The Daily Shot: 07-Jul-20

• The United States

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

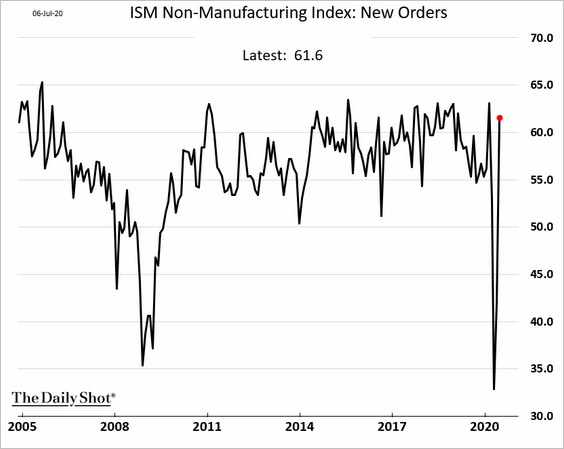

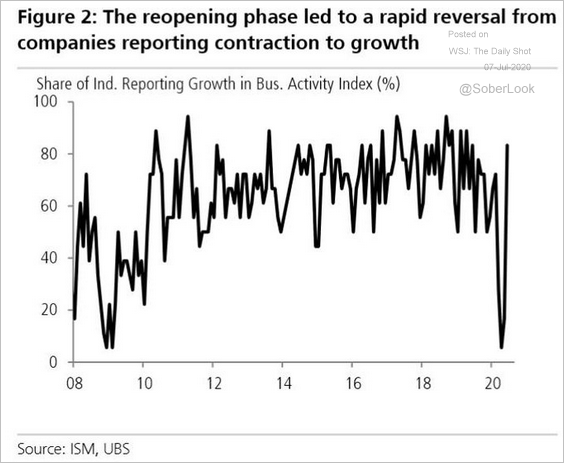

1. The ISM non-manufacturing report showed business activity returning to growth last month (PMI > 50). The headline index topped economists’ forecasts.

• 80% of industries reported growth.

Source: UBS, @jsblokland

Source: UBS, @jsblokland

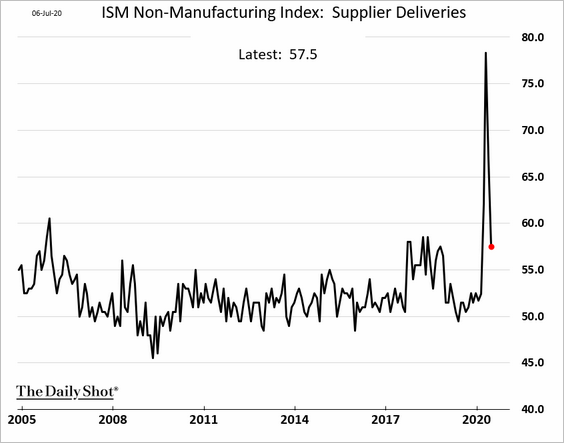

• Lockdown-related supplier bottlenecks have eased.

• Prices are rising again.

• Employment remains in contraction mode.

——————–

2. Forecasters have been surprised by the speed of the US economic rebound. Here is the Citi Economic Surprise Index (includes the ISM non-manufacturing report). However, the recovery has been losing momentum over the past couple of weeks.

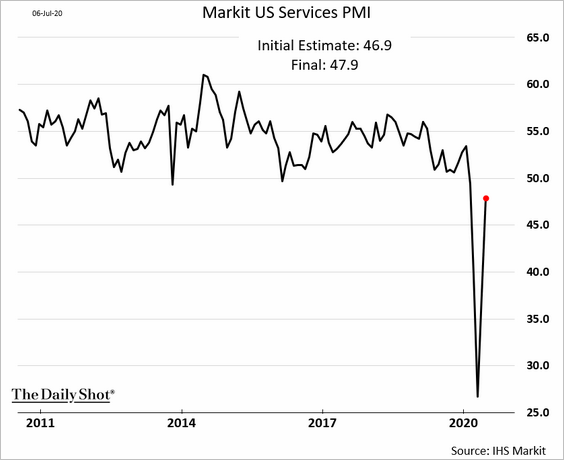

3. The updated Markit US Services PMI didn’t show the same level of strength as the ISM index, but it points to business activity stabilizing.

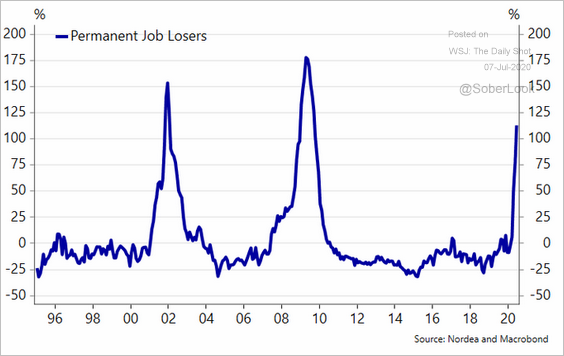

4. Next, we have some updates on the labor market.

• Permanent job losses are still climbing.

Source: @meremortenlund

Source: @meremortenlund

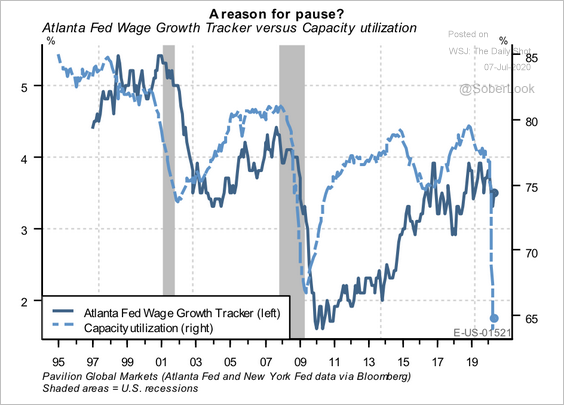

• The sharp decline in capacity utilization could trigger further reductions in wage growth.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

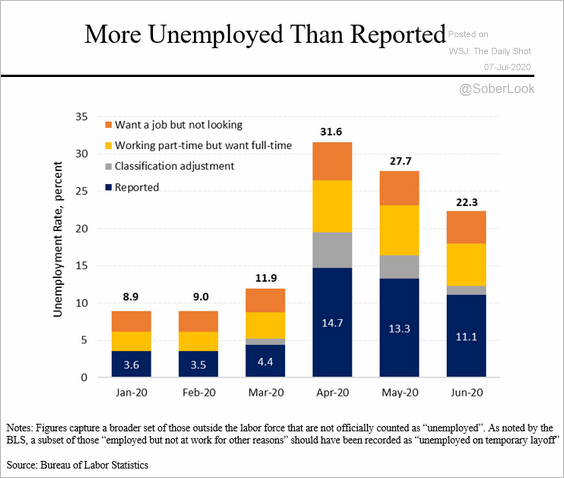

• Official unemployment figures do not capture the full extent of the labor market weakness.

Source: @SteveRattner

Source: @SteveRattner

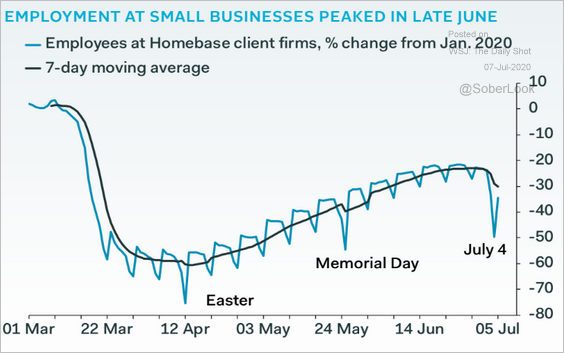

• The recovery in small business employment has stalled.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

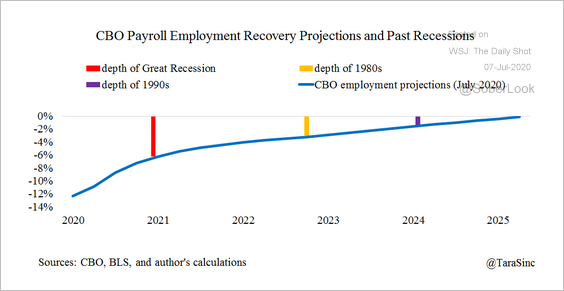

• The labor market will take years to recover from the pandemic shock.

