The Daily Shot: 18-Sep-20

• Administrative Update

• The United States

• The United Kingdom

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Alternatives

• Global Developments

• Food for Thought

Administrative Update

Please note that at the end of each section of The Daily Shot, there is a “Back to Index” link, which gets you to another section in two clicks (without having to scroll).

The United States

1. At first glance, the August residential construction report was a bit softer than expected.

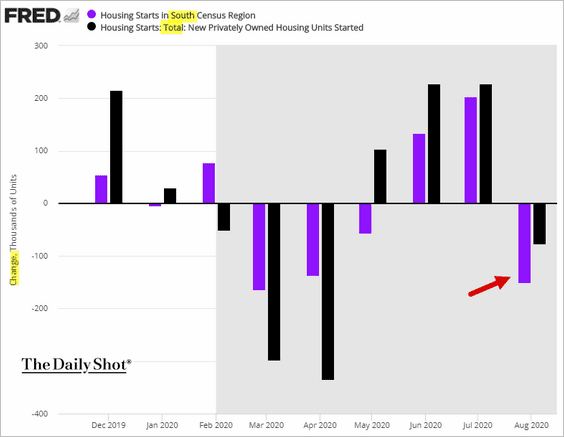

However, some of the weakness can be attributed to Hurricane Laura and Tropical Storm Marco. We can see that the drop in housing starts was more pronounced in the South.

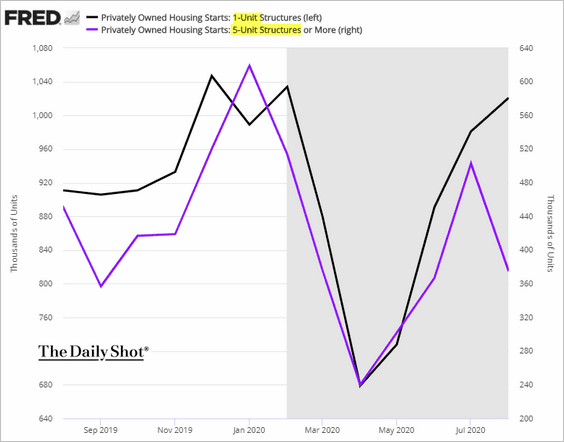

Moreover, the decline was driven by multi-family housing.

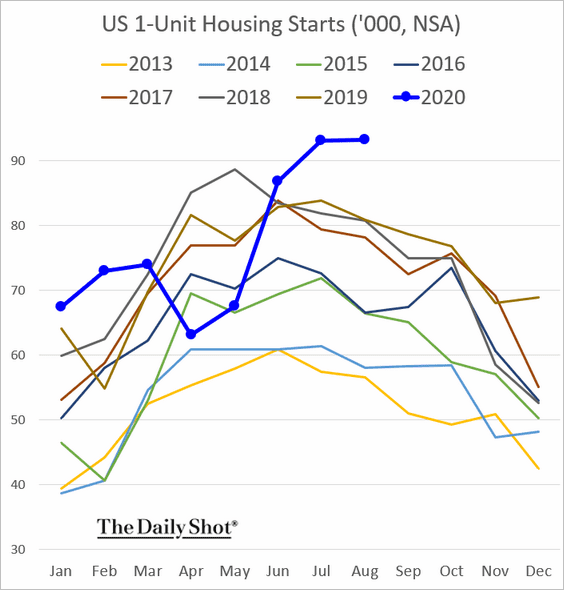

Single-family construction activity remains robust.

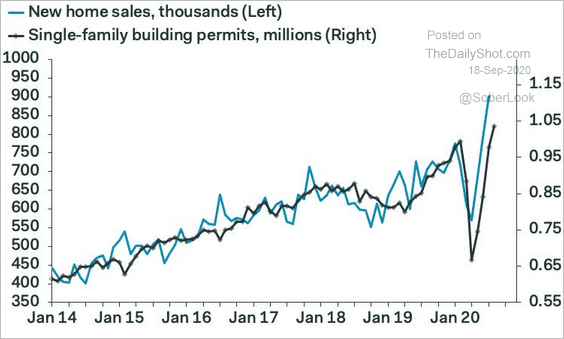

New home sales point to further improvements in residential construction ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

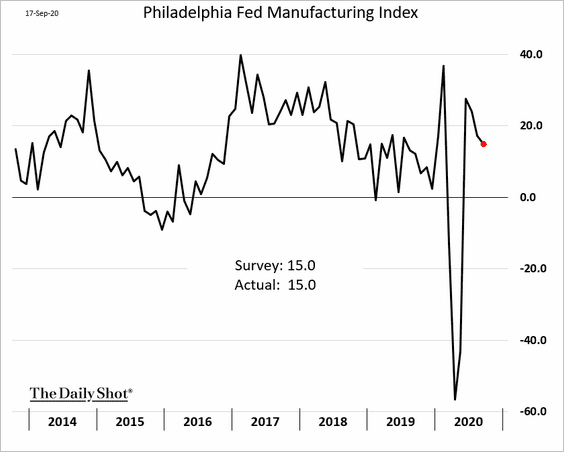

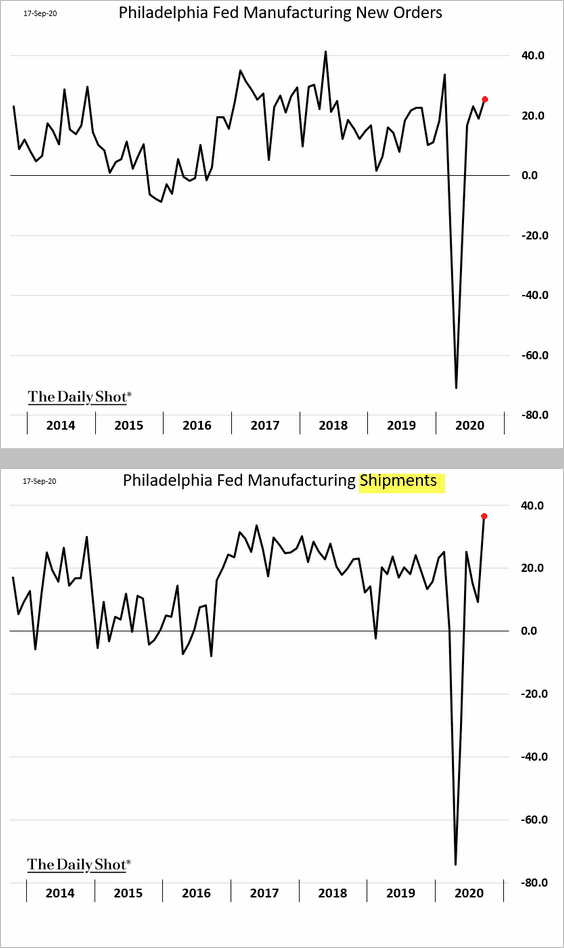

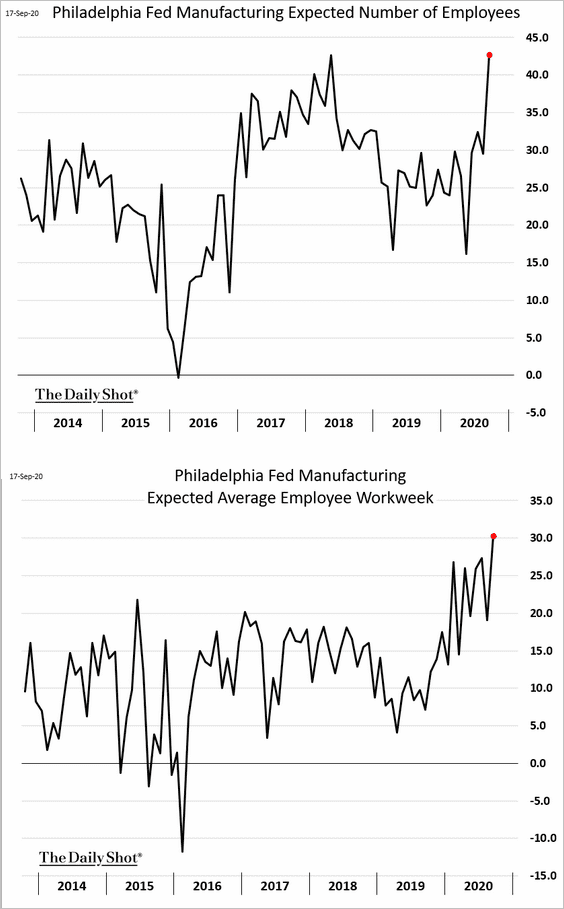

2. The Philly Fed’s September regional manufacturing report was solid. The headline index declined, …

… but the underlying trends showed strength in factory activity.

• Orders and shipments:

• Expected employment:

——————–

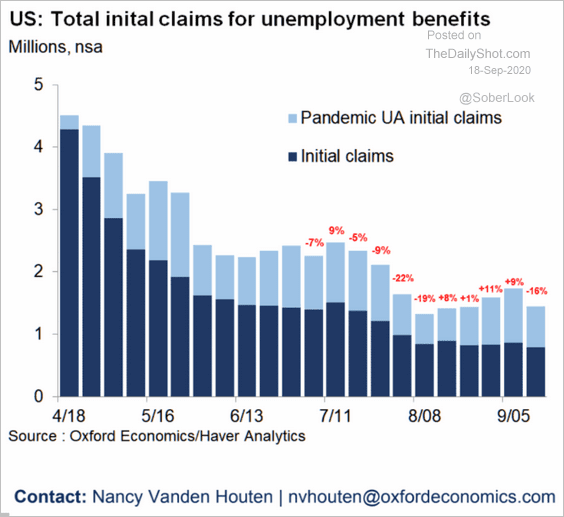

3. Initial jobless claims fell last week but held above one million new applications.

Source: Oxford Economics

Source: Oxford Economics

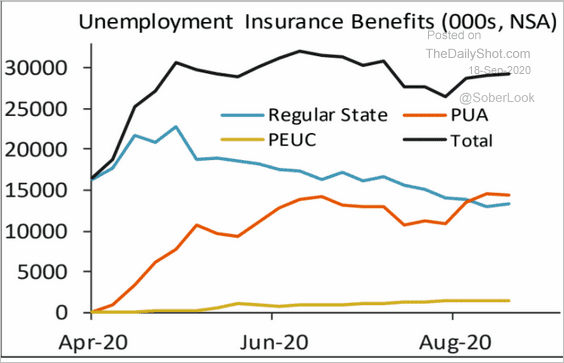

The total number of Americans receiving unemployment benefits remains stubbornly high.

Source: Piper Sandler

Source: Piper Sandler

——————–

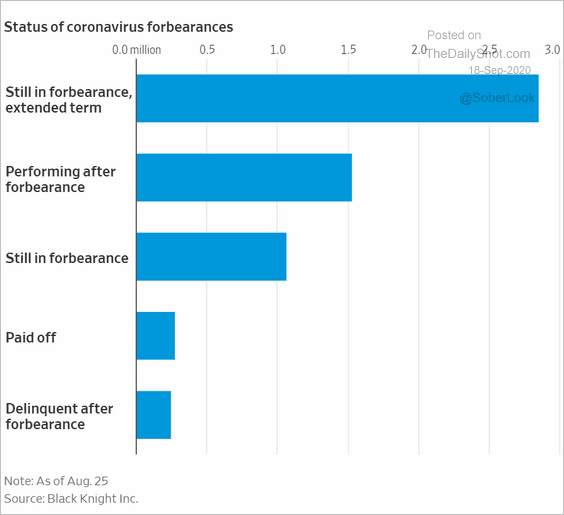

4. Mortgage lenders continue to kick the can down the road by extending loan forbearance.

Source: @WSJ Read full article

Source: @WSJ Read full article

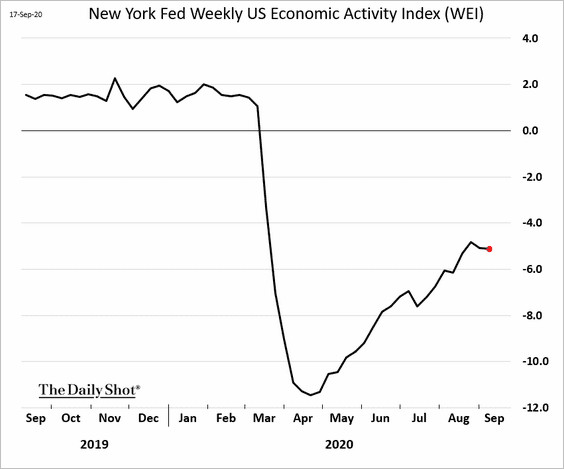

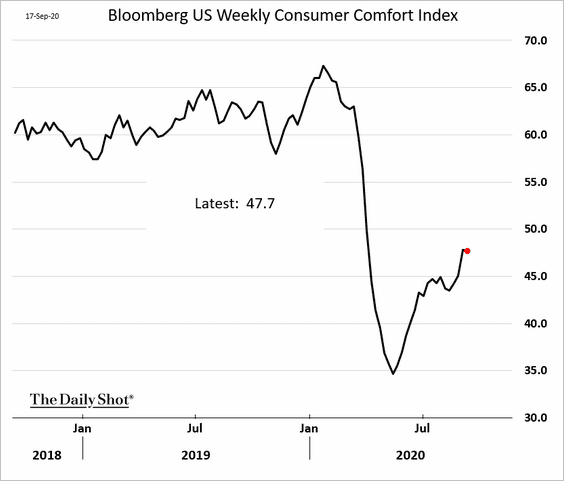

5. Next, let’s take a look at some high-frequency indicators of economic activity.

• The NY Fed’s weekly national activity index:

• Bloomberg’s consumer sentiment index:

• The Oxford Economics Recovery Tracker:

![]() Source: Oxford Economics

Source: Oxford Economics

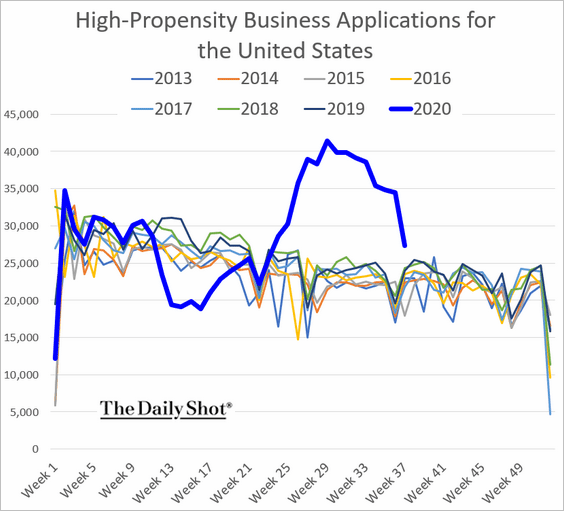

• Business applications:

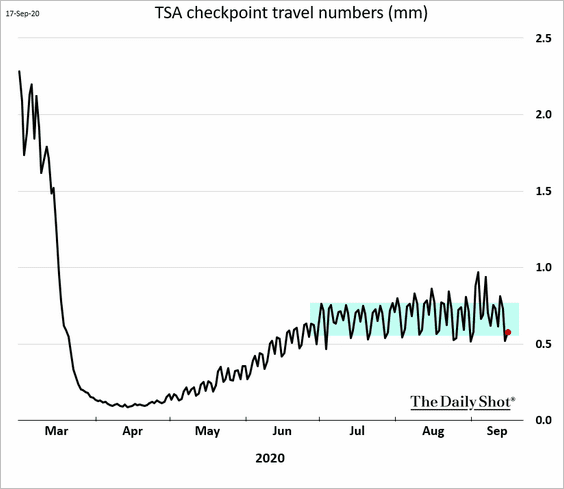

• Air travel:

Source: TSA

Source: TSA

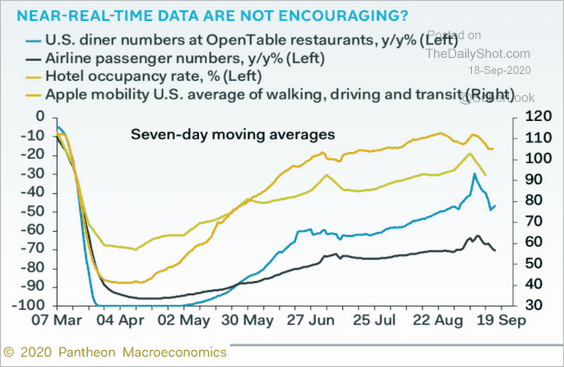

• Other indicators from Pantheon Macroeconomics:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

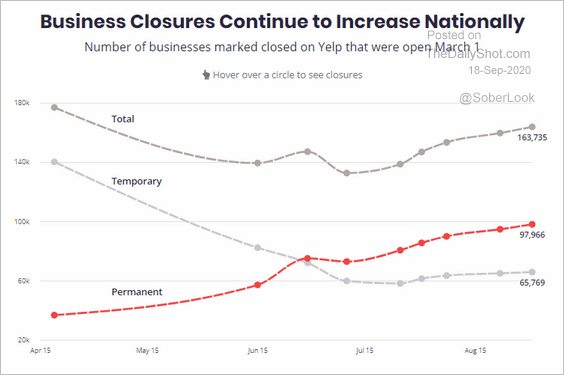

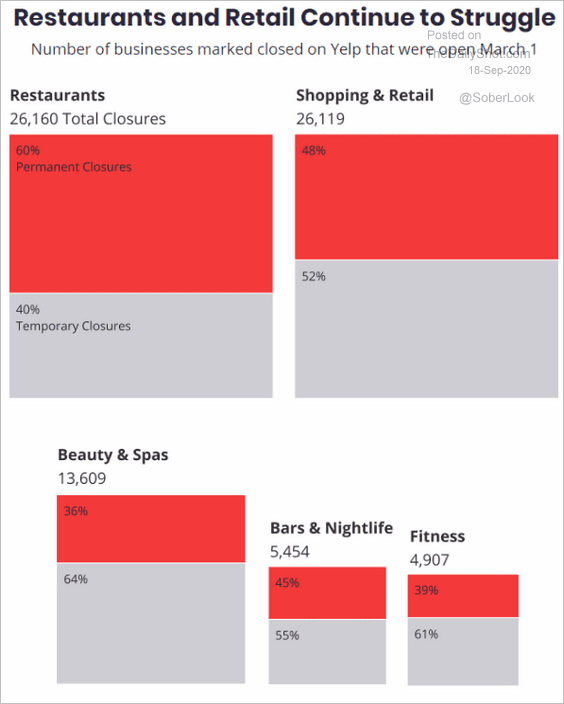

6. Permanent business closures continue to climb.

Source: Yelp Read full article

Source: Yelp Read full article

Source: Yelp Read full article

Source: Yelp Read full article

——————–

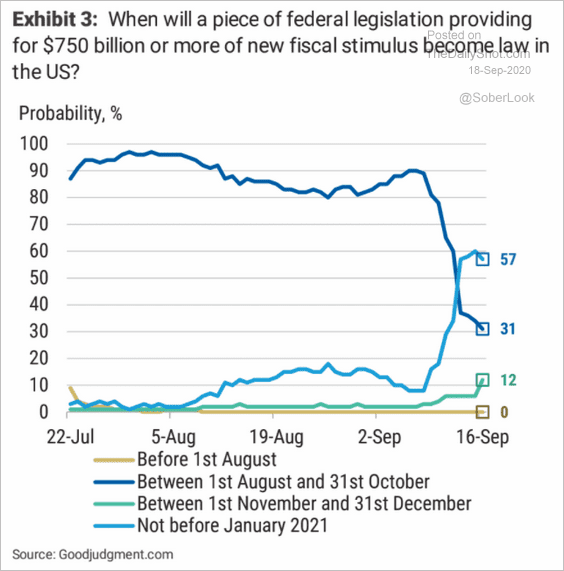

7. The $44 billion currently allocated for enhanced unemployment payments ($300/week) is expected to run out this month. Will we see a replacement? Forecasters increasingly expect a delay in the next stimulus package.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

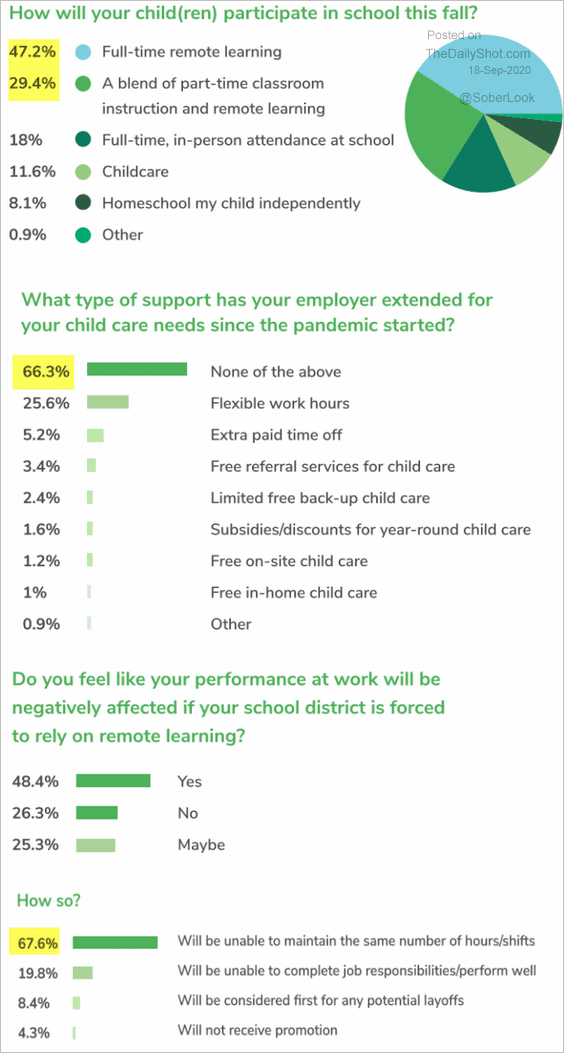

8. Remote schooling, while often necessary, is taking a massive toll on the economy, …

Source: Branch

Source: Branch

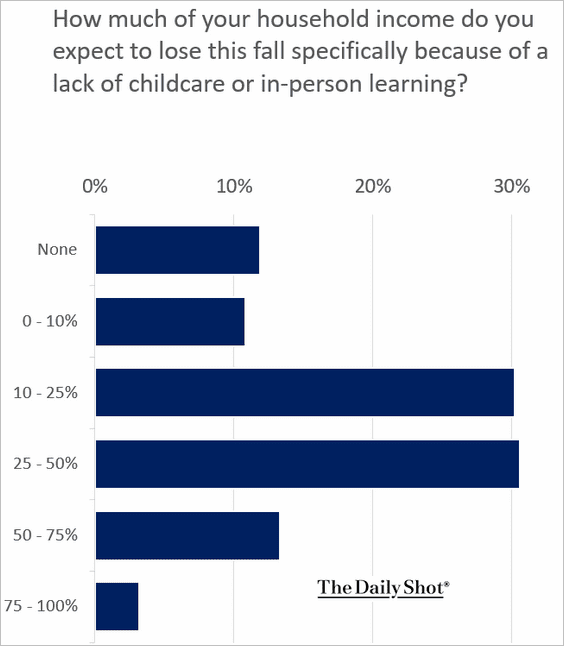

…. as households with school-age children lose income.

Source: Branch

Source: Branch

The United Kingdom

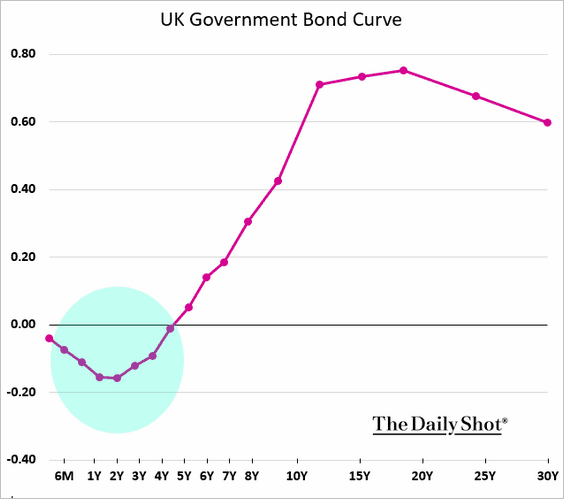

The Bank of England is contemplating negative rates.

Source: CNBC Read full article

Source: CNBC Read full article

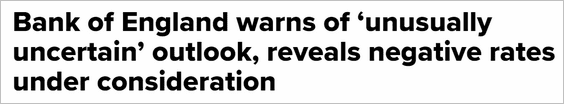

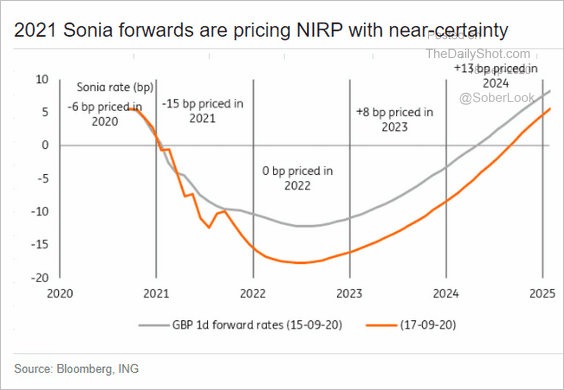

The market has been anticipating negative rates for some time and is now convinced that the central bank will get there.

