The Daily Shot: 20-Aug-20

• Equities

• Credit

• Rates

• Commodities

• Energy

• Emerging Markets

• The United Kingdom

• The Eurozone

• Canada

• The United States

• Global Developments

• Food for Thought

Equities

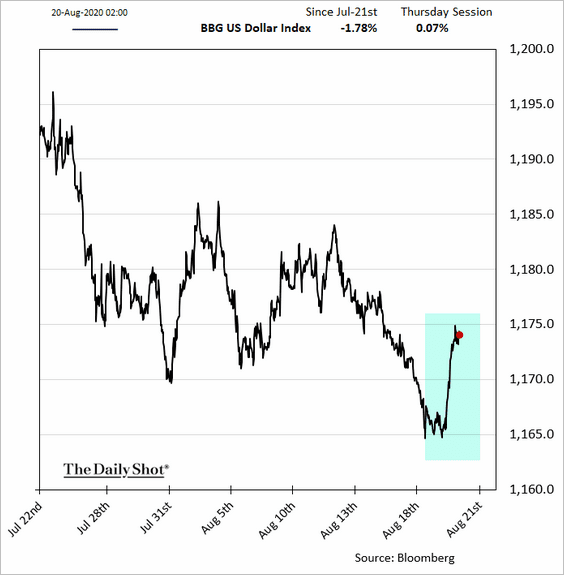

1. The US dollar bounced from the lows after the Fed minutes were released. Some have suggested that the market response was due to the Fed’s rejection of yield-curve control as a policy tool. It is used by several central banks, notably the BoJ.

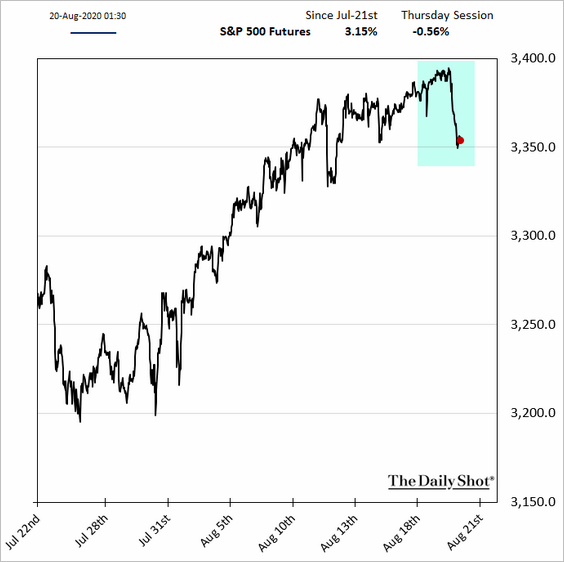

Here is how stock futures reacted to a stronger dollar.

The dollar weakness has provided support for US stocks this year, and investors a jittery about this trend reversing.

Source: BofA Merrill Lynch Global Research, @WallStJesus

Source: BofA Merrill Lynch Global Research, @WallStJesus

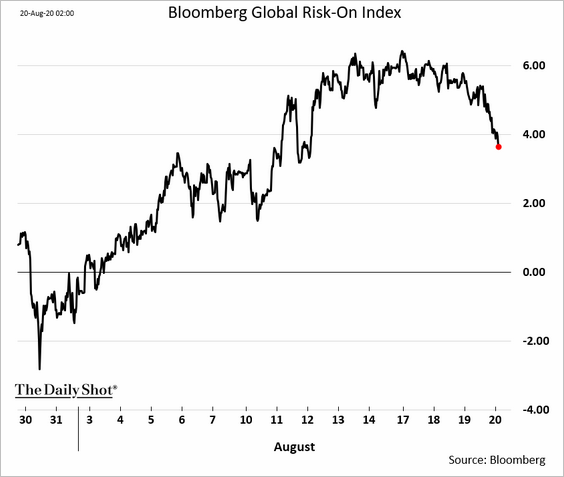

The pullback in risk assets is not unique to US stocks. Here is Bloomberg’s global risk-on index.

——————–

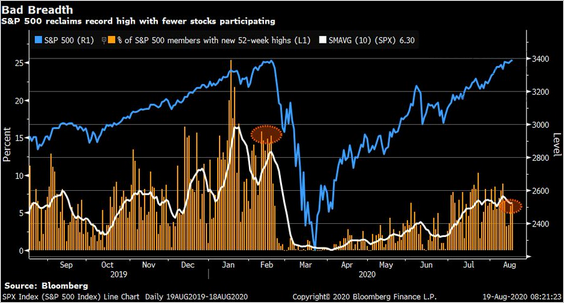

2. Only about 6% of the S&P 500 members are making new 52-week highs.

Source: @LizAnnSonders, @Bloomberg, @TheTerminal, Bloomberg Finance L.P.

Source: @LizAnnSonders, @Bloomberg, @TheTerminal, Bloomberg Finance L.P.

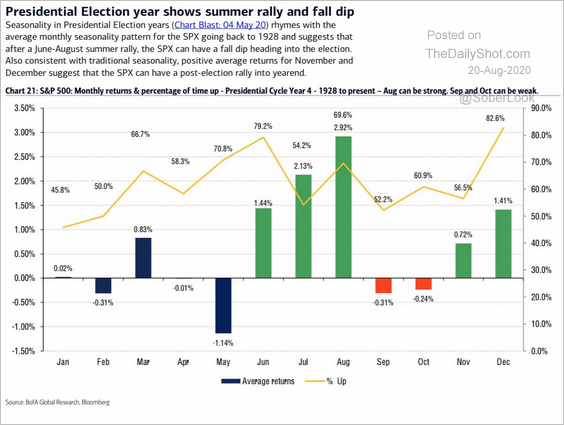

3. Here is the S&P 500 seasonal performance during elections years.

Source: BofA Merrill Lynch Global Research, @WallStJesus

Source: BofA Merrill Lynch Global Research, @WallStJesus

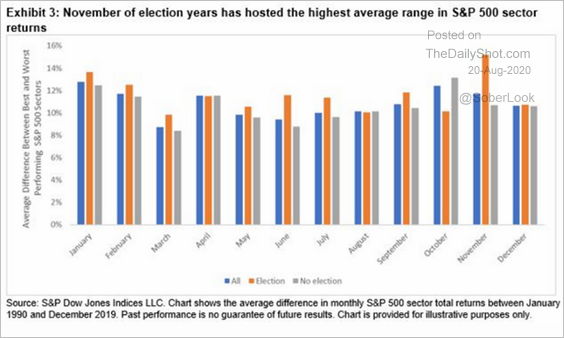

Sector dispersion increases around presidential elections.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

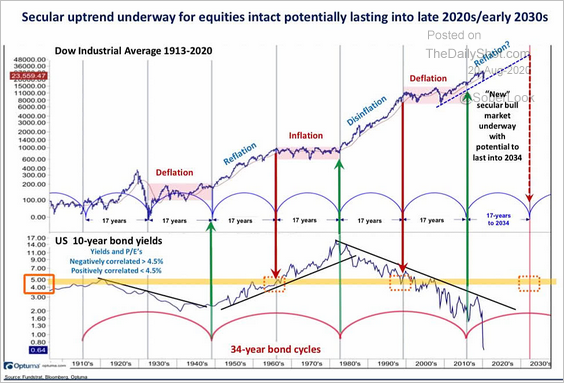

4. Are we in a reflation cycle?

Source: @carlquintanilla, @rsluymer

Source: @carlquintanilla, @rsluymer

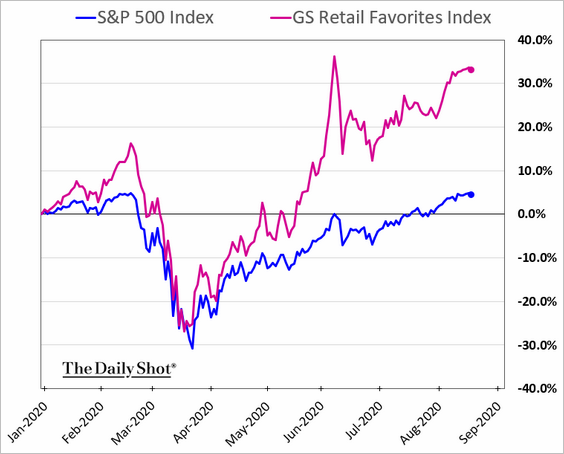

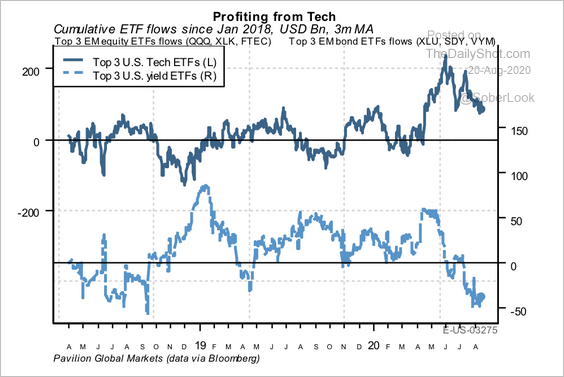

5. Stocks favored by retail investors continue to outperform.

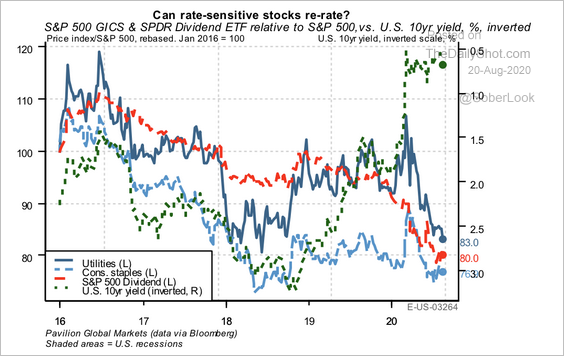

5. Given the depressed Treasury yields (green line in chart below), is there more upside for dividend stocks (red line), which investors have been avoiding (2nd chart)?

