The Daily Shot: 18-Mar-20

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

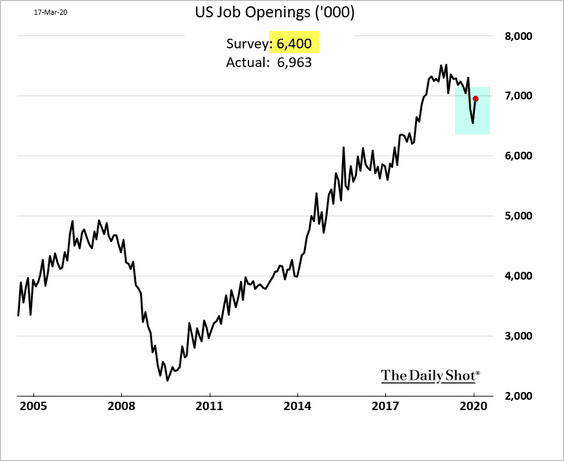

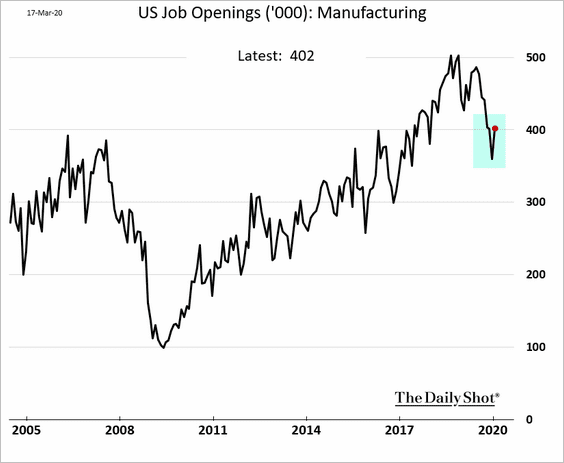

1. Job openings improved in January.

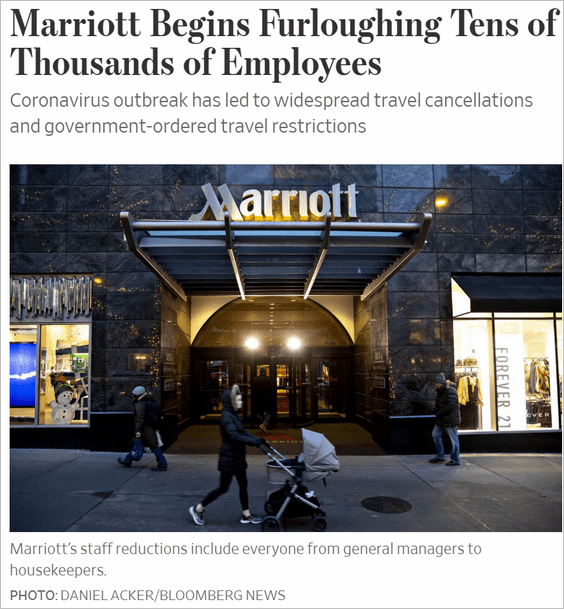

However, much has changed since then, as hiring freezes, furloughs, and layoffs are picking up.

Source: @WSJ Read full article

Source: @WSJ Read full article

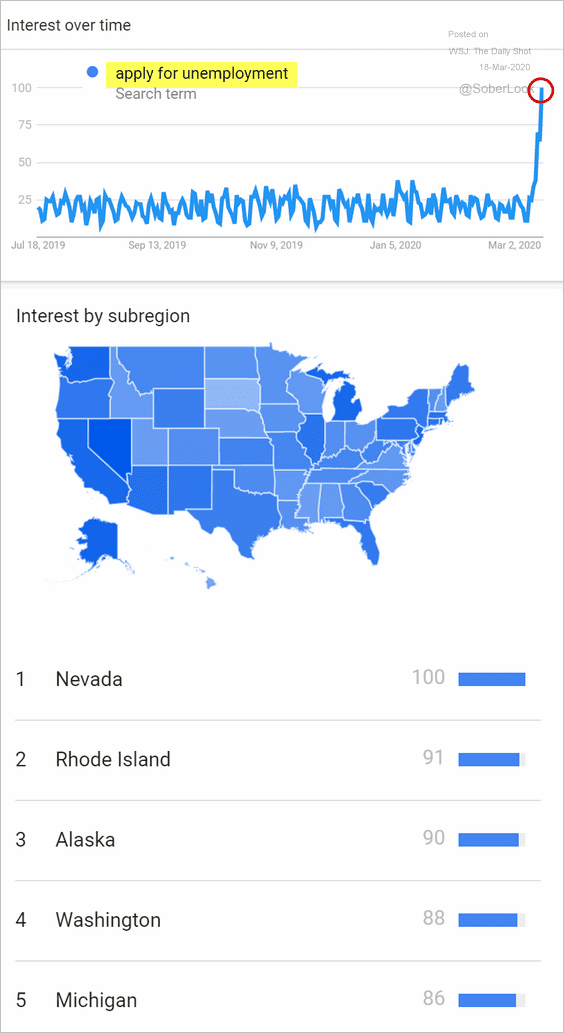

Online search activity related to filing for unemployment has soared in recent days.

Source: Google Trends

Source: Google Trends

Below are some recent trends (since last July).

Source: Google Trends

Source: Google Trends

Source: Google Trends

Source: Google Trends

——————–

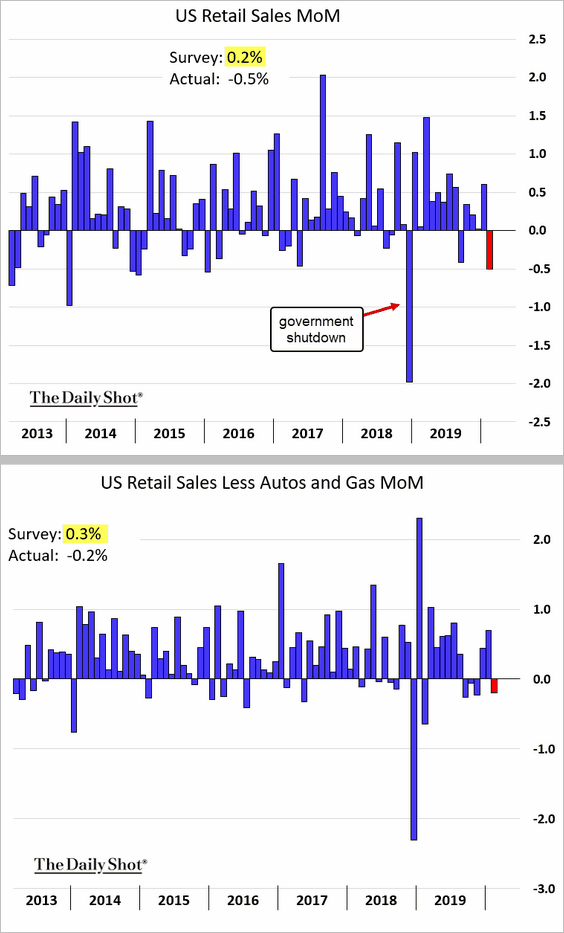

2. Retail sales weakened in February, but that was just a hint of what’s to come.

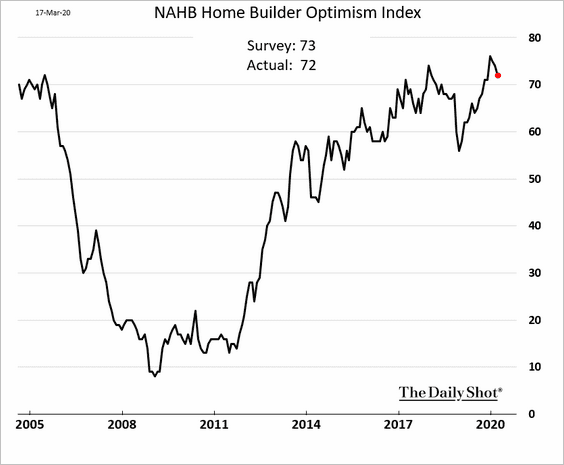

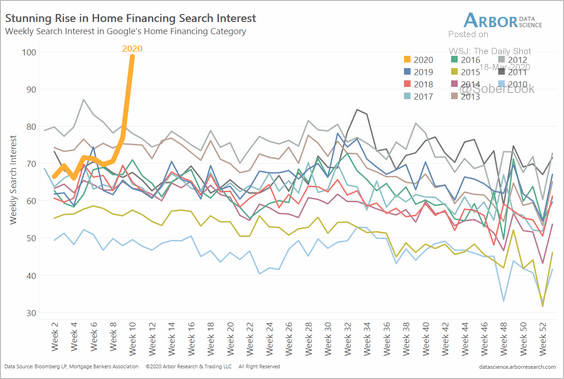

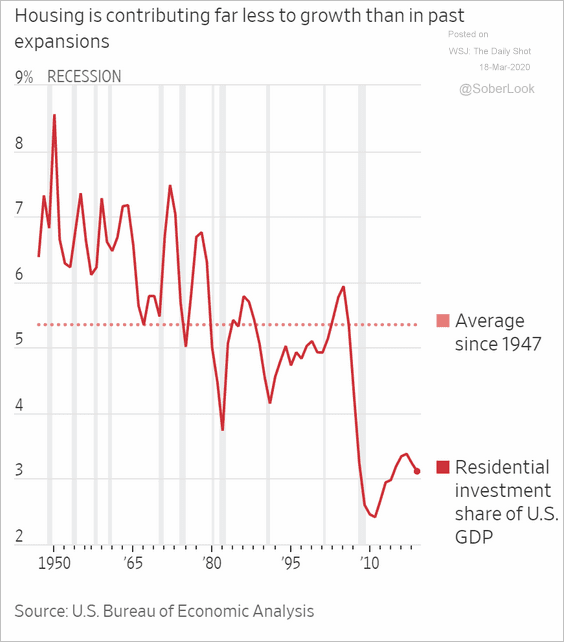

3. Next, we have some updates on the housing market.

• Homebuilder optimism (still healthy):

• Search activity for home financing:

Source: Arbor Research & Trading

Source: Arbor Research & Trading

• Weak residential investment (contributing to housing shortages):

