The Daily Shot: 09-Apr-20

• Administrative Update

• The United States

• Canada

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

Administrative Update

As a reminder, please note that the Daily Shot will not be published on Friday, April 10th.

The United States

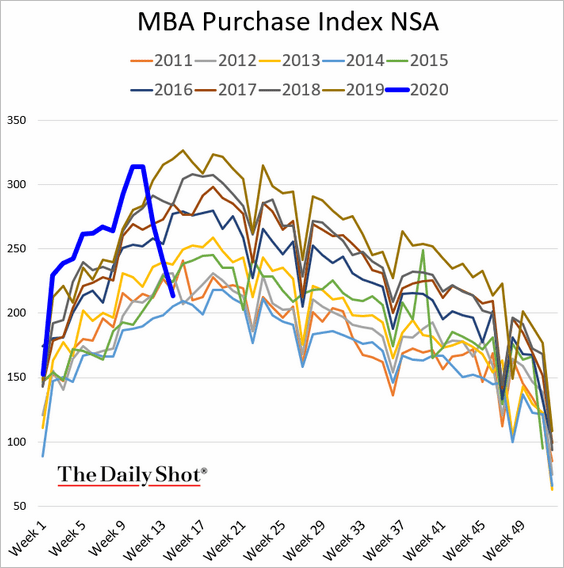

1. Let’s begin with the housing market.

• Mortgage applications to purchase a home continued to decline last week.

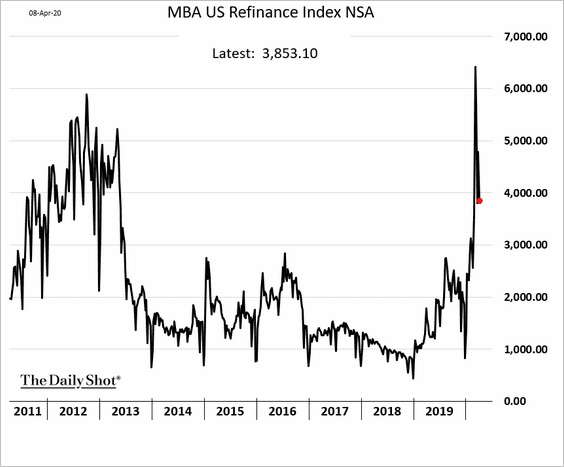

Refi applications are off the highs but remain elevated.

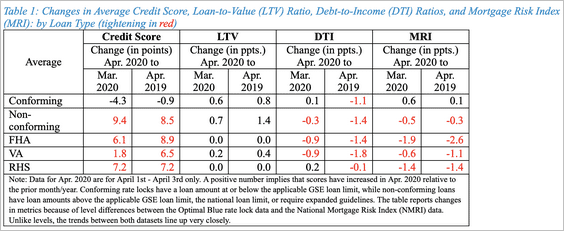

• Early indicators for the first week of the month show that credit availability has generally tightened compared to March 2020 and April 2019.

Source: American Enterprise Institute Read full article

Source: American Enterprise Institute Read full article

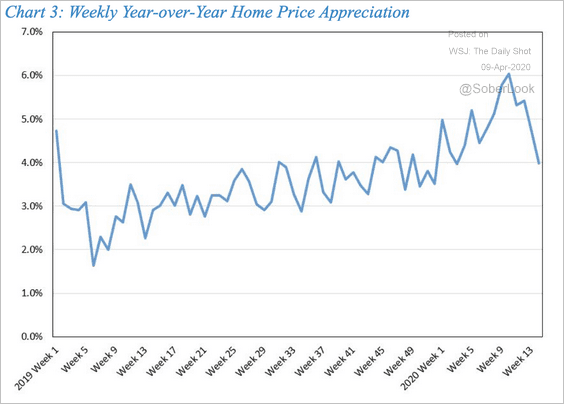

• High-frequency indicators suggest that home price appreciation has slowed. Will national housing price averages fall below last year’s levels?

Source: American Enterprise Institute Read full article

Source: American Enterprise Institute Read full article

——————–

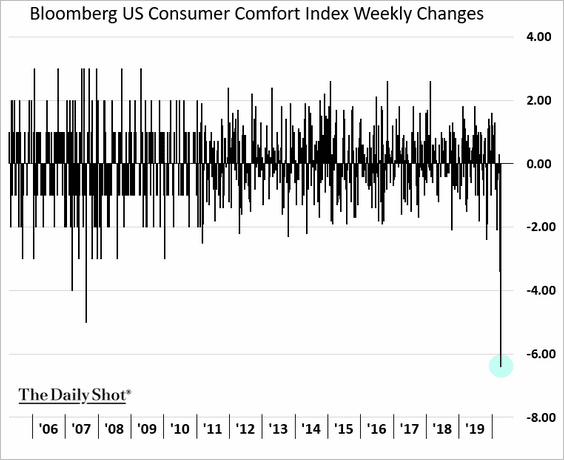

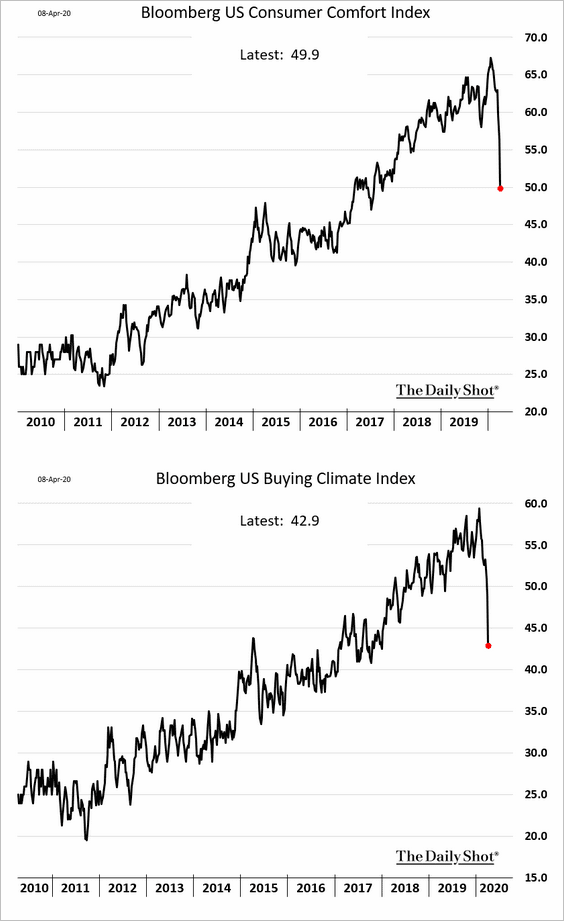

2. The Bloomberg Consumer Comfort Index registered the largest weekly decline on record (going back to the 1980s).

Source: @TheTerminal

Source: @TheTerminal

But given what has transpired in the economy, the absolute level is still elevated (for example, here is a similar index in Australia).

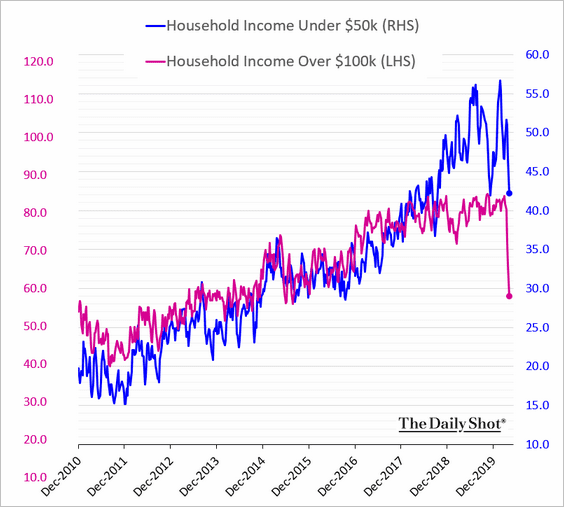

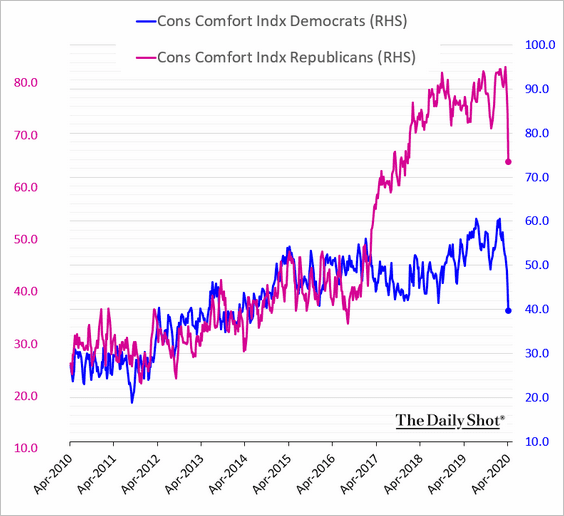

Below are a couple of sub-group comparisons from the Consumer Comfort index.

• By income:

Source: @TheTerminal

Source: @TheTerminal

• By political affiliation:

Source: @TheTerminal

Source: @TheTerminal

——————–

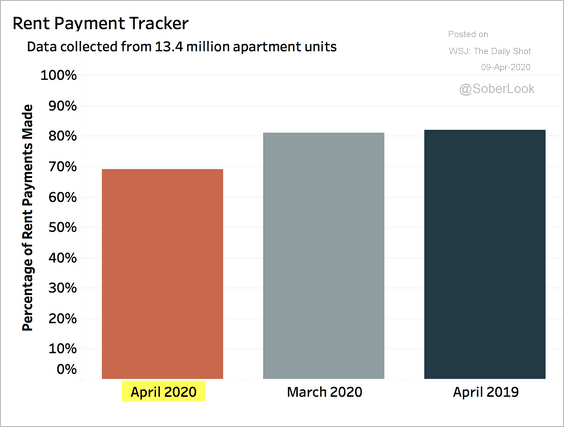

3. More Americans are skipping rent payments.

Source: National Multifamily Housing Council Read full article

Source: National Multifamily Housing Council Read full article

The share of cost-burdened renters has been holding above 40% over the past decade.

Source: US Census Bureau Read full article

Source: US Census Bureau Read full article

——————–

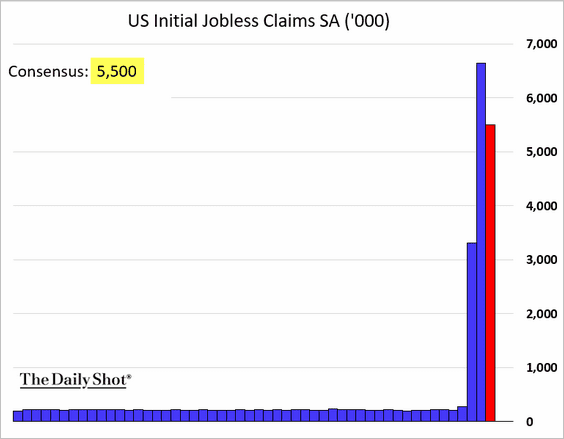

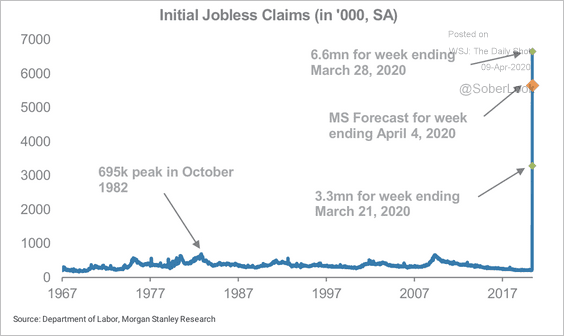

4. Next, we have some updates on the labor market.

• What should we expect from today’s initial jobless claims report? The consensus estimate is for another 5.5 million new unemployment filings.

