The Daily Shot: 23-Oct-20

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

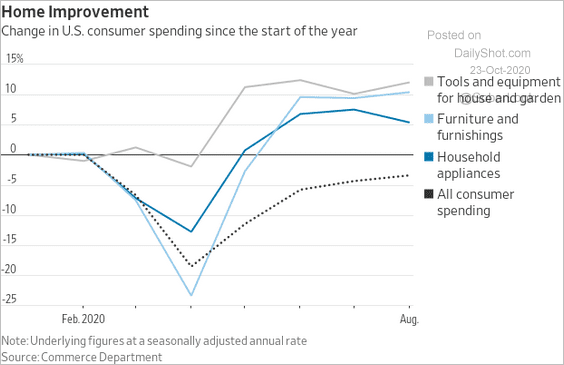

• Emerging Markets

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

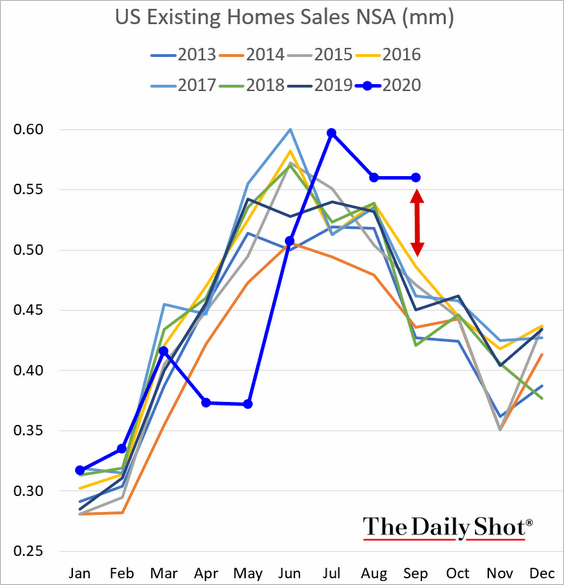

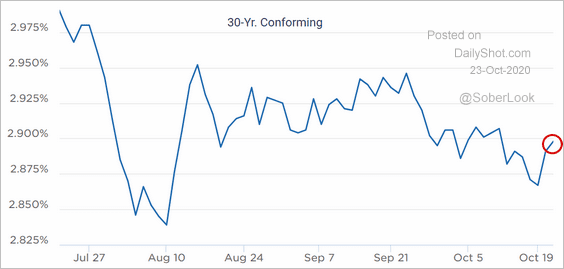

1. Existing home sales are holding at multi-year highs (well above last year’s levels).

• Inventories remain depressed.

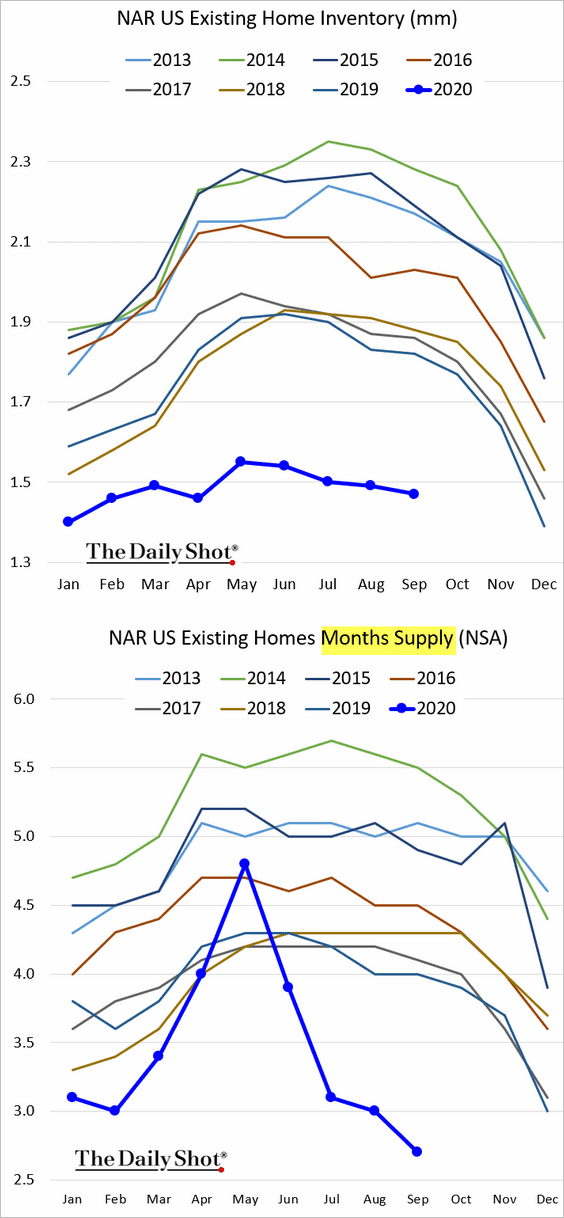

• Declining mortgage rates have fueled the housing rally.

Source: BCA Research

Source: BCA Research

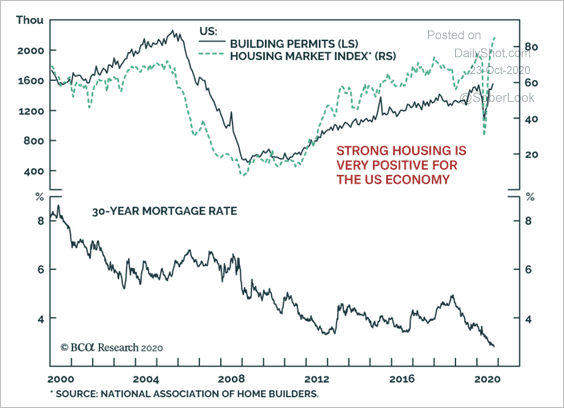

• But have mortgage rates bottomed?

Source: Optimal Blue

Source: Optimal Blue

——————–

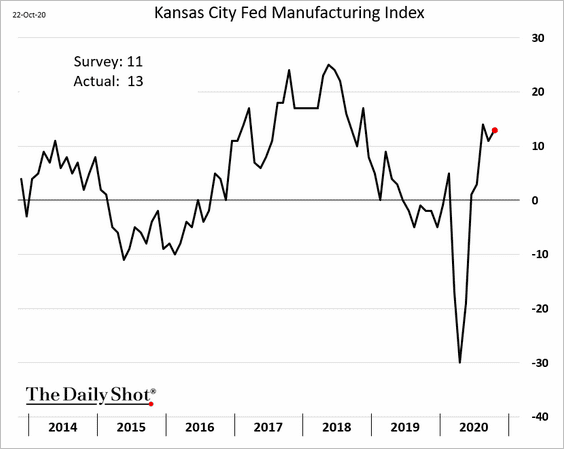

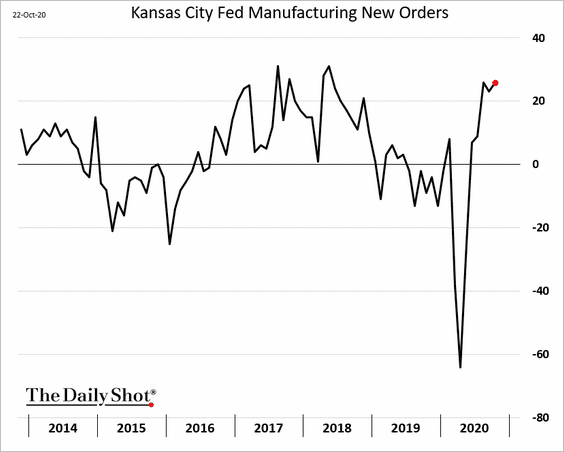

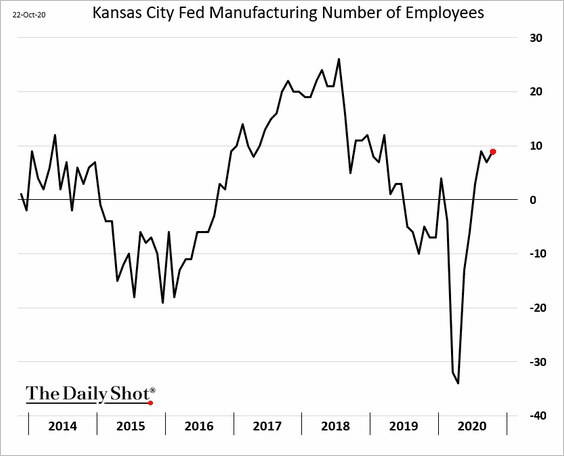

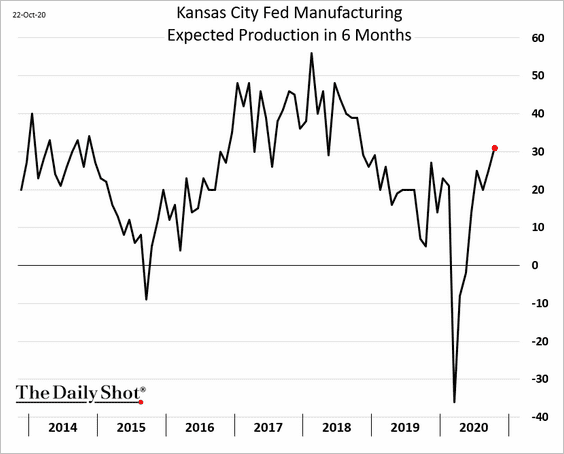

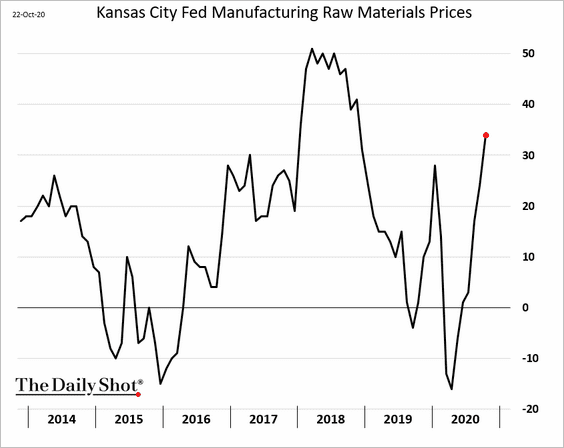

2. The Kansas City Fed’s manufacturing report continues to show robust factory activity in the region.

Here are some of the subindices.

Input costs have been rising.

