The Daily Shot: 15-Jun-20

• Equities

• Credit

• Energy

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• Europe

• The United Kingdom

• The United States

• Food for Thought

Equities

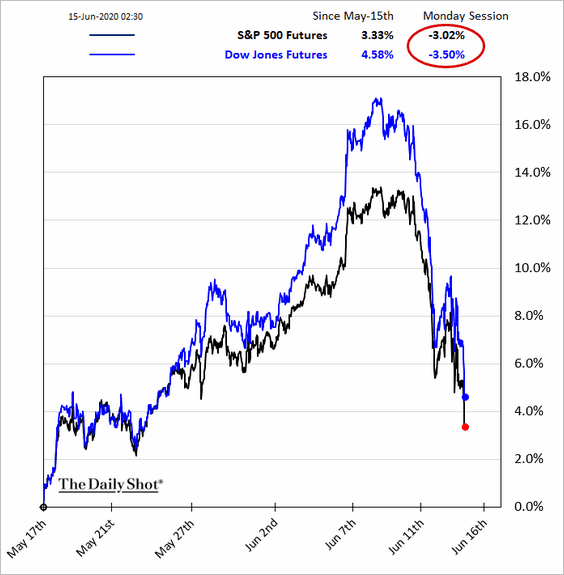

1. Stock futures are lower as risk-off sentiment returns.

One of the catalysts for the selloff is the latest jump in new COVID-19 cases in China.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

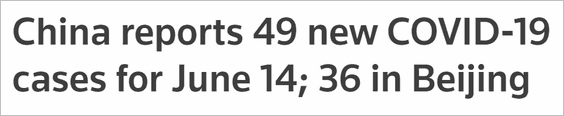

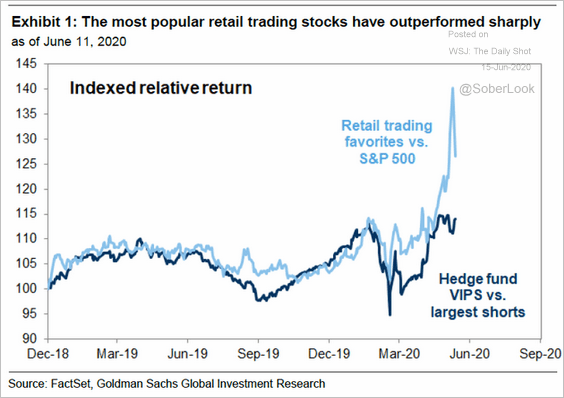

2. While it’s not clear how much of the recent rally was driven by retail investors/traders, their increased presence in the market has been signaling a spike in speculative fervor.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

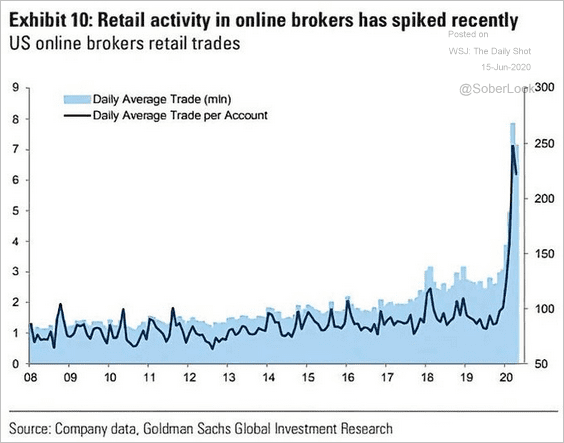

• US consumers, especially those under 40, have been unusually bullish.

Source: NY Fed

Source: NY Fed

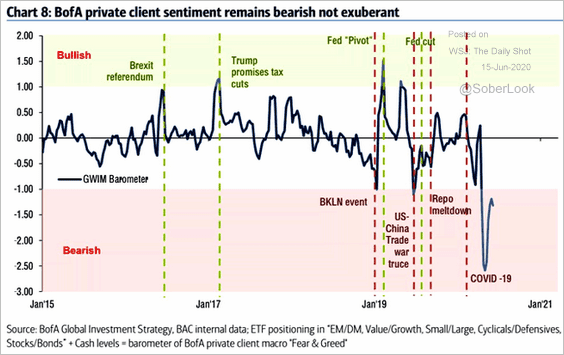

By the way, Bank of America’s private clients (wealthier investors) have not shown the same level of enthusiasm for stocks.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

• Shares of companies popular with individual investors have outperformed.

Source: @tracyalloway

Source: @tracyalloway

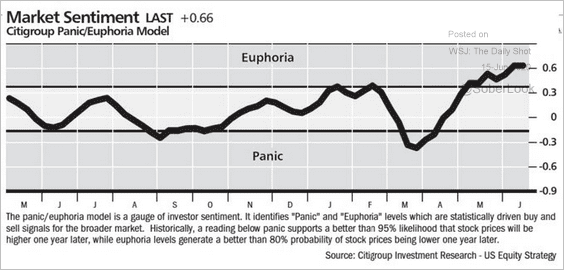

• Citigroup’s market sentiment index has been in “euphoria” mode in recent weeks.

Source: Citi, @jessefelder, @barronsonline

Source: Citi, @jessefelder, @barronsonline

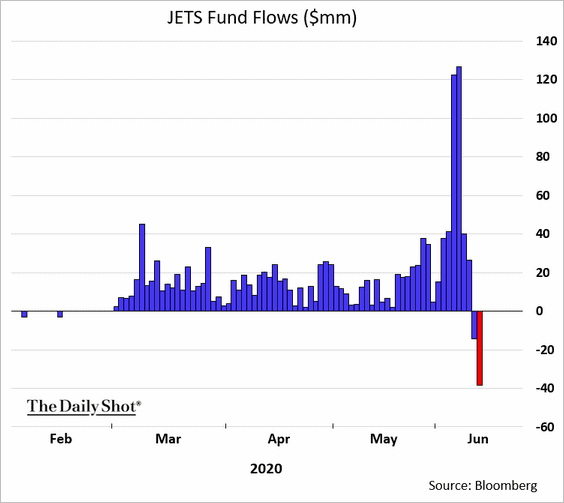

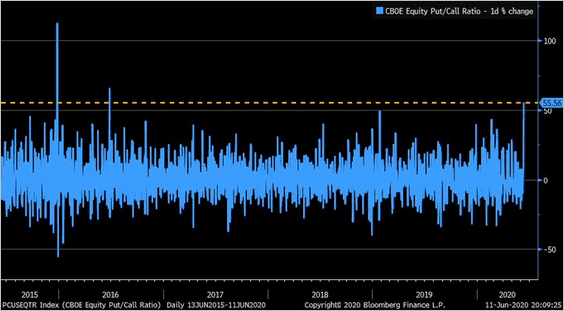

3. But speculative sentiment started to shift after the selloff last week.

• JETS ETF flows (airline stocks):

h/t Katherine Greifeld

h/t Katherine Greifeld

• Jump in the put/call ratio:

Source: @LizAnnSonders, @bloomberg

Source: @LizAnnSonders, @bloomberg

——————–

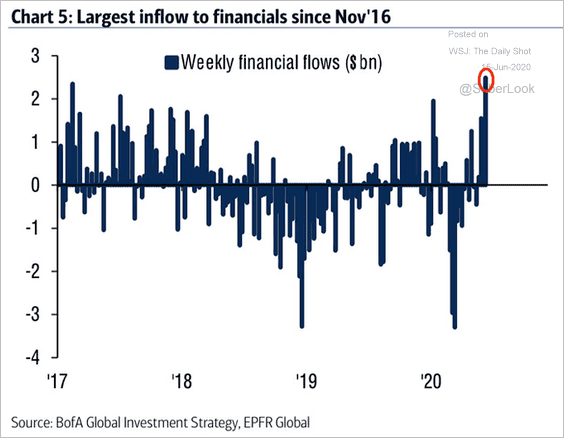

4. Financial-sector ETFs registered significant inflows.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

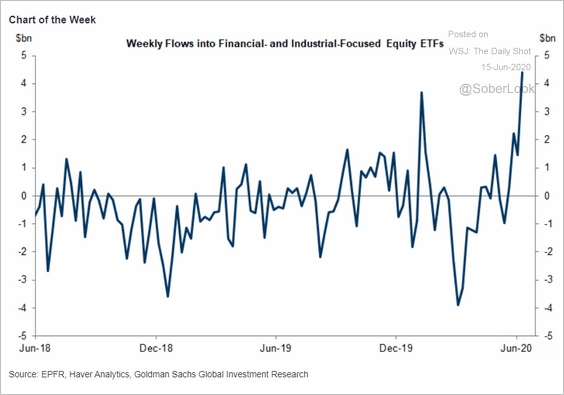

This chart combines financial and industrial ETF flows.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

