The Daily Shot: 25-Mar-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

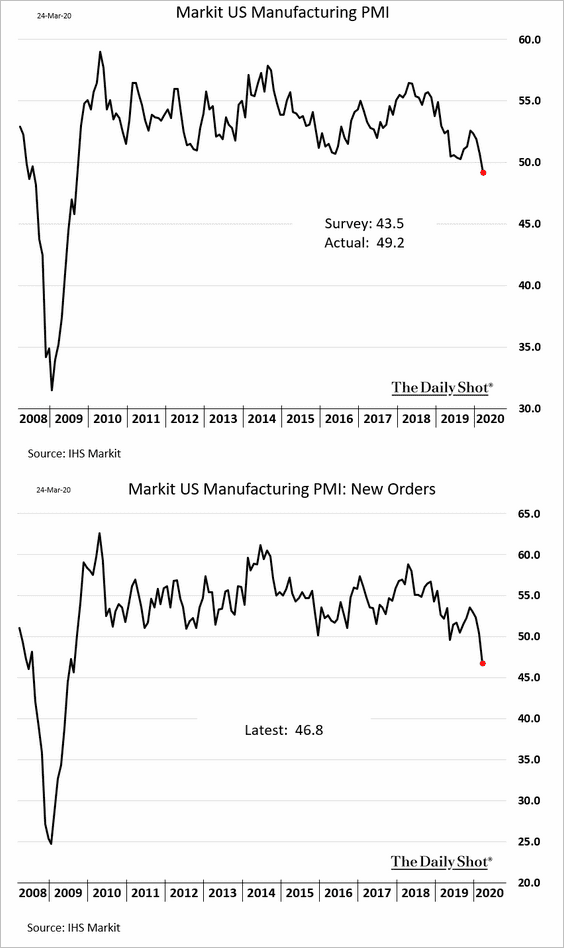

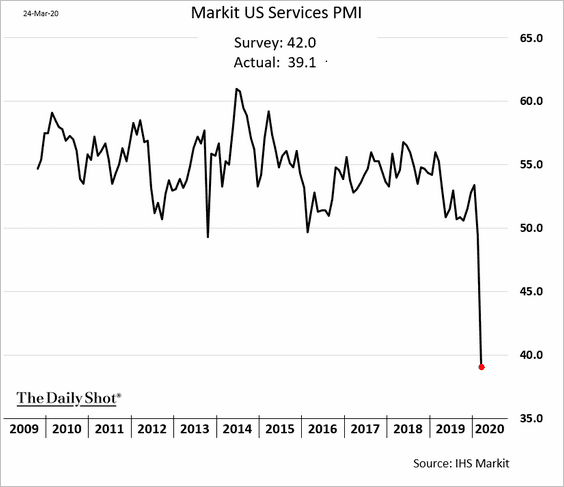

1. Markit PMI data point to a sharp deterioration in business activity this month. The contraction in manufacturing wasn’t as severe as economists were forecasting, but the worst is yet to come.

On the other hand, Markit’s index of service-sector activity collapsed.

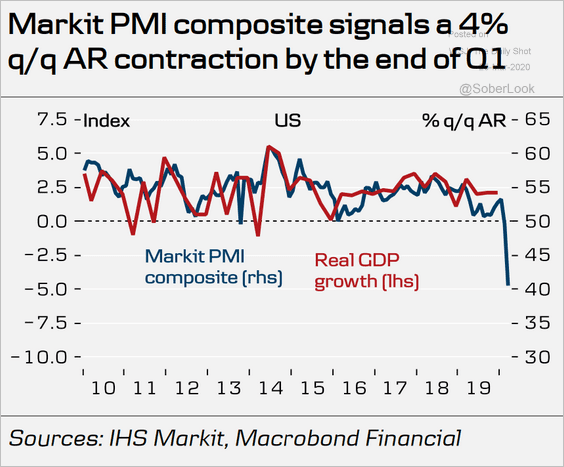

The composite PMI is probably underestimating the nation’s economic contraction.

Source: Danske Bank

Source: Danske Bank

——————–

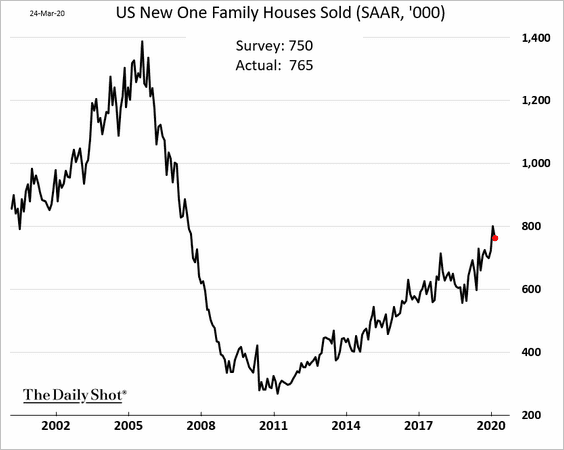

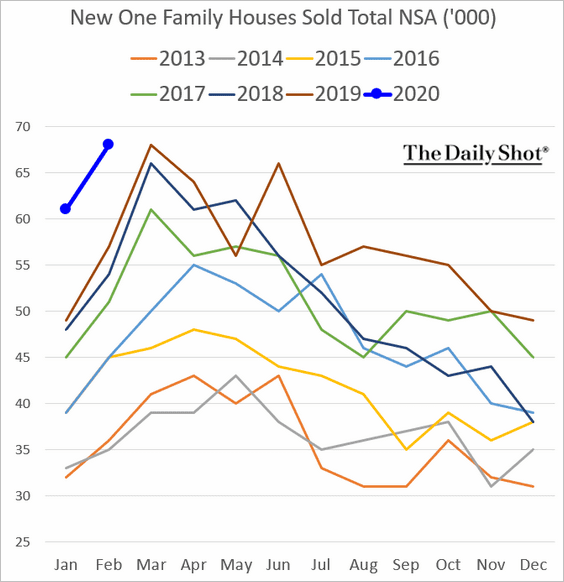

2. The market for new homes was vibrant in January and February, but we won’t see sales back at these levels for a while.

Here are the US new home sales without seasonal adjustments.

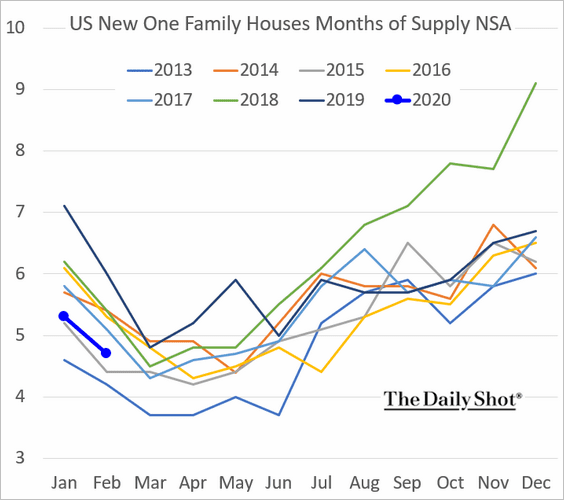

Inventories of new homes remain relatively low (in contrast to what we saw in 2006/07).

——————–

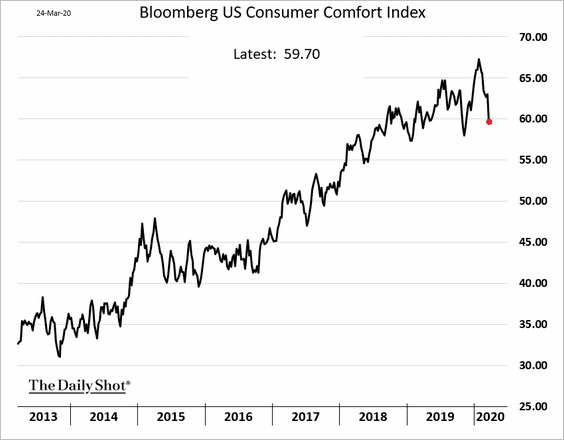

3. Bloomberg’s consumer sentiment index has been remarkably stable.

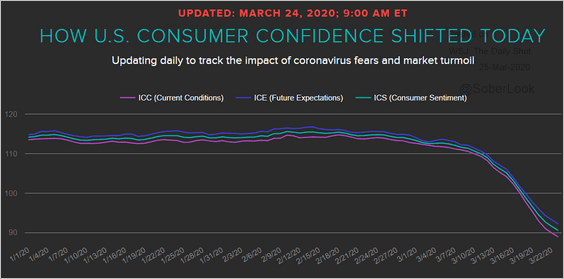

Here is the daily index from Morning Consult.

Source: Morning Consult

Source: Morning Consult

——————–

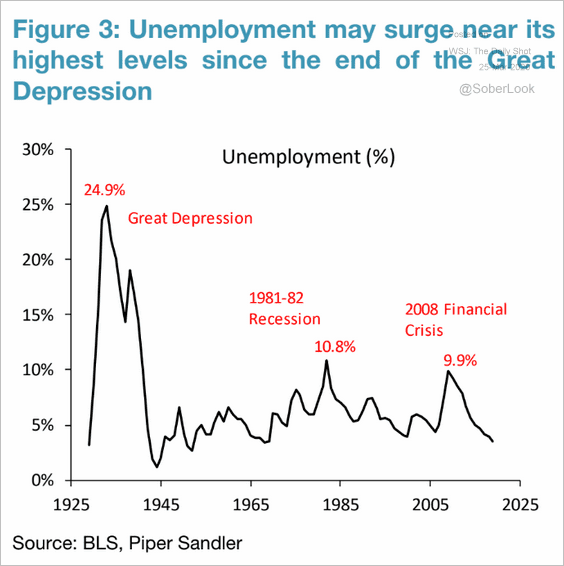

4. How severe are job losses in the US? Several economists expect the unemployment rate to hit levels not seen since the Great Depression – well above what we had in 2008.

Source: Piper Sandler

Source: Piper Sandler

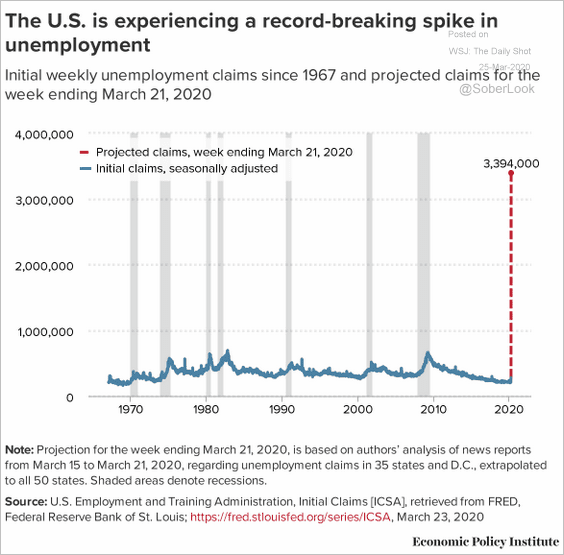

The spike in initial unemployment claims is expected to be unprecedented.

