The Daily Shot: 18-May-20

• Administrative Update

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Rates

• Food for Thought

Administrative Update

Please note that The Daily Shot will not be published next Monday, May 25th.

The United States

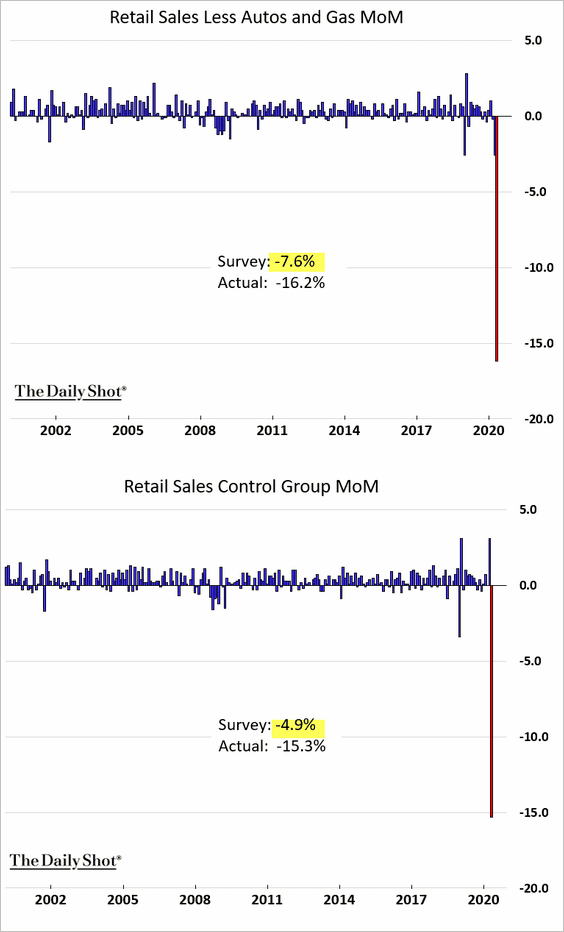

1. Retail sales plummetted in April, declining by more than double the consensus estimates.

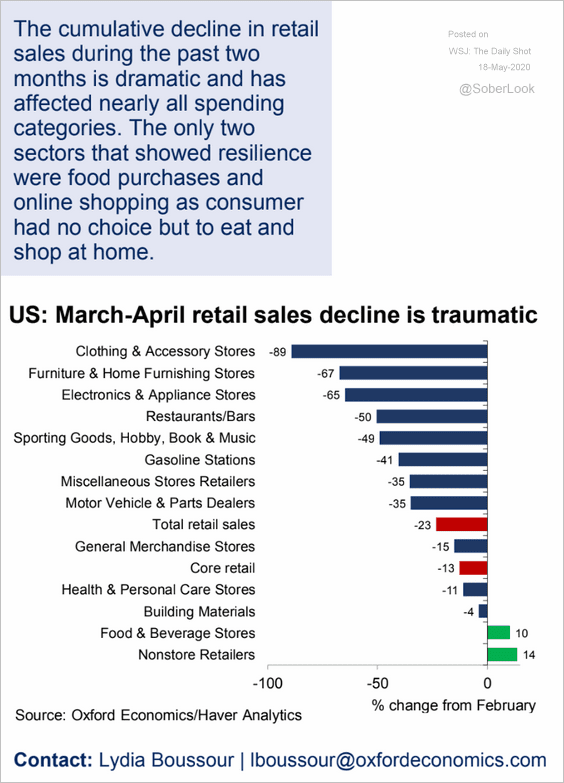

Here is the breakdown by sector.

Source: Oxford Economics

Source: Oxford Economics

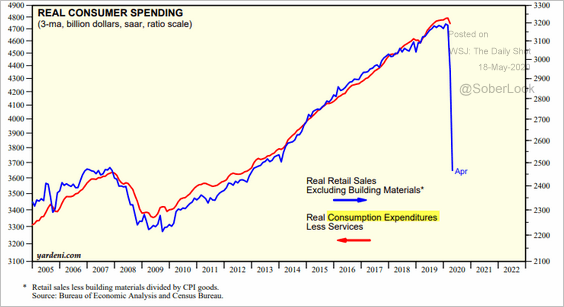

The retail sales report points to a massive correction in consumer spending, which accounts for about 70% of the US GDP.

Source: Yardeni Research

Source: Yardeni Research

——————–

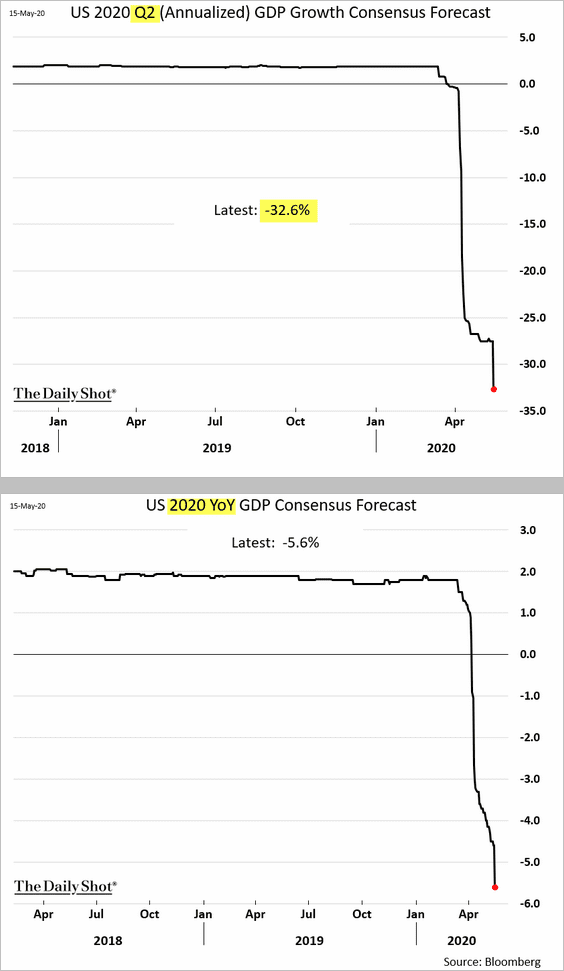

2. Economists continue to downgrade their GDP growth forecasts. The latest consensus estimate suggests that during this quarter, the US economy will shrink by nearly a third.

Source: @TheTerminal

Source: @TheTerminal

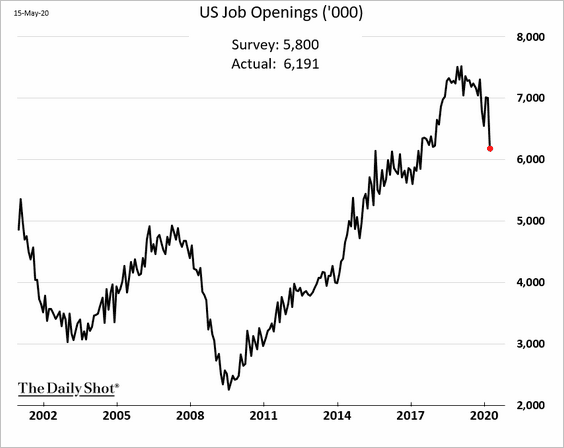

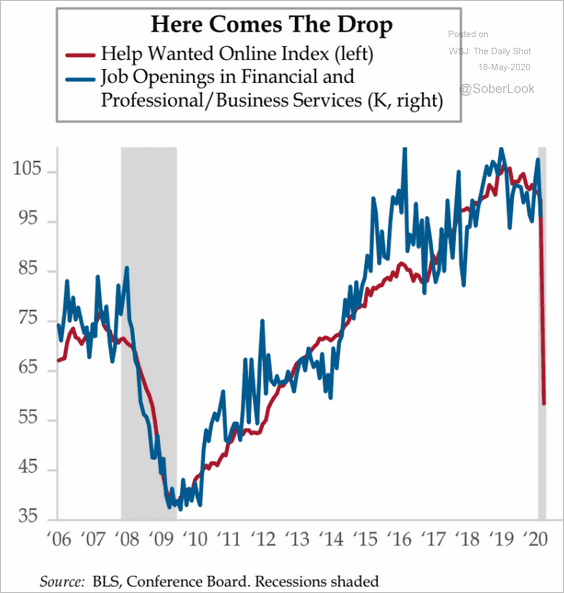

3. Job openings fell in March, but the drop was less severe than expected.

Here are a couple of sector trends.

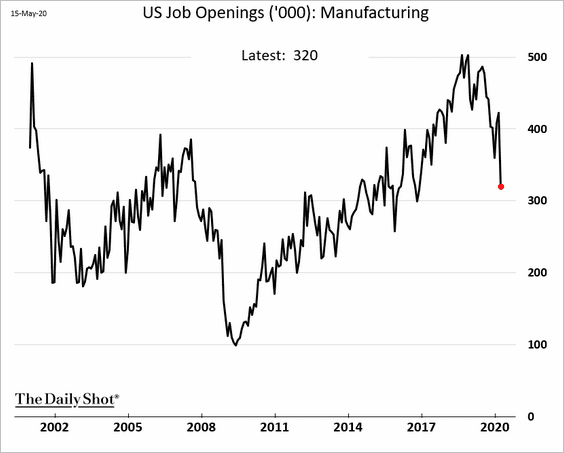

• Manufacturing:

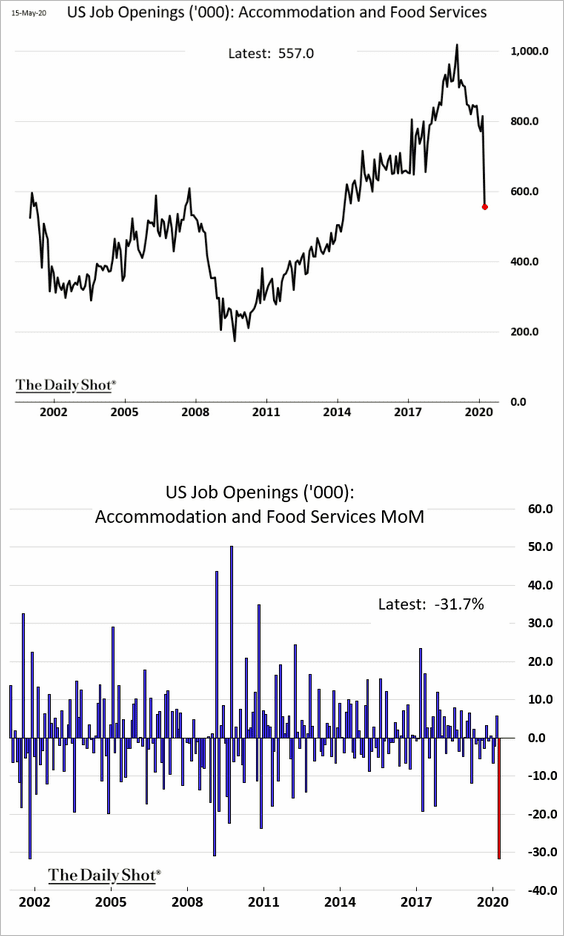

• Accommodation and Food Services:

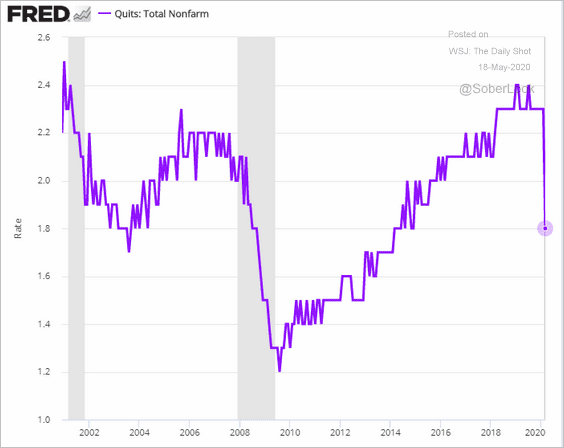

Voluntary resignations declined sharply.

Based on help-wanted data, job openings probably plummetted in April.

Source: The Daily Feather

Source: The Daily Feather

——————–

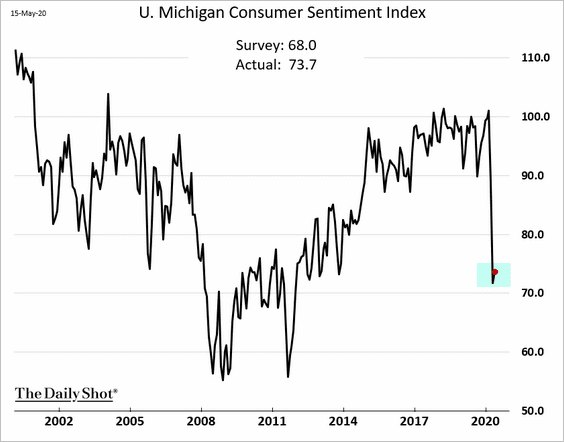

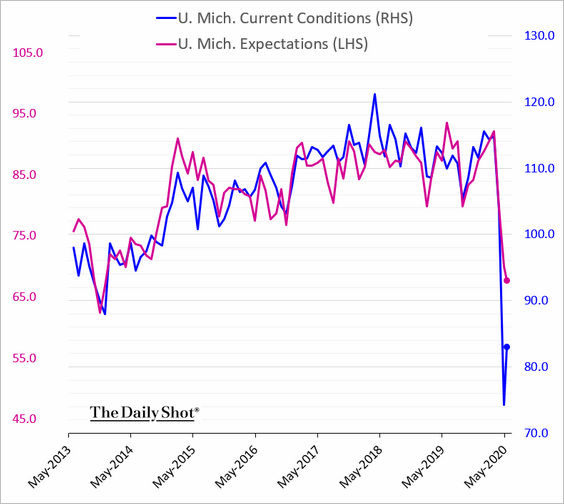

4. Consumer sentiment has stabilized this month.

While expectations are still weakening, the index of current conditions bounced.

