The Daily Shot: 01-Apr-20

• The United States

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

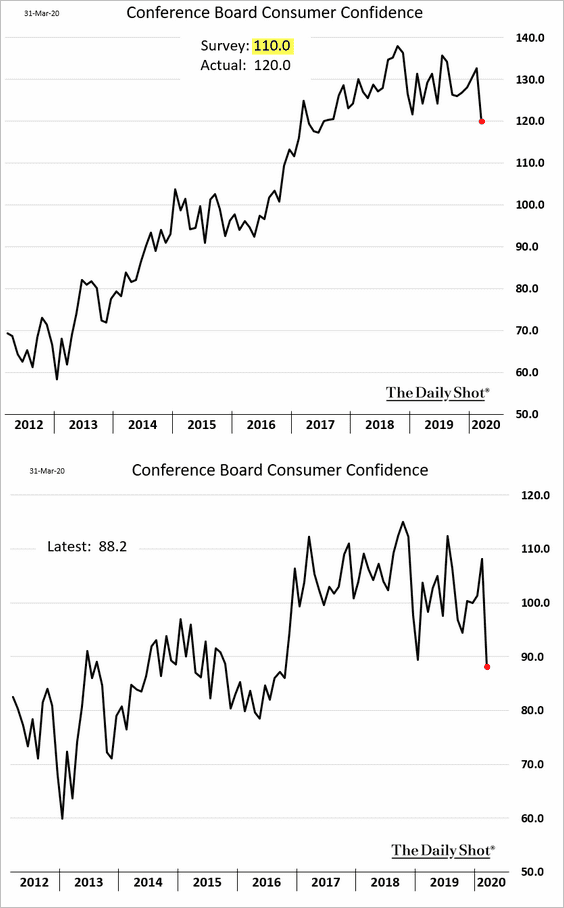

1. The Conference Board’s consumer confidence indicator declined less than the market was expecting.

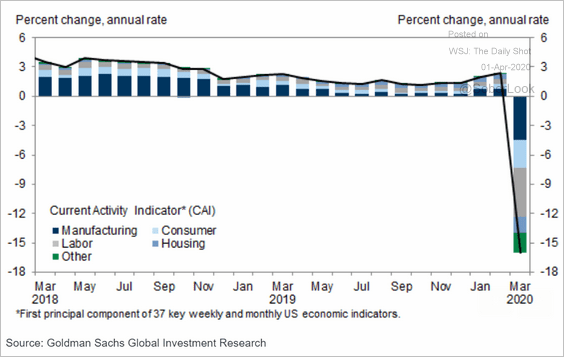

Considering the collapse in US economic activity (see Goldman’s Current Activity Indicator below), consumer sentiment has been remarkably resilient.

Source: Goldman Sachs

Source: Goldman Sachs

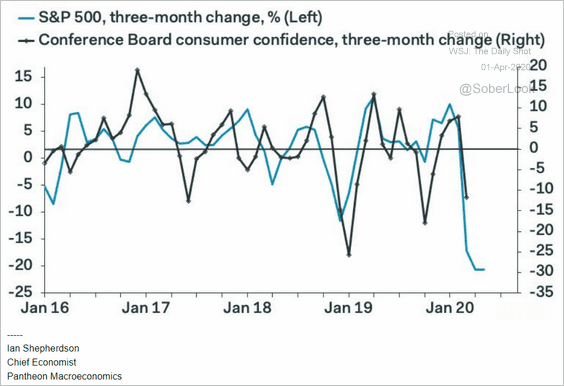

But we are likely to see consumer confidence deteriorate further in April.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

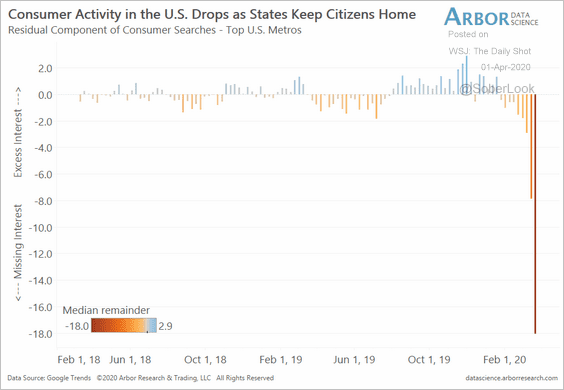

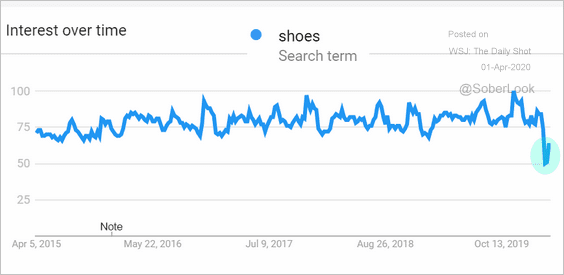

2. Based on Google search data, consumer activity has declined sharply.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

For example, here is the search frequency for the word “shoes.”

Source: Google Trends

Source: Google Trends

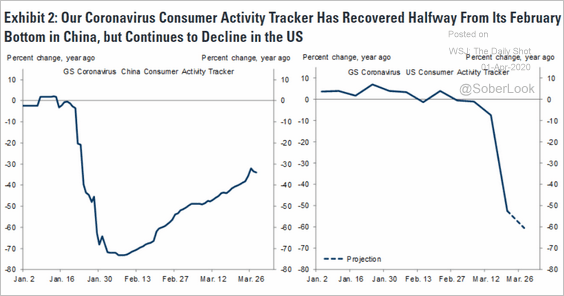

Below is Goldman’s consumer activity tracker for China and the US.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

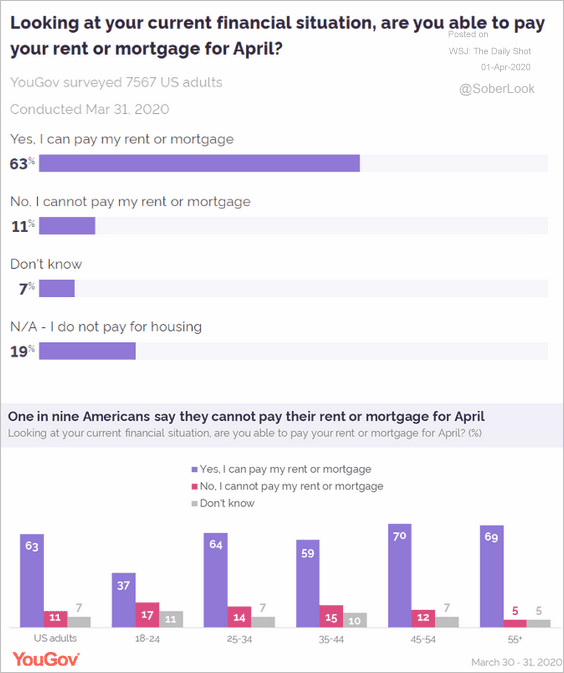

3. April rent and mortgage payments are due.

Source: @YouGovUS Read full article

Source: @YouGovUS Read full article

Source: The New York Times Read full article

Source: The New York Times Read full article

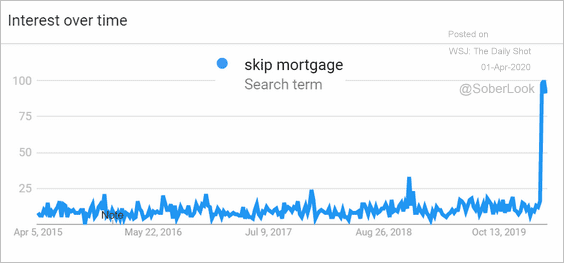

Here is the search frequency for the phrase “skip mortgage.”

Source: Google Trends

Source: Google Trends

——————–

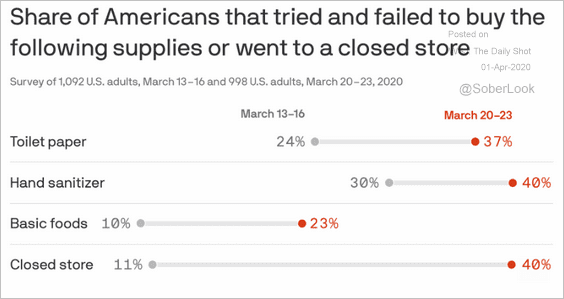

4. Americans are having trouble obtaining certain goods, partially as a result of hoarding. In some cases, resupplying stores has been challenging.

Source: @axios Read full article

Source: @axios Read full article

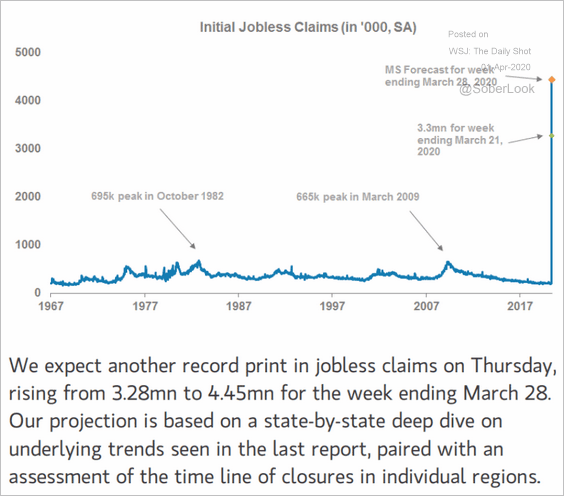

5. Morgan Stanley expects the latest initial unemployment claims to hit 4.45 million.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

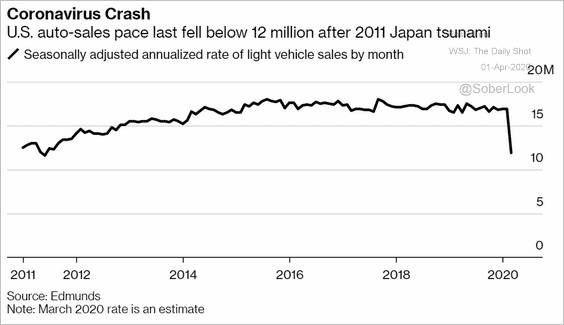

6. Automobile sales have declined sharply.

Source: @technology Read full article

Source: @technology Read full article

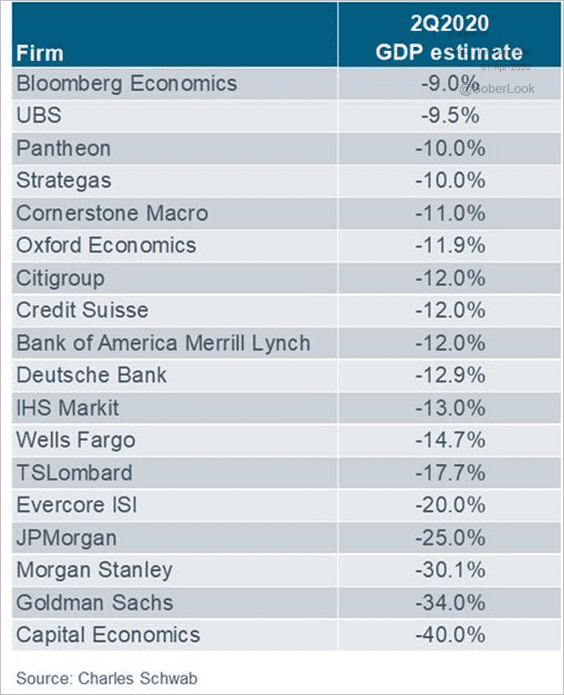

7. Below is an updated set of Q2 GDP growth estimates.

Source: @LizAnnSonders

Source: @LizAnnSonders

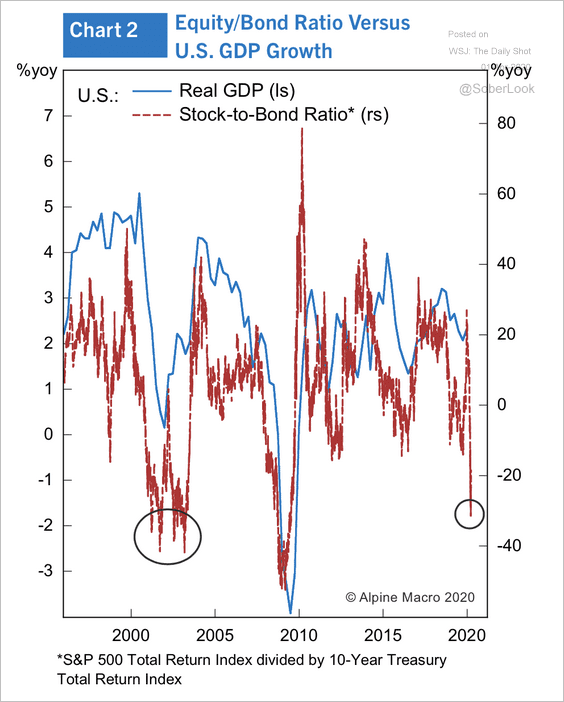

• The equity-bond ratio is down 30%, which is on par with the 2001 recession and implies the US economy could contract 1-2% this year, according to Alpine Macro.

