To receive the Daily Shot newsletter in your inbox, please sign up at our Email Center. Previous issues of the Daily Shot are available online at DailyShotWSJ.com.

Have questions, feedback or comments? Contact author [email protected].

Twitter: @SoberLook

The Daily Shot: 12-Mar-20

• Credit

• Equities

• Rates

• Commodities

• Emerging Markets

• China

• Asia – Pacific

• Europe

• The United Kingdom

• Canada

• The United States

• Global Developments

• Food for Thought

Credit

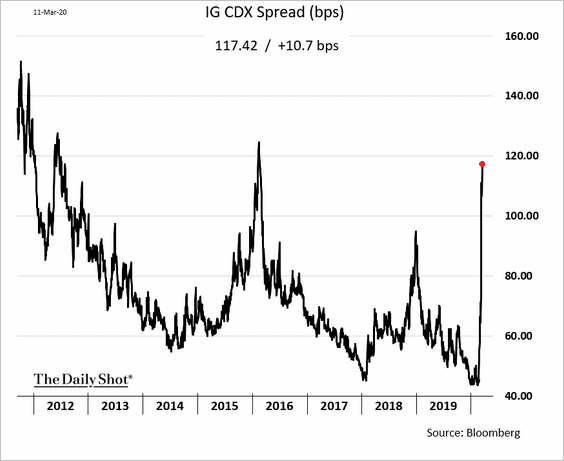

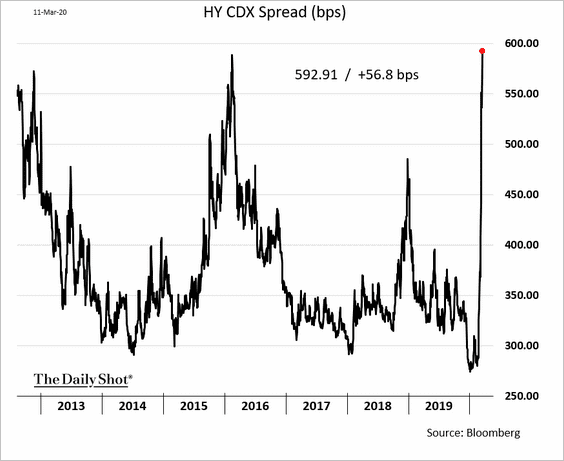

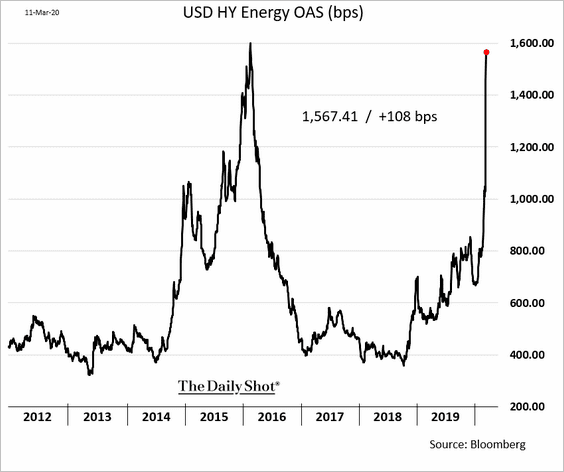

1. We are finally seeing some capitulation in credit.

• Investment-grade CDX spread:

• High-yield CDX spread (approaching 600 bps):

• High-yield energy sector bond spreads:

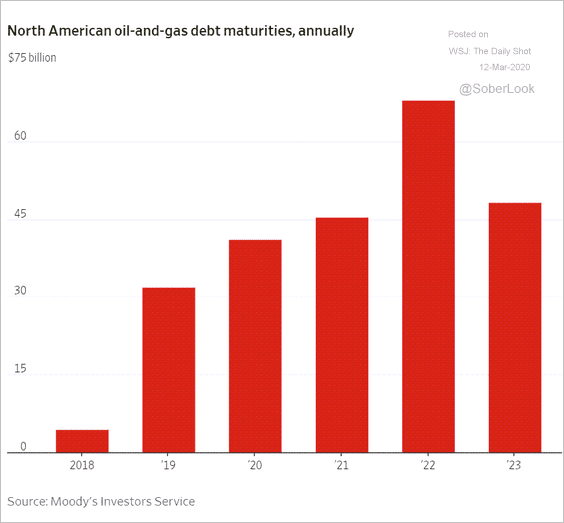

By the way, here is the maturity wall in oil & gas.

Source: @WSJ Read full article

Source: @WSJ Read full article

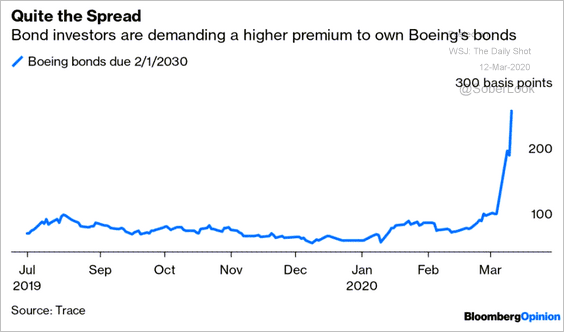

• Boeing bond spread:

Source: @bopinion Read full article

Source: @bopinion Read full article

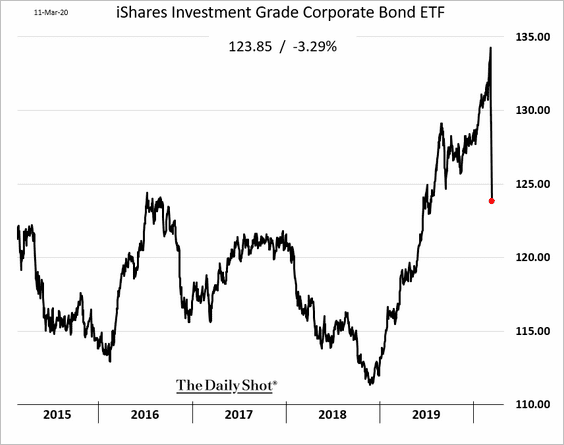

• The largest investment-grade corporate bond ETF:

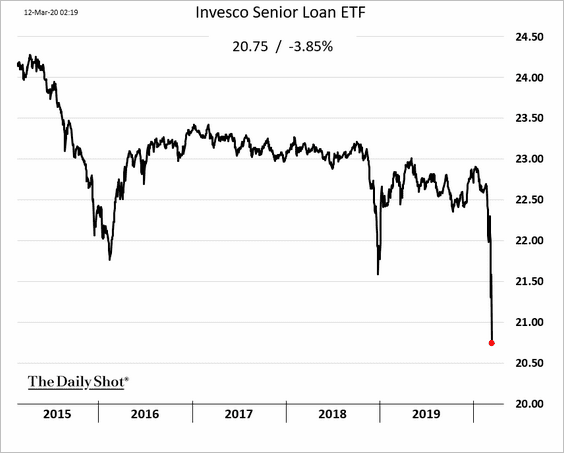

• Leveraged loans:

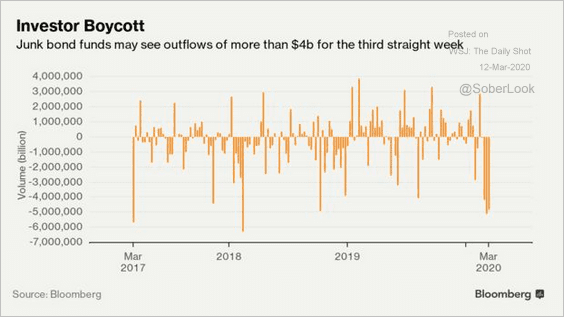

• High-yield fund flows:

Source: @markets Read full article

Source: @markets Read full article

——————–

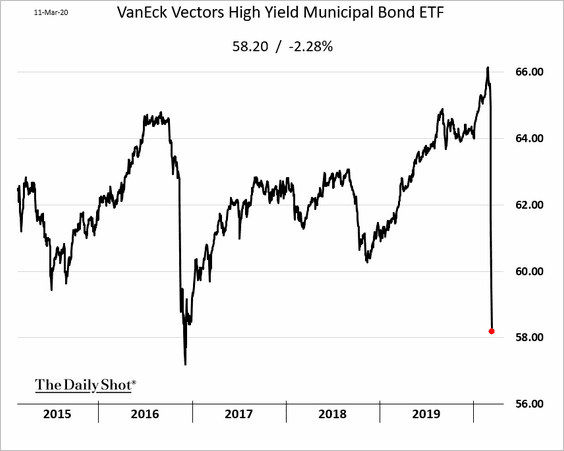

2. As we mentioned a few days ago (#5 here), the muni market looked frothy. High-yield muni bonds seemed particularly vulnerable. Well, the market finally cracked.

Many states and municipalities will feel the pressure from both the revenue and the cost perspective (as they ramp up efforts to contain the epidemic). Below is an email from a Daily Shot subscriber.

I have seen no news coverage of the imminent reduction in government revenues that the coronavirus displacement will cause. As the owner of a hospitality company, we are a canary in the coal mine (to wit, a major local competitor is entering bankruptcy already), and it seems certain to me that there will be a meaningful reduction in sales tax revenue, payroll taxes, etc. The decline in economic activity will be felt by local state and federal governments everywhere in the US, just as calls for more fiscal stimulus grow louder. Seems like a part of the conversation that’s been missing?

Sincerely,

Steve Slayton

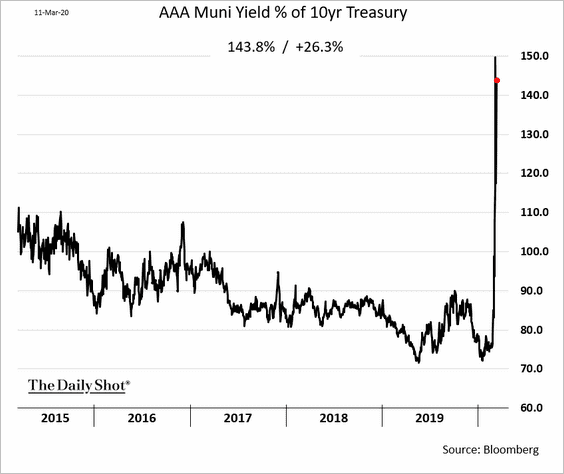

Here is the ratio of AAA muni yields to the 10yr Treasury.

