The Daily Shot: 23-Jul-20

• Important Update Regarding The Daily Shot

• The United States

• Canada

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

Important Update Regarding The Daily Shot

The Daily Shot will no longer be published by The Wall Street Journal beginning on August 1. The Daily Shot will still be available as an independent publication. If you would like to continue to receive The Daily Shot, you can get more information on how to subscribe here.

The United States

1. Let’s begin with the housing market.

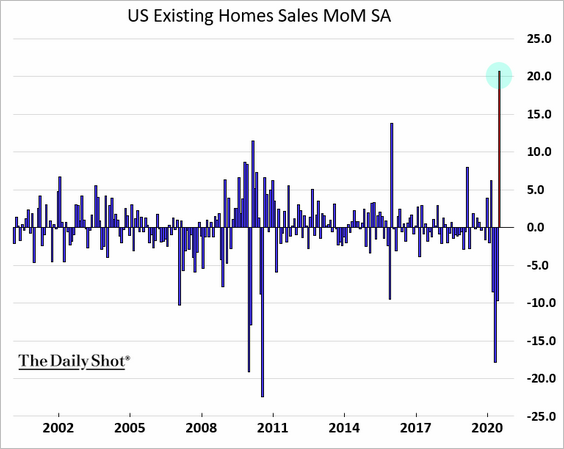

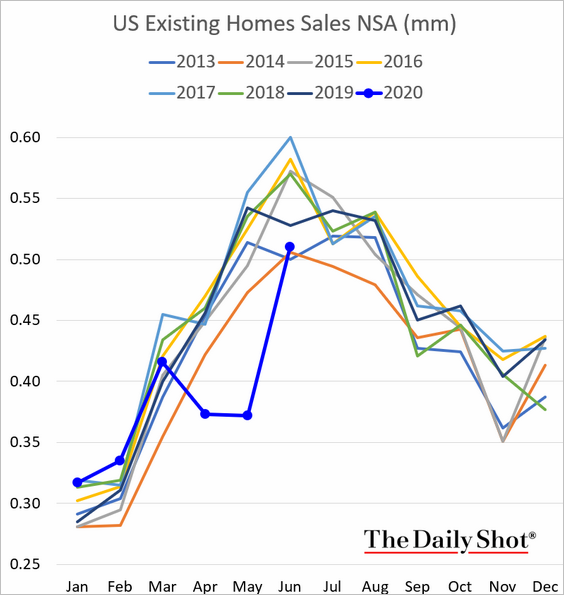

• Existing home sales rose sharply in June.

– Despite the increase, sales are running just above the levels we saw in 2014.

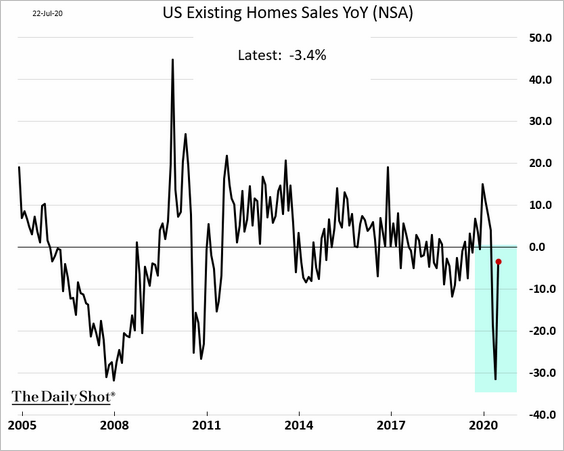

– Here is the year-over-year change.

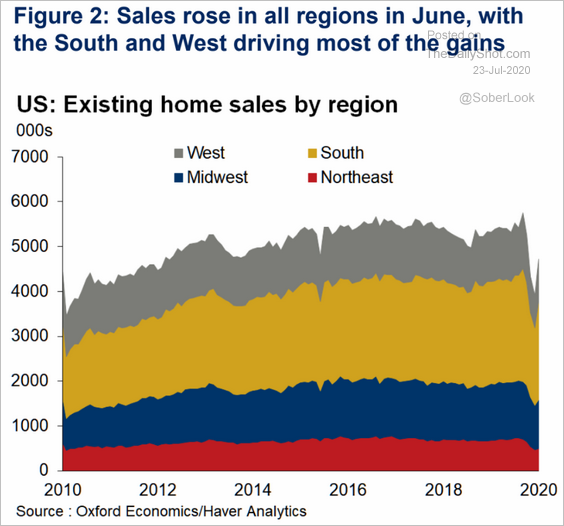

– This chart shows the regional breakdown.

Source: Oxford Economics

Source: Oxford Economics

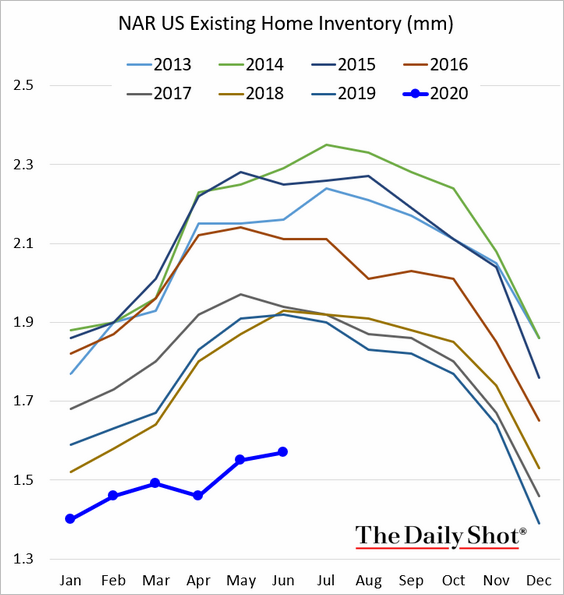

– Inventories remain at multi-year lows.

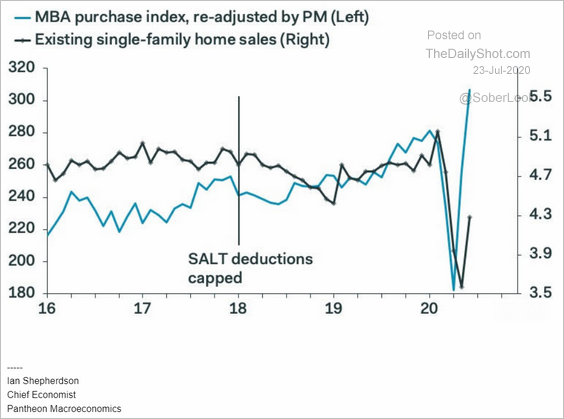

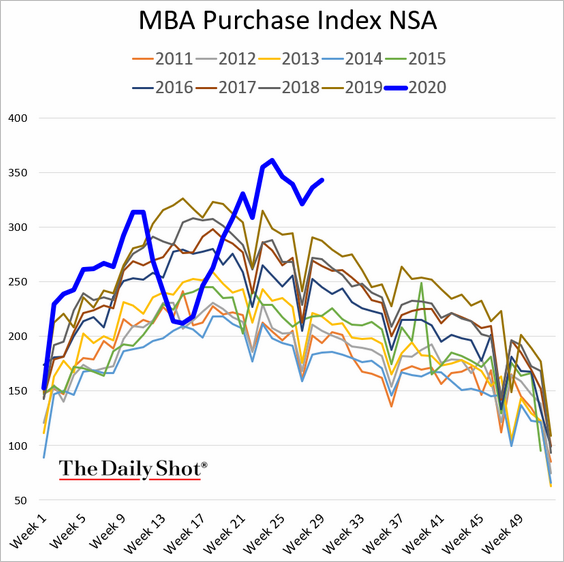

– Record-low mortgage rates and brisk loan applications point to further improvements in home sales (2 charts).

Source: Piper Sandler

Source: Piper Sandler

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

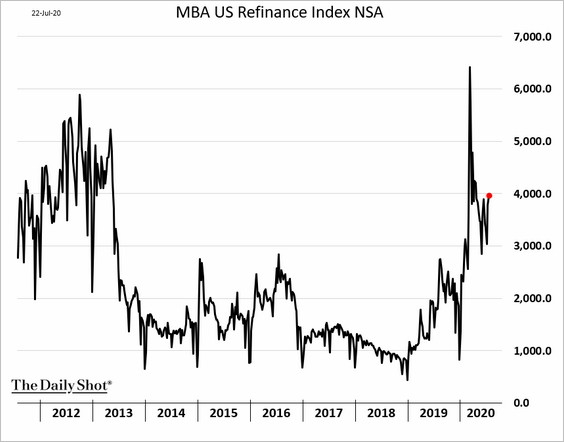

• Mortgage applications remain elevated.

– Home purchase applications:

– Refinance applications:

——————–

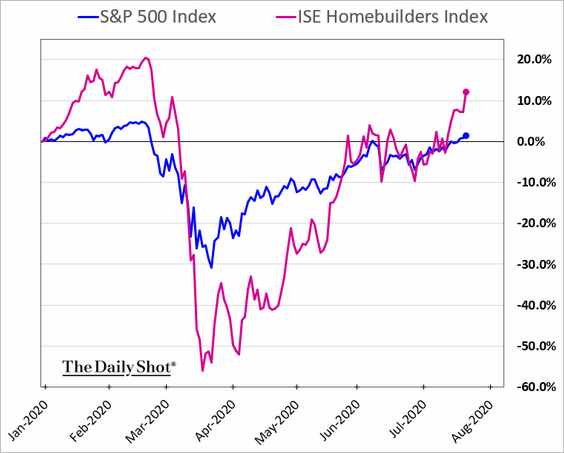

• Homebuilder shares are now outperforming year-to-date.

——————–

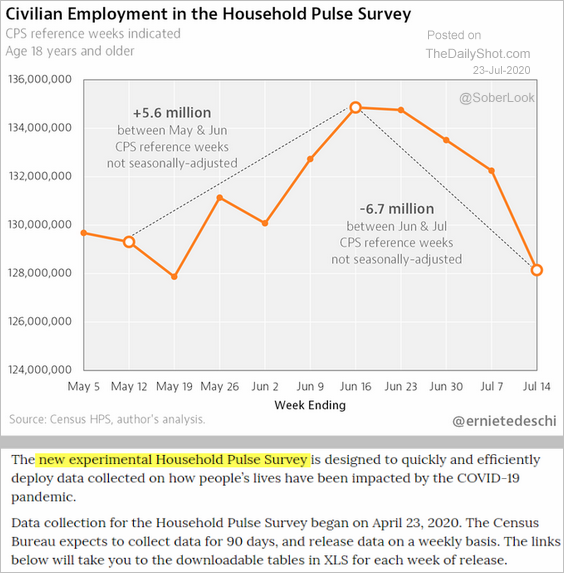

2. The Household Pulse Survey (from the Census Bureau) suggests that the labor market rebound peaked in mid-June and has been reversing since.

