The Daily Shot: 20-Oct-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

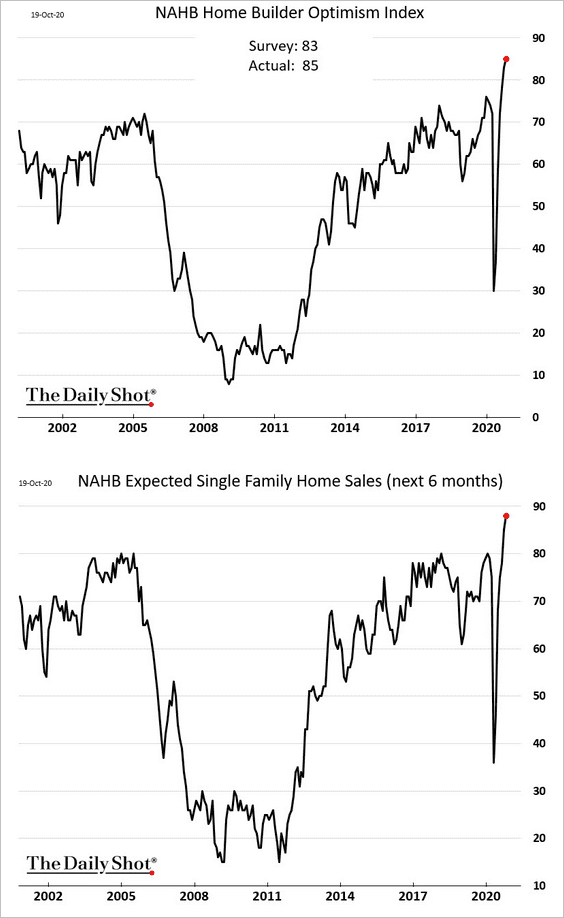

1. Let’s begin with the housing market.

• Homebuilder sentiment is at record highs as demand for new houses soars.

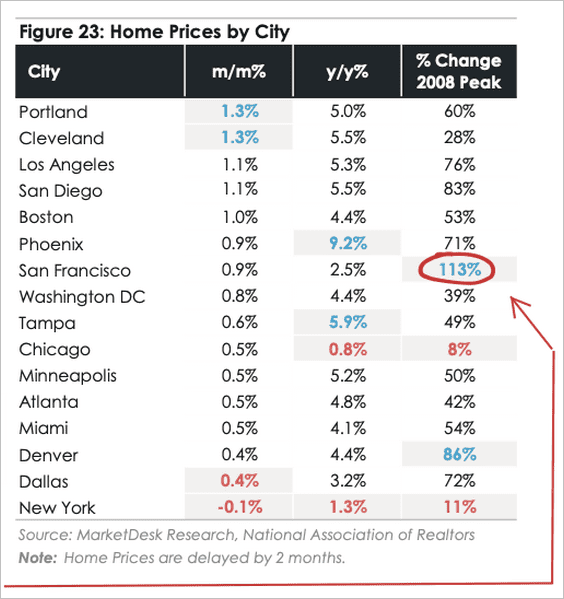

• Most home prices across key metro areas have rebounded above the 2008 peak. Property markets in cities such as San Francisco and Denver appear frothy.

Source: MarketDesk Research

Source: MarketDesk Research

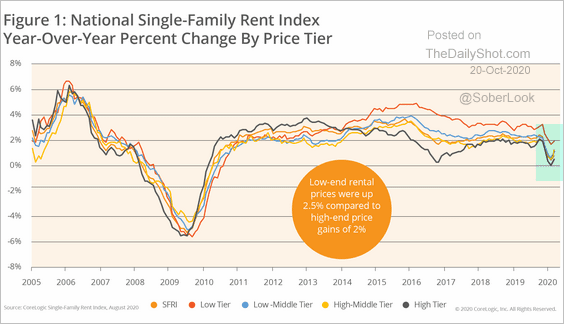

• According to CoreLogic, rents seem to be bottoming.

Source: CoreLogic

Source: CoreLogic

——————–

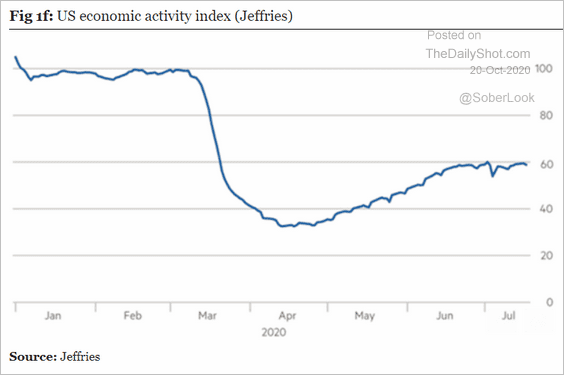

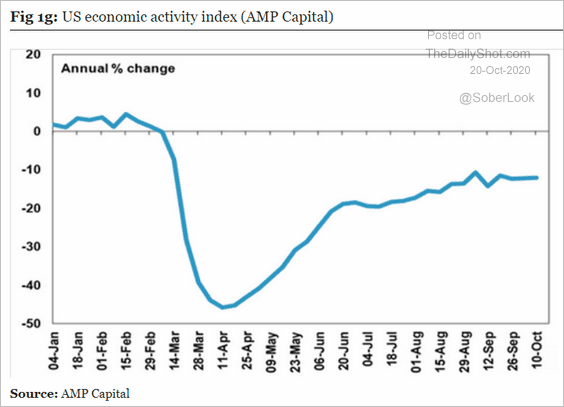

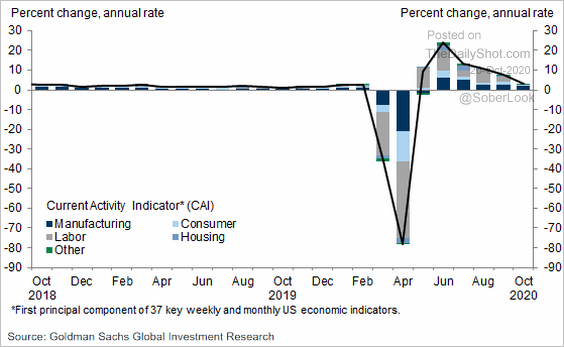

2. High-frequency indicators continue to signal slower economic recovery.

• Jeffries:

Source: Jeffries, Longview Economics

Source: Jeffries, Longview Economics

• AMP Capital:

Source: AMP Capital, Longview Economics

Source: AMP Capital, Longview Economics

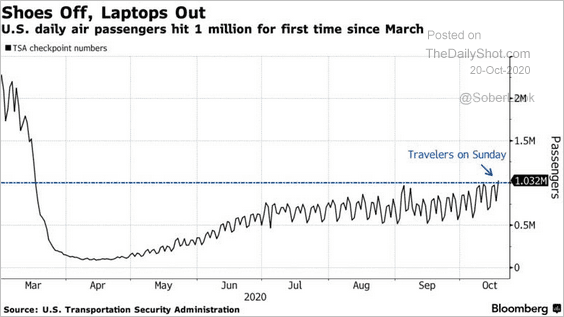

However, the number of air passengers climbed above one million for the first time since March.

Source: @business Read full article

Source: @business Read full article

Here is Goldman’s Current Activity Indicator (CAI).

Source: Goldman Sachs

Source: Goldman Sachs

——————–

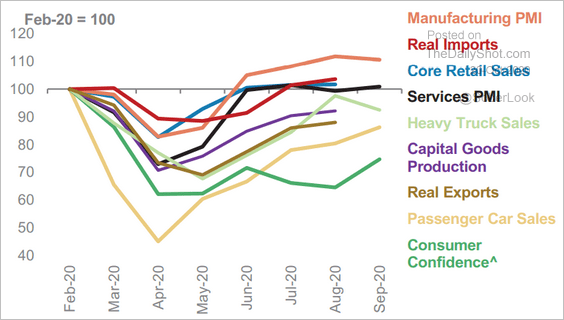

3. This chart shows some of the key economic indicators since February.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

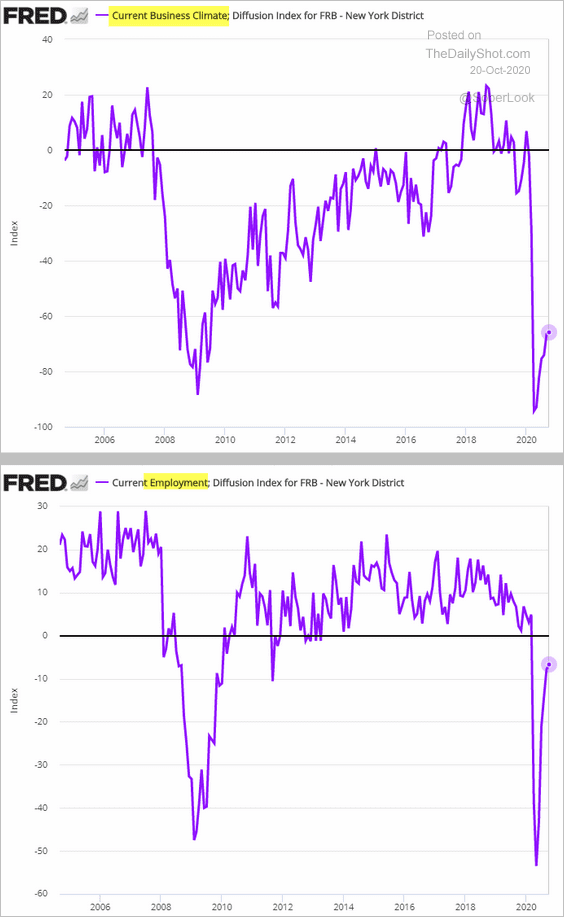

4. The NY Fed’s measure of nonmanufacturing activity has been showing improvement but has not rebounded to pre-crisis levels. The pandemic remains a drag on the service-sector recovery.

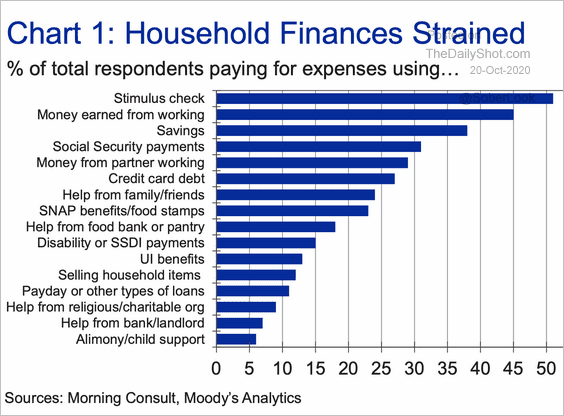

5. Many households are struggling to pay expenses and absent another stimulus package, the situation may deteriorate further.