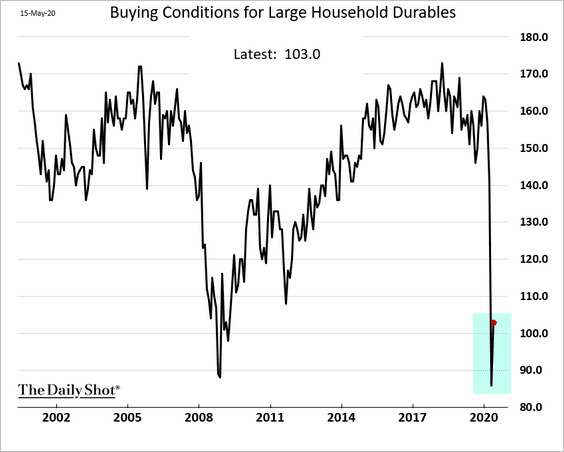

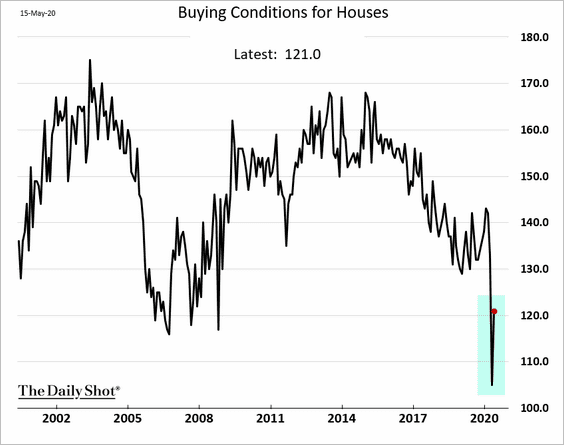

Buying conditions are off the lows.

• Large household durables:

• Housing:

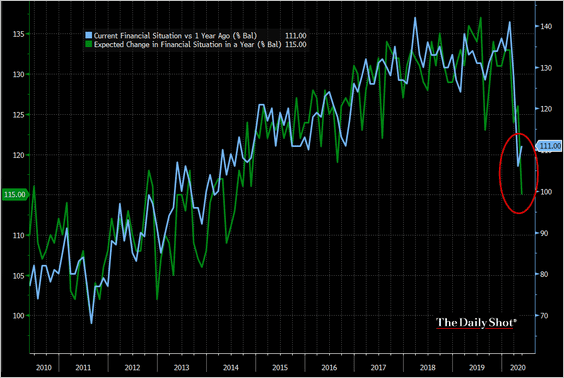

Households’ assessment of their current financial situation ticked higher, but expectations for future changes in personal finances continue to deteriorate.

Source: @TheTerminal

Source: @TheTerminal

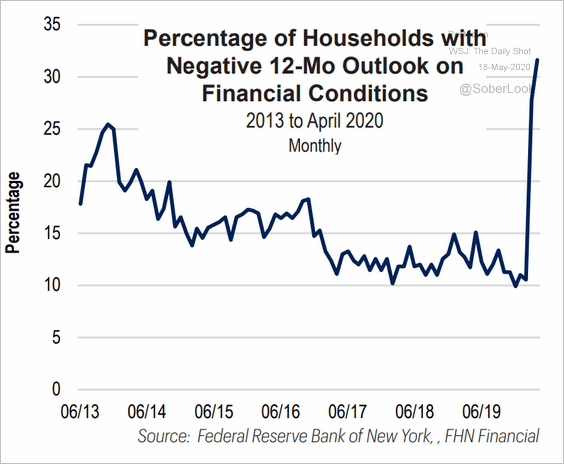

The NY Fed’s survey confirms this trend.

Source: FHN Financial

Source: FHN Financial

——————–

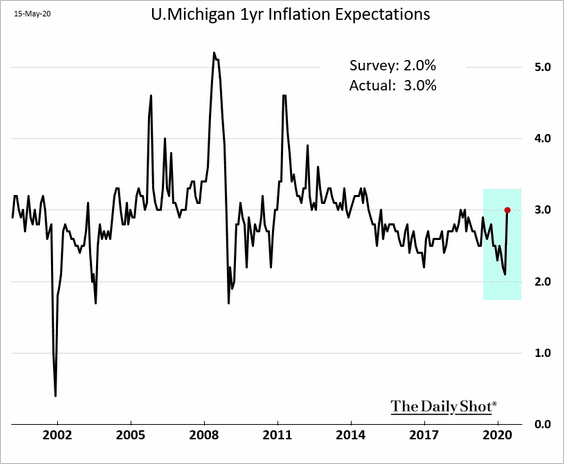

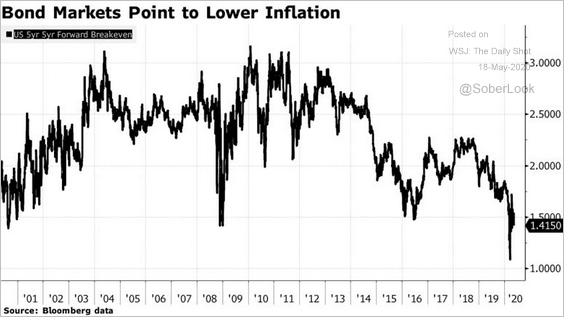

5. Consumer inflation expectations jumped this month, driven by product shortages and higher grocery prices.

The markets, on the other hand, see extremely low inflation for years to come.

Source: @markets Read full article

Source: @markets Read full article

——————–

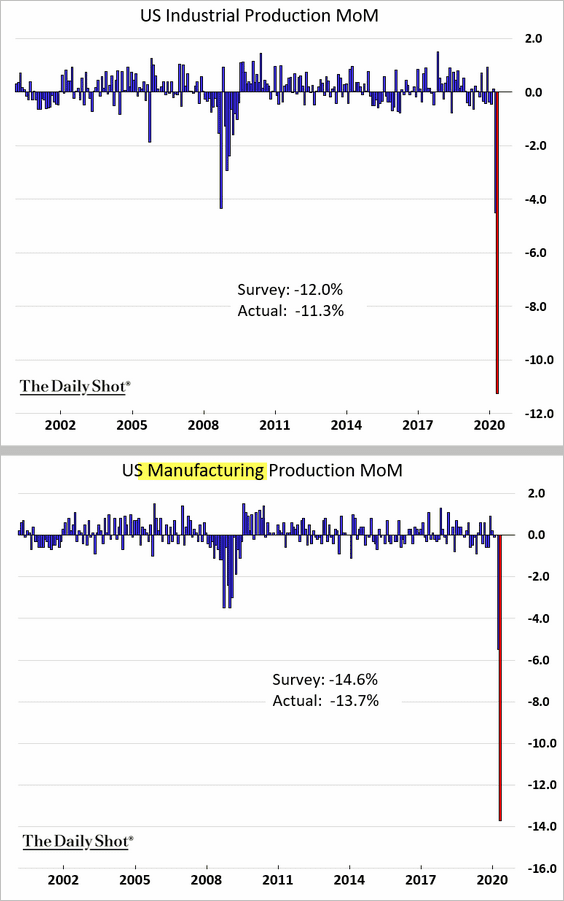

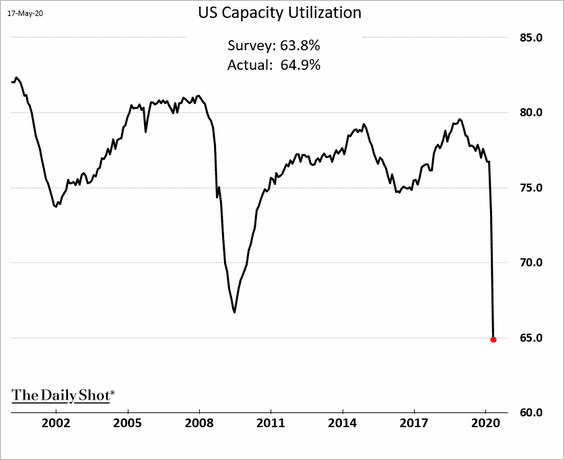

6. Industrial production plunged last month.

Here is capacity utilization.

——————–

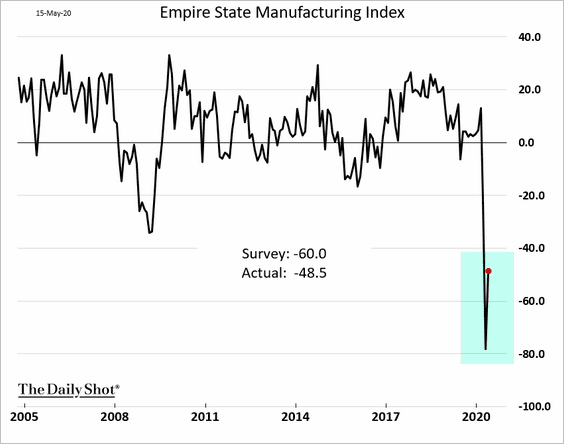

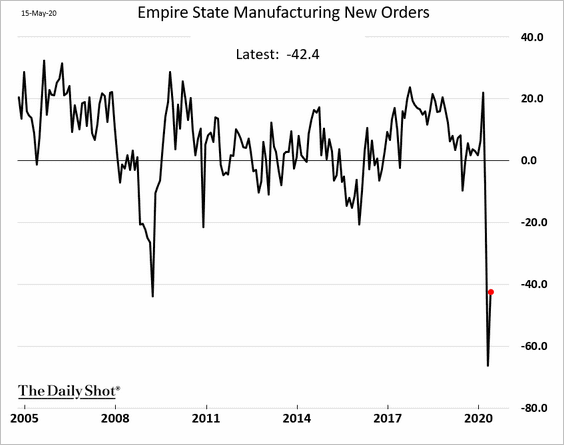

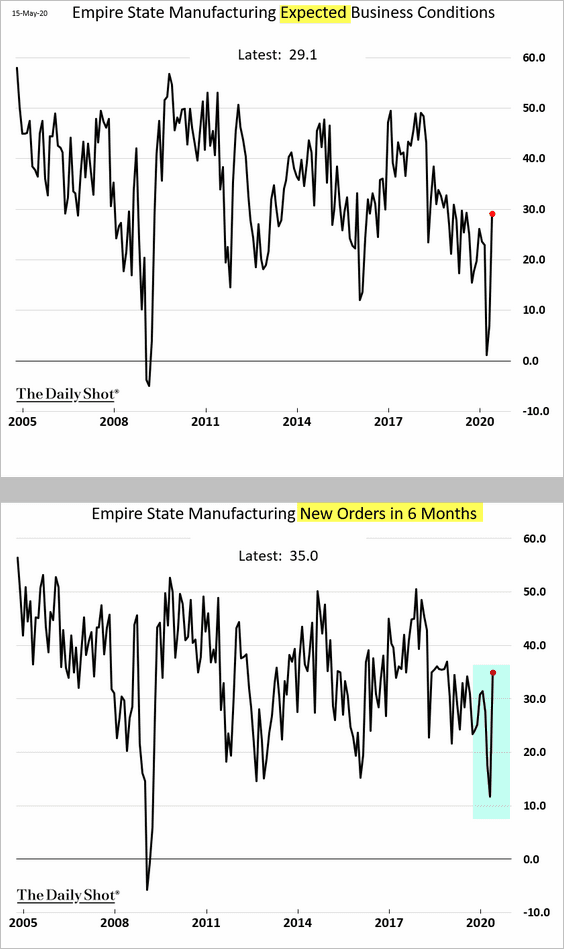

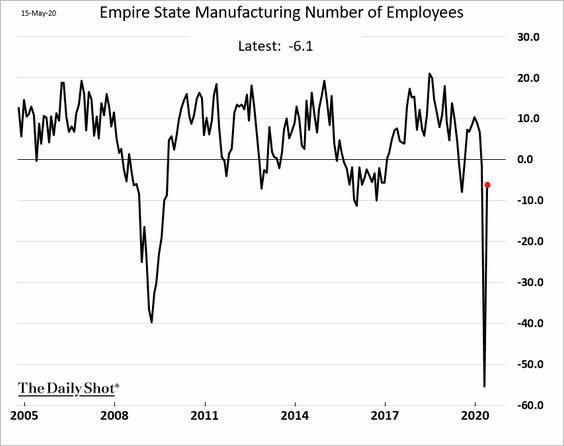

7. There was a modest improvement in the NY Fed’s manufacturing report (Empire Manufacturing) for May.

Fewer companies reported declines in new orders, …

… and manufacturers are more upbeat about the future.

Layoffs have slowed.

——————–

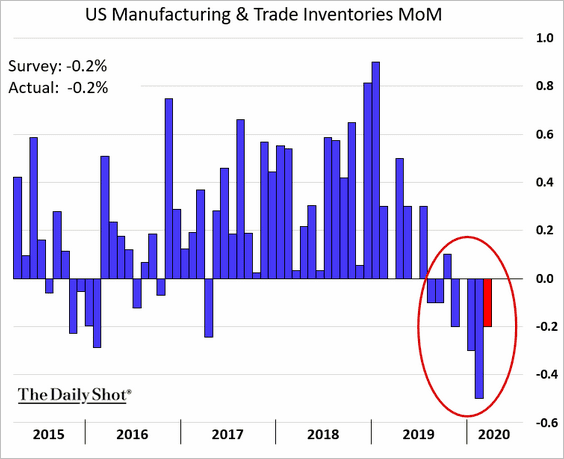

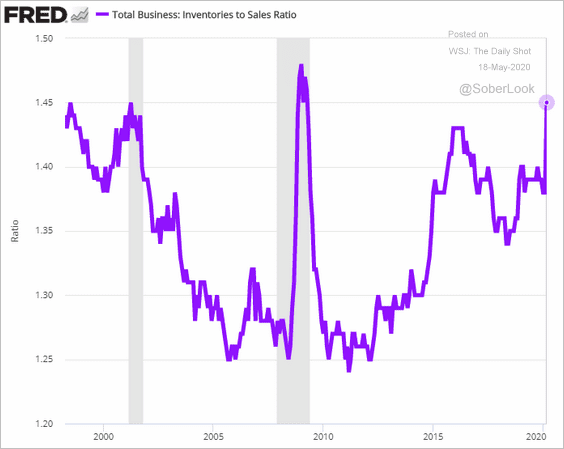

8. Businesses continued inventory reductions in March (which started last year).

Nonetheless, the inventories-to-sales ratio is at the highest level since 2009.

