The Daily Shot: 24-Jun-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• China

• India

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

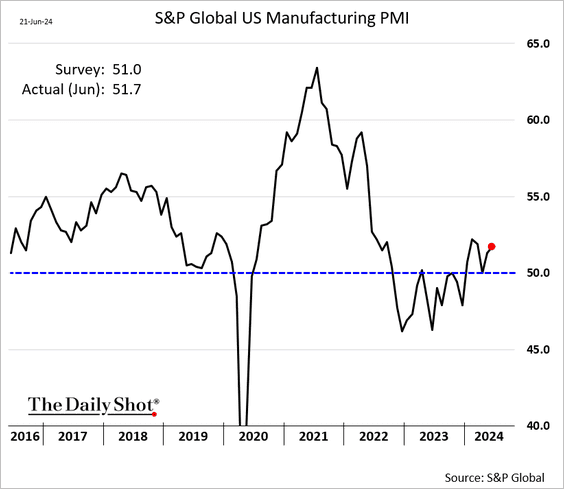

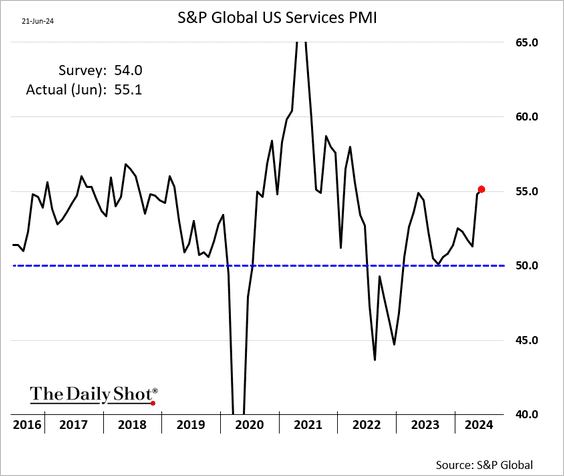

1. US business activity strengthened this month, according to the PMI report from S&P Global.

– Manufacturing:

– Services:

Source: MarketWatch Read full article

Source: MarketWatch Read full article

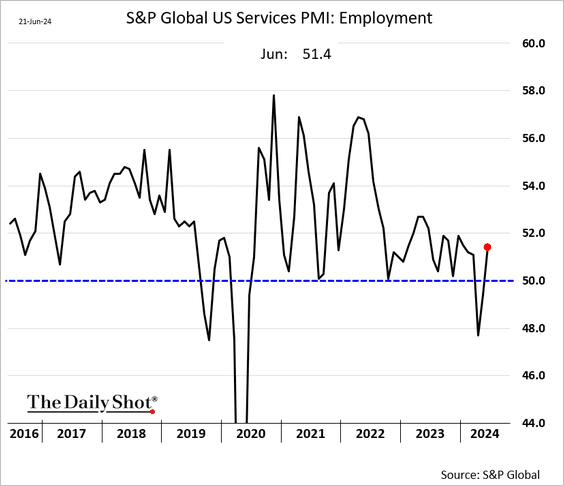

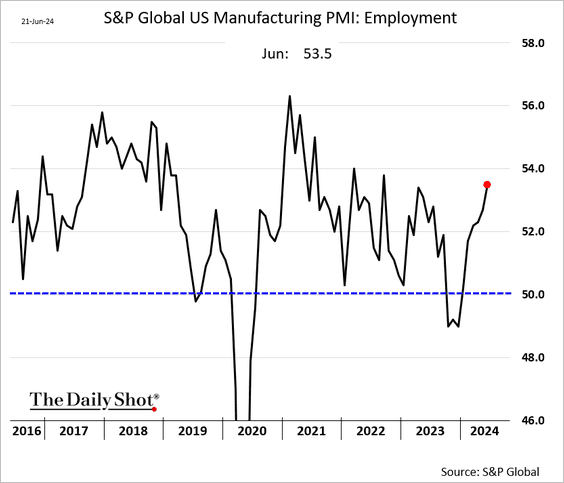

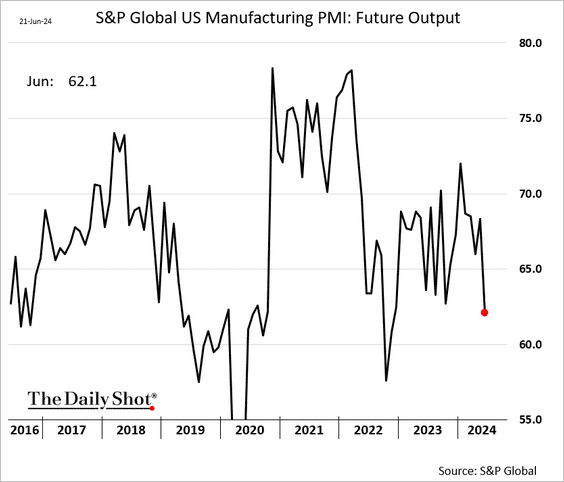

• Factories have increased their hiring.

However, manufacturers’ outlook softened in June.

——————–

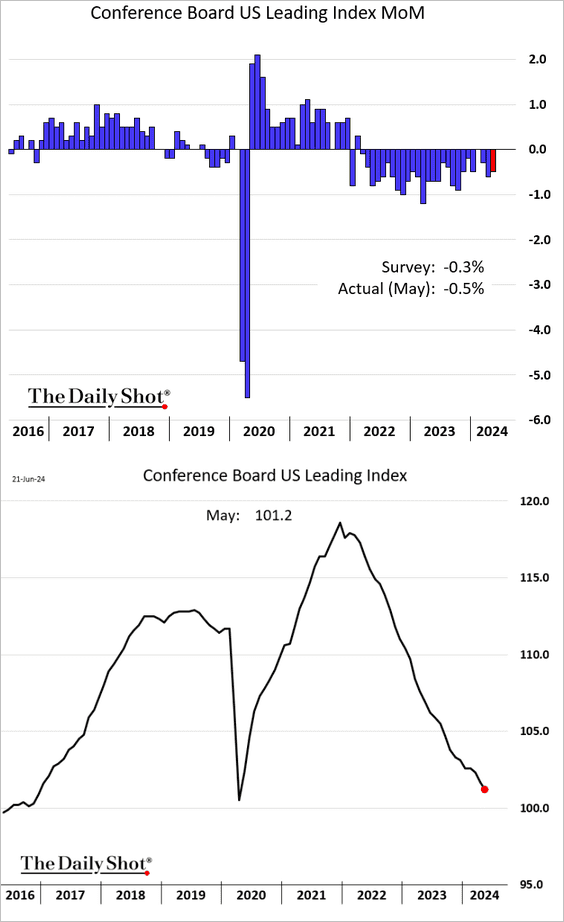

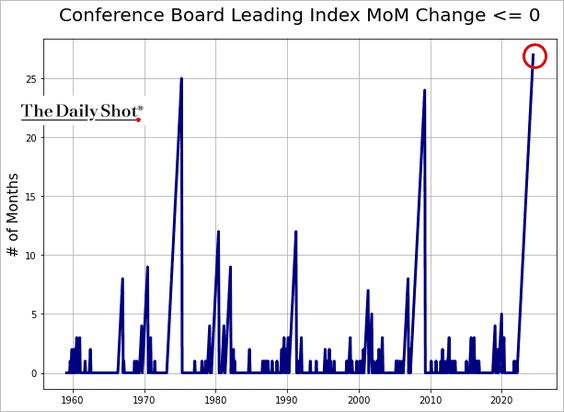

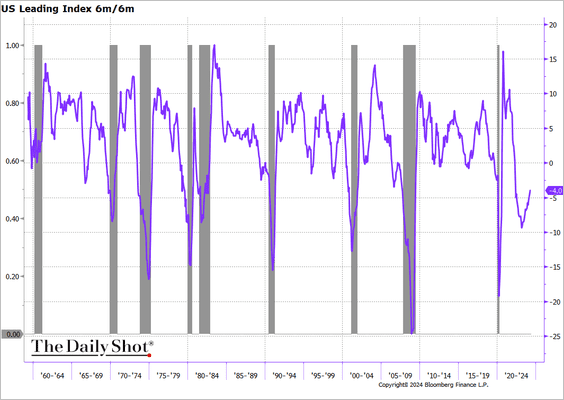

2. The Conference Board’s leading index declined again in May.

• This indicator has not seen an increase in 27 months, a new record.

• The six-month changes in the index continue to signal a recession.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

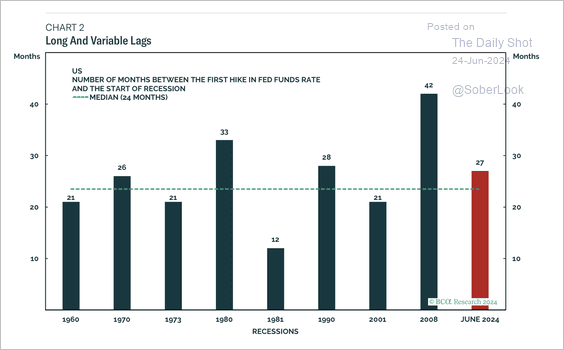

3. On average, it has taken about two years for a recession to begin following the start of a Fed hiking cycle.

Source: BCA Research

Source: BCA Research

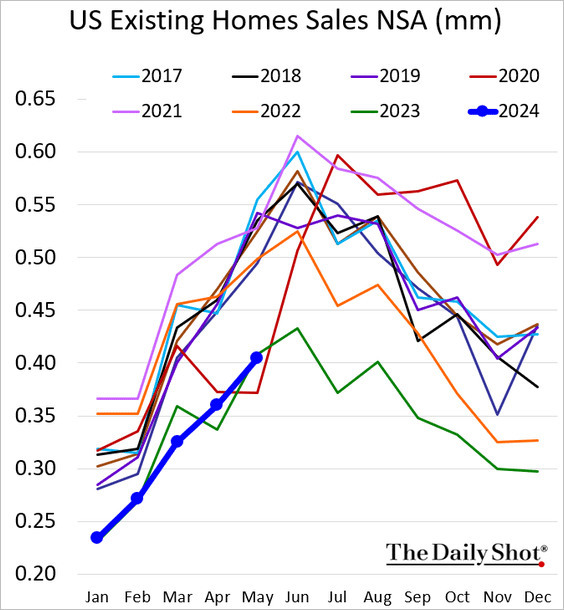

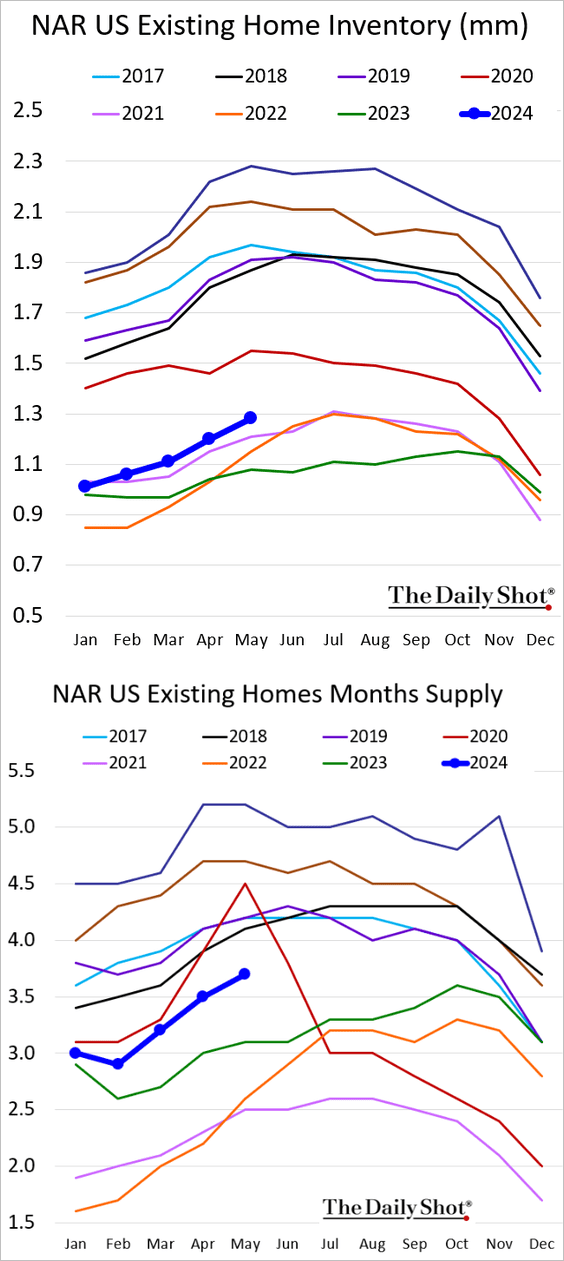

4. Existing home sales held at 2023 levels in May.

Source: Reuters Read full article

Source: Reuters Read full article

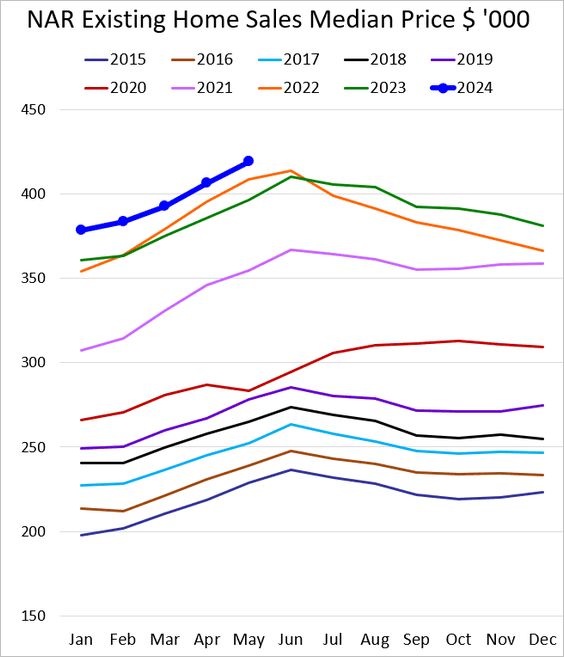

• Sale prices remain at record highs.

• Inventories of homes for sale continue to trend higher.

