The Daily Shot: 09-Sep-20

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia-Pacific

• China

• Emerging Markets

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

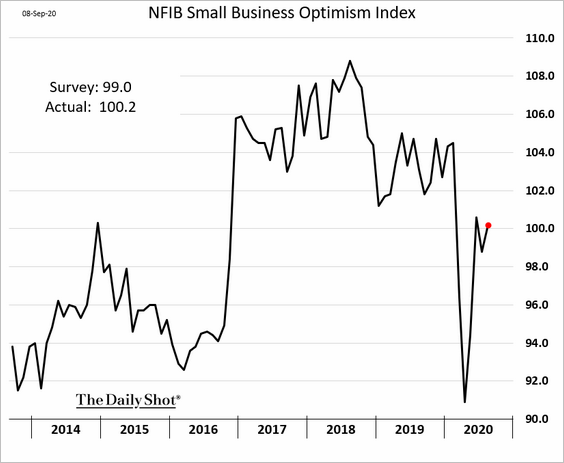

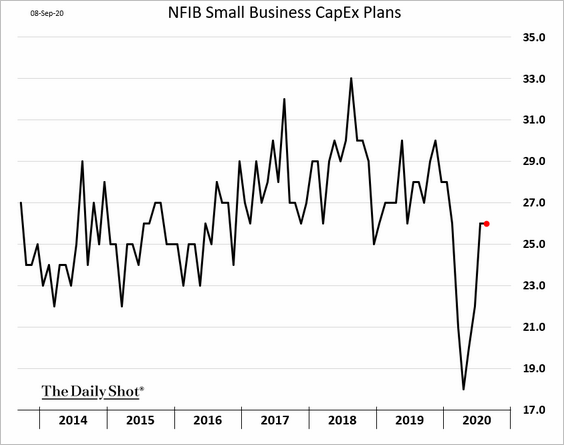

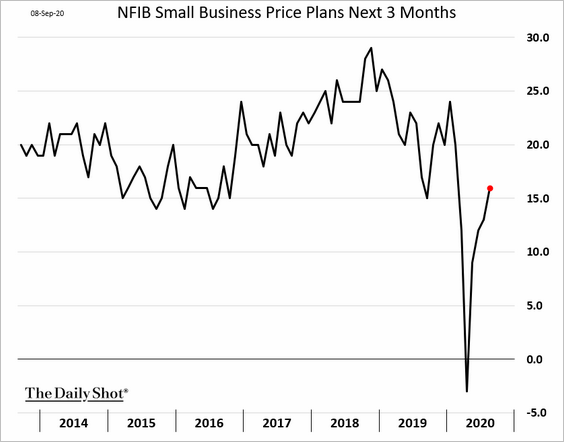

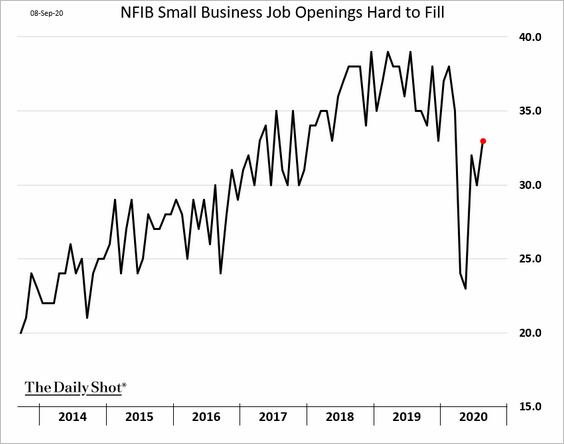

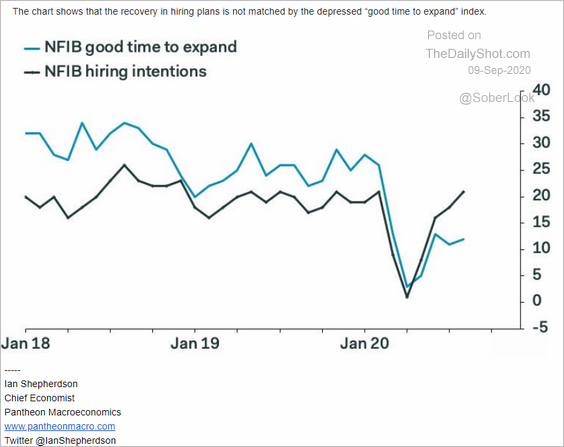

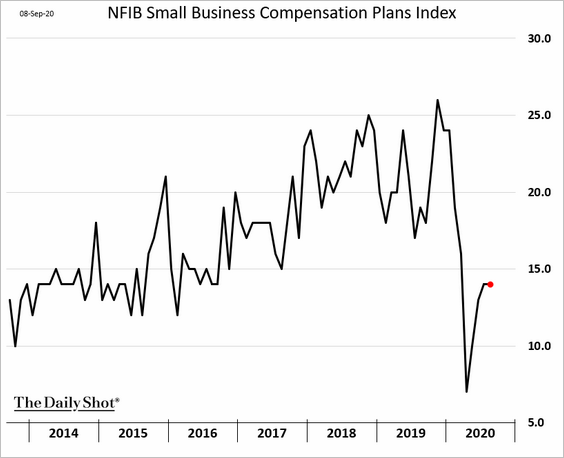

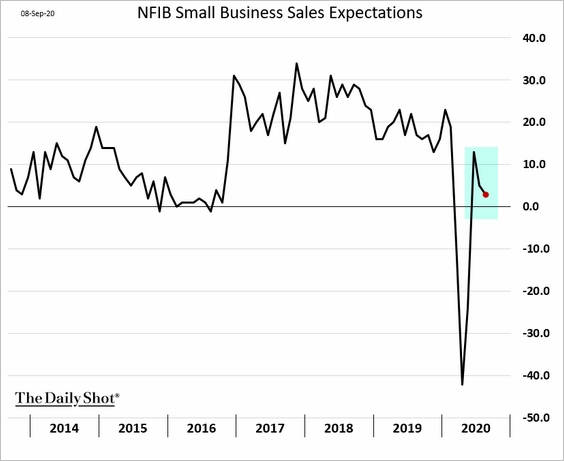

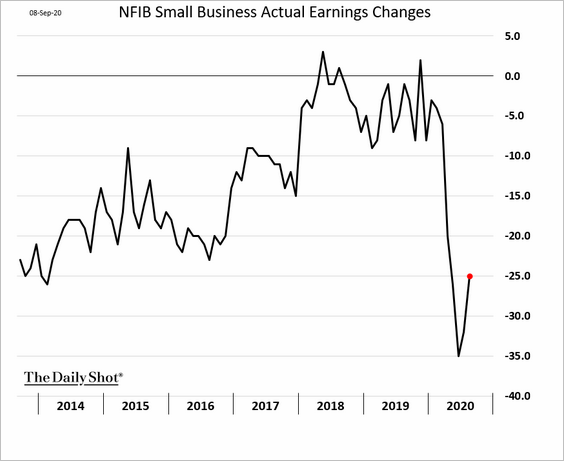

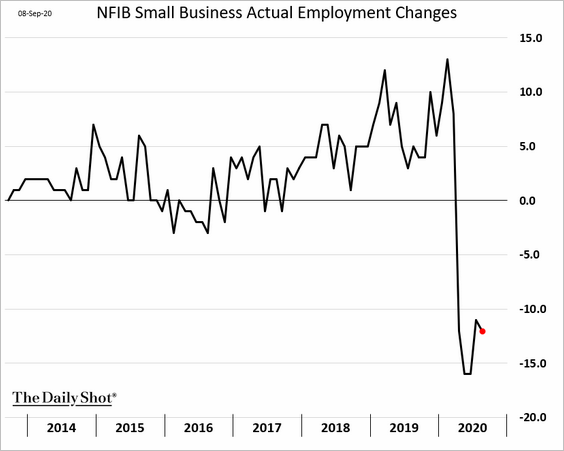

1. The NFIB small business sentiment report painted a mixed picture of the US recovery.

• The headline index ticked higher.

• CapEx expectations remain stable.

• More firms expect to boost prices. It’s worth noting that the US dollar weakness will be putting upward pressure on import prices, which will impact many small firms.

• Businesses are having a tougher time filling job openings.

• Hiring intentions have picked up momentum, but the index seems inconsistent with business climate assessment.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• The “compensation plans” index remains subdued.

• Sales expectations have been moderating after the initial rebound.

• While small businesses are generally more optimistic, the current environment remains challenging.

– Earnings:

– Employment:

——————–

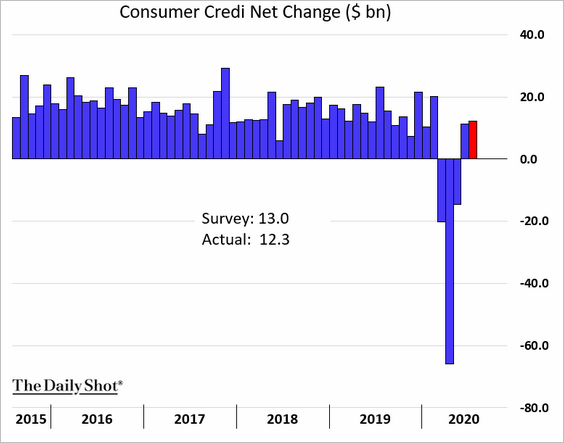

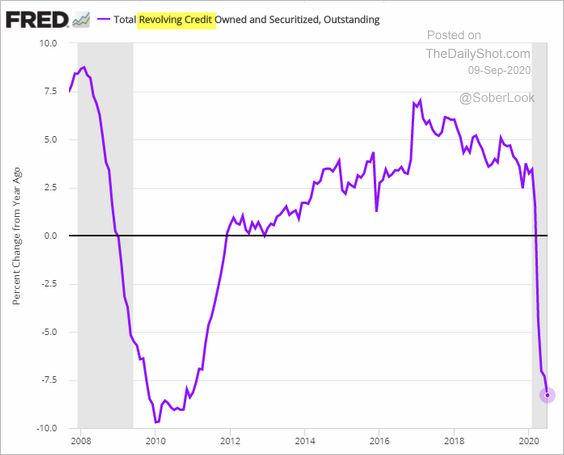

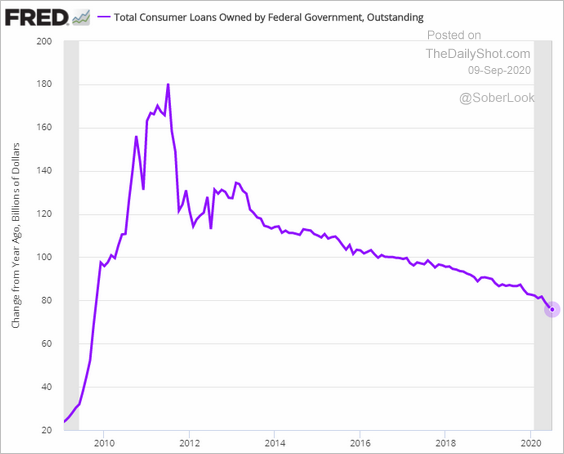

2. US consumer credit expanded again in July.

Here are a couple of observations.

