The Daily Shot: 31-Jul-20

• The United States

• Canada

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

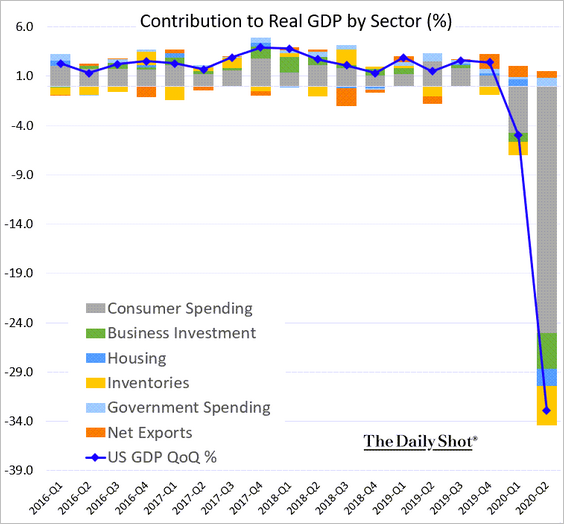

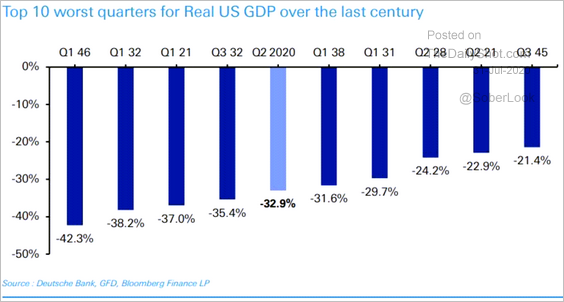

1. As was widely expected, the second-quarter GDP contraction was severe.

• It was one of the worst quarterly declines over the past century.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

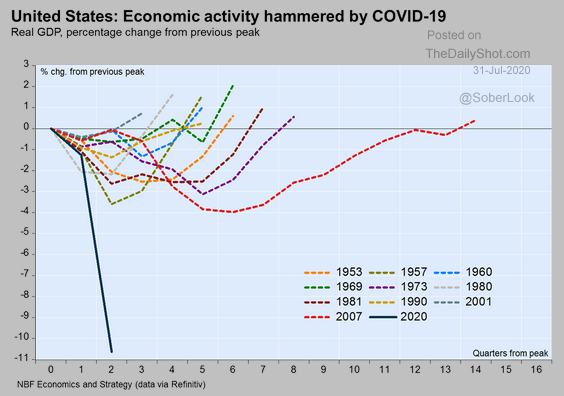

• Here are the GDP trajectories for some of the past recessions.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

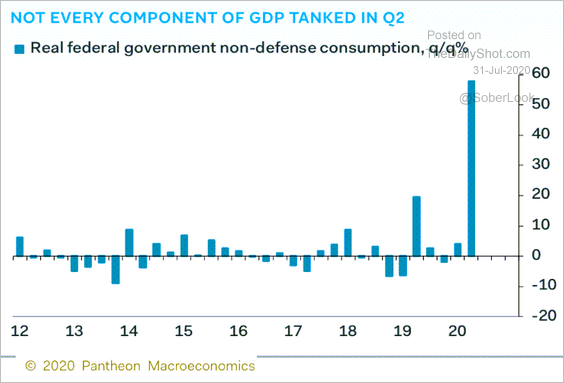

• While private consumption plummetted, the federal government stepped in.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

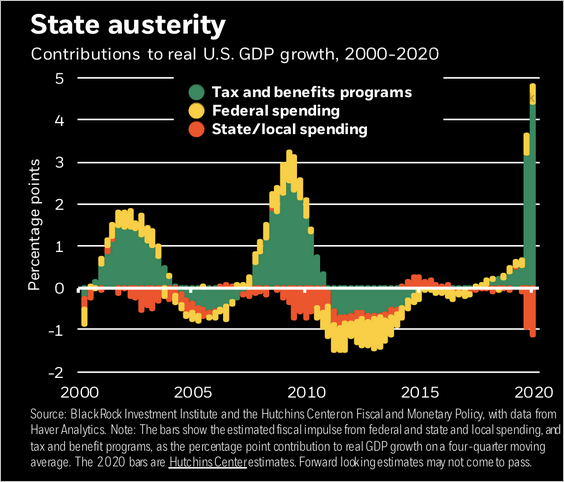

However, the decline in state and local spending has been a drag on GDP growth.

Source: BlackRock

Source: BlackRock

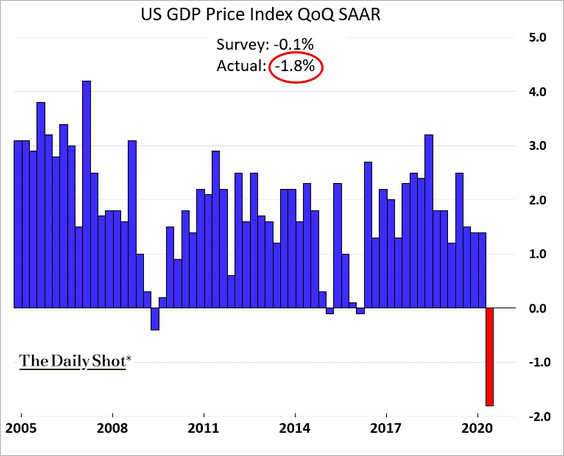

• Q2 price declines were bigger than expected.

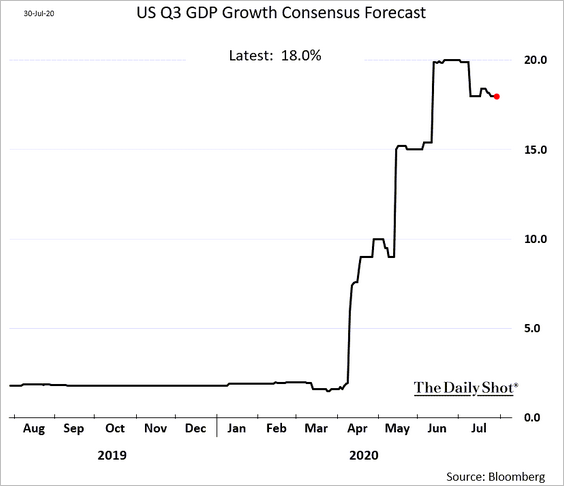

• Economists are forecasting a rebound in Q3.

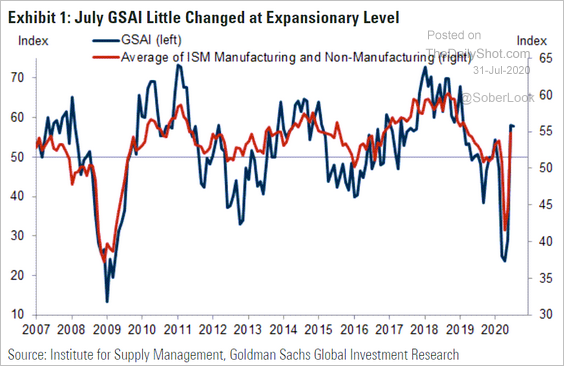

– High-frequency indicators continue to show modest positive growth. Here is the Goldman Sachs Analyst Index (tracking analysts’ sentiment across industries).

Source: Goldman Sachs

Source: Goldman Sachs

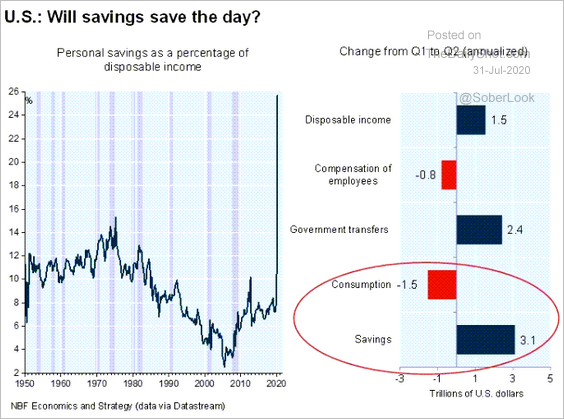

– This year’s sharp increase in savings should (in theory) boost consumption in the months ahead.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

——————–

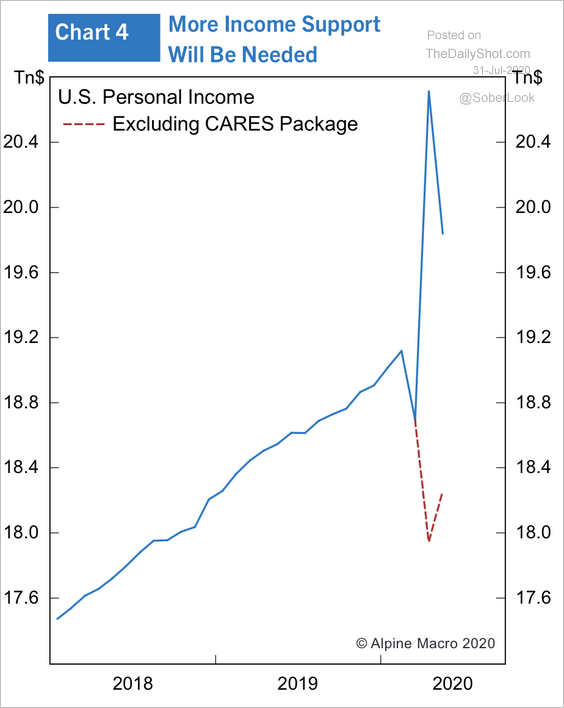

2. Uncertainty around growth in the second half of the year remains elevated. Without more stimulus, personal incomes will crater, and consumer spending will follow, according to Alpine Macro.