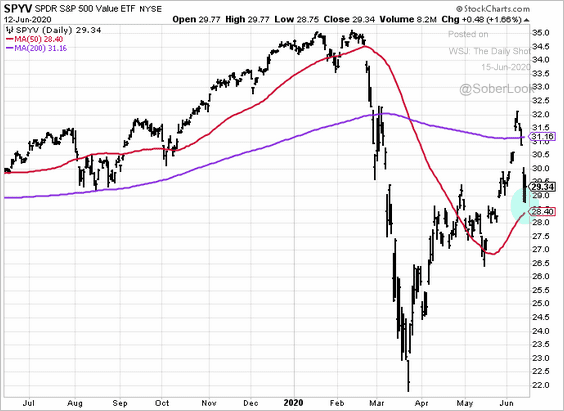

5. Value stocks are about to test support.

h/t Adam Haigh

h/t Adam Haigh

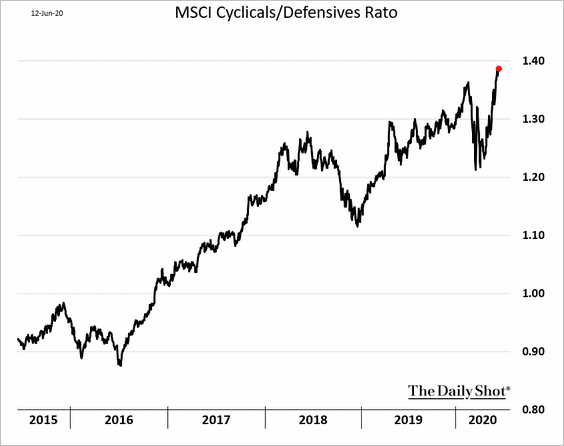

6. Cyclicals continue to outperform defensive sectors.

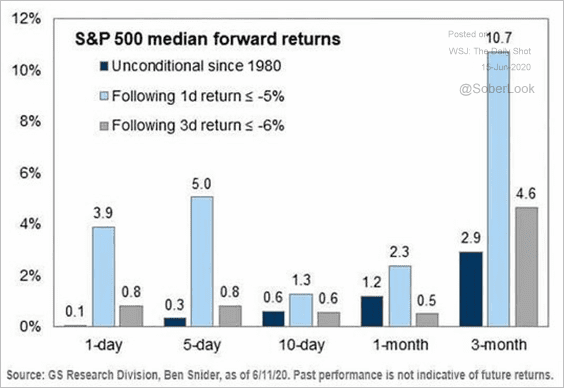

7. How does the S&P 500 perform following 5% and 6% declines?

Source: Goldman Sachs, @ISABELNET_SA

Source: Goldman Sachs, @ISABELNET_SA

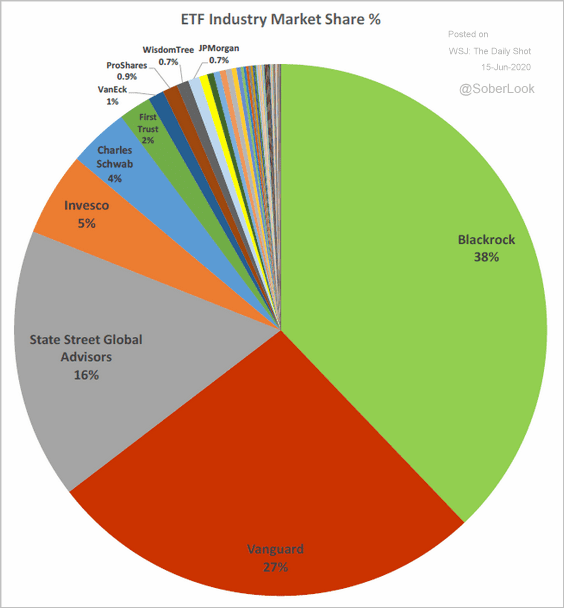

8. Finally, here is the breakdown of the ETF industry.

Source: @NateGeraci

Source: @NateGeraci

Credit

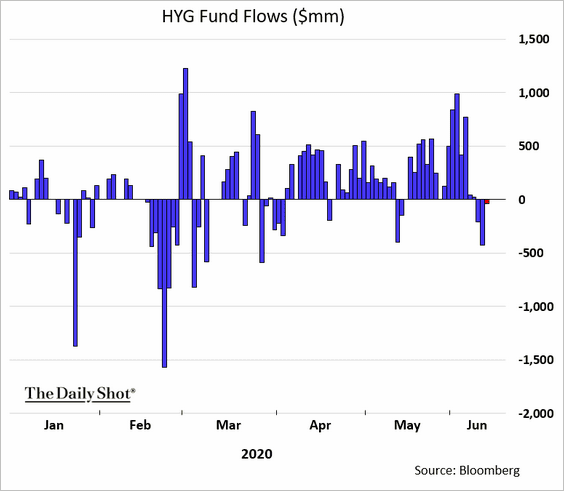

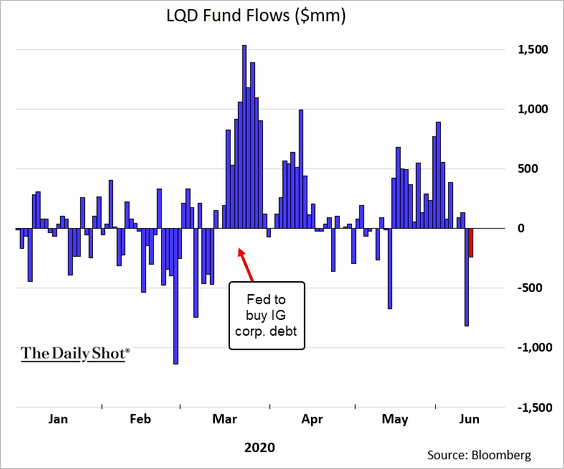

1. Corporate credit ETFs saw some outflows in recent days.

• High yield:

• Investment grade:

h/t Claire Ballentine

h/t Claire Ballentine

——————–

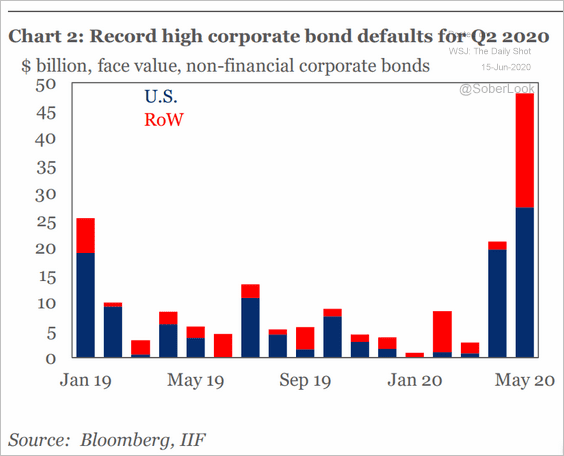

2. Corporate defaults have risen sharply.

Source: IIF

Source: IIF

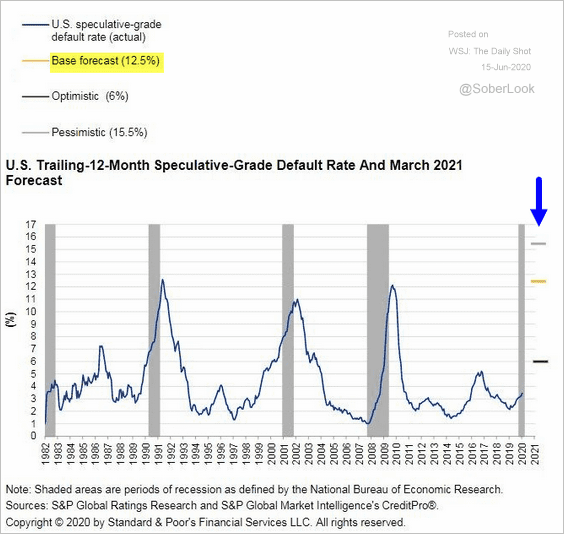

How high will the leveraged finance default rate get over the next three quarters?

Source: @lcdnews Read full article

Source: @lcdnews Read full article

——————–

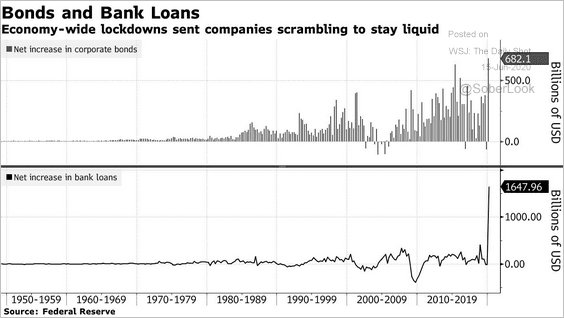

3. Corporate bond and loan financing spiked in the first quarter.

Source: @markets Read full article

Source: @markets Read full article

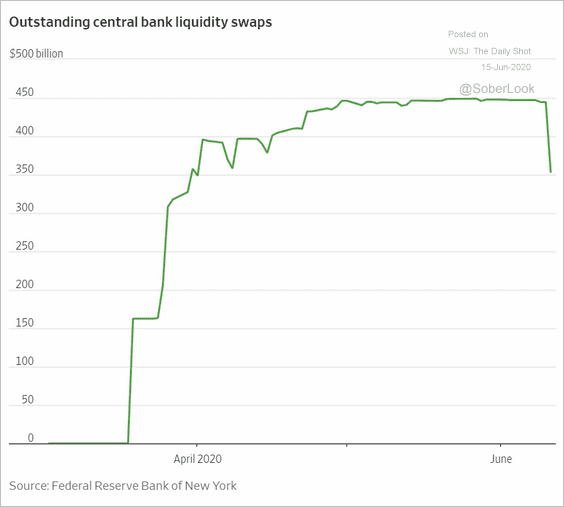

4. The Fed’s liquidity swaps with other central banks are off the highs.

Source: @WSJ Read full article

Source: @WSJ Read full article

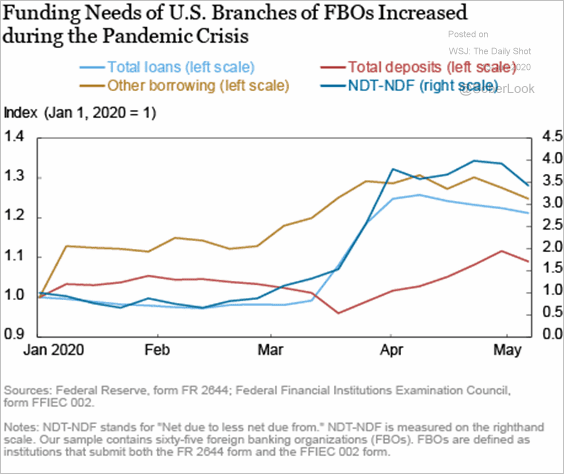

This program helped US branches of foreign banks access US dollars when liquidity tightened in March.

Source: Liberty Street Economics Read full article

Source: Liberty Street Economics Read full article

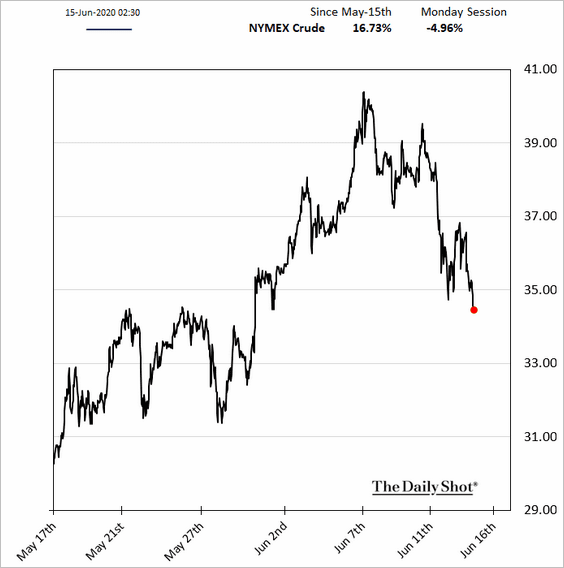

Energy

1. US crude oil futures are back below $35/bbl as risk aversion returns.

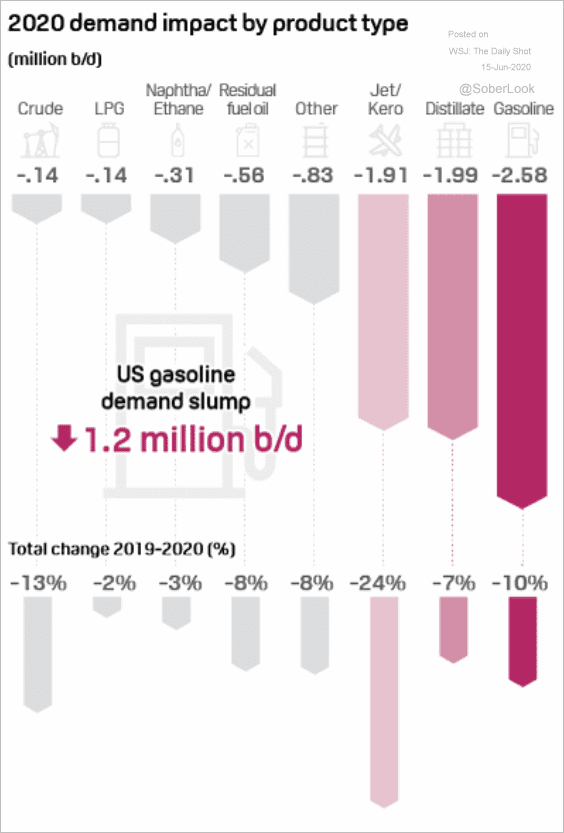

2. This chart shows the 2020 demand impact by product.

Source: S&P Global Market Intelligence, {ht} Morning Consult

Source: S&P Global Market Intelligence, {ht} Morning Consult

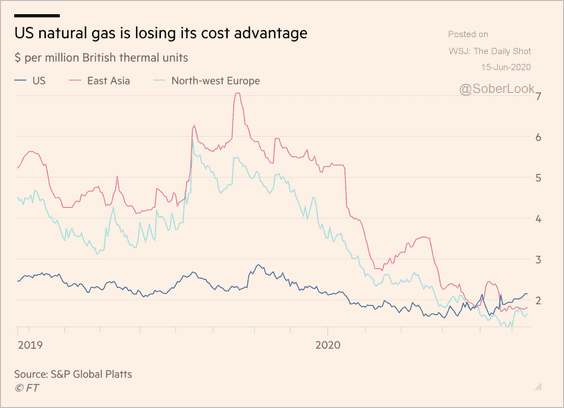

3. US natural gas cost advantage is gone.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

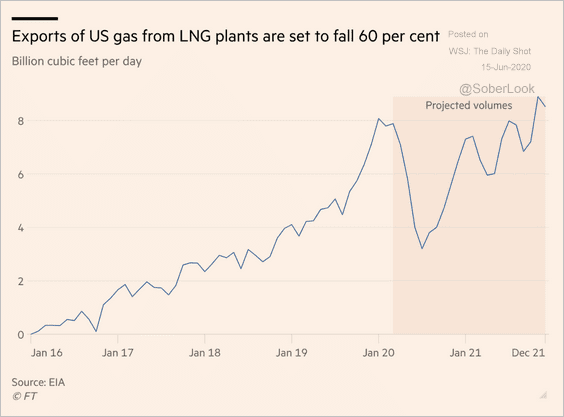

US LNG exports are expected to drop substantially this year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

