The Daily Shot: 16-Apr-20

• Energy

• Commodities

• Equities

• Credit

• Rates

• Emerging Markets

• China

• Asia – Pacific

• Canada

• The United States

• Global Developments

• Food for Thought

Energy

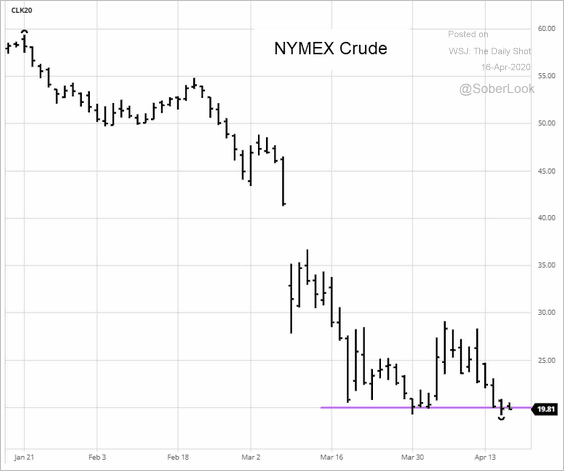

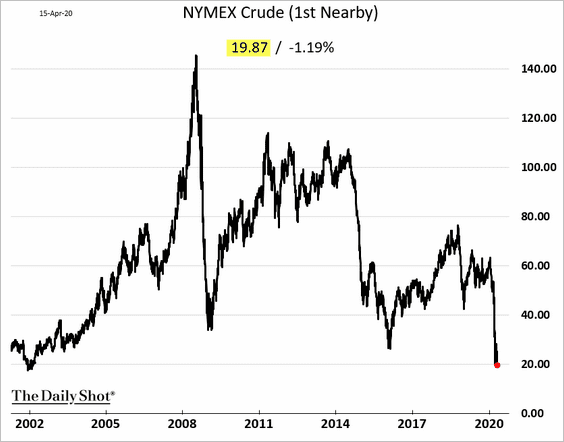

1. US crude oil futures are testing the $20/bbl support again, trading near the lowest level since 2002. The market remains skeptical about the recently announced production cuts.

Source: barchart.com

Source: barchart.com

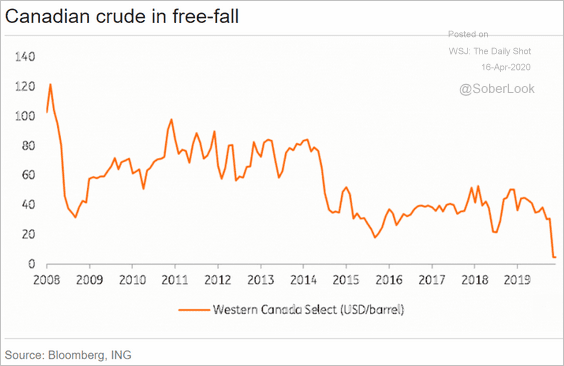

Here is Canadian crude.

Source: ING

Source: ING

——————–

2. With global producers agreeing to cut output, will the Saudis ease their crude oil discount?

Source: @markets Read full article

Source: @markets Read full article

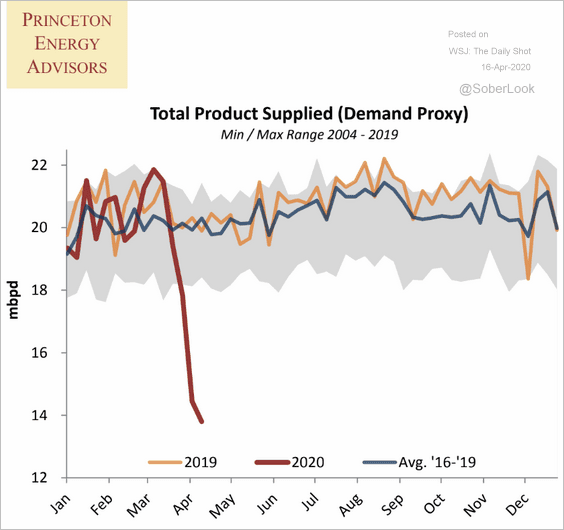

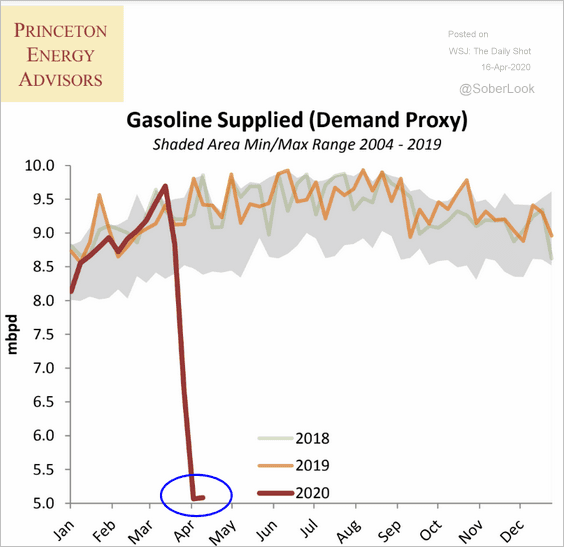

3. US petroleum products demand continues to fall.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

However, gasoline demand seems to have bottomed.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

——————–

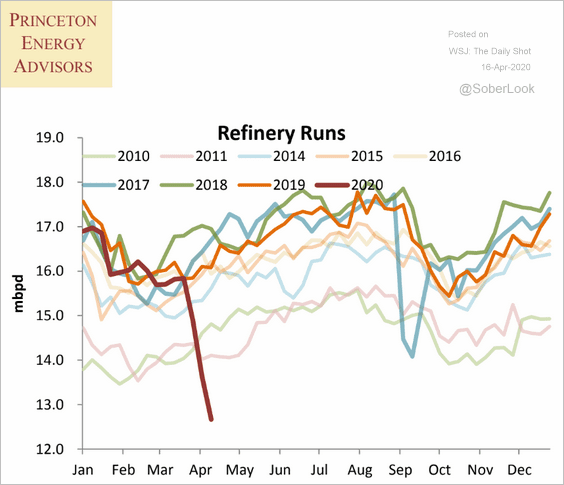

4. Refinery inputs keep moving lower.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

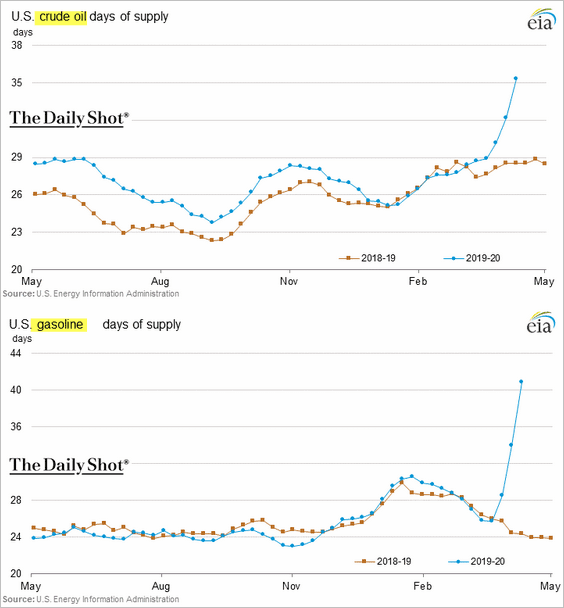

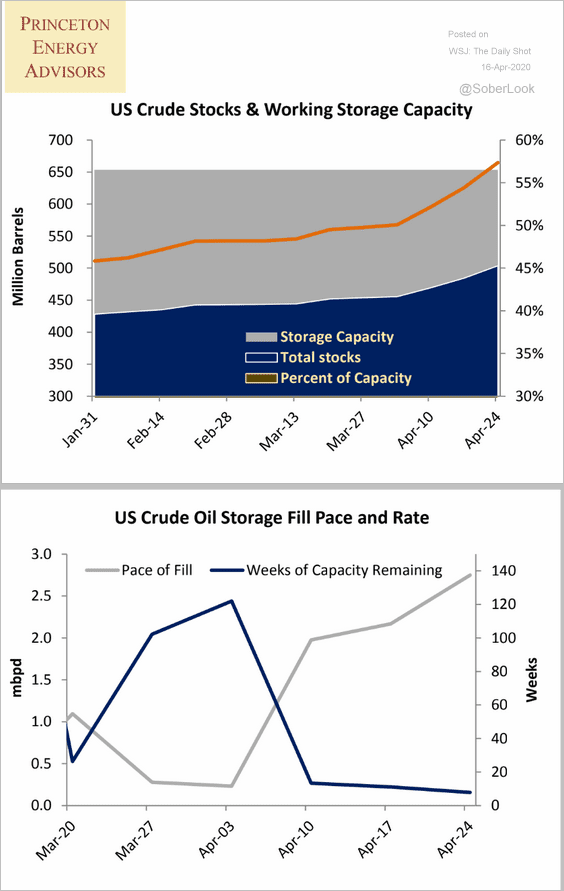

5. The charts below show US crude oil and gasoline inventories, measured in days of supply.

Crude oil storage facilities are getting filled quickly.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

——————–

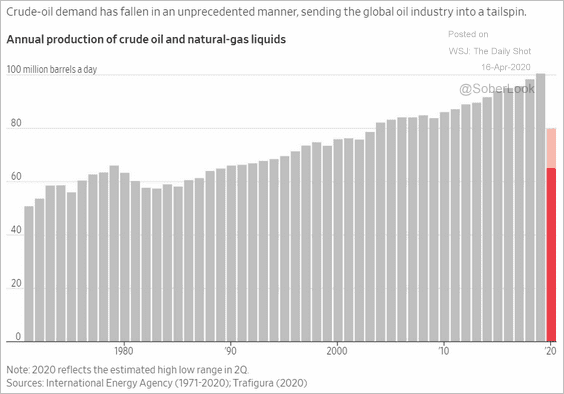

6. The slump in global liquids production this year will be unprecedented.

Source: @WSJ Read full article

Source: @WSJ Read full article

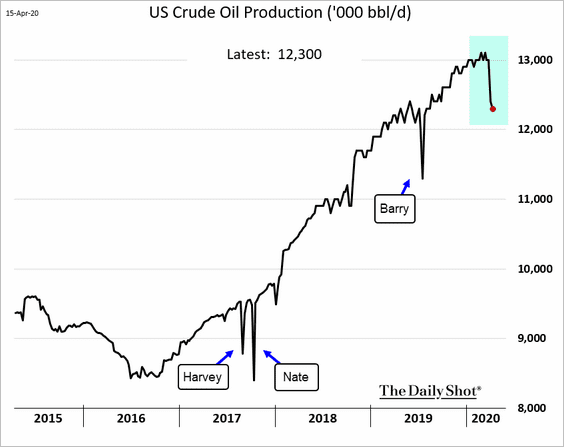

In the US, the output decline has just started.

Commodities

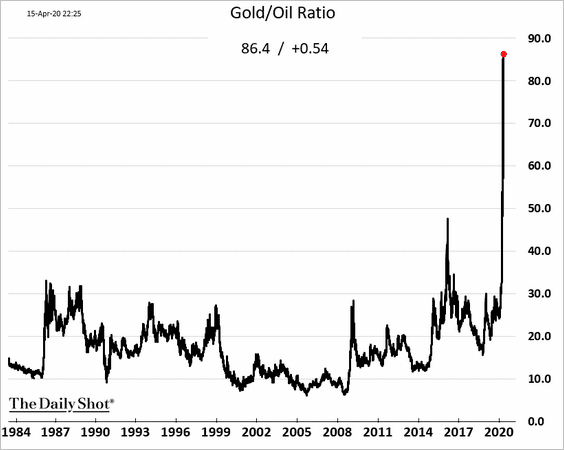

1. The gold-to-oil ratio continues to rise.

2. The US government may end up buying meat and milk products.

Source: Reuters Read full article

Source: Reuters Read full article

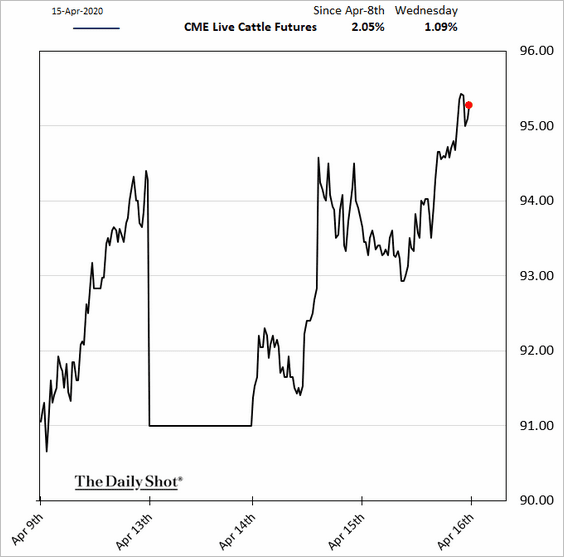

Livestock futures have stabilized.