——————–

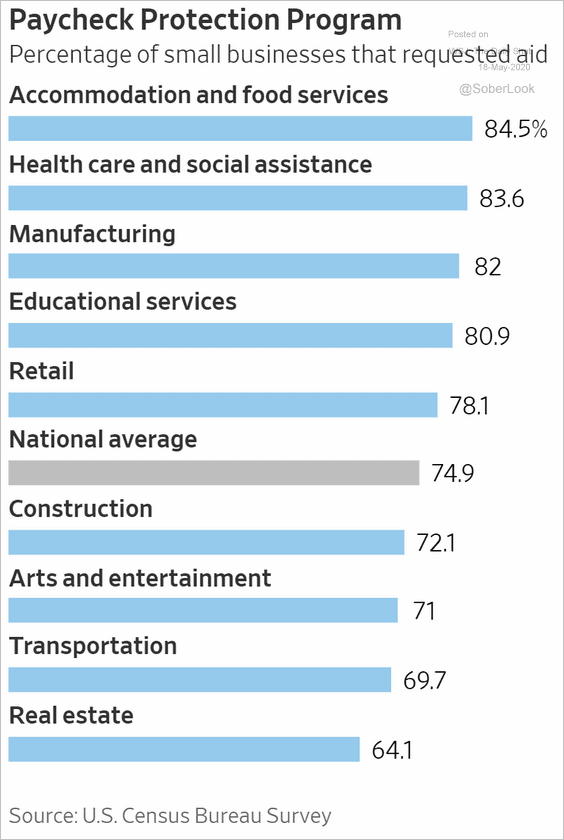

9. Nearly three-quarters of US small businesses applied for government assistance.

Source: @WSJ Read full article

Source: @WSJ Read full article

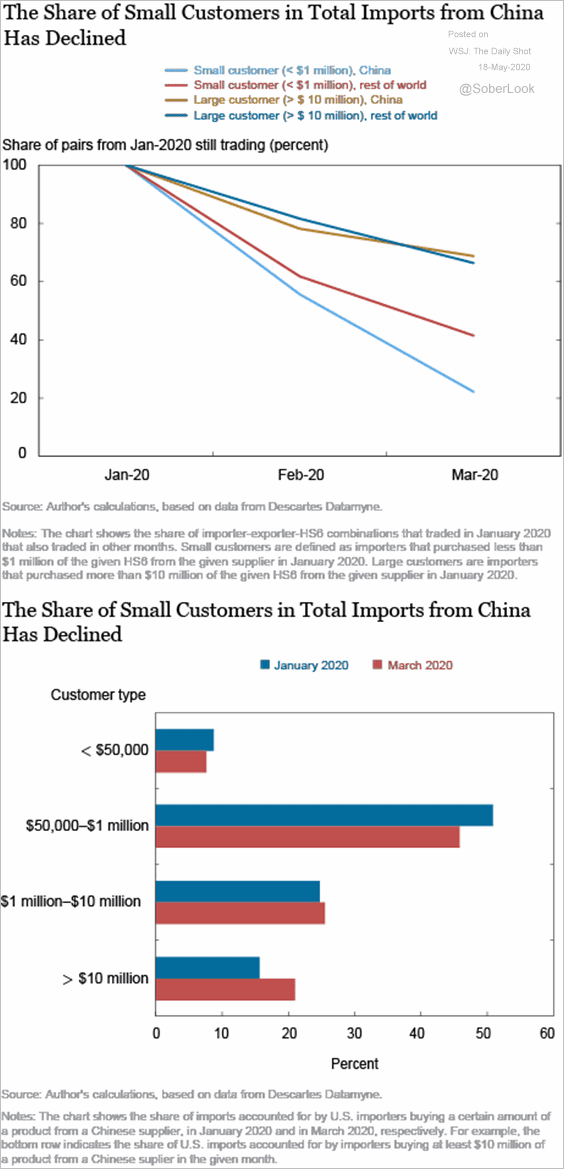

10. Smaller firms sharply reduced their imports from China as demand collapsed.

Source: Liberty Street Economics Read full article

Source: Liberty Street Economics Read full article

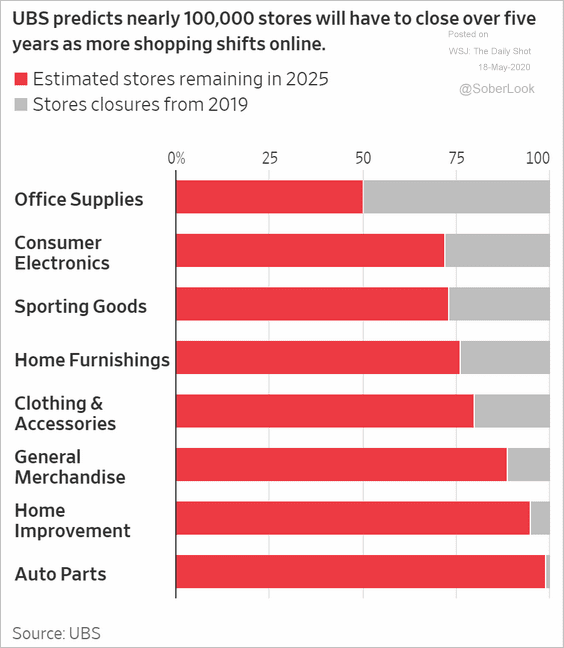

11. The pandemic has accelerated the US “retailmageddon.”

Source: @WSJ Read full article

Source: @WSJ Read full article

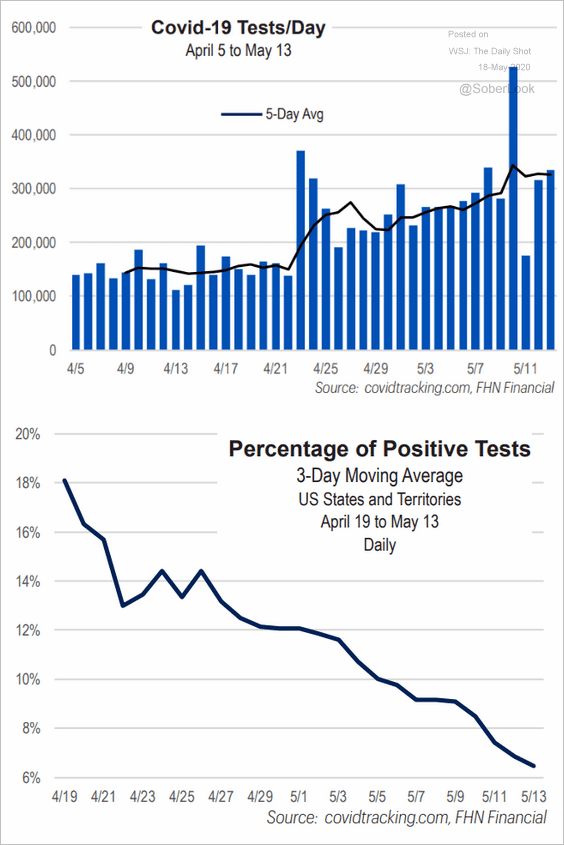

12. COVID-19 testing continues to improve.

Source: FHN Financial

Source: FHN Financial

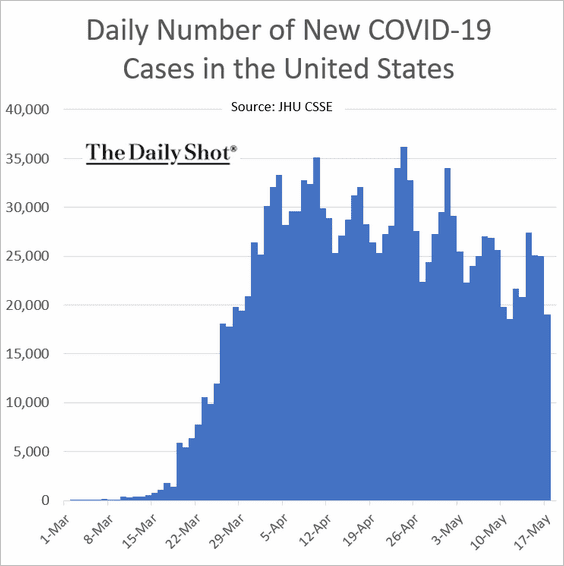

And the number of new cases is trending lower.

Canada

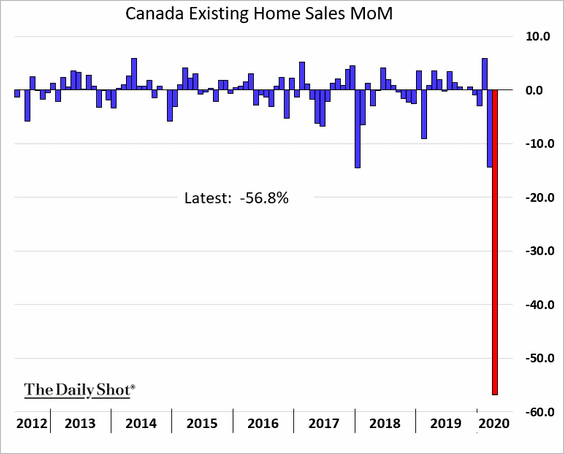

1. Existing home sales collapsed in April.

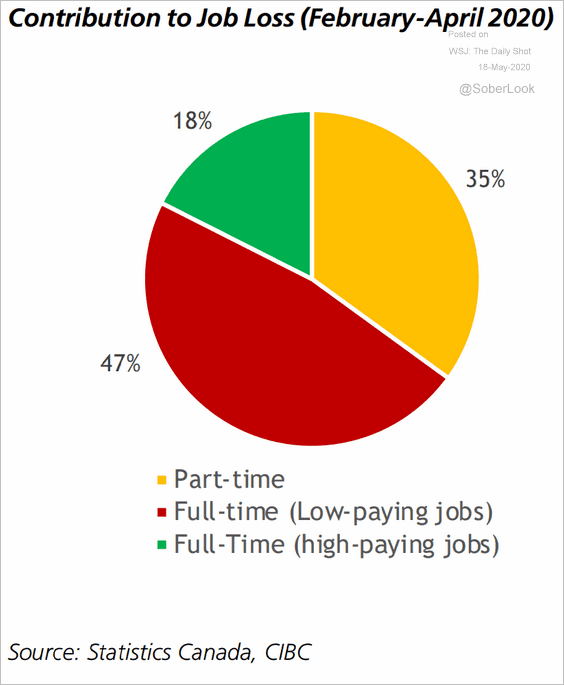

2. Here is the distribution of job losses since February.

Source: CIBC Capital Markets

Source: CIBC Capital Markets

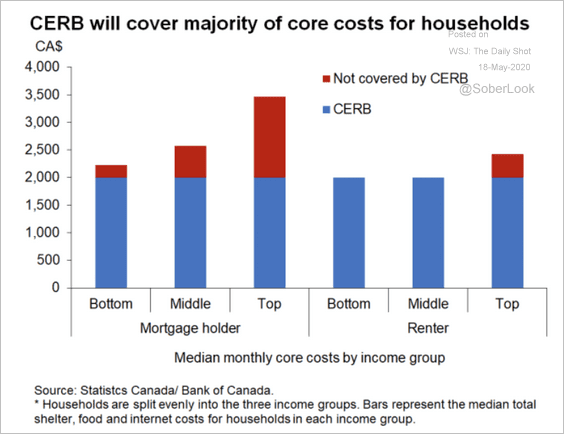

3. Canada’s Emergency Response Benefit (CERB) is helping many households stay afloat.

Source: Oxford Economics

Source: Oxford Economics

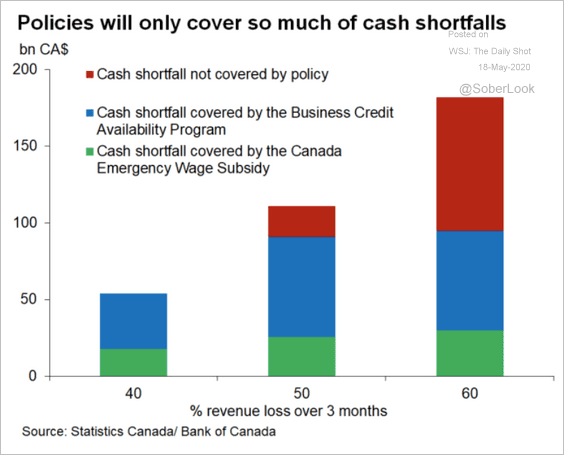

However, for businesses, current policies won’t cover the loss of a sustained drop in revenues.

