The Daily Shot: 15-Apr-20

• The United States

• Canada

• Europe

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

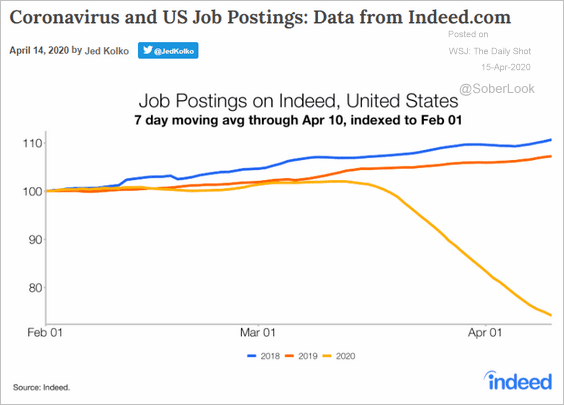

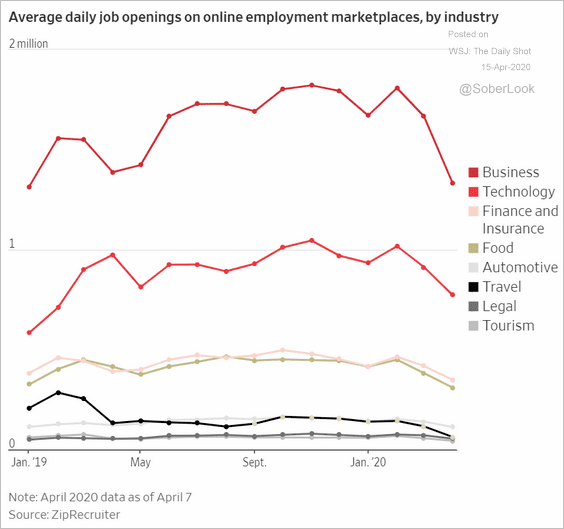

1. Let’s begin with some updates on the labor market.

• Online job openings have been dwindling (2 charts).

Source: @JedKolko, @indeed Read full article

Source: @JedKolko, @indeed Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

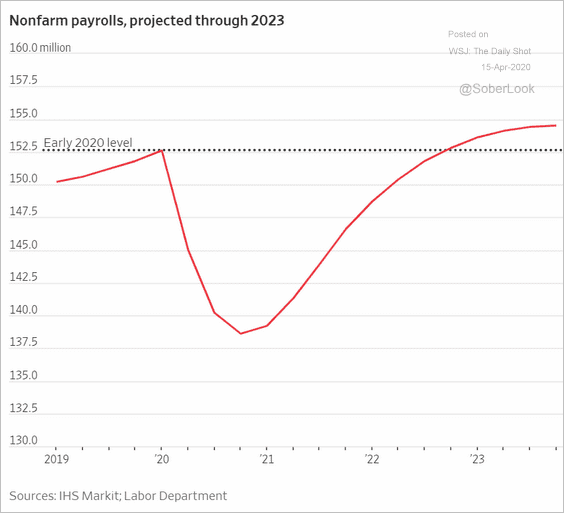

• Analysts anticipate net job losses to continue through the third quarter, reaching unprecedented levels.

Source: @WSJ Read full article

Source: @WSJ Read full article

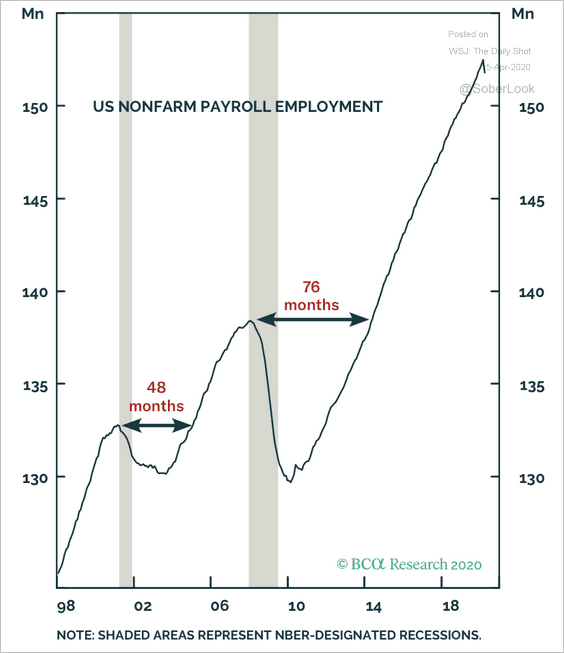

• Historically, it has taken some time for employment to return to pre-recession levels.

Source: BCA Research

Source: BCA Research

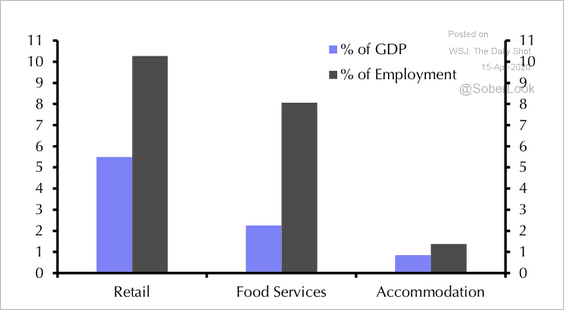

• Service sectors hit the hardest by the current crisis have an outsize percentage of total employment.

Source: Capital Economics

Source: Capital Economics

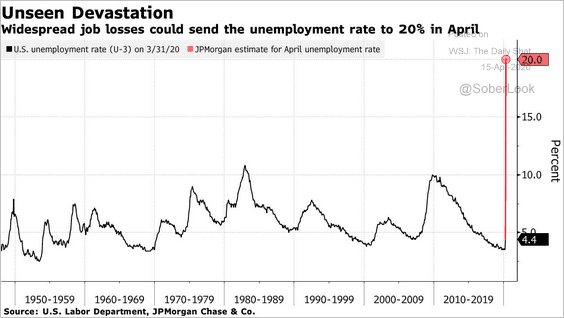

• JP Morgan expects the unemployment rate to reach 20%.

Source: @markets Read full article

Source: @markets Read full article

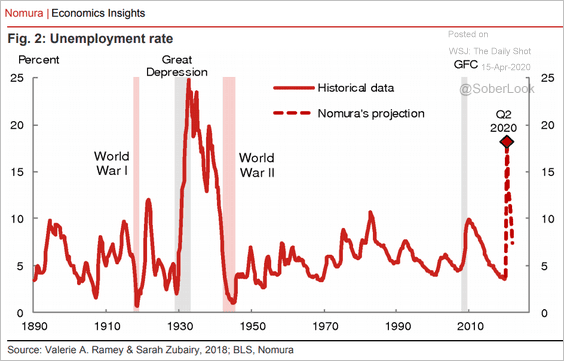

– Nomura’s forecast is similar.

Source: Nomura Securities

Source: Nomura Securities

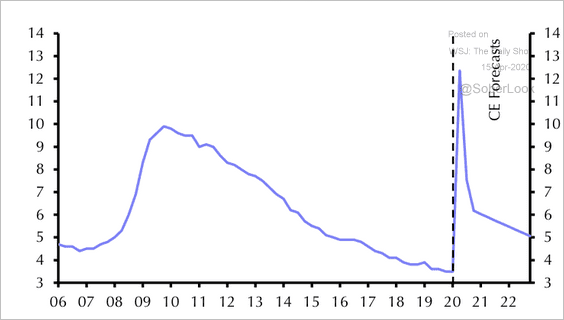

– And here is an estimate from Capital Economics.

Source: Capital Economics

Source: Capital Economics

——————–

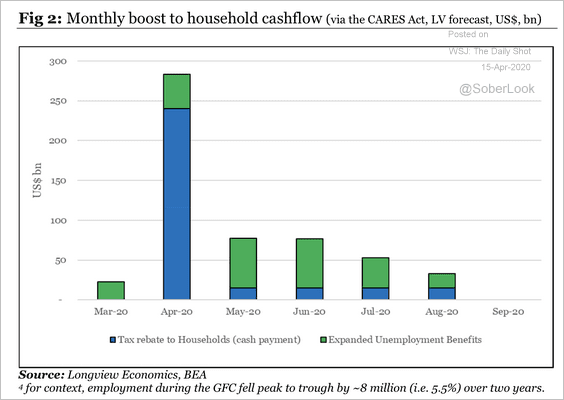

2. This chart projects the US Treasury’s cash flow to households.

Source: Longview Economics

Source: Longview Economics

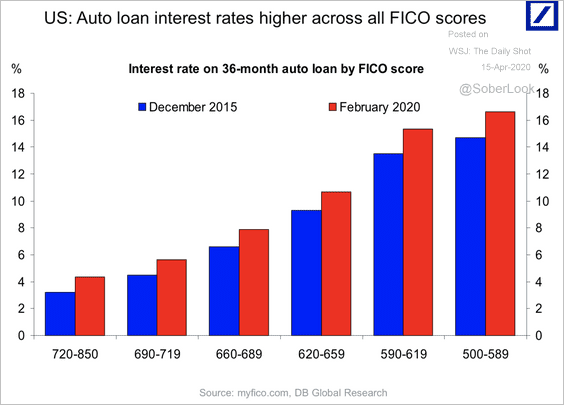

3. Many households will not be able to manage their high-interest auto loans.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