• The overnight rate trajectory priced into the market:

Source: ING

Source: ING

• The overnight rate expectations over time:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

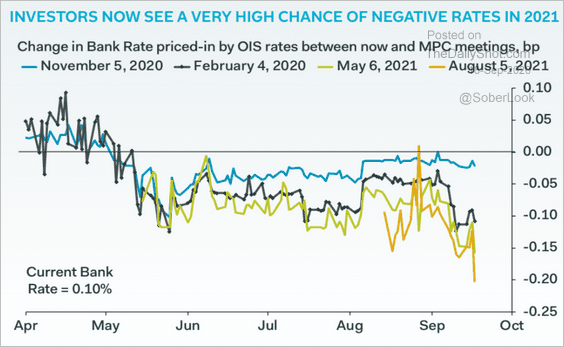

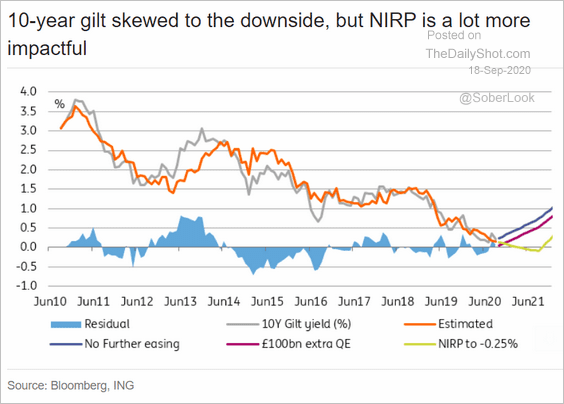

• The gilt curve:

According to ING, setting rates to -25 bps will have a much greater impact on gilt yields than another £100 billion of QE.

Source: ING

Source: ING

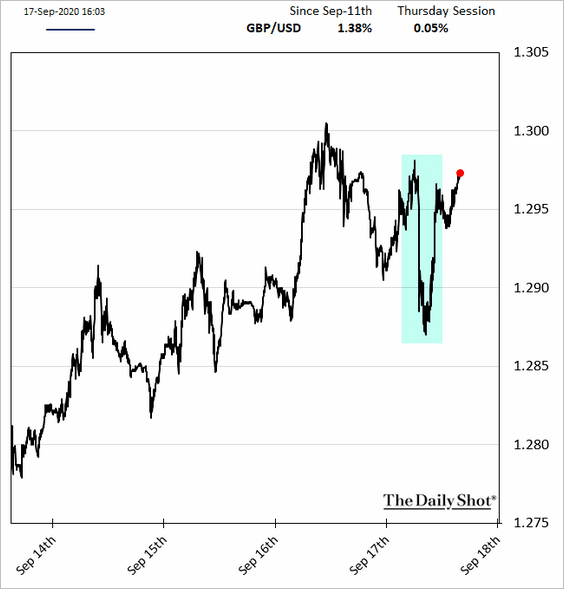

By the way, the pound sold off initially after the MPC announcement but rebounded shortly after.

Europe

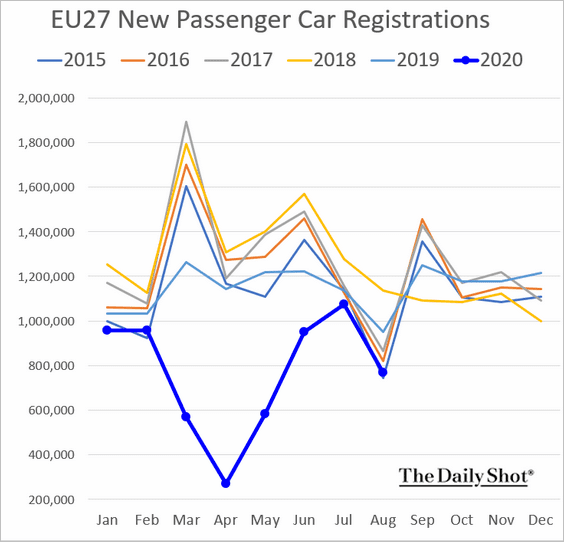

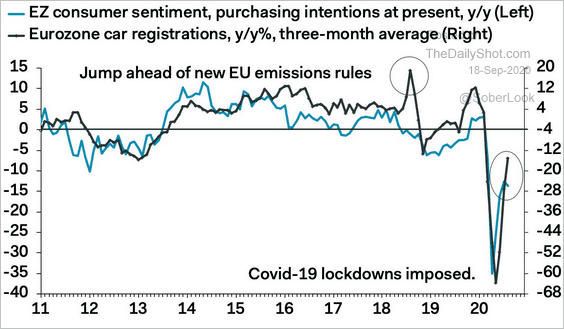

1. EU car registrations weakened last month.

But consumer sentiment points to a rebound.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

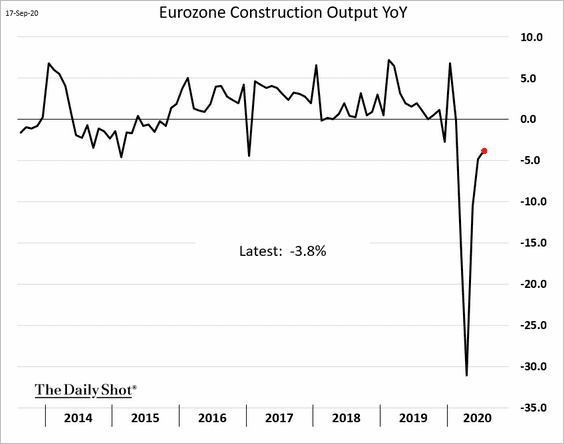

2. Eurozone construction recovery has slowed.

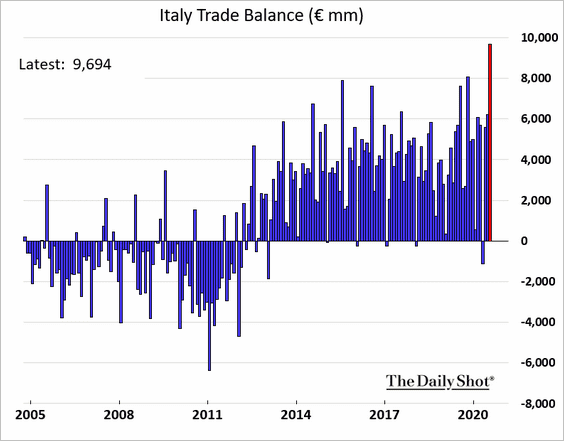

3. Italian trade surplus hit a record high.

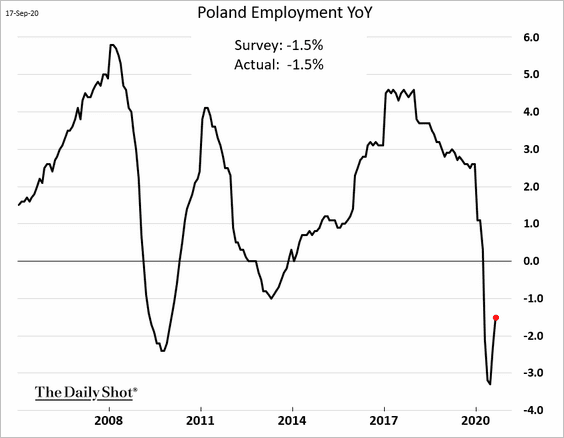

4. Poland’s labor market recovery will take some time.

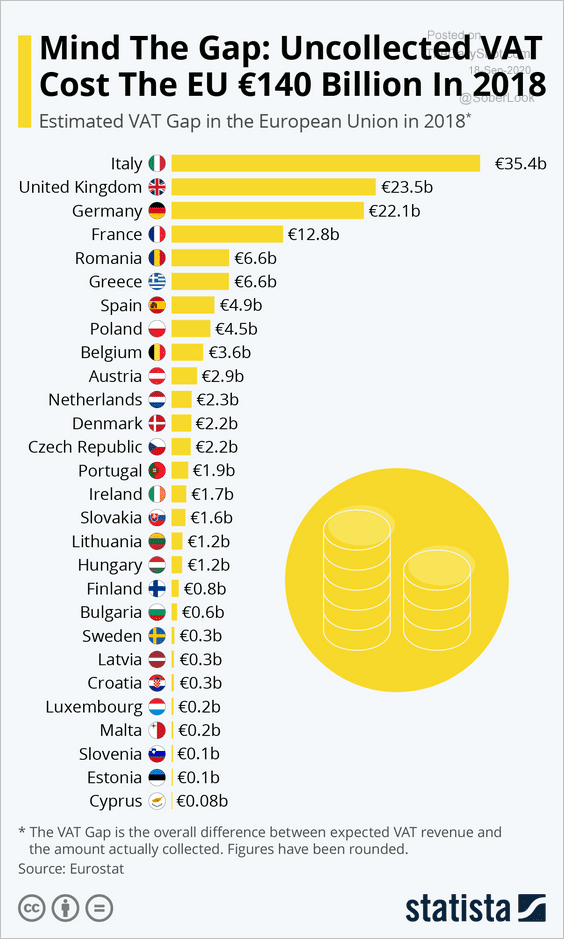

5. This chart shows the cost of uncollected VAT in the EU.

Source: Statista

Source: Statista

Asia – Pacific

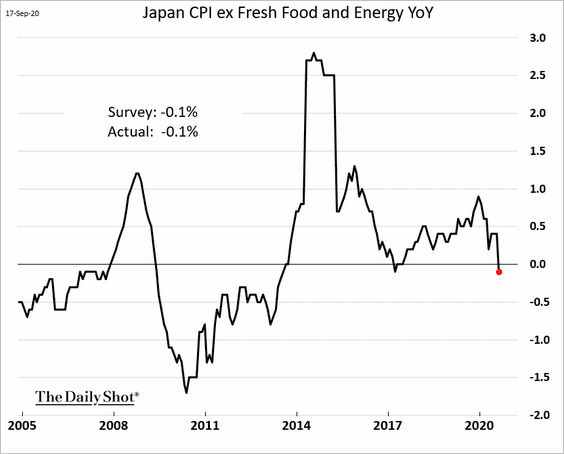

1. Japan is in deflation again, as the core CPI drops below zero.

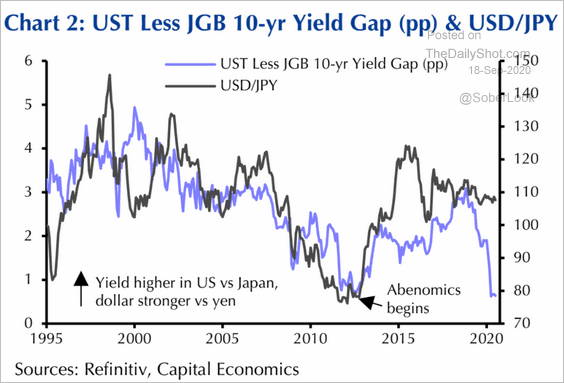

2. The US-Japan yield differential suggests that the yen should be stronger.

Source: Capital Economics

Source: Capital Economics

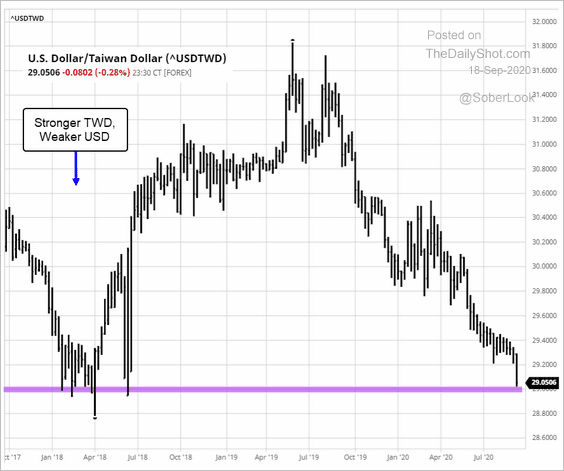

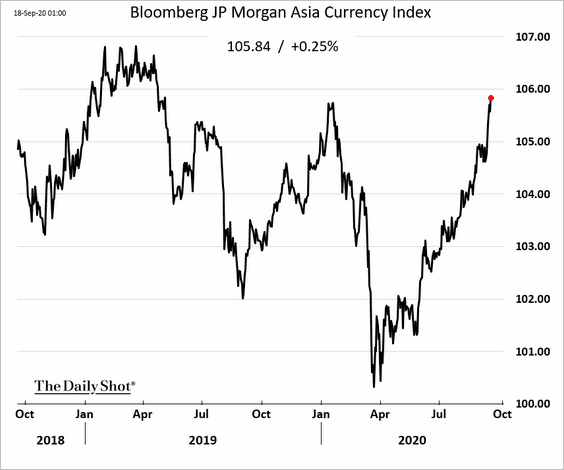

3. Asian currencies are rallying.

• The South Korean won is approaching January highs.