Source: Oxford Economics

Source: Oxford Economics

The United Kingdom

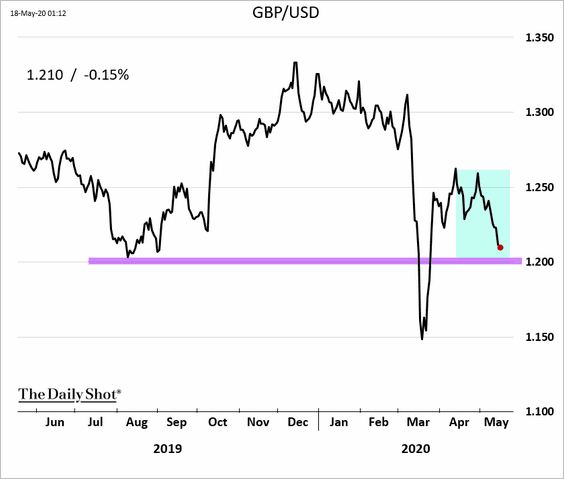

1. The pound has been rolling over. Will we test $1.20?

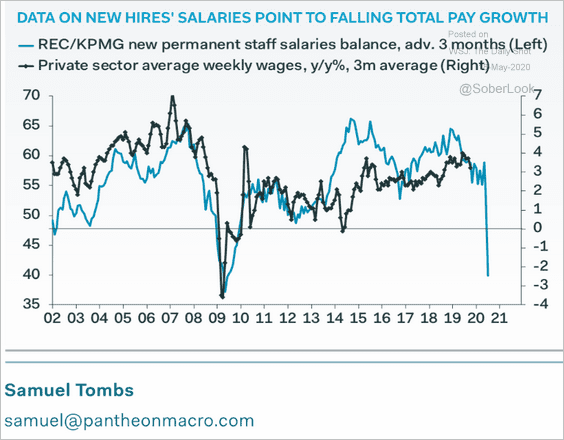

2. High-frequency indicators suggest that wages are now declining.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

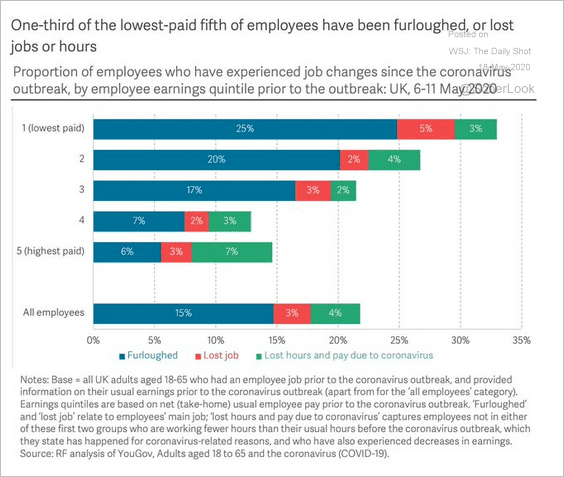

3. The lowest-paid workers have been hit the hardest.

Source: @adam_tooze, @resfoundation Read full article

Source: @adam_tooze, @resfoundation Read full article

The Eurozone

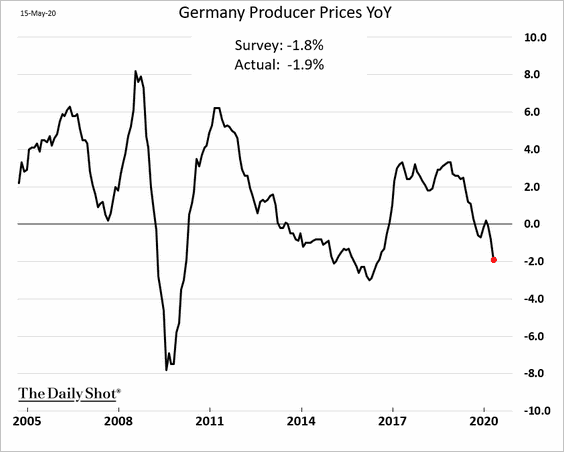

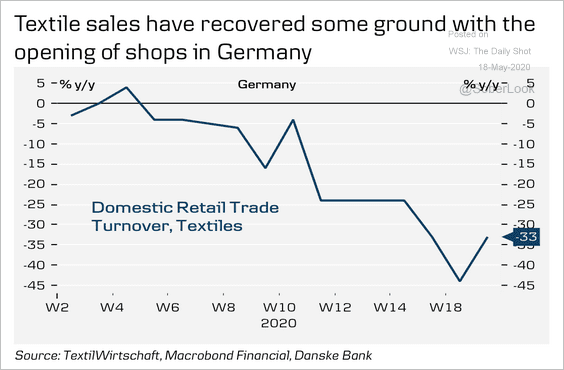

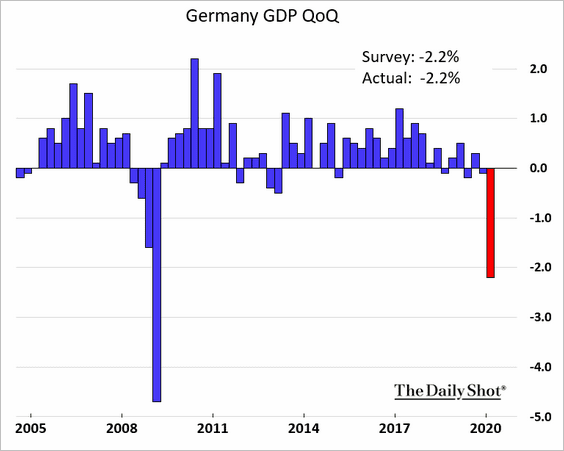

1. Let’s begin with Germany.

• Producer prices are falling.

• German textile sales are starting to recover.

Source: Danske Bank

Source: Danske Bank

• Here is the Q1 GDP decline (Q2 will be substantially worse).

——————–

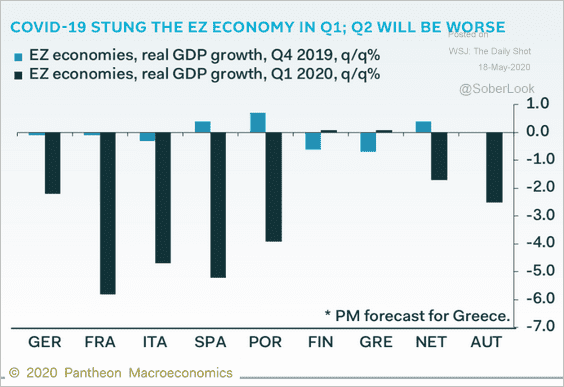

2. Below are the Q1 GDP results across the Eurozone.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

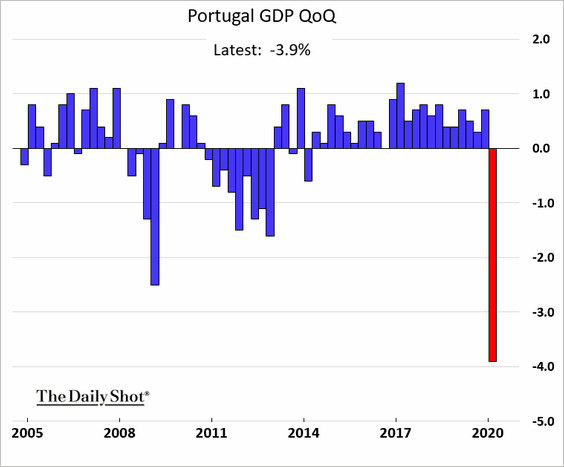

And this is the GDP chart for Portugal.

——————–

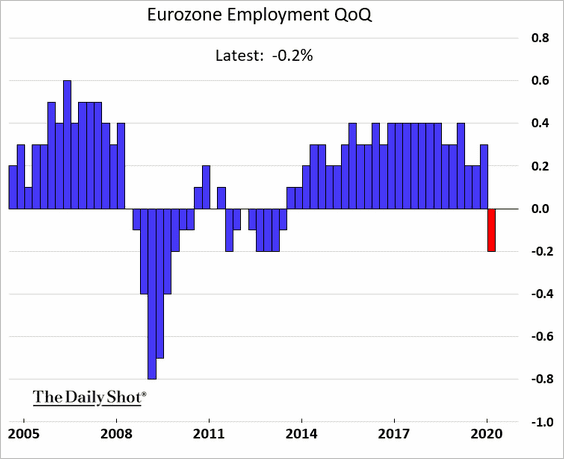

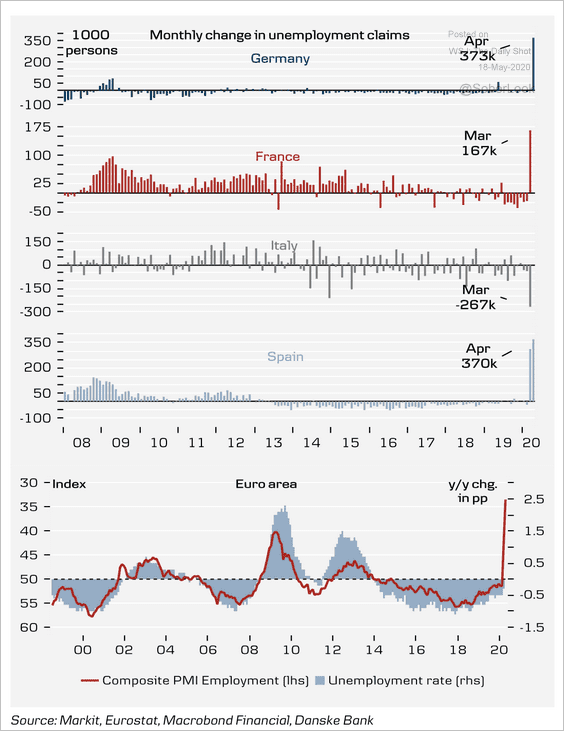

3. Employment declined in Q1 for the first time since 2013 (the Eurozone debt crisis).

Job losses have accelerated across the euro area.

Source: Danske Bank

Source: Danske Bank

——————–

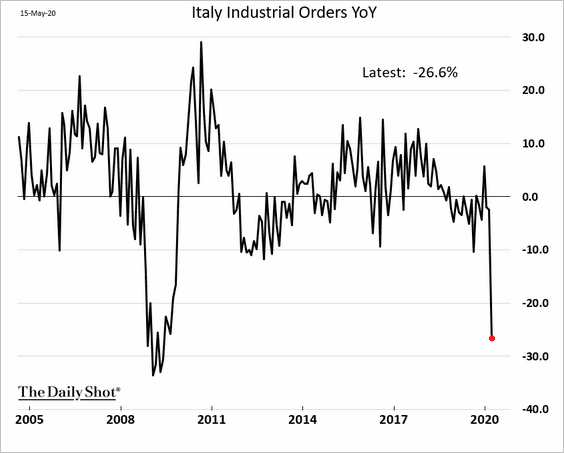

4. Italian industrial orders tumbled in March.

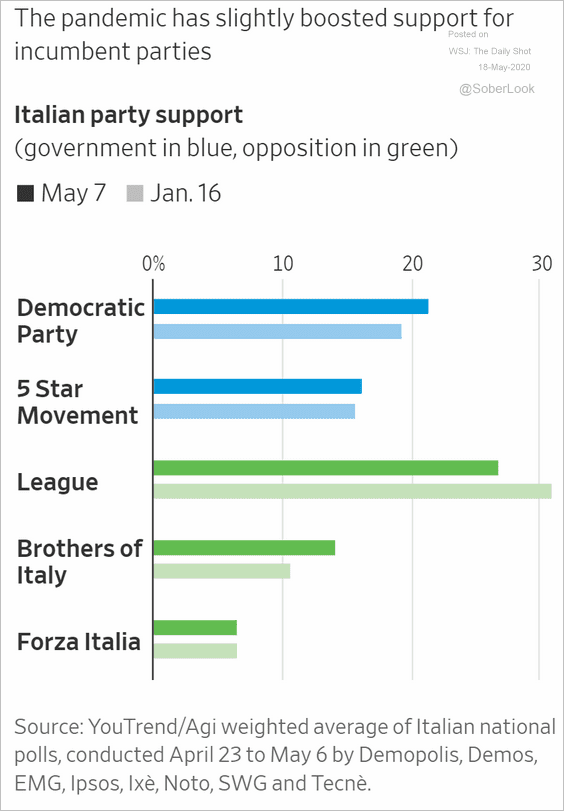

Separately, here are the latest polls.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

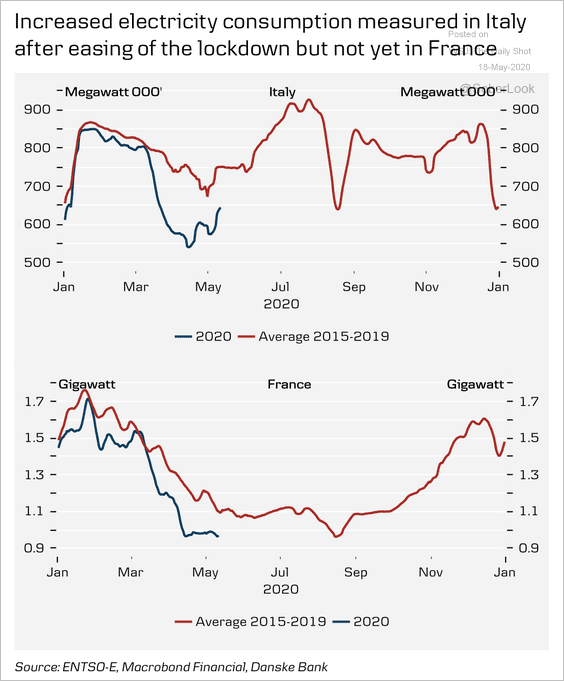

5. Electricity consumption is stabilizing in Italy, but not yet in France.

Source: Danske Bank

Source: Danske Bank

Europe

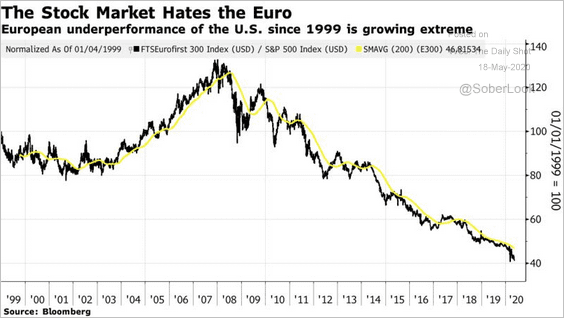

1. European equities’ underperformance vs. the US continues to widen.

Source: @johnauthers, @bopinion Read full article

Source: @johnauthers, @bopinion Read full article

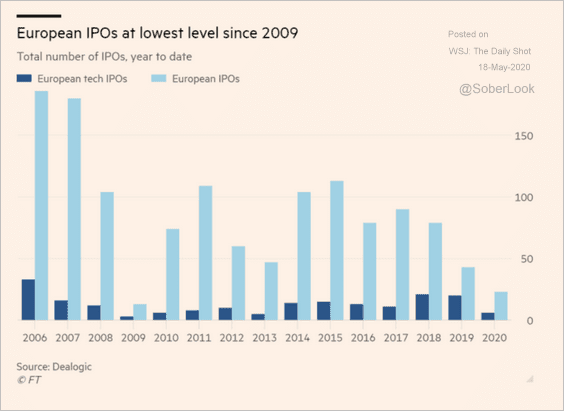

2. IPOs have slowed.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

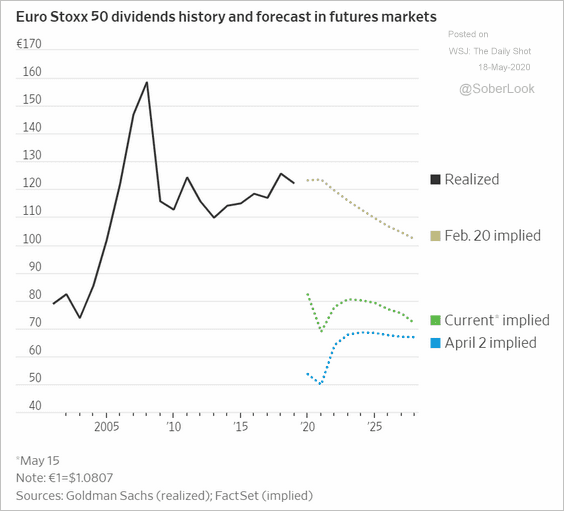

3. The markets expect much lower dividends from the largest Europen firms in the years ahead. Banks have been driving much of this trend.

