The Daily Shot: 18-Jun-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

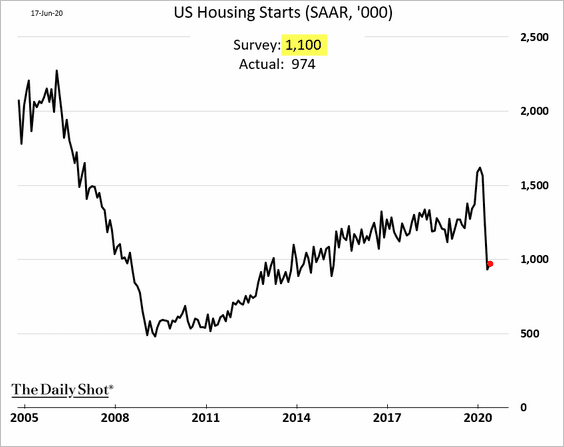

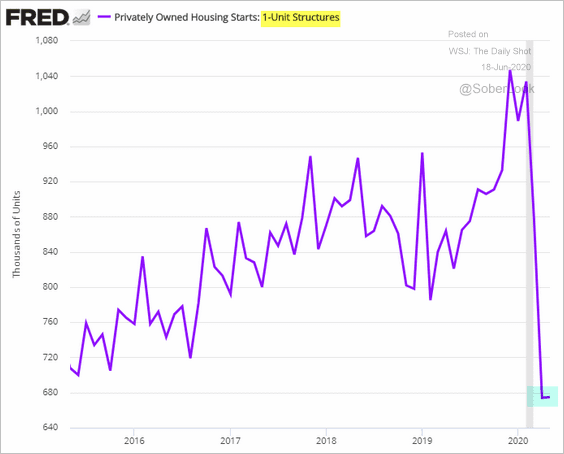

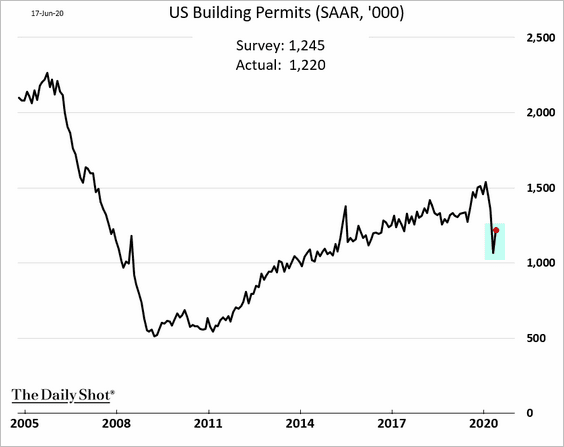

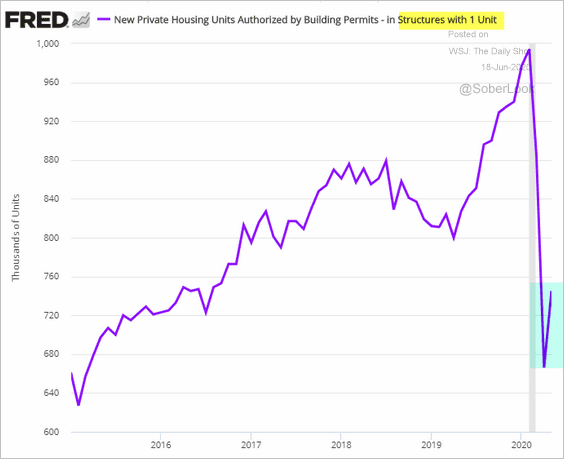

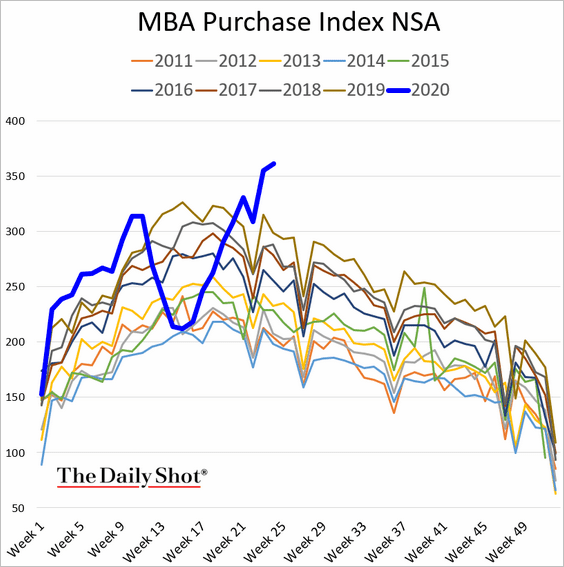

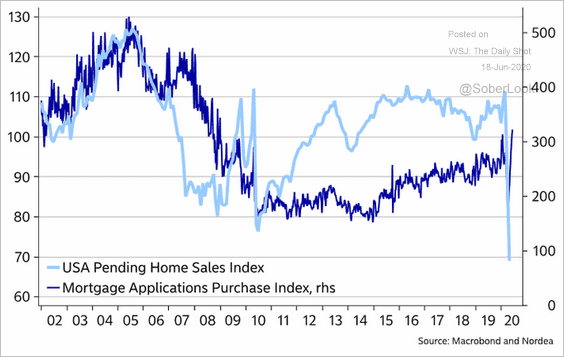

1. Let’s begin with the housing market.

• Residential construction didn’t rebound much in May. Economists were hoping to see more of a pop in housing starts.

Single-family construction starts were flat.

However, building permits showed some improvement.

• Mortgage applications suggest that we should have already seen a stronger bounce in the housing market.

Source: @MikaelSarwe

Source: @MikaelSarwe

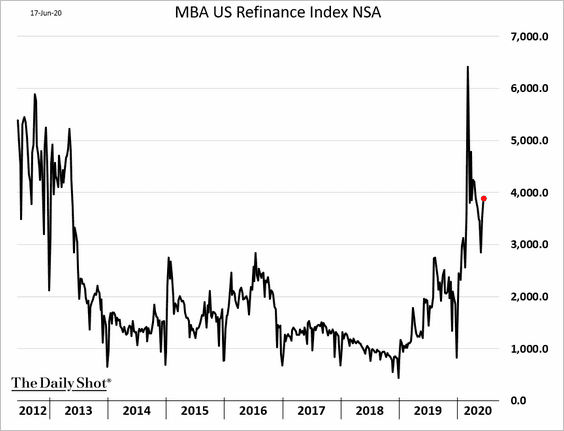

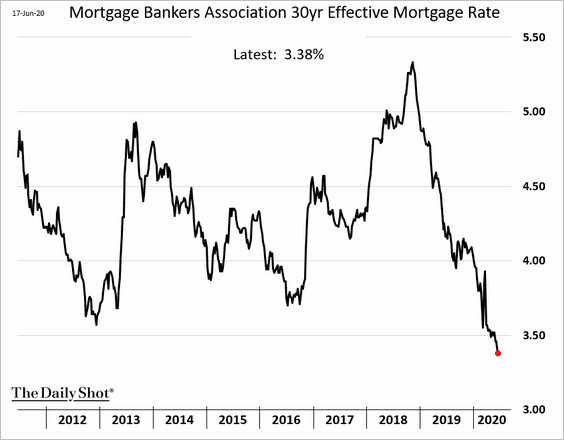

• Mortgage refinance activity remains elevated as rates hover near record lows (second chart).

——————–

2. Next, we have some updates on the labor market.

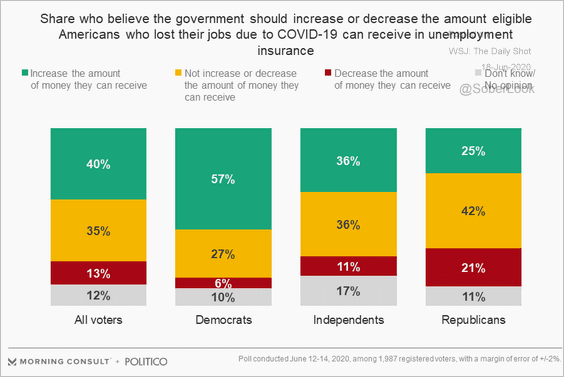

• Should the unemployment benefits be increased?

Source: Morning Consult Read full article

Source: Morning Consult Read full article

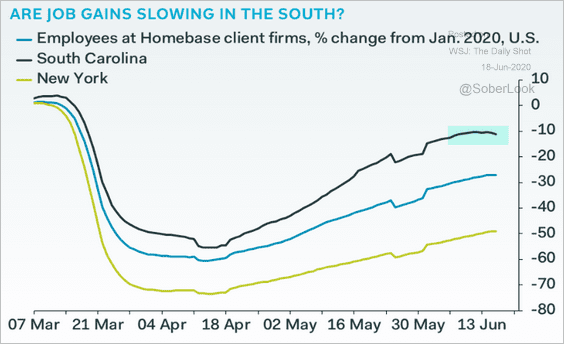

• Is the rebound in job gains losing momentum in some areas of the country?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

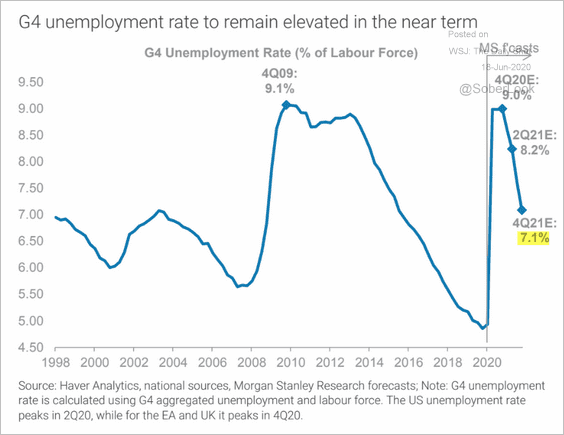

• Morgan Stanley sees the unemployment rate remaining above 7% through the end of 2021.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

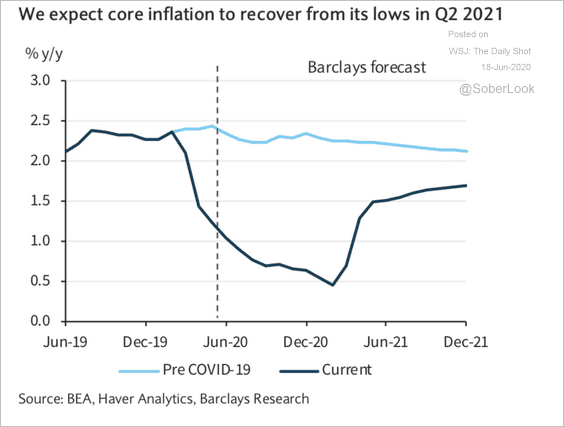

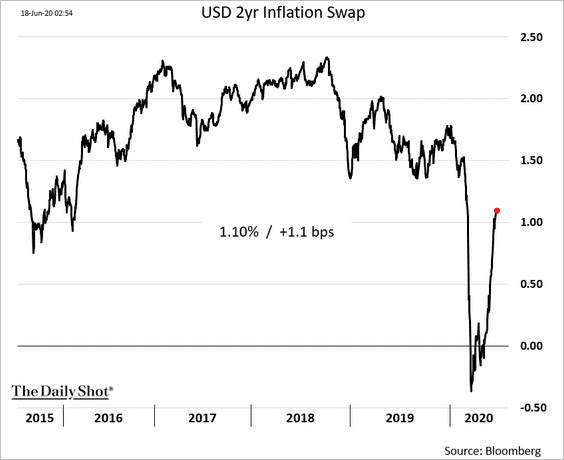

3. Barclays Research expects the core inflation to bottom at 0.5% early next year before recovering.

Source: Barclays Research

Source: Barclays Research

Market-based short-term inflation expectations are rebounding.

