The Daily Shot: 15-Oct-20

• China

• Australia

• The Eurozone

• Canada

• The United States

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

China

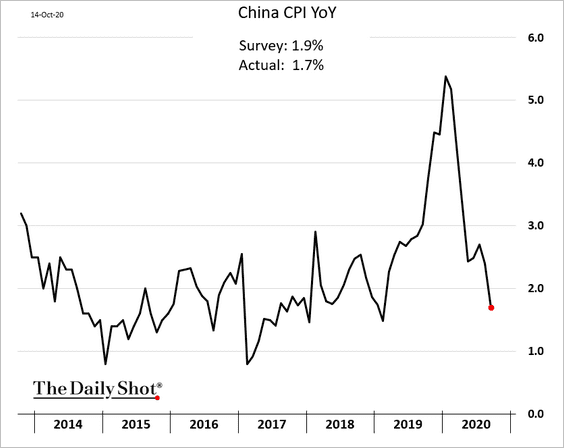

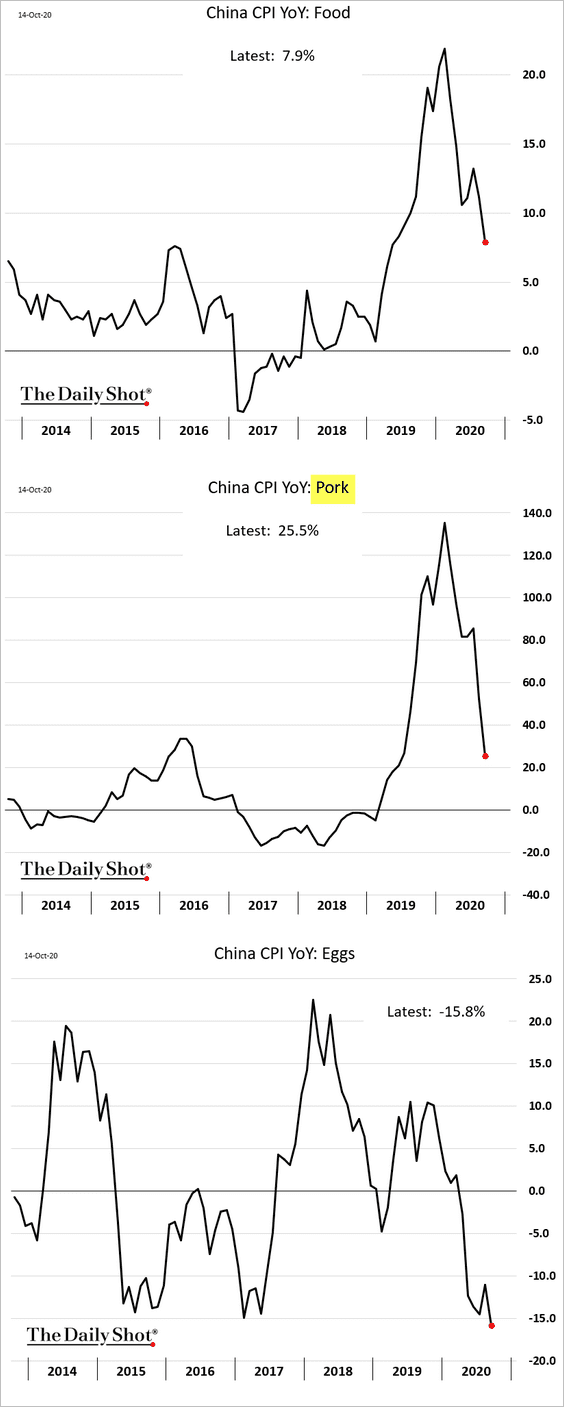

1. Consumer inflation continues to moderate, with the September figures coming in below market expectations.

Slower food inflation, particularly pork, has been dragging the headline CPI lower. China has made progress in rebuilding its pig population while also boosting pork imports.

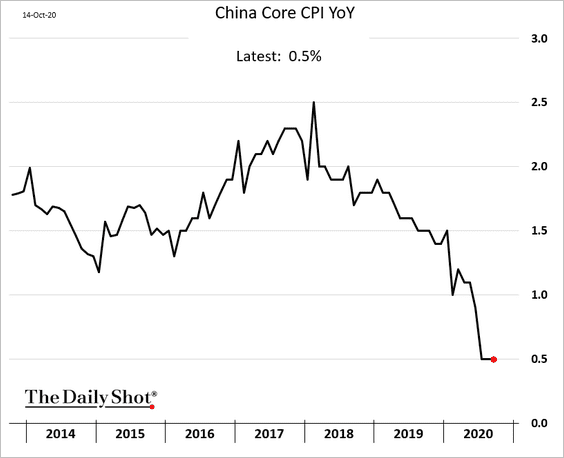

Core inflation appears to have stabilized.

——————–

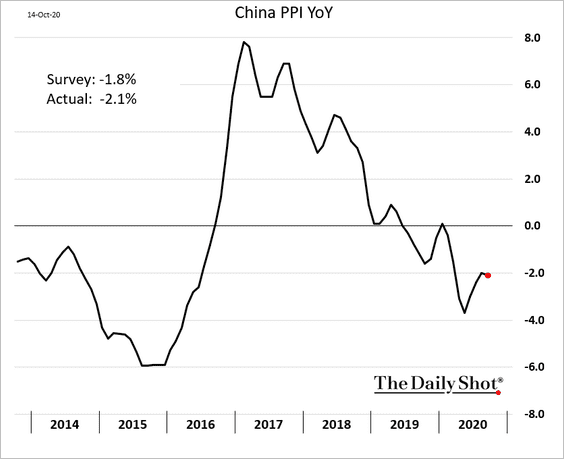

2. The PPI edged lower (an increase was expected). Falling producer prices tend to pressure industrial profits.

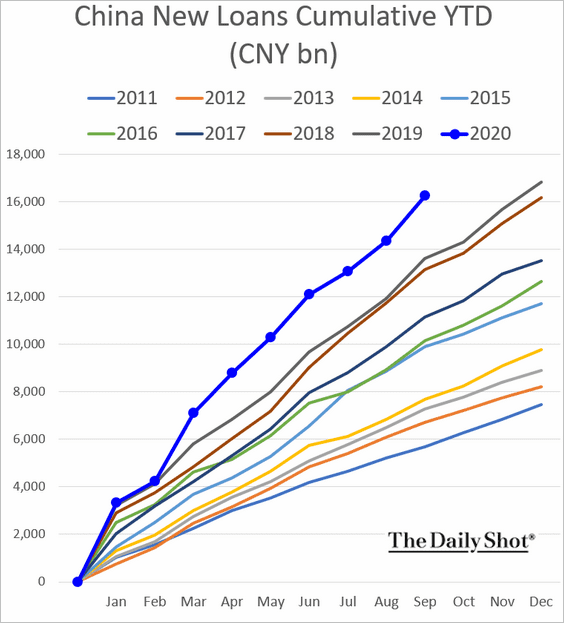

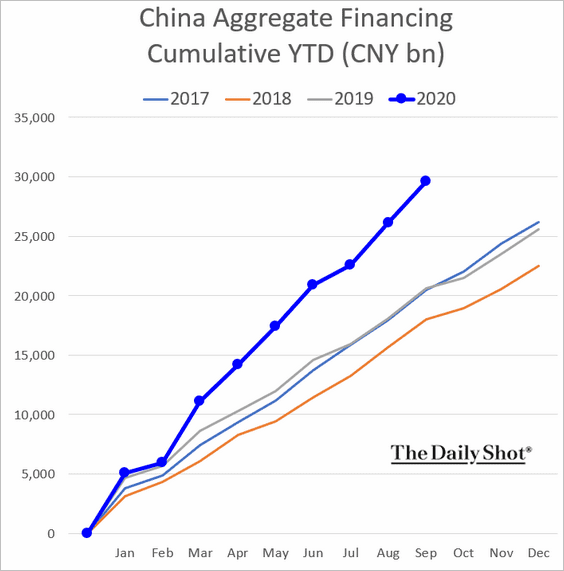

3. Credit expansion accelerated last month, with the year-to-date bank loan growth far exceeding last year’s levels.

Here is China’s aggregate credit growth (including bonds).

——————–

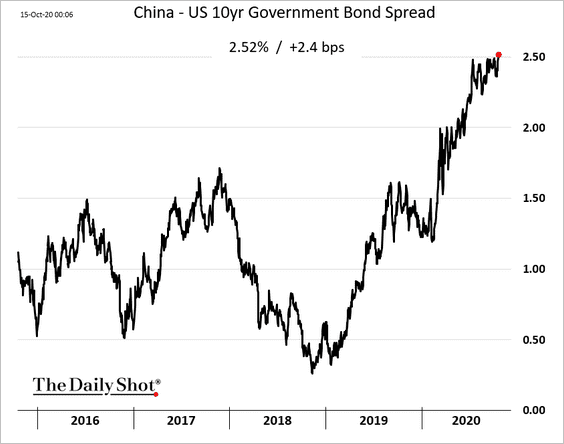

4. The 10yr yield differential with the US hit a multi-year high.

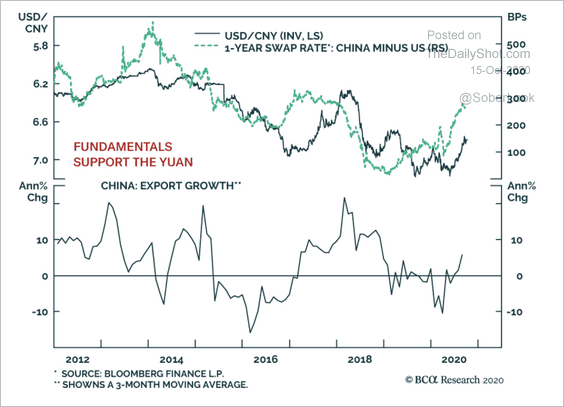

Interest rate differentials (vs. the US) and export growth remain supportive of the yuan.

