The Daily Shot: 09-Jul-20

• Global Developments

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• China

• Emerging Markets

• Commodities

• Equities

• Alternatives

• Rates

• Food for Thought

Global Developments

1. Technical indicators point to further downside risks for the US dollar.

Source: Reuters Read full article

Source: Reuters Read full article

Source: barchart.com

Source: barchart.com

——————–

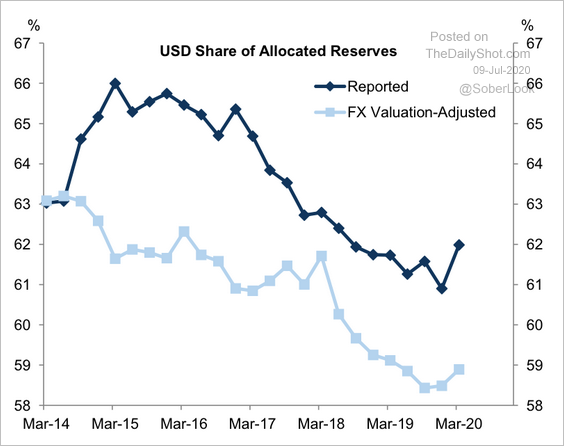

2. The reported share of dollar reserves globally rose amid market volatility in Q1.

Source: Goldman Sachs

Source: Goldman Sachs

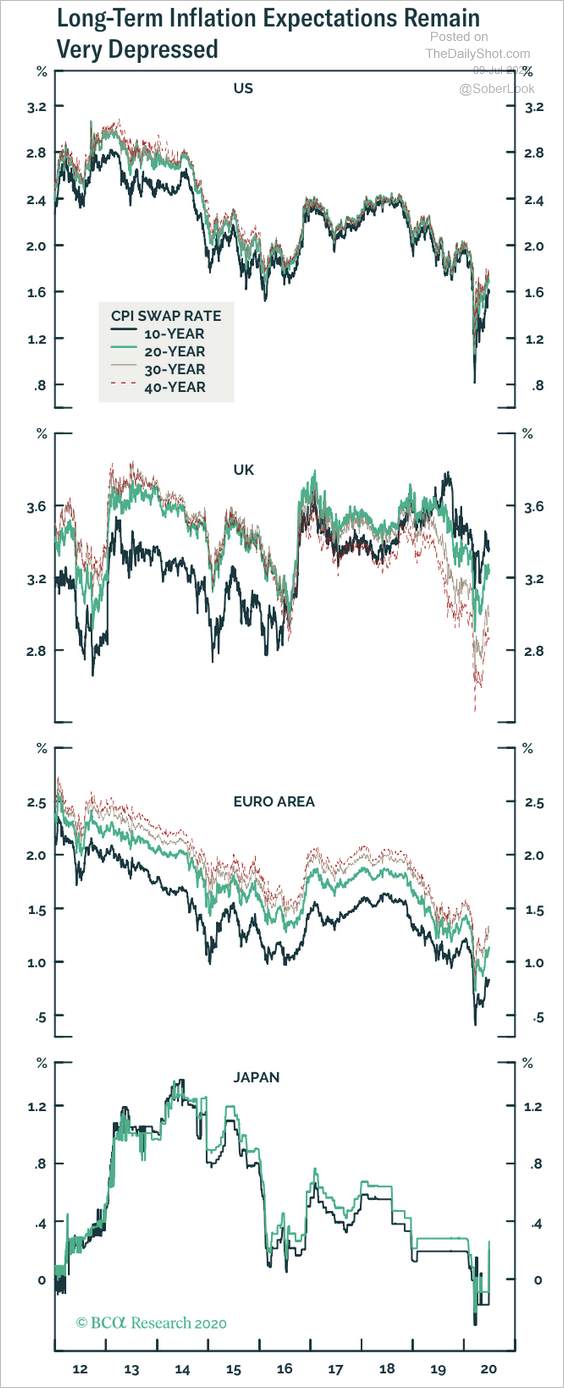

3. Despite the recent bounce, inflation swap markets still expect the CPI to remain subdued for years to come.

Source: BCA Research

Source: BCA Research

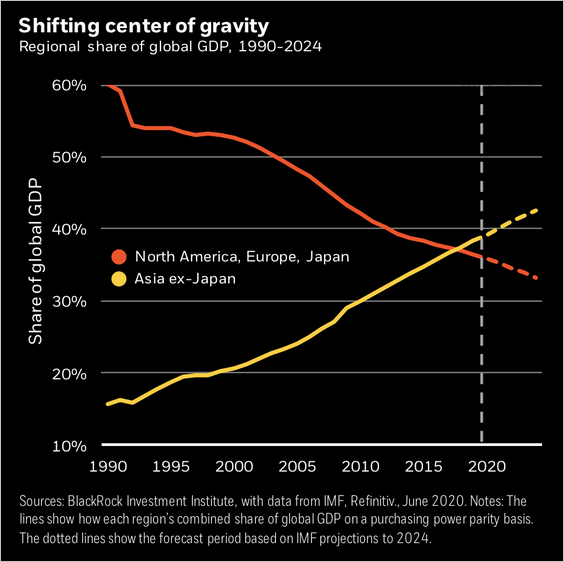

4. Asia ex-Japan is expected to take up the largest share of global GDP over the next few years.

Source: BlackRock

Source: BlackRock

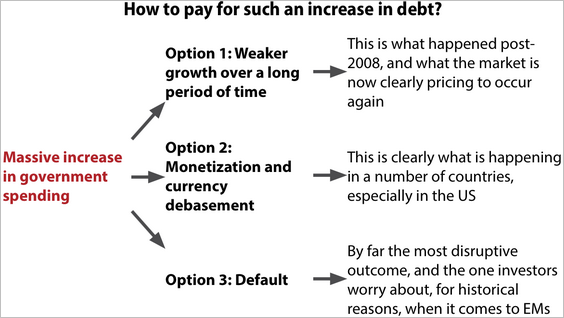

5. What options do governments typically have in addressing a massive spike in sovereign debt?

Source: Gavekal

Source: Gavekal

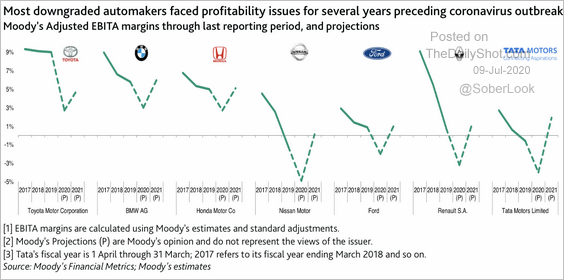

6. Margin growth will become increasingly difficult for automakers over the next several years, according to Moody’s.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

