The Daily Shot: 28-Aug-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Food for Thought

The United States

1. For the first time in years, the Fed announced a new approach to inflation targeting. The central bank will now focus on price levels rather than the rate of change. Moreover, the Fed will put a higher emphasis on the health of the labor market.

Source: CNBC Read full article

Source: CNBC Read full article

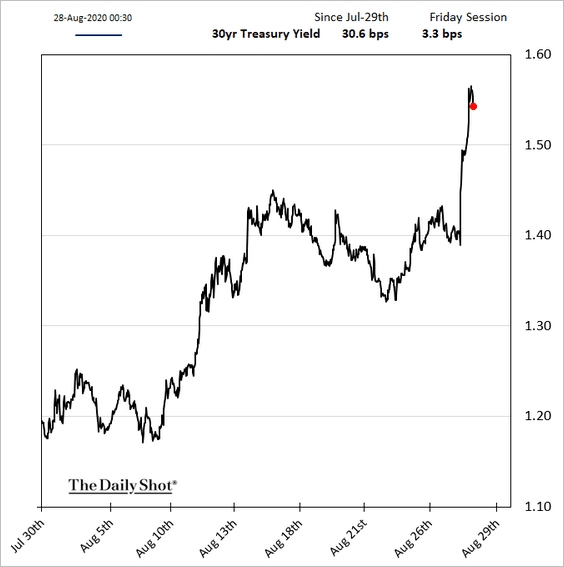

• The markets reacted by pushing longer-term Treasury yields higher in anticipation of rising inflation ahead.

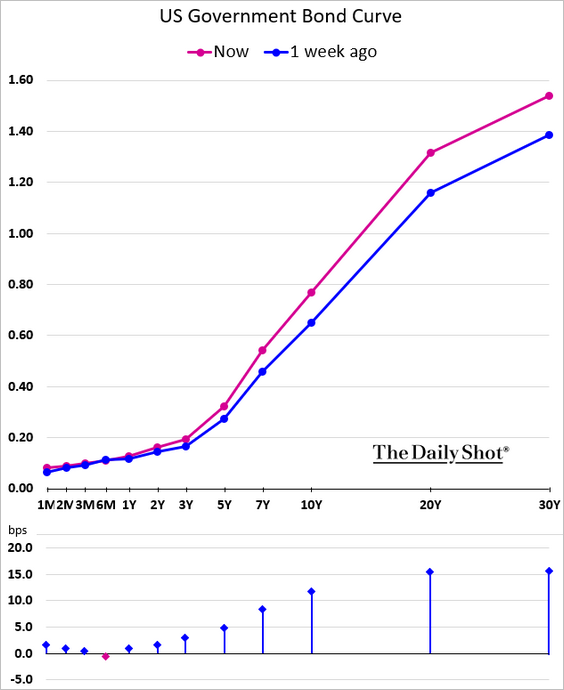

The Treasury curve steepened.

Inflation expectations climbed further, with the 10yr inflation swap approaching 2% again.

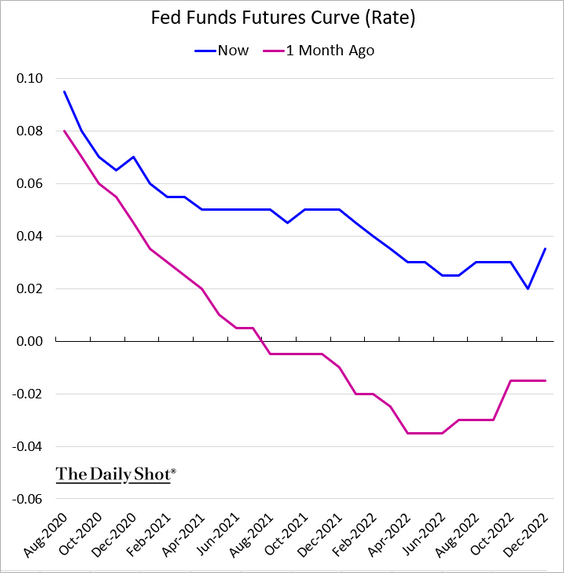

• Given the Fed’s new tools on inflation, the probability of the central bank taking rates below zero has diminished. The market-implied fed funds rate trajectory is now entirely in positive territory.

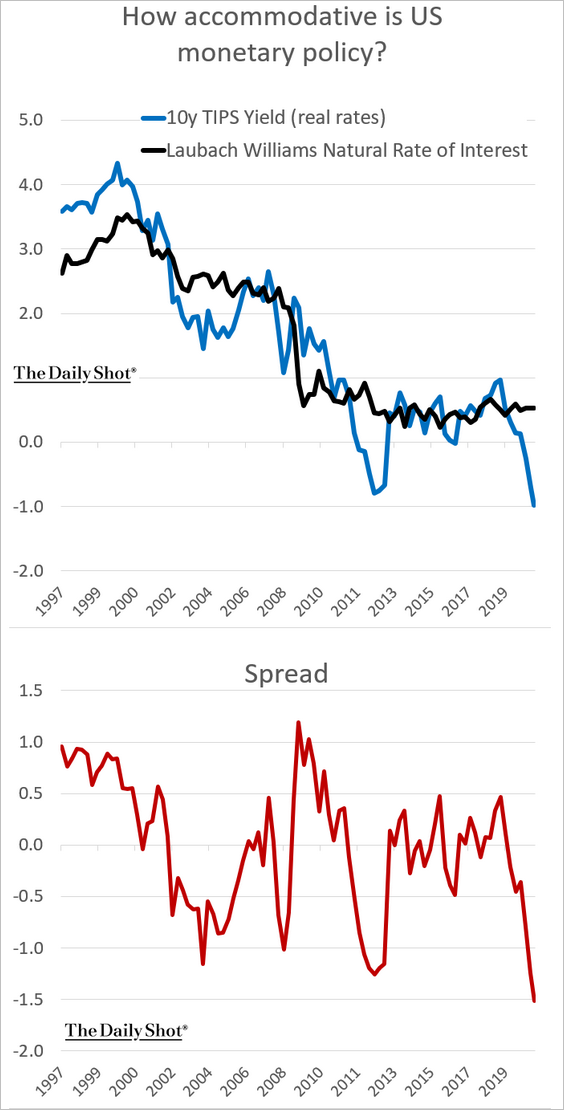

• Just how accommodative is the Fed’s policy. One way to assess it is by comparing market-implied longer-term real rates to the “neutral” rate. By this measure, the current monetary policy is the most accommodative in decades (market rates are well below the neutral rate). As inflation expectations climb further, the spread in the chart below will widen even more.

——————–

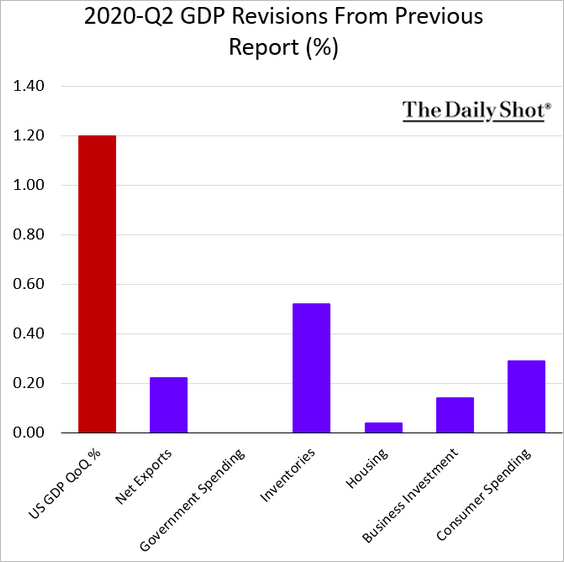

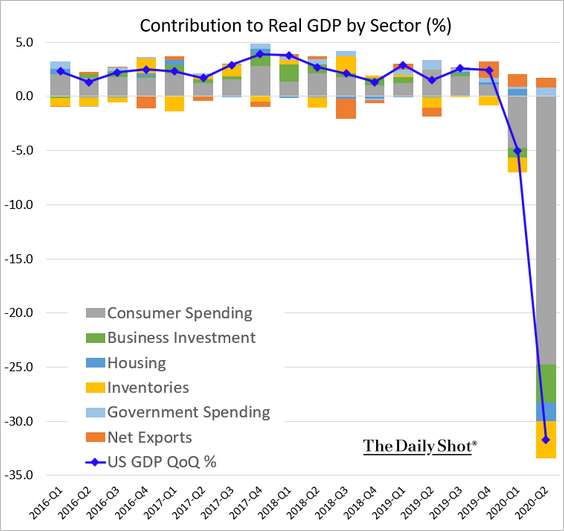

2. The Q2 GDP was revised higher.

Nonetheless, it was still the worst quarter in recent history.