Source: BCA Research

Source: BCA Research

——————–

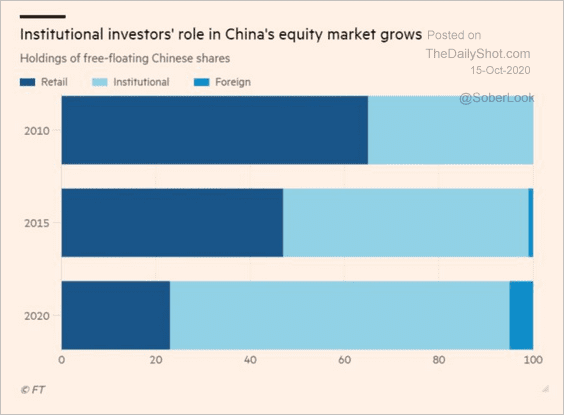

5. China’s stock market capitalization hit a record high.

Source: @jessefelder, @FT Read full article

Source: @jessefelder, @FT Read full article

Institutional investors now dominate the market.

Source: @adam_tooze, @KangHexin Read full article

Source: @adam_tooze, @KangHexin Read full article

——————–

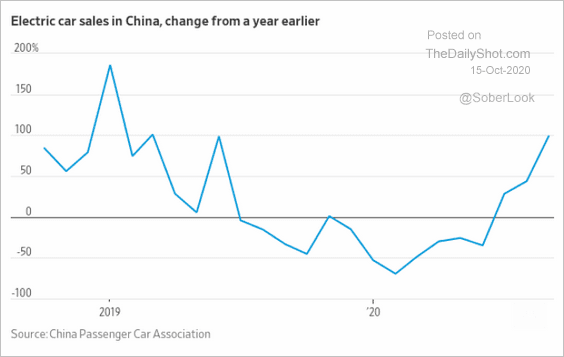

6. EV sales are accelerating again despite a 10% cut in subsidies.

Source: @WSJ Read full article

Source: @WSJ Read full article

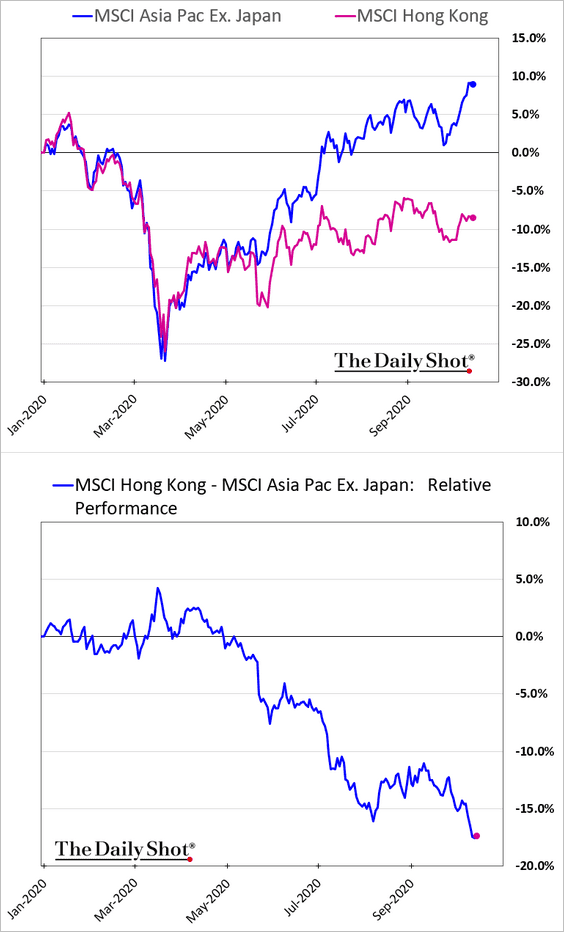

7. Hong Kong’s stock market underperformance continues to widen.

Australia

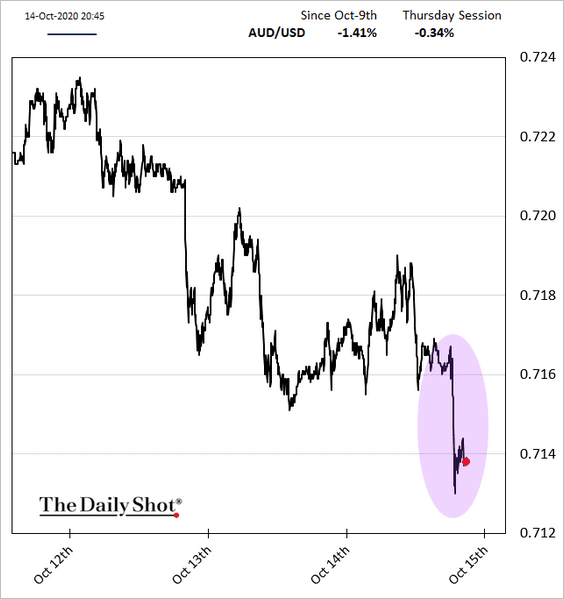

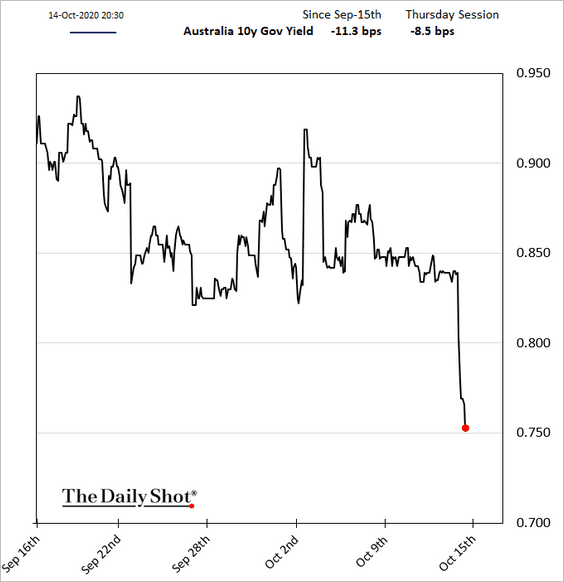

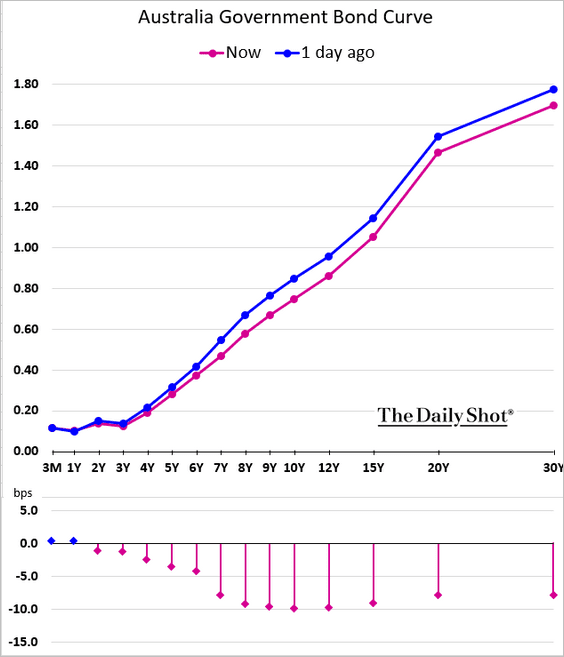

1. The RBA is looking at another rate cut as well as potentially buying longer-dated bonds.

Source: News.com.au Read full article

Source: News.com.au Read full article

The Aussie dollar and bond yields fell.

The yield curve flattened.

——————–

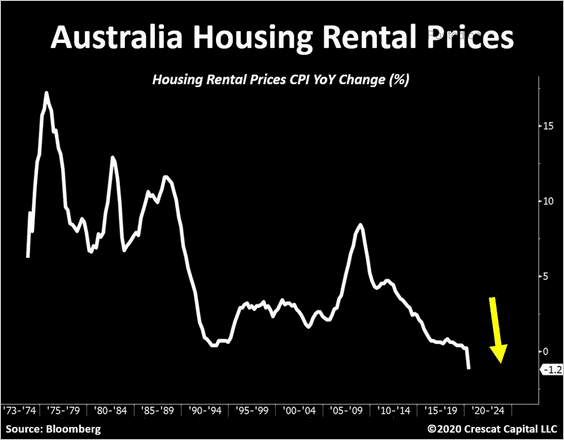

2. Rental prices have been declining this year.

Source: @TaviCosta

Source: @TaviCosta

The Eurozone

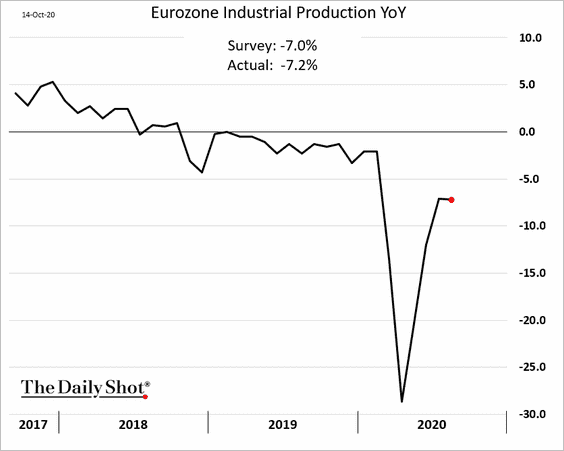

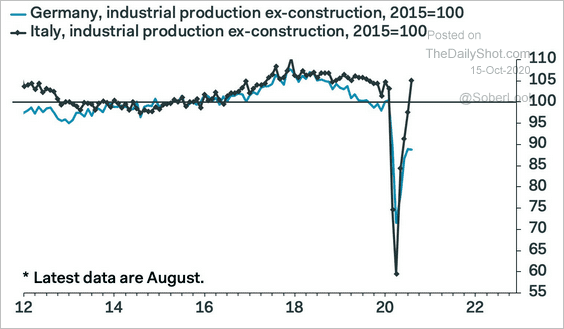

1. The rebound in industrial production stalled in August.

Gains have been uneven, with Germany underperforming.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

