The Daily Shot: 01-May-20

• The United States

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Rates

• Food for Thought

The United States

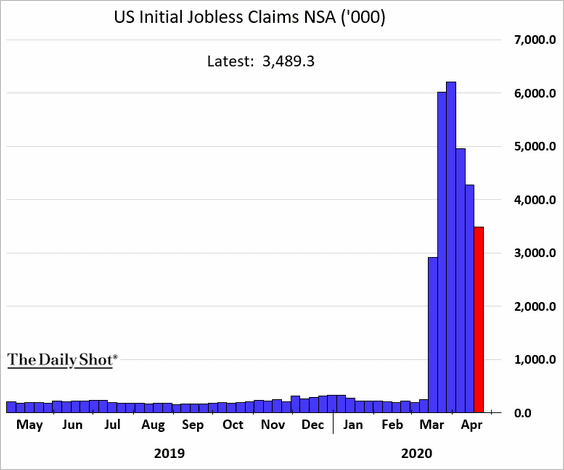

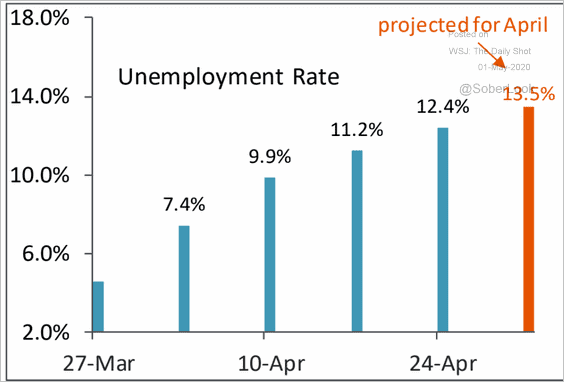

1. Millions more Americans filed for unemployment benefits last week.

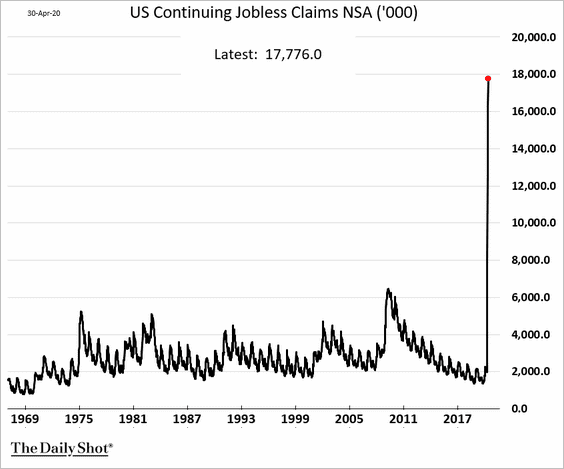

With the increase in the figures above, continuing jobless claims probably exceeded 20 million.

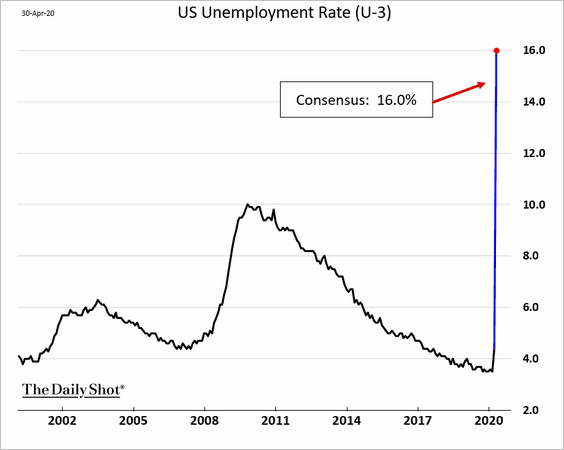

Economists expect the April unemployment rate to hit 16%.

Source: @TheTerminal

Source: @TheTerminal

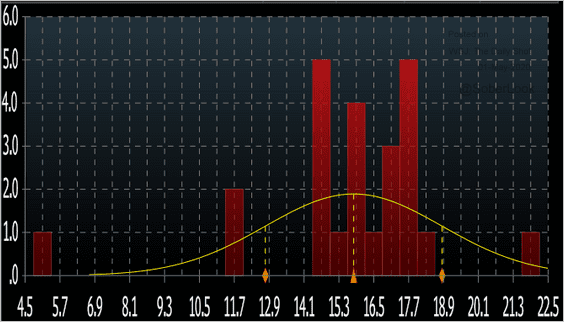

Here is the distribution of unemployment forecasts from Bloomberg’s survey.

Source: @TheTerminal

Source: @TheTerminal

Piper Sandler is forecasting a smaller unemployment figure because many applications for benefits were denied. Those who didn’t qualify will no longer be counted as part of the labor force.

Source: Piper Sandler

Source: Piper Sandler

——————–

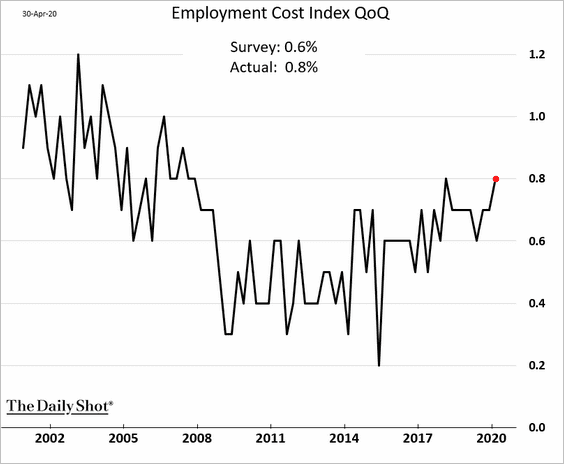

2. Growth in the employment cost index has been trending higher in recent years. But the trend is unlikely to persist going forward.

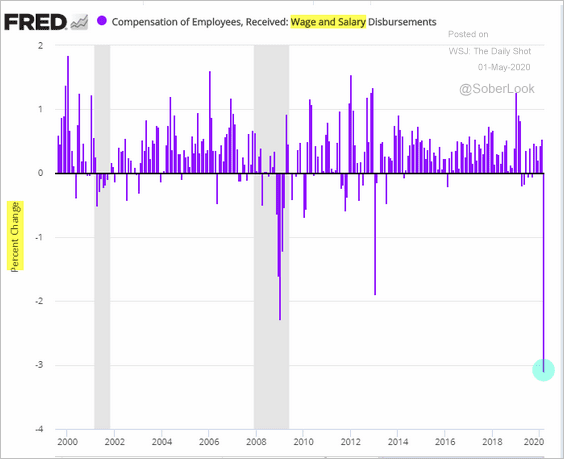

Wages received by employees saw the largest decline in recent decades.

——————–

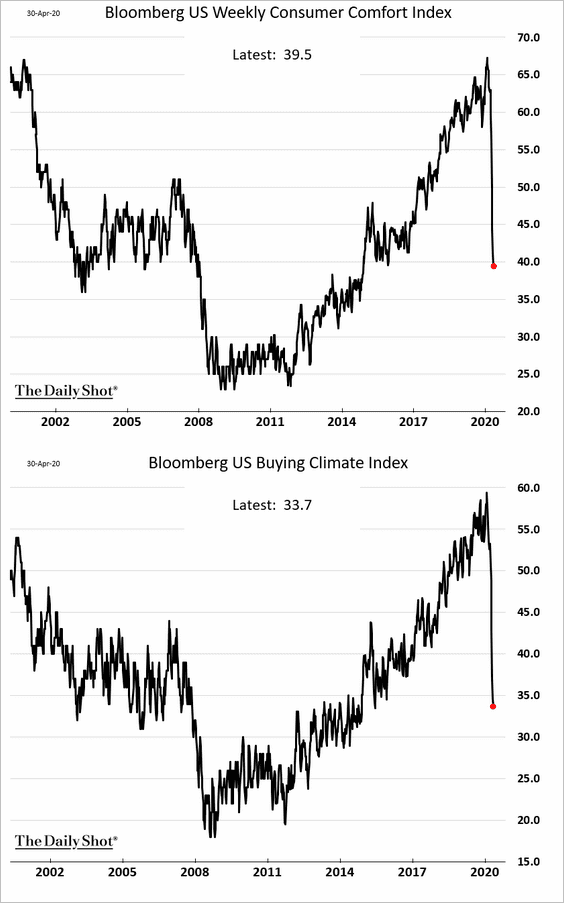

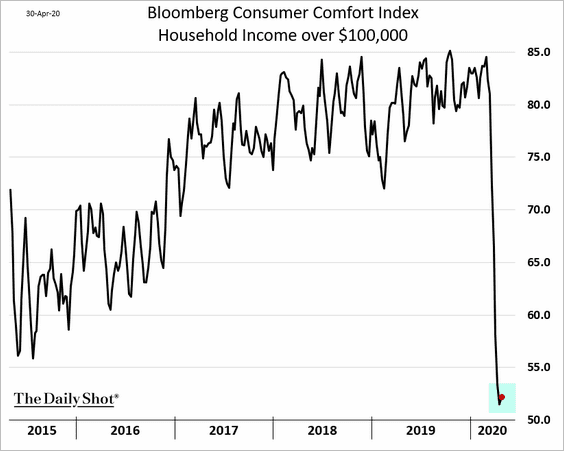

3. Bloomberg’s consumer sentiment index continues to plummet.

The index seems to have stabilized for households with incomes above $100k, probably as a result of the stock market rebound.

——————–

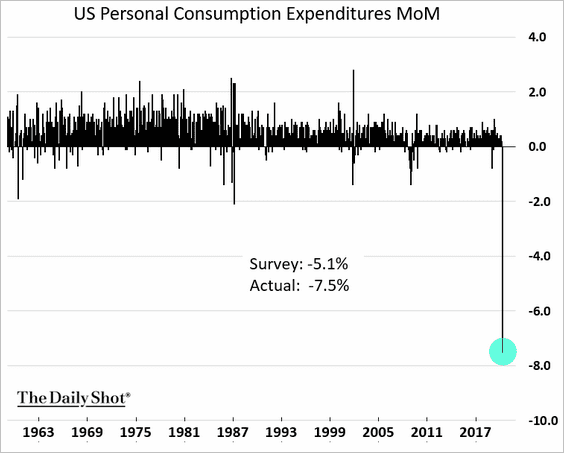

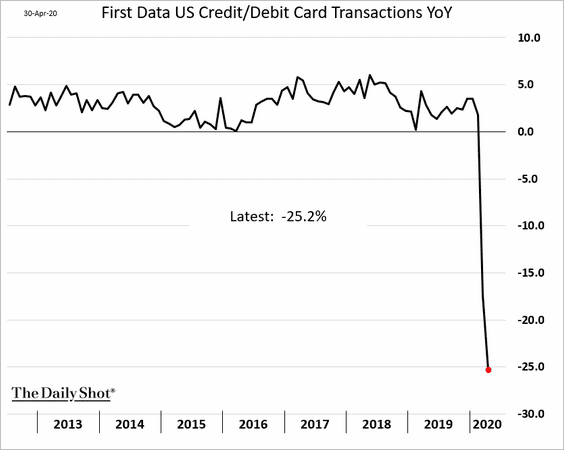

4. Consumer spending tumbled in March.

Credit card spending is now down 25% from the same time last year.

