The Daily Shot: 11-Jun-20

• The United States

• Europe

• Asia – Pacific

• China

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

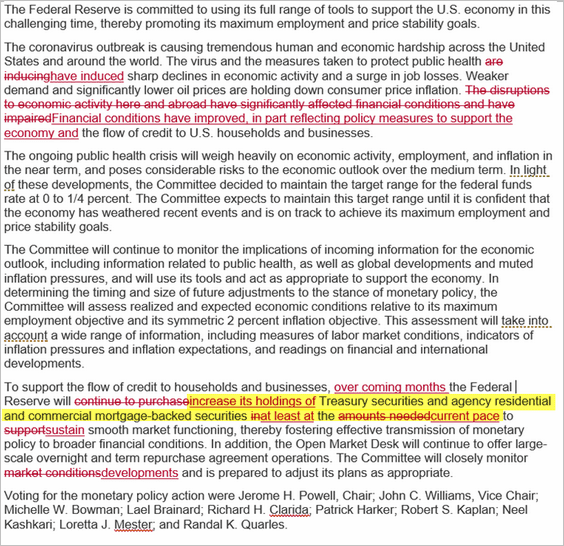

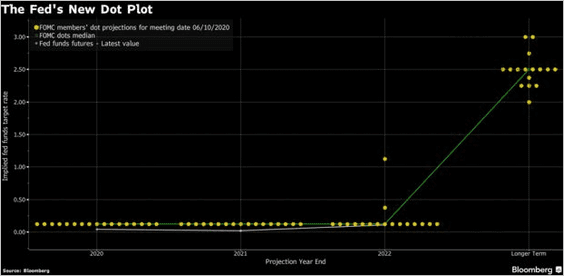

1. The Federal Reserve will continue with its stimulus measures and expects to keep rates near zero through 2022.

• Changes in the FOMC statements:

Source: @econchart

Source: @econchart

• The “dot plot”:

Source: @markets Read full article

Source: @markets Read full article

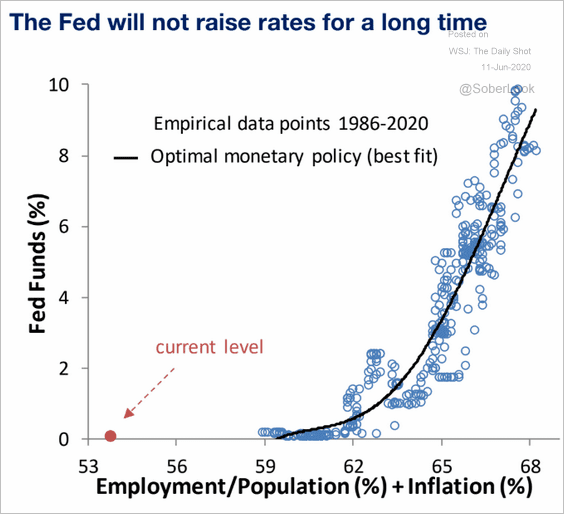

A comparison of current conditions to historical data also points to a prolonged period of near-zero rates.

Source: Piper Sandler

Source: Piper Sandler

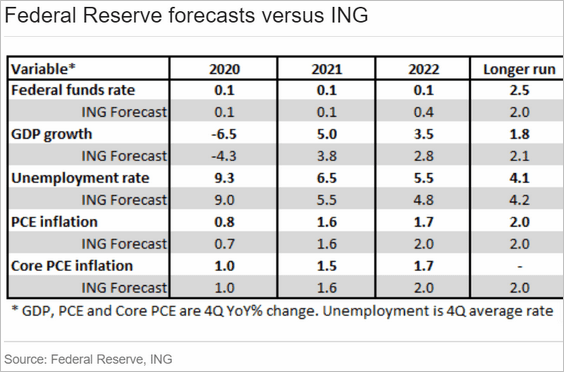

This table shows the Fed’s projections for rates, GDP growth, and inflation (compared to ING’s forecasts).

Source: ING

Source: ING

——————–

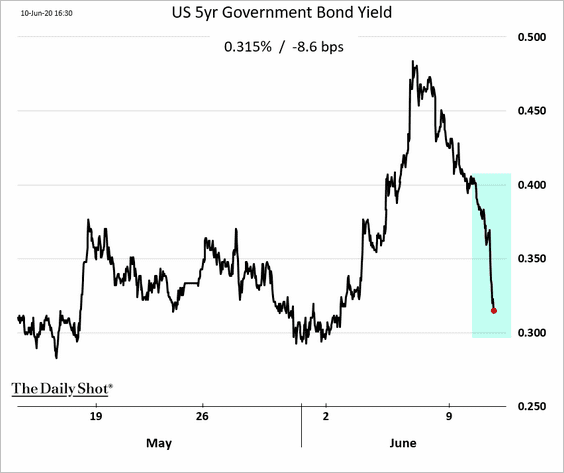

2. Treasuries rallied in response to the Fed’s zero-rate forecast.

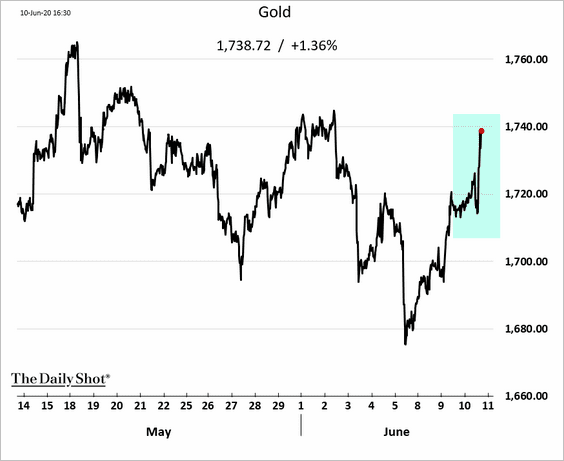

Gold advanced.

——————–

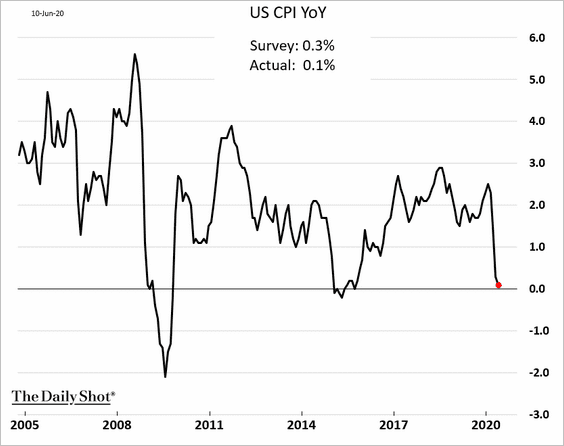

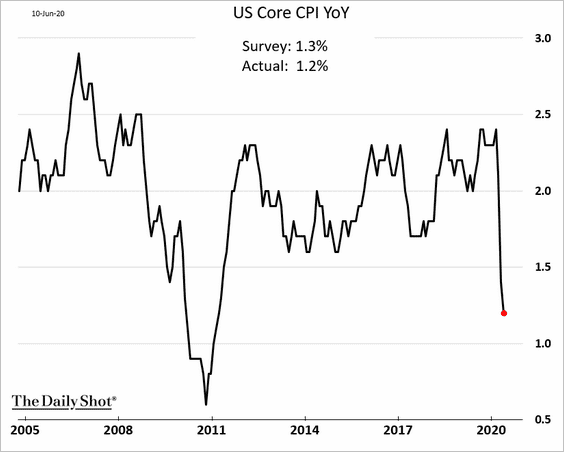

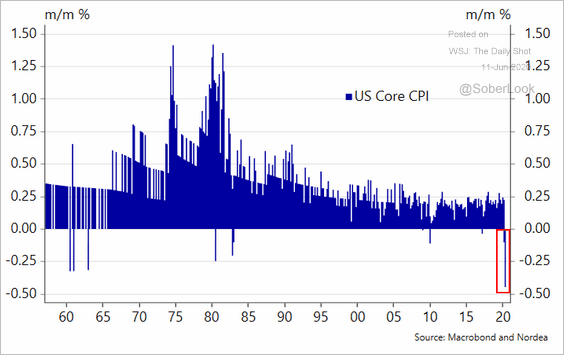

3. The May CPI report was weaker than the consensus estimate, as inflation continues to moderate.

• The headline CPI (approaching zero):

• The core CPI:

• The core CPI monthly changes:

Source: @meremortenlund Read full article

Source: @meremortenlund Read full article

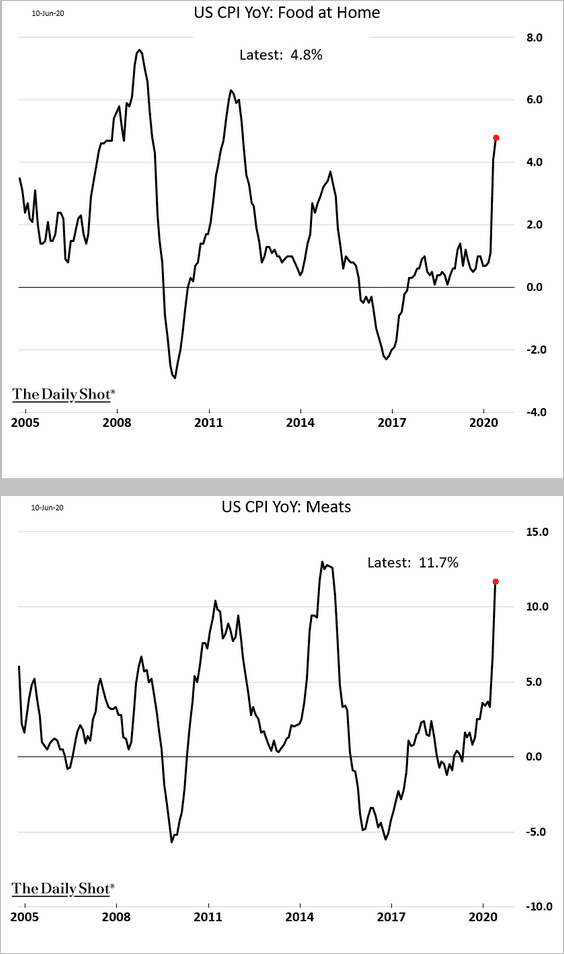

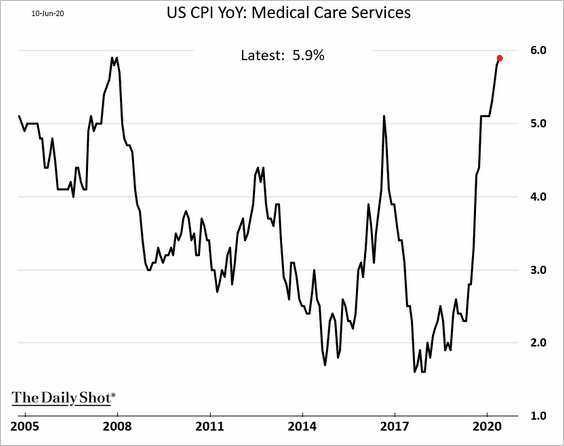

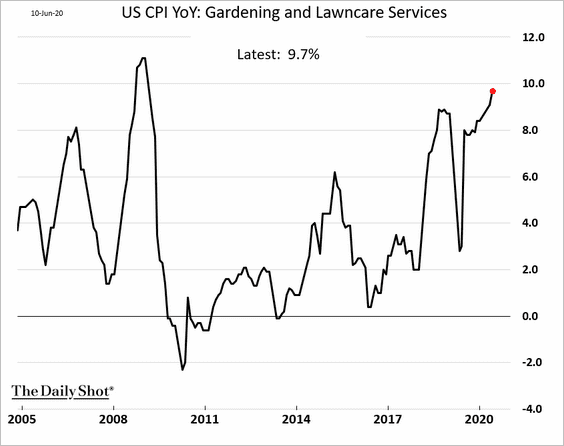

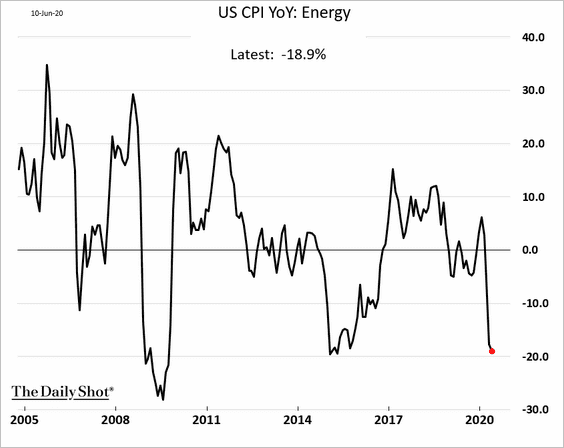

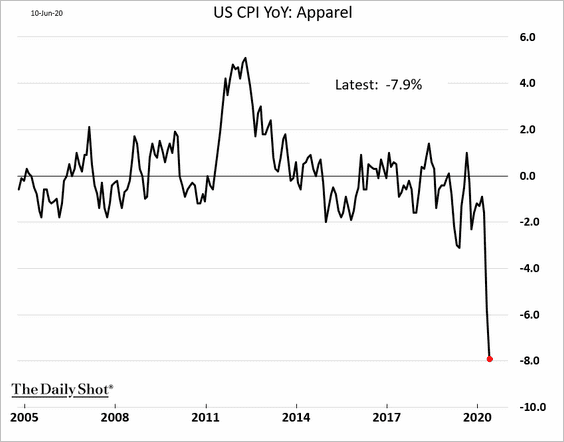

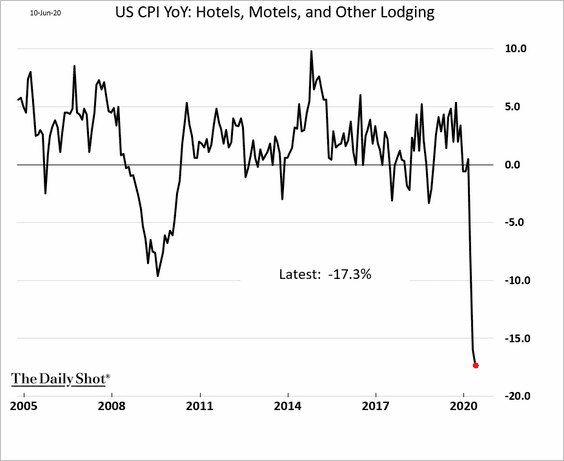

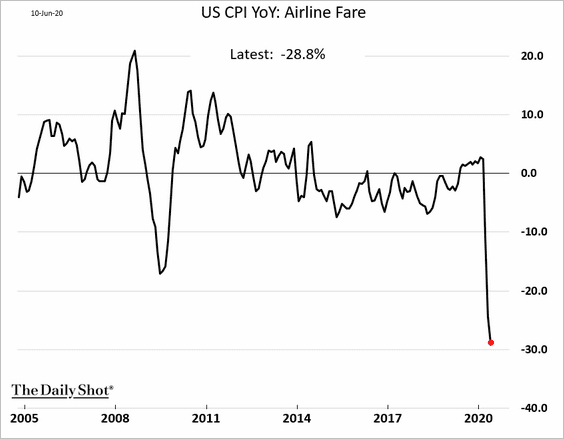

Below is a select set of CPI components.

• Higher inflation sectors:

– Groceries:

– Medical care services:

– Landscaping services:

• Lower inflation sectors:

– Energy:

– Apparel:

– Hotels:

– Airline fare:

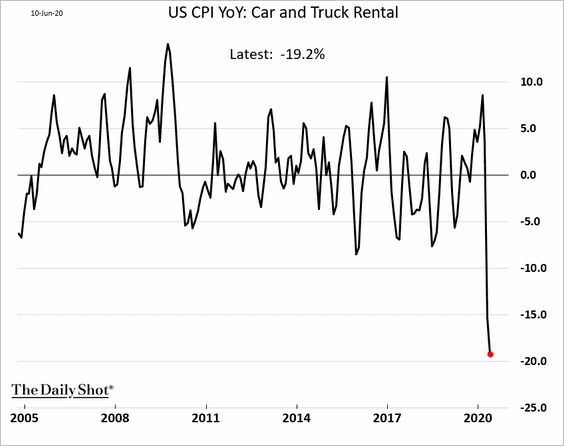

– Car rental:

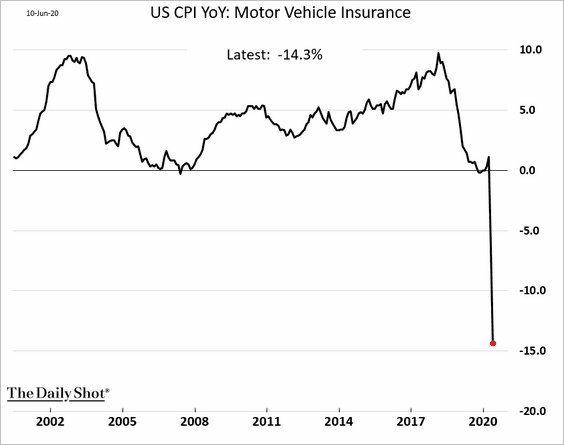

– Auto insurance:

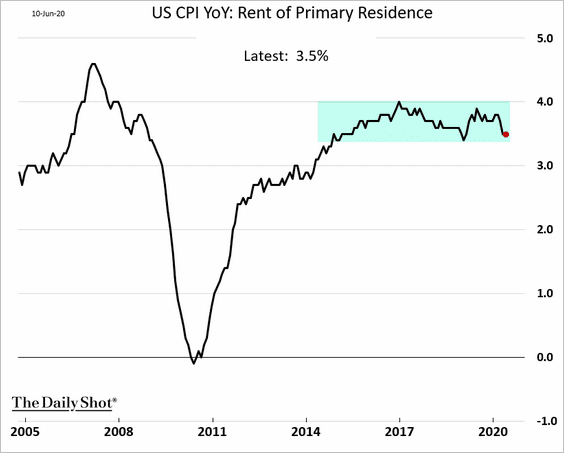

• Rent CPI held steady in May:

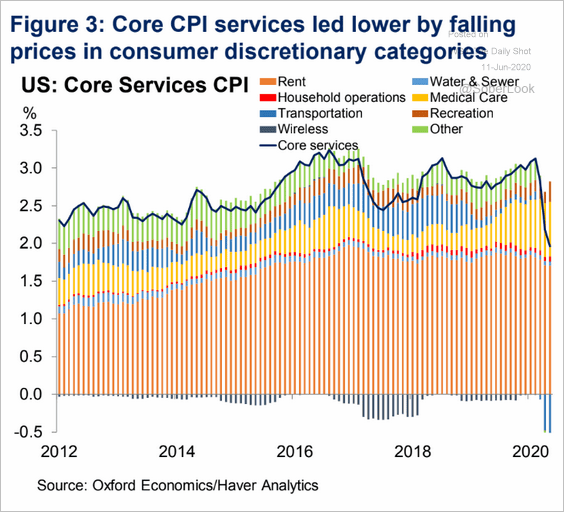

• This chart shows the composition of the core services CPI.