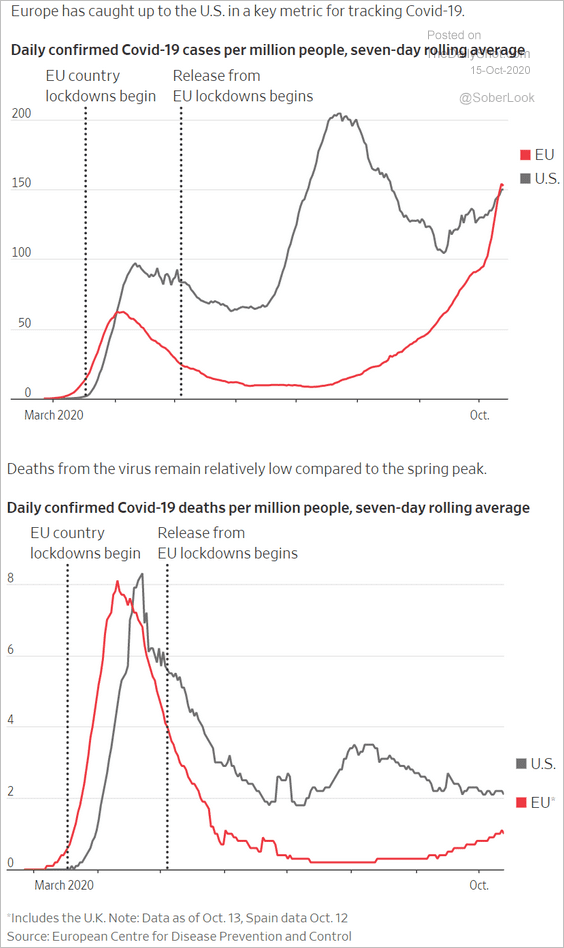

2. The second wave of COVID infections shows no signs of slowing.

Source: @WSJ Read full article

Source: @WSJ Read full article

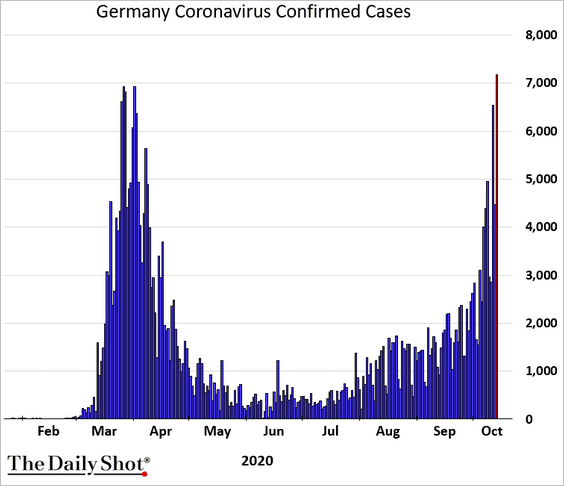

• Germany (daily new cases):

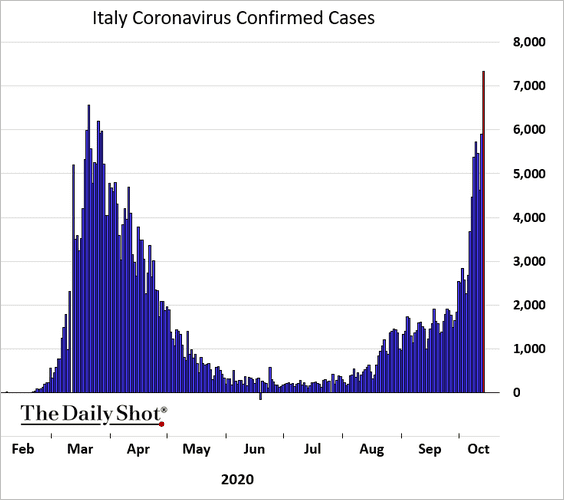

• Italy:

Source: Bloomberg Finance L.P.

Source: Bloomberg Finance L.P.

——————–

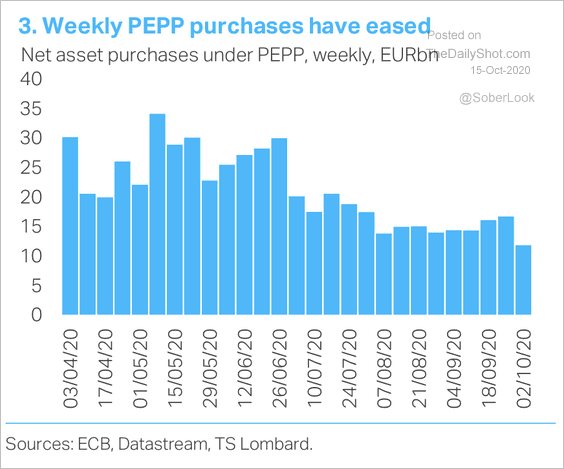

3. The ECB’s net asset purchases under PEPP have eased.

Source: TS Lombard

Source: TS Lombard

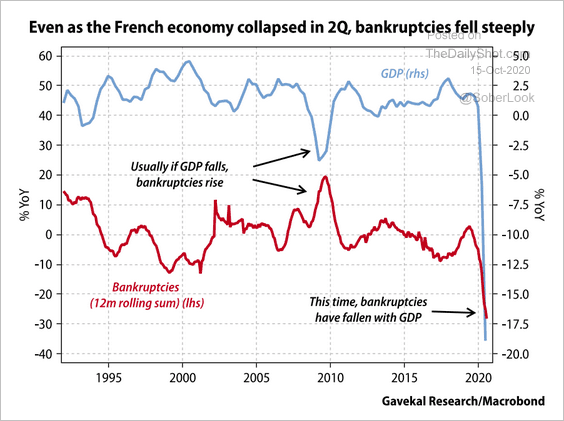

4. French bankruptcies tumbled this year due to the change in the law (in March). There are a lot of “zombie” firms out there these days.

Source: Gavekal

Source: Gavekal

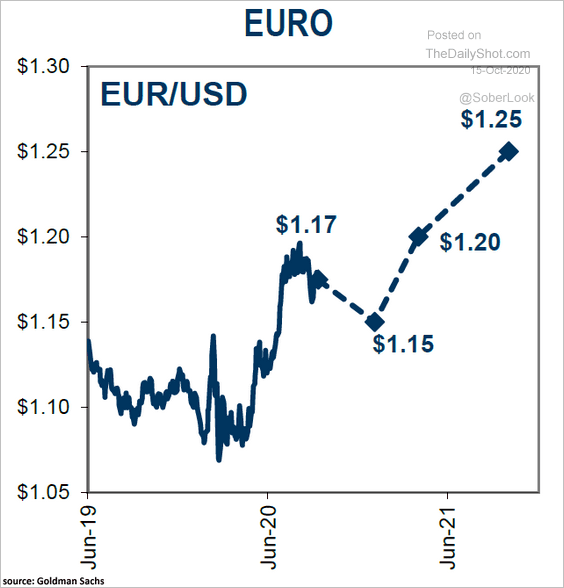

5. Goldman expects fresh gains for the euro next year.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

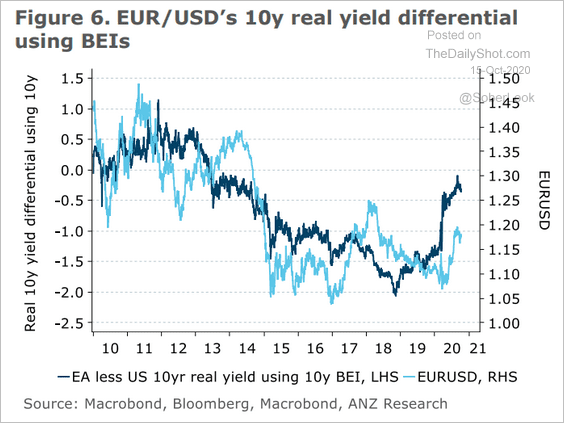

And real rate differentials point to further euro upside.

Source: ANZ Research

Source: ANZ Research

Canada

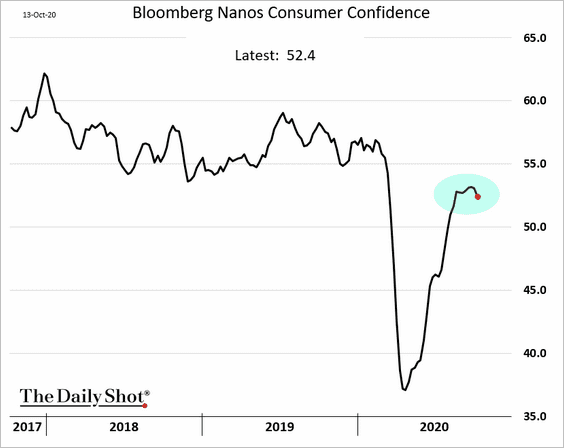

1. Gains in consumer confidence have stalled.

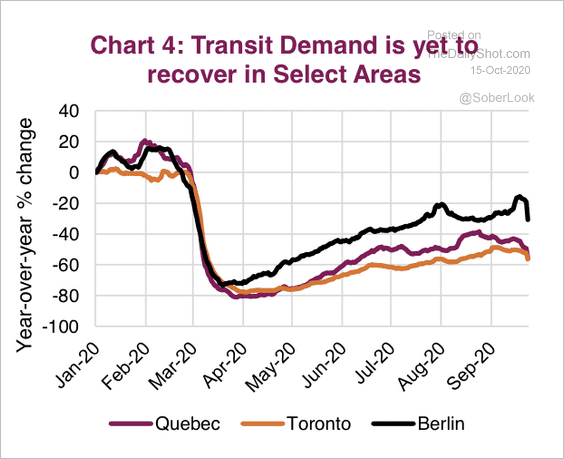

Transit demand is slowing again.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

Here is the Oxford Economics Recovery Tracker.