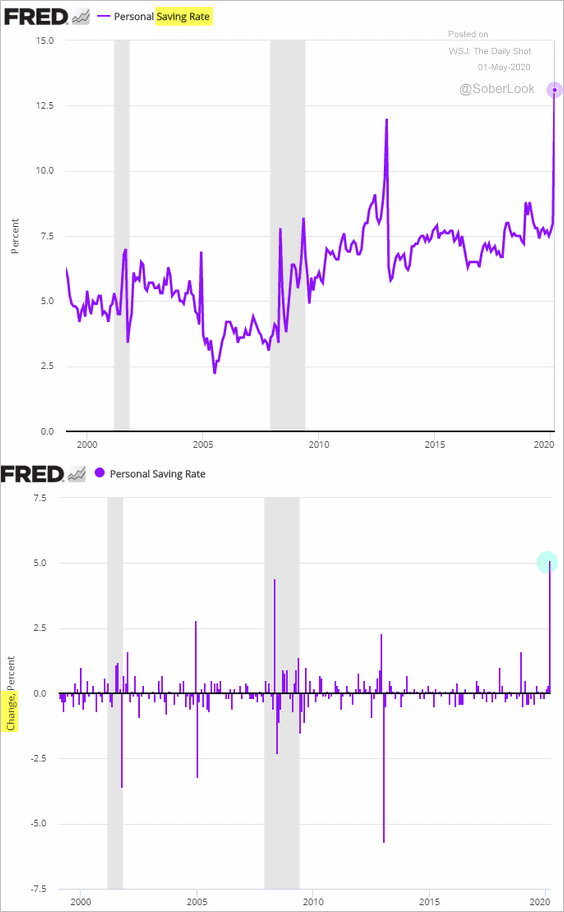

The US savings rate increased by the highest percentage in 39 years (see story)

——————–

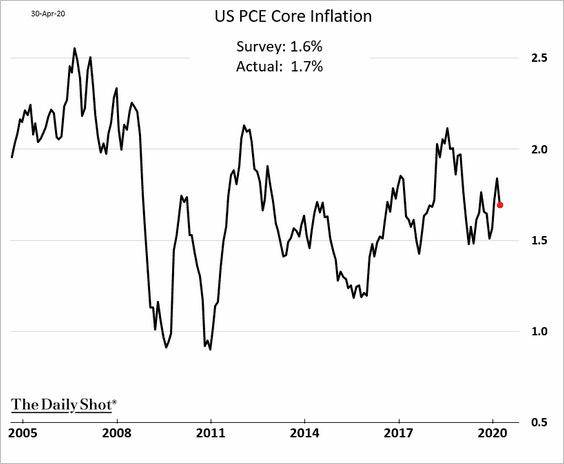

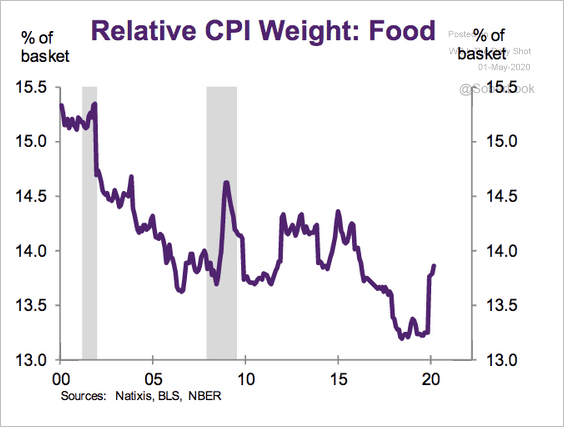

5. Next, we have a couple of updates on inflation.

• The core PCE inflation was a bit firmer than expected in March. We are likely to see substantial declines in the months to come.

• This chart shows the relative weight of food in the US CPI.

Source: Natixis

Source: Natixis

——————–

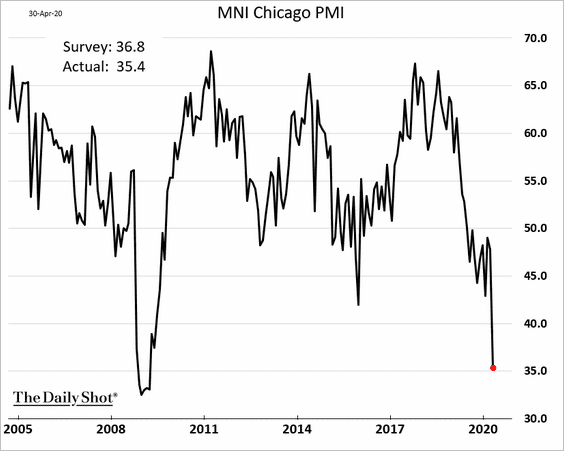

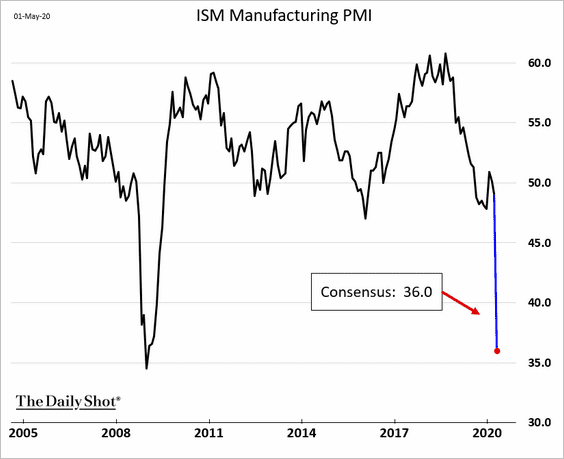

6. The Chicago PMI index, a regional measure of business activity, hit the lowest level since 2009.

The Chicago PMI, combined with the regional Fed surveys, points to a sharp deterioration in factory activity at the national level (ISM). Here is the consensus estimate for the ISM index (out today at 10 AM EST).

Source: @TheTerminal

Source: @TheTerminal

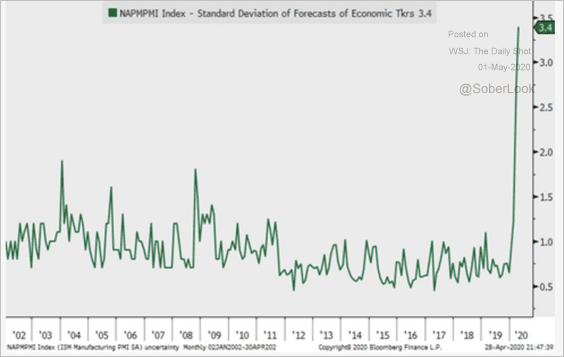

But individual forecasts for the ISM index are all over the place, with the standard deviation of economist estimates at the highest level in decades.

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

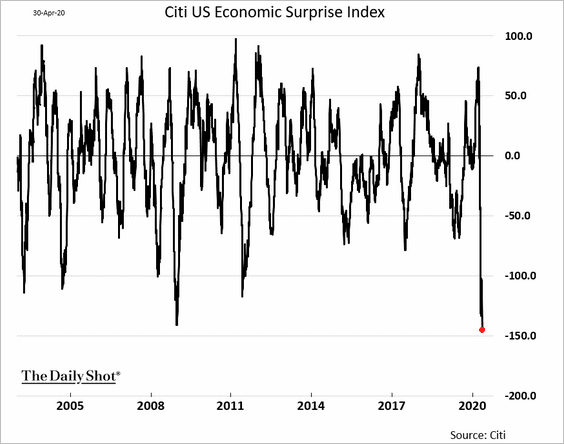

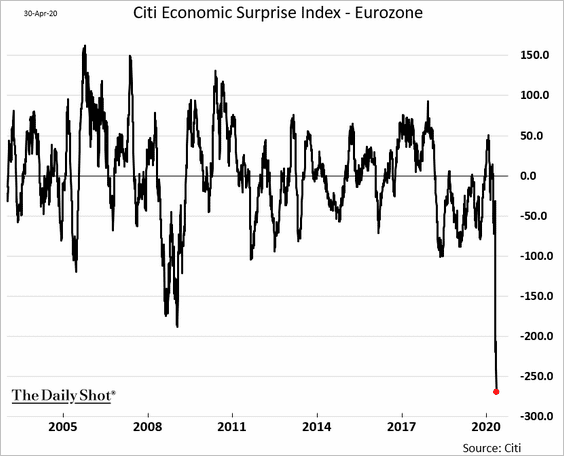

7. The Citi Economic Surprise Index hit a record low.

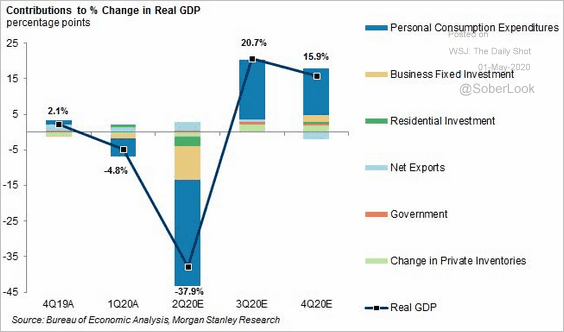

8. Finally, here is Morgan Stanley’s forecast for the US GDP growth through the end of the year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

The Eurozone

1. The ECB cut the TLTRO-III minimum rate to -1% (paying lenders to take the central bank’s money). As mentioned previously (#4 here), the move should cancel the adverse effect of negative rates and rising reserves. The central bank also introduced another facility (PELTROs) to be used as bridge financing for maturing ECB loans.

At a later stage, we may also see another increase in the ECB securities purchases, perhaps focused entirely on Italy and Spain. Some were hoping to see a boost to QE in this meeting.

——————–

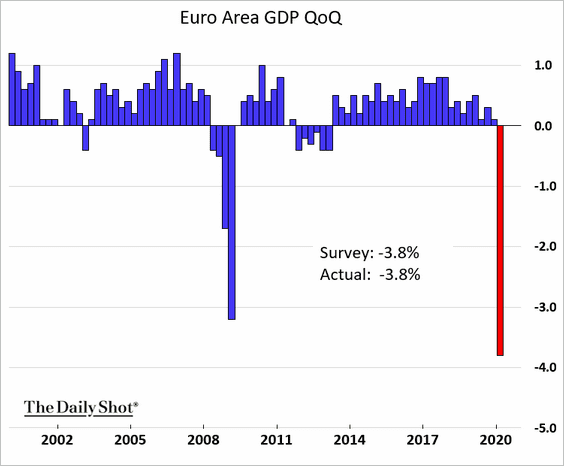

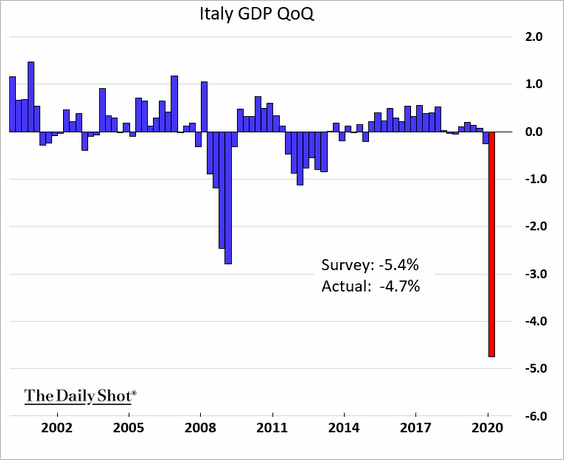

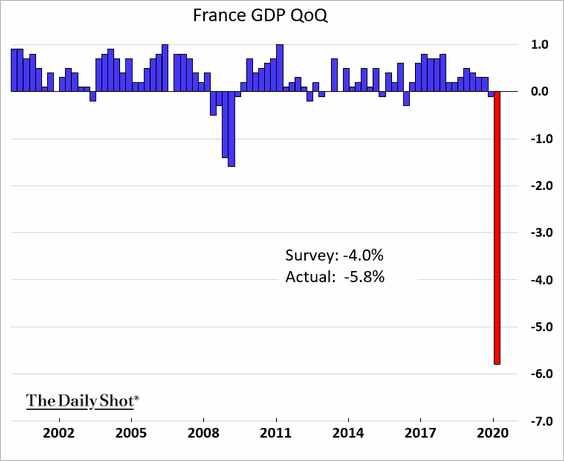

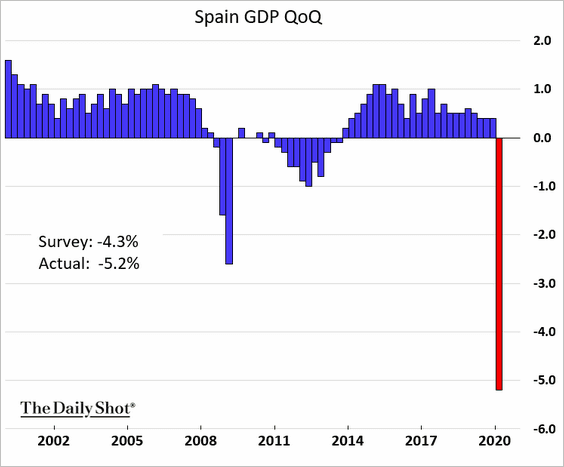

2. The Eurozone GDP contracted by 3.8% in the first quarter, the biggest decline since the introduction of the euro. And the second-quarter slump will be considerably worse.

Here are the GDP declines for Italy, France, and Spain.