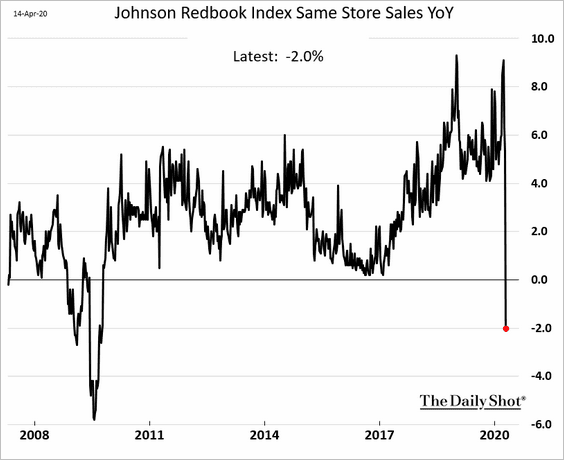

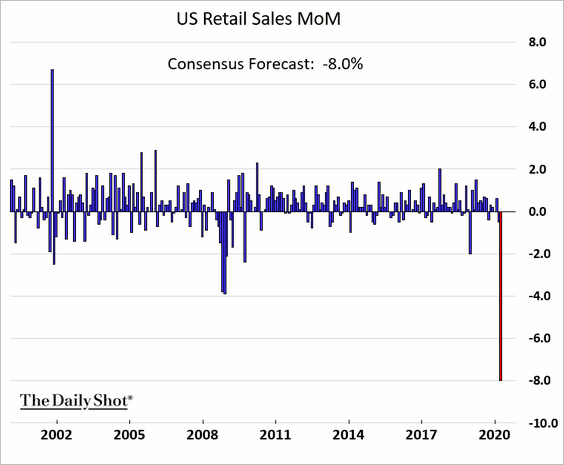

4. Various indicators point to a record decline in retail sales last month (the report is out today at 8:30 AM EST). Here is the Johnson Redbook Same-Store Sales Index.

The median estimate is an 8% monthly drop, according to Bloomberg.

——————–

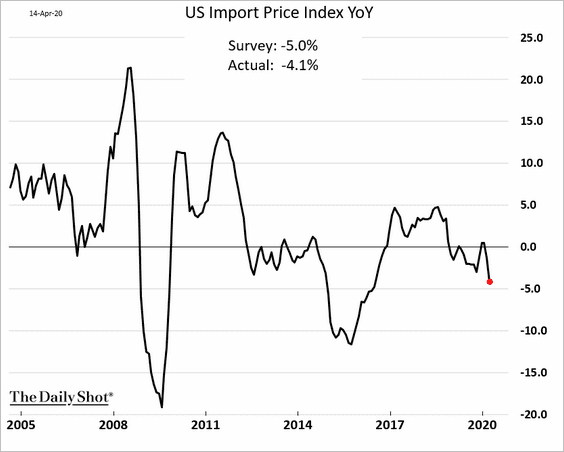

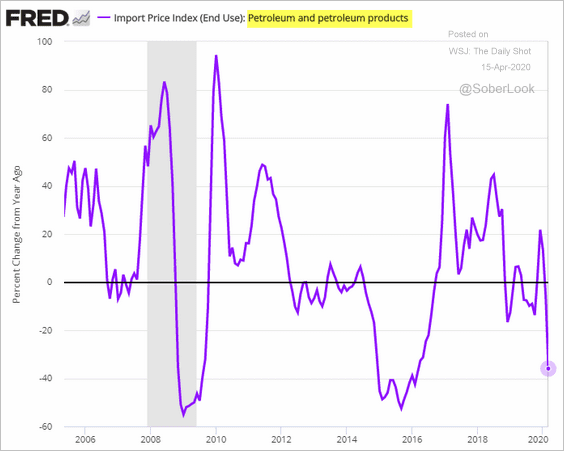

5. Import prices have been declining, driven by cheaper fuel imports.

——————–

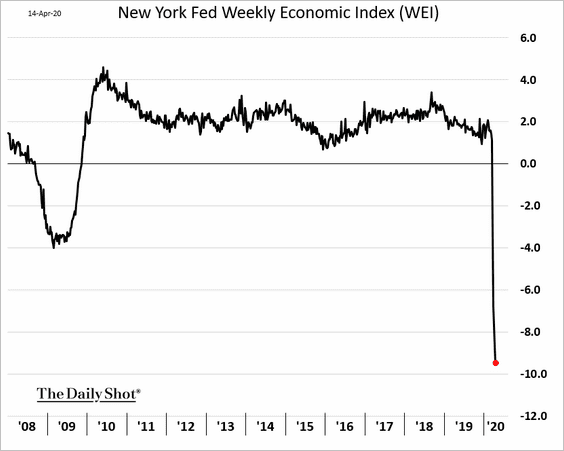

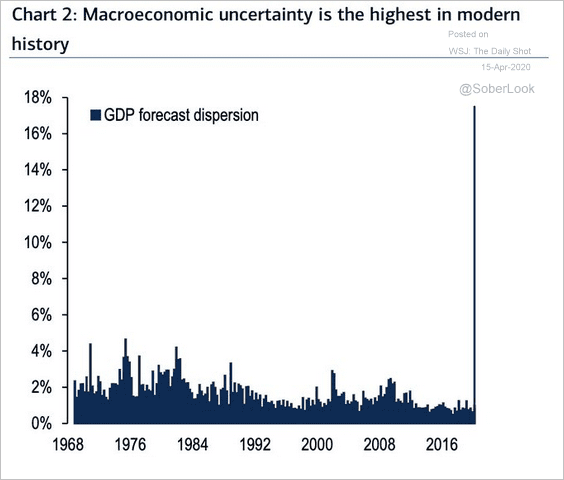

6. High-frequency measures signal an extreme quarterly contraction in the GDP. Below is the NY Fed’s weekly activity tracker.

However, there is little consensus on the magnitude of the drop, amid unprecedented economic uncertainty. The dispersion in economists’ GDP forecasts is at record levels.

Source: BofA Merrill Lynch Global Research, @RobinWigg

Source: BofA Merrill Lynch Global Research, @RobinWigg

——————–

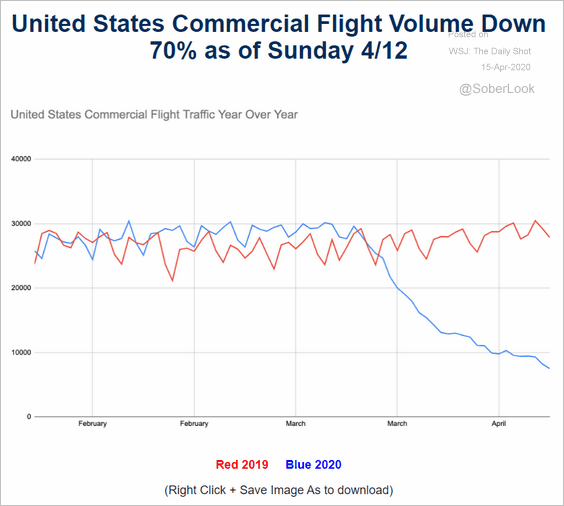

7. The airline industry is in deep trouble.

Source: FlightAware

Source: FlightAware

The federal government agreed to provide substantial financial support.

Source: The New York Times Read full article

Source: The New York Times Read full article

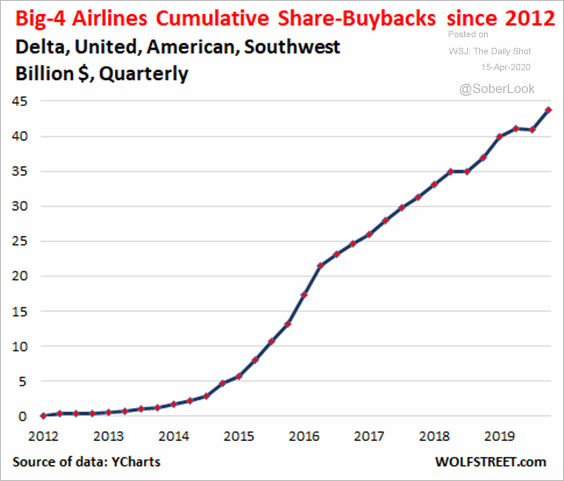

Some have expressed concerns about moral hazard, given the industry’s share repurchase activity in recent years (see story from a few weeks ago).

