The Daily Shot: 03-Jun-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

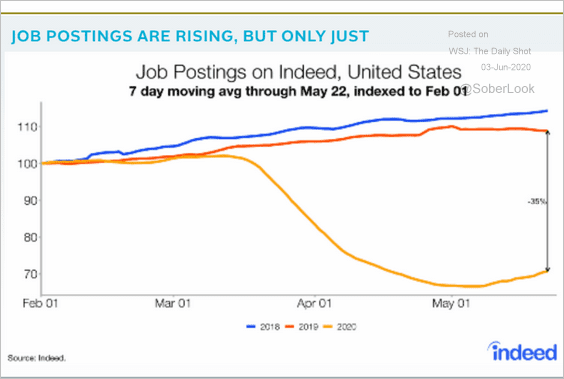

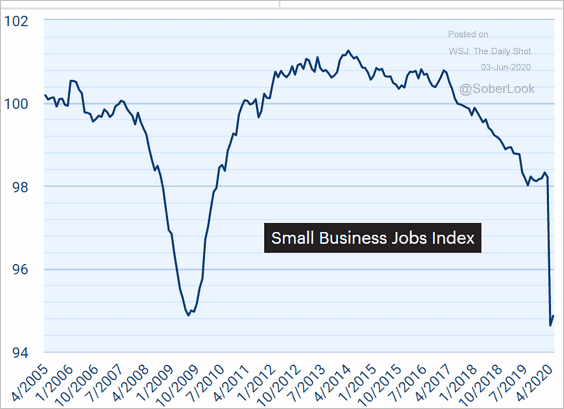

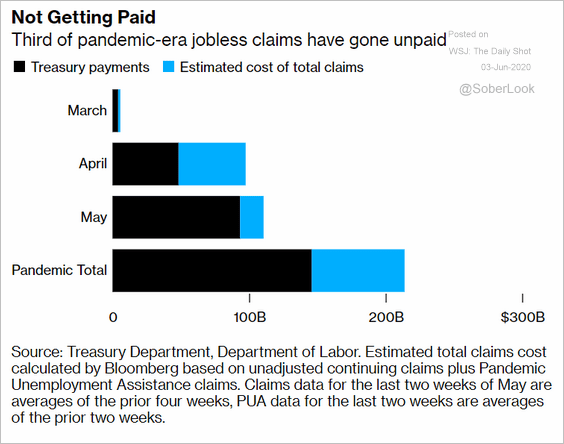

1. Let’s start with some updates on the labor market.

• Job postings are off the lows, but the improvement has been slow.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• The Paychex/IHS Markit Small Busines Jobs Index is still below the worst levels of 2008/09.

Source: Paychex / IHS Markit Small Business Employment Watch

Source: Paychex / IHS Markit Small Business Employment Watch

• A third of recent jobless claims haven’t been paid.

Source: @business Read full article

Source: @business Read full article

——————–

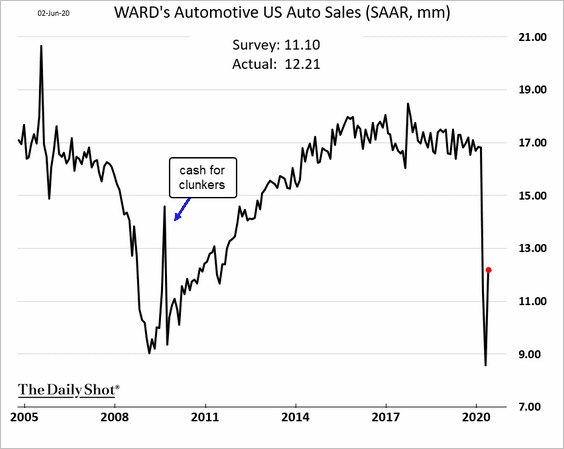

2. US vehicle sales bounced from the lows last month.

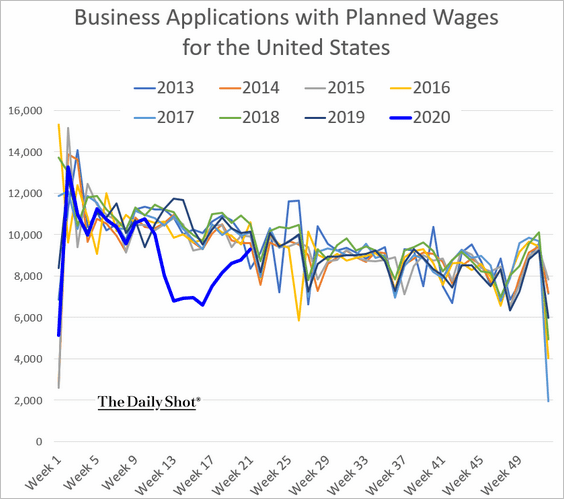

3. Business applications have rebounded.

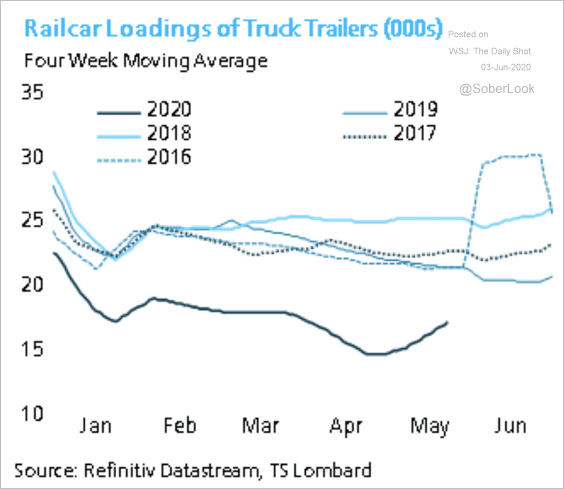

4. Railcar loadings of truck trailers are gradually recovering.

Source: TS Lombard

Source: TS Lombard

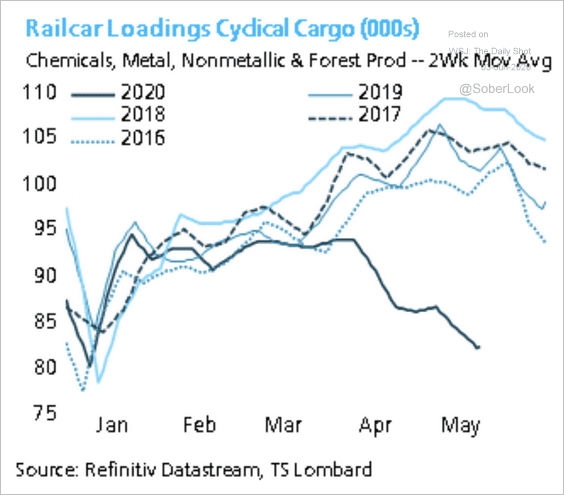

However, railcar loadings of cyclical cargo remain very weak.

Source: TS Lombard

Source: TS Lombard

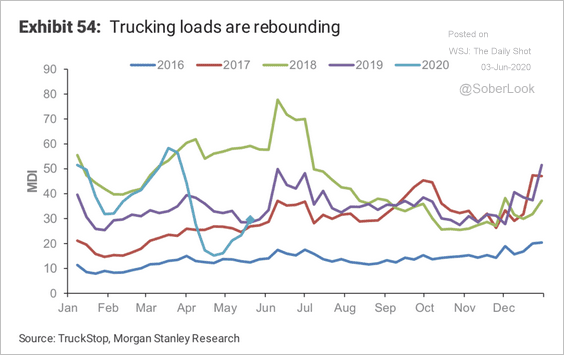

This chart shows the overall trucking loads.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

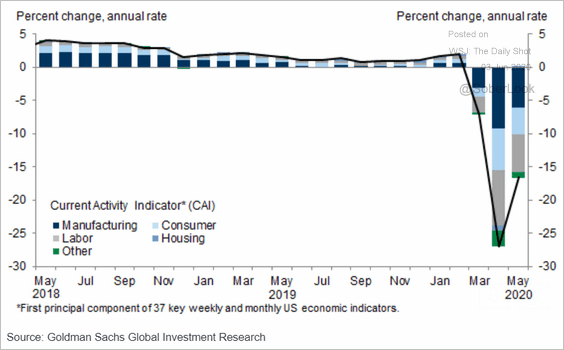

5. Goldman’s current activity indicator (CAI) improved in May but continued to show ongoing economic contraction.

Source: Goldman Sachs

Source: Goldman Sachs

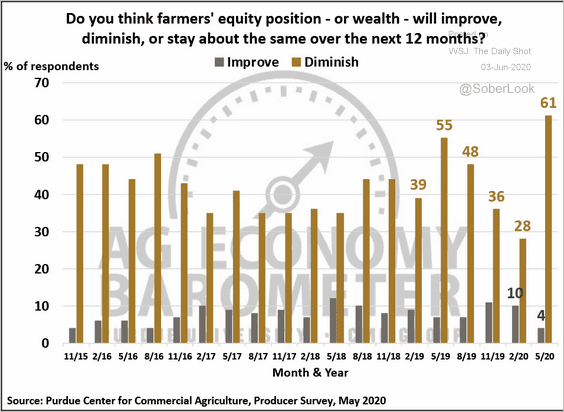

6. 61% of US farmers expect their net worth to diminish in the next 12 months.

Source: Purdue University/CME Group Ag Economy Barometer

Source: Purdue University/CME Group Ag Economy Barometer

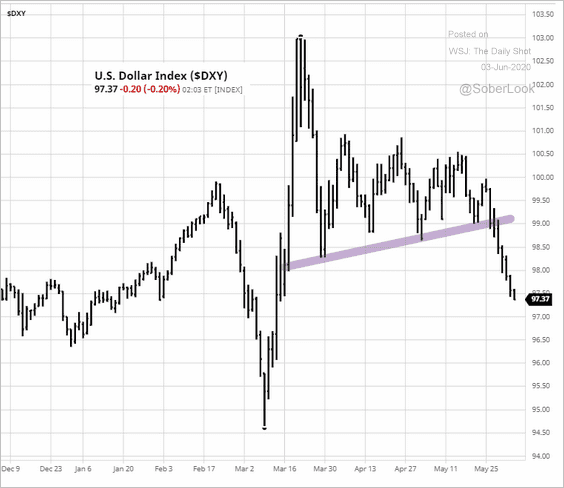

7. The US dollar continues to fall as global risk appetite returns. It’s a helpful trend for US manufacturers and exporters.

Source: barchart.com

Source: barchart.com

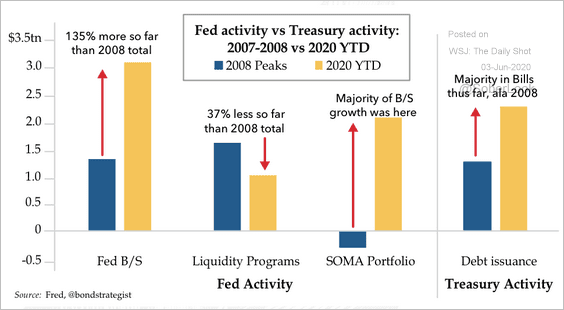

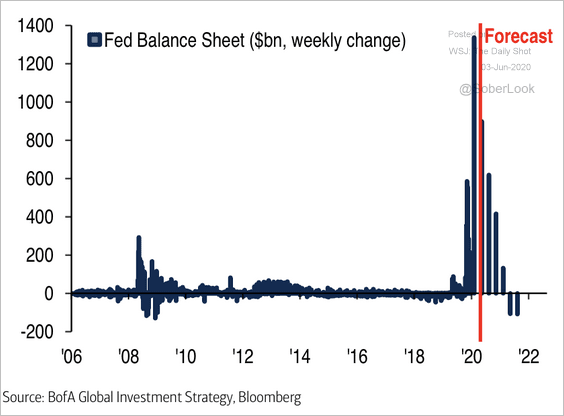

8. This chart compares the recent Fed and Treasury stimulus to actions taken in 2007-2008.

Source: The Daily Feather

Source: The Daily Feather

BofA expects the Fed stimulus to slow in the coming months.

