The Daily Shot: 29-Sep-20

• The United States

• Canada

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Alternatives

• Food for Thought

The United States

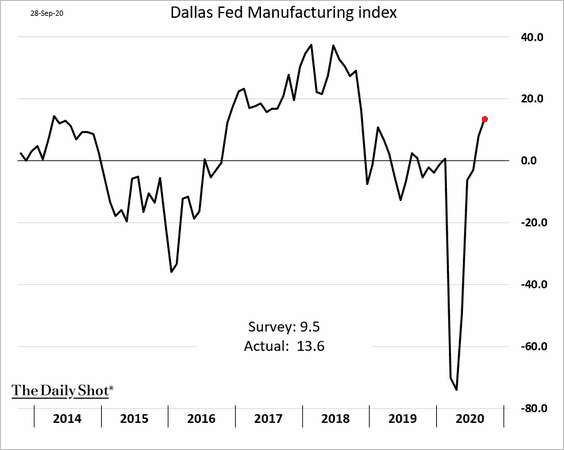

1. Texas-area factory activity accelerated this month, according to the Dallas Fed survey.

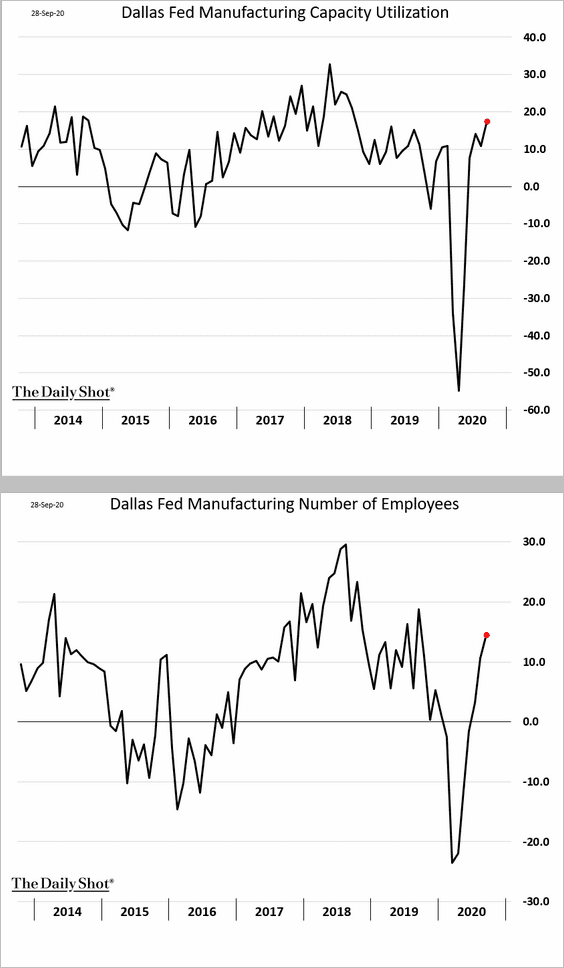

Here are the indices of capacity utilization and employment.

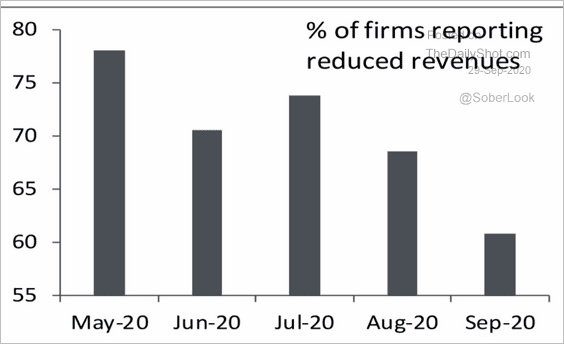

The percentage of factories reporting reduced revenues declined further.

Source: Piper Sandler

Source: Piper Sandler

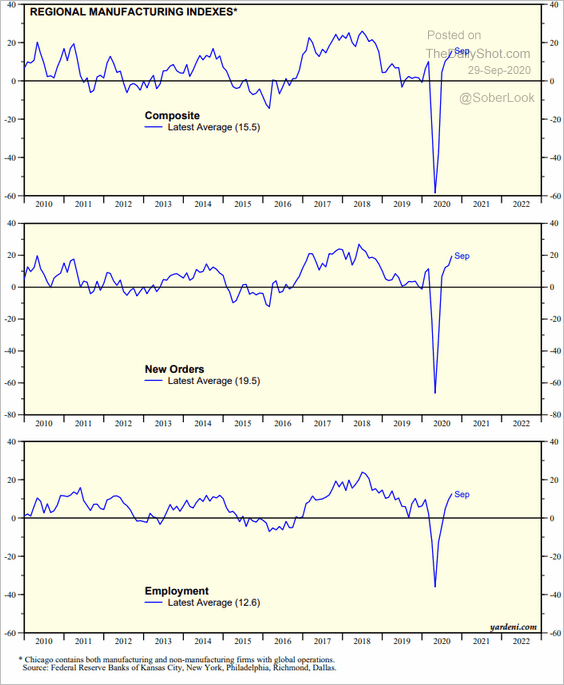

Overall, the regional manufacturing indicators point to robust factory output in September.

Source: Yardeni Research

Source: Yardeni Research

——————–

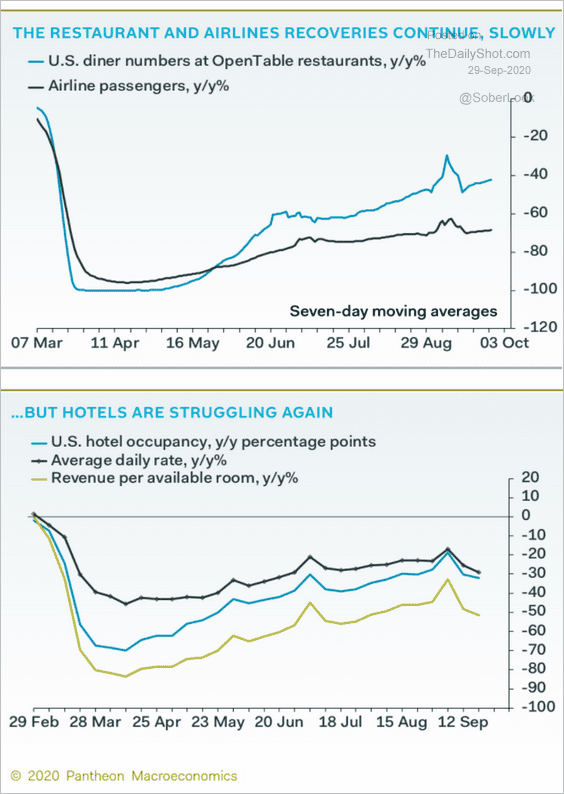

2. High-frequency data indicate improvements for restaurants and airlines, but hotels are still struggling.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

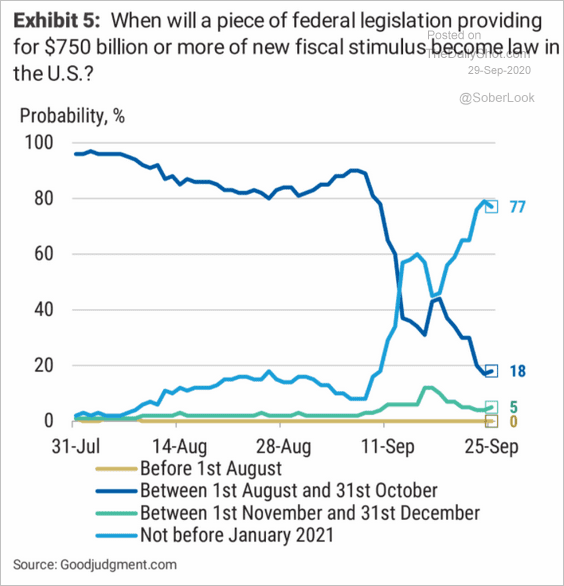

3. Forecasters are increasingly convinced that the next government stimulus package won’t be implemented until next year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

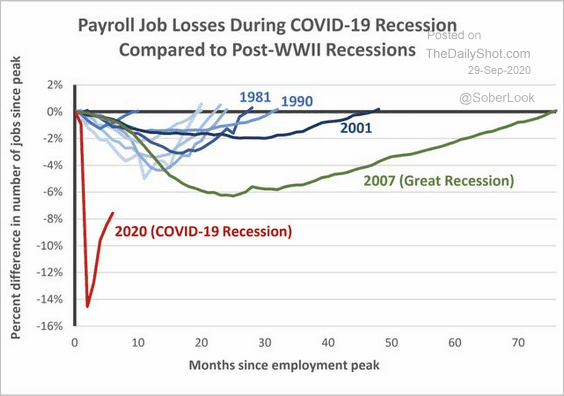

4. Here are a couple of updates on employment.

• The employment situation in perspective:

Source: @Noahpinion Read full article

Source: @Noahpinion Read full article

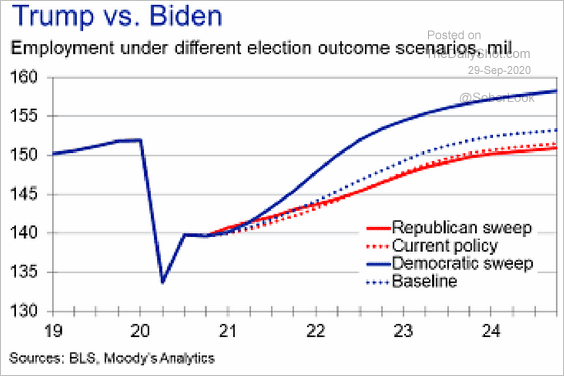

• Moody’s Analytics employment projections under various election outcomes:

Source: Moody’s Analytics

Source: Moody’s Analytics

——————–

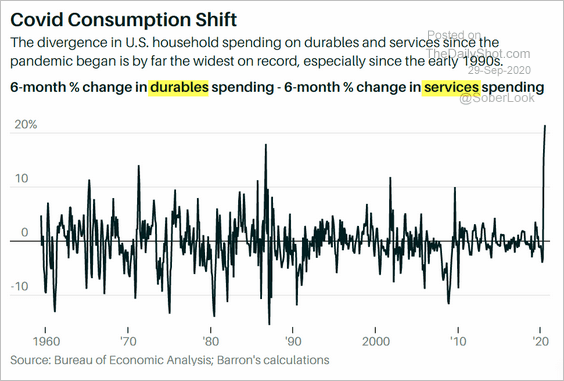

5. The spread between durables and services consumption has blown out. An example of this trend is Americans buying cars but spending less on flying, ride-hailing, and other public transportation.