Source: Pavilion Global Markets

Source: Pavilion Global Markets

Source: Pavilion Global Markets

Source: Pavilion Global Markets

——————–

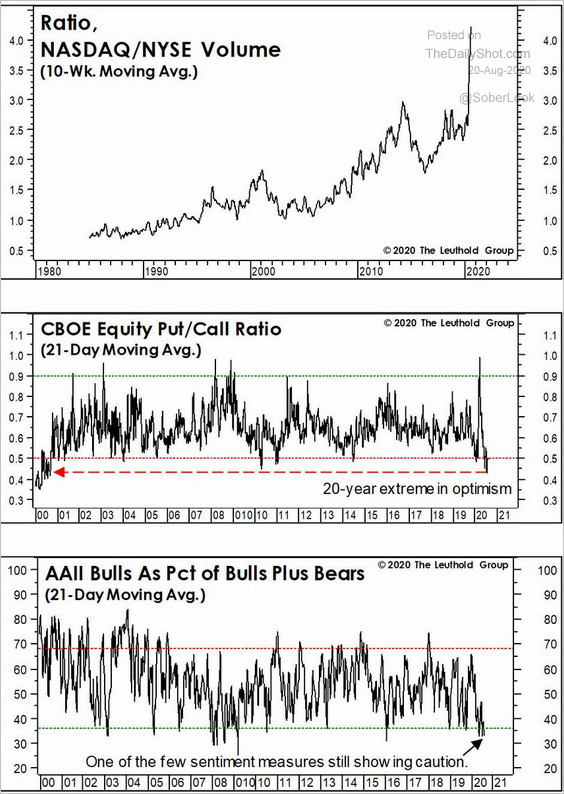

6. Most sentiment indicators have been showing extreme optimism, except for the AAII index (third panel). Part of the reason is that the American Association of Individual Investors survey focuses on older investors who have been persistently nervous.

Source: @LeutholdGroup

Source: @LeutholdGroup

7. Currency market implied volatility has diverged from VIX. A worrisome signal for stocks?

Source: @markets Read full article

Source: @markets Read full article

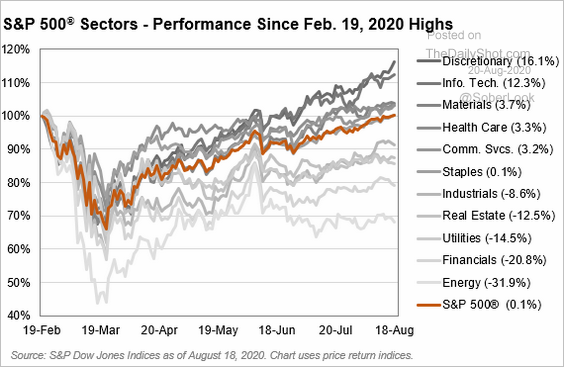

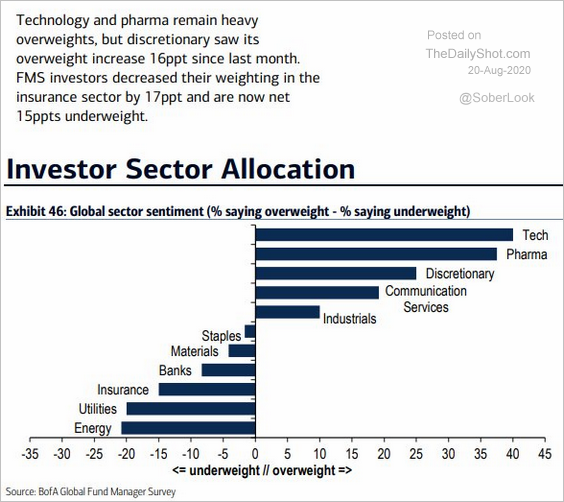

8. Next, we have some sector updates.

• Relative performance since the February highs:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

• Investor allocations:

Source: BofA Merrill Lynch Global Research, @Saburgs

Source: BofA Merrill Lynch Global Research, @Saburgs

• The SPDR Financials ETF (XLF) is at support relative to the S&P 500.

Source: @DantesOutlook

Source: @DantesOutlook

Credit

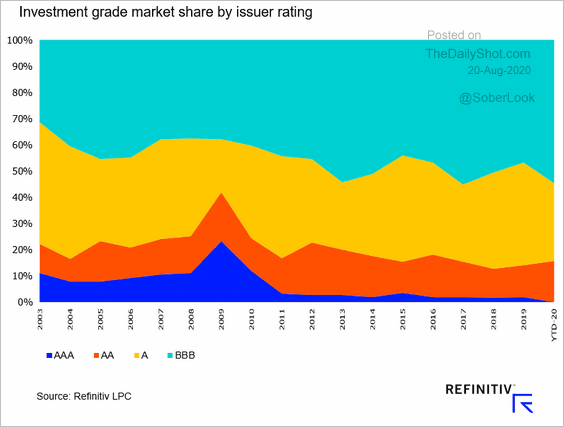

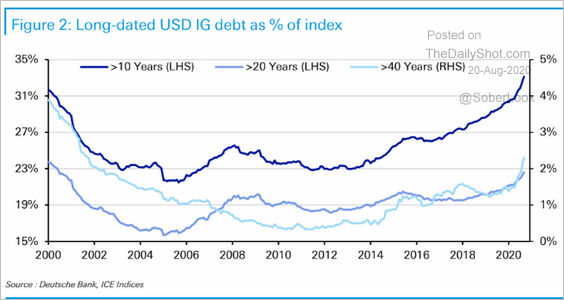

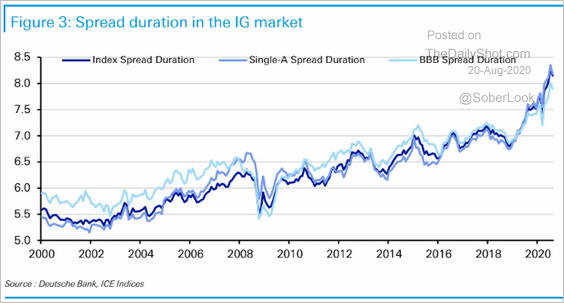

1. The corporate investment-grade (IG) bond market looks increasingly risky.

• The concentration of BBB names keeps climbing.

Source: @LPCLoans, @refinitiv

Source: @LPCLoans, @refinitiv

• The concentration of longer-duration bonds is also rising.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

This chart shows the IG market spread duration (sensitivity to widening spreads).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

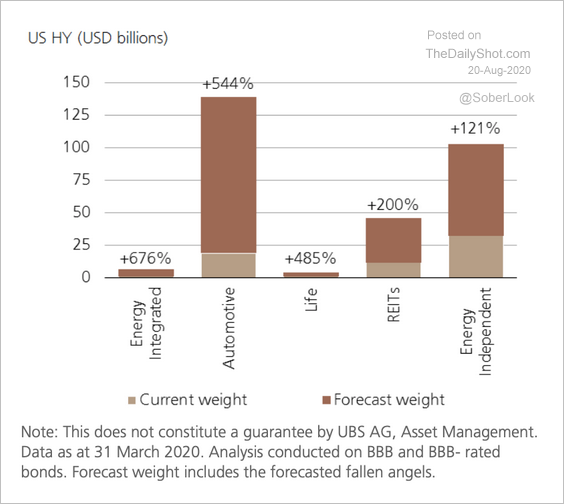

2. In the US, automotive and independent energy companies are most impacted by high-yield ratings, according to UBS, …

Source: UBS Read full article

Source: UBS Read full article

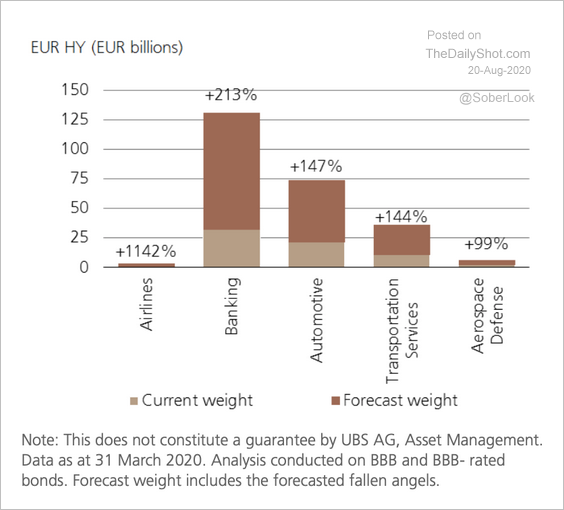

… and in Europe, banking and autos are most impacted.