Source: @WSJ Read full article

Source: @WSJ Read full article

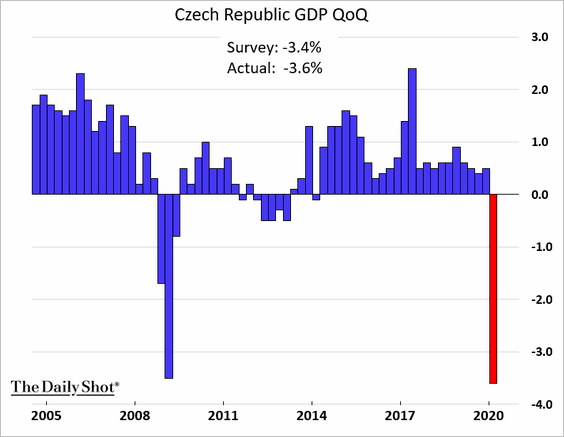

4. Here is the Czech Republic’s Q1 GDP decline.

Asia – Pacific

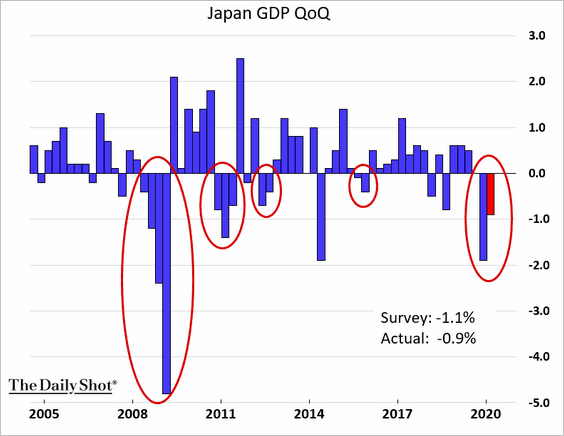

1. Japan’s Q1 GDP contraction was less severe than expected. Nonetheless, the nation entered its fifth recession since 2008.

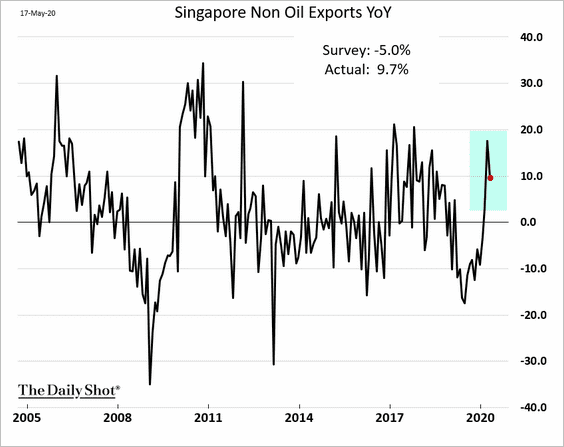

2. Singapore’s exports remain resilient.

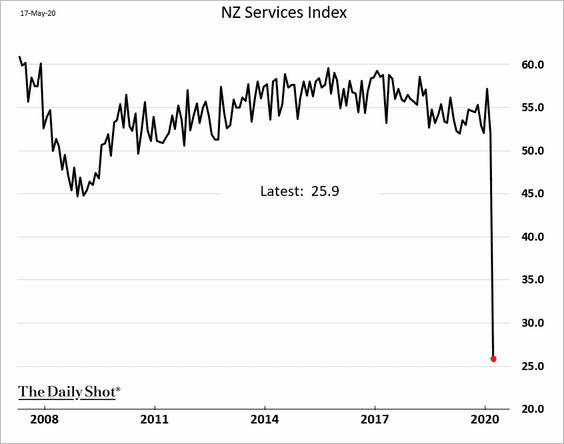

3. New Zealand’s service sector got crushed last month.

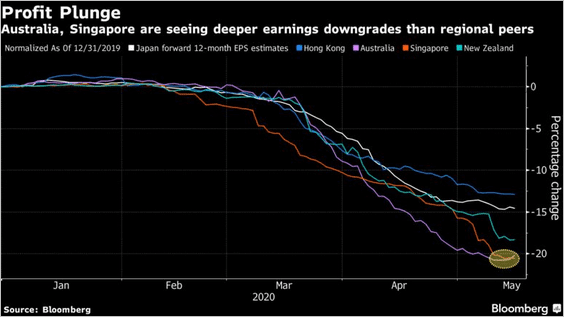

4. This chart shows consensus forward earnings-per-share estimates for select markets.

Source: @markets Read full article

Source: @markets Read full article

China

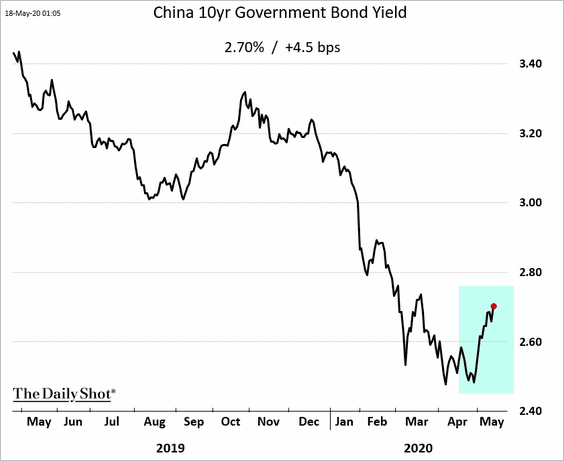

1. The selloff in longer-dated government bonds continues.

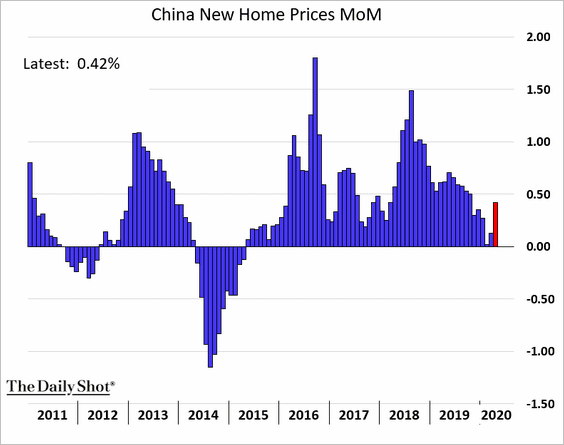

2. Home prices rose last month.

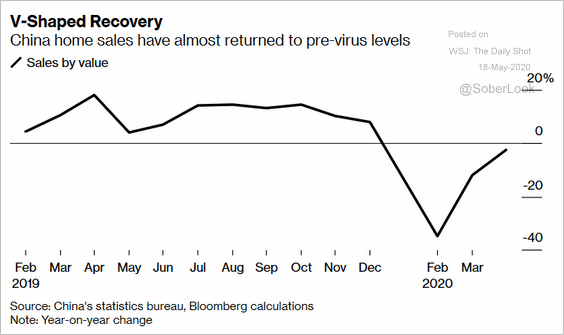

And home sales have nearly recovered.