Source: @wolfofwolfst

Source: @wolfofwolfst

Canada

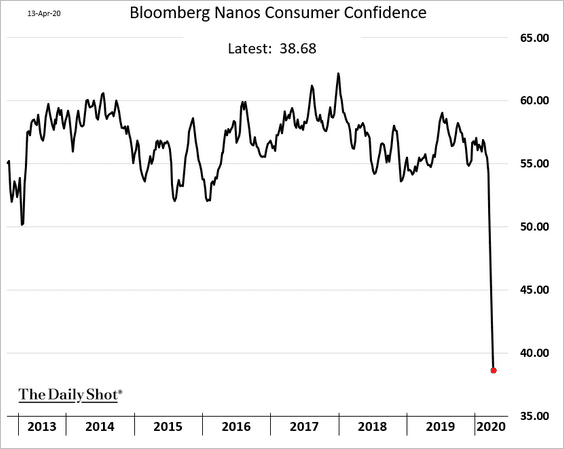

1. Consumer confidence continues to deteriorate.

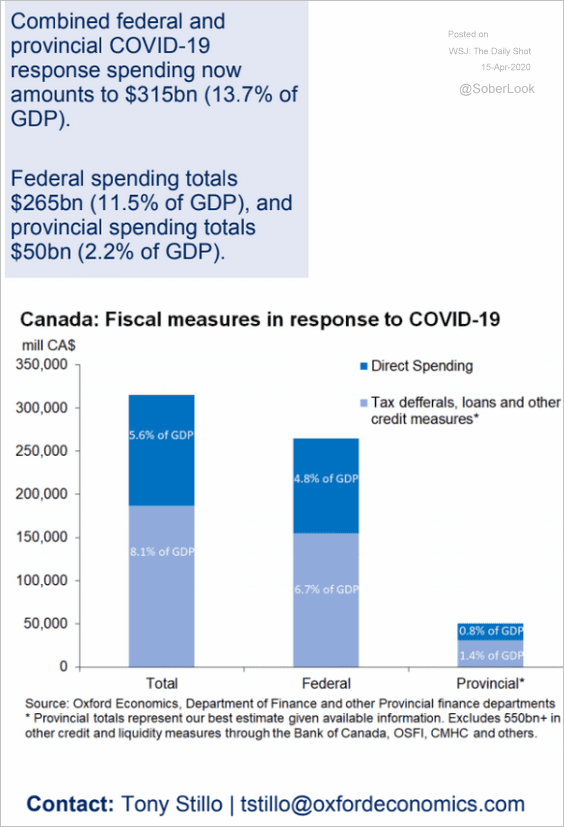

2. Here is a summary of fiscal measures to cushion the economic contraction.

Source: Oxford Economics

Source: Oxford Economics

Europe

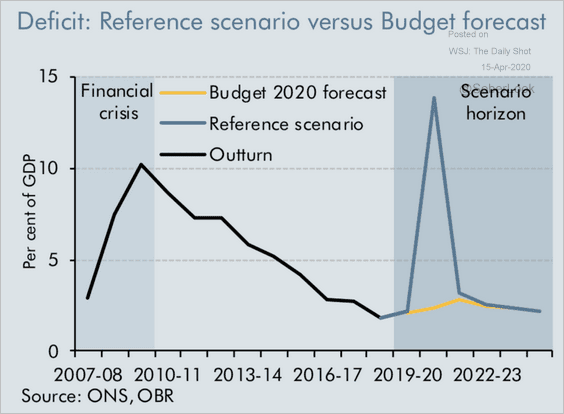

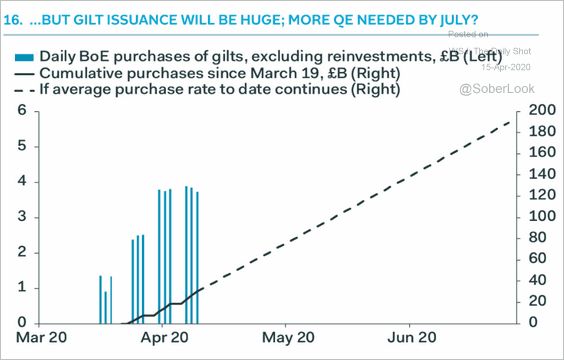

1. UK government spending and gilt issuance will spike in the months to come.

Source: OBR Read full article

Source: OBR Read full article

Will the BoE boost its QE program to absorb all the new debt?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

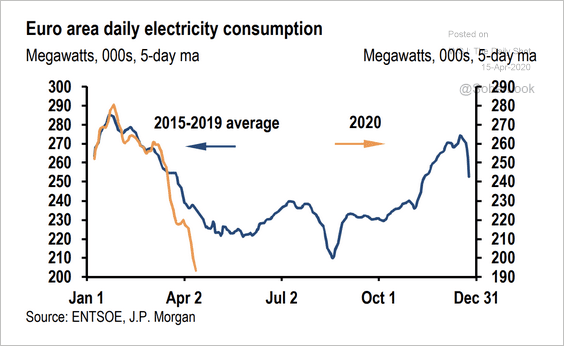

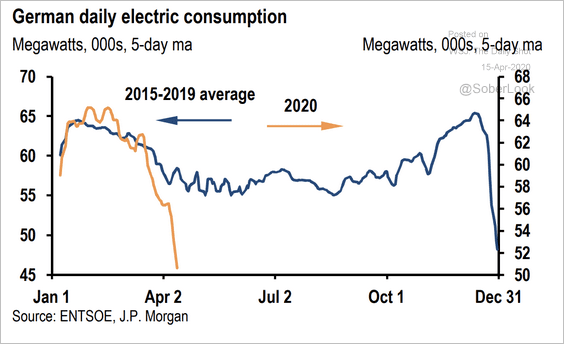

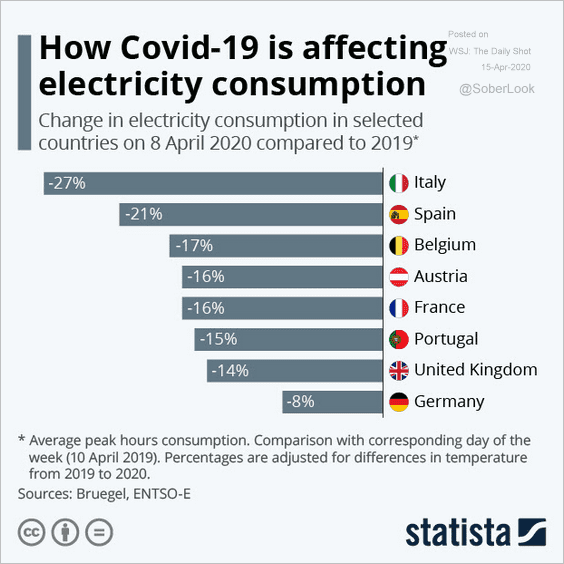

2. Electricity usage in the Eurozone has been plummetting.

Source: JP Morgan

Source: JP Morgan

Source: JP Morgan

Source: JP Morgan

Source: Statista

Source: Statista

——————–

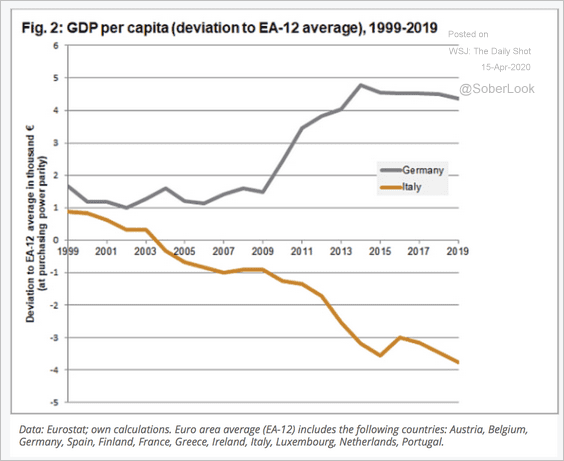

3. This chart shows the GDP-per-capita trajectories for Germany and Italy over the past couple of decades.

Source: The Vienna Institute for International Economic Studies Read full article

Source: The Vienna Institute for International Economic Studies Read full article

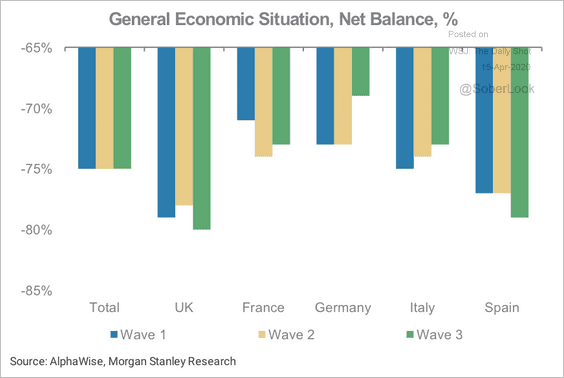

4. A substantial majority of European consumers think the economy will worsen over the next six months (“waves” correspond to the phases of the pandemic from January to March).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

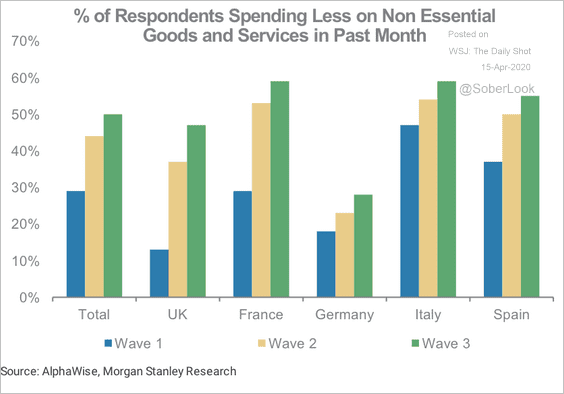

Respondents are also increasingly cutting non-essential spending.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

