The Daily Shot: 21-May-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• Emerging Markets

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

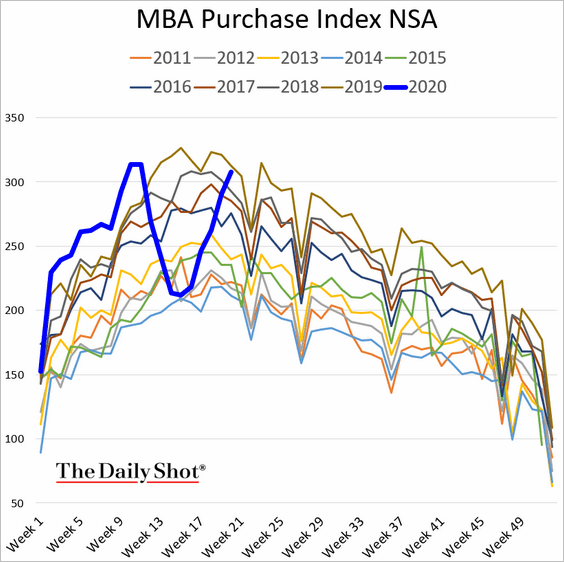

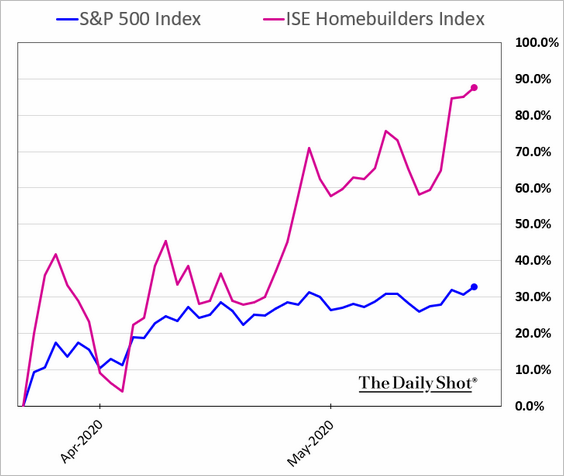

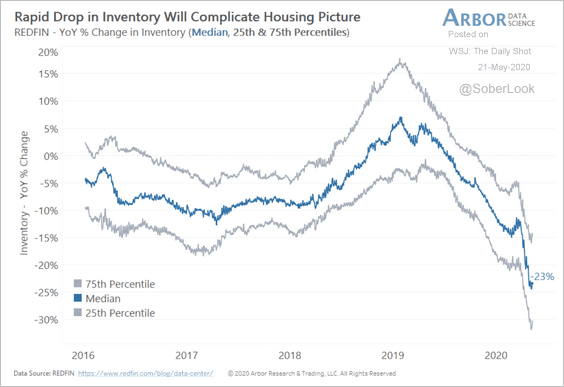

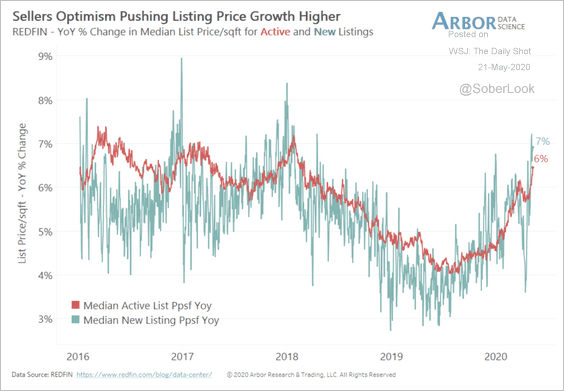

1. Once again, let’s start with the housing market.

• Mortgage applications to purchase a home are almost back to 2019 levels. It’s been an impressive rebound.

• Shares of homebuilders have been outperforming since the market lows.

• The onset of lockdowns sparked a collapse in housing inventory.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

• Active housing list prices are rising again.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

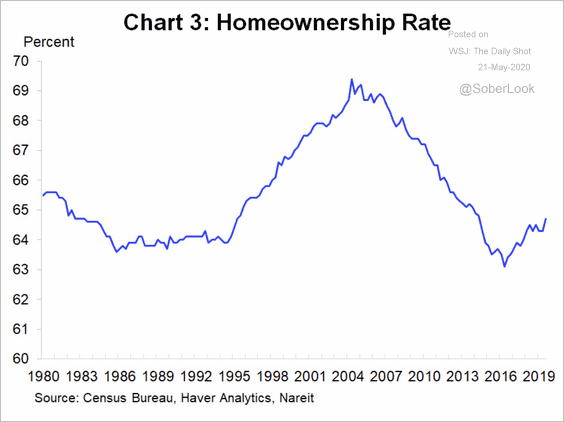

• Before the pandemic hit, homeownership was on the rise for three years.

Source: Nareit Read full article

Source: Nareit Read full article

——————–

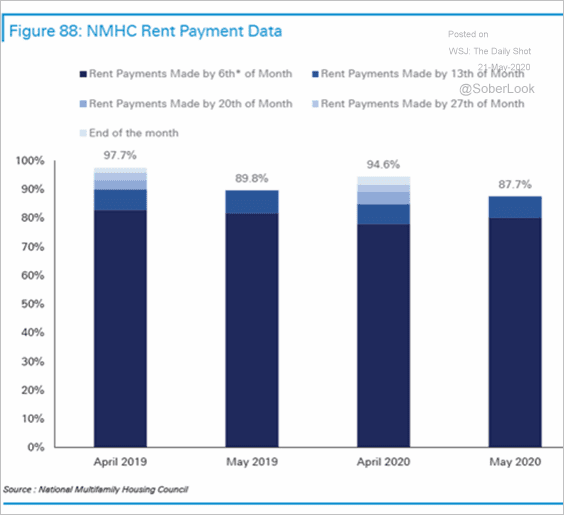

2. Fears of large swaths of American skipping rent payments appear to be unfounded (for now).

Torsten Sløk (Deutsche Bank): – The data below from the National Multifamily Housing Council covers 11.5 million apartment units nationwide, and it shows that:

• the share of people paying their rent on time in April and May 2020 is not dramatically different from what we saw in April and May of 2019, and

• the share of people paying their rent for May 2020 is ahead compared with the same time in April 2020.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

3. Industrial and apartment properties are expected to generate the highest total return over the next two years.

Source: The Urban Land Institute Read full article

Source: The Urban Land Institute Read full article

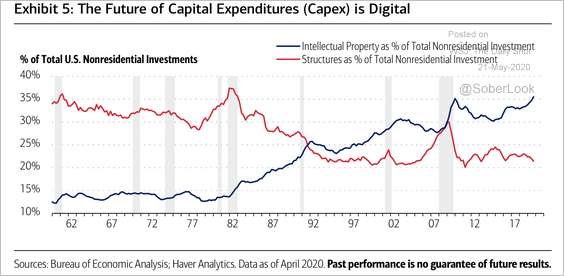

4. Non-residential investment has shifted away from physical structures to intellectual property.

Source: BofA Merrill Lynch Global Research

Source: BofA Merrill Lynch Global Research

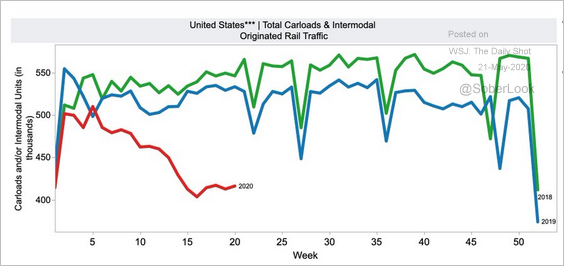

5. Rail freight activity remains weak.

Source: @adam_tooze, @AAR_FreightRail Read full article

Source: @adam_tooze, @AAR_FreightRail Read full article

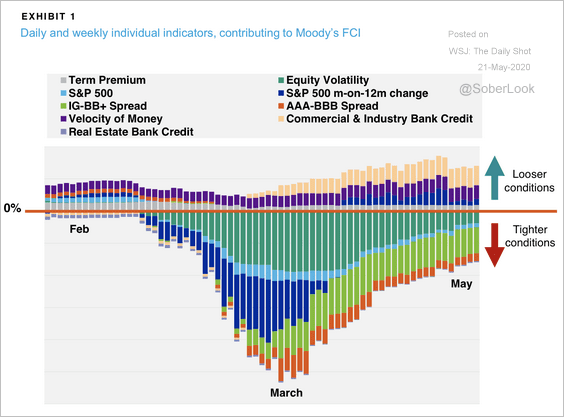

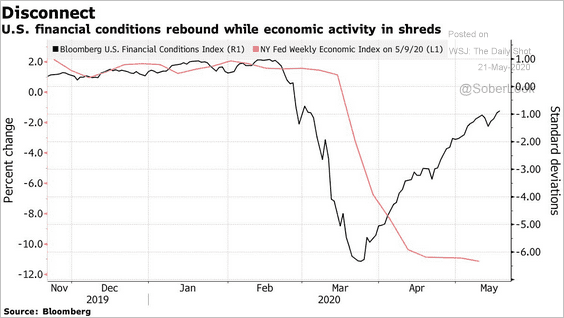

6. The Moody’s US financial conditions indicator has improved significantly since March.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

A massive gap has opened up between easing financial conditions and depressed economic activity.

Source: @markets Read full article

Source: @markets Read full article

——————–

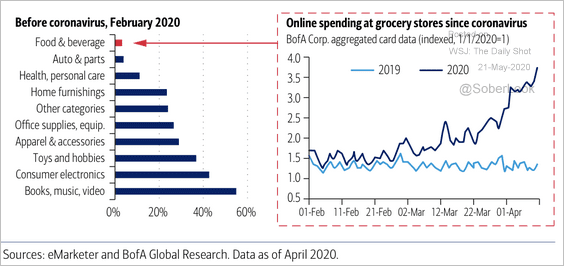

7. This chart shows e-commerce as a share of total retail revenue.

Source: BofA Merrill Lynch Global Research

Source: BofA Merrill Lynch Global Research

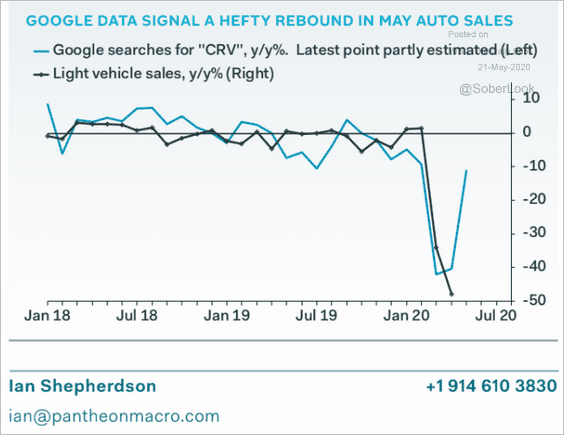

8. Google search activity points to a rebound in vehicle sales.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

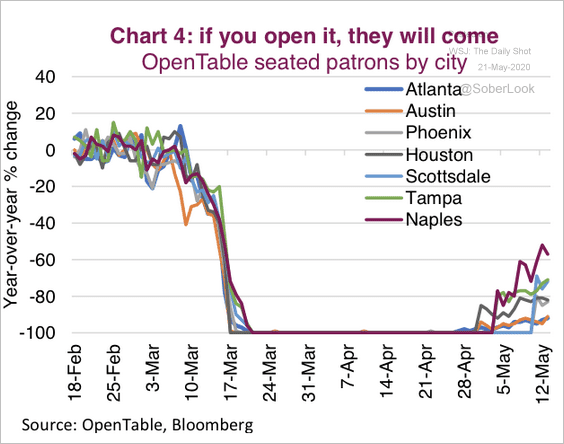

9. Consumers are starting to make restaurant reservations again as cities slowly reopen.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

