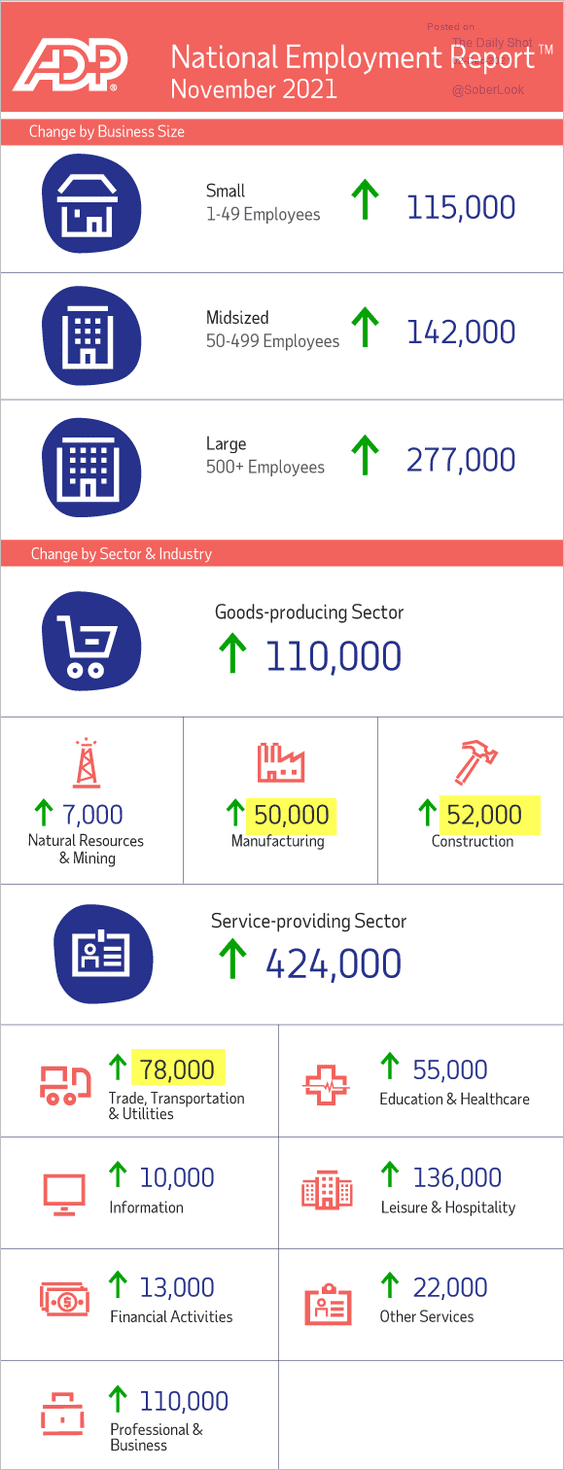

4. Residential and nonresidential construction spending trends continue to diverge.

5. The Atalanta Fed’s GDPNow estimate for the fourth-quarter GDP growth is nearing 10% (annualized).

Source: @AtlantaFed

Source: @AtlantaFed

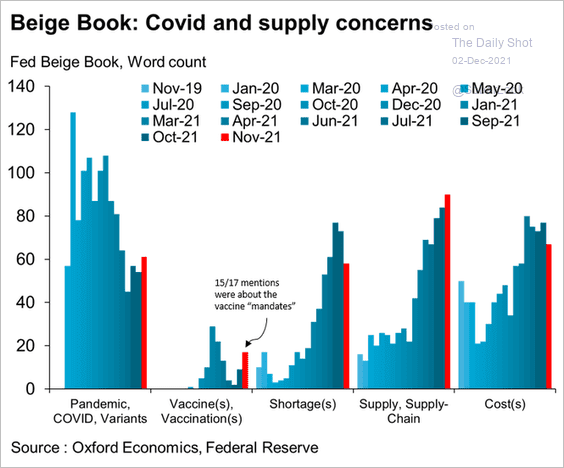

6. The Fed’s Beige Book continues to show supply chain challenges, although the number of comments related to “shortages” declined.