Source: Alpine Macro

Source: Alpine Macro

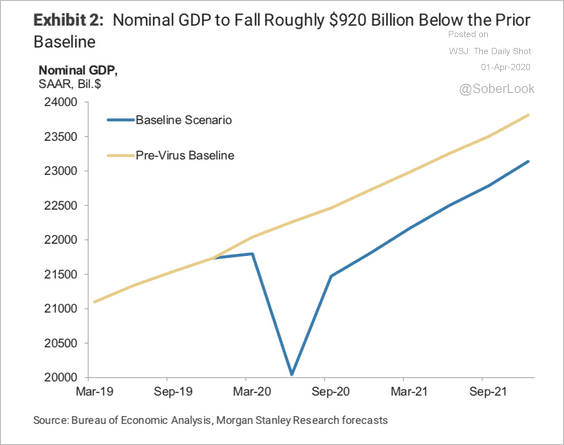

• Here is the GDP trajectory projection from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

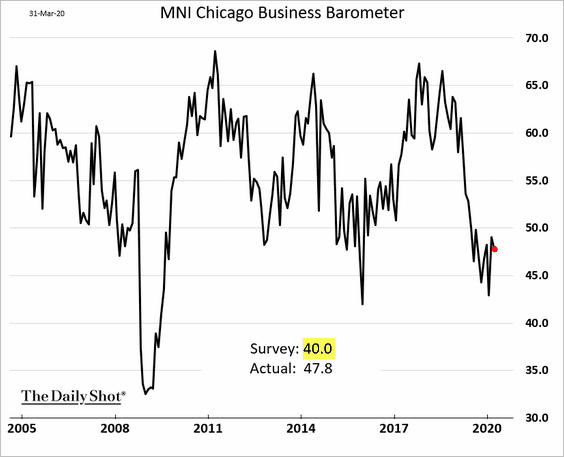

8. The Chicago PMI index, which is an indicator of factory activity in the Midwest, was relatively stable in March. That result is unlikely to be repeated in April.

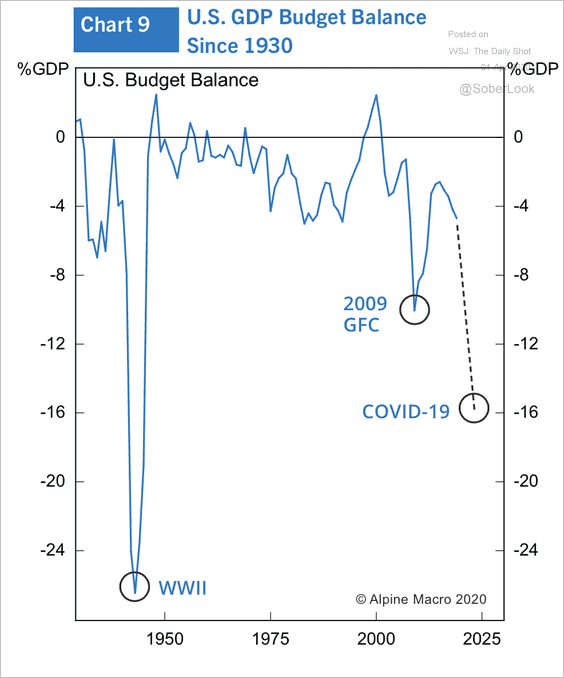

9. How much will the federal deficit increase as a result of the crisis? Here is an estimate from Alpine Macro.

Source: Alpine Macro

Source: Alpine Macro

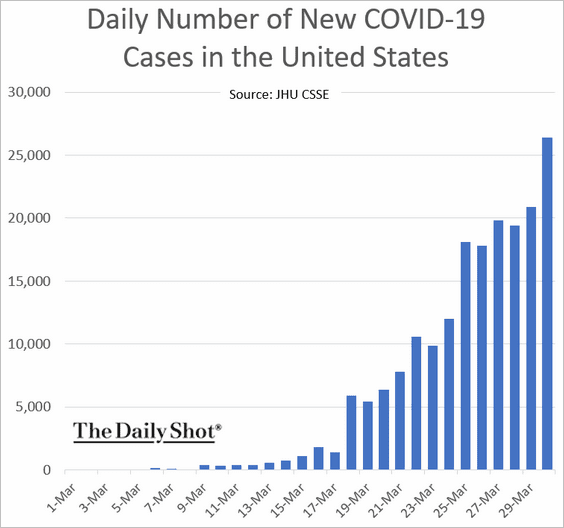

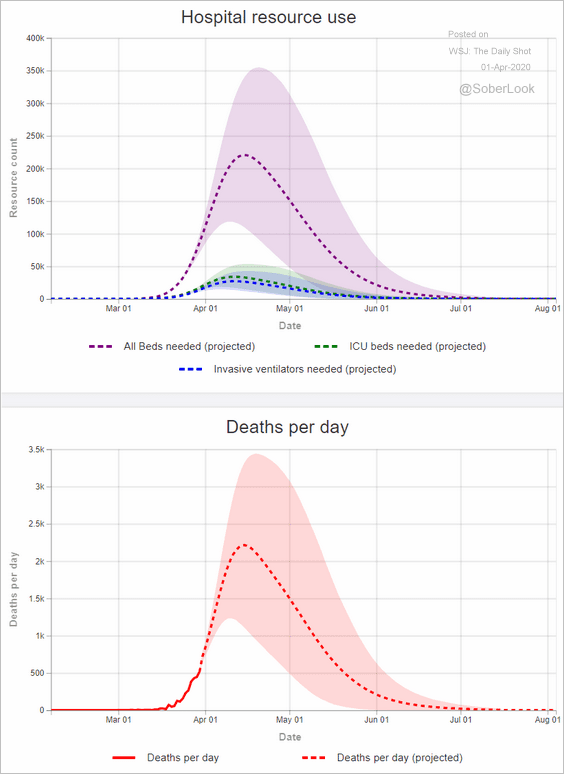

10. Finally, we have some updates on the epidemic.

• The number of new cases spiked again.

Source: CNBC Read full article

Source: CNBC Read full article

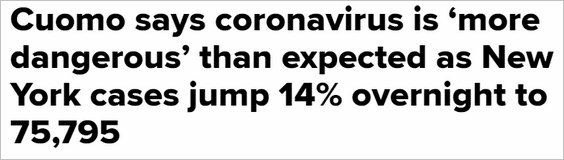

• Testing remains a challenge.

Source: @financialtimes, {ht} H99@jessefelder Read full article

Source: @financialtimes, {ht} H99@jessefelder Read full article

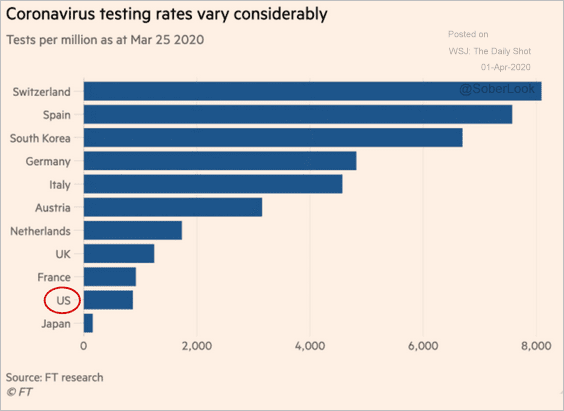

• Models show that the number of new US cases will peak in a couple of weeks. By then, over 200k will be hospitalized, with over two thousand people dying per day.

Source: Institute for Health Metrics and Evaluation

Source: Institute for Health Metrics and Evaluation

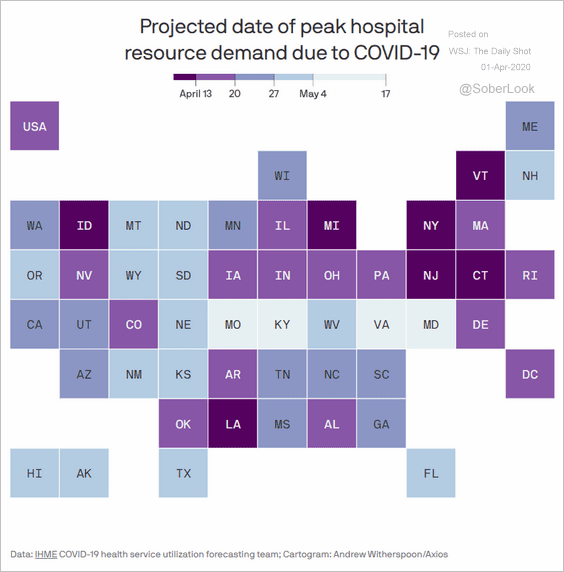

• While, mid-April is the expected peak at the national level, the number of new infections will peak at different times for each state.

Source: @axios Read full article

Source: @axios Read full article

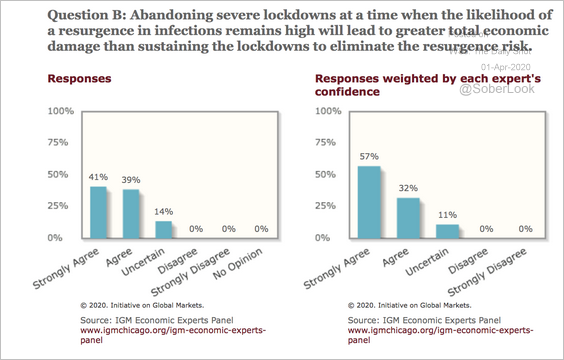

• Would abandoning lockdowns too early lead to greater economic damage?