Source: BofA Merrill Lynch Global Research

Source: BofA Merrill Lynch Global Research

Canada

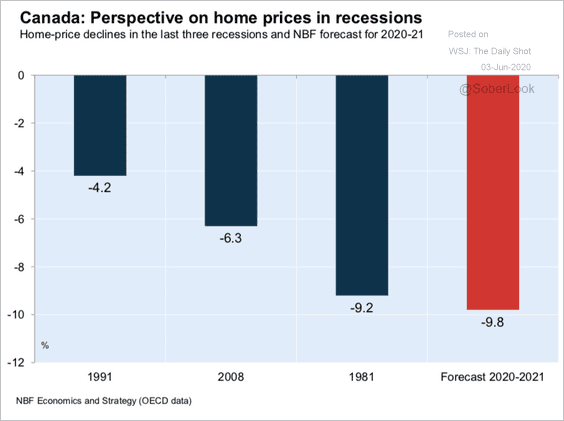

1. National Bank of Canada expects home prices to decrease 9.8% in this recession.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

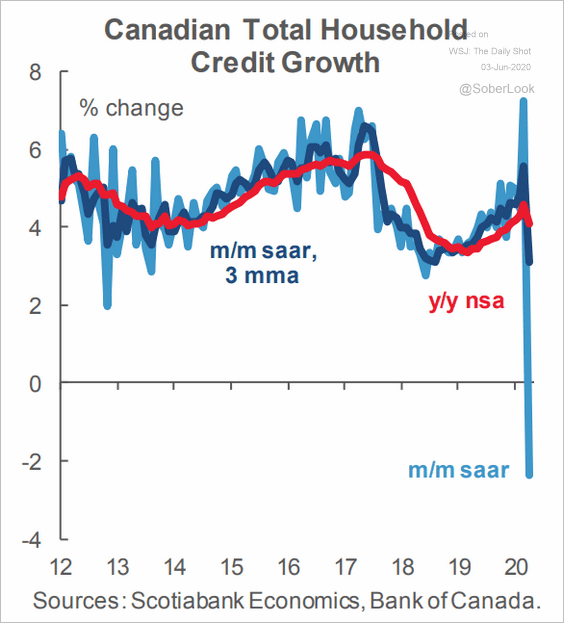

2. Total household credit has contracted this year.

Source: Scotiabank Economics

Source: Scotiabank Economics

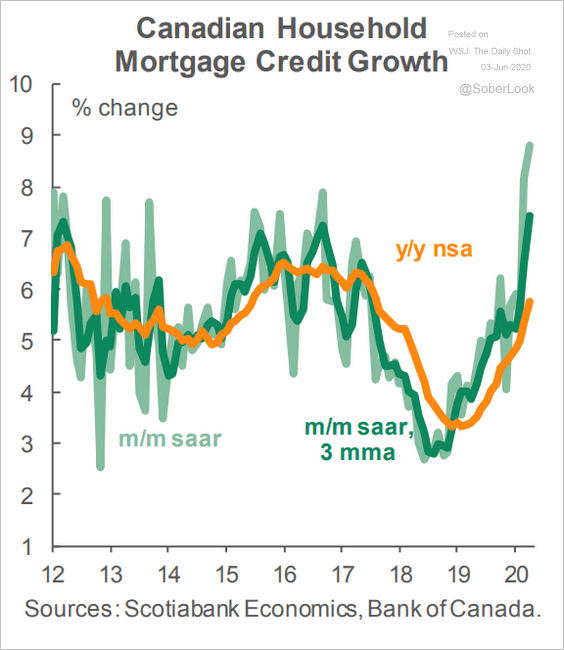

But mortgage credit expansion has been robust.

Source: Scotiabank Economics

Source: Scotiabank Economics

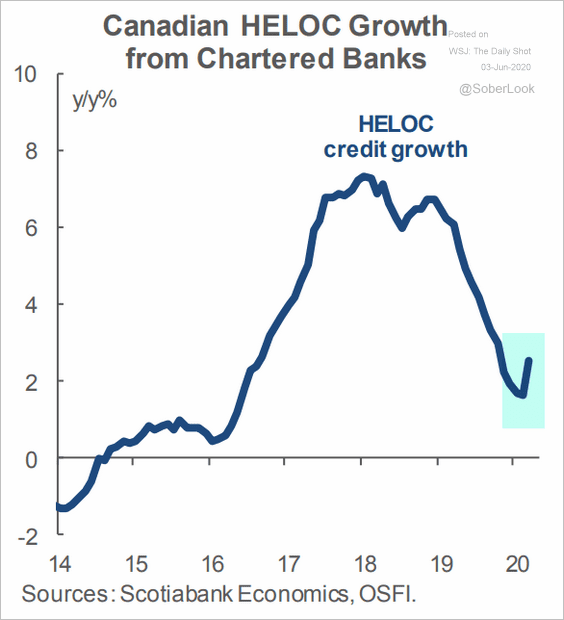

Revolving home equity loan balances have increased.

Source: Scotiabank Economics

Source: Scotiabank Economics

The United Kingdom

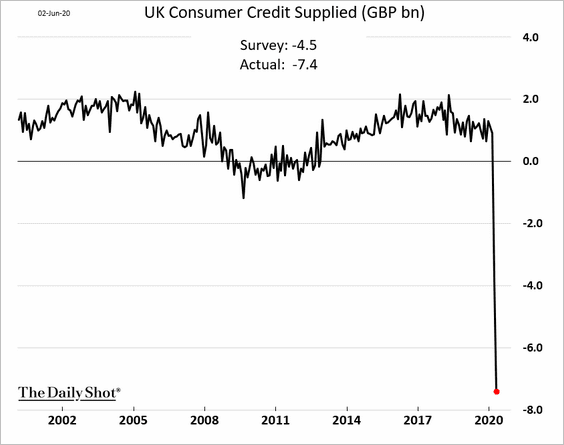

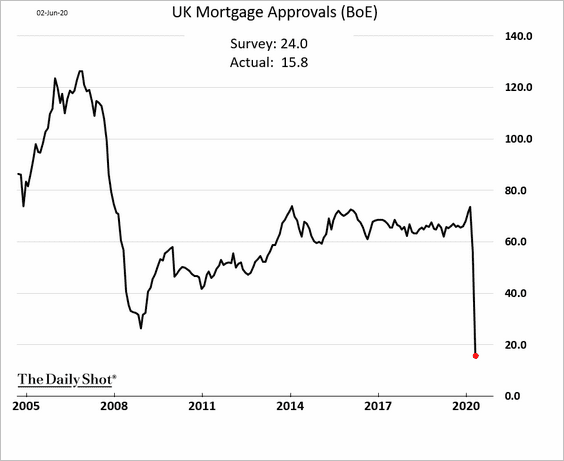

1. Consumer credit plummetted in April.

Mortgage applications dipped below the 2008/09 lows.

——————–

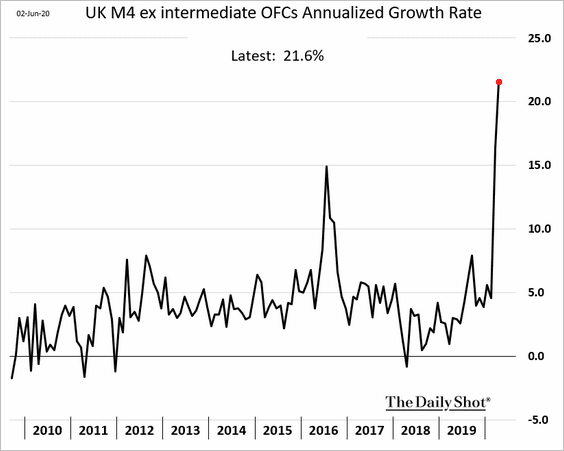

2. The broad money supply (see definition of M4) exploded as the BoE launched QE, and corporations tapped bank credit lines.

Source:

Source:

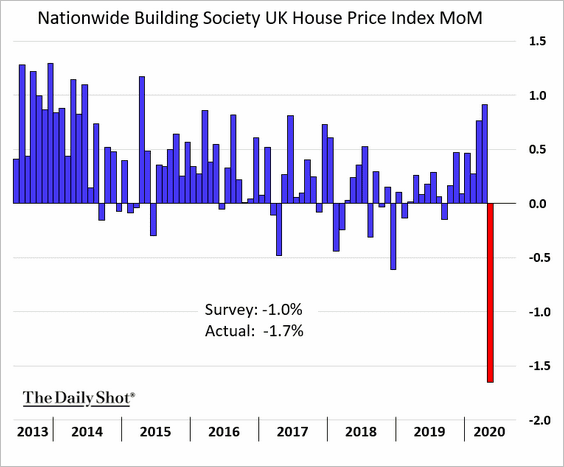

3. Home prices declined in April.

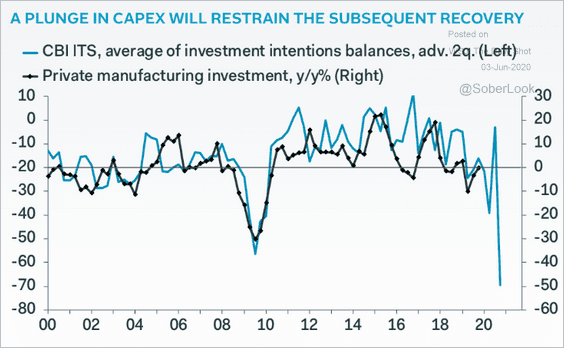

4. The weakness in CapEx will be a drag on growth.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

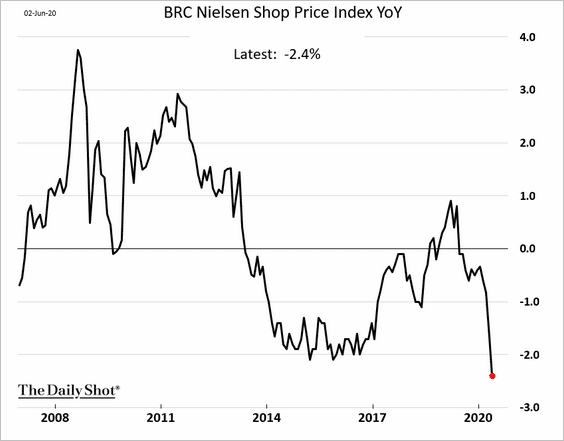

5. Retailers have accelerated their price cuts.

Source: Yahoo Finance Read full article

Source: Yahoo Finance Read full article

The Eurozone

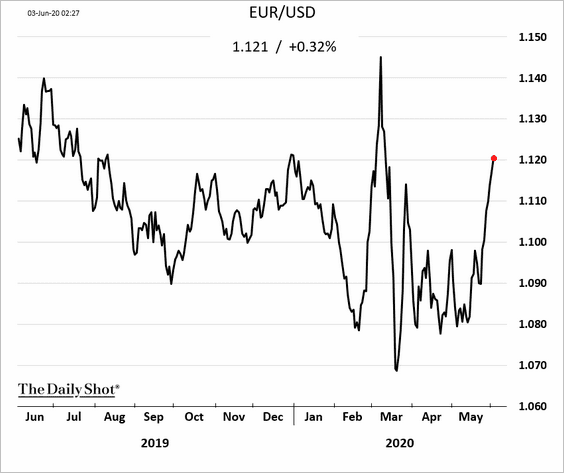

1. The euro is moving higher.

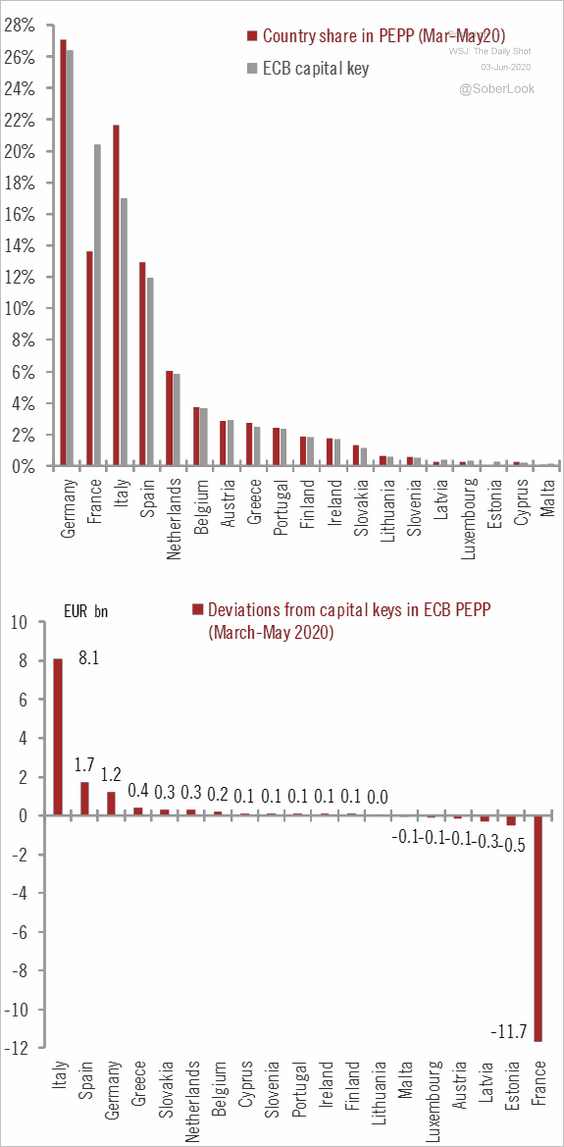

2. The ECB has deviated from capital keys to favor Italy’s debt.

Source: @fwred

Source: @fwred

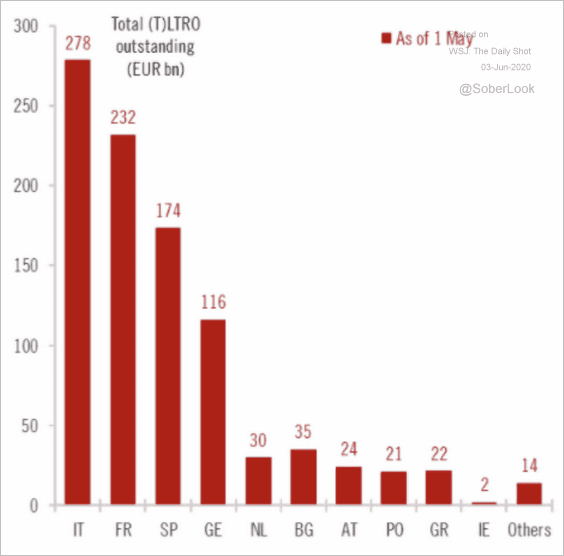

3. This chart shows the LTRO balances outstanding by country.

Source: @fwred

Source: @fwred

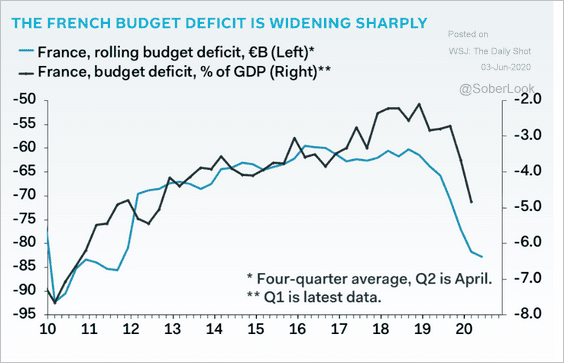

4. The French budget deficit has widened sharply.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

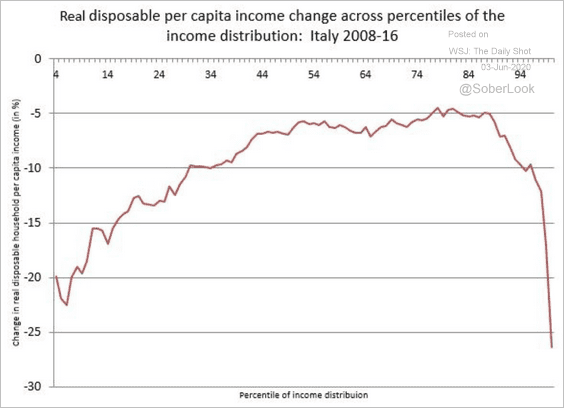

5. Disposable incomes in Italy have declined for everyone, especially for the very poor and the very rich.

Source: @BrankoMilan, @lisdata

Source: @BrankoMilan, @lisdata

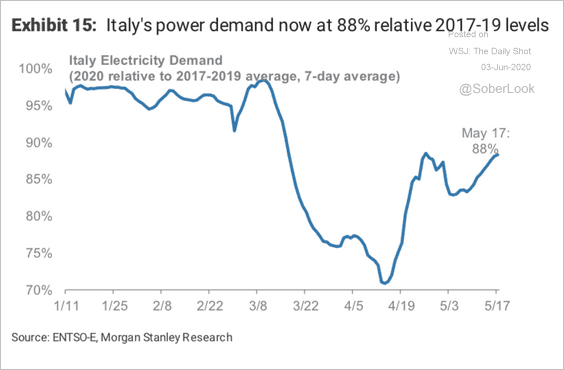

6. Italian electricity usage is improving.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

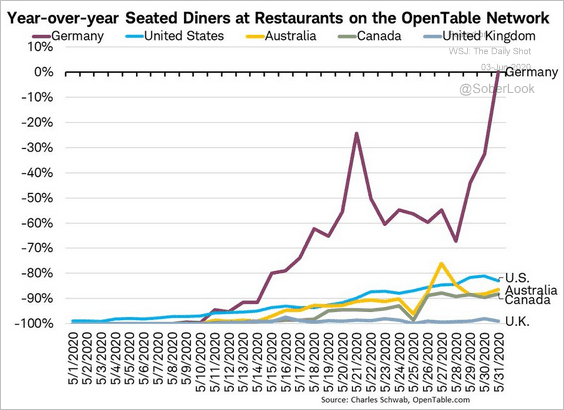

7. Germans are going out to eat.

Source: @JeffreyKleintop

Source: @JeffreyKleintop

Asia – Pacific

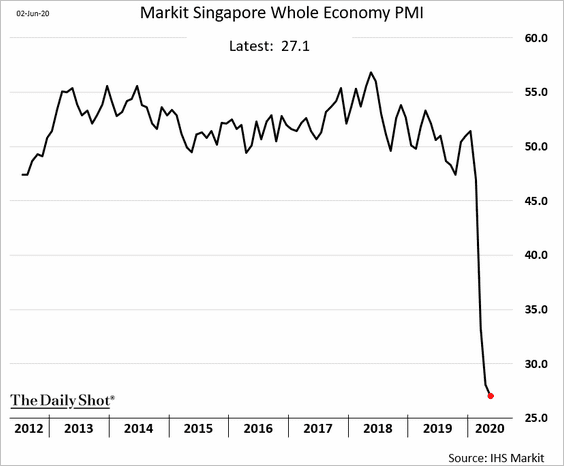

1. Singapore’s business activity contraction accelerated in May.

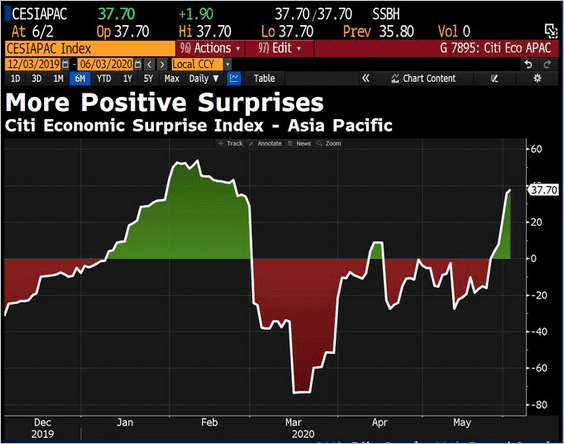

2. The Citi Economic Surprise Index for Asia-Pacific has been improving.

Source: @DavidInglesTV

Source: @DavidInglesTV

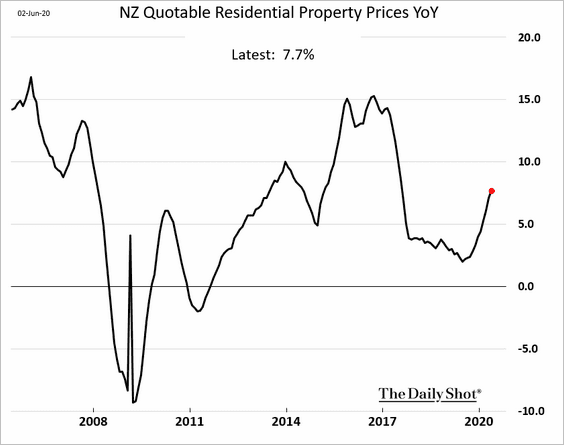

3. New Zealand’s housing market remains robust.

4. Next, we have some updates on Australia.

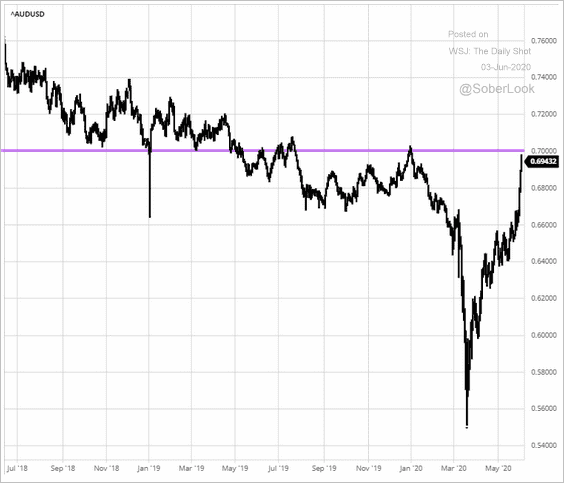

• The Aussie dollar is testing resistance at USD 0.7.

Source: barchart.com

Source: barchart.com

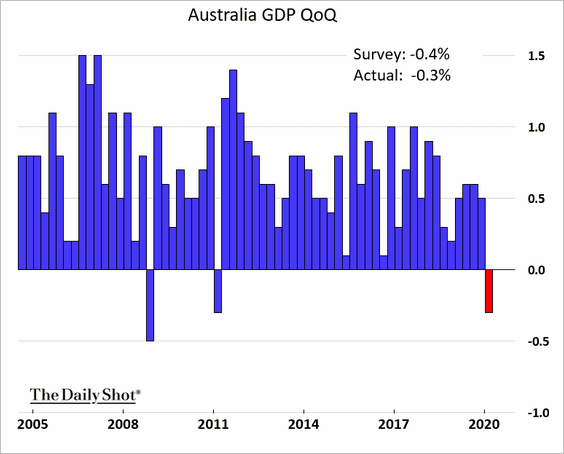

• The Q1 GDP decline was a bit less severe than expected. Q2 will be a very different story.

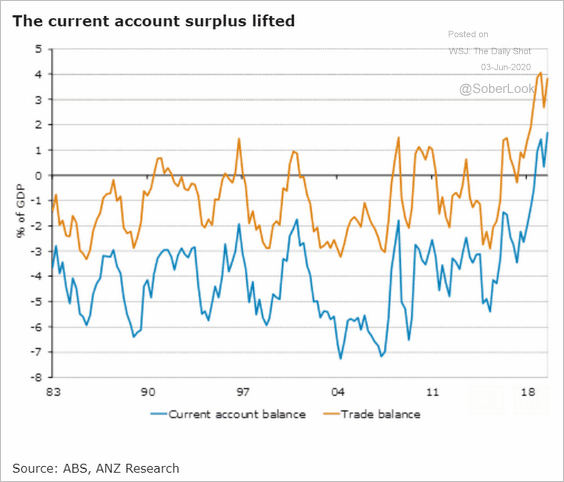

• The current account surplus continues to climb.

Source: ANZ Research

Source: ANZ Research

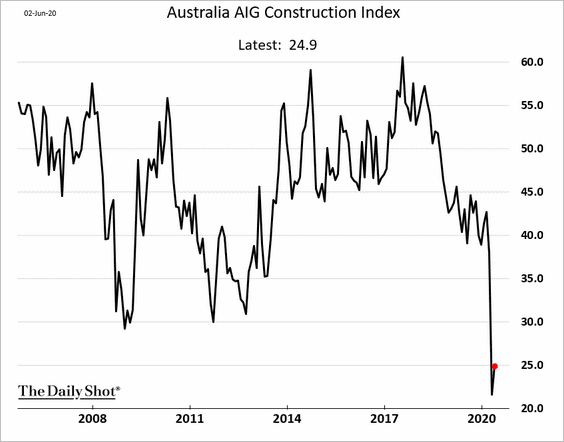

• Construction activity remained extremely weak in May.