![]() Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

——————–

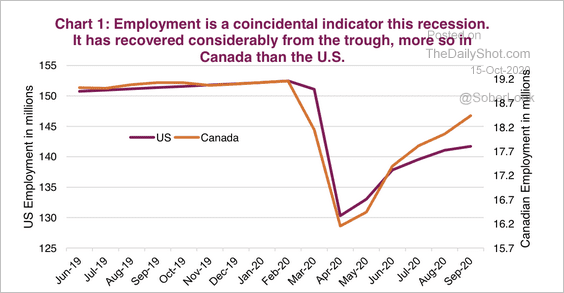

2. Canada’s employment has been recovering considerably faster than the US.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

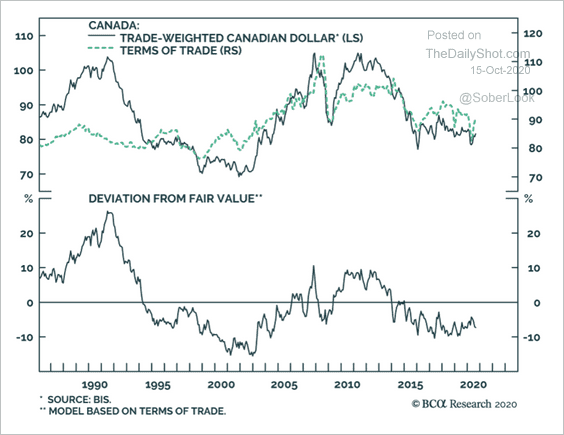

3. The Canadian dollar has deviated from fair value.

Source: BCA Research

Source: BCA Research

The United States

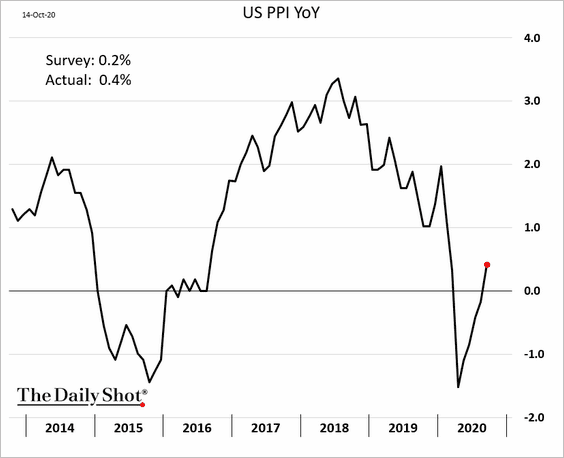

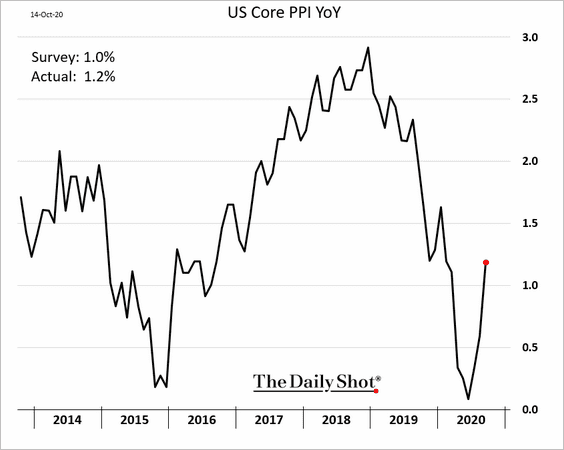

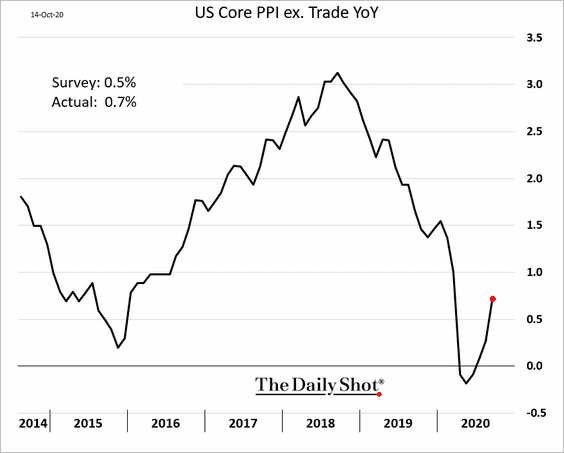

1. Producer prices increased more than expected (0.4% vs. 0.2% year-over-year).

Here is the core PPI.

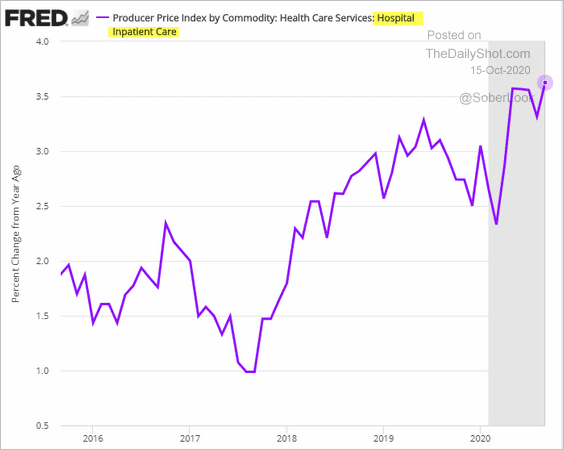

• Hospital care PPI rose sharply since the start of the pandemic.

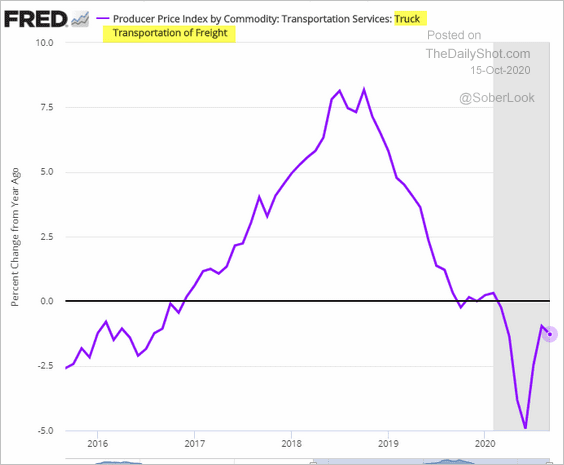

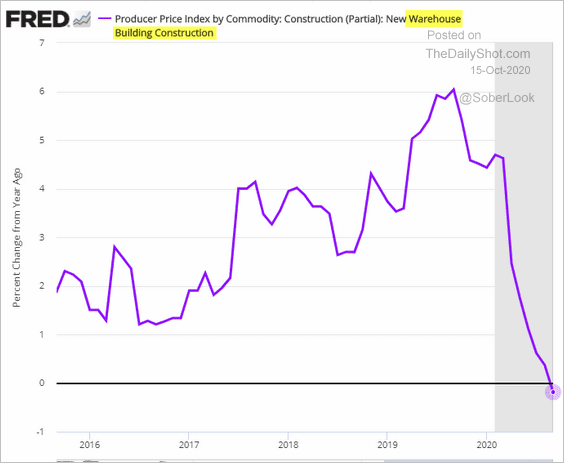

• Logisitcs-related price indices moderated last month.

– Truck transportation of freight:

– Warehouse construction costs:

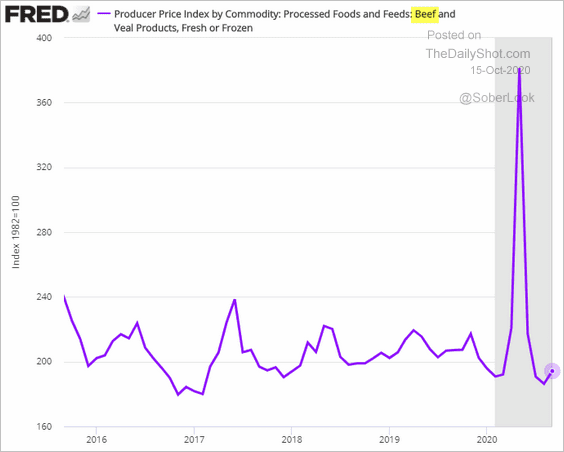

• This chart shows the spike in beef prices earlier this year, as the closure of processing facilities created a massive supply/demand imbalance.

——————–

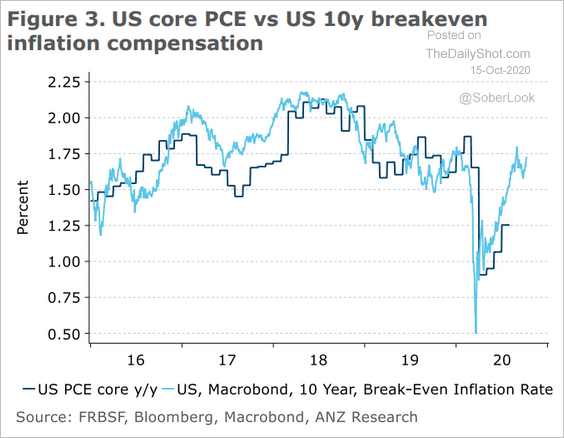

2. Market-based inflation expectations continue to signal higher consumer inflation ahead.

Source: ANZ Research

Source: ANZ Research

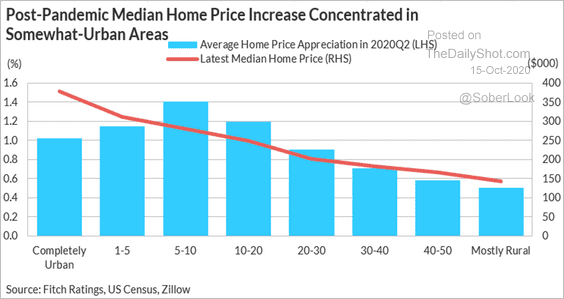

3. The move out of cities has been mostly to the suburbs, not to rural areas.

Source: Fitch Ratings

Source: Fitch Ratings

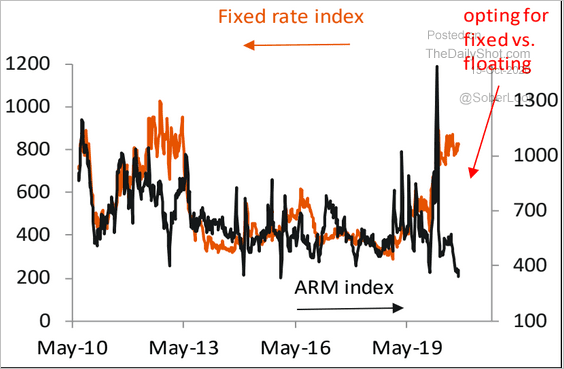

With the 30yr mortgage rates at record lows, homebuyers have been opting for fixed-rate loans.

