The Daily Shot: 23-Sep-20

• Administrative Update

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Global Developments

• Food for Thought

Administrative Update

Our Terms of Use document has been updated to accommodate corporate subscriptions.

The United States

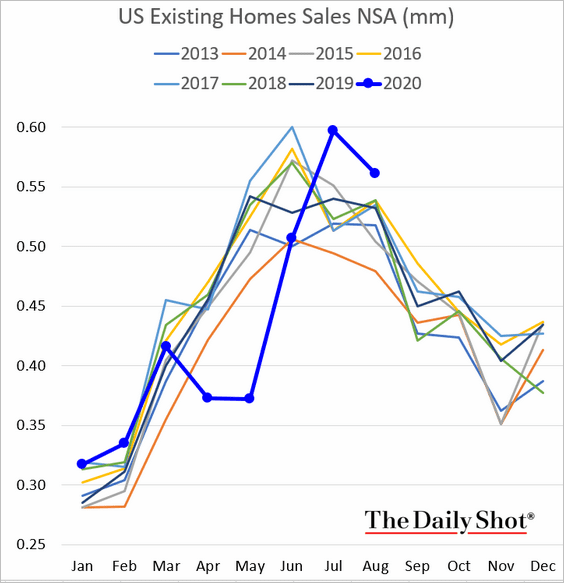

1. Existing home sales remain above last year’s levels.

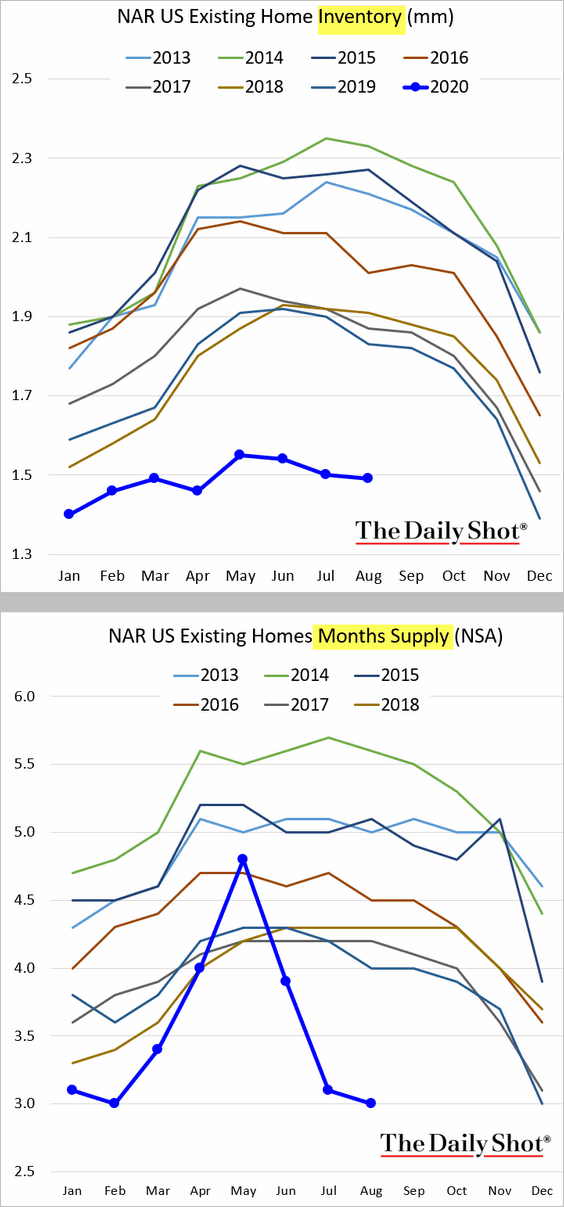

Inventories of houses for sale are extremely low.

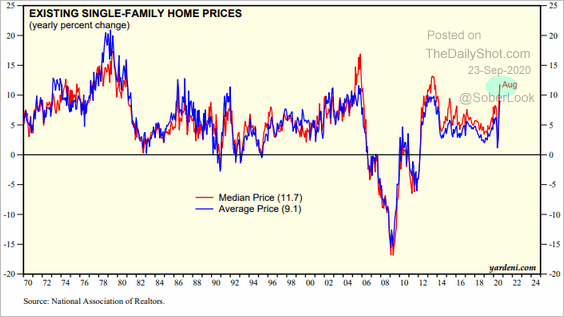

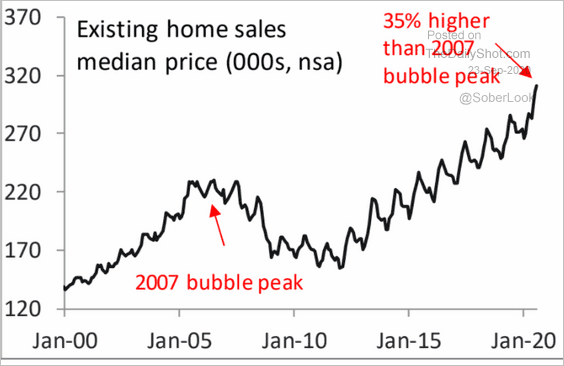

With mortgage rates near record lows, price gains are accelerating.

Source: Yardeni Research

Source: Yardeni Research

Source: Piper Sandler

Source: Piper Sandler

——————–

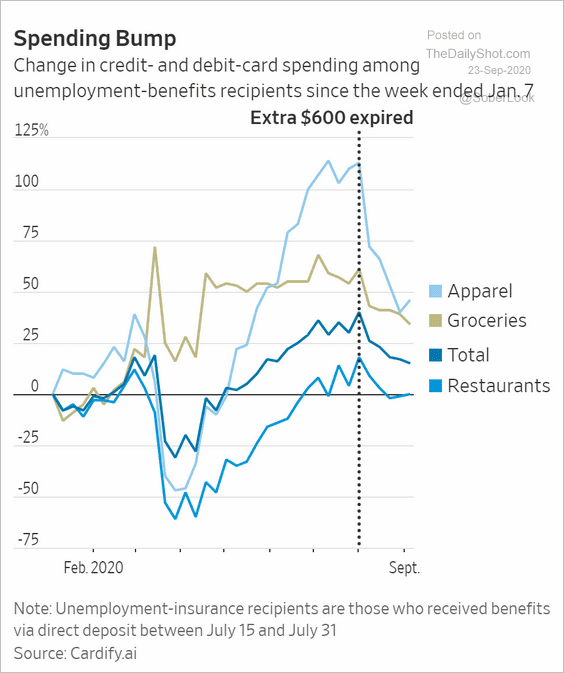

2. Credit card spending has slowed after the $600/week incremental unemployment checks stopped. They will slow further once the $300 payments expire.

Source: @WSJ Read full article

Source: @WSJ Read full article

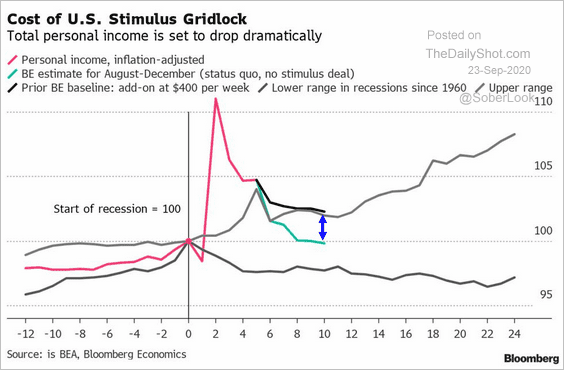

The lack of additional stimulus will have a substantial impact on the GDP, as incomes decline sharply.

Source: @adam_tooze, @markets Read full article

Source: @adam_tooze, @markets Read full article

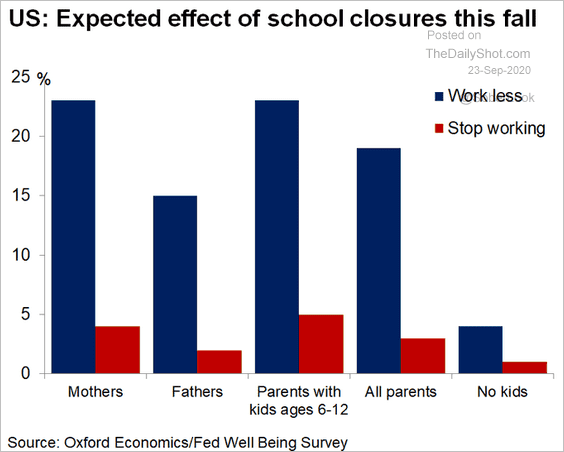

Moreover, school closures are creating a material drag on the economy.

Source: @GregDaco Read full article

Source: @GregDaco Read full article

——————–

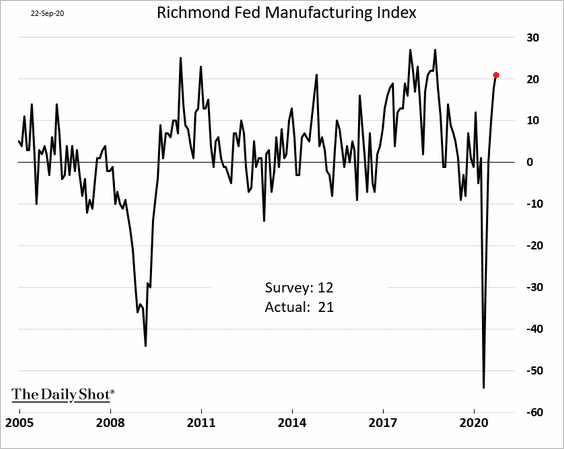

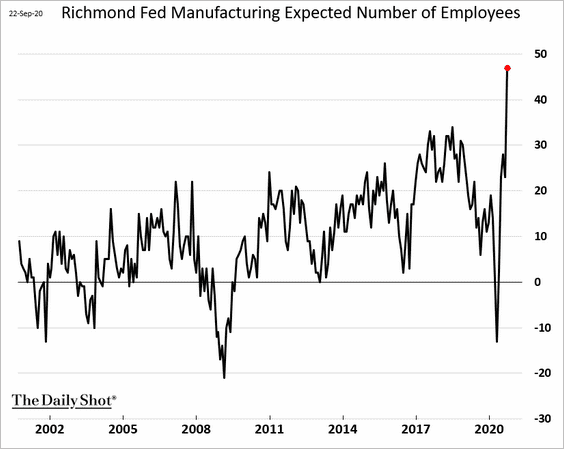

3. The Richmond Fed’s regional factory activity index came roaring back over the past few months.

The employment expectations index hit a record high.

