The Daily Shot: 21-Sep-20

• The United States

• Canada

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

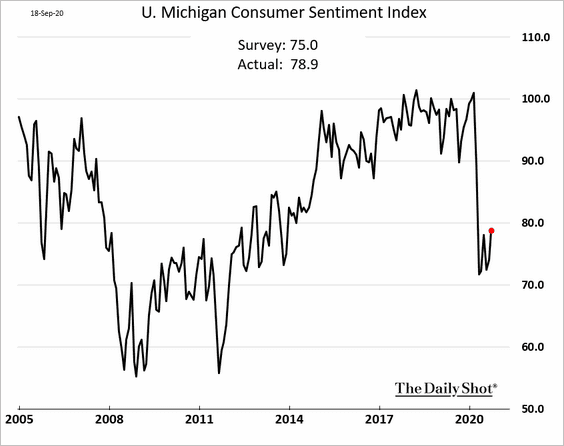

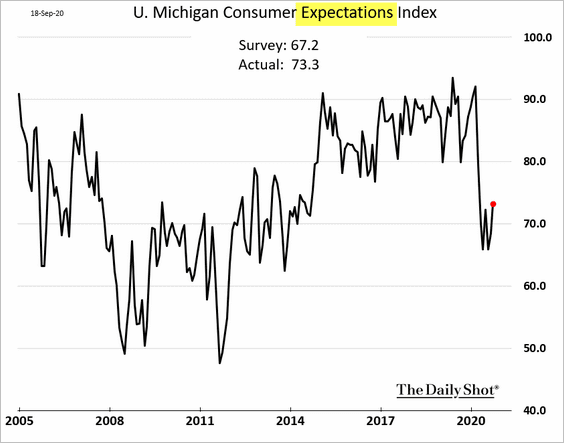

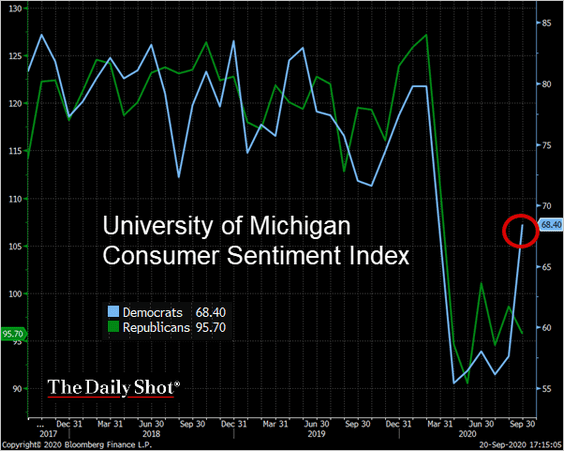

1. Consumer sentiment edged up this month, with the U. Michigan index topping forecasts.

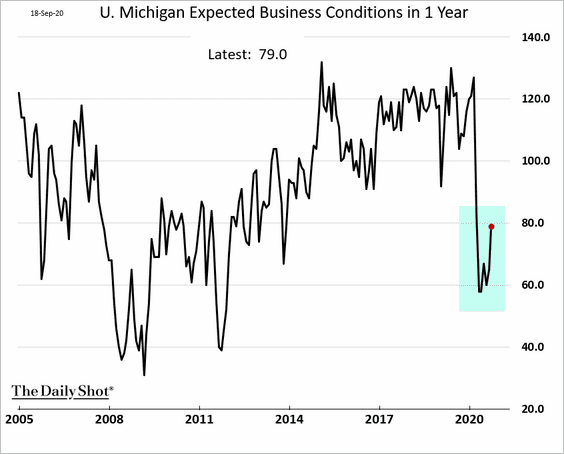

Expectations of business conditions improved.

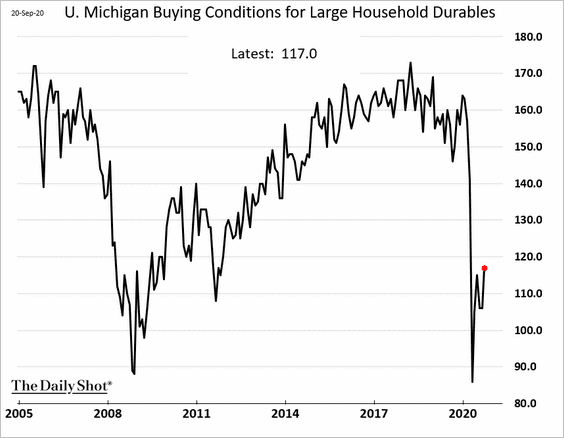

And so did the buying conditions for “large household durables.”

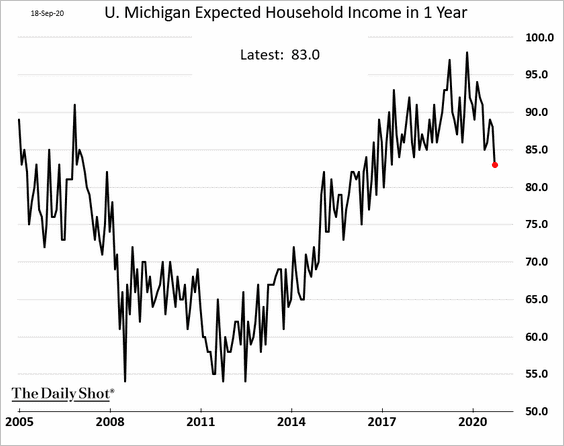

However, household income expectations are rolling over.

Democrats drove the September gains in sentiment.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

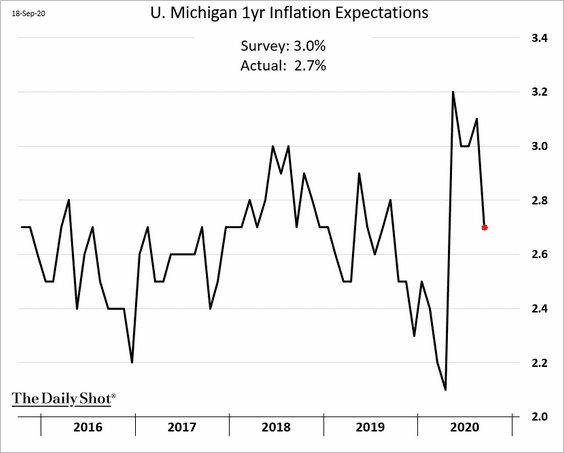

2. Inflation expectations eased this month.

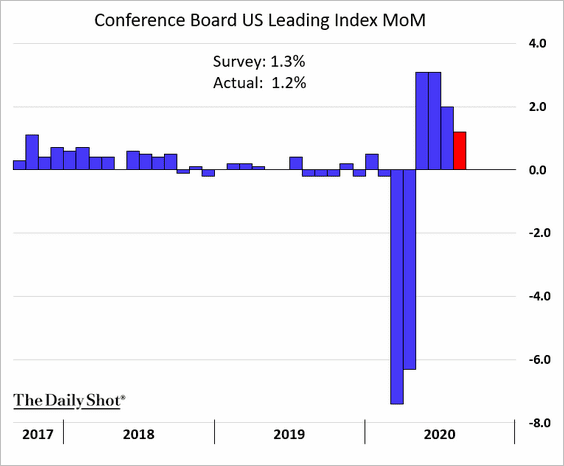

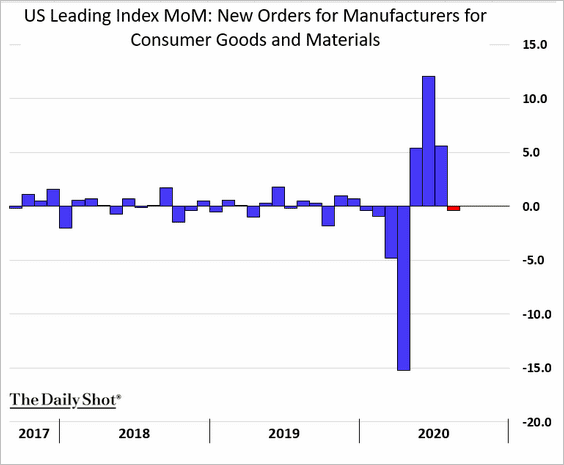

3. The Conference Board’s index of leading indicators showed slower gains last month.

Weaker factory orders were among the subindices contributing to the slowdown.

——————–

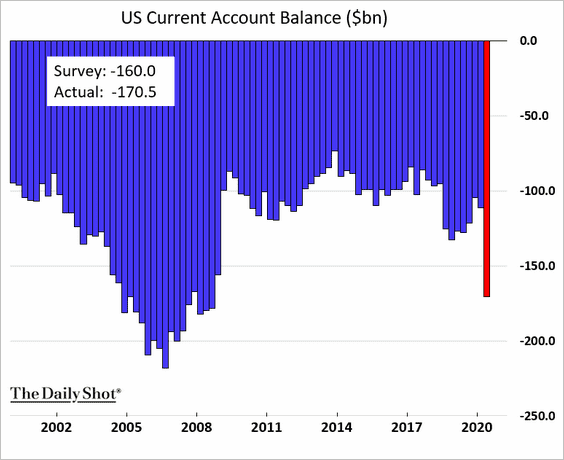

4. The current account deficit widened sharply in the second quarter.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

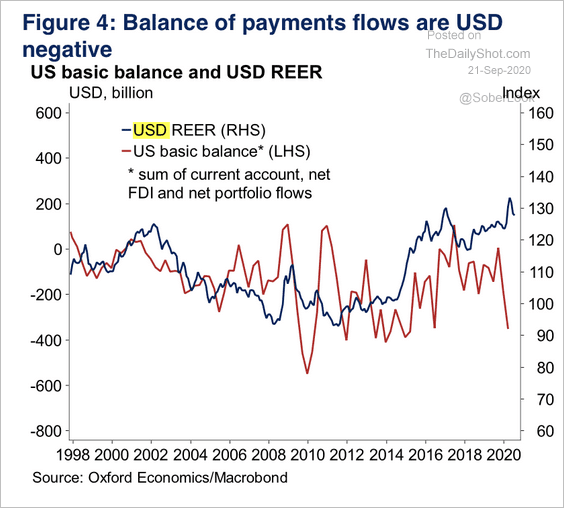

5. The balance of payments points to downside risks for the US dollar.

Source: Oxford Economics

Source: Oxford Economics

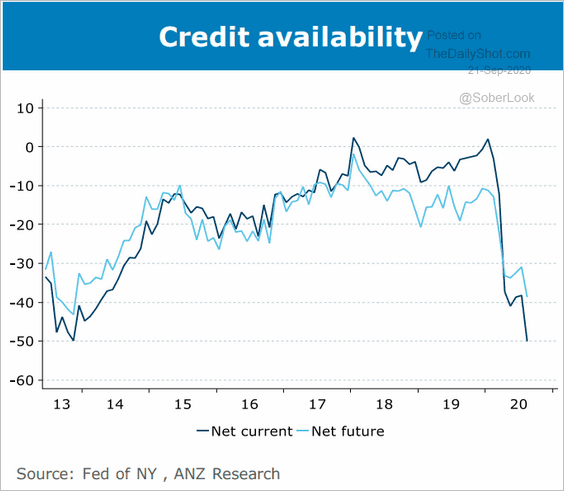

6. Next, let’s take a look at some household finance trends.

• Household credit availability has as declined considerably.

Source: ANZ Research

Source: ANZ Research

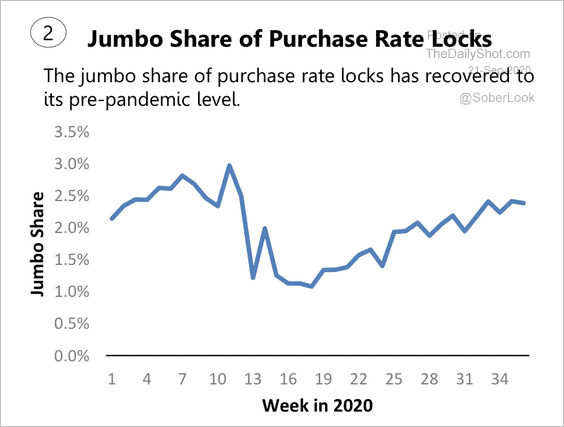

• The jumbo share of mortgage rate-locks has returned to pre-pandemic levels.

Source: AEI Housing Center

Source: AEI Housing Center

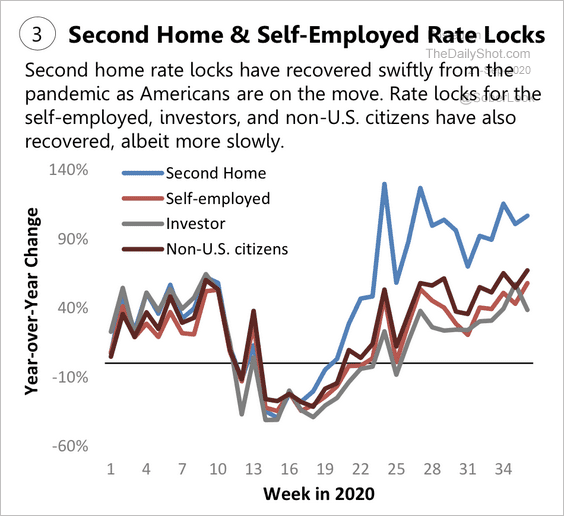

Americans buying a second home drove a great deal of the rise in rate-locks.

