The Daily Shot: 22-Sep-20

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

The United States

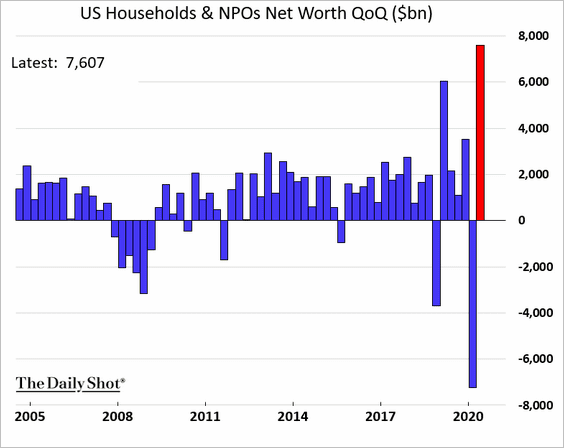

1. US household net worth rose sharply last quarter (biggest quarterly gain since 1952) as the stock market recovered.

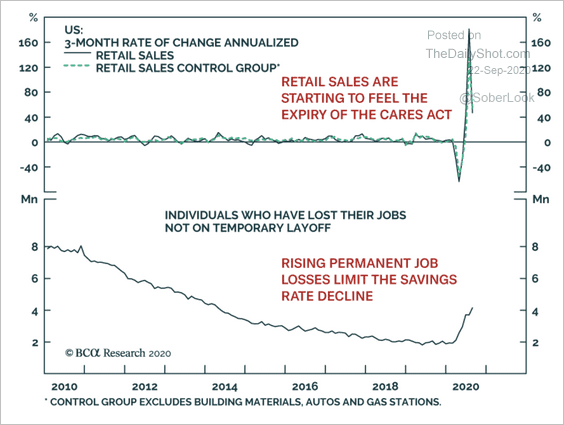

2. The expiration of the $300/week unemployment benefits this month will reverberate through the economy.

Source: BCA Research

Source: BCA Research

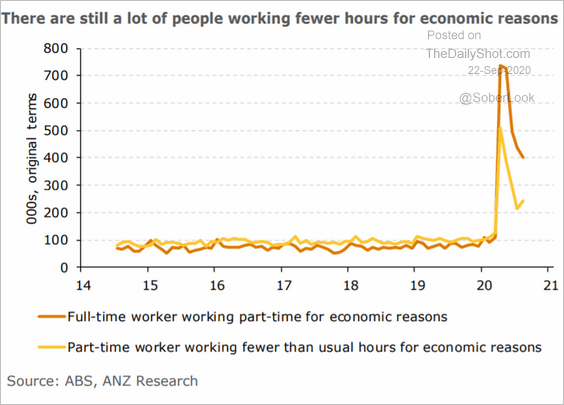

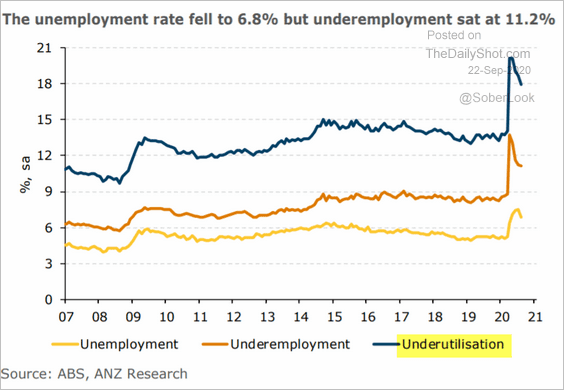

3. Next, we have some updates on the labor market.

• Labor underutilization continues to be a concern (2 charts).

Source: ANZ Research

Source: ANZ Research

Source: ANZ Research

Source: ANZ Research

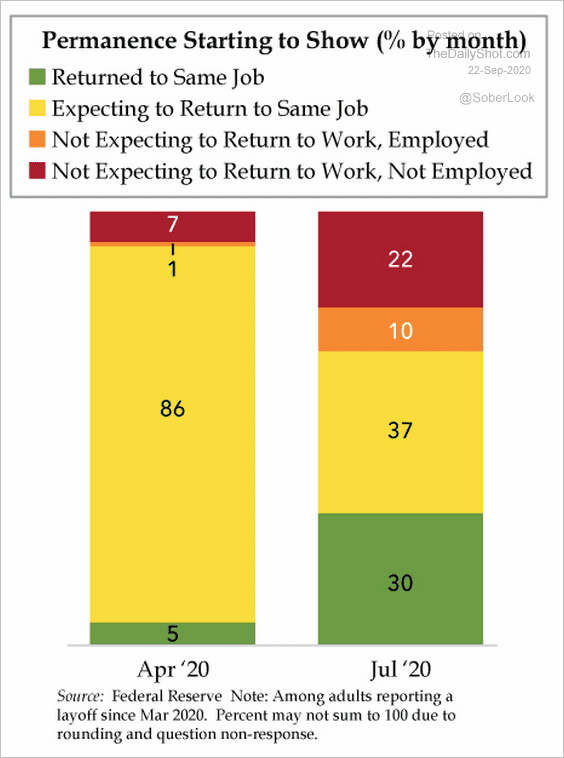

• More of the layoffs have become permanent.

Source: The Daily Feather

Source: The Daily Feather

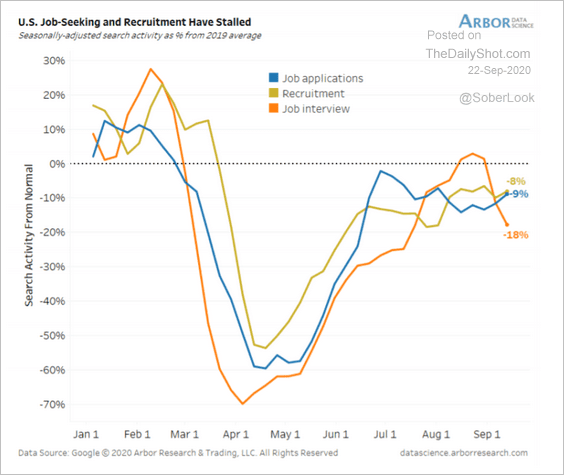

• Job-related online search activity remains below last year’s levels.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

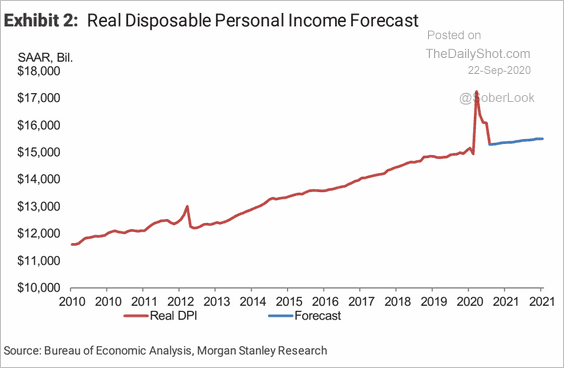

4. Here is Morgan Stanley’s projection for the pace of growth in disposable income.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

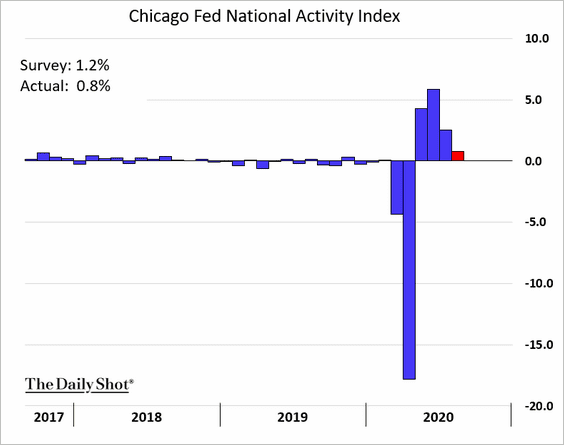

5. Similar to the leading index, the Chicago Fed National Activity Index showed a smaller increase last month.

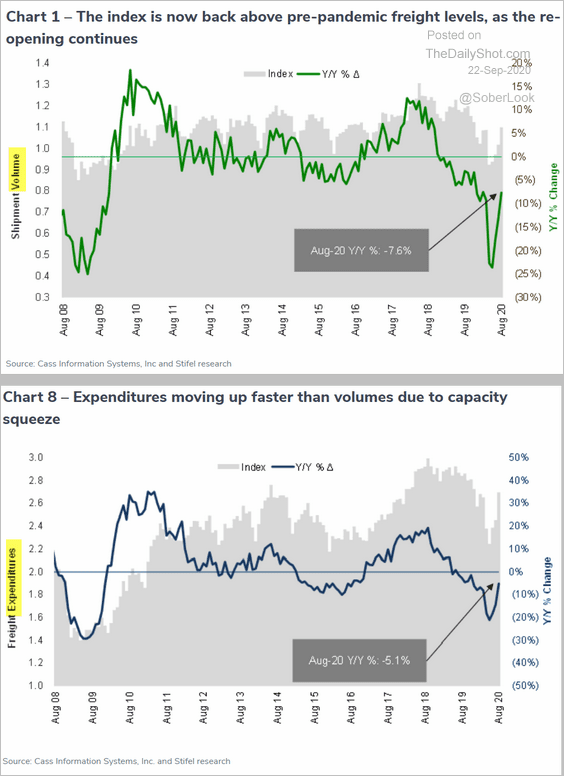

6. Freight activity is rebounding.

Source: Cass Information Systems

Source: Cass Information Systems

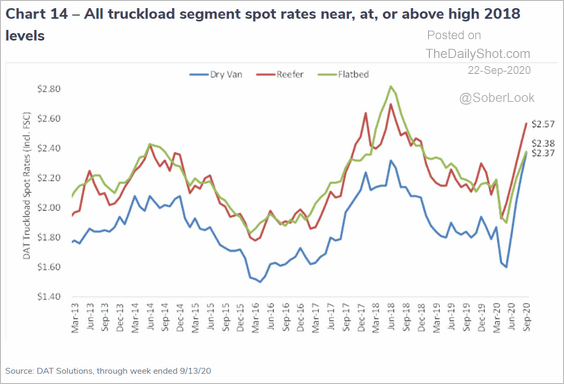

• Truckload rates have increased sharply.

Source: Cass Information Systems

Source: Cass Information Systems

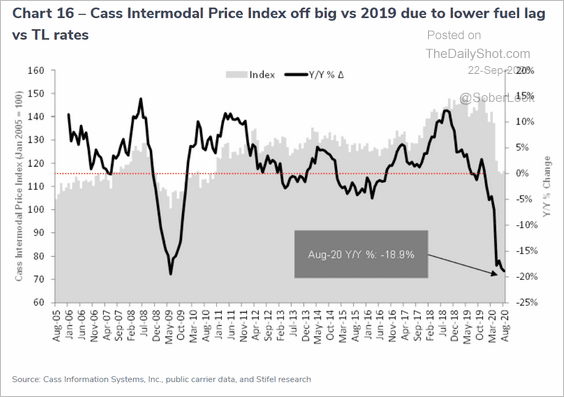

• However, intermodal shipment prices remain depressed.