Equities

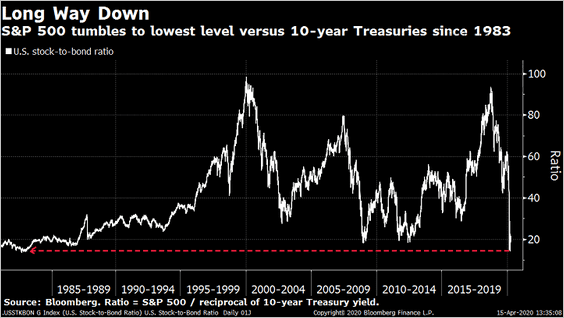

1. The S&P 500 reached its lowest level versus 10-year Treasuries since 1983.

Source: @TheOneDave

Source: @TheOneDave

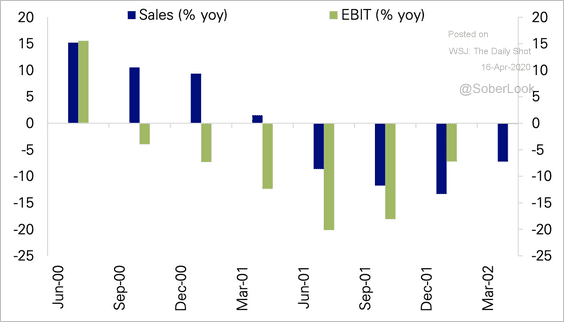

2. Earnings growth slowed well before sales growth in past recessions (such as in 2001), according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

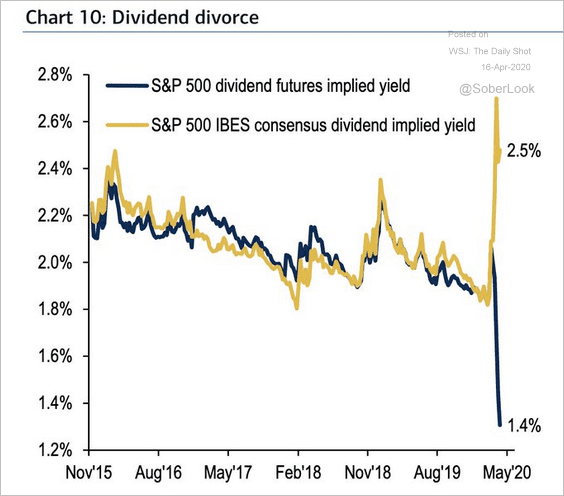

3. Dividend futures have diverged from consensus dividend yield estimates.

Source: BofA Merrill Lynch Global Research, @RobinWigg

Source: BofA Merrill Lynch Global Research, @RobinWigg

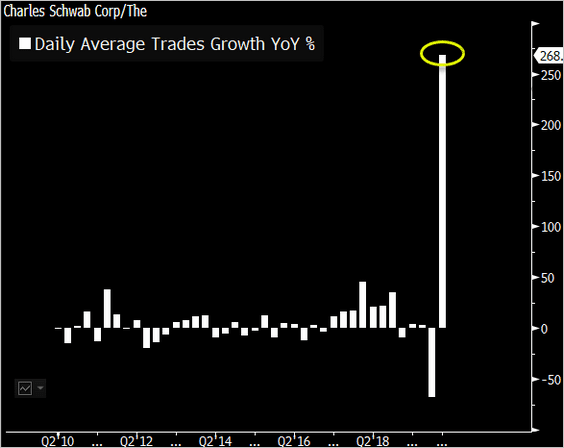

4. Discount brokers saw a massive increase in trading volumes this year.

Source: @EricBalchunas, @mbarna6

Source: @EricBalchunas, @mbarna6

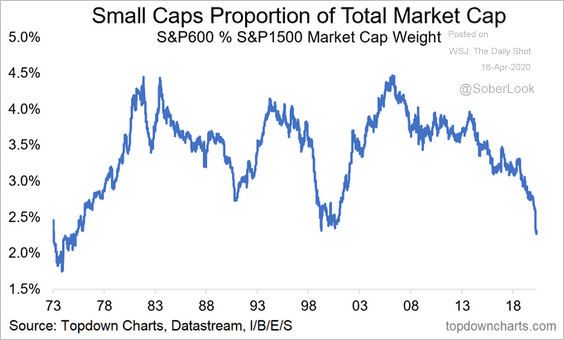

5. Small caps’ proportion of the total US market is near multi-decade lows.

Source: @topdowncharts Read full article

Source: @topdowncharts Read full article

6. Banks continue to underperform. This chart shows the ratio of the SPDR banks ETF to the S&P 500 ETF.

Credit

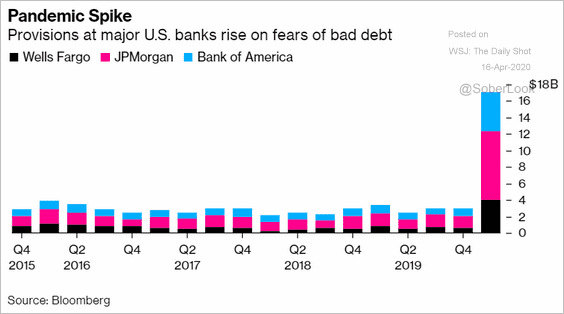

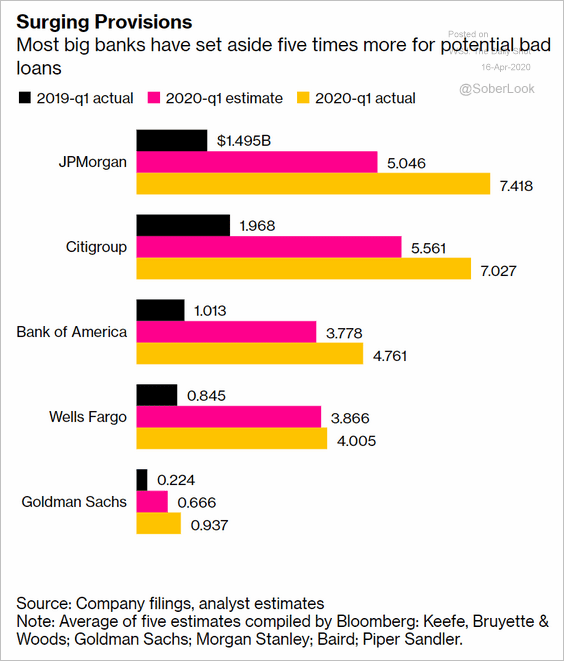

1. US banks’ credit loss provisions are piling up.

Source: @business Read full article

Source: @business Read full article

Source: @markets Read full article

Source: @markets Read full article

——————–

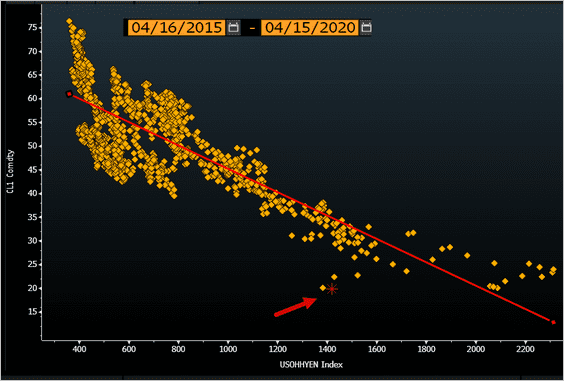

2. Are energy-sector bond spreads too tight? The scatterplot below shows the US crude oil price (y-axis) vs. energy high-yield spreads (x-axis).

Source: @TheTerminal

Source: @TheTerminal

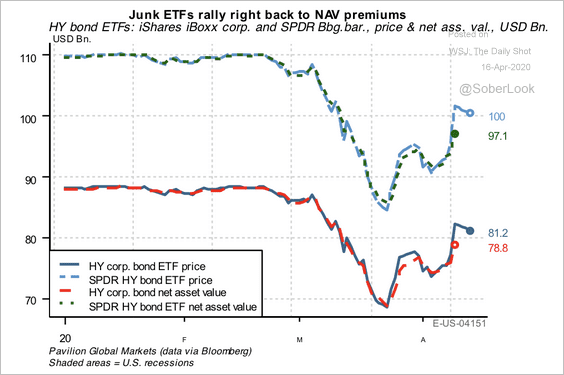

3. Junk bond ETFs now trade at a premium to their net asset values (NAV).

Source: Pavilion Global Markets

Source: Pavilion Global Markets

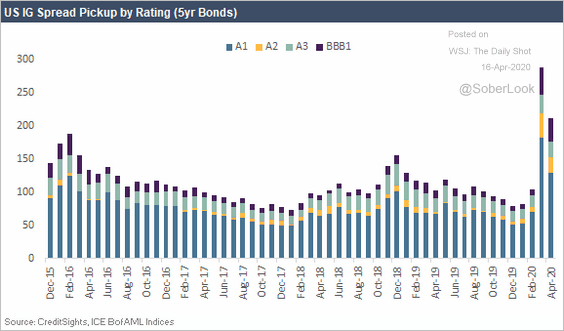

4. This chart shows investment-grade spreads by rating.

Source: CreditSights

Source: CreditSights

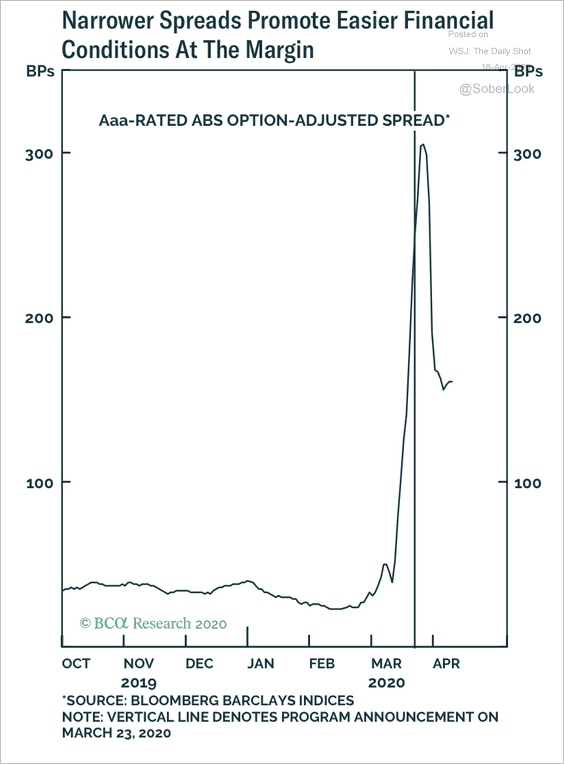

5. ABS spreads have narrowed significantly, suggesting that the Fed’s Term Asset-Backed Securities Loan Facility (TALF) is already having an impact.

Source: BCA Research

Source: BCA Research

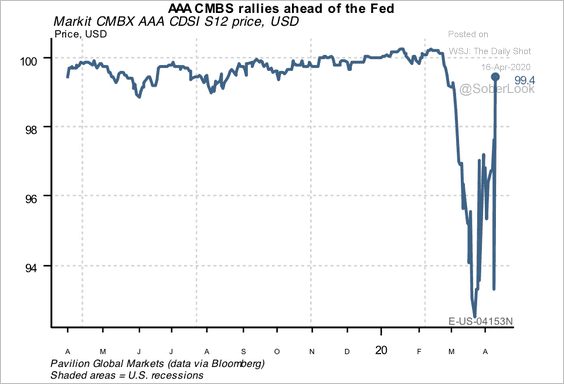

AAA-rated commercial mortgage-backed securities (CMBS) are also TALF-eligible (see story).