Source: AEI Housing Center

Source: AEI Housing Center

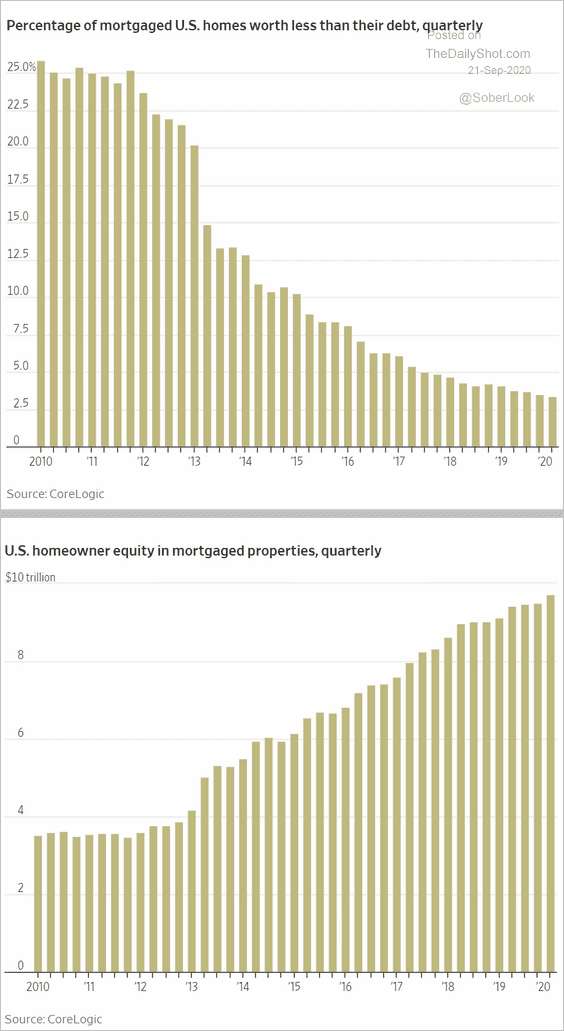

• The percentage of homes with negative equity continues to shrink.

Source: @WSJ Read full article

Source: @WSJ Read full article

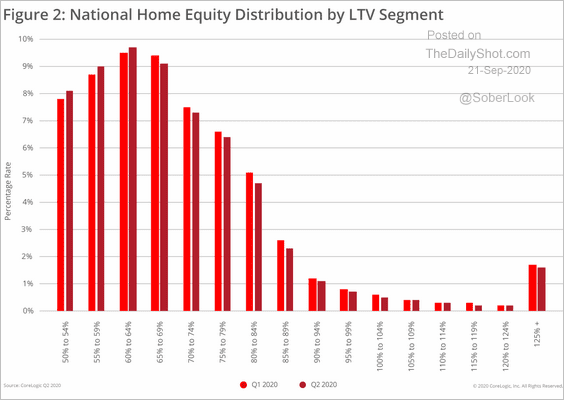

Here is the LTV distribution in Q2 and Q1.

Source: CoreLogic

Source: CoreLogic

——————–

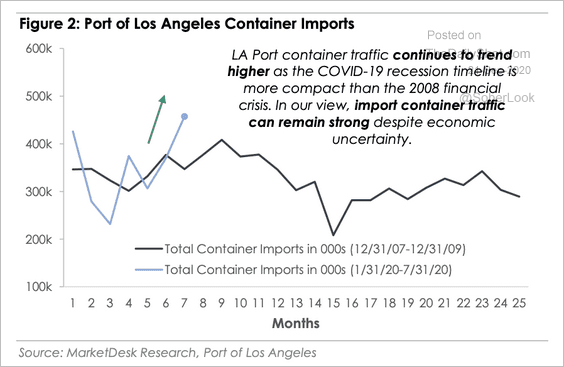

7. Container imports at the Port of Los Angeles are recovering faster than after previous downturns.

Source: MarketDesk Research

Source: MarketDesk Research

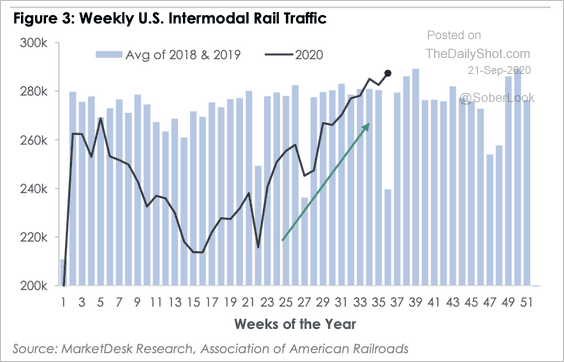

Weekly intermodal rail traffic is trending higher.

Source: MarketDesk Research

Source: MarketDesk Research

——————–

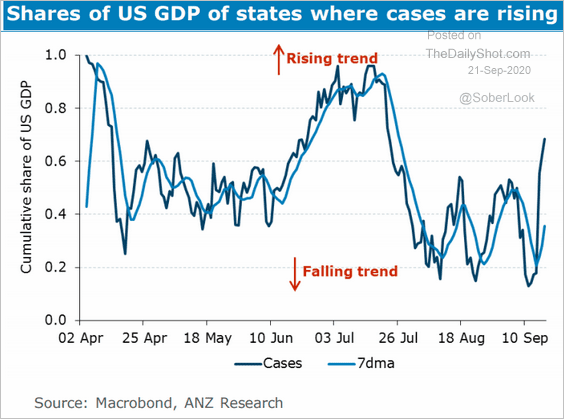

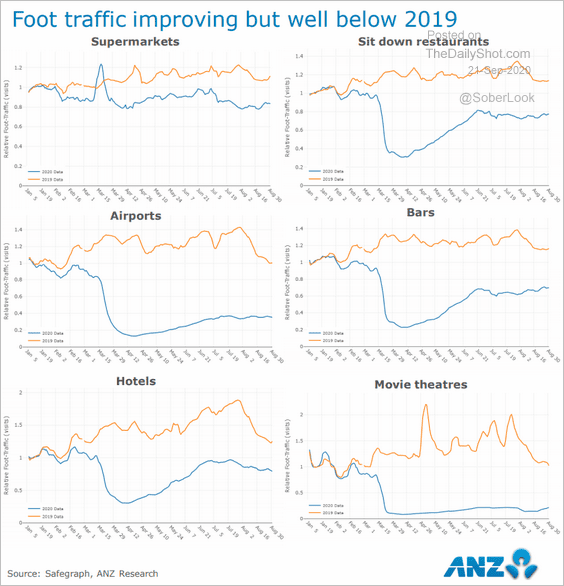

8. Finally, we have some high-frequency indicators from ANZ.

• States with rising new COVID cases (GDP-weighted):

Source: ANZ Research

Source: ANZ Research

• Foot traffic:

Source: ANZ Research

Source: ANZ Research

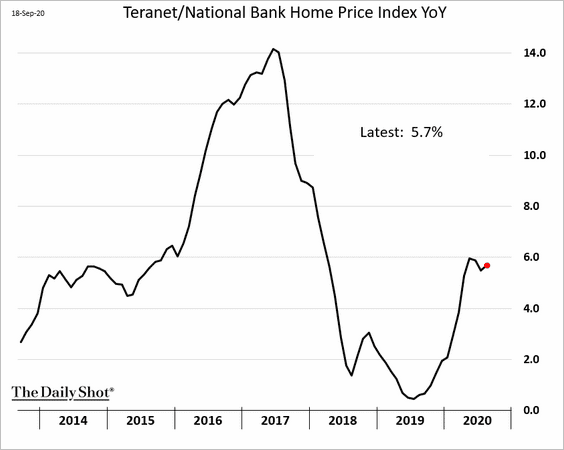

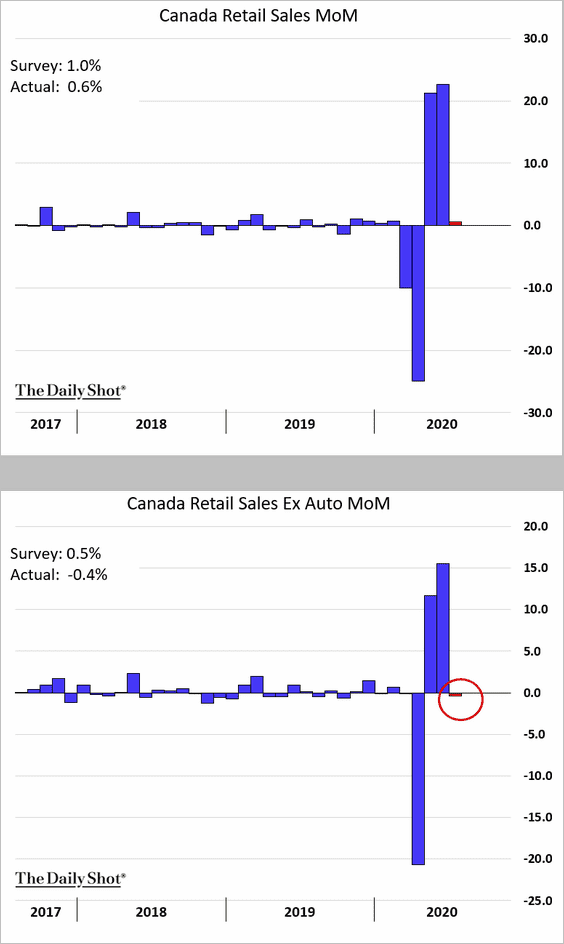

Canada

1. Home price appreciation remains robust.

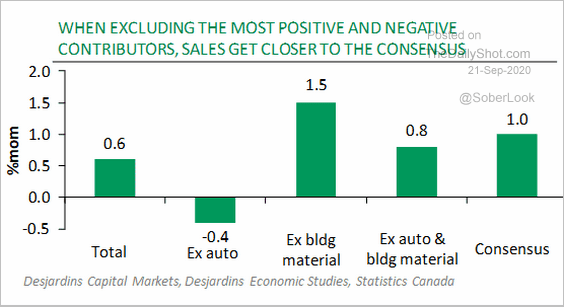

2. July retail sales were softer than expected.

Source: Desjardins

Source: Desjardins

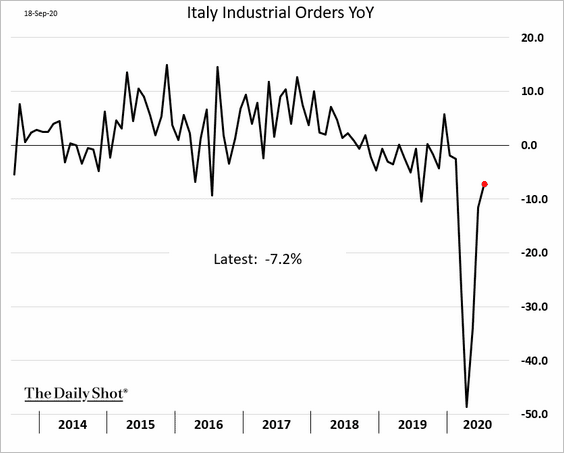

The Eurozone

1. Italian industrial orders continued to improve in July.

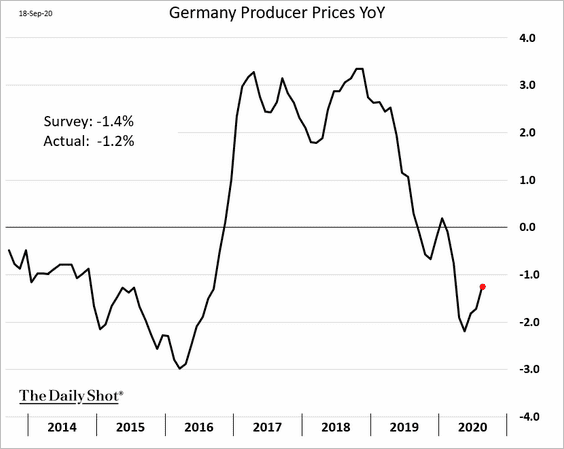

2. Germany’s producer prices are starting to rebound.

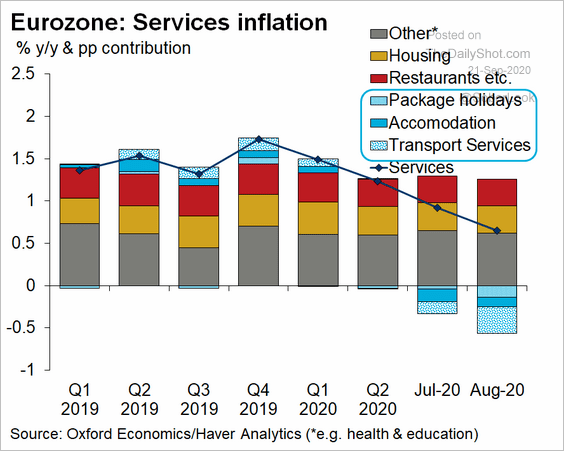

3. The recent decline in service inflation was driven by travel-related sectors, the impact of which is likely to be transient.