Source: @WSJ Read full article

Source: @WSJ Read full article

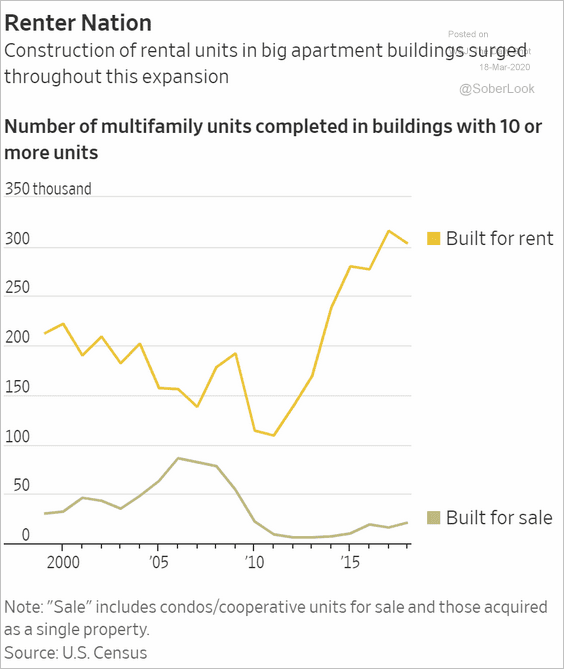

• Homes built for rent:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

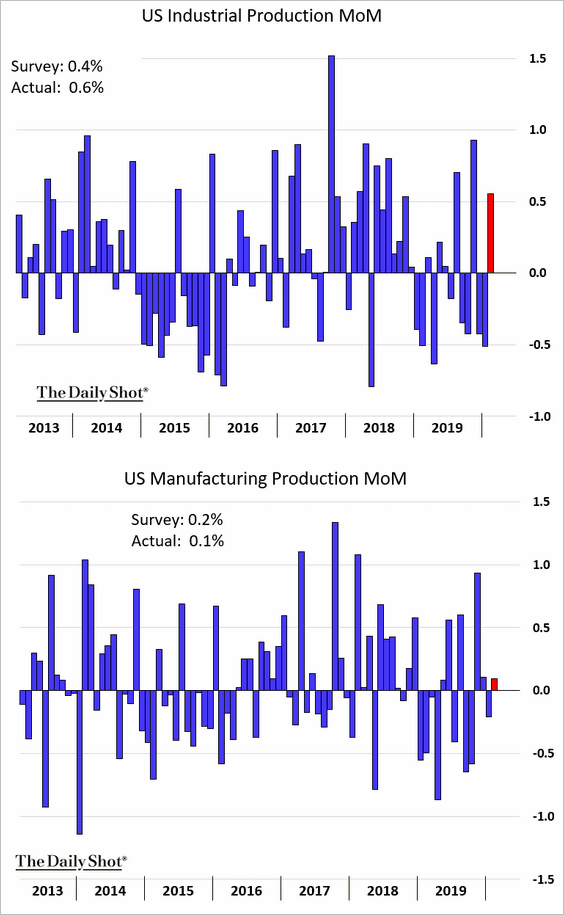

4. US industrial production strengthened last month.

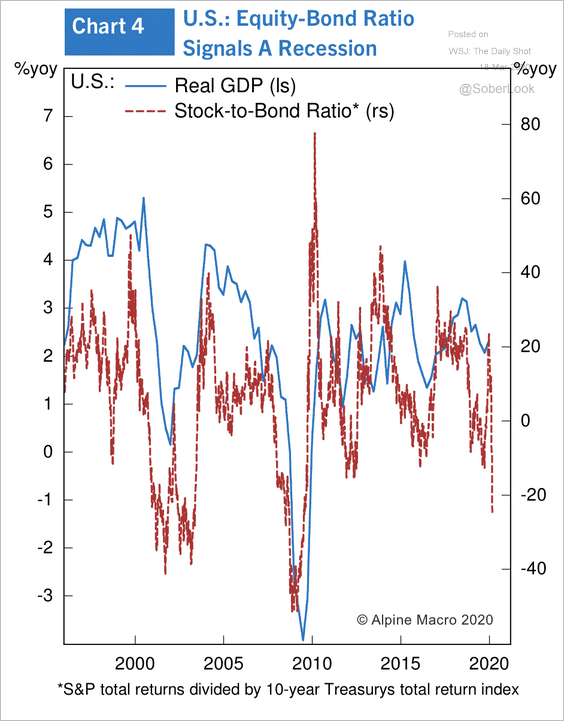

5. According to Alpine Macro, the US stocks-to-bonds ratio implies an annualized GDP growth rate between zero and -1%.

Source: Alpine Macro

Source: Alpine Macro

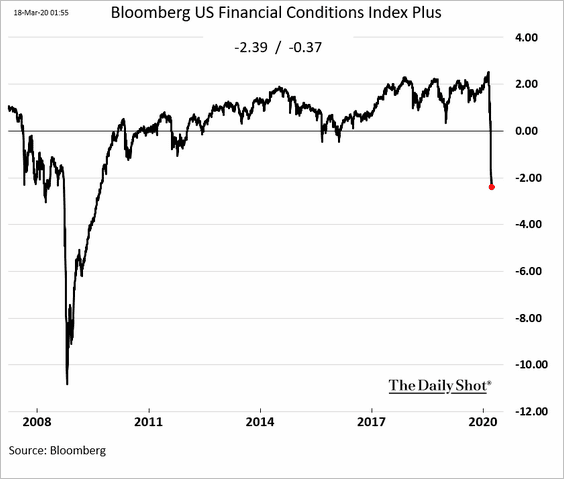

6. Financial conditions continue to tighten.

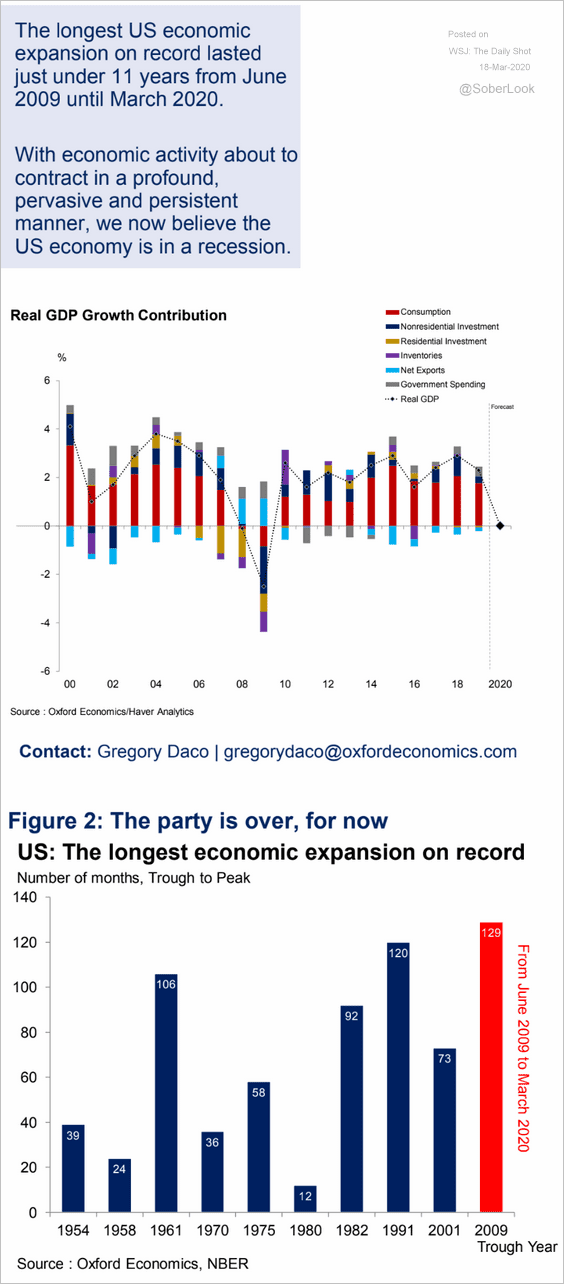

7. The longest economic expansion on record is over.

Source: Oxford Economics

Source: Oxford Economics

The United Kingdom

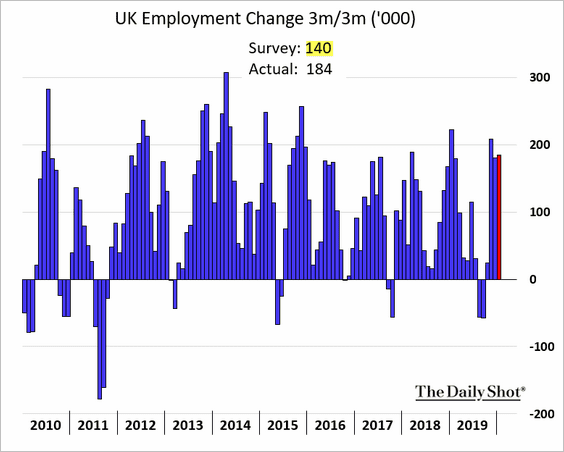

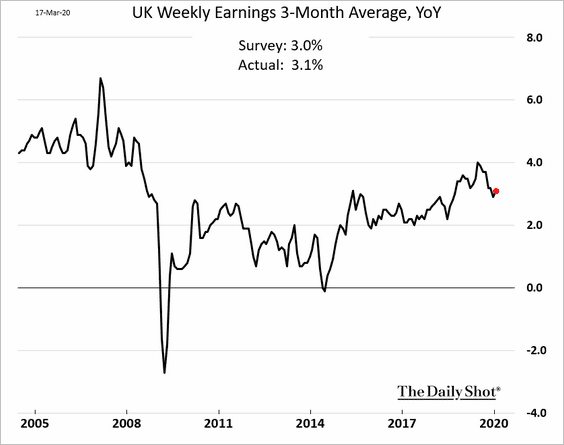

1. The employment report topped economists’ forecasts.

Wage growth remains robust.

• The unemployment rate ticked higher.

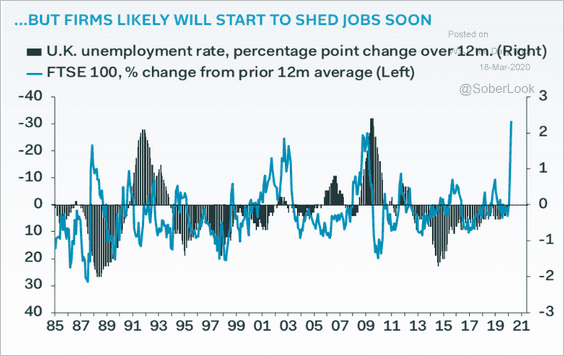

• And there is trouble ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

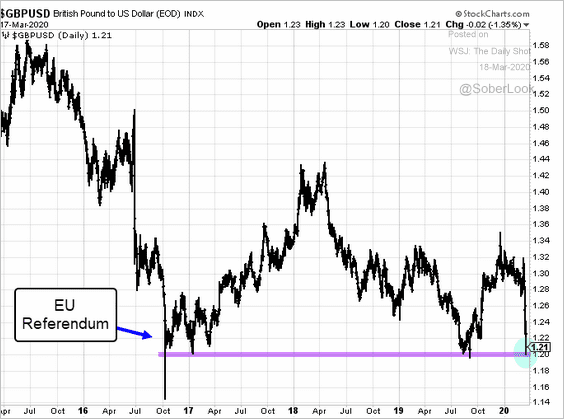

2. Is the British pound going to break below $1.20?

The Eurozone

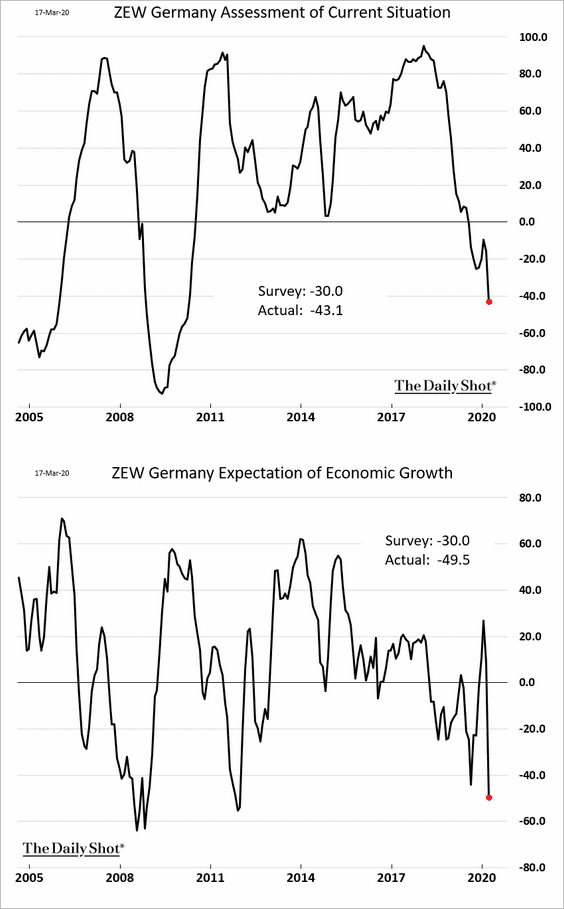

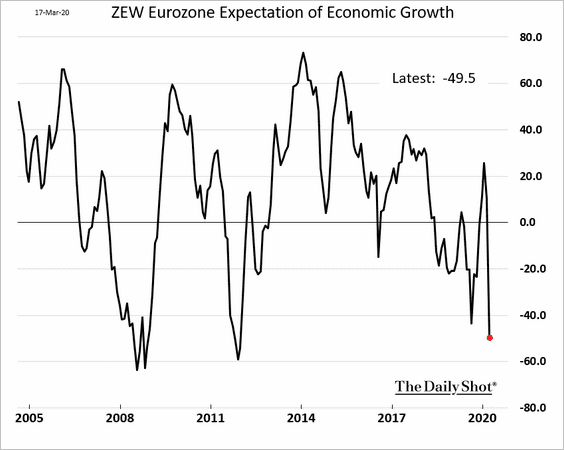

The ZEW indicator showed sentiment deteriorating rapidly this month.

• Germany:

• The Eurozone:

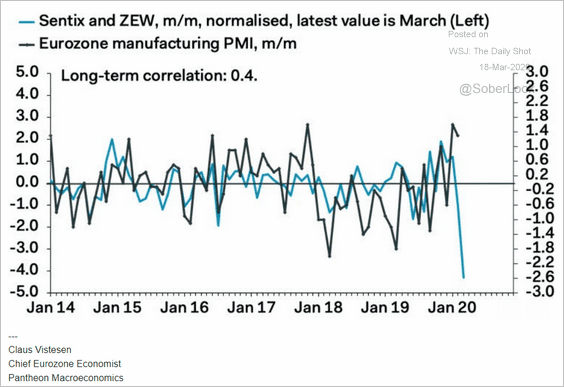

• We are going to see this weakness showing up in March business activity (PMI).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

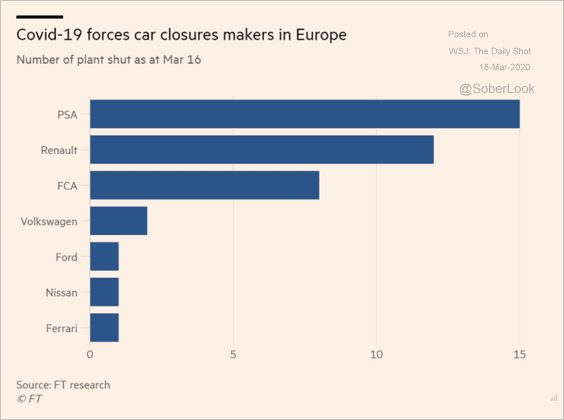

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Europe

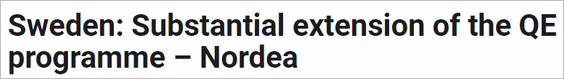

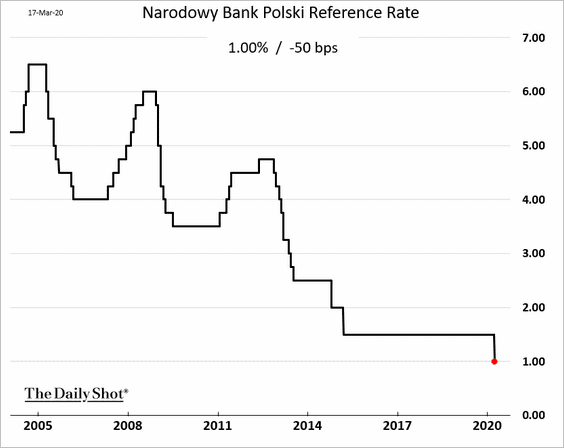

Central banks continue to ease.

• Sweden:

Source: FX Street Read full article

Source: FX Street Read full article

• Poland:

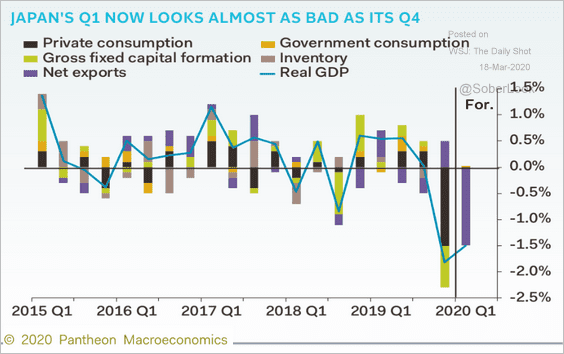

Asia – Pacific

1. Japan’s recession is deepening.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

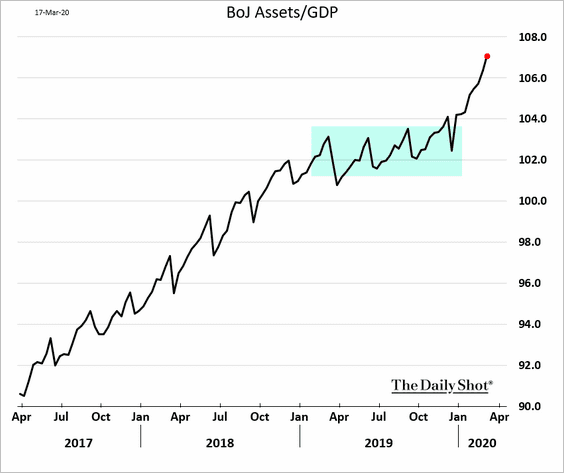

2. The BoJ is ramping up asset purchases.

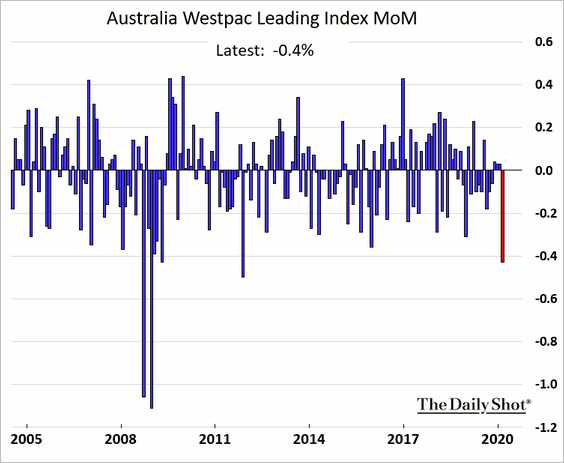

3. Australia’s leading indicator is showing signs of weakness.

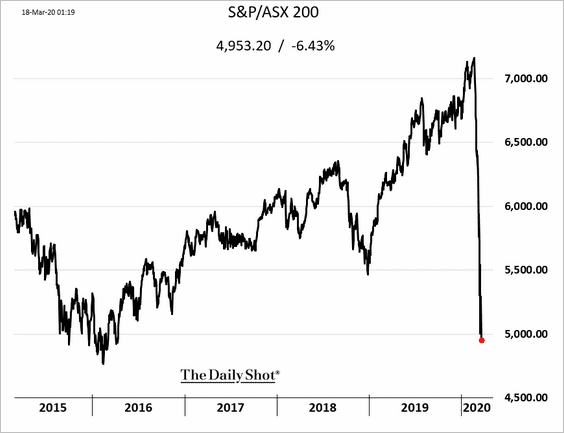

The stock market continues to tumble.