Source: Pavilion Global Markets

Source: Pavilion Global Markets

——————–

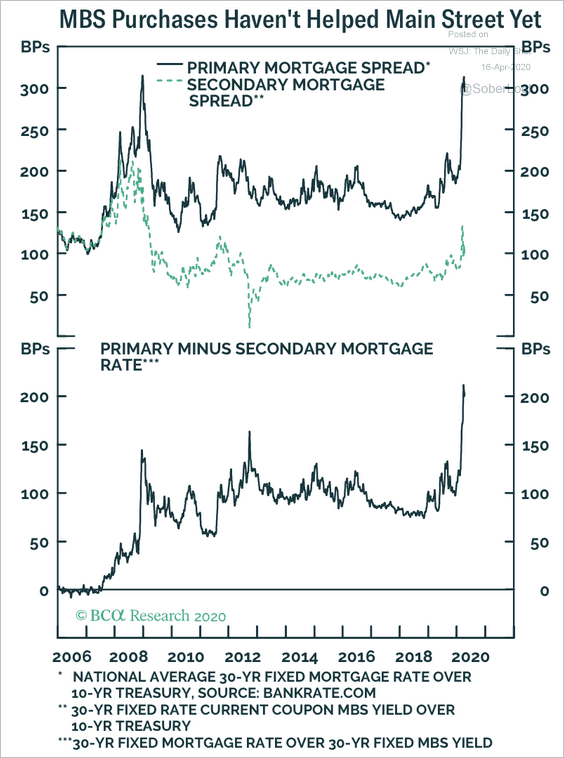

6. The spread between the current-coupon agency MBS and the 10-year Treasury yield has tightened, but mortgage rates still don’t fully reflect the improvement.

Source: BCA Research

Source: BCA Research

Rates

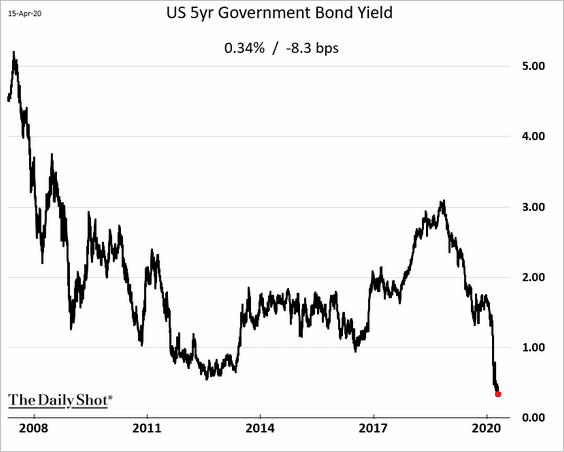

1. The 5-year Treasury yield hit a record low.

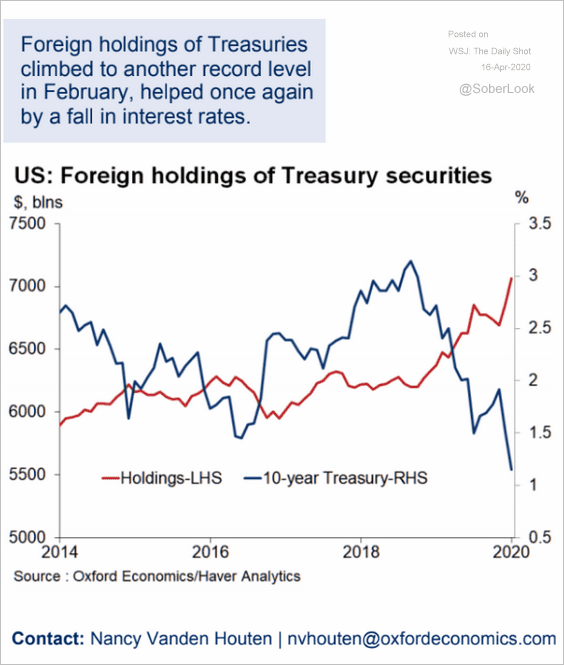

2. Foreign holdings of Treasury securities continue to climb.

Source: Oxford Economics

Source: Oxford Economics

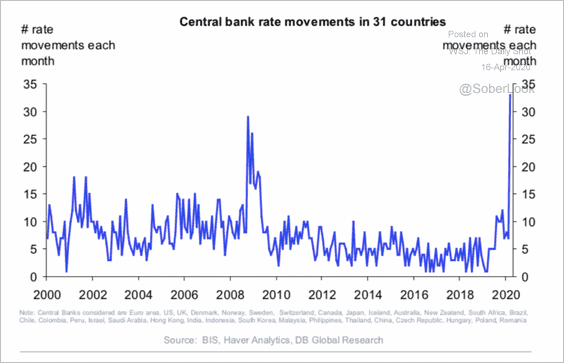

3. Central banks are cutting rates at a record pace.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Emerging Markets

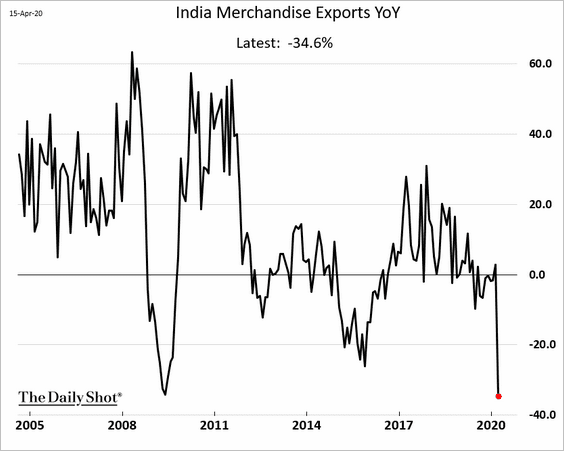

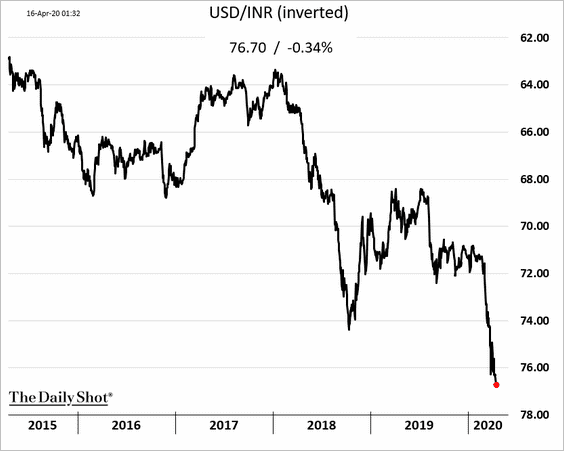

1. India’s exports tumbled in March.

The rupee keeps drifting lower.

——————–

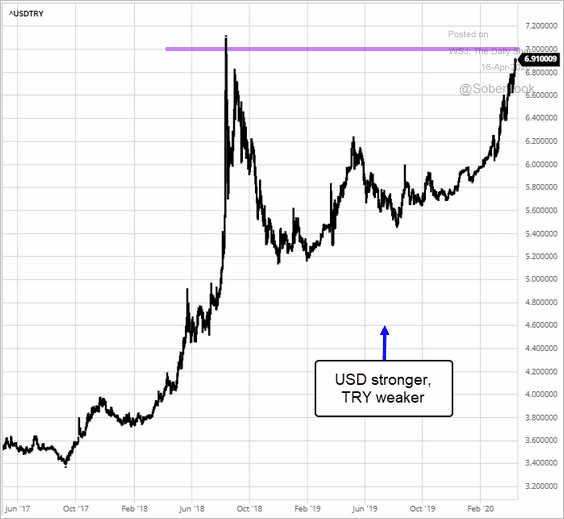

2. Dollar-lira is about to test resistance at 7.0, as Turkey’s currency continues to weaken.

Source: barchart.com

Source: barchart.com

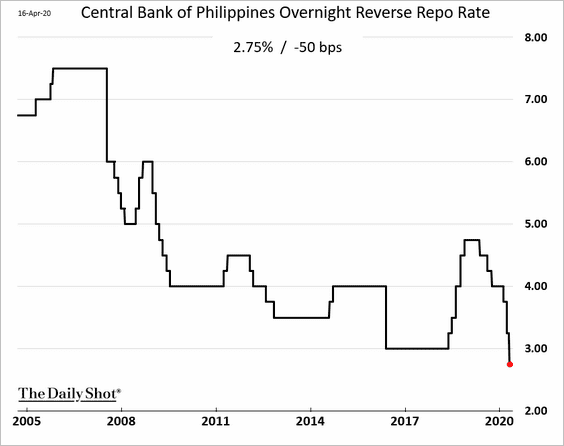

3. The Philippine central bank unexpectedly cut rates again.

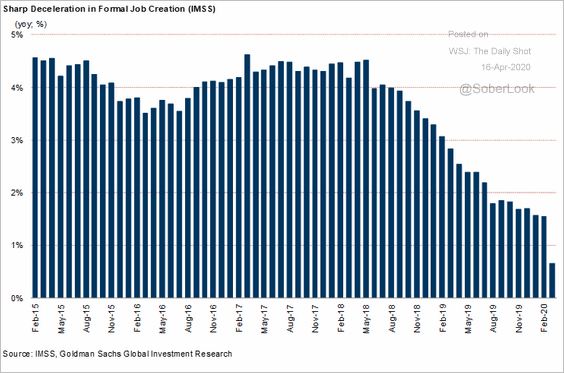

4. Next, we have some updates on Mexico.

• Job creation has been slowing.

Source: Goldman Sachs

Source: Goldman Sachs

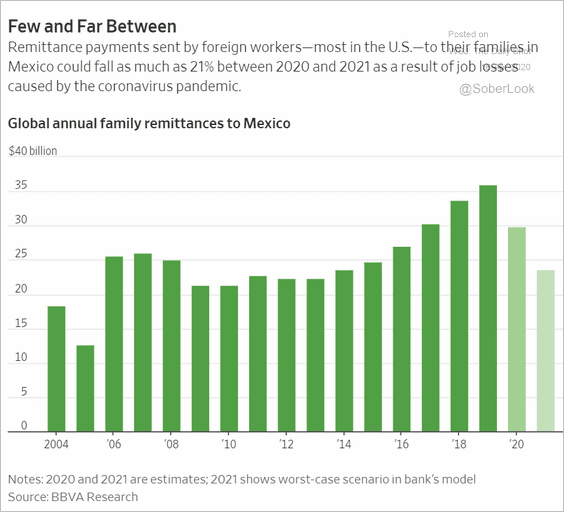

• Remittances are expected to decline sharply over the next couple of years.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

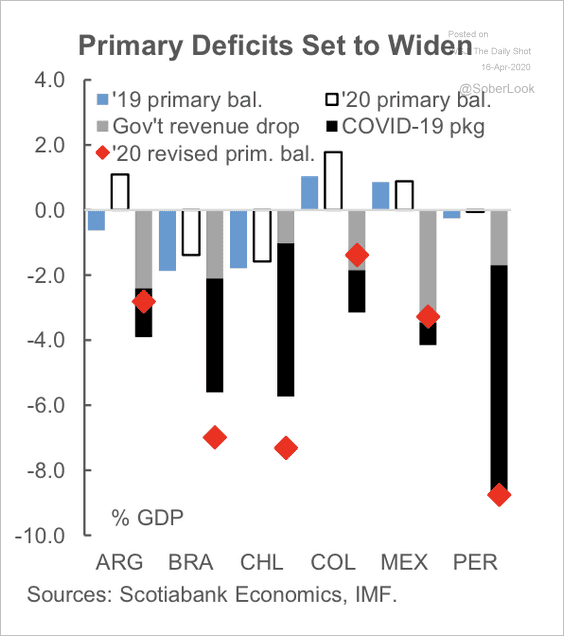

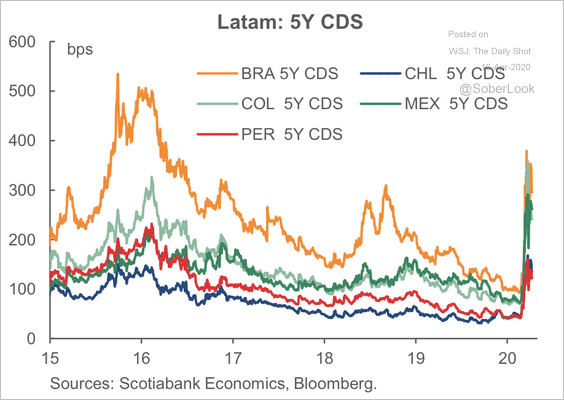

5. LatAm government deficits will increase substantially this year.

Source: Scotiabank Economics

Source: Scotiabank Economics

Sovereign credit default swap spreads have widened.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