——————–

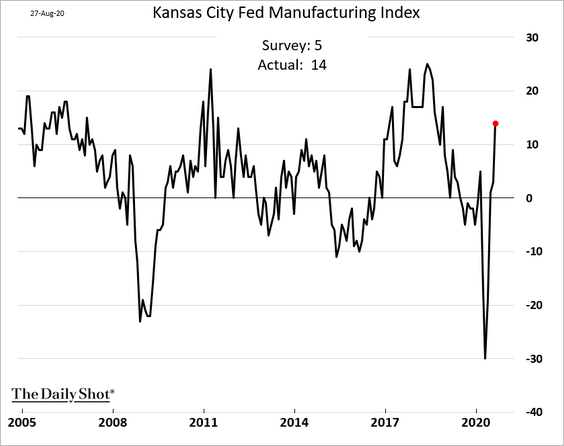

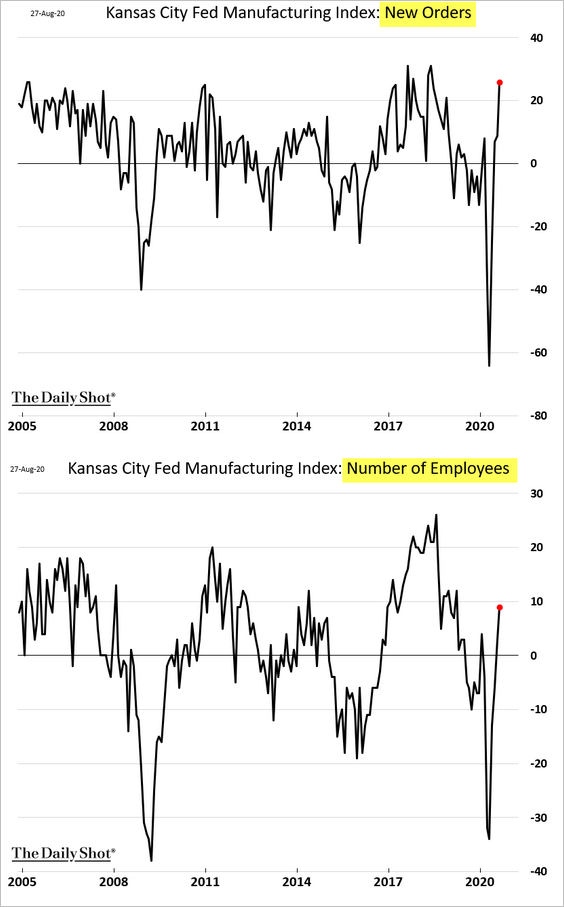

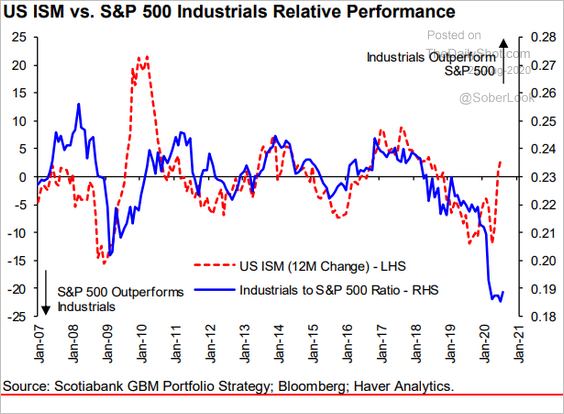

3. The Kansas City Fed manufacturing index rocketed higher in August.

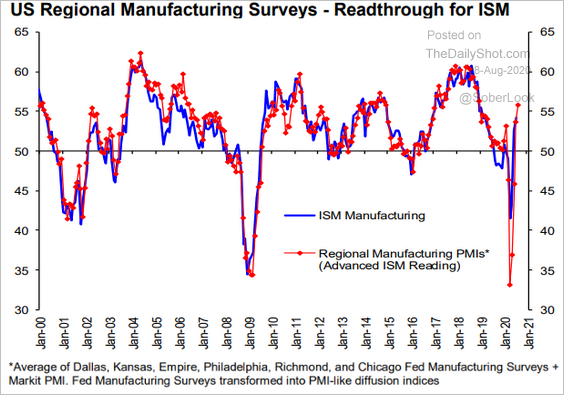

The regional Fed surveys (such as the one above) point to further improvements in factory activity at the national level (ISM).

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

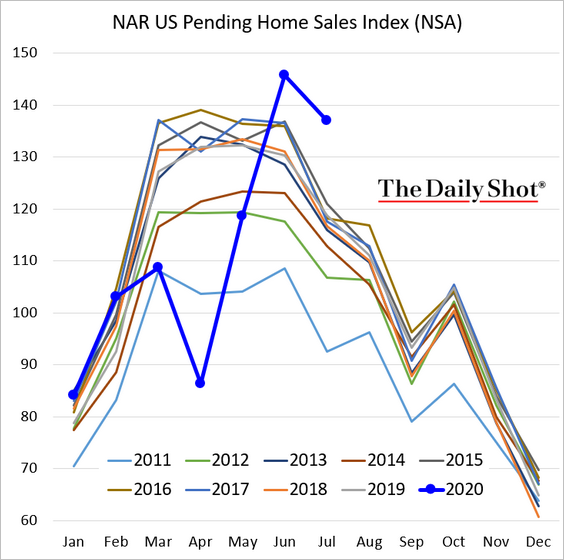

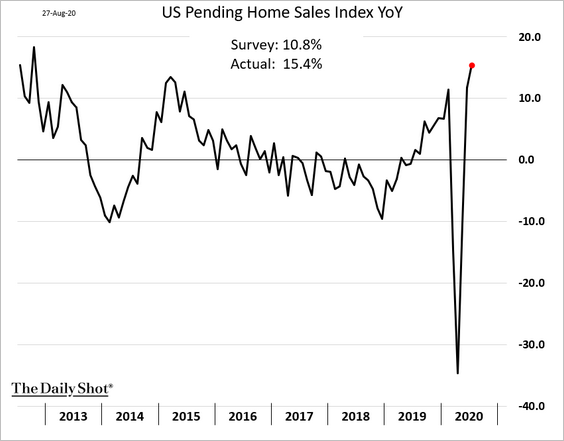

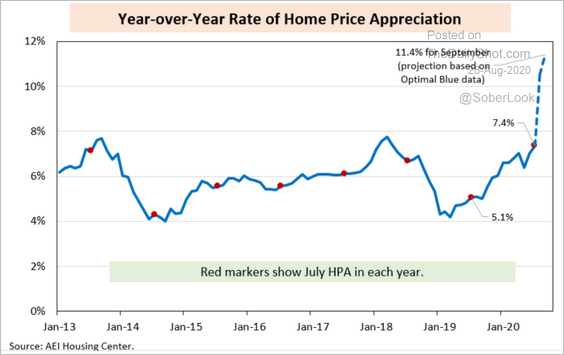

4. Next, we have some updates on the housing market.

• Pending home sales are up over 15% from a year ago.

• Home price appreciation has accelerated, according to AEI Housing Center.

Source: AEI Housing Center

Source: AEI Housing Center

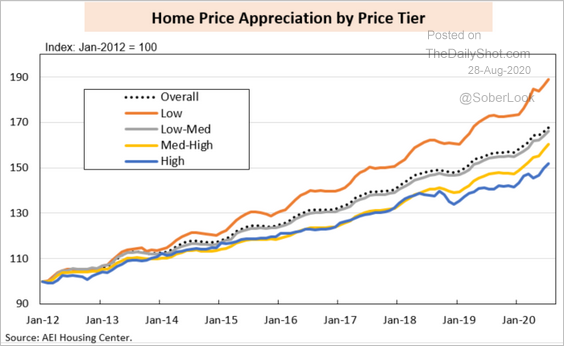

– Lower-tier homes continue to outperform.

Source: AEI Housing Center

Source: AEI Housing Center

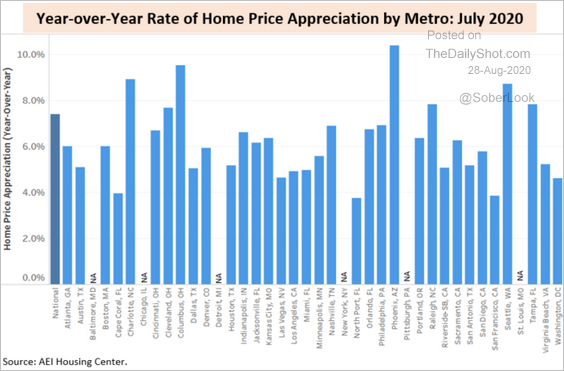

– Here are the price gains by metro area

Source: AEI Housing Center

Source: AEI Housing Center

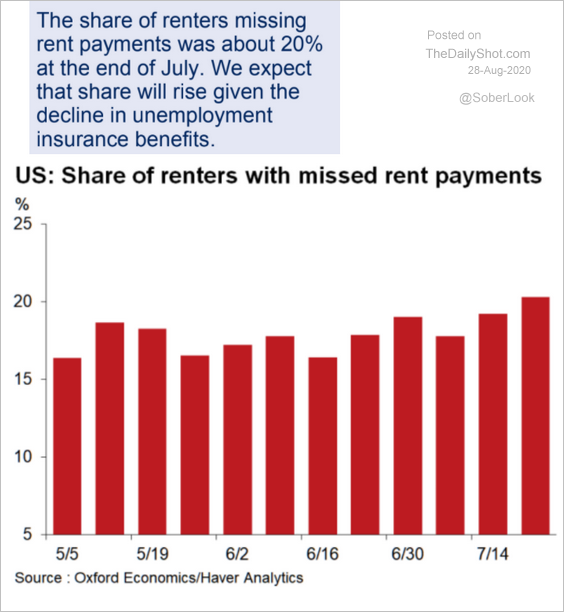

• The share of renters with missed payments is expected to climb, according to Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

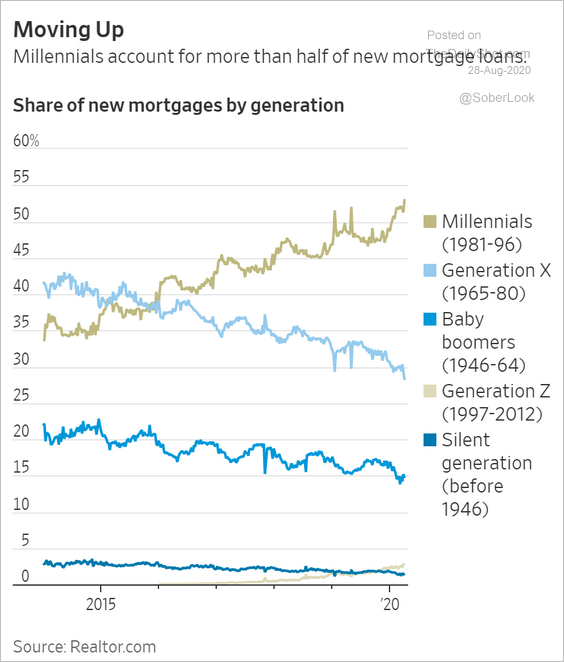

• Millennials now account for more than half of new mortgages.