——————–

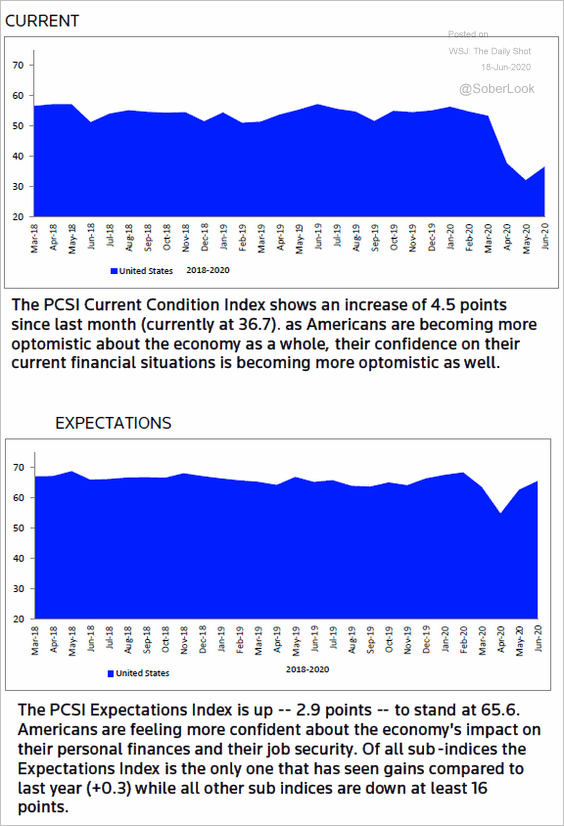

4. According to Refinitiv, consumer sentiment improved in June, with the expectations index approaching pre-crisis levels (second chart).

Source: Refinitiv

Source: Refinitiv

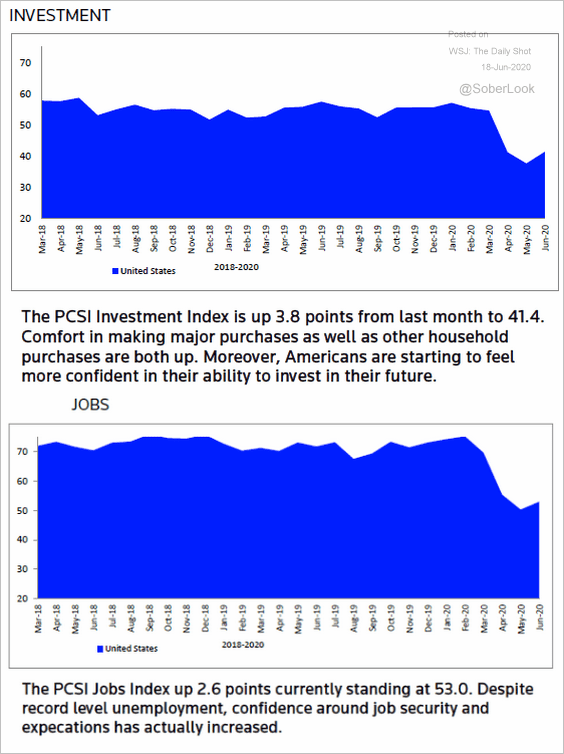

Here are the sentiment indices on investment and jobs.

Source: Refinitiv

Source: Refinitiv

——————–

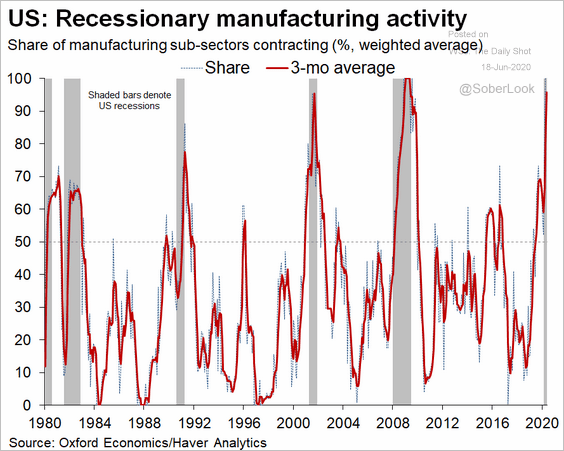

5. The manufacturing sector remains in recession.

Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

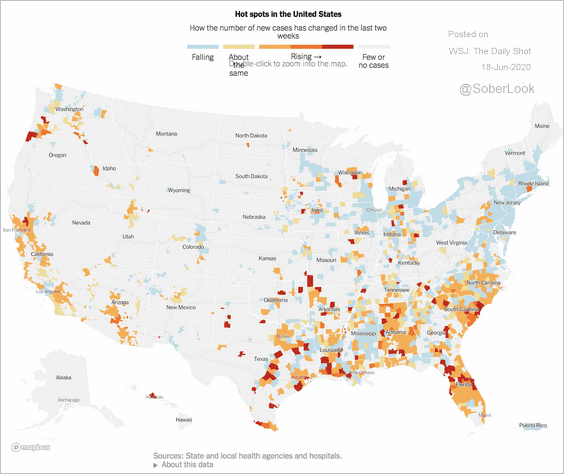

6. Finally, this map shows the COVID-19 hotspots.

Source: The New York Times Read full article

Source: The New York Times Read full article

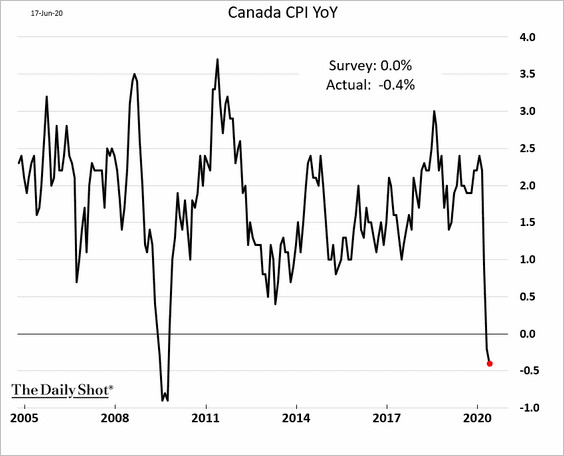

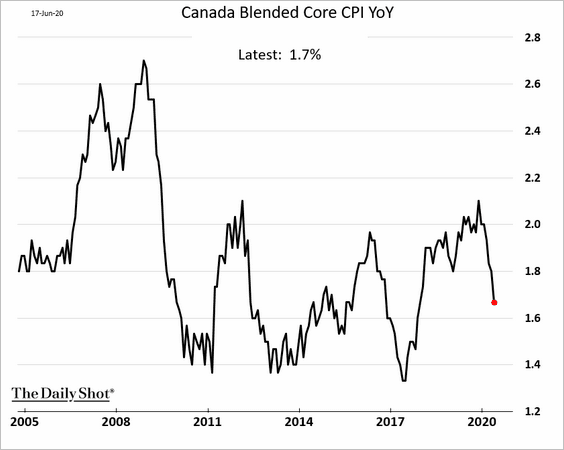

Canada

1. Canada faces deflation for the first time in over a decade.

Core inflation continues to moderate.