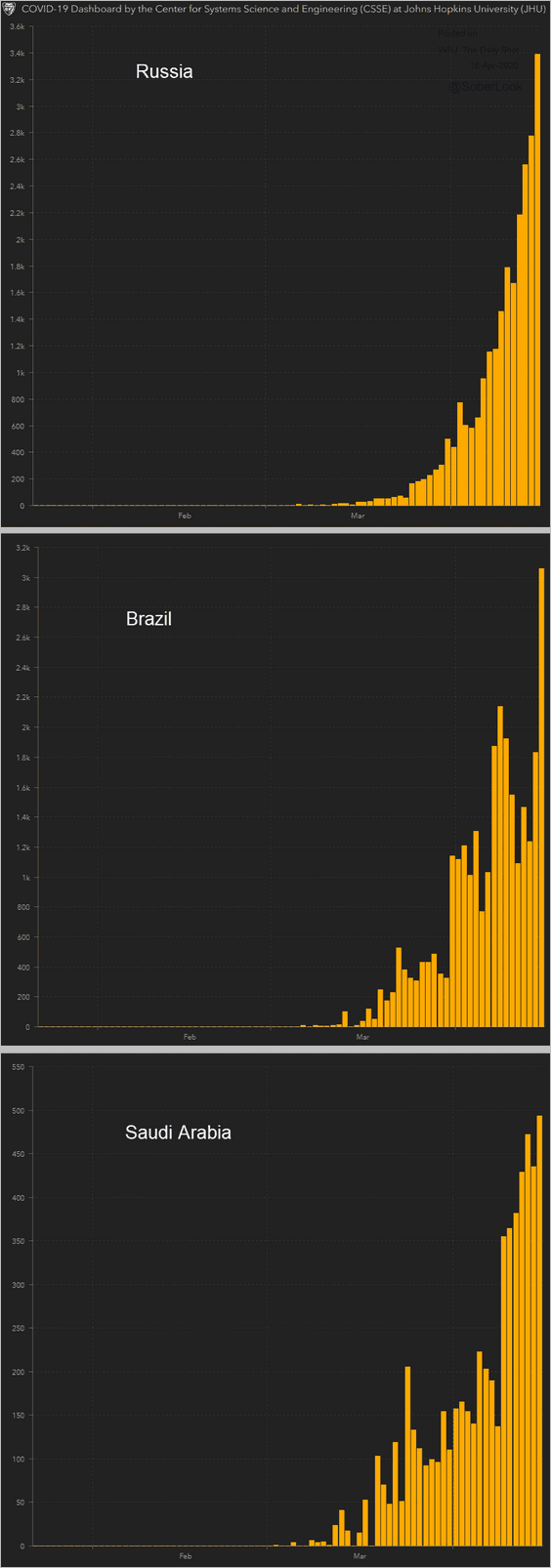

6. Some EM economies have yet to see peak levels of new coronavirus cases.

Source: JHU CSSE

Source: JHU CSSE

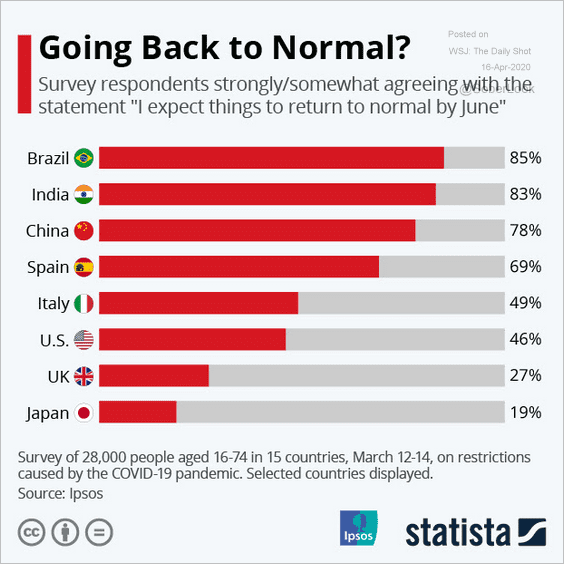

Returning to “normal” by June? Unlikely.

Source: Statista

Source: Statista

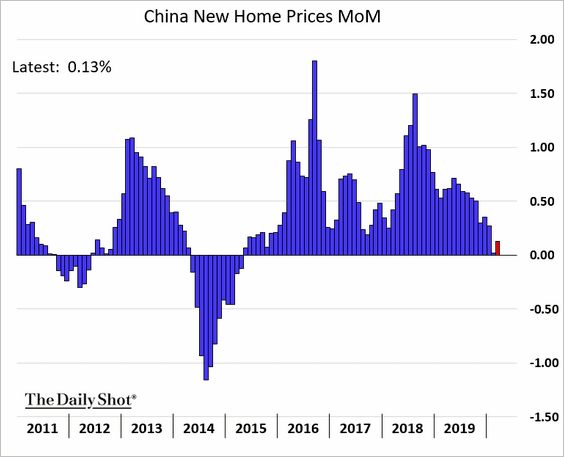

China

1. Home prices ticked higher last month.

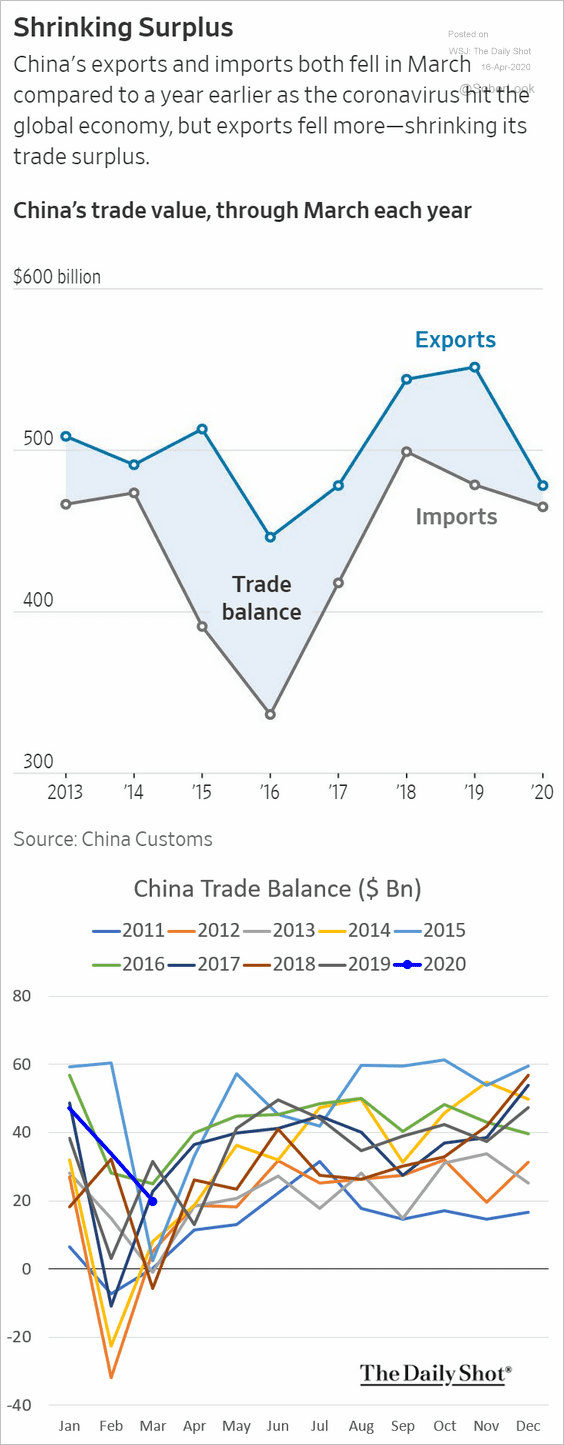

2. The trade surplus has been narrowing.

Source: @WSJ Read full article

Source: @WSJ Read full article

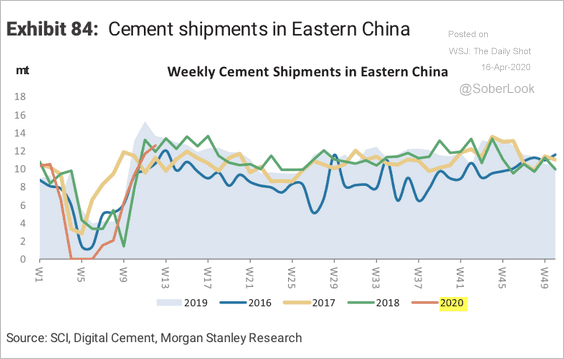

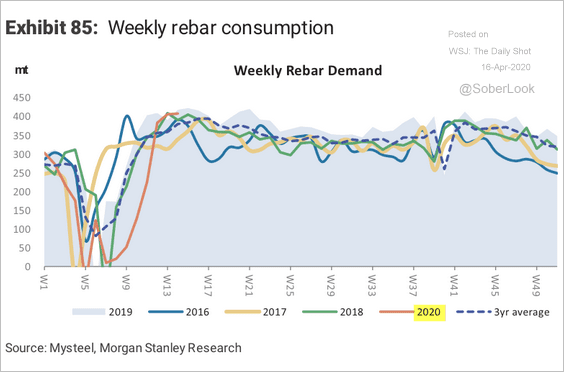

3. Cement shipments and steel rebar consumption are back to normal (two charts).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Asia – Pacific

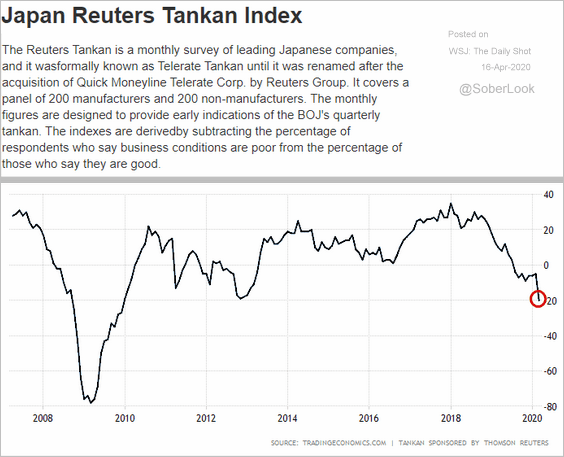

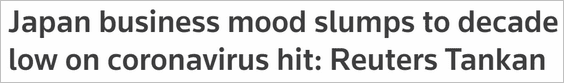

1. Japan’s Reuters Tankan business sentiment indicator slumps to the lowest level in a decade.

Source: Tradingeconomics.com, Investing.com (text)

Source: Tradingeconomics.com, Investing.com (text)

Source: Reuters Read full article

Source: Reuters Read full article

——————–

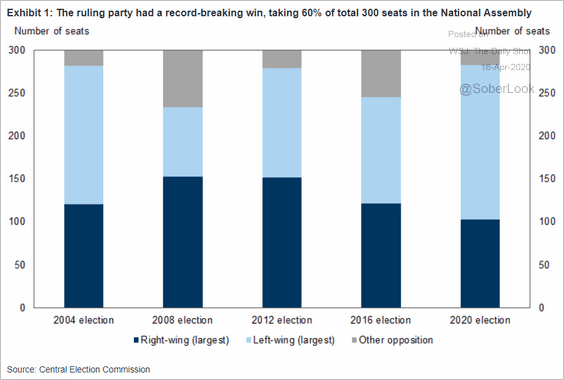

2. South Korea’s ruling party took 60% of the 300 seats in the National Assembly – a record.

Source: Goldman Sachs

Source: Goldman Sachs

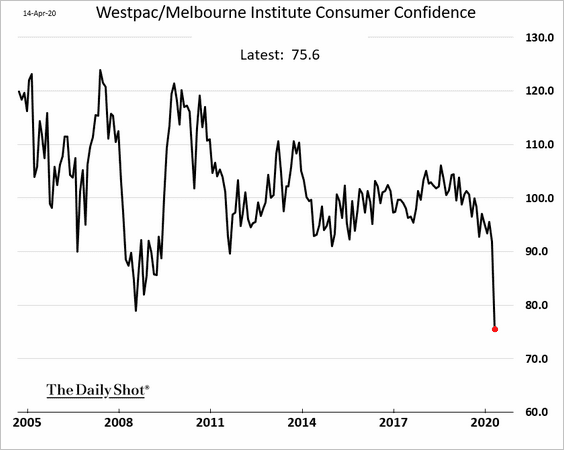

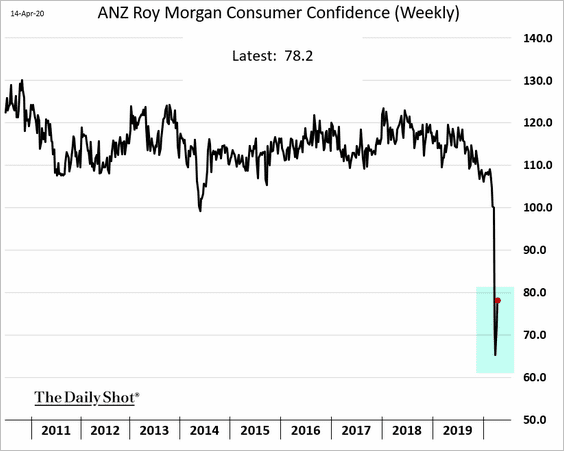

3. Next, we have some updates on Australia.

• Consumer sentiment has deteriorated to unprecedented levels.