Source: @WSJ Read full article

Source: @WSJ Read full article

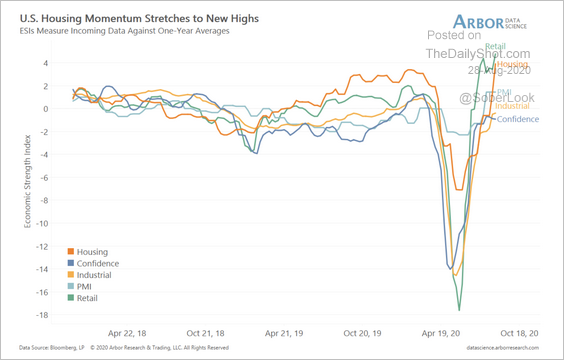

• Retail and housing have led the recovery in economic activity.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

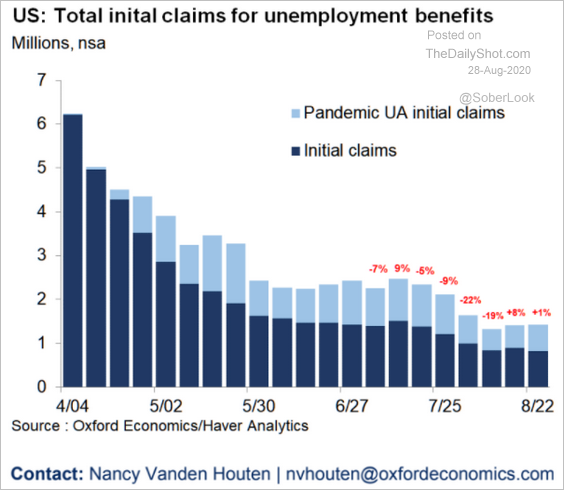

5. More than a million Americans a week still file for unemployment.

Source: Oxford Economics

Source: Oxford Economics

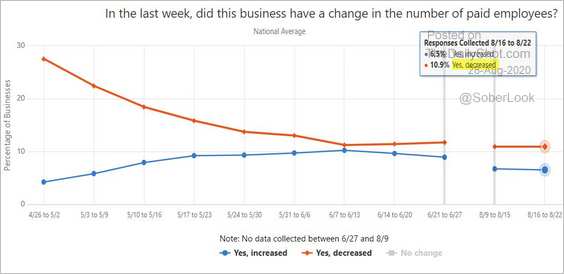

Small businesses are shedding jobs.

Source: @ernietedeschi, @uscensusbureau Read full article

Source: @ernietedeschi, @uscensusbureau Read full article

By the way, here is why one should be careful using seasonal adjustments, especially in the current environment.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

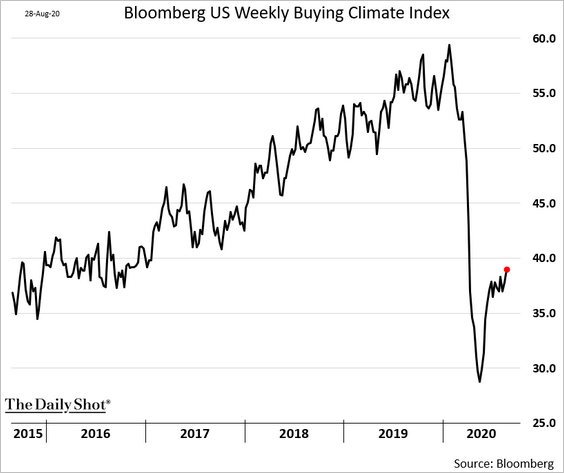

6. Bloomberg’s Buying Climate Index resumed its recovery.

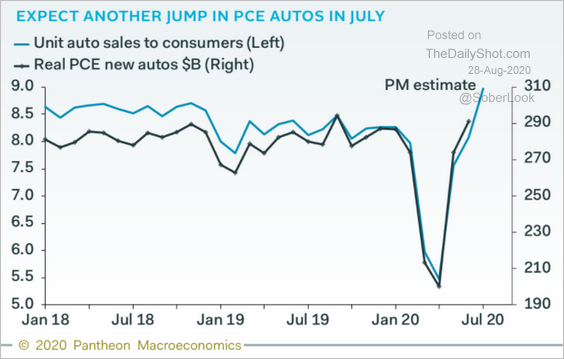

Here is a forecast from Pantheon Macroeconomics for US car sales.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Canada

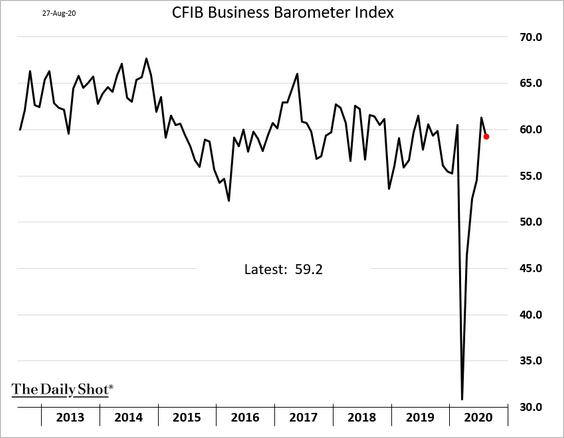

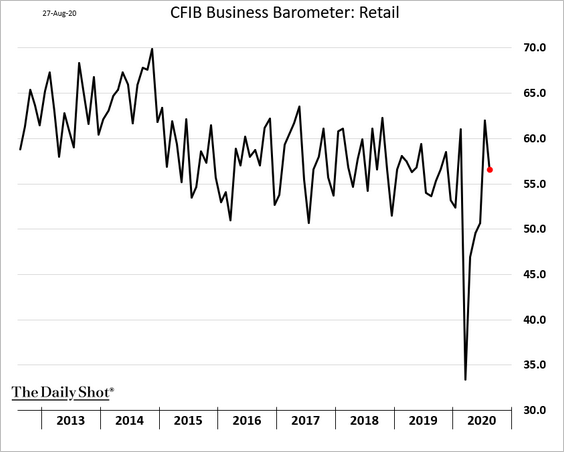

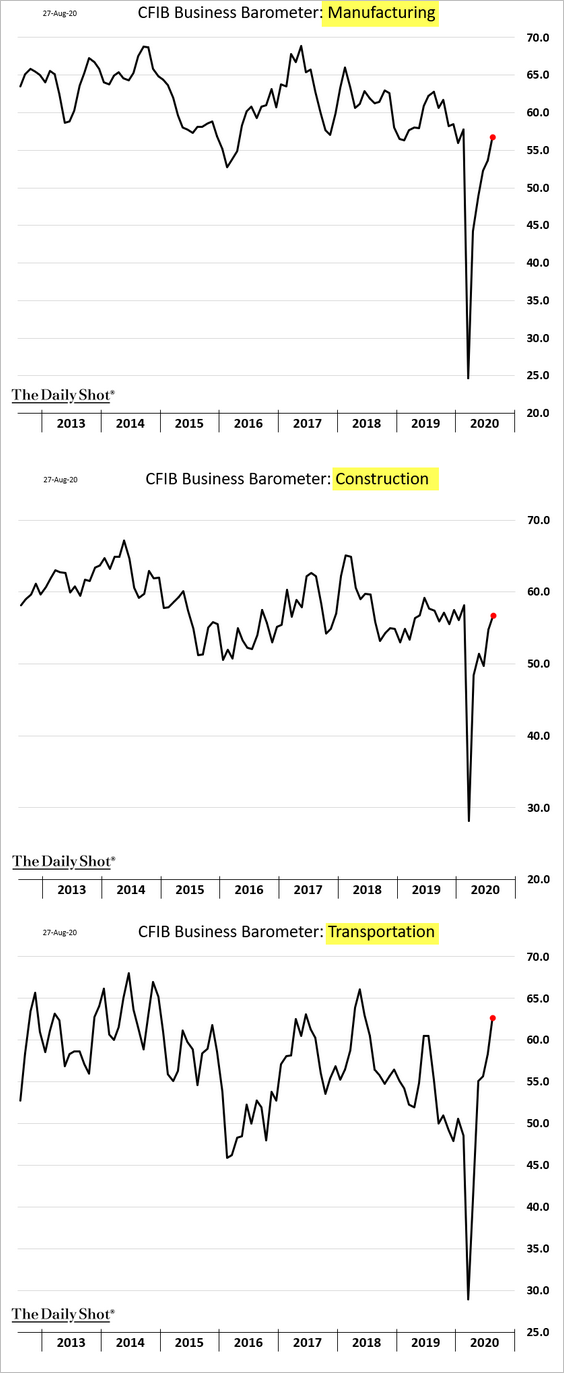

1. The CFIB small/medium-size business sentiment ticked lower this month.

The dip came from the retail sector, which tends to be volatile.

Most other sectors continued to rebound.

