To receive the Daily Shot newsletter in your inbox, please sign up at our Email Center. Previous issues of the Daily Shot are available online at DailyShotWSJ.com.

Have questions, feedback or comments? Contact author [email protected].

Twitter: @SoberLook

The Daily Shot: 11-Mar-20

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

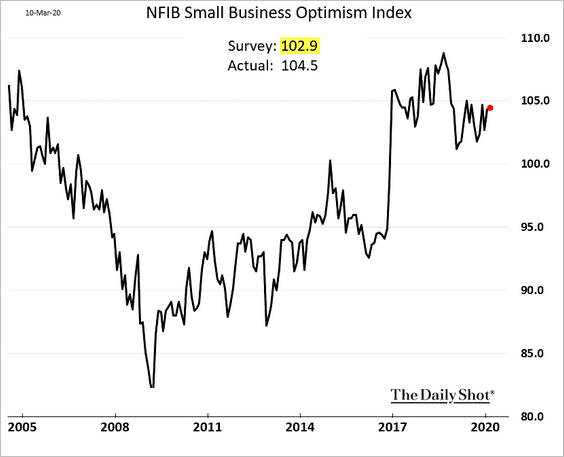

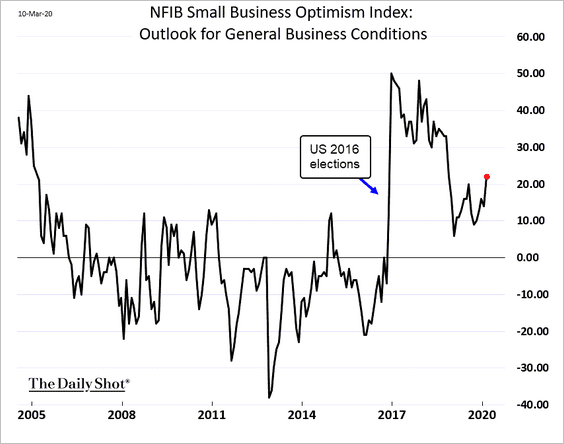

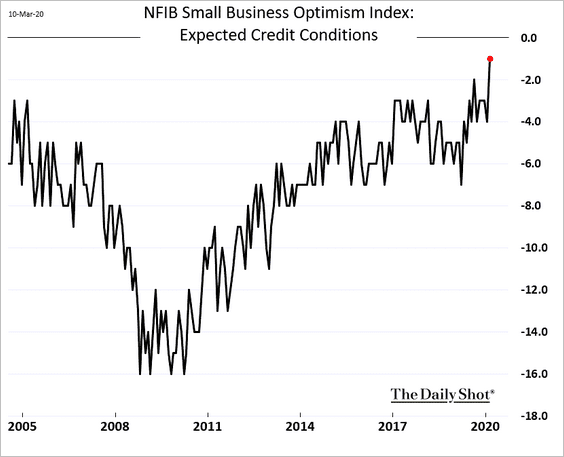

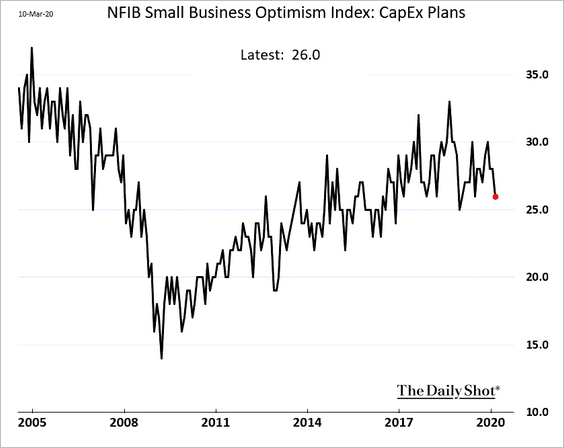

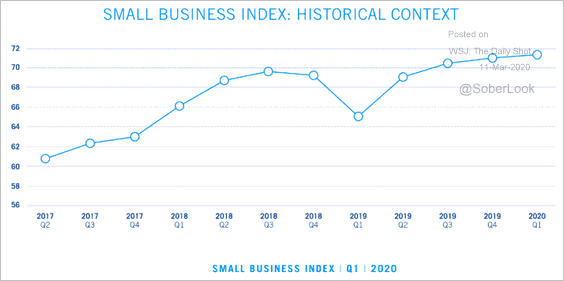

1. US small business sentiment held up well in February, with the NFIB index topping economists’ forecasts.

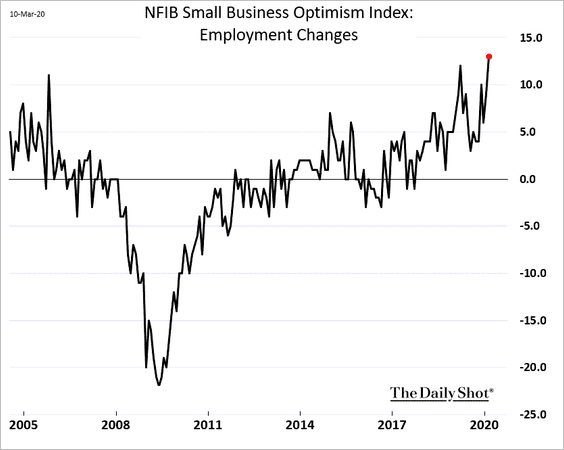

• Hiring was robust.

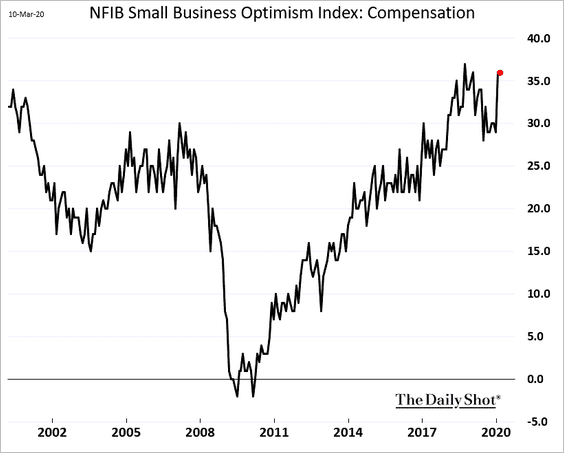

• More firms are boosting compensation.

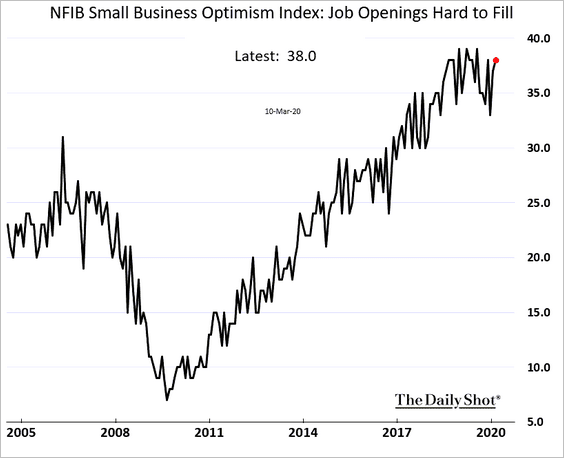

• The “job openings hard to fill” indicator remains near multi-year highs.

• Business conditions outlook improved.

• Small businesses are optimistic about being able to access credit.

• CapEx expectations softened.

A separate report from the US Chamber of Commerce also showed strengthening confidence.

Source: U.S. Chamber of Commerce Read full article

Source: U.S. Chamber of Commerce Read full article

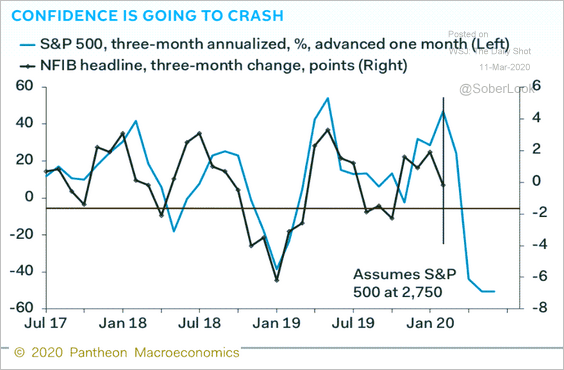

However, small business optimism will register a significant deterioration in March in response to the stock market rout.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

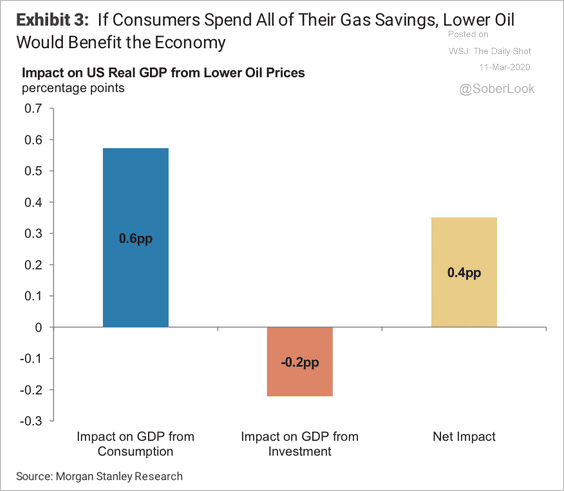

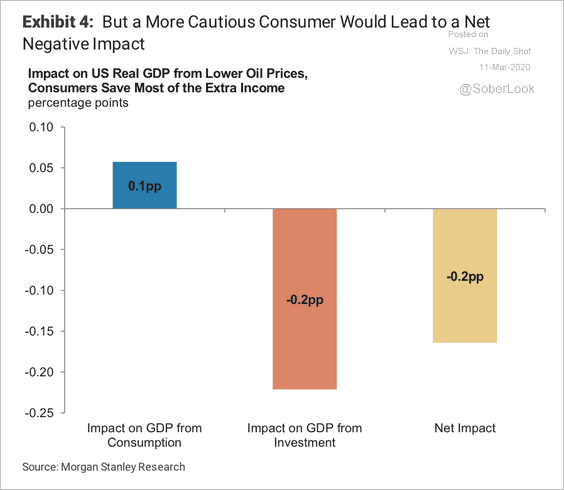

2. How will lower oil prices impact the nation’s economic growth? Here are two scenarios from Morgan Stanley:

• Consumers will spend their savings from lower fuel prices:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Consumers will be more cautious:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

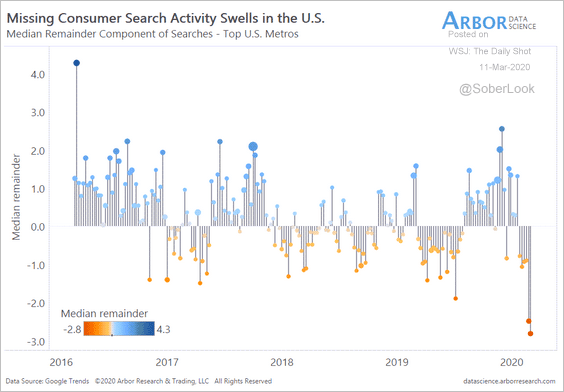

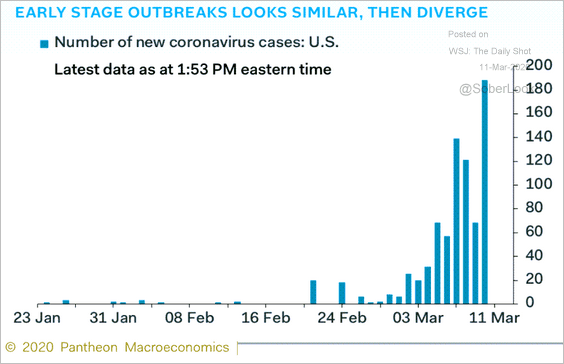

3. Online search activity suggests that consumers are getting nervous as the number of new US coronavirus cases climbs (second chart).