• USD/TWD is at support.

• Here is Bloomberg’s Asia currency index.

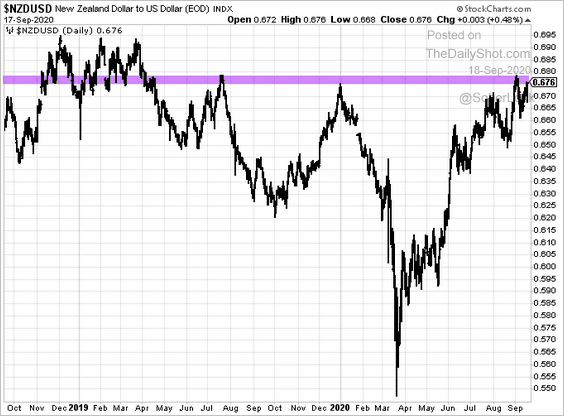

4. The New Zealand dollar is testing resistance after the Finance Minister’s comments.

Source: Newstalk ZB Read full article

Source: Newstalk ZB Read full article

——————–

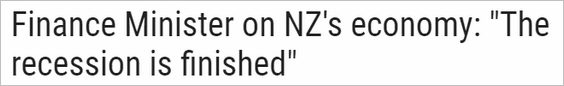

5. Next, we have some updates on Australia.

• Online search activity points to Australia’s economic activity underperforming.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

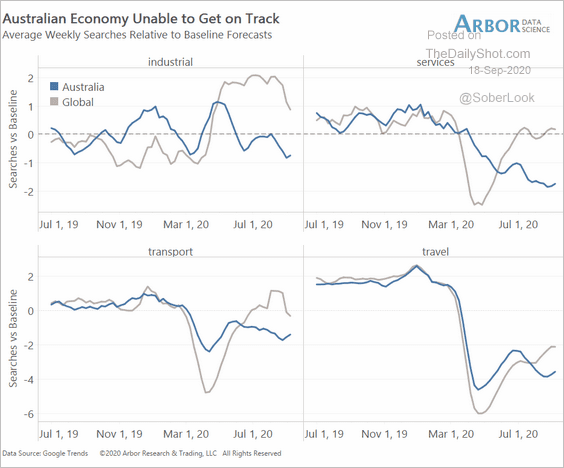

• The pipeline of apartments due to be completed is expected to decline next year. In the future, the RBA expects supply to slowly adjust as international borders reopen.

Source: RBA Read full article

Source: RBA Read full article

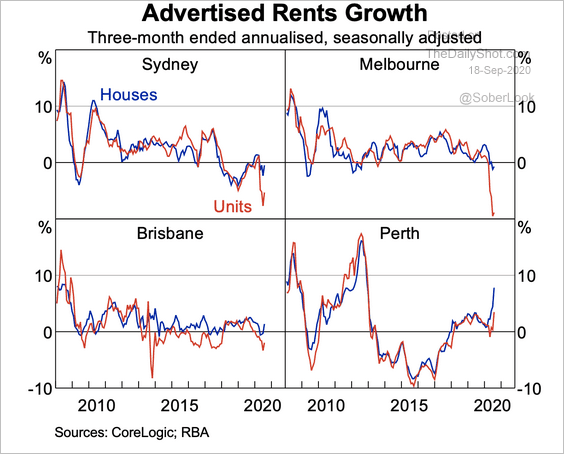

– Advertised rents are declining, except in Perth, which follows several years of weak growth.

Source: RBA Read full article

Source: RBA Read full article

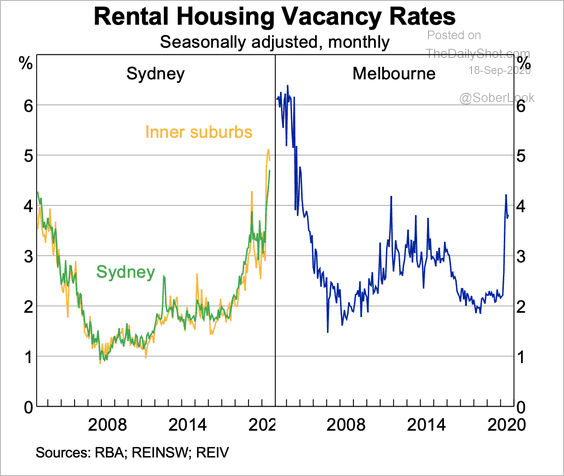

– Vacancies have risen in Sydney and Melbourne.

Source: RBA Read full article

Source: RBA Read full article

China

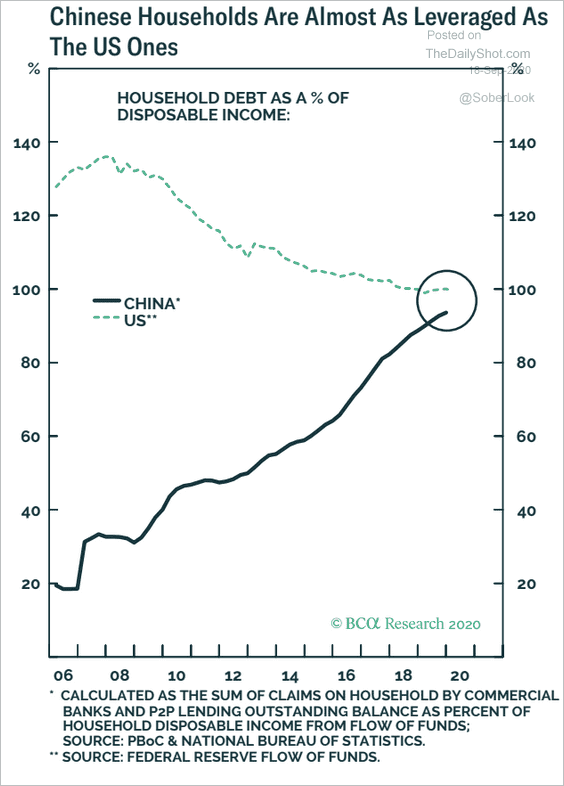

1. China’s households are almost as leveraged as the US ones.

Source: BCA Research

Source: BCA Research

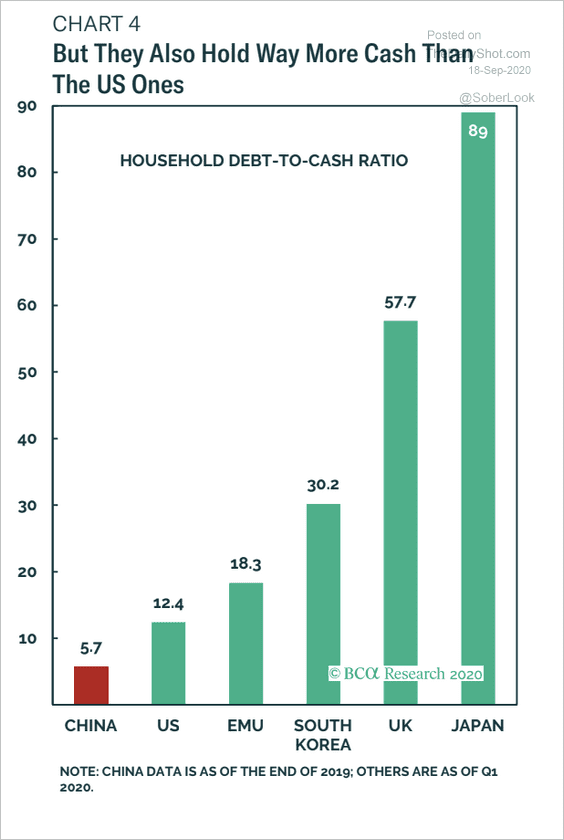

However, they have more cash than the US counterparts.

Source: BCA Research

Source: BCA Research

——————–

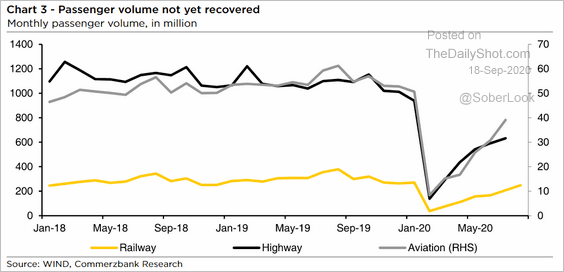

2. Passenger volume has not yet recovered.

Source: Commerzbank Research

Source: Commerzbank Research

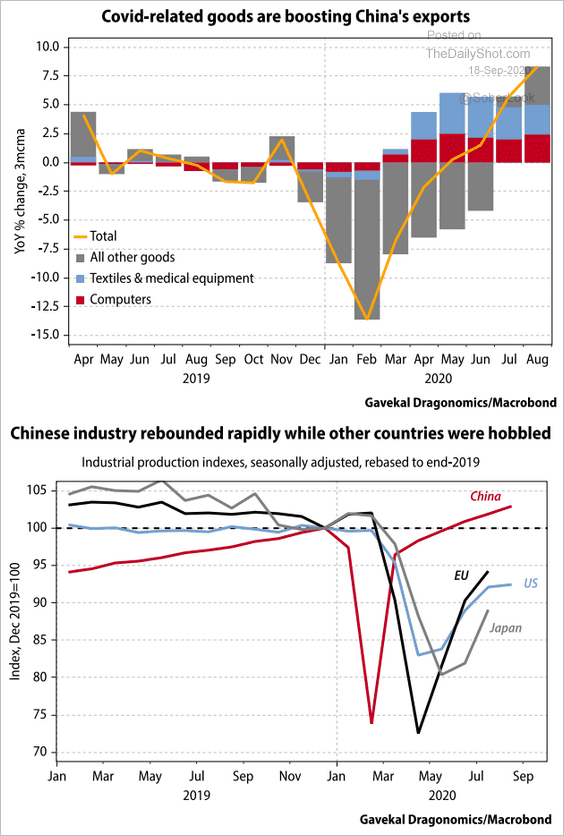

3. Exports helped China’s industry to recover faster than other economies.

Source: Gavekal

Source: Gavekal

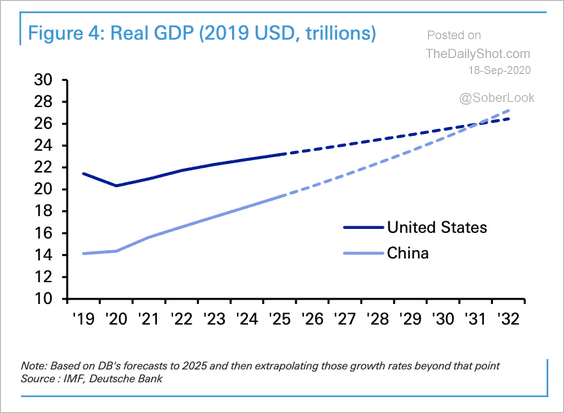

4. Here is Deutsche Bank’s forecast for China’s GDP trajectory vs. the US.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