• Credit card balances are down substantially from a year ago.

• Growth in government-sponsored student debt continues to slow.

——————–

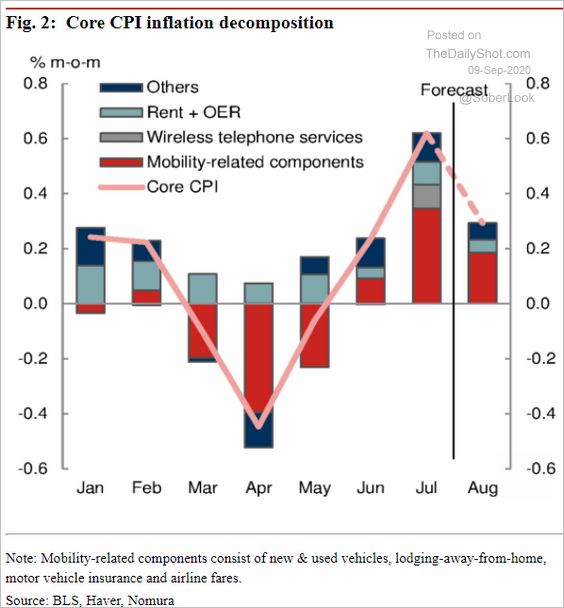

3. Nomura expects a smaller increase in the core CPI in August, with gains still driven by pandemic-related price rebounds.

Source: Nomura Securities

Source: Nomura Securities

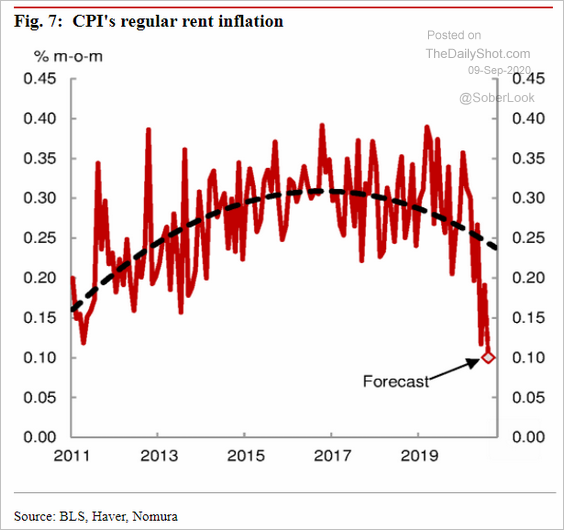

• Rent inflation continues to moderate.

Source: Nomura Securities

Source: Nomura Securities

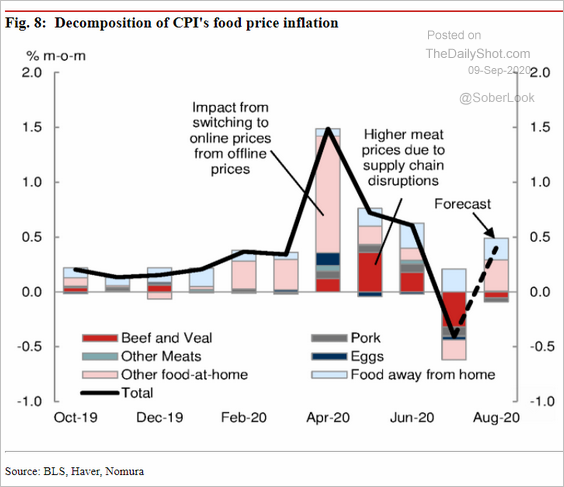

• Here is the breakdown of food inflation.

Source: Nomura Securities

Source: Nomura Securities

——————–

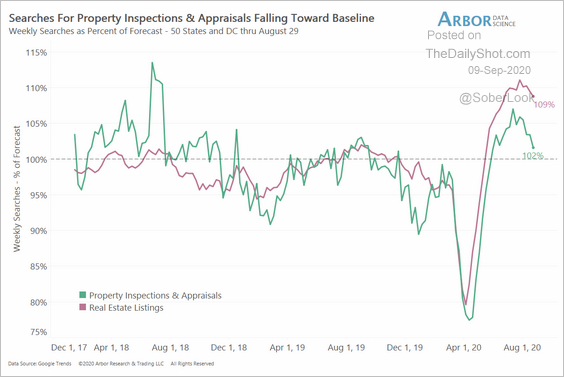

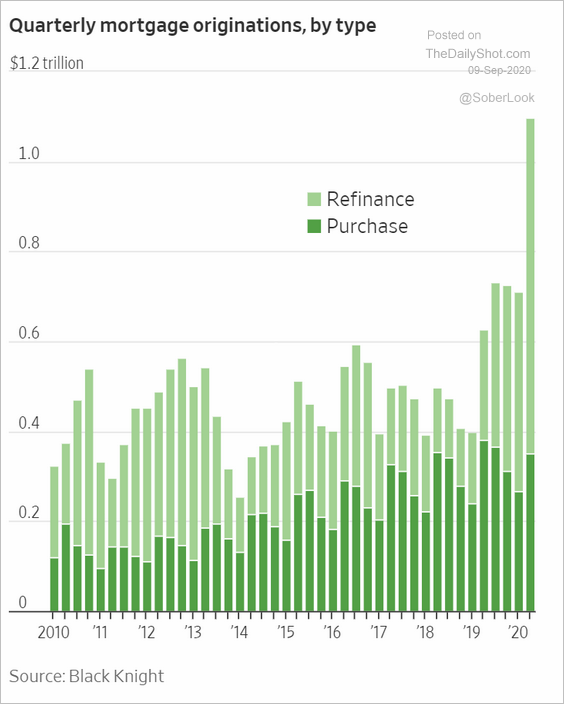

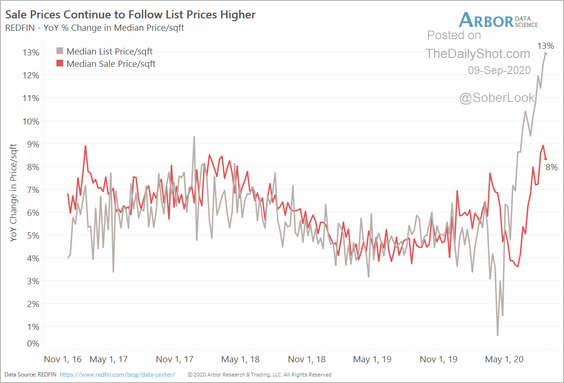

4. Next, we have a couple of updates on the housing market.

• Search activity for property inspections and appraisals have been moderating.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

• Mortgage originations spiked last quarter.

Source: @WSJ Read full article

Source: @WSJ Read full article

• Gains in home sale prices have been lagging list prices.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

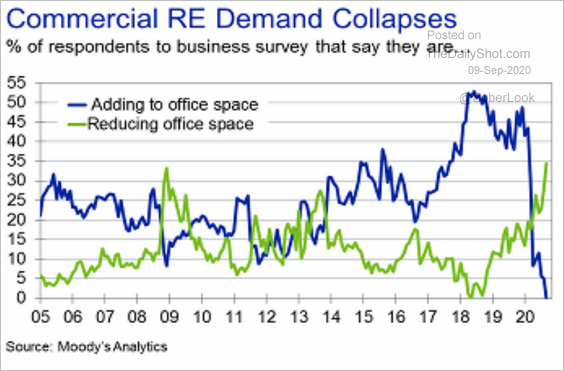

5. Demand for office space has collapsed.

Source: Moody’s Analytics

Source: Moody’s Analytics

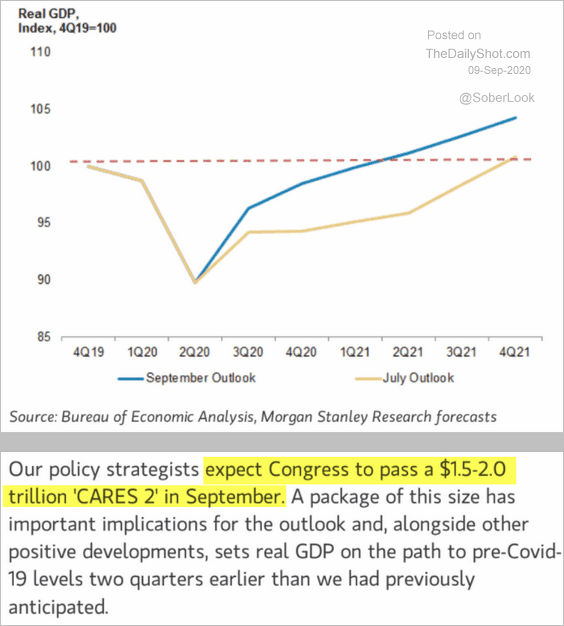

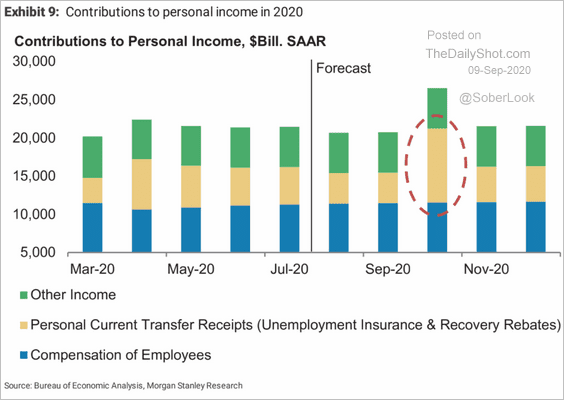

6. Morgan Stanley expects Congress to pass a $1.5-2.0 trillion “CARES 2” stimulus package in September.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

The result will be a substantial boost to consumption (chart below) and GDP growth.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Despite all the challenges, it’s not an unrealistic assumption.

