The Daily Shot: 17-Aug-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

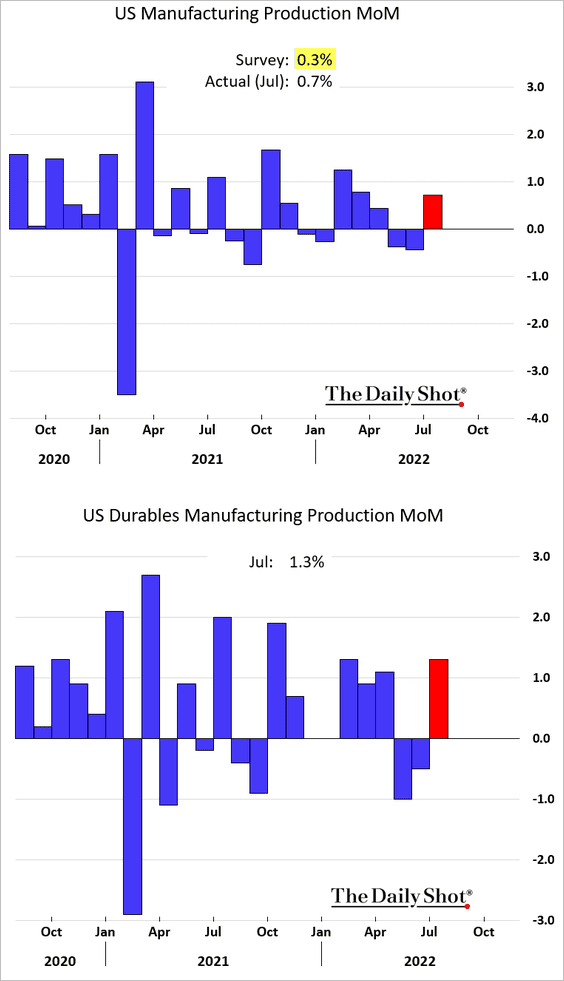

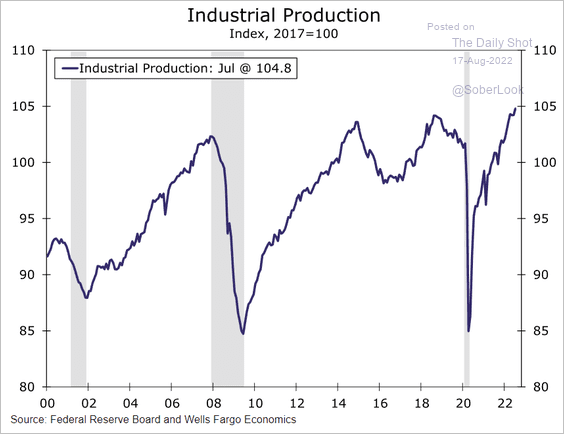

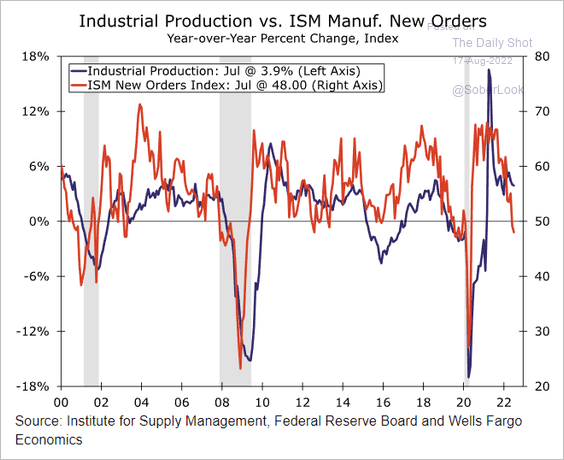

1. July manufacturing output surprised to the upside, diverging from much weaker survey-based data. We see a similar trend in Europe.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

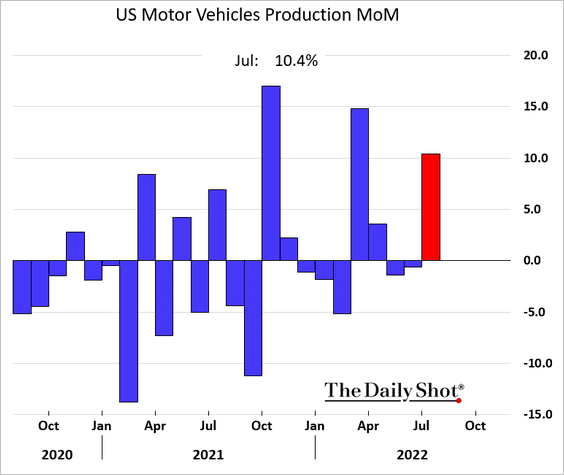

• Vehicle production jumped.

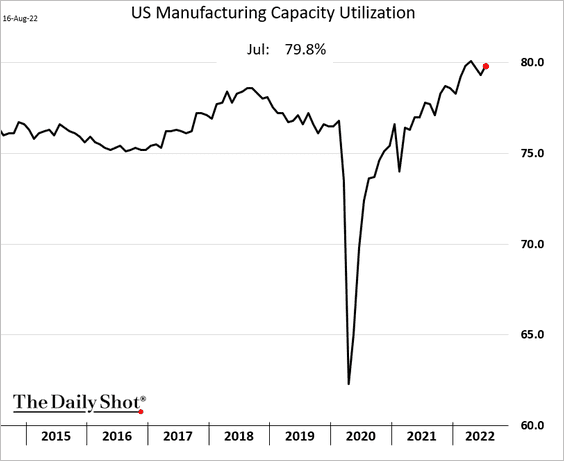

• Capacity utilization improved.

• Survey-based indicators continue to point to manufacturing weakness ahead.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

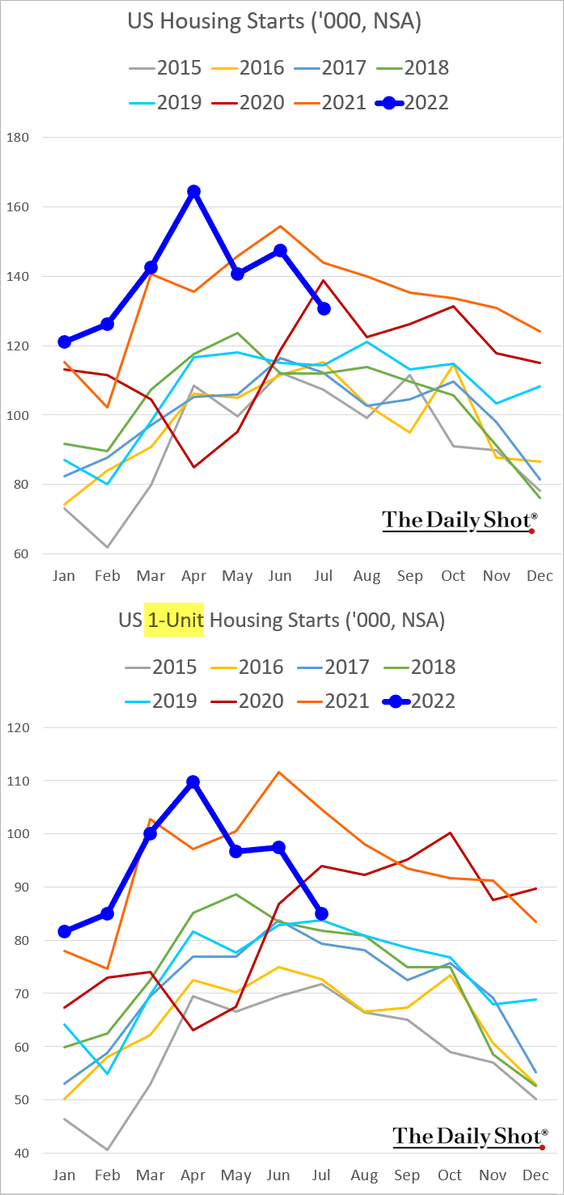

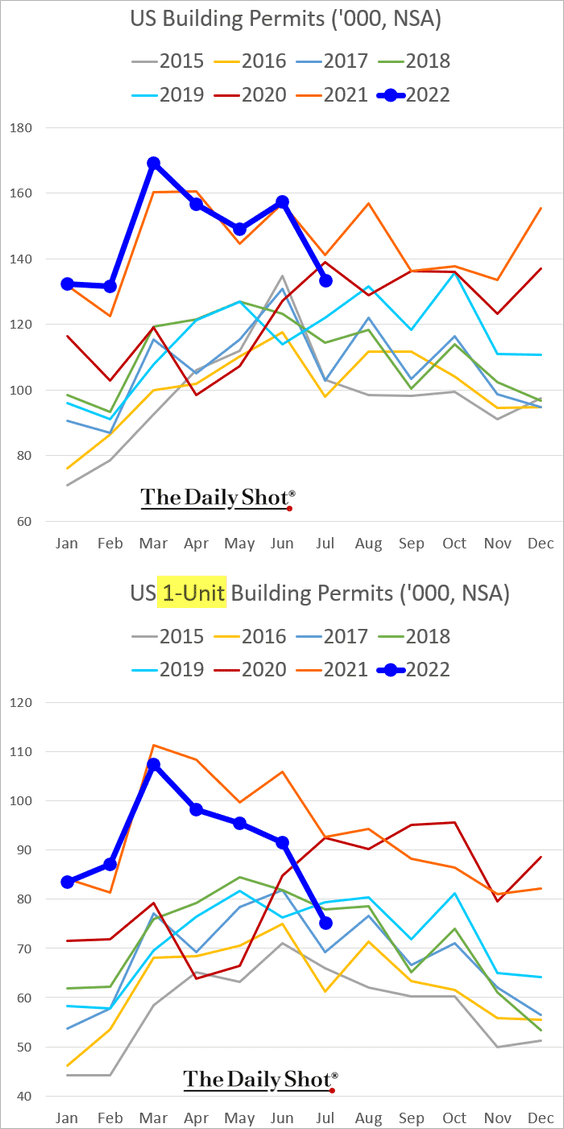

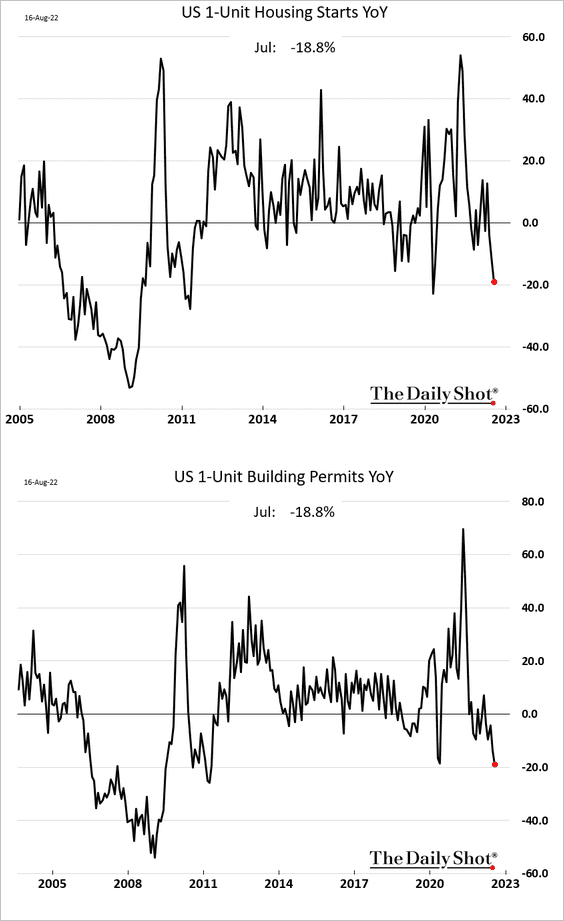

2. Next, we have some updates on the housing market.

• Residential construction slumped last month, with declines driven by single-family housing.