Source: Moody’s Analytics and Morning Consult

Source: Moody’s Analytics and Morning Consult

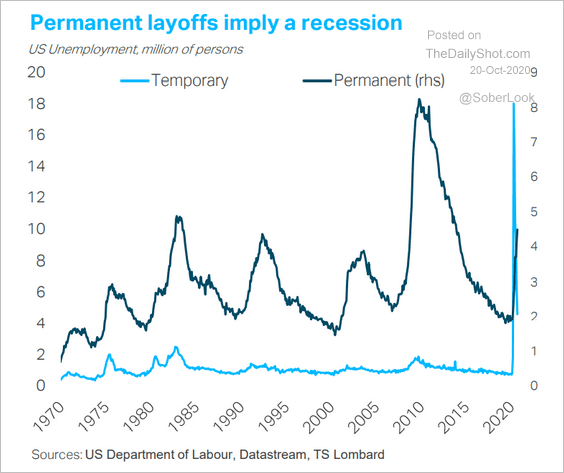

6. Permanent layoffs are at levels consistent with previous recessions.

Source: TS Lombard

Source: TS Lombard

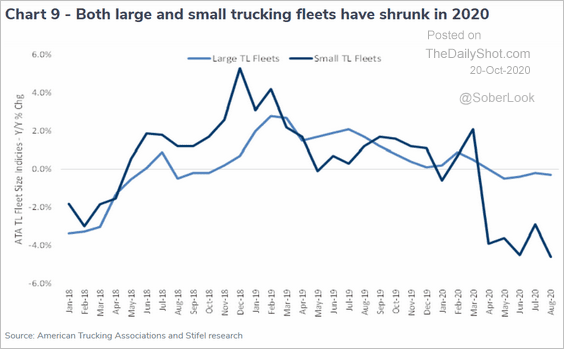

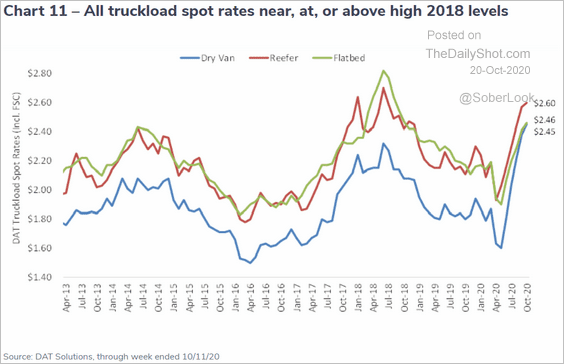

7. US trucking fleets have been shrinking.

Source: Cass Information Systems

Source: Cass Information Systems

As inventories tightened this year, demand for shipments boosted truck freight rates.

Source: Cass Information Systems

Source: Cass Information Systems

——————–

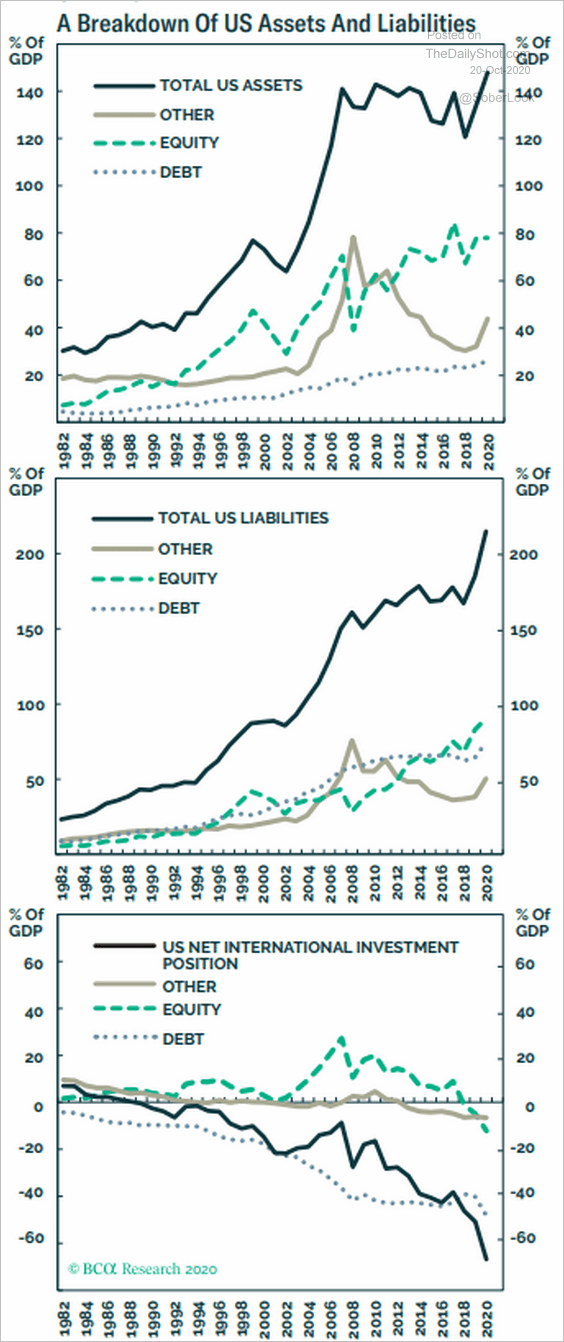

8. The charts below show the nation’s assets and liabilities vis-à-vis the rest of the world.

Source: BCA Research

Source: BCA Research

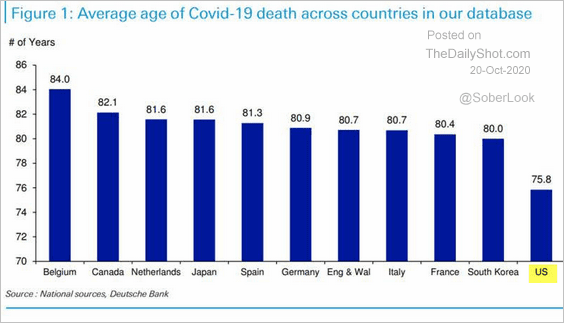

9. The average age of US COVID deaths is well below what we see in other advanced economies.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Canada

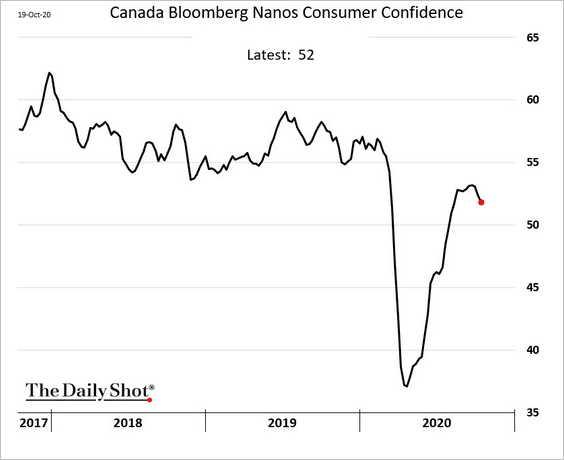

1. Consumer confidence is rolling over as daily infections climb.

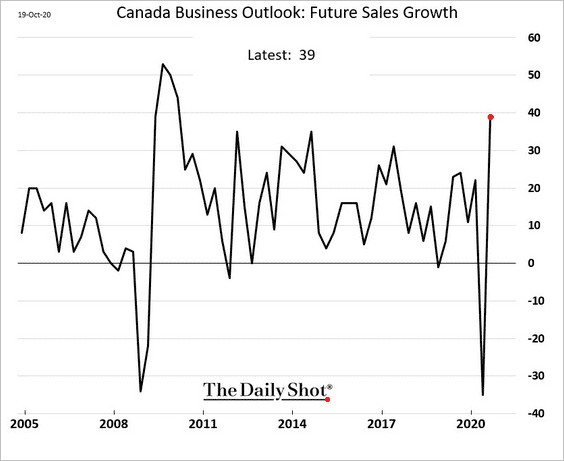

2. Business outlook improved sharply before the latest spike in COVID cases.

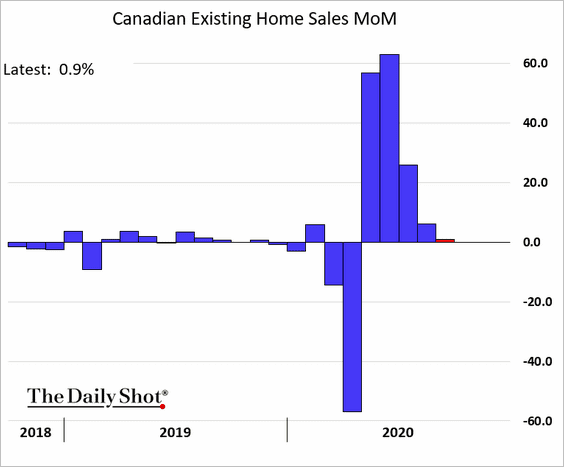

3. Existing home sales have leveled off in September.

The United Kingdom

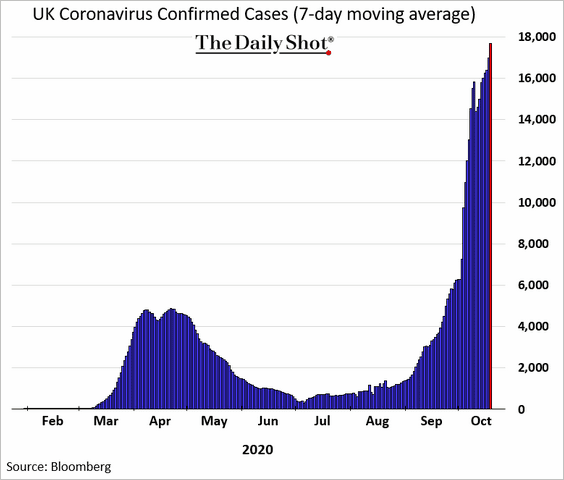

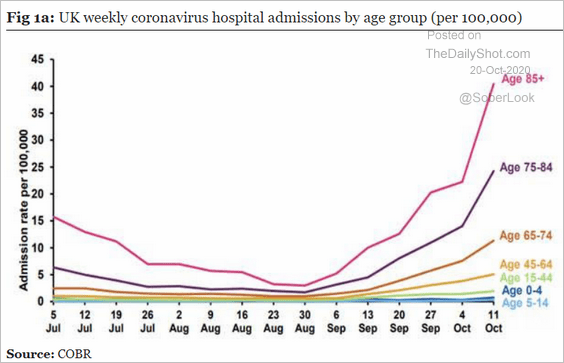

1. Daily COVID cases hit a new high, while hospital admissions keep climbing.

Source: Longview Economics

Source: Longview Economics

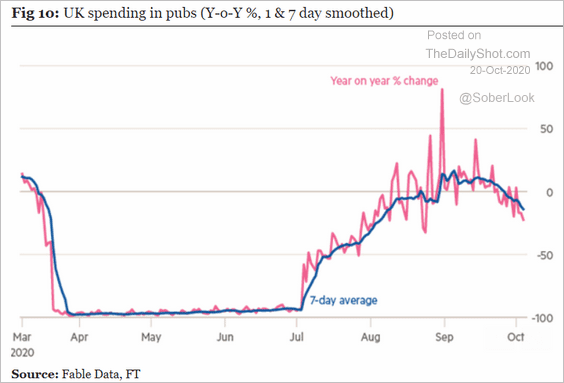

Spending at pubs has rolled over.