Source: @GregDaco

Source: @GregDaco

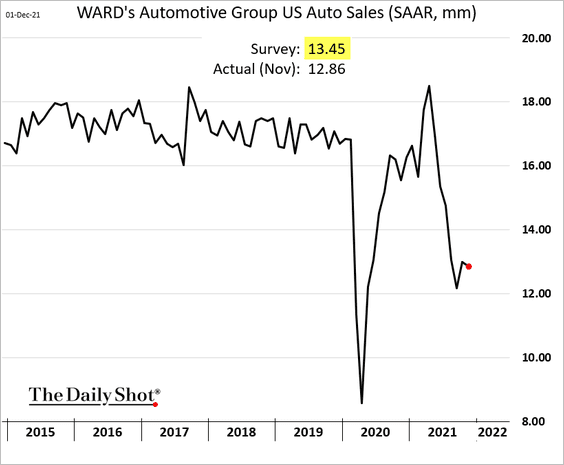

7. US November vehicle sales surprised to the downside.

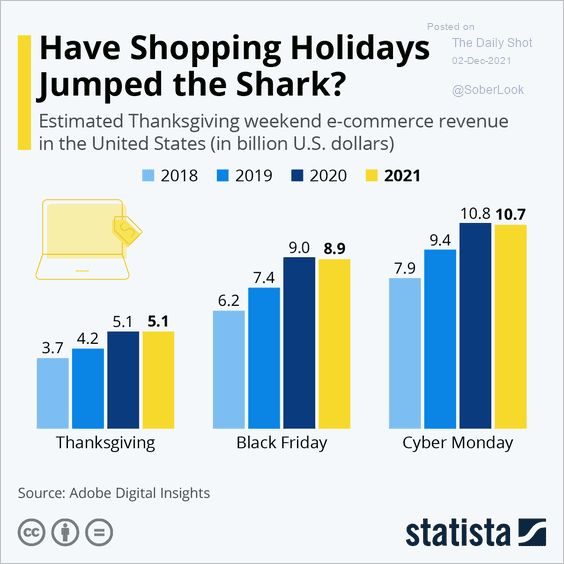

8. Thanksgiving week retail sales were disappointing relative to last year.

Source: Statista

Source: Statista

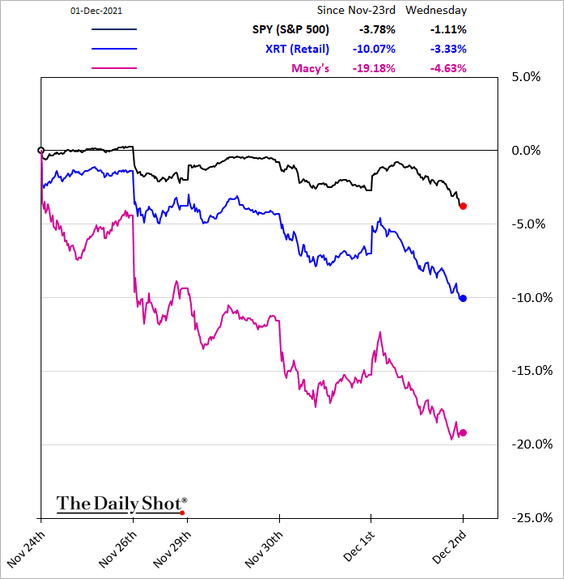

Retail stocks have underperformed over the past few days (partially related to omicron).