——————–

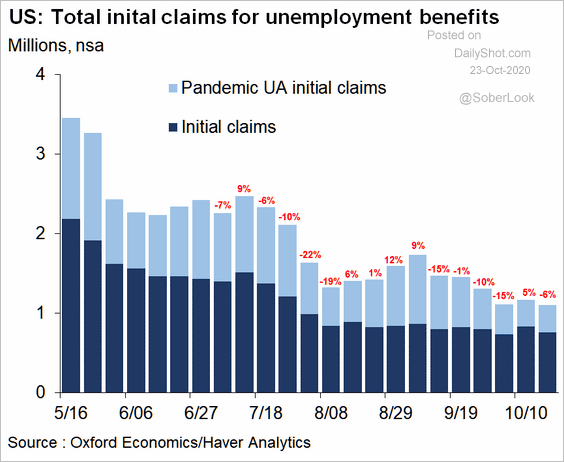

3. First-time unemployment applications are holding above one million per week.

Source: Oxford Economics

Source: Oxford Economics

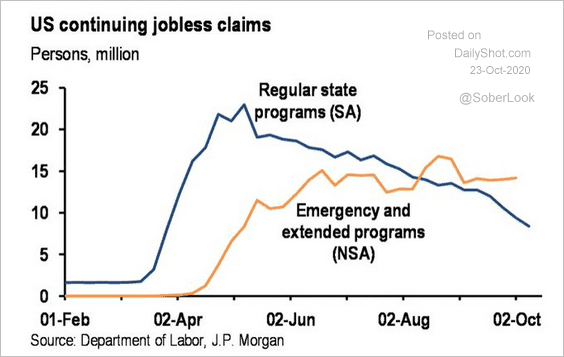

This chart shows continuing jobless claims. As the regular state benefits expire, some have moved to emergency/extended programs.

Source: JPMorgan, @carlquintanilla

Source: JPMorgan, @carlquintanilla

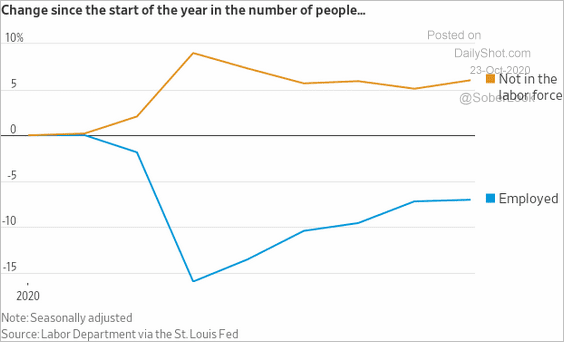

Many Americans have exited the labor force altogether.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

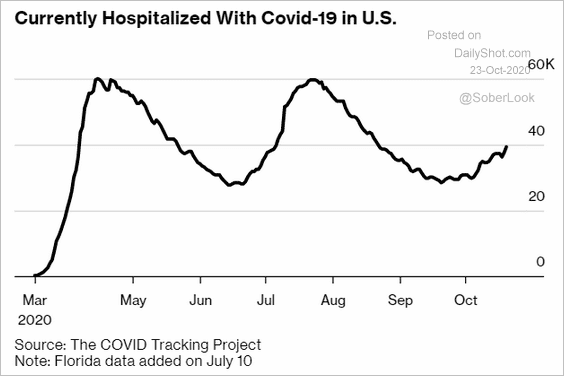

4. COVID hospitalizations are rising again.

Source: @business Read full article

Source: @business Read full article

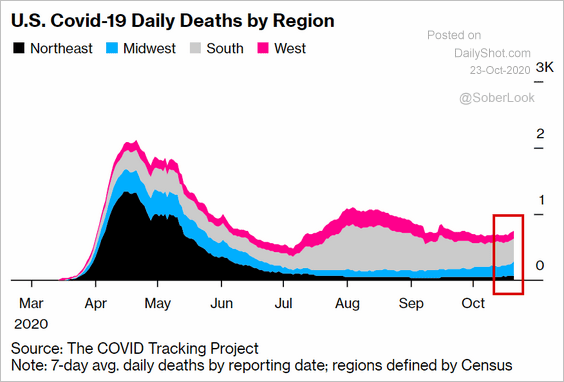

And so are COVID-related deaths (mostly in the Midwest).

Source: @business Read full article

Source: @business Read full article

——————–

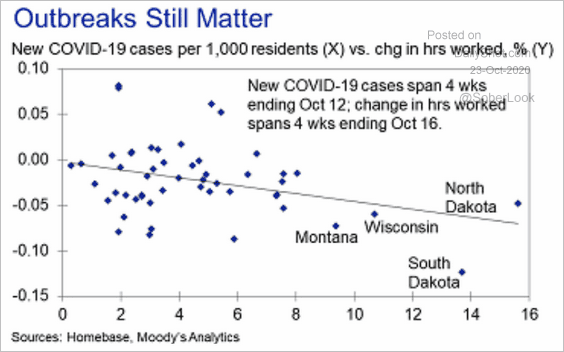

5. The COVID spike is impacting the nation’s labor markets. This scatterplot shows new cases and hours worked (by state).

Source: Moody’s Analytics

Source: Moody’s Analytics

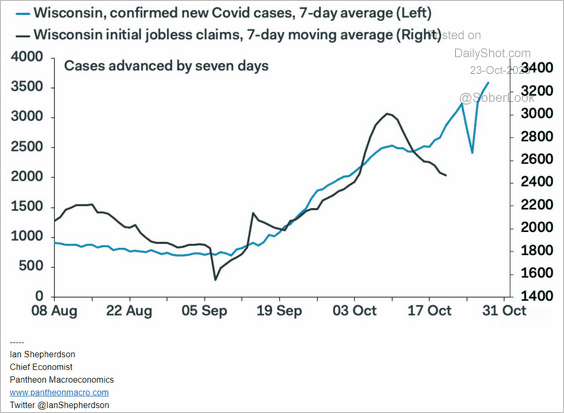

Here is Wisconsin, for example.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

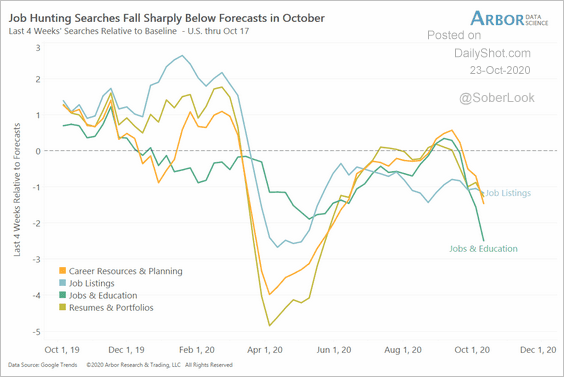

Job-related online search activity is down sharply.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

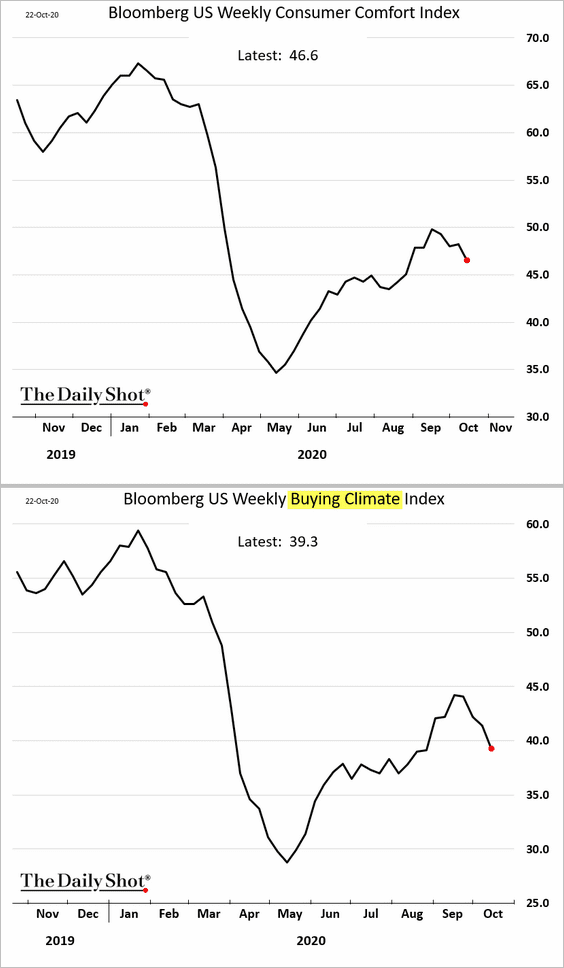

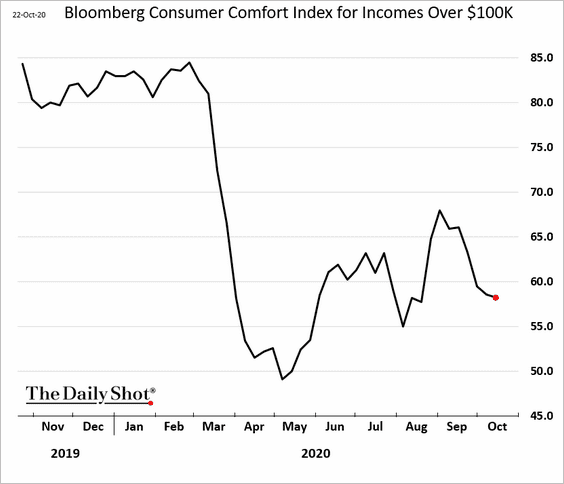

6. Bloomberg’s consumer sentiment index is rolling over.

Here is the index for higher-income households, representing a large portion of consumption in the US.

——————–

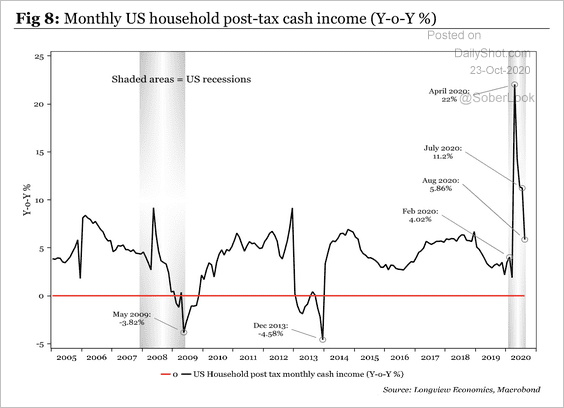

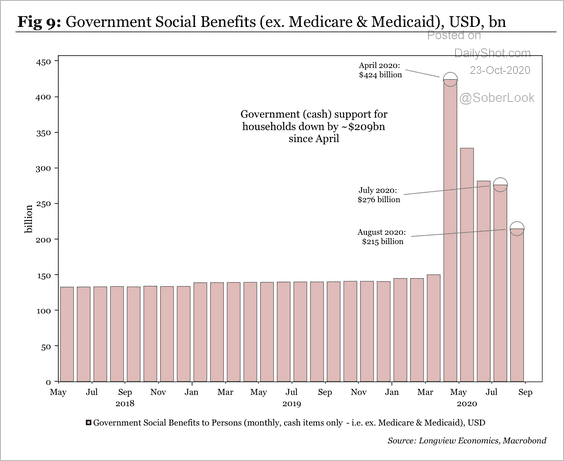

7. Household post-tax cash income is nearing to pre-crisis levels.

Source: Longview Economics

Source: Longview Economics

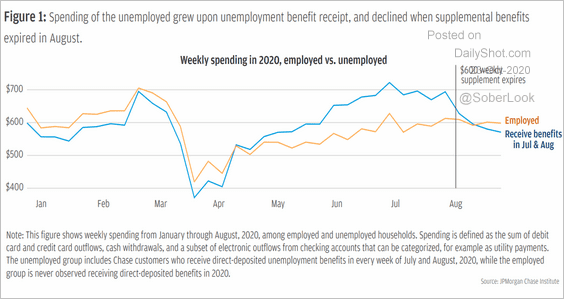

Government cash support for households is falling. Will consumers continue to spend without additional income support amidst the pandemic?

