The Daily Shot: 29-Jun-20

• Administrative Update

• Rates

• Credit

• Equities

• Energy

• Commodities

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• The United States

• Global Developments

• Food for Thought

Administrative Update

Please note that the Daily Shot will not be published on Friday, July 3rd.

Rates

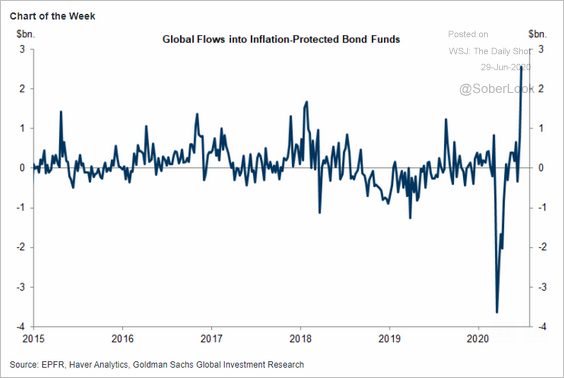

1. Flows into inflation-protected bond funds soared as investors hedge against a potential inflation shock.

Source: Goldman Sachs

Source: Goldman Sachs

There is some concern that the combination of global monetary and fiscal stimulus will propel consumer prices higher. However, Japan provides a case study of a decade-long stimulus that didn’t result in inflationary pressures.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

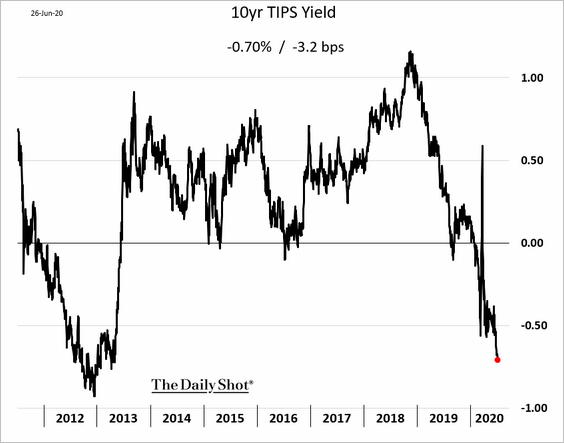

As a result of this demand for inflation product, yields on inflation-linked Treasuries (TIPS) continue to fall. These yields are a measure of effective real rates in the US (and have been moving deeper into negative territory).

Declining real rates have been a tailwind for gold.

——————–

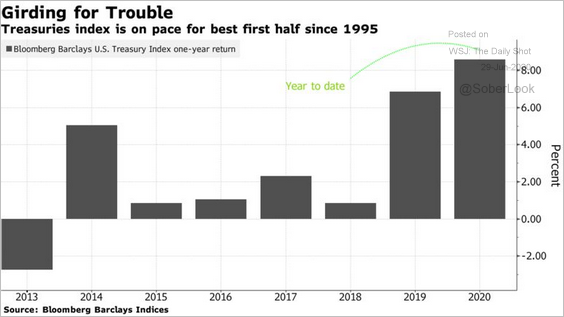

2. So far, it’s been a good year for Treasuries.

Source: @markets Read full article

Source: @markets Read full article

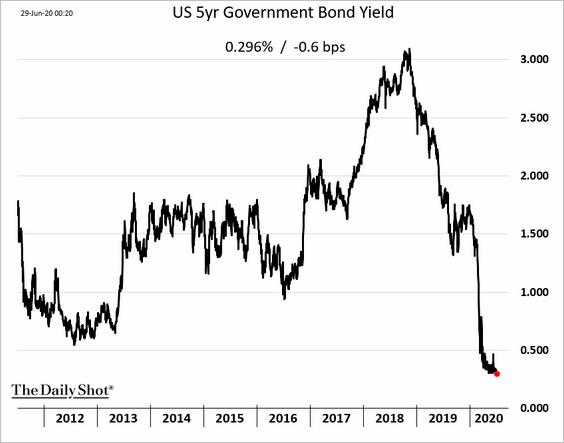

The 5yr note yield dipped below 0.3% – the lowest on record.

——————–

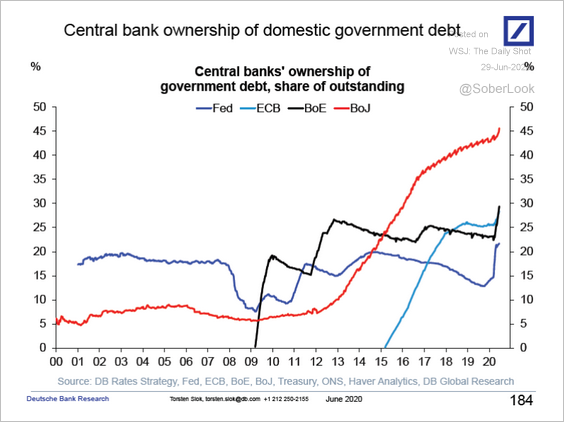

3. This chart shows the major central banks’ ownership of domestic government debt.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

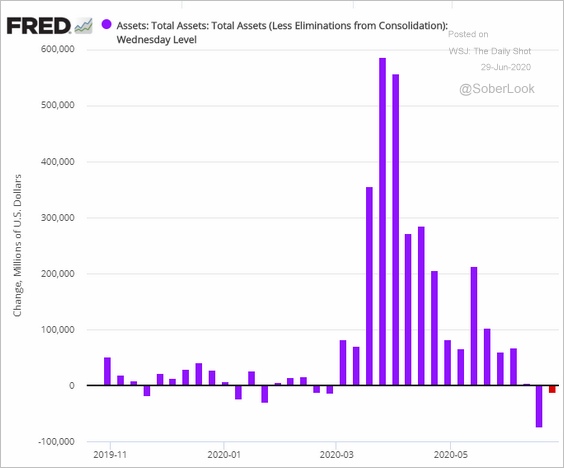

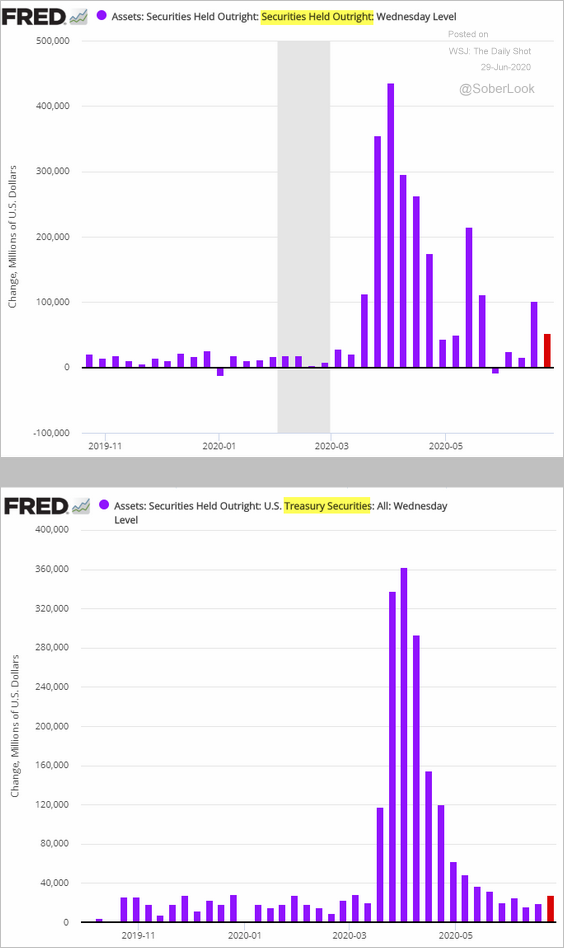

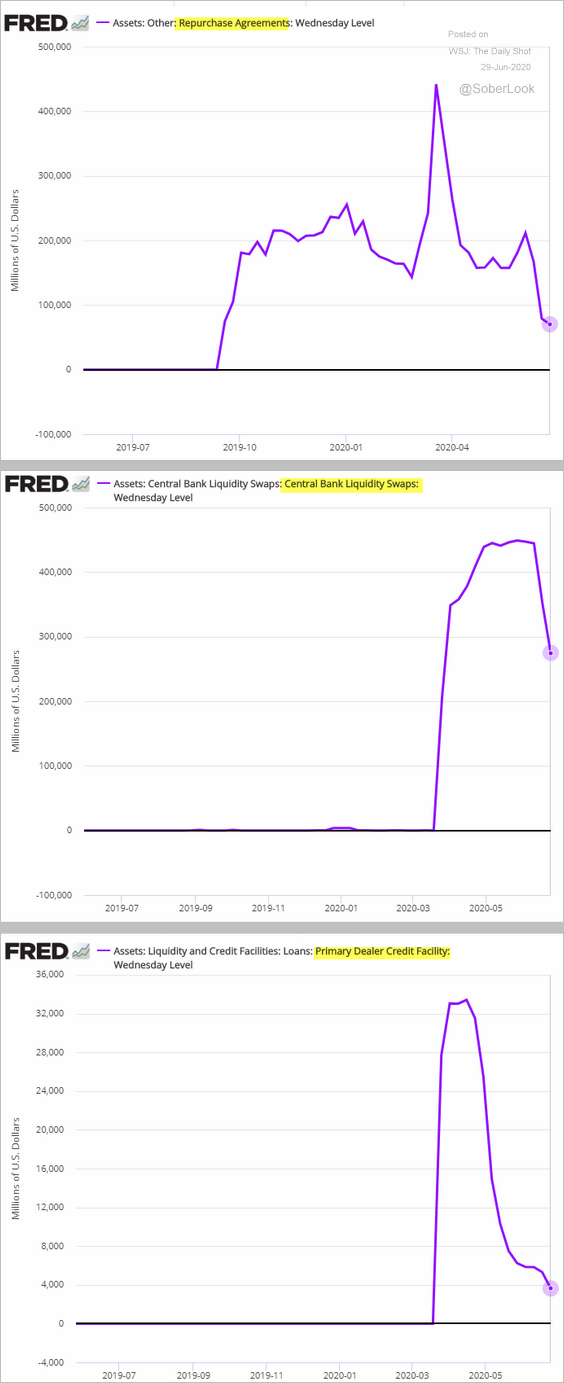

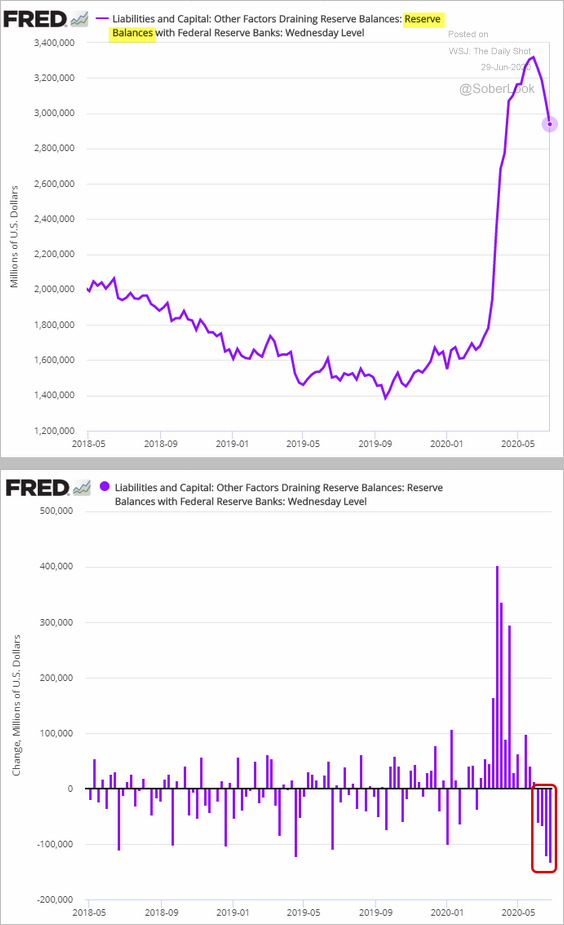

4. The Fed’s balance sheet declined again last week.

While the central bank’s securities holdings continue to climb, …

… there is less demand for some of the Fed’s facilities, as liquidity and risk appetite return.