——————–

3. The Citi Economic Surprise Index hit another record low.

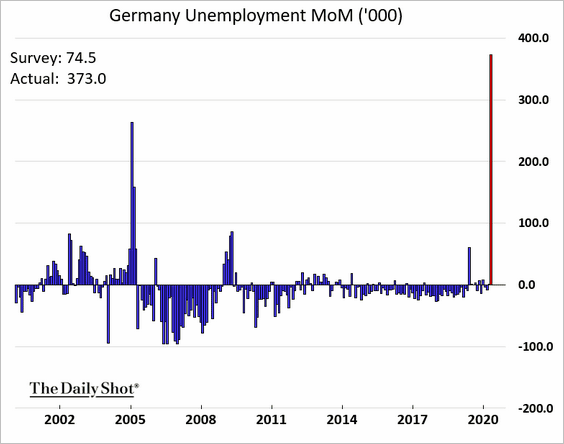

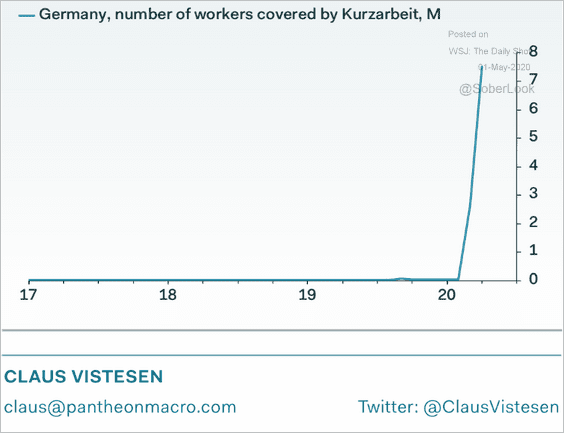

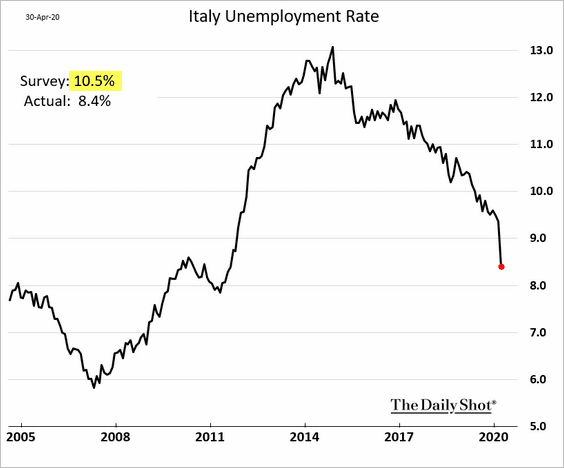

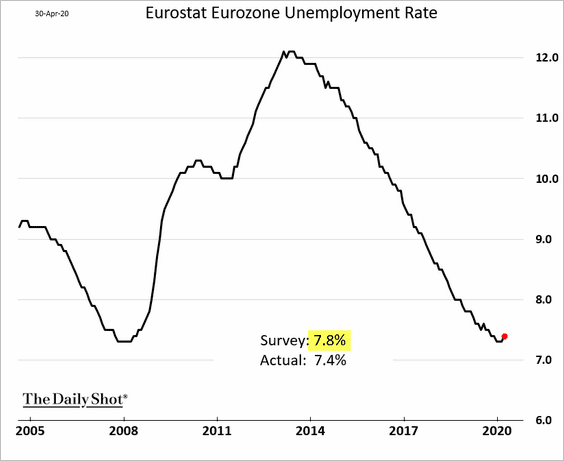

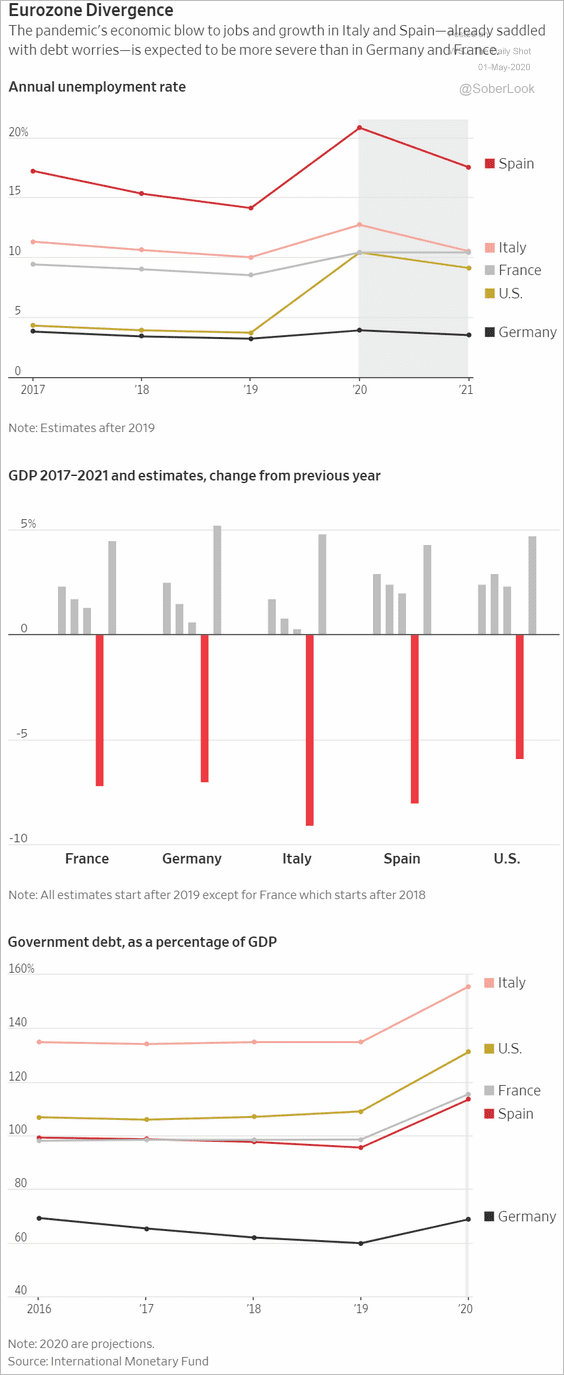

4. Next, we have some updates on the labor markets.

• Germany’s unemployment increase was a shocker.

And that’s in addition to the record number of workers covered by Kurzarbeit (“short-time work”).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Italy’s unemployment rate unexpectedly declined in March. Laid-off Italians stopped looking for work during the lockdown.

• At the Eurozone level, the March unemployment rate was more stable than expected (same reason as above).

• Here are some forecasts for unemployment, GDP growth, and government debt.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

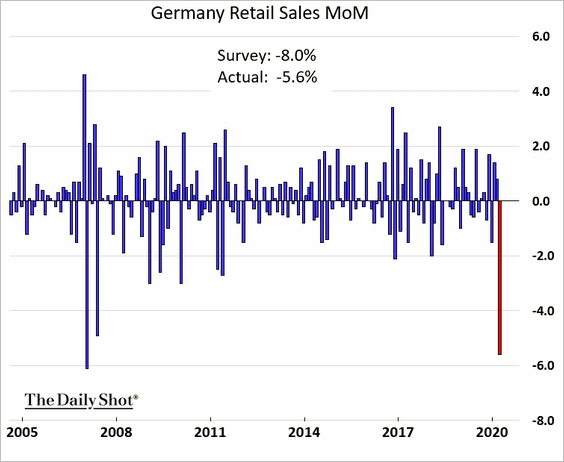

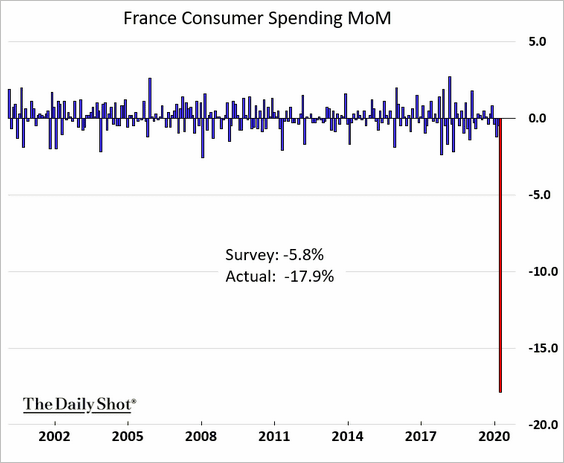

5. Consumer spending plunged in March.

• German retail sales (not as bad as expected):

• French consumer spending:

——————–

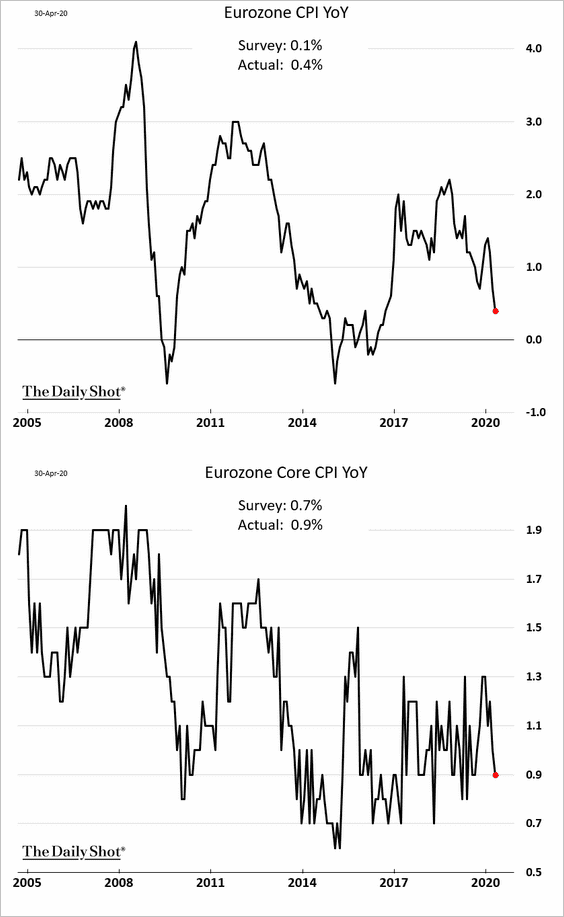

6. Eurozone inflation topped estimates in April. The downward trend, however, will continue.

Japan

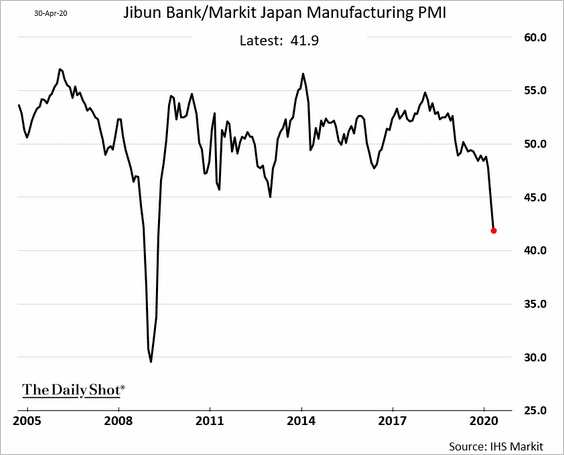

1. The manufacturing contraction hasn’t been as severe as what we saw in 2009 (for now).

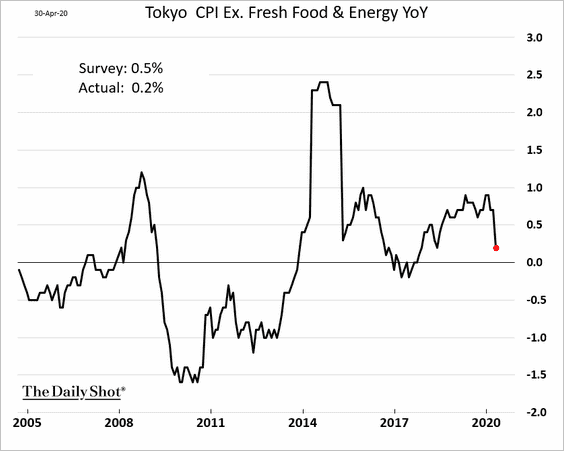

2. The Tokyo CPI report suggests that Japan is rapidly headed for deflation again.

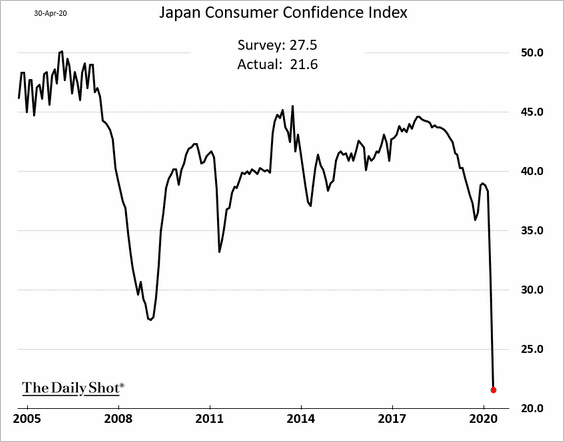

3. Consumer confidence hit a record low in April.

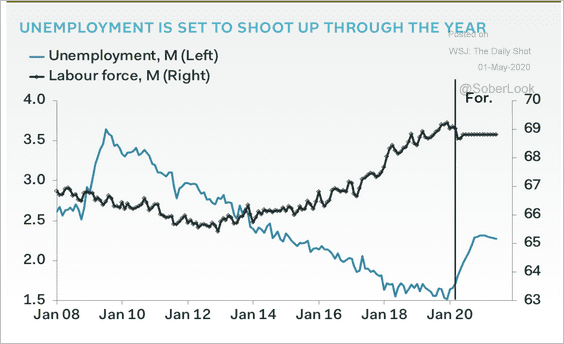

4. Here is a forecast for Japan’s unemployment rate from Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Asia – Pacific