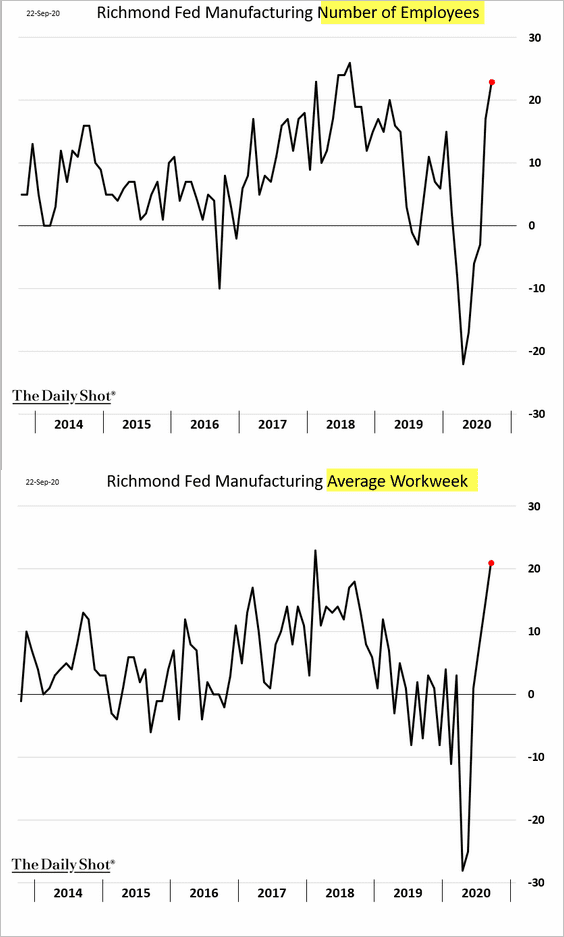

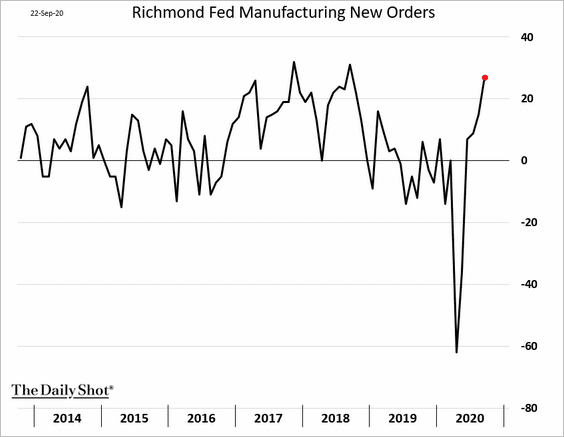

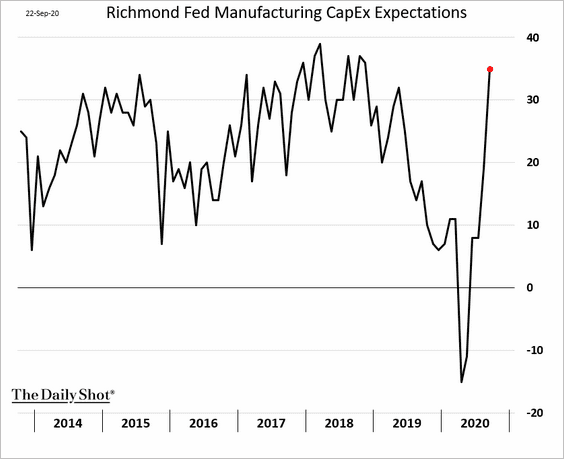

Here are some of the components of the Richmond Fed Manufacturing index.

• Employment:

• New orders:

• CapEx expectations:

——————–

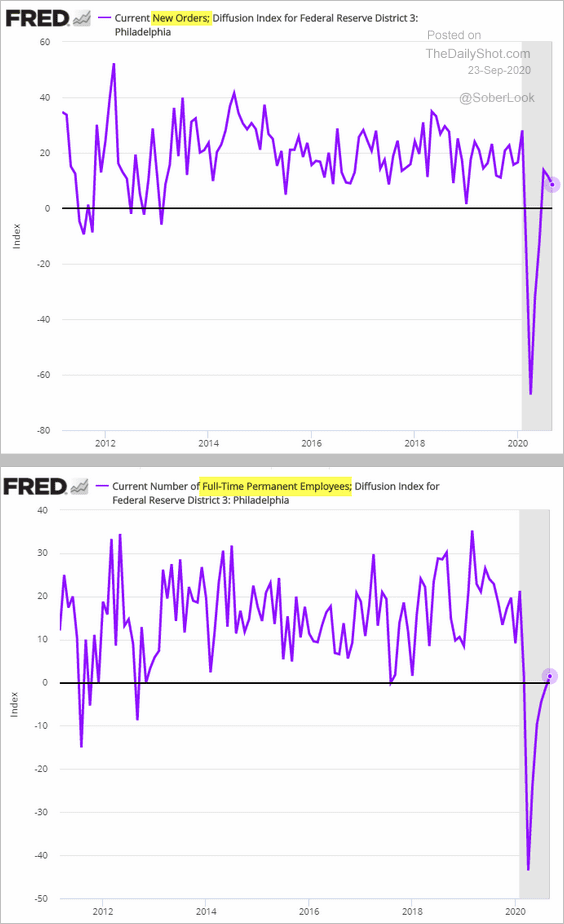

4. The Philly Fed’s regional non-manufacturing report shows persistent weakness in services.

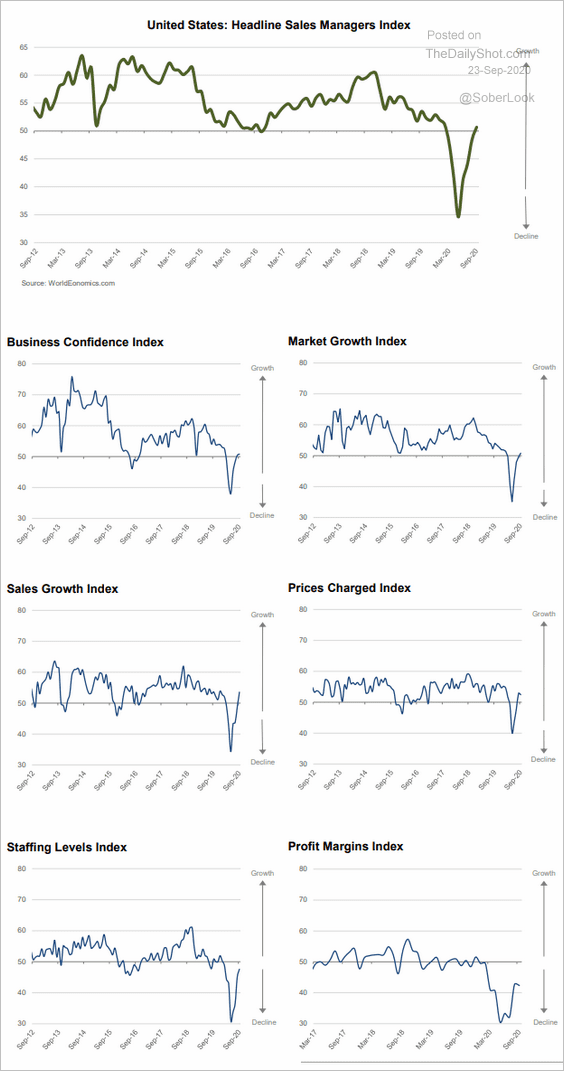

5. At the national level, the World Economics SMI report shows stabilization in business activity.

Source: World Economics

Source: World Economics

6. The NY Fed’s weekly index of US economic activity has stalled.

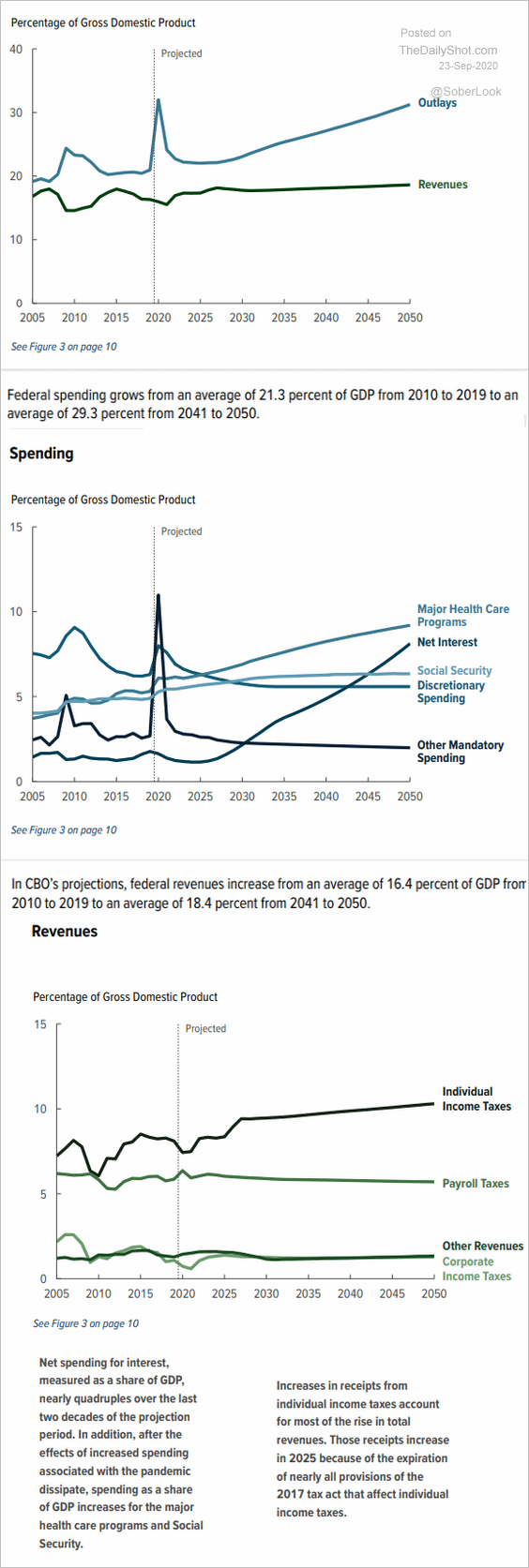

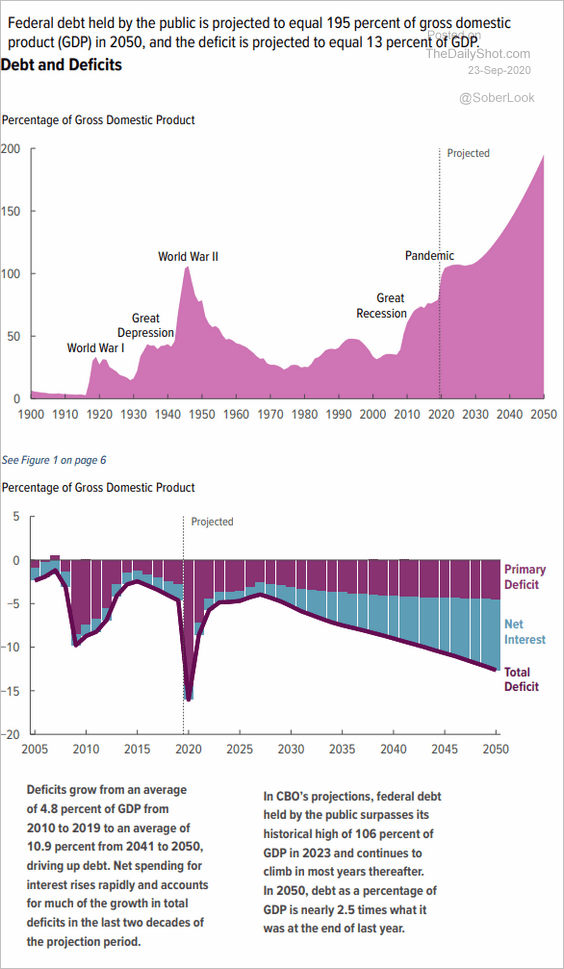

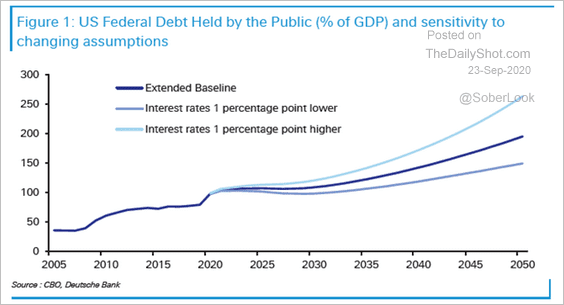

7. The CBO’s long-term projections of the nation’s fiscal picture look grim.

• Spending and revenues:

Source: CBO

Source: CBO

• Debt and deficit:

Source: CBO

Source: CBO

• The long-term outcome is heavily dependent on rates. But no worries. The Fed will come to the rescue, absorbing the massive amounts of debt needed to fund the budget gap, keeping funding costs low. Welcome to MMT.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Here is the change in marketable Treasuries by quarter.

