The Daily Shot: 24-Sep-20

• Equities

• Rates

• Commodities

• Energy

• Emerging Markets

• Asia – Pacific

• The Eurozone

• The United Kingdom

• The United States

• Global Developments

• Food for Thought

Equities

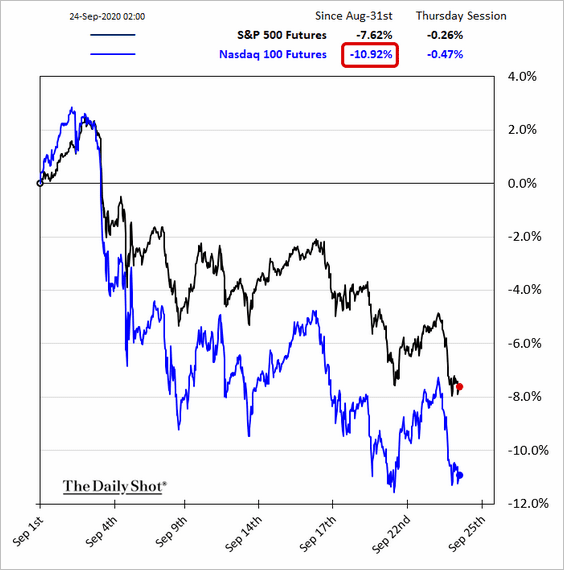

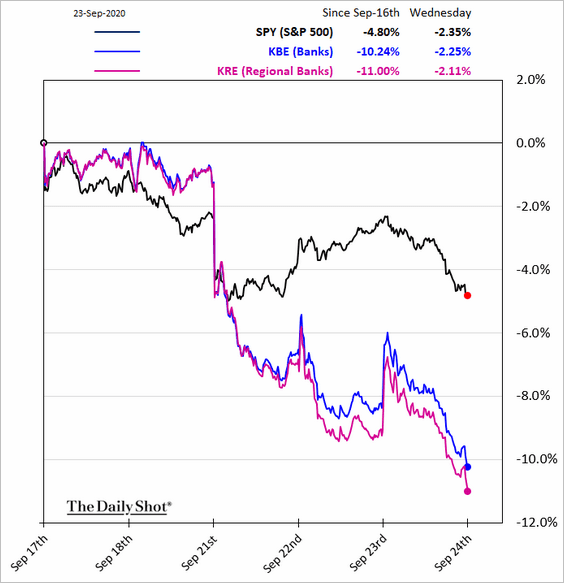

1. It’s been a rough month for stocks.

Let’s take a look at a few reasons for the US market jitters.

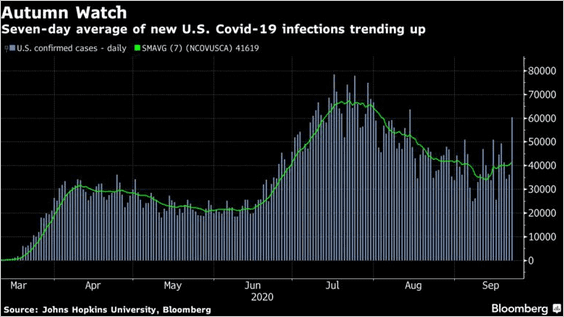

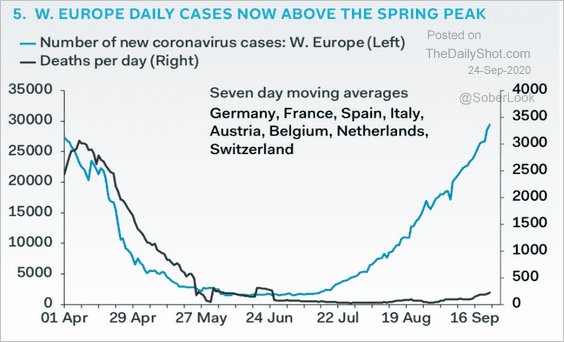

• There are some concerns about lockdowns returning.

Source: @business Read full article

Source: @business Read full article

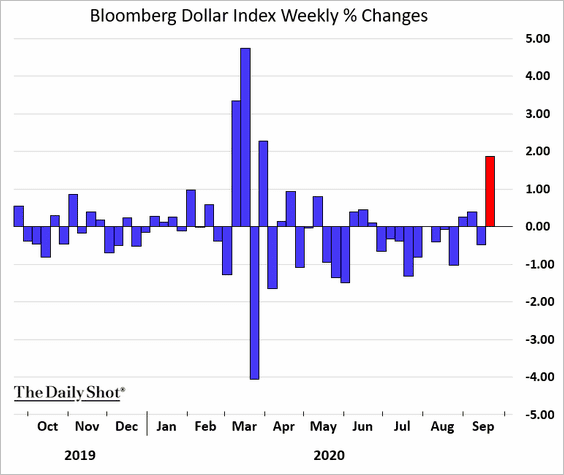

• The rising US dollar is generally not great for risk assets, including equities.

• Potential regulatory action is spooking tech investors.

Source: Reuters Read full article

Source: Reuters Read full article

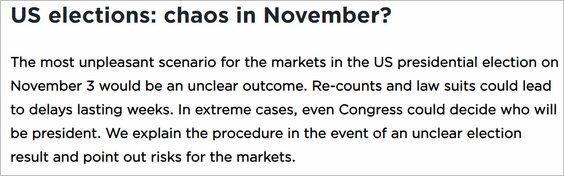

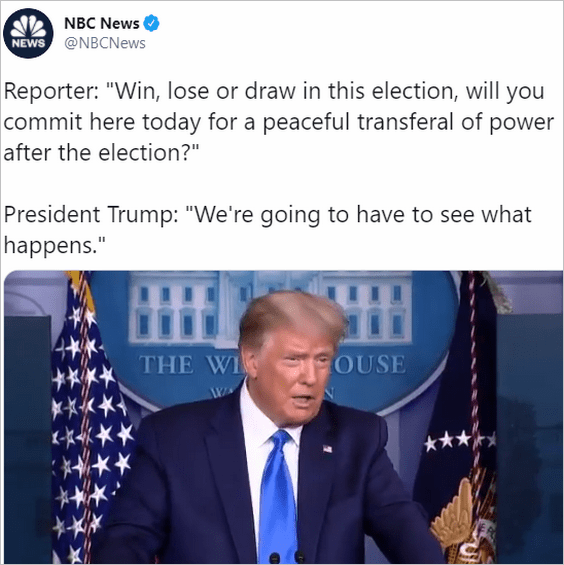

• Rising political uncertainty is on the minds of some investors.

Source: Commerzbank Research

Source: Commerzbank Research

Source: Twitter

Source: Twitter

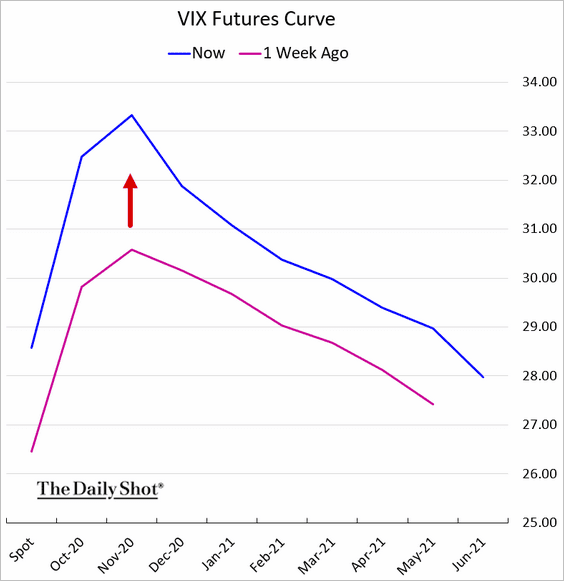

This risk is increasingly being priced into the options markets. Here is the VIX futures curve.

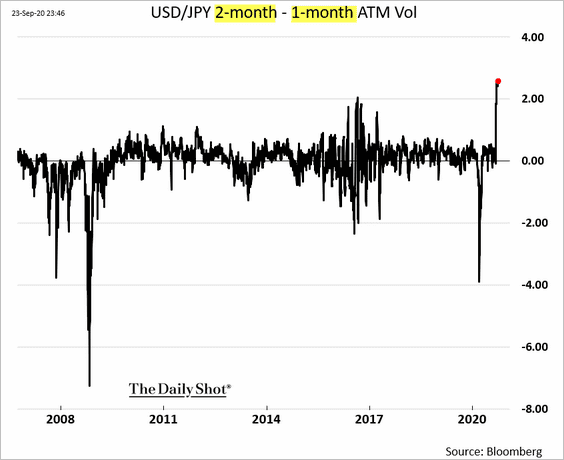

Currency markets are also pricing in the US political risk. Here is the spread between the two- and the one-month USD/JPY implied volatility.

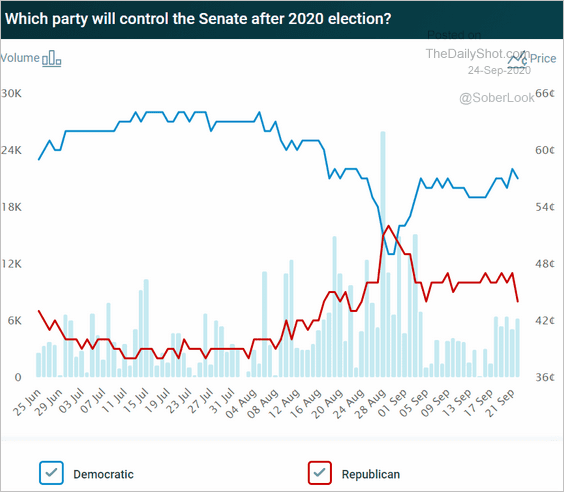

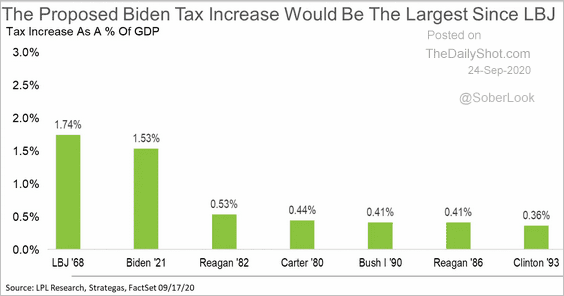

• Moreover, the risk of higher taxes ahead is pressuring stocks, boosted by expectations that Democrats could flip the Senate.

Source: The Economist Read full article

Source: The Economist Read full article

Source: @PredictIt

Source: @PredictIt

Tax increases could be substantial.

Source: CNBC Read full article

Source: CNBC Read full article

Source: LPL Research

Source: LPL Research

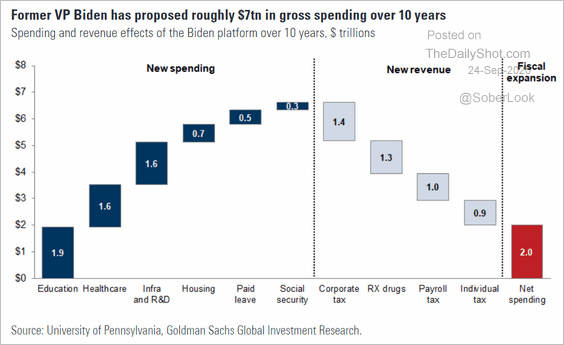

On the whole, Biden’s current proposals point to a net fiscal expansion (spending exceeding tax increases).