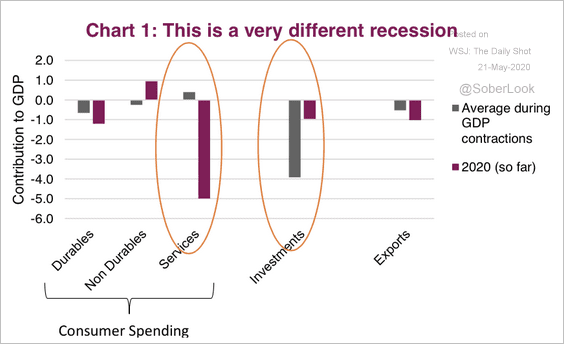

10. The service sector is at the epicenter of this crisis, which wasn’t the case in previous periods of GDP contractions.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

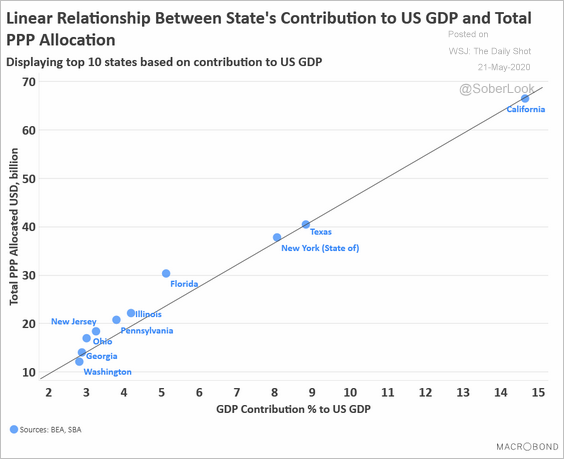

11. The state-level allocations of PPP small-business loans are highly correlated with each state’s GDP share.

Source: Macrobond

Source: Macrobond

Canada

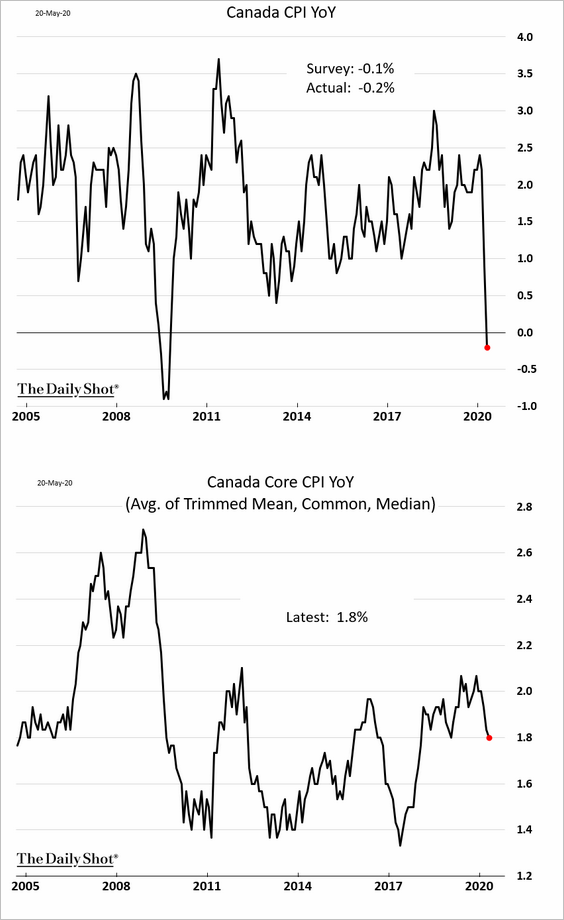

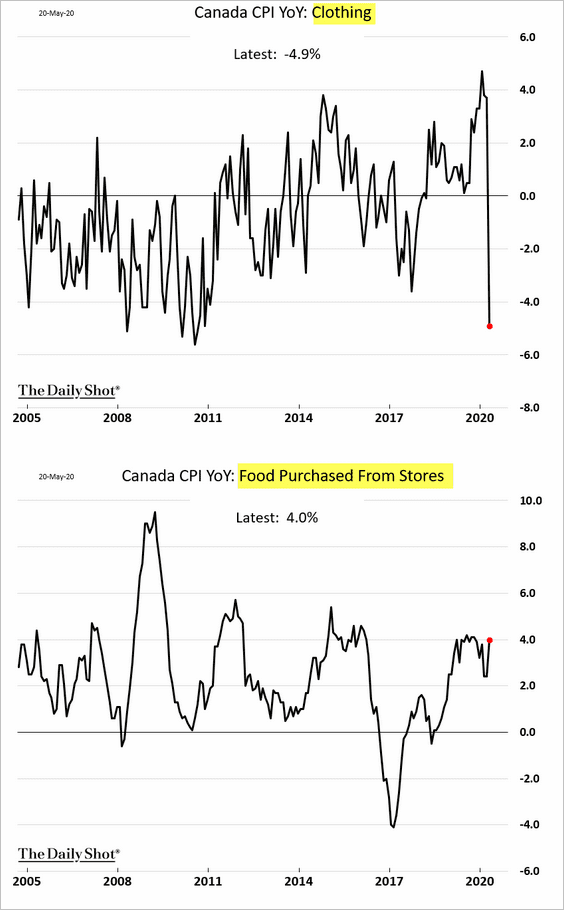

1. The headline CPI dipped into deflation territory, while the core CPI has held up.

Just as in the US, the lockdown effects are noticeable in the CPI report.