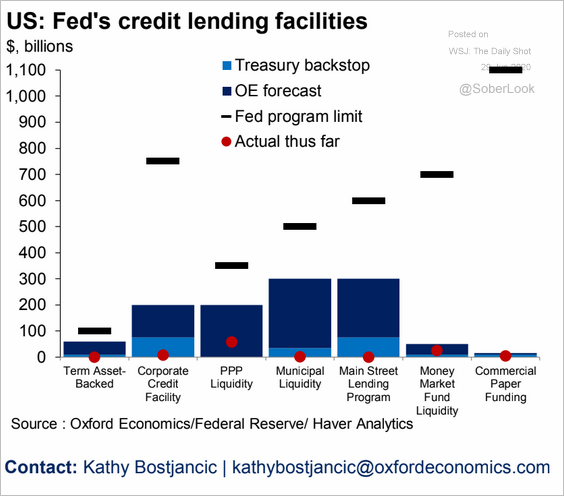

• The utilization of the Fed’s crisis-fighting measures remains extremely low.

Source: Oxford Economics

Source: Oxford Economics

• Reserves have retreated from the peak as the Fed’s balance sheet shrinks.

——————–

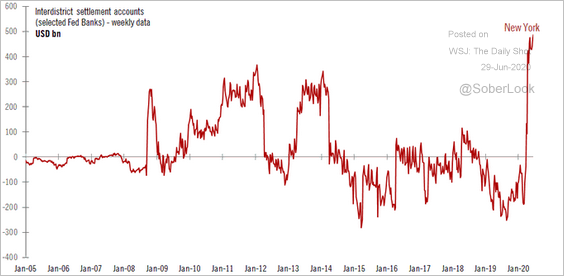

5. There is a substantial imbalance among the Federal Reserve banks (similar to the TARGET2 imbalances in the Eurozone).

Source: @TCosterg

Source: @TCosterg

6. The US broad money supply (M2) growth rate hit another record high.

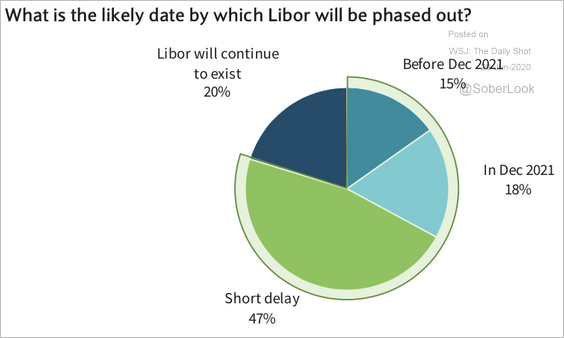

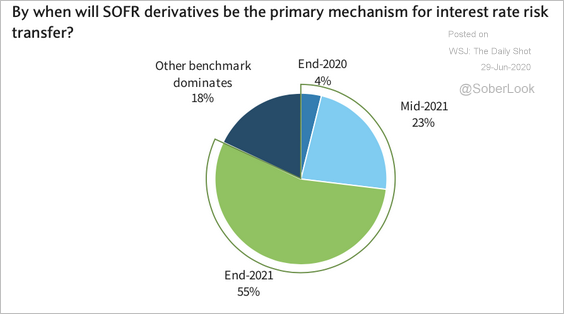

7. 47% of Barclays fixed-income clients surveyed expect a short delay by which Libor will phase out.

Source: Barclays Research

Source: Barclays Research

And 55% expect SOFR derivatives will be the primary mechanism for interest rate risk transfer by the end of 2021.

Source: Barclays Research

Source: Barclays Research

Credit

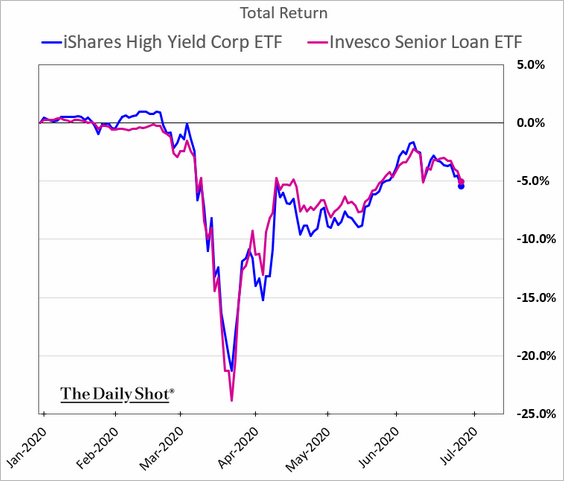

1. The performance trends of US high-yield bonds and leveraged loans have been nearly identical this year.

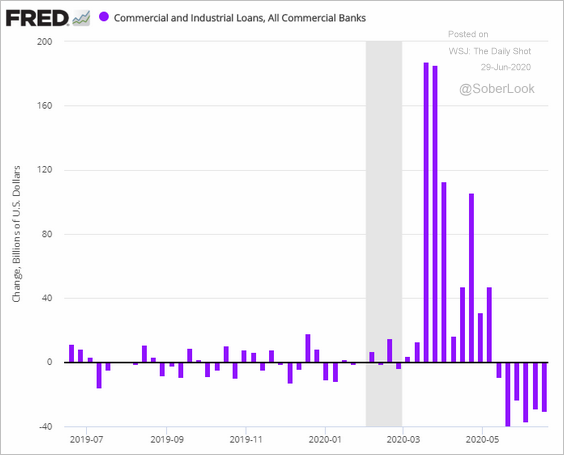

2. Business loan balances have been declining as companies reduce their drawn amounts at banks. Part of this trend is the rapid-fire bond issuance, which allowed firms to pay down their revolving credit facilities.

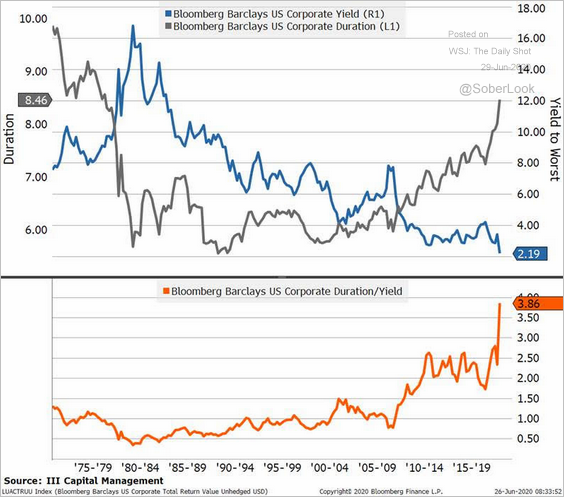

3. All the newly-issued investment-grade debt sent the average duration of US corporate bonds soaring. The second chart below shows the duration-to-yield ratio. Investors are taking more duration risk while getting paid less.

Source: III Capital Management

Source: III Capital Management

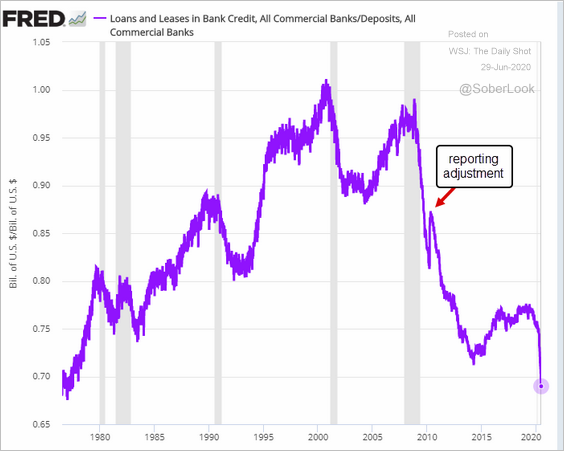

4. Despite lower corporate loan balances, US banks’ loan-to-deposit (LTD) ratio hit the lowest level since the 1970s.

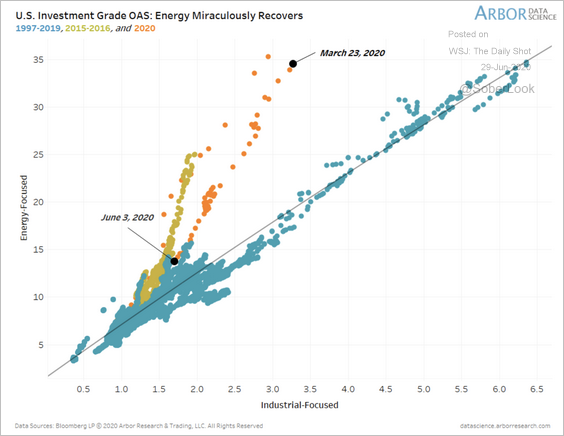

5. Energy credit spreads have recovered at an unprecedented pace over the past few months.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

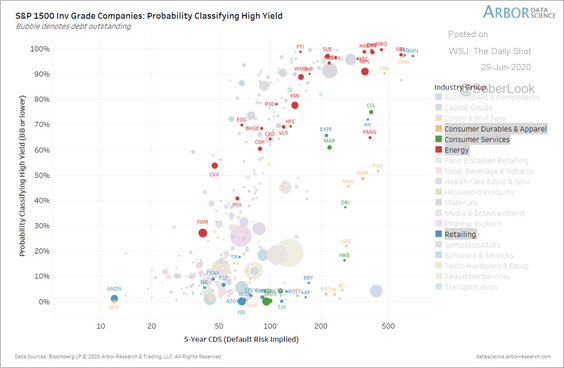

• However, a large number of energy companies (red dots below) continue to see high probabilities of classifying as junk.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

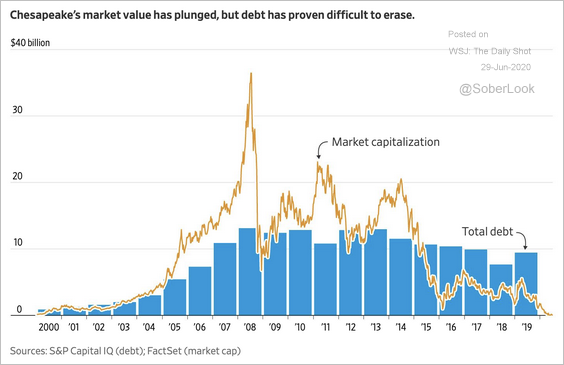

• Chesapeake Energy officially filed for bankruptcy protection (which was widely expected).

