The Daily Shot: 17-Jun-20

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

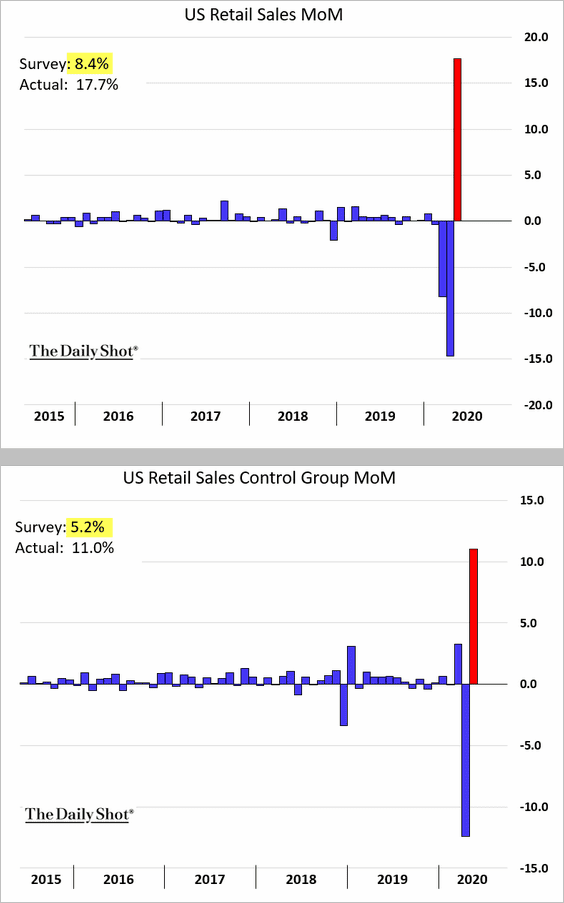

1. Retail sales rebounded sharply in May, topping economists’ forecasts. The “control group” (second chart) excludes volatile sectors such as autos, building materials, gasoline, etc.

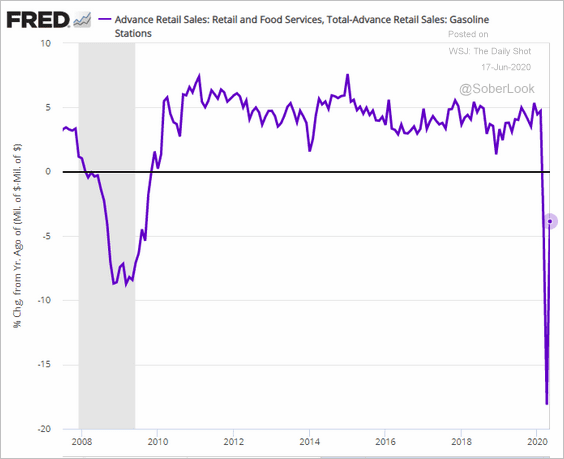

Here is the year-over-year chart (ex. gasoline sales).

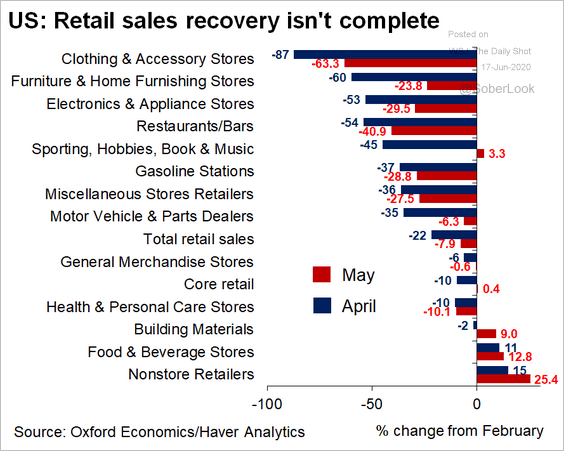

How much have retail sales changed since February (by sector)?

Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

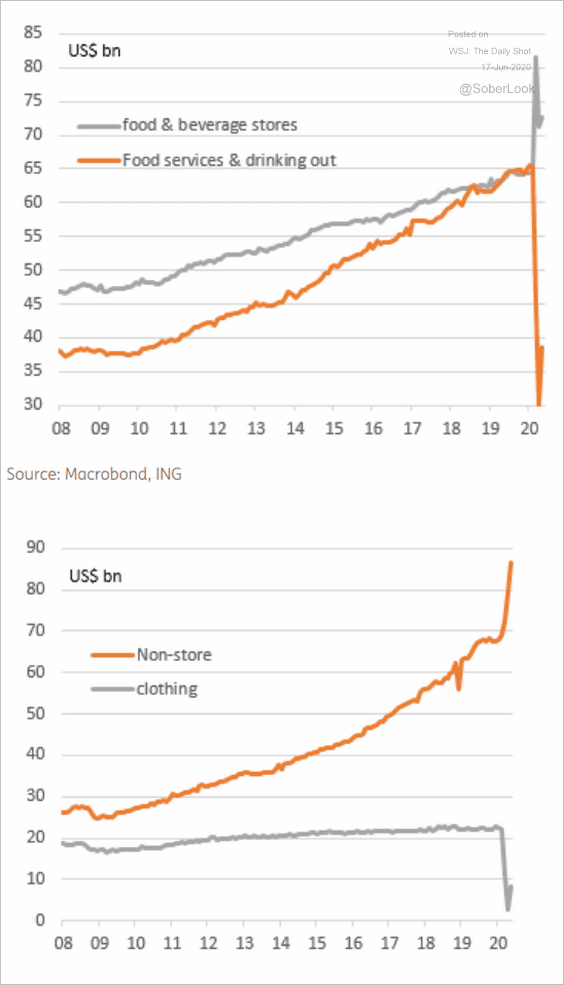

These charts show a couple of sector trends in retail sales (dollar amounts).

Source: ING

Source: ING

——————–

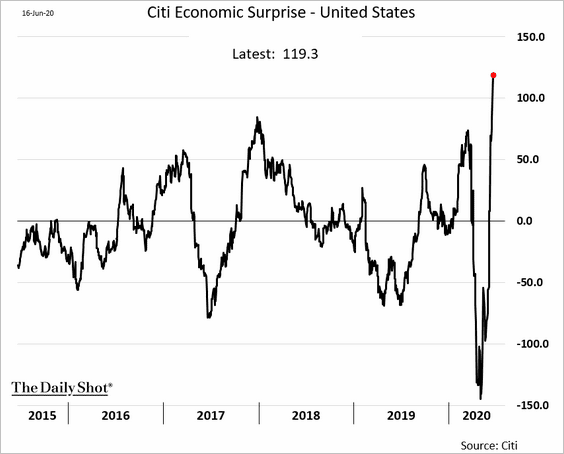

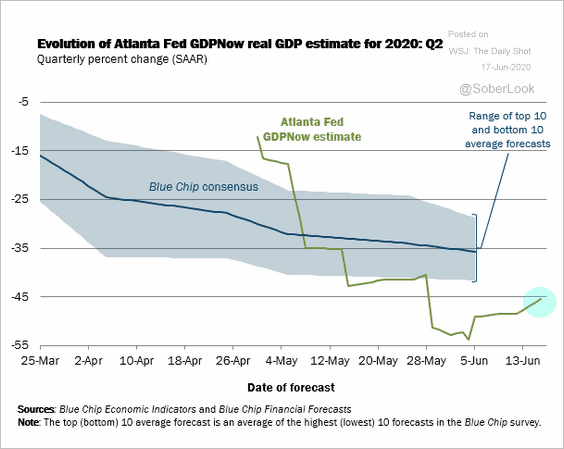

2. The rebound in retail sales sent the Citi Economic Surprise Index to a new high and boosted the Atlanta Fed’s GDPNow Q2 growth forecast (second chart).

Source: Atlanta Fed

Source: Atlanta Fed

——————–

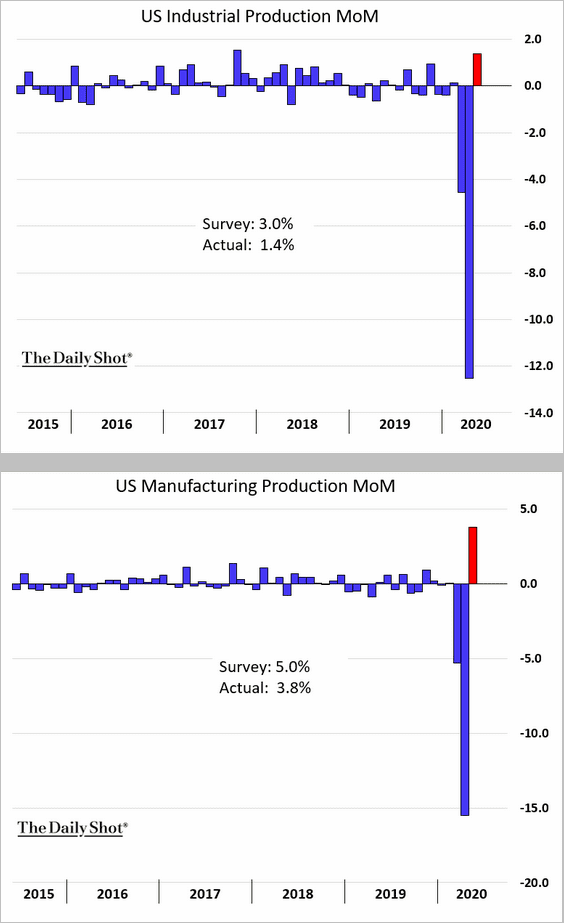

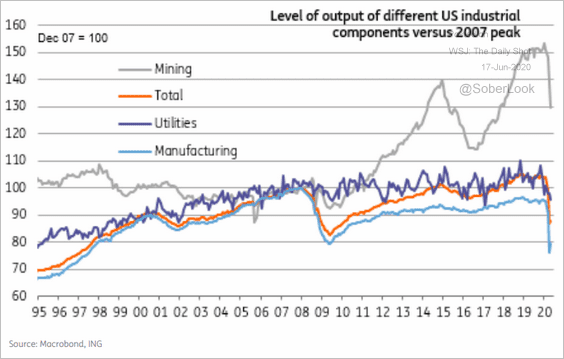

3. Industrial production saw a modest bounce in May.

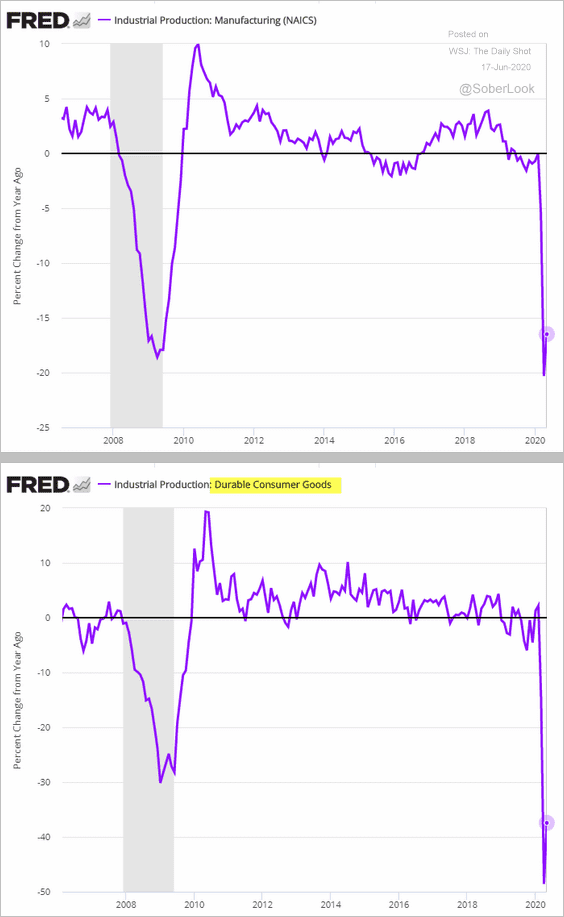

Here is the year-over-year change in manufacturing output.