Source: Cass Information Systems

Source: Cass Information Systems

——————–

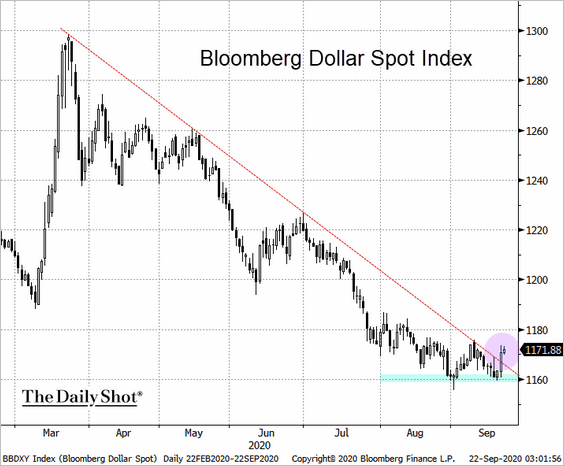

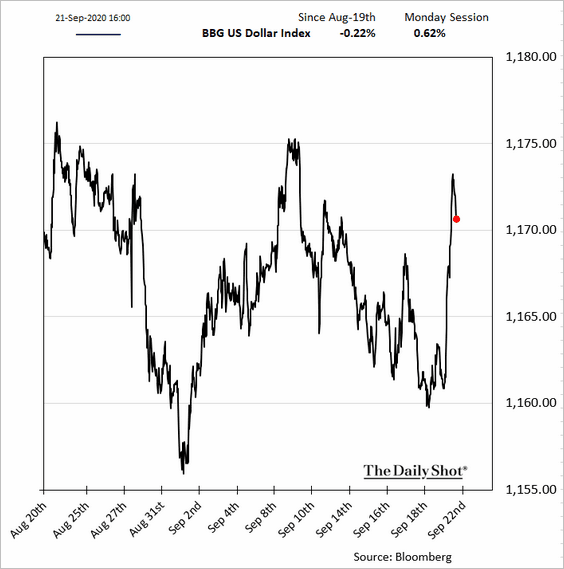

7. Has the US dollar bottomed?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

The United Kingdom

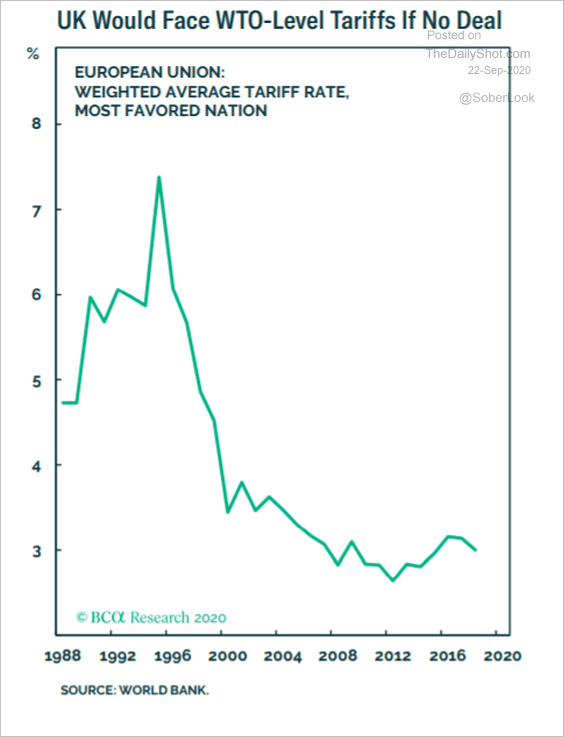

1. Are UK exporters ready to start paying a 3% tariff to the EU?

Source: BCA Research

Source: BCA Research

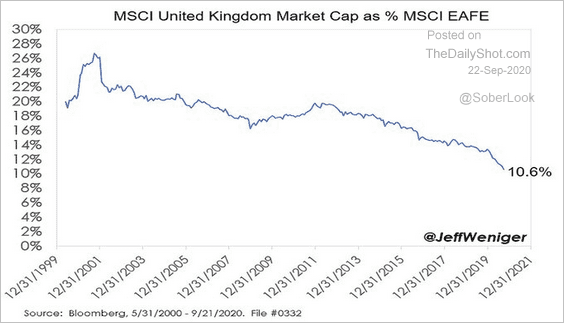

2. The UK stock market’s share of the MSCI EAFE index capitalization keeps shrinking.

Source: @JeffWeniger

Source: @JeffWeniger

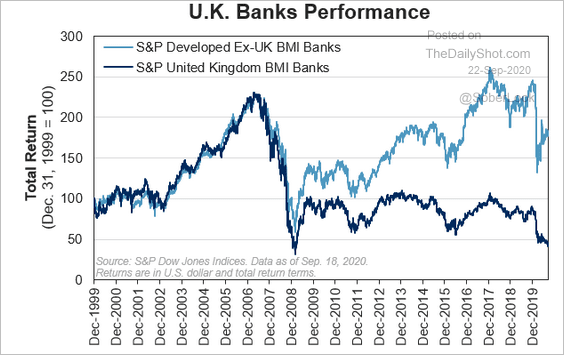

UK banks continue to underperform.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

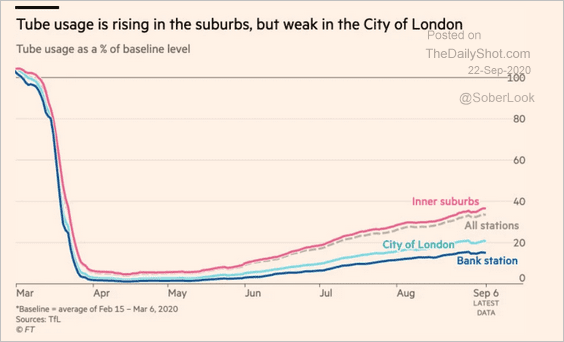

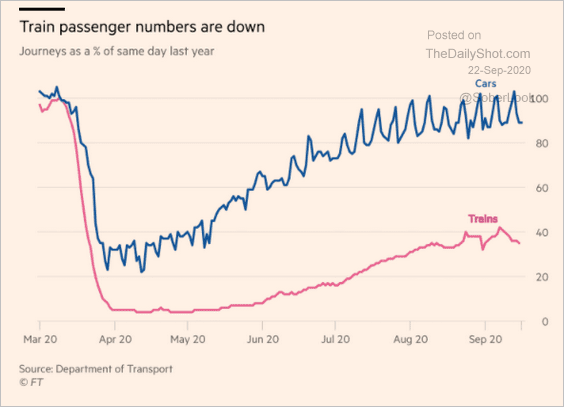

3. Here are a couple of charts on mobility.

• Tube usage:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• Cars vs. trains:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Mobility is expected to take a hit again as the nation struggles with higher infection rates.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

——————–

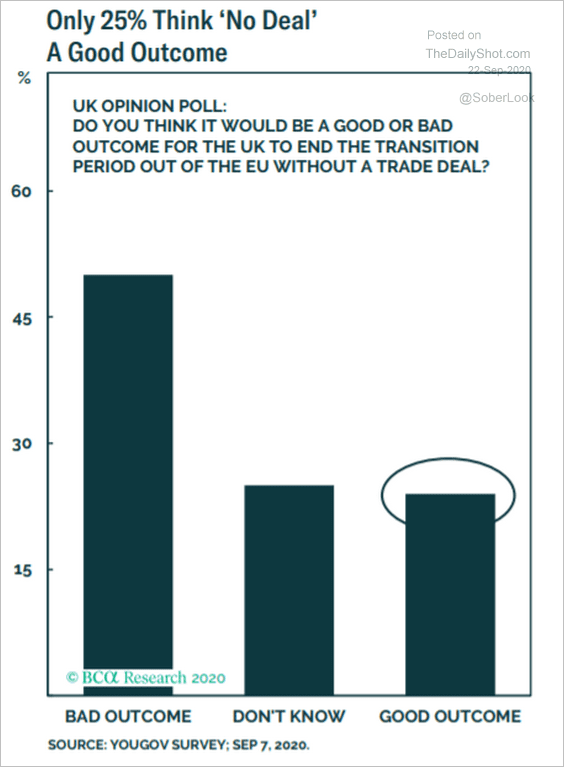

4. Finally, here are a couple of poll results.

• Views on the no-deal outcome:

Source: BCA Research

Source: BCA Research

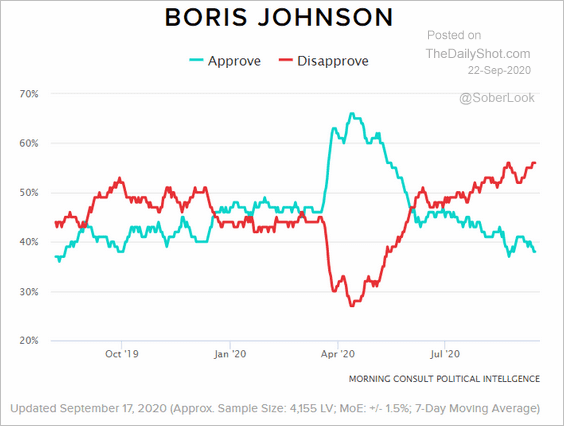

• The Prime Minister’s approval ratings:

Source: Morning Consult

Source: Morning Consult

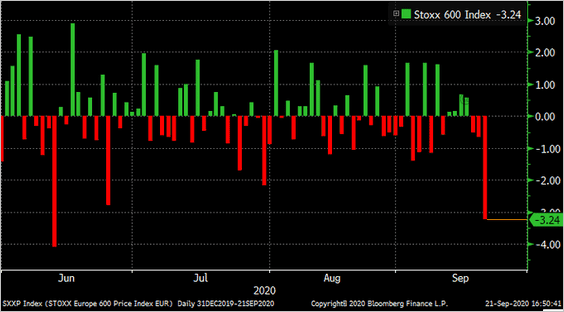

The Eurozone

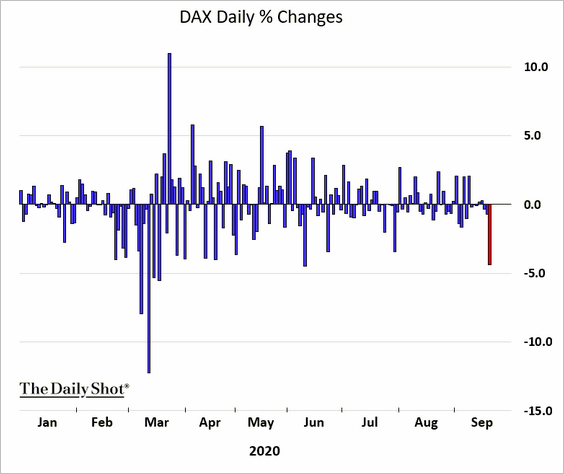

1. European shares sold off sharply on Monday, but markets are stable this morning.

Source: @markets Read full article

Source: @markets Read full article

——————–

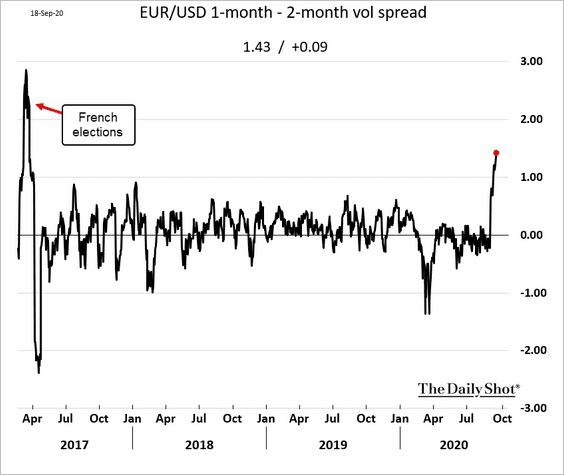

2. EUR/USD options are pricing in a significant US election risk.

Source: Anil Varma, Bloomberg Finance L.P.

