The Daily Shot: 13-Apr-20

• The United States

• Canada

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

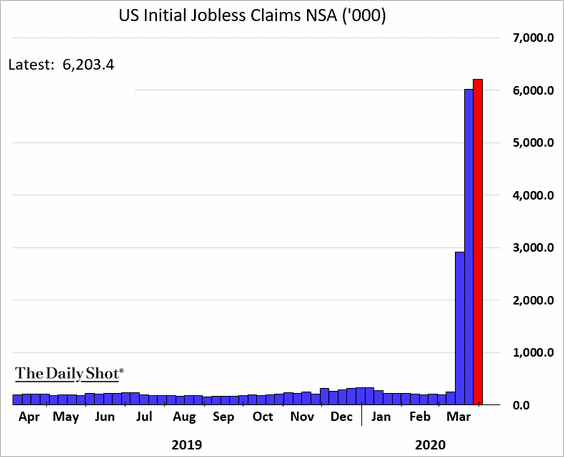

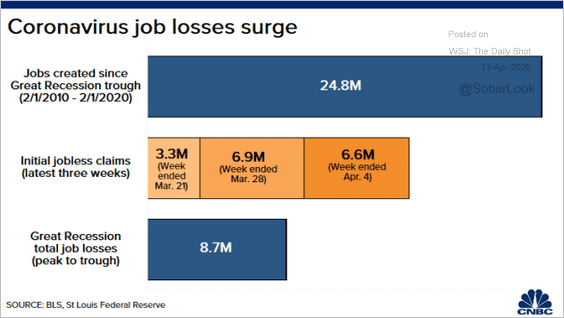

1. Let’s begin with the labor market.

• Over six million Americans filed for unemployment the week ending April 4th.

• About two-thirds of the jobs created since the last recession have been wiped out.

Source: CNBC Read full article

Source: CNBC Read full article

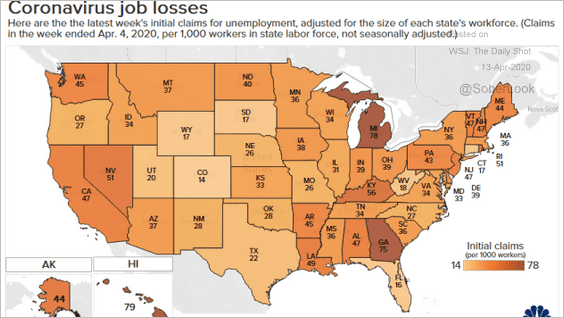

• Next, we have some data on unemployment filings by state.

– The week ending April 4th:

Source: CNBC Read full article

Source: CNBC Read full article

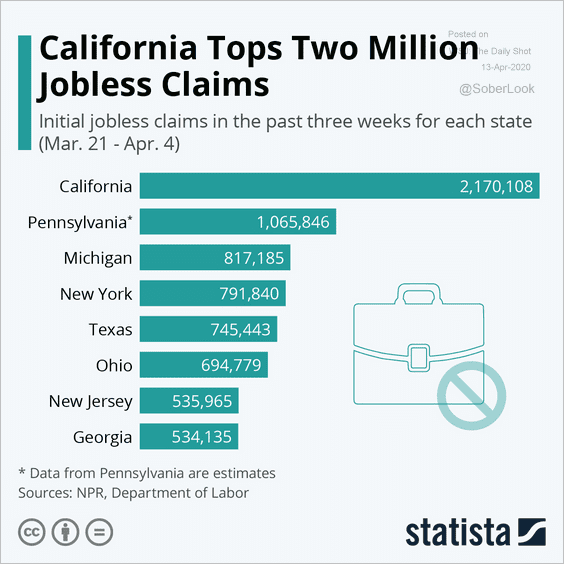

– March 21st – April 4th:

Source: Statista

Source: Statista

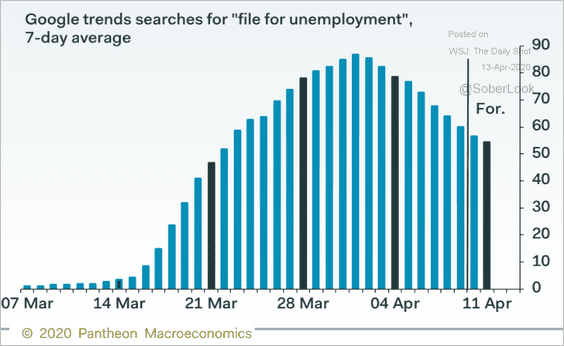

• Google search activity suggests that initial claims have peaked.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

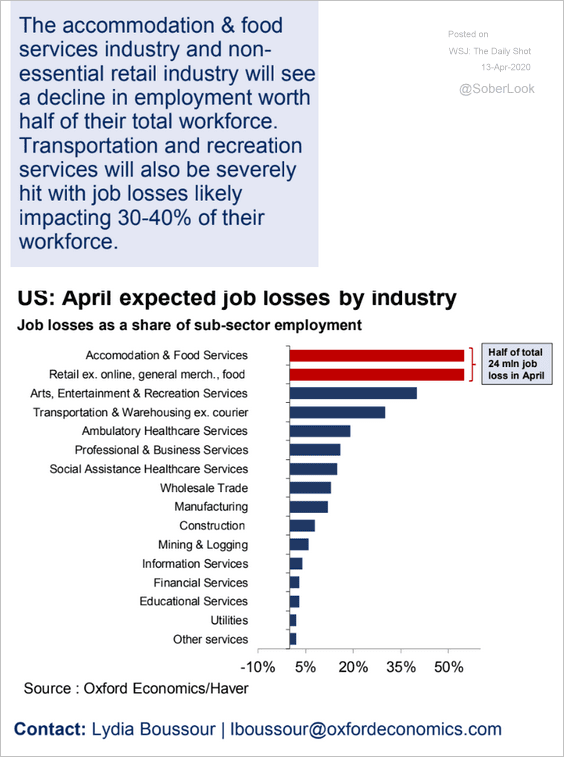

• Oxford Economics estimates that 24 million jobs will be lost this month, with half of if coming from hotels, restaurants, and retail.

Source: Oxford Economics

Source: Oxford Economics

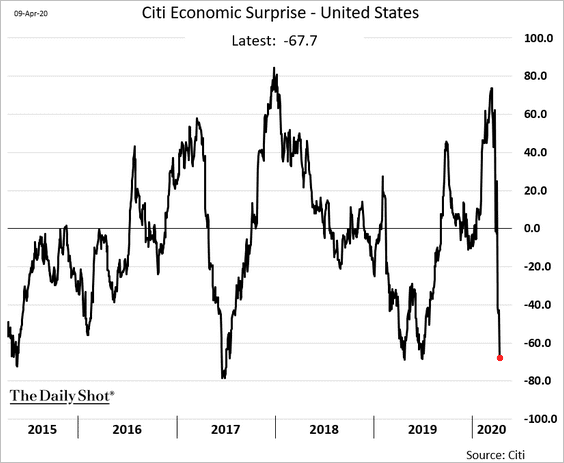

• The claims report sent the Citi Economic Surprise Index deeper into negative territory.

——————–

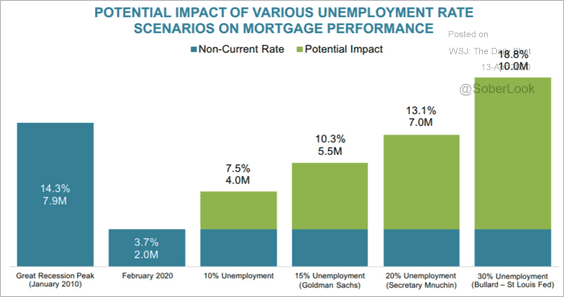

2. If the unemployment rate climbs to 15% (as recently projected by Goldman Sachs), we could be looking at 5.5 million past-due mortgages, according to Black Knight.

Source: Black Knight

Source: Black Knight

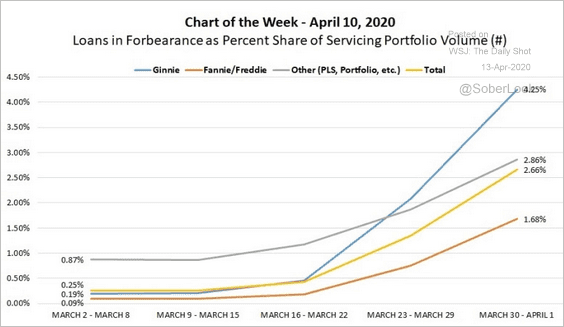

The percentage of loans in forbearance (see definition) has been climbing rapidly.

Source: Mortgage Bankers Association Read full article

Source: Mortgage Bankers Association Read full article

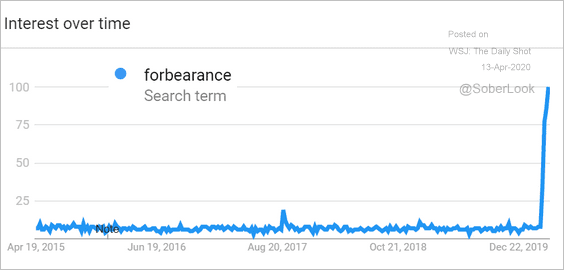

Here is the online search activity for the word “forbearance” (over time).

Source: Google Trends

Source: Google Trends

——————–

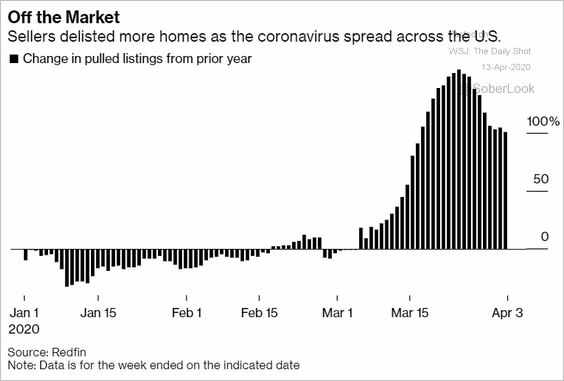

3. Sellers have been rapidly delisting homes.

Source: @markets Read full article

Source: @markets Read full article

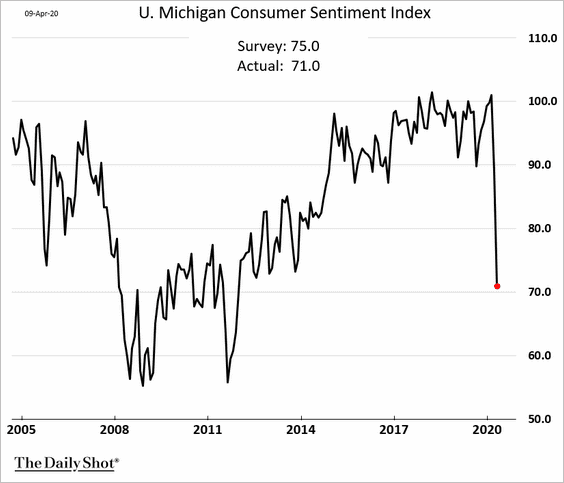

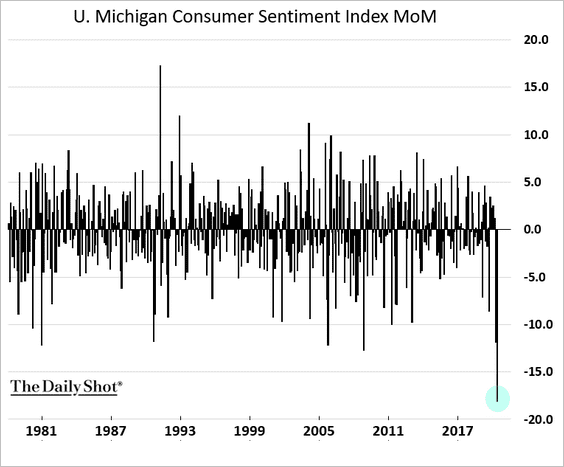

4. The U. Michigan Consumer Sentiment Index registered a record decline this month.

Here are the monthly changes.