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

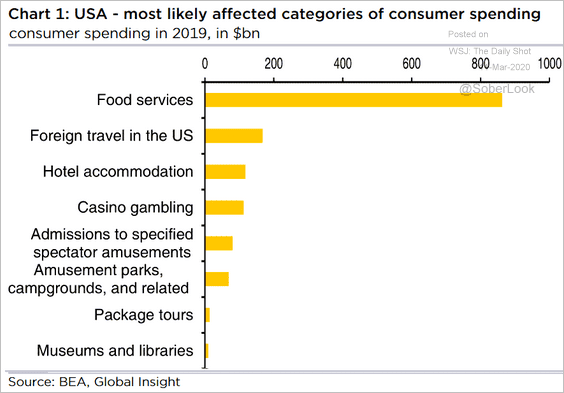

Which US sectors are most vulnerable to a pullback in consumption?

Source: Commerzbank Research

Source: Commerzbank Research

——————–

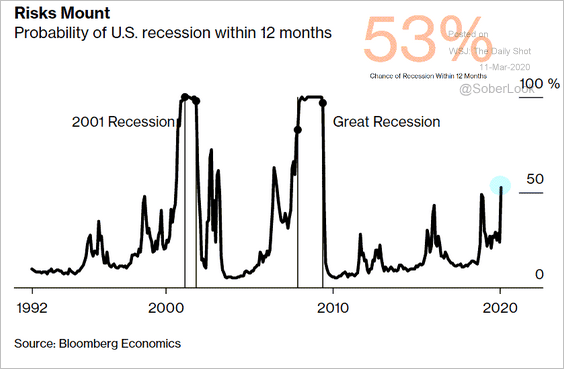

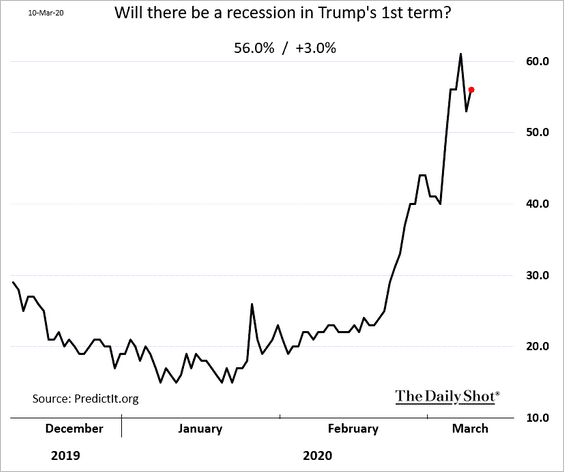

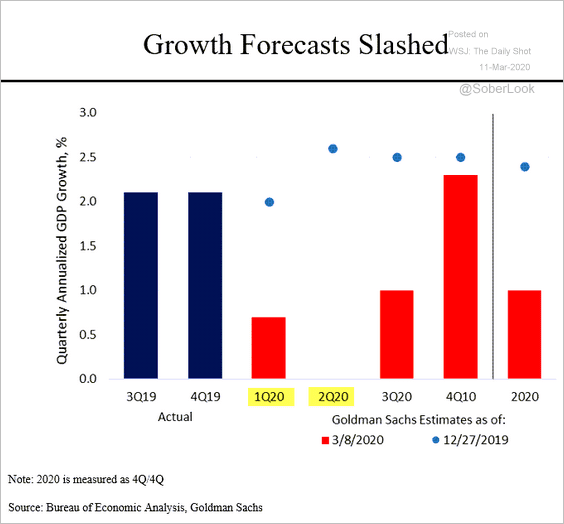

4. Recession probability indicators have risen above 50%.

• Bloomberg’s recession indicator:

Source: @business Read full article

Source: @business Read full article

• The betting markets:

Economists have been downgrading their growth forecasts.

Source: Goldman Sachs, Steven Rattner

Source: Goldman Sachs, Steven Rattner

The United Kingdom

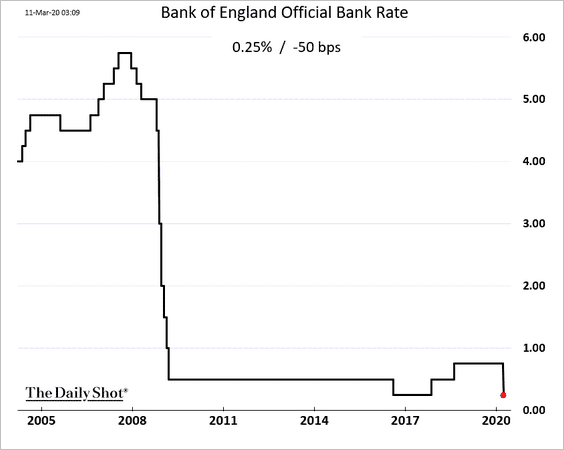

1. The Bank of England cut rates by 50 bps in an emergency move to cushion the coronavirus impact.

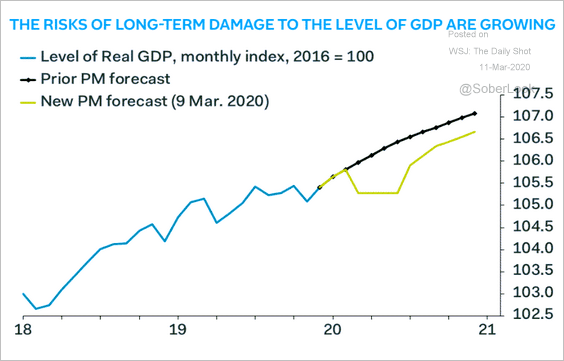

2. According to Pantheon Macroeconomics, the nation’s GDP growth could see long-term damage from the epidemic.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

The Eurozone

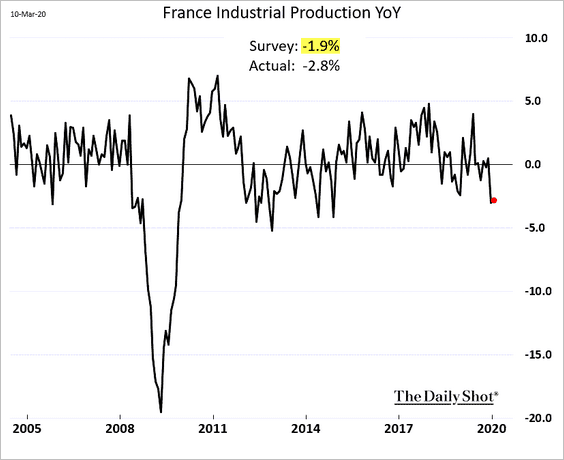

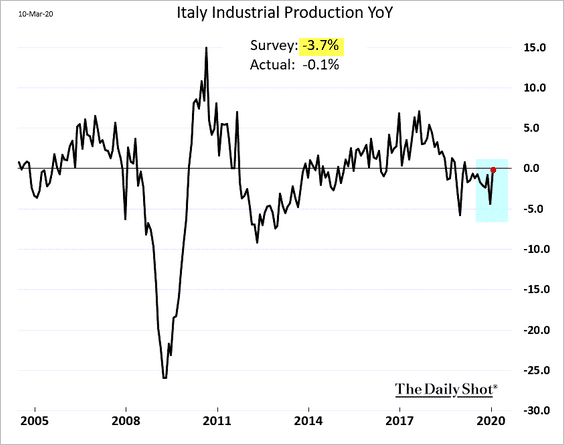

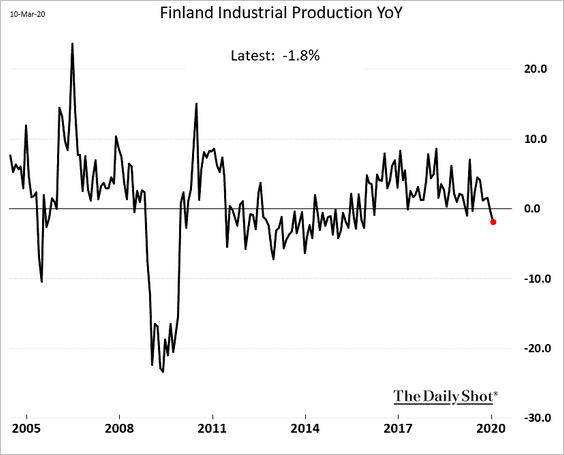

1. Industrial production reports have been mixed.

• France:

• Italy:

• Finland:

The new orders-to-inventory ratio in France has been pointing to a rebound in factory output.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

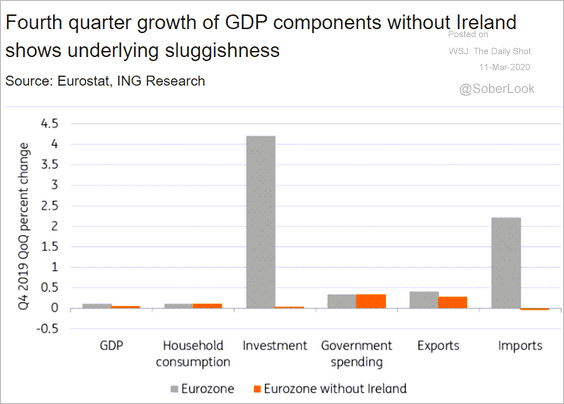

2. Economists are concerned that the Eurozone may be headed for a recession.

• The GDP growth was already weak going into the first quarter. ING removed Ireland from the GDP components below because the nation is a tax haven. Its vast subsidiaries of foreign firms and massive capital flows distort the GDP.

Source: ING

Source: ING

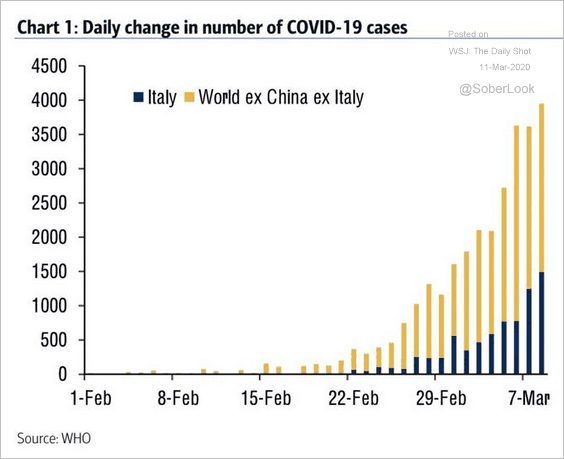

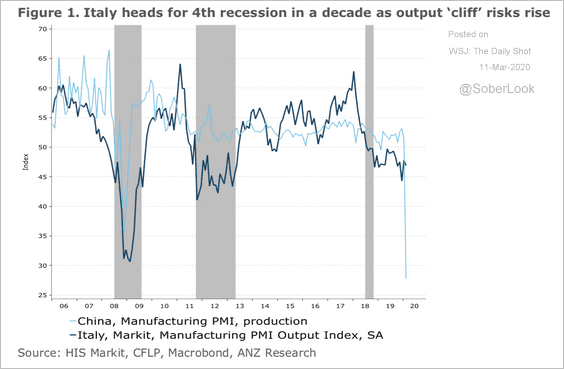

• Can Italy contain the coronavirus? Unlike China, it has no ability to deploy an aggressive police state.