——————–

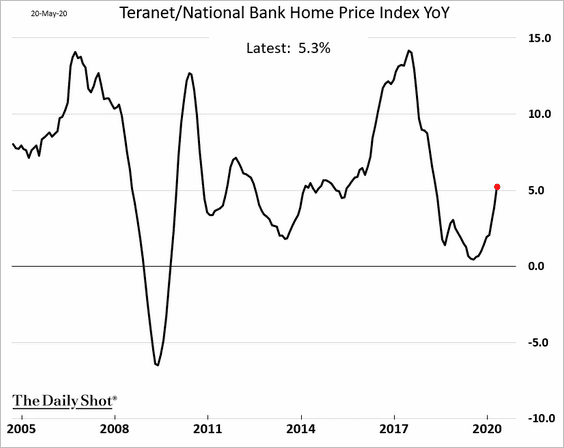

2. Home price appreciation strengthened last month.

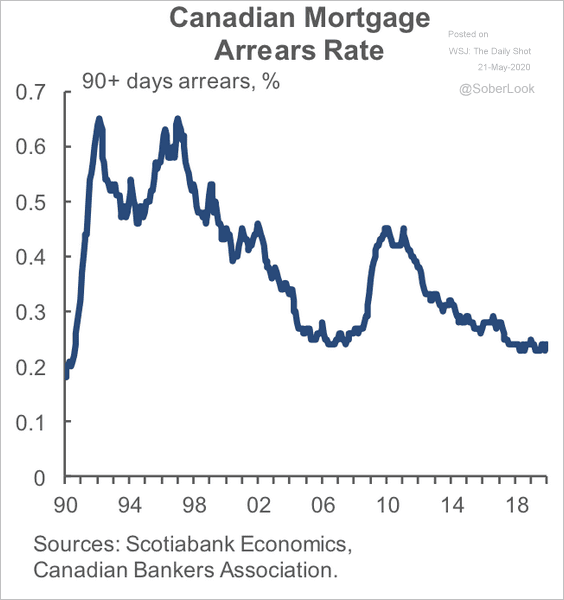

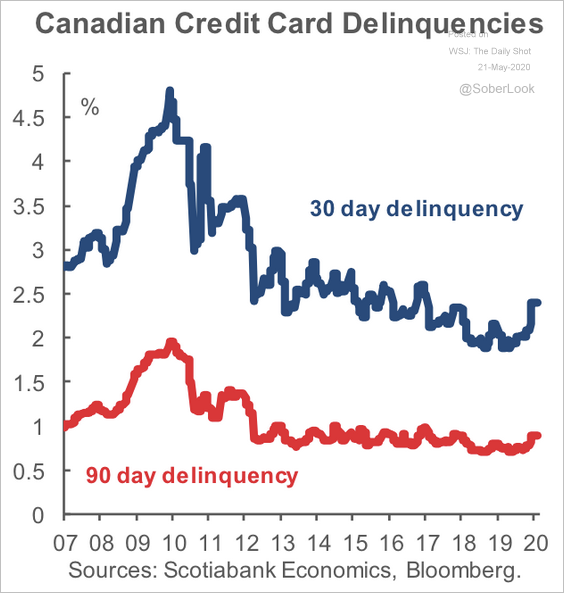

3. Credit card and mortgage delinquencies are still relatively low (for now).

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

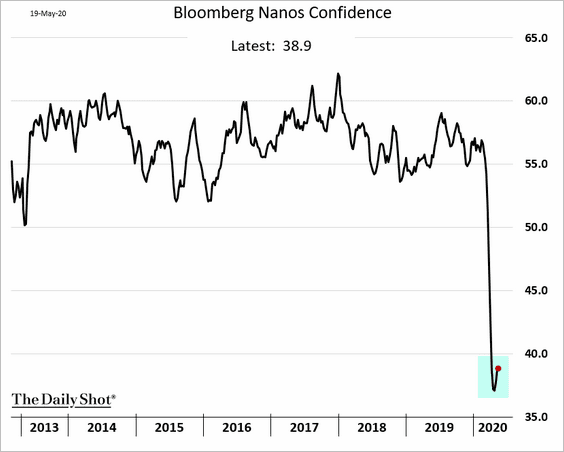

4. Consumer confidence is off the lows (barely).

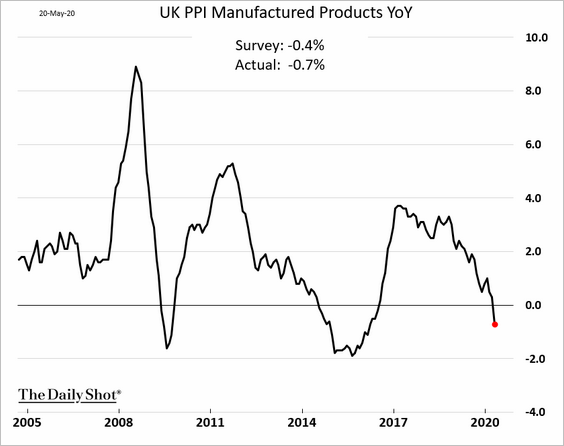

The United Kingdom

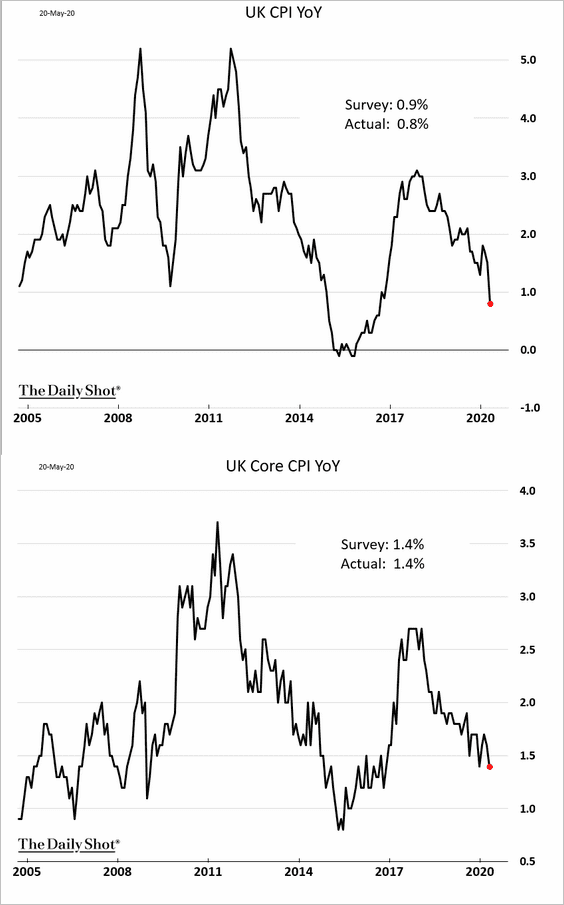

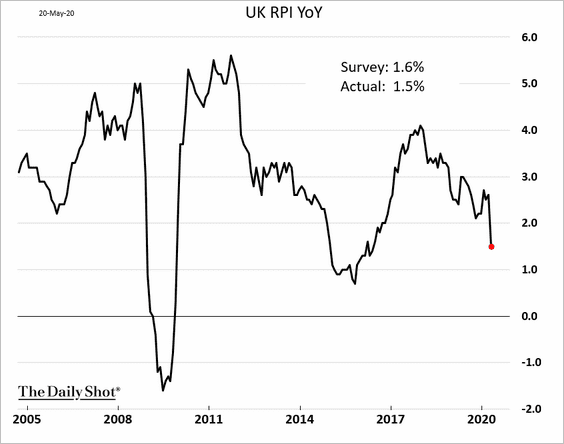

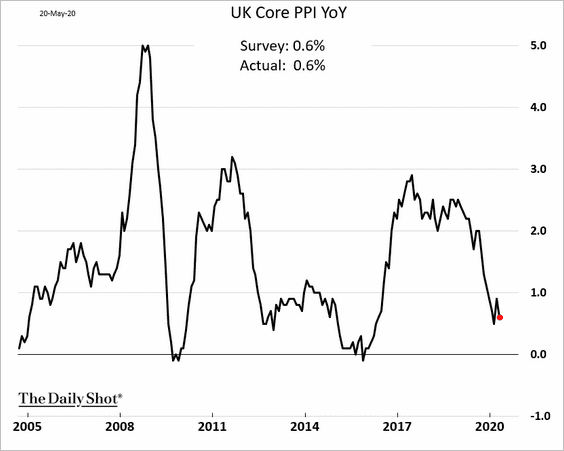

1. The April inflation report was largely in line with expectations, as the downward trend continued.

Here is the retail price index.

Below are a couple of PPI charts.

• The core PPI:

• Manufactured products PPI:

——————–

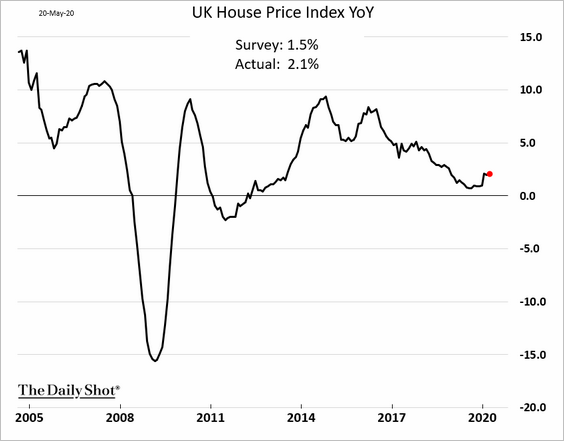

2. Home price appreciation remained resilient in March.

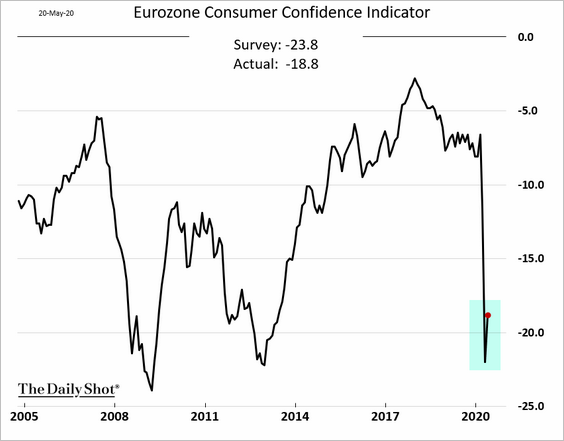

The Eurozone

1. Consumer confidence bounced from the lows.

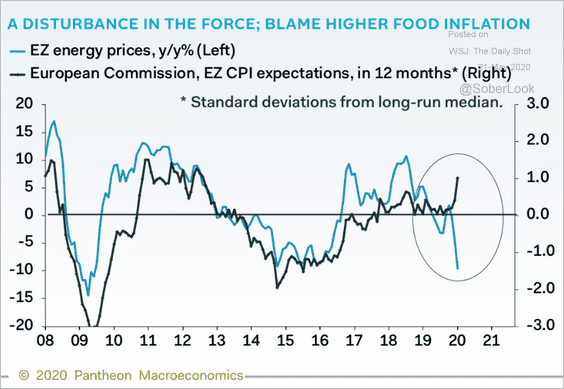

2. Higher food prices boosted consumer inflation expectations.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

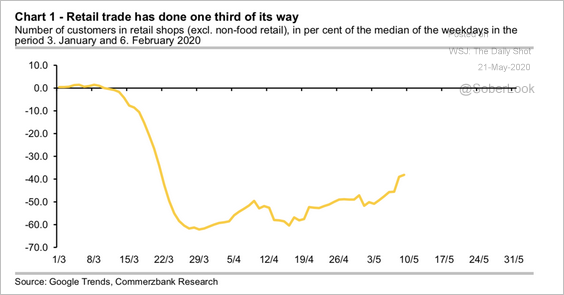

3. Germany’s retail trade is recovering.

Source: Commerzbank Research

Source: Commerzbank Research

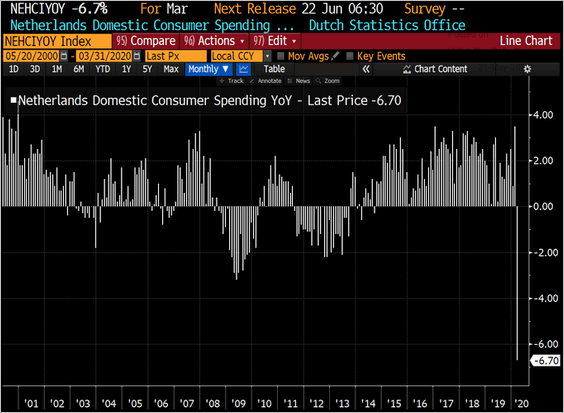

4. Dutch consumer spending plummetted.

Source: @jsblokland, @TheTerminal

Source: @jsblokland, @TheTerminal

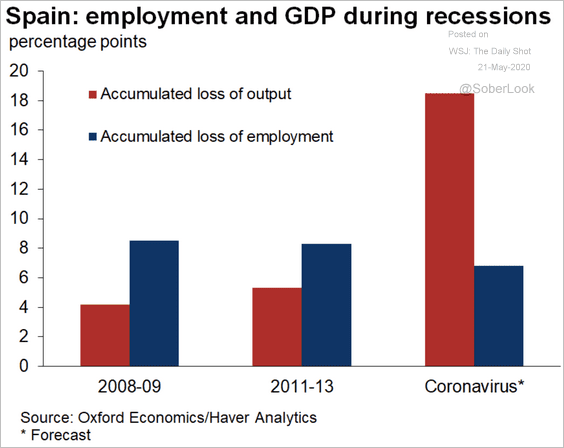

5. Spain’s loss of output in 2020 will be larger than the decline in employment, which is quite unusual.

Source: @atalaveraEcon

Source: @atalaveraEcon

Europe

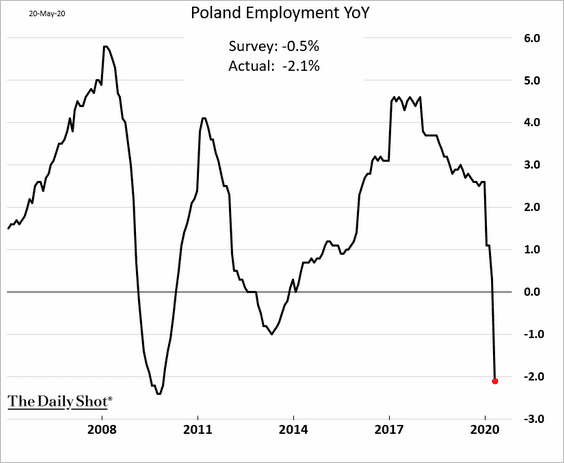

1. Poland’s employment deteriorated sharply last month.

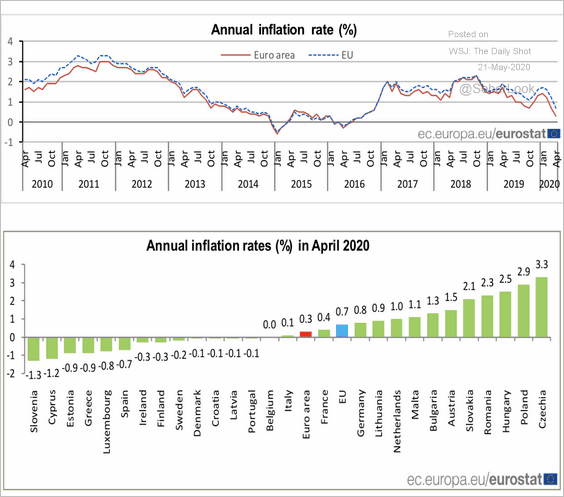

2. Next, we have some data on consumer inflation across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

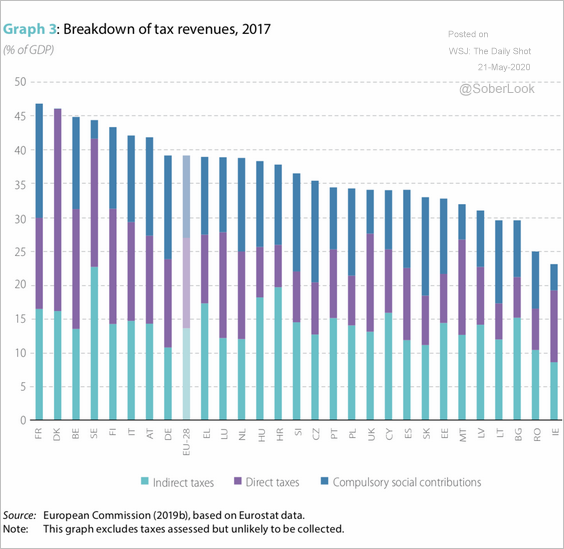

3. Here is the breakdown of tax revenues in the EU.

Source: Arbor Research & Trading Read full article

Source: Arbor Research & Trading Read full article

Asia – Pacific

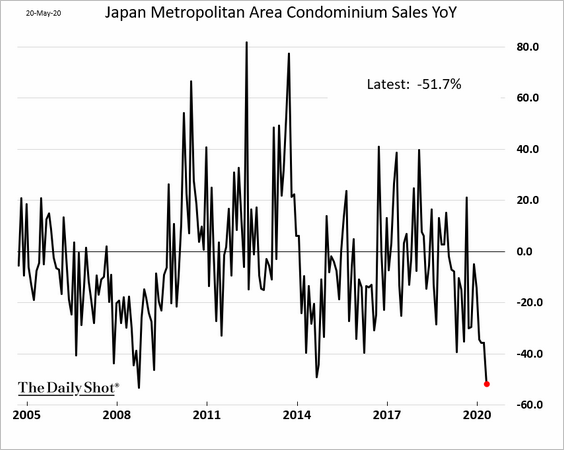

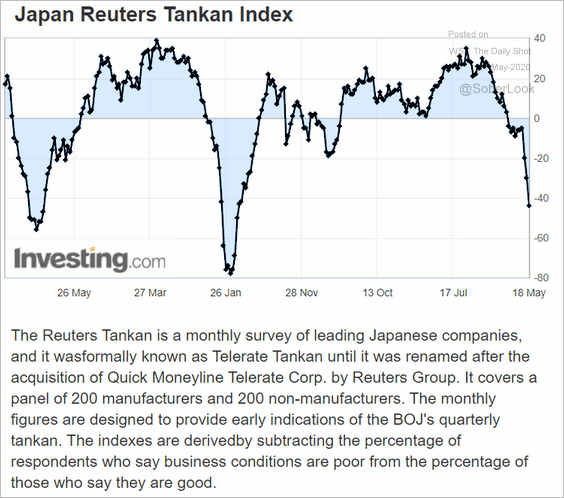

1. Let’s begin with Japan.

• Condominium sales:

• The Reuters Tankan Index (see overview below):

——————–

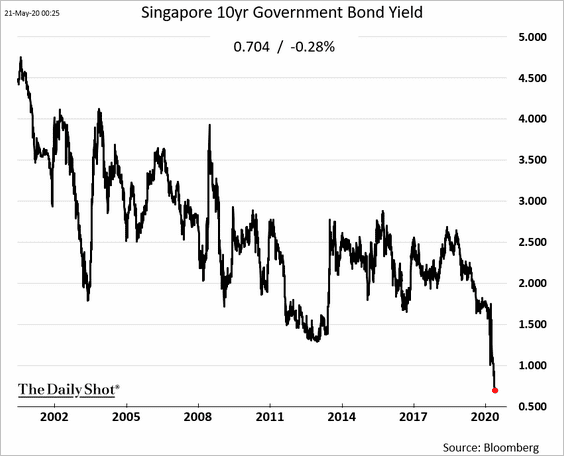

2. Singapore’s government bond yields are at record lows.

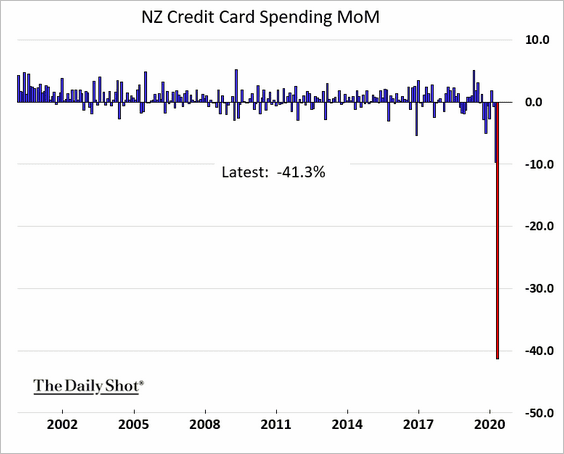

3. Credit card spending in New Zealand crashed last month.

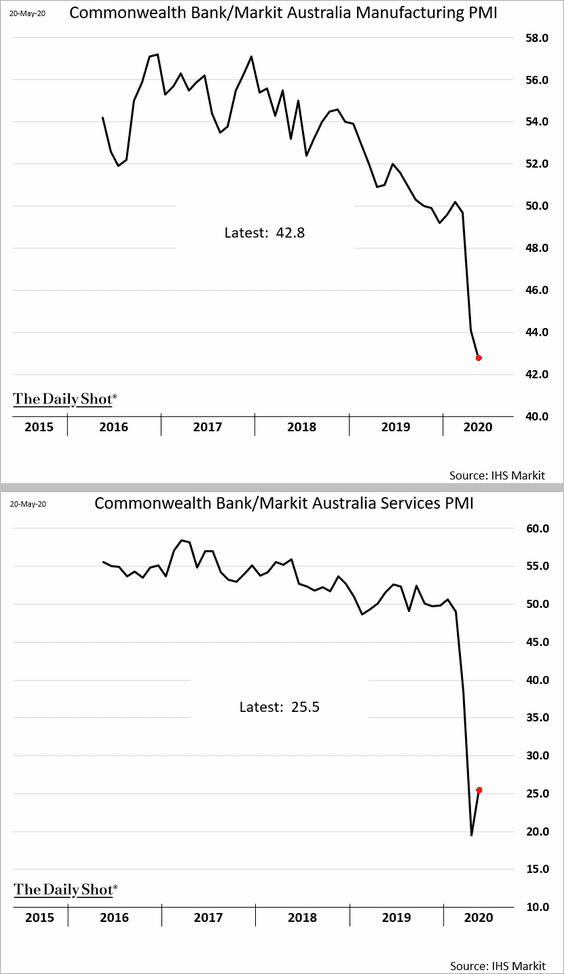

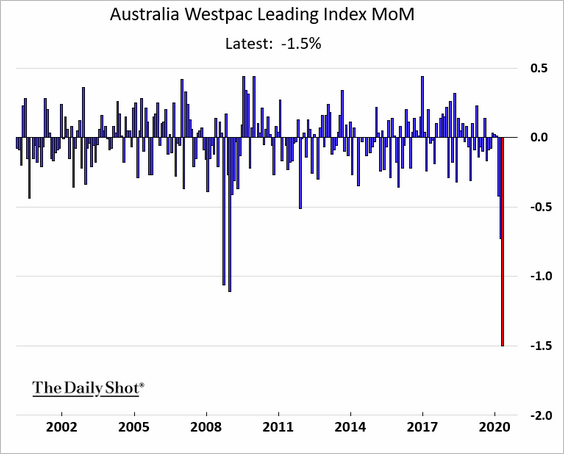

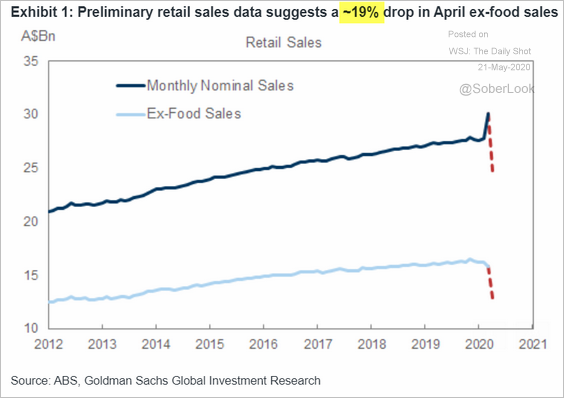

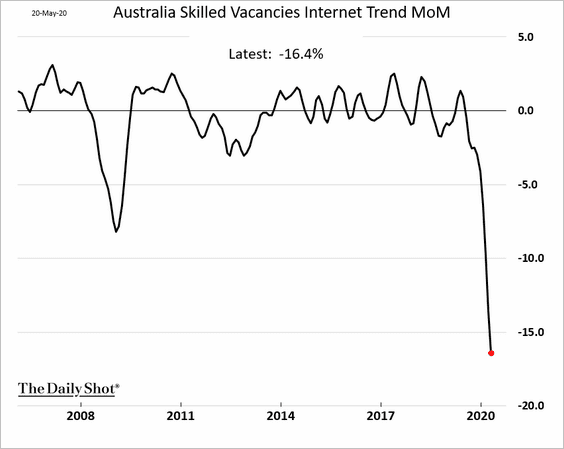

4. Next, we have some updates on Australia.

• Manufacturing contraction worsened in May, but the declines in service-sector activity eased slightly.

• Here is the index of leading indicators (through April).

• Preliminary data suggest that retail sales tumbled 19% in April (according to Goldman).

Source: Goldman Sachs

Source: Goldman Sachs

• Skilled-labor vacancies plummetted last month.

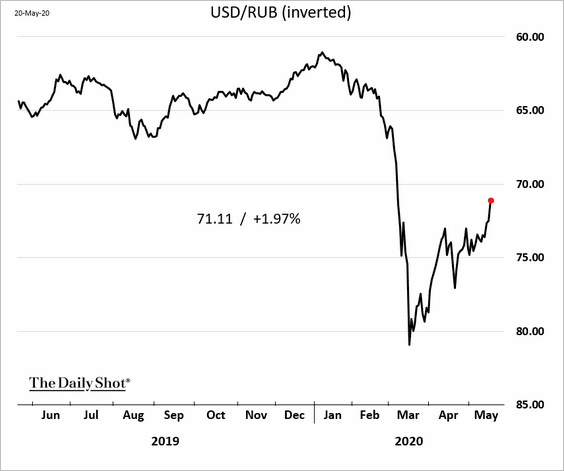

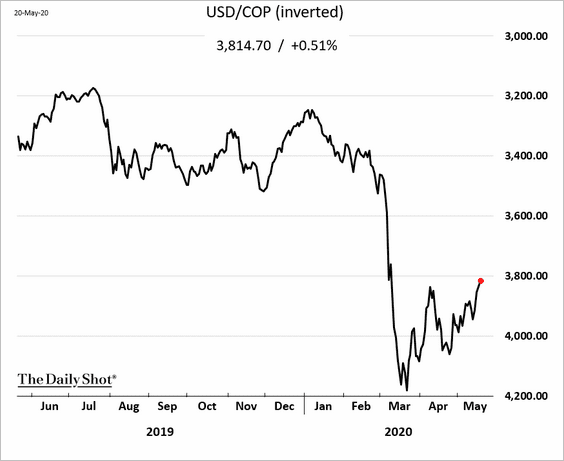

Emerging Markets

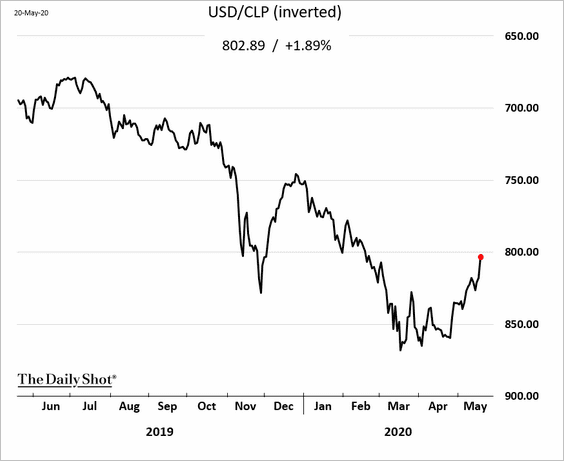

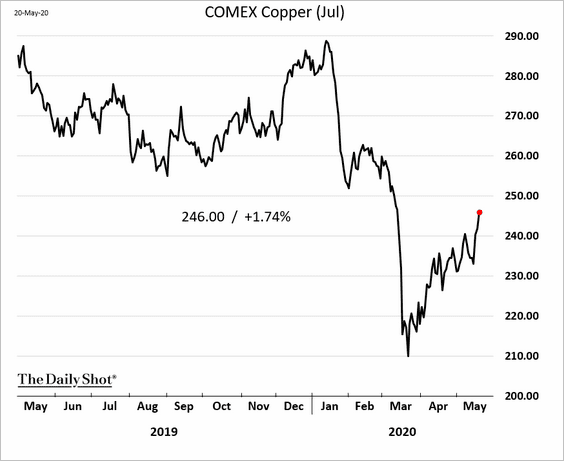

1. Improving commodity/energy prices have been a tailwind for some exporters’ currencies.

• The Russian ruble:

• The Colombian peso:

• The Chilean peso (boosted by copper):

——————–

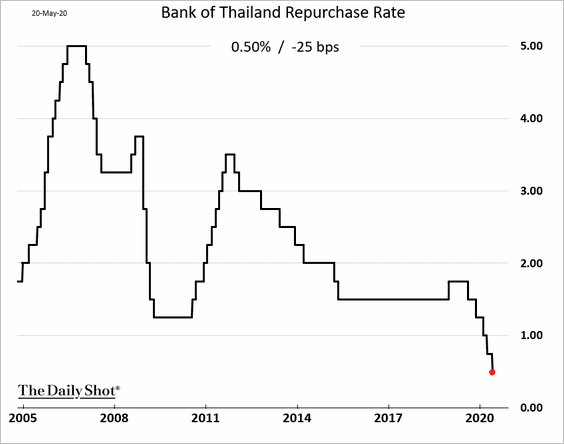

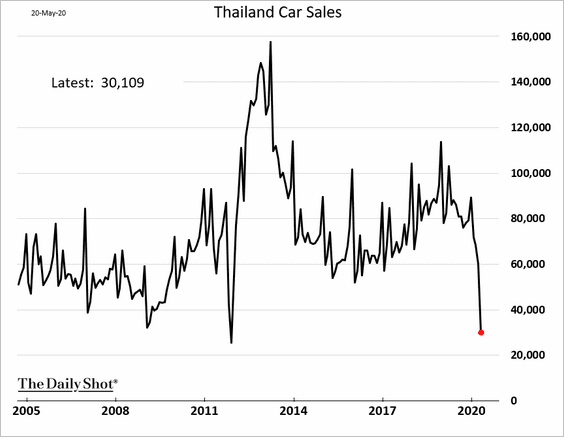

2. Thailand’s central bank cut rates again.

This chart shows Thailand’s automobile sales.