Source: Fox Business Read full article

Source: Fox Business Read full article

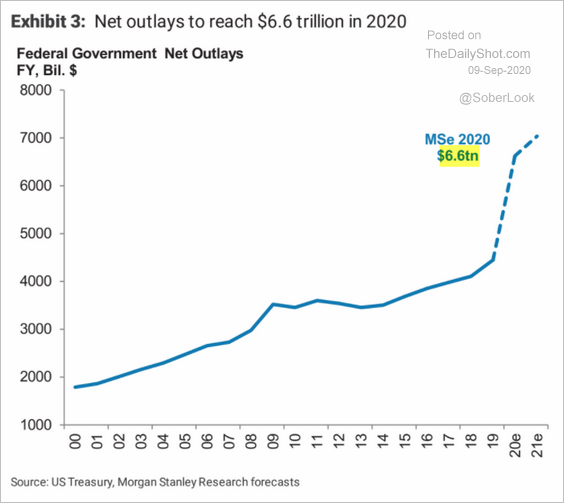

The bill would push the net US 2020 spending to $6.6 trillion.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

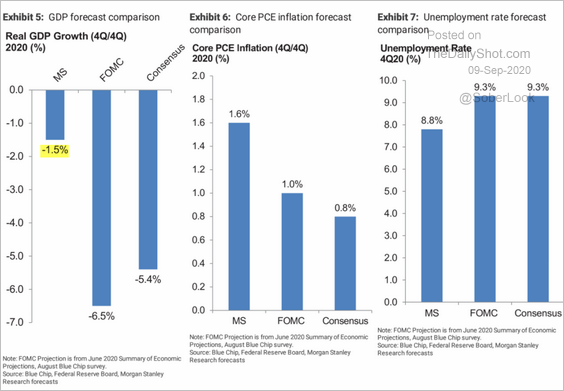

Based on this assumption of fresh stimulus, Morgan Stanley sees much higher growth and inflation than the consensus estimates.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

All this additional liquidity is likely to give another boost to the stock market. It will also have a positive impact on credit, commodities, and emerging markets. On the other hand, it’s a negative development for the US dollar.

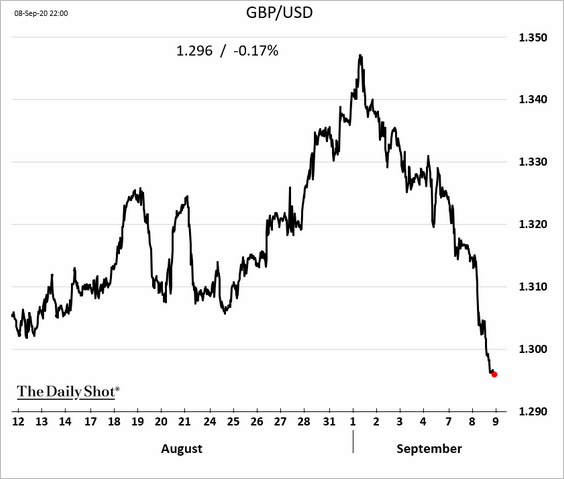

The United Kingdom

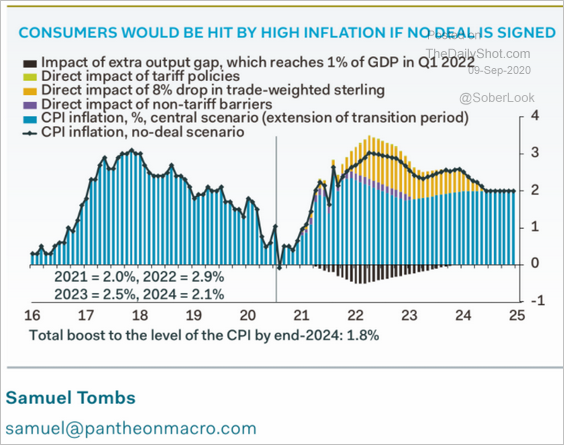

The pound continues to drift lower amid heightened no-deal Brexit concerns.

• Such an outcome will sharply boost inflation in the UK.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

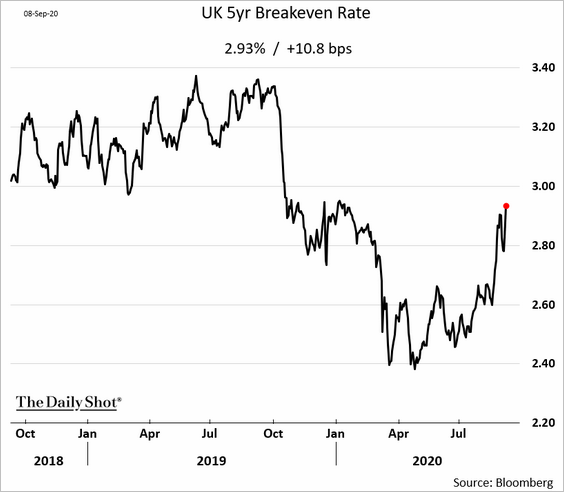

• Market-based inflation expectations are on the rise.

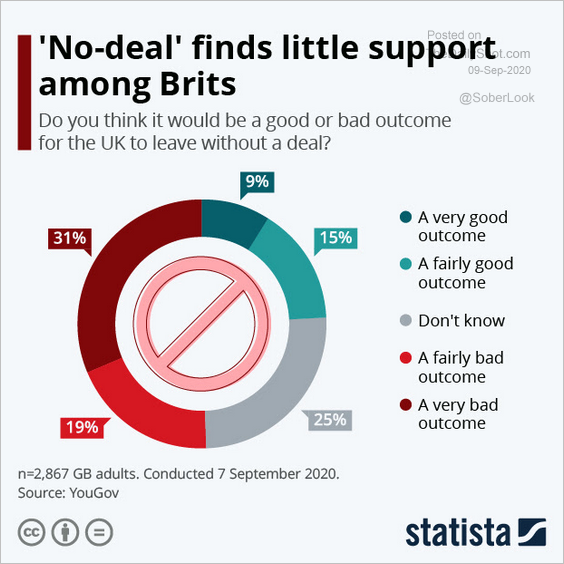

• The public is not enthusiastic about a no-deal Brexit.

Source: Statista

Source: Statista

The Eurozone

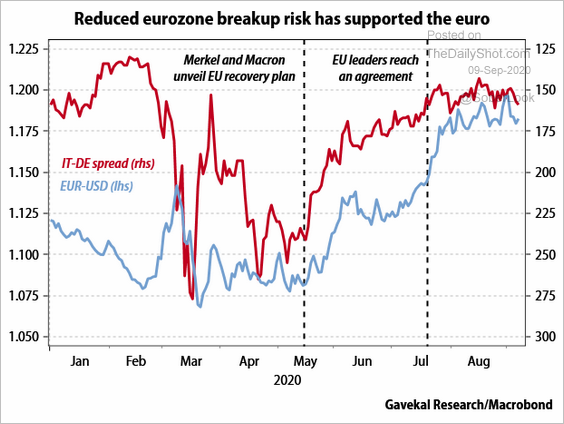

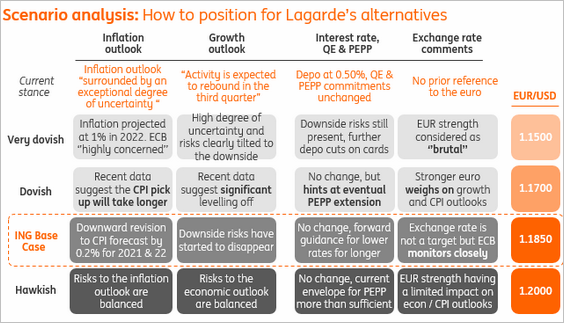

1. Let’s start with some updates on the euro.

• The currency has been supported by reduced Eurozone breakup risk.

Source: Gavekal

Source: Gavekal

• Here are some potential outcomes for the euro based on the ECB’s stance.

Source: ING

Source: ING

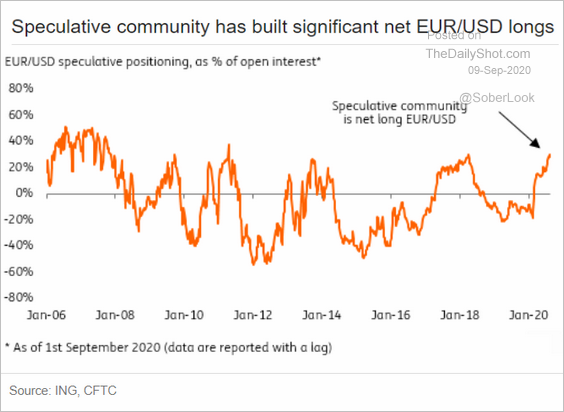

• Speculative bets on the euro make the currency vulnerable to a sharp selloff.