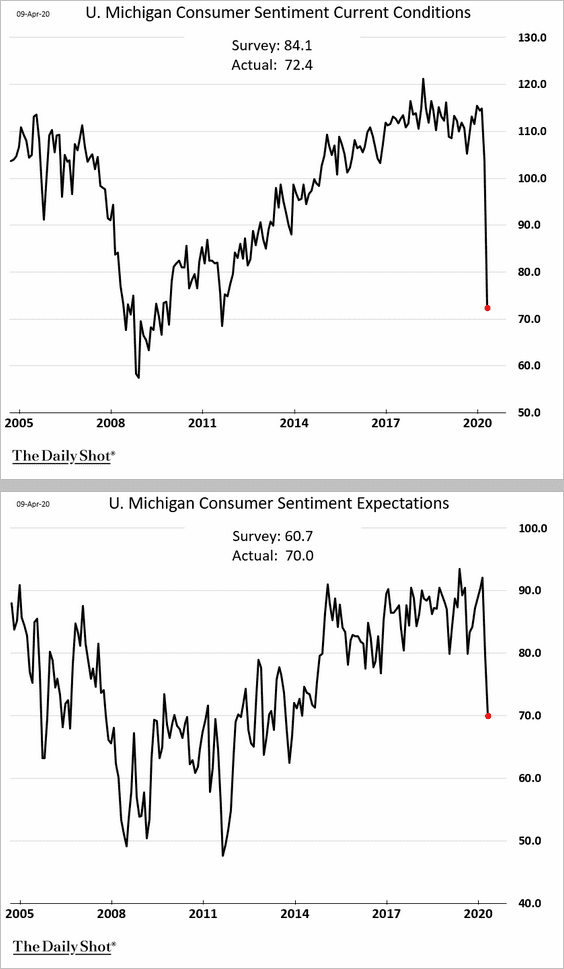

• The “current conditions” index was hit particularly hard, but Americans are still relatively optimistic about the future (second chart).

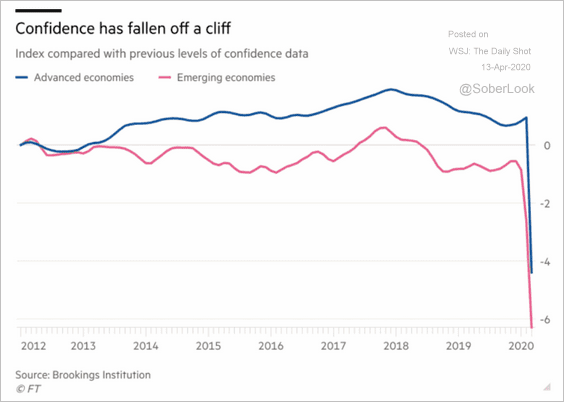

• US consumer confidence has been more resilient than what we see globally (chart below). But analysts expect US sentiment to deteriorate further.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

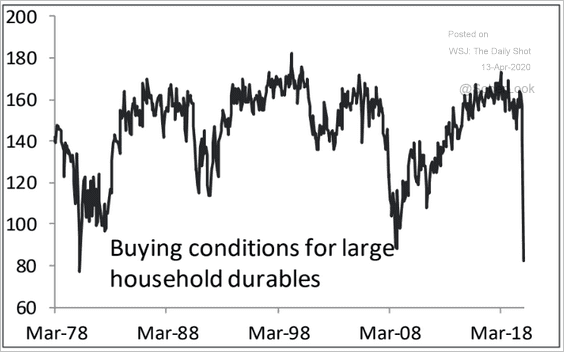

• Here is the U. Michigan index of buying conditions for large household durables.

Source: Piper Sandler

Source: Piper Sandler

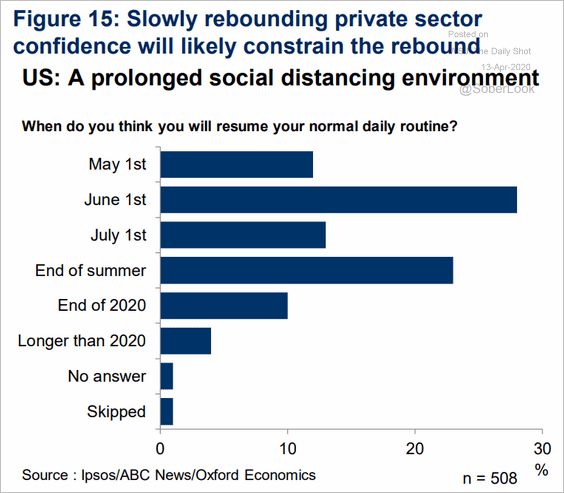

• This survey asked, “When do you think you will resume your normal daily routine?”

Source: Oxford Economics

Source: Oxford Economics

——————–

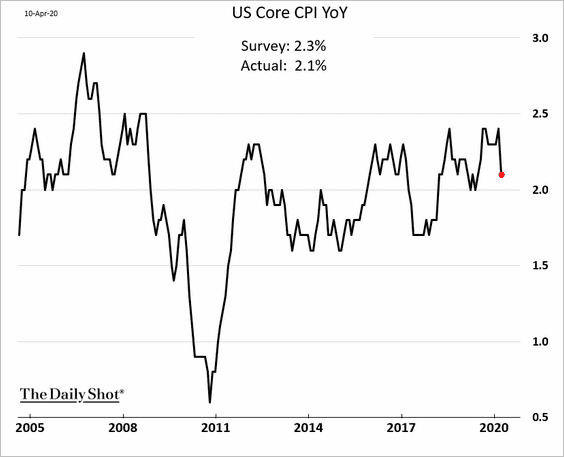

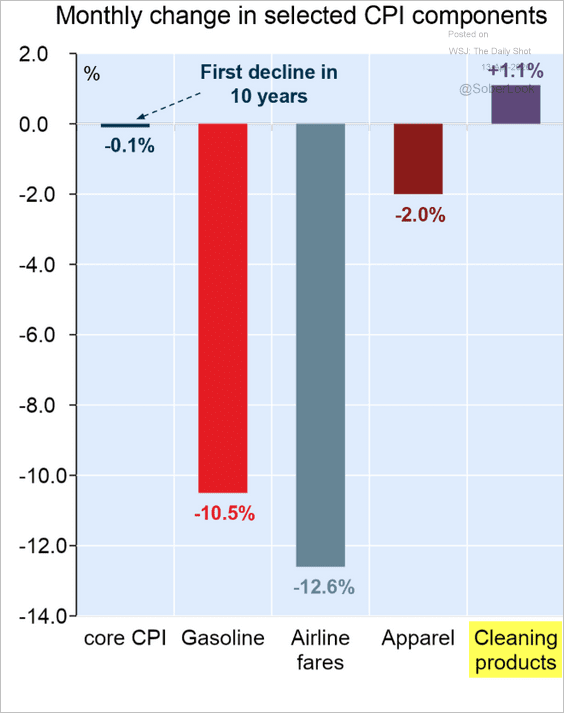

5. The March core CPI came in below expectations.

• Not surprisingly, the key drivers of the decline were apparel, hotel prices, and airline fares. The drop in gasoline prices put downward pressure on the headline CPI.

Source: Jocelyn Paquet, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Jocelyn Paquet, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

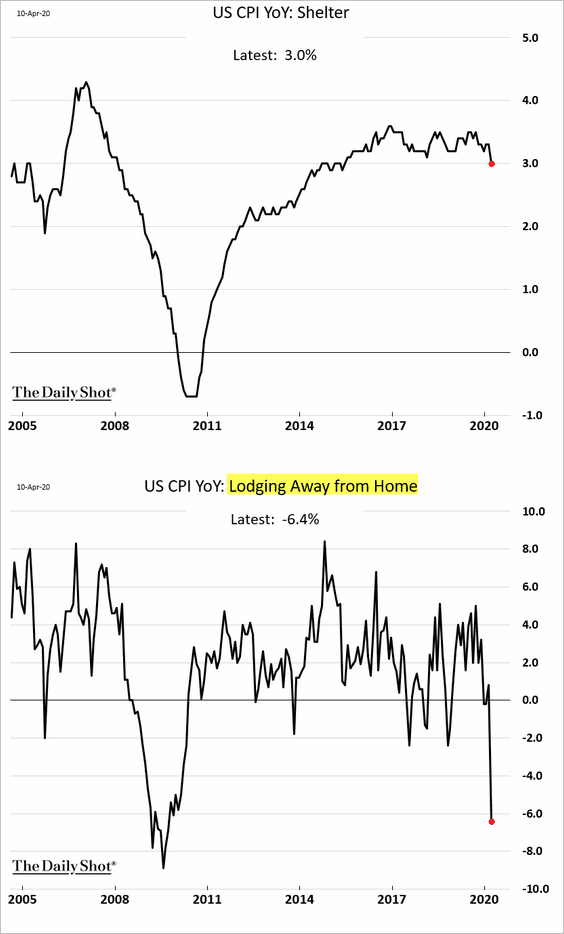

Below are the year-over-year price changes for shelter and airline fares.

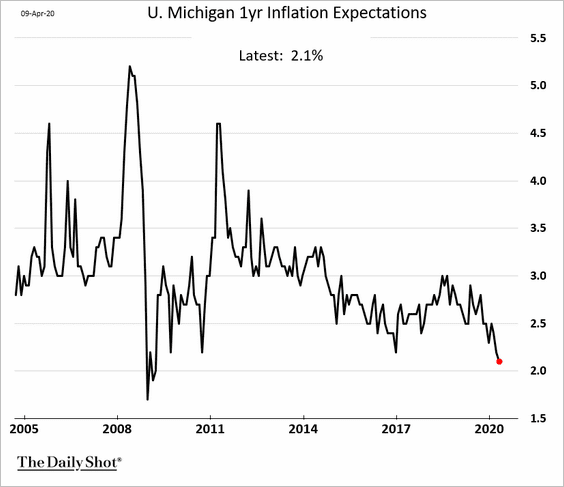

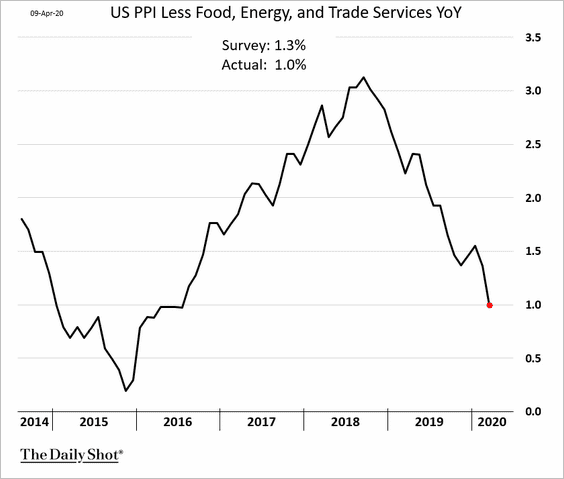

• Consumer inflation expectations hit the lowest level since 2009.

• US producer price inflation is rapidly slowing as well.

——————–

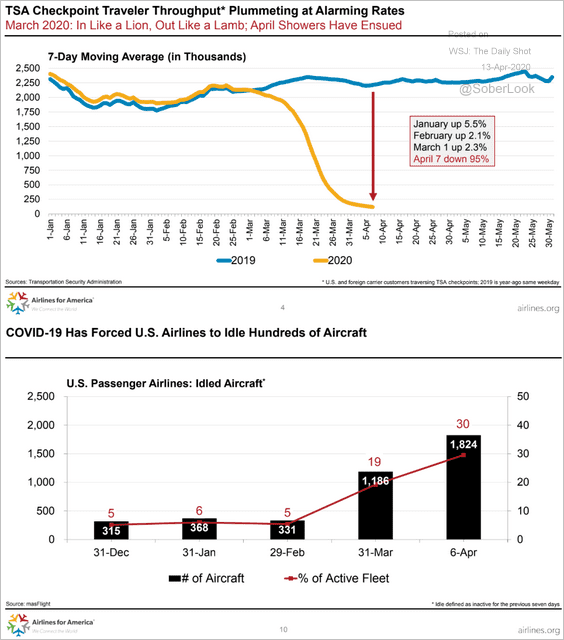

6. Here is a summary of what’s going on with the airline industry.

Source: Airlines for America

Source: Airlines for America

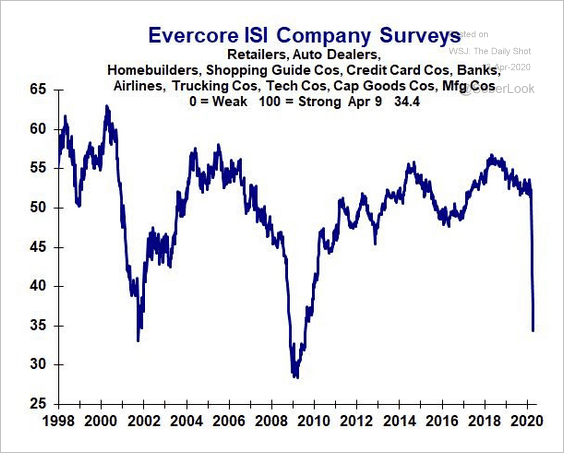

7. Below is the Evercore ISI business survey.

Source: Evercore ISI Read full article

Source: Evercore ISI Read full article

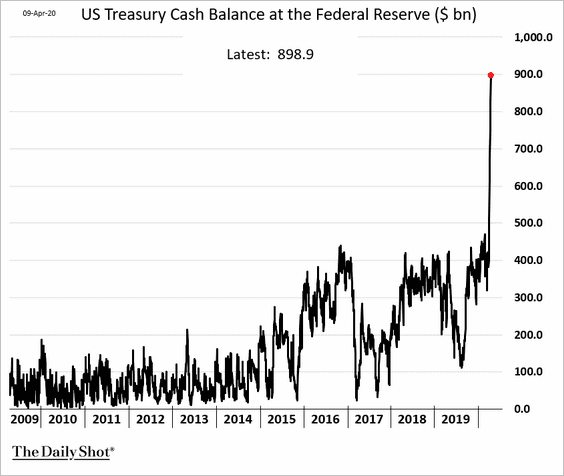

8. The US Treasury’s cash balances are approaching $900 billion.

But payments are starting to flow.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

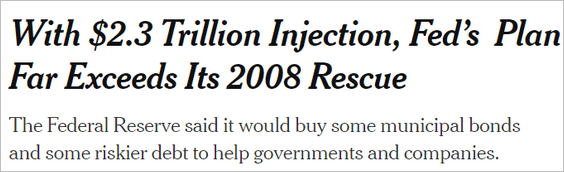

9. The Fed unveiled a massive expansion of its stimulus program.

Source: The New York Times Read full article

Source: The New York Times Read full article

• The central bank will extend its financing to include the following.