Source: @ernietedeschi, @uscensusbureau Further reading

Source: @ernietedeschi, @uscensusbureau Further reading

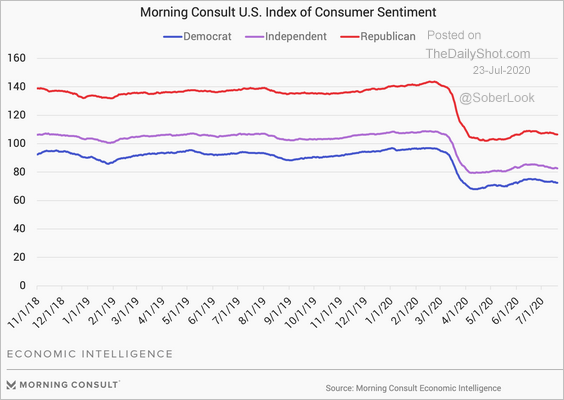

3. Measures of consumer sentiment remain subdued.

• The Morning Consult Index of Consumer Sentiment:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

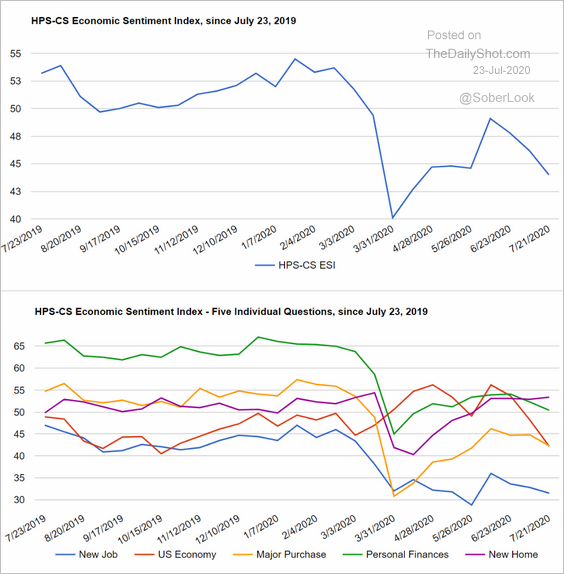

• The HPS-CS Economic Sentiment Index:

Source: @HPSInsight, @CivicScience

Source: @HPSInsight, @CivicScience

By the way, notice the strength in the housing component of the above index (purple).

——————–

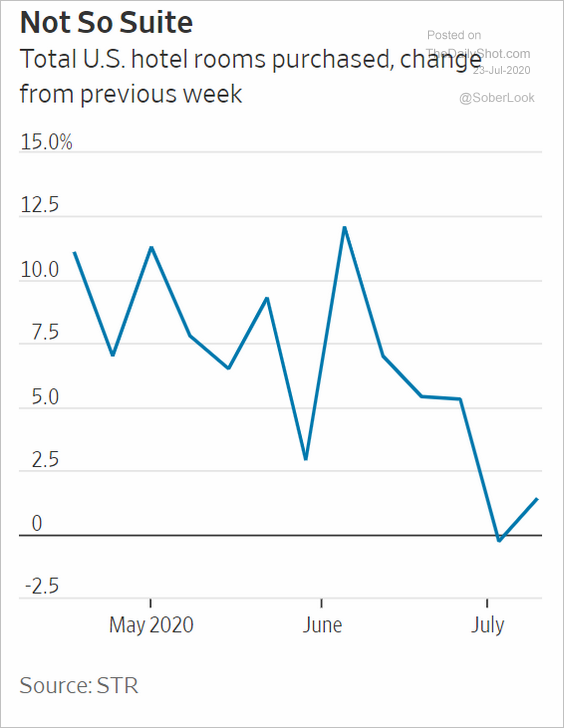

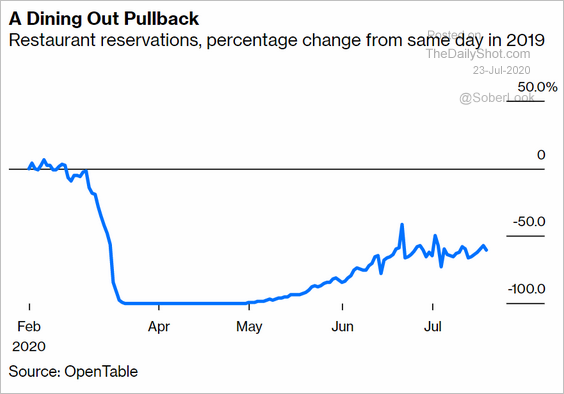

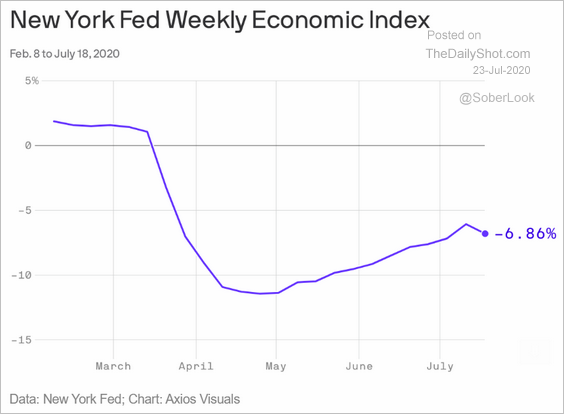

4. Next, we have some high-frequency indicators of economic activity.

• Hotel room purchases (weekly changes):

Source: @WSJ Read full article

Source: @WSJ Read full article

• Restaurant reservations:

Source: @Noahpinion, @bopinion Read full article

Source: @Noahpinion, @bopinion Read full article

• The NY Fed’s economic activity index (WEI):

Source: @axios Read full article

Source: @axios Read full article

——————–

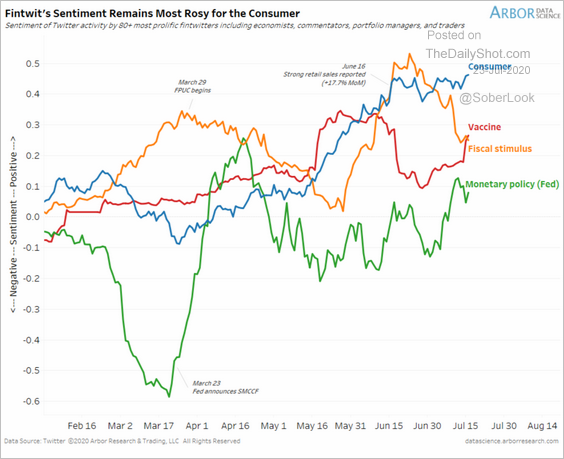

5. Finally, financial Twitter sentiment has been most upbeat on the consumer.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Canada

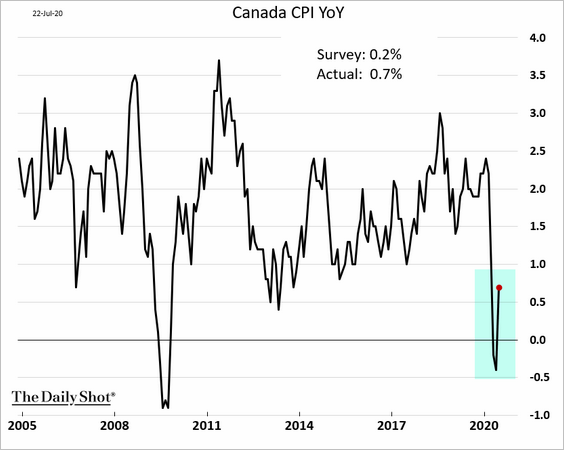

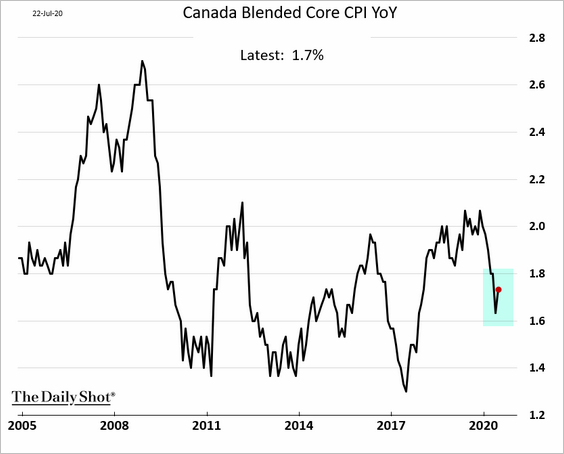

1. Inflation surprised to the upside.

Source: Reuters Read full article

Source: Reuters Read full article

• Headline CPI:

• Core CPI:

——————–

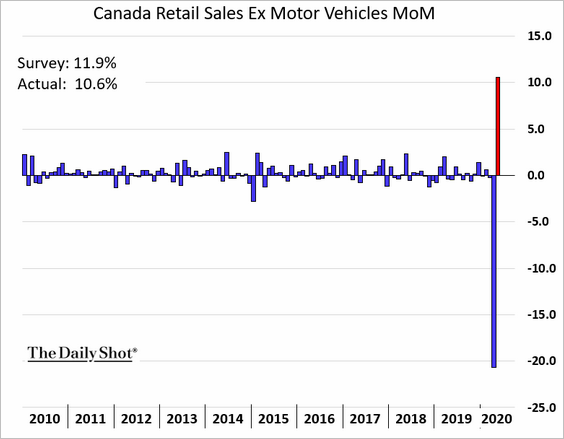

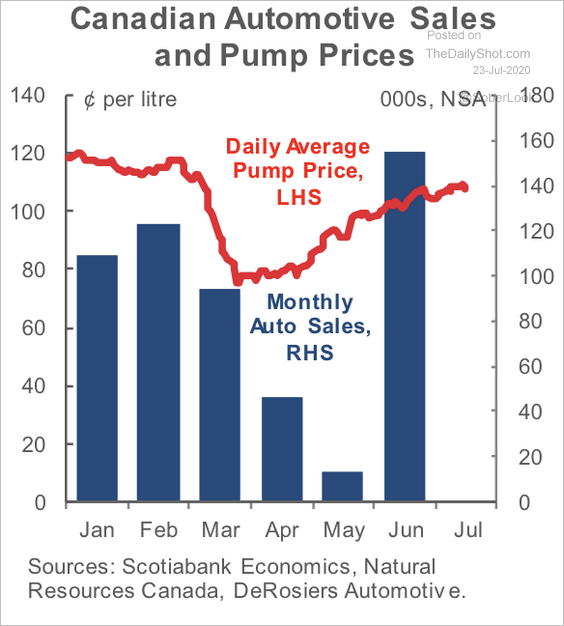

2. Retail sales rose sharply in May, after a record decline.

Car sales rebounded in June.