Source: Oxford Economics

Source: Oxford Economics

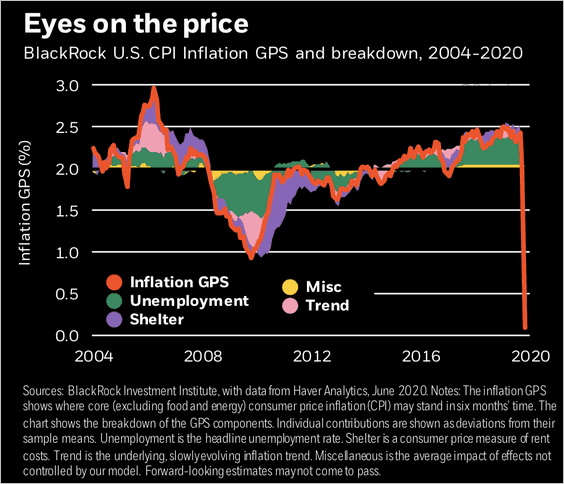

• Finally, here is BlackRock’s inflation tracker.

Source: BlackRock

Source: BlackRock

——————–

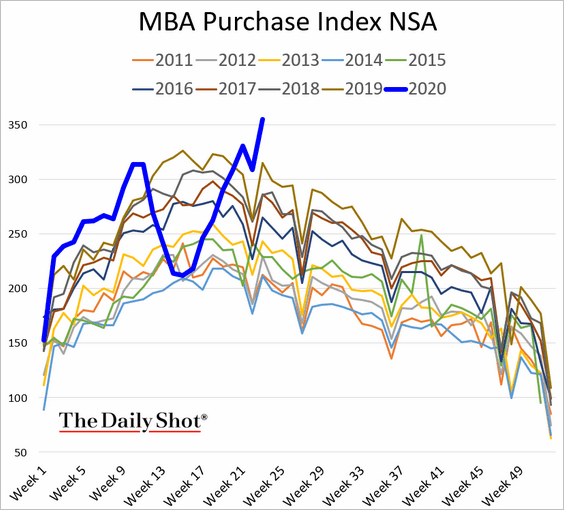

4. Mortgage applications to purchases a home are at a multi-year high.

5. Consumer confidence is rebounding.

• Sentiment indicator from Morning Consult:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

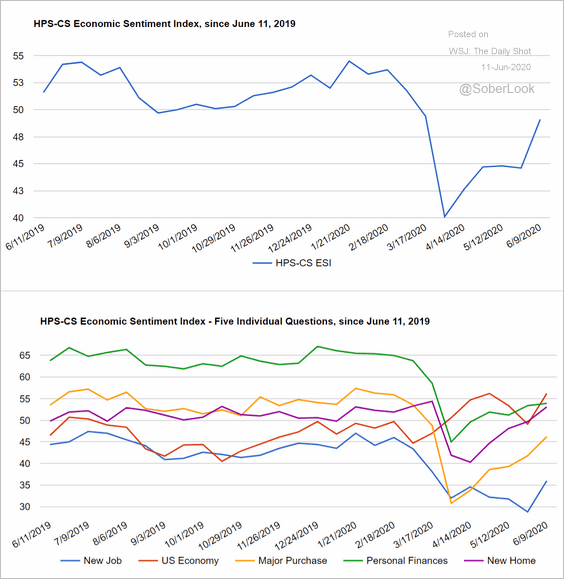

• Sentiment indicator from Hamilton Place Strategies, CivicScience:

Source: Hamilton Place Strategies, CivicScience Read full article

Source: Hamilton Place Strategies, CivicScience Read full article

——————–

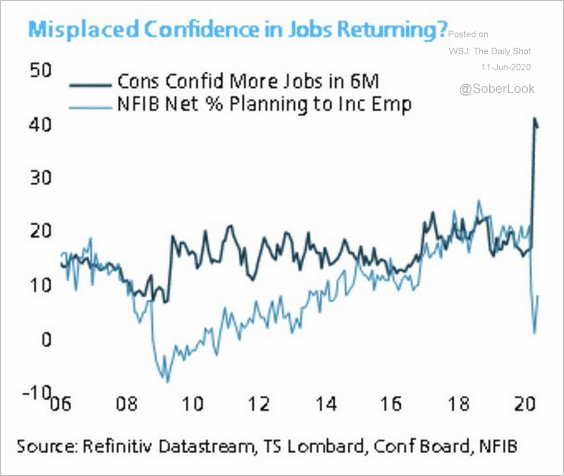

6. Is there too much consumer optimism about jobs returning, given that fewer small businesses plan to boost employment?

Source: @TS_Lombard, @LizAnnSonders

Source: @TS_Lombard, @LizAnnSonders

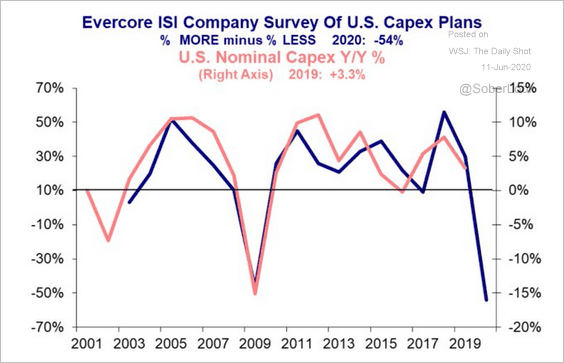

7. Business investment plummetted this quarter.

Source: Evercore ISI, @LizAnnSonders

Source: Evercore ISI, @LizAnnSonders

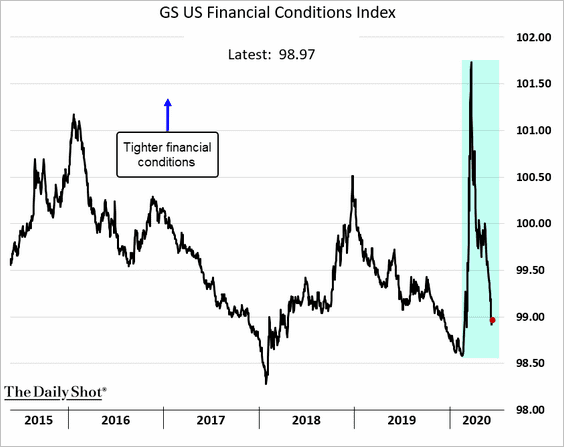

8. US financial conditions are almost back to pre-crisis levels.

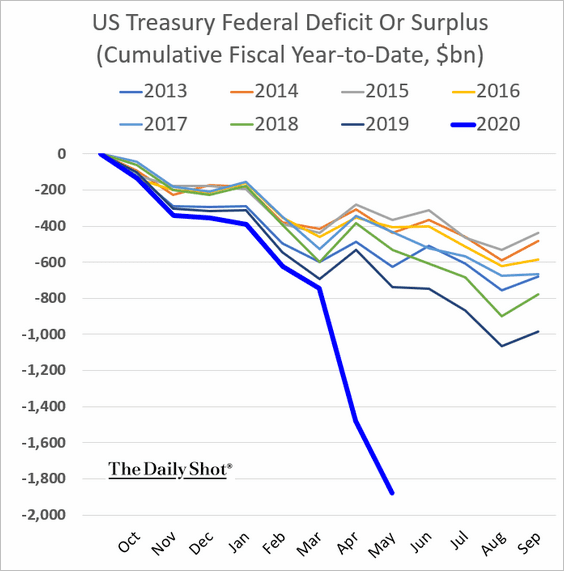

9. The budget gap continues to widen.

Europe

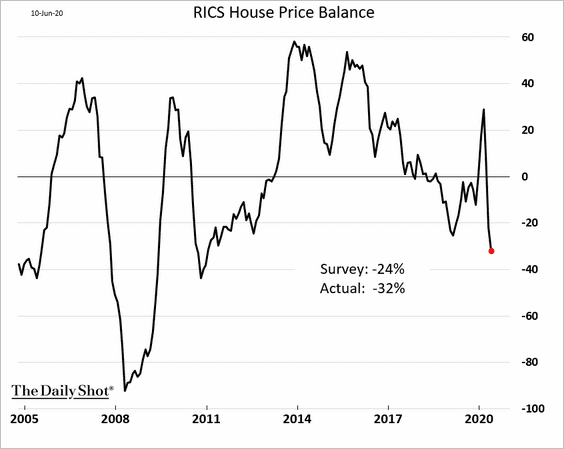

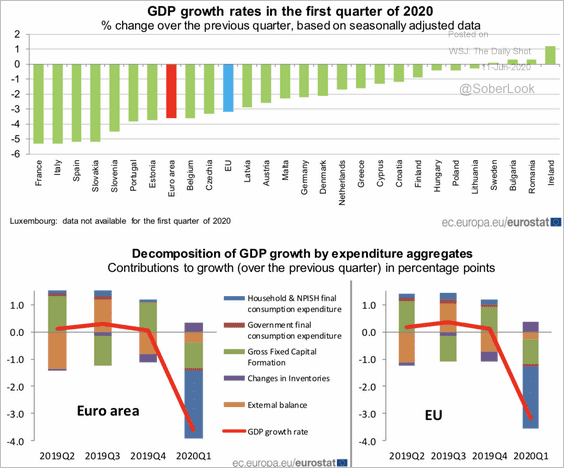

1. Home prices in the UK are expected to decline, according to the latest RICS report.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