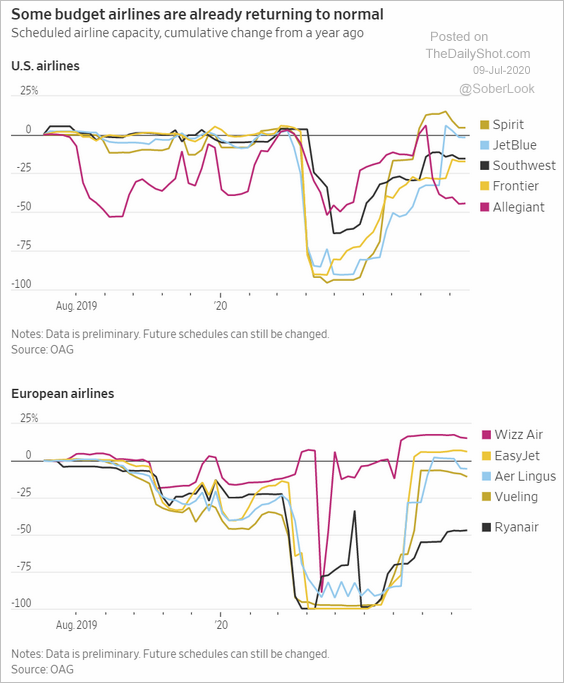

7. Budget airlines see capacity returning to normal.

Source: @WSJ Read full article

Source: @WSJ Read full article

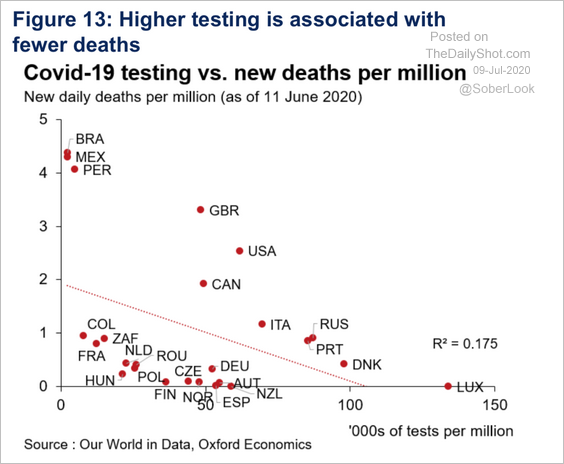

8. There is an inverse relationship between COVID-19 testing rates and deaths.

Source: Oxford Economics

Source: Oxford Economics

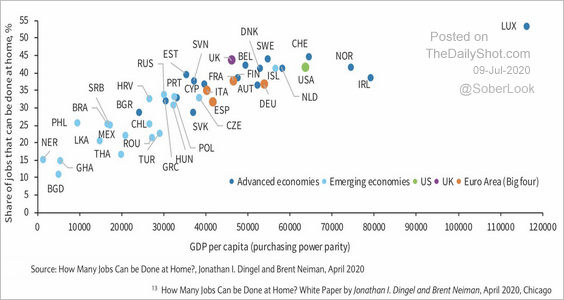

9. The share of jobs that can be done at home is correlated with the GDP per capita.

Source: @Barclays, @LizAnnSonders

Source: @Barclays, @LizAnnSonders

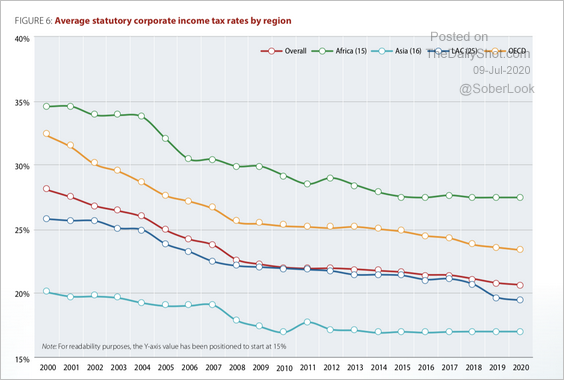

10. This chart shows the trend in corporate tax rates by region.

Source: OECD Read full article

Source: OECD Read full article

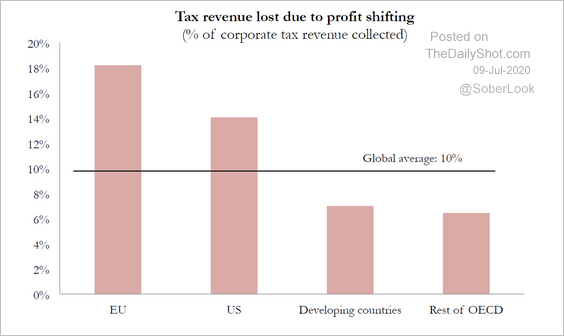

And here is an estimate of tax revenue lost due to companies shifting profits to tax havens.

Source: WID Read full article

Source: WID Read full article

The United States

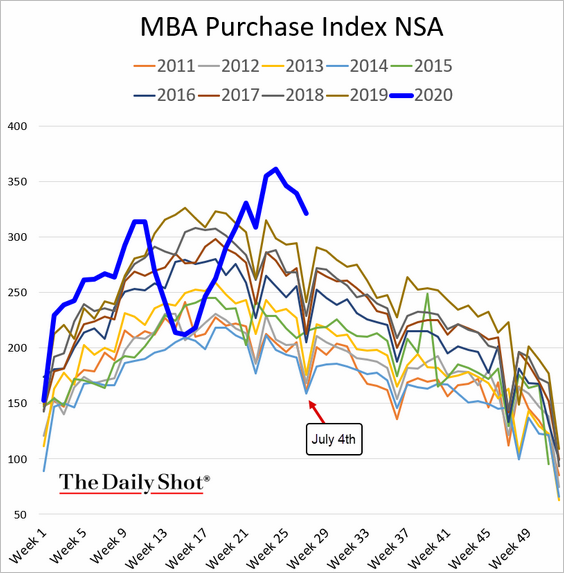

1. Loan applications to purchase a home remain elevated as mortgage rates hit record lows.

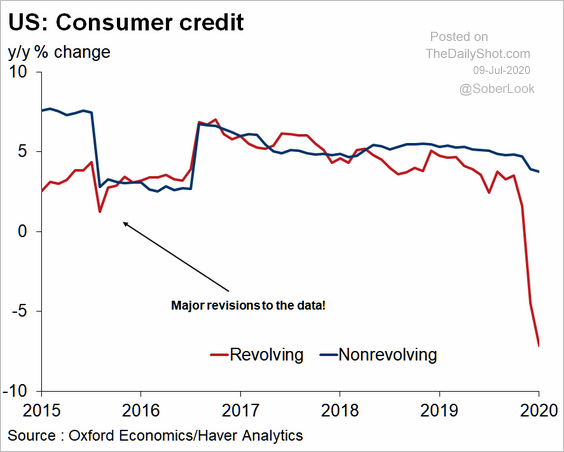

2. Credit card borrowing declined sharply this year. Households cut back spending while the government offered generous support.

Source: Oxford Economics

Source: Oxford Economics

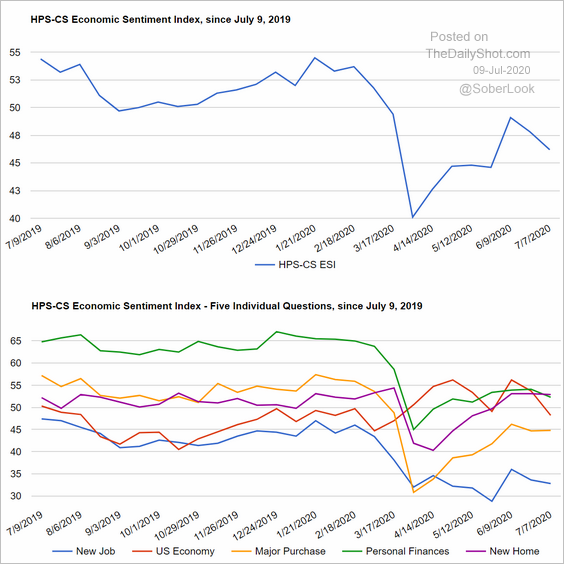

3. High-frequency indicators continue to signal a pause in the recovery.

• Consumer sentiment:

Source: @HPSInsight, @CivicScience Read full article

Source: @HPSInsight, @CivicScience Read full article

• The Oxford Economics Recovery Tracker:

![]() Source: Oxford Economics

Source: Oxford Economics

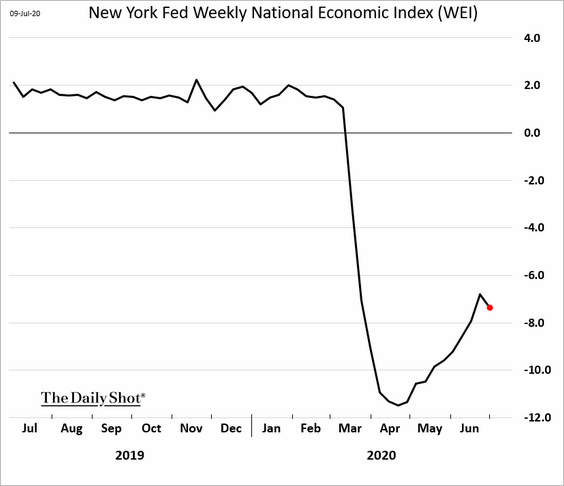

• The New York Fed’s economic activity index (at the national level):