Source: @WSJ Read full article

Source: @WSJ Read full article

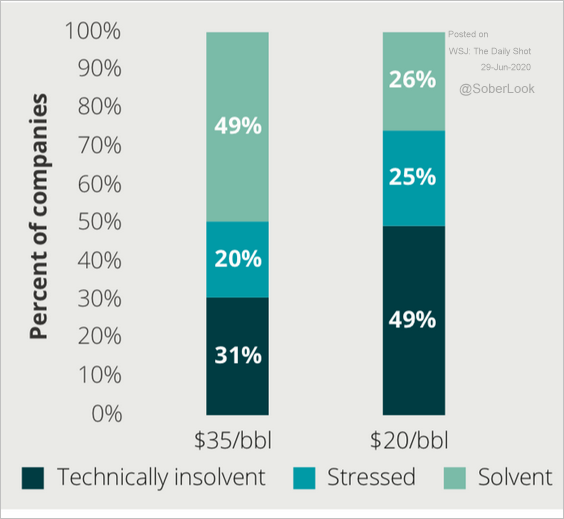

• This chart shows the percentage of US shale firms that would be insolvent or stressed under two different oil price scenarios.

Source: Deloitte Read full article

Source: Deloitte Read full article

——————–

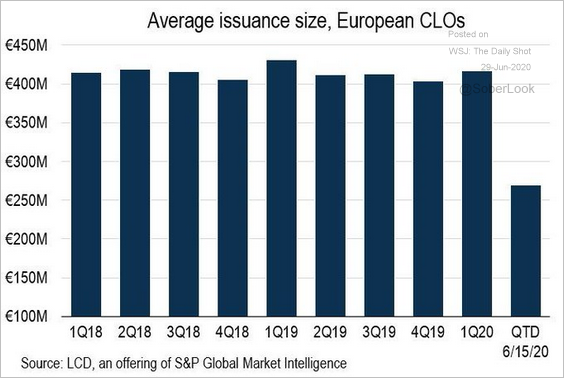

6. European CLO deals have been much smaller this quarter.

Source: @lcdnews, @millarlr

Source: @lcdnews, @millarlr

Equities

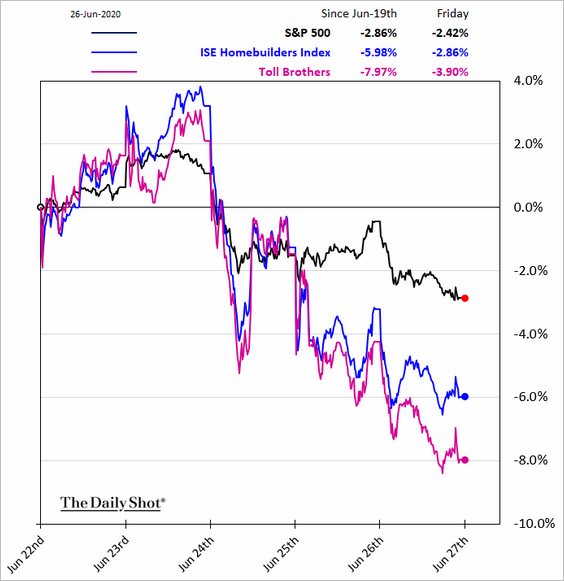

1. Friday was a rough day for the market as the S&P 500 retests support.

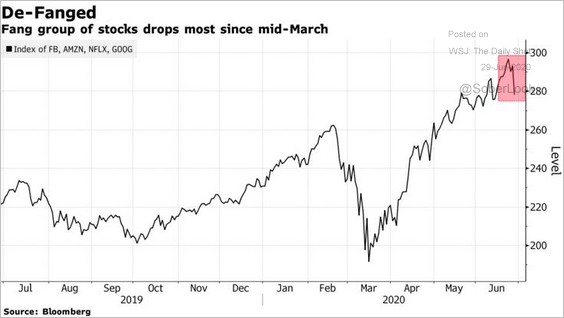

Tech mega-caps declined sharply, led by Facebook (see story).

Source: @markets Read full article

Source: @markets Read full article

Here are some sector trends.

• Communication Services:

• Banks:

• Homebuilders:

• Energy:

• Pharma:

——————–

2. US shares lagged global peers last week.

• Europe:

• Japan:

• Emerging markets:

——————–

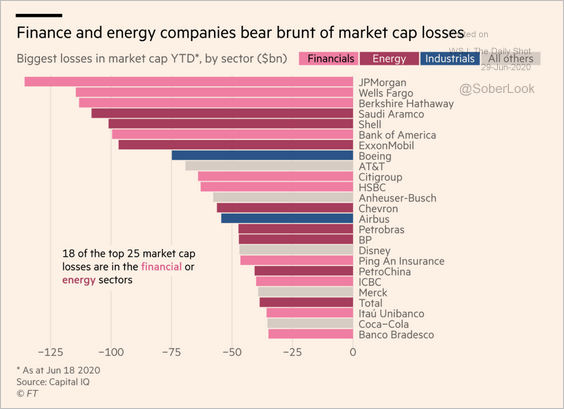

3. Which sectors have seen the largest market cap losses this year?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

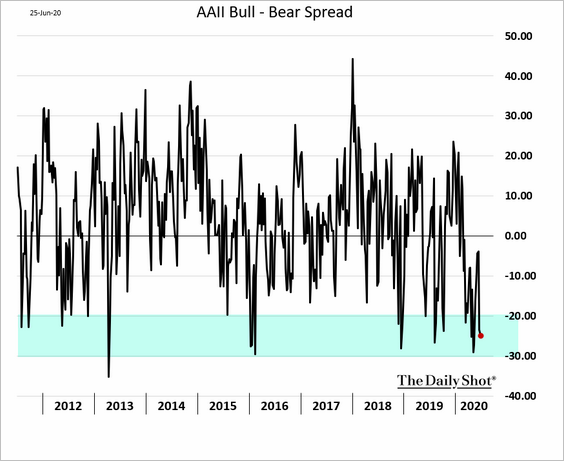

4. The AAII bull-bear spread shows that investors remain cautious.

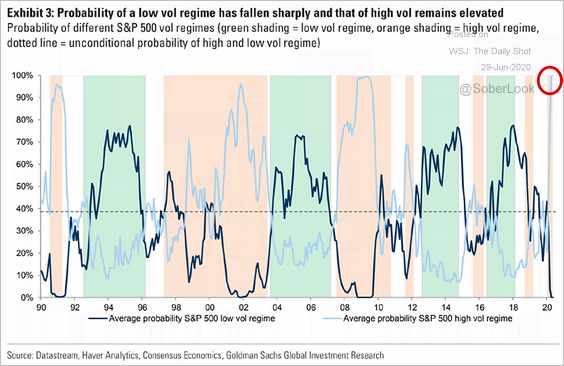

5. The market expects the high-volatility regime to persist.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

Energy

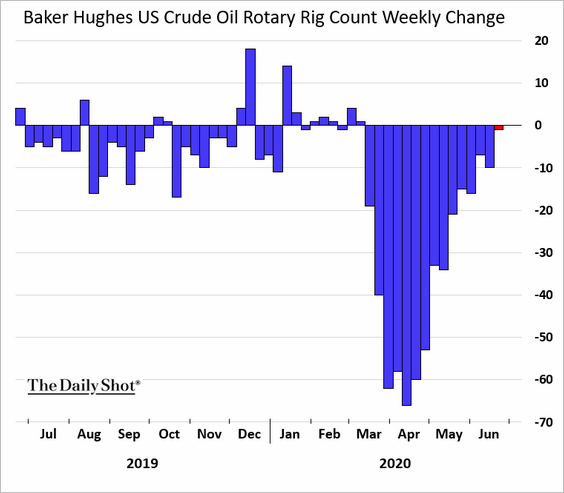

1. The US oil rig count appears to be bottoming.

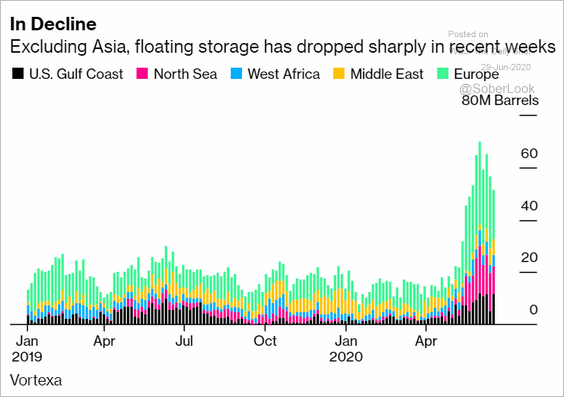

2. Floating storage has been declining.

Source: @markets Read full article

Source: @markets Read full article

Commodities

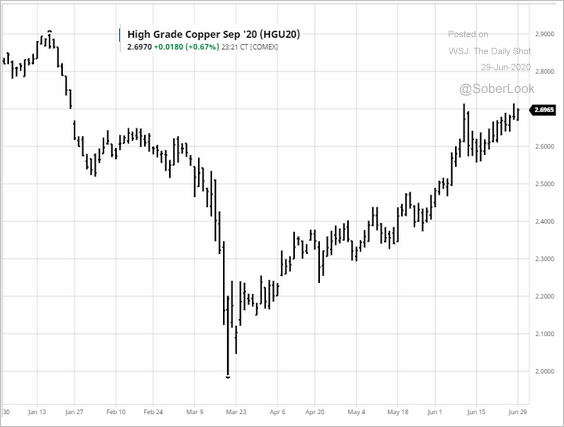

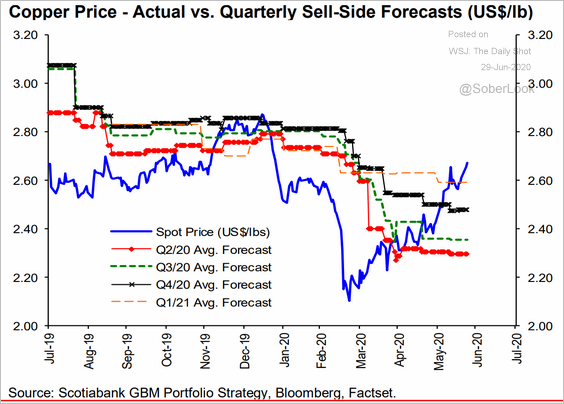

1. Copper continues to rally, exceeding expectations.

Source: barchart.com

Source: barchart.com

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

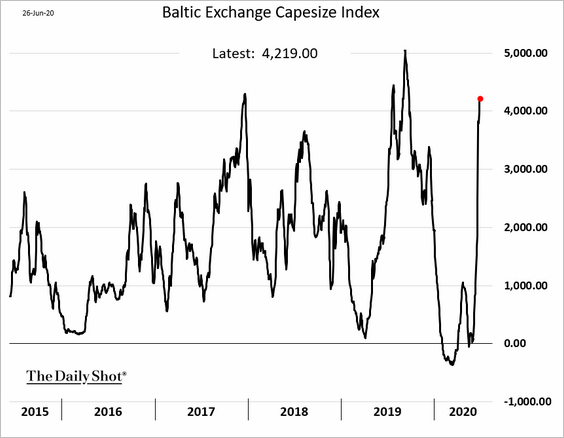

2. Demand for large-sized bulk carriers sent shipping costs soaring. Here is the Baltic Capesize Index.

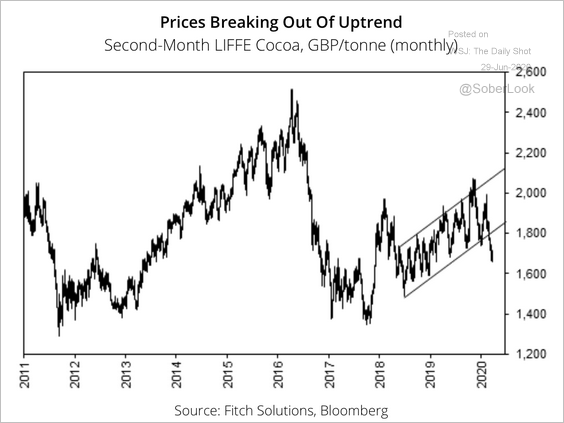

3. Cocoa prices are tumbling, which has been a major setback for Ghana.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