——————–

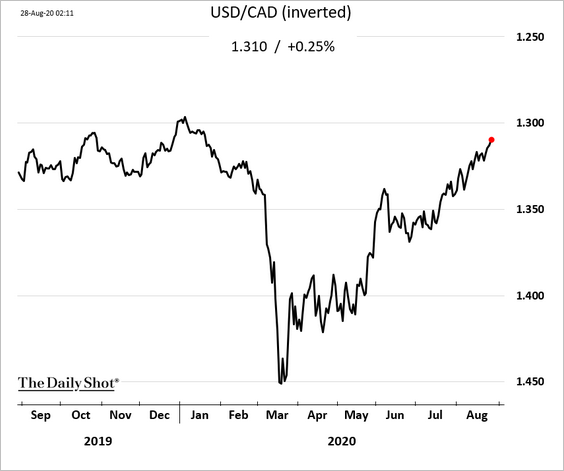

2. With the Fed’s dovish tilt on inflation, the loonie keeps climbing against USD.

The United Kingdom

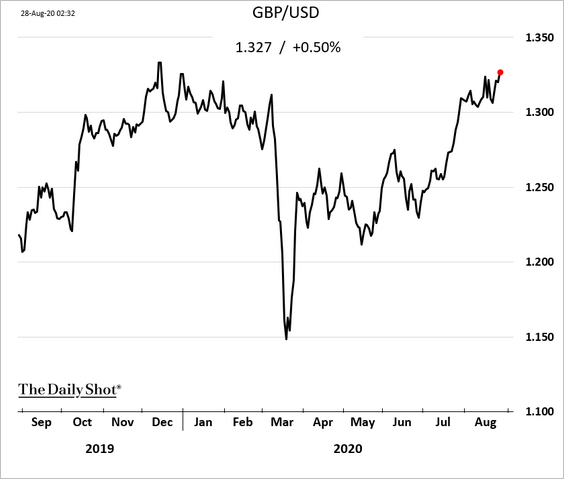

1. The pound continues to advance.

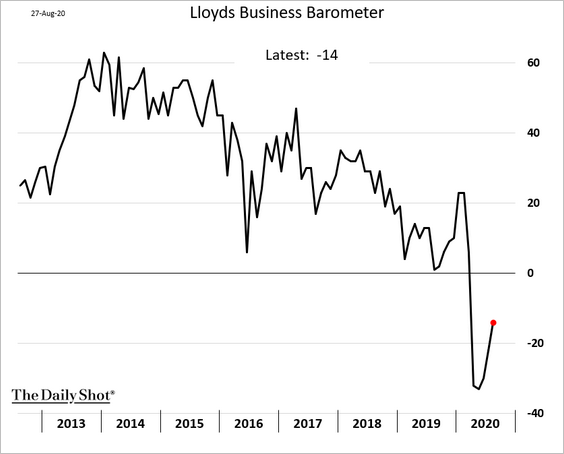

2. Here is this month’s Lloyds Business Barometer.

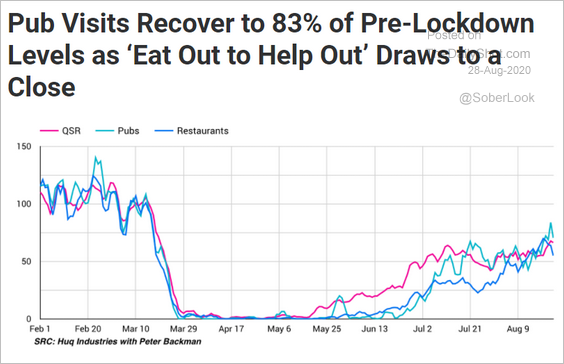

3. “Eat out to help out” has been working.

Source: Huq Read full article

Source: Huq Read full article

The Eurozone

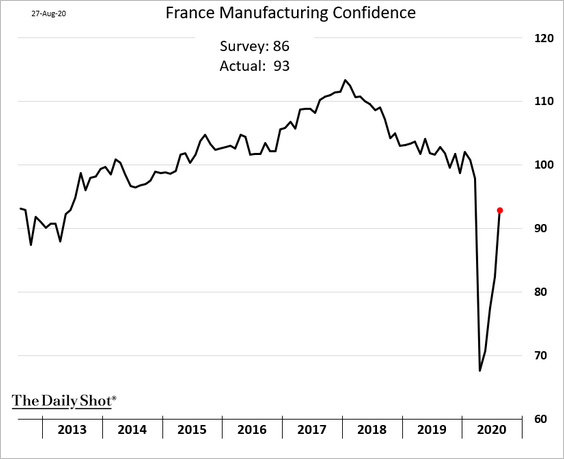

1. French manufacturing confidence is recovering faster than expected.

2. Italian industrial orders are improving rapidly.

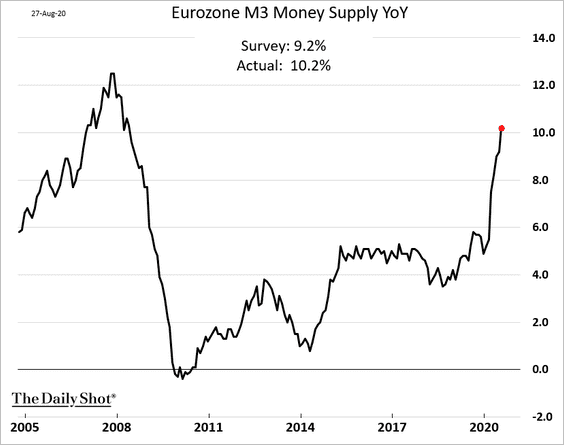

3. The euro-area broad money supply year-over-year growth exceeded 10% last month.

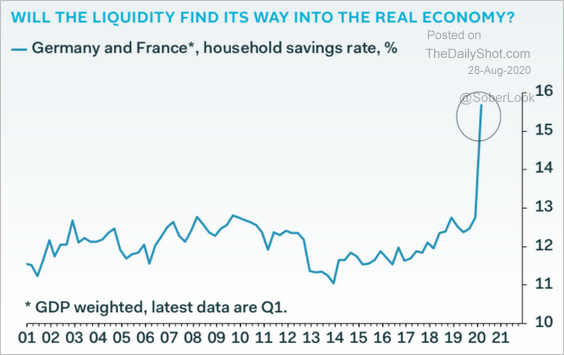

Household liquidity spiked. Will it translate into more spending?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

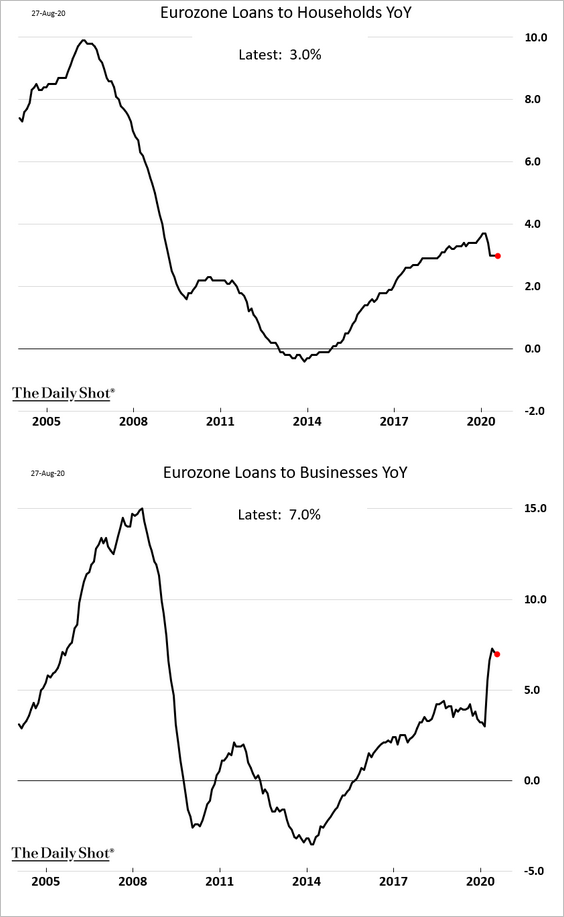

Loan growth has been more modest.