Source: Anil Varma, Bloomberg Finance L.P.

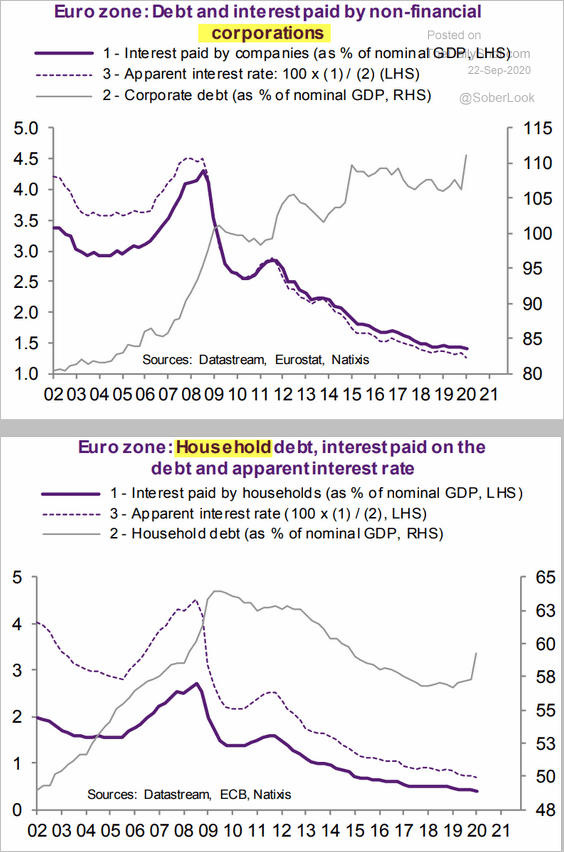

3. These charts show the evolution of corporate and household debt in the Eurozone.

Source: Natixis

Source: Natixis

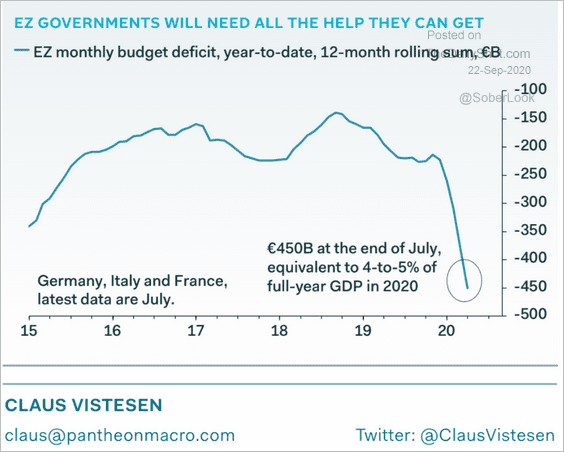

4. The budget gap continues to widen.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Asia – Pacific

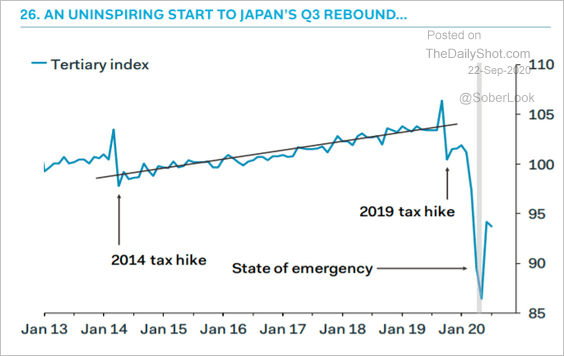

1. Japan’s service sector activity remains soft.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

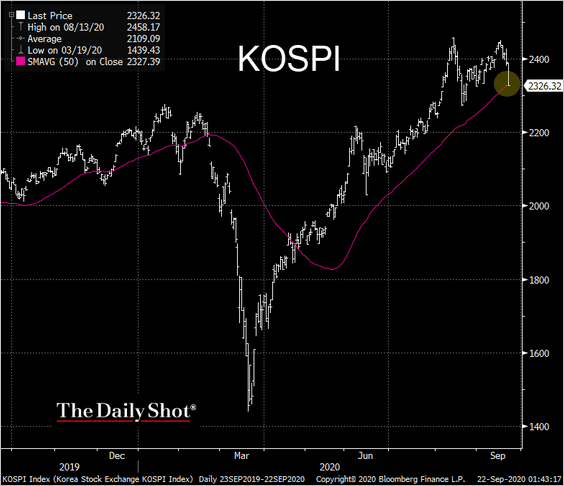

2. South Korea’s KOSPI index is testing support at the 50-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

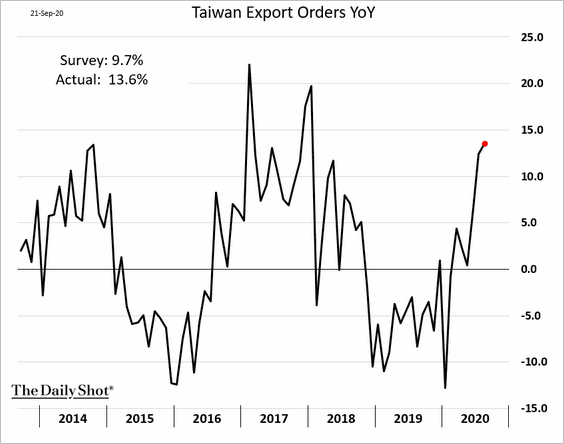

3. Taiwan’s export orders continue to beat expectations.

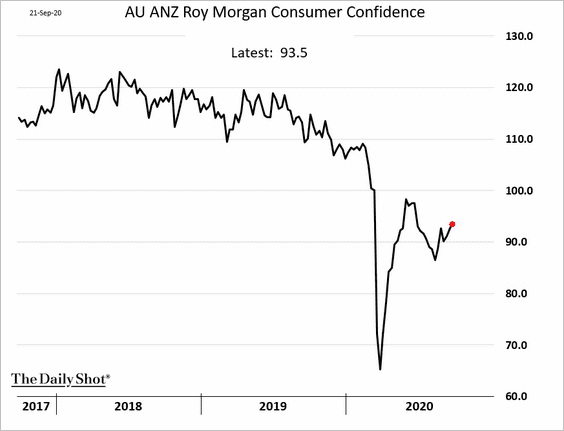

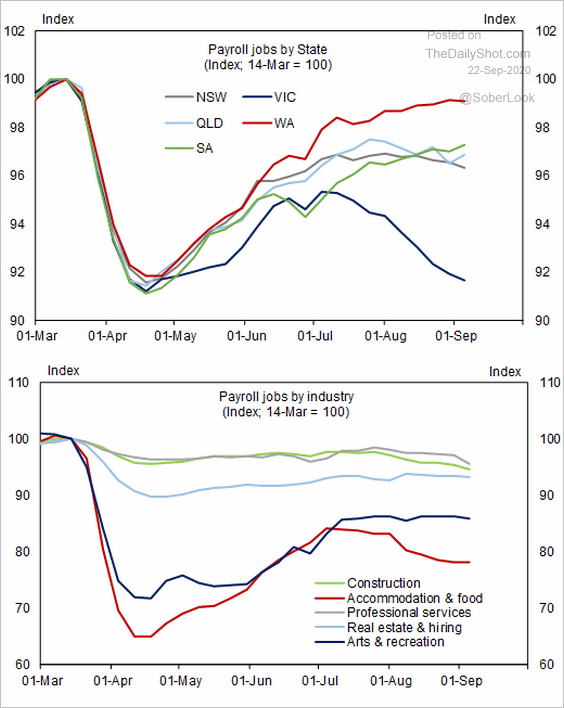

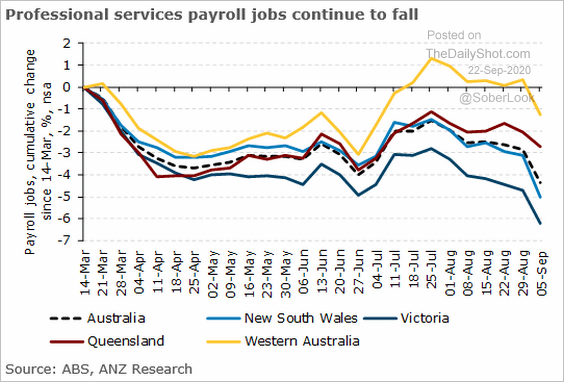

4. Next, we have some updates on Australia.

• Consumer confidence:

• Payrolls (3 charts):

Source: Goldman Sachs

Source: Goldman Sachs

Source: @ANZ_Research, @cfbirch

Source: @ANZ_Research, @cfbirch

• New infections:

Source: Goldman Sachs

Source: Goldman Sachs

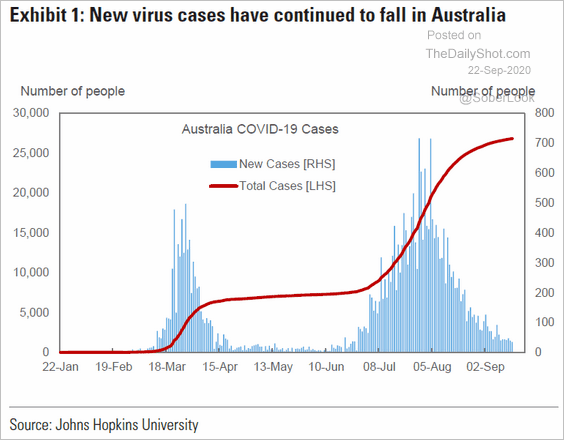

By the way, will we see a third wave?