– Housing starts:

– Building permits:

– Single-family starts and permits year-over-year changes:

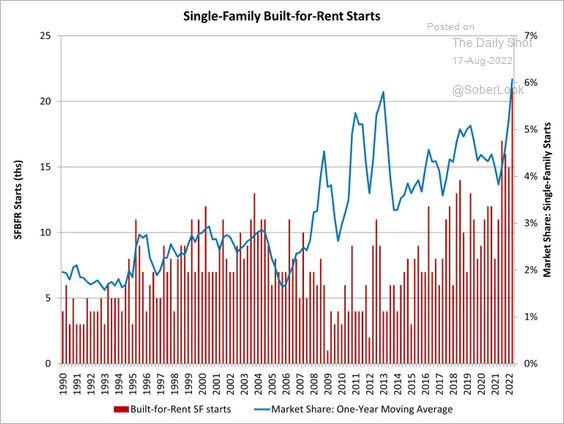

• On the other hand, construction of single-family homes built-for-rent has accelerated.

Source: NAHB Read full article

Source: NAHB Read full article

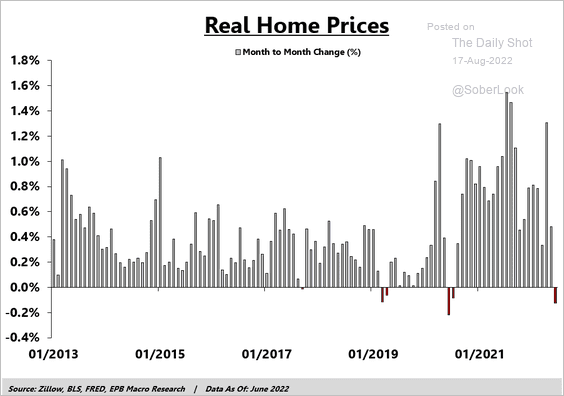

• Real home prices declined in June.

Source: @EPBResearch

Source: @EPBResearch

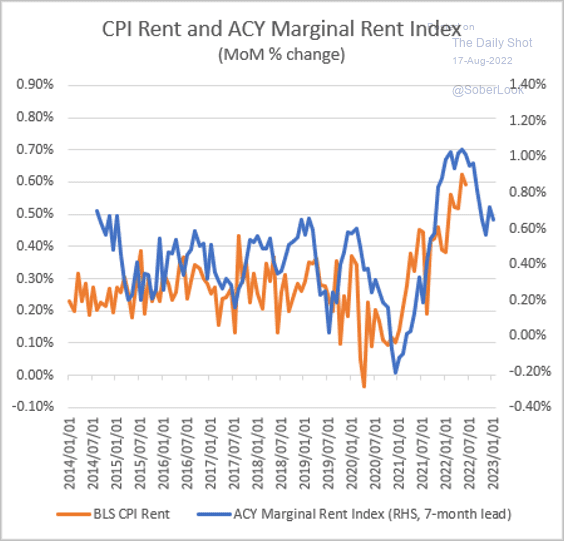

• Is rent inflation about to peak?

Source: Lynn Fisher, Essent Guaranty Further reading

Source: Lynn Fisher, Essent Guaranty Further reading

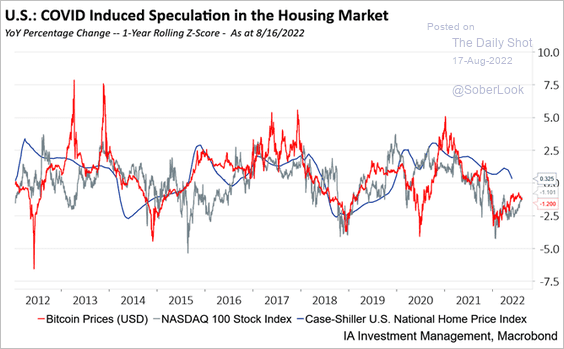

• Will housing prices adjust lower with risk assets?

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

——————–

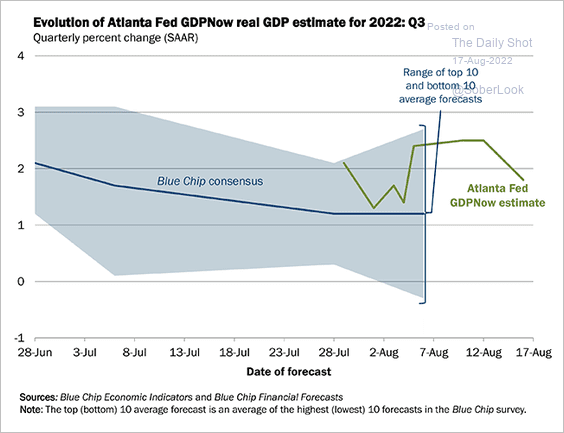

3. The GDPNow model’s Q3 GDP growth forecast is back below 2%.

Source: Atlanta Fed

Source: Atlanta Fed

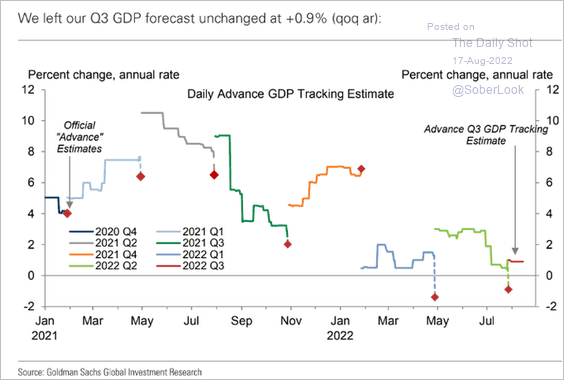

Goldman’s estimate has the current quarter’s growth at 0.9%.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

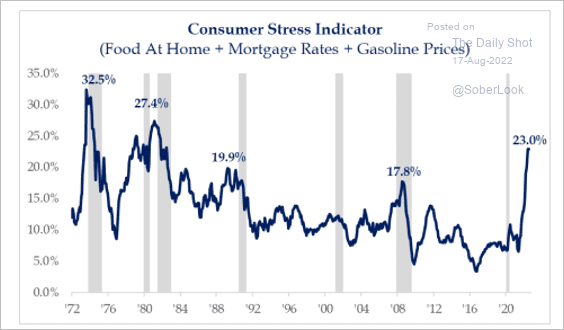

4. Has US consumer “stress” peaked?

Source: @StrategasRP

Source: @StrategasRP

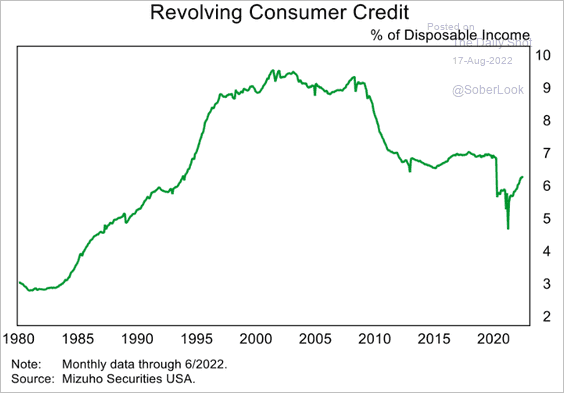

5. This chart shows revolving consumer credit (credit card debt) as a share of disposable income.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