Source: Alpine Macro

Source: Alpine Macro

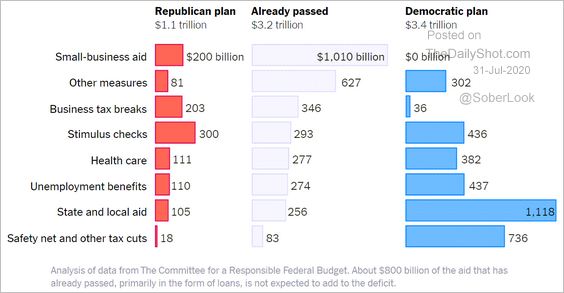

And there is work to be done to get to an agreement on the stimulus package.

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

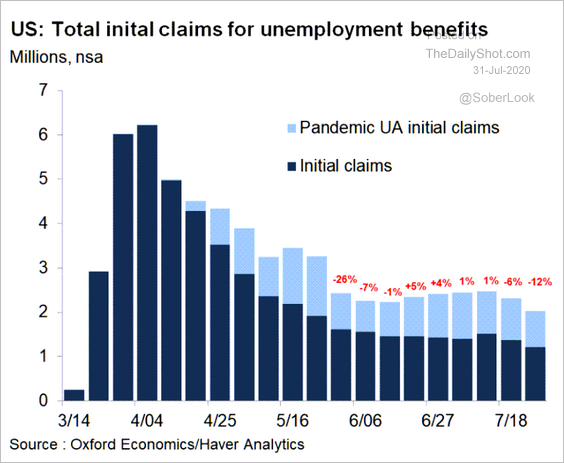

3. Next, we have some updates on the labor market.

• Total initial jobless claims declined last week to the lowest level since the start of the crisis. But it’s still 2 million new unemployment applications.

Source: Oxford Economics

Source: Oxford Economics

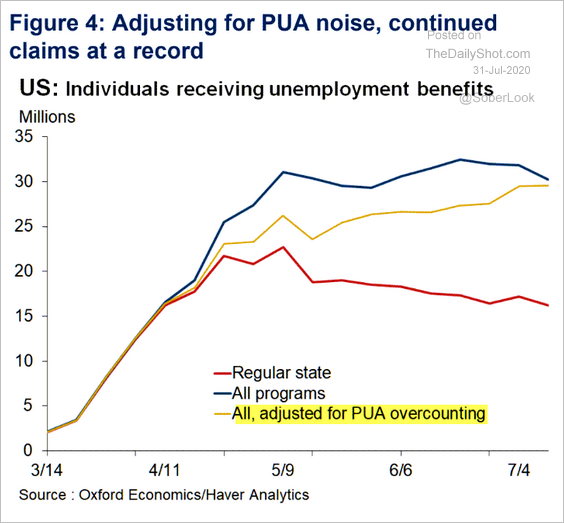

Here are the total continuing claims, with an adjustment from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

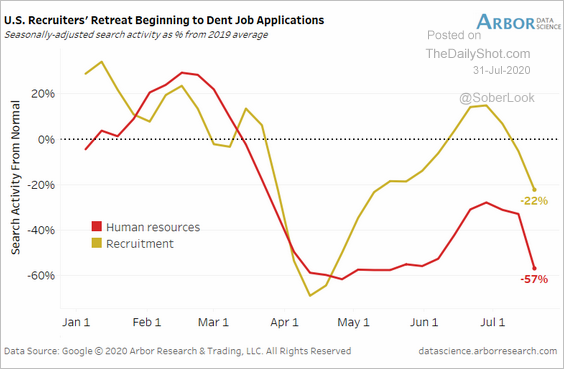

• Online searches for recruiters and human resources have been slowing.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

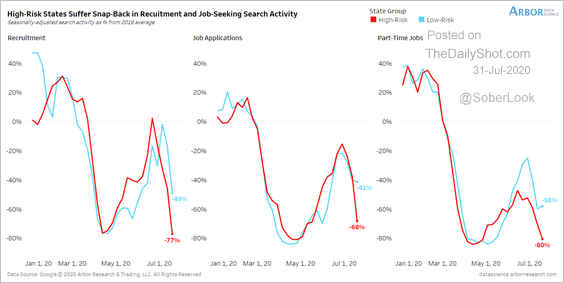

States with worsening coronavirus outbreaks saw greater declines in online job-seeking activity.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

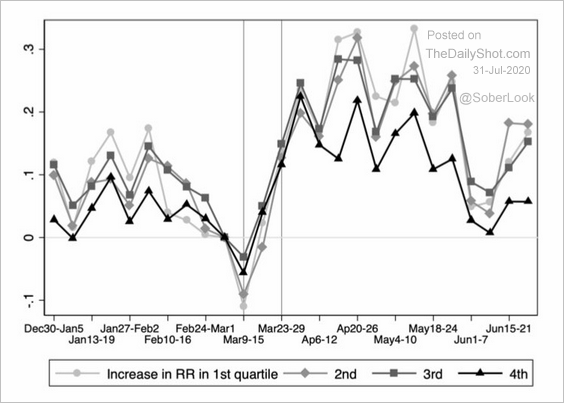

• Despite the turbocharged unemployment benefits, employers saw more applicants per vacancy after the CARES Act. Even in lower-wage occupations (4th quartile), job applications remained elevated.

Source: @mioana, @DaphneSkandalis, @DanielBZhao Read full article

Source: @mioana, @DaphneSkandalis, @DanielBZhao Read full article

——————–

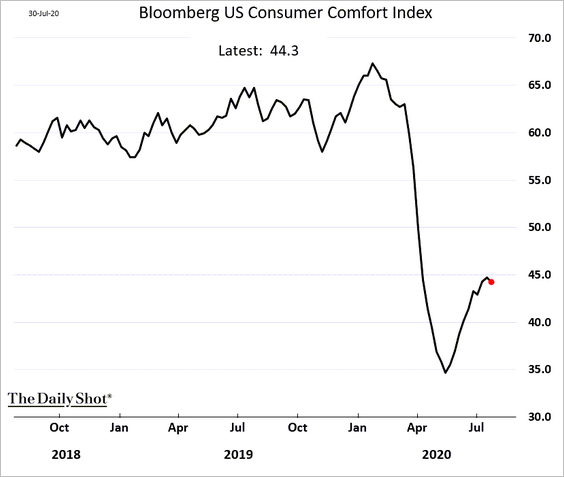

4. The Bloomberg Consumer Comfort Index shows that improvements in sentiment are on hold for now.

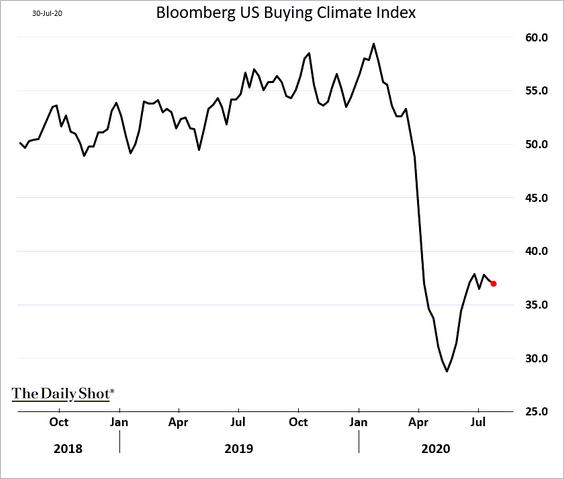

Here is the buying climate index.

Canada

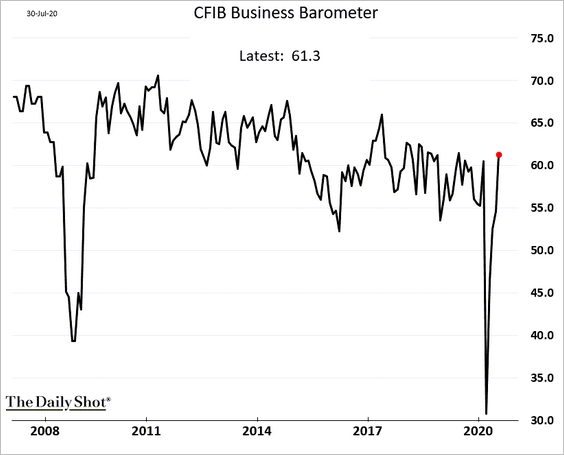

1. Business activity for small and medium-sized firms has rebounded sharply.

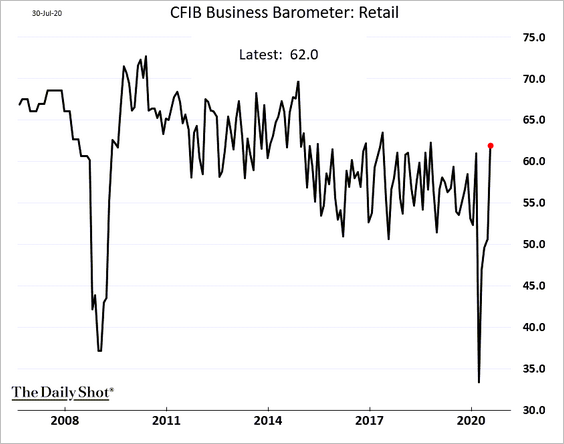

Here is the retail sector, for example.