Source: @markets Read full article

Source: @markets Read full article

——————–

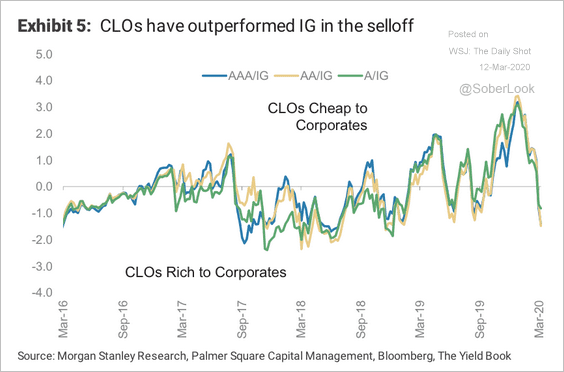

3. CLOs have recently outperformed corporate investment-grade credit on a spread basis (at the top of the capital structure).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

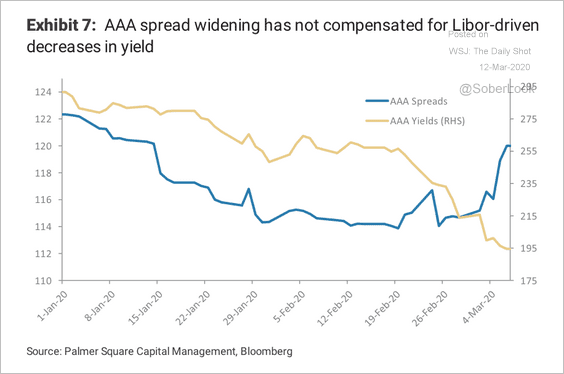

CLO AAA-spread widening has not been nearly enough to compensate for the drop of the floating rate component of AAA returns, according to Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

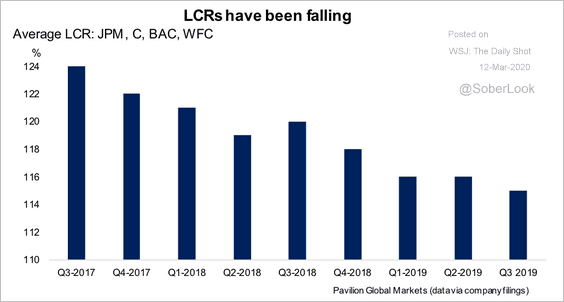

3. Bank liquidity coverage ratios (LCRs), which require dealers to stockpile 30 days of funding to cover stressed liquidity outflows, have declined.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

Equities

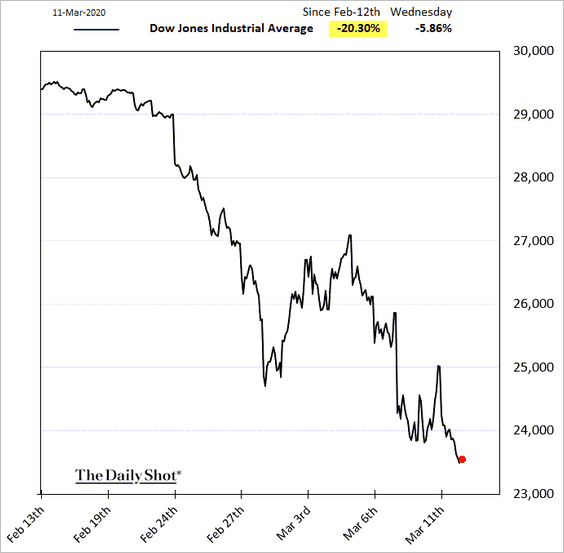

1. The Dow entered bear-market territory.

Source: @WSJ Read full article

Source: @WSJ Read full article

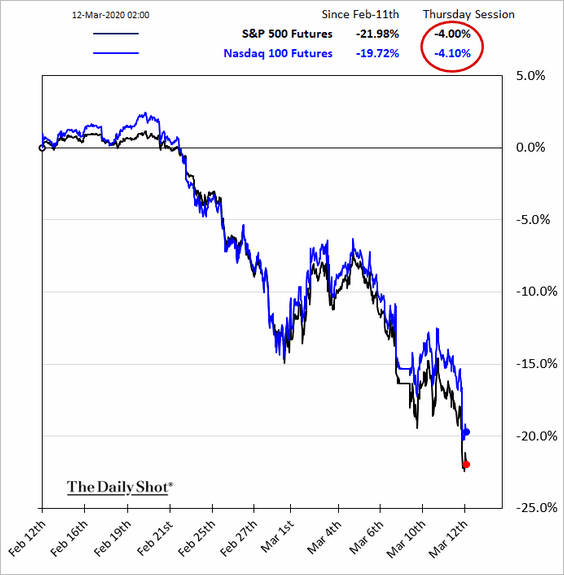

And the market is lower again in early trading after the White House introduced travel restrictions.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

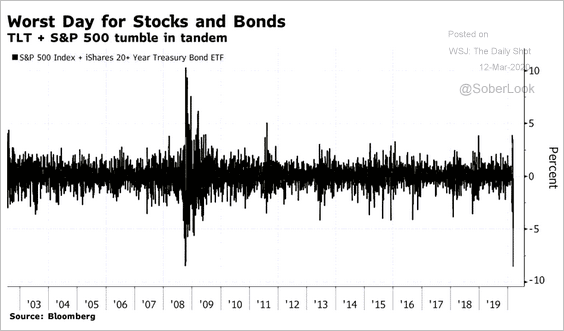

2. Wednesday was a rough day for both stocks and bonds.

Source: @markets Read full article

Source: @markets Read full article

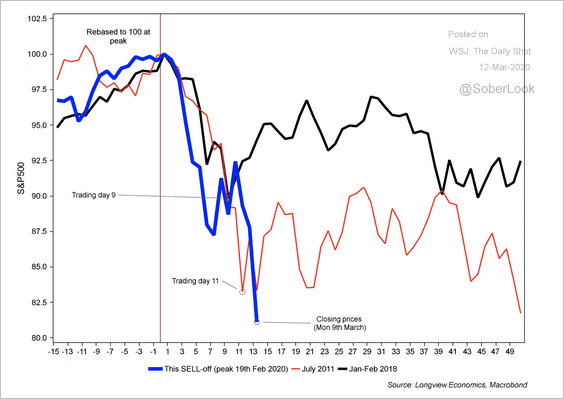

3. Here’s the current sell-off (as of the 9th) mapped against other recent sell-offs.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

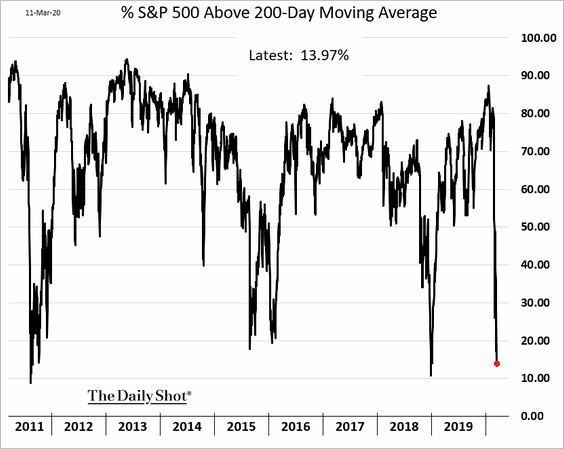

4. The share of S&P 500 stocks trading above their 200-day moving average dipped below 15%.

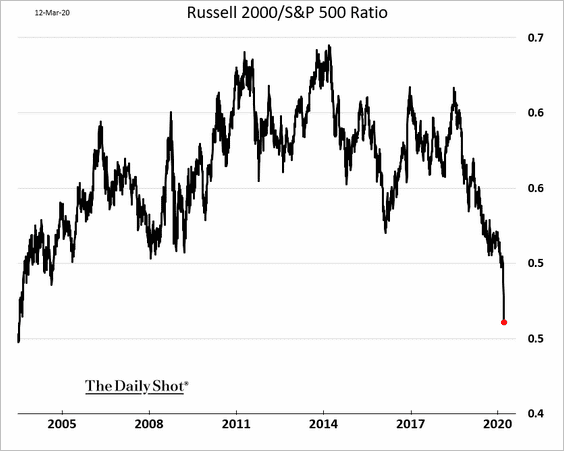

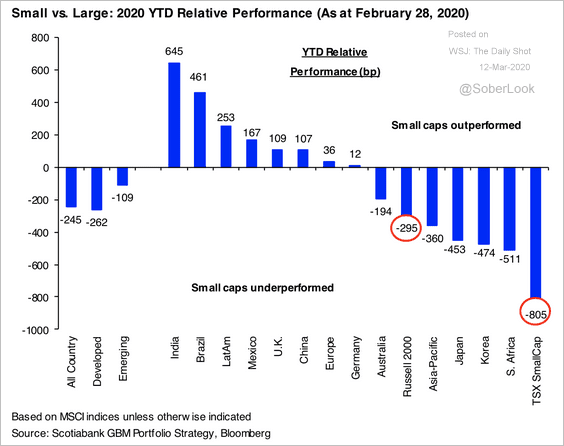

5. The recent underperformance of small-cap shares has been severe.

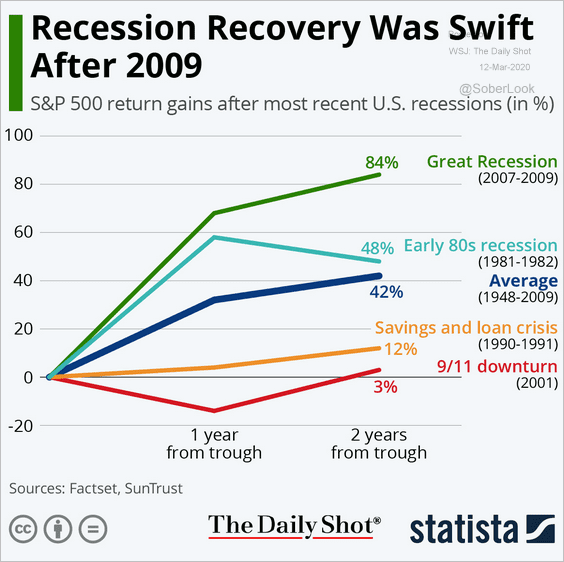

6. How do stocks perform in the years immediately following a recession?

Source: SunTrust Private Wealth Management, Statista

Source: SunTrust Private Wealth Management, Statista

Rates

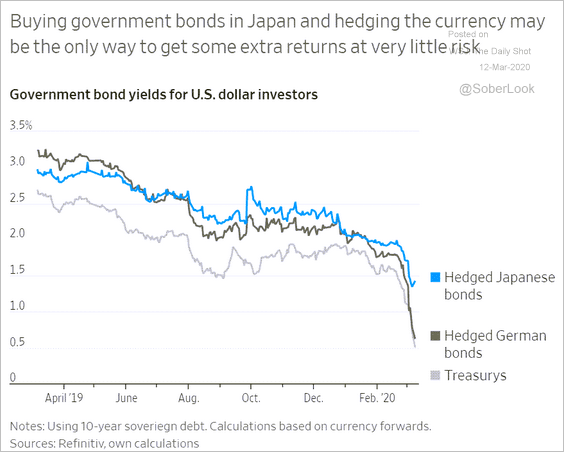

Dollar-hedged JGBs look attractive relative to Treasuries. It’s a tailwind for the yen.