Source: @TaraSinc

Source: @TaraSinc

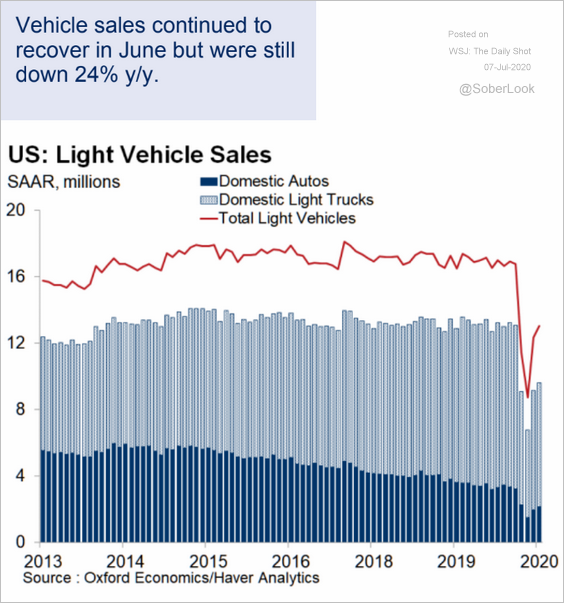

5. Vehicle sales continue to improve.

Source: Oxford Economics

Source: Oxford Economics

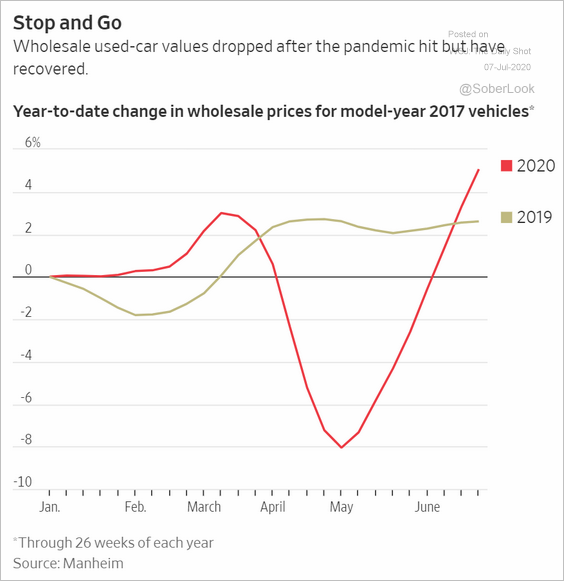

• Wholesale prices for used cars rebounded sharply.

Source: @WSJ Read full article

Source: @WSJ Read full article

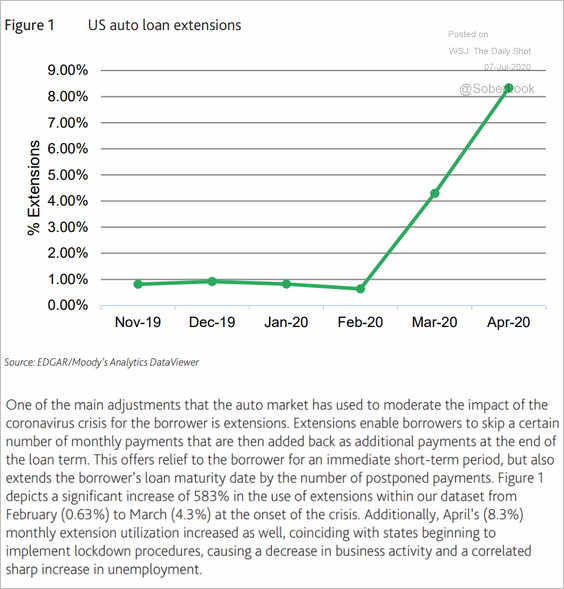

• Many buyers who financed their automobiles had their loans extended, allowing them to defer some payments.

Source: Moody’s Analytics

Source: Moody’s Analytics

——————–

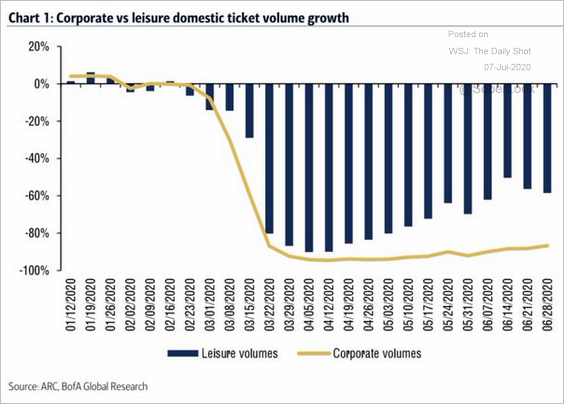

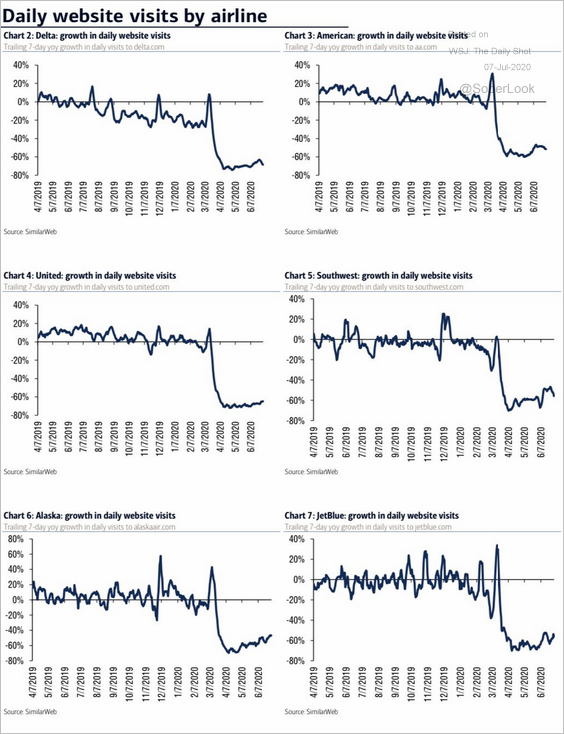

6. The airline industry continues to struggle.

• Ticket purchases relative to last year:

Source: BofA Merrill Lynch Global Research, @WallStJesus

Source: BofA Merrill Lynch Global Research, @WallStJesus

• Airline website visits:

Source: BofA Merrill Lynch Global Research, @WallStJesus

Source: BofA Merrill Lynch Global Research, @WallStJesus

——————–

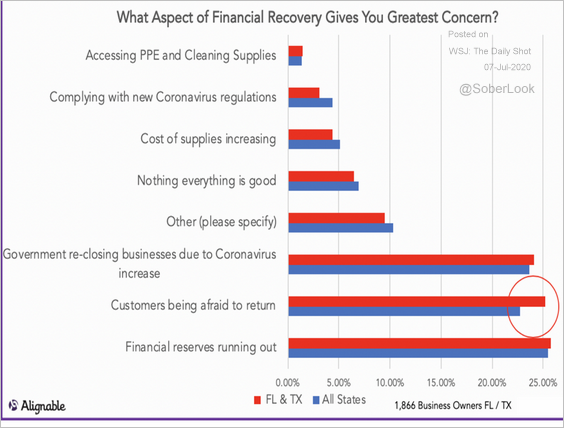

7. Many small businesses remain concerned about customers being afraid to return.

Source: Alignable Read full article

Source: Alignable Read full article

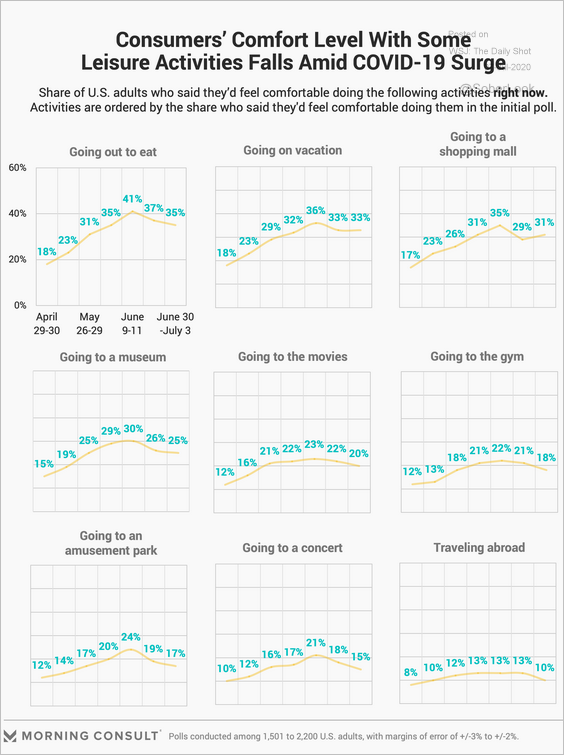

Consumers’ comfort level with some activities has weakened over the past couple of weeks.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

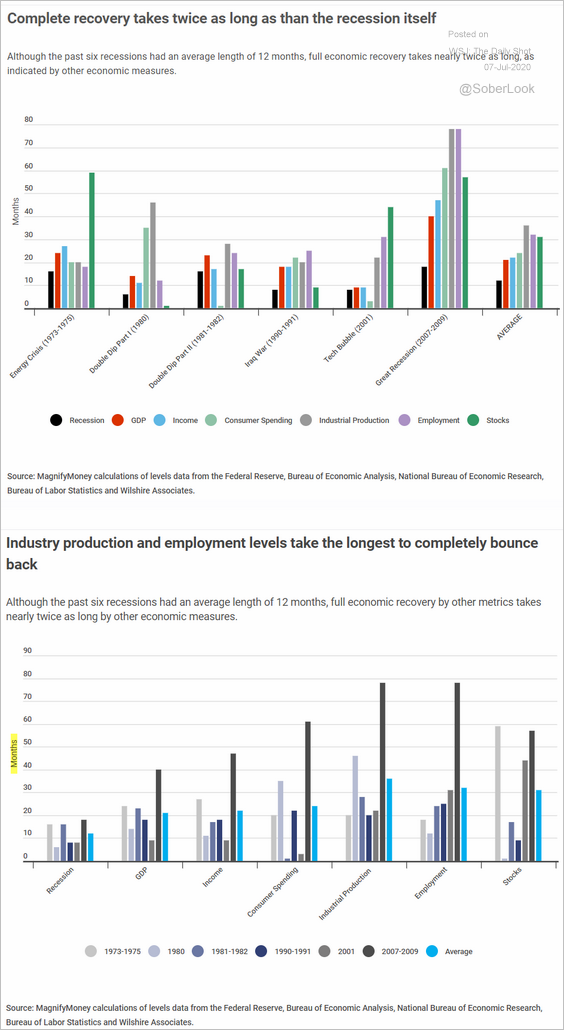

8. How long do key economic indicators typically take to recover since the start of the recession?

Source: MagnifyMoney

Source: MagnifyMoney

The Eurozone

1. Germany’s industry performed poorly in May, with the data surprising to the downside.

• Factory orders (year-over-year):

