The Daily Shot: 25-Sep-20

• Administrative Update

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

Administrative Update

On September 30th at 12:30 PM EST, Sandy Leeds will be conducting a webinar on the latest market trends and economic developments. This event is a collaboration between The Daily Shot and Texas Executive Education (University of Texas). Our subscribers can sign up here.

The United States

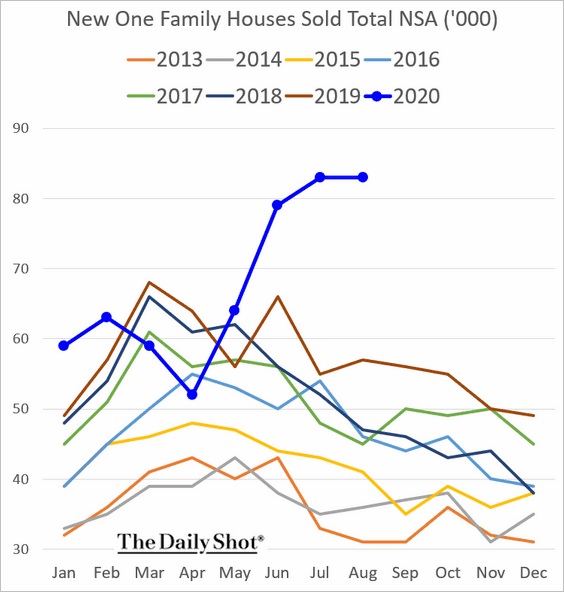

1. New home sales remain remarkably strong.

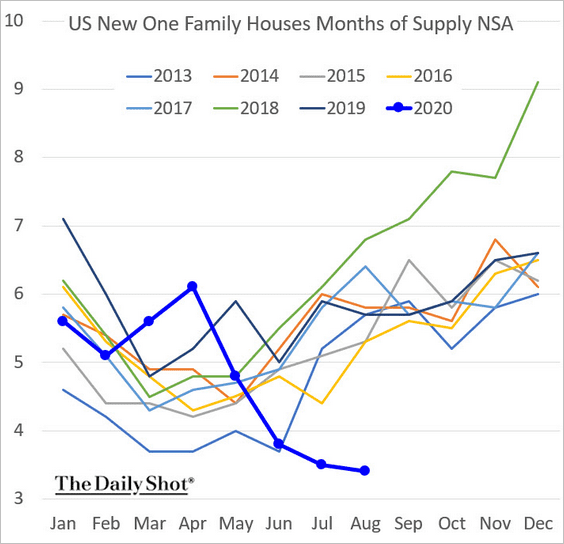

And inventories of new houses are at multi-year lows.

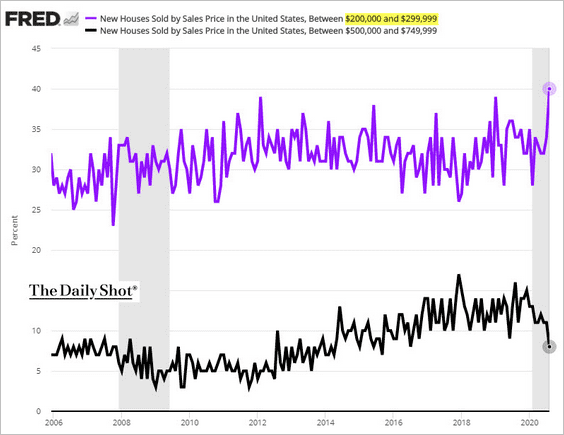

Builders have been selling more “starter” houses, while higher-end home sales saw a decline.

——————–

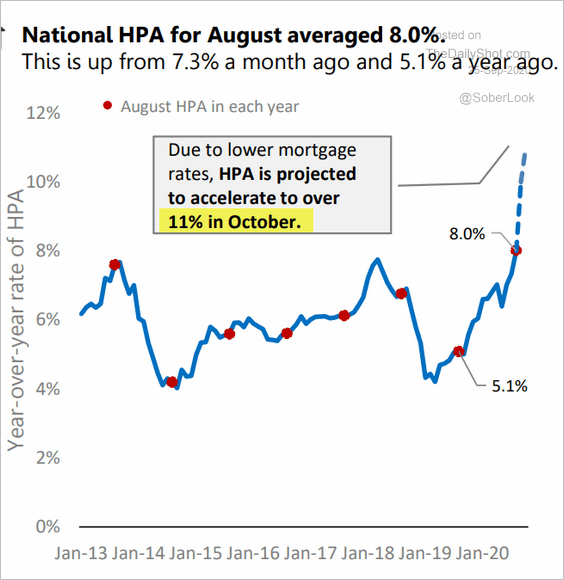

2. According to the AEI Housing Center, home price appreciation will reach 11% next month. Is the housing market overheating?

Source: AEI Housing Center

Source: AEI Housing Center

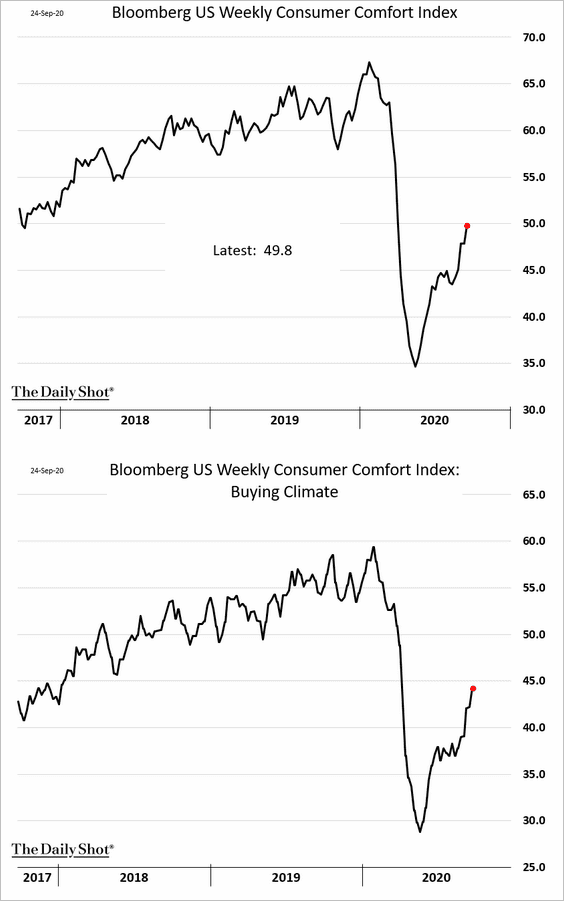

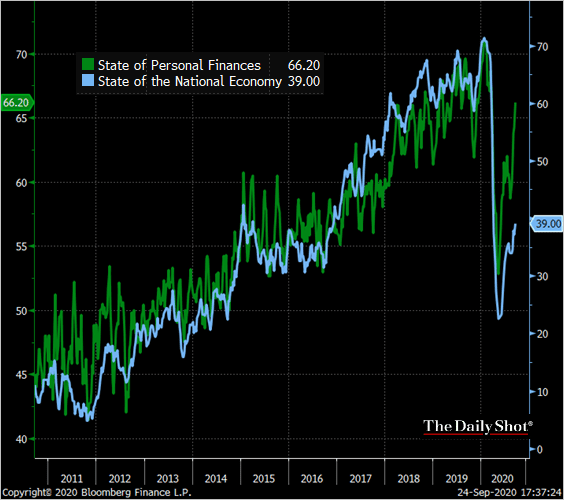

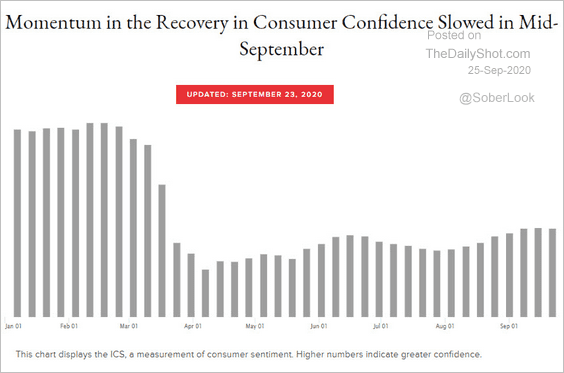

3. Next, we have some updates on consumer confidence.

• Bloomberg’s consumer sentiment continues to recover. The second chart below is the “buying climate” index.

• Bloomberg’s report shows that Americans are much more upbeat about personal finances than the state of the economy.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• An alternative sentiment index from Morning Consult shows a much more uneven recovery.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

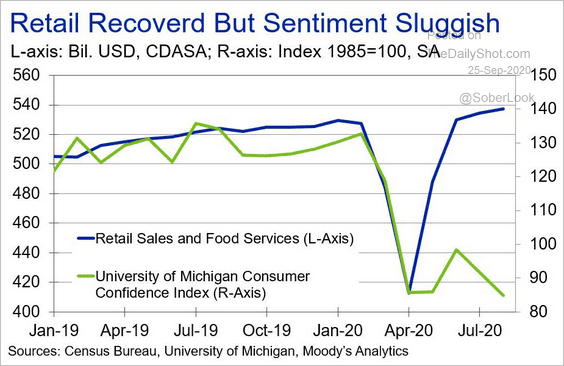

• There is a divergence between retail sales and consumer confidence.

Source: Moody’s Analytics

Source: Moody’s Analytics

——————–

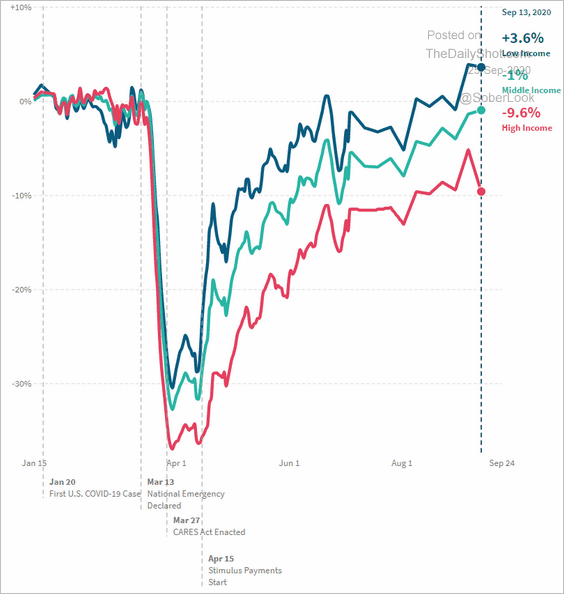

4. A measure of consumer spending from Harvard University shows that wealthier households remain much more cautious than those with lower incomes.

Source: Opportunity Insights

Source: Opportunity Insights

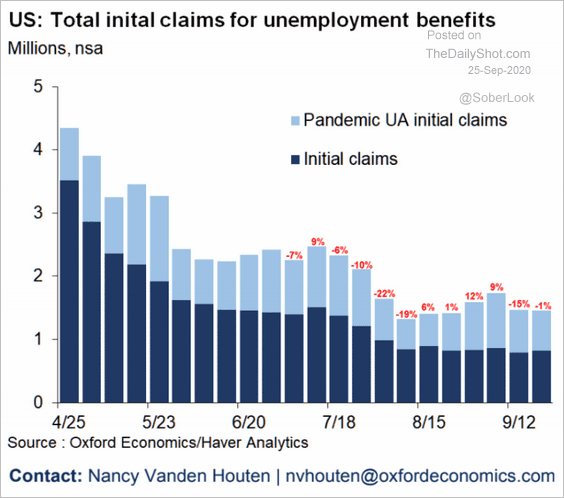

5. Once again, more than a million Americans filed for unemployment benefits last week. Initial jobless claims remain stubbornly high.