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

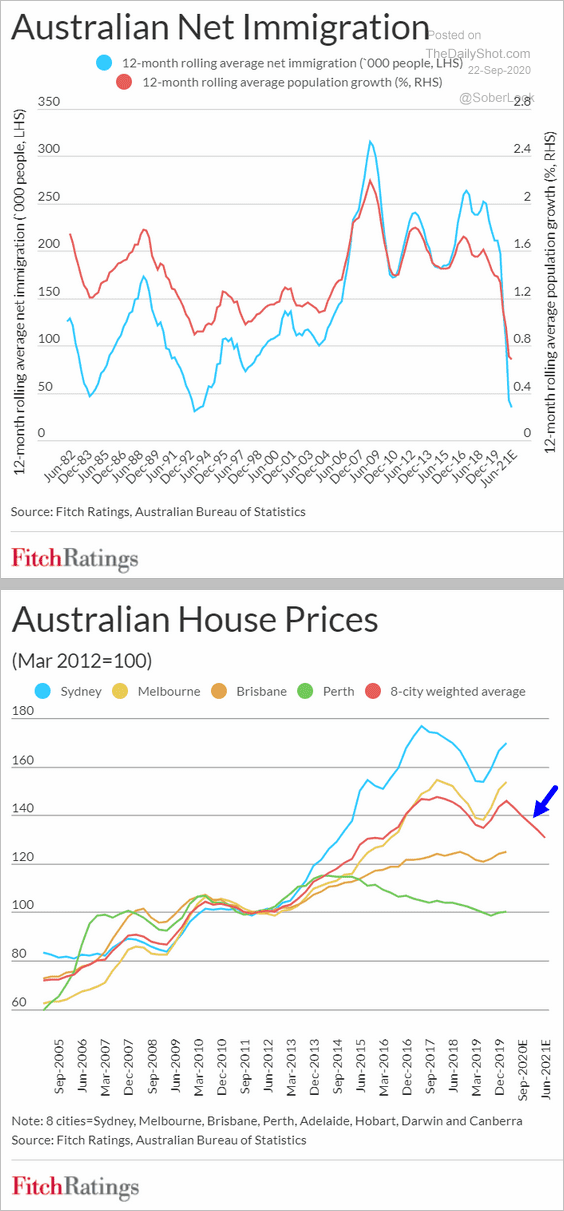

• The collapse in immigration and its impact on home prices:

Source: Fitch Ratings

Source: Fitch Ratings

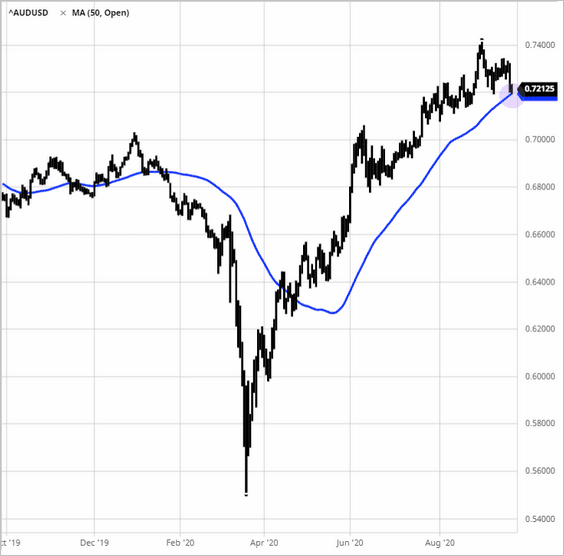

• The Aussie dollar (at 50d moving average):

China

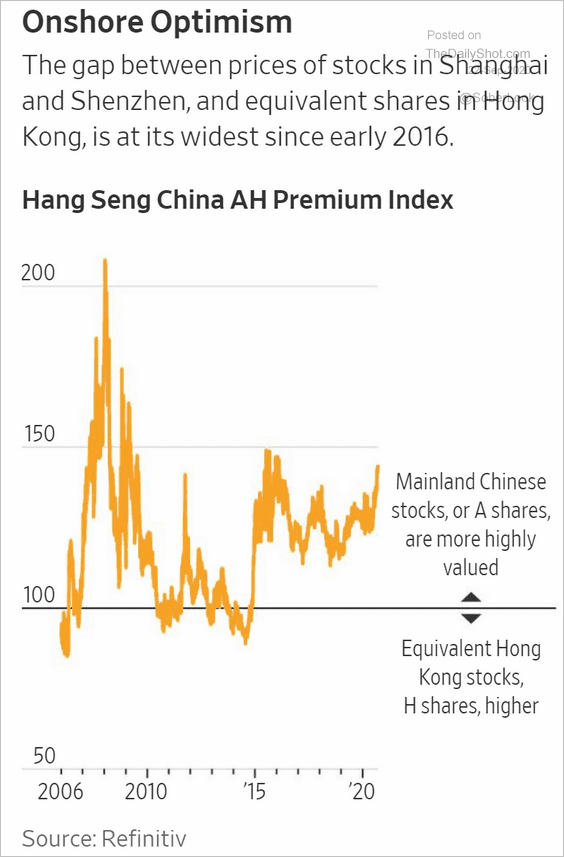

1. Mainland shares are trading at a premium vs. Hong Kong.

Source: @WSJ Read full article

Source: @WSJ Read full article

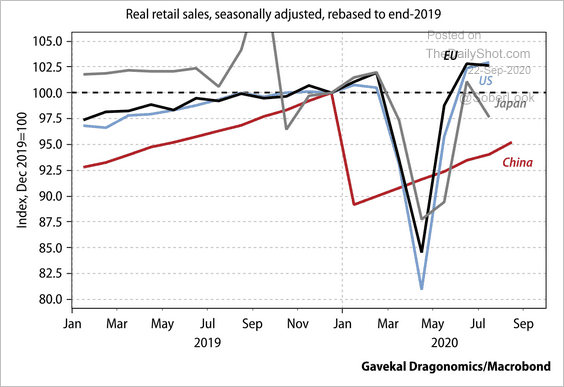

2. China’s consumption recovery has lagged other major economies.

Source: Gavekal

Source: Gavekal

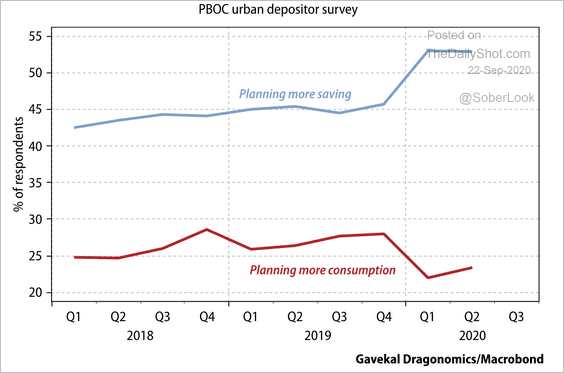

Households have been more cautious about spending.

Source: Gavekal

Source: Gavekal

——————–

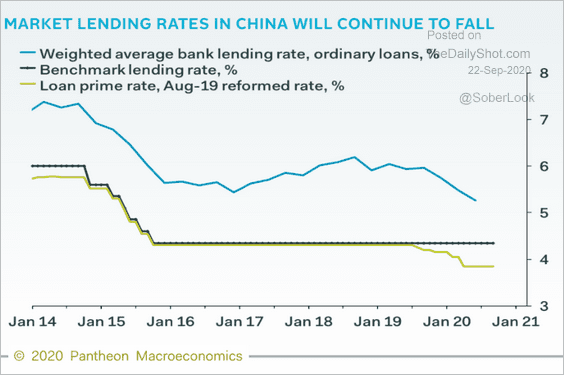

3. Loan rates are expected to drift lower.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

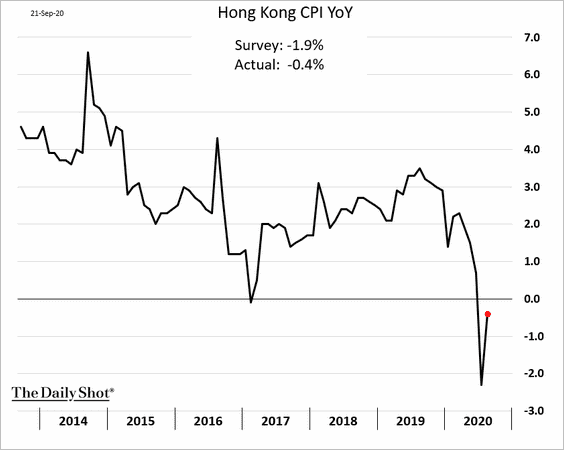

4. Hong Kong’s CPI is rebounding.

Emerging Markets

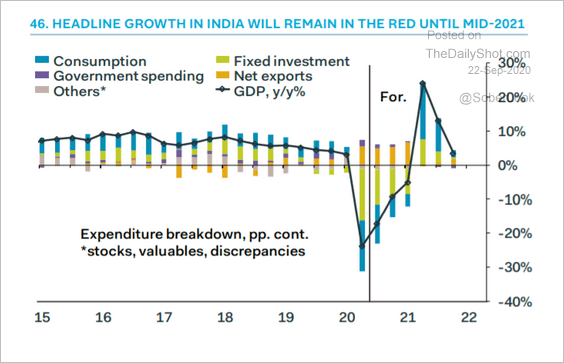

1. Let’s begin with some updates on India.

• The recovery will take some time.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

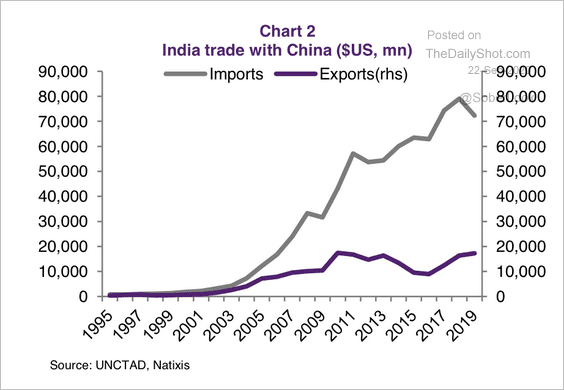

• India has a large trade deficit with China.

Source: Natixis

Source: Natixis

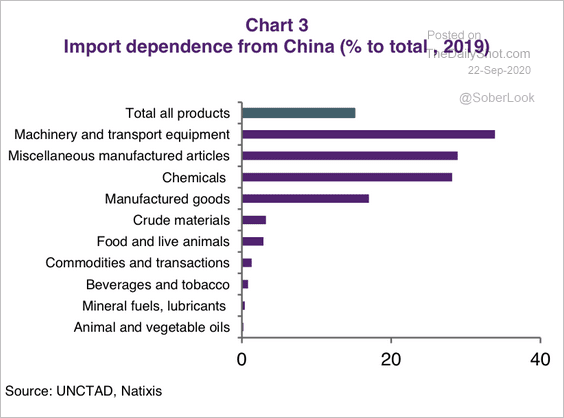

• Here is a breakdown of India’s import dependence on China.

Source: Natixis

Source: Natixis

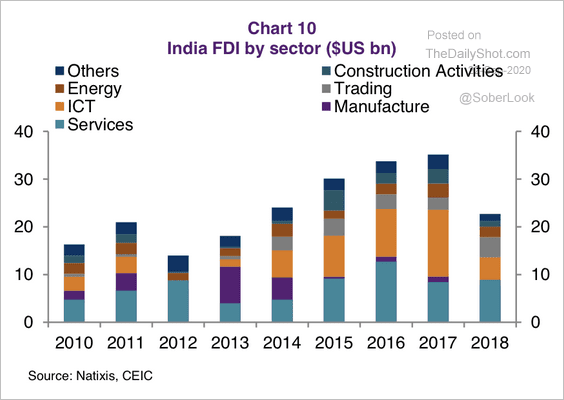

• India’s foreign direct investment has been concentrated in services and information/commercial technology (ICT).