——————–

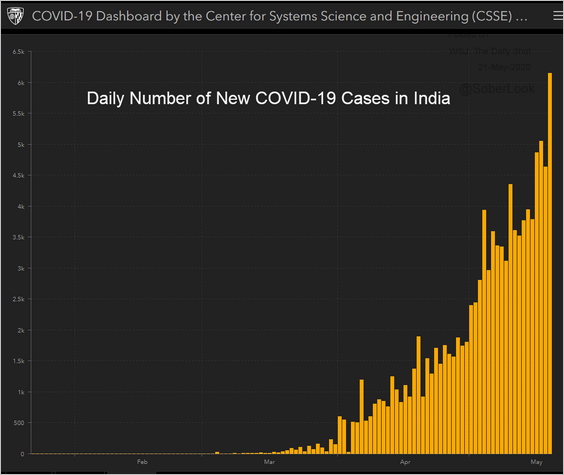

3. New coronavirus cases in India have accelerated.

Source: JHU CSSE

Source: JHU CSSE

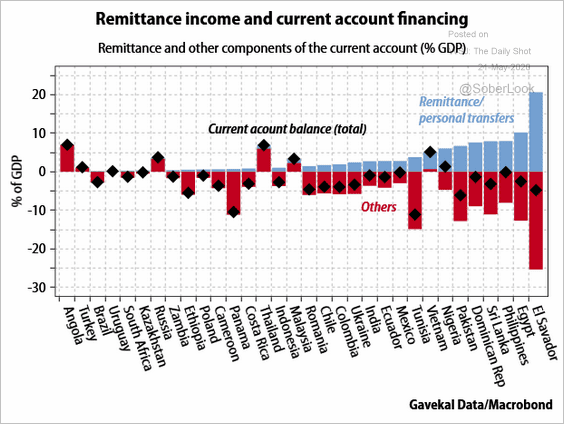

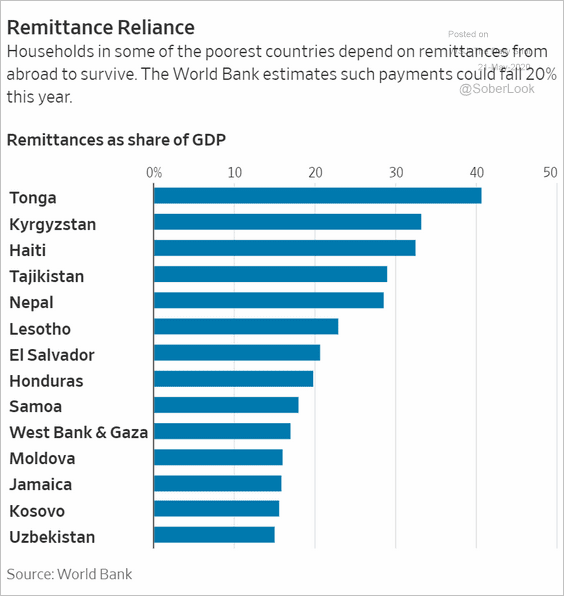

4. The pressure on remittances will create substantial challenges for many EM economies (2 charts).

Source: Gavekal

Source: Gavekal

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

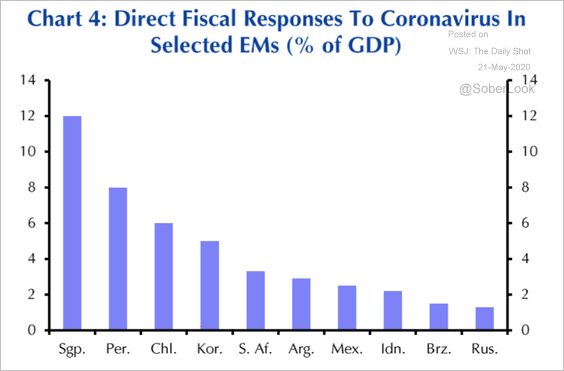

5. This chart shows the fiscal responses to the crisis in select countries.

Source: Capital Economics

Source: Capital Economics

Energy

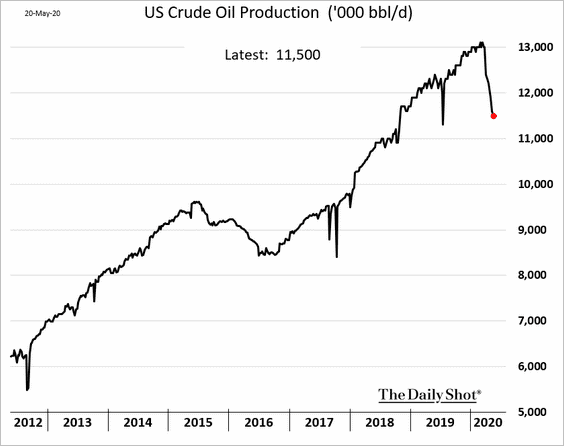

1. US crude oil output continues to slow.

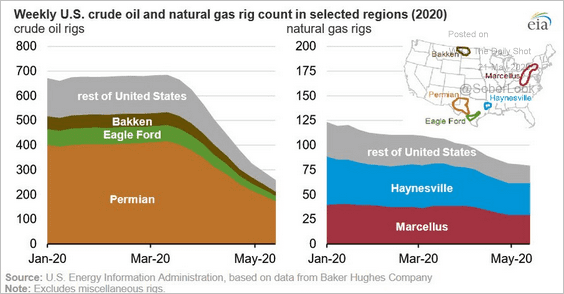

Here is the breakdown of the US rig count.

Source: @EIAgov Read full article

Source: @EIAgov Read full article

——————–

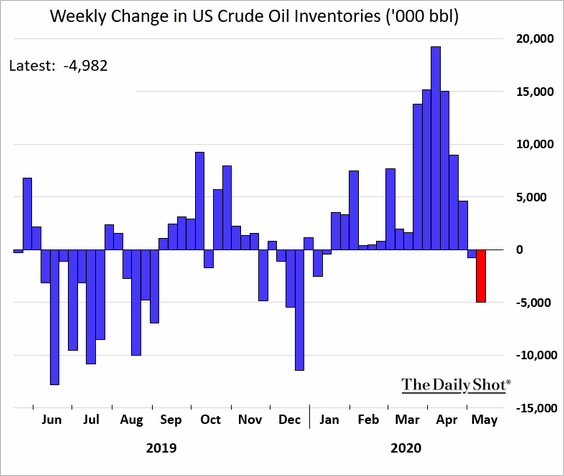

2. Crude oil inventories are finally declining.

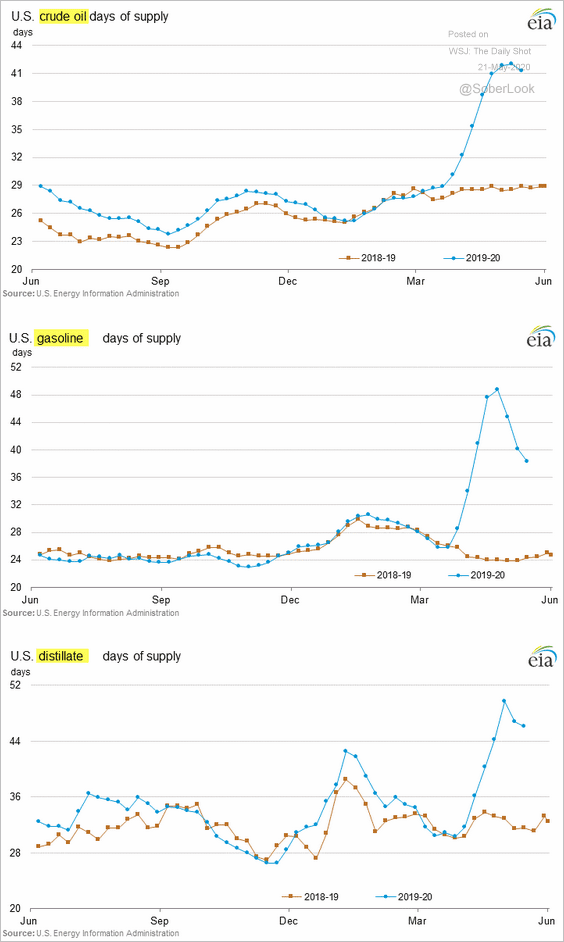

The next charts show crude oil and refined product inventories in terms of days of supply.

——————–

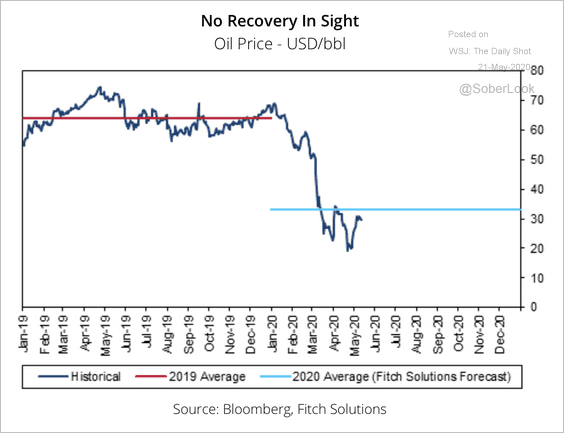

3. Fitch expects Brent crude to average at about $33/bbl over the course of the year.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