Source: @WSJ Read full article

Source: @WSJ Read full article

Commodities

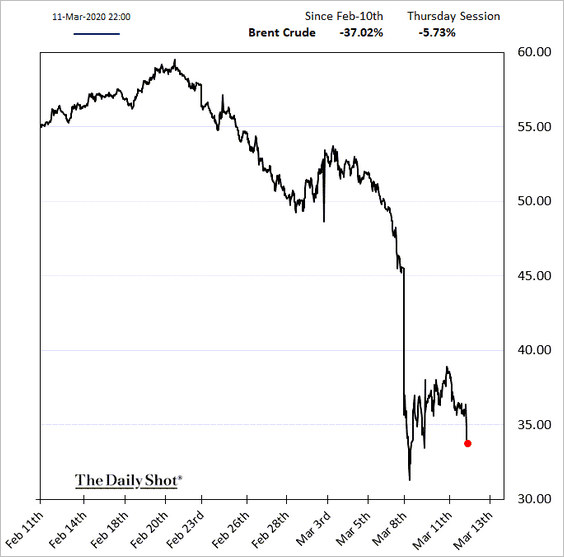

1. Crude oil is sharply lower on Thursday as the US imposes travel restrictions.

2. Copper is under pressure again.

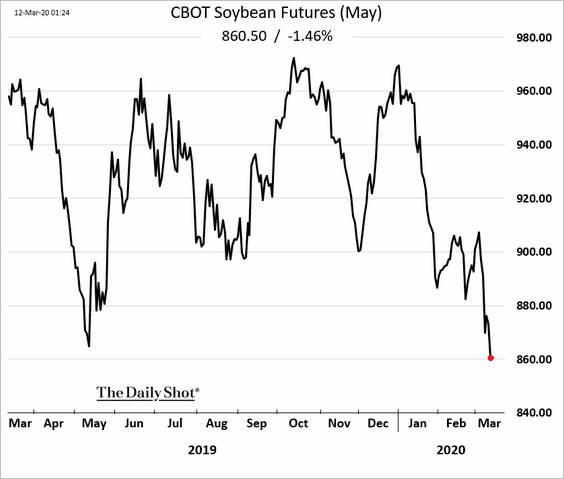

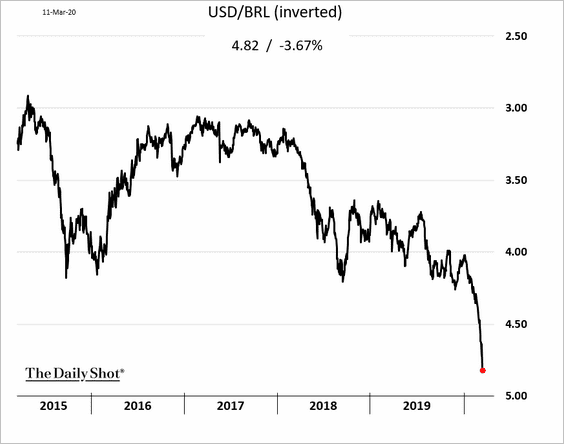

3. US soybean futures are tumbling as the Brazilian real hits a new low (see the EM section).

Emerging Markets

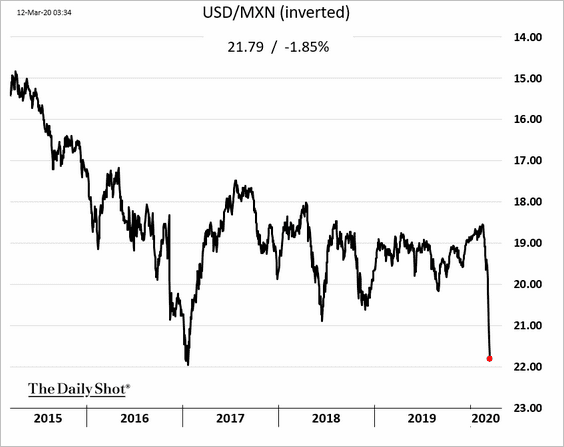

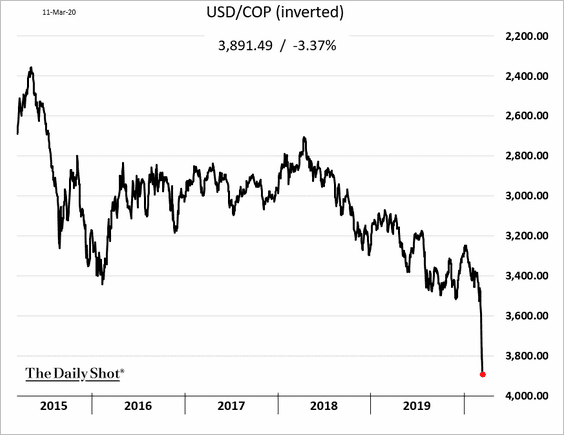

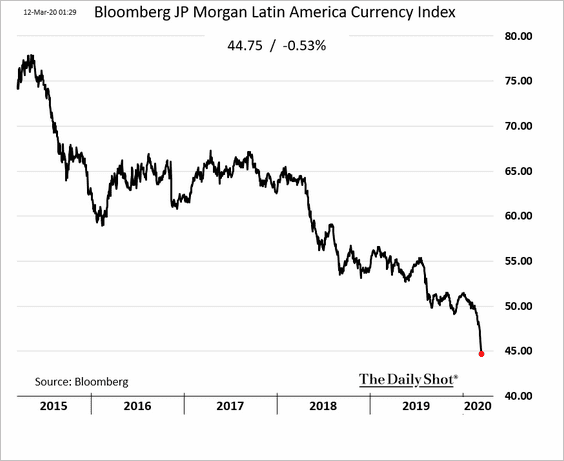

1. Latin American currencies are plunging.

• The Mexican peso:

• The Colombian peso:

• The Brazilian real (headed toward 5 to the dollar):

• Bloomberg’s LatAm currency index:

——————–

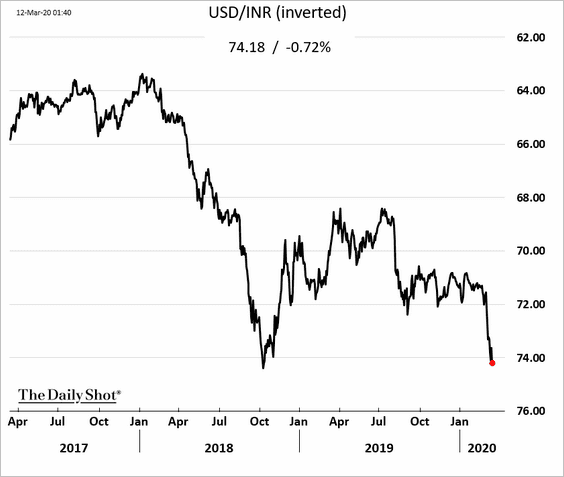

2. The Indian rupee is approaching record lows.

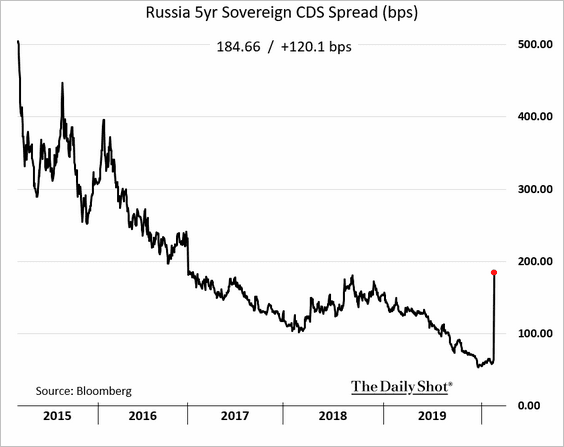

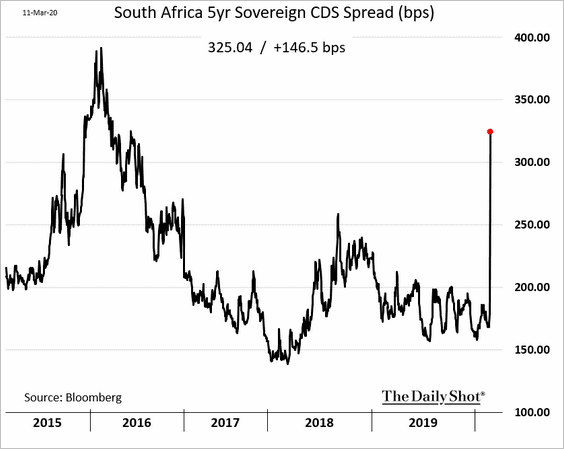

3. EM sovereign credit default swap spreads continue to widen.

• Russia:

• South Africa:

——————–

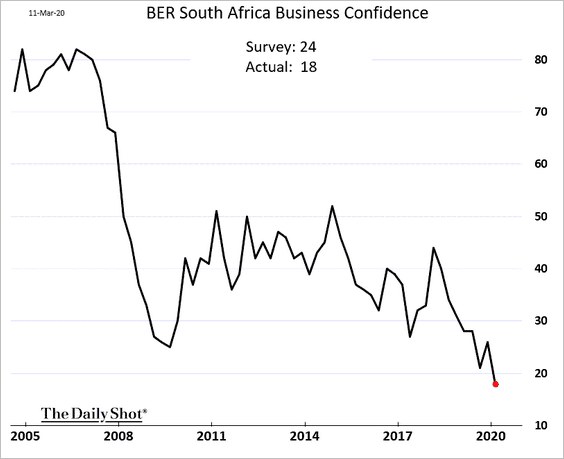

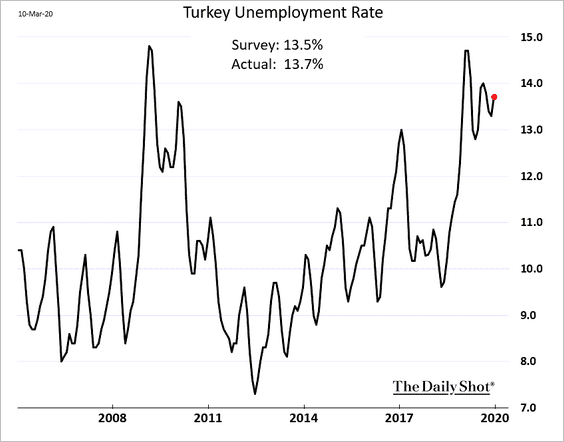

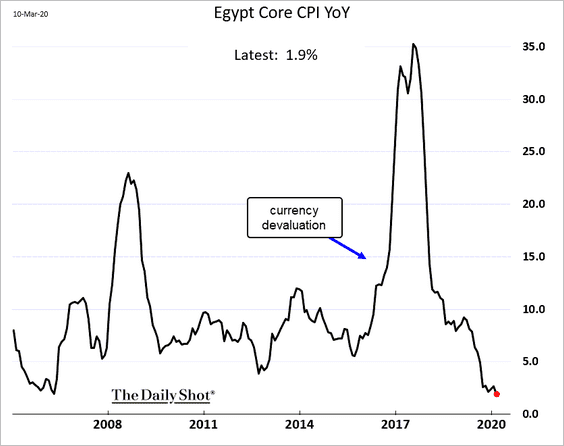

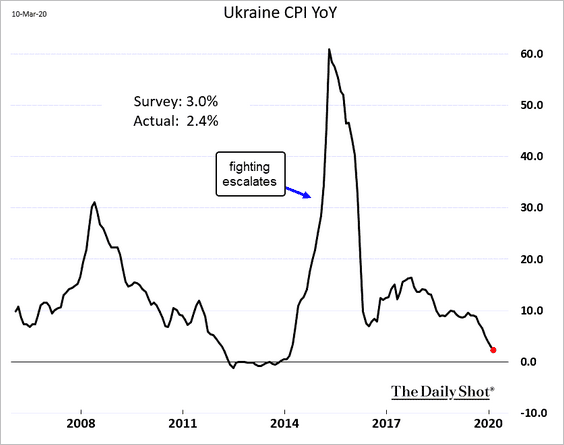

4. Next, let’s run through some recent economic data updates.

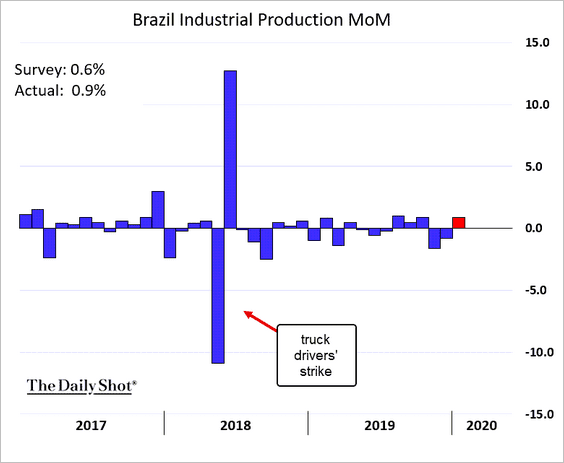

• Brazil’s industrial production (better than expected):

• South Africa’s business confidence:

• The unemployment rate in Turkey:

• Egypt’s consumer inflation:

• Ukrainian inflation:

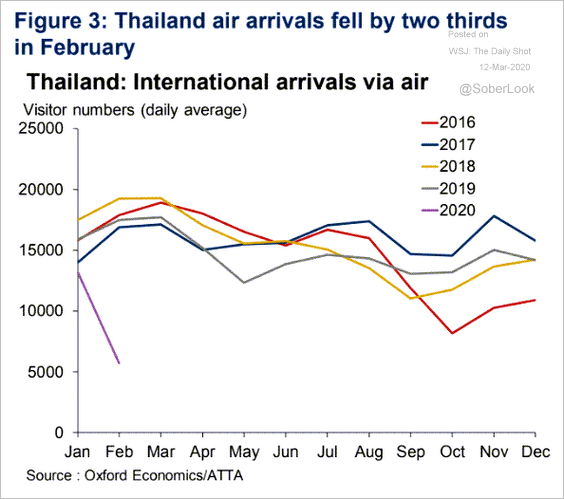

• Thailand’s international arrivals:

Source: Oxford Economics

Source: Oxford Economics

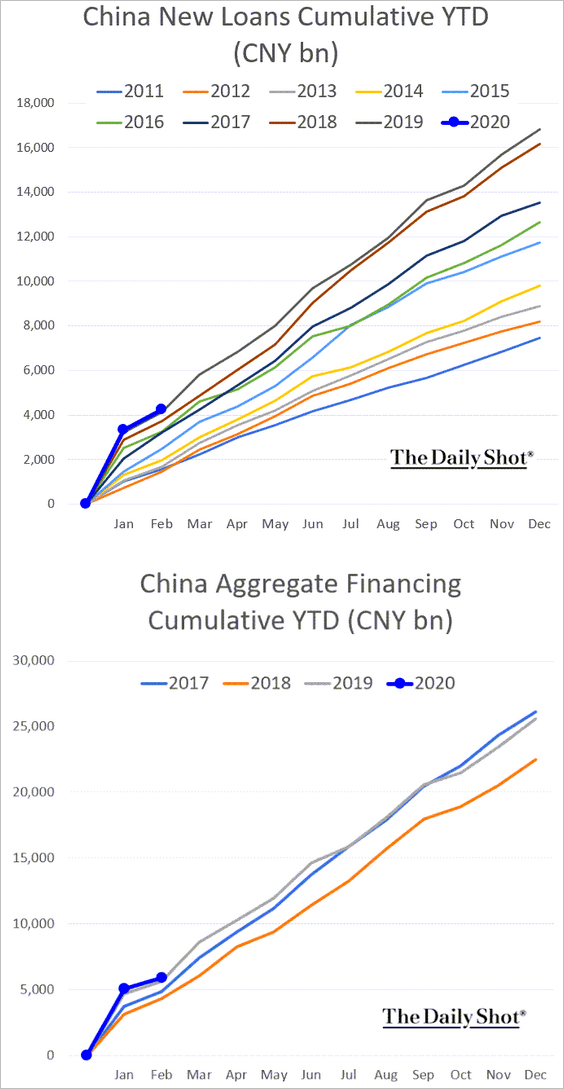

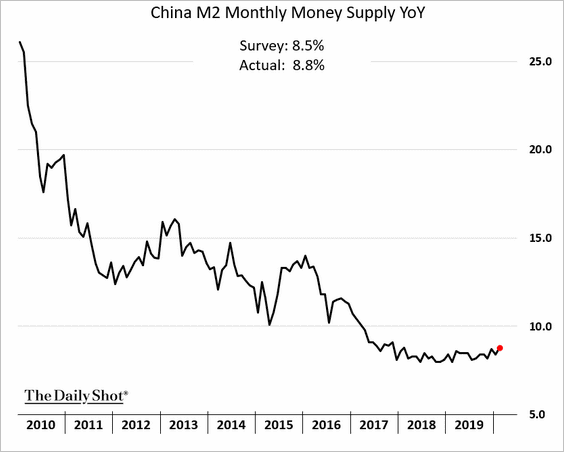

China

1. Last month’s credit growth was weaker than expected. However, on a year-to-date basis, credit expansion is following last year’s path.

The M2 (broad) money supply growth improved.

——————–

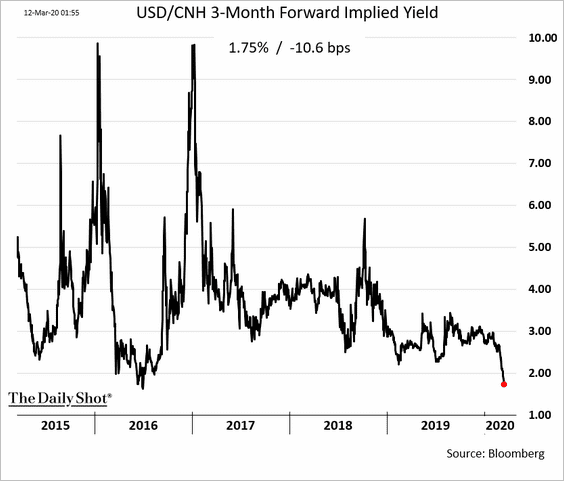

2. Here is the 3-month interest rate implied by the F/X forward market.

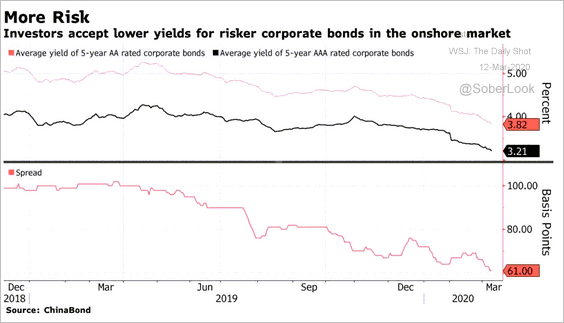

3. Lower-rated corporate bonds have performed remarkably well.

Source: @markets Read full article

Source: @markets Read full article

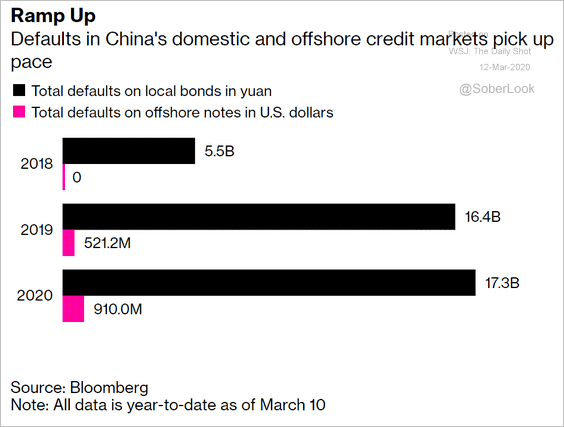

Defaults are picking up.

Source: @markets Read full article

Source: @markets Read full article

——————–

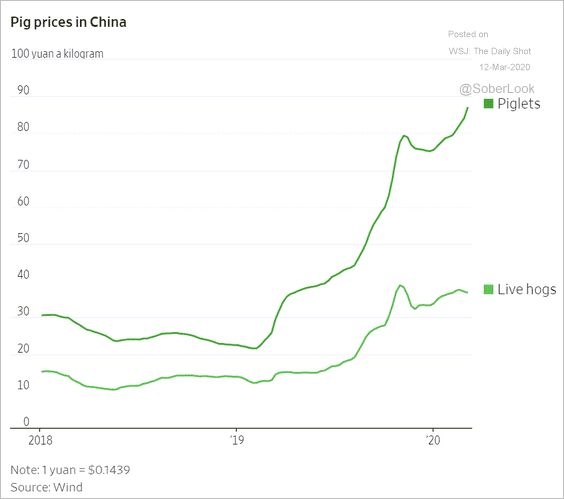

4. Pig shortages persist.

Source: @WSJ Read full article

Source: @WSJ Read full article

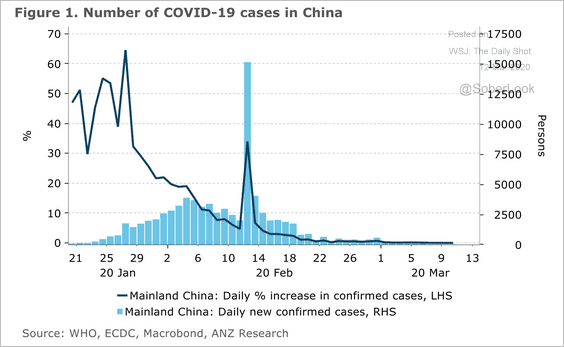

5. Is China on track to see its first day of zero new infections?

Source: ANZ Research

Source: ANZ Research

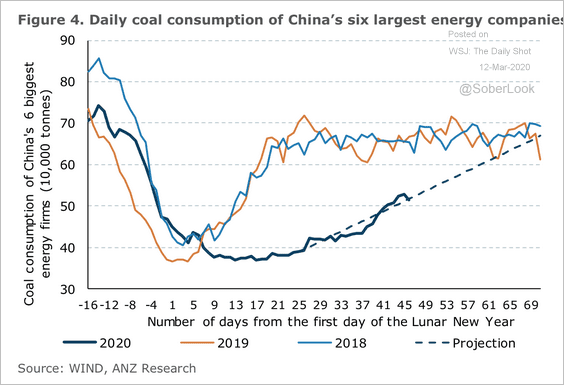

6. Coal consumption is recovering.

Source: ANZ Research

Source: ANZ Research

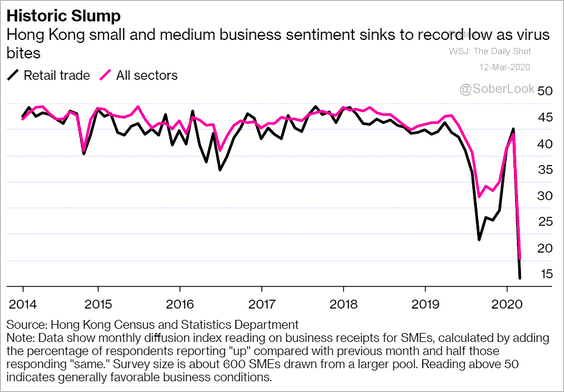

7. Hong Kong’s small and medium-size business sentiment has collapsed.

Source: @business Read full article

Source: @business Read full article

Asia – Pacific

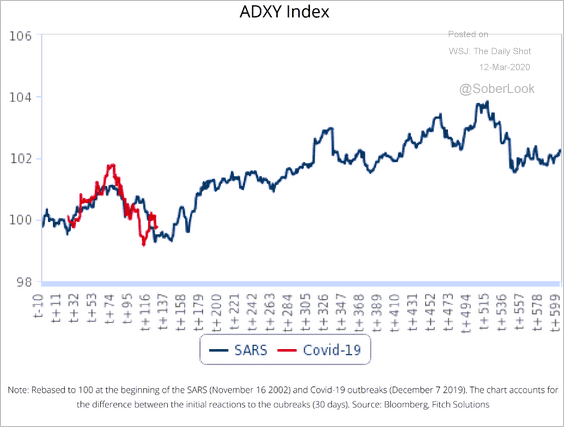

1. Asian currencies are following the path taken during the SARS epidemic.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