Source: Longview Economics

Source: Longview Economics

——————–

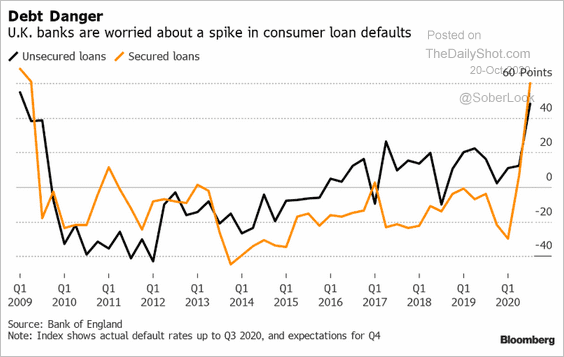

2. Banks are concerned about a spike in consumer delinquencies.

Source: @fergalob

Source: @fergalob

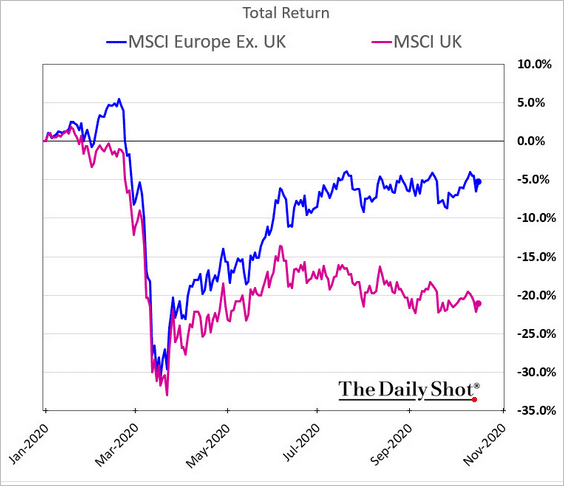

3. UK shares continue to underperform.

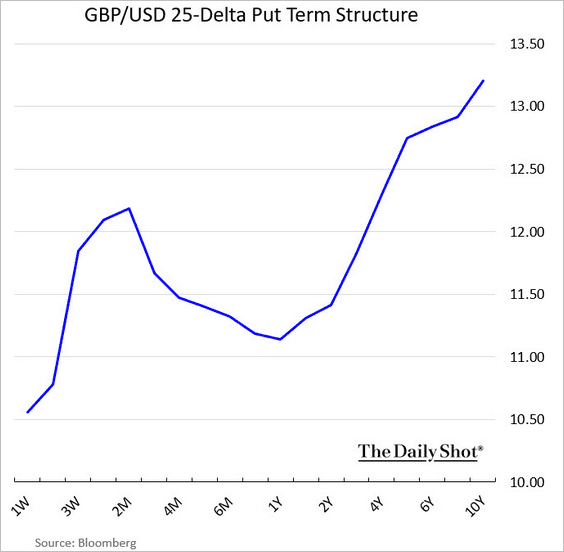

4. The British pound implied volatility term structure points to concerns about the US elections and uncertainty around the “unofficial” Brexit deadline.

h/t @vkaramanis_fx

h/t @vkaramanis_fx

The Eurozone

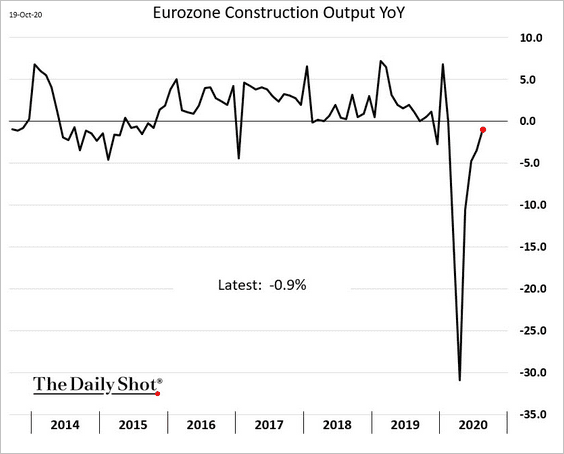

1. Construction output has nearly recovered.

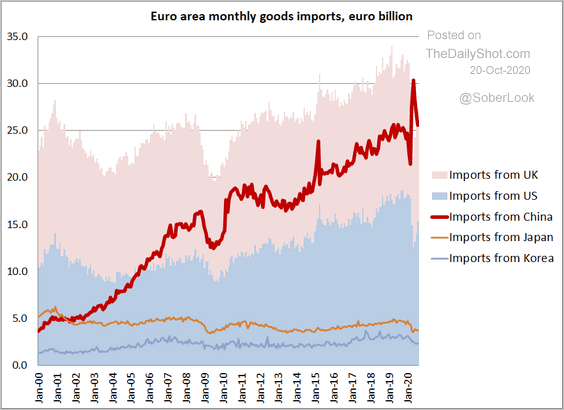

2. The euro area now imports as much from China as it does from the US and UK combined.

Source: @Brad_Setser

Source: @Brad_Setser

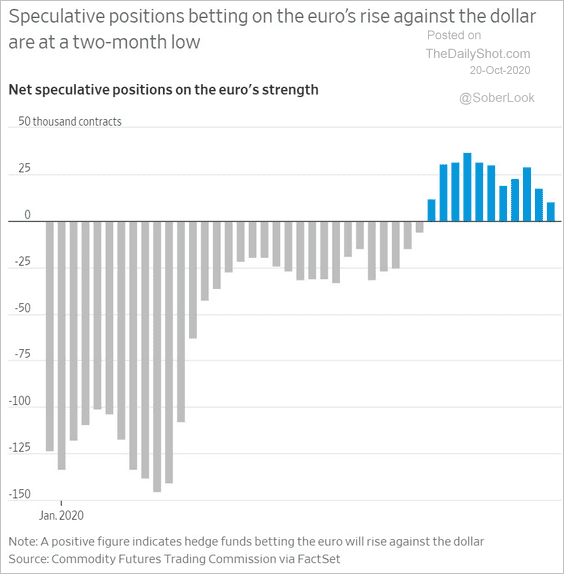

3. Speculative bets on the euro have been moderating.

Source: @WSJ Read full article

Source: @WSJ Read full article

Asia – Pacific

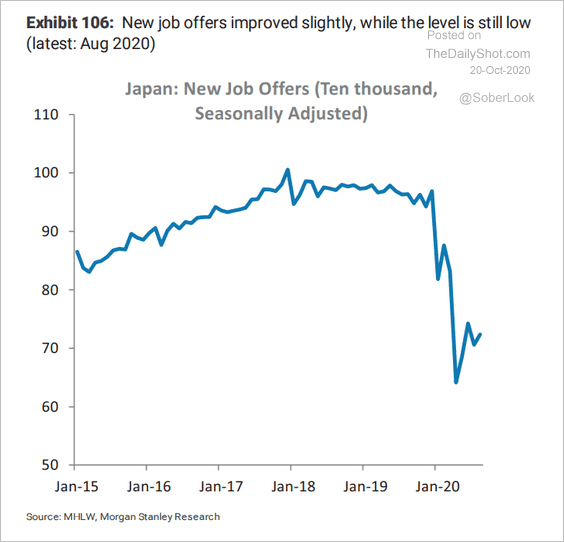

1. The number of new job offers in Japan remains depressed.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

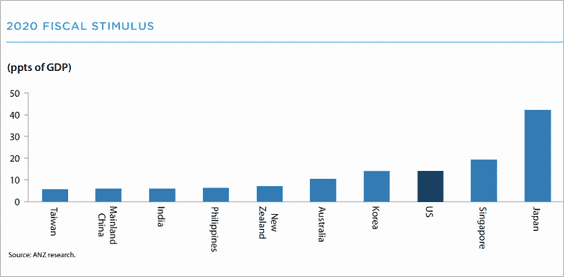

2. This chart shows the amount of 2020 fiscal stimulus across Asia (% of GDP).

Source: ANZ Research

Source: ANZ Research

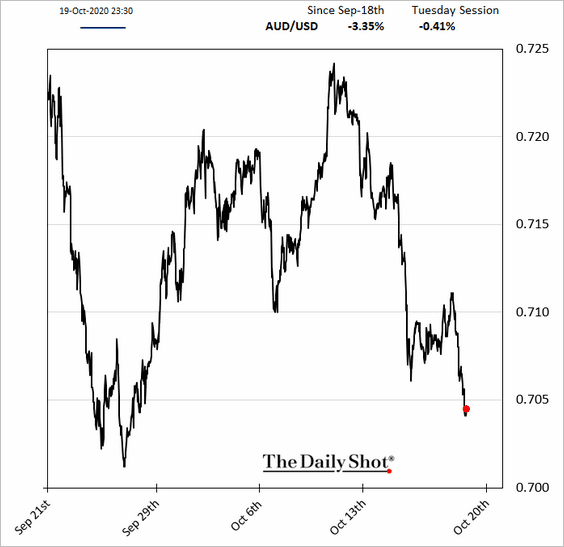

3. The Aussie dollar retreated in response to the RBA’s increasingly dovish stance (more QE, rate cuts, potentially negative rates ahead).

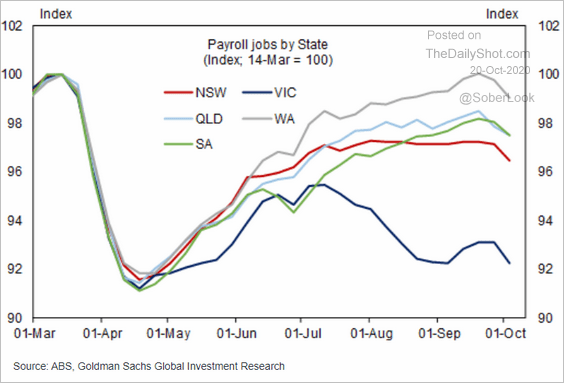

Separately, Australia’s payrolls turned lower at the end of last month.