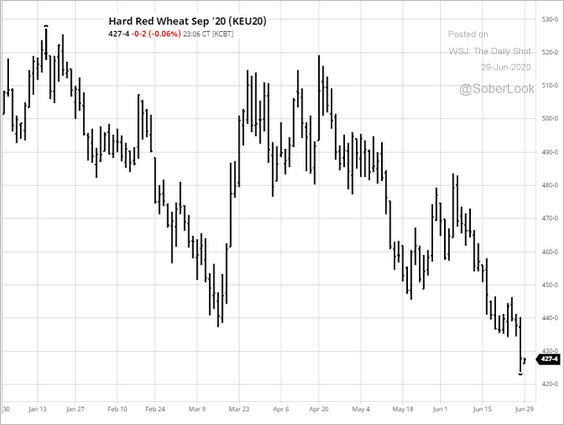

4. US winter wheat futures have been under pressure.

Source: barchart.com

Source: barchart.com

5. Chicago hog prices continue to tumble.

Source: barchart.com

Source: barchart.com

Emerging Markets

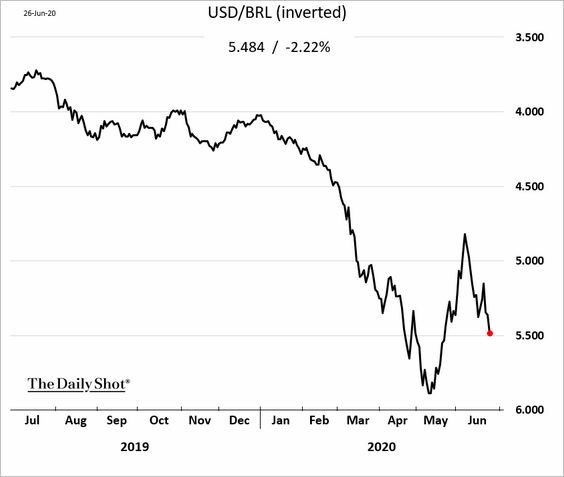

1. The Brazilian real’s rebound was short-lived.

Separately, Brazil’s Ibovespa index has significantly underperformed the rest of the world during the pandemic.

Source: Koyfin

Source: Koyfin

——————–

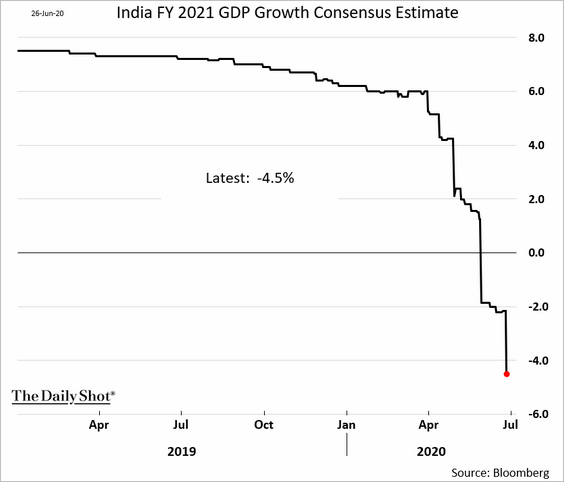

2. Economists continue to downgrade India’s 2021 fiscal year GDP estimates. The chart below is based on Bloomberg’s survey.

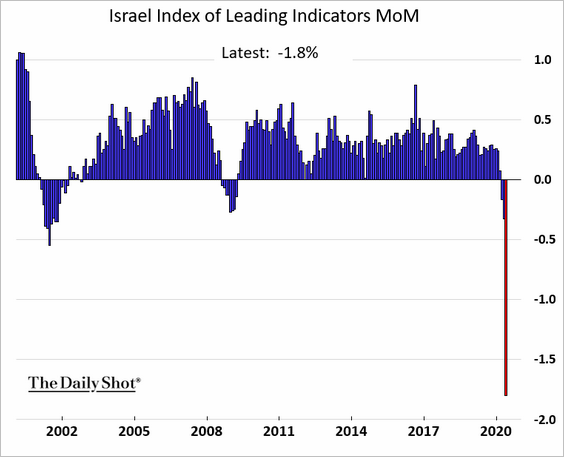

3. Israel’s index of leading indicators experienced a record drop last month.

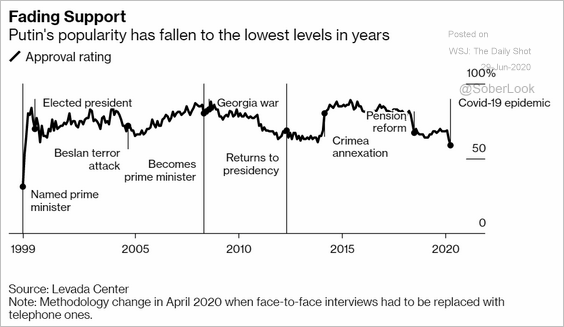

4. Putin’s popularity has declined this year.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

China

1. Industrial profits have rebounded.

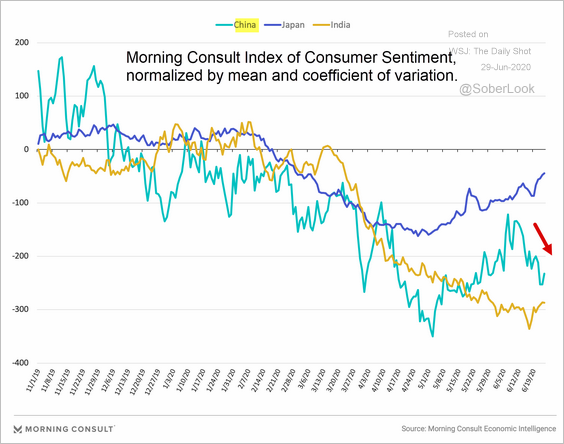

2. Consumer sentiment seems to be deteriorating again.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

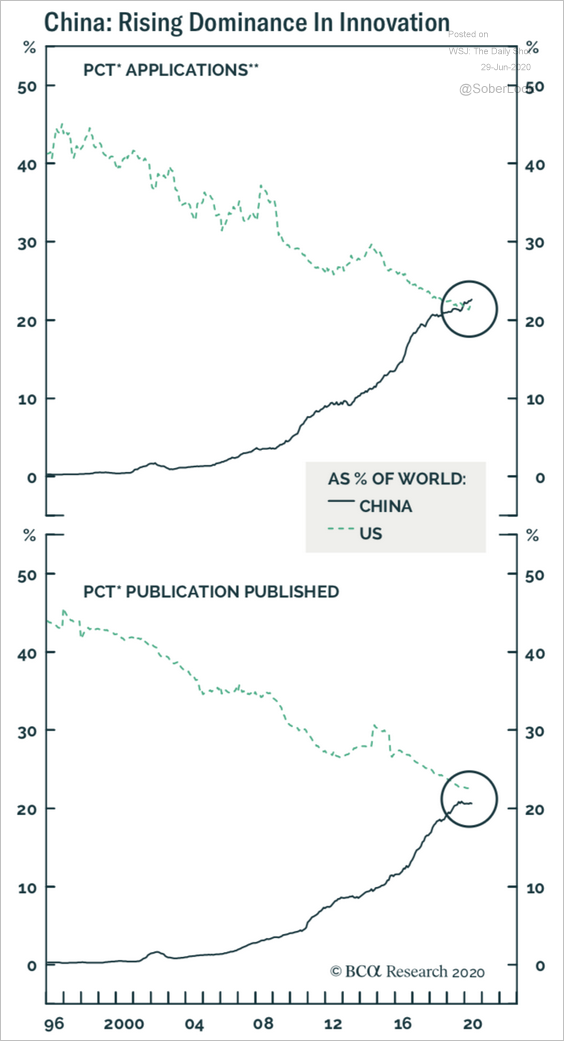

3. China is increasingly dominating in innovation (PCT = Patent Cooperation Treaty).

Source: BCA Research

Source: BCA Research

Asia – Pacific

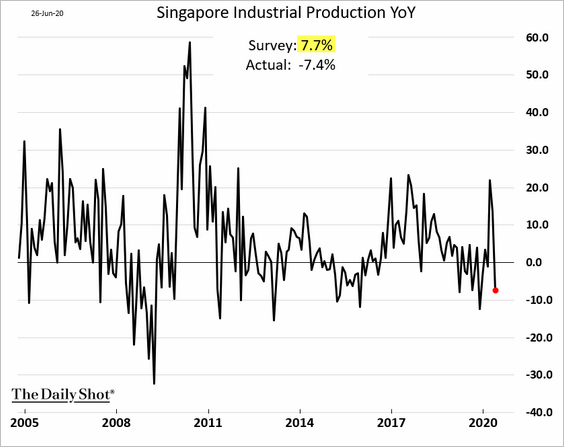

1. Singapore’s industrial production unexpectedly declined last month.

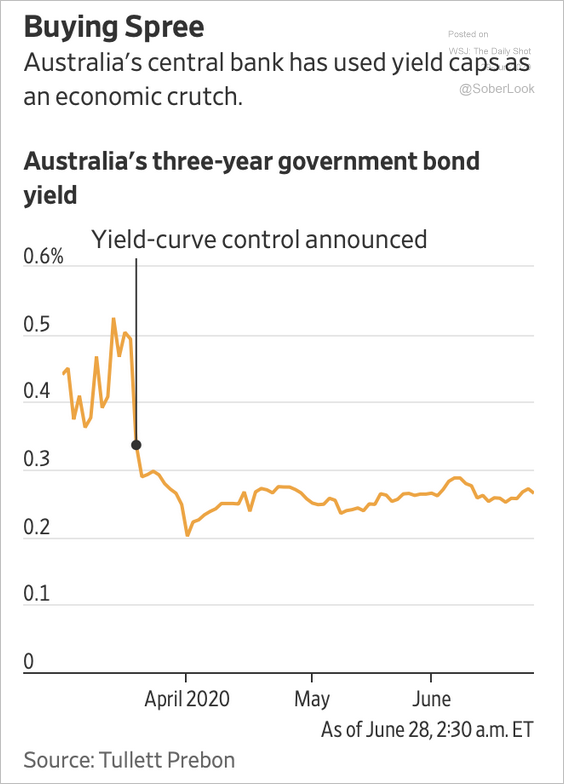

2. The Australian government’s 3-year bond yield has stabilized in a tight range around the RBA’s 0.25% target level.

Source: Fitch Solutions Macro Research Read full article

Source: Fitch Solutions Macro Research Read full article

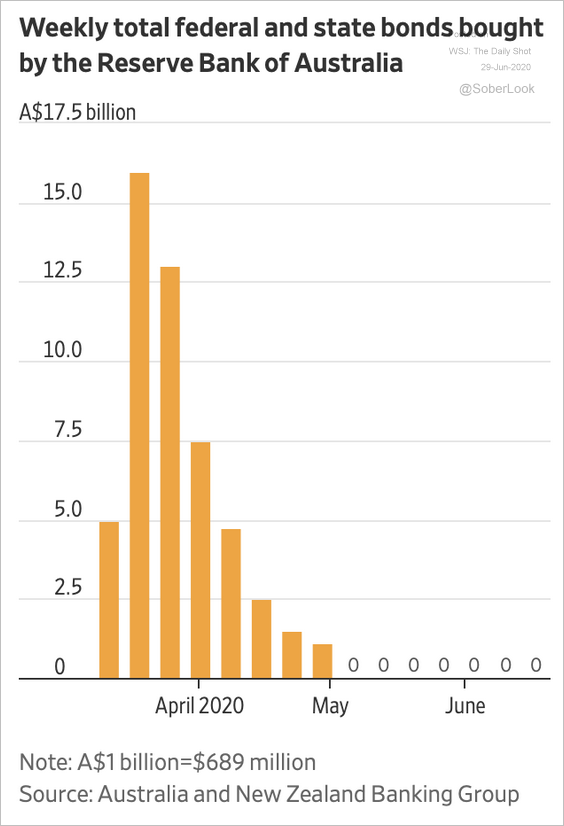

The central bank frontloaded federal and state bond purchases as lockdowns stopped economic activity.