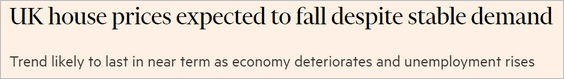

2. Sweden’s consumer spending plummeted in April.

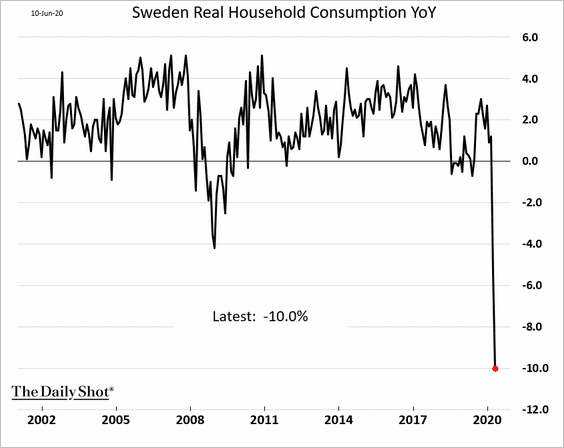

3. Here is a summary of the Q1 GDP changes across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

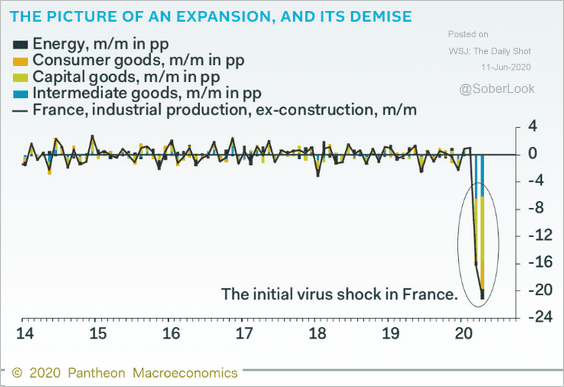

4. This chart shows the composition of French industrial production.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

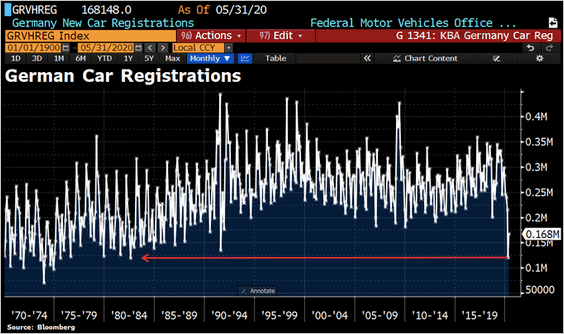

5. German car sales bounced from multi-decade lows.

Source: @Schuldensuehner, @TheTerminal

Source: @Schuldensuehner, @TheTerminal

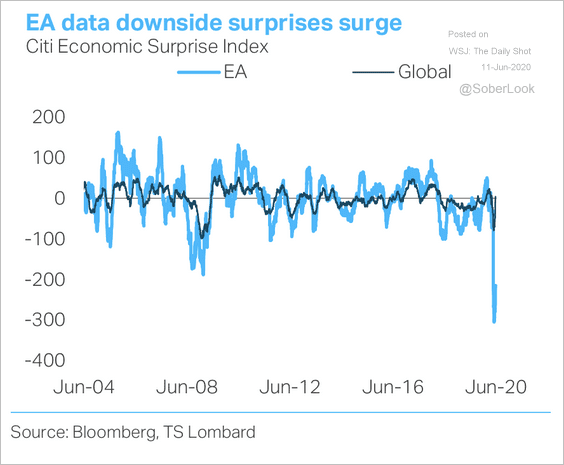

7. The Eurozone’s economic data surprises have been worse than the global trend.

Source: TS Lombard

Source: TS Lombard

Asia – Pacific

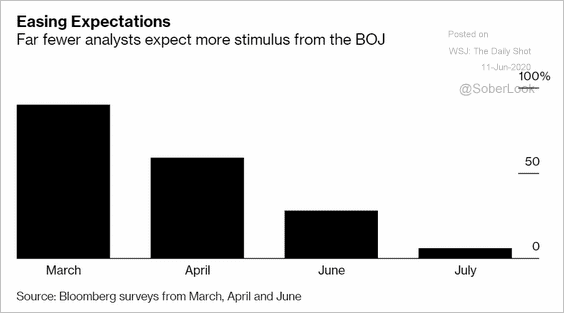

1. Few economists expect more stimulus from the BoJ.

Source: @markets Read full article

Source: @markets Read full article

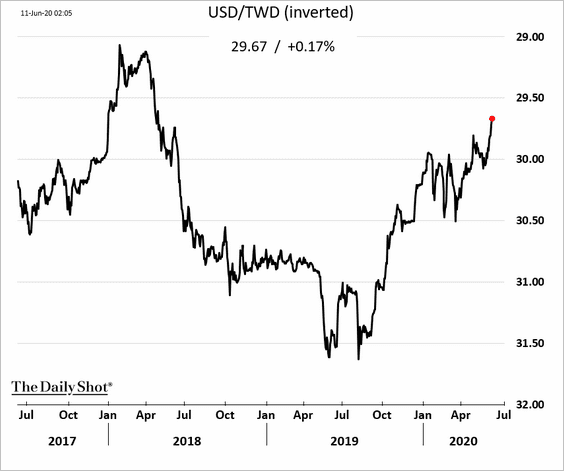

2. The rally in the Taiwan dollar continues.

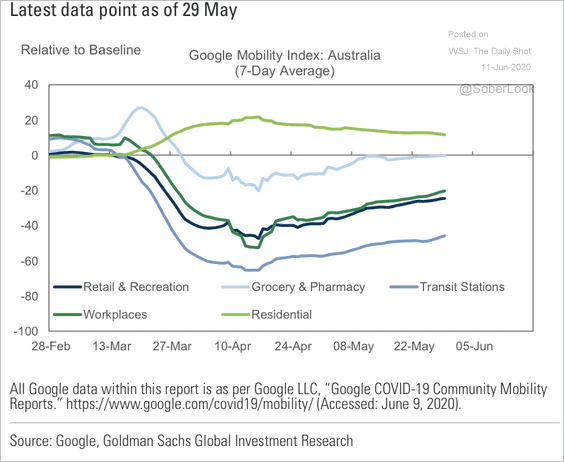

3. According to the Google Maps data, Australia is experiencing a gradual recovery in workplaces and retail/recreation activity, but a slow recovery in public transport.

Source: Goldman Sachs

Source: Goldman Sachs

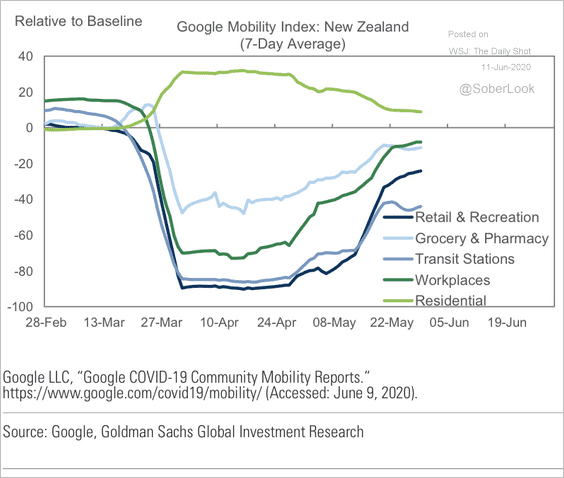

4. New Zealand had a sharper downturn and faster recovery.

Source: Goldman Sachs

Source: Goldman Sachs

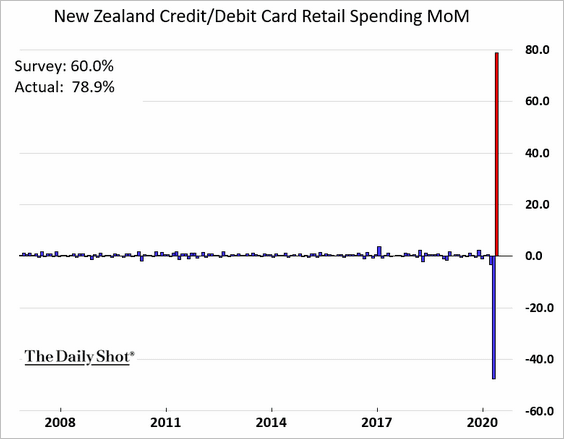

New Zeland’s credit card spending rebounded in May.