Source: UBS Read full article

Source: UBS Read full article

——————–

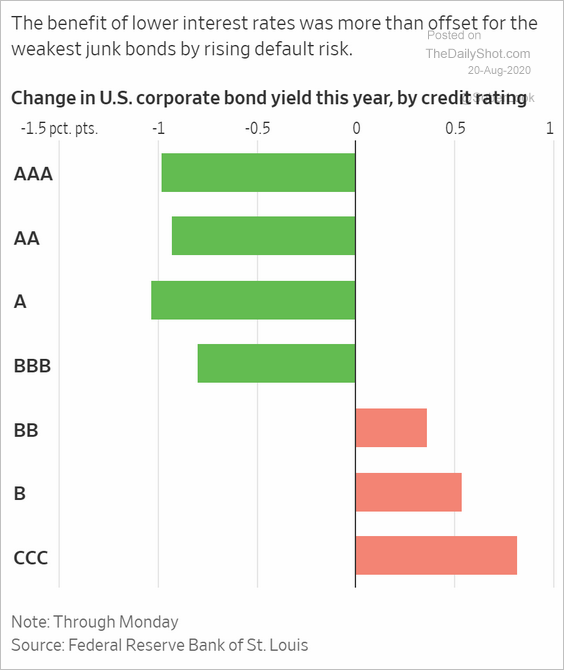

3. This chart shows this year’s US corporate bond yield changes, by rating.

Source: @WSJ Read full article

Source: @WSJ Read full article

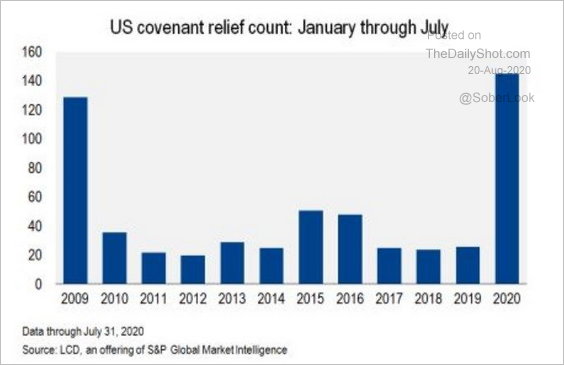

4. A record number of leveraged loans got covenant relief as earnings plummetted.

Source: @lcdnews

Source: @lcdnews

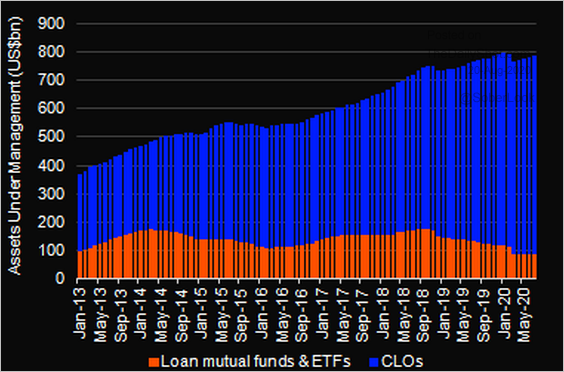

5. Here is the AUM of leveraged loan mutual funds and ETFs vs. CLOs.

Source: @LPCLoans

Source: @LPCLoans

Rates

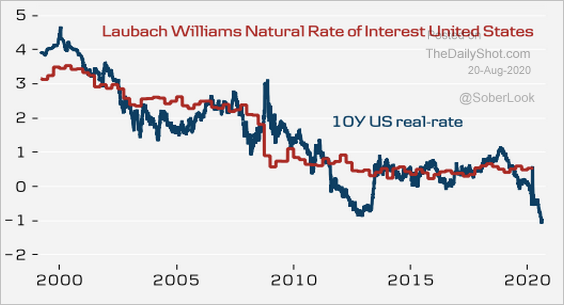

1. US 10yr real yields are now below the neutral rate of interest.

Source: Danske Bank

Source: Danske Bank

2. The 10yr Treasury futures are holding support.

Source: @DantesOutlook

Source: @DantesOutlook

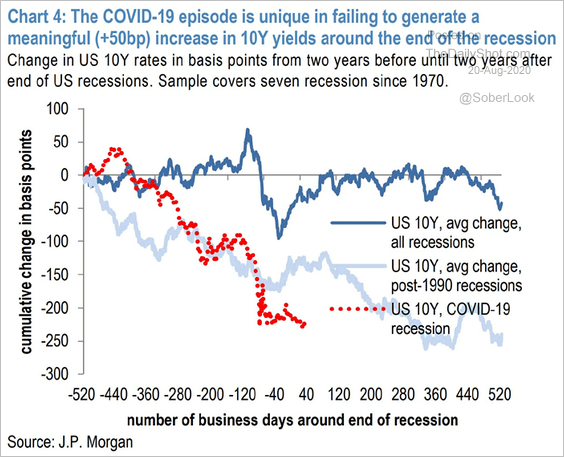

3. This year’s 10yr yield decline has been sharper than in previous recessions.

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @jpmorgan

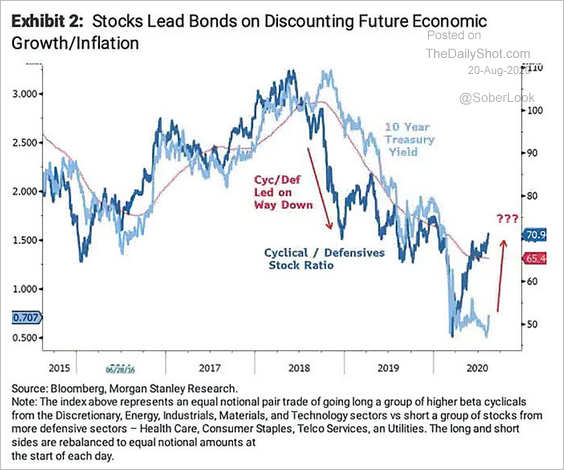

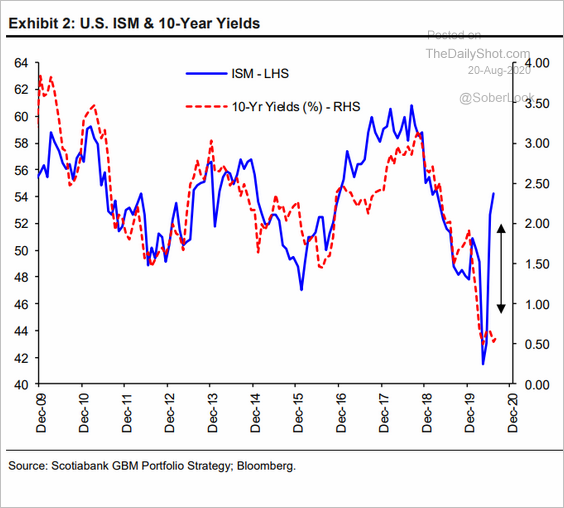

4. Fundamentals point to higher yields (2 charts).

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

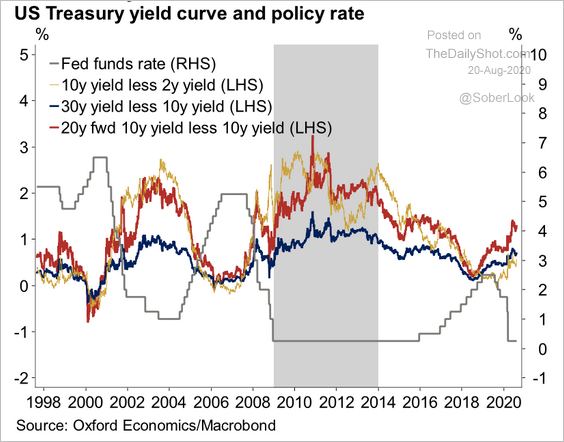

5. A steepening bias builds as long as the Fed stays on hold, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

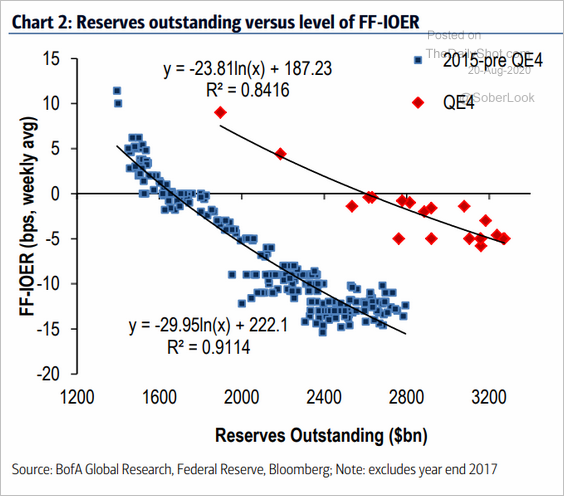

6. This scatterplot shows the fed funds – IOER spread vs. reserves (lower liquidity results in higher interbank rates).

Source: BofA Merrill Lynch Global Research

Source: BofA Merrill Lynch Global Research

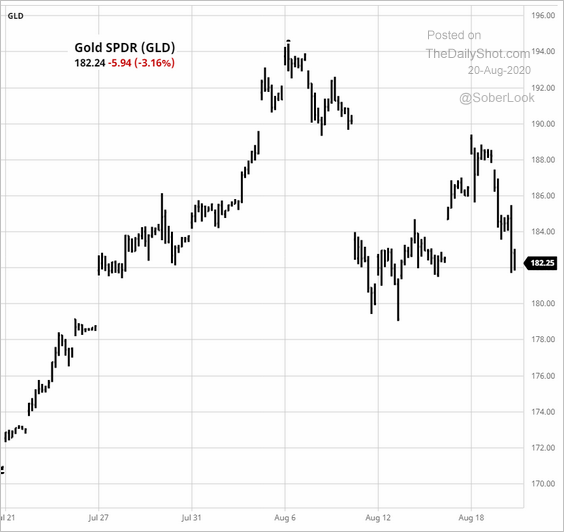

Commodities

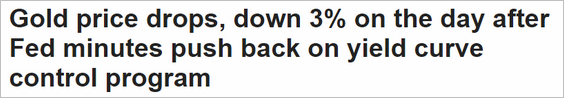

1. The Fed’s yield control rejection put some downward pressure on gold.

Source: Kitco Read full article

Source: Kitco Read full article

Source: barchart.com

Source: barchart.com

The jump in the dollar and real yields (10yr TIPS shown below) are a headwind for gold.