——————–

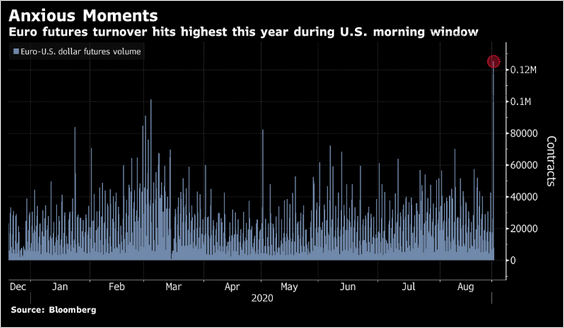

4. With the Fed announcing a new approach to addressing inflation, the CME EUR/USD futures volume spiked.

Source: Robert Fullem

Source: Robert Fullem

Asia – Pacific

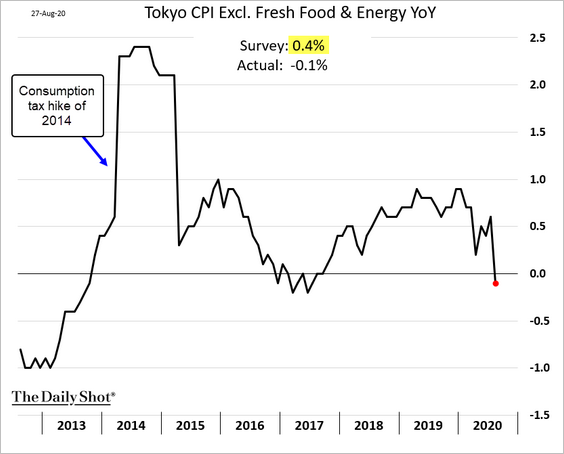

1. Is Japan in deflation again? The August Tokyo core CPI unexpectedly moved into negative territory.

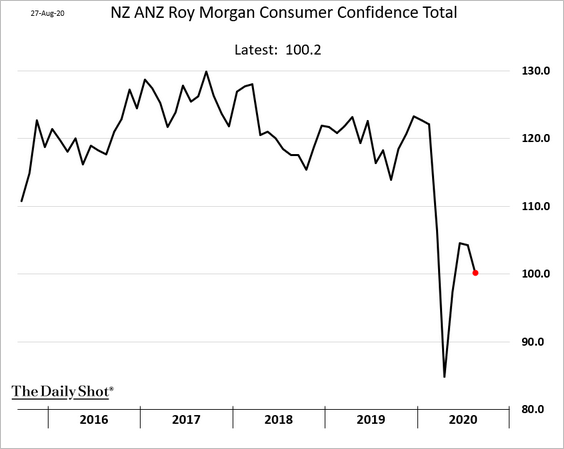

2. New Zealand’s consumer confidence dipped this month.

3. The Aussie dollar hit the highest level since 2018 as the Fed announced its new inflation targeting method.

China

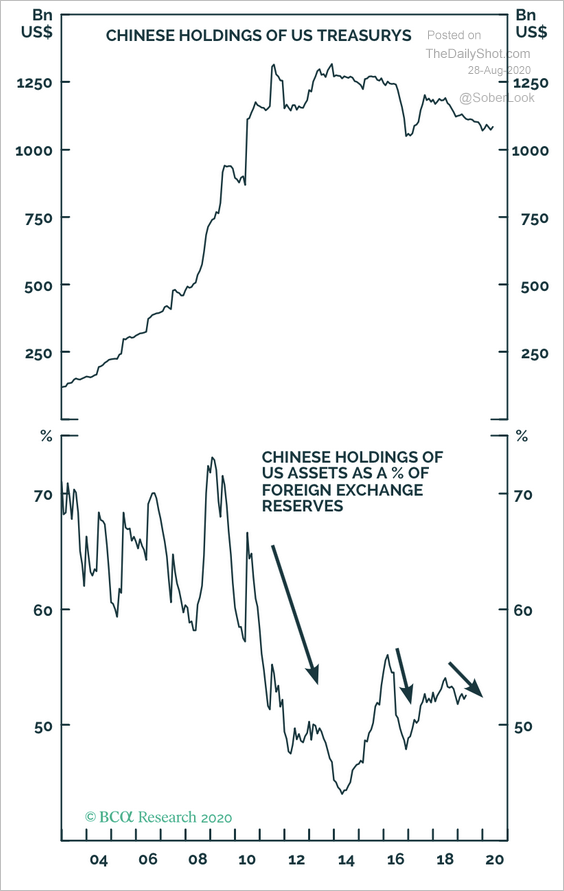

1. The renminbi keeps grinding higher vs. USD.

2. The renminbi’s role in cross-border settlement is well below its 2016 peak.

Source: BCA Research

Source: BCA Research

3. Stocks are testing resistance again.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

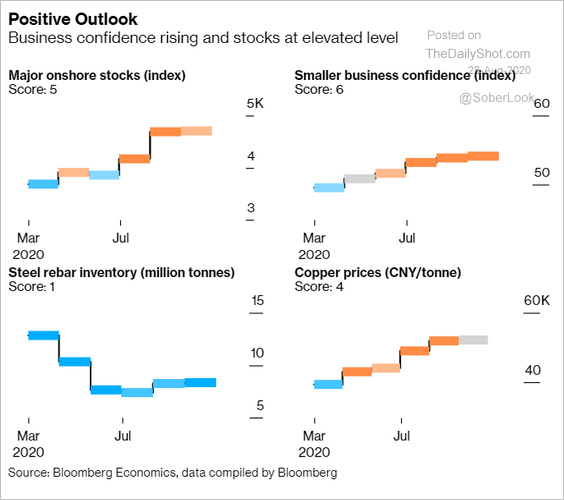

4. The nation’s business outlook continues to improve.

Source: @markets Read full article

Source: @markets Read full article

Emerging Markets

1. The Indian rupee came to life in recent days. The Fed’s dovish tilt has been helpful.

Source: @markets Read full article

Source: @markets Read full article

Source: Reuters Read full article

Source: Reuters Read full article

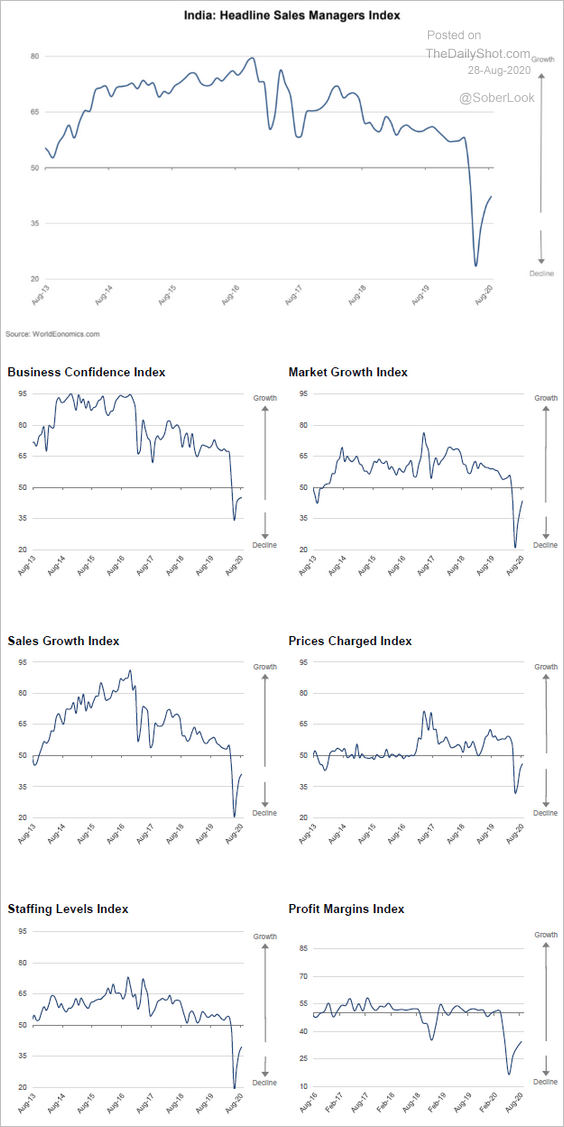

India’s business activity remains weak, according to the latest SMI report from World Economics.

Source: World Economics

Source: World Economics

——————–

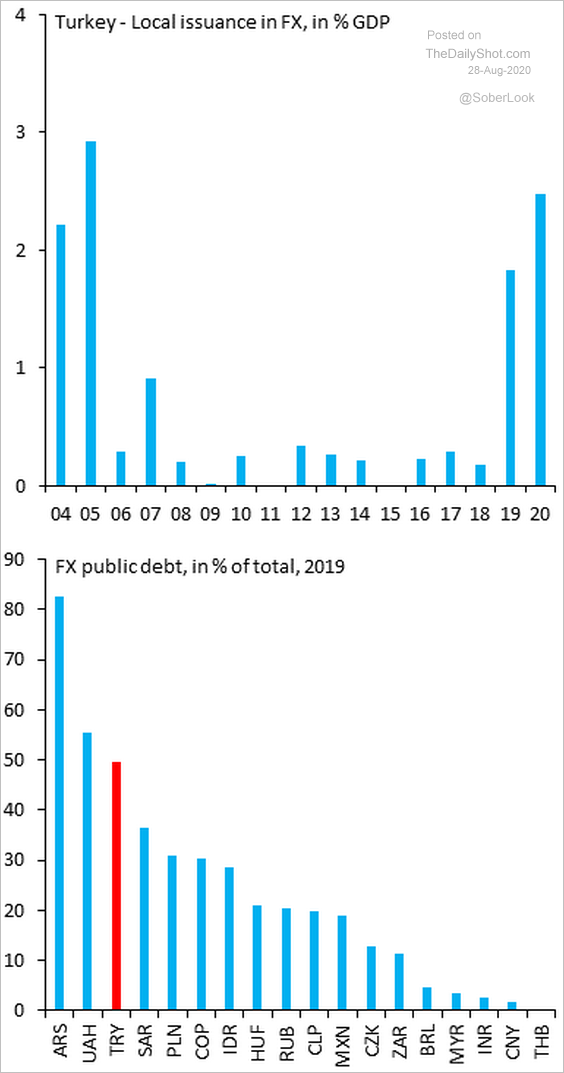

2. Here is a comment on Turkey from Sergi Lanau, IIF.

Turkey is on track to issue the most FX debt in the local market since 2005. Since foreigners are unlikely to buy in, it doesn’t really ease the external financing constraint. It moves “existing” dollars around and increases the FX mismatch on the government’s balance sheet.