However, the weekly indicator shows a rebound.

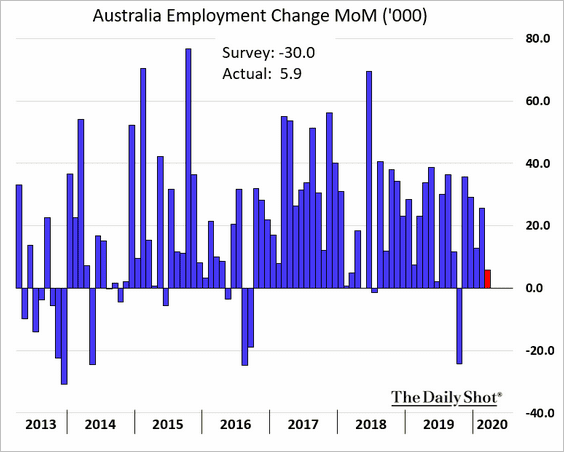

• The March employment report surprised to the upside.

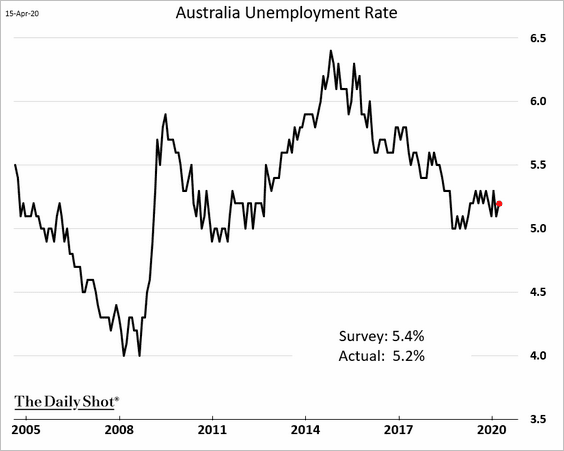

Here is the unemployment rate.

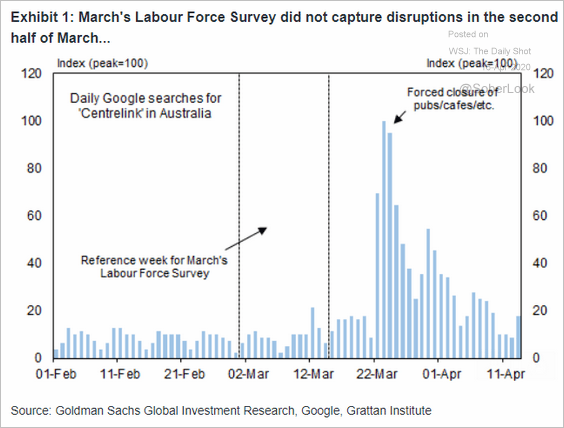

However, the labor market measurements took place in the first half of March, before the pandemic-related disruptions.

Source: Goldman Sachs

Source: Goldman Sachs

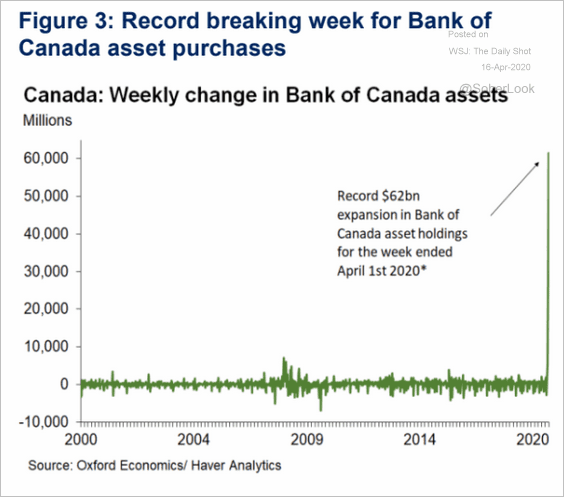

Canada

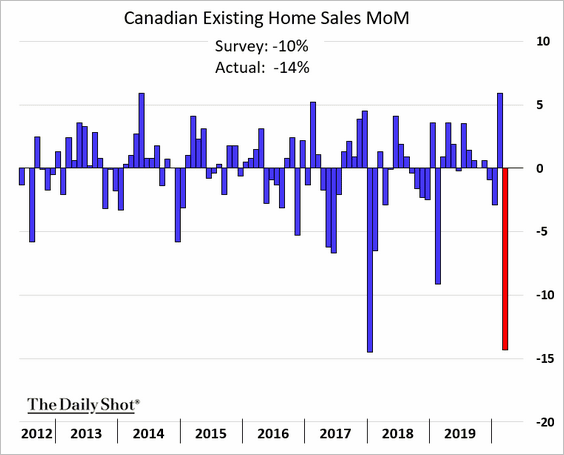

1. Existing home sales tumbled last month.

Source: @markets Read full article

Source: @markets Read full article

——————–

2. The BoC has ramped up asset purchases.

Source: Oxford Economics

Source: Oxford Economics

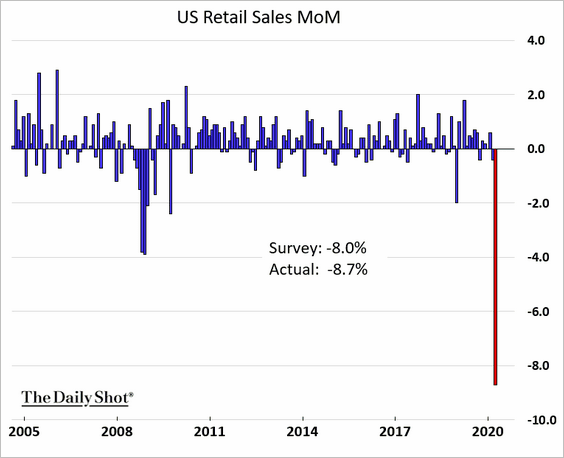

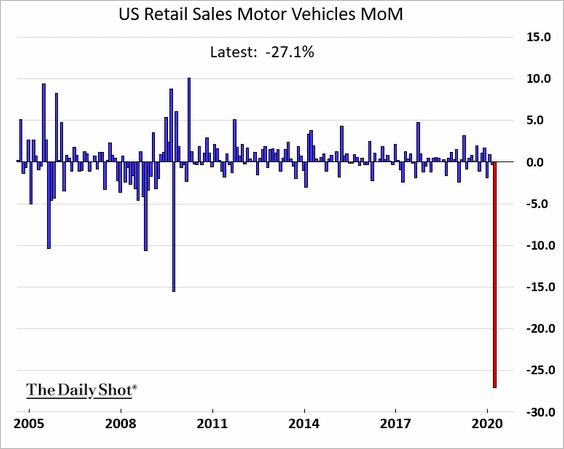

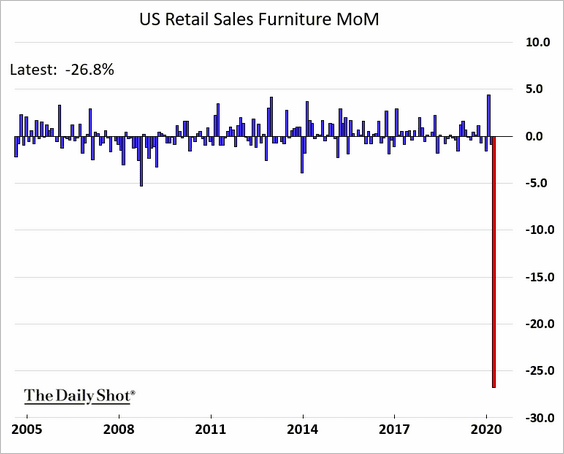

The United States

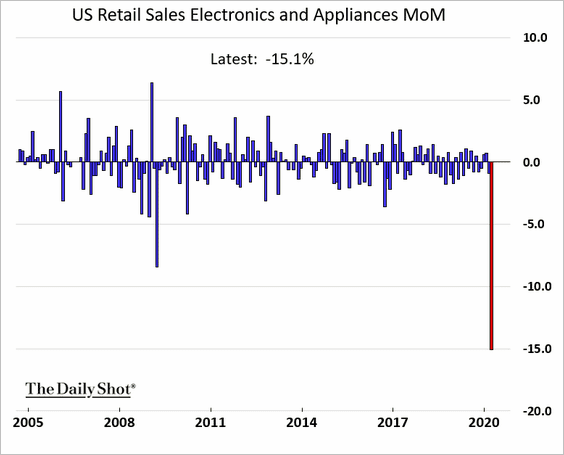

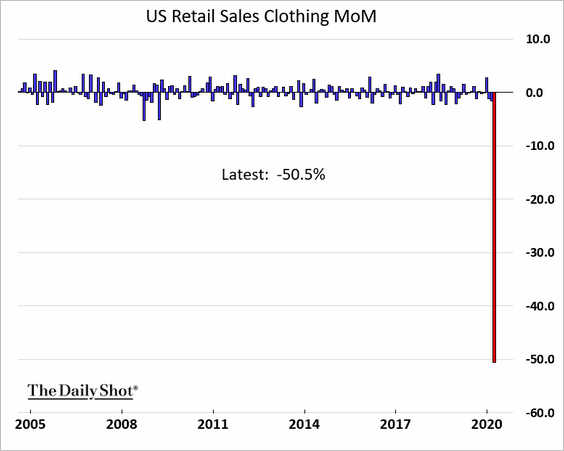

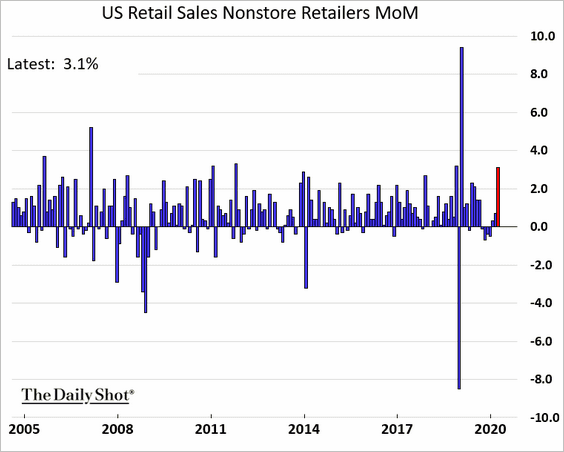

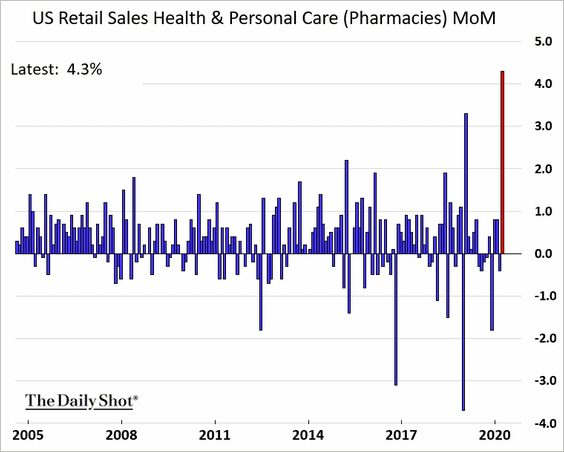

1. Retail sales plunged in March.

Here are some of the hardest-hit sectors.