And this chart shows the components of industrial production (levels).

Source: ING

Source: ING

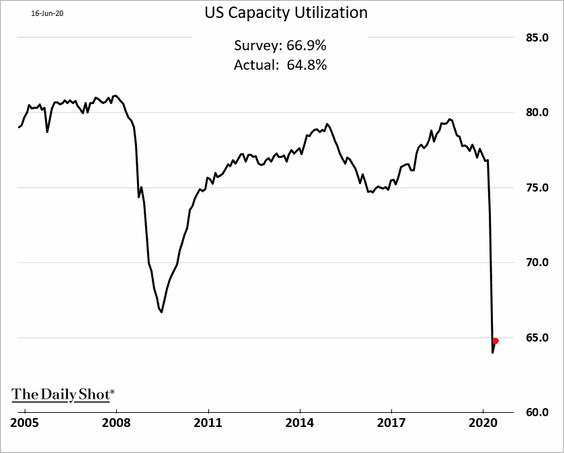

Capacity utilization remains well below the worst levels of 2008/09. As a result, business investment recovery will take a long time.

——————–

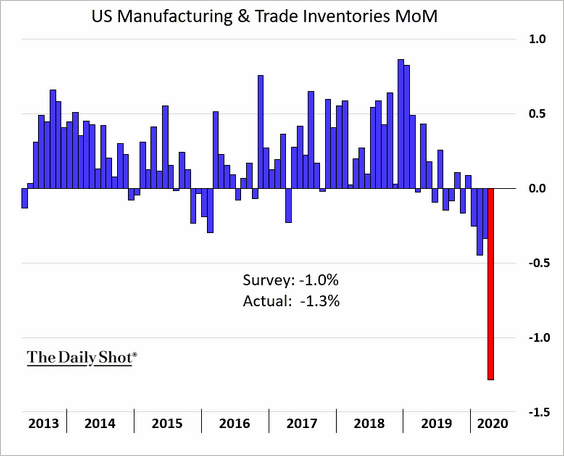

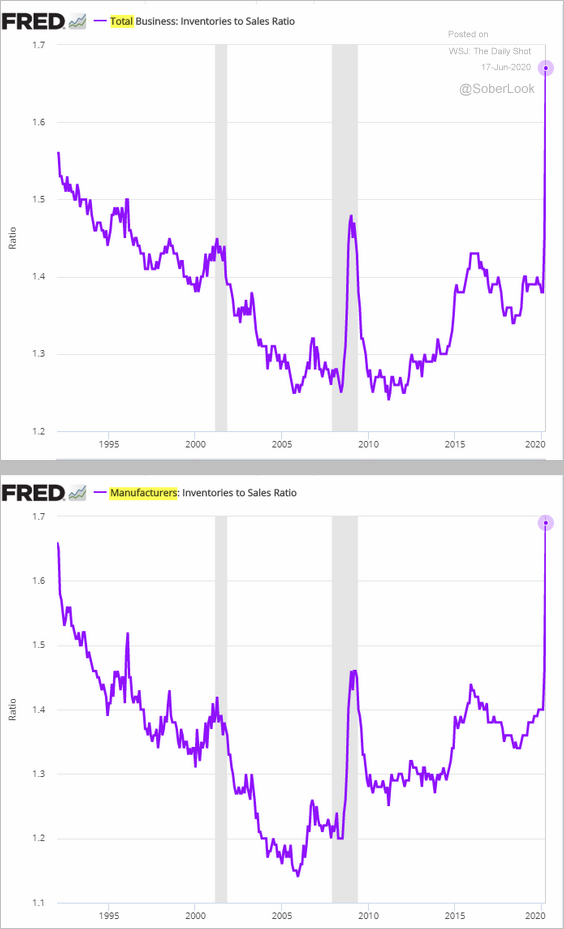

4. Business inventories declined sharply in April.

Nonetheless, the inventory-to-sales ratio hit a new high.

——————–

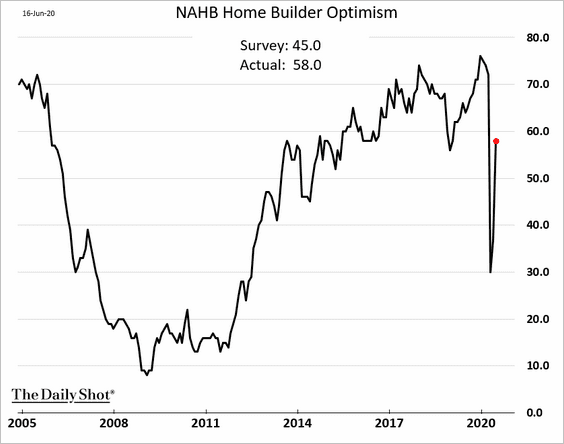

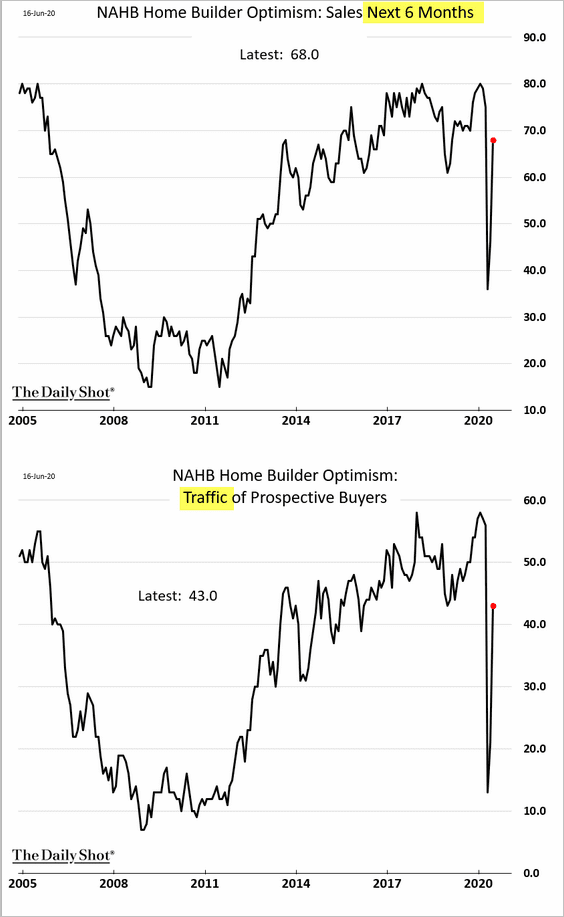

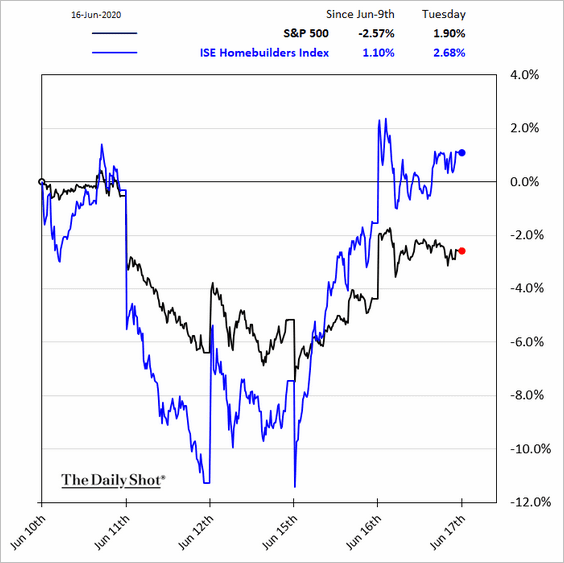

5. Homebuilder optimism recovered further this month as demand picks up (3 charts).

——————–

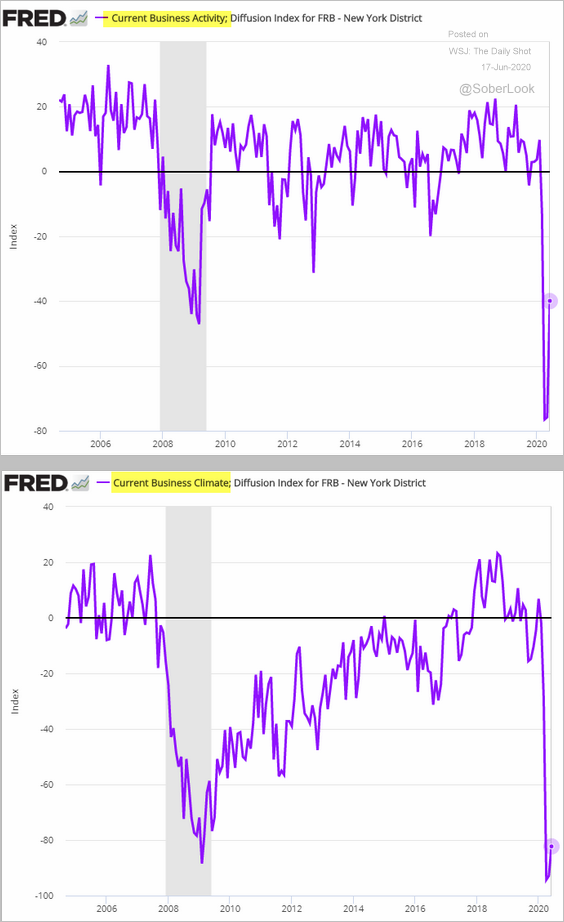

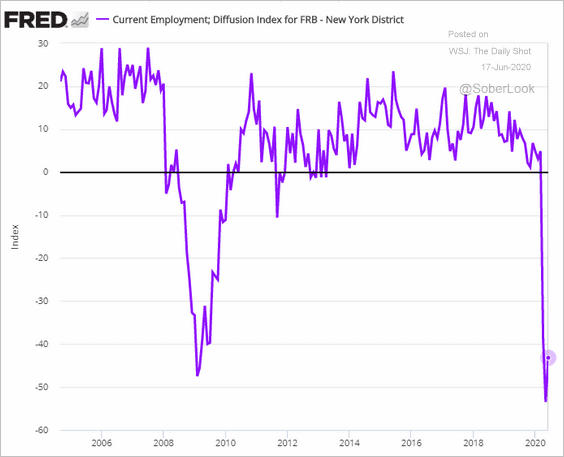

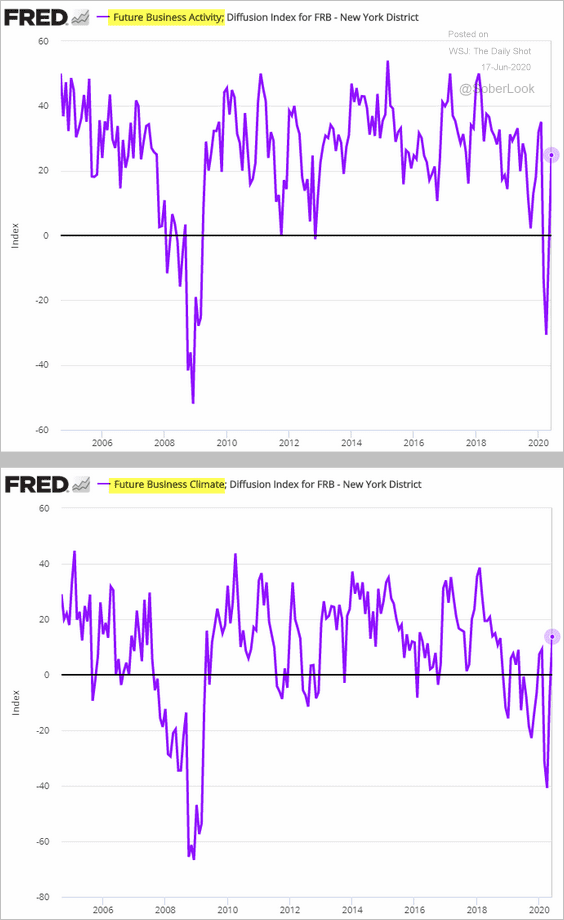

6. The NY Fed’s regional service sector index improved somewhat in June, but activity remains soft.

Here is the service-sector employment index.