Source: @OliverRakau

Source: @OliverRakau

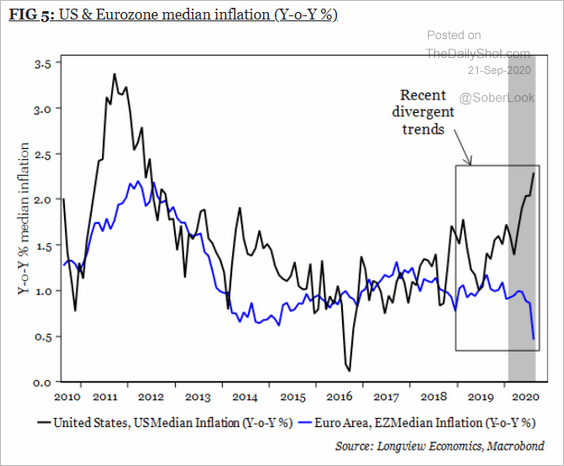

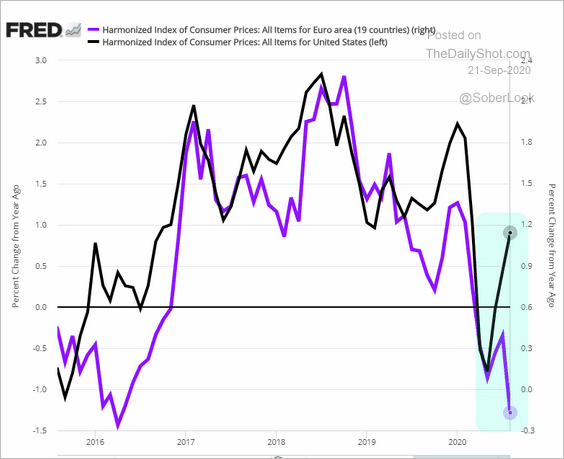

That’s part of the reason for the divergence between the Eurozone and the US, which is unlikely to persist.

• Median inflation:

Source: Longview Economics

Source: Longview Economics

• EU-harmonized CPI:

——————–

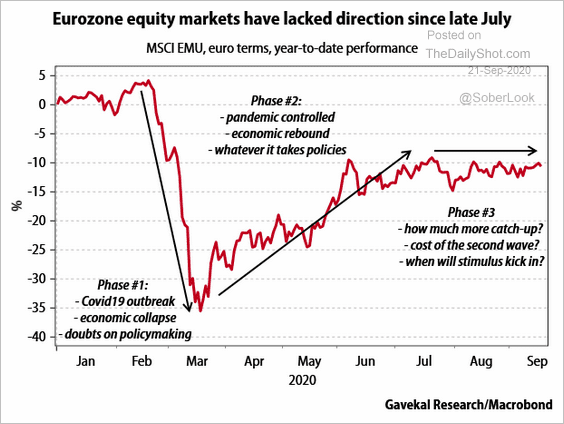

4. Eurozone shares have been treading water.

Source: Gavekal

Source: Gavekal

Europe

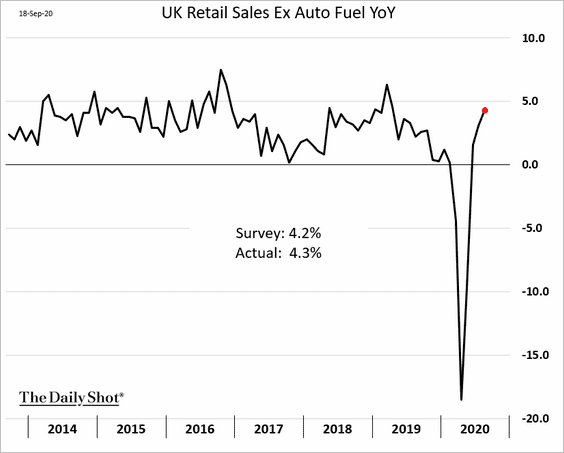

1. Last month’s UK retail sales surprised to the upside.

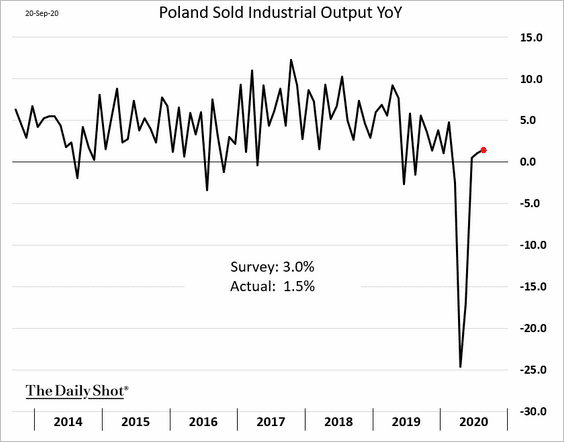

2. Poland’s industrial output growth is moderating.

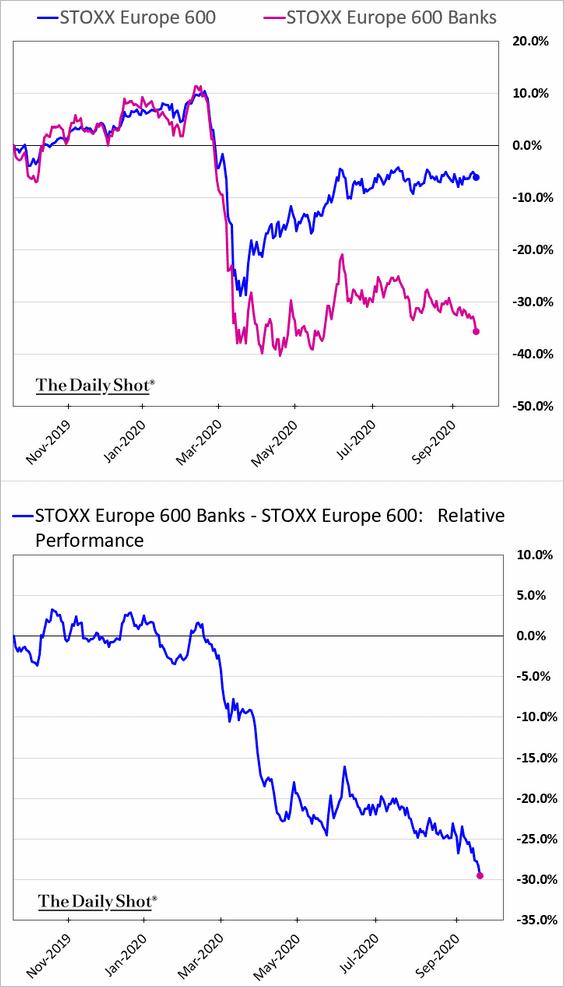

3. European banks’ underperformance has accelerated (nearly 30% year-to-date).

Asia – Pacific

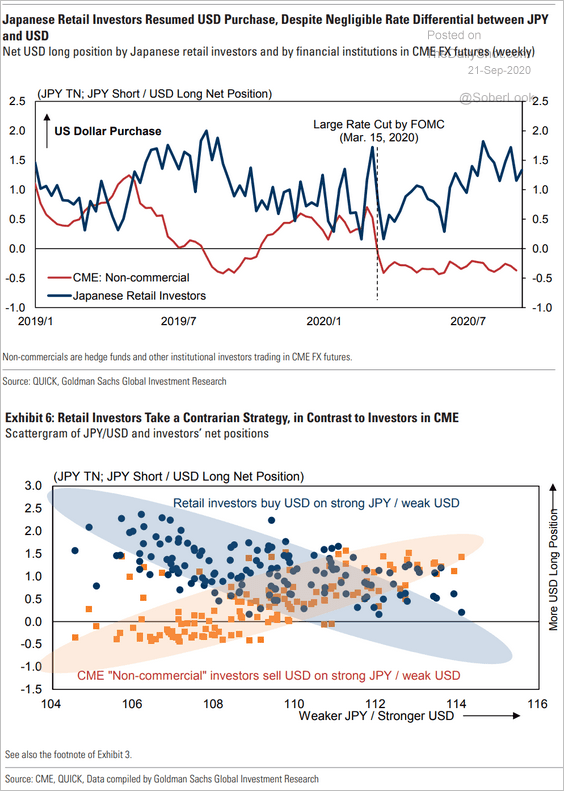

1. Japanese retail currency traders have been returning to the US dollar, just as hedge funds built a massive net-short position in the greenback. Retail investors tend to buy the US dollar when it has depreciated against the yen (“value investing”), whereas hedge funds tend to do the opposite.

Source: Goldman Sachs

Source: Goldman Sachs

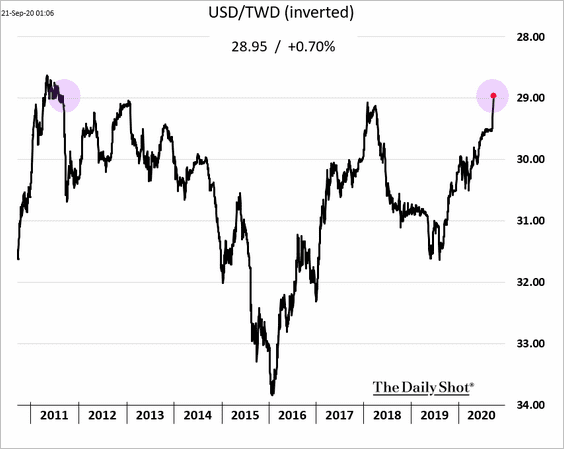

2. The Taiwan dollar hit the highest level vs. USD since 2011.

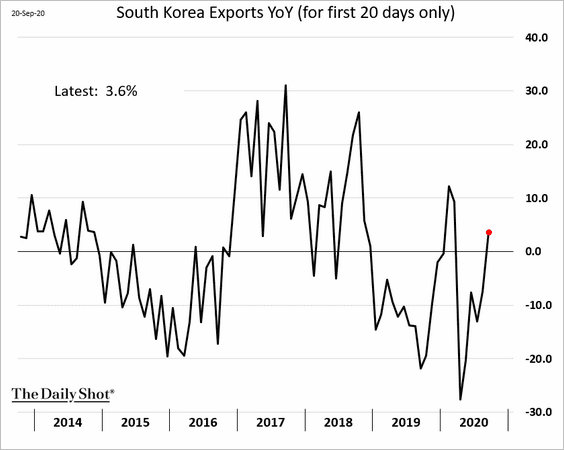

3. South Korean exports continue to rebound (now up year-over-year).

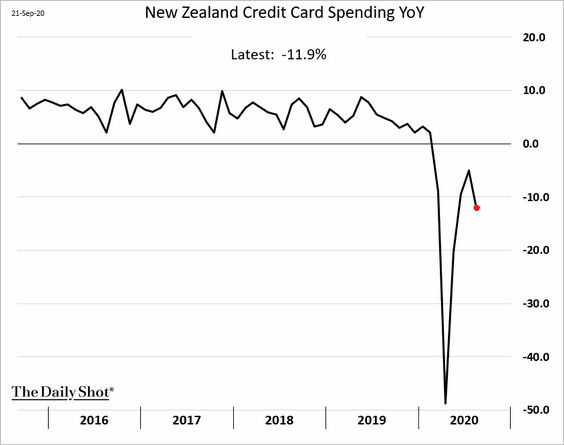

4. New Zealand’s credit card spending weakened last month.

China

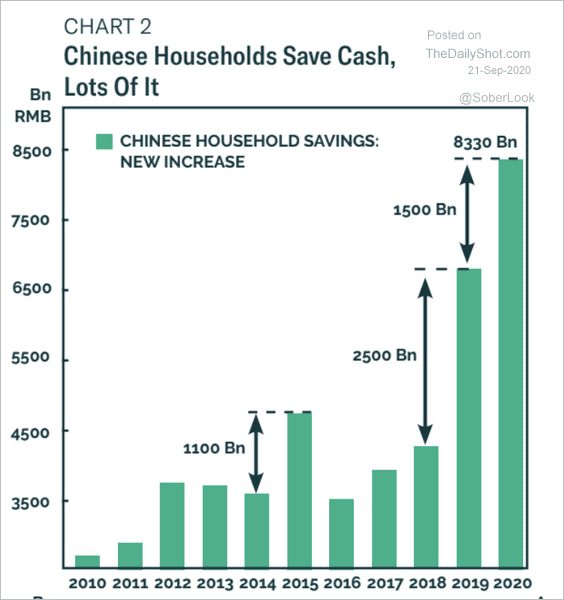

1. According to BCA Research, “Chinese households have added a total of 8.3 trillion yuan to their bank deposits so far this year, or about 8% of China’s 2019 national output.”