Source: Oxford Economics

Source: Oxford Economics

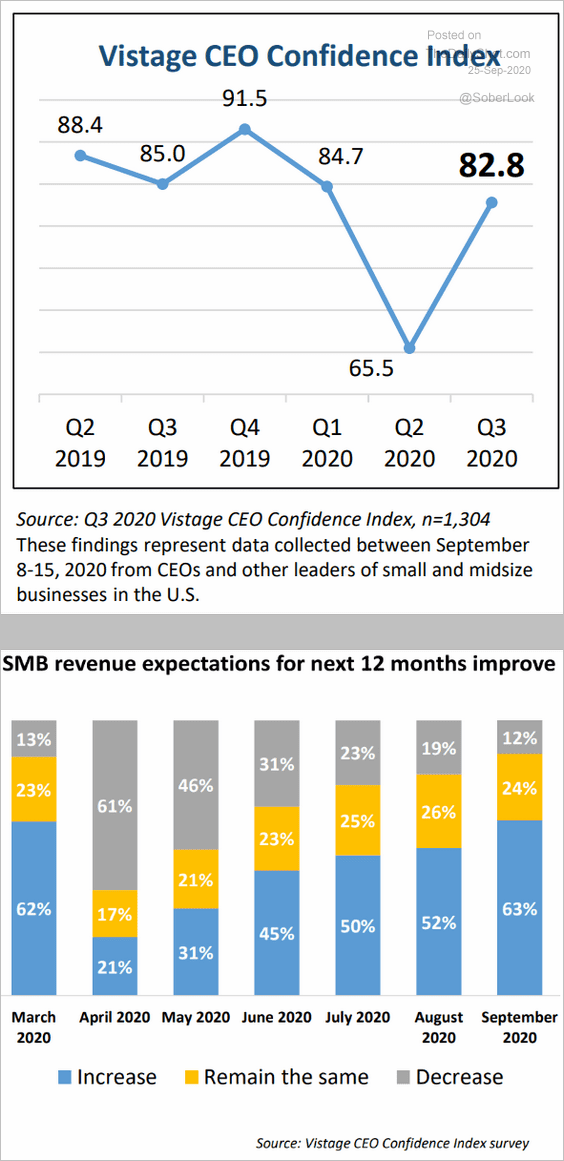

6. The Vistage CEO Confidence Index rebounded this quarter as small and medium-size firms feel more optimistic.

Source: Vistage

Source: Vistage

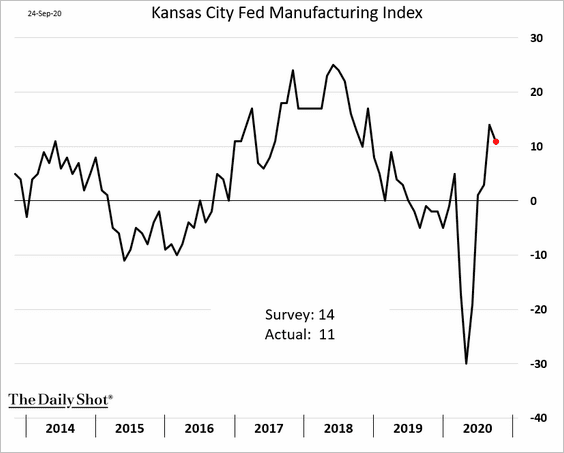

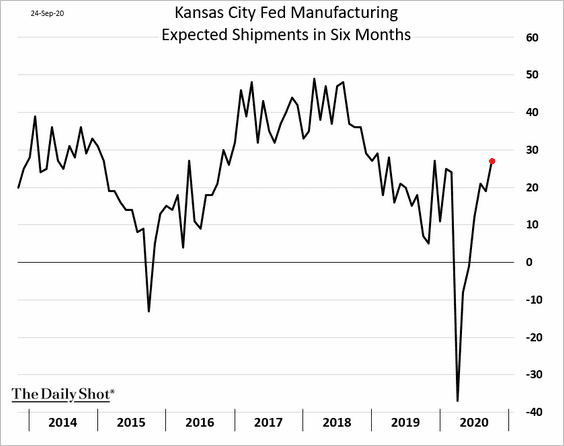

7. The Kansas City Fed’s factory activity gauge edged lower this month but remained robust.

The region’s manufacturers are increasingly upbeat about the future.

——————–

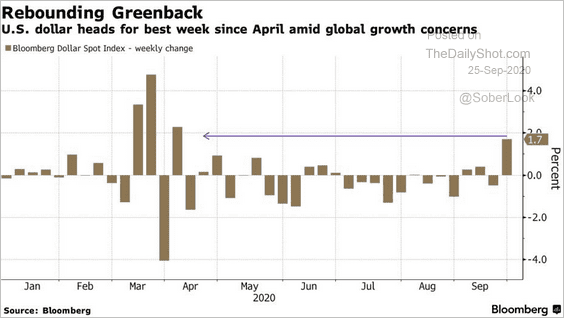

8. It’s been a good week for the US dollar.

Source: @markets Read full article

Source: @markets Read full article

Canada

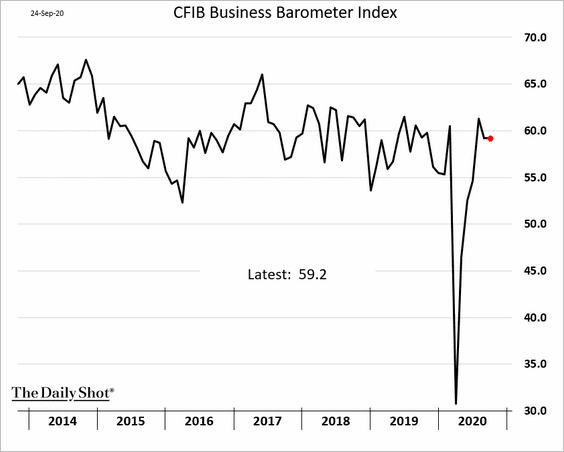

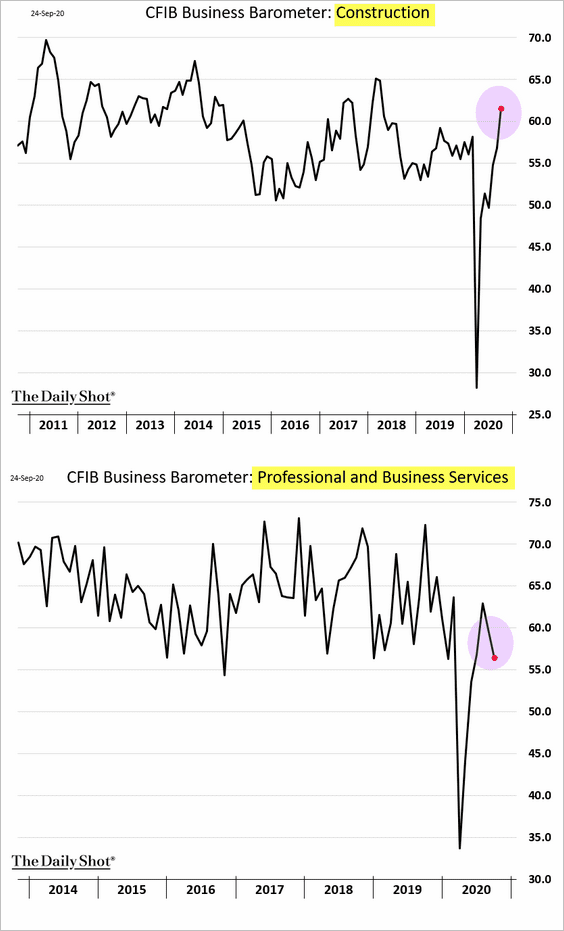

1. The CFIB small and medium-sized business index was flat this month. To be sure, the overall activity is at pre-crisis levels.

The underlying trends were a mixed bag. Here are a couple of examples.

——————–

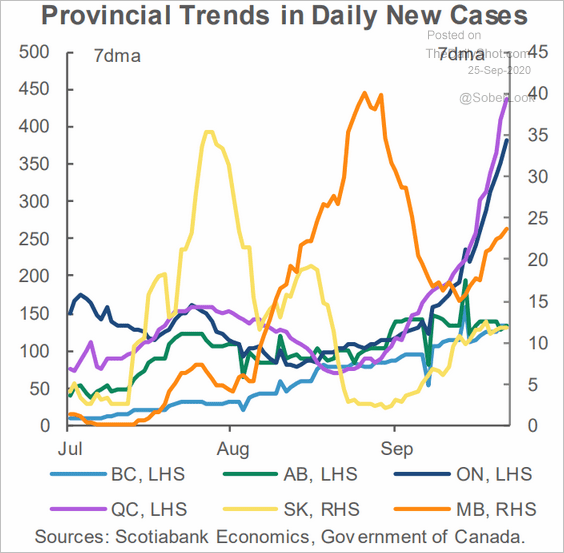

2. This chart shows the daily new COVID cases by province.

Source: Scotiabank Economics

Source: Scotiabank Economics

The United Kingdom

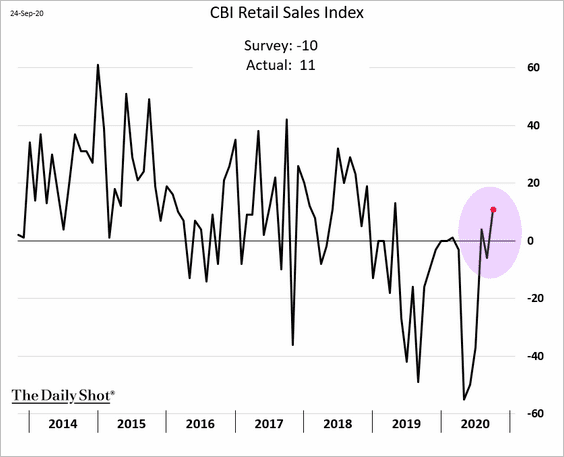

1. Retail sales rebounded sharply, according to CBI.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

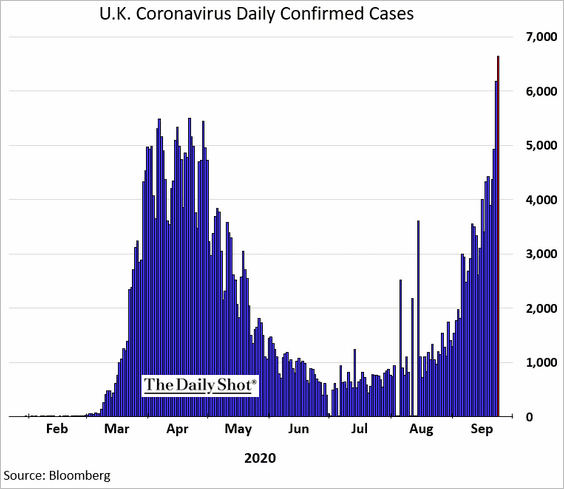

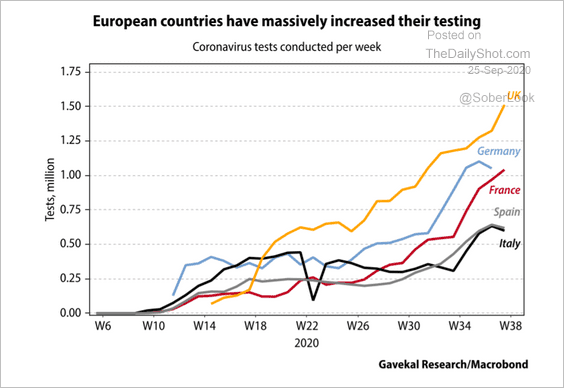

2. But these improvements could be at risk as the number of new infections hits a record.

Some (but not all) of these increases in new cases are due to more testing.