Source: Oxford Economics

Source: Oxford Economics

Canada

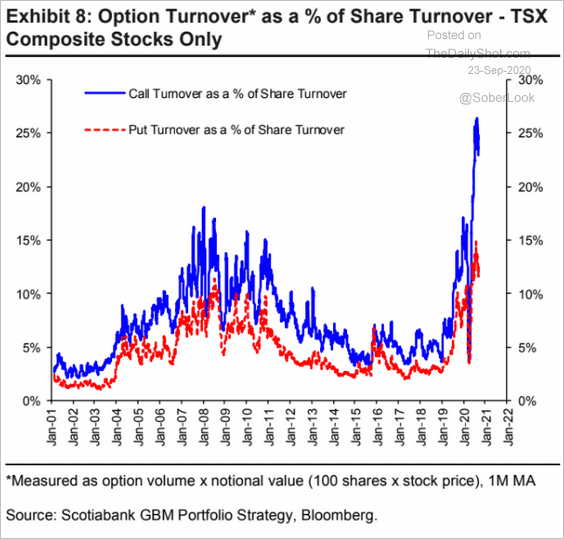

1. Retail-driven frenzied call option bets on the market have not been limited to the US.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

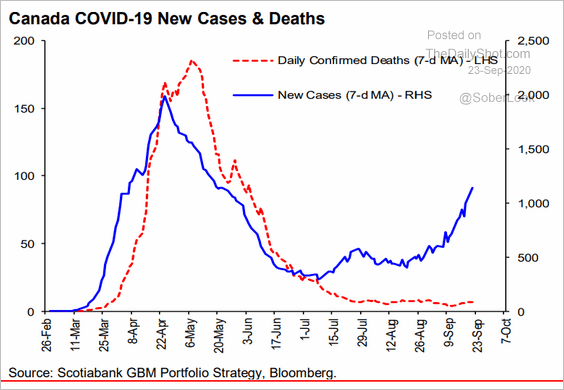

2. The second wave is here.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

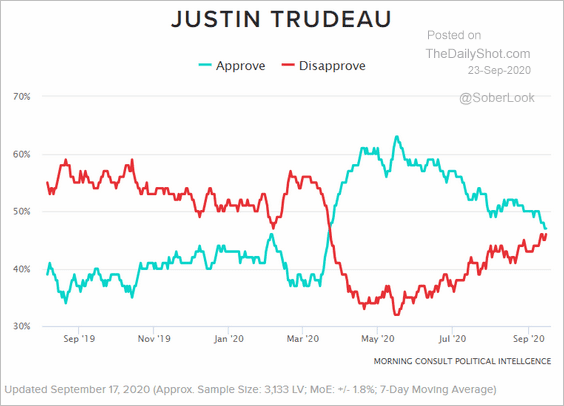

3. Approval ratings for Justin Trudeau have been deteriorating.

Source: Morning Consult

Source: Morning Consult

The United Kingdom

1. Factory orders weakened this month.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

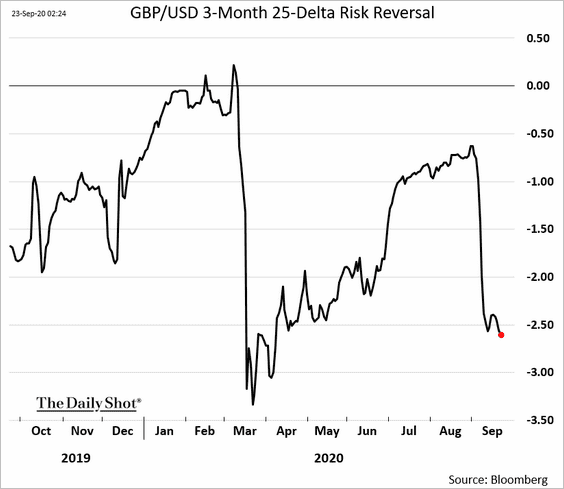

2. Options traders’ sentiment on the British pound continues to deteriorate.

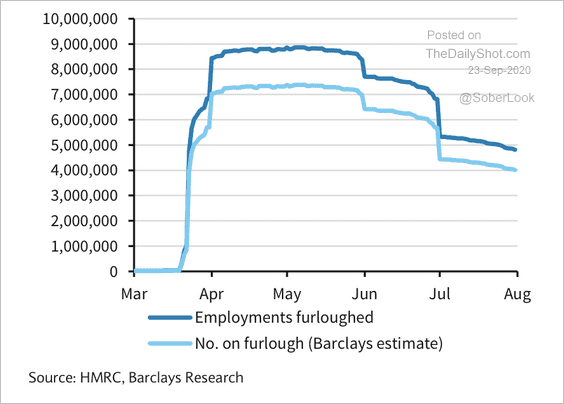

3. The number of furloughed workers is gradually declining.

Source: Barclays Research

Source: Barclays Research

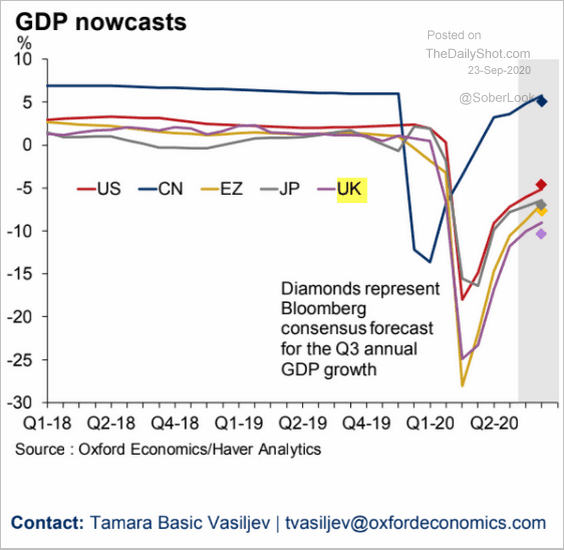

4. The nation’s recovery lags other economies.

Source: Oxford Economics

Source: Oxford Economics

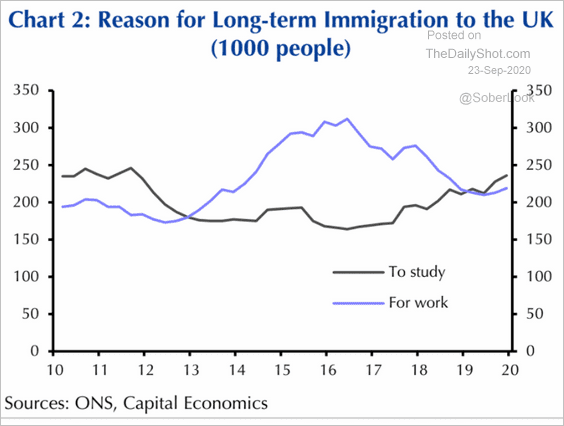

5. Here are the reasons for long-term immigration to the UK.

Source: Capital Economics

Source: Capital Economics

The Eurozone

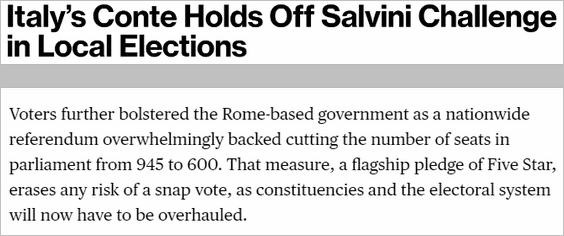

1. Italy’s political situation was stabilized by the referendum to cut the number of parliament seats (see comment below from Bloomberg).

Source: @bpolitics Read full article

Source: @bpolitics Read full article

Bond yields are nearing last year’s lows.

——————–

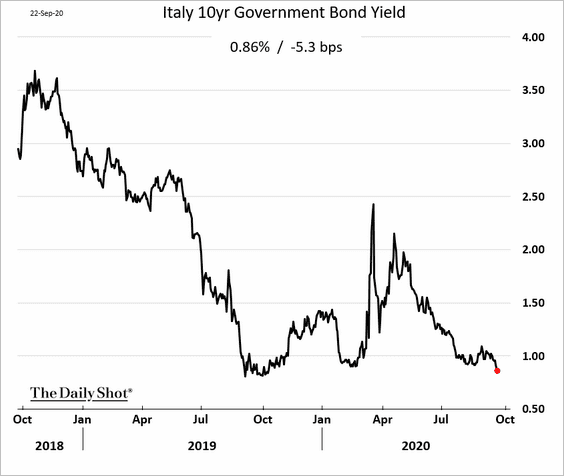

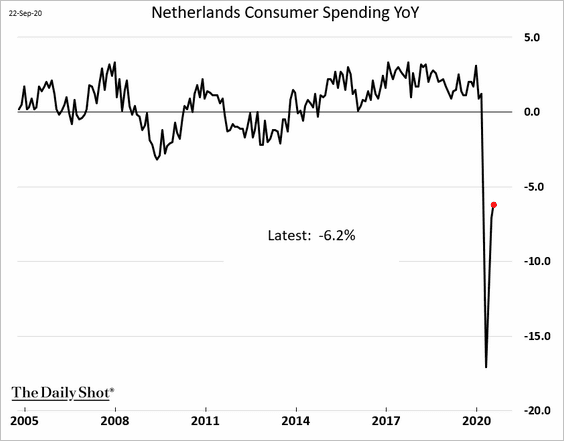

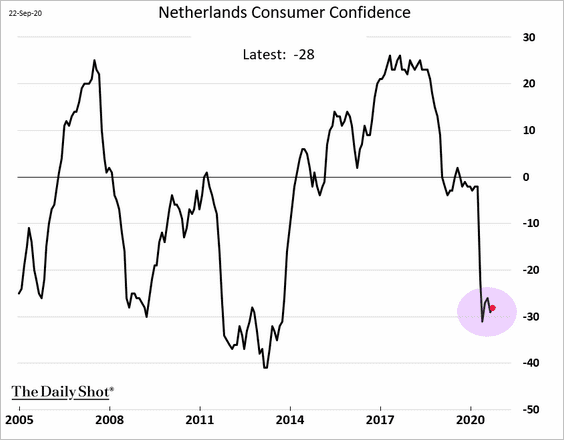

2. Next, we have some updates on the Netherlands.

Consumer spending was still weak in July.

The situation hasn’t improved significantly since, with consumer sentiment remaining depressed (through September).

Here is the problem.