Source: IGM Forum Read full article

Source: IGM Forum Read full article

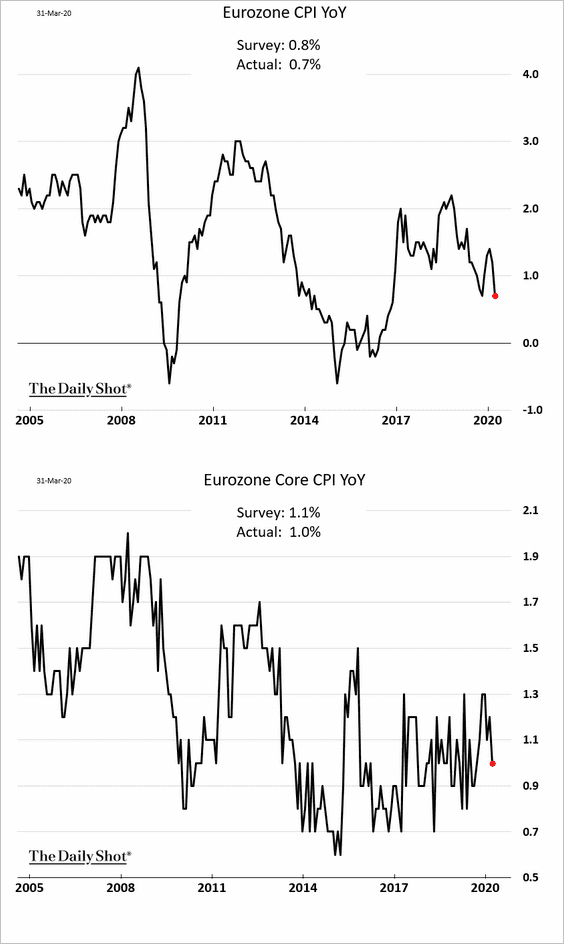

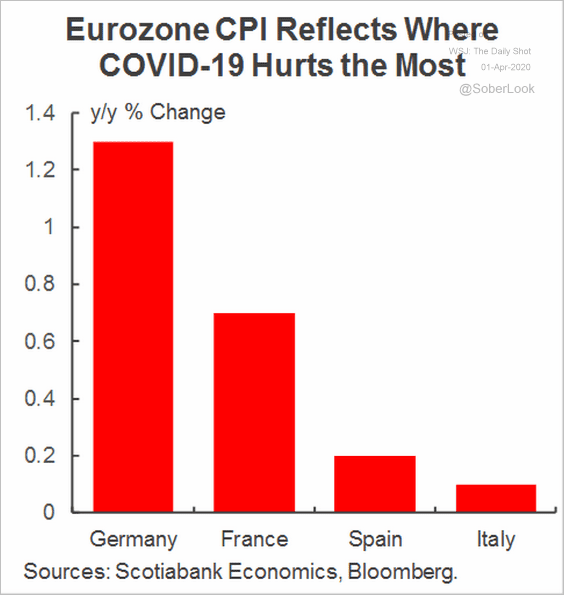

The Eurozone

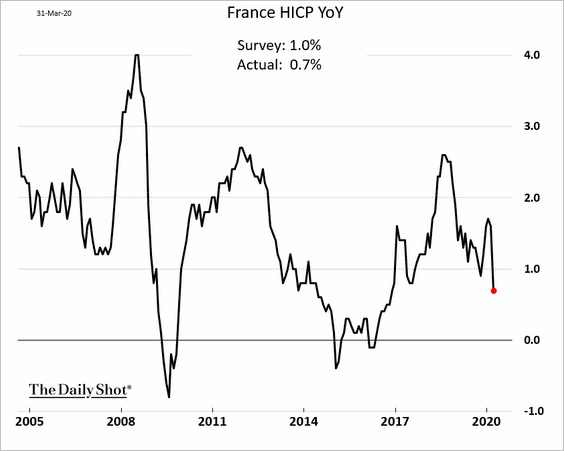

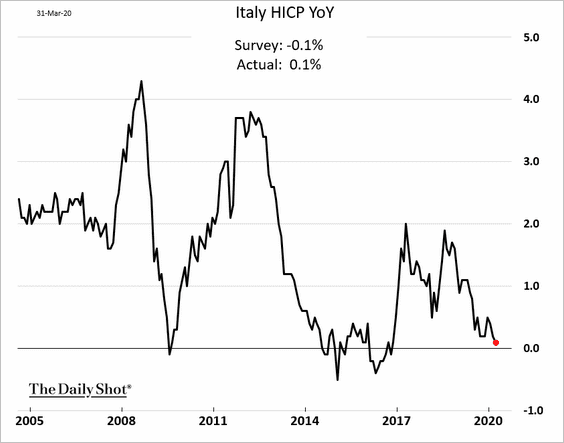

1. Inflation across the euro area declined as oil prices fell.

• France:

• Italy:

• The Eurozone:

• CPI summary:

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

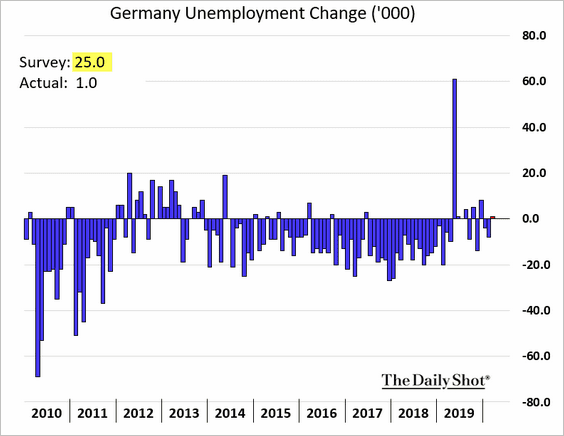

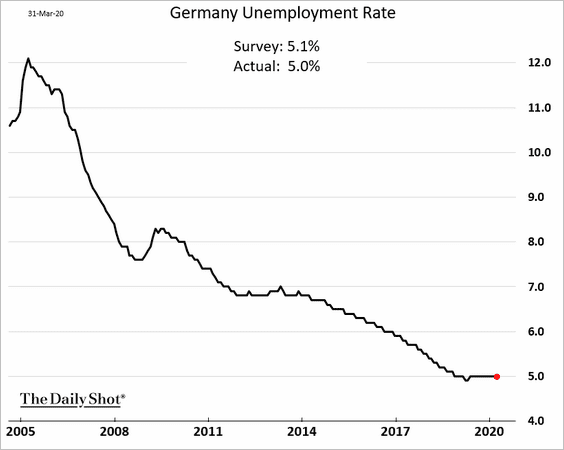

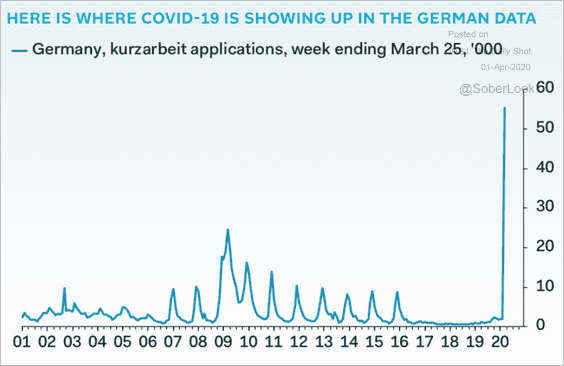

2. Germany’s latest employment report was remarkably upbeat.

The key reason is Kurzarbeit (“short-time work”).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Asia – Pacific

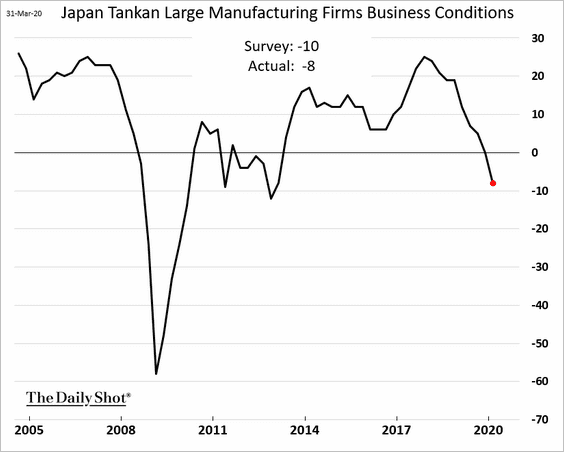

1. Japan’s Tankan manufacturing index declined less than expected (but there will be further deterioration in April).

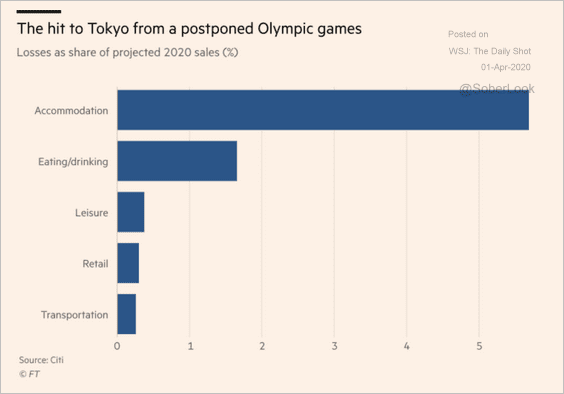

2. What’s the economic impact of postponed Olympic games?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

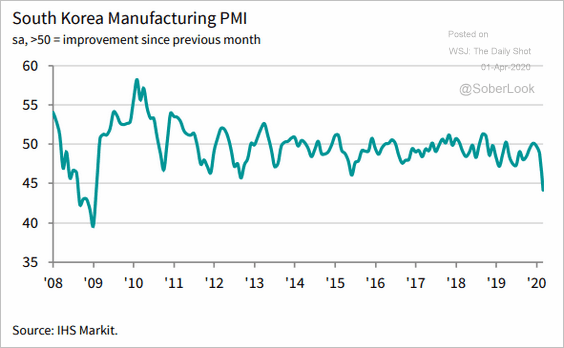

3. South Korea’s manufacturing PMI hit the lowest level since 2009.

Source: @IHSMarkitPMI Read full article

Source: @IHSMarkitPMI Read full article

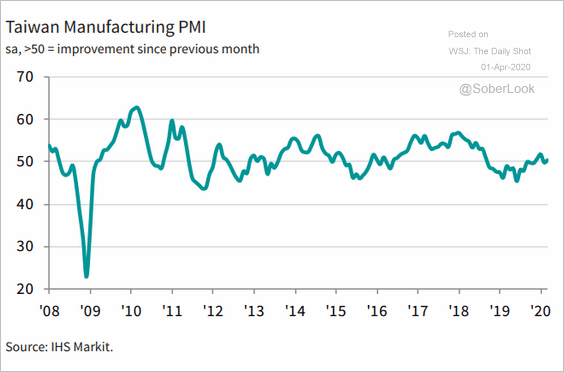

4. Taiwan’s factory activity has been resilient.

Source: @IHSMarkitPMI Read full article

Source: @IHSMarkitPMI Read full article

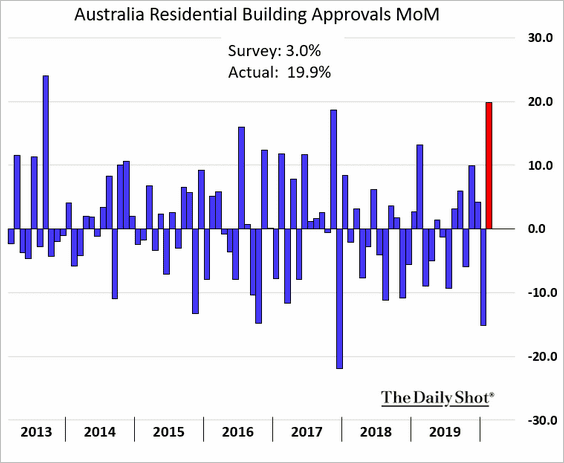

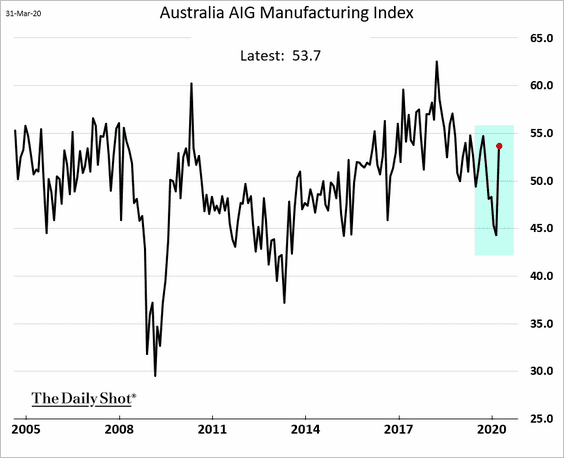

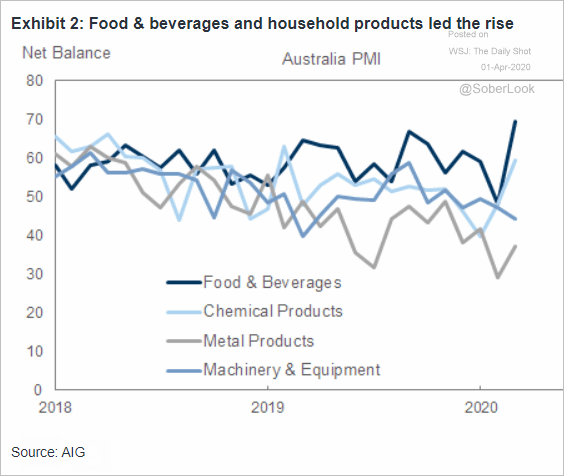

5. Next, we have a couple of updates on Australia.

• Building approvals rose by 20% in February, the highest monthly increase since 2013.