Source: @TheTerminal

Source: @TheTerminal

Here is a forecast from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

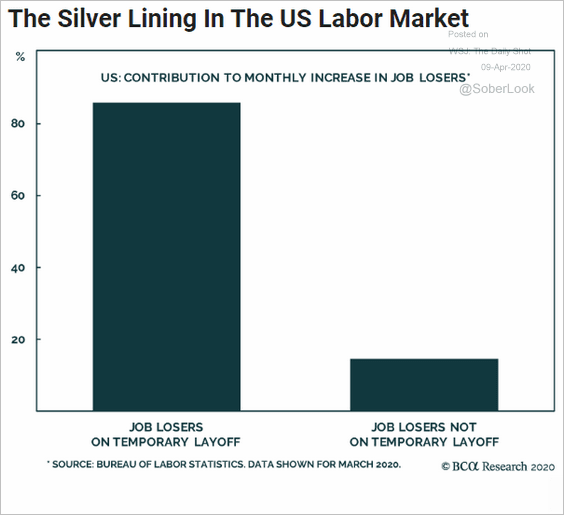

• Most layoffs so far have been classified as “temporary.”

Source: BCA Research

Source: BCA Research

• Many industries will see close to a full replacement of income for workers using unemployment insurance under the CARES Act.

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

——————–

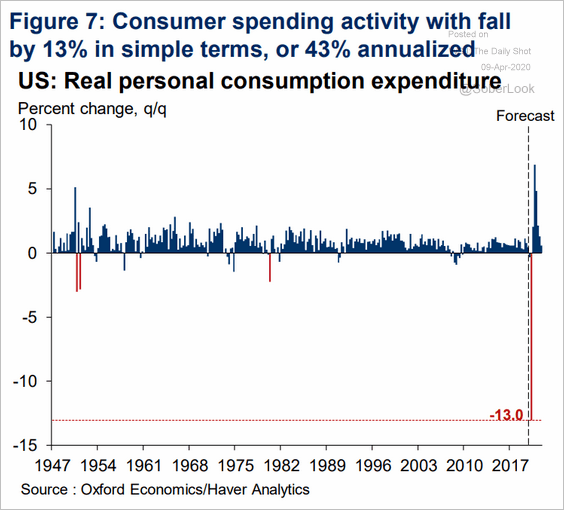

5. Here is a forecast from Oxford Economics for quarterly changes in consumer spending.

Source: Oxford Economics

Source: Oxford Economics

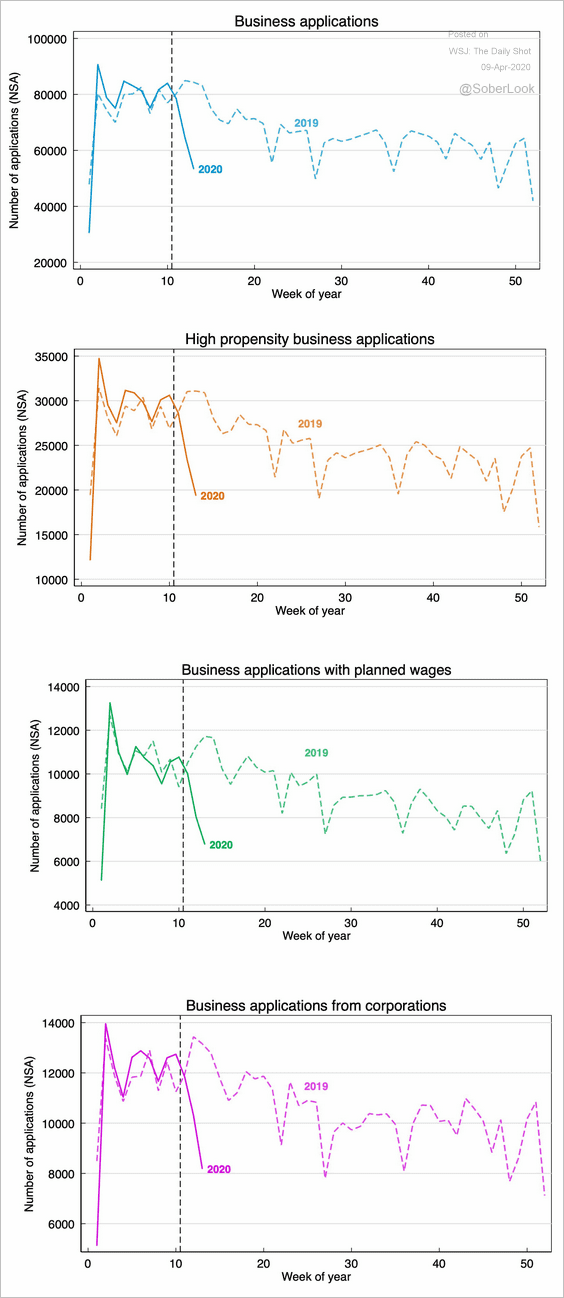

6. Business applications have decreased sharply.

Source: @kevinrinz, Business Formation Statistics Read full article

Source: @kevinrinz, Business Formation Statistics Read full article

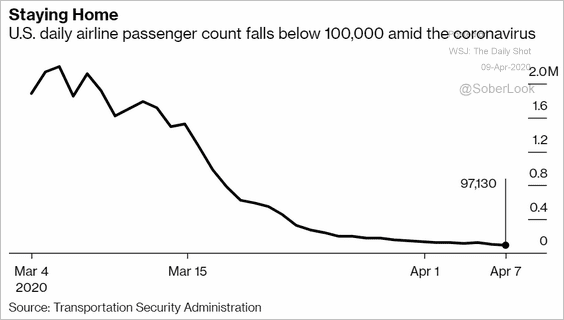

7. The daily airline passenger count dipped below 100k.

Source: @business Read full article

Source: @business Read full article

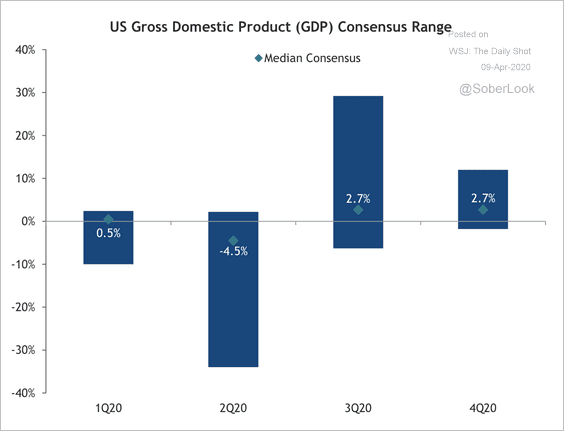

8. Consensus GDP forecasts look too optimistic.

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

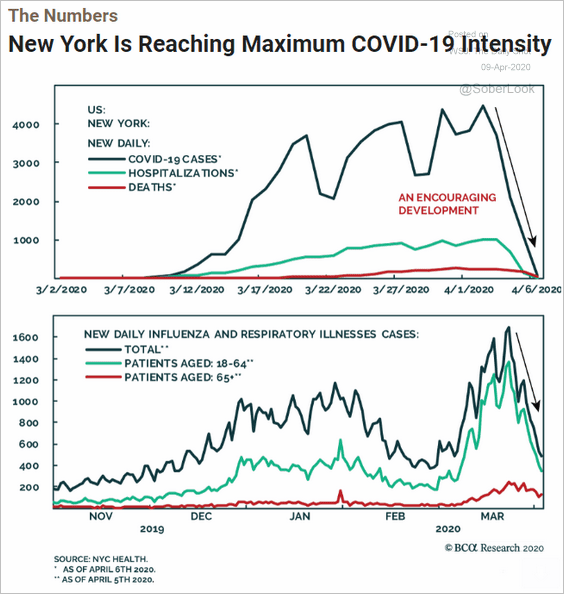

9. The New York COVID-19 epidemic intensity has been moderating.

Source: BCA Research

Source: BCA Research

Canada

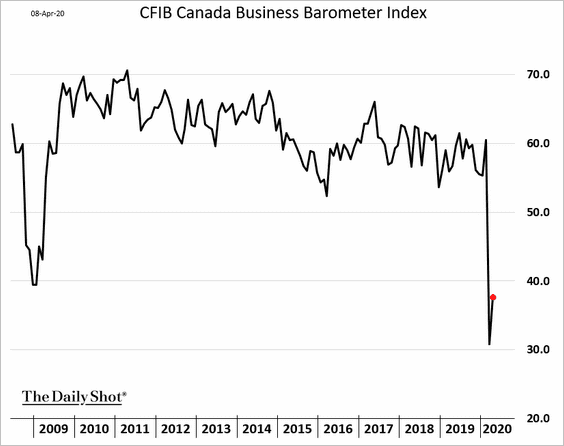

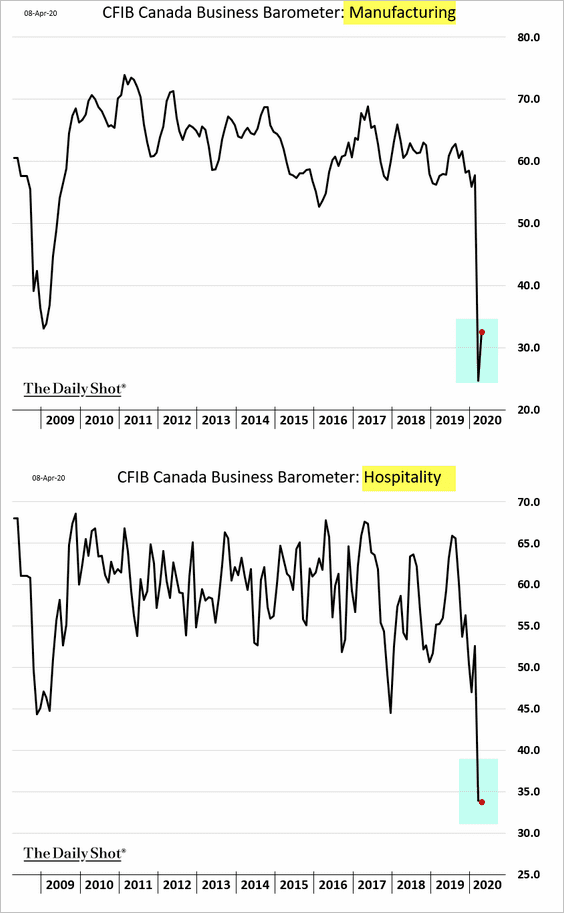

1. The CFIB small business activity indicator bounced from record lows.

Not all sectors saw improvements.

