The Daily Shot: 23-Jun-20

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with the housing market.

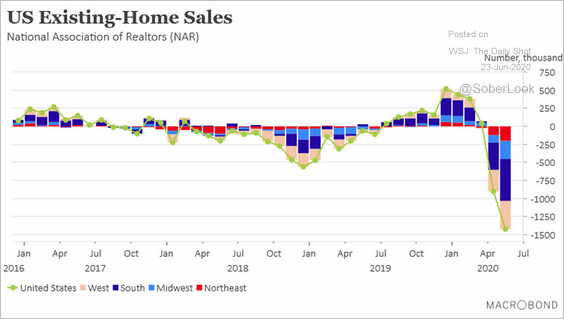

• The existing home sales report for May was disappointing, with sales down almost 27% from May of 2019 (second chart).

This chart shows the year-over-year changes by region.

Source: @MacrobondF Read full article

Source: @MacrobondF Read full article

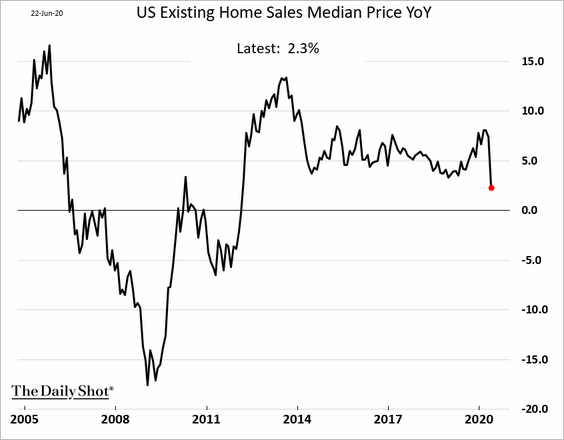

• The median price growth rate declined.

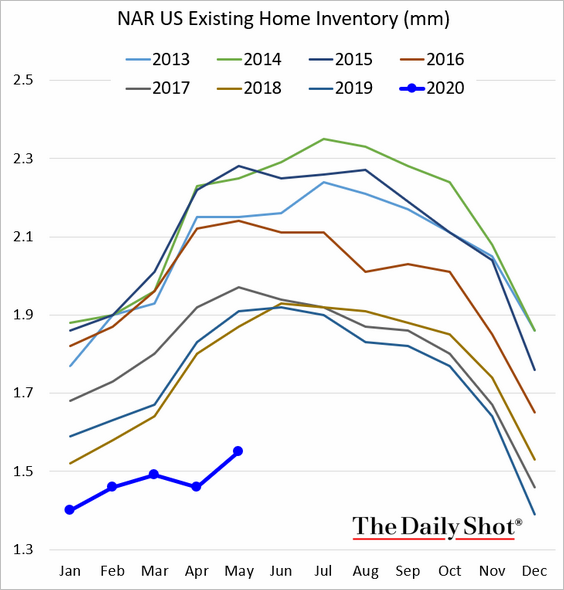

• Inventories of existing homes for sale remain at multi-year lows.

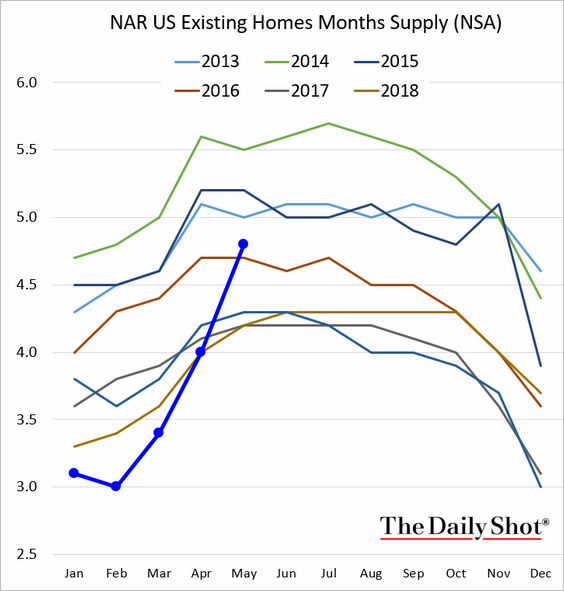

However, when measured in months of supply, inventories are above 2016 levels. This is due to the sharp slowdown in sales (above).

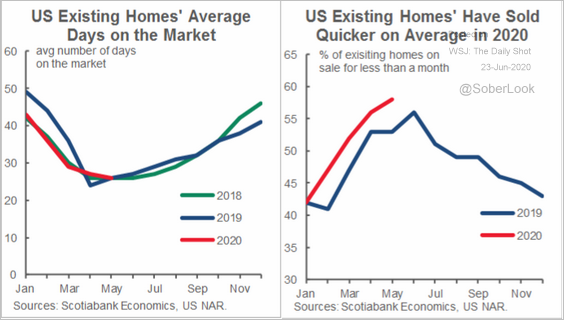

Nonetheless, the average time houses are in the market is consistent with previous years, and homes have been selling quicker on average.

Source: Scotiabank Economics

Source: Scotiabank Economics

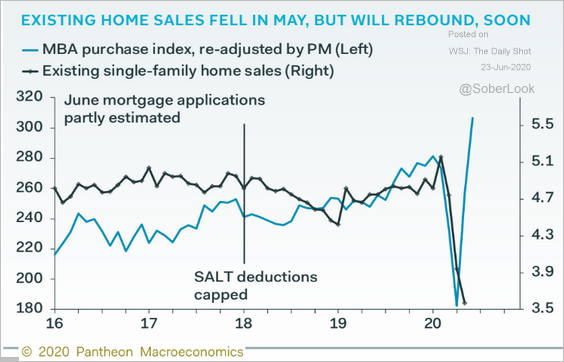

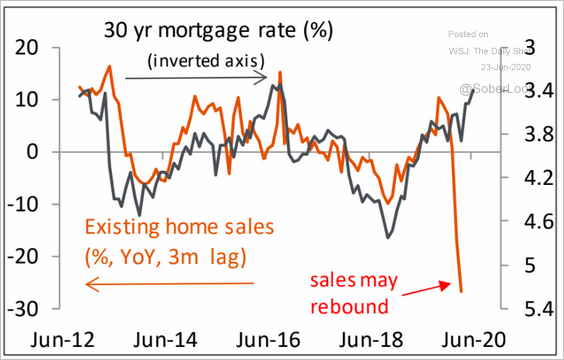

• Mortgage applications (chart below) and mortgage rates (second chart) point to a sharp rebound in home sales this month.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Piper Sandler

Source: Piper Sandler

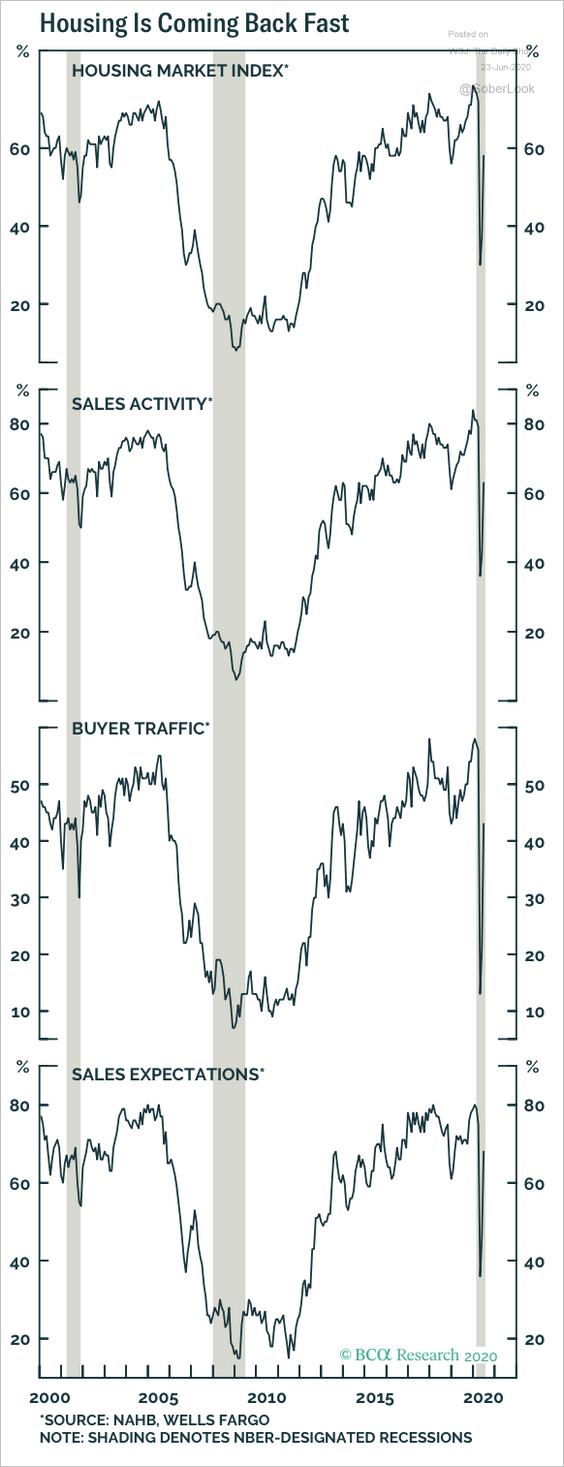

Other indicators also point to strength in the housing market.

