The Daily Shot: 06-Oct-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

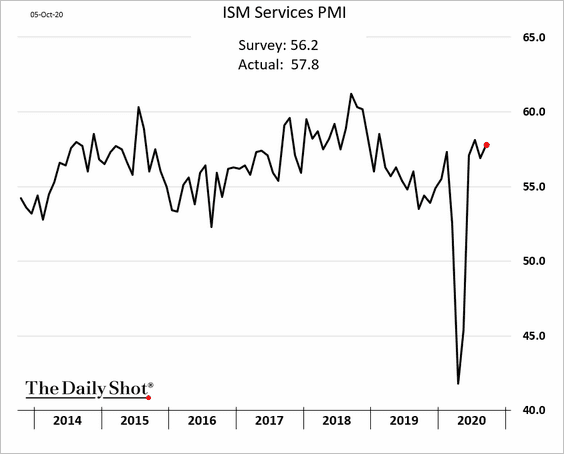

1. The ISM Services PMI index topped economists’ forecasts, pointing to stronger growth in service industries last month.

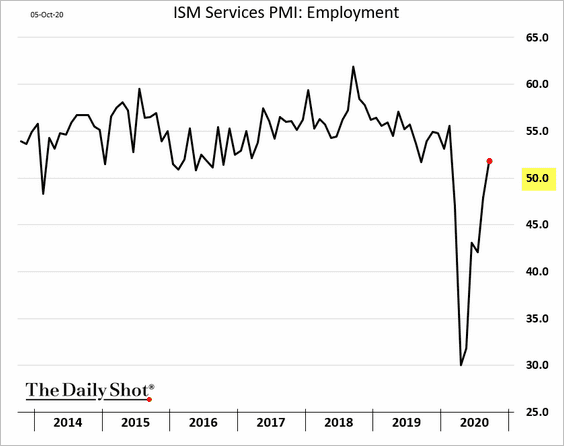

Service employment is back in expansion territory (PMI > 50).

——————–

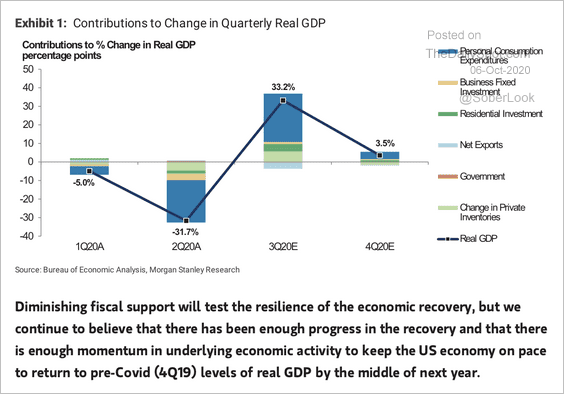

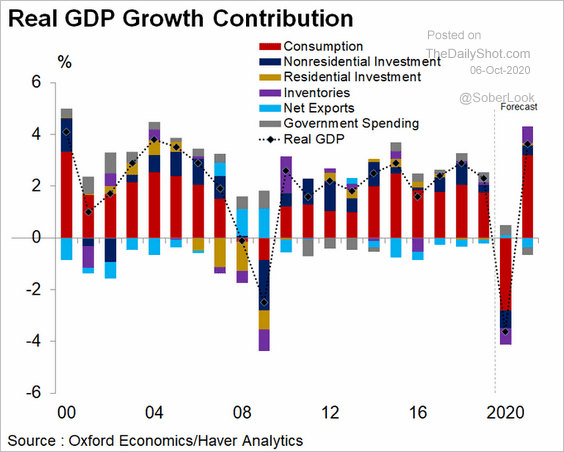

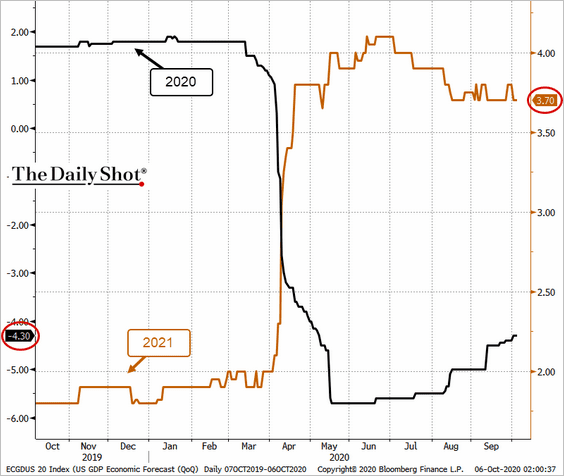

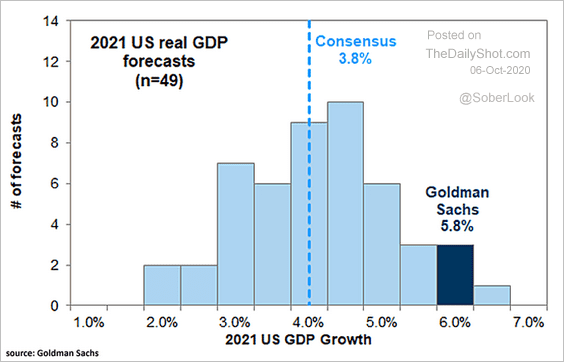

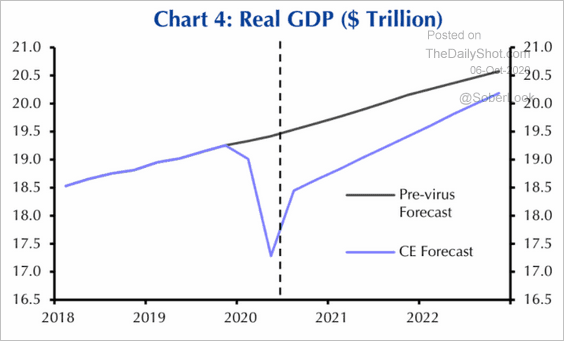

2. Next, let’s take a look at some GDP forecasts.

• Morgan Stanley’s forecast for Q3 and Q4 (see comment):

Source: Morgan Stanley Research

Source: Morgan Stanley Research

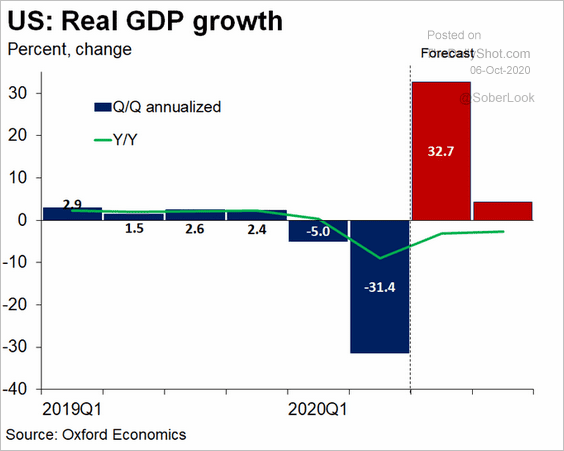

• Oxford Economics’ forecast for Q3 and Q4:

Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

• Oxford Economics’ projection for 2020 and 2021:

Source: Oxford Economics

Source: Oxford Economics

• Consensus 2020 and 2021 forecasts over time (from Bloomberg):

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Goldman’s projection for 2021 vs. the distribution of forecasts:

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

• Capital Economics’ GDP trajectory:

Source: Capital Economics

Source: Capital Economics

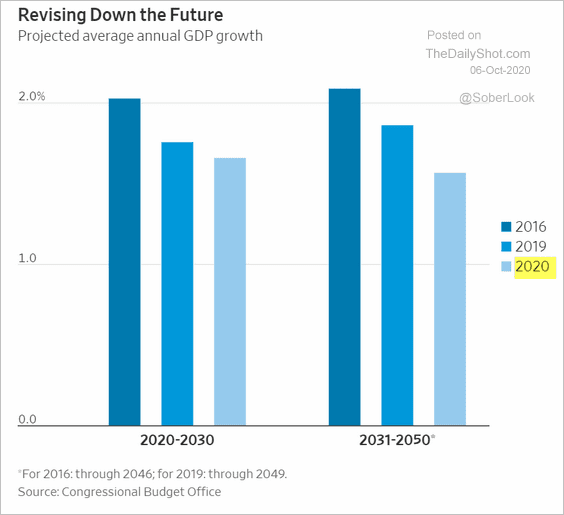

• The CBO continues to downgrade its long-term GDP forecasts for the United States.

Source: @WSJ Read full article

Source: @WSJ Read full article

Essentially, there are two drivers of economic output: labor force expansion and productivity improvements. Based on the projections below, neither will provide a boost to economic growth.

– The CBO is downgrading the nation’s population growth forecast (capping the labor force). Population growth will slow even more if immigration is curtailed.

Source: @WSJ Read full article

Source: @WSJ Read full article

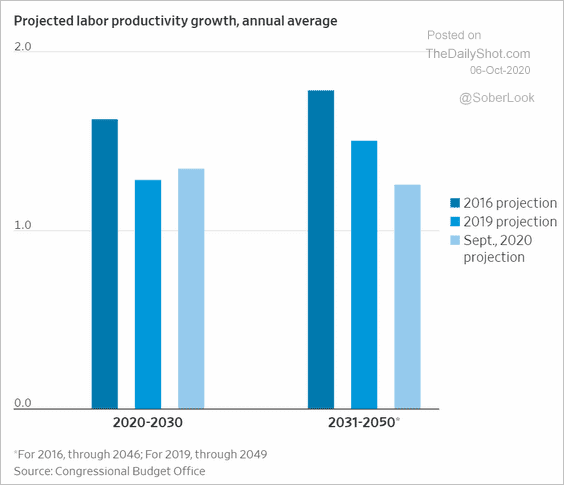

– And productivity gains are expected to be limited.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

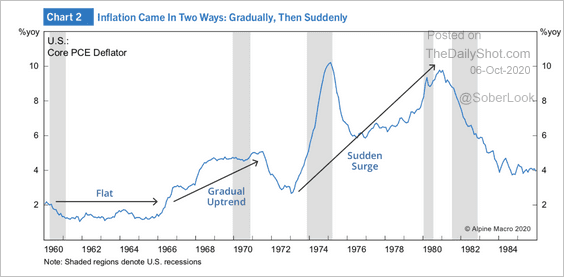

3. Next, we have some updates on inflation.

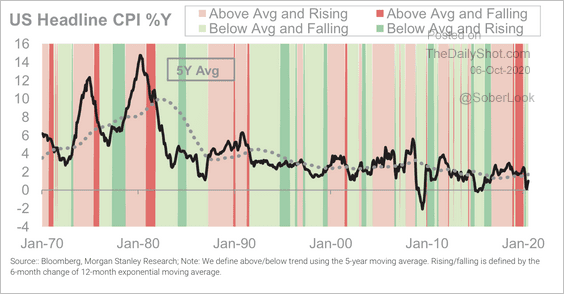

• Here’s a look at inflation regimes across history.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

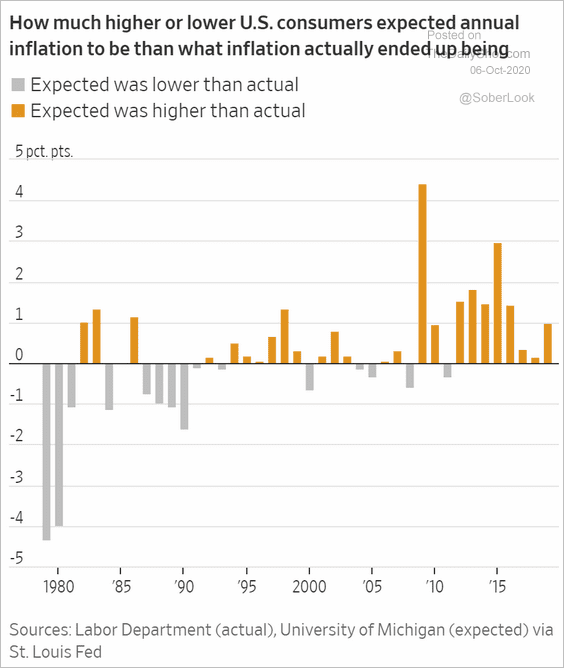

• Consumer inflation expectations have been overshooting the actual price gains.