Source: Gavekal

Source: Gavekal

——————–

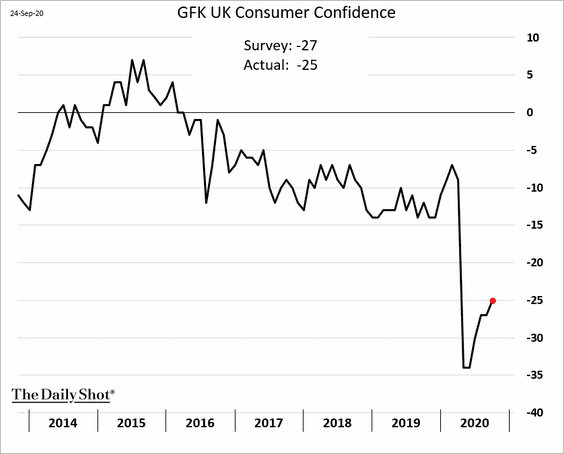

3. Consumer sentiment remains depressed.

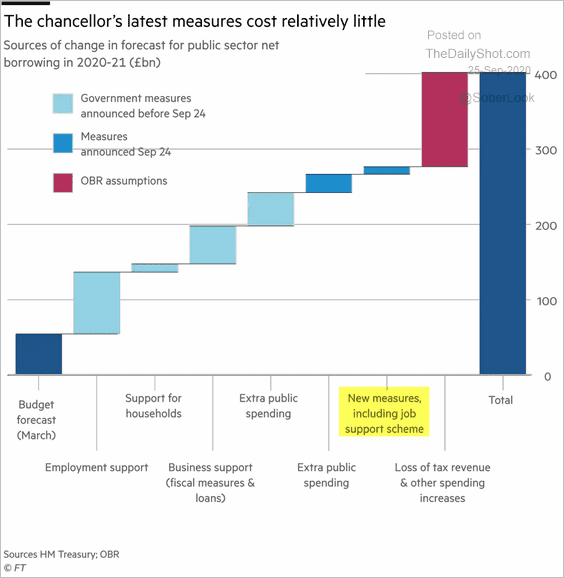

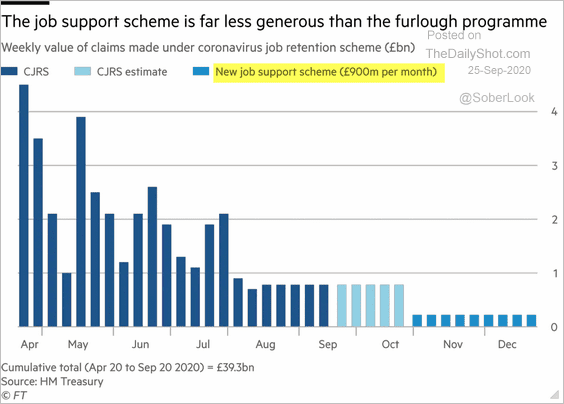

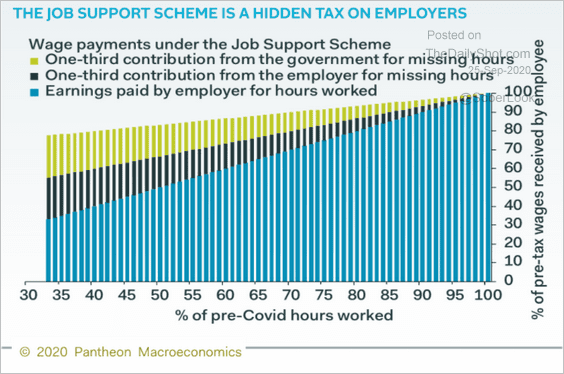

4. Analysts are skeptical about the latest job support scheme from the government.

• While the new program is relatively inexpensive, …

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• … it relies on employers contributing to the scheme.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Why would companies pay part-time employees for hours they don’t work when they can hire full-time workers?

——————–

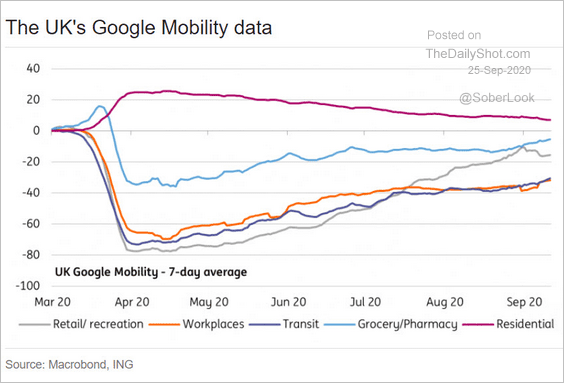

5. Here is the latest mobility data.

Source: ING

Source: ING

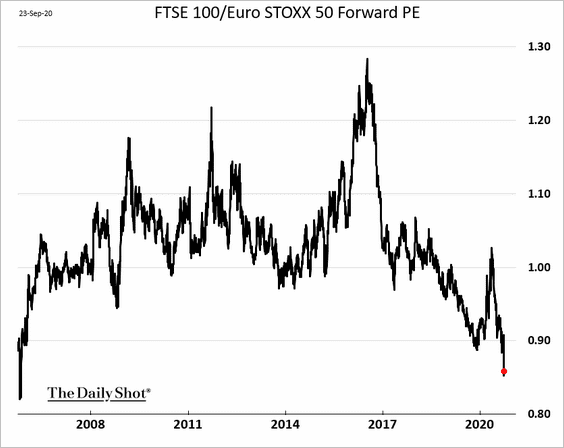

6. UK shares appear to be extremely cheap relative to other European firms.

h/t @mikamsika

h/t @mikamsika

The Eurozone

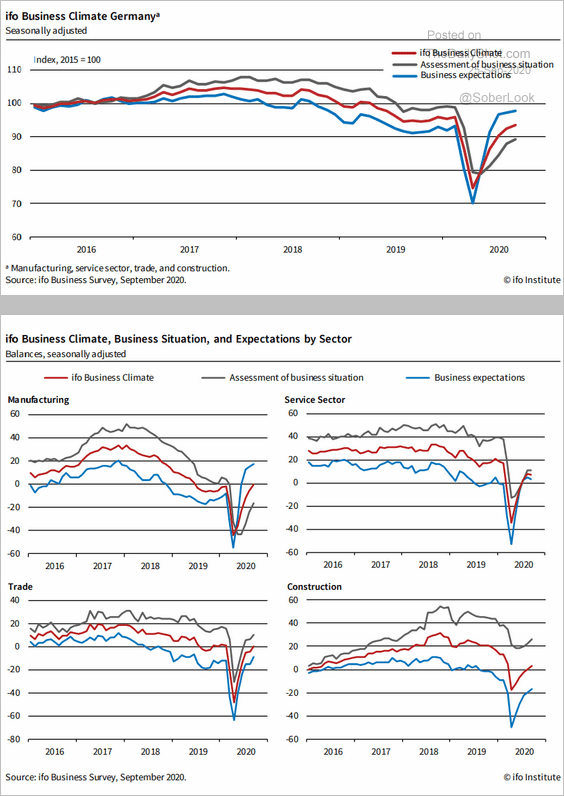

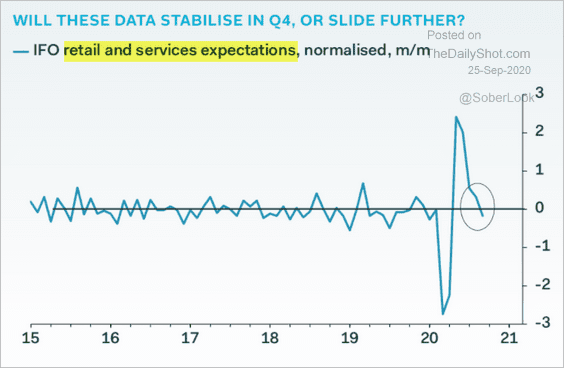

1. The rebound in Germany’s Ifo business climate indicators is moderating.

Source: ifo Institute

Source: ifo Institute

Services, in particular, showed a loss of momentum due to the second wave of the pandemic.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

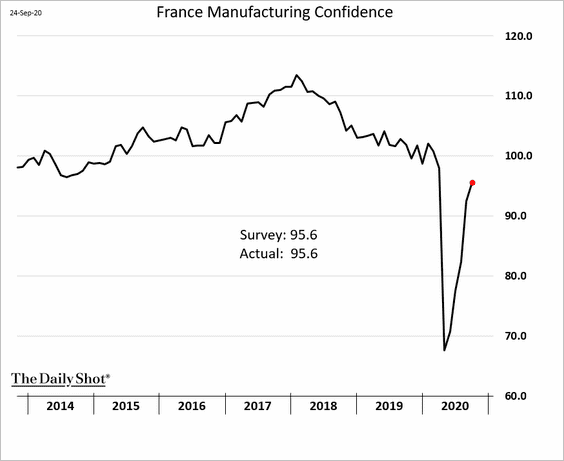

2. French manufacturing confidence continues to recover.

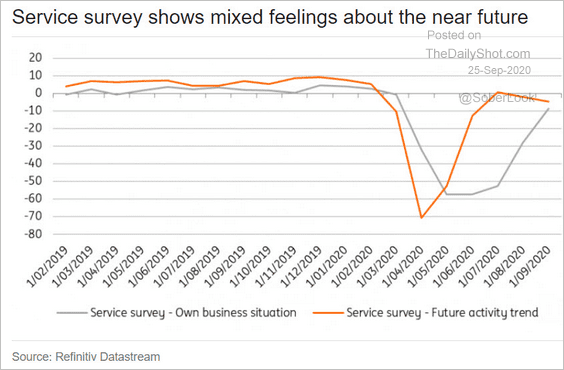

But just like in Germany, service businesses are becoming less upbeat.