• Manufacturing activity jumped in March as households stocked up on essential goods (including food and chemical products) in response to the pandemic.

Source: Goldman Sachs

Source: Goldman Sachs

China

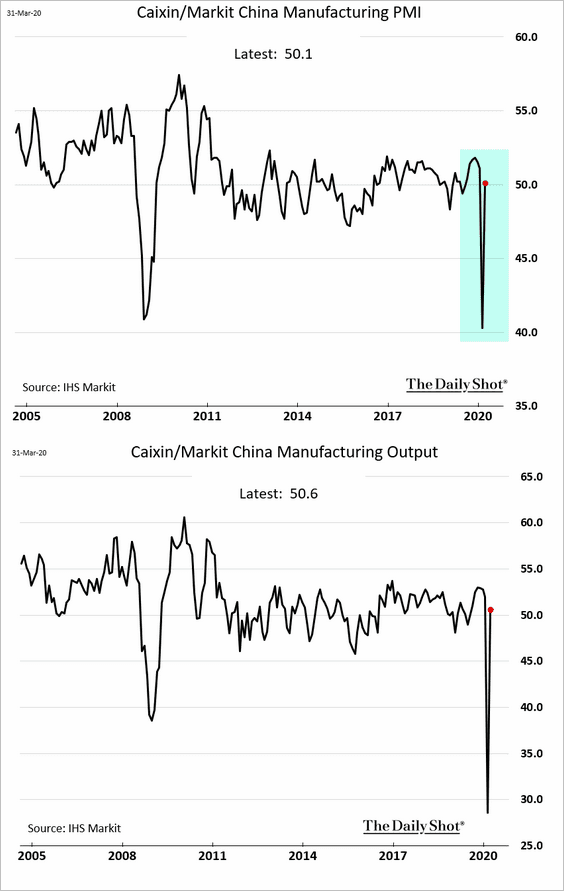

1. The Markit manufacturing PMI confirmed a rebound in China’s factory activity.

Source: @IHSMarkitPMI Read full article

Source: @IHSMarkitPMI Read full article

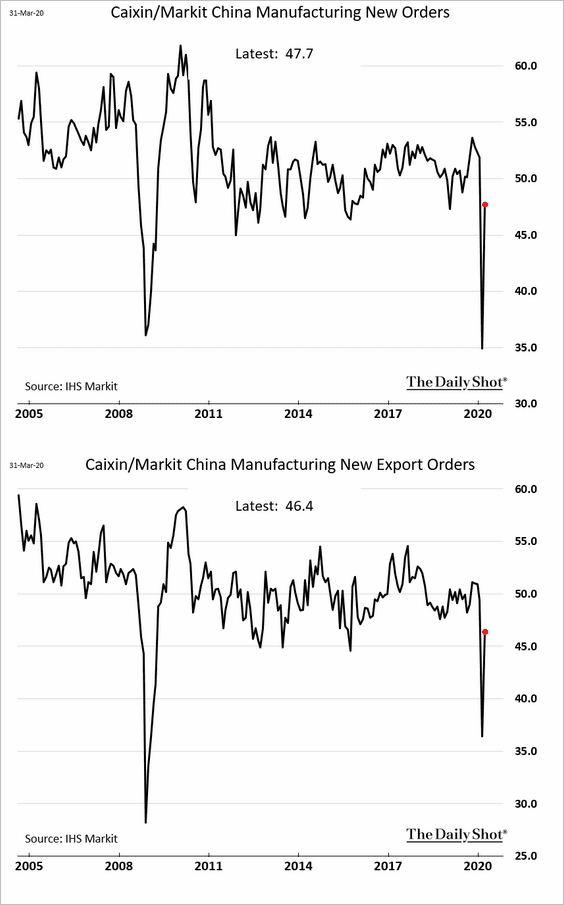

While new orders are still in contraction territory (PMI < 50), the improvement was remarkable.

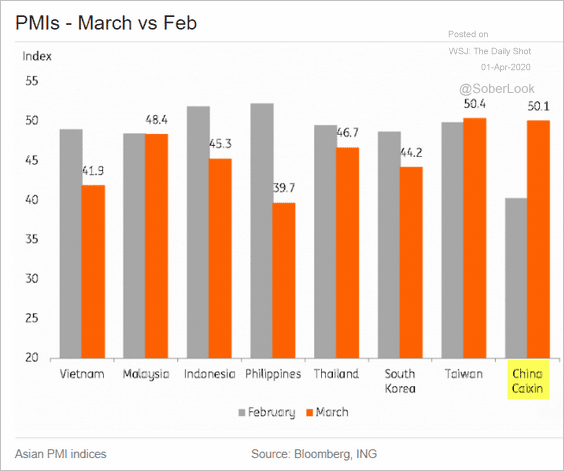

Here is how China’s PMI compares to other Asian economies.

Source: ING

Source: ING

——————–

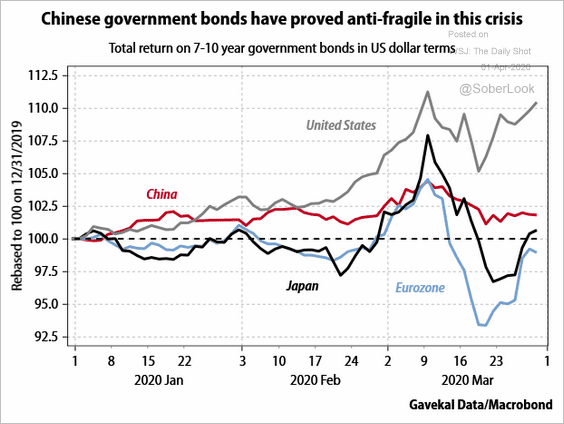

2. China’s government bonds have been less volatile than debt markets elsewhere.

Source: Gavekal

Source: Gavekal

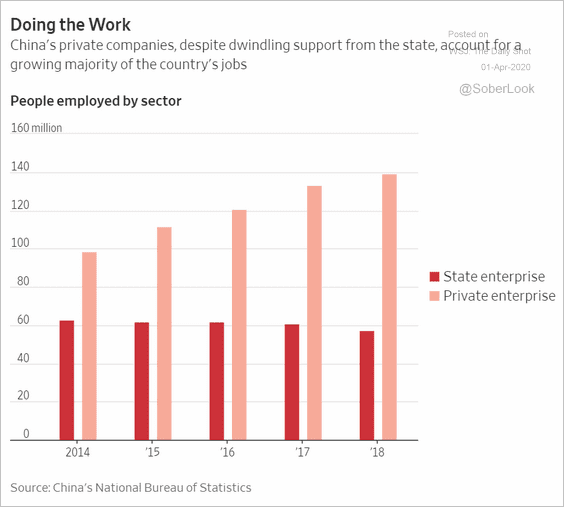

3. The private sector accounts for a growing majority of China’s jobs.

Source: @WSJ Read full article

Source: @WSJ Read full article

Emerging Markets

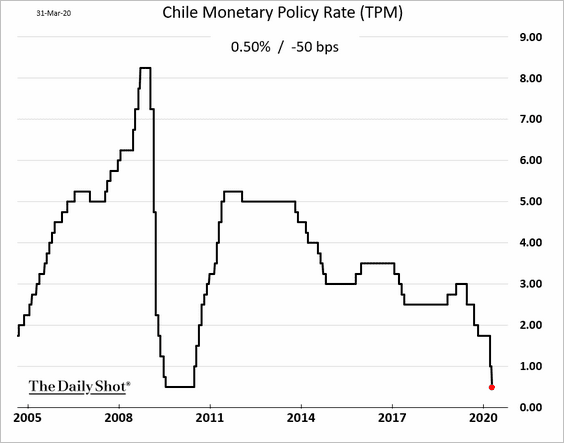

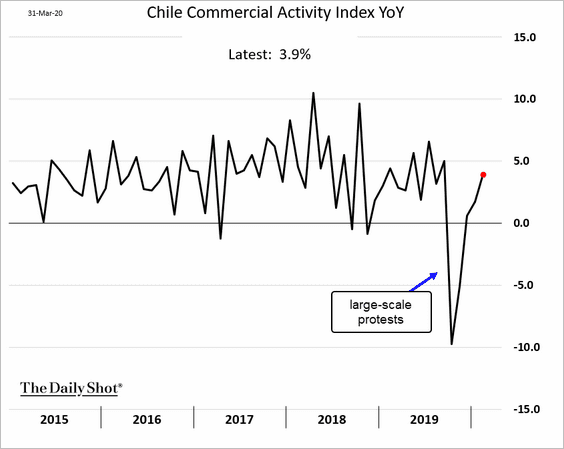

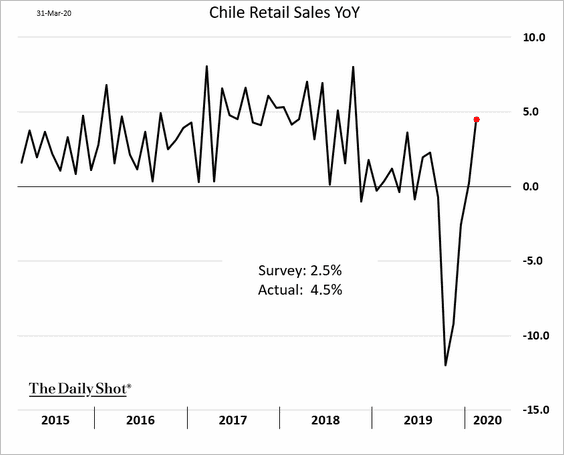

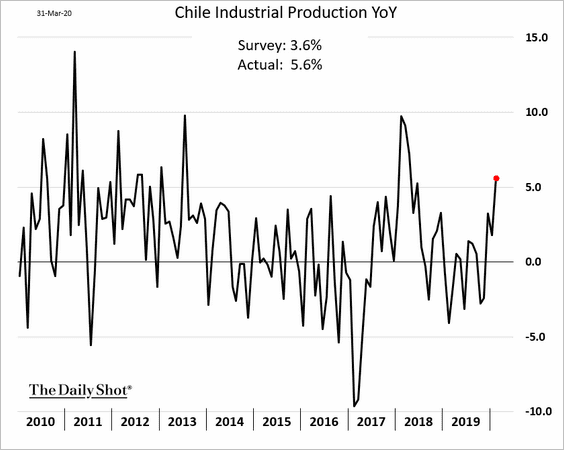

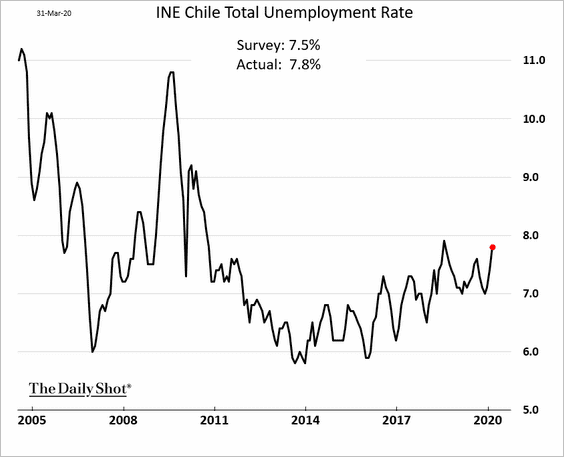

1. Let’s begin with Chile.

• The central bank cut rates by 50 bps.

• Economic activity was rebounding in February.

– Commercial activity:

– Retail sales:

– Industrial production:

However, the unemployment rate rose more than expected.

——————–

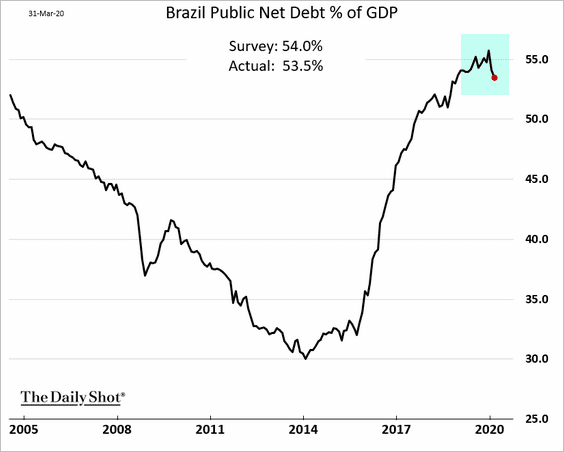

2. Brazil’s debt-to-GDP ratio has been moving lower. However, it will likely be on an upward trajectory in the near-term.