——————–

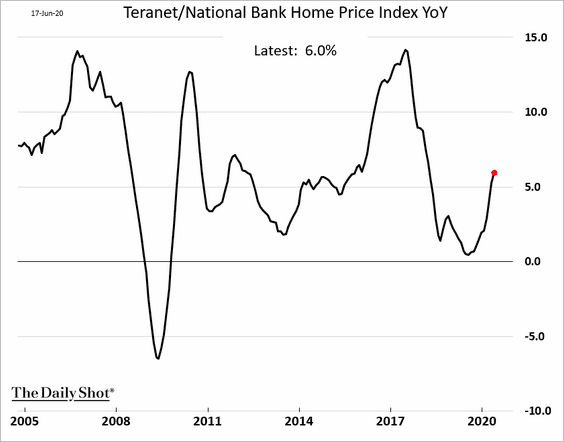

2. Home price appreciation is rebounding.

The United Kingdom

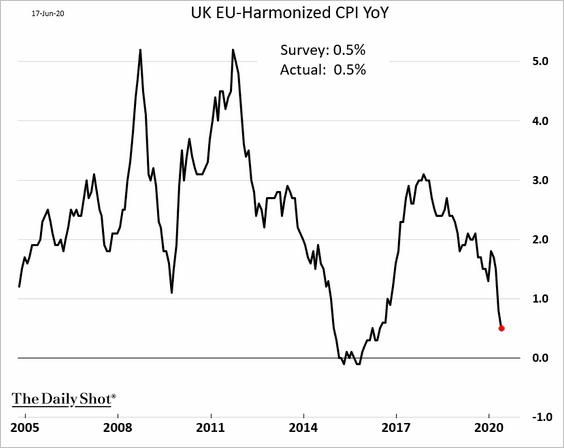

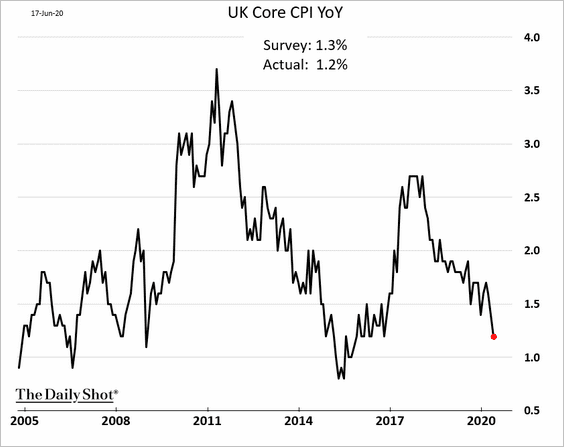

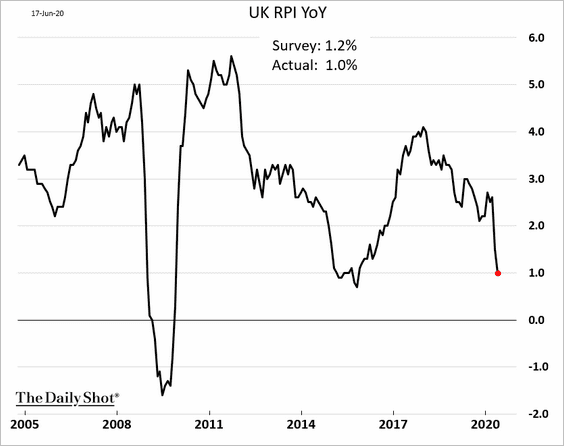

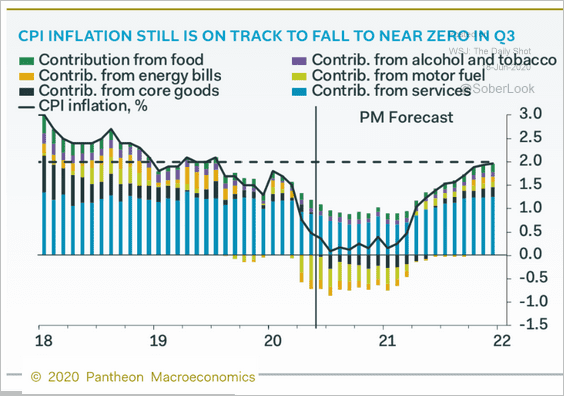

1. Inflation is slowing across the board.

• The headline CPI:

• Core CPI:

• The retail price index (RPI):

Here is a forecast from Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

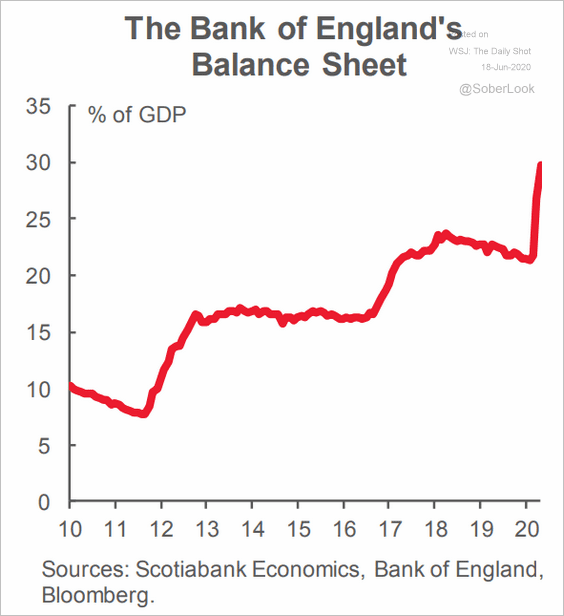

2. The Bank of England’s balance sheet is expanding rapidly.

Source: Scotiabank Economics

Source: Scotiabank Economics

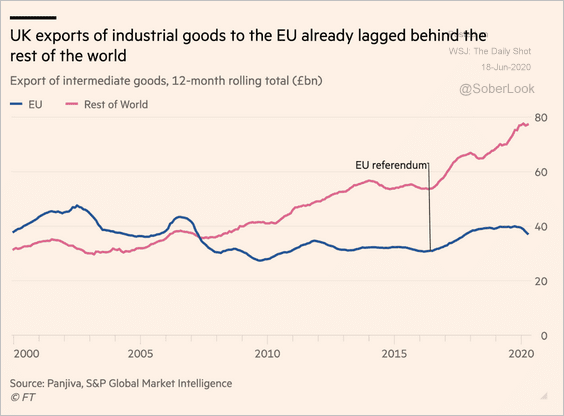

3. This chart shows UK exports of industrial goods to the EU vs. the rest of the world.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

The Eurozone

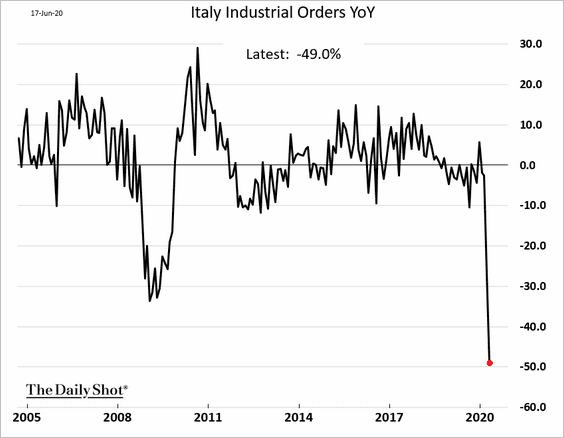

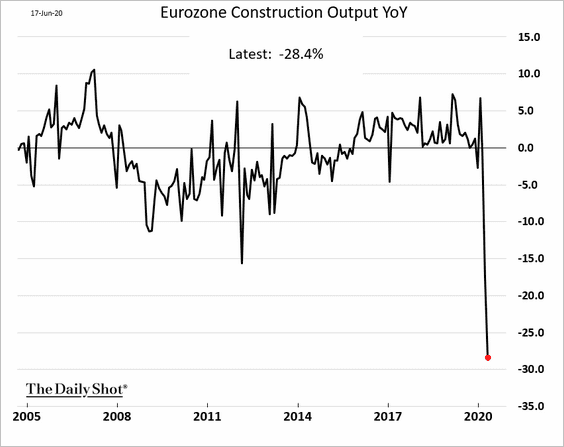

1. April’s economic reports continue to point to a disastrous month for the euro area.

• Italian industrial orders:

• Eurozone construction output:

——————–

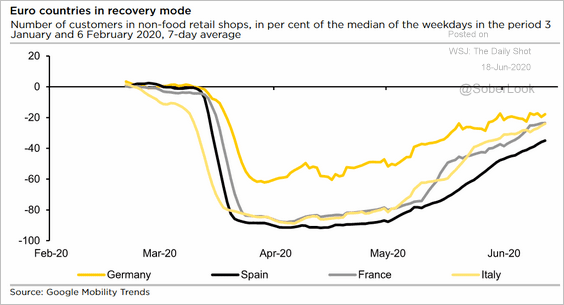

2. But activity seems to be recovering.

Source: Commerzbank Research

Source: Commerzbank Research

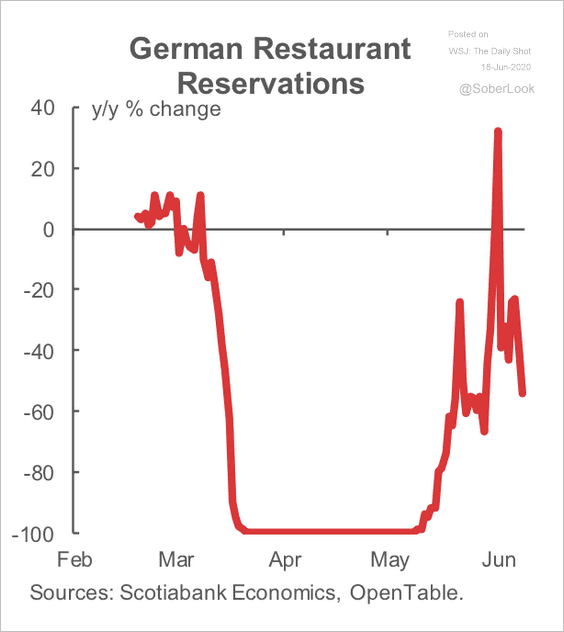

However, there has been a pullback in Germany’s restaurant reservations.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

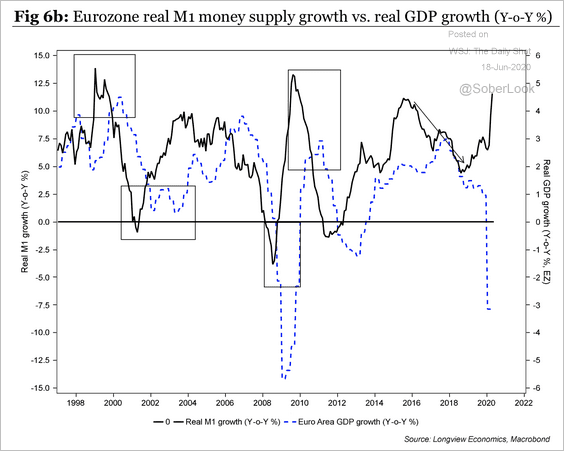

3. Real M1 money supply growth is typically a leading indicator of economic growth.

Source: Longview Economics

Source: Longview Economics

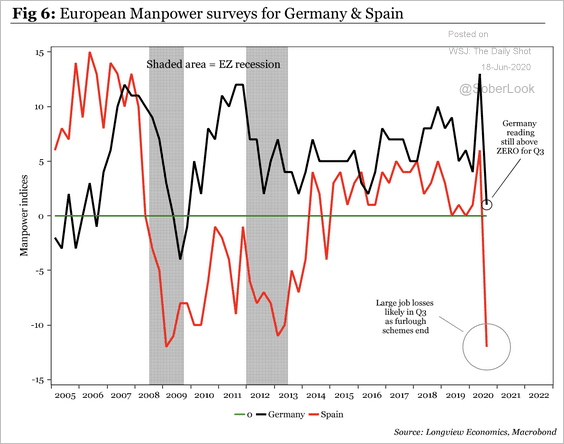

4. The employment outlook in Spain has been far worse than in Germany.

Source: Longview Economics

Source: Longview Economics

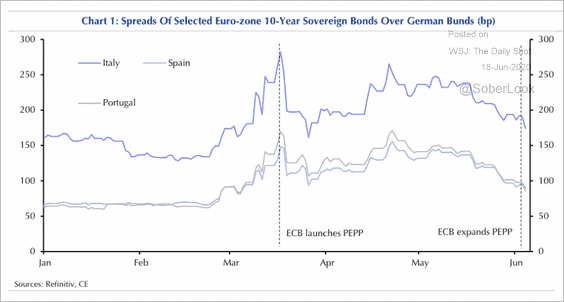

5. Following the expansion of the ECB’s Pandemic Emergency Purchase Program (PEPP), riskier sovereign spreads narrowed substantially.