Source: @EPBResearch

Source: @EPBResearch

——————–

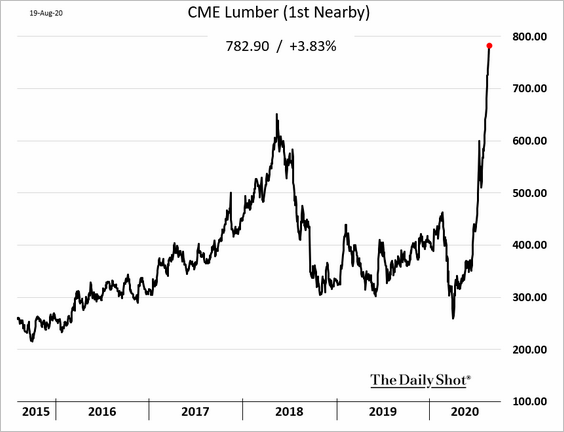

2. US lumber futures continue to soar.

Energy

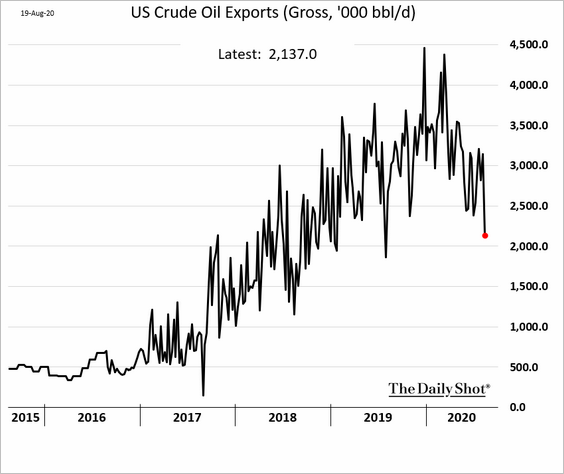

1. US crude oil exports are rolling over.

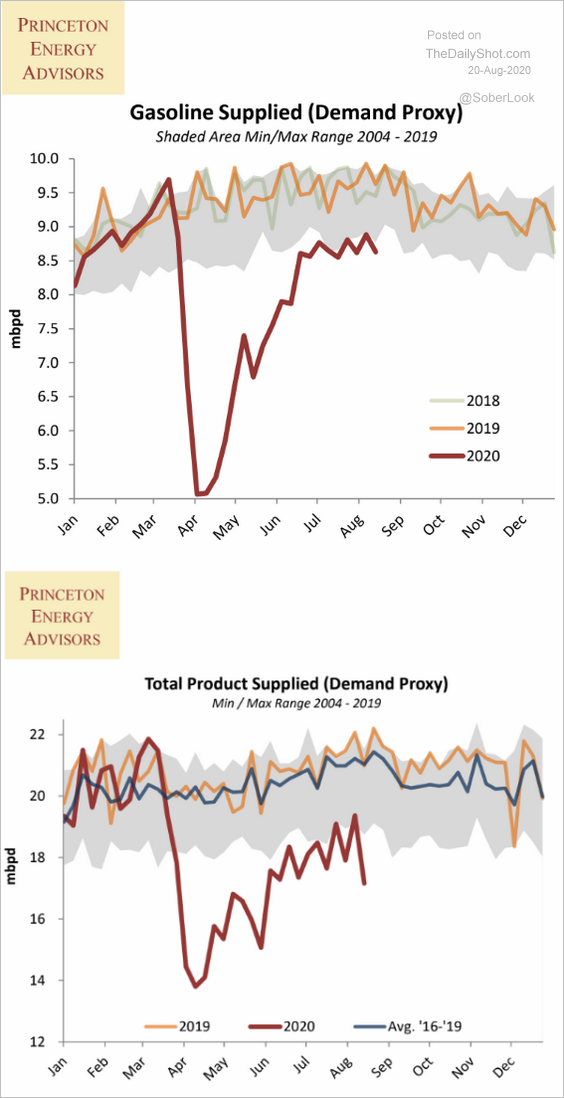

2. The recovery in US refined product demand has paused.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

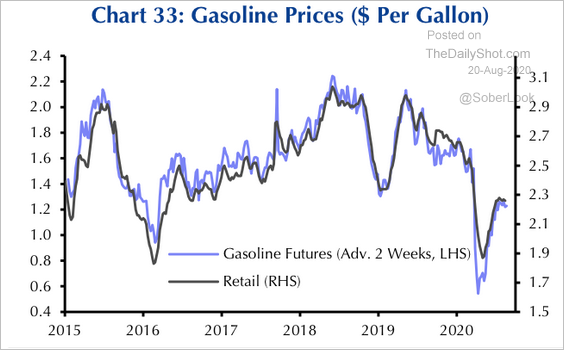

3. The rebound in retail gasoline prices has faded in recent weeks.

Source: Capital Economics

Source: Capital Economics

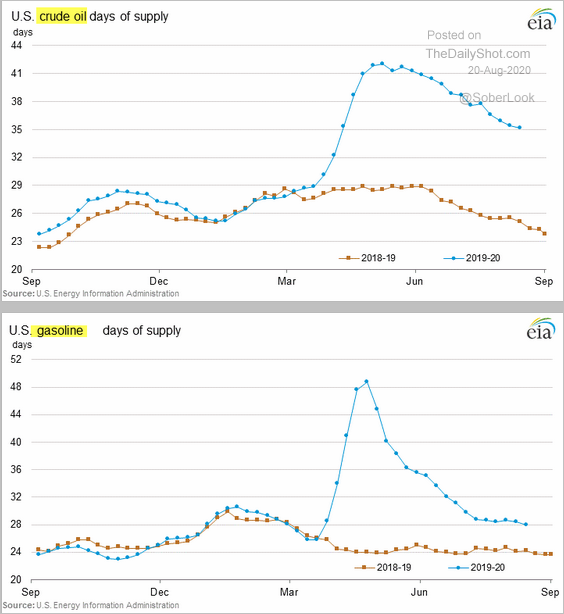

4. US crude oil and gasoline inventories remain elevated relative to last year.

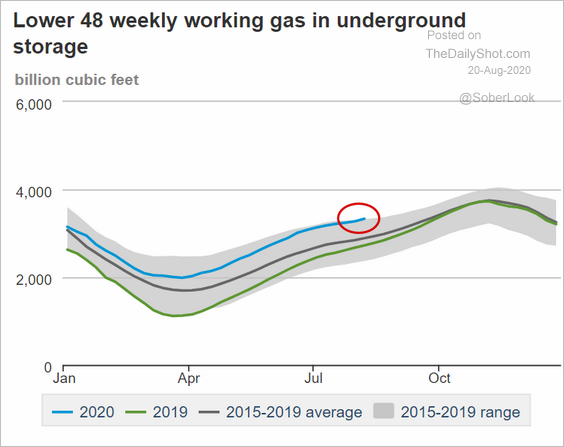

5. US natural gas in storage is the highest in over five years.

Source: EIA

Source: EIA

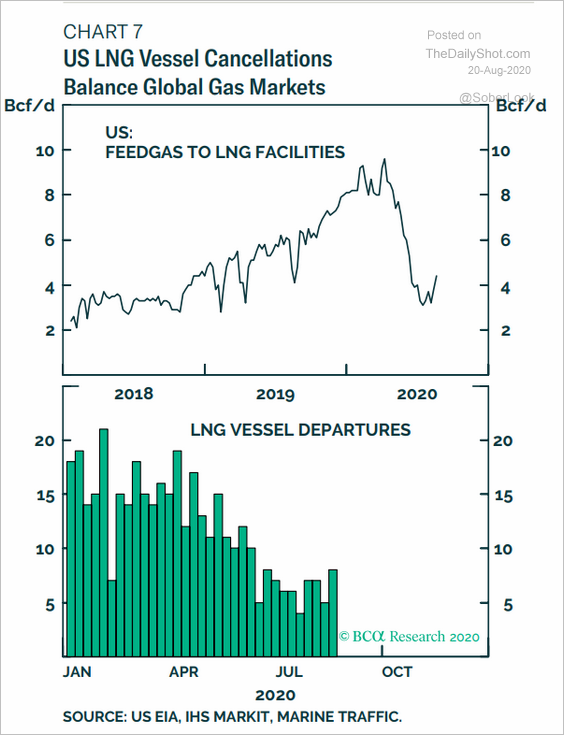

LNG demand remains soft.

Source: BCA Research

Source: BCA Research

Emerging Markets

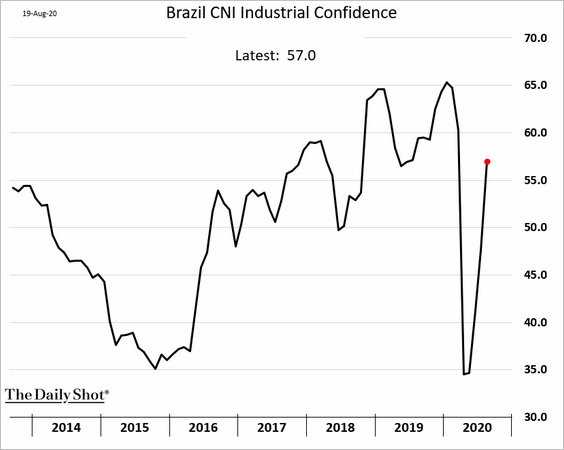

1. Brazil’s industrial confidence is rebounding quickly.

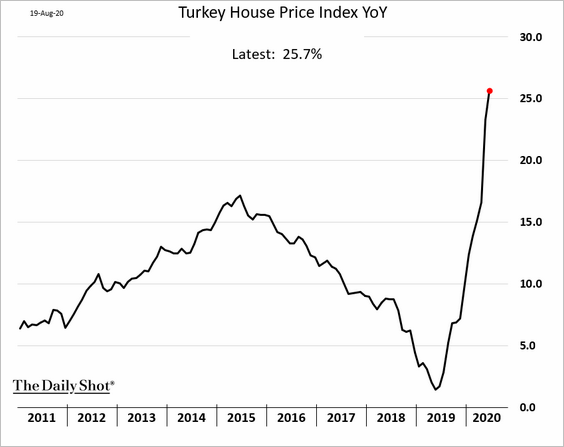

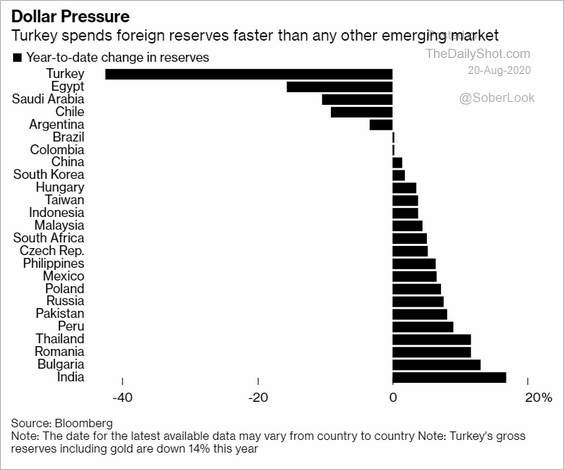

2. Next, we have a couple of updates on Turkey.

• Home prices are soaring.

• Foreign reserves collapsed this year.

Source: @markets Read full article

Source: @markets Read full article

——————–

3. Here is how we deal with political opponents in Russia.

Source: @WSJ Read full article

Source: @WSJ Read full article

The ruble weakened (the chart shows the US dollar strengthening against the ruble).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