——————–

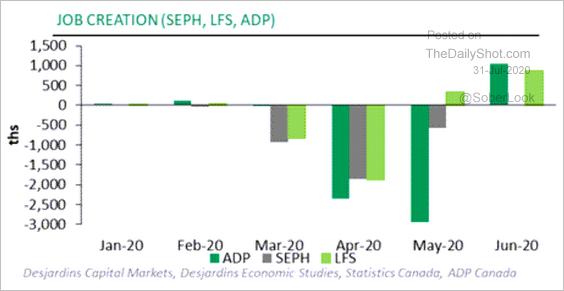

2. Surveys point to net job creation in June.

Source: Desjardins

Source: Desjardins

The Eurozone

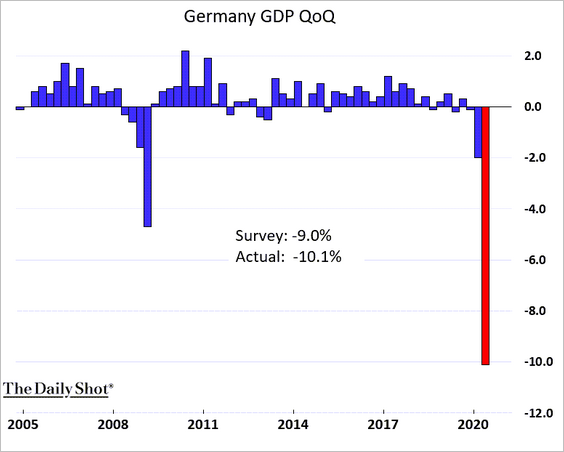

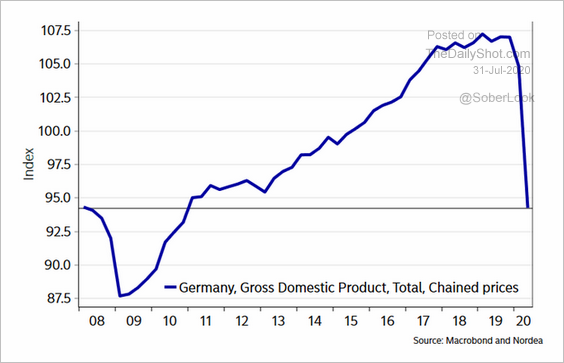

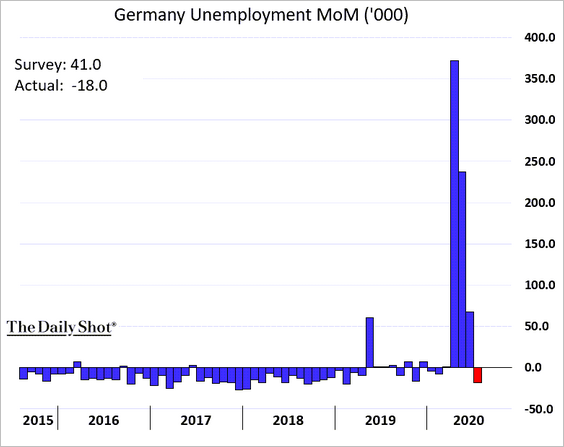

1. Let’s begin with Germany.

• The GDP tanked in Q2, wiping out ten years of growth (second chart).

Source: @AndreasSteno

Source: @AndreasSteno

• Net unemployment unexpectedly declined this month.

• Consumer inflation hit zero in July for the first time since 2016.

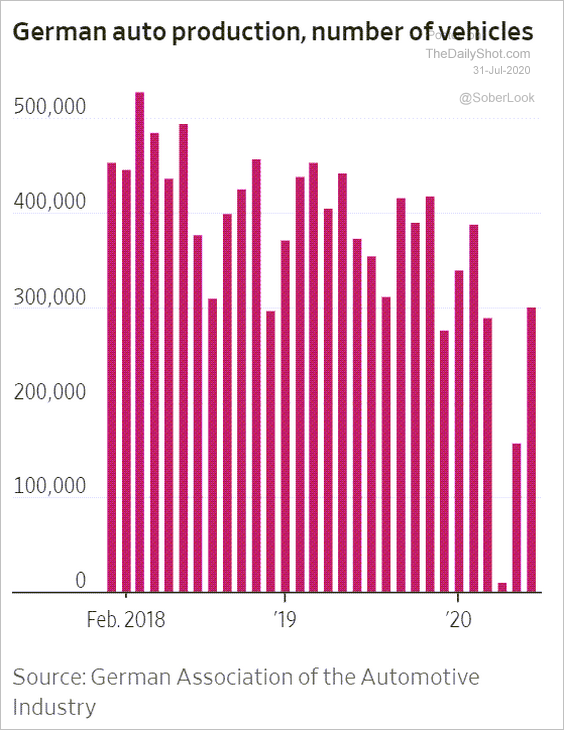

• Automobile production has been recovering.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

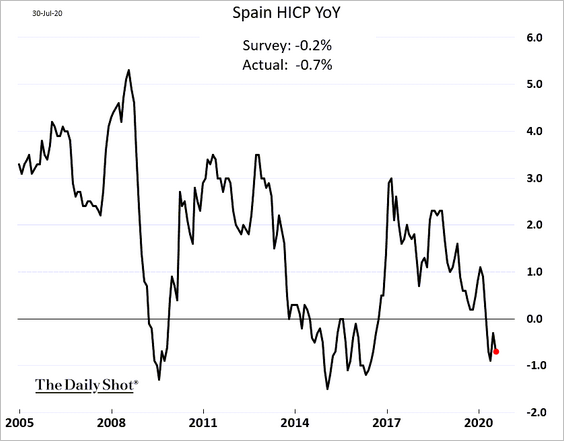

2. Spain’s deflationary pressures worsened this month.

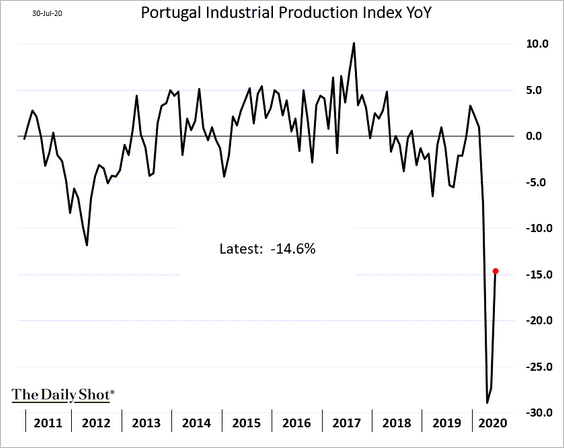

3. Portugal’s industrial production picked up last month but remains depressed.

4. Italian June unemployment rate topped economists’ forecasts.

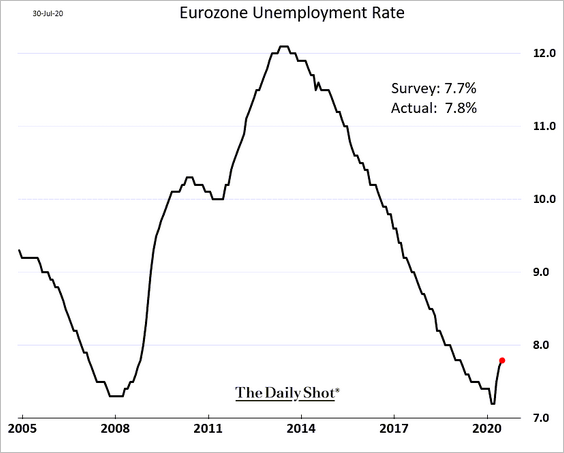

5. At the Eurozone level, the unemployment rate ticked higher.

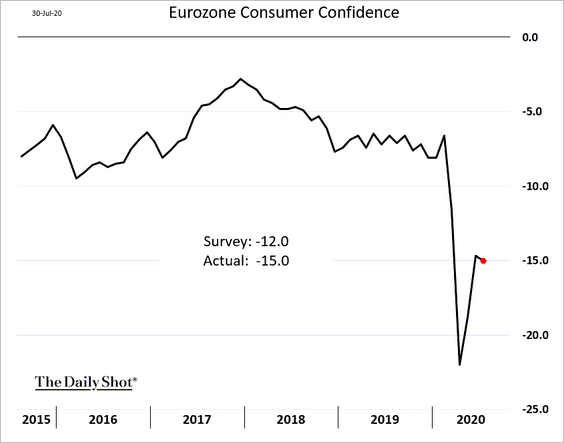

6. The updated consumer confidence index showed sentiment improvements pausing in July.

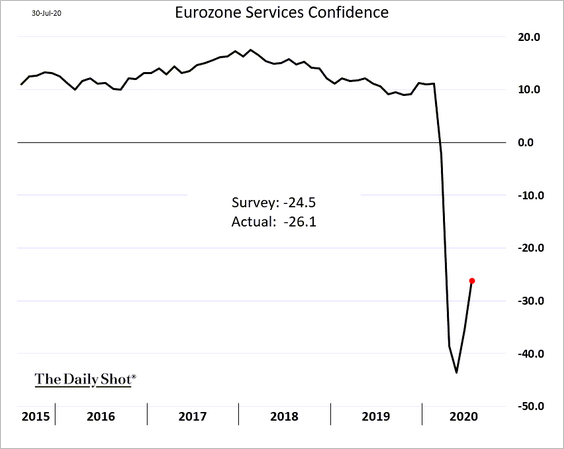

Service-sector confidence is higher but remains depressed.

Sentiment in manufacturing is rebounding.

——————–

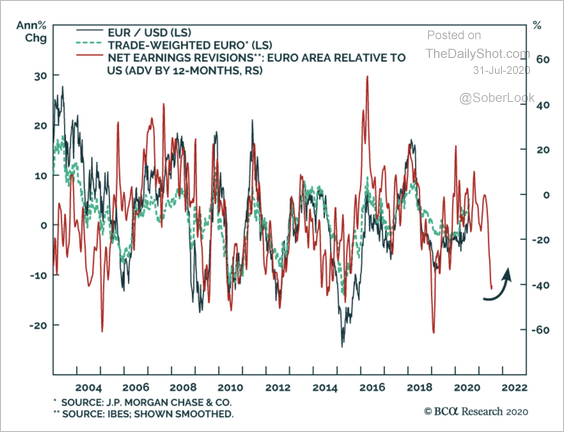

7. Improving earnings revisions, especially in European cyclical stocks, could be the catalyst for the next leg in the euro rally, according to BCA Research.