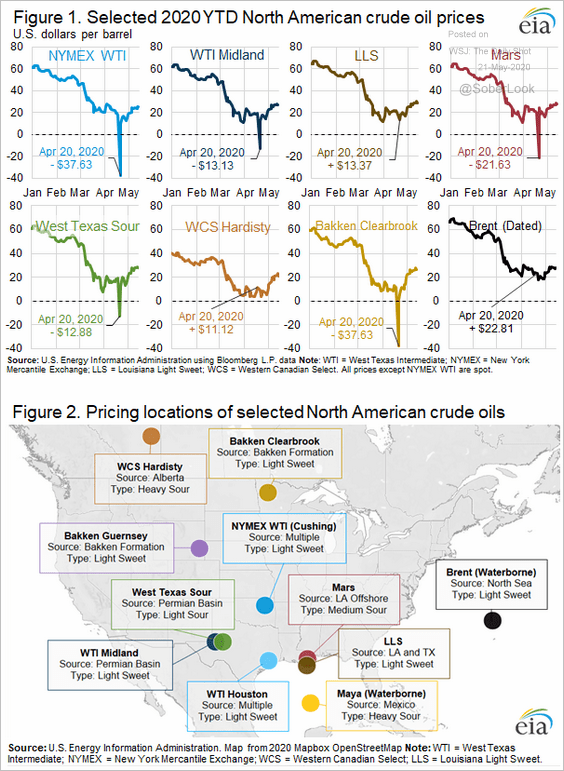

4. These charts provide the history of regional US crude oil prices year-to-date.

Source: EIA

Source: EIA

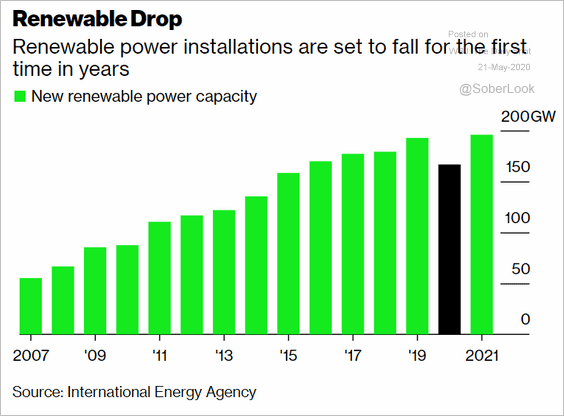

5. Renewable power installation will decline this year.

Source: @business Read full article

Source: @business Read full article

Equities

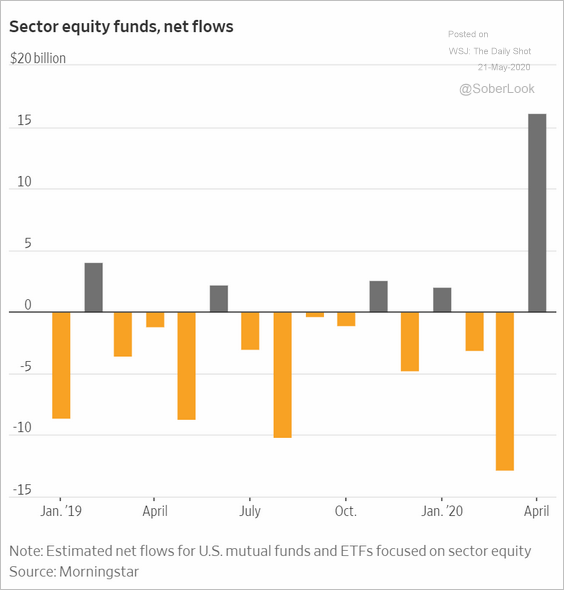

1. Sector funds saw substantial capital inflows.

Source: @WSJ Read full article

Source: @WSJ Read full article

2. The performance gap between US and non-US shares continues to widen.

Source: BofA Merrill Lynch Global Research, @jsblokland

Source: BofA Merrill Lynch Global Research, @jsblokland

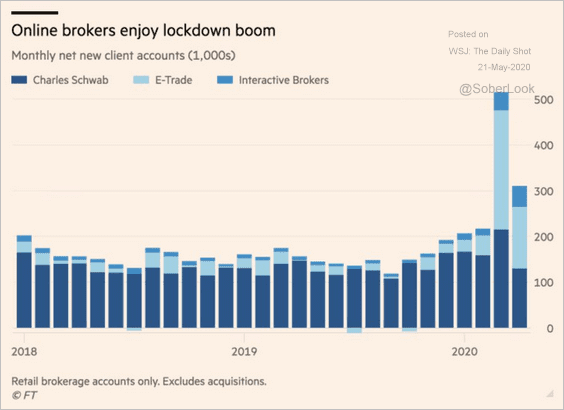

3. Online brokers enjoyed a flurry of new account openings over the past couple of months.

Source: @FT, @jessefelder Read full article

Source: @FT, @jessefelder Read full article

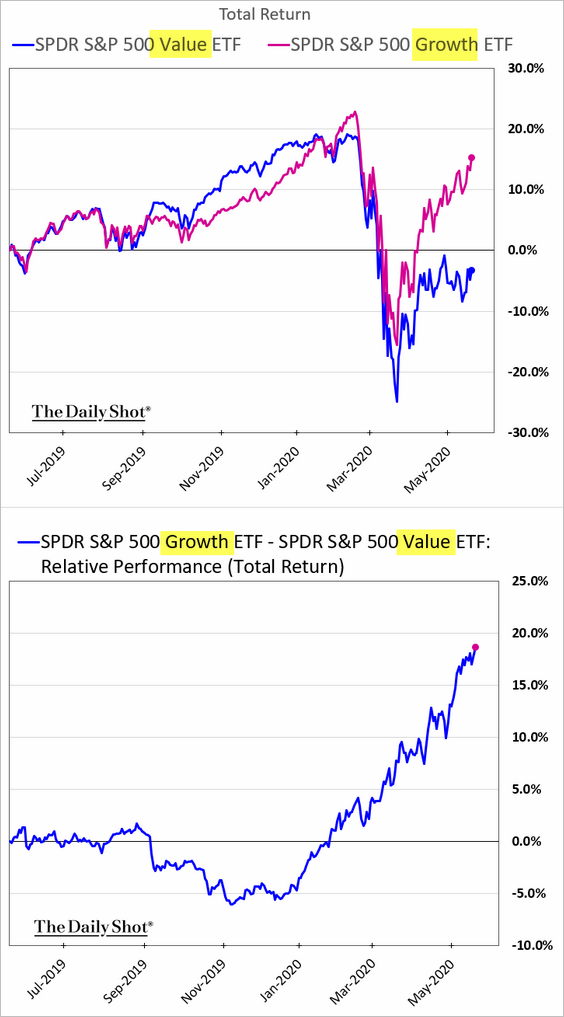

4. Growth shares are still widening their outperformance vs. value.

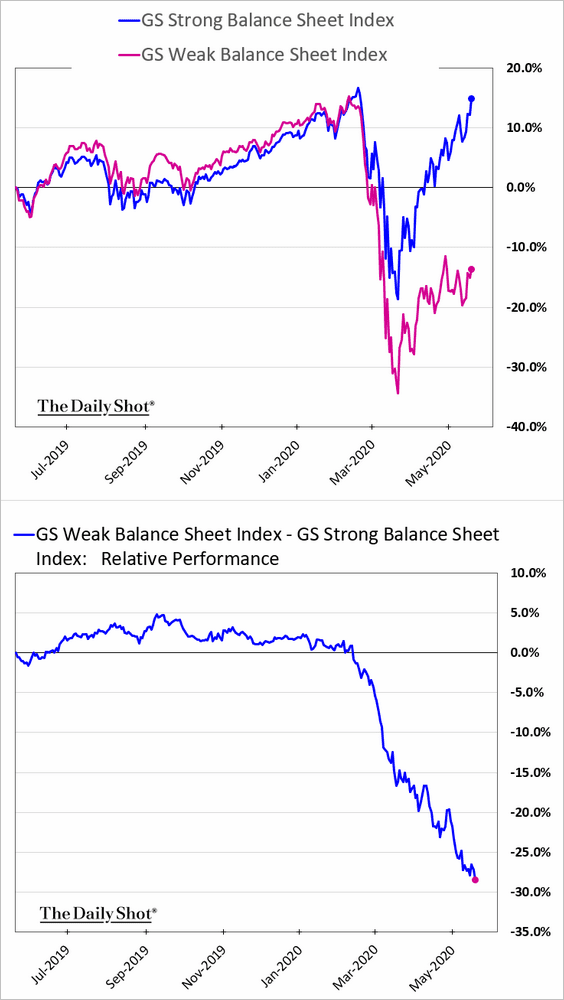

5. Investors continue to favor companies with strong balance sheets.

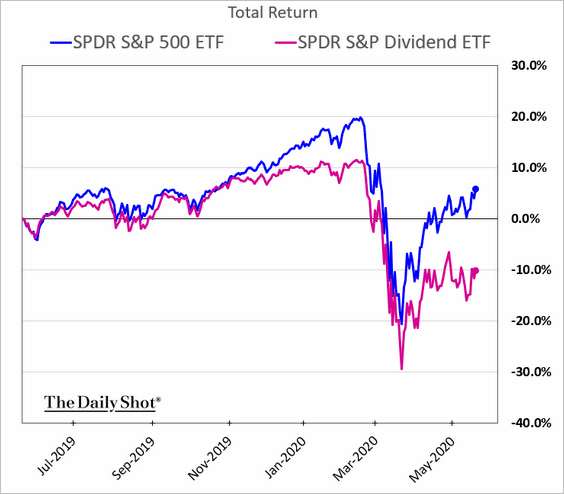

6. High-dividend stocks are underperforming.

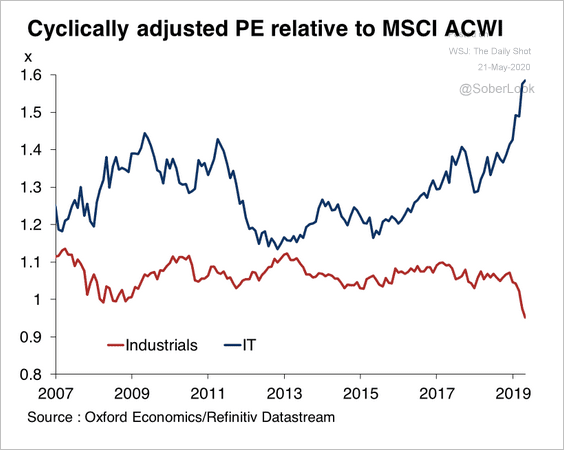

7. Industrials trade at a near-record discount to tech.

Source: Oxford Economics

Source: Oxford Economics

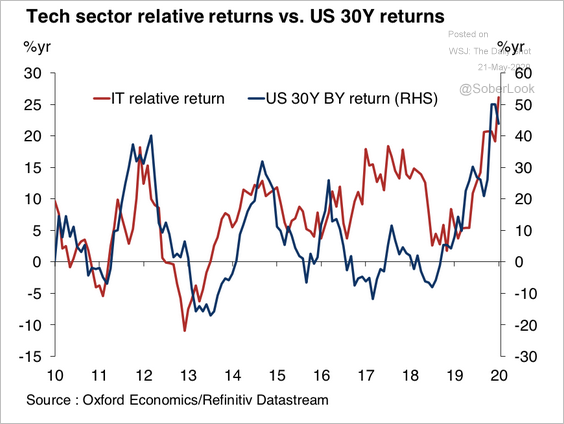

The tech sector is vulnerable to higher bond yields, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

——————–

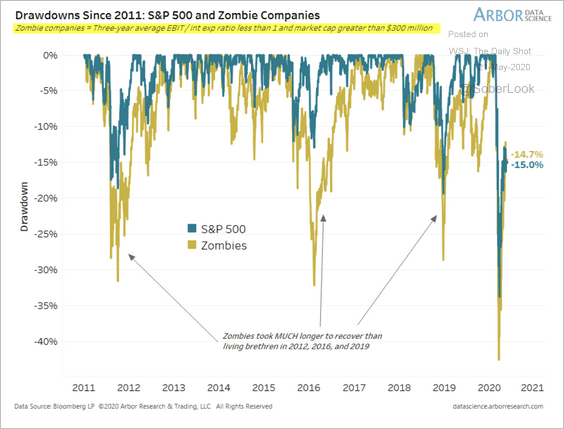

8. The drawdowns of US zombie companies have been more severe than the broader market …

Source: Arbor Research & Trading

Source: Arbor Research & Trading

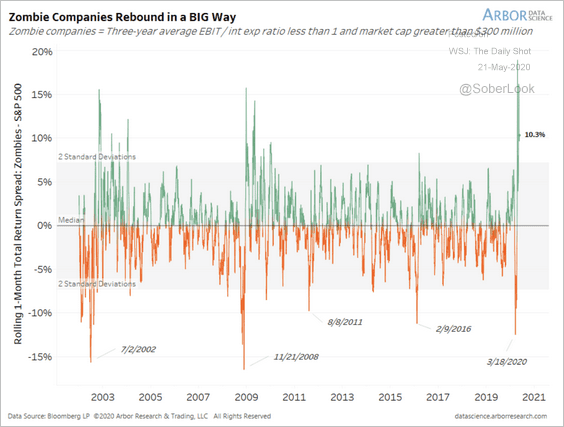

… but they also rebound strongly.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