Source: @business Read full article

Source: @business Read full article

——————–

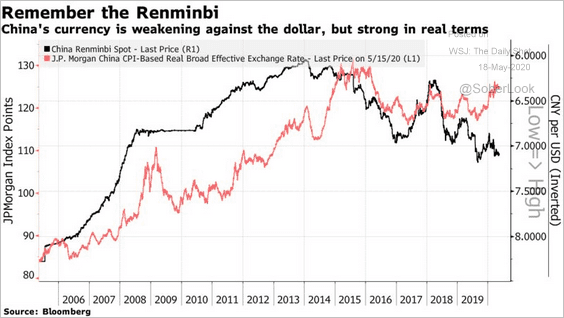

3. While the renminbi has been drifting lower against the dollar, it has strengthened vs. other currencies.

Source: @johnauthers, @bopinion Read full article

Source: @johnauthers, @bopinion Read full article

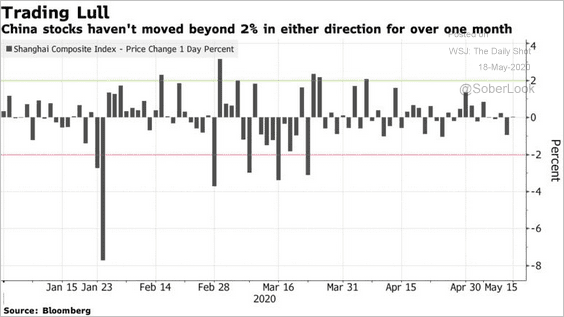

4. Stock volatility has been relatively subdued over the past couple of months.

Source: @markets Read full article

Source: @markets Read full article

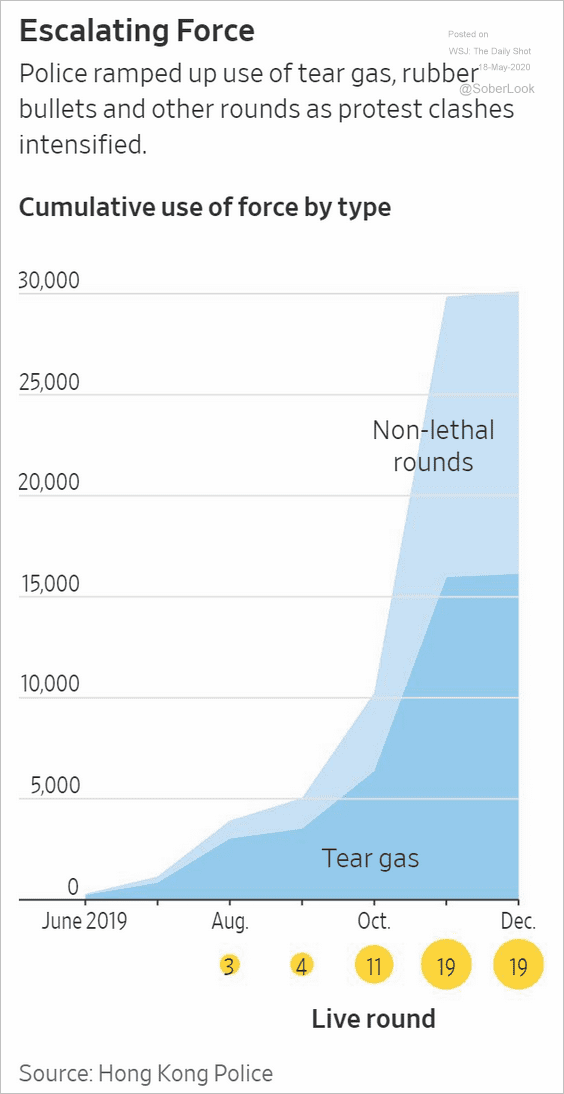

5. Finally, this chart shows the use of force by the Hong Kong police against demonstrators.

Source: @WSJ Read full article

Source: @WSJ Read full article

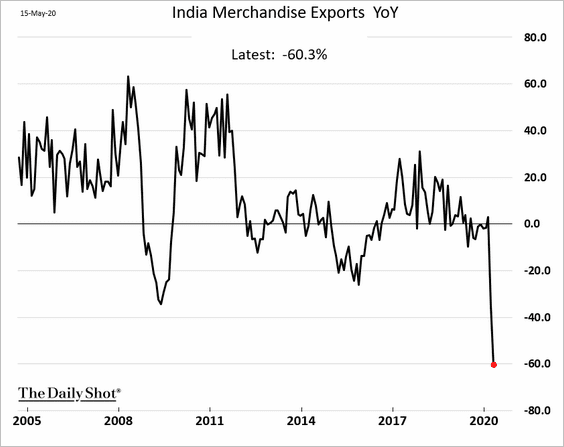

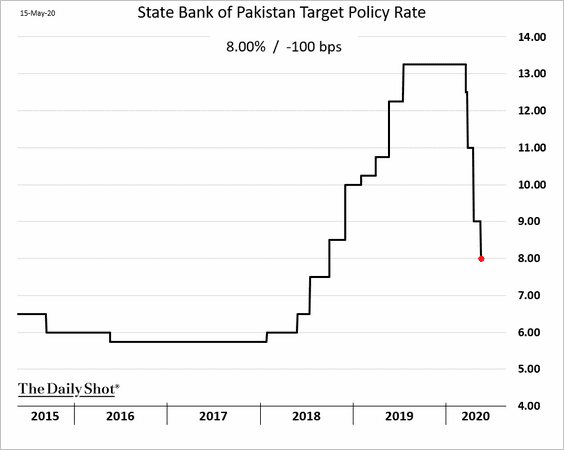

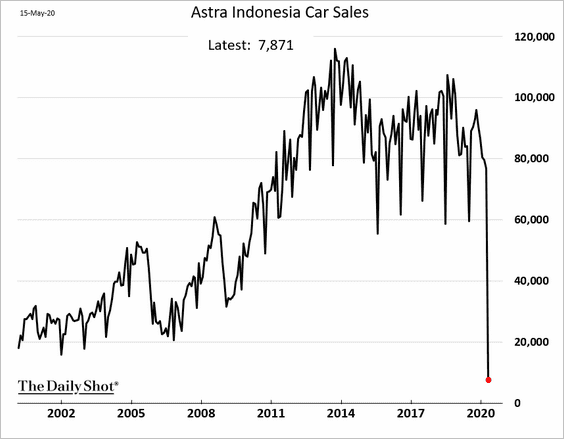

Emerging Markets

1. India’s exports plummetted in April.

2. Pakistan’s central bank cut rates again.

3. Car sales in Indonesia stopped last month.

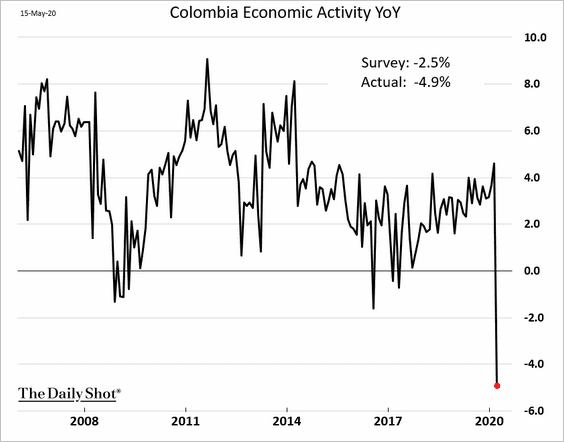

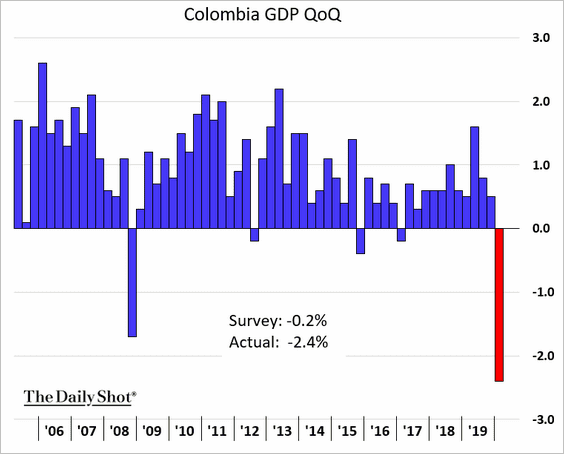

4. The March decline in Colombia’s economic activity was extreme.

Here is the first-quarter GDP deterioration (worse than expected).

——————–

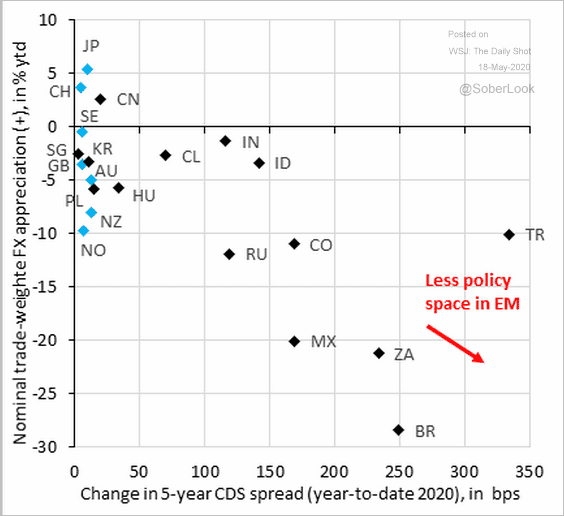

5. With currencies severely weakened and limited investor appetite for government debt, the ability to implement substantial fiscal stimulus has been diminished in many EM economies.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

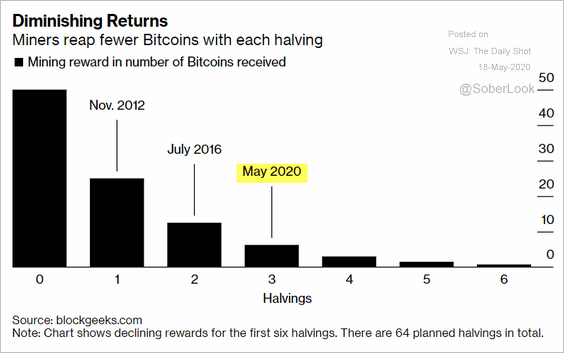

Cryptocurrency

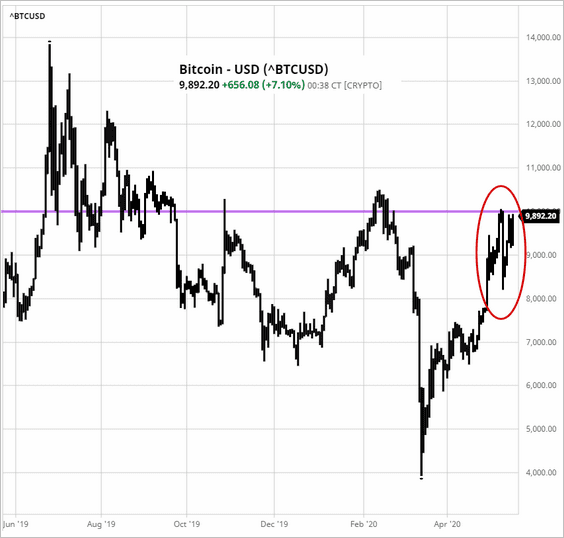

1. Bitcoin is testing the $10k resistance again.

2. Below is the halving schedule.

Source: @markets Read full article

Source: @markets Read full article

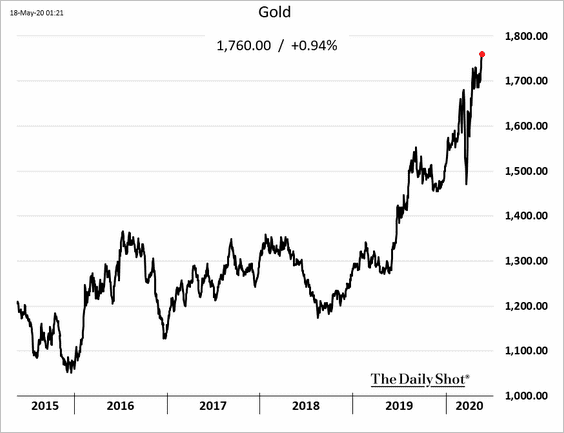

Commodities

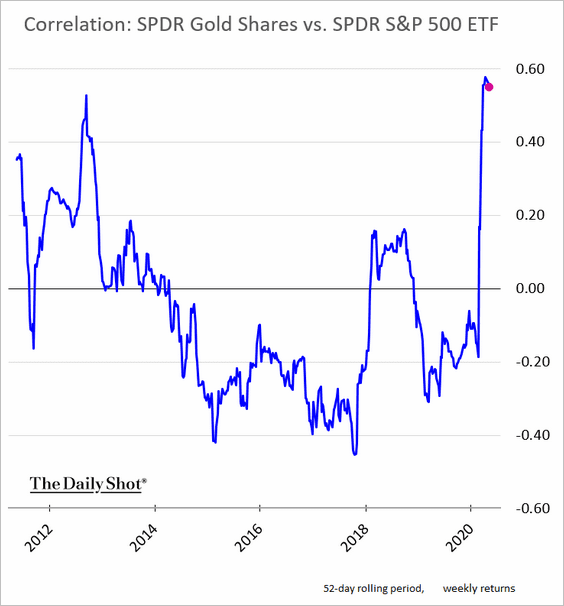

1. Gold continues to rally.

Gold’s correlation to the stock market has been unusually high this year.

——————–

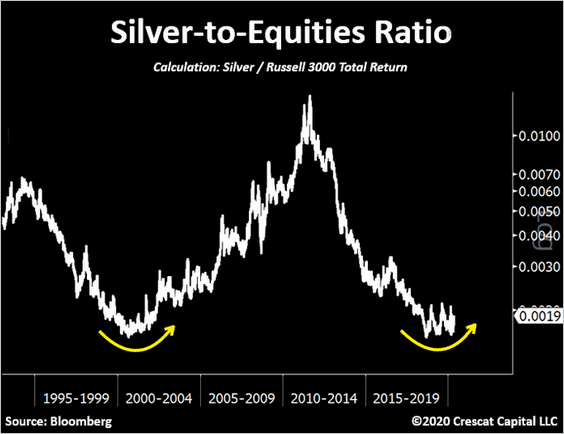

2. Here is the silver-to-equities ratio.

Source: @TaviCosta

Source: @TaviCosta

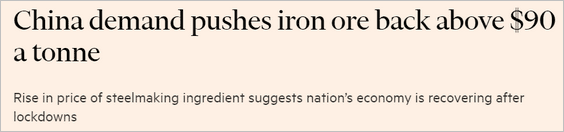

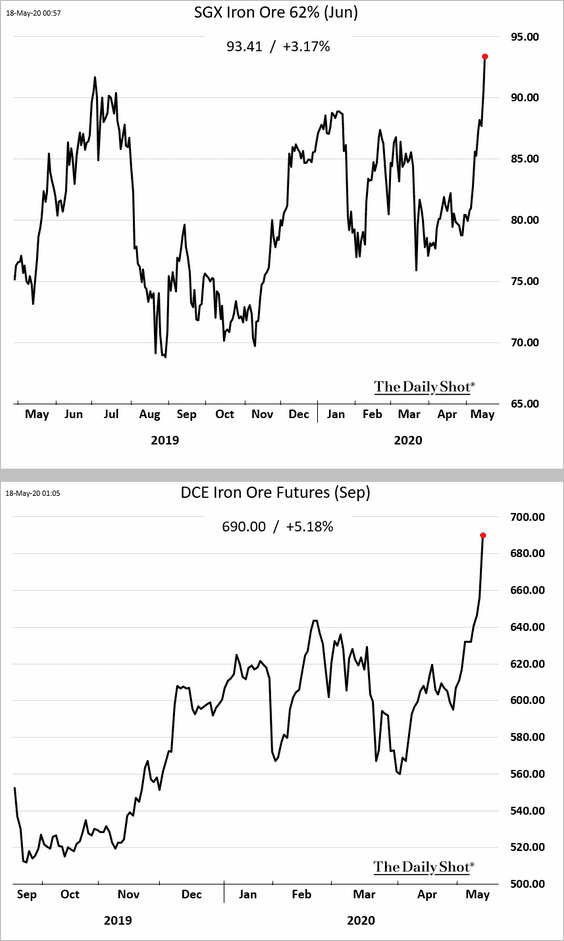

3. China’s economic rebound has been a tailwind for iron ore.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

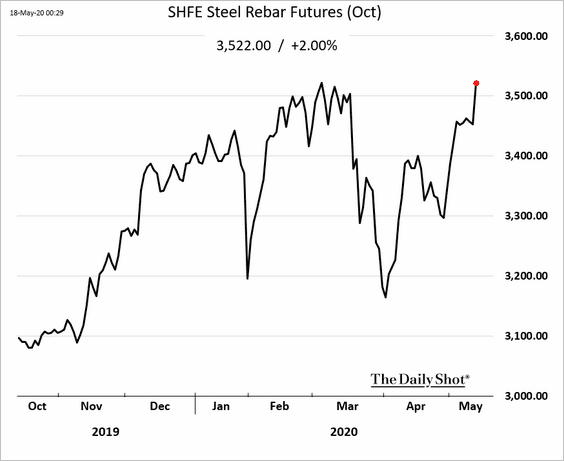

Steel futures in China are also rallying.

——————–

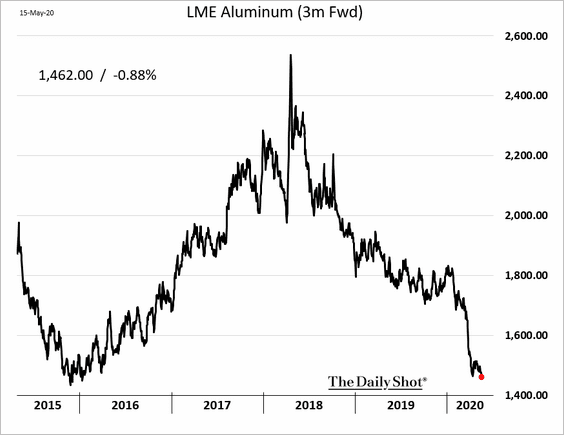

4. Aluminum prices hit the lowest level since early 2016.

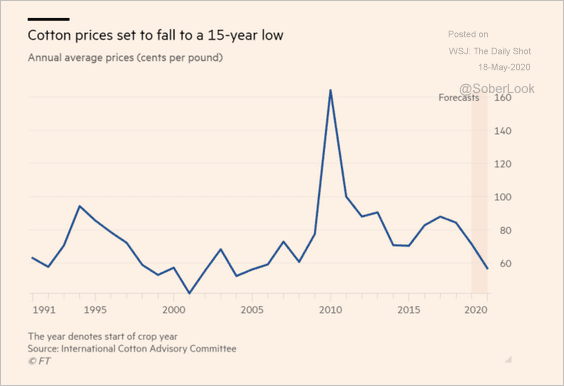

5. Cotton prices are expected to remain soft.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

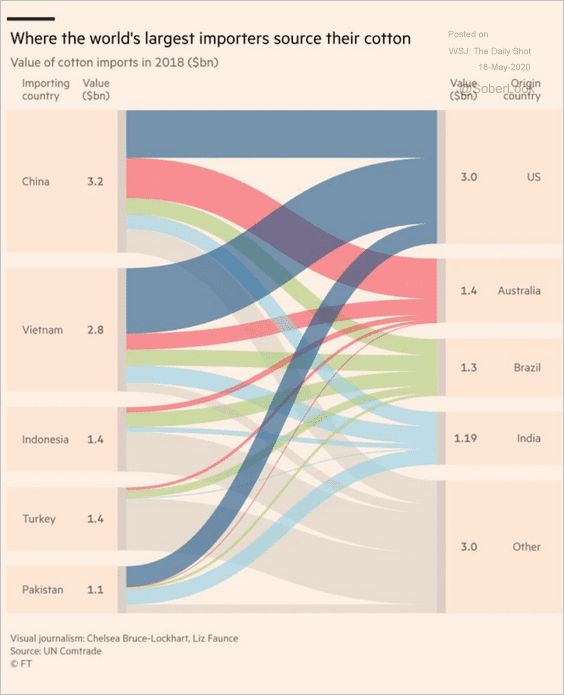

Below are global trade flows in cotton.