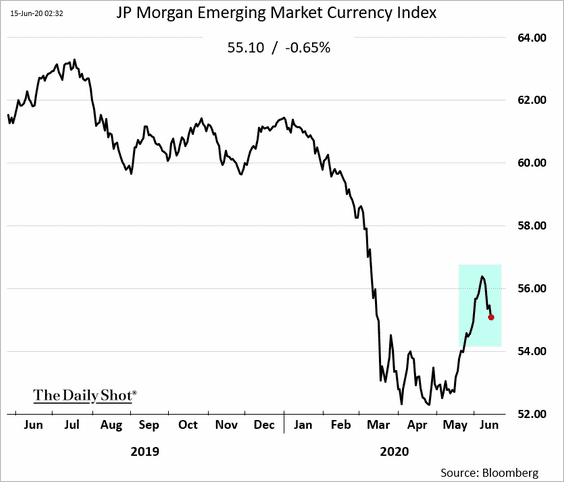

Emerging Markets

1. The rebound in EM currencies is fading.

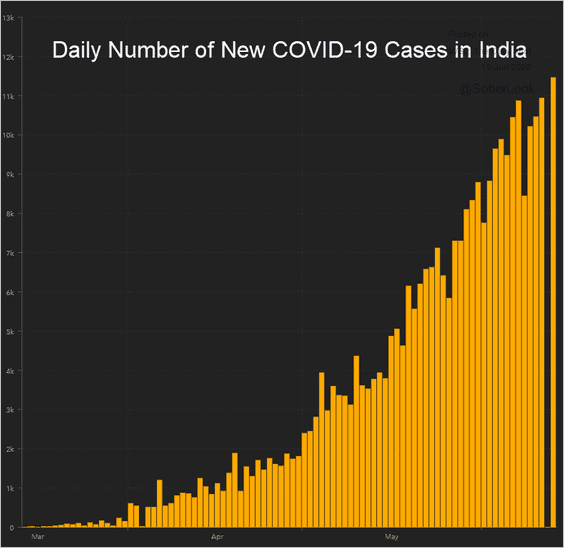

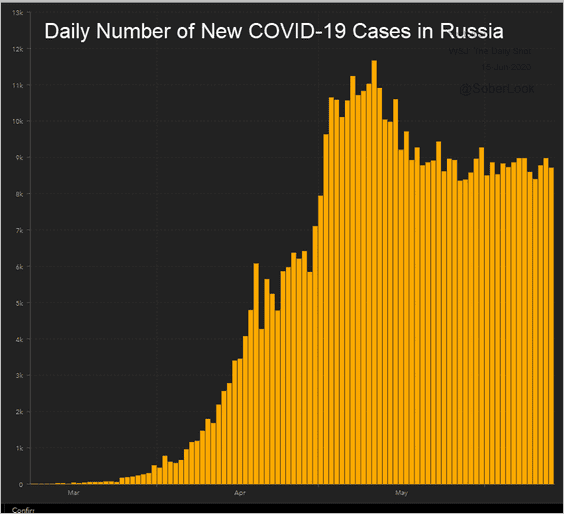

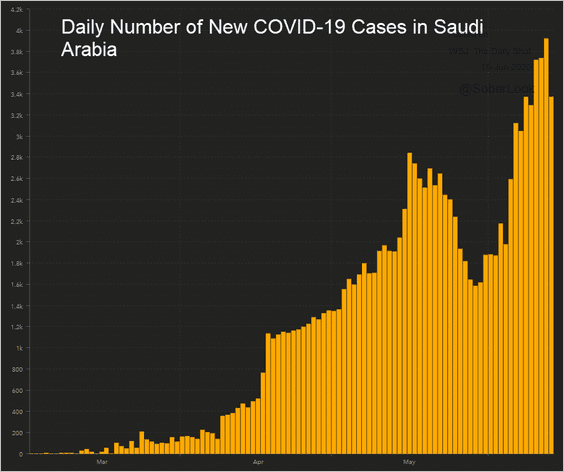

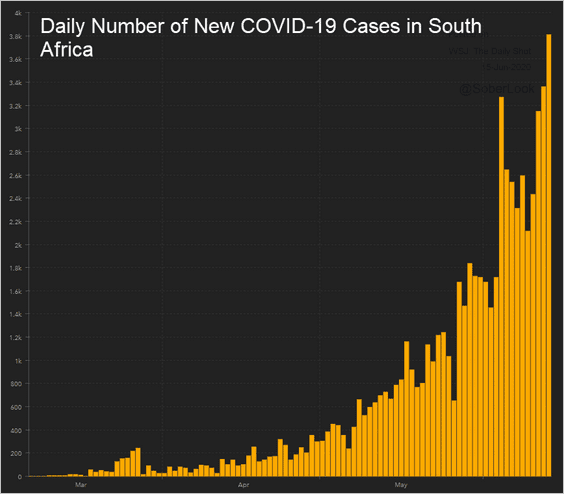

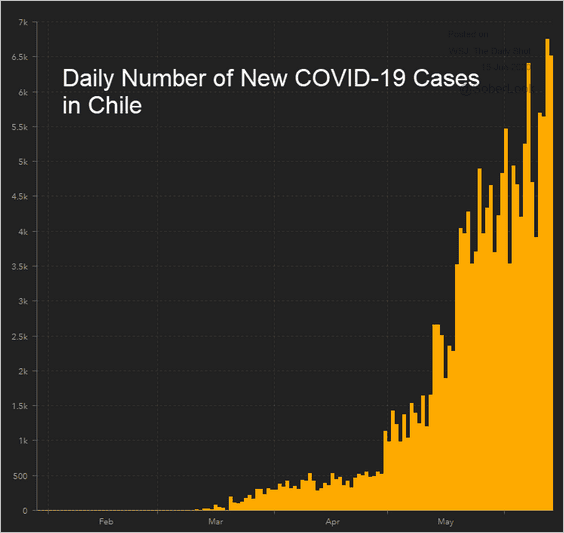

2. Many developing countries continue to struggle in their efforts to get the pandemic under control. The charts below show the number of new cases reported each day.

• India:

Source: Source: JHU CSSE

Source: Source: JHU CSSE

• Russia:

Source: Reuters Read full article

Source: Reuters Read full article

Source: Source: JHU CSSE

Source: Source: JHU CSSE

• Saudi Arabia:

Source: Source: JHU CSSE

Source: Source: JHU CSSE

• South Africa:

• Chile:

Source: The New York Times Read full article

Source: The New York Times Read full article

Source: Source: JHU CSSE

Source: Source: JHU CSSE

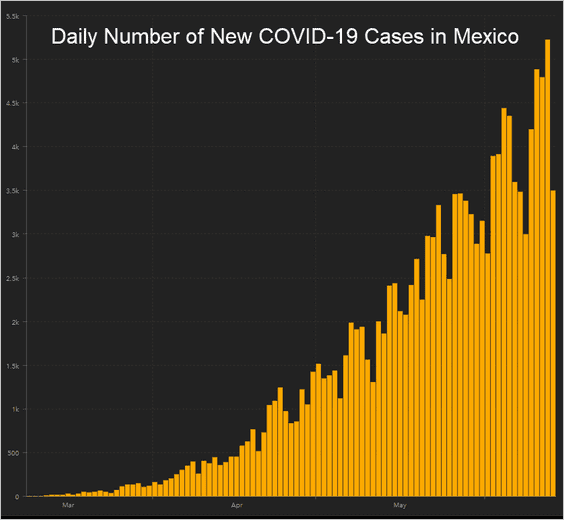

• Mexico:

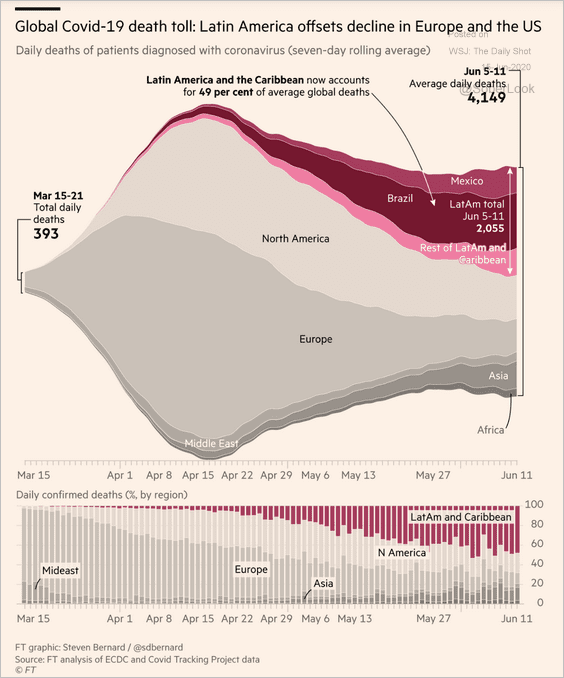

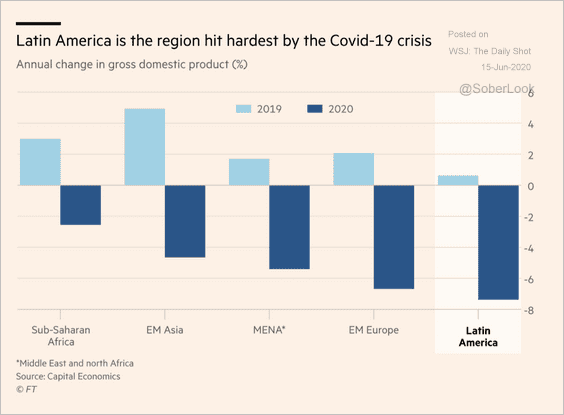

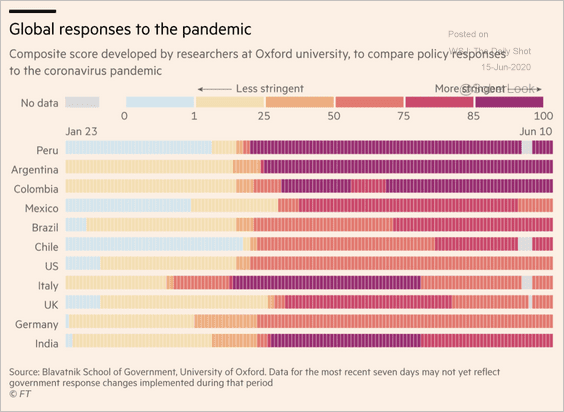

Latin America has been hit particularly hard (3 charts).

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

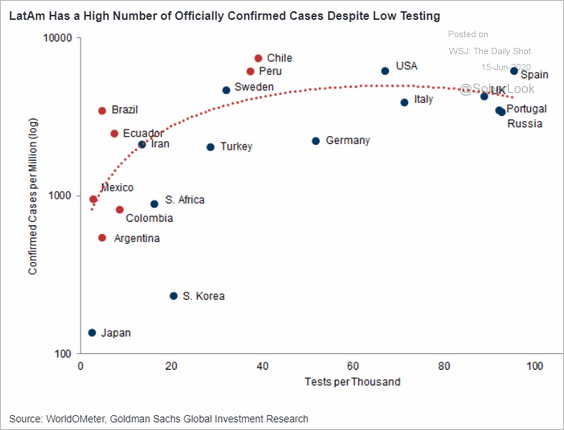

The number of cases in LatAm nations is elevated despite low testing rates.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

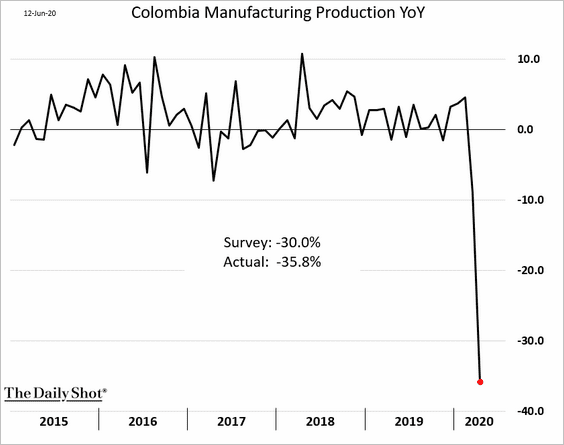

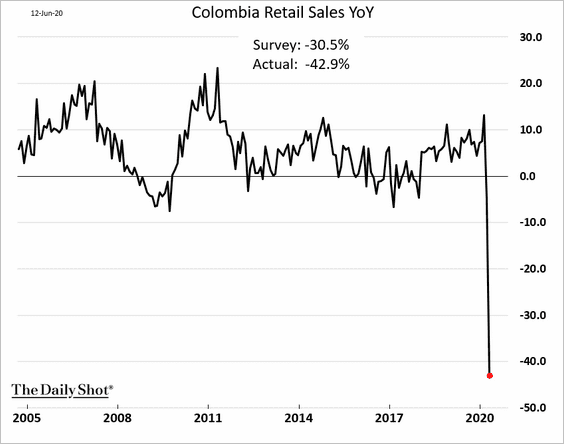

3. Colombia’s economy tanked in April.

• Manufacturing output:

• Retail sales:

——————–

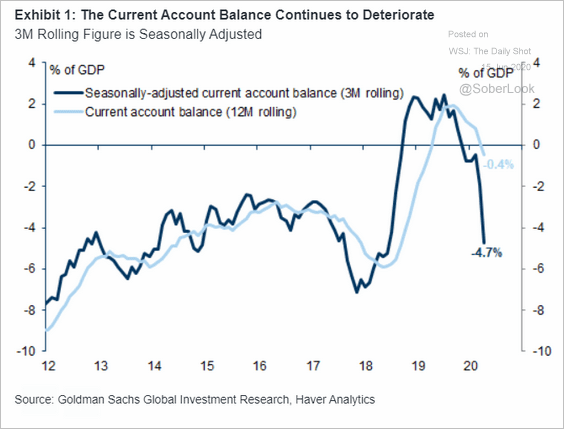

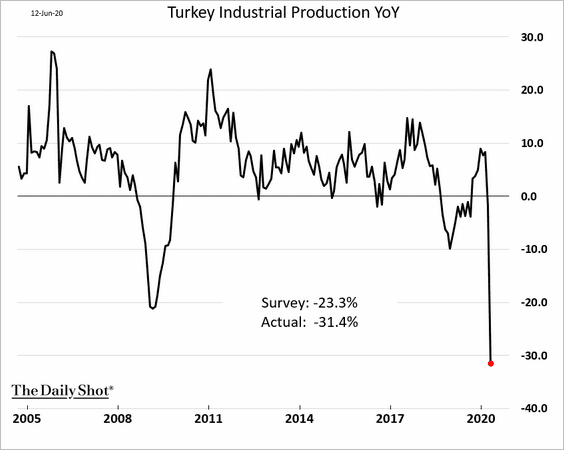

4. Here are a couple of updates on Turkey.

• Current account:

Source: Goldman Sachs

Source: Goldman Sachs

• Industrial production (through April):

——————–

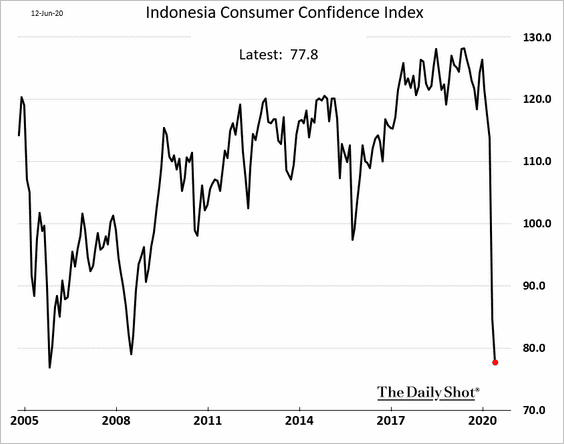

5. Indonesia’s consumer confidence declined further in May.

China

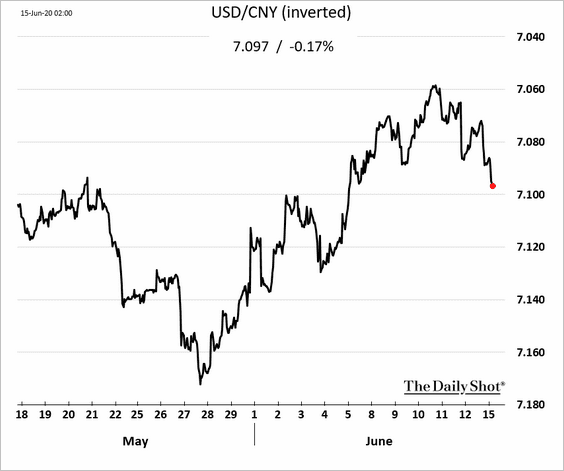

1. The renminbi is rolling over.

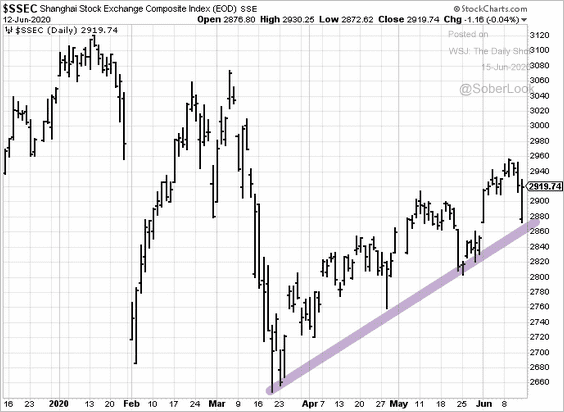

2. The stock market is at support.

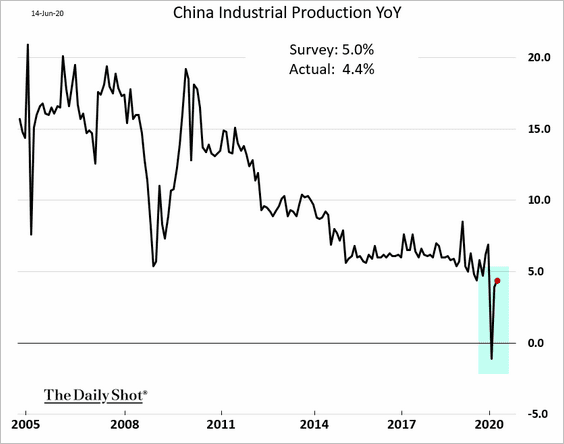

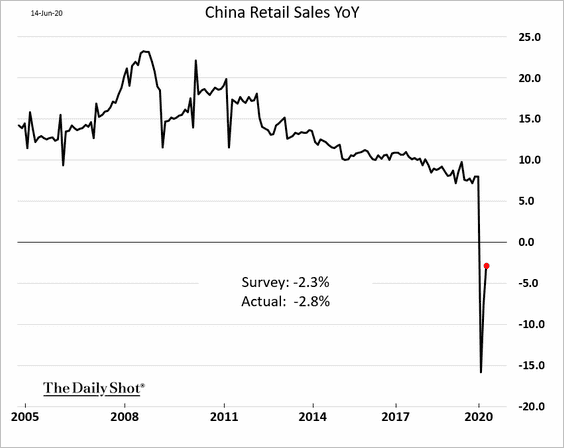

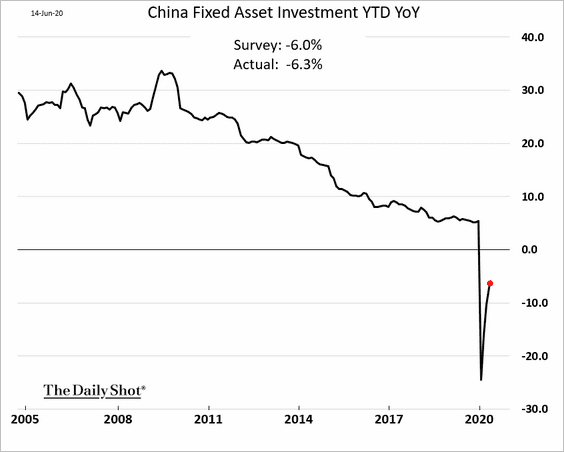

3. May economic data showed further improvement, although the report was a bit below economists’ forecasts.

• Industrial production:

• Retail sales:

• Fixed asset investment:

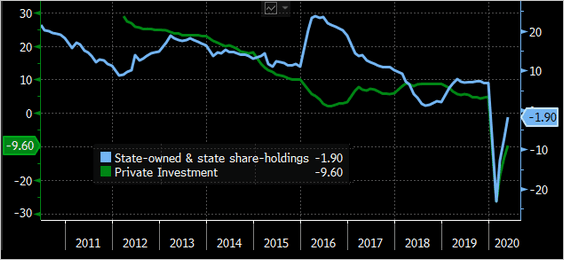

State vs. private investment:

Source: @TheTerminal

Source: @TheTerminal

——————–

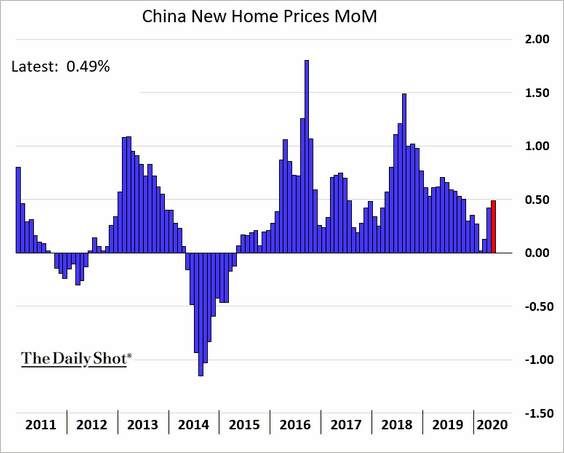

4. Home prices continue to climb.

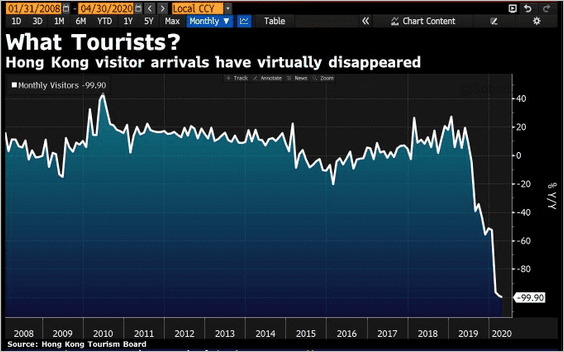

5. Nobody is traveling to Hong Kong these days.

Source: @DavidInglesTV

Source: @DavidInglesTV

Asia – Pacific

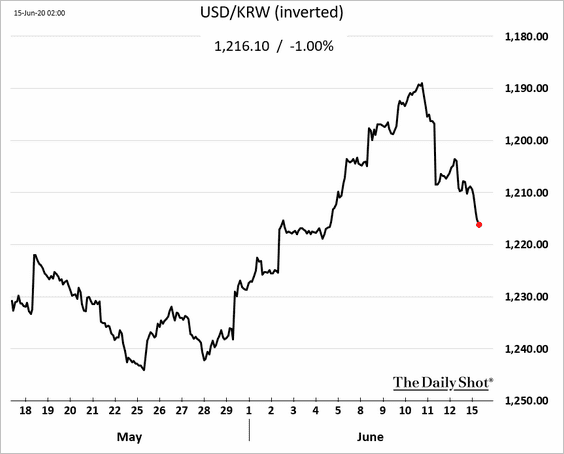

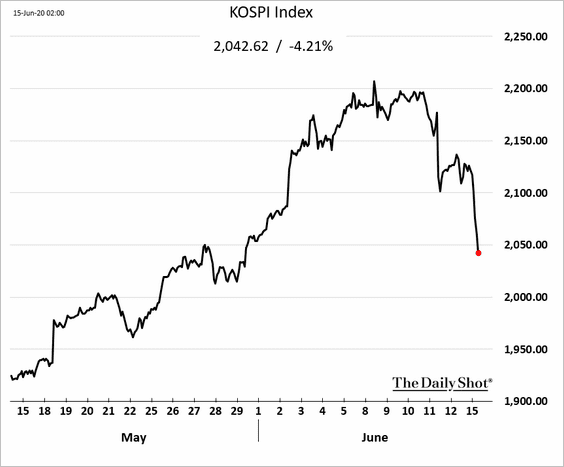

1. South Korea’s market is under pressure as the number of infections in China jumps.

• The won:

• The stock market:

——————–

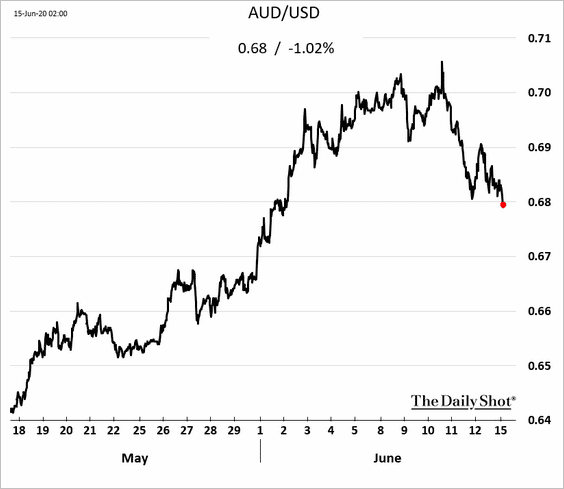

2. The Aussie dollar is also rolling over.

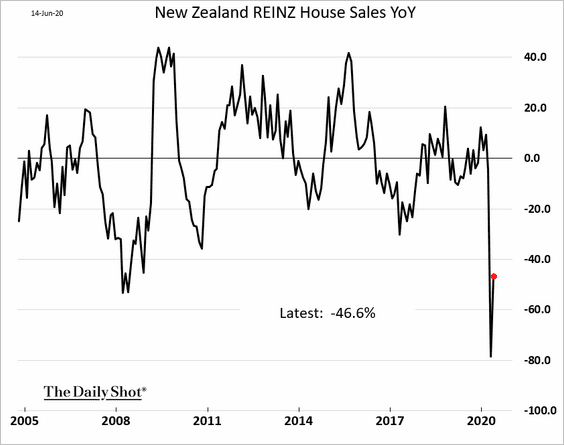

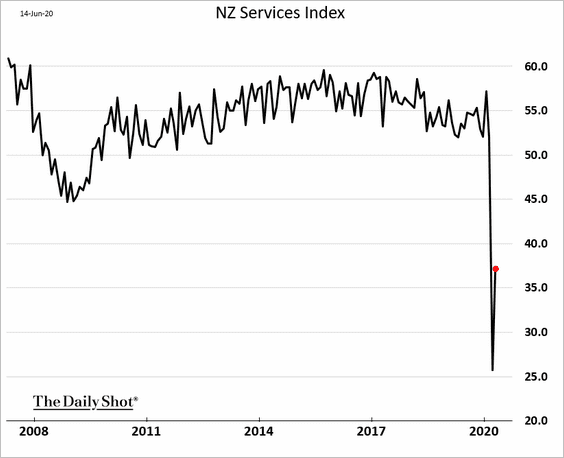

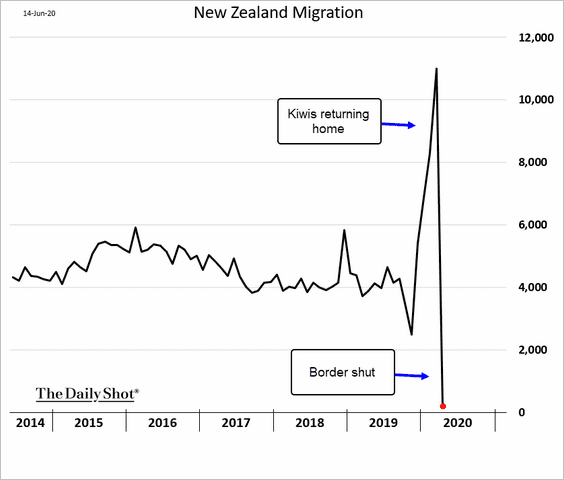

3. Next, we have some updates on New Zealand.

• Home sales:

• Service sector activity:

• Migration:

The Eurozone

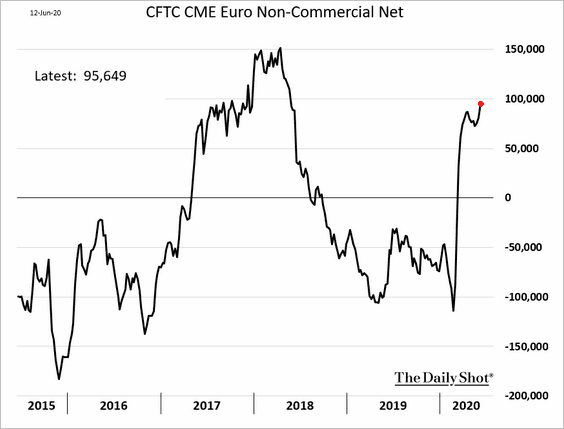

1. Traders are boosting their bets on the euro.

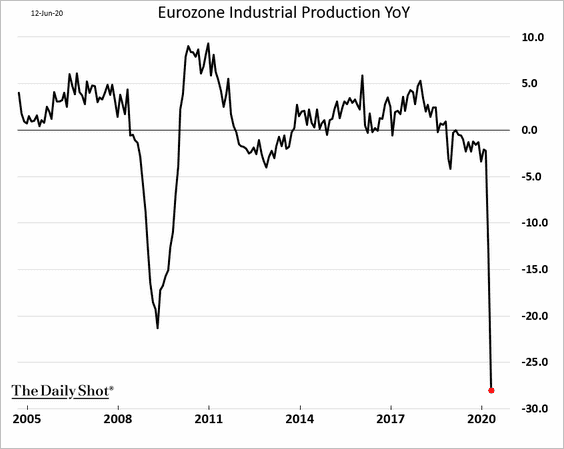

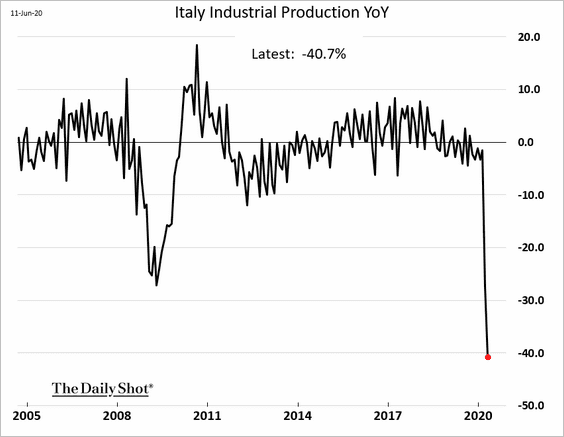

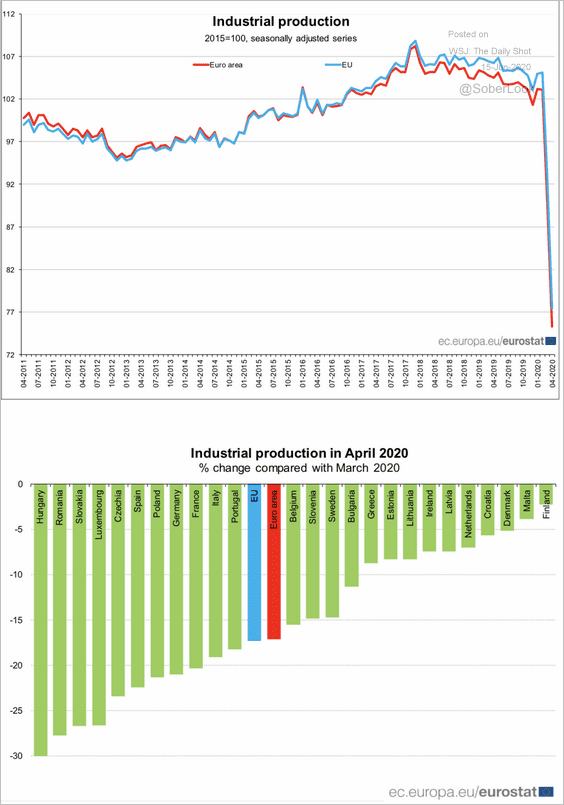

2. Industrial production crashed in April.

——————–

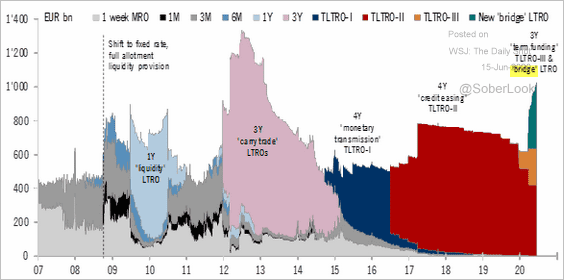

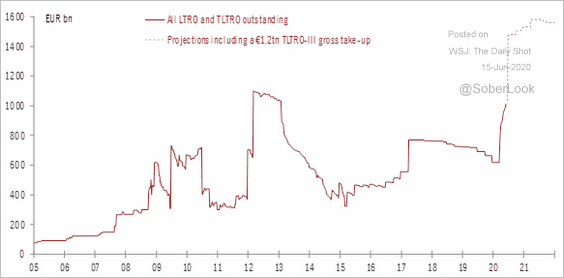

3. Analysts will be closely monitoring demand for the new low-cost TLTRO tranche to see how much additional liquidity the ECB’s program will generate. Here is a comment from Frederik Ducrozet, Pictet Wealth Management.

… the ECB has run weekly LTROs since mid-March as bridge funding into the June TLTRO-III, with a total rising to €389bn this week. This amount will also mature on 24 June.

To recap, the current total amount of (T)LTRO liquidity of €1,023bn will be reduced to €263bn before the TLTRO-III.4 kicks in (1023 – 214 – 157 – 389 = 263).

As a result, the June TLTRO-III gross take-up to be announced next Thursday needs to be €750bn, or larger, for total liquidity not to shrink.

Source: @fwred

Source: @fwred

Source: @fwred

Source: @fwred

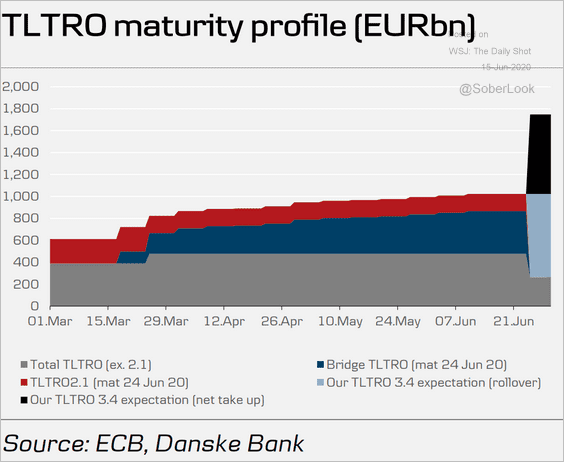

Here is the TLTRO maturity profile.

Source: Danske Bank

Source: Danske Bank

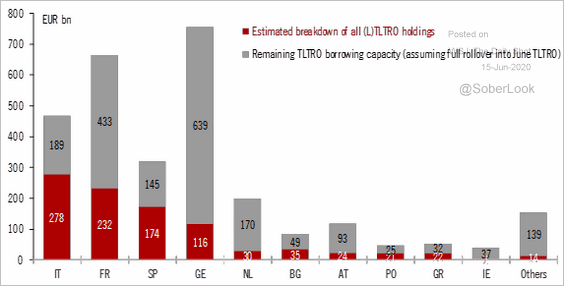

This chart shows the remaining TLTRO capacity by country.