Source: BCA Research

Source: BCA Research

——————–

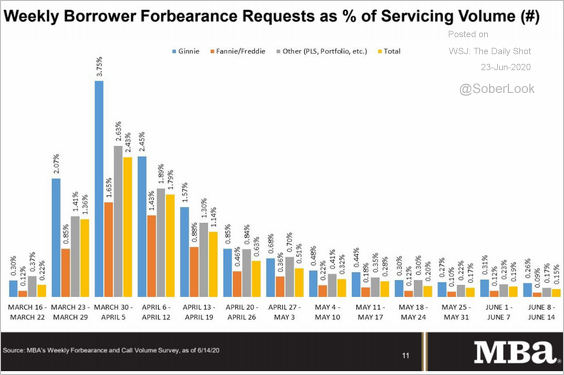

2. Mortgage forbearance requests have slowed.

Source: Mortgage Bankers Association

Source: Mortgage Bankers Association

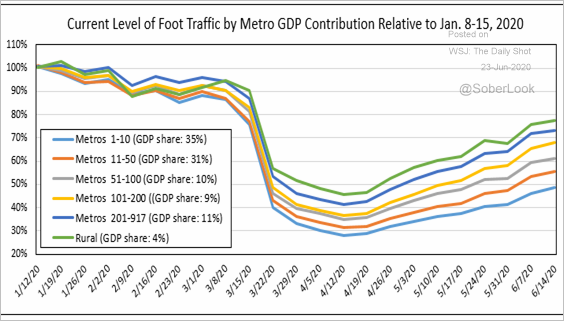

3. Next, let’s take a look at some economic activity indicators.

• Foot traffic by metro size (AEI monitors foot traffic “to retail establishments, restaurants, shopping malls, hotels, movie theaters, airports, hospitals, and other places of commerce …” ):

Source: AEI Housing Center

Source: AEI Housing Center

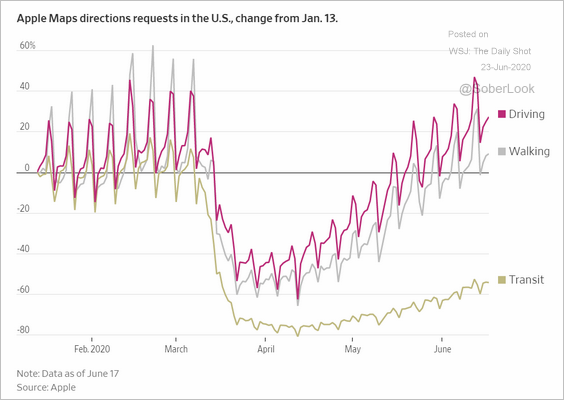

• Driving, walking, and public transit:

Source: @WSJ Read full article

Source: @WSJ Read full article

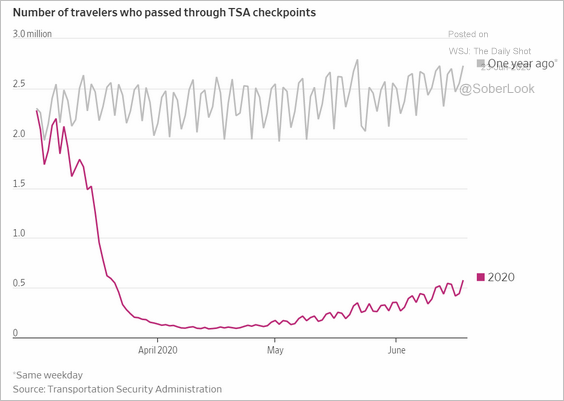

• Flying:

Source: @WSJ Read full article

Source: @WSJ Read full article

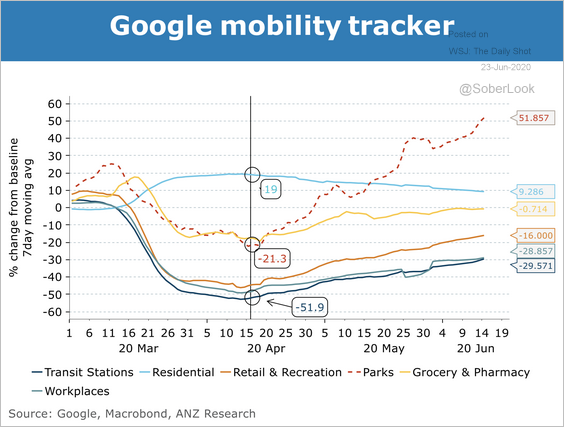

• Mobility trends by destination:

Source: ANZ Research

Source: ANZ Research

——————–

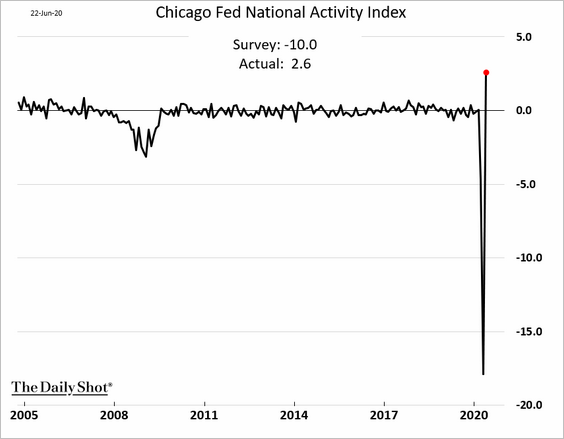

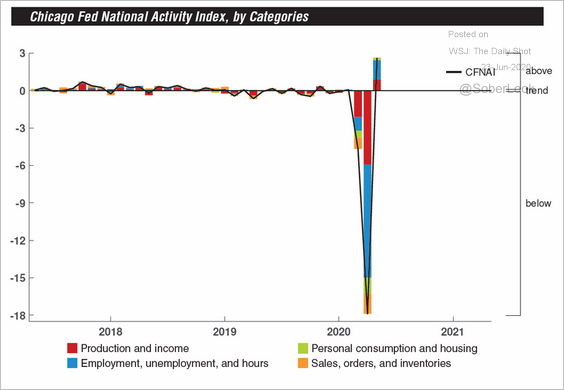

4. The Chicago Fed’s national activity index rebounded in May.

Source: @GregDaco, @ChicagoFed

Source: @GregDaco, @ChicagoFed

——————–

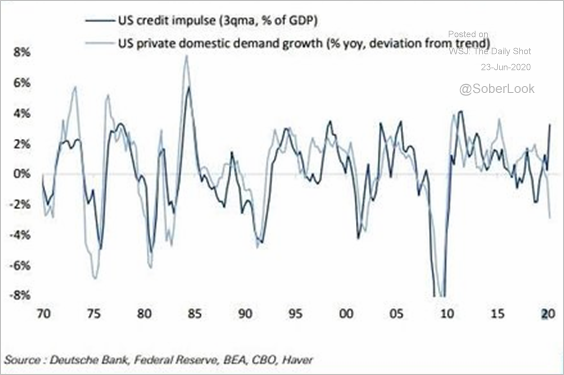

5. Credit expansion is expected to provide a tailwind for the GDP.

Source: @ISABELNET_SA, @DeutscheBank

Source: @ISABELNET_SA, @DeutscheBank

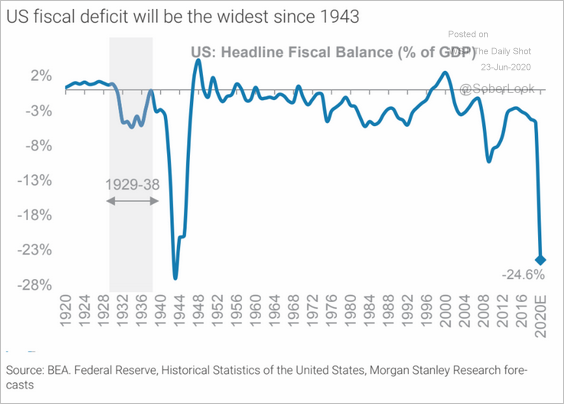

6. According to Morgan Stanley, the federal budget deficit will be the highest since 1943.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