Source: Natixis

Source: Natixis

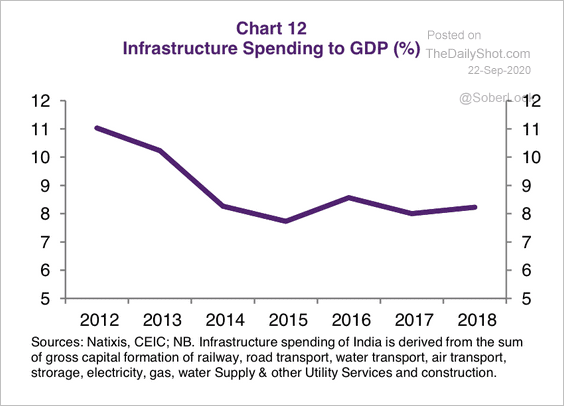

• India’s infrastructure spending has been stuck in low gear since 2012.

Source: Natixis

Source: Natixis

——————–

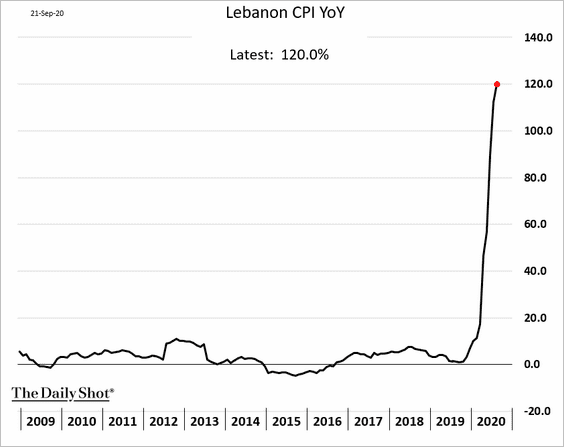

2. Lebanon’s inflation hit 120%.

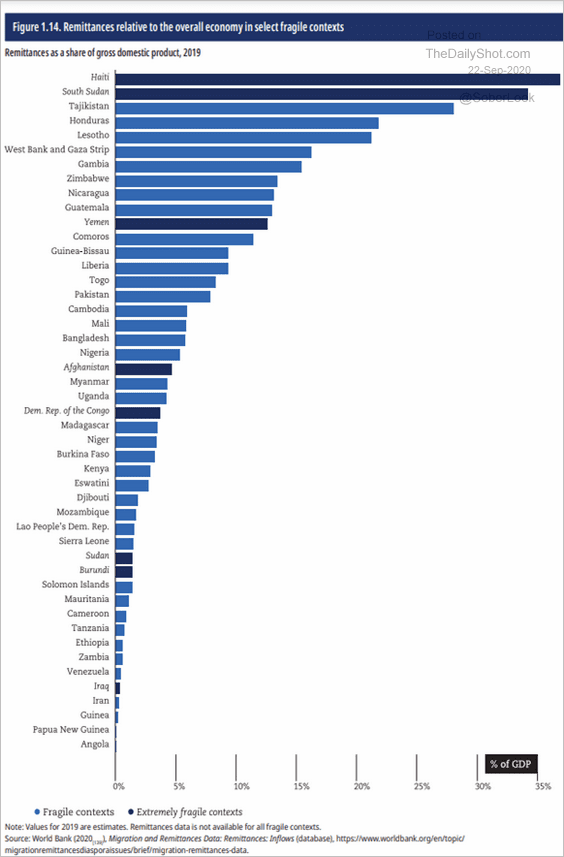

3. This chart shows remittances as a share of each country’s GDP.

Source: OECD Read full article

Source: OECD Read full article

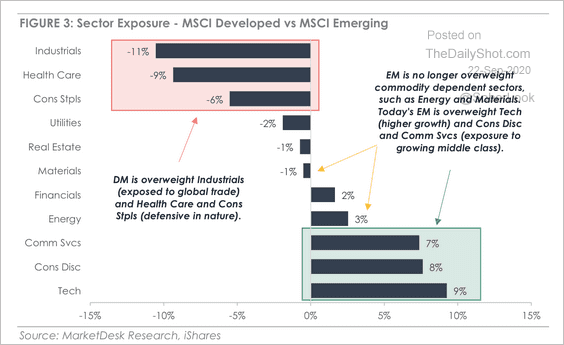

4. The MSCI Emerging Market Index is more exposed to technology and consumer discretionary than the MSCI DM.

Source: MarketDesk Research

Source: MarketDesk Research

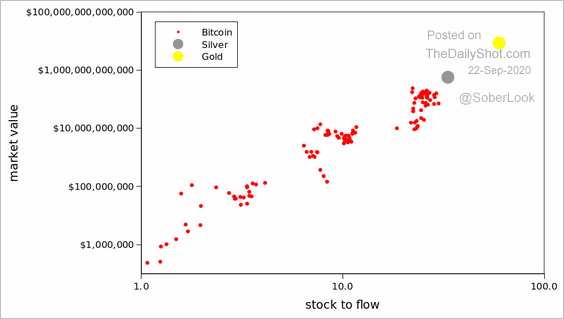

Cryptocurrency

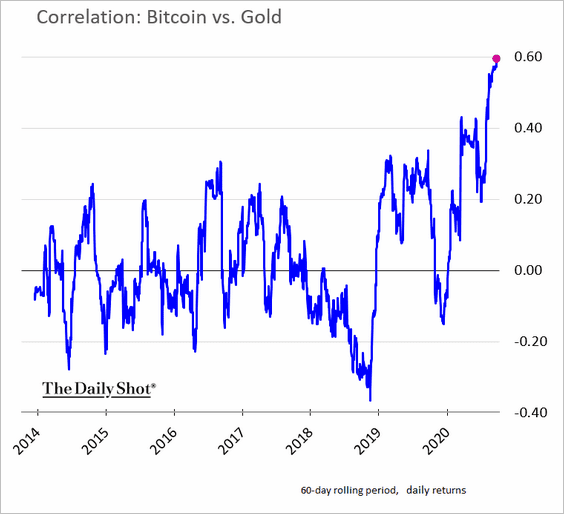

1. The Bitcoin – gold correlation hit the highest level in years.

2. Here is Bitcoin’s stock-to-flow trajectory.

Source: @100trillionUSD

Source: @100trillionUSD

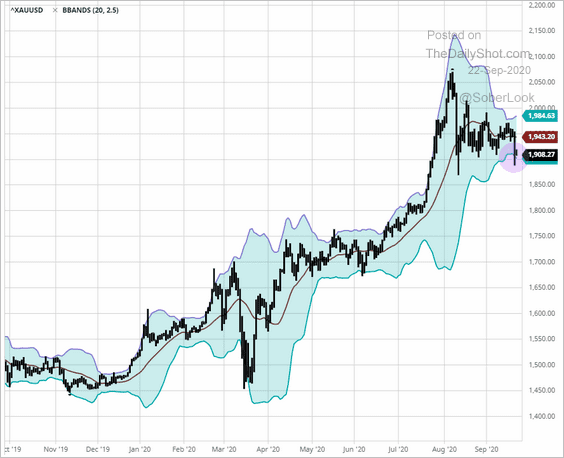

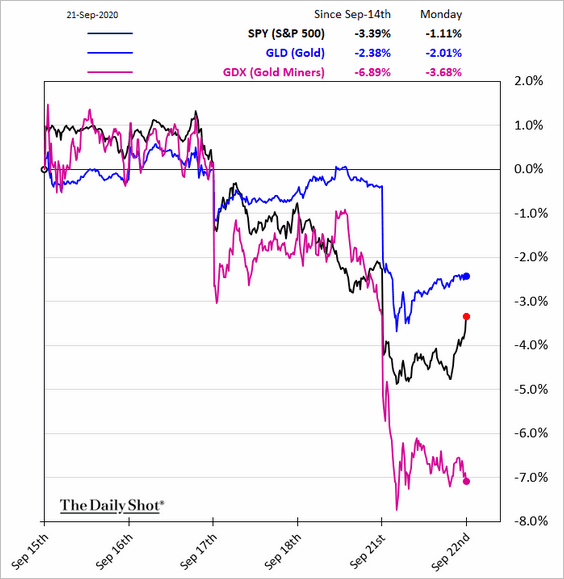

Commodities

1. The US dollar rebound is putting pressure on commodities.

Gold is at the lower Bollinger band.

Source: barchart.com

Source: barchart.com

Shares of gold miners took a hit in recent days.