——————–

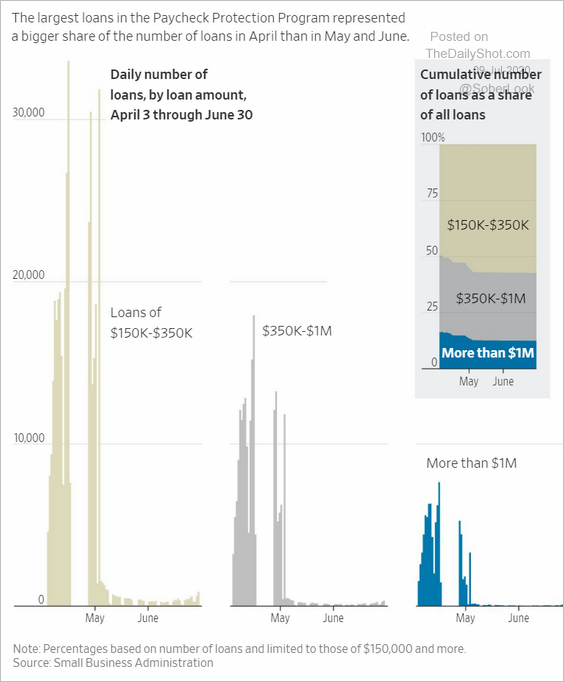

4. Next, we have some additional data on PPP loans (by loan size, over time).

Source: @WSJ Read full article

Source: @WSJ Read full article

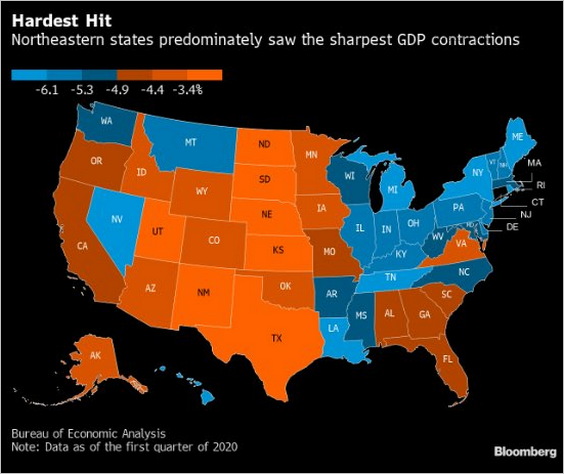

5. In the first quarter, Northeast states saw a sharper GDP contraction than the rest of the country.

Source: @LizAnnSonders, @BEA_News, @bloomberg

Source: @LizAnnSonders, @BEA_News, @bloomberg

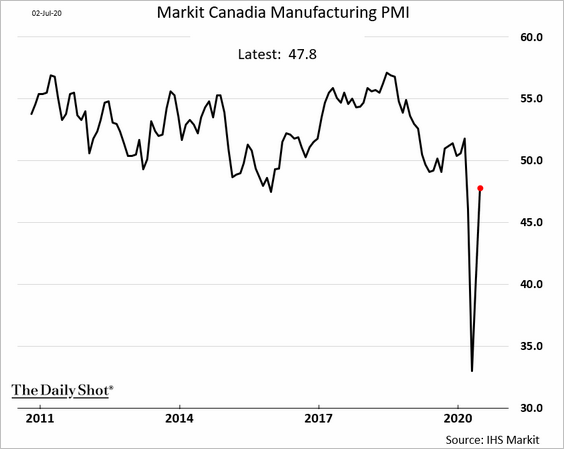

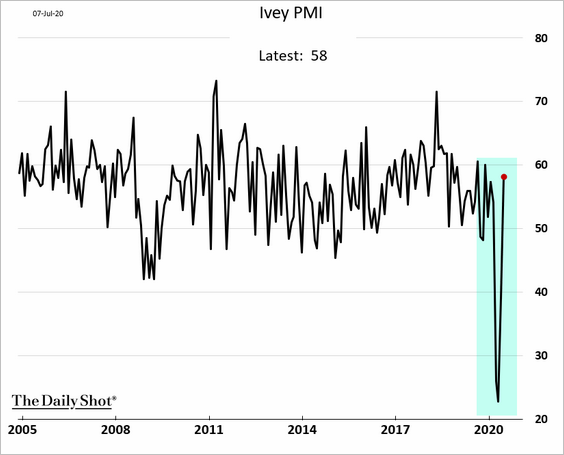

Canada

1. The nation’s factory activity stabilized in June.

• Markit PMI:

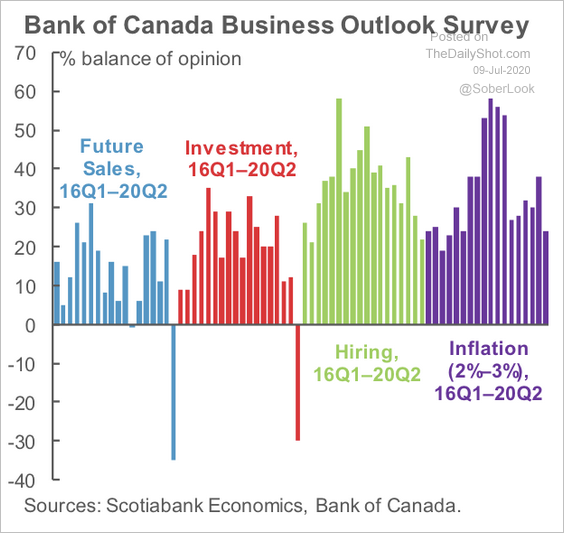

• Ivey PMI:

Source: Reuters Read full article

Source: Reuters Read full article

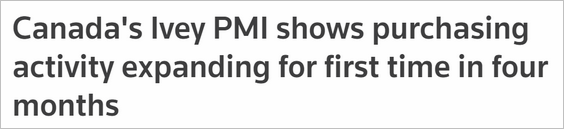

——————–

2. Businesses expect a record drop in future sales and investment.

Source: Scotiabank Economics

Source: Scotiabank Economics

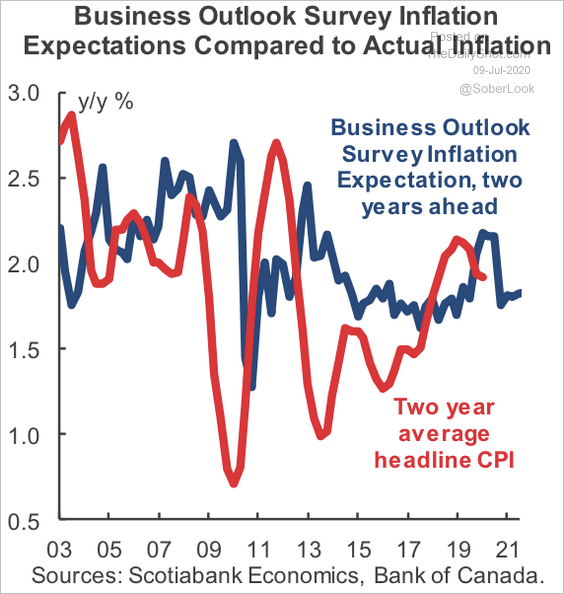

3. This chart shows the business inflation outlook vs. actual inflation.

Source: Scotiabank Economics

Source: Scotiabank Economics

The United Kingdom

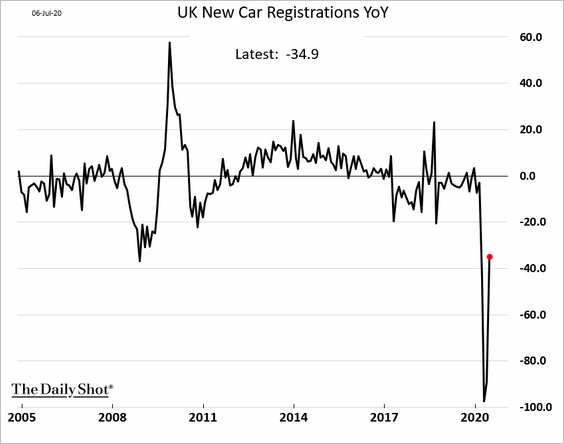

1. Car registrations rebounded last month but remained 35% below 2019 levels.

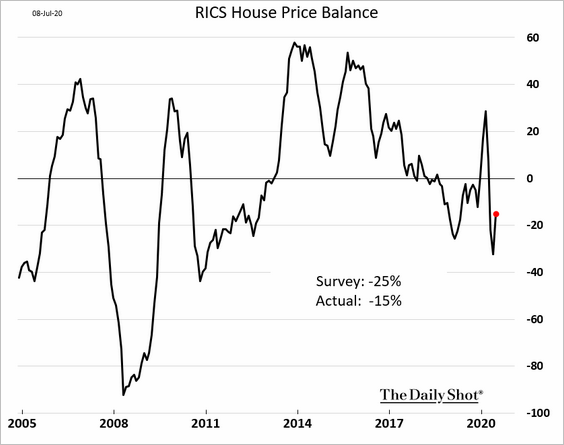

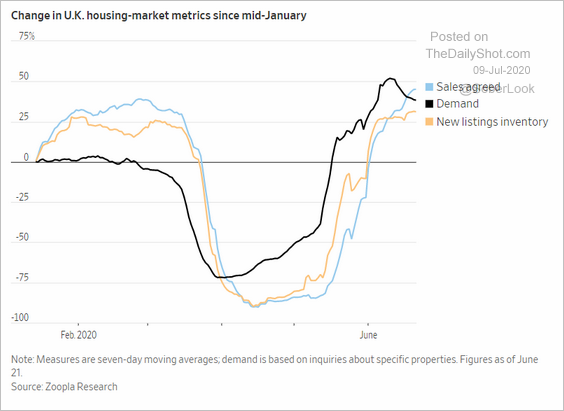

2. The RICS housing index was better than expected, as housing metrics improve (second chart).

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

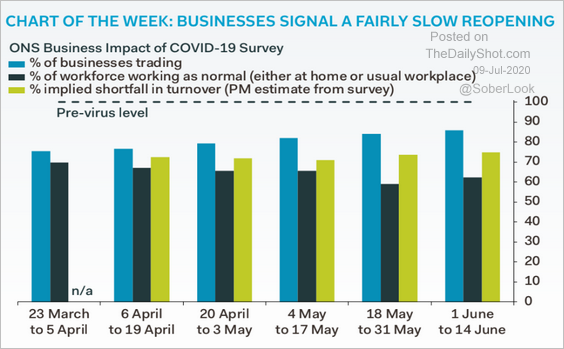

3. The reopening process has been sluggish.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

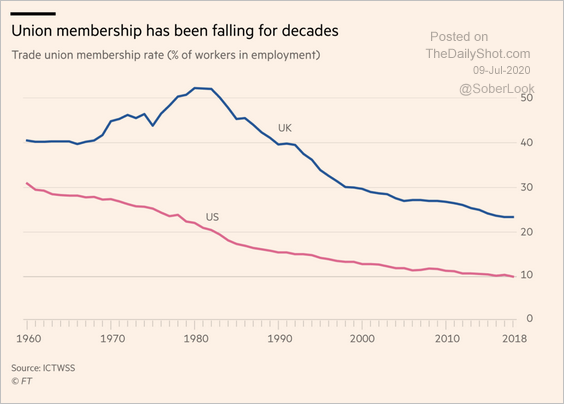

4. This chart shows union membership in the UK and the US.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

The Eurozone

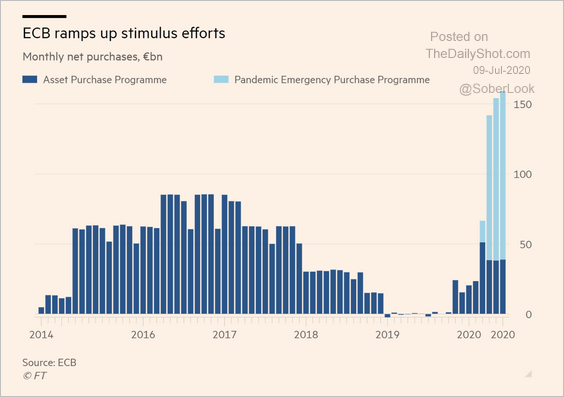

1. Let’s start with this chart of ECB asset purchases.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

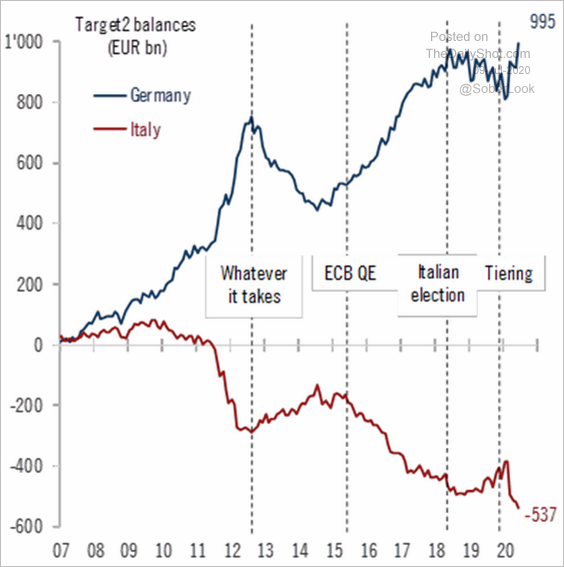

2. TARGET2 imbalances have widened further after the latest tranche of TLTRO funding (see story).

Source: @fwred, Pictet Wealth Management

Source: @fwred, Pictet Wealth Management

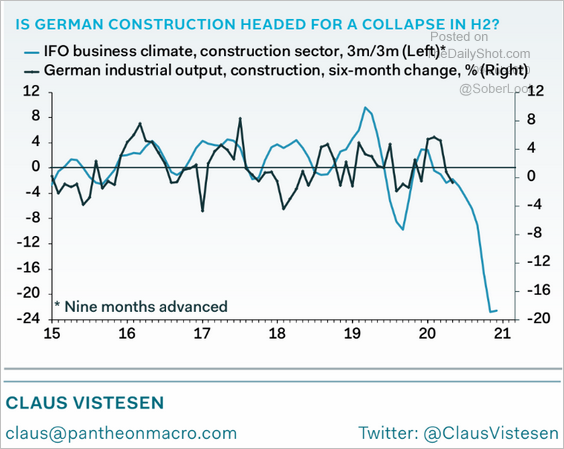

3. The Ifo indicator has been pointing to downside risks for Germany’s construction output.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Japan

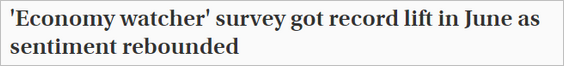

1. The Economy Watchers indicator rebounded sharply last month.

Source: The Japan Times Read full article

Source: The Japan Times Read full article

——————–

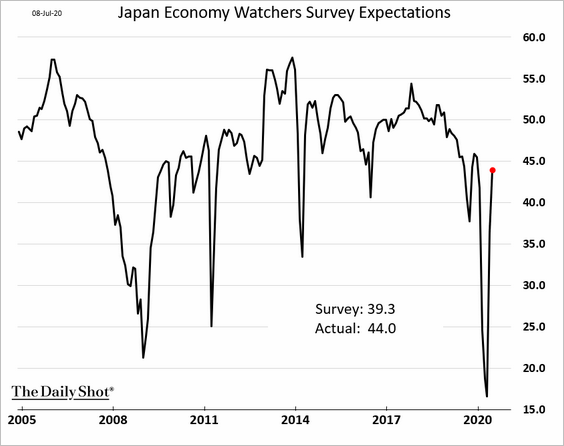

2. The acceleration in Japan’s broad money supply growth has been unprecedented.

China

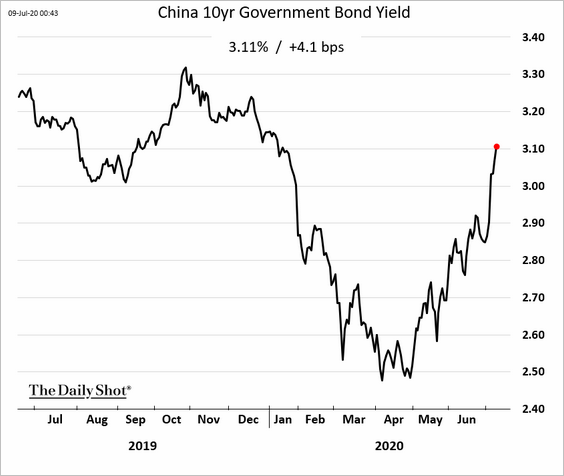

1. Rising bond yields, …

… widening spreads with Treasuries, …

… and portfolio inflows into the equity market (greenlighted by Beijing) …

… are supporting the renminbi.