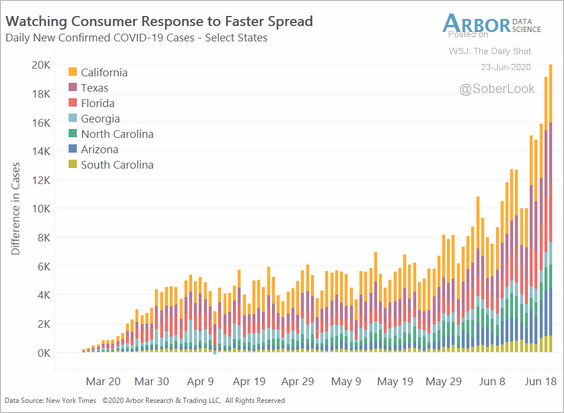

7. Here are some of the states with rising rates of infections.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

The United Kingdom

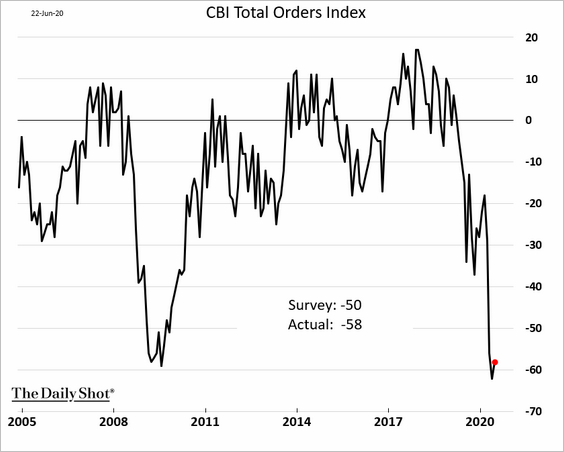

1. The CBI report showed industrial orders remaining exceptionally weak this month.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

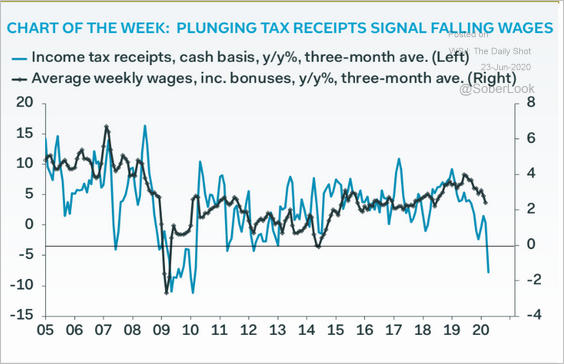

2. Wages are probably declining at this point.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

3. Here is the Bank of England’s balance sheet.

Source: @markets Read full article

Source: @markets Read full article

The Eurozone

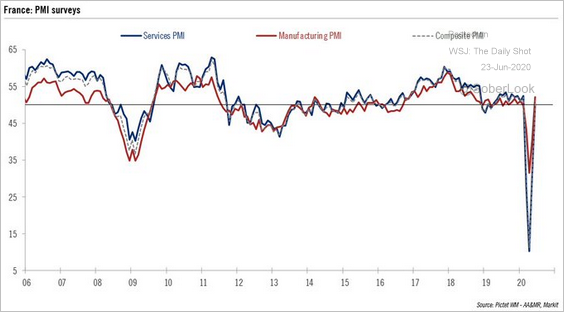

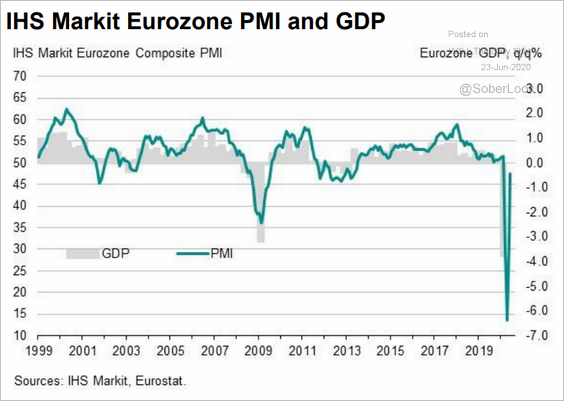

1. The preliminary Markit PMI report shows improvement in business activity this month (topping economists’ estimates). French businesses are in growth mode (PMI > 50).

• French manufacturing and services PMI:

Source: @nghrbi

Source: @nghrbi

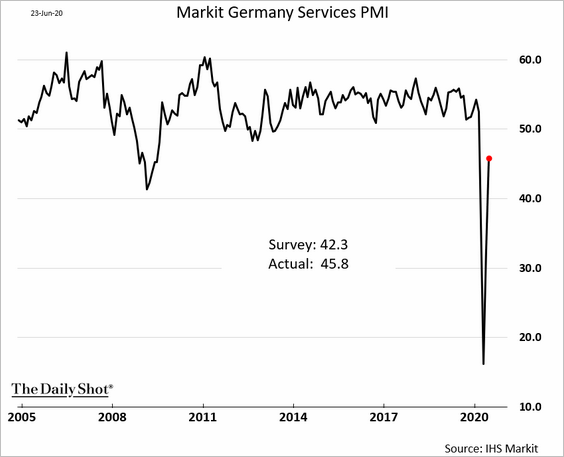

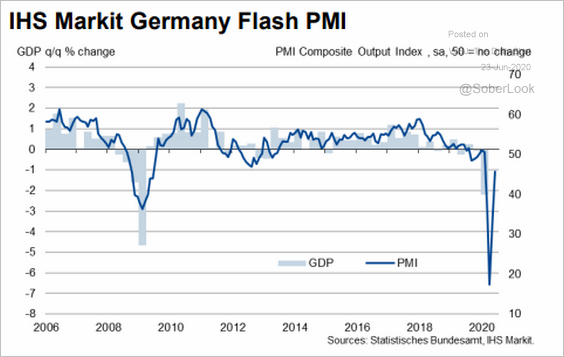

• German PMI:

– manufacturing:

– services:

– composite:

Source: @IHSMarkitPMI Read full article

Source: @IHSMarkitPMI Read full article

• The Eurozone PMI:

Source: @IHSMarkitPMI Read full article

Source: @IHSMarkitPMI Read full article

——————–

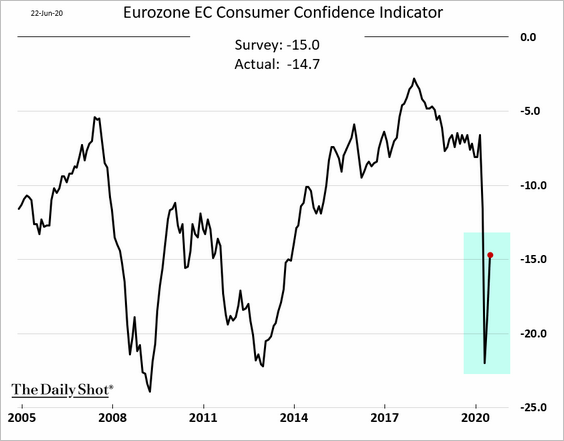

2. Consumer confidence is rebounding.

3. Lufthansa bonds tumbled after Thiele’s threat to block the rescue plan because it dilutes current shareholders (see story).

Source: @Schuldensuehner Further reading

Source: @Schuldensuehner Further reading

Europe

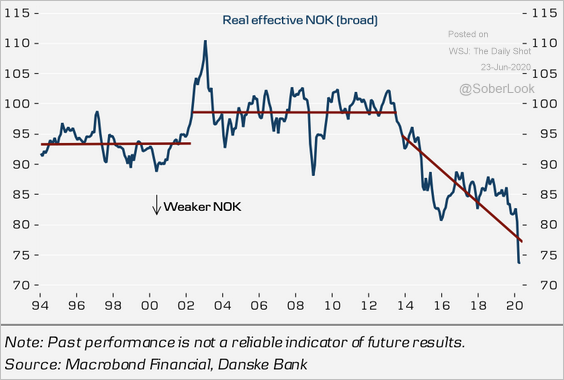

1. The Norwegian Krone has suffered during the dollar’s rise, which contributed to a negative terms of trade shock via commodities, according to Danske Bank.