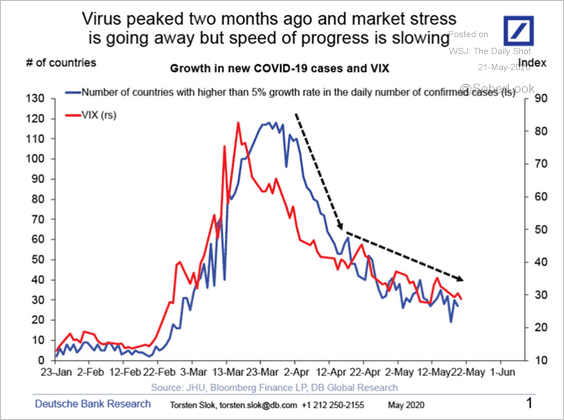

9. VIX is tracking the pandemic progress.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

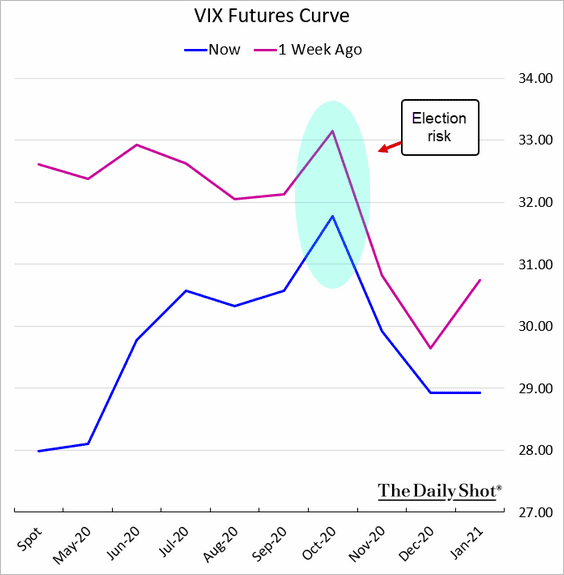

10. The VIX futures curve is in contango now, as the focus shifts toward the 2020 elections.

Credit

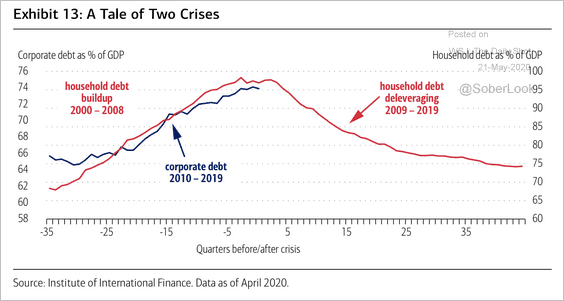

1. Will corporate debt follow a similar path as household debt?

Source: BofA Merrill Lynch Global Research

Source: BofA Merrill Lynch Global Research

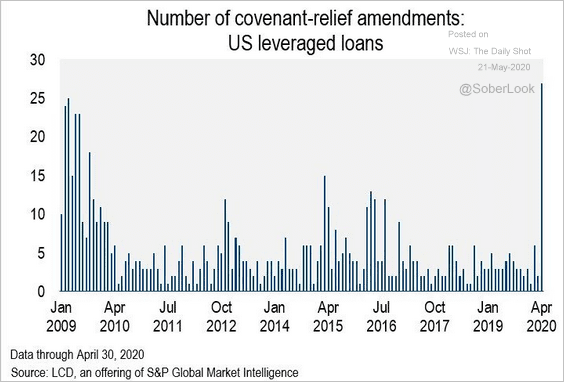

2. As earnings tumble, the number of leveraged loans getting covenant relief hit a record high.

Source: @lcdnews

Source: @lcdnews

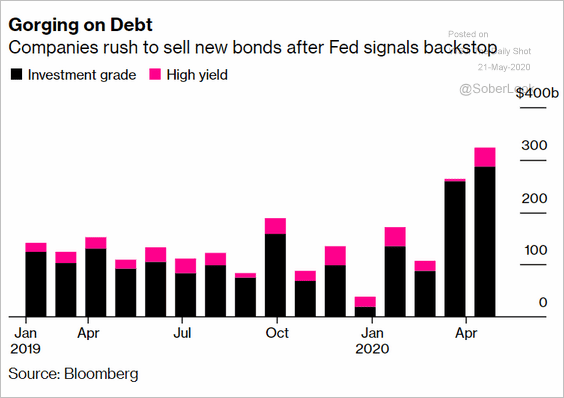

3. The Fed’s support for the corporate debt market gave issuers a boost.

Source: @markets Read full article

Source: @markets Read full article

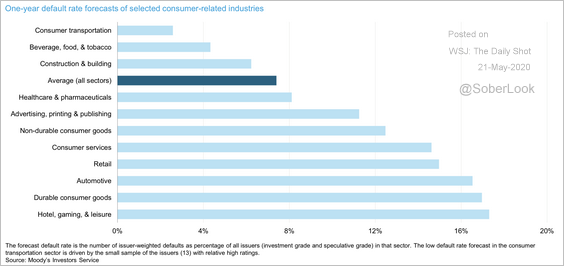

4. Moody’s expects defaults in many consumer-related industries to rise above 10% in the coming year.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

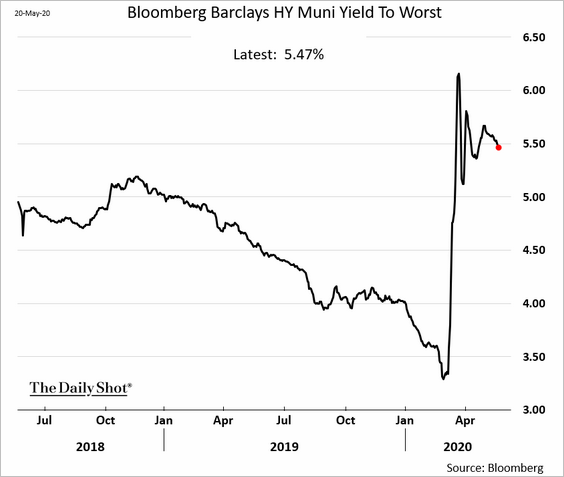

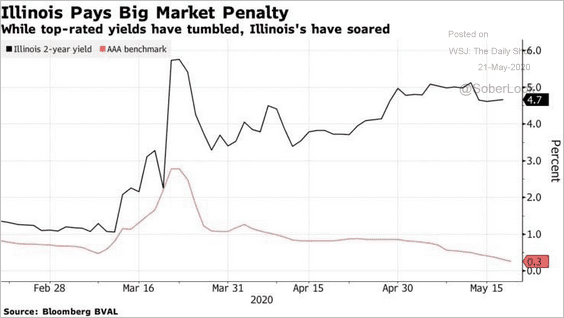

5. High-yield muni spreads remain elevated.

Source: @DiMartinoBooth, @markets Read full article

Source: @DiMartinoBooth, @markets Read full article

Rates

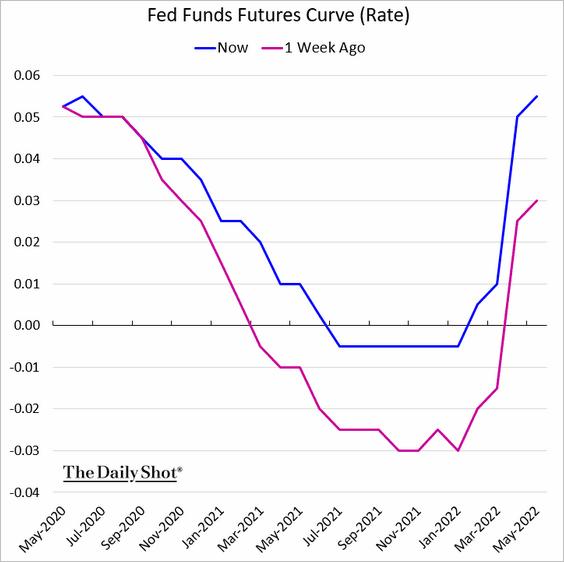

1. The fed funds futures continue to price a small probability of negative rates next year.

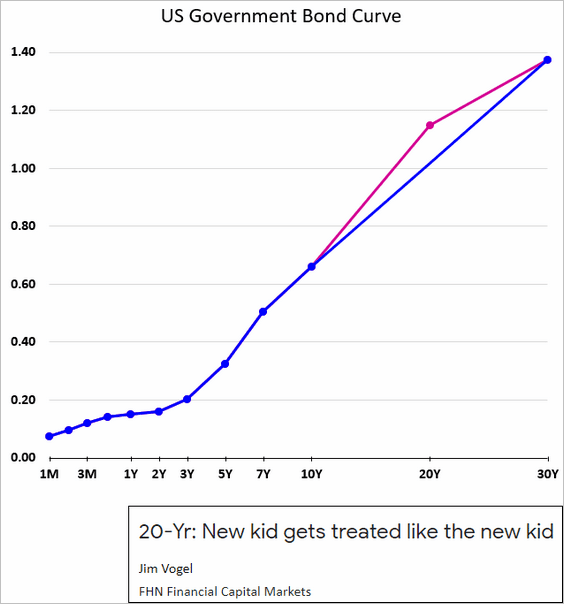

2. The new 20-year Treasury issue didn’t get much love.

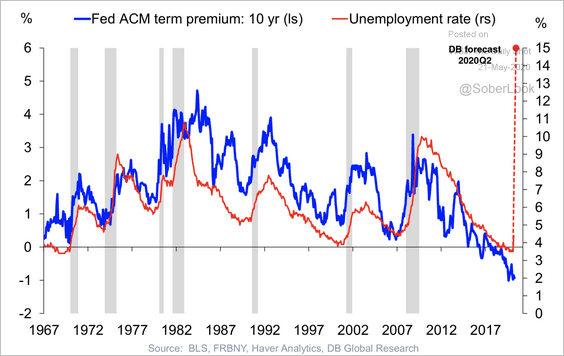

3. Will we see an increase in Treasury term premium?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Global Developments