Source: BCA Research

Source: BCA Research

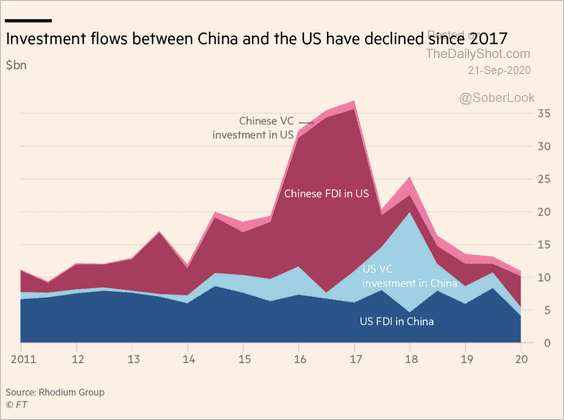

2. This chart shows US-China investment flows.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

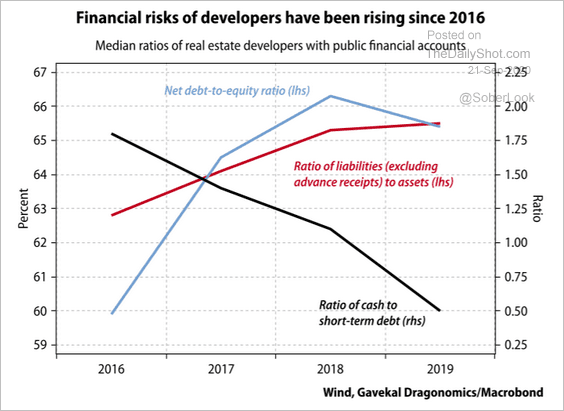

3. Real estate developers’ credit risk has been rising for some time.

Source: Gavekal

Source: Gavekal

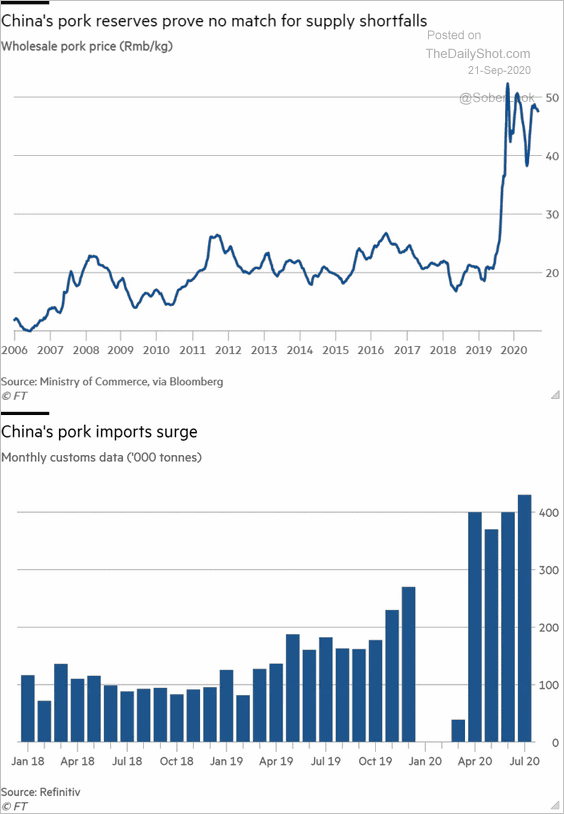

4. Pork shortages persist.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

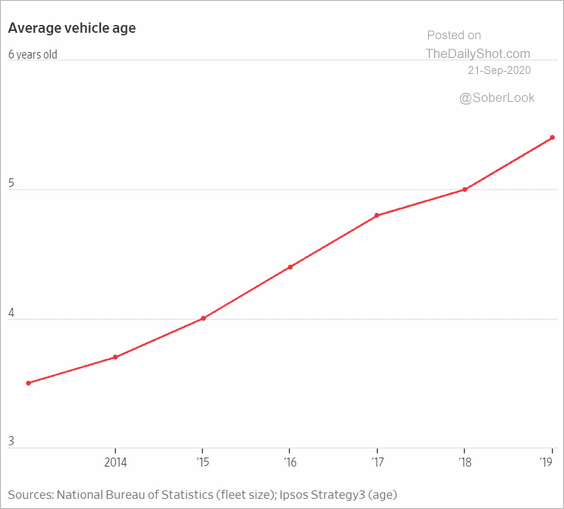

5. China’s vehicles are getting older (on average).

Source: @WSJ Read full article

Source: @WSJ Read full article

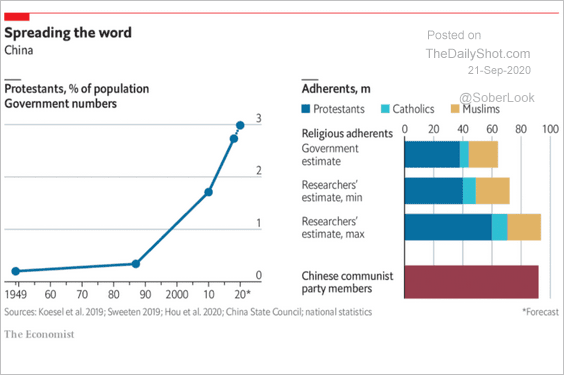

6. What percentage of China’s population is Protestant?

Source: The Economist Read full article

Source: The Economist Read full article

Emerging Markets

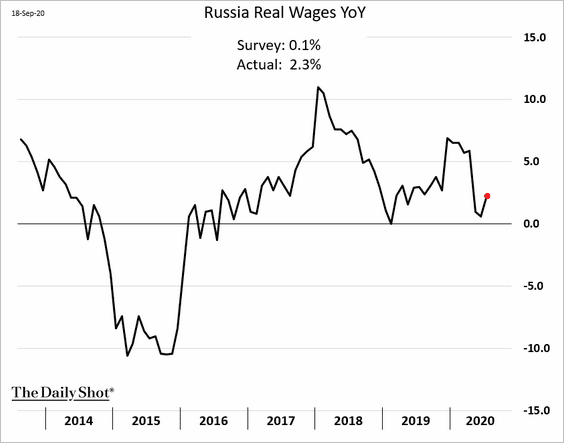

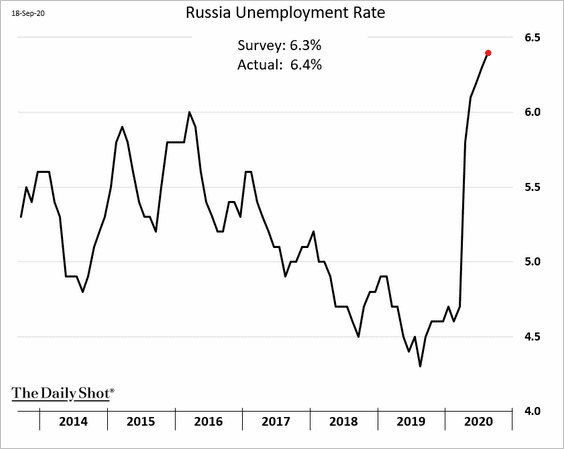

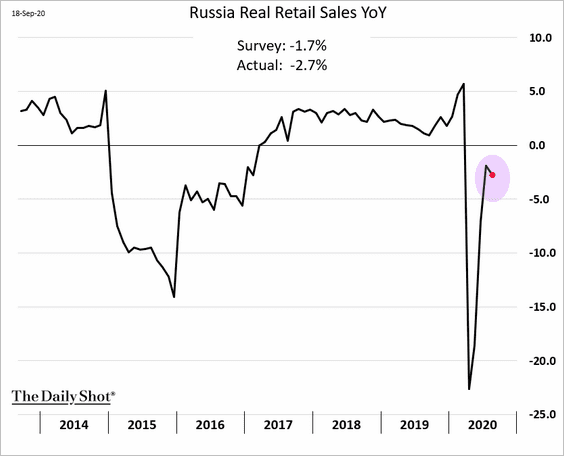

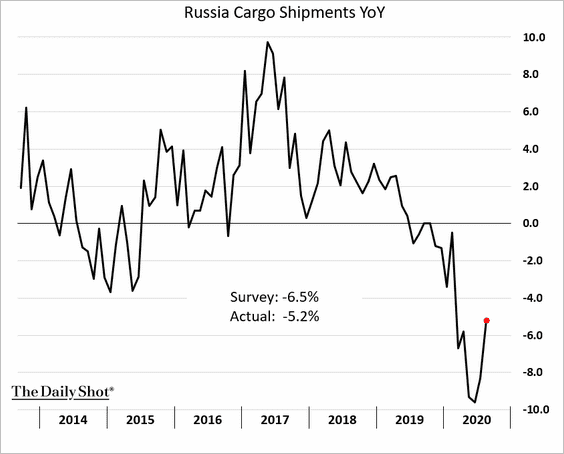

1. Let’s begin with some updates on Russia.

• Wage growth:

• The unemployment rate:

• Retail sales:

• Cargo shipments:

——————–

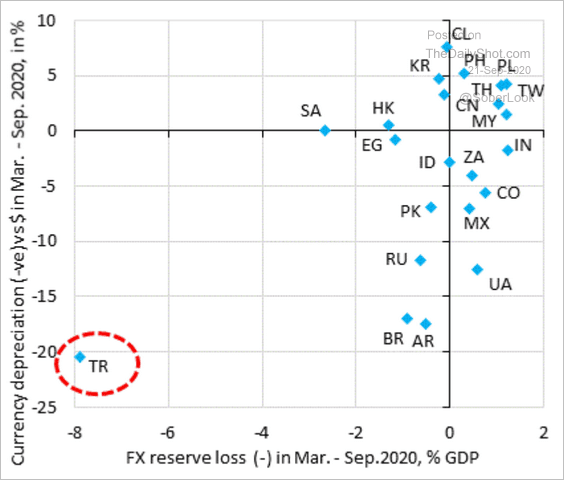

2. Turkey’s loss of FX reserves and the lira’s depreciation stand out vs. other EM economies.

Source: @RobinBrooksIIF, @UgrasUlkuIIF

Source: @RobinBrooksIIF, @UgrasUlkuIIF

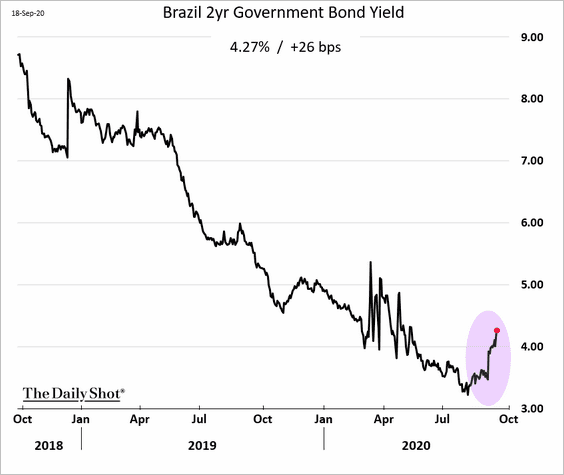

3. Investors were hit by the realization that Brazil’s central bank is on hold for now.

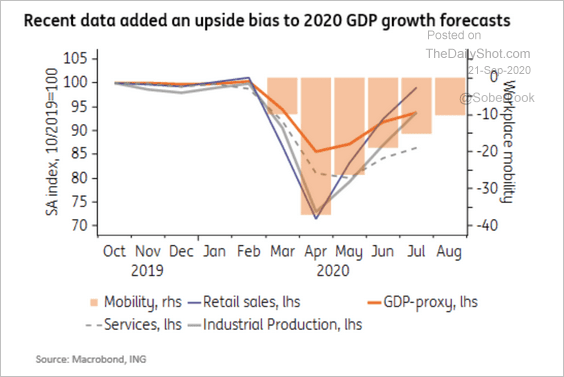

ING forecasts a greater GDP upside for Brazil this year as the nation’s recovery from the pandemic gains momentum.

Source: ING

Source: ING

Cryptocurrency

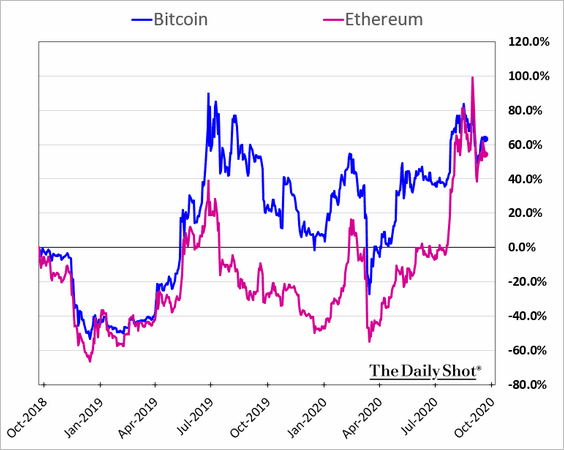

After last year’s underperformance, Ethereum has caught up with Bitcoin.