Source: @BarronsOnline Read full article

Source: @BarronsOnline Read full article

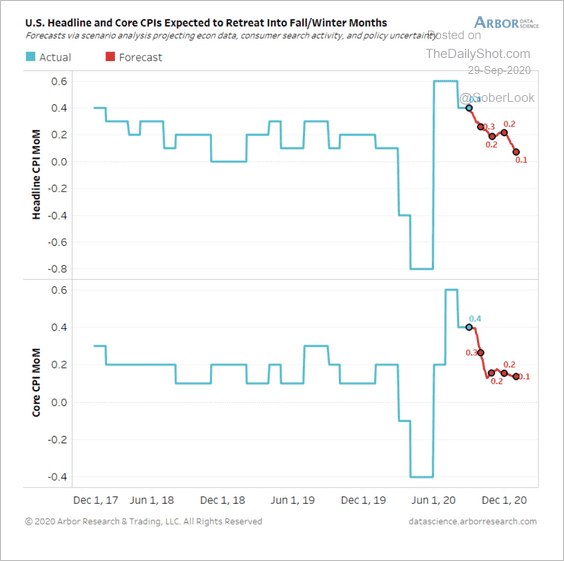

6. Arbor Data Science expects headline and core CPIs to decline into year-end.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

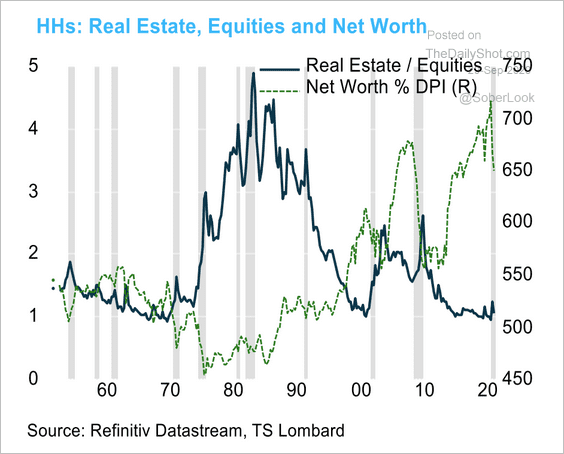

7. Will real estate values rise relative to equities in the coming years? If so, we could see a shift in household balance sheets.

Source: TS Lombard

Source: TS Lombard

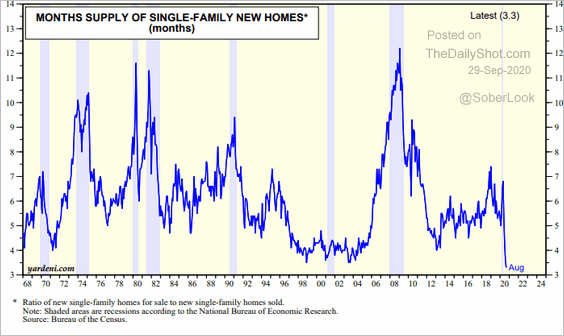

8. Here is a long-term chart of new home inventories.

Source: Yardeni Research

Source: Yardeni Research

Canada

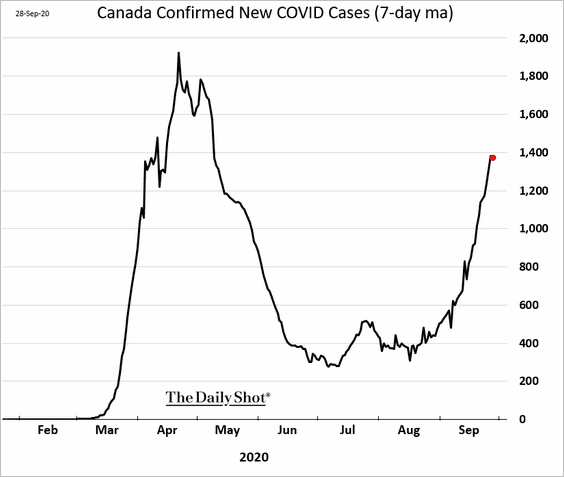

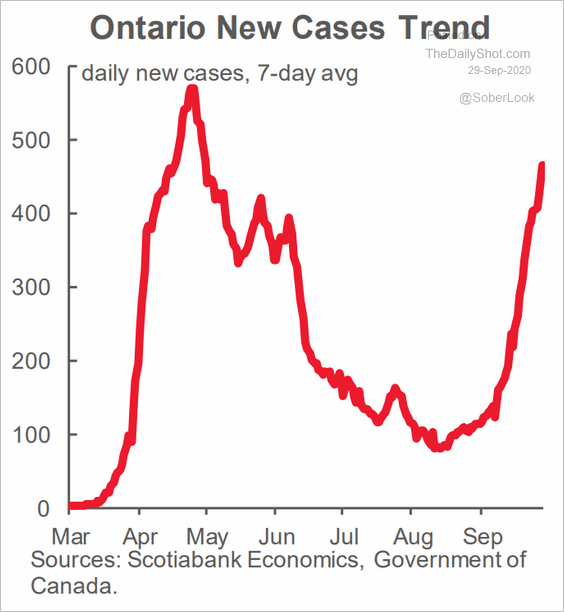

1. The number of new COVID cases has exploded, especially in Ontario.

Source: Scotiabank Economics

Source: Scotiabank Economics

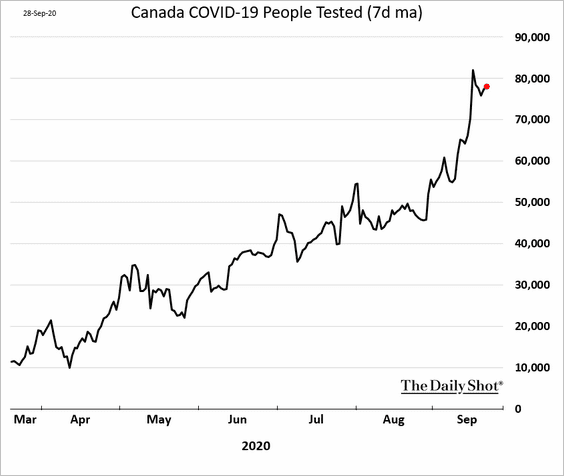

A portion (but not all) of this trend can be explained by increased testing.

The Eurozone

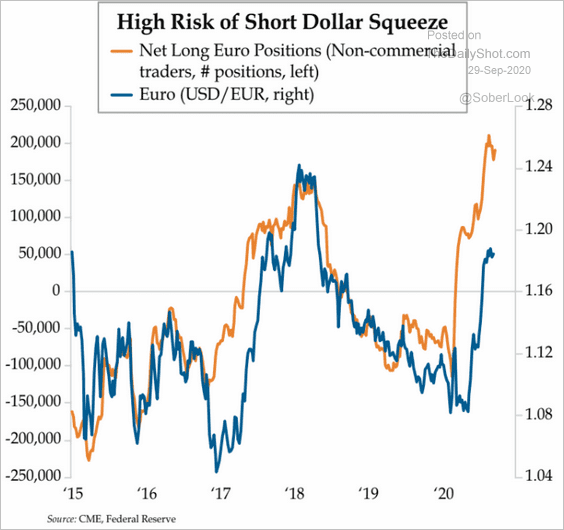

1. The euro remains vulnerable to a potential unwind of massive short-dollar bets.

Source: The Daily Feather

Source: The Daily Feather

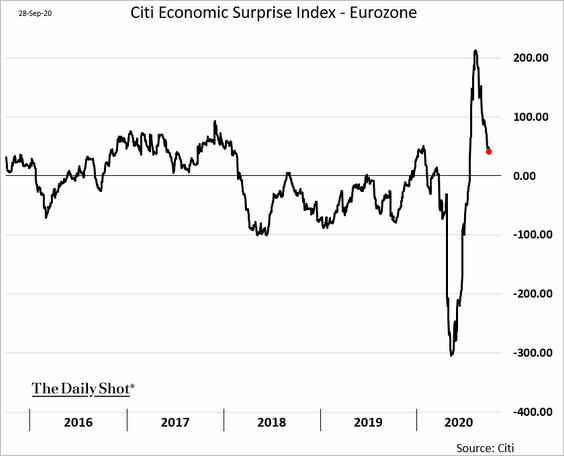

2. The Citi Economic Surprise Index shows that the rebound momentum has slowed.

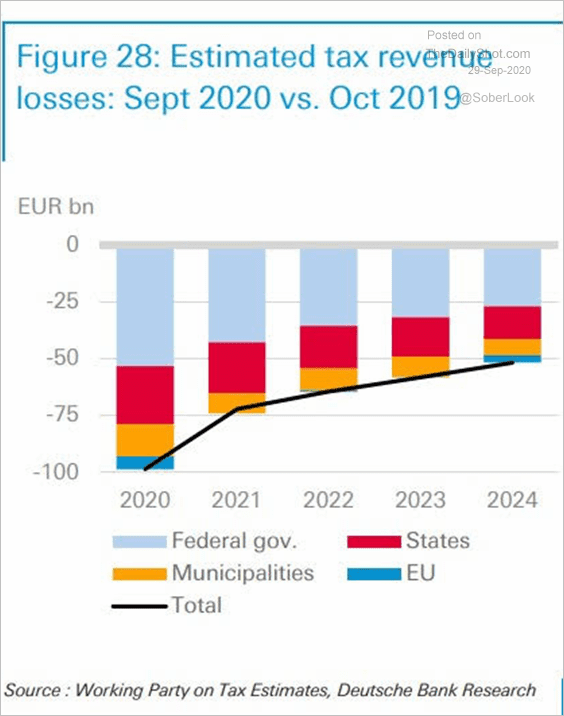

3. Germany’s tax revenue losses have been significant.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

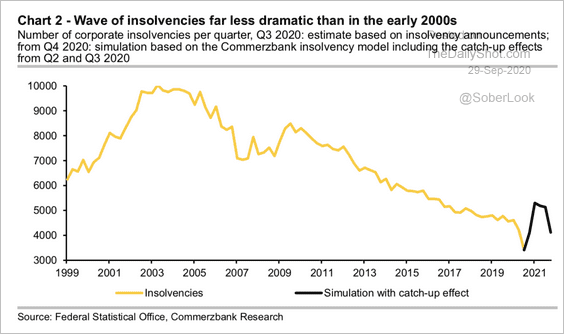

4. In March, Germany suspended the obligation for companies to file for insolvency. That moratorium on disclosure requirements is about to be lifted. Here is Commerzbank’s forecast.