——————–

2. The headline consumer inflation rate held steady last month, …

… but the core CPI dipped below 1% for the first time in a decade.

——————–

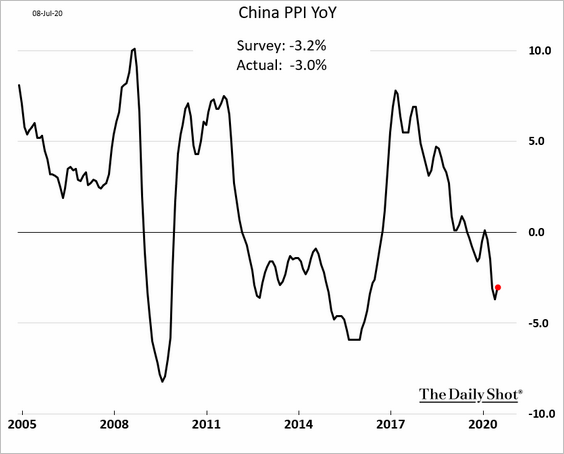

3. The PPI ticked up, but producer prices remain well below last year’s levels.

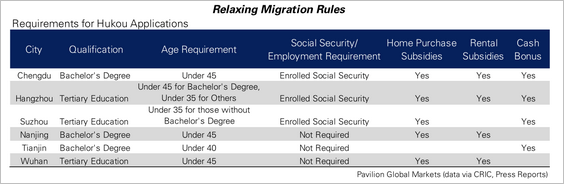

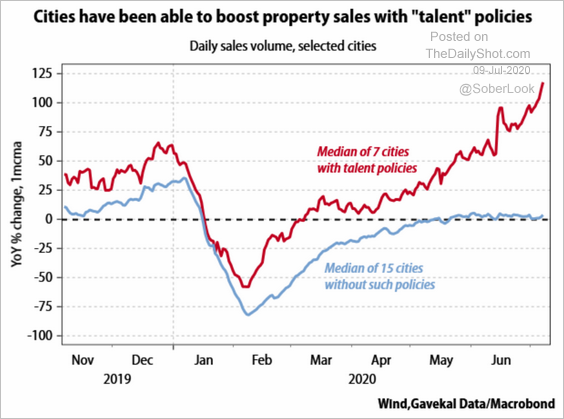

4. Over the past few months, several cities have eased requirements to attract new residents and boost local economic activity.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

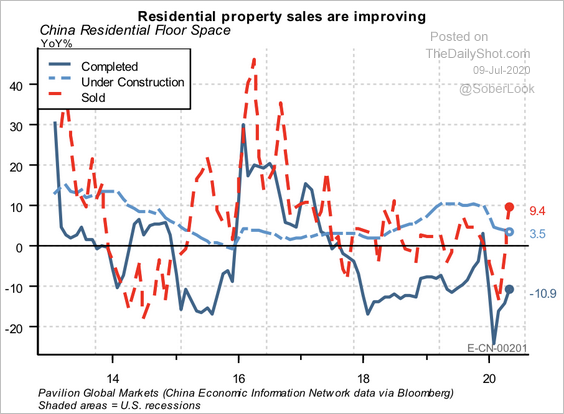

Relaxing migration rules should help the recovery in Chinese housing, according to Pavilion Global Markets.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

Home sales in cities with such policies substantially outperformed peers (chart from Gavekal).