– Small and mid-size business loans (Main Street Lending Program, up to $600 billion).

– Municipal debt (Municipal Liquidity Facility, up to $500 billion).

– Corporate debt, including high-yield bonds that were recently downgraded from investment-grade (“fallen angels”).

The program will even include corporate bond ETFs that are “mostly” investment-grade, collateralized loan obligations (CLOs), and commercial mortgage-backed securities (CMBS).

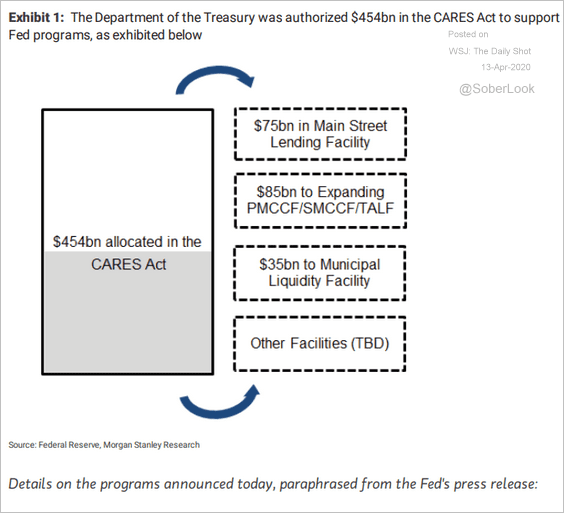

The US Treasury is providing the first-loss (equity) tranche for the Fed’s financing facilities.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

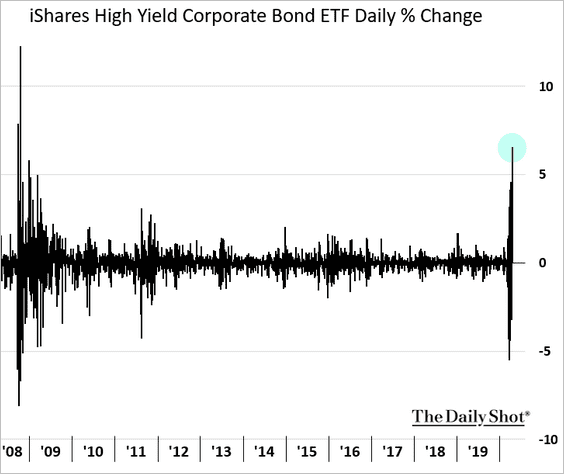

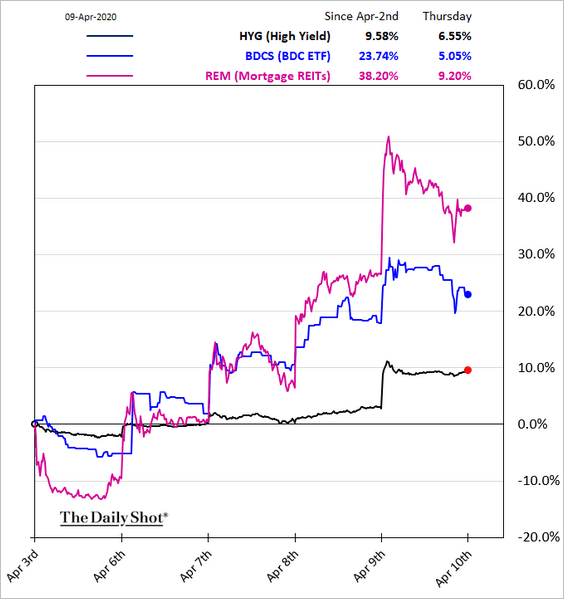

Credit markets rallied sharply last week in response to the Fed’s announcement. The largest high-yield ETF jumped on Thursday – the biggest one-day gain since 2008.

Other assets, such as mortgage REITs and BDCs also had quite a week.

Source: Further reading

Source: Further reading

Canada

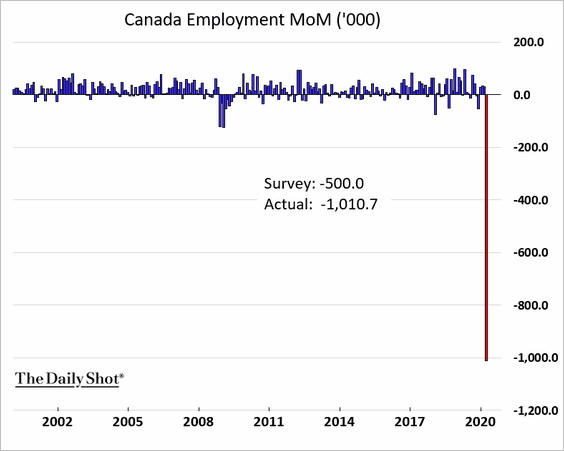

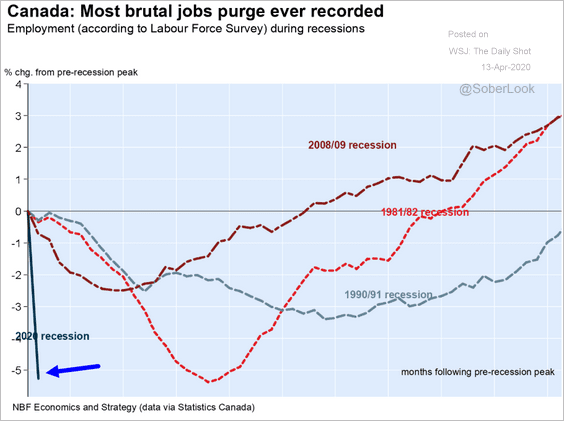

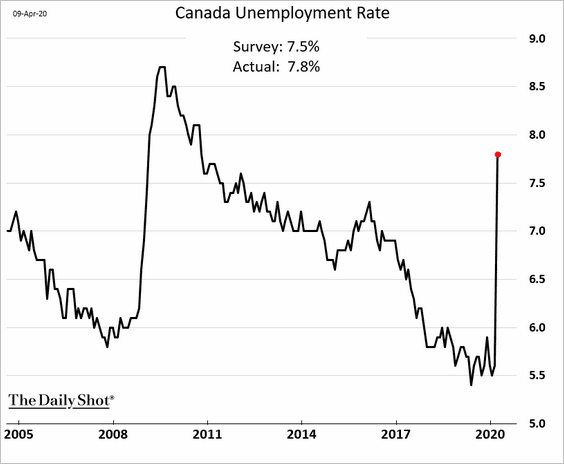

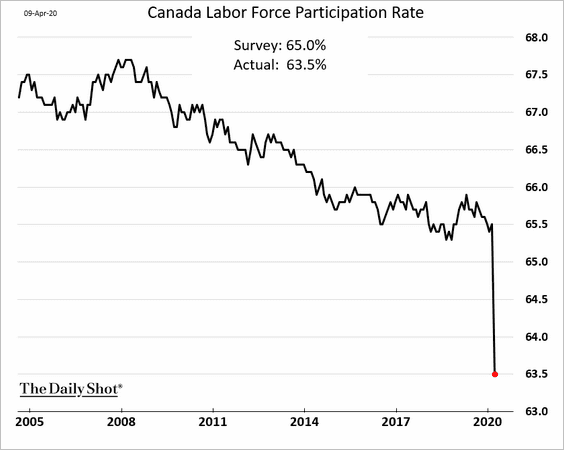

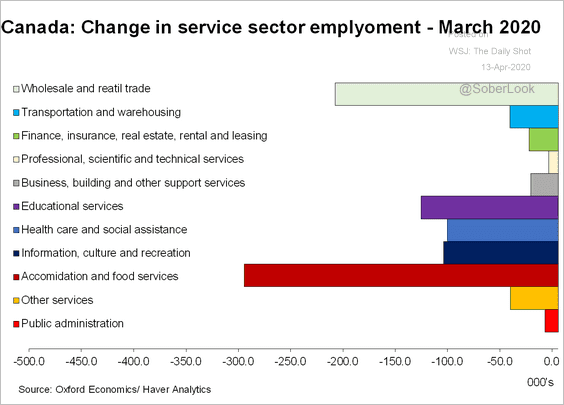

1. The hit to Canada’s labor market has been unprecedented.

Source: Jocelyn Paquet, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Jocelyn Paquet, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

• The unemployment rate rose sharply.

• Labor force participation tumbled.

• Here are the job losses by sector.

Source: Oxford Economics

Source: Oxford Economics

——————–

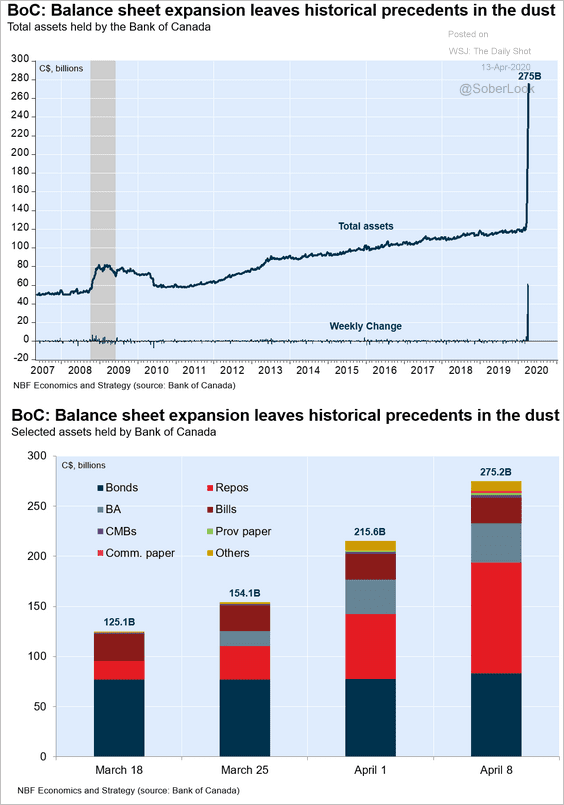

2. The BoC’s balance sheet is expanding rapidly.

Source: Jocelyn Paquet, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Jocelyn Paquet, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

The Eurozone

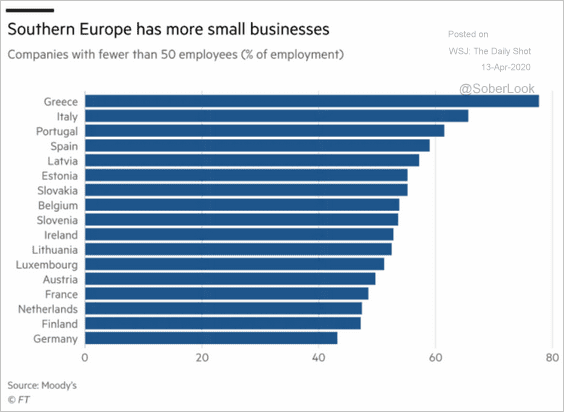

1. The Eurozone’s small businesses are particularly vulnerable to the economic downturn.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