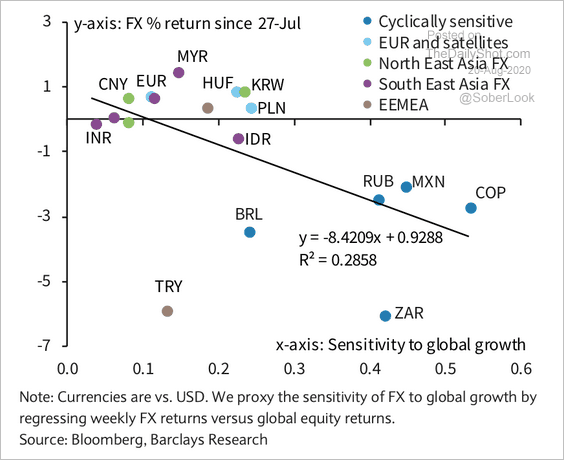

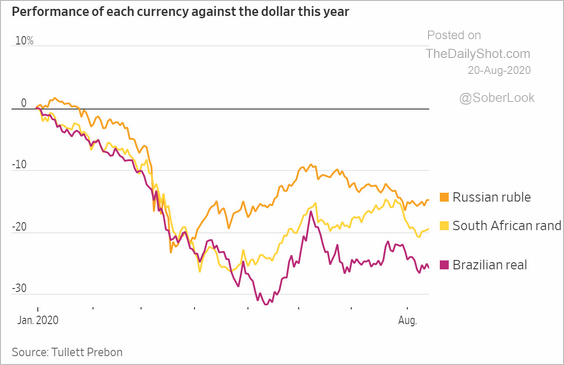

4. Cyclically sensitive EM currencies have underperformed despite broad dollar weakness (2 charts).

Source: Barclays Research

Source: Barclays Research

Source: @WSJ Read full article

Source: @WSJ Read full article

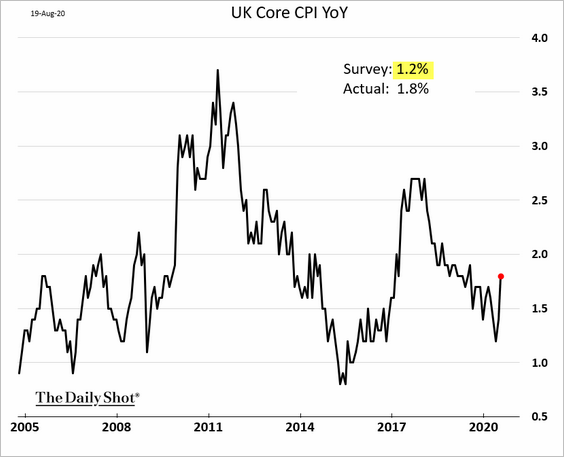

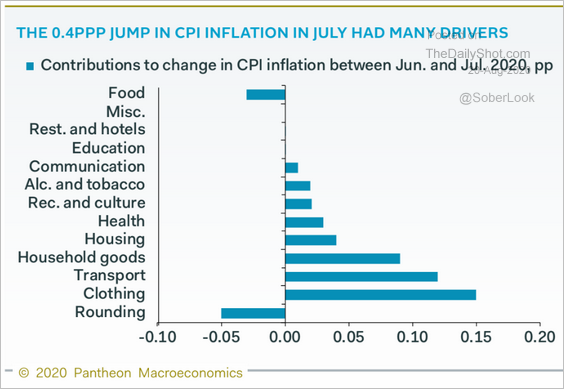

The United Kingdom

1. The CPI unexpectedly popped last month.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

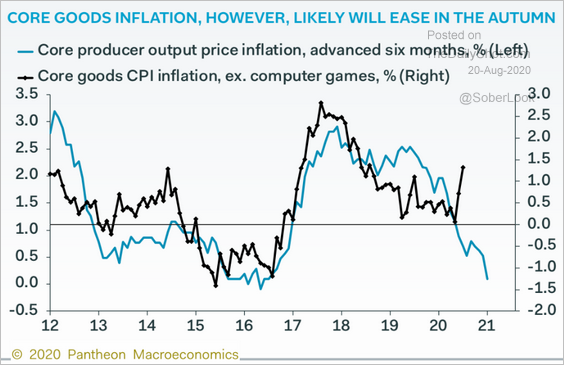

However, Pantheon Macroeconomics sees this as a transient move, with inflation easing in the months ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

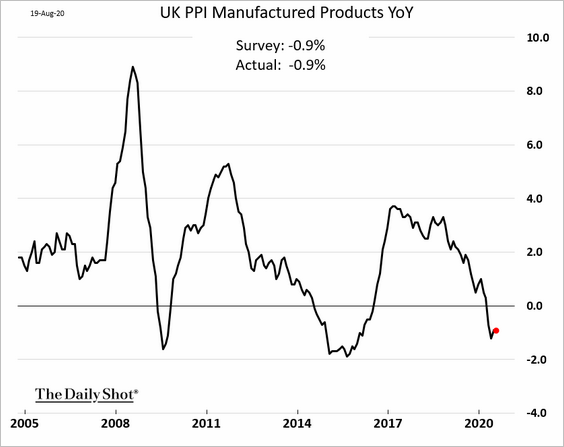

Here is the PPI.

——————–

2. The pound held resistance.

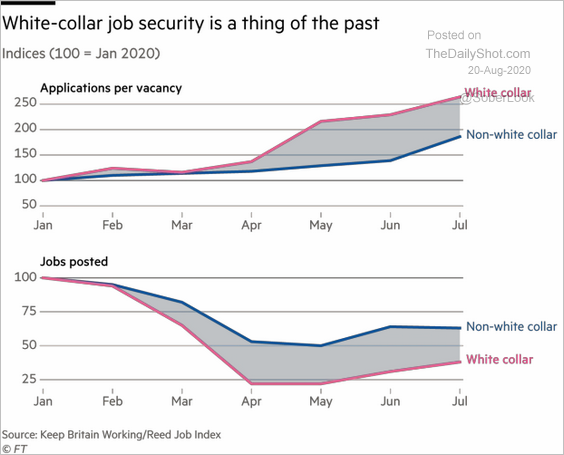

3. This year has been tough on white-collar workers.

Source: @adam_tooze, @FT Read full article

Source: @adam_tooze, @FT Read full article

The Eurozone

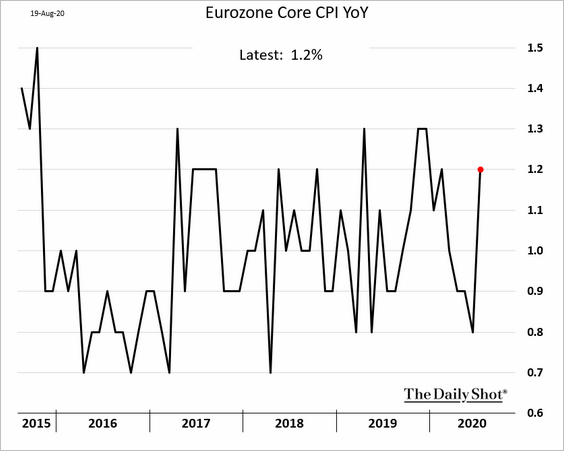

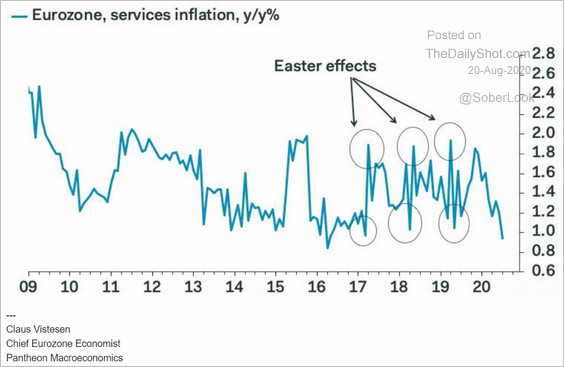

1. The Eurozone’s core CPI jump will be reversed soon.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

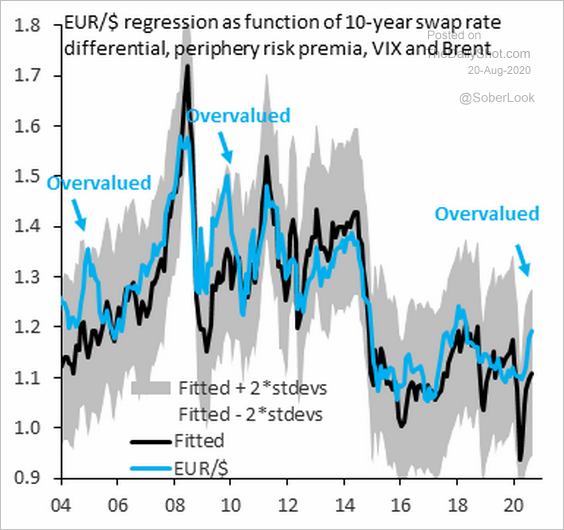

2. Is the euro overvalued?

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

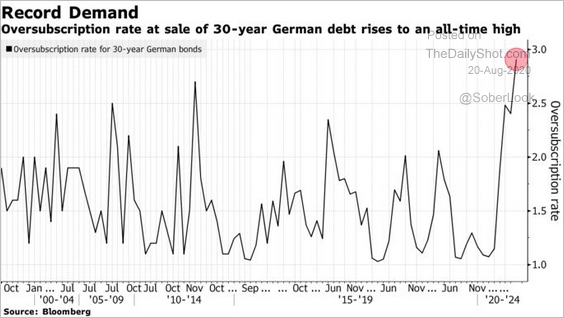

3. Investors flocked to Germany’s 30yr debt auction.

Source: @markets Read full article

Source: @markets Read full article

Canada

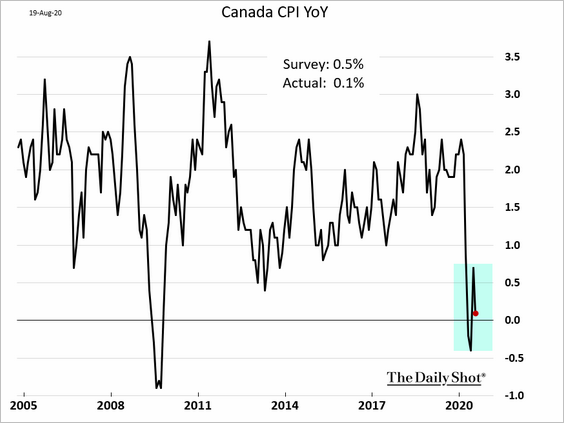

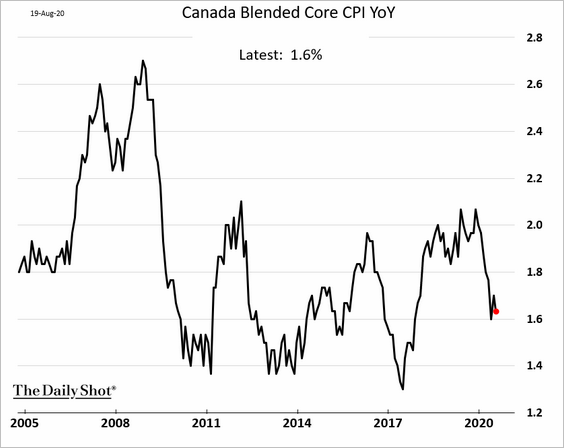

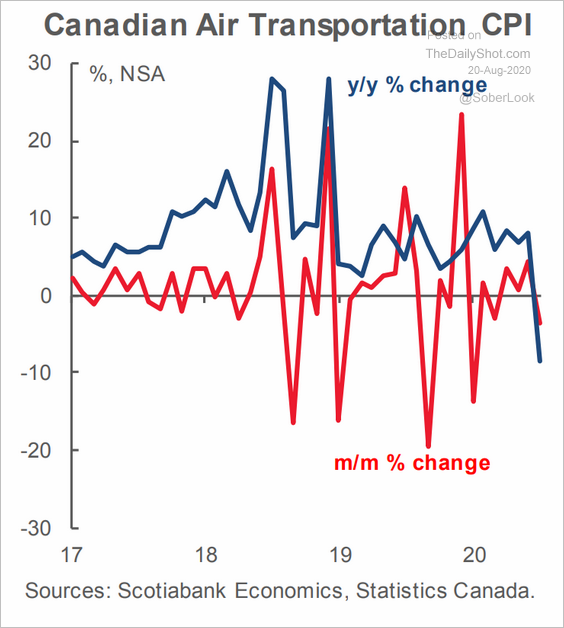

1. The CPI declined last month.

Air transportation was especially weak.