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

Europe

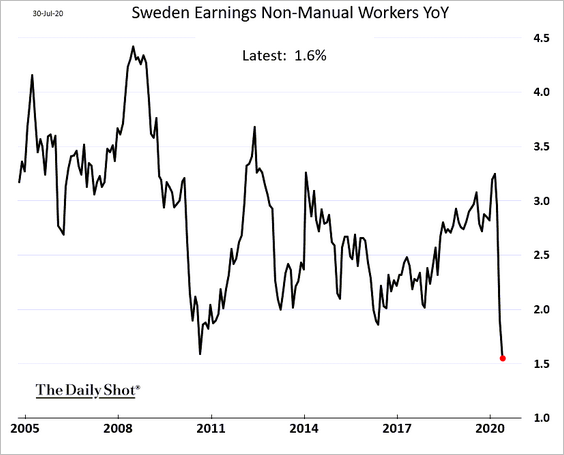

1. The sharp decline in Sweden’s wage growth poses a problem for Riksbank (disinflationary pressures).

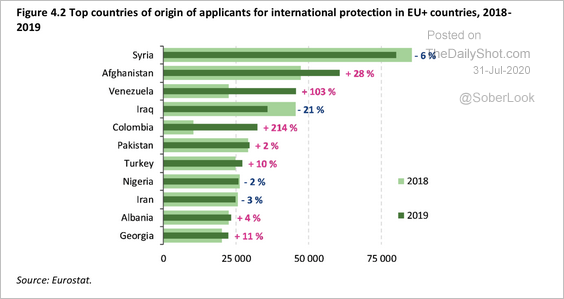

2. This chart shows the origins of EU asylum seekers.

Source: EASO Asylum Report 2020 Read full article

Source: EASO Asylum Report 2020 Read full article

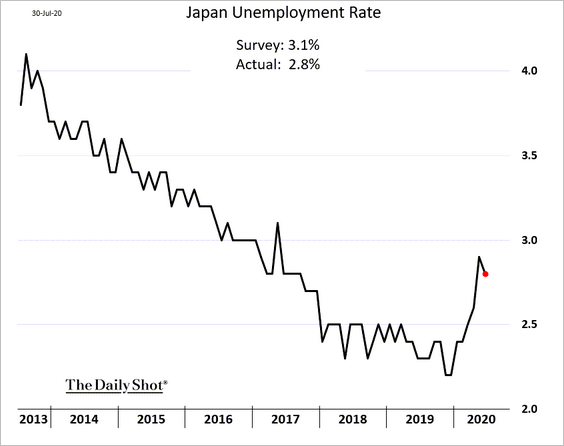

Japan

1. The unemployment rate unexpectedly ticked lower.

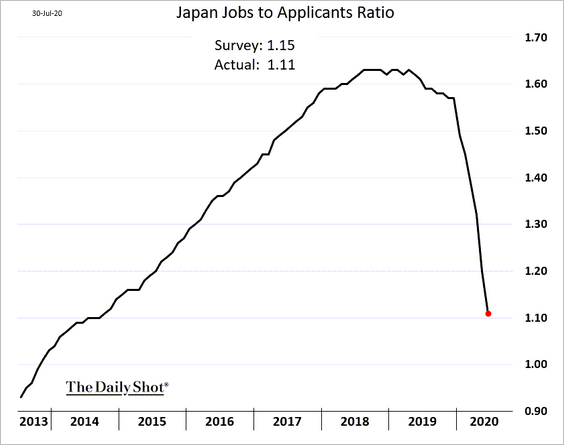

But the jobs-to-applicants ratio continues to tumble.

——————–

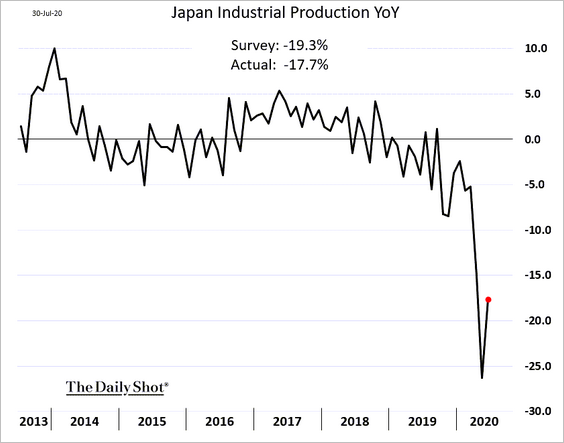

2. Industrial production improved in June.

3. The BoJ has been more realistic about inflation lately. The 2% target may remain elusive for a long time.

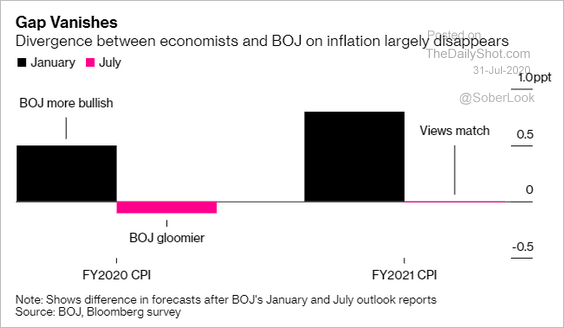

Source: @tracyalloway Read full article

Source: @tracyalloway Read full article

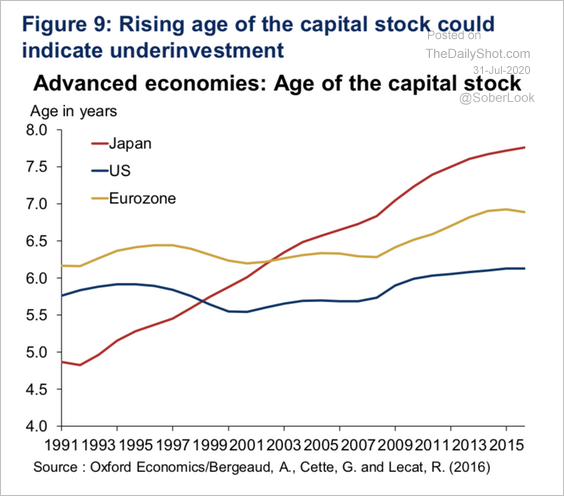

4. Japan’s capital stock (equipment, structures, etc.) has been aging faster than it has been in other advanced economies.

Source: Oxford Economics

Source: Oxford Economics

5. The yen continues to climb.

Asia – Pacific

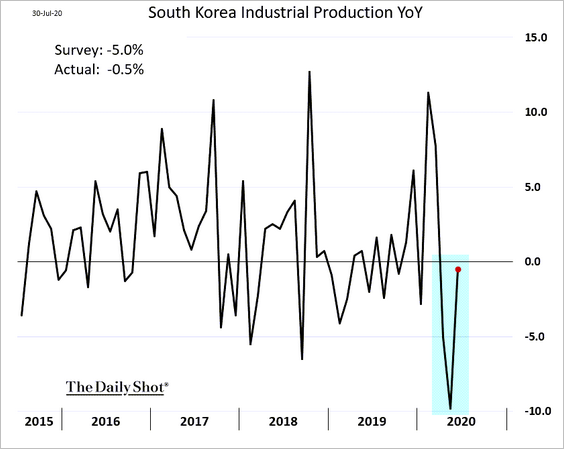

1. South Korea’s industrial production rebounded sharply in June.

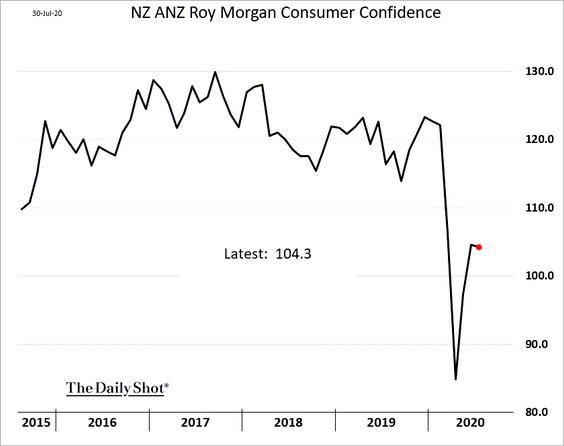

2. New Zealand’s consumer confidence ticked lower.

3. Next, we have some updates on Australia.

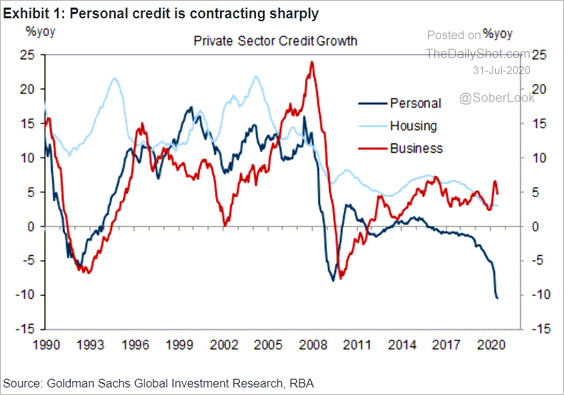

• Private sector credit growth:

Source: Goldman Sachs

Source: Goldman Sachs

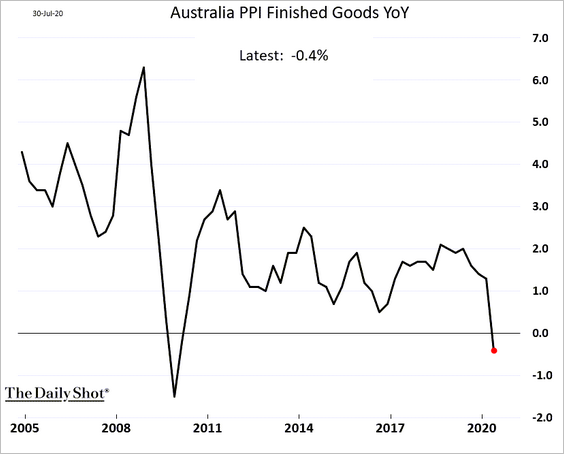

• Producer prices (through Q2):

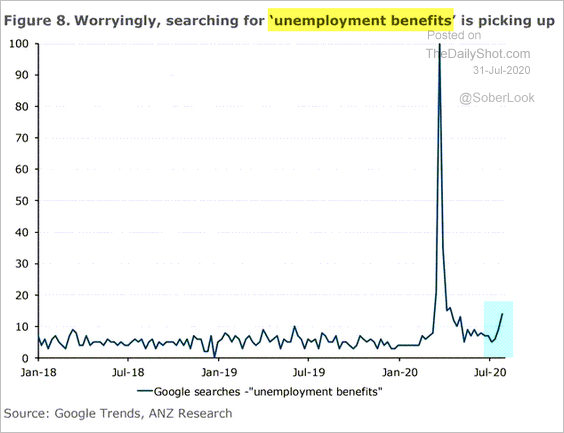

• Online search for unemployment benefits:

Source: ANZ Research

Source: ANZ Research

• The Aussie dollar:

China

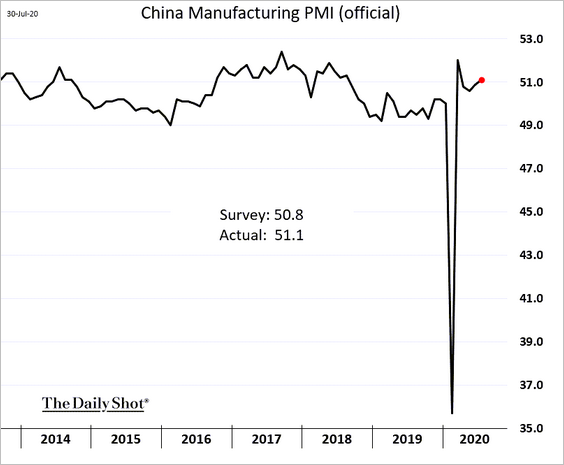

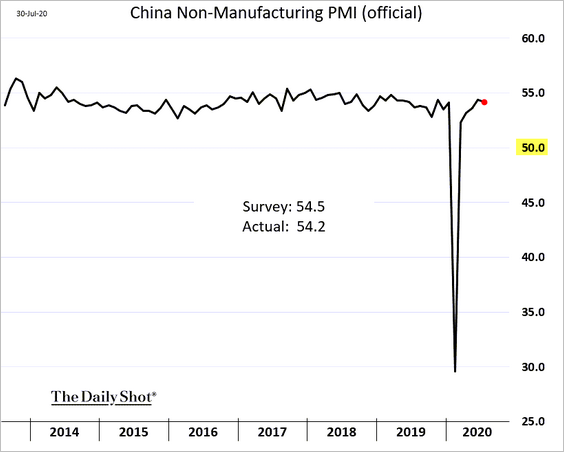

1. The official PMI indicators show steady growth.

• Manufacturing:

• Non-manufacturing:

——————–

2. Container throughput improved further.

Source: Goldman Sachs

Source: Goldman Sachs

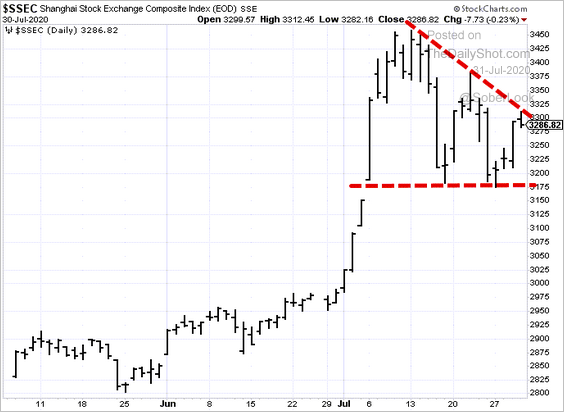

3. The Shanghai Composite has been consolidating.

h/t Sharon Chen

h/t Sharon Chen

4. Hong Kong’s retail sales bounced from the lows but remain nearly 25% below last year’s levels.

Emerging Markets

1. Mexico’s GDP plummetted last quarter.

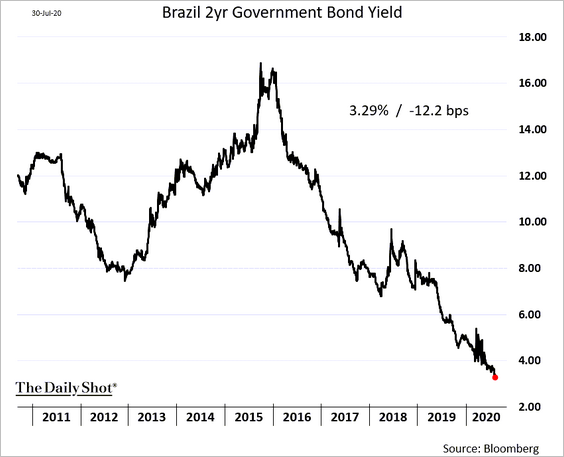

2. Brazil’s local-currency bond yields continue to fall.

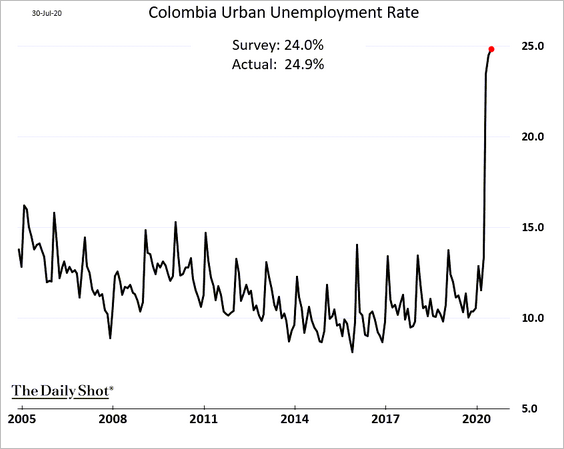

3. Colombia’s urban unemployment rate is nearing 25%.

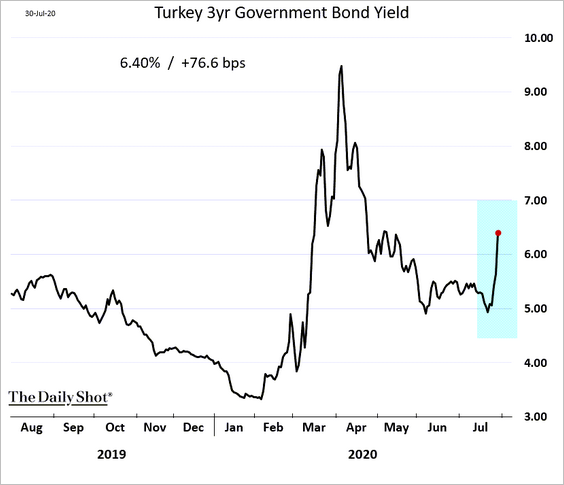

4. Turkey’s domestic bond yields have been rising amid a weaker lira and concerns about higher inflation.

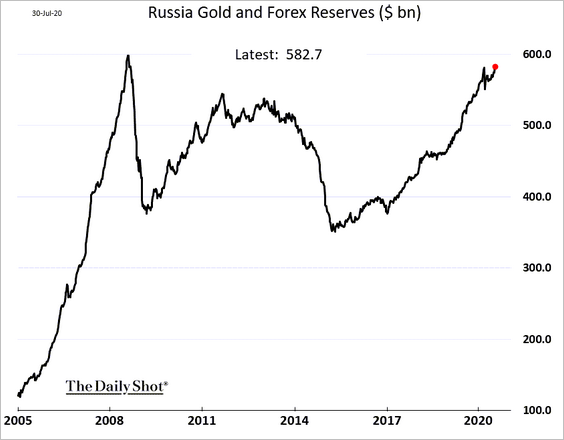

5. Russia’s F/X and gold reserves are approaching record highs, boosted by the latest rally in gold prices.

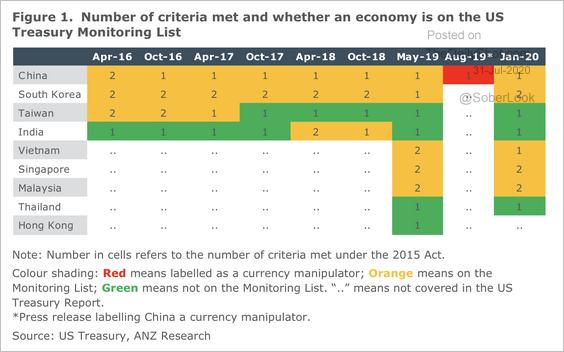

6. Which countries are at risk of being labeled a currency manipulator by the US?

Source: ANZ Research

Source: ANZ Research

Commodities

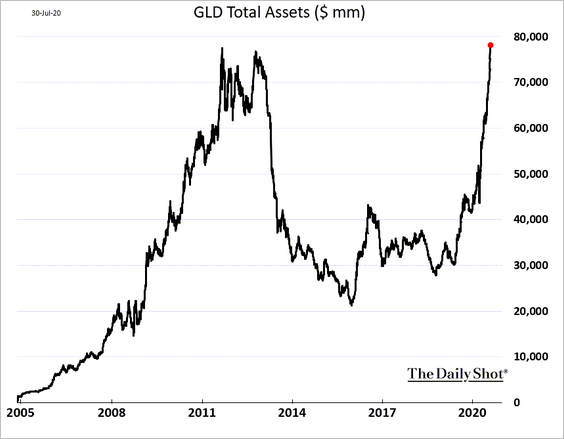

1. Assets under management at the largest gold ETF (GLD) hit a record high.

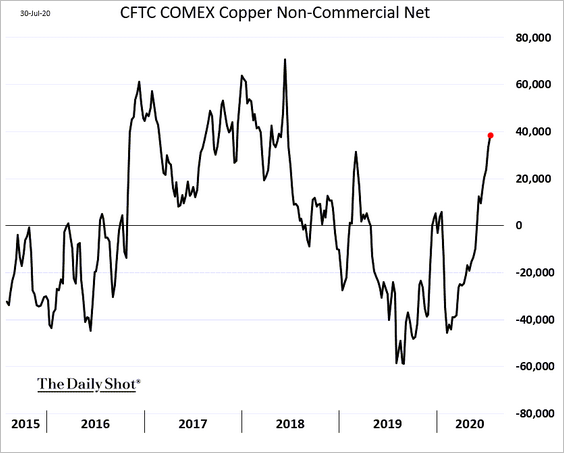

2. Speculative bets on copper continue to climb.

3. Coffee prices are rebounding amid improved global demand.

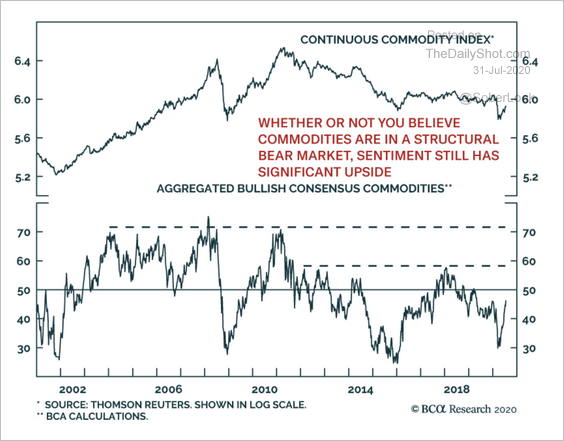

4. Sentiment remains low, which could support further upside in commodities.

Source: BCA Research

Source: BCA Research

Equities

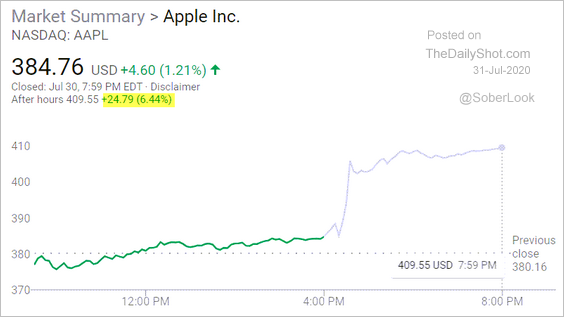

1. The market was impressed with what it heard from the tech mega-cap firms after the close, pushing shares sharply higher.

Source: Google

Source: Google

Source: Google

Source: Google

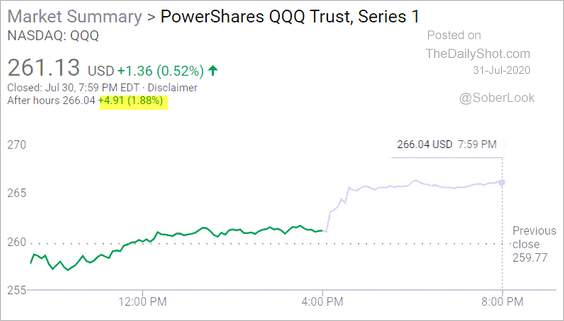

Here is the Nasdaq 100 ETF (QQQ).

Source: Google

Source: Google

——————–

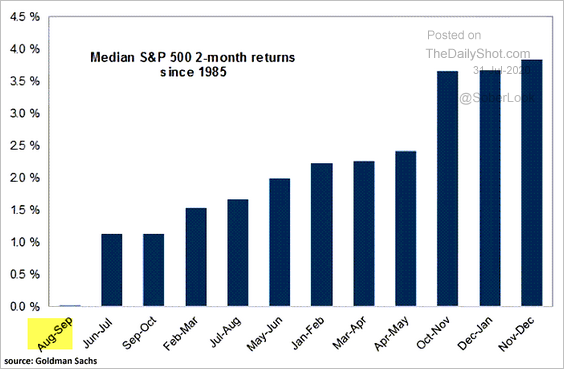

2. The August-September period typically isn’t great for the S&P 500.

Source: @ISABELNET_SA, @GoldmanSachs Read full article

Source: @ISABELNET_SA, @GoldmanSachs Read full article

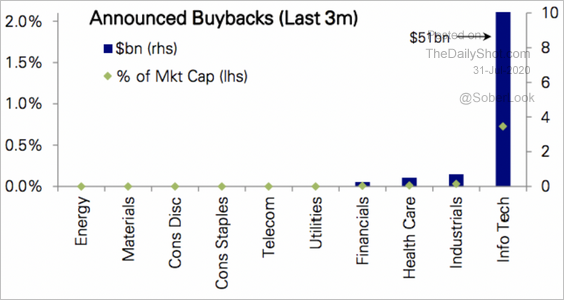

3. Except for tech, buybacks have become a thing of the past in the age of COVID.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