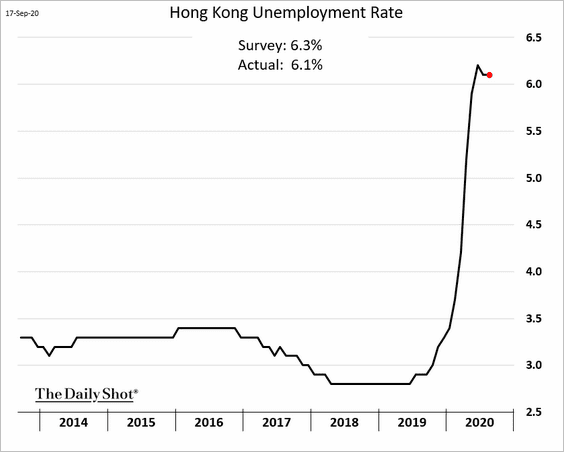

5. Hong Kong’s unemployment rate held steady last month (an increase was expected).

Emerging Markets

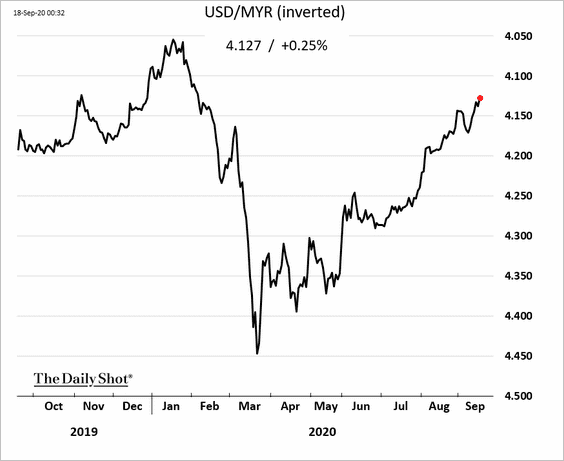

1. The Malaysian ringgit continues to rally.

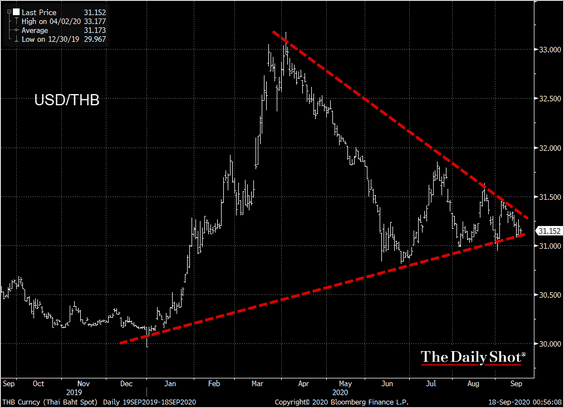

2. The Thai baht (USD/THB) has been consolidating.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

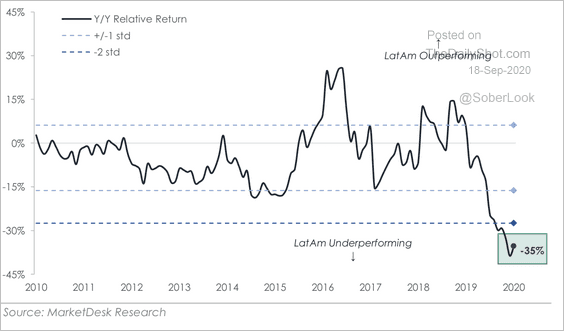

3. Latin America’s stocks have significantly underperformed broad emerging markets.

Source: MarketDesk Research

Source: MarketDesk Research

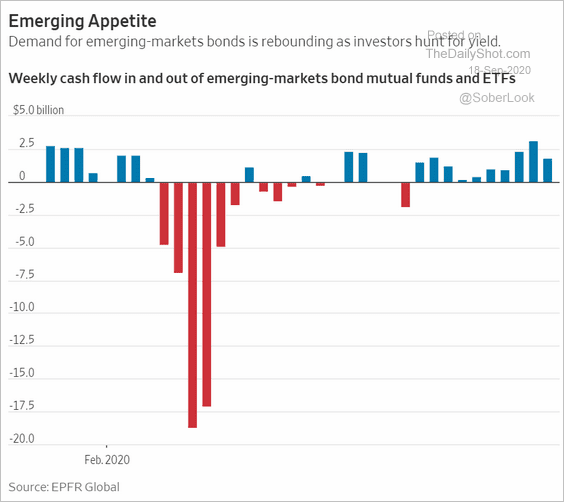

4. EM bond markets are enjoying robust fund inflows.

Source: @WSJ Read full article

Source: @WSJ Read full article

Commodities

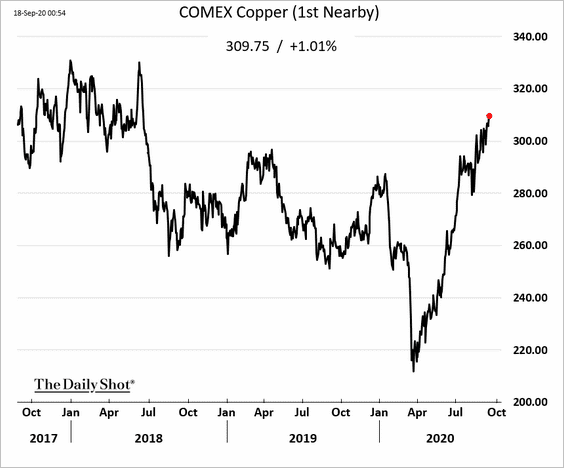

1. Copper hit the highest level in over two years.

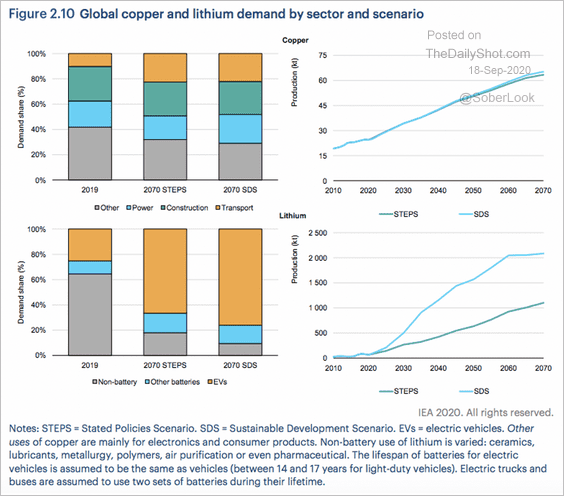

2. Demand for Lithium could skyrocket as the world shifts to electric vehicles.

Source: IEA

Source: IEA

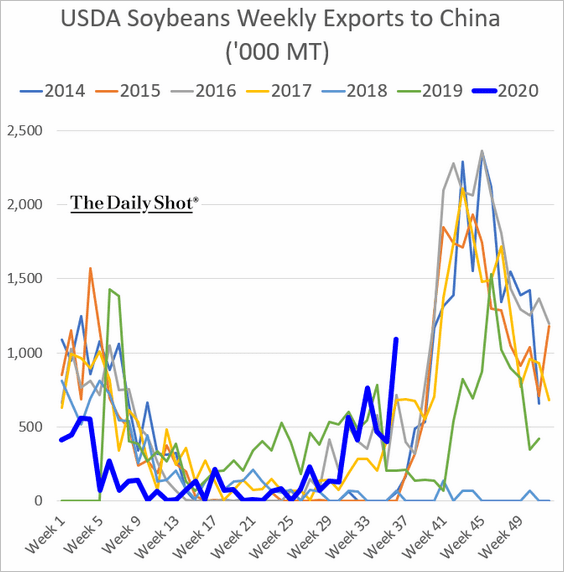

3. US soybean exports to China have picked up momentum.

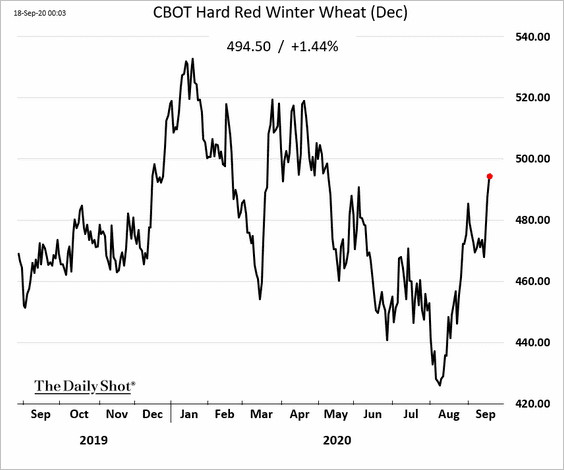

4. US high-protein wheat prices are rebounding.

Energy

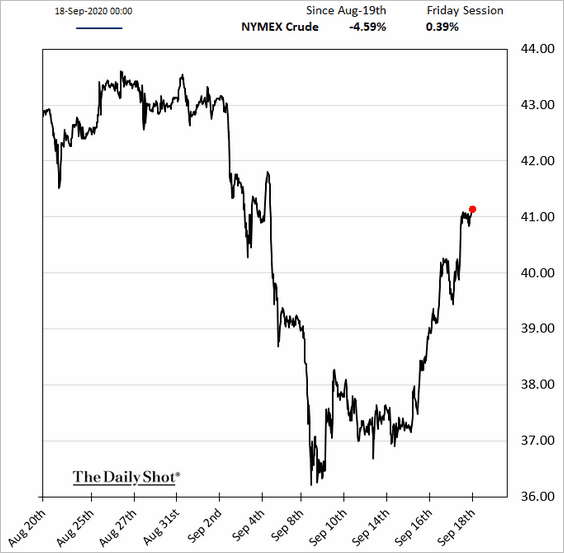

1. Crude oil has bounced sharply in recent days on lower-than-expected US inventories.

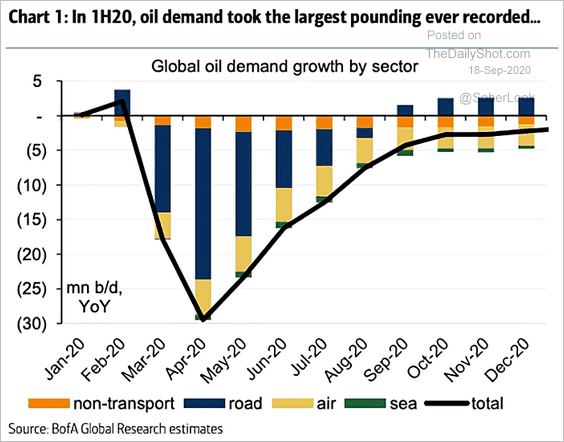

2. This chart shows the evolution of global oil demand by sector.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

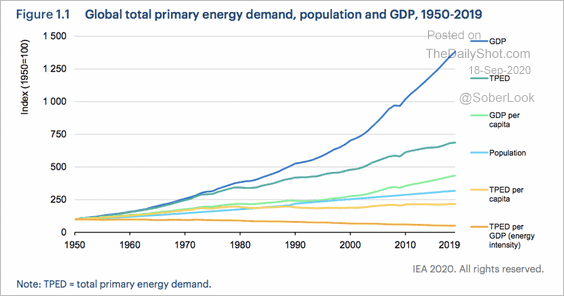

3. Since 1990, greater energy efficiency has led to a decrease in the amount of energy demanded per unit of GDP, according to IEA.

Source: IEA

Source: IEA

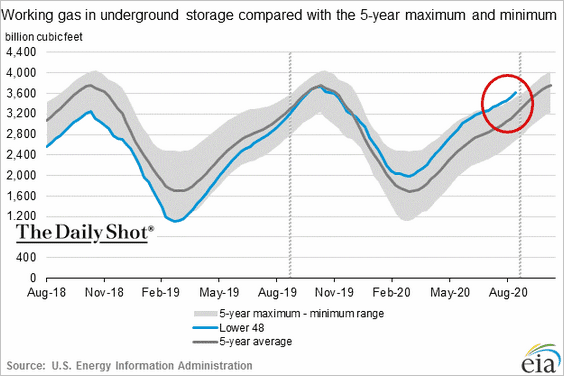

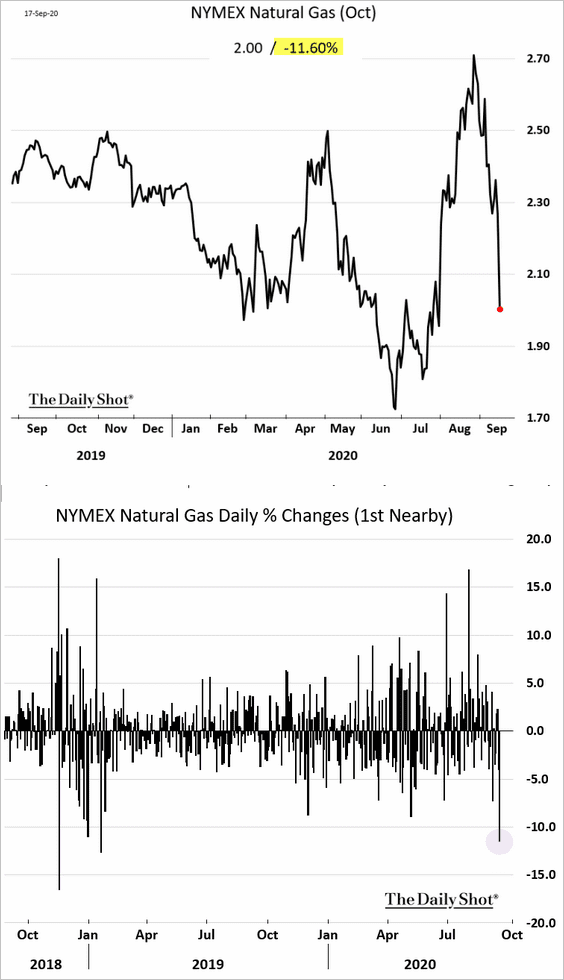

4. Despite the heat waves this summer, the amount of US natural gas in storage rose to a five-year high last week.

Natural gas futures plummetted by almost 12%.