——————–

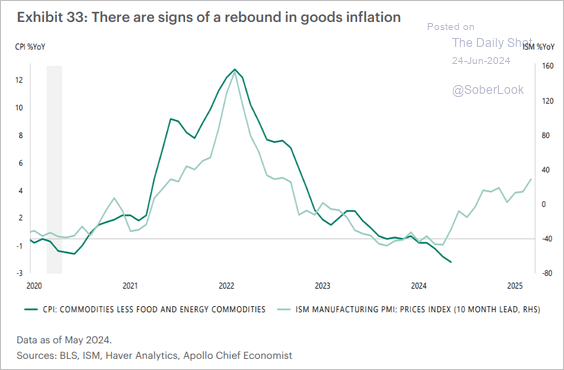

5. Is goods deflation about to end?

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

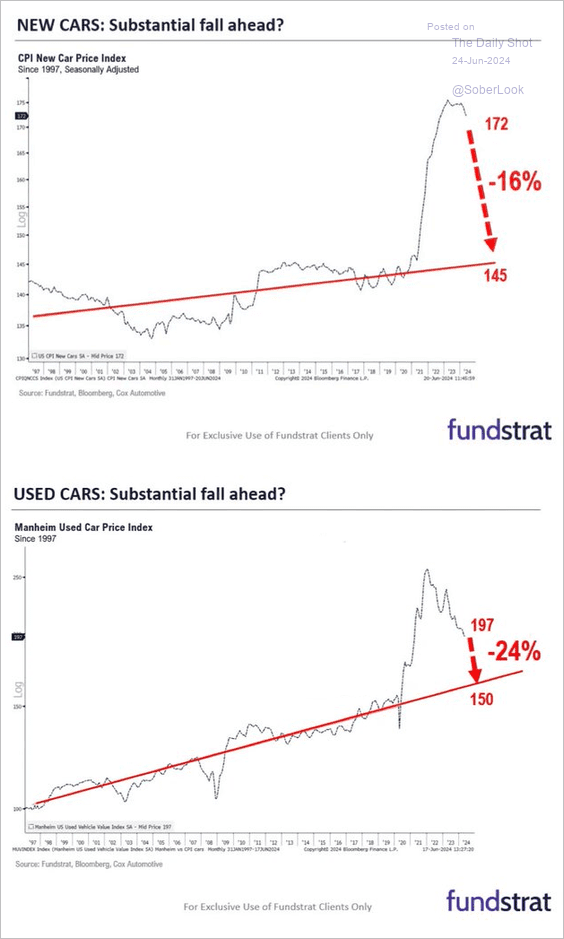

• Should we expect sharp declines in car prices ahead?

Source: @fundstrat; @carlquintanilla

Source: @fundstrat; @carlquintanilla

Back to Index

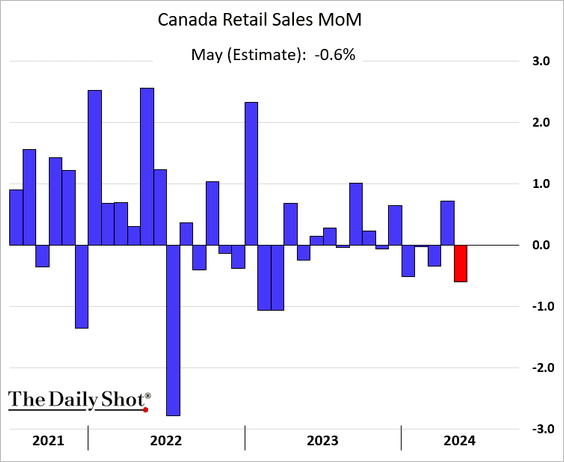

Canada

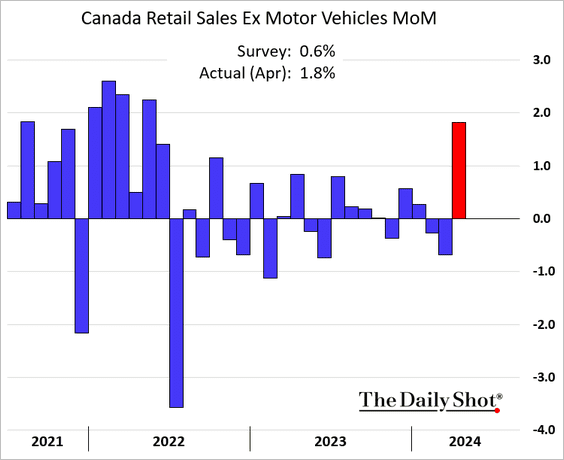

1. Retail sales jumped in April, …

… but estimates point to a pullback in May.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

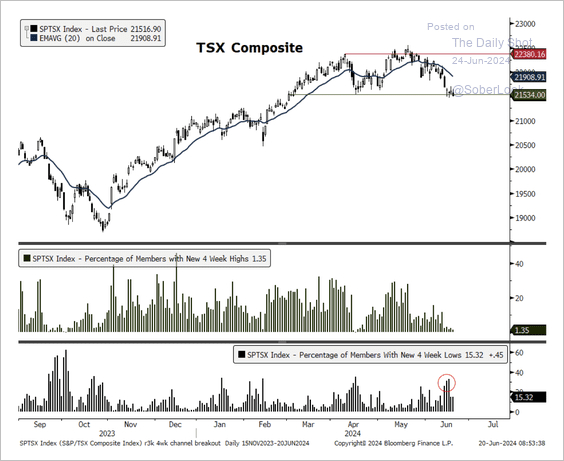

2. The TSX Composite is confined to a tight trading range with weak breadth.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Back to Index

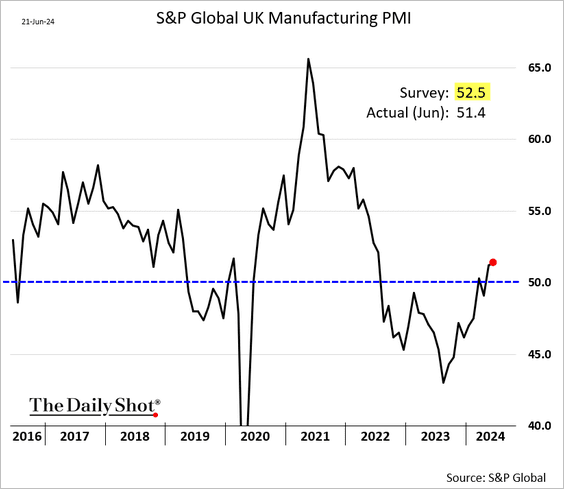

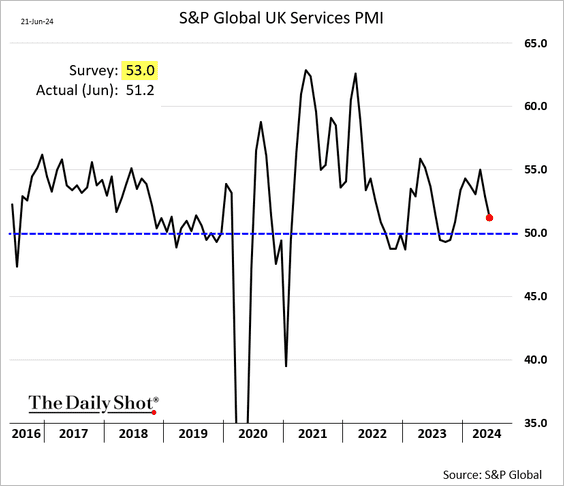

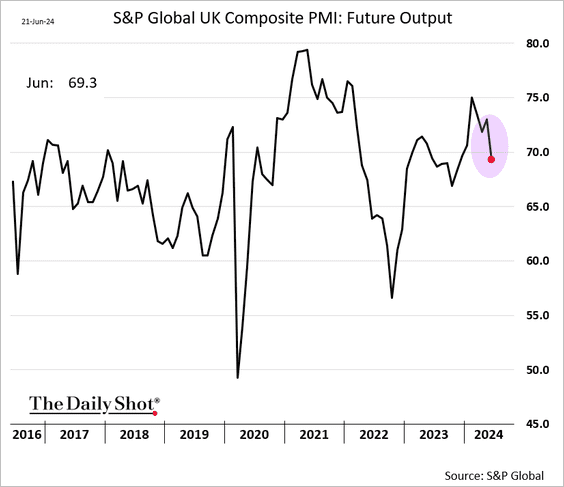

The United Kingdom

1. UK manufacturing PMI was softer than expected this month but held in growth territory.

• Services growth decelerated sharply ahead of the elections.

• Business outlook softened.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

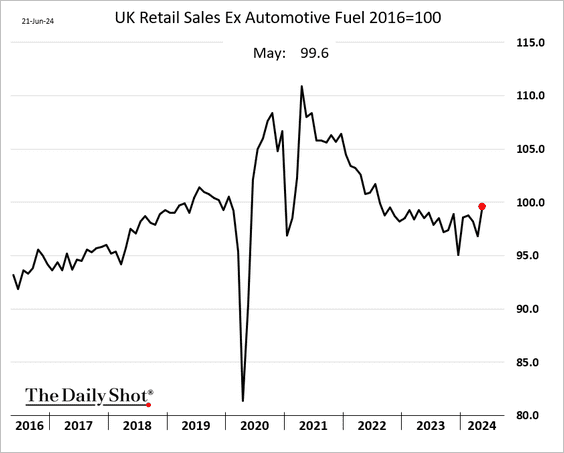

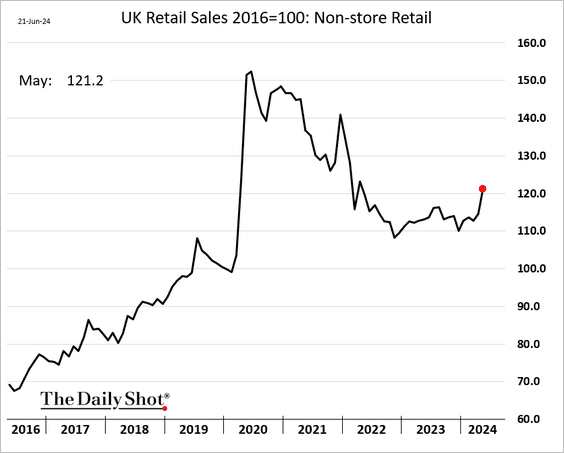

2. UK retail sales surged in May, …

… boosted by an increase in online purchases.

——————–

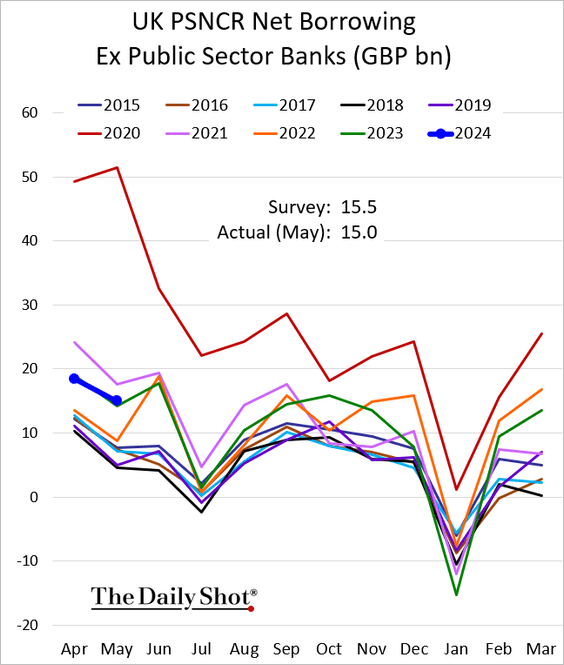

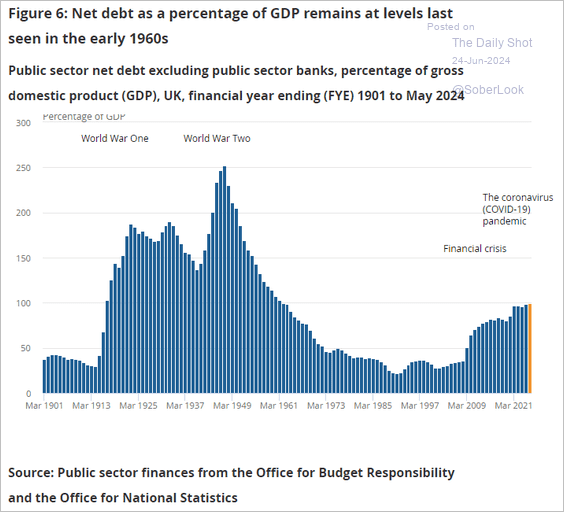

3. Government borrowing was roughly in line with 2023 levels.

• The debt-to-GDP ratio hit a multi-decade high.

Source: ONS

Source: ONS

Source: Reuters Read full article

Source: Reuters Read full article

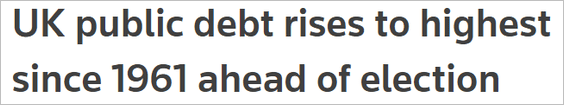

Here is the evolution of the government’s balance sheet.