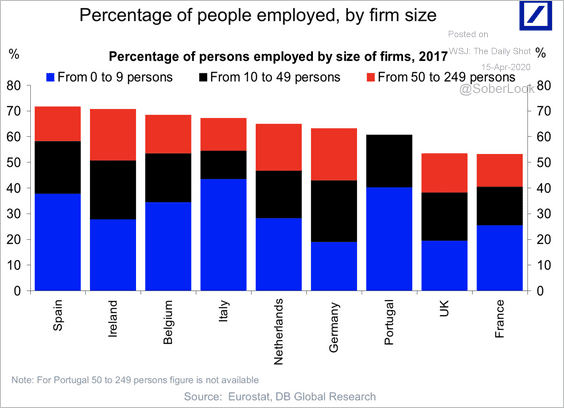

5. This chart shows employment by firm size.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

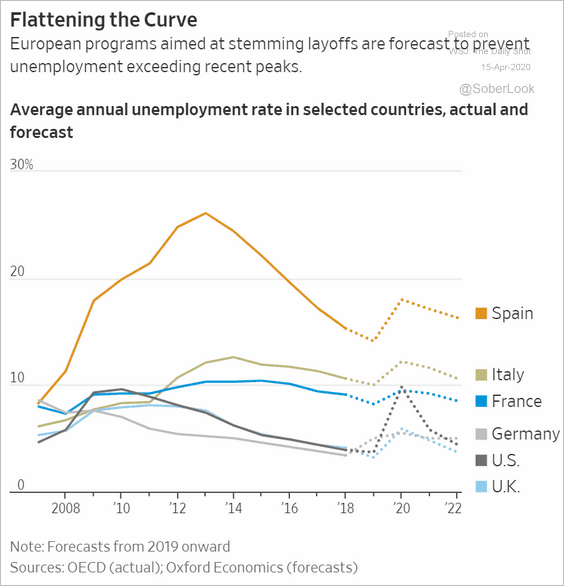

6. Government programs are expected to cushion the slump in labor markets.

Source: @WSJ Read full article

Source: @WSJ Read full article

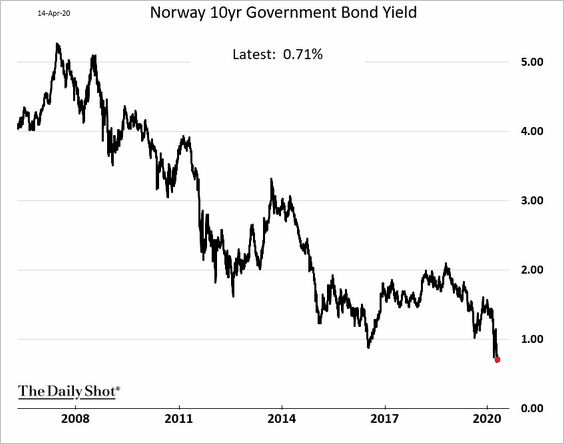

7. Norway’s bond yields are near record lows.

8. Switzerland’s sight deposits continue to signal F/X intervention by the central bank (SNB).

Emerging Markets

1. Capital outflows have been unprecedented.

Source: IIF

Source: IIF

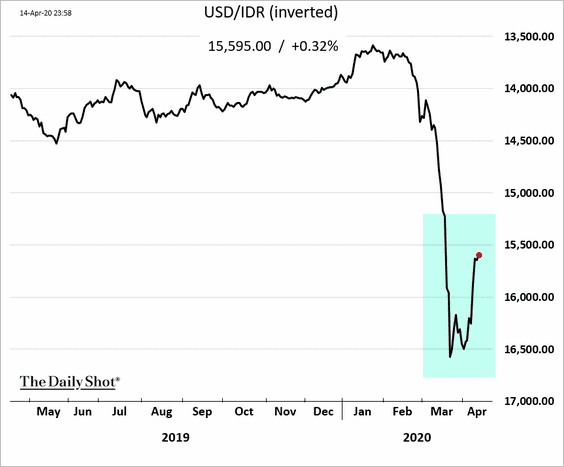

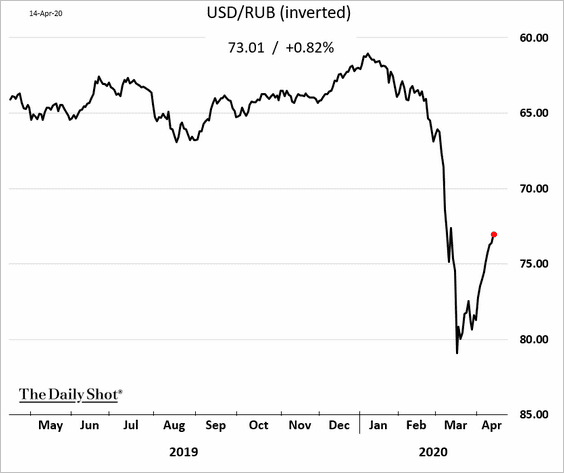

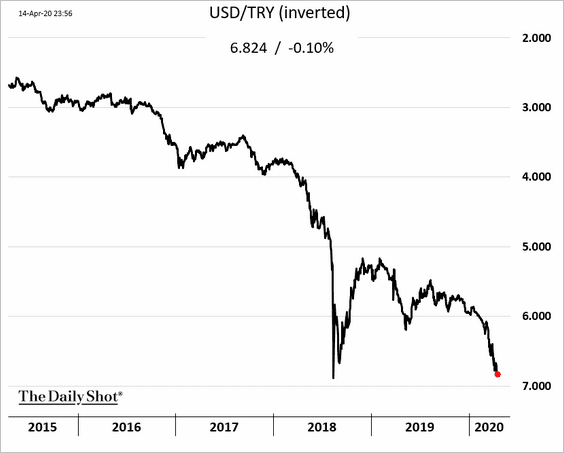

But there are signs of stabilization as EM currencies bounce from the lows.

• The Indonesian rupiah:

• The Russian ruble:

The Turkish lira is bucking the trend.

——————–

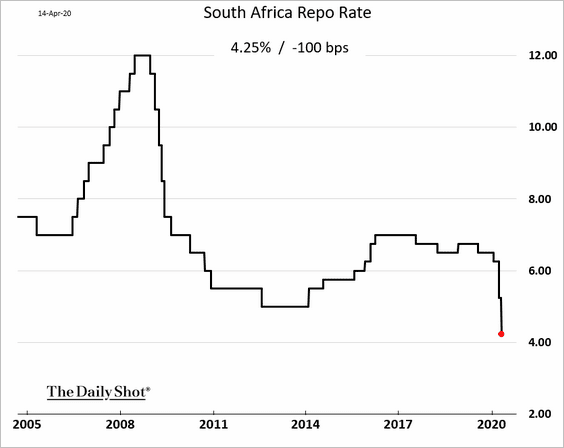

2. South Africa’s central bank (SARB) cut rates again.

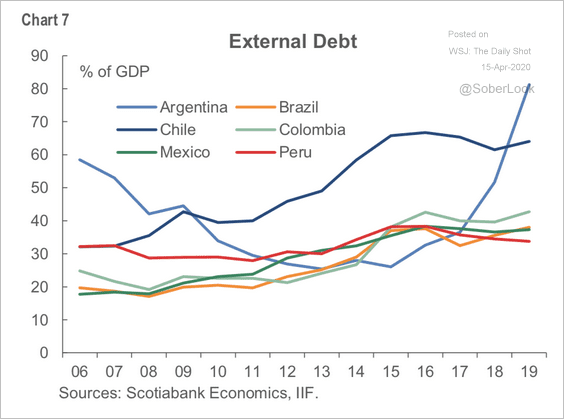

3. Next, we have a couple of charts on debt levels in Latin America.

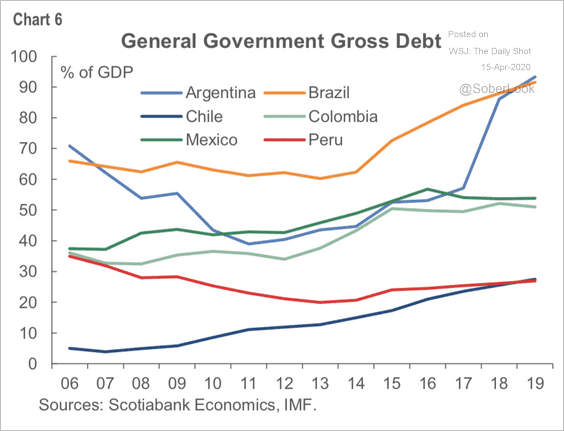

• External (foreign-currency) debt:

Source: Scotiabank Economics

Source: Scotiabank Economics

• Government debt:

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

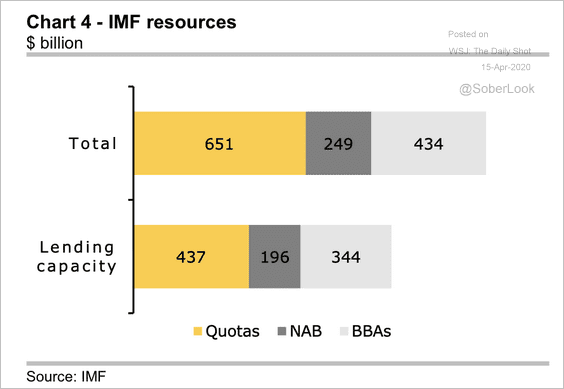

4. The IMF has limited resources, which could make it difficult for EM countries seeking a bailout.

Source: JP Morgan

Source: JP Morgan

Commodities

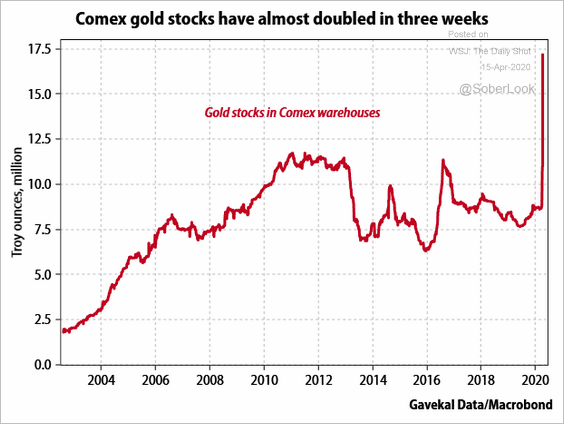

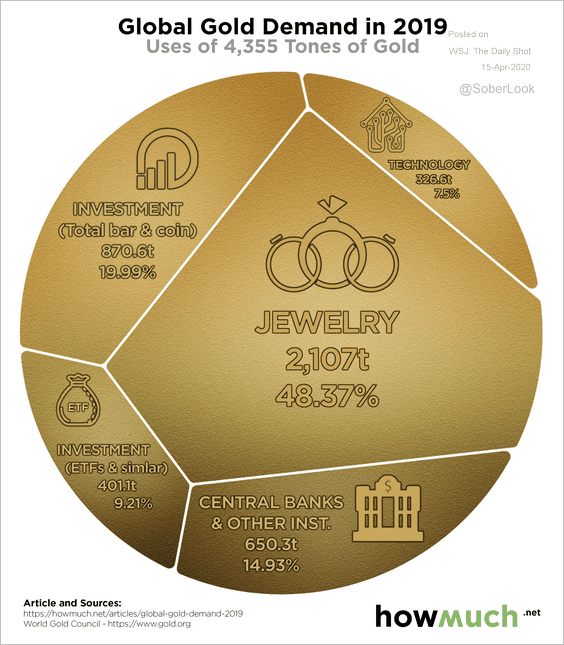

1. Demand for physical gold has slowed, with COMEX warehouse inventories rising sharply.

Source: Gavekal

Source: Gavekal

Jewelry is a substantial portion of the demand, and that sector is shut down.