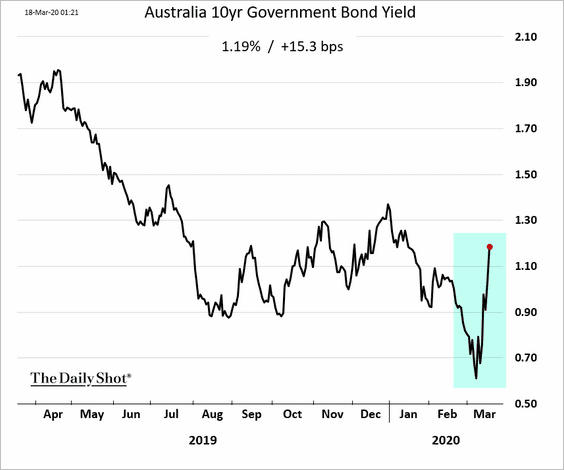

And now Australian bond prices are falling as well (nowhere to hide).

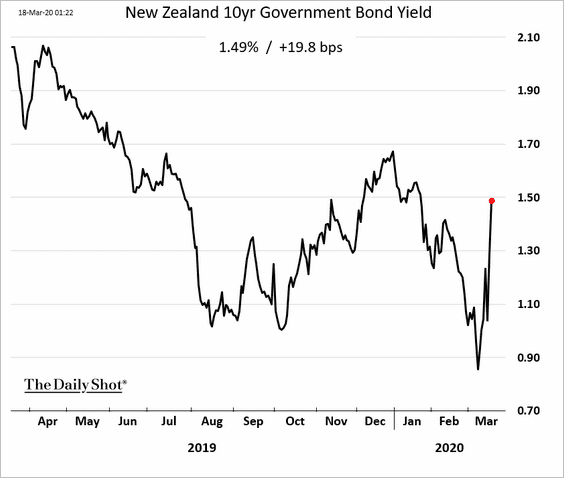

4. New Zealand’s government bonds are under pressure as well.

China

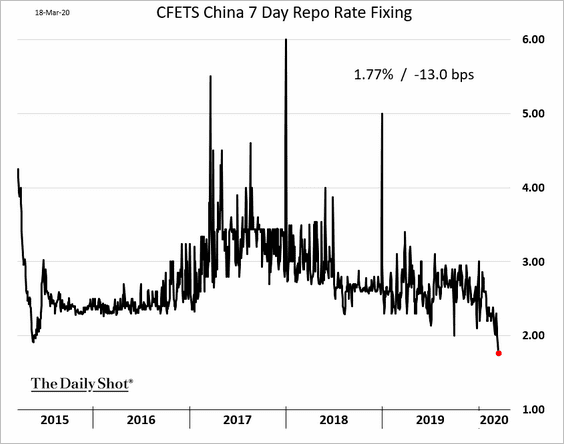

1. Without any official announcements, the PBoC is letting short-term rates dip to multi-year lows (unofficial easing).

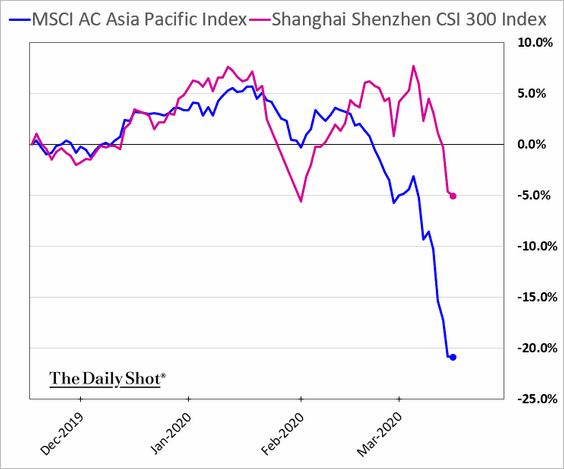

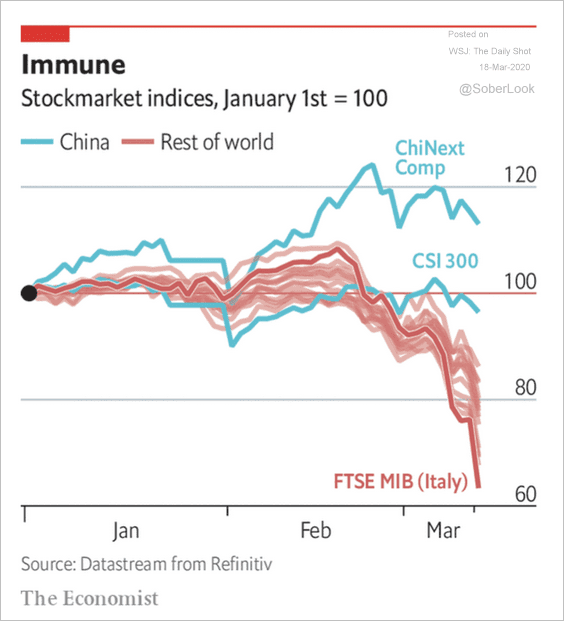

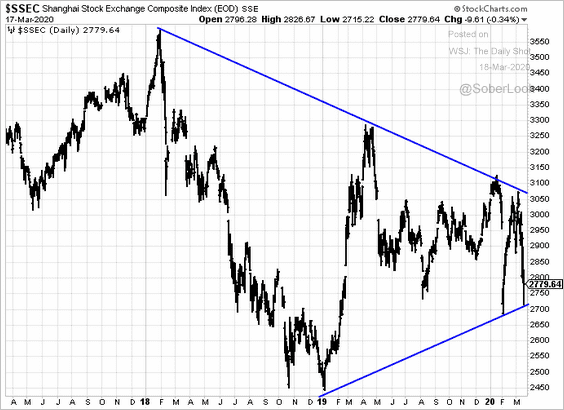

2. The stock market has outperformed peers in Asia and globally.

Source: The Economist Read full article

Source: The Economist Read full article

The Shanghai Composite has been consolidating.

h/t April Ma, @TheTerminal

h/t April Ma, @TheTerminal

——————–

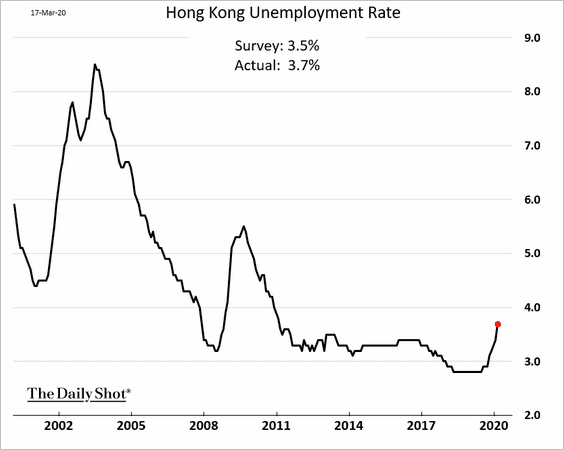

3. Hong Kong’s unemployment rate is creeping higher.

Emerging Markets

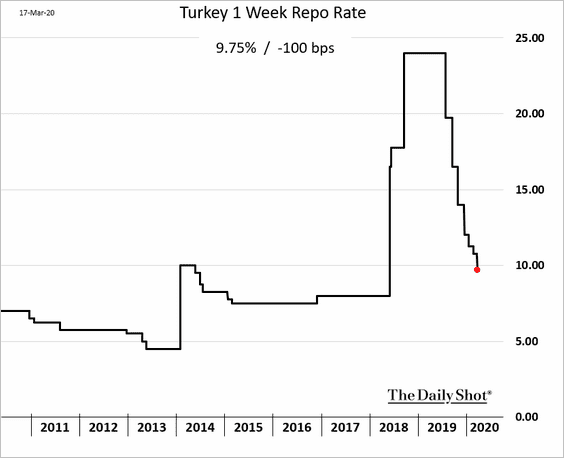

1. Turkey’s central bank cut rates again.

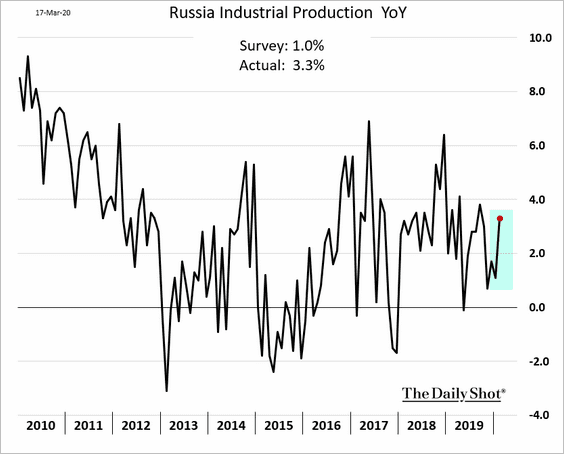

2. Russia’s industrial production has been improving. The rebound is unlikely to last in the current environment.

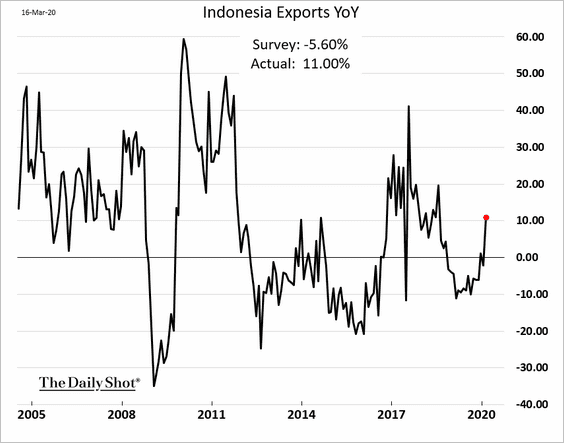

3. Indonesia’s exports unexpectedly strengthened last month.

Commodities

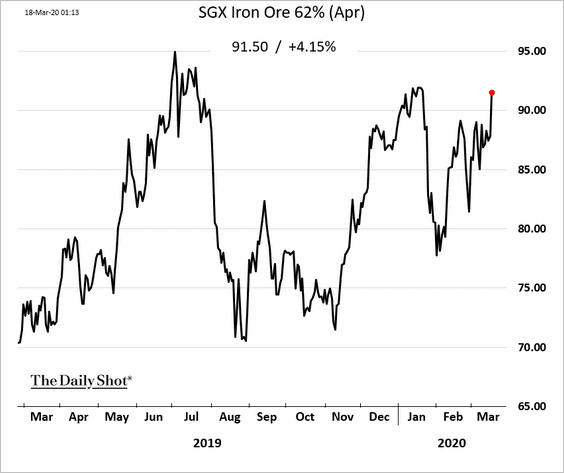

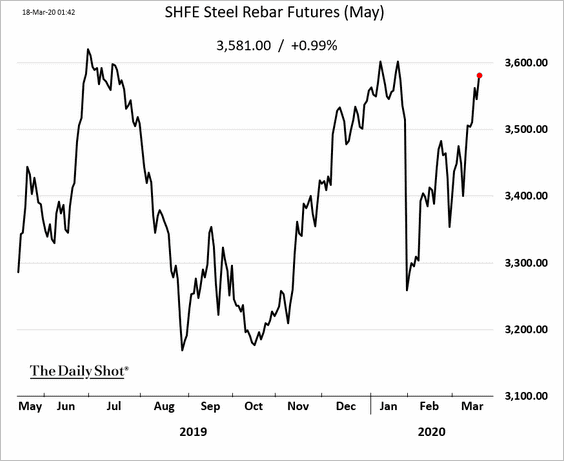

1. China’s steel demand seems to be picking up.

• Iron ore futures (Singapore):

• Steel rebar futures (Shanghai):