Source: @adam_tooze, @patricianilsson, @EmikoTerazono Read full article

Source: @adam_tooze, @patricianilsson, @EmikoTerazono Read full article

——————–

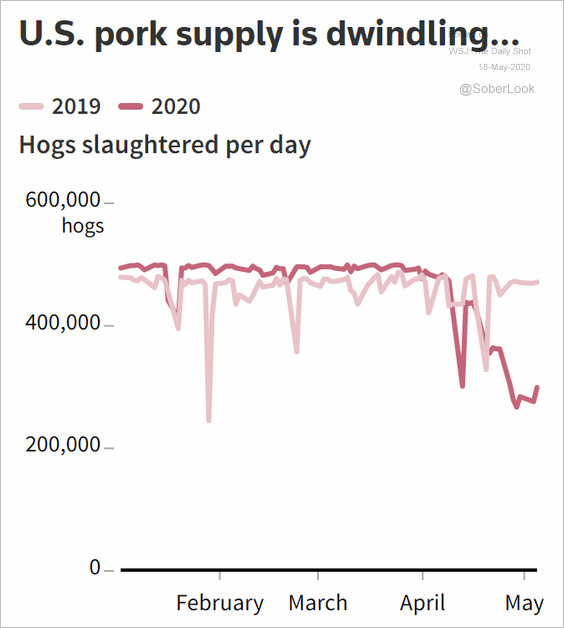

6. US pork supply has declined substantially over the past month.

Source: Reuters Read full article

Source: Reuters Read full article

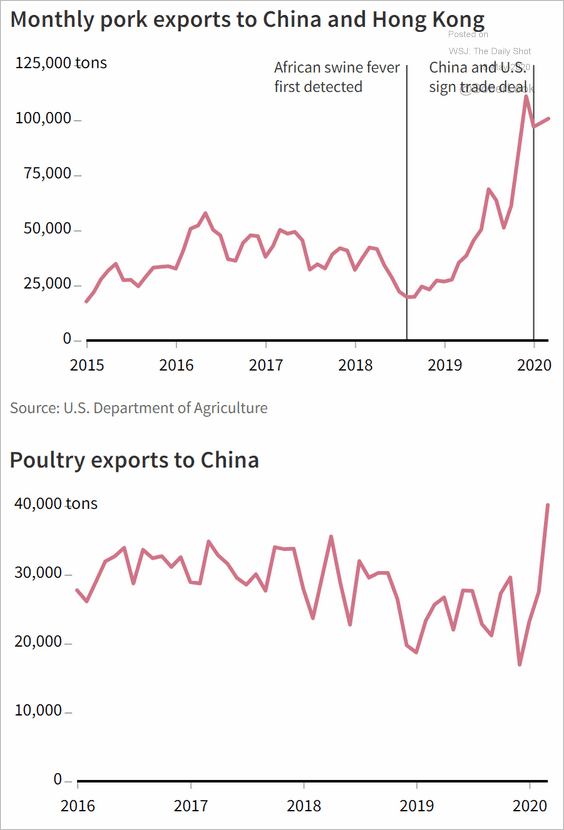

These charts show US pork and poultry exports to China.

Source: Reuters Read full article

Source: Reuters Read full article

Energy

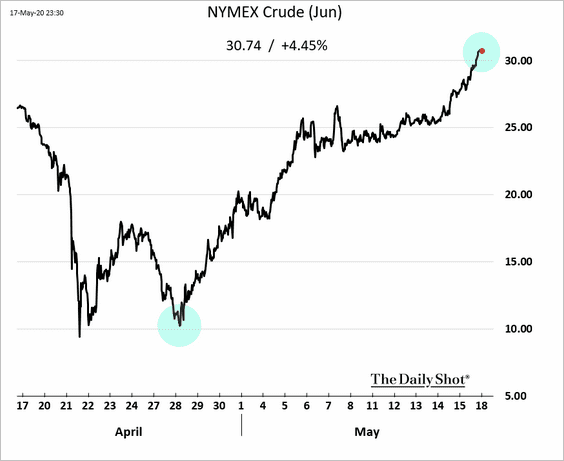

1. The June US crude oil contract has tripled in value since the April lows.

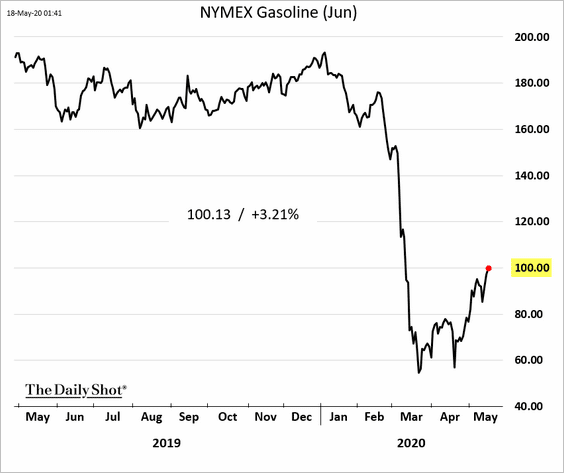

2. NYMEX gasoline futures breached $1.0/gal.

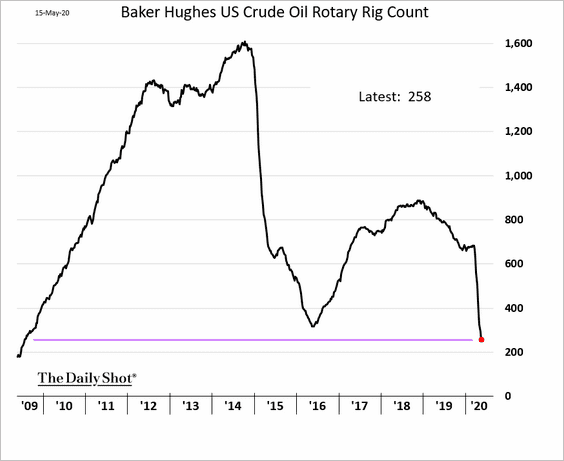

3. The US crude oil rig count continues to shrink, reaching the lowest level since 2009.

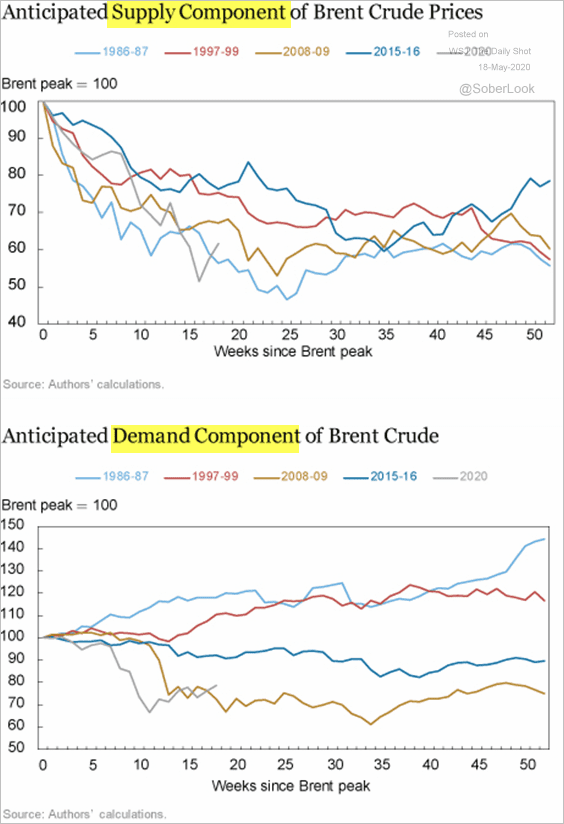

4. These charts break out the impact of supply and demand expectations on Brent crude prices.

Source: Liberty Street Economics Read full article

Source: Liberty Street Economics Read full article

Equities

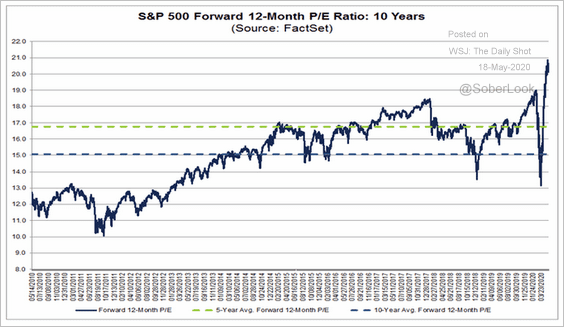

1. US share valuations remain a concern. Here is the 12-month forward price/earnings ratio. The bull argument is that the market should look beyond one year to a sharp recovery in earnings. Perhaps.

Source: @FactSet Read full article

Source: @FactSet Read full article

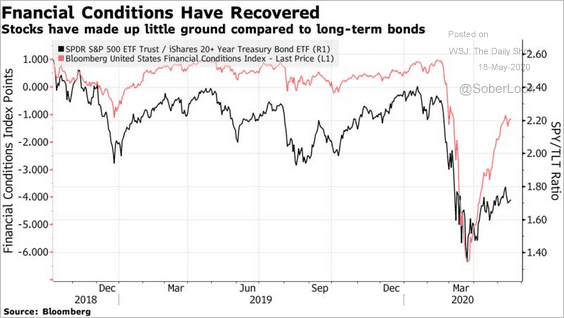

2. This chart shows the US stocks-to-bonds ratio vs. financial conditions.

Source: @johnauthers, @bopinion Read full article

Source: @johnauthers, @bopinion Read full article

Alternatives

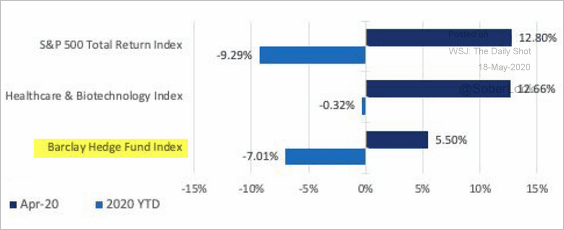

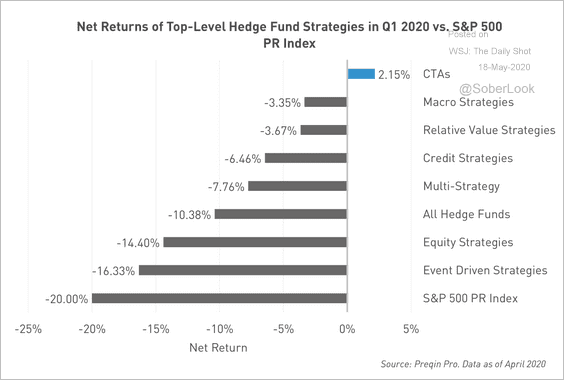

1. Despite a relatively strong performance in April, hedge funds are still down on a year-to-date basis (on average).

Source: BarclayHedge

Source: BarclayHedge

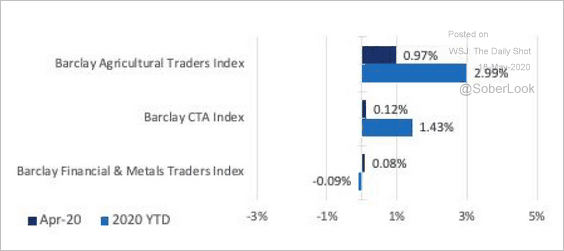

2. Managed futures operators (CTAs) have continued to produce positive results this year.

Source: BarclayHedge

Source: BarclayHedge

CTAs have been the top performer in Q1 versus the S&P 500.

Source: Preqin Read full article

Source: Preqin Read full article

——————–

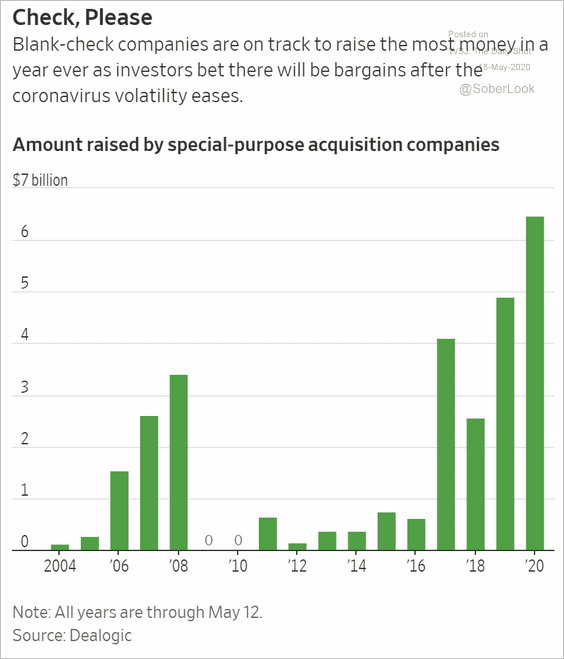

3. SPACs have become extremely popular, boosted by the DraftKings transaction.

Source: @WSJ Read full article

Source: @WSJ Read full article

Credit

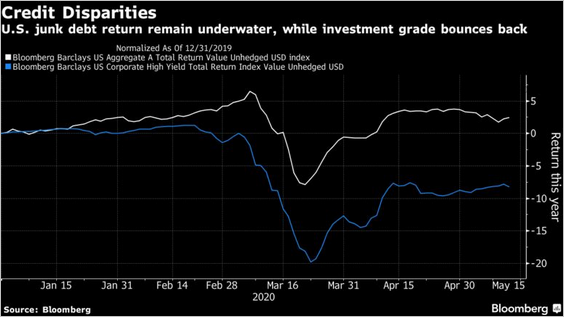

1. Investment-grade debt has outperformed high yield this year.

Source: @markets Read full article

Source: @markets Read full article

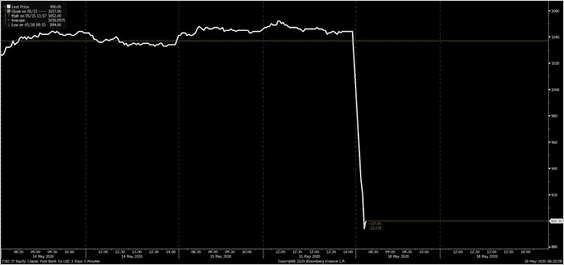

2. Shares of Japan Post Bank took a hit on concerns about exposure to US CLO debt. Japanese and other Asian institutions have been key players in the AAA CLO debt. Without their participation, many CLO deals would not have closed.