Source: @howmuch_net Read full article

Source: @howmuch_net Read full article

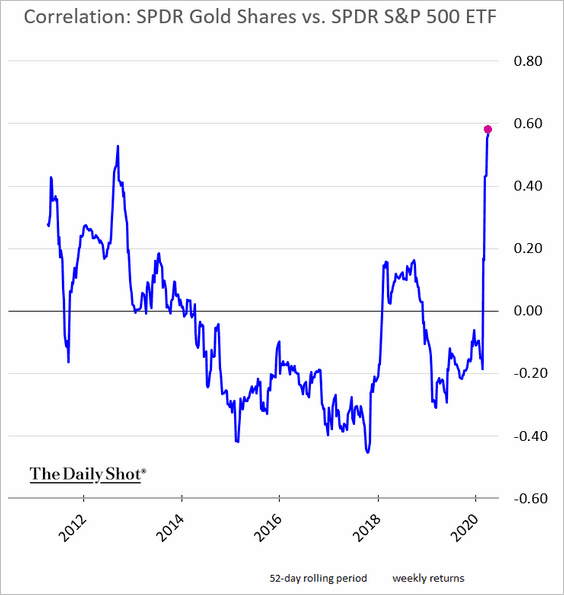

Separately, the correlation between gold and stocks has been unusually high (both partially driven by US monetary and fiscal stimulus).

h/t Ranjeetha Pakiam

h/t Ranjeetha Pakiam

——————–

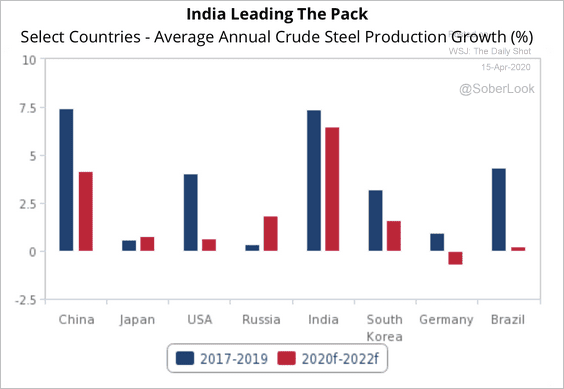

2. India will be the global steel production and consumption bright spot as demand from construction, automotive and infrastructure sectors continues to accelerate, according to Fitch

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

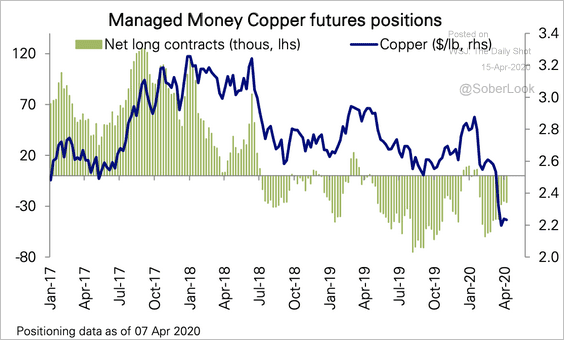

3. Hedge funds have been trimming their bets against copper over the past few weeks.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

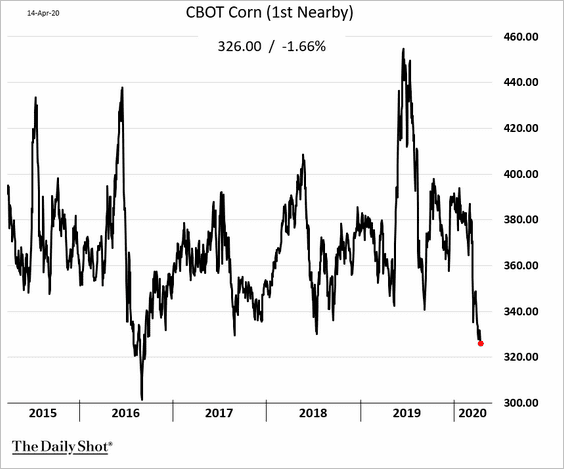

4. US corn futures closed at the lowest level since 2016.

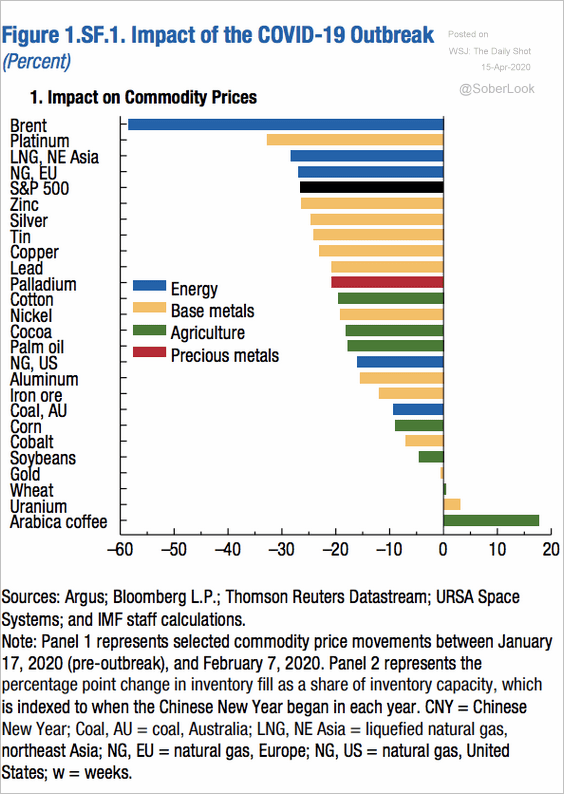

5. How has the current crisis impacted commodity prices?

Source: IMF Read full article

Source: IMF Read full article

Energy

1. US crude oil contango has widened to the highest level since 2009.

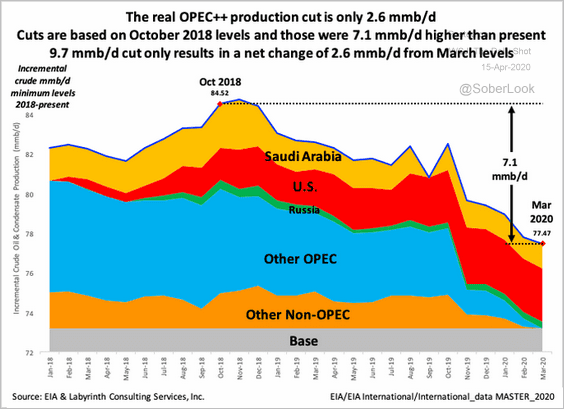

2. The latest agreement to reduce the global crude oil output by 9.7 million barrels per day (mmb/d) is based on the October 2018 levels. The new production target is, therefore, only 2.6 mmb/d lower than the March levels.

Source: @aeberman12

Source: @aeberman12

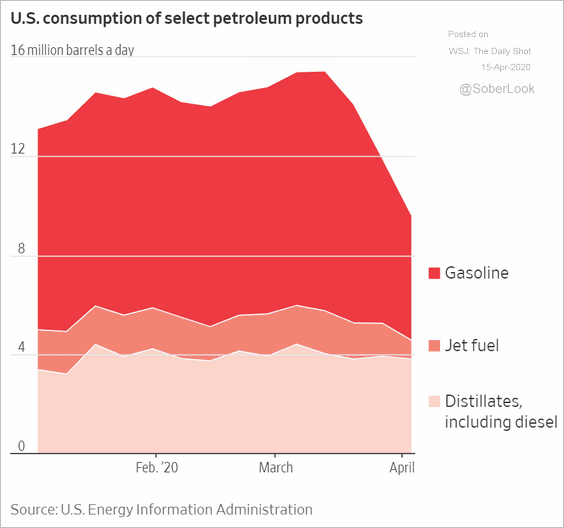

3. This chart shows the US consumption of petroleum products.

Source: @WSJ Read full article

Source: @WSJ Read full article

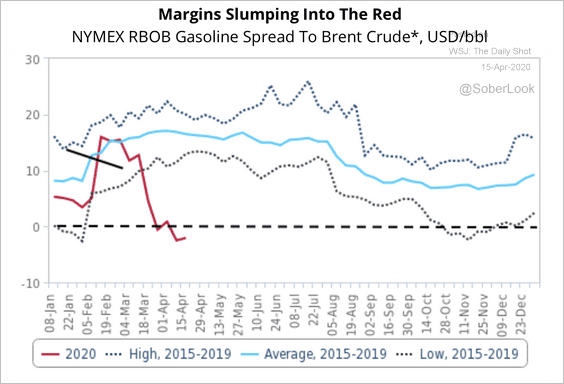

4. The current glut in the global fuels market has seen gasoline trade at a discount to Brent crude (negative margin).

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

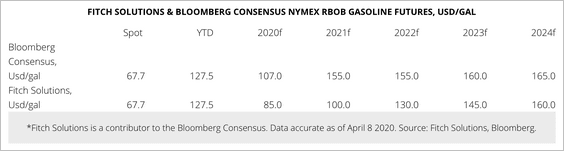

5. The table below shows Fitch’s expectations versus consensus for NYMEX gasoline futures.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