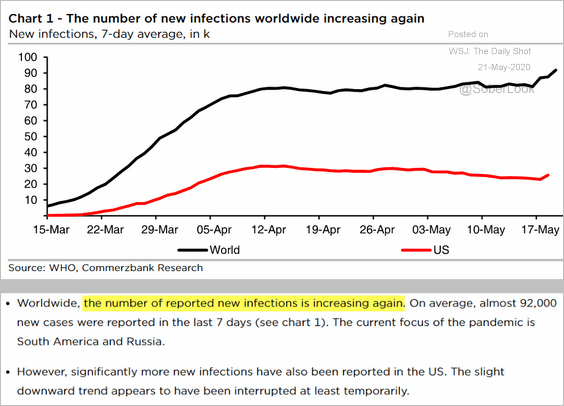

1. New infections are on the rise again, according to Commerzbank.

Source: Commerzbank Research

Source: Commerzbank Research

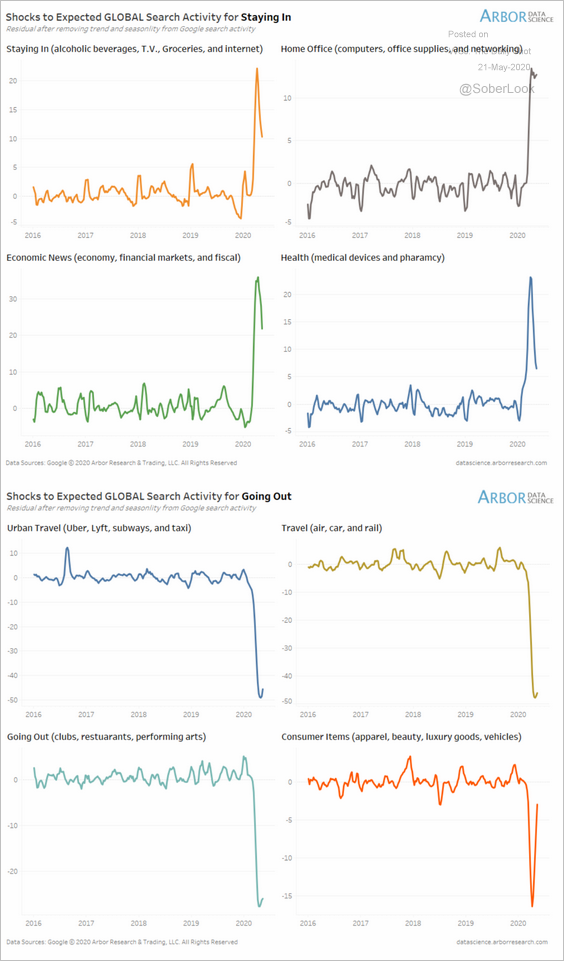

2. Some of the lockdown-related consumer activity is reversing.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

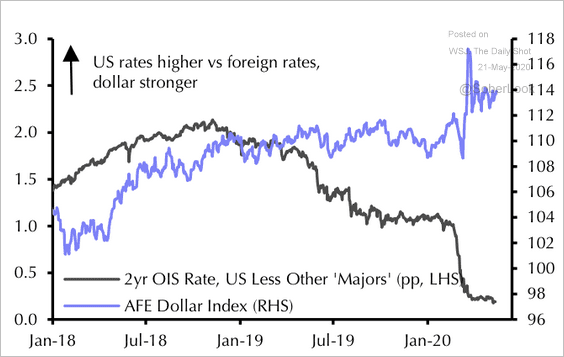

3. Interest rate differentials have moved sharply against the US dollar.

Source: Capital Economics

Source: Capital Economics

Food for Thought

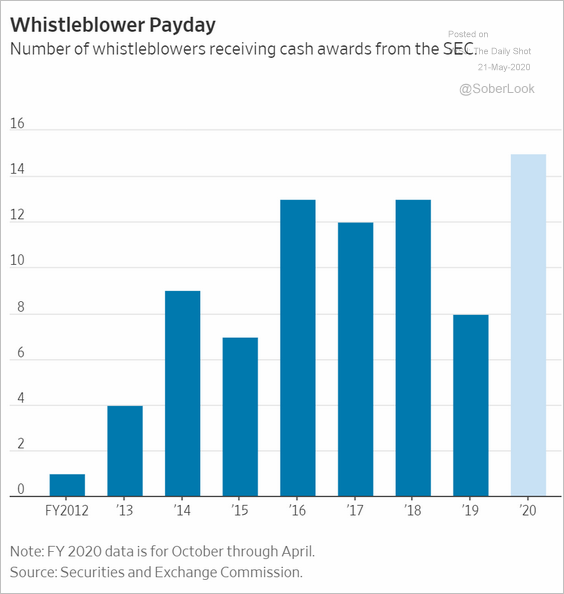

1. SEC whistleblower awards:

Source: @WSJ Read full article

Source: @WSJ Read full article

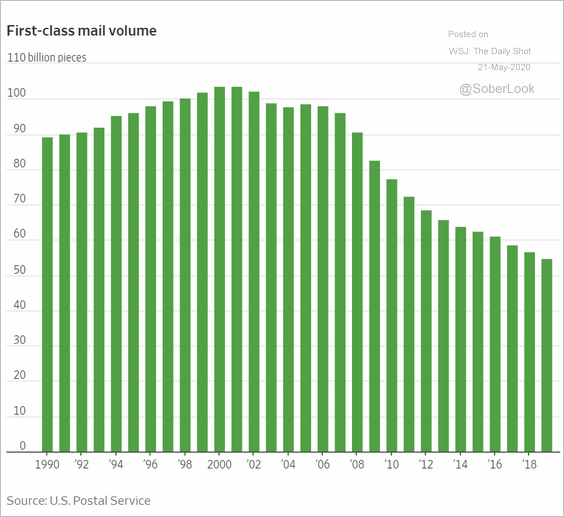

2. First-class mail volume:

Source: @WSJ Read full article

Source: @WSJ Read full article

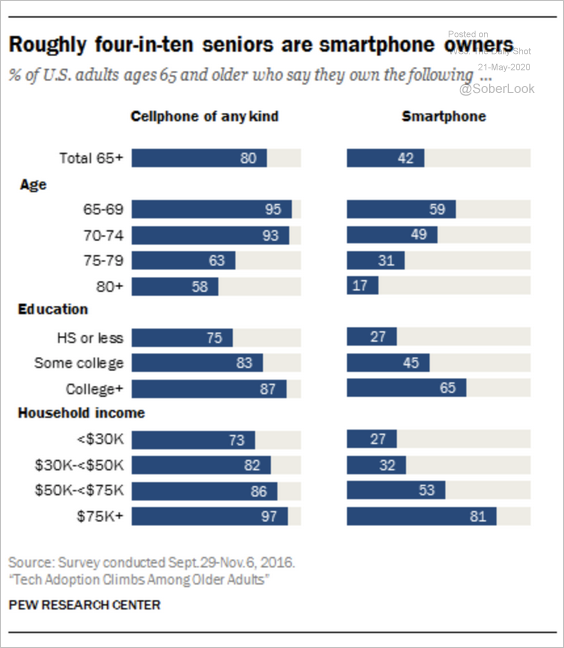

3. Smartphone ownership among seniors:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

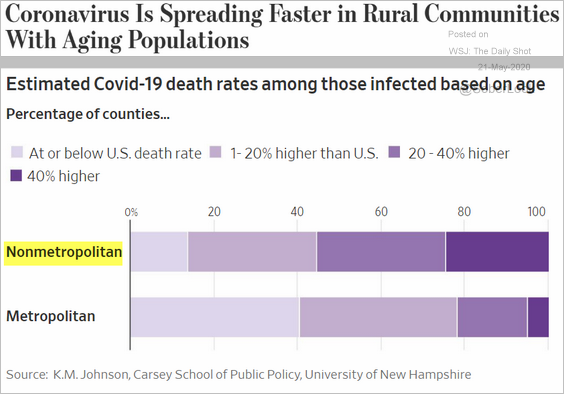

4. Coronavirus impact on rural communities.

Source: @WSJ Read full article

Source: @WSJ Read full article

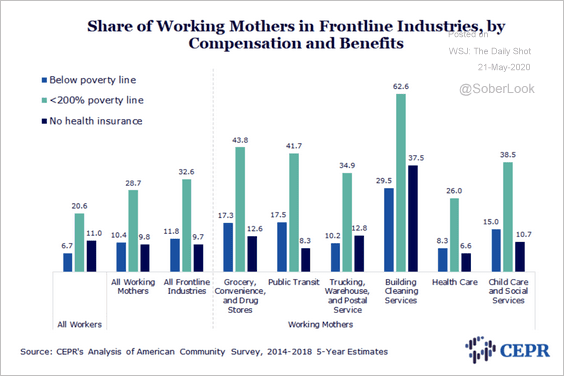

5. Mothers in frontline industries:

Source: CEPR

Source: CEPR

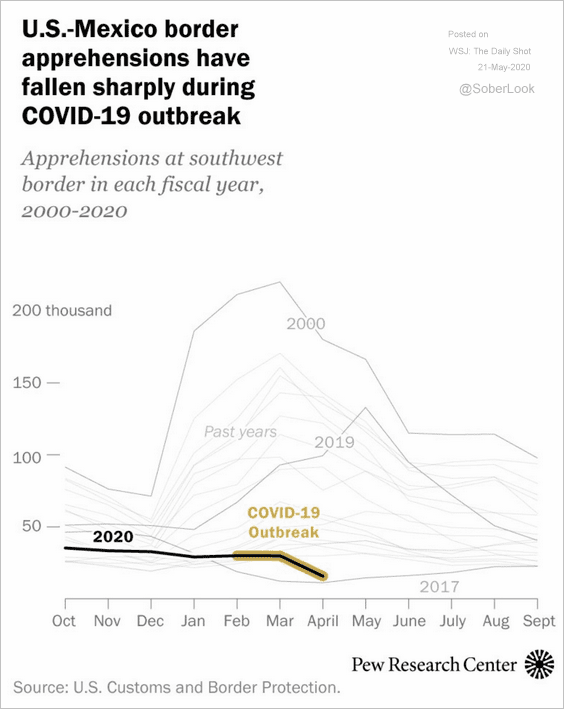

6. US-Mexico border apprehensions:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

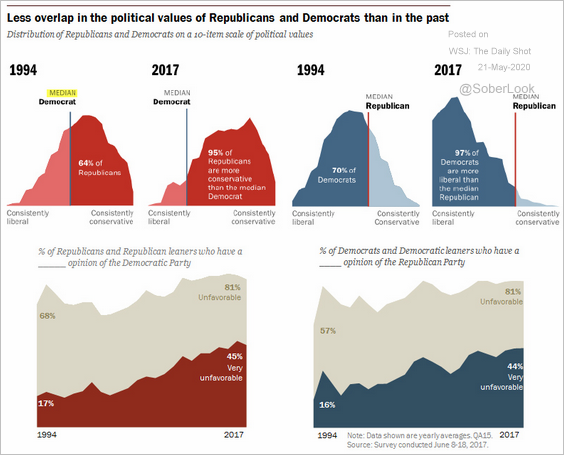

7. The US political divide:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

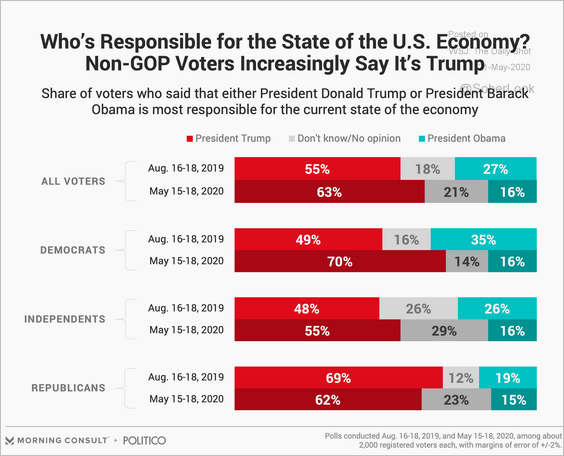

8. Who is responsible for the state of the economy?

Source: Morning Consult Read full article

Source: Morning Consult Read full article

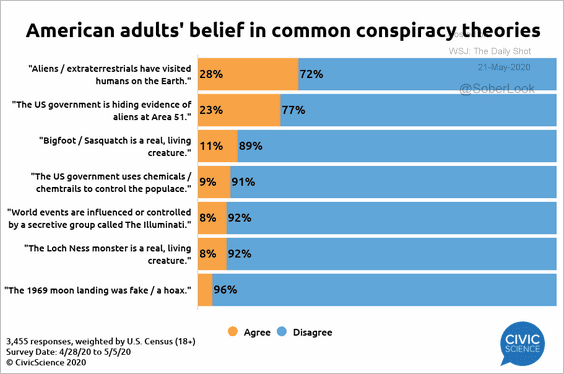

9. Conspiracy theories:

Source: @CivicScience

Source: @CivicScience

——————–