Source: Scotiabank Economics

Source: Scotiabank Economics

The Eurozone

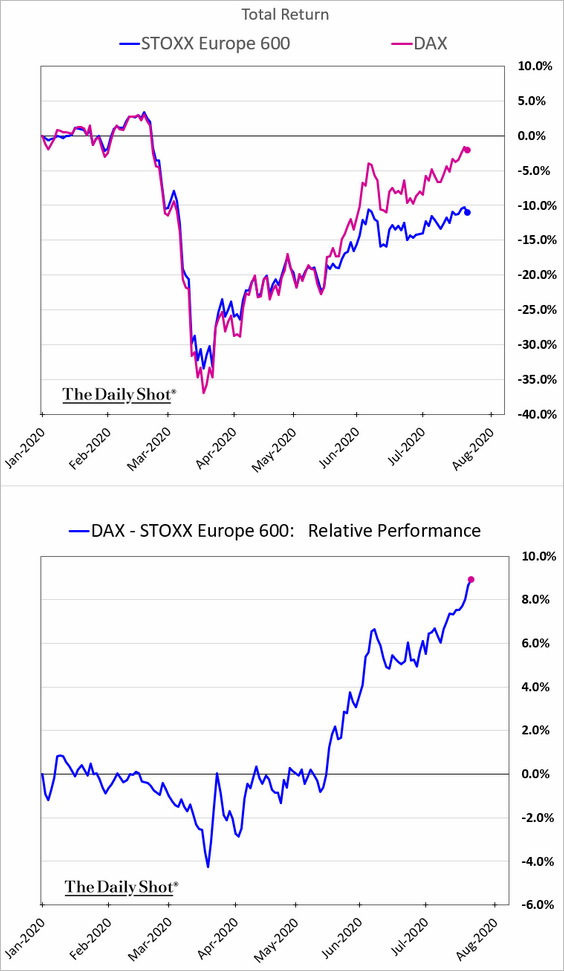

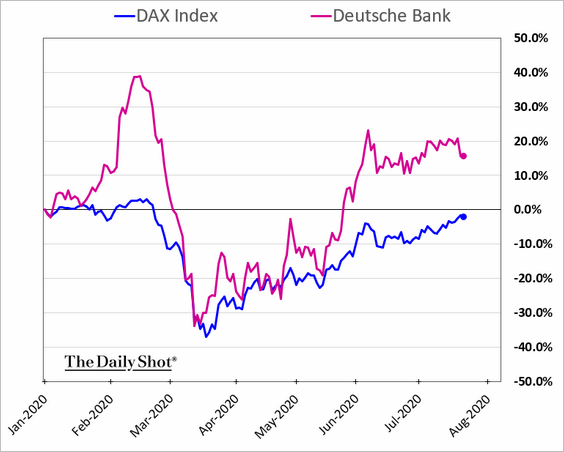

1. Germany’s DAX index has been outperforming.

The rebound in Deutsche Bank shares has been especially impressive.

——————–

2. Italian 30yr government bond yield dipped below 2% for the first time since March.

3. Euro-area bond funds have been experiencing capital outflows since 2014.

Source: Goldman Sachs

Source: Goldman Sachs

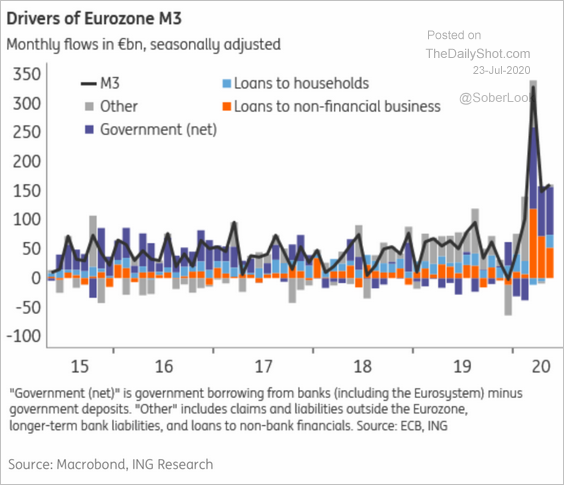

4. There were two key drivers behind the recent spike in the broad money supply.

• Banks purchased massive amounts of government debt to sell to the ECB, as the central bank accelerated its QE.

• Liquidity needs boosted corporate borrowing, a good portion of which was tapping existing credit lines.

Source: ING

Source: ING

——————–

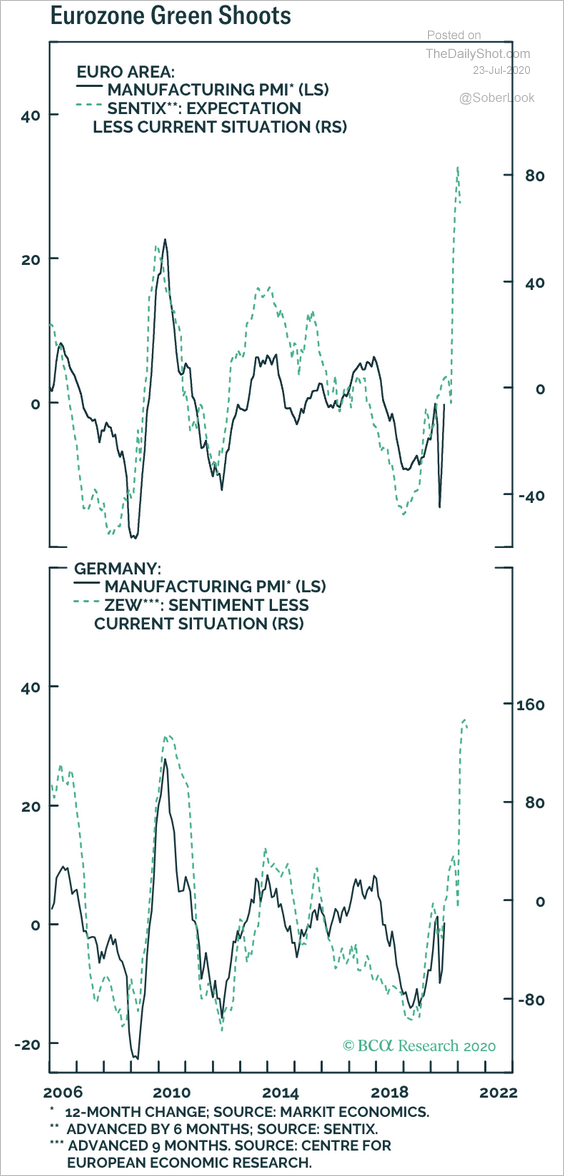

5. Recent improvements in German business expectations point to a significant recovery in manufacturing PMIs.

Source: BCA Research

Source: BCA Research

Scotiabank expects July PMIs to signal an expansion (PMI above 50).

Source: Scotiabank Economics

Source: Scotiabank Economics

Europe

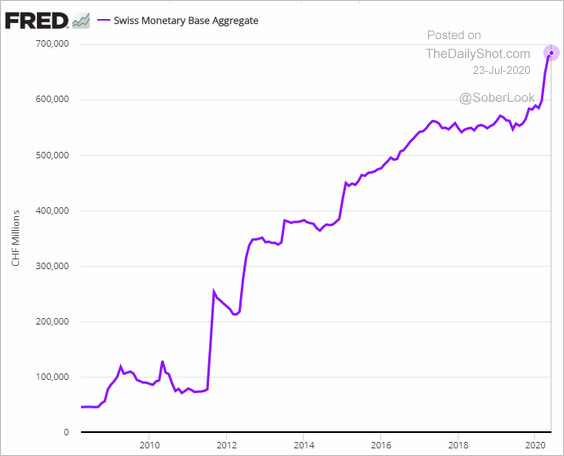

1. The Swiss monetary base is approaching CHF 700 bn. It’s now bigger than the annualized GDP of Switzerland (based on Q1 2020).

2. Poland’s economy is rebounding.

• Consumer confidence:

• Retail sales (June):