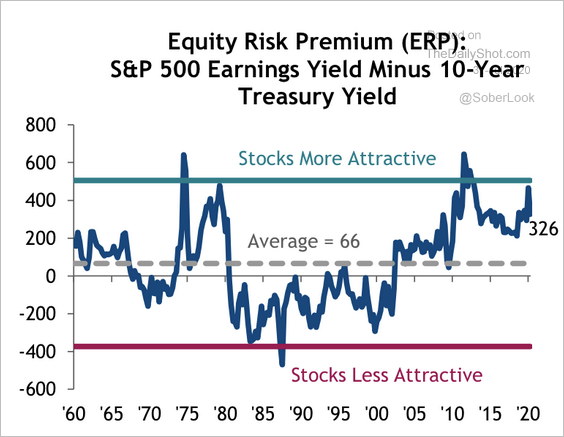

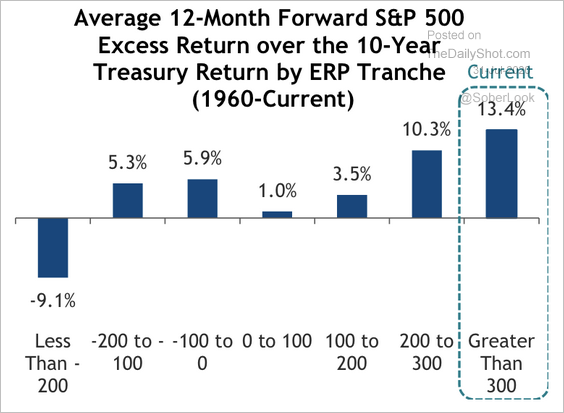

4. Stocks remain attractive relative to Treasury bonds (2 charts).

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

——————–

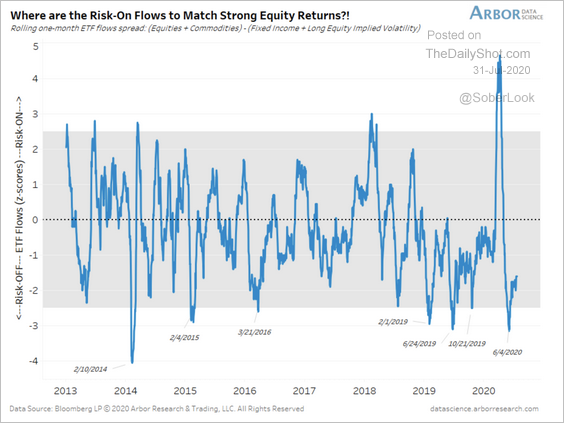

5. Risk-on flows have not matched strong equity returns.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

6. Globally, companies with exposure to China have been outperforming.

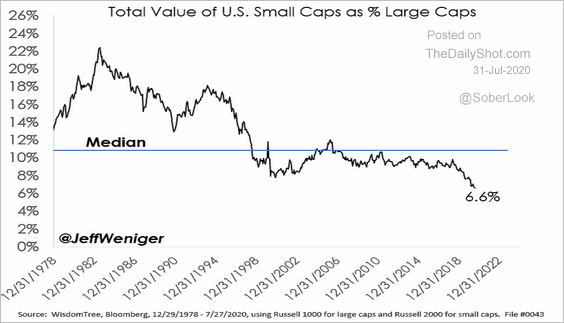

7. This chart shows the total value of US small caps as a percentage of large caps.

Source: @JeffWeniger

Source: @JeffWeniger

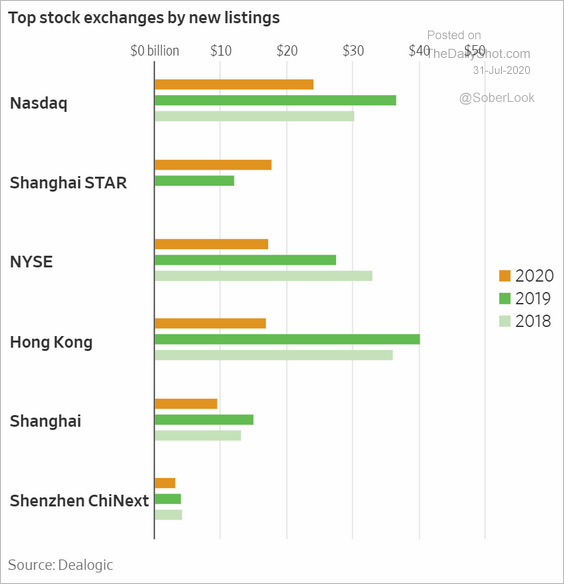

8. Which are the top exchanges for new stock listings?

Source: @WSJ Read full article

Source: @WSJ Read full article

Rates

1. The 10yr Treasury yield is at the lowest level since the start of the crisis.

Source: Investing.com

Source: Investing.com

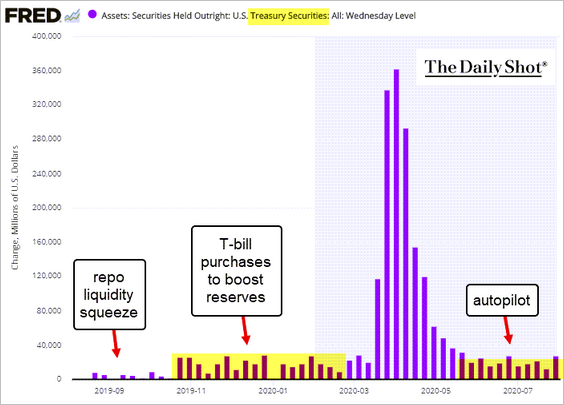

2. The Fed has put Treasury purchases on autopilot.

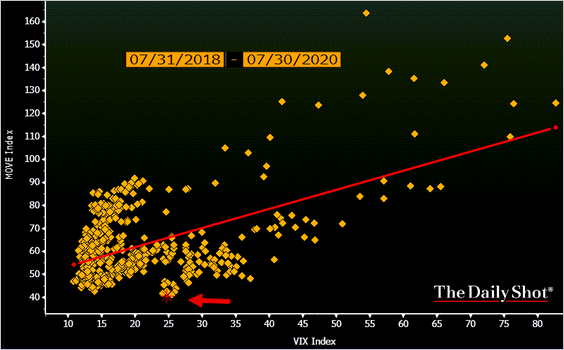

3. This scatterplot shows the Treasury volatility index (MOVE) vs. equity volatility (VIX). Rate vol is hitting extreme lows.