Source: @SergiLanauIIF

Source: @SergiLanauIIF

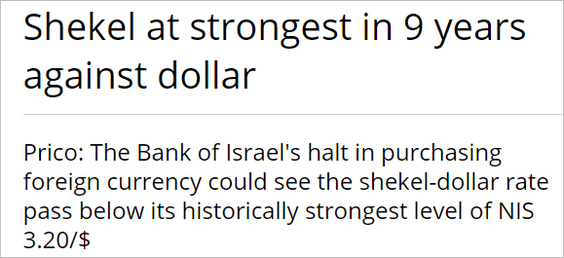

3. The Israeli shekel hit a 9-year high vs. USD.

Source: Globes Read full article

Source: Globes Read full article

——————–

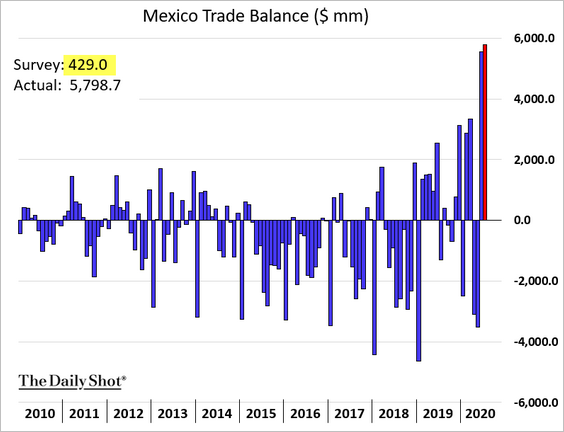

4. Mexico’s trade surplus hit a record as US automobile demand climbs.

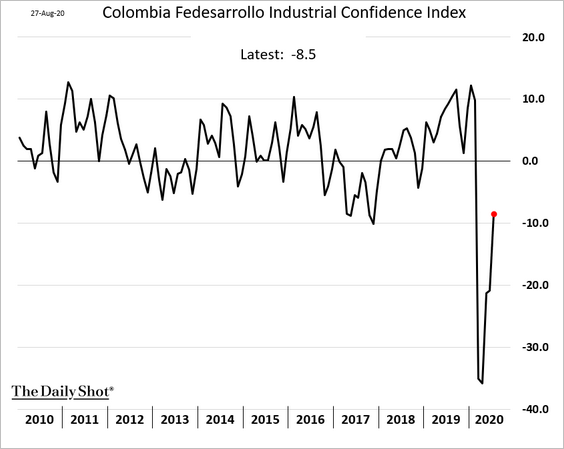

5. Colombia’s industrial sentiment is recovering.

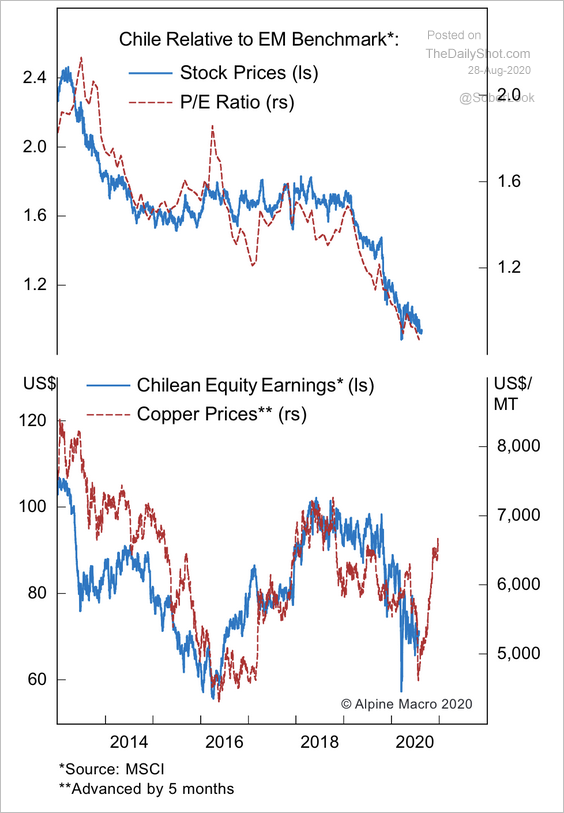

6. Chilean equities appear cheap, and rising copper prices could support earnings growth.

Source: Alpine Macro

Source: Alpine Macro

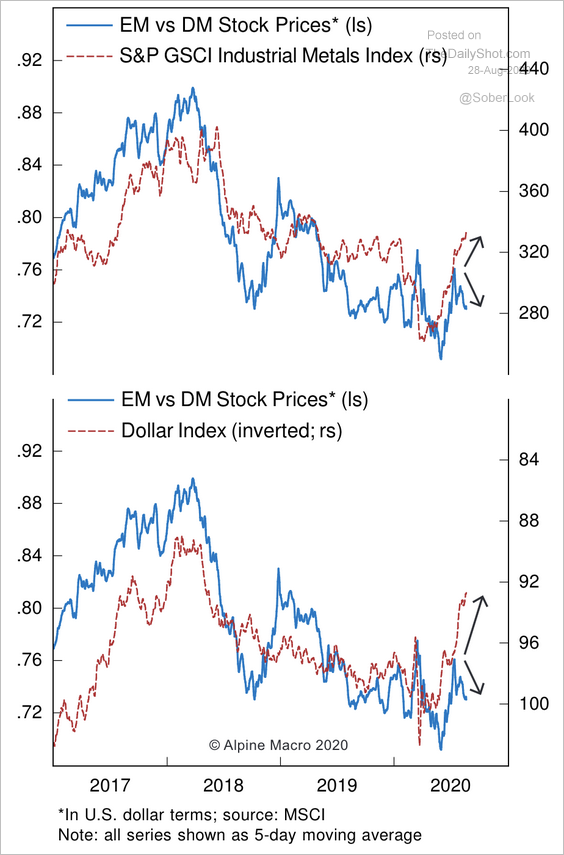

7. EM stocks have diverged from commodities and the dollar.

Source: Alpine Macro

Source: Alpine Macro

Commodities

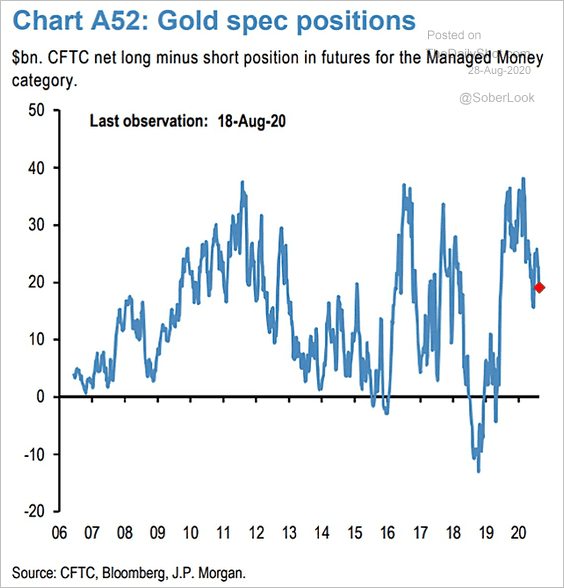

1. Speculative bets on gold have moderated.

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @jpmorgan

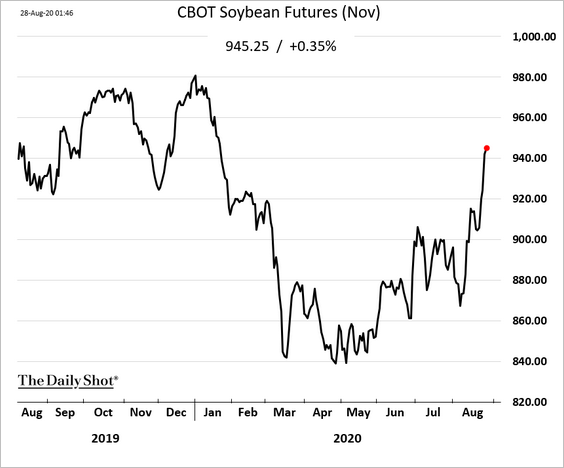

2. US soy futures are rallying.

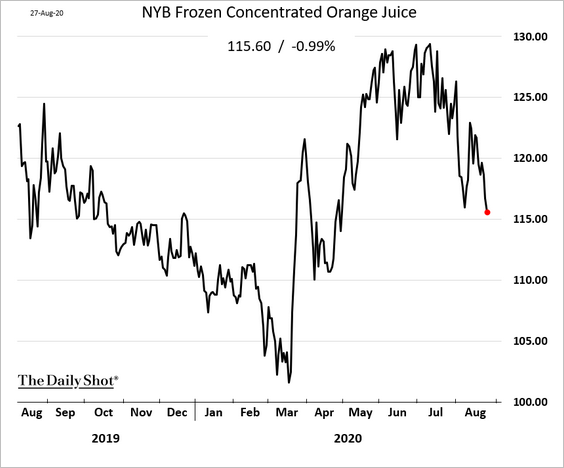

3. The lockdown-related rally in US orange juice prices has been fading.

Energy

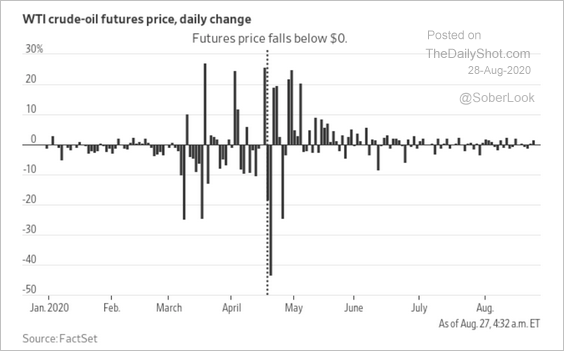

1. Oil markets have been very quiet since June.

Source: @WSJ Read full article

Source: @WSJ Read full article

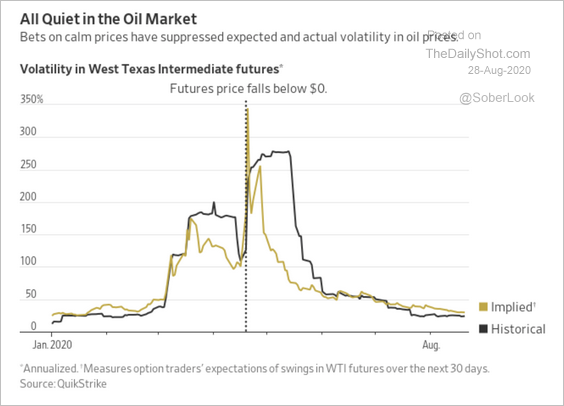

WTI crude oil futures volatility is back near January lows.