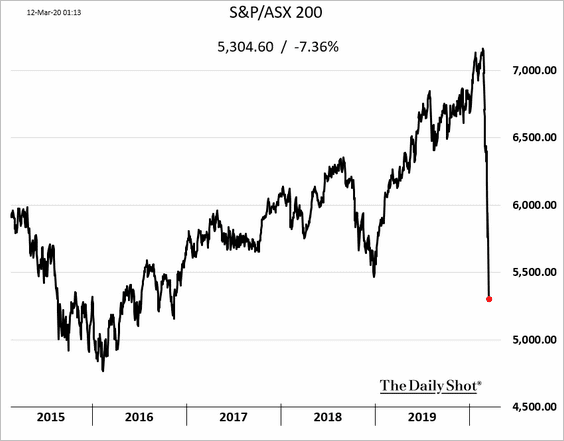

2. Australia’s stock market selloff has wiped out three years of gains.

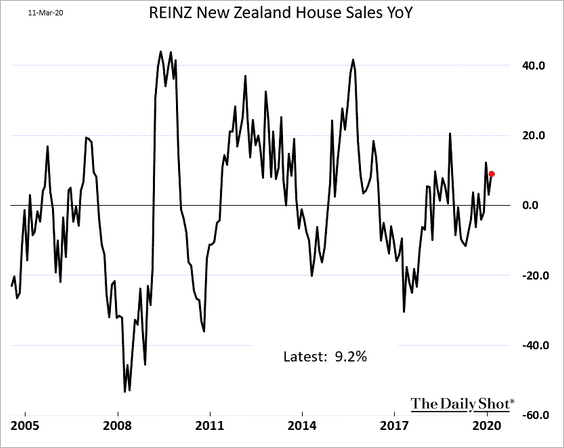

3. New Zealand’s home sales have been improving.

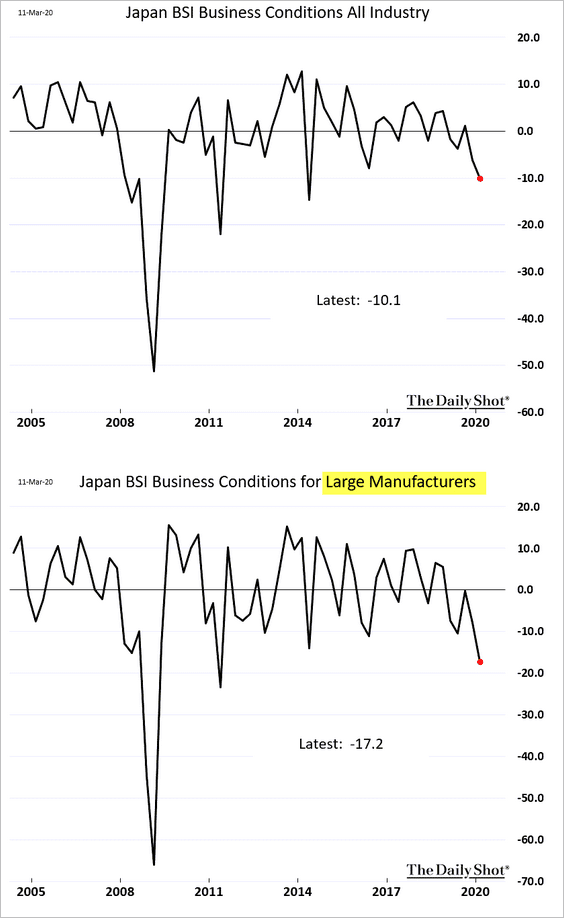

4. Next, we have a couple of updates on Japan.

• The stock market:

• Business conditions:

Europe

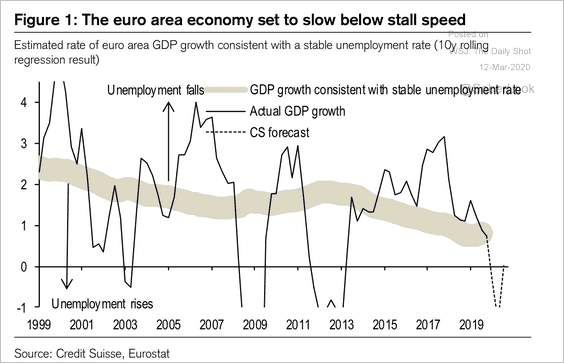

1. Credit Suisse is projecting a deep downturn in euro-area GDP growth. The economy is expected to be under the “stall speed” – the pace of growth below which unemployment is likely to rise.

Source: Credit Suisse

Source: Credit Suisse

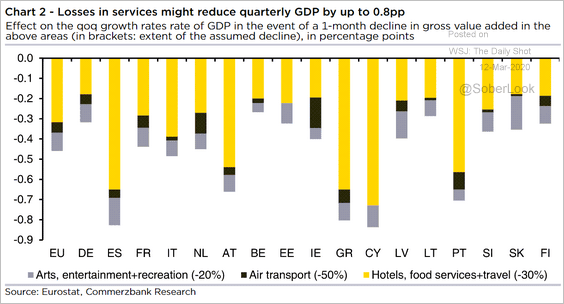

2. Losses in services are expected to be substantial.

Source: Commerzbank Research

Source: Commerzbank Research

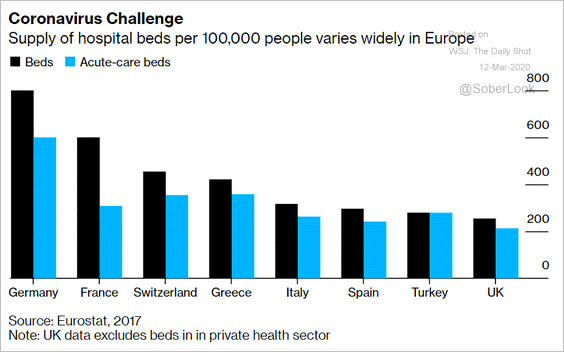

3. Here is the supply of hospital beds in Europe.

Source: @business Read full article

Source: @business Read full article

The United Kingdom

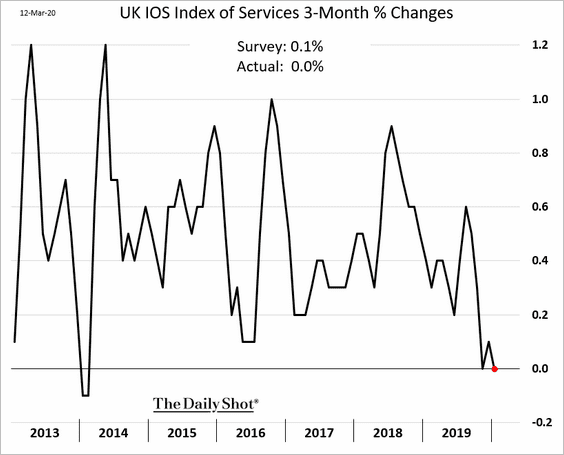

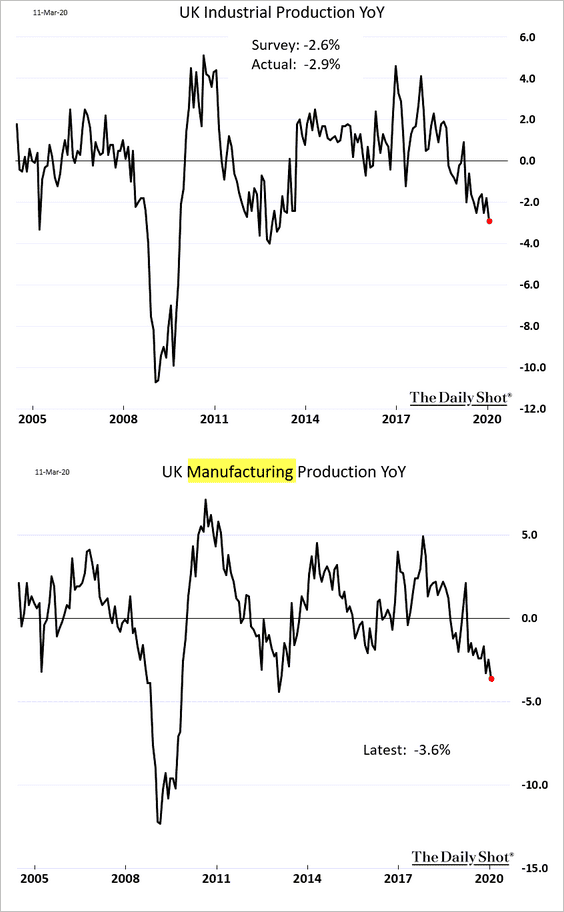

1. Despite the recent improvements in sentiment, hard data trends remain poor.

• Services:

• Industrial production:

——————–

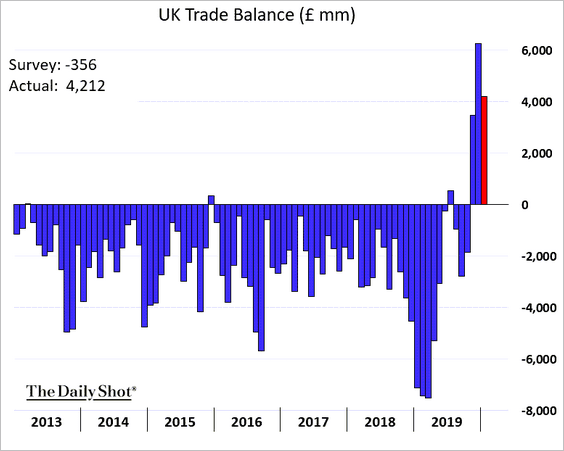

2. Trade has been in surplus.

Here is a comment from Pantheon Macroeconomics.

January’s large trade surplus primarily reflects a surge in exports of erratics-including non-monetary gold-which says nothing about the underlying state of the economy. The trade deficit excluding erratics, however, has declined sharply in recent months and was a mere £0.7B in January, much smaller than its average of GBP 2.5B since the 2016 EU referendum. The small deficit reflects continued weakness in demand for imports, which has not recovered since the second Brexit deadline in October. Firms still seem to be running down the stocks of imported goods they accumulated before the October Brexit deadline, instead of placing new orders.