However, forward-looking indicators show rising optimism.

——————–

7. Next, let’s take a look at some high-frequency national economic activity trackers.

• From Oxford Economics:

![]() Source: Oxford Economics

Source: Oxford Economics

• From ANZ:

![]() Source: ANZ Research

Source: ANZ Research

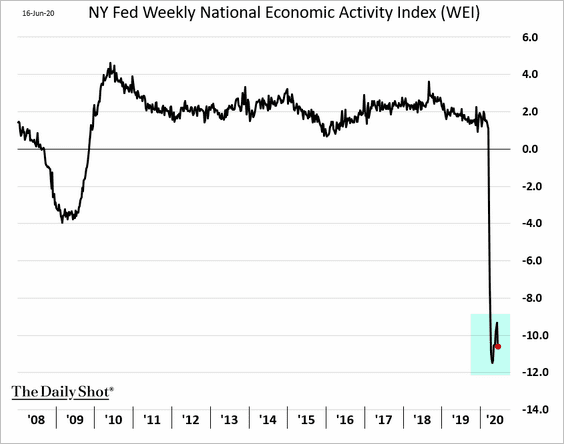

• The NY Fed’s economic activity index:

——————–

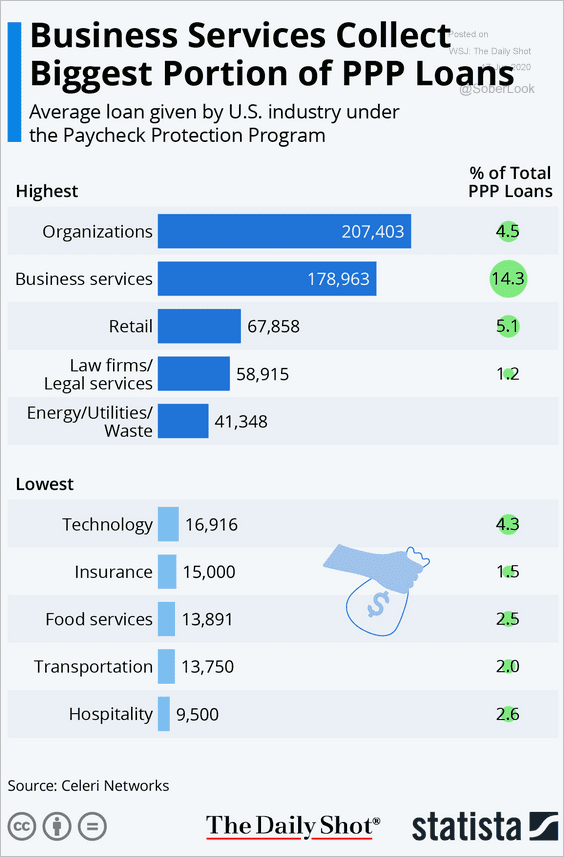

8. Finally, we have some data on the PPP program (from Celeri Networks).

Source: Statista

Source: Statista

The United Kingdom

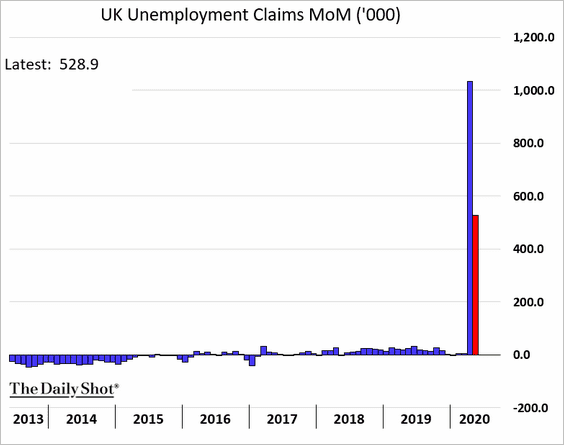

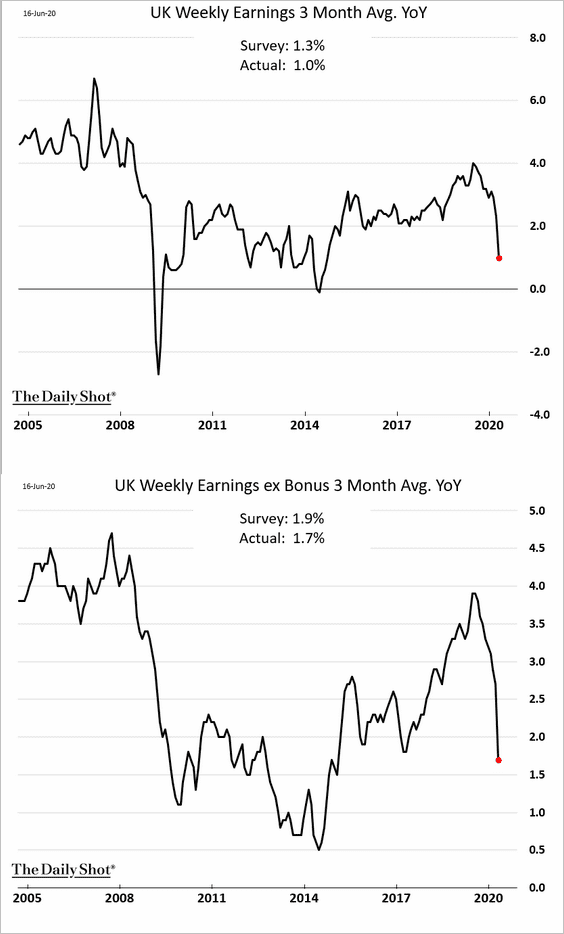

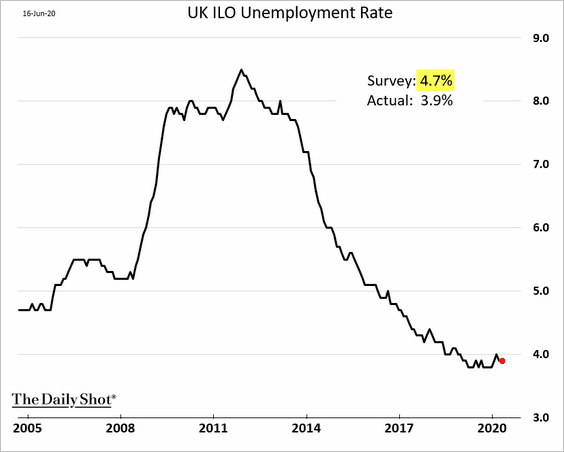

1. Let’s begin with the labor market.

• Unemployment claims rose by over half a million last month.

• Wage growth continues to moderate.

• The unemployment rate remained surprisingly stable in April.

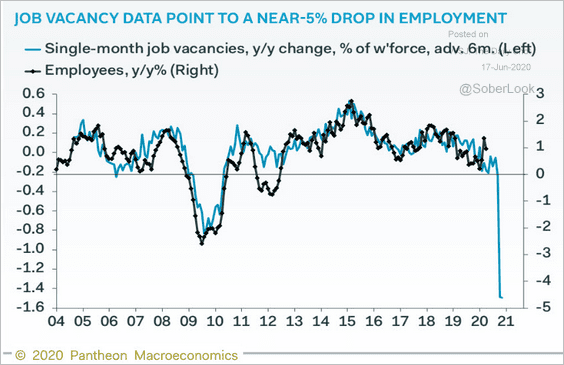

• Here is a comment from Samuel Tombs, Pantheon Macroeconomics.

The UK jobs data have been kept in suspended animation by the furlough scheme, which now has helped 8.7m stay on the payroll. The slump in vacancies points to a second wave of redundancies in autumn, when many furloughed workers will be laid off and unable to find new work.

Source: @samueltombs

Source: @samueltombs

——————–

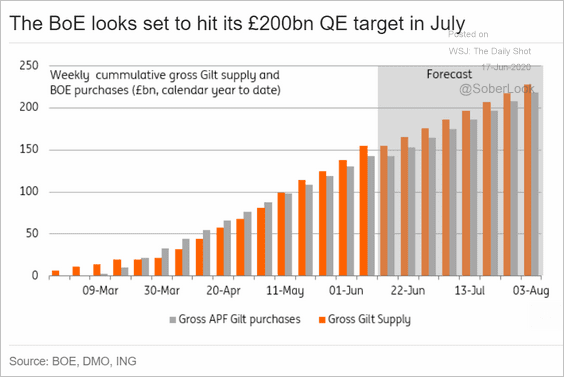

2. The BoE will likely hit its QE target in July but will need to continue buying gilts to keep up with the issuance.

Source: ING

Source: ING

The Eurozone

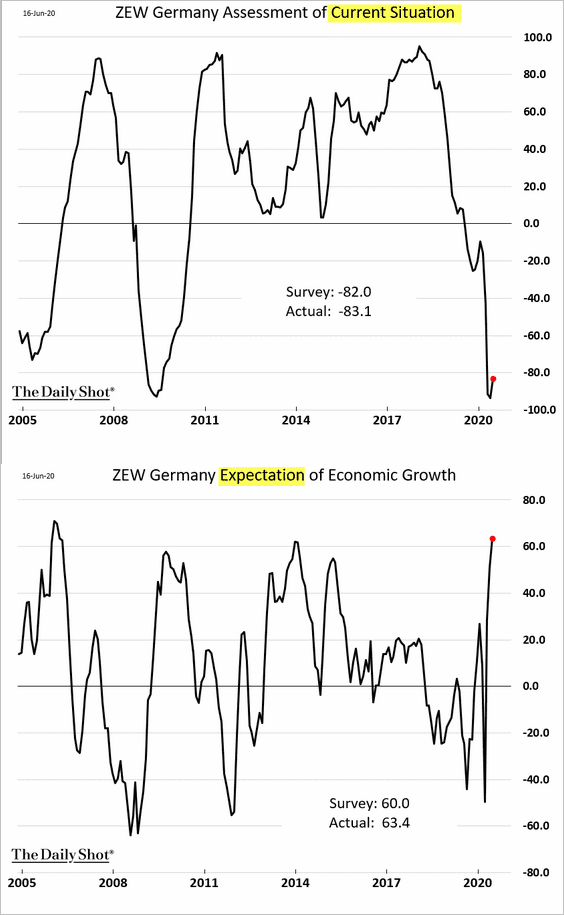

1. The ZEW expectations index shows a sharp rebound in optimism in Germany.

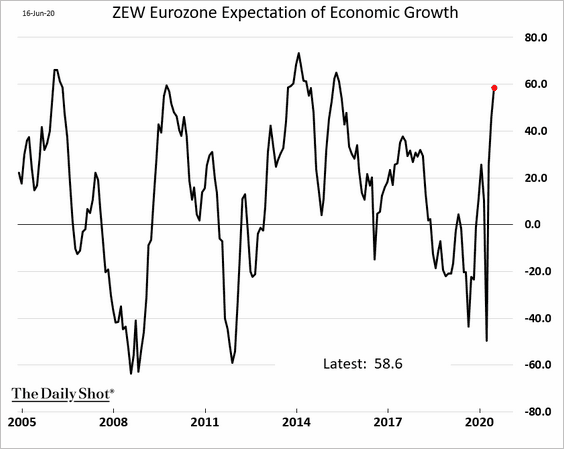

Here is the same index at the Eurozone level.