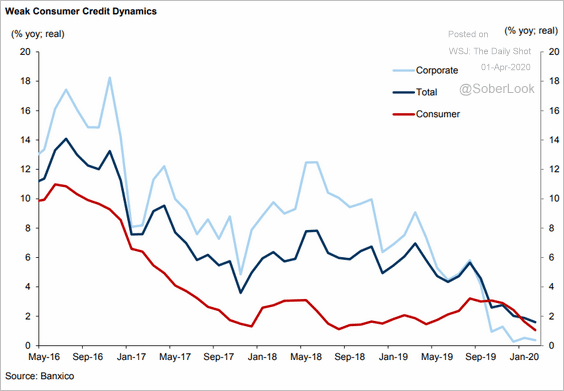

3. Mexico’s credit growth has been slowing.

Source: Goldman Sachs

Source: Goldman Sachs

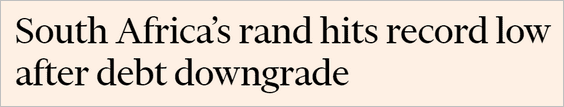

4. The South African rand hit a record low after the downgrade.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

USD/ZAR is testing resistance at 18 rand to the dollar.

——————–

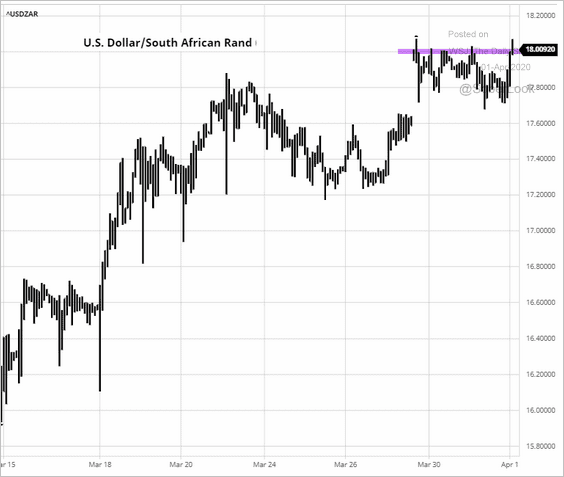

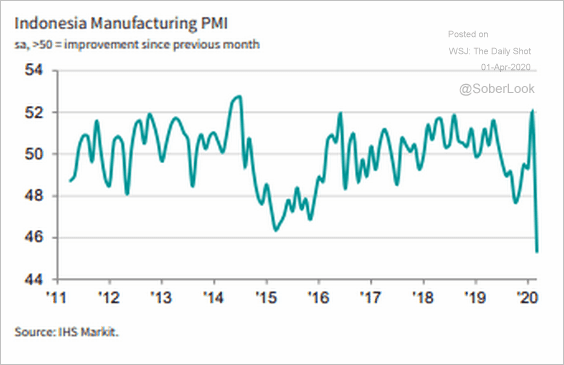

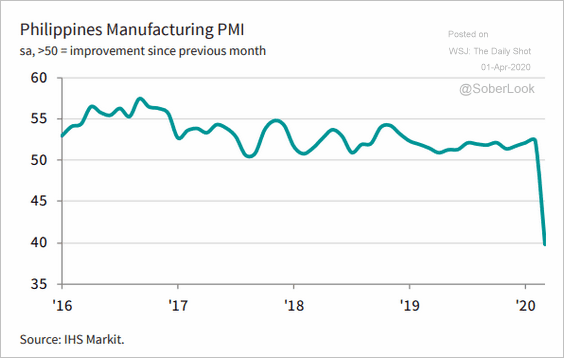

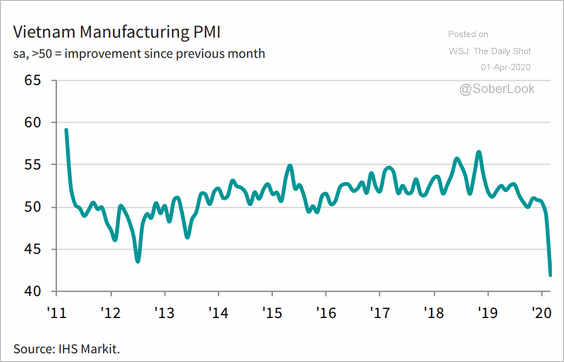

5. Manufacturing activity stalled across Asia. Here are the PMI indices.

• Indonesia:

Source: @IHSMarkitPMI Read full article

Source: @IHSMarkitPMI Read full article

• Thailand:

Source: @IHSMarkitPMI Read full article

Source: @IHSMarkitPMI Read full article

• The Philippines:

Source: @IHSMarkitPMI Read full article

Source: @IHSMarkitPMI Read full article

• Vietnam:

Source: @IHSMarkitPMI Read full article

Source: @IHSMarkitPMI Read full article

——————–

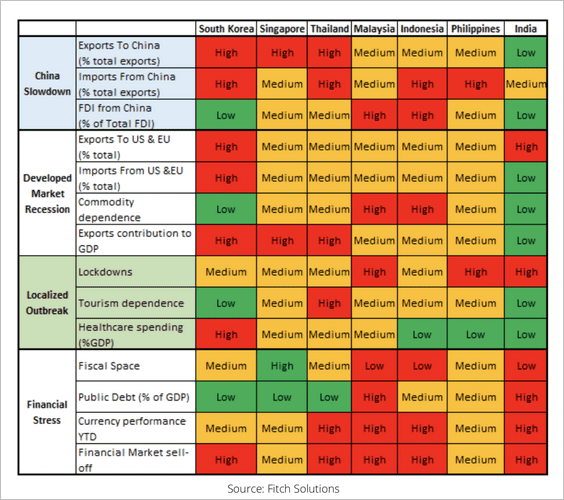

6. Here is Fitch Solutions’ Asia vulnerability heat map.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

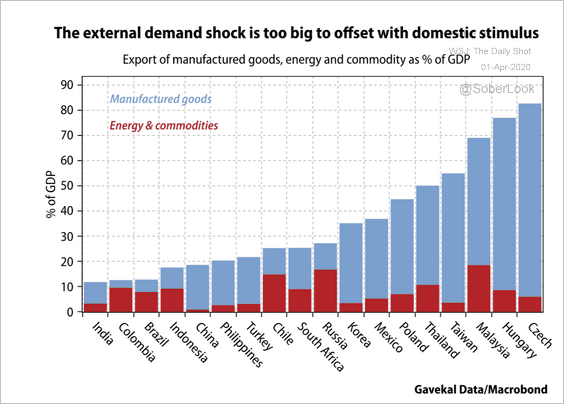

7. Which nations depend most on exports of manufactured goods and commodities?

Source: Gavekal

Source: Gavekal

Commodities

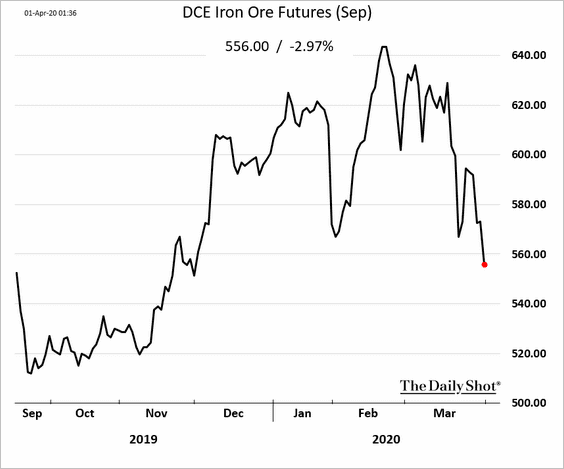

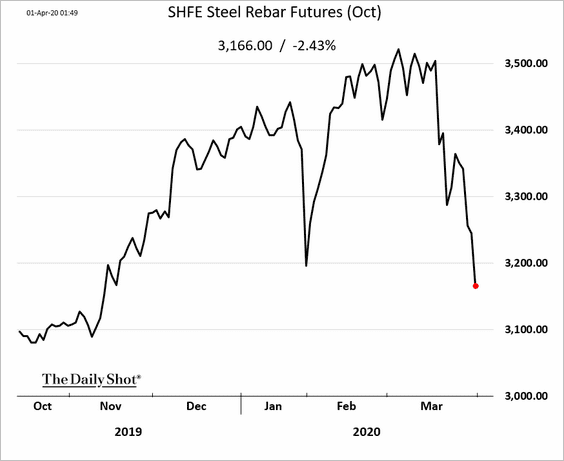

1. China’s iron ore and steel futures have been selling off.

——————–

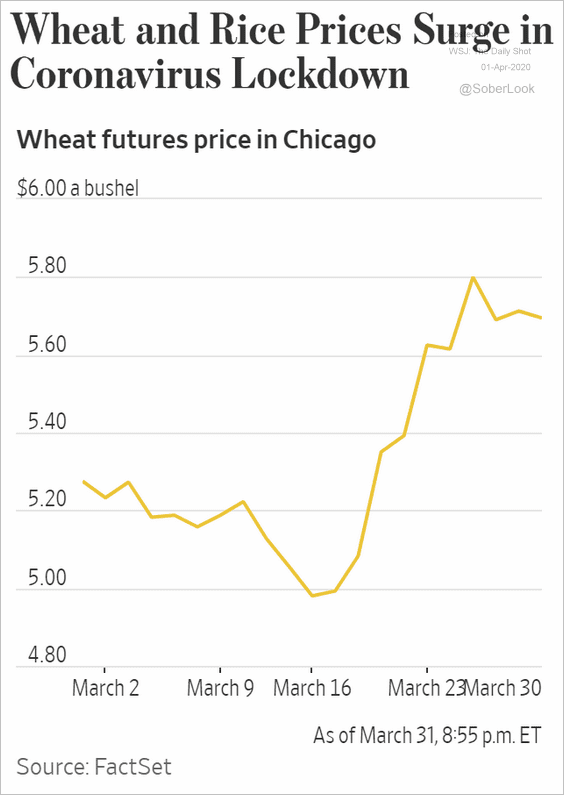

2. Hoarding and export bans in some countries have pushed wheat and rice prices higher.

Source: @WSJ Read full article

Source: @WSJ Read full article

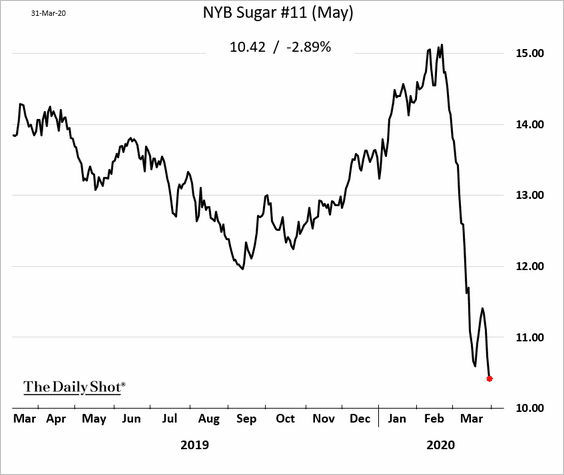

3. Sugar futures in New York resumed their declines.

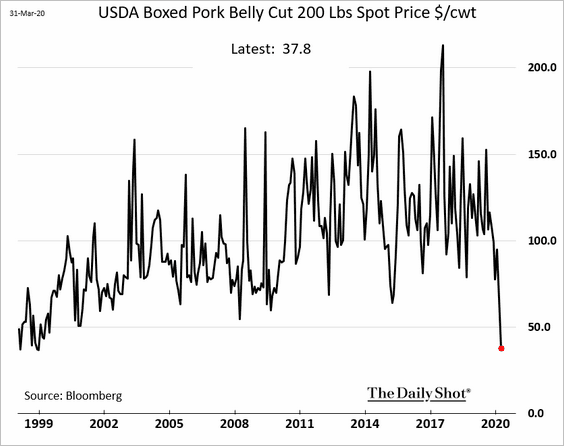

4. Restaurant closures put US pork belly prices under pressure.

Source: Michael Hirtzer, @TheTerminal Read full article

Source: Michael Hirtzer, @TheTerminal Read full article

Energy

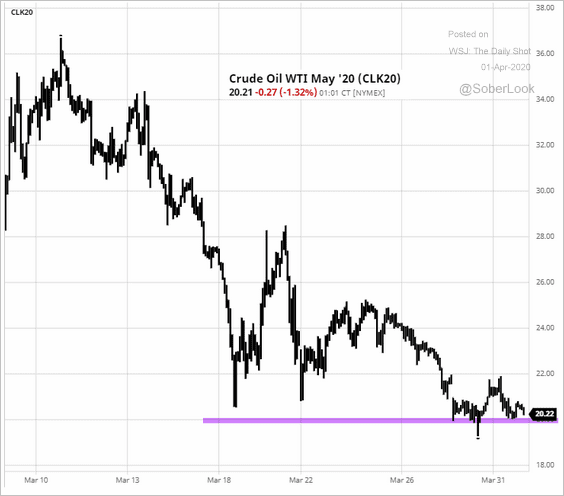

1. NYMEX crude continues to test support at $20/bbl.

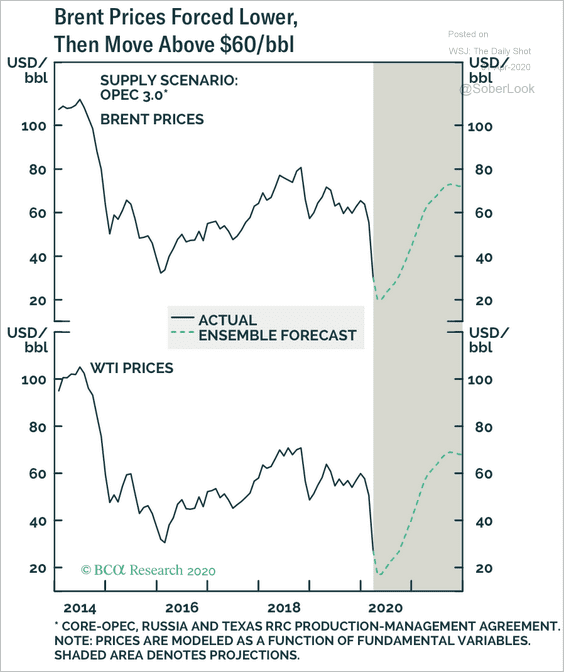

2. BCA Research expects the Brent oil price to fall lower before staging a rebound above $60 per barrel.

Source: BCA Research

Source: BCA Research

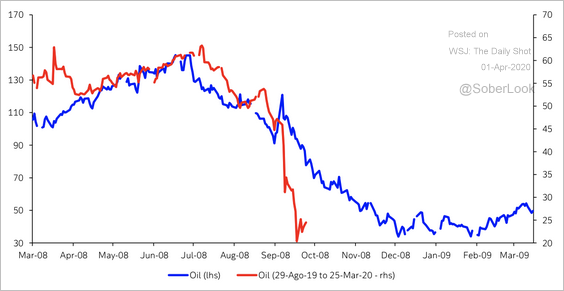

3. Here is a comparison of oil prices now versus 2008.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

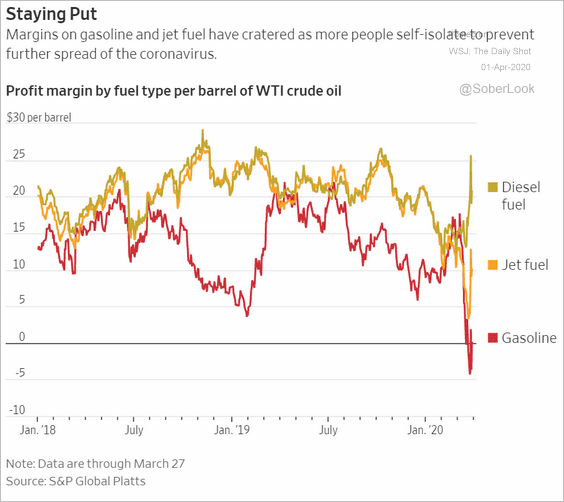

4. The gasoline crack spread in the US has been near zero amid weak demand.

Source: @WSJ Read full article

Source: @WSJ Read full article

5. Ethanol prices have declined sharply.

Source: @business Read full article

Source: @business Read full article

Equities

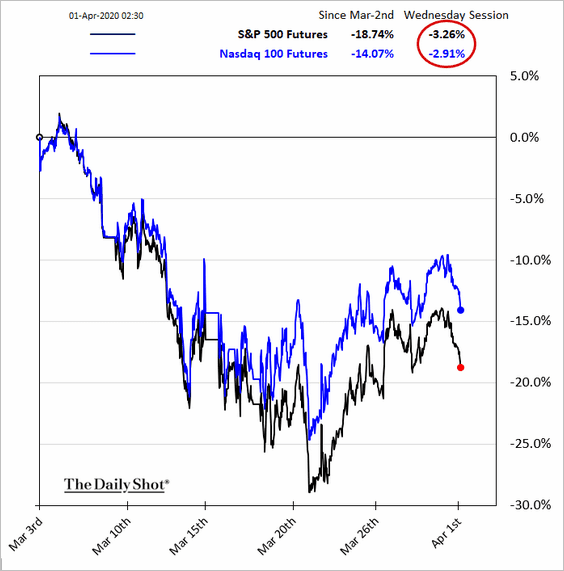

1. US futures are heavy in early trading amid White House warnings.

Source: Fox News Read full article

Source: Fox News Read full article

——————–

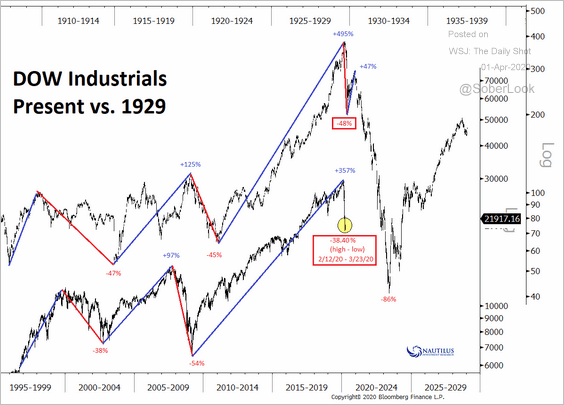

2. Here is the Dow vs. 1929.

Source: @NautilusCap

Source: @NautilusCap

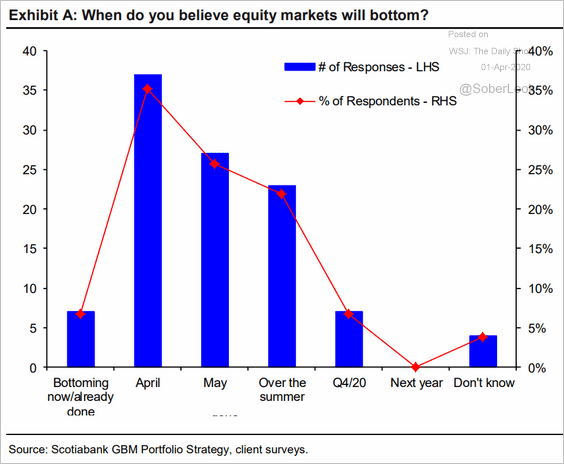

3. When will equities bottom?

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

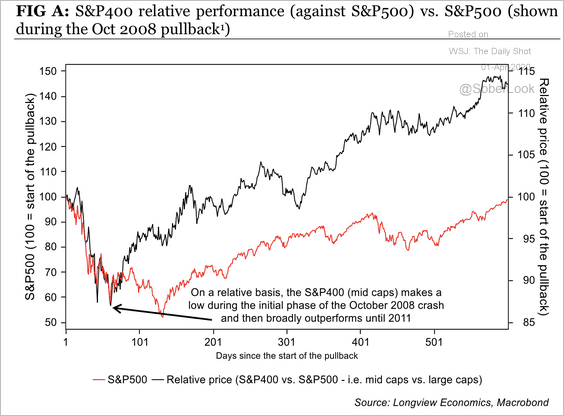

4. In 2008, the S&P 400 (mid-caps) made a relative low during the initial phase of the market crash and then rebounded before the S&P 500 was able to recover.

Source: Longview Economics

Source: Longview Economics

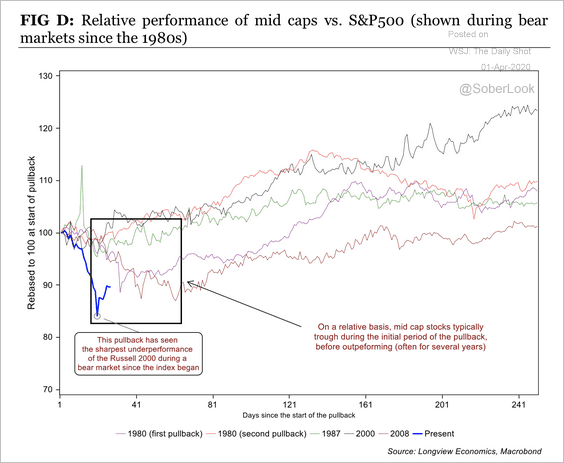

Here’s how the S&P 400 performed relative to the S&P 500 during past bear markets.

Source: Longview Economics

Source: Longview Economics

——————–

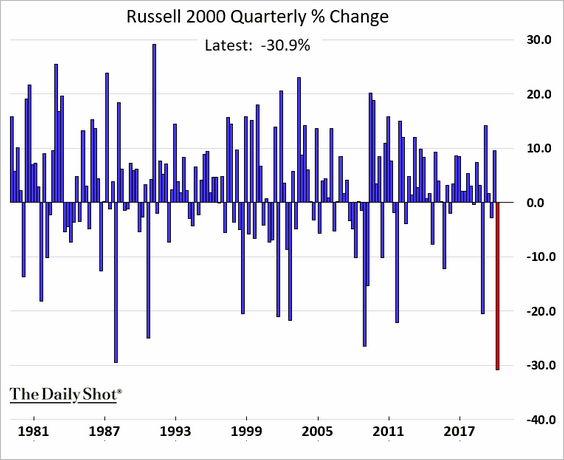

5. It was a rough quarter for small caps, which registered the biggest decline on record.

h/t Sophie Caronello, @TheTerminal

h/t Sophie Caronello, @TheTerminal

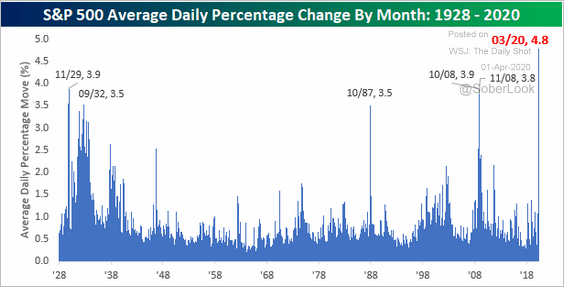

6. March was the most volatile month on record.

Source: @bespokeinvest

Source: @bespokeinvest

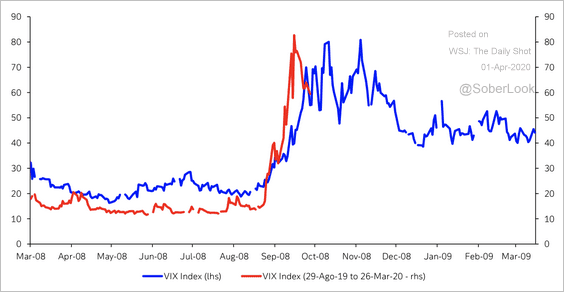

7. Here is VIX now versus 2008.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

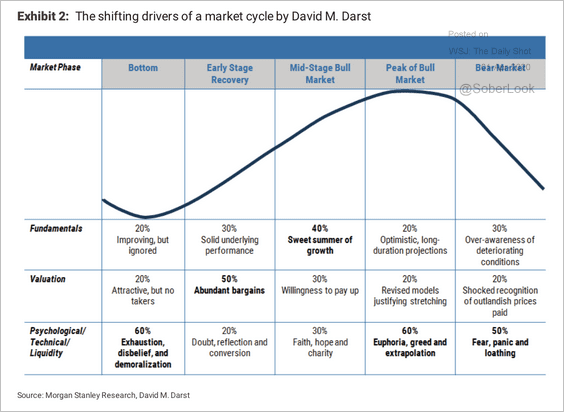

8. The illustration below shows the drivers of each stage of the market cycle.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