Source: Goldman Sachs

Source: Goldman Sachs

——————–

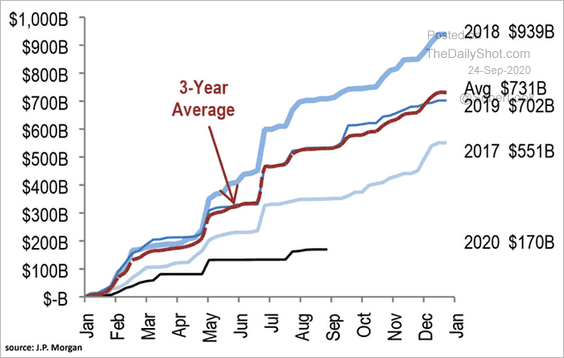

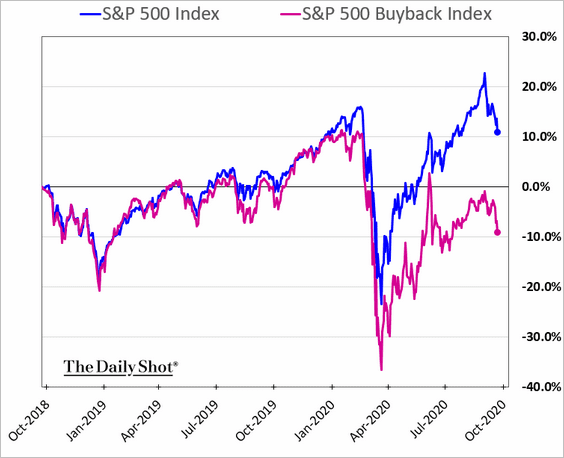

2. Share buyback activity is running well below the levels we’ve seen in recent years. Companies known for buying their stock have been underperforming (second chart).

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @jpmorgan

——————–

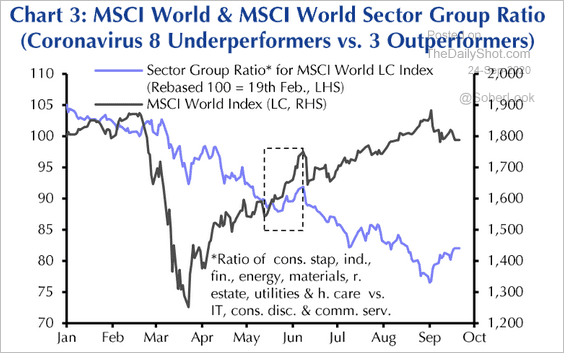

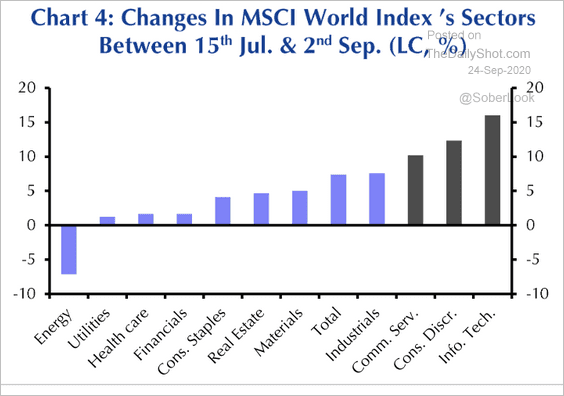

3. Stocks perceived to be less exposed to the virus continued to outperform (2 charts).

Source: Capital Economics

Source: Capital Economics

Source: Capital Economics

Source: Capital Economics

——————–

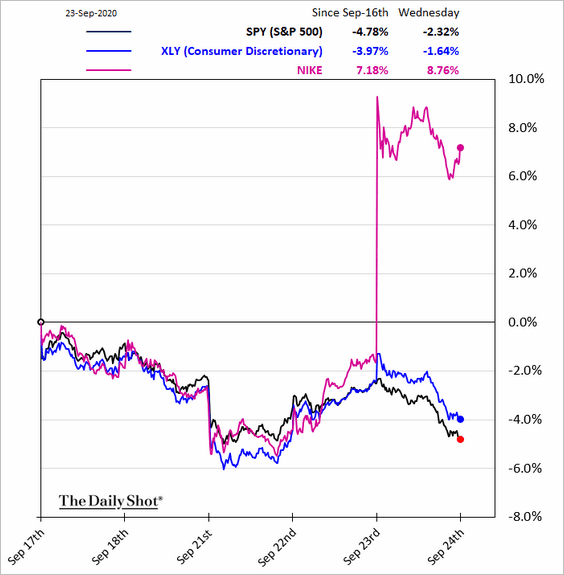

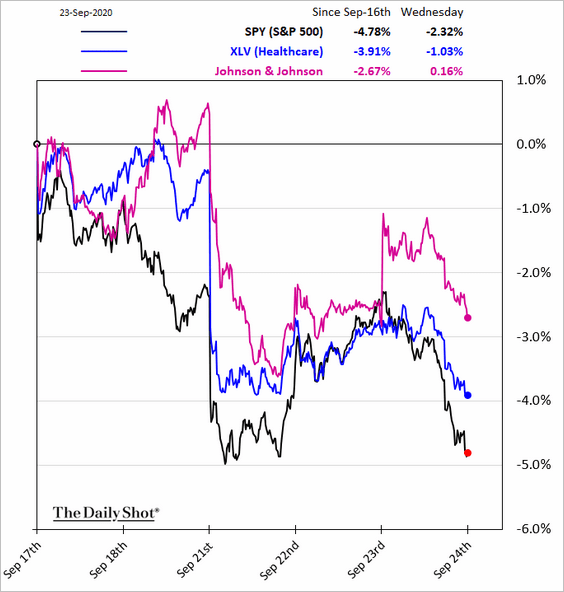

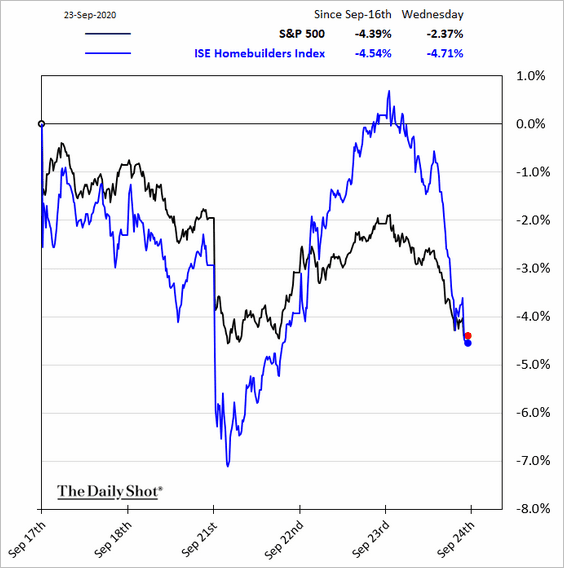

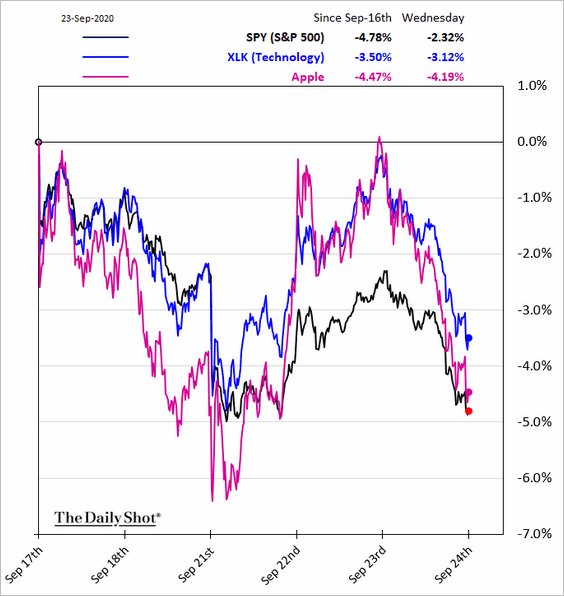

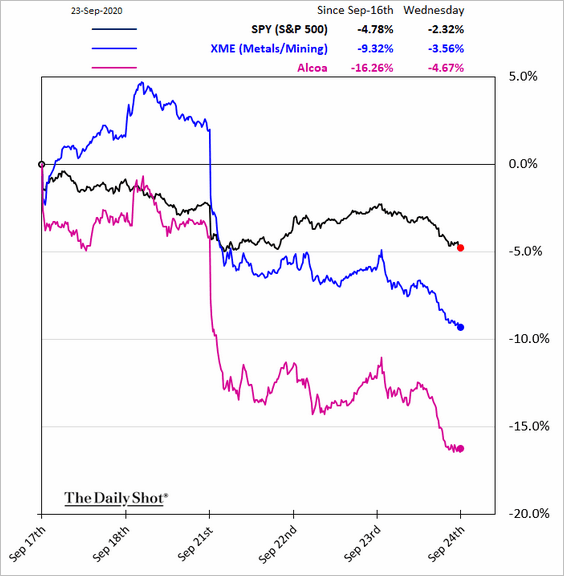

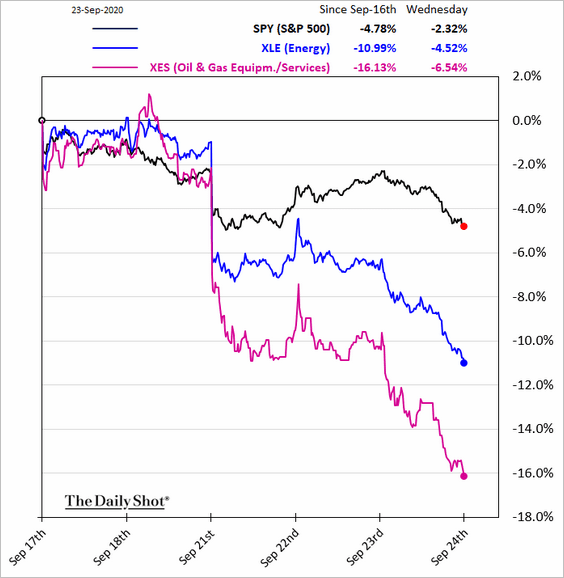

4. Here are some sector performance charts.

• Banks:

• Consumer Discretionary:

• Healthcare:

• Homebuilders:

• Tech:

• Metals & Mining:

• Energy:

——————–

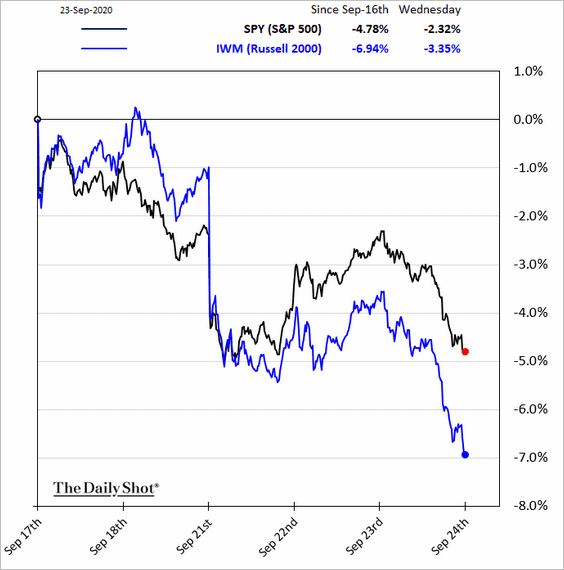

5. Small caps are underperforming again.

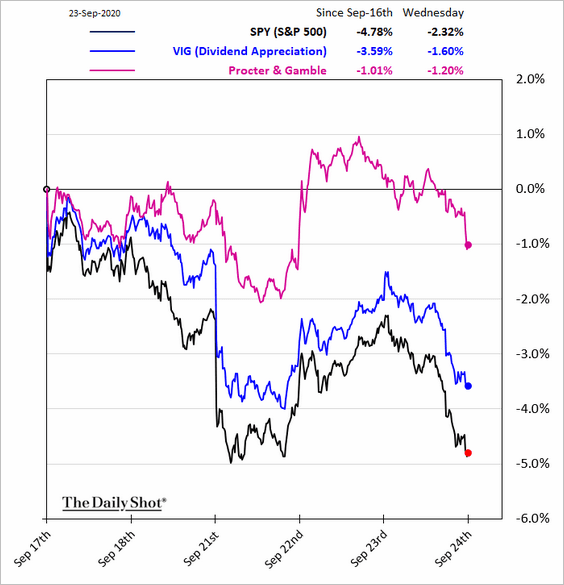

6. Shares of firms known for dividend growth have been more stable.

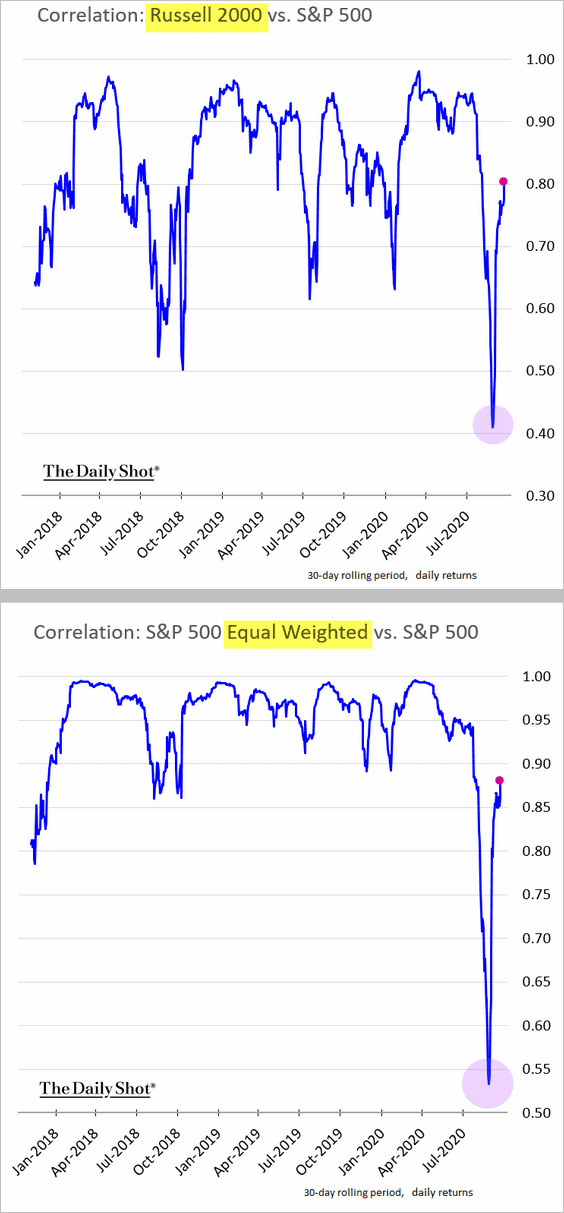

7. The S&P 500 correlation to smaller stocks is recovering.

Rates

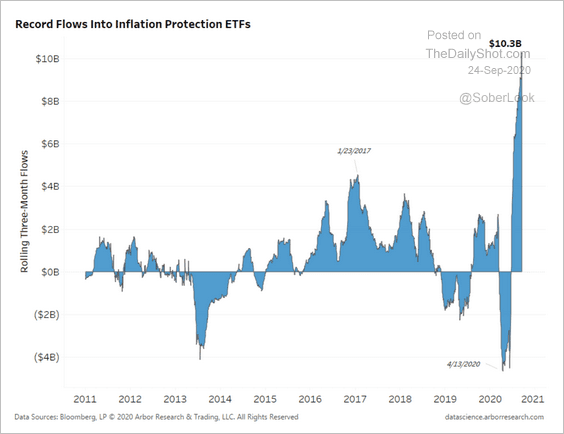

1. TIPs continue to see record inflows, amassing $10.3 billion over the past 3 months.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

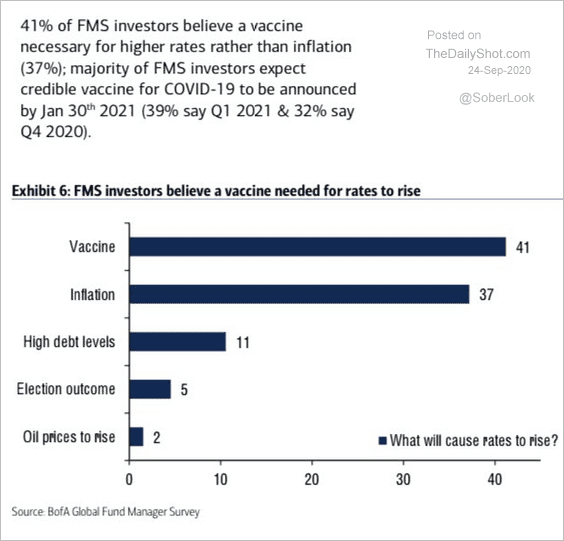

2. What would it take for rates to rise?

Source: BofA Securities, @WallStJesus

Source: BofA Securities, @WallStJesus

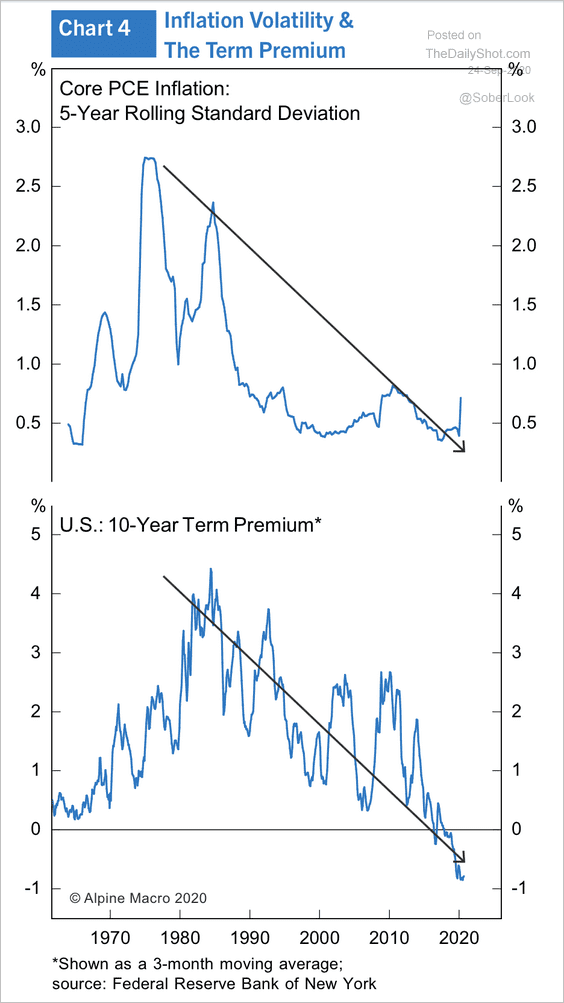

3. Declining inflation volatility has been pushing down the 10-year Treasury term premium for several decades.

Source: Alpine Macro

Source: Alpine Macro

Commodities

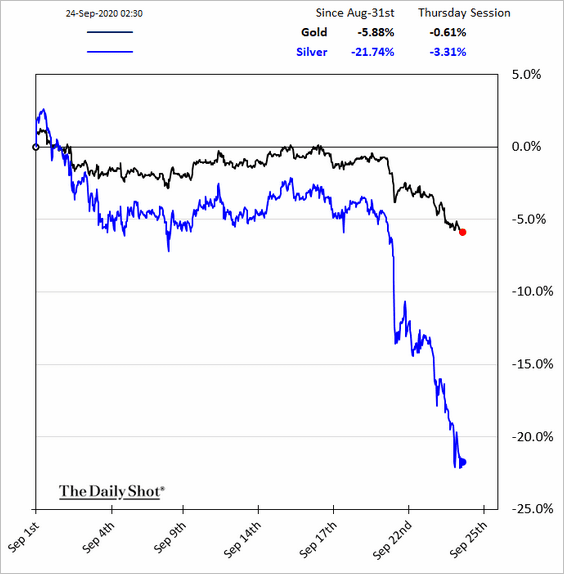

1. It’s been a challenging month for precious metals.

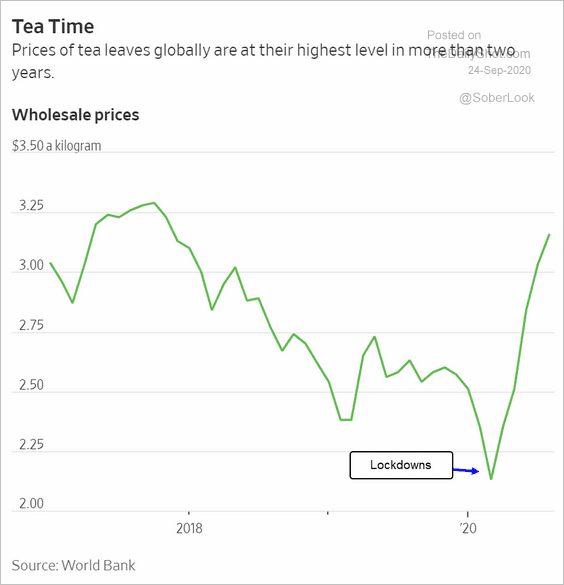

2. The pandemic boosted tea prices.

Source: @WSJ Read full article

Source: @WSJ Read full article

Energy

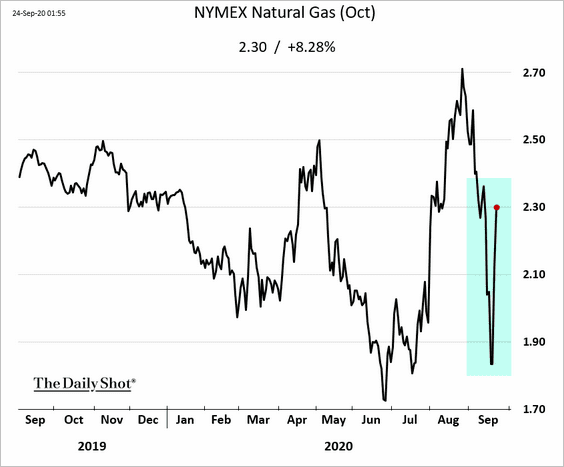

1. US natural gas prices came roaring back after the recent collapse and are now up over 25% from the lows.

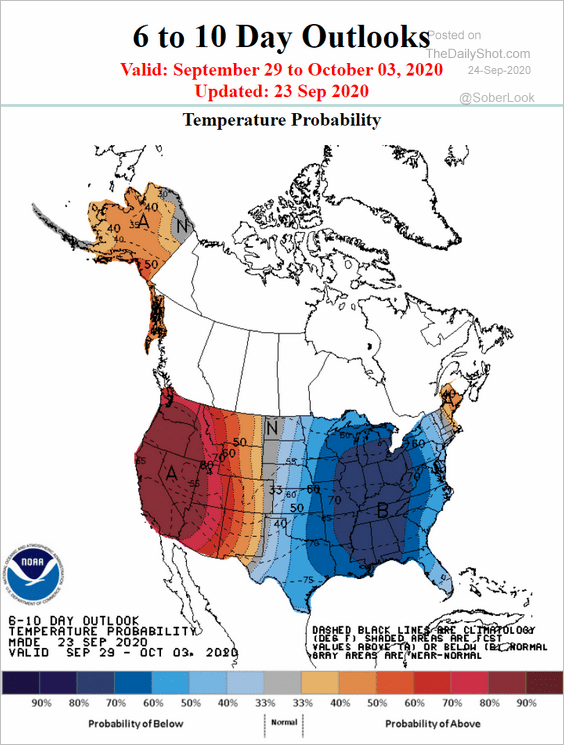

A forecast for cold weather in the eastern US was the catalyst for this reversal (heating demand).