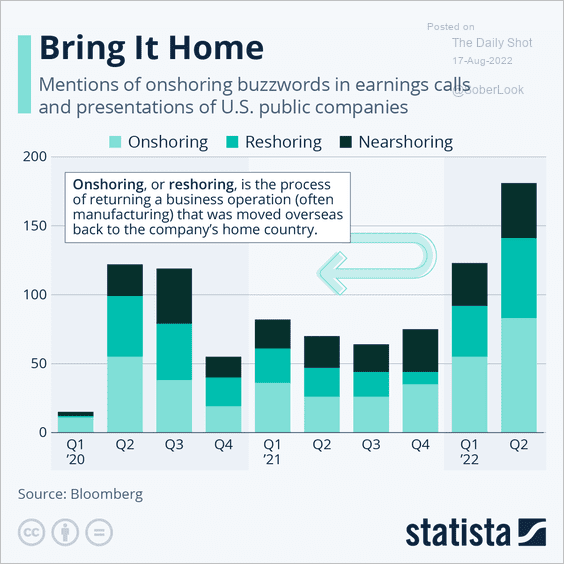

6. Public firms are increasingly talking about onshoring/nearshoring to reduce supply chain risks.

Source: Statista

Source: Statista

Back to Index

Canada

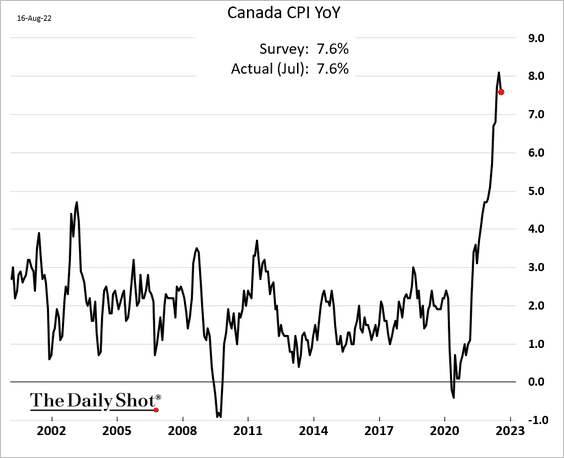

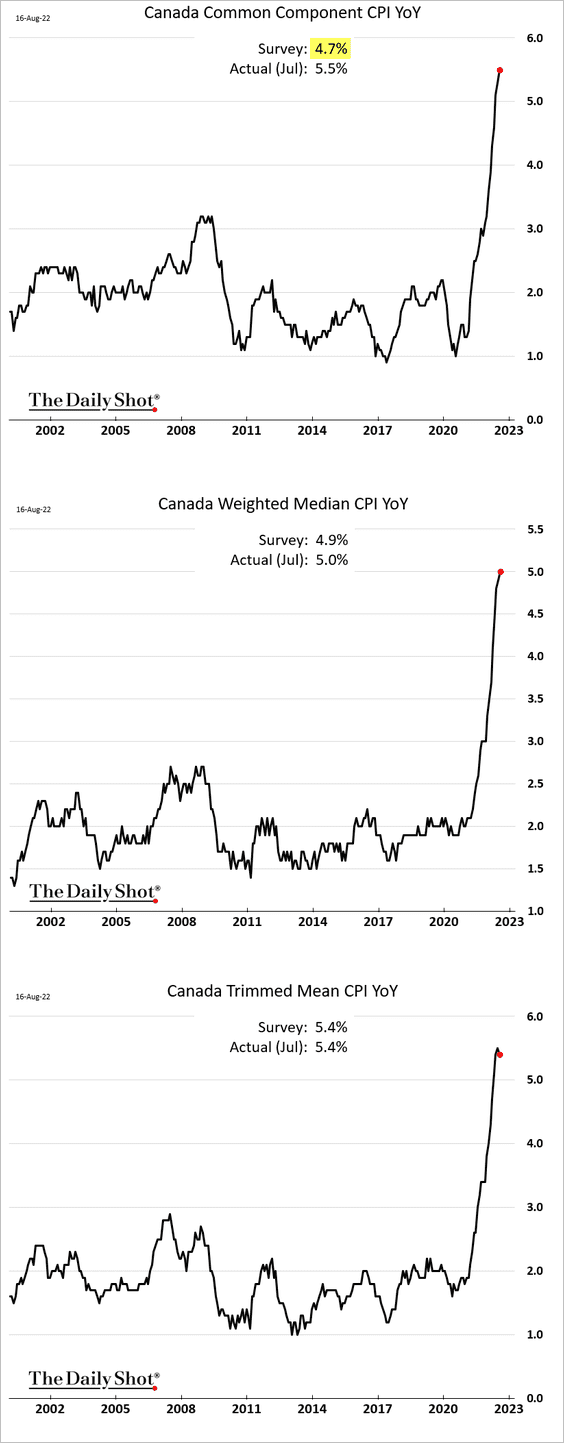

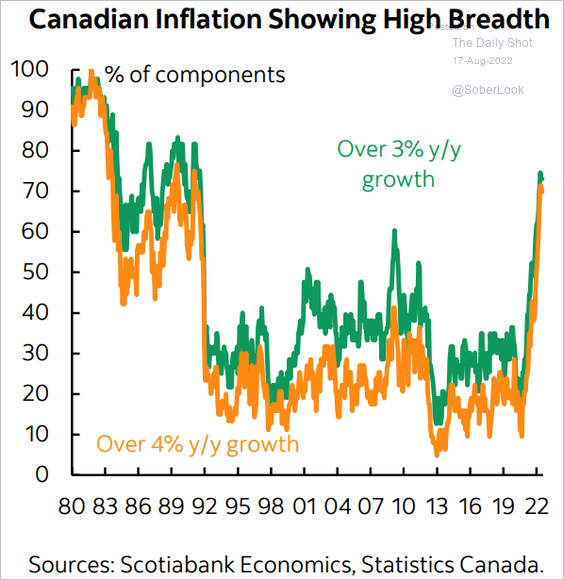

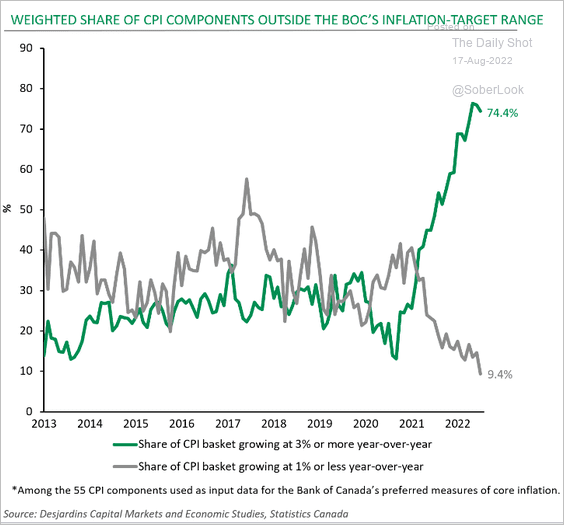

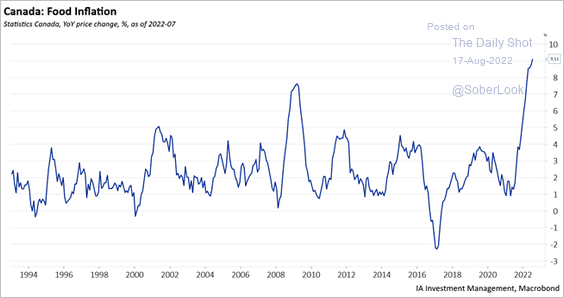

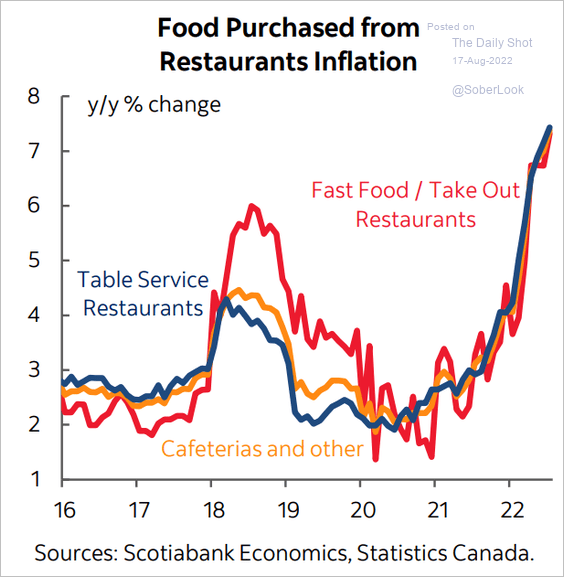

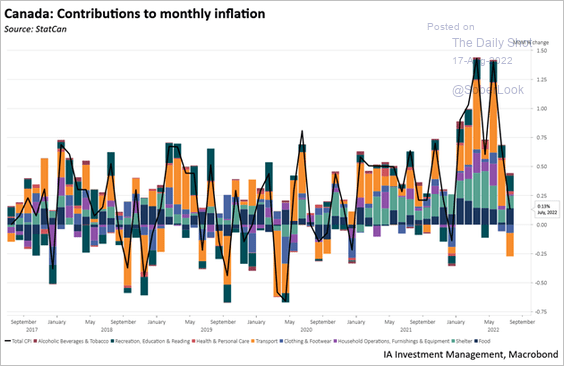

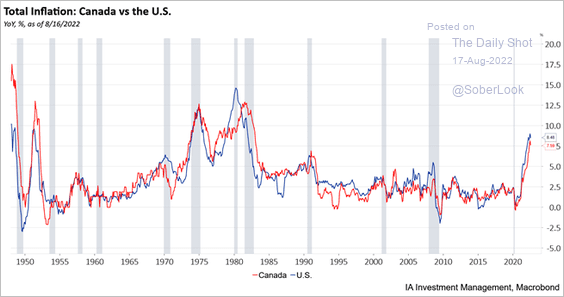

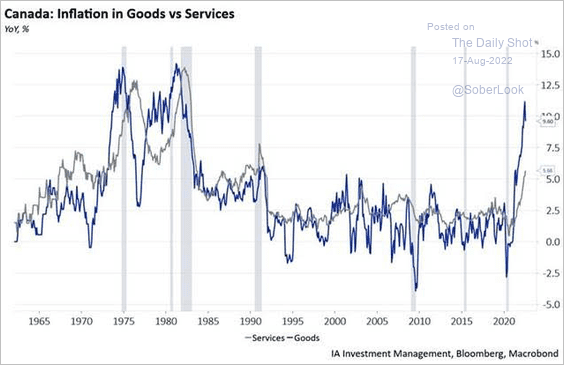

1. The CPI report was in line with forecasts, with severe inflationary pressures persisting.

• Headline CPI:

• Core CPI measures:

• Inflation breadth (2 charts):

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Desjardins

Source: Desjardins

• Food inflation (2 charts):

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

Source: Scotiabank Economics

Source: Scotiabank Economics

• CPI contributions:

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

• Comparison to the US:

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

• Services inflation, which is more correlated to wage growth, is accelerating.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

——————–

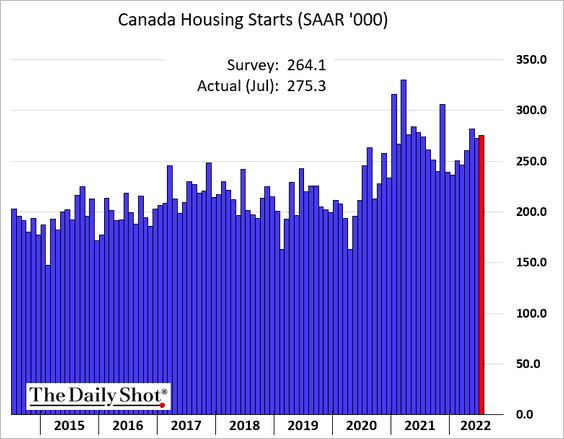

2. Housing starts topped expectations.

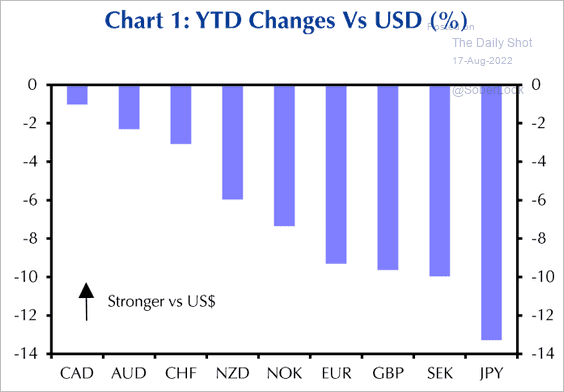

3. The loonie has outperformed other DM currencies vs. USD this year.

Source: Capital Economics

Source: Capital Economics

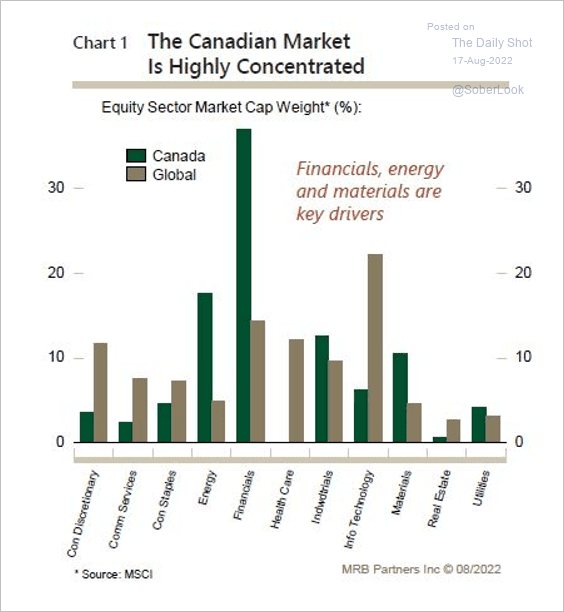

4. Here is a breakdown of sector weightings in the MSCI Canada Index versus the MSCI World Index.

Source: MRB Partners

Source: MRB Partners

Back to Index

The United Kingdom

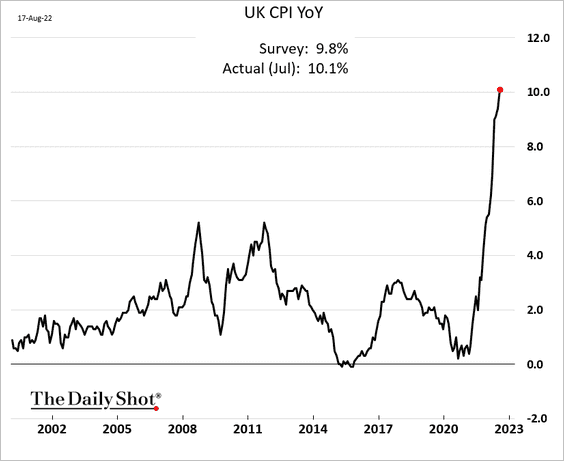

1. The CPI topped 10% last month, exceeding forecasts. We will have more on the inflation report tomorrow.

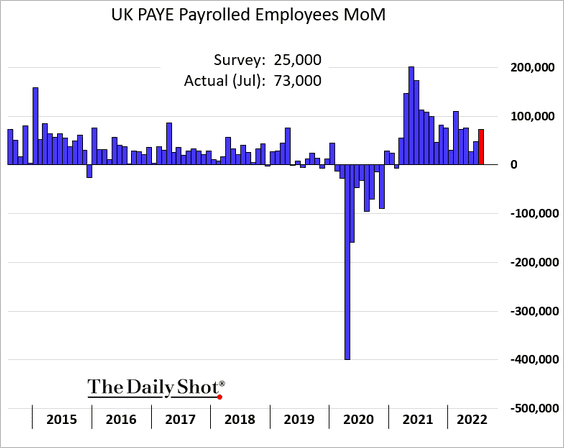

2. July payrolls surprised to the upside, but this figure is likely to be revised down.

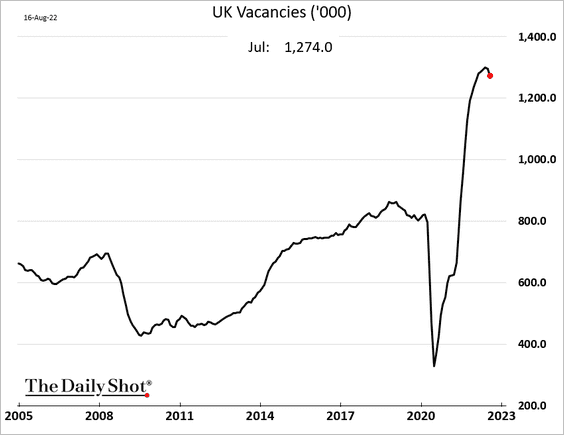

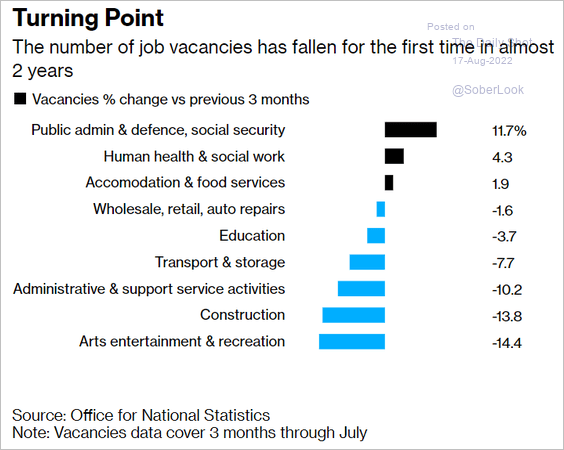

• Vacancies appear to have peaked.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