——————–

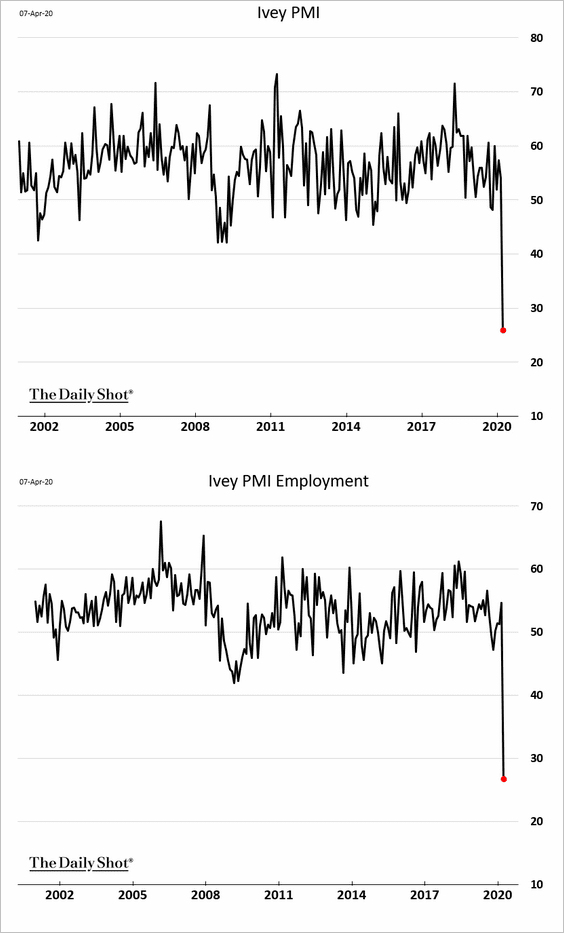

2. The overall economic activity in Canada, as measured by Ivey PMI, registered the worst deterioration in recent decades (see story).

Source:

Source:

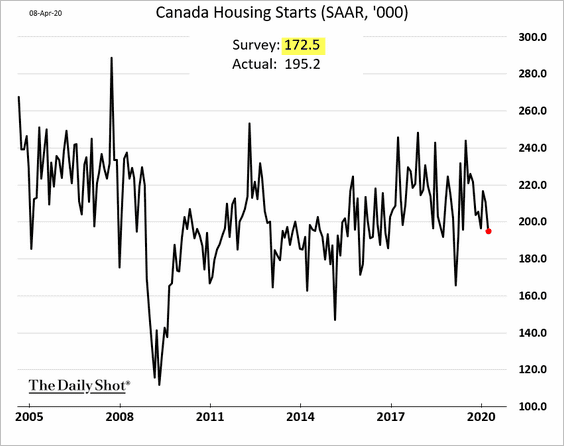

3. Housing starts remained resilient last month.

The Eurozone

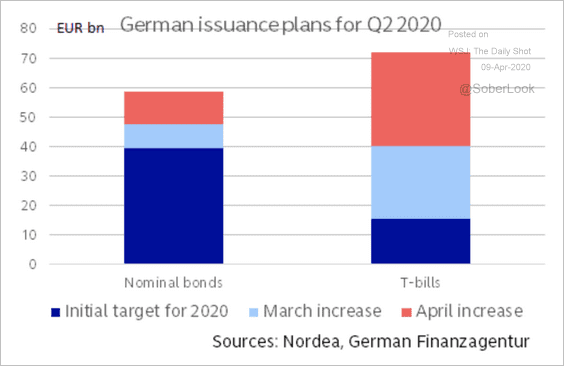

1. German government bond issuance will more than double from the previous Q2 plans, according to Nordea.

Source: Nordea Markets Read full article

Source: Nordea Markets Read full article

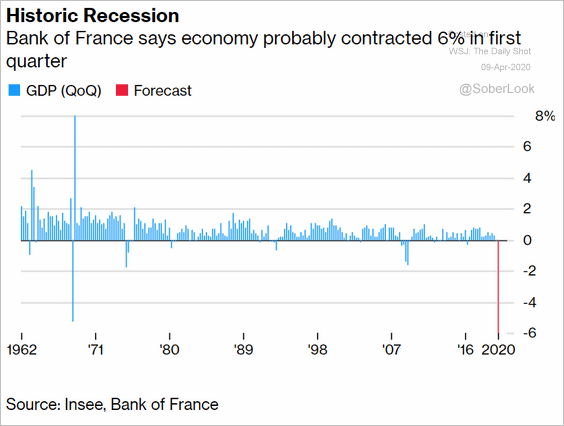

2. The Bank of France estimates that the economy contracted by 6% last quarter. What happens in Q2?

Source: @markets Read full article

Source: @markets Read full article

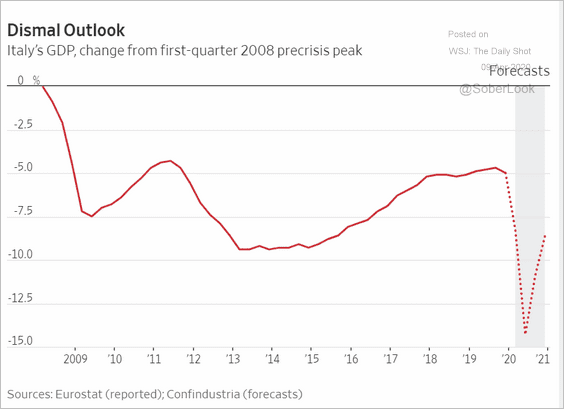

3. Italy’s economy never recovered from the financial crisis.

Source: @WSJ Read full article

Source: @WSJ Read full article

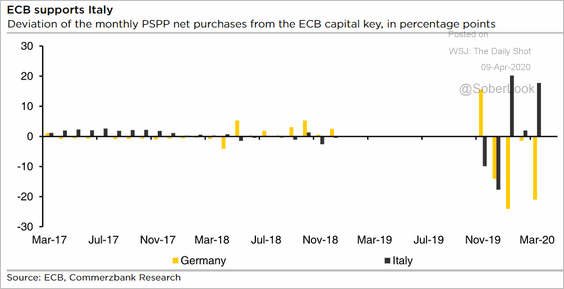

4. The ECB’s recent deviations from the capital key have been favoring Italy.

Source: Commerzbank Research

Source: Commerzbank Research

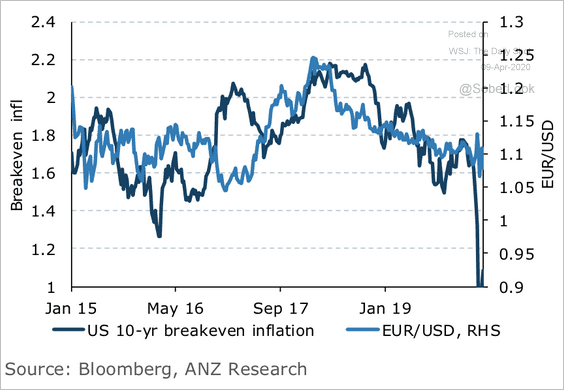

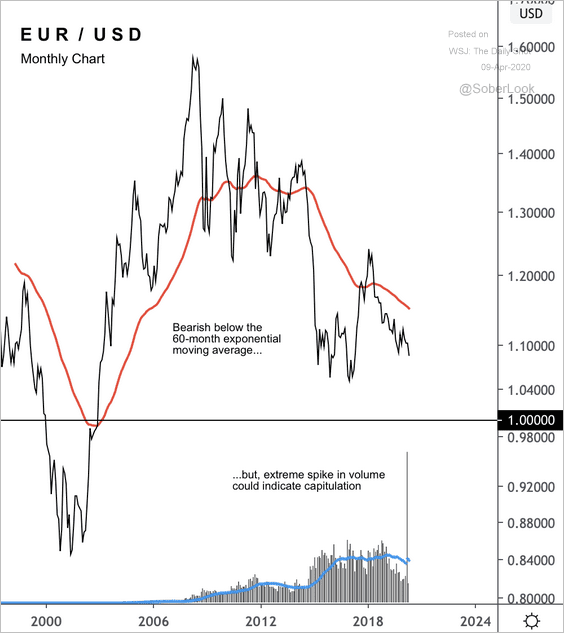

5. Could weak US inflation expectations push EUR/USD towards parity?

Source: ANZ Research

Source: ANZ Research

Separately, the EUR/USD trading volume hit extreme levels over the past month.

Source: @DantesOutlook

Source: @DantesOutlook

Europe

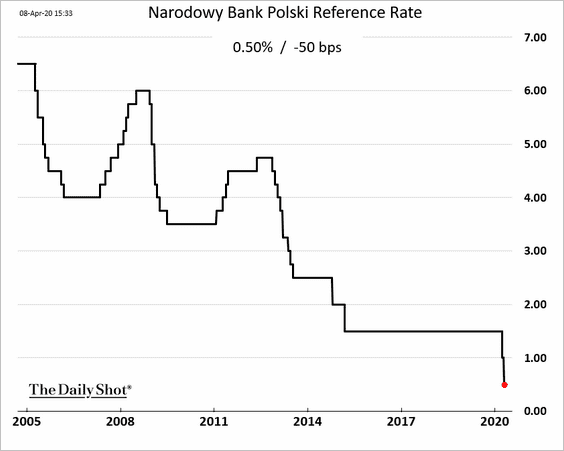

1. Poland’s central bank unexpectedly cut its benchmark rate. The nation’s real rate is now one of the lowest in the world.