Source: Scotiabank Economics

Source: Scotiabank Economics

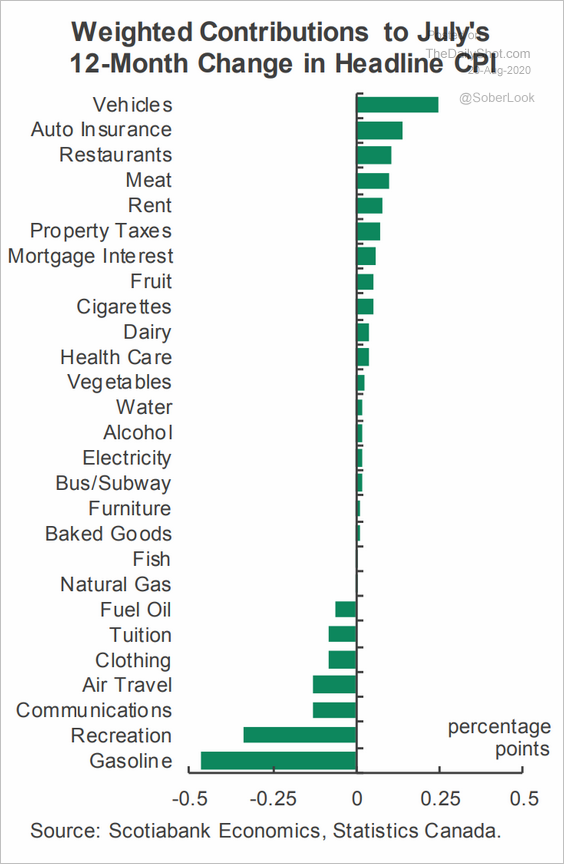

Here are the contributions to the headline CPI.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

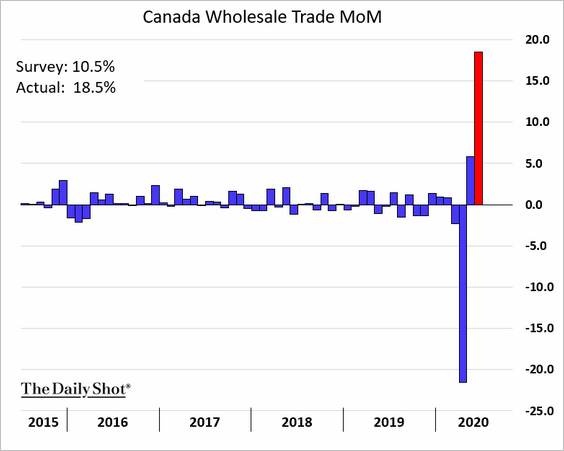

2. June wholesale trade exceeded expectations.

3. The Oxford Economics recovery tracker continues to show gradual improvement.

![]() Source: Oxford Economics

Source: Oxford Economics

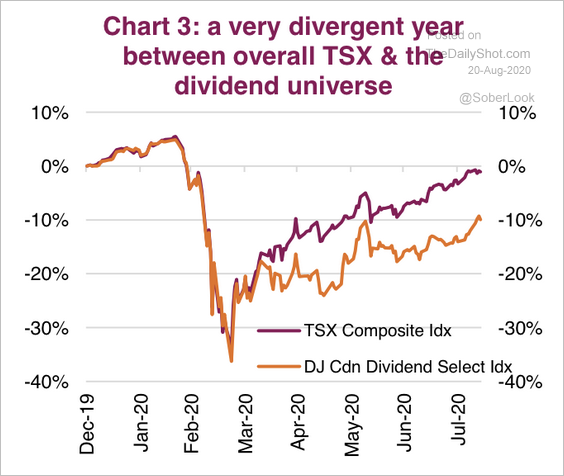

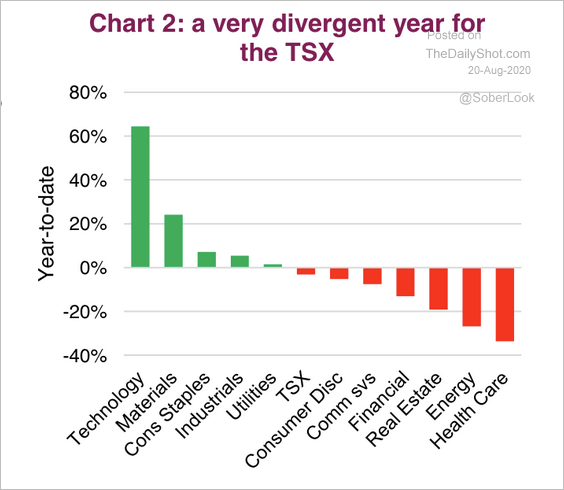

4. Dividend stocks have trailed the overall market by about 10% this year.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

Here is the year-to-date performance of TSX sectors.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

The United States

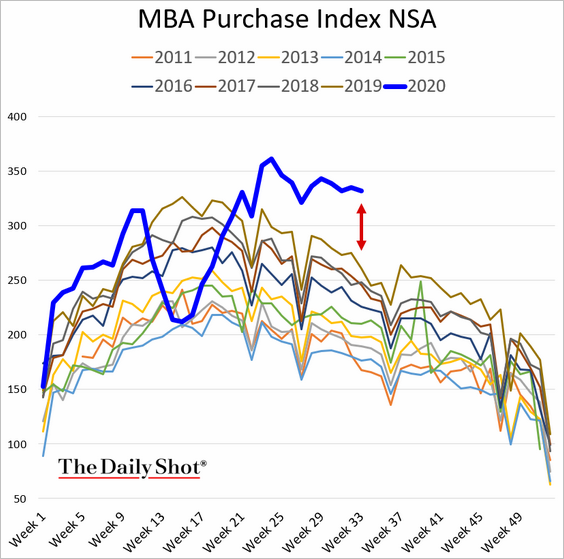

1. Home purchase mortgage activity is holding at multi-year highs.

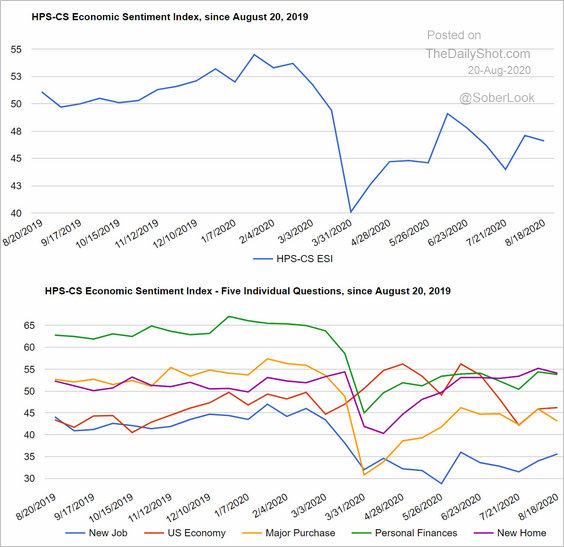

2. The recovery in consumer sentiment remains fragile.

Source: @HPSInsight, @CivicScience

Source: @HPSInsight, @CivicScience

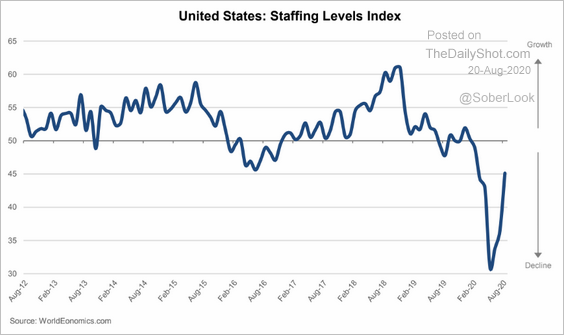

3. The World Economics SMI staffing levels index shows slower deterioration in the labor market but no recovery (SMI < 50 = contraction).