Source: Piper Sandler

Source: Piper Sandler

Emerging Markets

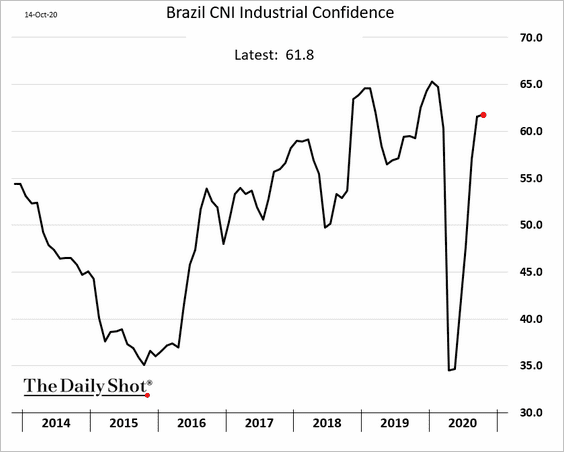

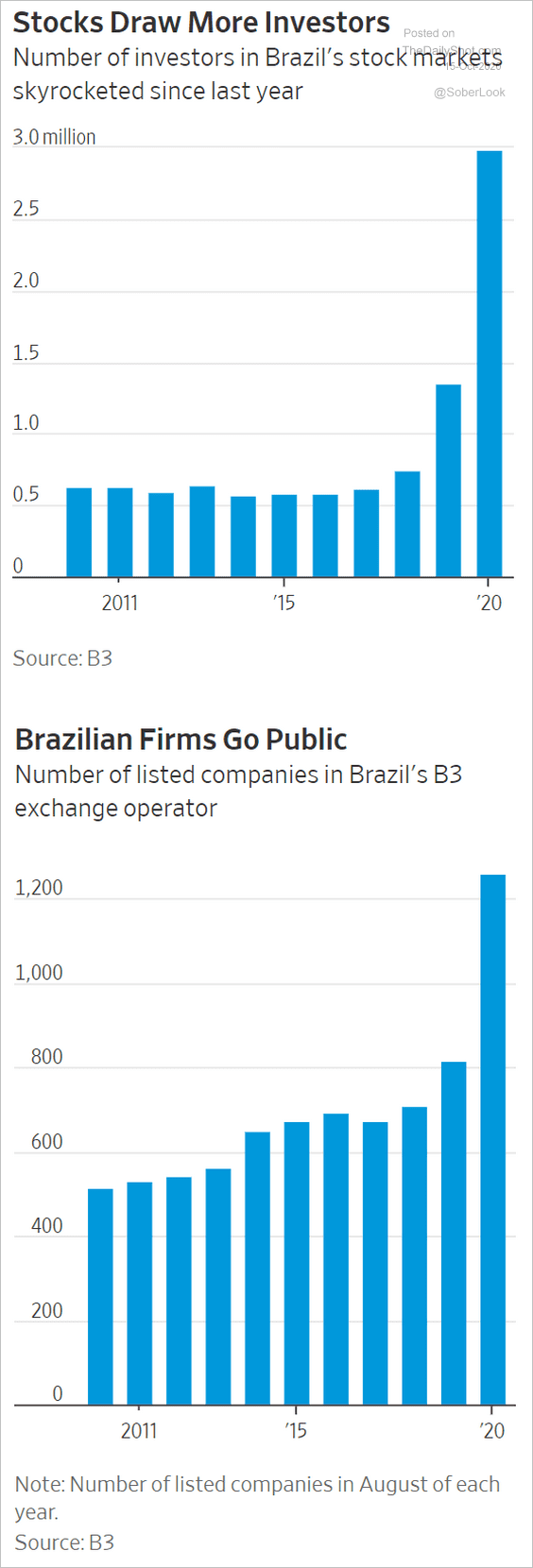

1. Here are a couple of updates on Brazil.

• Industrial confidence has fully recovered.

• It’s been a good year for Brazil’s stock market.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

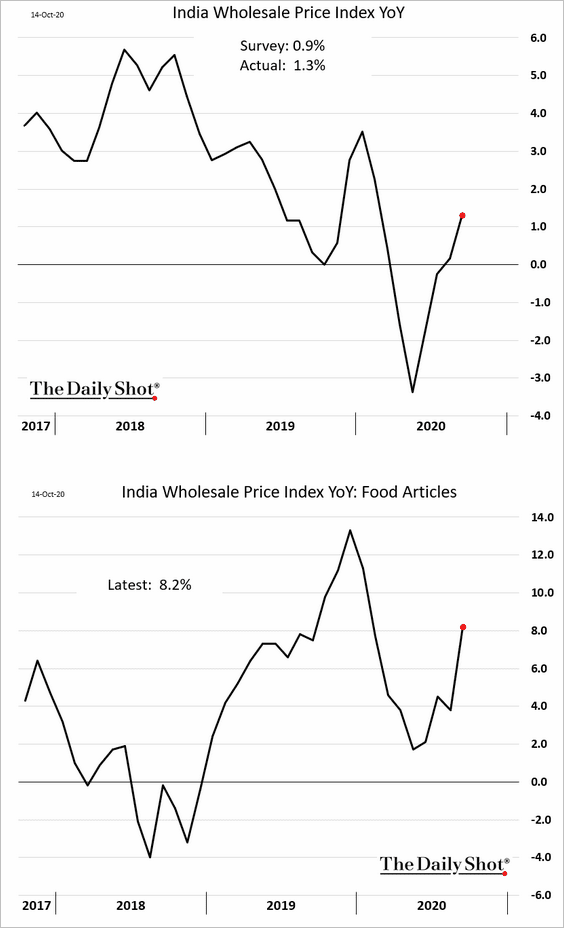

2. Food prices have been boosting India’s wholesale inflation (which exceeded market expectations).

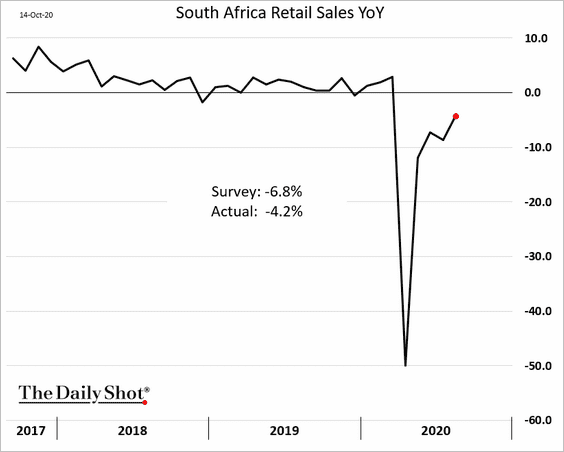

3. South Africa’s retail sales continue to rebound.

Commodities

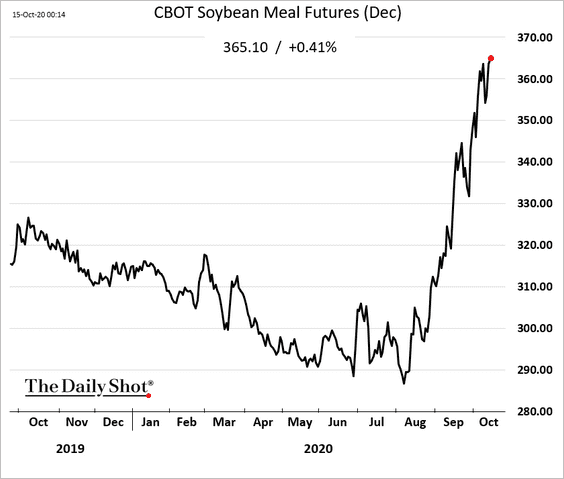

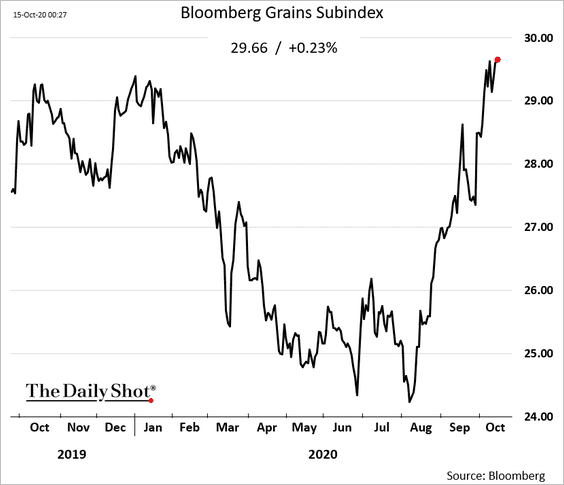

1. Soybean meal futures continue to rally, partially due to higher feed demand for China’s rising pig population (see the China section).

Here is Bloomberg’s grains index.

——————–

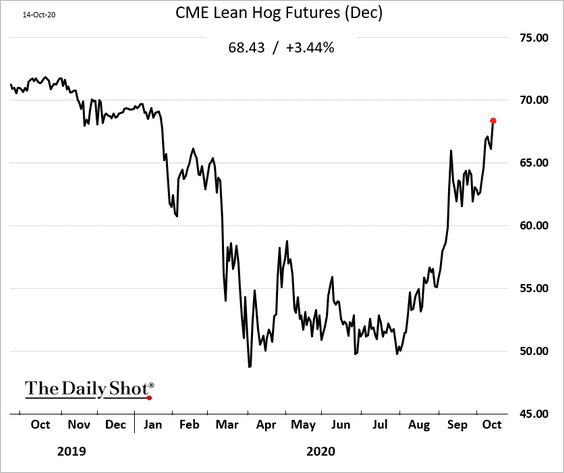

2. US hog prices keep climbing.

Source: Successful Farming Read full article

Source: Successful Farming Read full article

Source: Brownfield Ag News Read full article

Source: Brownfield Ag News Read full article

Energy

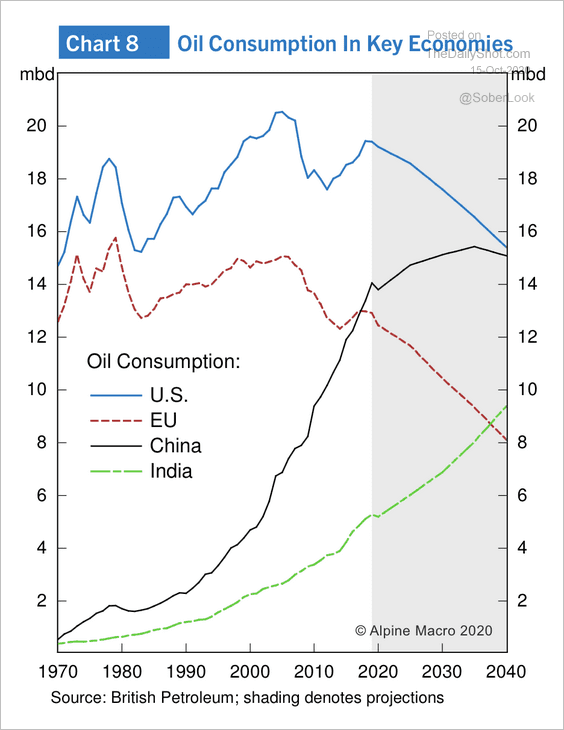

1. Oil consumption in China and India is projected to rise, albeit from a low base. The US and Europe reached peak oil consumption about 15 years ago.