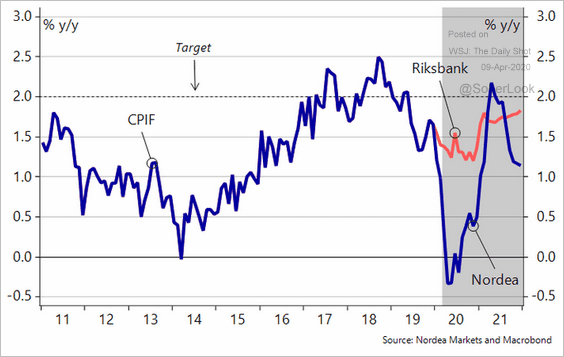

2. Sweden is headed for deflation.

Source: @TorbjrnIsaksson Read full article

Source: @TorbjrnIsaksson Read full article

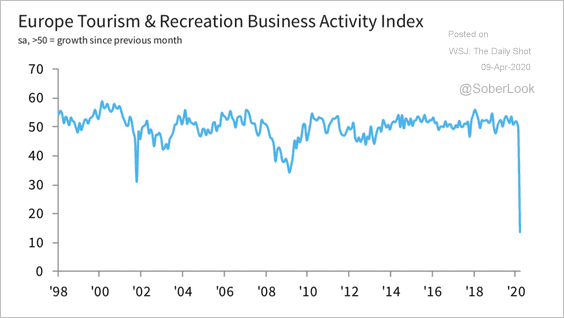

3. Here is the European Tourism & Recreation Business Activity Index from IHS Markit.

Source: IHS Markit Read full article

Source: IHS Markit Read full article

Asia – Pacific

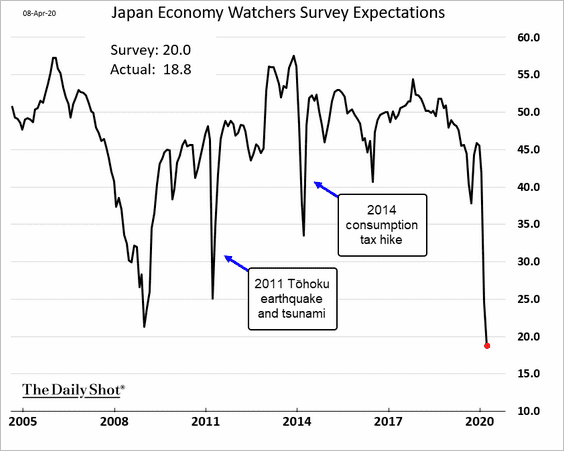

1. Japan’s Economy Watchers index (an indicator of service-sector activity) hit a record low (see story).

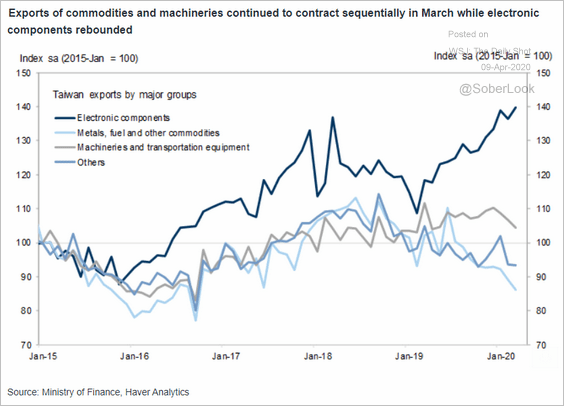

2. This chart shows Taiwan’s exports by sector.

Source: Goldman Sachs

Source: Goldman Sachs

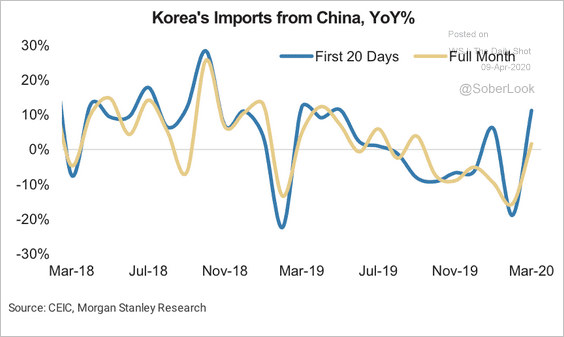

3. South Korea’s imports from China rebounded in March.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

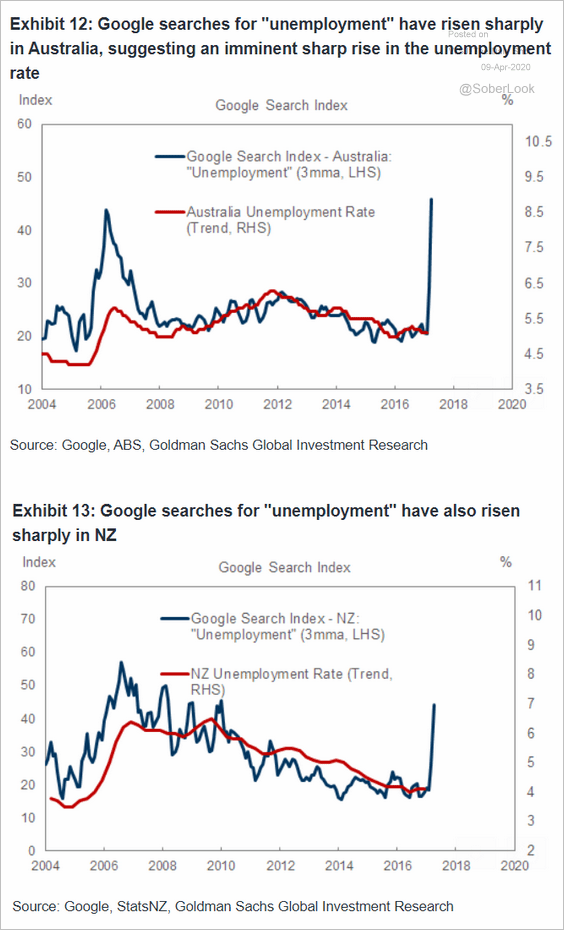

4. The unemployment rate in Australia and New Zealand is about to spike.

Source: Goldman Sachs

Source: Goldman Sachs

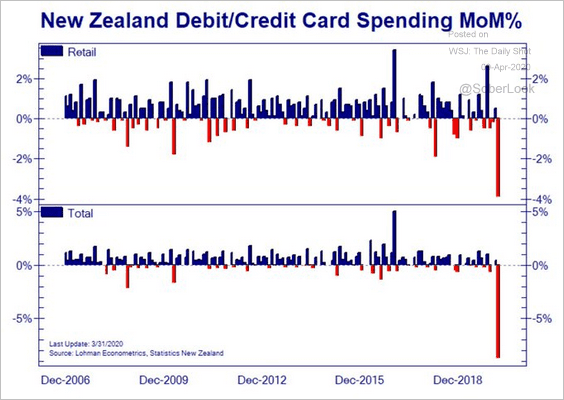

5. New Zealand’s credit card spending registered a massive decline last month.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