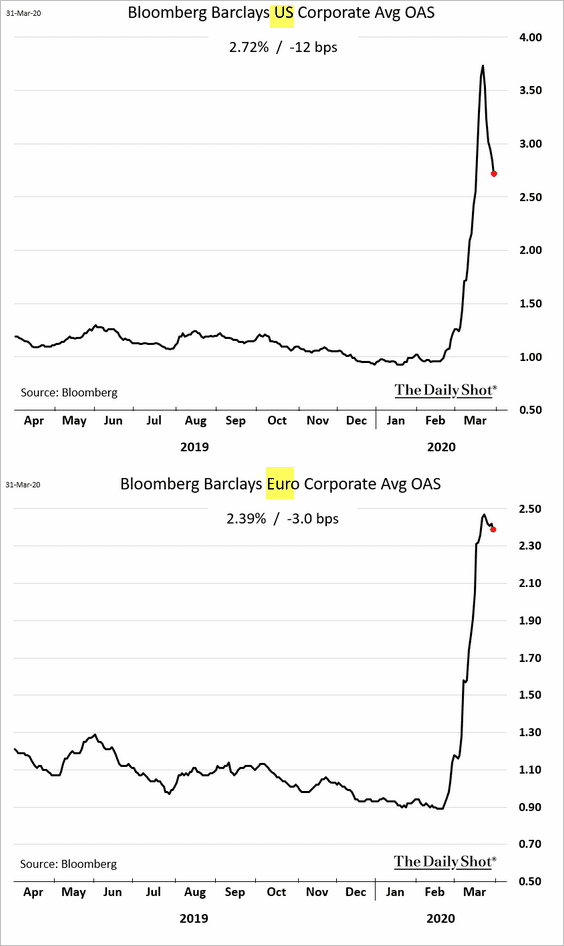

Credit

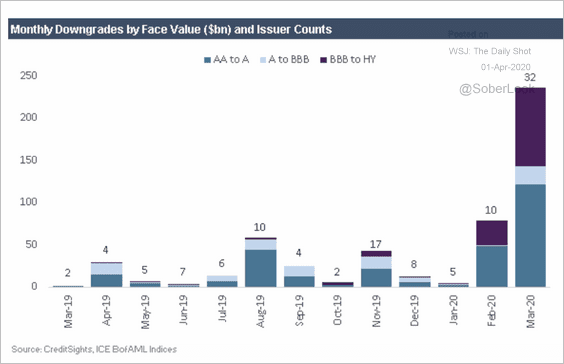

1. Credit downgrades are accelerating.

Source: CreditSights

Source: CreditSights

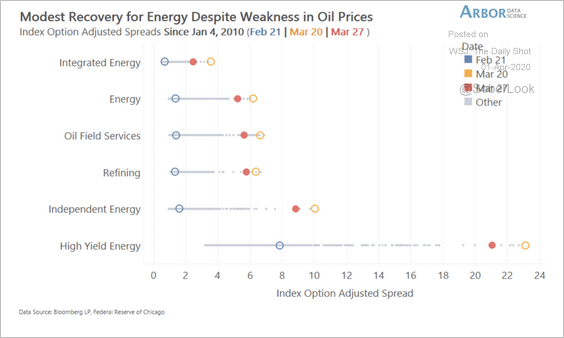

2. There’s been a modest recovery in energy sector credits (tighter option-adjusted spreads) over the past week. More pain ahead?

Source: Arbor Research & Trading

Source: Arbor Research & Trading

3. European investment-grade spreads haven’t tightened as quickly as US counterparts, which were helped by the Fed.

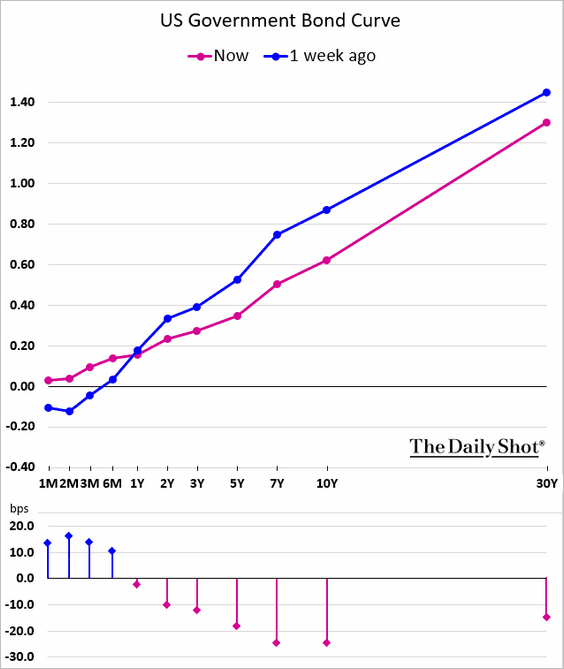

Rates

1. Treasury bill yields pulled out of negative territory as the curve flattened (the Fed is now buying Treasuries across maturities).

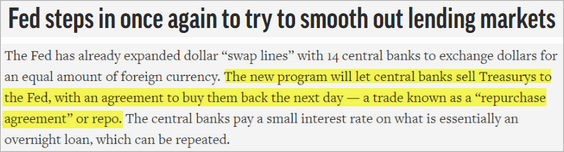

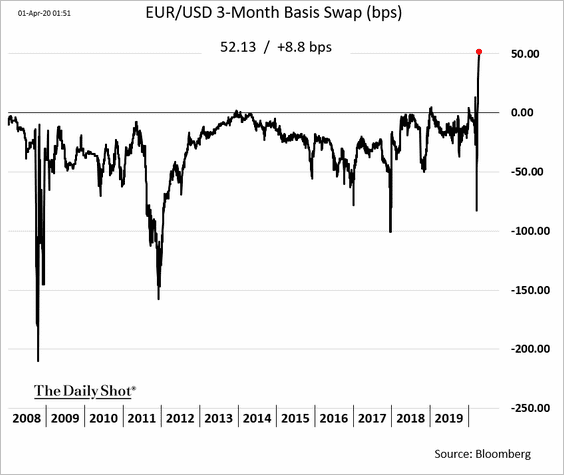

2. The Fed launched a new program to provide dollars to other central banks via repo financing.

Source: AP Read full article

Source: AP Read full article

The cross-currency swap basis is in uncharted territory amid rising supplies of dollars outside the US.

Global Developments

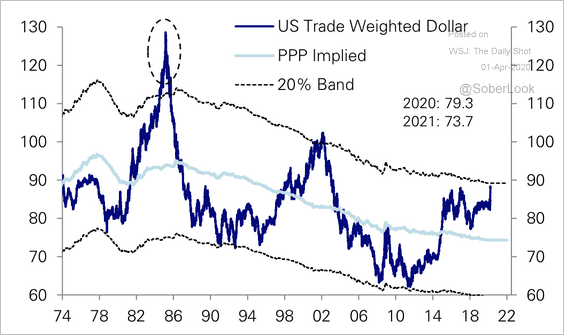

1. Let’s start with some updates on the US dollar.

• The dollar has run up to the top of its valuation bands.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• The US currency has diverged from speculative investors’ bets.

Source: ING

Source: ING

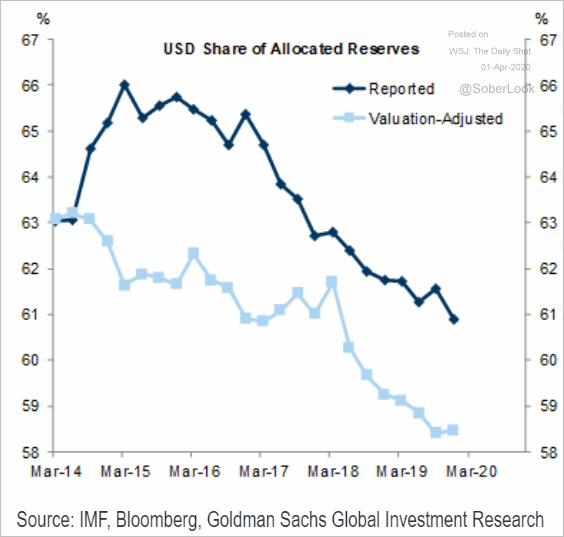

• Here is the USD share of reserve currencies.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

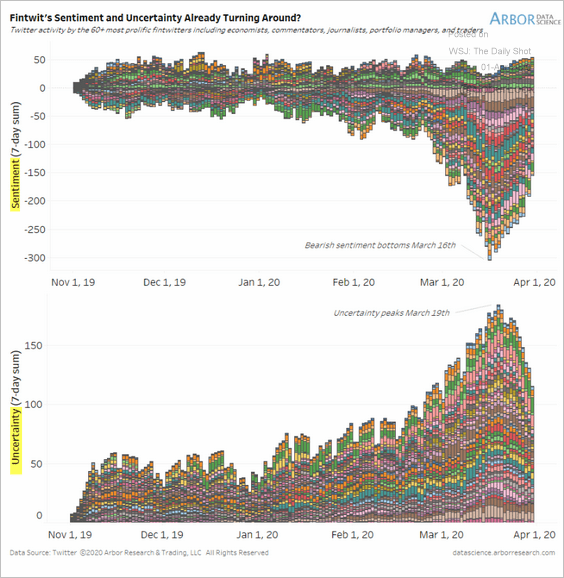

2. Based on financial Twitter activity, bearish sentiment has bottomed.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

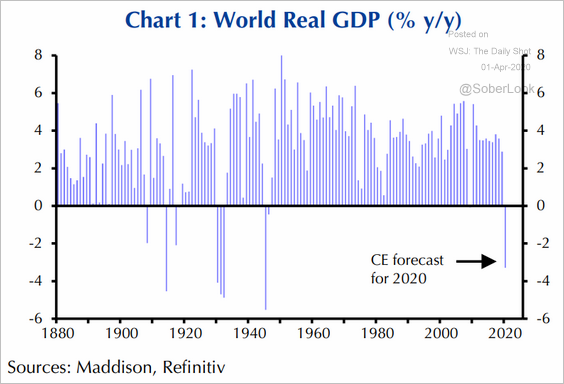

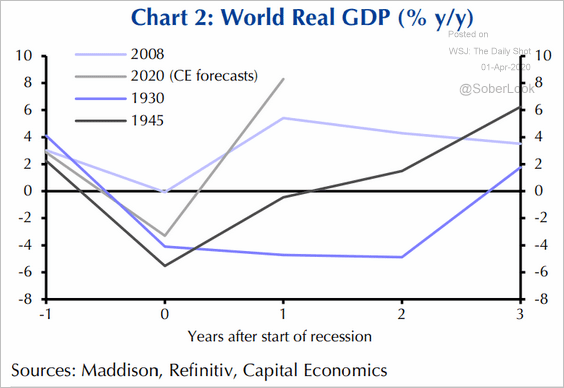

3. Capital Economics expects 2020 to be the first negative GDP year since WW-II.

Source: Capital Economics

Source: Capital Economics

But the rebound is expected to be faster than during previous contractions.