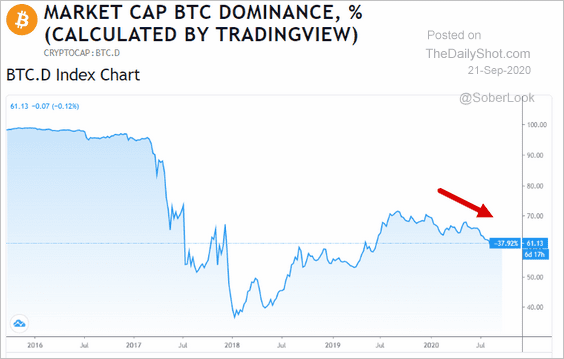

Here is Bitcoin’s relative market cap (“dominance”).

Source: tradingview.com

Source: tradingview.com

Commodities

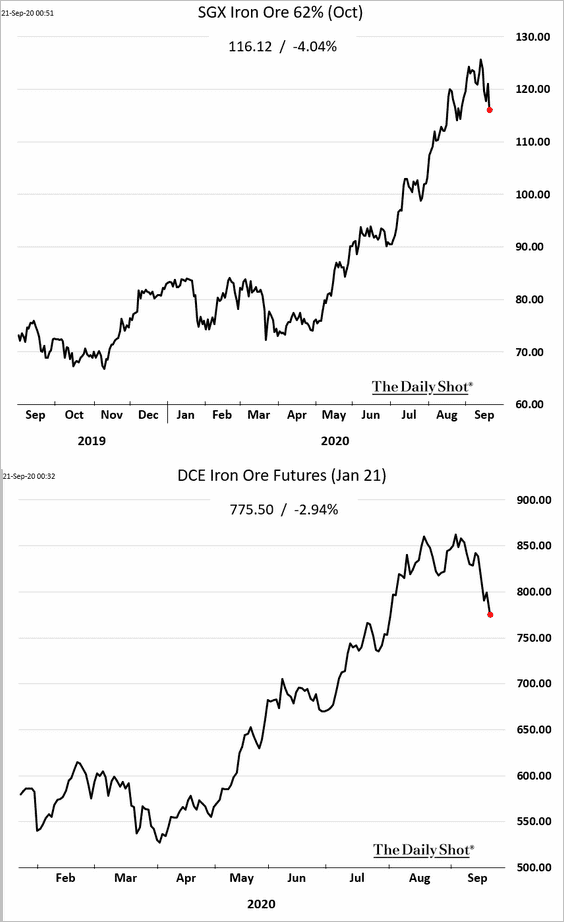

1. Iron ore prices are rolling over.

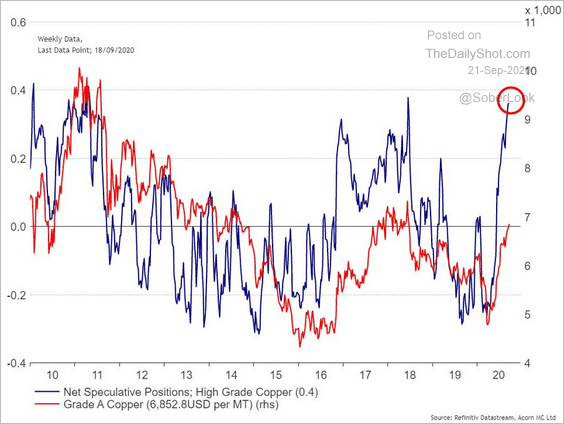

2. Hedge funds’ bets on copper remain elevated.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

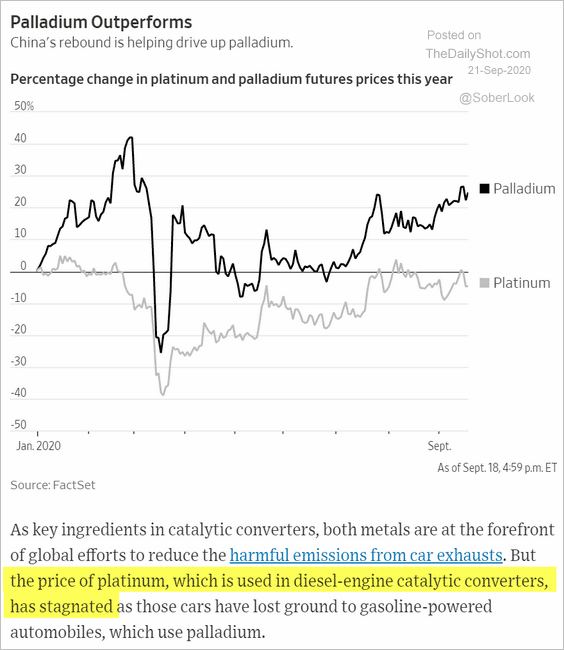

3. Platinum’s underperformance vs. palladium has widened as China’s automobile sales rebound, while sales growth in the EU (a large proportion of diesel cars) has been tepid.

Source: @WSJ Read full article

Source: @WSJ Read full article

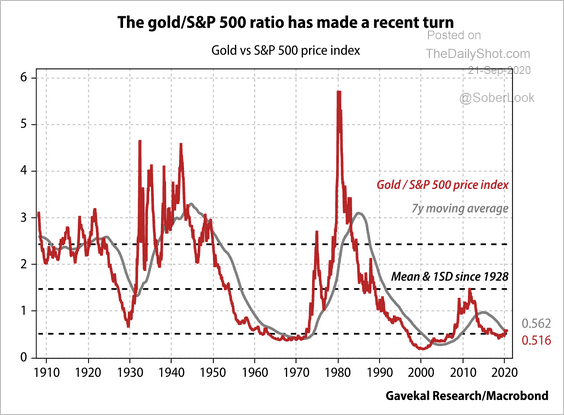

4. Gold appears cheap relative to the S&P 500.

Source: Gavekal

Source: Gavekal

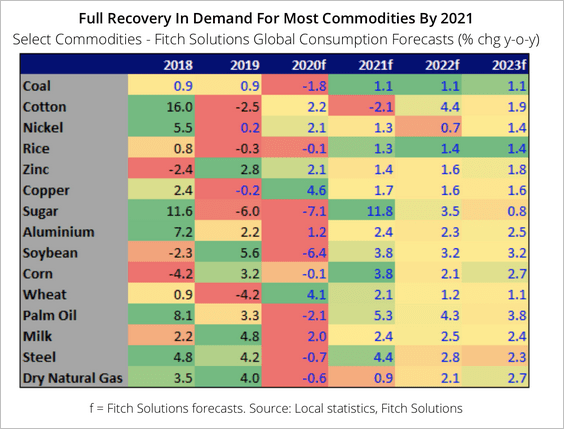

5. Fitch expects a full demand recovery for most commodities by 2021.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

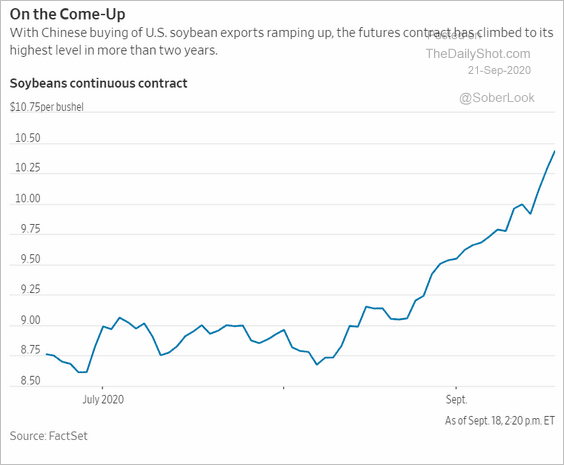

6. US soybean futures keep climbing.

Source: @WSJ Read full article

Source: @WSJ Read full article

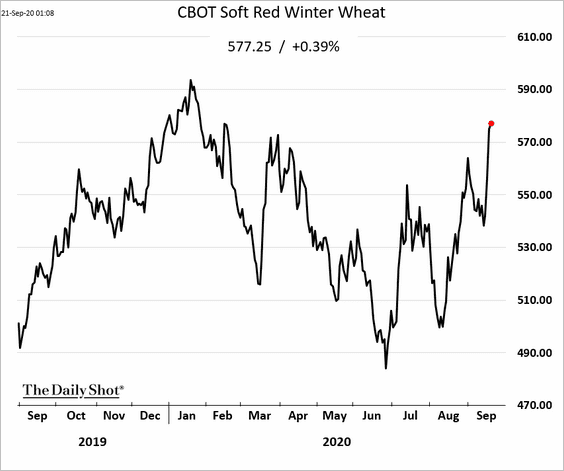

7. US wheat is at pre-crisis levels.

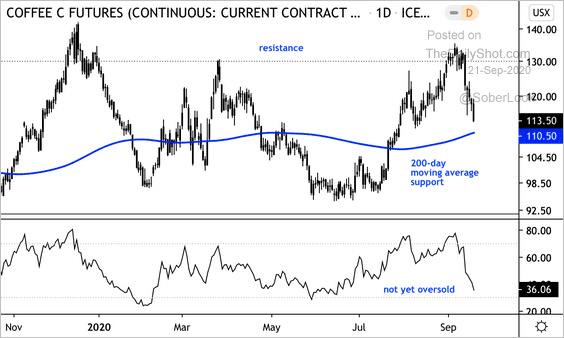

8. Coffee futures are approaching the 200-day moving average.

Source: @DantesOutlook

Source: @DantesOutlook

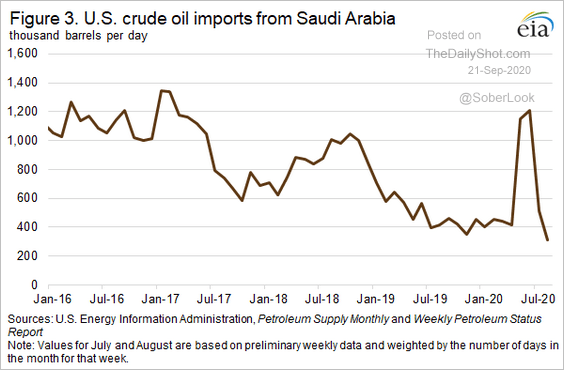

Energy

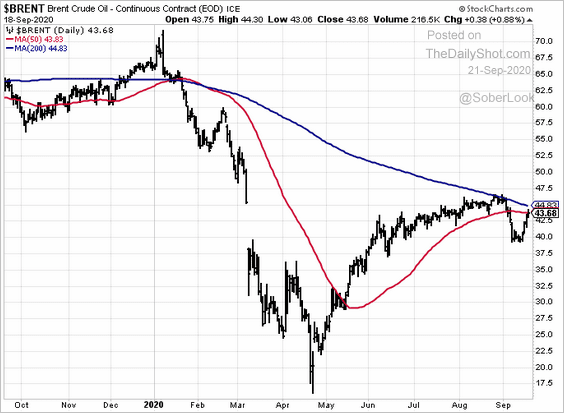

1. Brent is testing resistance at its 50-day moving average.

2. US crude oil imports from Saudi Arabia are at multi-year lows.

Source: EIA

Source: EIA

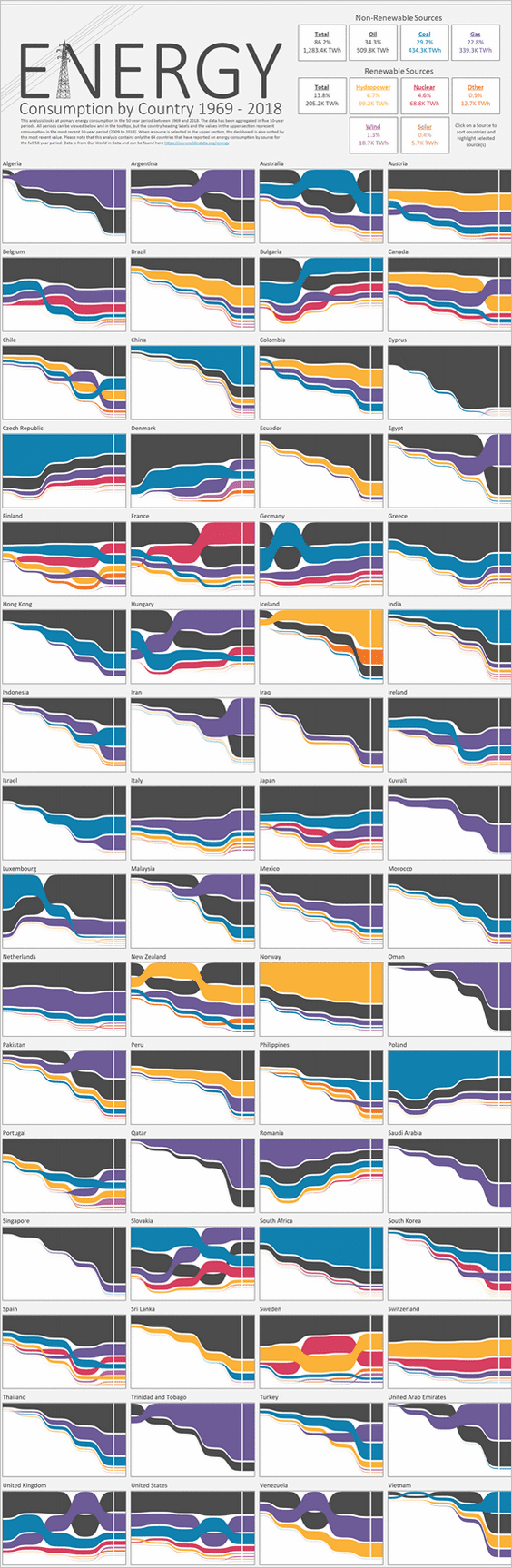

3. This next chart may be a bit difficult to read – click on the link below the chart to zoom in. It shows each country’s energy mix over time.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