Source: ING

Source: ING

——————–

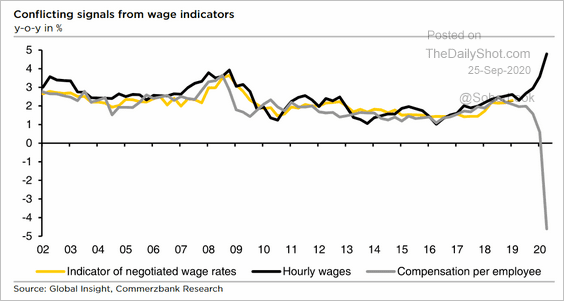

3. The pandemic has distorted the Eurozone’s wage metrics.

Source: Commerzbank Research

Source: Commerzbank Research

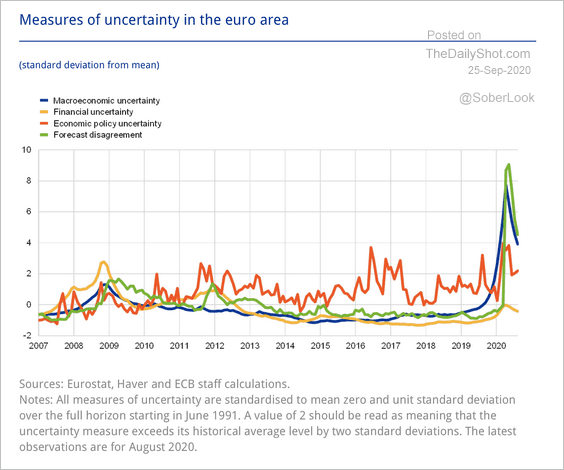

4. Here are some measures of uncertainty.

Source: ECB Read full article

Source: ECB Read full article

Europe

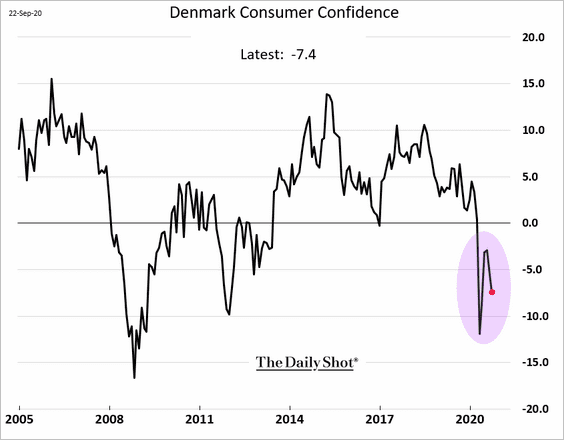

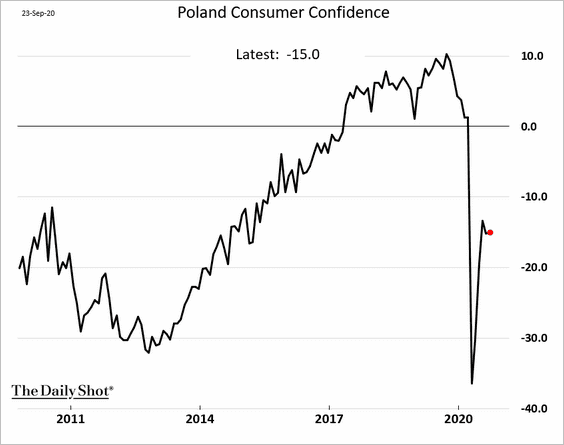

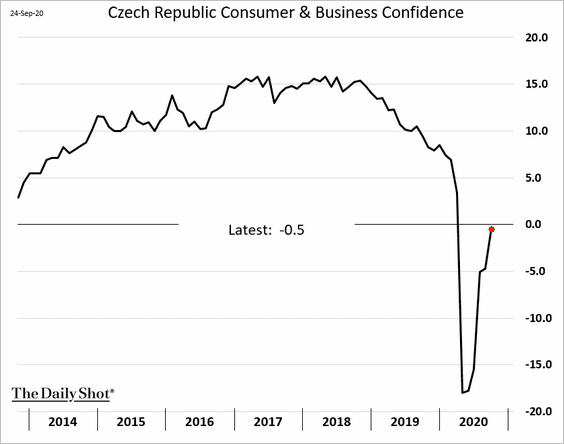

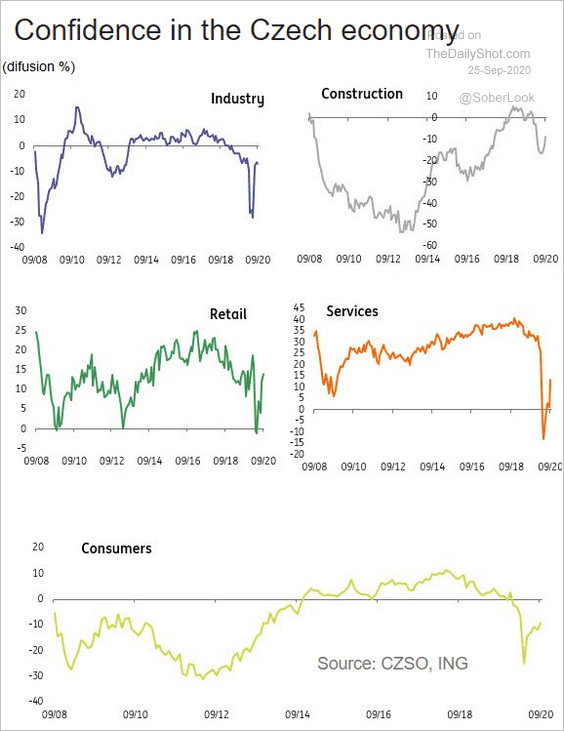

1. Let’s take a look at some sentiment indicators.

• Denmark:

• Poland:

• The Czech Republic (2 charts):

Source: ING

Source: ING

——————–

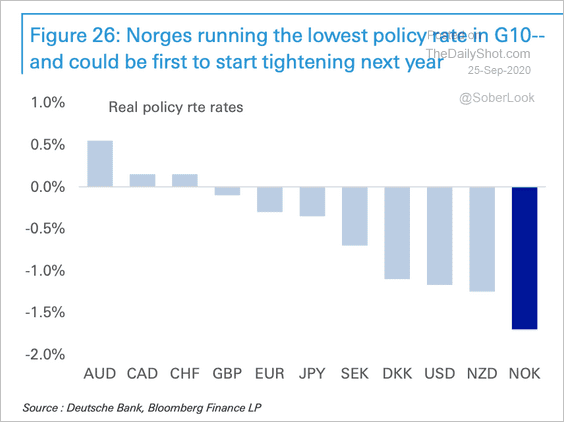

2. Norway has the lowest real rates in the developed world. Will the Norges Bank be the first to tighten?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

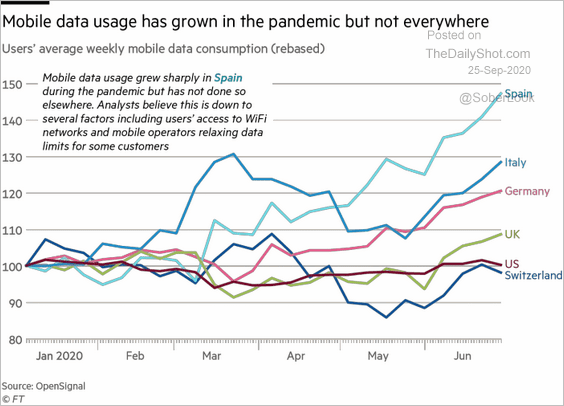

3. This chart shows mobile data usage in Western Europe.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Asia – Pacific

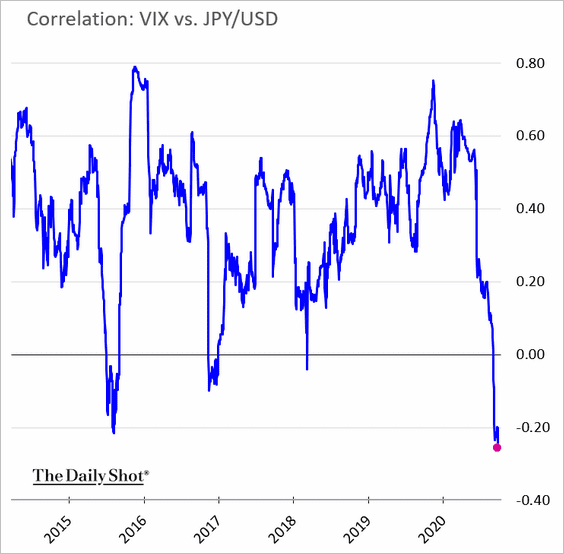

1. Lately, the yen has been less of a “safe-haven” asset. Here is the correlation with VIX.

h/t Masaki Kondo

h/t Masaki Kondo

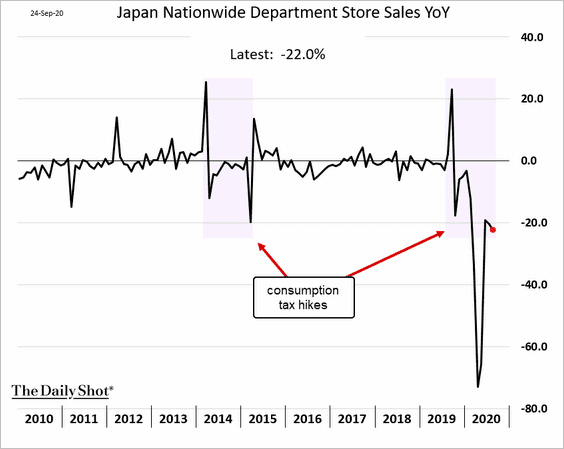

2. Japan’s department store dales remain depressed.

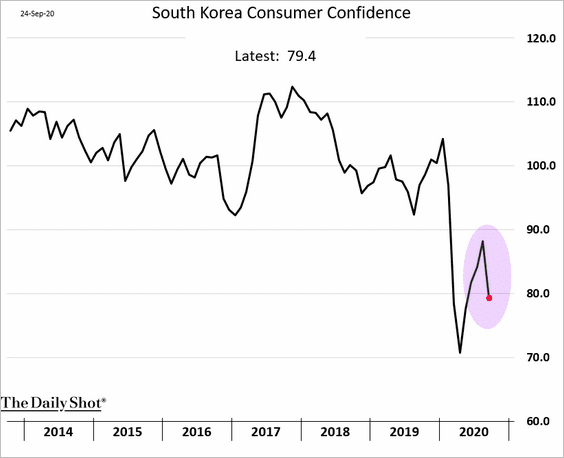

3. South Korea’s consumer confidence has deteriorated again.

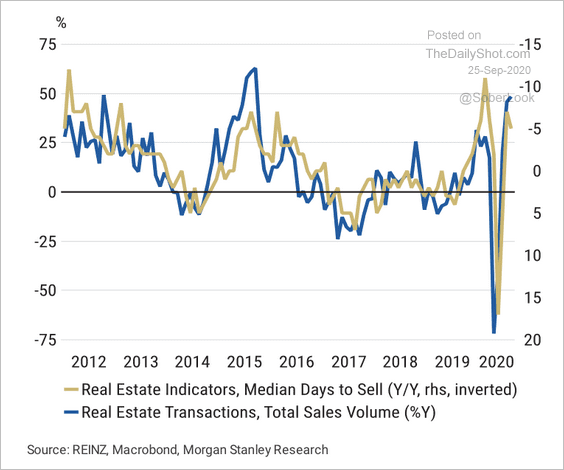

4. New Zealand’s housing market has rebounded, in part due to the RBNZ’s dovish policies.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

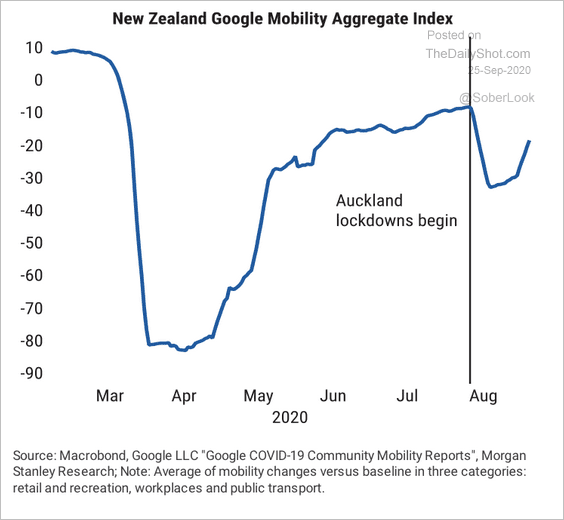

The recent lockdown in Auckland has temporarily weighed on economic activity.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

China

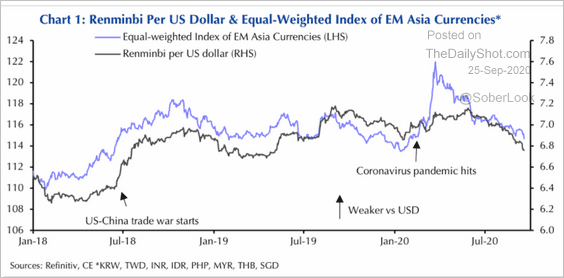

1. Capital Economics expects the renminbi to pull up other Asian currencies in the months ahead.

Source: Capital Economics

Source: Capital Economics

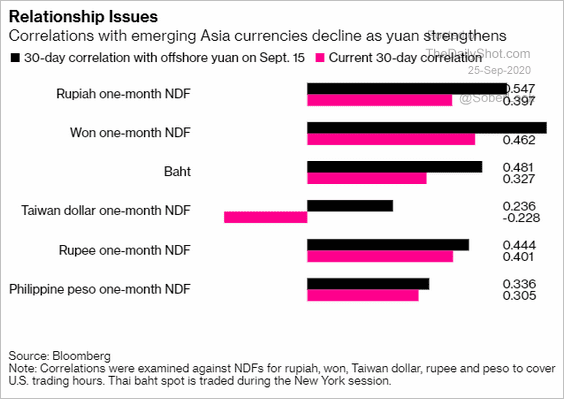

For now, the correlation between the yuan and other Asian currencies has weakened.