Source: @WSJ Read full article

Source: @WSJ Read full article

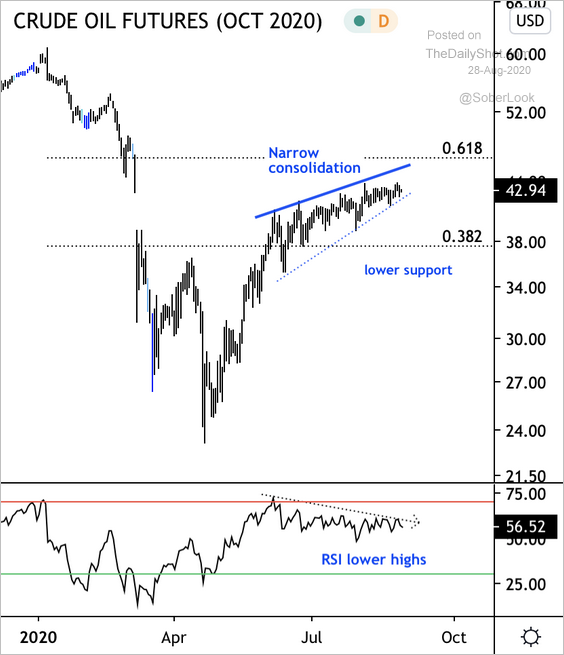

The October WTI crude oil futures contract is consolidating in a narrow range.

Source: @DantesOutlook

Source: @DantesOutlook

——————–

2. US natural gas futures continue to rally.

Equities

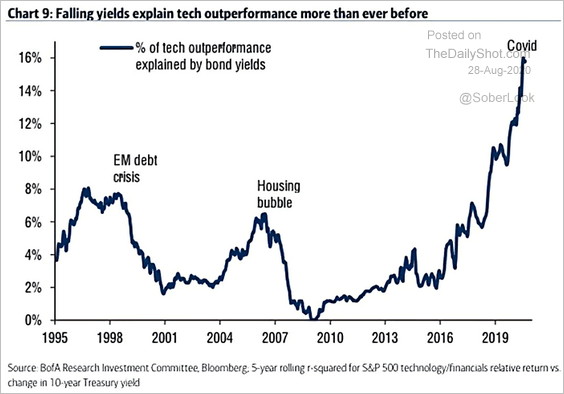

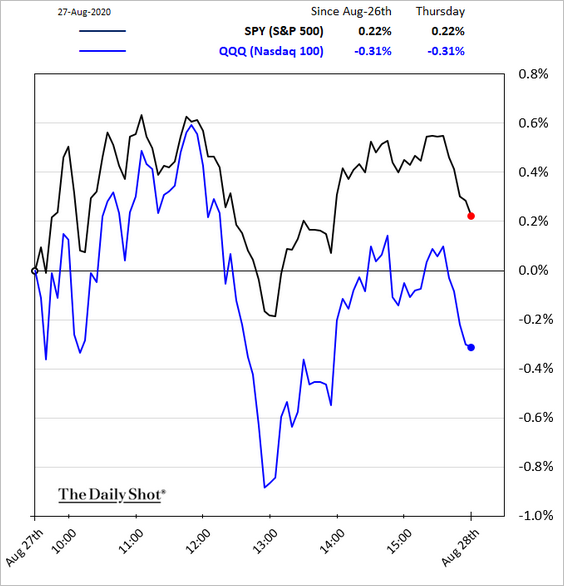

1. The tech sector has benefitted from falling US bond yields.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

As yields rose in response to the Fed’s dovish tilt on inflation (see the US section), tech shares underperformed on Thursday.

——————–

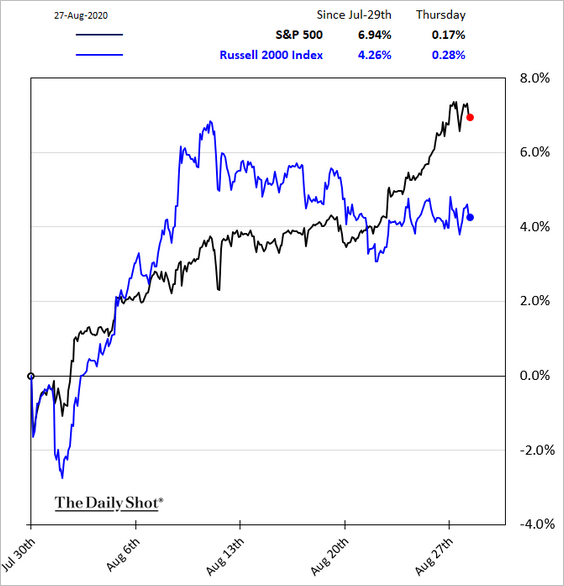

2. Small caps continue to struggle.

By the way, when China’s output prices weaken, US small firms are hurt (harder to compete on price).

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

3. Will we see industrials begin to outperform as factory activity (ISM) rebounds?

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

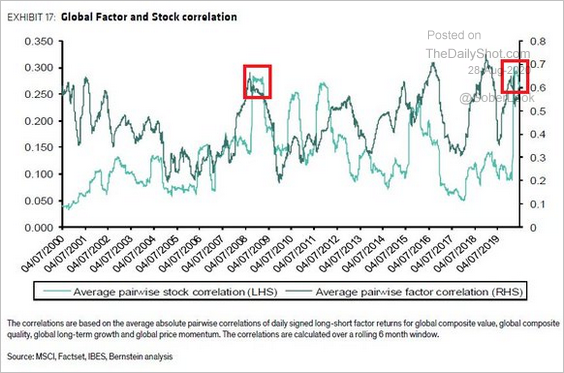

4. Global shares and equity factors are now highly correlated.

Source: Bernstein, @MacroCharts, @markets Read full article

Source: Bernstein, @MacroCharts, @markets Read full article

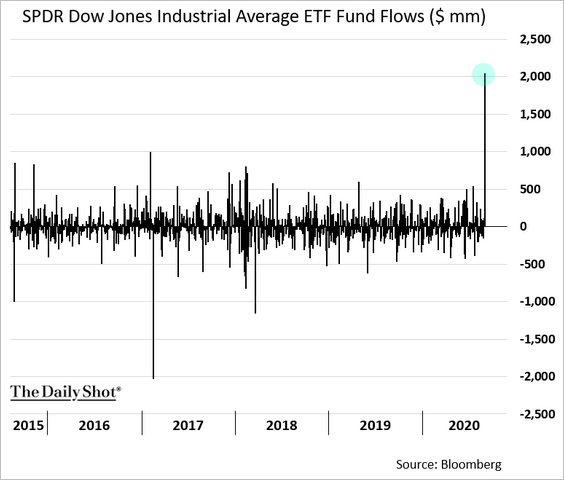

5. The rebalancing of the Dow (see story), which introduced more tech into the index, has attracted substantial capital inflows into the SPDR Dow ETF.