Source: Fitch Solutions Macro Research Read full article

Source: Fitch Solutions Macro Research Read full article

——————–

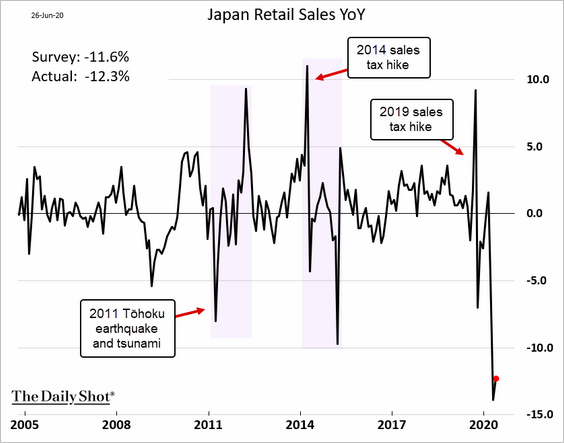

3. Japan’s May retail sales were 12% below last year’s level. It’s going to be a slow recovery.

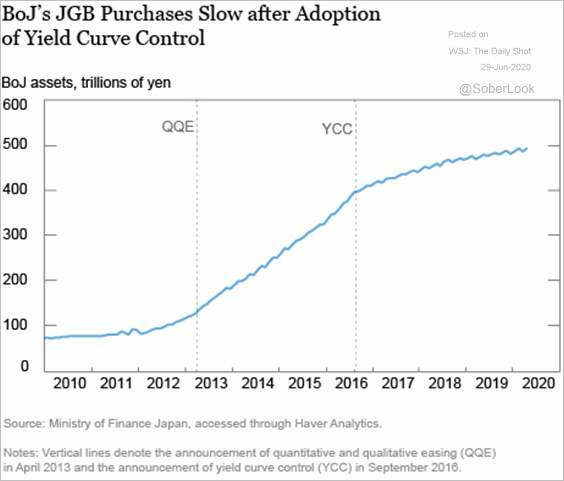

4. This chart shows how the pace of JGB purchases slowed after the BoJ implemented yield curve control. Will the Fed implement a similar strategy?

Source: Liberty Street Economics Read full article

Source: Liberty Street Economics Read full article

The Eurozone

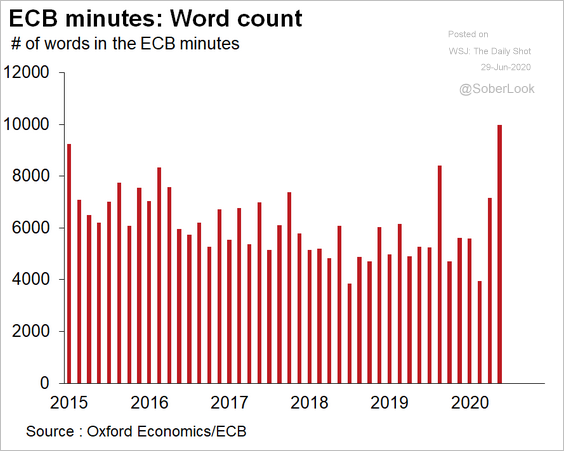

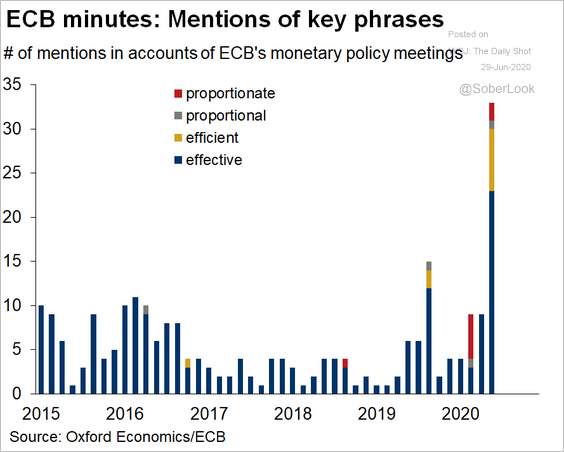

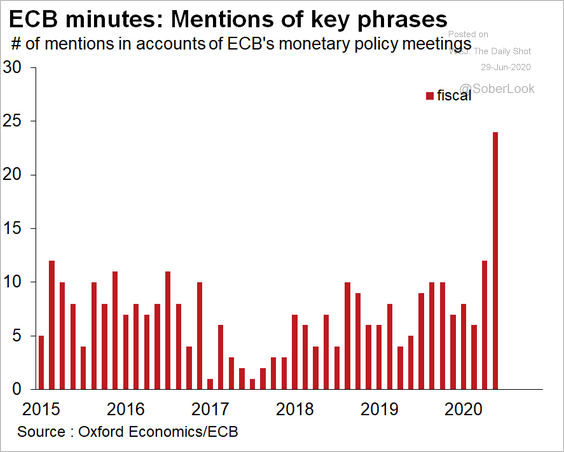

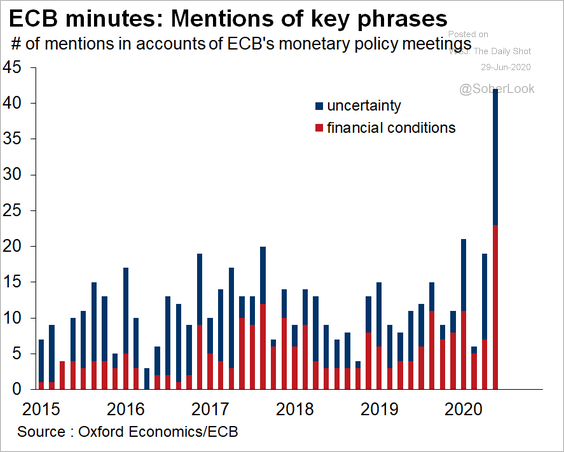

1. Let’s start with some charts on the ECB minutes (from Oxford Economics).

• The total word count:

Source: @OliverRakau, @ecb

Source: @OliverRakau, @ecb

• Mentions of the words “proportionate,” “proportional,” “efficient,” and “effective”:

Source: @OliverRakau, @ecb

Source: @OliverRakau, @ecb

• “fiscal” (meaning the governments need to step up stimulus):

Source: @OliverRakau, @ecb

Source: @OliverRakau, @ecb

• “uncertainty” and “financial conditions”:

Source: @OliverRakau, @ecb

Source: @OliverRakau, @ecb

——————–

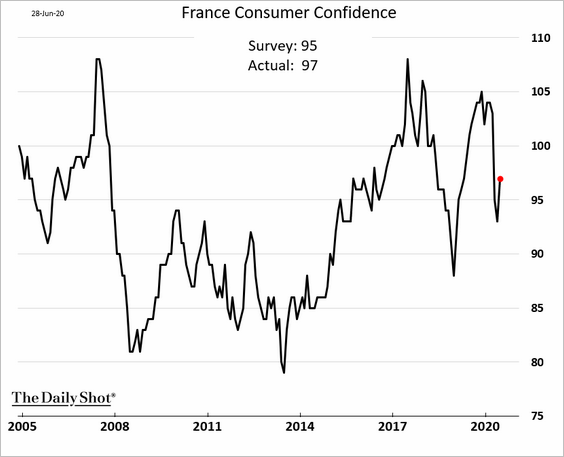

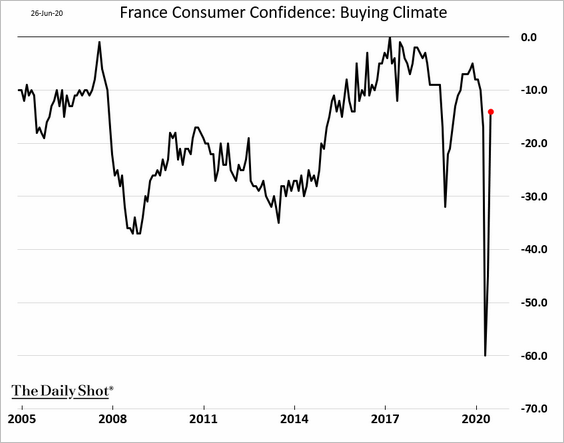

2. French consumer sentiment has been resilient.

The buying climate measure rebounded.

——————–

3. Italian consumer confidence bounced from multi-year lows.

Manufacturing sentiment remains weak.

——————–

4. After a rebound, Spain’s May retail sales were still 20% below last year’s level.

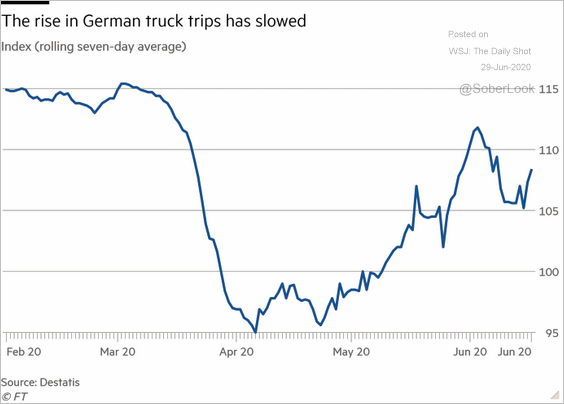

5. The recovery in the German truck trip index has stalled.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

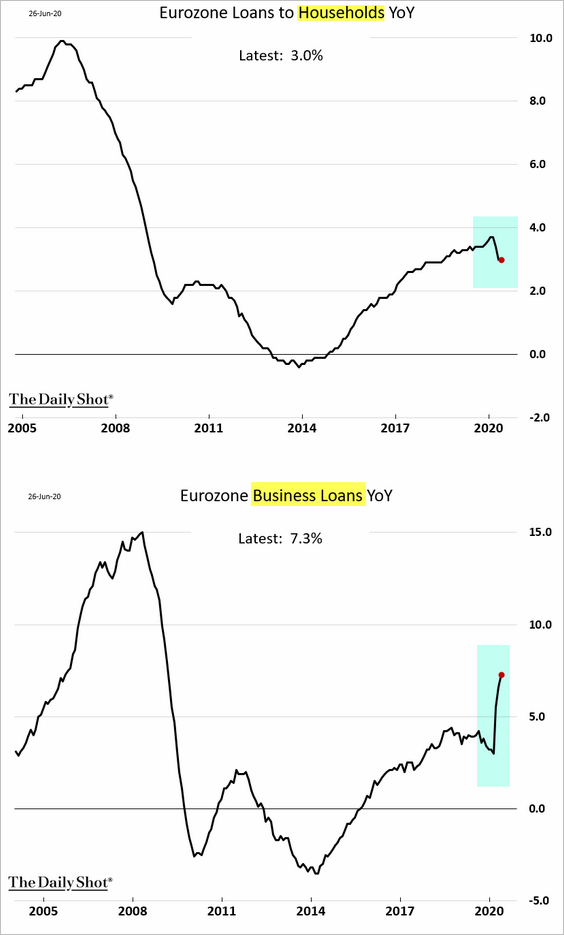

6. Loan growth trends diverged further in May. While household finance slowed, companies tapped credit lines to meet cash needs.