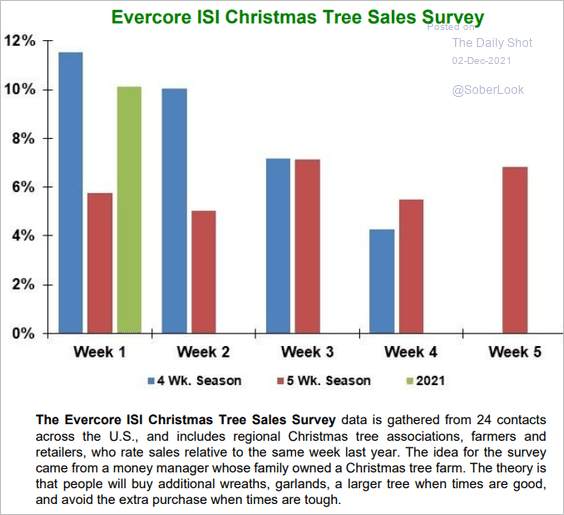

9. Finally, here is a survey from Evercore ISI on Christmas tree sales.

Source: Evercore ISI

Source: Evercore ISI

Back to Index

Global Developments

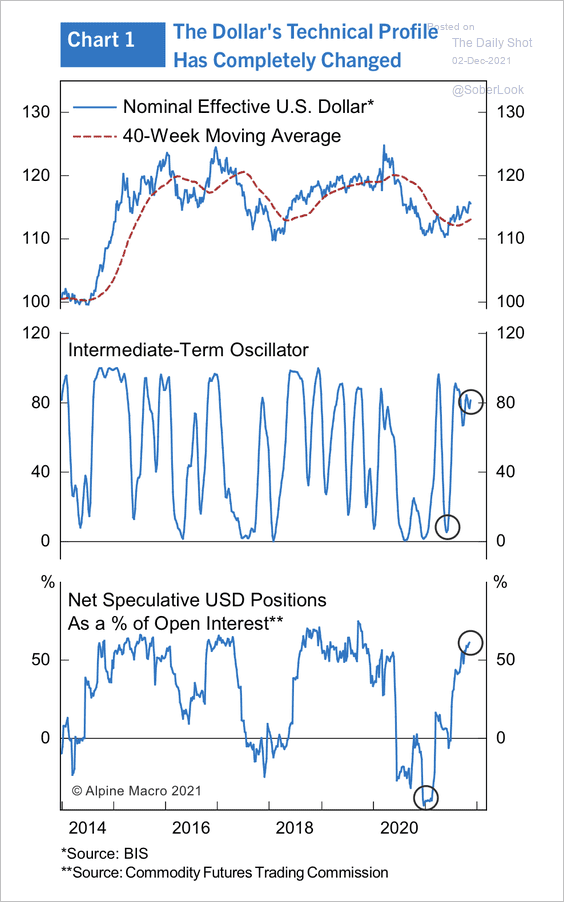

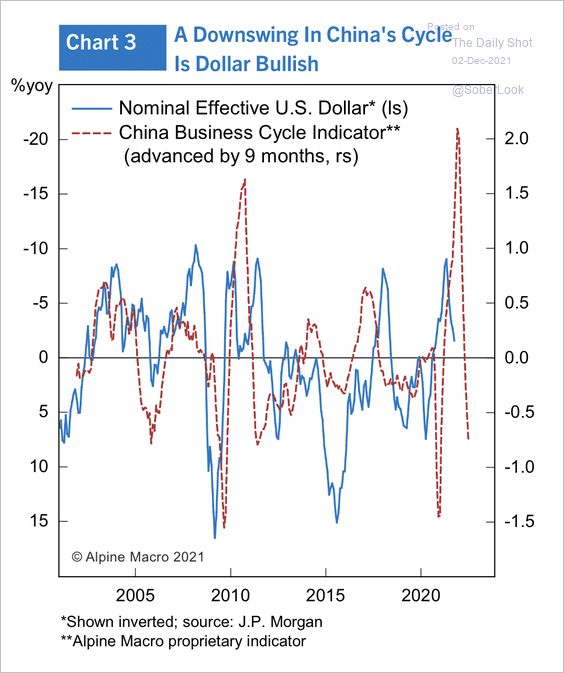

1. The dollar appears overbought in the short-term, while bullish positioning is near an extreme.

Source: Alpine Macro

Source: Alpine Macro

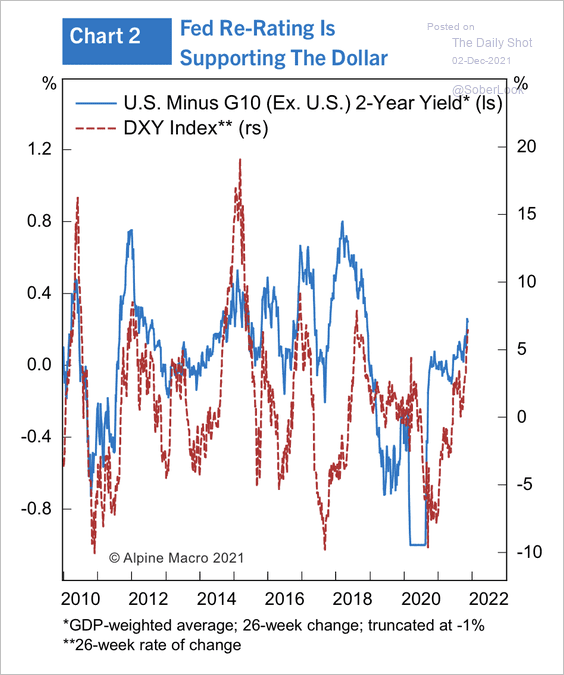

So far, yield differentials and a slowdown in China have supported dollar strength (2 charts).