• Industrial production:

——————–

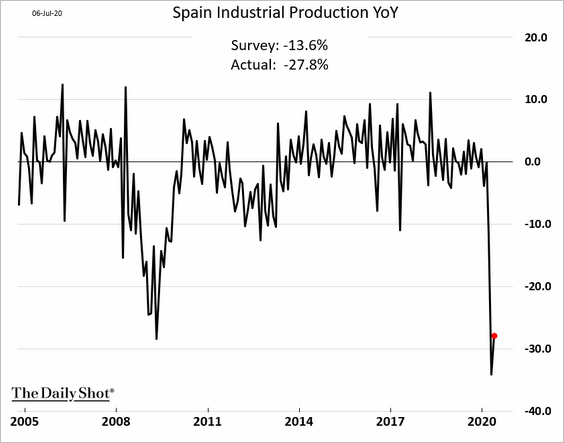

2. Spain’s industrial production was also extremely weak in May.

3. Investor confidence remains soft.

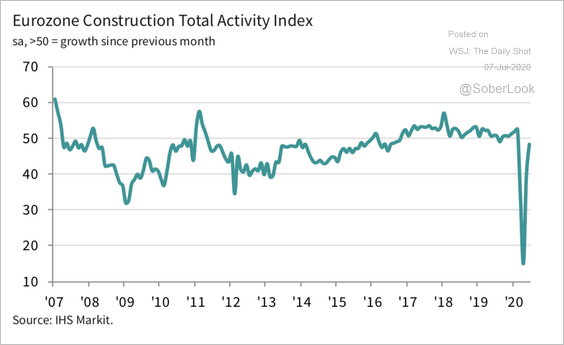

4. Euro-area construction activity stabilized in June.

Source: IHS Markit Read full article

Source: IHS Markit Read full article

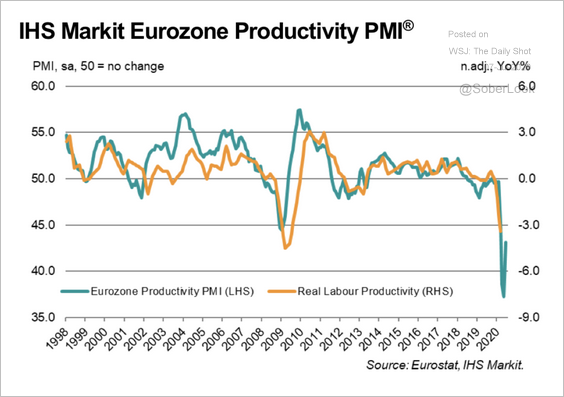

5. Markit’s index of productivity is still quite weak.

Source: IHS Markit Read full article

Source: IHS Markit Read full article

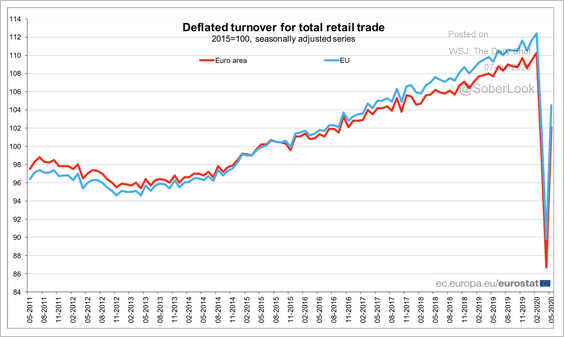

6. Retail sales rebounded in May.

Source: Eurostat Read full article

Source: Eurostat Read full article

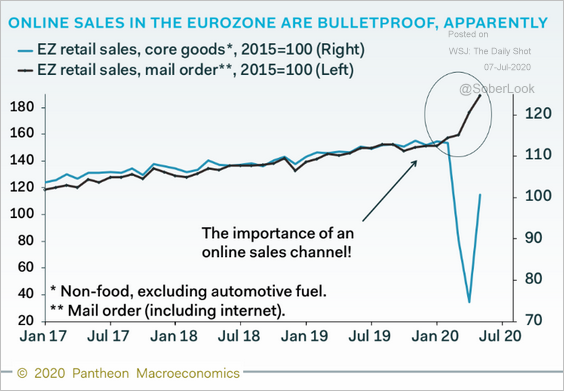

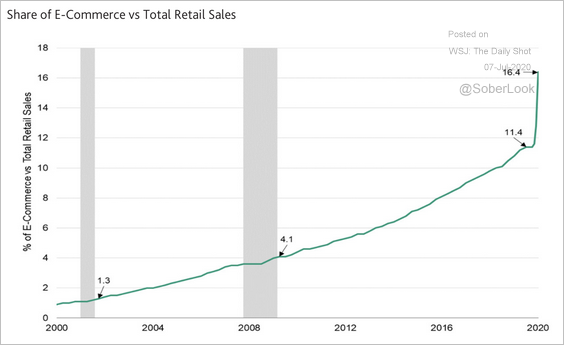

Internet sales strengthened during the crisis.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Japan

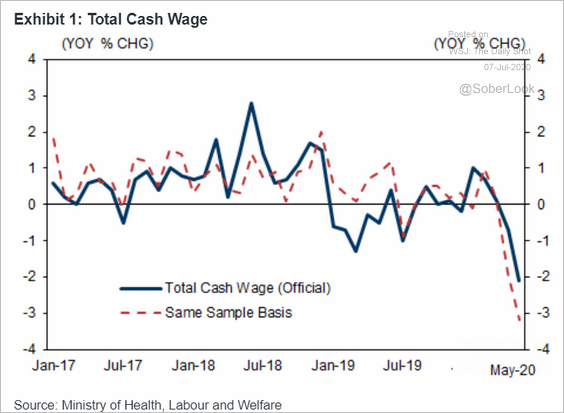

1. Wage growth surprised to the downside.

According to Goldman Sachs, the result was even weaker when using the same sample to measure changes in wages.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

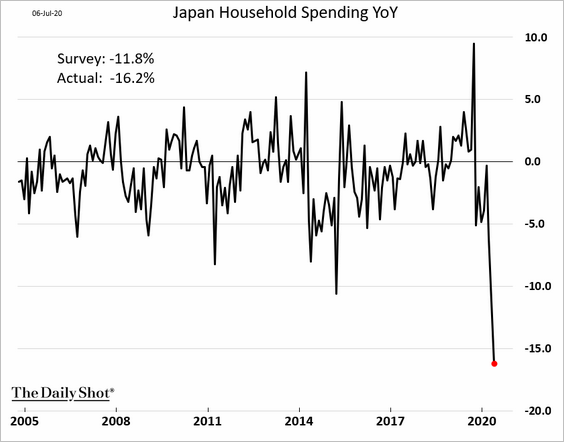

2. Household spending registered the largest yearly decline on record.

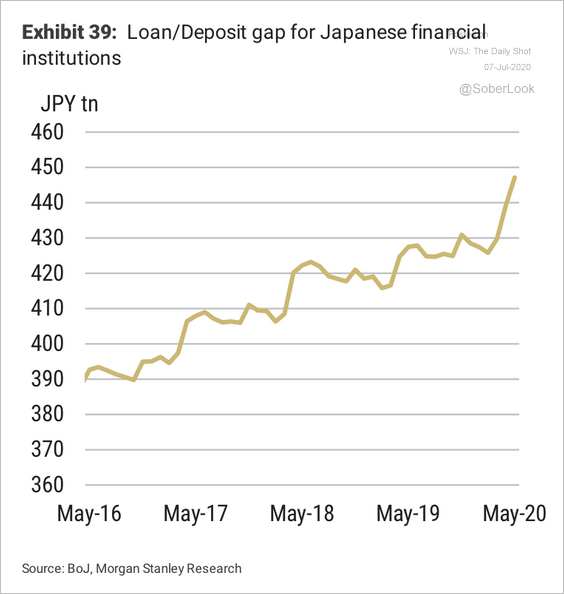

3. The loan-to-deposit gap for Japanese financial institutions is rising.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Asia – Pacific

1. Australia’s service-sector activity remains exceptionally weak.

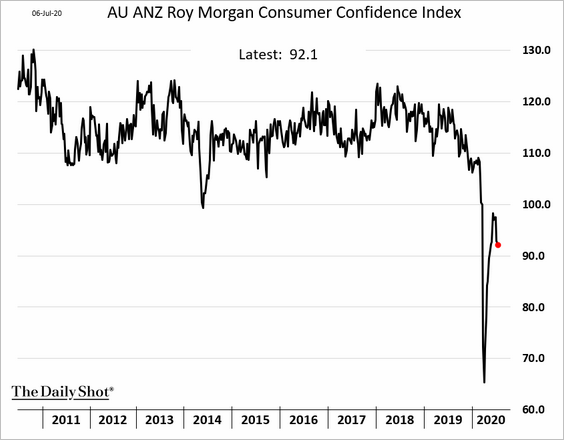

The rebound in consumer confidence is fading.