——————–

2. Silver is lower again in early trading.

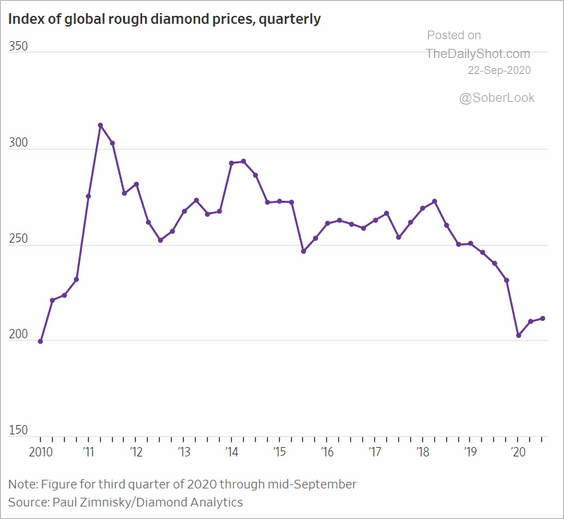

3. Have diamond prices bottomed?

Source: @WSJ Read full article

Source: @WSJ Read full article

Energy

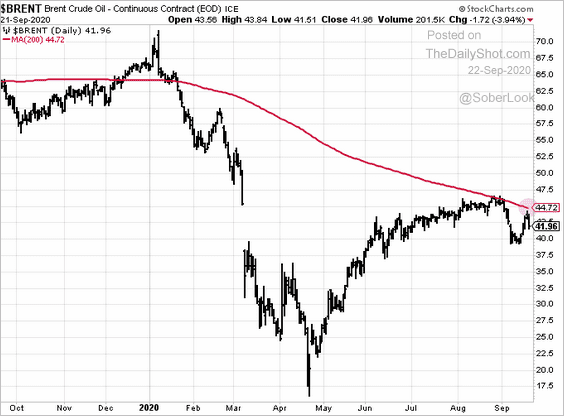

1. Brent held resistance at the 200d moving average.

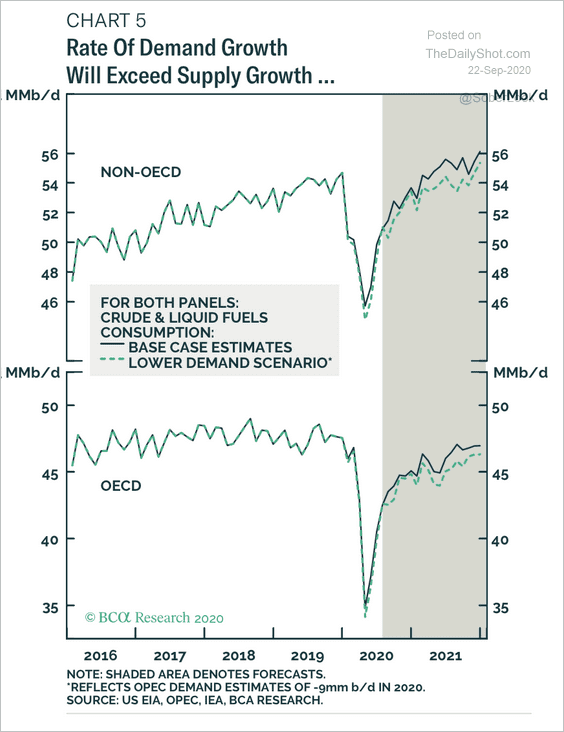

2. BCA Research expects oil demand growth to exceed the increases in supply next year.

Source: BCA Research

Source: BCA Research

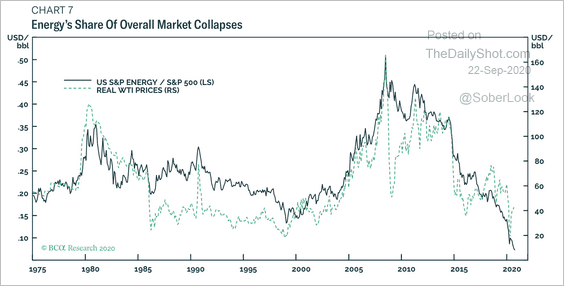

The recovery in oil prices from all-time lows has done little to support energy stocks.

Source: BCA Research

Source: BCA Research

——————–

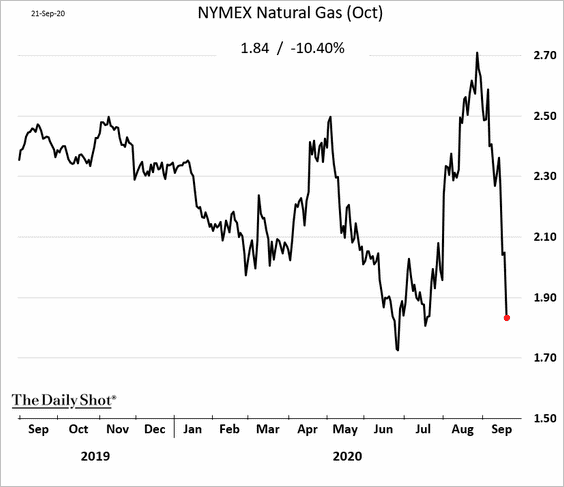

3. US natural gas has cratered in recent days.

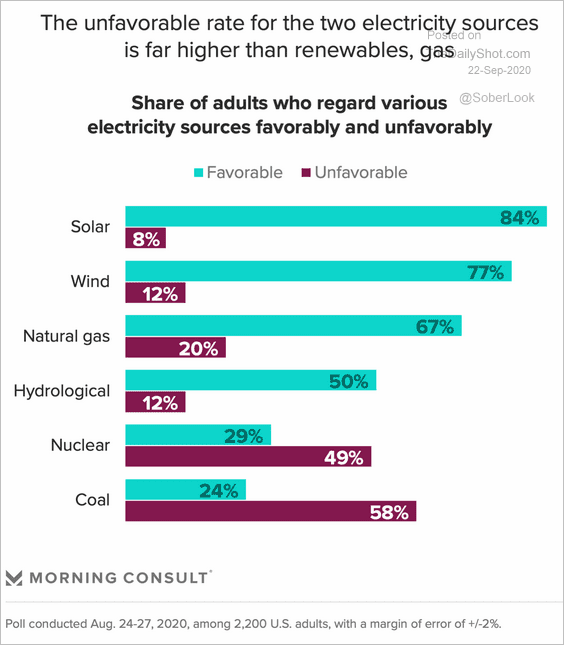

4. Here is how Americans view different energy sources.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

Equities

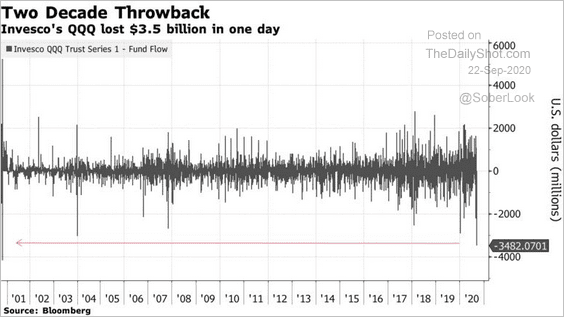

1. QQQ (Nasdaq 100 ETF) experienced some outflows.

Source: @markets Read full article

Source: @markets Read full article

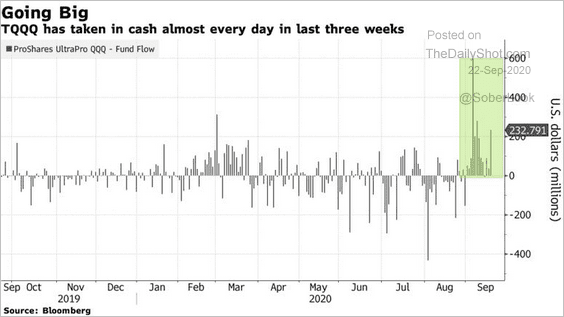

However, the 3x leveraged Nasdaq 100 ETF continues to see inflows.

Source: @markets Read full article

Source: @markets Read full article

——————–

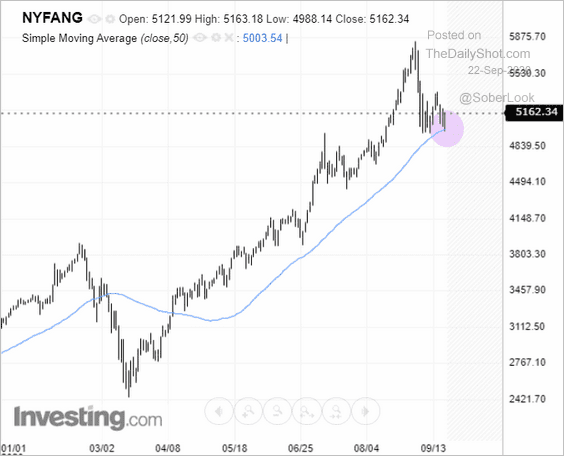

2. FANG stocks are at the 50-day moving average.

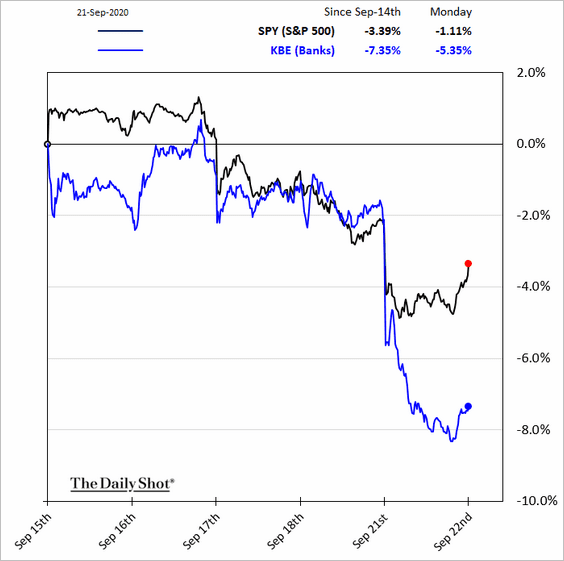

3. Bank shares tumbled on Monday, driven in part by this story.

4. Next, we have some updates on small-cap stocks.

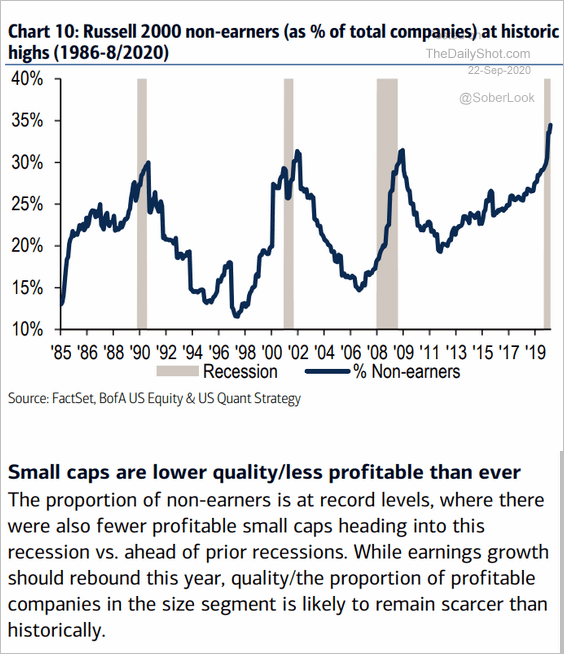

• Unprofitable companies are becoming a large component of the market.

Source: BofA Securities

Source: BofA Securities

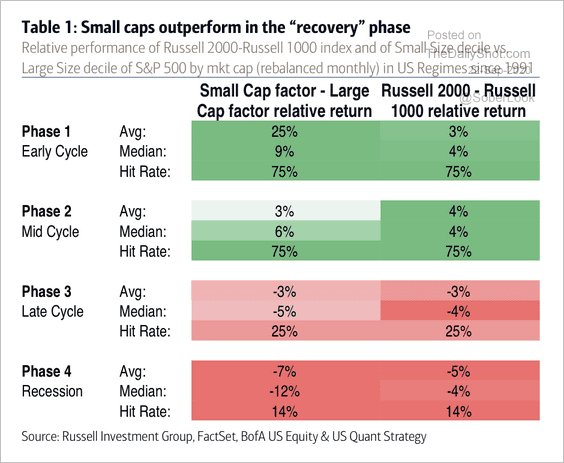

• Small-cap stocks tend to outperform during an economic recovery …

Source: BofA Securities

Source: BofA Securities

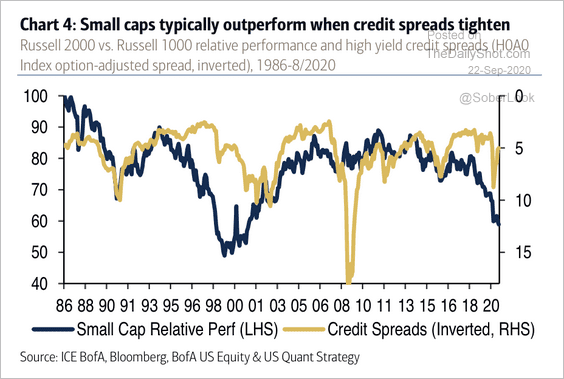

• … and when credit spreads tighten.