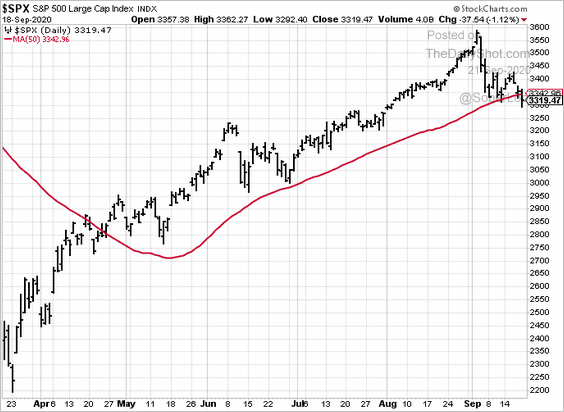

Equities

1. The S&P 500 closed below its 50-day moving average.

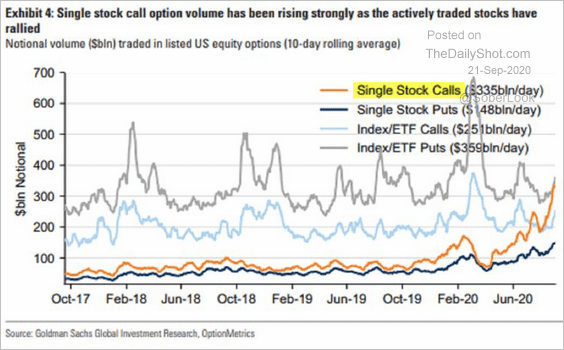

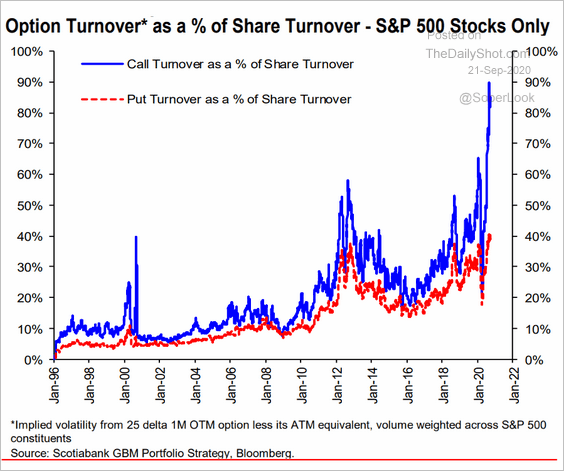

2. Call option volumes remain elevated (2 charts).

Source: Goldman Sachs, @markets Read full article

Source: Goldman Sachs, @markets Read full article

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

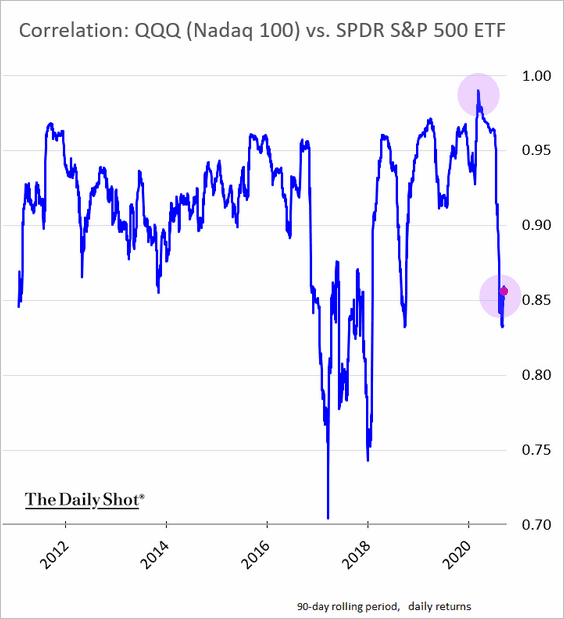

3. The correlation between the S&P 500 and the Nasdaq 100 has declined from peak levels, pointing to a pullback in the tech mega-caps’ leadership.

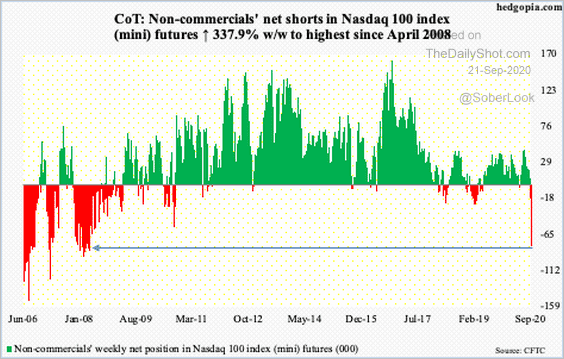

Hedge funds are holding the largest net-short position in Nasdaq 100 futures since 2008.

Source: @hedgopia

Source: @hedgopia

——————–

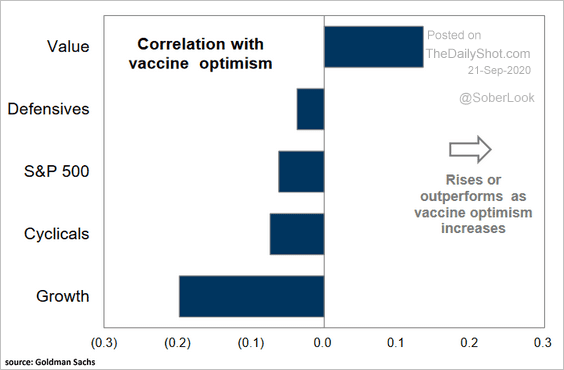

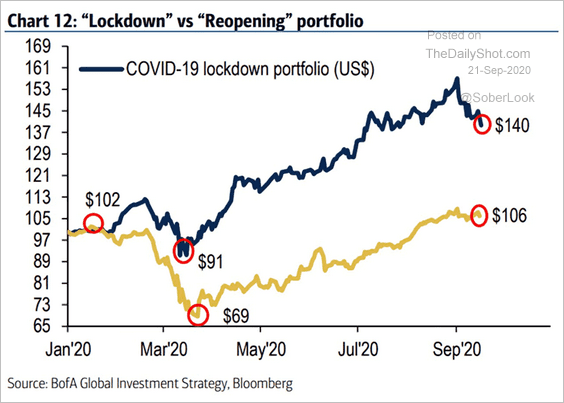

4. Vaccine optimism has been supporting value vs. growth.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

Many of the “lockdown” stocks are classified as growth.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

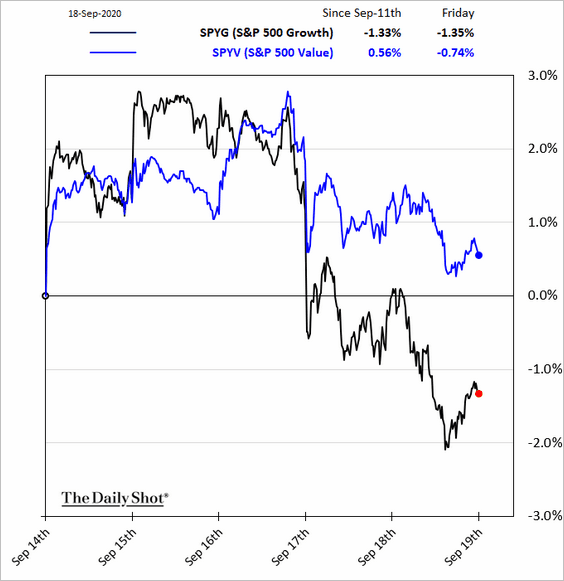

Here is value vs. growth over the past five days.

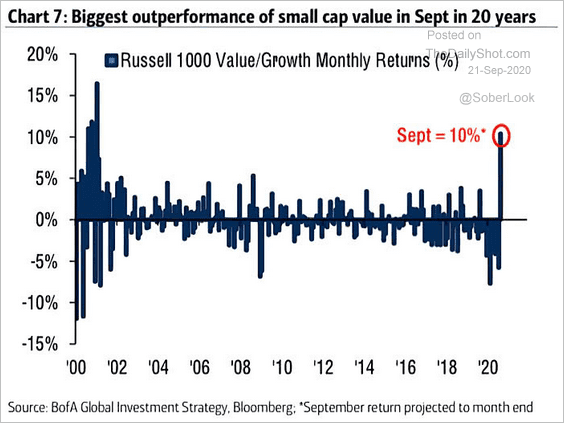

And this is the monthly relative performance.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