China

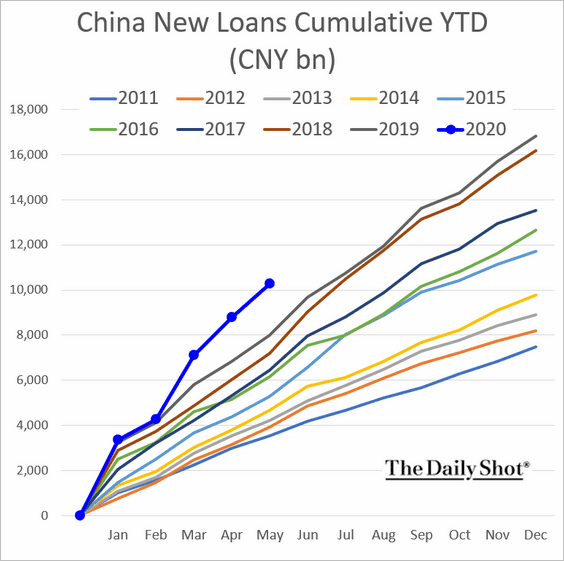

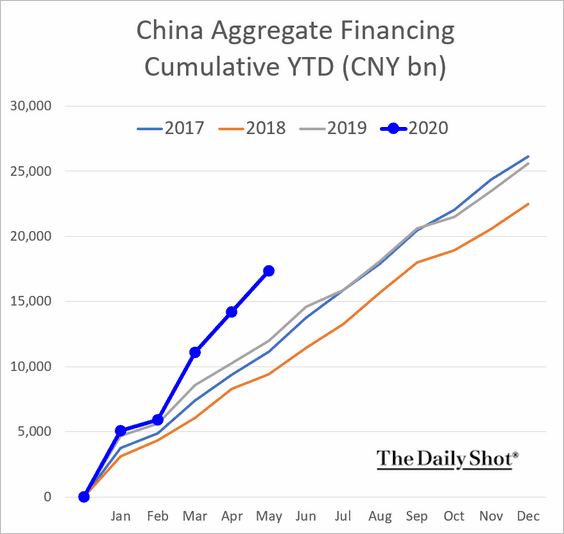

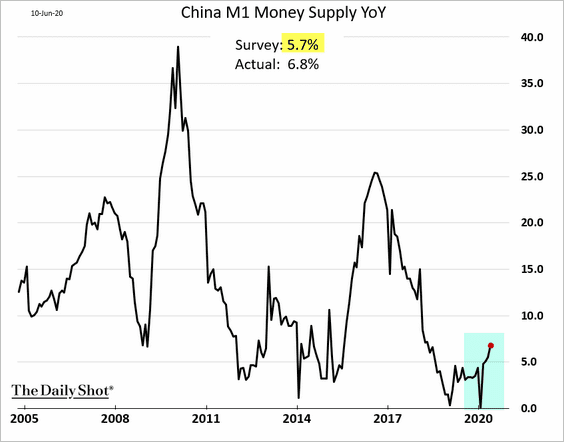

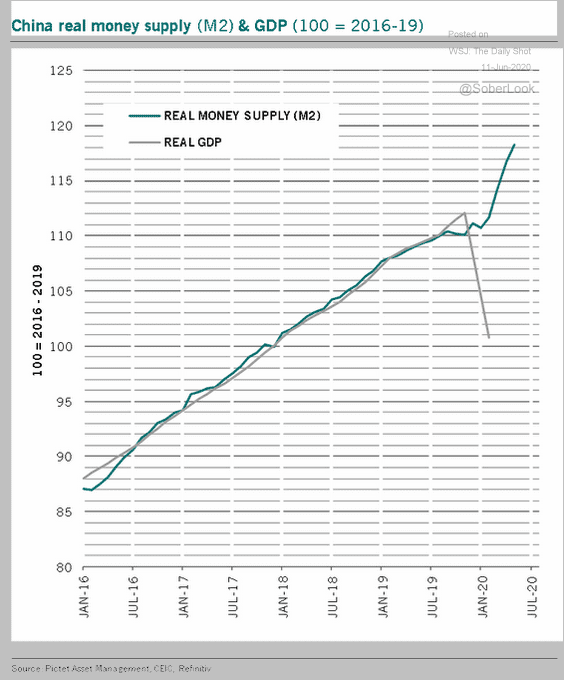

1. Robust credit expansion continues.

• Bank loans (year-to-date):

• Total financing:

• The M1 money supply growth:

• M2 (broad) money supply (level):

Source: @PkZweifel

Source: @PkZweifel

——————–

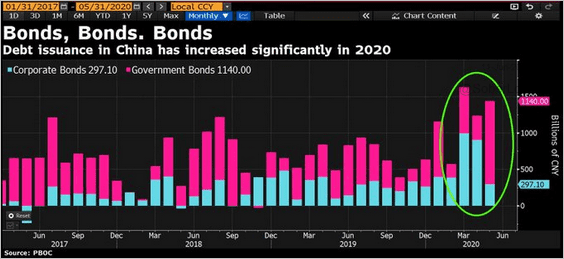

2. Bond issuance remains strong.

Source: @DavidInglesTV

Source: @DavidInglesTV

Commodities

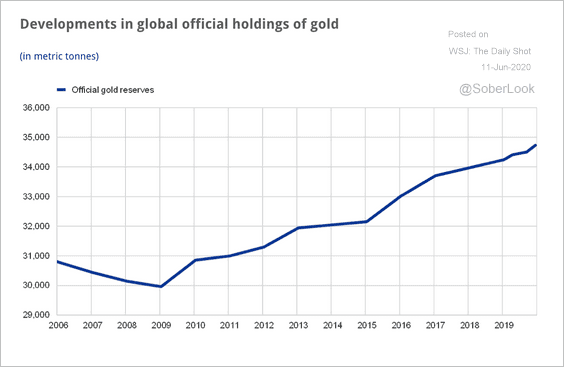

1. This chat shows official gold reserves (held by global central banks).

Source: ECB Read full article

Source: ECB Read full article

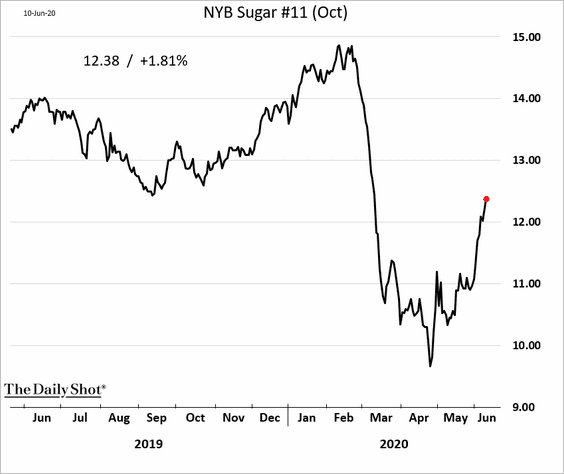

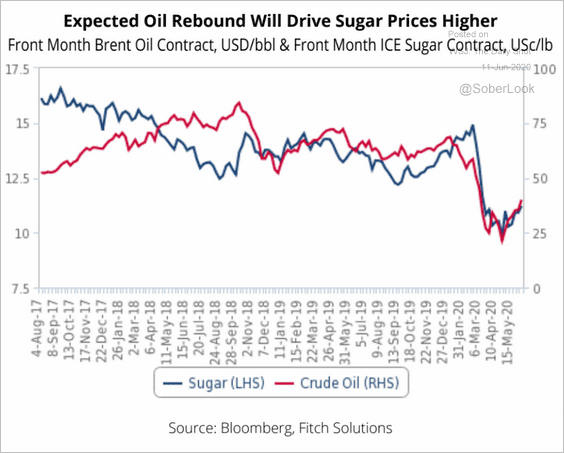

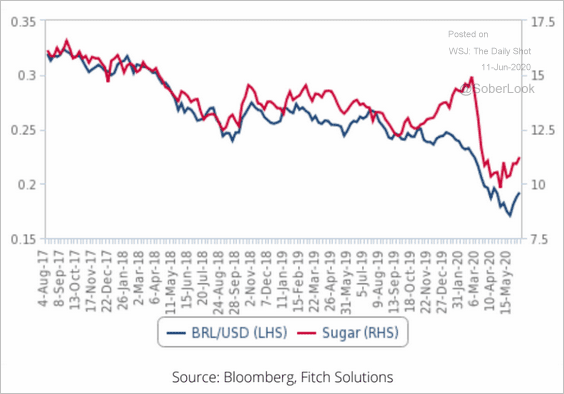

2. Sugar continues to rebound, …

… helped by higher oil prices (sugar is a fuel source in Brazil) and …

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

… a bounce in the Brazilian real.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

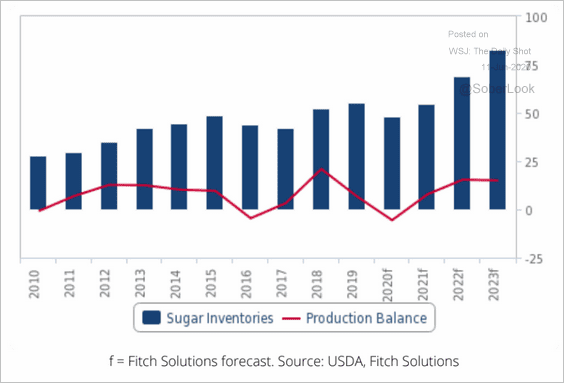

But sugar inventories are expected to climb.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Energy

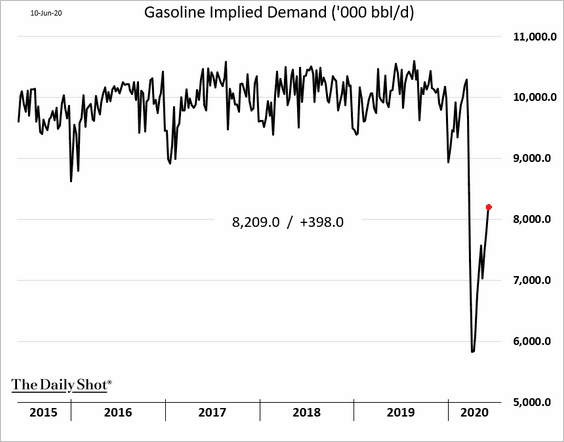

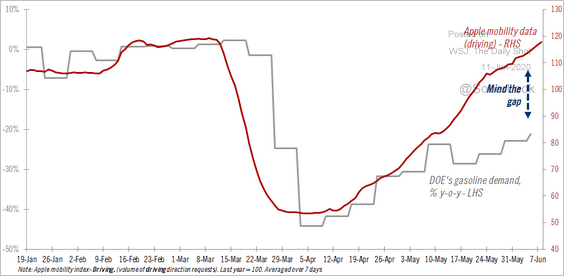

1. US gasoline demand is rebounding.

The gap between US driving activity and gasoline demand keeps widening.