——————–

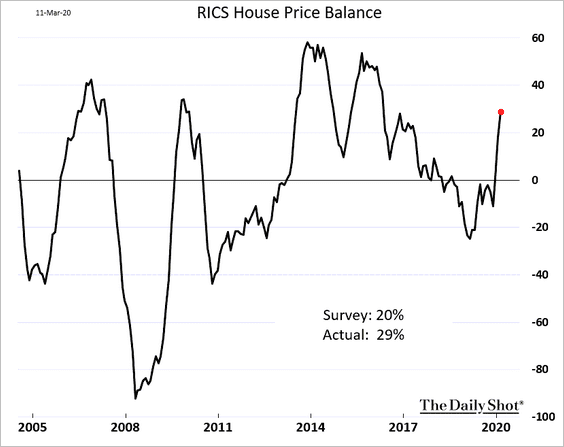

3. The housing market rebound continues.

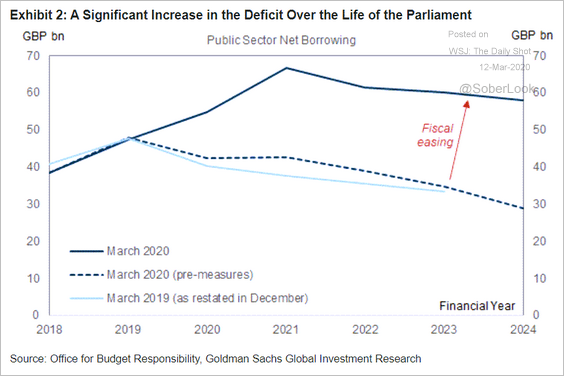

4. The government is going on a spending splurge.

Source: The Guardian Read full article

Source: The Guardian Read full article

Source: Goldman Sachs

Source: Goldman Sachs

Canada

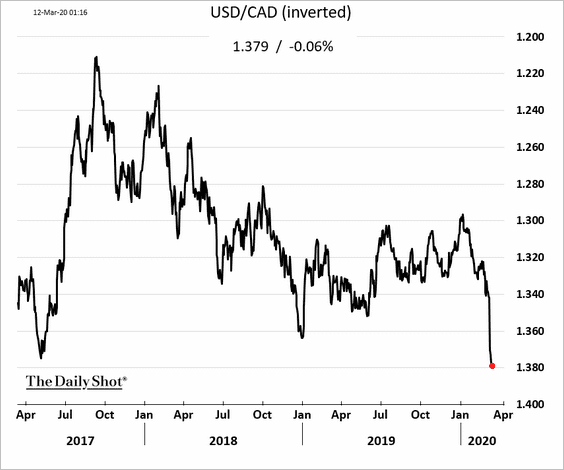

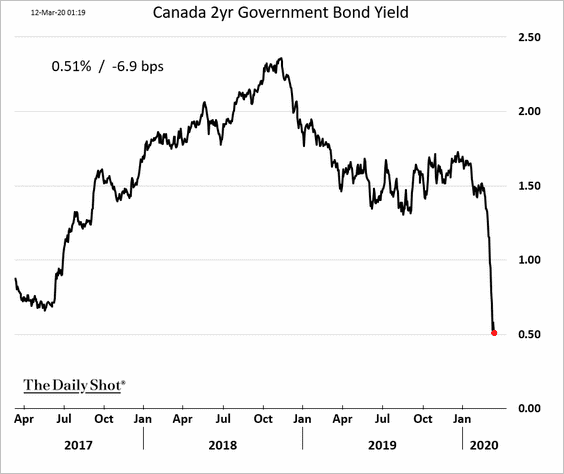

The loonie and bond yields are moving lower.

The United States

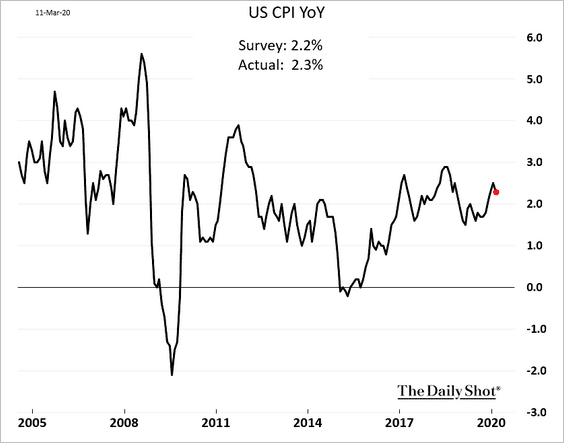

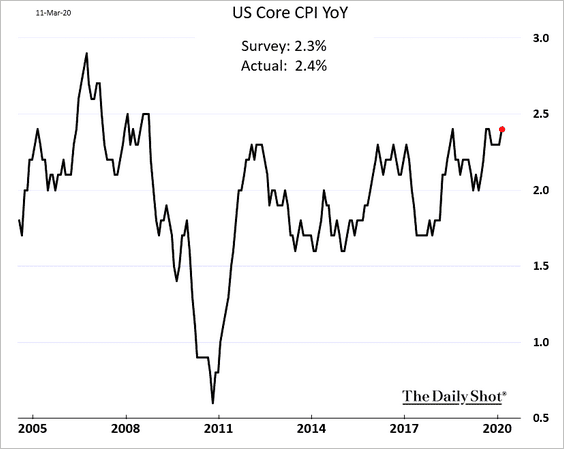

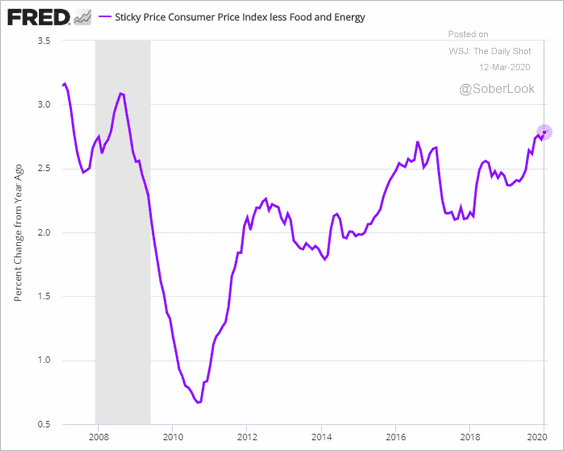

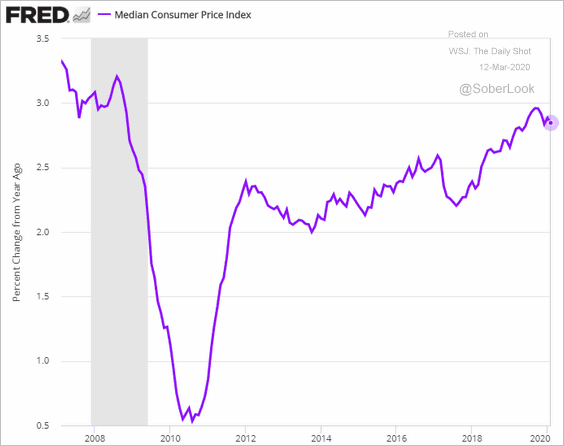

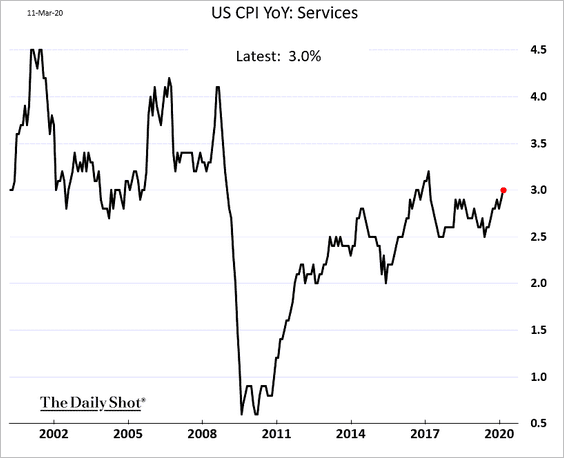

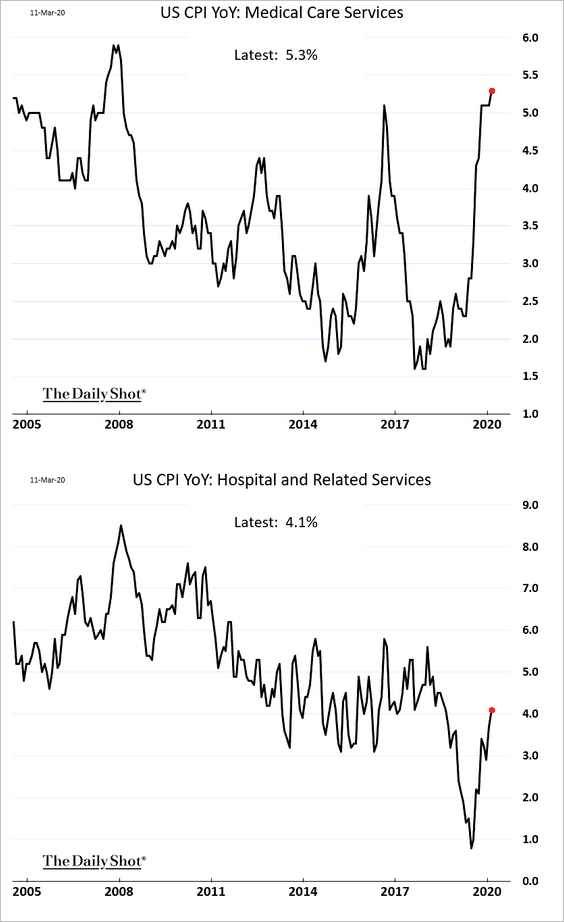

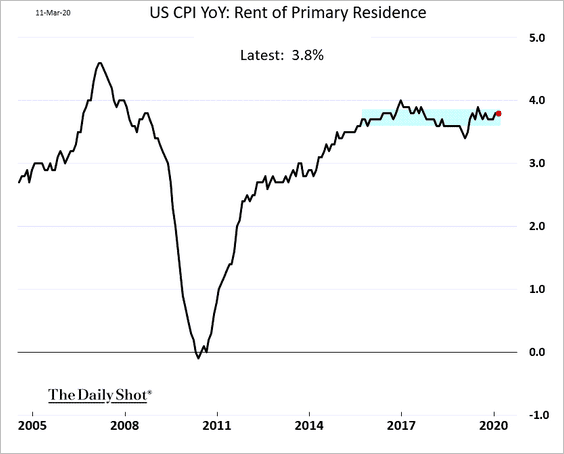

1. Let’s begin with the CPI figures for February, which topped economists’ forecasts.

• The headline CPI:

• The core CPI:

• The sticky and median CPI:

• Services:

• Medical services:

• Rent:

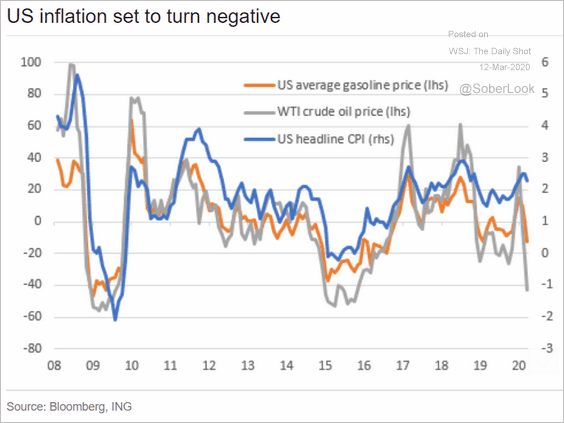

The recent increases in inflation will be reversed shortly as a result of the crash in oil prices and weakening consumer demand. Will the headline CPI dip into negative territory?

Source: ING

Source: ING

——————–

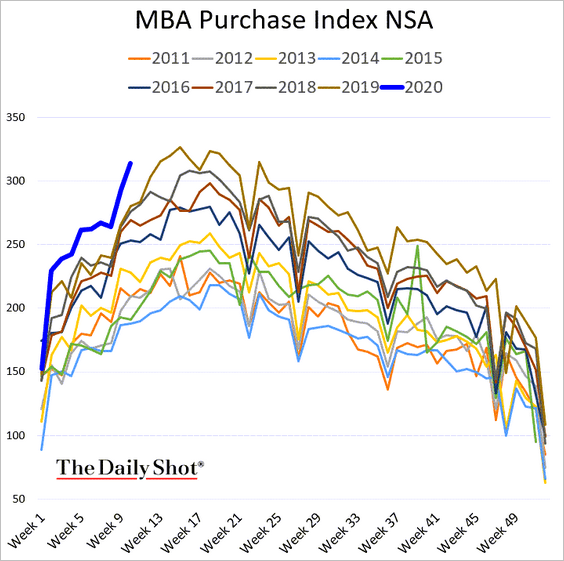

2. Mortgage applications for house purchase remain at multi-year highs.

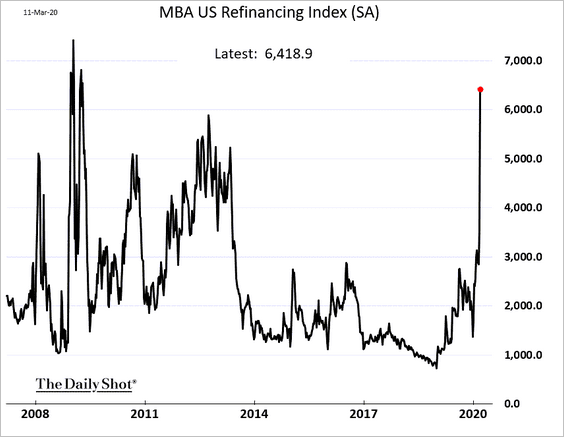

And refinancing activity hit the highest level since 2008.