——————–

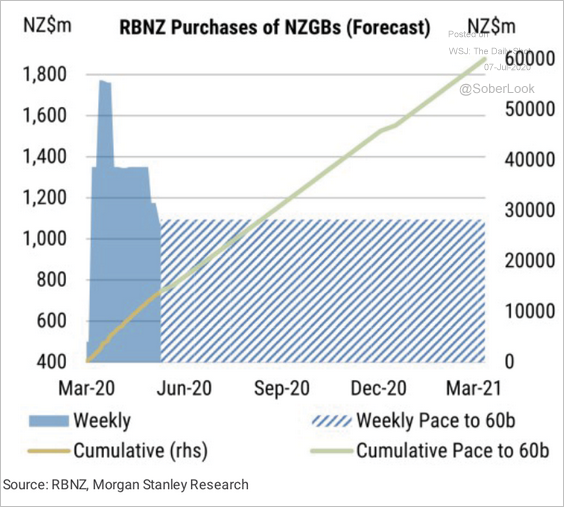

2. The RBNZ’s purchasing program will reach NZ$60 bn by the end of 1Q21.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

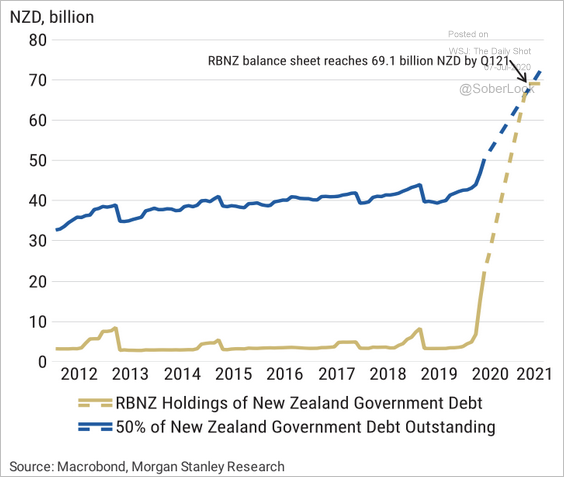

The central bank is set to own nearly half of outstanding New Zealand government bonds at the end of its QE program.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

China

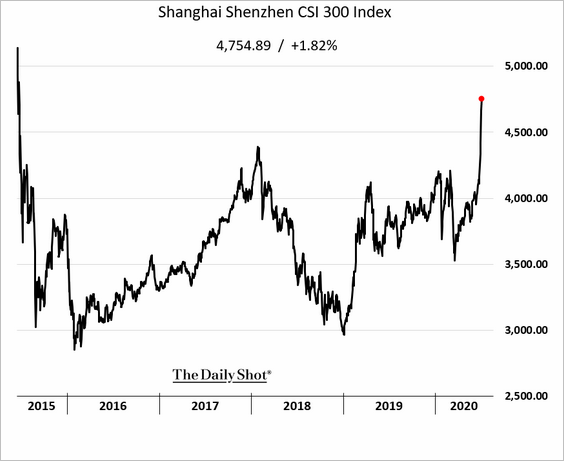

1. The stock market keeps climbing, boosted by Beijing’s jawboning.

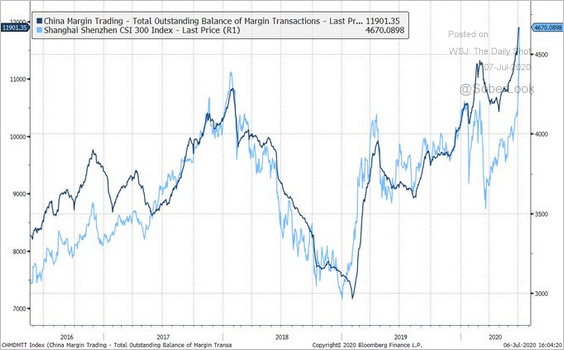

Margin trading is popular again (2 charts).

Source: @EffMktHype

Source: @EffMktHype

Source: @Schuldensuehner

Source: @Schuldensuehner

Is the market overheating?