Source: BofA Securities

Source: BofA Securities

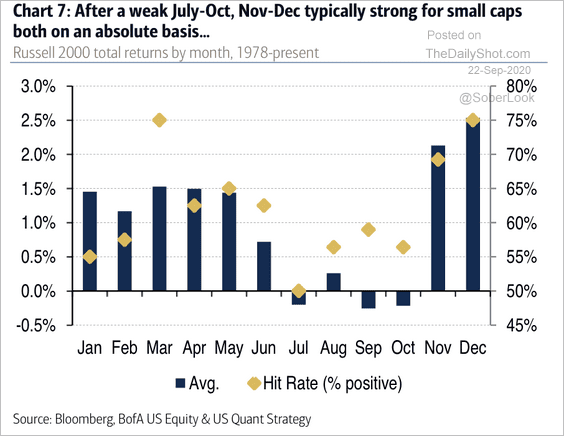

• Small-caps also have a higher hit-rate in November and December.

Source: BofA Securities

Source: BofA Securities

——————–

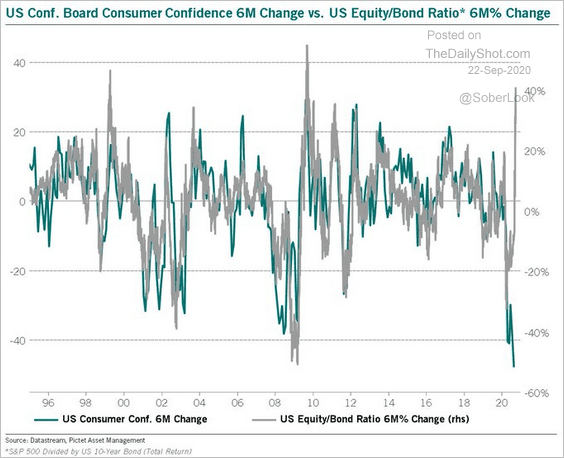

5. The equity-to-bond ratio has diverged from consumer sentiment.

Source: @BittelJulien

Source: @BittelJulien

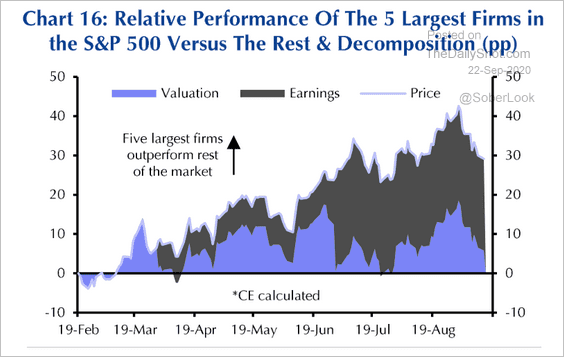

6. The outperformance of the five largest stocks in the S&P 500 has been driven by higher earnings.

Source: Capital Economics

Source: Capital Economics

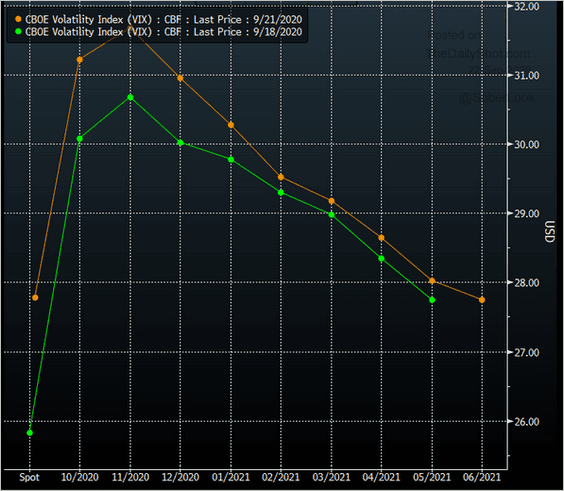

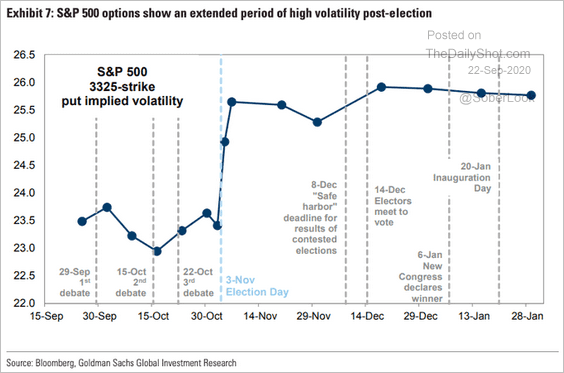

7. Here is the VIX futures curve.

Source: @tracyalloway

Source: @tracyalloway

Volatility is expected to remain elevated even after the elections.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

Credit

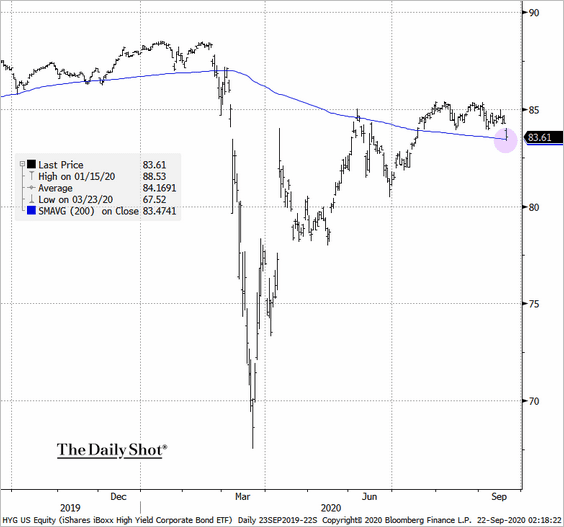

1. HYG, the largest high-yield ETF is testing support at the 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

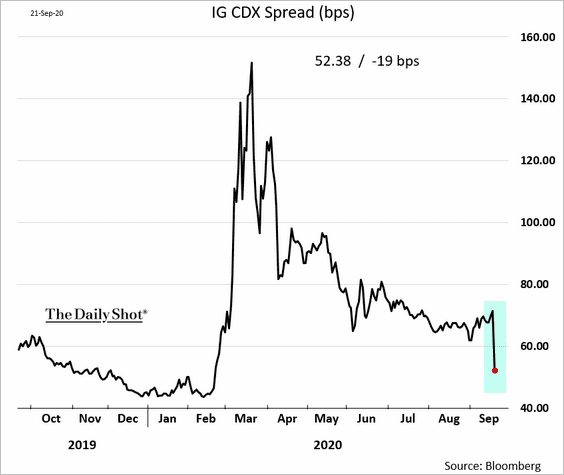

2. The on-the-run investment-grade CDX spread is back near 50 bps after the fallen angels were removed from the index in the latest roll.