——————–

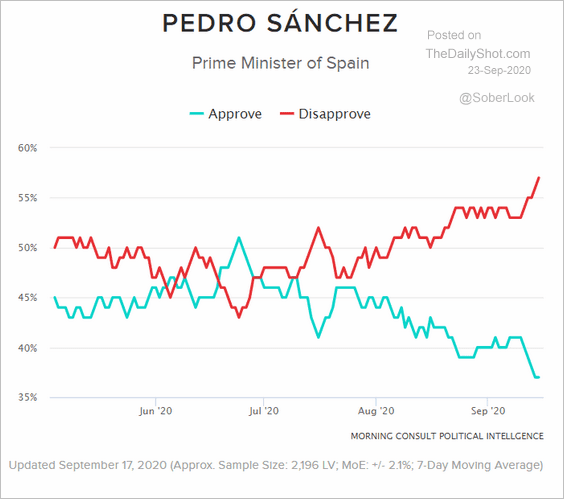

3. Spain’s Sanchez is increasingly unpopular.

Source: Morning Consult

Source: Morning Consult

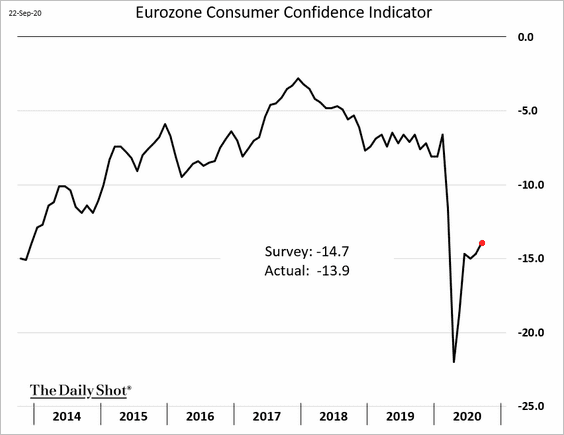

4. Consumer confidence has been gradually recovering at the Eurozone level.

Source: ING Read full article

Source: ING Read full article

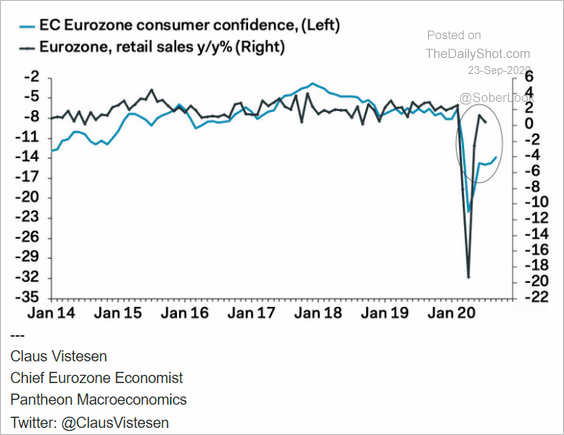

But is it enough to sustain the recovery in retail sales?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

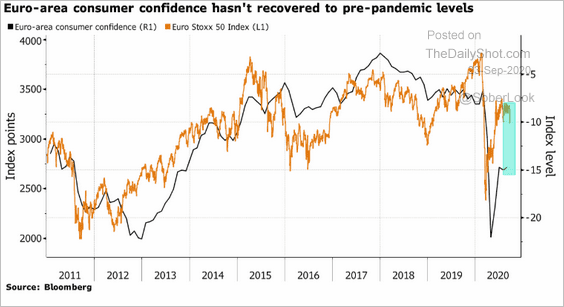

And is it enough to hold on to the stock market rebound?

Source: @mikamsika, Bloomberg Finance L.P.

Source: @mikamsika, Bloomberg Finance L.P.

——————–

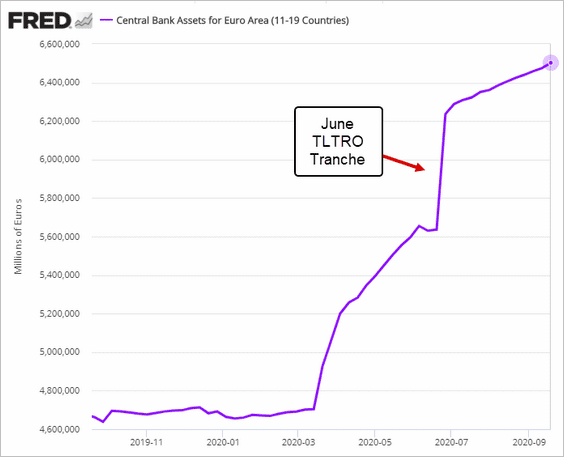

5. The ECB’s (Eurosystem) balance sheet is grinding higher (€6.5 trillion).

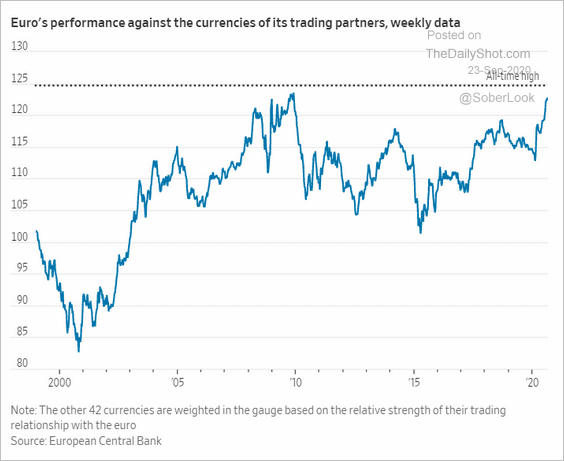

6. This chart shows the euro trade-weighted index.

Source: @WSJ Read full article

Source: @WSJ Read full article

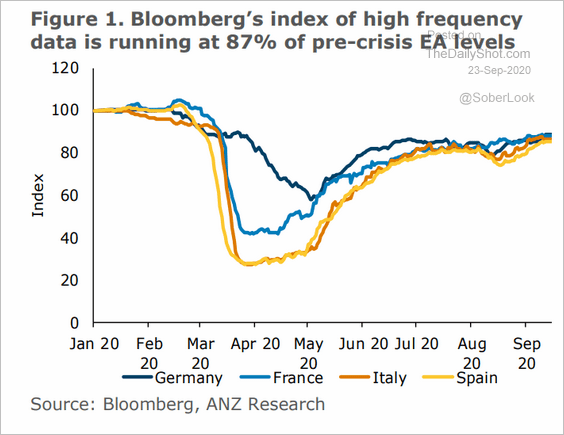

7. Finally, we have Bloomberg’s index of high-frequency indicators.

Source: ANZ Research

Source: ANZ Research

Asia – Pacific

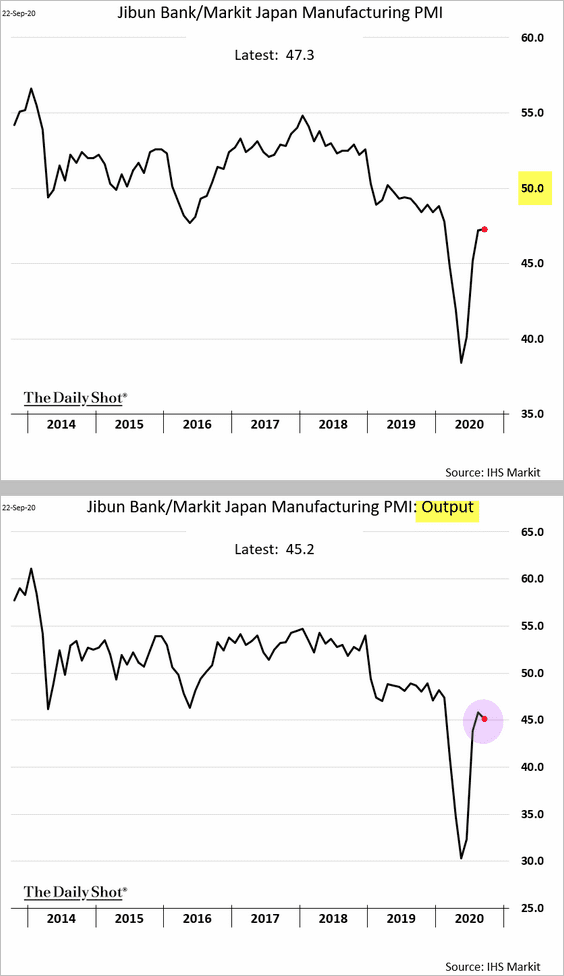

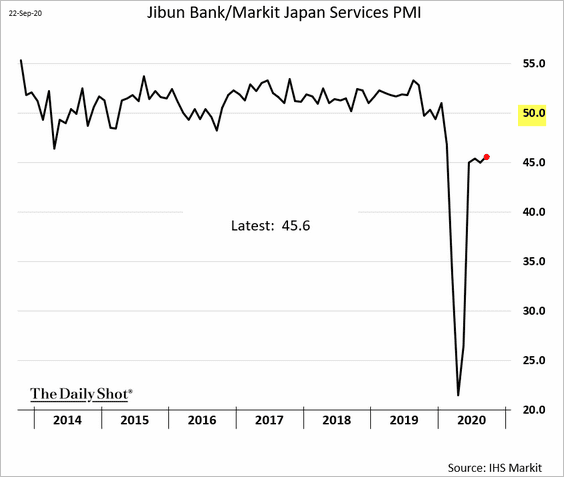

1. The Markit PMI report showed Japan’s businesses continuing to struggle in September.

• Manufacturing:

• Services:

——————–

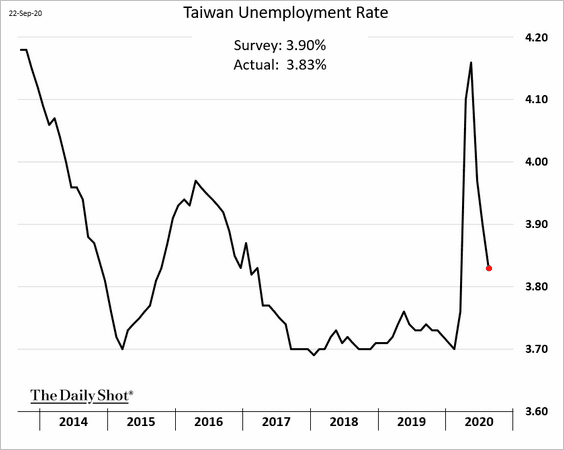

2. Taiwan’s unemployment rate is declining rapidly.

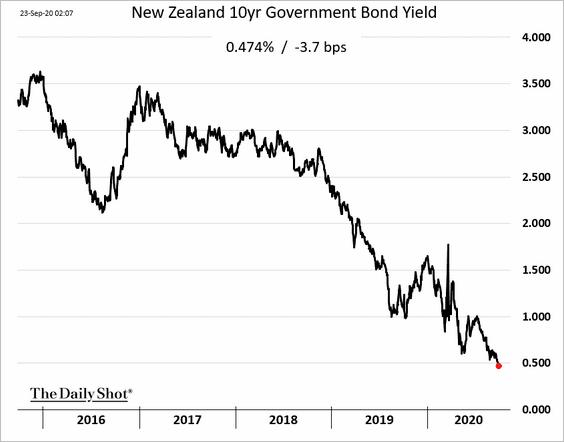

3. New Zealand’s 10yr yield dipped below 0.5%.

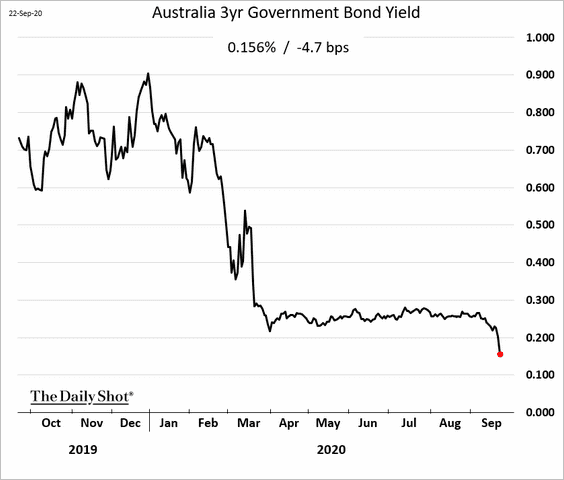

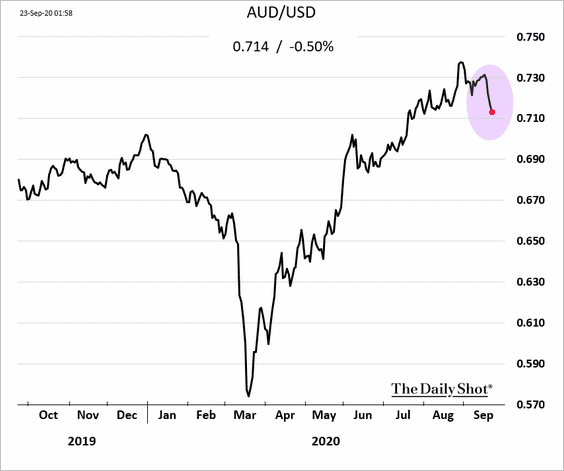

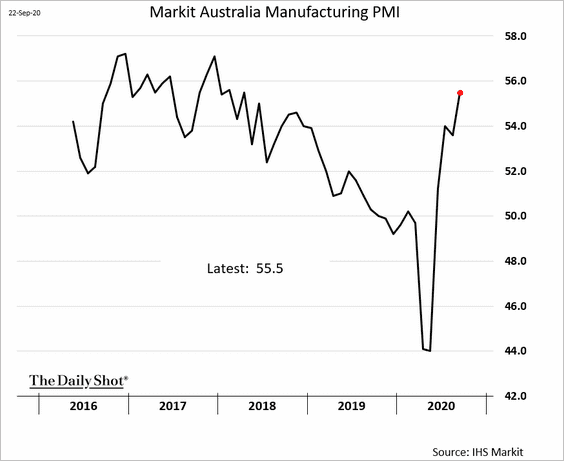

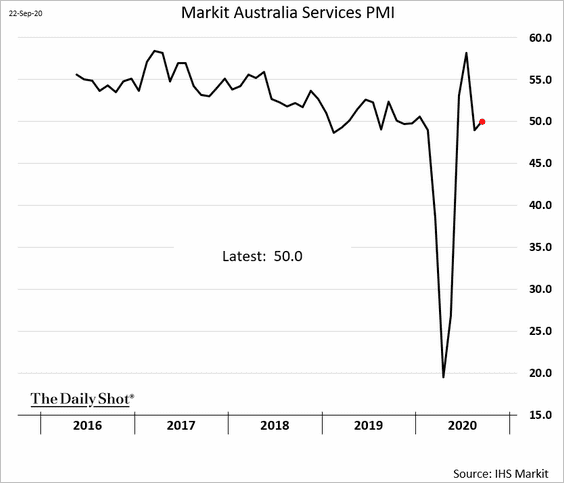

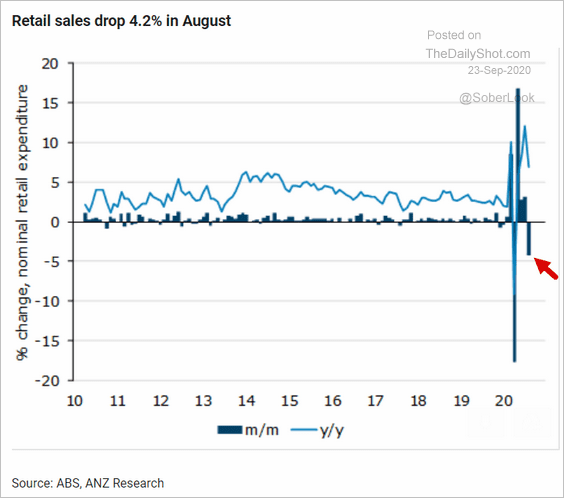

4. Next, we have some updates on Australia,

• The 3-year bond yield:

• The Aussie dollar:

• Business activity (PMI > 50 means expansion):

• Retail sales:

Source: ANZ Research

Source: ANZ Research

China

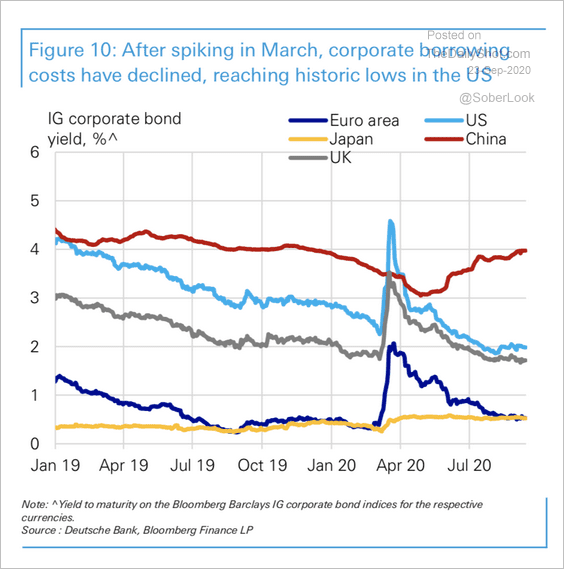

1. China’s corporate borrowing costs have diverged from other economies.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

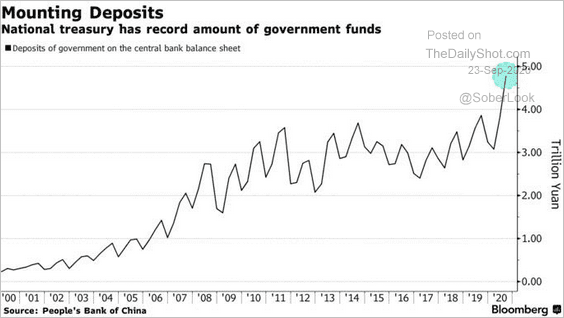

2. The spike in government deposits with the central bank points to massive debt issuance to fund stimulus programs.

Source: @markets Read full article

Source: @markets Read full article

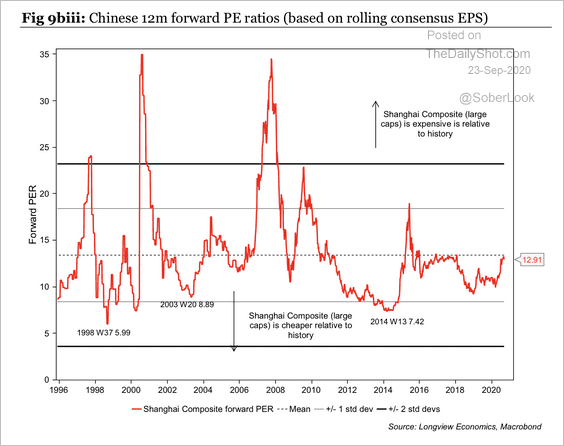

3. On an absolute basis, China’s 12-month forward price-to-earnings ratio is still low relative to past levels …

Source: Longview Economics

Source: Longview Economics

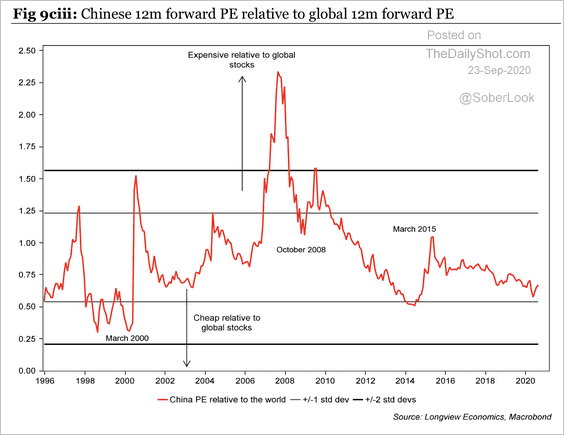

… and valuations are attractive relative to the rest of the world.

Source: Longview Economics

Source: Longview Economics

Emerging Markets

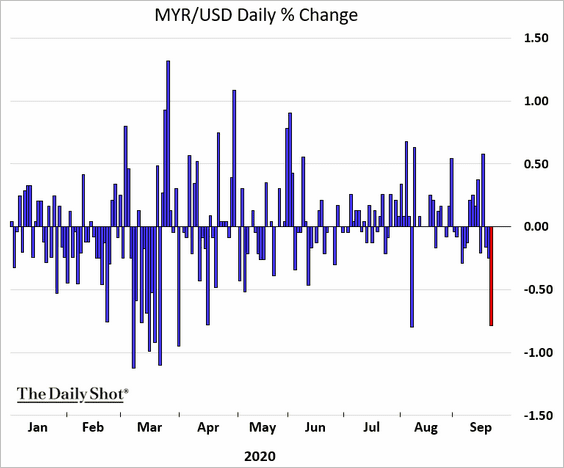

1. The Malaysian ringgit took a hit amid political uncertainty.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

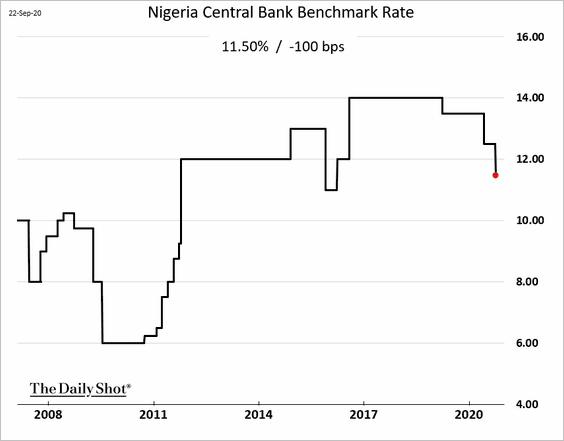

2. Nigeria’s central bank cut rates despite high inflation.

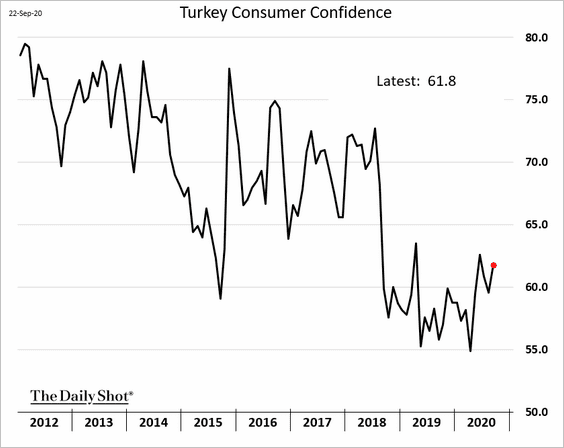

3. Turkey’s consumer confidence remains depressed.

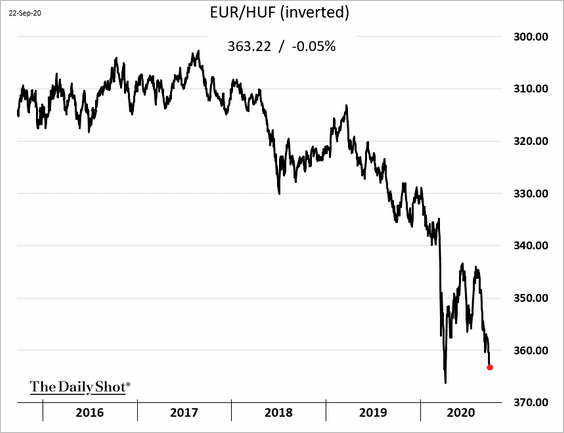

4. The Hungarian forint is approaching record lows vs. the euro.

Commodities

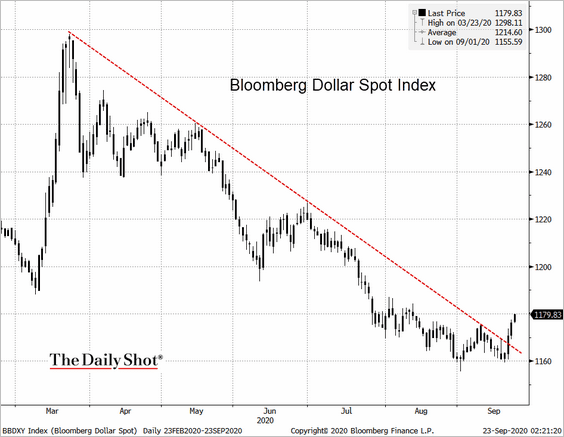

1. The dollar continues to move higher, pressuring commodities.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

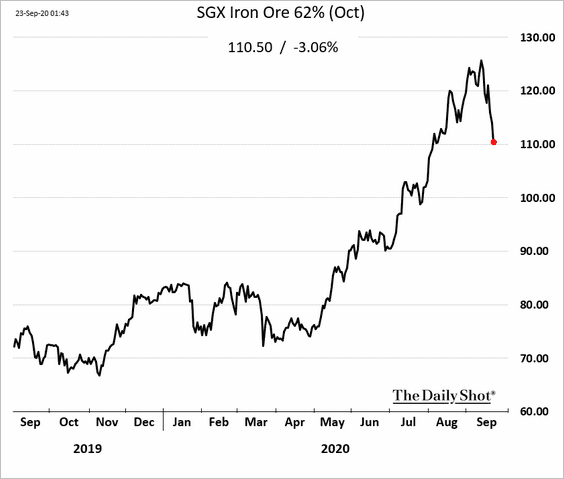

Here is iron ore.