Source: ING

Source: ING

——————–

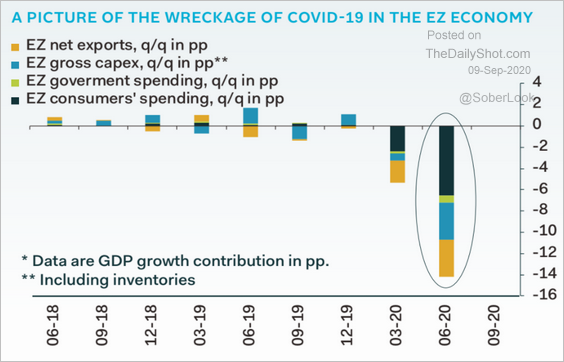

2. Here is the breakdown of the Eurozone’s GDP changes.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

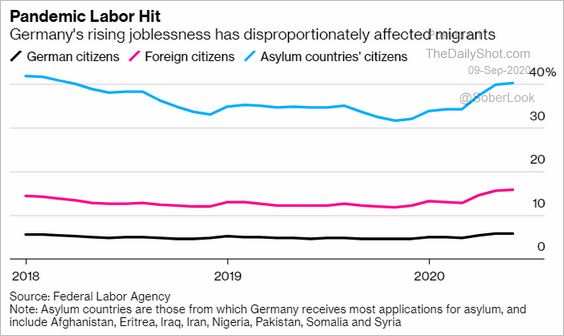

3. Next, we have some updates on Germany.

• Exports should continue to recover.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Labor costs spiked as hours worked plunged while wages remained near pre-crisis levels.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• The crisis hit immigrants the hardest.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

——————–

4. Italian retail sales worsened again in July.

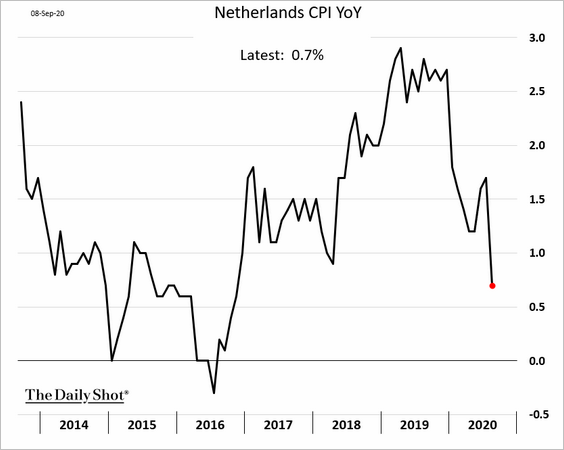

5. Inflation has slowed across the Eurozone.

Europe

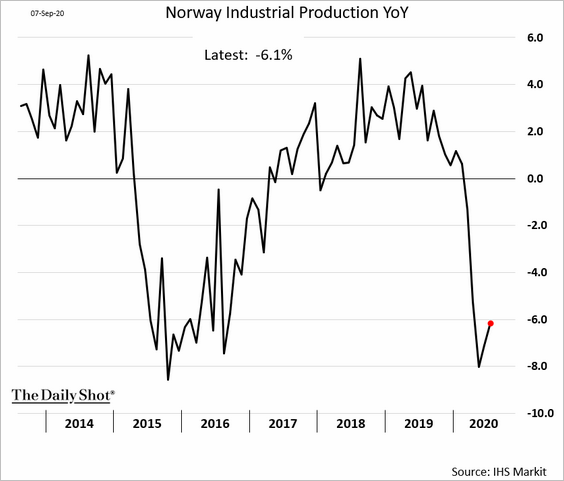

1. Norway’s industrial production remains soft.

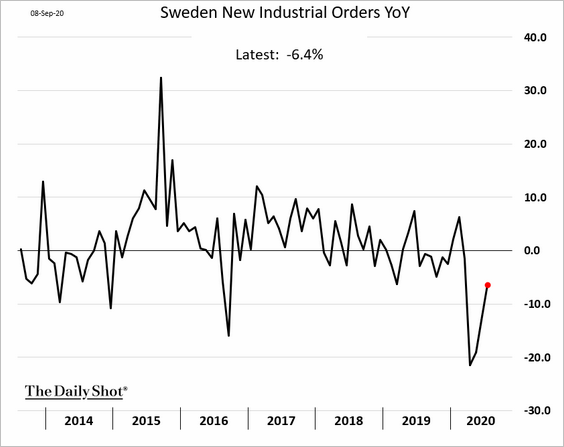

2. Sweden’s industrial orders are recovering.

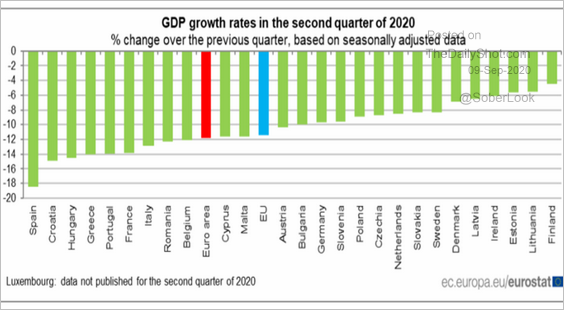

3. Here are the Q2 GDP declines across the EU.

Source: Eurostat

Source: Eurostat

Asia-Pacific

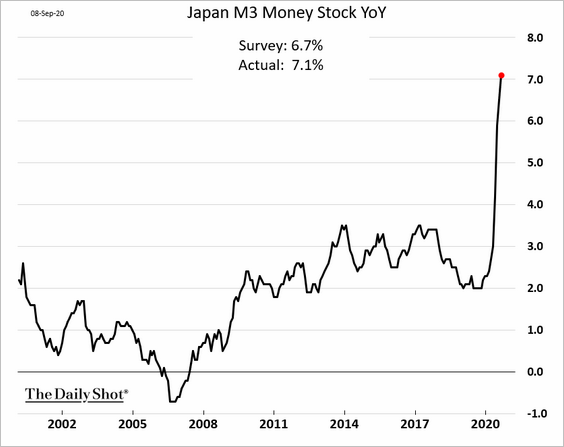

1. Let’s begin with Japan.

• The broad money supply growth hit a record.

• The Economy Watchers Expectations index surprised to the upside, signaling a more robust recovery.

——————–

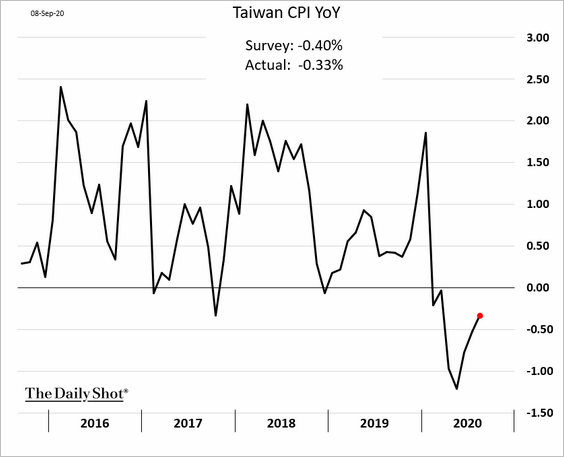

2. Taiwan’s CPI is rebounding.

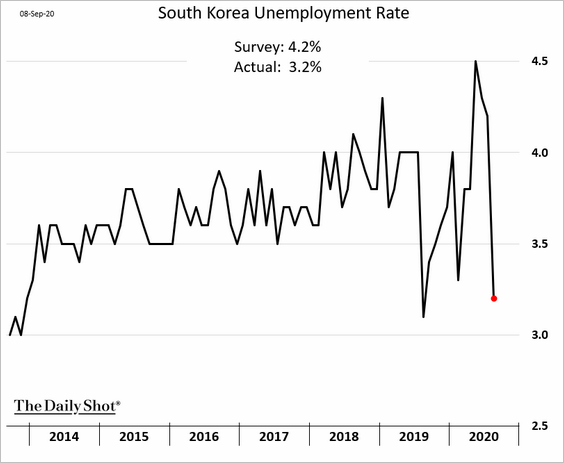

3. South Korea’s unemployment rate surprised to the downside.

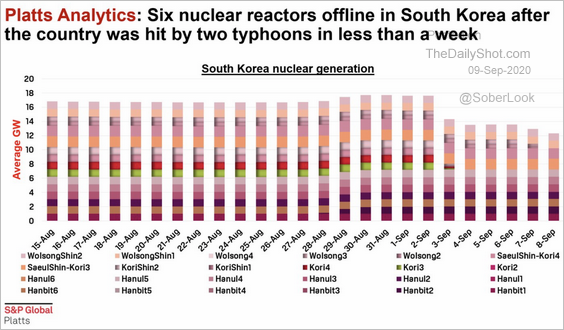

Separately, South Korea is experiencing nuclear reactor outages after being hit with typhoons.

Source: Platts, @bbrunettienergy

Source: Platts, @bbrunettienergy

——————–

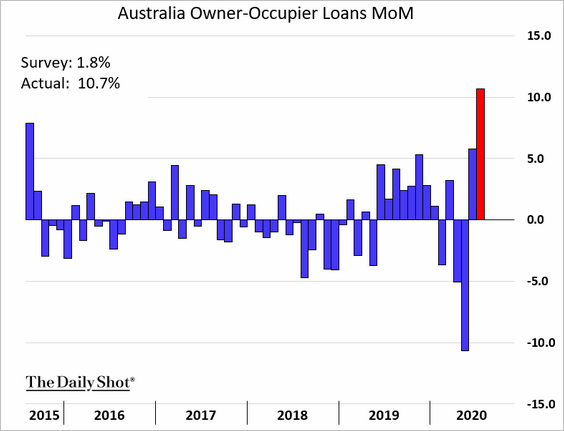

4. Australia’s mortgage approvals spiked before the Melbourne lockdown.

Source:

Source:

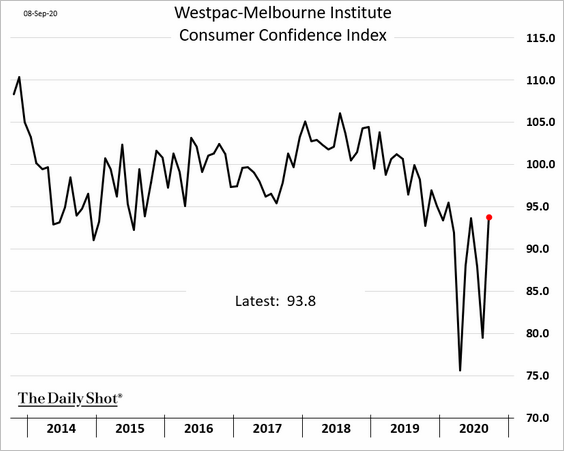

Australia’s consumer confidence rebounded this month.