Source: Gavekal

Source: Gavekal

Emerging Markets

1. Brazil’s retail sales rebounded in May, exceeding forecasts.

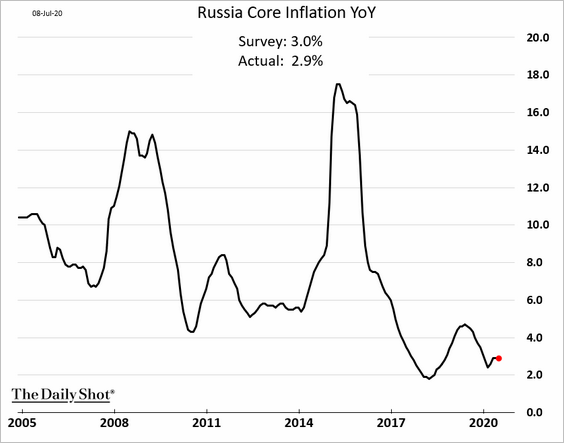

2. Russia’s inflation remains subdued.

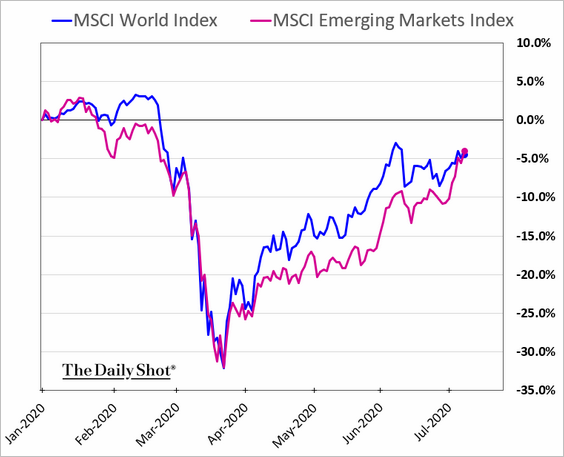

3. EM stocks have caught up with global markets year-to-date.

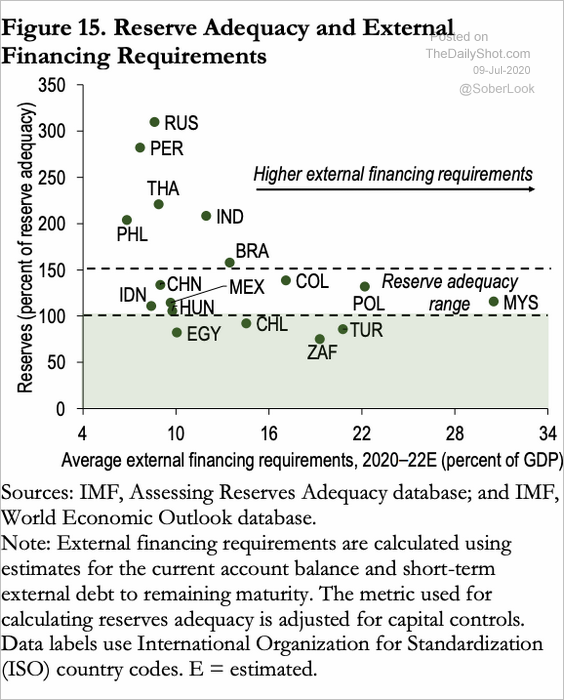

4. This scatterplot from the IMF shows each country’s foreign reserves vs. external financing requirements.

Source: @adam_tooze

Source: @adam_tooze

Commodities

1. Gold topped $1,800/oz for the first time since 2011.

2. Copper continues to rally.

3. Lumber futures are breaking out.

Source: @FibLines

Source: @FibLines

Equities

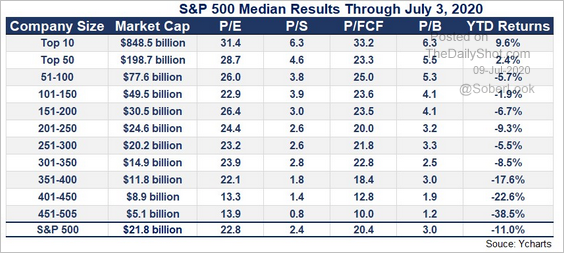

1. The biggest companies by market cap are the most expensive and have the highest returns this year.

Source: @awealthofcs Read full article

Source: @awealthofcs Read full article

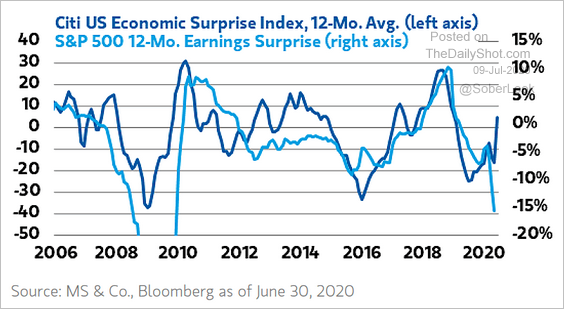

2. Will the streak of positive US economic surprises translate into Q2 earnings surprises?

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

3. The S&P 500 futures sentiment indicator points to extreme bullishness.

Source: @TommyThornton

Source: @TommyThornton

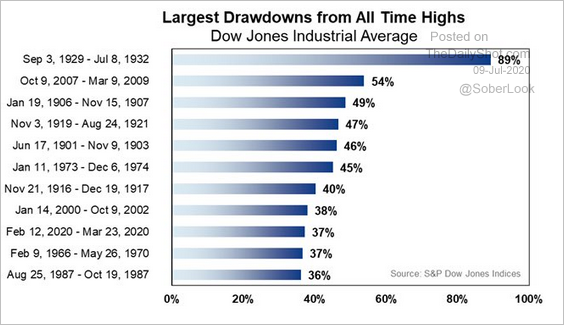

4. This chart shows the largest drawdowns in the Dow since the start of the 20th century.

Source: @LizAnnSonders, @SPGlobal

Source: @LizAnnSonders, @SPGlobal

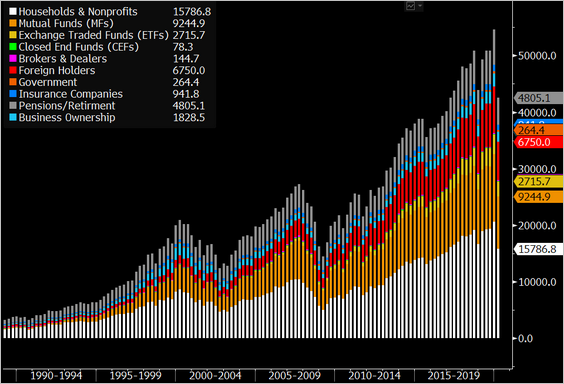

5. Who owns the US stock market?

Source: @JSeyff, @TheTerminal

Source: @JSeyff, @TheTerminal

6. Market breadth hasn’t been great lately.

Source: @LizAnnSonders, @Bloomberg

Source: @LizAnnSonders, @Bloomberg

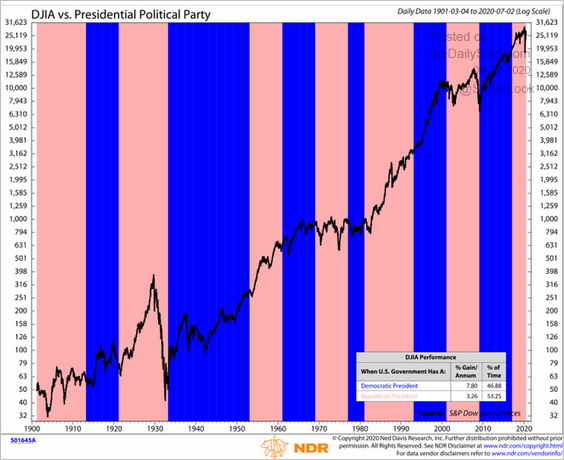

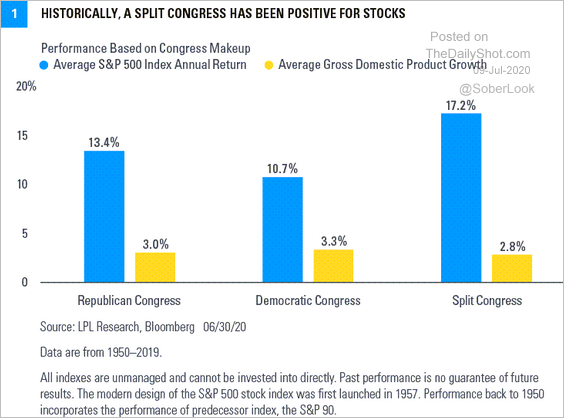

7. How does the US market perform under different political regimes?

• President’s party:

Source: @WillieDelwiche

Source: @WillieDelwiche

• Control of Congress:

Source: LPL Research

Source: LPL Research

——————–

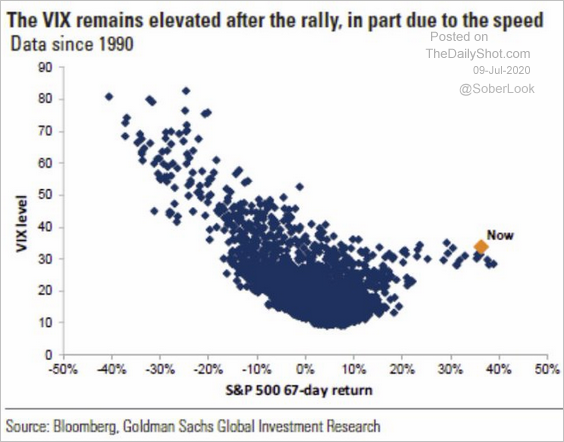

8. Given the market rally, VIX remains elevated.

Source: @MacroCharts

Source: @MacroCharts

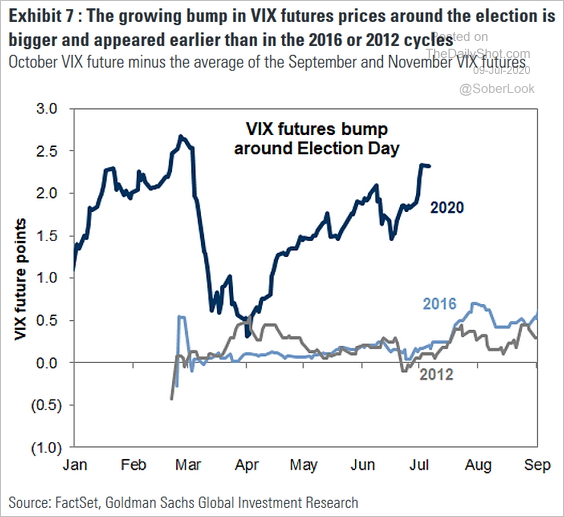

The election premium in VIX futures is well above the levels we saw in 2016 or 2012.