Source: Commerzbank Research

Source: Commerzbank Research

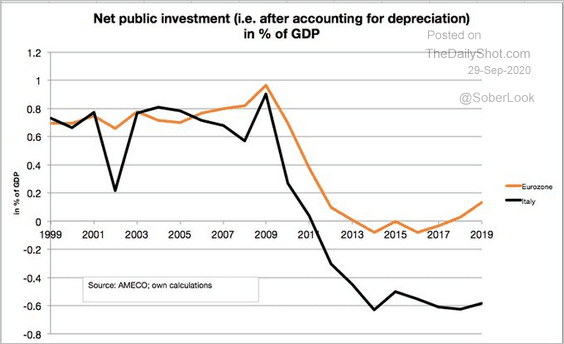

5. Italy’s public investment has lagged the Eurozone.

Source: @heimbergecon

Source: @heimbergecon

Asia – Pacific

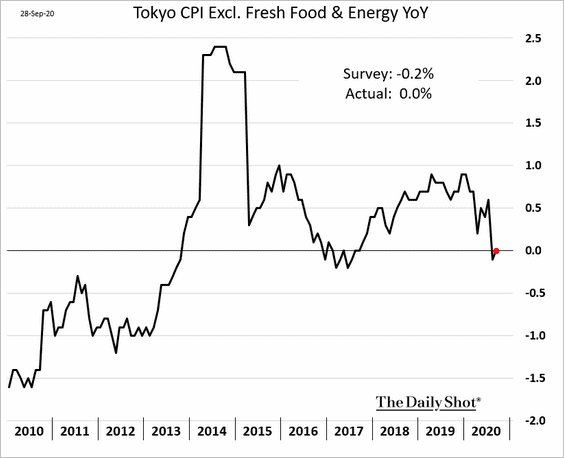

1. Tokyo’s core CPI is back at zero.

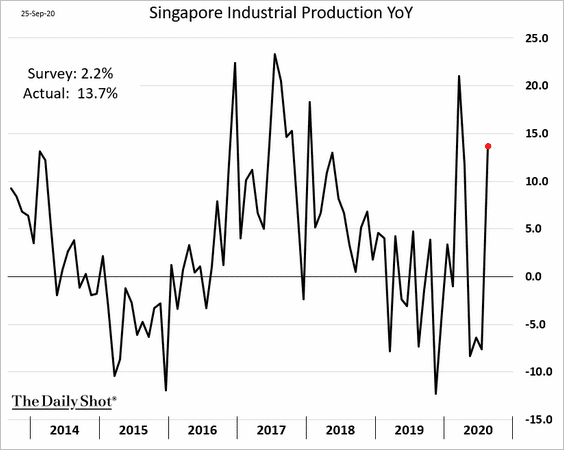

2. Singapore’s industrial production rebounded last month.

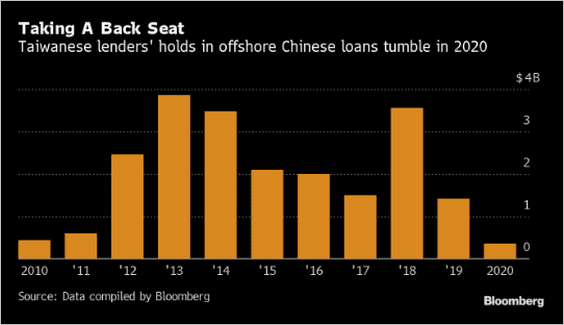

3. Taiwan’s banks have been cutting back on loans to China.

Source: @tracyalloway, @AppleLamCP Read full article

Source: @tracyalloway, @AppleLamCP Read full article

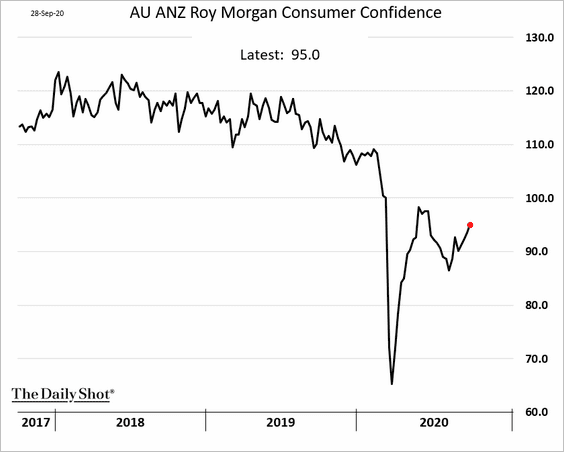

4. Australia’s consumer sentiment continues to recover.

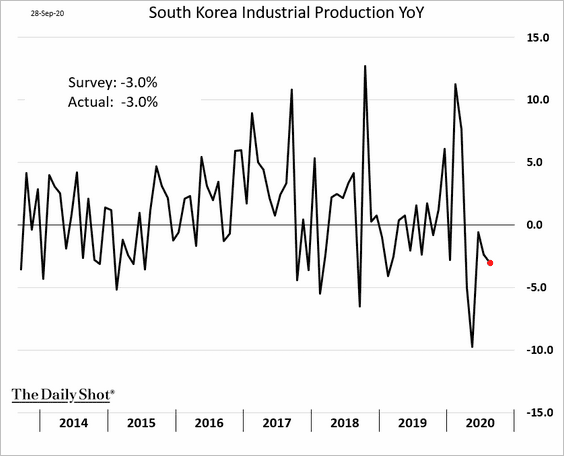

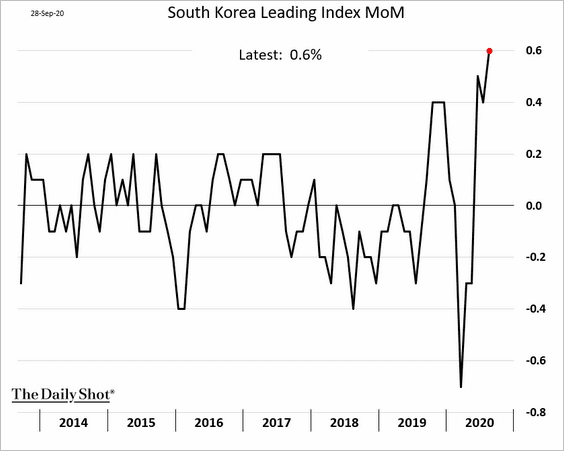

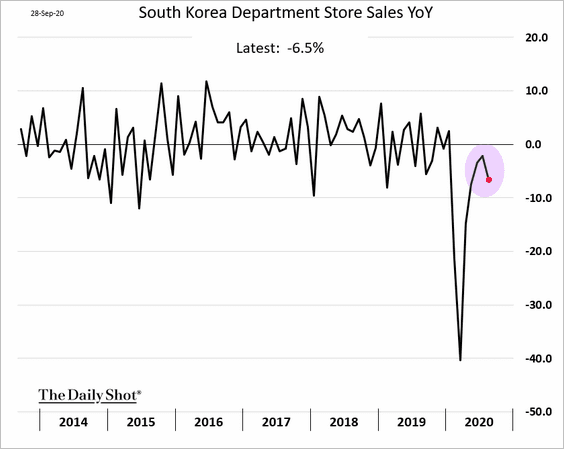

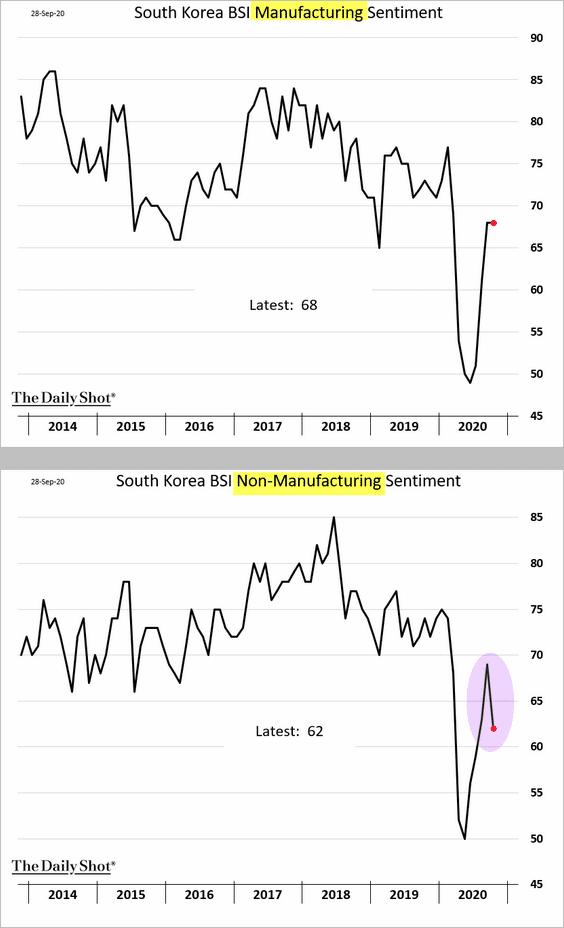

5. Next, we have some updates on South Korea.

• Industrial production (August):

• Leading index (August):

• Department store sales (August):

• Business sentiment (September):

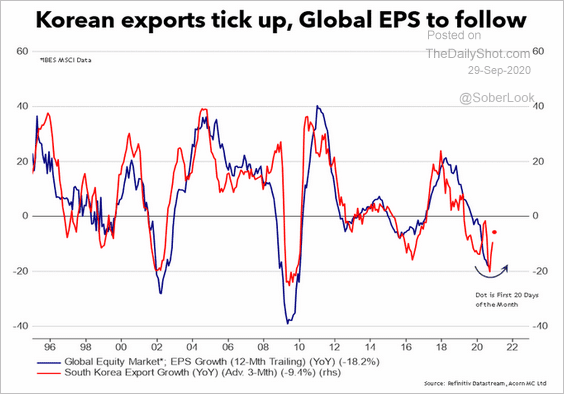

• Exports (through September) vs. global corporate earnings:

Source: @RichardDias_CFA

Source: @RichardDias_CFA

China

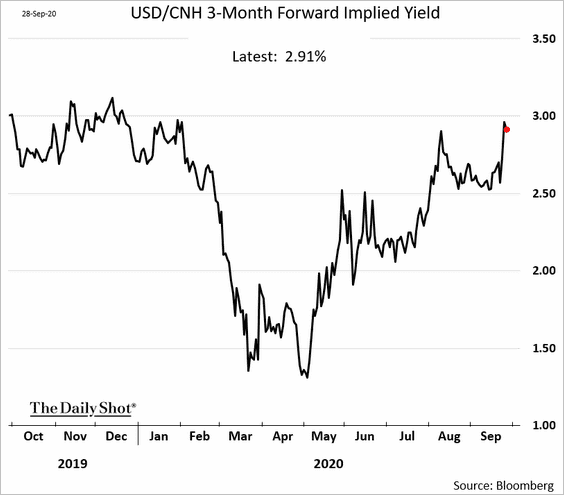

1. F/X forwards point to tightening liquidity in the offshore yuan.

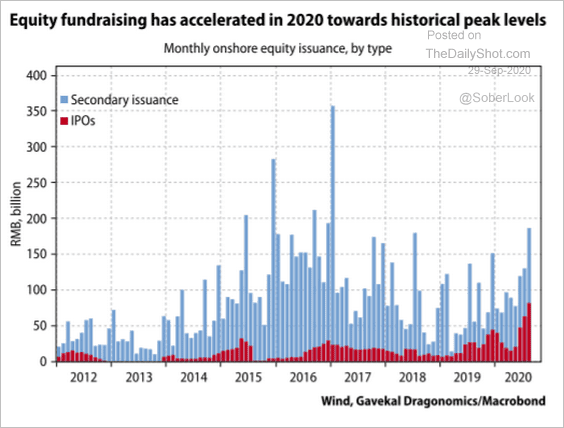

2. IPO activity has accelerated.

Source: Gavekal

Source: Gavekal

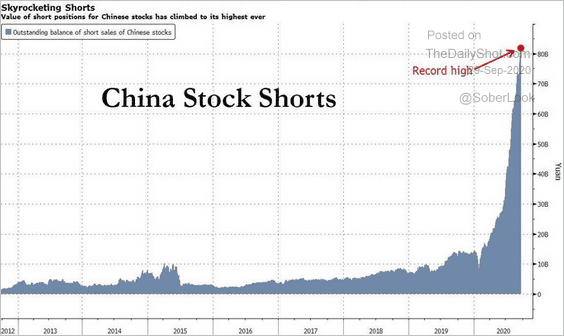

3. Short interest in China’s shares has increased sharply this year.

Source: @leadlagreport, @ZeroHedge

Source: @leadlagreport, @ZeroHedge

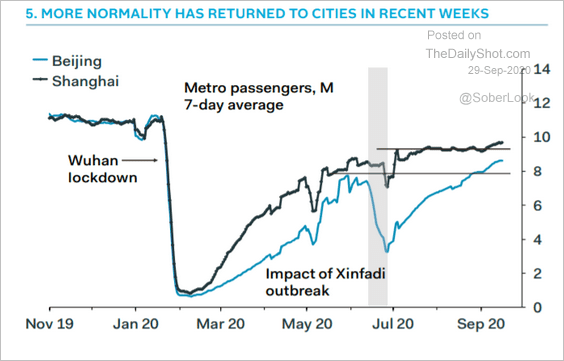

4. Metro passenger numbers are rebounding.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

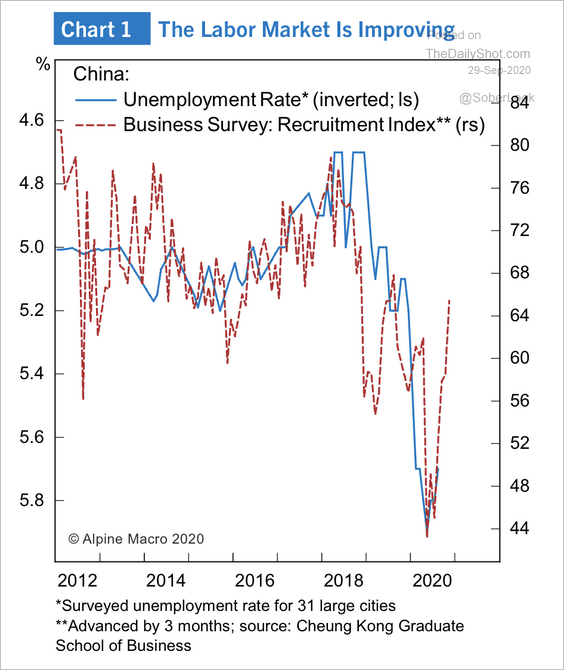

5. The employment situation is improving quickly.

Source: Alpine Macro

Source: Alpine Macro

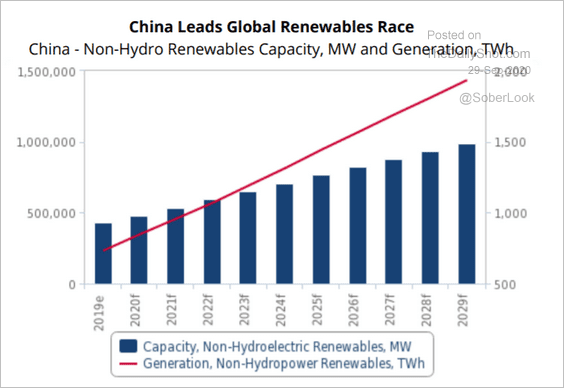

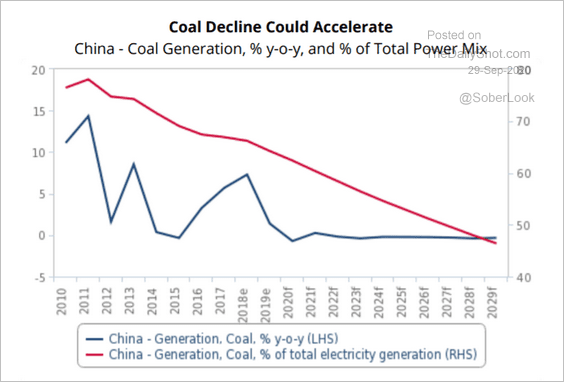

6. Renewables growth is expected to remain robust, while coal usage is likely to decline.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Emerging Markets

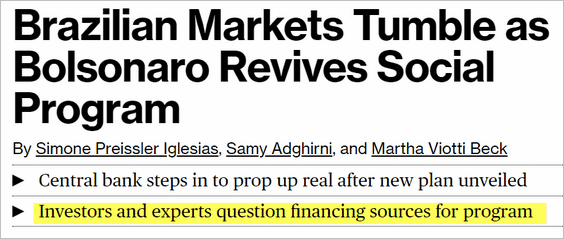

1. Let’s begin with Brazil.

• The government is backing new “basic income” payments to the poor, spooking investors.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

• Assets sold off across the board.

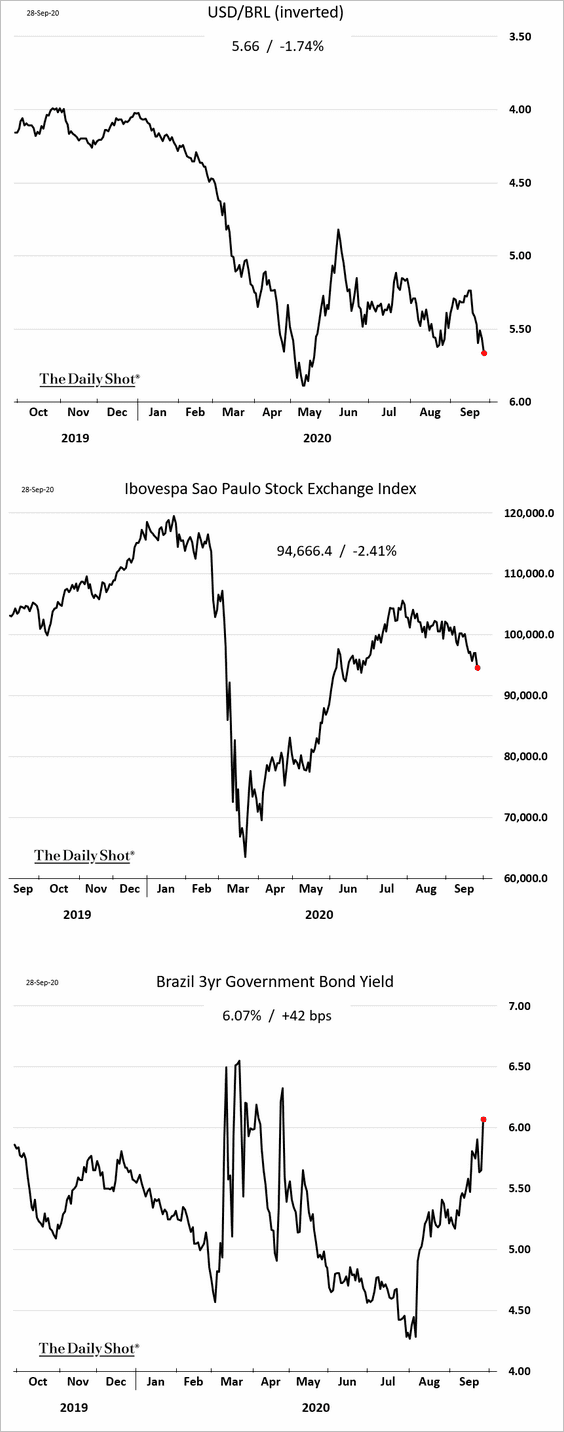

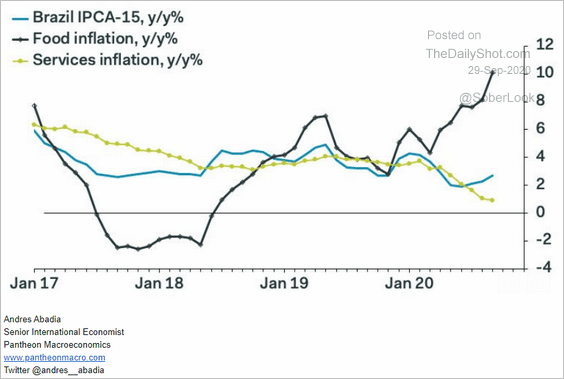

• Loan growth is accelerating.

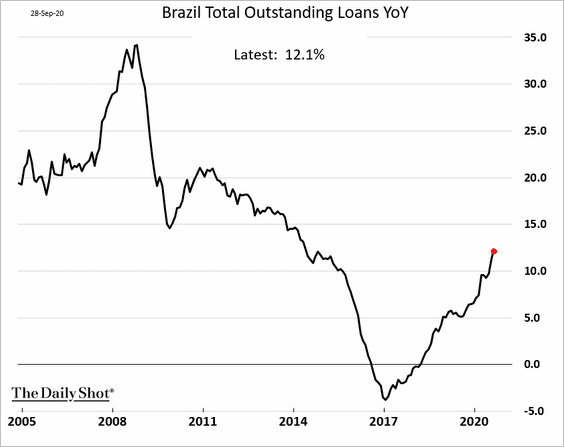

• Excluding food, inflation has slowed substantially this year.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

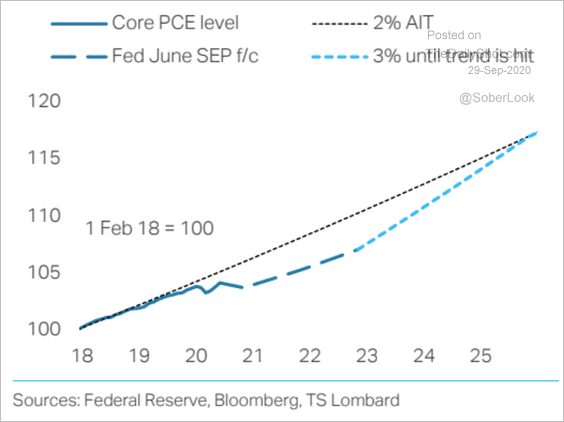

It may take five years for Brazil to reach average inflation, according to TS Lombard.

Source: TS Lombard

Source: TS Lombard

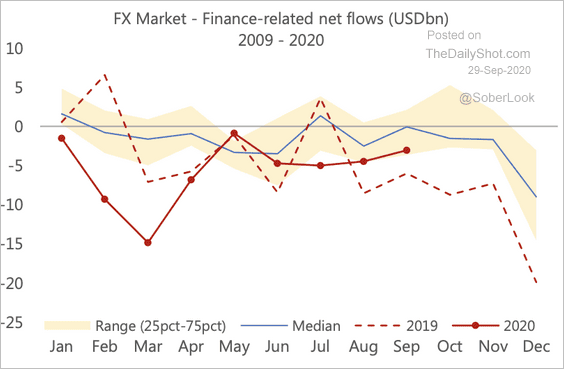

• Financial outflows have slowed materially from the plunge in March.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

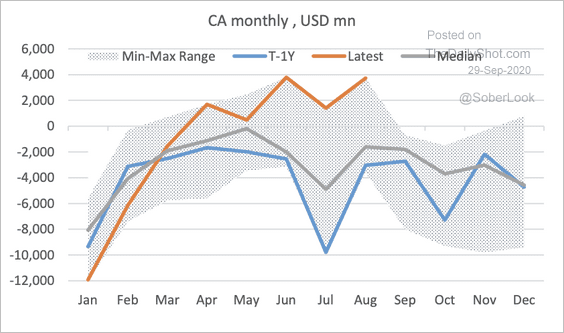

• Brazil’s current account surplus continues to grow.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

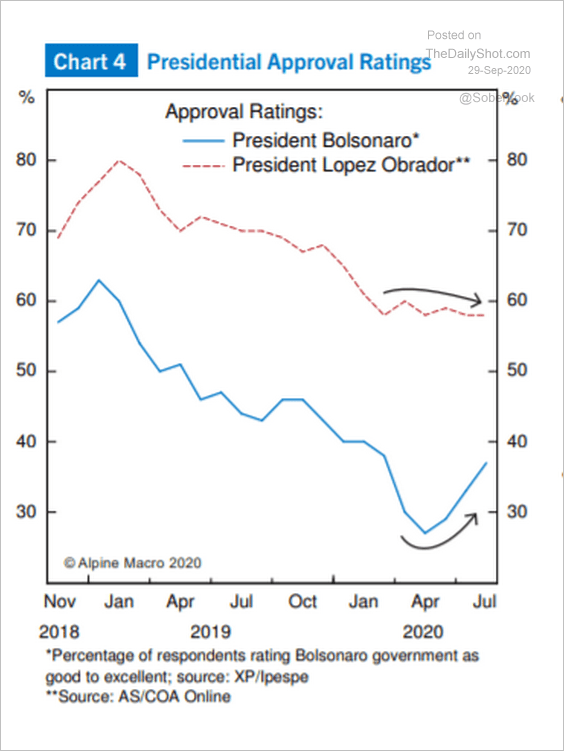

• Support for Bolsonaro is rebounding.