Source: Goldman Sachs

Source: Goldman Sachs

China

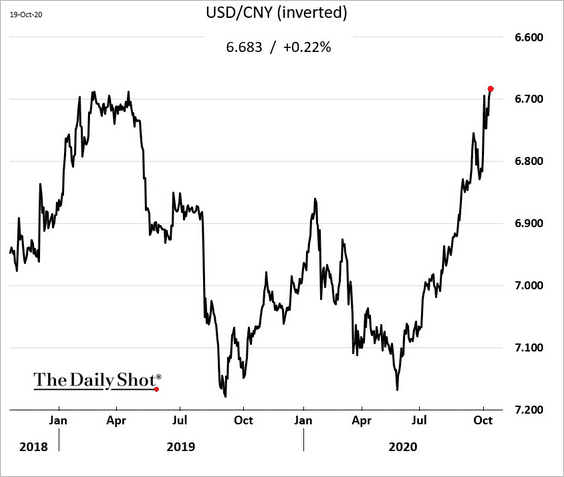

1. The renminbi keeps climbing vs. USD, exceeding the highs reached in early 2019.

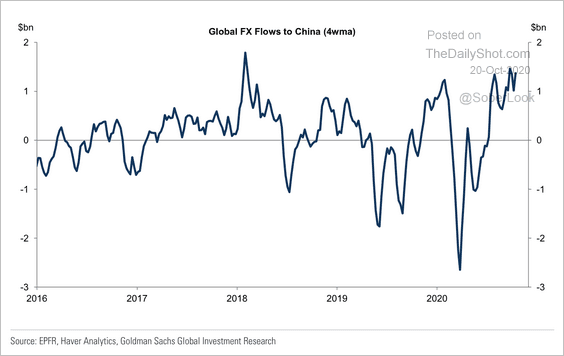

Capital inflows have been supportive of China’s currency.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

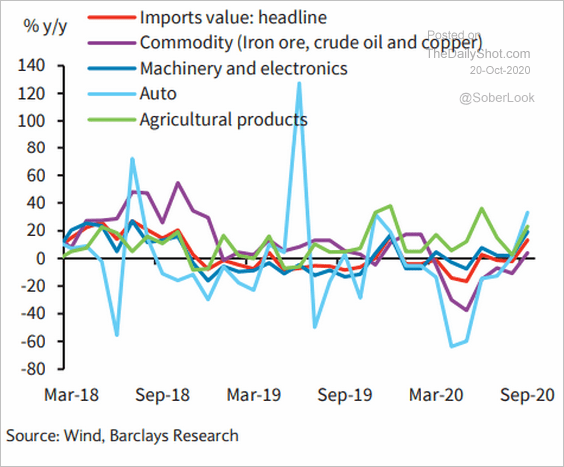

2. Imports improved broadly in September.

Source: Barclays Research

Source: Barclays Research

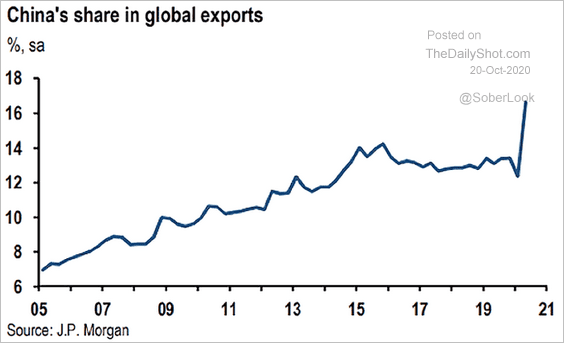

China’s share of global exports hit a new high this year.

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @jpmorgan

——————–

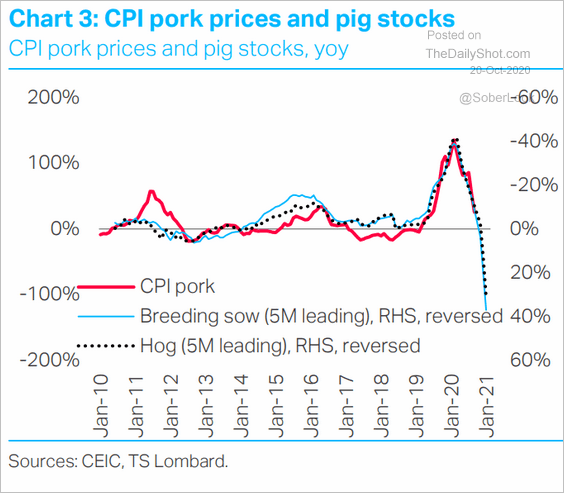

3. China’s pig herd surged 20% (year-over-year) in the third quarter. This trend will continue to put downward pressure on China’s CPI.

Source: TS Lombard

Source: TS Lombard

Emerging Markets

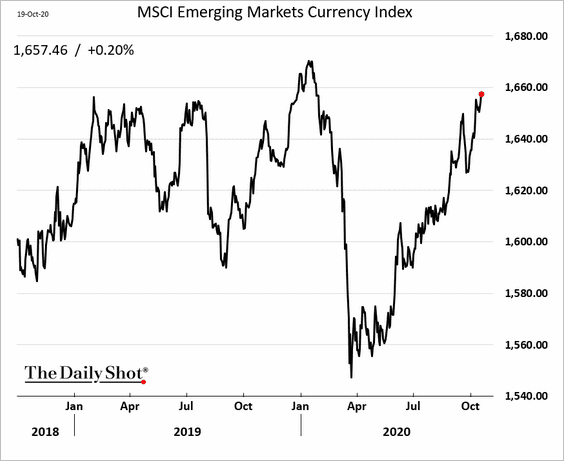

1. EM currencies continue to climb vs. USD.

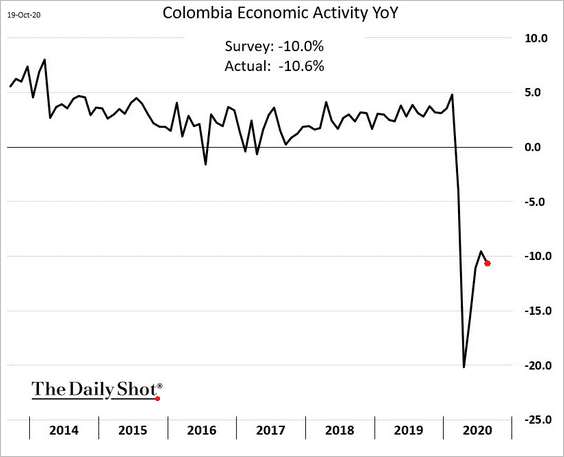

2. Colombia’s economic recovery has stalled.

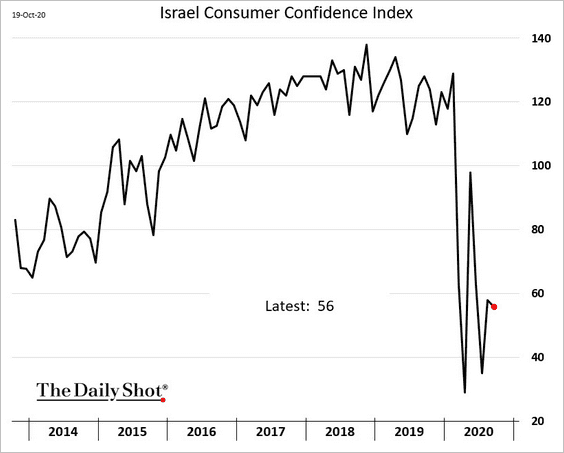

3. Israel’s consumer confidence remains depressed.

Commodities

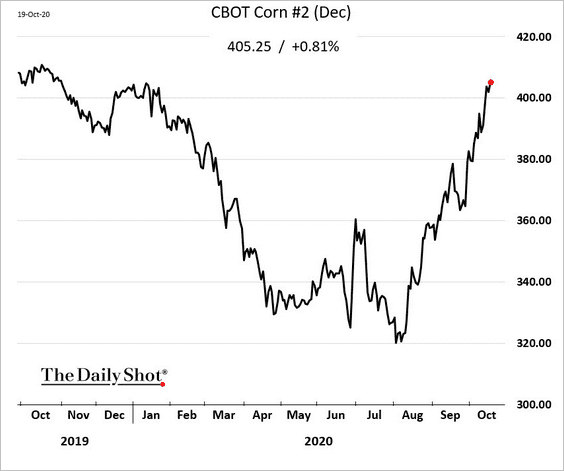

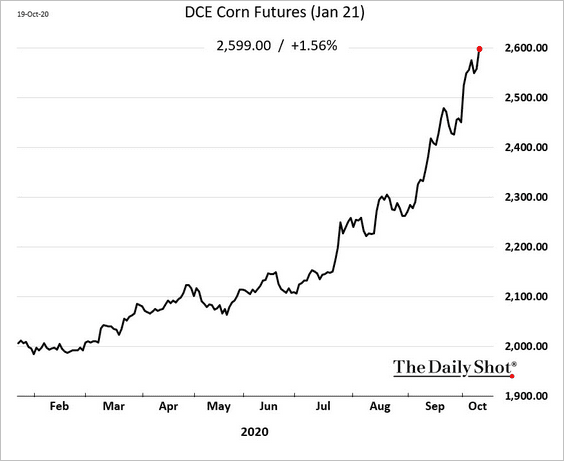

1. US corn futures are tracking the rally in China.

Source: @WSJ Read full article

Source: @WSJ Read full article

• US corn futures:

• China corn futures:

——————–

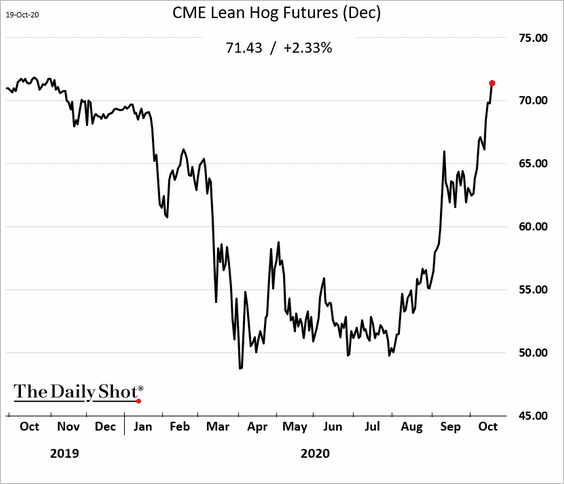

2. Strong US demand for pork has been driving hog futures higher.

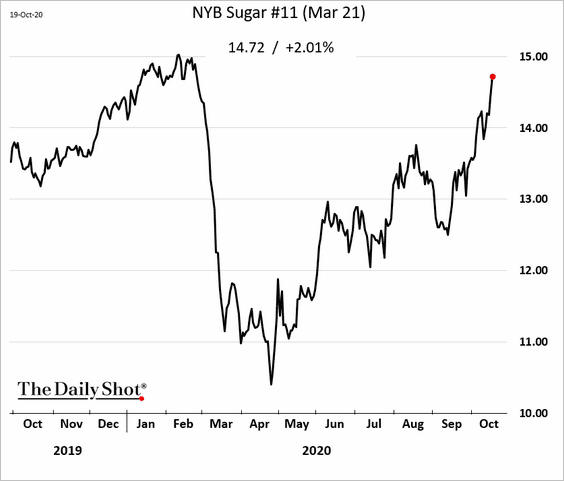

3. Sugar futures keep rising.

Energy

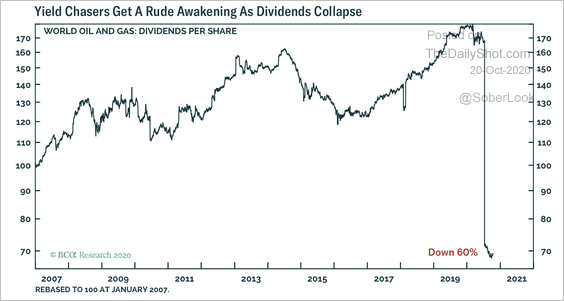

1. Global oil and gas dividends per share have collapsed.

Source: BCA Research

Source: BCA Research

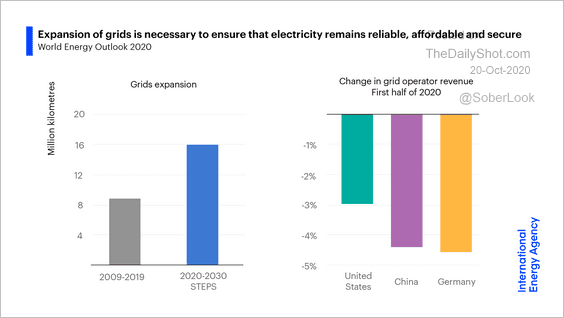

2. Grid operator revenues declined during the first half of 2020. This may limit much-needed capital investment in this space.