Source: @DavidInglesTV

Source: @DavidInglesTV

——————–

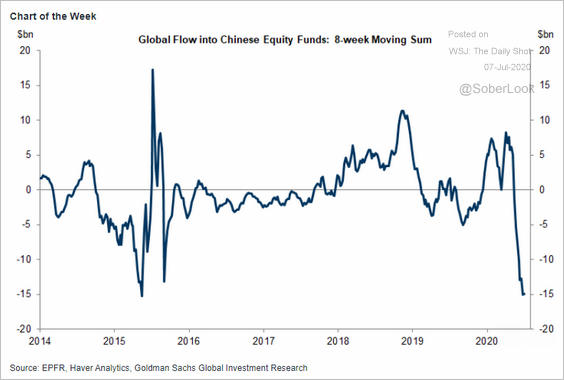

2. China’s equity funds saw significant outflows ahead of the rally.

Source: Goldman Sachs

Source: Goldman Sachs

3. The renminbi rose sharply over the past 24 hours.

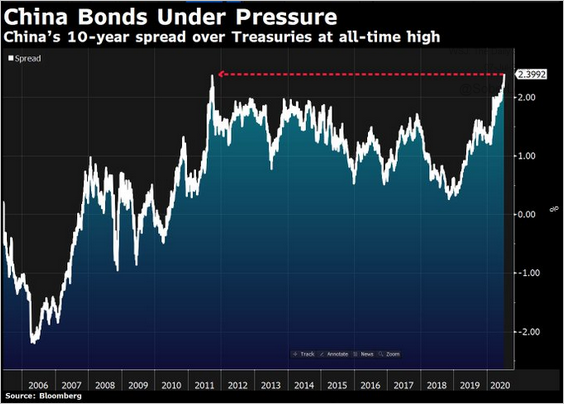

4. The 10yr bond spread to Treasuries hit a record high.

Source: @DavidInglesTV

Source: @DavidInglesTV

Emerging Markets

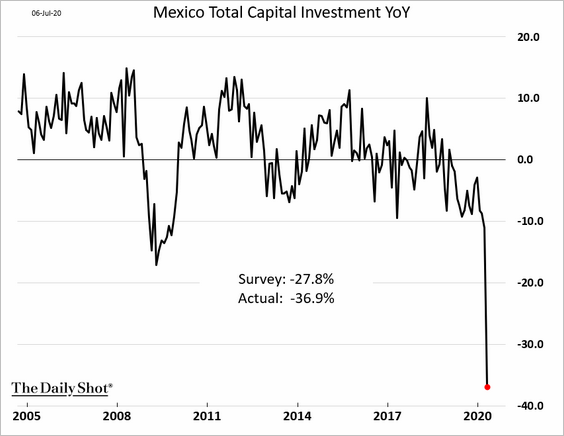

1. Mexico’s business investment collapsed in April, and analysts don’t expect to see a significant recovery in May.

2. Indonesia’s consumer confidence remained extremely weak last month.

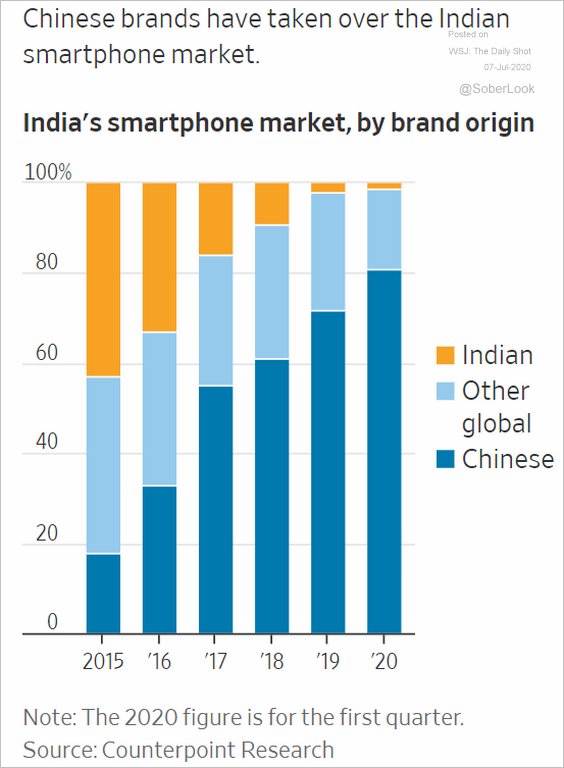

3. Can India roll back its economic integration with China?

Source: @WSJ Read full article

Source: @WSJ Read full article

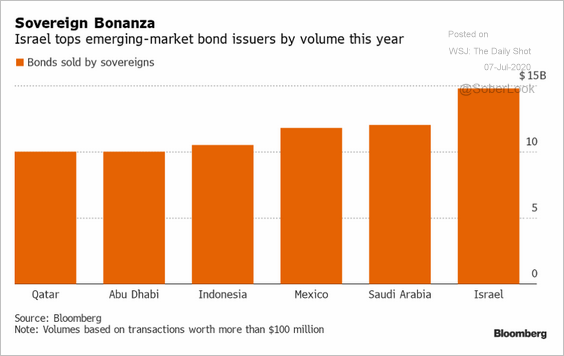

4. Here are the top EM sovereign debt issuers this year.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

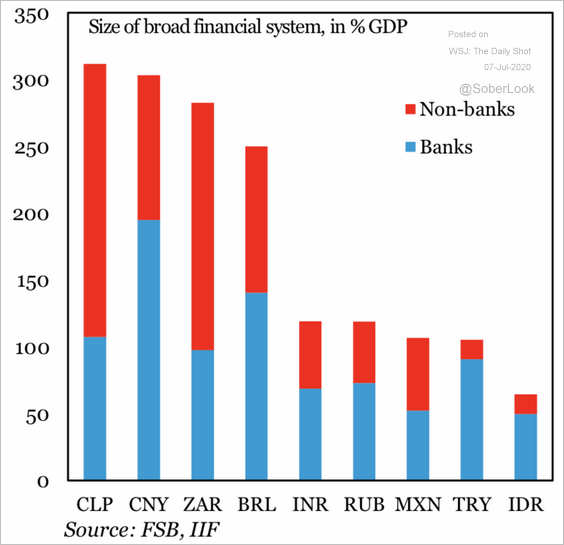

5. How large is each nation’s financial system?

Source: IIF

Source: IIF

Commodities

1. The rally in iron ore has resumed, with Singapore futures topping $100/MT.

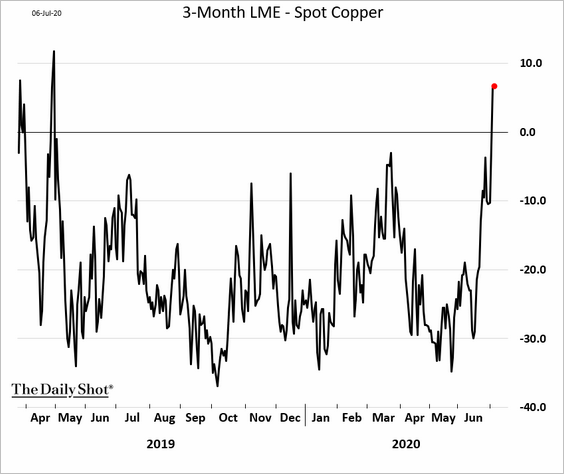

2. Copper has recovered most of the year-to-date losses.

The copper curve is now in backwardation, signaling improving supply/demand fundamentals.

h/t Winnie Zhu

h/t Winnie Zhu

——————–

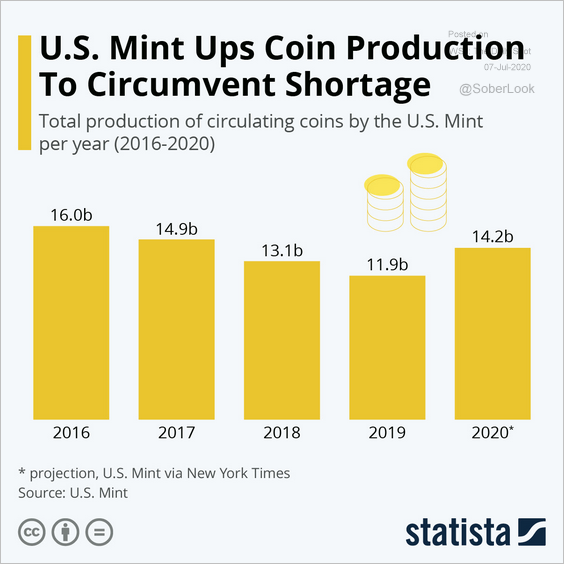

3. The US Mint boosted its production of coins this year to meet rising demand.

Source: Statista

Source: Statista

Equities

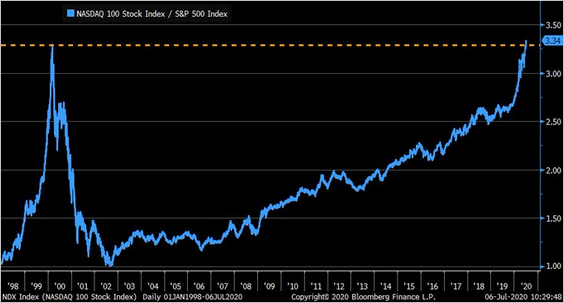

1. The NASDAQ 100/S&P 500 ratio hit a record high.

Source: @LizAnnSonders, @bloomberg

Source: @LizAnnSonders, @bloomberg

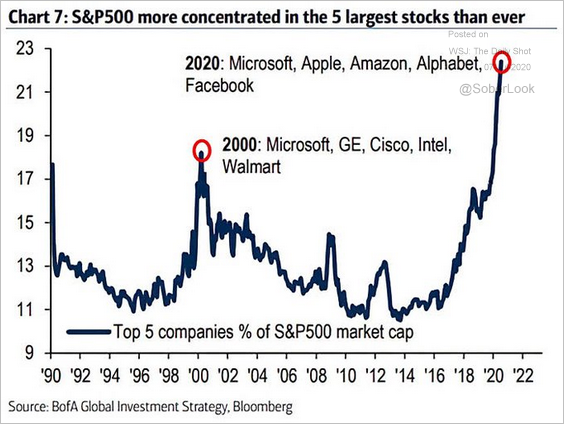

2. The S&P 500 is extremely concentrated.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

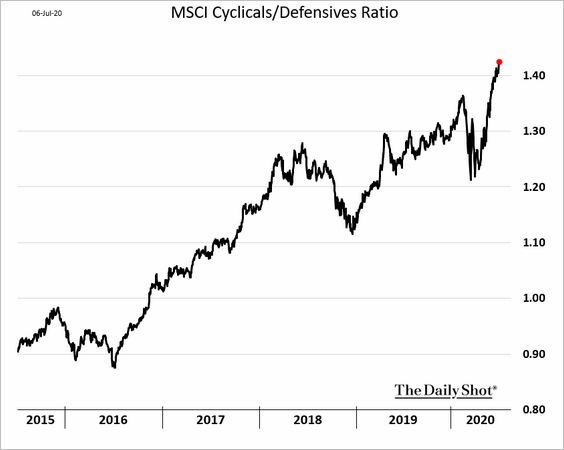

3. Cyclical sectors continue to outperform.

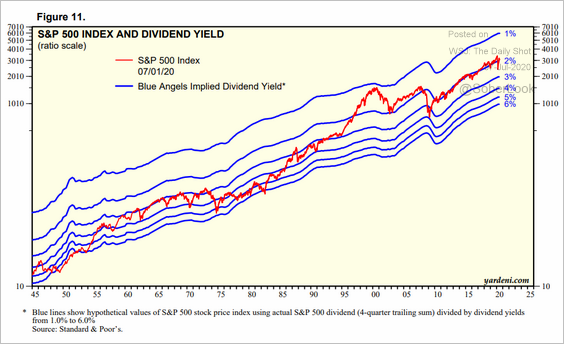

4. The S&P 500 dividend yield has been anchored at 2% over the past decade.

Source: Yardeni Research

Source: Yardeni Research

The spread between the S&P 500 dividend yield and the 10yr Treasury is off the highs but remains in positive territory.