China

1. China’s government bond curve is steepening in response to rate cut expectations.

2. Corporate issuance of dollar-denominated bonds has collapsed.

Source: @markets Read full article

Source: @markets Read full article

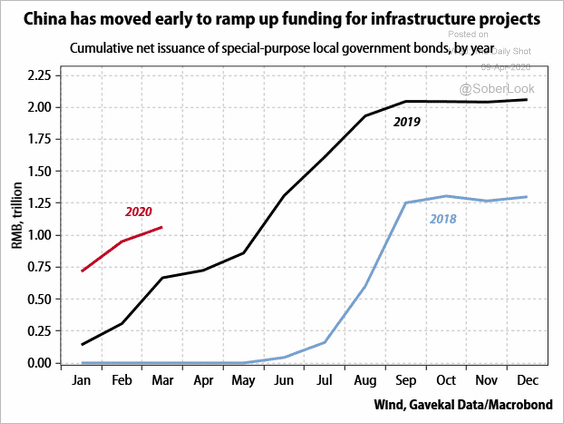

3. Beijing is ramping up infrastructure spending.

Source: Gavekal

Source: Gavekal

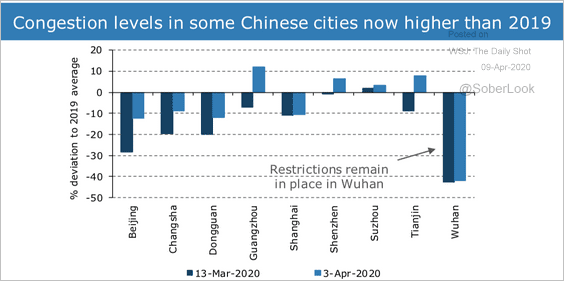

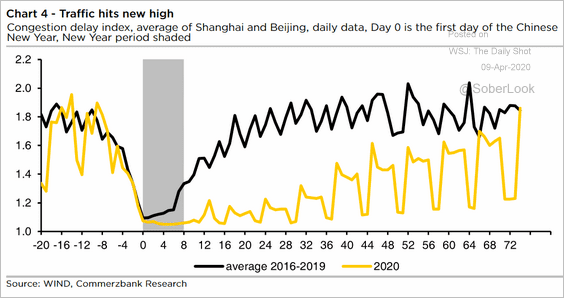

4. Traffic congestion is returning.

Source: ANZ Research

Source: ANZ Research

Source: Commerzbank Research

Source: Commerzbank Research

——————–

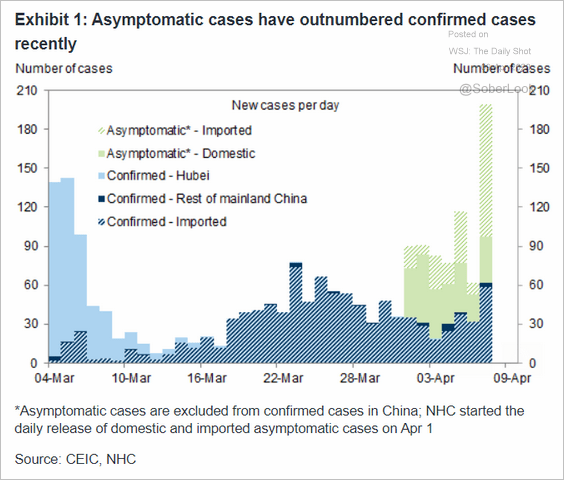

5. Asymptomatic cases should worry Beijing (see story).

Source: Goldman Sachs

Source: Goldman Sachs

Emerging Markets

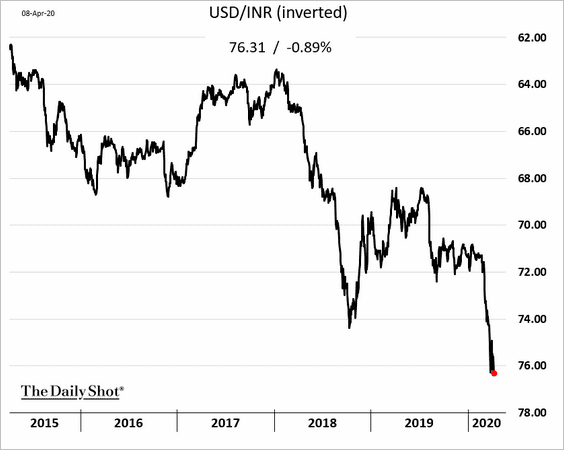

1. The Indian rupee hit a record low.

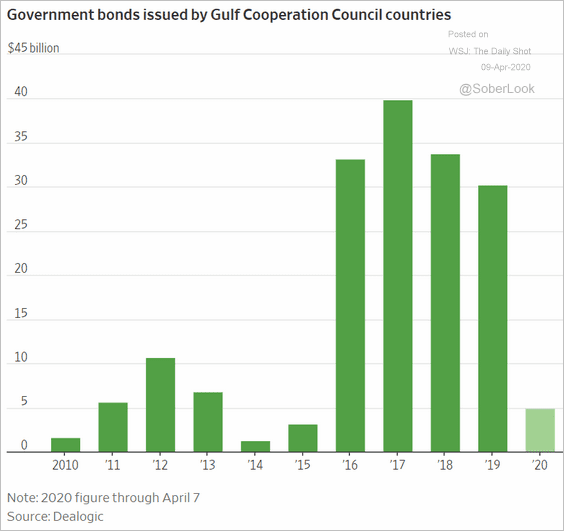

2. Qatar taps the bond market, testing demand for Persian Gulf debt.

Source: @WSJ Read full article

Source: @WSJ Read full article

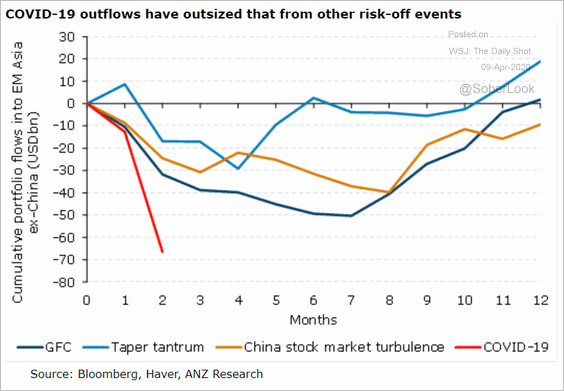

3. Portfolio outflows from EM Asia have been severe.

Source: ANZ Research

Source: ANZ Research

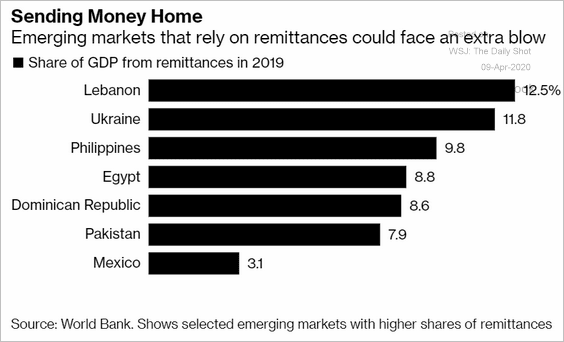

4. Which countries rely most on remittances?

Source: @markets Read full article

Source: @markets Read full article

Commodities

1. Will copper-to gold ratio follow the 2007 trajectory?

Source: @markets Read full article

Source: @markets Read full article

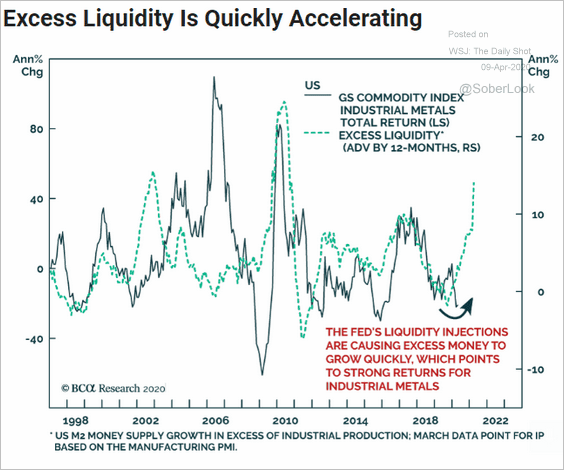

2. The recent spike in excess liquidity bodes well for industrial metals.

Source: BCA Research

Source: BCA Research

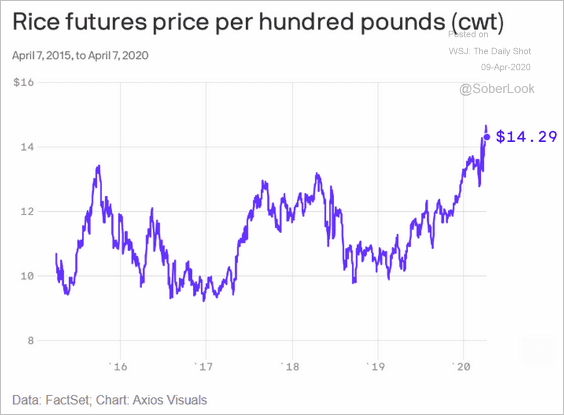

3. Rice prices remain elevated amid hoarding and export bans.

Source: @axios Read full article

Source: @axios Read full article

Energy

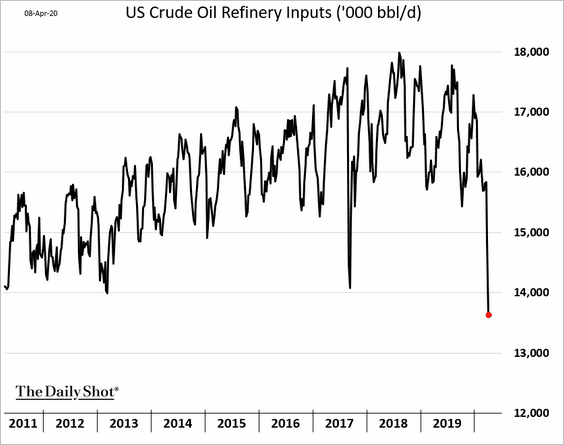

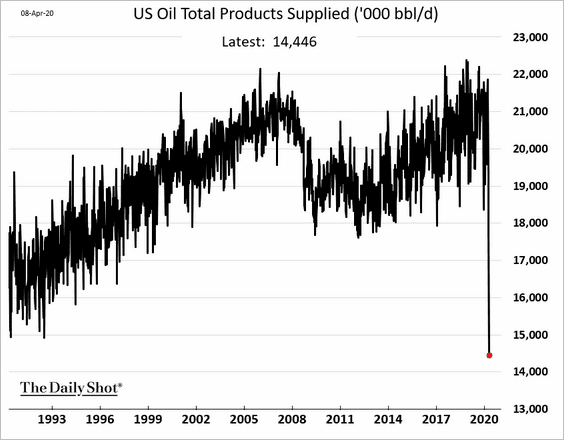

1. The collapse in US gasoline demand has been unprecedented.

Refinery inputs have plummetted.

This chart shows the total oil products supplied in the US.

Source: Further reading

Source: Further reading

——————–

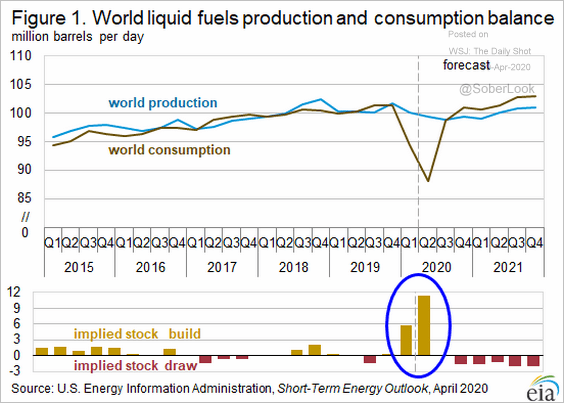

2. The Department of Energy expects record inventory builds globally as demand collapses.

Source: EIA Read full article

Source: EIA Read full article

US inventories (shown in terms of days of supply) are rising rapidly.

——————–

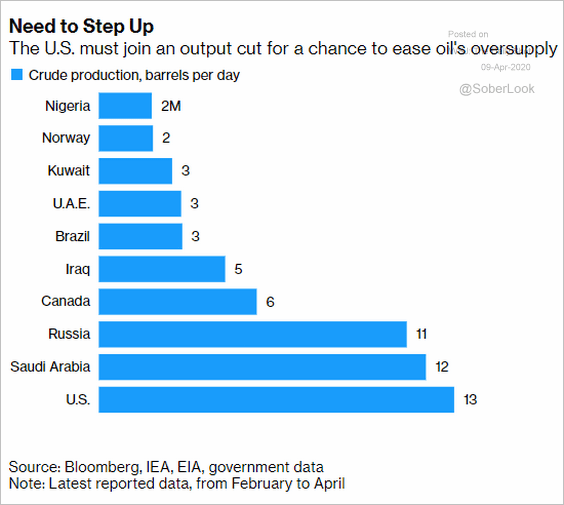

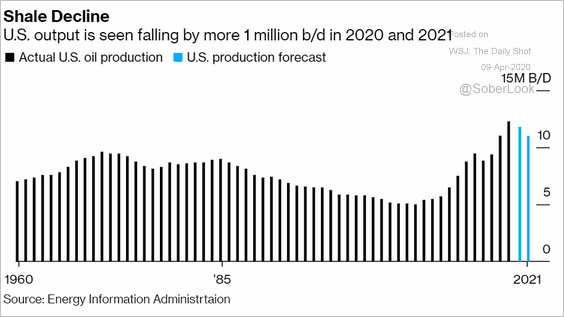

3. The US will be cutting production.

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

Equities

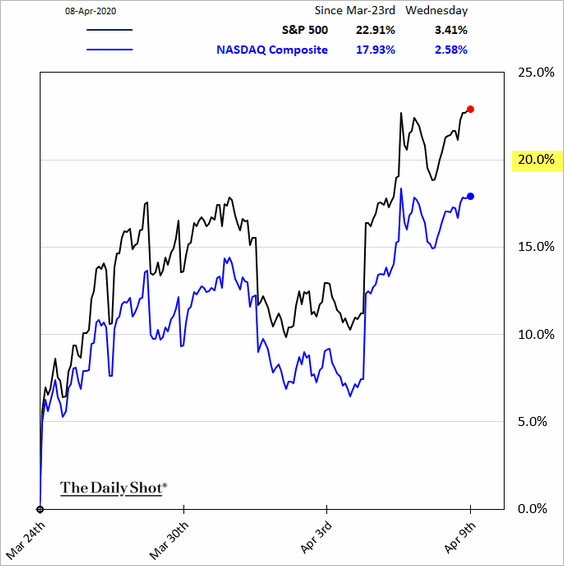

1. The S&P 500 is out of bear market.

But is the worst over for US stocks?

Source: @johnauthers, @bopinion Read full article

Source: @johnauthers, @bopinion Read full article

——————–

2. The S&P 500 earnings revisions ratio still has ways to go before bottoming.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

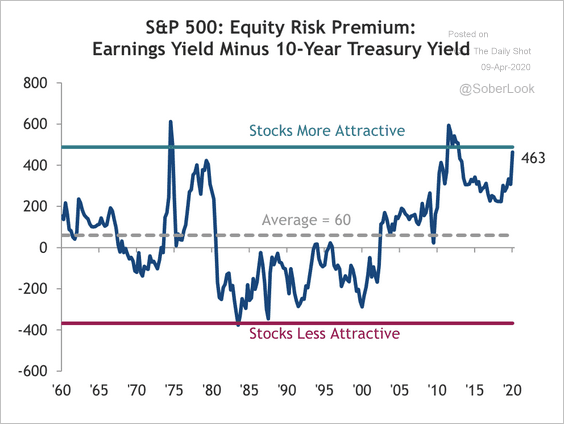

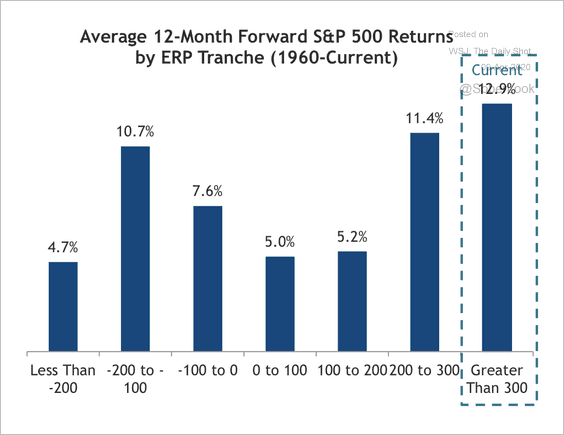

3. Current equity risk-premium levels have historically been associated with positive 12-month average returns, according to SunTrust (two charts).