——————–

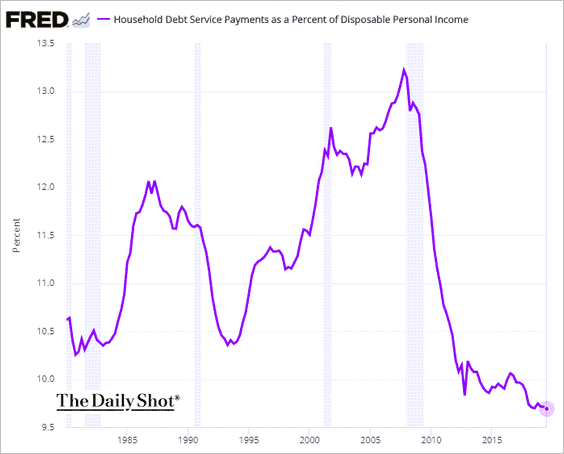

3. The massive wave of mortgage refinancing will further ease US households’ debt-related expenses, which were already near record lows.

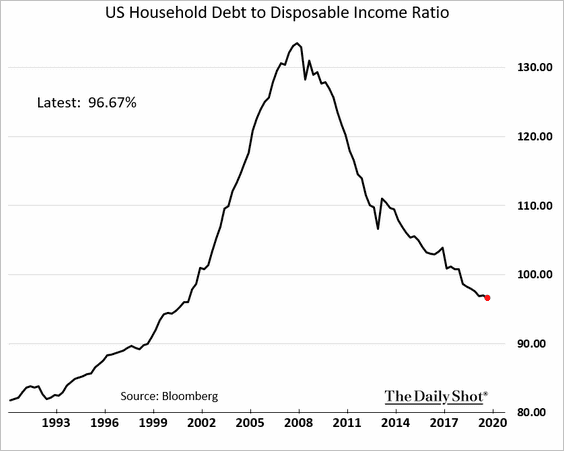

Households’ debt-to-disposable income ratio is at the lowest level in nearly two decades. The consumer is entering the current slowdown in decent shape. It doesn’t mean, however, that we won’t see a pickup in delinquencies in the months ahead as layoffs climb.

——————–

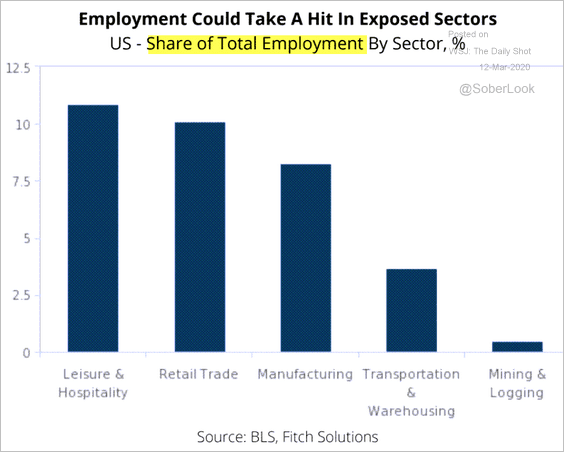

5. Which sectors will have the most layoffs?

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

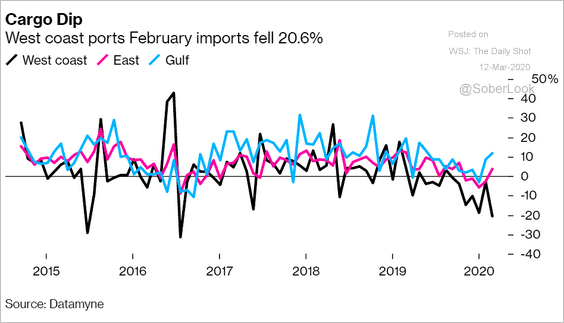

6. West coast port activity tumbled 20.6%.

Source: @markets Read full article

Source: @markets Read full article

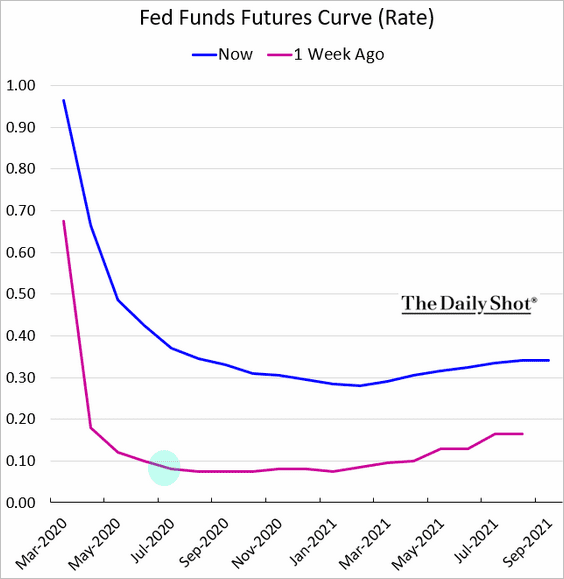

7. The market now expects the Federal Reserve to take rates below 0.1% this summer. Is the fed funds rate headed for zero again?

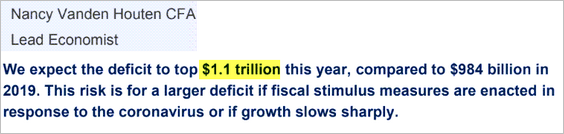

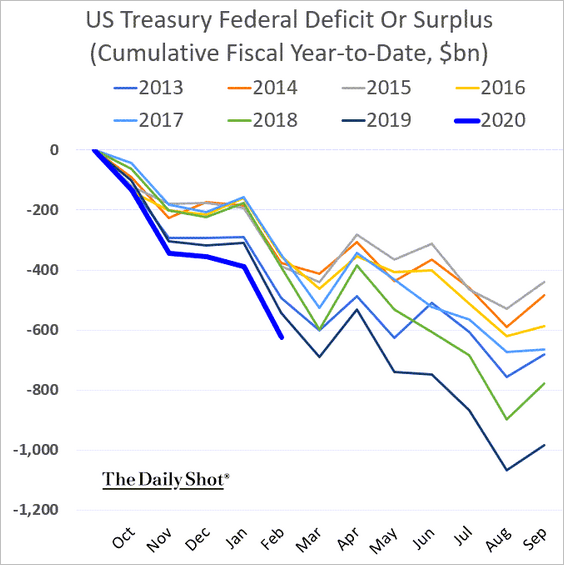

8. The federal budget deficit is expected to hit $1.1 trillion this year. Below is a comment from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

Global Developments

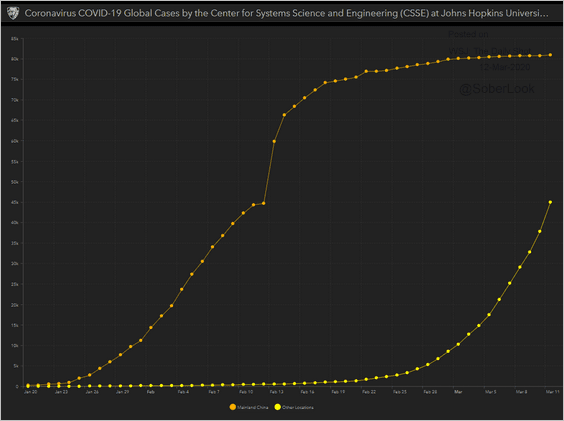

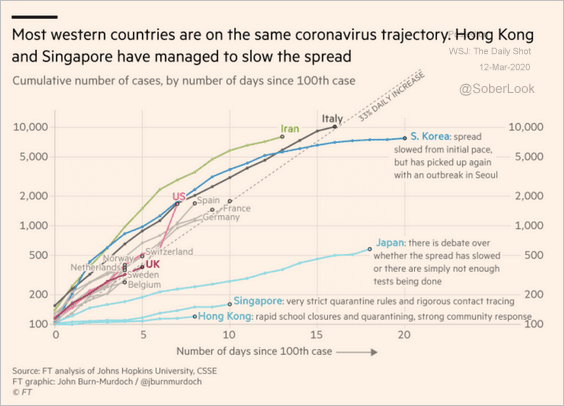

1. Here is the number of new coronavirus cases outside of China (yellow line).

Source: JHU CSSE

Source: JHU CSSE

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

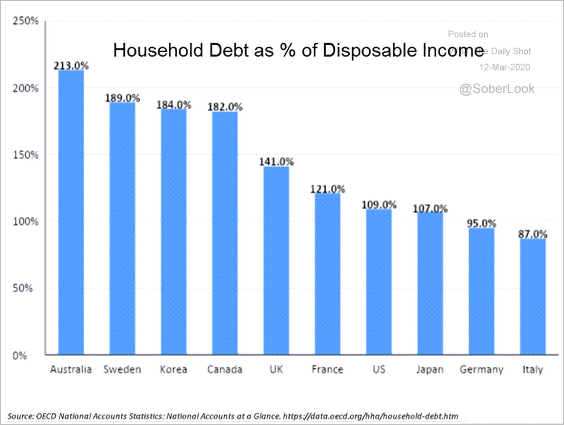

2. This chart shows the ratio of household debt to disposable income for developed economies.

Source: Denys Hildin, Star Mountain Capital

Source: Denys Hildin, Star Mountain Capital

3. Here is the year-to-date small-cap performance relative to large-caps across different countries.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

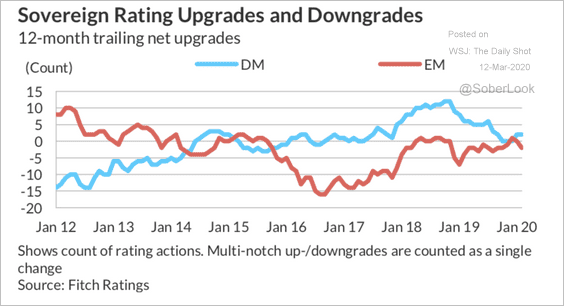

4. Are we about to see more sovereign downgrades?

Source: Fitch Ratings

Source: Fitch Ratings

——————–

Food for Thought

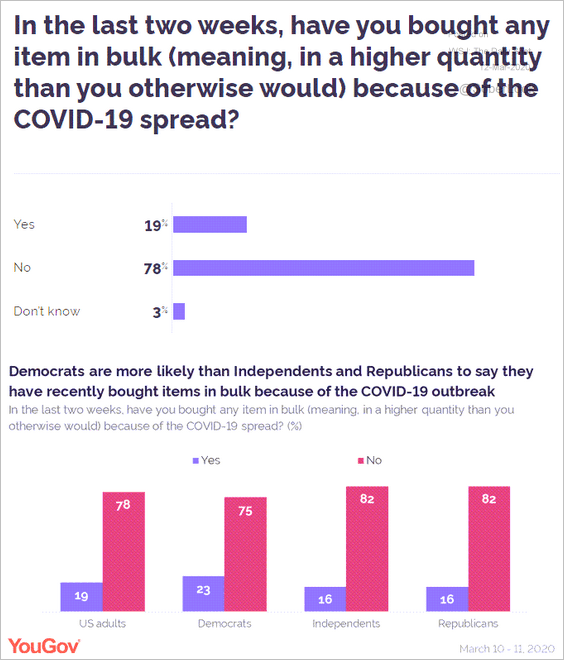

1. Who is hoarding?

Source: @YouGovUS Read full article

Source: @YouGovUS Read full article

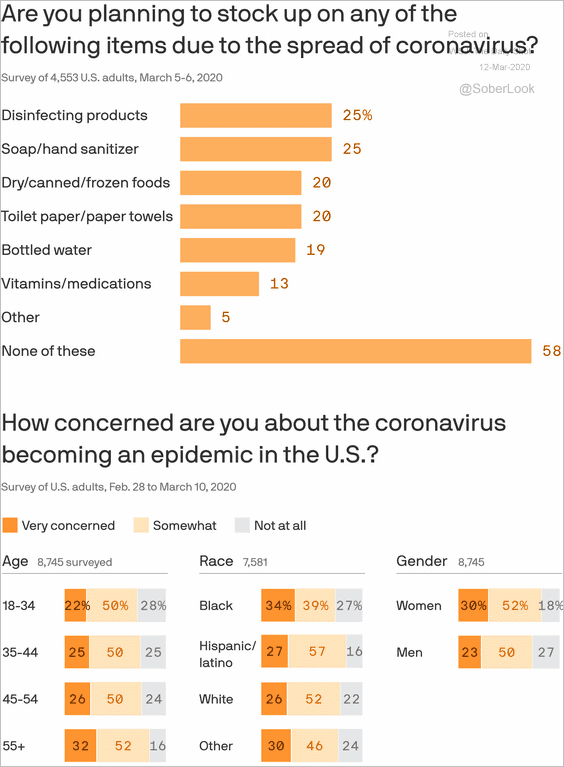

What are they hoarding?