Source: ONS

Source: ONS

Back to Index

The Eurozone

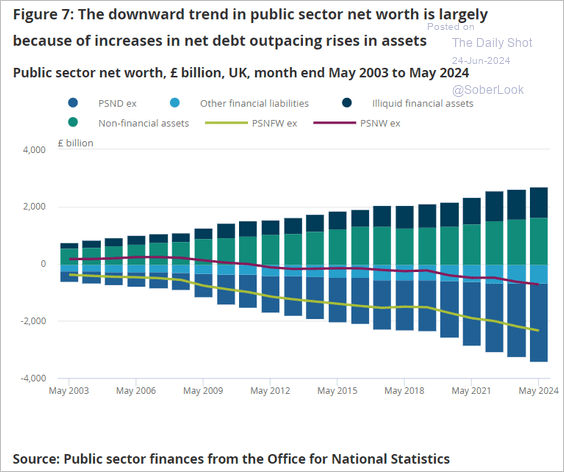

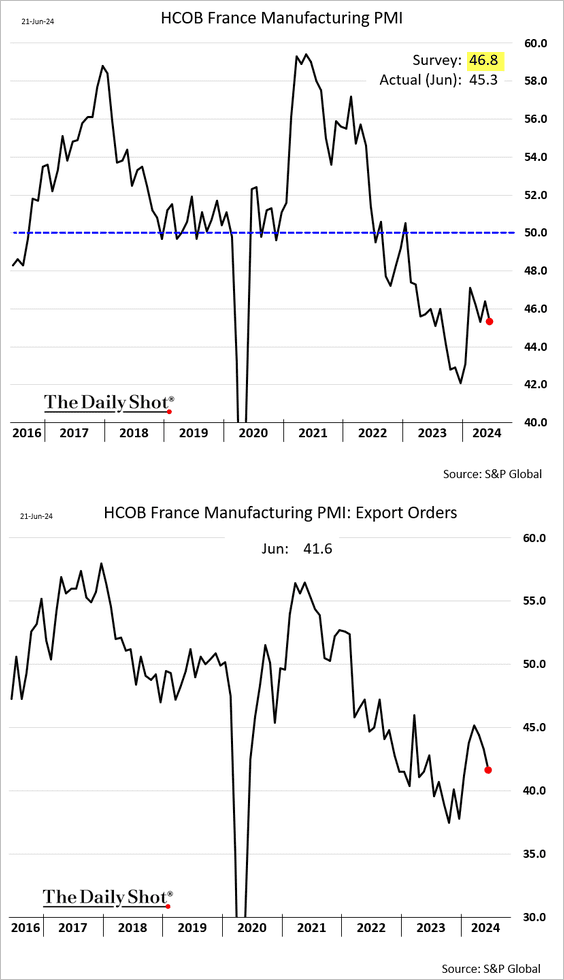

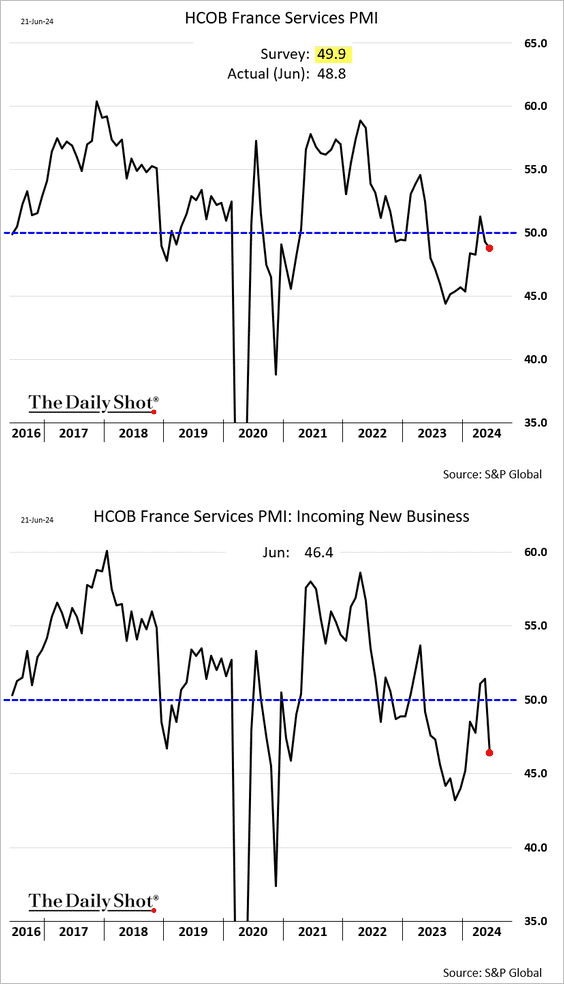

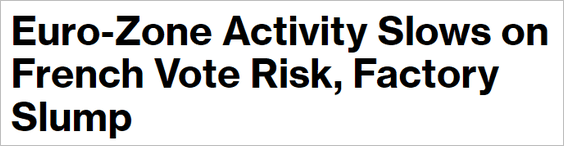

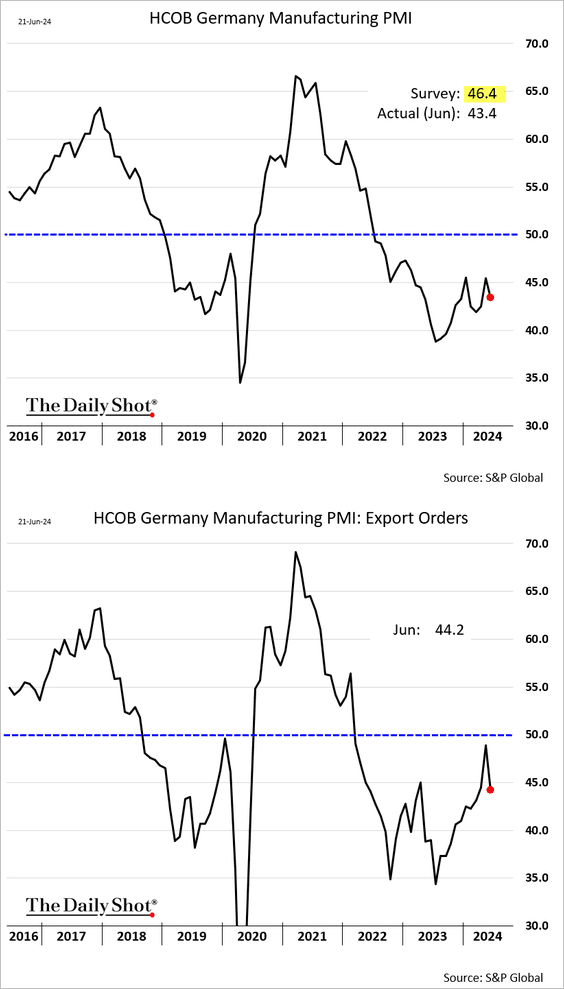

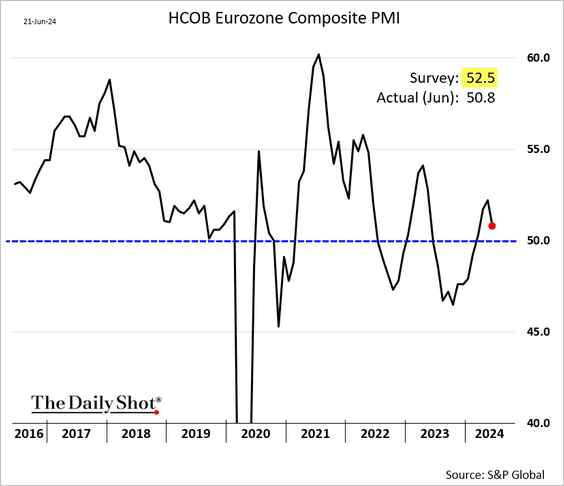

1. The recovery in business activity experienced a setback ahead of the French elections, as PMI figures came in below expectations.

• France:

– Manufacturing:

– Services:

Source: @economics Read full article

Source: @economics Read full article

• Germany:

– Manufacturing:

– Services (stronger than expected):

• The Eurozone (slower growth):

——————–

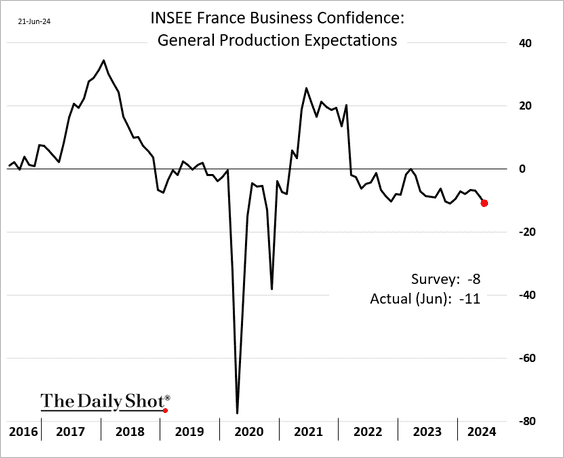

2. French production expectations have been declining.

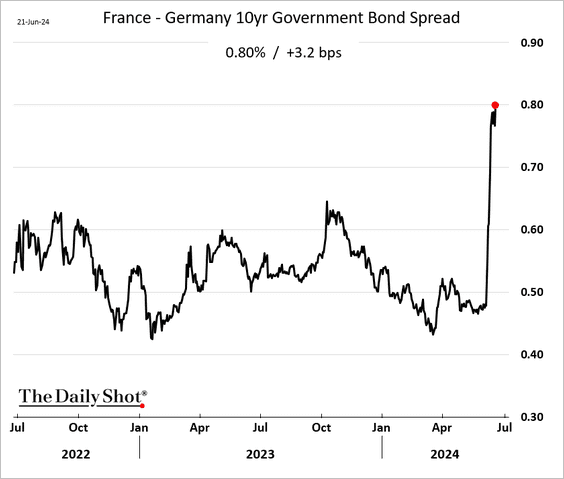

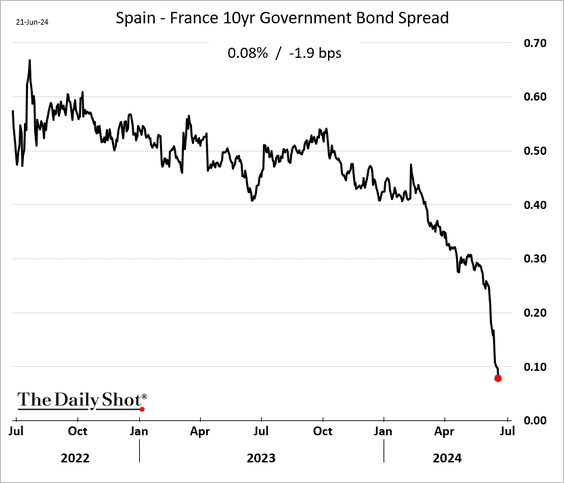

3. French assets remain under pressure as investors grow increasingly uneasy about the upcoming elections.

– France-Germany 10-year bond spread:

– Spain-France 10-year bond spread:

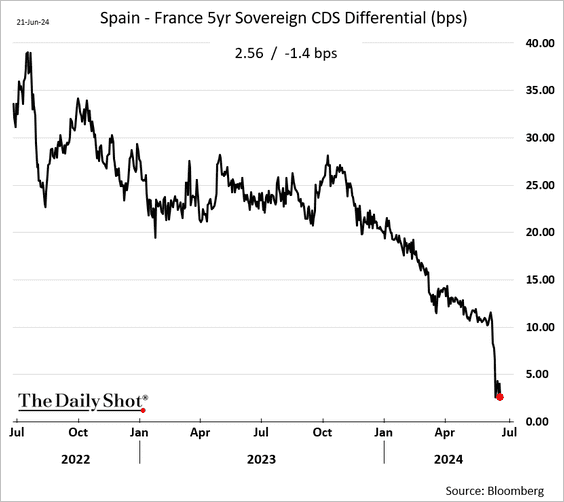

– Spain-France sovereign CDS spread differential:

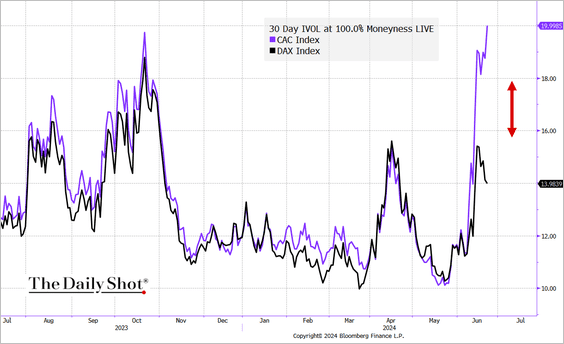

– France vs. Germany equity implied volatility:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

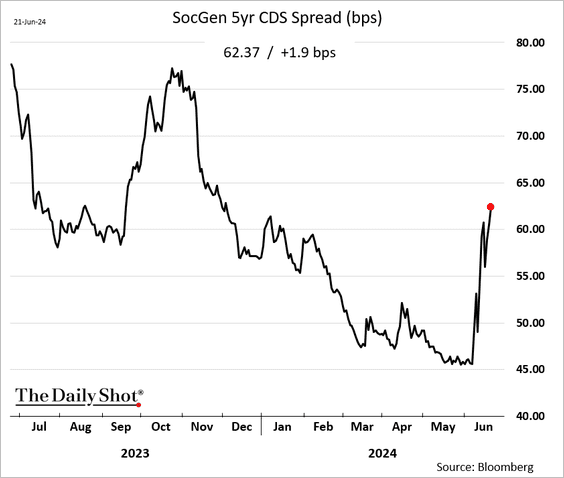

– French banks have seen their CDS spreads widen.

——————–

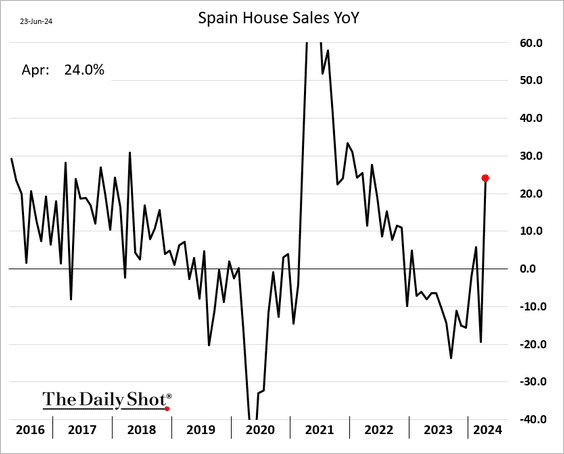

4. Spain’s house sales rebounded in April.

Back to Index

Japan

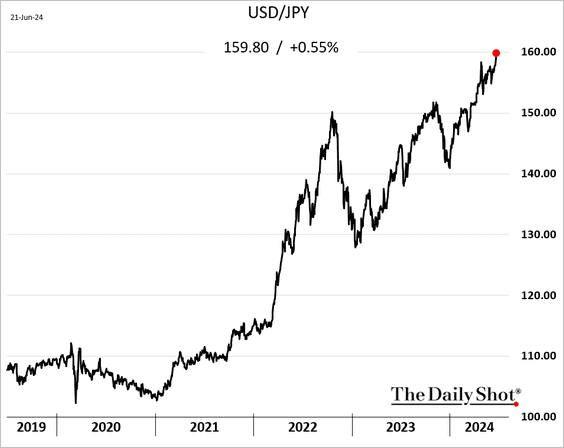

1. Dollar-yen is trading near 160. Will the authorities intervene in the currency markets again?

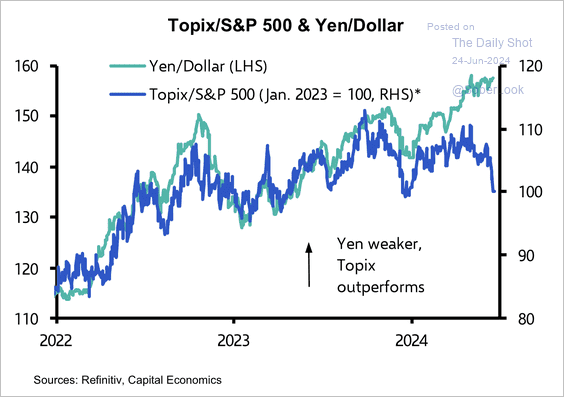

2. The TOPIX Index has underperformed the S&P 500 despite the usual boost from a weak yen.

Source: Capital Economics

Source: Capital Economics

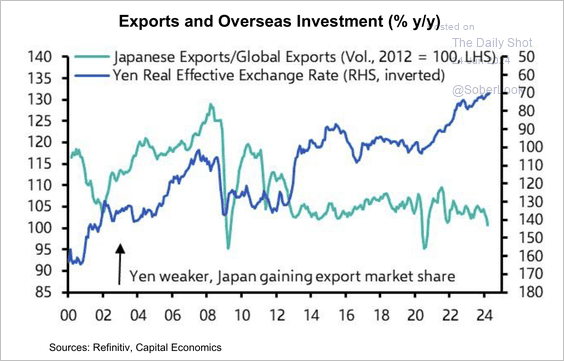

3. Export volumes have declined recently despite the large depreciation of the yen in recent years.

Source: Capital Economics

Source: Capital Economics

Back to Index

China

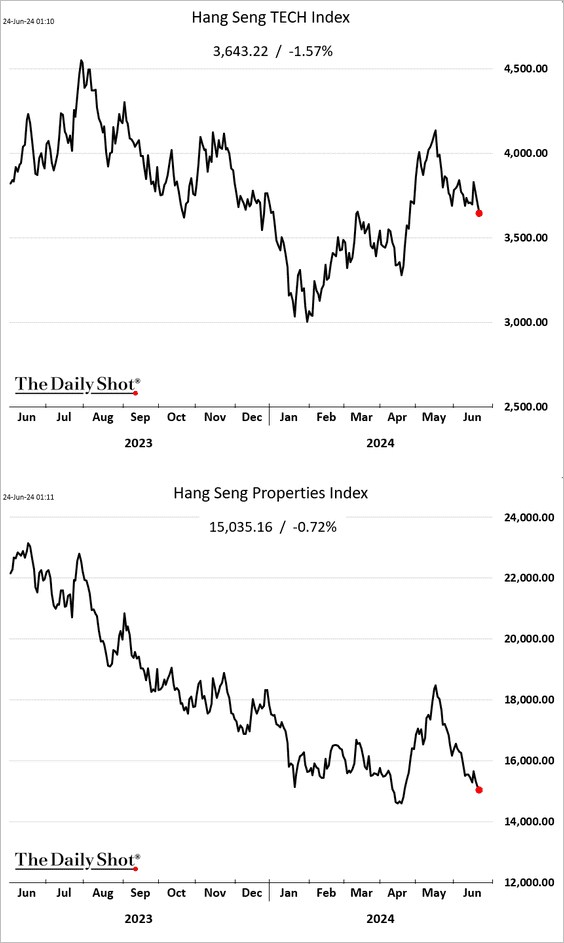

1. Hong Kong-listed shares have been reversing recent gains.

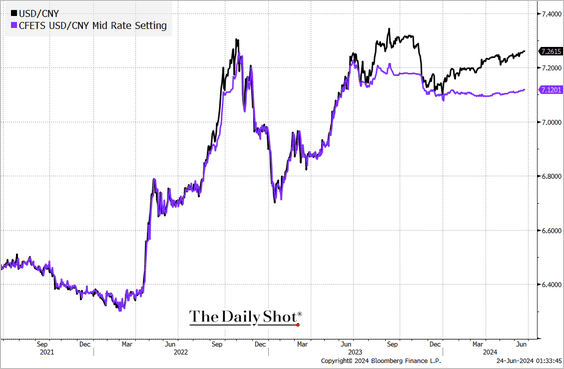

2. The renminbi continues to trade weaker than Beijing’s midpoint rate setting.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