Source: BofA Merrill Lynch Global Research, @carlquintanilla

Source: BofA Merrill Lynch Global Research, @carlquintanilla

For example, Italy’s decision to quarantine the whole country would affect 15% of Europe’s GDP.

Source: ANZ Research

Source: ANZ Research

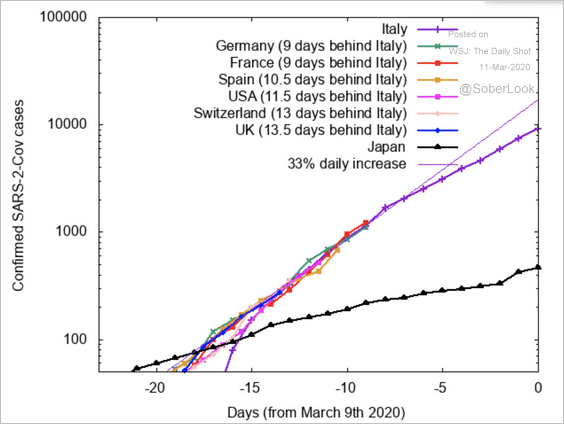

• The number of new coronavirus cases (“SARS-2-Cov”) is climbing across Europe.

Source: @MarkJHandley

Source: @MarkJHandley

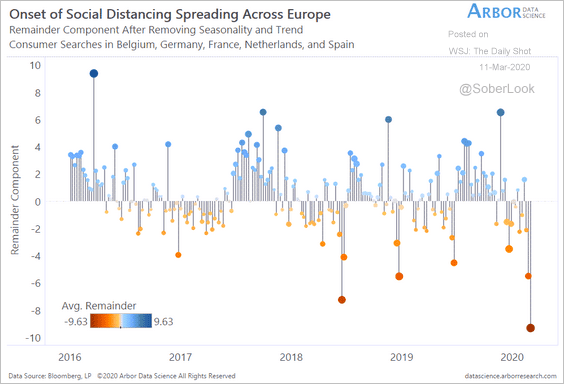

• Social “distancing” is spreading.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

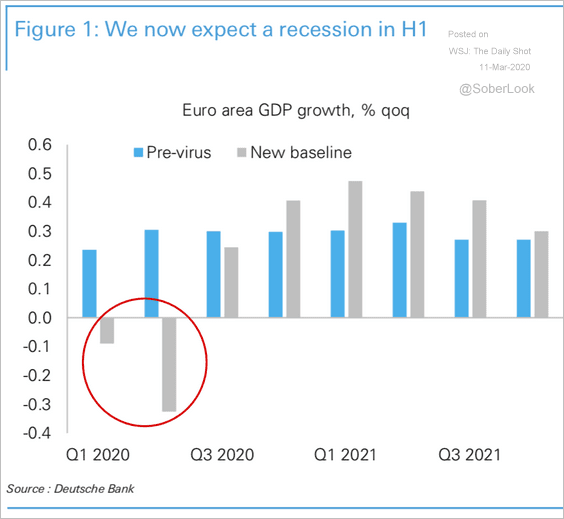

• Deutsche Bank now expects a recession.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Asia – Pacific

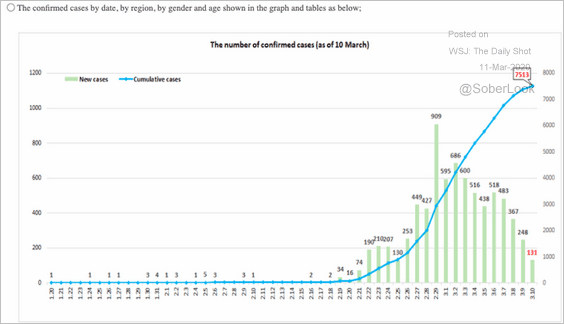

1. South Korea has been quite successful in its fight against the epidemic.

Source: @HelenBranswell Read full article

Source: @HelenBranswell Read full article

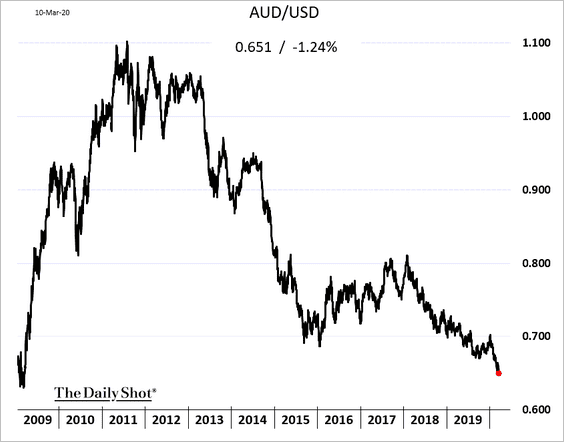

2. Next, we have some updates on Australia.

• The Aussie dollar hit an 11-year low.

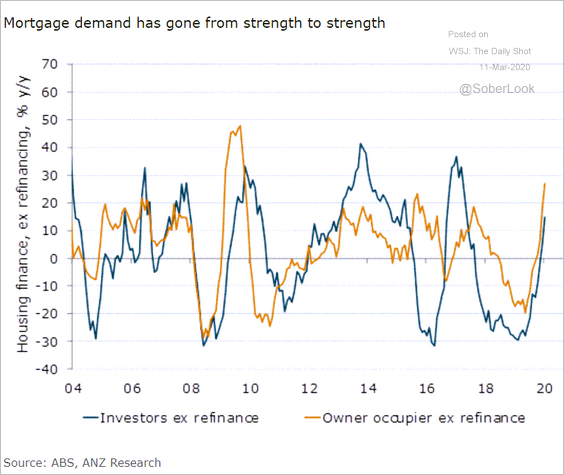

• Demand for housing finance has strengthened further.

Source: ANZ Research

Source: ANZ Research

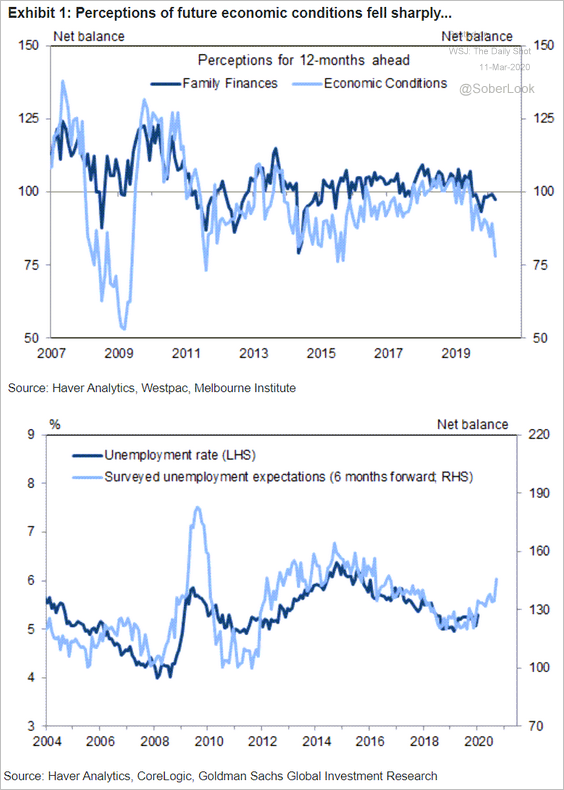

• Consumers expect a weaker economy and higher unemployment ahead.

Source: Goldman Sachs

Source: Goldman Sachs

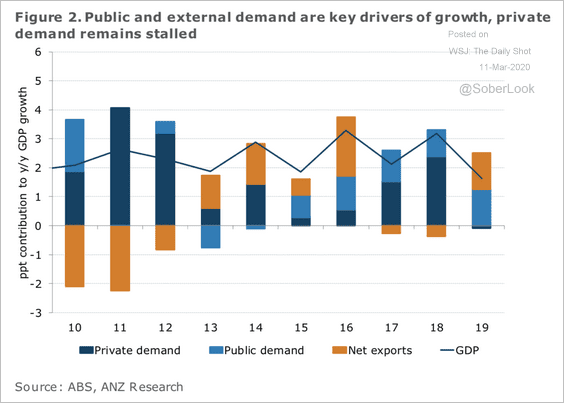

• The GDP growth has been driven by external demand and the government.

Source: ANZ Research

Source: ANZ Research

China

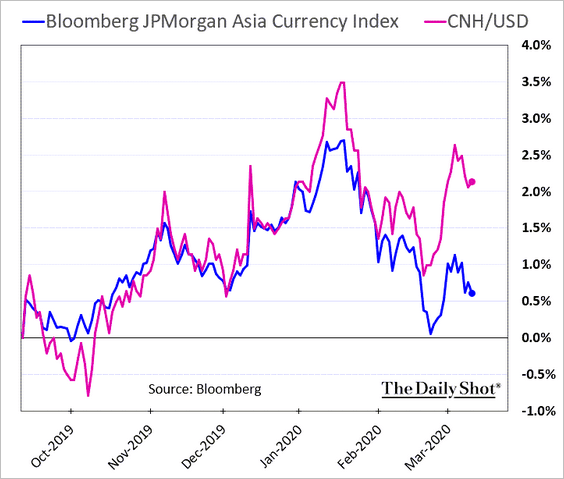

1. The renminbi has been resilient relative to other Asian currencies.

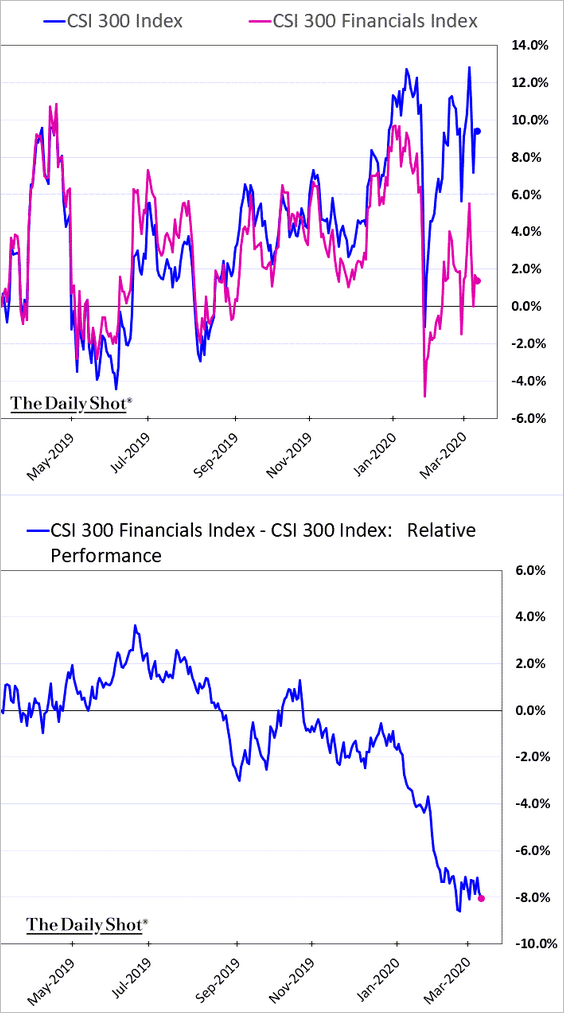

2. China’s banks have underperformed as a result of sharp declines in rates (bond yields and short-term swap rates are near multi-year lows).