Source: Economic Policy Institute

Source: Economic Policy Institute

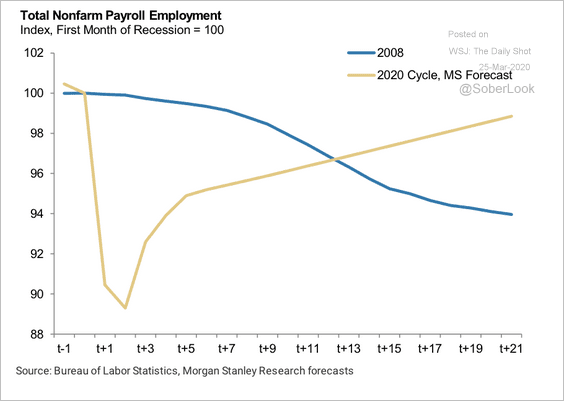

The good news is that economists project a much faster recovery in the labor market than what we saw after 2008.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

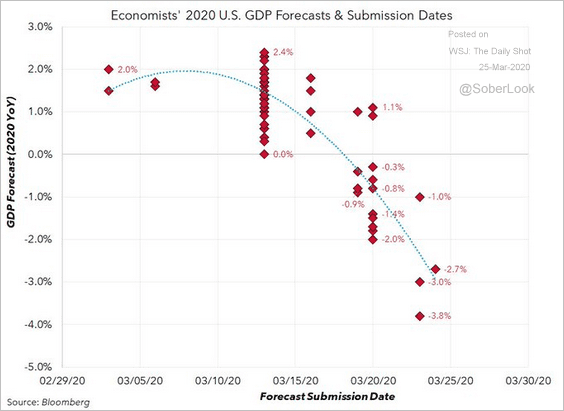

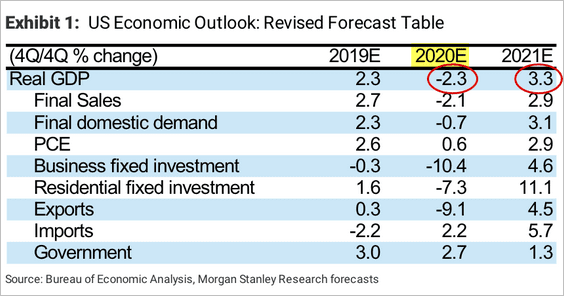

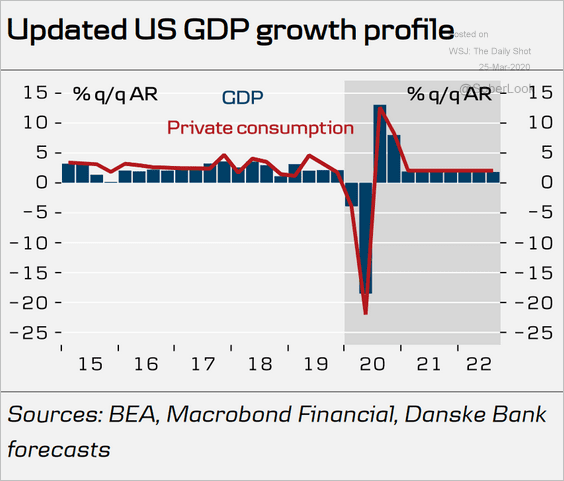

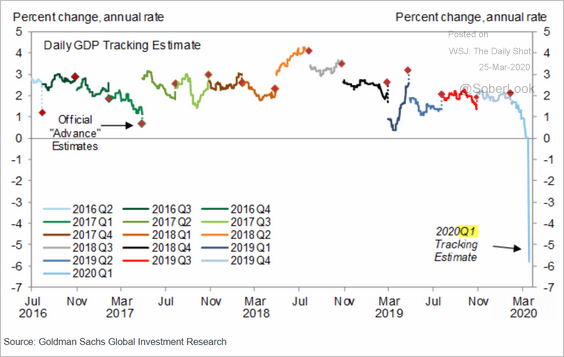

5. Next, let’s take a look at some GDP forecasts.

• The 2020 GDP growth forecasts from different economists by submission date:

Source: @M_McDonough

Source: @M_McDonough

• Morgan Stanley’s forecast for 2020 and 2021:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Danske Bank’s forecast:

Source: Danske Bank

Source: Danske Bank

• Goldman’s Q1 GDP tracker:

Source: Goldman Sachs

Source: Goldman Sachs

• The combination of unprecedented fiscal and monetary measures should cushion the shock to the economy.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

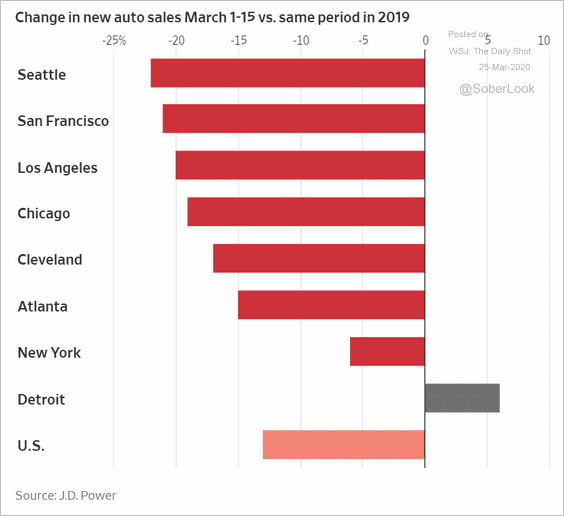

6. Car sales are collapsing.

Source: @WSJ Read full article

Source: @WSJ Read full article

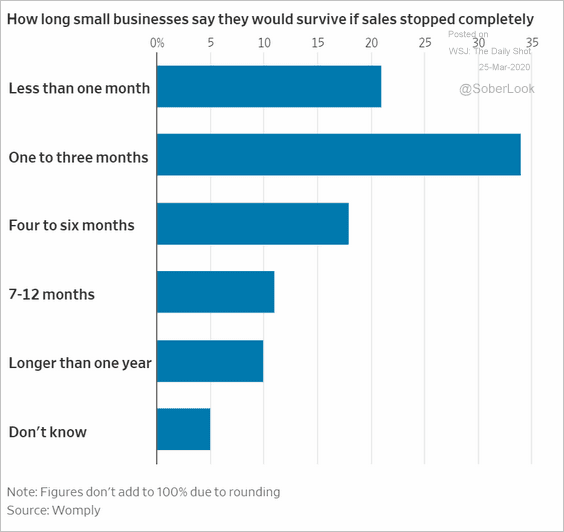

7. A large proportion of US small businesses will run out of cash soon.

Source: @WSJ Read full article

Source: @WSJ Read full article

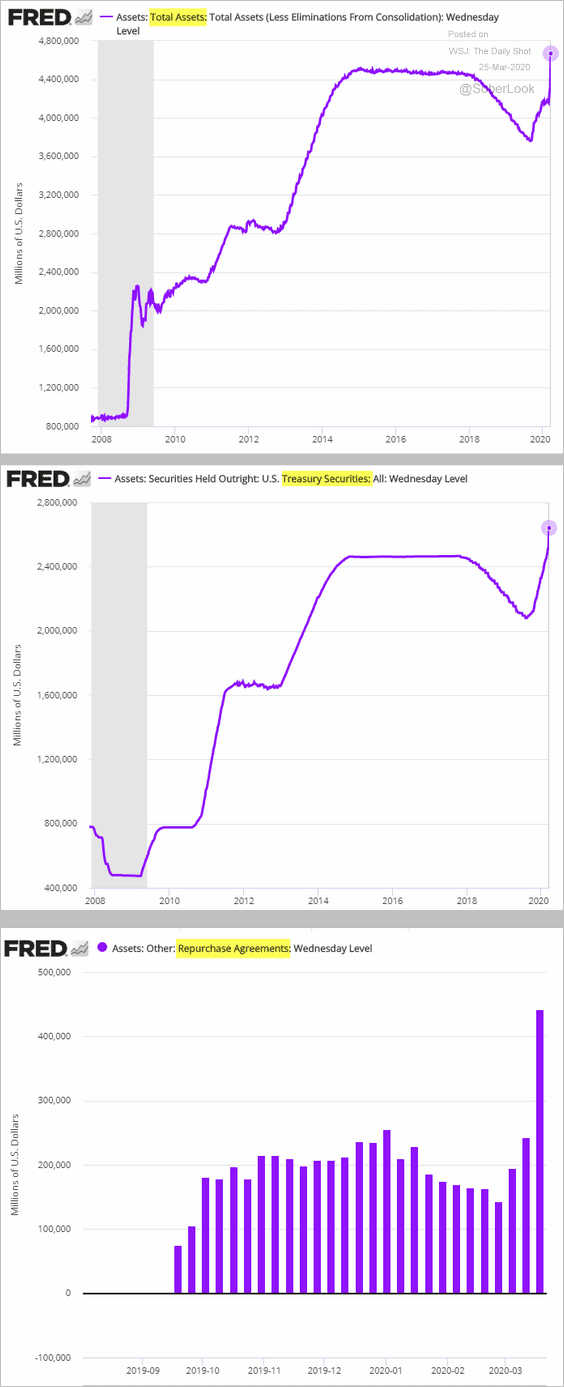

8. The size of the Fed’s balance sheet hit a new record last week, with the latest increase driven by purchases of Treasury securities (second chart) and rising demand for repo financing (third chart – see overview).