——————–

2. Copper remains under pressure.

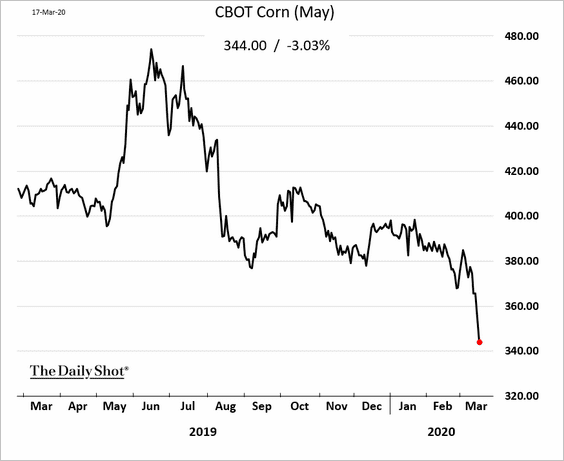

3. US corn prices are tumbling.

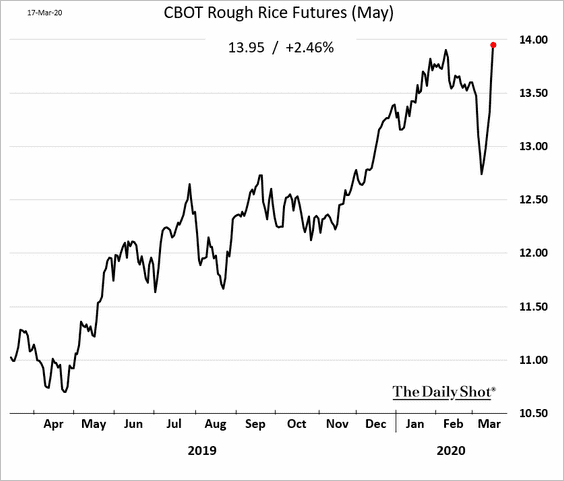

4. Rice futures soared in recent days, driven by hoarders.

h/t Michael Hirtzer, @TheTerminal

h/t Michael Hirtzer, @TheTerminal

Source: Seeking Alpha Read full article

Source: Seeking Alpha Read full article

Energy

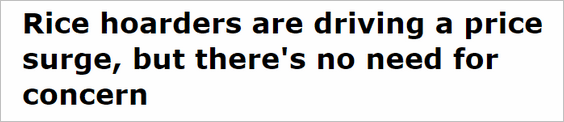

1. US crude oil dipped below $27/bbl while Brent is below $29. We are now near the 2016 lows.

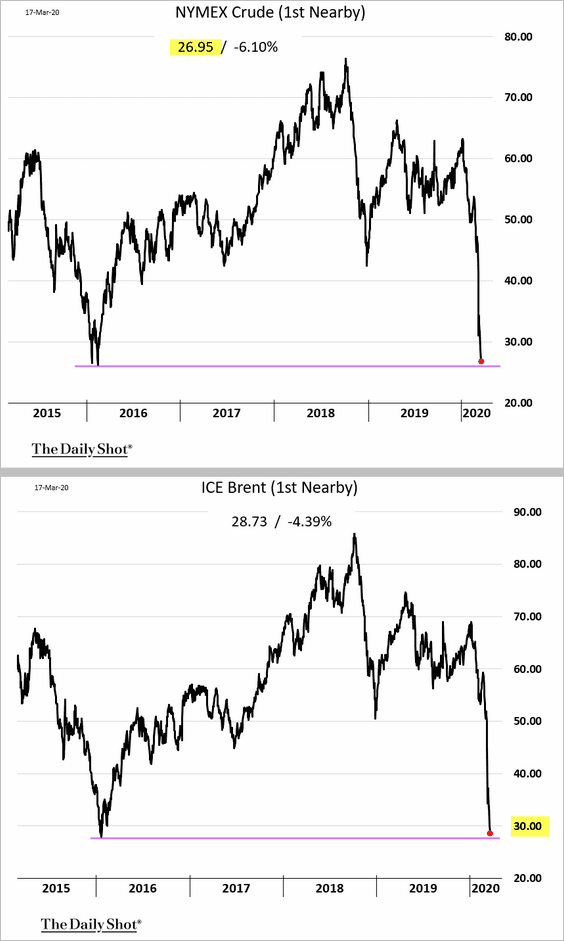

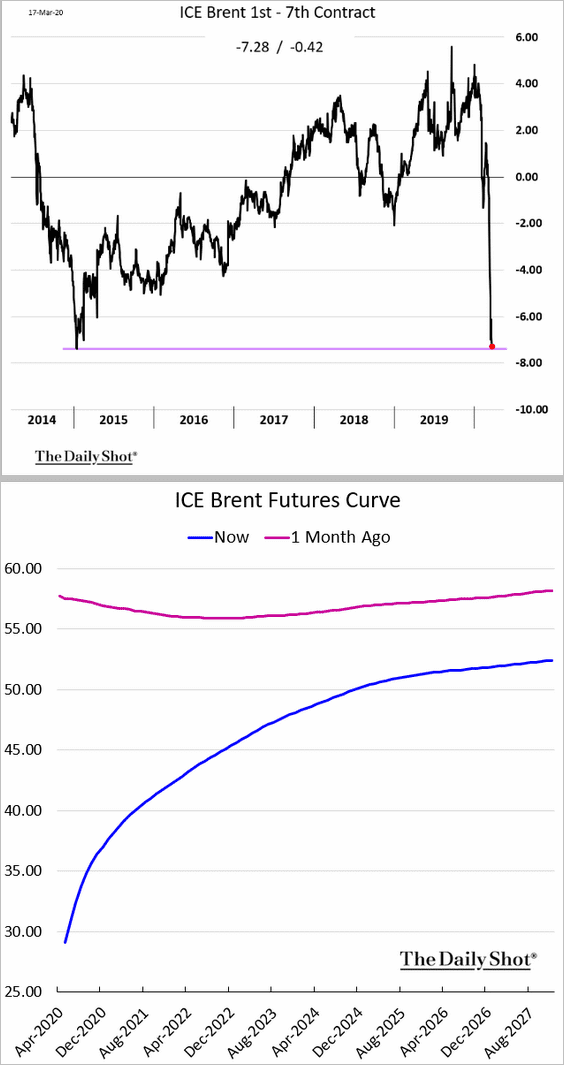

2. Brent contango is also near extreme levels.

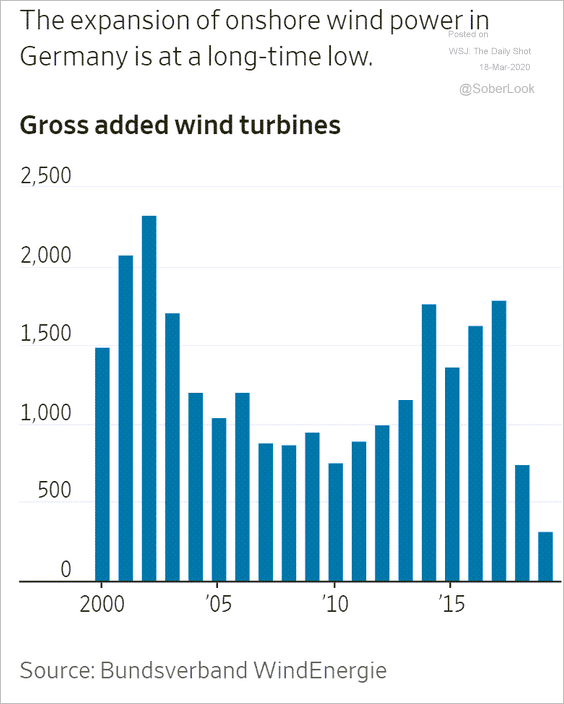

3. Separately, Germany has been slowing its investment in wind turbines.

Source: @WSJ Read full article

Source: @WSJ Read full article

Equities

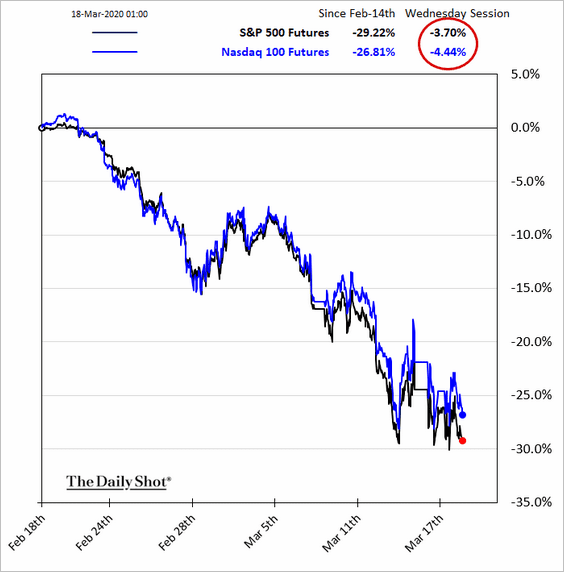

1. Stocks had a good day on Tuesday on stimulus hopes, …

Source: @bloomberglaw Read full article

Source: @bloomberglaw Read full article

… but futures hit limit-down again in early trading on Wednesday.

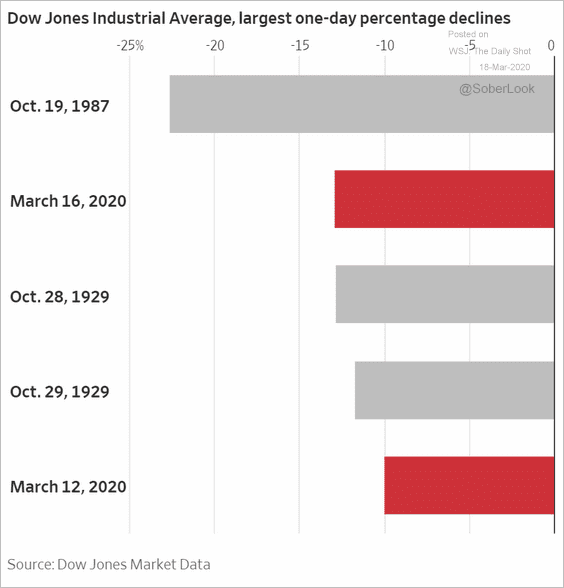

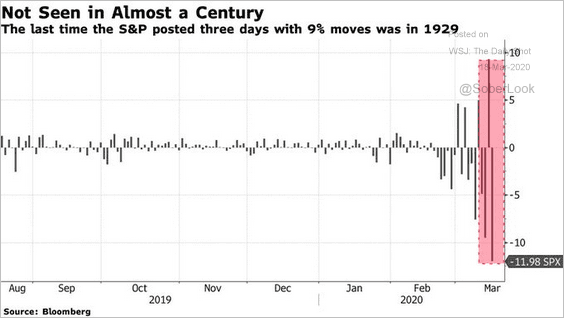

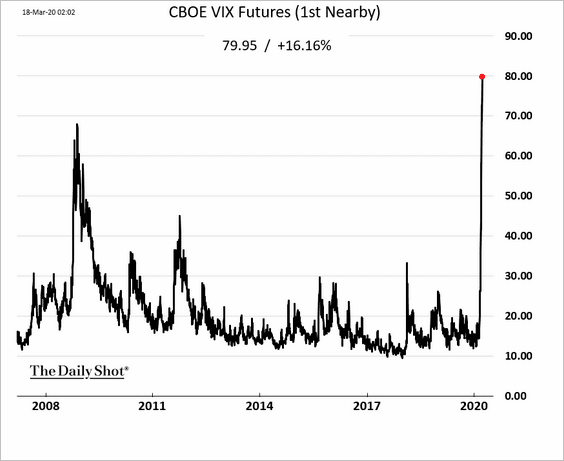

Extreme market volatility persists (3 charts).

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @jessefelder, Bloomberg Read full article

Source: @jessefelder, Bloomberg Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

VIX futures are approaching 80 for the first time.

——————–

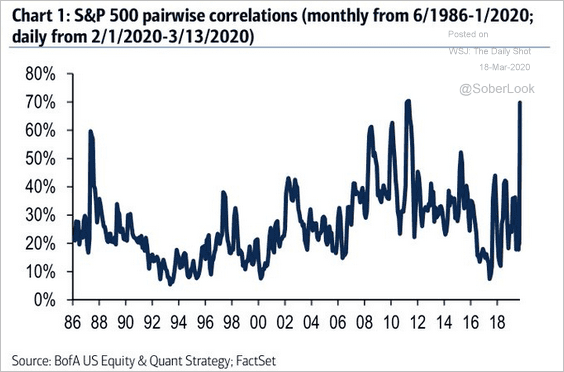

2. Correlations are near extremes.

Source: BofAML, @TayTayLLP

Source: BofAML, @TayTayLLP

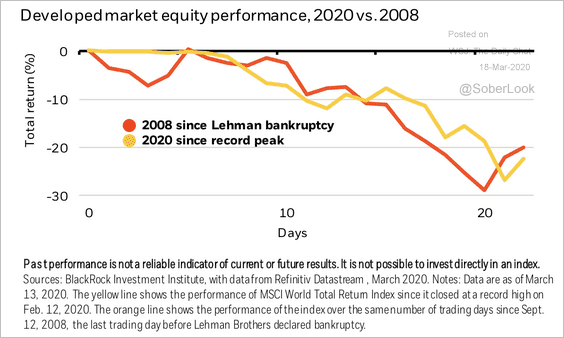

3. This selloff has been the sharpest in history.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

Source: BlackRock

Source: BlackRock

——————–

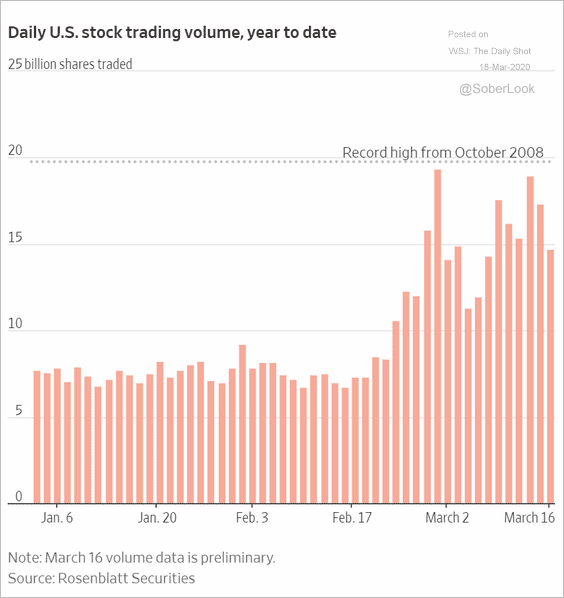

4. Trading volumes have picked up.

Source: @WSJ Read full article

Source: @WSJ Read full article

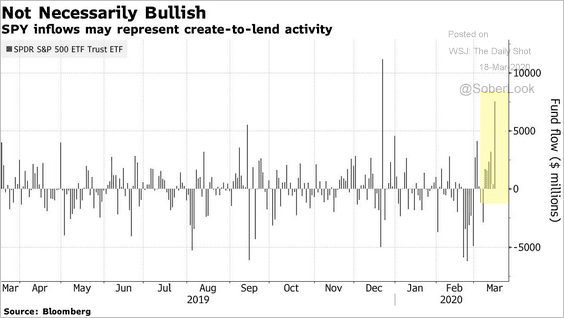

5. The largest index ETF is registering substantial inflows. The demand could be coming from short-sellers who want to borrow the security (to short it).