h/t Lucille Liu, @TheTerminal

h/t Lucille Liu, @TheTerminal

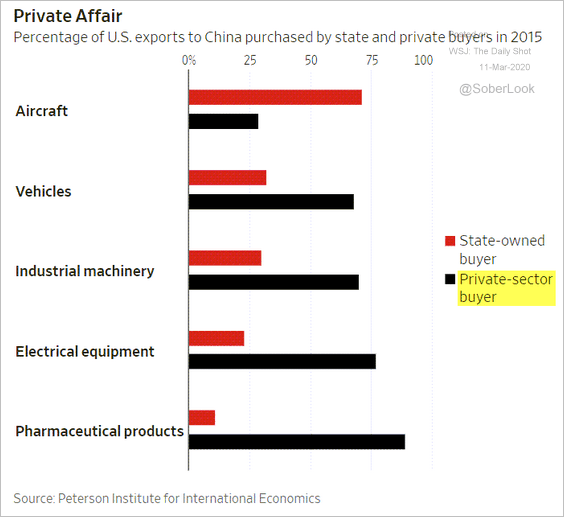

3. The private sector is in no position to import massive amounts of US goods (per the phase-1 agreement).

Source: @WSJ Read full article

Source: @WSJ Read full article

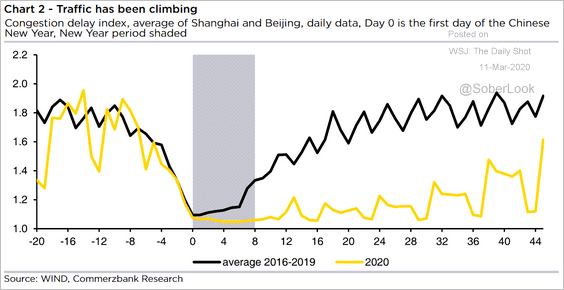

4. Economic activity is slowly recovering.

• Property transactions:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Traffic:

Source: Commerzbank Research

Source: Commerzbank Research

Emerging Markets

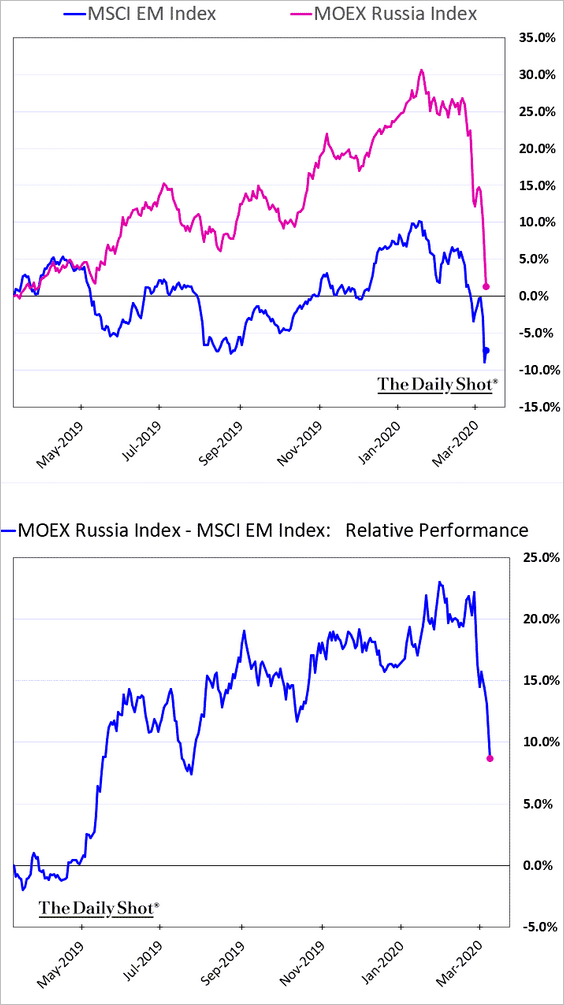

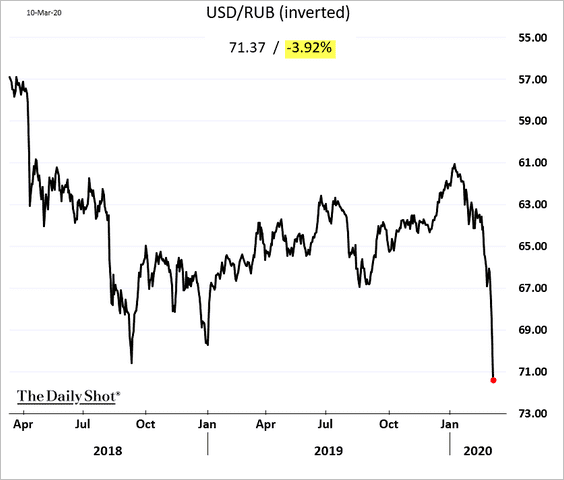

1. Russia’s stock market and the ruble tumbled in response to the price war with Saudi Arabia.

• The ruble:

• Stock market relative performance:

——————–

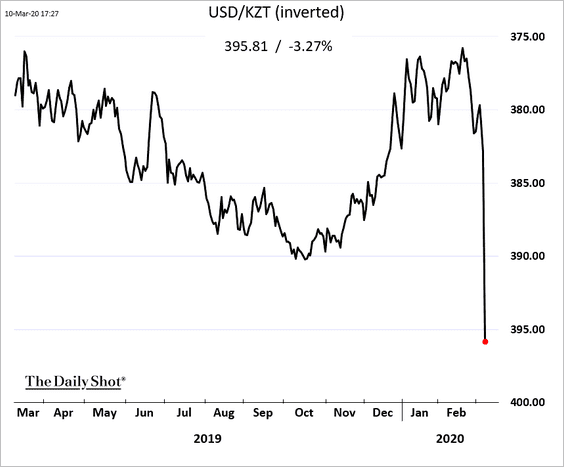

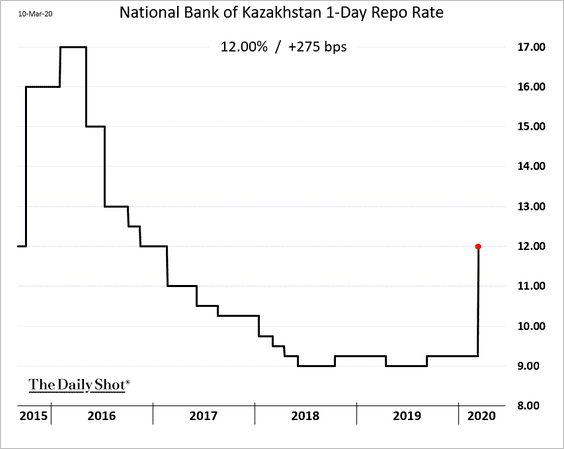

2. Kazakhstan’s currency, the tenge, followed the ruble lower (the nation is an oil exporter).

The central bank hiked rates in an attempt to stabilize the tenge.

——————–

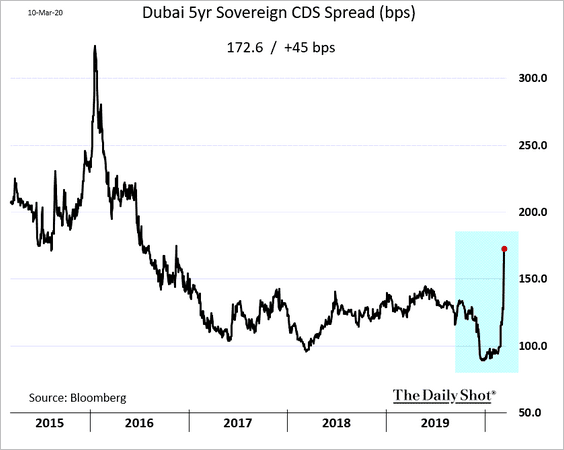

3. EM sovereign credit default swaps have widened in recent days. Some Gulf states saw significant increases in the cost of protection as oil prices fell.

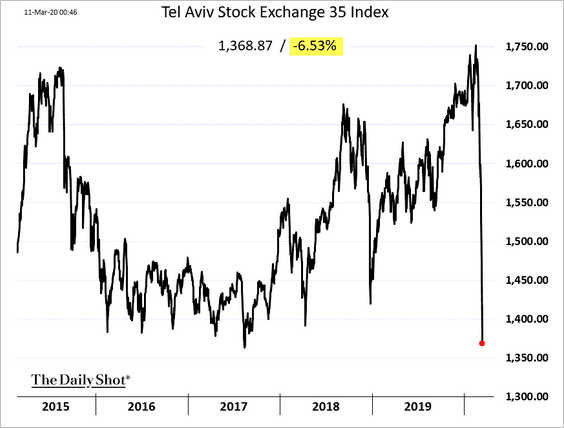

4. Israel’s stock market tumbled.

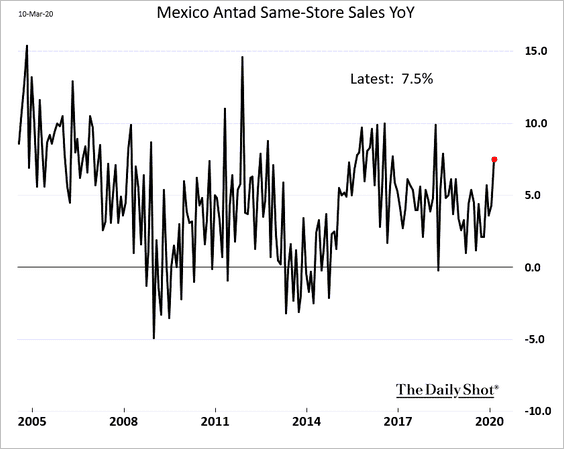

5. Next, we have some updates on Mexico.

• The peso:

• Same-store sales:

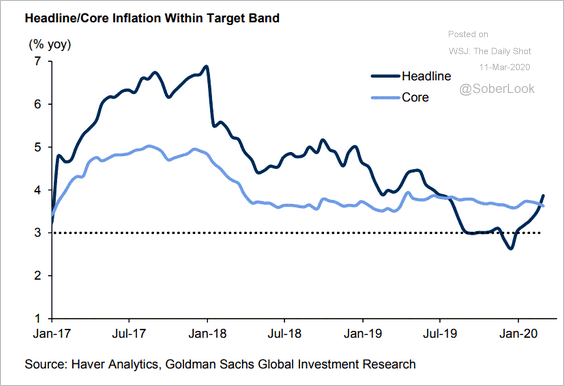

• The CPI:

Source: Goldman Sachs

Source: Goldman Sachs

——————–

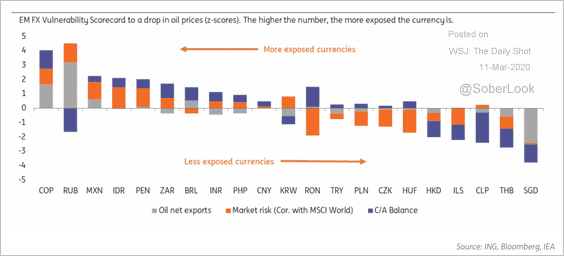

6. Here is a summary of EM exposure to oil prices.

Source: ING

Source: ING

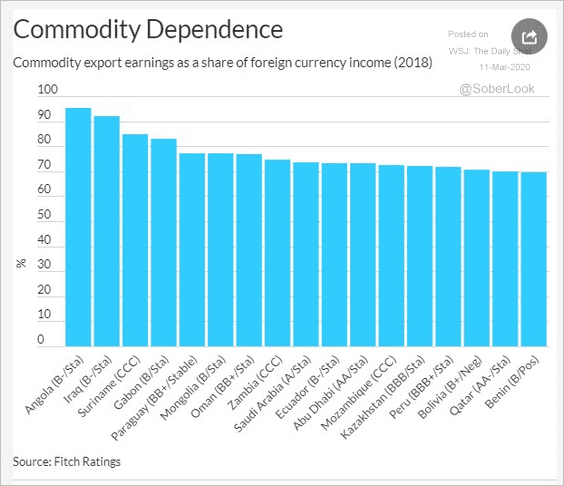

These countries are extremely dependent on commodity exports.