Source: Capital Economics

Source: Capital Economics

Asia – Pacific

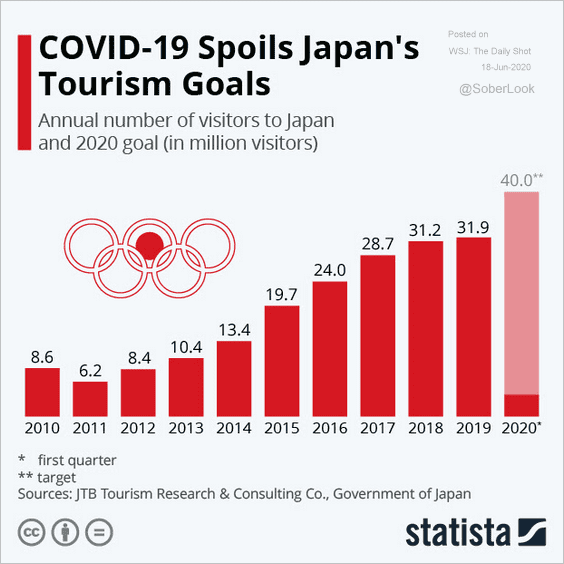

1. Japan’s expected 2020 tourism boom didn’t materialize.

Source: Statista

Source: Statista

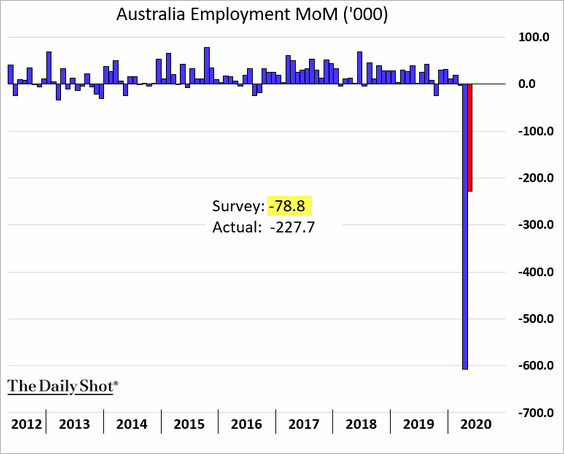

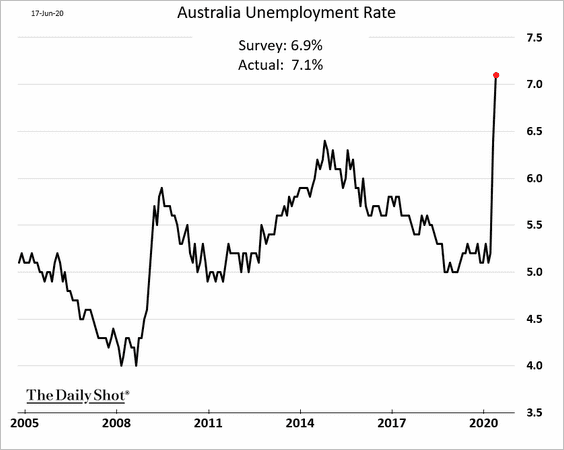

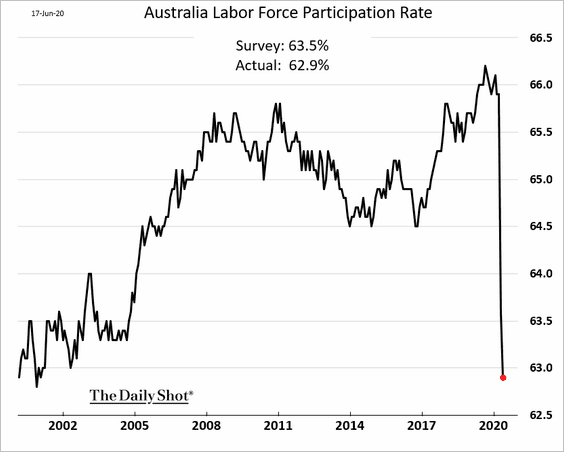

2. Australia’s May jobs report was disappointing.

• Job losses (much higher than expected):

• The unemployment rate:

• Labor force participation:

——————–

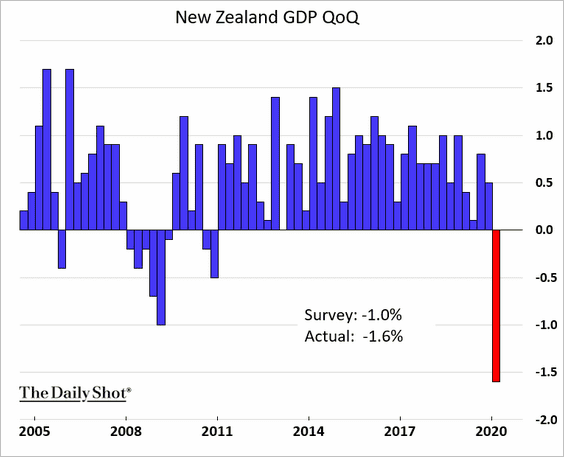

3. New Zealand’s Q1 GDP decline was larger than expected.

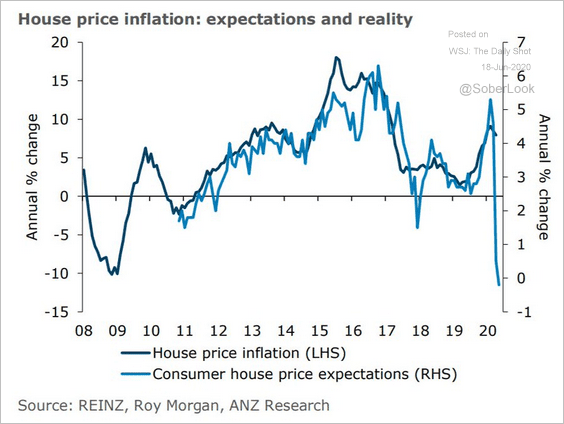

Will New Zealand’s home prices decline this year?