Canada

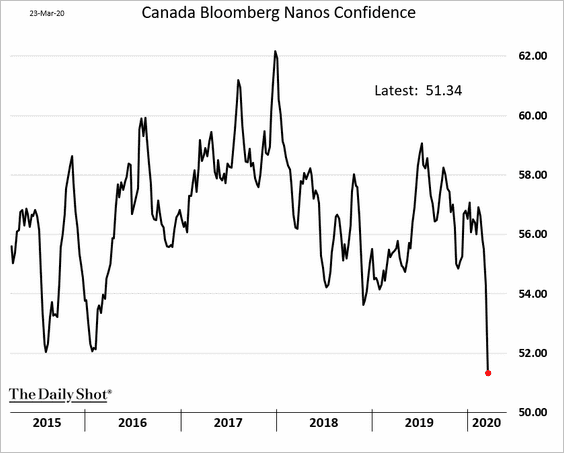

1. Consumer confidence plummeted this month.

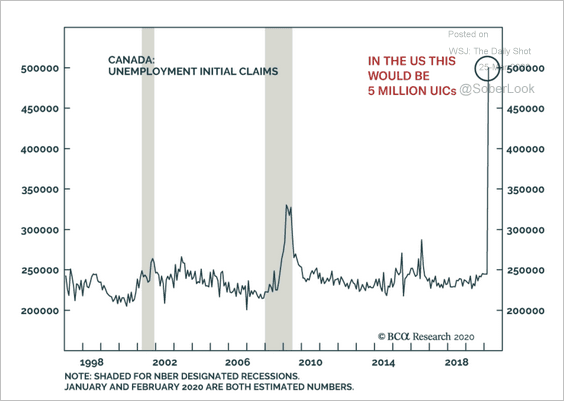

2. Unemployment claims surged last week.

Source: BCA Research

Source: BCA Research

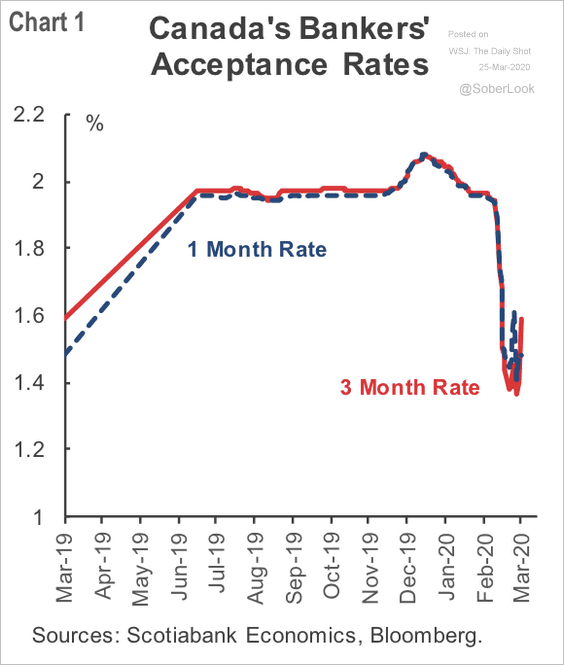

3. The Bank of Canada set up a facility targeting bankers’ acceptance paper. The goal is to get rates back toward 1%, the upper end of the BoC’s rate corridor. According to Scotiabank, this could improve the monetary transmission mechanism before future rate cuts.

Source: Scotiabank Economics

Source: Scotiabank Economics

4. Canada has relatively few cases of the coronavirus compared to “hot-spots” below.

Source: Scotiabank Economics

Source: Scotiabank Economics

The United Kingdom

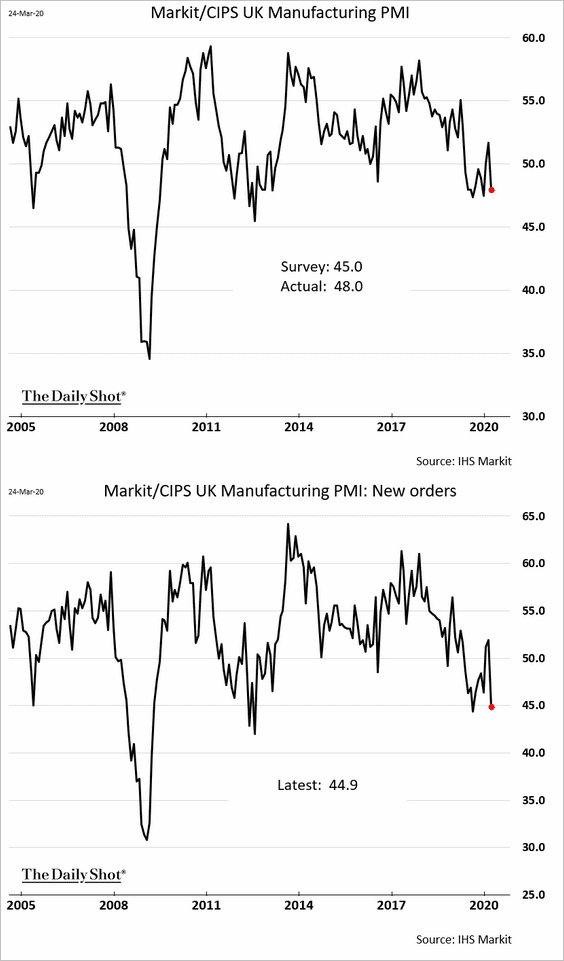

The UK PMI report showed similar dynamics to what we saw in the US and the Eurozone.

• The manufacturing contraction was milder than expected, although there is more to come.

• The contraction in services was more severe than what we saw in 2008.

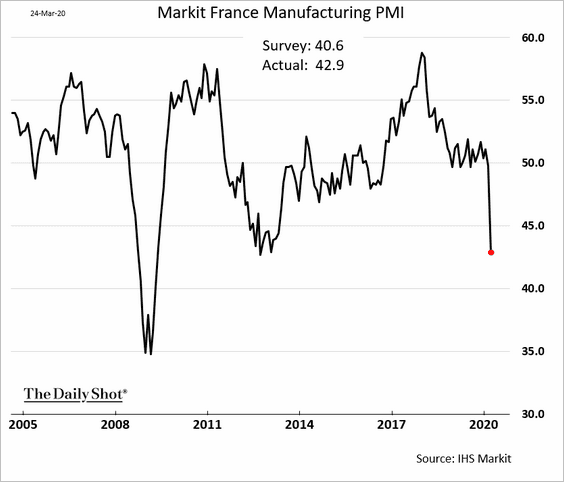

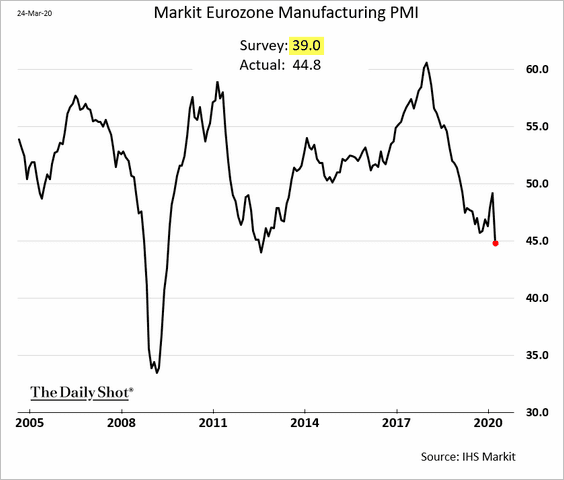

The Eurozone

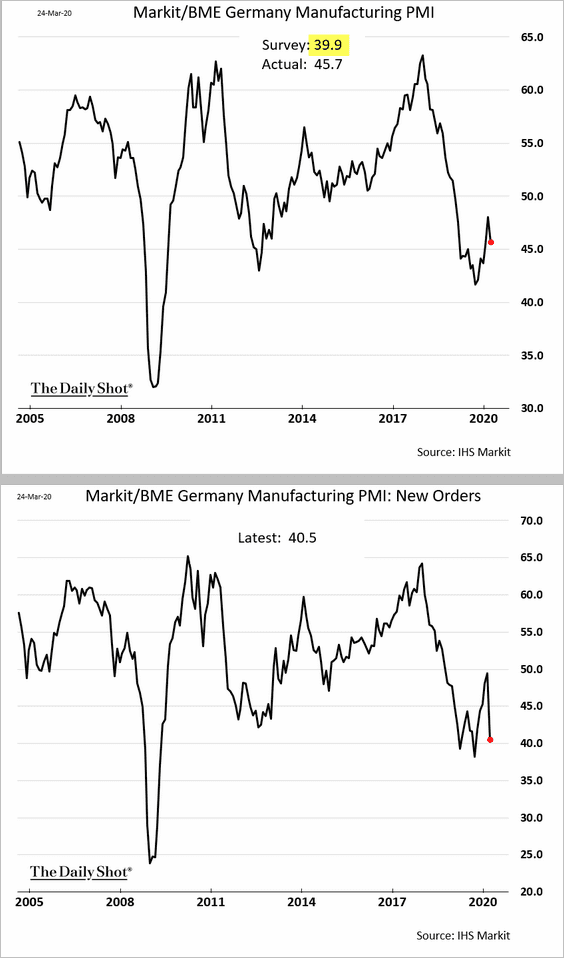

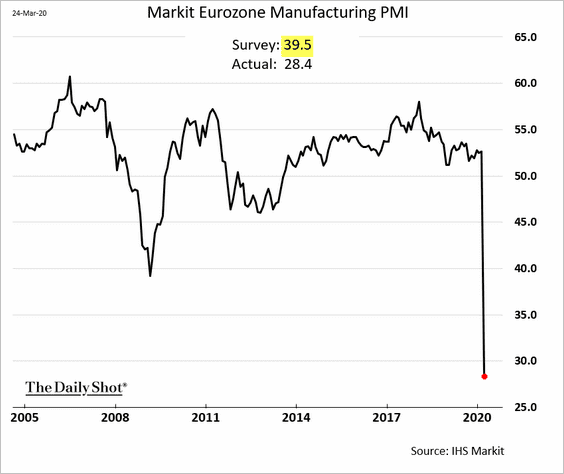

1. Similar to the US and the UK, factory activity declines weren’t as extreme as some had feared, but April figures are expected to be worse.

• Germany:

• France (fastest contraction since 2013):

• The Eurozone:

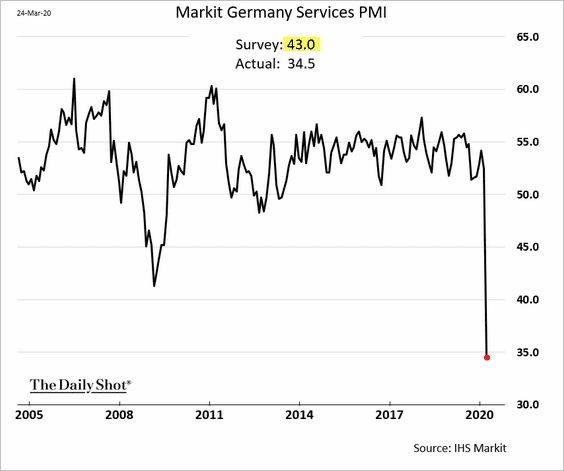

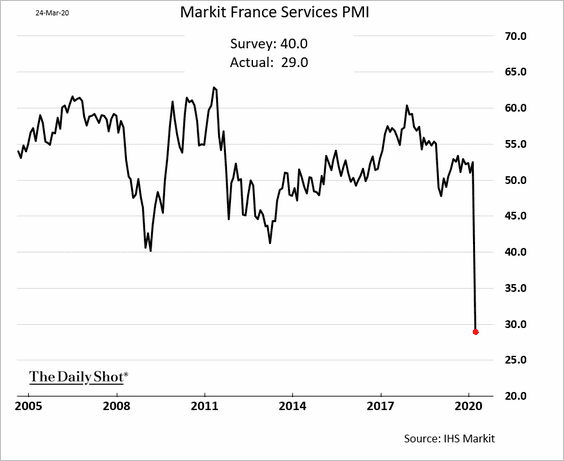

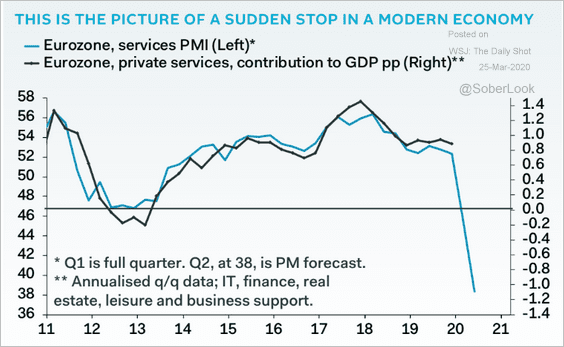

On the other hand, services imploded in March.