Source: Danske Bank

Source: Danske Bank

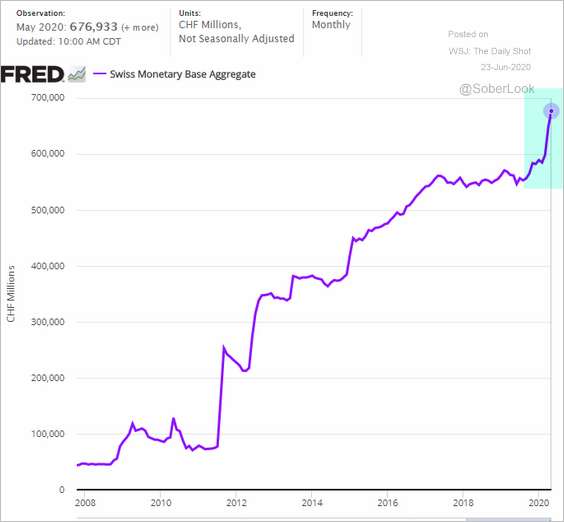

2. The Swiss monetary base hit a new record as the SNB expands its balance sheet.

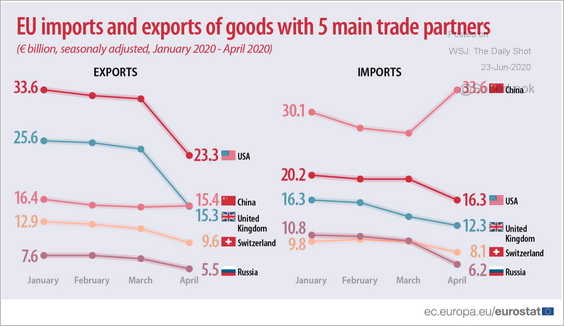

3. This chart shows the trends in EU trade this year.

Source: Eurostat Read full article

Source: Eurostat Read full article

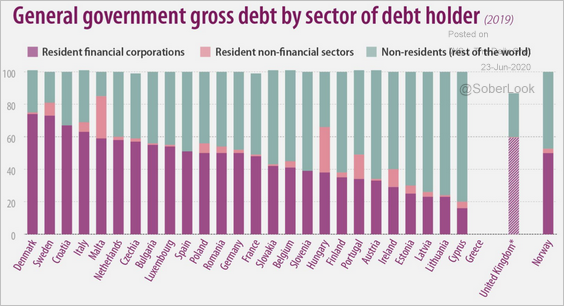

4. Who owns each nation’s government debt?

Source: Eurostat Read full article

Source: Eurostat Read full article

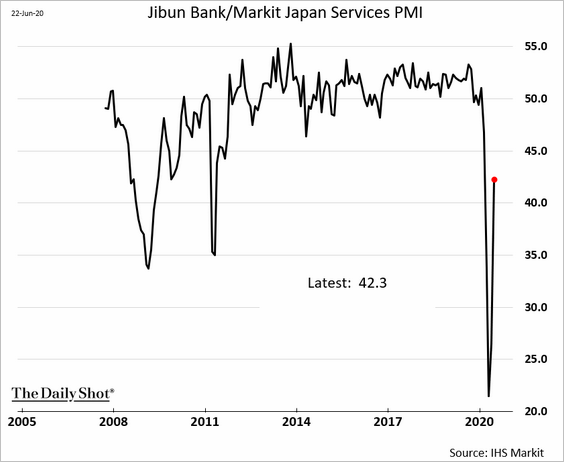

Asia – Pacific

1. Japan’s factory activity deteriorated further in June.

The contraction in services has slowed.

——————–

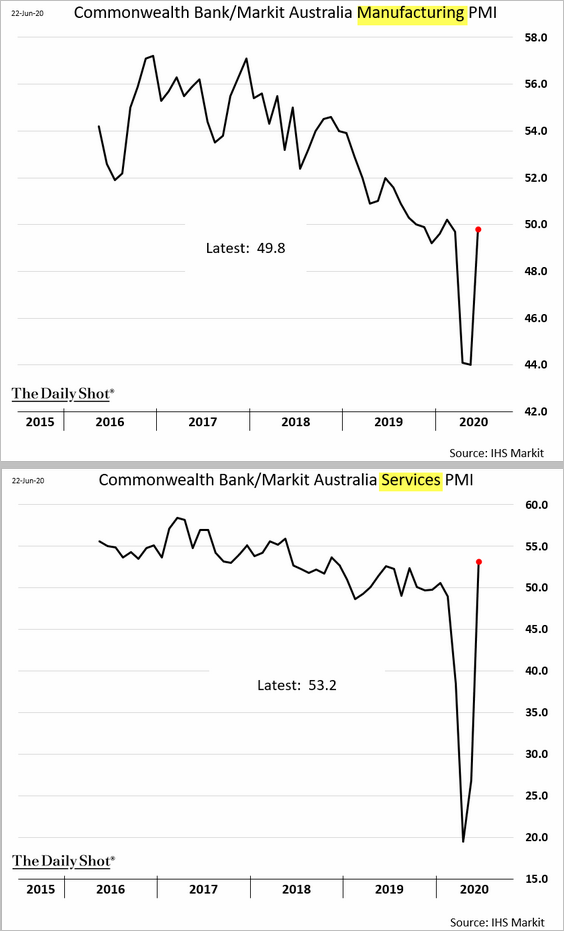

2. Australia’s business activity has stabilized.

China

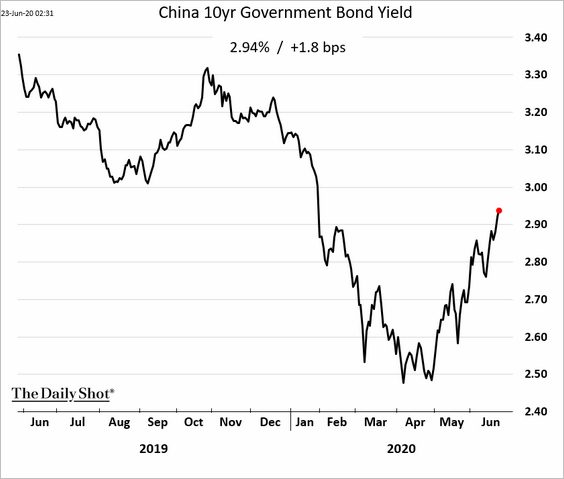

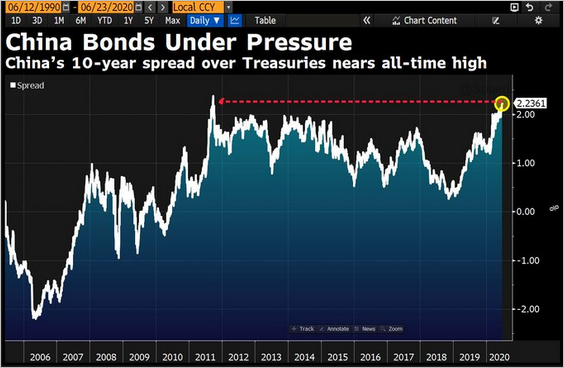

1. Bond yields keep climbing.

Here is the spread to Treasuries.

Source: @DavidInglesTV

Source: @DavidInglesTV

——————–

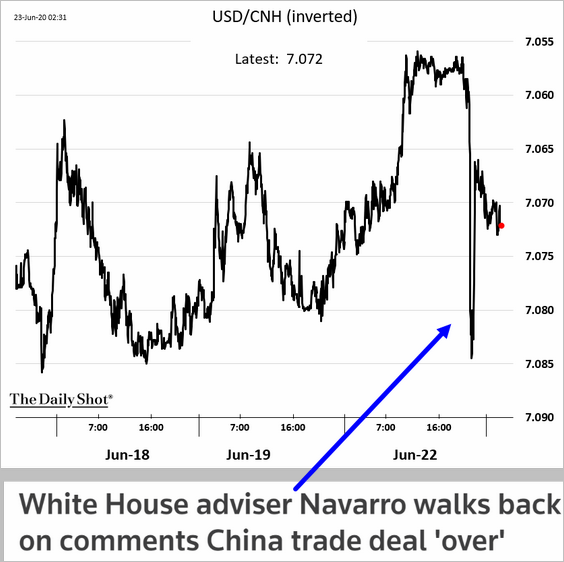

2. The renminbi dipped and then rebounded in response to some confusing messaging from the White House.

Source: Reuters Read full article

Source: Reuters Read full article

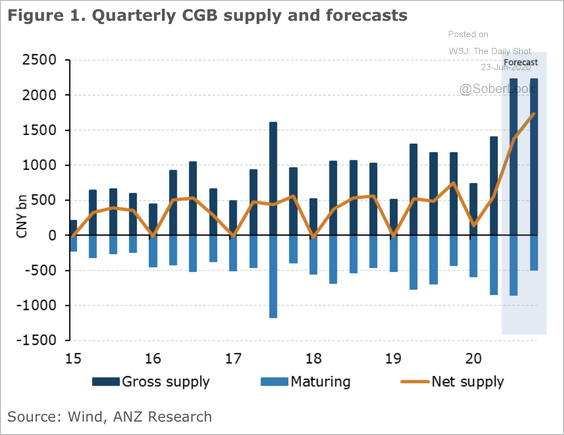

3. The Ministry of Finance’s issuance of CNY 1 trillion of special treasury bonds in the next few weeks will be a prelude to China’s bond supply peak this year, according to ANZ Research.