• Car sales:

• Furniture:

• Appliances:

• Clothing (down 50%):

But there were some winners.

• Online retail:

• Pharmacies:

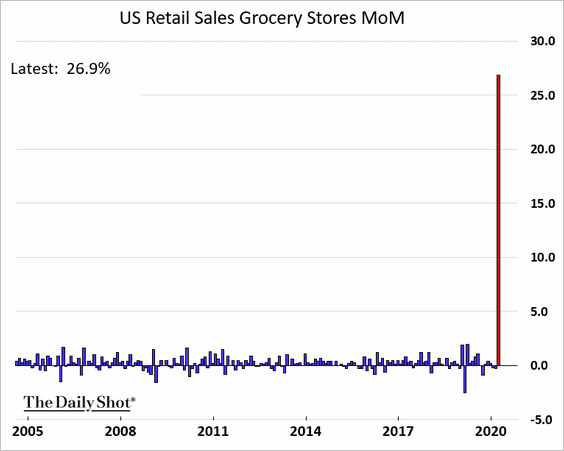

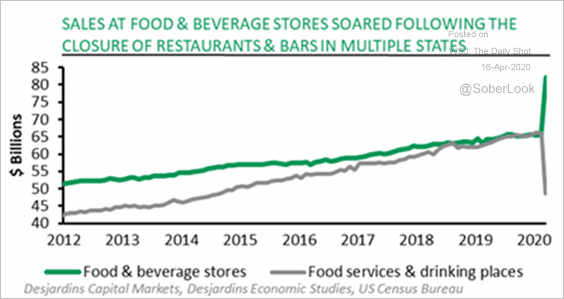

• Grocery stores:

The huge increase in grocery store sales was driven by hoarding as well as restaurant closures.

Source: Desjardins

Source: Desjardins

——————–

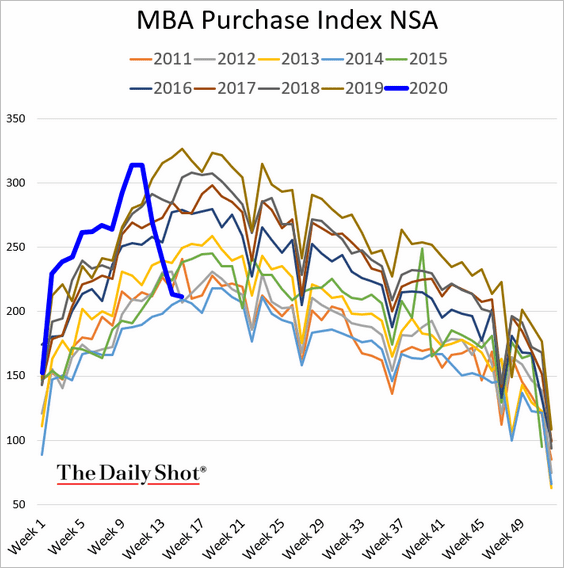

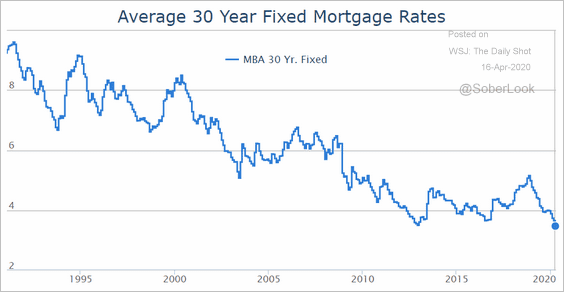

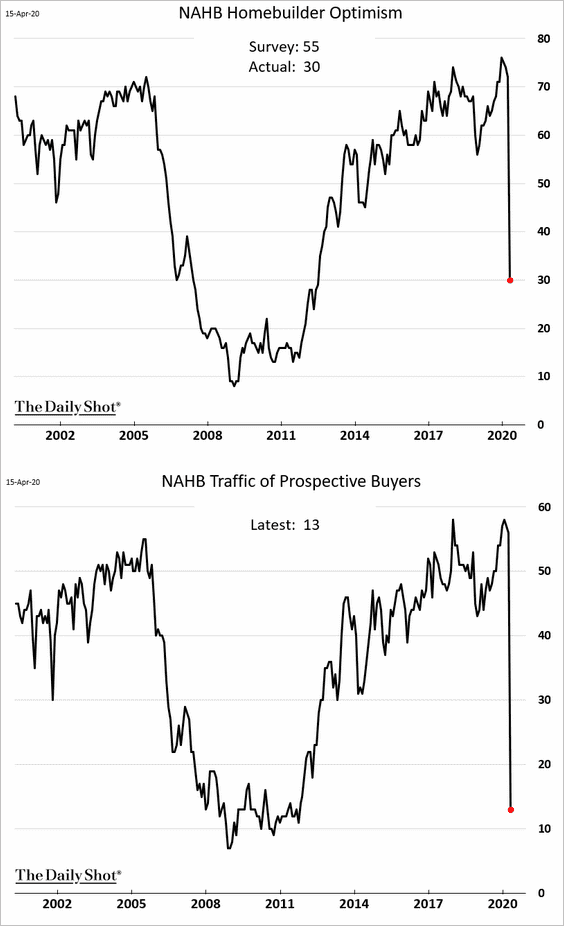

2. Next, we have some updates on the housing market.

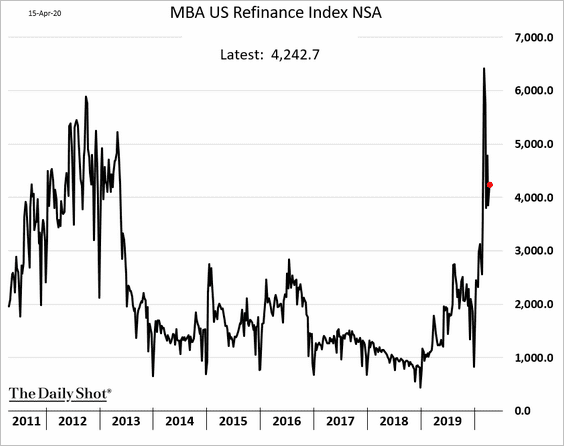

• Mortage applications to purchase a home are declining but have not collapsed.

Refi applications remain elevated as mortgage rates hover near record lows (second chart).

Source: Mortgage News Daily

Source: Mortgage News Daily

• Homebuilder sentiment plummetted this month.

——————–

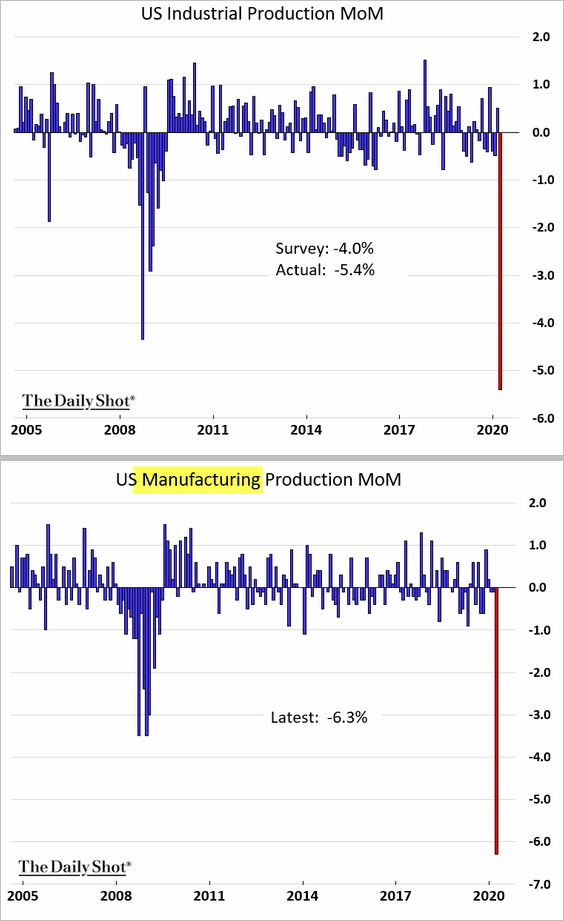

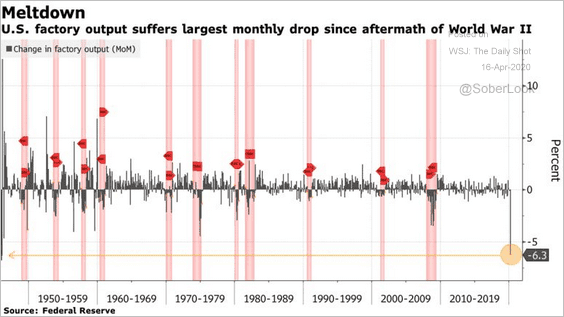

3. Industrial production crashed in March, with factory output registering the worst decline since WW-II.

Source: @markets Read full article

Source: @markets Read full article

——————–

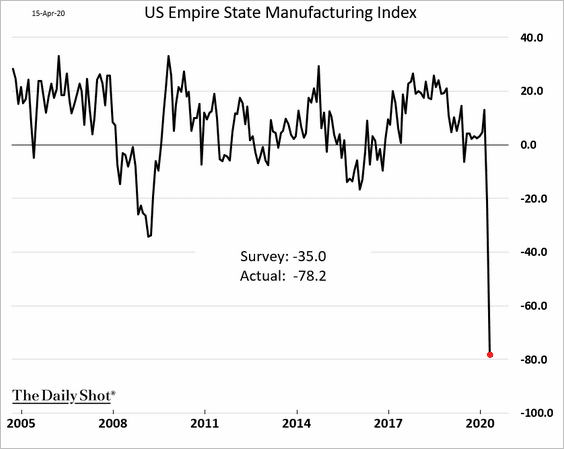

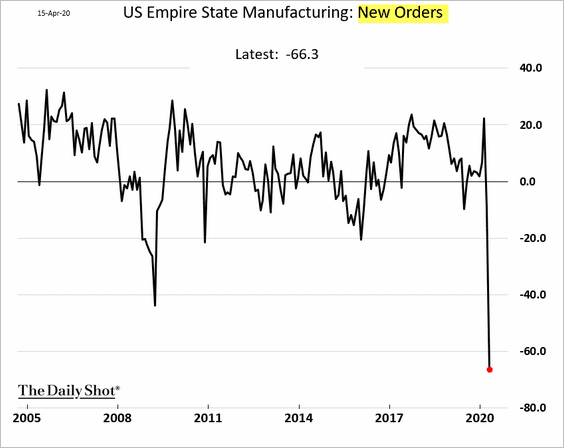

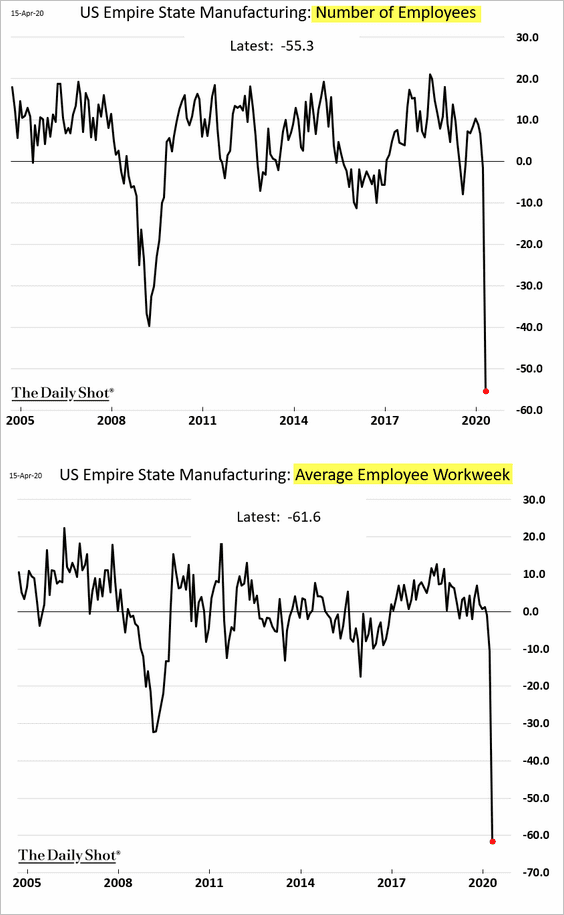

4. Manufacturing activity went from bad to worse in April. The NY Fed’s report (Empire State Manufacturing) showed factories shutting down.