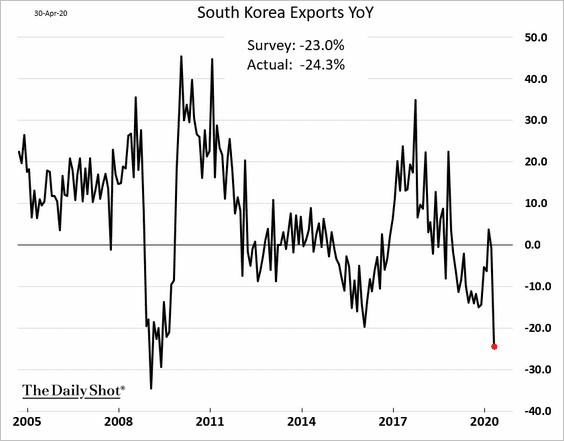

1. South Korea’s exports are down 24% from April 2019.

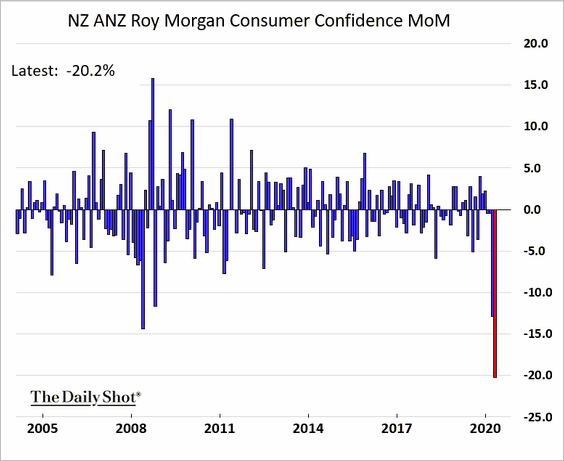

2. New Zealand’s consumer confidence registered a massive decline this month.

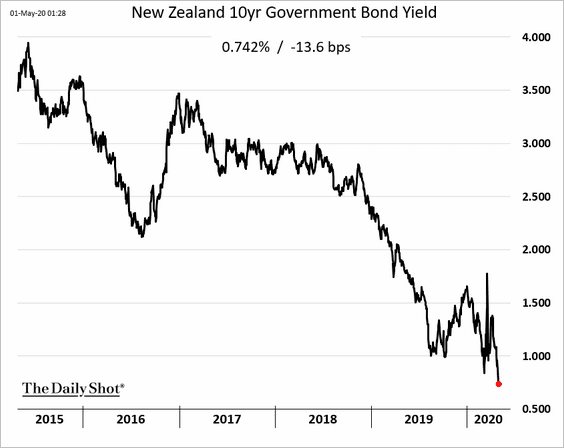

The 10yr bond yield hit a new low.

——————–

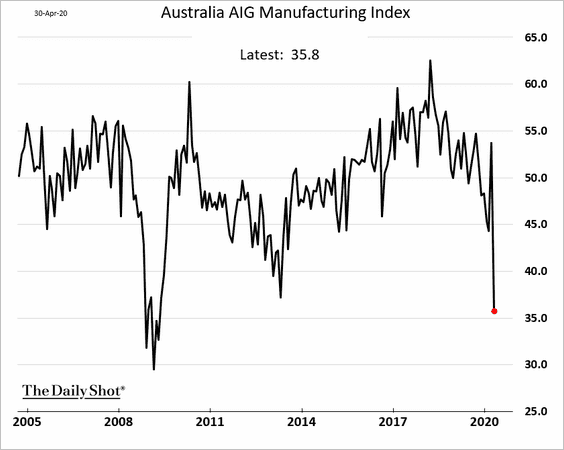

3. Australia’s manufacturing activity has been contracting at the fastest pace since 2009.

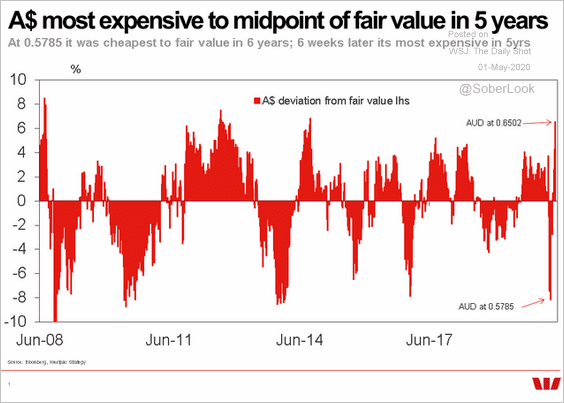

Separately, the Aussie dollar appears to be overbought.

Source: Westpac, @Robert__Rennie

Source: Westpac, @Robert__Rennie

China

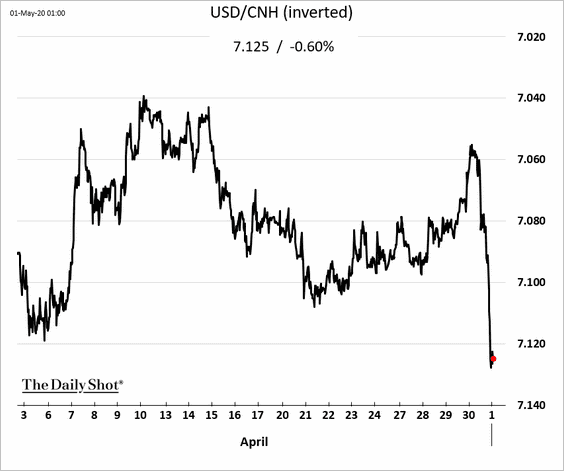

1. The renminbi started the month on a weak note (the chart shows the offshore RMB).

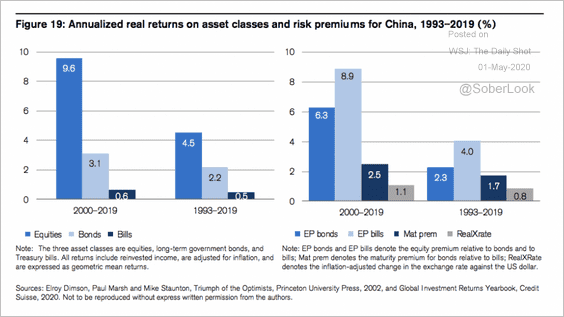

2. The past 20 years have been good for China’s capital markets.

Source: Credit Suisse

Source: Credit Suisse

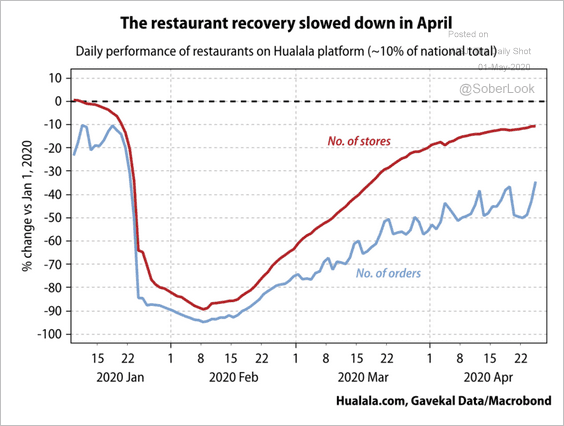

3. China’s restaurant recovery has lost momentum.

Source: Gavekal

Source: Gavekal

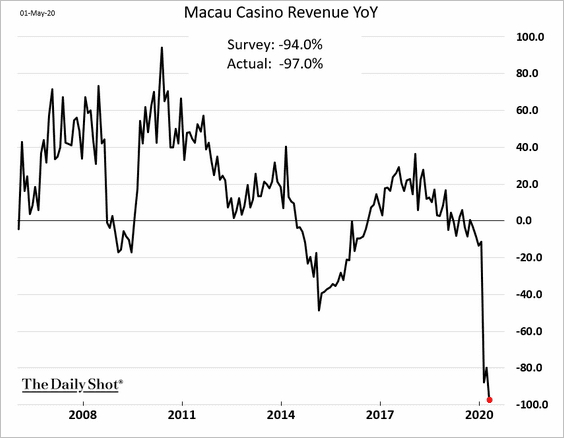

4. Macau gaming revenues are down 97% on a year-over-year basis.

Emerging Markets

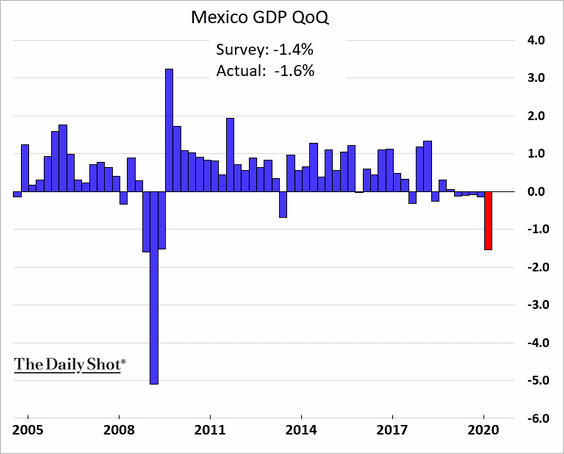

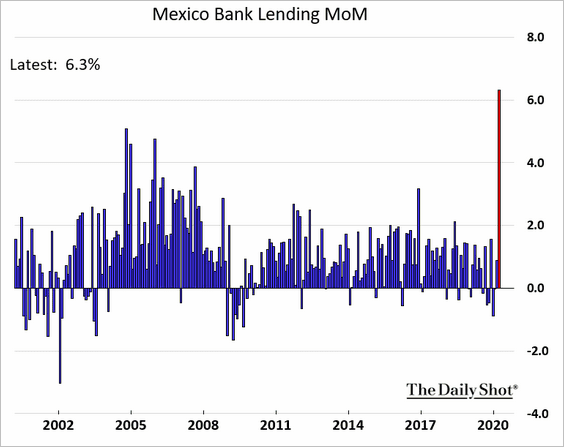

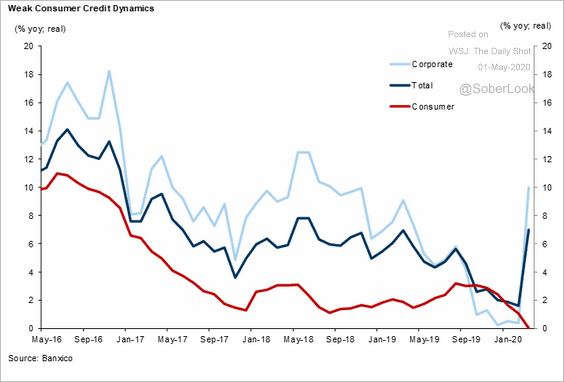

1. Let’s begin with Mexico.

• The Q1 GDP:

• Month-over-month loan growth (driven by corporate demand for liquidity):

Year-over-year loan growth:

Source: Goldman Sachs

Source: Goldman Sachs

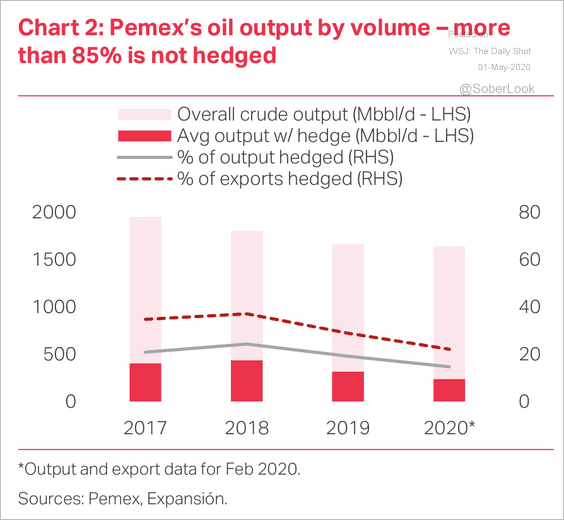

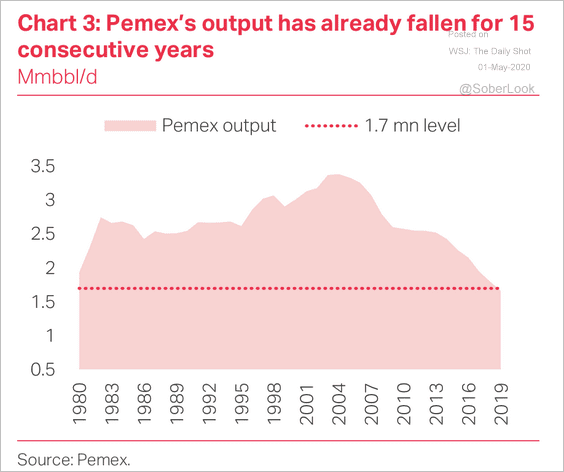

• The oil price shock has added to mounting problems for Pemex, Mexico’s state oil behemoth (two charts).