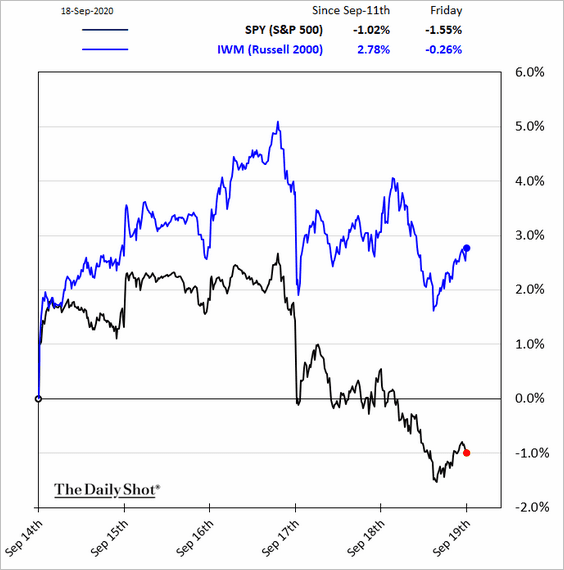

5. Small caps continue to outperform.

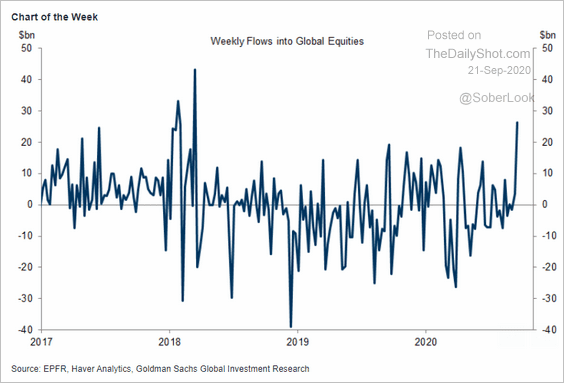

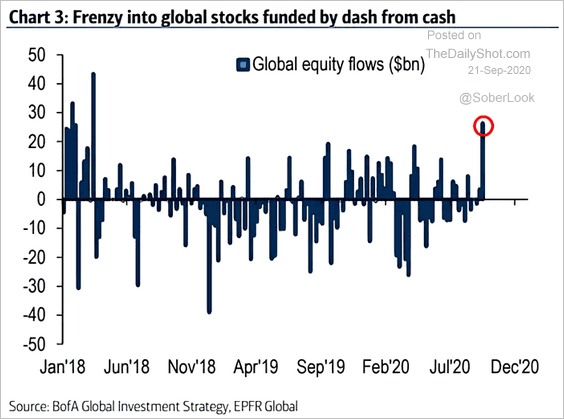

6. Flows into stocks rose sharply last week.

Source: Goldman Sachs

Source: Goldman Sachs

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

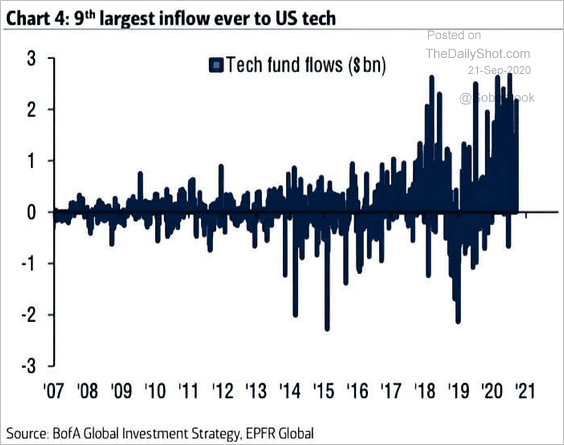

Tech inflows remain robust.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

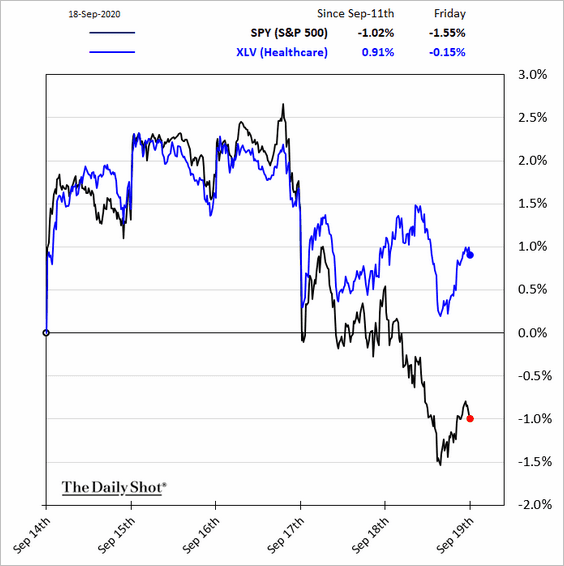

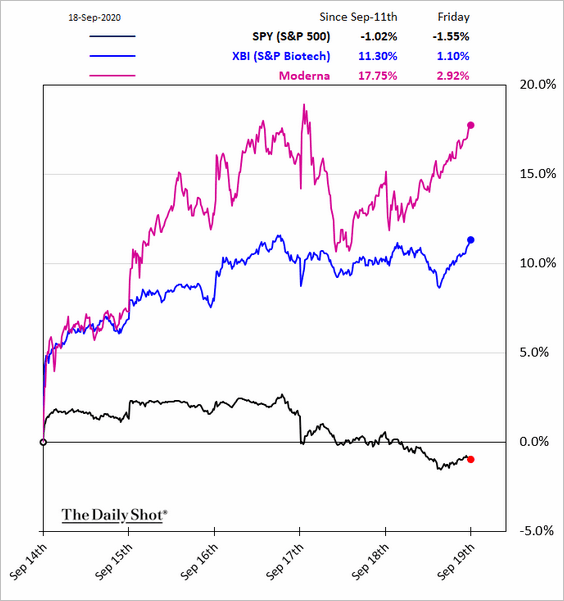

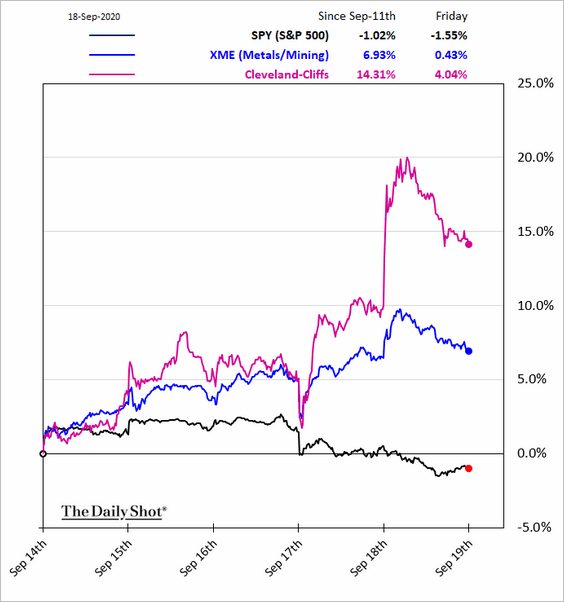

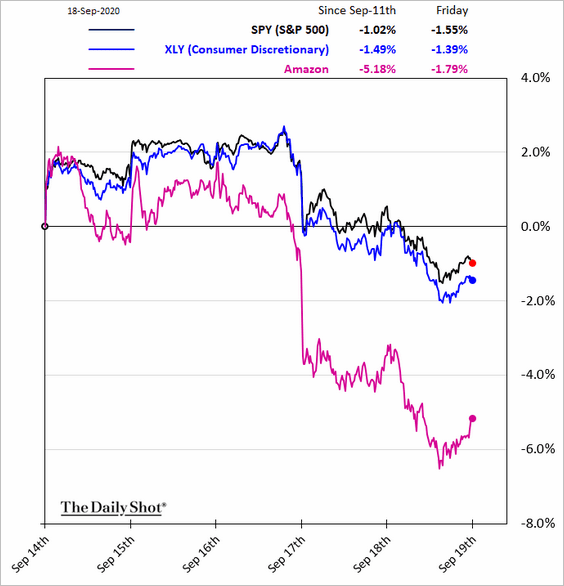

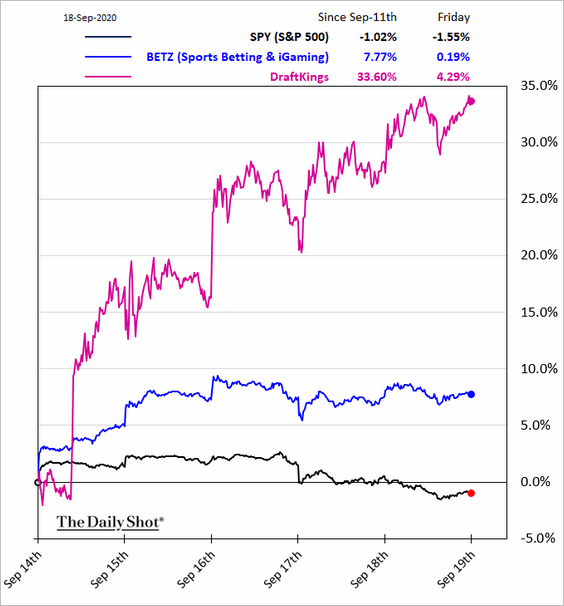

7. Next, we have some sector updates.

• Healthcare and biotech:

• Metals & Mining:

• Consumer Discretionary:

• Sports betting:

——————–

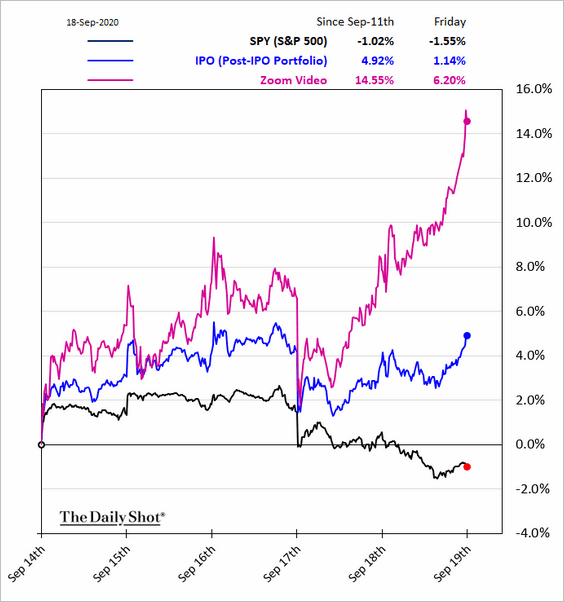

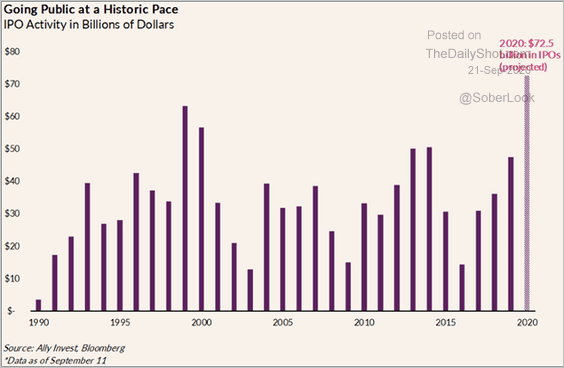

8. Post-IPO shares have been outperforming, …

… boosting demand for new offerings.

Source: Ally Invest

Source: Ally Invest

Rates

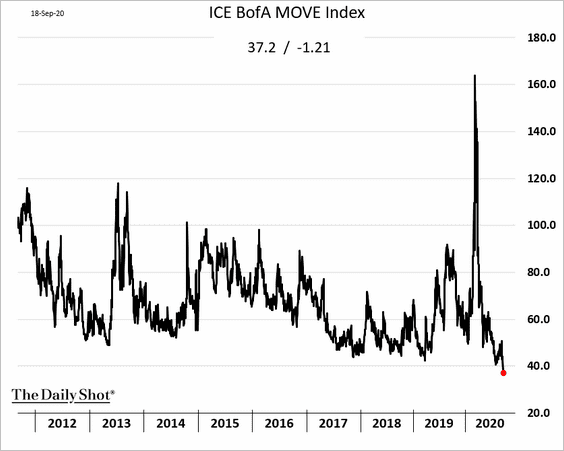

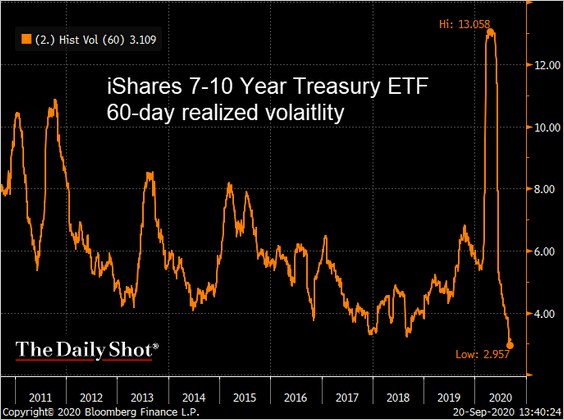

1. Treasury implied volatility is at new lows.

This chart shows the realized volatility for the iShares 7-10 year Treasury ETF.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

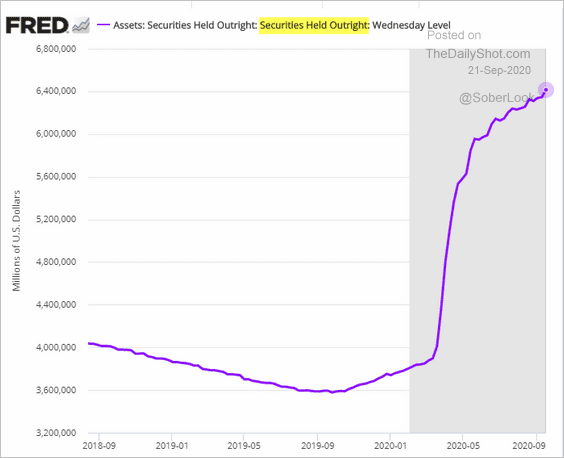

2. The Fed’s securities holdings are grinding higher.

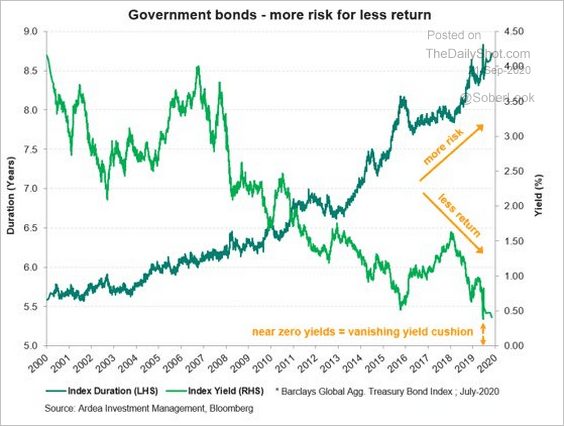

3. The risk-return profile for government bonds has deteriorated in recent years.

Source: @jsblokland Read full article

Source: @jsblokland Read full article

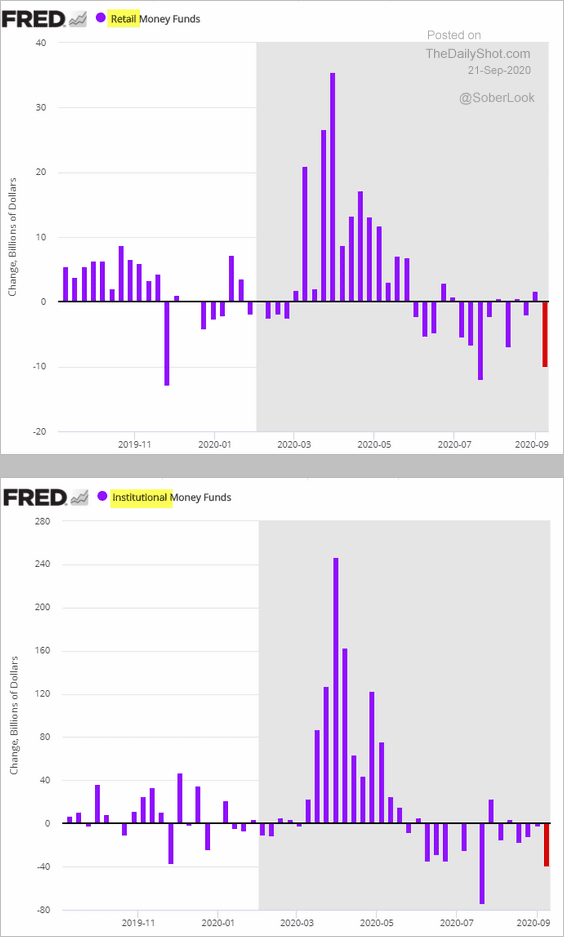

4. Money market funds had some outflows last week. As we saw in the equities section, some of this capital has been flowing into stocks.