Source: NOAA

Source: NOAA

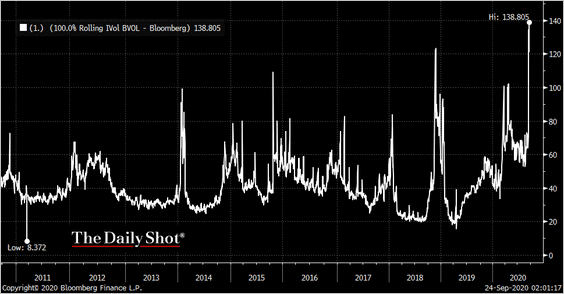

Natural gas implied volatility is at the highest level in at least a decade.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

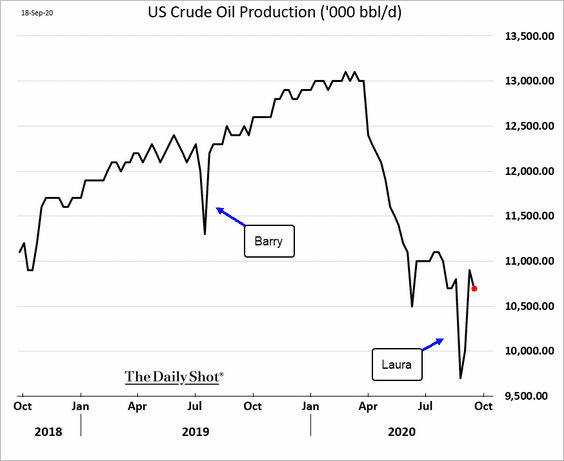

2. US crude oil production remains depressed.

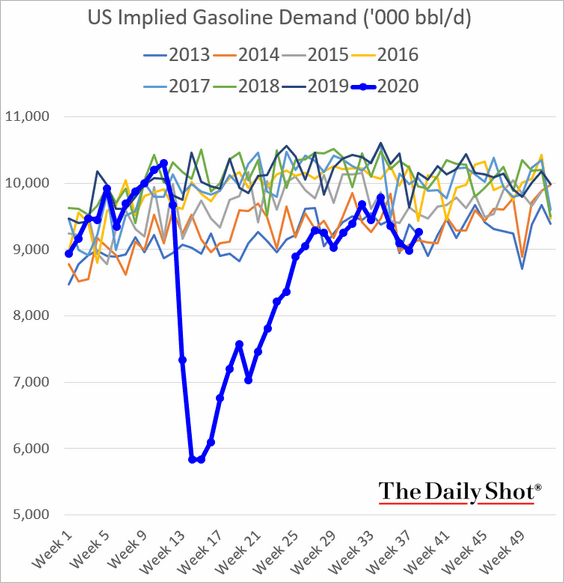

3. Here is the implied US gasoline demand.

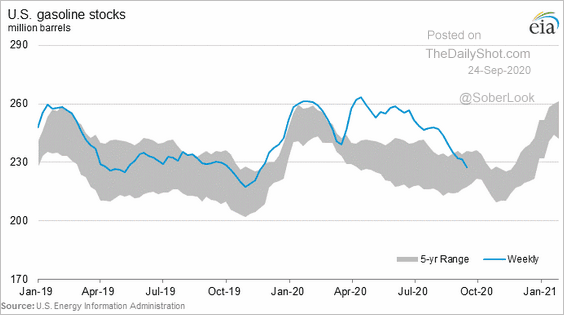

Gasoline inventories have been declining (absolute levels shown).

Emerging Markets

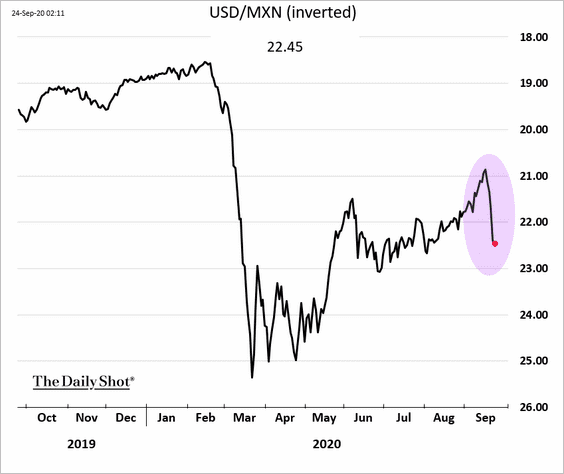

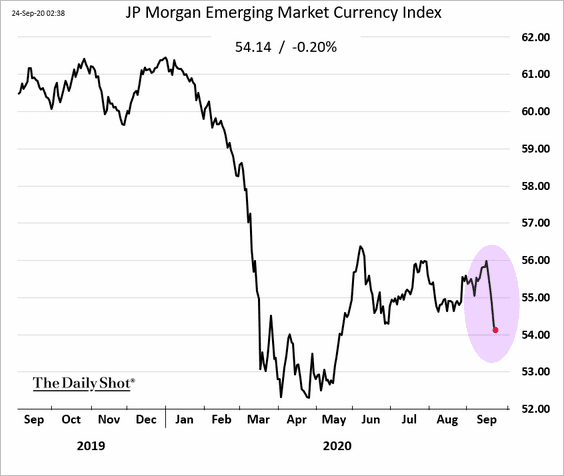

1. EM currencies sold off amid increased risk aversion.

• The Mexican peso:

• The JP Morgan EM Currency Index:

——————–

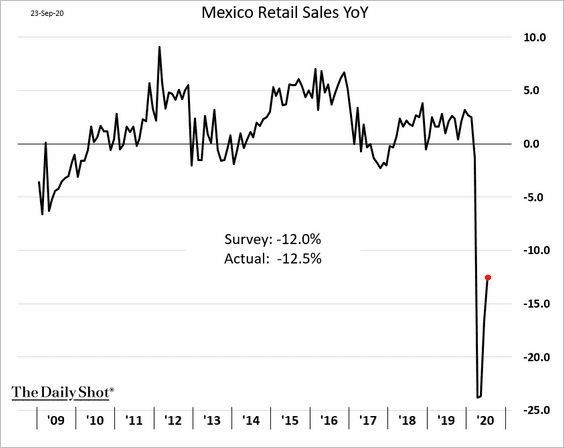

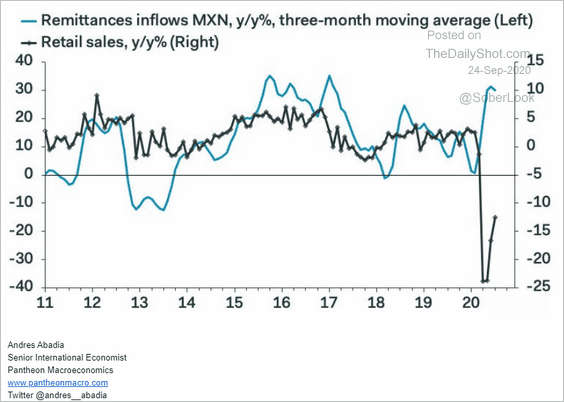

2. Here are some updates on Mexico.

• Retail sales (through July):

• Retail sales vs. remittances:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

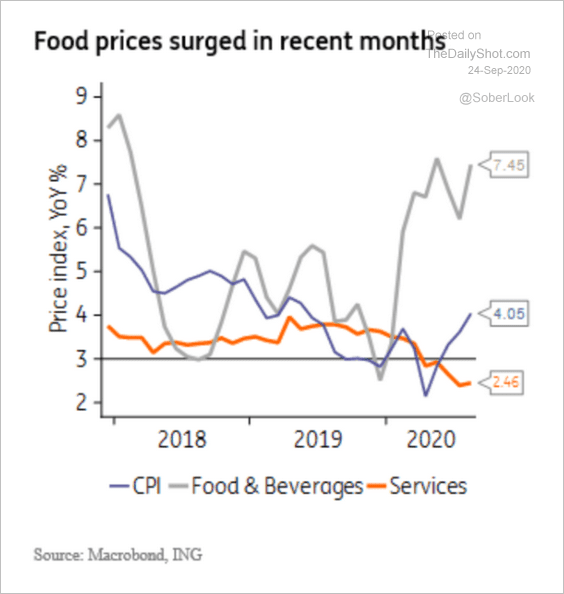

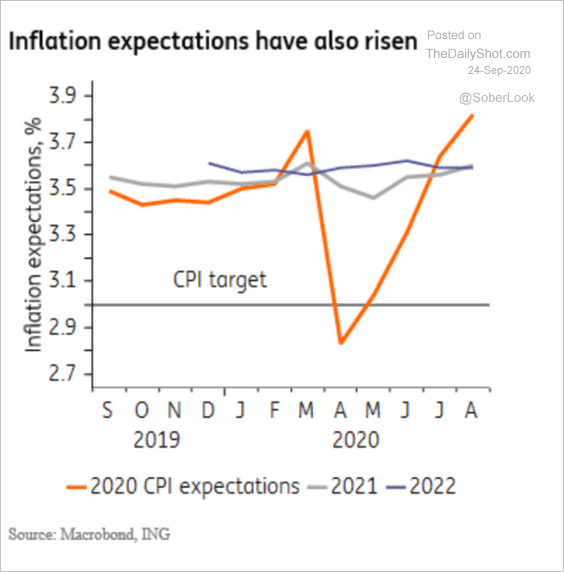

• Food CPI and inflation expectations:

Source: ING

Source: ING

Source: ING

Source: ING

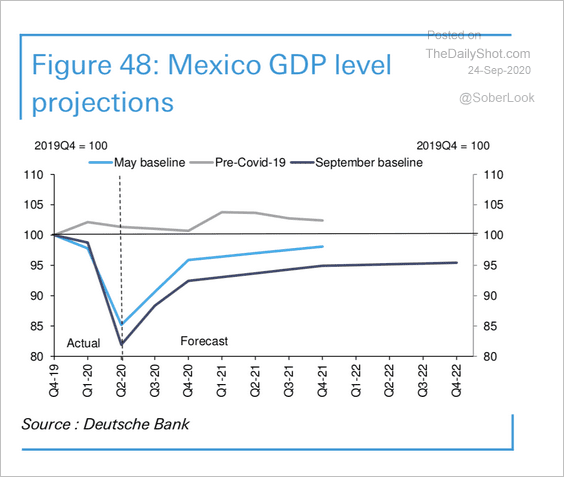

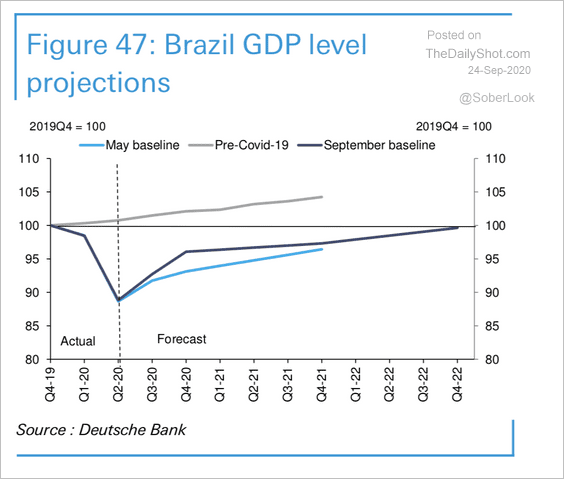

• Deutsche Bank’s forecasts for Mexico vs. Brazil:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

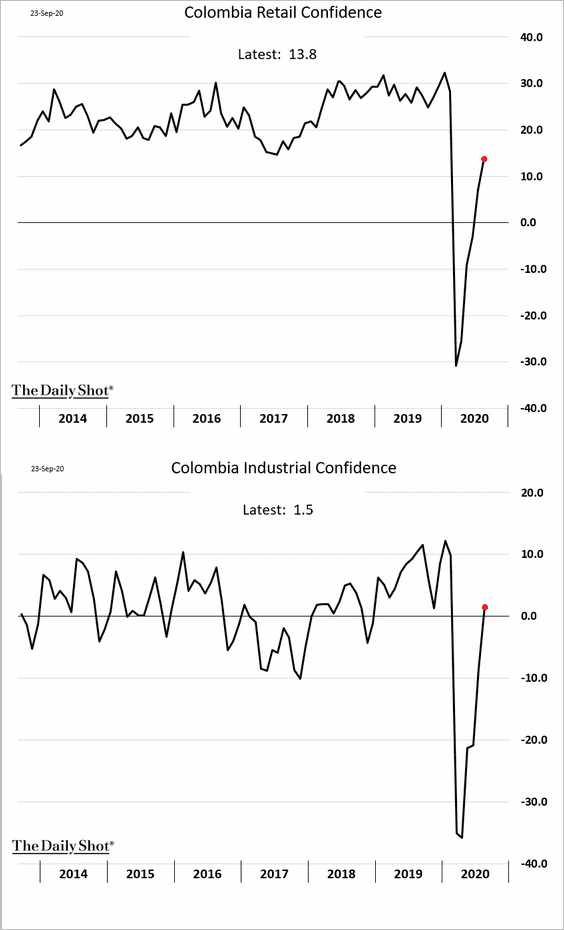

3. Colombia’s sentiment indicators are recovering.

Asia – Pacific

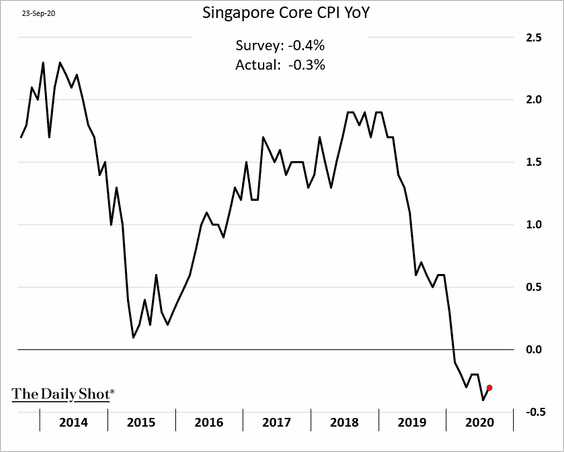

1. Has Singapore’s inflation bottomed?

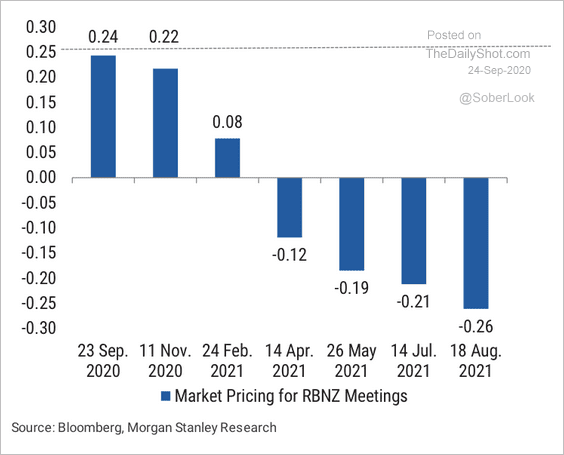

2. Markets are pricing in a chance that the RBNZ cuts rates ahead of its 12-month forward guidance ending March 2021, according to Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

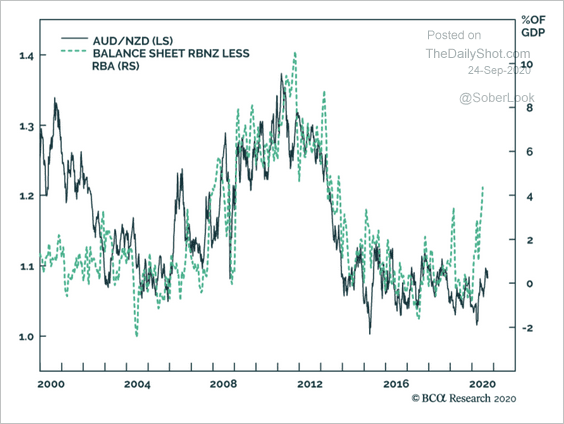

The growth of the RBNZ’s balance sheet relative to the RBA could support a higher AUD/NZD cross rate.

Source: BCA Research

Source: BCA Research

——————–

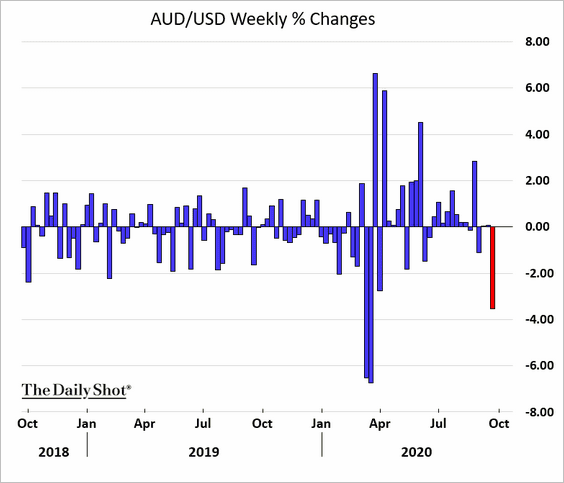

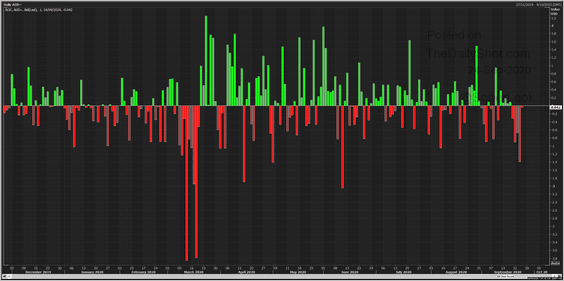

3. The Aussie dollar suffered its largest decline since mid-June.

Source: @Scutty

Source: @Scutty

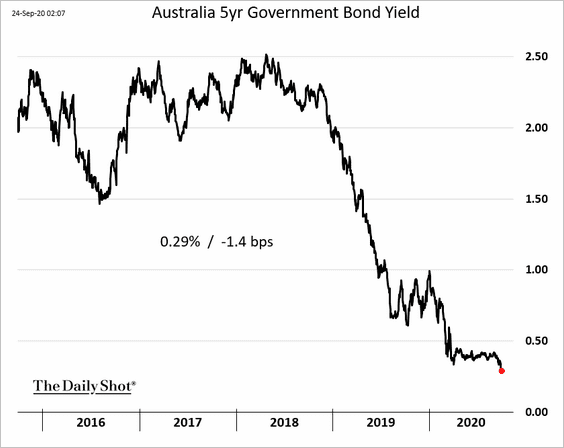

Australia’s 5yr yield dipped below 0.3%.