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

——————–

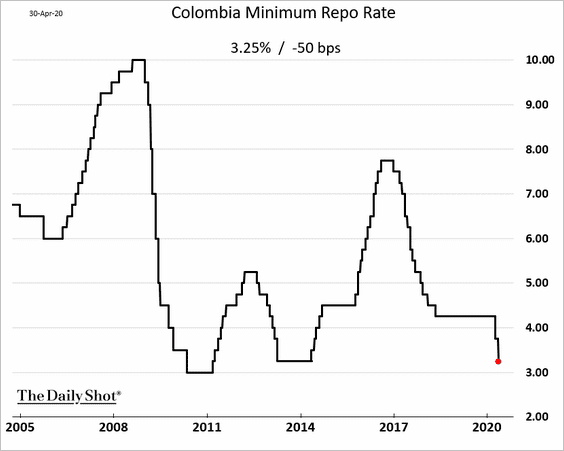

2. Colombia’s central bank cut rates again.

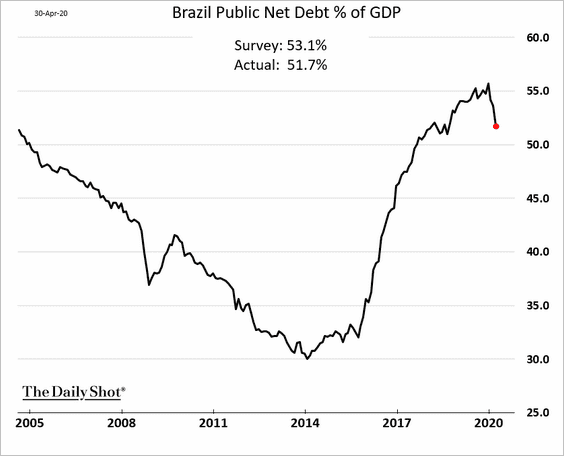

3. Brazil’s debt-to-GDP ratio has been rolling over. Will the trend continue?

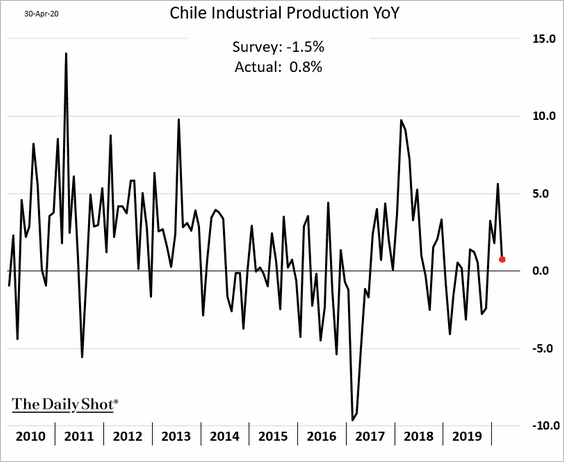

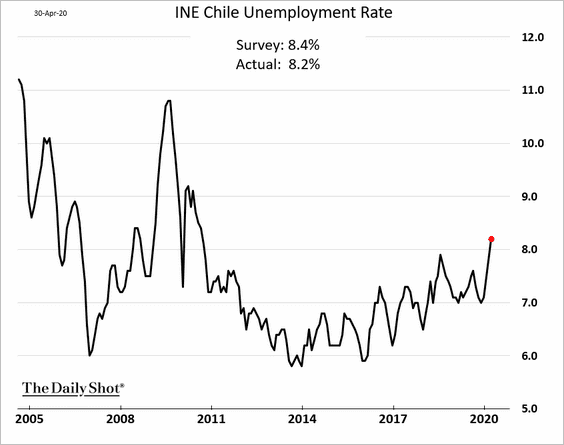

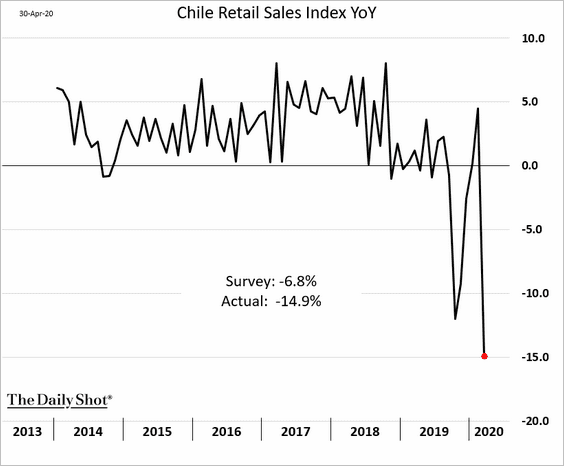

4. Next, we have some updates on Chile.

• March industrial production (stronger than expected):

• The unemployment rate:

• Retail sales:

——————–

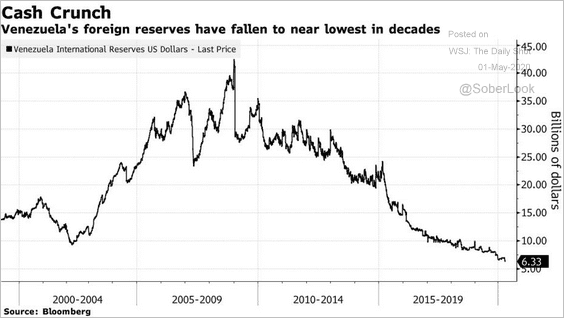

5. This chart shows Venezuela’s foreign reserves.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

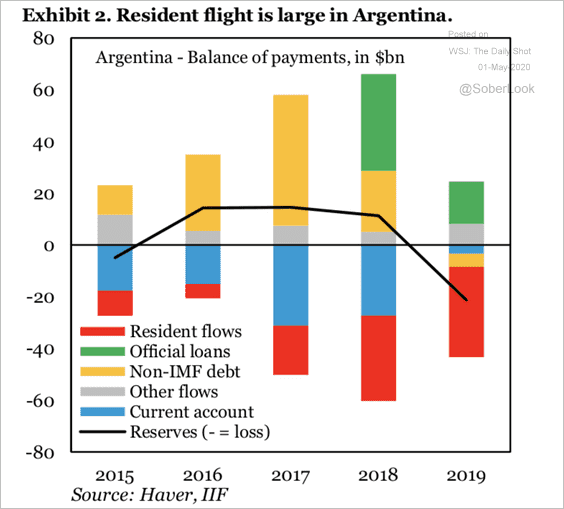

6. Argentina’s residents have been moving capital out of the country.

Source: IIF

Source: IIF

——————–

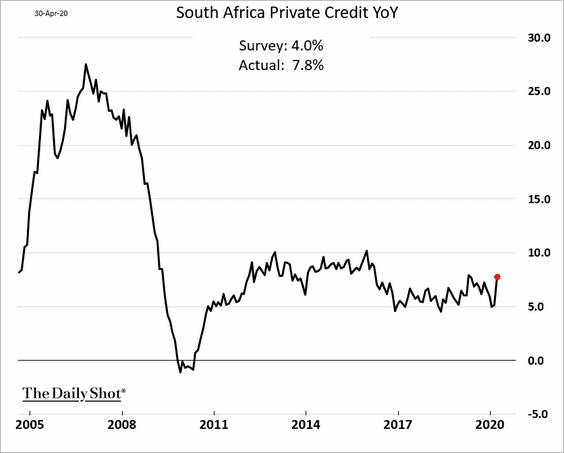

7. South Africa’s private credit growth accelerated due to corporate demand.

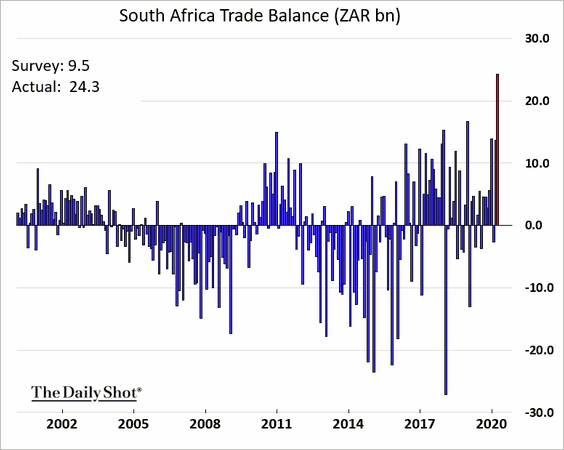

The nation’s trade surplus hit a record high.

——————–

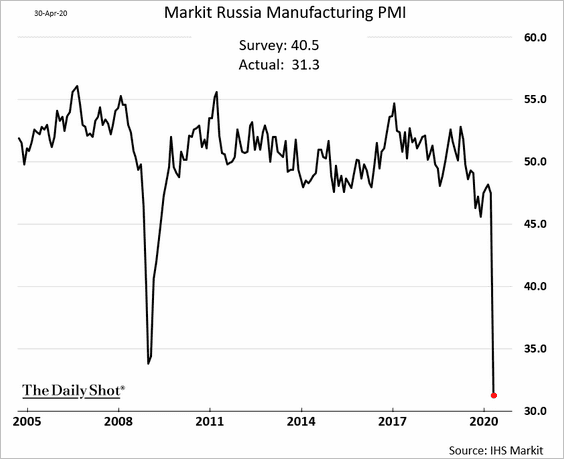

8. Russia’s manufacturing sector came to a grinding halt in April.

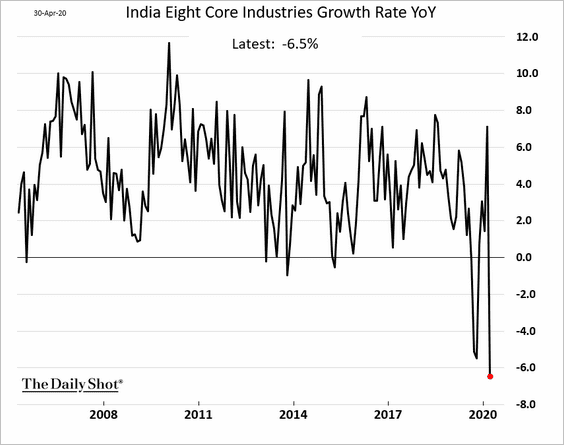

9. India’s key industries registered the largest decline seen in recent years.

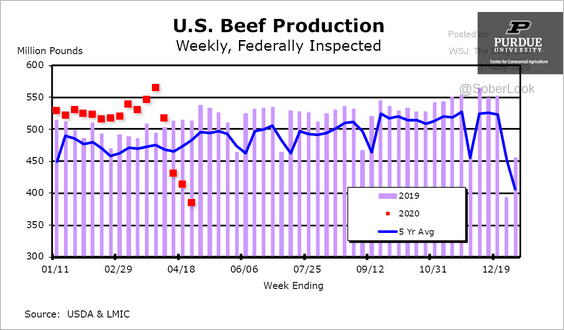

Commodities

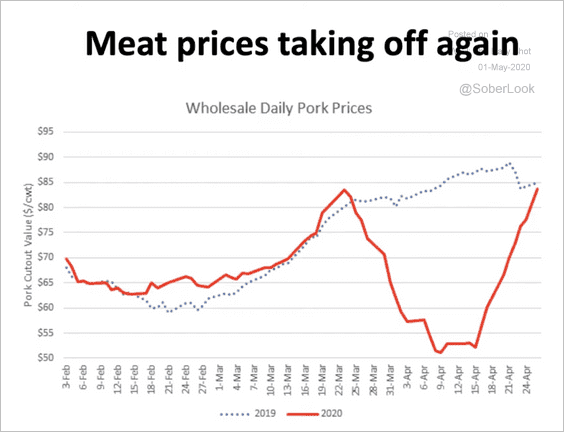

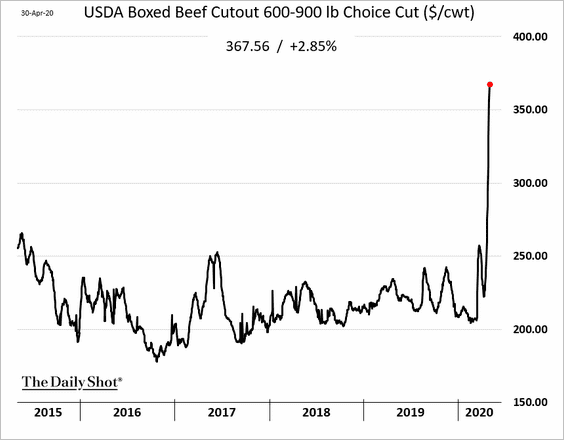

1. US meat prices continue to climb, …

Source: Purdue University Read full article

Source: Purdue University Read full article

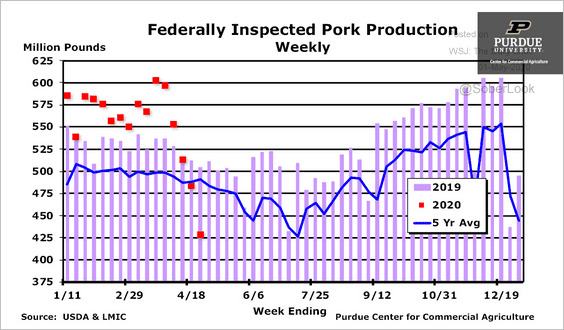

… as production deteriorates.