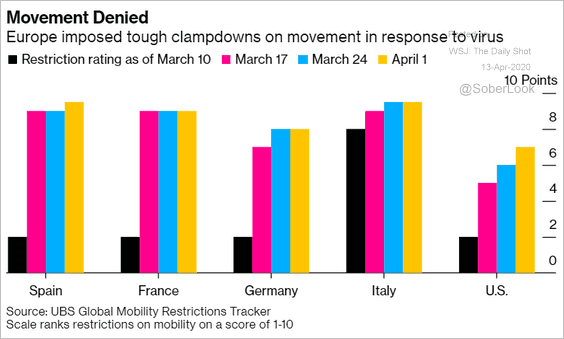

2. Epidemic-related restrictions in the Eurozone have been tighter than in the US.

Source: @business Read full article

Source: @business Read full article

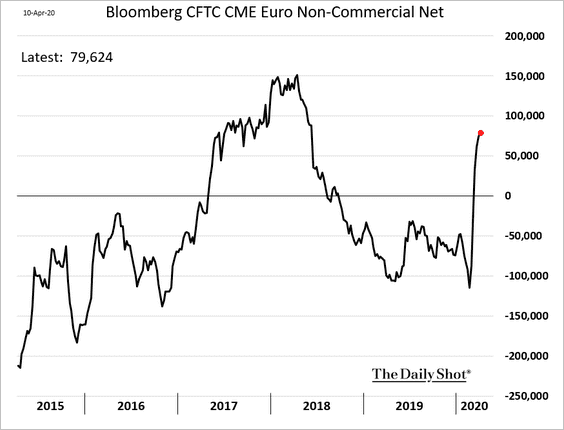

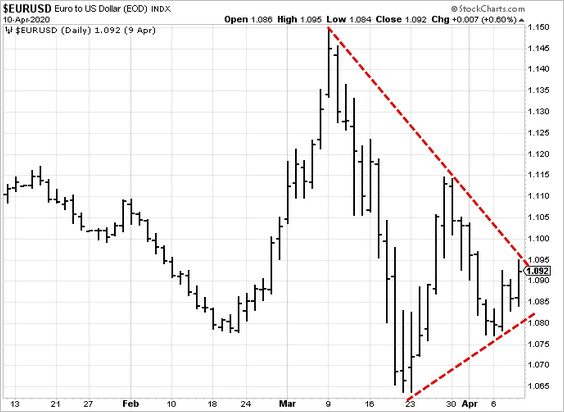

3. Speculative accounts are boosting their bets on the euro.

The euro has been consolidating.

Asia – Pacific

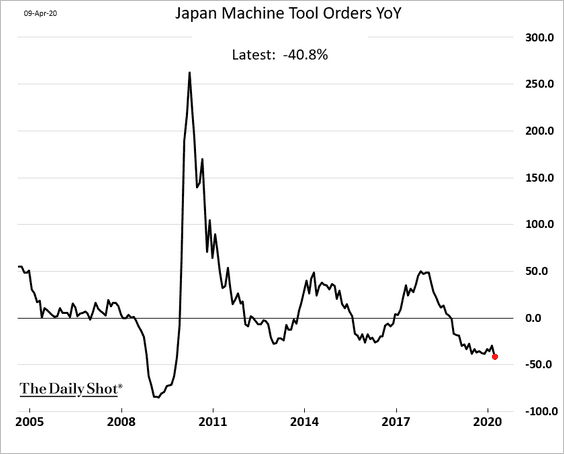

1. Japan’s machine tool orders are down over 40% from a year ago.

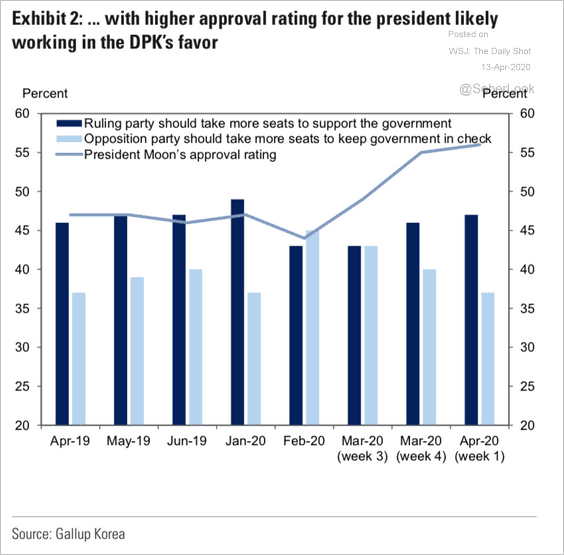

2. President Moon’s approval rating has improved substantially in recent weeks.

Source: Goldman Sachs

Source: Goldman Sachs

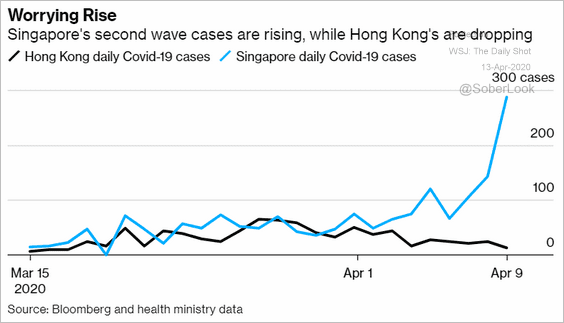

3. Singapore’s coronavirus cases have diverged from Hong Kong.

Source: @business Read full article

Source: @business Read full article

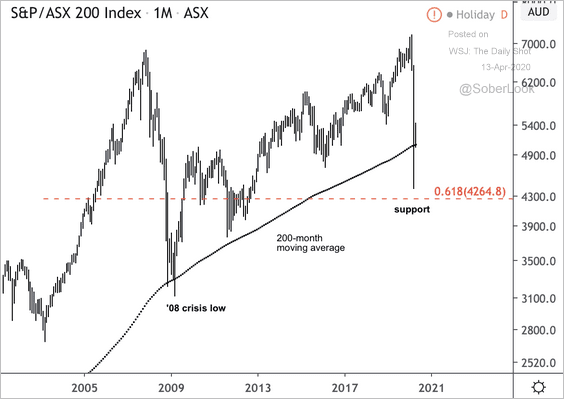

4. Australia’s ASX 200 index is at its 200-month moving average.

Source: @DantesOutlook

Source: @DantesOutlook

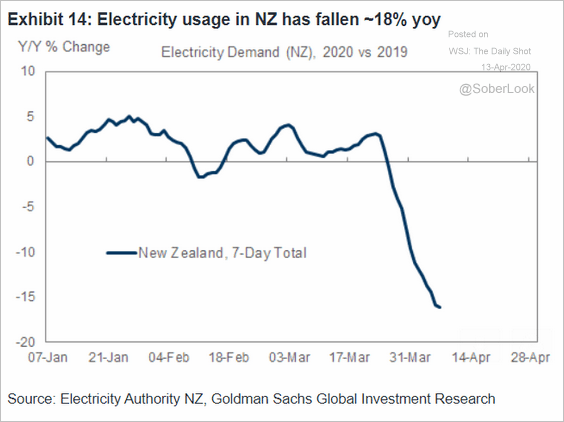

5. Here is New Zealand’s electricity usage.

Source: Goldman Sachs

Source: Goldman Sachs

China

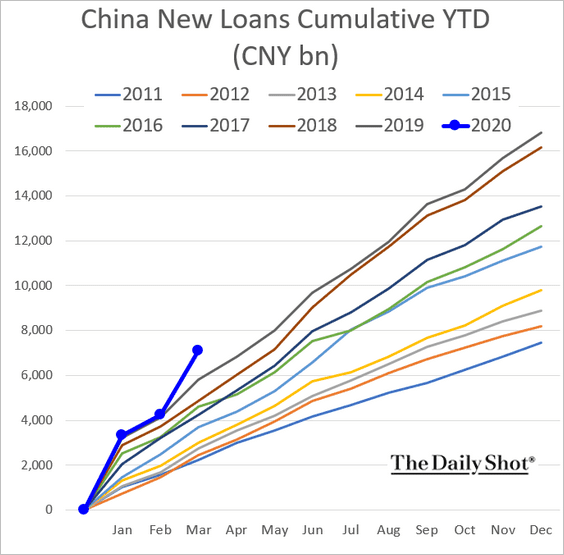

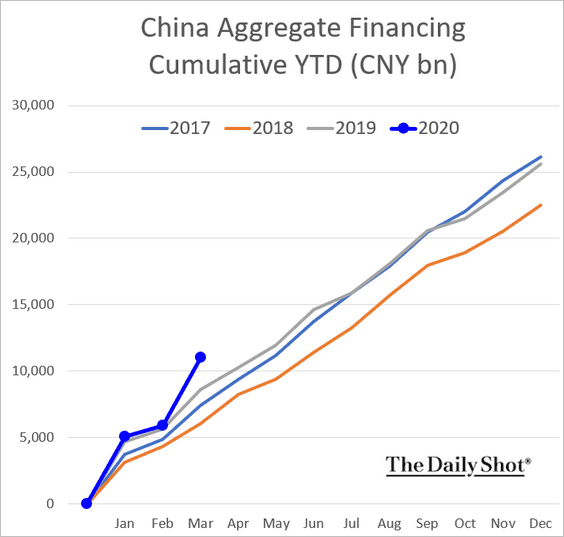

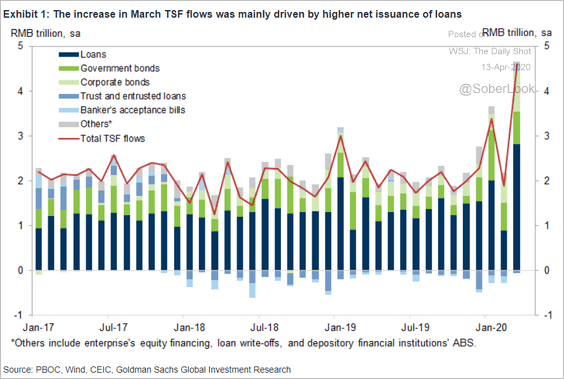

1. Beijing is infusing the economy with credit as loan growth accelerates.

• Bank loans:

• Aggregate financing (includes bond issuance):

Source:

Source:

Source: Goldman Sachs

Source: Goldman Sachs

——————–

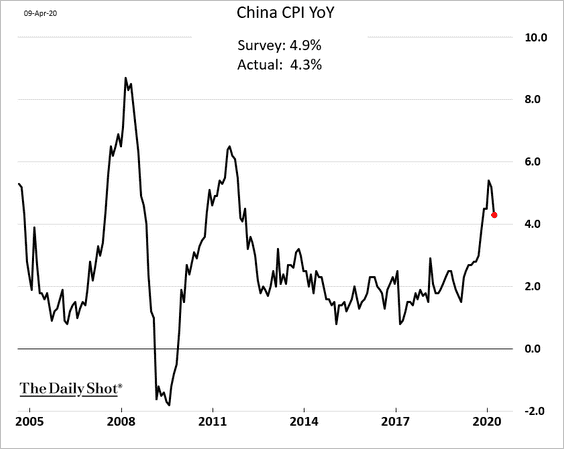

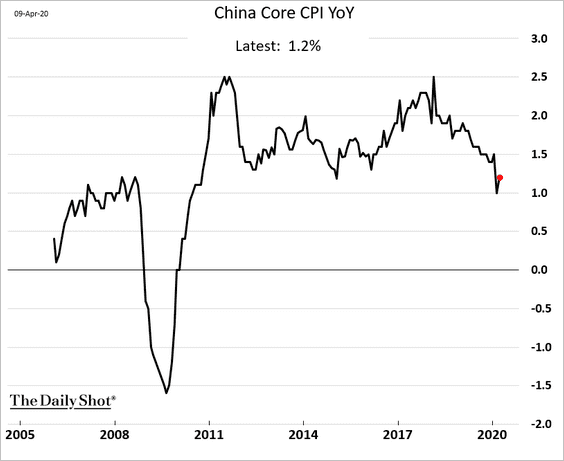

2. The headline CPI moderated last month as meat prices stabilized.

But the core inflation measure ticked higher.

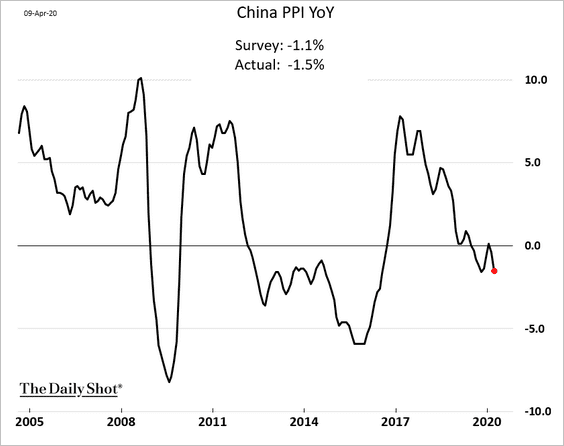

Producer price inflation is back in negative territory.