Source: Thomas Costerg, Pictet Wealth Management

Source: Thomas Costerg, Pictet Wealth Management

——————–

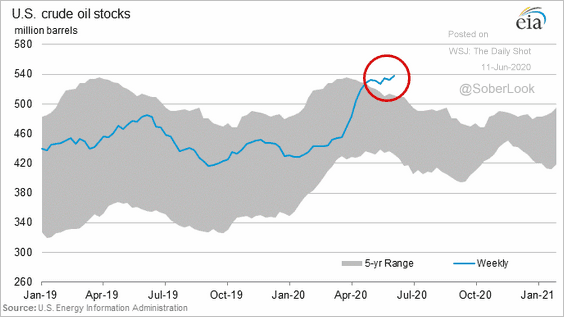

2. US crude oil inventories hit a record high.

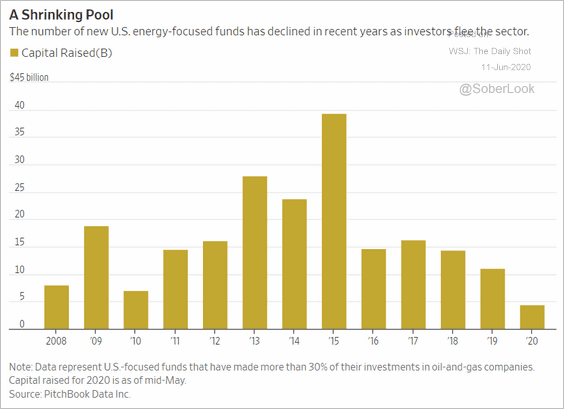

3. Fundraising for energy-focused investing has been slowing in recent years.

Source: @WSJ Read full article

Source: @WSJ Read full article

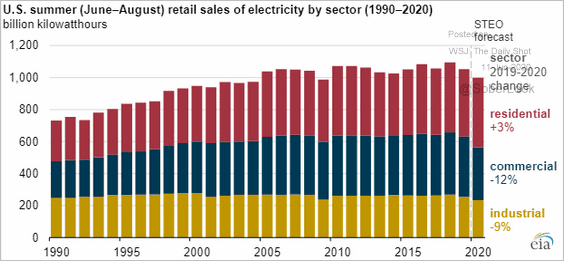

4. US electricity demand has decreased substantially this year.

Source: EIA Read full article

Source: EIA Read full article

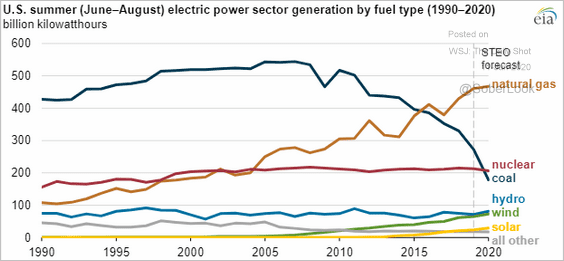

Coal usage for electricity generation is collapsing.

Source: EIA Read full article

Source: EIA Read full article

Equities

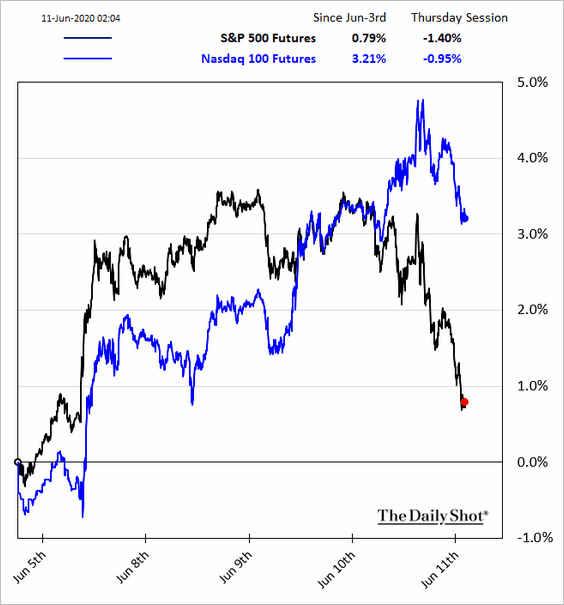

1. The S&P 500 futures are lower amid worries about the “second wave.”

Source: @business Read full article

Source: @business Read full article

——————–

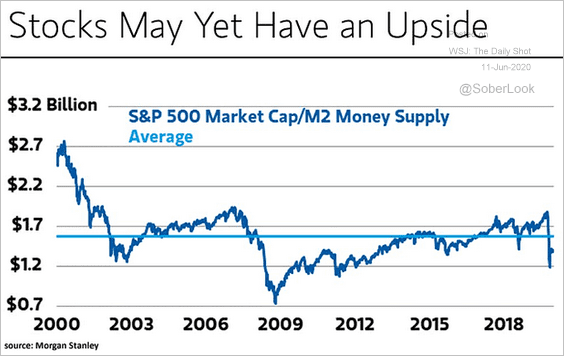

2. Some investors have become convinced that the sharp rise in the money supply can support the equity rally. But there is a problem with this assumption.

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

There are two drivers of the recent money supply spike.

• The first one is the result of the Fed’s massive securities purchases. The central bank buys bonds from dealers, who, in turn, purchase them from investors, boosting the money supply in the process (see #3 here of an overview). Are institutional investors who sold their bonds to the Fed rotating out of Treasuries into stocks? Much lower Treasury yields make stocks attractive on a relative basis. Still, it’s doubtful that pensions, insurance companies, funds, and other bondholders suddenly got interested in the equity market in a way that would sustain the rally.

• The second source of the recent growth in the US money supply comes from companies tapping credit lines as well as getting new loans to boost their liquidity (as revenues collapse). But corporations are certainly not drawing credit lines to purchase shares.

• It’s worth noting that the federal government’s stimulus does not increase the money supply because cash simply flows from bond investors to stimulus recipients (no new money is created).

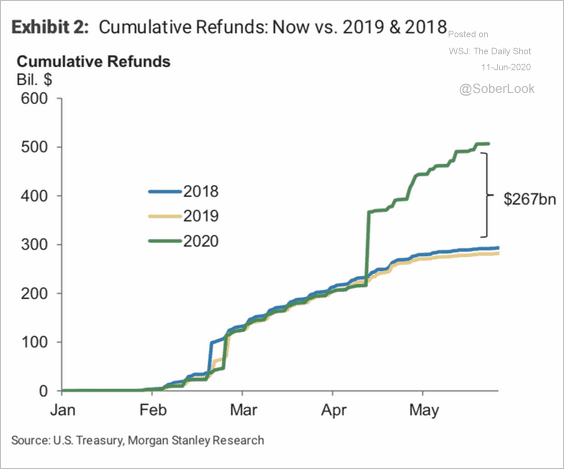

3. There is some anecdotal evidence that retail investors have been using stimulus money (chart below) to invest in the stock market.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

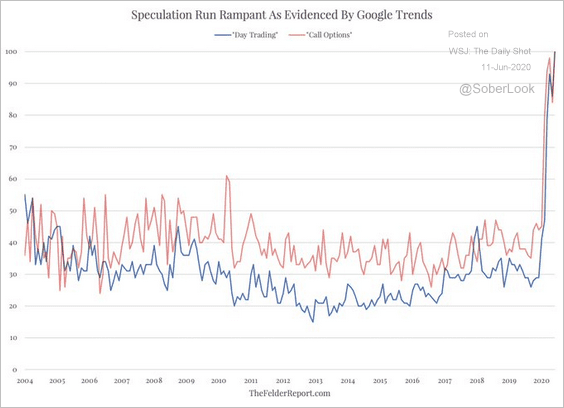

Indeed, the online search activity for “day trading” and “call options” rose to record levels. But this trend suggests that the market rally is vulnerable.

Source: @jessefelder

Source: @jessefelder

——————–

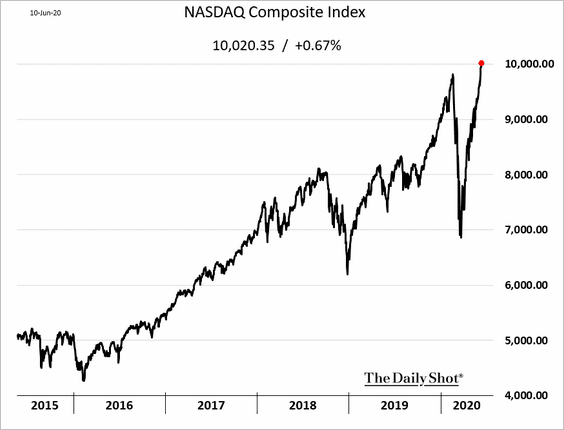

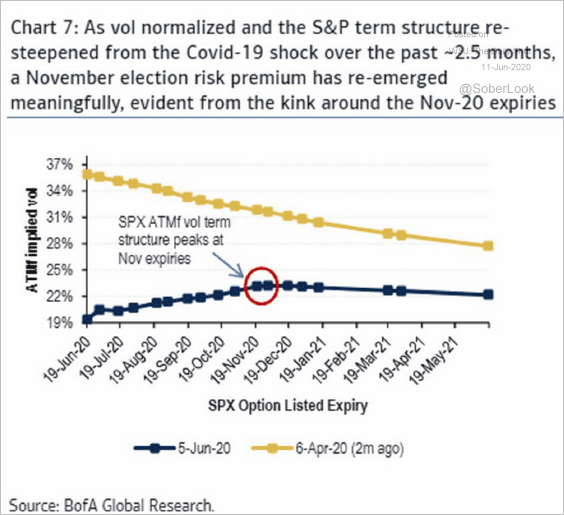

4. The Nasdaq Composite broke above 10k for the first time.

What is the composition of the Nasdaq Composite?