Source: Longview Economics

Source: Longview Economics

Source: JPMorgan Chase Institute Read full article

Source: JPMorgan Chase Institute Read full article

——————–

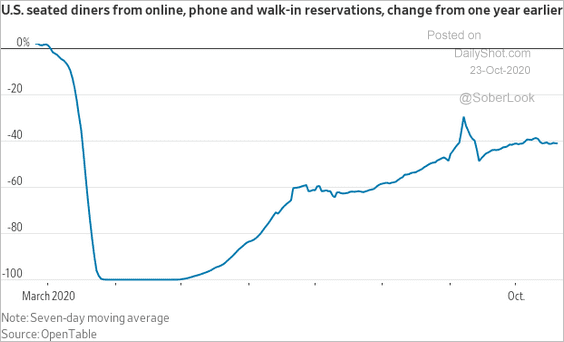

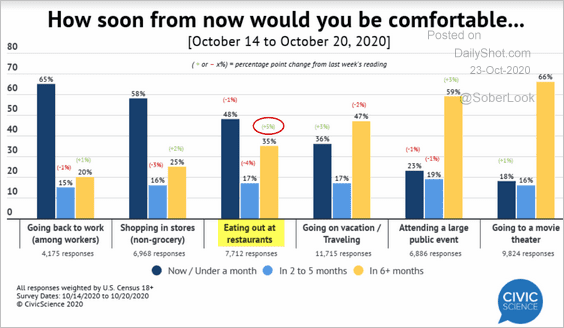

8. The recovery in restaurant traffic has stalled (2 charts).

Source: @jeffsparshott, @WSJ

Source: @jeffsparshott, @WSJ

Source: @CivicScience

Source: @CivicScience

——————–

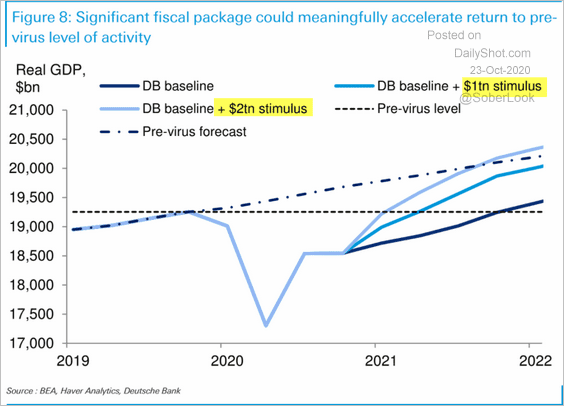

9. Additional stimulus could propel the GDP recovery toward the pre-crisis trend.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

The United Kingdom

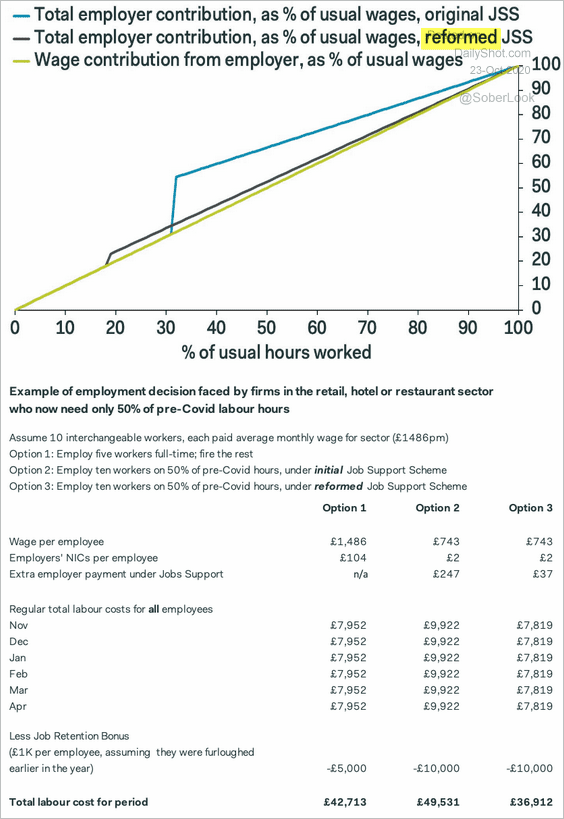

1. Realizing that the earlier proposal will disincentivize employers from holding on to part-time workers, the government amended its jobs support scheme.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

The new incentive structure is much more attractive for employers and will result in fewer job losses (but much higher government spending). The schedule below from Pantheon Macroeconomics provides an example of the impact on labor costs.

Source: Samuel Tombs, Pantheon Macroeconomics

Source: Samuel Tombs, Pantheon Macroeconomics

——————–

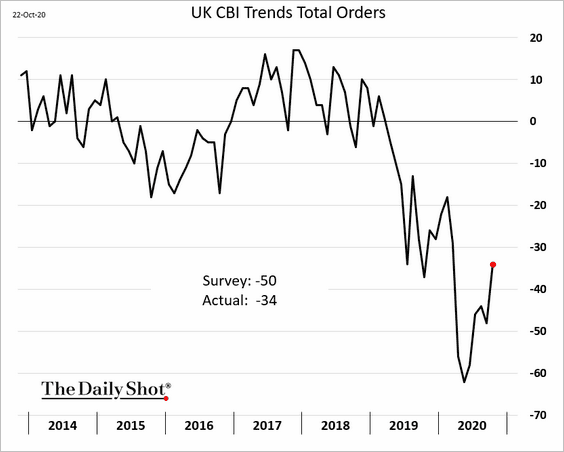

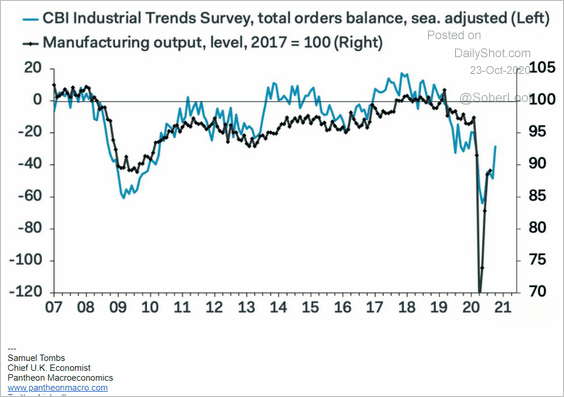

2. The CBI index showed improvement in industrial orders.

Source: Reuters Read full article

Source: Reuters Read full article

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

The Eurozone

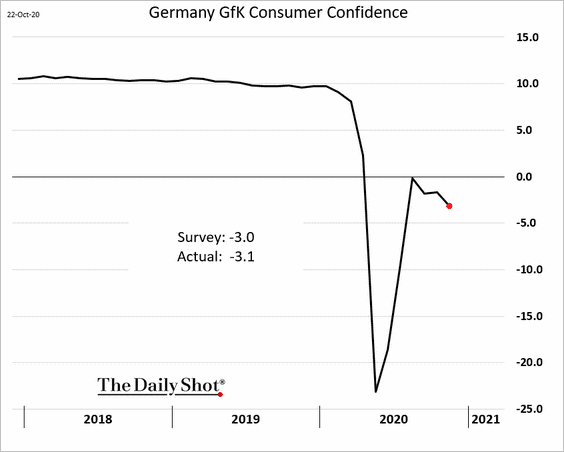

1. German consumer confidence is deteriorating as the pandemic worsens.

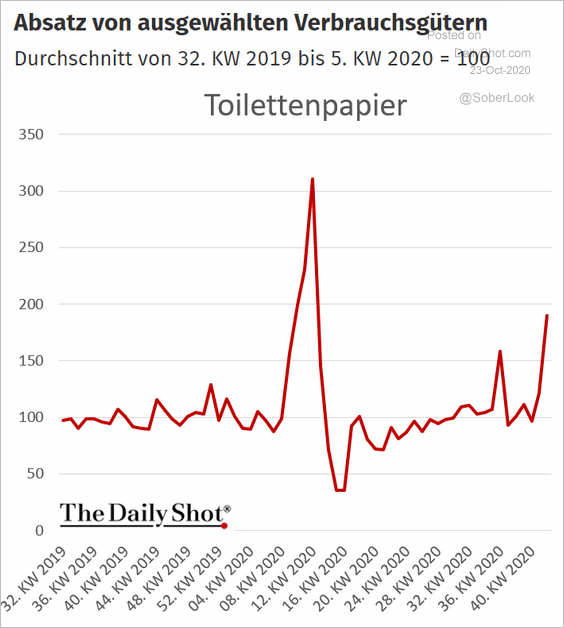

German households are hoarding toilet paper again.

Source: Statistisches Bundesamt (Destatis), h/t Carolynn Look (Bloomberg)

Source: Statistisches Bundesamt (Destatis), h/t Carolynn Look (Bloomberg)

——————–

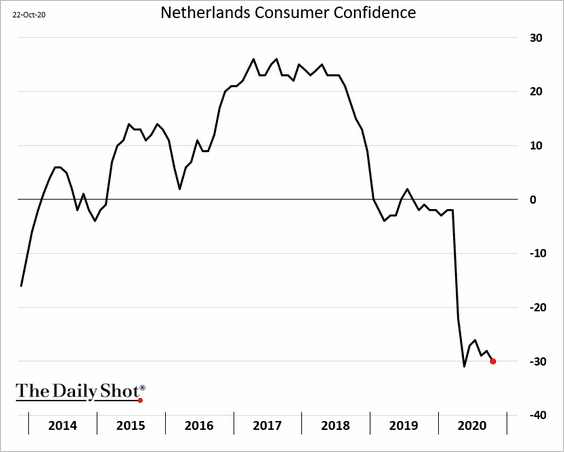

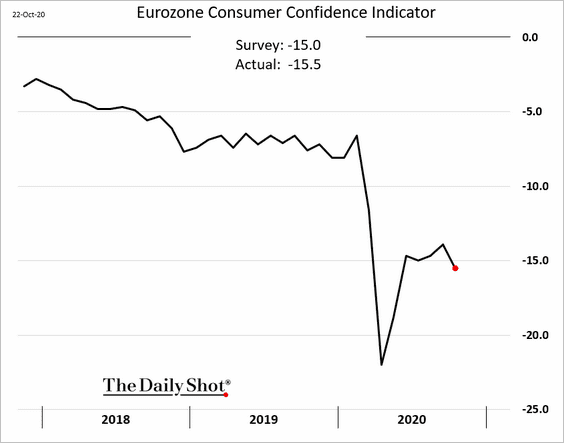

2. Consumer confidence is worsening across the euro area.

The Netherlands:

The Eurozone:

——————–

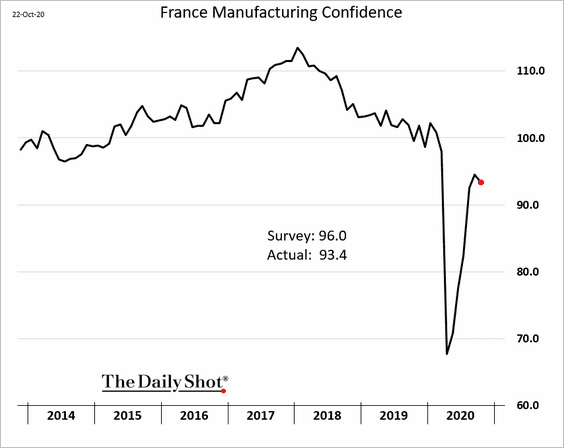

3. French manufacturing sentiment edged lower this month.

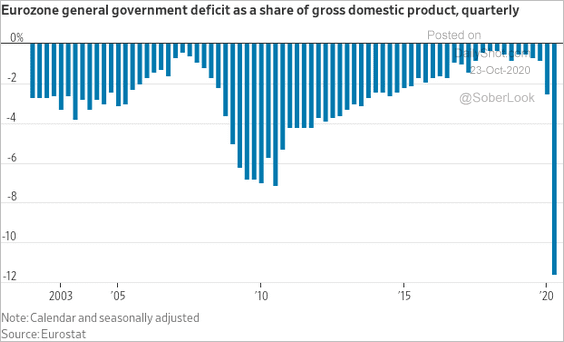

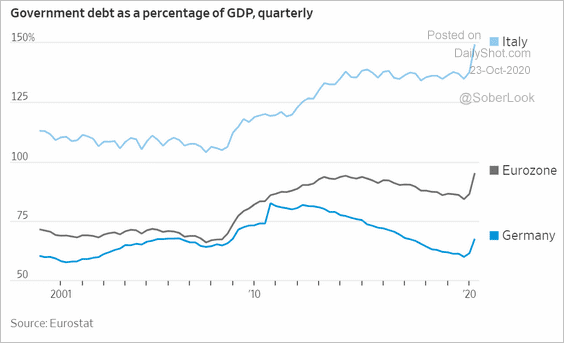

4. Government deficits have blown out this year, pushing debt levels sharply higher.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Asia – Pacific

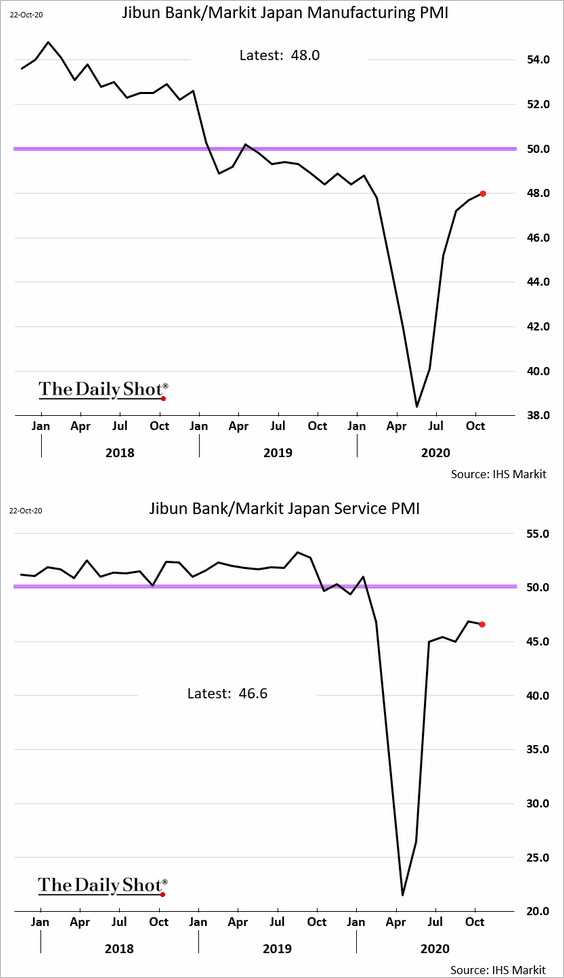

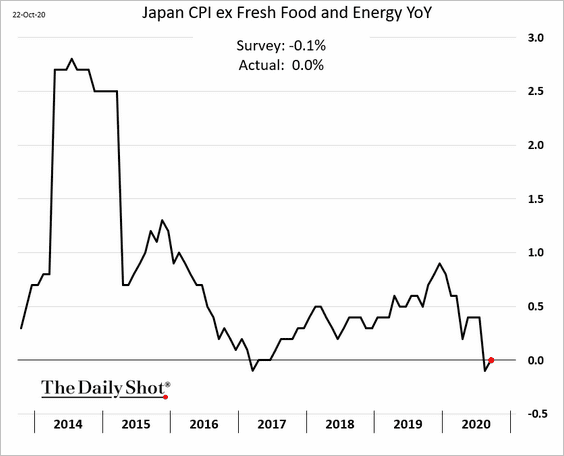

1. Let’s begin with Japan.

• The Markit PMI report showed business activity continuing to shrink this month (PMI < 50).

• Inflation ticked higher but remains depressed.

——————–

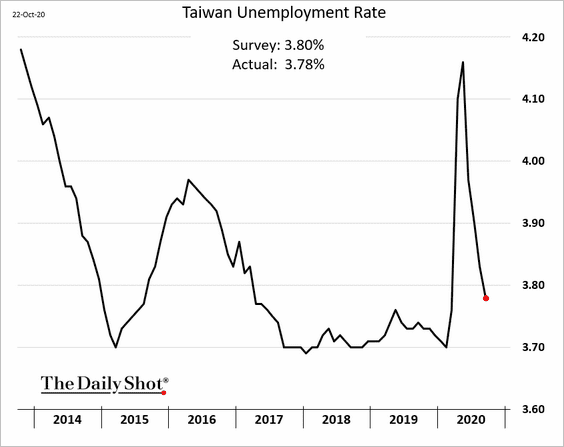

2. Taiwan’s unemployment rate continues to fall.

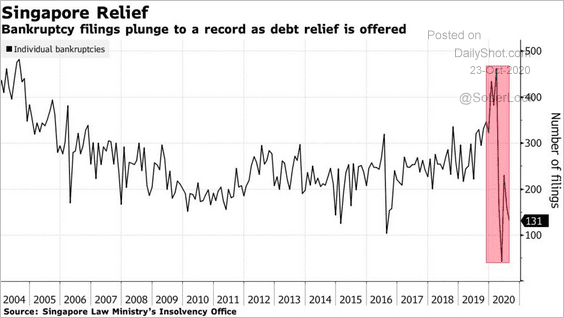

3. Singapore’s default rates tumbled amid debt relief.

Source: @markets Read full article

Source: @markets Read full article

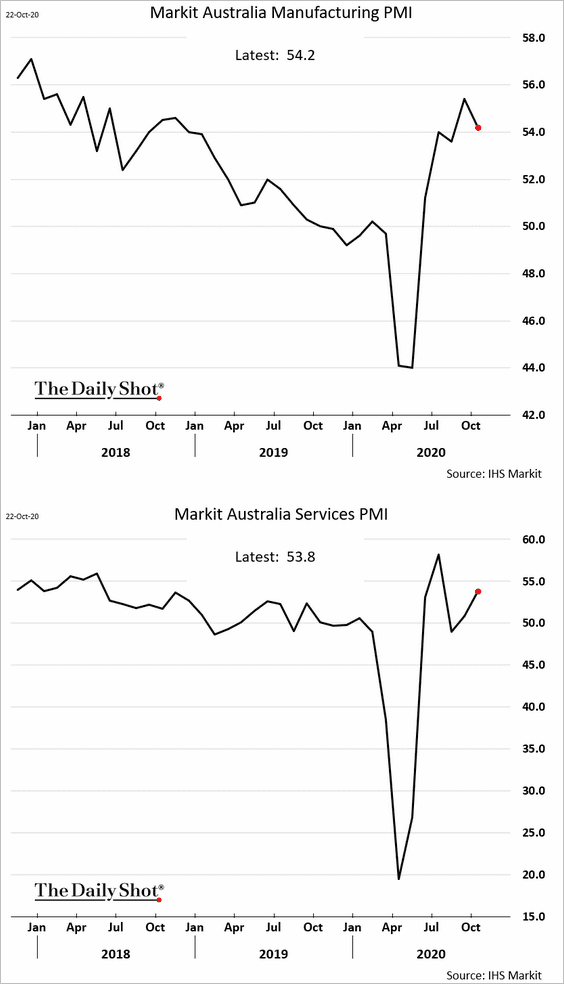

4. Australia’s business activity remained resilient this month, according to Markit PMI.

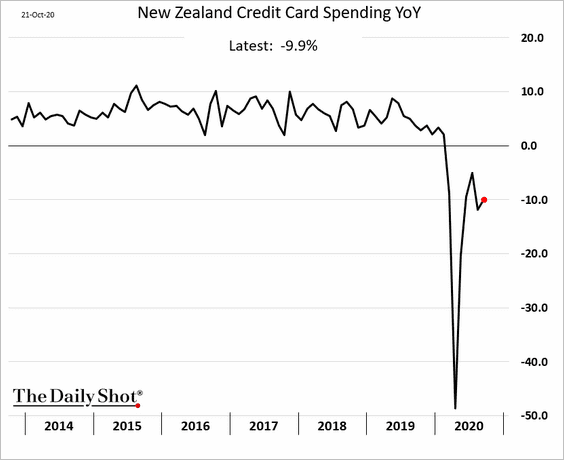

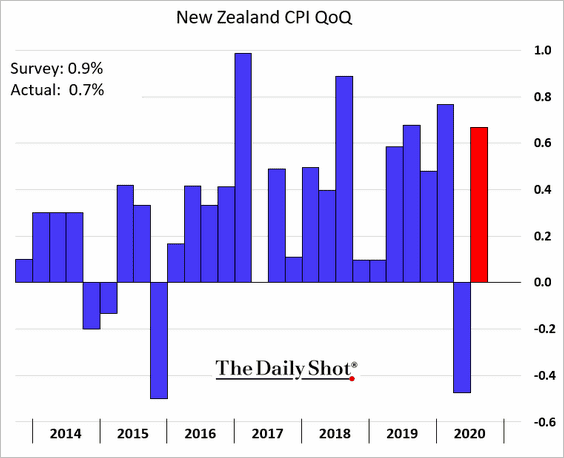

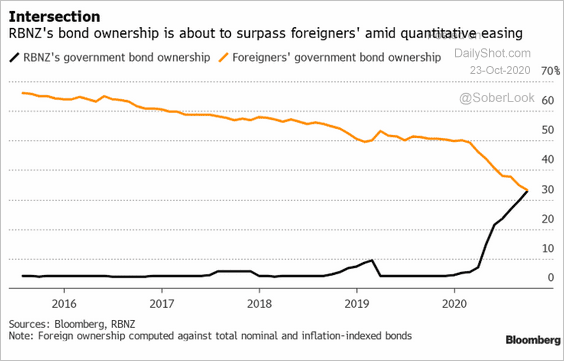

5. Next, we have some updates on New Zealand.

• Credit card spending:

• Quarterly CPI (below consensus):

• Bloomberg’s estimates of RBNZ’s government bond ownership (vs. debt held by foreigners):

Source: Masaki Kondo, Bloomberg Finance L.P.