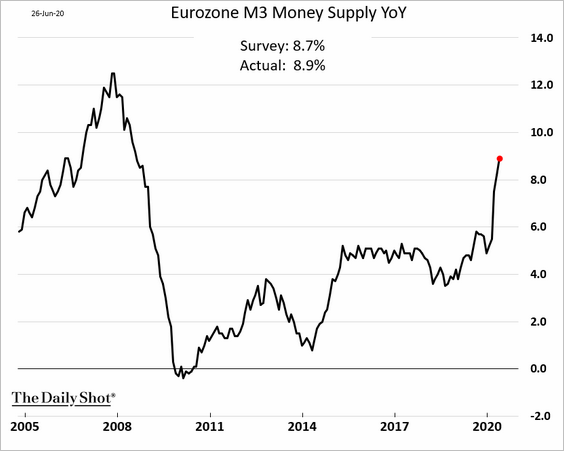

The broad money supply (M3) growth accelerated.

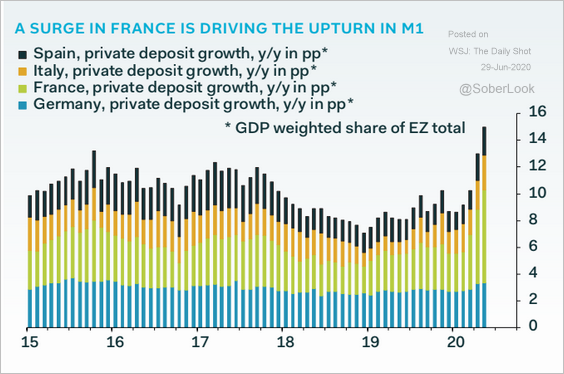

Here is the growth in M1 (mostly bank deposits) by country.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

The United States

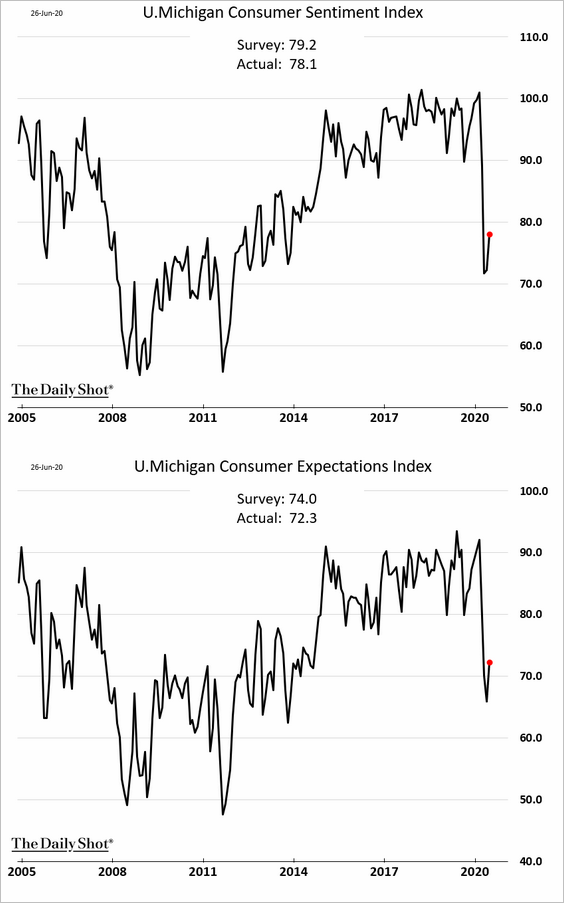

1. The final U. Michigan consumer sentiment report was below the earlier estimate, suggesting that confidence deteriorated in the latter part of June.

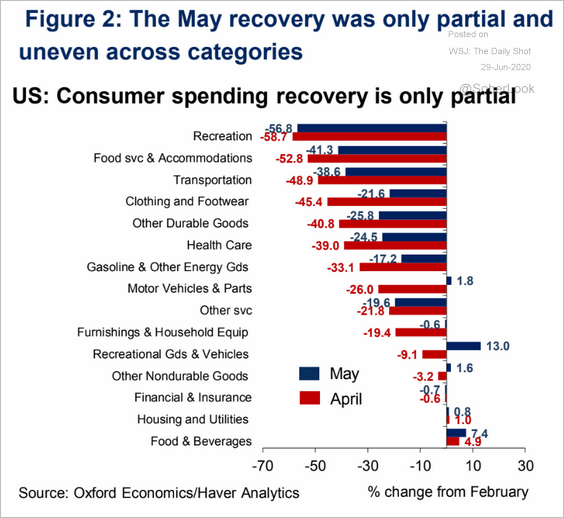

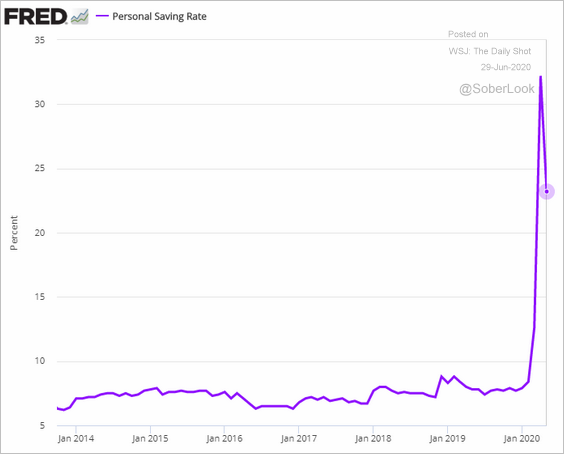

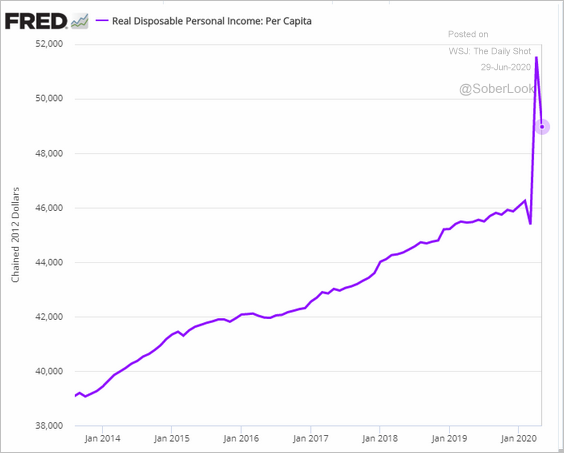

2. Consumption bounced from multi-year lows in May. The second chart shows net changes since February (by sector).

Source: Oxford Economics

Source: Oxford Economics

The savings rate came off the highs.

Disposable income declined.

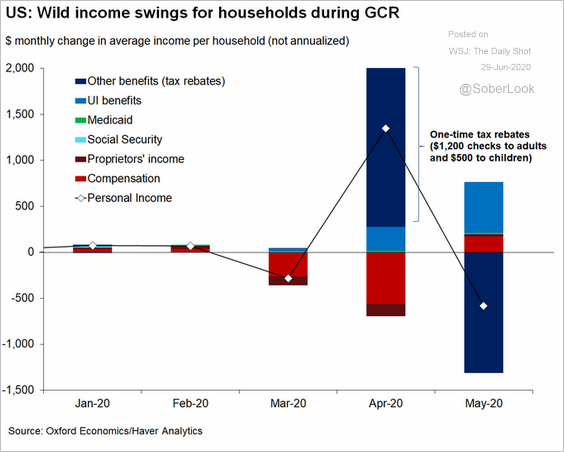

Here are the drivers of swings in personal income. The three key components are the stimulus checks (dark blue), unemployment benefits (light blue), and compensation (red).

Source: @GregDaco

Source: @GregDaco

——————–

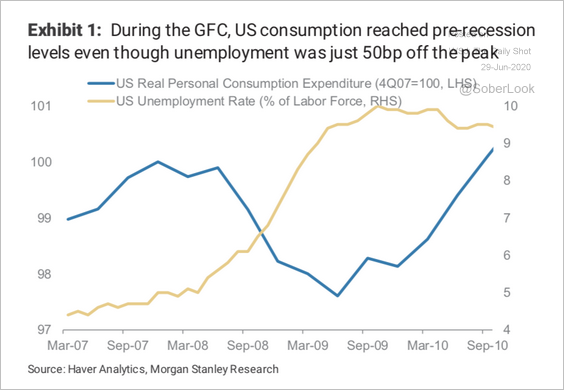

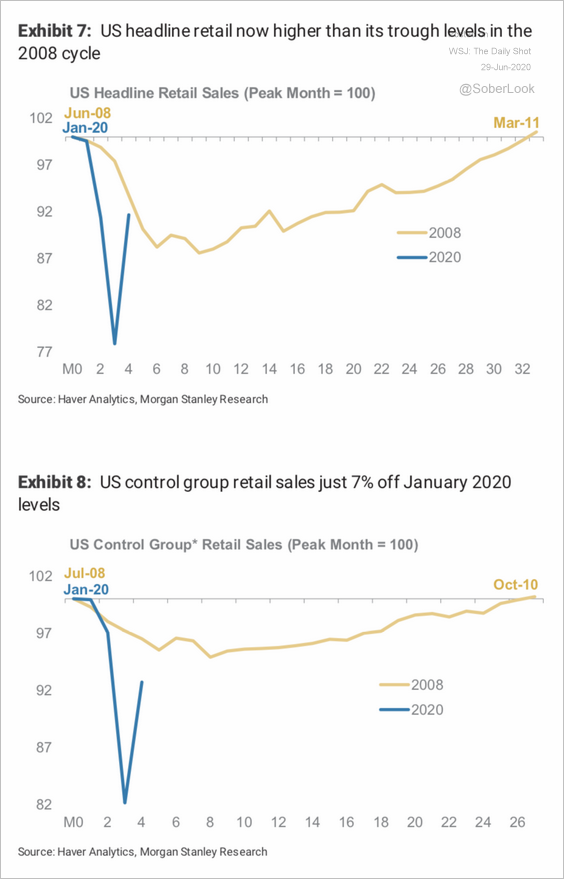

3. How do the current trends in consumption and retail sales compare to 2008?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