Source: World Economics

Source: World Economics

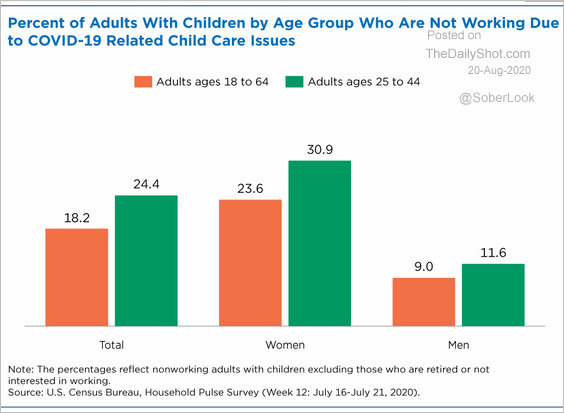

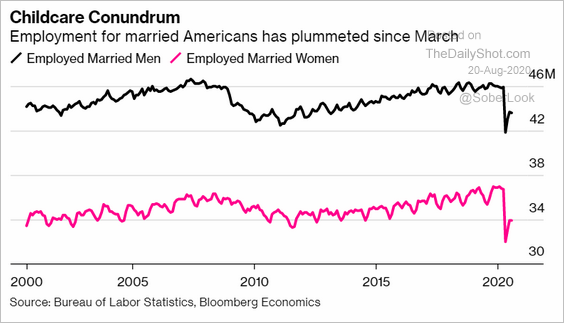

4. Childcare-related challenges remain a substantial drag on economic growth (2 charts).

Source: U.S. Census Bureau

Source: U.S. Census Bureau

Source: @business Read full article

Source: @business Read full article

——————–

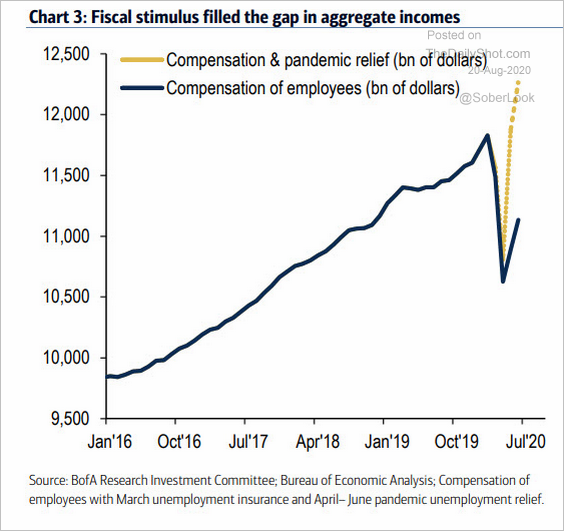

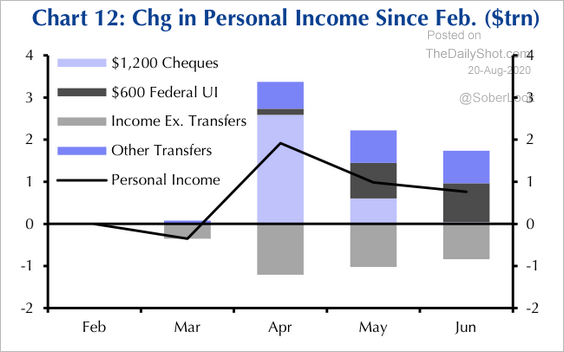

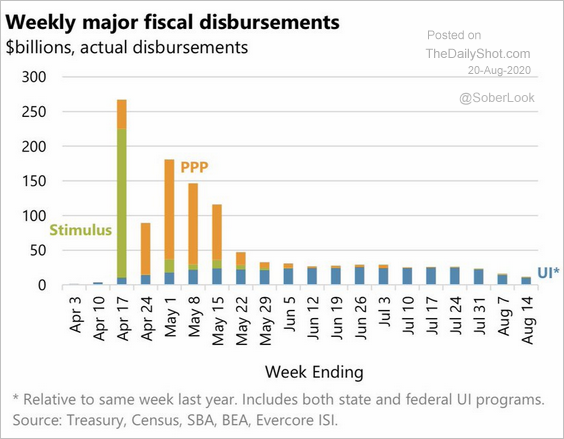

5. Fiscal support has been critical for the recovery.

• Compensation with and without pandemic relief (2 charts):

Source: BofA Merrill Lynch Global Research, @jsblokland

Source: BofA Merrill Lynch Global Research, @jsblokland

Source: Capital Economics

Source: Capital Economics

• Fiscal disbursements:

Source: Evercore ISI, @LizAnnSonders

Source: Evercore ISI, @LizAnnSonders

——————–

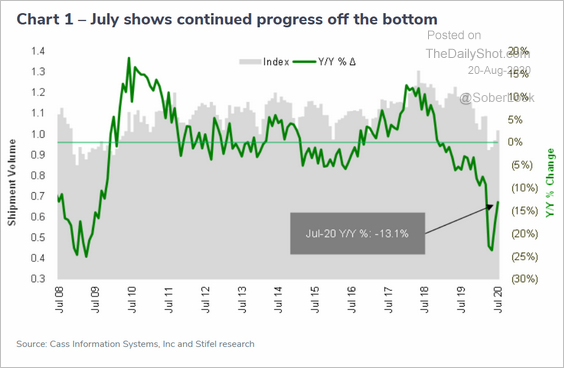

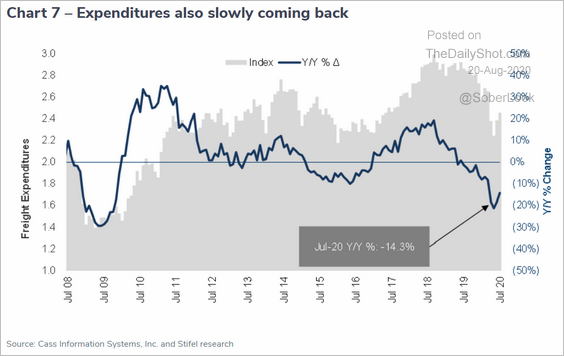

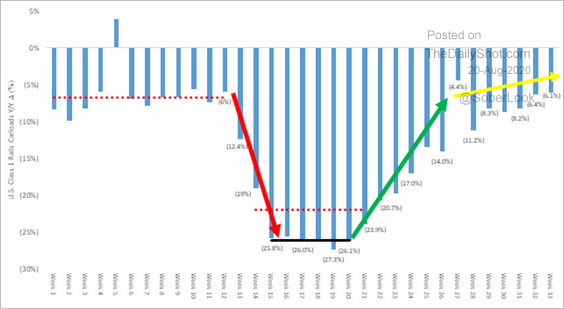

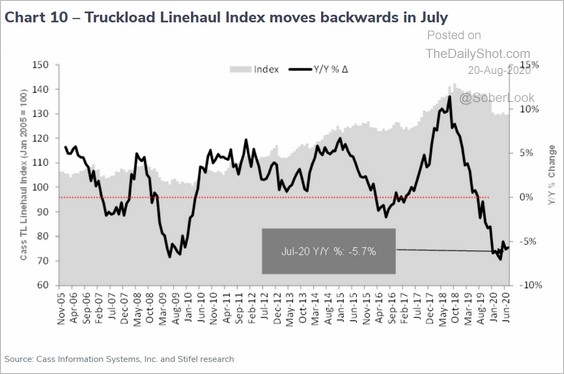

6. Freight activity is gradually improving.

• Shipments:

Source: Cass Information Systems

Source: Cass Information Systems

• Freight expenditures:

Source: Cass Information Systems

Source: Cass Information Systems

• Rail traffic (vs. last year):

Source: Cass Information Systems

Source: Cass Information Systems

• Truck freight demand remains weak.

Source: Cass Information Systems

Source: Cass Information Systems

Global Developments

1. The semiconductor equity market cap has sharply diverged from sales.

![]() Source: BCA Research

Source: BCA Research

2. Global equities’ market value is approaching $90 trillion.

Source: @DavidInglesTV

Source: @DavidInglesTV

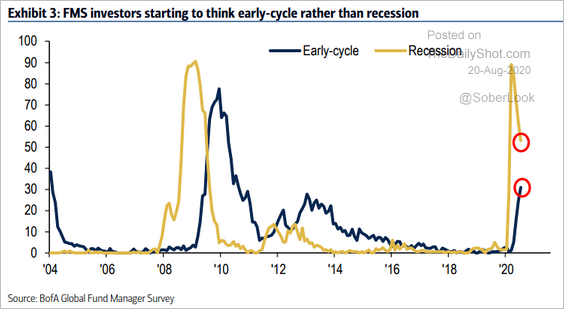

3. Fund managers increasingly see “early-cycle” rather than recession.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