Source: Fitch Ratings

Source: Fitch Ratings

Commodities

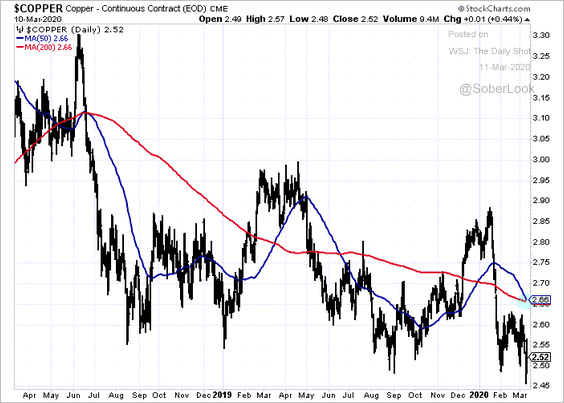

1. Copper formed a death cross.

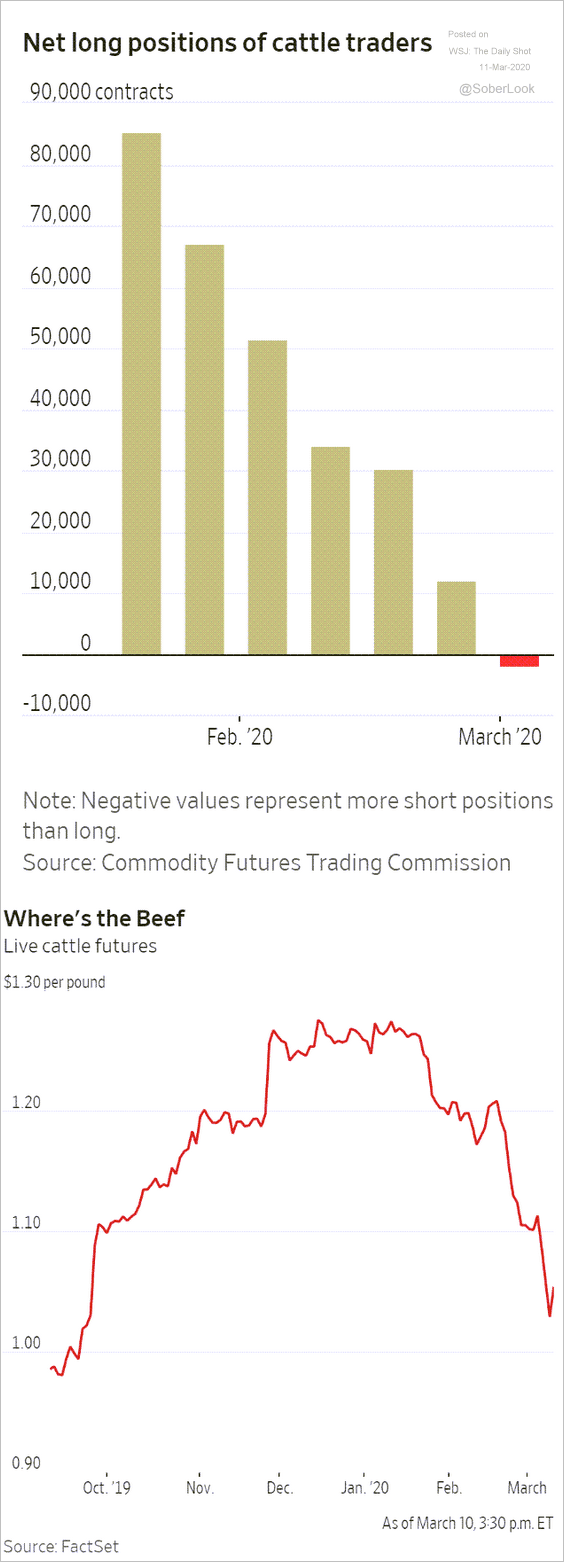

2. Speculative accounts have turned bearish on cattle.

Source: @WSJ Read full article

Source: @WSJ Read full article

Energy

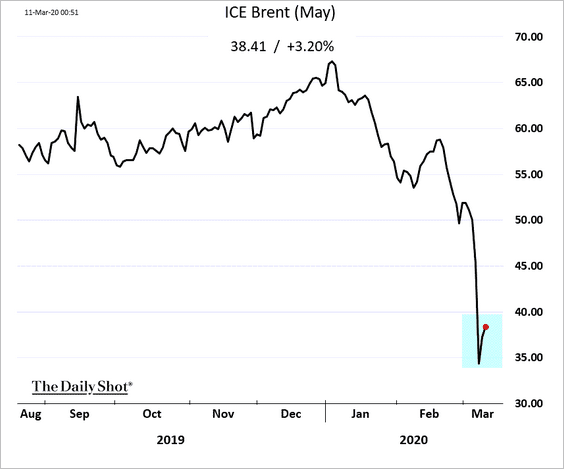

1. Crude oil has bounced from the lows.

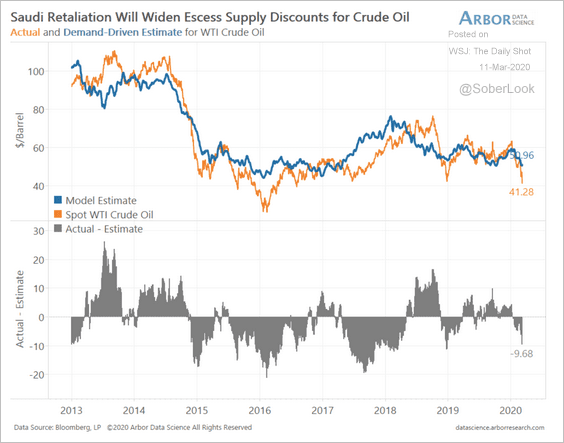

2. Arbor Data Science’s demand-driven estimate for WTI crude oil is just above $50. However, discounts in excess of $10 have persisted for long periods of time since 2013.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

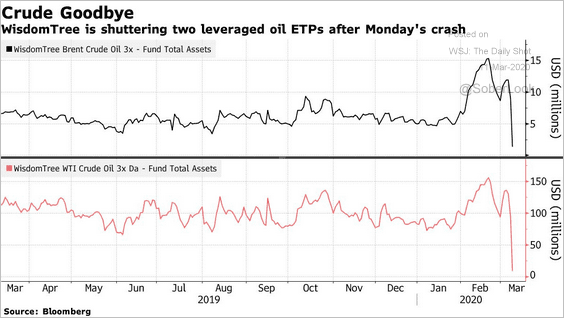

3. Some 3x leveraged crude oil ETFs are shutting down.

Source: @markets Read full article

Source: @markets Read full article

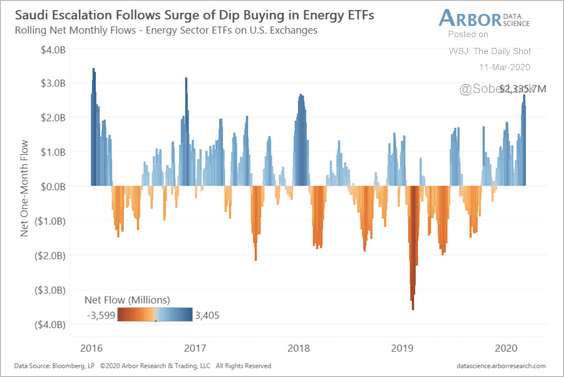

4. Net inflows into energy sector ETFs were on the rise before the Saudi escalation.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Equities

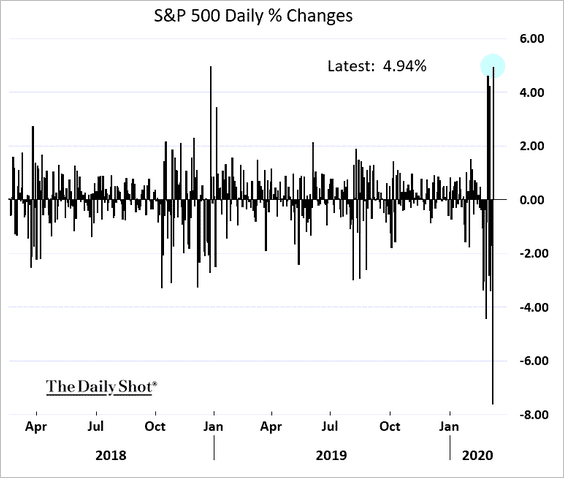

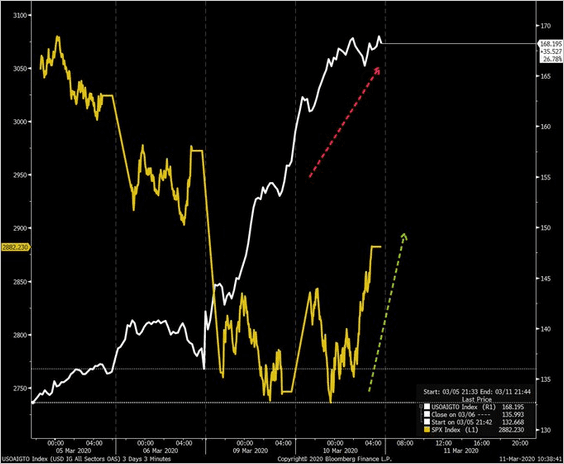

1. Stocks saw a sharp rebound on Tuesday as volatility continues. US futures are lower in early trading, although the Bank of England’s emergency rate cut cushioned the declines.