Source: @fwred

Source: @fwred

——————–

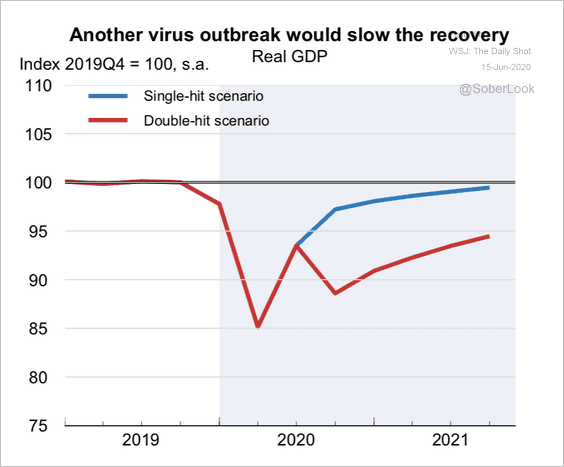

4. A second wave of the pandemic would be devastating for Europe.

Source: OECD

Source: OECD

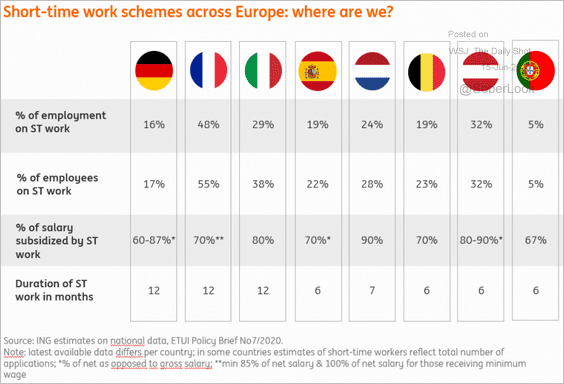

5. This table provides a summary of short-time work programs in Europe.

Source: ING

Source: ING

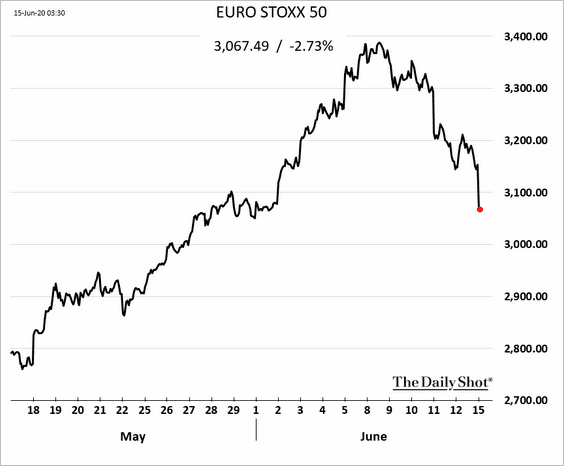

Europe

1. The stock market is under pressure as risk aversion resurfaces.

2. Here is a summary of the April crash in industrial production in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

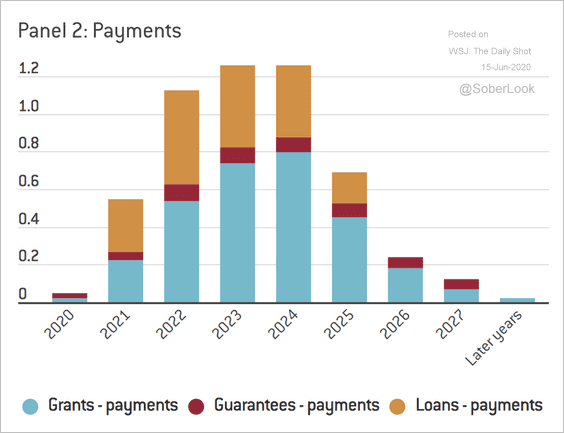

3. This chart gives the profile of the EU stimulus payments.

Source: Bruegel Read full article

Source: Bruegel Read full article

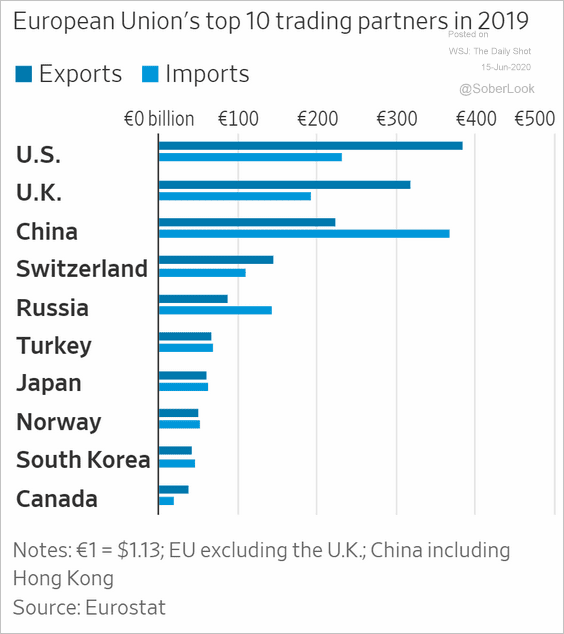

4. Who are the EU’s biggest trading partners?

Source: @WSJ Read full article

Source: @WSJ Read full article

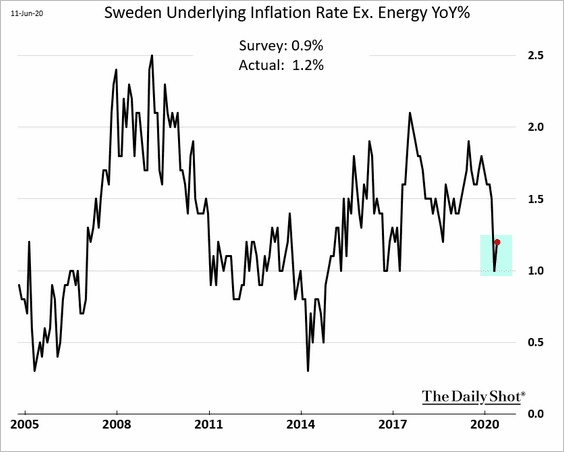

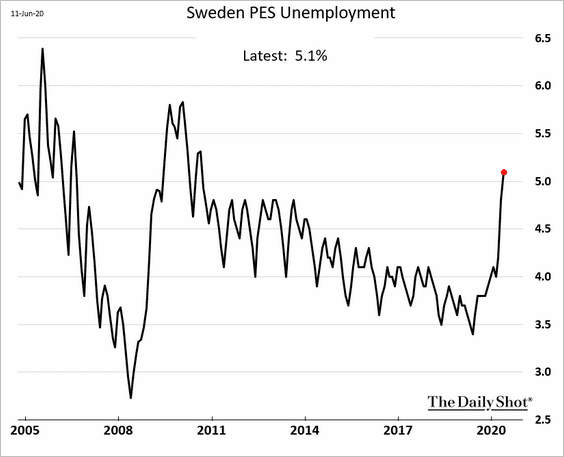

5. Finally, we have a couple of updates on Sweden.

• Core CPI:

• Unemployment (through May):

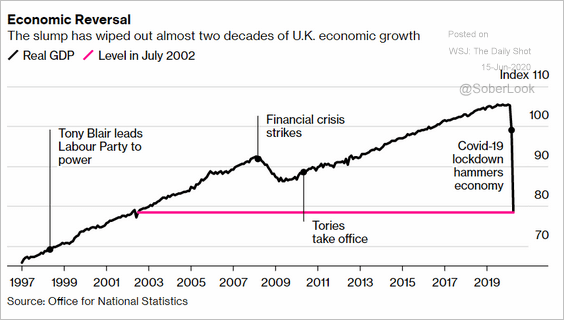

The United Kingdom

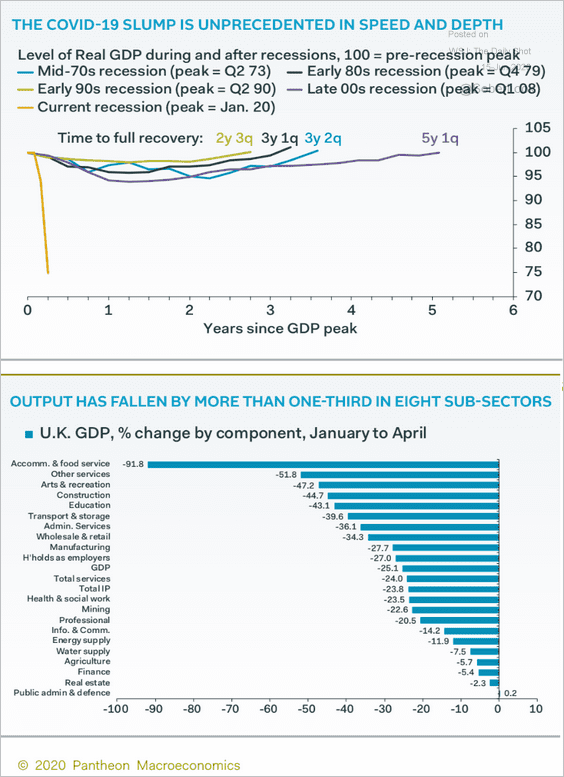

1. The April GDP contraction was unprecedented.

Source: @markets Read full article

Source: @markets Read full article

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

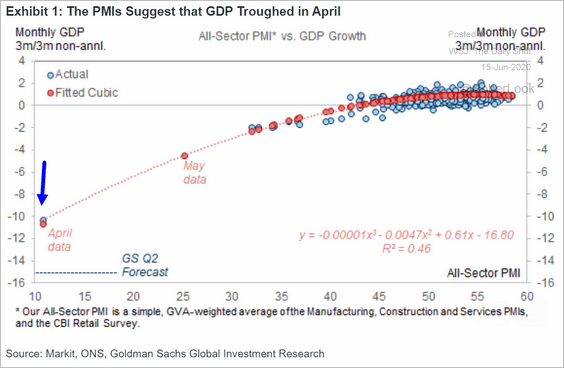

The PMI (business activity) has been an excellent predictor of the GDP.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

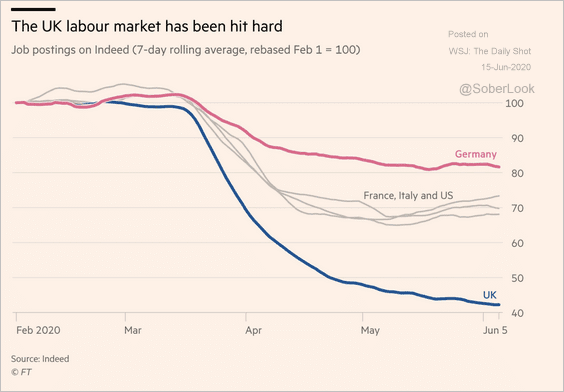

3. The UK labor market has been impacted more than other developed economies.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