Source: @markets Read full article

Source: @markets Read full article

——————–

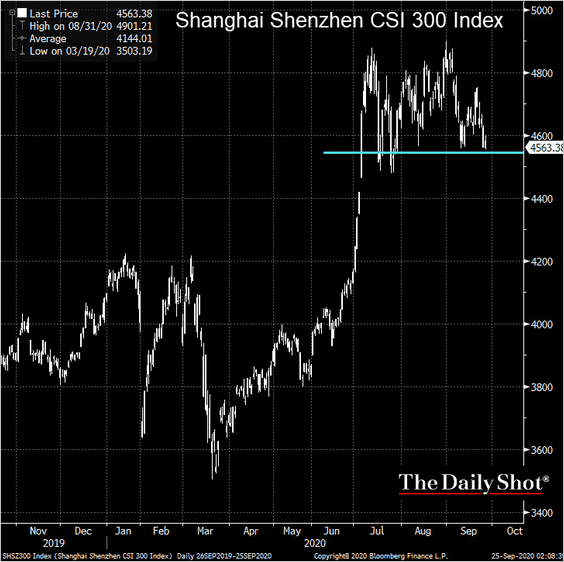

2. China’s key stock market indicator is at support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

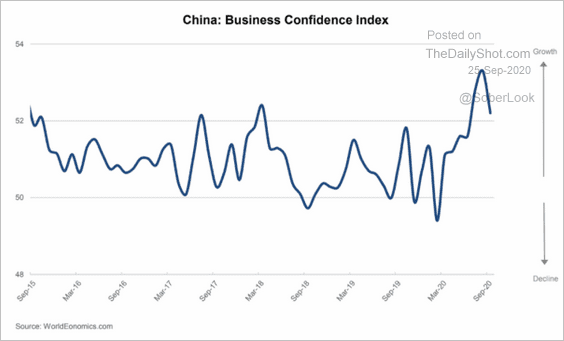

3. The World Economics SMI report shows that the post-lockdown bounce in business optimism is waning.

Source: World Economics

Source: World Economics

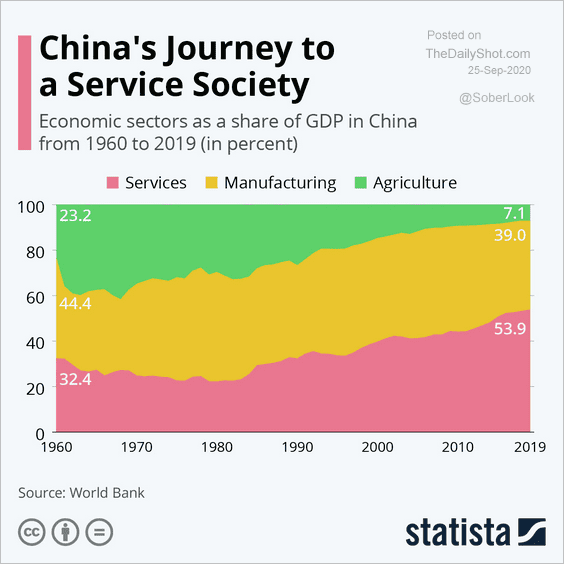

4. China’s service sector share of the GDP continues to grow.

Source: Statista

Source: Statista

Emerging Markets

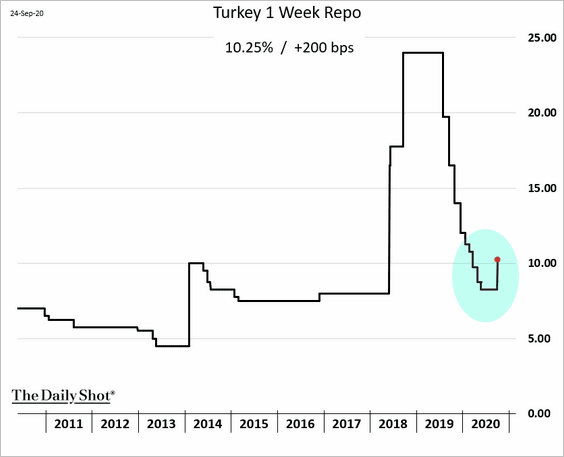

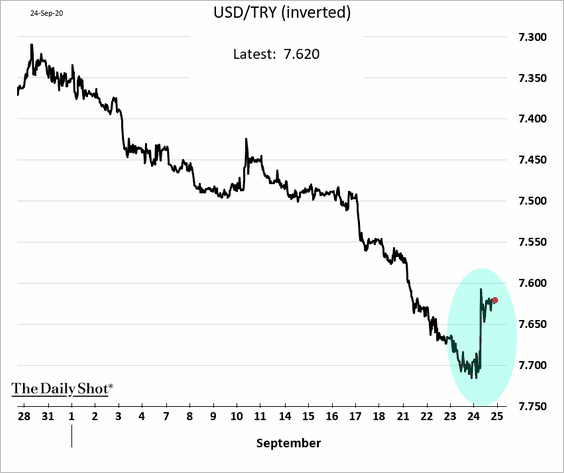

1. Let’s begin with Turkey.

• The central bank surprised the markets with a massive rate hike to defend the lira.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

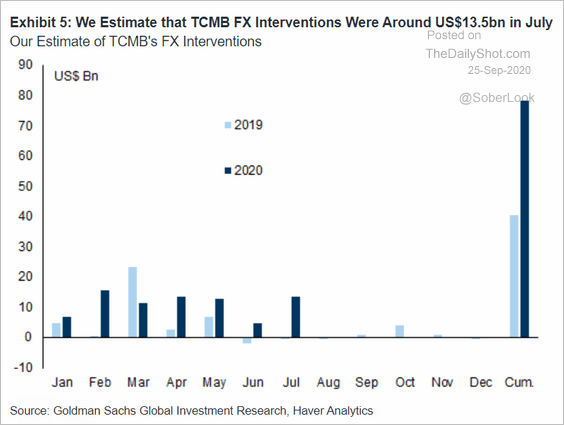

The central bank has been spending a tremendous amount of F/X reserves to defend the currency, …

Source: Goldman Sachs

Source: Goldman Sachs

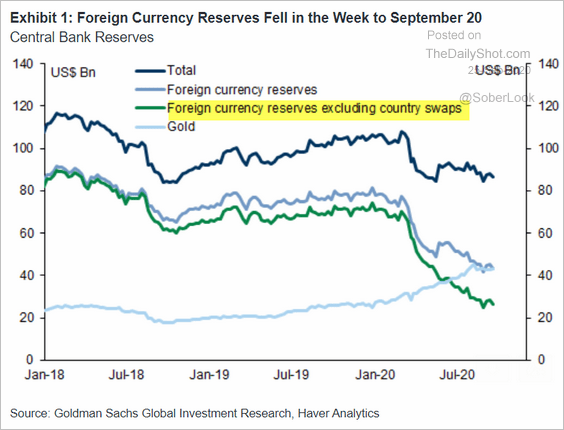

… but it can’t afford to do so for much longer as reserves dwindle (without boosting the lira). So it opted for a rate hike instead.

Source: Goldman Sachs

Source: Goldman Sachs

The lira jumped.

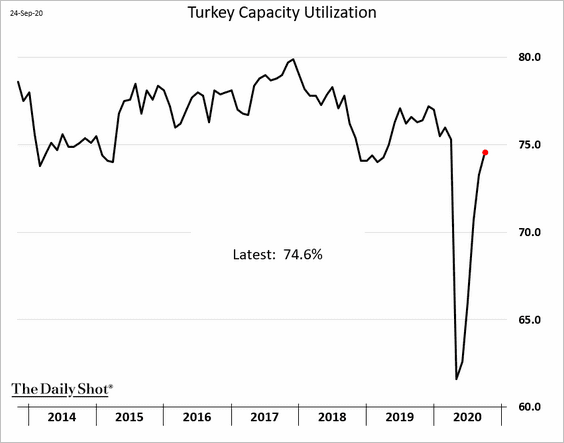

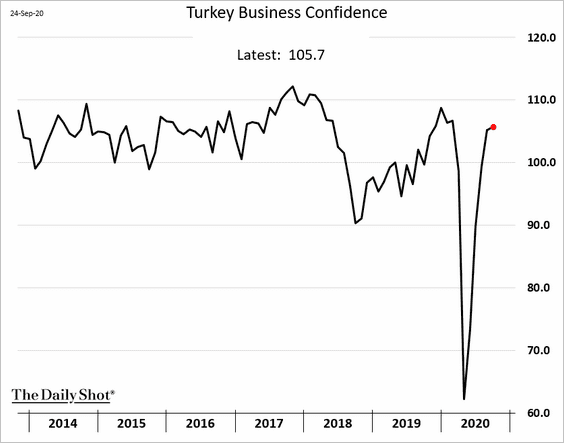

• Capacity utilization and business confidence have been improving.

——————–

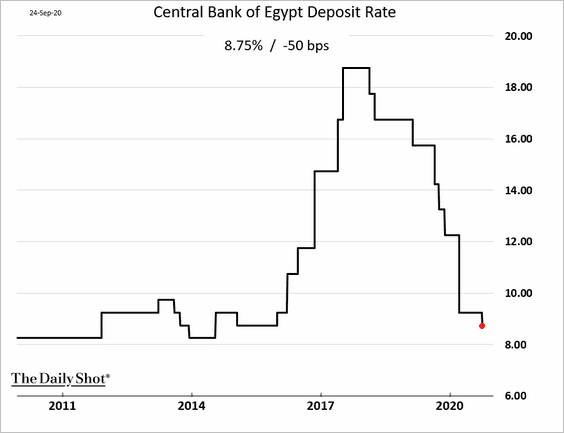

2. Egypt’s central bank cut rates as inflation eases.

Source: Nasdaq/Reuters Read full article

Source: Nasdaq/Reuters Read full article

——————–

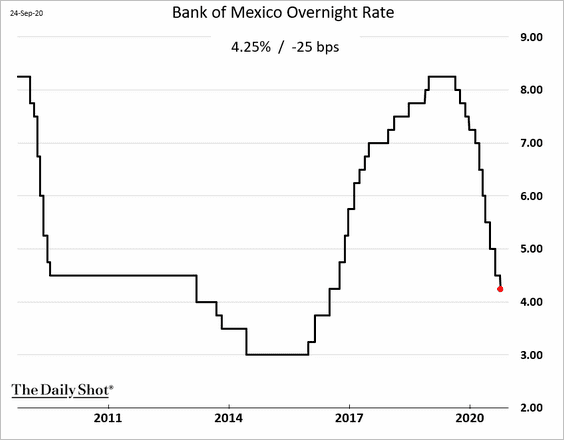

3. Mexico’s central bank also cut rates despite higher inflation. The economy has been in such bad shape, Banxico had little choice.