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

——————–

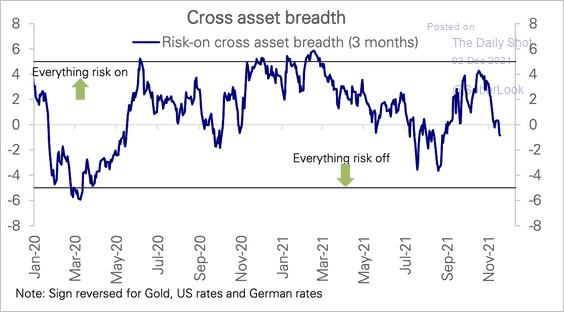

2. Declining market breadth implies wide divergences across asset class returns. This could signal a risk-off environment.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

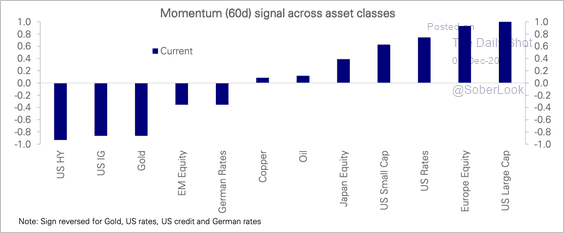

This chart shows the recent momentum dispersion across asset classes.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