Source: @tracyalloway

Source: @tracyalloway

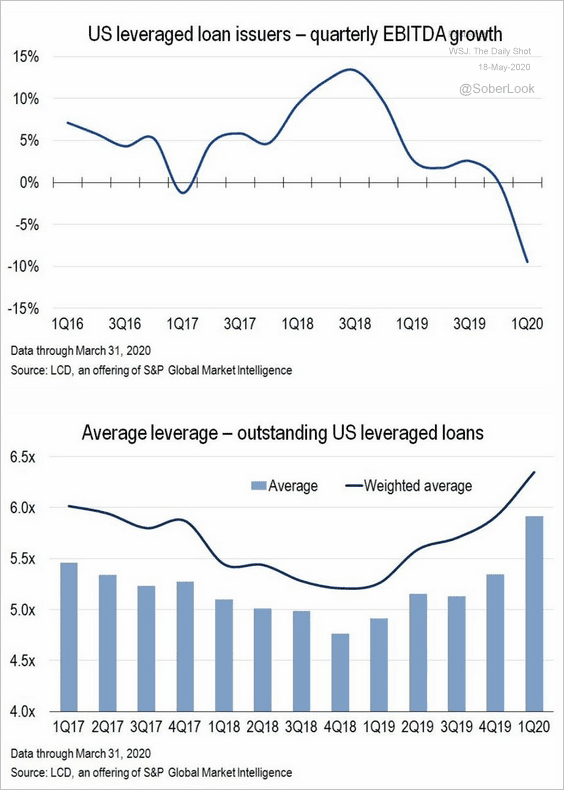

3. Leveraged loan leverage has risen substantially as earnings tumbled.

Source: S&P Global Market Intelligence, @jessefelder Read full article

Source: S&P Global Market Intelligence, @jessefelder Read full article

Rates

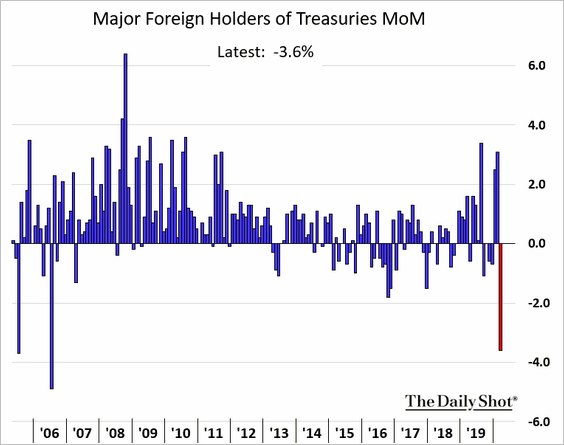

1. Foreigners dumped US government bonds in March.

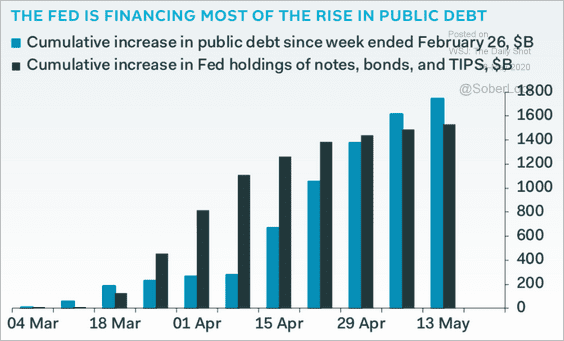

2. The Fed has been financing most of the increase in US federal government debt issuance.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

Food for Thought

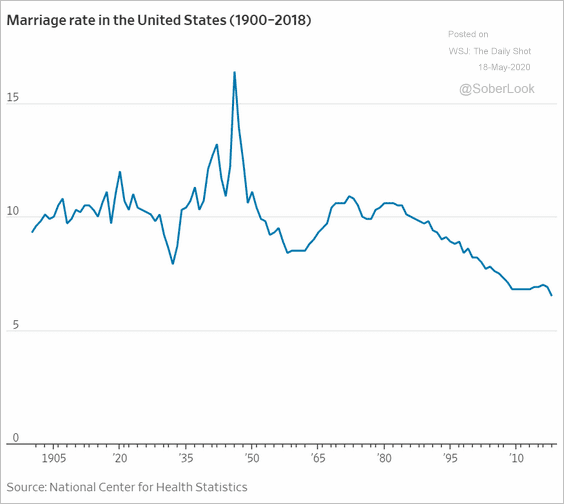

1. US marriage rate:

Source: @WSJ Read full article

Source: @WSJ Read full article

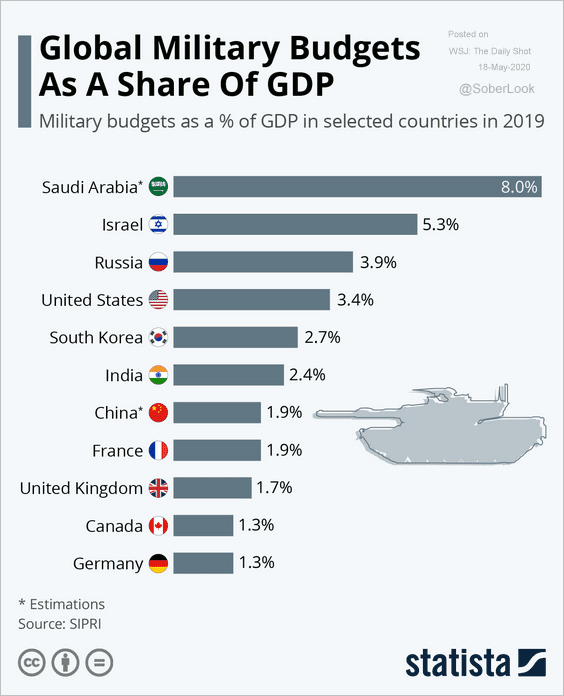

2. Military budgets as a % of GDP:

Source: Statista

Source: Statista

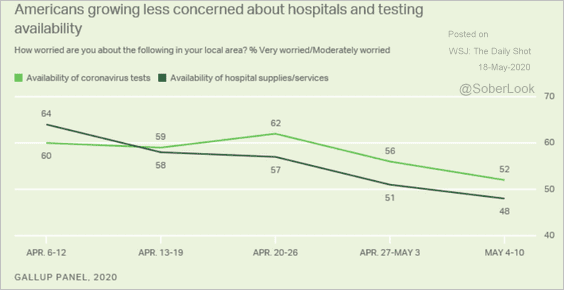

3. Concerns about hospitals and testing availability:

Source: Gallup Read full article

Source: Gallup Read full article

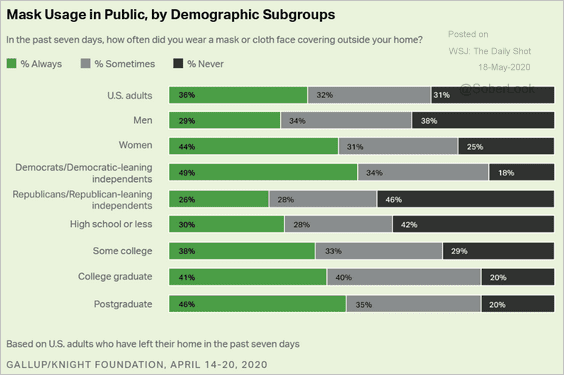

4. Mask usage:

Source: Gallup Read full article

Source: Gallup Read full article

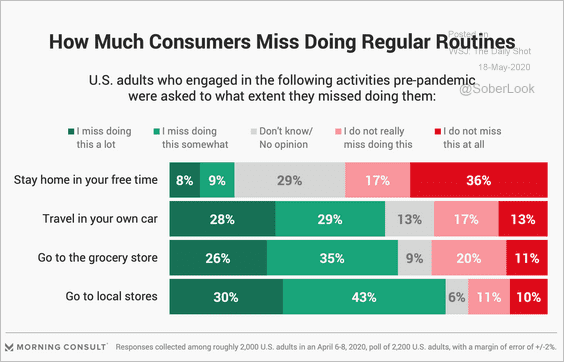

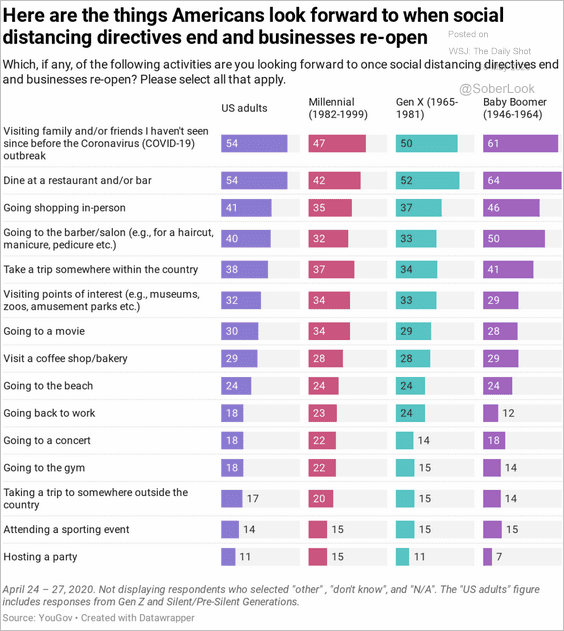

5. What did you miss the most during the lockdown (2 charts)?

Source: Morning Consult Read full article

Source: Morning Consult Read full article

Source: YouGov Read full article

Source: YouGov Read full article

——————–

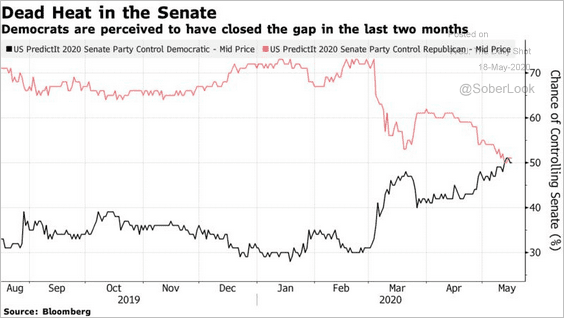

6. Which party will control the Senate?

Betting market odds:

Source: @johnauthers, @bopinion Read full article

Source: @johnauthers, @bopinion Read full article

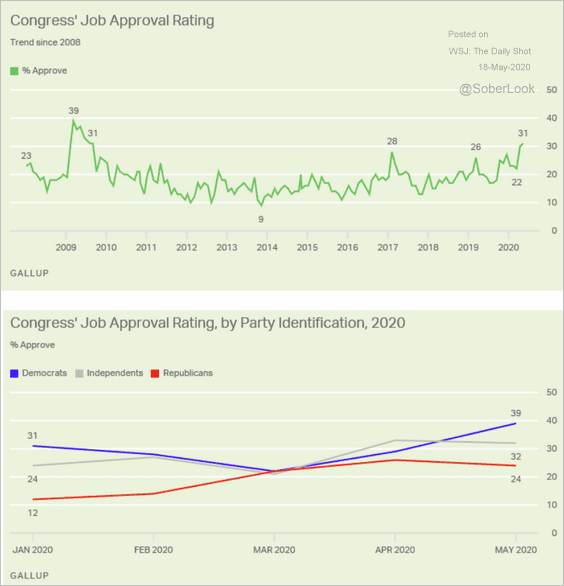

7. Congress’ job approval:

Source: Gallup Read full article

Source: Gallup Read full article

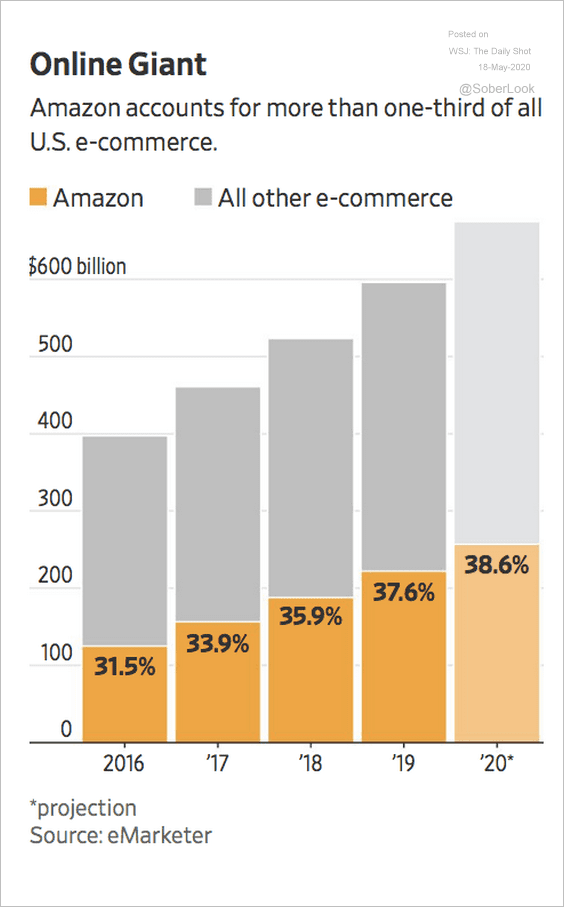

8. Amazon vs. the rest of US e-commerce:

Source: @WSJ Read full article

Source: @WSJ Read full article

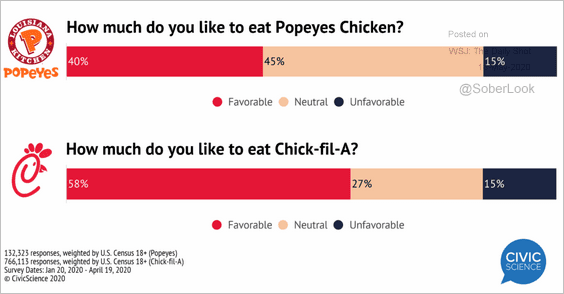

9. Popeyes vs. Chick-fil-A:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–