• New orders:

• Employment:

——————–

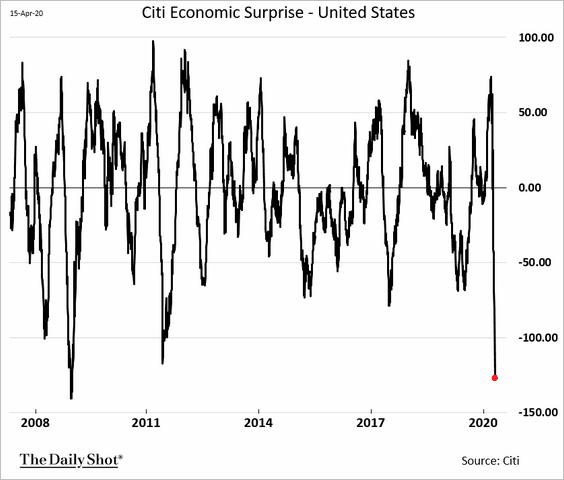

5. The Citi Economic Surprise Index hit the lowest level since 2008.

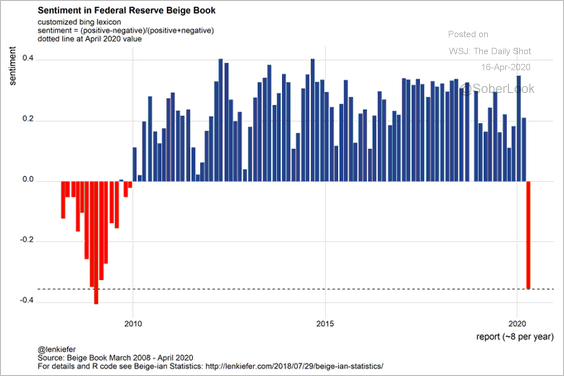

6. The Fed’s Beige Book showed business activity plunging.

Source: @lenkiefer

Source: @lenkiefer

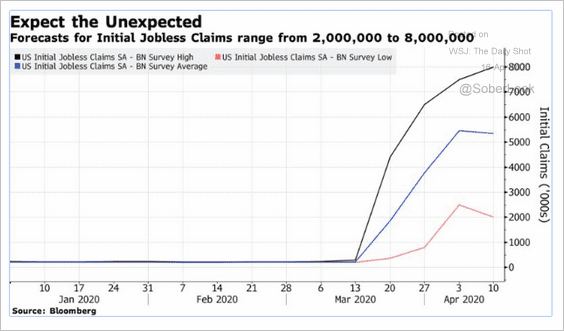

7. Next, we have some updates on the labor markets.

• How many more Americans filed for unemployment last week? Estimates vary from 2 to 8 million.

Source: @johnauthers, @bopinion Read full article

Source: @johnauthers, @bopinion Read full article

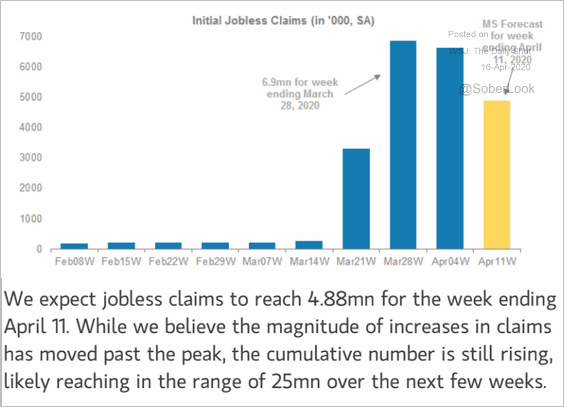

Most analysts think that new unemployment claims have peaked. Here is Morgan Stanley’s forecast.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

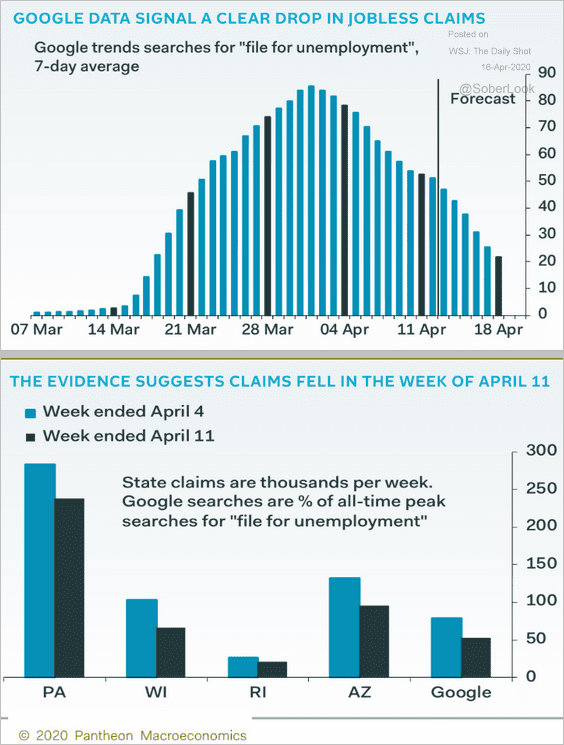

Google search analysis from Pantheon Macroeconomics supports that view.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

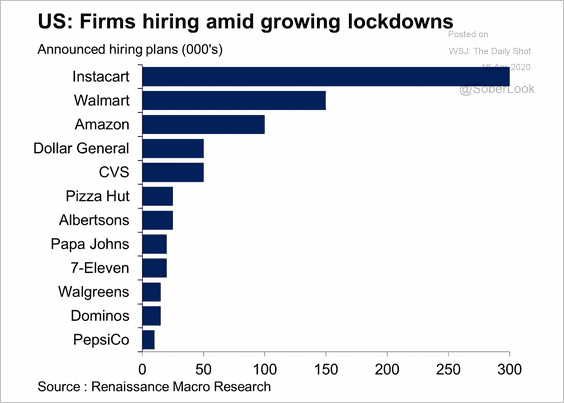

• Which firms have been hiring during the lockdowns?

Source: Oxford Economics

Source: Oxford Economics

——————–

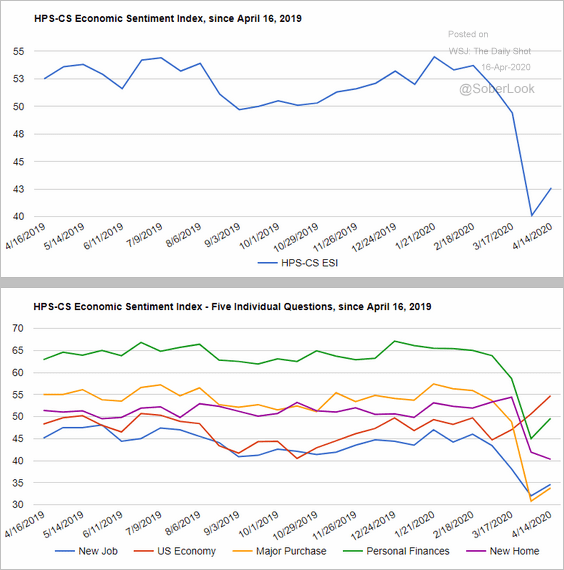

8. Has consumer sentiment bottomed?

Source: @HPS_CS Read full article

Source: @HPS_CS Read full article

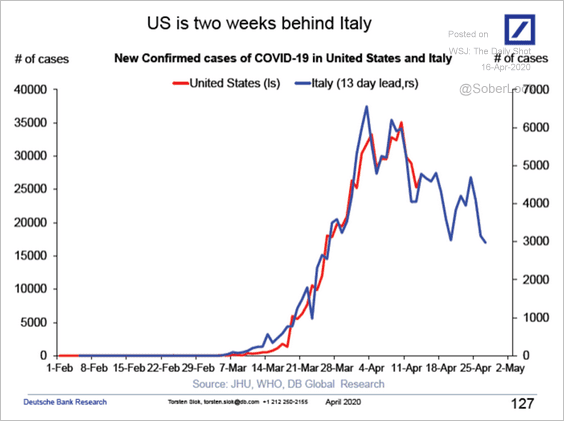

9. New coronavirus cases in the US are running two weeks behind Italy.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Global Developments

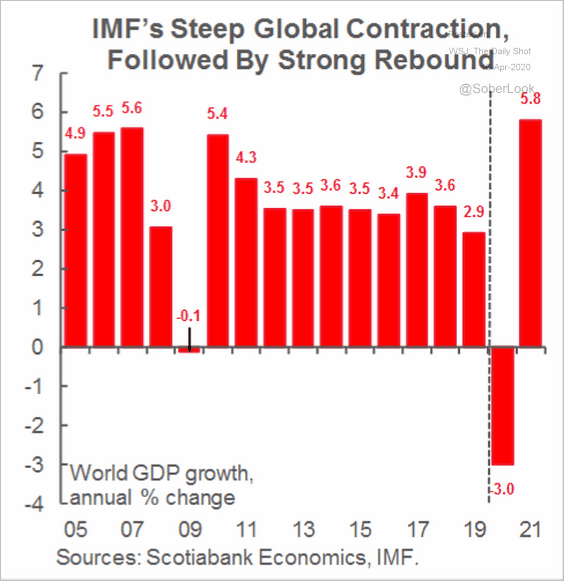

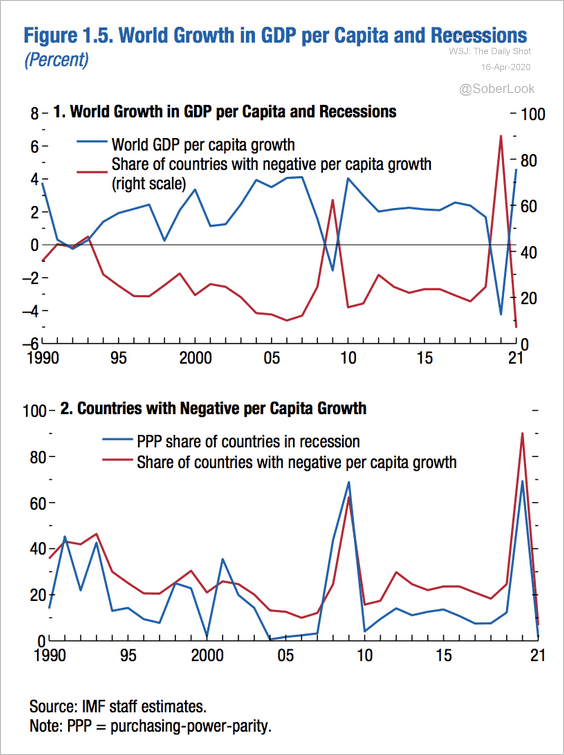

1. The IMF sees a sharp contraction in the GDP this year, followed by a rebound in 2021.

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: IMF Read full article

Source: IMF Read full article

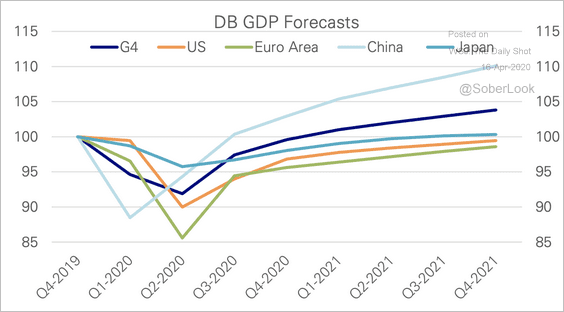

Deutsche Bank’s baseline view is for a record plunge in Q1 and Q2 GDP, followed by a rebound beginning in Q3. It will take about a full year to return to 2019 levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