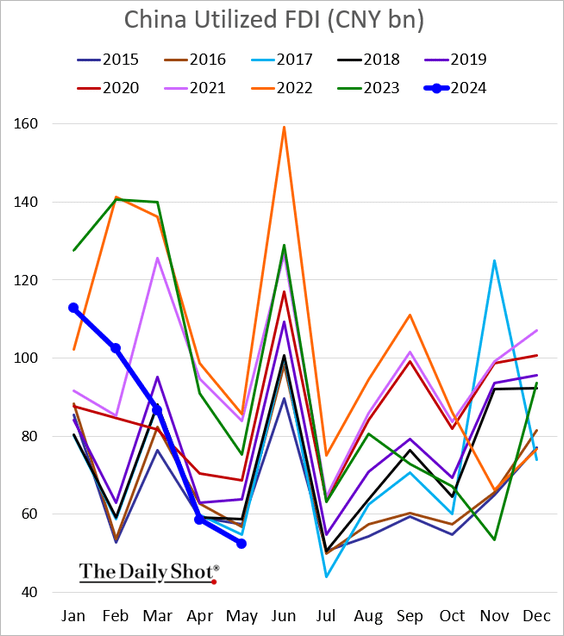

3. Utilized foreign direct investment hit a multi-year low.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

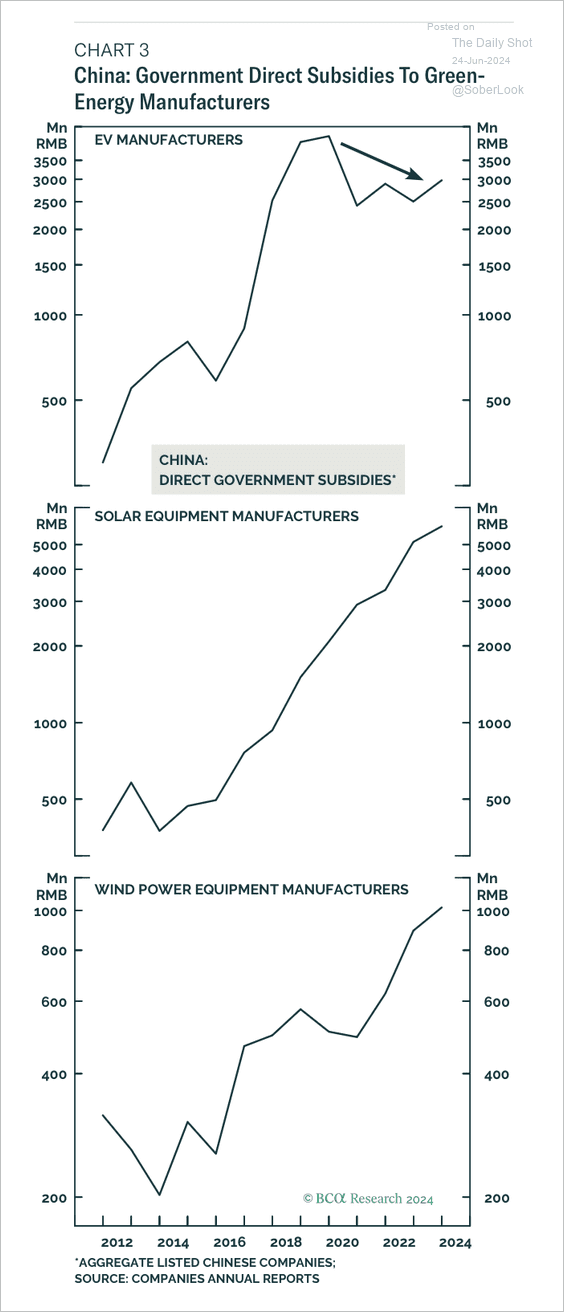

4. Government support for clean energy sectors, such as solar and wind, has continued to rise, possibly crowding out private bank loans.

Source: BCA Research

Source: BCA Research

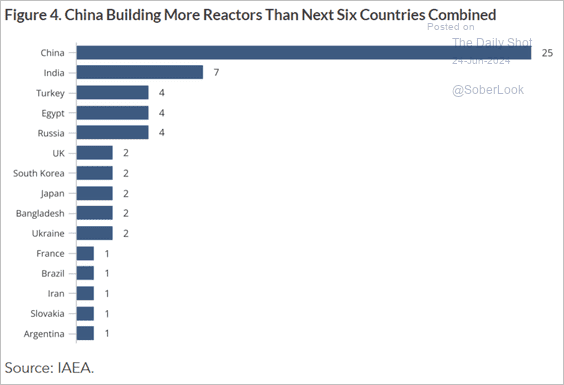

5. China is leading in nuclear reactor construction, outpacing the combined total of the next six countries.

Source: MacroPolo Read full article

Source: MacroPolo Read full article

Back to Index

India

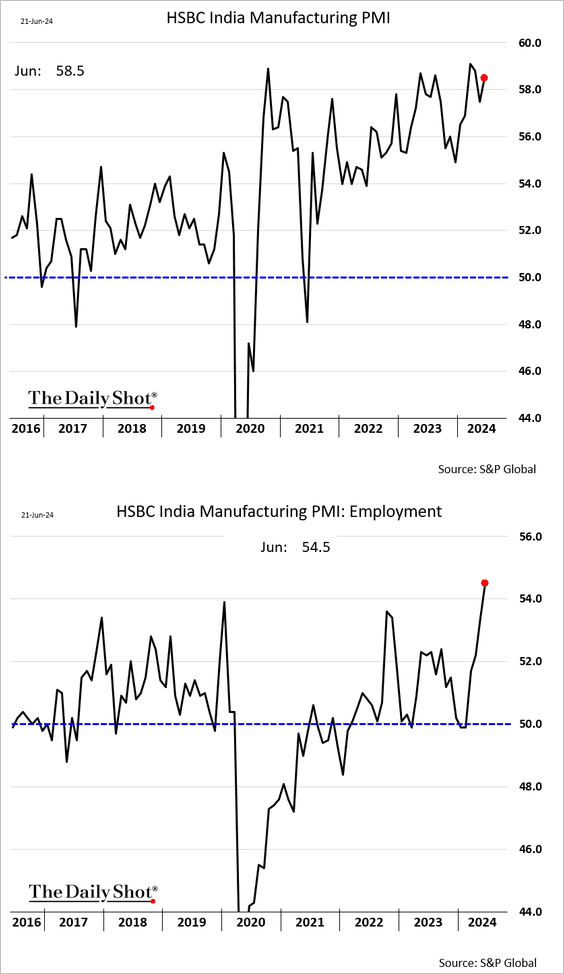

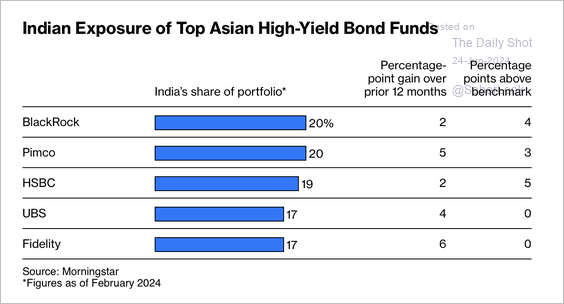

1. The PMI reports continue to show exceptionally robust business growth.

– Manufacturing:

– Services:

——————–

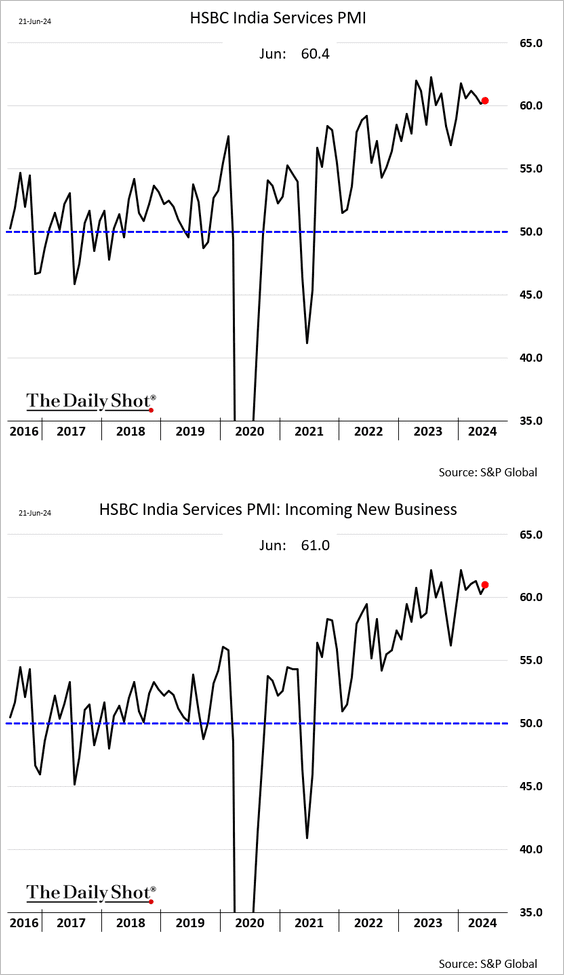

2. Economists keep boosting their projections for India’s GDP growth.

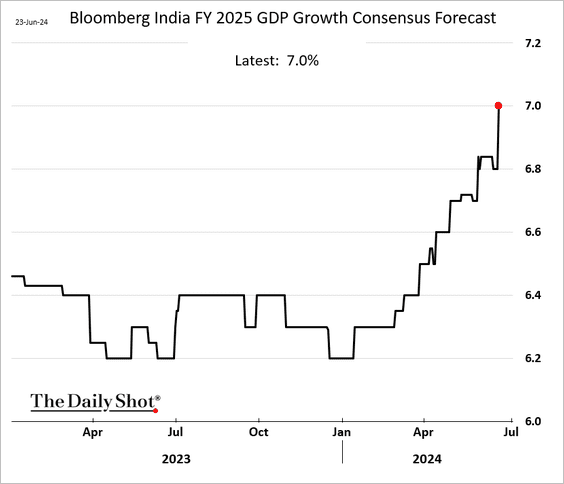

3. Exposure to Indian sovereign bonds has increased among Asian high-yield bond funds.

Source: @BW Read full article

Source: @BW Read full article

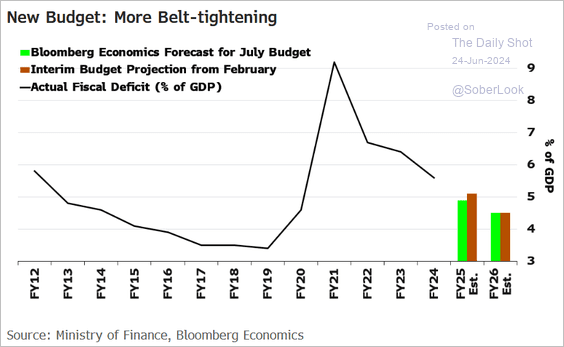

4. Fiscal tightening could be a headwind for economic growth.

Source: Abhishek Gupta; @TheTerminal, Bloomberg Finance L.P. Read full article

Source: Abhishek Gupta; @TheTerminal, Bloomberg Finance L.P. Read full article

Back to Index

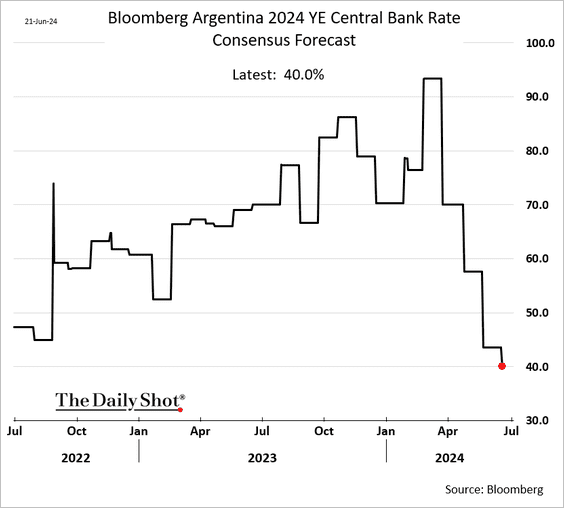

Emerging Markets

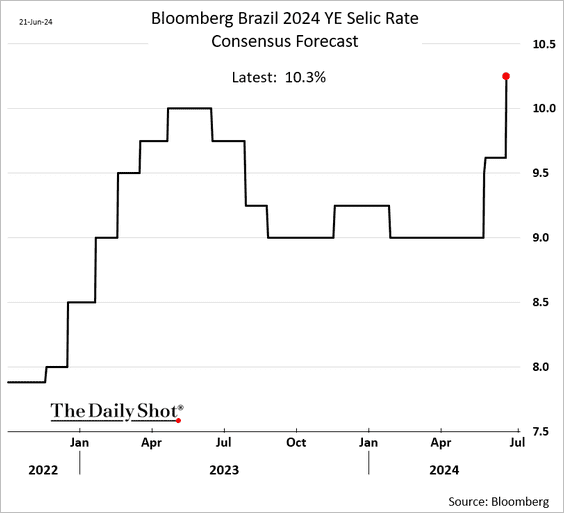

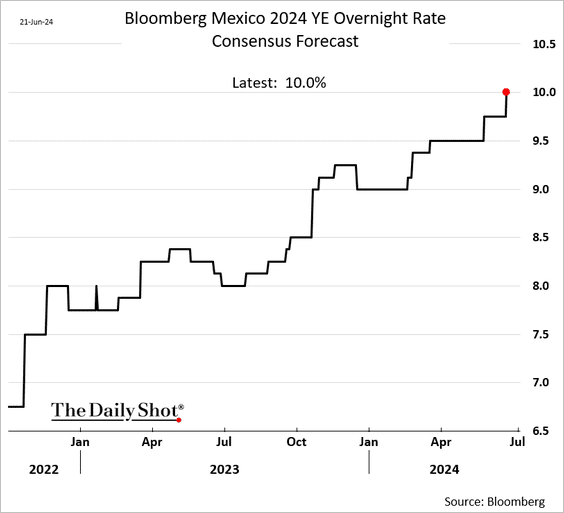

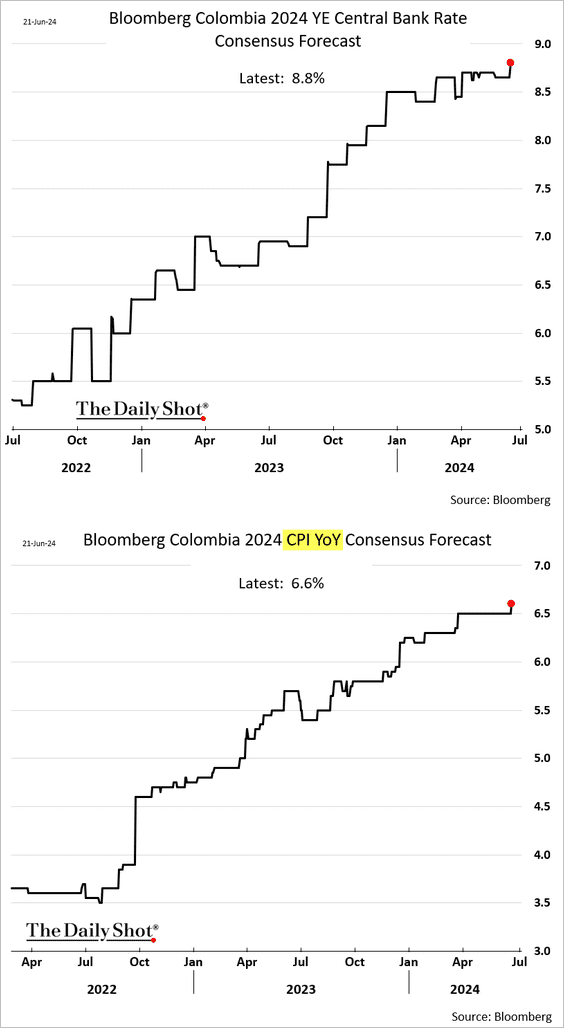

1. Economists increasingly see LatAm central banks keeping rates “higher for longer.”

– Brazil:

– Mexico:

– Colombia:

• Argentina is an exception due to its ongoing recession.

——————–

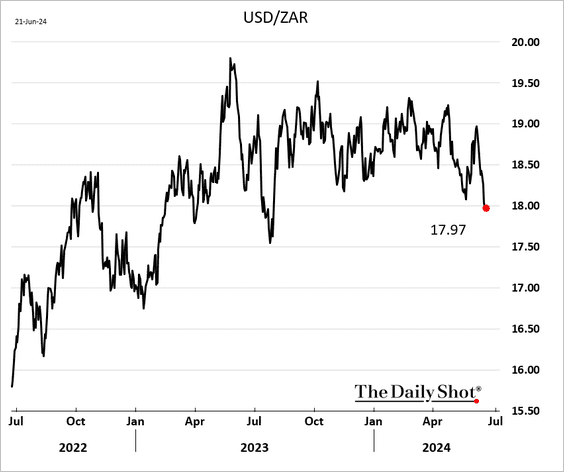

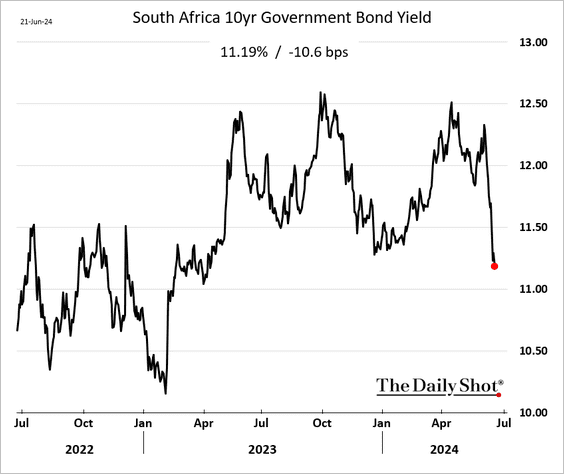

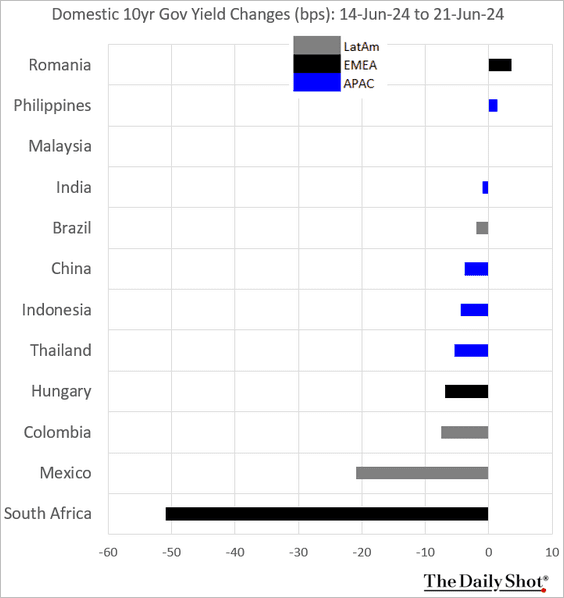

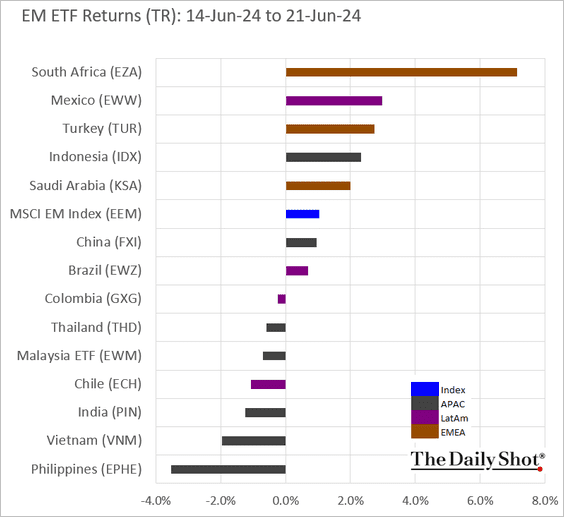

2. South Africa successfully formed a coalition after the ANC lost its majority, a development that was welcomed by the markets.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

• The rand strengthened.

• Bond yields declined sharply.

——————–

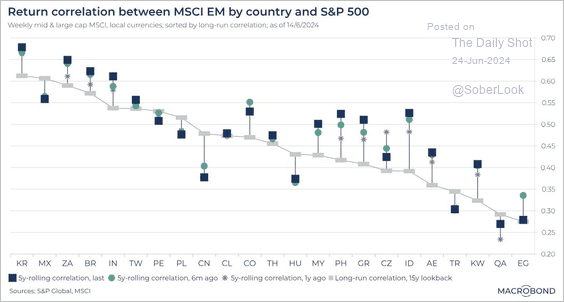

3. This chart shows the five-year rolling weekly return correlations between EM country equity indices and the S&P 500.

Source: Macrobond

Source: Macrobond

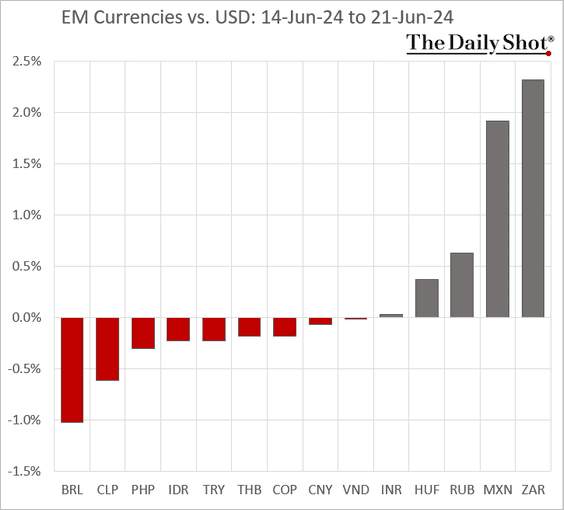

4. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

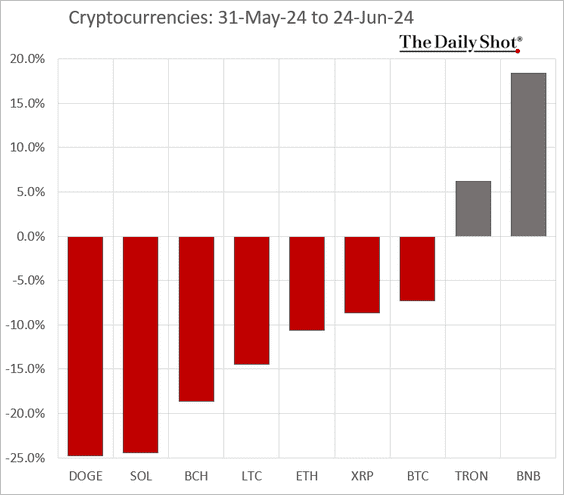

Cryptocurrency

1. June has been a challenging month for crypto assets.

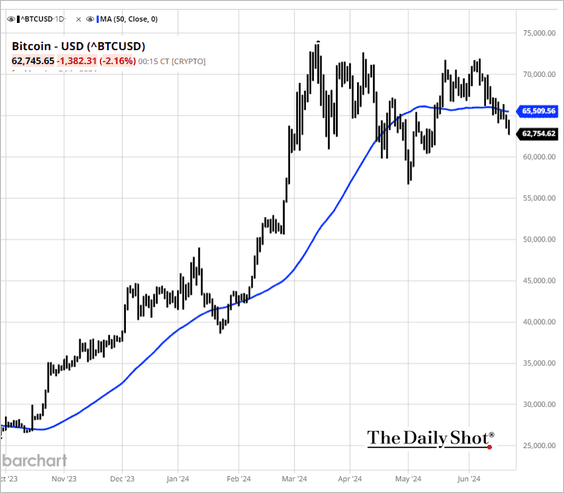

2. Bitcoin dropped below its 50-day moving average.

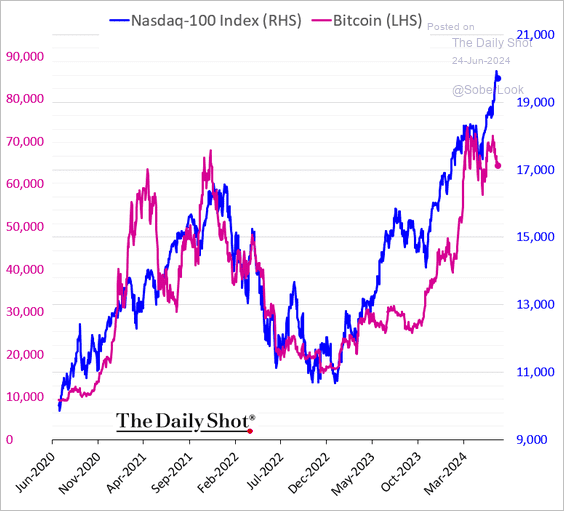

3. Bitcoin has not been keeping up with Nasdaq’s rapid gains.

h/t Stifel

h/t Stifel

Back to Index

Commodities

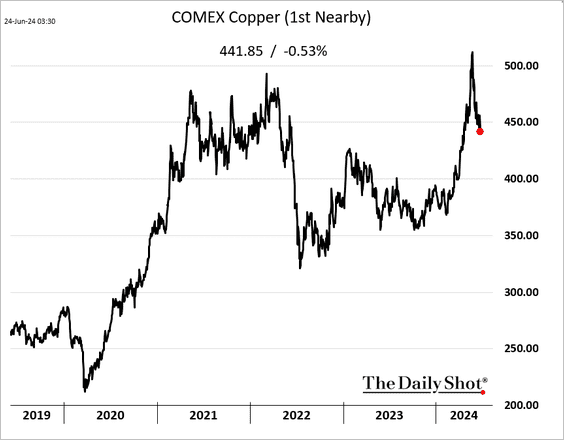

1. Copper futures continue to decline.

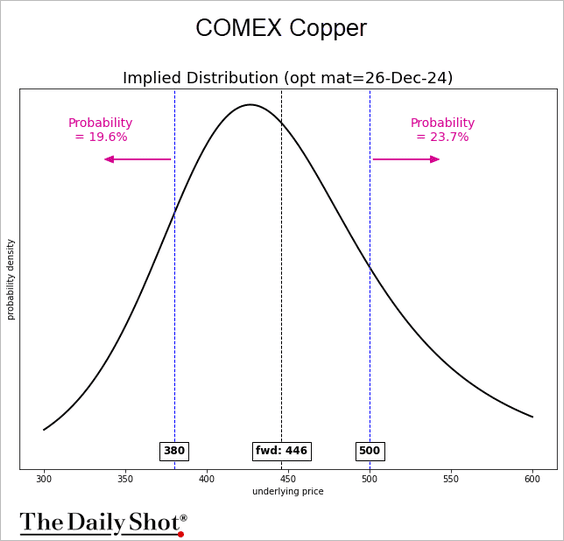

• The options market sees a 24% probability of copper price returning to $5 per pound by the end of the year.