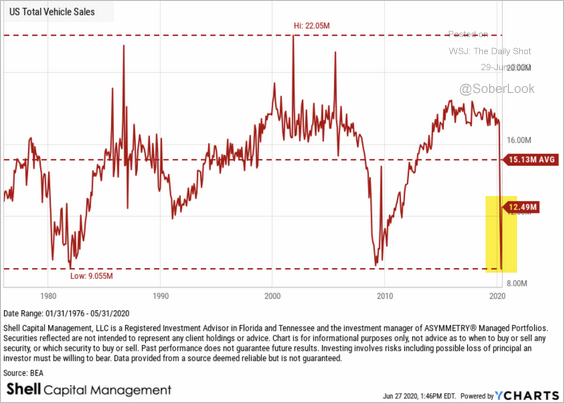

4. Here is a long-term chart of US vehicle sales.

Source: ASYMMETRY Observations Read full article

Source: ASYMMETRY Observations Read full article

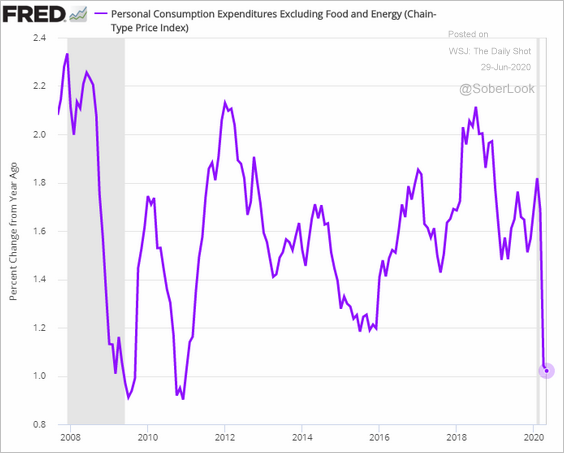

5. The core PCE inflation hit the lowest level since 2011. Is it bottoming?

6. Next, we have some high-frequency indicators tracking the recovery.

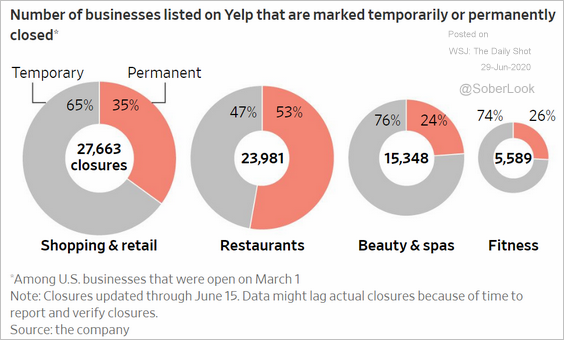

• Businesses still closed:

Source: @WSJ Read full article

Source: @WSJ Read full article

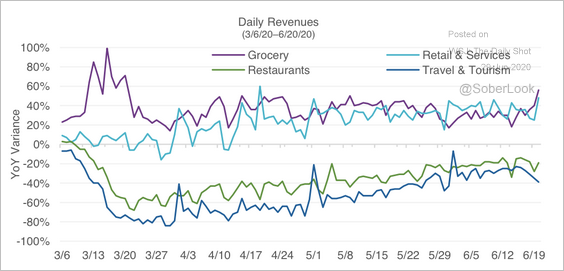

• Daily revenues by sector:

Source: Natixis Investment Managers

Source: Natixis Investment Managers

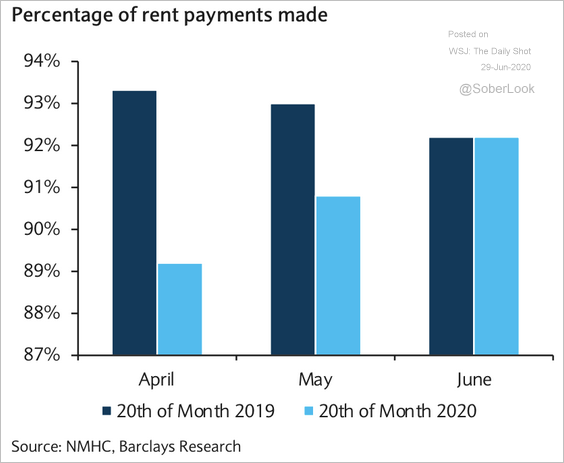

• Rent payments vs. 2019:

Source: Barclays Research

Source: Barclays Research

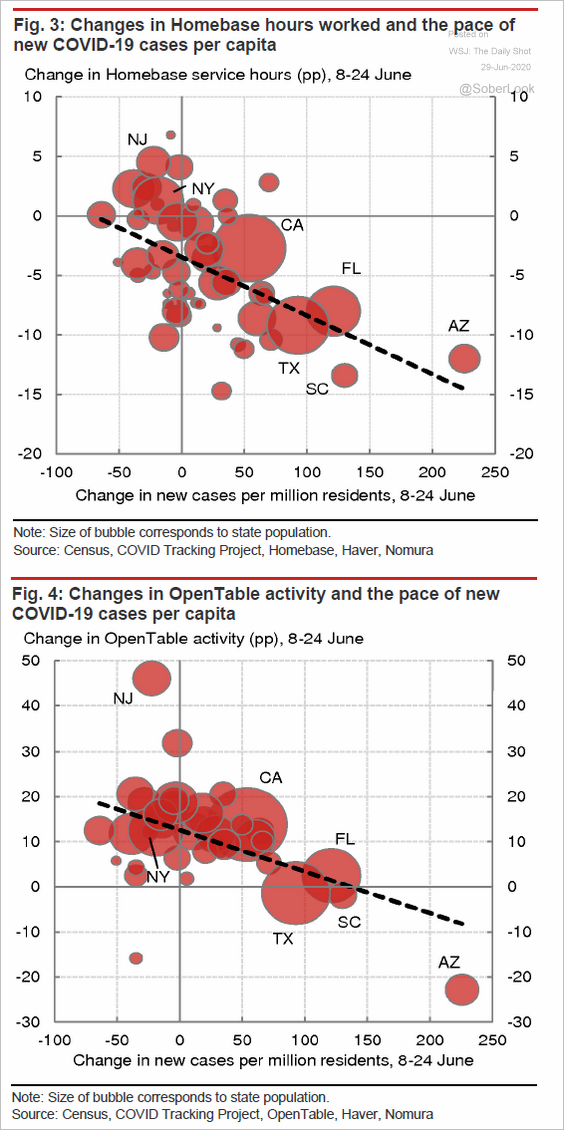

• The pace of recovery vs. the number of new infections:

Source: Nomura Securities, @tracyalloway

Source: Nomura Securities, @tracyalloway

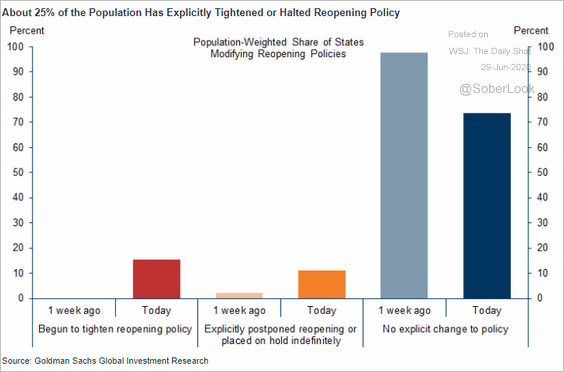

• Tightening or halting reopening measures:

Source: Goldman Sachs

Source: Goldman Sachs

Global Developments

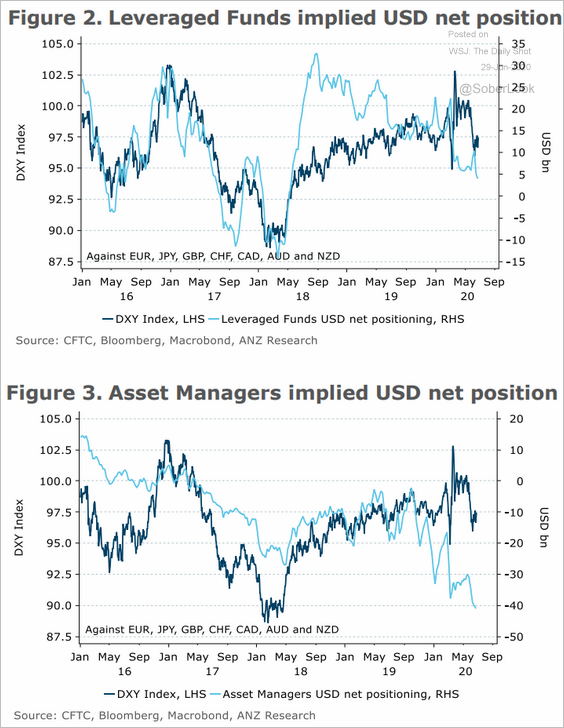

1. Leveraged funds and asset managers are increasingly glum on the US dollar.

Source: ANZ Research

Source: ANZ Research

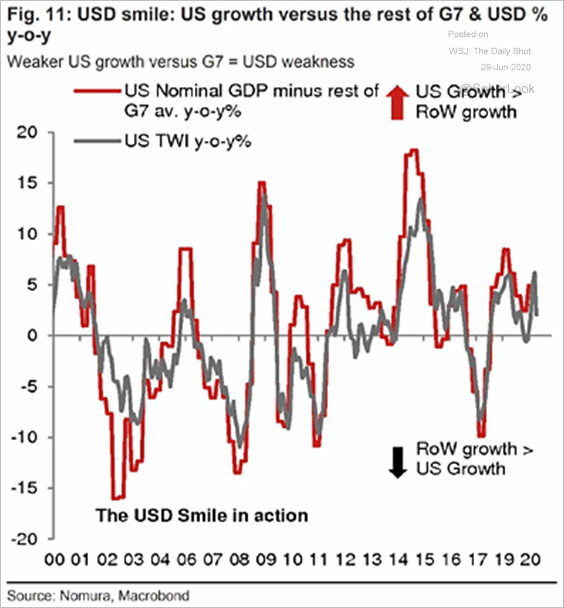

By the way, the dollar (trade-weighted index) is correlated to the US GDP growth relative to the rest of G7 (see this story on “dollar smile”).