——————–

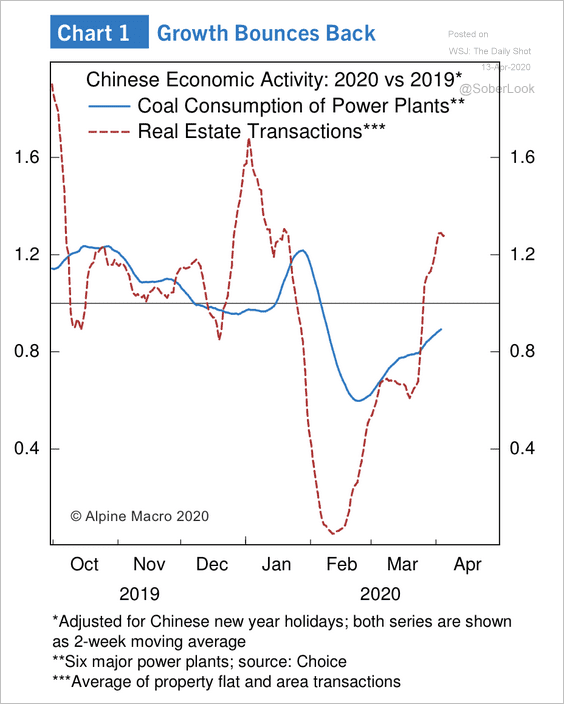

3. Economic activity has been rebounding.

Source: Alpine Macro

Source: Alpine Macro

Emerging Markets

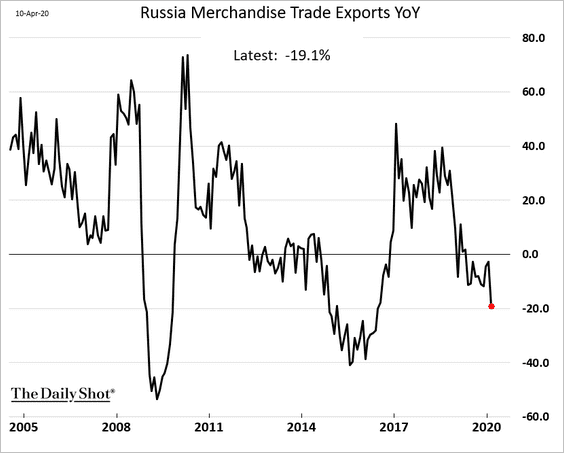

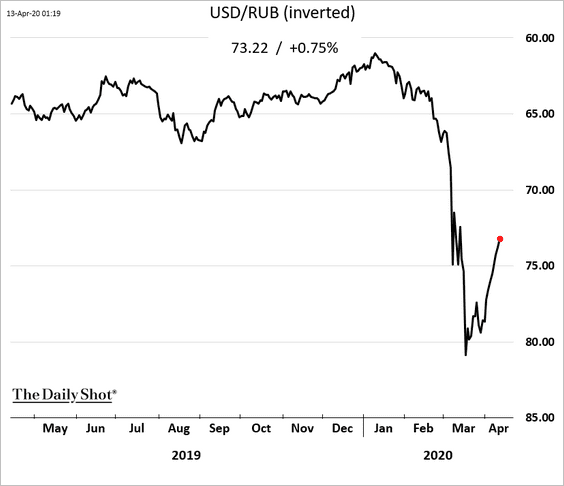

1. Russia’s exports were slowing in February.

Separately, the ruble is rebounding with crude oil.

——————–

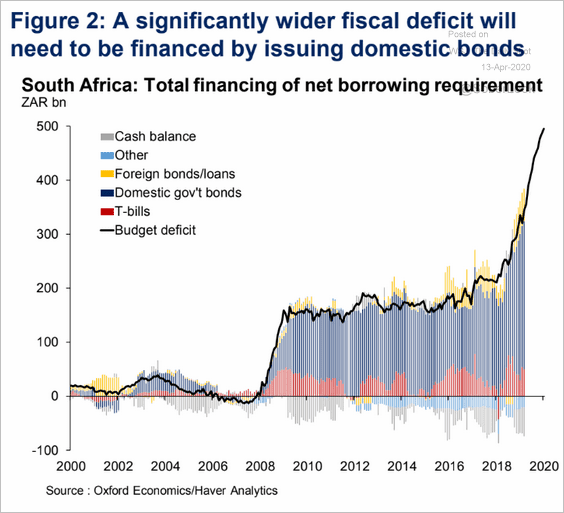

2. South Africa’s budget deficit continues to widen. The government will be forced to issue more domestic debt to finance the gap.

Source: Oxford Economics

Source: Oxford Economics

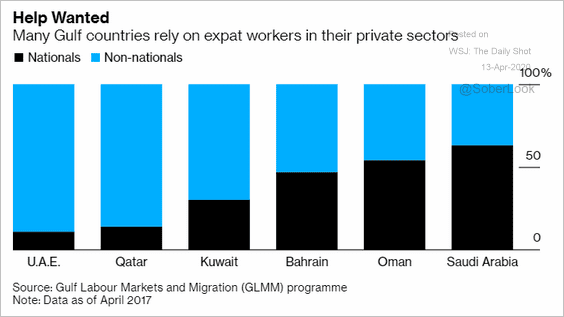

3. Gulf states rely on expat workers.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

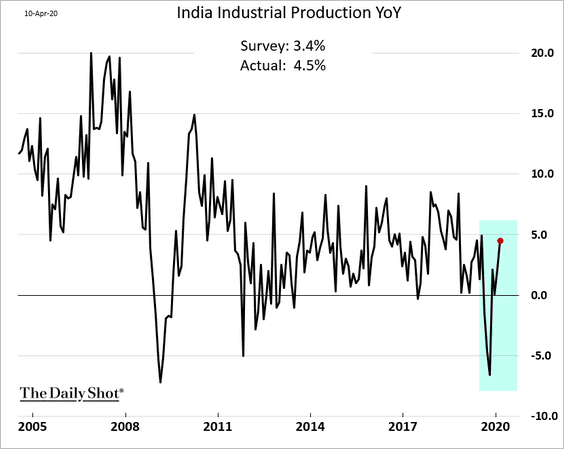

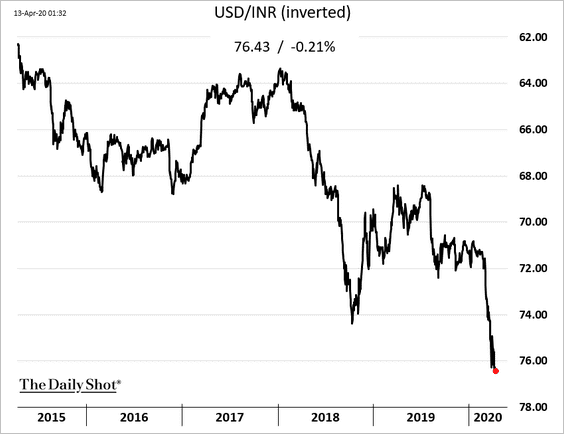

4. India’s industrial production was recovering in February.

The rupee hit another low vs. the dollar.

——————–

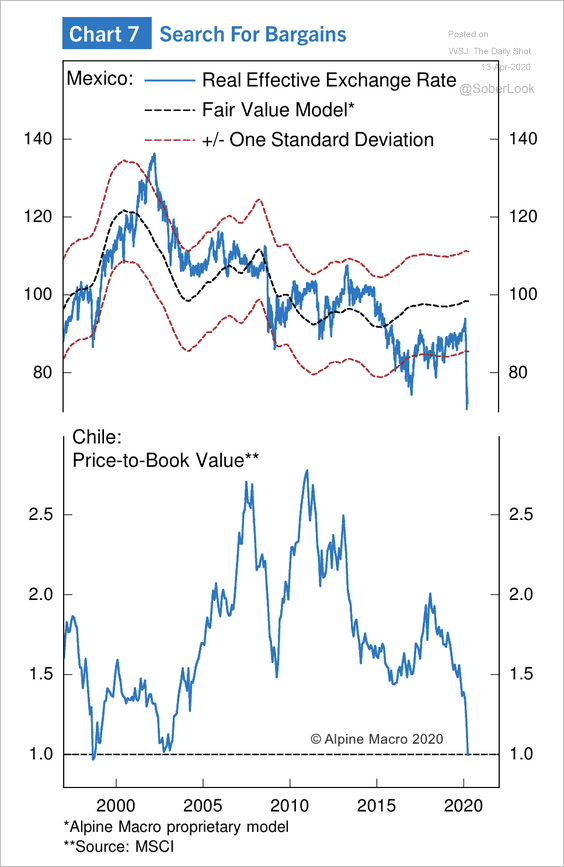

5. Mexico’s and Chile’s equity markets are at depressed valuation levels, according to Alpine Macro.

Source: Alpine Macro

Source: Alpine Macro

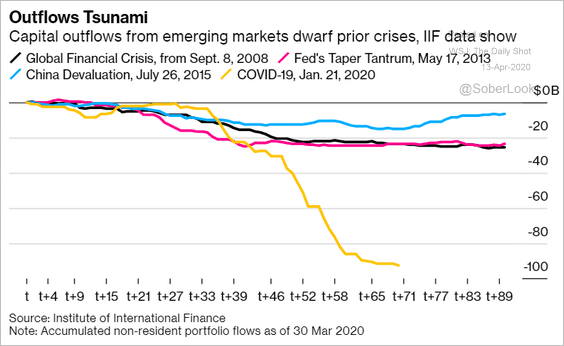

6. Capital outflows have been unprecedented.

Source: @markets Read full article

Source: @markets Read full article

Is there more to come?

Source: BofA Merrill Lynch Global Research

Source: BofA Merrill Lynch Global Research

Commodities

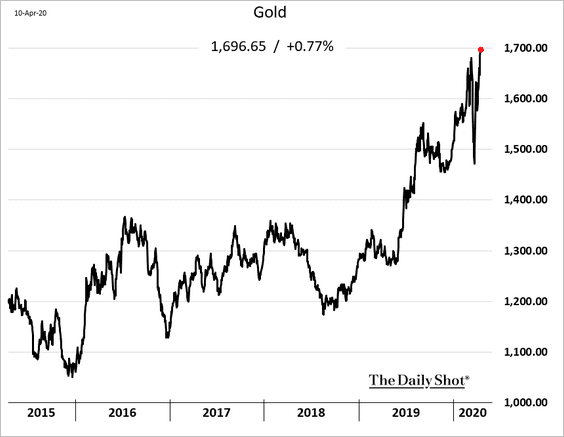

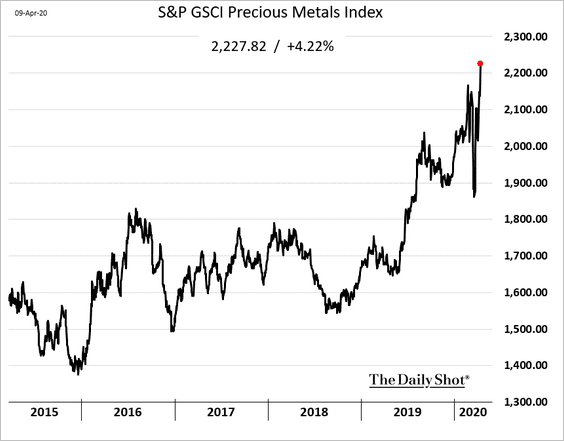

1. It was a good week for precious metals as the Fed unveiled another round of unprecedented stimulus.

——————–

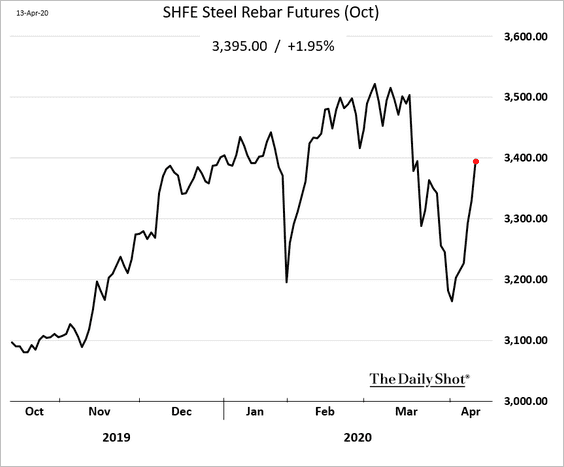

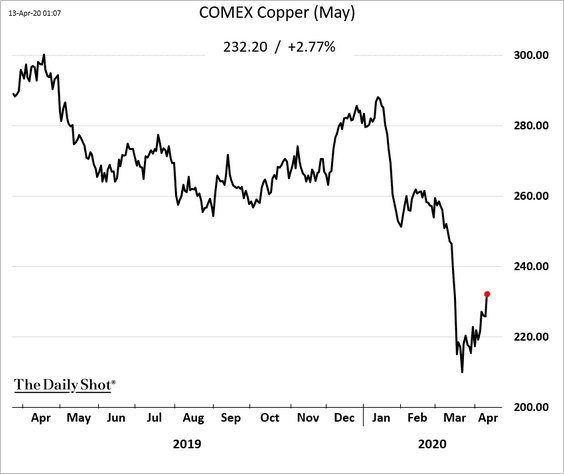

2. Industrial metals are rebounding.

• Steel rebar (Shanghai):