Source: @WSJ Read full article

Source: @WSJ Read full article

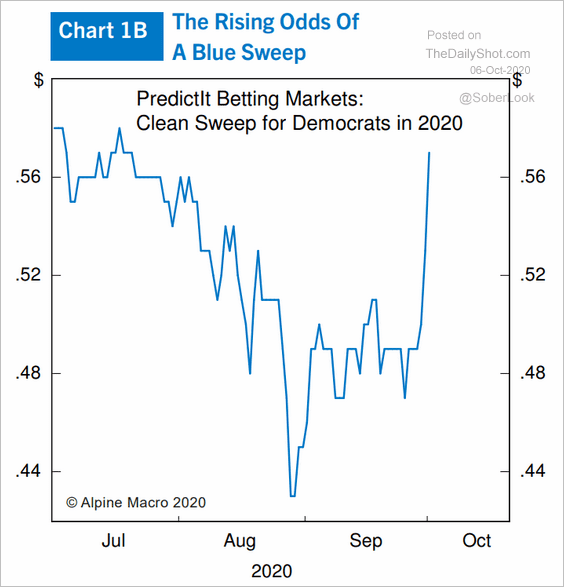

• A Democratic sweep in the 2020 election …

Source: Alpine Macro

Source: Alpine Macro

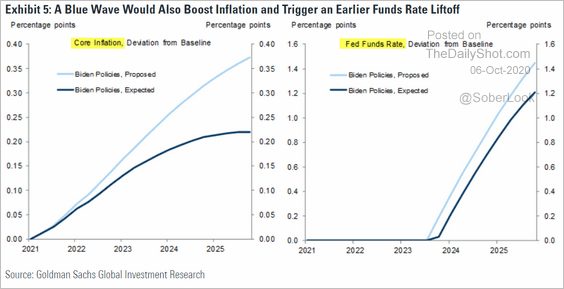

… could accelerate inflation (and rate hikes) via another round of massive government stimulus (according to Goldman Sachs).

Source: Jan Hatzius, Goldman Sachs

Source: Jan Hatzius, Goldman Sachs

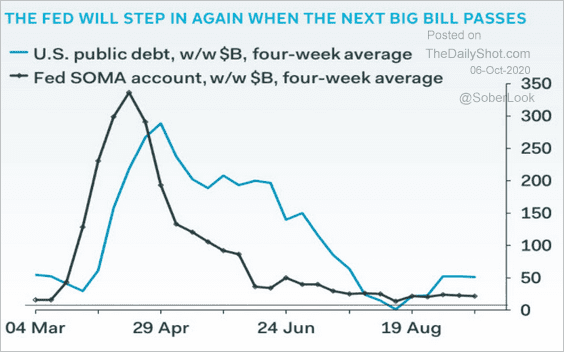

By the way, the Fed is expected to step up its securities purchases to support the next big stimulus bill (creating another huge monetary and fiscal liquidity injection).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

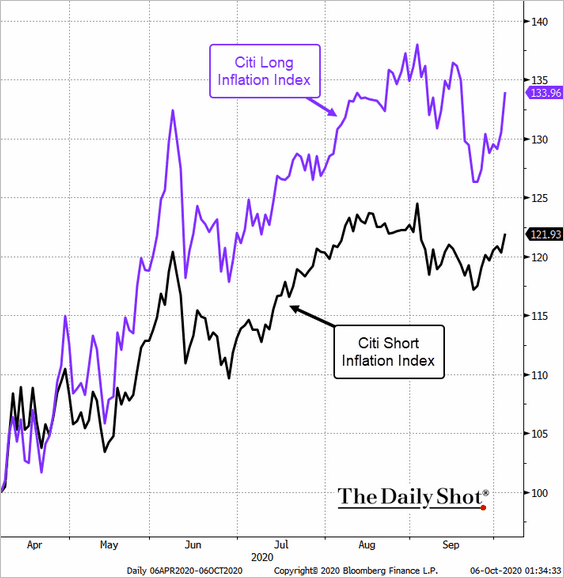

• The stock market has been pricing in firmer inflation since the launch of the US fiscal and monetary stimulus earlier this year.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Here is how inflation accelerated in the 1970s.

Source: Alpine Macro

Source: Alpine Macro

——————–

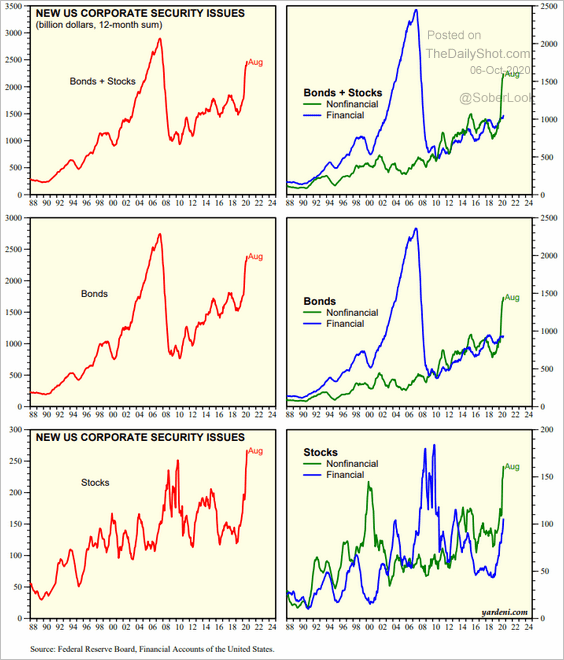

4. US securities issuance soared this year.

Source: Yardeni Research

Source: Yardeni Research

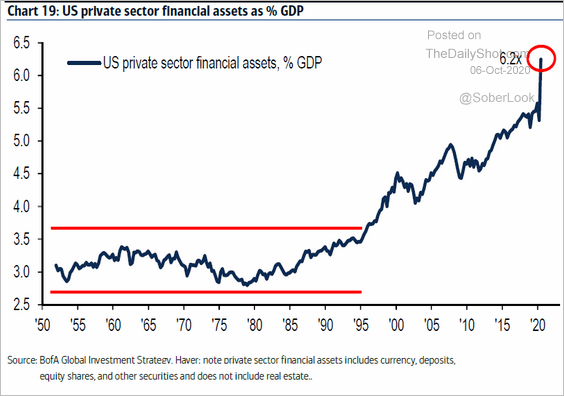

This chart shows US financial assets as a percentage of the GDP.

Source: BofA Global Research

Source: BofA Global Research

——————–

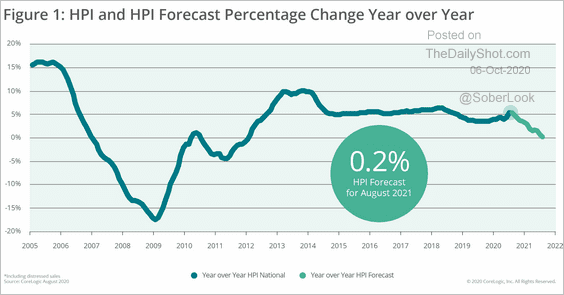

5. CoreLogic still expects home price appreciation to slow substantially over the next twelve months.

Source: CoreLogic

Source: CoreLogic

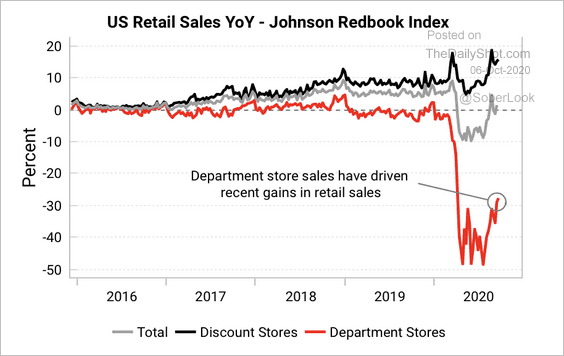

6. The recent rebound in retail sales was driven by department stores.

Source: Variant Perception

Source: Variant Perception

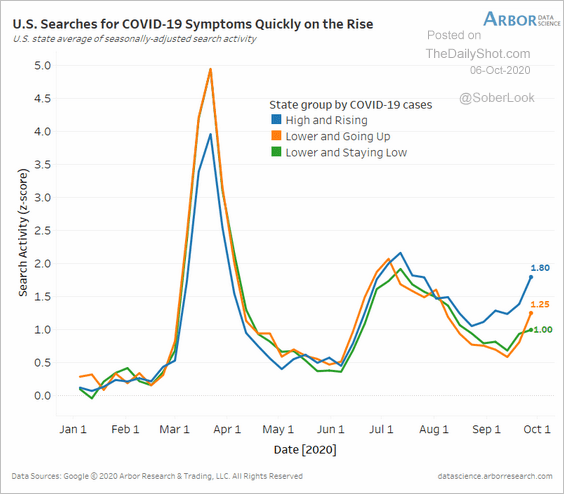

7. Online search activity for COVID-19 symptoms is rising again.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Canada

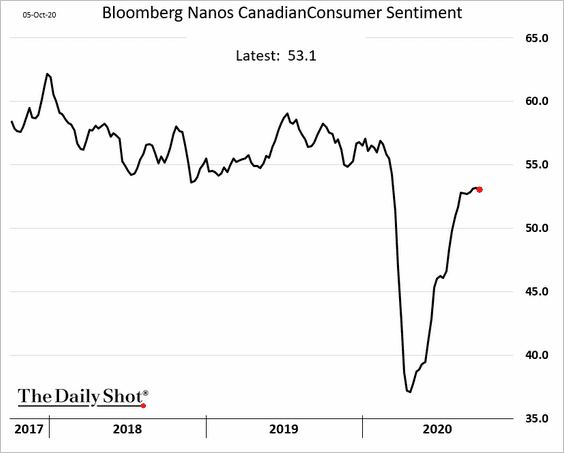

1. The recovery in consumer confidence has stalled, …

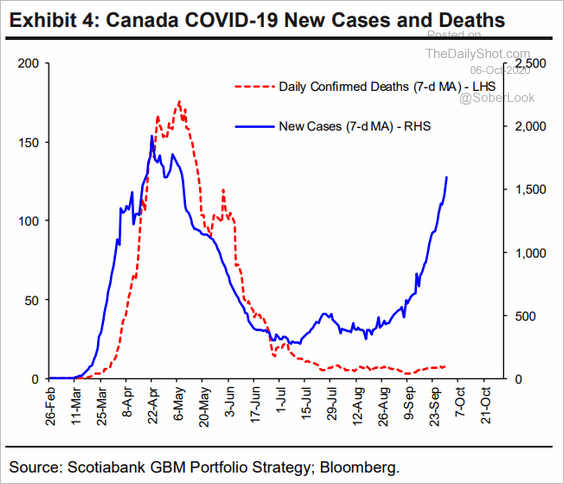

… as the number of new infections rises.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