——————–

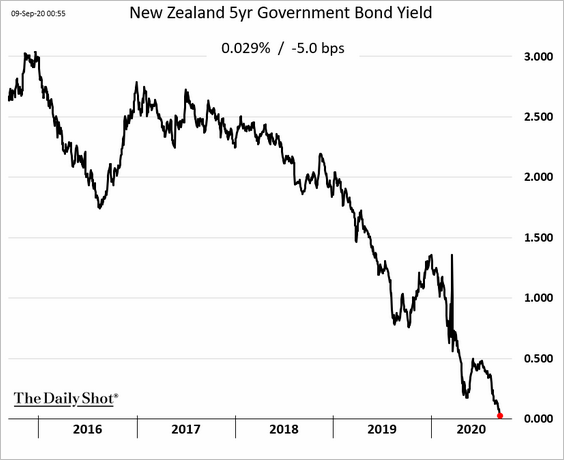

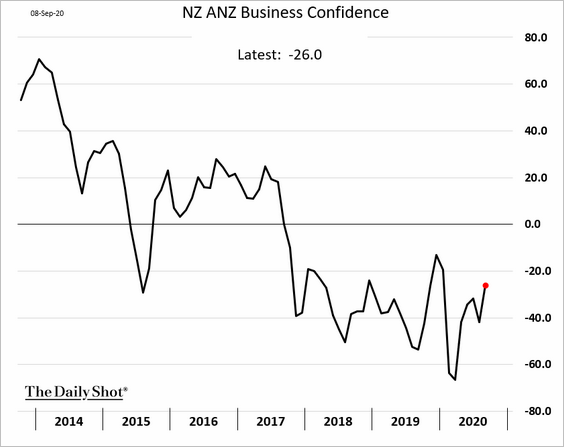

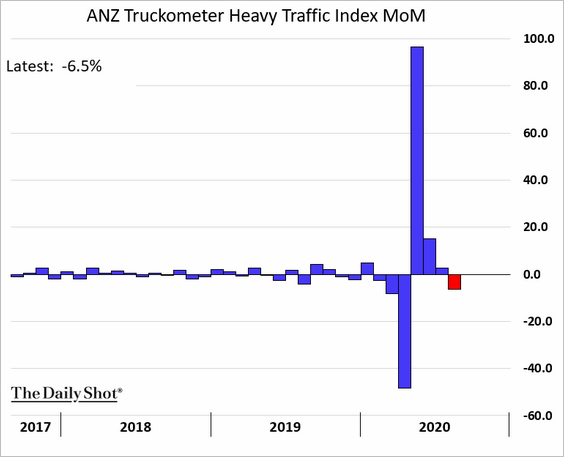

5. Next, we have some updates on New Zealand.

• Bond yields are about to dip below zero as the RBNZ contemplates negative rates.

Source: Yahoo Finance Read full article

Source: Yahoo Finance Read full article

• Business confidence is recovering.

• Truck activity slowed last month.

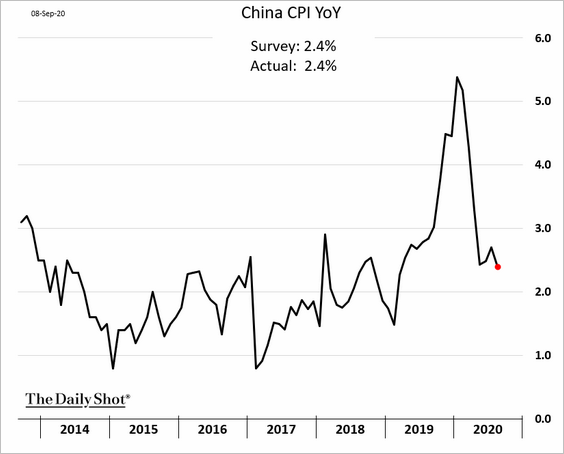

China

1. Price increases moderated in August.

Core inflation remained flat.

——————–

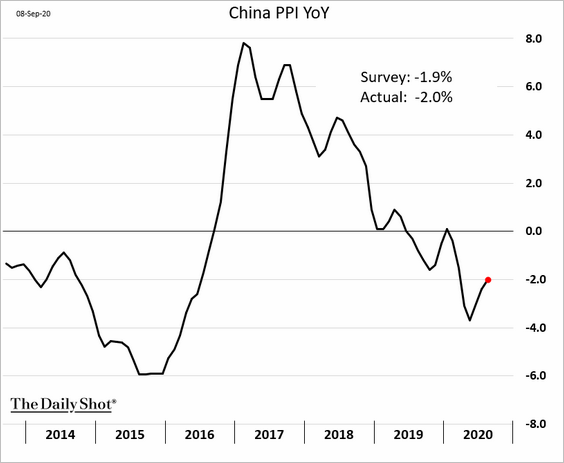

2. The PPI appears to be rebounding, which is a positive sign for industrial profits.

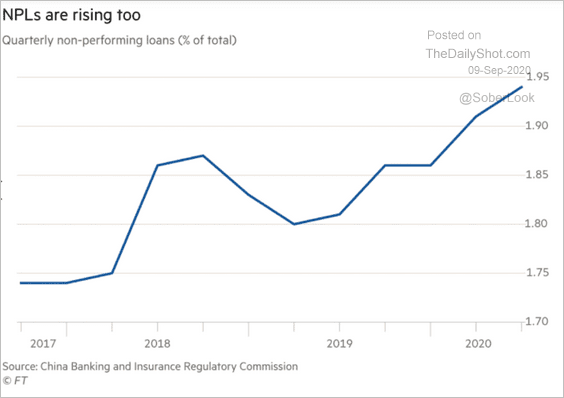

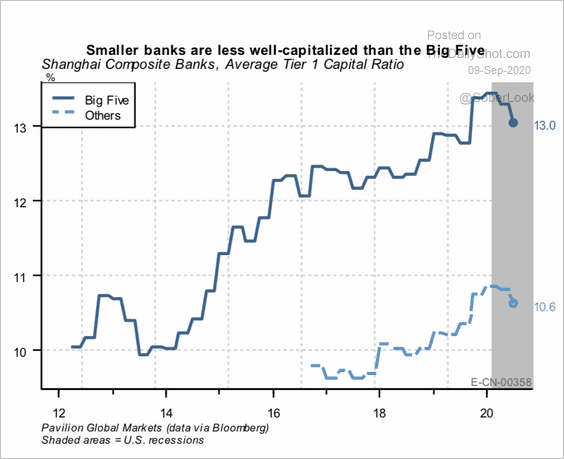

3. Nonperforming loans have been climbing.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Smaller banks are significantly less well-capitalized than the Big Five.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