Source: ANZ Research, @Callum_Thomas

Source: ANZ Research, @Callum_Thomas

China

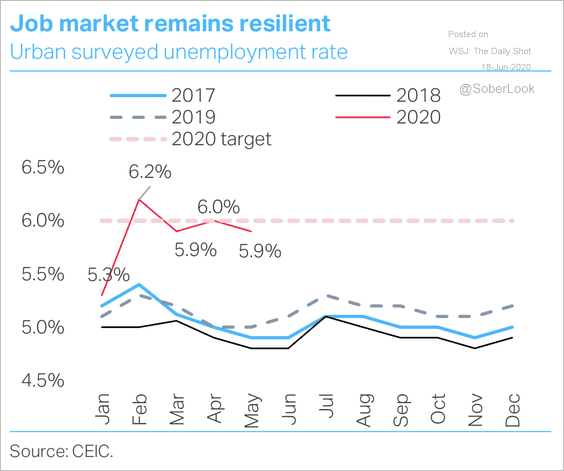

1. The unemployment rate is starting to decline.

Source: TS Lombard

Source: TS Lombard

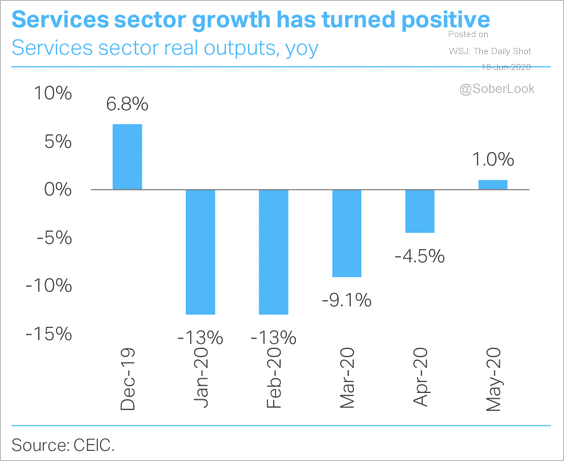

2. The services sector registered positive year-over-year growth in May.

Source: TS Lombard

Source: TS Lombard

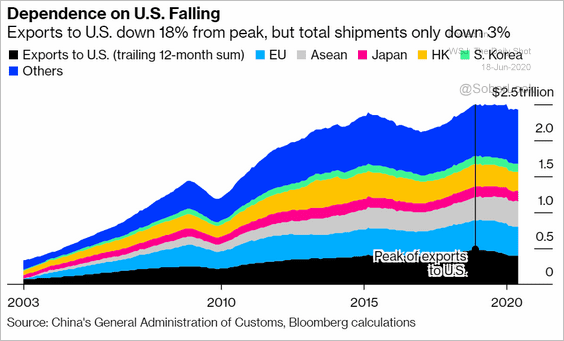

3. This chart shows the composition of China’s exports.

Source: @business Read full article

Source: @business Read full article

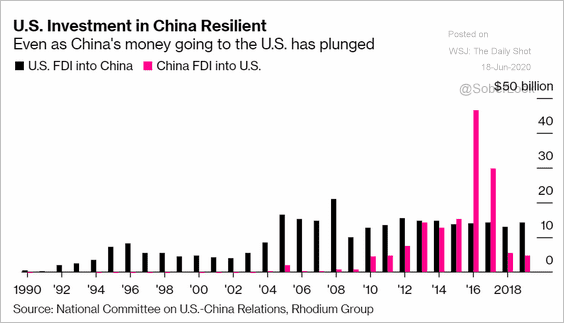

4. While China’s investment in the US has slowed, investment flows in the other direction remain stable.

Source: @business Read full article

Source: @business Read full article

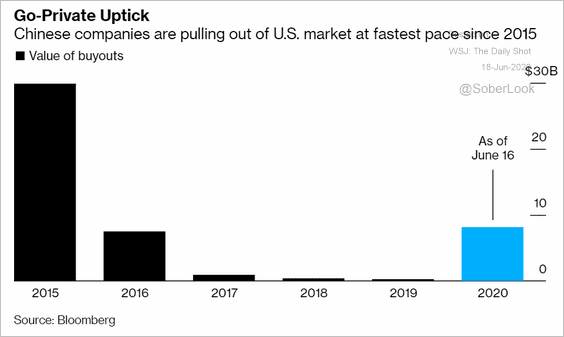

5. Chinese public companies are pulling out of the US market.

Source: @markets Read full article

Source: @markets Read full article

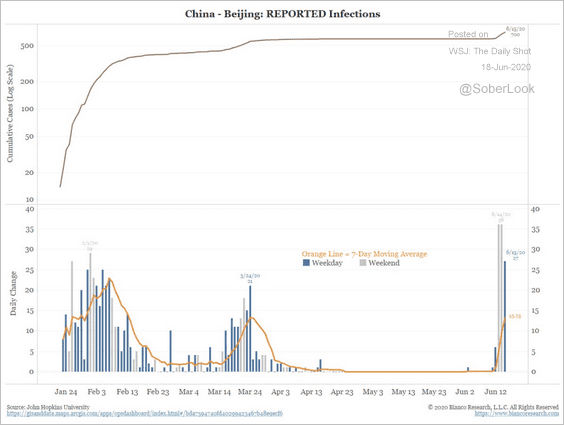

6. The government is extremely concerned about the spike in infections in Bejing.

Source: @biancoresearch

Source: @biancoresearch

Emerging Markets

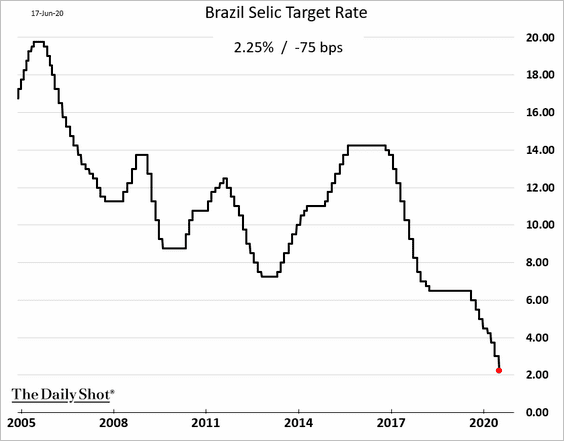

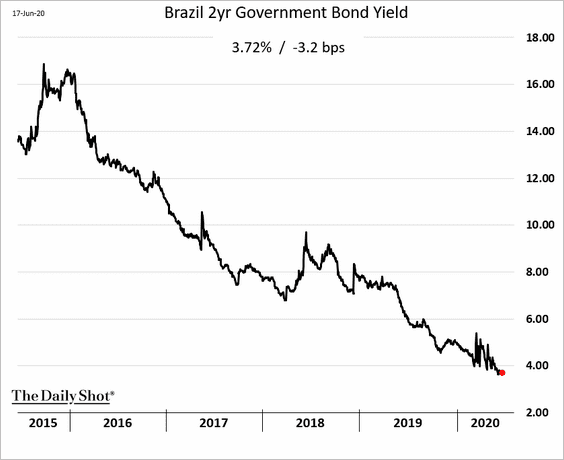

Brazil’s central bank cut rates to record lows.

Here is the 2yr bond yield.

Energy

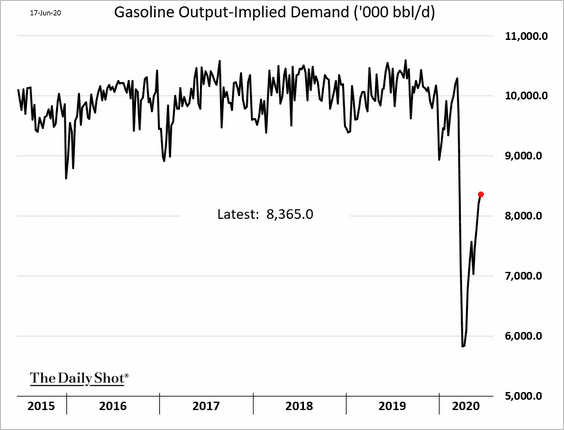

1. US gasoline demand continues to recover.

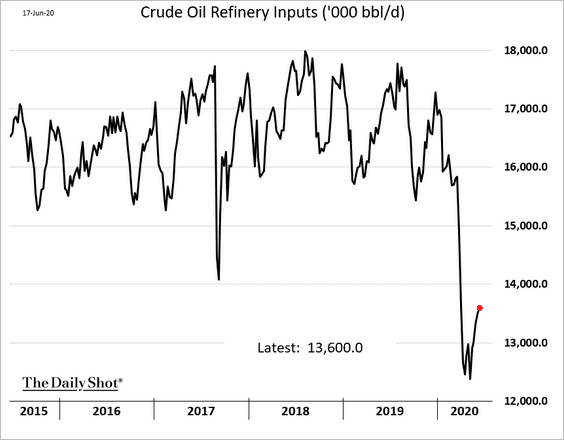

2. US refinery runs are off the lows but remain depressed.

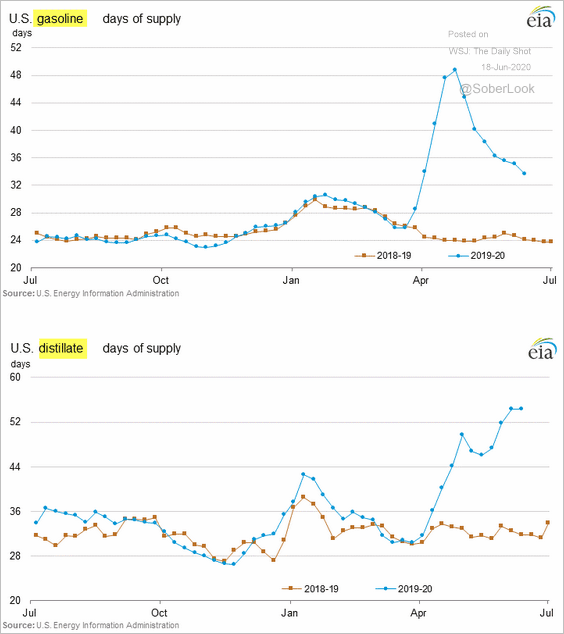

3. This chart shows gasoline and distillates inventories measured in days of supply.

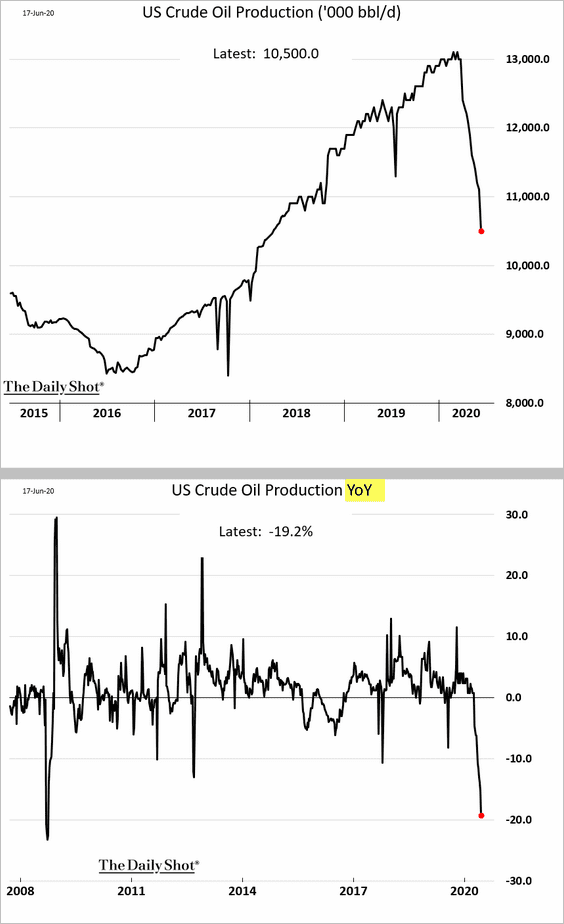

4. US crude oil production is down 19% from the same time a year ago.

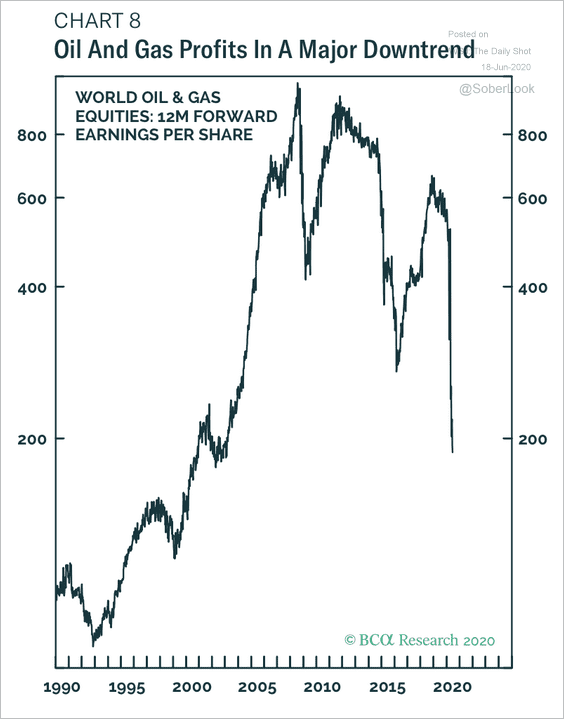

5. Global oil and gas profits are in a historic downtrend.

Source: BCA Research

Source: BCA Research

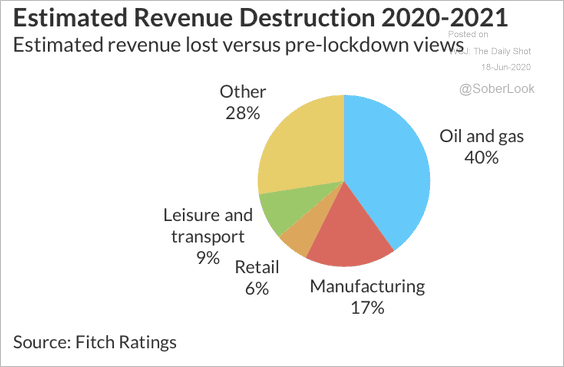

Fitch expects the oil and gas sector to face a record amount of revenue destruction resulting from the pandemic.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

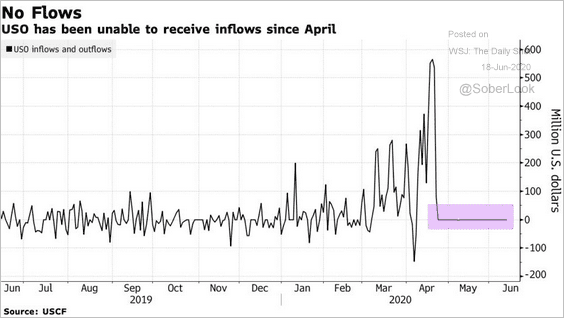

6. USO used to be the largest crude oil ETF. But after oil prices went negative and the fund almost collapsed, inflows have completely stopped.