——————–

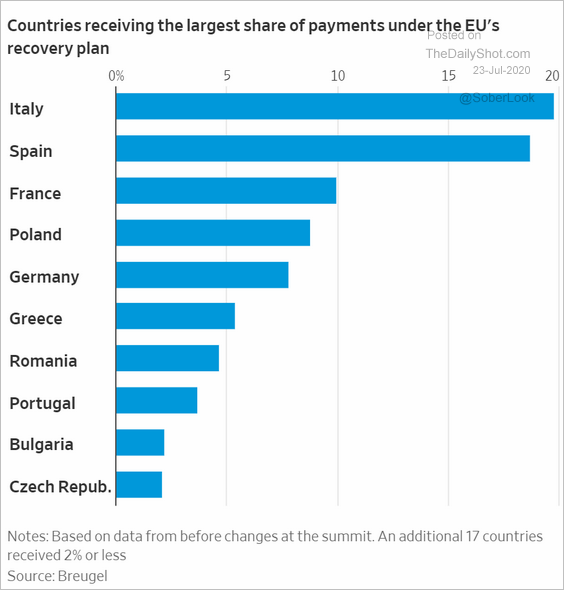

3. Which countries benefit the most from the EU stimulus plan?

Source: @WSJ Read full article

Source: @WSJ Read full article

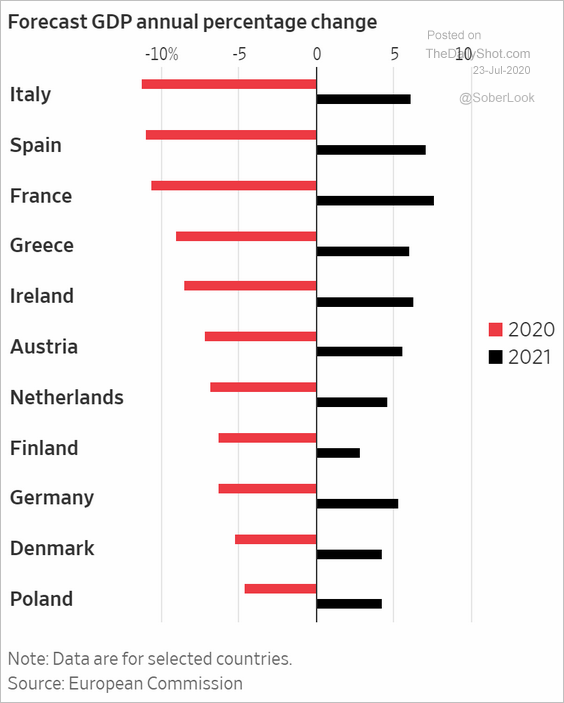

4. Here are the GDP growth forecasts for the largest EU economies.

Source: @WSJ Read full article

Source: @WSJ Read full article

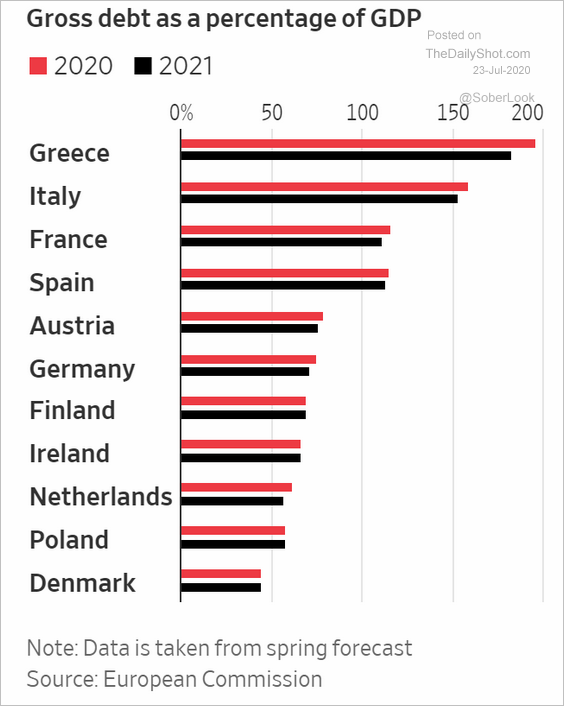

5. Finally, we have the debt-to-GDP ratios by country.

Source: @WSJ Read full article

Source: @WSJ Read full article

Asia – Pacific

1. The Aussie dollar rebound has been impressive.

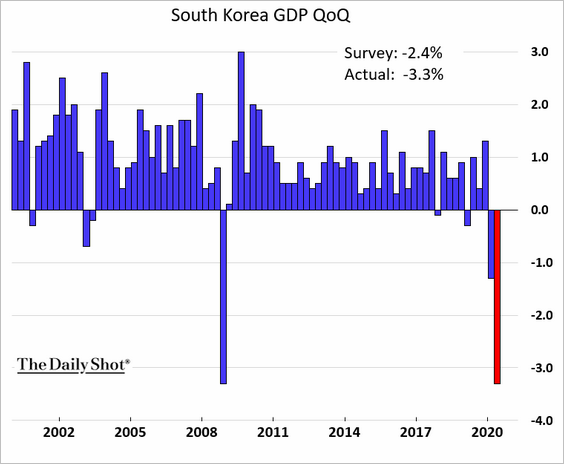

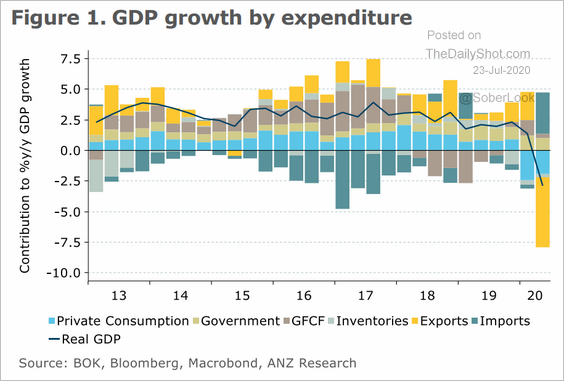

2. South Korea is officially in a recession as the Q2 GDP surprises to the downside (2 charts).

Source: ANZ Research

Source: ANZ Research

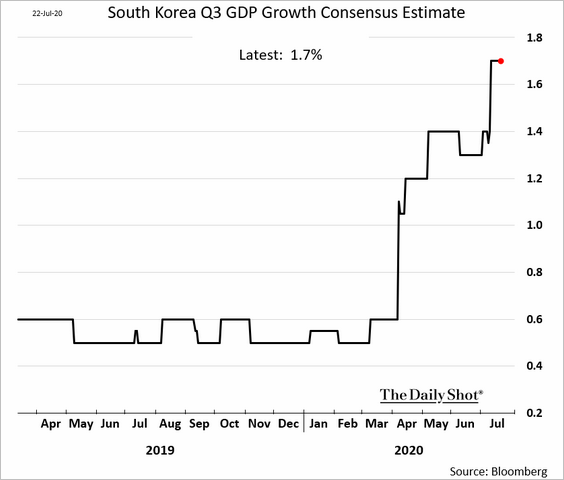

But economists expect a rebound this quarter.

(Based on Bloomberg’s survey)

(Based on Bloomberg’s survey)