——————–

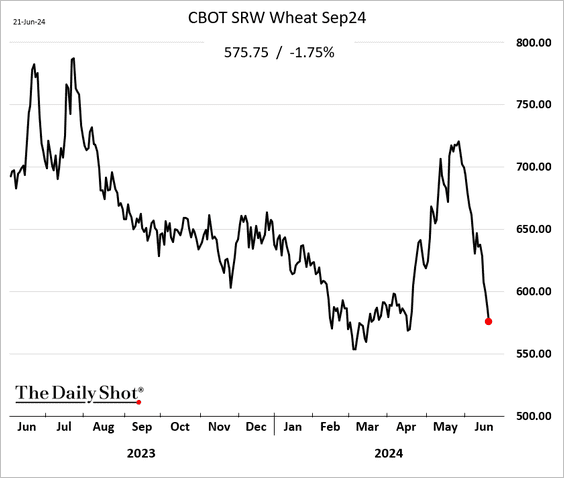

2. The selloff in wheat prices has been relentless.

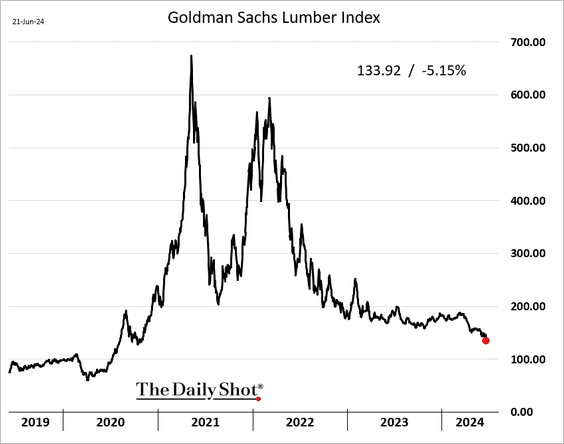

3. Lumber prices continue to sink amid a soft US housing market.

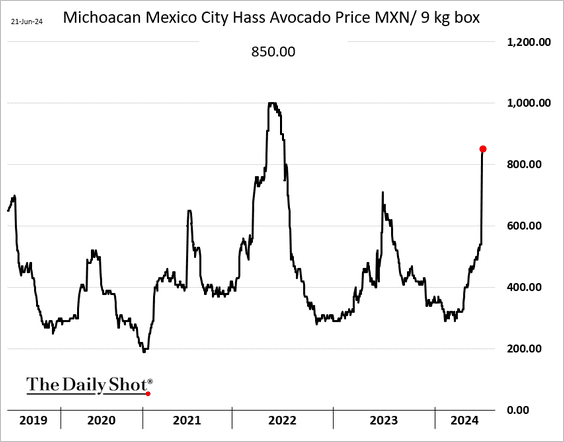

4. Avacado prices are surging again.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

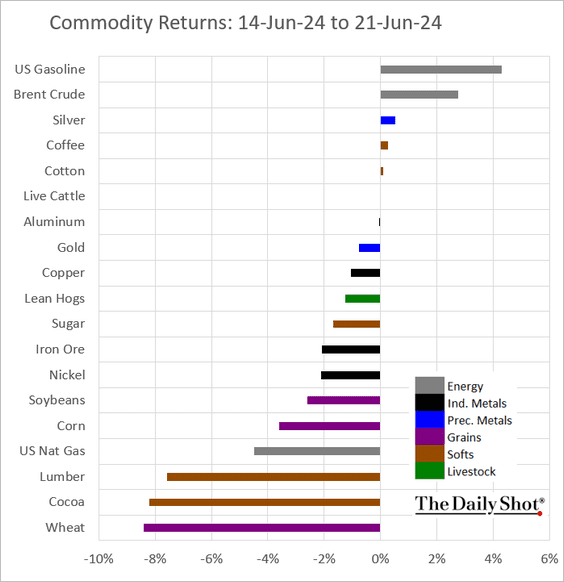

5. Here is last week’s performance data.

Back to Index

Equities

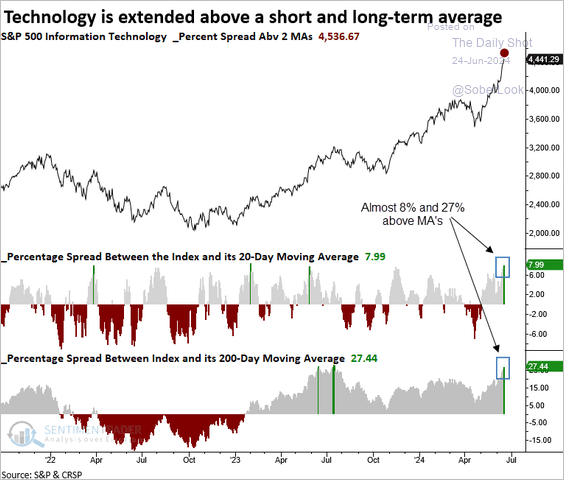

1. The rally in S&P 500 tech stocks appears extended.

Source: SentimenTrader

Source: SentimenTrader

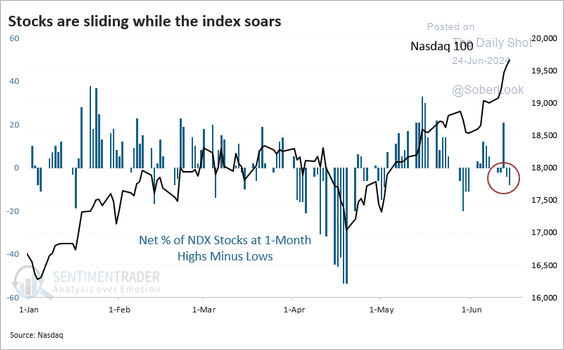

• More Nasdaq 100 stocks have made new one-month lows despite the index’s rally.

Source: SentimenTrader

Source: SentimenTrader

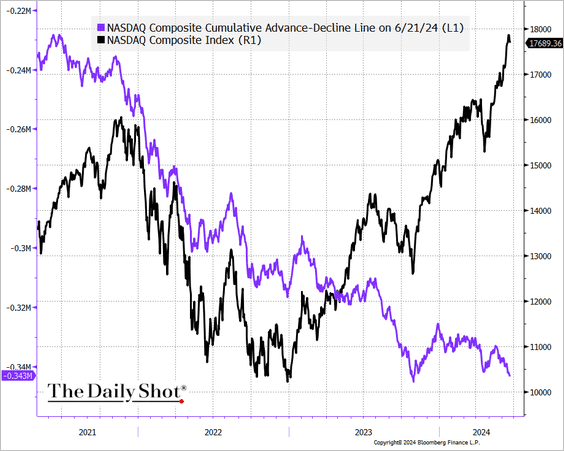

– Here is the Nasdaq Composite advance-decline line.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

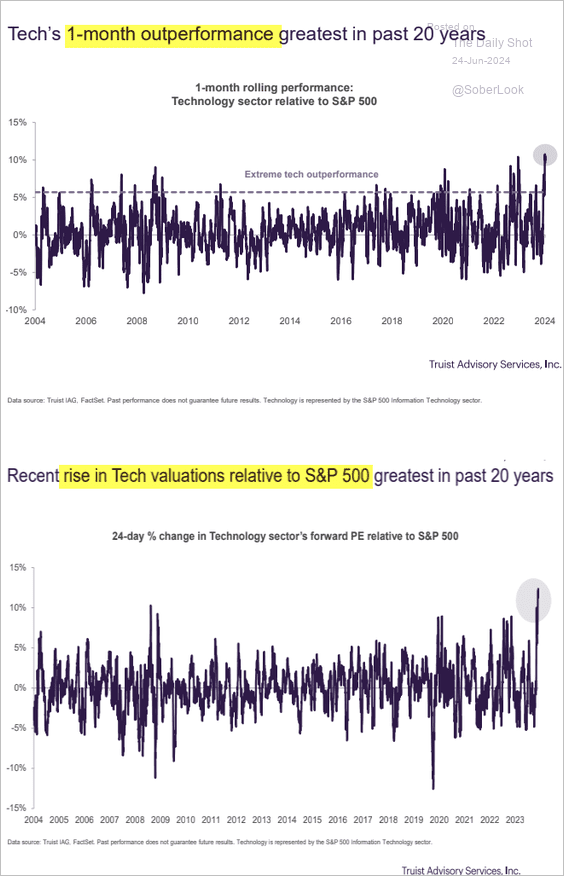

• Tech outperformance, both in terms of prices and valuations, has been extreme.

Source: Truist Advisory Services

Source: Truist Advisory Services

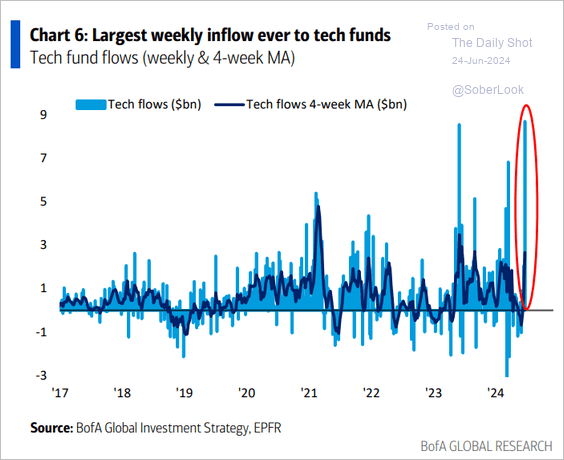

• Tech fund inflows have been massive.

Source: BofA Global Research

Source: BofA Global Research

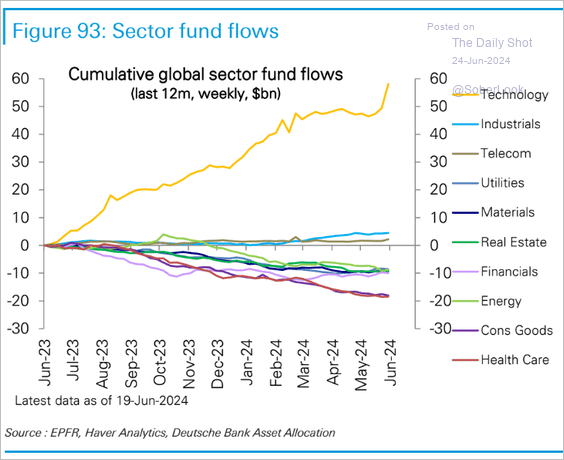

Source: Deutsche Bank Research

Source: Deutsche Bank Research

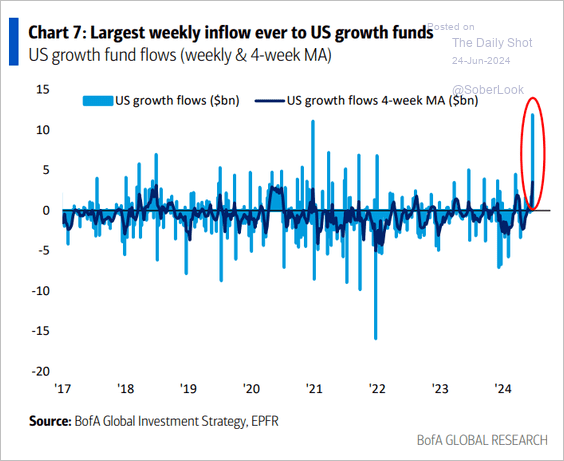

This chart shows flows into US growth finds.

Source: BofA Global Research

Source: BofA Global Research

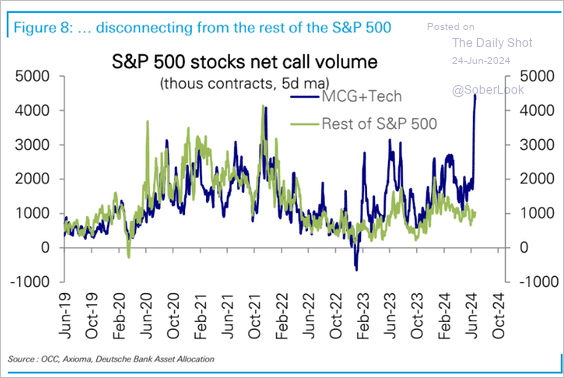

• Tech call option volume surged last week.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

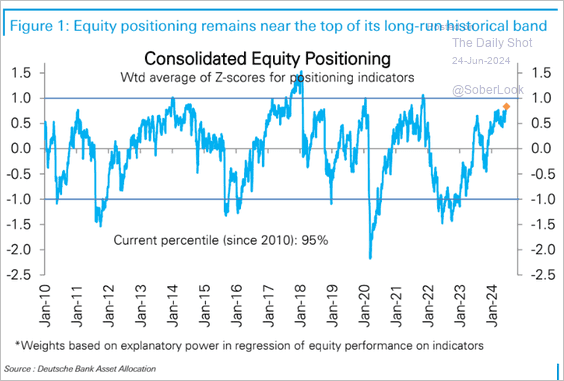

2. Deutsche Bank’s positioning indicator shows exceptionally bullish sentiment.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

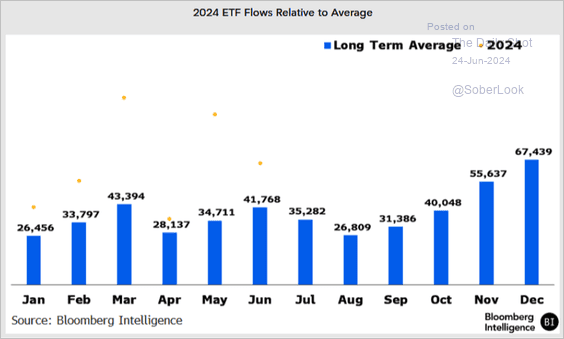

3. Total ETF flows have exceeded the long-term average this year, and typically see a stronger advance in Q4.

Source: @EricBalchunas

Source: @EricBalchunas

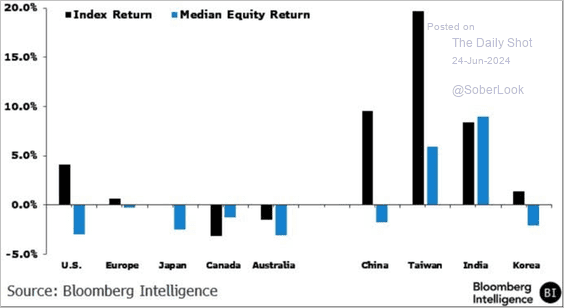

4. High market-cap gains have caused performance distortions across global markets. However, India has been relatively balanced this quarter.

Source: @GinaMartinAdams

Source: @GinaMartinAdams

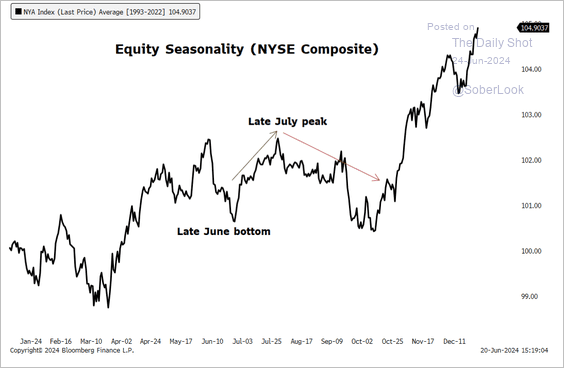

5. US stocks are entering a small window of seasonal strength before a summertime peak.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

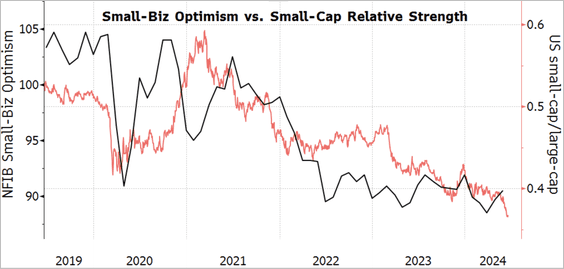

6. The uptick in US small-business optimism has diverged from the persistent downtrend in small-caps vs. large-caps. Could we see a turnaround?