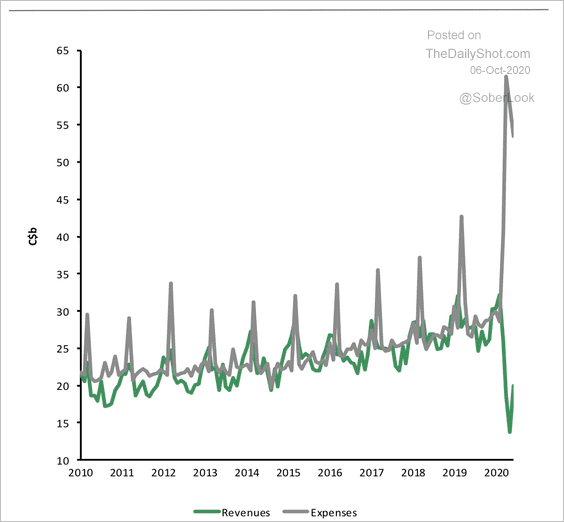

2. The budget gap has blown out.

Source: Desjardins

Source: Desjardins

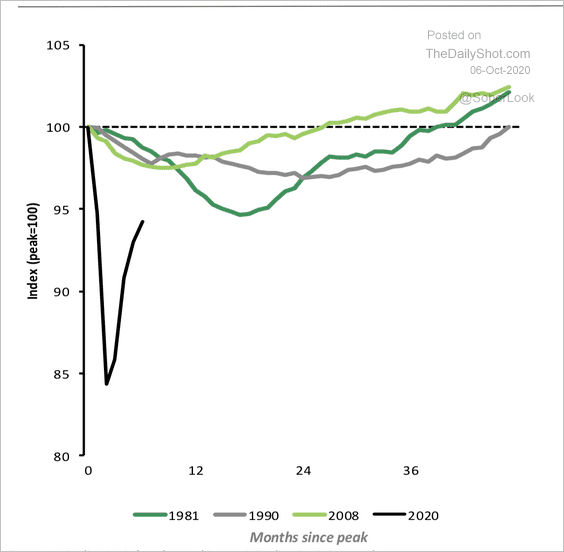

3. This chart shows Canada’s employment contraction vs. previous recessions.

Source: Desjardins

Source: Desjardins

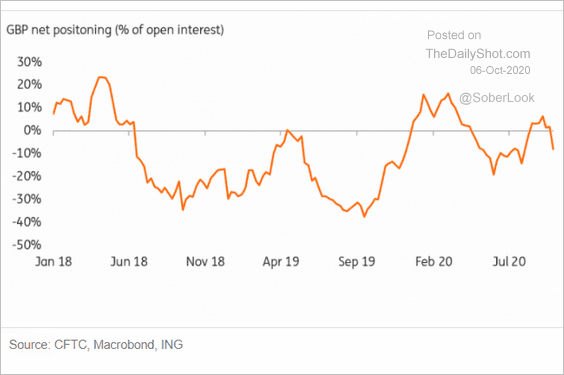

The United Kingdom

1. Speculative accounts are net short the pound again.

Source: ING

Source: ING

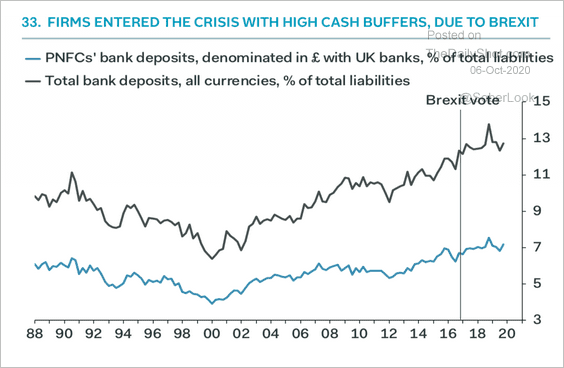

2. UK firms were better prepared for this crisis as they increased cash balances ahead of Brexit.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

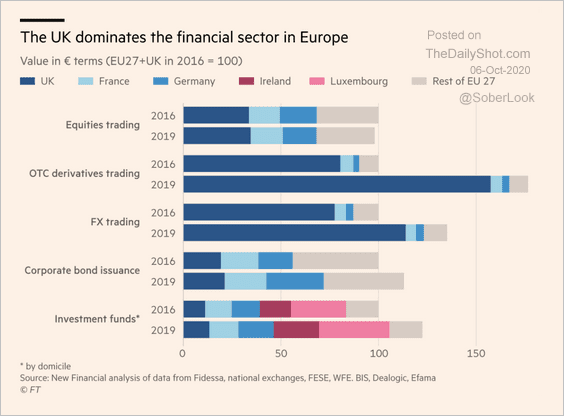

3. The UK dominates the financial sector in Europe.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

The Eurozone

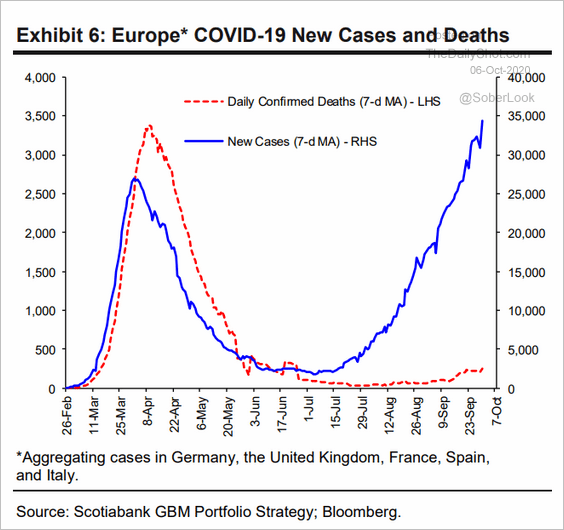

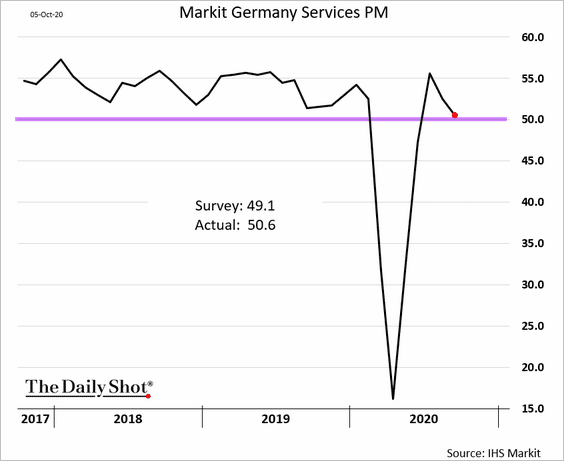

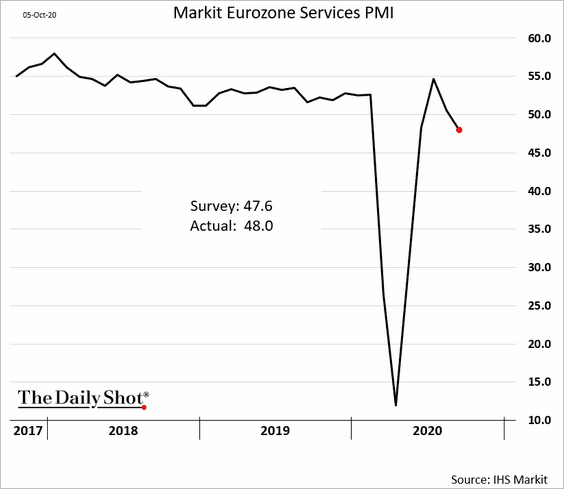

1. European service-sector recovery is stalling amid the second wave of infections.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

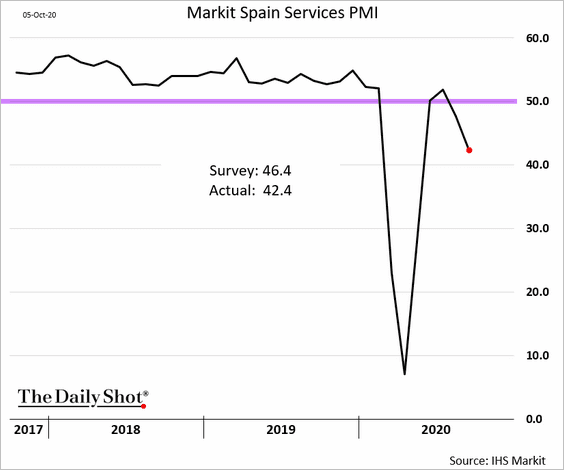

The slowdown was especially pronounced in Spain.

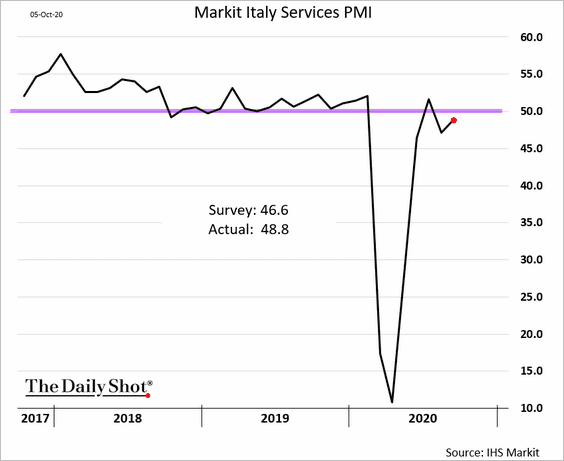

Here are the PMI trends for Italy, Germany, and the Eurozone (through September).

——————–

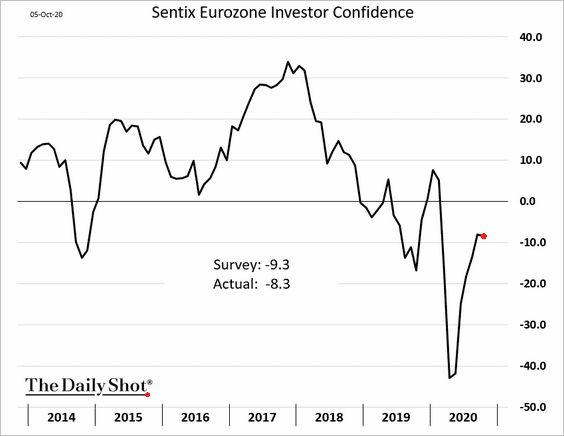

2. The improvement in investor confidence stalled but did not decline as much as expected.

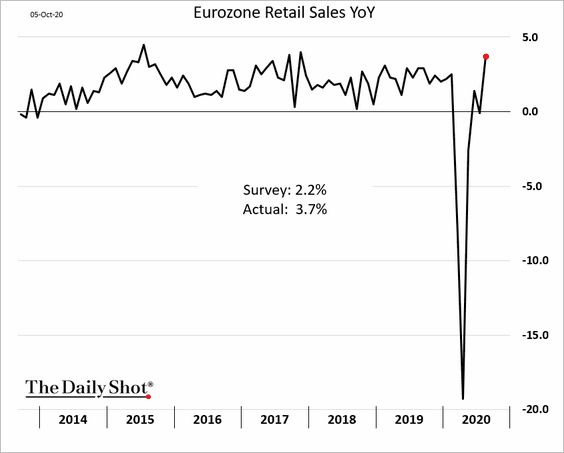

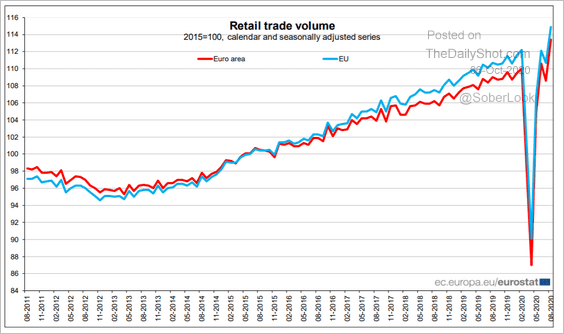

3. Retail sales soared in August, making a full (v-shaped) recovery.

Source: Eurostat Read full article

Source: Eurostat Read full article

——————–

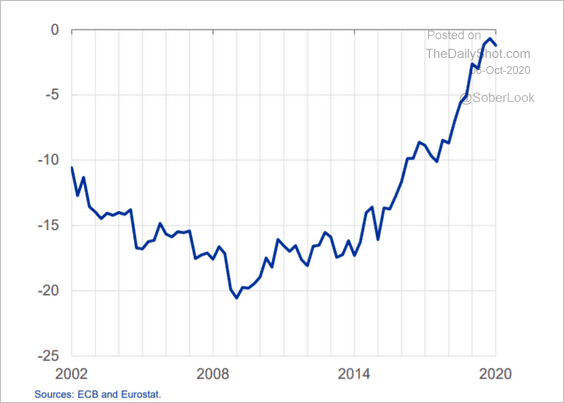

4. The Eurozone’s net foreign assets have been rising.

Source: ECB Read full article

Source: ECB Read full article

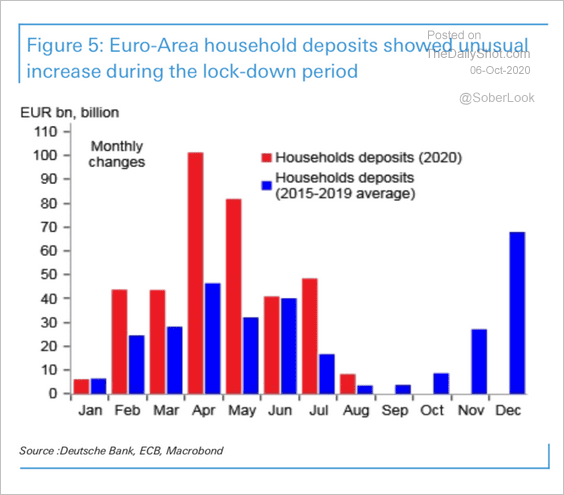

5. Household deposits expanded much faster than usual this year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Europe