Source: @markets Read full article

Source: @markets Read full article

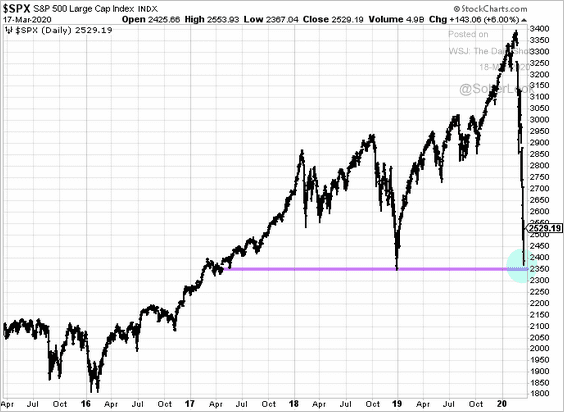

6. Will the S&P 500 break support?

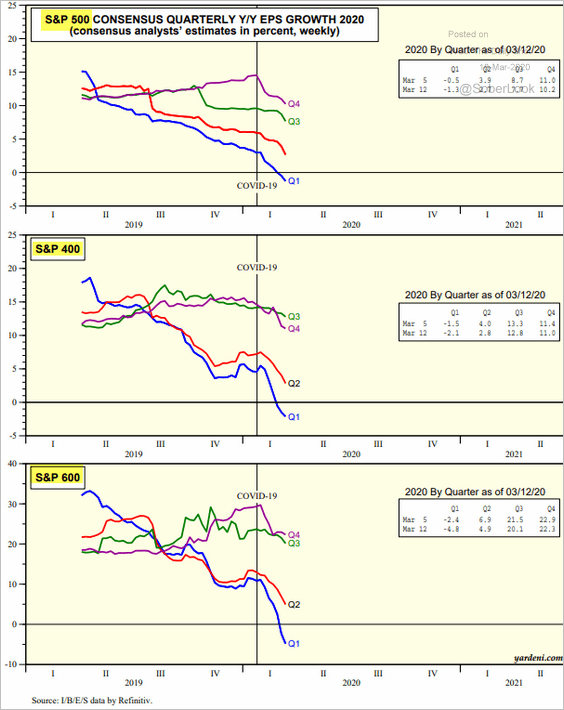

7. Analysts continue to downgrade earnings growth estimates.

Source: Yardeni Research

Source: Yardeni Research

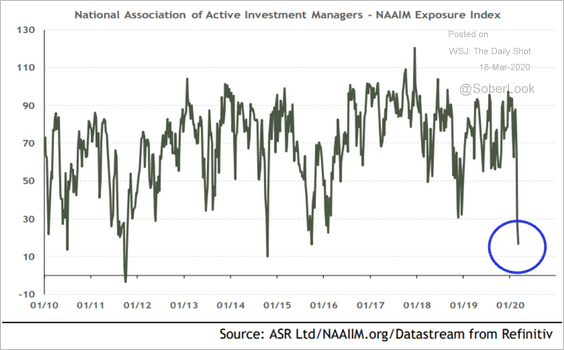

8. US active manager pessimism reached 2016 levels.

Source: Absolute Strategy Research

Source: Absolute Strategy Research

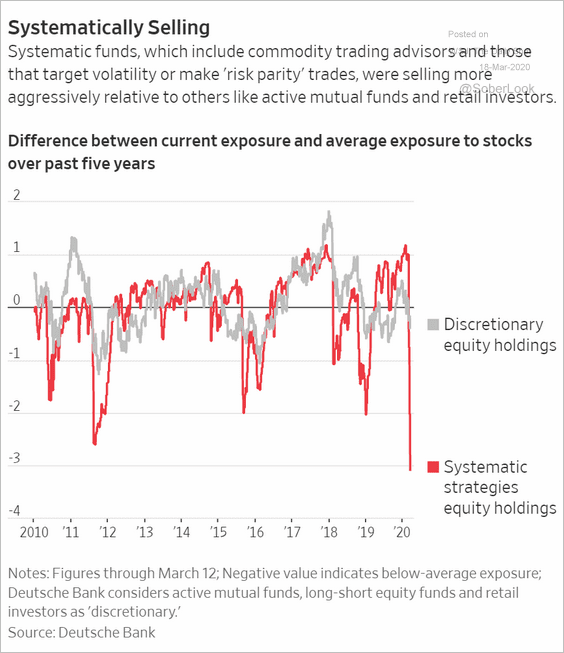

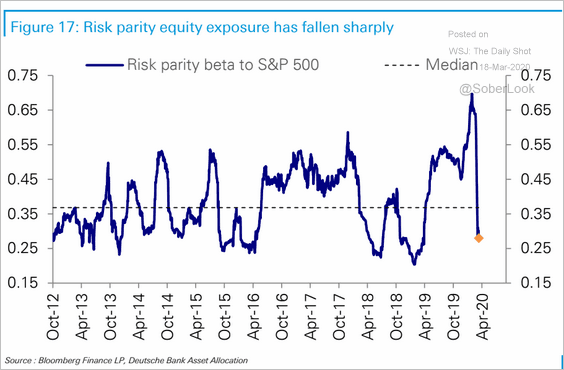

9. Systematic funds have been aggressive sellers (2 charts).

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

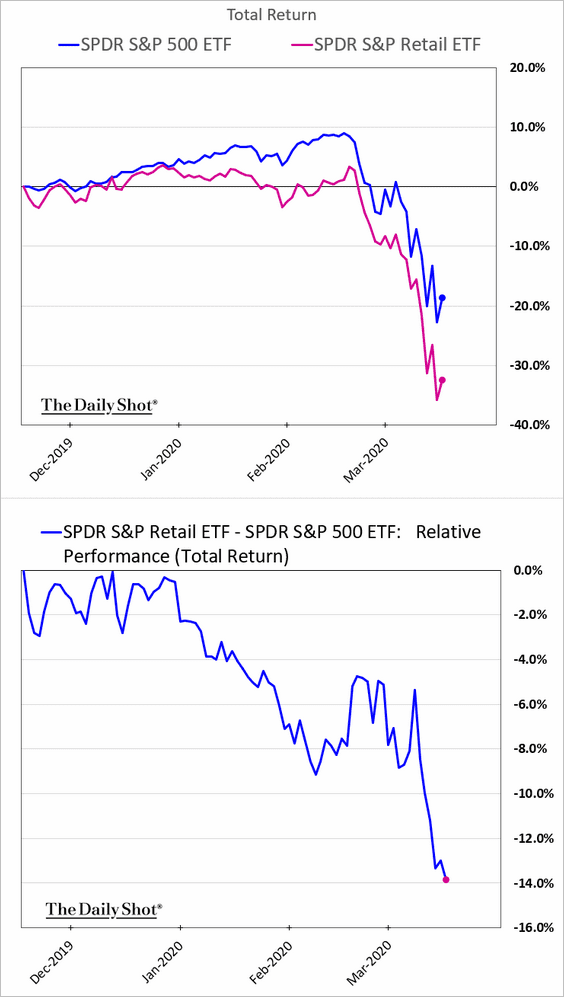

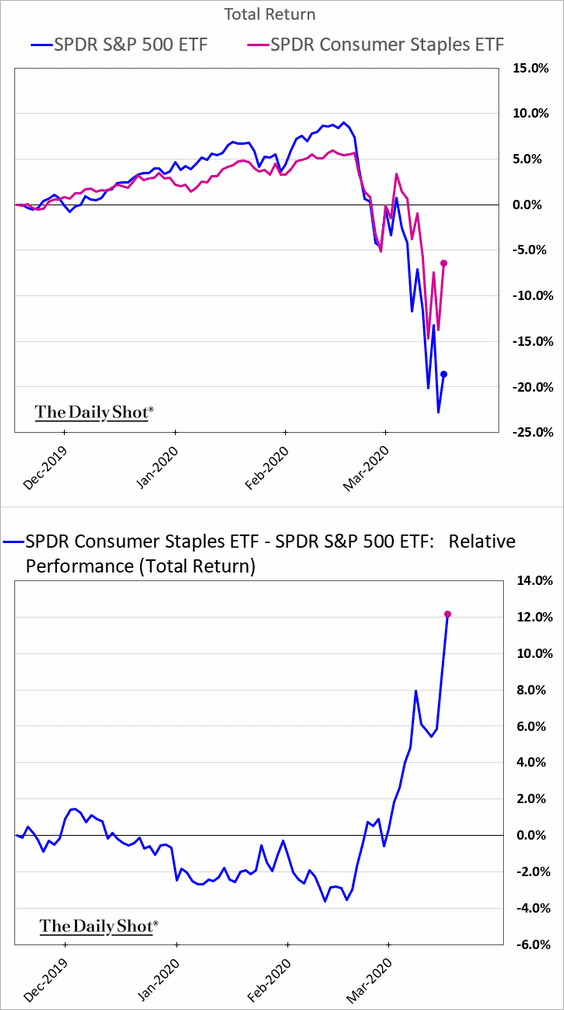

10. Next, we have some sector performance updates.

• Retail:

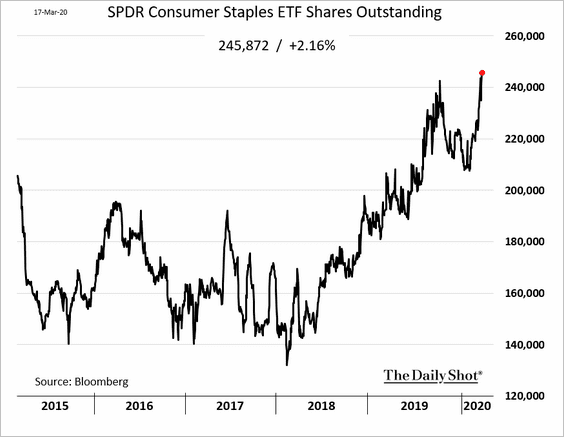

• Consumer staples:

Consumer staples ETF shares outstanding (a measure of fund inflows):

——————–

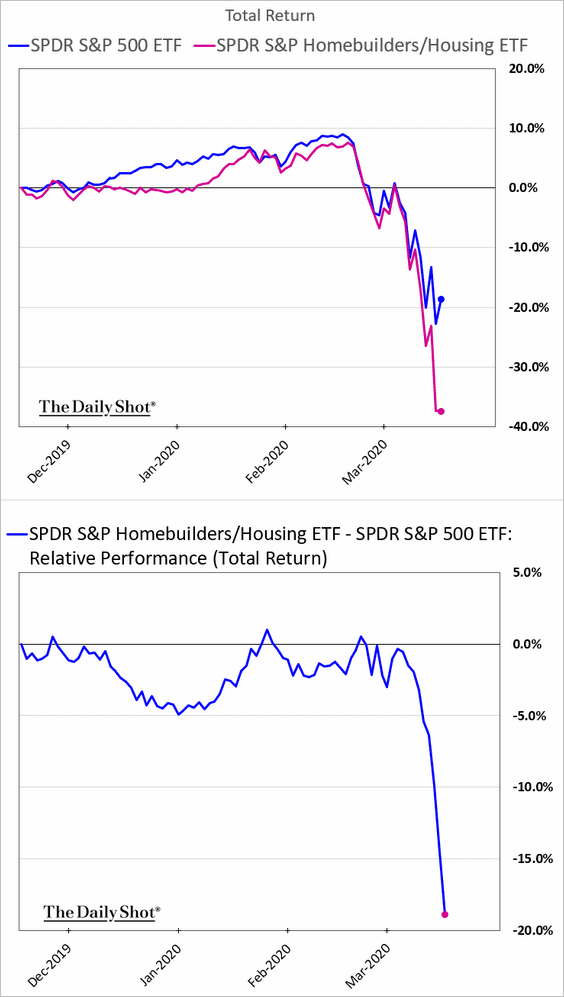

• Homebuilders:

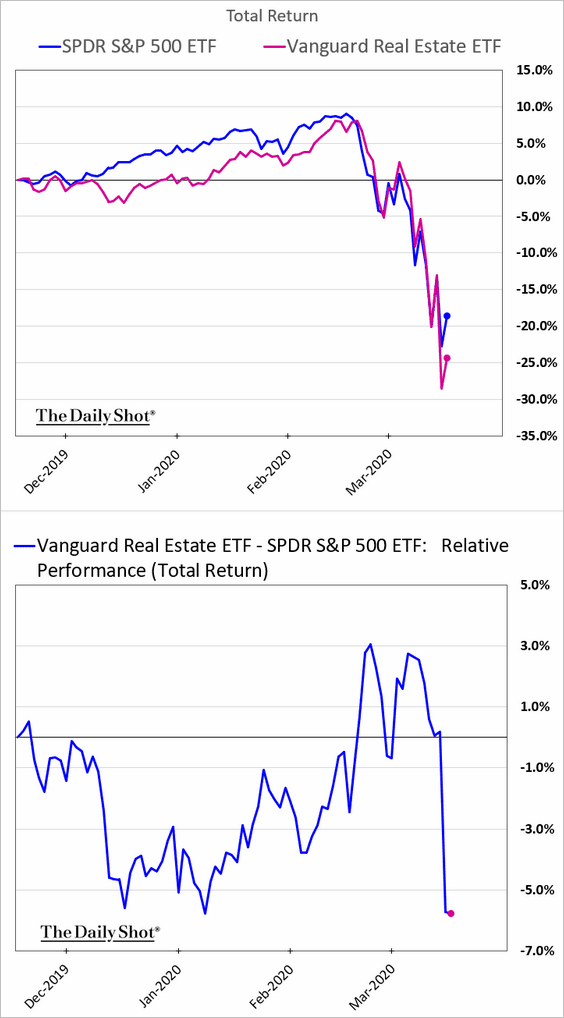

• REITs:

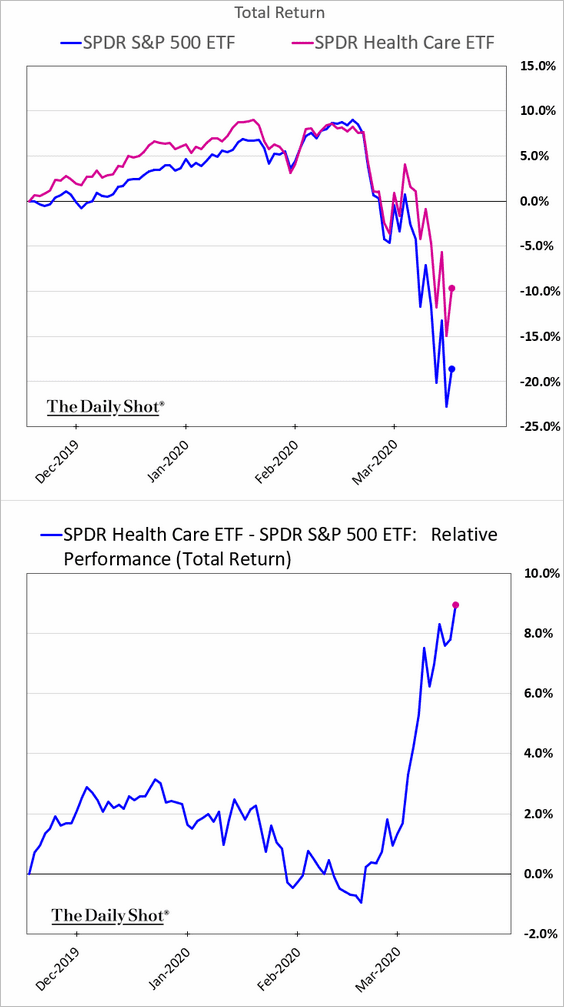

• Healthcare:

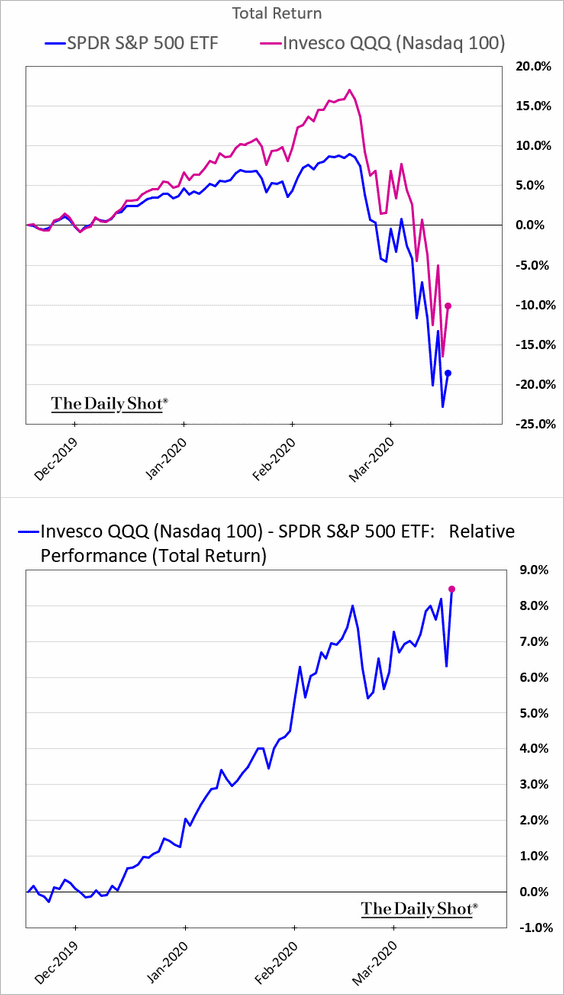

• Tech:

• Industrials:

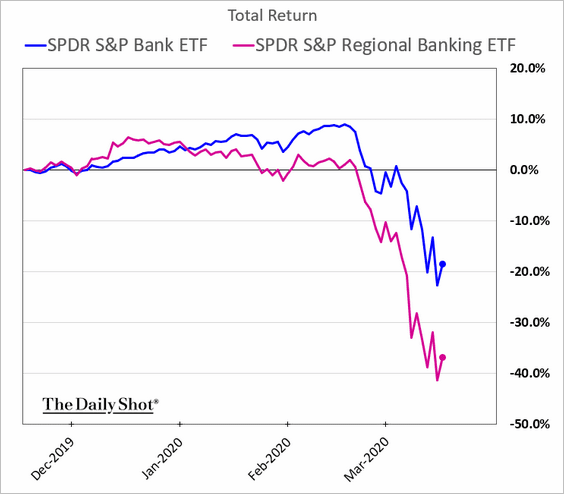

• Regional banks (vs. broad bank index):

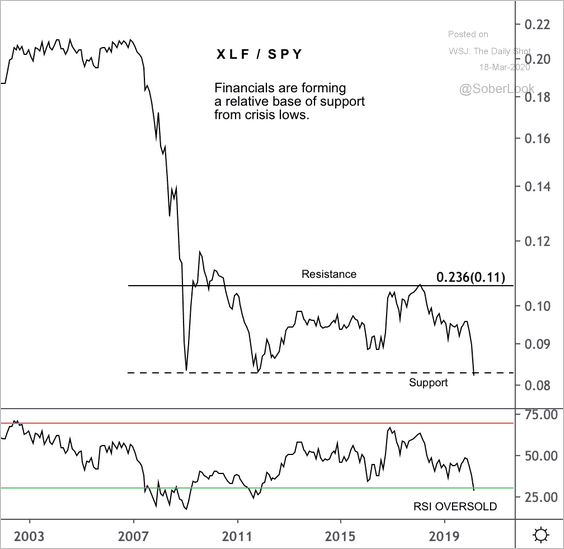

• The SPDR financial sector ETF is at long-term support relative to the S&P 500.