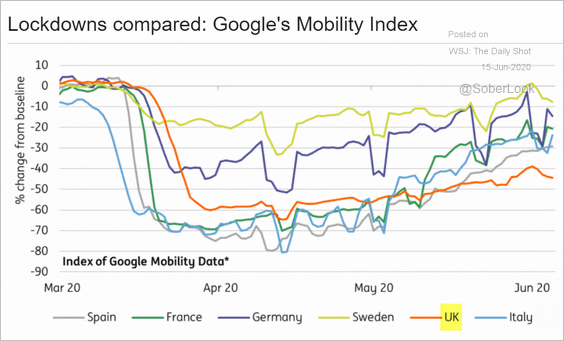

4. The UK mobility (driving) trend lags other countries.

Source: ING

Source: ING

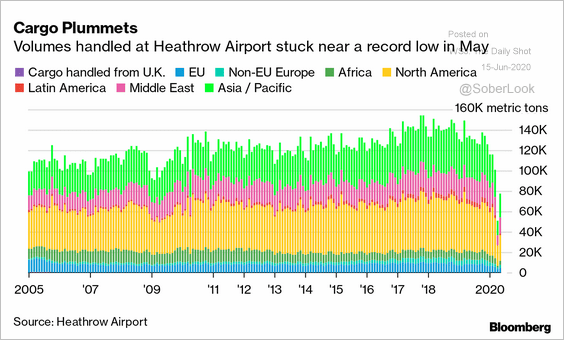

5. Cargo volumes plummetted, and the recovery remains tepid.

Source: @business Read full article

Source: @business Read full article

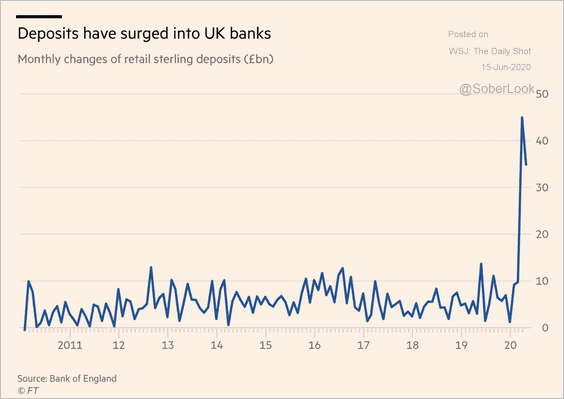

6. Bank deposits have risen sharply.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

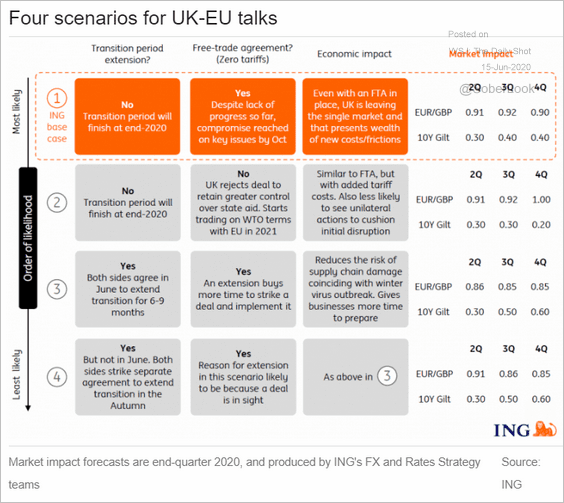

7. Here are some potential scenarios (and market impacts) for the UK-EU trade negotiations (from ING).

Source: ING

Source: ING

The United States

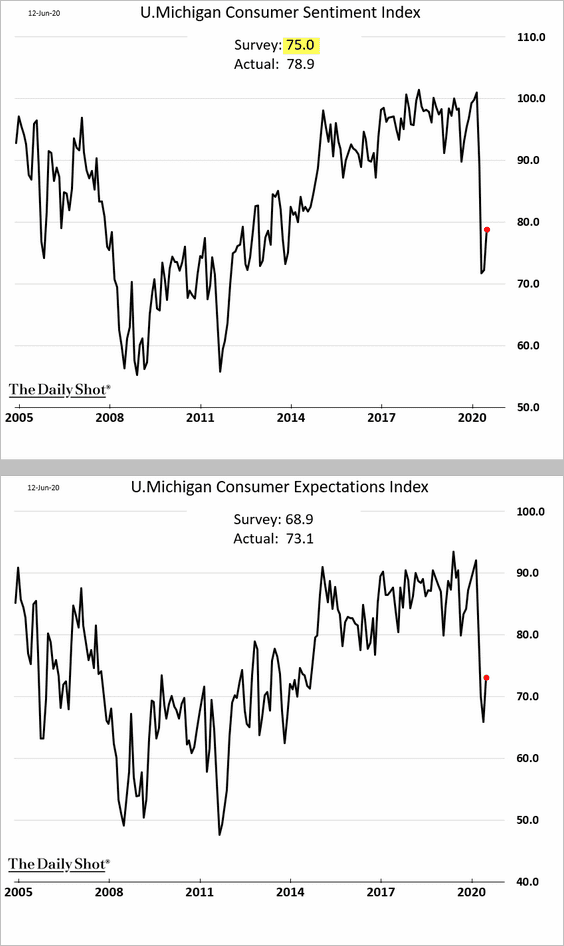

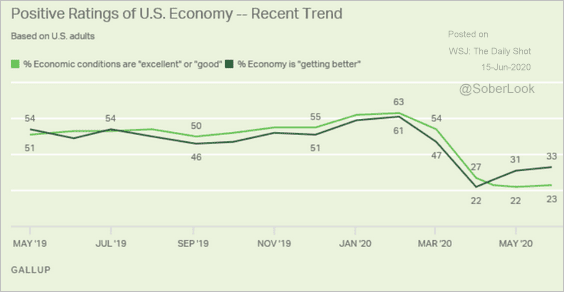

1. Consumer sentiment improved again in June, according to the U. Michigan survey.

Economic confidence is still depressed.

Source: Gallup Read full article

Source: Gallup Read full article

——————–

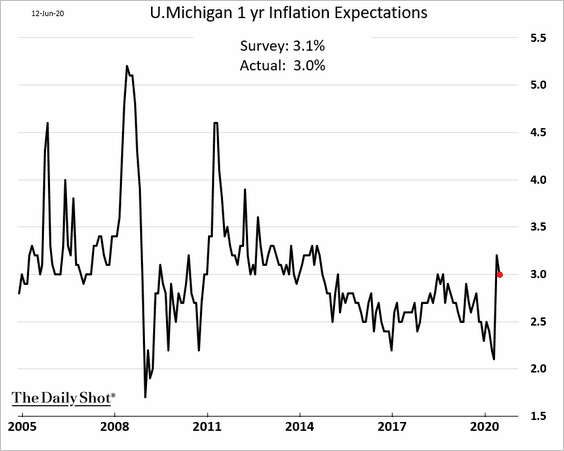

2. Households’ inflation expectations remain elevated.

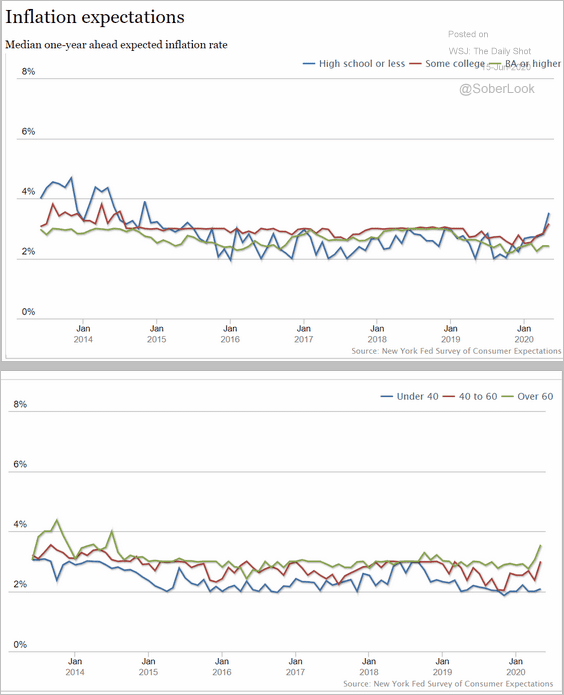

Here is a separate survey on inflation expectations from the NY Fed.

• By education and age:

Source: NY Fed

Source: NY Fed

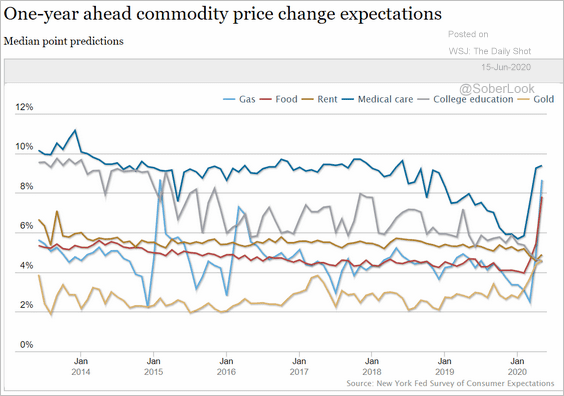

• By sector:

Source: NY Fed

Source: NY Fed

——————–

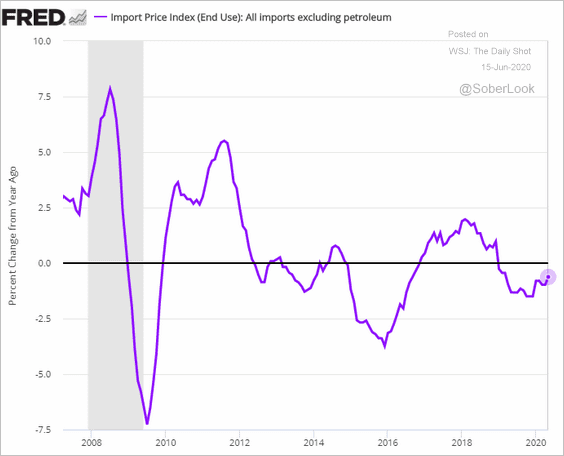

3. Import prices have stabilized.

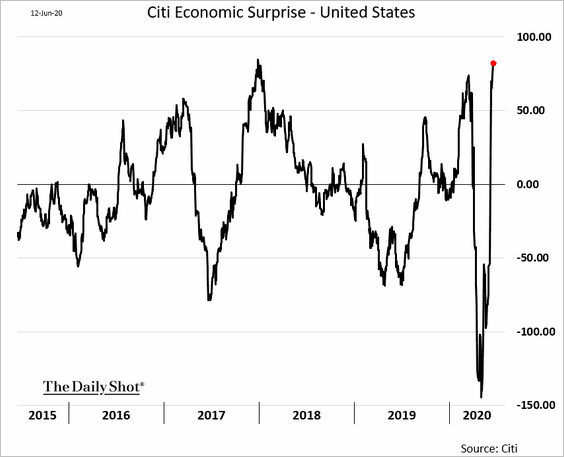

4. The Citi Economic Surprise Index continues to climb.

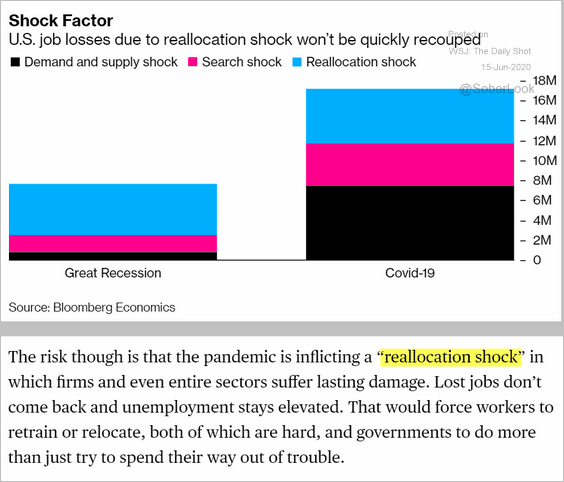

5. The labor market may have suffered significant structural damage.

Source: @business Read full article

Source: @business Read full article

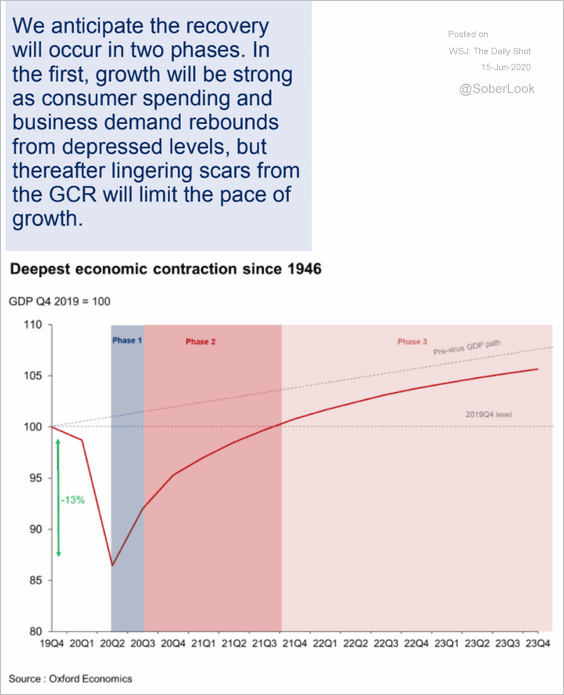

6. The initial sharp rebound in economic activity will give way to weak growth over the next few years, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

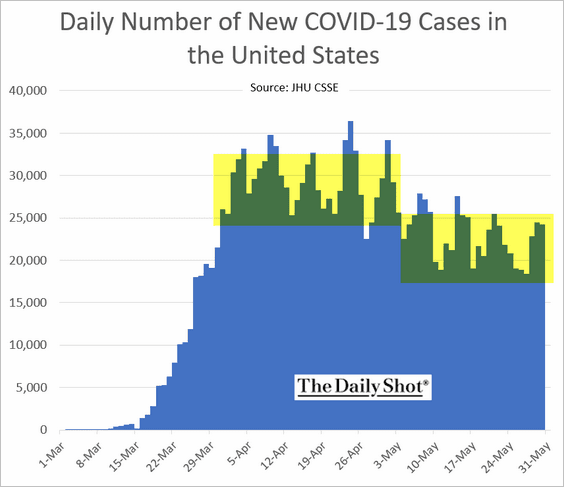

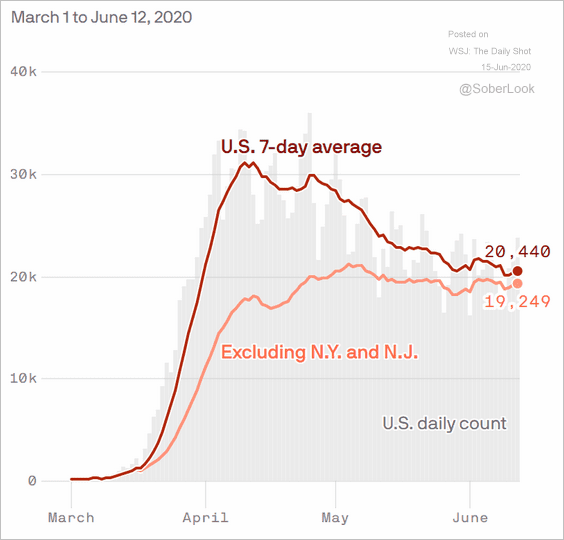

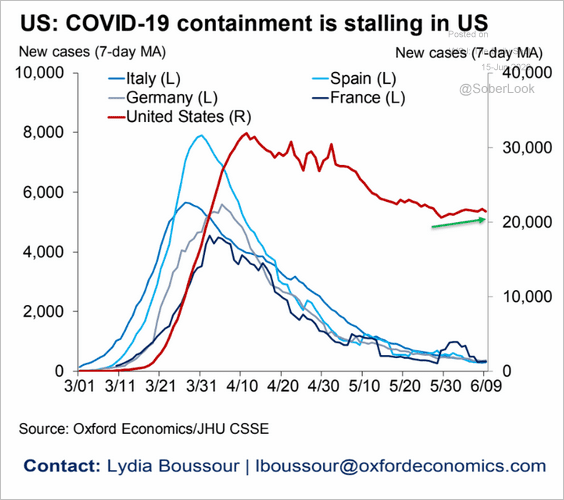

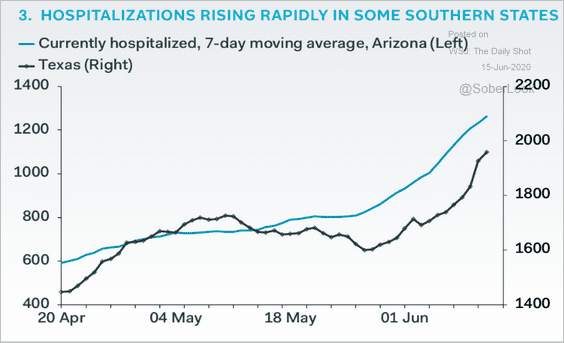

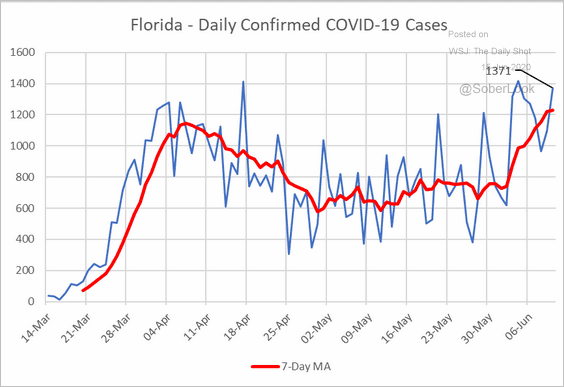

7. The US continues to make advances in battling the pandemic. But progress has been painfully slow, and significant challenges remain.