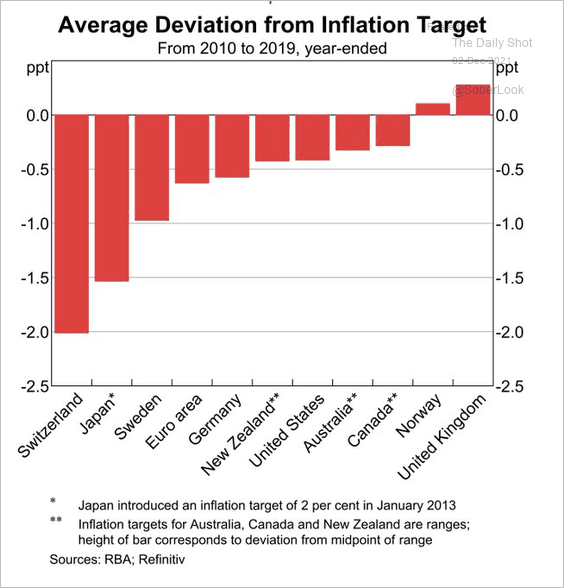

3. Here is the average deviation from central banks’ inflation targets.

Source: @acemaxx, @BIS_org Read full article

Source: @acemaxx, @BIS_org Read full article

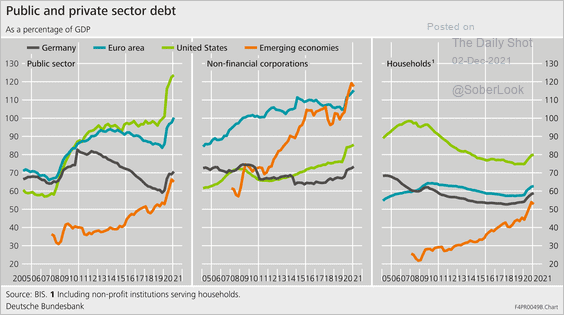

4. Finally, we have public and private sector debt over time for select economies.

Source: Bundesbank Read full article

Source: Bundesbank Read full article

——————–

Food for Thought

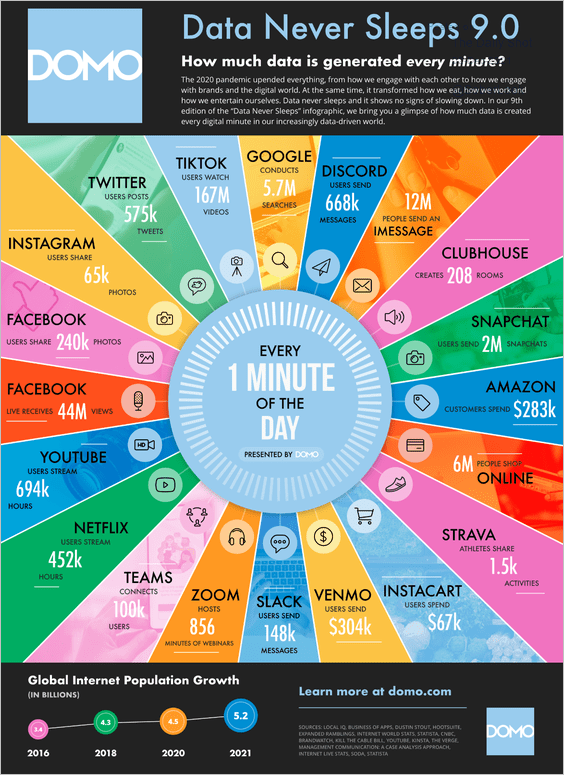

1. A minute on the internet:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

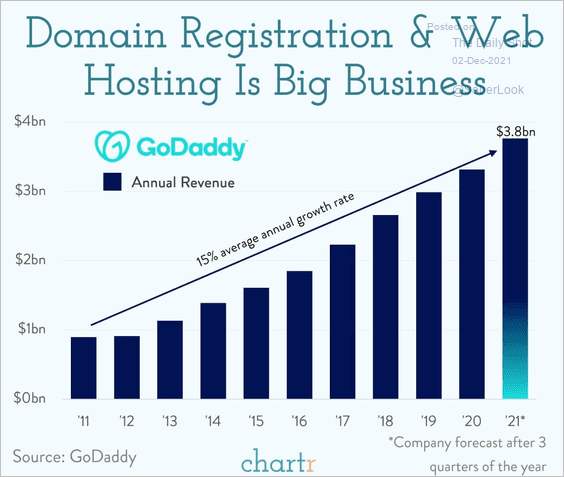

2. GoDaddy annual revenue:

Source: @chartrdaily

Source: @chartrdaily

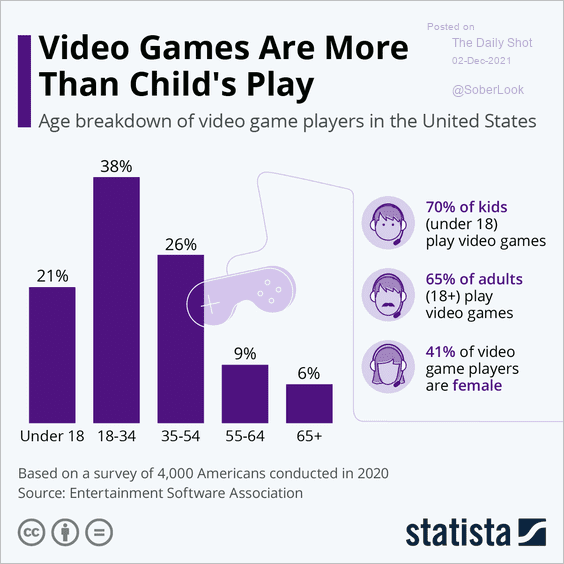

3. US video game players:

Source: Statista

Source: Statista

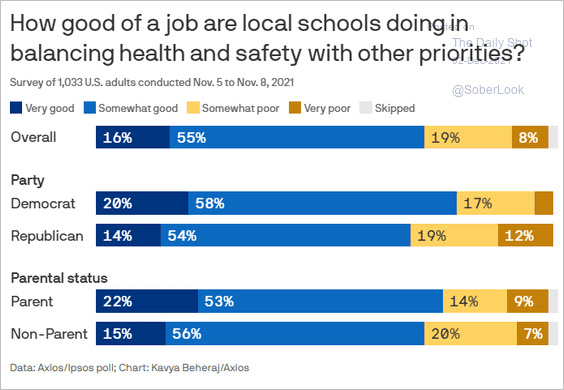