Source: @TheTerminal

Source: @TheTerminal

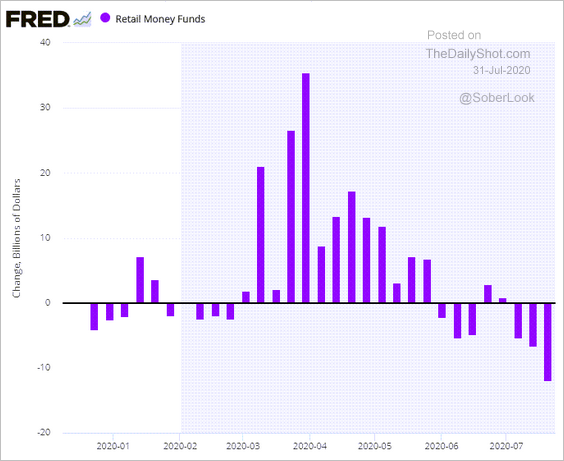

4. Retail investors have been pulling out of money market funds.

Global Developments

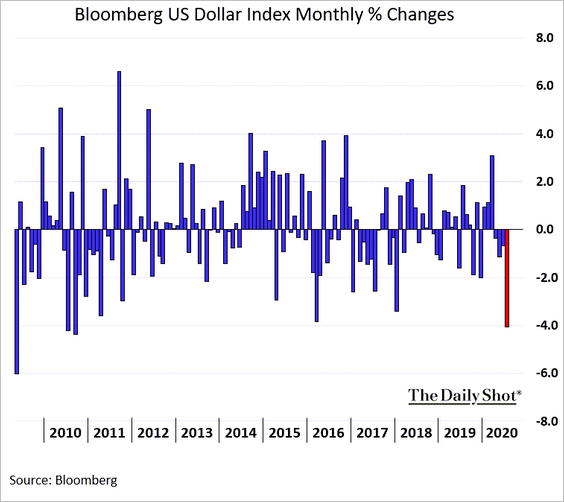

1. It’s been a rough month for the US dollar.

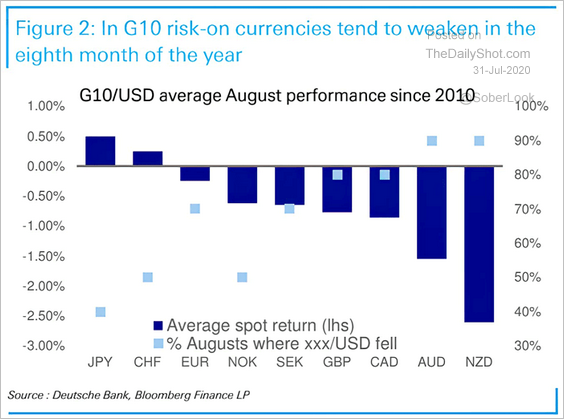

2. G10 risk-on currencies tend to weaken in August.

Source: @DeutscheBank, @ISABELNET_SA

Source: @DeutscheBank, @ISABELNET_SA

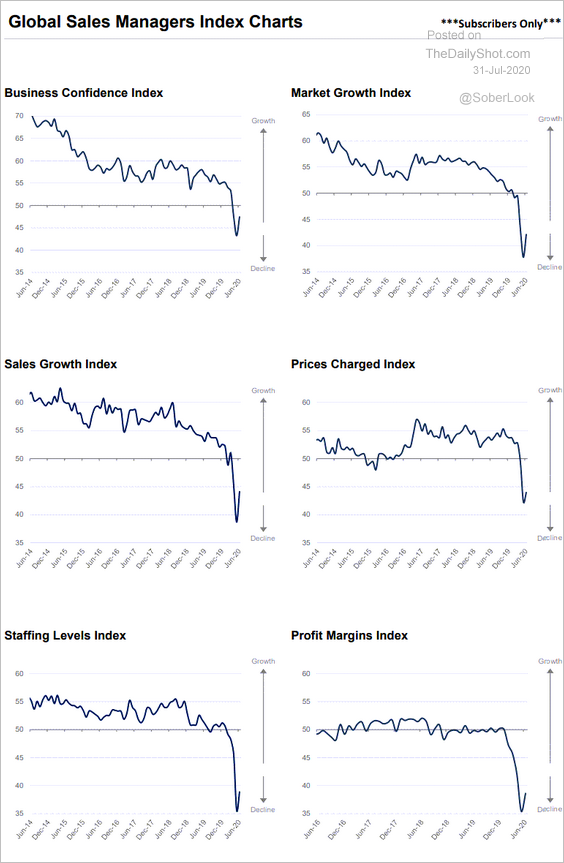

3. Global business activity remains depressed, according to the World Economics SMI report.

Source: World Economics

Source: World Economics

——————–

Food for Thought

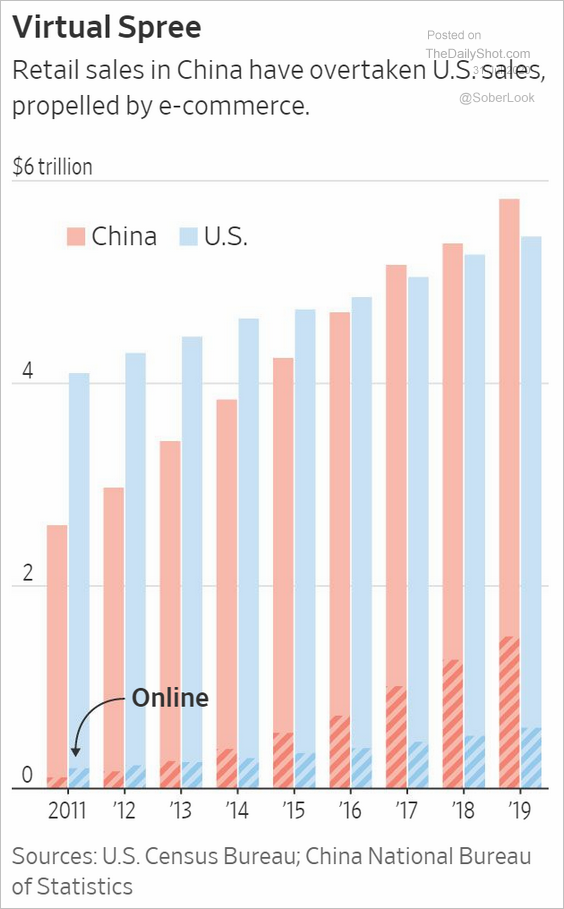

1. Retail sales in China and the US:

Source: @WSJ Read full article

Source: @WSJ Read full article

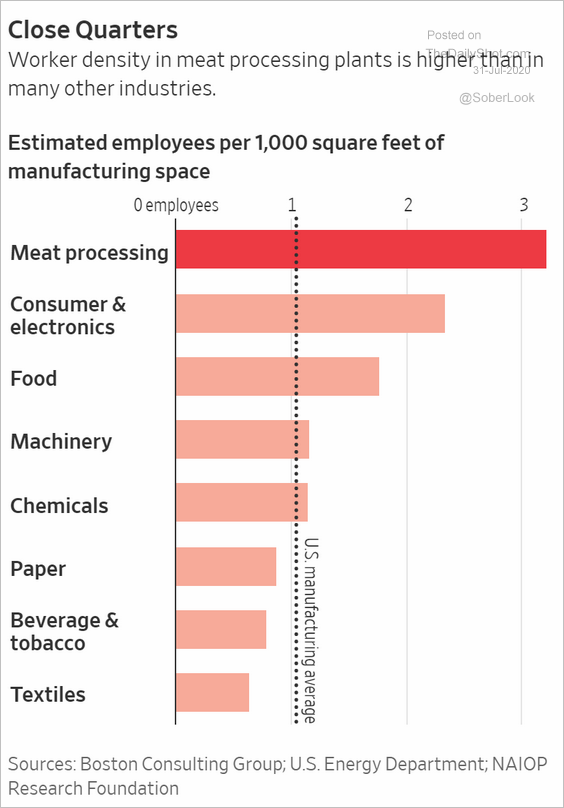

2. Worker density by sector:

Source: @WSJ Read full article

Source: @WSJ Read full article

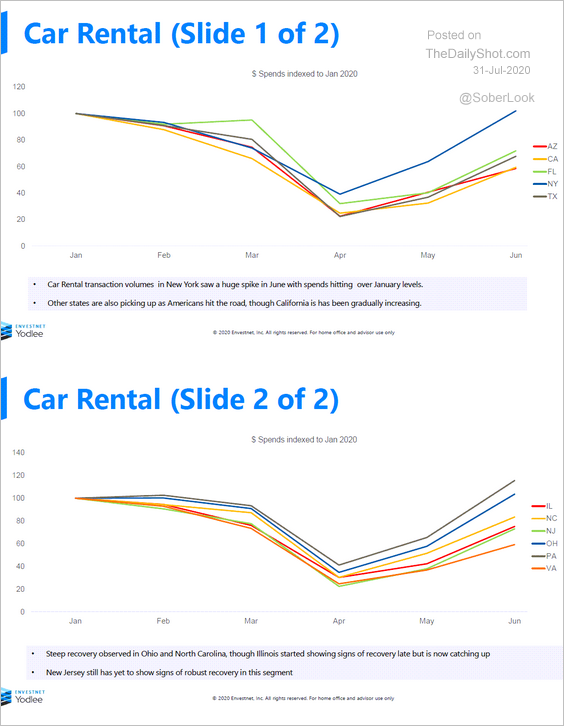

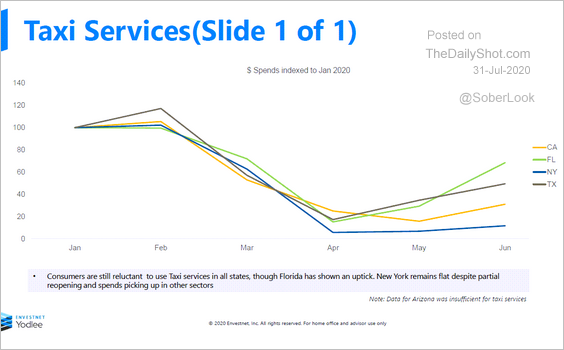

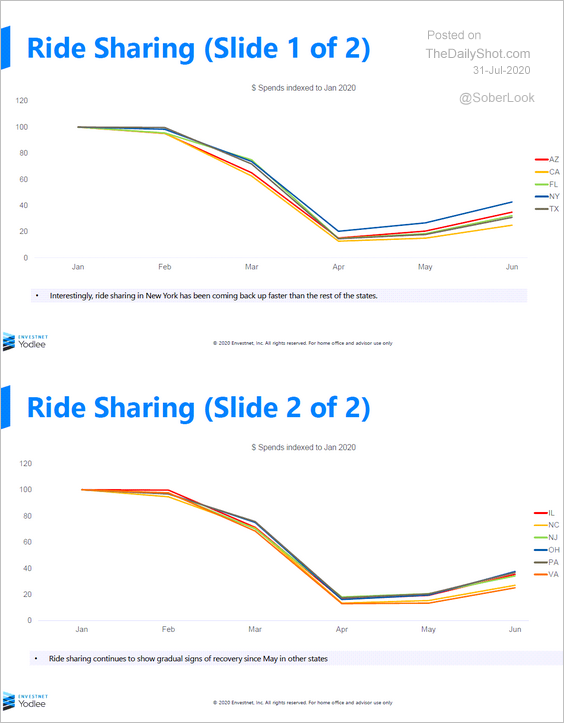

3. Transportation recovery trends in the US (by state):

• Car rentals:

Source: Envestnet Yodlee

Source: Envestnet Yodlee

• Taxi services:

Source: Envestnet Yodlee

Source: Envestnet Yodlee

• Ridesharing:

Source: Envestnet Yodlee

Source: Envestnet Yodlee

——————–

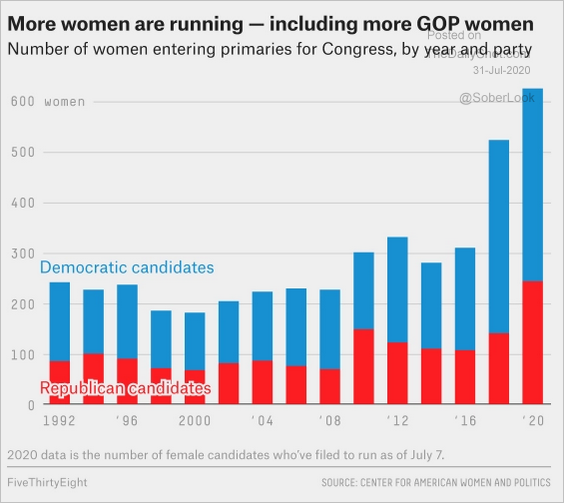

4. Women running for Congress:

Source: FiveThirtyEight Read full article

Source: FiveThirtyEight Read full article

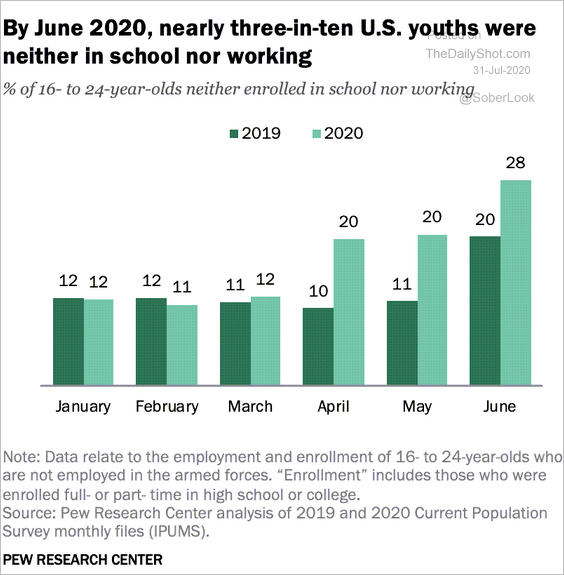

5. US youth neither in school nor working:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

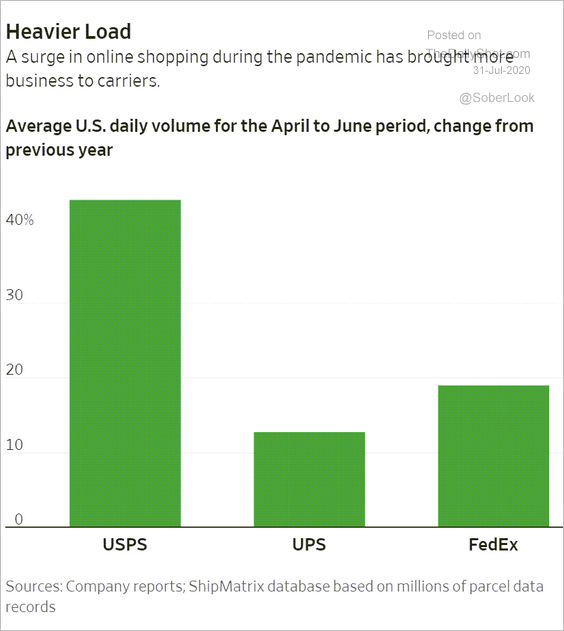

6. The increase in US carriers’ volume (April – June):

Source: @WSJ Read full article

Source: @WSJ Read full article

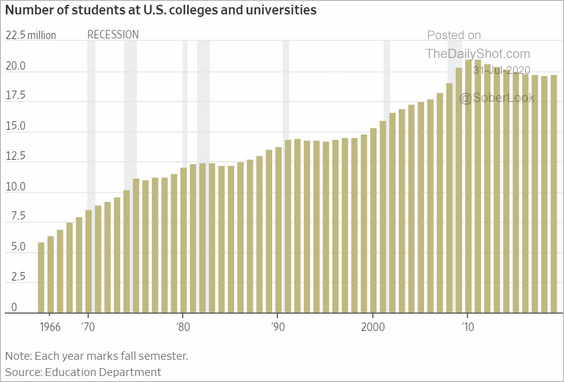

7. The number of college students in the US:

Source: @WSJ Read full article

Source: @WSJ Read full article

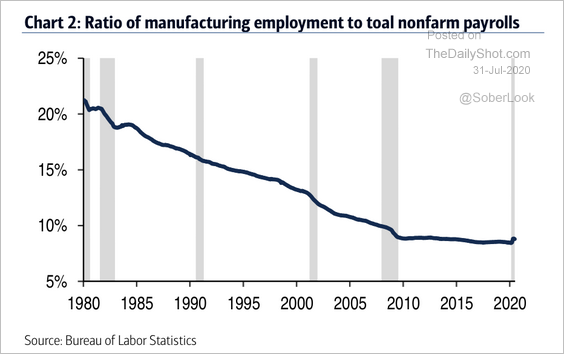

8. The ratio of manufacturing employment to total jobs in the US:

Source: BofA Merrill Lynch Global Research

Source: BofA Merrill Lynch Global Research

9. Bigfoot sightings:

Source: Standard Journal Read full article

Source: Standard Journal Read full article

——————–

Have a great weekend!