Source: Alpine Macro

Source: Alpine Macro

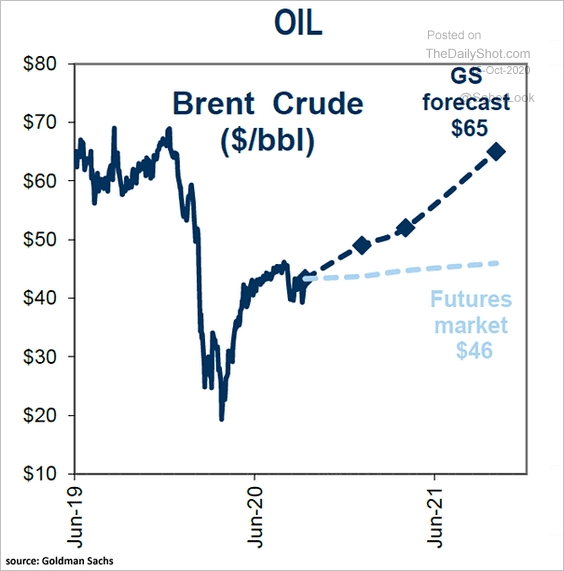

2. Goldman expects oil prices to climb next year (much more than is currently priced into the market).

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

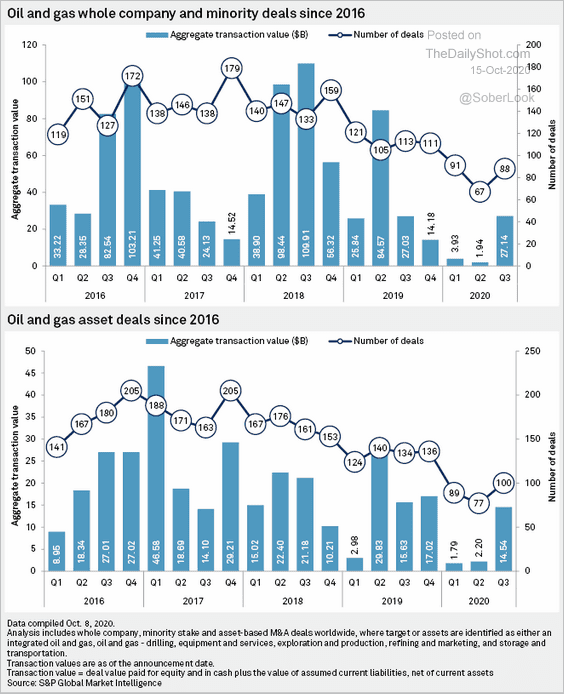

3. Oil & Gas deal activity has been slow this year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Equities

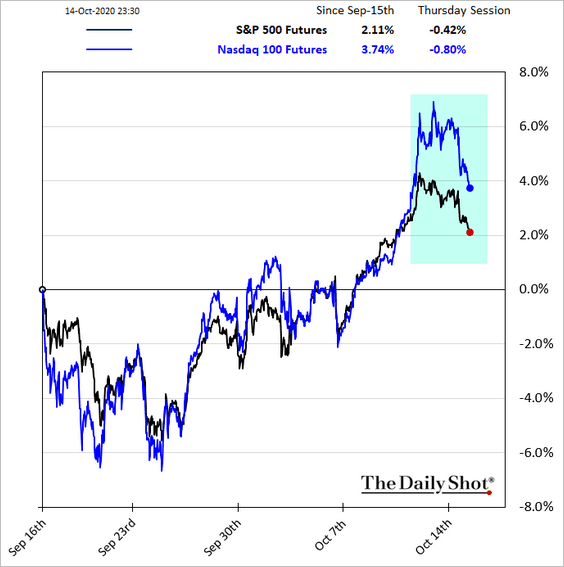

1. With stimulus on hold, the market rally appears to have stalled.

Source: The Hill Read full article

Source: The Hill Read full article

——————–

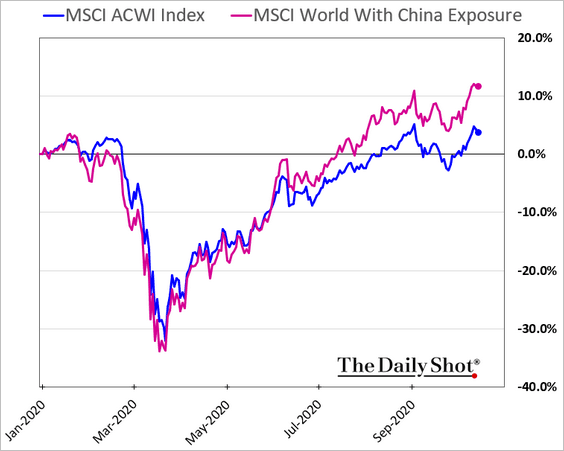

2. Companies with China exposure continue to outperform.

3. Gavekal warns that the underperformance of S&P 500 bank stocks vs. Treasury bonds could be a worrying sign for the broader market.

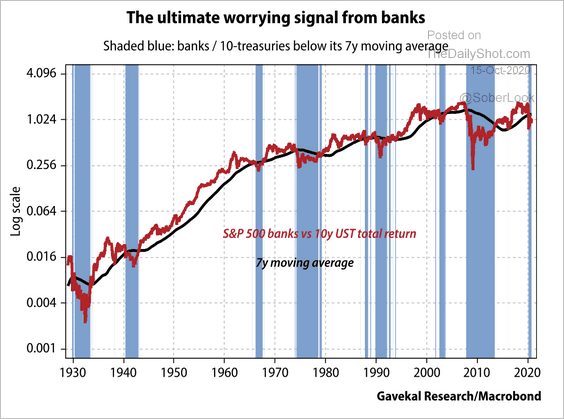

Source: Gavekal

Source: Gavekal

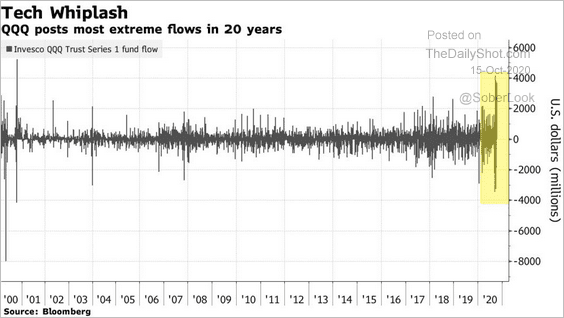

4. Flows in and out of QQQ (Nasdaq 100 ETF) have been massive. Some suggests that these swings are due to dealers’ enormous options exposure. QQQ, which is highly liquid, is sometimes used as a delta hedge against short portfolios of single-stock options.

Source: @markets Read full article

Source: @markets Read full article

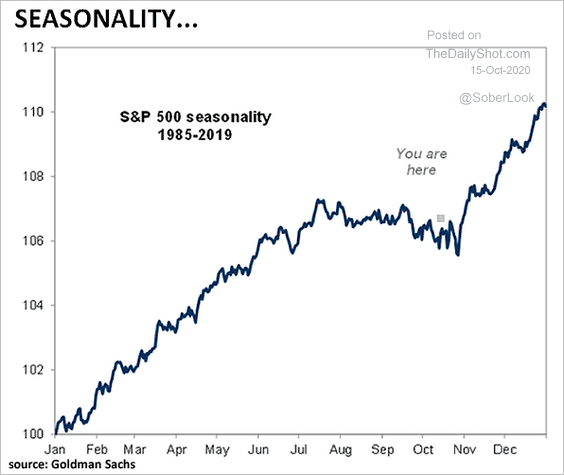

5. Seasonality should work in market’s favor this quarter.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

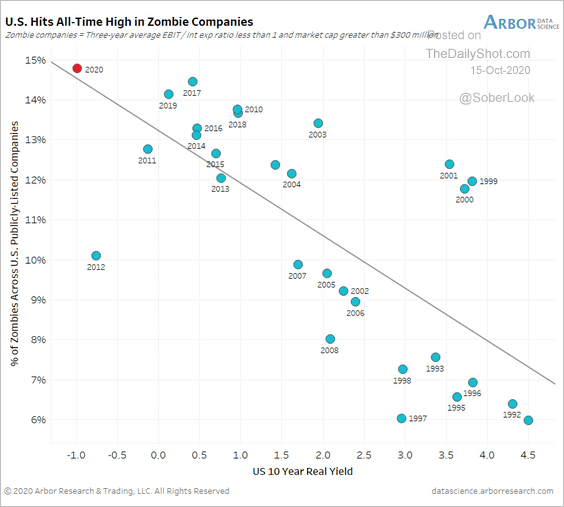

6. The percentage of US “zombie” firms (which are sustained by low interest rates) is at multi-decade highs.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

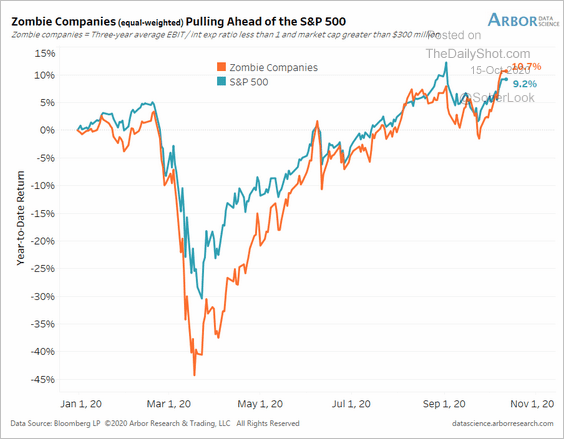

And these companies are now outperforming year-to-date.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