——————–

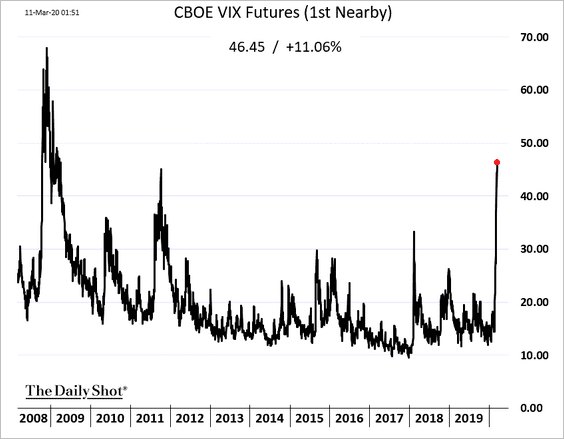

2. The front VIX futures contract hit another multi-year high.

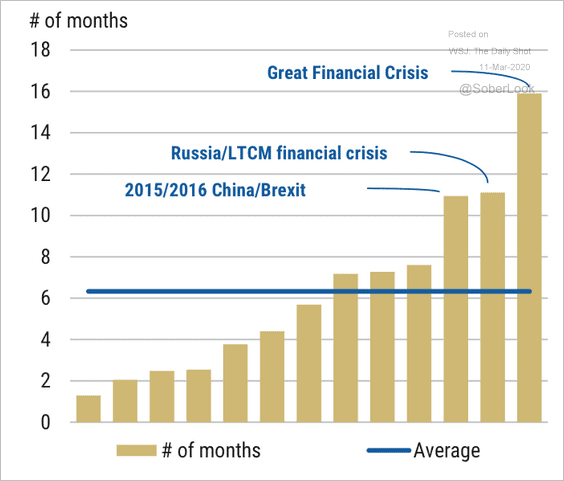

3. How long does it take for VIX to return to its pre-spike low?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

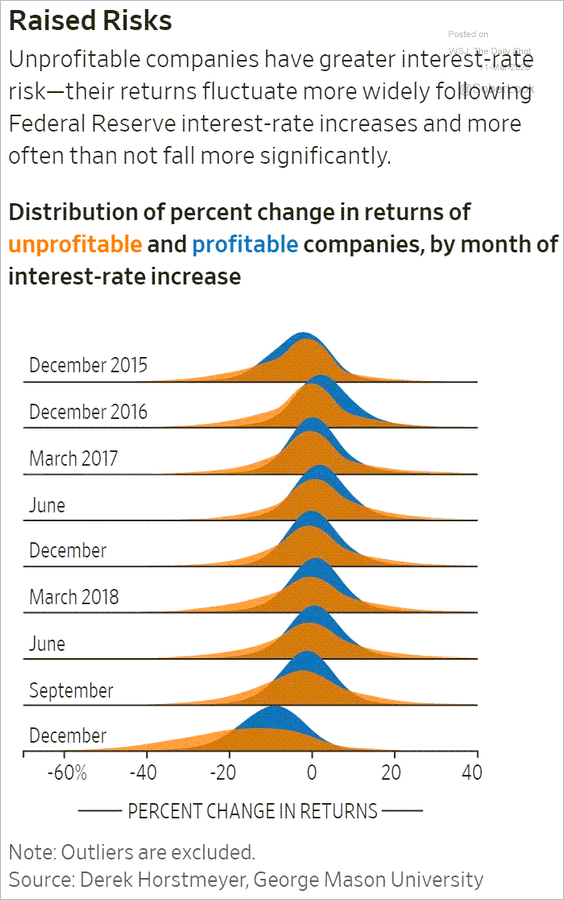

4. This chart shows the performance distribution of profitable and unprofitable companies.

Source: @WSJ Read full article

Source: @WSJ Read full article

5. Buybacks have been providing a strong tailwind for stocks in recent years. But companies have pulled back on share repurchases.

Source: @WSJ Read full article

Source: @WSJ Read full article

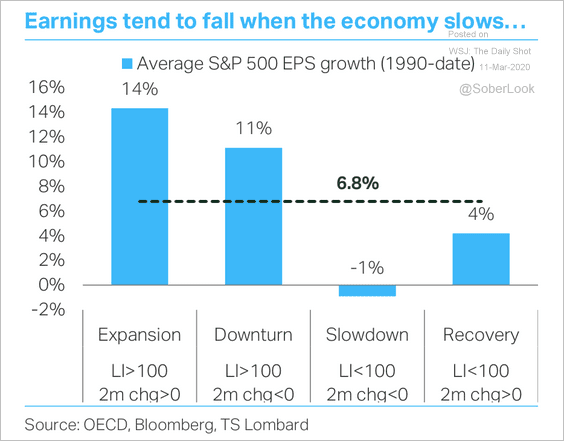

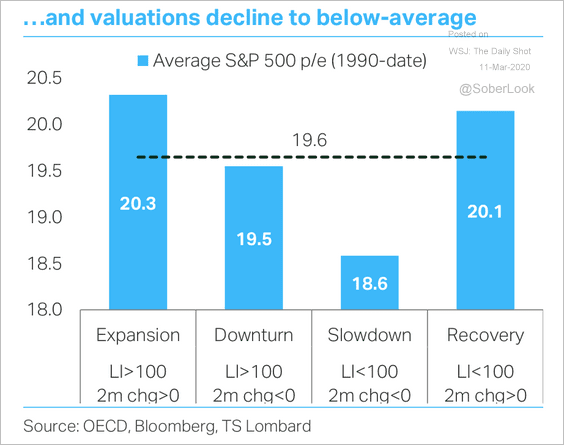

6. Earnings are expected to be stagnant this year, while valuations tend to be below average during slowdown phases of the economic cycle. This could take the S&P 500 down to the 2,500 level, according to TS Lombard.

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Credit

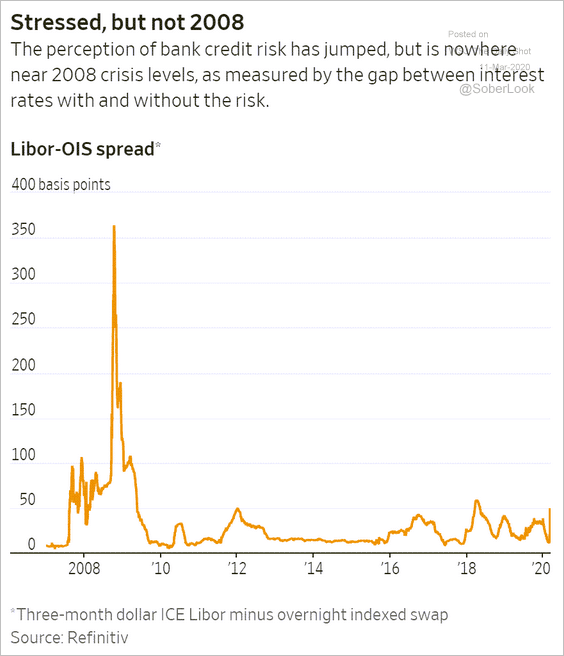

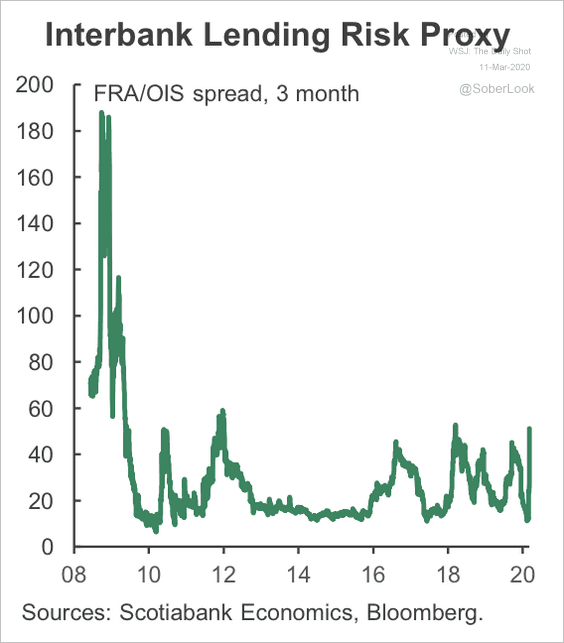

1. US LIBOR-OIS spreads have widened, but there are no signs of significant stress in the banking system.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Scotiabank Economics

Source: Scotiabank Economics

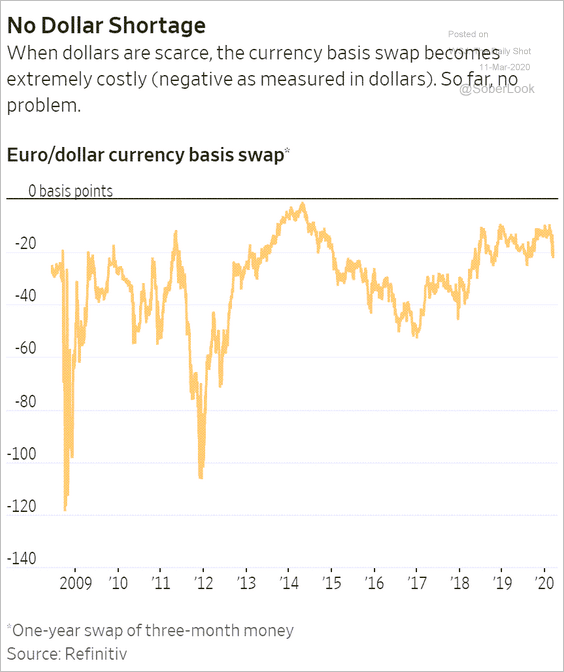

And foreign banks have no trouble accessing US dollar financing.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

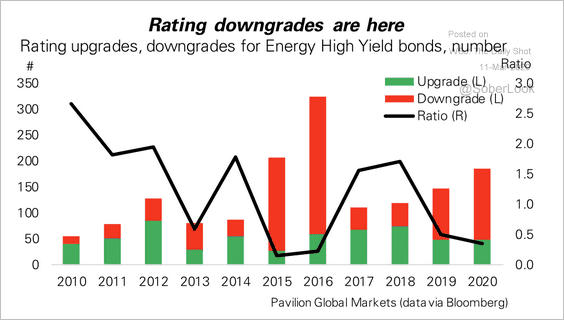

2. Next, we have some updates on the energy sector.

• Rating downgrades are coming:

Source: Pavilion Global Markets

Source: Pavilion Global Markets

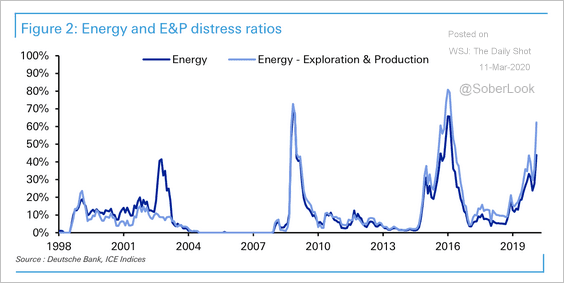

• The energy sector was already under significant stress prior to the coronavirus.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

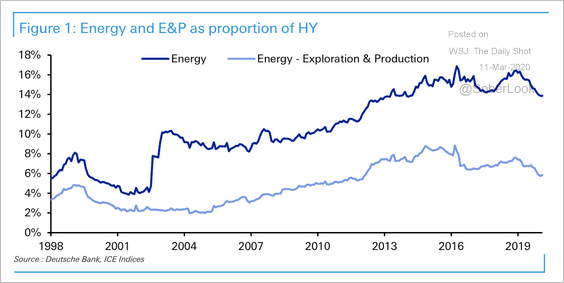

• Energy is still the largest sector in high-yield at around 14%, albeit a couple of percentage points off the 2016 highs.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

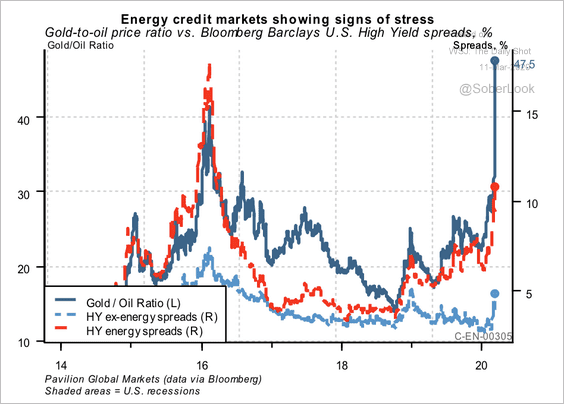

• Historically, risk-off periods proxied by the rising gold/oil price ratio have coincided with sharp increases in energy credit spreads.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