4. Views on local schools balancing health with other priorities:

Source: @axios Read full article

Source: @axios Read full article

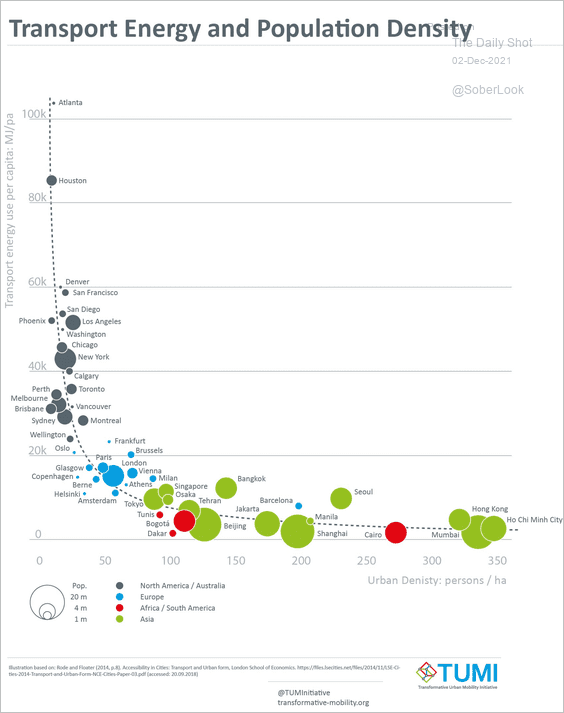

5. Transport energy usage per capita vs. population density:

Source: @TUMInitiative

Source: @TUMInitiative

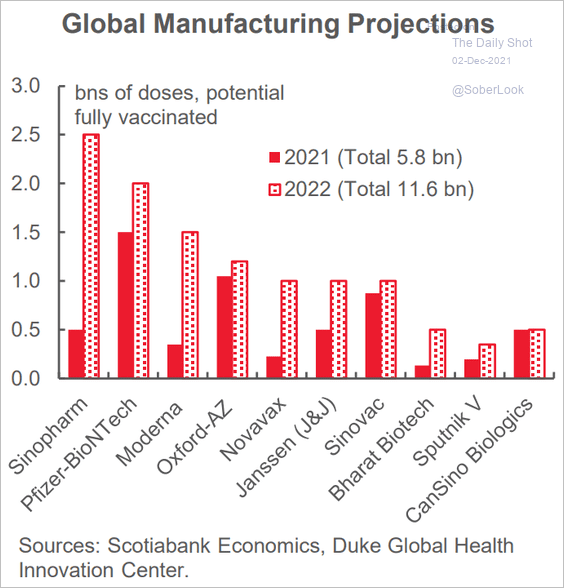

6. Vaccine production ramping up:

Source: Scotiabank Economics

Source: Scotiabank Economics

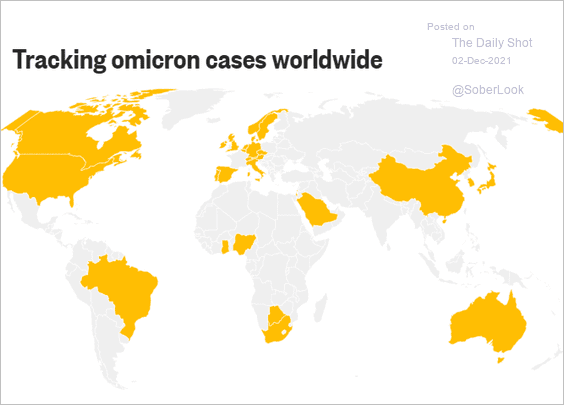

7. Omicron cases:

Source: NBC News Read full article

Source: NBC News Read full article

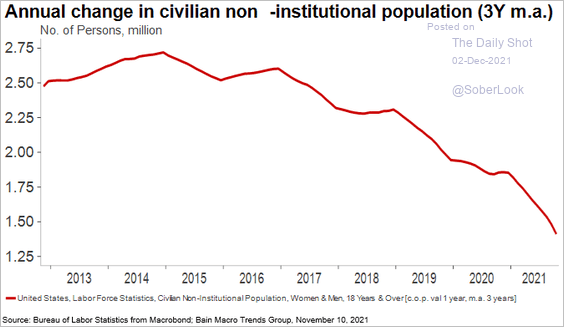

8. US population growth:

Source: Bain & Company Read full article

Source: Bain & Company Read full article

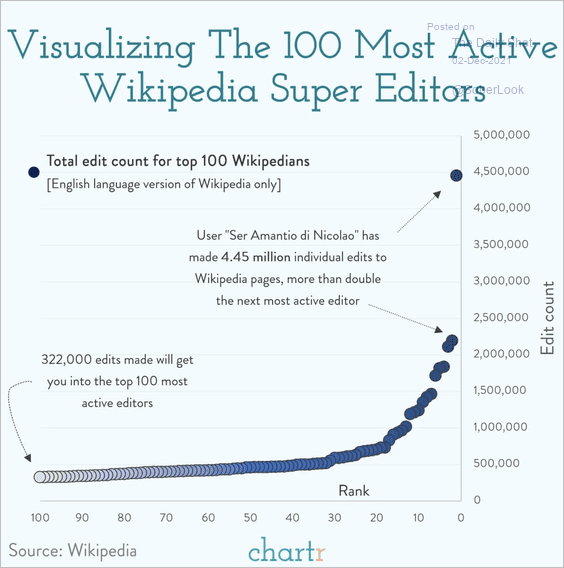

9. Wikipedia editors:

——————–

Back to Index