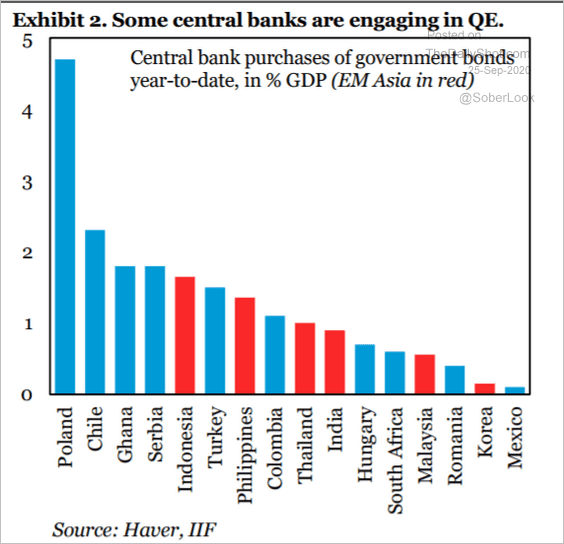

4. Some EM central banks have been engaging in QE.

Source: IIF

Source: IIF

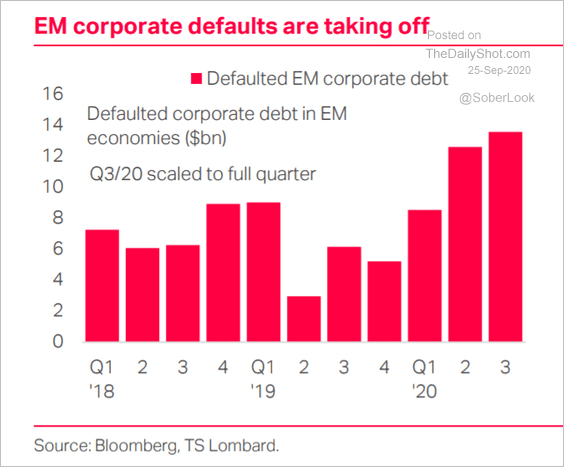

5. EM corporate defaults have been rising.

Source: TS Lombard

Source: TS Lombard

Commodities

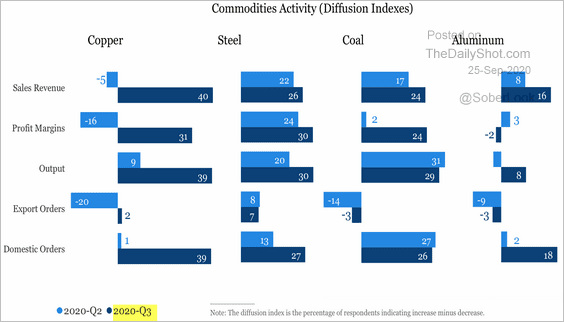

1. China’s demand for industrial commodities has been strengthening.

• Diffusion indices from the China Beige Book report:

Source: China Beige Book

Source: China Beige Book

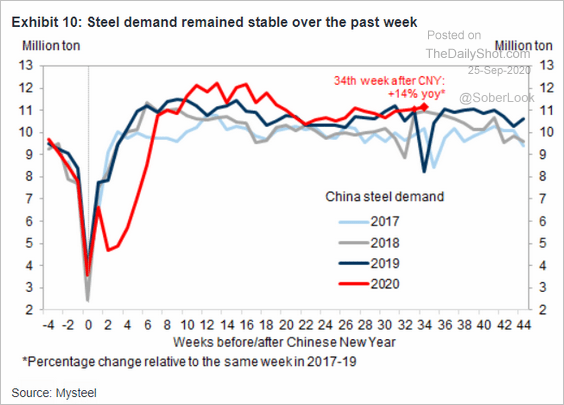

• Steel demand:

Source: Goldman Sachs

Source: Goldman Sachs

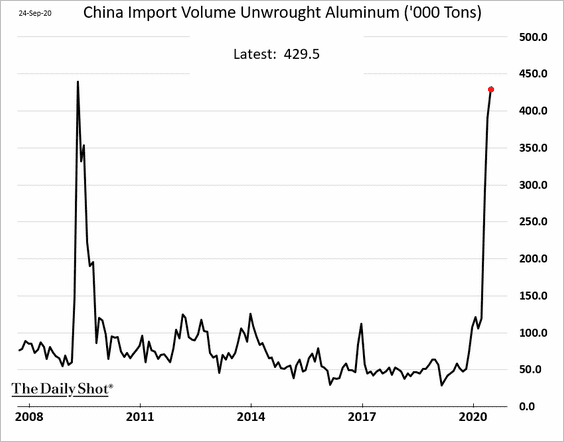

• Aluminum imports:

h/t @PhoebeSedge

h/t @PhoebeSedge

——————–

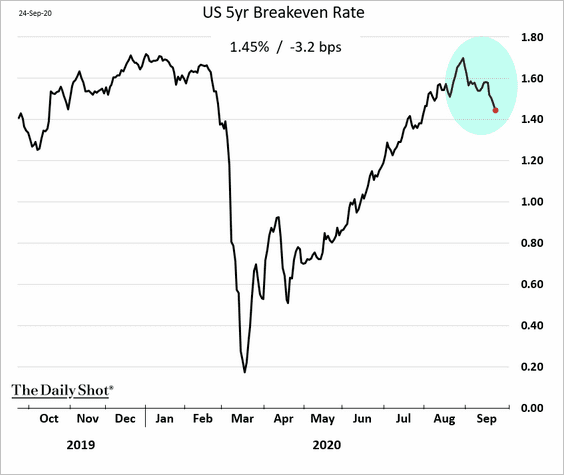

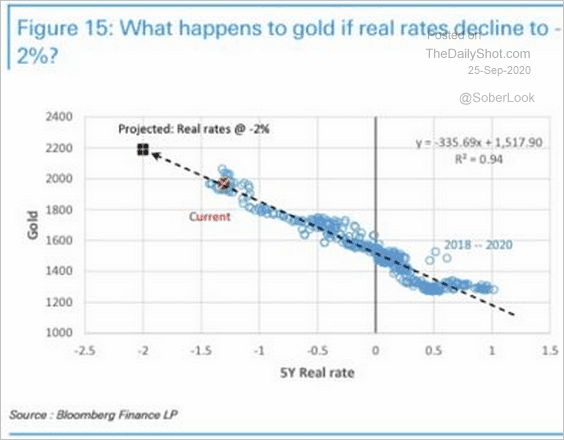

2. Moderating inflation expectations (chart below) and a stronger dollar have been pressuring gold.

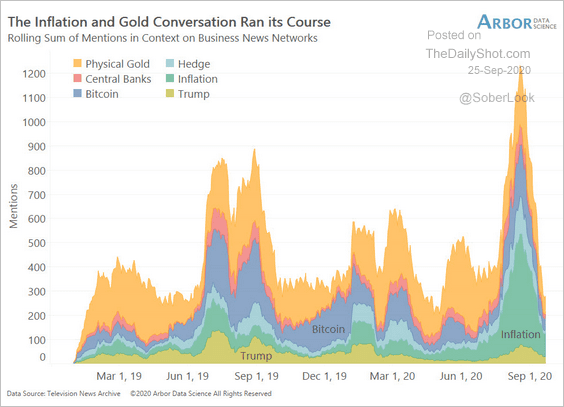

This chart shows declining interest in gold and inflation.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

However, should real rates move lower, the rally in gold will resume.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Energy

1. BP shares closed at the lowest level in 25 years as energy-sector investors continue to sell.

Source: @JavierBlas

Source: @JavierBlas

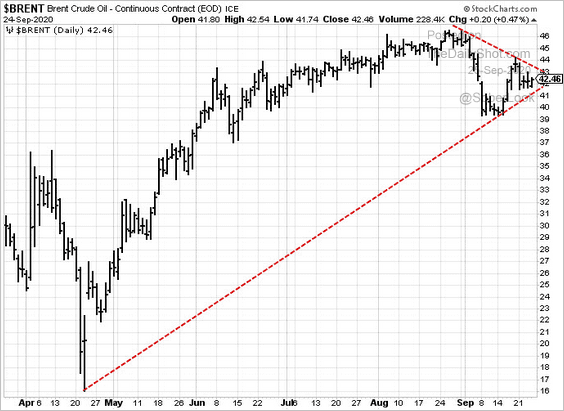

2. Brent has been consolidating.

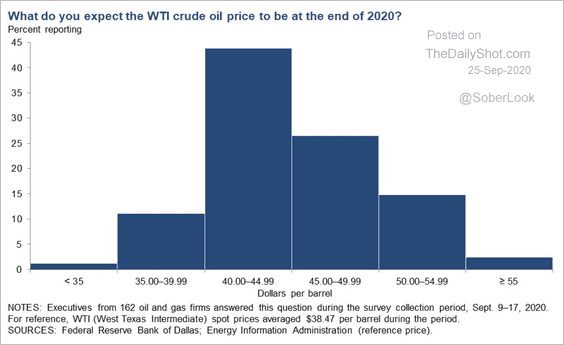

3. Where do energy companies see WTI by the end of the year? Here is the Dallas Fed Energy Survey result.

Source: Federal Reserve Bank of Dallas

Source: Federal Reserve Bank of Dallas

Equities

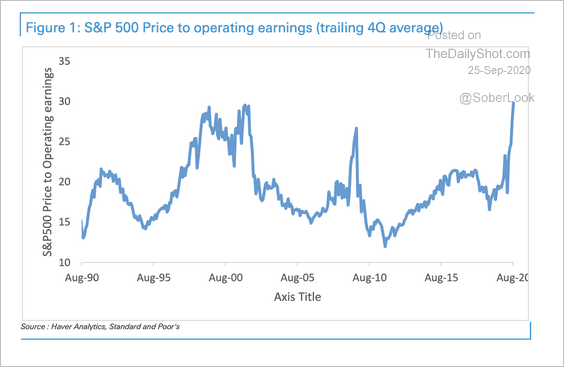

1. Stock valuations remain a concern.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

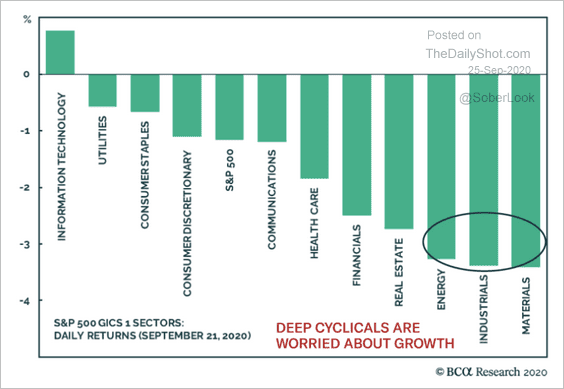

2. IT was the only sector to hold onto positive returns (following a record run) so far this month.

Source: BCA Research

Source: BCA Research

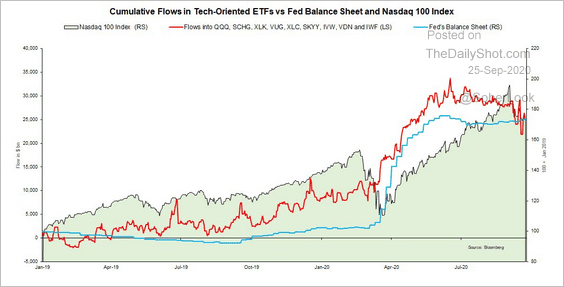

3. This chart shows how flows into tech-oriented ETFs have led the Nasdaq index, closely tracking growth in the Fed’s balance sheet.