——————–

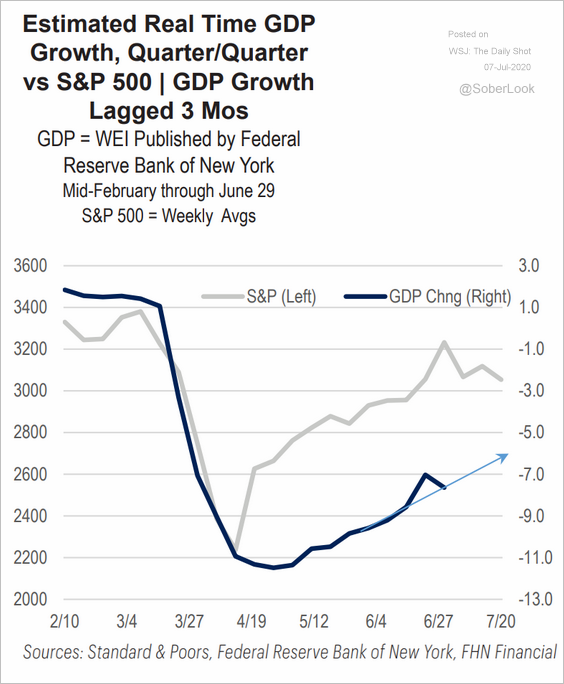

5. The stock market has outperformed economic activity.

Source: FHN Financial

Source: FHN Financial

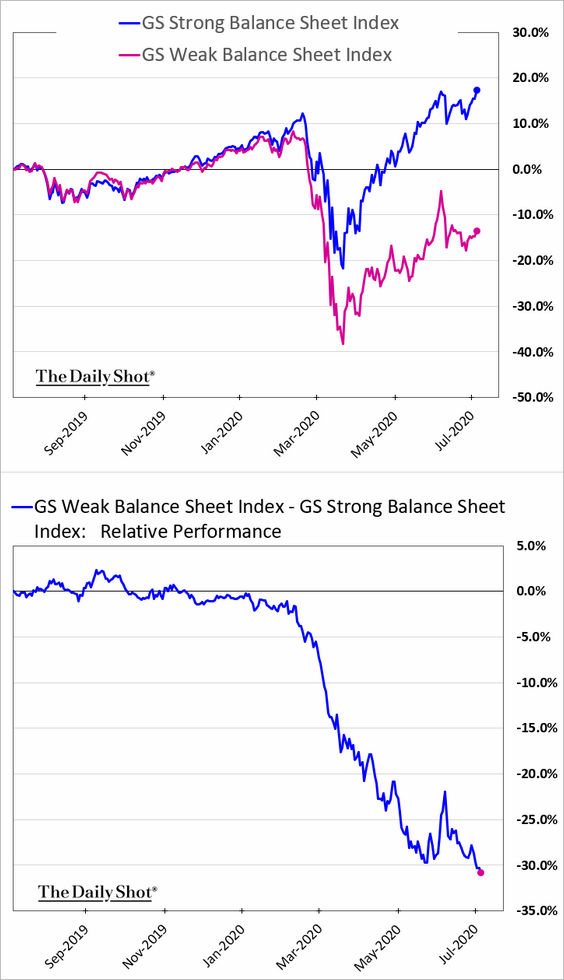

6. The gap between companies with strong and weak balance sheets continues to widen.

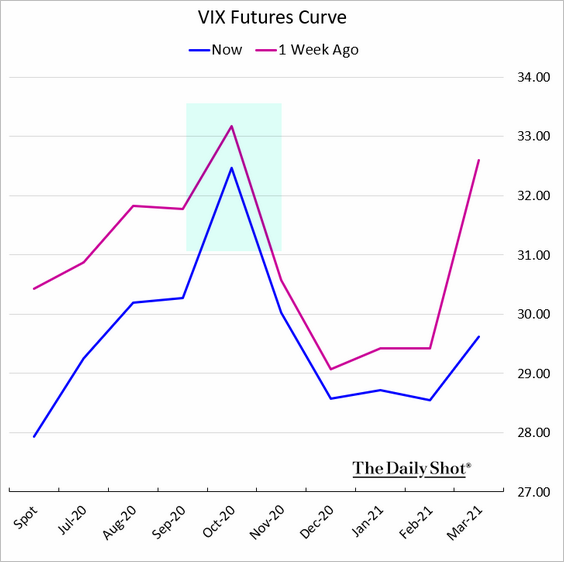

7. The volatility market is increasingly focused on the 2020 elections. Here is the VIX futures curve.

Credit

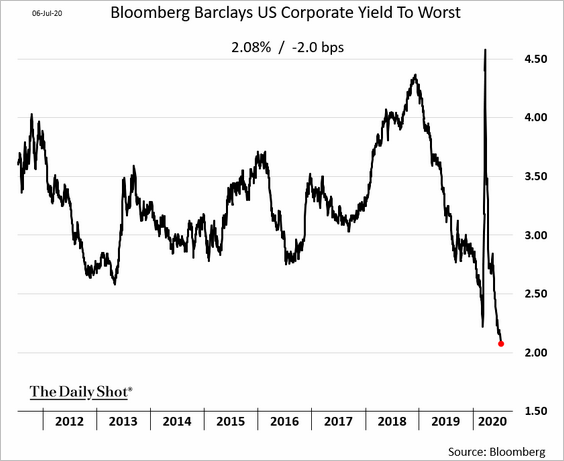

1. US investment-grade yields are at record lows, with the Bloomberg/Barclays index approaching 2%. Thanks to the Federal Reserve, financing costs have collapsed for companies with strong balance sheets.

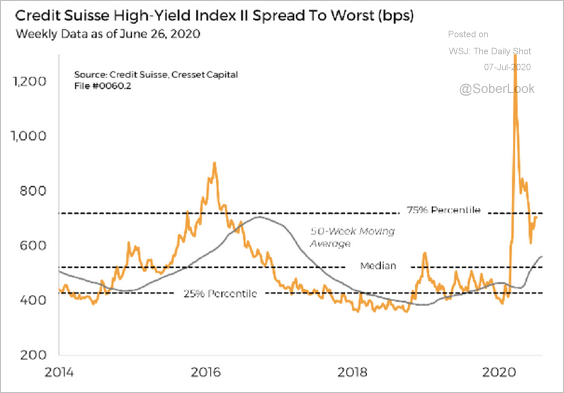

2. According to Crescat, current high-yield spreads do not adequately compensate income investors for the unprecedented supply, especially as the Fed decided to focus on purchasing investment-grade corporate bonds.

Source: Crescat Capital

Source: Crescat Capital

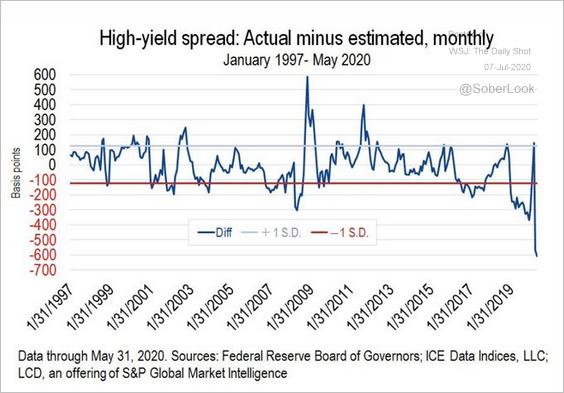

A model based on economic indicators shows that high-yield spreads are remarkably tight.

Source: @jessefelder Read full article

Source: @jessefelder Read full article

——————–

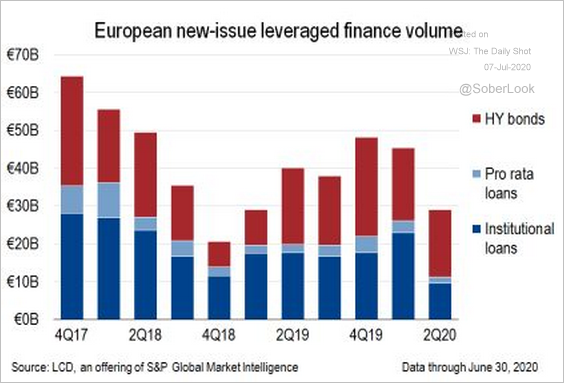

3. European leveraged finance issuance slowed in the second quarter.

Source: @lcdnews, @millarlr

Source: @lcdnews, @millarlr

Rates

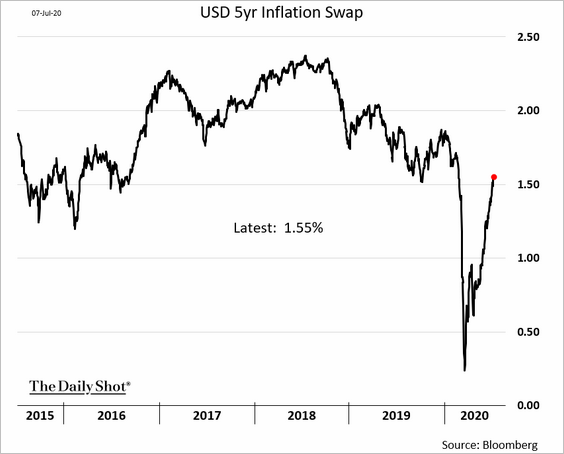

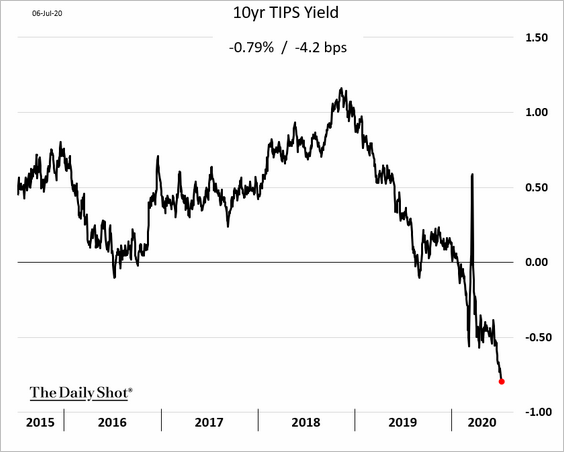

1. Market-based inflation expectations keep climbing.

As a result, effective real rates (TIPS yields) are moving deeper into negative territory.