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

——————–

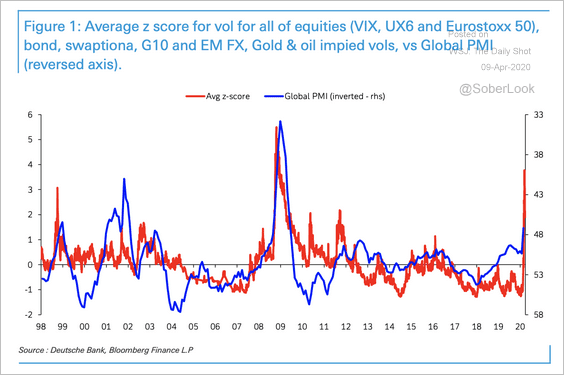

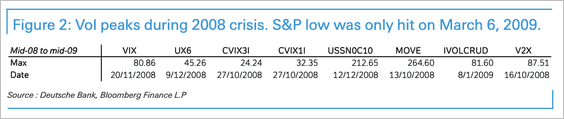

4. According to Deutsche Bank, there is a good chance that financial asset volatility has peaked, but there is no guarantee that risk appetite has bottomed.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

During the 2008 crisis, vol peaked around six months before the S&P 500 low.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

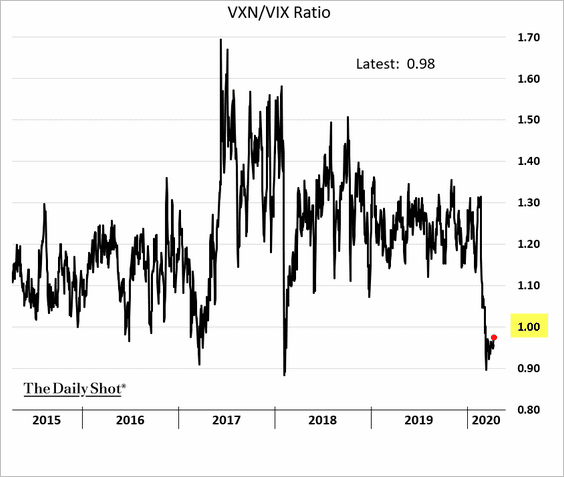

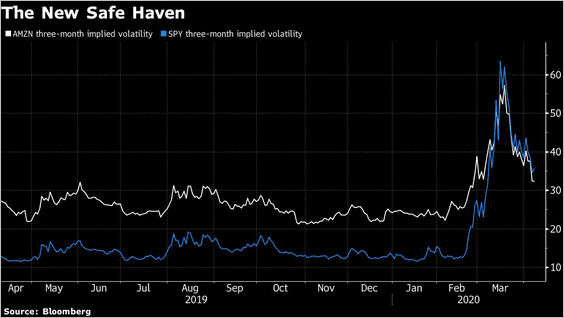

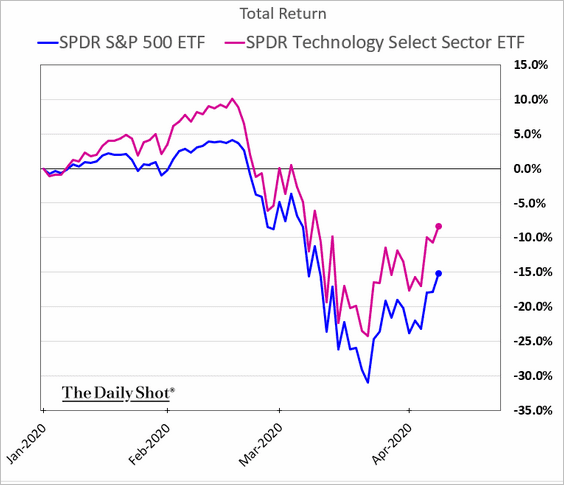

5. Tech firms have been viewed as a “safe-haven” sector in this selloff. The Nasdaq 100 VIX-equivalent (VXN) remains below VIX.

Source: @markets Read full article

Source: @markets Read full article

——————–

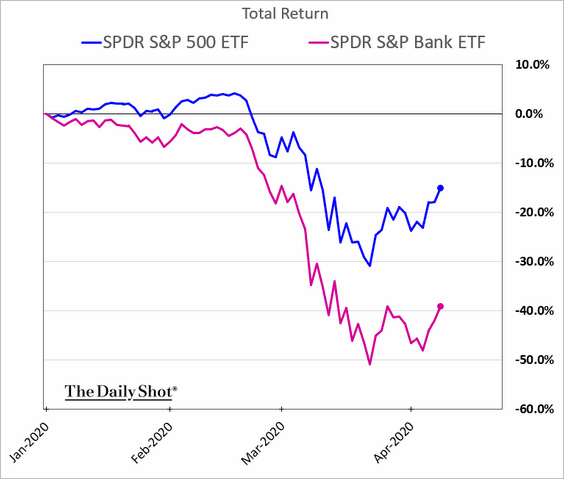

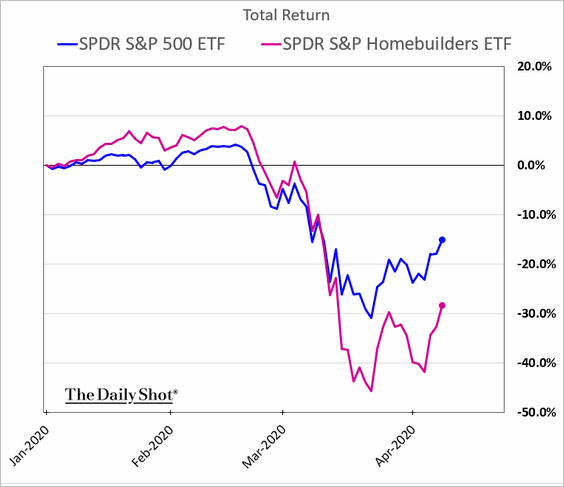

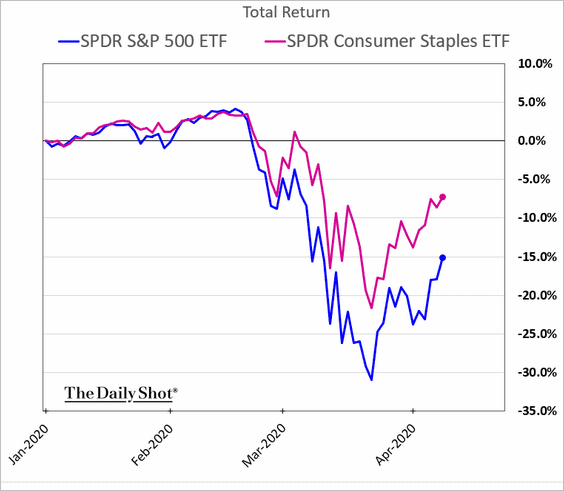

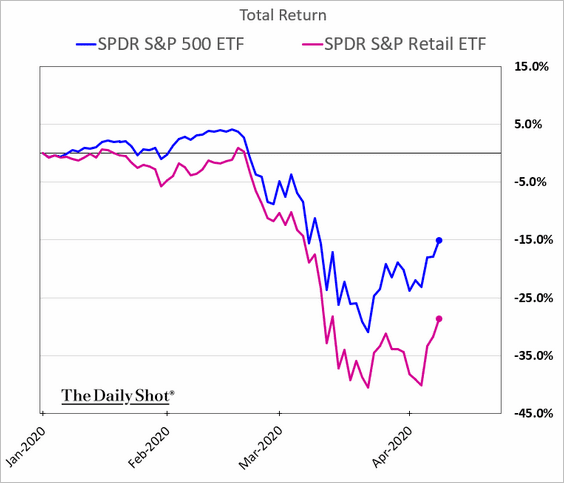

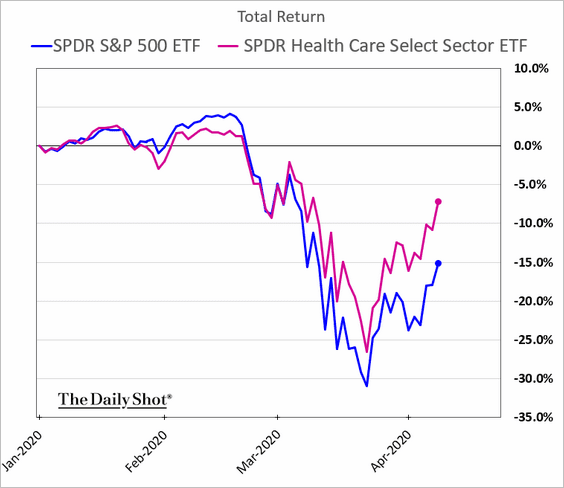

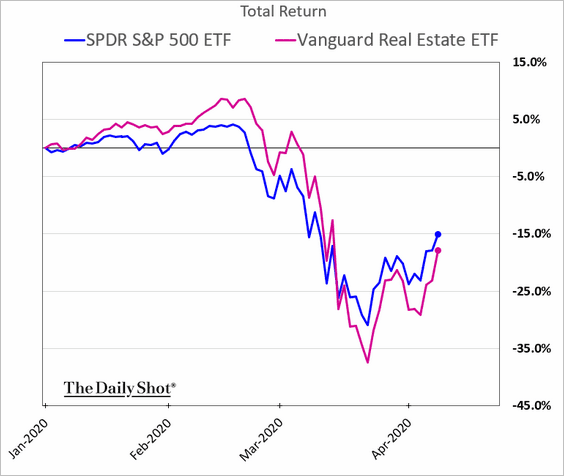

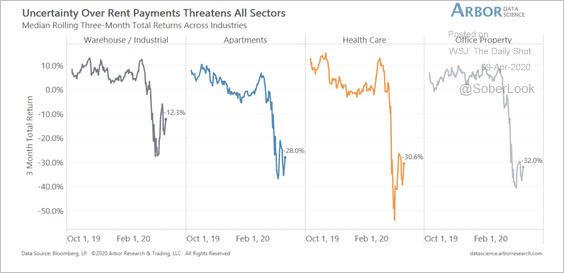

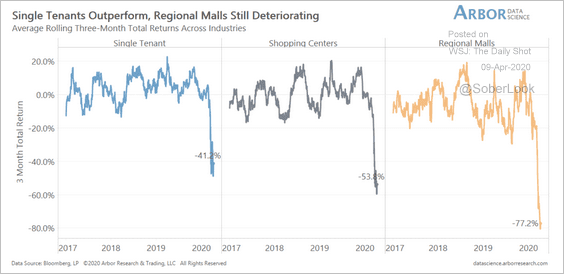

6. Next, we have some sector updates (year-to-date).

• Banks:

• Housing:

• Consumer staples:

• Retail:

• Tech:

• Healthcare:

• Transportation:

• REITs:

REITs by sector:

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

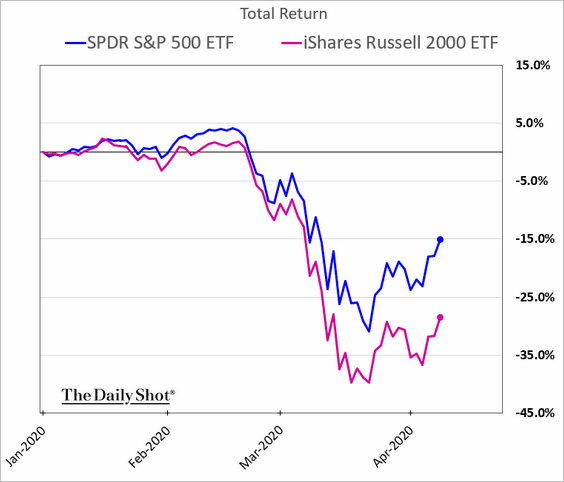

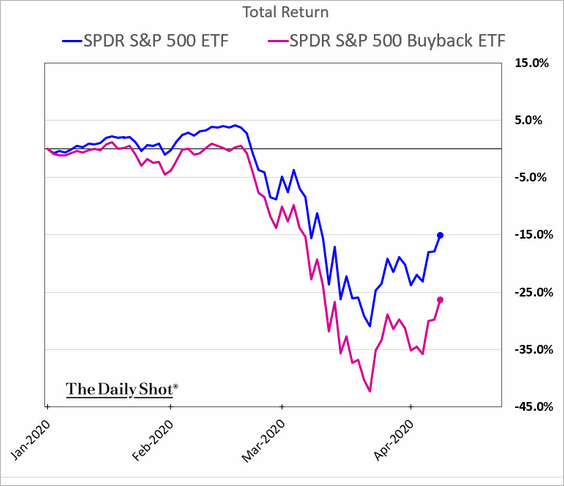

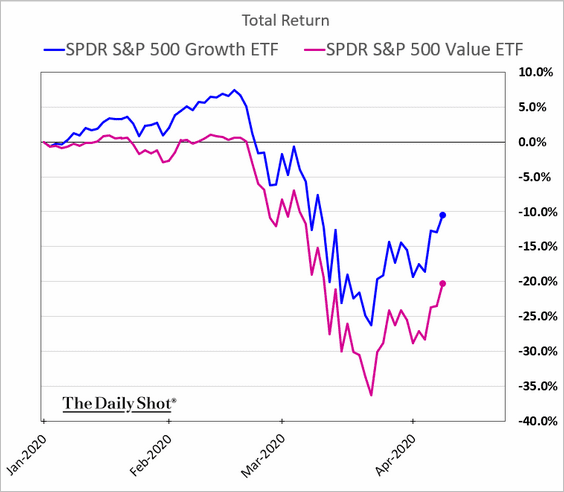

7. Finally, here are some style/factor performance charts (year-to-date):

• Small caps:

• High-dividend:

• Firms known for share buybacks:

• Value vs. growth:

Credit

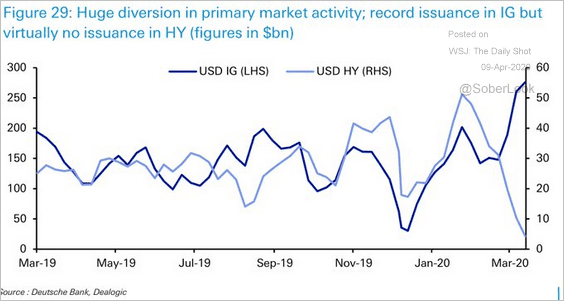

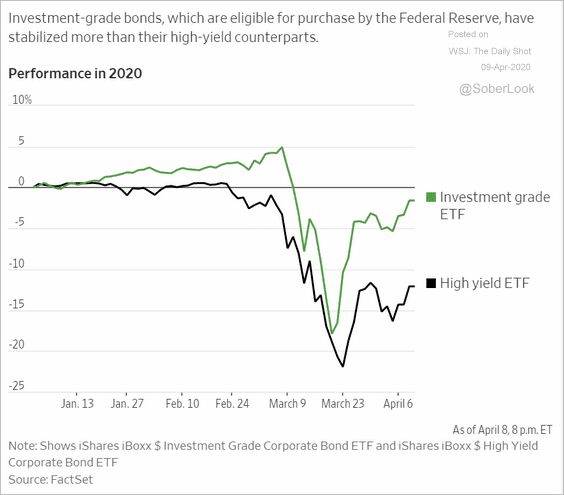

1. Investment-grade and high-yield bond issuance trends have diverged sharply.

Source: Deutsche Bank Research, @TayTayLLP

Source: Deutsche Bank Research, @TayTayLLP

Here is the relative performance (year-to-date):

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

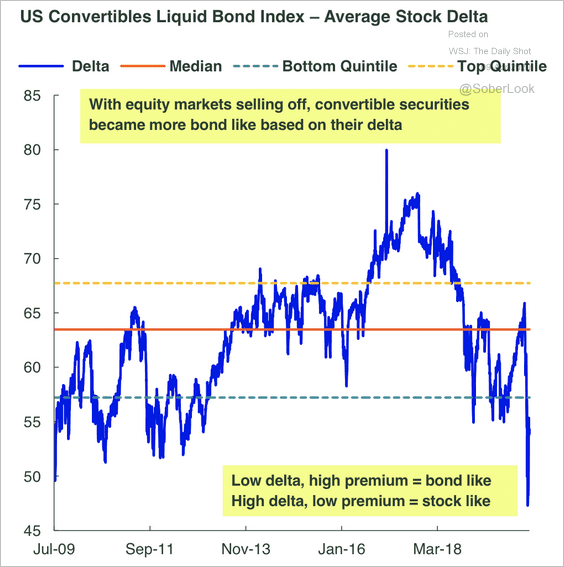

2. Convertibles have performed relatively well during this downturn as their sensitivity to the equity market (delta) declined sharply.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

Premiums on convertibles increased substantially.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

——————–

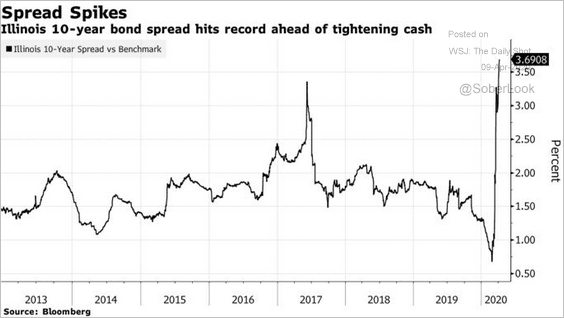

3. Will Illinois debt be downgraded to junk?

Source: @markets Read full article

Source: @markets Read full article

Rates

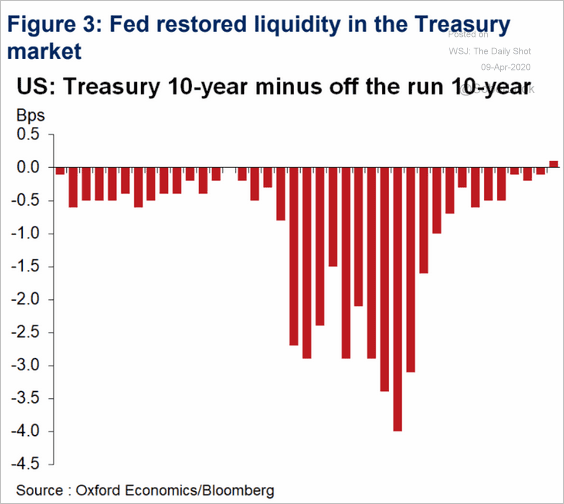

1. The Fed’s recent actions have stabilized liquidity in the Treasury market. Here is the spread between on- and off-the-run 10yr note.