The Eurozone

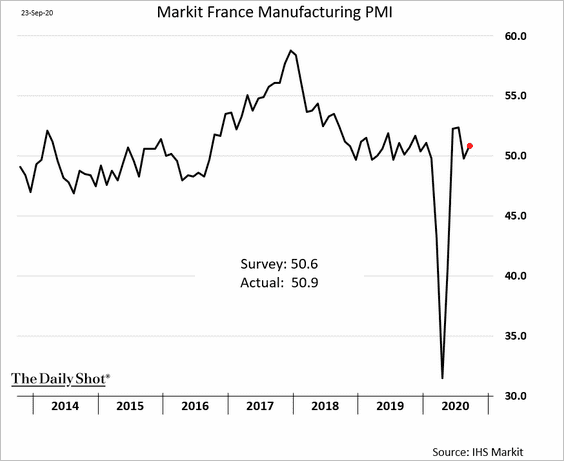

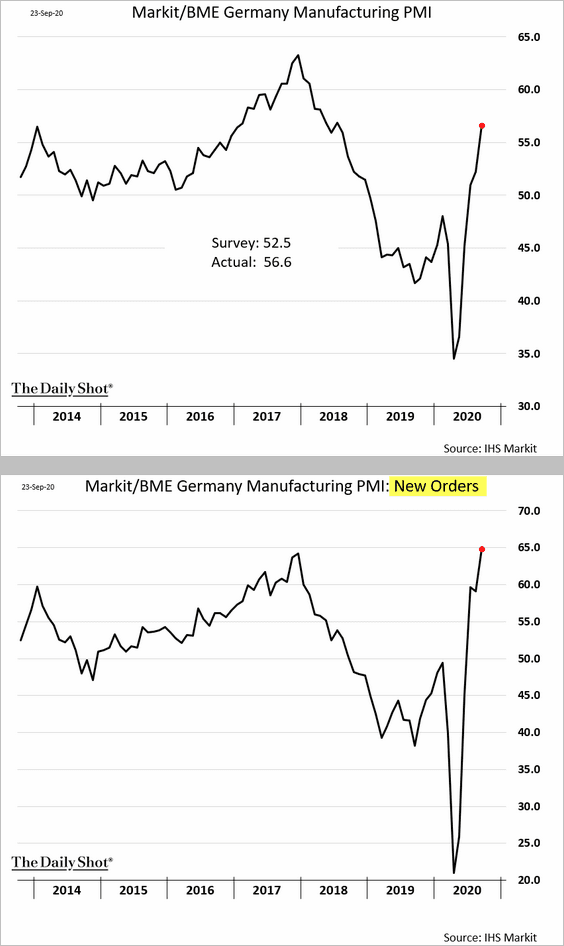

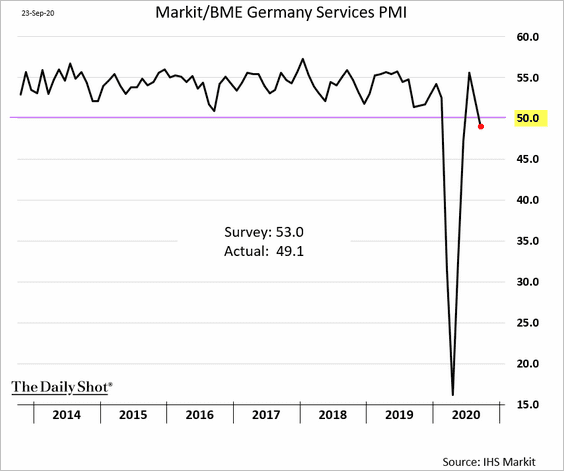

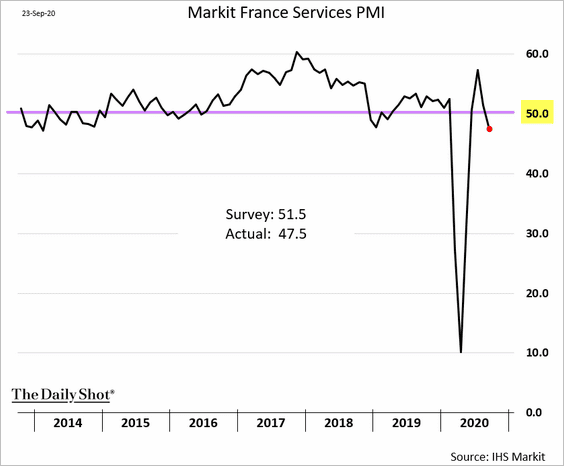

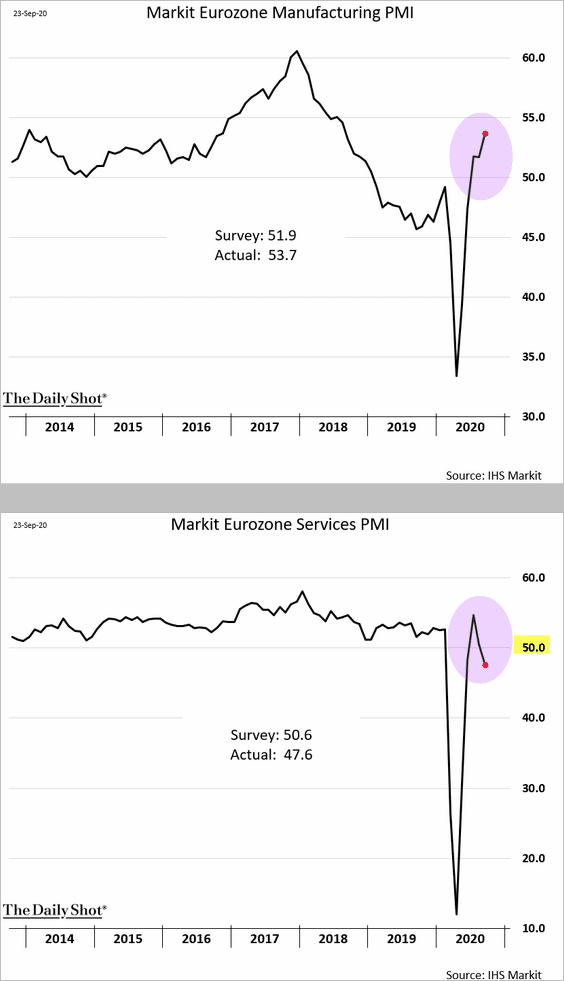

1. The second wave of the pandemic is pressuring the service sector, while factory activity remains robust.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• September manufacturing PMIs for Germany and France (preliminary):

• Services PMIs:

• The PMI at the Eurozone level:

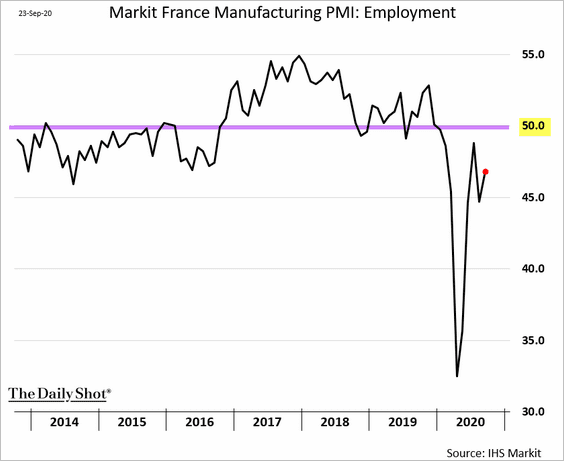

2. French manufacturing employment remains soft.

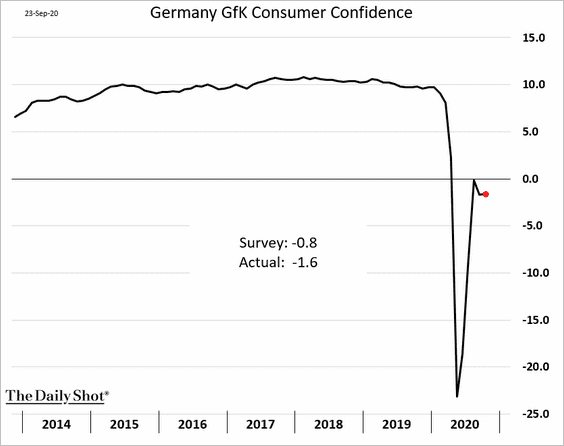

3. The recovery in Germany’s consumer sentiment has stalled.

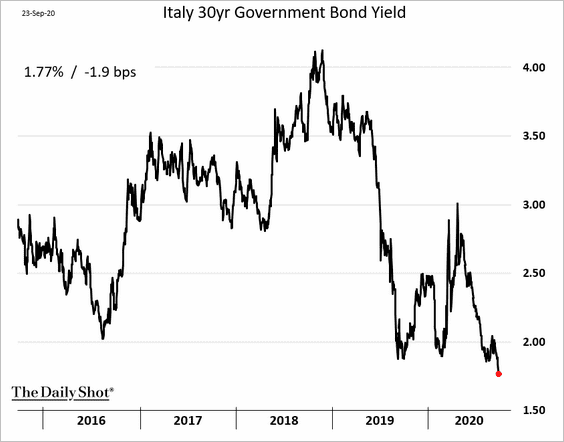

4. Italy’s 30yr bond yield hit a record low.

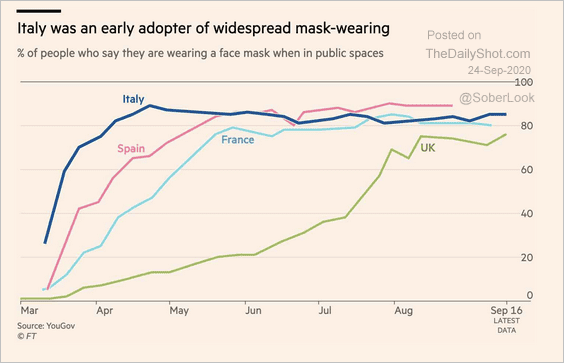

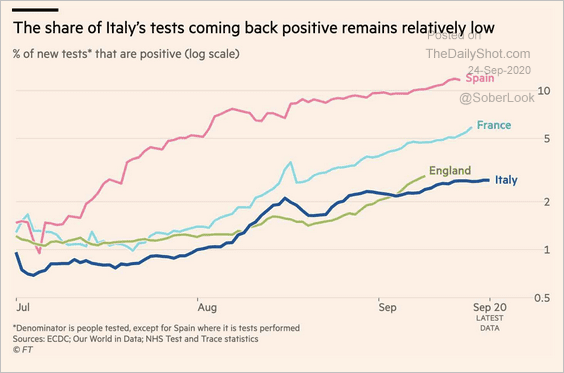

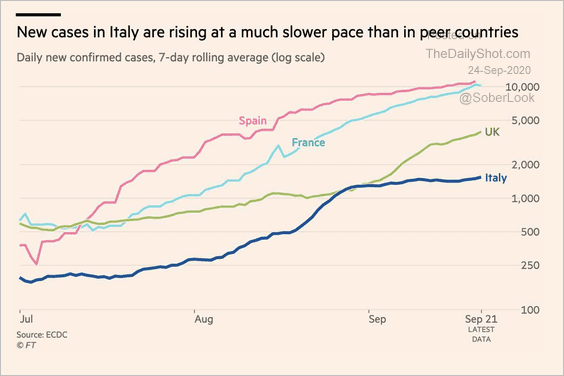

The latest rally was driven by the referendum results. Italy is also benefitting from much lower infection rates in the second wave.

• Mask-wearing:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• Positive cases from tests:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• New cases:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

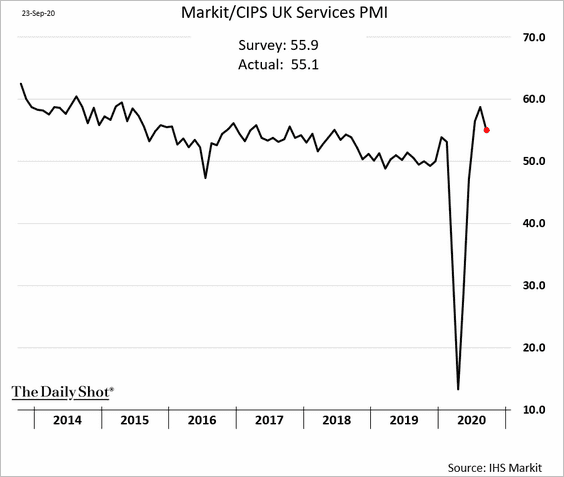

The United Kingdom

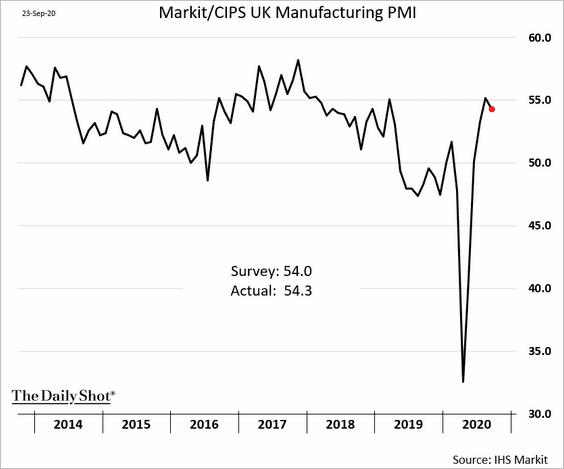

1. The Markit PMI report showed that business activity remained resilient this month (PMI well above 50).

• Manufacturing:

• Services:

——————–

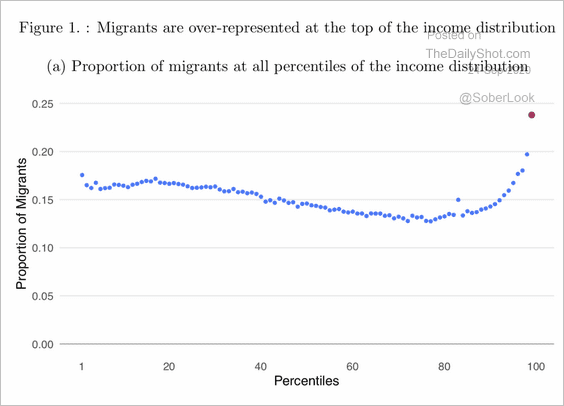

2. The UK has a lot of wealthy immigrants.

Source: CAGE Read full article

Source: CAGE Read full article

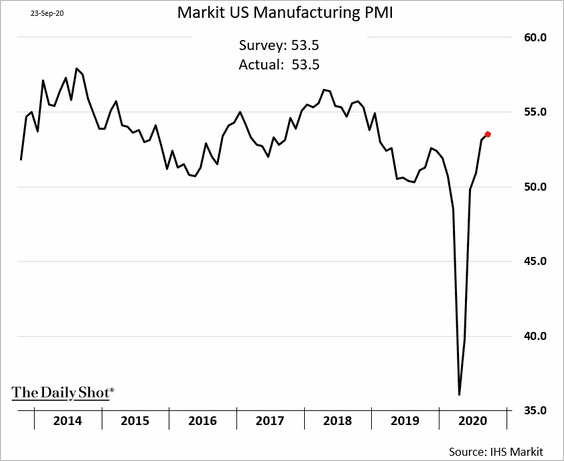

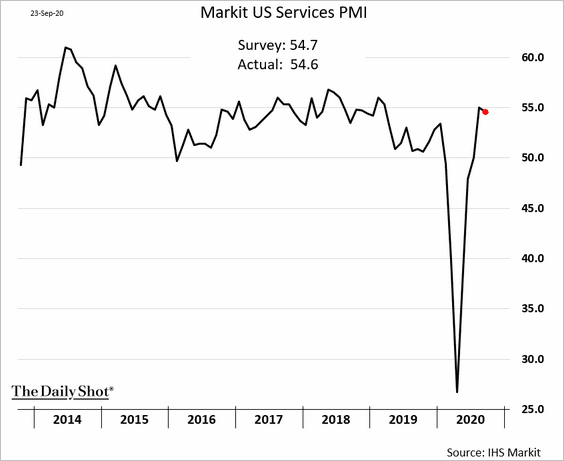

The United States

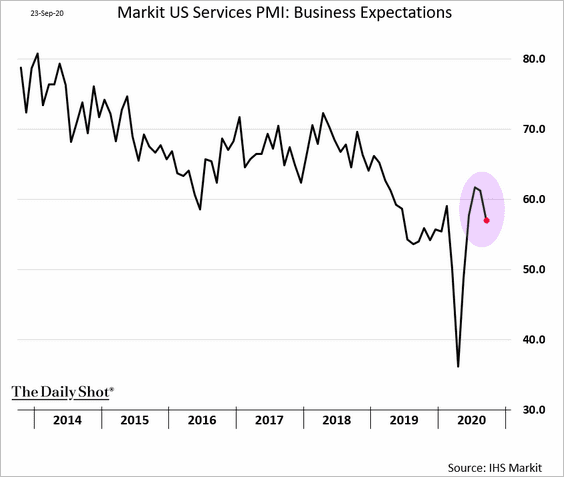

1. The Markit PMI report showed stable growth in business activity (PMI > 50).

• Manufacturing:

• Services:

But service firms are becoming less upbeat.

——————–

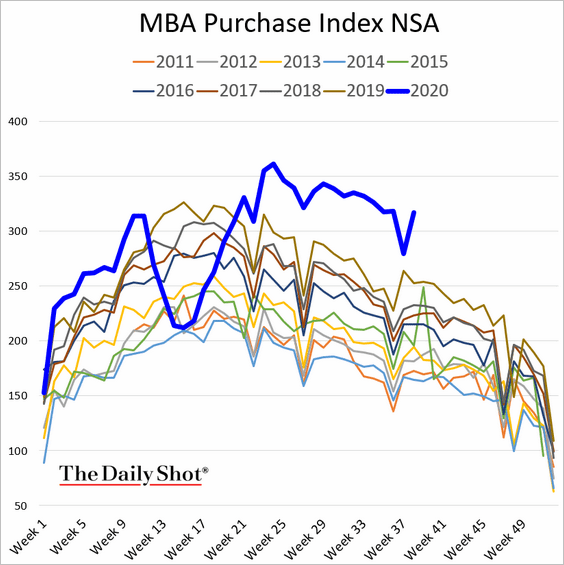

2. Mortgage applications for house purchase remain elevated.

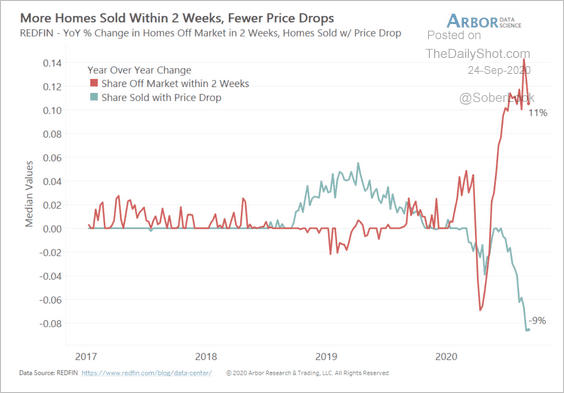

Homes are selling briskly, with fewer sellers willing to drop prices.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

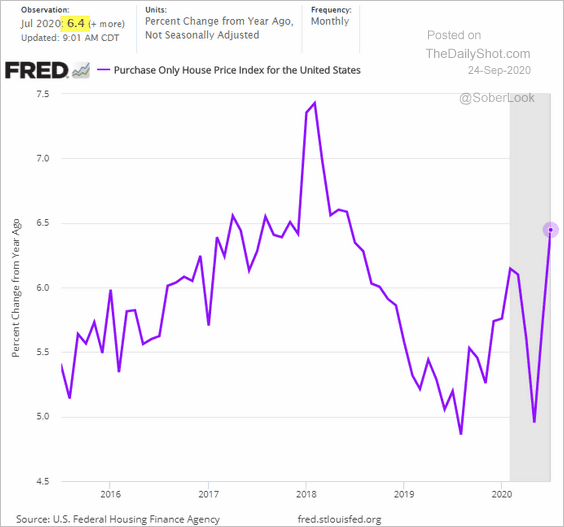

And home price appreciation has rebounded.

——————–

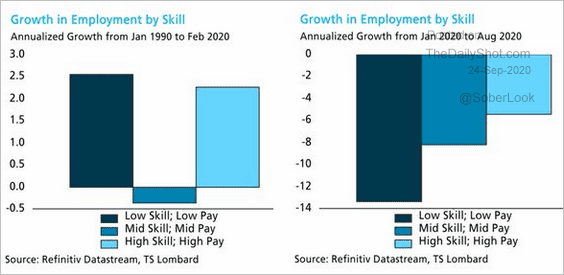

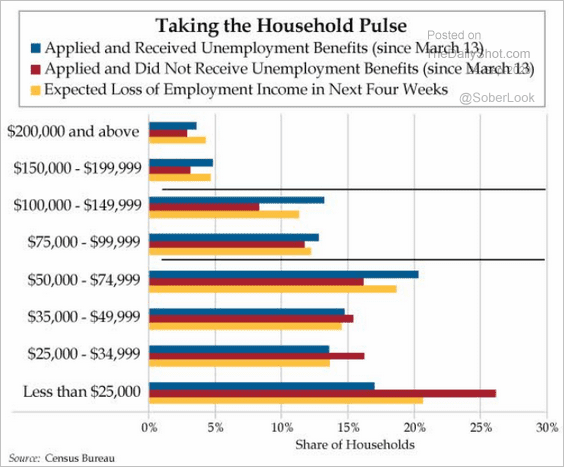

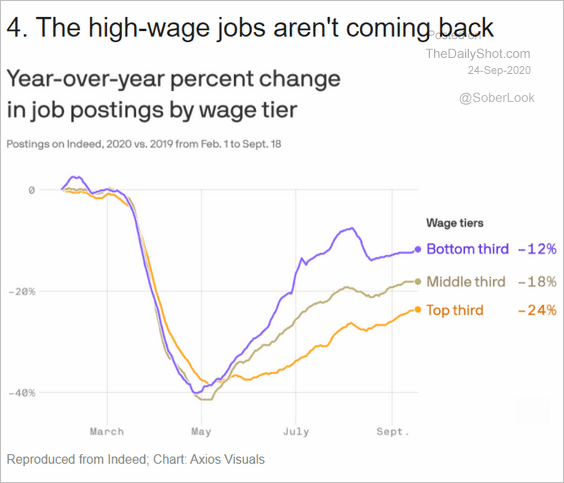

3. Next, we have some updates on the labor market.

• Job growth by skill level over the past three decades:

Source: @LizAnnSonders, @TS_Lombard, @Refinitiv

Source: @LizAnnSonders, @TS_Lombard, @Refinitiv

• Job status and income expectations:

Source: The Daily Feather

Source: The Daily Feather

• Job postings by wage tier:

Source: @axios Read full article

Source: @axios Read full article

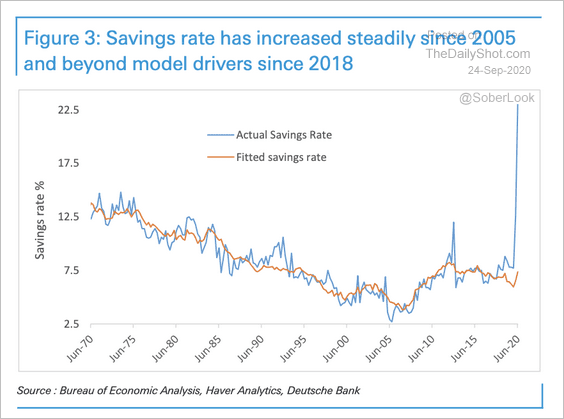

4. The US personal savings rate has been increasing since 2005, and recently surged due to government stimulus.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Global Developments

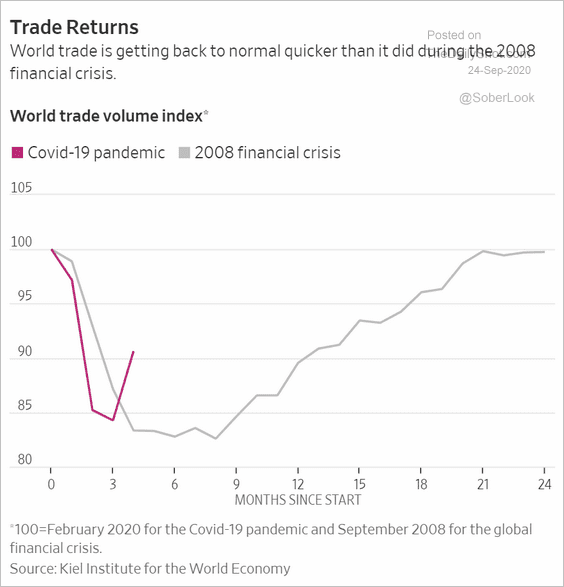

1. Global trade is rebounding.

Source: @WSJ Read full article

Source: @WSJ Read full article

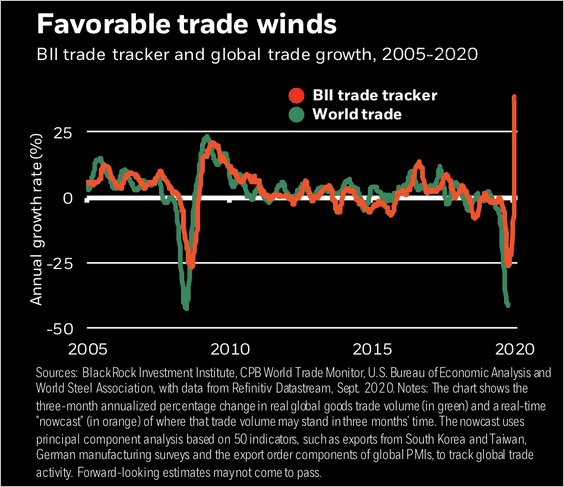

Here is BlackRock’s real-time trade indicator.