Source: ANZ Research

Source: ANZ Research

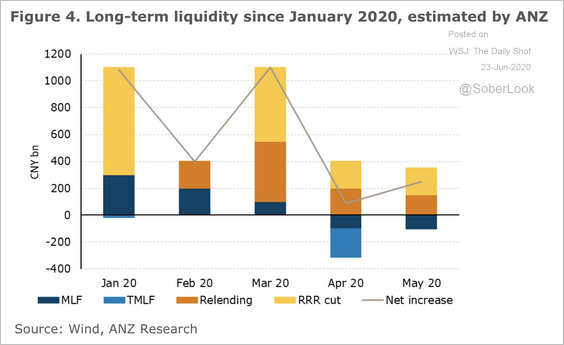

4. The PBoC has emphasized long-term liquidity injections this year.

Source: ANZ Research

Source: ANZ Research

5. This chart shows China’s financial conditions index.

Source: VOX EU Read full article

Source: VOX EU Read full article

Emerging Markets

1. Turkey’s economy has been under severe pressure.

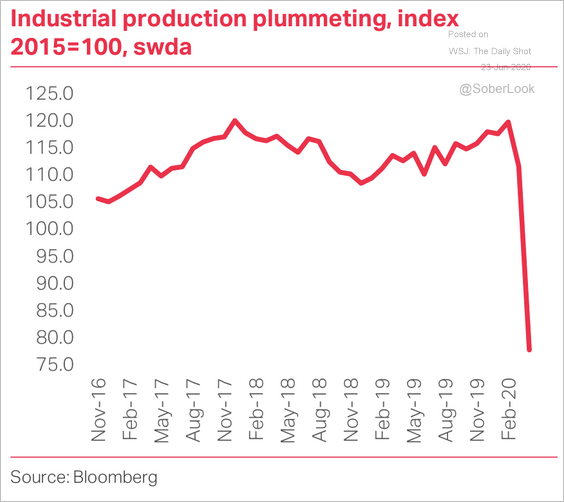

• Industrial production:

Source: TS Lombard

Source: TS Lombard

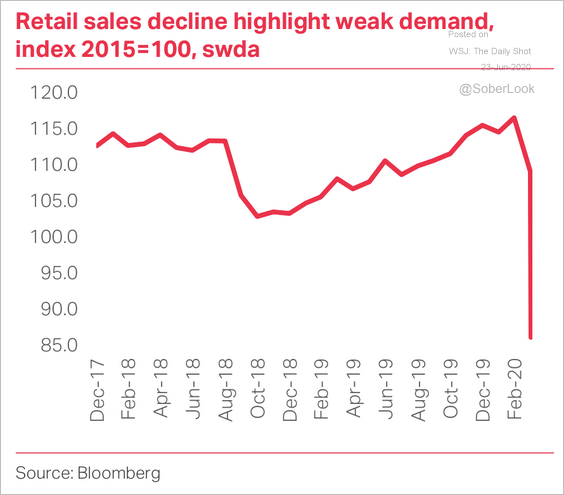

• Retail sales:

Source: TS Lombard

Source: TS Lombard

Nonetheless, the stock market is rapidly rebounding.

——————–

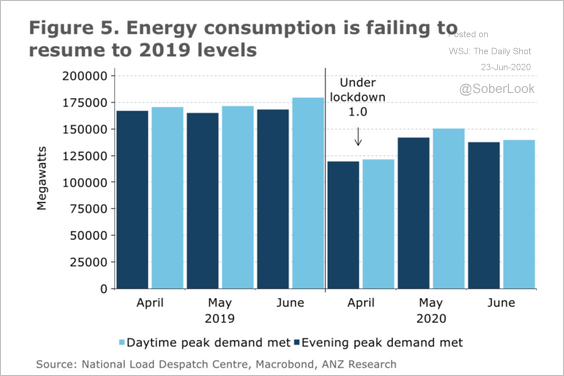

2. India’s energy consumption is not recovering to last year’s levels.

Source: ANZ Research

Source: ANZ Research

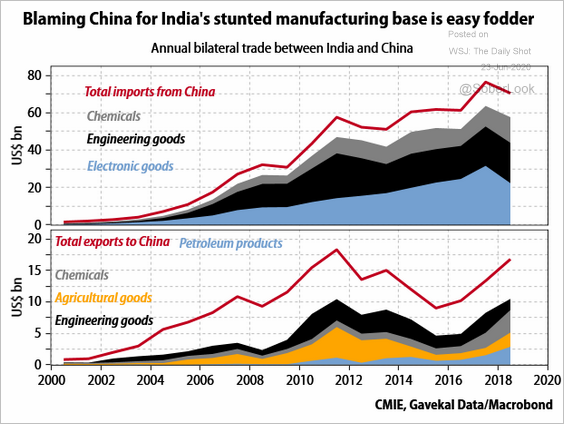

Separately, this chart shows India’s trade with China.

Source: Gavekal

Source: Gavekal

——————–

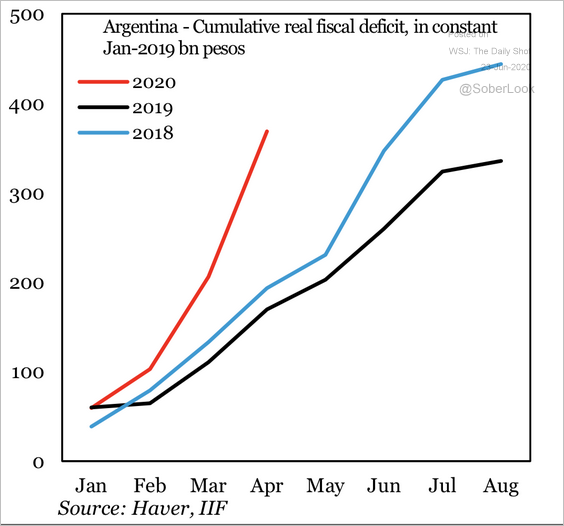

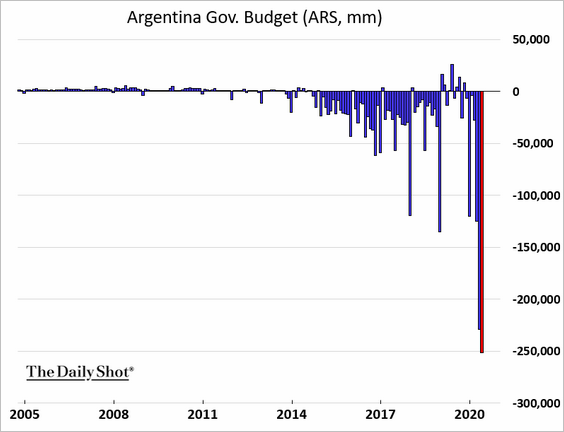

3. Argentina’s fiscal deficit has blown out.

Source: IIF

Source: IIF

——————–

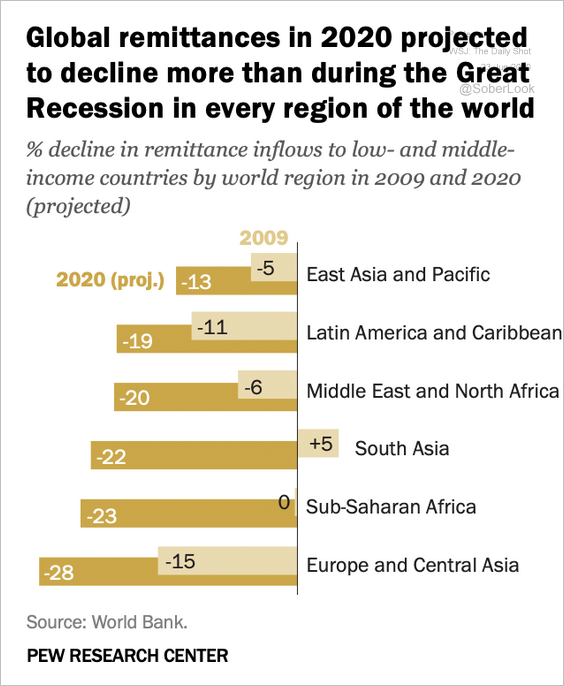

4. Remittances across EM economies plummetted this year.

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

Equities

1. The US-China trade tensions are back in the news. But for now, all is well.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