Source: @VincentDeluard

Source: @VincentDeluard

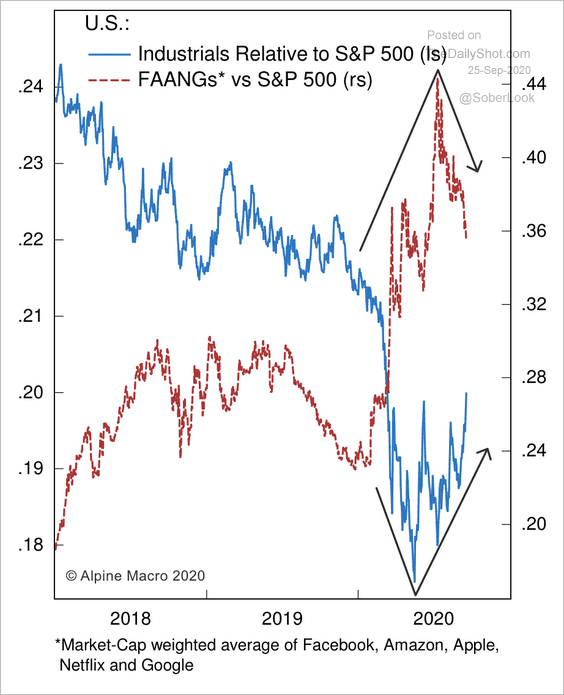

4. Are we seeing a market rotation out of large tech and into industrials?

Source: Alpine Macro

Source: Alpine Macro

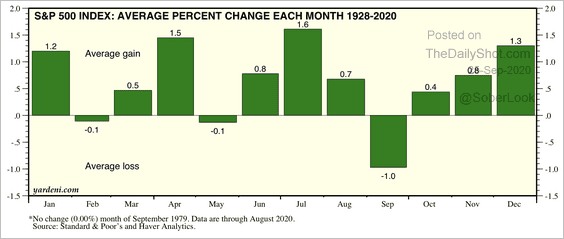

5. On average, September tends to be a difficult month for the S&P 500, before a recovery in Q4.

Source: Yardeni Research

Source: Yardeni Research

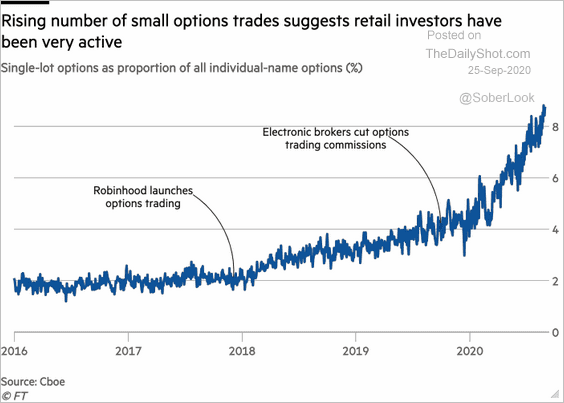

6. Will we see a decline in retail options frenzy after the recent selloff?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

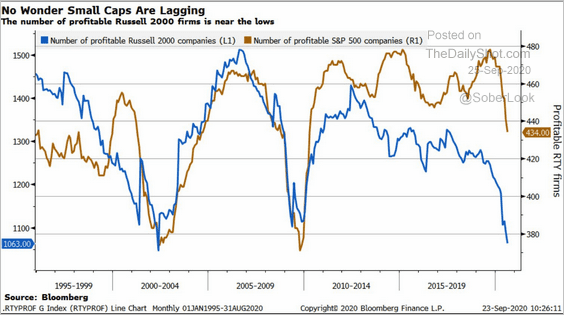

7. A much higher percentage of small firms have been unprofitable vs. larger companies.

Source: Bloomberg Finance L.P., @LizAnnSonders

Source: Bloomberg Finance L.P., @LizAnnSonders

Credit

1. US high-yield sales hit a new record.

Source: @markets Read full article

Source: @markets Read full article

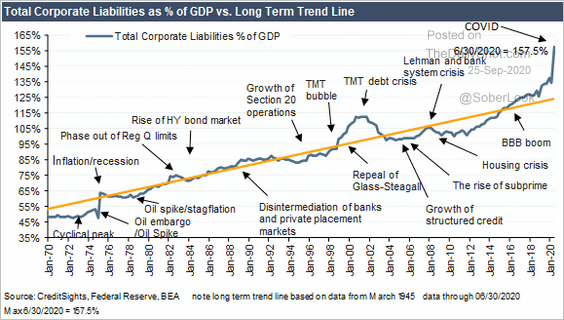

2. Below, we have the total US corporate liabilities as a percent of the GDP.

Source: CreditSights

Source: CreditSights

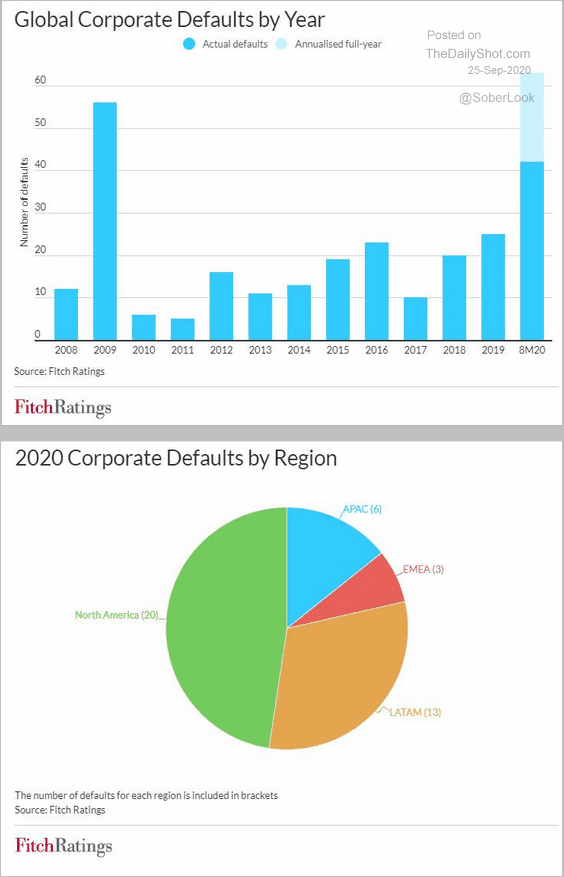

3. This chart shows corporate defaults globally.

Source: Fitch Ratings

Source: Fitch Ratings

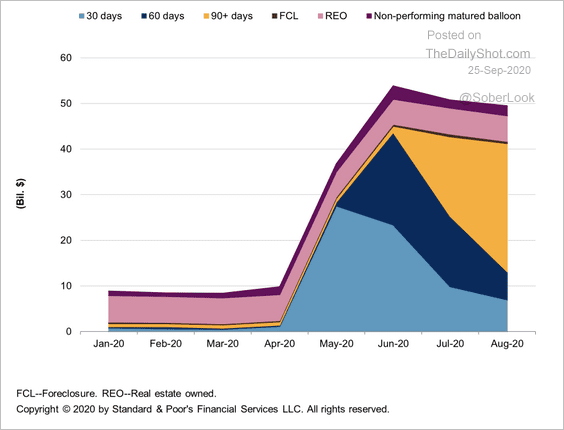

4. Commercial real estate mortgages that are 90+ days past due have been rising.

Source: S&P Global Ratings

Source: S&P Global Ratings

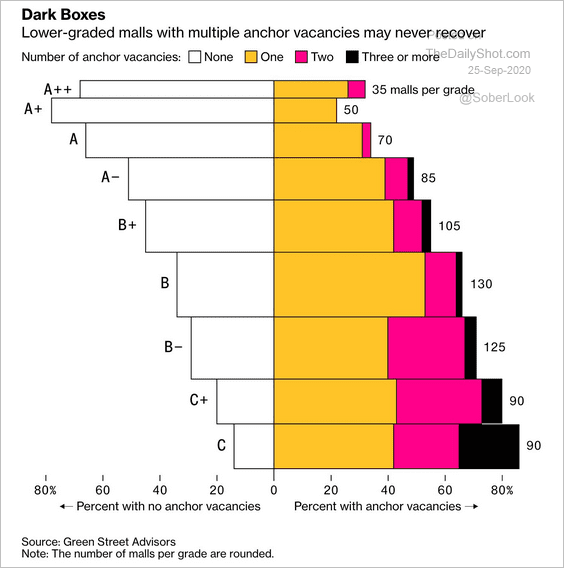

Many retail properties have been struggling, and some are never coming back.

Source: @adam_tooze, @bbgvisualdata Read full article

Source: @adam_tooze, @bbgvisualdata Read full article

Rates

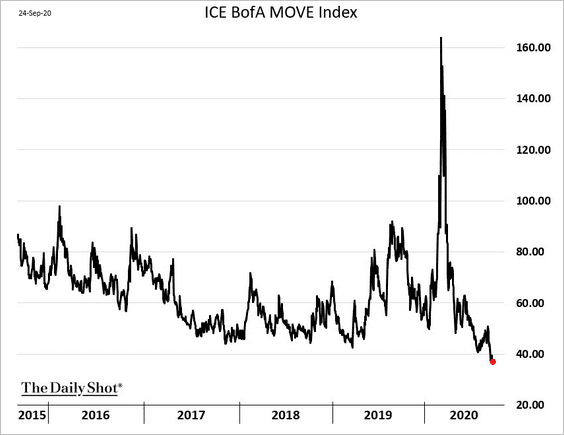

1. Treasury implied volatility continues to hit new lows (chart below) as yields remain stuck in a range (2nd chart).

——————–

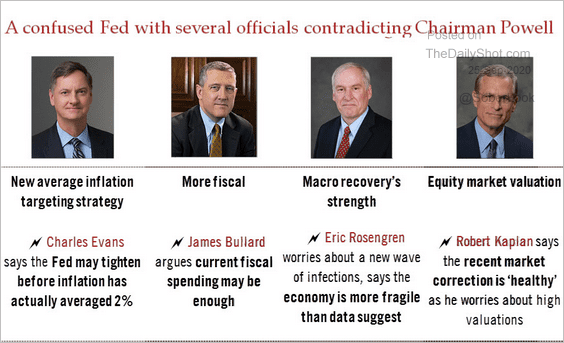

2. Recently, we’ve been getting conflicting messages from key Fed officials.

Source: @TCosterg

Source: @TCosterg

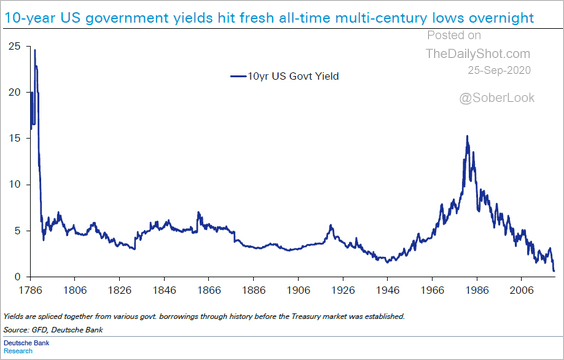

3. This chart shows US government borrowing costs going back to 1786.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