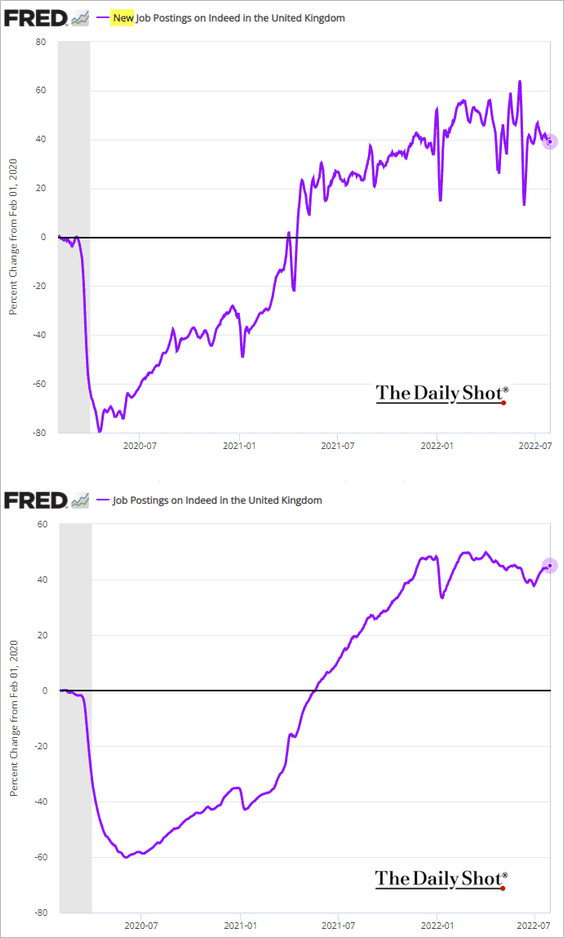

Postings on Indeed have been relatively stable.

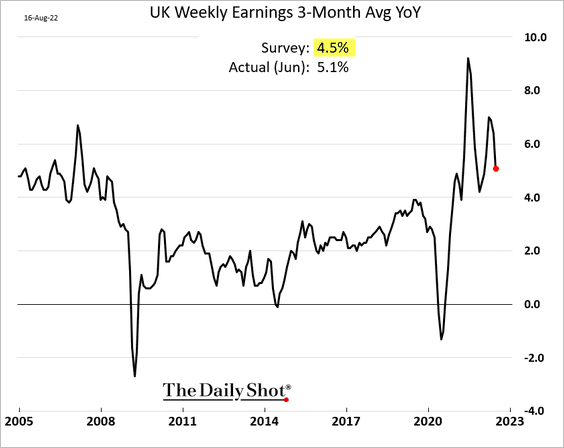

• Wage growth topped expectations, fueling inflation concerns.

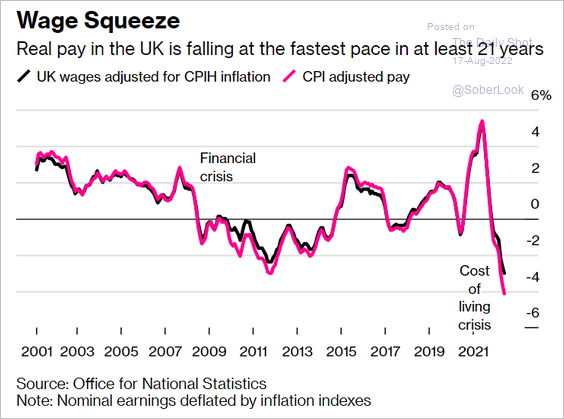

• Real pay growth is deep in negative territory.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

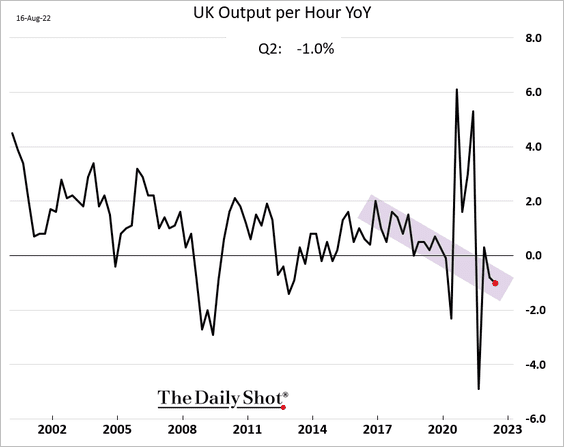

3. Productivity growth continues to trend lower.

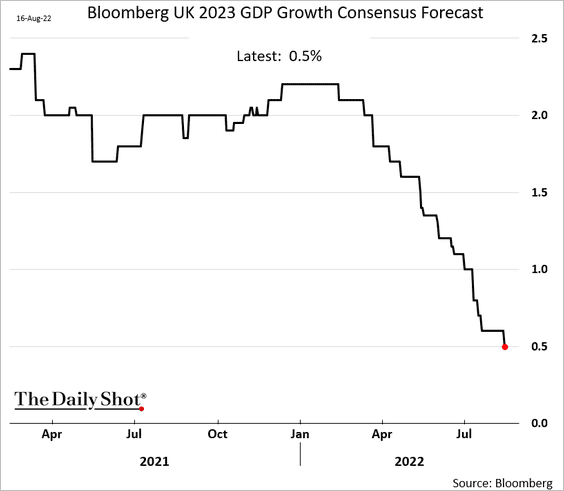

4. Economists have now downgraded the UK 2023 GDP growth to 0.5%.

Back to Index

The Eurozone

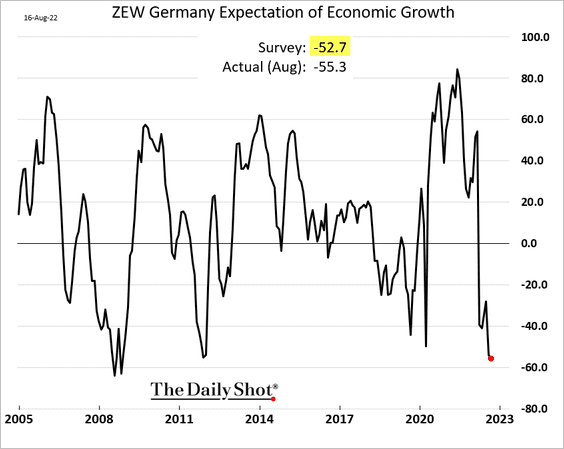

1. Germany’s ZEW expectations of economic growth hit the lowest level since the financial crisis.

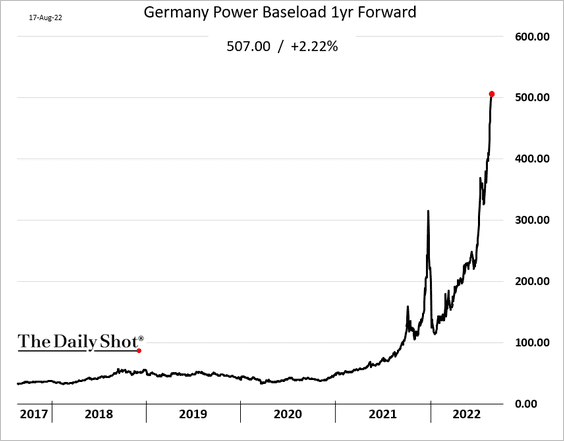

2. Germany’s electricity prices hit a record high.

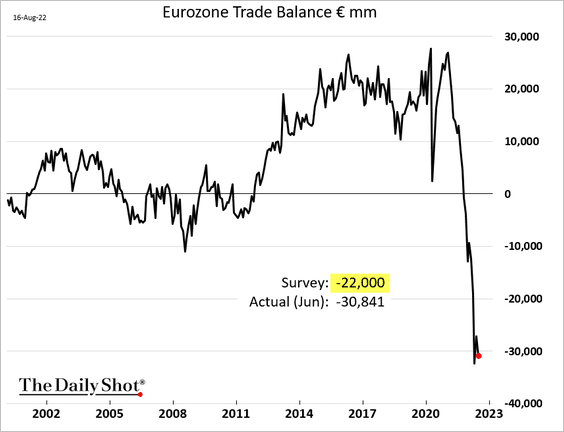

3. The Eurozone’s trade deficit widened more than expected in June as surging energy imports take a toll.

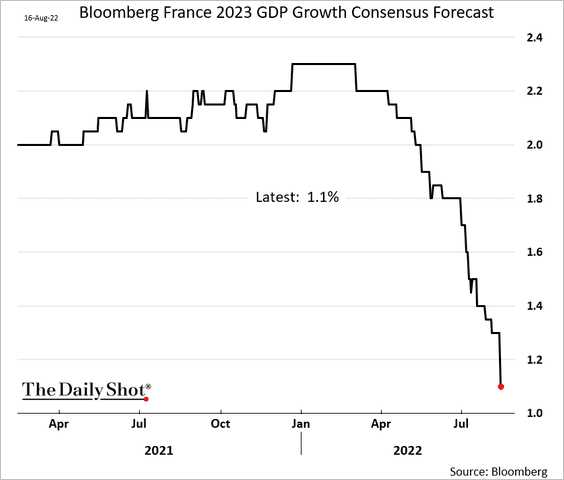

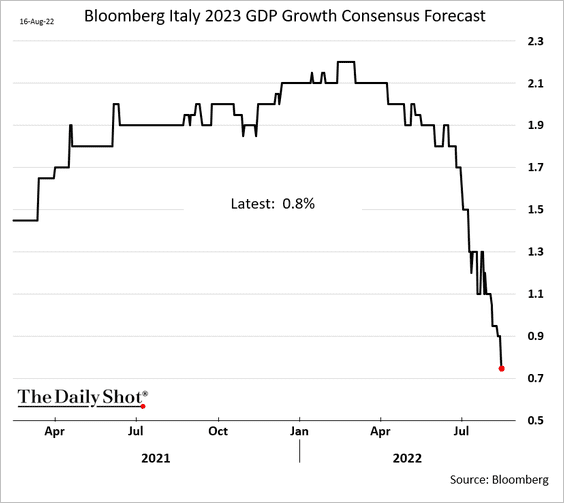

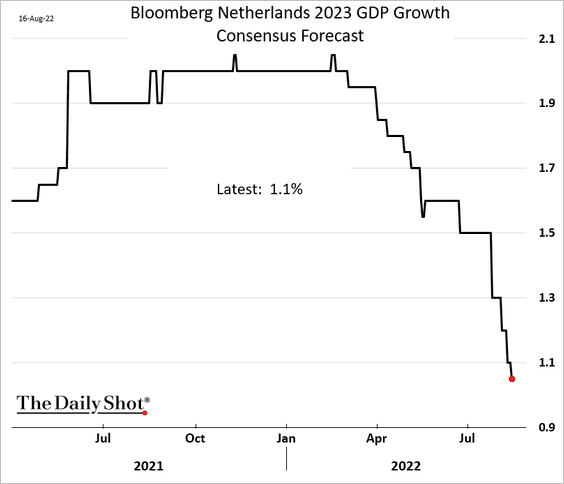

4. Economists continue to downgrade their growth forecasts for 2023.

• France:

• Italy:

• The Netherlands:

——————–

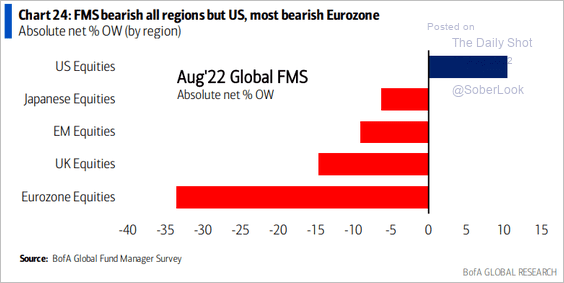

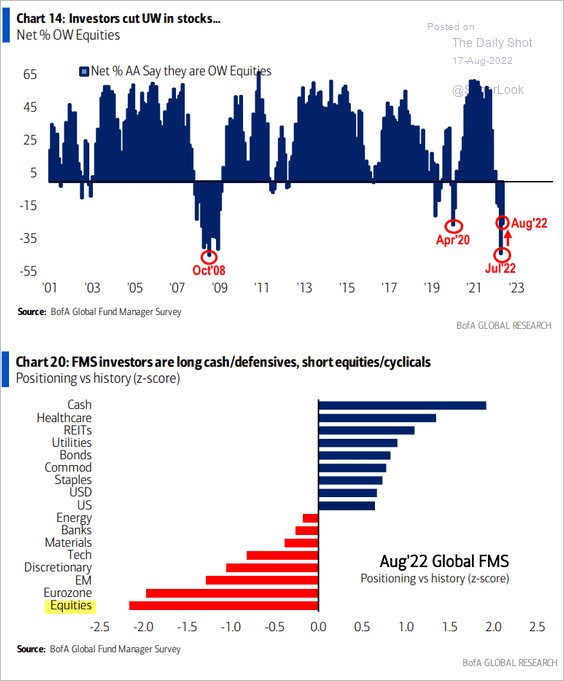

5. Fund managers are still very bearish on euro-area stocks.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Europe

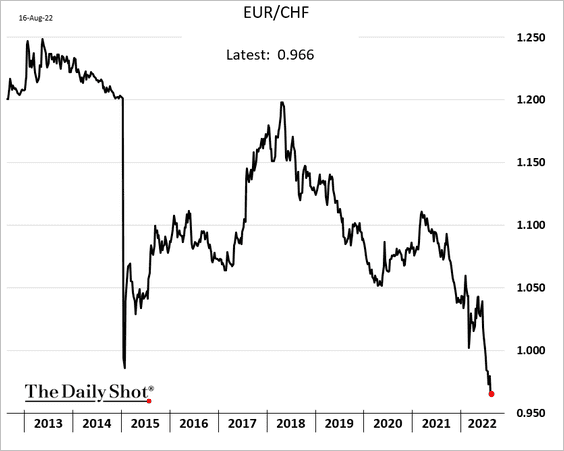

1. The Swiss franc continues to strengthen vs. the euro.

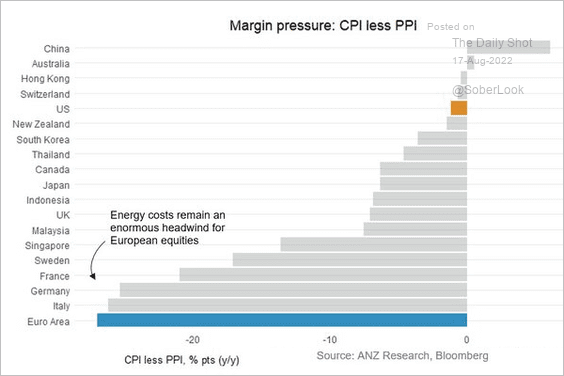

2. European firms are facing severe margin pressures.

Source: @jbfm_

Source: @jbfm_

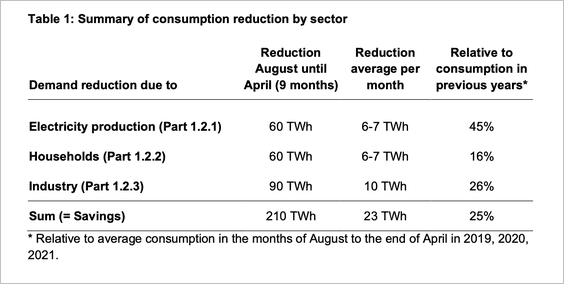

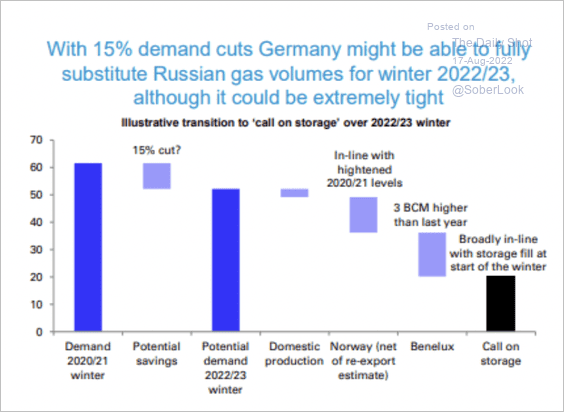

3. This table shows the share of reduced gas consumption necessary to avoid rationing if Russian volumes come to a halt.

Source: ECONtribute Read full article

Source: ECONtribute Read full article

Some estimates suggest Germany could fully substitute Russian gas volumes this winter.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Japan

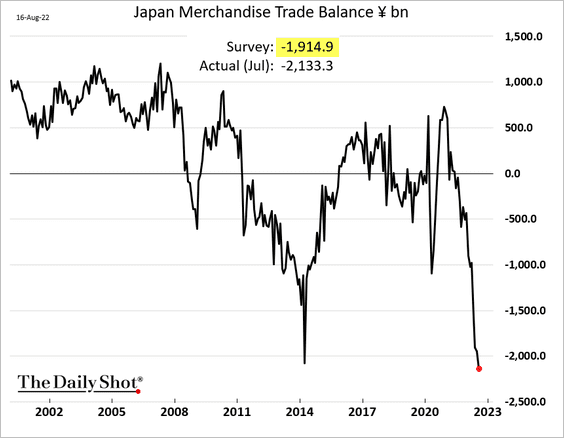

1. The trade deficit hit a new record, topping expectations.

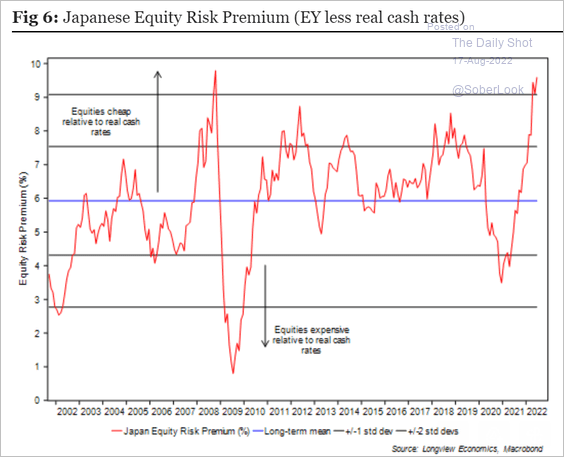

2. Japan’s equity risk premium is the highest since the financial crisis (stocks are cheap).

Source: Longview Economics

Source: Longview Economics

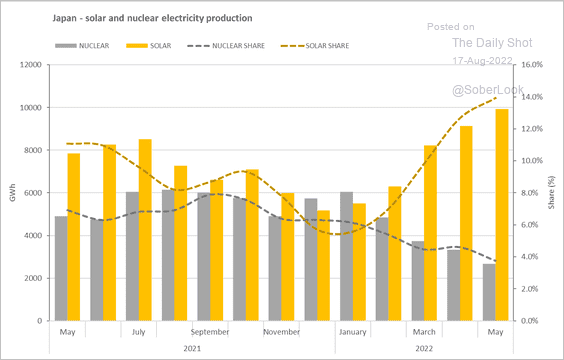

3. Here is Japan’s solar and nuclear electricity production.

Source: IEA

Source: IEA

Back to Index

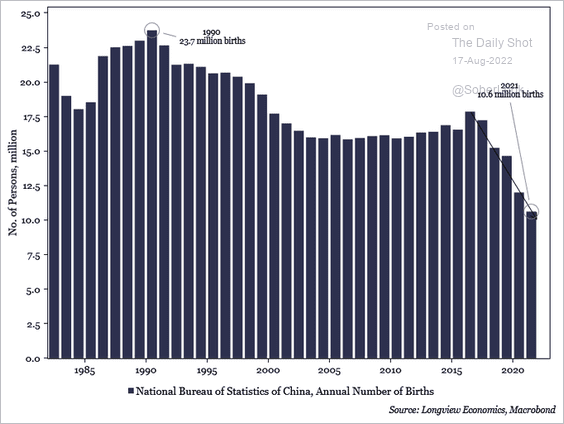

China

1. The government is promising more stimulus.

Source: Reuters Read full article

Source: Reuters Read full article

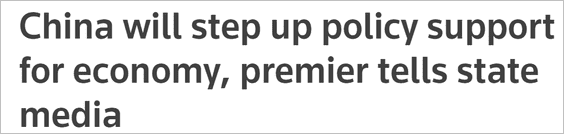

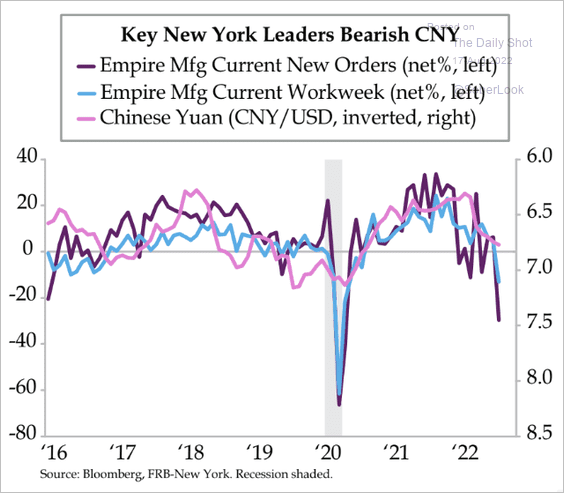

2. Leading indicators point to a weaker RMB, but it’s unclear if Beijing will let that happen.

• Falling US demand:

Source: Quill Intelligence

Source: Quill Intelligence

• Short-term rate differentials:

Source: @TaviCosta

Source: @TaviCosta

——————–

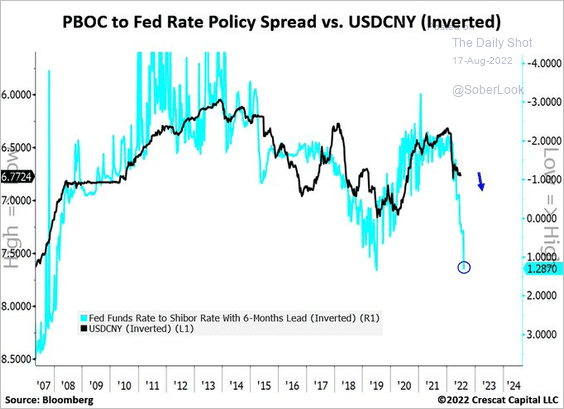

3. China’s demographic trends have been worsening.

Source: @Lvieweconomics

Source: @Lvieweconomics

Back to Index

Emerging Markets

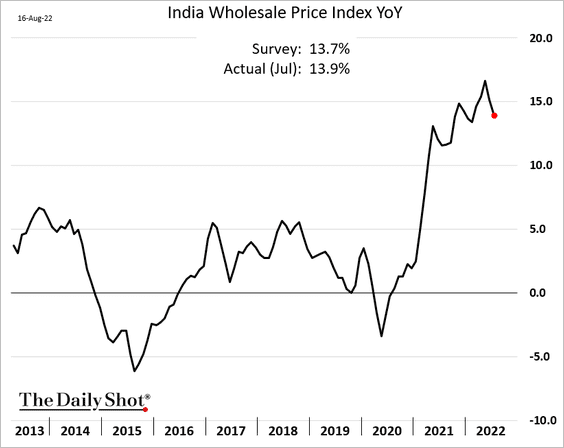

1. India’s wholesale prices were a bit higher than expected.

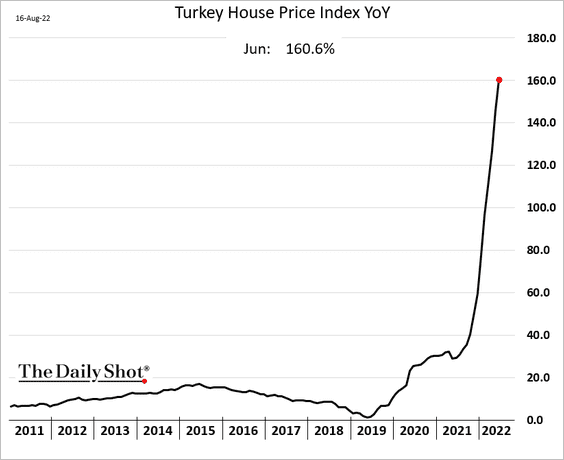

2. Housing becomes attractive when the currency is massively devalued, and hyperinflation takes over.

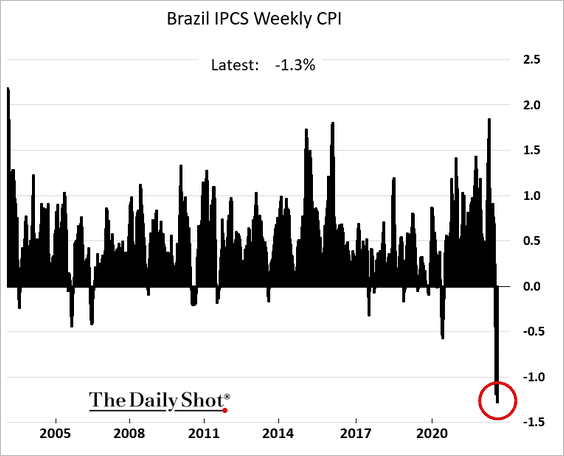

3. Has Brazil’s inflation peaked?

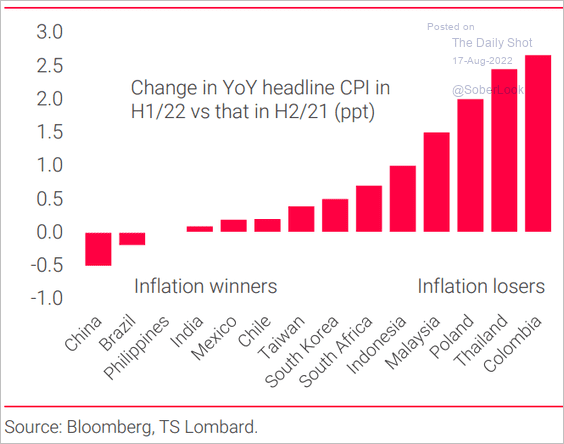

4. This chart shows how inflation accelerated/slowed in the first half of this year vs. the second half of 2021.

Source: TS Lombard

Source: TS Lombard

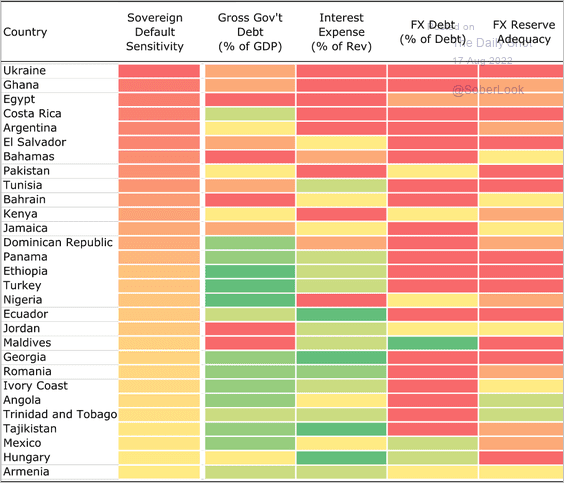

5. Here are the countries with the highest risk of sovereign default, according to Wells Fargo (some are already in default).

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Energy

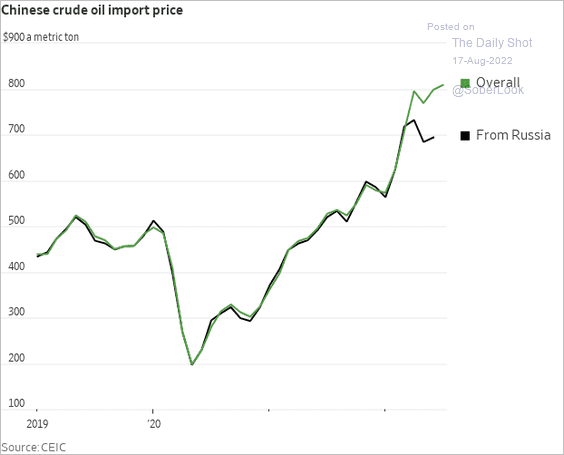

1. China’s refineries are benefitting from cheap Russian oil.

Source: @WSJ Read full article

Source: @WSJ Read full article

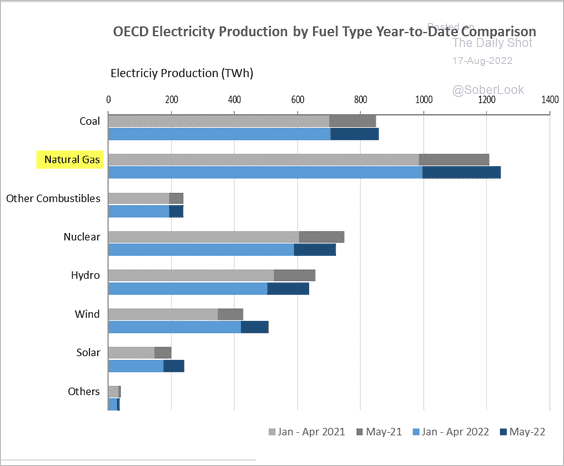

2. Natural gas and renewables usage is up this year in OECD economies.

Source: IEA

Source: IEA

Back to Index

Equities

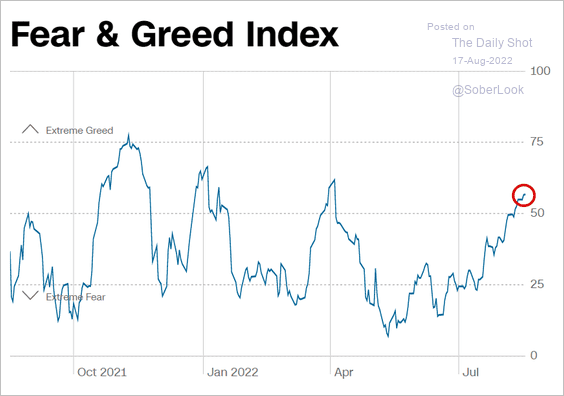

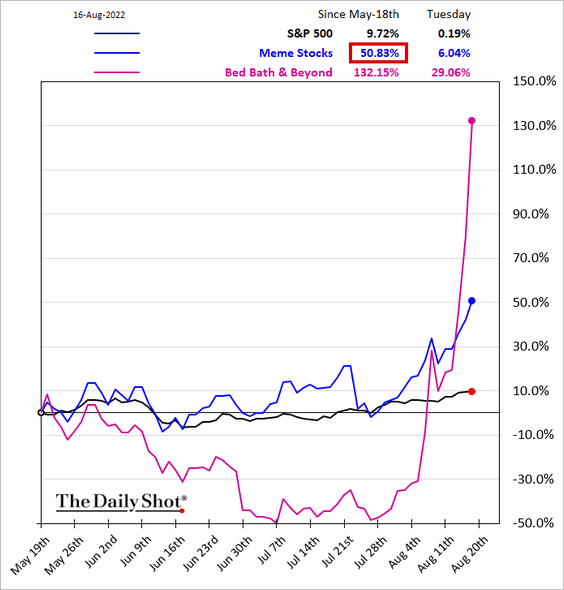

1. Risk appetite is back.

Source: CNN Business

Source: CNN Business

A basket of meme stocks is up some 50% this month.

——————–

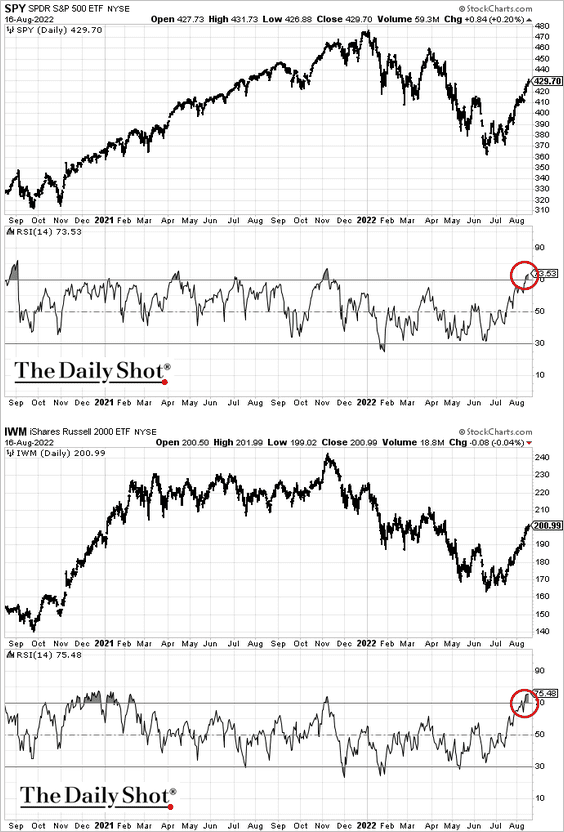

2. The Relative Strength Index (RSI) continues to show the S&P 500 and the Russell 2000 in overbought territory.

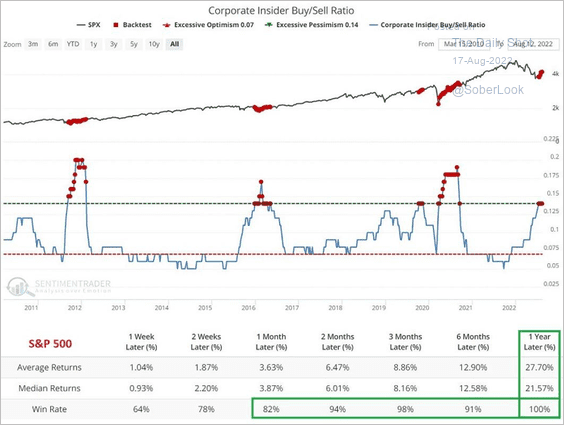

3. Corporate insiders have been accumulating stocks recently, which typically signals an upward trend for equities.

Source: SentimenTrader

Source: SentimenTrader

4. Fund managers are still underweight stocks, albeit less than in July.

Source: BofA Global Research

Source: BofA Global Research

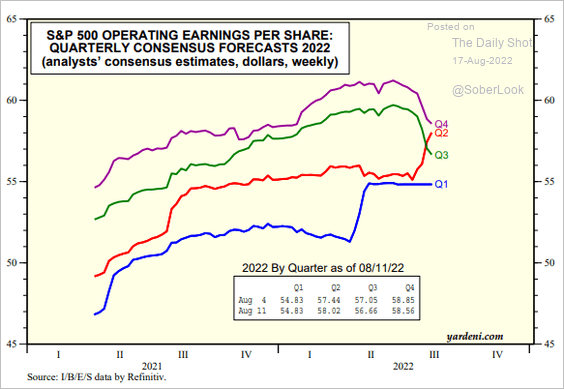

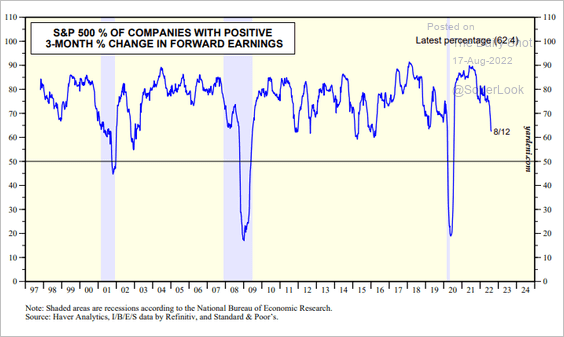

5. Second-quarter S&P 500 earnings have been better than expected. But analysts have been downgrading earnings forecasts for Q3 and Q4 (as well as next year).

Source: Yardeni Research

Source: Yardeni Research

Source: Yardeni Research

Source: Yardeni Research

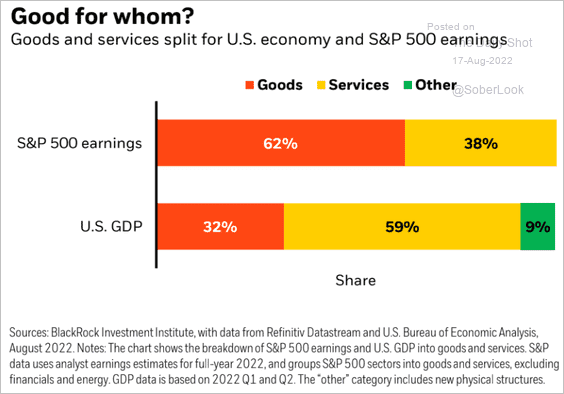

• Households have been shifting spending from goods to services. What does that mean for corporate earnings?