Source: @axios Read full article

Source: @axios Read full article

Source: Yahoo News Read full article

Source: Yahoo News Read full article

——————–

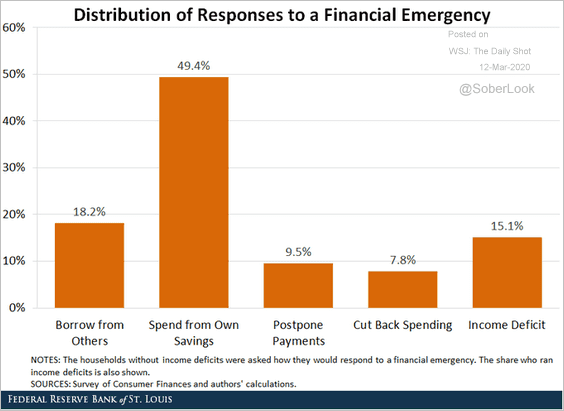

2. Handling financial emergencies:

Source: @stlouisfed Read full article

Source: @stlouisfed Read full article

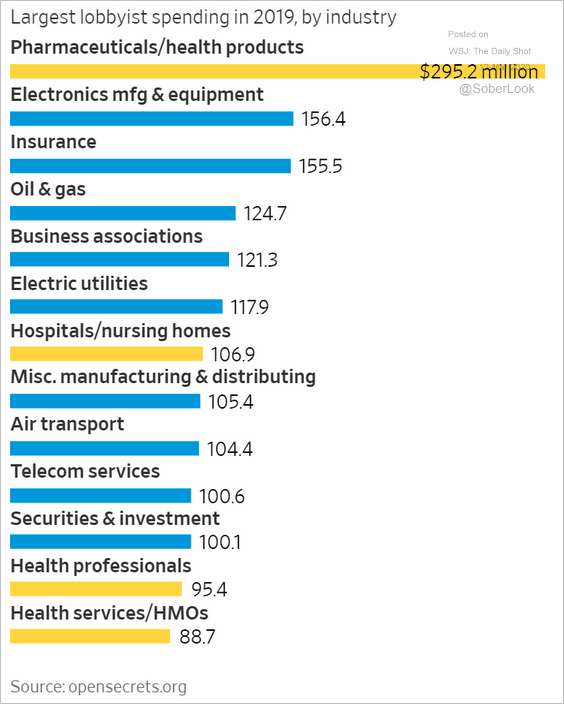

3. Lobbyist spending:

Source: @WSJ Read full article

Source: @WSJ Read full article

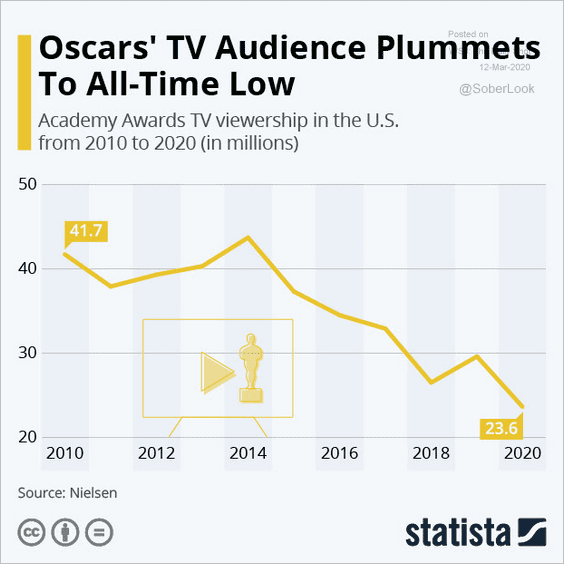

4. Oscars’ TV audience:

Source: Statista

Source: Statista

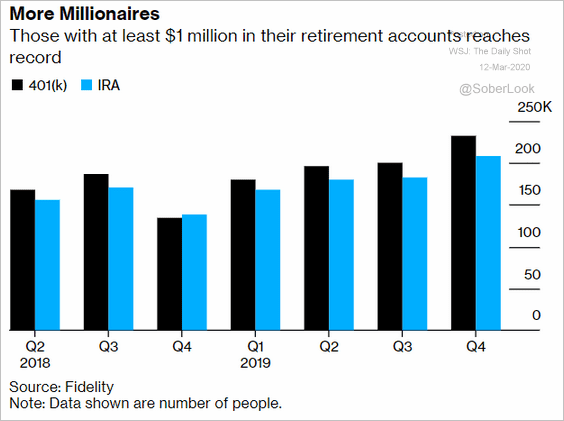

5. Americans with at least $1 million in their 401k (the numbers will look very different in Q1):

Source: @markets Read full article

Source: @markets Read full article

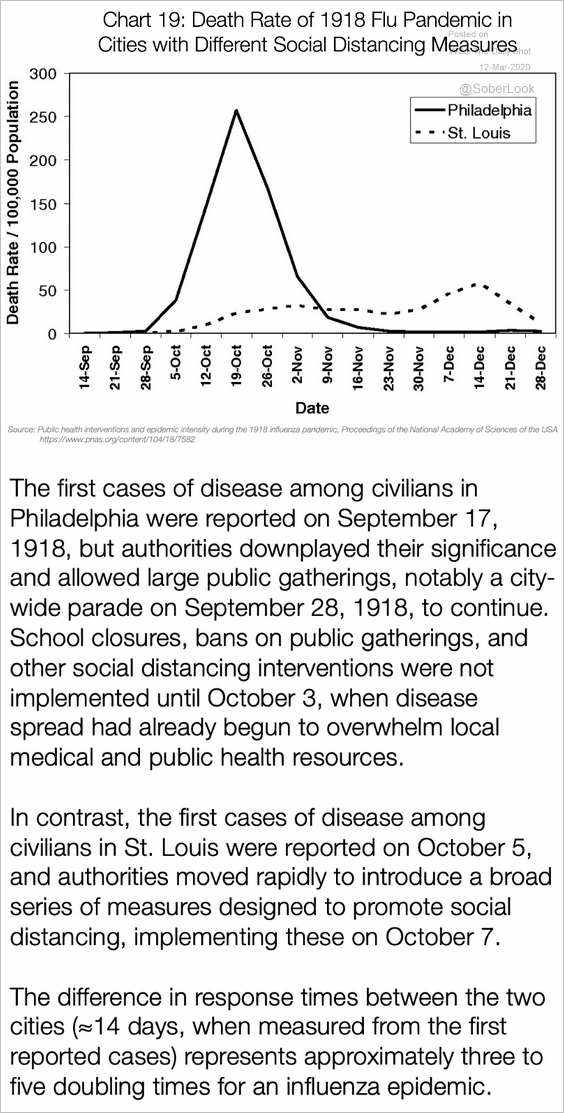

6. Social distancing:

Source: Tomas Pueyo Read full article

Source: Tomas Pueyo Read full article

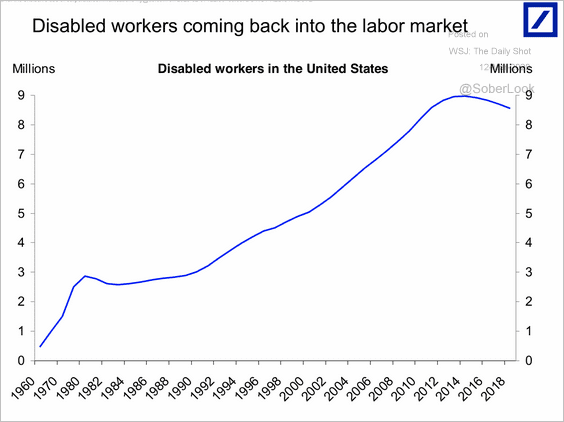

7. Disabled workers:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

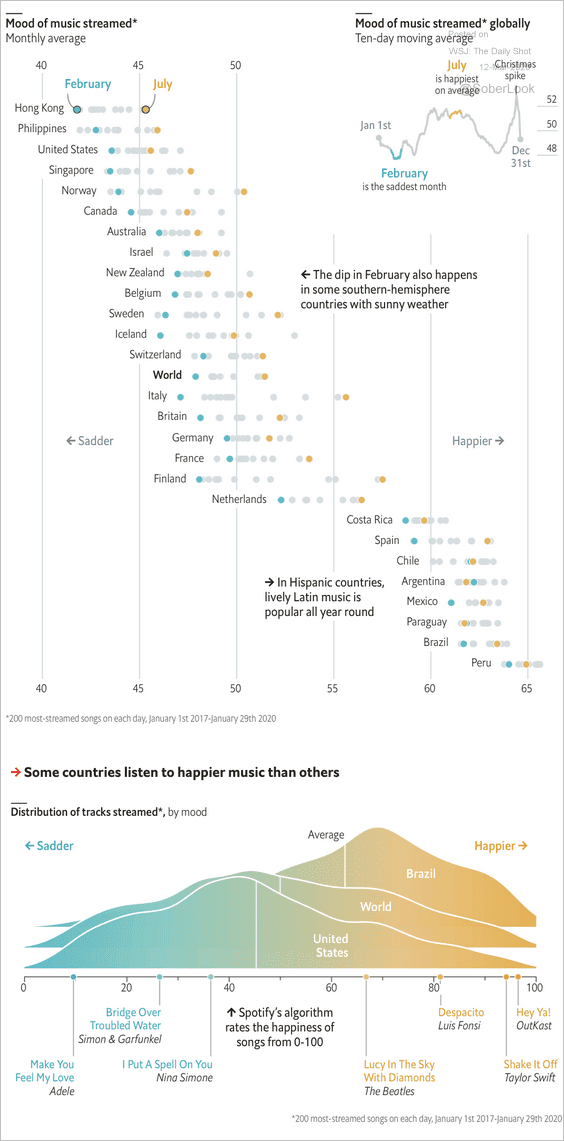

8. The mood of music streamed around the world:

Source: The Economist Read full article

Source: The Economist Read full article

——————–