• Germany:

• France:

• The Eurozone:

The PMI figures may be underestimating the level of GDP contraction.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

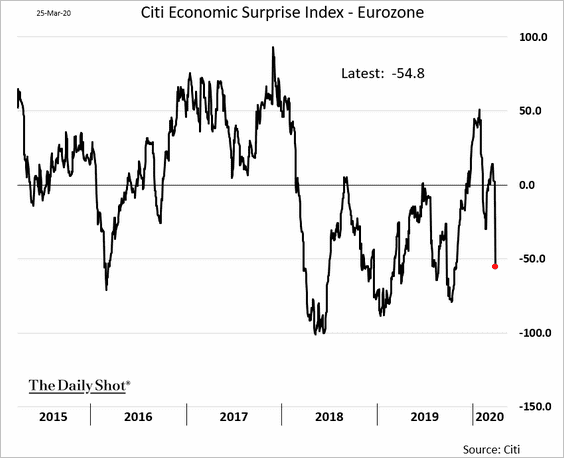

2. The Citi Economic Surprise Index tumbled after the PMI releases.

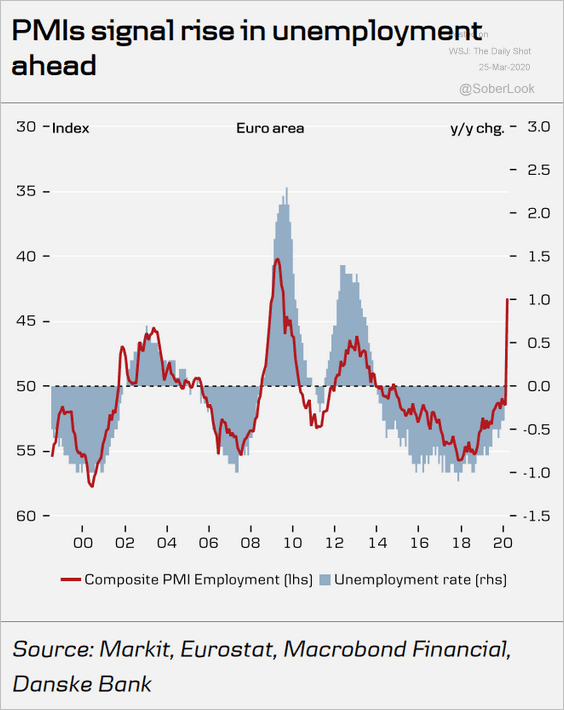

3. How severe will the euro-area unemployment get?

Source: Danske Bank

Source: Danske Bank

4. The ECB’s balance sheet is nearing €5 trillion and will keep climbing.

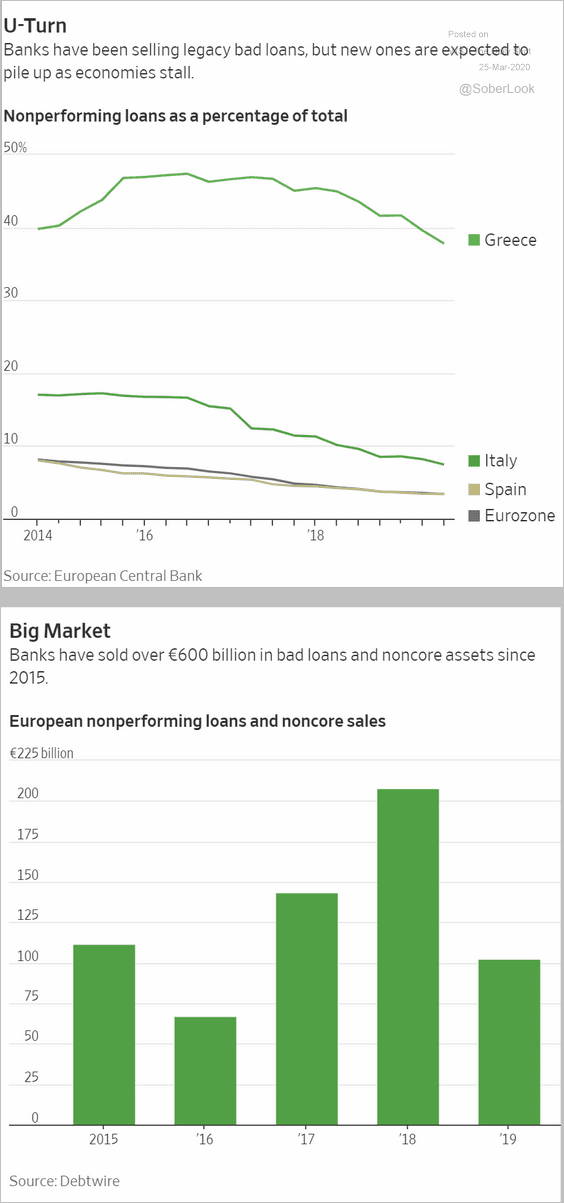

5. The banking system has substantially reduced the amount of bad debt in recent years. But these figures will begin climbing again.

Source: @WSJ Read full article

Source: @WSJ Read full article

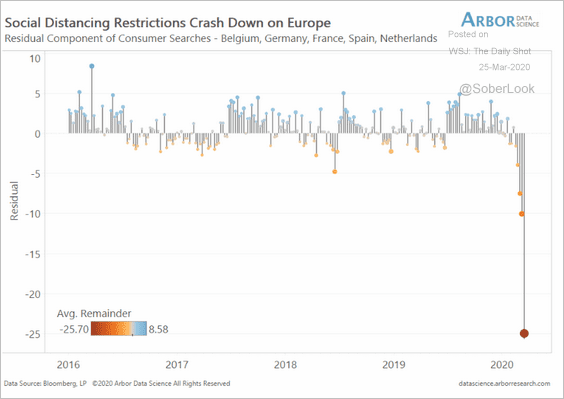

6. Based on online search data, the Eurozone’s consumer activity outside of Italy is collapsing.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

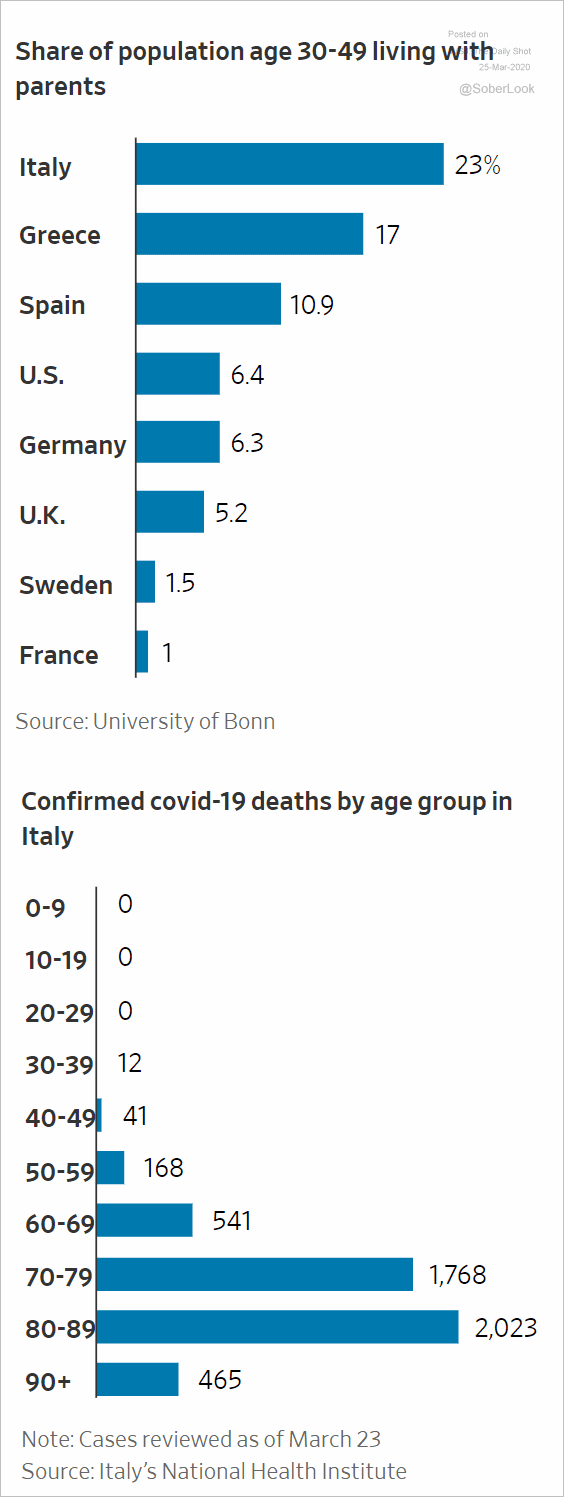

7. Italy has been struggling with coronavirus transmissions between younger and older household members, which had devastating effects.

Source: @WSJ Read full article

Source: @WSJ Read full article

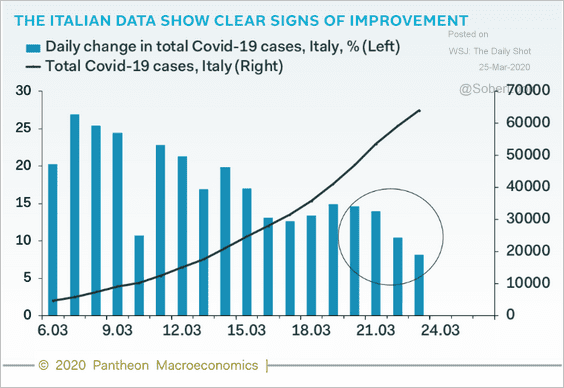

But there is finally some promising news. The growth rate in new cases appears to be slowing.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Asia – Pacific

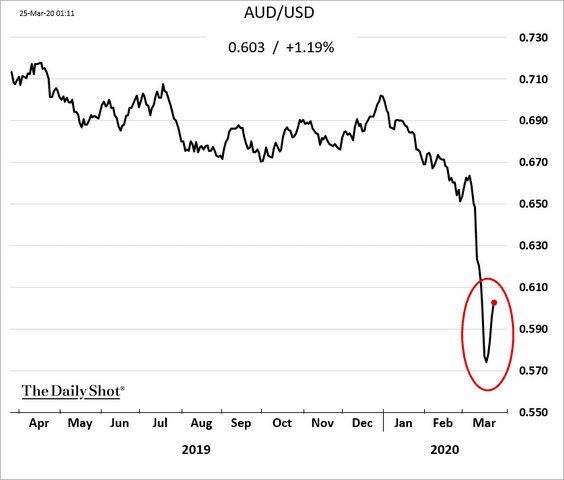

The combination of unprecedented fiscal and monetary measures in the US has improved market sentiment globally.