——————–

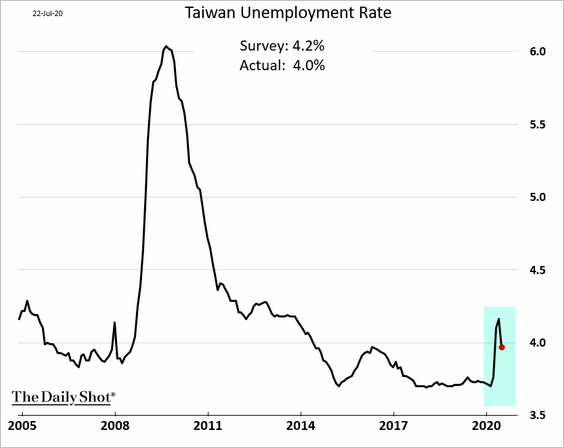

3. Taiwan’s unemployment rate unexpectedly declined.

China

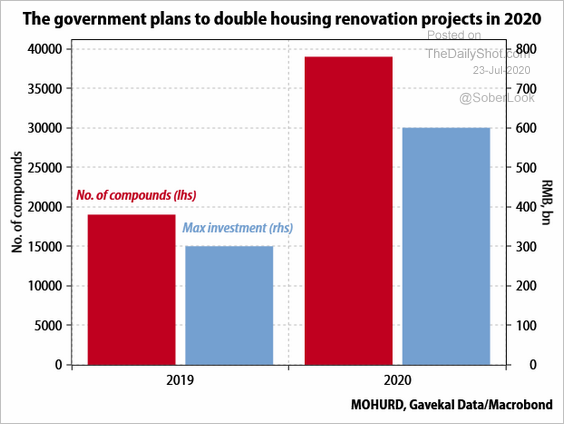

1. China is investing heavily in housing renovation projects.

Source: Gavekal

Source: Gavekal

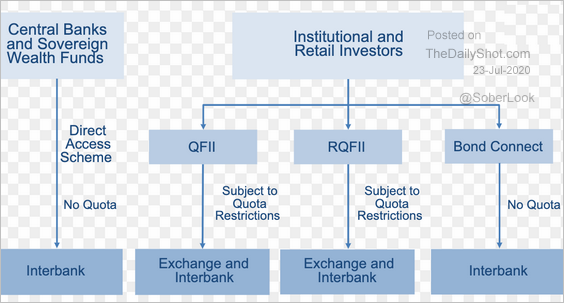

2. Beijing plans to unify its fragmented bond market.

Source: @adam_tooze, Caixin Global Read full article

Source: @adam_tooze, Caixin Global Read full article

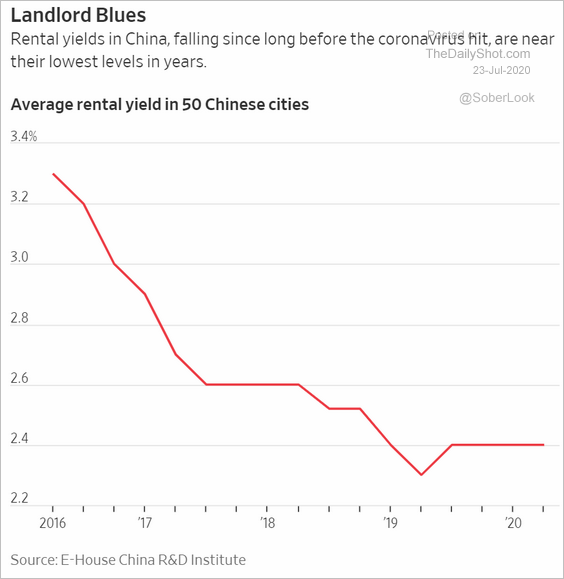

3. Rental property yields have been depressed in recent years.

Source: @WSJ Read full article

Source: @WSJ Read full article

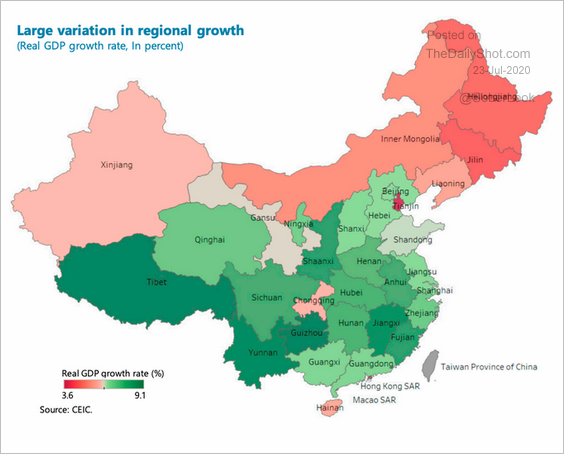

4. There is a significant variation in regional economic growth.

Source: @adam_tooze, IMF Read full article

Source: @adam_tooze, IMF Read full article

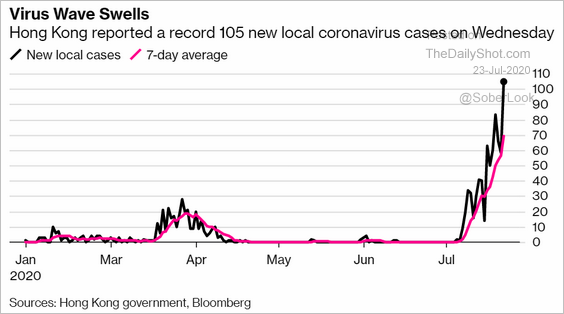

5. Hong Kong’s coronavirus cases are on the rise.

Source: @business Read full article

Source: @business Read full article

Emerging Markets

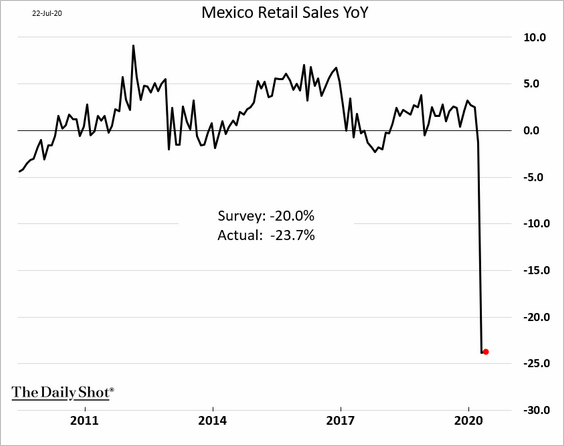

1. Mexico’s retail sales showed no improvement in May.

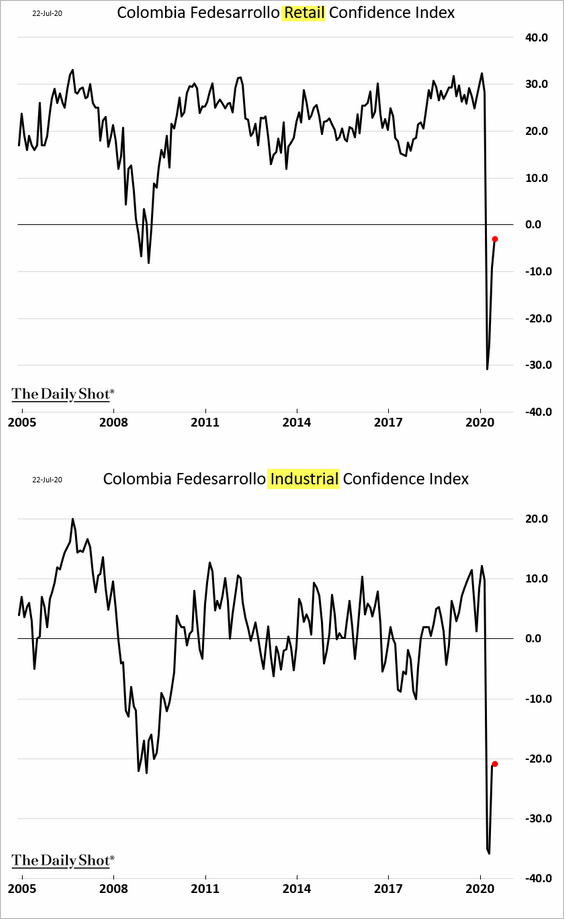

2. Colombia’s sentiment indicators are still extremely weak.

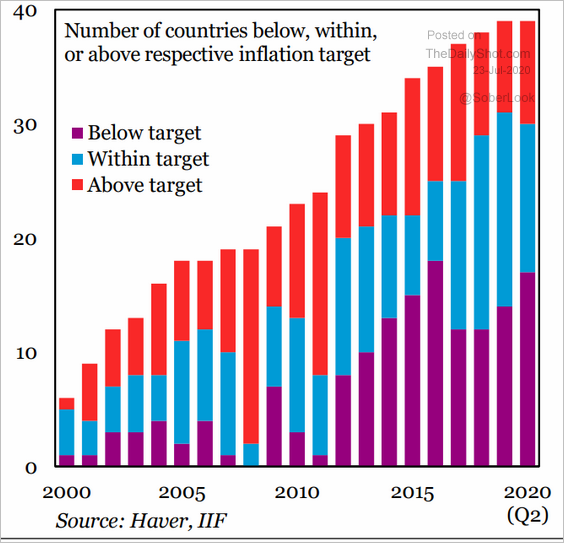

3. This chart shows the number of countries with inflation running below, within, and above central banks’ targets.

Source: IIF

Source: IIF

Cryptocurrency

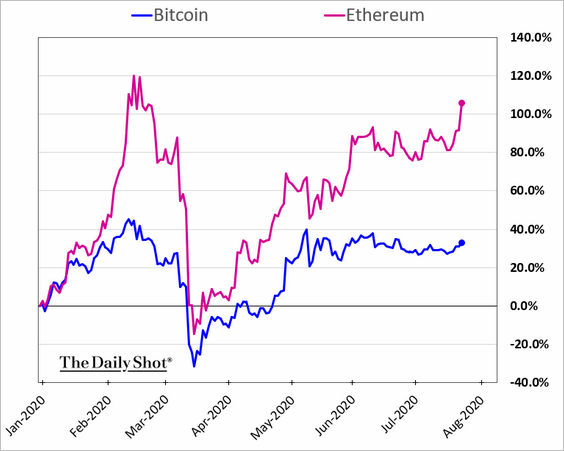

1. Ethereum has been outperforming Bitcoin this year.

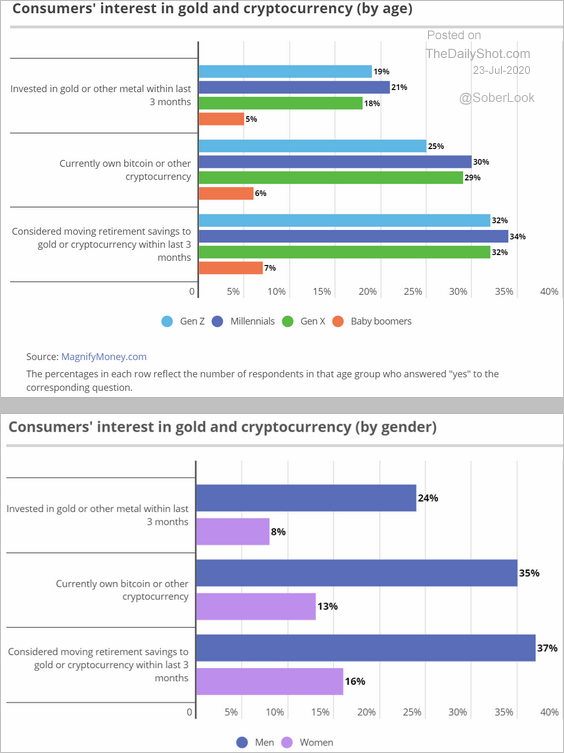

2. Next, we have the demographics of consumers interested in gold and cryptocurrency.

Source: MagnifyMoney.com Read full article

Source: MagnifyMoney.com Read full article

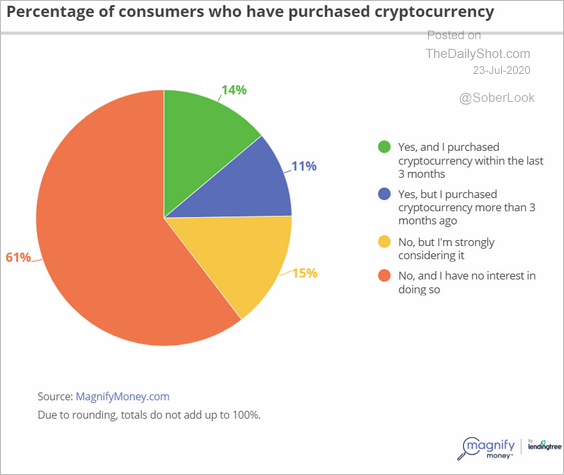

3. What percentage of consumers have purchased cryptocurrency?

Source: MagnifyMoney.com Read full article

Source: MagnifyMoney.com Read full article

Commodities

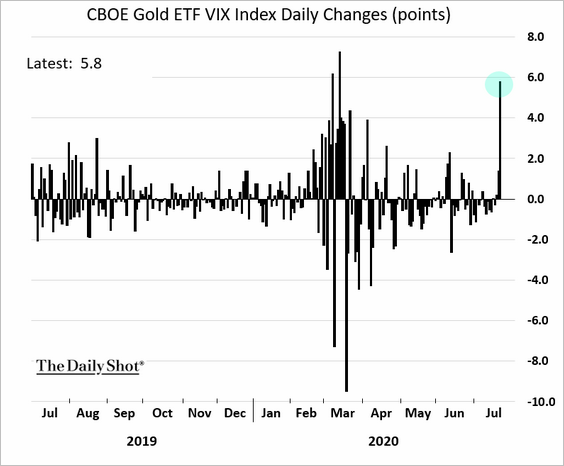

1. On Wednesday, gold implied volatility increased by most since March.

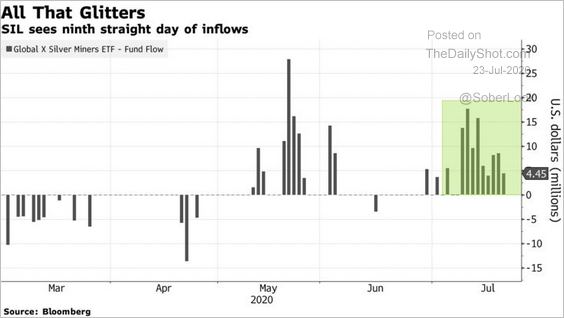

2. The largest silver mining ETF continues to get inflows.

Source: @markets Read full article

Source: @markets Read full article

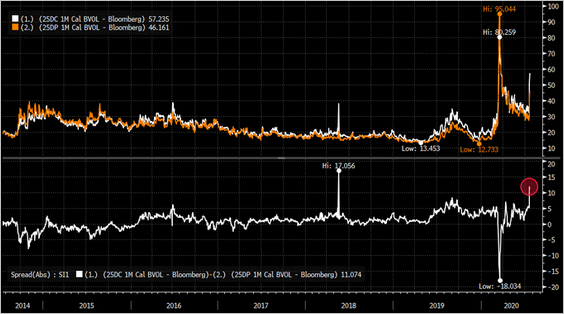

The massive rally in silver appears to be stretched.

• The RSI:

• Silver risk reversal (shows a spike in demand for call options):

Source: @iv_technicals

Source: @iv_technicals

——————–

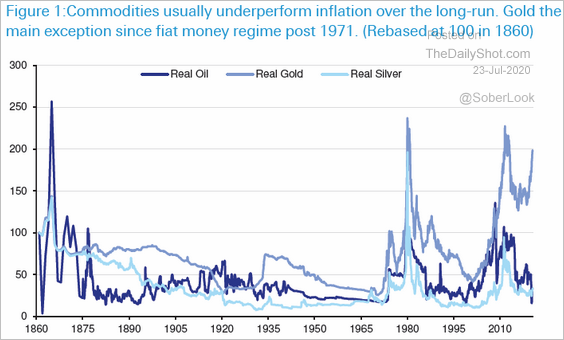

3. The next chart shows the inflation-adjusted prices of oil, gold, and silver, going back to 1860.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

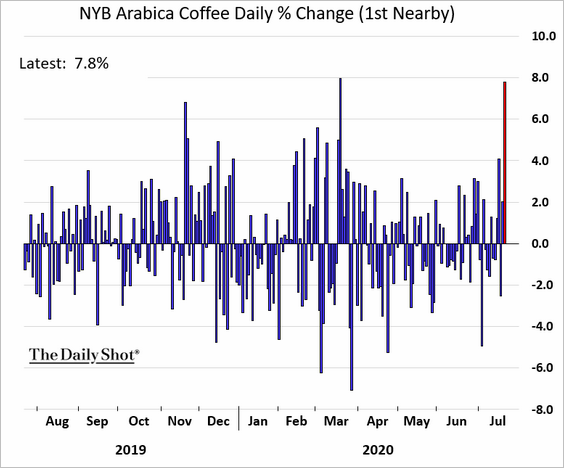

4. Coffee prices rose by most since March due to colder weather hitting southern Brazil.

Source:

Source:

Energy

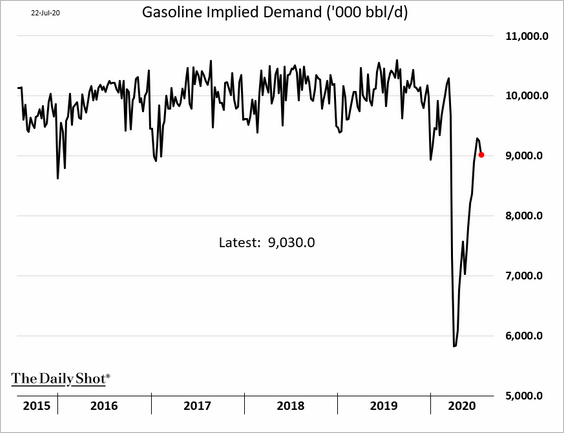

1. The rebound in US gasoline demand is fading.

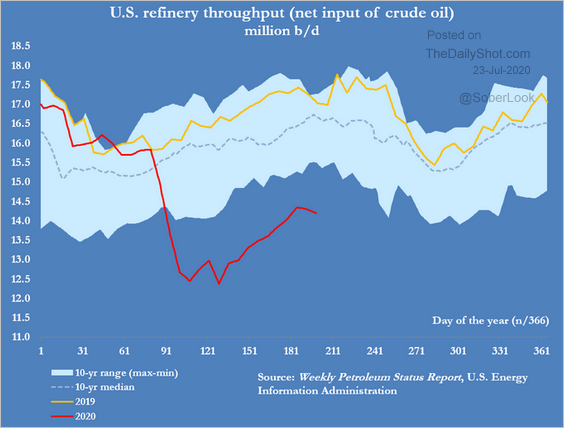

2. Refinery inputs remain well under the low end of the 10-year range.

Source: @JKempEnergy

Source: @JKempEnergy

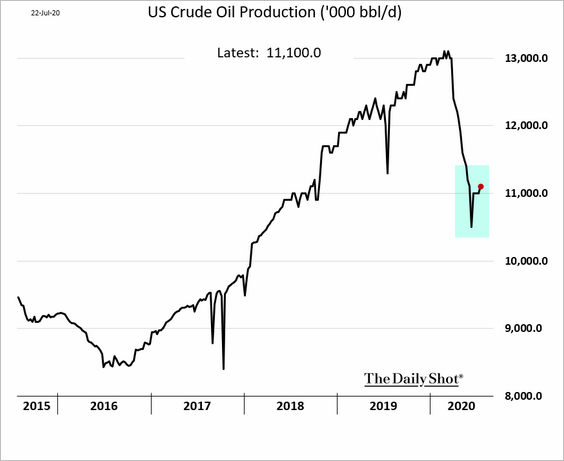

3. US oil production appears to have bottomed.

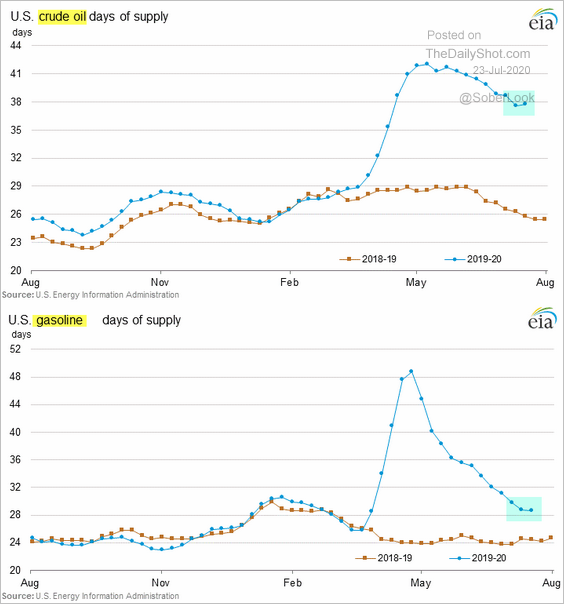

4. US crude oil and gasoline inventory declines paused last week.

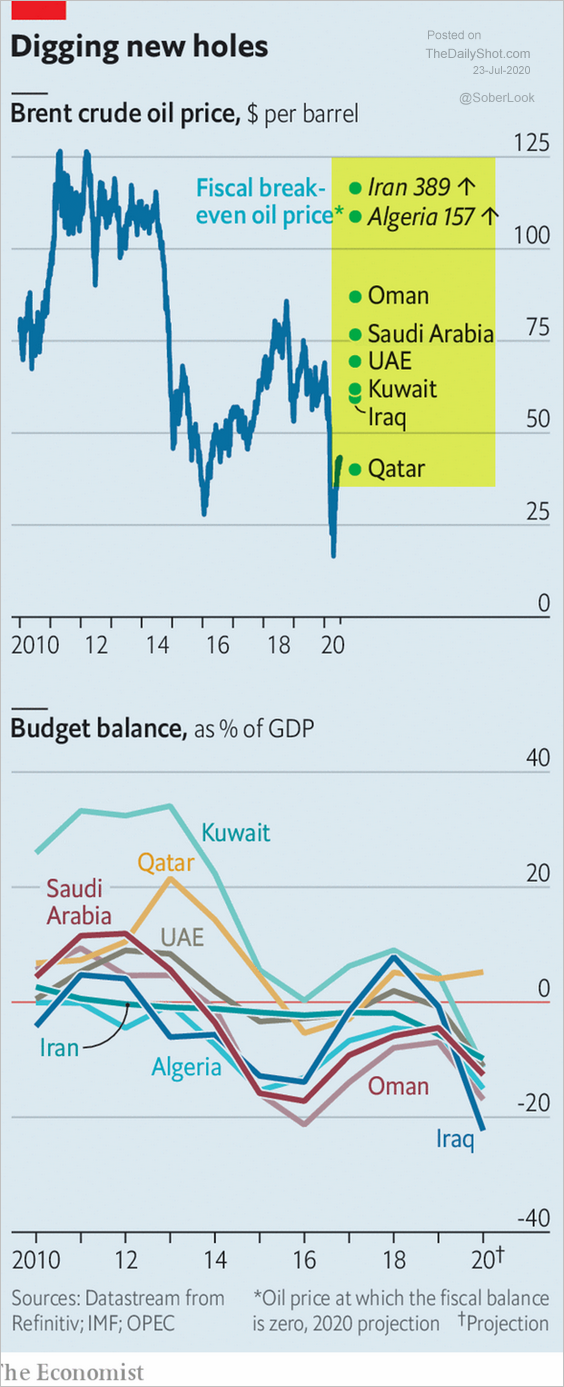

5. With crude oil prices still well below fiscal breakevens, Middle-East oil exporters’ government budgets remain under pressure.

Source: @adam_tooze, The Economist Read full article

Source: @adam_tooze, The Economist Read full article

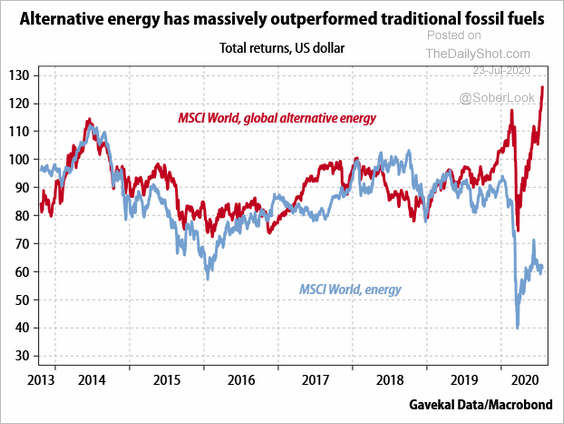

6. Shares of alternative energy firms have outperformed significantly over the past 12 months.

Source: Gavekal

Source: Gavekal

Equities

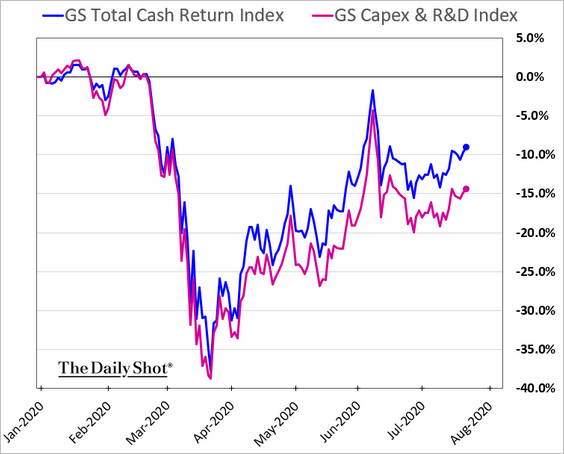

1. Since March, investors have been rewarding companies that focus on total return (dividends and share buybacks) rather than CapEx and R&D.

Source: Goldman Sachs

Source: Goldman Sachs

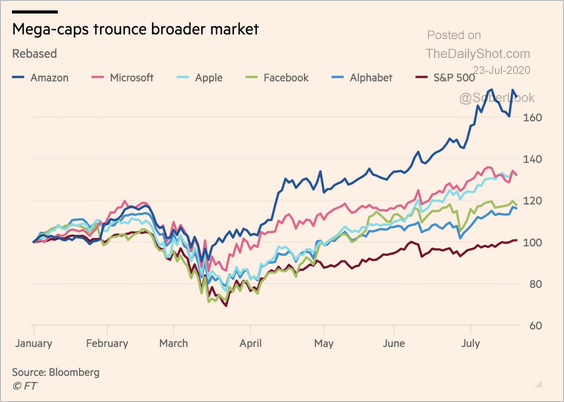

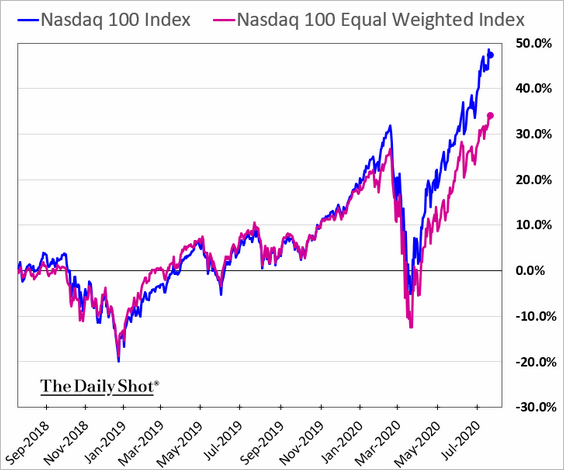

2. The tech mega-cap outperformance has been impressive.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

The above trend shows up in the underperformance of the Nasdaq 100 equal-weight index.