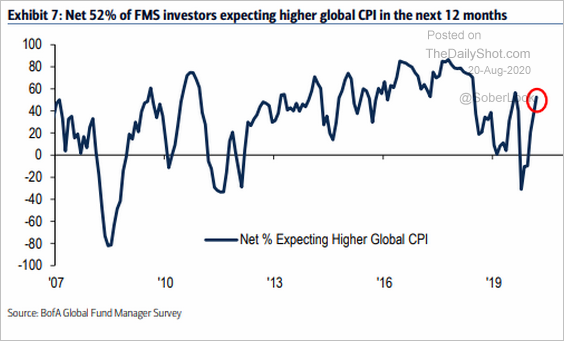

4. This chart shows fund managers’ views on inflation.

Source: BofA Merrill Lynch Global Research, @Saburgs

Source: BofA Merrill Lynch Global Research, @Saburgs

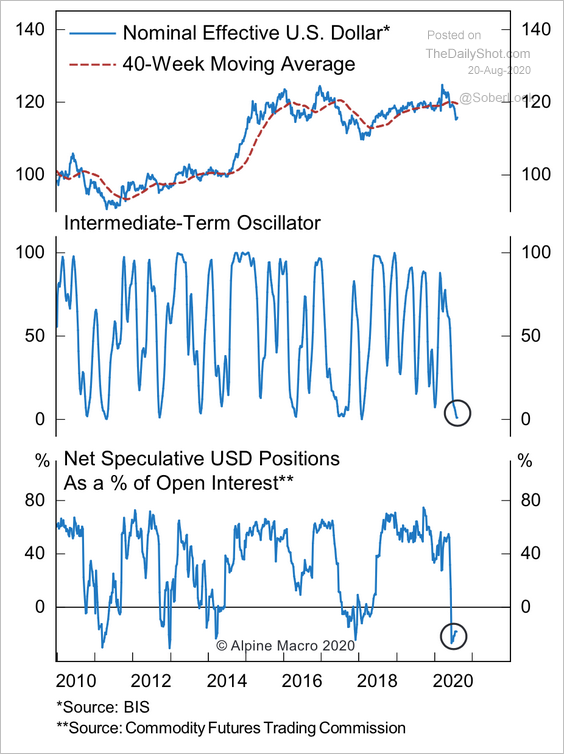

5. The US dollar seems to be oversold.

Source: Alpine Macro

Source: Alpine Macro

——————–

Food for Thought

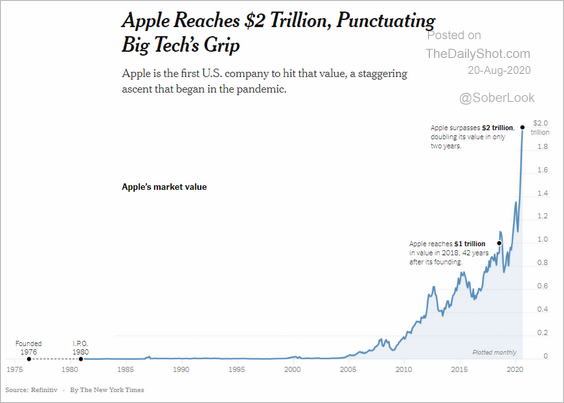

1. Apple’s market value:

Source: The New York Times Read full article

Source: The New York Times Read full article

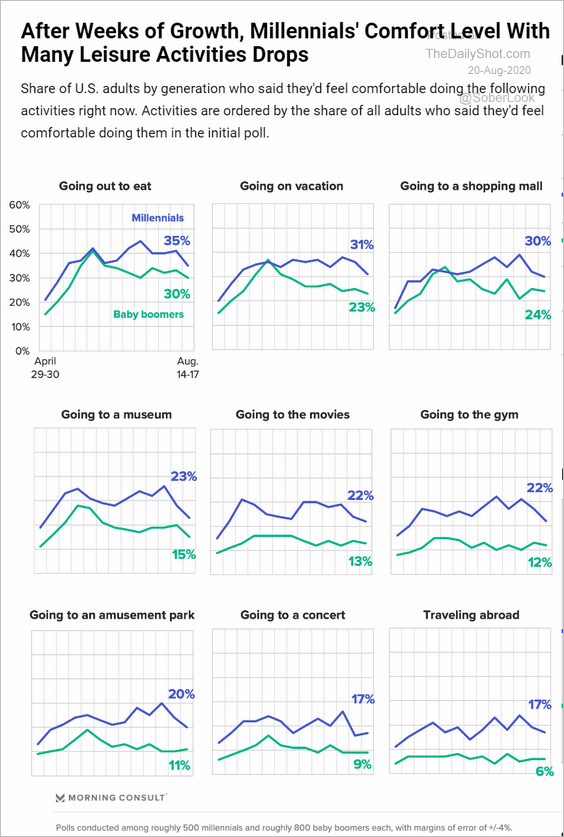

2. Comfort level with different activities:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

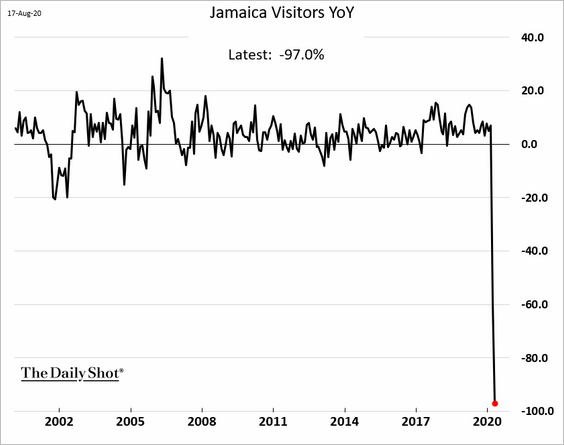

3. Visitors to Jamaica (year-over-year changes):

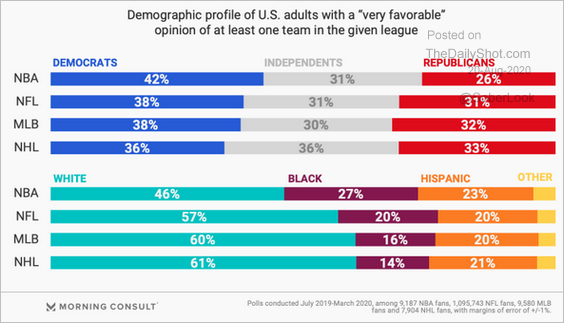

4. Sports fans’ demographic profile:

Source: @MorningConsult Read full article

Source: @MorningConsult Read full article

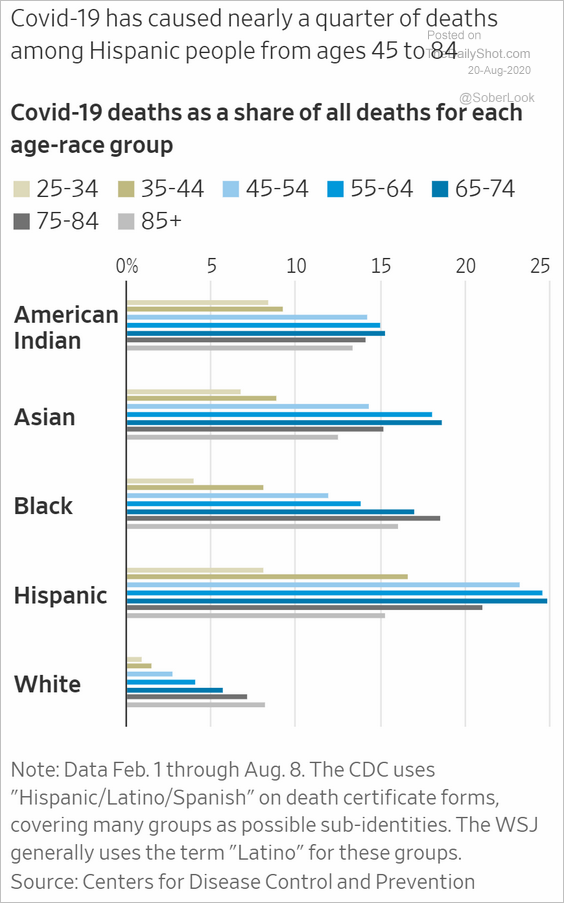

5. COVID deaths by race and age:

Source: @WSJ Read full article

Source: @WSJ Read full article

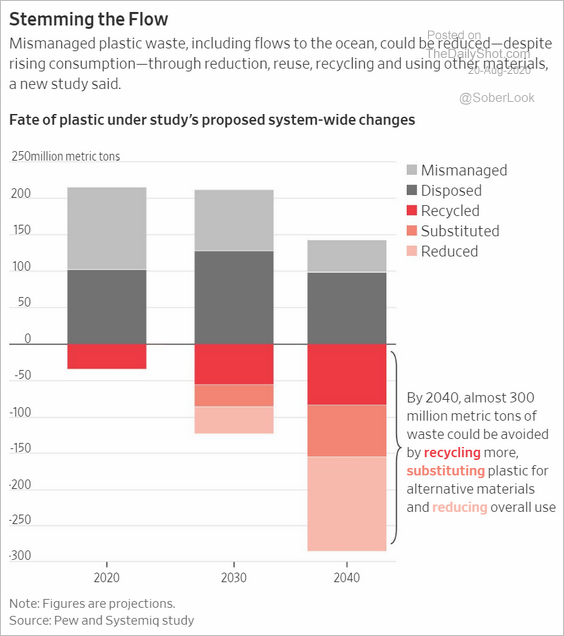

6. Dealing with plastic waste:

Source: @WSJ Read full article

Source: @WSJ Read full article

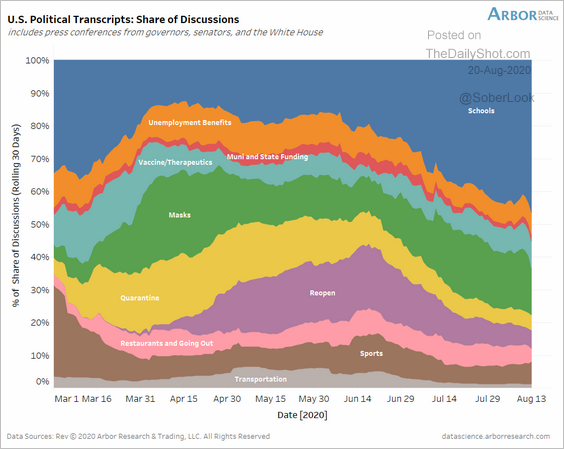

7. Government communications, by topic:

Source: Arbor Research & Trading

Source: Arbor Research & Trading

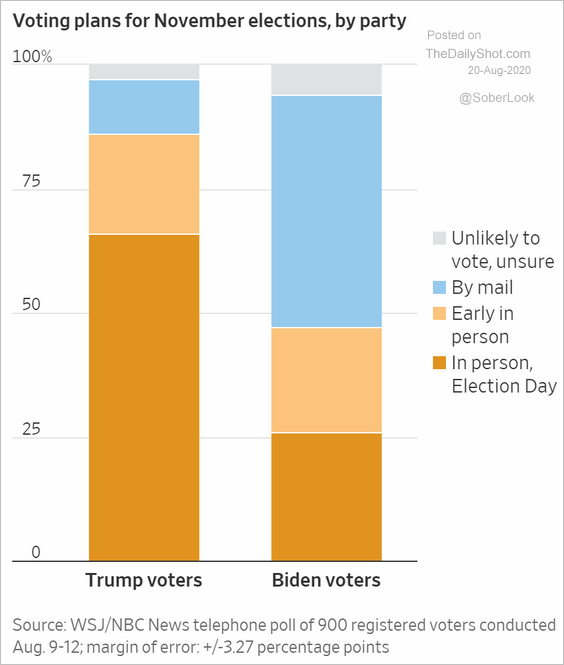

8. Voting by mail:

Source: @WSJ Read full article

Source: @WSJ Read full article

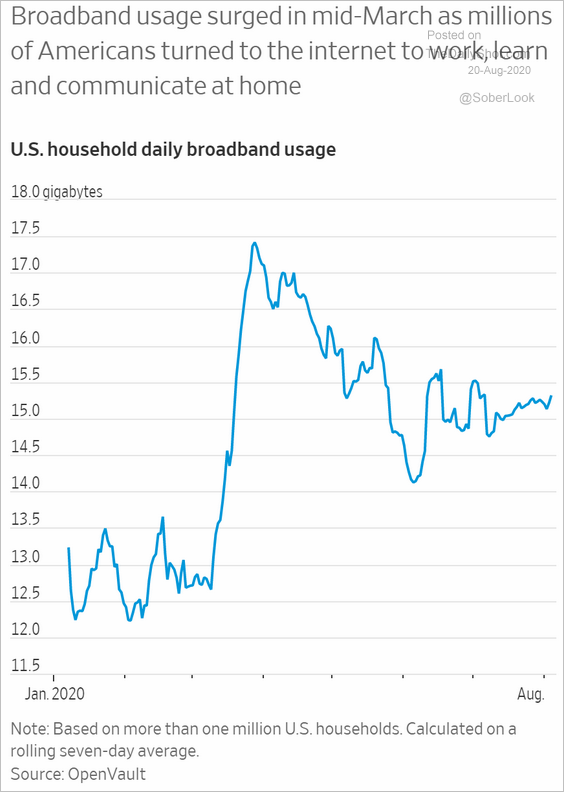

9. Broadband usage:

Source: @WSJ Read full article

Source: @WSJ Read full article

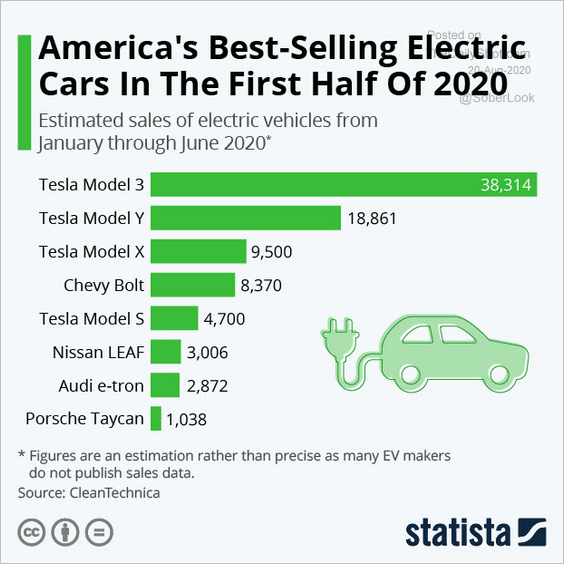

10. Best-selling US electric vehicles:

Source: Statista

Source: Statista

——————–