• The Aussie dollar:

• The South Korean won:

China

1. The PBoC is getting ready to cut bank deposit rates, which should improve bank margins.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

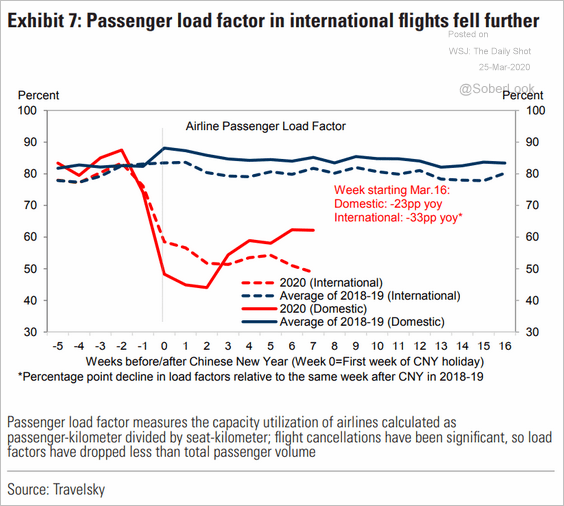

2. While domestic flights are gradually recovering, international flights hit a new low for the year.

Source: Goldman Sachs

Source: Goldman Sachs

Emerging Markets

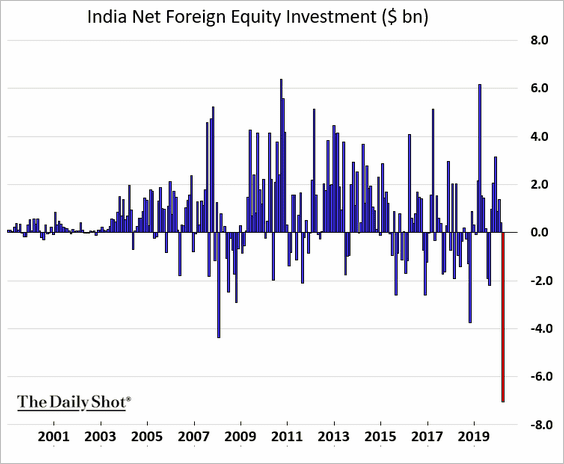

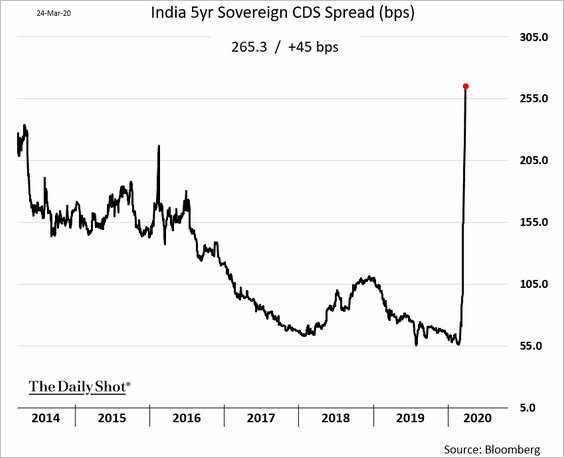

1. Let’s begin with India.

• Equity outflows have been unprecedented.

Source: Nupur Acharya, @TheTerminal

Source: Nupur Acharya, @TheTerminal

• The sovereign credit default swap spread keeps widening.

——————–

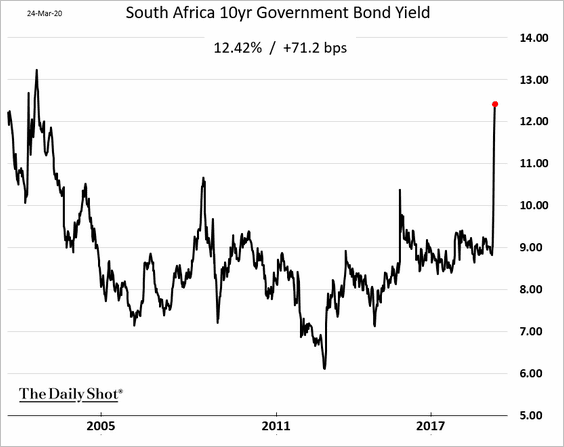

2. South Africa’s local bond yields hit the highest level since 2002.

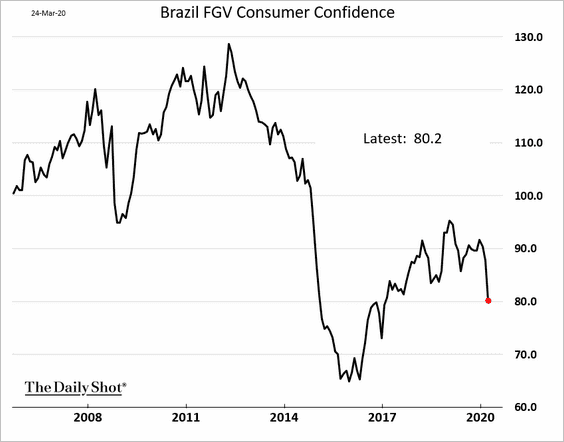

3. Brazil’s consumer confidence is deteriorating.

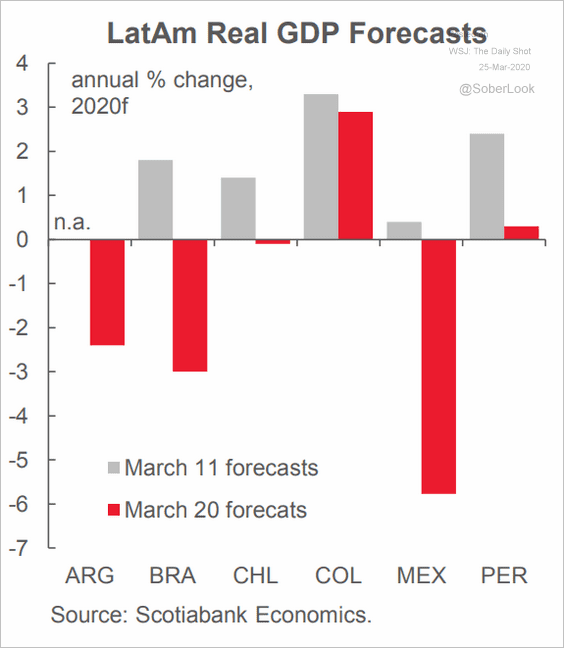

4. Here is Scotiabank’s forecast for LatAm 2020 GDP growth.

Source: Scotiabank Economics

Source: Scotiabank Economics

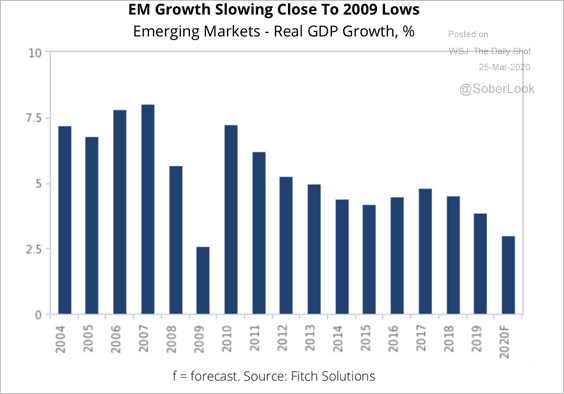

5. The overall EM growth is expected to be the slowest since 2009.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Commodities

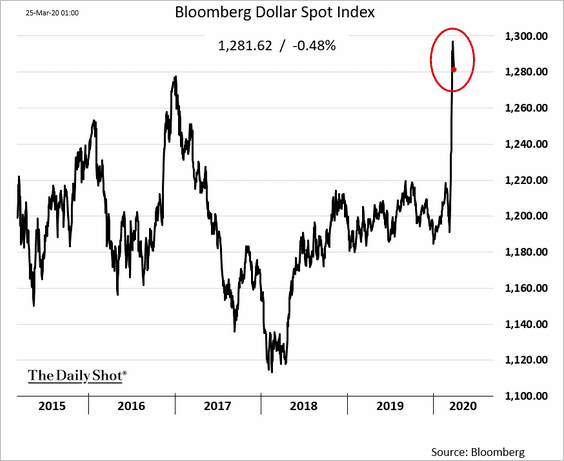

1. The US dollar rally has stalled.

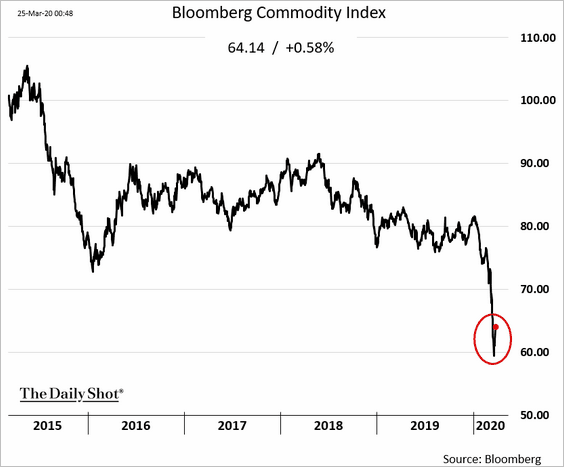

And commodities appear to have bottomed.

——————–

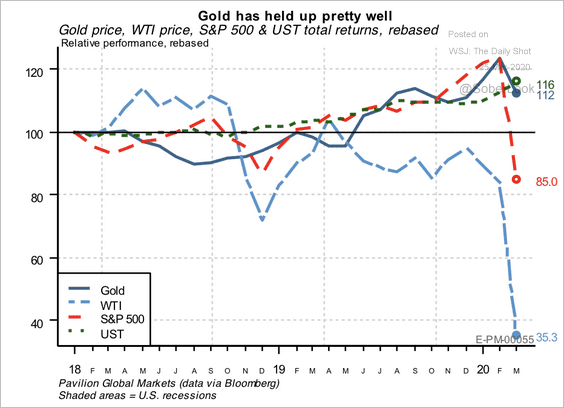

2. Gold has held up well compared to equities, oil, and Treasuries.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

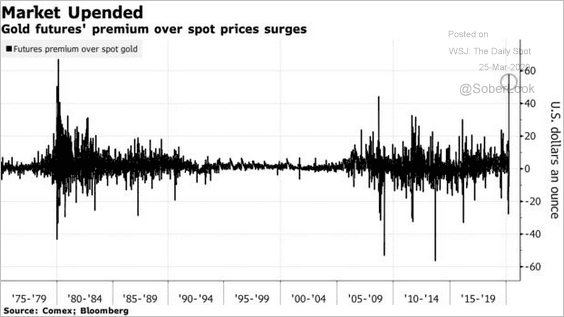

3. According to Bloomberg, the sharp divergence between the COMEX futures and physical gold was “fueled by logistic disruptions and tight market in New York.”