h/t Jorge

h/t Jorge

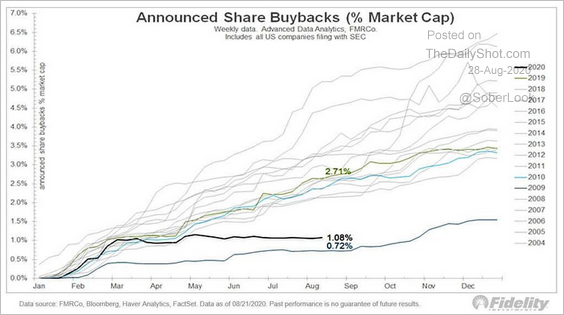

6. Share buybacks have flatlined.

Source: @TimmerFidelity

Source: @TimmerFidelity

——————–

Food for Thought

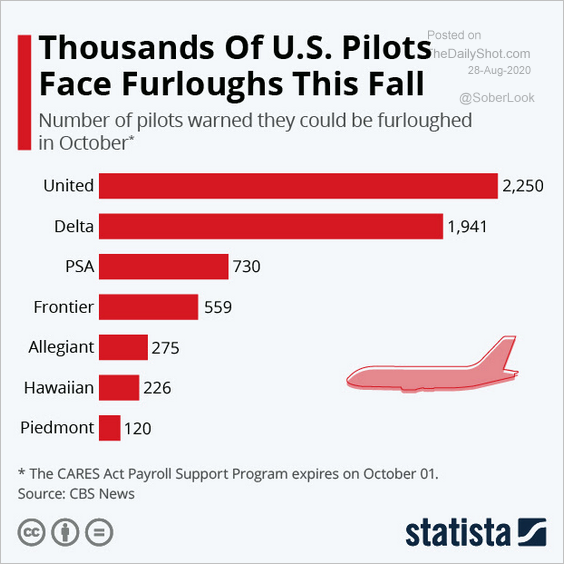

1. Pilot furloughs:

Source: Statista

Source: Statista

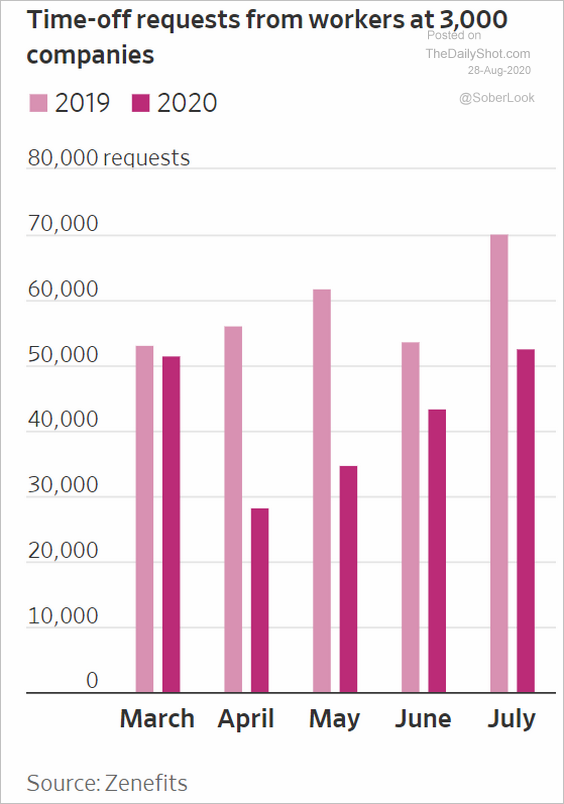

2. Employees not taking vacation:

Source: @WSJ Read full article

Source: @WSJ Read full article

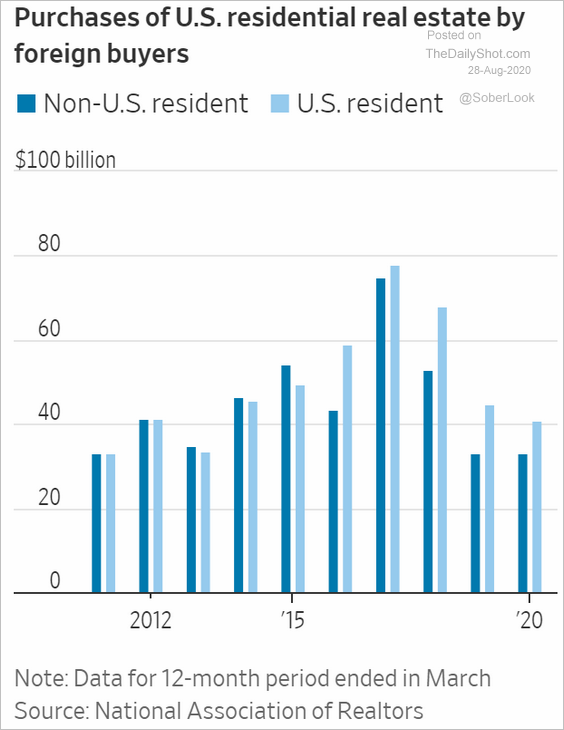

3. Purchases of US residential properties by foreign buyers:

Source: @WSJ Read full article

Source: @WSJ Read full article

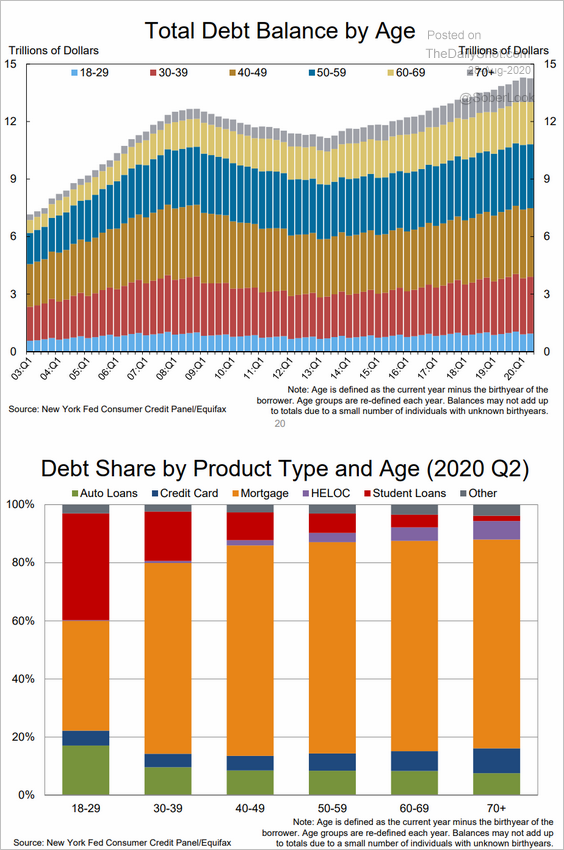

4. US household debt balances by age:

Source: NY Fed

Source: NY Fed

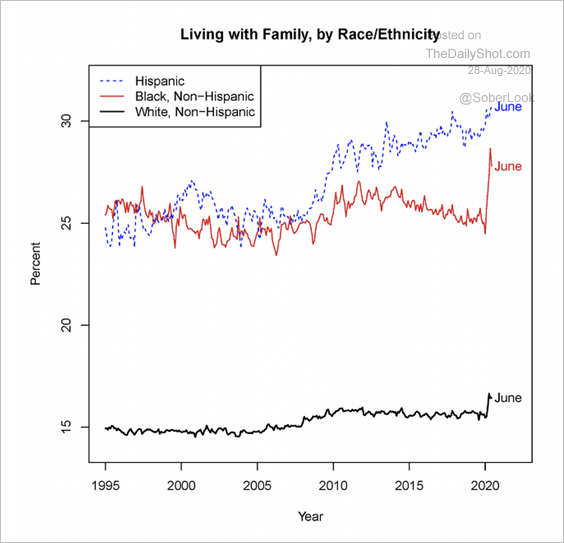

5. The percentage of people living with family:

Source: Federal Reserve

Source: Federal Reserve

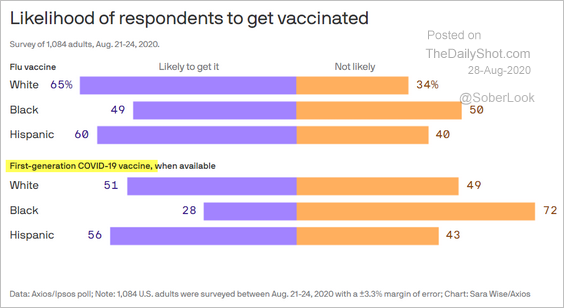

6. Who will get vaccinated?

Source: @axios Read full article

Source: @axios Read full article

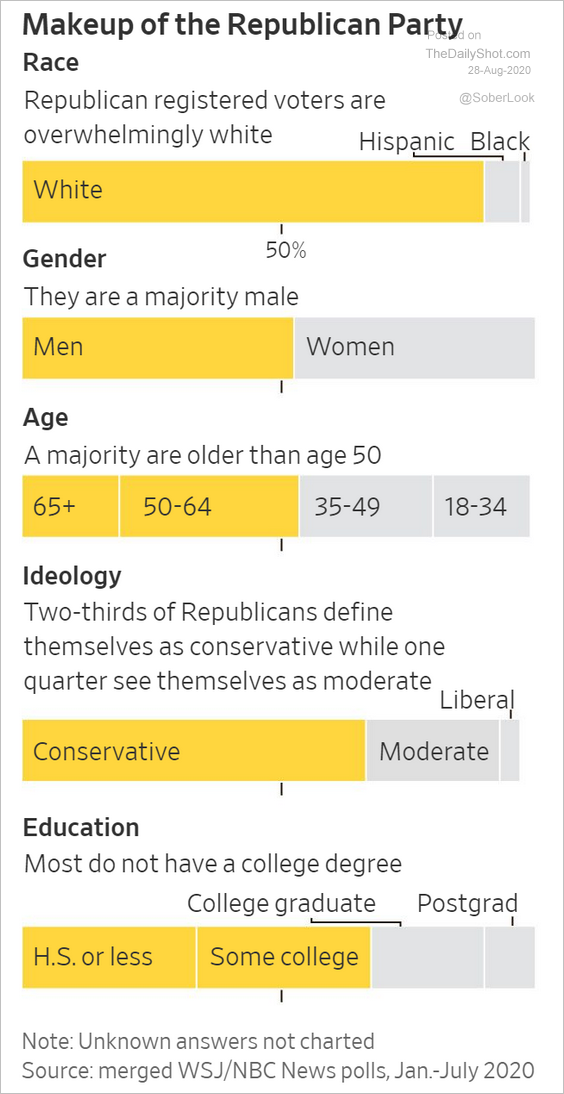

7. GOP demographics:

Source: @WSJ Read full article

Source: @WSJ Read full article

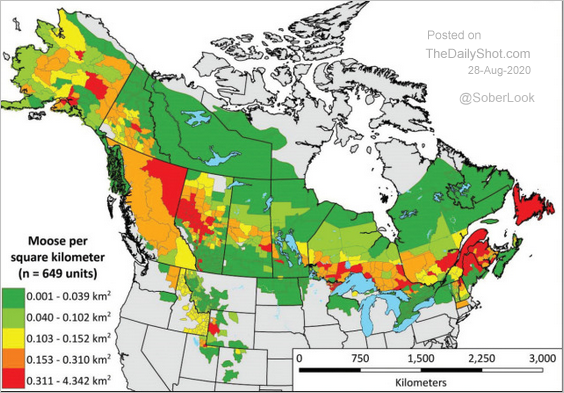

8. Moose density in North America:

Source: @onlmaps Read full article

Source: @onlmaps Read full article

——————–

Have a great weekend!