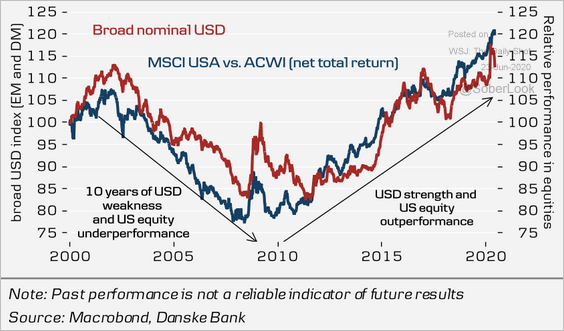

2. Will the dollar’s decline lead to US equity underperformance relative to the rest of the world?

Source: Danske Bank

Source: Danske Bank

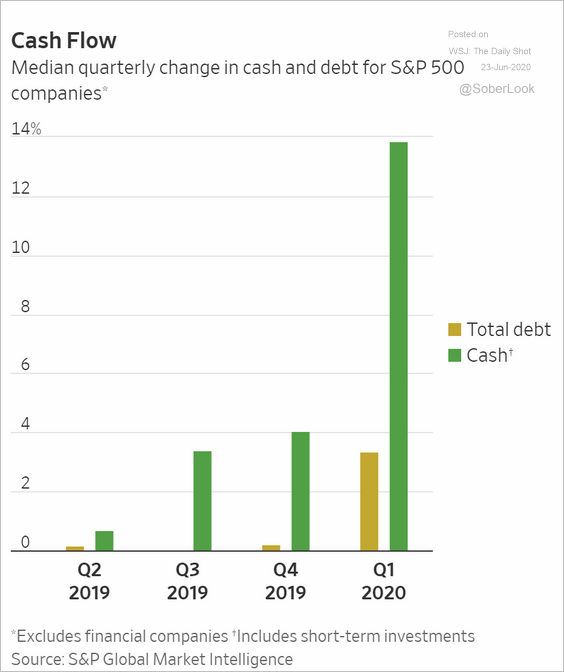

3. Large firms are sitting on a great deal of cash.

Source: @WSJ Read full article

Source: @WSJ Read full article

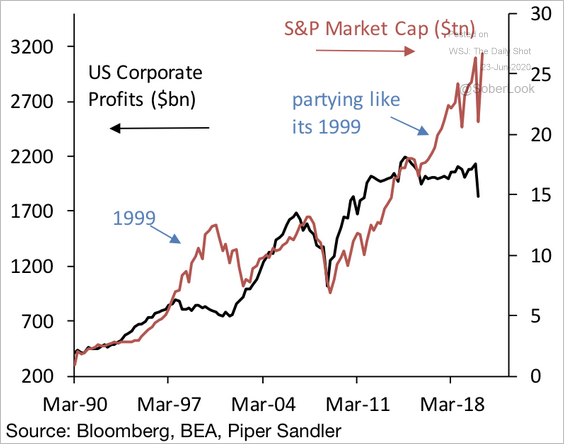

4. Corporate profits have remained flat and even dropped as the S&P 500 market cap made new highs.

Source: Piper Sandler

Source: Piper Sandler

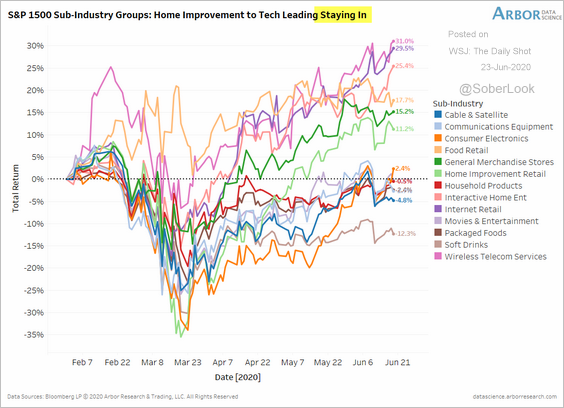

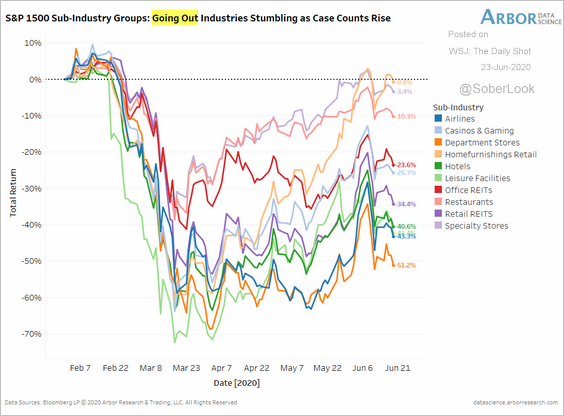

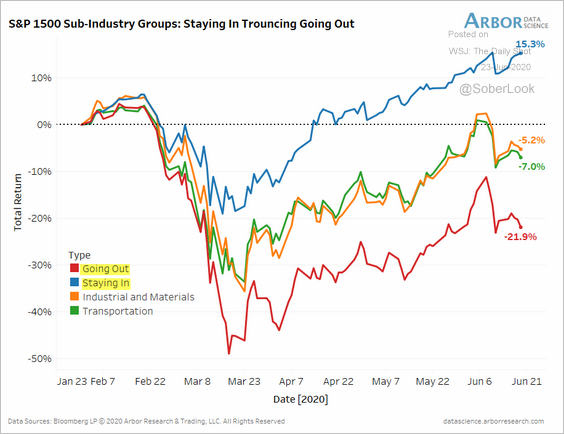

5. “Staying in” stocks are outperforming “going out” sectors again as the number of new infections remains elevated (3 charts).