Source: @DantesOutlook

Source: @DantesOutlook

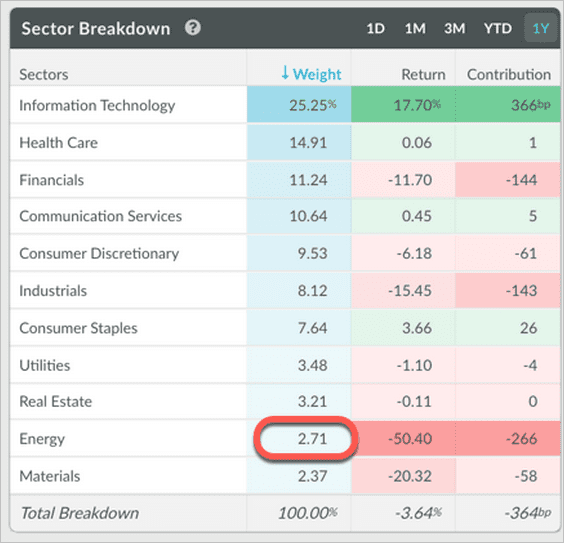

• Energy is now the second smallest sector weighting in the S&P 500.

Source: Koyfin

Source: Koyfin

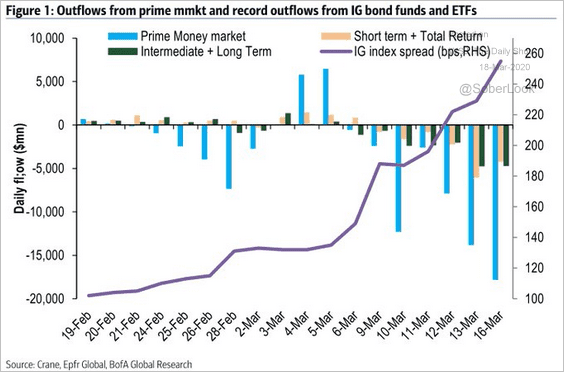

Credit

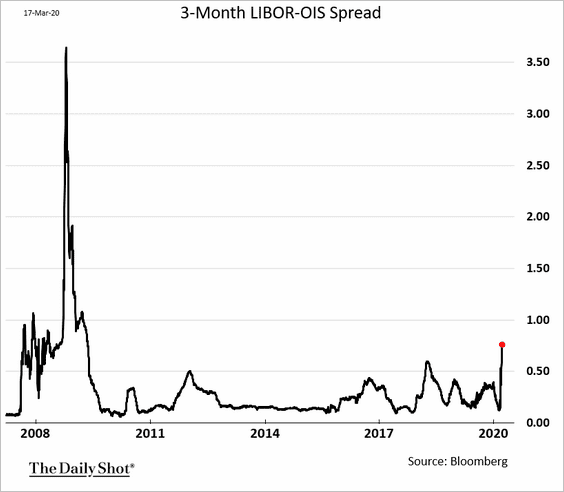

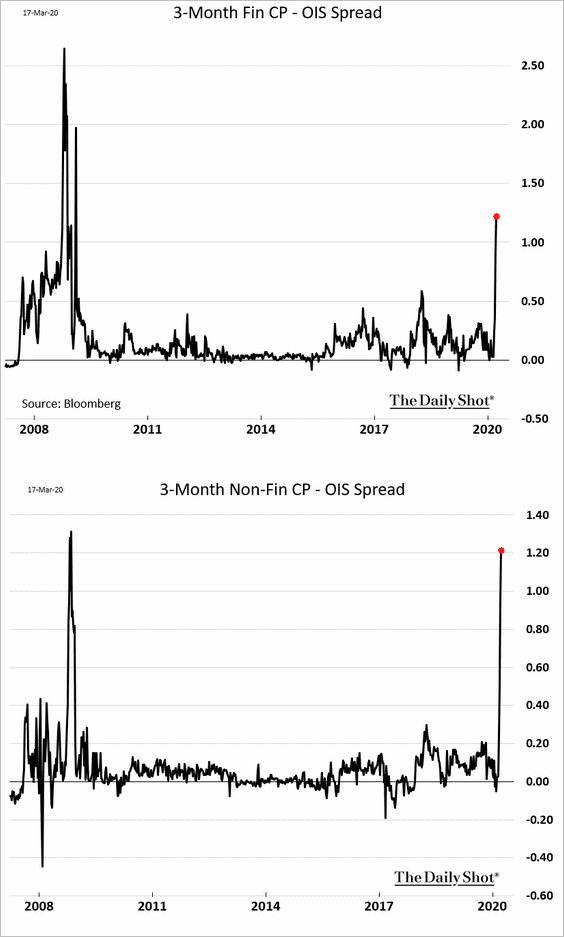

1. We continue to see stress in the funding markets.

• Prime money market funds are experiencing substantial outflows.

Source: BofAML, @TayTayLLP

Source: BofAML, @TayTayLLP

• LIBOR – OIS spread:

• Commercial paper (CP) spreads:

The first chart shows financial CP spreads (banks); the second is non-financial CP (non-bank corporations).

• The Fed is now stepping in to ease the stress in commercial paper markets.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Reuters Read full article

Source: Reuters Read full article

——————–

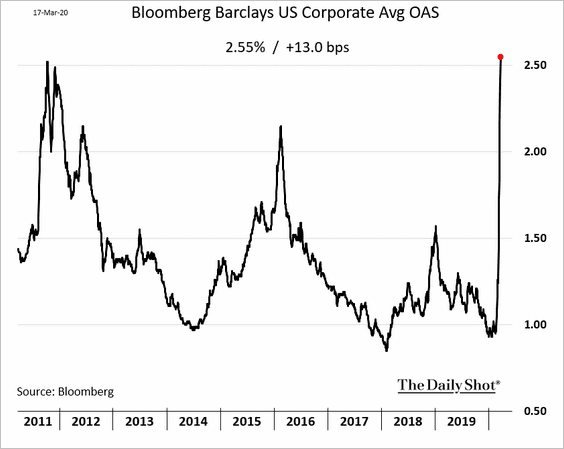

2. Corporate bond spreads keep widening.

• Investment-grade:

• Energy-sector high-yield:

——————–

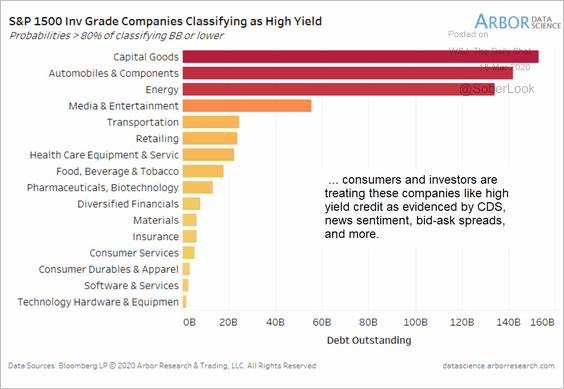

3. The market now views many investment-grade bonds as junk.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

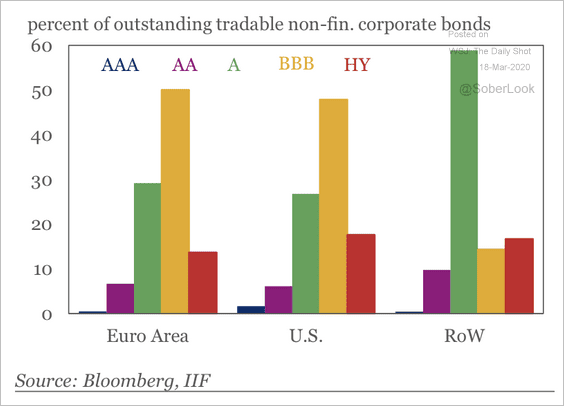

There’s a growing risk of downgrades from BBB to junk.

Source: IIF

Source: IIF

——————–

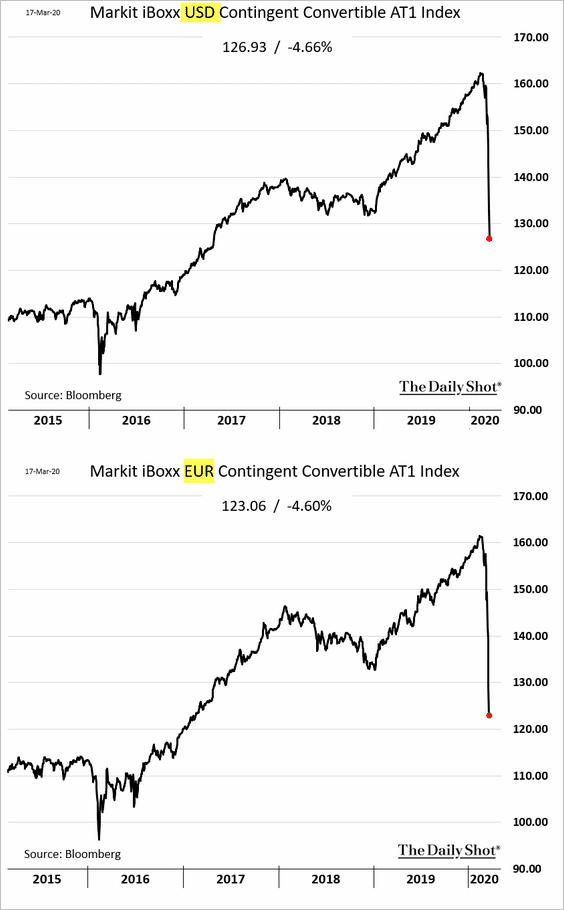

4. Bank CoCos are tumbling.

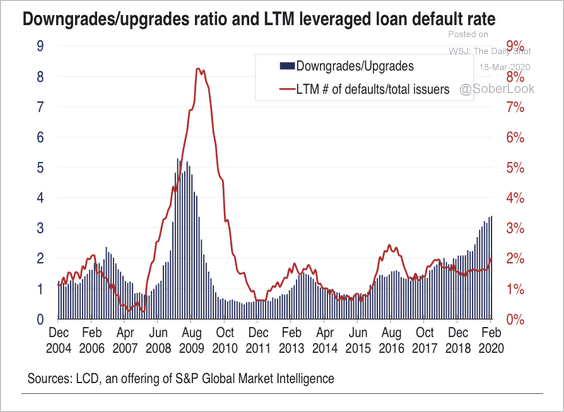

5. Credit downgrades are a pinch-point for CLOs currently holding significant single-B debt. With the 7.5% CCC bucket limit, many would be forced to sell low-quality loans, according to S&P.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

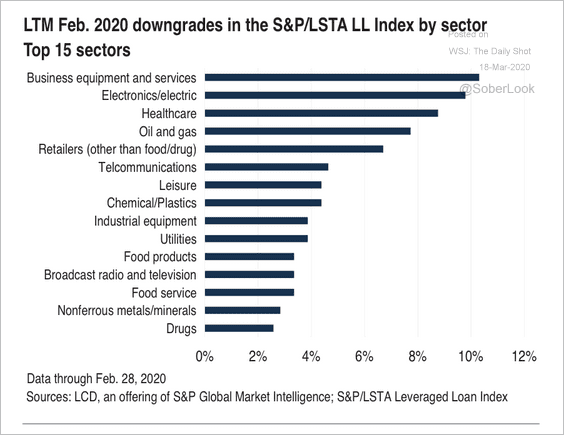

6. The top three sectors vulnerable to downgrade activity (shown below) make up a substantial portion of the overall leveraged loan market, according to S&P.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

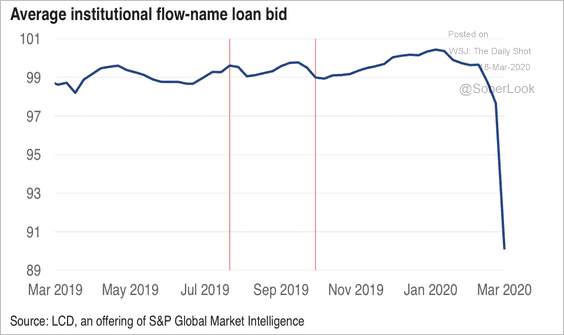

The primary loan market has been essentially shuttered amid market volatility. Bids on institutional loans tanked.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