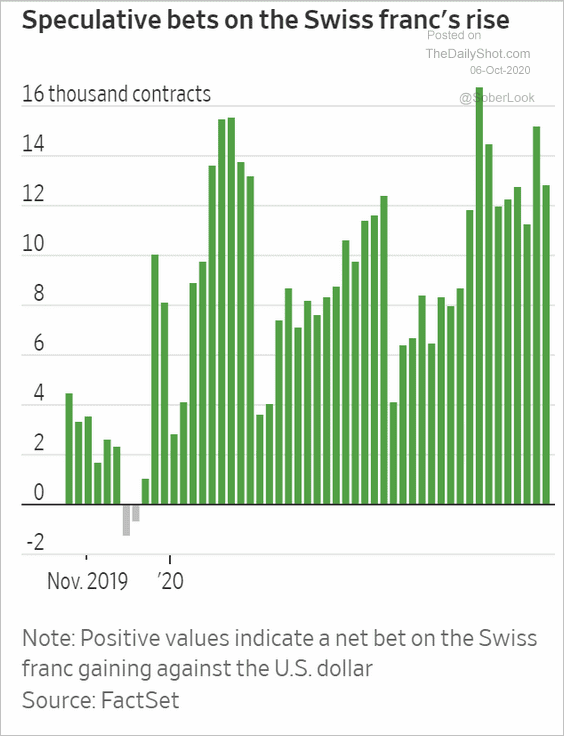

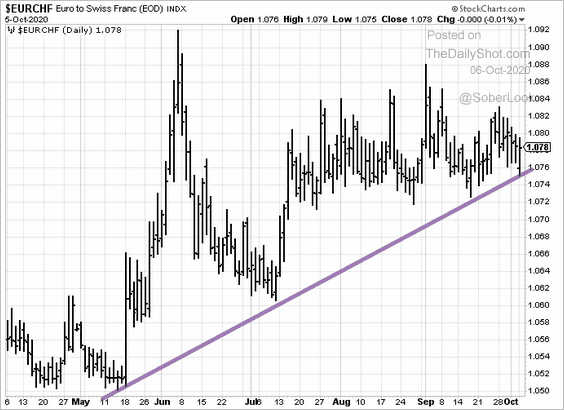

1. Despite the SNB’s efforts to keep the Swiss franc from appreciating, hedge funds continue to maintain net long positions.

Source: @WSJ Read full article

Source: @WSJ Read full article

EUR/CHF is holding support.

——————–

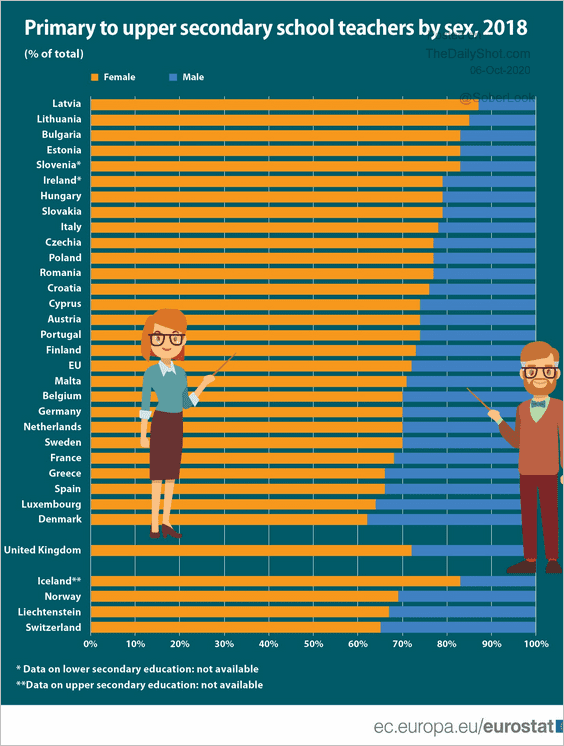

2. Here is a Food for Thought item: male vs. female school teachers in Europe.

Source: Eurostat Read full article

Source: Eurostat Read full article

Asia – Pacific

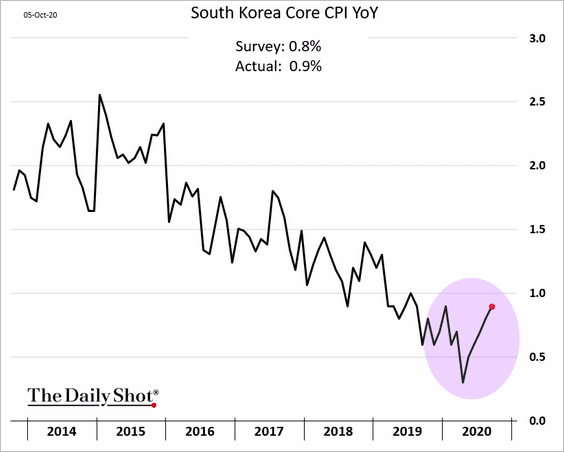

1. South Korea’s CPI appears to be rebounding.

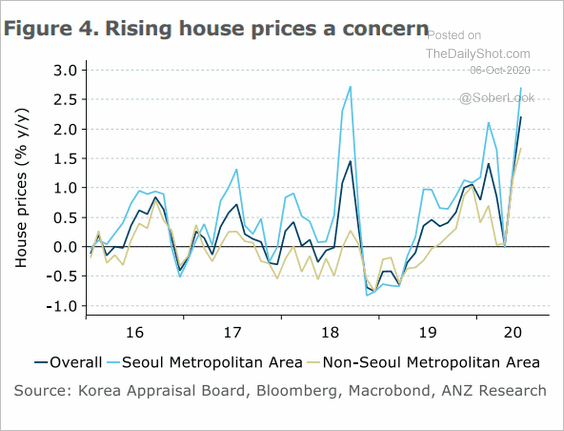

Home price appreciation is accelerating.

Source: ANZ Research

Source: ANZ Research

——————–

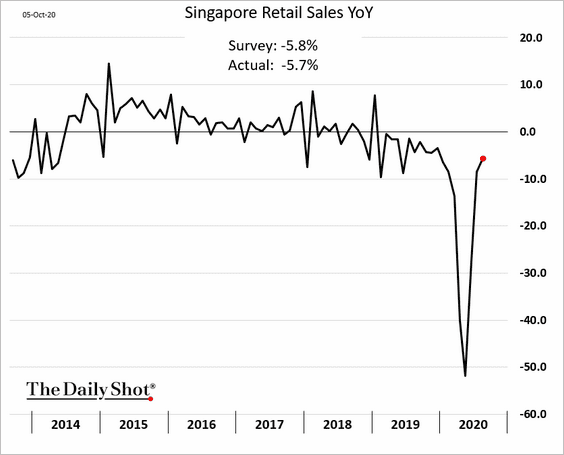

2. Singapore’s retail sales are still below last year’s levels.

3. Next, we have some updates on Australia.

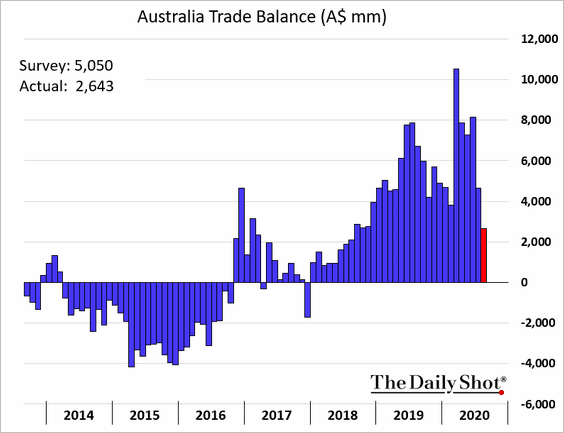

• The nation’s trade surplus unexpectedly contracted.

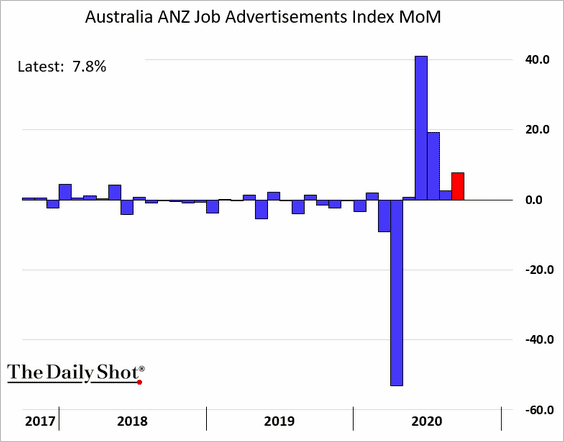

• Job advertisements continue to increase.

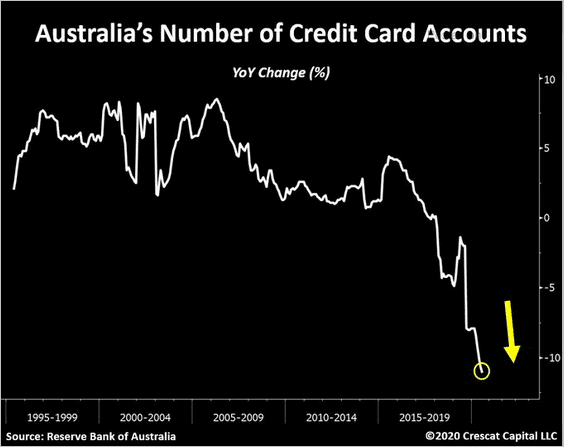

• Here is the number of credit card accounts.