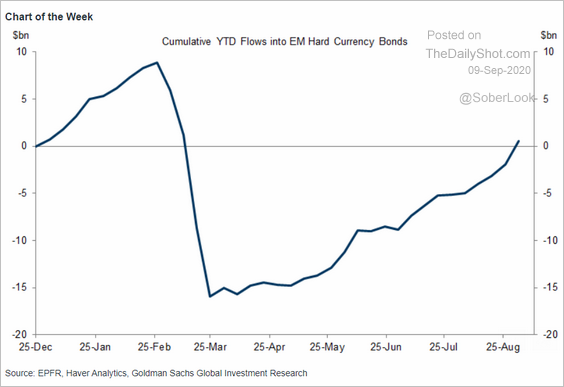

Emerging Markets

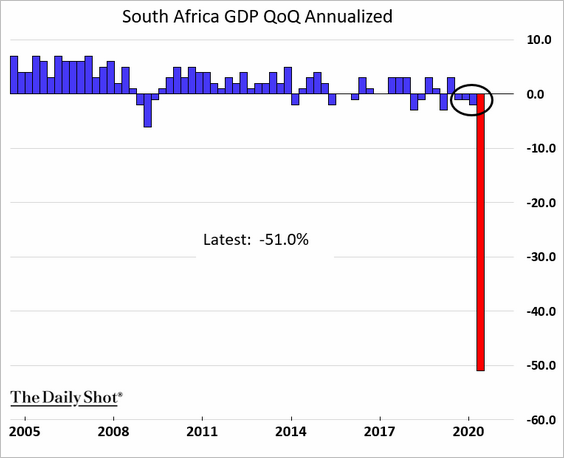

1. South Africa’s GDP decreased by 51% (annualized) in the second quarter. It was the fourth consecutive decline.

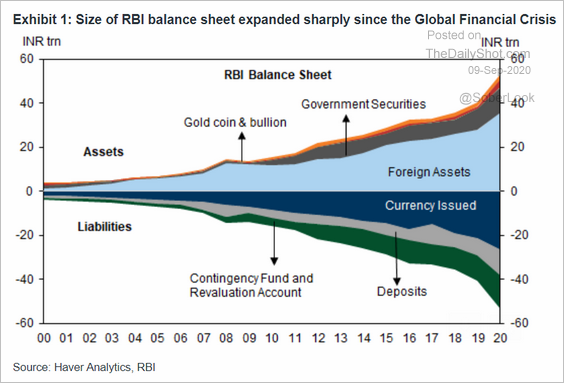

2. This chart shows the Indian central bank’s balance sheet.

Source: Goldman Sachs

Source: Goldman Sachs

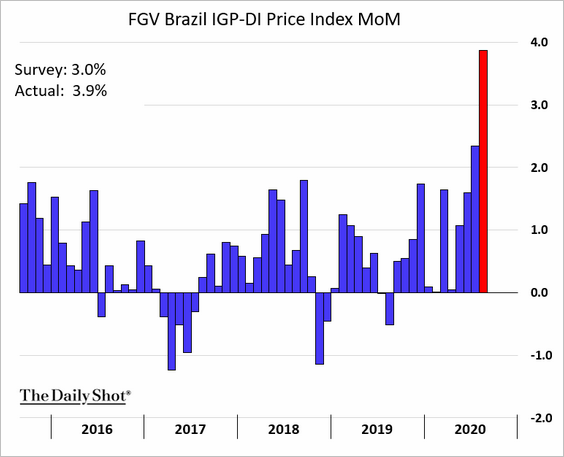

3. Brazil’s inflation jumped last month.

4. EM dollar-denominated bond yields have declined sharply amid ongoing inflows (second chart).

Source: @lisaabramowicz1

Source: @lisaabramowicz1

Source: Goldman Sachs

Source: Goldman Sachs

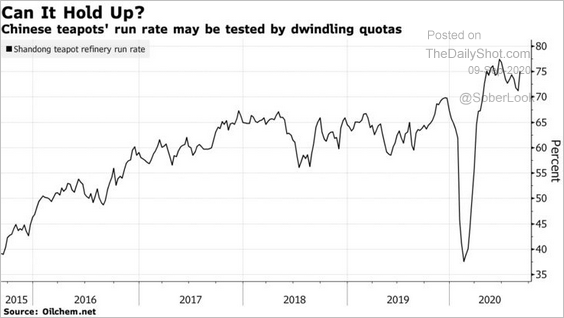

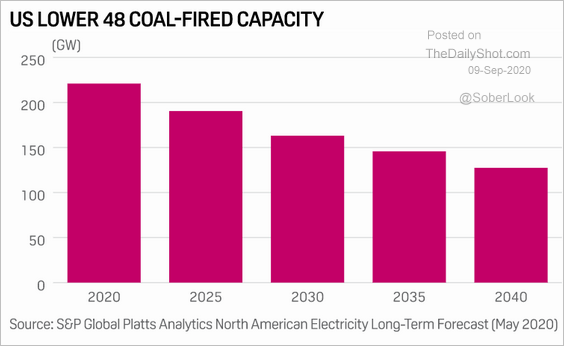

Energy

1. Brent crude dipped below $40/bbl.

2. US natural gas has been rolling over as well.

3. China’s refinery rate has been elevated but is likely to slow as crude oil imports hit quotas.

Source: @business Read full article

Source: @business Read full article

4. US coal-fired capacity is expected to keep declining over the next couple of decades.

Source: Platts

Source: Platts

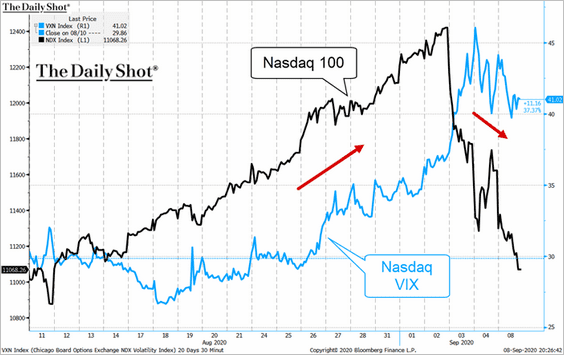

Equities

1. The Nasdaq 100 implied volatility has been drifting lower even as the market sold off.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

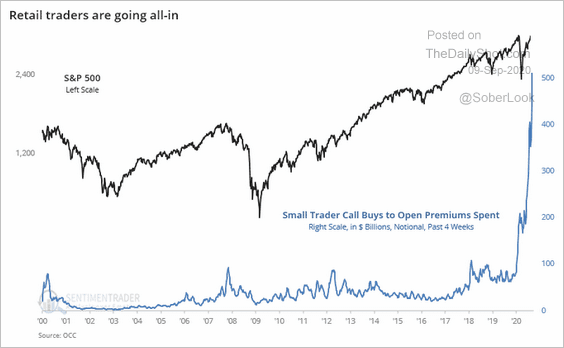

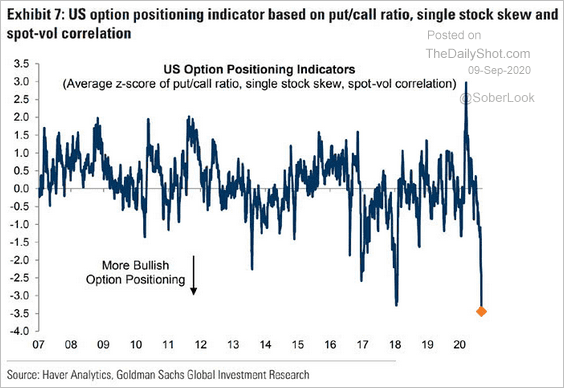

The trend suggests that some of the massive call option bets (2 charts below) are getting unwound.

Source: @sentimentrader

Source: @sentimentrader

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

——————–

3. The Nasdaq 100 is at its 50-day moving average.

Interestingly, other indicators are there as well.

Source: @markets Read full article

Source: @markets Read full article

——————–

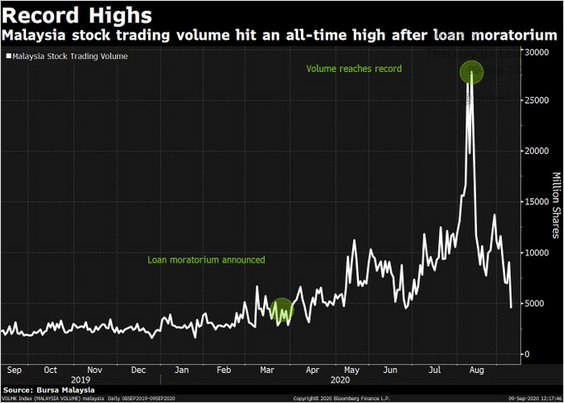

4. By the way, the retail infatuation with stock trading is not unique to the US. Malaysia’s moratorium on loan payments put cash in investors’ pockets, some of which ended up in the market.

Source: @tracyalloway, @yantoultrangui Read full article

Source: @tracyalloway, @yantoultrangui Read full article

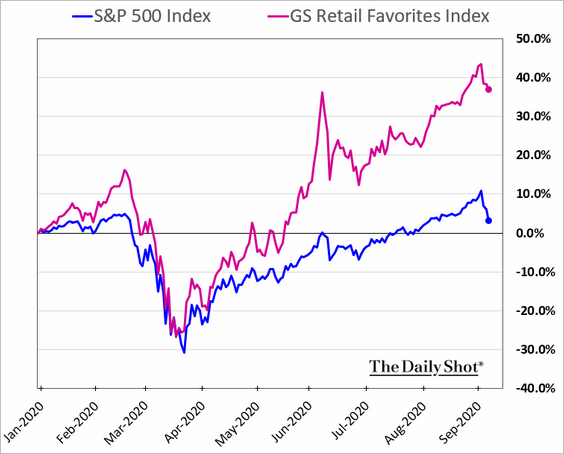

5. Despite the market pullback, stocks favored by retail investors continue to outperform.

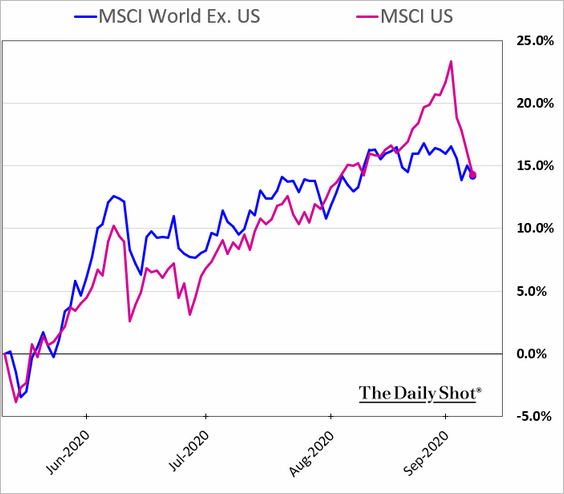

6. US shares have underperformed global peers this month.

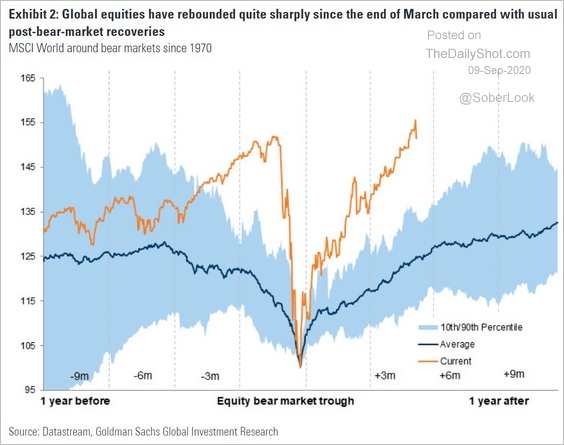

7. Here is the current global market rebound vs. previous post-bear-market recoveries.

Source: Goldman Sachs, @jsblokland

Source: Goldman Sachs, @jsblokland

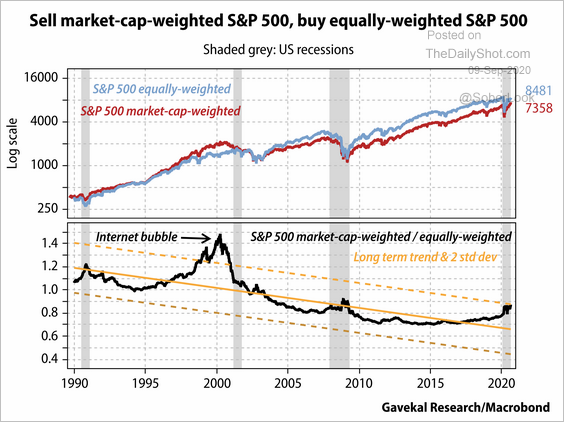

8. The market-cap-weighted S&P 500 is overbought versus the equal-weighted S&P 500.

Source: Gavekal

Source: Gavekal

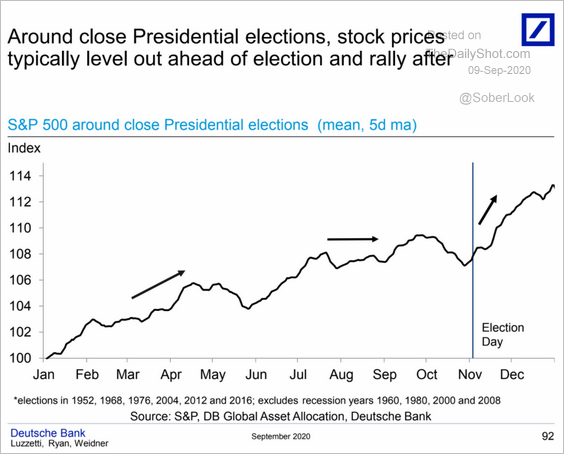

9. Will the market follow the typical Presidential elections pattern?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