Source: @markets Read full article

Source: @markets Read full article

Equities

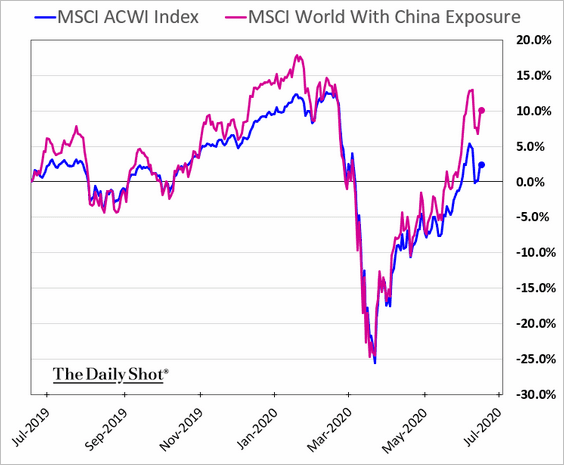

1. Companies with China exposure are outperforming again.

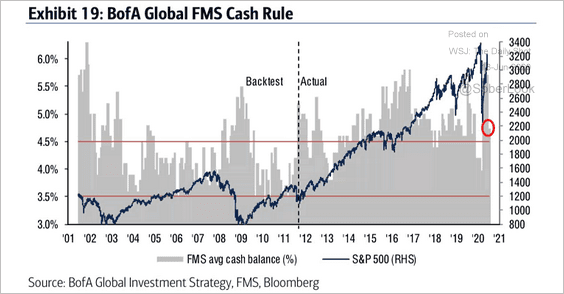

2. Fund managers’ cash balances are declining quickly.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

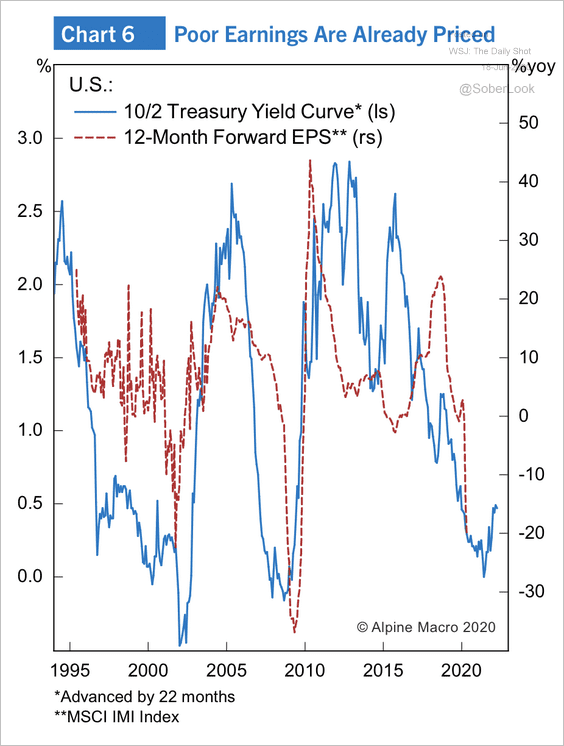

3. The narrative that markets are looking beyond the disastrous earnings declines in the near-term has been giving bulls some ammunition. The stock market has already discounted a 20% drop in earnings 12-months out.

Source: Alpine Macro

Source: Alpine Macro

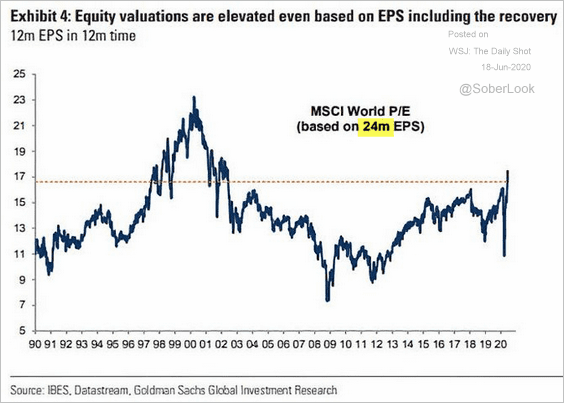

But stocks are also overvalued based on the 24-month earnings-per-share expectations.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

——————–

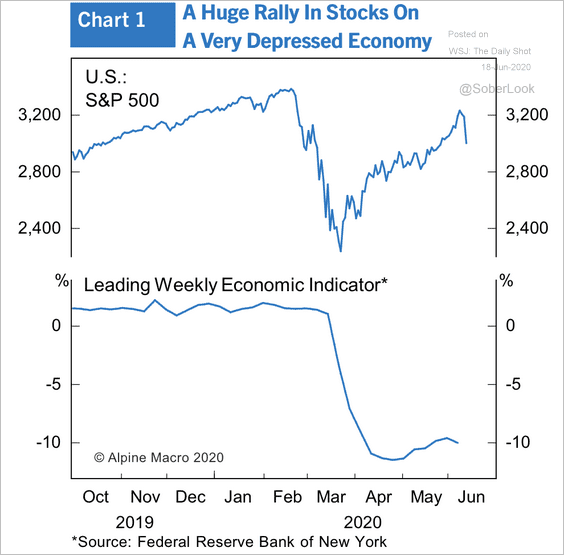

4. Analysts remain concerned about the market’s disconnect with the economy.

Source: Alpine Macro

Source: Alpine Macro

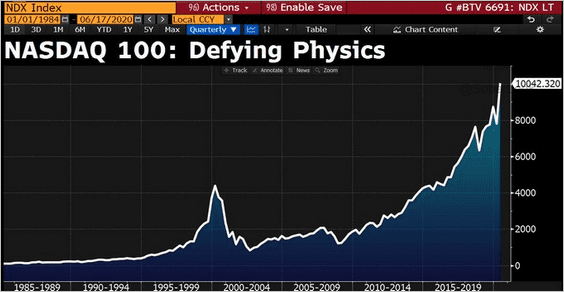

5. The Nasdaq 100 index has had an impressive run.

Source: @TheChartress

Source: @TheChartress

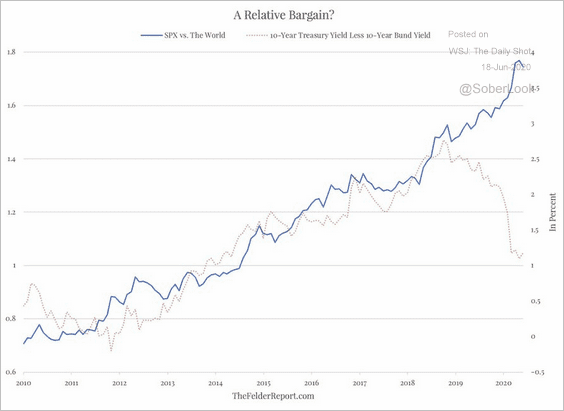

6. The solid blue line in the chart below is the S&P 500 relative performance vs. the rest of the world. The red dotted line is the spread between the 10yr Treasury yield and the 10yr Bund yield.

Source: @jessefelder Read full article

Source: @jessefelder Read full article

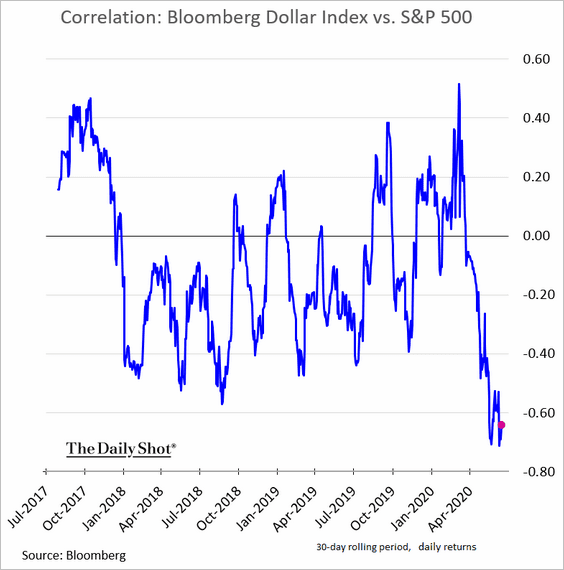

7. The S&P 500/US dollar correlation is increasingly negative.

h/t Adam Haigh

h/t Adam Haigh

8. Quantitative hedge funds have been scraping data on retail investors’ most popular shares and trading on this information (see story). Here are the most popular stocks on Robinhood.