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

——————–

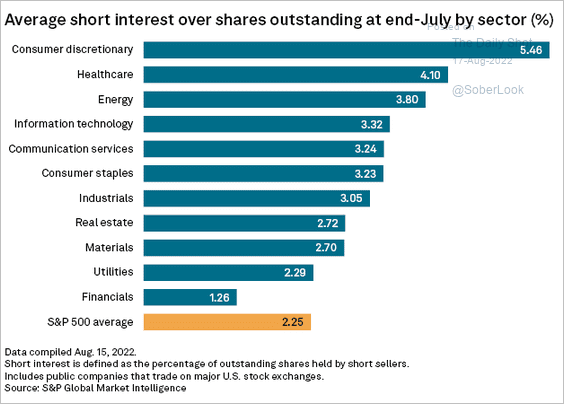

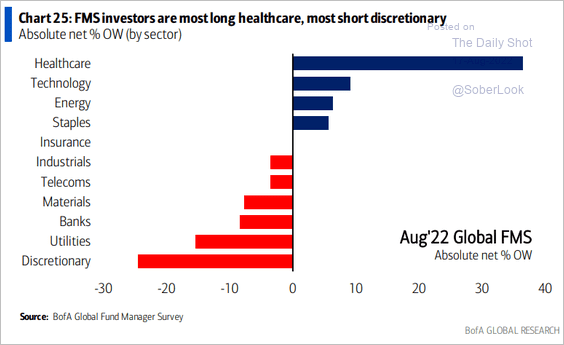

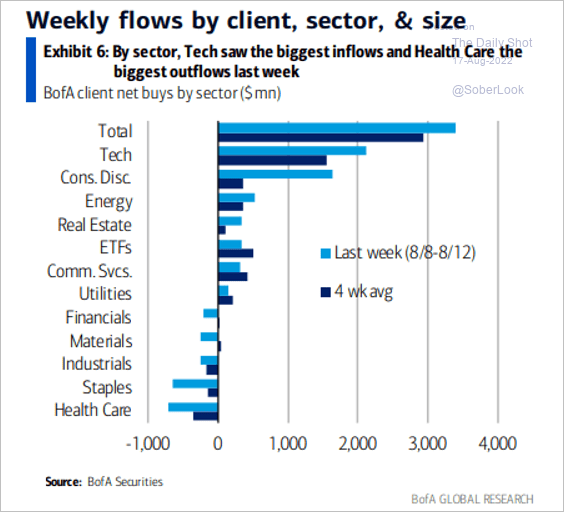

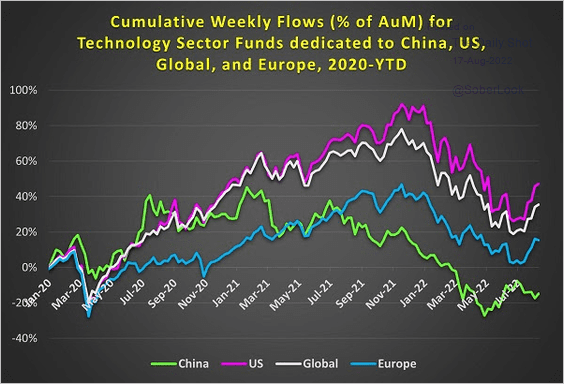

6. Next, we have some sector updates.

• Short interest by sector:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

• Fund managers’ sector positioning:

Source: BofA Global Research

Source: BofA Global Research

• BoA client flows:

Source: BofA Global Research

Source: BofA Global Research

• Tech fund flows globally:

Source: EPFR Global Navigator

Source: EPFR Global Navigator

——————–

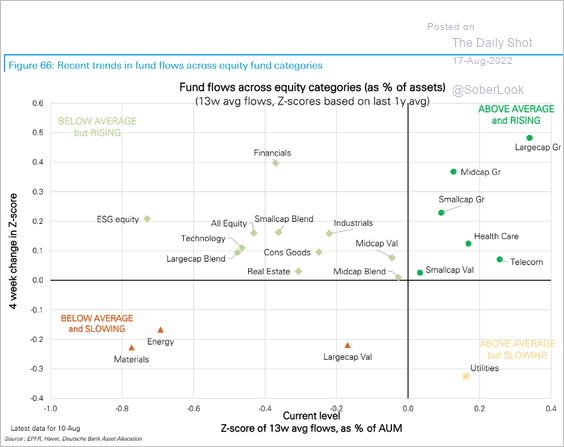

7. This scatterplot shows the recent trends in fund flows by category.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

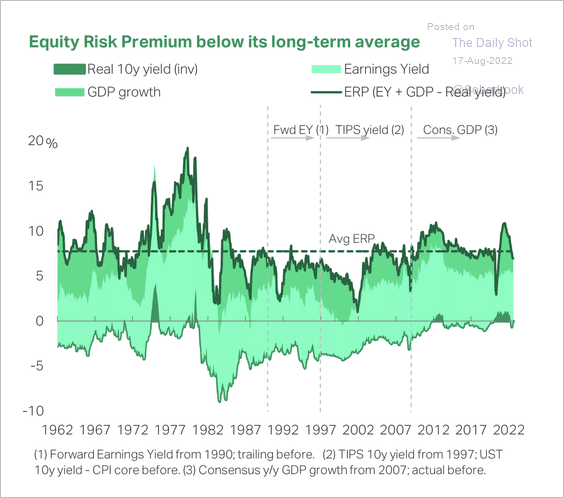

8. The equity risk premium has fallen to below-average levels for the first time since the onset of the pandemic …

Source: TS Lombard

Source: TS Lombard

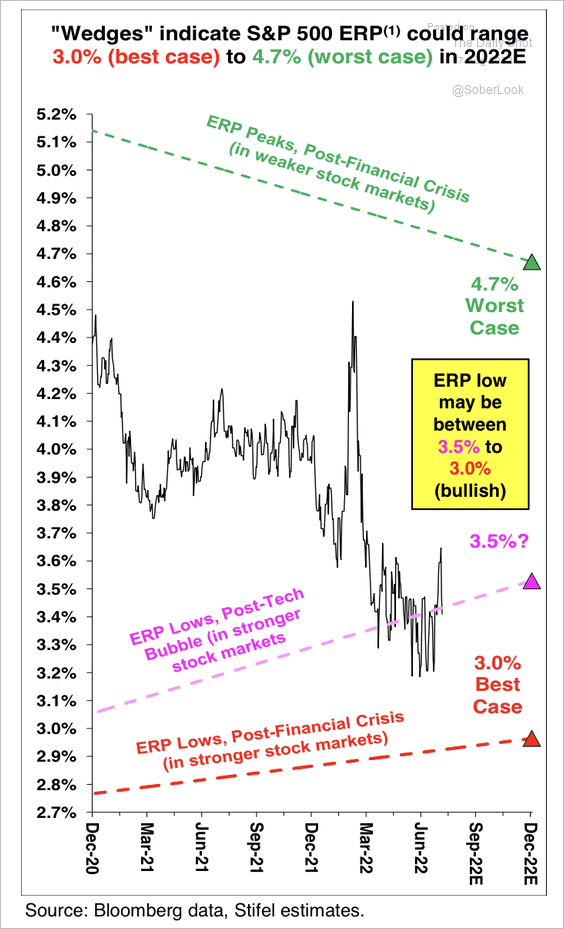

… and could have further room to fall.

Source: Stifel

Source: Stifel

——————–

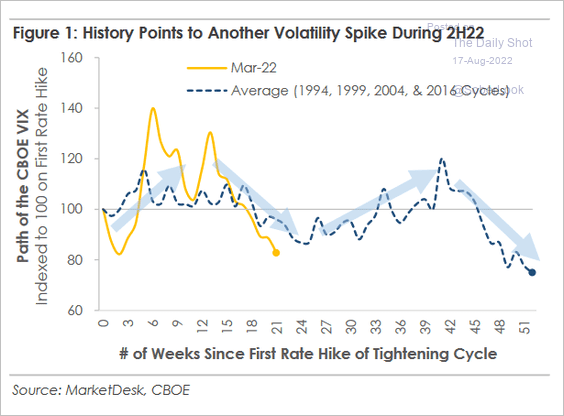

9. Another volatility spike on the way?

Source: MarketDesk Research

Source: MarketDesk Research

Back to Index

Credit

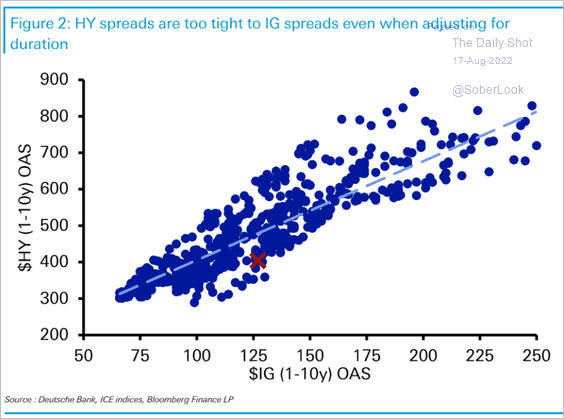

1. High-yield spreads are too tight relative to investment grade.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

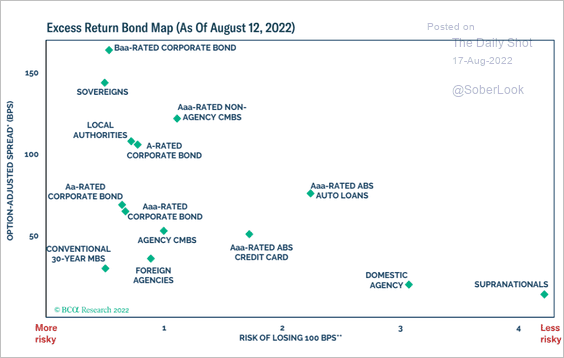

2. Here is the risk-return profile across credit asset classes. The y-axis is the return (spread), and the x-axis is a risk estimate.