Source: Masaki Kondo, Bloomberg Finance L.P.

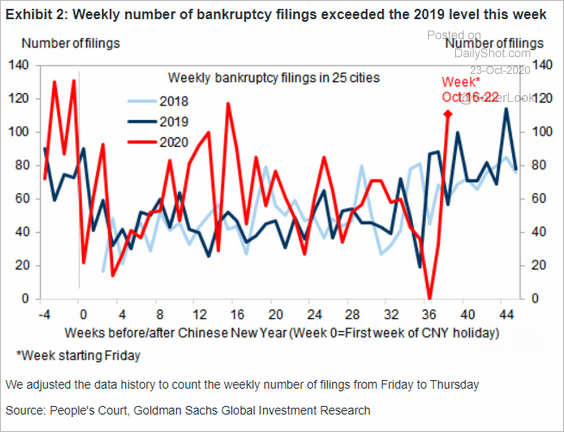

China

1. Bankruptcy filings are up.

Source: Goldman Sachs

Source: Goldman Sachs

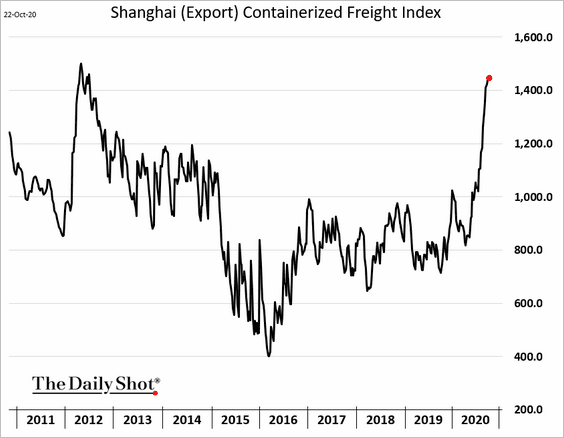

2. The Shanghai Freight Index continues to climb, indicating robust export demand.

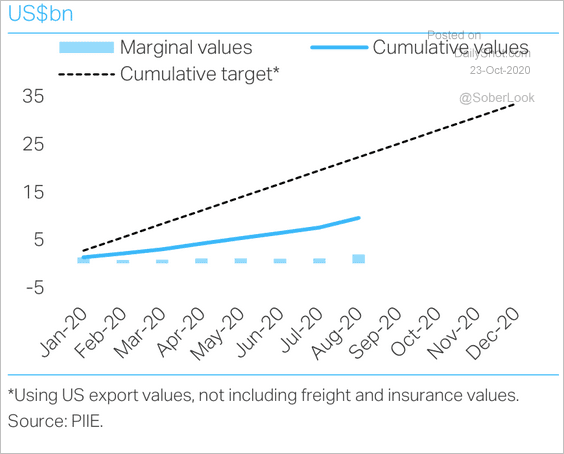

3. China has fulfilled less than half of its Phase-1 targets for farm goods from the US.

Source: TS Lombard

Source: TS Lombard

——————–

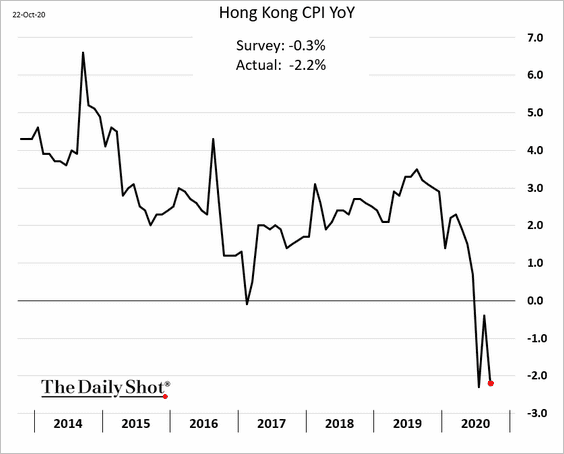

4. Hong Kong remains in deflation, with the latest CPI report coming in well below estimates.

Emerging Markets

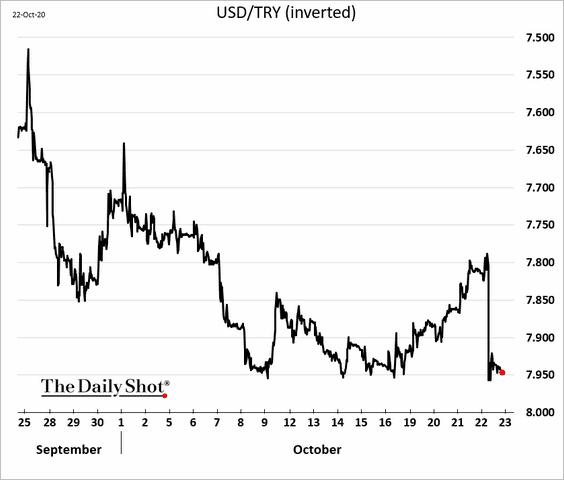

1. The Turkish central bank unexpectedly left rates unchanged (another hike was expected). The lira tumbled, trading near record lows.

Source: @WSJ Read full article

Source: @WSJ Read full article

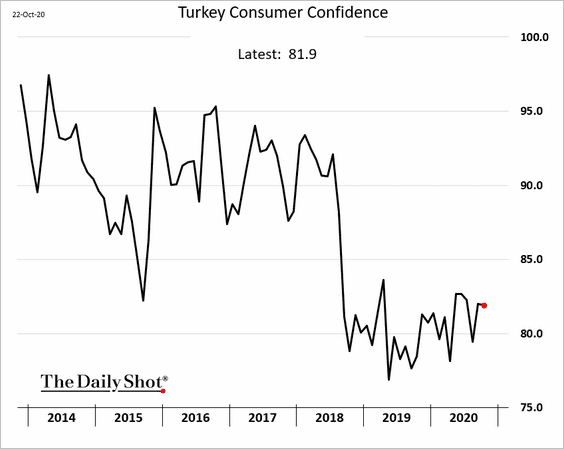

Separately, Turkey’s consumer confidence remains depressed.