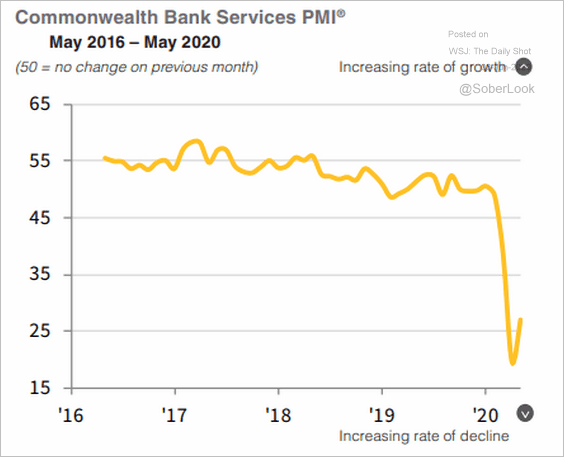

• Service sector activity continued to shrink (PMI < 50).

Source: @IHSMarkitPMI Read full article

Source: @IHSMarkitPMI Read full article

China

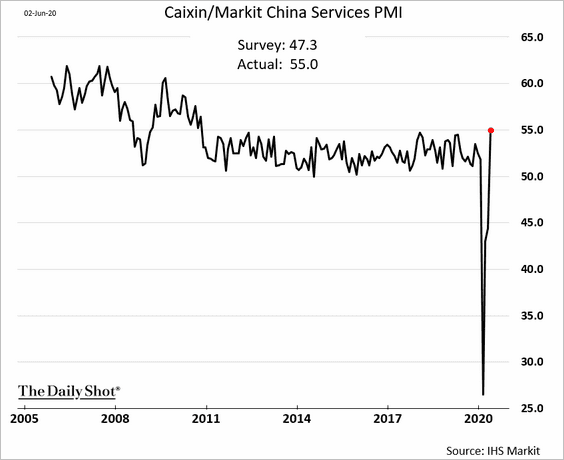

1. According to Markit, China’s service sector activity hit a multi-year high in May. The rebound has been remarkable.

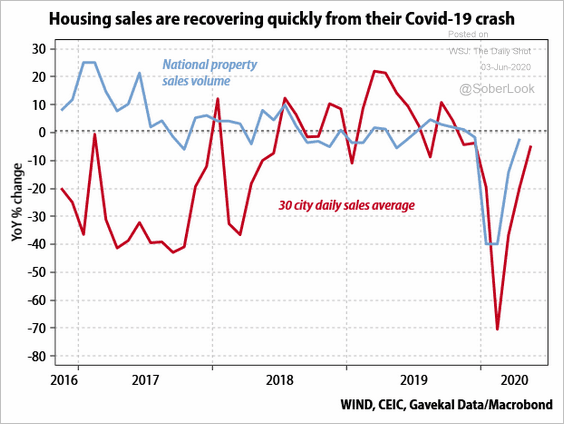

2. Housing sales are recovering.

Source: Gavekal

Source: Gavekal

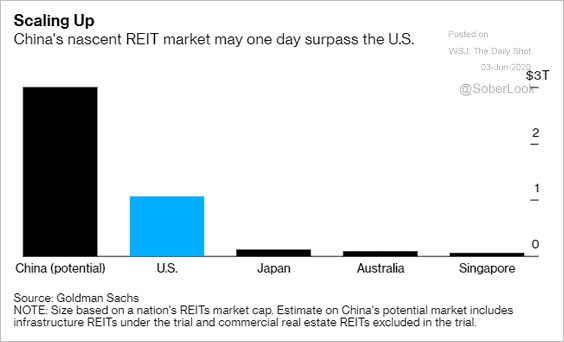

3. China’s REIT market is expected to be massive.

Source: @tracyalloway Read full article

Source: @tracyalloway Read full article

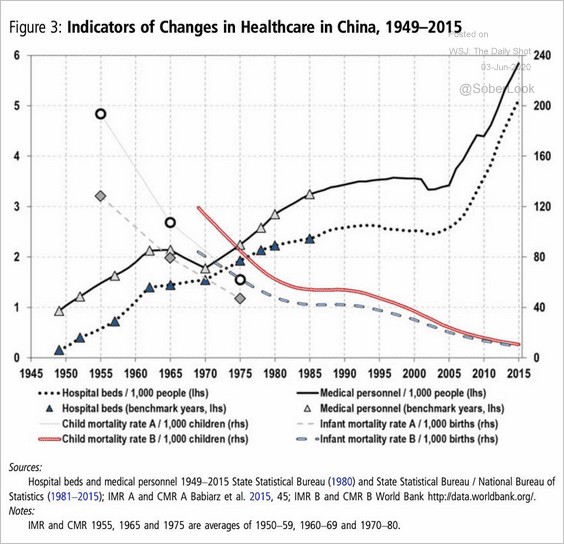

4. This chart shows long-term changes in China’s healthcare system.

Source: @adam_tooze Read full article

Source: @adam_tooze Read full article

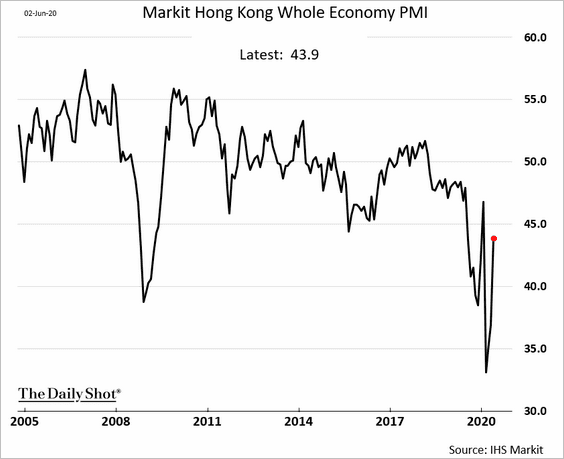

5. Hong Kong’s economy showed signs of stabilization in May.

Emerging Markets

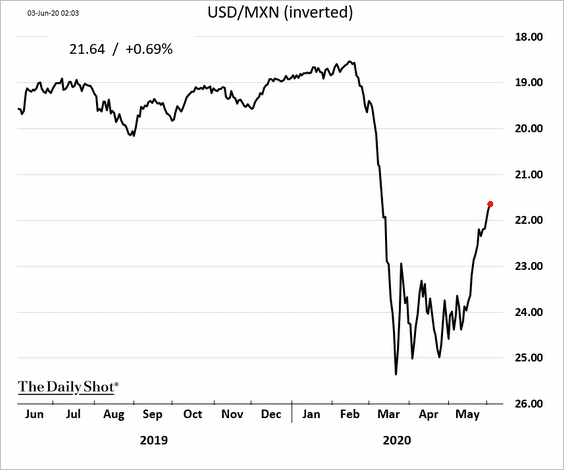

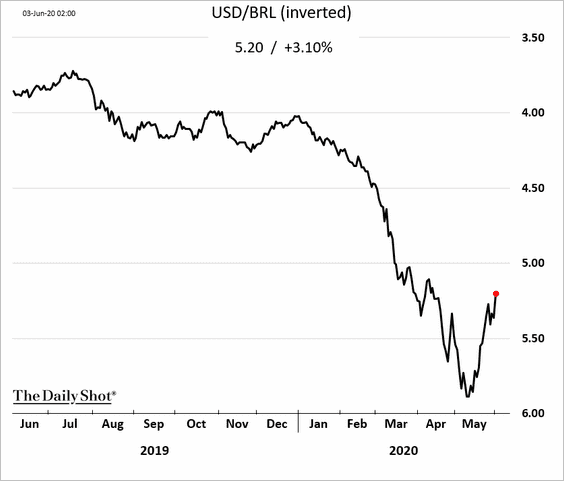

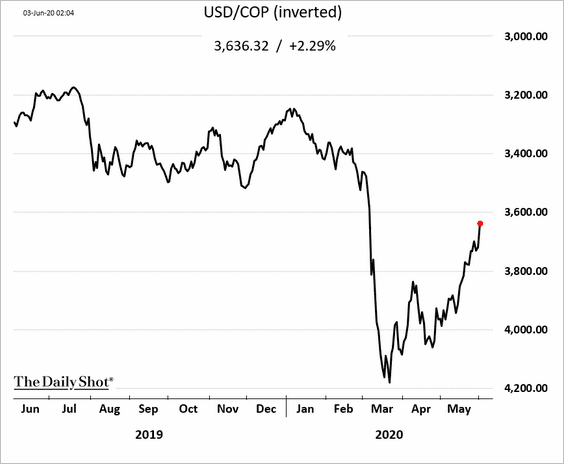

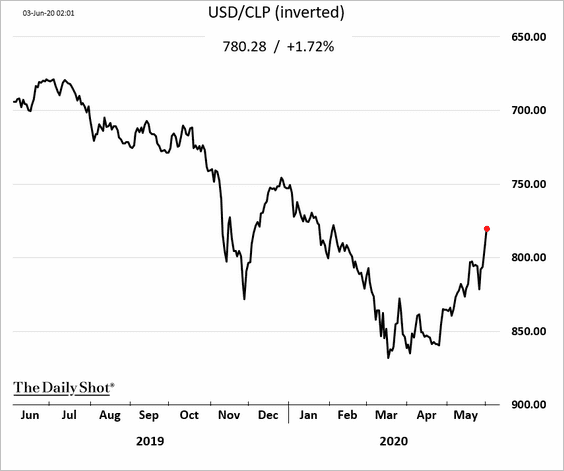

1. EM currencies are rebounding, especially in Latin America.

• The Mexican peso:

• The Brazilian real:

• The Colombian peso:

• The Chilean peso:

——————–

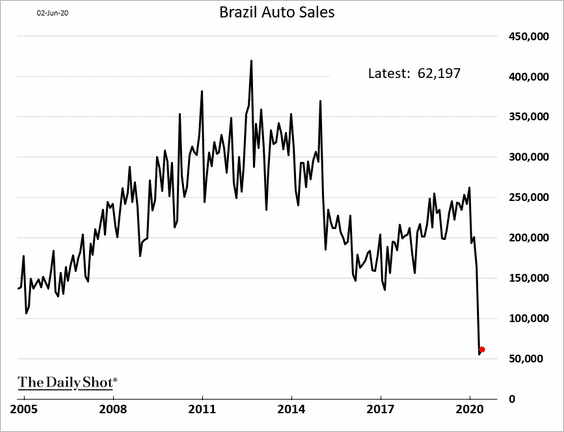

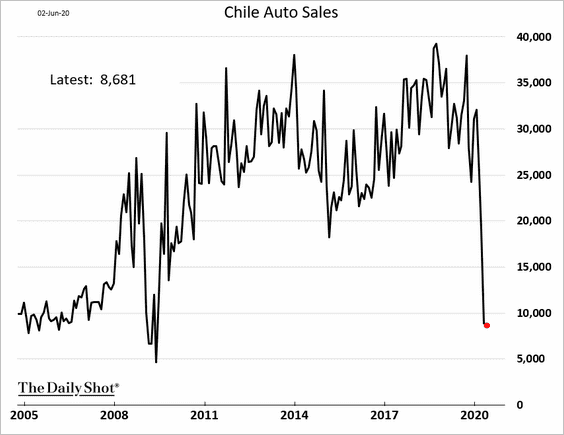

2. LatAm automobile sales showed no signs of a rebound in May.

• Brazil:

• Chile:

——————–

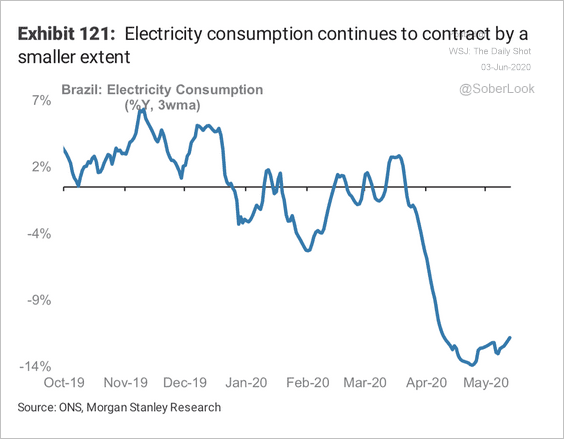

3. Electricity consumption continues to show extreme weakness in Brazil’s economy.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

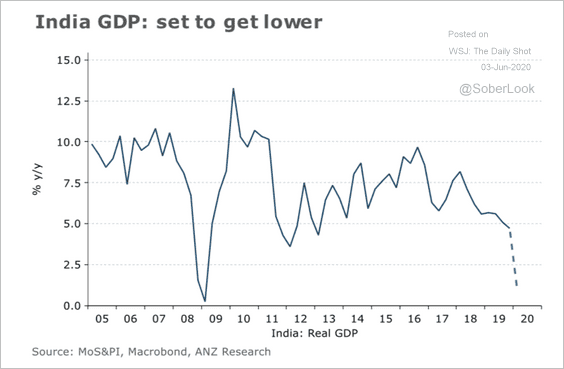

4. Next, we have some updates on India.

• Expected GDP growth (from ANZ Research):

Source: ANZ Research

Source: ANZ Research

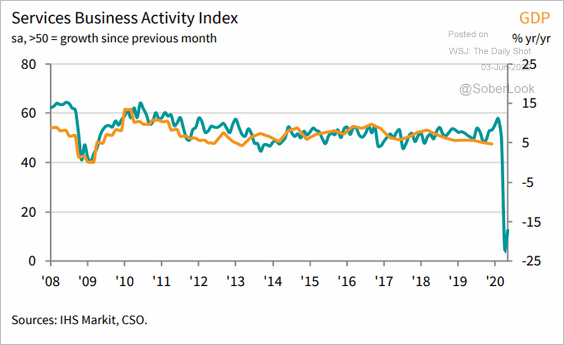

• Service -sector business activity (deep in contraction territory):

Source: @IHSMarkitPMI Read full article

Source: @IHSMarkitPMI Read full article

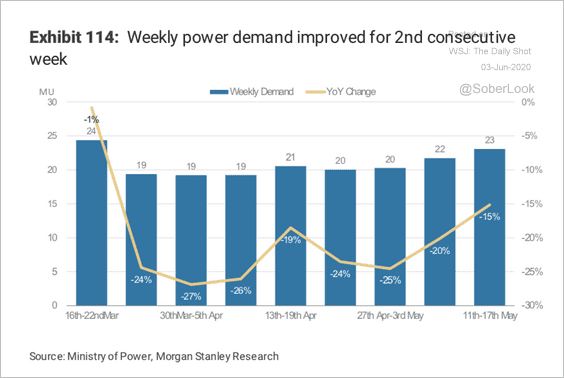

• Power demand improvements:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

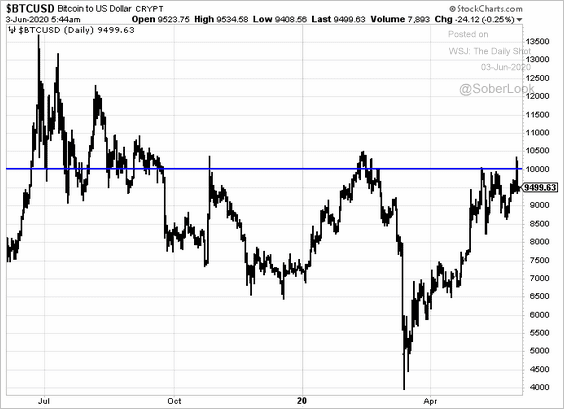

Cryptocurrency

Bitcoin’s climb above $10k was short-lived.

Commodities

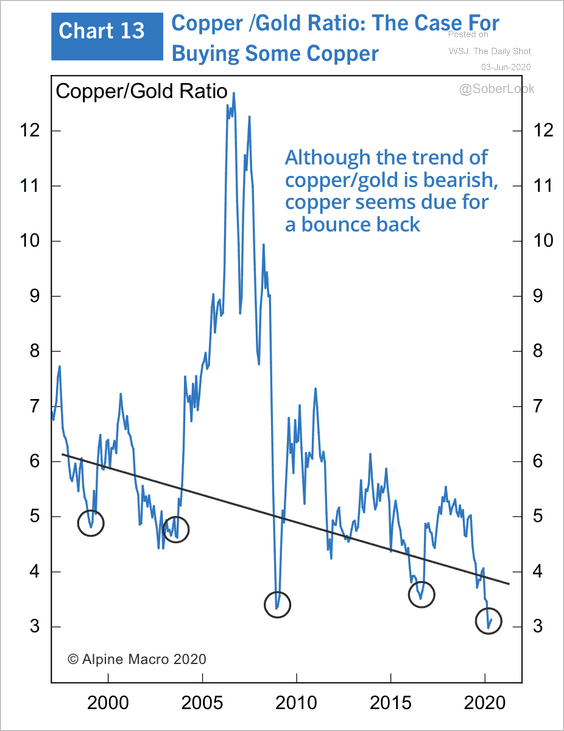

1. The copper-to-gold ratio is at an extreme low.

Source: Alpine Macro

Source: Alpine Macro

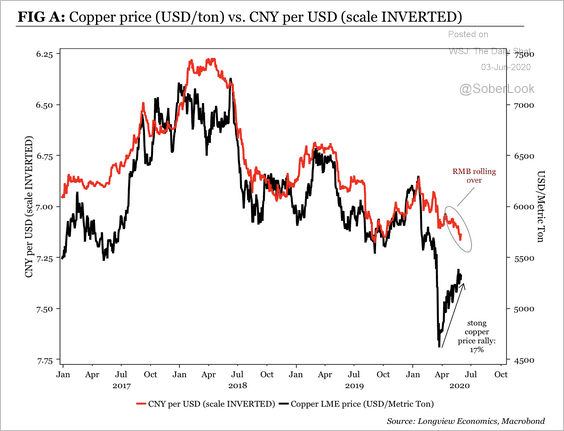

2. Copper has rallied despite the weakening CNY/USD.

Source: Longview Economics

Source: Longview Economics

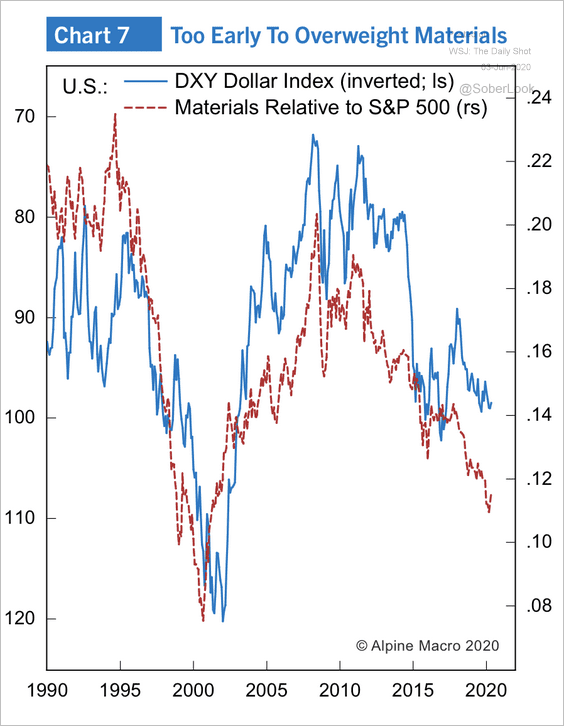

3. The dollar will need to weaken further to support a sustained breakout in materials stocks.

Source: Alpine Macro

Source: Alpine Macro

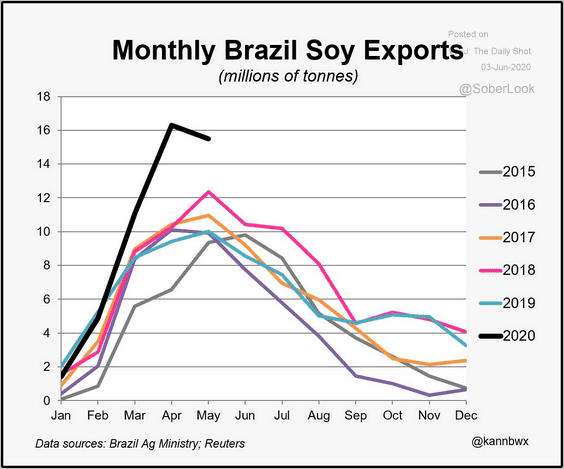

4. Brazil’s exports of soybeans (mostly to China) are significantly higher than in previous years.

Source: @kannbwx

Source: @kannbwx

Energy

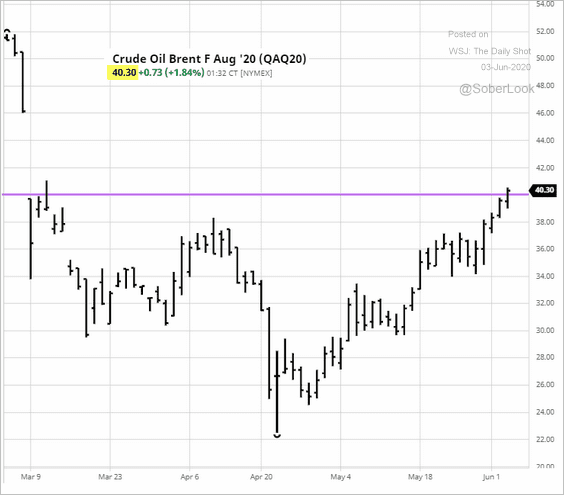

1. Brent crude is testing resistance at $40/bbl as OPEC+ considers an extension of production cuts.

Source: barchart.com

Source: barchart.com

——————–

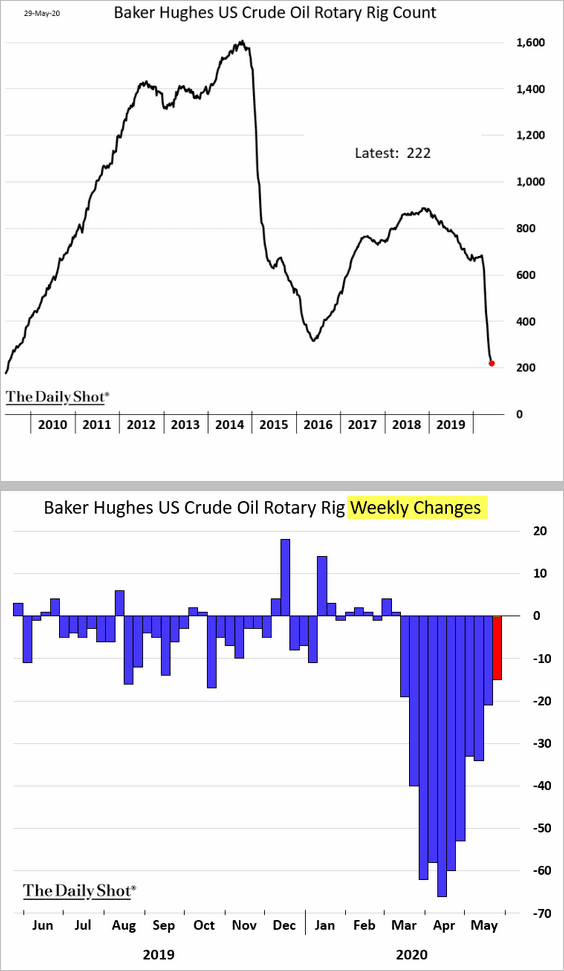

2. The decline in US oil rigs is slowing.

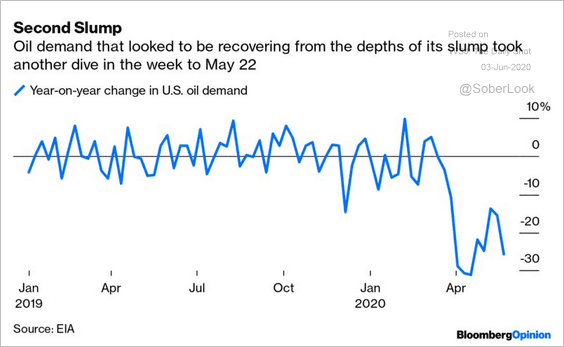

3. The improvements in US oil demand have stalled.

Source: @bopinion Read full article

Source: @bopinion Read full article

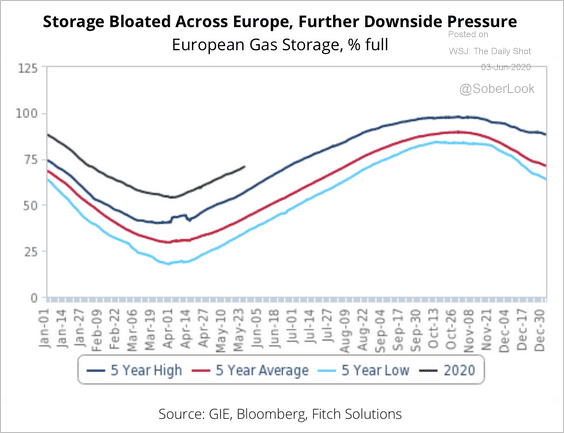

4. Further weakness in Asian LNG demand will see more gas within Europe as re-routings to Asia are uneconomical, according to Fitch.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Equities