Source: BCA Research

Source: BCA Research

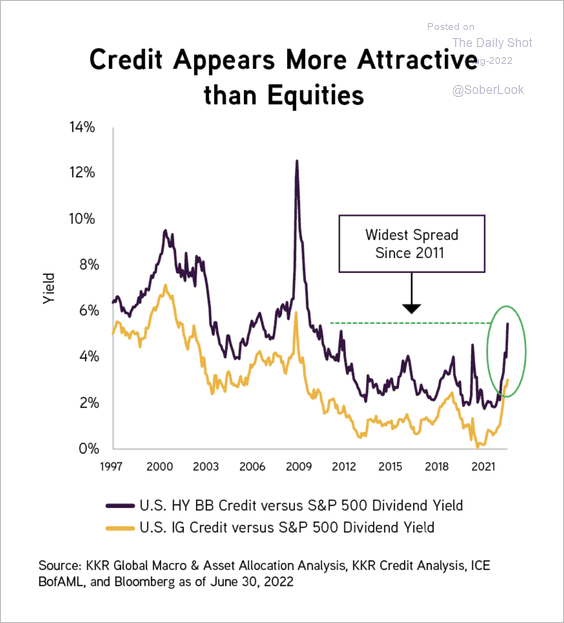

3. The spread between credit yields and the S&P 500 dividend yield is the widest since 2011.

Source: KKR Read full article

Source: KKR Read full article

Back to Index

Rates

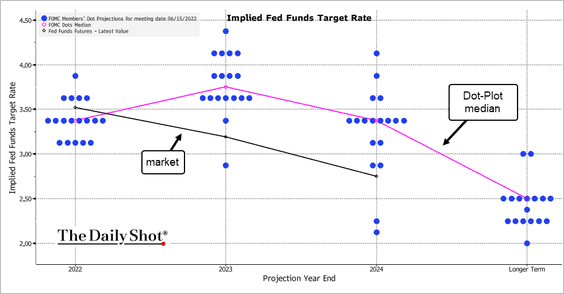

1. The market continues to bet against the Fed’s dot plot.

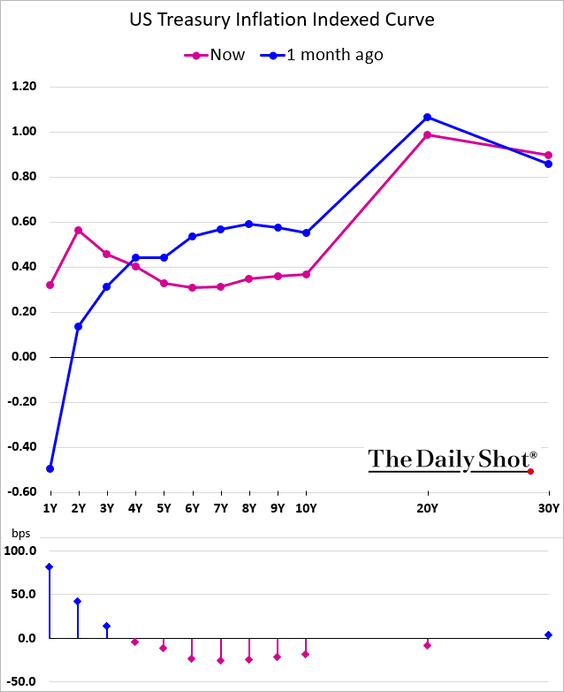

2. The TIPS curve (real yields) is now inverted.

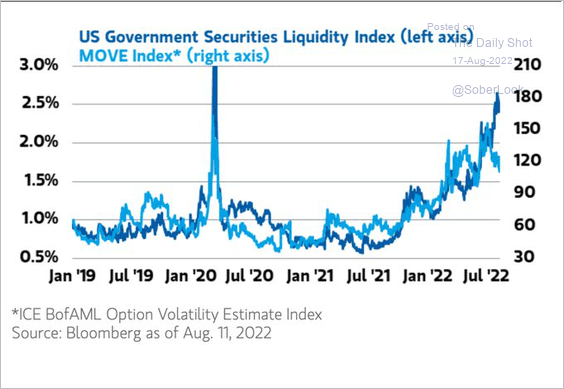

3. Treasury market liquidity has worsened (higher deviations from the fit along the curve) and could deteriorate further with QT.

Source: @acemaxx, @MorganStanley

Source: @acemaxx, @MorganStanley

Back to Index

Global Developments

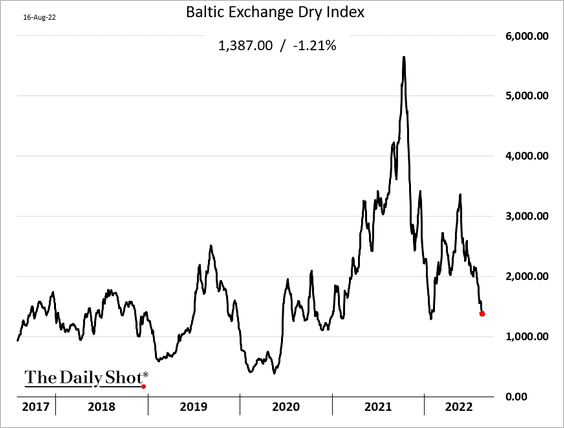

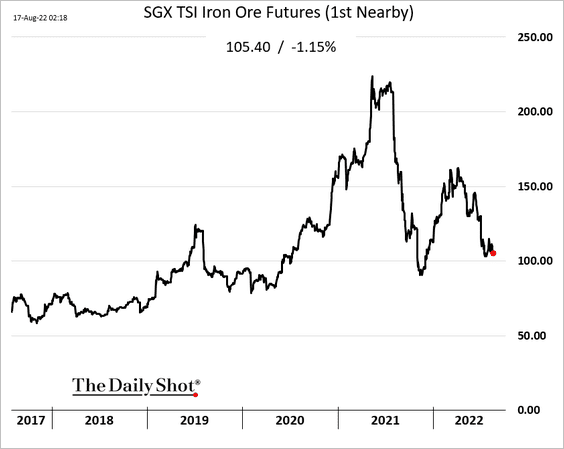

1. Dry bulk shipping prices are nearing January lows, …

… driven in part by weakness in iron ore prices (softer demand for steel in China).

——————–

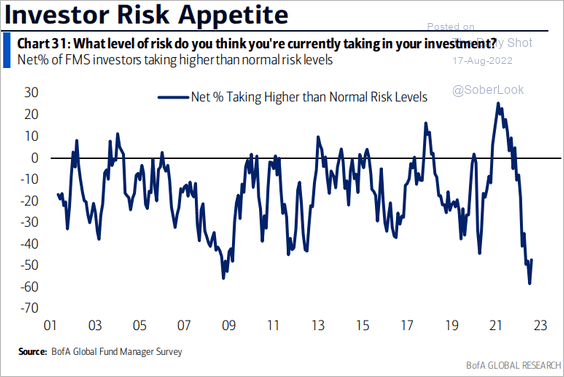

2. Fund managers remain risk averse.

Source: BofA Global Research

Source: BofA Global Research

——————–

Food for Thought

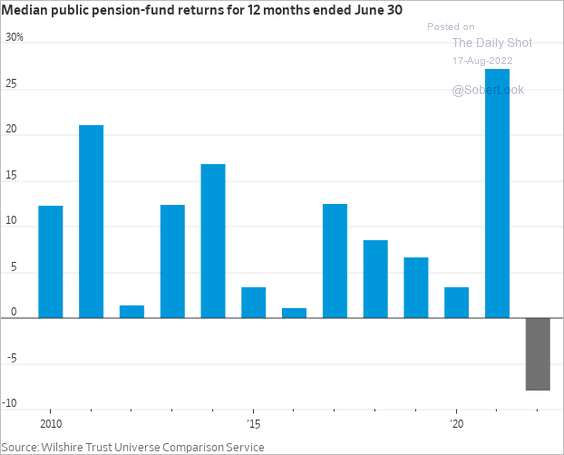

1. Public pension-fund returns:

Source: @WSJ Read full article

Source: @WSJ Read full article

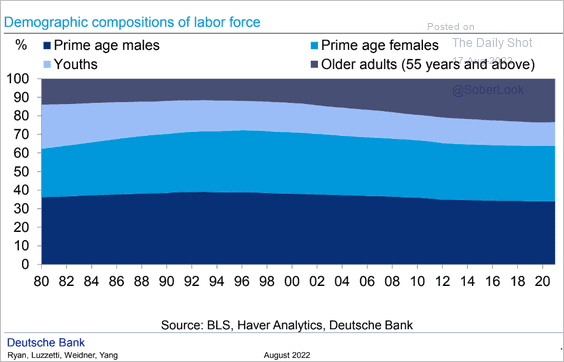

2. The demographic composition of the US labor force:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

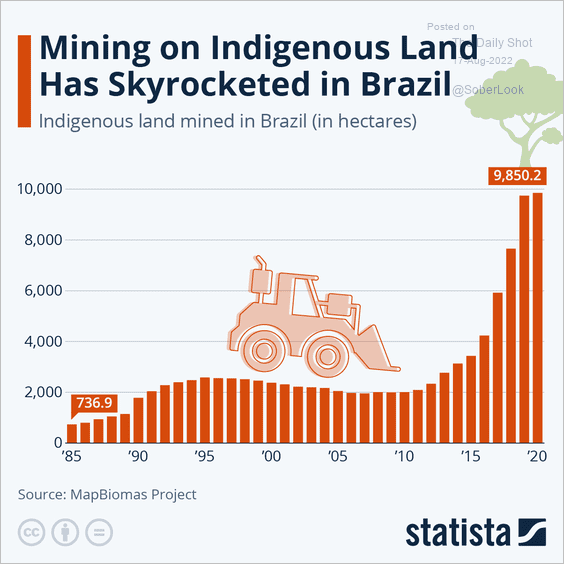

3. Indigenous land mining in Brazil:

Source: Statista

Source: Statista

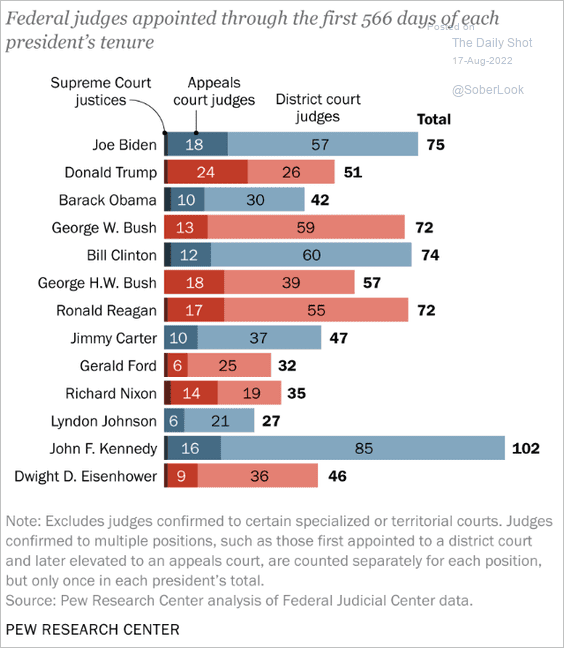

4. Federal judges appointed in the first 566 days of each president’s tenure:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

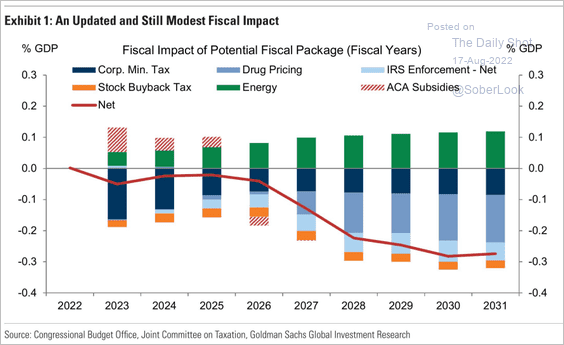

5. The “Inflation Reduction Act” – impact on the federal deficit:

Source: Goldman Sachs, @ayeshatariq, h/t @pav_chartbook

Source: Goldman Sachs, @ayeshatariq, h/t @pav_chartbook

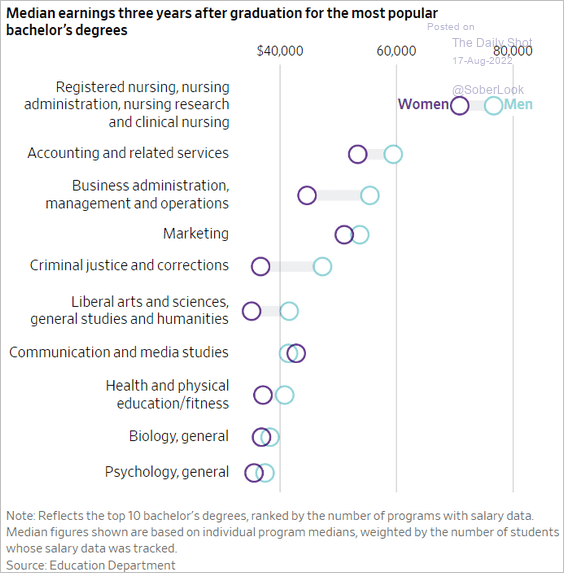

6. Median earnings three years after college graduation:

Source: @WSJ Read full article

Source: @WSJ Read full article

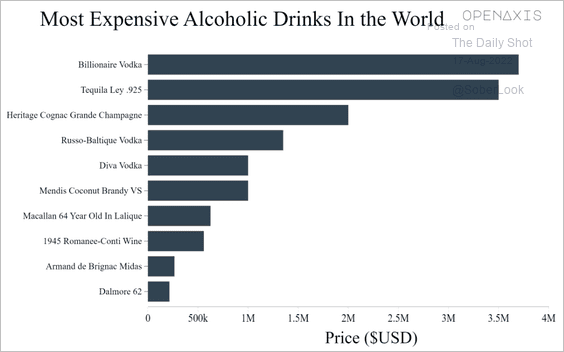

7. Most expensive alcoholic drinks in the world:

Source: OpenAxis

Source: OpenAxis

——————–

Back to Index