——————–

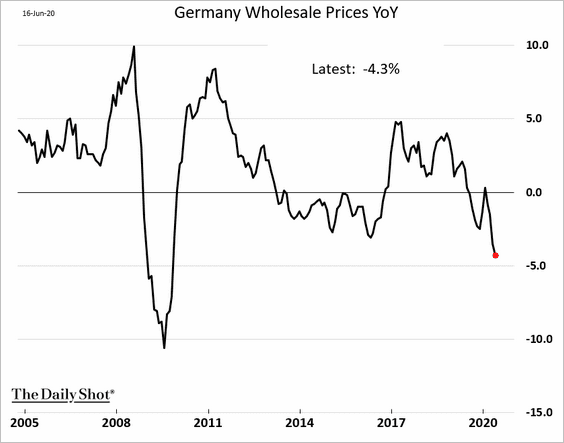

2. Germany’s wholesale deflation deepened in May.

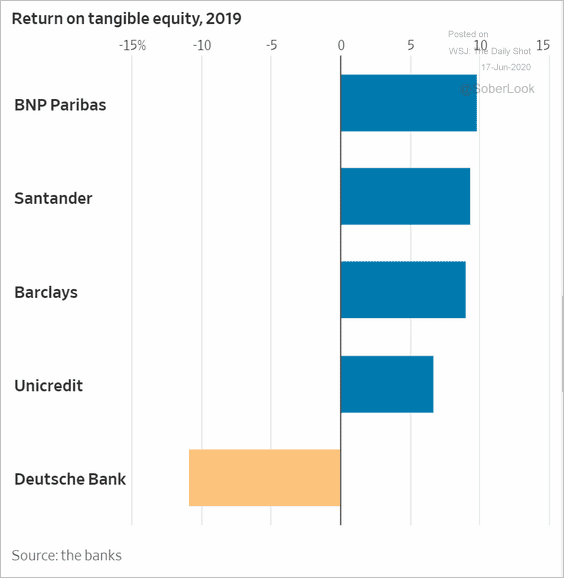

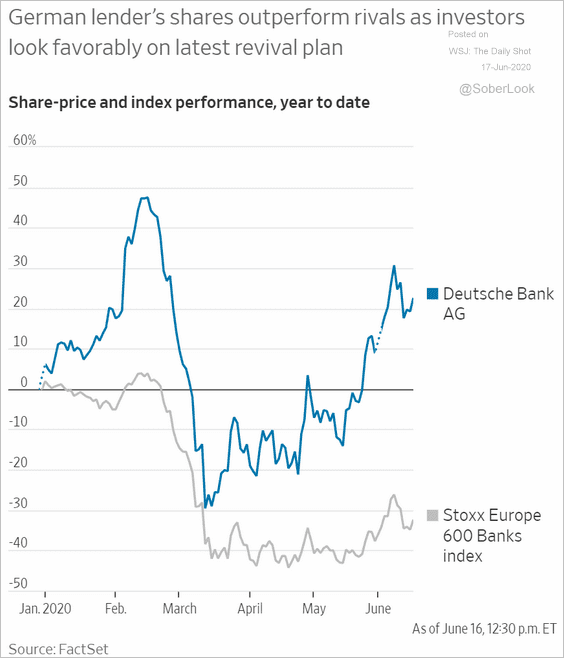

3. After a disastrous 2019 (chart below), Deutsche Bank is now outperforming (second chart).

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

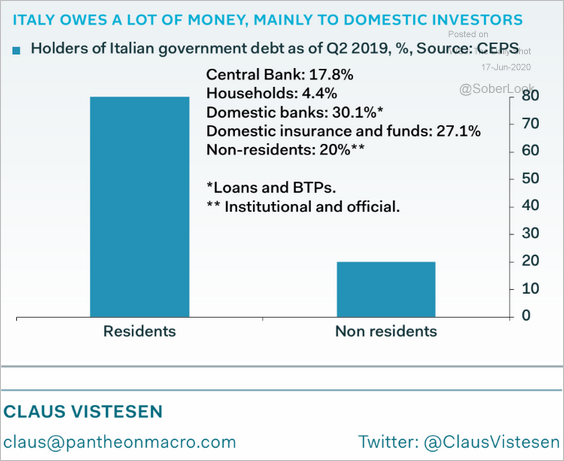

4. Italian government debt is still mostly held by domestic investors.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