Source: Oxford Economics

Source: Oxford Economics

2. US-Germany bond spreads have tightened sharply.

Source: @markets Read full article

Source: @markets Read full article

Global Developments

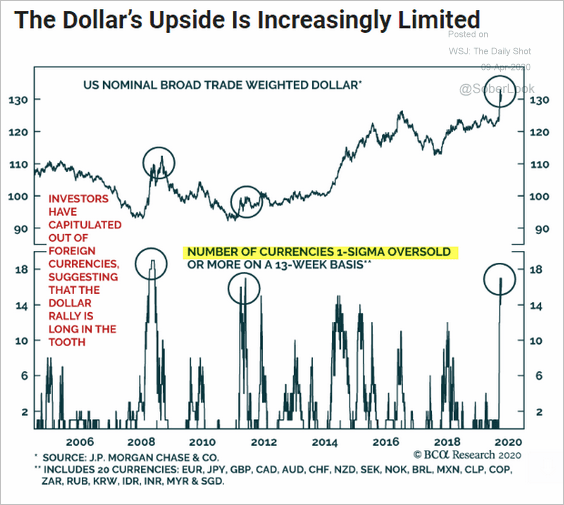

1. Is the dollar rally over?

Source: BCA Research

Source: BCA Research

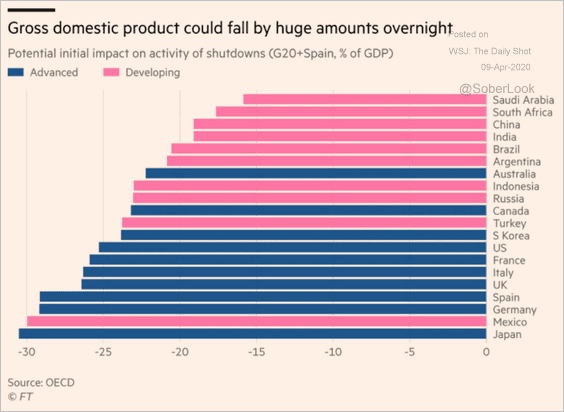

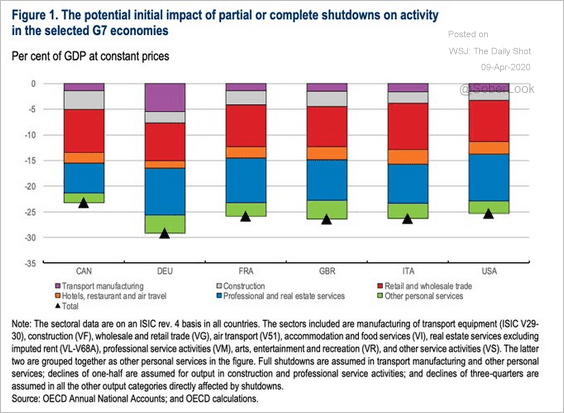

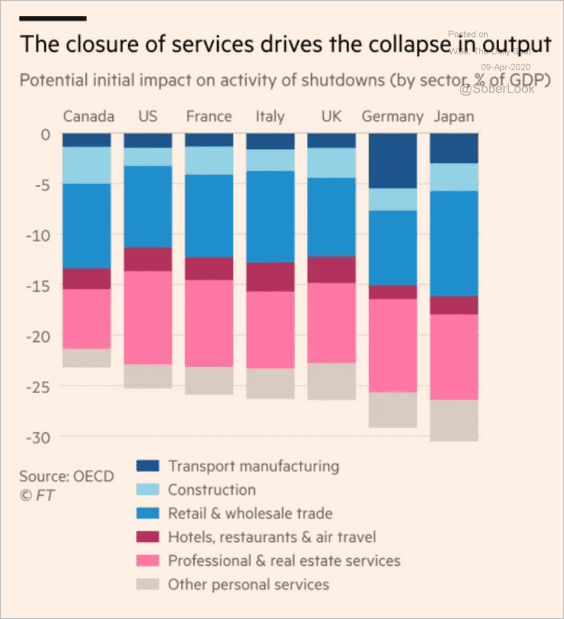

2. GDP declines around the world will be massive as service-sector activity collapses.

Source: @financialtimes, @adam_tooze Read full article

Source: @financialtimes, @adam_tooze Read full article

Source: @adam_tooze, @OECD Read full article

Source: @adam_tooze, @OECD Read full article

Source: @financialtimes, @adam_tooze Read full article

Source: @financialtimes, @adam_tooze Read full article

——————–

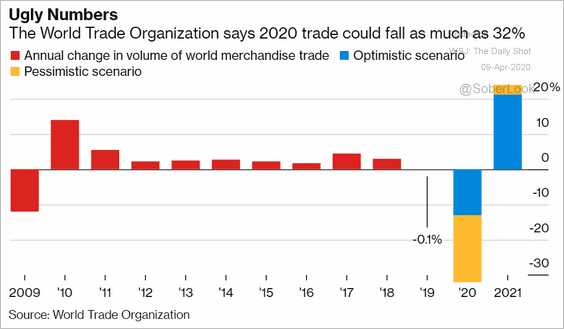

3. Here are a couple of scenarios for global trade.

Source: @business Read full article

Source: @business Read full article

——————–

Food for Thought

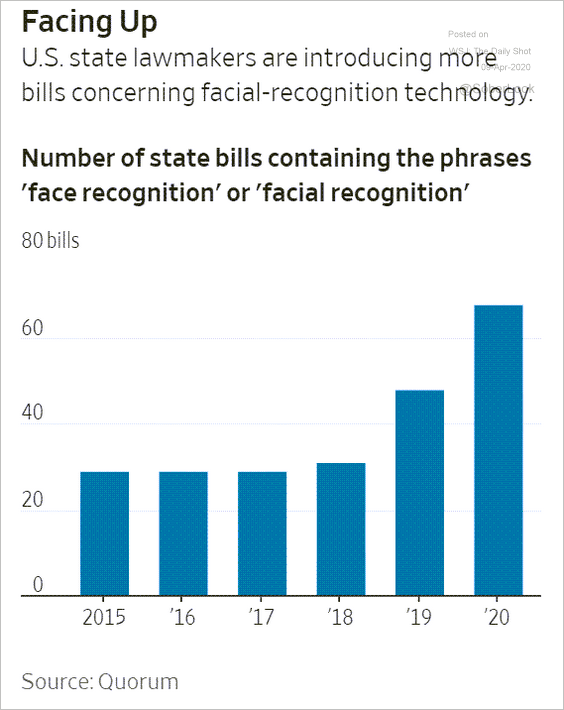

1. Legislation on facial-recognition technology:

Source: @WSJ Read full article

Source: @WSJ Read full article

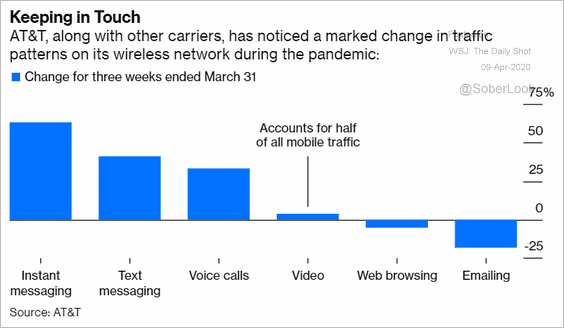

2. Changes in wireless traffic patterns:

Source: @bopinion Read full article

Source: @bopinion Read full article

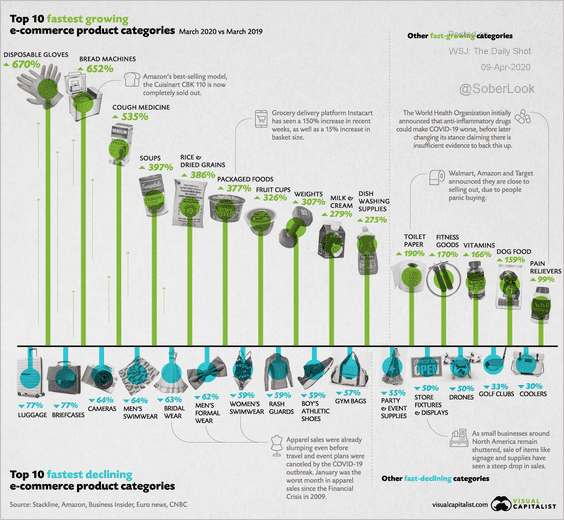

3. Popular e-commerce products:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

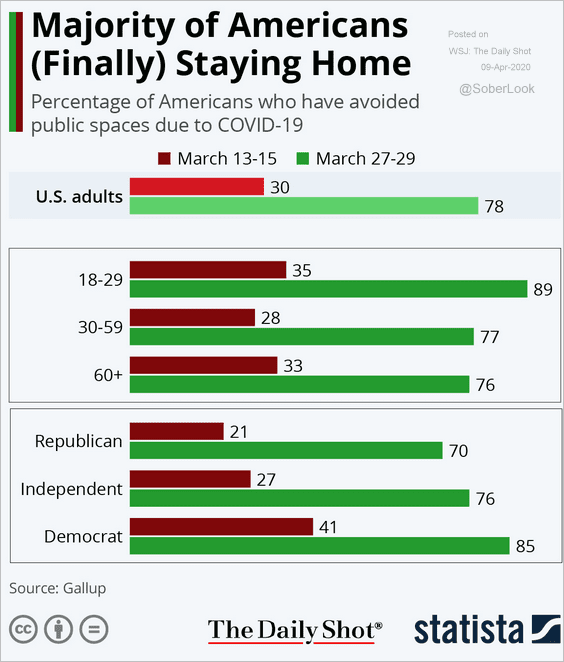

4. Who is staying at home?

Source: Statista

Source: Statista

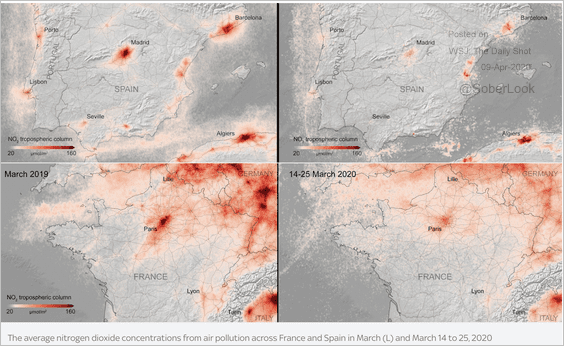

5. Air pollution over Spain and France:

Source: Sky UK Read full article

Source: Sky UK Read full article

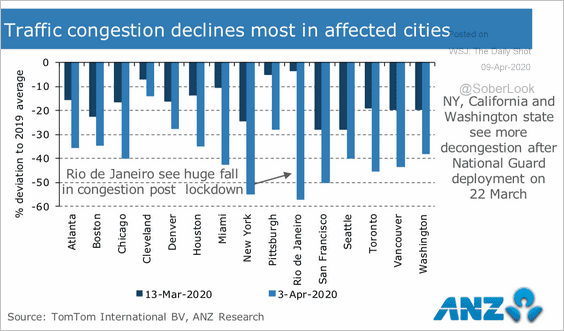

6. Traffic congestion:

Source: ANZ Research

Source: ANZ Research

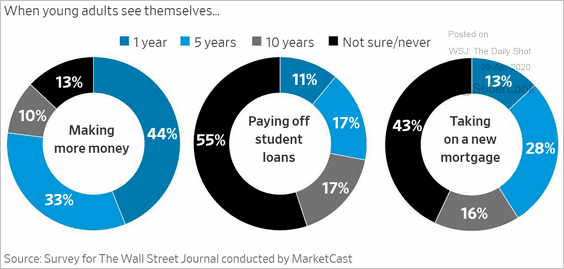

7. Young adults’ financial goalposts:

Source: @WSJ Read full article

Source: @WSJ Read full article

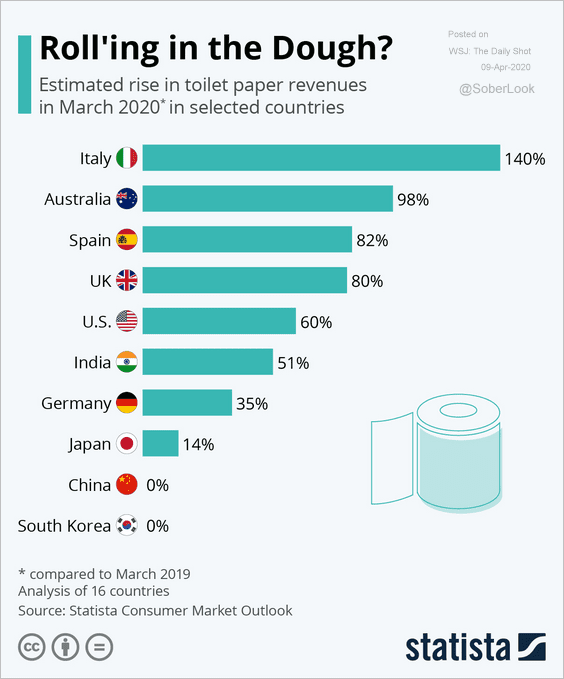

8. Toilet paper revenues:

Source: Statista

Source: Statista

——————–

The next Daily Shot will be out on Monday, April 13th.

Have a great weekend!