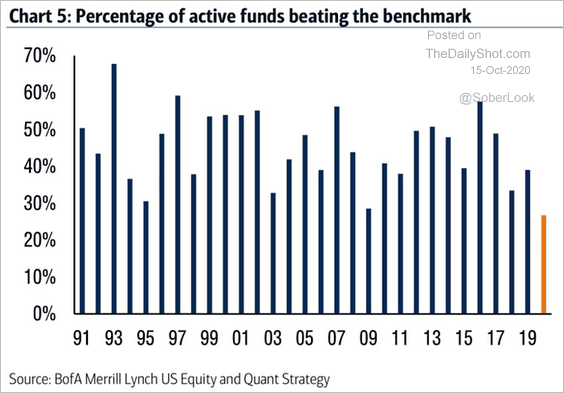

7. Active funds are struggling this year (anyone who is not overweight in tech mega-caps is probably underperforming).

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

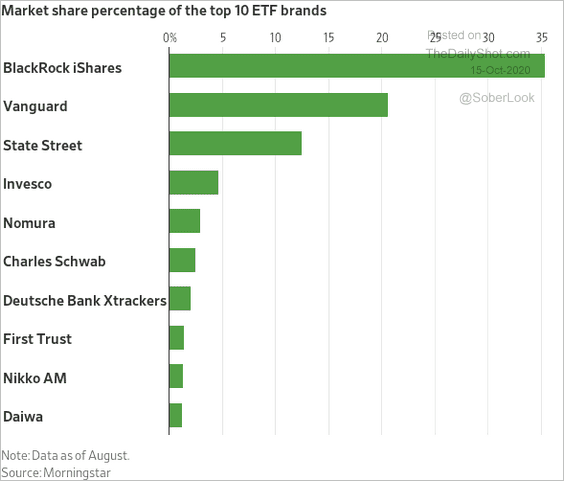

8. These brands dominate the ETF market.

Source: @WSJ Read full article

Source: @WSJ Read full article

Credit

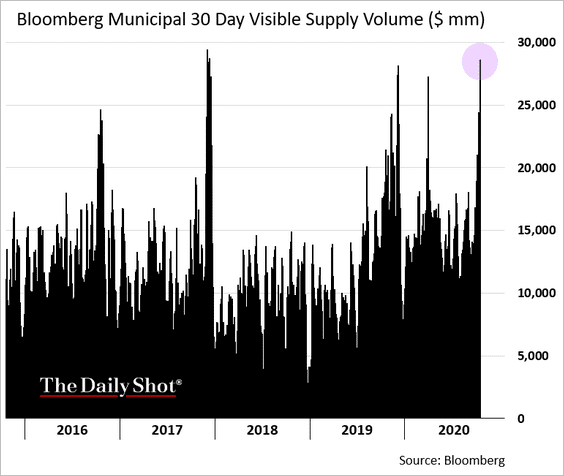

1. Municipal bond issuance has accelerated.

Source: The Bond Buyer Read full article

Source: The Bond Buyer Read full article

——————–

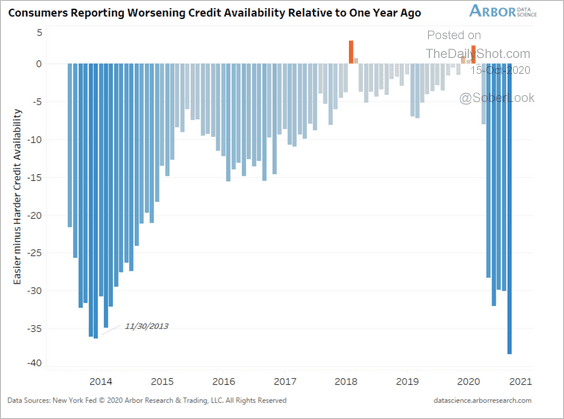

2. US consumer debt borrowers are increasingly encountering tighter credit conditions relative to one year ago.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Rates

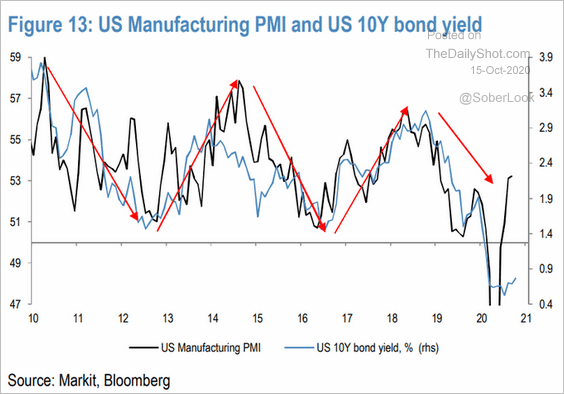

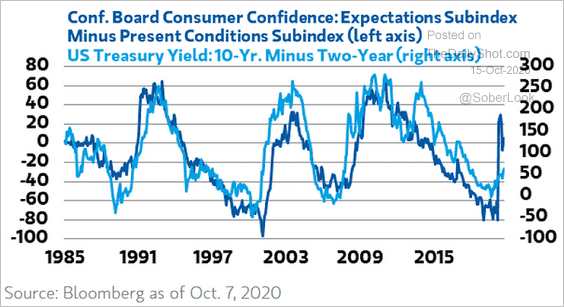

1. Economic indicators continue to signal higher Treasury yields and a steeper curve.

• Manufacturing:

Source: @jsblokland

Source: @jsblokland

• Consumer sentiment:

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

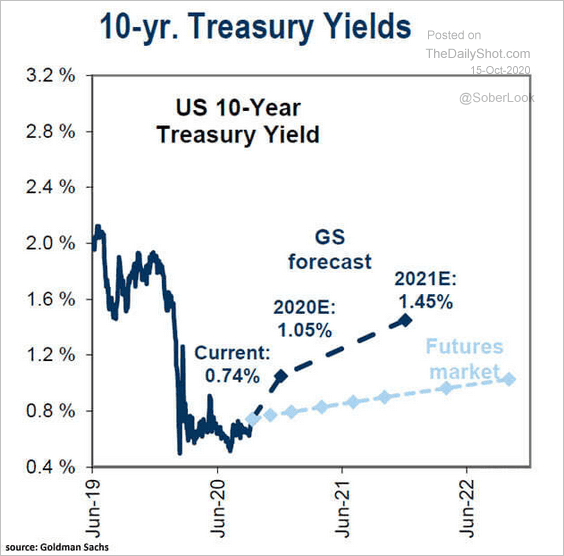

Goldman expects yields to rise well above the levels currently priced into the market.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

——————–

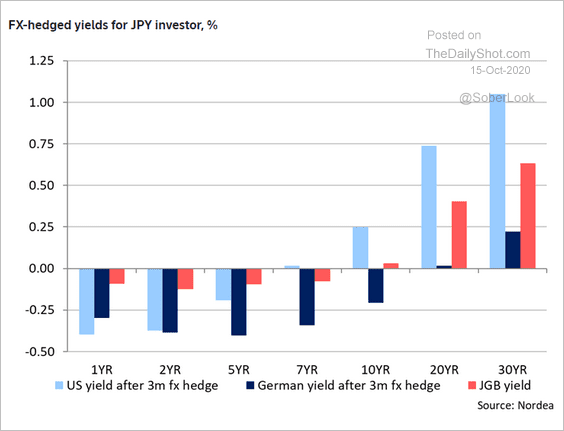

2. Longer-dated Treasuries look attractive when hedged into yen.

Source: Nordea Markets

Source: Nordea Markets

Global Developments

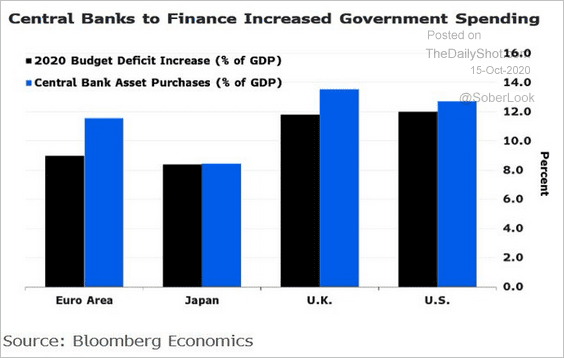

1. Central banks have been financing massive budget deficits this year, …

Source: @lisaabramowicz1, @economics

Source: @lisaabramowicz1, @economics

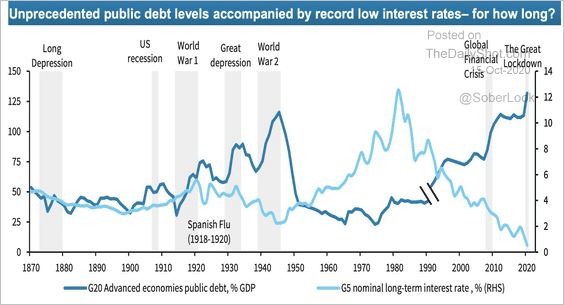

… which created this unprecedented divergence between the G20 debt-to-GDP ratio and long-term rates.

Source: @Schuldensuehner Read full article

Source: @Schuldensuehner Read full article

——————–

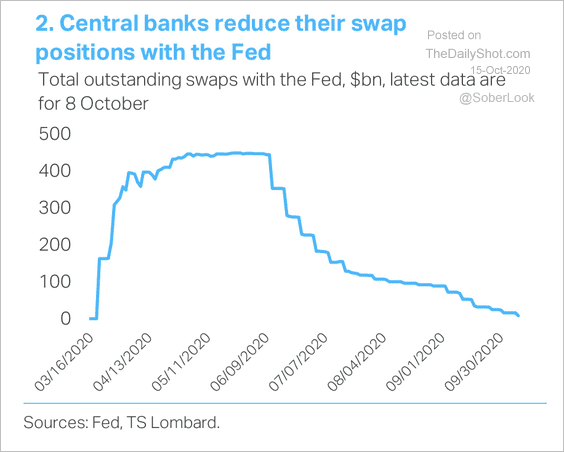

2. The reduction in the Fed’s liquidity swap demand indicates an improvement in global risk/liquidity sentiment, which has likely pushed the dollar lower, according to TS Lombard.