Source: Robintrack Read full article

Source: Robintrack Read full article

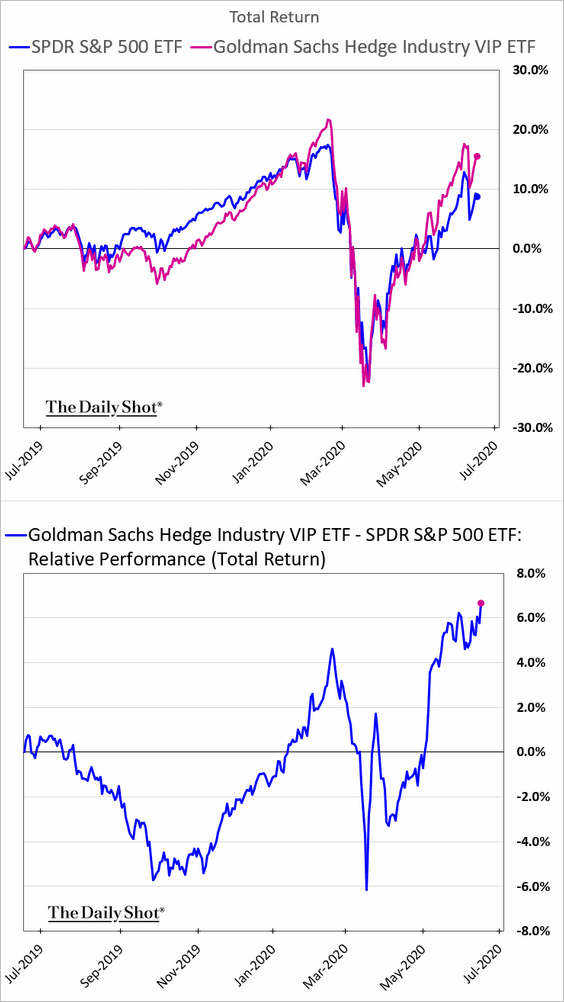

9. Hedge funds’ stock picks have been outperforming.

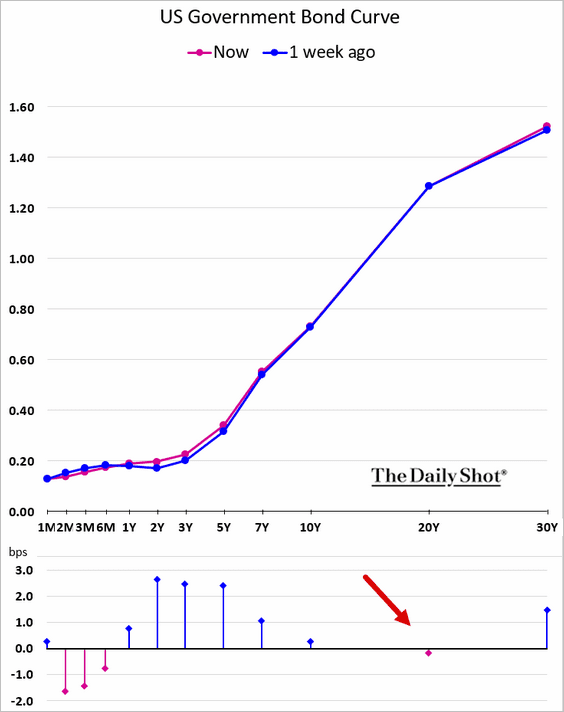

Rates

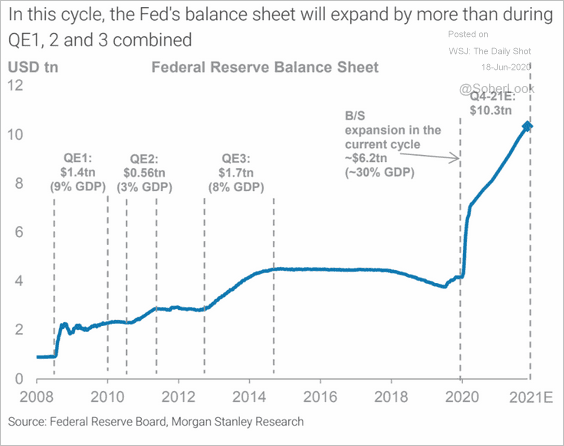

1. The 20yr Treasury is finally getting some respect.

2. Morgan Stanley sees the Fed’s balance sheet exceeding $10 trillion by the end of next year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Global Developments

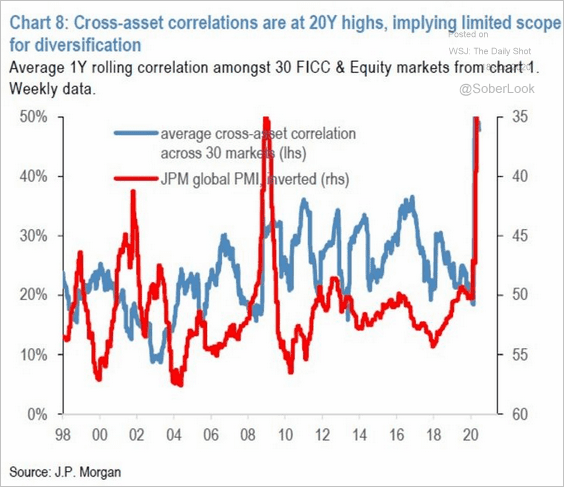

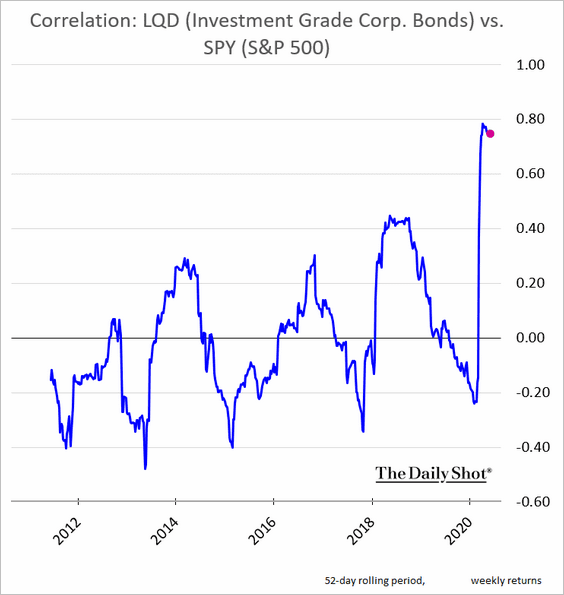

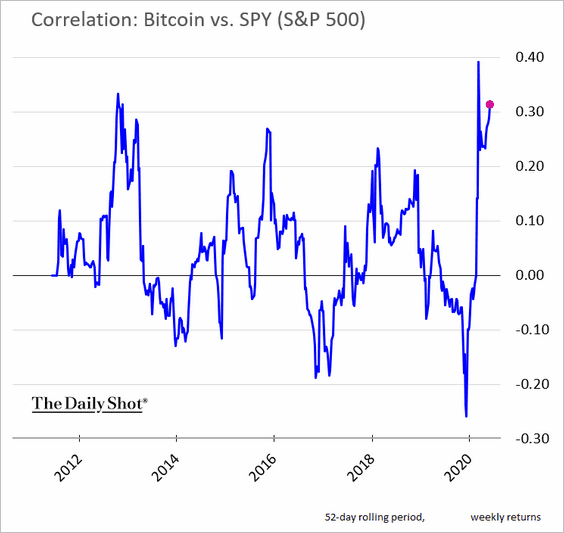

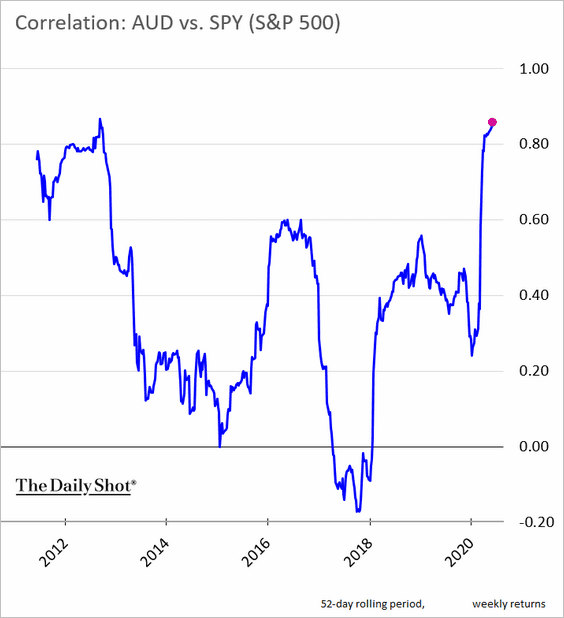

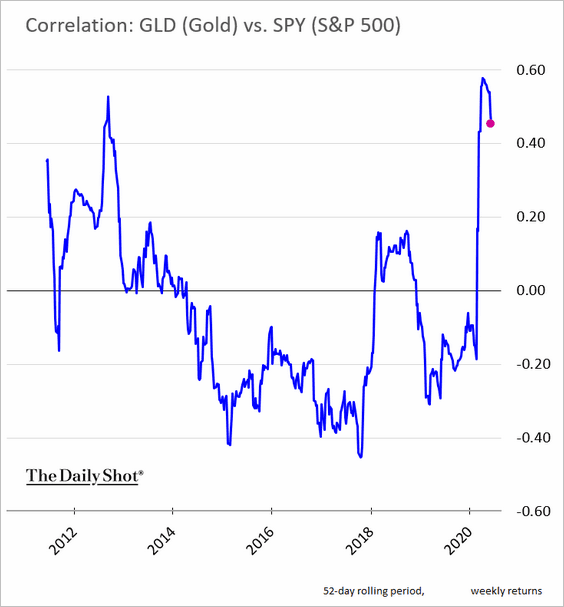

1. Risk assets have been highly correlated since the start of the crisis.

Source: JPMorgan, @markets Read full article

Source: JPMorgan, @markets Read full article

Here are some examples.

• S&P 500 vs. US investment-grade bonds:

• S&P 500 vs. Bitcoin:

• The S&P 500 vs. the Aussie dollar:

Even some assets viewed as defensive have been correlated with the stock market.

——————–

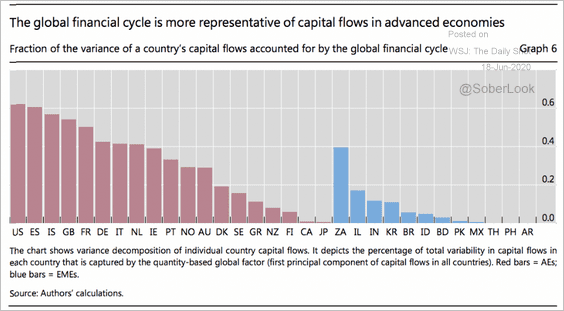

2. According to BIS, capital flows into advanced economies are generally more correlated to the global financial cycle than flows into their emerging counterparts.