Source: IEA Read full article

Source: IEA Read full article

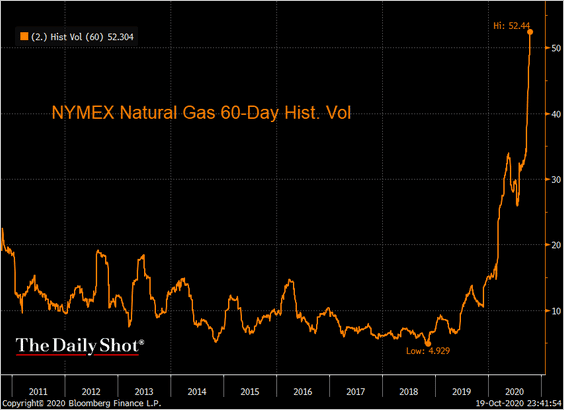

3. US natural gas volatility continues to climb.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

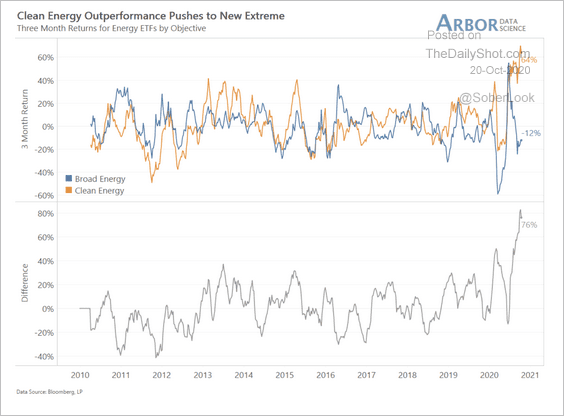

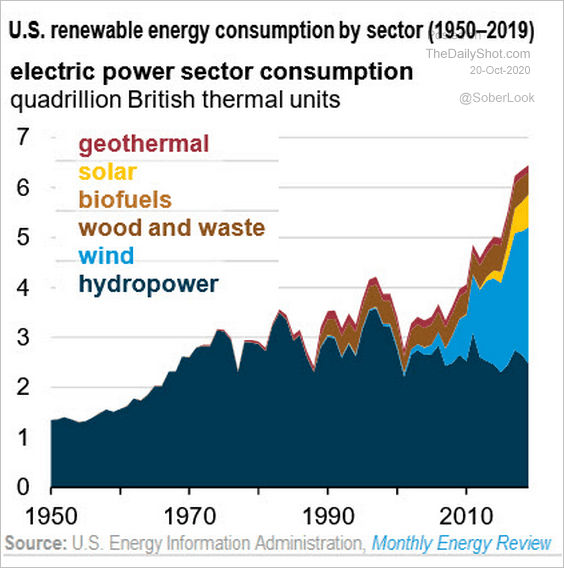

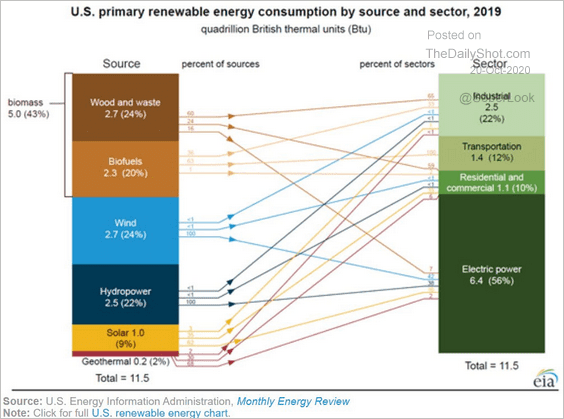

4. Next, we have some updates on renewable energy.

• Clean energy ETFs’ outperformance:

Source: Arbor Research & Trading

Source: Arbor Research & Trading

• US renewables consumption by source:

Source: @EIAgov

Source: @EIAgov

• US renewables use by source and sector in 2019:

Source: @EIAgov

Source: @EIAgov

Equities

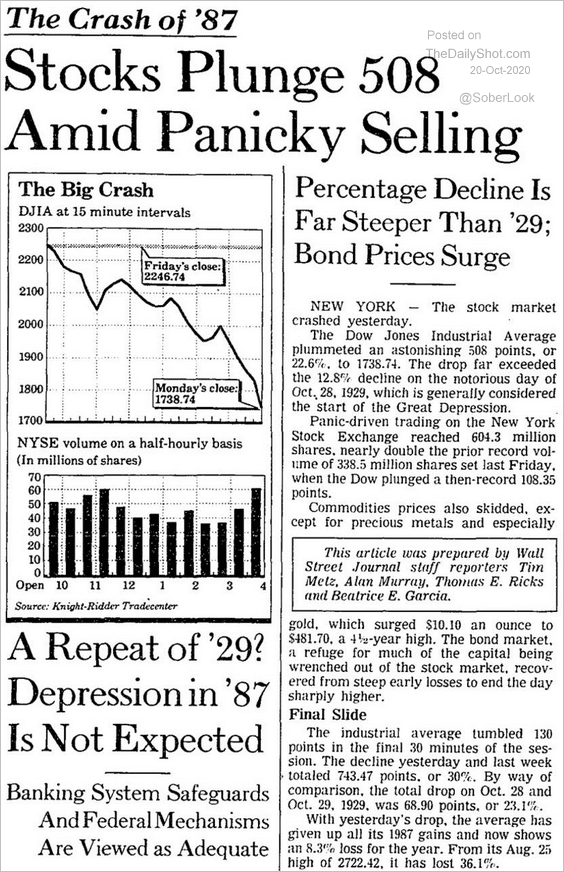

1. Uncertainty around stimulus and the 1987 crash anniversary put some pressure on stocks on Monday.

Source: Reuters Read full article

Source: Reuters Read full article

Source: @WSJ

Source: @WSJ

——————–

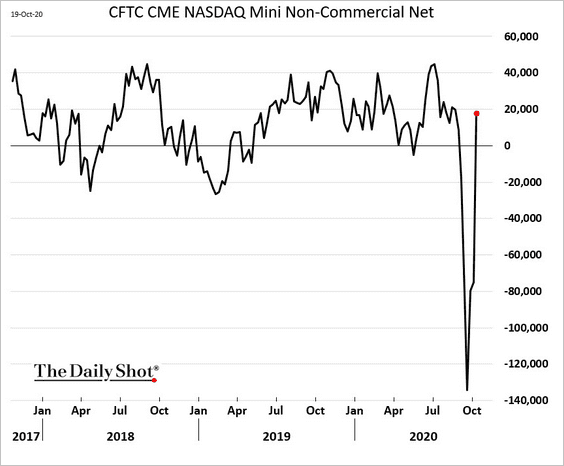

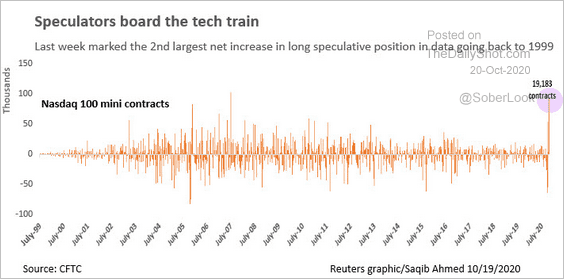

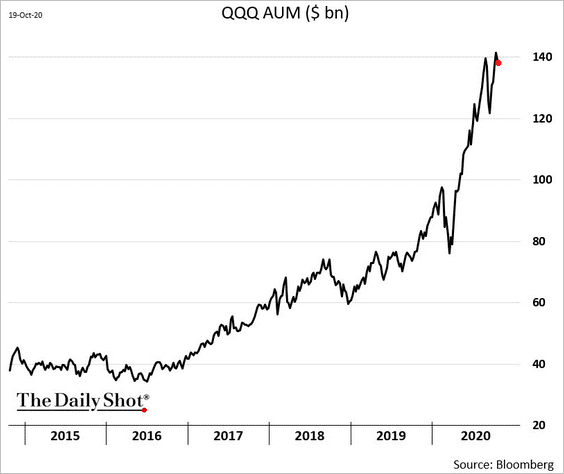

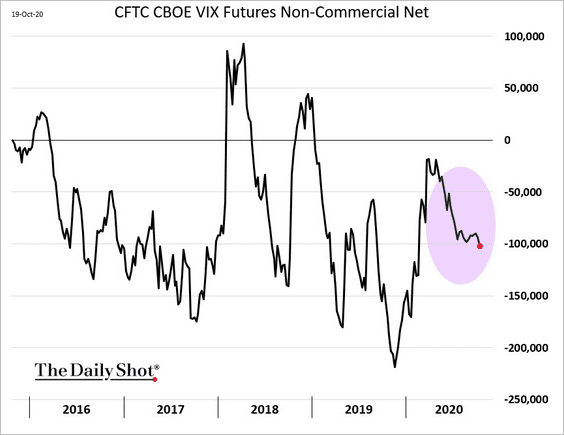

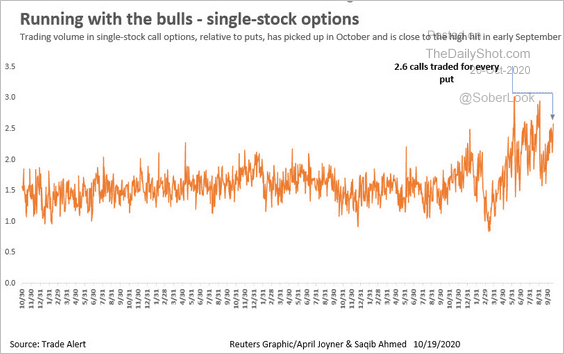

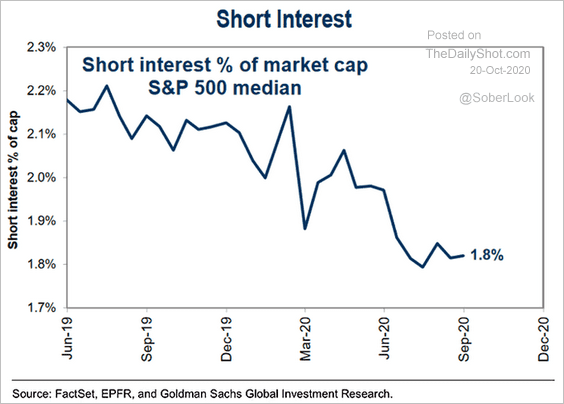

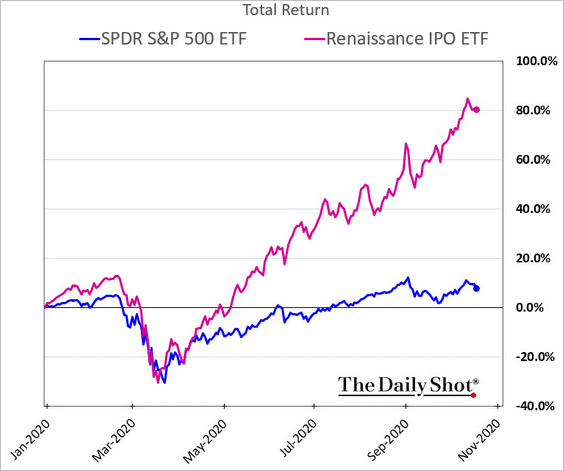

2. Multiple indicators have been signaling increasingly bullish sentiment in the market.

• Speculative bets in Nasdaq 100 futures have turned positive again. It was one of the largest position increases on record (2nd chart).