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

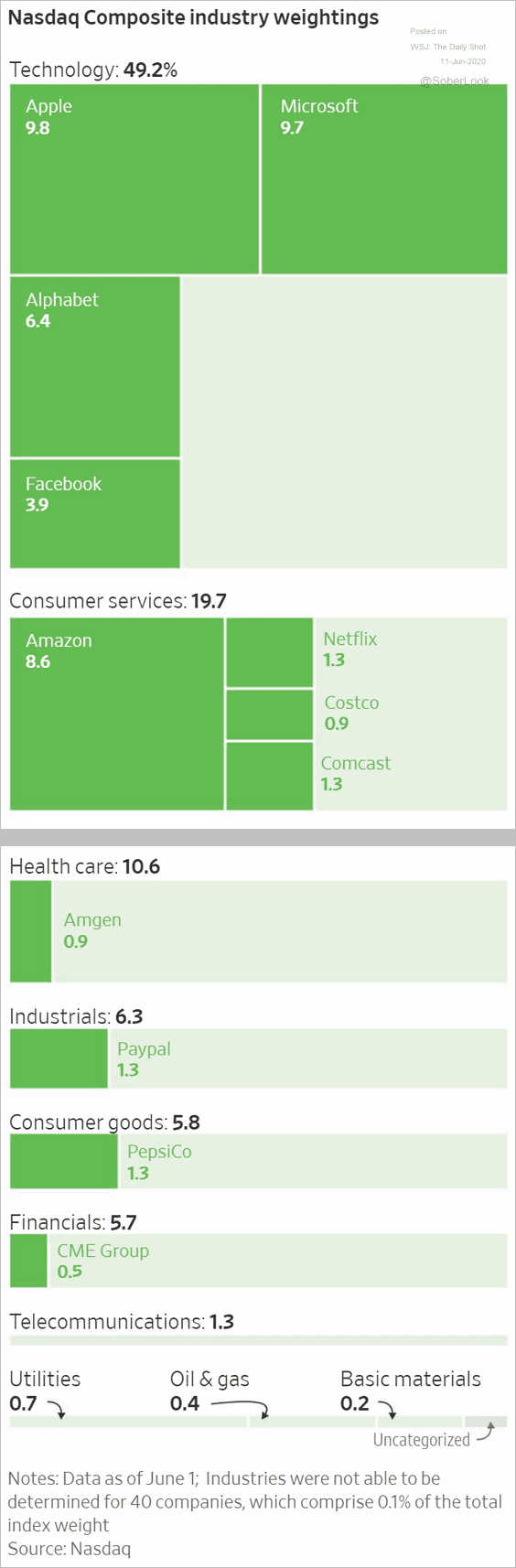

5. Tesla is about to become the most valuable automaker in the world.

Source: @technology Read full article

Source: @technology Read full article

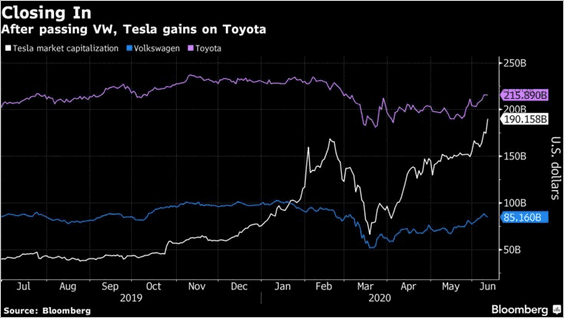

6. The options market shows some nervousness about the November elections.

Source: BofA Merrill Lynch Global Research, @markets Read full article

Source: BofA Merrill Lynch Global Research, @markets Read full article

Rates

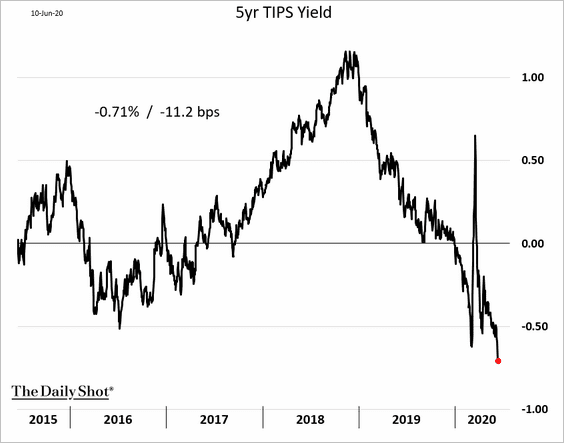

1. Real rates implied by inflation-linked Treasury yields are pushing deeper into negative territory.

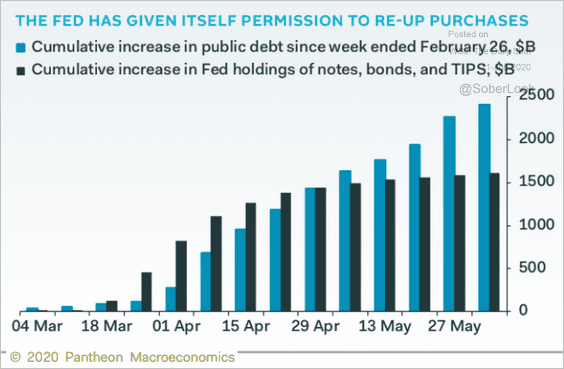

2. Will the Fed boost the pace of its securities purchases to keep up with the government’s issuance?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Global Developments