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

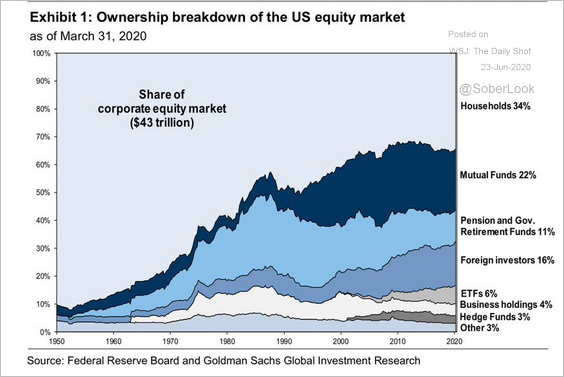

6. Who owns US equities?

Source: Goldman Sachs, @Callum_Thomas, @PriapusIQ

Source: Goldman Sachs, @Callum_Thomas, @PriapusIQ

Credit

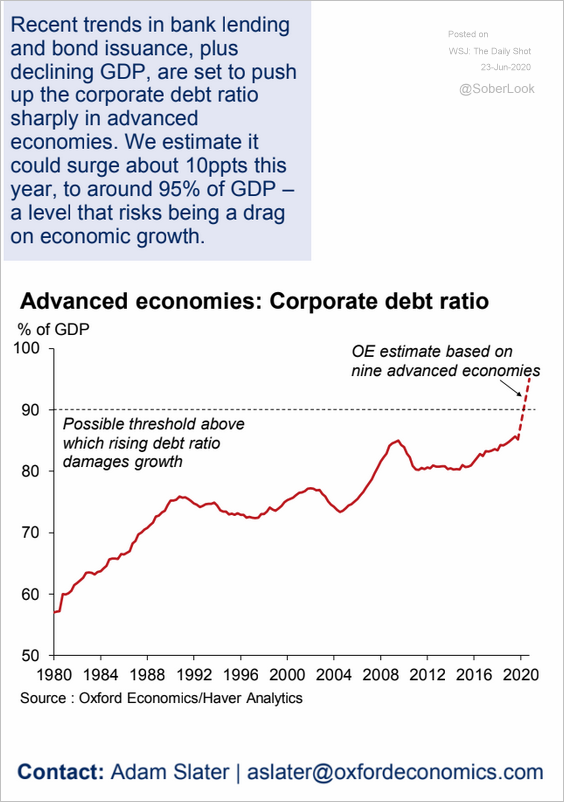

1. According to Oxford Economics, corporate credit in advanced economies hit a record high as a percentage of GDP.

Source: Oxford Economics

Source: Oxford Economics

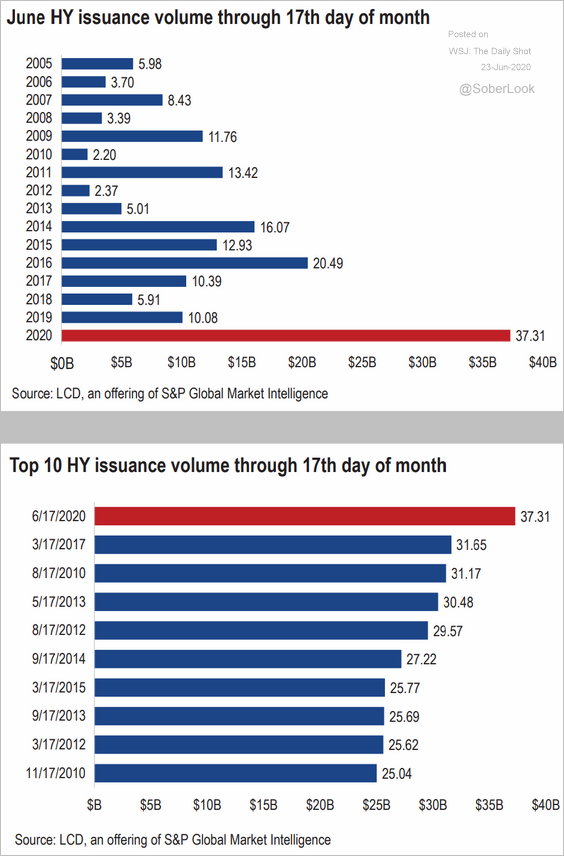

2. High yield debt issuance this month has been unprecedented.

Source: LCD/S&P Global Market Intelligence

Source: LCD/S&P Global Market Intelligence

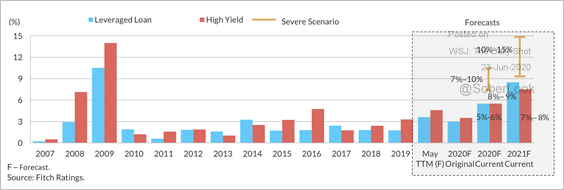

3. Fitch revised its default rate forecast sharply higher.

Source: Fitch Ratings

Source: Fitch Ratings

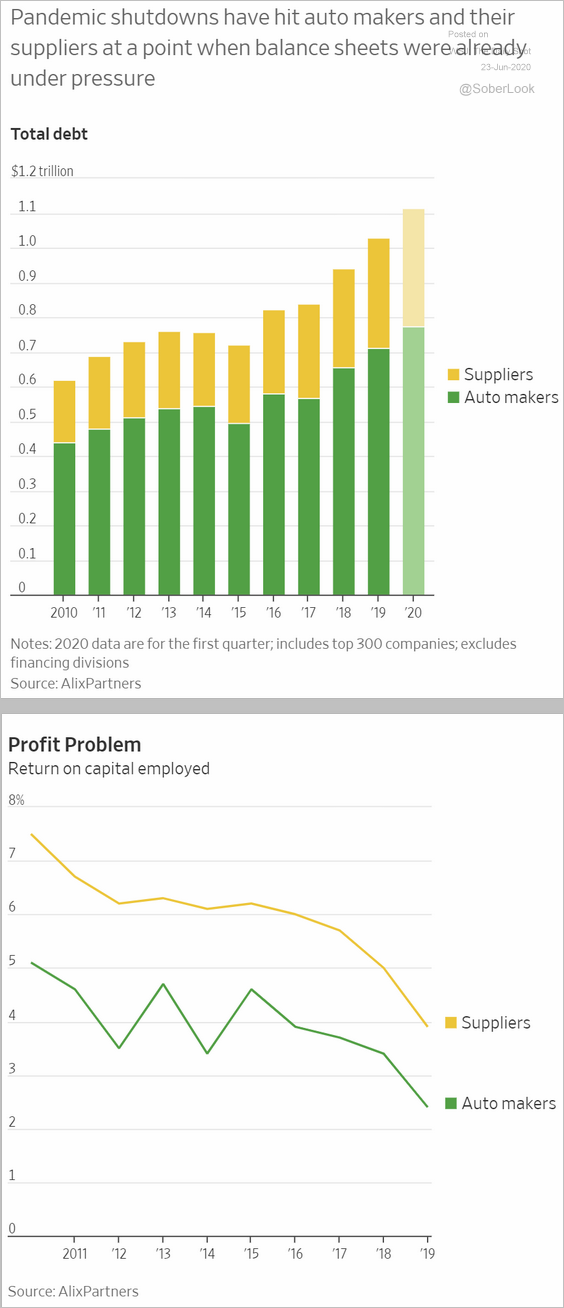

4. Automakers’ debt increased significantly in recent years.

Source: @WSJ Read full article

Source: @WSJ Read full article

Rates

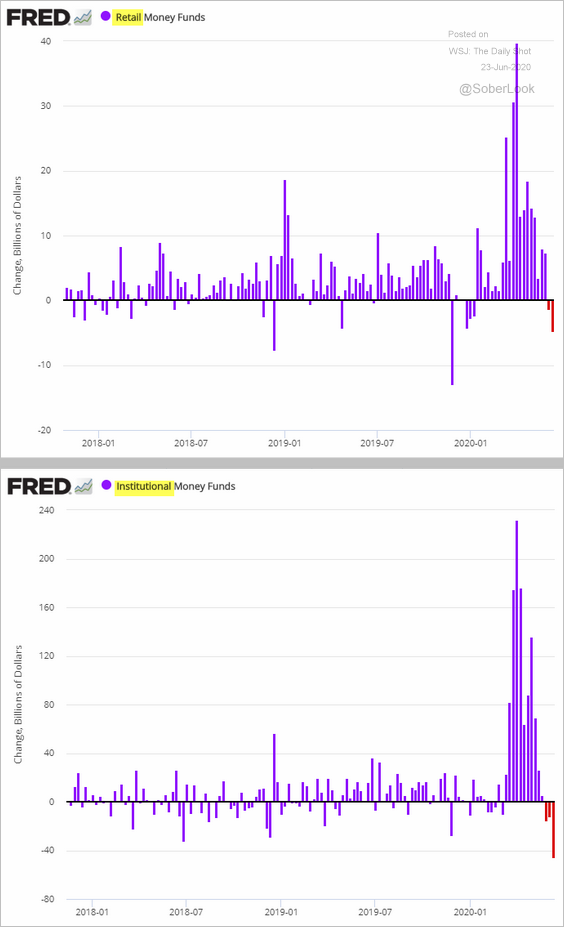

1. Money market funds registered some outflows in recent weeks.

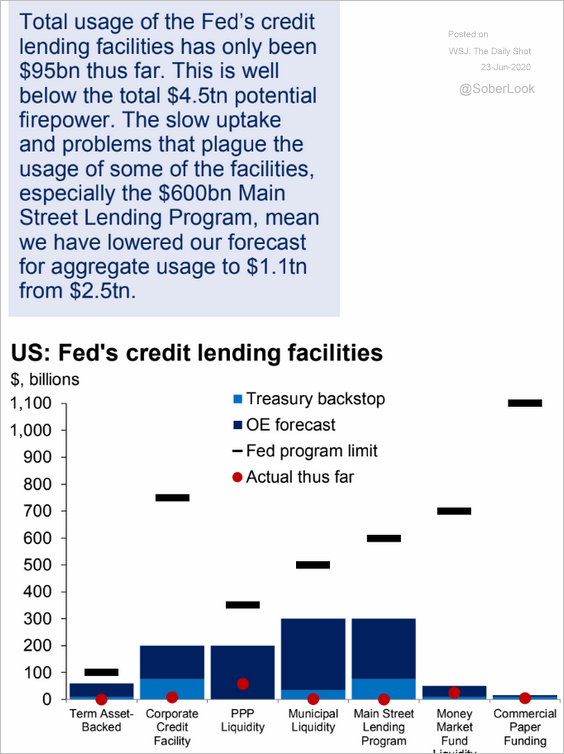

2. The Fed’s crisis-fighting facilities have not been utilized much so far.

Source: Oxford Economics

Source: Oxford Economics

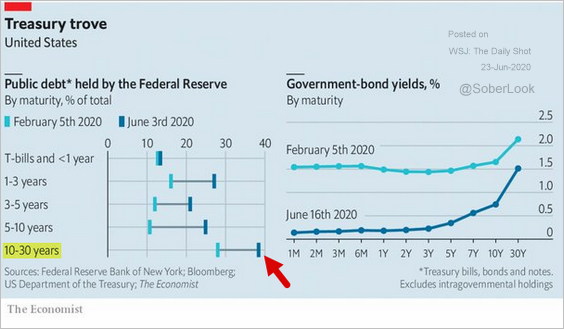

3. The Fed now owns a meaningful portion of long-term Treasury securities.

Source: @adam_tooze Read full article

Source: @adam_tooze Read full article

Global Developments

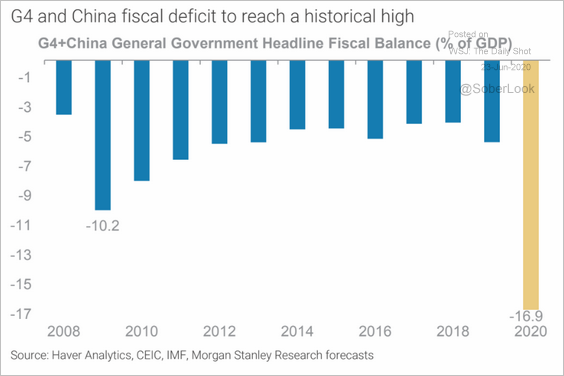

1. The largest economies are running unprecedented fiscal deficits.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