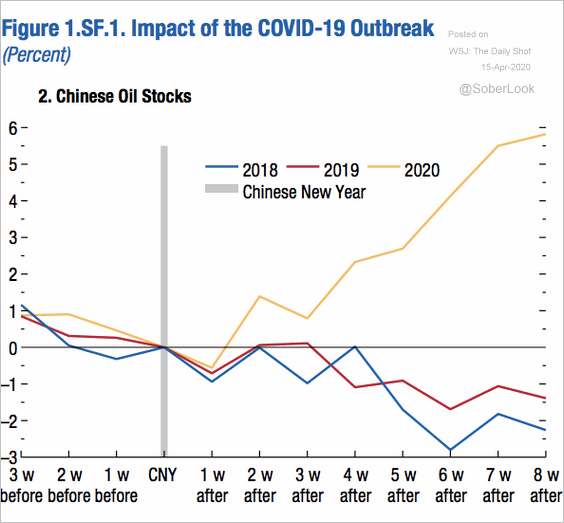

6. Crude oil inventories in China have been climbing.

Source: IMF Read full article

Source: IMF Read full article

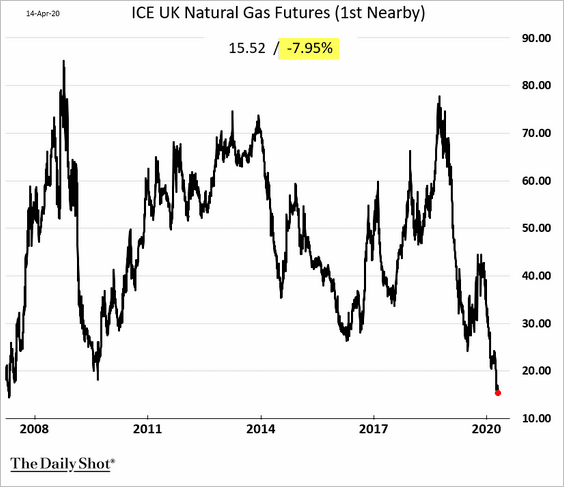

7. European natural gas futures hit the lowest level since 2007.

Equities

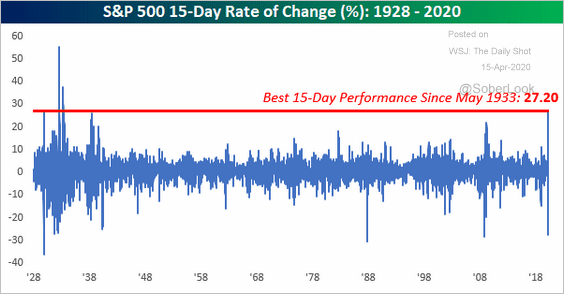

1. It’s been a good 15 days for US stocks.

Source: @bespokeinvest

Source: @bespokeinvest

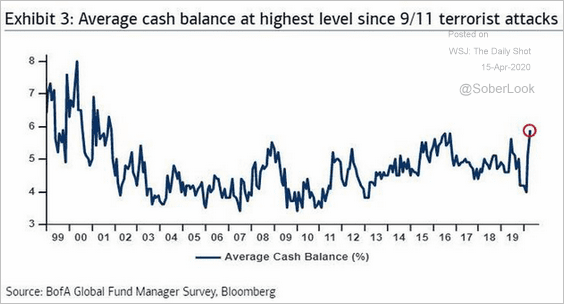

2. Fund managers are running substantial cash balances.

Source: BofA Merrill Lynch Global Research, @Amdalleq

Source: BofA Merrill Lynch Global Research, @Amdalleq

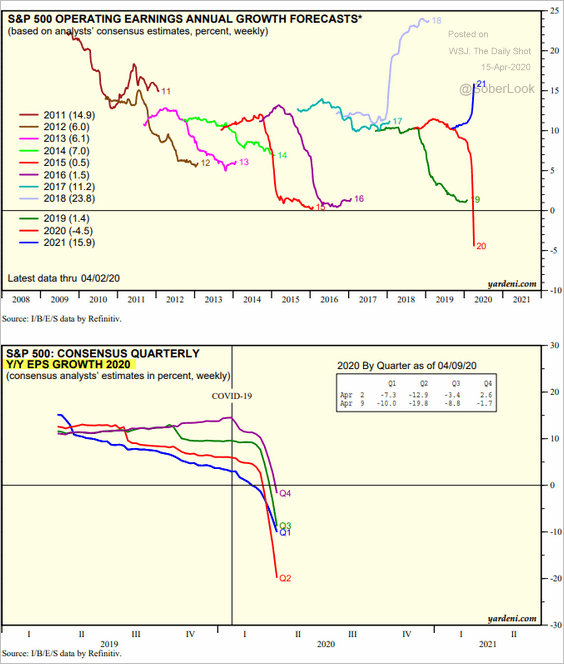

3. Next, we have some updates on corporate earnings.

• Analysts continue to downgrade their earnings growth forecasts for 2020. However, they expect a rebound in 2021.

Source: Yardeni Research

Source: Yardeni Research

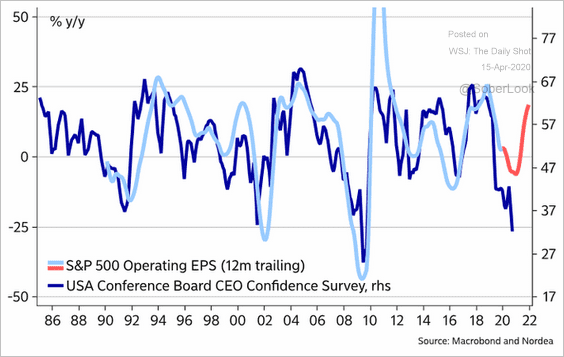

• Earnings growth expectations for next year have diverged from CEO confidence.

Source: @MikaelSarwe

Source: @MikaelSarwe

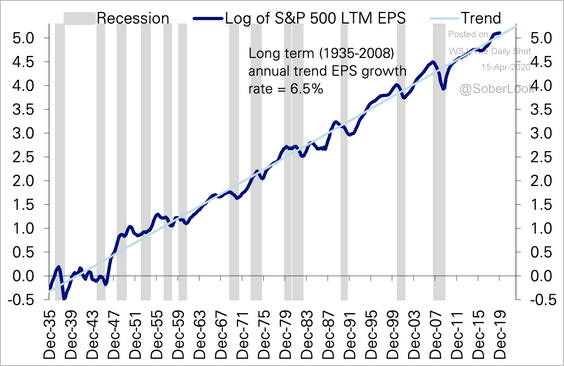

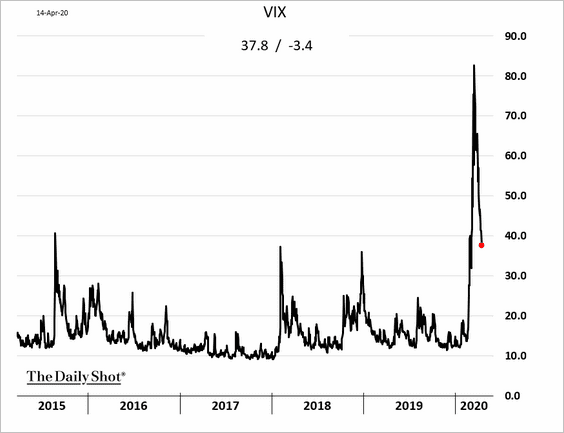

• The S&P 500 earnings-per-share growth over the past 85 years has been relatively stable.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

However, there have been periods when earnings growth deviated from the trend.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

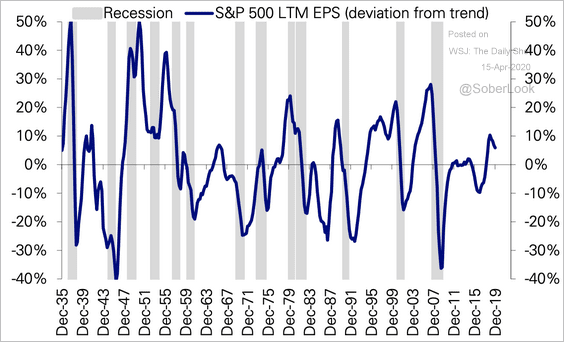

• Here’s what happens during an earnings shock, according to BCA Research.

Source: BCA Research

Source: BCA Research

——————–

4. The largest health care ETF had substantial inflows this week.

Source: @markets Read full article

Source: @markets Read full article

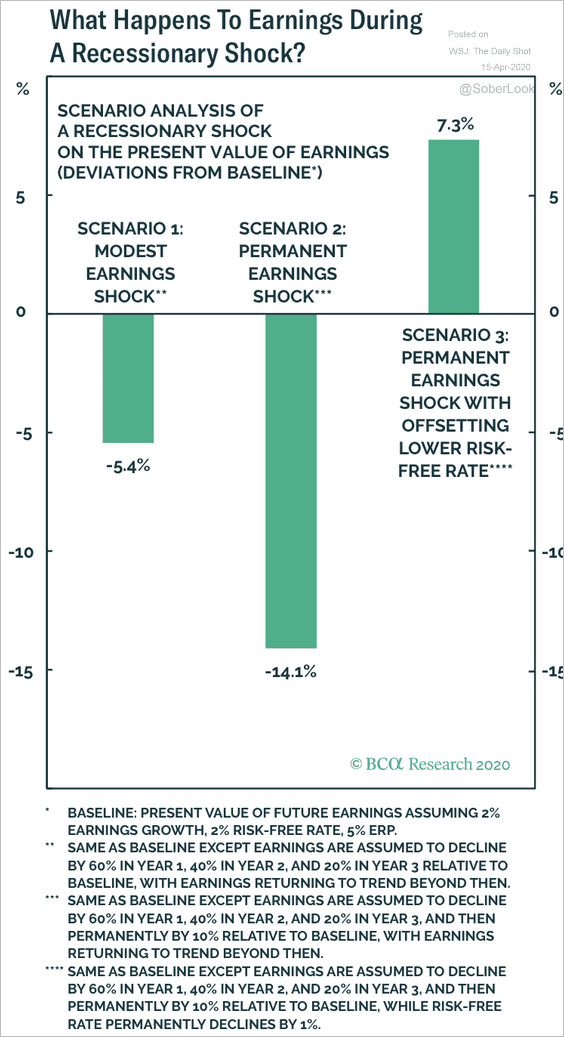

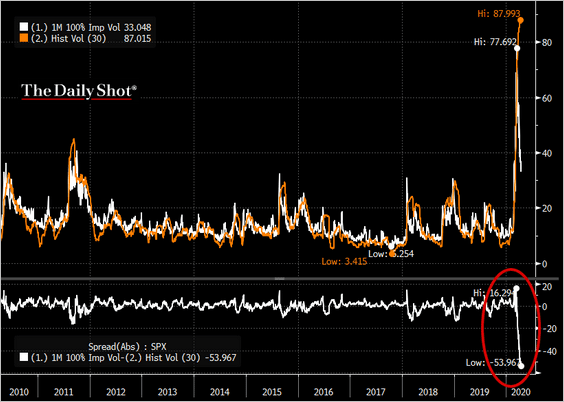

5. VIX is below 40 for the first time since early March.

Investors’ sudden burst of optimism has created an unusual gap between implied and historical volatility.