Source: @markets Read full article

Source: @markets Read full article

Energy

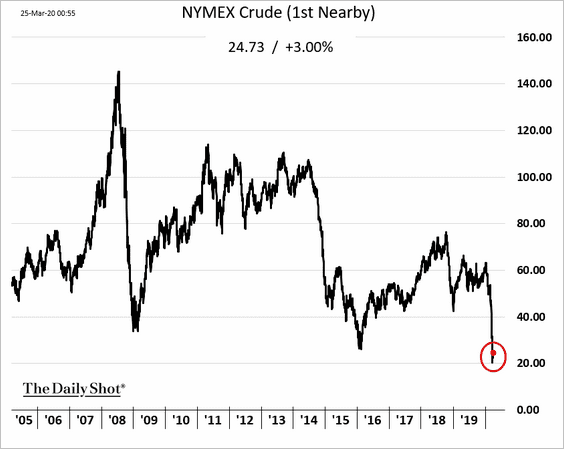

1. Crude oil appears to have stabilized but remains at multi-year lows.

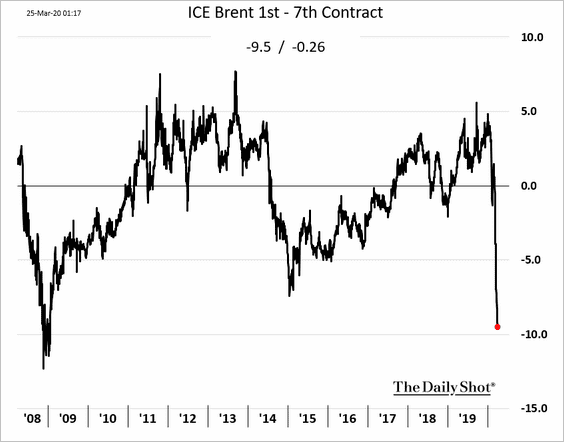

2. The Brent contango continues to deepen even after a modest price increase.

Equities

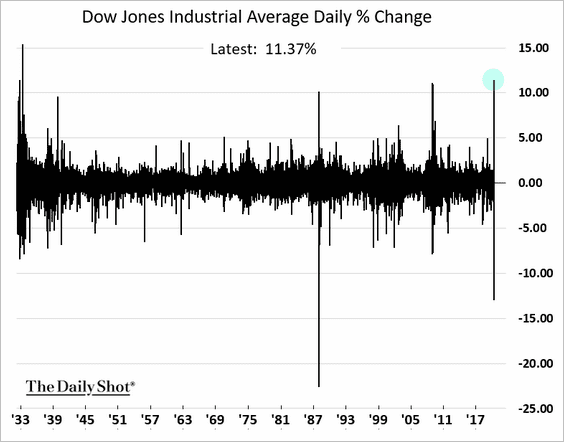

1. The Dow registered its largest single-day increase since 1933 on Tuesday, as extreme volatility continues.

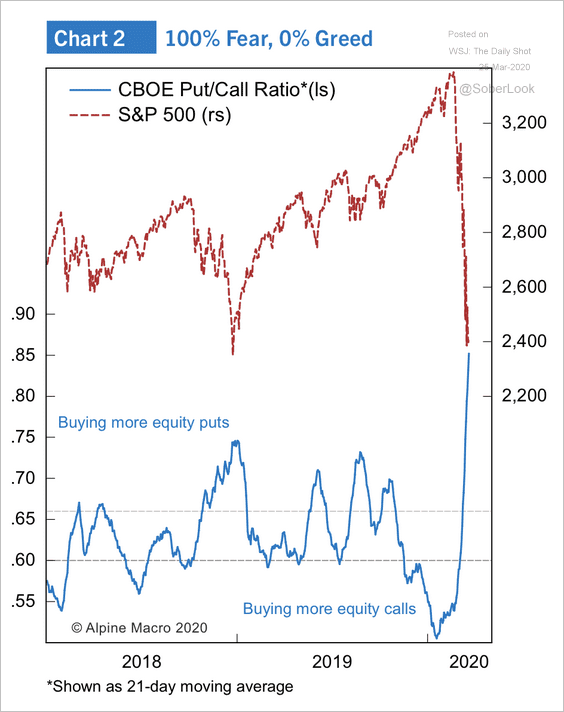

2. The put-call ratio is near extreme levels.

Source: Alpine Macro

Source: Alpine Macro

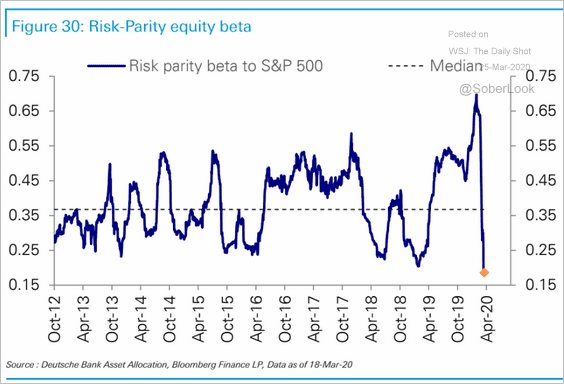

3. Risk parity funds’ exposure to the S&P 500 hit the lowest level in years as volatility spikes.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

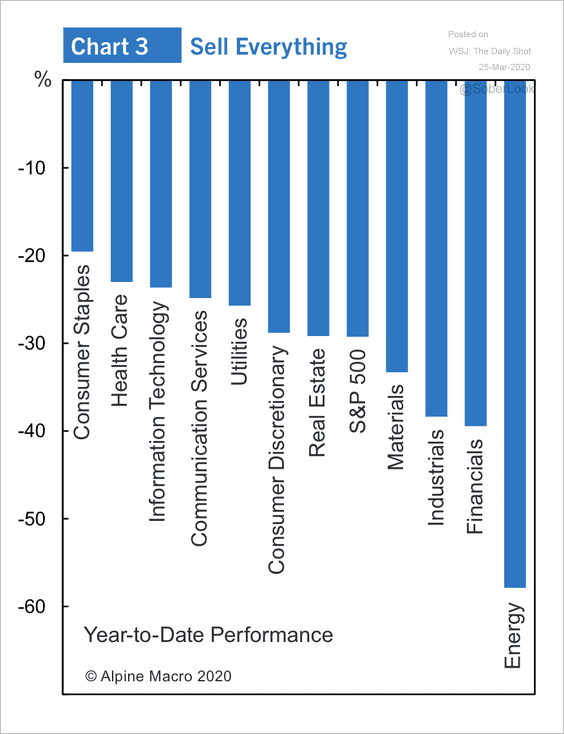

4. Next, we have some sector updates.

• Year-to-date performance:

Source: Alpine Macro

Source: Alpine Macro

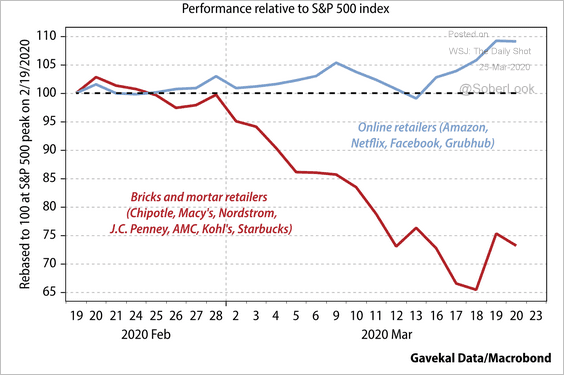

• Online vs. traditional retailers relative to the S&P 500:

Source: Gavekal

Source: Gavekal

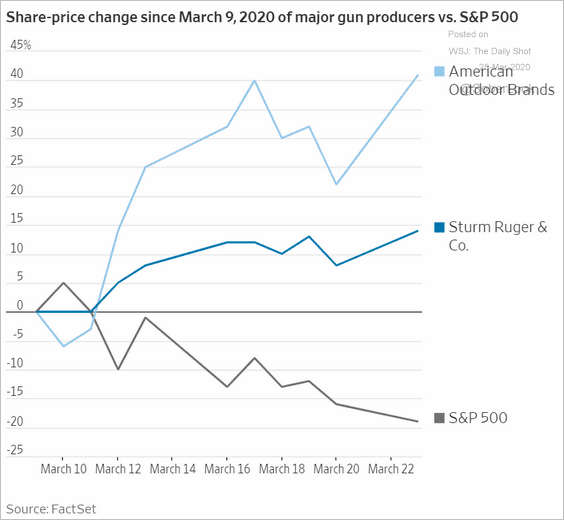

• Gun manufacturers:

Source: @WSJ Read full article

Source: @WSJ Read full article

Credit

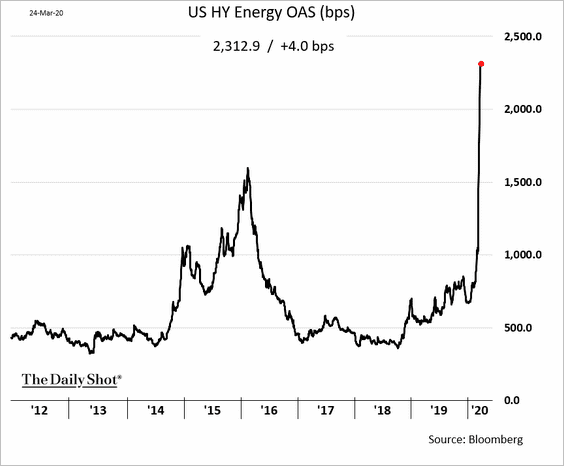

1. Energy-sector high-yield bond spreads keep widening.

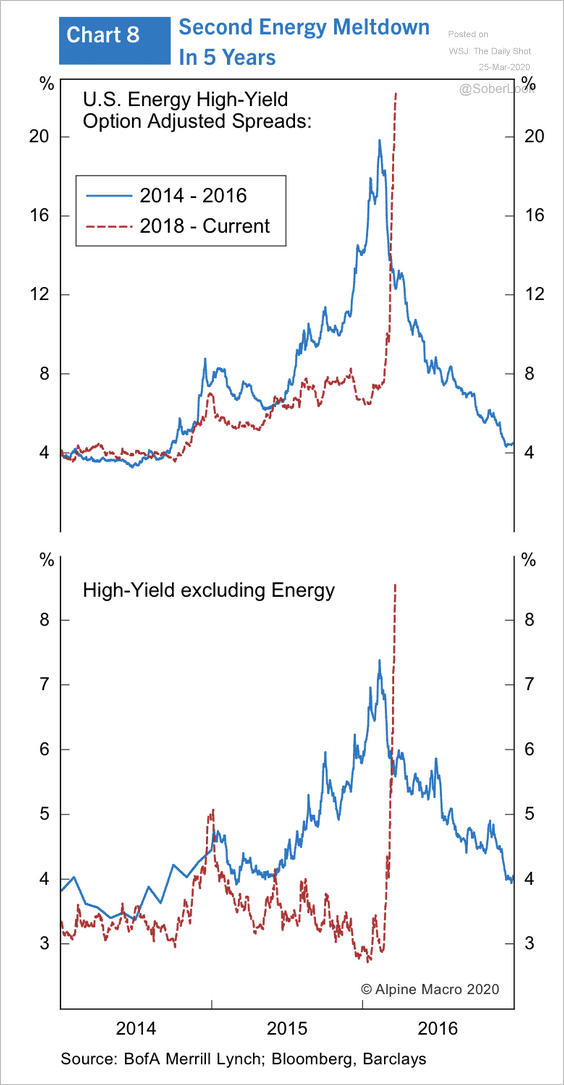

2. Here is the current high-yield spread trajectory vs. the 2014-2016 energy meltdown?

Source: Alpine Macro

Source: Alpine Macro

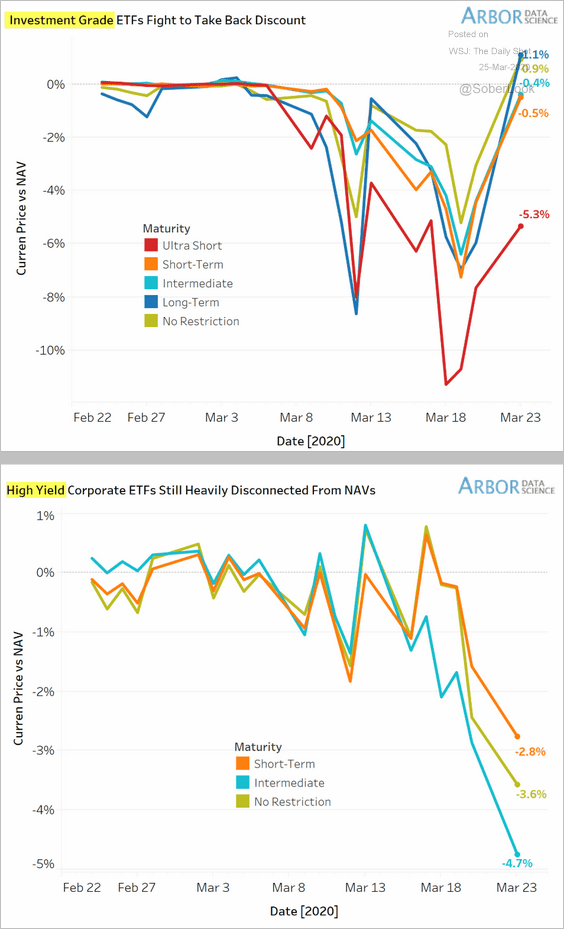

3. The Fed’s latest policy measures helped investment-grade bond ETFs recover some of the discount to NAV. But that’s not the case for high-yield ETFs.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

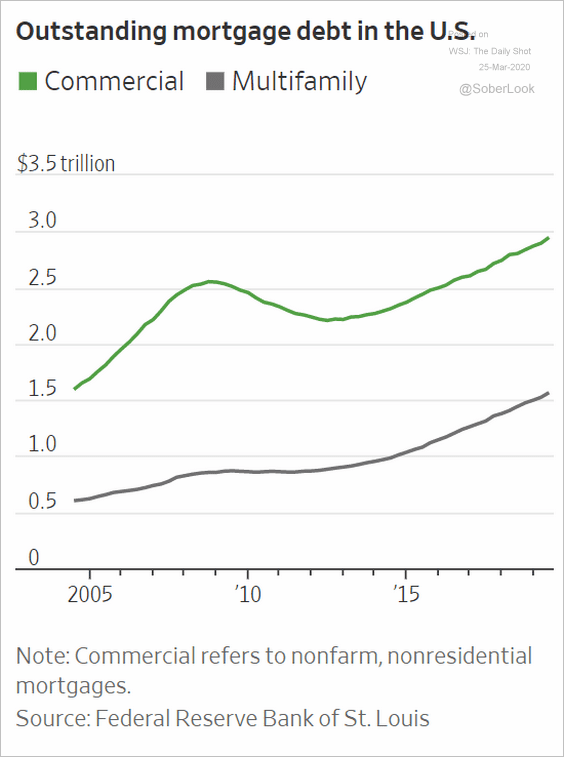

4. CMBS debt has been under pressure as many businesses halt rent payments.

Source: @WSJ Read full article

Source: @WSJ Read full article

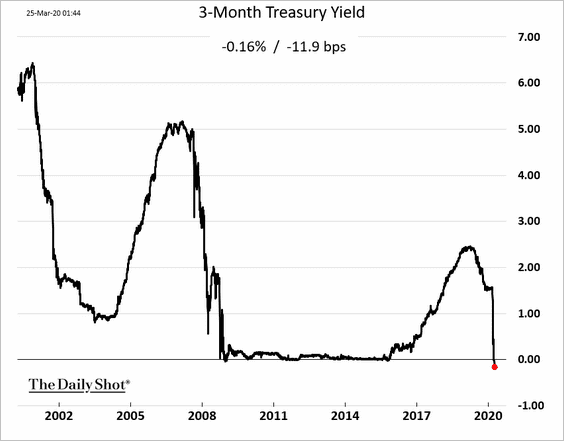

Rates

1. The 3-month T-Bill yield hit the lowest level on record.

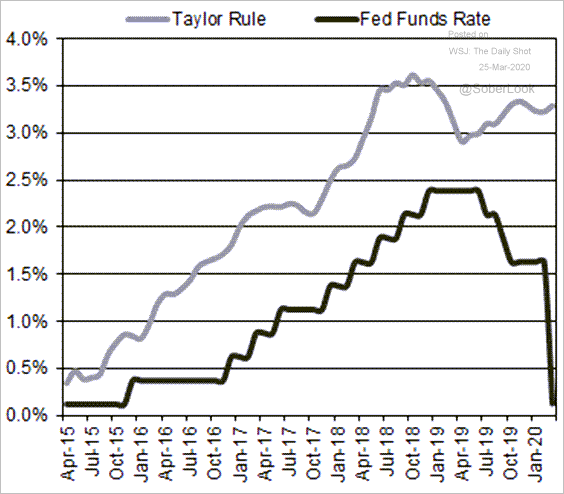

2. Here is why using a “rule-based” approach to drive policy rates doesn’t work.

Source: @BobBrinker

Source: @BobBrinker

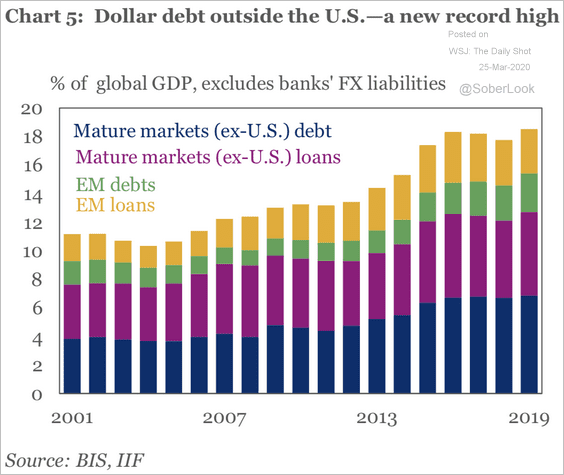

Global Developments

1. There is quite a bit of dollar-denominated debt out there. The latest US dollar rally has been a headache for non-US borrowers.