Source: @ISABELNET_SA, @Nomura

Source: @ISABELNET_SA, @Nomura

——————–

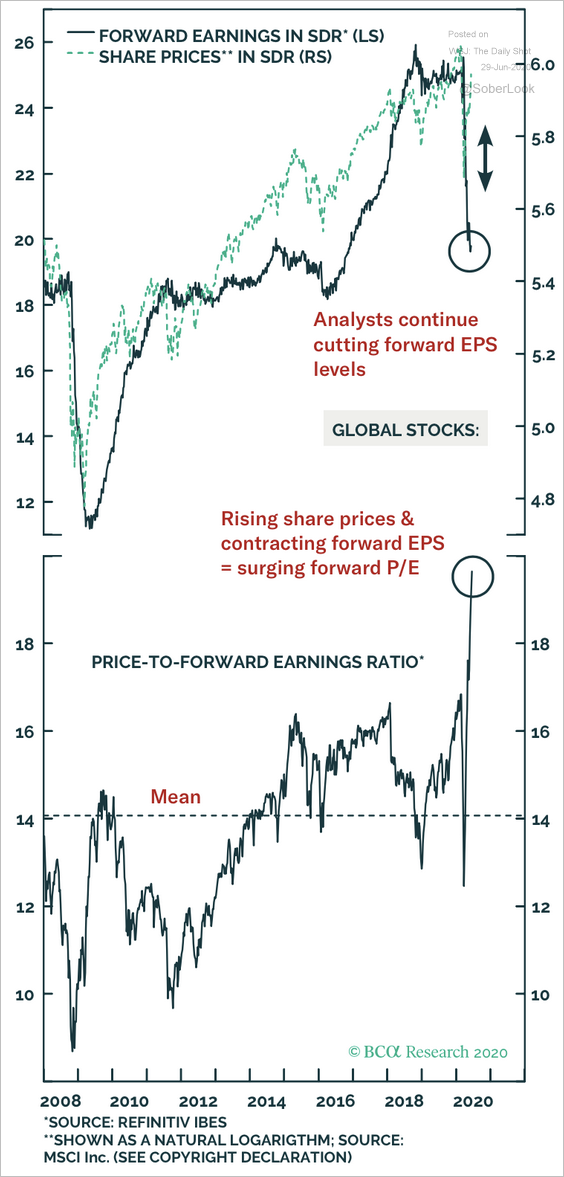

2. Global stocks have been pricing in a lot of good news, leading to soaring valuations.

Source: BCA Research

Source: BCA Research

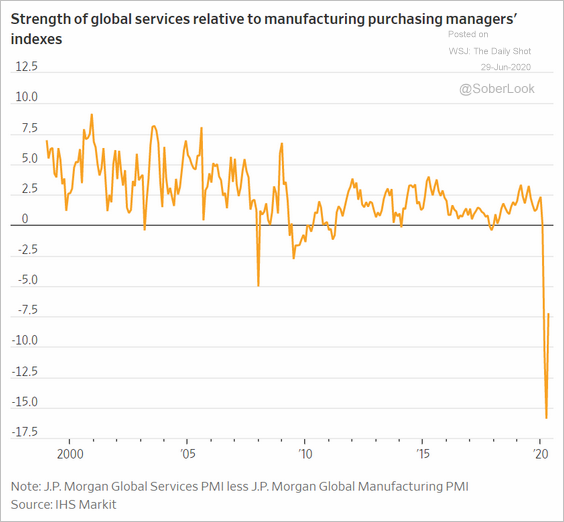

3. Here is the global manufacturing PMI.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Food for Thought

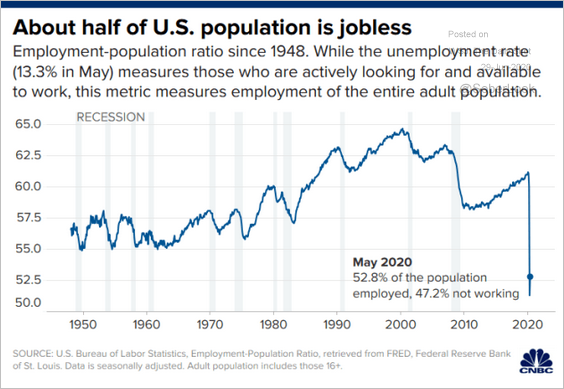

1. US employment-to-population ratio since 1948:

Source: CNBC Read full article

Source: CNBC Read full article

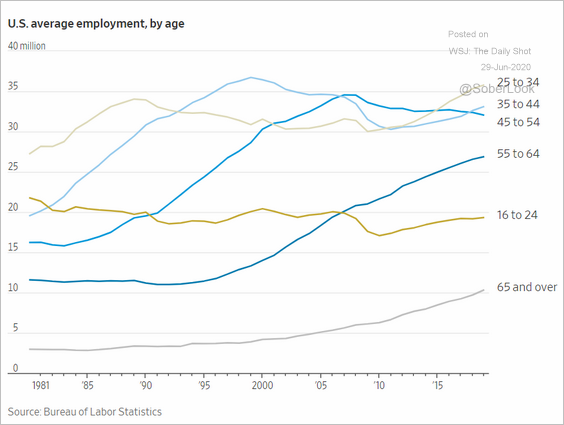

2. US average employment, by age:

Source: @WSJ Read full article

Source: @WSJ Read full article

3. US exports by state:

Source: Statista

Source: Statista

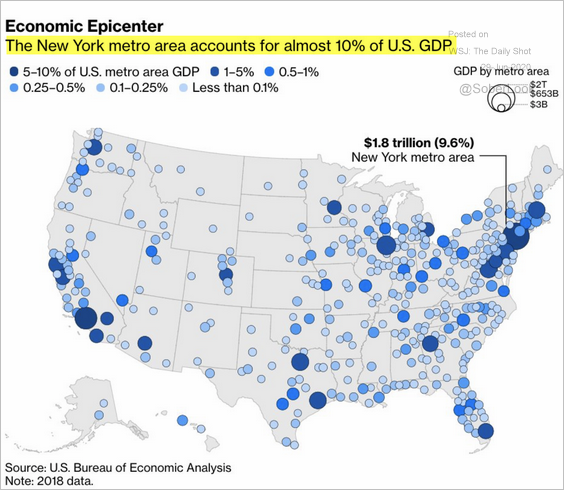

4. GDP by metro area:

Source: @adam_tooze, @bopinion Read full article

Source: @adam_tooze, @bopinion Read full article

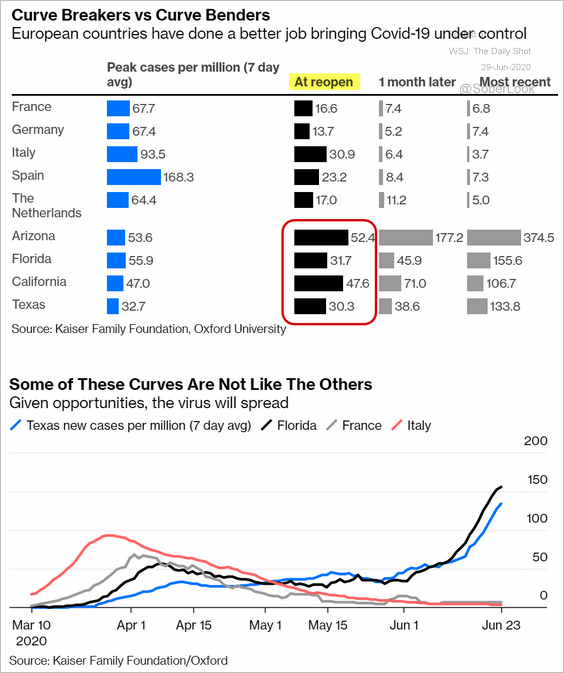

5. Reopening in the US vs. Europe:

Source: @bopinion Read full article

Source: @bopinion Read full article

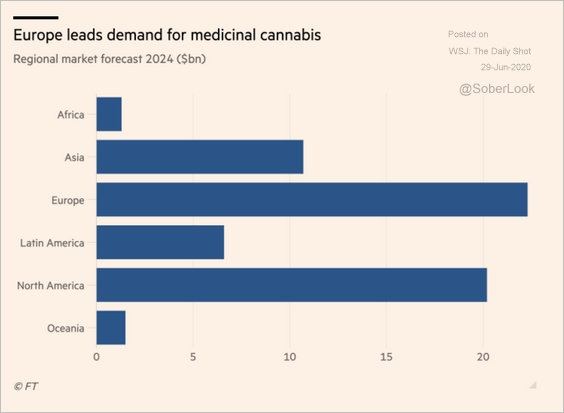

6. The medicinal cannabis industry:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

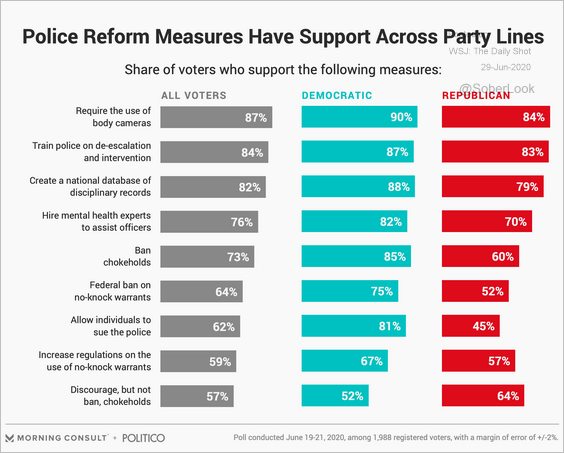

7. Views on police reform:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

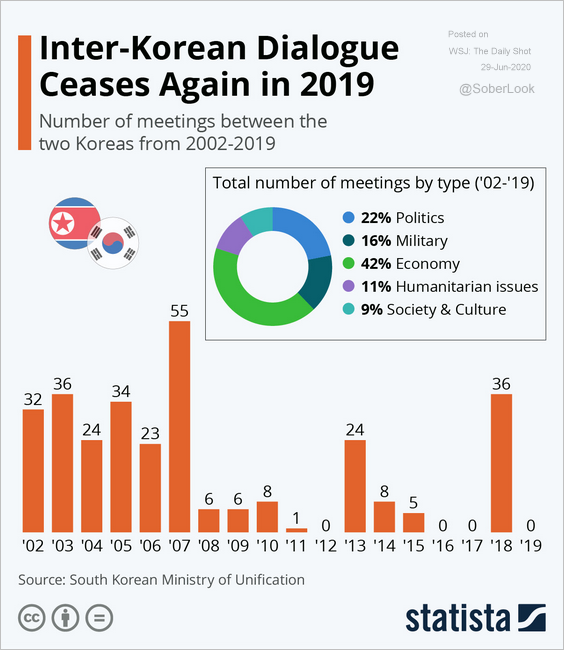

8. Inter-Korean dialogue:

Source: Statista

Source: Statista

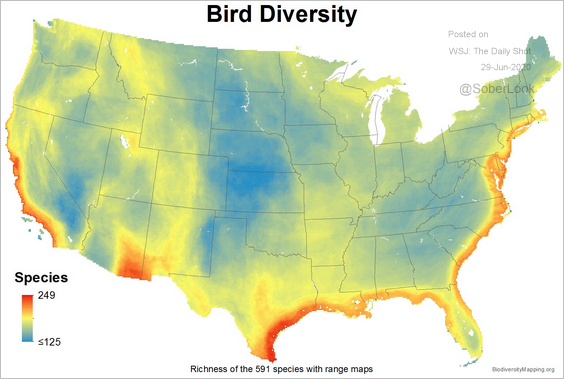

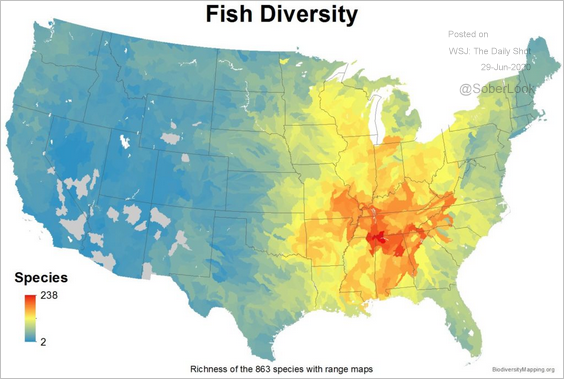

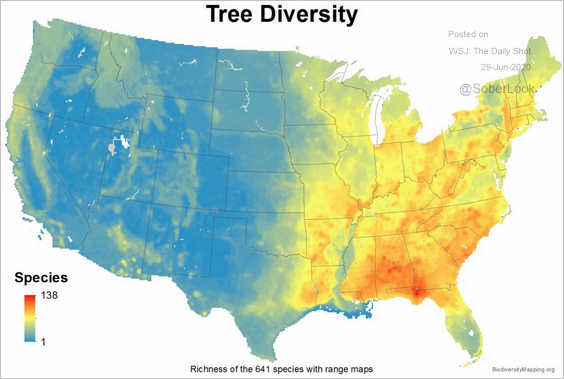

9. Bird, fish, and tree diversity in the continental US:

Source: Instituto de Pesquisas Ecológicas

Source: Instituto de Pesquisas Ecológicas

Source: Instituto de Pesquisas Ecológicas

Source: Instituto de Pesquisas Ecológicas

Source: Instituto de Pesquisas Ecológicas

Source: Instituto de Pesquisas Ecológicas

——————–