Source: Capital Economics

Source: Capital Economics

——————–

Food for Thought

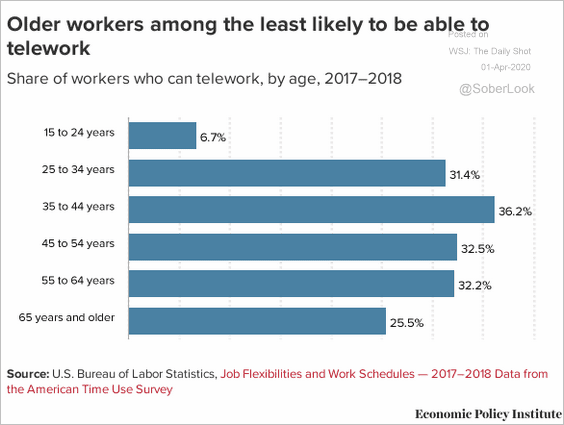

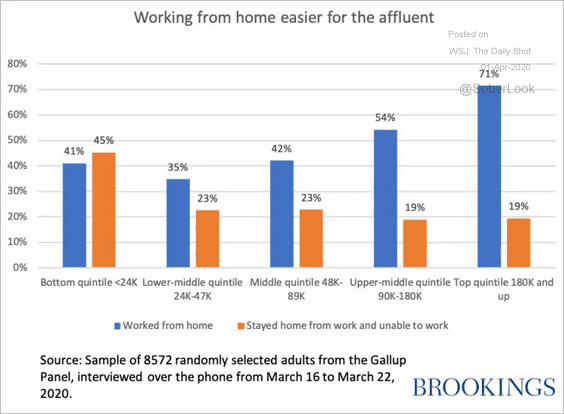

1. Who can work from home?

• By age:

Source: Economic Policy Institute

Source: Economic Policy Institute

• By income:

Source: The Brookings Institution Read full article

Source: The Brookings Institution Read full article

——————–

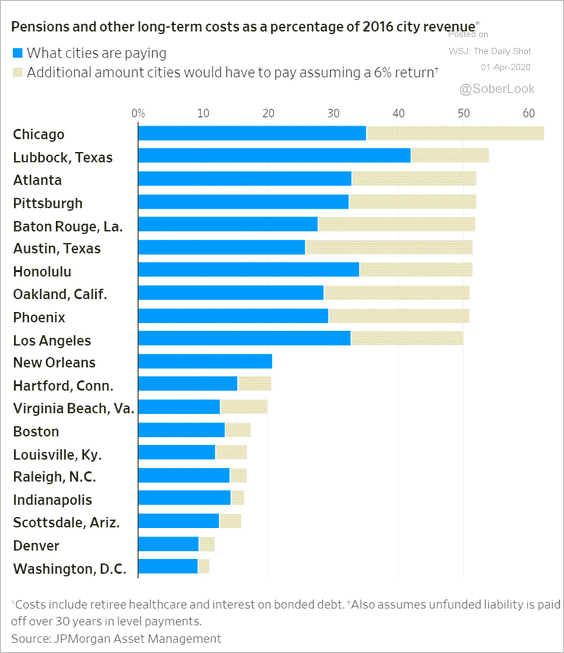

2. Pension liabilities of large US cities:

Source: @WSJ Read full article

Source: @WSJ Read full article

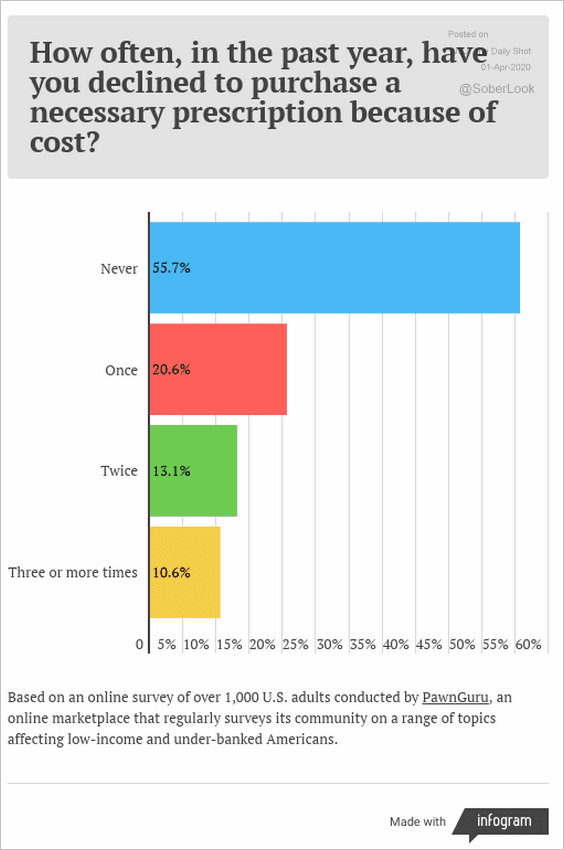

3. Skipping medications due to cost:

Source: HighTower Advisors, RCG Economics, Pawn Guru

Source: HighTower Advisors, RCG Economics, Pawn Guru

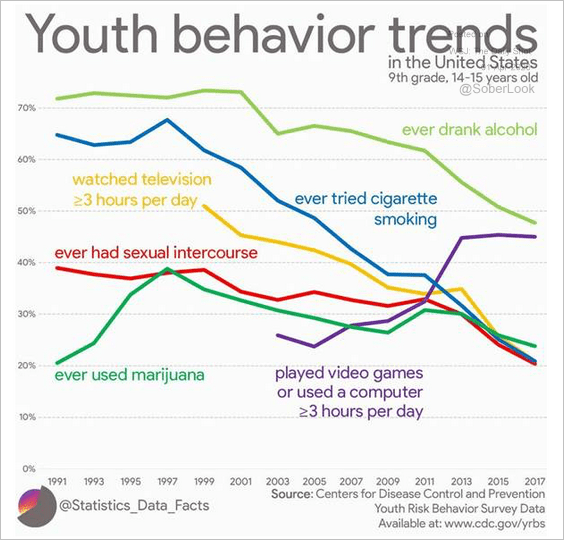

4. Adolescent risk behaviors:

Source: HighTower Advisors, RCG Economics, statistics_data_facts

Source: HighTower Advisors, RCG Economics, statistics_data_facts

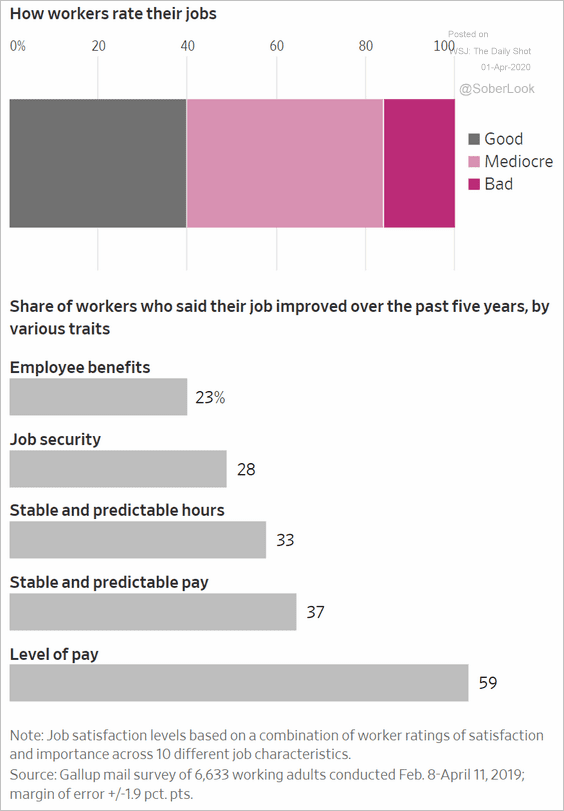

5. Gallup’s job satisfaction survey:

Source: @WSJ Read full article

Source: @WSJ Read full article

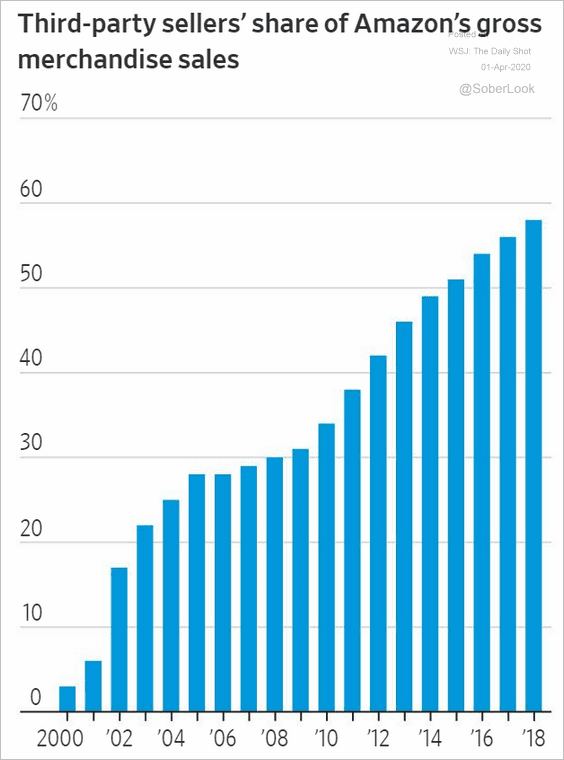

6. Third-party sellers on Amazon:

Source: @WSJ Read full article

Source: @WSJ Read full article

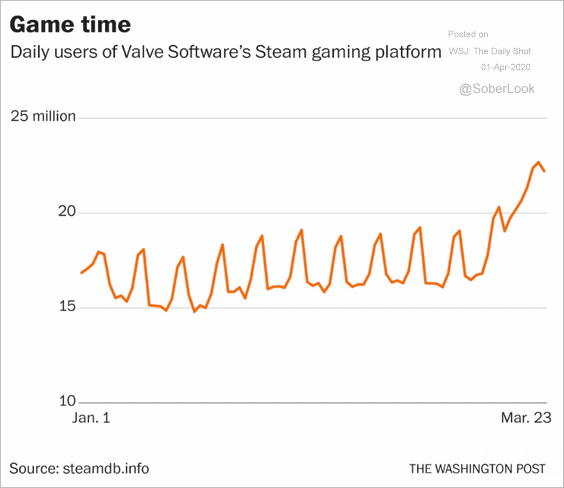

7. Video game streaming:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

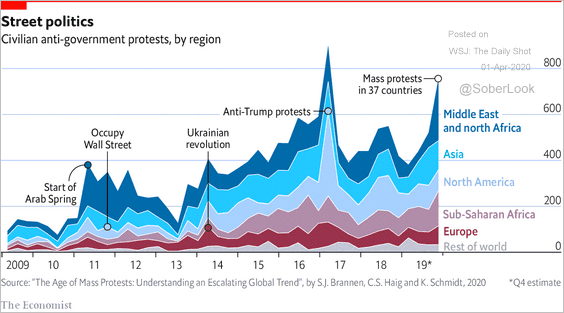

8. Anti-government protests:

Source: The Economist Read full article

Source: The Economist Read full article

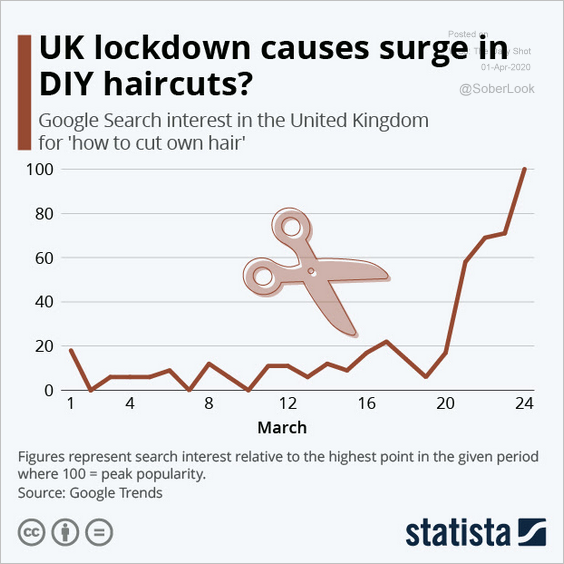

9. Do-it-yourself (DIY) haircuts:

Source: Statista

Source: Statista

——————–