Source: @TaviCosta

Source: @TaviCosta

China

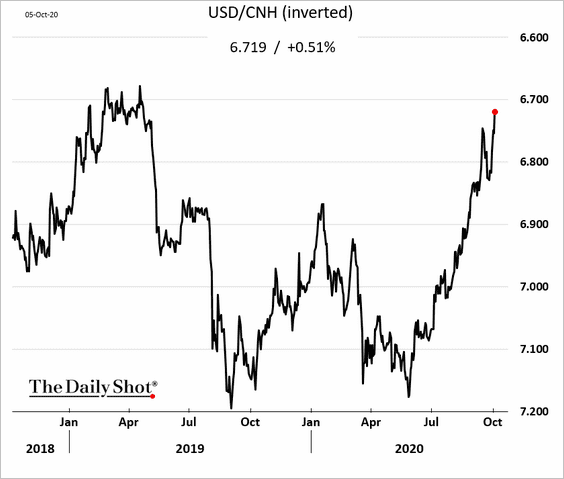

1. The renminbi keeps climbing.

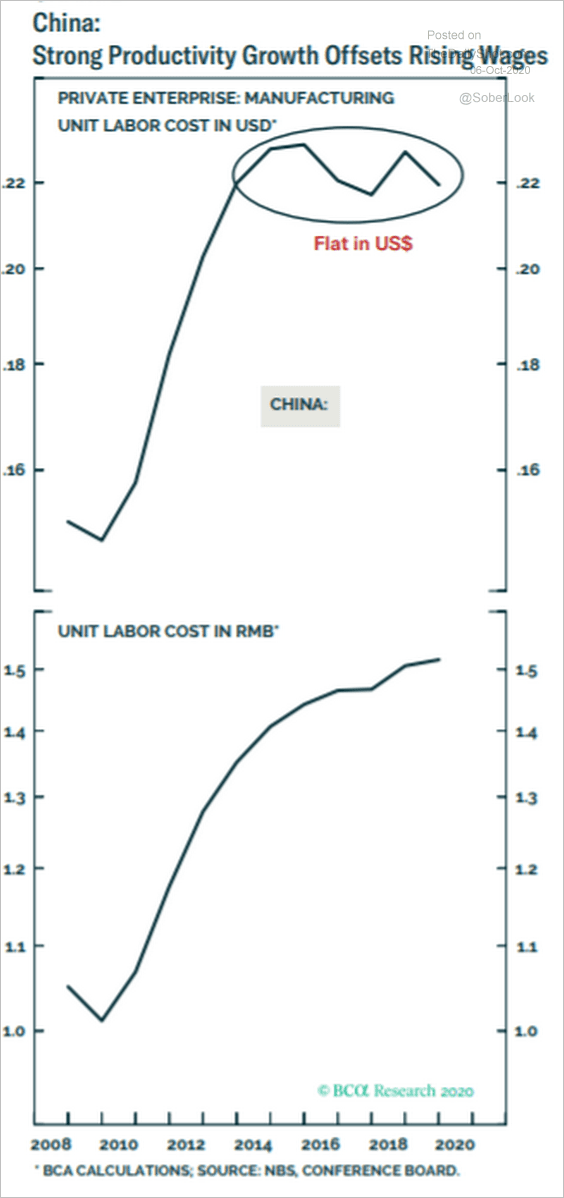

2. China’s unit labor costs have been flat in recent years in dollar terms.

Source: BCA Research

Source: BCA Research

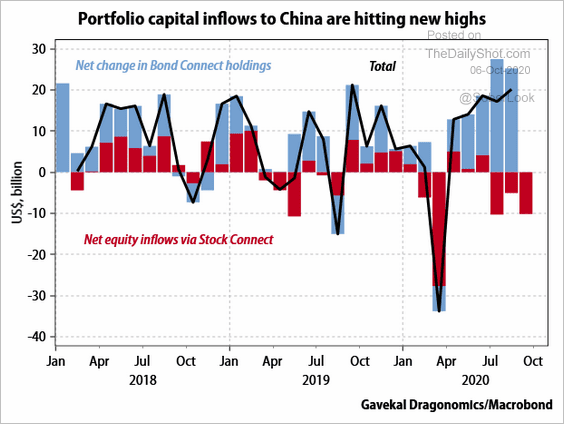

3. Portfolio inflows remain robust.

Source: Gavekal

Source: Gavekal

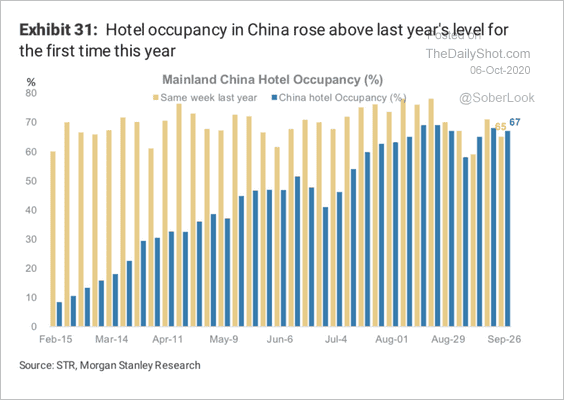

4. Hotel occupancy has recovered.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

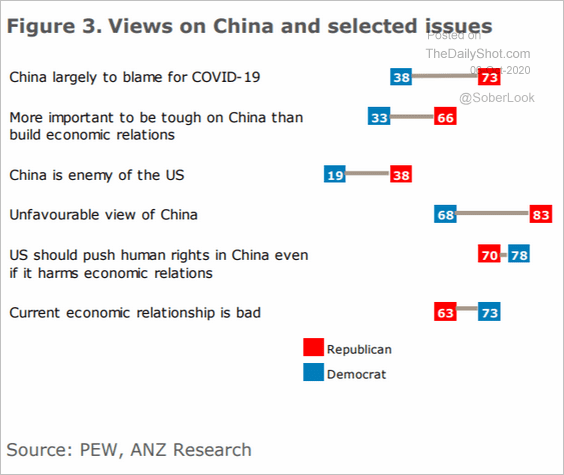

5. This chart shows US views on China (by political affiliation).

Source: ANZ Research

Source: ANZ Research

Emerging Markets

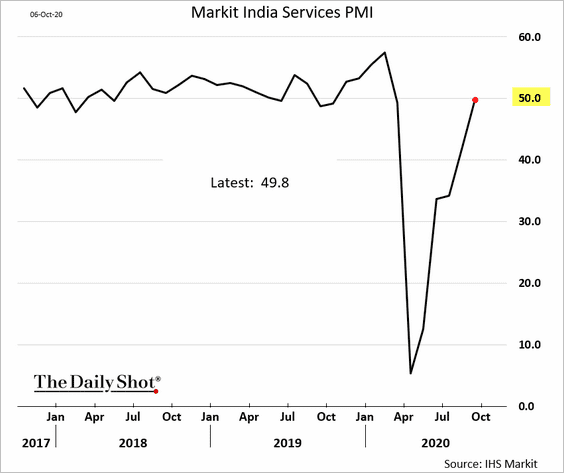

1. Let’s begin with India.

• Service-sector activity has stabilized.

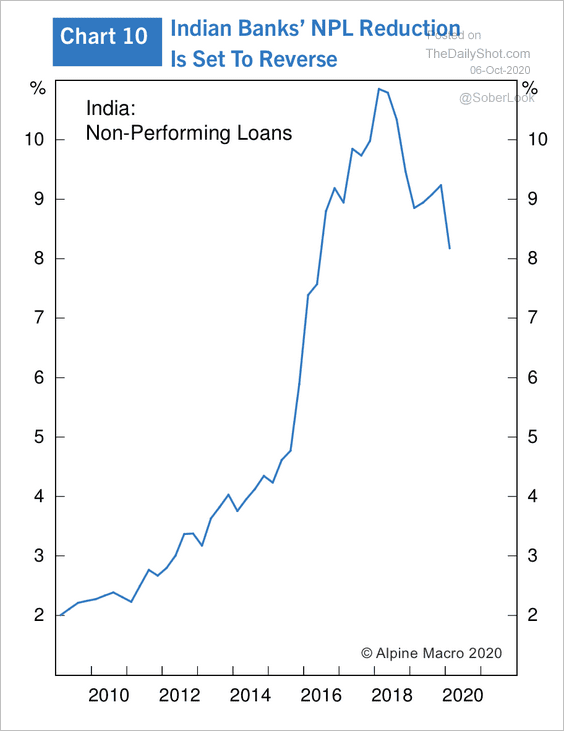

• The reduction in non-performing loans in India could end, given the pandemic.

Source: Alpine Macro

Source: Alpine Macro

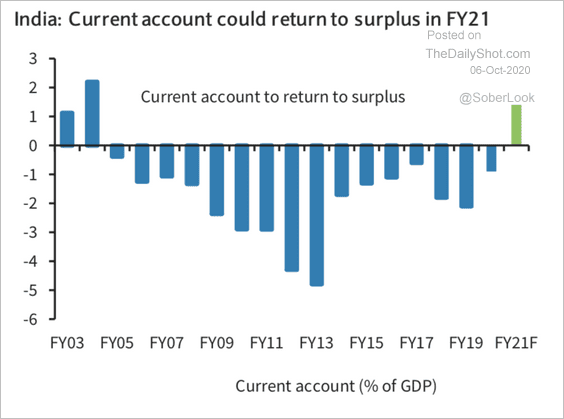

• The nation’s current account could swing into surplus.

Source: Barclays Research

Source: Barclays Research

——————–

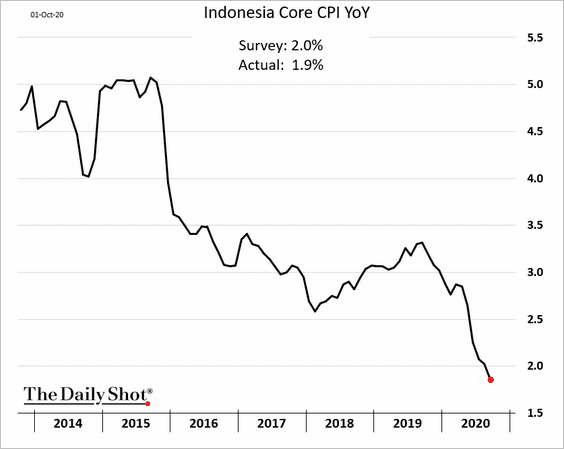

2. Indonesia’s consumer inflation is tumbling.

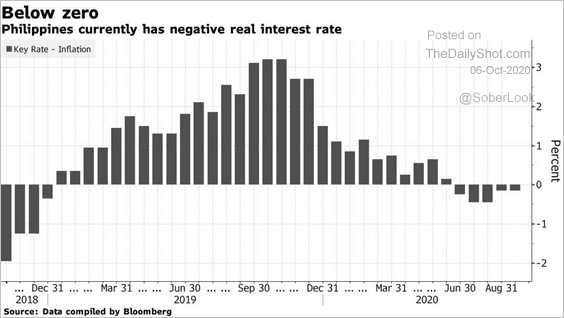

3. The Philippines currently has negative real rates.

Source: @business Read full article

Source: @business Read full article

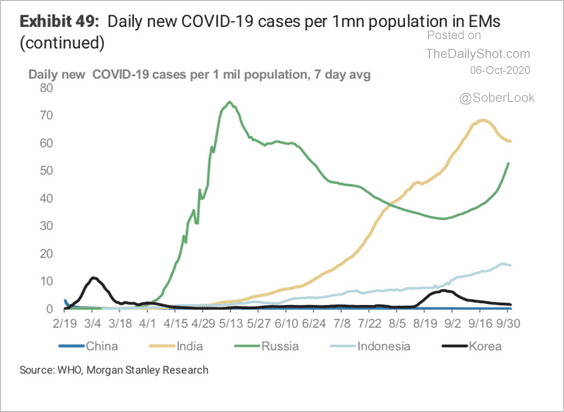

4. New COVID cases are rising in Russia.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

5. Central European recovery has lost momentum.

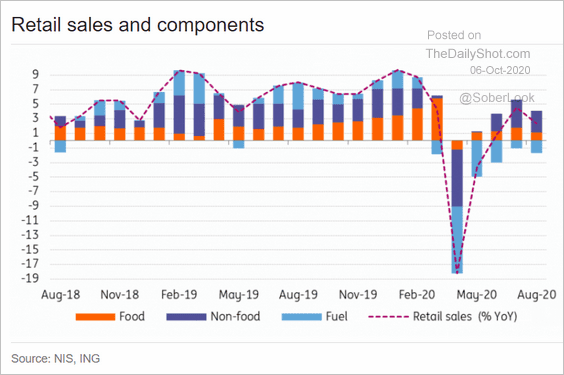

• Romanian retail sales:

Source: ING

Source: ING

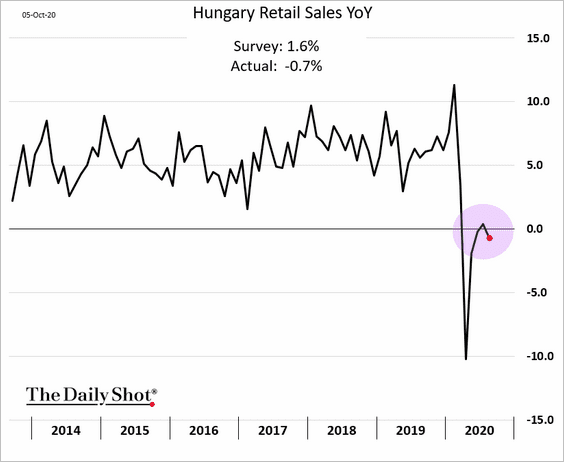

• Hungarian retail sales:

——————–

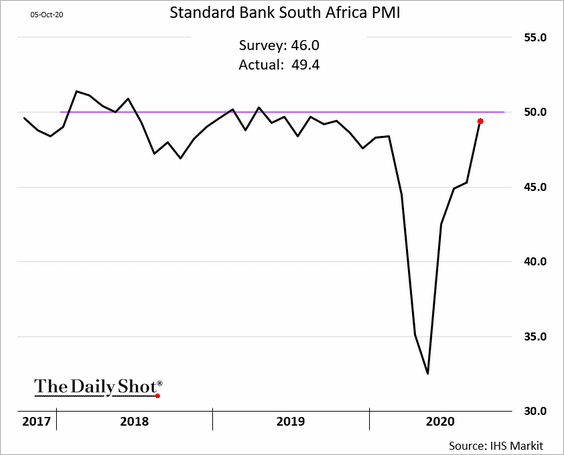

6. South Africa’s business activity has almost stabilized.

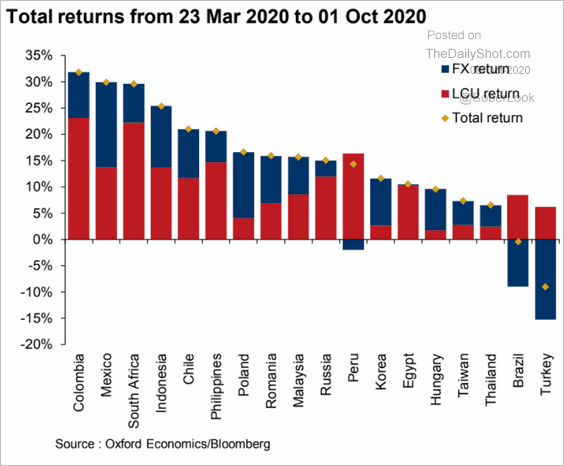

7. This chart shows the total return across emerging markets since March (in local currency and in dollars).

Source: Oxford Economics

Source: Oxford Economics

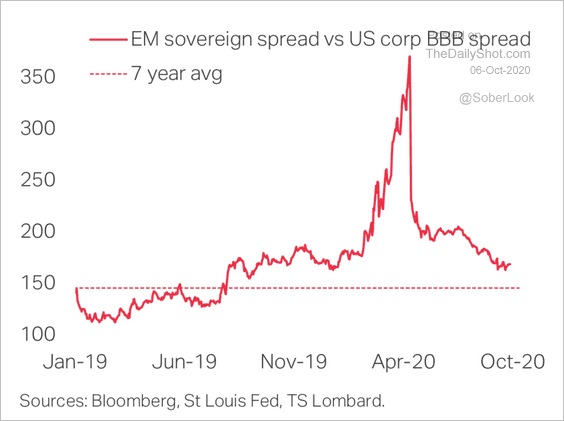

8. Sovereign spreads have tightened but remain above average.

Source: TS Lombard

Source: TS Lombard

Cryptocurrency

Bitcoin is primed for a breakout.

Energy

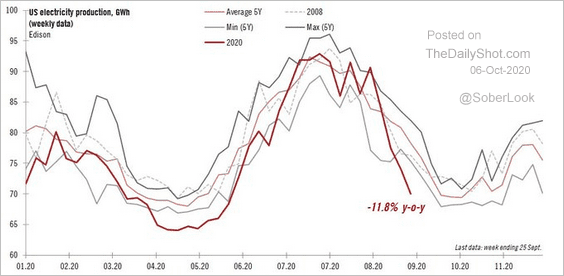

1. US electricity production is the lowest in years (for this time of the year).

Source: @TCosterg

Source: @TCosterg

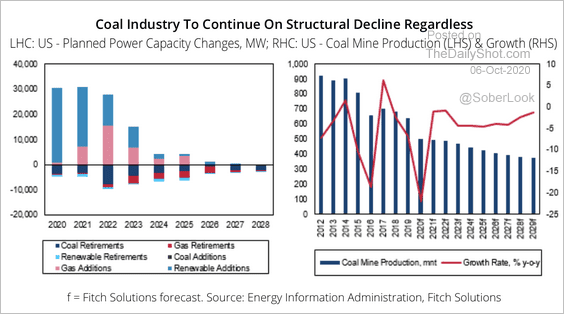

2. Fitch expects a continued structural decline for the US coal industry.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Equities

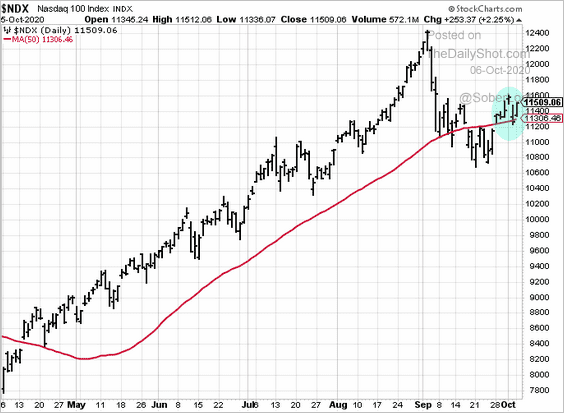

1. The Nasdaq 100 index is holding above the 50-day moving average.

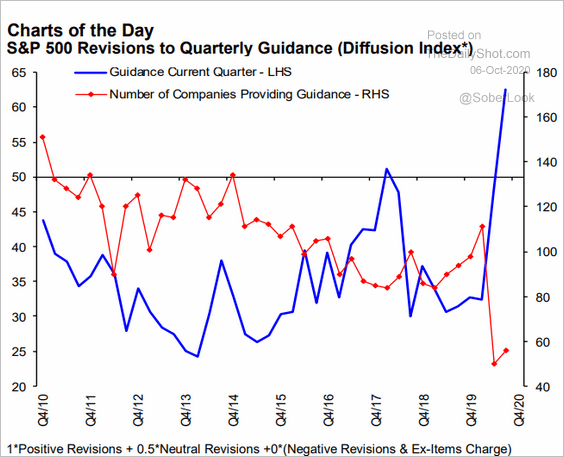

2. Fewer companies are providing guidance, but those that have been are increasingly upbeat.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

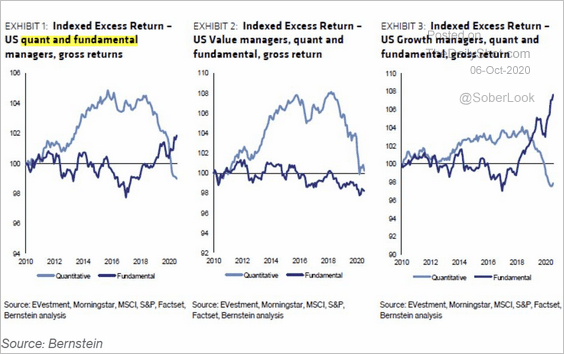

3. Quant strategies’ underperformance worsened this year.

Source: @markets Read full article

Source: @markets Read full article

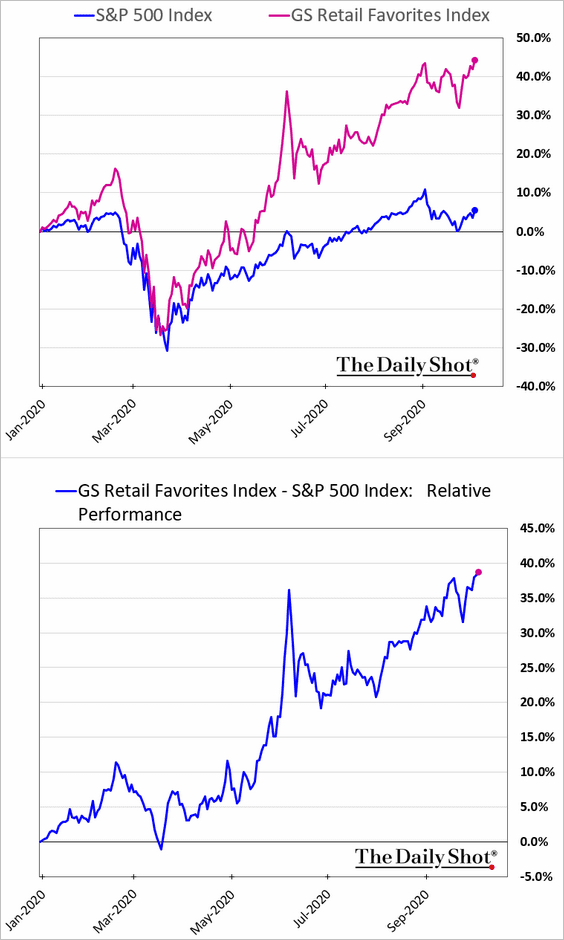

4. Stocks favored by retail investors keep widening their gap vs. the broader market.

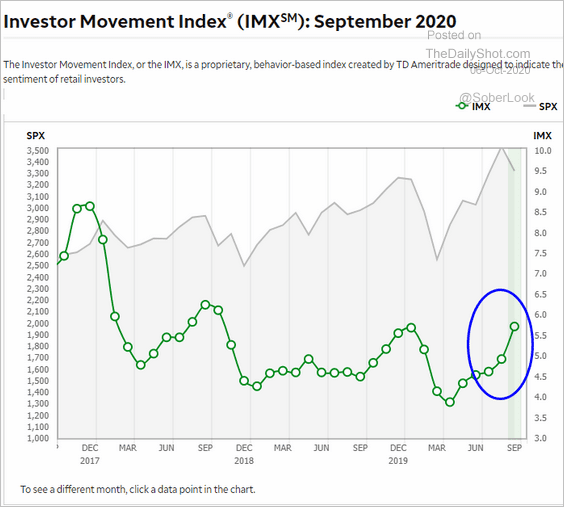

The TD Ameritrade index shows that retail investors are increasingly upbeat.

Source: TD Ameritrade

Source: TD Ameritrade

——————–

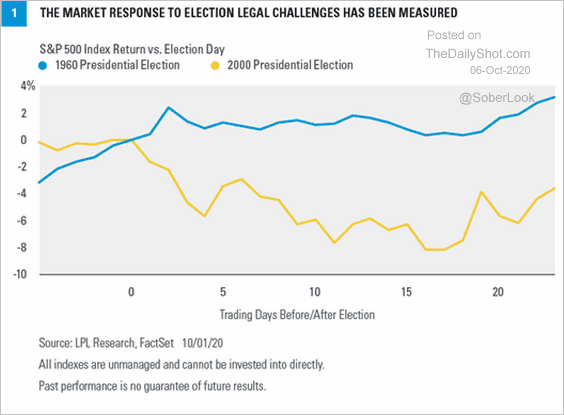

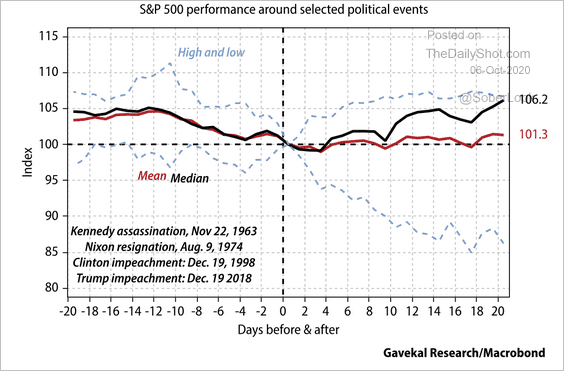

5. How does the market respond to legal challenges in elections?

Source: LPL Research

Source: LPL Research

Political shocks can have a substantial impact on the market.