Source: Purdue University Read full article

Source: Purdue University Read full article

Source: Purdue University Read full article

Source: Purdue University Read full article

——————–

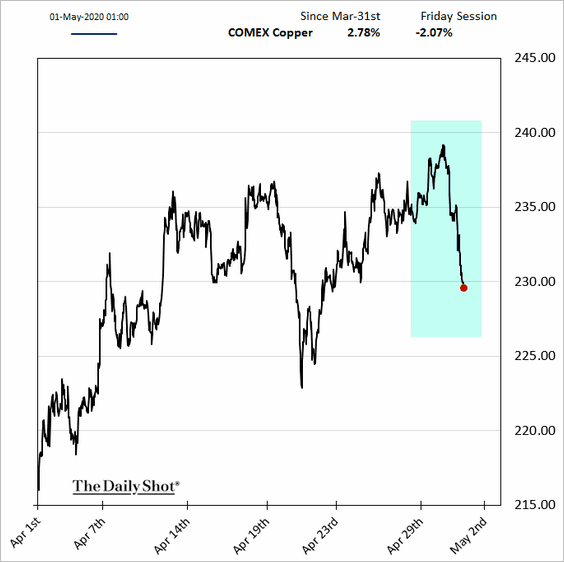

2. The rebound in copper appears to be fading.

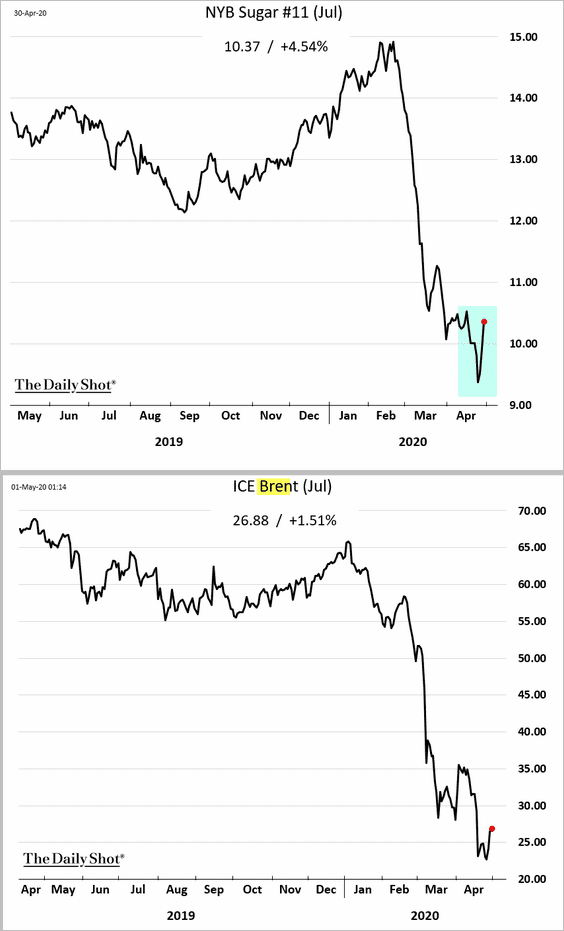

3. Sugar futures are rebounding with oil. Sugar (ethanol) is a key fuel source in Brazil and is therefore sensitive to energy prices.

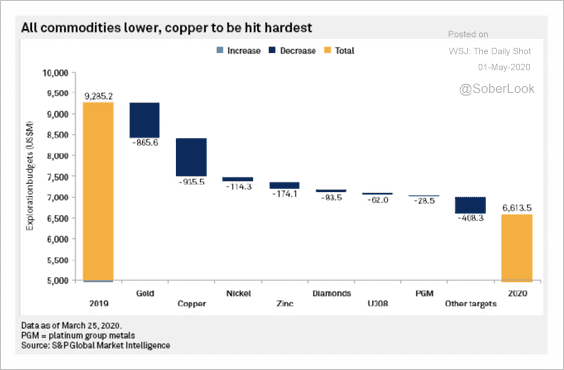

4. S&P expects a decline in exploration budgets, especially for copper and gold.

Source: S&P Global Market Intelligence Read full article

Source: S&P Global Market Intelligence Read full article

Equities

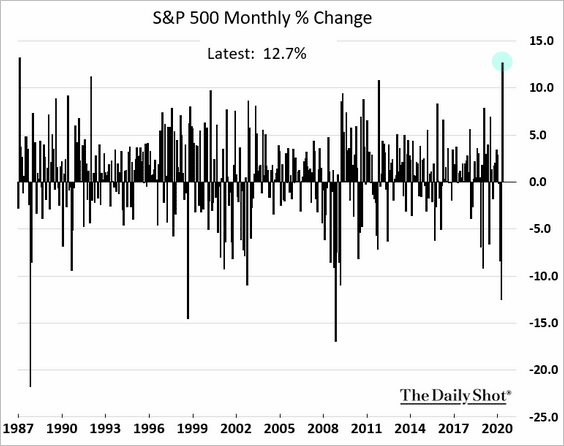

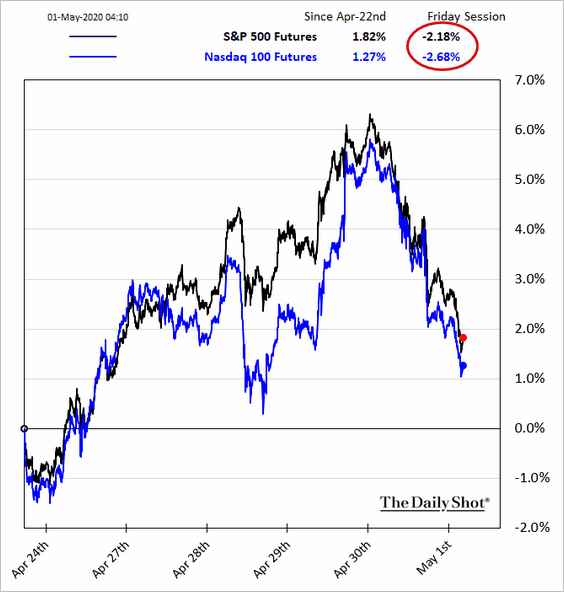

1. April was a good month for stocks.

But the rally appears to be fading, with futures down in early trading.

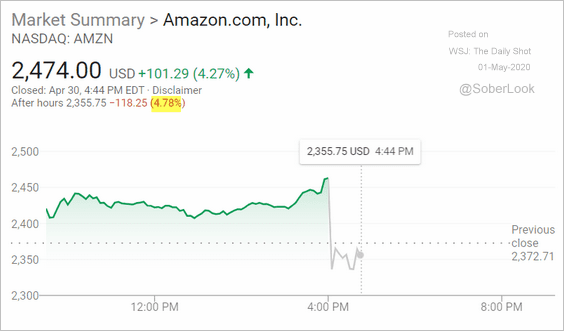

A somewhat disappointing report from Amazon (higher costs) is weighing on Nasdaq.

Source: Google

Source: Google

——————–

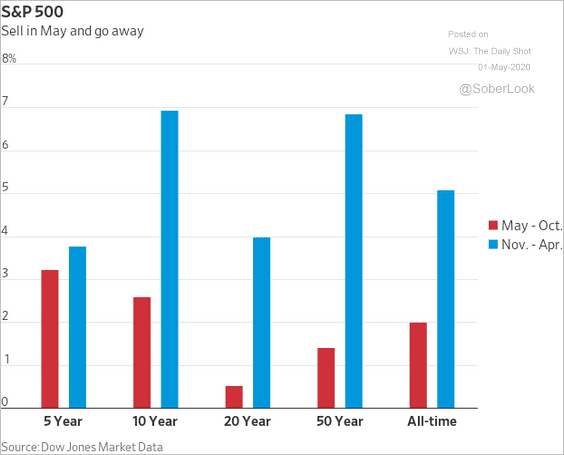

2. Historically, the S&P 500 has recorded stronger gains during November-April vs. May-October.

Source: @barronsonline

Source: @barronsonline

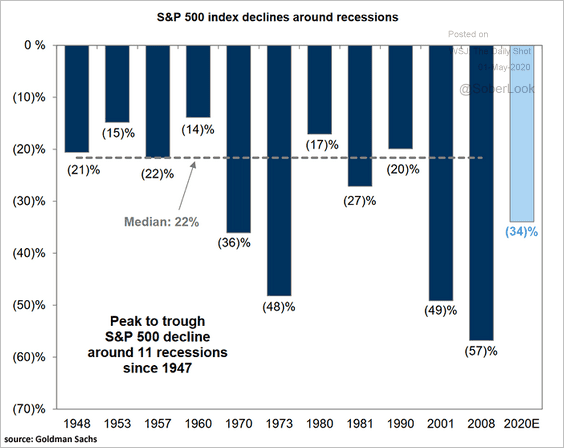

3. The median S&P 500 decline around recessions is 22%.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

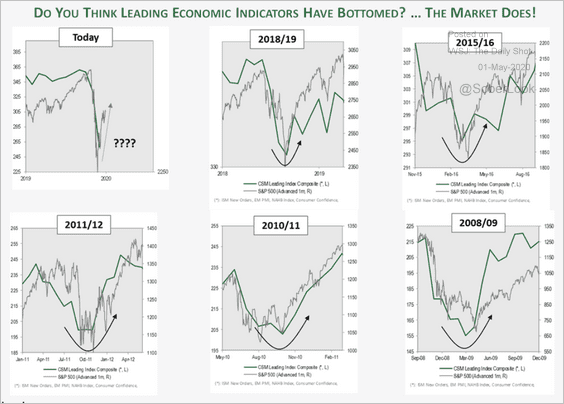

4. Stocks usually bottom when leading indicators begin to improve.

Source: Cornerstone Macro

Source: Cornerstone Macro

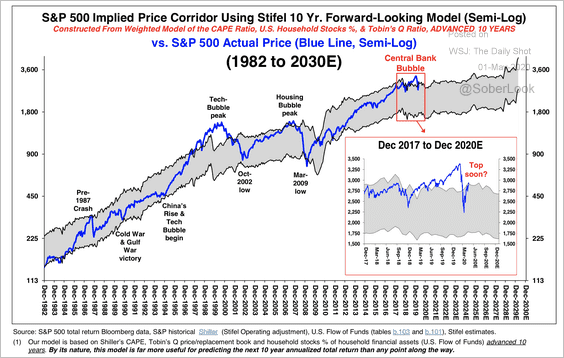

5. Stifel’s model doesn’t support a move much past 2,950 this year for the S&P 500.

Source: Stifel

Source: Stifel

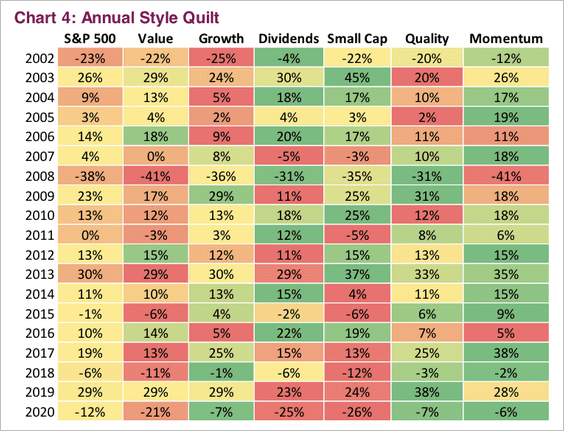

6. This table shows annual returns for S&P 500 style factors.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

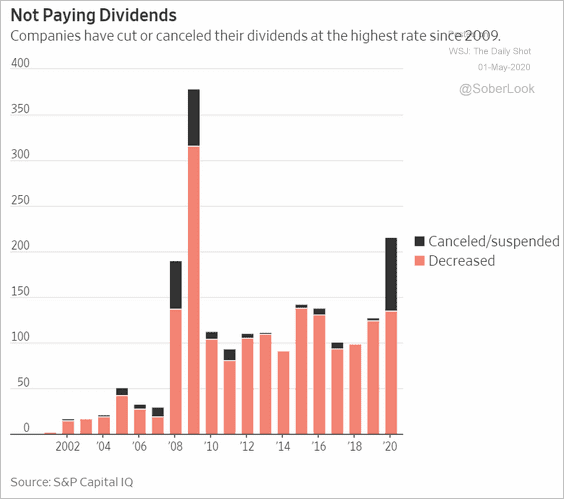

7. Companies are suspending dividends, …

Source: @WSJ Read full article

Source: @WSJ Read full article

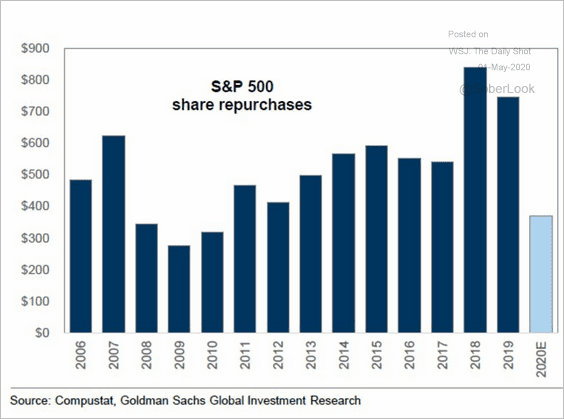

… while share repurchase activity has slowed.