Source: @TheTerminal

Source: @TheTerminal

The second panel below shows the spread between the two volatility indicators.

Source: @TheTerminal

Source: @TheTerminal

Credit

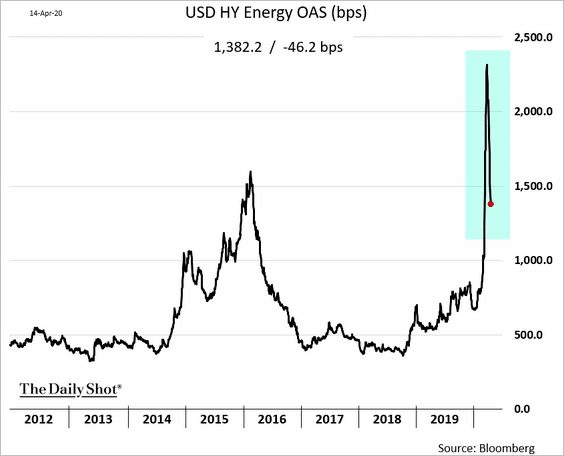

1. Energy-sector high-yield spreads have been tightening.

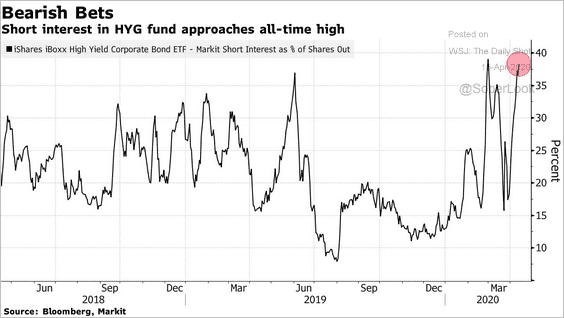

2. Short interest in the largest high-yield ETF remains elevated.

Source: @markets Read full article

Source: @markets Read full article

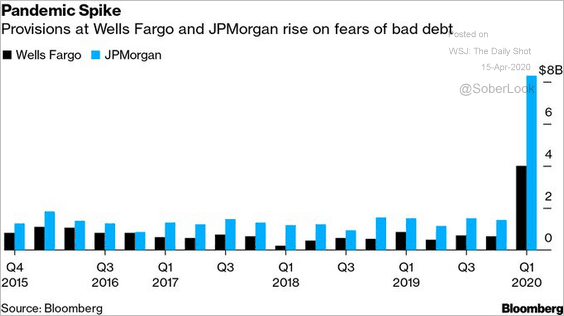

3. Earnings reports show US banks boosting provisions.

Source: @carlquintanilla, @business

Source: @carlquintanilla, @business

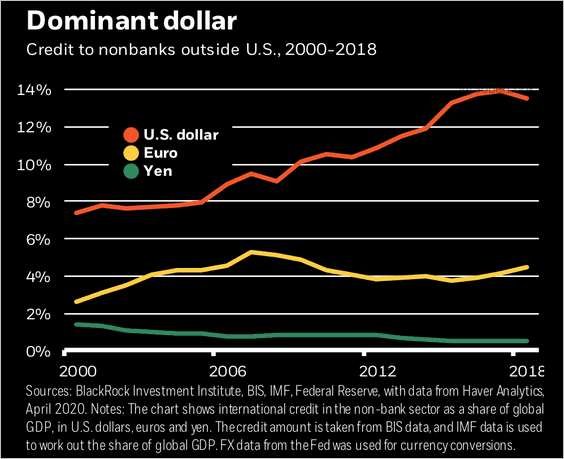

4. Dollar credit to non-banks outside of the US as a share of GDP has risen substantially from 2007 to 2018. This trend points to the need for the Fed’s liquidity swaps in times of stress.

Source: BlackRock

Source: BlackRock

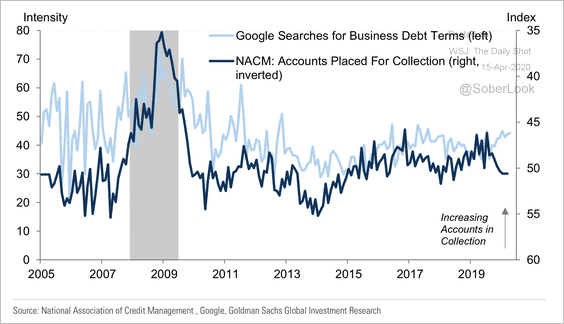

5. Searches for business debt terms have increased recently, which could signal a rise in accounts placed for collection.

Source: Goldman Sachs

Source: Goldman Sachs

Rates

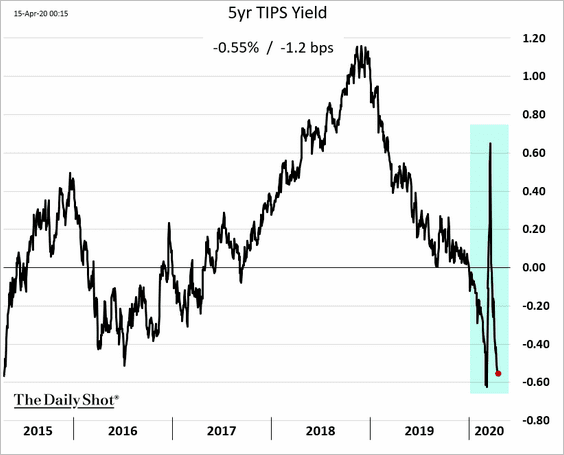

1. Market-based long-term US inflation expectations have been rebounding amid unprecedented monetary and fiscal stimulus measures.

With inflation expectations rising, effective real rates are approaching multi-year lows again. Here is the 5yr inflation-linked Treasury (TIPS) yield.

——————–

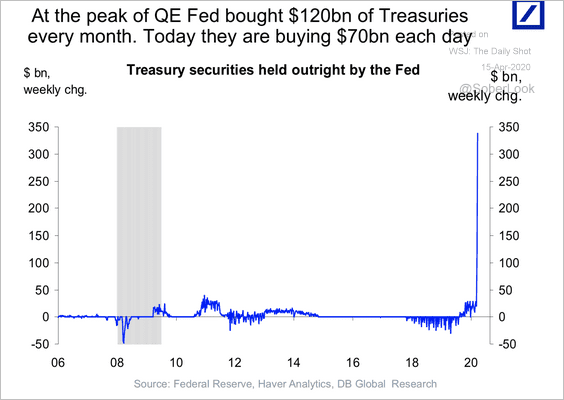

2. The Fed has been buying $70bn of Treasury securities each day.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Global Developments