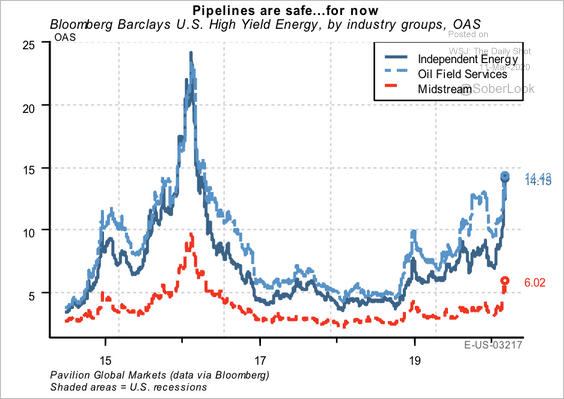

• The midstream/pipeline segment has shown more resilience to spread widening.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

——————–

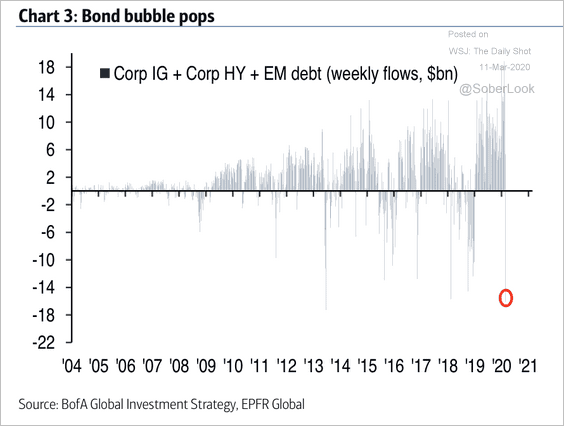

3. Investors rushed out of corporate bonds and EM debt in recent days.

Source: BofA Merrill Lynch Global Research

Source: BofA Merrill Lynch Global Research

4. Credit spreads widened on Tuesday despite the stock market rebound.

Source: @tracyalloway

Source: @tracyalloway

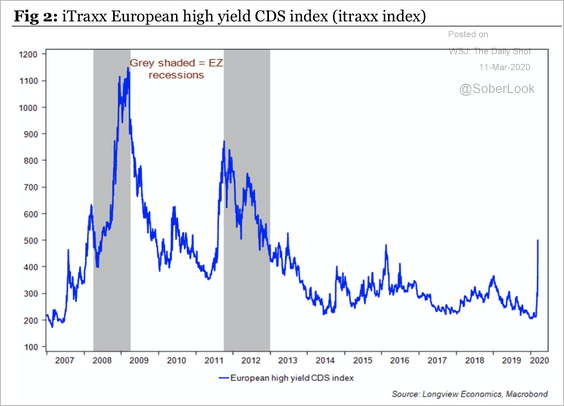

5. In Europe, the HY iTraxx spread (high-yield credit default swaps) spiked to the highest level since 2015.

Source: Longview Economics

Source: Longview Economics

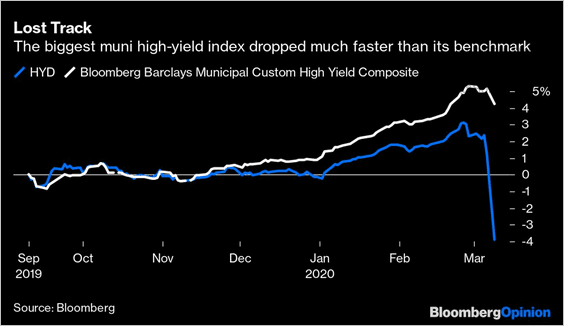

6. Muni bond prices are lagging the sharp drop in the largest muni ETF. The gap is mostly due to the illiquidity of these bonds and slow adjustments to the marks.

Source: @BloombergQuint Read full article

Source: @BloombergQuint Read full article

Rates

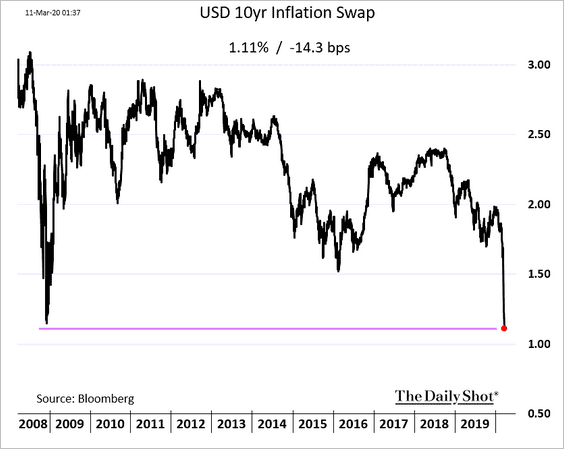

1. US market-based inflation expectations are plummeting.

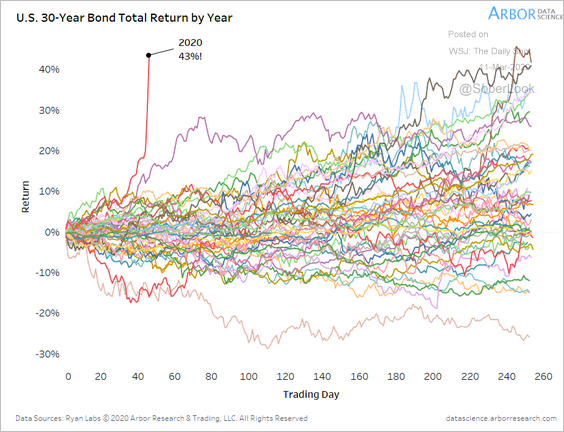

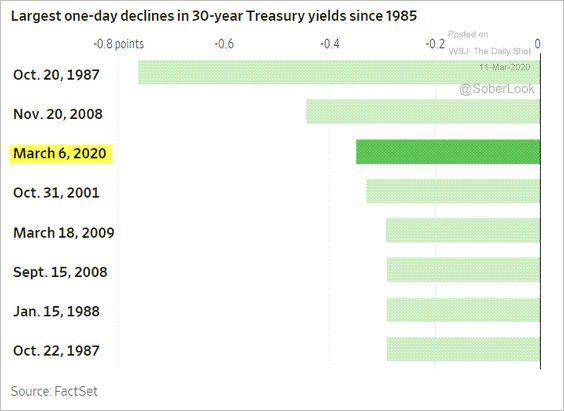

2. This year’s rally in the 30-year Treasury has been highly unusual.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

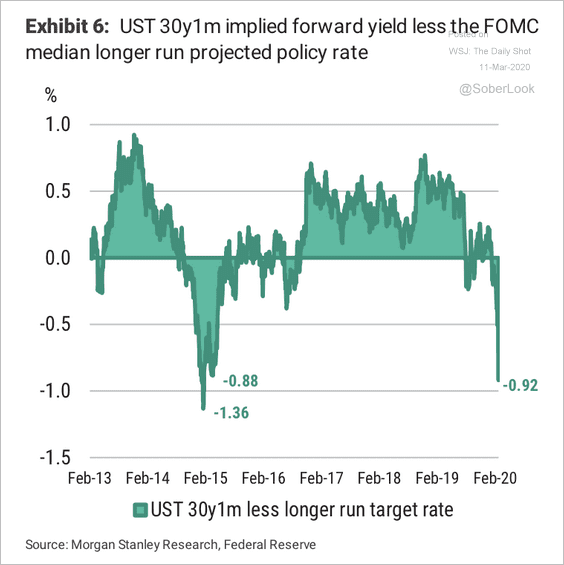

3. The market’s pricing of short-term rates 30 years out is well below the FOMC’s projection for the “longer run” fed funds rate.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

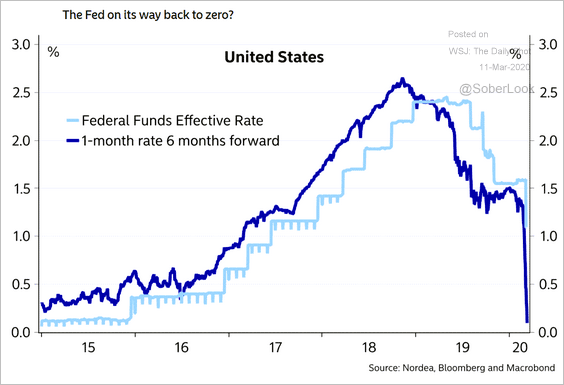

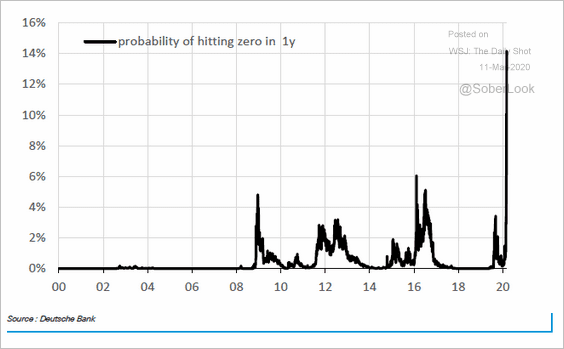

4. Will the Fed take rates back to zero again?

Source: Nordea Markets

Source: Nordea Markets

The market-based probability of the 10-year Treasury yield hitting zero has risen sharply.