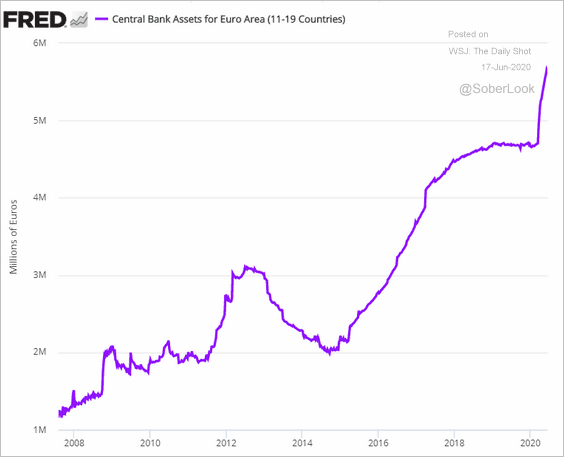

5. The ECB’s (Eurosystem) balance sheet is approaching €6 trillion.

Europe

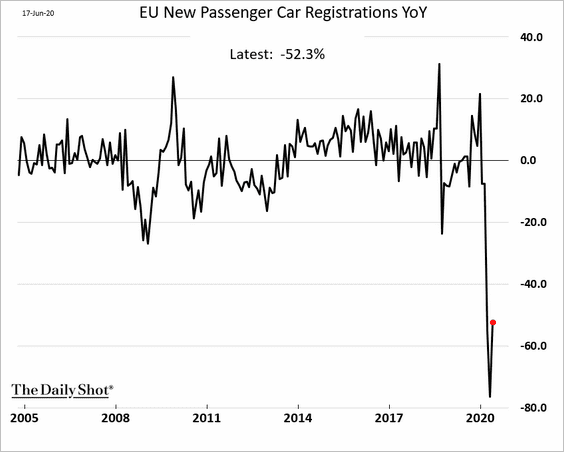

1. EU car registrations bounced from extreme lows but remain depressed.

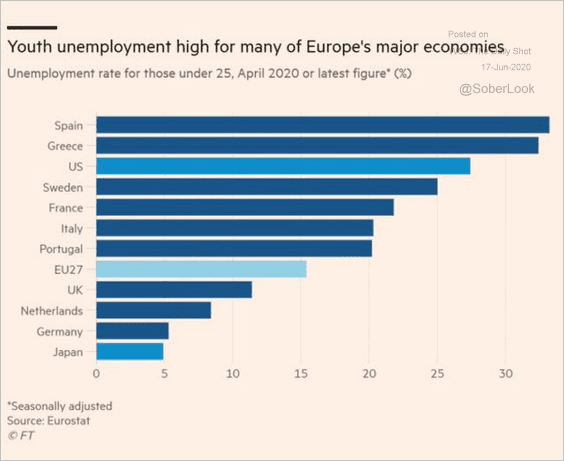

2. This chart shows youth unemployment across Europe (with the US and Japan shown for comparison).

Source: @adam_tooze, @FT Read full article

Source: @adam_tooze, @FT Read full article

Japan

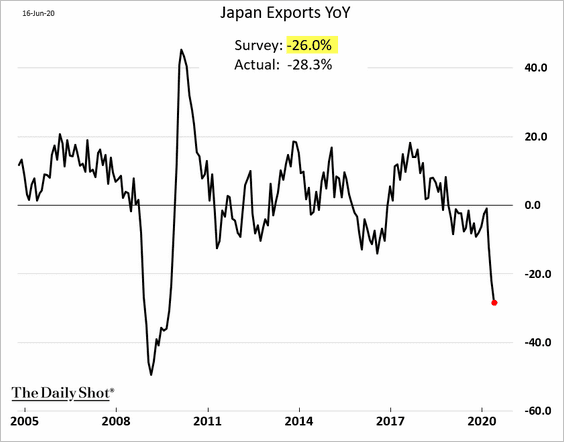

1. Exports deteriorated further in May.

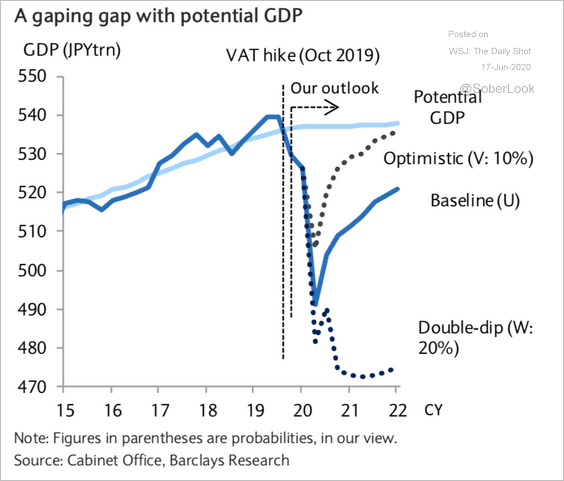

2. Another wave of infections could be devastating for Japan’s economy.

Source: Barclays Research

Source: Barclays Research

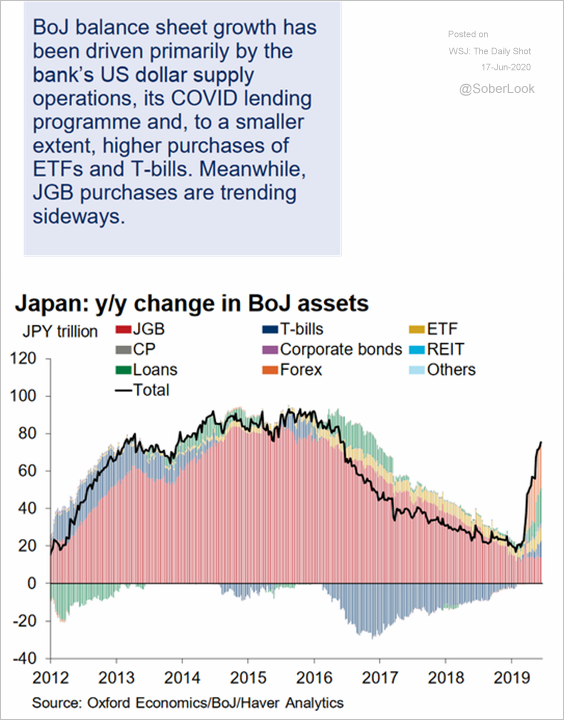

3. This chart shows the year-over-year growth in the BoJ’s balance sheet by asset class.

Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

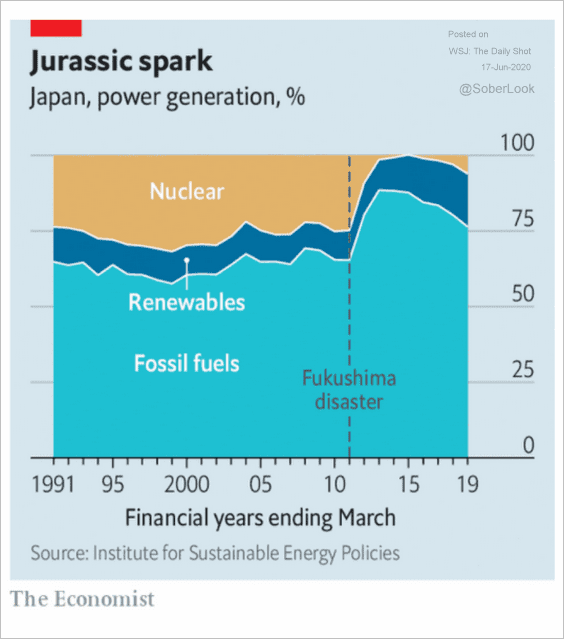

4. Finally, here is Japan’s distribution of fuel types used for power generation.

Source: @adam_tooze, @TheEconomist Read full article

Source: @adam_tooze, @TheEconomist Read full article

Asia – Pacific

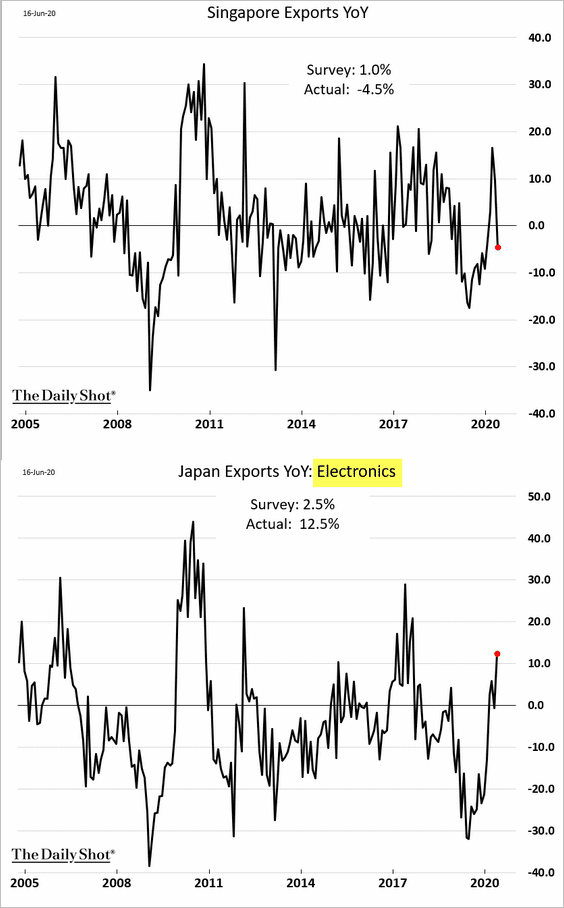

1. Singapore’s exports dipped into negative territory again on a year-over-year basis. However, electronics exports are rebounding.

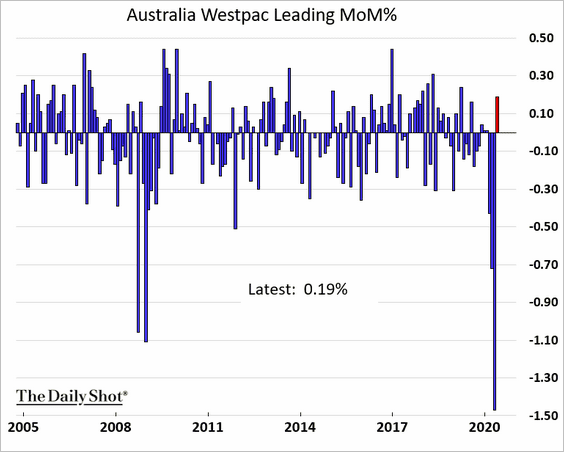

2. Australia’s index of leading indicators finally increased in May after a record decline.

China

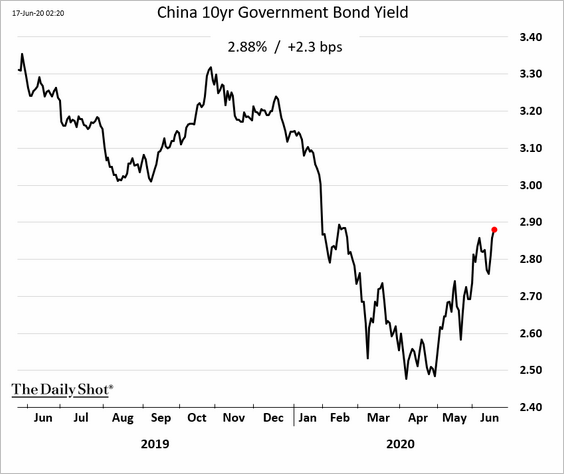

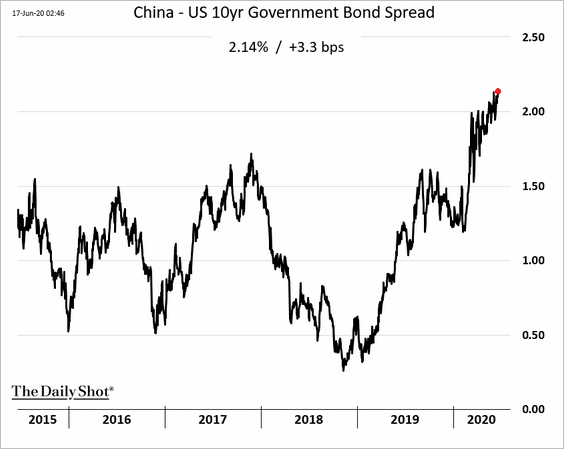

1. Bond yields are still climbing.

Here is the spread between China’s and US 10yr yields.

——————–

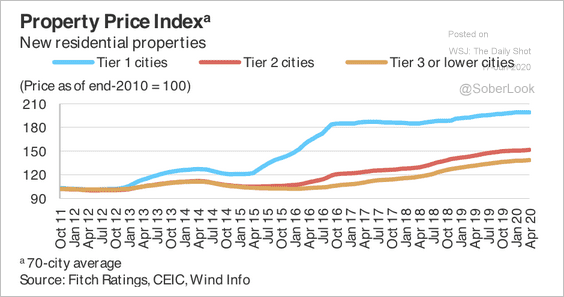

2. New home prices keep rising.

Source: Fitch Ratings

Source: Fitch Ratings

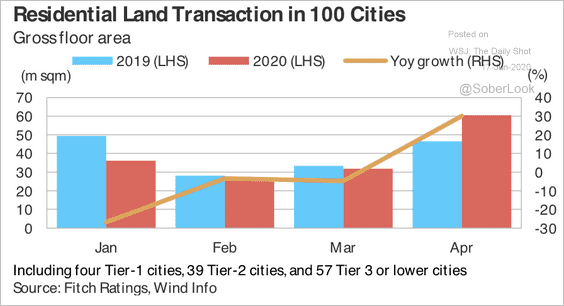

Residential land transactions picked up in April.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

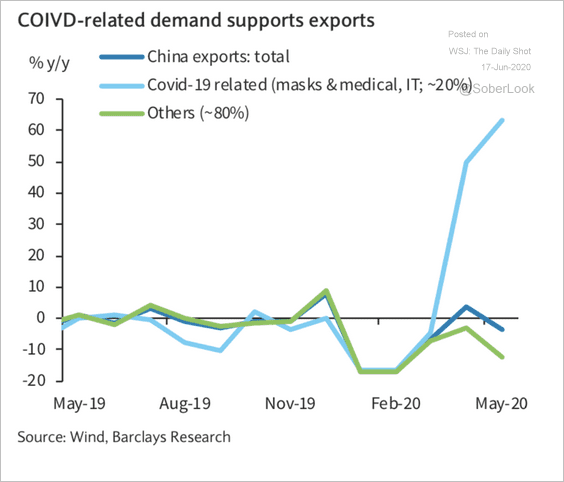

3. China’s exports have weakened this year except for the COVID-related products.

Source: Barclays Research

Source: Barclays Research

——————–

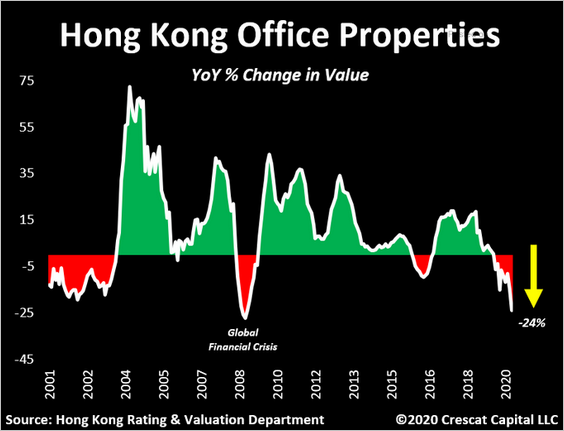

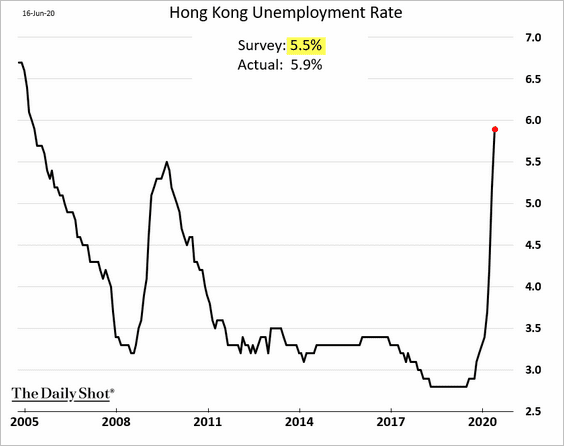

4. Next, we have a couple of updates on Hong Kong.

• Office property values:

Source: @TaviCosta

Source: @TaviCosta

• The unemployment rate:

Emerging Markets

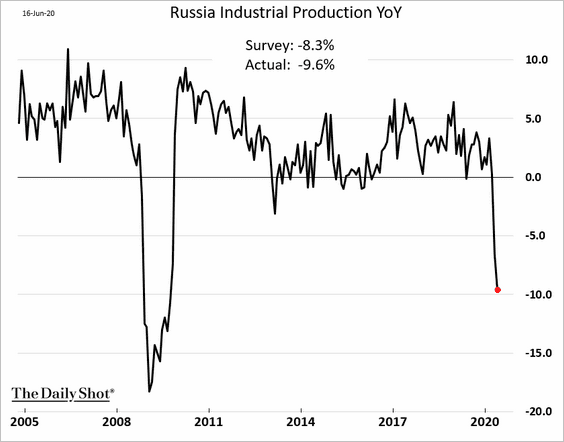

1. Russia’s industrial production weakened further in May.

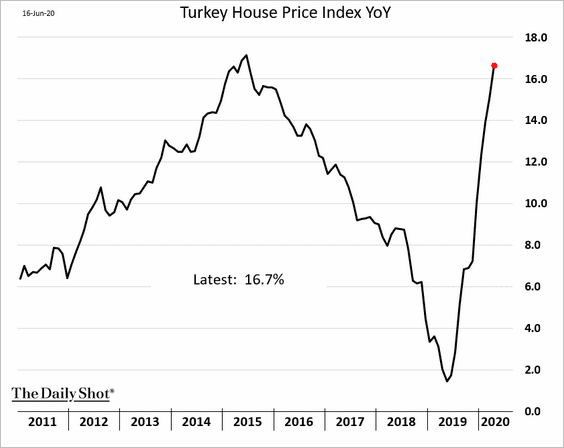

2. Turkey’s home prices are soaring as foreigners take advantage of a weak lira.

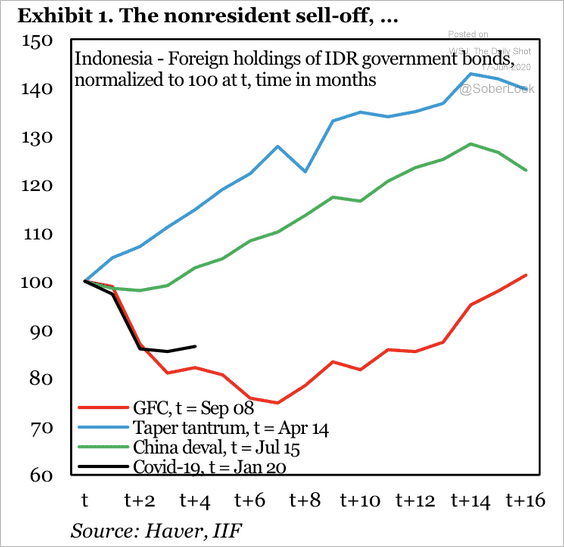

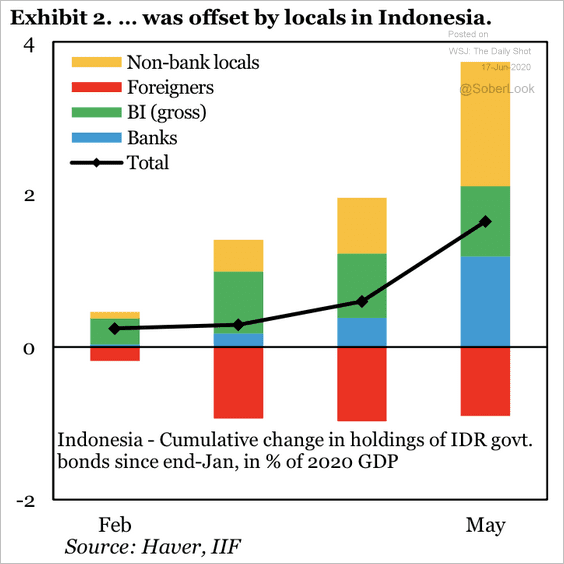

3. Foreign holdings of Indonesian government bonds collapsed during the first few months of this year.

Source: IIF

Source: IIF

But the local financial system was still able to absorb ample amounts of government debt.