Source: Reuters Read full article

Source: Reuters Read full article

Here are the QQQ (Nasdaq 100 ETF) assets under management.

• Non-commercial positions in VIX futures have been moving further into negative territory (short vol).

• Demand for call options vs. puts remains elevated.

Source: Reuters Read full article

Source: Reuters Read full article

• Short interest has been low relative to the S&P 500 market cap.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

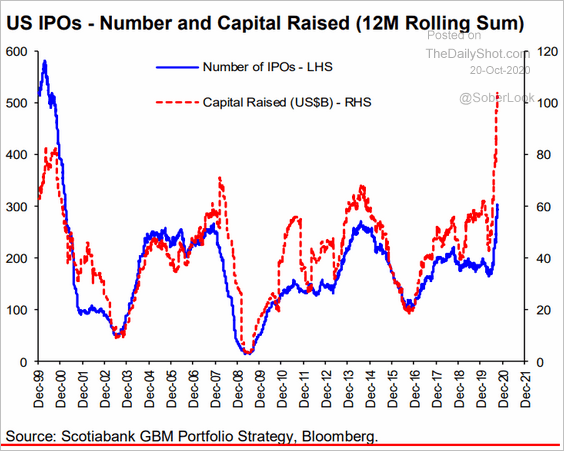

• The outperformance of post-IPO shares has been remarkable.

These valuations have accelerated IPO activity, …

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

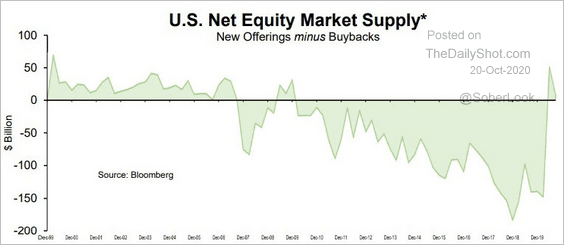

… pushing the net US equity market supply into positive territory for the first time in over a decade.

Source: @jessefelder, @VincentDeluard Read full article

Source: @jessefelder, @VincentDeluard Read full article

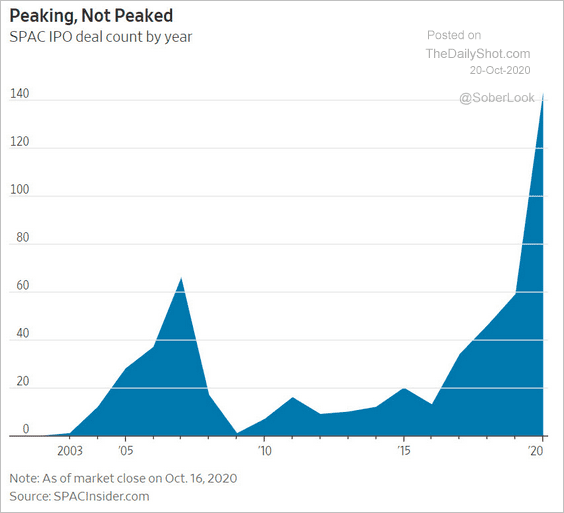

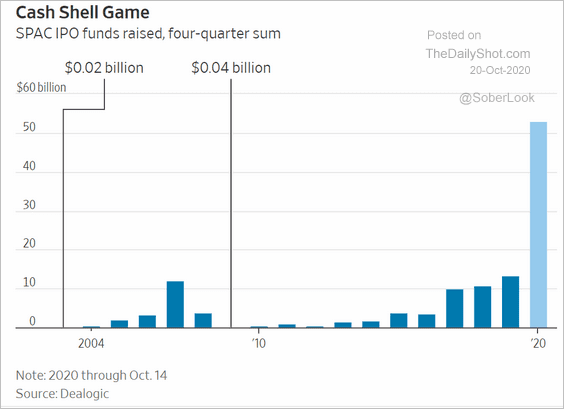

• SPAC issuance has been extraordinary.

– The number of deals:

Source: @WSJ Read full article

Source: @WSJ Read full article

– Dollar amount:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

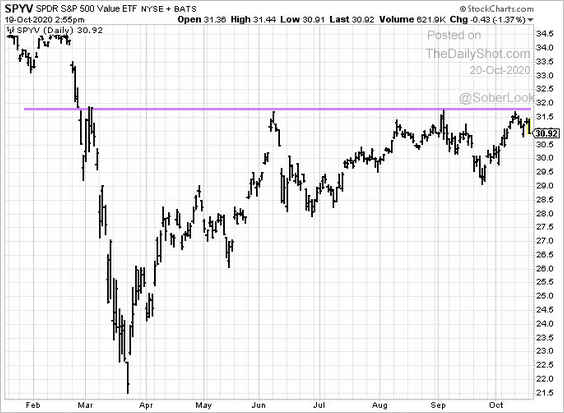

3. Value stocks have not been able to break resistance.

h/t @lena_popina

h/t @lena_popina

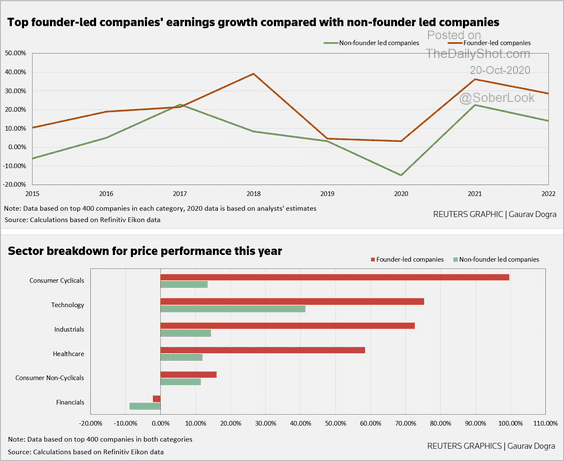

4. Founder-led companies have outperformed this year.

Source: Reuters Read full article

Source: Reuters Read full article

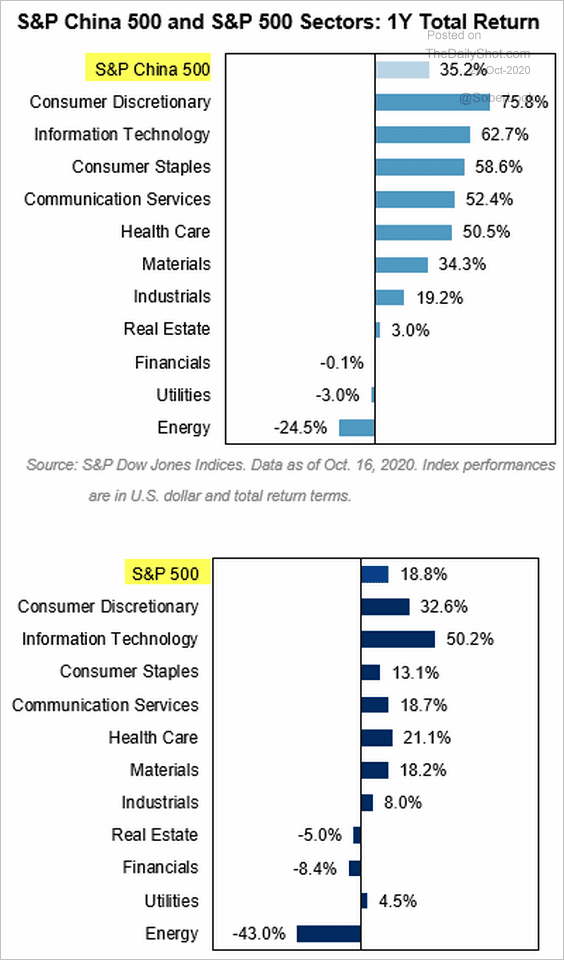

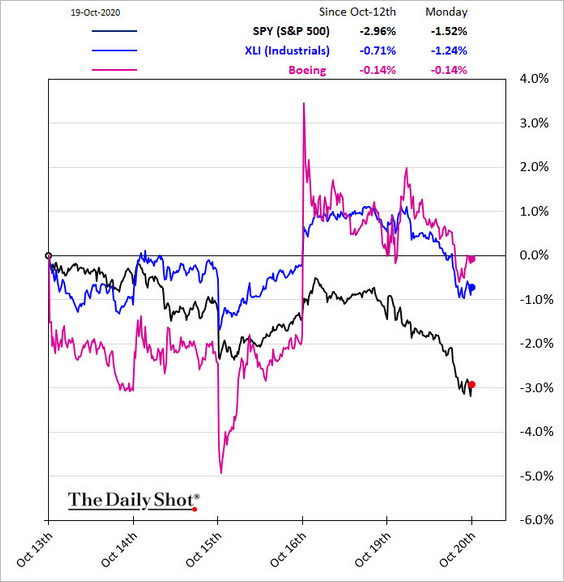

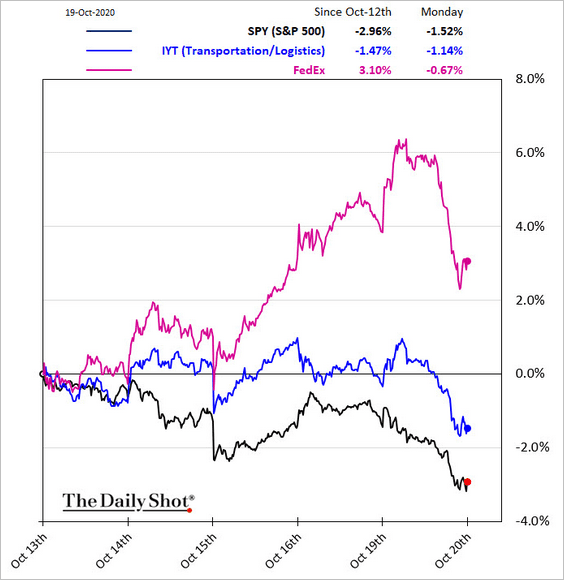

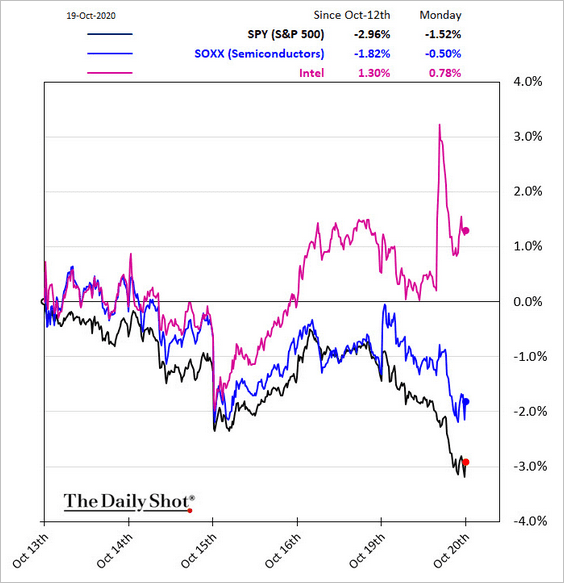

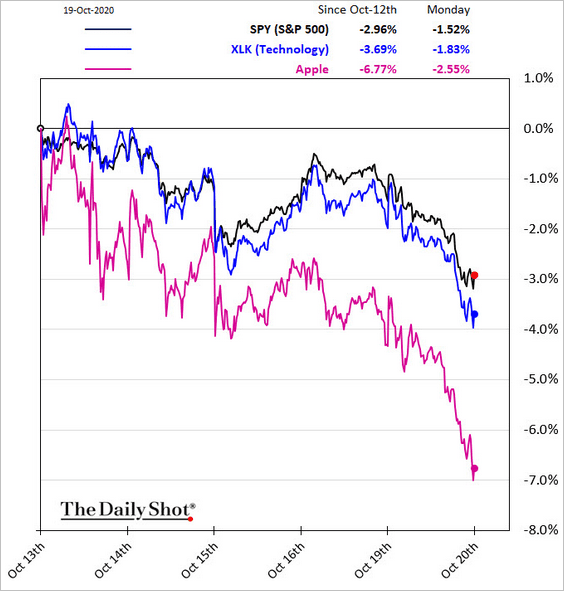

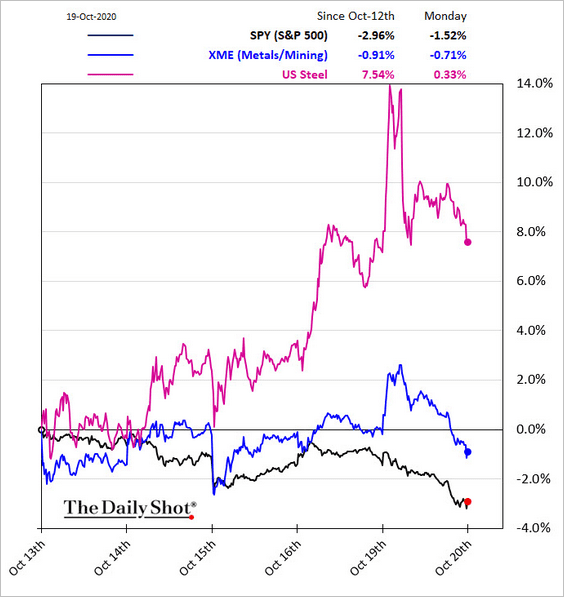

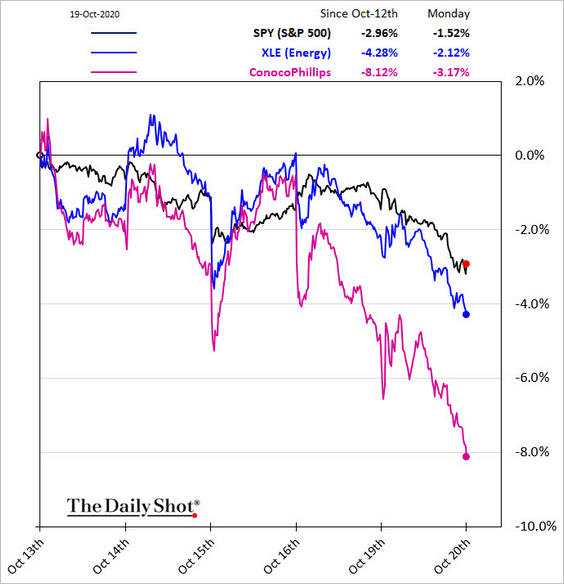

5. Finally, we have some sector updates.

• US vs. China 1-year returns by sector:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

• Relative performance over the past five business days:

– Industrials:

– Transportation/logistics:

– Semiconductors:

Source: @WSJ Read full article

Source: @WSJ Read full article

– Tech:

– Metals & Mining:

– Energy:

Source: @WSJ Read full article

Source: @WSJ Read full article

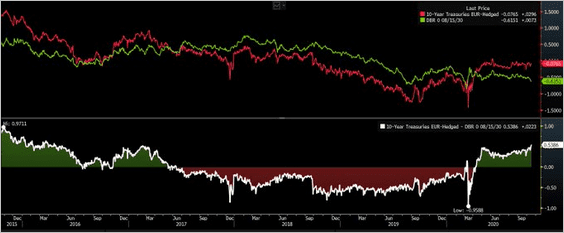

Rates

1. Treasuries hedged into euros (red line) are now significantly more attractive than Bunds (green) for euro-based investors.

Source: @EPBResearch

Source: @EPBResearch

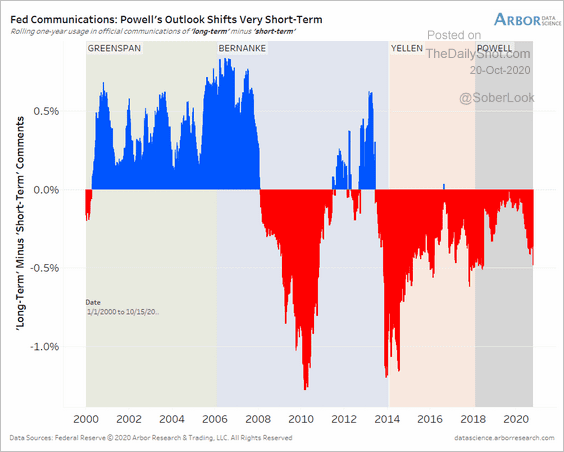

2. Fed officials have been more focused on “short-term” outcomes.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

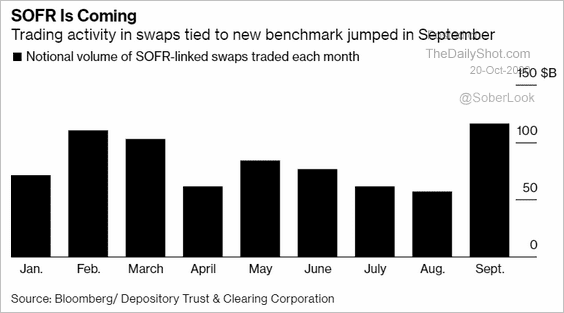

3. SOFR-linked swap trading activity picked up substantially last month amid an ongoing push to replace LIBOR.

Source: @markets Read full article

Source: @markets Read full article

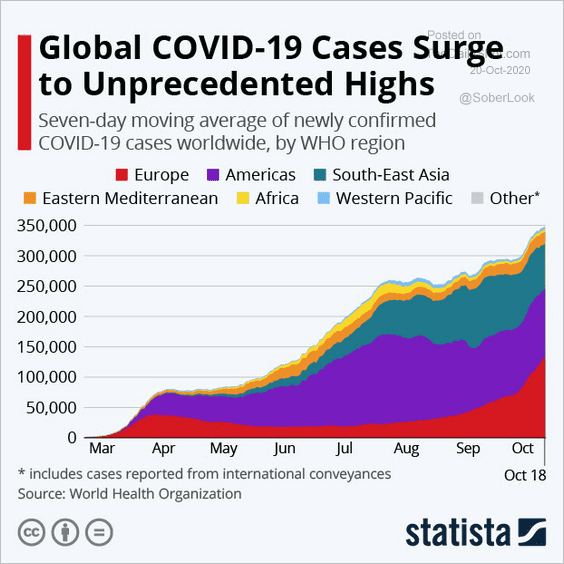

Global Developments

1. Let’s start with new COVID cases by region …

Source: Statista

Source: Statista

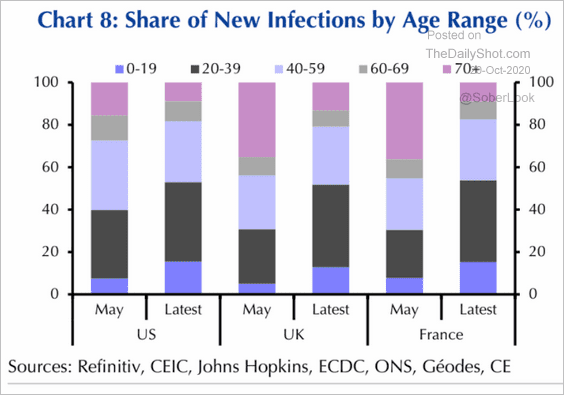

… and by age.

Source: Capital Economics

Source: Capital Economics

——————–

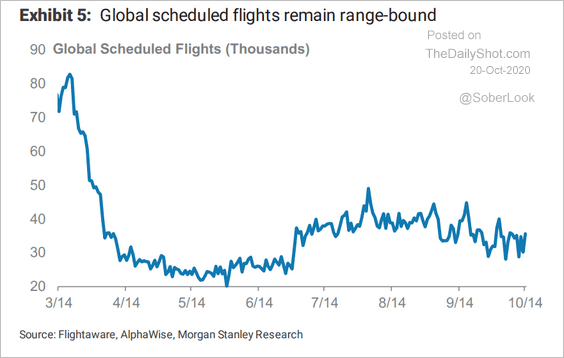

2. Global scheduled flights remain depressed.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

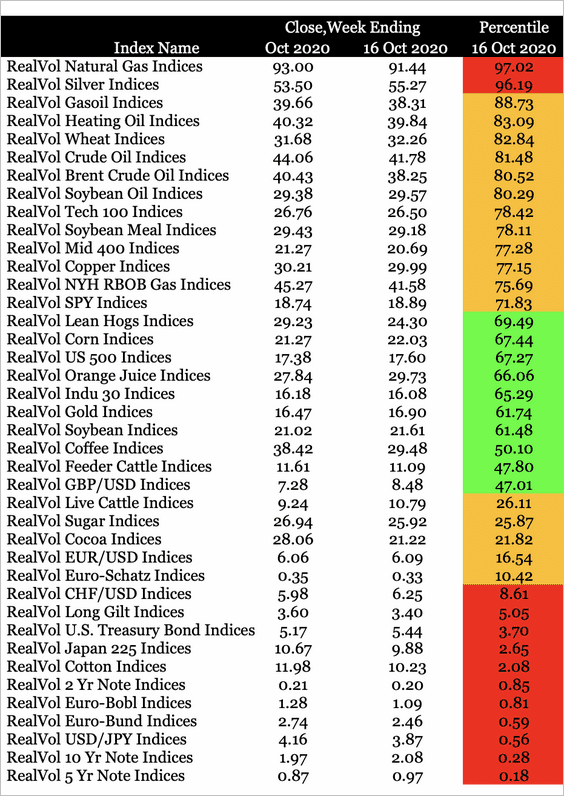

3. Which markets have been experiencing higher than average volatility (top)? Where has volatility been unusually low (bottom)?