Source: Gavekal

Source: Gavekal

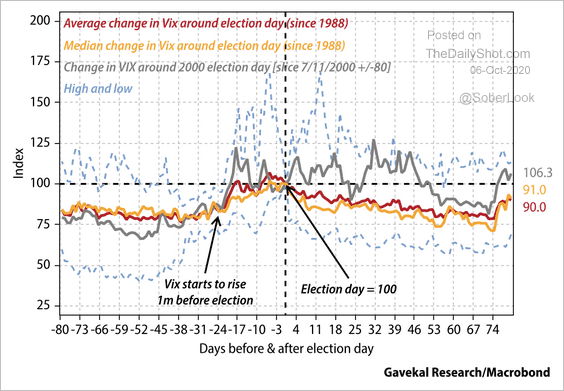

Investors tend to pay more for protection around elections.

Source: Gavekal

Source: Gavekal

Credit

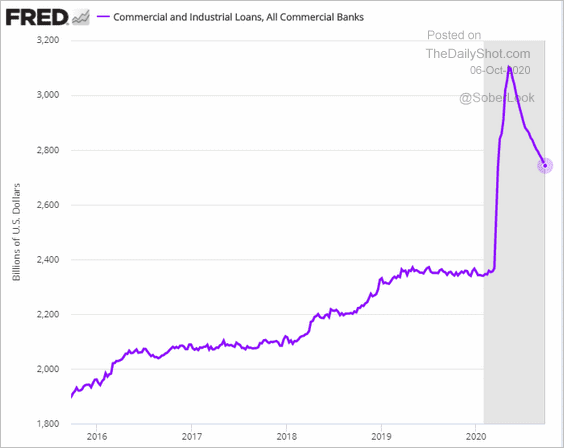

1. Business loan balances have been declining as companies pay down their revolving credit lines.

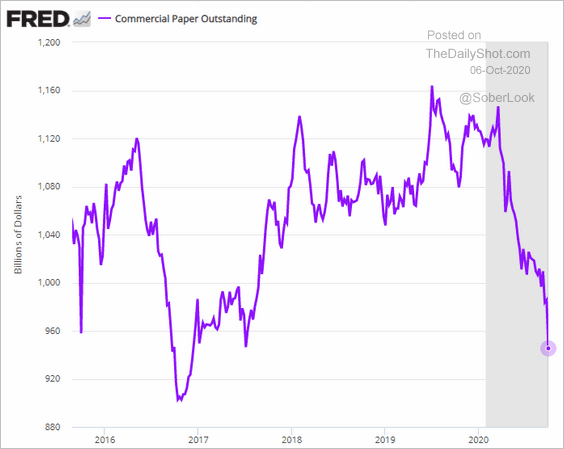

Commercial paper outstanding continues to shrink.

Source: @stlouisfed

Source: @stlouisfed

——————–

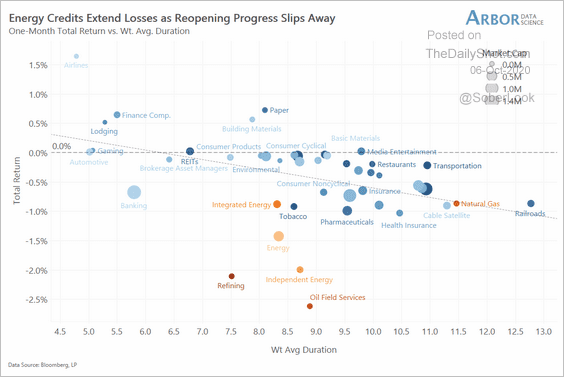

2. Energy credits have been underperforming.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

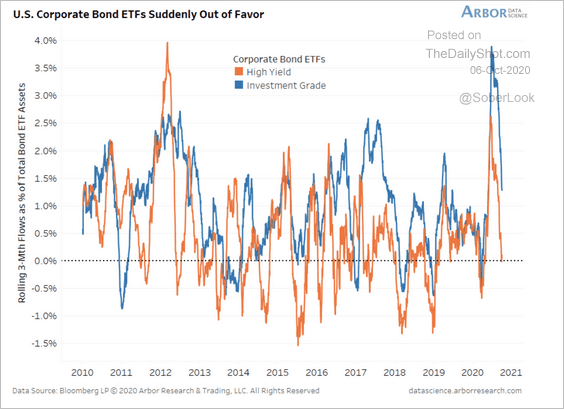

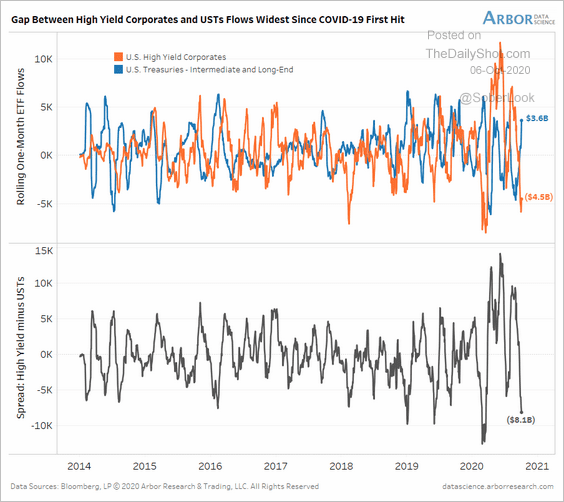

3. High-yield debt funds saw some outflows, especially relative to Treasuries.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

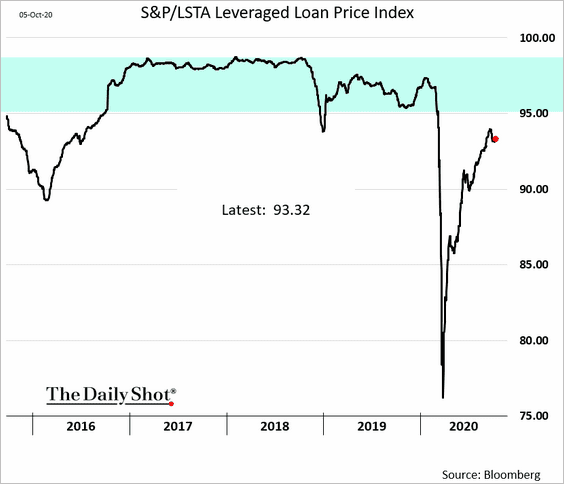

4. Leveraged loan prices remain below pre-crisis levels.

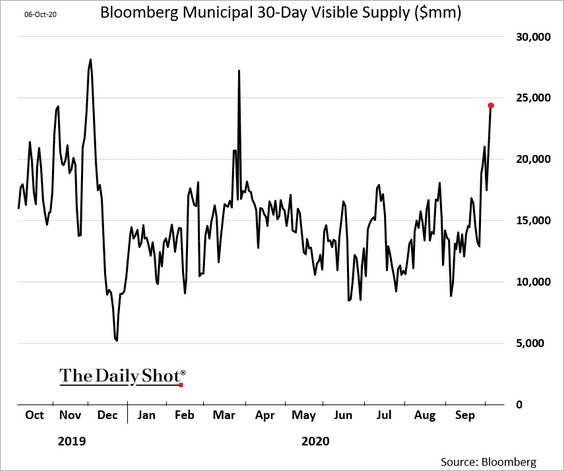

5. Muni bond issuance is accelerating again.

Rates

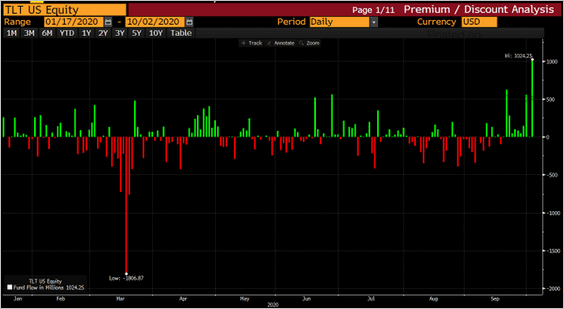

1. Long-term Treasuries (TLT) saw substantial inflows last week.

Source: @lisaabramowicz1

Source: @lisaabramowicz1

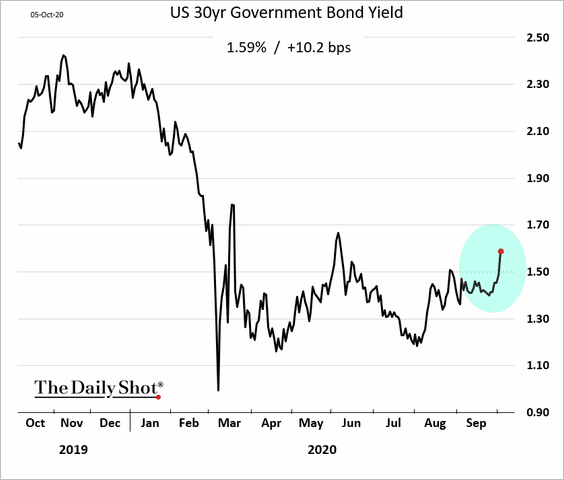

Nonetheless, long-term Treasury yields climbed.

——————–

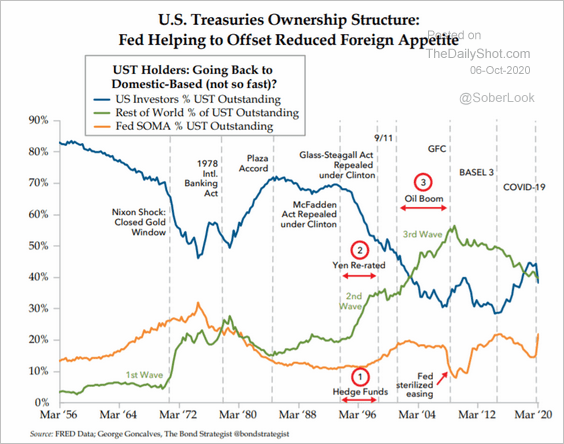

2. This chart shows the ownership structure in Treasury securities since the 1950s.

Source: The Daily Feather

Source: The Daily Feather

Global Developments

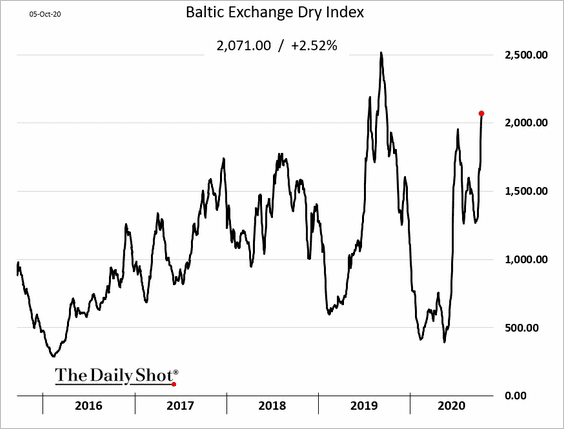

1. Dry bulk shipping costs are climbing rapidly.

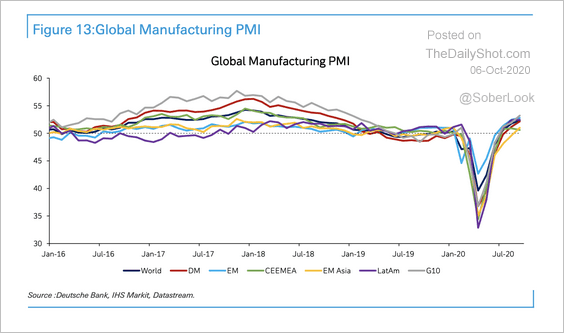

2. Global manufacturing is back in expansion mode (PMI > 50).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

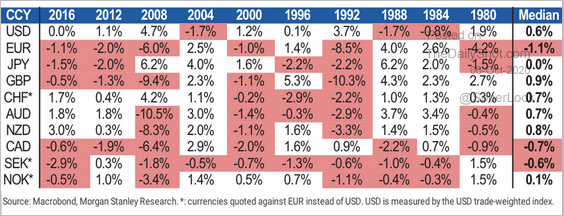

3. This table shows G10 currencies’ historical performance one month into US elections.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

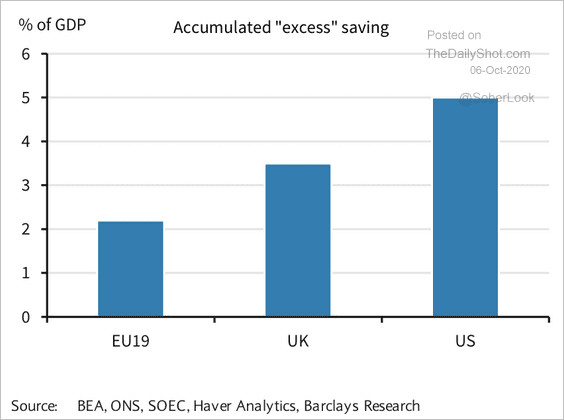

4. Developed market households accumulated sizable savings, which could support growth if risks diminish, according to Barclays.