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @ExcellRichard

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @ExcellRichard

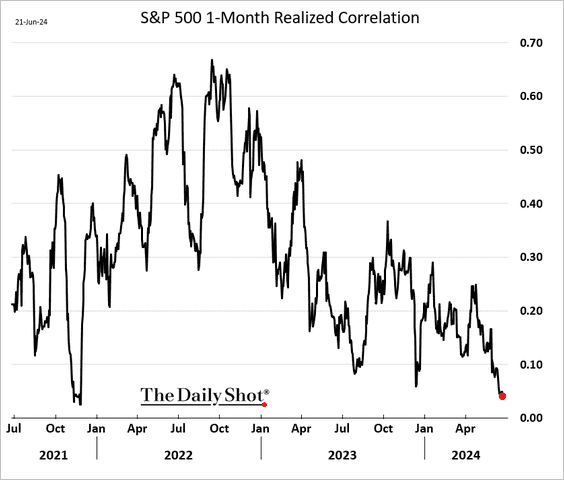

7. Correlations among S&P 500 members continue to drift lower.

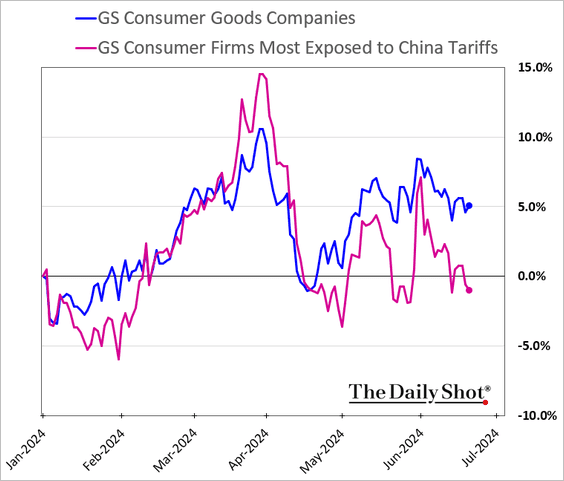

8. Consumer stocks exposed to US tariffs against China have been underperforming recently.

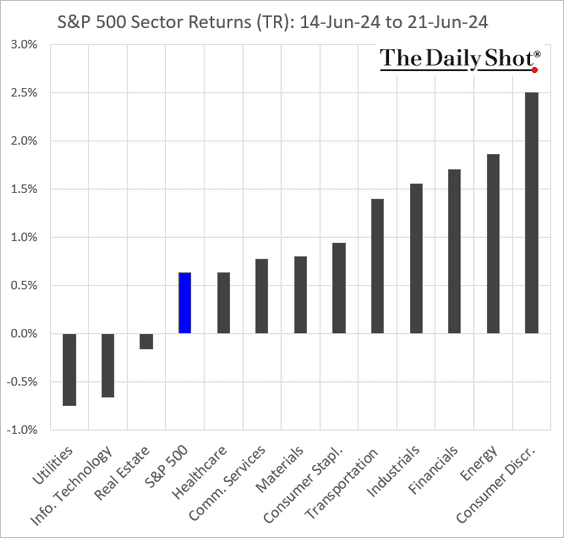

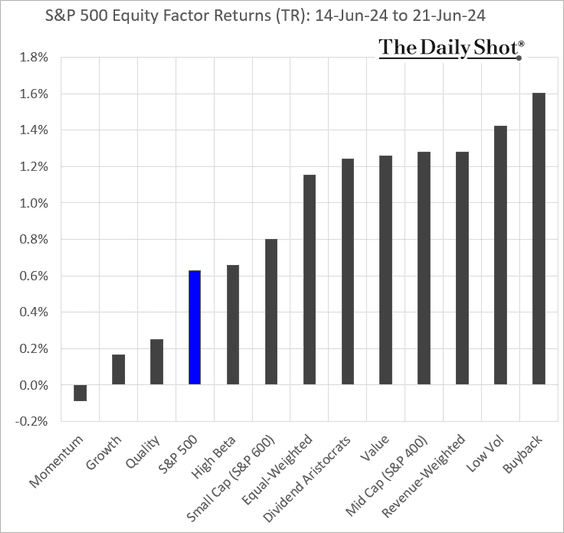

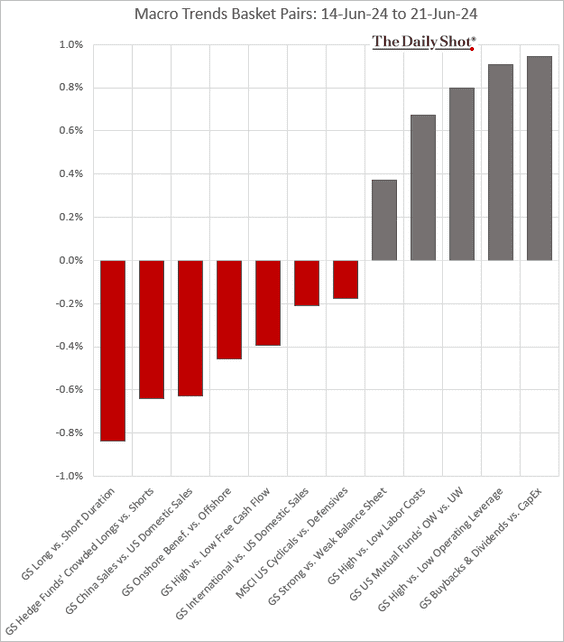

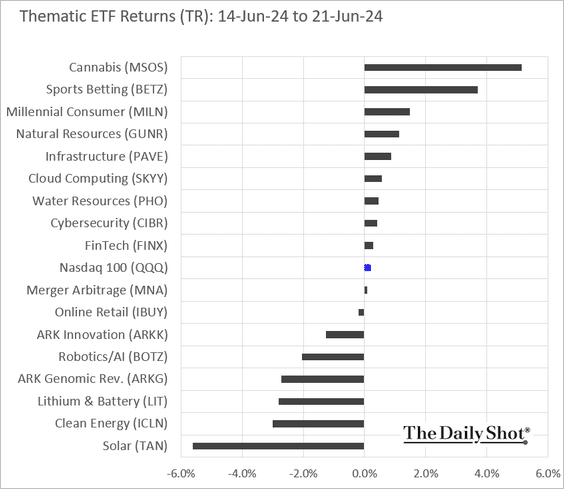

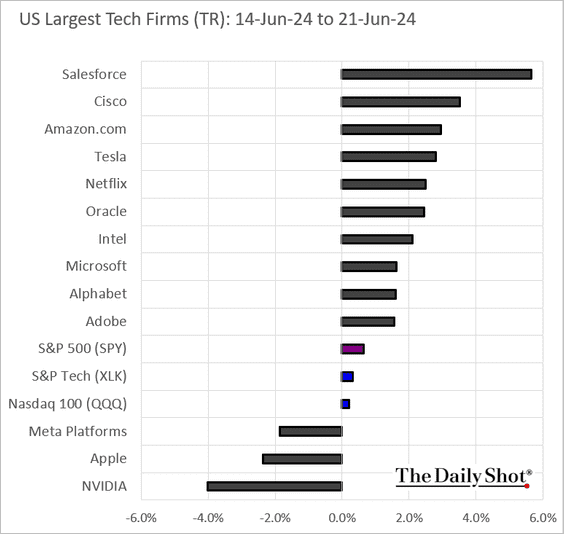

9. Next, we have some performance data from last week.

• Sectors:

• Equity factors:

• Macro basket pairs’ relative performance:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Credit

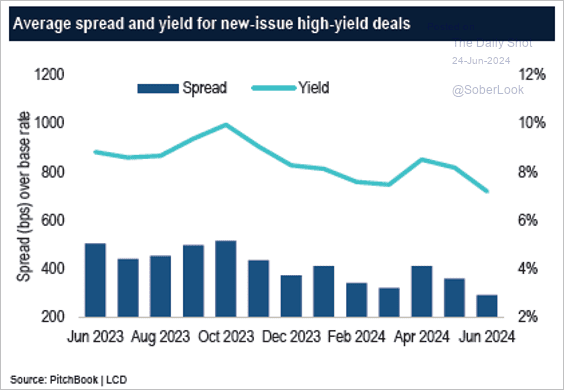

1. High-yield new-issue spreads and yields continue to fall.

Source: PitchBook

Source: PitchBook

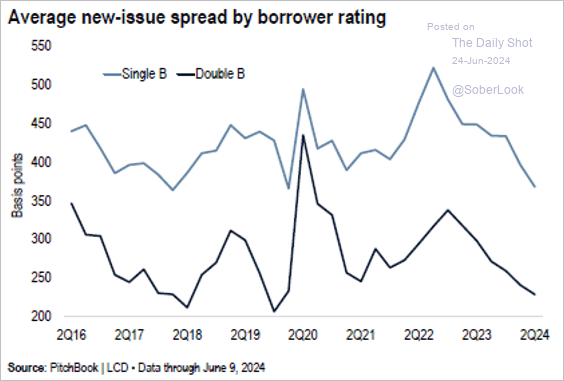

2. US leveraged loan spreads continue to narrow amid a shortage of net supply and surging investor demand, according to PitchBook.

Source: PitchBook

Source: PitchBook

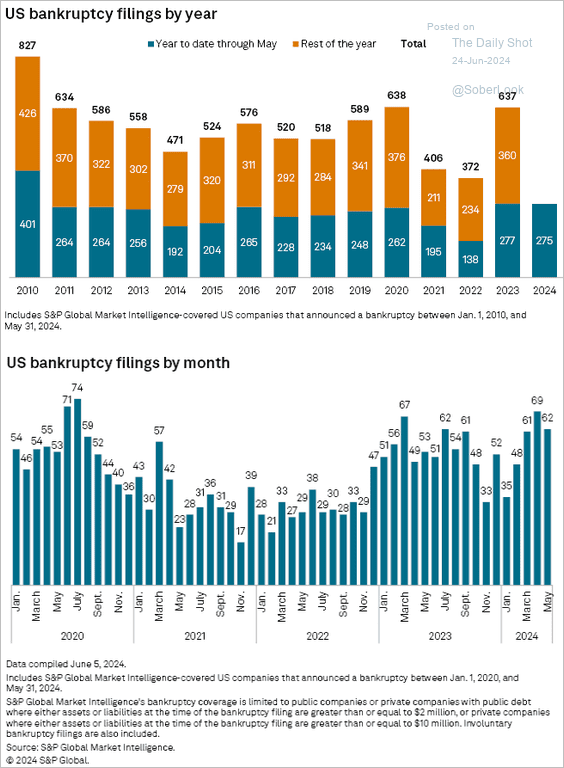

3. Here is a look at bankruptcy filings in the US.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

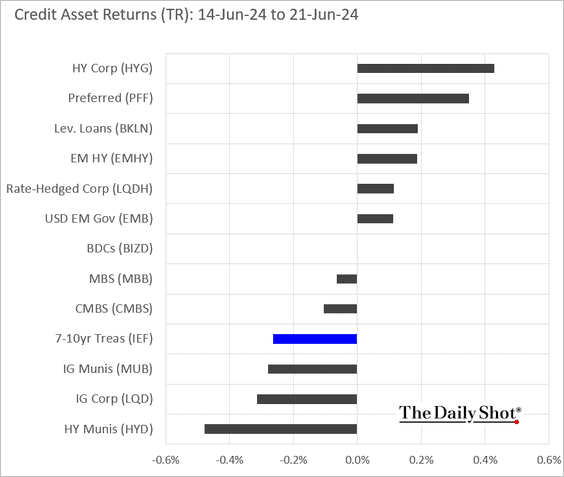

4. Finally, we have last week’s performance data.

Back to Index

Rates

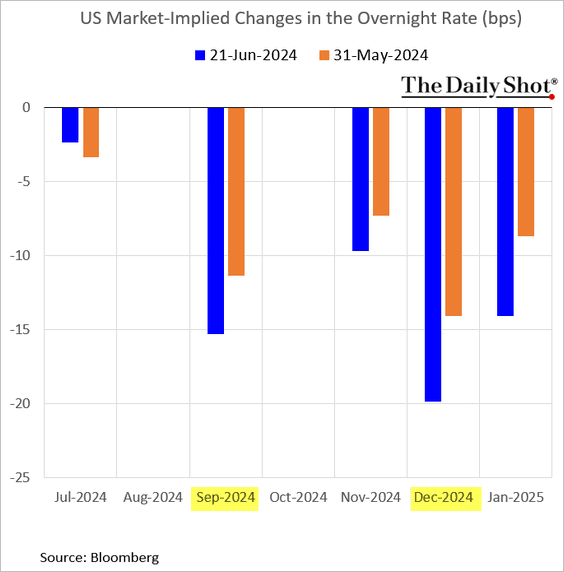

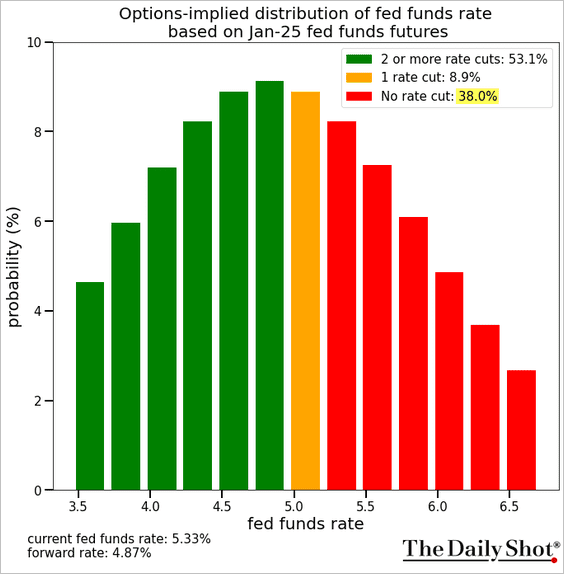

1. The market anticipates a significant probability of Fed rate cuts in both September and December.

The options market is still assigning about a 38% chance of no rate cuts this year.