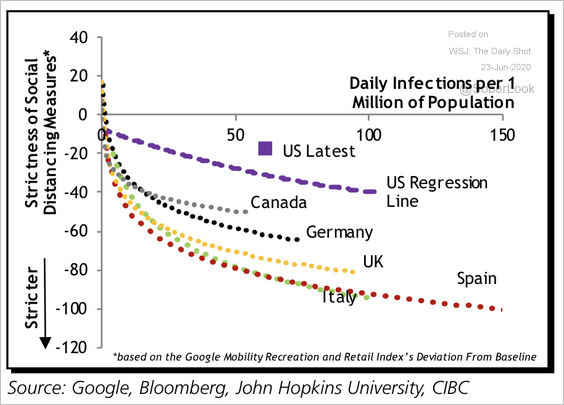

2. This chart shows how strict social distancing measures have been in select countries.

Source: CIBC Capital Markets

Source: CIBC Capital Markets

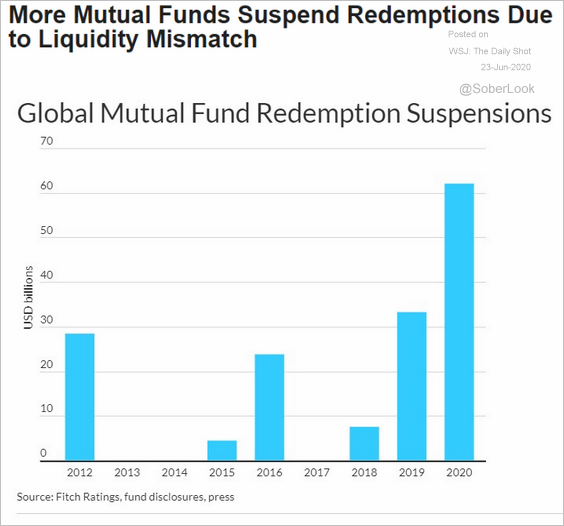

3. Many mutual funds suspended redemptions this year.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

Food for Thought

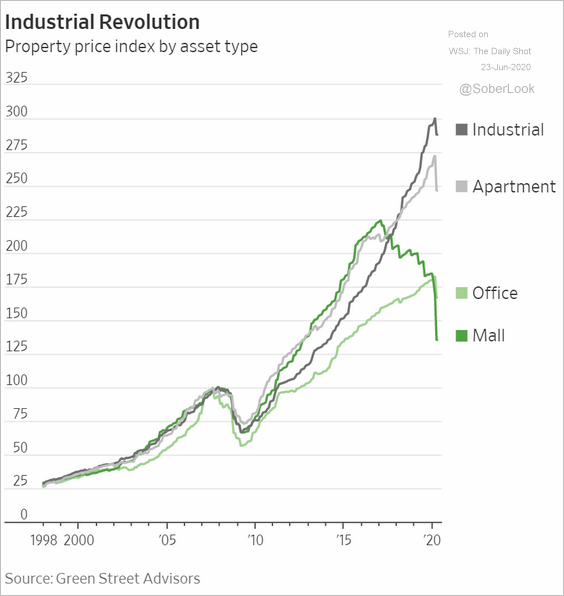

1. Commercial property prices:

Source: @WSJ Read full article

Source: @WSJ Read full article

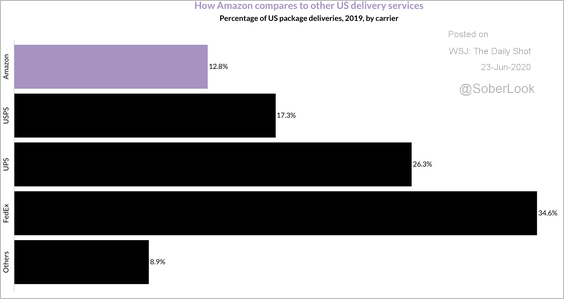

2. Who delivered US packages in 2019?

Source: Digital Commerce 360 Read full article

Source: Digital Commerce 360 Read full article

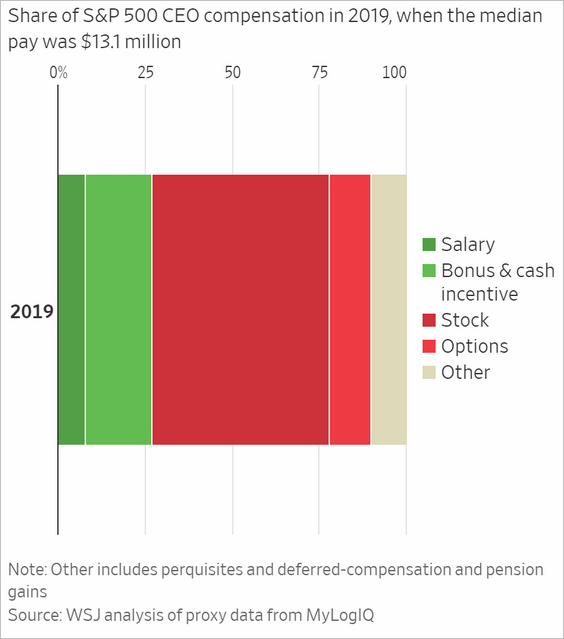

3. The structure of CEO compensation:

Source: @WSJ Read full article

Source: @WSJ Read full article

4. How comfortable are Americans with the following activities?

Source: Statista

Source: Statista

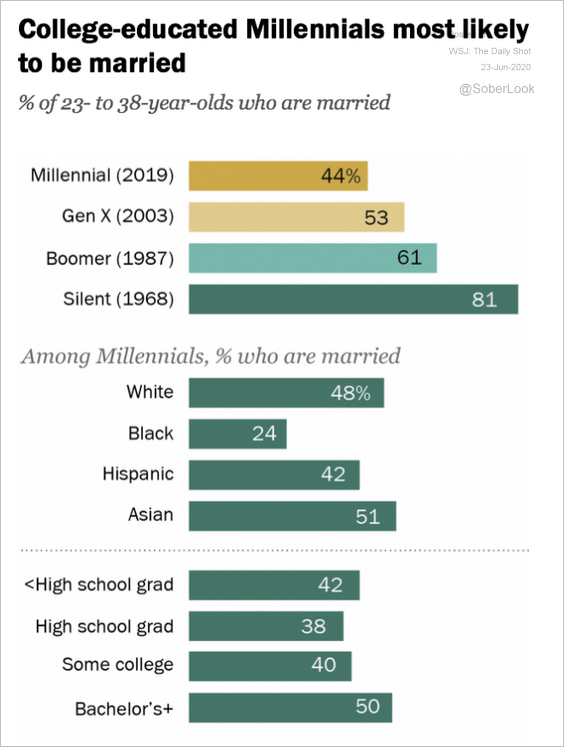

5. The percentage of 23- to 38-year-olds who are married:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

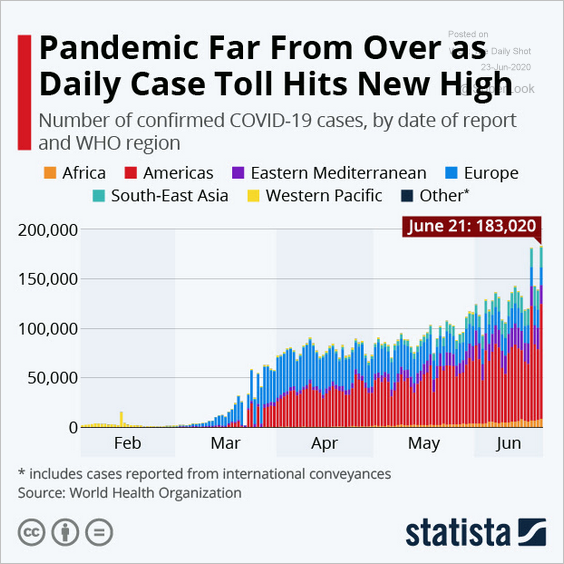

6. New COVID-19 cases by region:

Source: Statista

Source: Statista

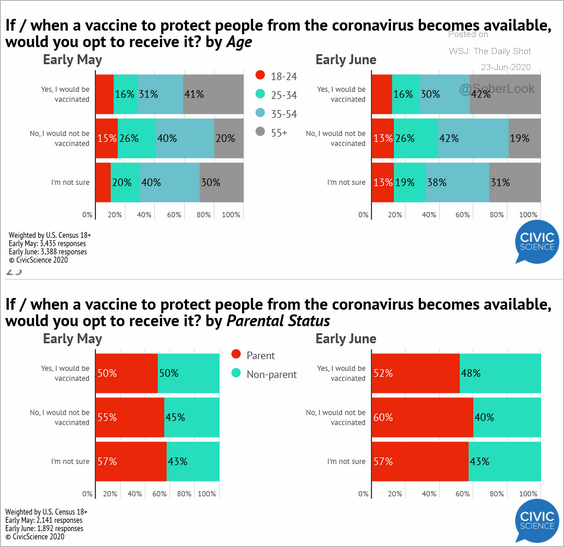

7. Views on vaccination:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

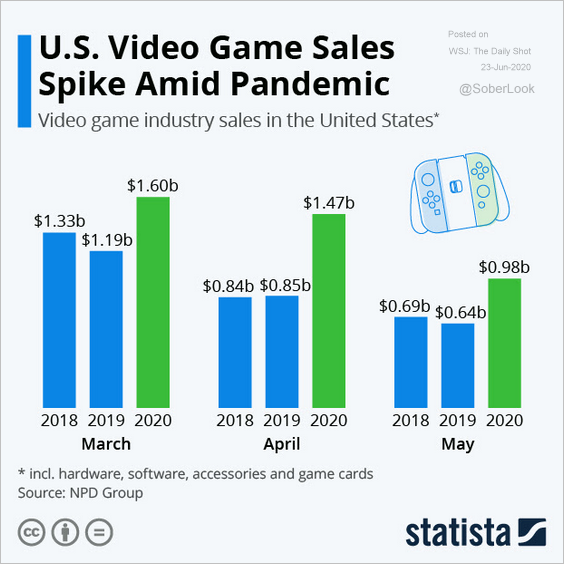

8. Video game sales:

Source: Statista

Source: Statista

9. The most expensive Google keywords:

Source: WordStream Read full article

Source: WordStream Read full article

——————–