• Copper (New York):

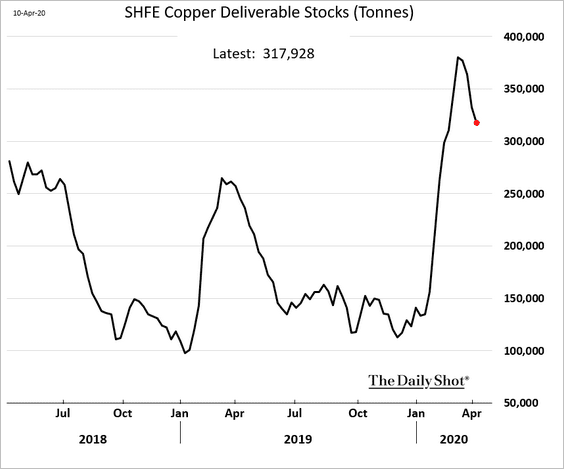

The Shanghai Futures Exchange copper inventories appear to have peaked.

Source: Phoebe Sedgman, @TheTerminal

Source: Phoebe Sedgman, @TheTerminal

Energy

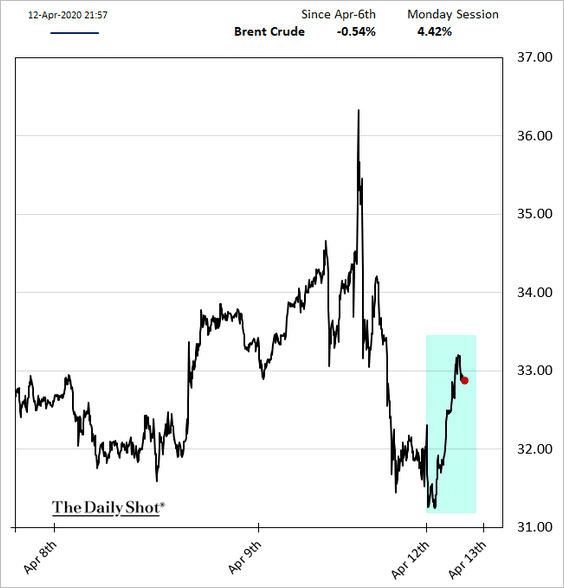

1. Global oil producers reached an agreement to cut output by 9.7 million barrels per day.

Source: @WSJ Read full article

Source: @WSJ Read full article

Brent crude rose.

——————–

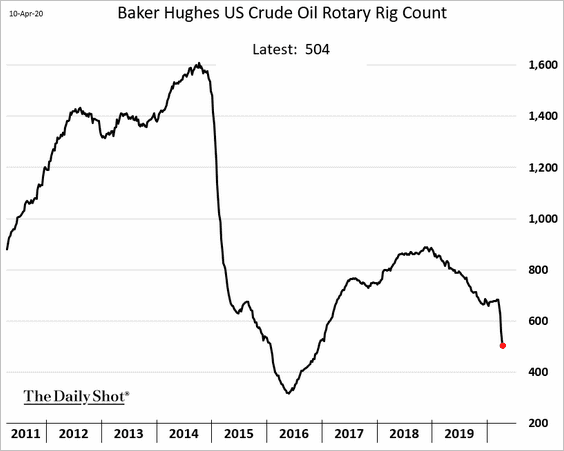

2. The US oil rig count continues to sink.

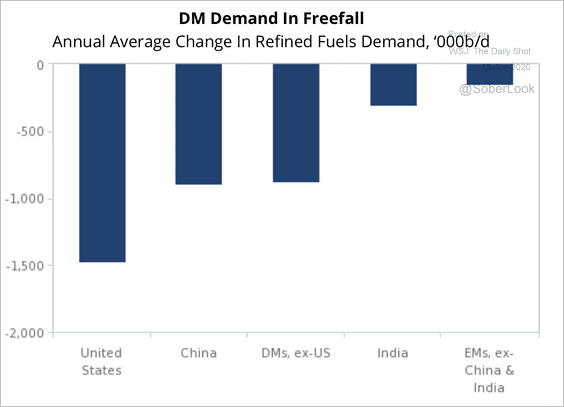

3. Global refined fuels demand is in freefall, according to Fitch.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

4. US natural gas output is expected to decline sharply.

Source: @markets Read full article

Source: @markets Read full article

Equities

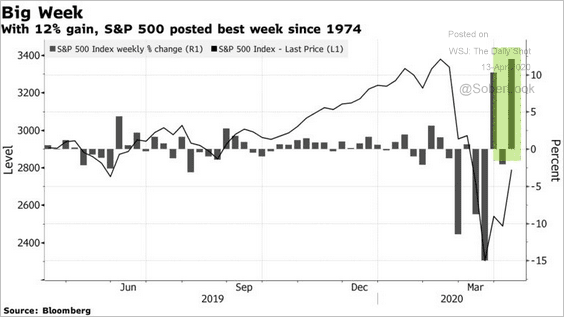

1. The S&P 500 had its best week since 1974.

Source: @markets Read full article

Source: @markets Read full article

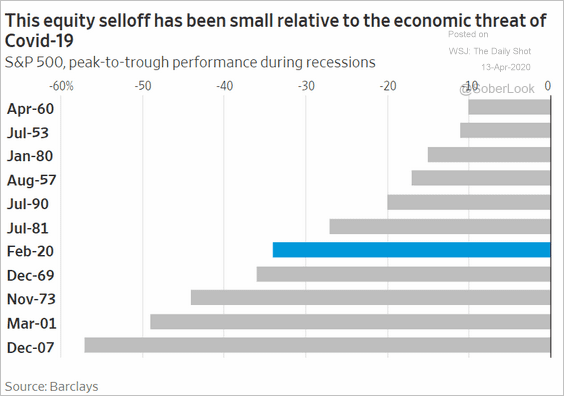

2. Given the expected massive economic contraction, the latest stock market selloff wasn’t extreme.

Source: @WSJ Read full article

Source: @WSJ Read full article

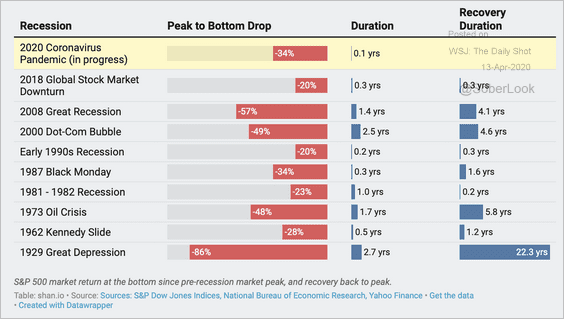

3. It took up to 2.5 years for the stock market to bottom during recent recessions, and almost five years to recover the losses.

Source: @rayshan Read full article

Source: @rayshan Read full article

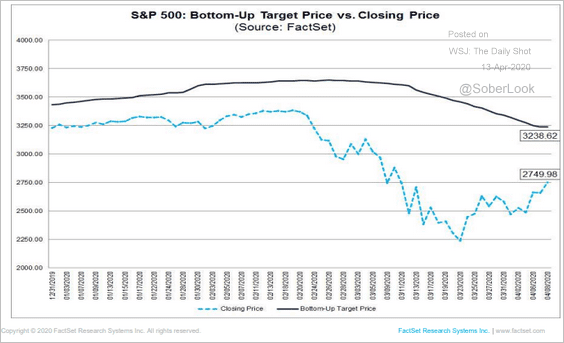

4. While the bottom-up 12-month target price for the S&P 500 has declined, …

Source: FactSet Research Systems

Source: FactSet Research Systems

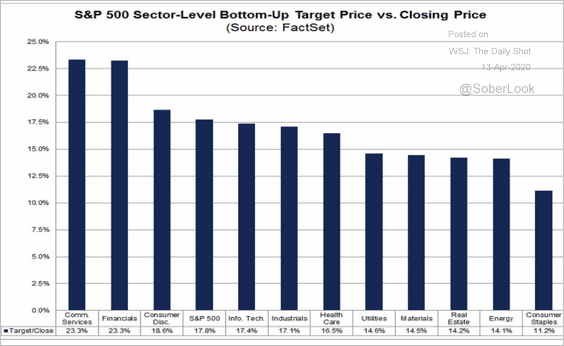

… analysts still expect substantial stock gains ahead. According to FactSet, “industry analysts in aggregate predict the S&P 500 will see an 17.8% increase in price over the next twelve months.”

Source: FactSet Research Systems

Source: FactSet Research Systems

——————–

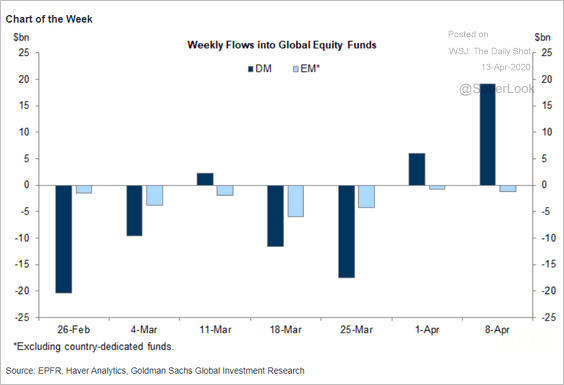

5. Developed-markets equities saw two consecutive weeks of fund inflows.

Source: Goldman Sachs

Source: Goldman Sachs

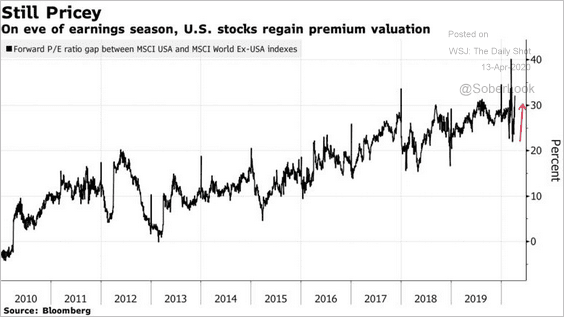

6. The valuation gap between US and non-US shares persists.

Source: @markets Read full article

Source: @markets Read full article

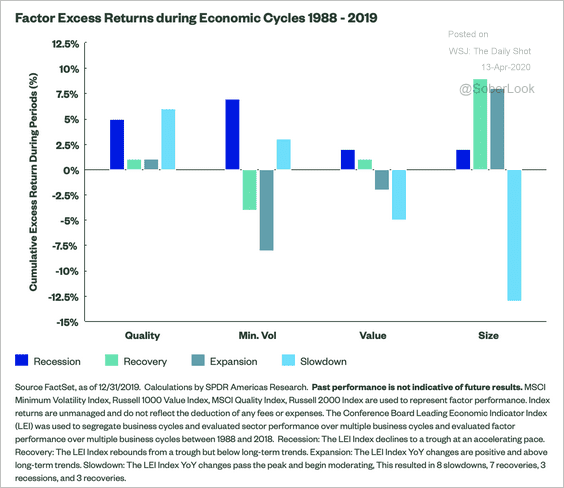

7. Here’s how equity factors performed during past economic cycles.

Source: SPDR Americas Research, @mattbartolini Read full article

Source: SPDR Americas Research, @mattbartolini Read full article

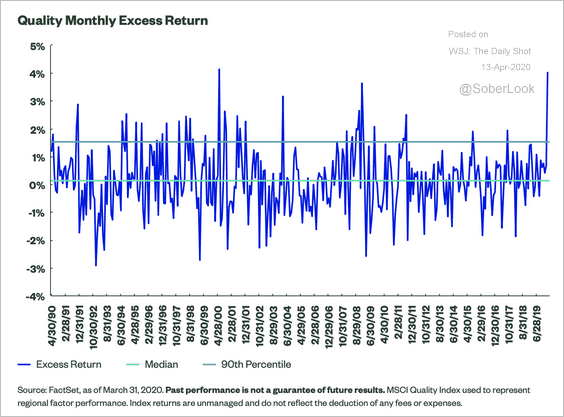

The “quality” factor delivered strong excess returns in the US last month.