h/t @LizAnnSonders

h/t @LizAnnSonders

——————–

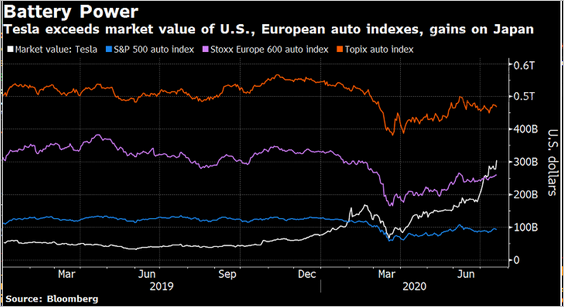

3. Here is Tesla’s market cap vs. the US, Europe, and Japan automotive sectors’ market value.

Source: @lisaabramowicz1, @TheOneDave, @theterminal

Source: @lisaabramowicz1, @TheOneDave, @theterminal

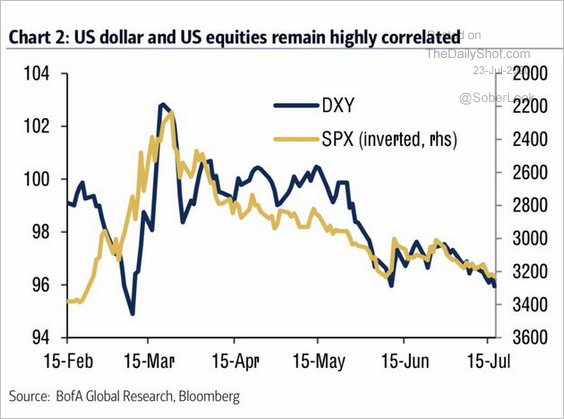

4. The S&P 500/US dollar inverse correlation remains intact.

Source: BofA Merrill Lynch Global Research, @WallStJesus

Source: BofA Merrill Lynch Global Research, @WallStJesus

5. The recent rise in market-based inflation expectations (breakeven rates) hasn’t done much to lift value stocks.

Source: BofA Merrill Lynch Global Research

Source: BofA Merrill Lynch Global Research

6. Insiders have been selling.

Source: @markets Read full article

Source: @markets Read full article

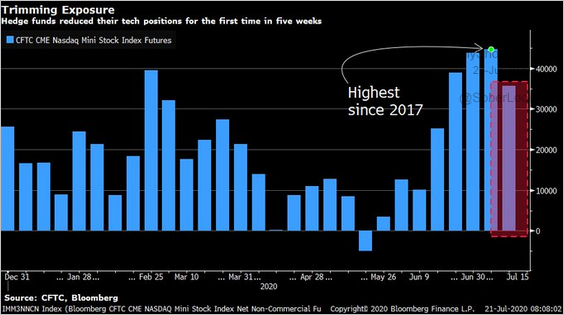

7. Hedge funds cut their exposure to Nasdaq 100 futures.

Source: @Bloomberg, @LizAnnSonders

Source: @Bloomberg, @LizAnnSonders

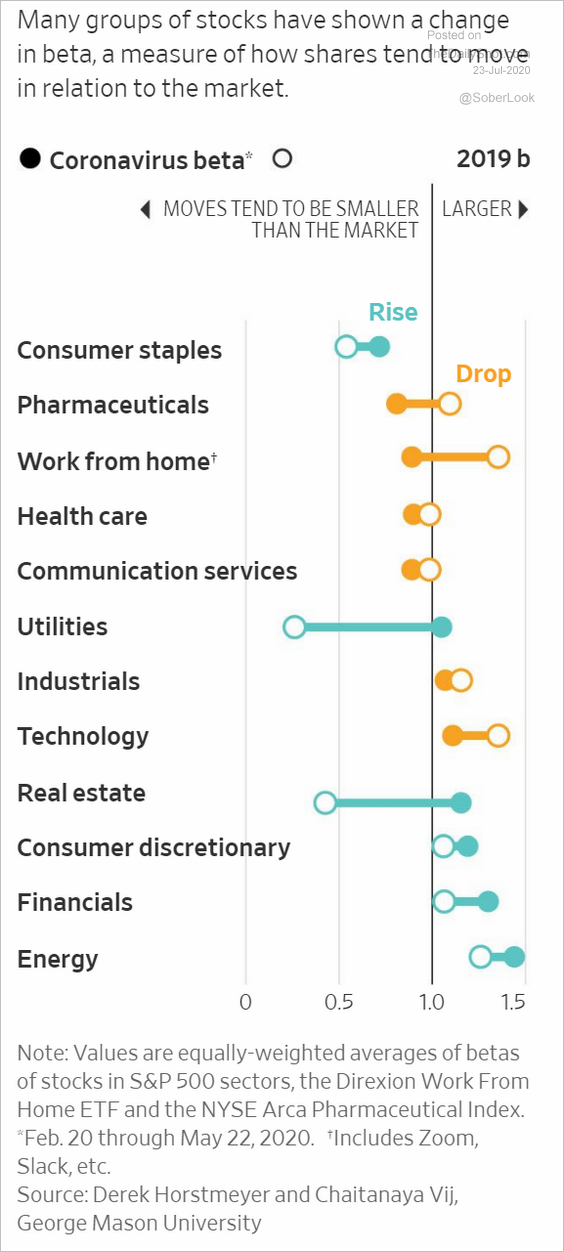

8. How has equity beta changed this year (by sector)?

Source: @WSJ Read full article

Source: @WSJ Read full article

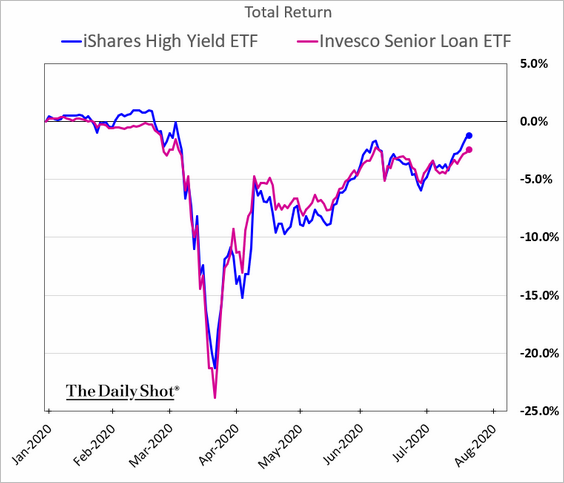

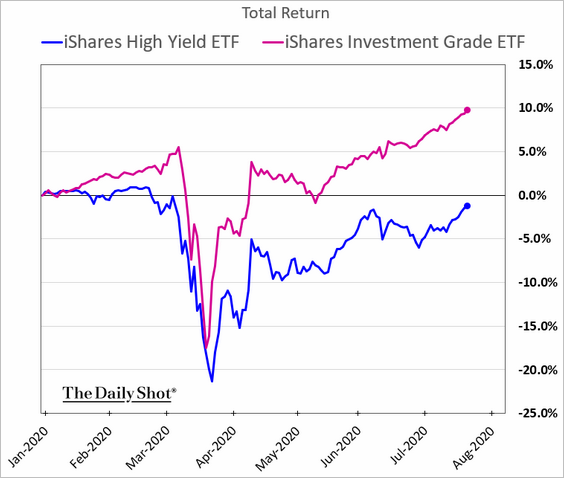

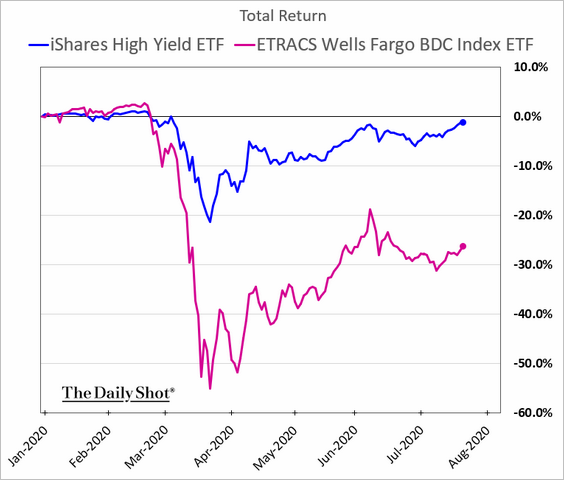

Credit

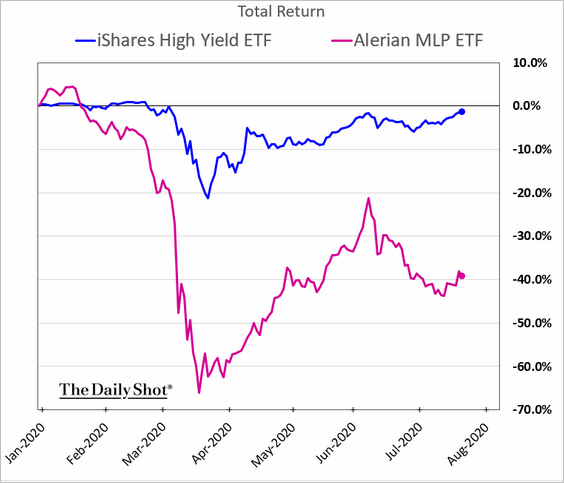

1. Let’s start with the relative performance of credit/income products year-to-date.

• Leveraged loans vs. high-yield:

• Investment-grade vs. high yield:

• High-yield munis vs. high-yield corporates:

• BDCs (lenders to small and medium-sized firms):

• MLPs (pipeline companies):

——————–

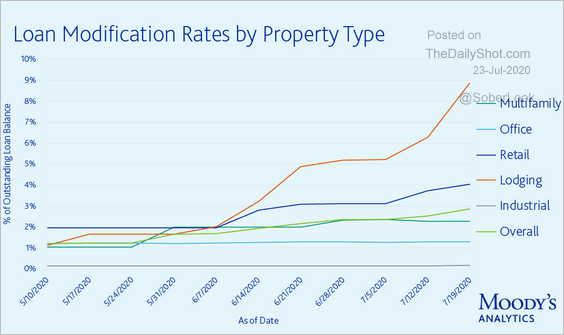

2. This chart shows the percentage of property loans that had to be modified.

Source: Moody’s Analytics

Source: Moody’s Analytics

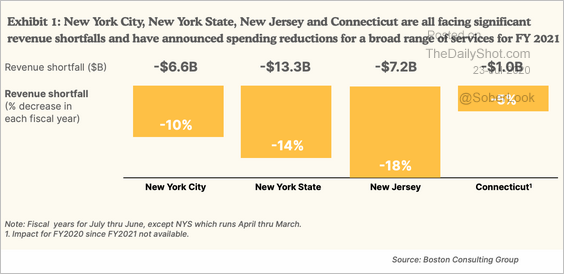

3. State and local budget shortfalls have been massive (2 charts).

Source: @adam_tooze, Partnership for New York City Read full article

Source: @adam_tooze, Partnership for New York City Read full article

Source: Alpine Macro

Source: Alpine Macro

Rates

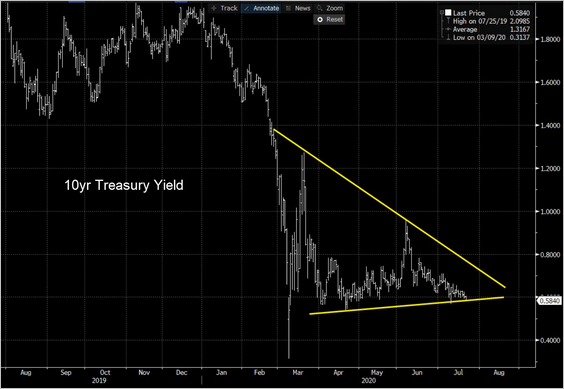

1. The 10yr Treasury yield is at support.

Source: @Not_Jim_Cramer, @TheTerminal

Source: @Not_Jim_Cramer, @TheTerminal

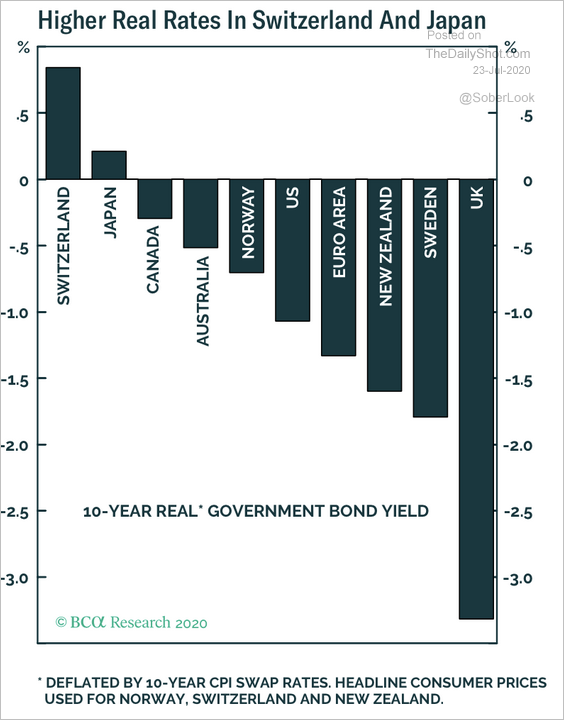

2. The highest real rates are now found in defensive currencies.

Source: BCA Research

Source: BCA Research

Global Developments

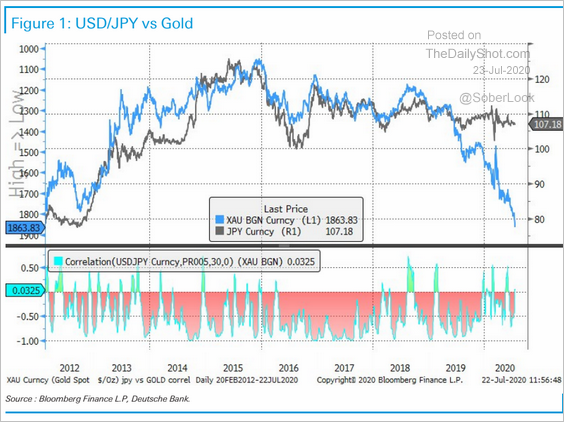

1. Gold has diverged from the yen (both usually trade as risk-off assets). One explanation for this gap is investors’ concerns about inflation.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