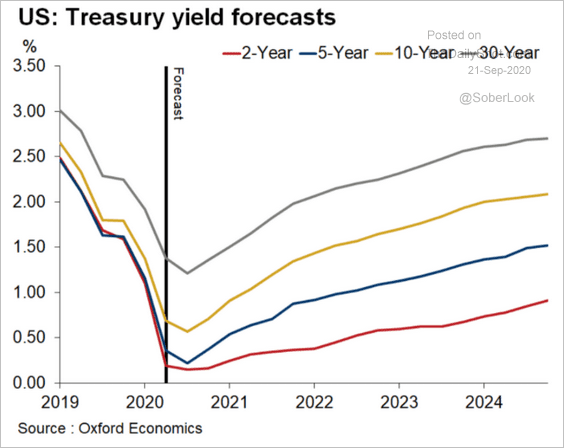

5. This chart shows the Oxford Economics’ forecast for Treasury yields.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

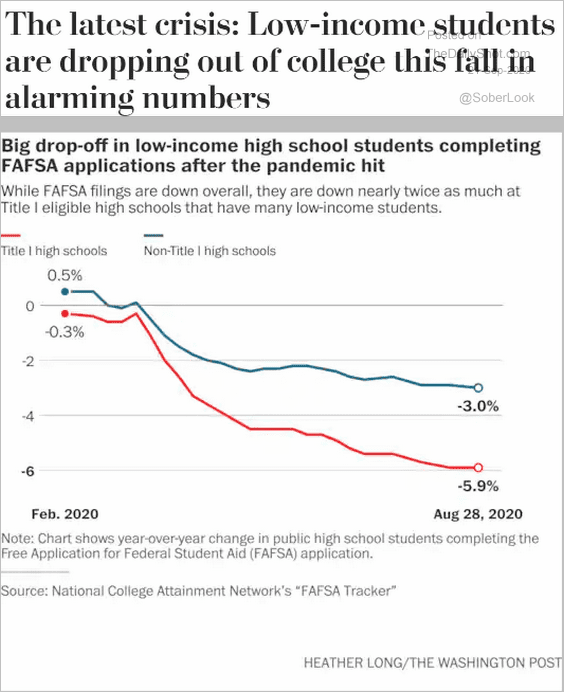

1. Low-income students dropping out of college (FAFSA = financial aid applications):

Source: The Washington Post Read full article

Source: The Washington Post Read full article

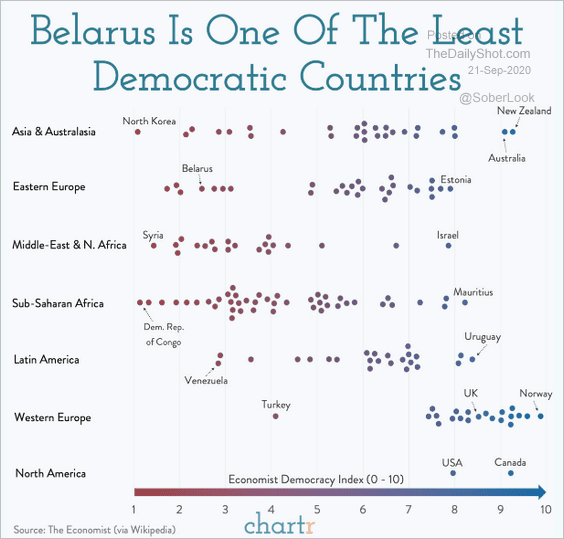

2. The Democracy Index by region:

Source: @chartrdaily

Source: @chartrdaily

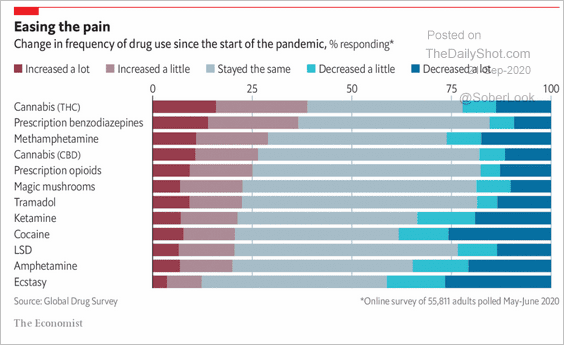

3. Changes in drug use since the start of the pandemic:

Source: The Economist Read full article

Source: The Economist Read full article

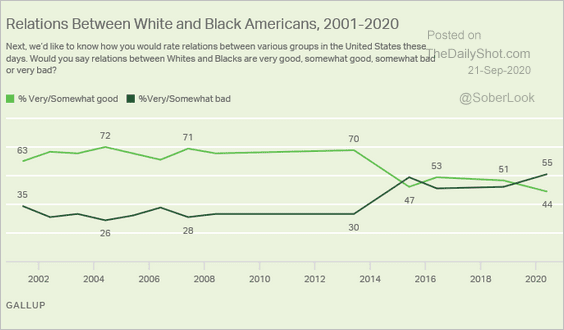

4. Views on relations between white and black Americans:

Source: Gallup Read full article

Source: Gallup Read full article

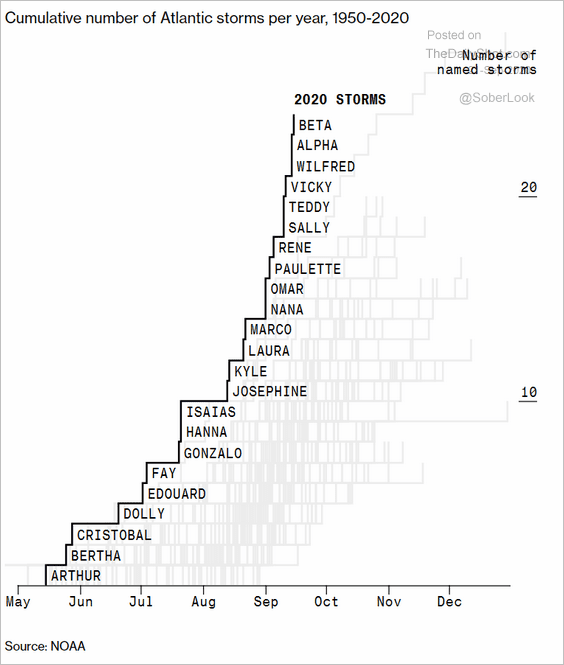

5. A record-breaking year for Atlantic storms:

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

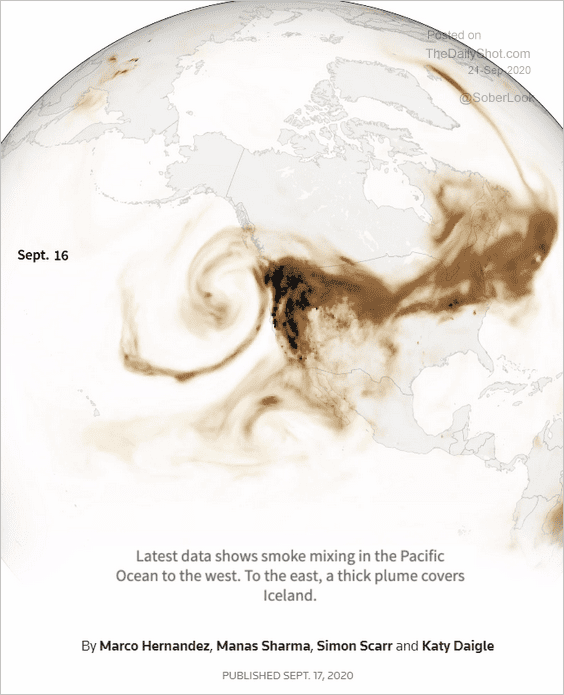

6. California fires impacting Iceland:

Source: Reuters Read full article

Source: Reuters Read full article

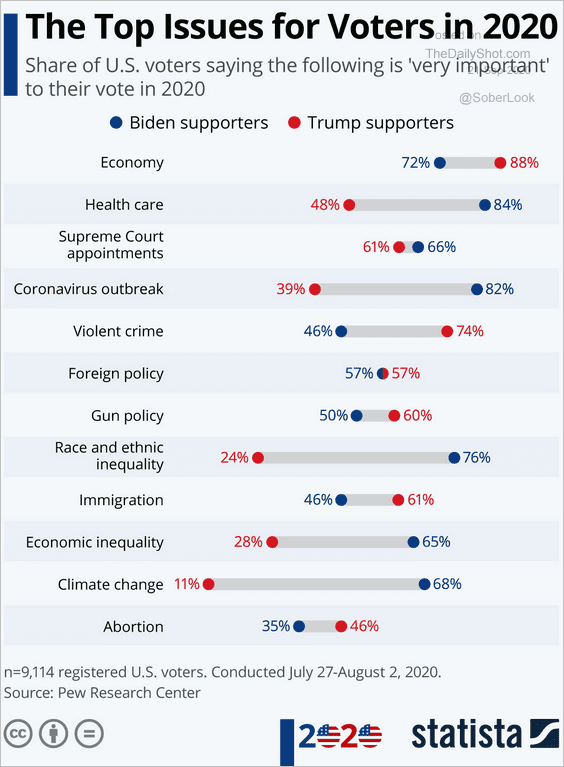

7. Top issues for US voters in 2020:

Source: Statista

Source: Statista

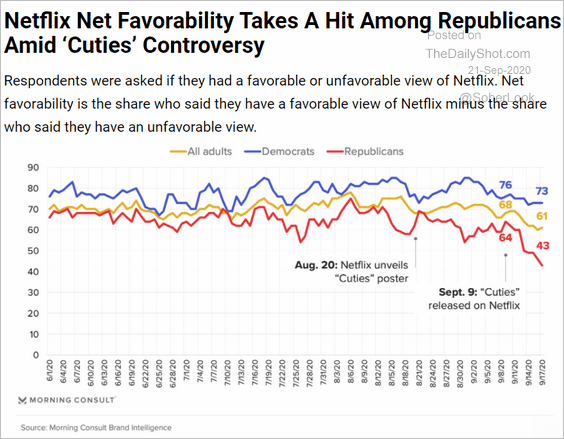

8. Netflix favorability ratings:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

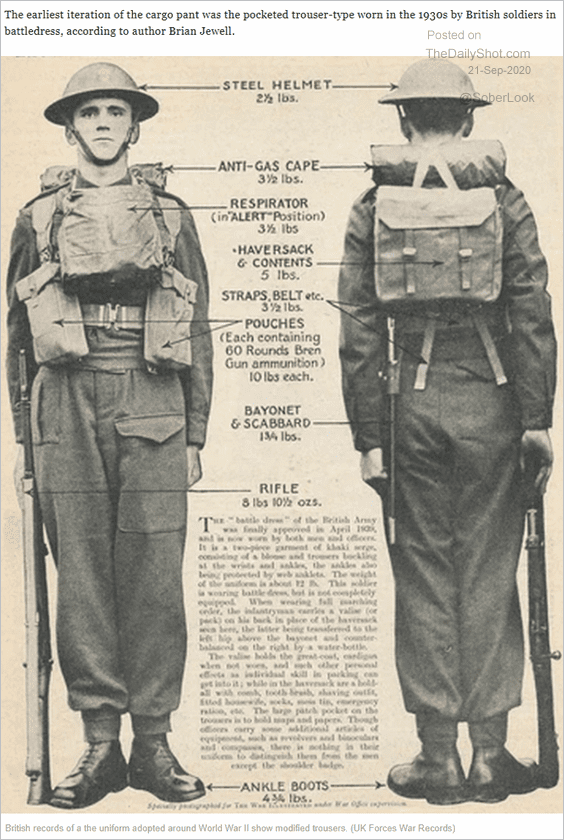

9. The origin of “cargo pants”:

Source: @adam_tooze, @MilitaryTimes Read full article

Source: @adam_tooze, @MilitaryTimes Read full article

——————–