Source: BlackRock

Source: BlackRock

——————–

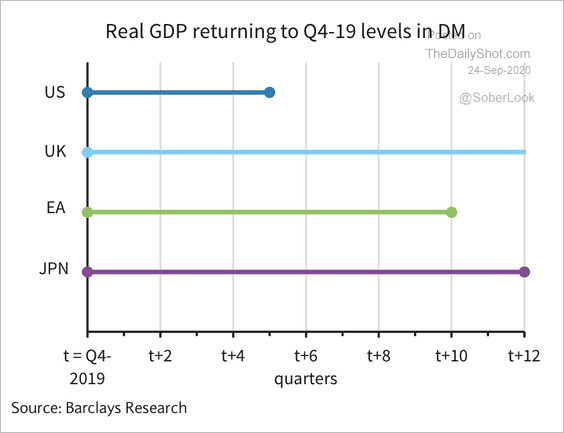

2. Advanced economies will need some time to fully recover from the global recession, according to Barclays.

Source: Barclays Research

Source: Barclays Research

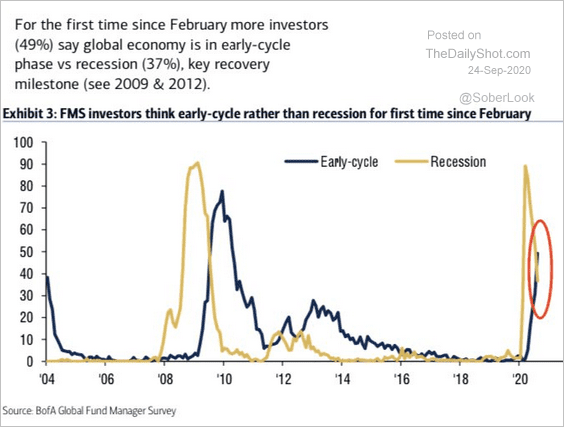

3. Early-cycle or recession?

Source: BofA Securities, @WallStJesus

Source: BofA Securities, @WallStJesus

——————–

Food for Thought

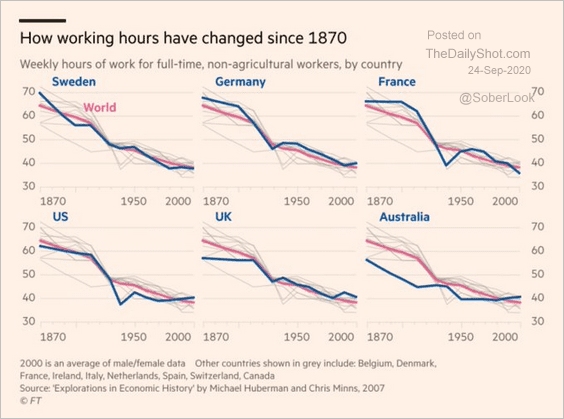

1. Changes in working hours since 1870:

Source: @adam_tooze, @FT Read full article

Source: @adam_tooze, @FT Read full article

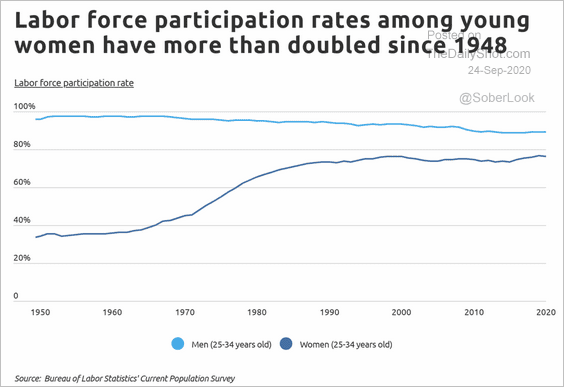

2. Labor force participation among young US women:

Source: Self Read full article

Source: Self Read full article

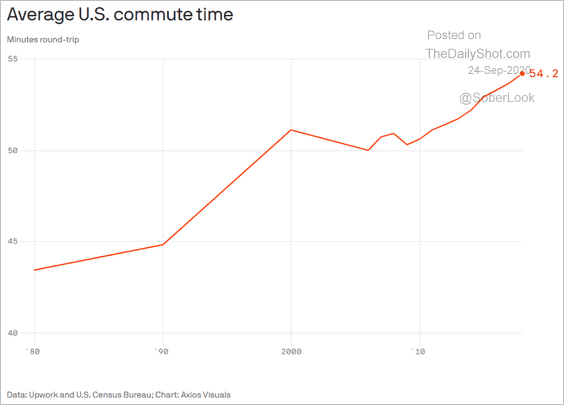

3. Average US commute time:

Source: @axios Read full article

Source: @axios Read full article

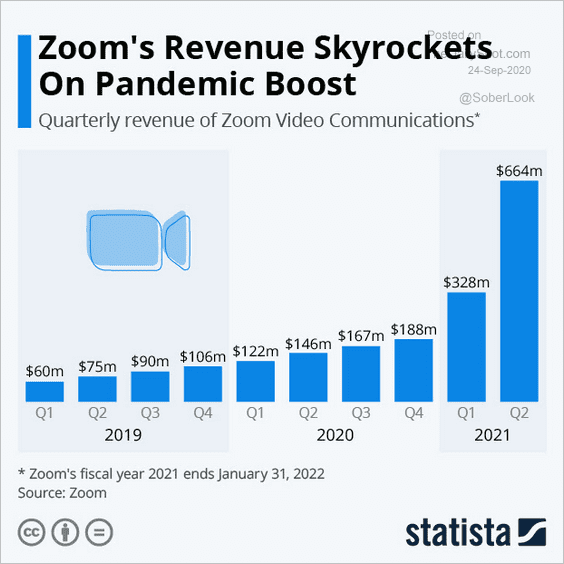

4. Zoom Video revenues:

Source: Statista

Source: Statista

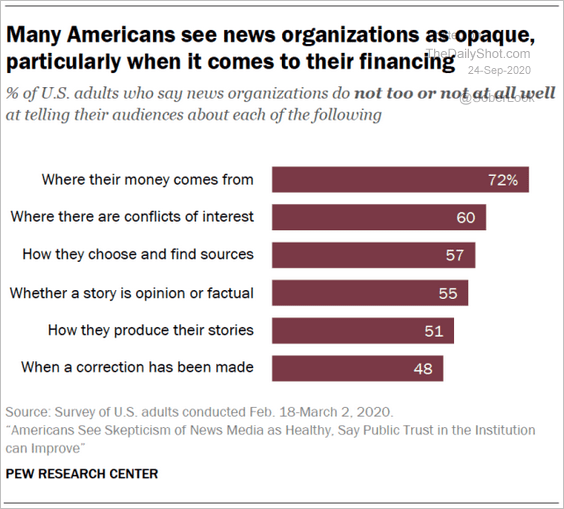

5. Americans’ views on news organizations:

Source: @gottfriedjeff, @pewresearch Read full article

Source: @gottfriedjeff, @pewresearch Read full article

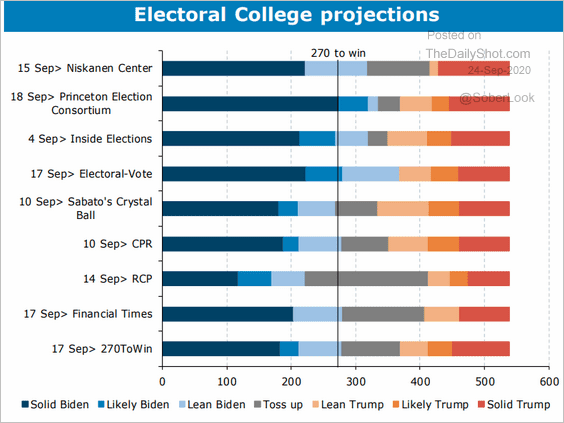

6. US Electoral College projections:

Source: ANZ Research

Source: ANZ Research

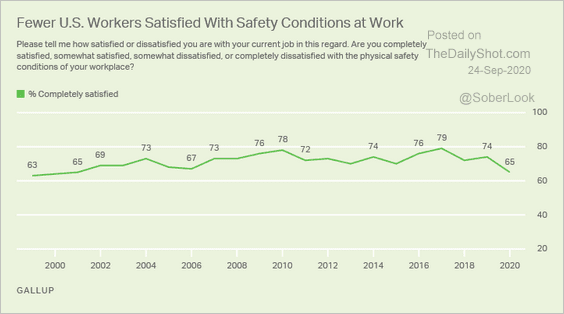

7. Satisfaction with safety conditions at work:

Source: @GallupNews Read full article

Source: @GallupNews Read full article

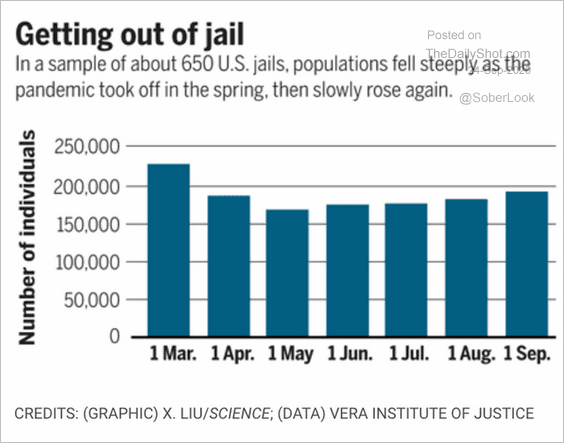

8. Population changes in US jails:

Source: @adam_tooze, @KellyServick Read full article

Source: @adam_tooze, @KellyServick Read full article

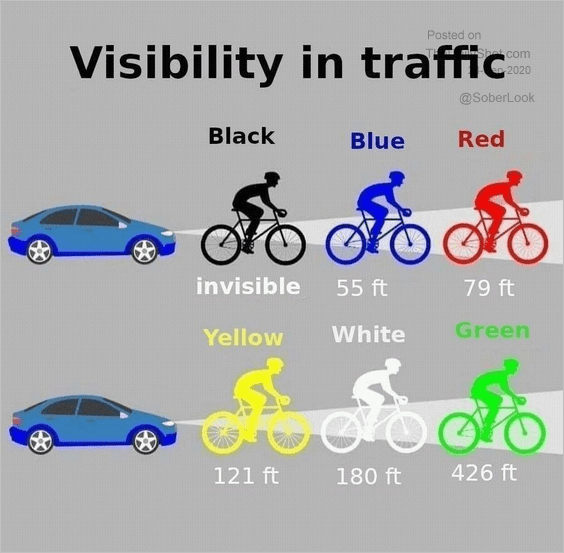

9. Visibility in the dark:

Source: @simongerman600 Read full article

Source: @simongerman600 Read full article

——————–