Source: IIF

Source: IIF

Commodities

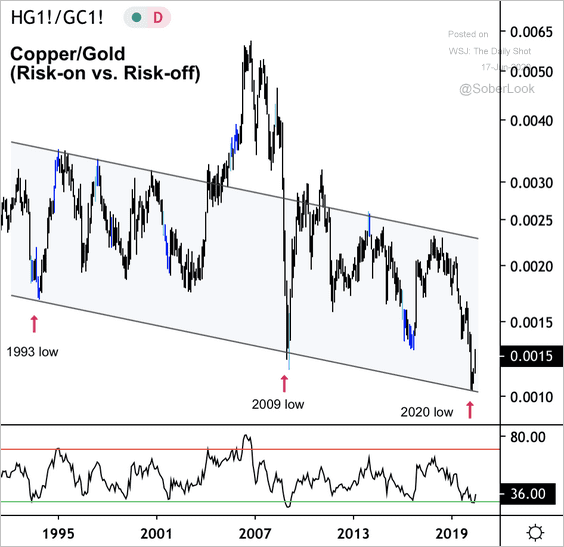

1. The copper/gold ratio is at long-term support.

Source: @DantesOutlook Further reading

Source: @DantesOutlook Further reading

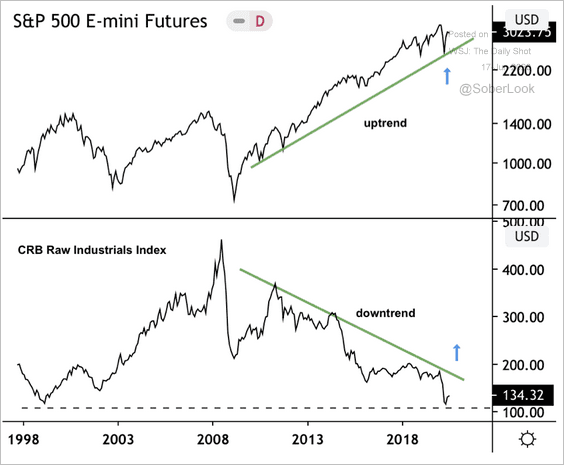

2. The CRB Raw Industrials Index is also at long-term support and has likely bottomed along with the S&P 500.

Source: @DantesOutlook Further reading

Source: @DantesOutlook Further reading

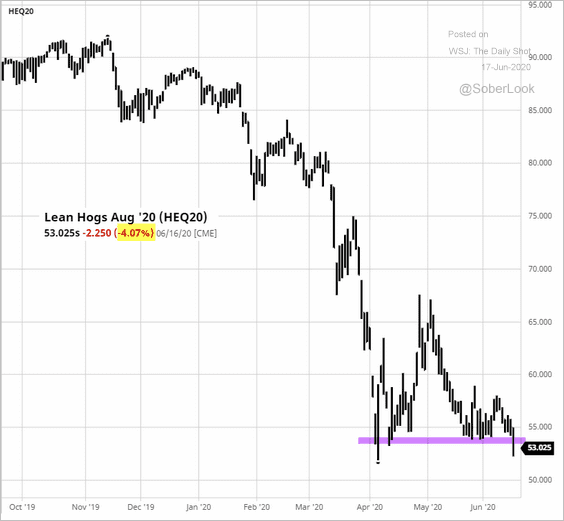

3. US hog futures are testing support.

Source: barchart.com

Source: barchart.com

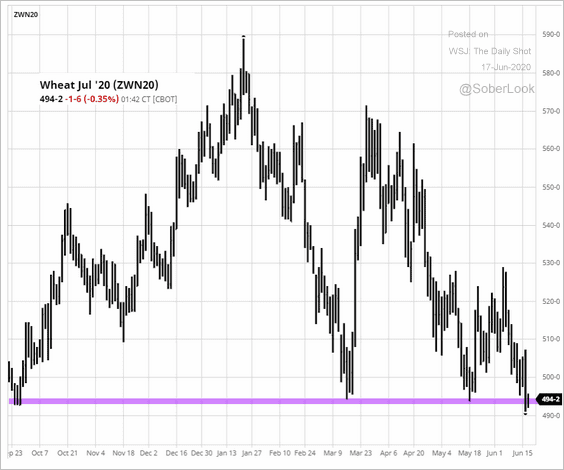

And so are US wheat futures.

Source: barchart.com

Source: barchart.com

——————–

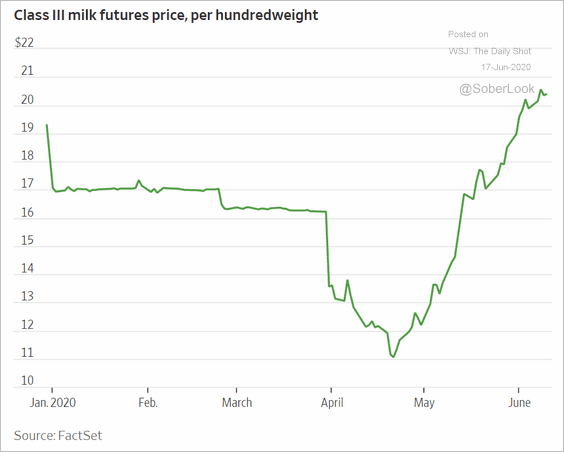

4. US milk futures keep climbing (class-III milk is mostly used to make cheese).

Source: @WSJ Read full article

Source: @WSJ Read full article

Equities

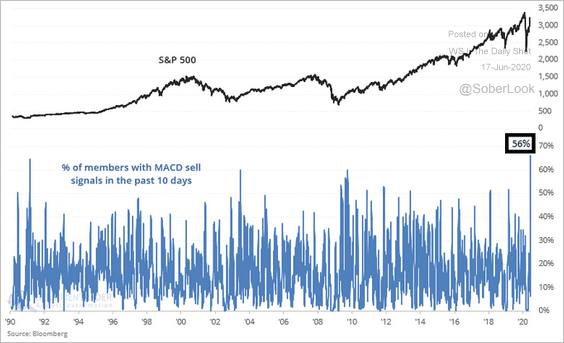

1. The S&P 500 technicals look terrible, with 56% of the index members sending sell signals.

Source: @sentimentrader

Source: @sentimentrader

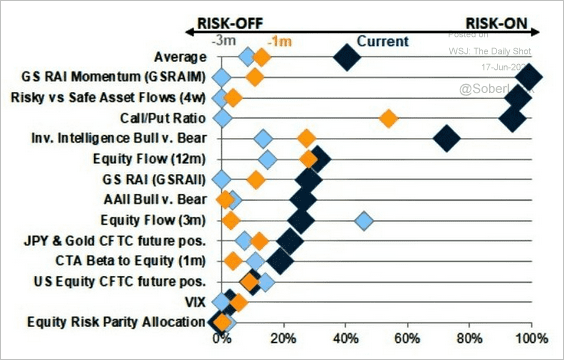

2. Here is a summary of sentiment indicators over the past couple of months.

Source: Goldman Sachs, @WallStJesus

Source: Goldman Sachs, @WallStJesus

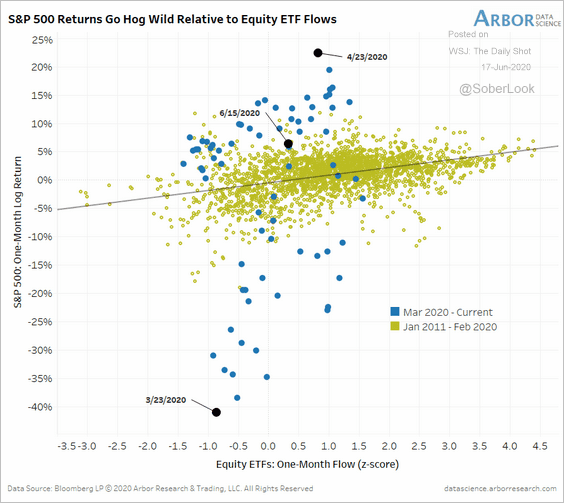

3. Equity ETF flows and stock returns have diverged.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

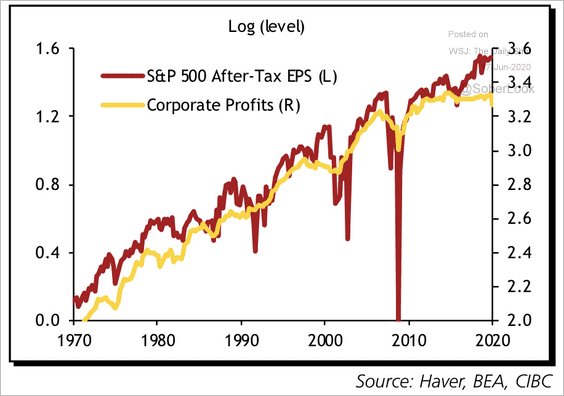

4. The S&P 500 earnings-per-share indicator is more cyclical than the broader US corporate profits.

Source: CIBC Capital Markets

Source: CIBC Capital Markets

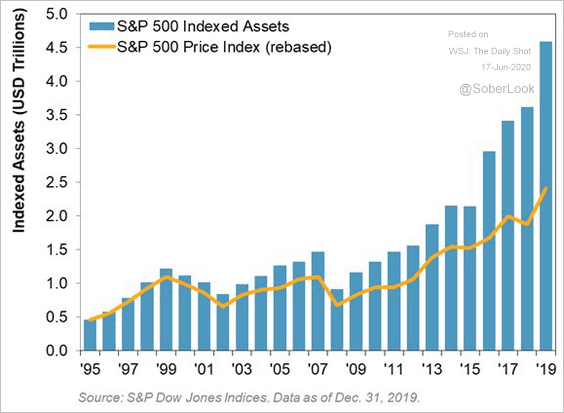

5. The AUM of assets indexed to the S&P 500 exceeded $4.5 trillion last year.

Source: @LizAnnSonders, @SPDJIndices

Source: @LizAnnSonders, @SPDJIndices

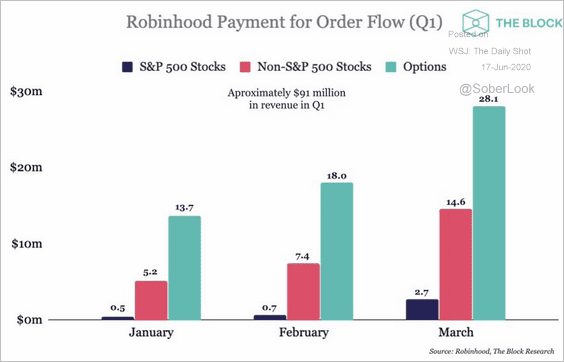

6. Robinhood’s profits show a spike in retail investor interest in options and smaller stocks.

Source: @fintechfrank

Source: @fintechfrank

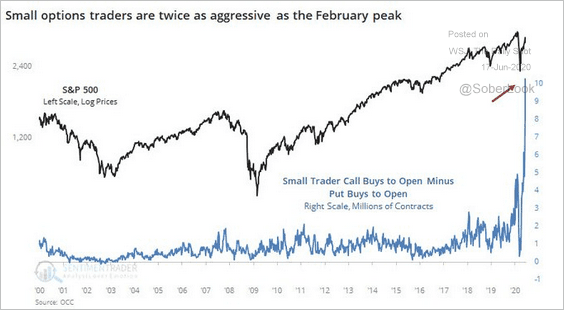

Retail investors’ demand for call options has been unprecedented.