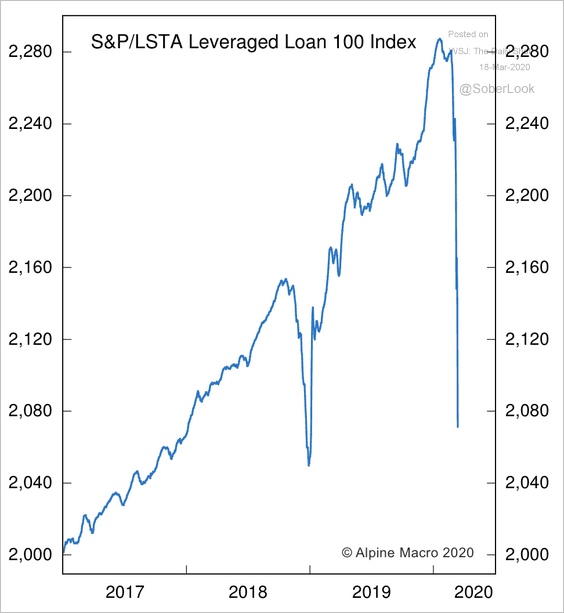

Source: Alpine Macro

Source: Alpine Macro

——————–

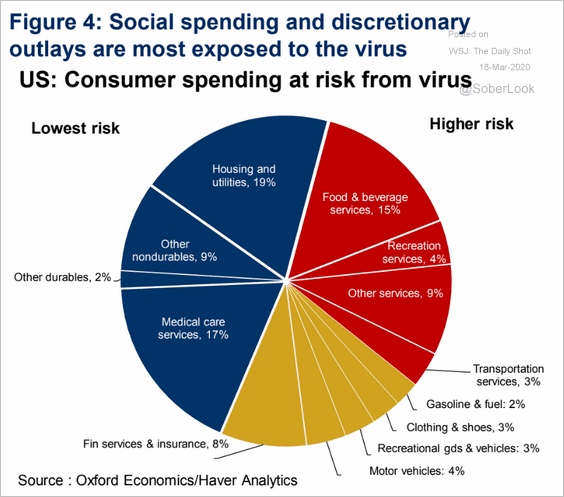

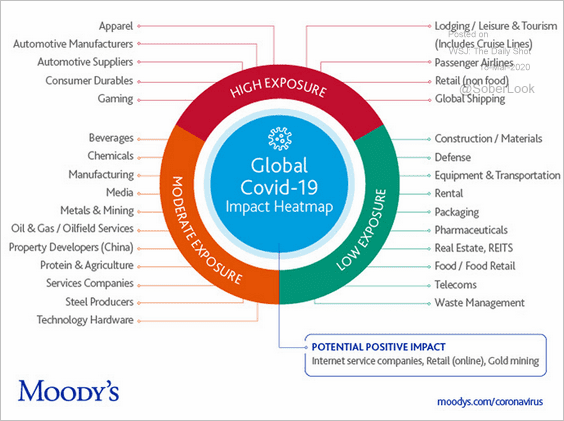

7. Here is another look at exposure by sector.

Source: Oxford Economics

Source: Oxford Economics

Source: Moody’s

Source: Moody’s

——————–

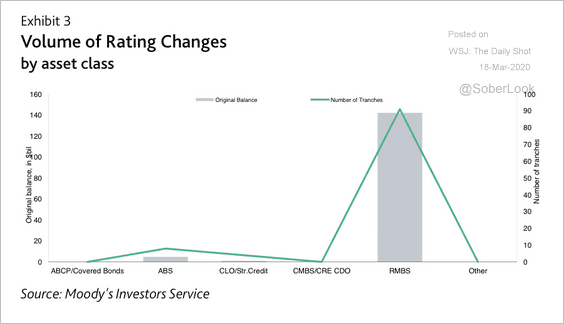

8. Last week, Moody’s upgraded a relatively large amount of residential mortgage-backed securities (RMBS). The MBS market now has a reliable buyer – the Fed (see story).

Source: Moody’s Investors Service

Source: Moody’s Investors Service

Rates

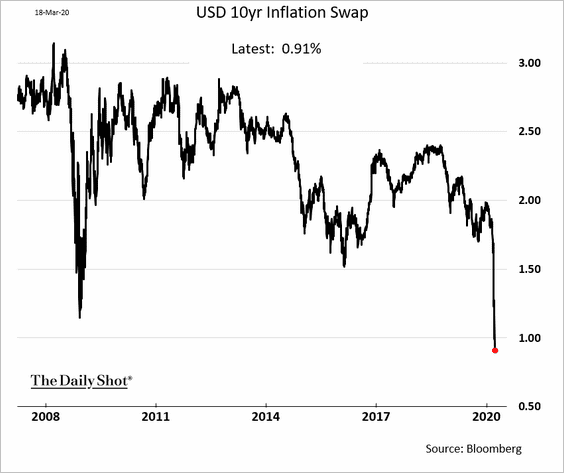

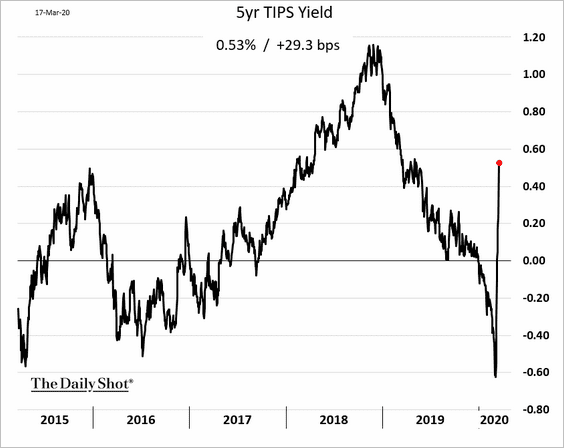

1. Inflation expectations are tumbling.

As a result, real rates are on the rise. Here is the 5yr TIPS (inflation-linked Treasury) yield.

——————–

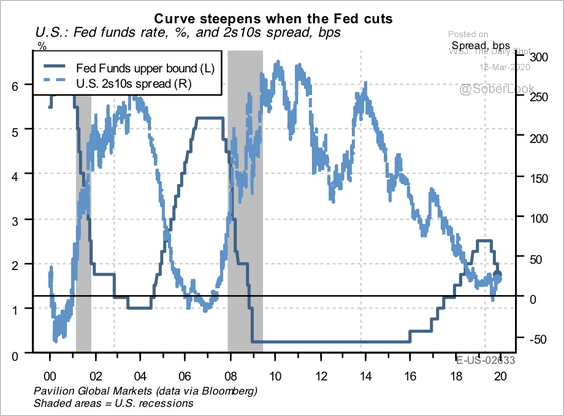

2. According to Pavilion Global Markets, previous aggressive easing cycles suggest that the near-zero Fed funds rate can be consistent with a sustained steepening of the yield curve. Ultimately, this dynamic could benefit bank net-interest margins.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

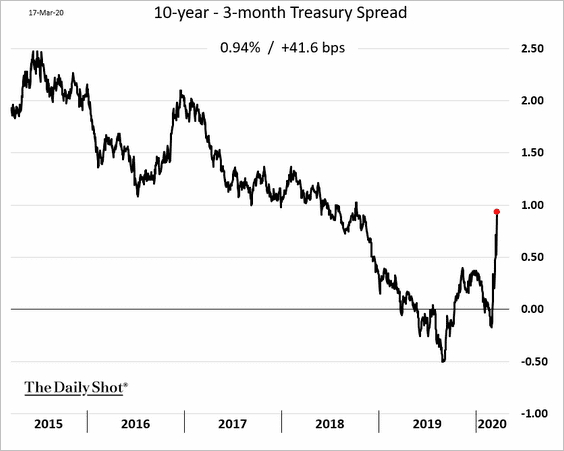

And the yield curve has indeed been steepening.