• New daily cases:

• Excluding NY and NJ:

Source: @axios Read full article

Source: @axios Read full article

• The US vs. other developed economies:

Source: Oxford Economics

Source: Oxford Economics

• State-level data:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: @MrMBrown

Source: @MrMBrown

——————–

Food for Thought

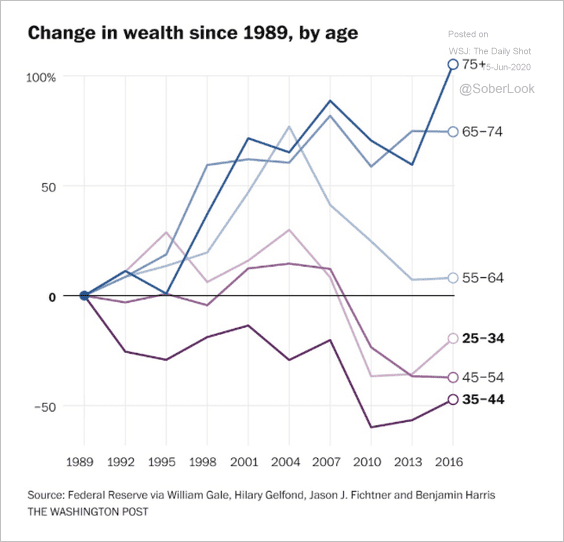

1. Changes in wealth by generation:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

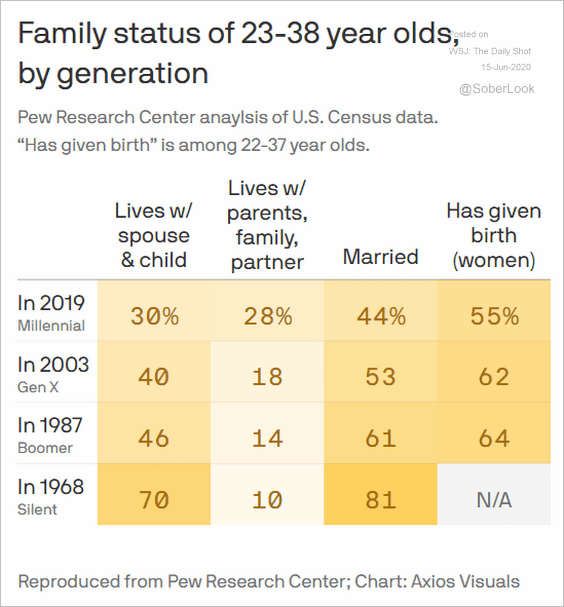

2. Family status of 23-38 year-olds, by generation:

Source: @axios Read full article

Source: @axios Read full article

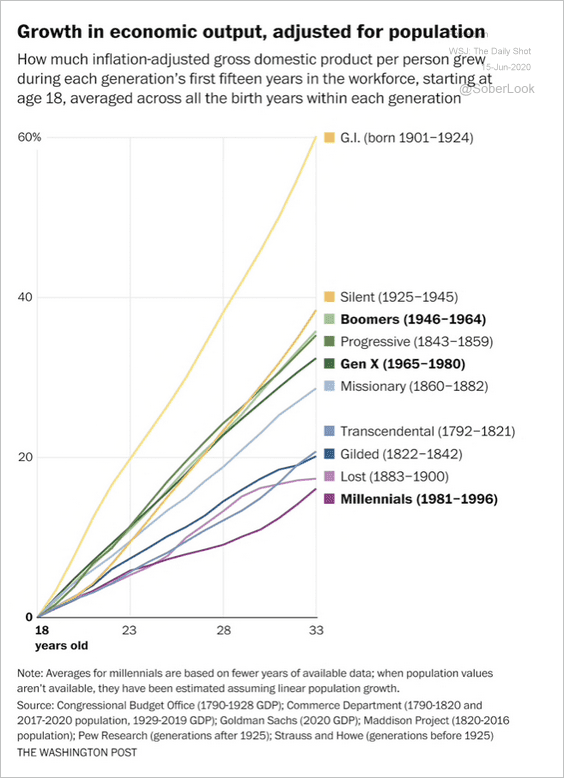

3. Economic output by generation:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

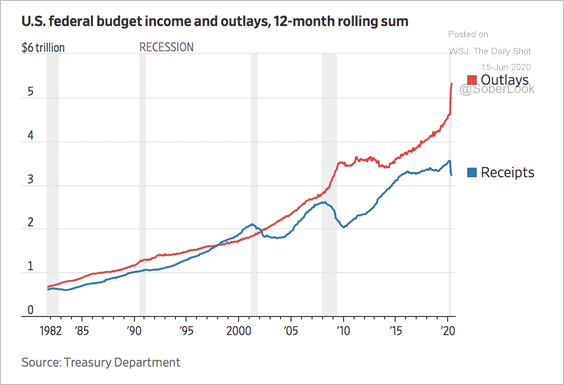

4. The US budget gap:

Source: @WSJ Read full article

Source: @WSJ Read full article

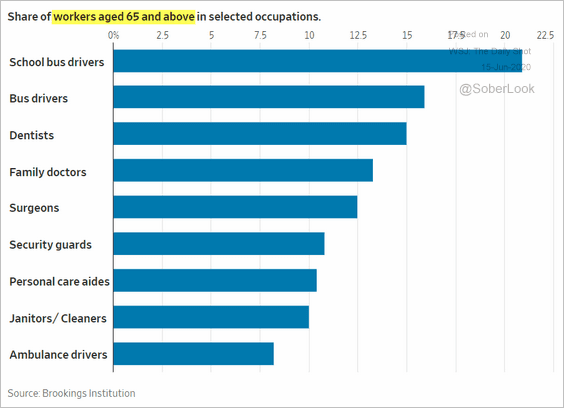

5. Older workers in select occupations:

Source: @WSJ Read full article

Source: @WSJ Read full article

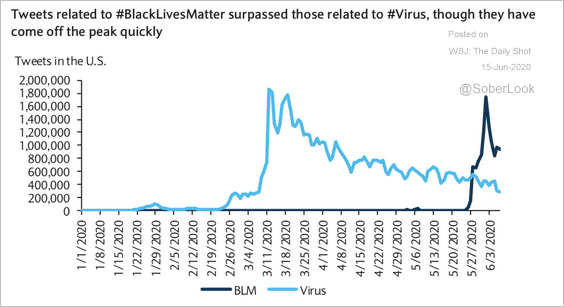

6. Twitter activity:

Source: Barclays Research

Source: Barclays Research

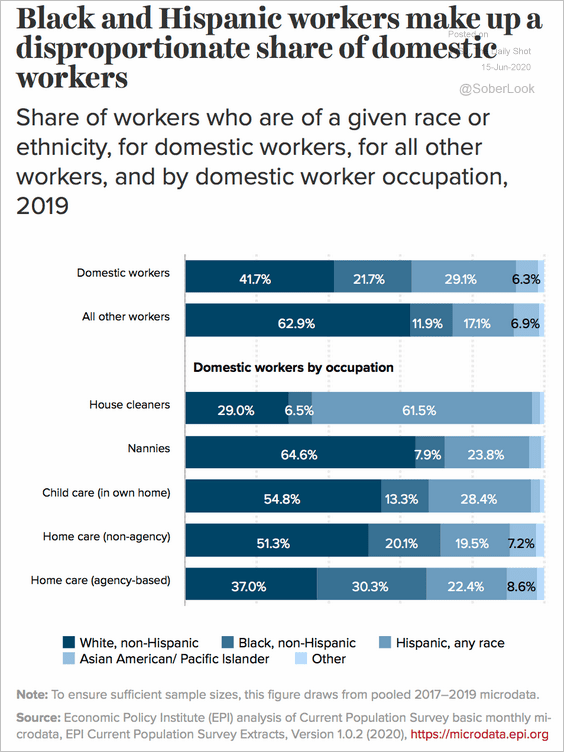

7. Domestic workers:

Source: The Economic Policy Institute Read full article

Source: The Economic Policy Institute Read full article

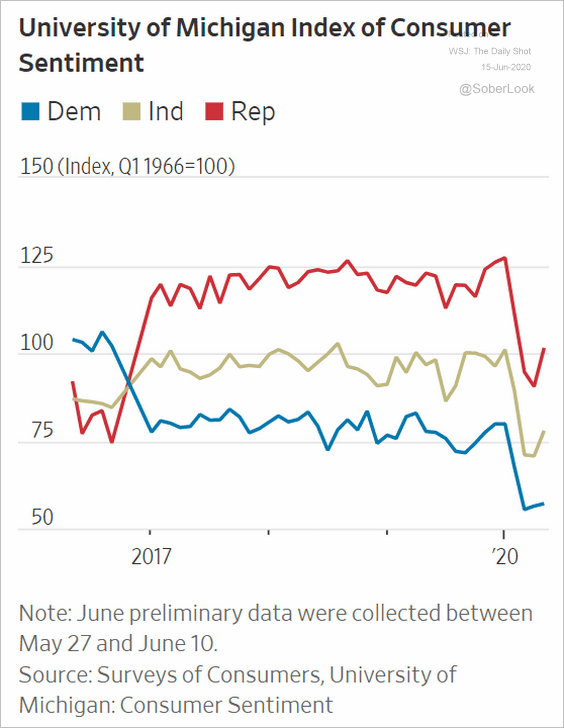

8. Consumer sentiment by political affiliation:

Source: @WSJ Read full article

Source: @WSJ Read full article

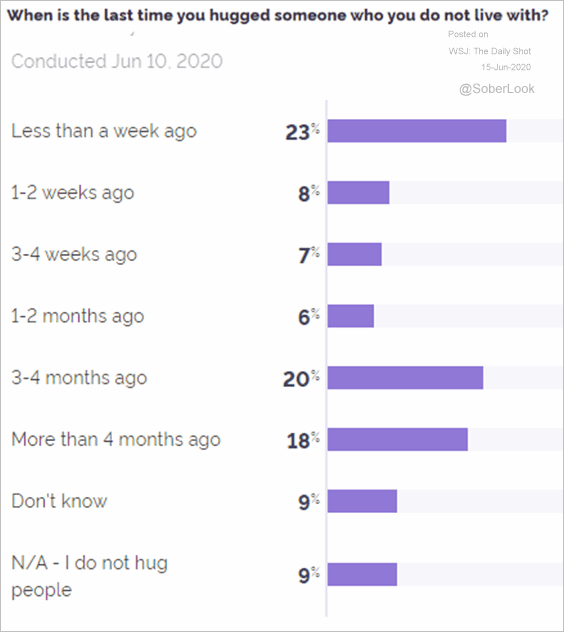

9. When was the last time you hugged someone who is not part of your household?

Source: YouGov

Source: YouGov

——————–