Source: Goldman Sachs, @markets Read full article

Source: Goldman Sachs, @markets Read full article

——————–

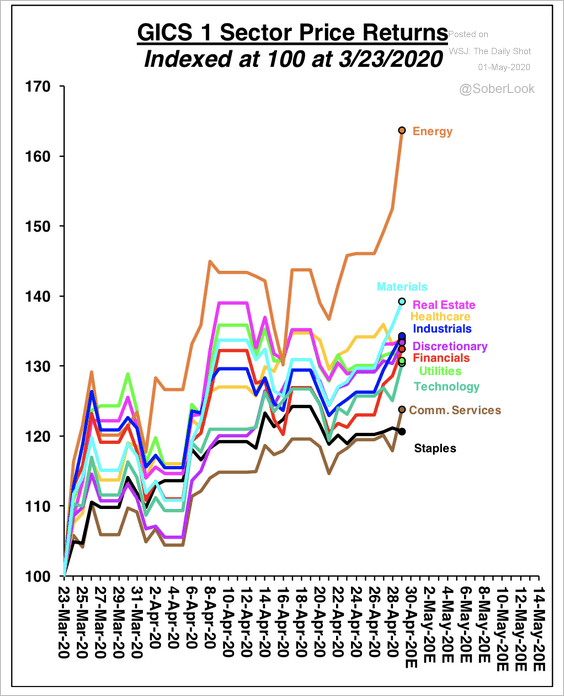

8. Energy has been a standout over the past month.

Source: Stifel

Source: Stifel

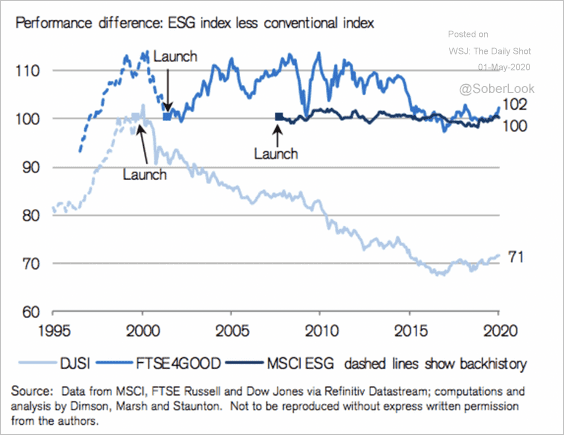

9. ESG indices have returned next to nothing over the past 20 years, and at worst have cost investors 30% of their investments, according to Credit Suisse.

Source: Credit Suisse

Source: Credit Suisse

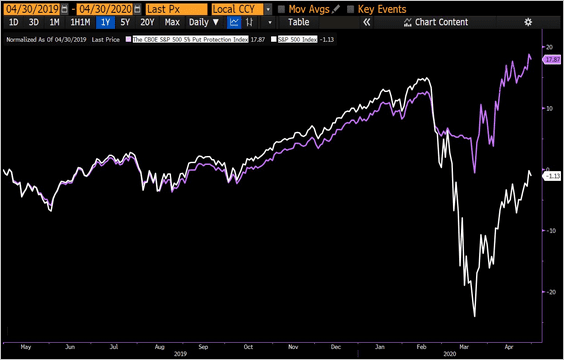

10. The put protection index has performed well this year.

Source: @iv_technicals

Source: @iv_technicals

Credit

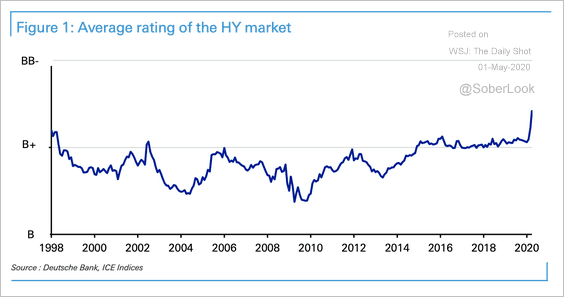

1. The US high-yield corporate bond market is closer to a BB- average credit rating than it has ever been as it continues to pick up fallen angels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

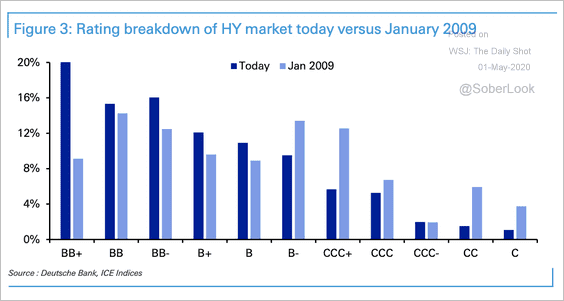

• vs. 2009:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

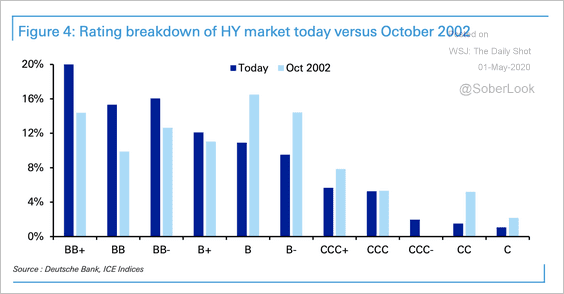

• vs. 2002:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

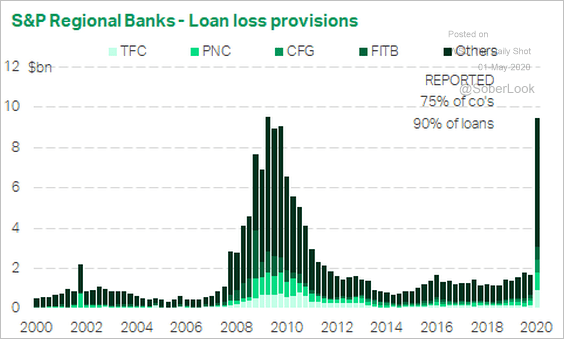

2. Regional banks have accelerated loan loss provisions.

Source: @andrea_cicione

Source: @andrea_cicione

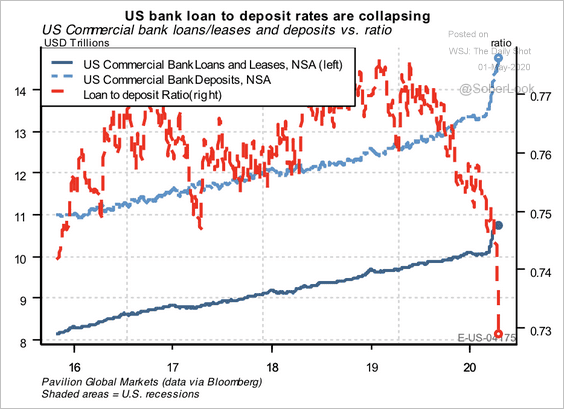

3. The US commercial bank loan-to-deposit ratio has collapsed to multi-year lows.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

Rates

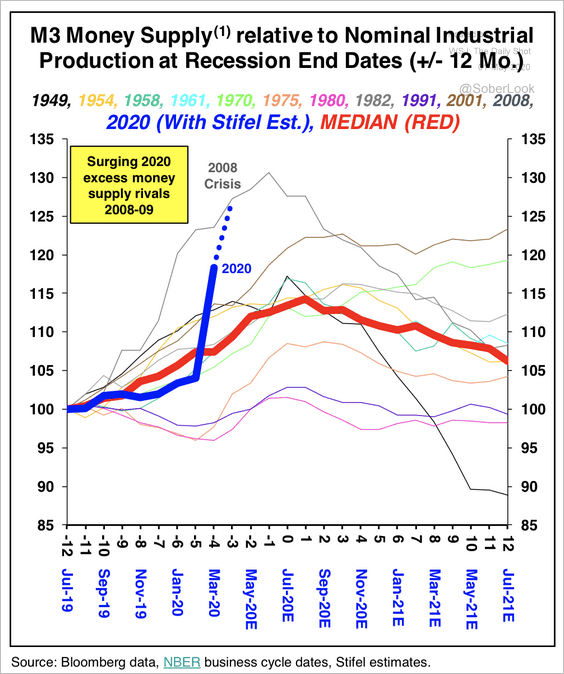

1. The US broad money supply is expected to reach 2008 levels, according to Stifel.

Source: Stifel

Source: Stifel

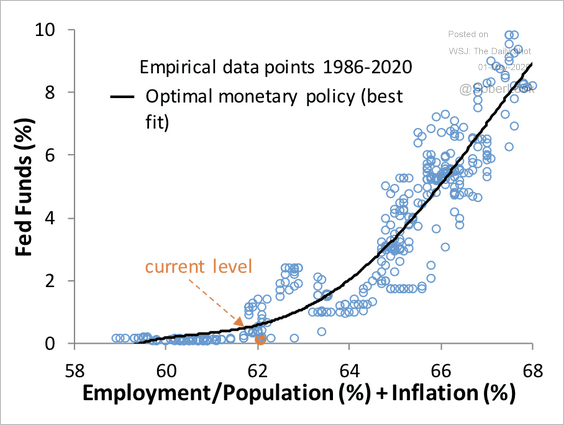

2. The FOMC policy is consistent with past monetary actions given the current employment and inflation environment, according to Piper Sandler.