Source: BIS

Source: BIS

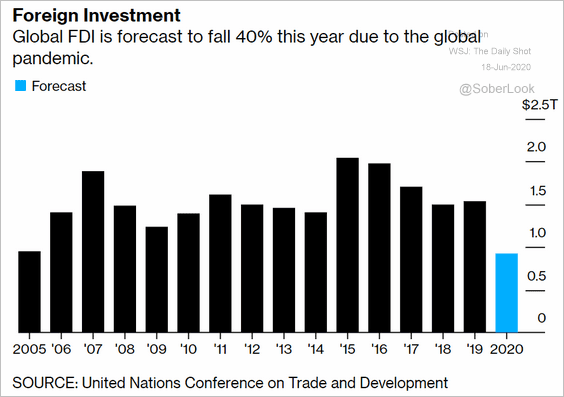

3. Foreign direct investment is down sharply this year.

Source: @markets Read full article

Source: @markets Read full article

——————–

Food for Thought

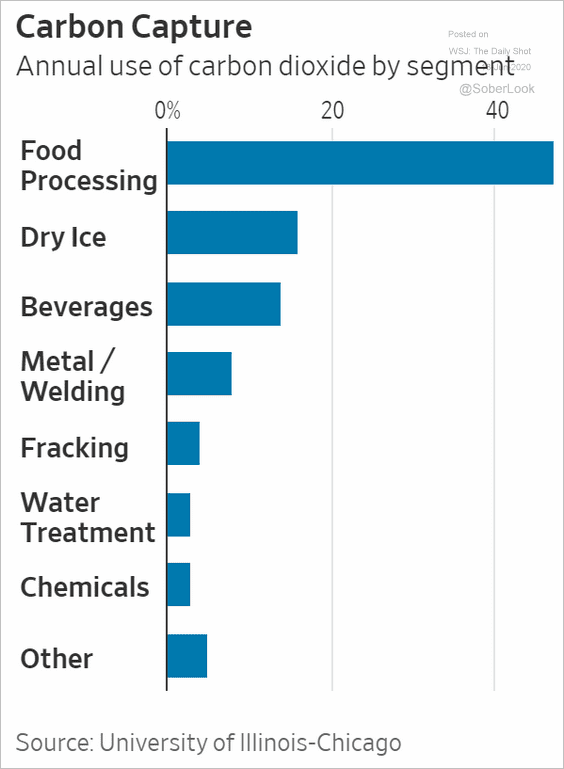

1. Who uses the most carbon dioxide?

Source: @WSJ Read full article

Source: @WSJ Read full article

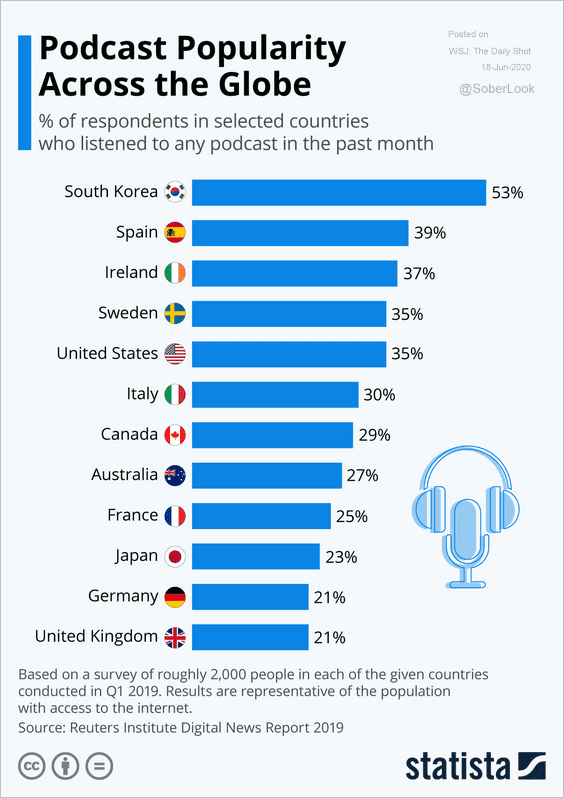

2. Podcast popularity:

Source: Statista

Source: Statista

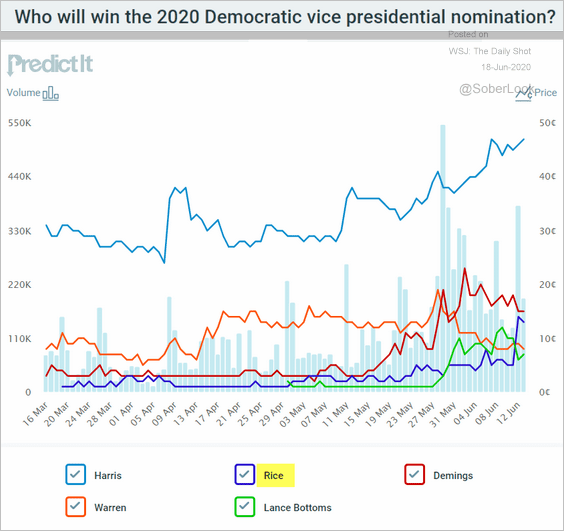

3. Democrats’ VP nomination odds in the betting markets.

Source: @PredictIt

Source: @PredictIt

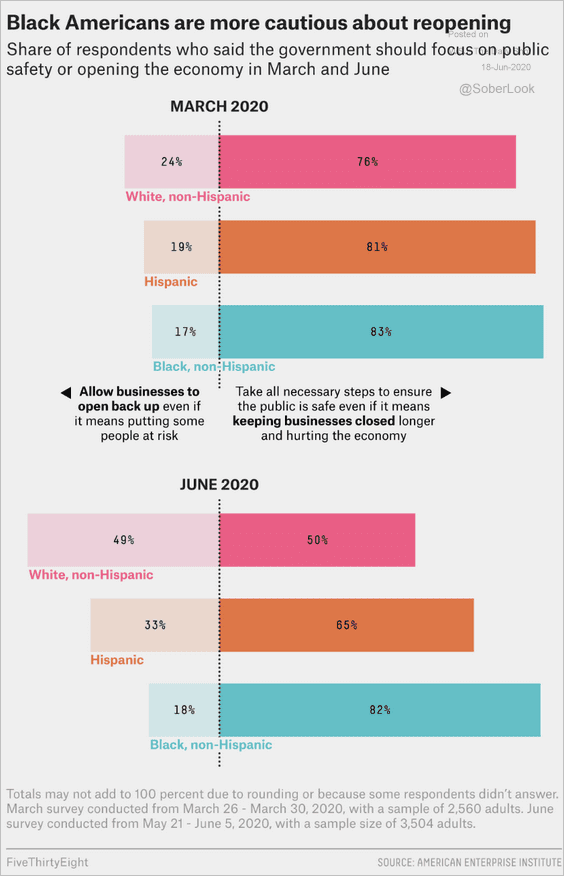

4. Views on reopening:

Source: FiveThirtyEight Read full article

Source: FiveThirtyEight Read full article

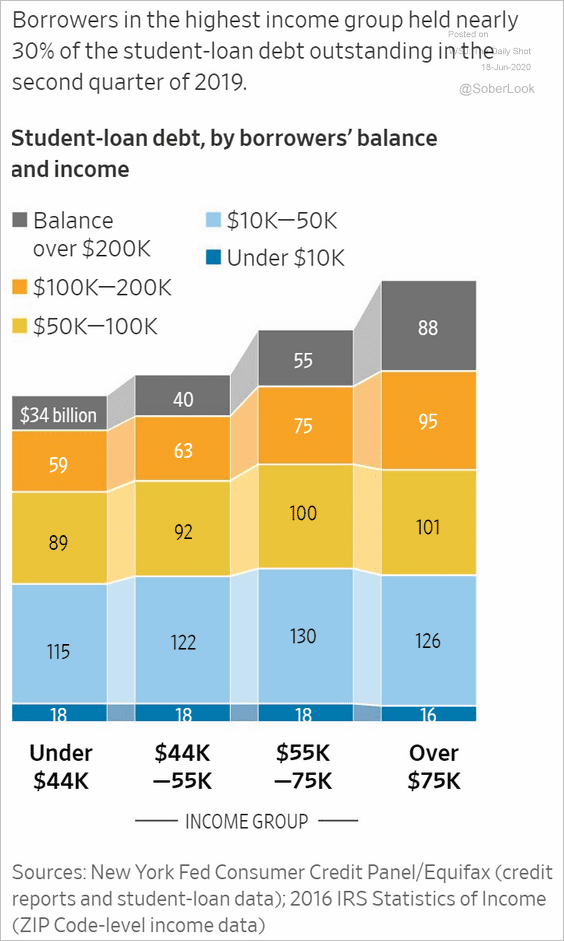

5. Student debt by income:

Source: @WSJ Read full article

Source: @WSJ Read full article

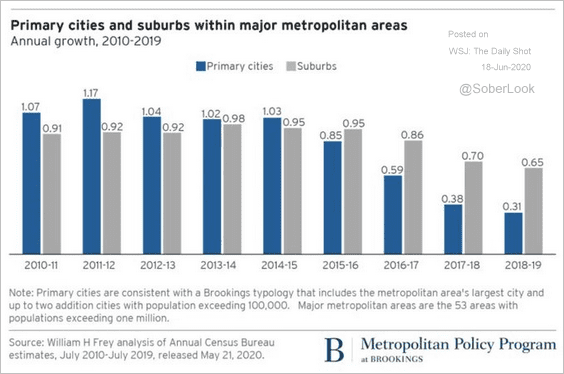

6. Growth of cities vs. suburbs:

Source: @CardiffGarcia Read full article

Source: @CardiffGarcia Read full article

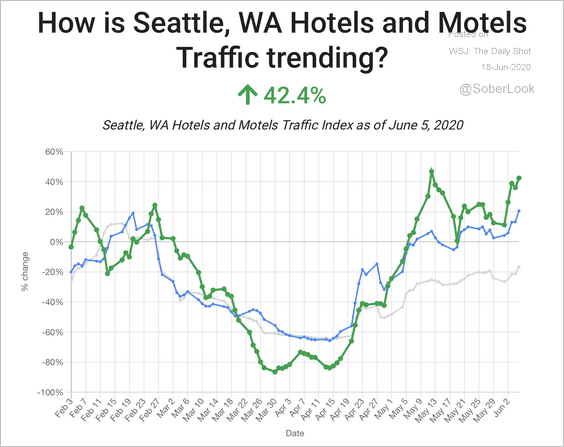

7. Seattle’s recovery:

Source: LocateAI Read full article

Source: LocateAI Read full article

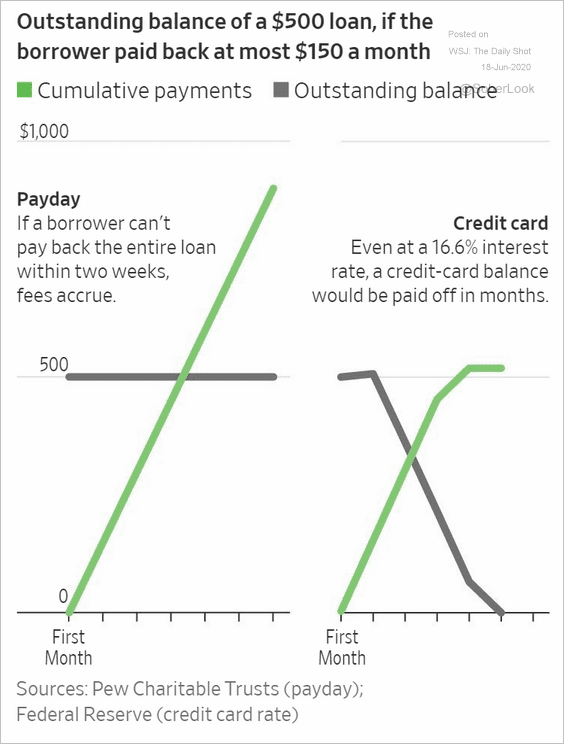

8. Payday loans vs. credit cards:

Source: @WSJ Read full article

Source: @WSJ Read full article

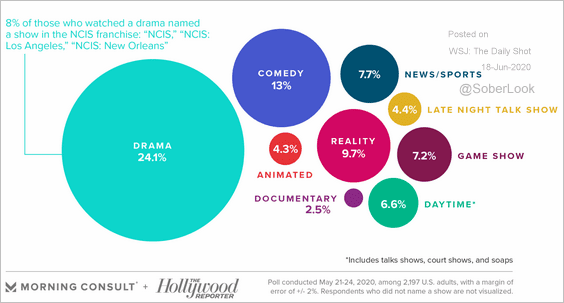

9. What types of shows were Americans watching in May?

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–