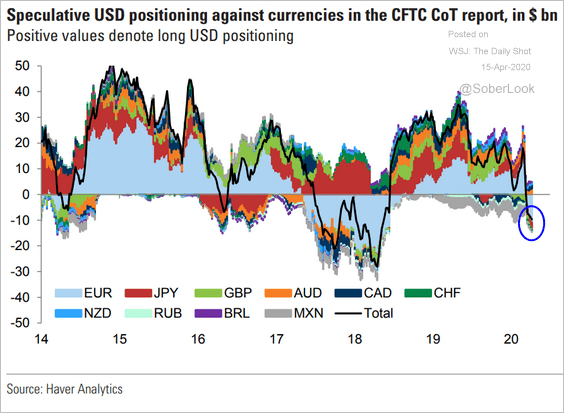

1. Speculative accounts continue to bet against the US dollar.

Source: Goldman Sachs

Source: Goldman Sachs

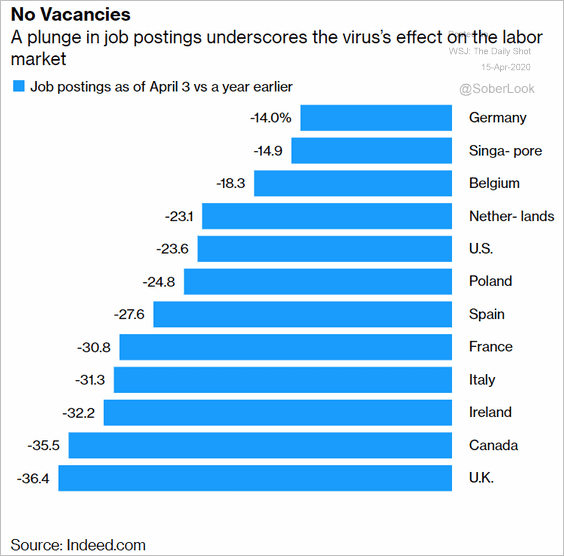

2. Job postings around the world have plunged.

Source: @markets Read full article

Source: @markets Read full article

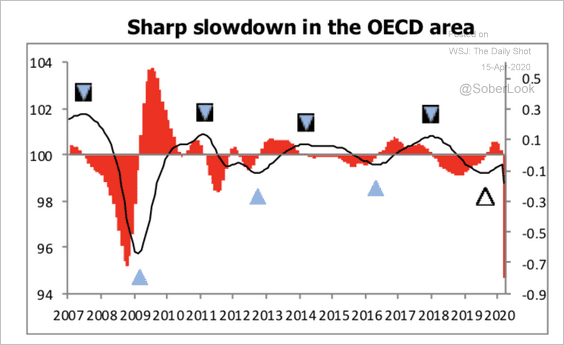

3. Economic activity in the OECD countries started rebounding before the pandemic.

Source: OECD Read full article

Source: OECD Read full article

4. Here is a summary of the G20+ economic policy responses.

Source: IMF Read full article

Source: IMF Read full article

——————–

Food for Thought

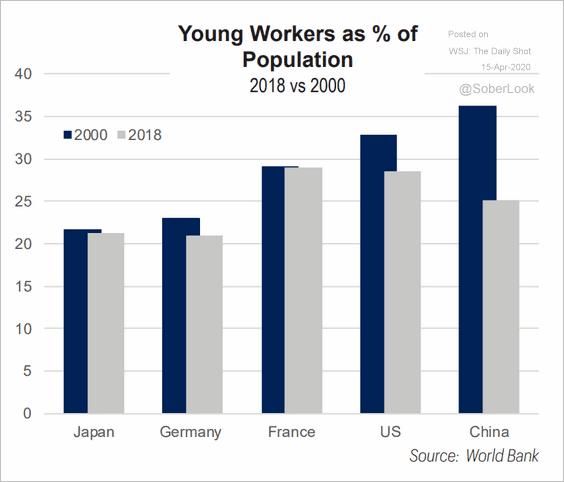

1. Young workers as a percentage of the population:

Source: FHN Financial

Source: FHN Financial

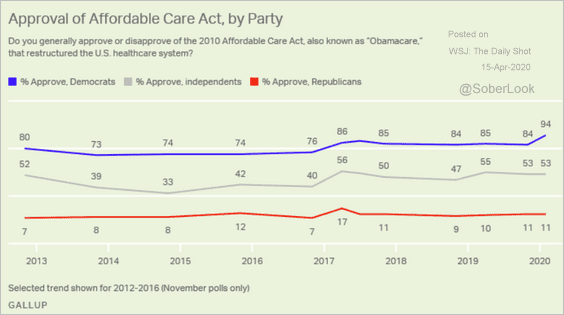

2. ACA approval rates:

Source: Gallup Read full article

Source: Gallup Read full article

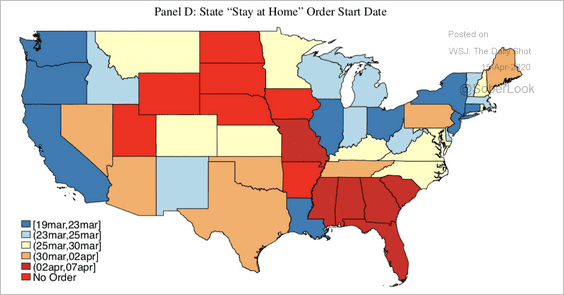

3. “Stay at home” orders by starting date:

Source: NBER Read full article

Source: NBER Read full article

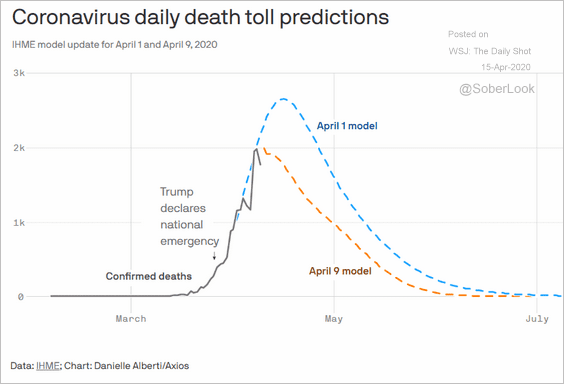

4. US coronavirus death toll predictions:

Source: @axios Read full article

Source: @axios Read full article

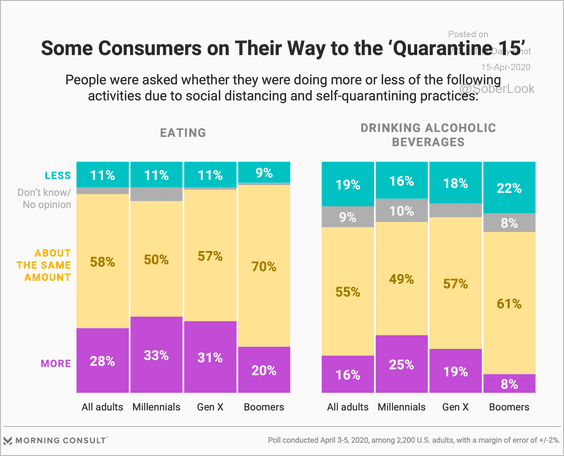

5. Eating and drinking during the quarantine:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

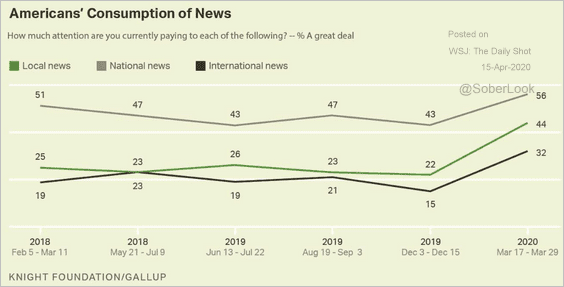

6. Paying attention to the news:

Source: Gallup Read full article

Source: Gallup Read full article

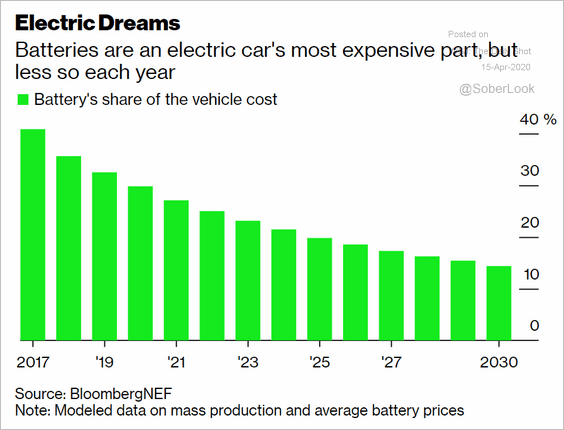

7. Battery’s share of electric vehicle cost:

Source: @business Read full article

Source: @business Read full article

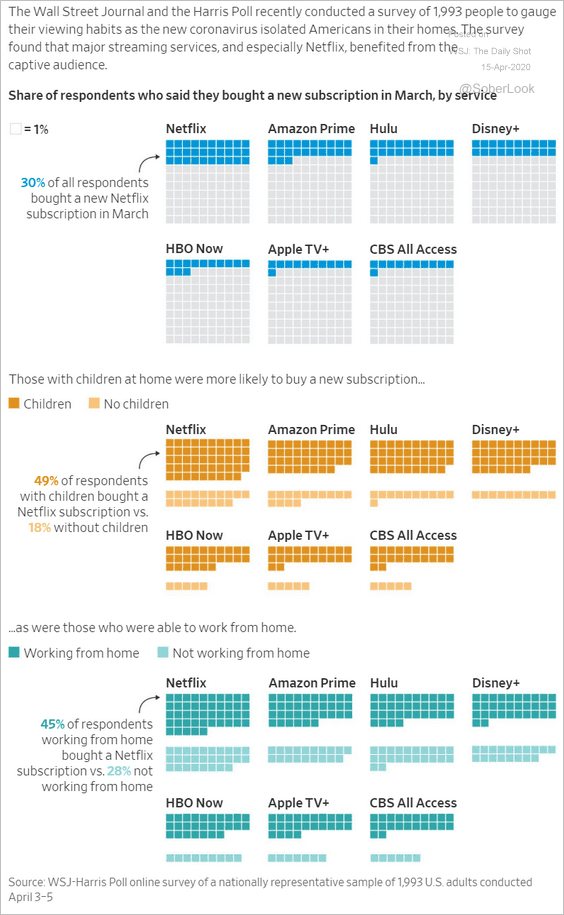

8. Buying a new subscription for streaming services:

Source: @WSJ Read full article

Source: @WSJ Read full article

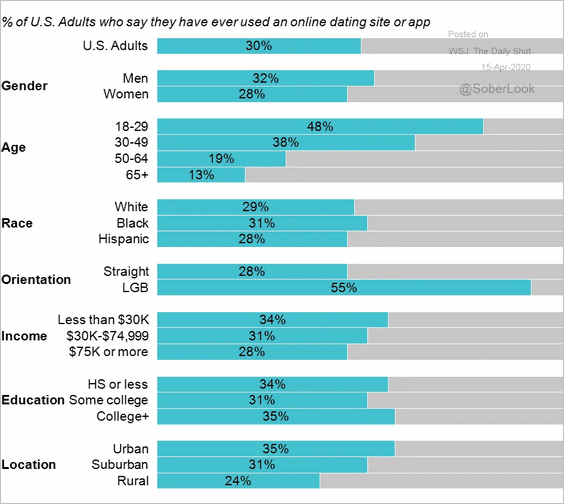

9. Using dating apps:

Source: Mekko Graphics

Source: Mekko Graphics

Back to Index