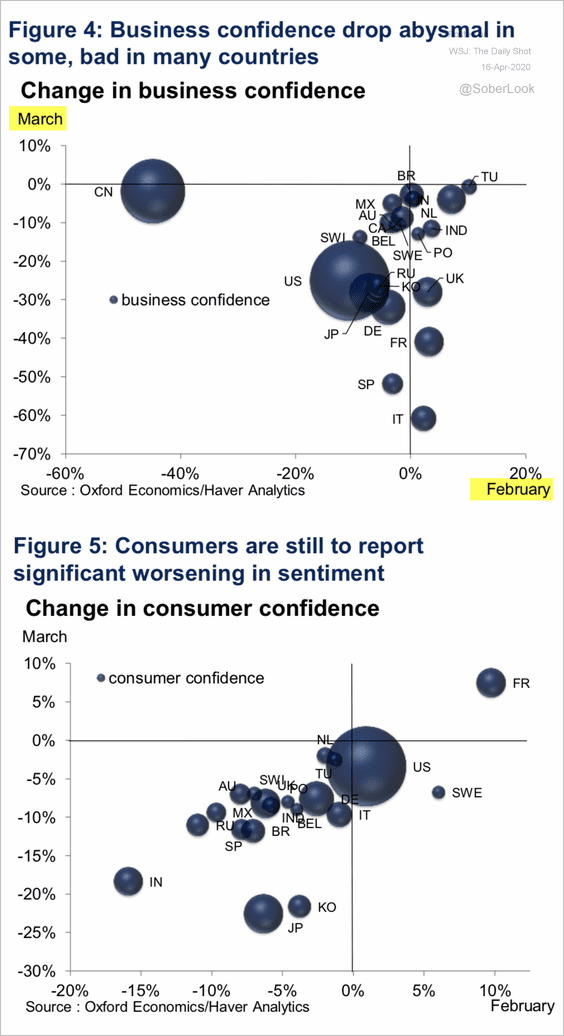

2. How has business and consumer sentiment changed between February and March?

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

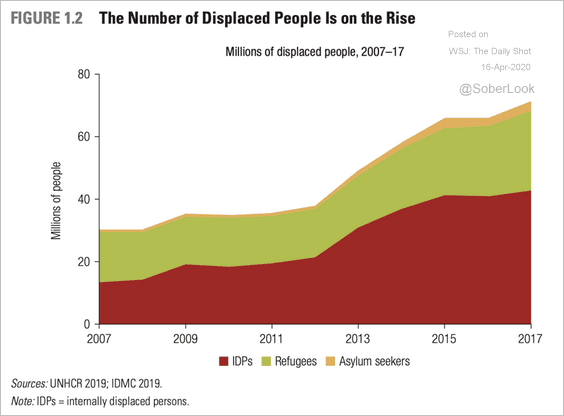

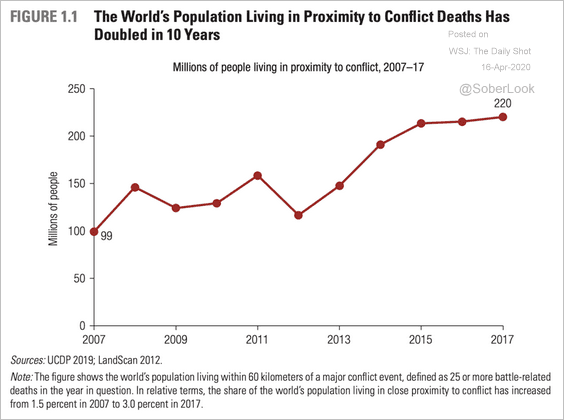

1. Displaced people around the world:

Source: World Bank

Source: World Bank

Source: World Bank

Source: World Bank

——————–

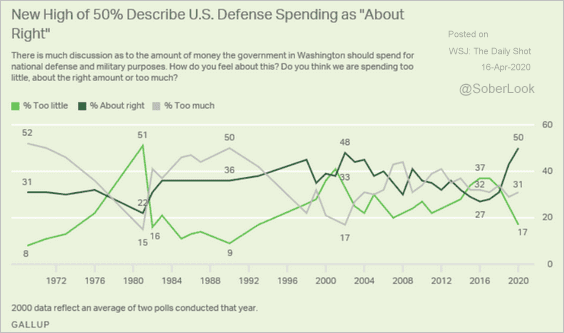

2. Views on US defense spending:

Source: Gallup Read full article

Source: Gallup Read full article

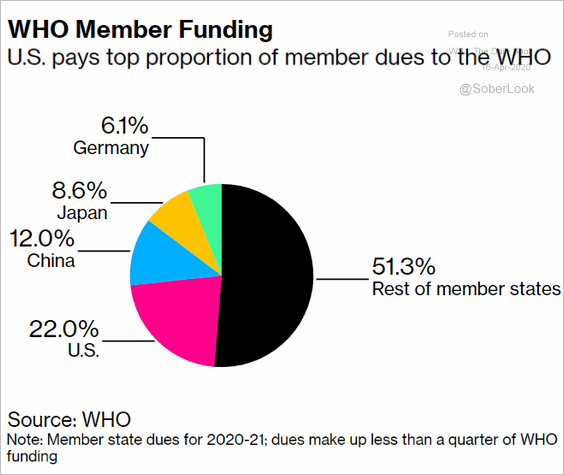

3. WHO funding sources:

Source: @bpolitics Read full article

Source: @bpolitics Read full article

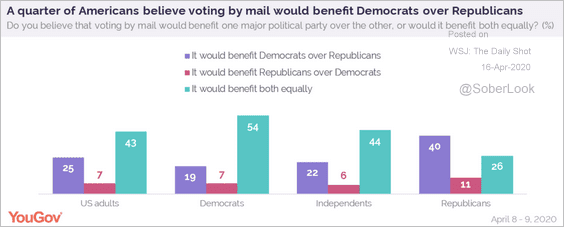

4. Voting by mail:

Source: @YouGovUS Read full article

Source: @YouGovUS Read full article

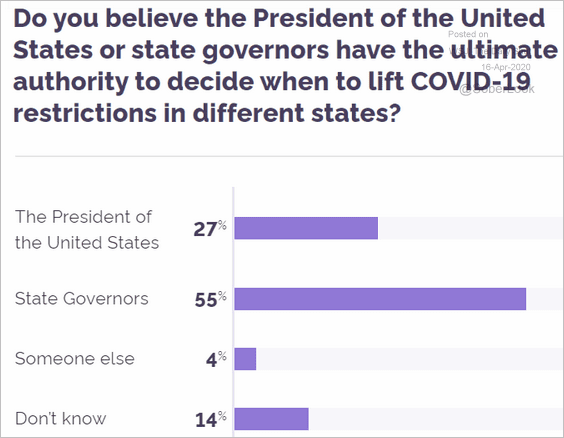

5. Who can decide to lift restrictions?

Source: YouGov Read full article

Source: YouGov Read full article

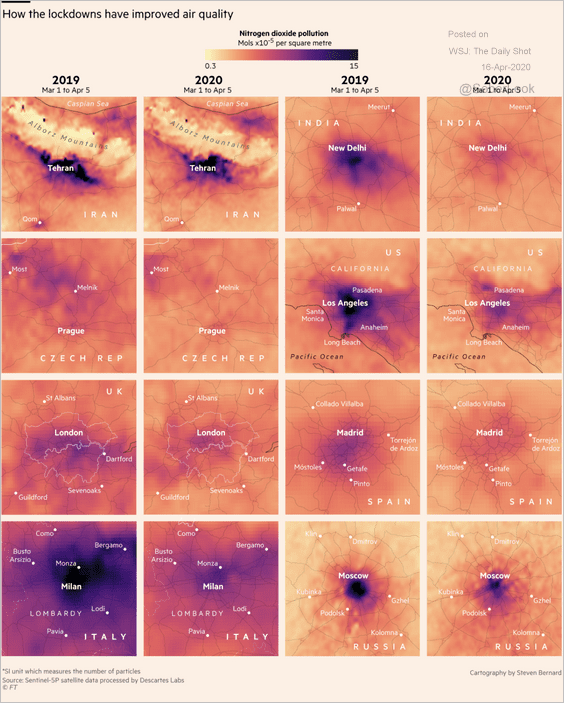

6. Improvements in air quality:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

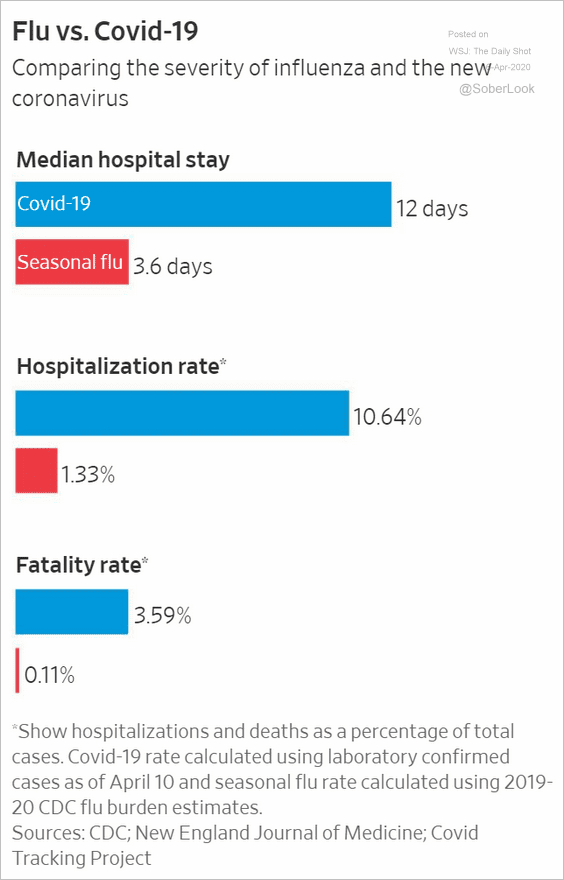

7. Flu vs. COVID-19:

Source: @WSJ Read full article

Source: @WSJ Read full article

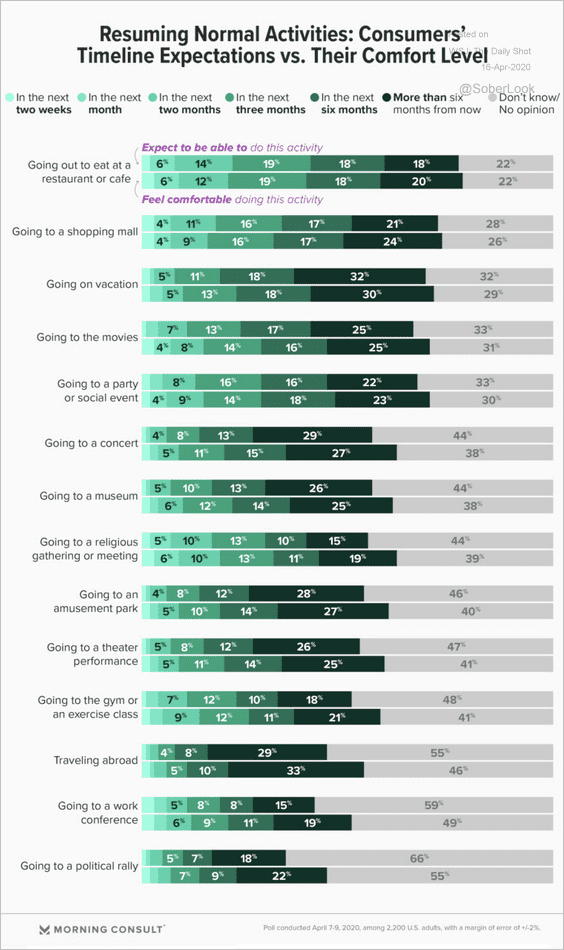

8. Resuming normal activities:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

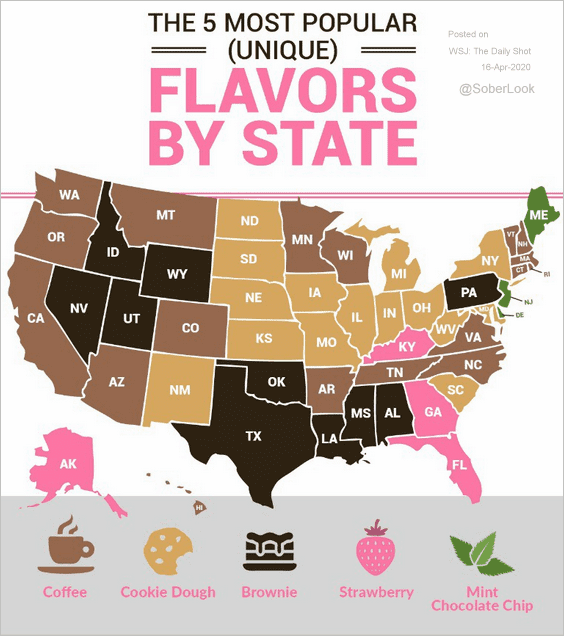

9. Most popular flavors:

Source: Frozen Dessert Supplies Read full article

Source: Frozen Dessert Supplies Read full article

——————–