Source: TS Lombard

Source: TS Lombard

3. Here is the Oxford Economics Global Recovery Tracker.

![]() Source: Oxford Economics

Source: Oxford Economics

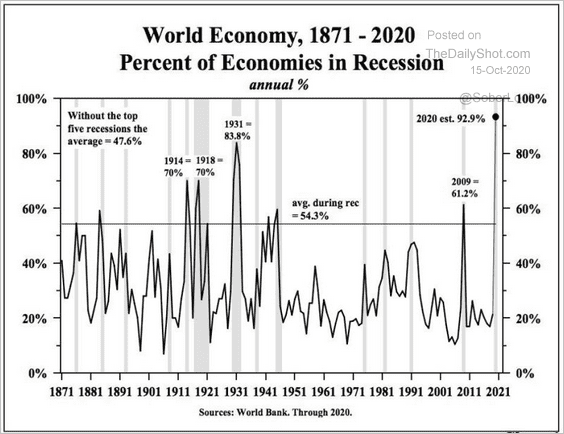

4. The percentage of economies in recession this year has been unprecedented in modern history.

Source: Hoisington Investment Mgt via CMG Wealth Managements and Tilo Marotz Read full article

Source: Hoisington Investment Mgt via CMG Wealth Managements and Tilo Marotz Read full article

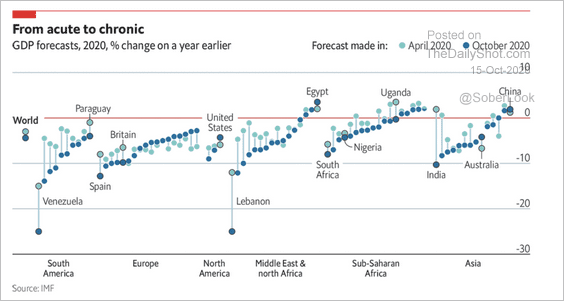

5. Below are the IMF’s GDP forecasts for 2020.

Source: The Economist Read full article

Source: The Economist Read full article

Food for Thought

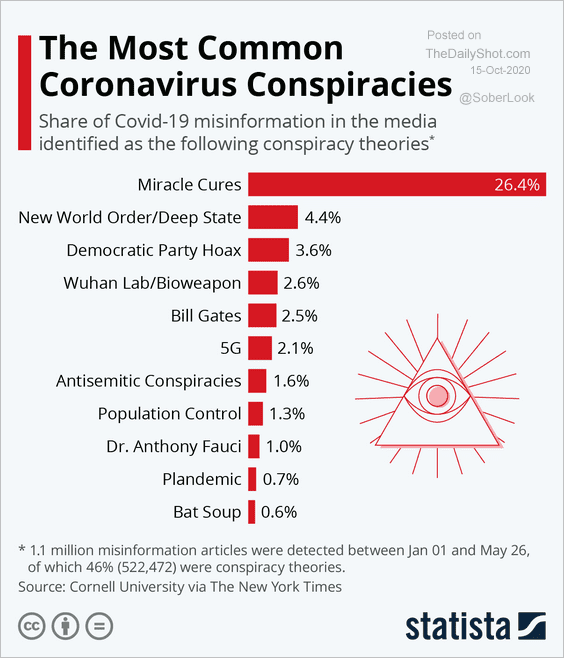

1. Common coronavirus conspiracy theories:

Source: Statista

Source: Statista

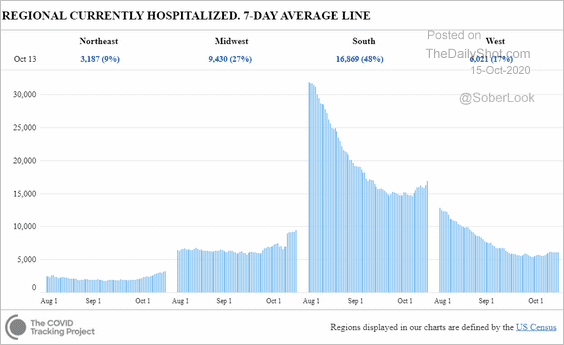

2. COVID-related hospitalizations by region in the US.

Source: CovidTracking.com

Source: CovidTracking.com

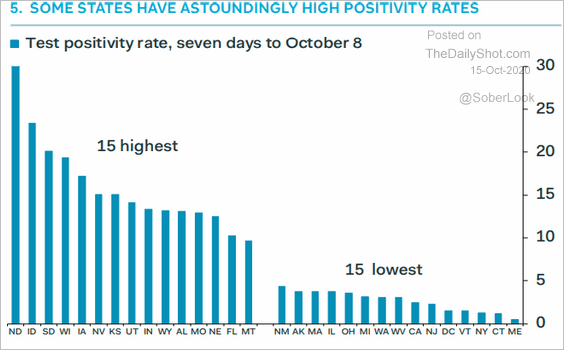

3. Positivity rates, by state:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

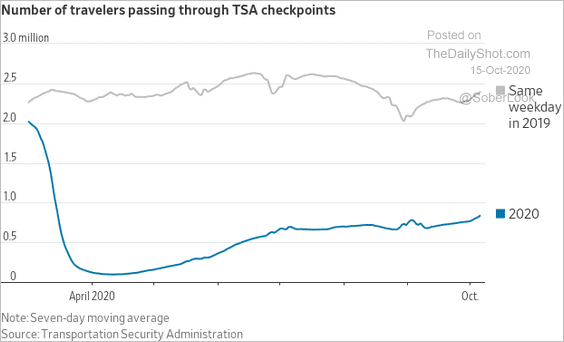

4. US airport traffic:

Source: @jeffsparshott, @WSJ

Source: @jeffsparshott, @WSJ

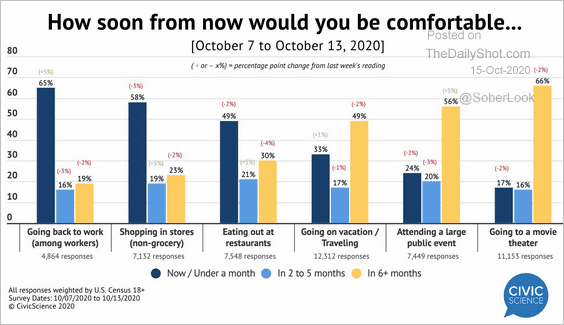

5. How soon would you be comfortable …

Source: @CivicScience Read full article

Source: @CivicScience Read full article

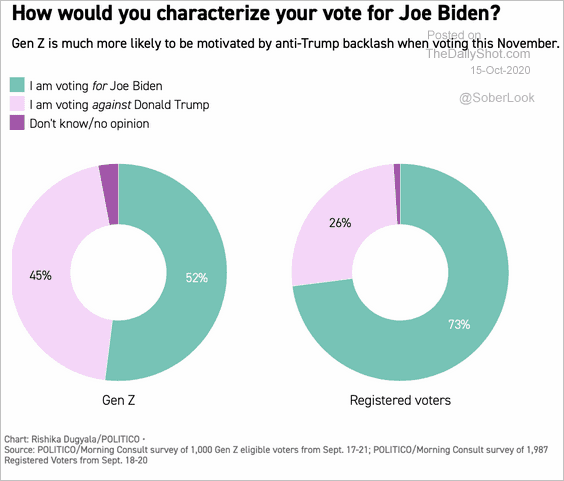

6. Gen-Z’s support for Biden:

Source: Politico Read full article

Source: Politico Read full article

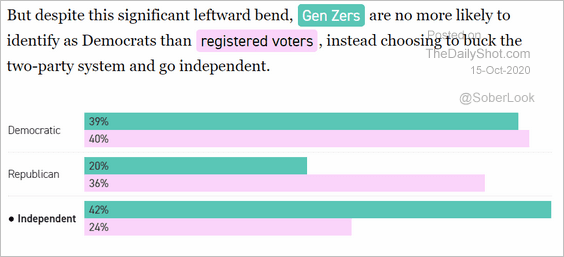

Gen-Z tilting independent:

Source: Politico Read full article

Source: Politico Read full article

——————–

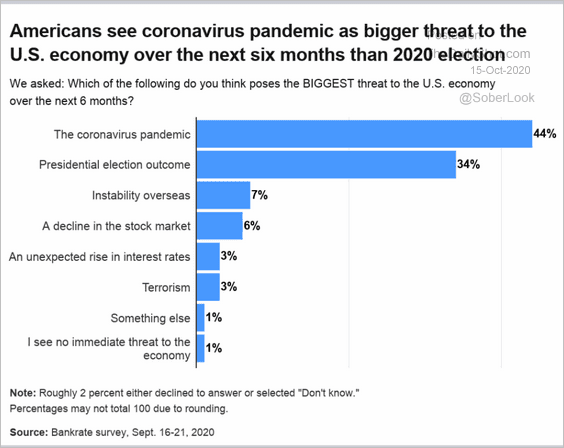

7. Biggest threats to the economy:

Source: Bankrate.com Read full article

Source: Bankrate.com Read full article

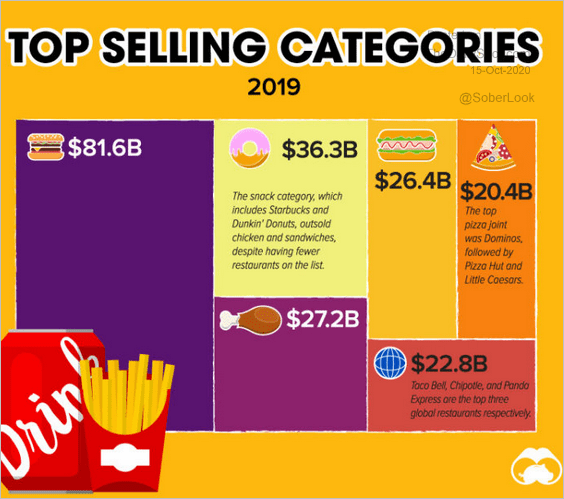

8. Top-selling fast-food categories:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

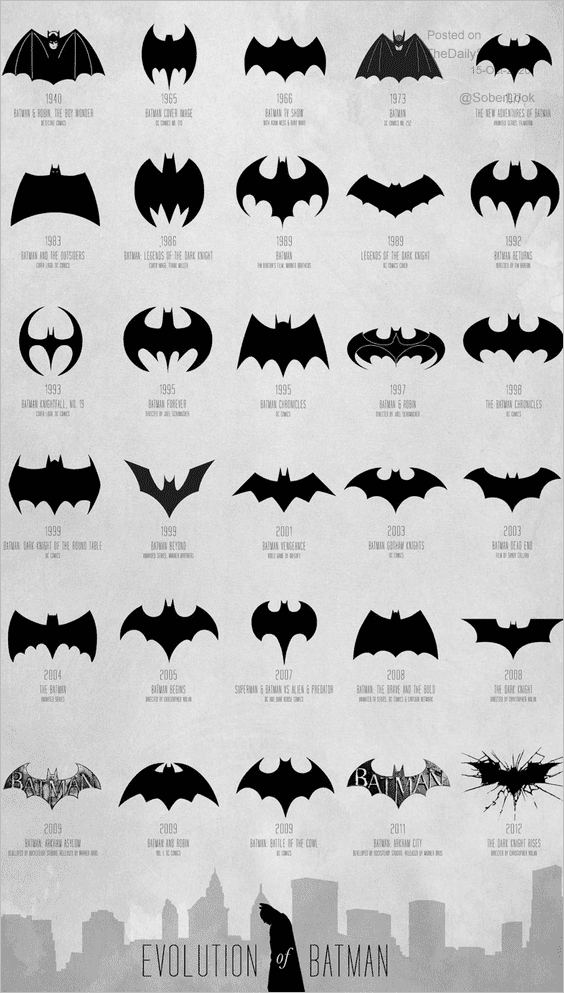

9. The evolution of Batman’s logo:

Source: James Eagle

Source: James Eagle

——————–