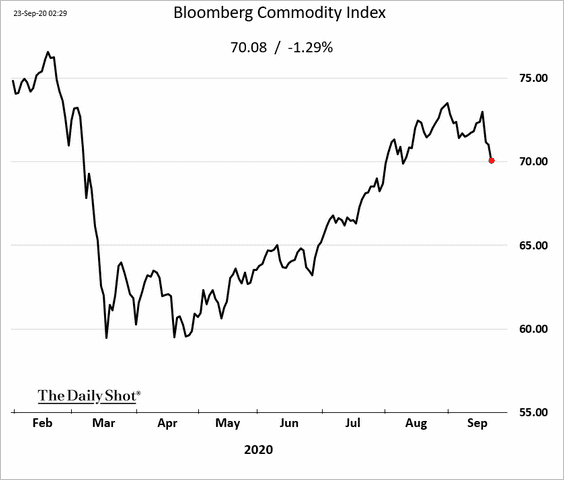

And this is Bloomberg’s commodity index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

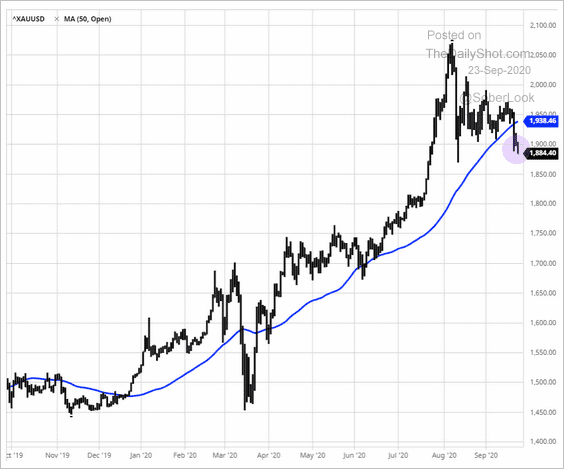

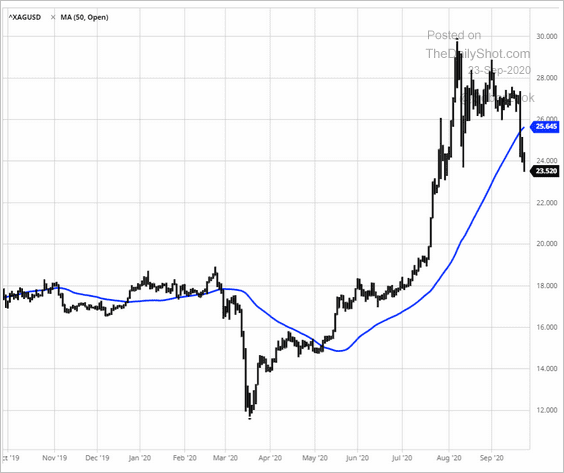

2. Precious metals have been rolling over.

• Gold:

Source: barchart.com

Source: barchart.com

• Silver:

Source: barchart.com

Source: barchart.com

——————–

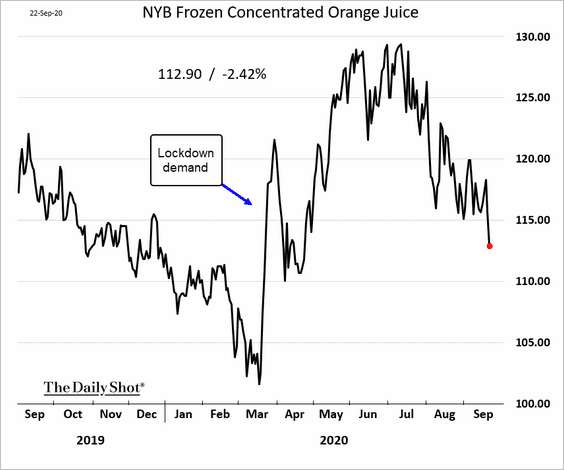

3. US orange juice futures are giving up the pandemic-related gains.

Equities

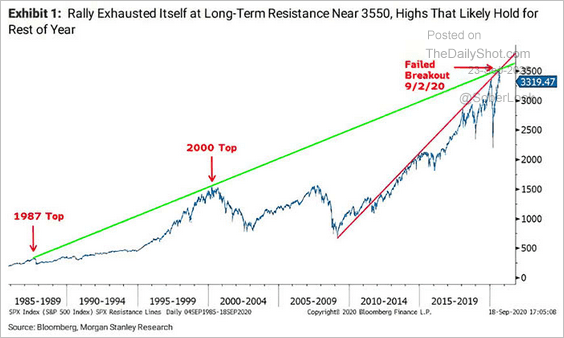

1. This chart suggests that we are not going to see another high for the S&P 500 for some time.

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

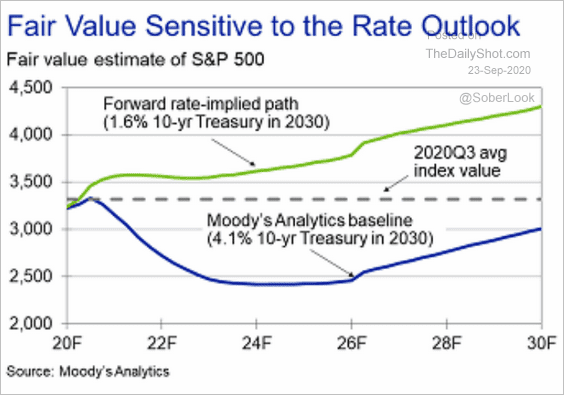

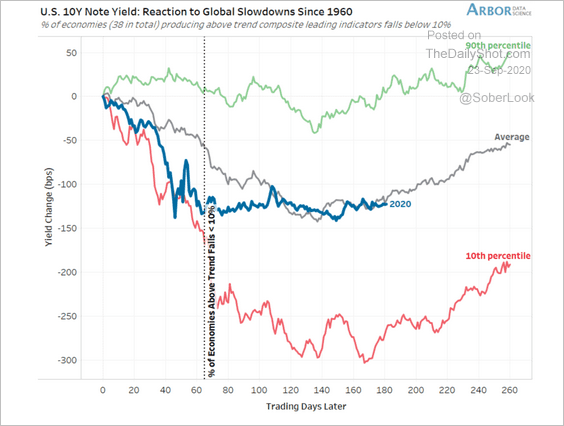

2. The S&P 500 fair value will be highly sensitive to Treasury yields in the years ahead.

Source: Moody’s Analytics

Source: Moody’s Analytics

Will the Fed cap increases in Treasury yields going forward?

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

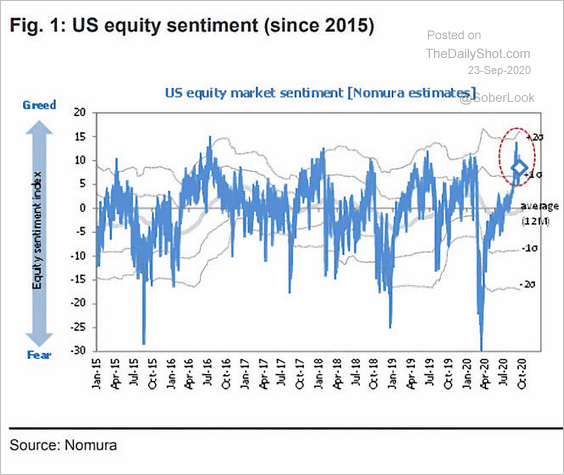

3. According to Nomura, sentiment remains bullish.

Source: @ISABELNET_SA, @Nomura

Source: @ISABELNET_SA, @Nomura

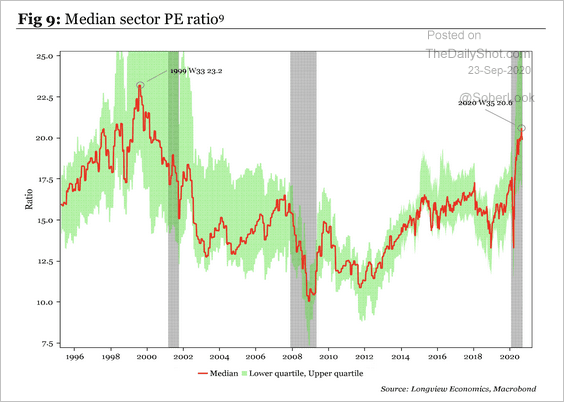

4. The median global sector price-to-earnings (P/E) ratio is at the highest level since the dot-com bubble.

Source: Longview Economics

Source: Longview Economics

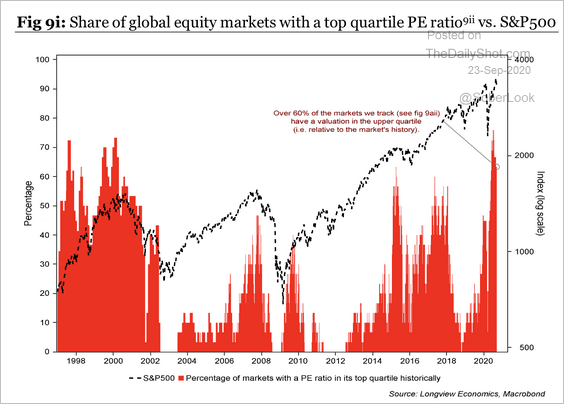

Most countries are close to record P/E levels.