Source: Deutsche Bank Research, @tracyalloway

Source: Deutsche Bank Research, @tracyalloway

Global Developments

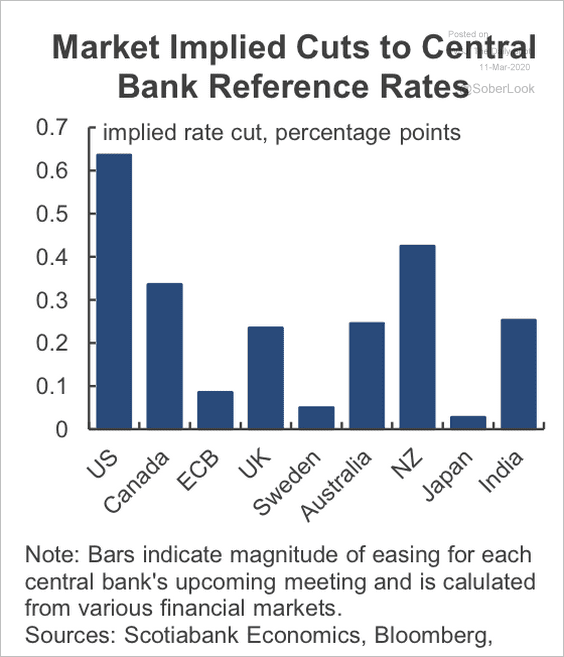

1. The market expects substantial easing from central banks.

Source: Evan Andrade, Scotiabank Economics

Source: Evan Andrade, Scotiabank Economics

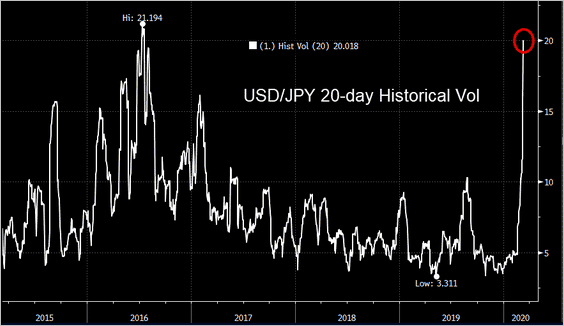

2. The yen’s volatility spiked to multi-year highs as the market’s perception of global risks swings wildly.

Source: @TheTerminal

Source: @TheTerminal

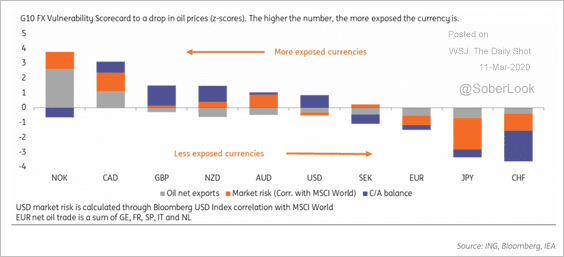

3. How much are advanced economies exposed to oil prices?

Source: ING

Source: ING

——————–

Food for Thought

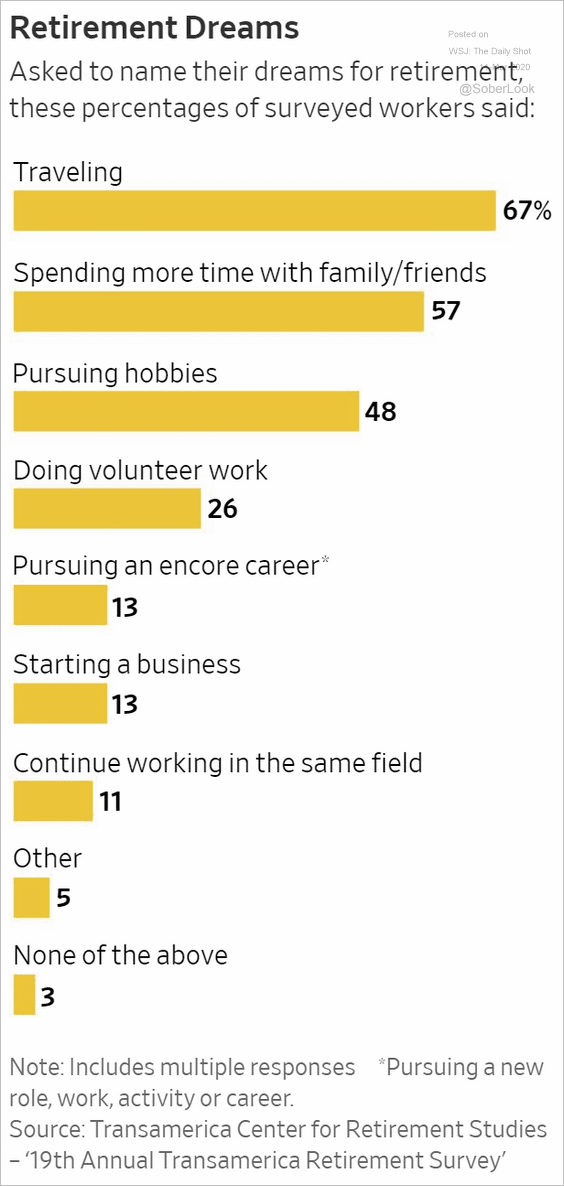

1. Retirement dreams:

Source: @WSJ Read full article

Source: @WSJ Read full article

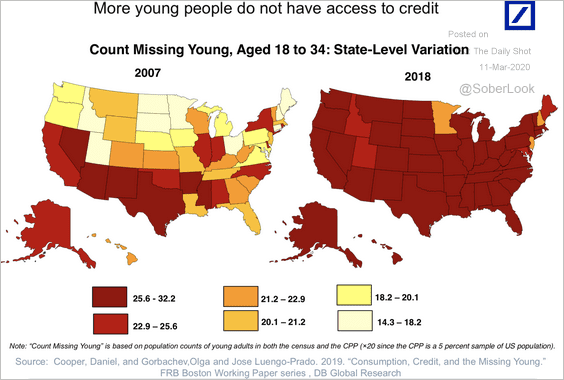

2. Young people with no access to credit:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

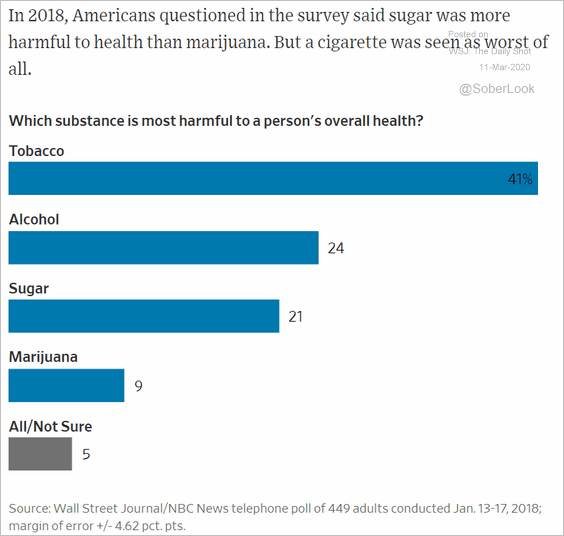

3. Which is the most harmful substance?

Source: @WSJ Read full article

Source: @WSJ Read full article

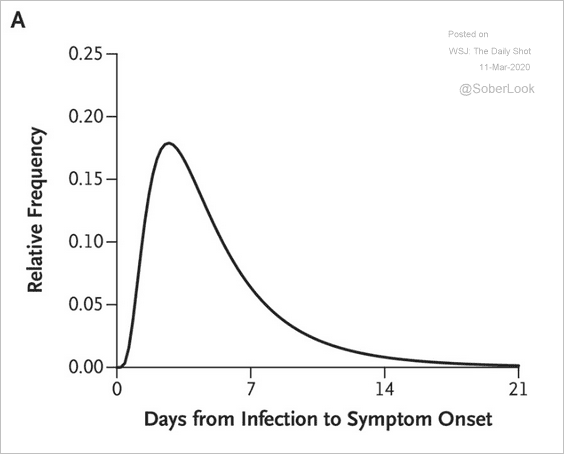

4. The coronavirus incubation period:

Source: NEJM Read full article

Source: NEJM Read full article

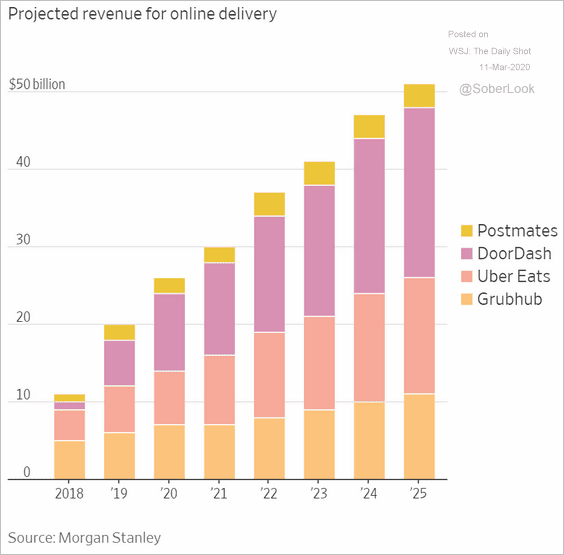

5. Online food delivery revenues:

Source: @WSJ Read full article

Source: @WSJ Read full article

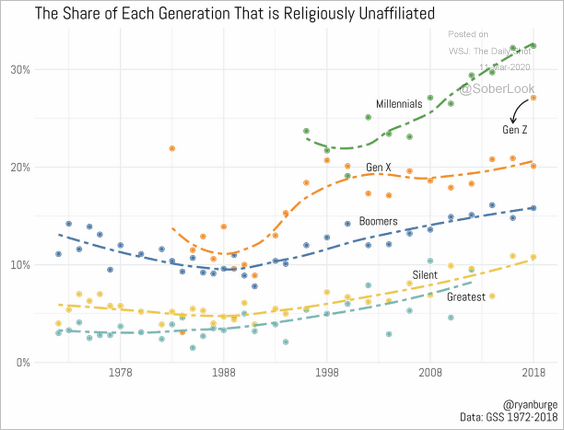

6. Religiously unaffiliated:

Source: @ryanburge Read full article

Source: @ryanburge Read full article

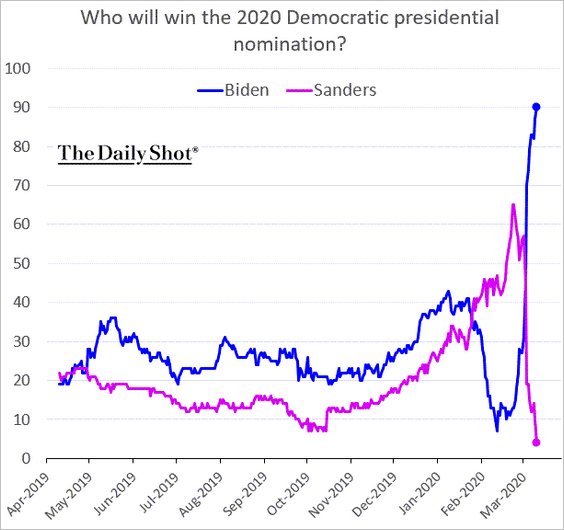

7. The betting markets probabilities:

• The Democratic presidential nomination:

Source: @PredictIt

Source: @PredictIt

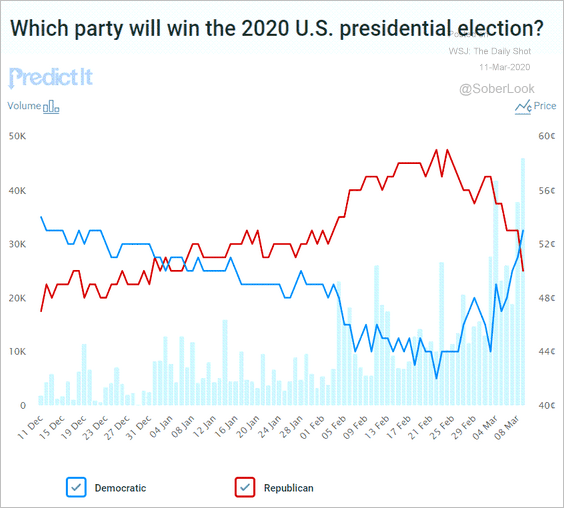

• The presidential election:

Source: @PredictIt

Source: @PredictIt

——————–

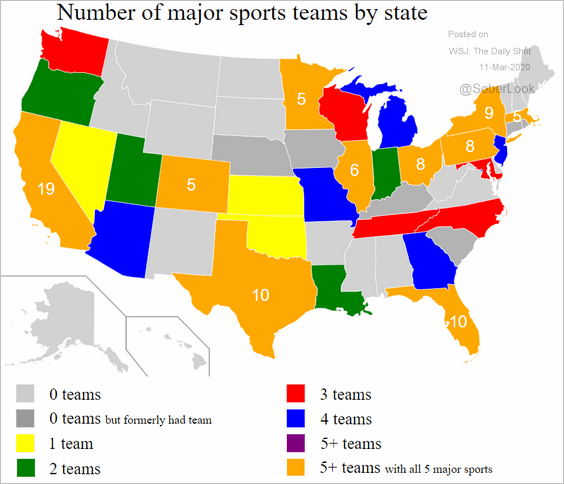

8. The number of major sports teams by state:

Source: Wikipedia Read full article

Source: Wikipedia Read full article

——————–