——————–

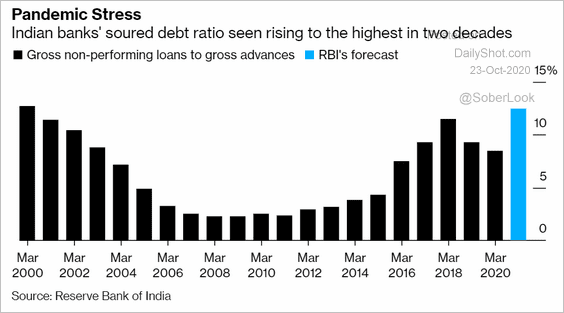

2. India’s bad debt levels are expected to climb sharply.

Source: @markets Read full article

Source: @markets Read full article

Commodities

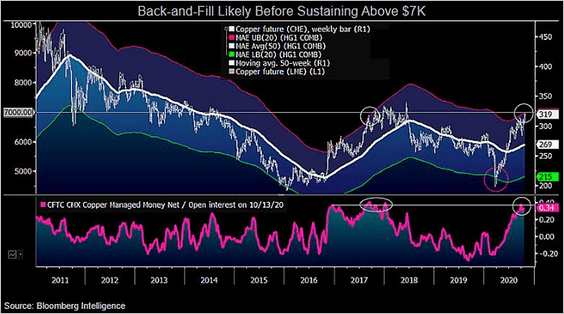

1. Copper is at resistance as speculative bets (managed money longs) are at the highest level in three years.

Source: @mikemcglone11

Source: @mikemcglone11

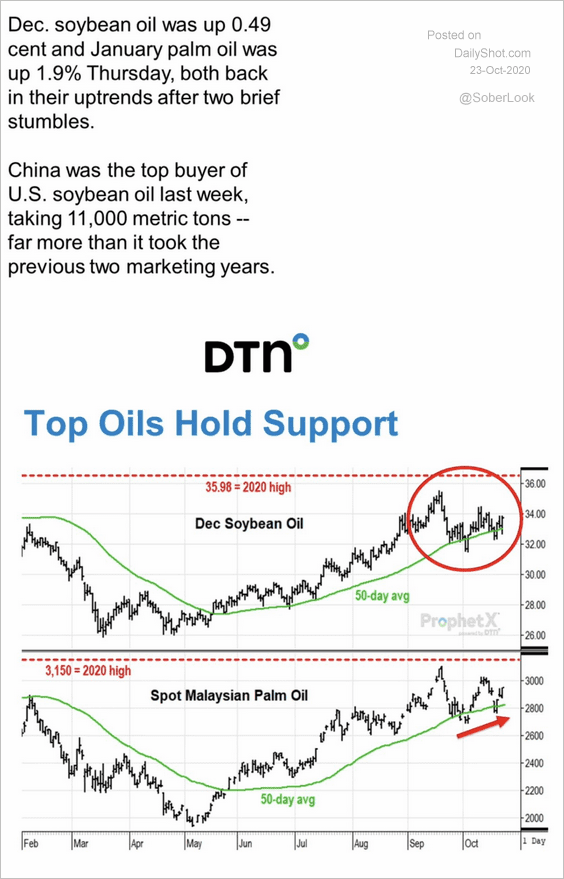

2. Soybean and palm oil futures are holding support.

Source: @ToddHultman1

Source: @ToddHultman1

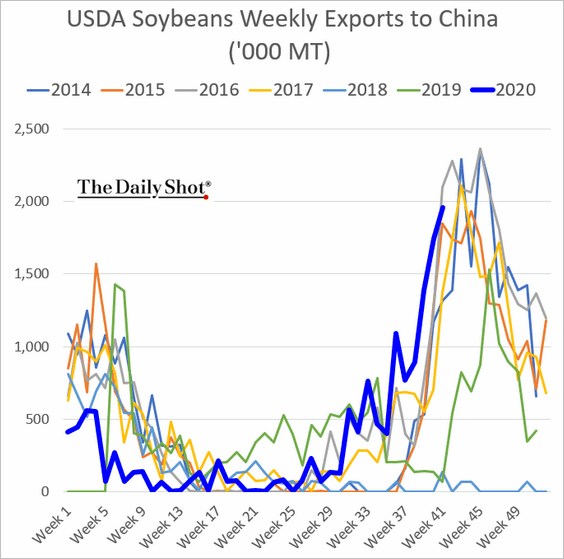

3. This chart shows US soybean exports to China.

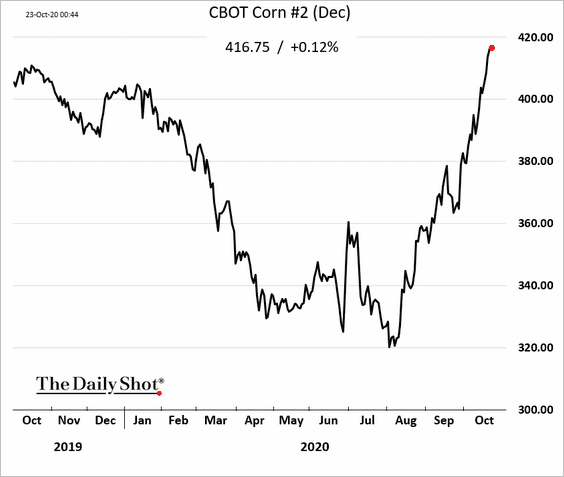

4. US corn futures continue to climb.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

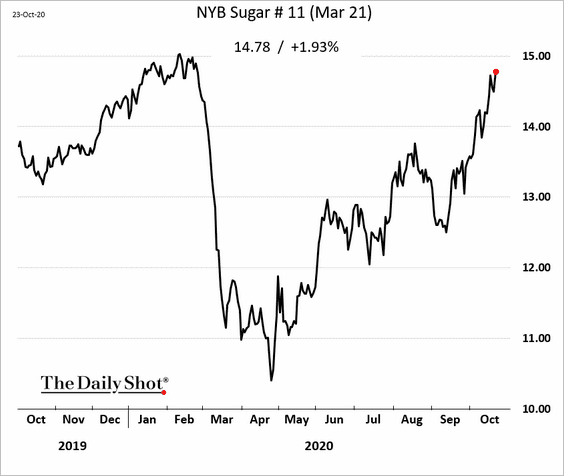

5. Sugar futures have nearly recovered the pandemic-related losses.

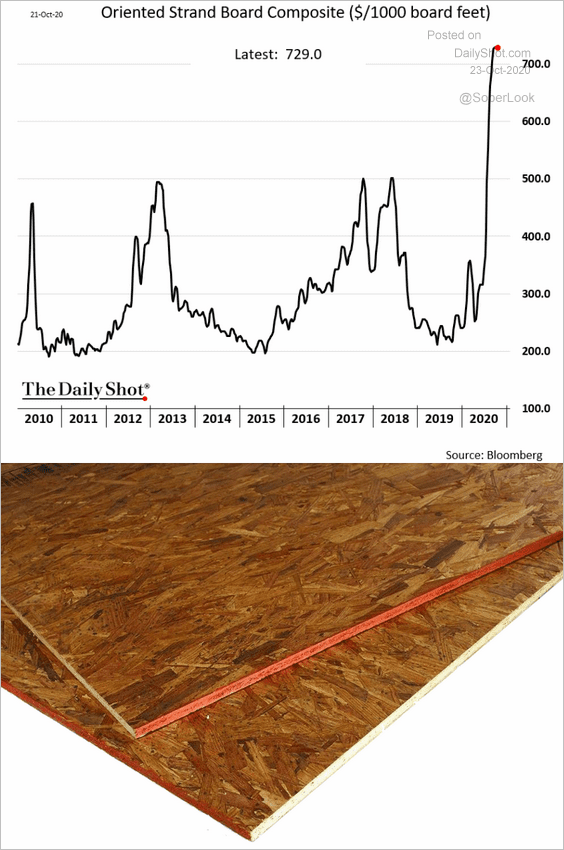

6. Oriented strand board composite prices in the US are at the highest levels in at least a decade, driven by the housing market and home improvement boom. Will higher mortgage rates halt/reverse the rally?

Source: Home Depot, h/t @Marcy_Nicholson

Source: Home Depot, h/t @Marcy_Nicholson

Source: @jeffsparshott, @WSJ

Source: @jeffsparshott, @WSJ

Energy

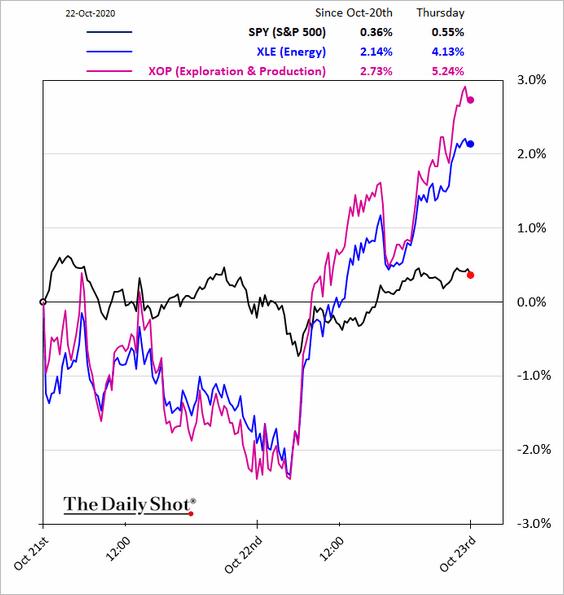

1. Energy stocks rallied on Thursday.

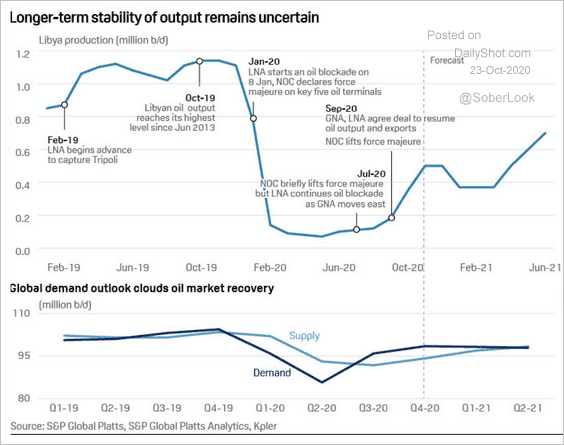

2. The prospect of crude oil from Libya hitting the market in the coming months coincides with an uncertain demand outlook, which may be negative for oil prices.

Source: @PlattsOil Read full article

Source: @PlattsOil Read full article

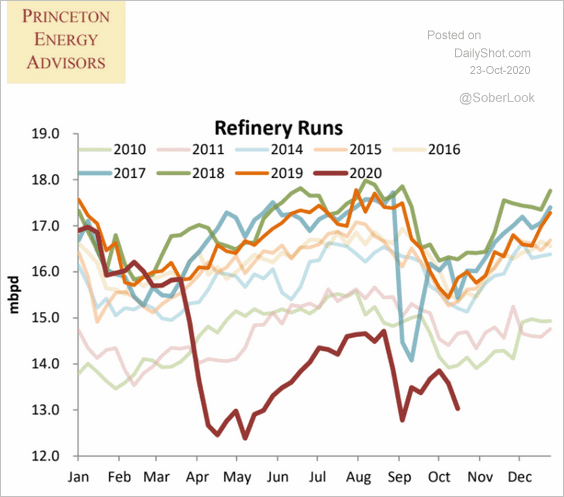

3. US refinery inputs remain depressed.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

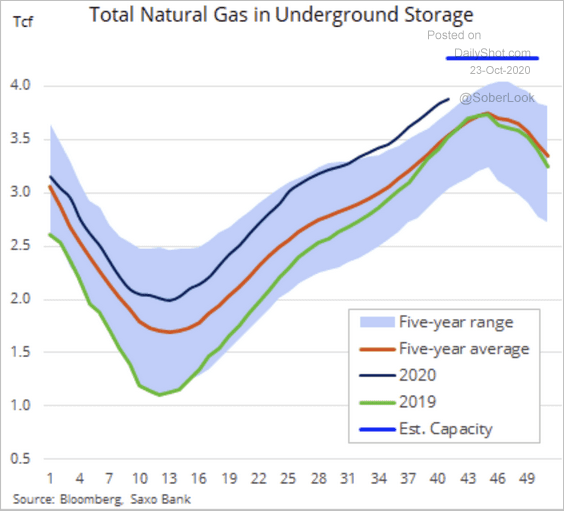

4. US natural gas storage levels are still above the 5-year range.

Source: @Ole_S_Hansen

Source: @Ole_S_Hansen

Equities

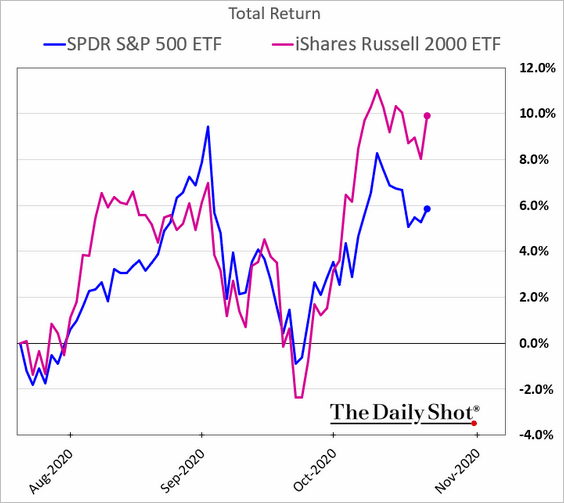

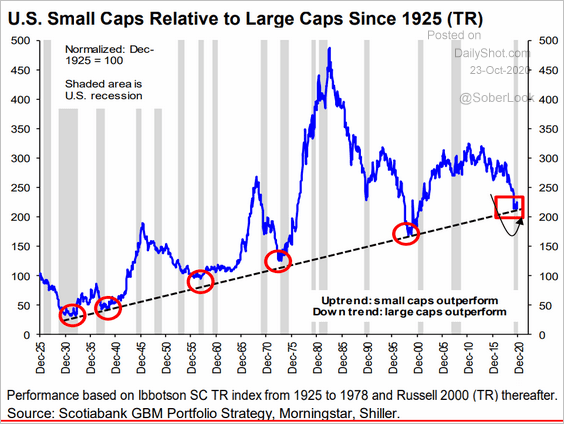

1. Small caps have been outperforming in recent weeks.

Is the multi-year underperformance in small caps finally over? Below is a long-term chart of relative performance.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

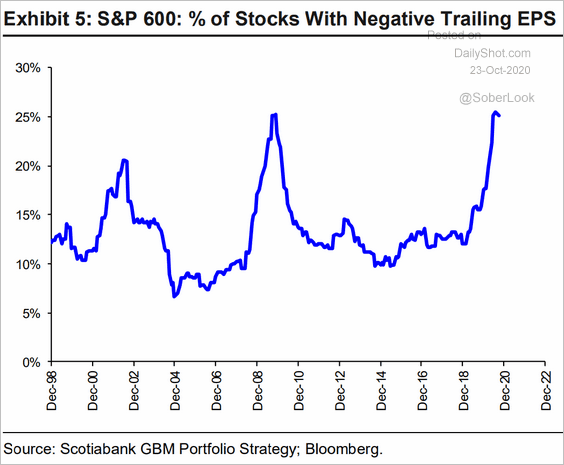

Here are some additional trends in small caps from Scotiabank GBM Portfolio Strategy.