Source: @sentimentrader

Source: @sentimentrader

——————–

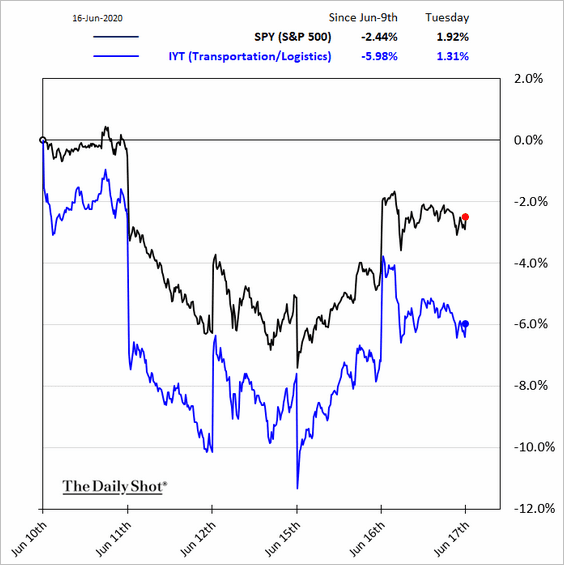

7. Next, we have some sector updates.

• Transportation:

• Homebuilders:

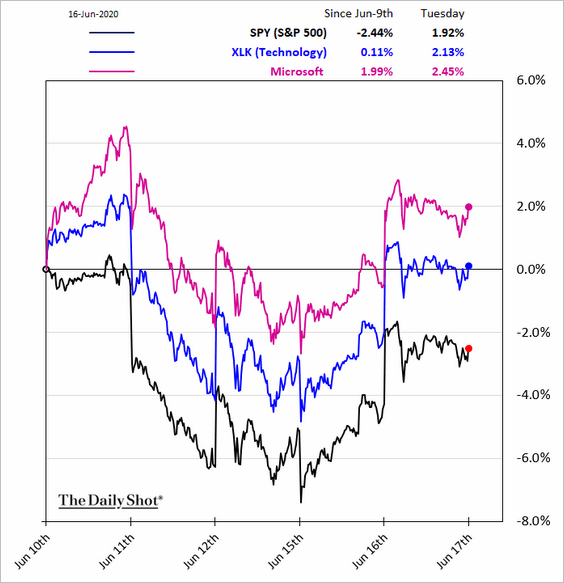

• Tech:

——————–

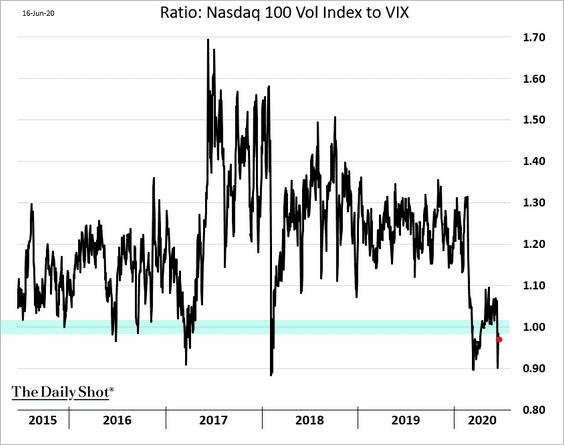

8. The tech mega-caps continue to trade as “safe-haven” assets. The NASDAQ 100 implied volatility remains below that of the S&P 500.

Credit

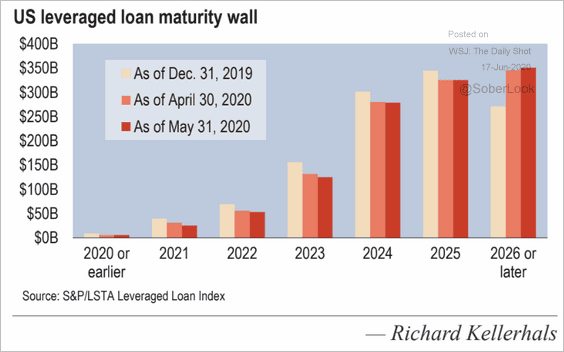

1. Leveraged loan maturities have been pushed out.

Source: LCD, S&P Global Market Intelligence

Source: LCD, S&P Global Market Intelligence

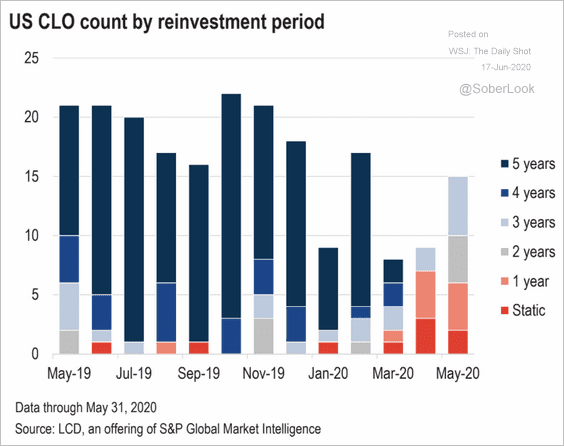

2. New CLO reinvestment periods have shortened dramatically. “Static” means that no reinvestment is allowed – the portfolio starts in runoff mode, and loan amortizations are used to pay down liabilities.

Source: LCD, S&P Global Market Intelligence

Source: LCD, S&P Global Market Intelligence

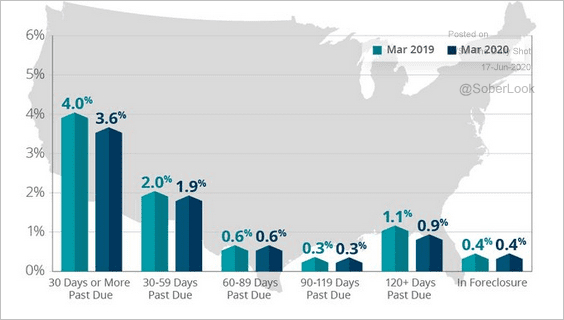

3. The forbearance option has kept residential mortgage delinquencies relatively low.

Source: @CoreLogicInc, @TayTayLLP

Source: @CoreLogicInc, @TayTayLLP

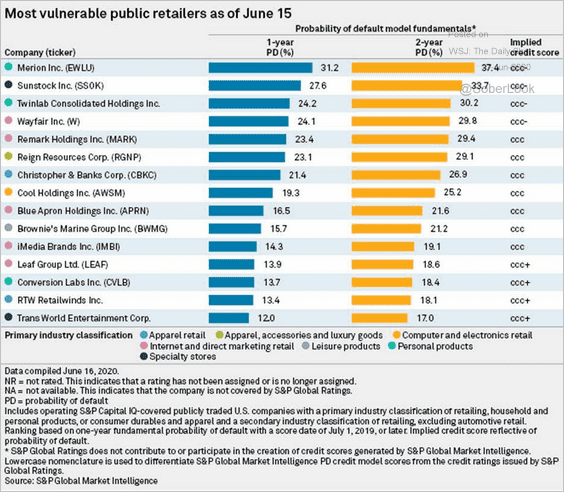

4. Which are the most vulnerable retailers?

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Global Developments

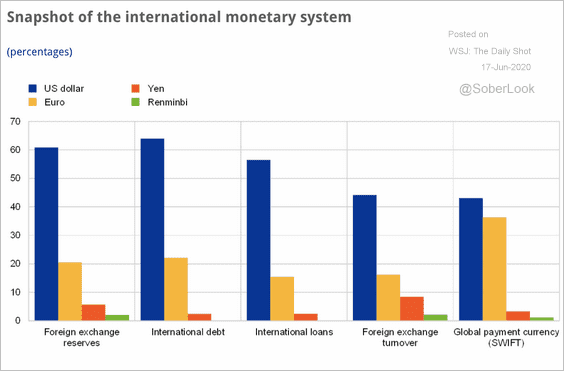

1. This chart shows the prevalence of select currencies in the international monetary system.

Source: ECB Read full article

Source: ECB Read full article

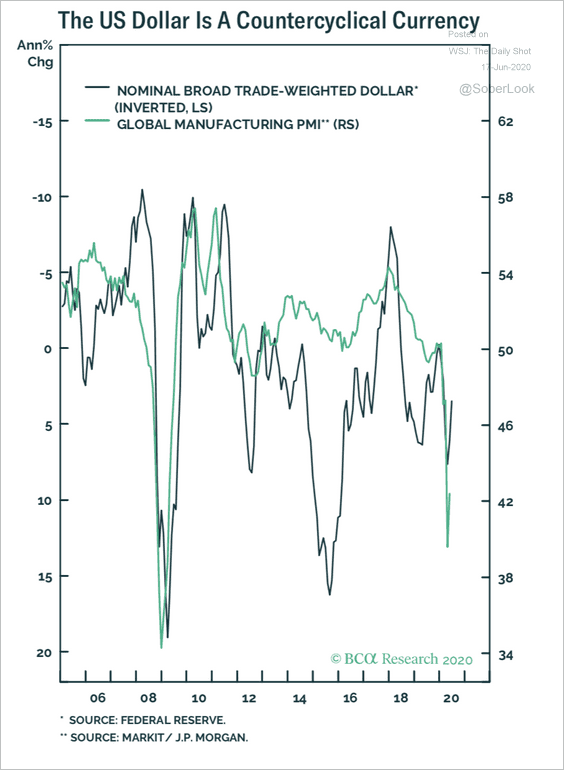

2. According to BCA Research, the dollar is a countercyclical currency (it tends to move in the opposite direction of the global business cycle).