Source: Longview Economics

Source: Longview Economics

——————–

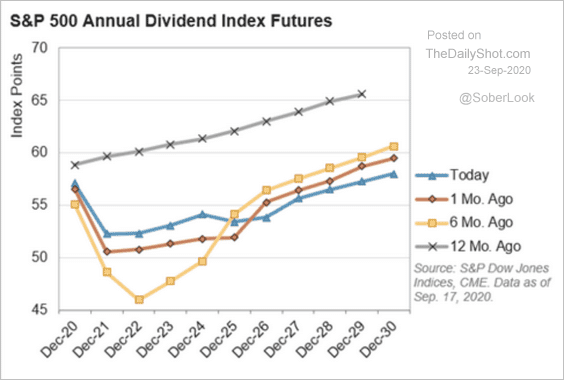

5. Investors have dampened expectations for the recovery in dividend payments.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

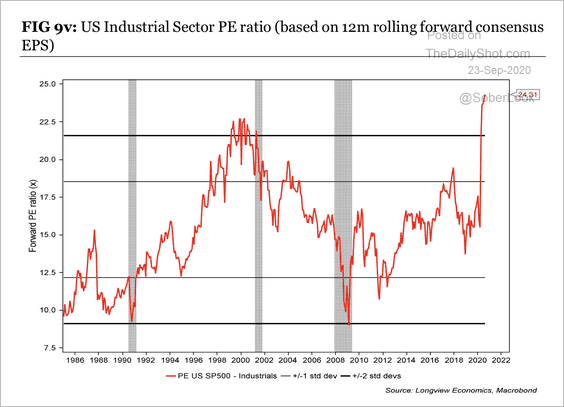

6. US industrial stocks are trading at multi-decade high P/E levels.

Source: Longview Economics

Source: Longview Economics

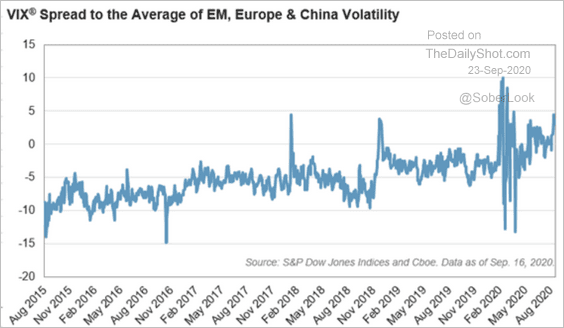

7. The chart below plots the elevated spread of VIX to implied volatility in other markets.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

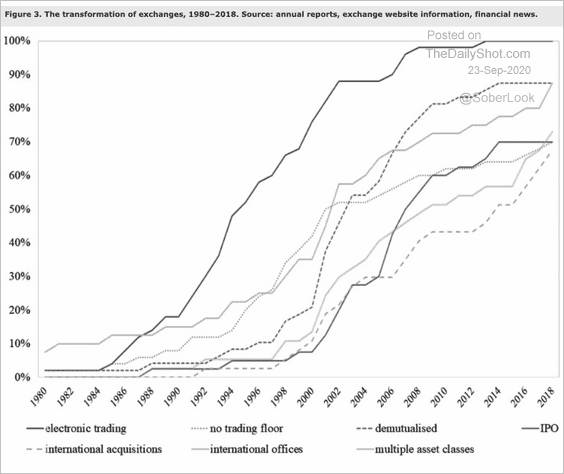

8. Here is the transformation of stock exchanges over the past four decades.

Source: Taylor & Francis Online, Snippet.Finance Read full article Further reading

Source: Taylor & Francis Online, Snippet.Finance Read full article Further reading

Credit

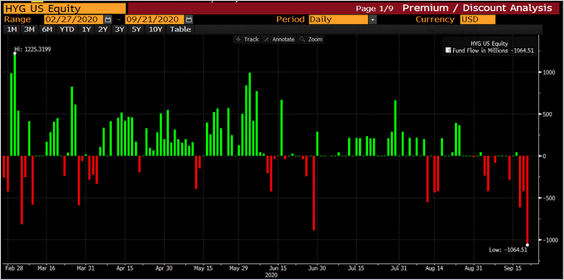

1. The largest high-yield ETF (HYG) saw some hefty outflows in recent days.

Source: @lisaabramowicz1

Source: @lisaabramowicz1

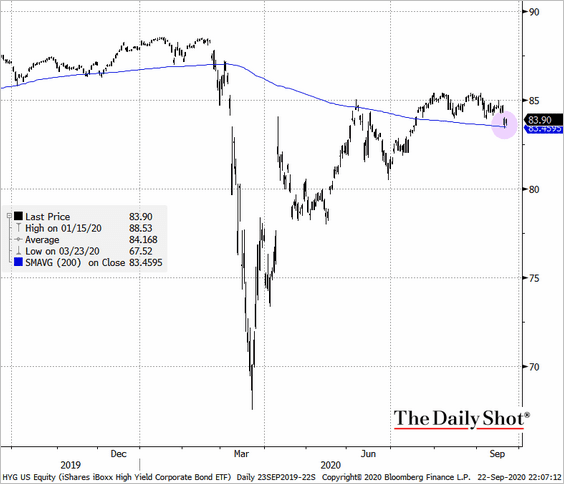

But HYG held support on Tuesday.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

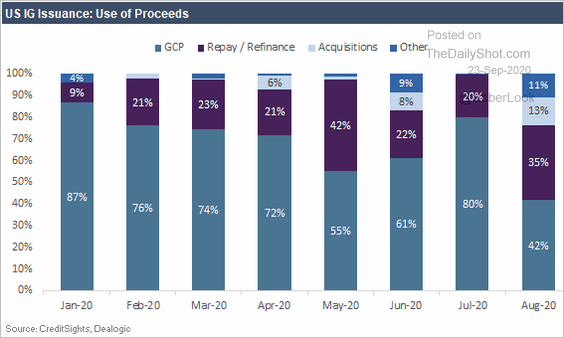

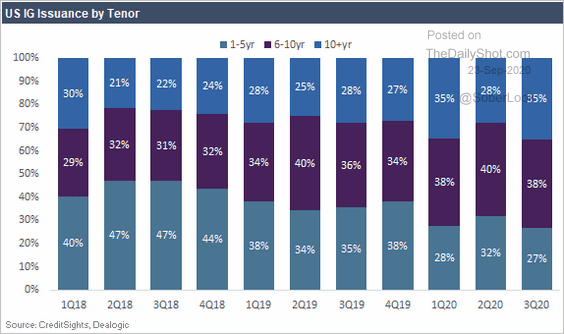

2. Next, let’s take a look at US investment-grade issuance trends.

• Use of proceeds:

Source: CreditSights

Source: CreditSights

• Tenor:

Source: CreditSights

Source: CreditSights

——————–

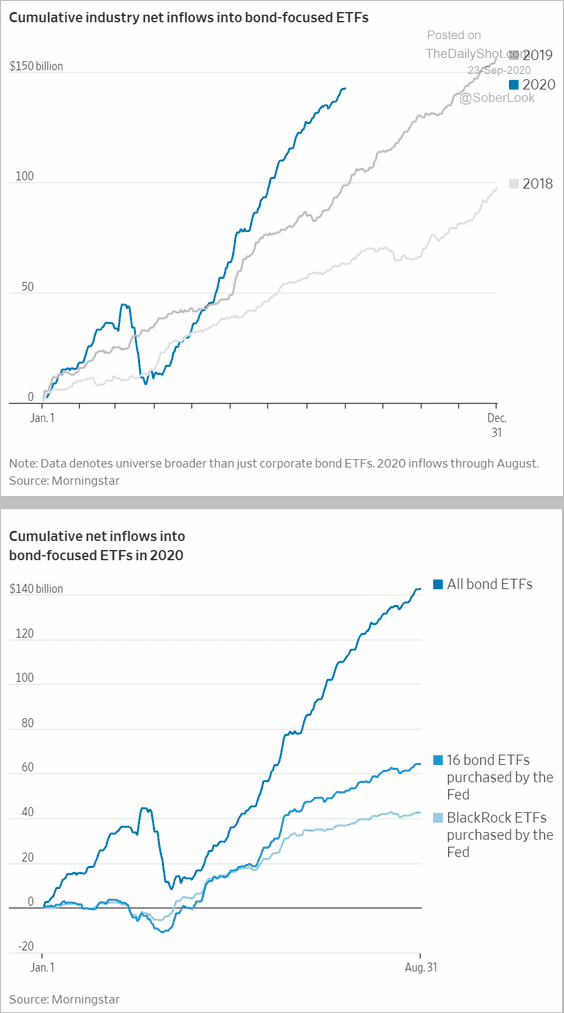

3. Bond ETF inflows have been unusually strong in this recovery.

Source: @WSJ Read full article

Source: @WSJ Read full article

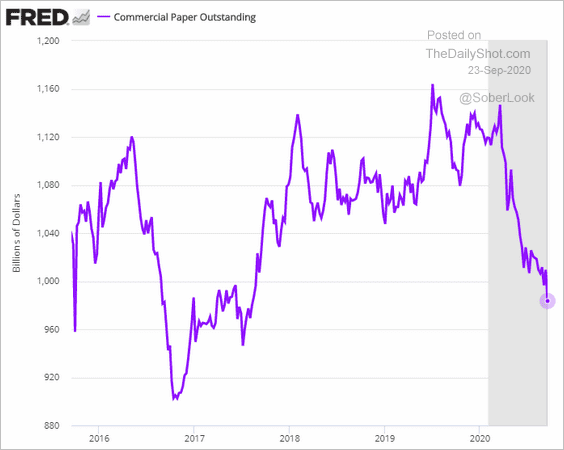

4. US commercial paper outstanding continues to shrink.

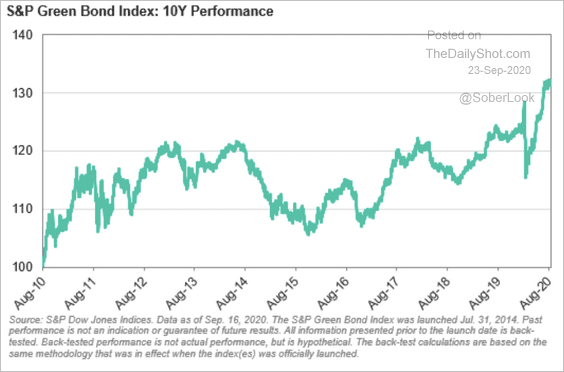

5. Green bonds have performed well over the years.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Global Developments

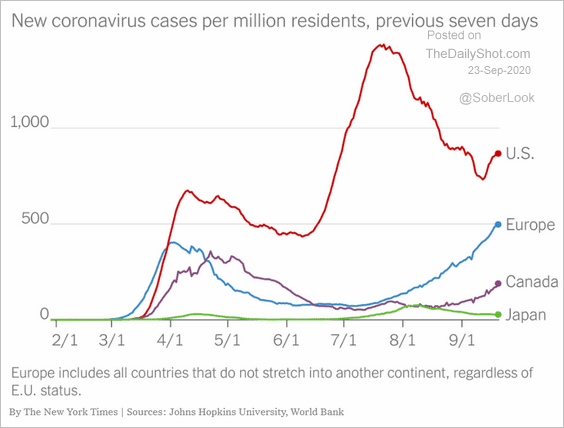

1. Here is the number of new COVID cases in select economies.

Source: The New York Times Read full article

Source: The New York Times Read full article

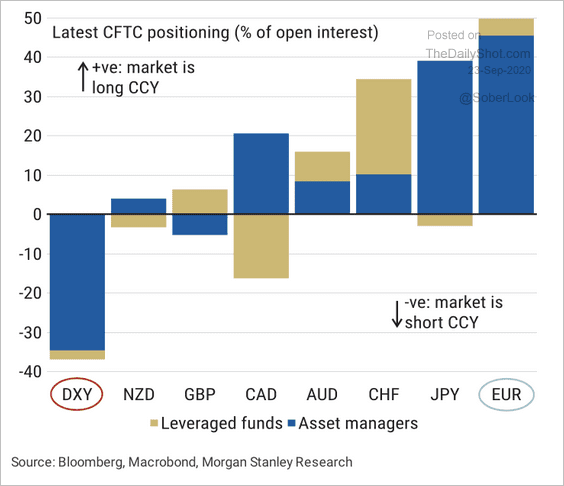

2. Investors have been negative on the US dollar.

Source: Absolute Strategy Research

Source: Absolute Strategy Research

Short dollar remains a core FX market position, especially versus the Euro. But this trade is now being unwound.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