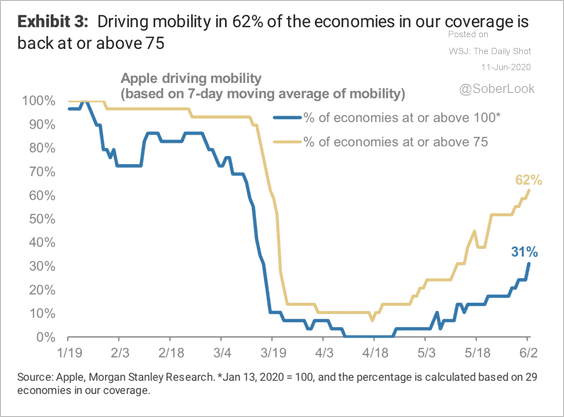

1. More people are driving again.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

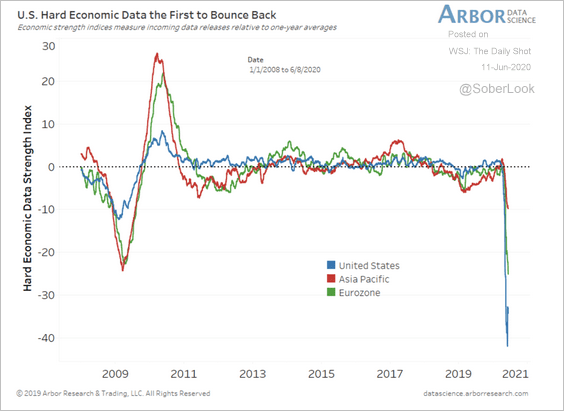

2. The US economic data momentum has been the first to bounce from the lows (before Asia-Pacific and the Eurozone).

Source: Arbor Research & Trading

Source: Arbor Research & Trading

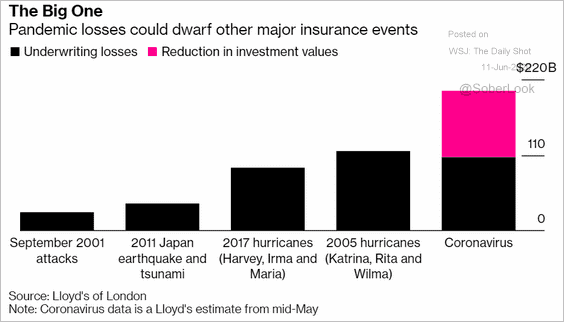

3. Insurance companies face substantial losses from the pandemic.

Source: @business Read full article

Source: @business Read full article

——————–

Food for Thought

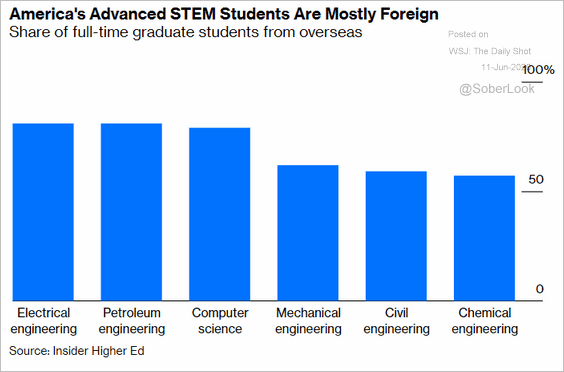

1. US STEM graduate students from overseas:

Source: @Noahpinion, @bopinion Read full article

Source: @Noahpinion, @bopinion Read full article

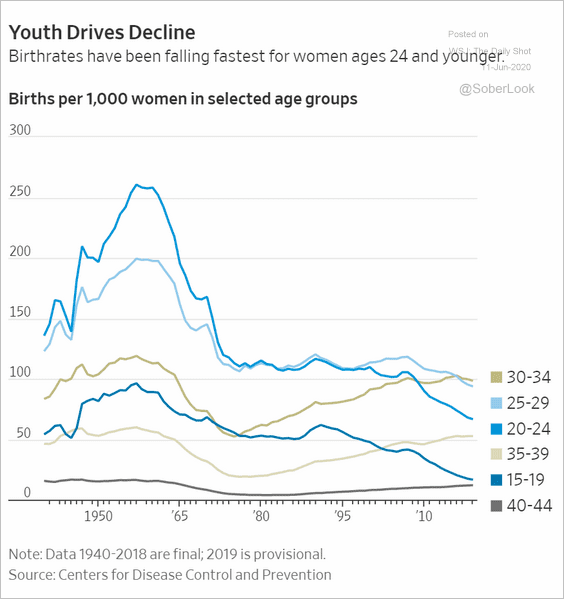

2. US birth rates by mother’s age:

Source: @WSJ Read full article

Source: @WSJ Read full article

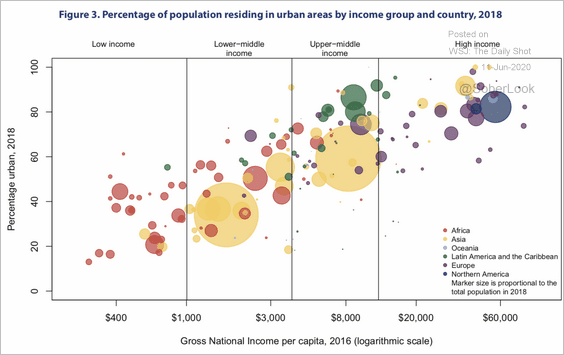

3. Urban population vs. GNP per capita:

Source: UN Read full article

Source: UN Read full article

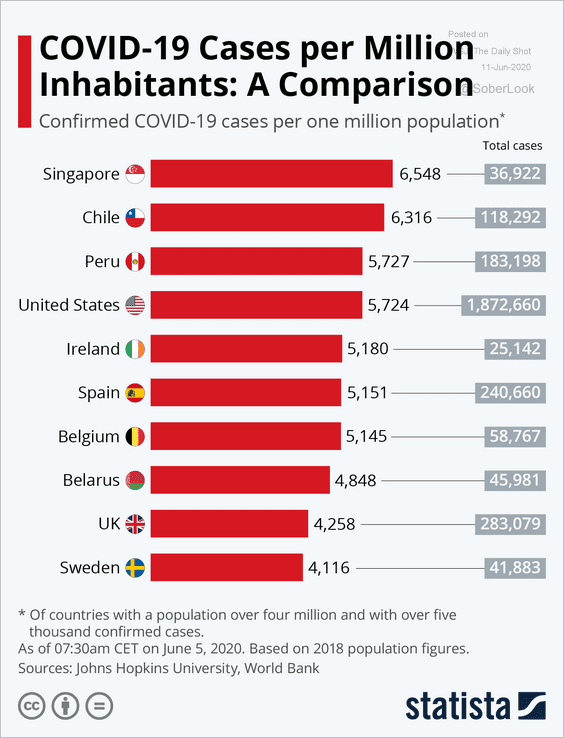

4. COVID-19 cases per million:

Source: Statista

Source: Statista

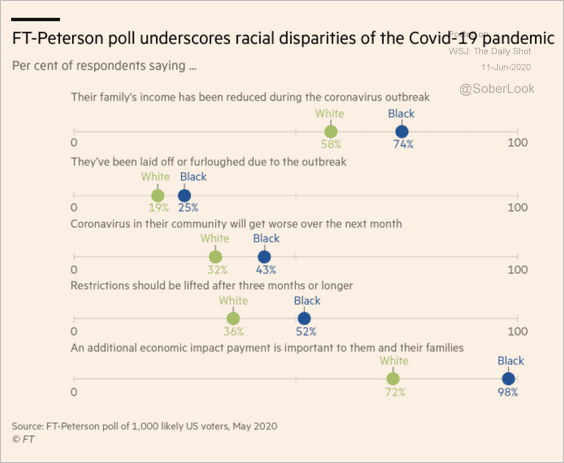

5. The economic impact on US households:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

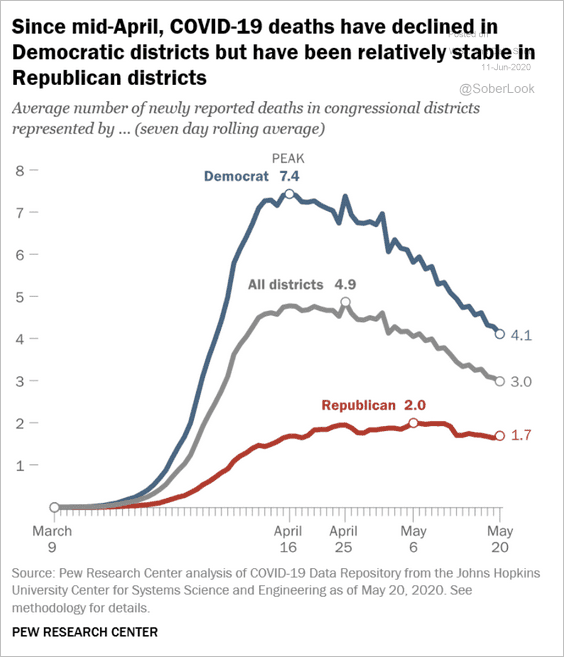

6. COVID-related deaths in red vs. blue districts:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

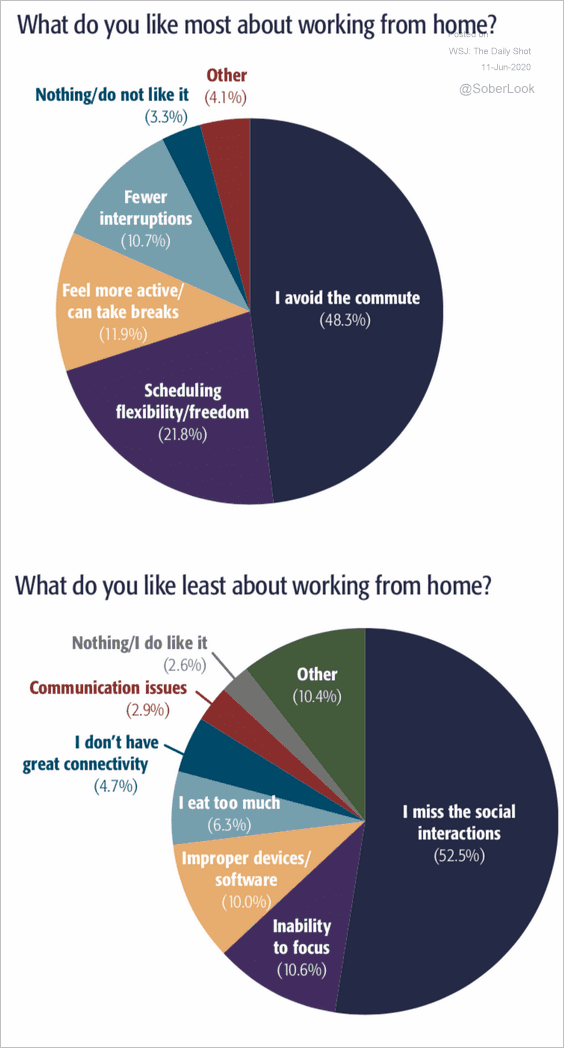

7. What do you like most/least about working from home?

Source: Pioneer Public

Source: Pioneer Public

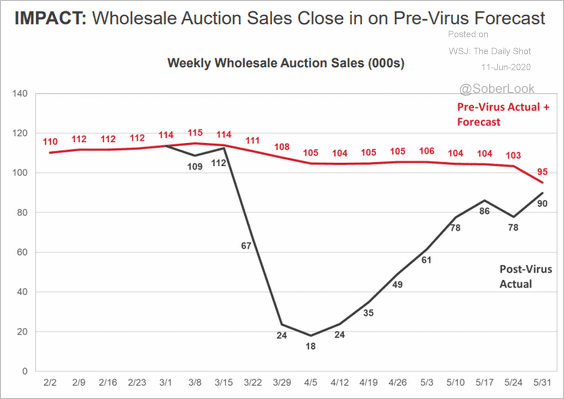

8. Wholesale used-car auctions in the US:

Source: J.D. Power

Source: J.D. Power

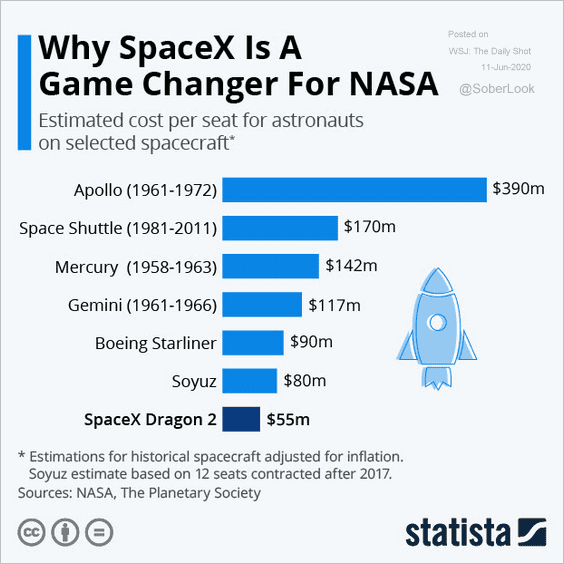

9. The cost of getting astronauts into space:

Source: Statista

Source: Statista

——————–