Source: Alpine Macro

Source: Alpine Macro

——————–

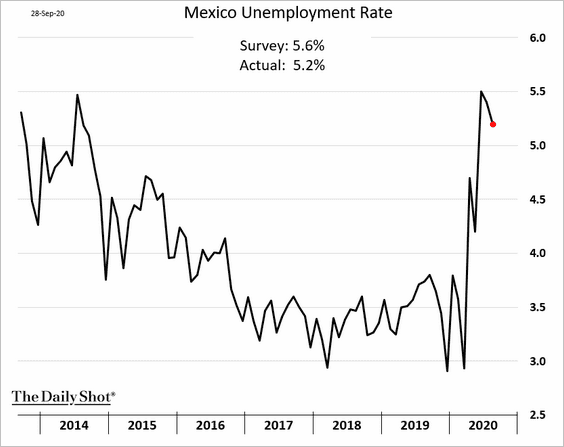

2. Next, we have some updates on Mexico.

• The unemployment rate appears to have peaked.

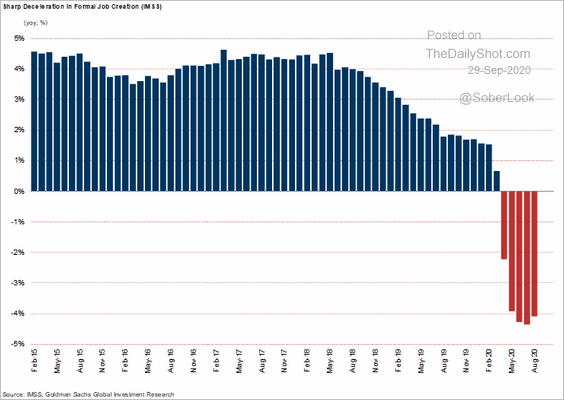

But formal job creation remains depressed.

Source: Goldman Sachs

Source: Goldman Sachs

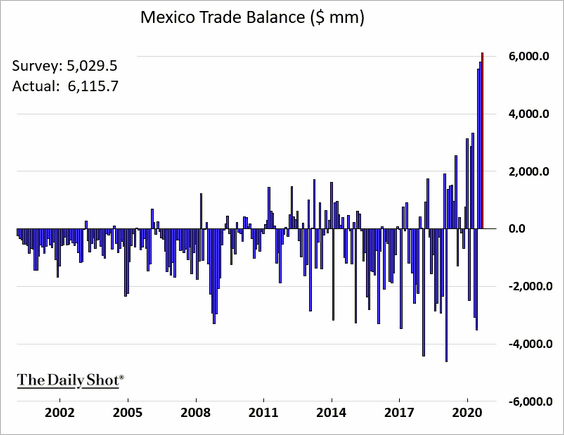

• Trade surplus hit another record, boosted by car demand in the US.

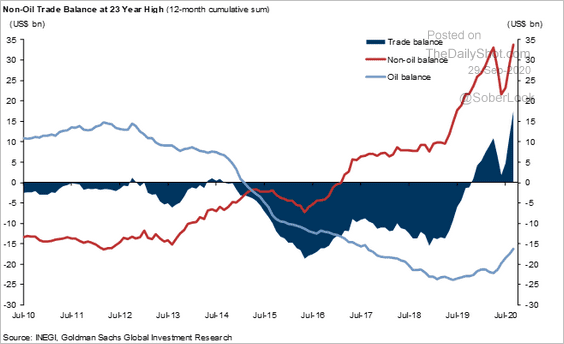

This chart separates Mexico’s oil and non-oil trade balance.

Source: Goldman Sachs

Source: Goldman Sachs

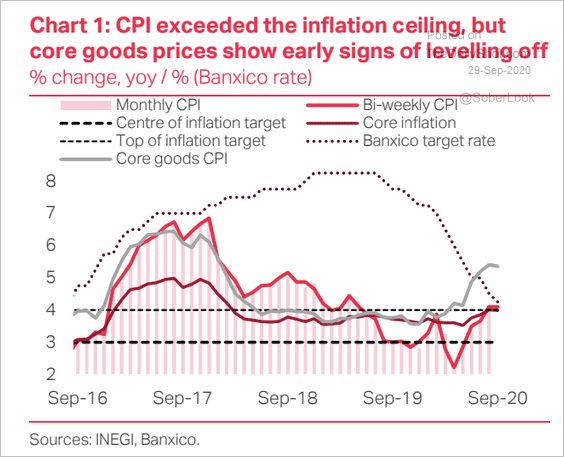

• Mexico’s core goods CPI is starting to level off, which could mean Banxico has further room to cut rates.

Source: TS Lombard

Source: TS Lombard

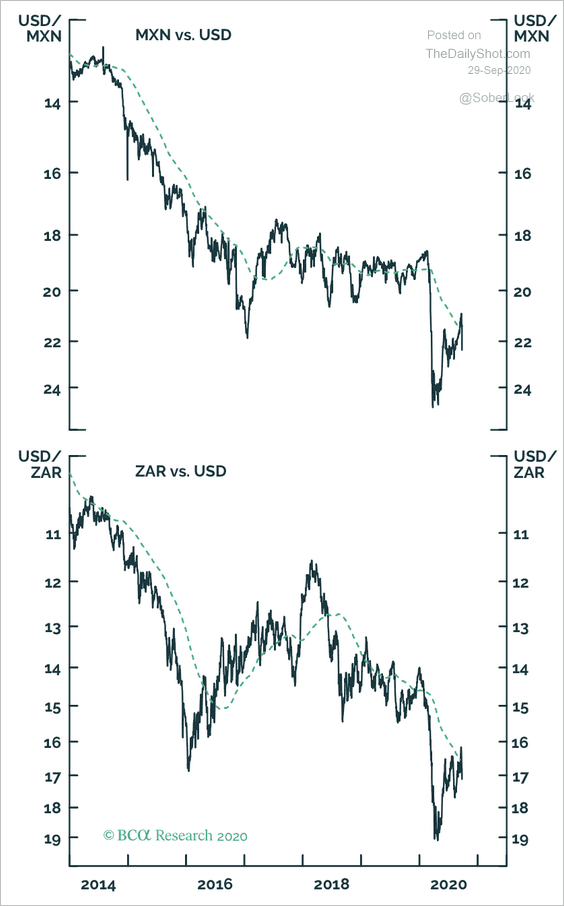

• USD/MXN and USD/ZAR are testing resistance at the 200-day moving average.

Source: BCA Research

Source: BCA Research

——————–

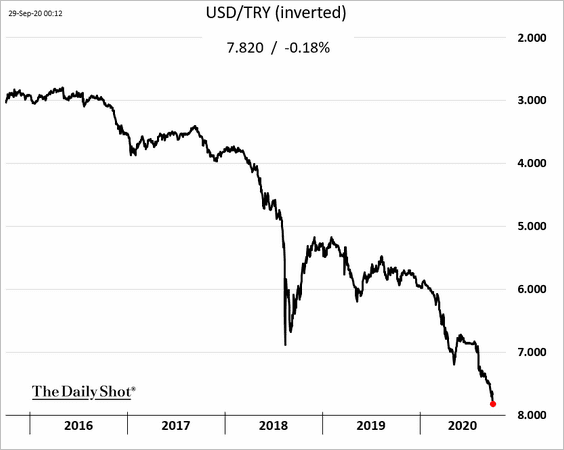

3. Despite the 200 bps rate hike, the Turkish lira’s selloff resumed as the currency hits new lows.

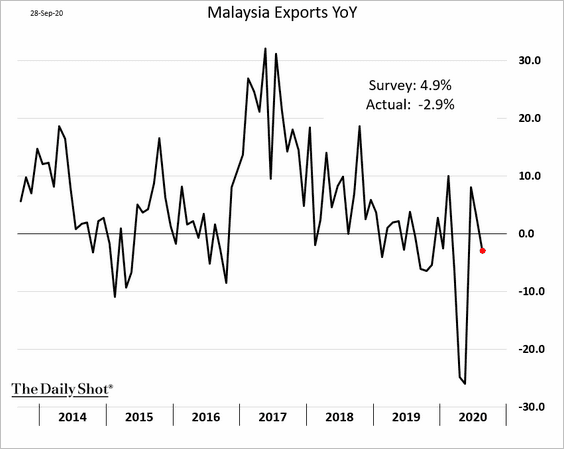

4. Malaysia’s exports weakened again.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

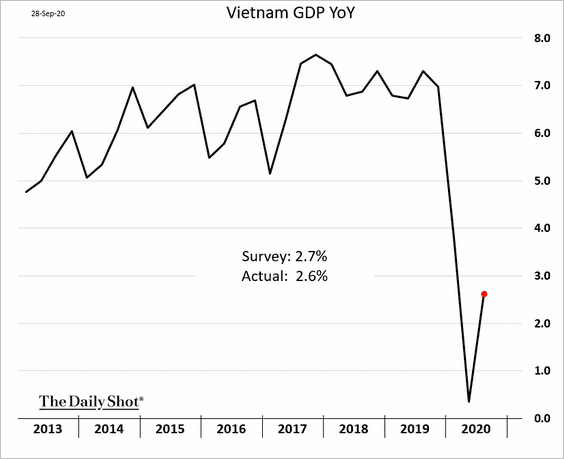

5. Vietnam’s recovery will take some time.

Commodities

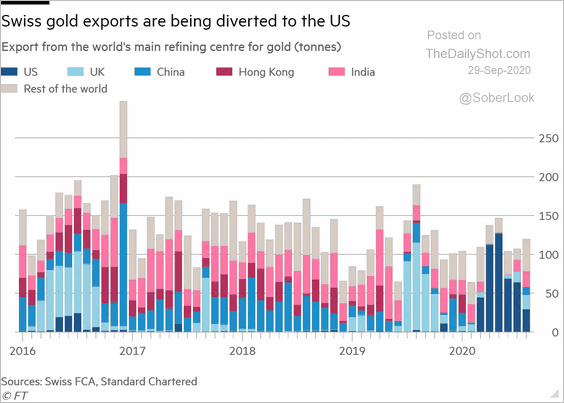

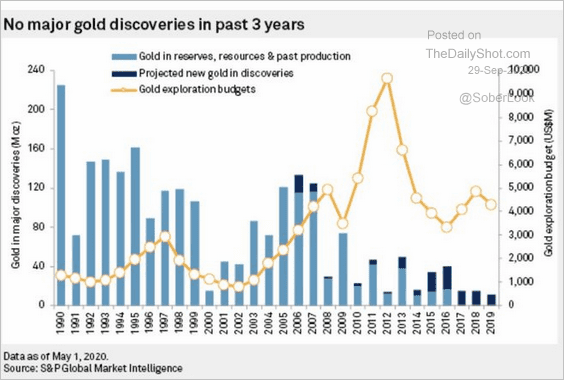

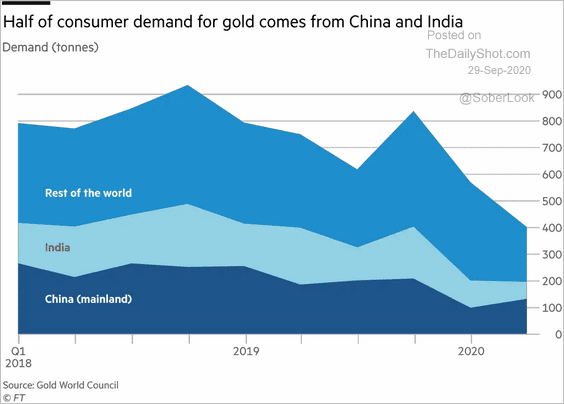

1. Let’s begin with some updates on gold.

• Swiss gold exports:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• Gold discoveries:

Source: S&P Global Market Intelligence, @blackbullforex

Source: S&P Global Market Intelligence, @blackbullforex

• Gold consumer demand:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

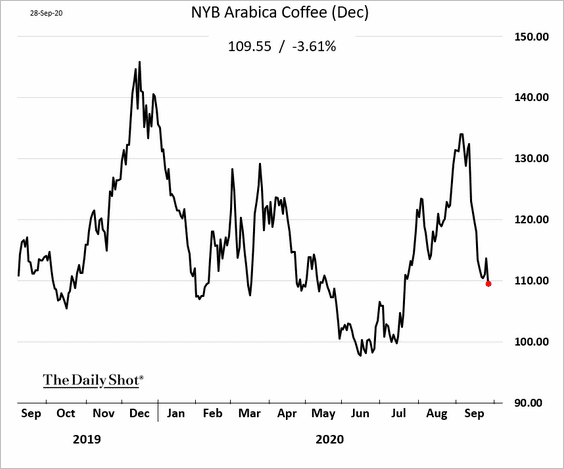

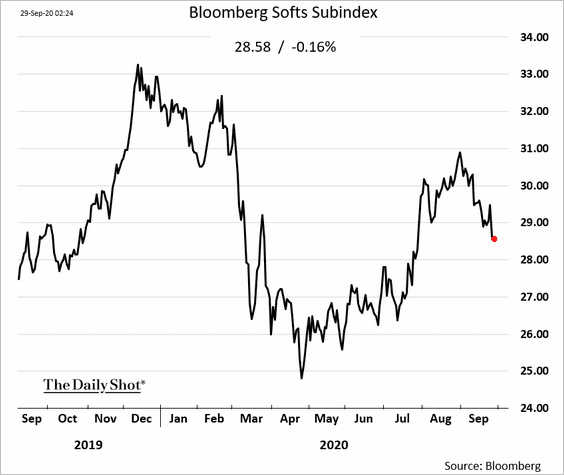

2. Brazil’s expected record shipments of coffee are pressuring prices. Honduras may increase output substantially as well.

Here is Bloomberg’s softs index.

——————–

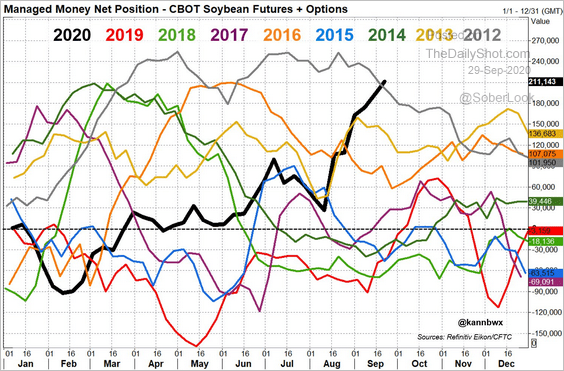

3. Managed money is most bullish on soybean futures since September 2012.

Source: @kannbwx

Source: @kannbwx

Equities

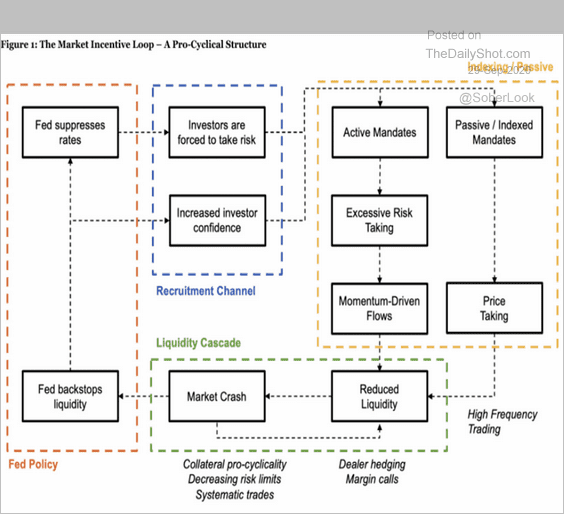

1. Let’s start with this Fed-driven pro-cyclical incentive structure for equities.

Source: Newfound Research

Source: Newfound Research

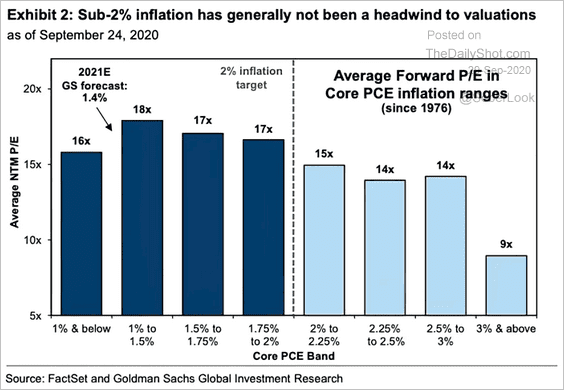

2. How does inflation impact share valuations?

Source: Goldman Sachs, @ISABELNET_SA

Source: Goldman Sachs, @ISABELNET_SA

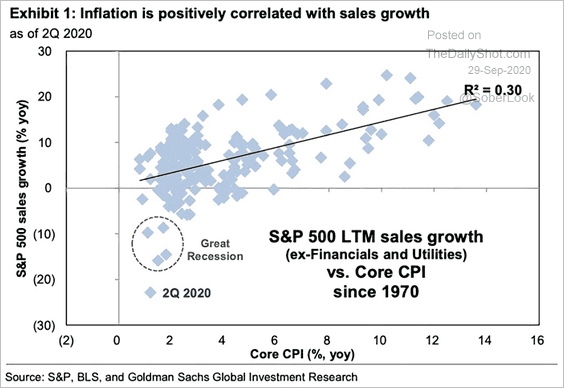

This scatterplot shows sales growth vs. the core CPI.

Source: Goldman Sachs, @ISABELNET_SA

Source: Goldman Sachs, @ISABELNET_SA

——————–

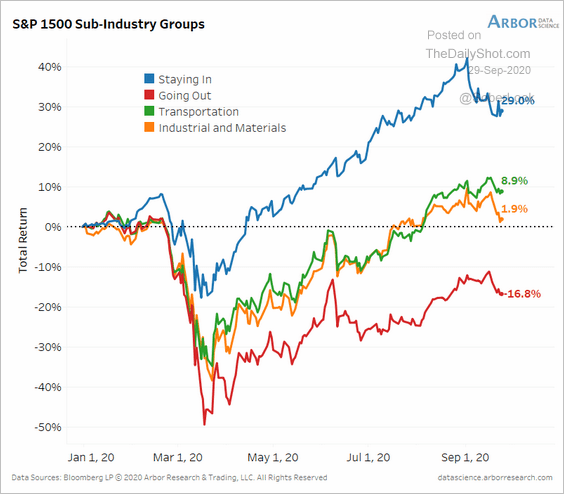

3. Next, we have the “staying in” vs. “going out” indices.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

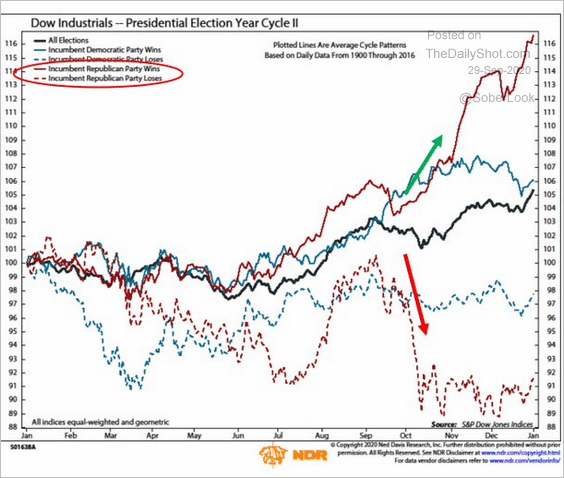

4. The market rally suggests that President Trump will get reelected.

Source: @markminervini

Source: @markminervini

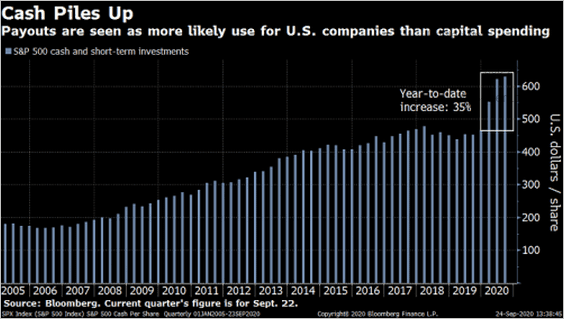

5. Could surging US corporate cash lead to higher shareholder payouts?

Source: @trevornoren Read full article

Source: @trevornoren Read full article

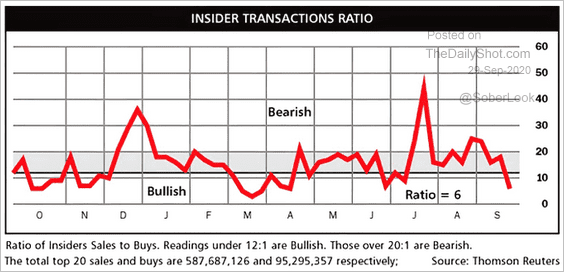

6. Insiders are no longer selling.

Source: @ISABELNET_SA

Source: @ISABELNET_SA

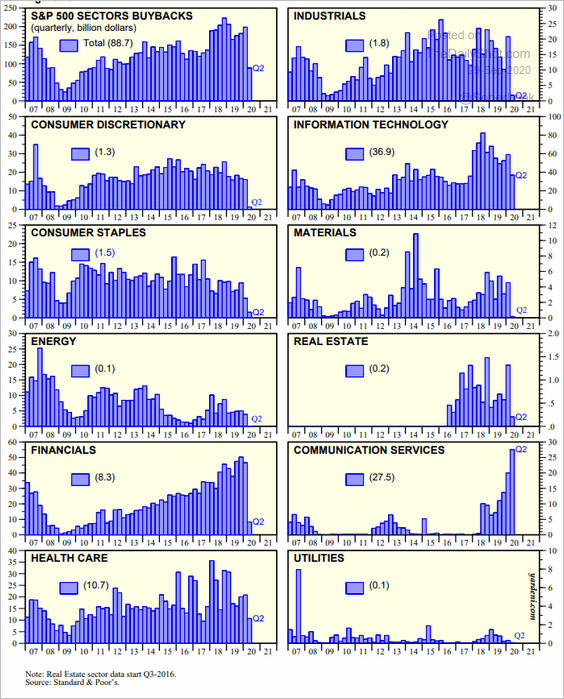

7. Next, we have some sector updates.

• Share buybacks by sector:

Source: Yardeni Research

Source: Yardeni Research

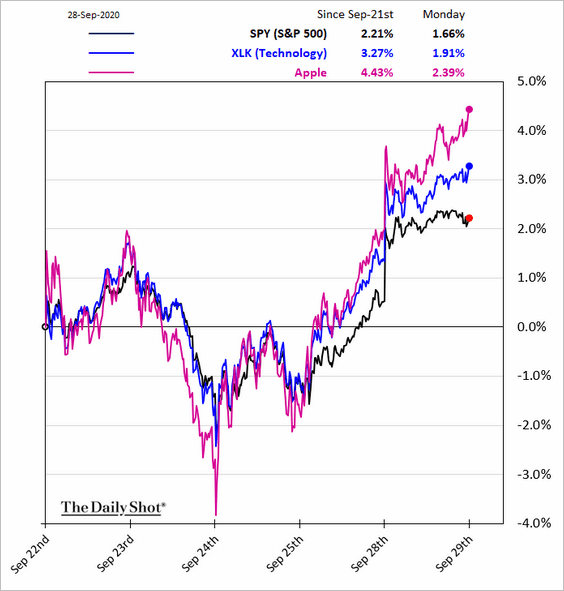

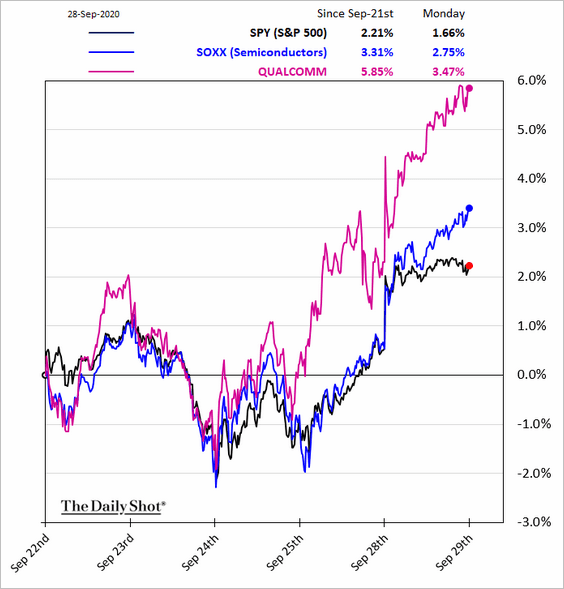

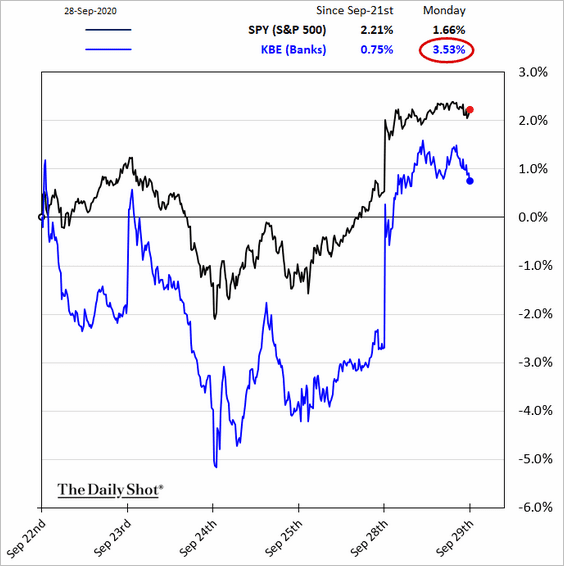

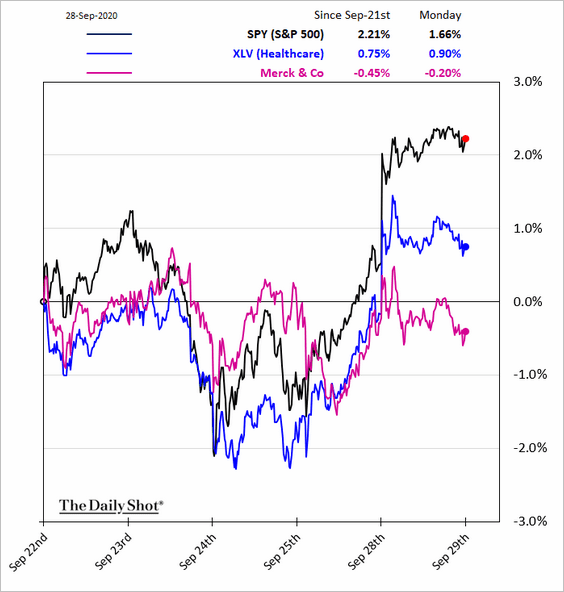

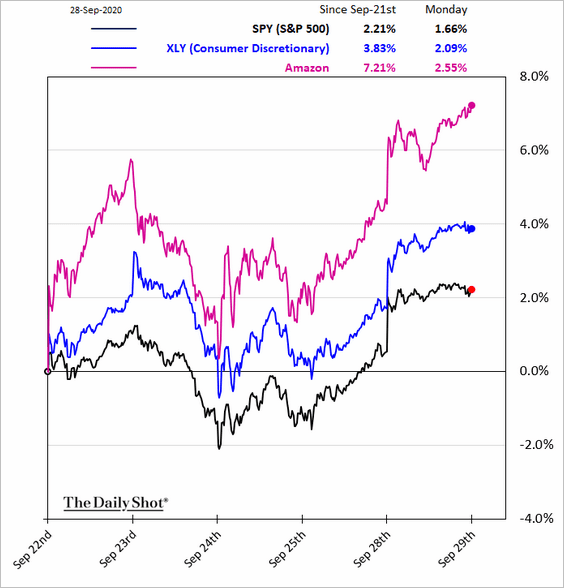

• Relative performance over the past five days:

– Tech:

– Semiconductors:

– Banks:

– Healthcare:

– Consumer Discretionary:

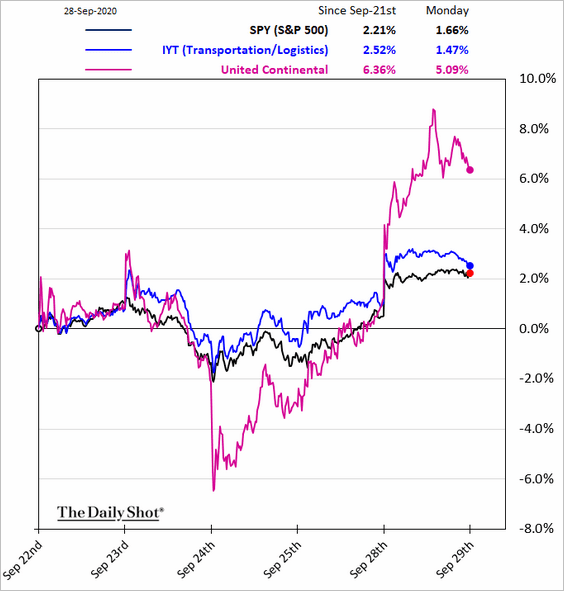

– Transportation:

——————–

8. Finally, we have some style/factor updates.

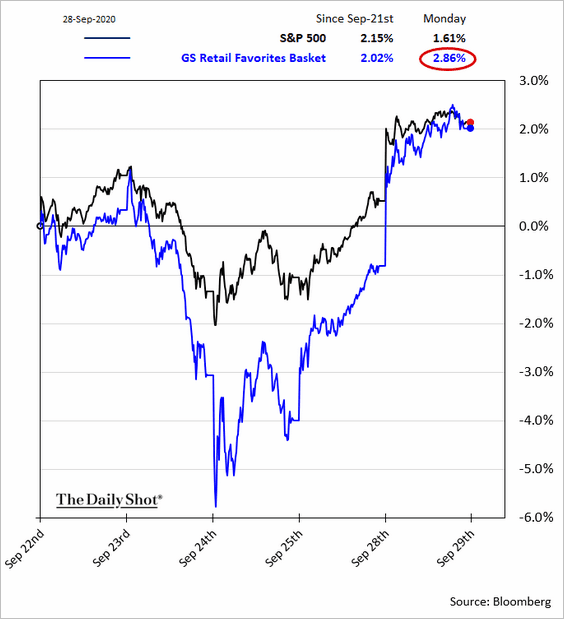

• Retail investors’ favorite stocks:

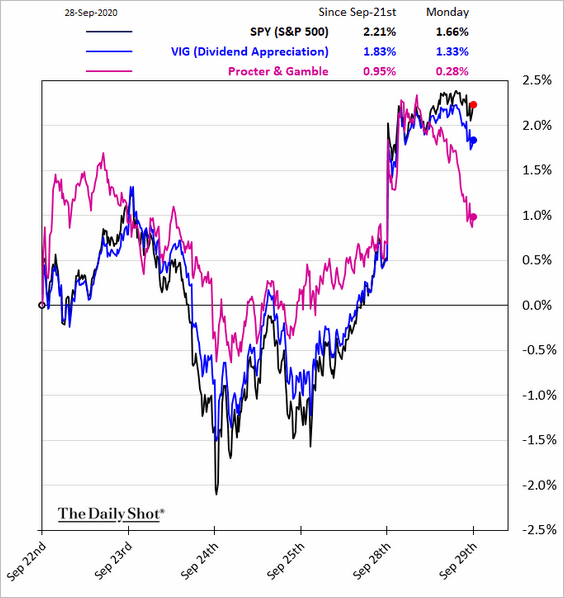

• Dividend appreciation:

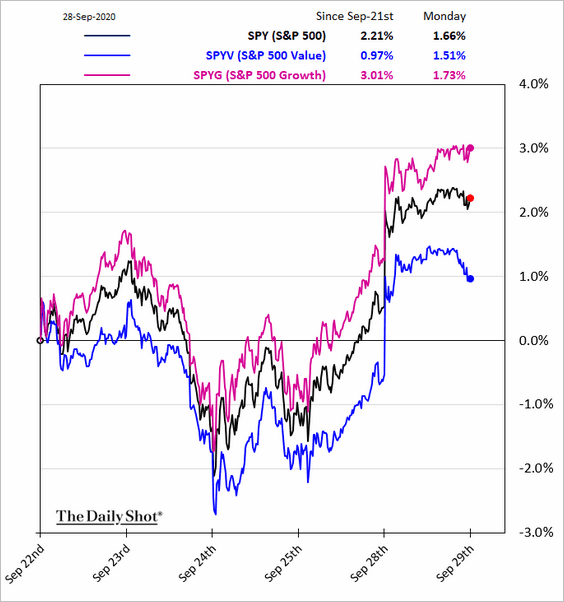

• Growth vs. value:

Alternatives

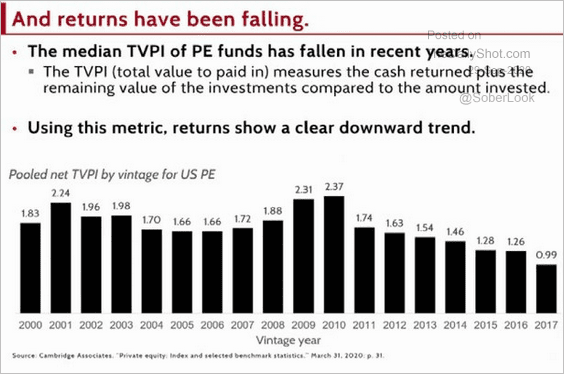

1. TVPI-based performance of private equity has been moderating.

Source: @apark_ Read full article

Source: @apark_ Read full article

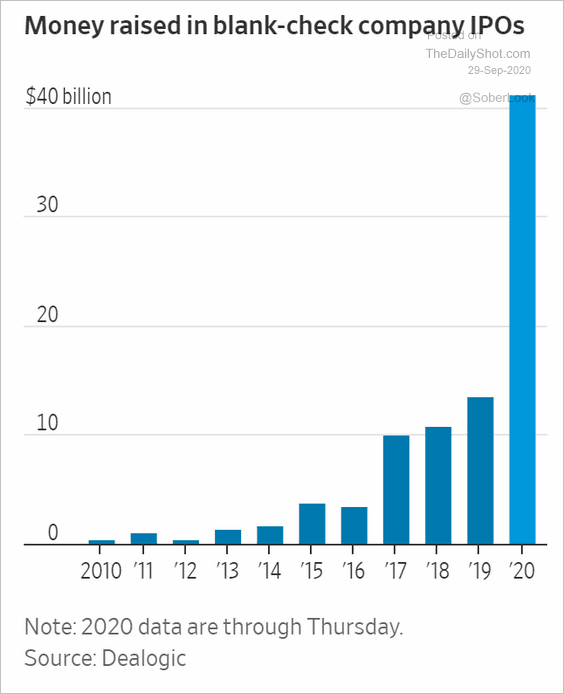

2. The SPAC madness continues.

Source: @WSJ Read full article

Source: @WSJ Read full article

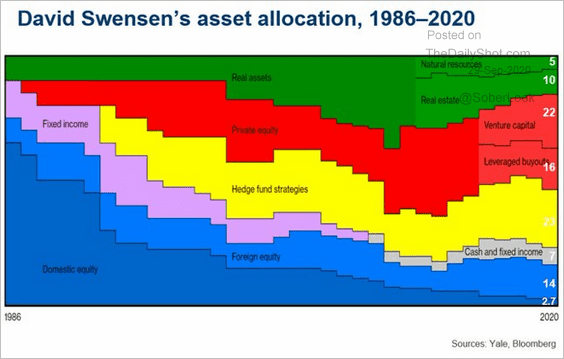

3. Here is the asset allocation over time for Yale’s endowment.

Source: @jessefelder, @johnauthers Read full article

Source: @jessefelder, @johnauthers Read full article

——————–

Food for Thought

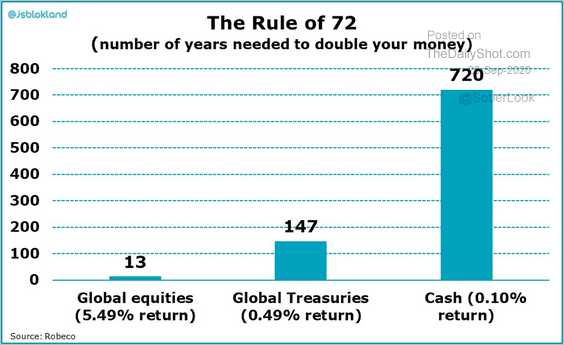

1. How long does it take to double your money?

Source: @jsblokland

Source: @jsblokland

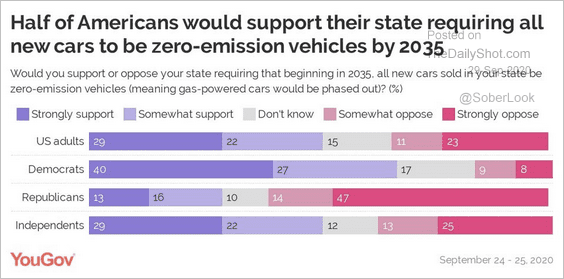

2. Support for phasing out gasoline-powered cars in the US:

Source: YouGov Read full article

Source: YouGov Read full article

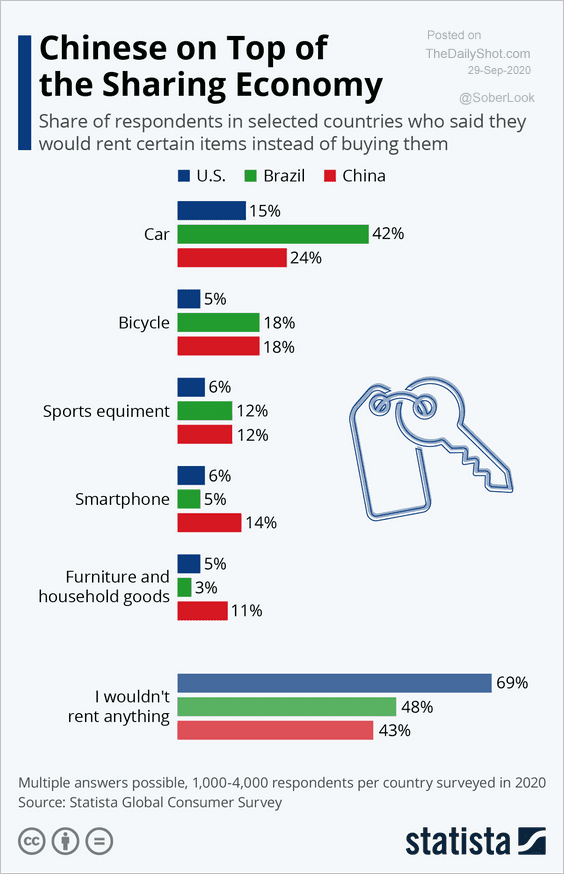

3. Renting vs. buying:

Source: Statista

Source: Statista

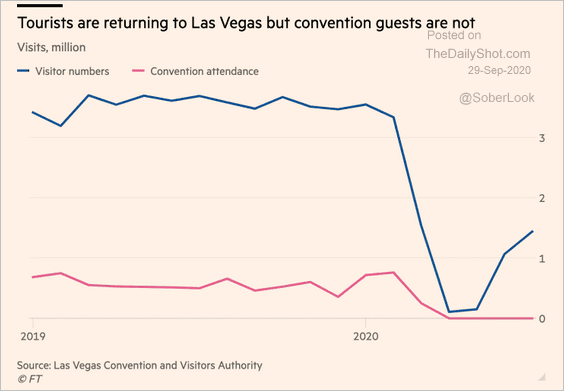

4. Vegas tourists vs. convention guests:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

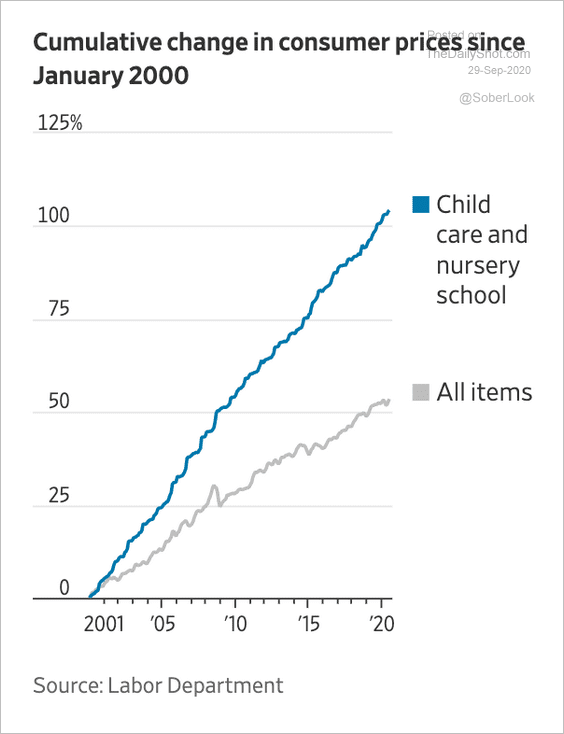

5. Childcare costs:

Source: @adam_tooze, @chris_rexrode, @laurenweberWSJ Read full article

Source: @adam_tooze, @chris_rexrode, @laurenweberWSJ Read full article

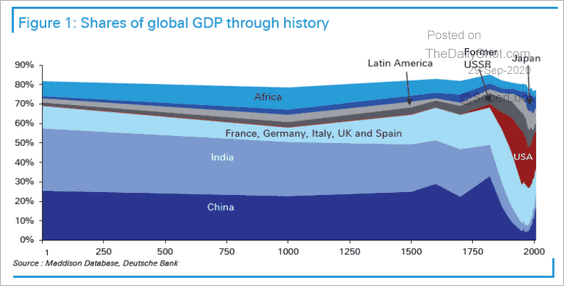

6. Share of global GDP over the past two thousand years:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

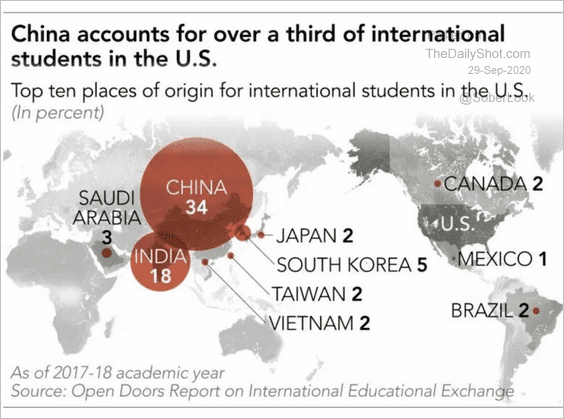

7. International students in the US:

Source: Nikkei Asian Review, @adam_tooze Read full article

Source: Nikkei Asian Review, @adam_tooze Read full article

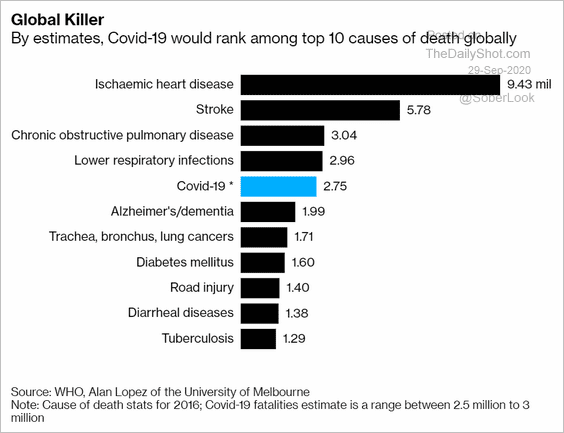

8. Top causes of death globally:

Source: @technology Read full article

Source: @technology Read full article

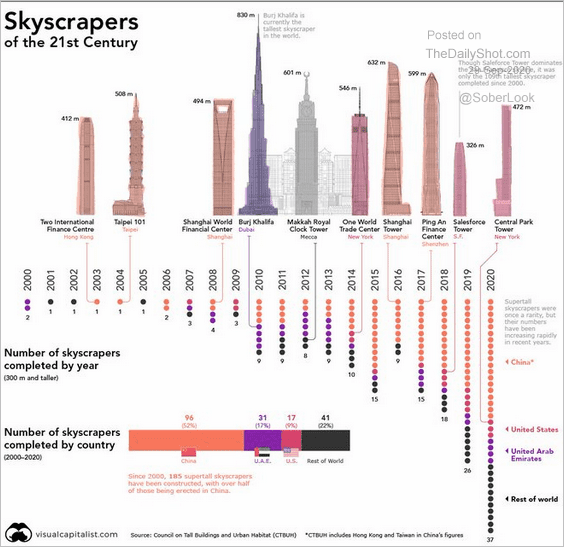

9. Skyscrapers:

Source: @VisualCap Read full article

Source: @VisualCap Read full article

——————–