Source: Demand Derivatives

Source: Demand Derivatives

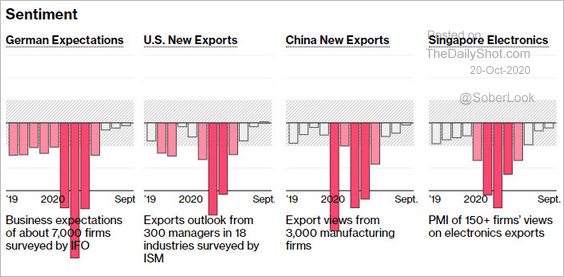

4. Trade sentiment has been recovering.

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

——————–

Food for Thought

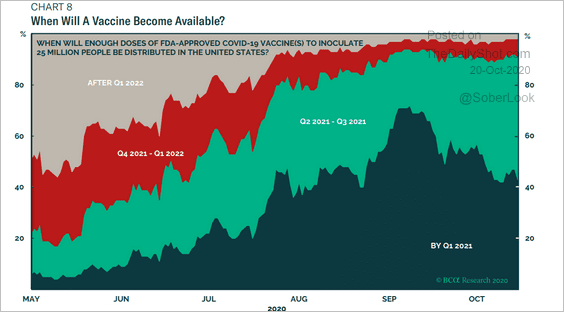

1. When will a vaccine become available?

Source: BCA Research

Source: BCA Research

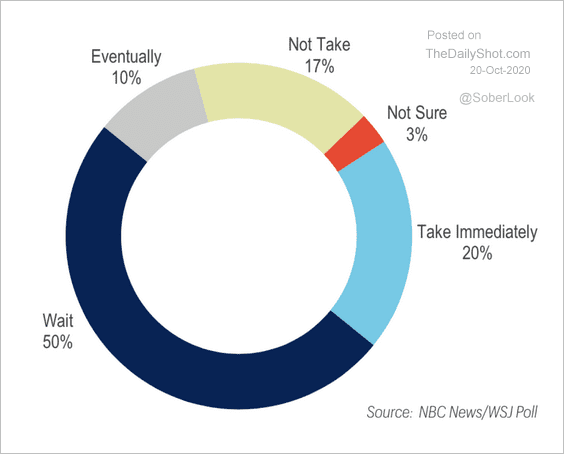

2. When will Americans get vaccinated?

Source: FHN Financial

Source: FHN Financial

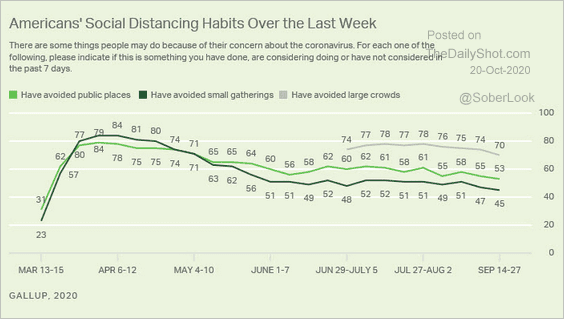

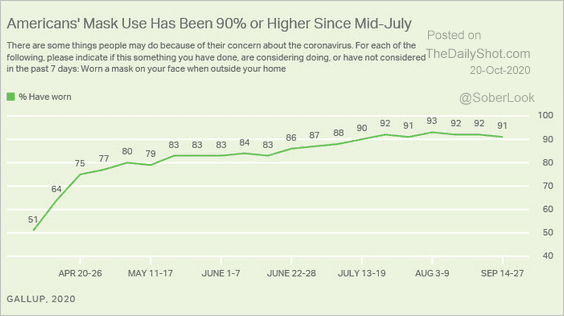

3. Social distancing and mask usage (2 charts):

Source: Gallup Read full article

Source: Gallup Read full article

Source: Gallup Read full article

Source: Gallup Read full article

——————–

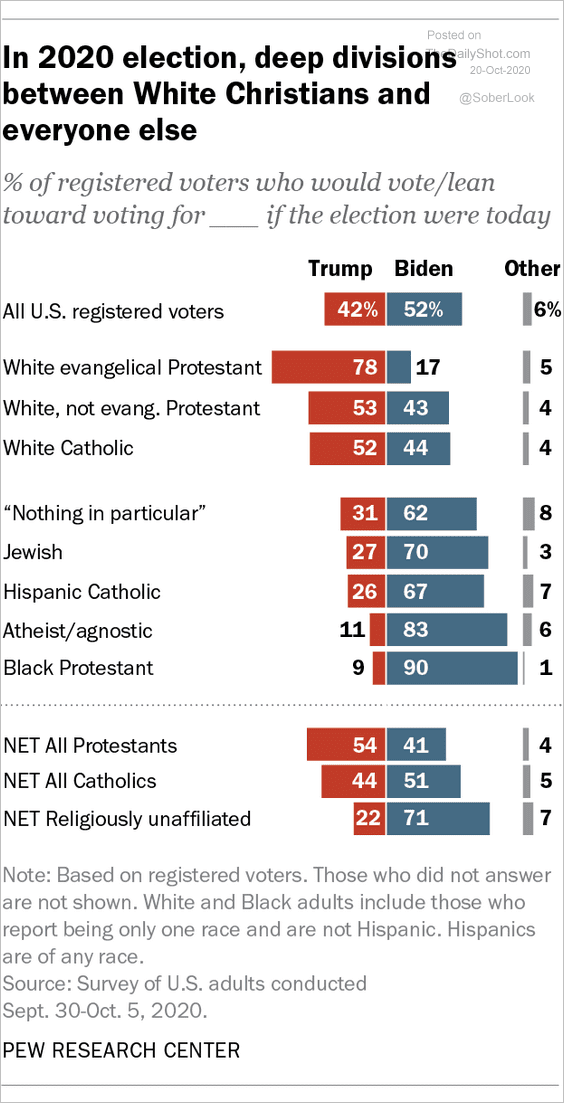

4. Political preferences by religious affiliation:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

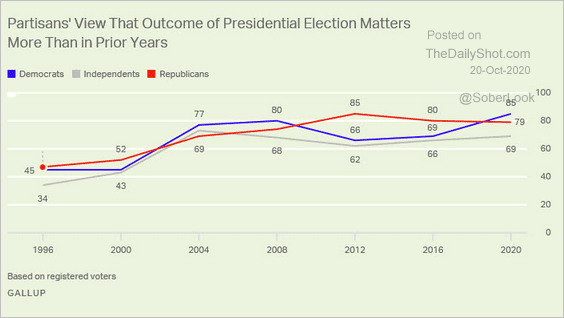

5. How important is this election?

Source: Gallup Read full article

Source: Gallup Read full article

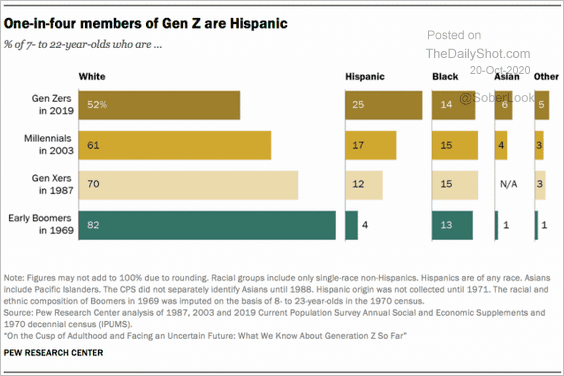

6. Changing demographics in the US:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

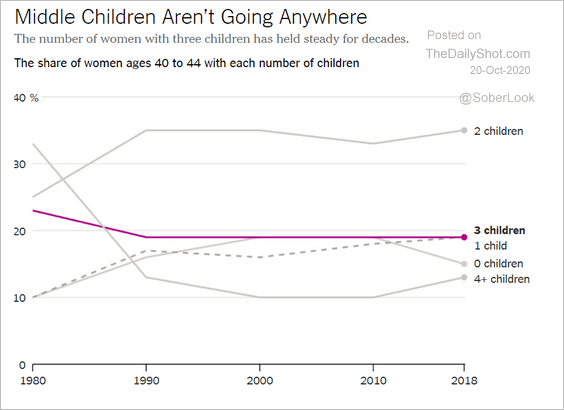

7. Percentage of women with three children:

Source: The New York Times Read full article

Source: The New York Times Read full article

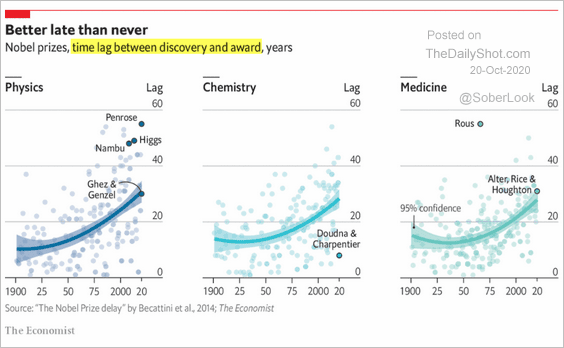

8. The time lag between discovery and the Nobel Prize:

Source: The Economist Read full article

Source: The Economist Read full article

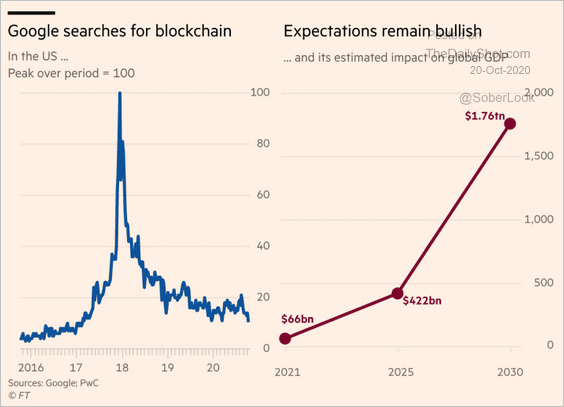

9. Search activity for blockchain and its expected impact on GDP:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

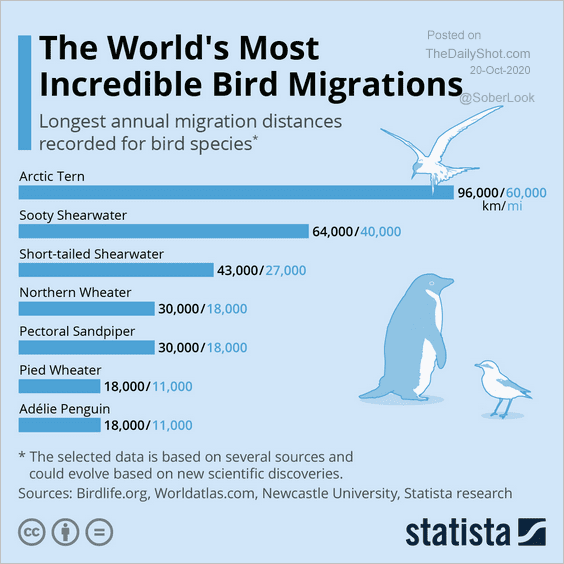

10. Longest bird migrations:

Source: Statista

Source: Statista

——————–