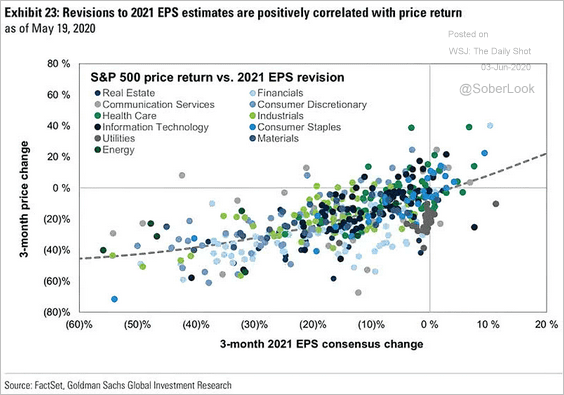

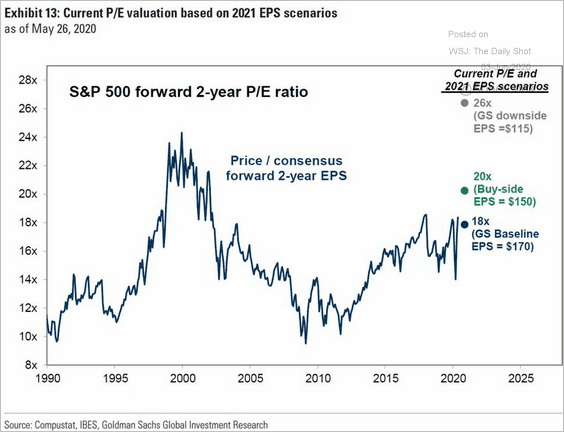

1. The market has been trading on 2021 earnings expectations, with this year’s earnings fiasco a foregone conclusion.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

How reasonable are the 2-year forward P/E ratios?

Source: @jessefelder, @johnauthers Read full article

Source: @jessefelder, @johnauthers Read full article

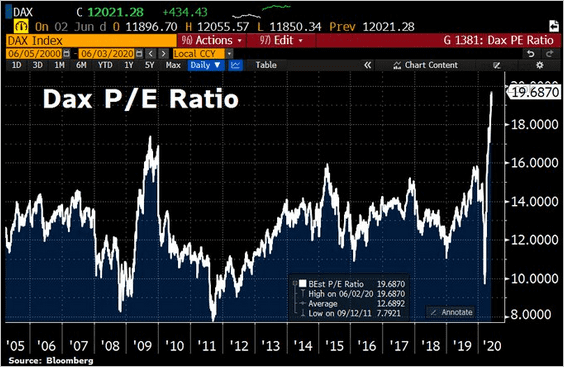

It’s worth noting that US valuations are not the only ones that look extremely rich based on near-term earnings expectations. Here is Germany’s Dax index.

Source: @Schuldensuehner

Source: @Schuldensuehner

——————–

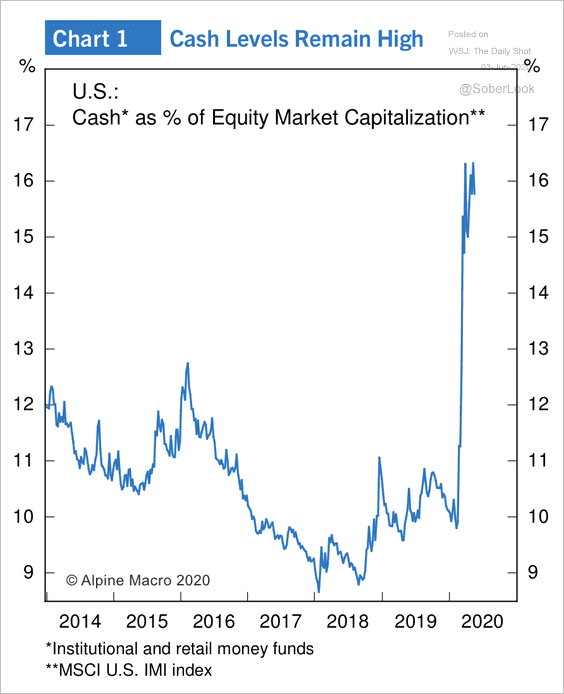

2. There is a great deal of cash on the sidelines (see chart).

Source: Alpine Macro

Source: Alpine Macro

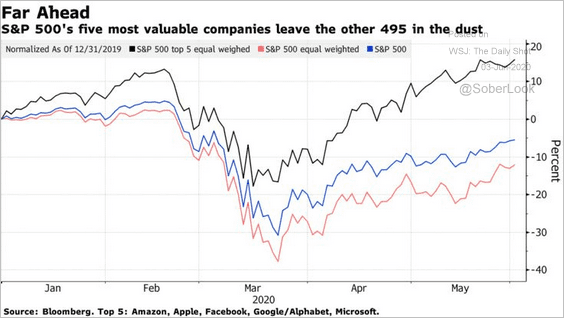

3. The five most valuable stocks have massively outperformed the market this year.

Source: @markets Read full article

Source: @markets Read full article

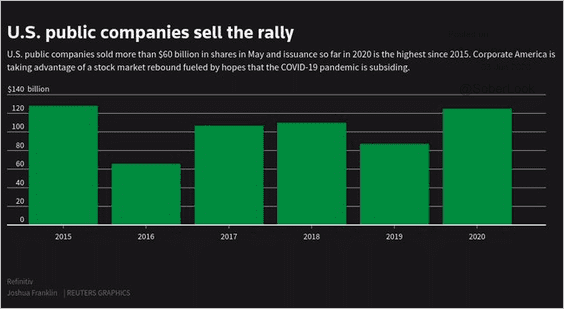

4. Equity issuance has spiked this year as firms take advantage of the rebound.

Source: @jessefelder, Reuters Read full article

Source: @jessefelder, Reuters Read full article

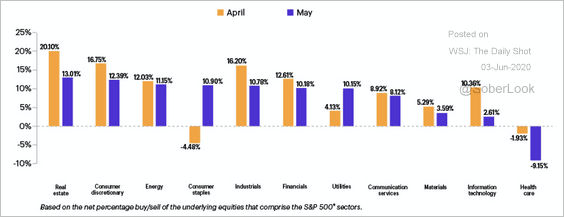

5. E*Trade customers had rotated out of healthcare and into consumer staples last month.

Source: E*Trade Financial Corporation

Source: E*Trade Financial Corporation

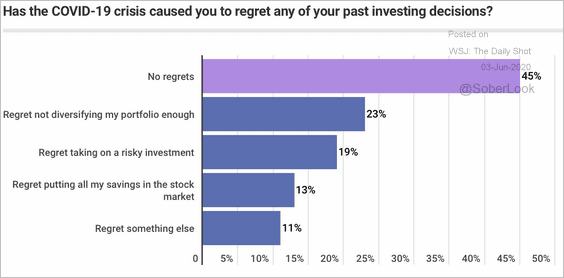

6. Do investors regret their decisions going into the crisis?

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

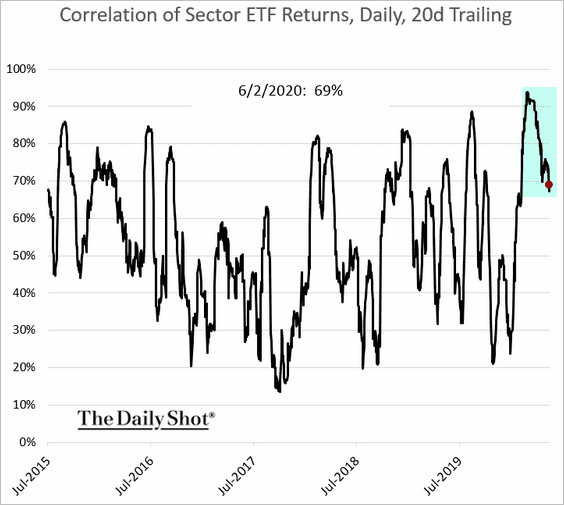

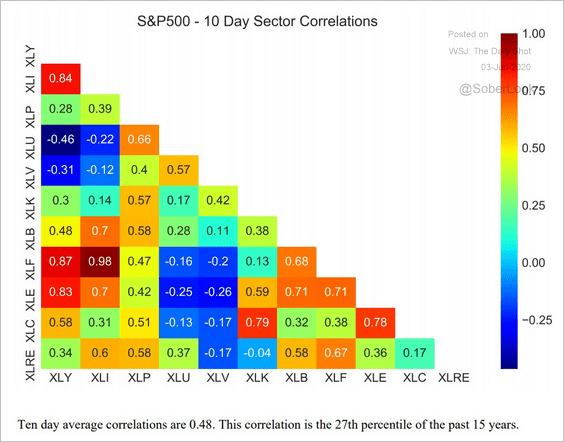

7. Sector correlations are off the highs.

Source: @HalfersPower

Source: @HalfersPower

——————–

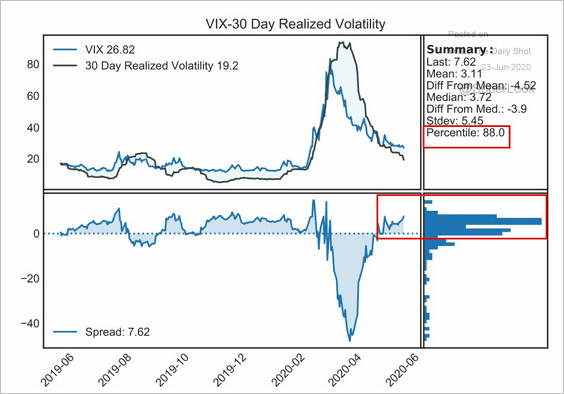

8. 30-day realized volatility is now falling faster than VIX, which has been flat over the past few days.

Source: @HalfersPower

Source: @HalfersPower

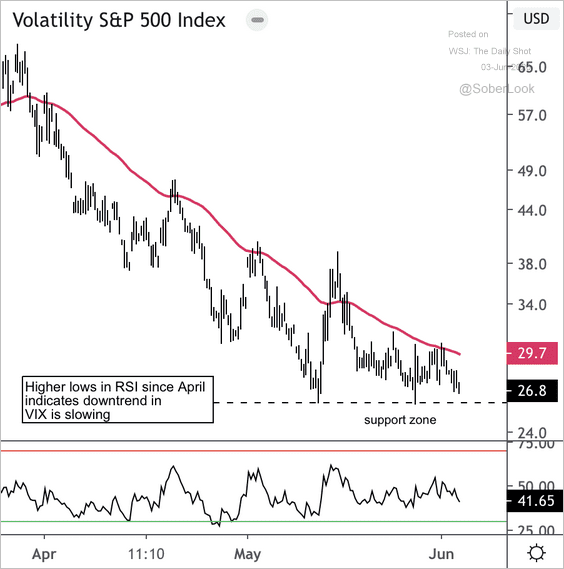

By the way, VIX is at support.