Source: IIF

Source: IIF

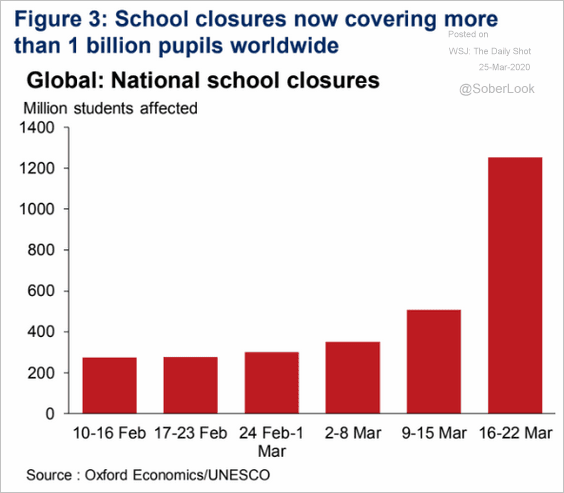

2. Worldwide school closures accelerate.

Source: Oxford Economics

Source: Oxford Economics

3. Online search activity shows consumers retreating globally.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

Food for Thought

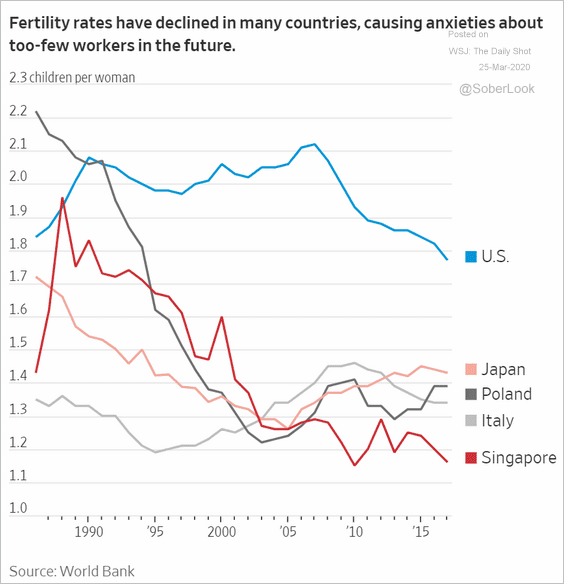

1. Fertility rates:

Source: @WSJ Read full article

Source: @WSJ Read full article

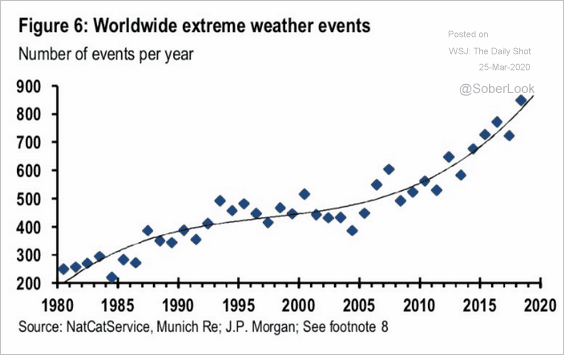

2. Extreme weather events:

Source: JP Morgan Securities, @GreenRupertRead, @TayTayLLP

Source: JP Morgan Securities, @GreenRupertRead, @TayTayLLP

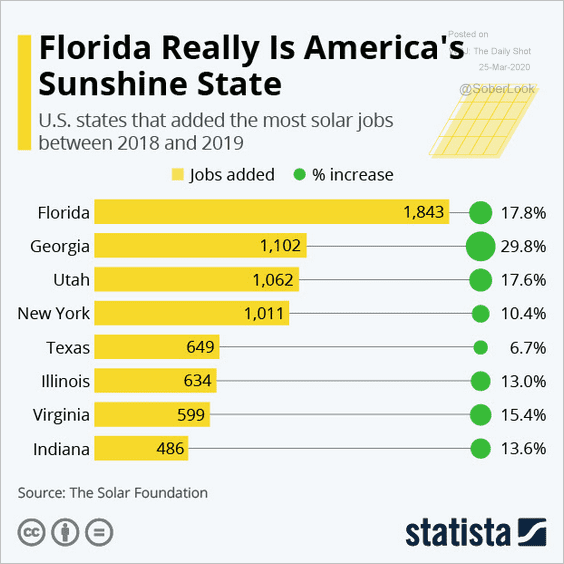

3. Solar jobs, by state:

Source: Statista

Source: Statista

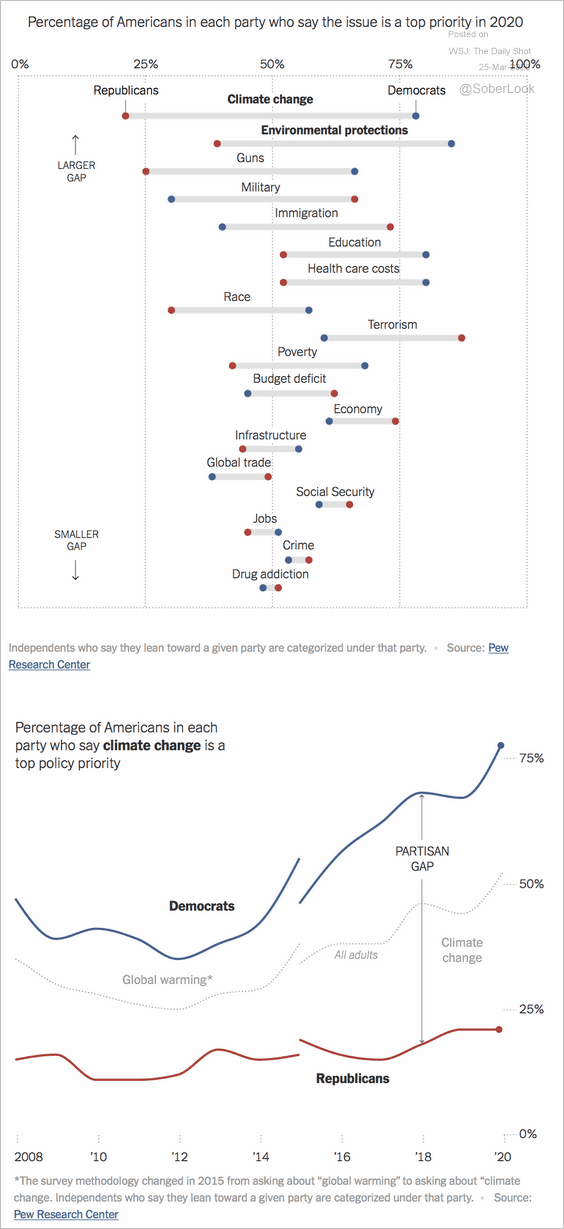

4. Partisan gaps on issues:

Source: The New York Times Read full article

Source: The New York Times Read full article

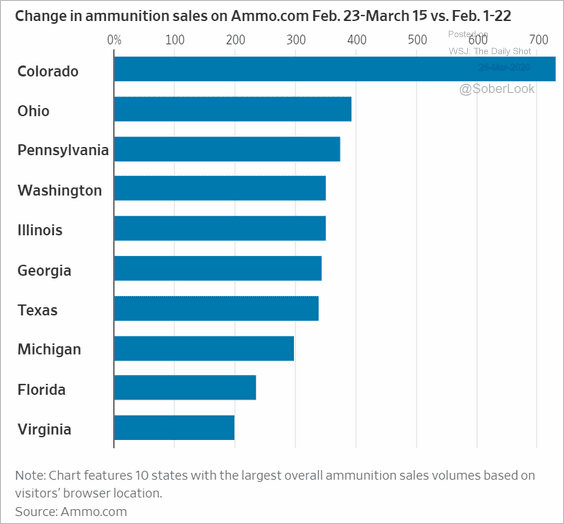

5. The increase in ammunition sales:

Source: @WSJ Read full article

Source: @WSJ Read full article

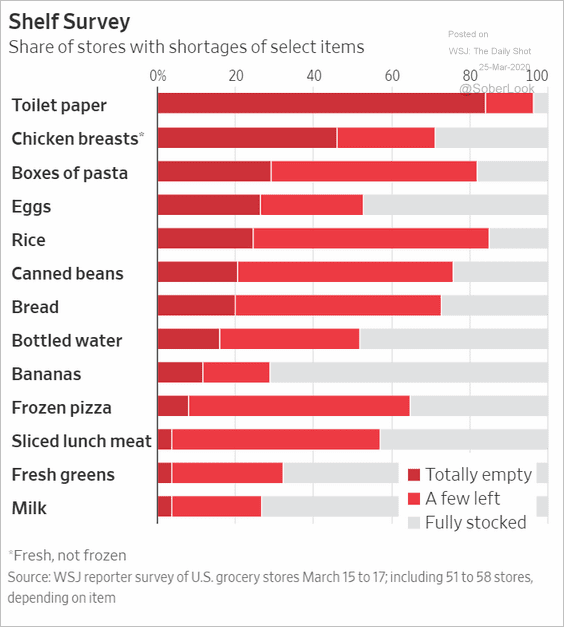

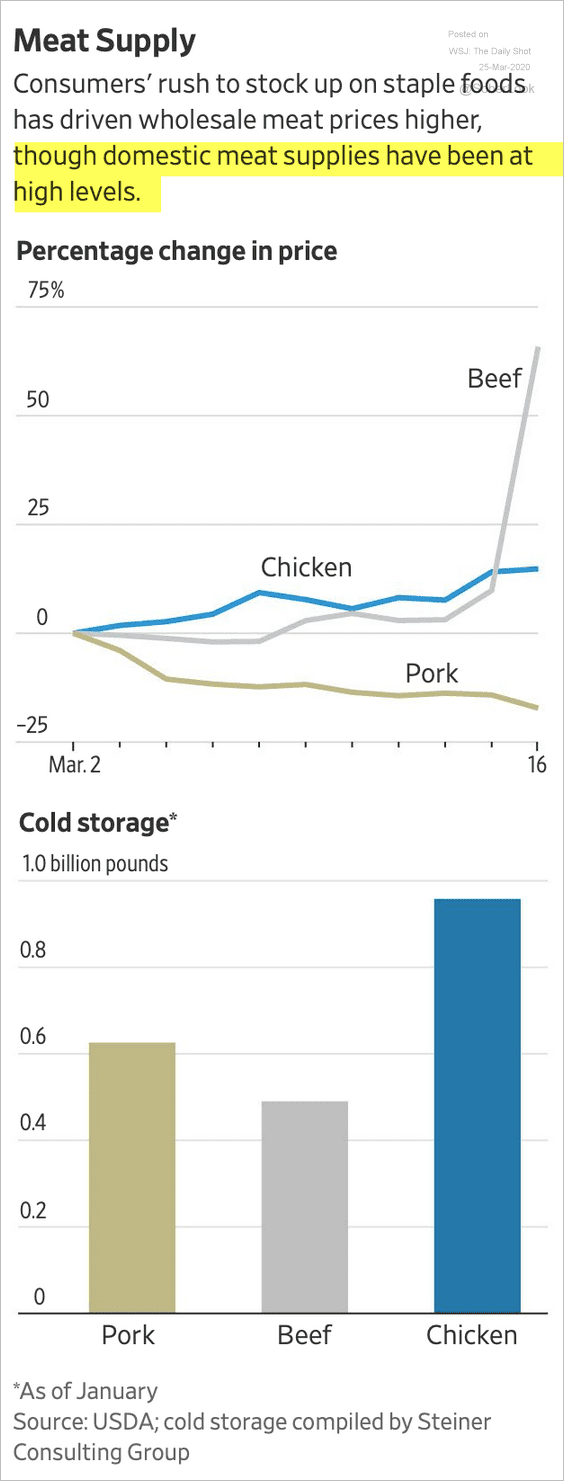

6. Grocery shortages:

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

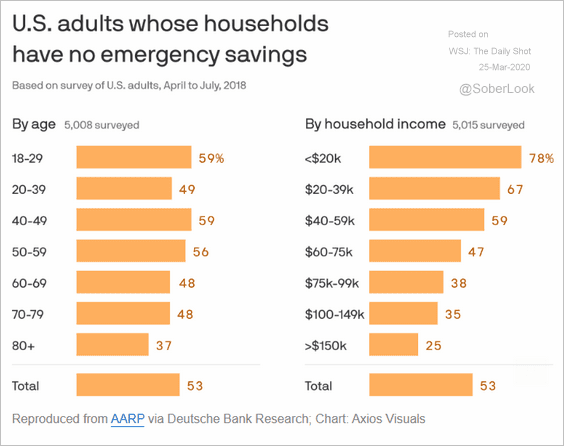

7. Emergency savings:

Source: @axios Read full article

Source: @axios Read full article

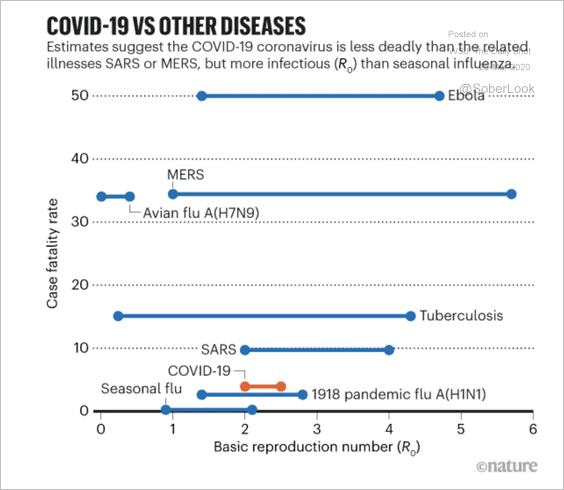

8. Fatality rates vs. contagiousness:

Source: Nature Read full article

Source: Nature Read full article

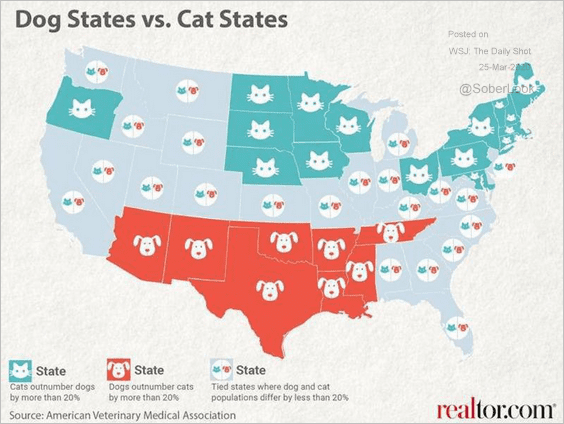

9. Dog states vs. cat states:

Source: realtor.com Read full article

Source: realtor.com Read full article

——————–