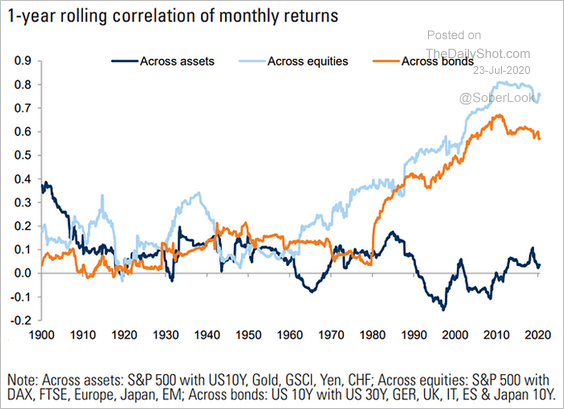

2. Global bond-stock correlations remain subdued.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

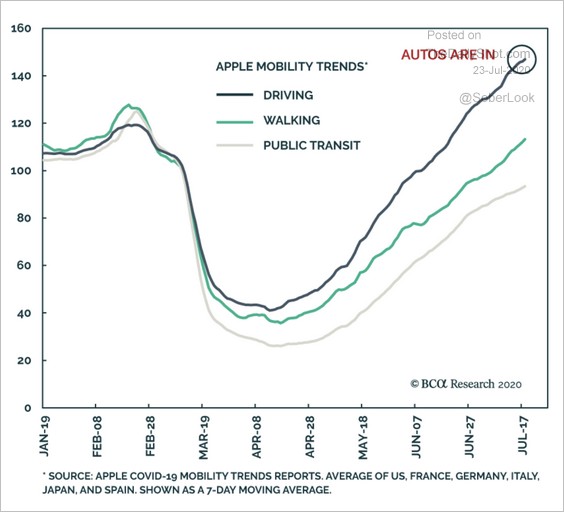

3. Driving has made a strong comeback across advanced economies.

Source: BCA Research

Source: BCA Research

——————–

Food for Thought

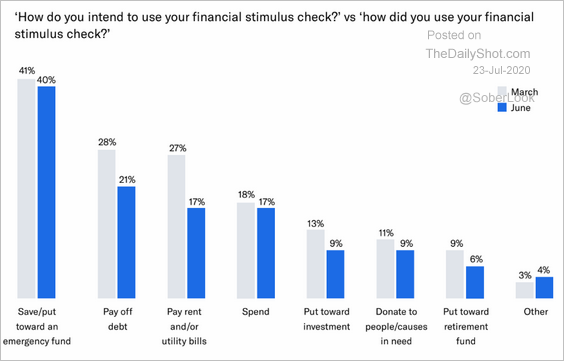

1. Planned vs. actual usage of US stimulus checks:

Source: Betterment Read full article

Source: Betterment Read full article

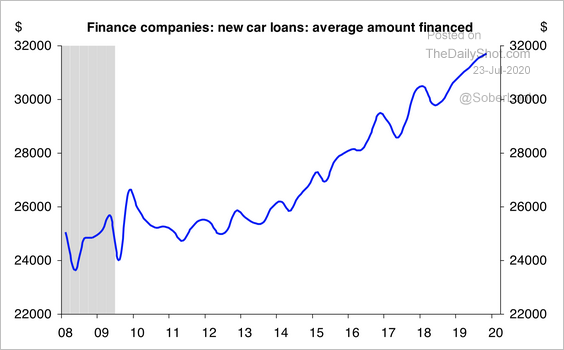

2. Average US car loan size:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

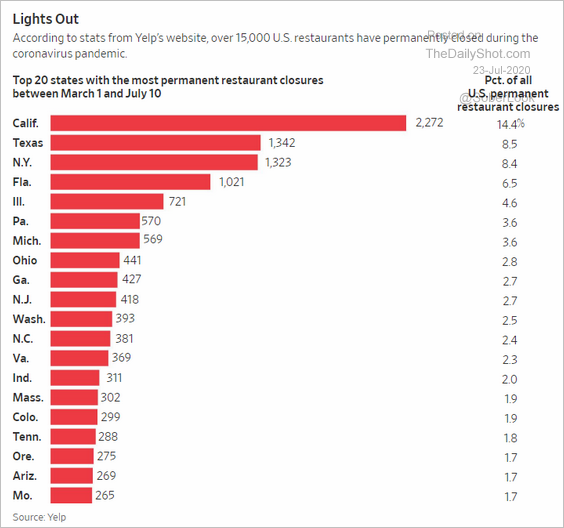

3. Restaurant closures:

Source: @WSJ Read full article

Source: @WSJ Read full article

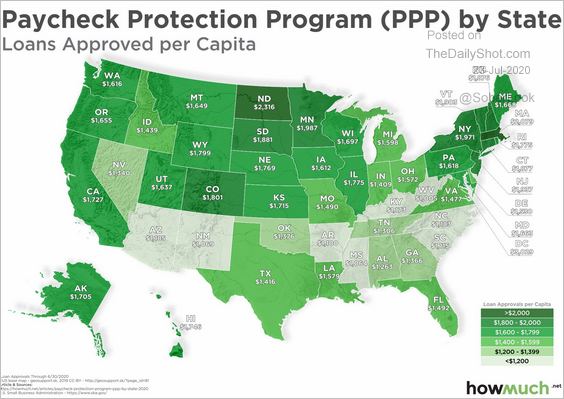

4. Federal aid for small business (PPP) per capita:

Source: @howmuch_net Read full article

Source: @howmuch_net Read full article

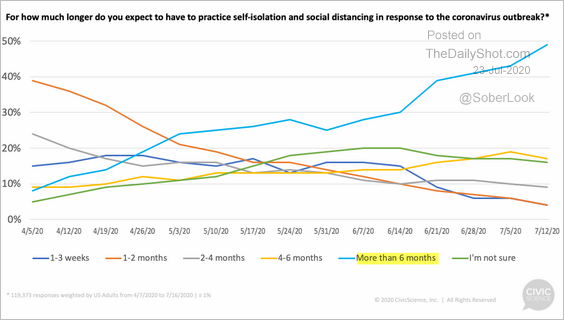

5. How much longer?

Source: @CivicScience Read full article

Source: @CivicScience Read full article

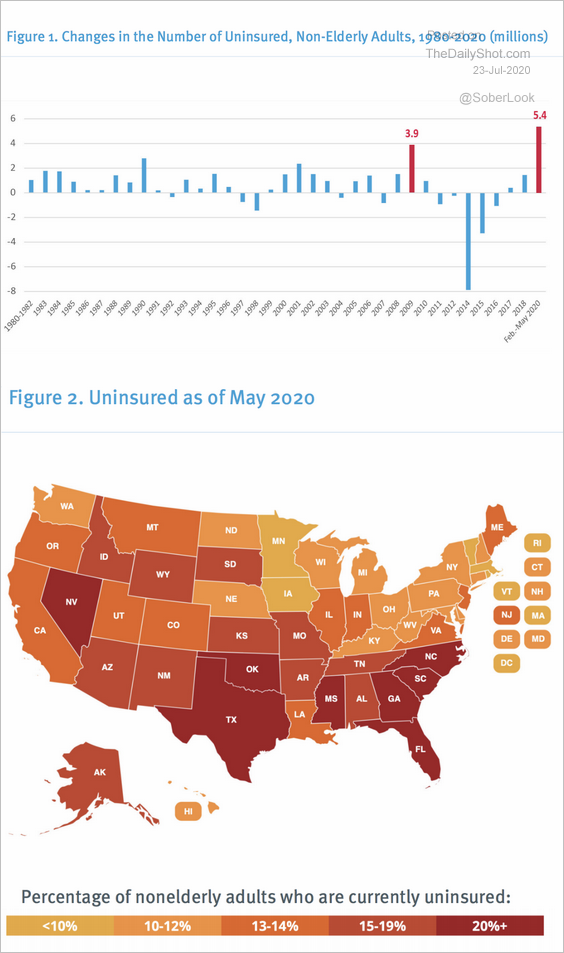

6. Changes in the number of uninsured:

Source: FamiliesUSA Read full article

Source: FamiliesUSA Read full article

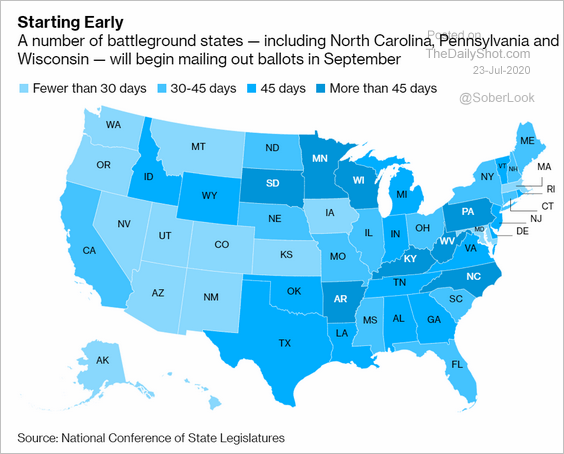

7. Absentee ballots (days before the election):

Source: @bpolitics Read full article

Source: @bpolitics Read full article

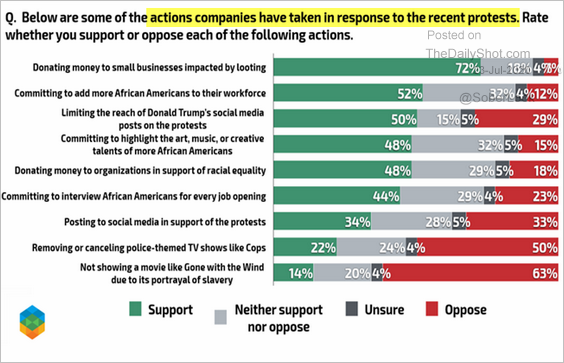

8. Support for actions companies took in response to the recent protests:

Source: Echelon Insights

Source: Echelon Insights

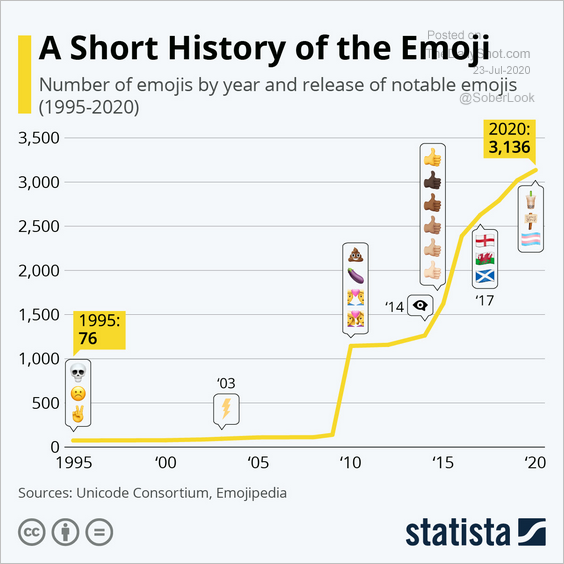

9. The proliferation of emojis:

Source: Statista

Source: Statista

——————–