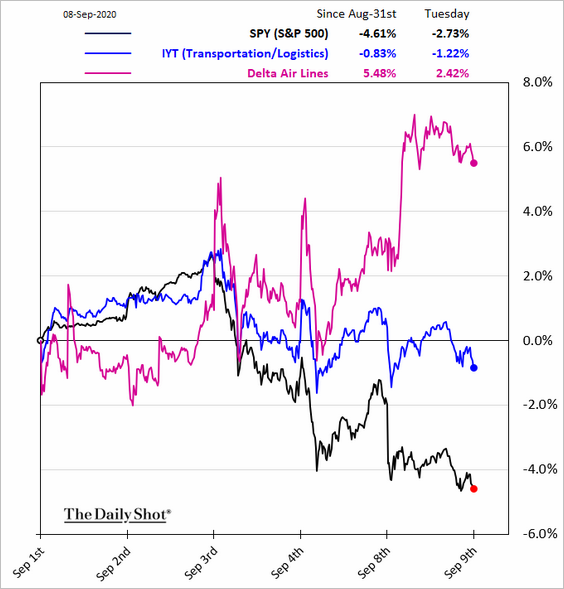

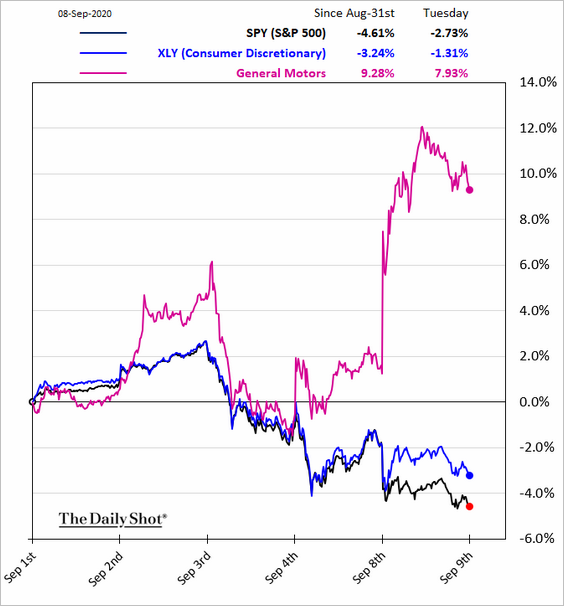

10. Here are a couple of sector updates.

• Transportation:

• Consumer Discretionary:

Source: CNBC Read full article

Source: CNBC Read full article

Credit

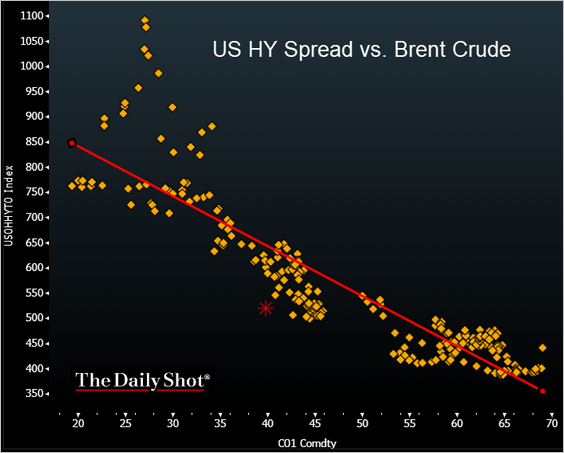

1. The decline in oil prices could result in wider credit spreads.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

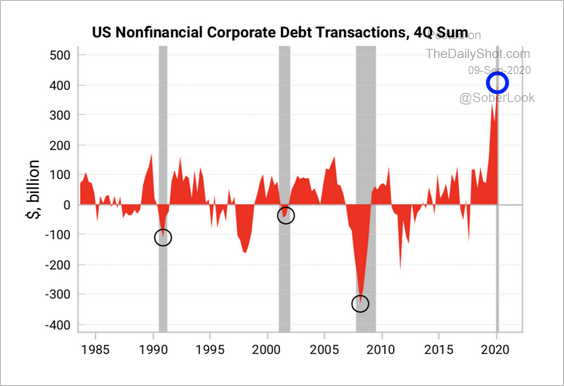

2. Corporate debt issuance has been unprecedented.

Source: Variant Perception

Source: Variant Perception

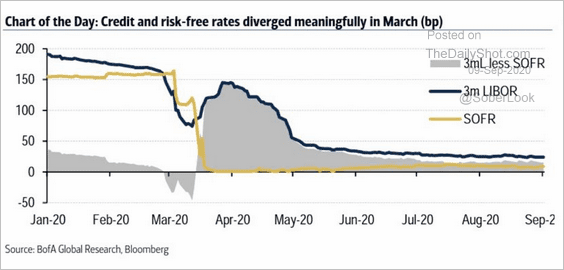

3. With LIBOR going away, the market may need another index that measures unsecured bank borrowing costs. SOFR represents collateralized lending (repo), which is not a good measure of bank credit.

Source: BofA Securities

Source: BofA Securities

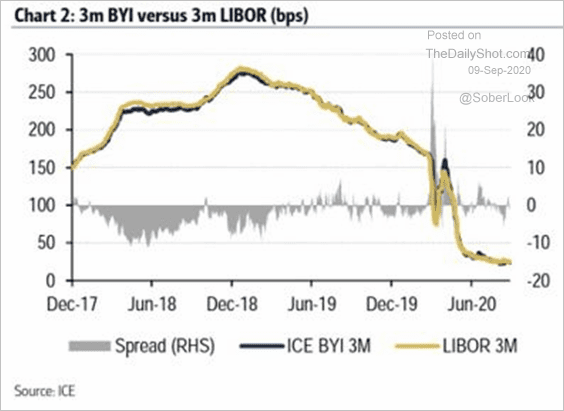

Could BYI be that index?

Source: BofA Securities

Source: BofA Securities

Rates

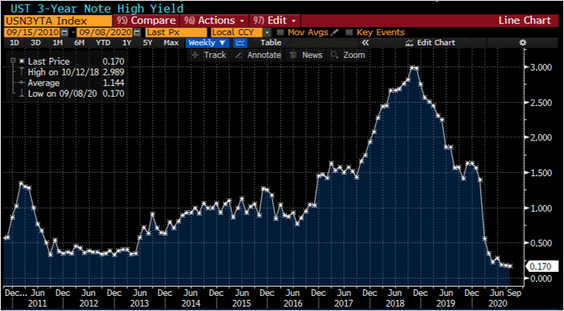

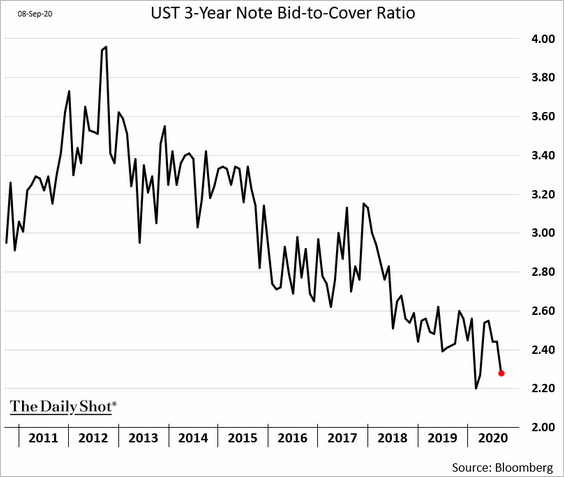

1. The 3-year Treasury note auction cleared at a record low yield.

Source: @lisaabramowicz1

Source: @lisaabramowicz1

However, demand has been soft, especially after the robust jobs report last week.

——————–

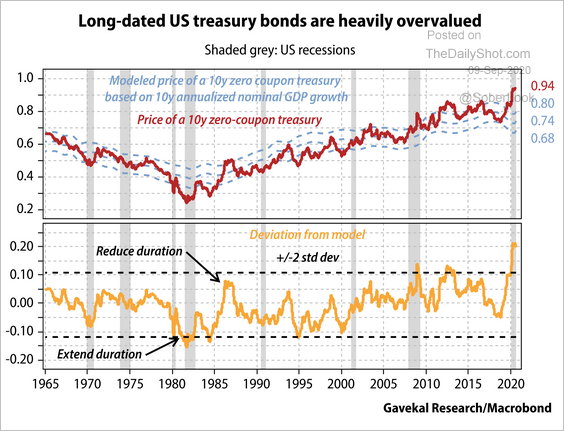

2. Long-dated Treasuries are overvalued, according to Gavekal.

Source: Gavekal

Source: Gavekal

Global Developments

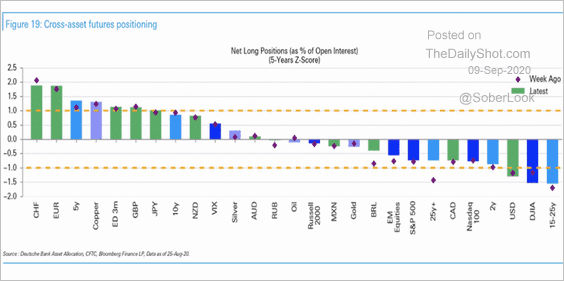

1. This chart shows futures positioning across different asset classes. There’s a high concentration of long bets in the Swiss franc and the euro.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