Source: @DantesOutlook

Source: @DantesOutlook

——————–

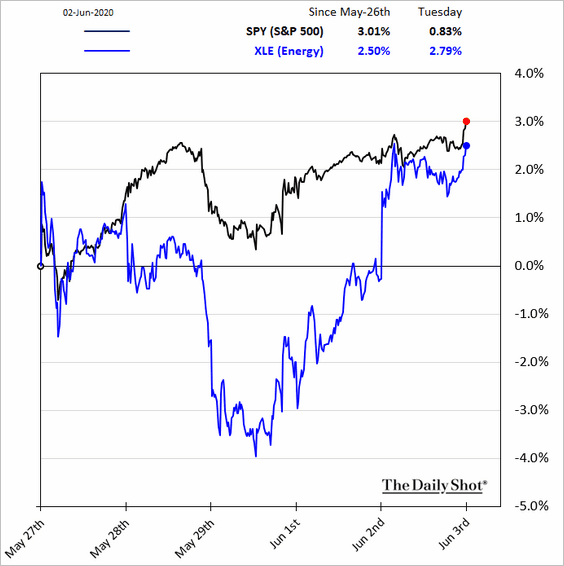

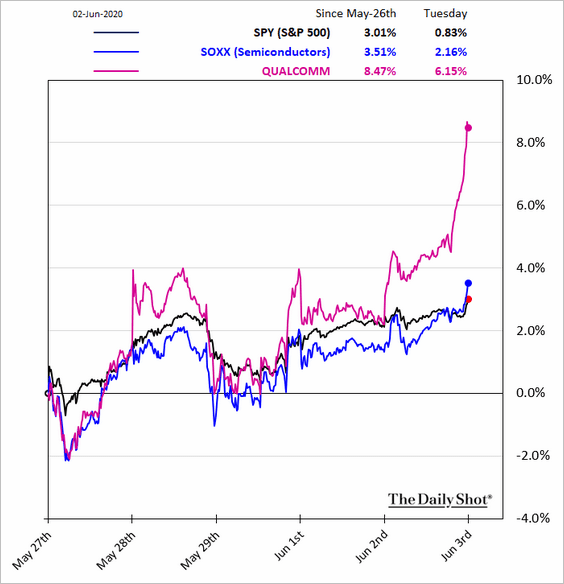

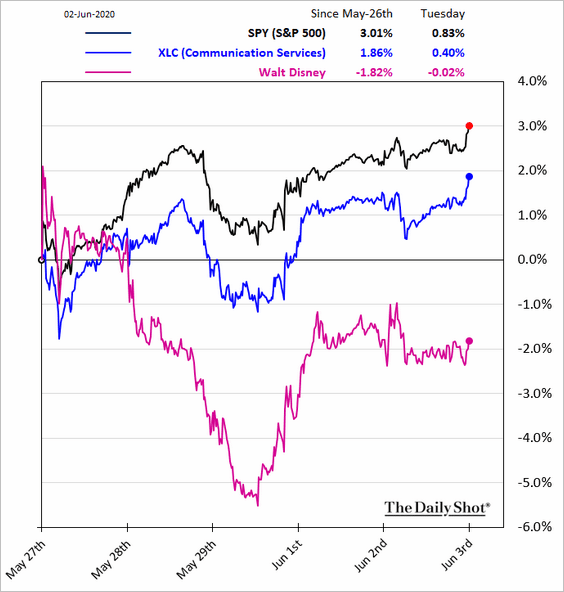

9. Finally, we have some sector updates.

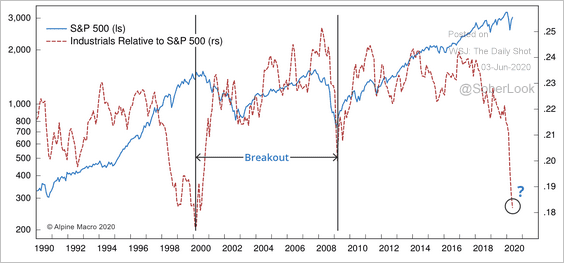

• Industrial stocks have significantly underperformed the S&P 500 over the past few years.

Source: Alpine Macro

Source: Alpine Macro

• Here are some performance charts for the past five days.

– Energy (see the energy section):

– Semiconductors:

– Communication Services:

Credit

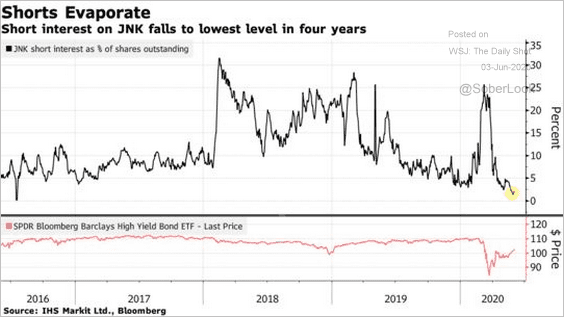

1. Short interest in the largest high-yield bond ETF is at a four-year low.

Source: @markets Read full article

Source: @markets Read full article

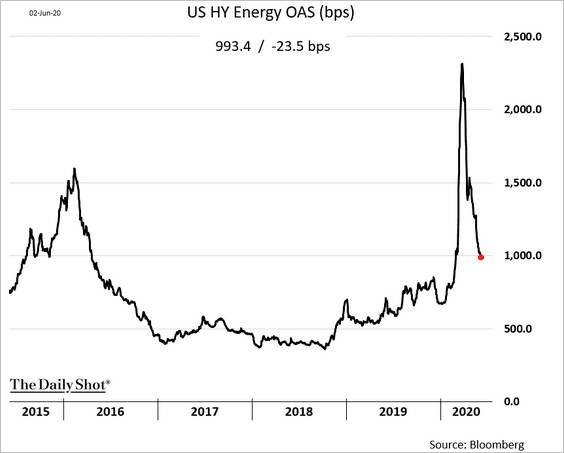

2. The average energy-sector high-yield bond spread dipped below 1,000 bps as oil prices climb.

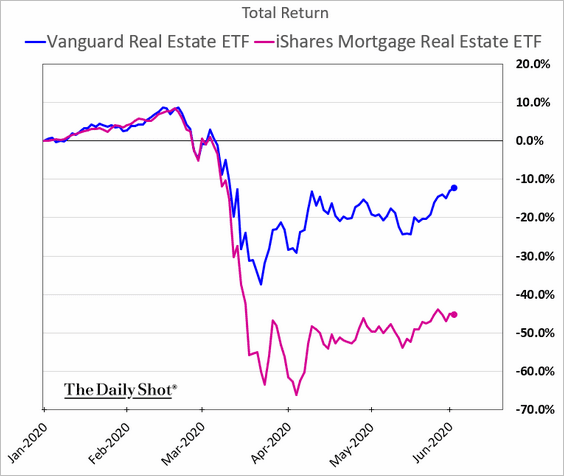

3. Mortgage REITs continue to struggle.

Rates

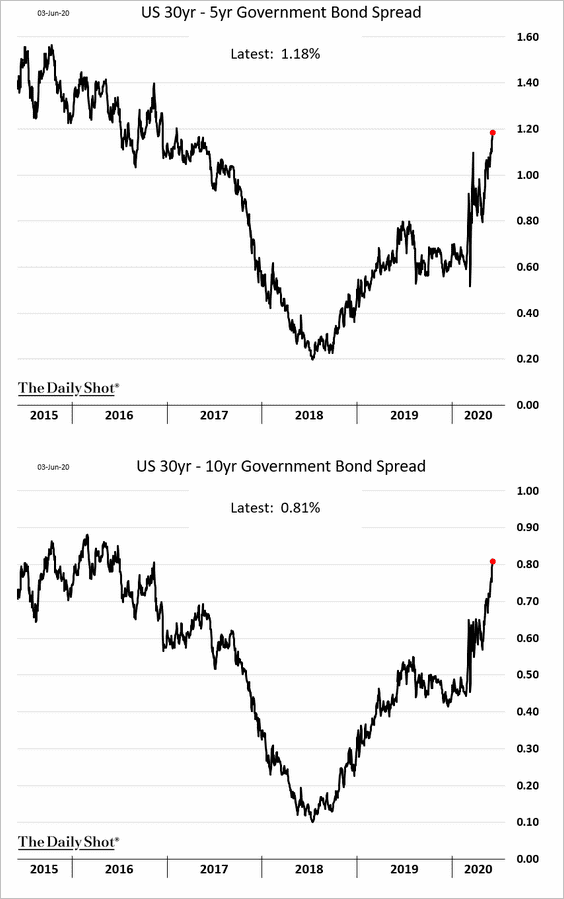

1. The long end of the Treasury curve keeps steepening.

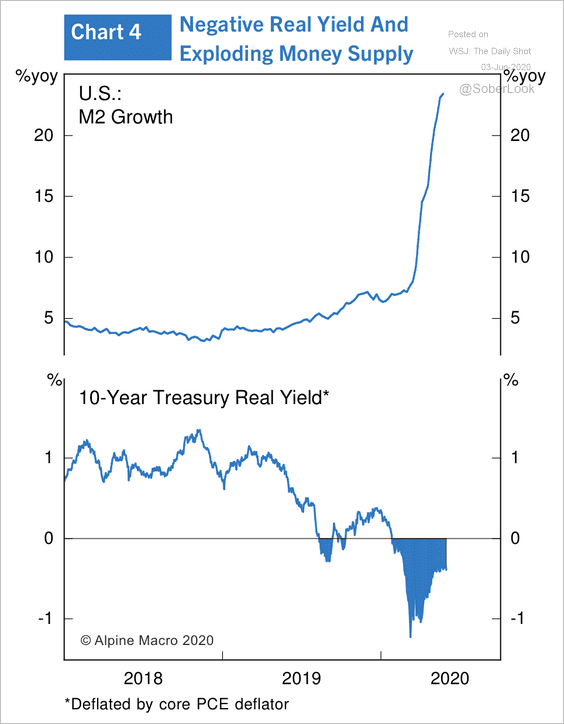

2. Real bond yields have fallen below zero, while the money supply has exploded upward.

Source: Alpine Macro

Source: Alpine Macro

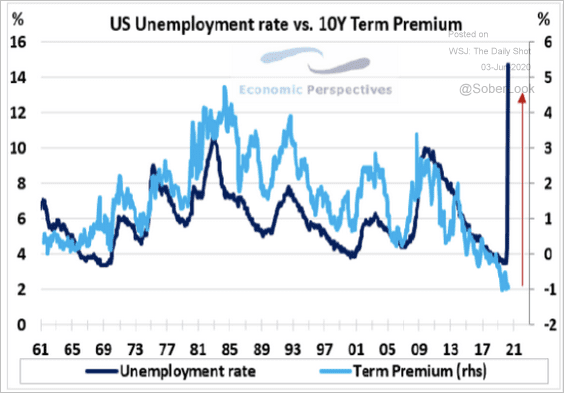

3. The sharp rise in unemployment could lead to an increase in term premia.

Source: Economic Perspectives

Source: Economic Perspectives

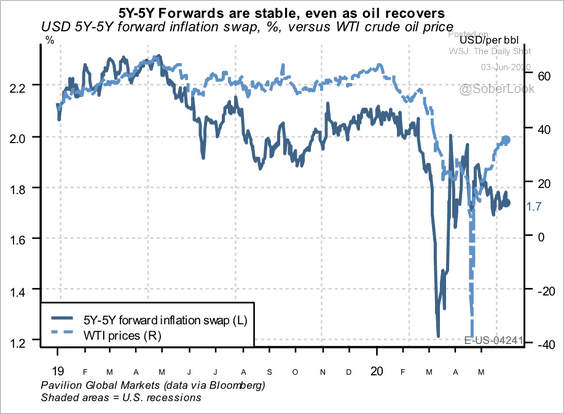

4. The 5-year, 5-year forward inflation swap rate hasn’t responded to the recovery in crude oil prices.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