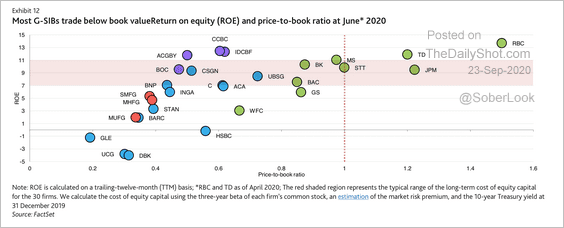

3. Most systemically important banks (G-SIBs) trade at prices below book value.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

——————–

Food for Thought

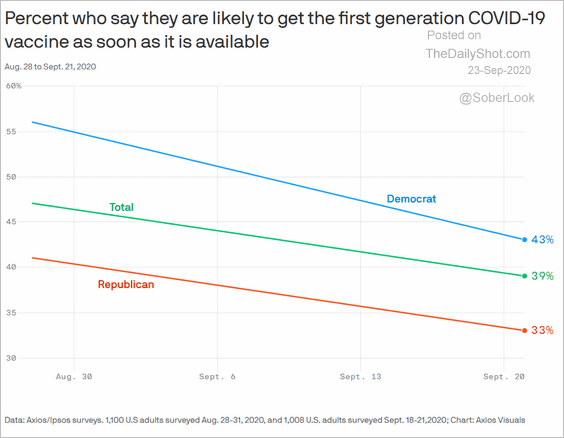

1. Americans’ increasing skepticism for the first-generation COVID vaccine:

Source: Axios Read full article

Source: Axios Read full article

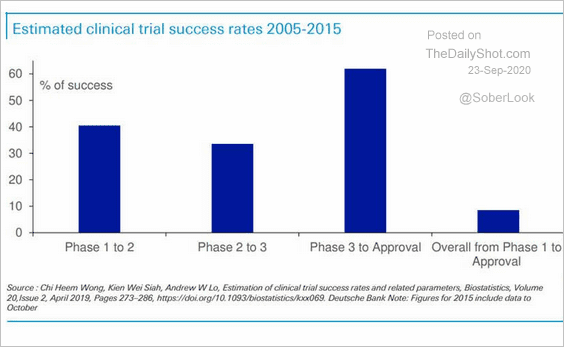

2. Vaccine regulatory approval rates:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

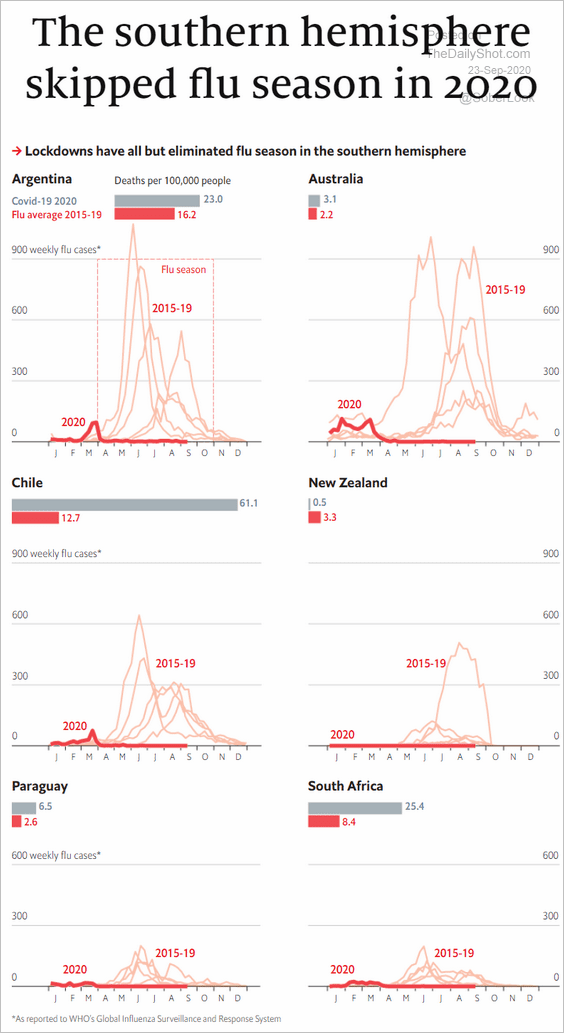

3. Flu cases in the southern hemisphere:

Source: The Economist Read full article

Source: The Economist Read full article

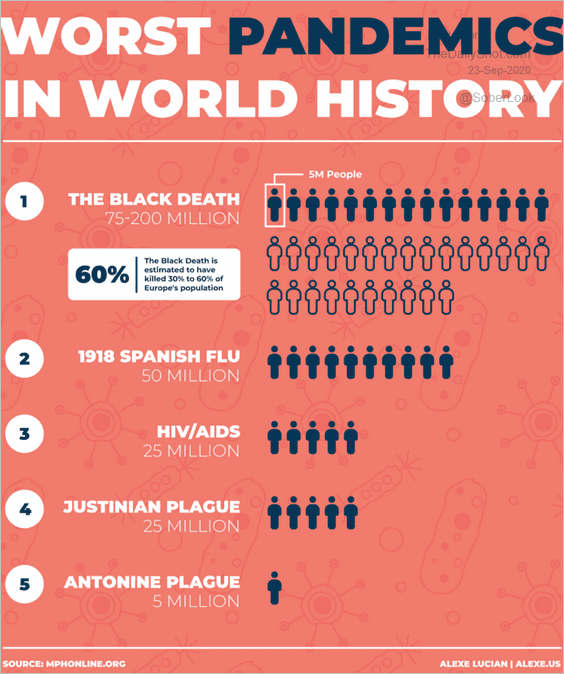

4. The worst pandemics in history:

Source: Medium Read full article

Source: Medium Read full article

5. Costliest hurricanes:

Source: Oxford Economics

Source: Oxford Economics

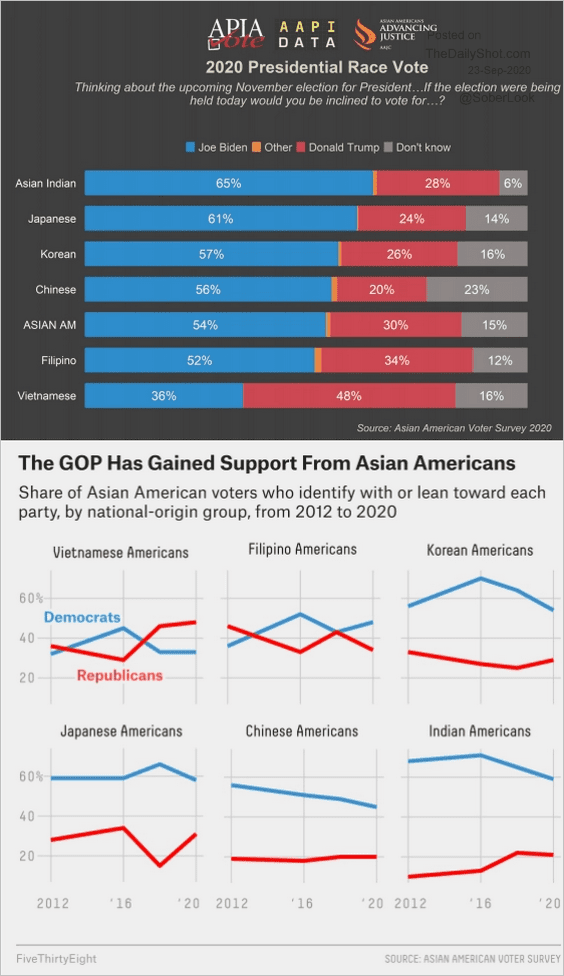

6. How Asian Americans are thinking about the 2020 election:

Source: FiveThirtyEight Read full article

Source: FiveThirtyEight Read full article

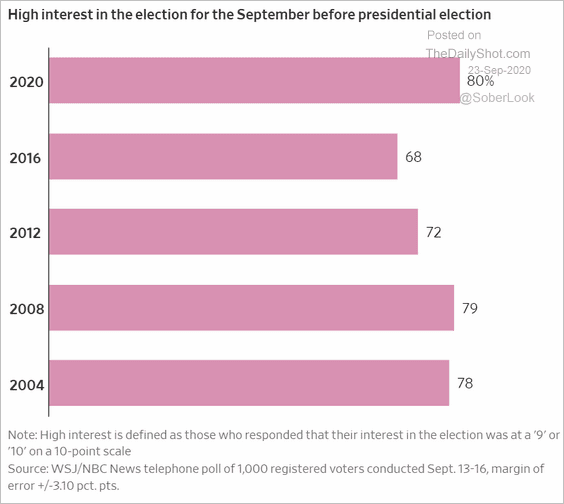

7. Election enthusiasm:

Source: @WSJ Read full article

Source: @WSJ Read full article

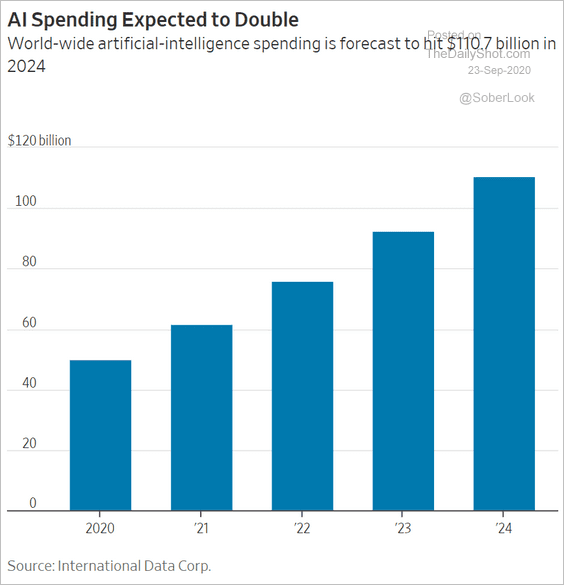

8. AI spending:

Source: @WSJ Read full article

Source: @WSJ Read full article

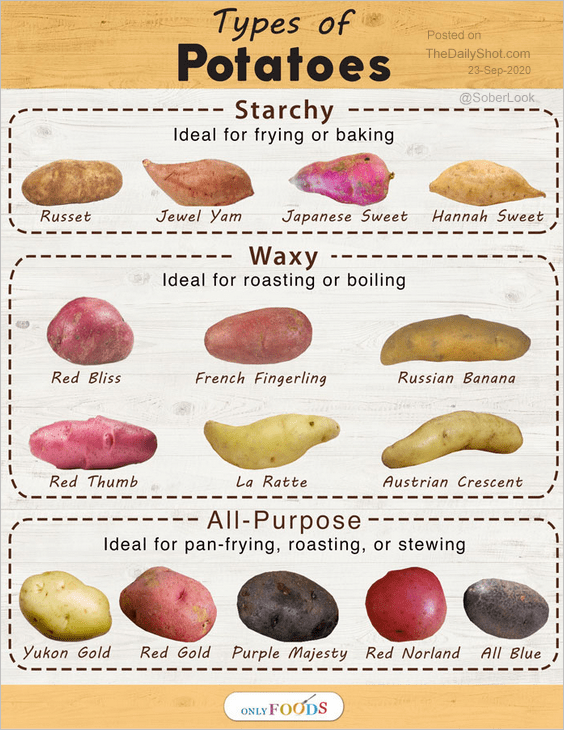

9. Types of potatoes:

Source: Only Foods Read full article Further reading

Source: Only Foods Read full article Further reading

——————–