Source: @ISABELNET_SA, @GoldmanSachs Read full article

Source: @ISABELNET_SA, @GoldmanSachs Read full article

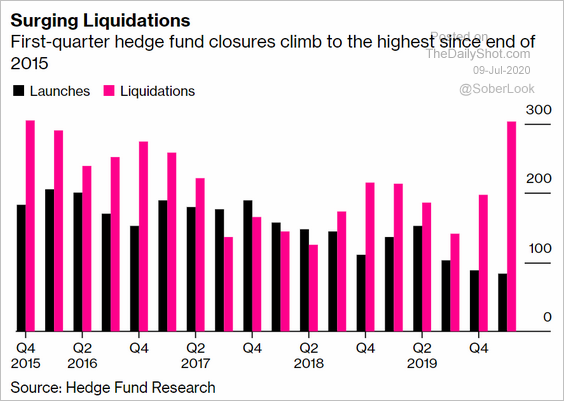

Alternatives

1. Hedge fund liquidations have accelerated this year.

Source: @markets Read full article

Source: @markets Read full article

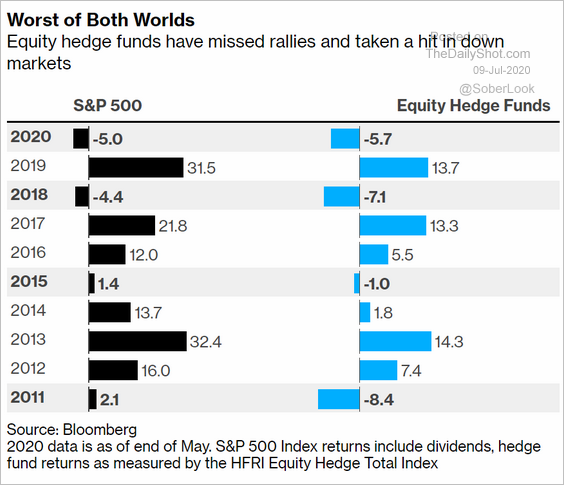

2. The risk/return profile of equity hedge funds hasn’t been exceptional over the past decade.

Source: @markets Read full article

Source: @markets Read full article

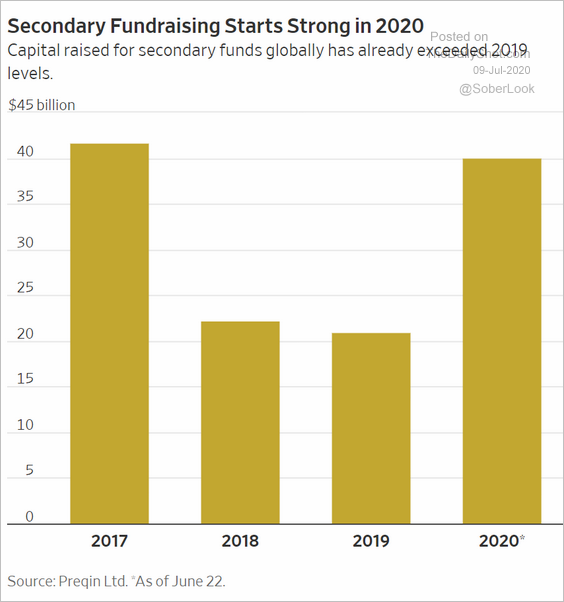

3. Secondary fund-of-funds products, which purchase LP interests from existing investors, are quite popular this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

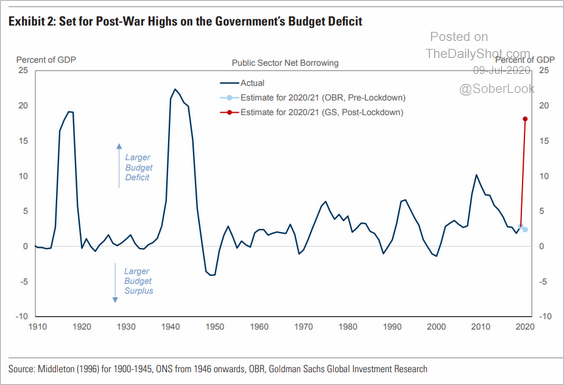

Rates

1. The US government just auctioned off the 10-year Treasury notes at a record low yield.

Source: @lisaabramowicz1

Source: @lisaabramowicz1

The market is not concerned about massive deficits.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

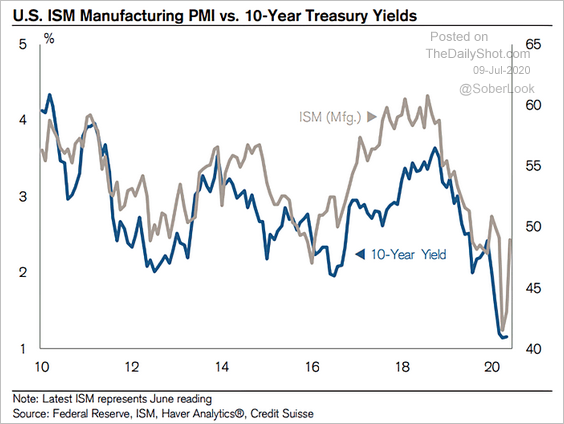

2. Does the stabilization in US manufacturing signal higher Treasury yields?

Source: @ISABELNET_SA, @csresearch

Source: @ISABELNET_SA, @csresearch

3. The iShares TIPS ETF (TIP), which holds inflation-linked Treasuries, hit a record high as investors rush to hedge against inflation.