Source: Piper Sandler

Source: Piper Sandler

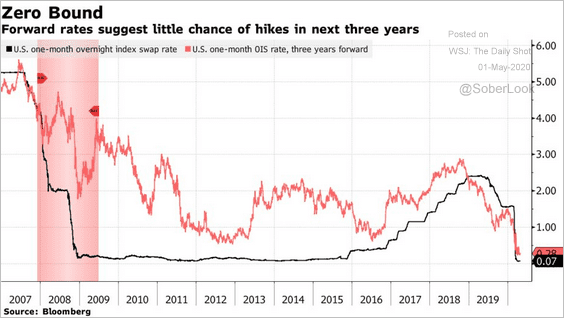

3. The market expects short-term rates to remain near zero for at least three years.

Source: @markets Read full article

Source: @markets Read full article

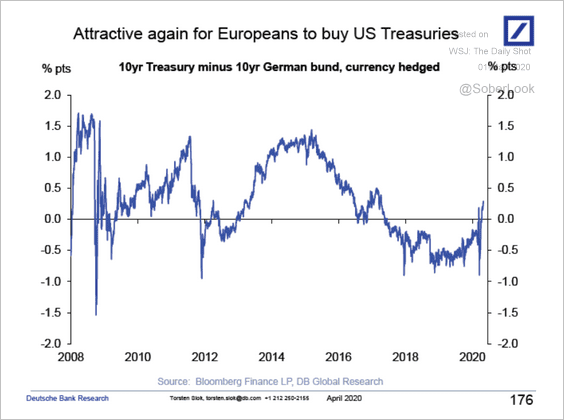

4. Treasuries swapped into euros are attractive again.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

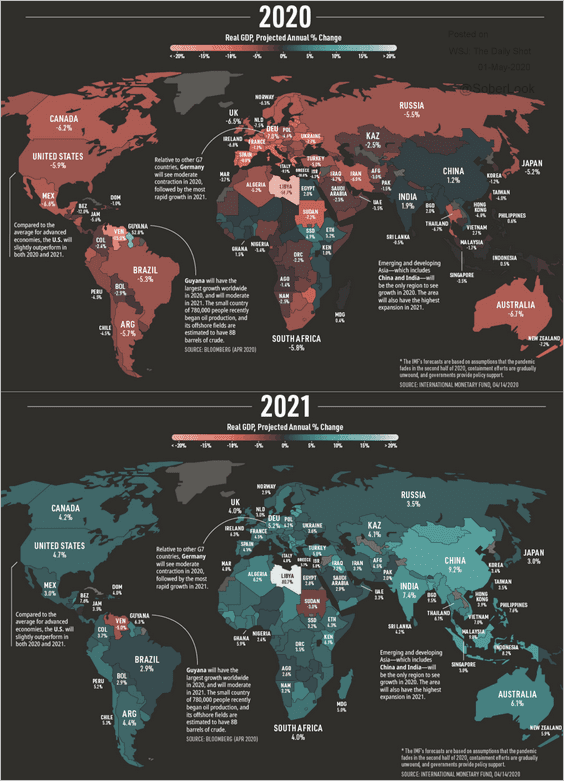

1. Global GDP forceasts for 2020 and 2021:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

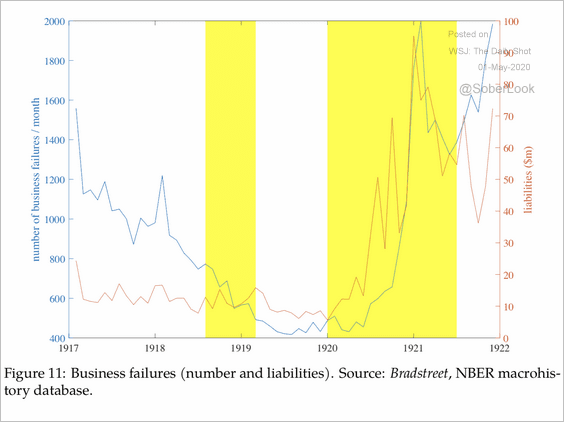

2. Business failures during the Spanish Flu:

Source: Federal Reserve Bank of Chicago Read full article

Source: Federal Reserve Bank of Chicago Read full article

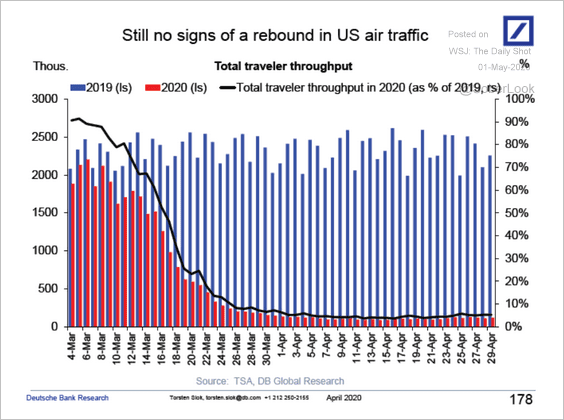

3. US air traffic:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

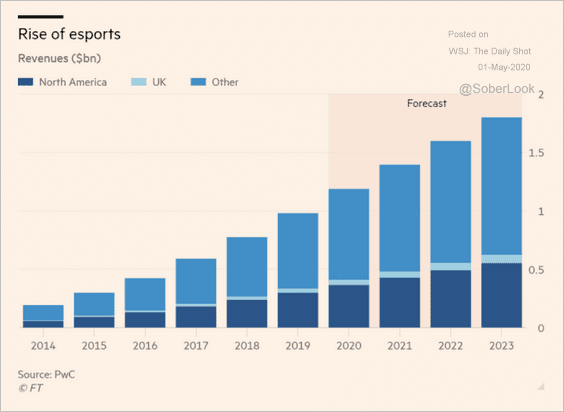

4. The rise of **esports**https://en.wikipedia.org/wiki/Esports

**:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

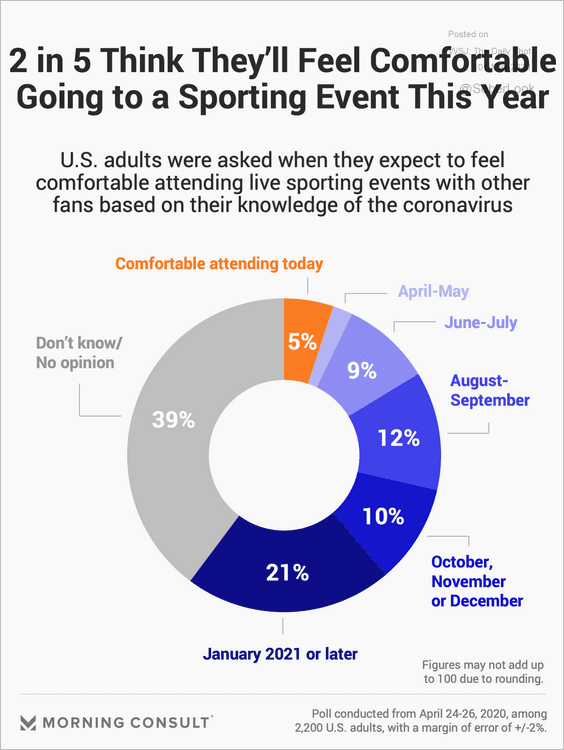

5. Going to a sporting event this year?

Source: Morning Consult Read full article

Source: Morning Consult Read full article

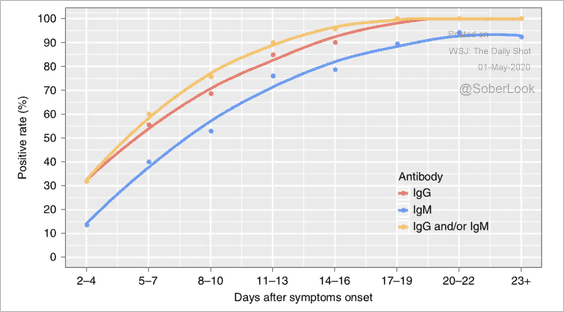

6. Antibody production during the progression of COVID-19:

Source: Nature Read full article

Source: Nature Read full article

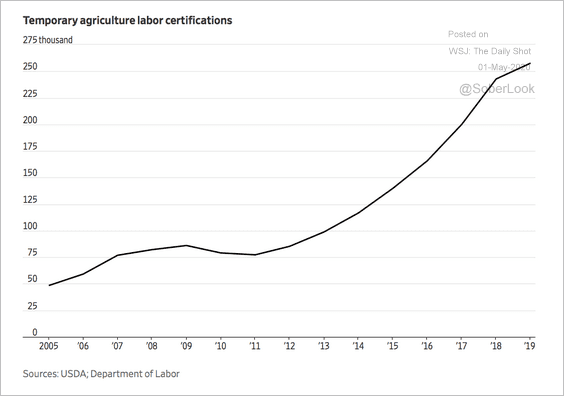

7. Migrant farm laborers:

Source: @WSJ Read full article

Source: @WSJ Read full article

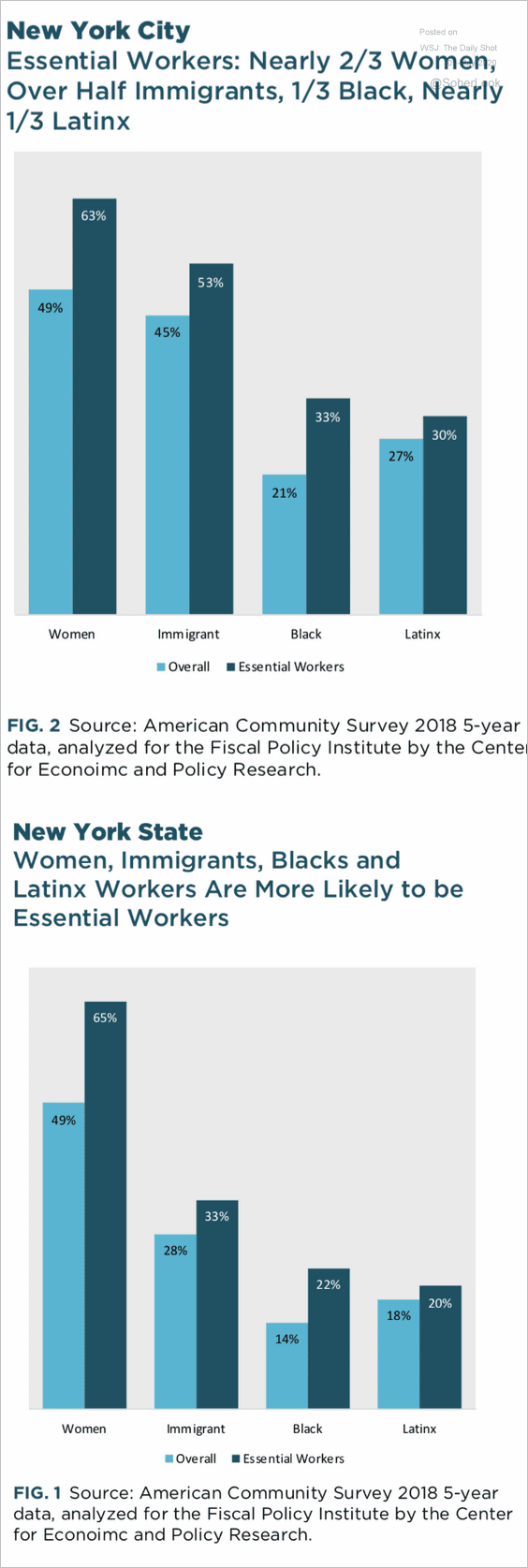

8. Essential workers:

Source: FPI Read full article

Source: FPI Read full article

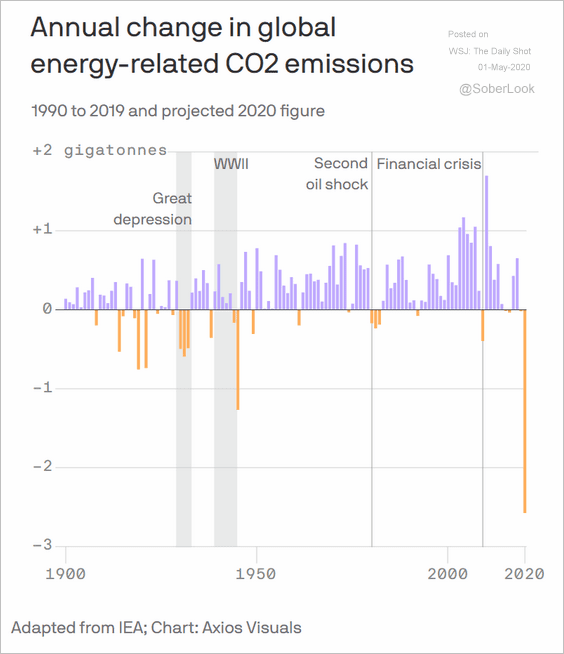

9. Projected CO2 emissions:

Source: @axios Read full article

Source: @axios Read full article

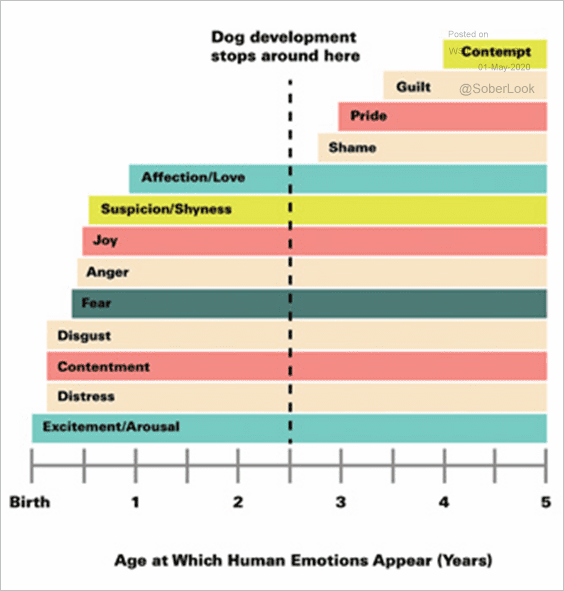

10. Dog emotions:

Source: Modern Dog Read full article

Source: Modern Dog Read full article

——————–

Have a great weekend!