——————–

2. The US broad money supply is 25% higher than it was a year ago.

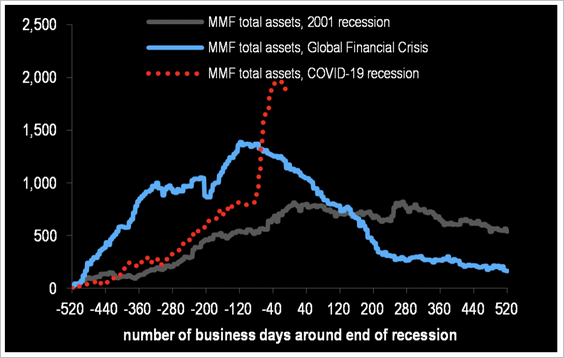

3. Money market funds saw substantial inflows compared to previous recessions.

Source: JP Morgan, @themarketear

Source: JP Morgan, @themarketear

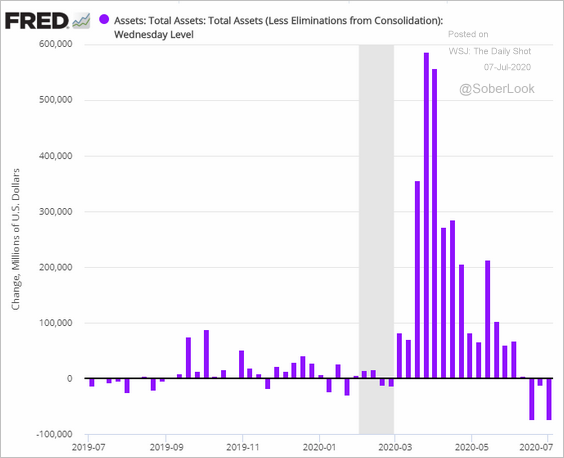

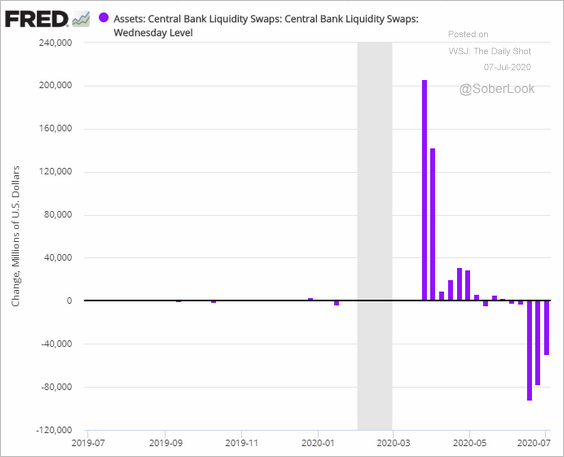

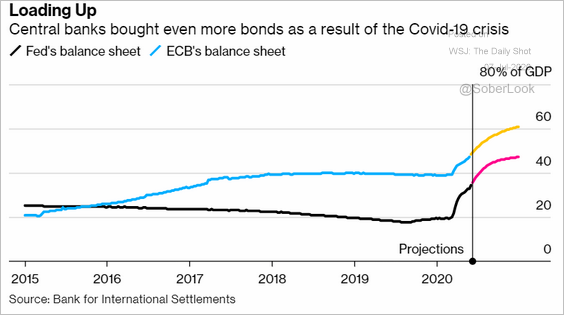

4. Next, we have some updates on the Fed’s balance sheet.

• Total assets continue to shrink, …

… pulled lower by credit/liquidity facilities.

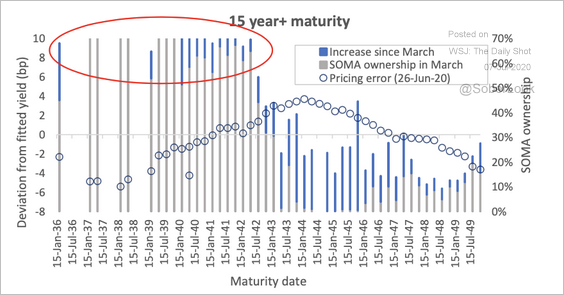

• The Fed has maxed its holdings in the 2036-2042 Treasury maturities.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

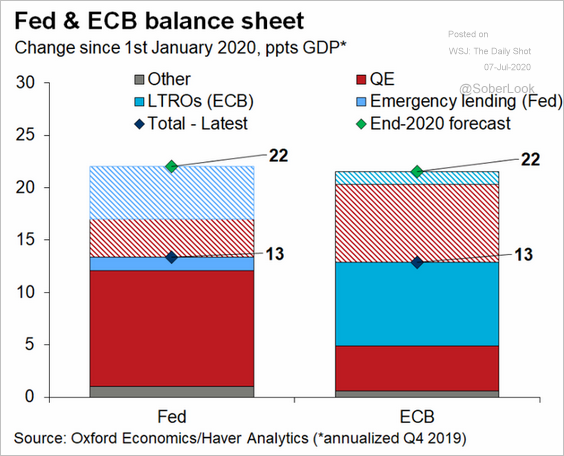

• The two charts below compare the Fed’s and the ECB’s balance sheets.

Source: @GregDaco

Source: @GregDaco

Source: @markets Read full article

Source: @markets Read full article

Global Developments

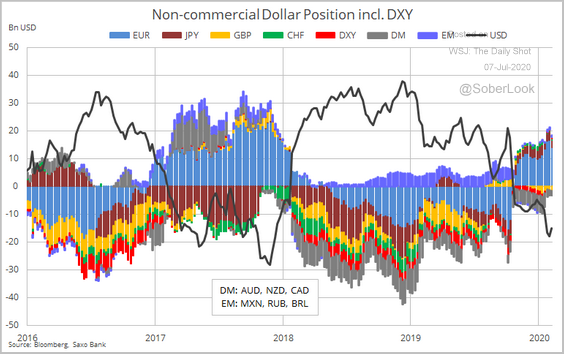

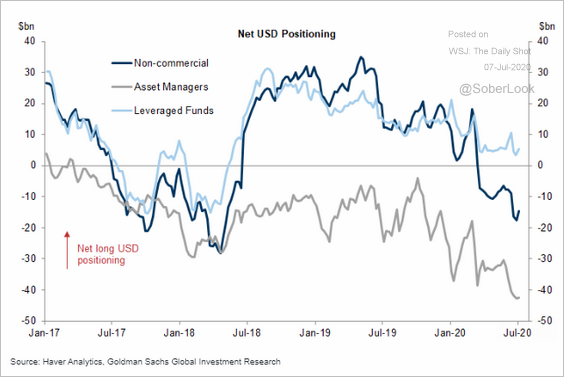

1. Asset managers continue to bet against the US dollar (2 charts).

Source: @Ole_S_Hansen

Source: @Ole_S_Hansen

Source: Goldman Sachs

Source: Goldman Sachs

——————–

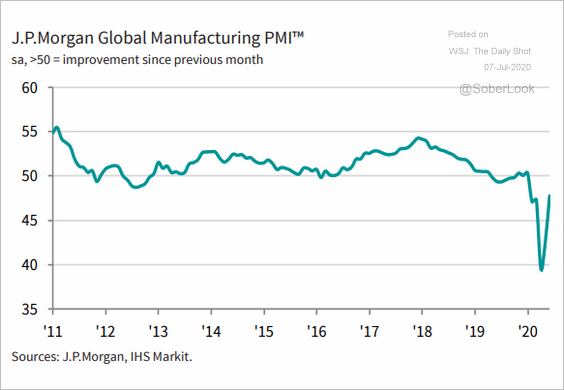

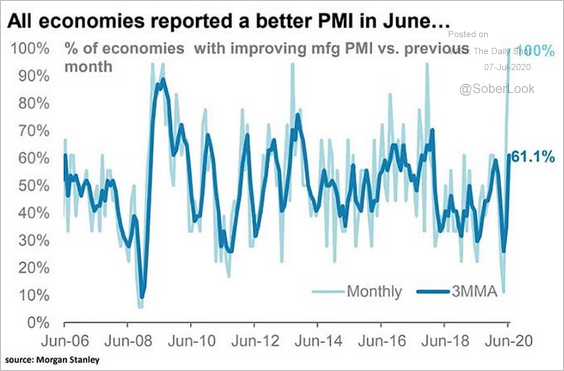

2. Global manufacturing is nearing stabilization (PMI = 50).

Source: @IHSMarkitPMI Read full article

Source: @IHSMarkitPMI Read full article

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

——————–

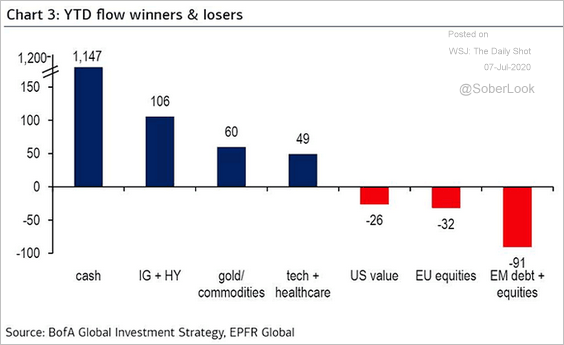

3. This chart shows the year-to-date fund flows by asset class.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

Food for Thought

1. E-commerce share of total retail sales:

Source: Moody’s Analytics

Source: Moody’s Analytics

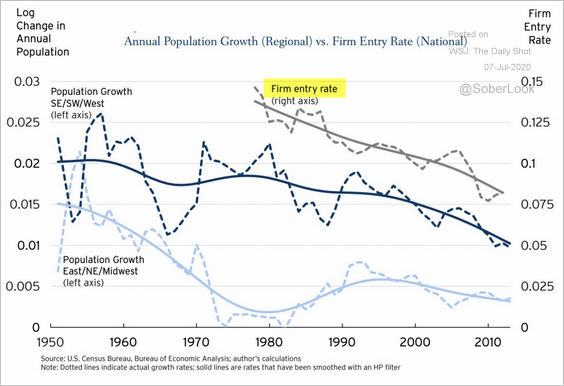

2. A multi-decade decline in US startups:

Source: Brookings Institution Read full article

Source: Brookings Institution Read full article

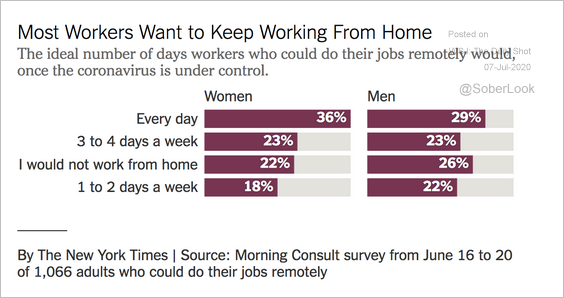

3. Preferences for working from home:

Source: The New York Times Read full article

Source: The New York Times Read full article

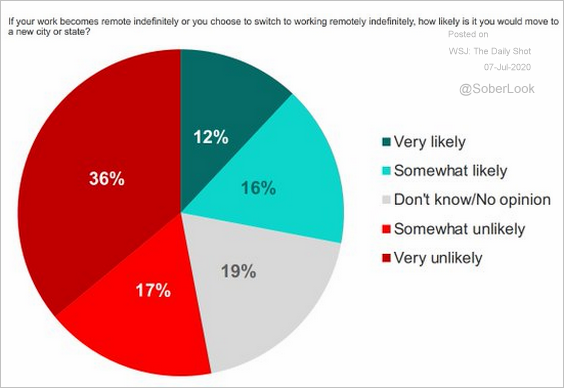

If your work becomes remote, would you move to a different city?