——————–

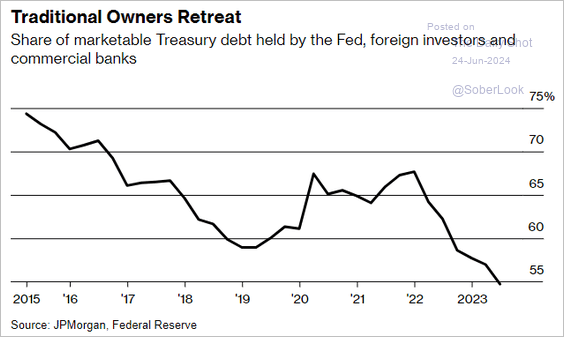

2. Here is the share of marketable Treasury debt held by the Fed, foreign investors, and commercial banks.

Source: @BW Read full article

Source: @BW Read full article

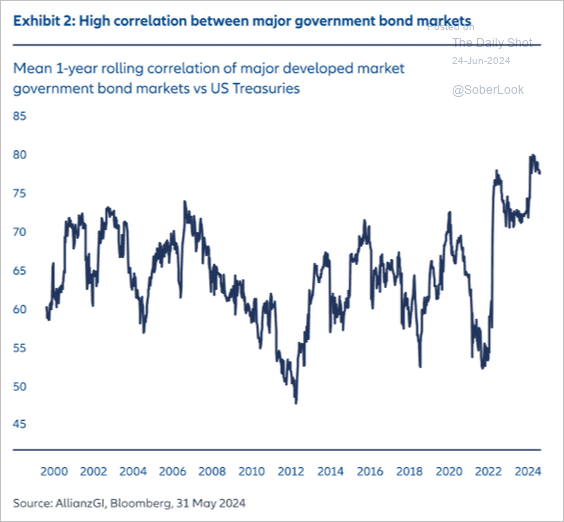

3. Bond markets across advanced economies have been more correlated to Treasuries in recent years.

Source: Allianz Global Investors

Source: Allianz Global Investors

Back to Index

Global Developments

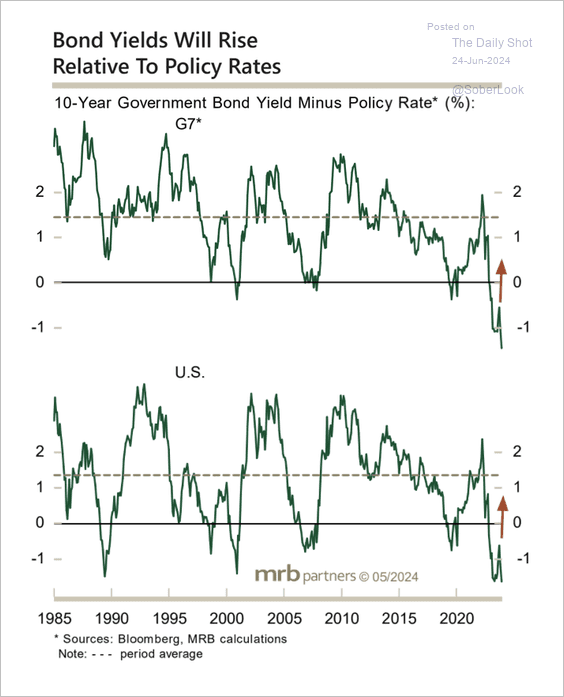

1. G7 policy rates are still very high versus government bond yields (inverse of charts below), which increases the scope of further policy easing.

Source: MRB Partners

Source: MRB Partners

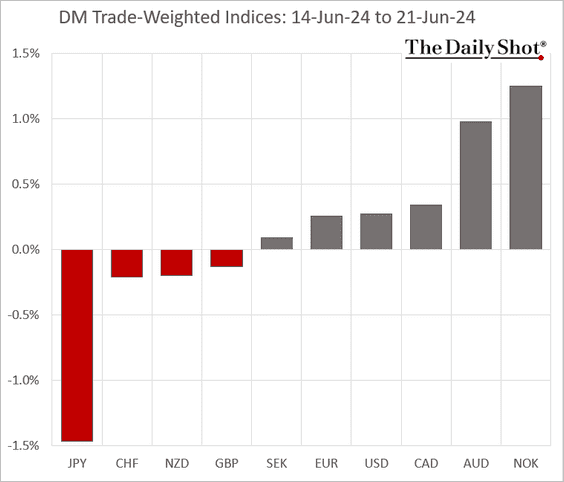

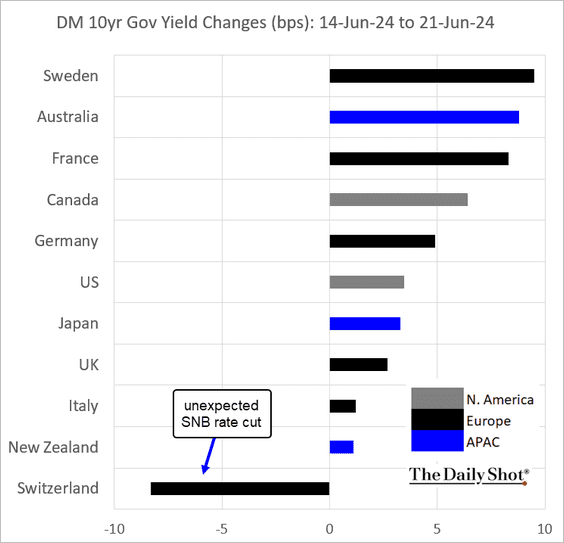

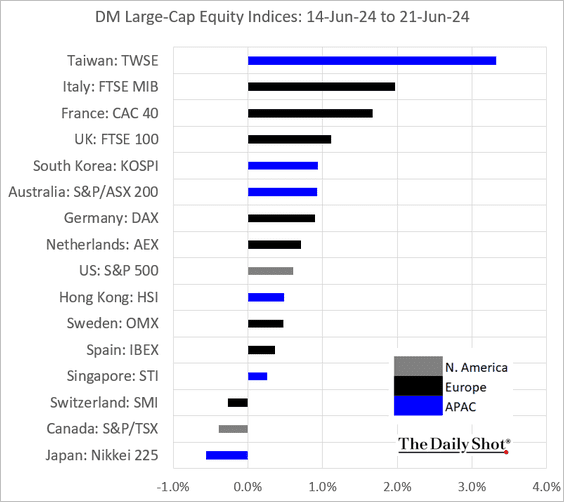

2. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equities:

——————–

Food for Thought

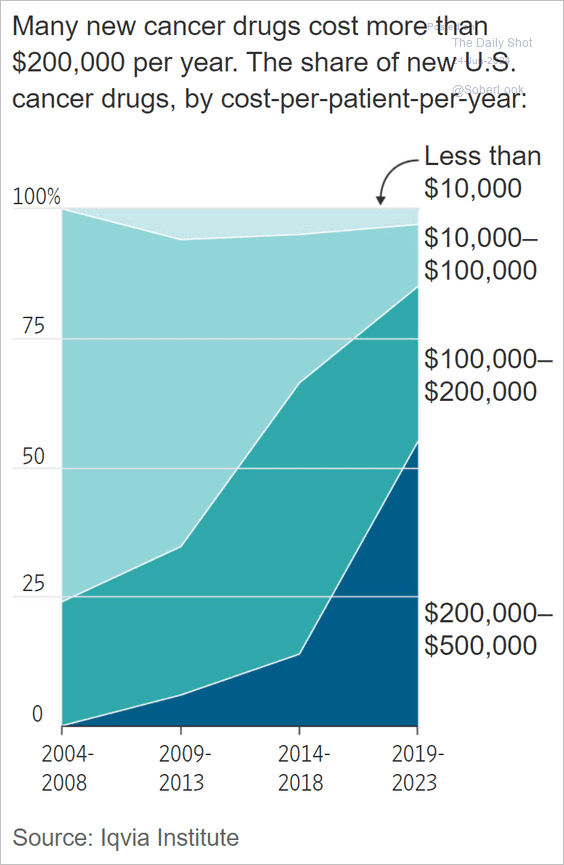

1. The share of new US cancer drugs by cost-per-patient-per-year:

Source: @WSJ Read full article

Source: @WSJ Read full article

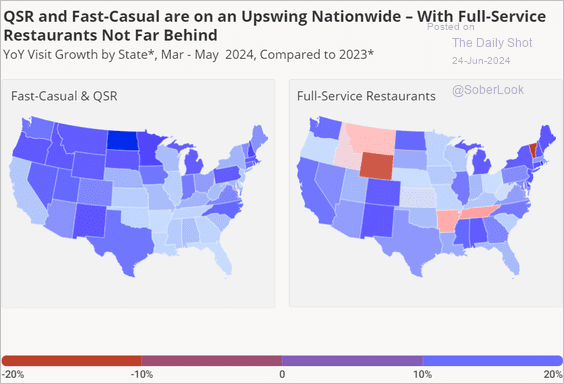

2. Changes in visits to fast-casual and quick-service restaurants:

Source: Placer.ai

Source: Placer.ai

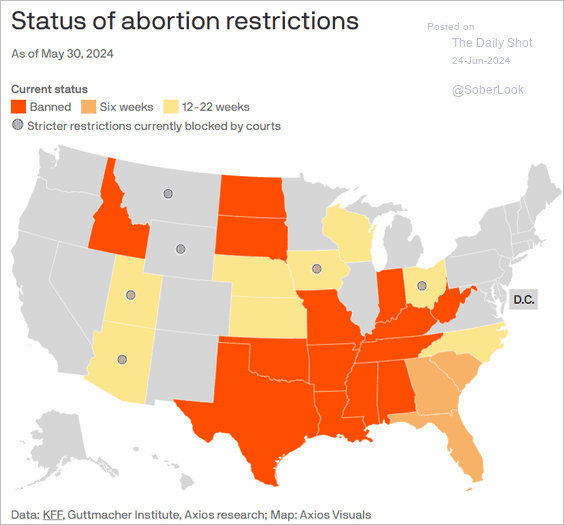

3. Status of abortion restrictions in the United States:

Source: @axios Read full article

Source: @axios Read full article

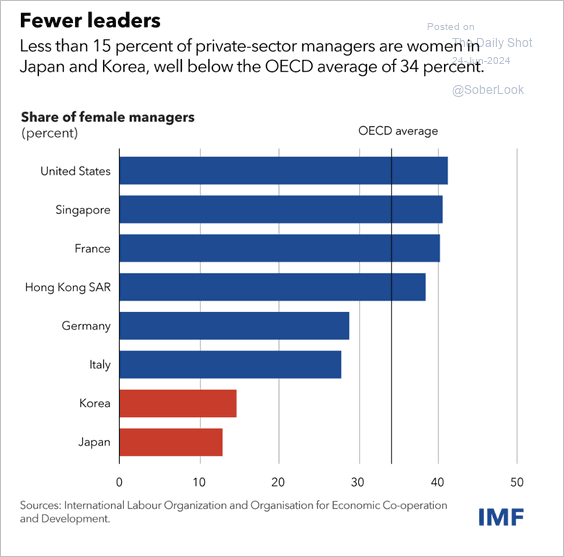

4. Share of female managers in selected countries compared to the OECD average:

Source: IMF Read full article

Source: IMF Read full article

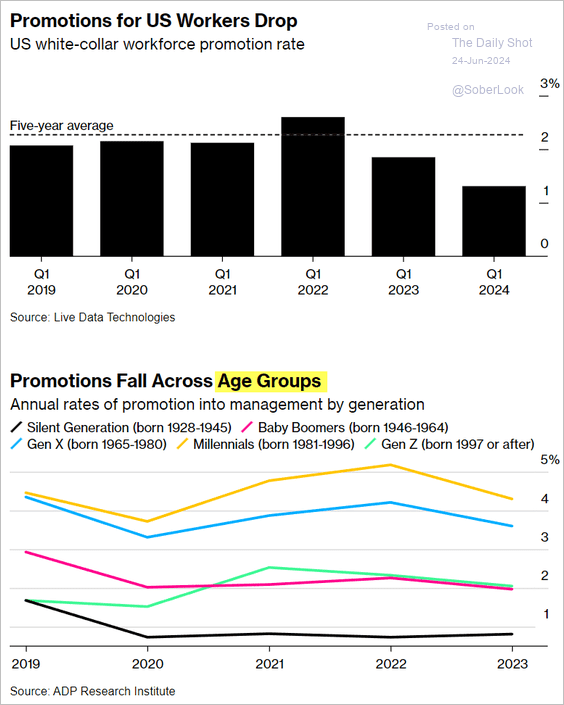

5. Promotions:

Source: @economics Read full article

Source: @economics Read full article

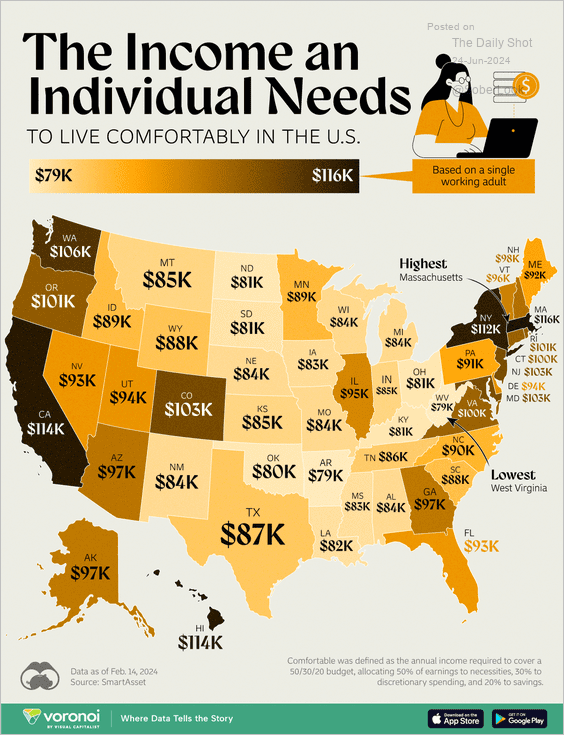

6. Required income for comfortable living in the US:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

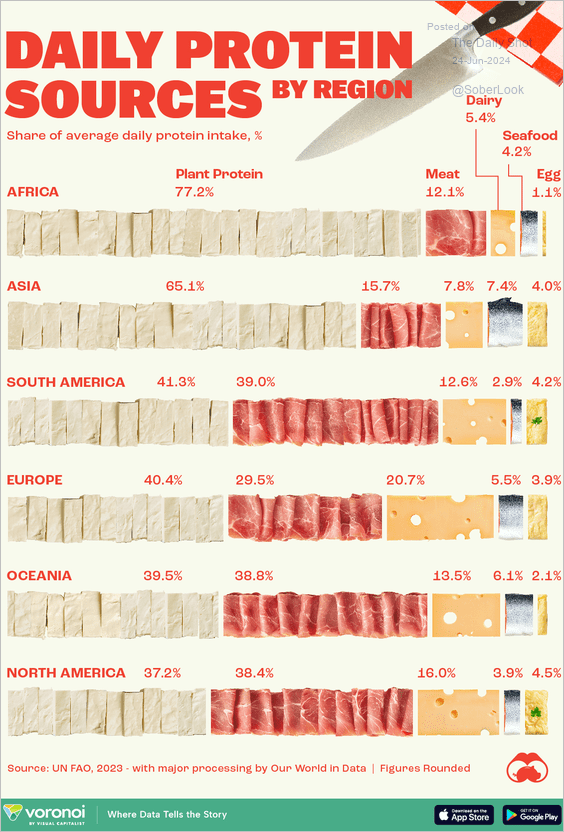

7. Daily protein sources around the world:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index