Source: SPDR Americas Research, @mattbartolini Read full article

Source: SPDR Americas Research, @mattbartolini Read full article

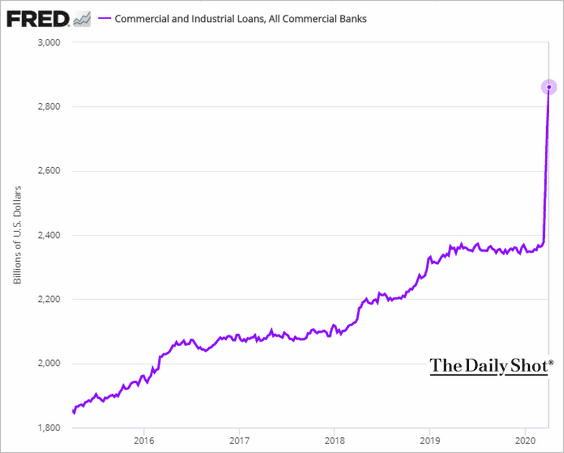

Credit

1. Corporate America has tapped nearly half a trillion of revolving debt.

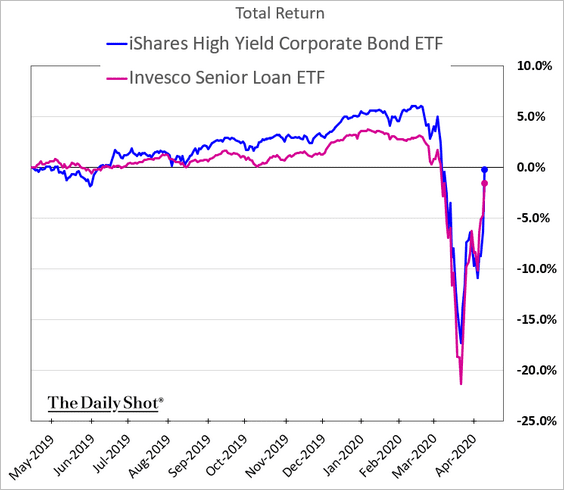

2. High-yield is outperforming leveraged loans again as the Fed moves into corporate bonds.

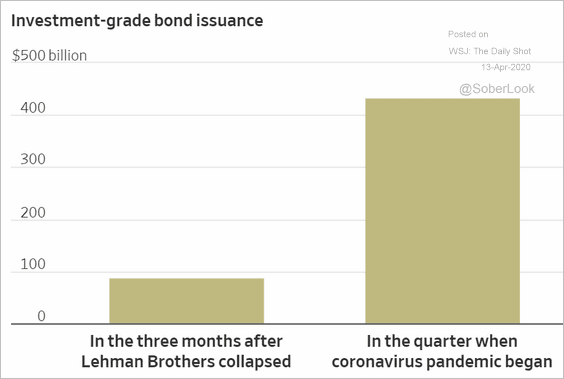

3. In contrast to the post-Lehman environment, investment-grade corporate debt markets have been open for business.

Source: @WSJ Read full article

Source: @WSJ Read full article

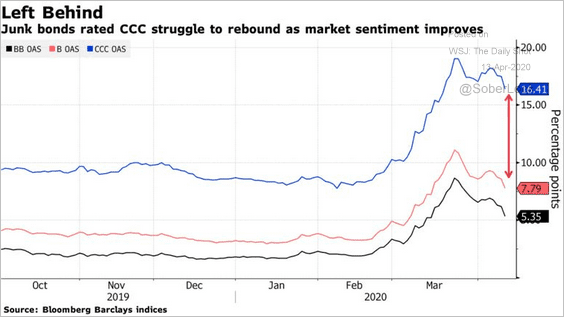

4. CCC spreads have not tightened much, even as better-rated credit rallied.

Source: @markets Read full article

Source: @markets Read full article

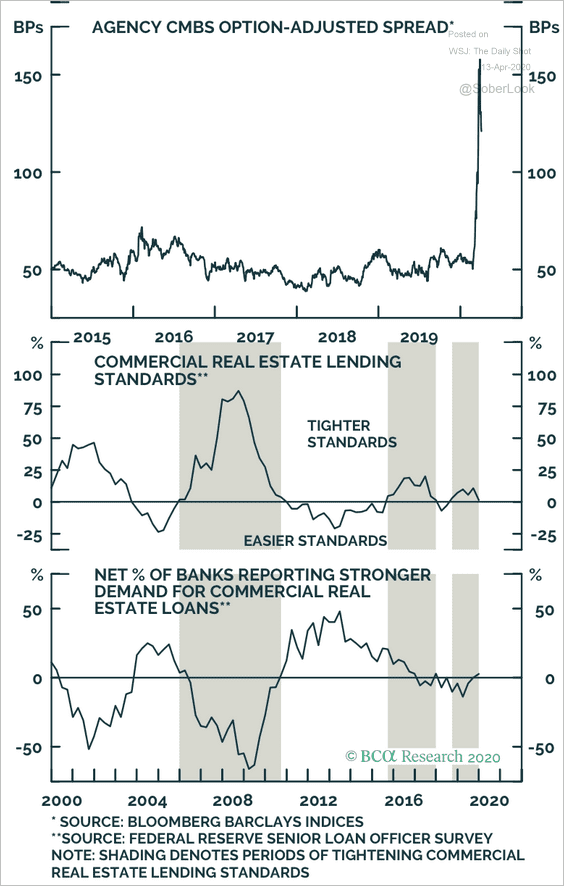

5. The average index spread for agency collateralized mortgage-backed securities (CMBS) widened well above historical levels last month. It’s worth noting that lending conditions and loan demand have been relatively stable over the past few years.

Source: BCA Research

Source: BCA Research

Rates

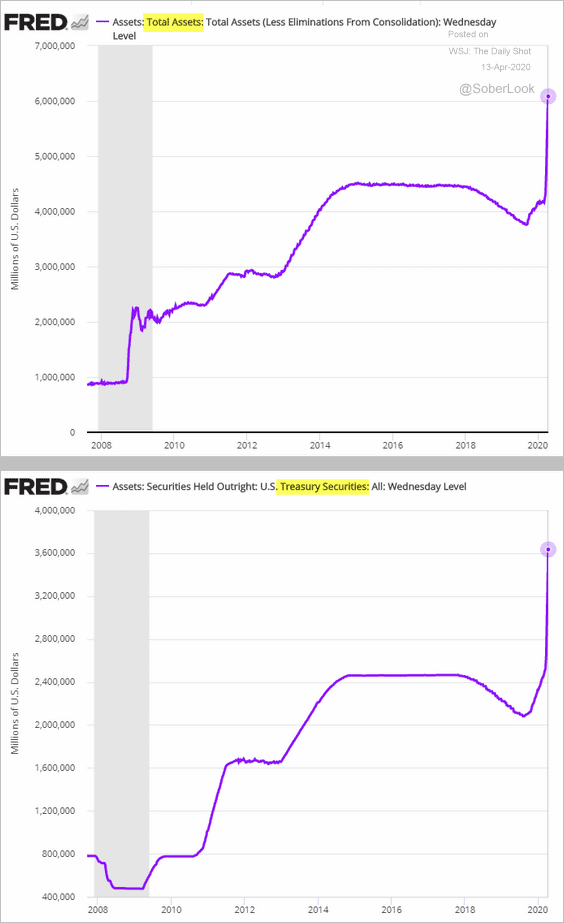

1. Let’s begin with some updates on the Fed.

• Total balance sheet and Treasury securities holdings:

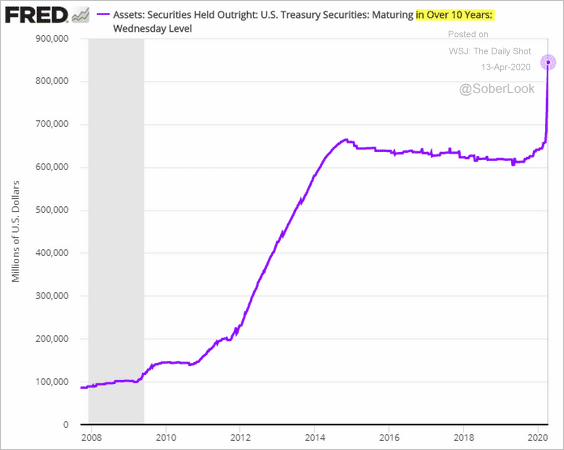

• Longer-dated Treasury debt holdings:

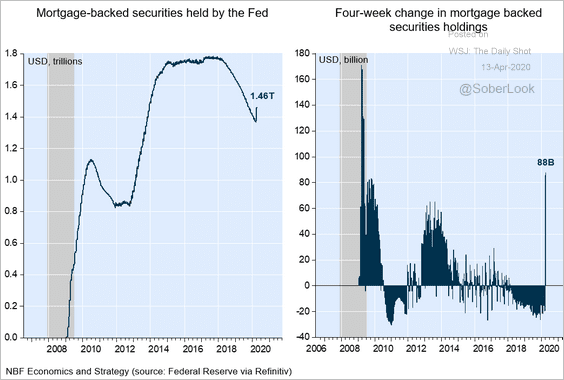

• MBS holdings:

Source: Jocelyn Paquet, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Jocelyn Paquet, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

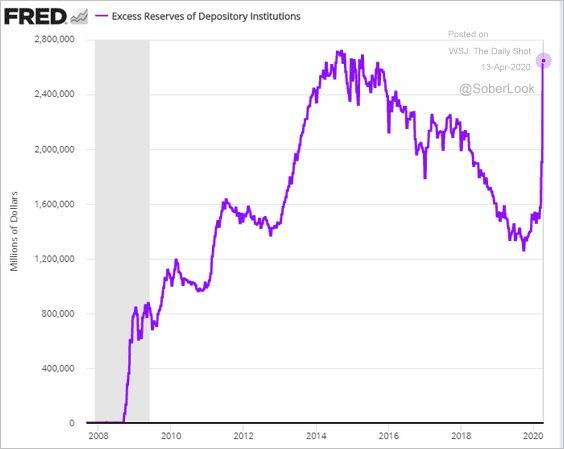

• Excess reserves (held back by the US Treasury’s massive cash balances at the Fed):

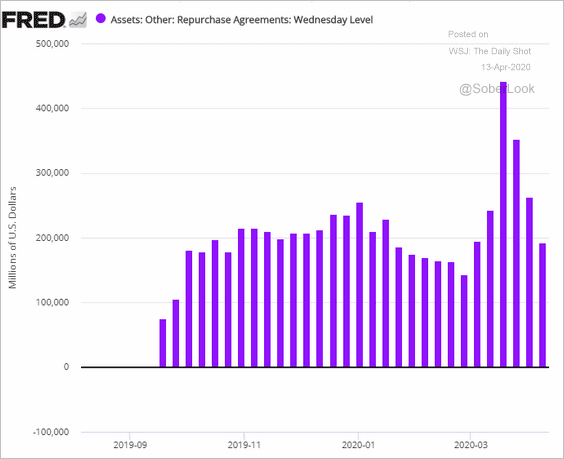

• Repo financing demand (moderating as reserves rise):

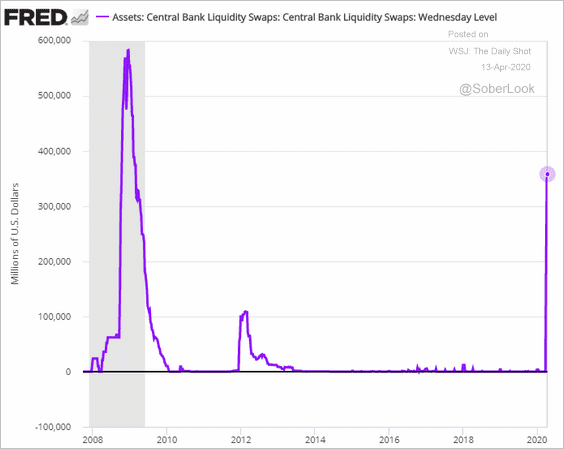

• Dollar swaps with other central banks:

——————–

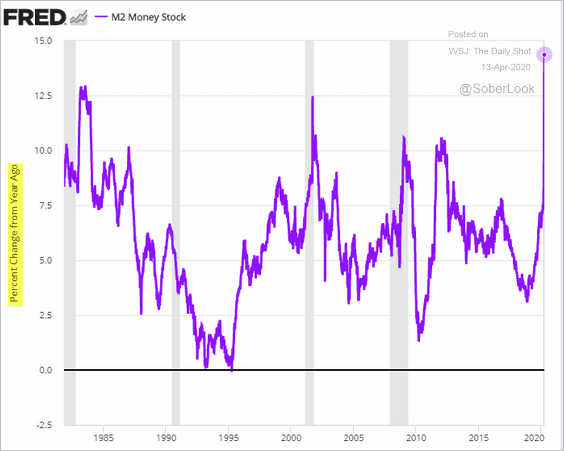

2. The Fed’s rapid balance sheet expansion is boosting the money supply (see illustration in #3 here).

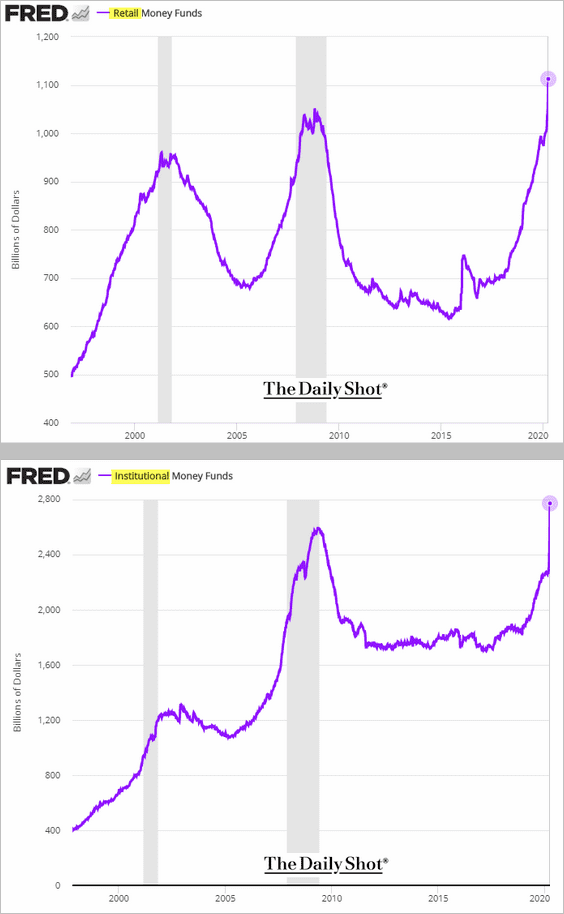

3. Money market fund balances hit a new record.

——————–

Food for Thought

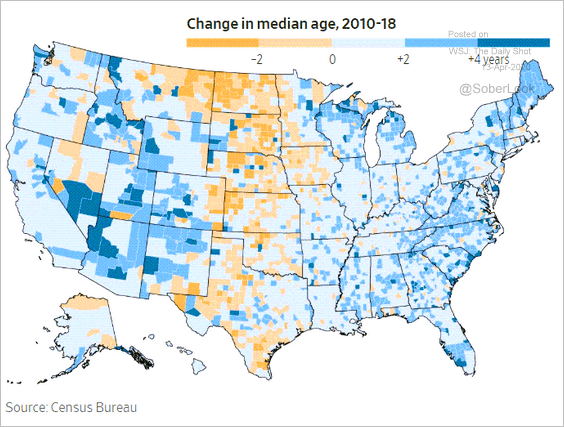

1. Change in median age by county:

Source: @WSJ Read full article

Source: @WSJ Read full article

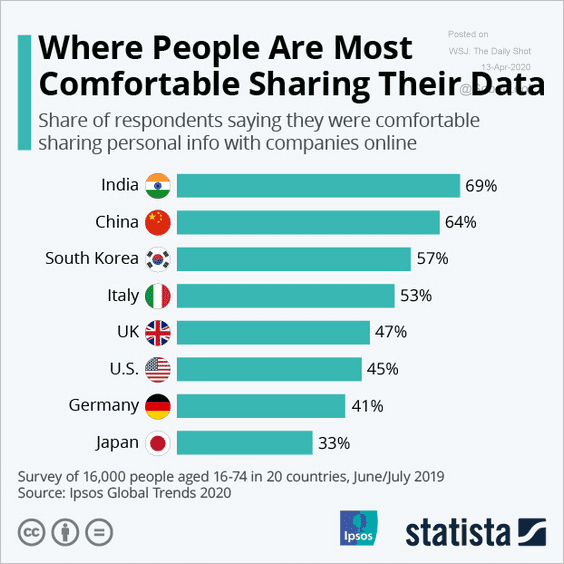

2. Who is comfortable sharing personal data?

Source: Statista

Source: Statista

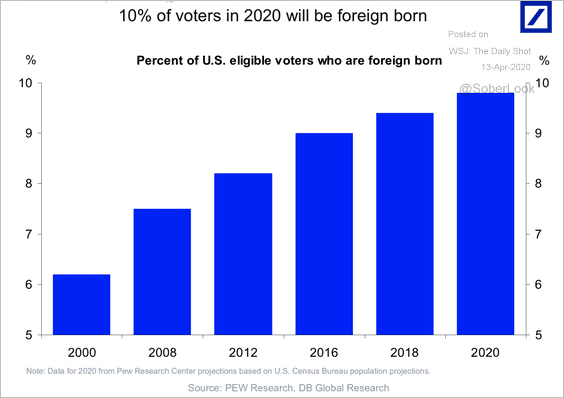

3. Foreign-born voters in the US:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

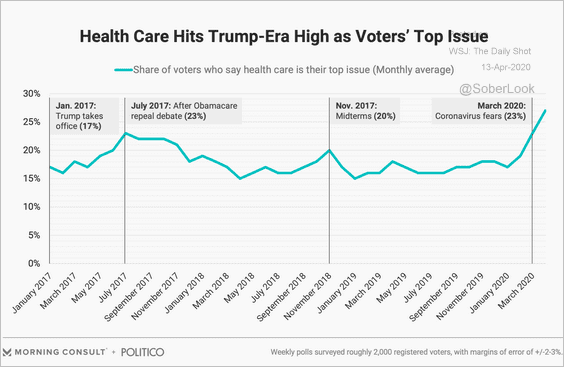

4. Healthcare as the top issue:

Source: @eyokley Read full article

Source: @eyokley Read full article

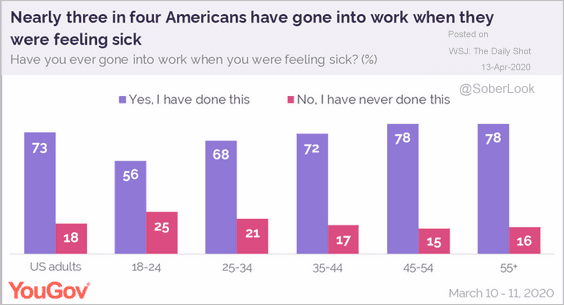

5. Going to work while feeling sick:

Source: @YouGovUS Read full article

Source: @YouGovUS Read full article

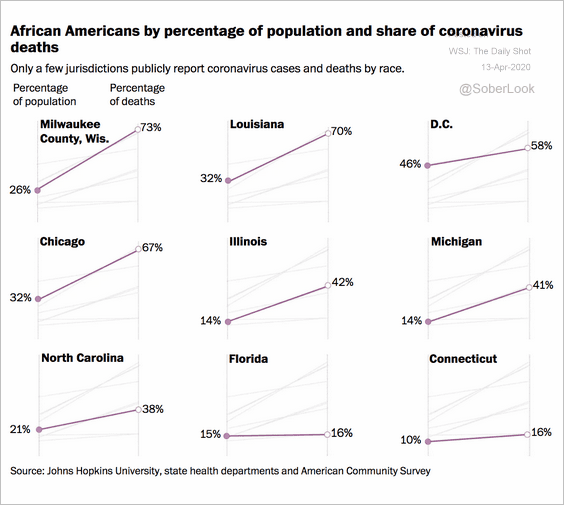

6. Coronavirus-related deaths among African Americans:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

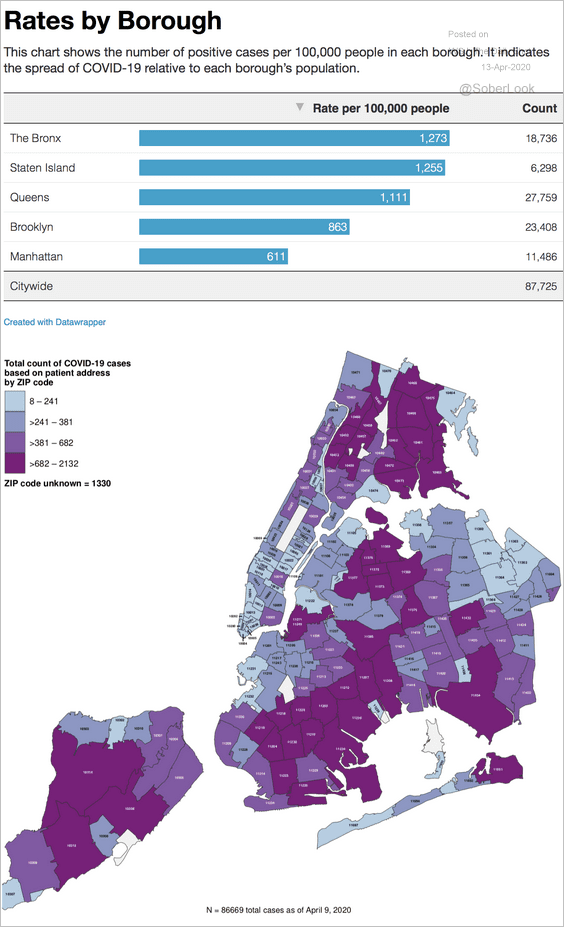

7. Coronavirus stats for New York City:

Source: City of New York. Read full article

Source: City of New York. Read full article

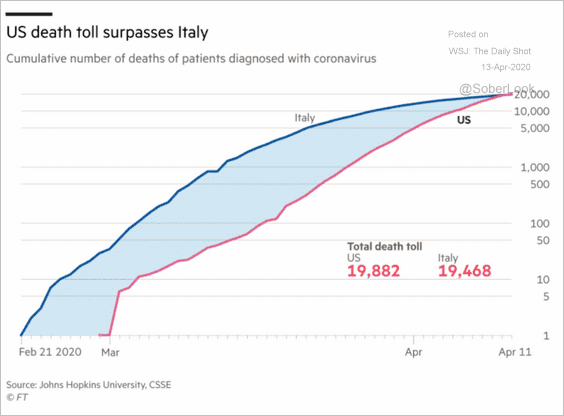

8. Deaths in the US vs. Italy:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

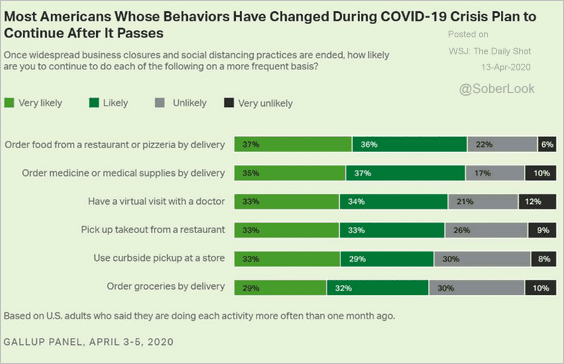

9. Continuing with changed behaviors:

Source: Gallup Read full article

Source: Gallup Read full article

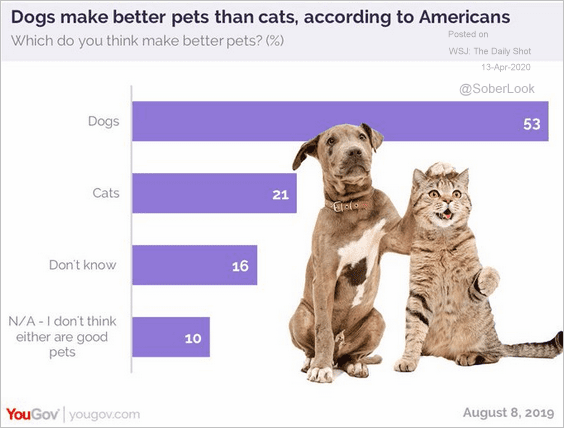

10. Dogs vs. cats:

Source: @YouGovUS Read full article

Source: @YouGovUS Read full article

——————–