——————–

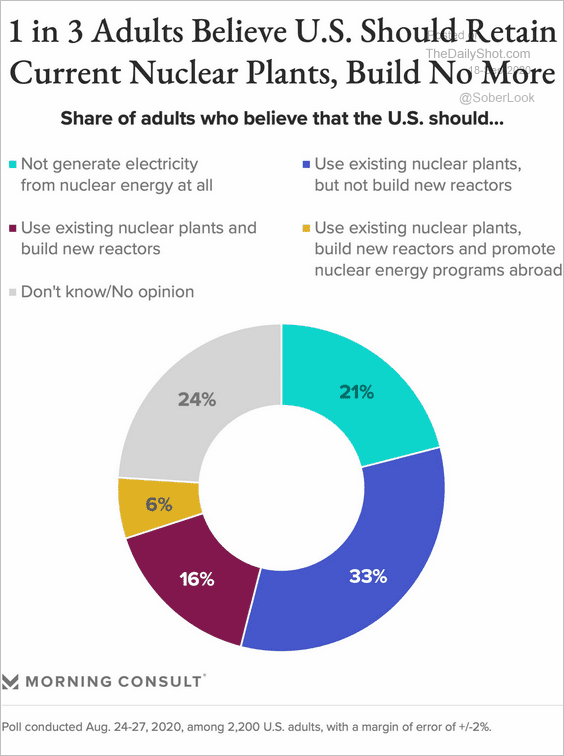

5. What are Americans’ views on nuclear energy?

Source: @MorningConsult, @l_m_j_ Read full article

Source: @MorningConsult, @l_m_j_ Read full article

Equities

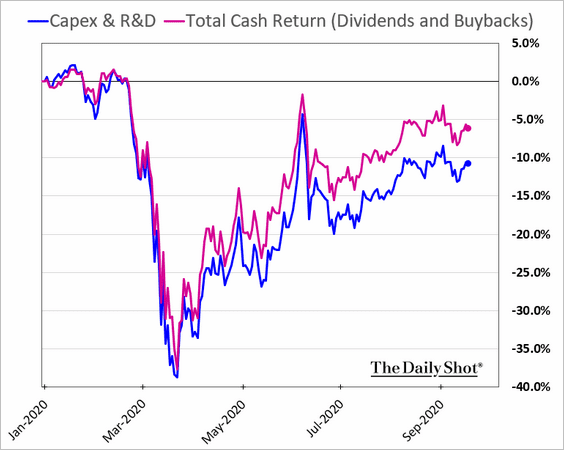

1. The market has been rewarding firms known for dividends and buybacks rather than those focused on CapEx and R&D. Here is the relative performance based on Goldman’s indices.

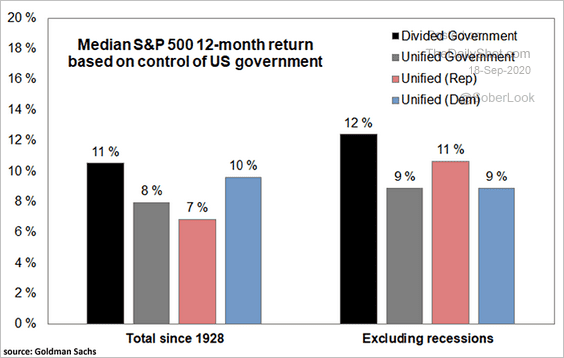

2. A divided government tends to be good for stocks (fewer adverse legislative surprises).

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

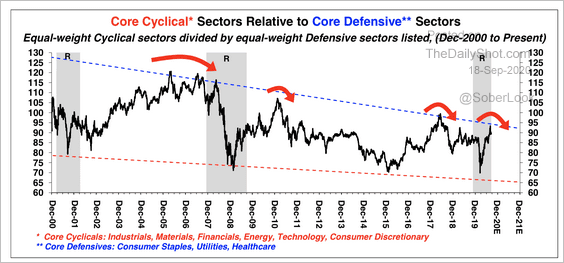

3. Cylicals/defensives ratio (equal-weighted) is at long-term resistance.

Source: Stifel

Source: Stifel

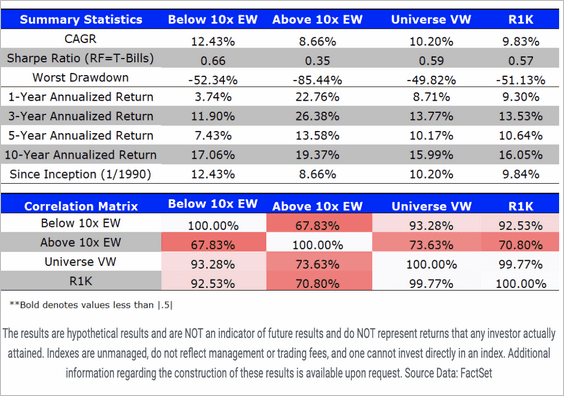

4. This table shows the results of buying stocks trading above and below 10x sales.

Source: @alphaarchitect Read full article

Source: @alphaarchitect Read full article

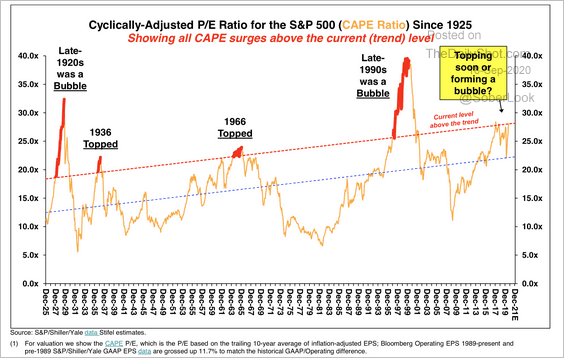

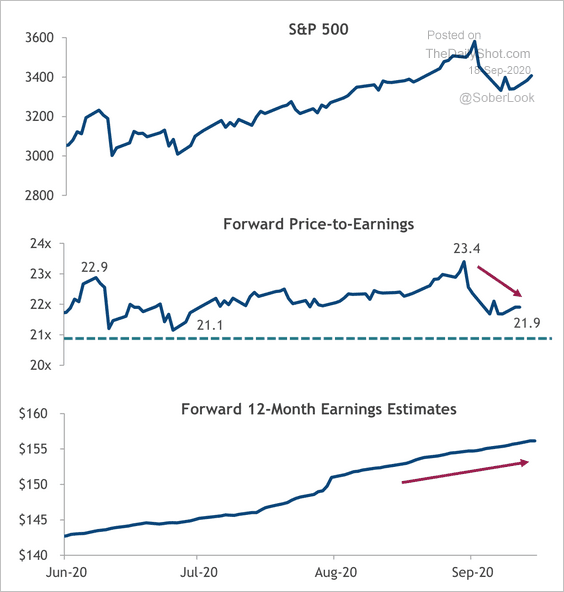

5. Next, we have some valuation trends.

• The S&P 500 cyclically adjusted price-to-earnings ratio (CAPE) is not yet at bubble territory.

Source: Stifel

Source: Stifel

• US valuations have been resetting while earnings rebound.

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

——————–

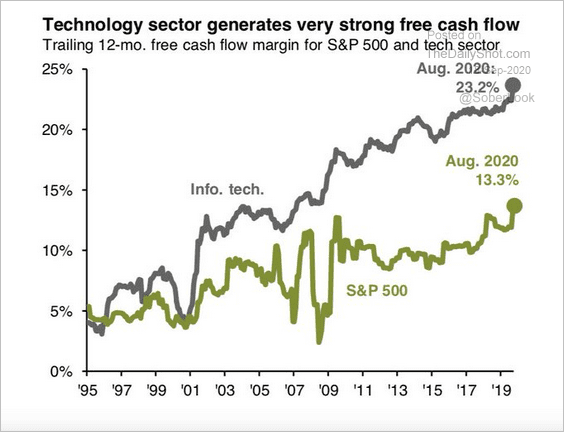

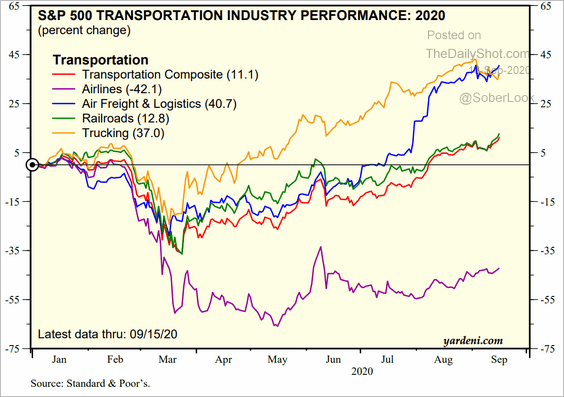

6. Here are a couple of sector updates.

• Tech sector free cash flow:

Source: @acemaxx, @JPMorganAM

Source: @acemaxx, @JPMorganAM

• Transportation subsectors’ YTD performance:

Source: Yardeni Research

Source: Yardeni Research

——————–

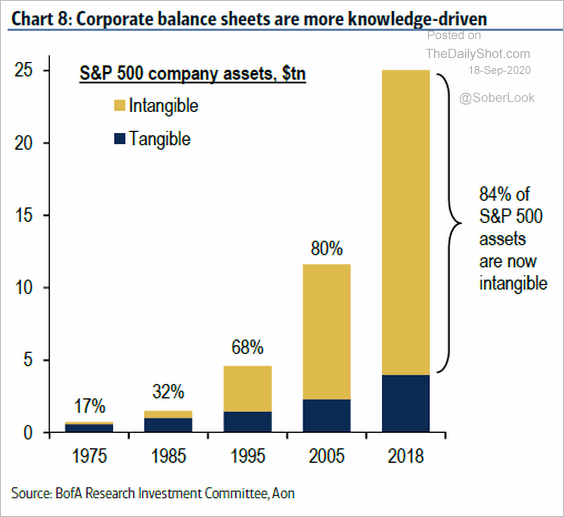

7. Intangible assets increasingly dominate corporate balance sheets.

Source: BofA Securities, @tracyalloway

Source: BofA Securities, @tracyalloway

8. Why did the rally stall on September 2nd?

Source: @BW Read full article

Source: @BW Read full article

Credit

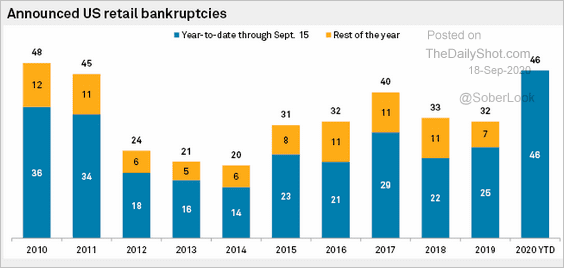

1. Large retailers continue to file for bankruptcy.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

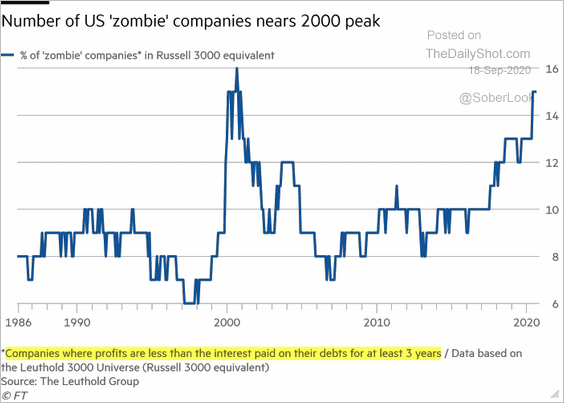

2. The number of ‘zombie’ companies is approaching the 2000 peak.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

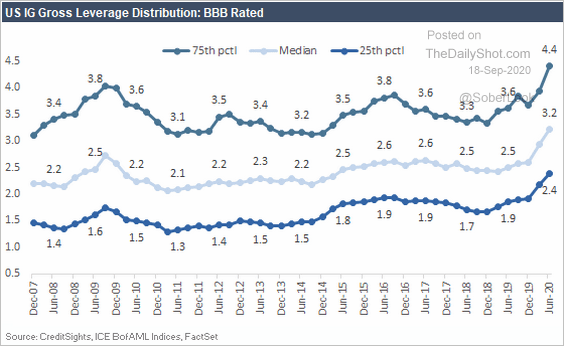

3. Gross leverage of BBB-rated firms is now above the 2009 highs.

Source: CreditSights

Source: CreditSights

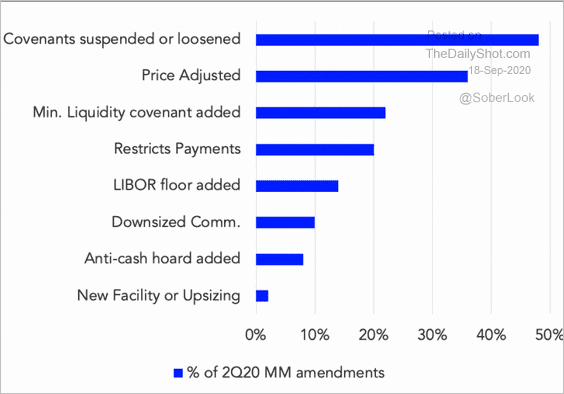

4. This chart shows US middle market loan amendments last quarter (“fixing” covenant violations).

Source: @theleadleft, @LPCLoans Read full article

Source: @theleadleft, @LPCLoans Read full article

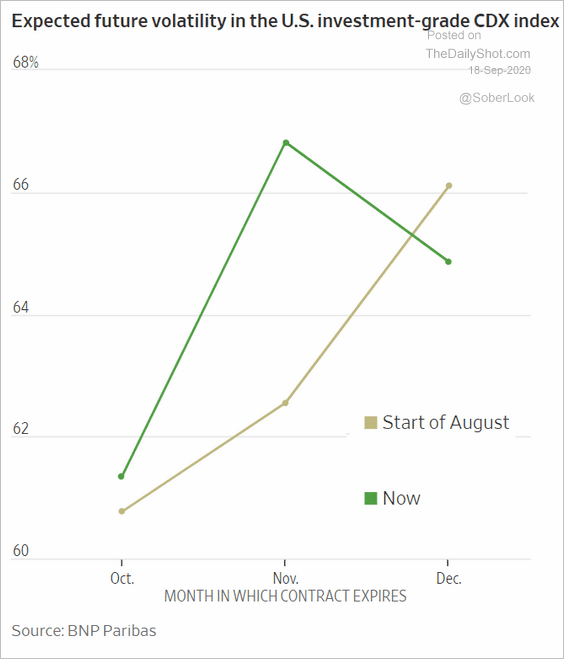

5. The credit volatility curve is now pricing in the risk of US elections.

Source: @WSJ Read full article

Source: @WSJ Read full article

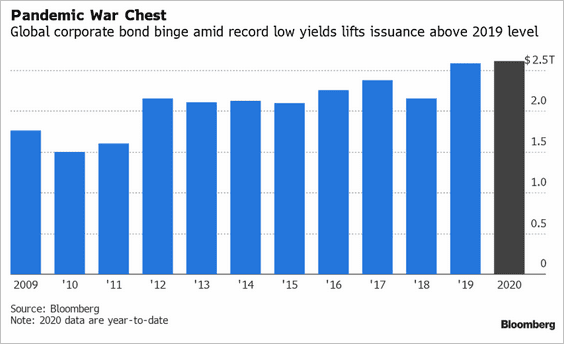

6. Global corporate bond issuance is now above last year’s levels.

Source: @MaxJReyes, Bloomberg Finance L.P.

Source: @MaxJReyes, Bloomberg Finance L.P.

Alternatives

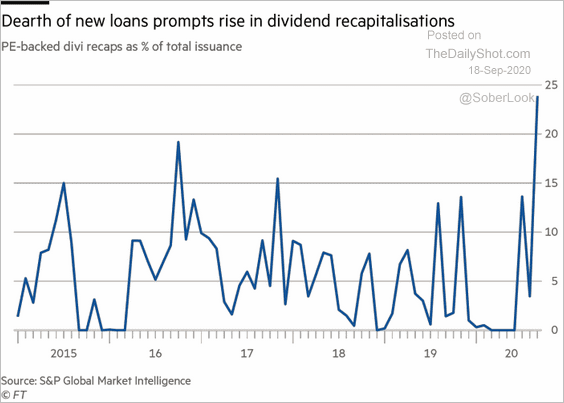

1. Dividend recaps spike amid extraordinarily cheap financing.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

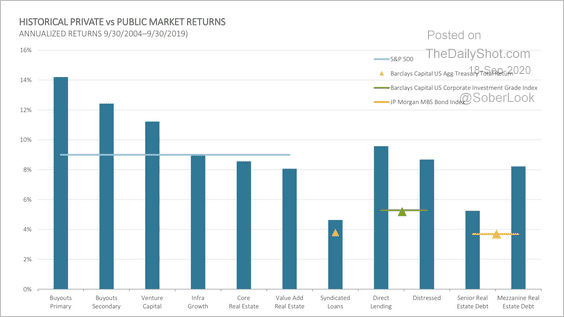

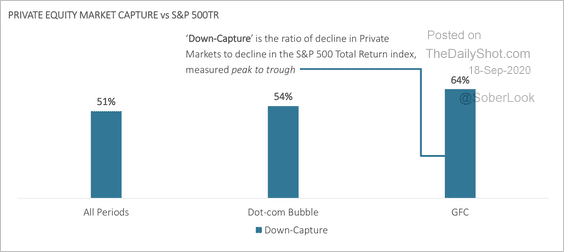

2. Private markets have largely outperformed during this cycle.

Source: StepStone Group

Source: StepStone Group

Private markets captured about 60% of the downside during the financial crisis. Historically, general partners are not forced to sell at the bottom and do not capture all the volatility in a market turmoil, according to StepStone.

Source: StepStone Group

Source: StepStone Group

——————–

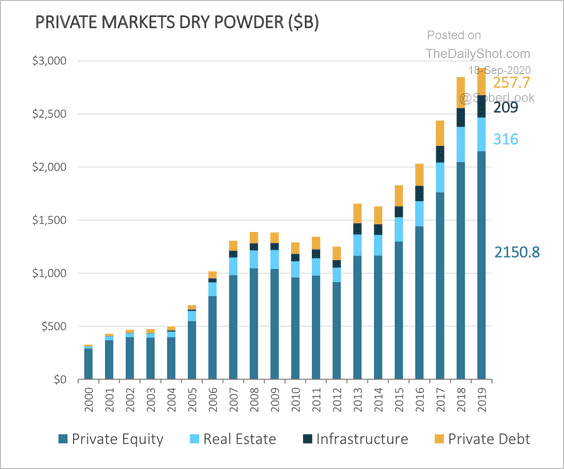

3. Here’s a breakdown of private market dry powder.

Source: StepStone Group

Source: StepStone Group

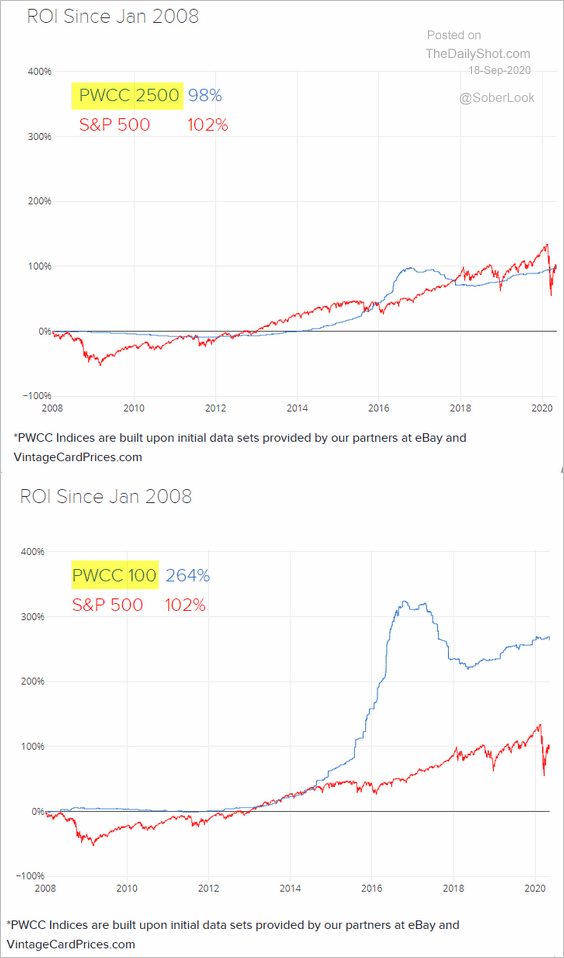

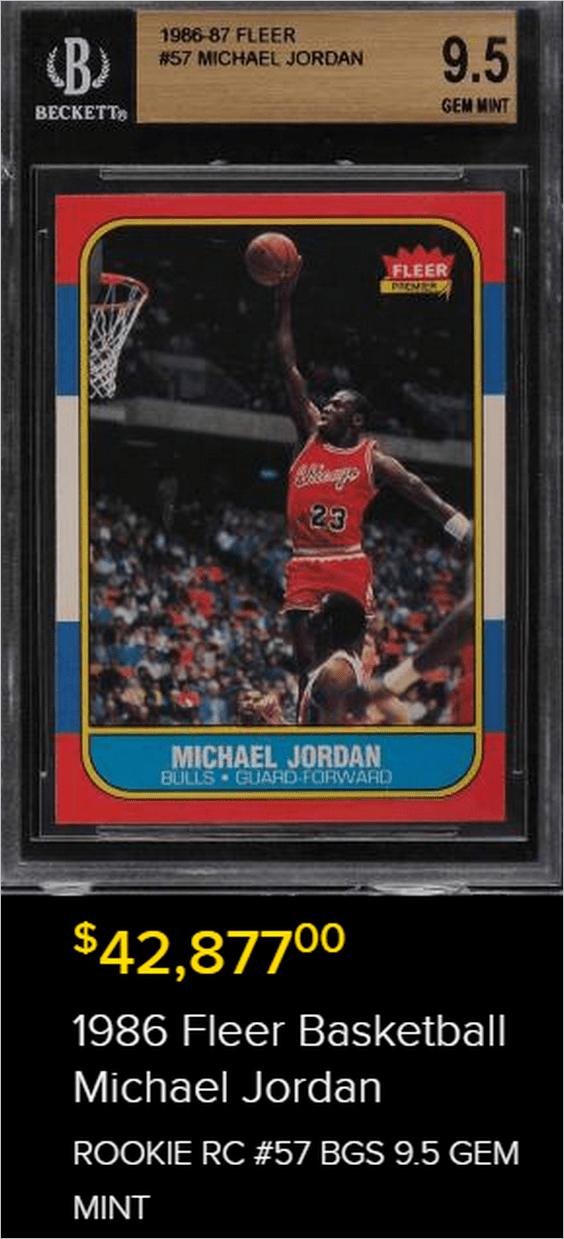

4. The sports card market has performed well in recent years. Just like in the stock market, the top 100 cards significantly outperformed the broad index.

Source: PWCC Further reading

Source: PWCC Further reading

Source: PWCC Further reading

Source: PWCC Further reading

Global Developments

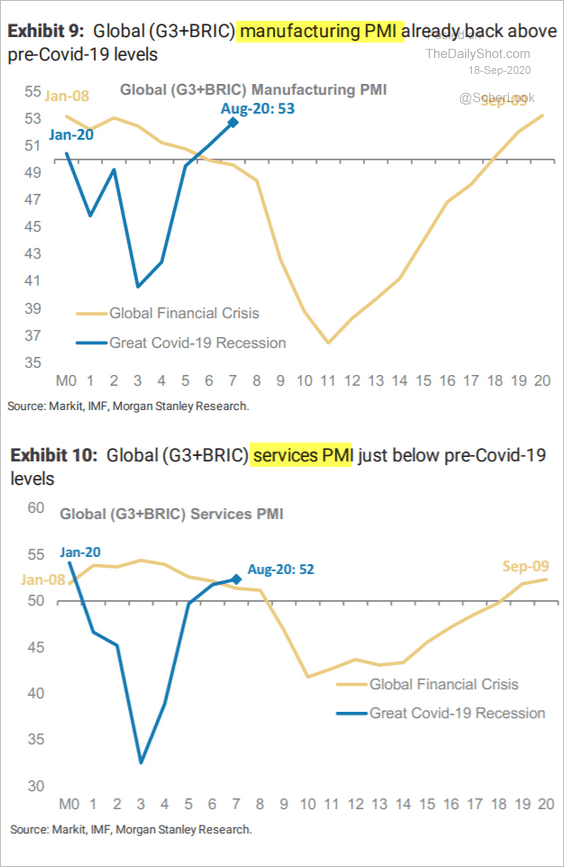

1. The largest economies have rebounded much faster than they did after the Great Financial Crisis.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