Global Developments

1. It’s risk-on in the currency markets.

Source: @DavidInglesTV

Source: @DavidInglesTV

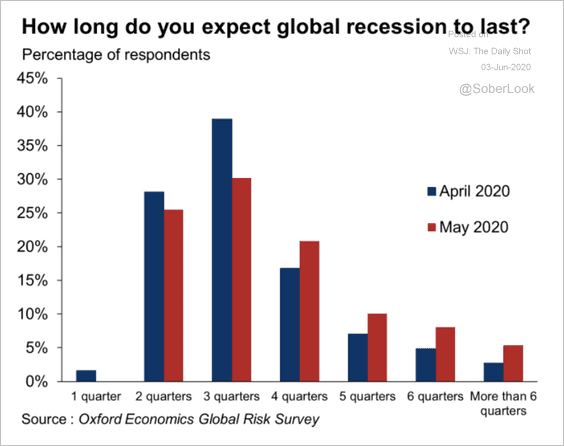

2. How long will the global recession last? This chart is from the Oxford Economics Risk Survey.

Source: Oxford Economics

Source: Oxford Economics

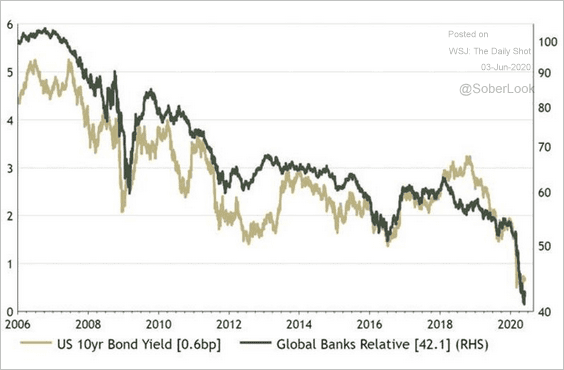

3. Global banks’ relative performance tracks the 10yr Treasury.

Source: @johnauthers, @bopinion Read full article

Source: @johnauthers, @bopinion Read full article

——————–

Food for Thought

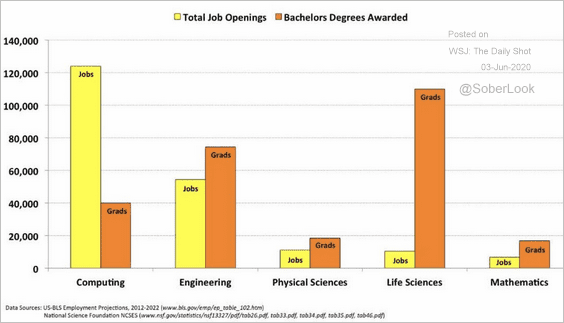

1. Degrees awarded vs. job openings:

Source: NSF, @briannekimmel

Source: NSF, @briannekimmel

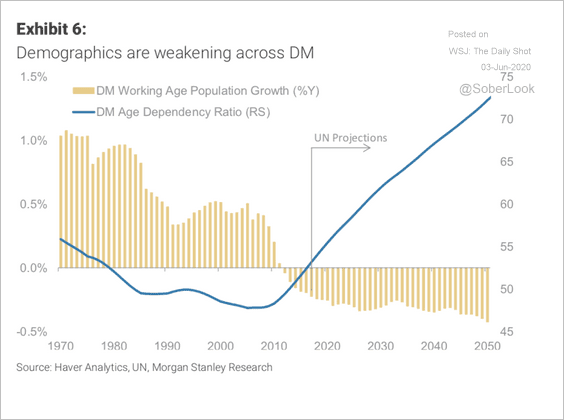

2. The age dependency ratio in advanced economies:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

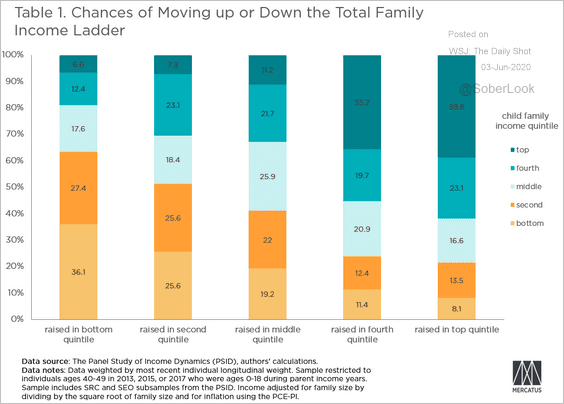

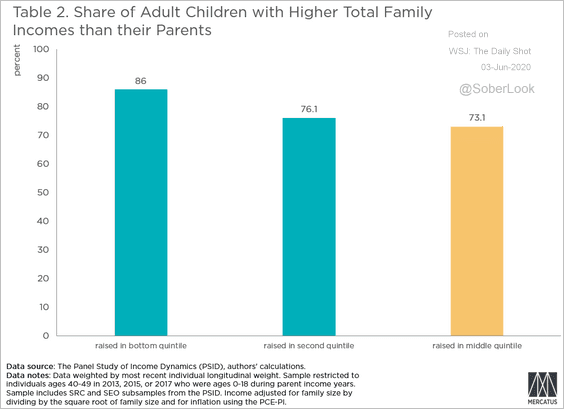

3. Moving up the income ladder (2 charts):

Source: Mercatus Center Read full article

Source: Mercatus Center Read full article

Source: Mercatus Center Read full article

Source: Mercatus Center Read full article

——————–

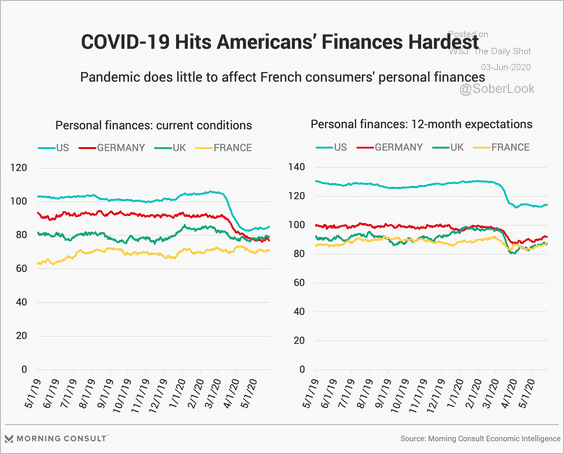

4. Hit to personal finances:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

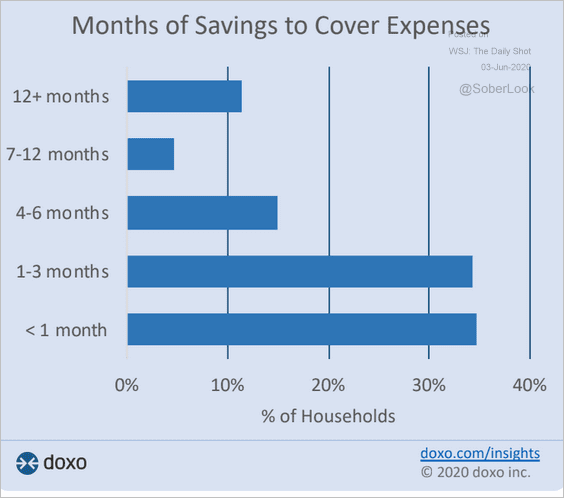

5. Months of savings (US households):

Source: doxo.com

Source: doxo.com

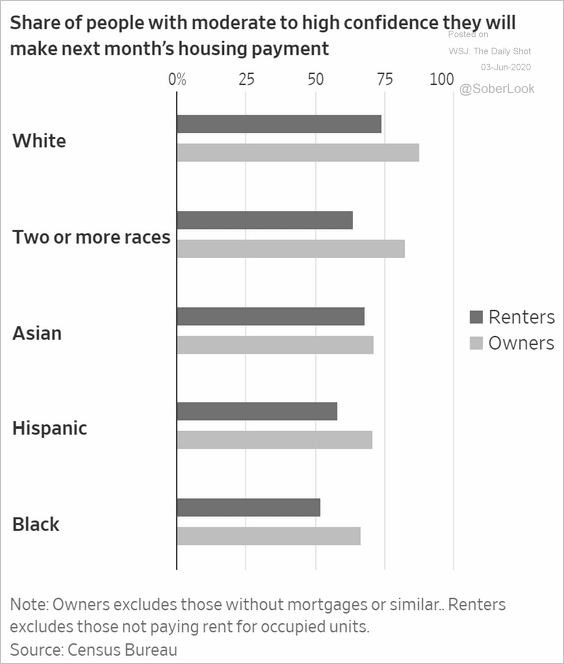

6. Making next month’s housing payment:

Source: @WSJ Read full article

Source: @WSJ Read full article

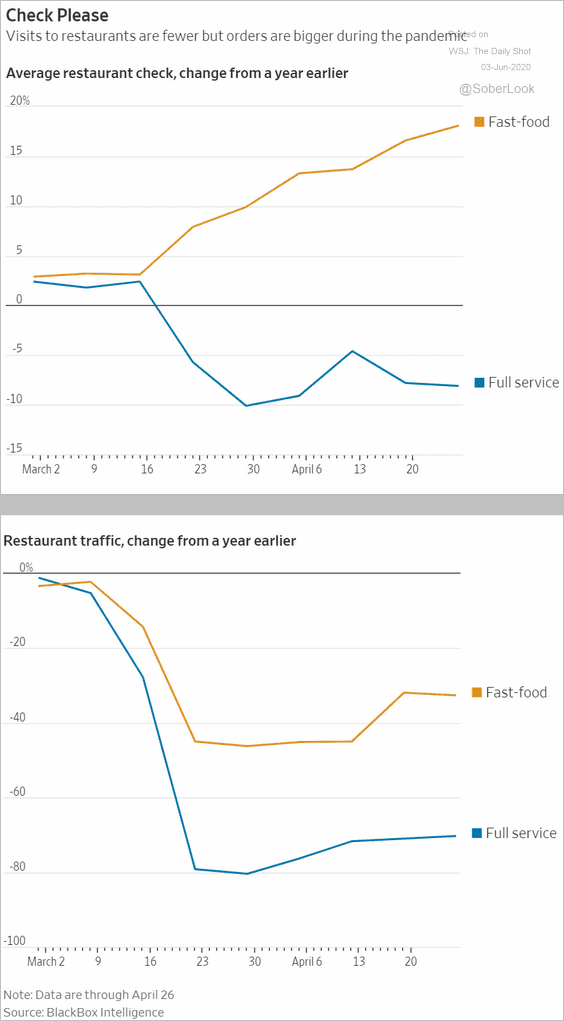

7. Restaurant orders and visits:

Source: @WSJ Read full article

Source: @WSJ Read full article

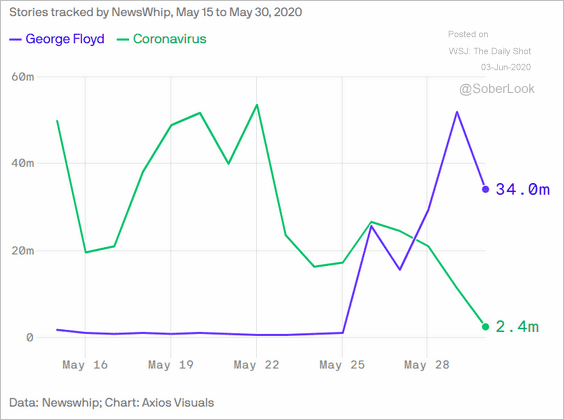

8. Media coverage of George Floyd and coronavirus:

Source: @axios Read full article

Source: @axios Read full article

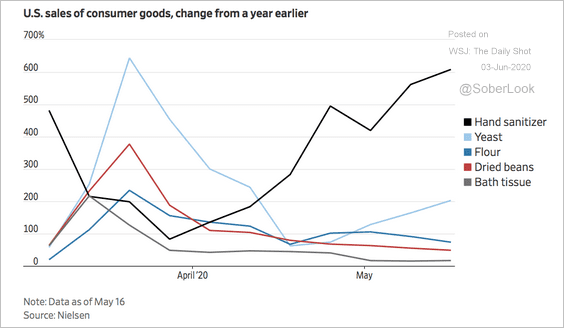

9. Demand for hand sanitizer:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–