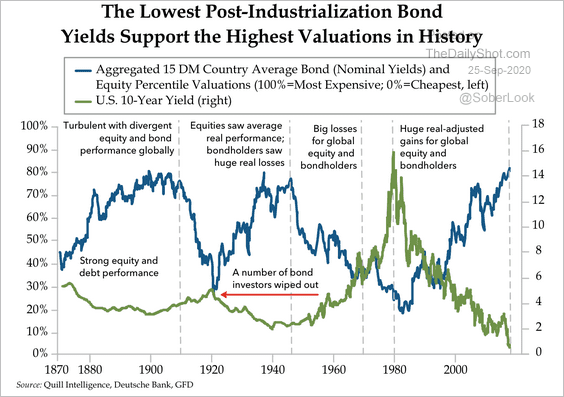

4. Globally, we are seeing record-low bond yields and record-high fixed-income valuations.

Source: Quill Intelligence

Source: Quill Intelligence

Global Developments

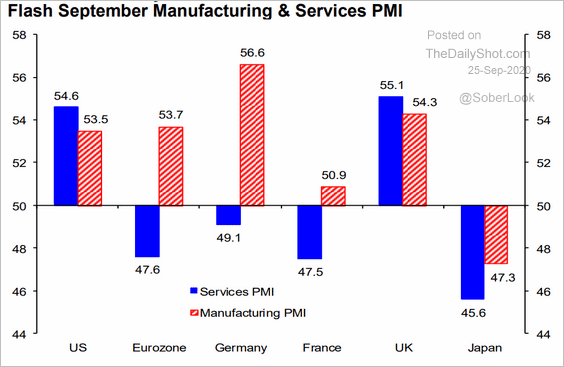

1. Let’s start with the September preliminary Markit PMI figures.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

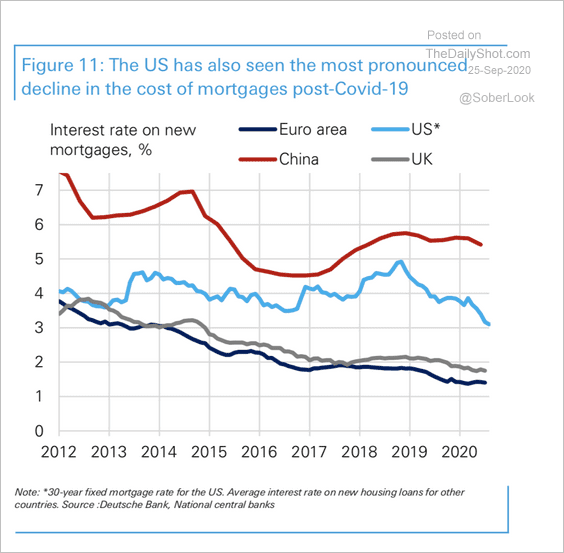

2. Mortgage rate declines in the US have been the most pronounced.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

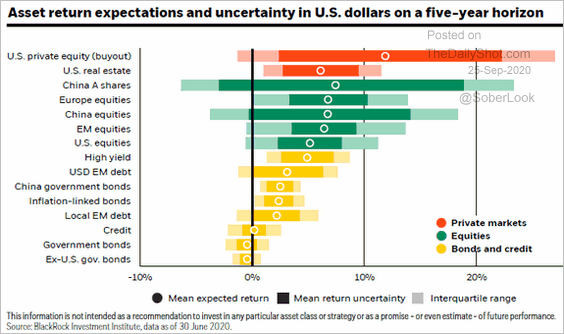

3. Here is the distribution of projected five-year returns across asset classes.

Source: @ISABELNET_SA, @blackrock

Source: @ISABELNET_SA, @blackrock

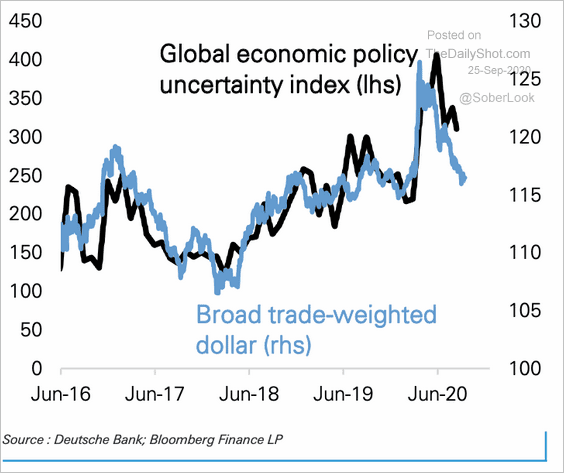

4. The US dollar has been correlated with the global economic policy uncertainty index.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

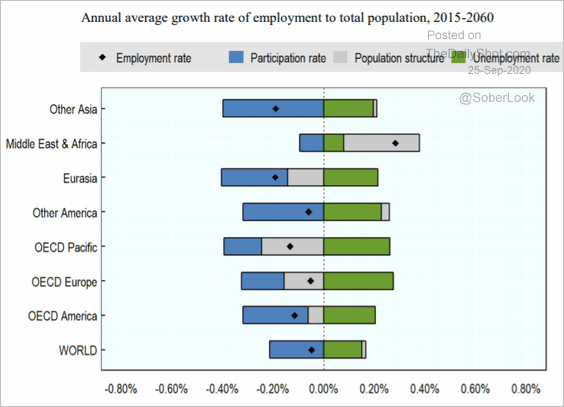

5. What are the components of global employment growth over the next few decades?

Source: OECD Read full article

Source: OECD Read full article

——————–

Food for Thought

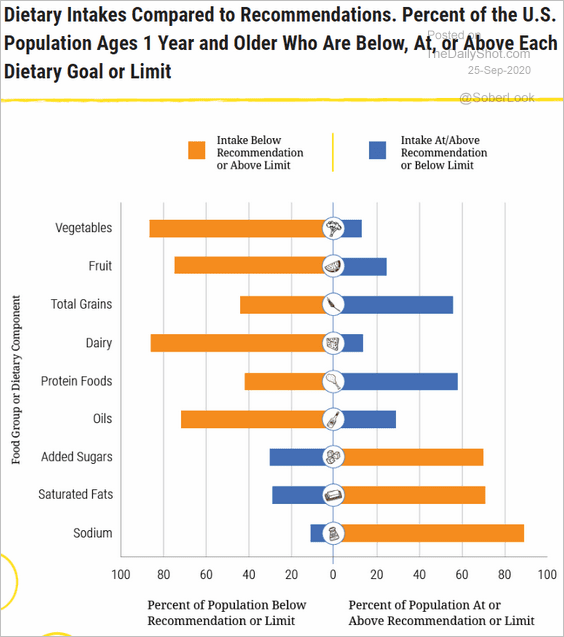

1. US dietary intakes vs. recommendations:

Source: health.gov

Source: health.gov

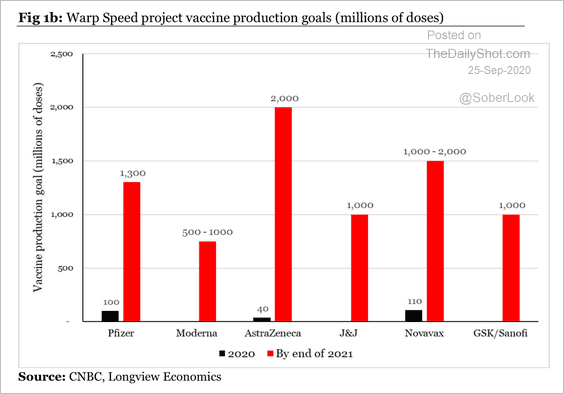

2. Vaccine production goals:

Source: Longview Economics

Source: Longview Economics

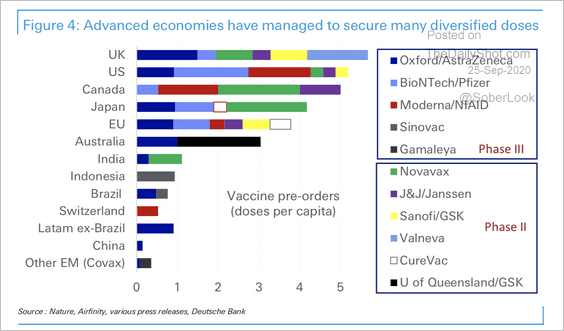

3. Advanced economies securing vaccine supplies from multiple manufacturers:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

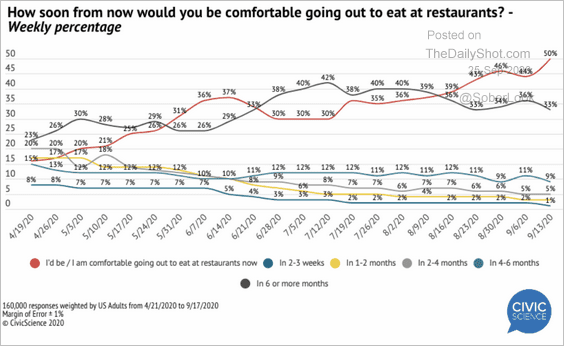

4. Going out to eat:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

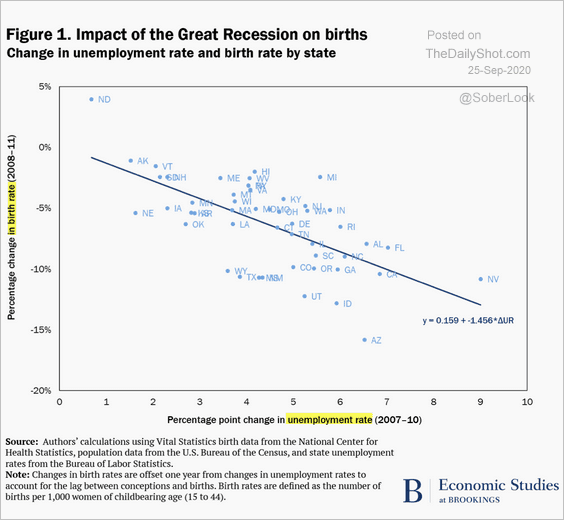

5. US birth rates vs. the unemployment rate during the Great Recession (by state):

Source: The Brookings Institution Read full article

Source: The Brookings Institution Read full article

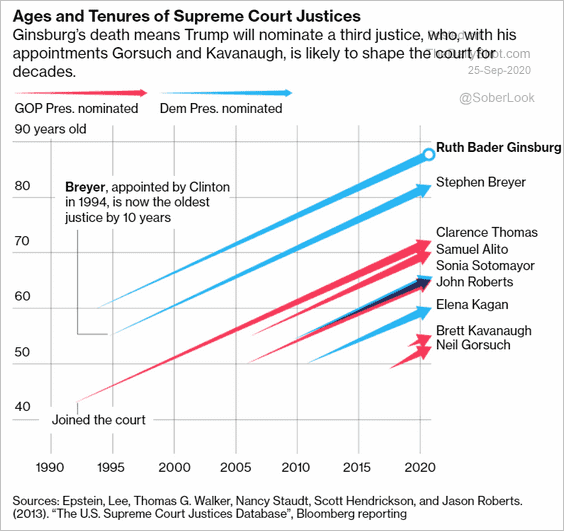

6. Ages and tenures of US Supreme Court justices:

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

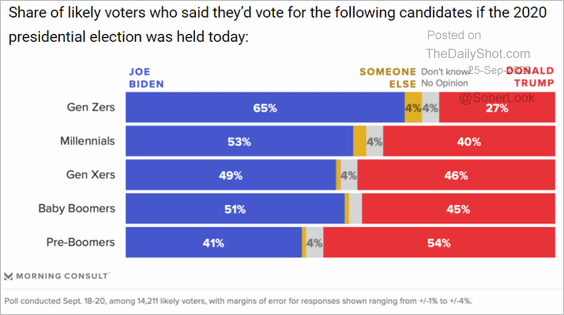

7. Political preferences by generation:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

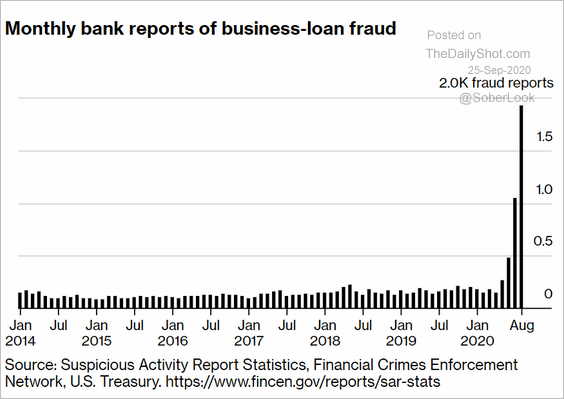

8. Business loan fraud in the US:

Source: @business Read full article

Source: @business Read full article

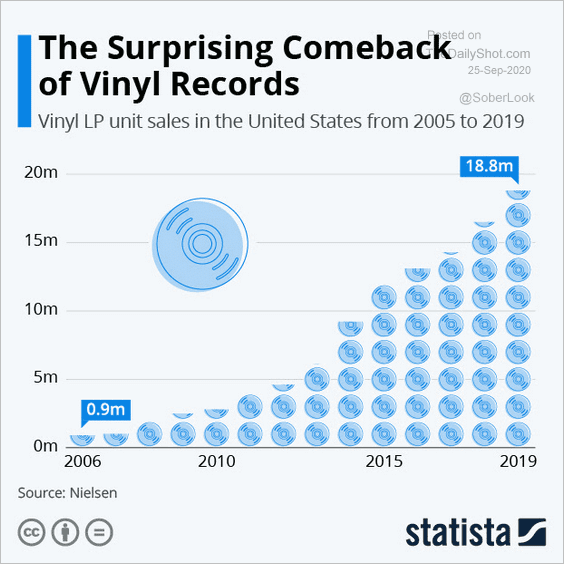

9. The comeback of vinyl records:

Source: Statista

Source: Statista

——————–

Have a great weekend!