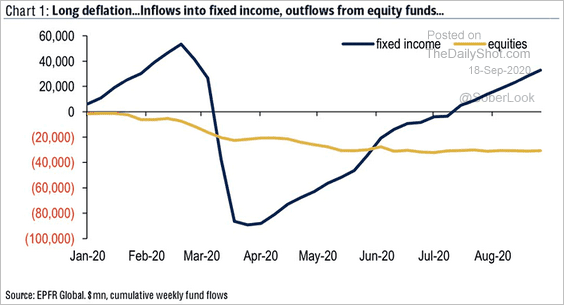

2. Fixed-income flows remain robust.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

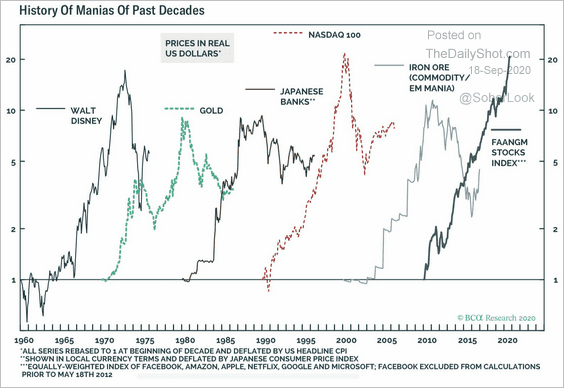

3. This chart shows some of the previous market “manias.”

Source: BCA Research

Source: BCA Research

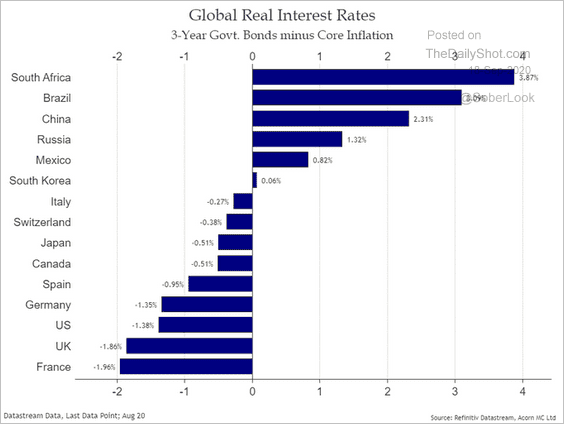

4. Finally, we have real interest rates around the world.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

——————–

Food for Thought

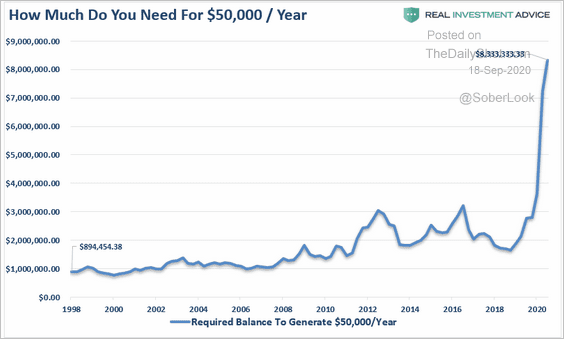

1. How much cash do you need to generate $50k/year without taking risk?

Source: @LanceRoberts, @slangwise Read full article

Source: @LanceRoberts, @slangwise Read full article

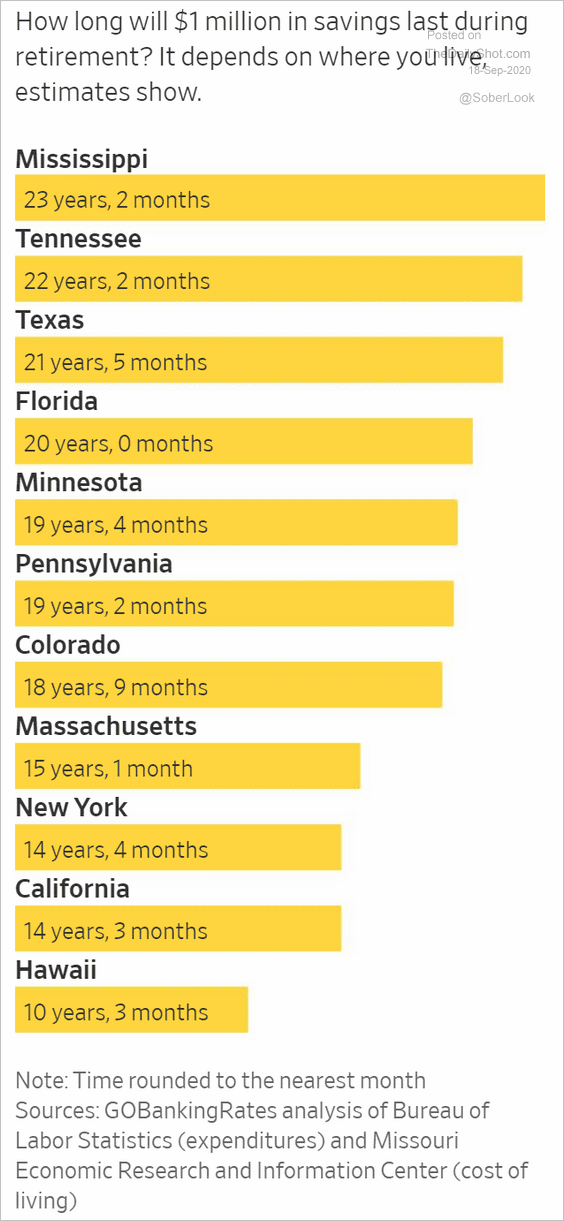

2. How long will $1 million in savings last during retirement?

Source: @WSJ Read full article

Source: @WSJ Read full article

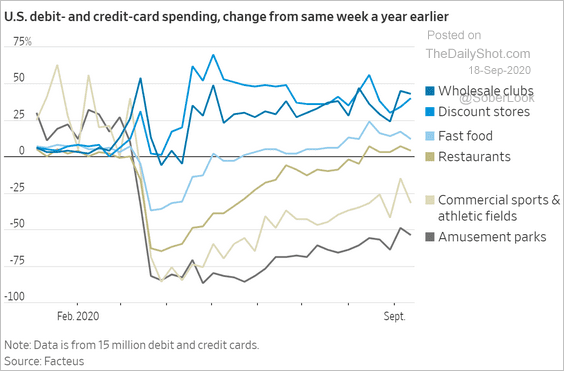

3. US debit- and credit-card spending changes (by sector):

Source: @WSJ Read full article

Source: @WSJ Read full article

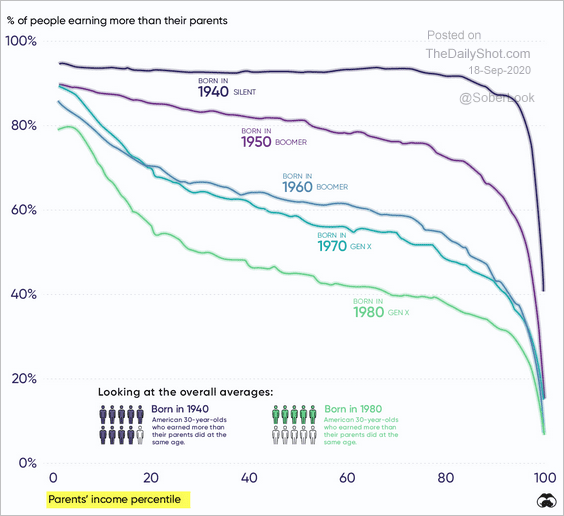

4. The decline in upward mobility:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

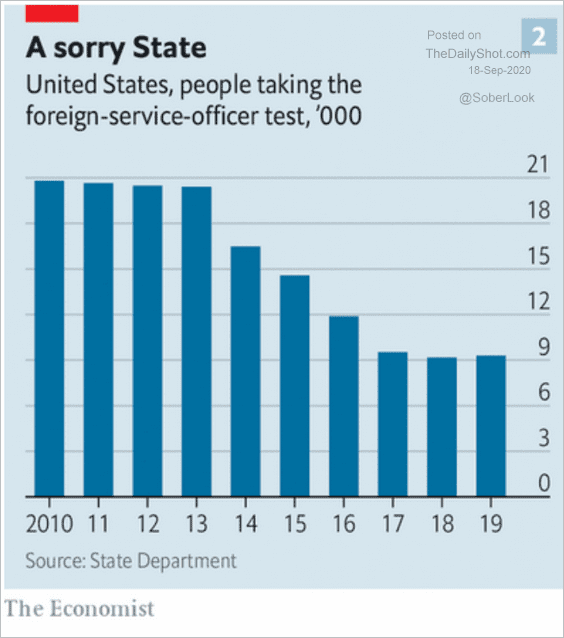

5. Taking the foreign-service-officer test:

Source: @adam_tooze, @TheEconomist Read full article

Source: @adam_tooze, @TheEconomist Read full article

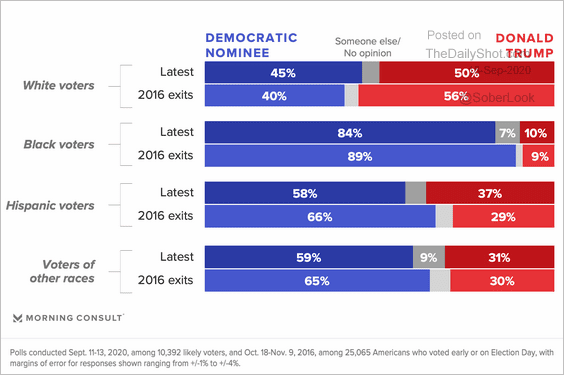

6. US presidential election polls (2020 vs. 2016):

Source: Morning Consult Read full article

Source: Morning Consult Read full article

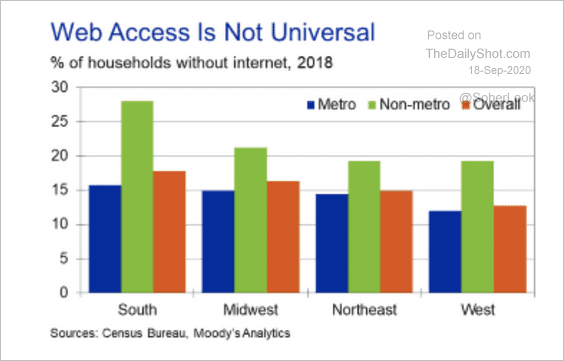

7. Households without internet:

Source: Moody’s Analytics

Source: Moody’s Analytics

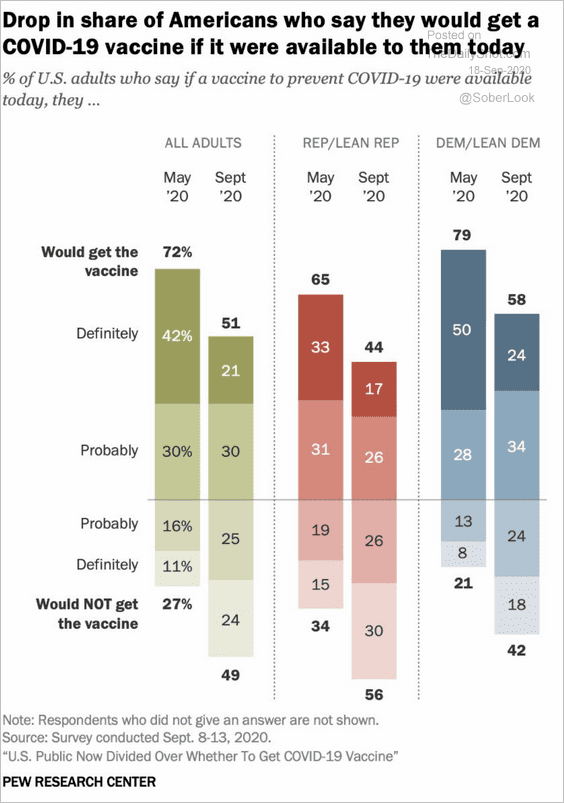

8. Second thoughts on a COVID-19 vaccine:

Source: @pewresearch Read full article

Source: @pewresearch Read full article

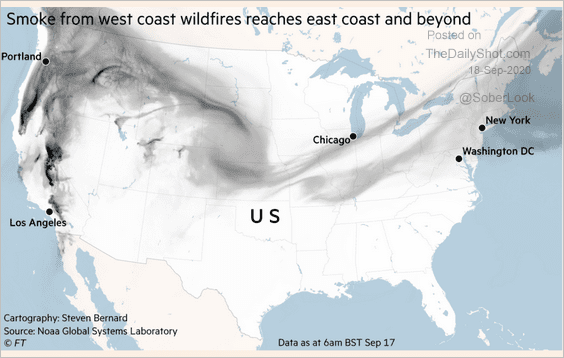

9. Smoke from the west coast:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

Have a great weekend!