——————–

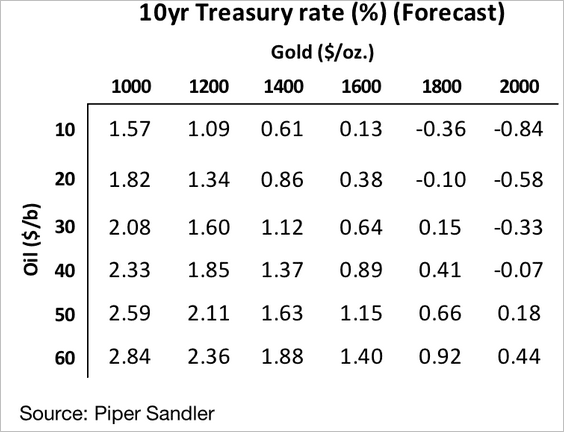

3. Here are Piper Sandler’s projected 10-year Treasury nominal rates for different levels of oil and gold prices.

Source: Piper Sandler

Source: Piper Sandler

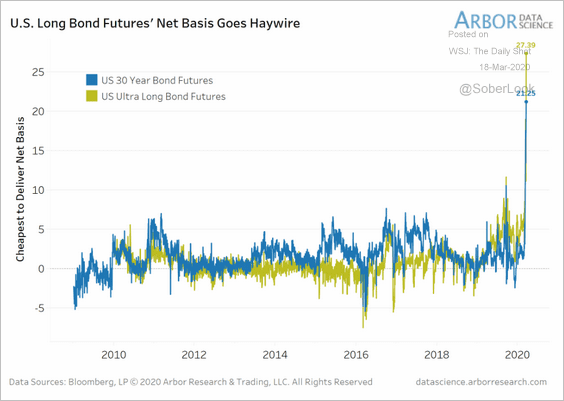

4. Long-bond futures’ cheapest-to-deliver basis spreads (see overview) have blown out (driven by extreme volatility).

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Global Developments

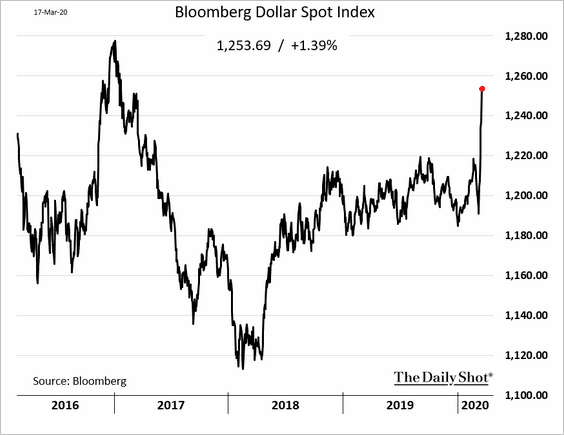

1. The US dollar keeps climbing.

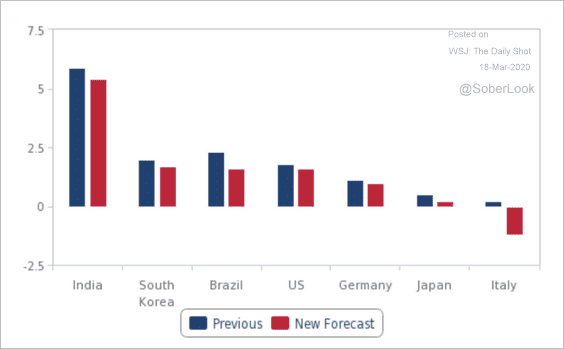

2. Economists continue to downgrade their 2020 growth forecasts (this one is from Fitch Solutions).

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

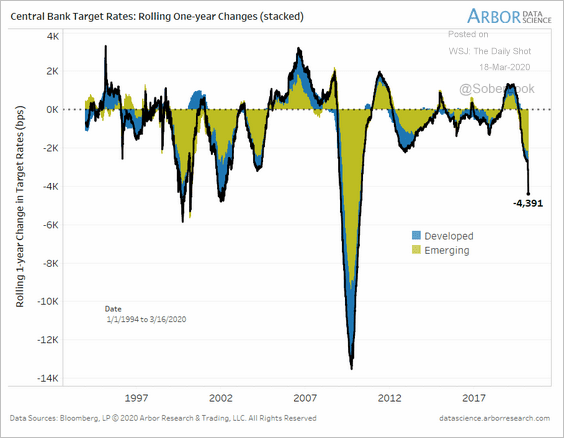

3. Central bank easing is accelerating.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

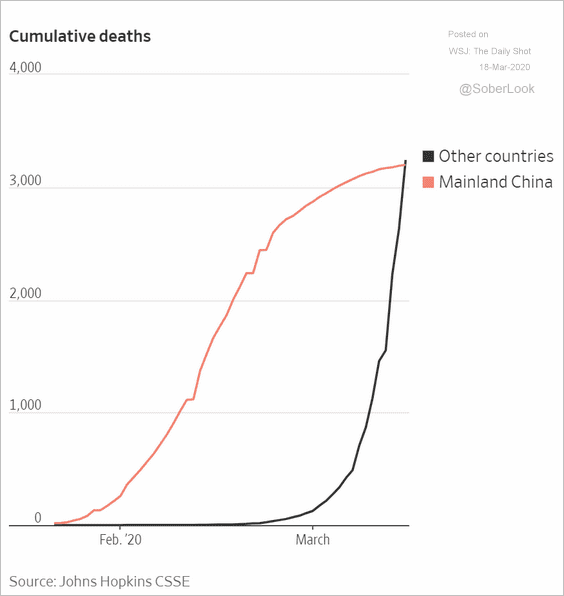

4. Here is the cumulative number of coronavirus-related deaths.

Source: @WSJ Read full article

Source: @WSJ Read full article

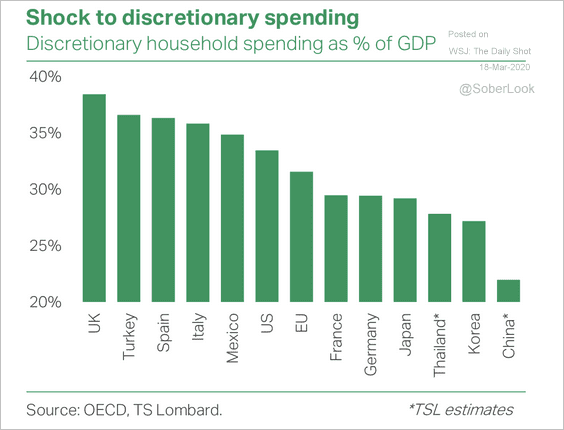

5. Consumer discretionary spending is about a third of GDP for some countries.

Source: TS Lombard

Source: TS Lombard

——————–

Food for Thought

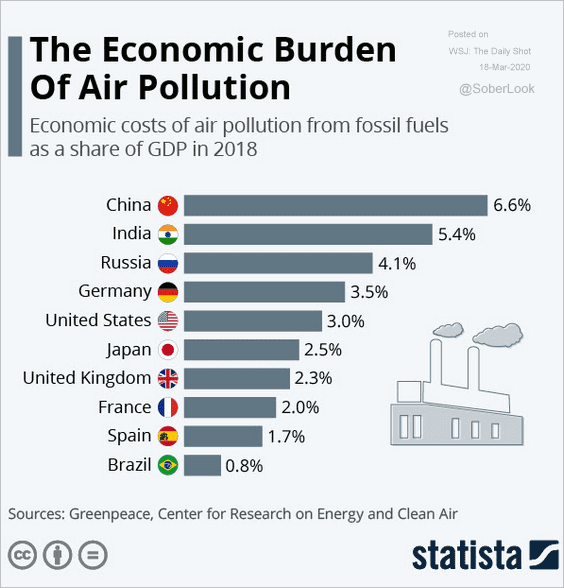

1. Economic costs of air pollution:

Source: Statista

Source: Statista

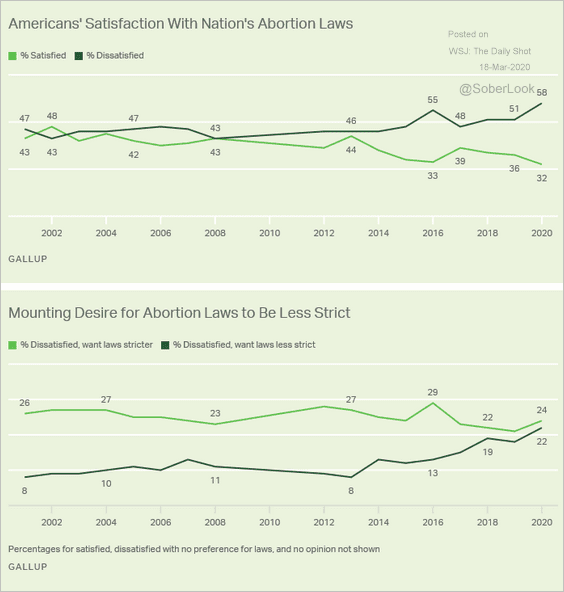

2. Views on abortion laws:

Source: Gallup Read full article

Source: Gallup Read full article

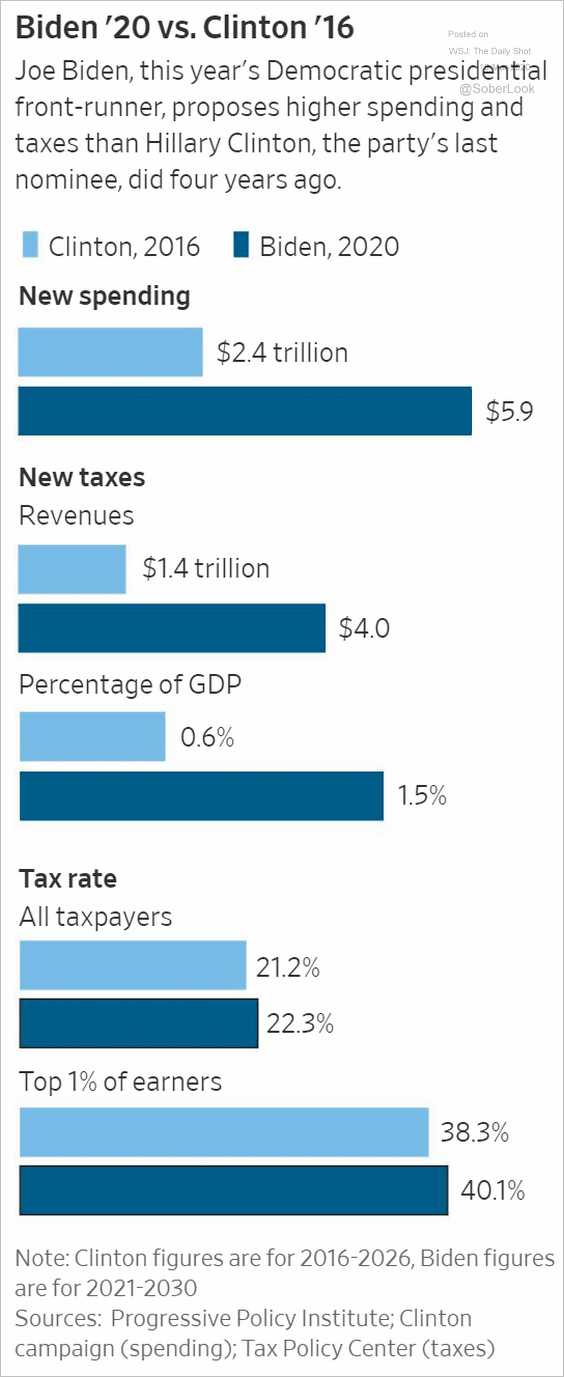

3. Biden-2020 vs. Clinton-2016 spending and tax proposals:

Source: @WSJ Read full article

Source: @WSJ Read full article

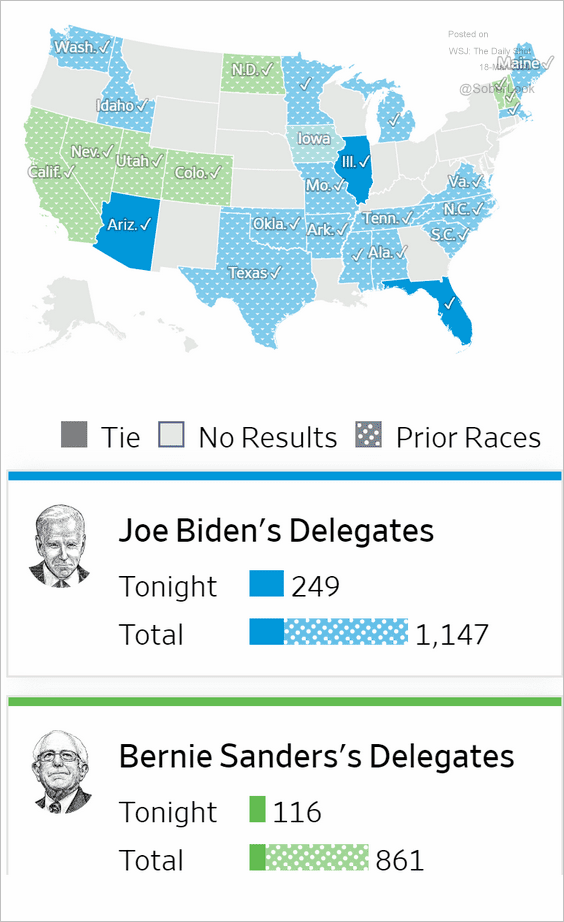

4. Democratic nomination delegate count:

Source: @WSJ Read full article

Source: @WSJ Read full article

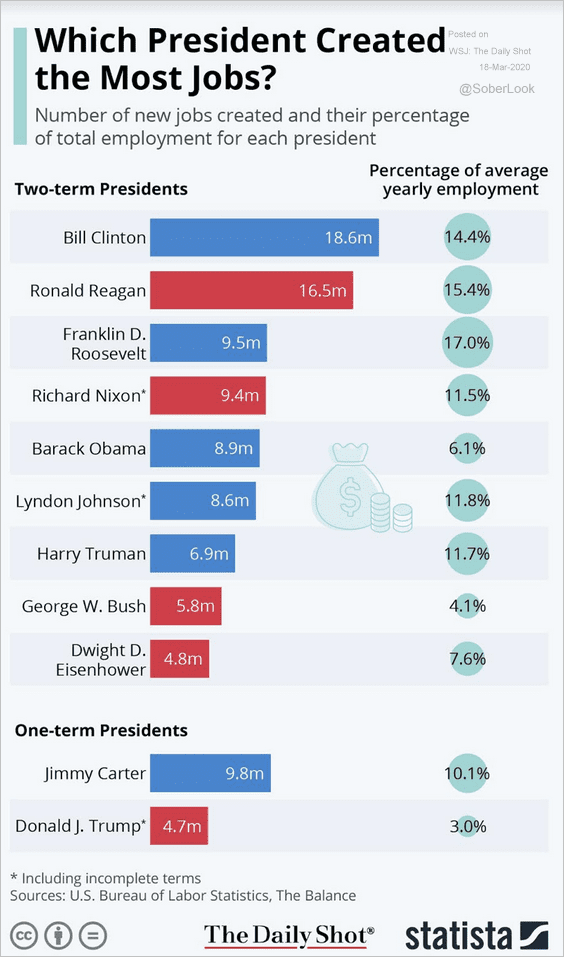

5. Job creation during different administrations:

Source: Statista

Source: Statista

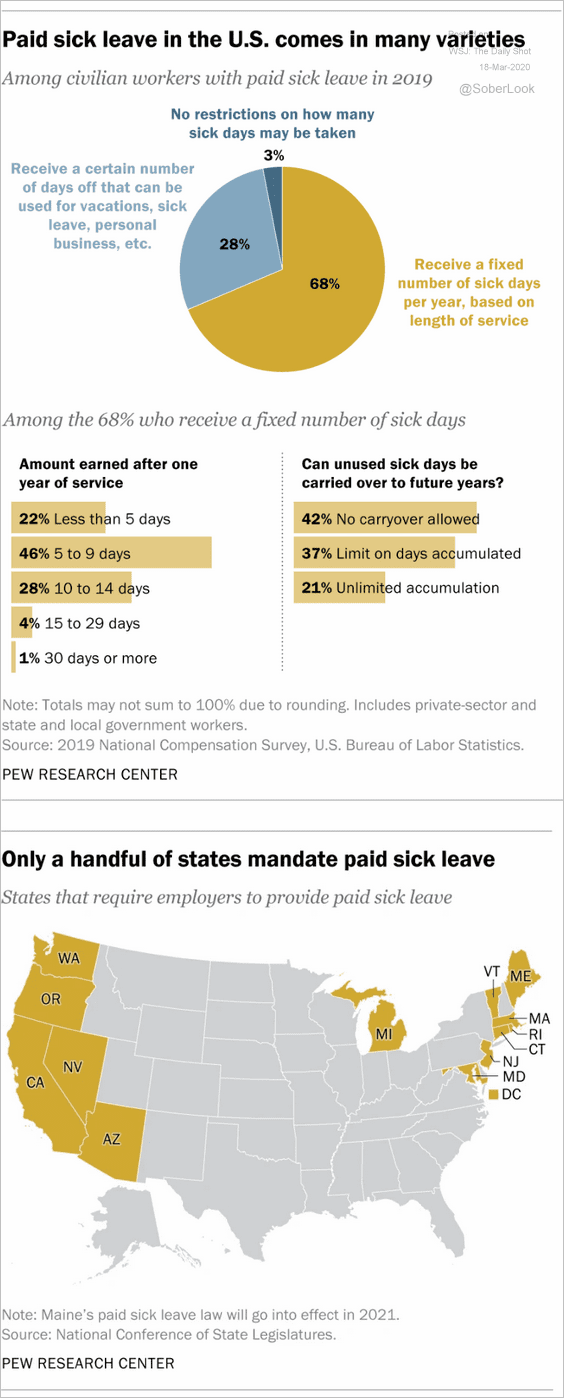

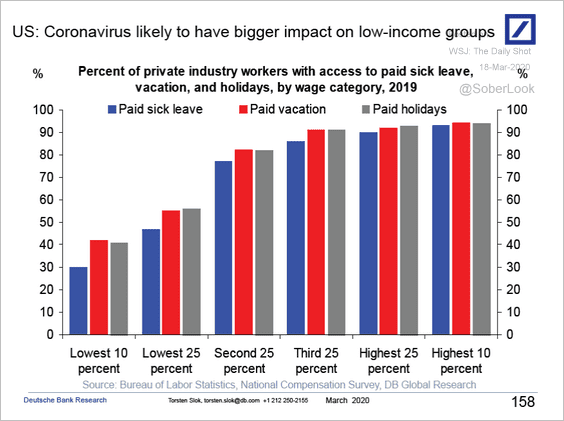

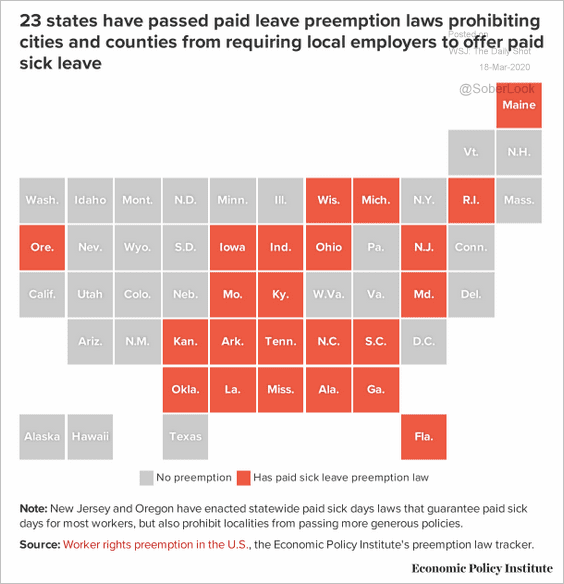

6. Data on paid sick leave:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Economic Policy Institute

Source: Economic Policy Institute

——————–

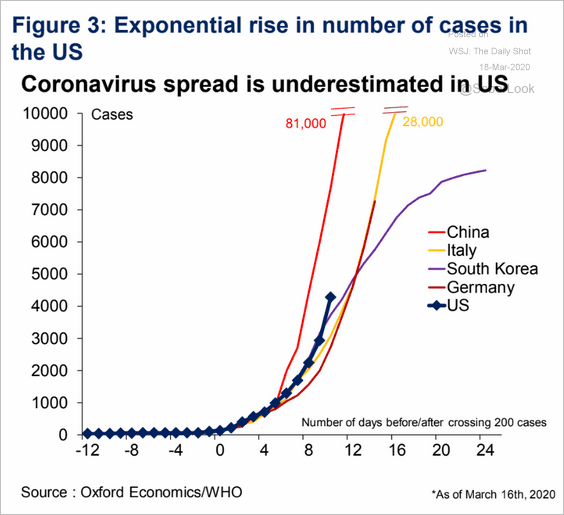

7. Is the spread of coronavirus in the US underestimated?

Source: Oxford Economics

Source: Oxford Economics

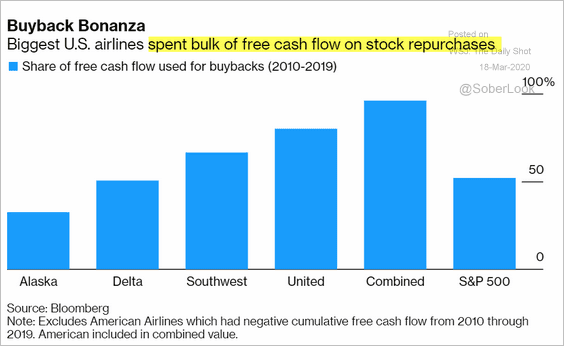

8. Airline cash spending:

Source: @markets Read full article

Source: @markets Read full article

Source: The Hill Read full article

Source: The Hill Read full article

——————–

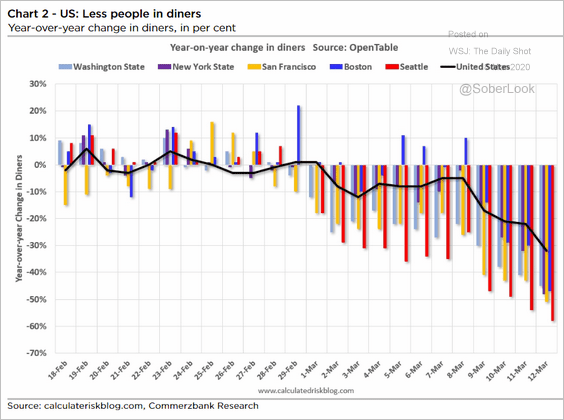

9. Visited a diner lately?

Source: Commerzbank Research

Source: Commerzbank Research

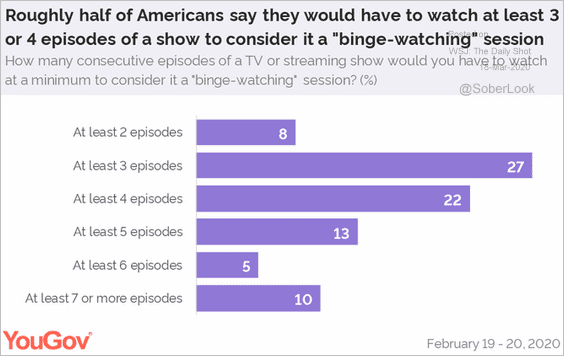

10. What’s considered “binge-watching”?

Source: @YouGovUS Read full article

Source: @YouGovUS Read full article

——————–