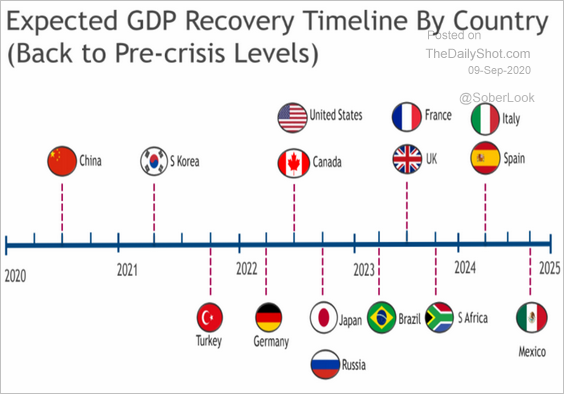

2. How long will it take each country to get back to pre-crisis GDP?

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

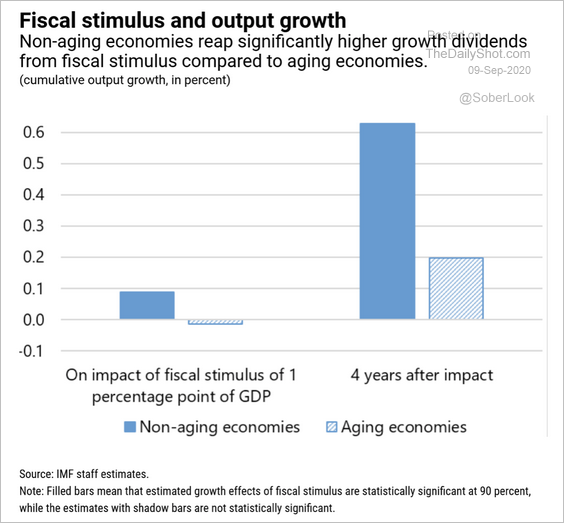

3. Fiscal stimulus has a much greater impact on non-aging economies.

Source: IMF Read full article

Source: IMF Read full article

——————–

Food for Thought

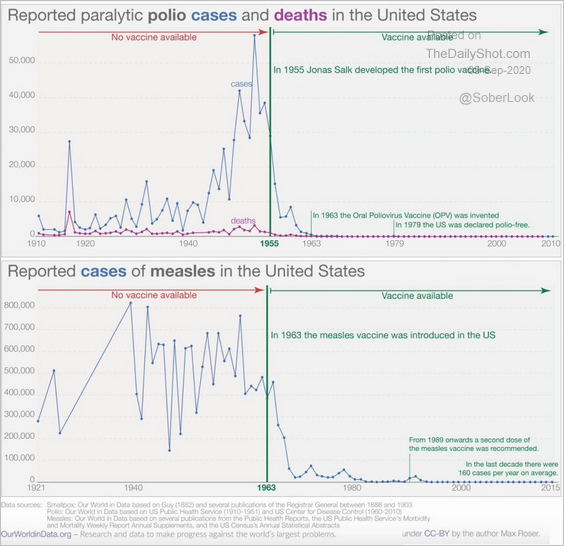

1. The effectiveness of polio and measles vaccines:

Source: @adam_tooze, @OurWorldInData Read full article

Source: @adam_tooze, @OurWorldInData Read full article

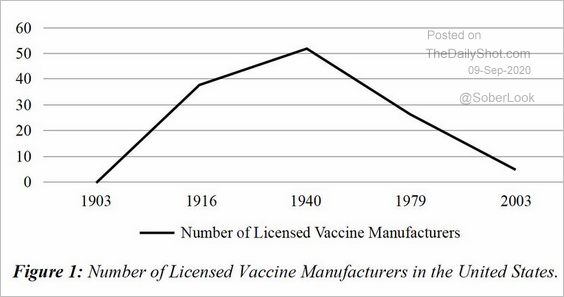

2. Licensed US vaccine manufacturers:

Source: Ana Santos Rutschman, @adam_tooze

Source: Ana Santos Rutschman, @adam_tooze

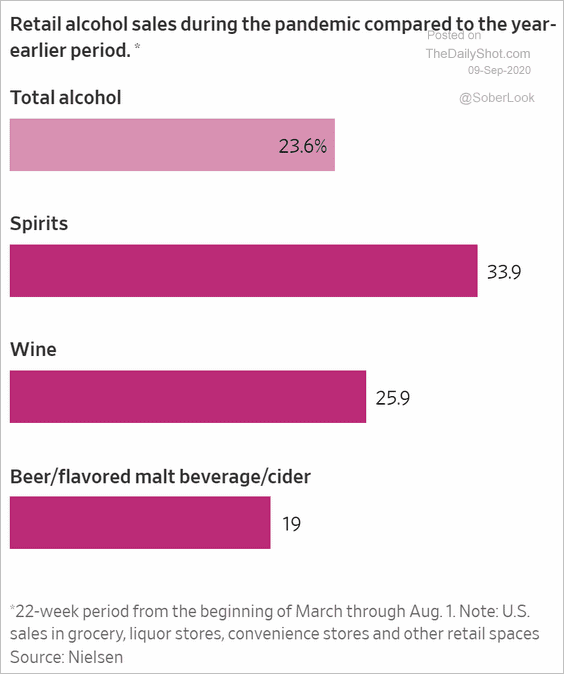

3. The increase in alcohol sales during the pandemic:

Source: @WSJ Read full article

Source: @WSJ Read full article

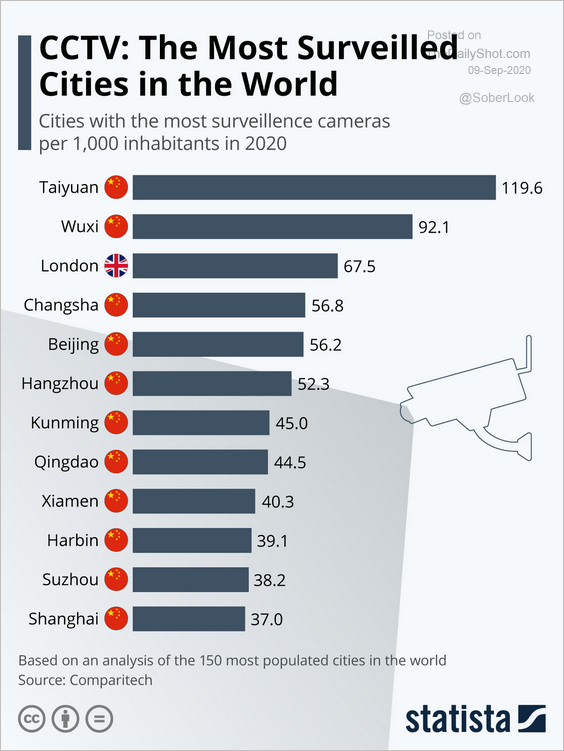

4. Most surveilled cities:

Source: Statista

Source: Statista

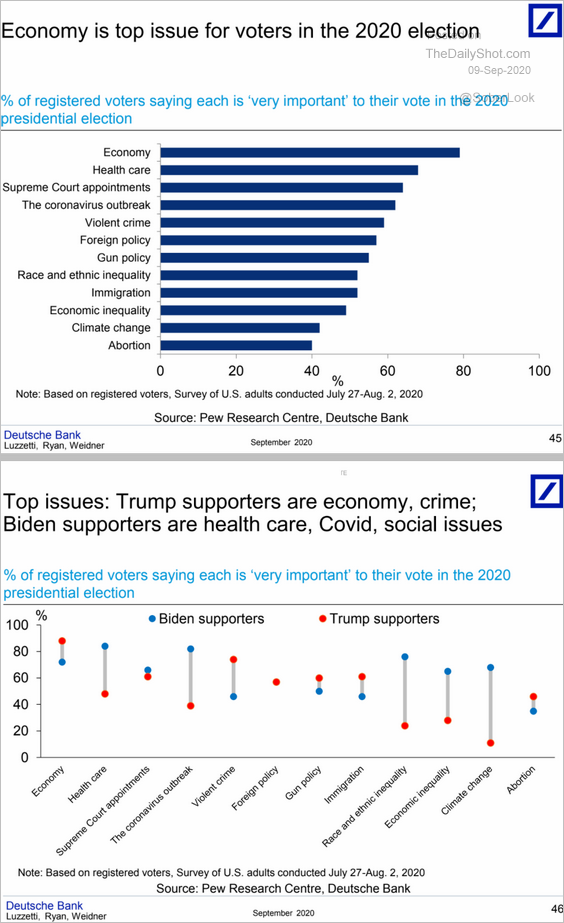

5. Top issues in the current US election:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

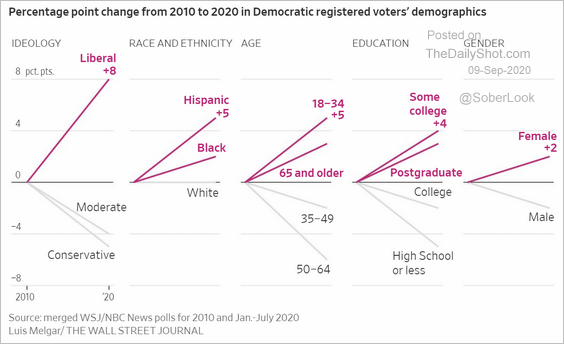

6. Democrats’ changing demographics:

Source: @WSJ Read full article

Source: @WSJ Read full article

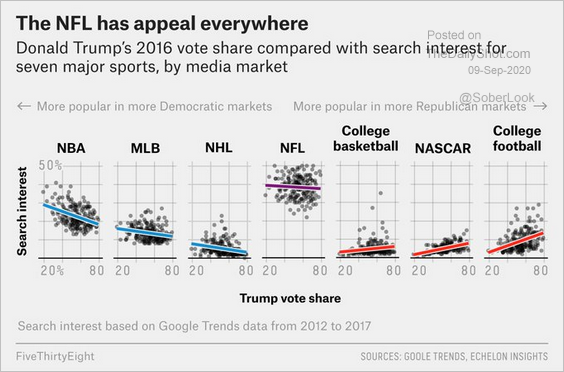

7. Political leaning in different sports:

Source: @FiveThirtyEight Read full article

Source: @FiveThirtyEight Read full article

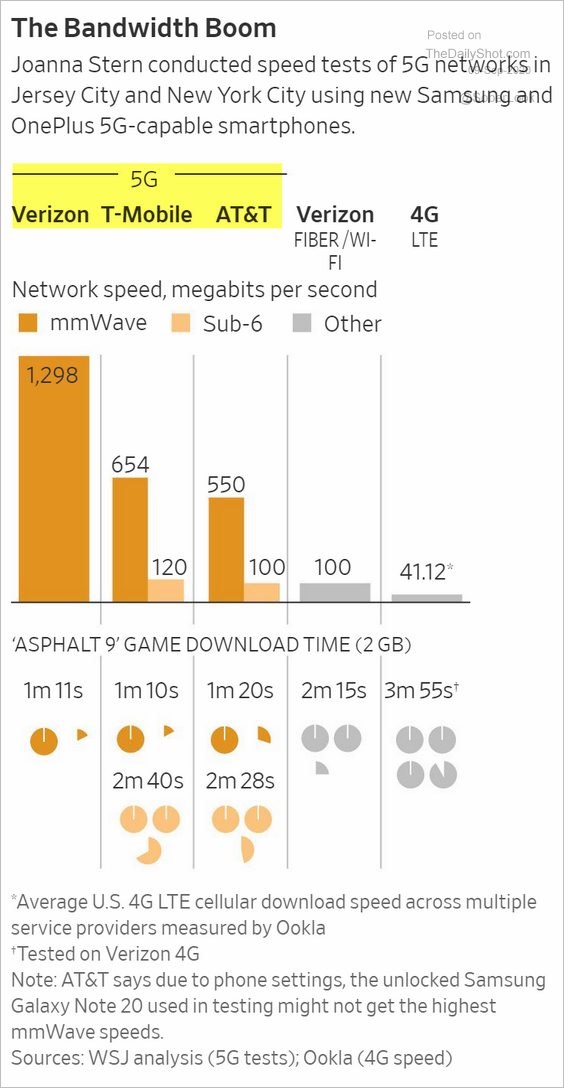

8. 5G network speeds:

Source: @WSJ Read full article

Source: @WSJ Read full article

9. UFO sightings by state:

Source: Satelliteinternet.com Read full article

Source: Satelliteinternet.com Read full article

——————–