• Money-losing small-cap firms:

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

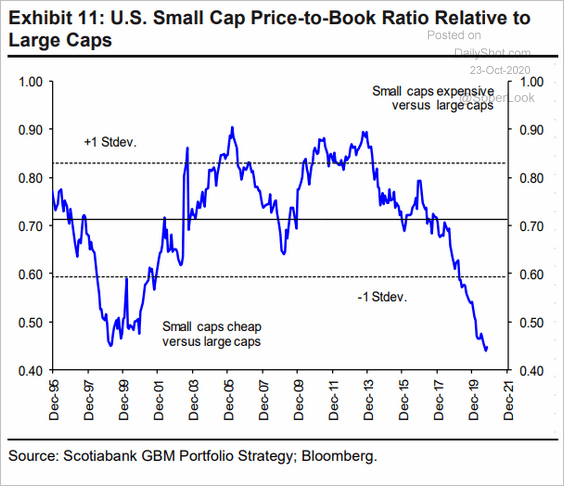

• Price-to-book ratio relative to large caps:

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

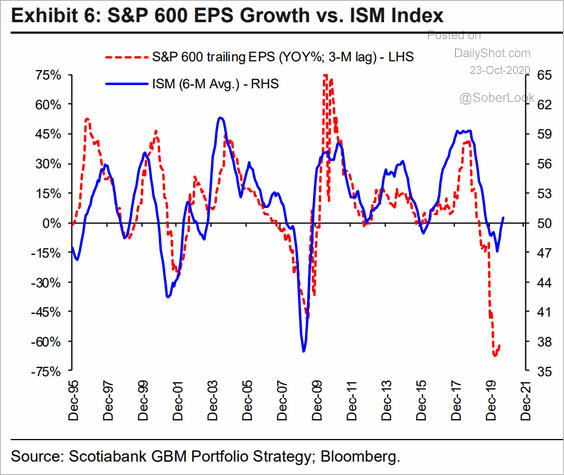

• Small-cap EPS relative to ISM (business activity):

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

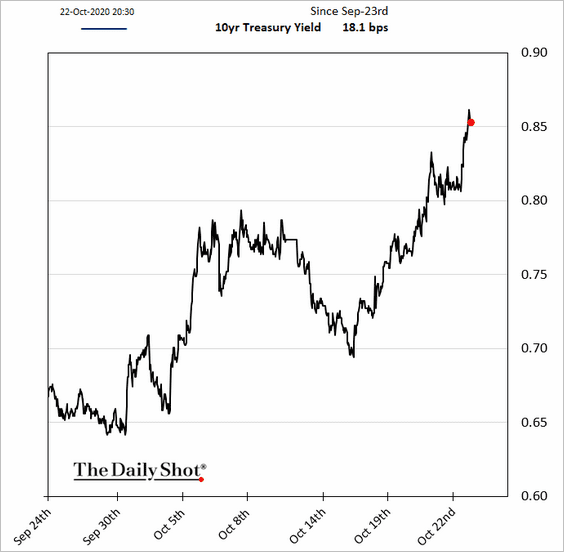

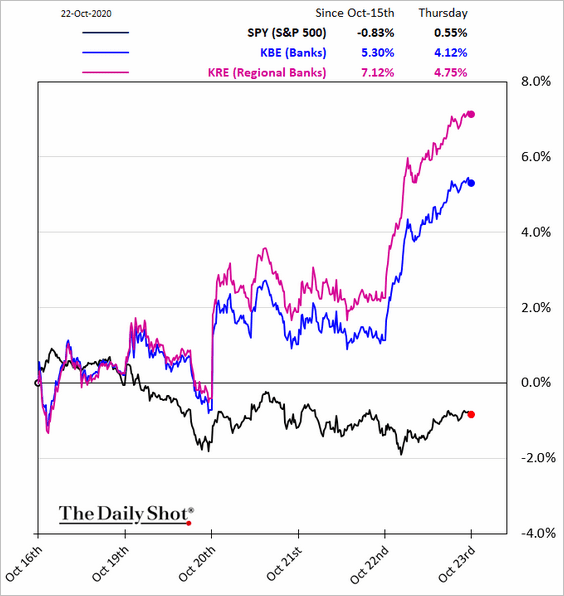

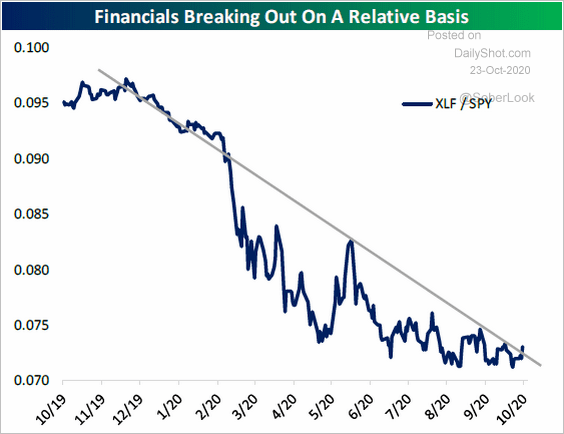

2. The jump in bond yields (below) is boosting bank shares (2nd chart).

Is the underperformance of financials finally over, as rates bottom?

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

——————–

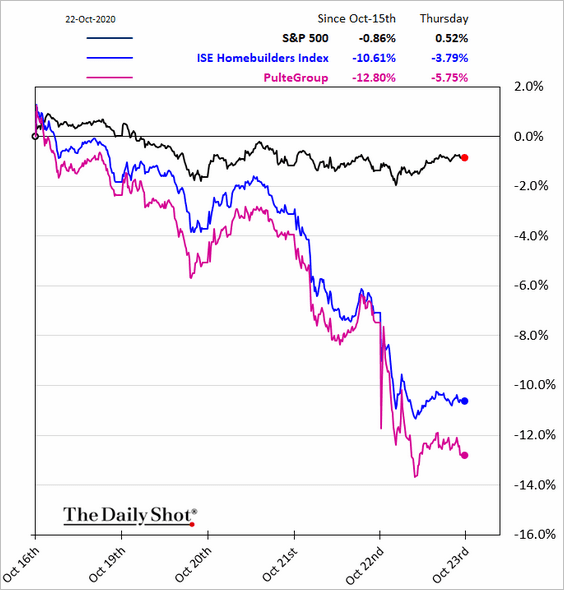

3. On the other hand, higher rates are not great for housing.

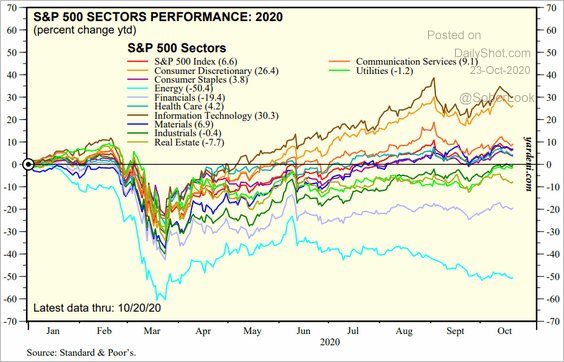

4. This chart shows the year-to-date relative performance across S&P 500 sectors.

Source: Yardeni Research

Source: Yardeni Research

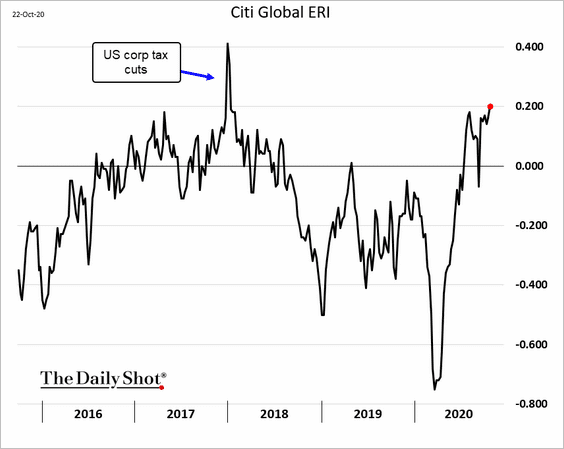

5. Global earnings revisions have been positive. This index measures the trend in analysts’ upgrades vs. downgrades.

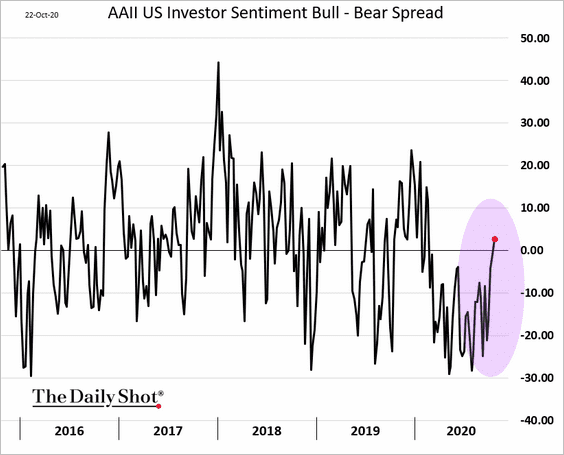

6. The AAII investor sentiment bull-bear spread has turned positive for the first time since the start of the pandemic.

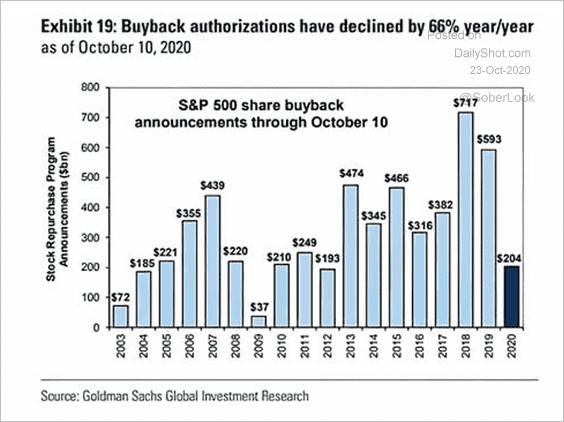

7. Share buybacks are at the lowest since 2009.

Source: Goldman Sachs

Source: Goldman Sachs

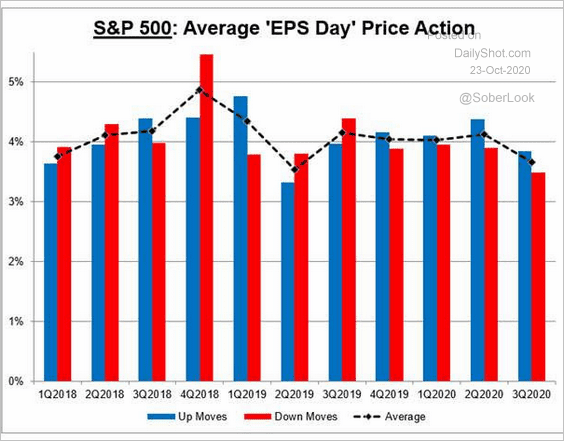

8. Volatility related to earnings releases has declined.

Source: Michael Dick, Mizuho Americas Trading Desk

Source: Michael Dick, Mizuho Americas Trading Desk

Rates

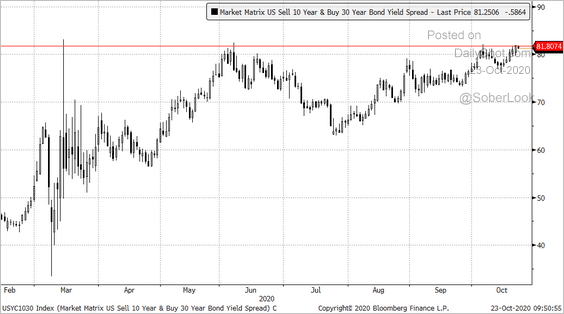

1. The 30yr – 10yr Treasury spread is at resistance. Progress on stimulus (with new supply coming to market) could steepen the curve further.