Source: @kgreifeld

Source: @kgreifeld

——————–

Food for Thought

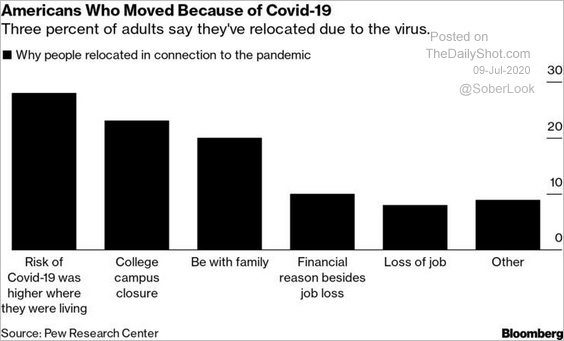

1. Why did COVID-19 cause some Americans to relocate?

Source: @DiMartinoBooth Read full article

Source: @DiMartinoBooth Read full article

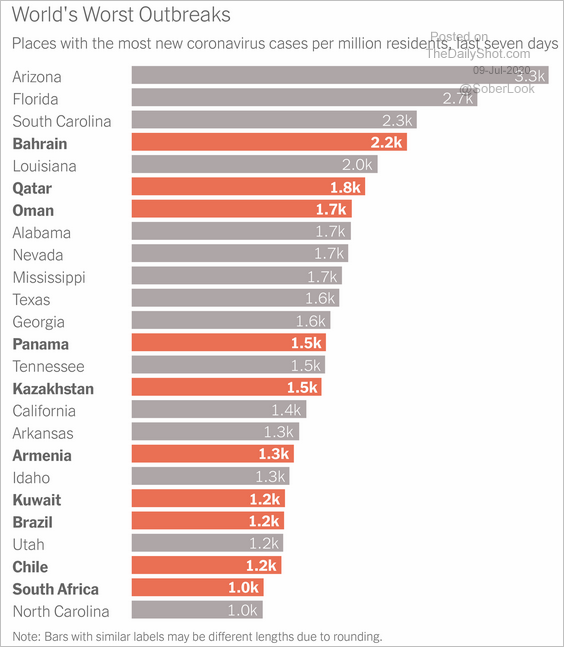

2. The world’s worst coronavirus outbreaks:

Source: The New York Times Read full article

Source: The New York Times Read full article

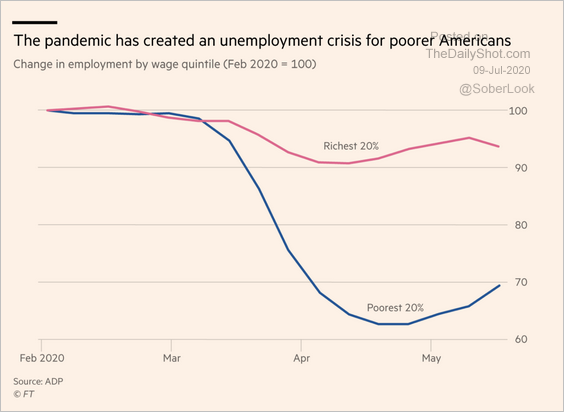

3. Change in employment by income:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

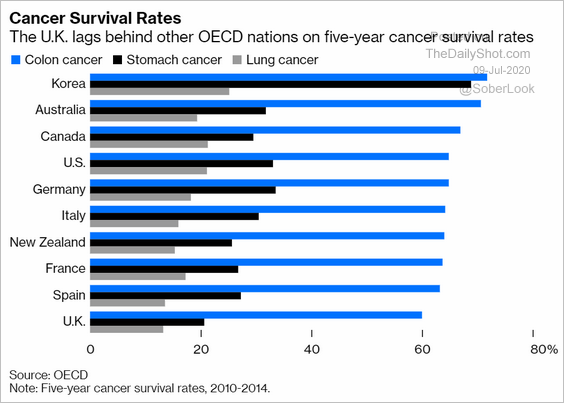

4. Cancer survival rates:

Source: @ThereseRaphael1, @bopinion Read full article

Source: @ThereseRaphael1, @bopinion Read full article

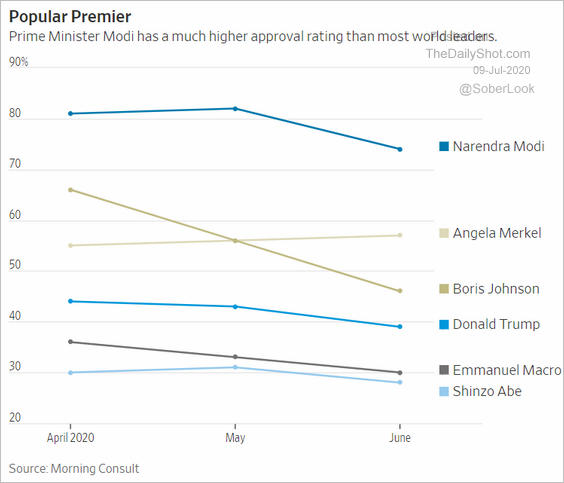

5. World leaders’ approval ratings:

Source: @WSJ Read full article

Source: @WSJ Read full article

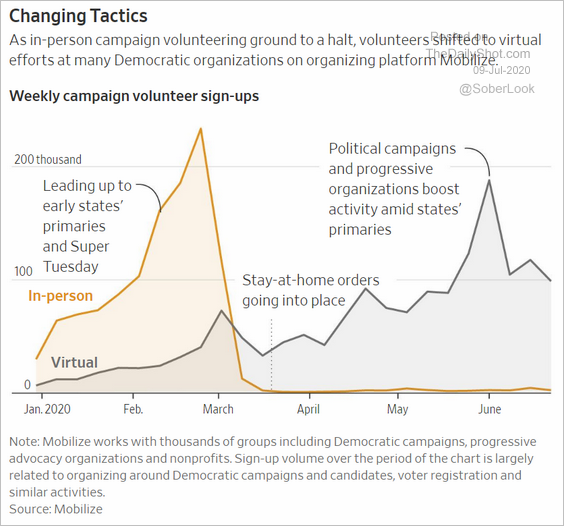

6. The Democratic party campaign volunteering trends:

Source: @WSJ Read full article

Source: @WSJ Read full article

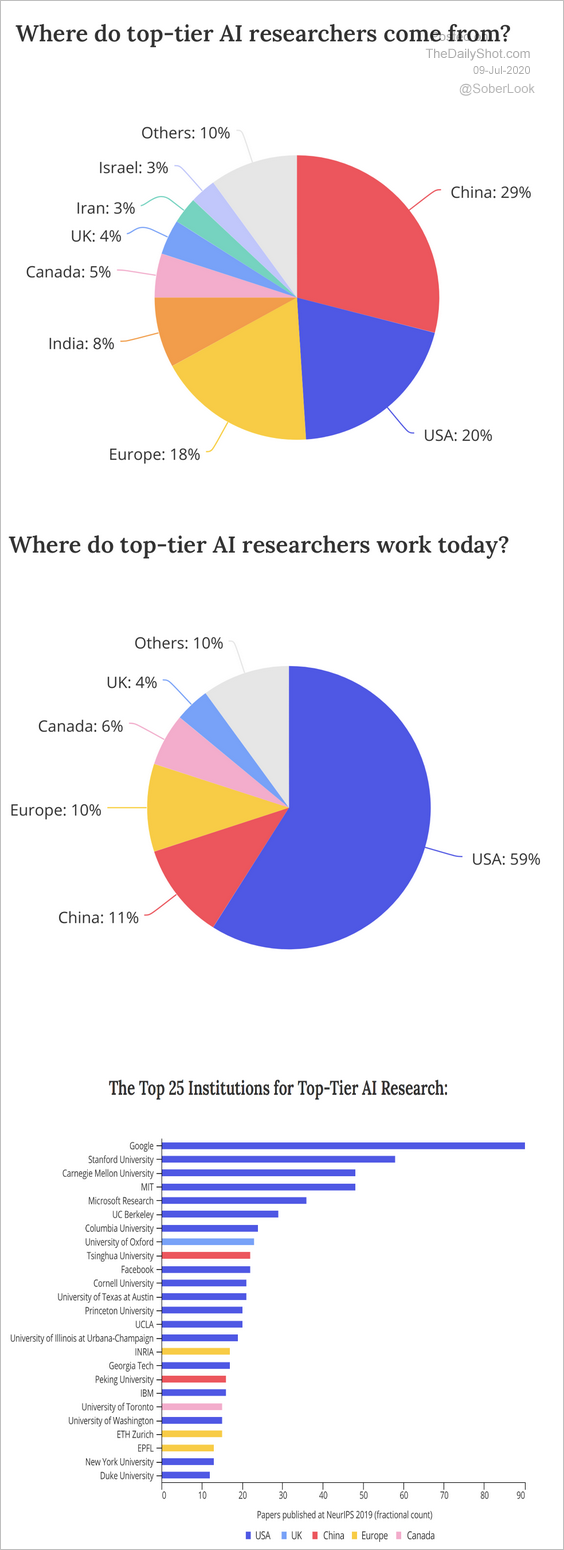

7. Top-tier AI researchers:

Source: MacroPolo

Source: MacroPolo

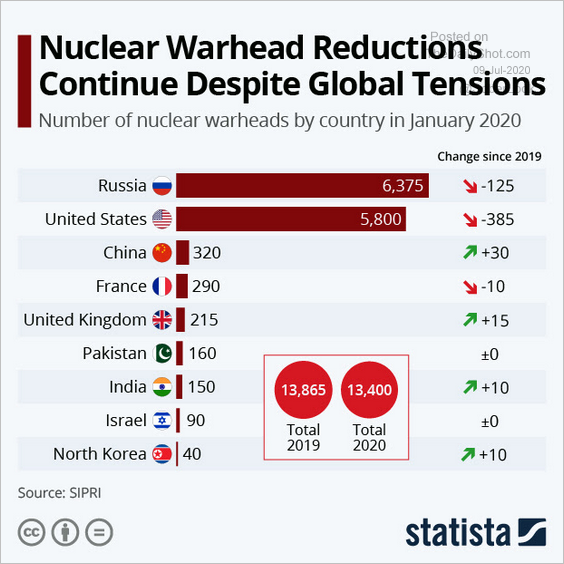

8. Nuclear warhead reductions:

Source: Statista

Source: Statista

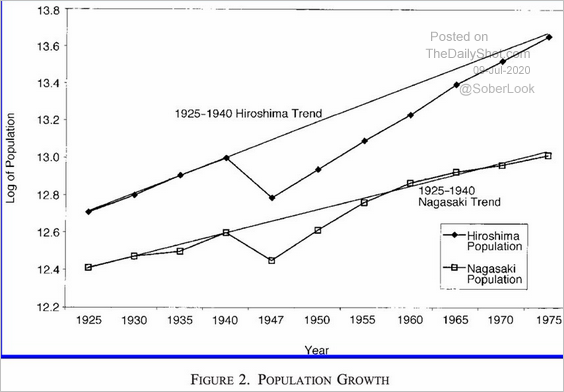

9. Population recovery in Hiroshima and Nagasaki after the atomic bombings in 1945.

Source: @adam_tooze, Donald Davis and David Weinstein Read full article

Source: @adam_tooze, Donald Davis and David Weinstein Read full article

——————–