Source: BCA Research

Source: BCA Research

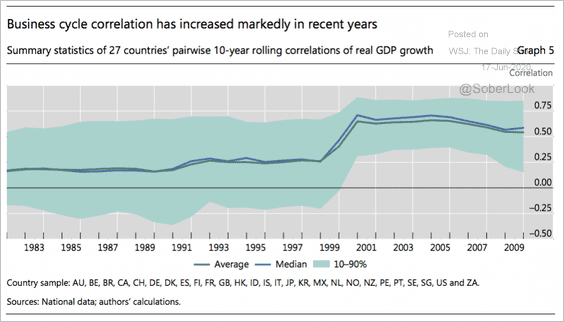

3. Global business cycles have become highly correlated over the past 40 years.

Source: BIS

Source: BIS

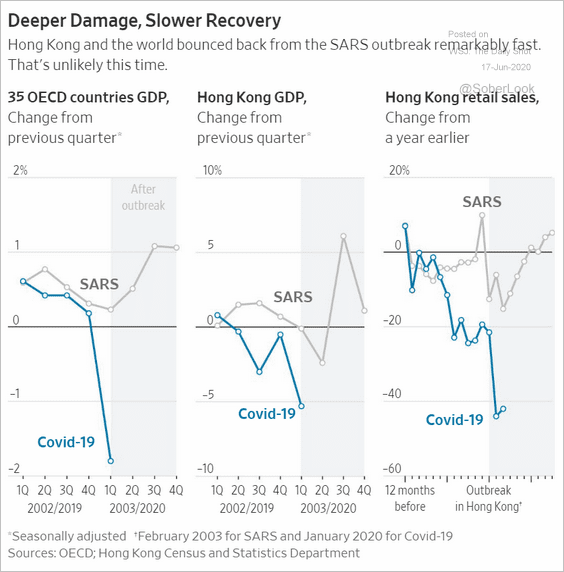

4. How does the current crisis compare to SARS?

Source: @WSJ Read full article

Source: @WSJ Read full article

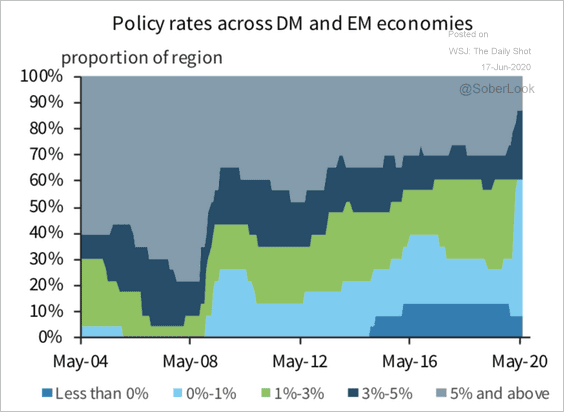

5. Finally, we have the distribution of central bank policy rates globally.

Source: Barclays Research

Source: Barclays Research

——————–

Food for Thought

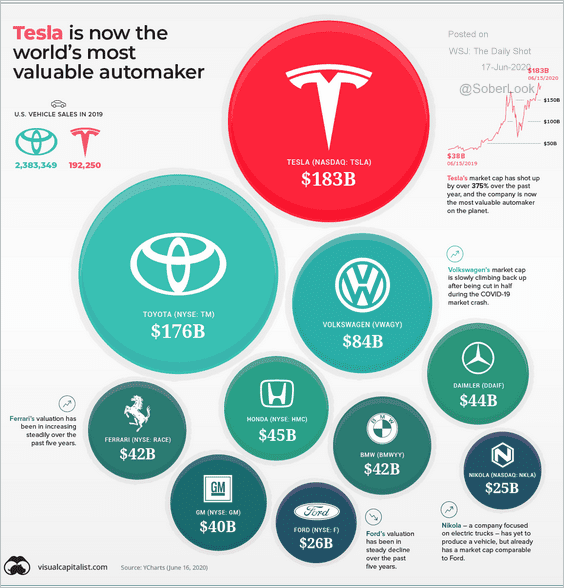

1. Tesla is now the most valuable automaker.

Source: @VisualCap Read full article

Source: @VisualCap Read full article

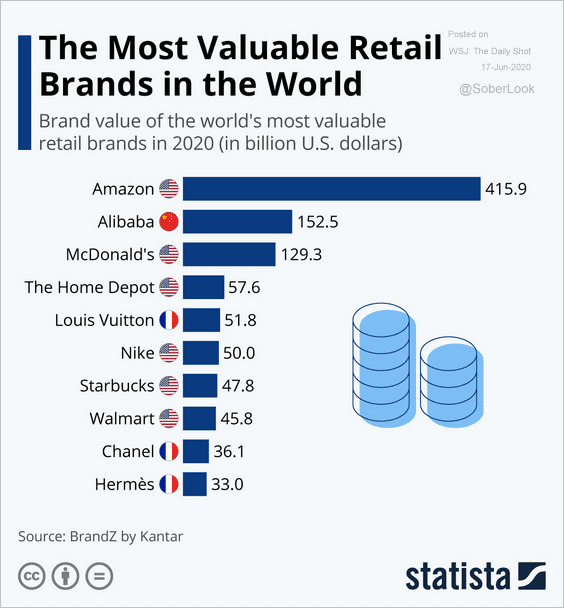

2. The most valuable retail brands:

Source: Statista

Source: Statista

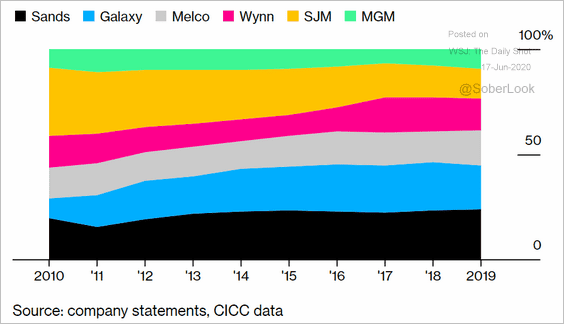

3. The Macau casino market:

Source: @luxury Read full article

Source: @luxury Read full article

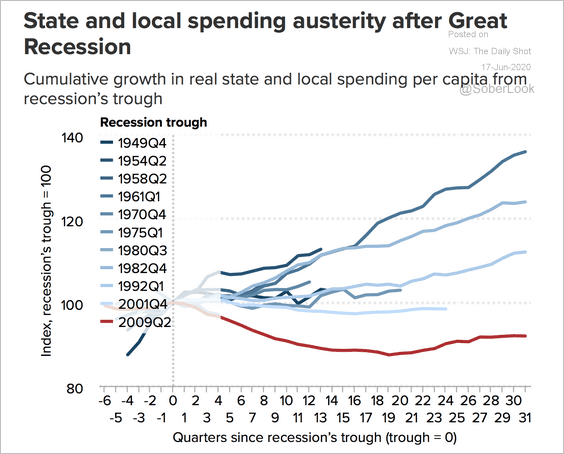

4. State and local government spending per capita in the US:

Source: @EconomicPolicy Read full article

Source: @EconomicPolicy Read full article

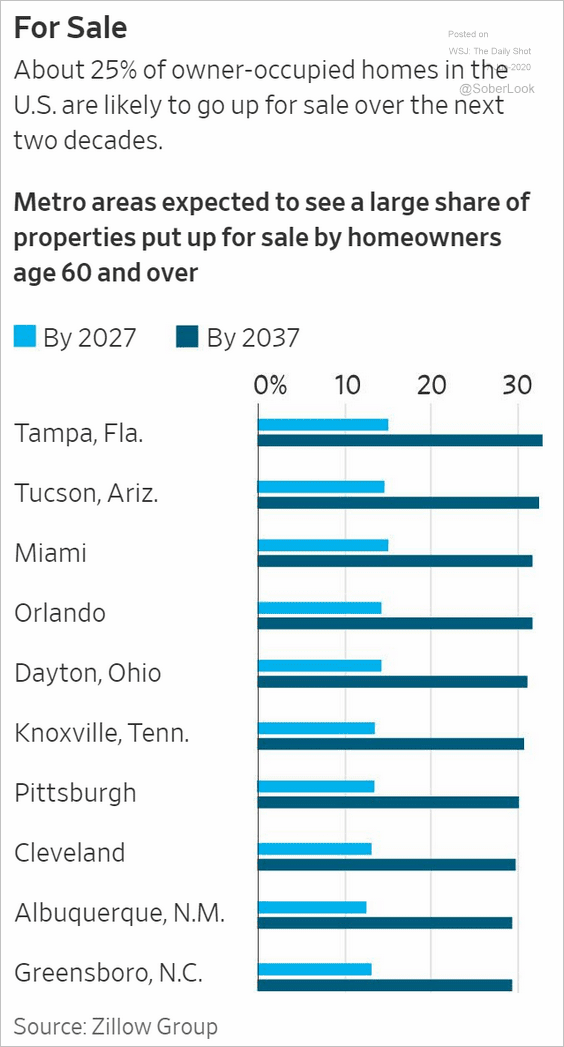

5. Aging homeowners will be selling a lot of homes over the next couple of decades.

Source: @WSJ Read full article

Source: @WSJ Read full article

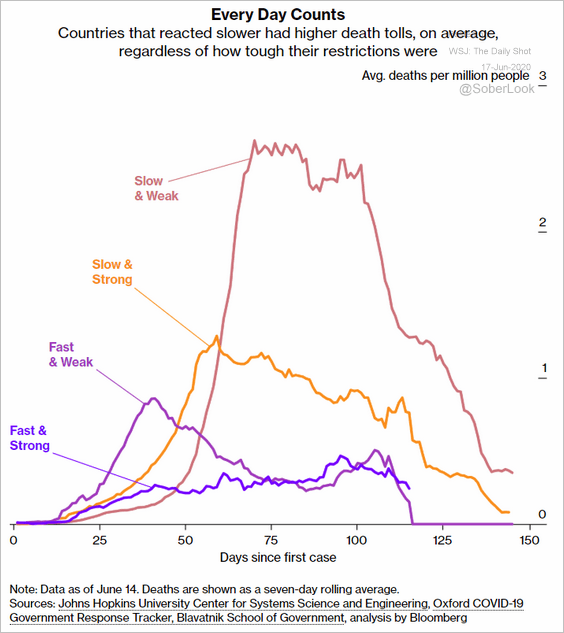

6. Every day counts in initial COVID responses.

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

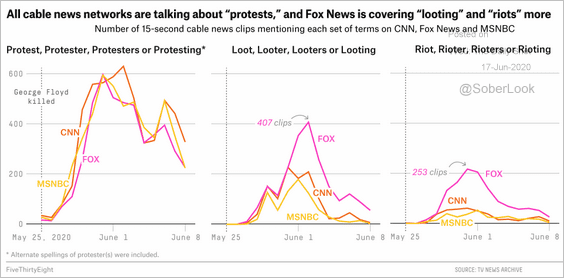

7. News coverage mentioning “protests,” “looting,” and “rioting”:

Source: FiveThirtyEight Read full article

Source: FiveThirtyEight Read full article

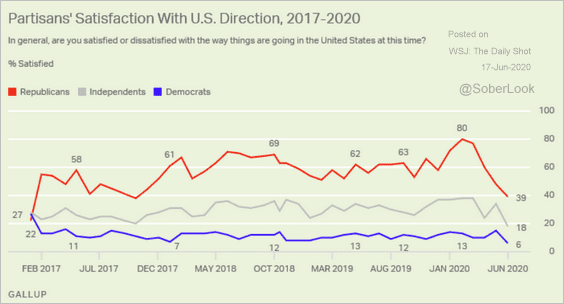

8. Satisfaction with the way things are going in the US:

Source: Gallup Read full article

Source: Gallup Read full article

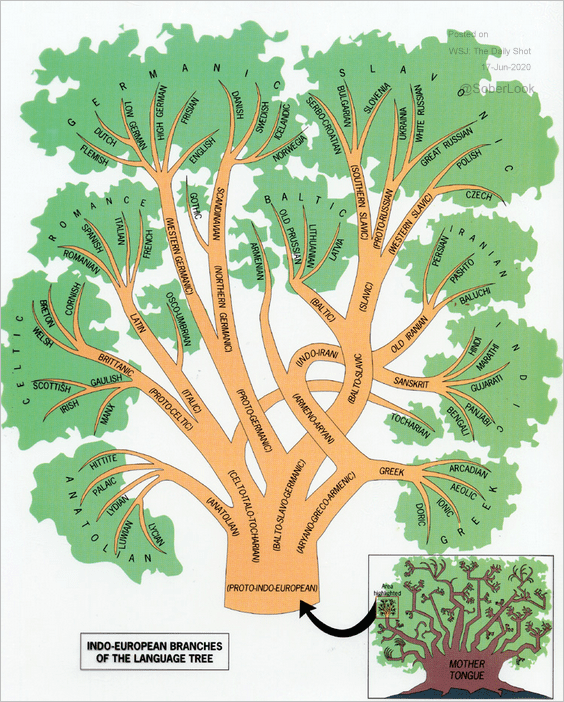

9. The Indo-European language tree:

Source: Anthropology.net

Source: Anthropology.net

——————–