Source: @EffMktHype

Source: @EffMktHype

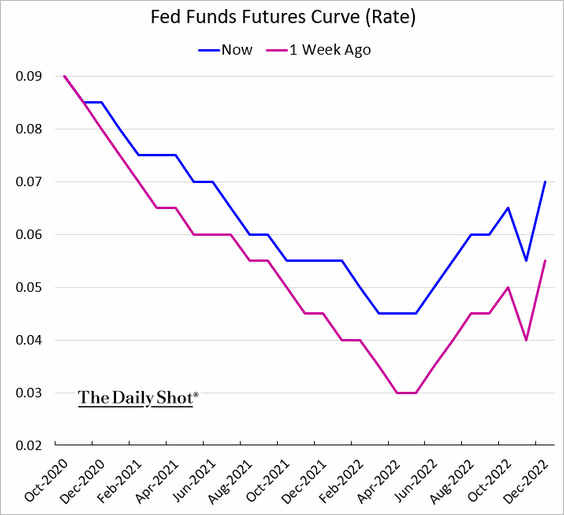

2. The market is no longer pricing in negative fed funds rates.

——————–

Food for Thought

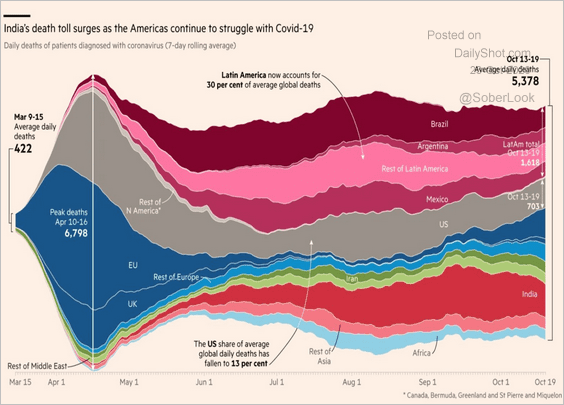

1. COVID-related deaths globally:

Source: @adam_tooze, @FT Read full article

Source: @adam_tooze, @FT Read full article

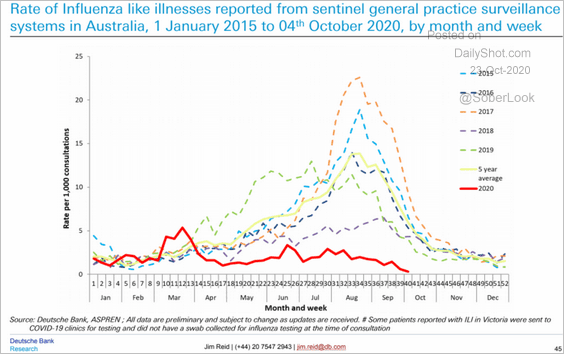

2. Flu cases in Australia:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

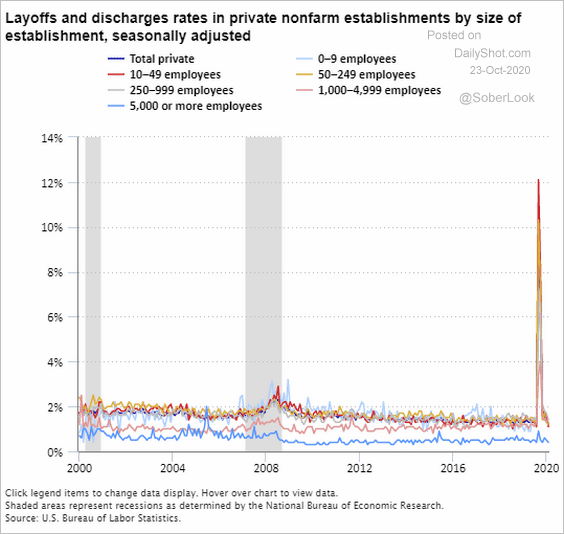

3. US small business layoffs:

Source: @BLS_gov Read full article

Source: @BLS_gov Read full article

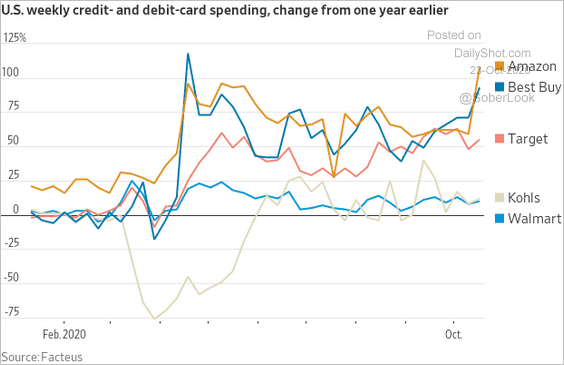

4. Credit and debit card spending:

Source: @jeffsparshott, @WSJ

Source: @jeffsparshott, @WSJ

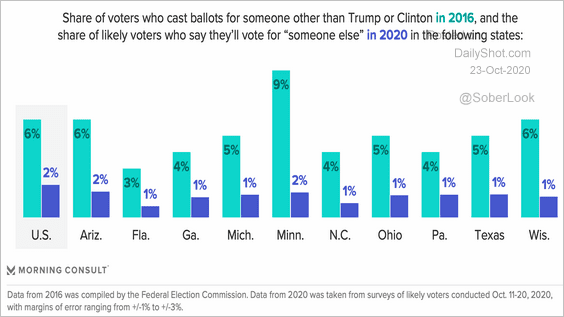

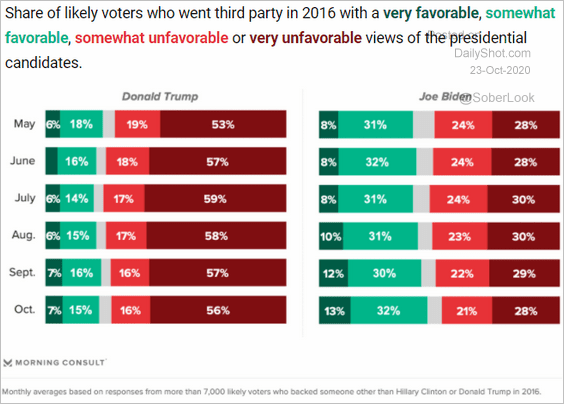

5. US third-party voter polls (2 charts):

Source: Morning Consult Read full article

Source: Morning Consult Read full article

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

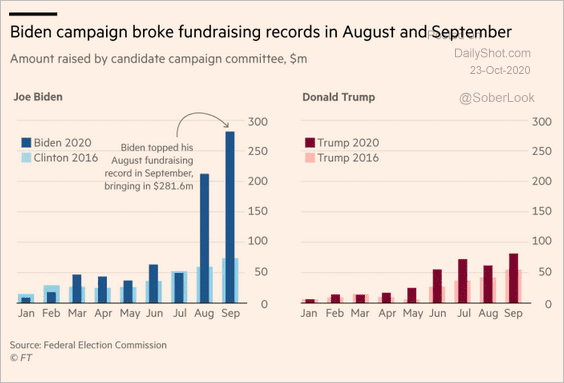

6. Presidential campaign fundraising:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

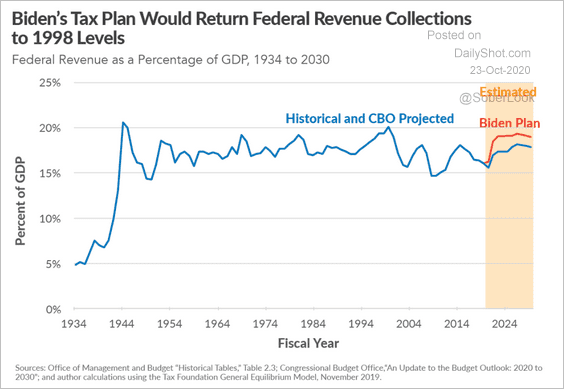

7. Federal tax revenue under Biden:

Source: @TaxFoundation Read full article

Source: @TaxFoundation Read full article

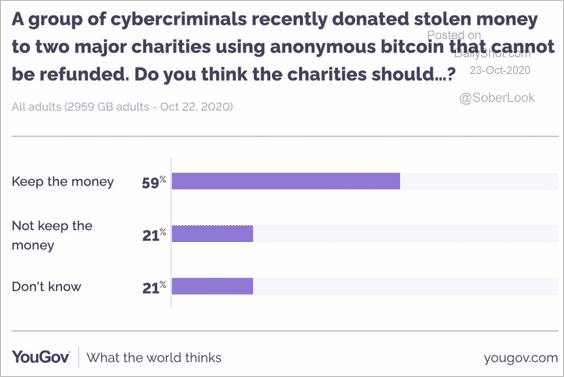

8. What should be done with a Bitcoin donation from hackers?

Source: @YouGov Read full article

Source: @YouGov Read full article

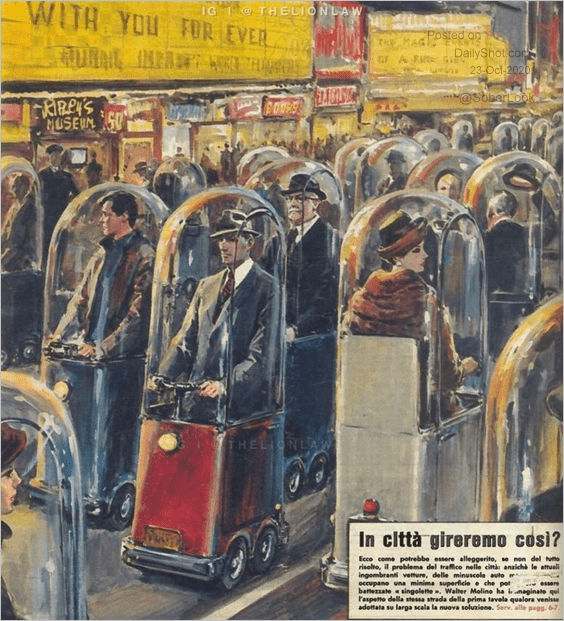

9. In 1962, an Italian magazine carried a story on how the world will look in 2022.

Source: Strati Georgopoulos

Source: Strati Georgopoulos

——————–

Have a great weekend.