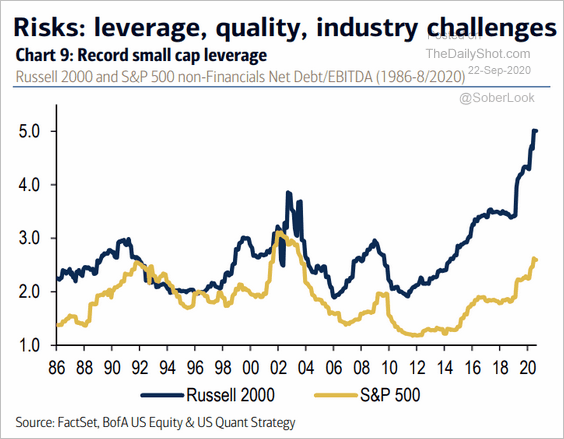

3. US small caps are running record leverage.

Source: BofA Securities

Source: BofA Securities

——————–

Food for Thought

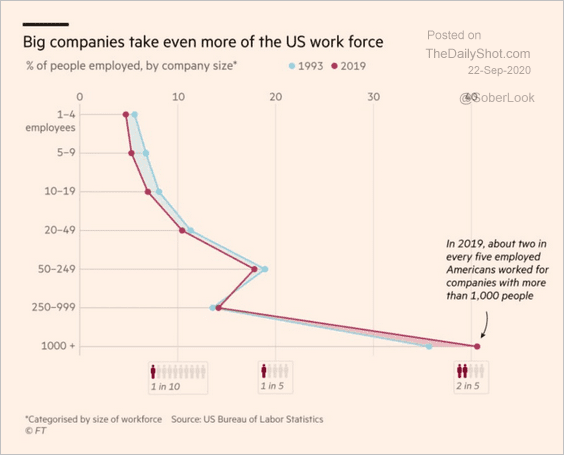

1. Employment by company size:

Source: @adam_tooze, @FT Read full article

Source: @adam_tooze, @FT Read full article

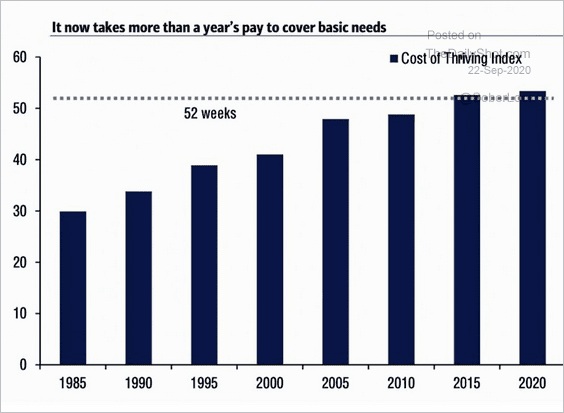

2. The cost of thriving:

Source: BofA Merrill Lynch Global Research, @MoHossain

Source: BofA Merrill Lynch Global Research, @MoHossain

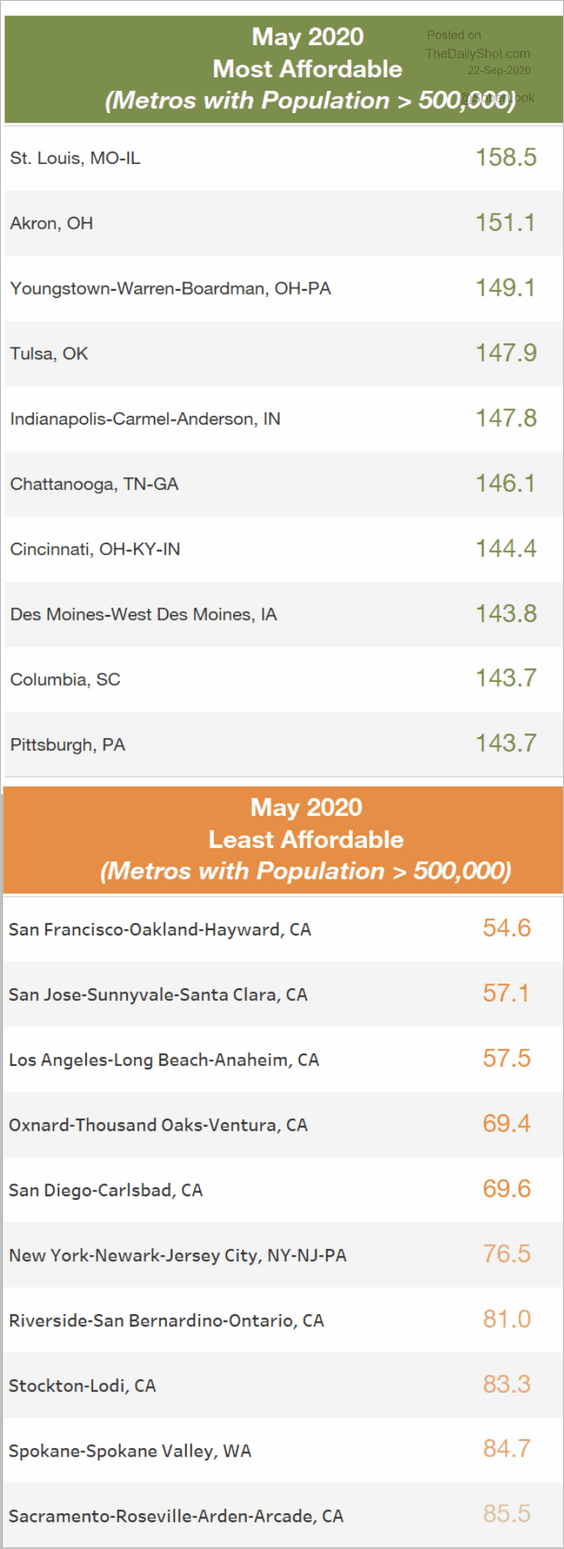

3. Most and least affordable US cities:

Source: US CARES Unempl Read full article

Source: US CARES Unempl Read full article

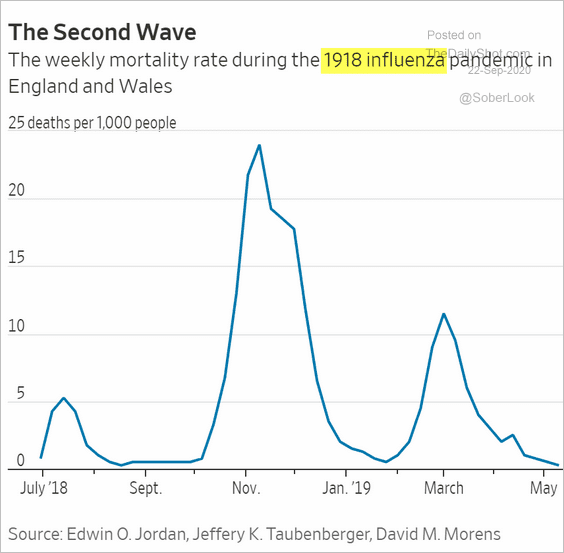

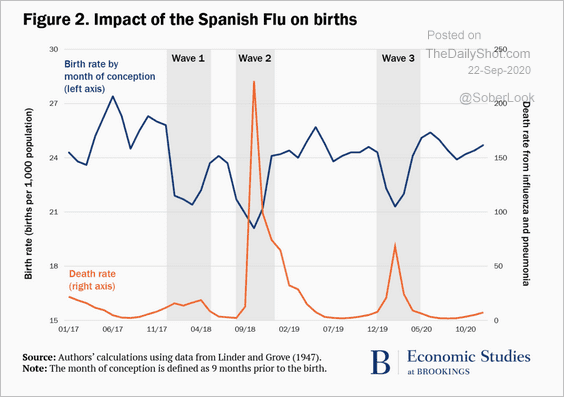

4. The Spanish Flu impact on births:

Source: The Brookings Institution Read full article

Source: The Brookings Institution Read full article

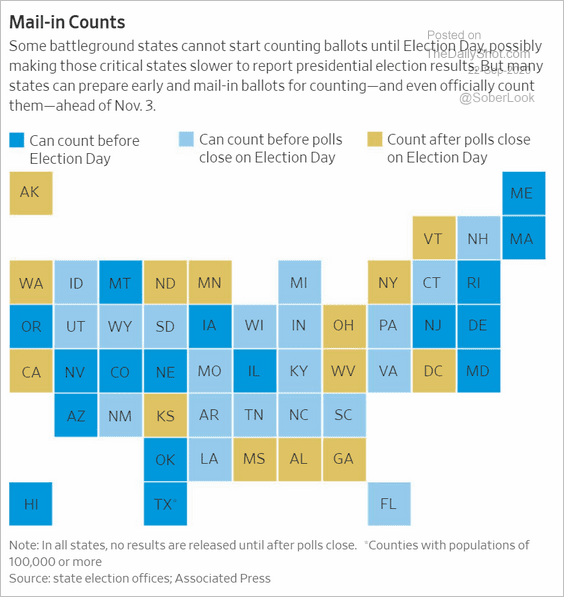

5. Counting mail-in ballots:

Source: @WSJ Read full article

Source: @WSJ Read full article

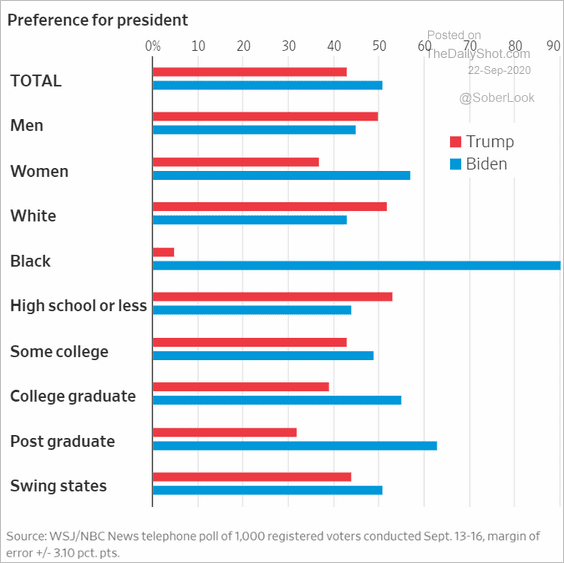

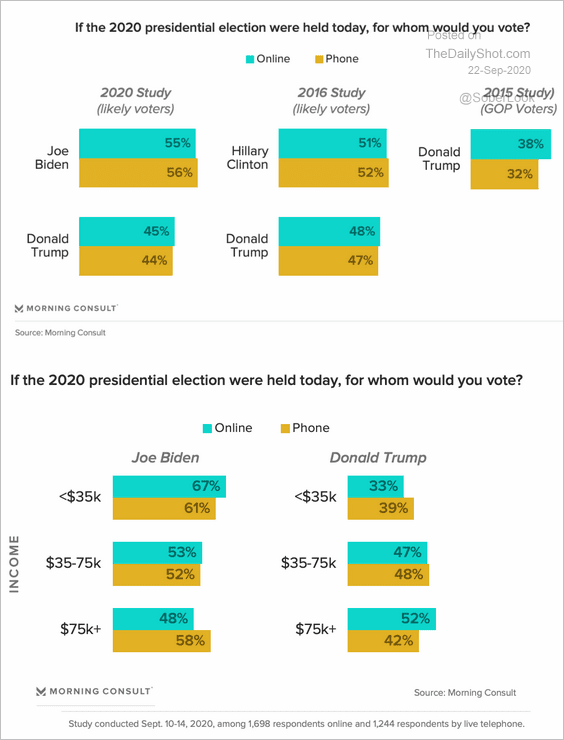

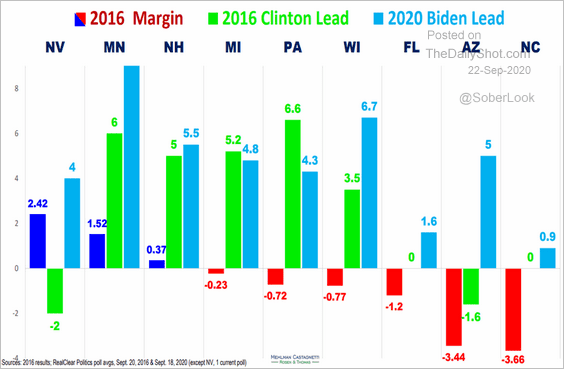

6. The latest poll results (2 charts):

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Morning Consult Read full article

Source: Morning Consult Read full article

• Swing states in 2020 vs. 2016:

Source: Mehlman Castagnetti Rosen & Thomas

Source: Mehlman Castagnetti Rosen & Thomas

——————–

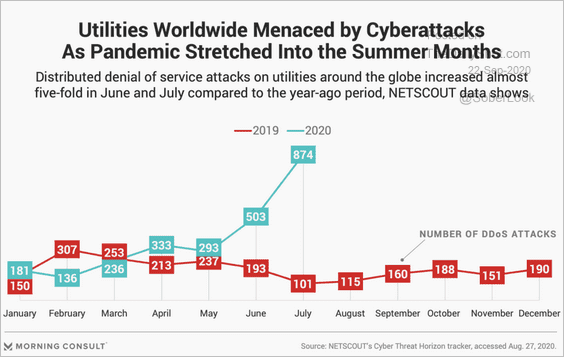

7. Cyber attacks on utilities:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

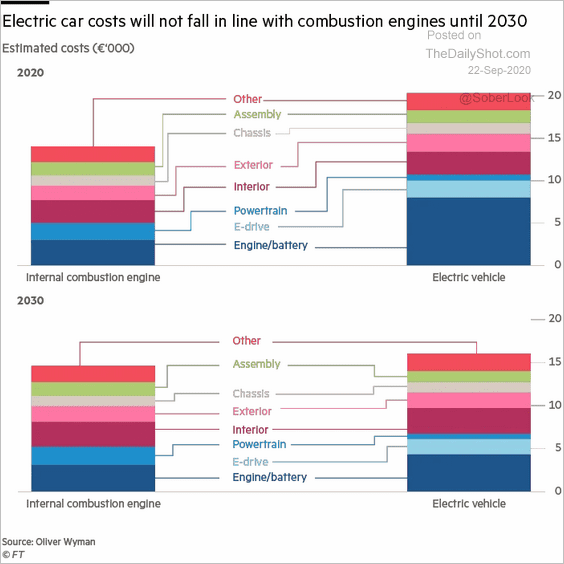

8. Electric vehicle costs:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

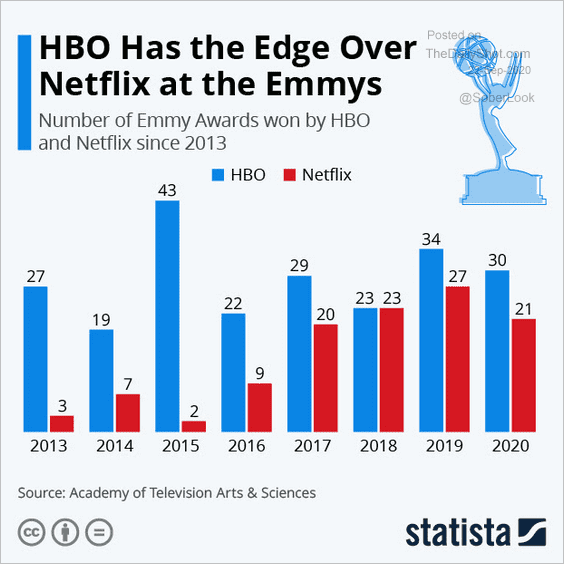

9. HBO vs. Netflix:

Source: Statista

Source: Statista

——————–