Source: Barclays Research

Source: Barclays Research

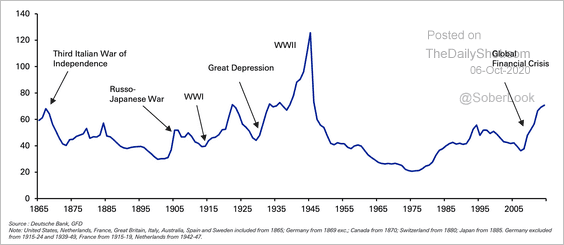

5. This chart shows the global median debt-to-GDP ratio over time.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

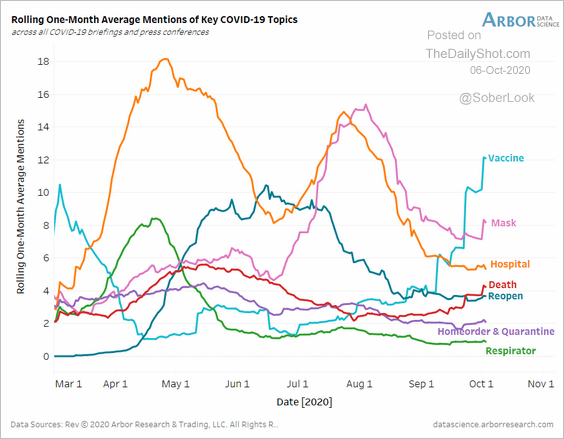

1. Topics covered in official briefings and press conferences:

Source: Arbor Research & Trading

Source: Arbor Research & Trading

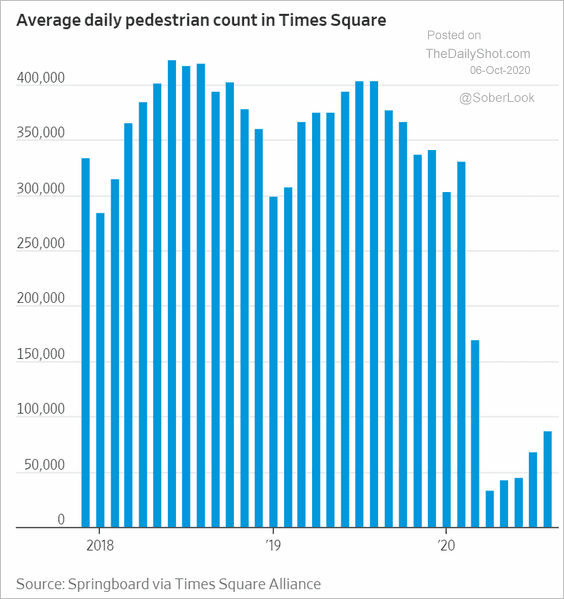

2. Times Square visitors:

Source: @WSJ Read full article

Source: @WSJ Read full article

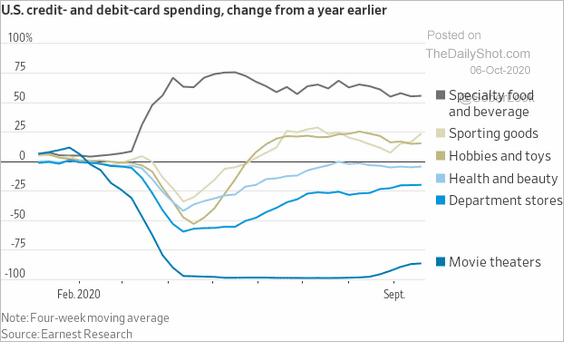

3. Credit- and debit-card spending by sector:

Source: @jeffsparshott

Source: @jeffsparshott

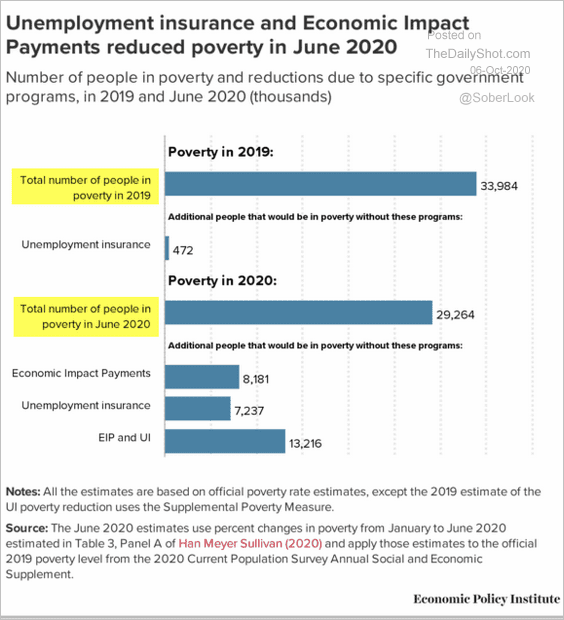

4. US government payments reduced poverty in 2020.

Source: Economic Policy Institute Read full article

Source: Economic Policy Institute Read full article

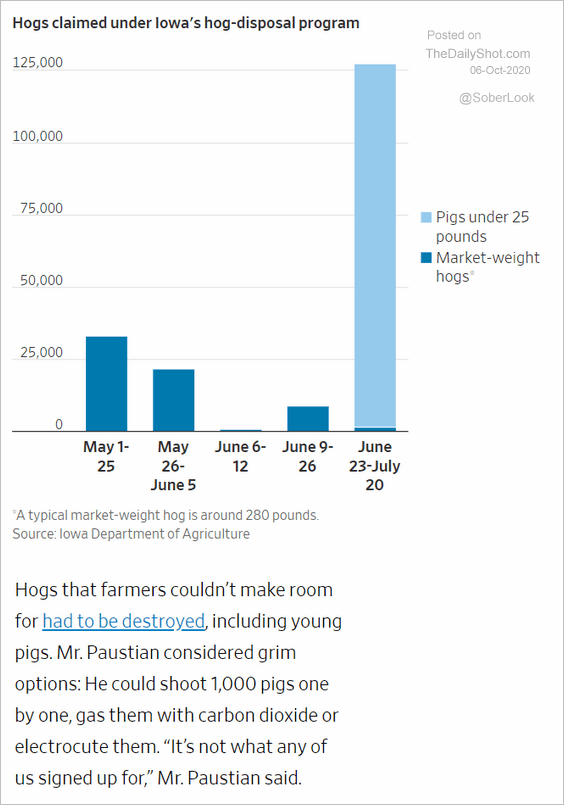

5. Iowa’s hog-disposal program:

Source: @WSJ Read full article

Source: @WSJ Read full article

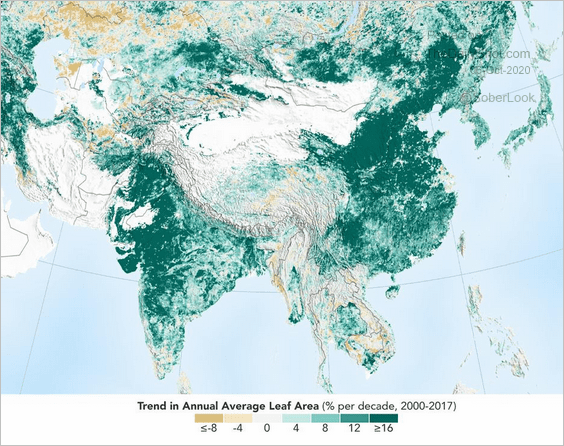

6. Improvements in leaf areas globally:

Source: @simongerman600 Read full article

Source: @simongerman600 Read full article

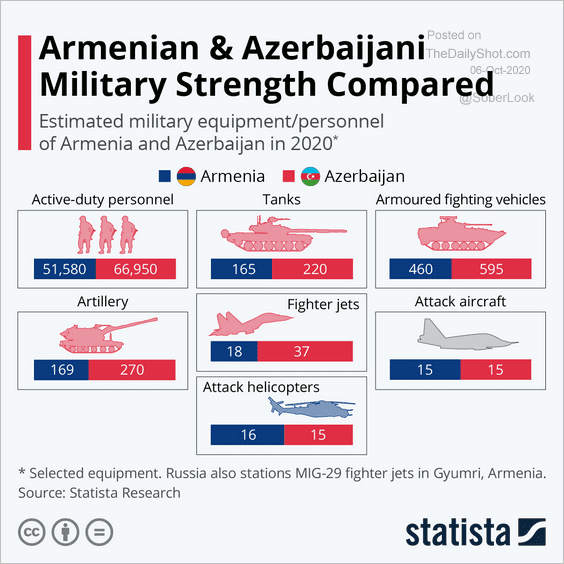

7. Armenia vs. Azerbaijan military strength:

Source: Statista

Source: Statista

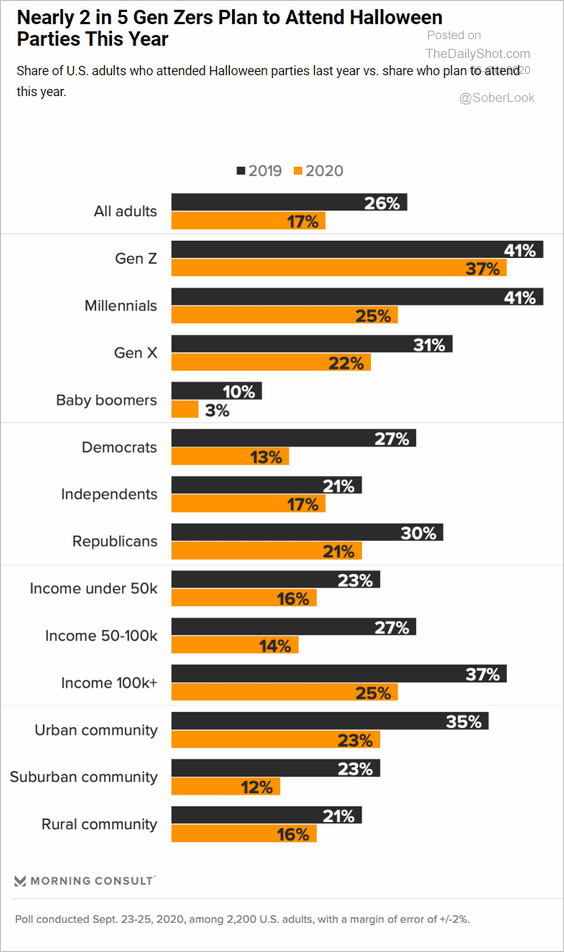

8. Who will be attending a Halloween party this year?

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–