Source: @MorningConsult Read full article

Source: @MorningConsult Read full article

——————–

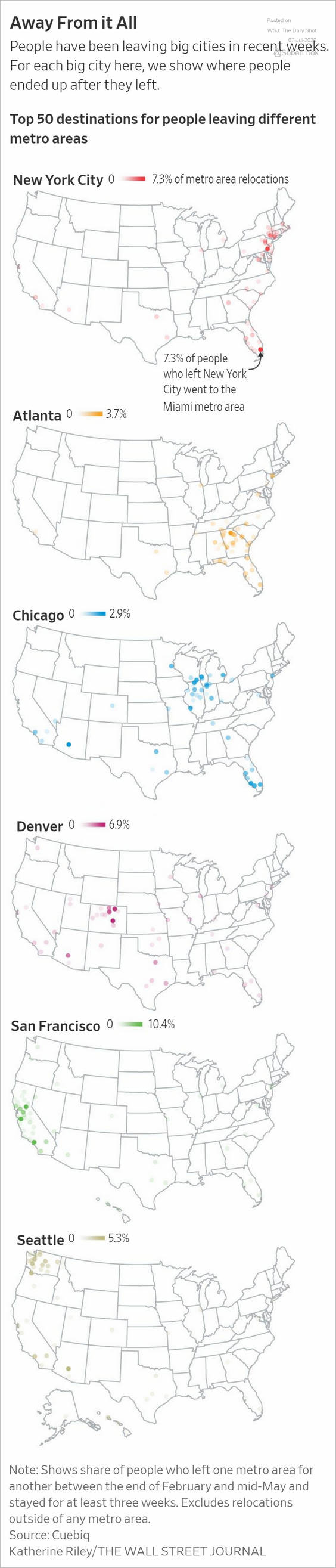

4. Leaving big cities:

Source: @WSJ Read full article

Source: @WSJ Read full article

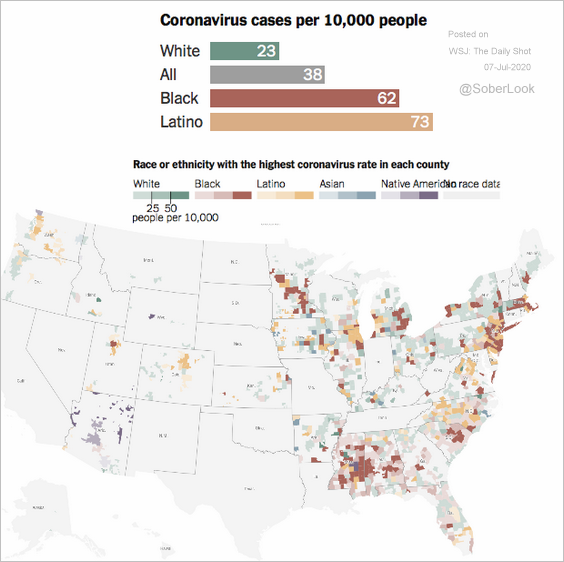

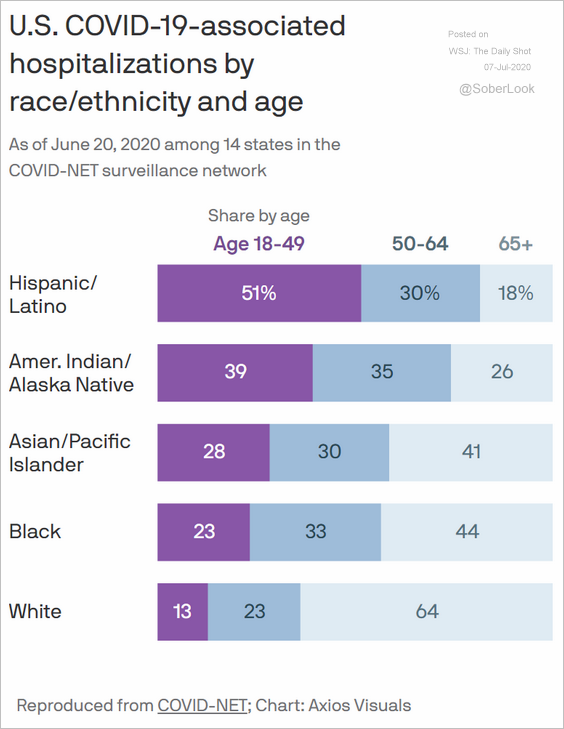

5. COVID-19 cases/hospitalizations by race/ethnicity (2 charts):

Source: The New York Times Read full article

Source: The New York Times Read full article

Source: @axios

Source: @axios

——————–

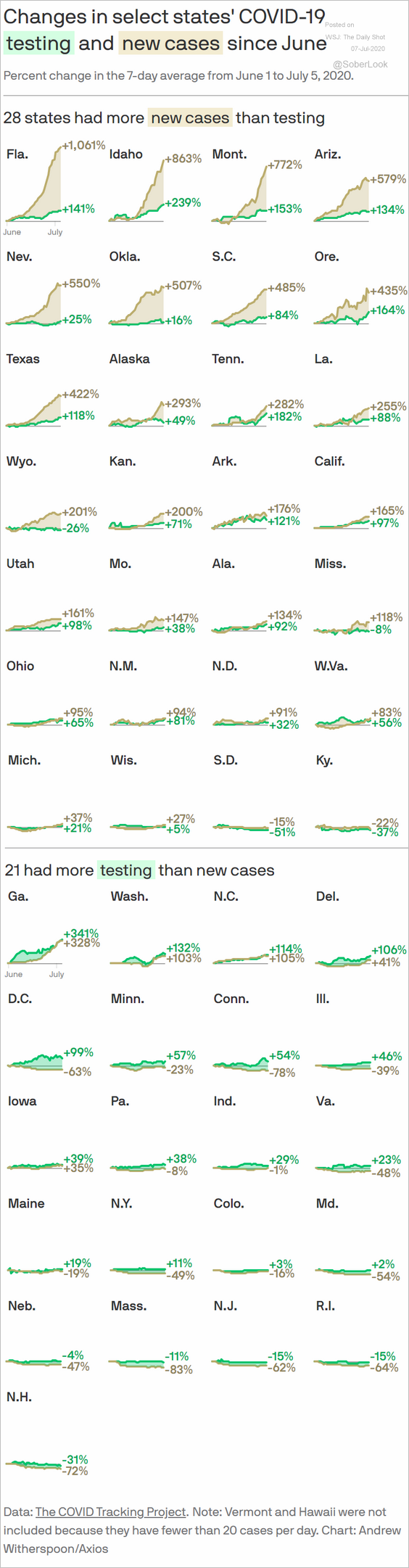

6. Testing vs. new cases, by state:

Source: @axios Read full article

Source: @axios Read full article

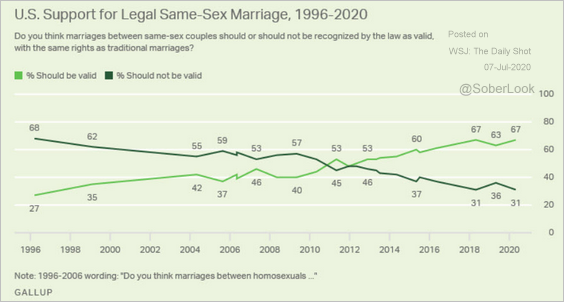

7. US views on same-sex marriage:

Source: Gallup Read full article

Source: Gallup Read full article

The history of same-sex marriage legalization globally:

Source: Statista

Source: Statista

——————–

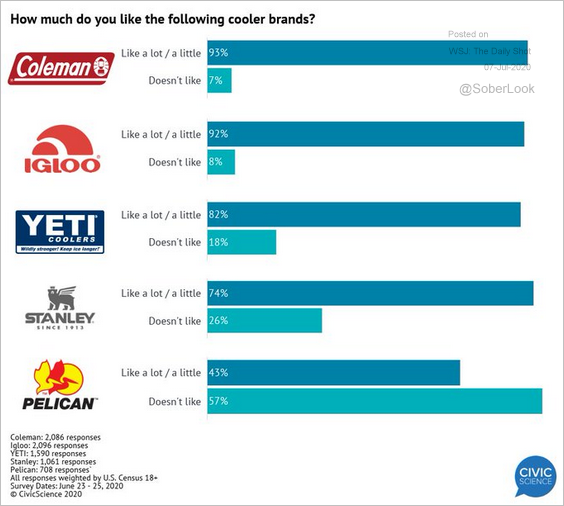

8. Preferences for brands of coolers:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–