The Daily Shot: 26-Oct-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

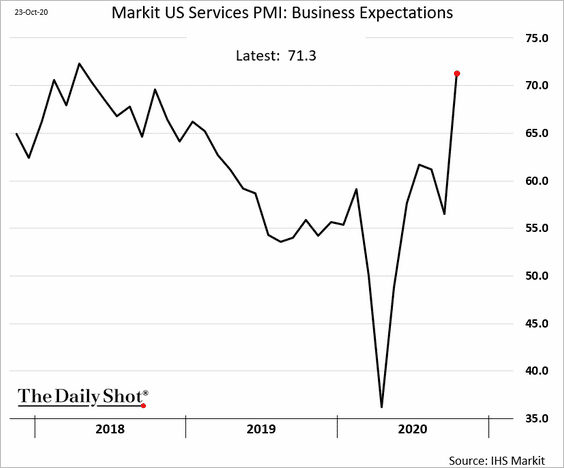

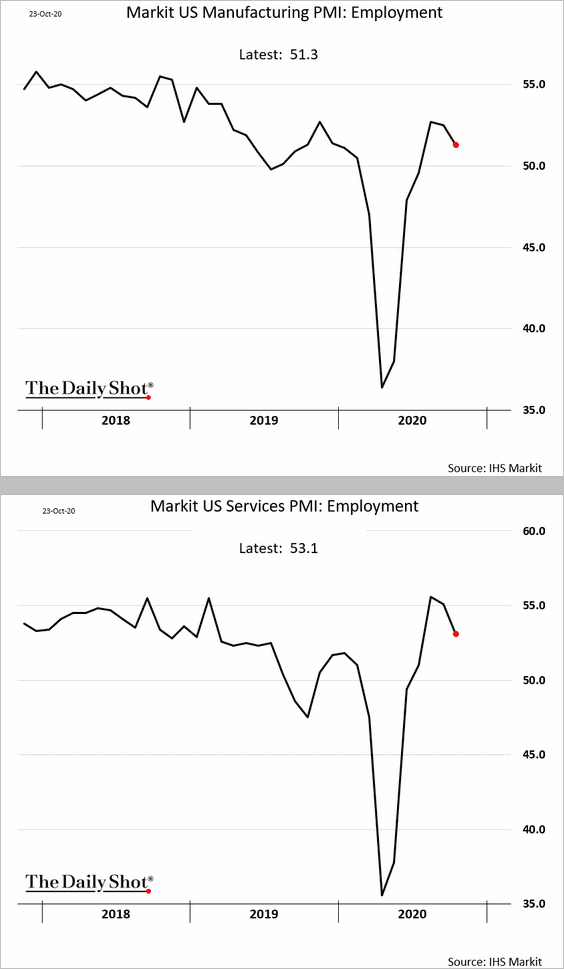

1. The preliminary Markit PMI report showed robust business activity in October. Services’ performance (2nd chart) exceeded forecasts.

Service companies seem to be upbeat about the future despite the worsening pandemic.

While hiring continues, the pace has slowed.

——————–

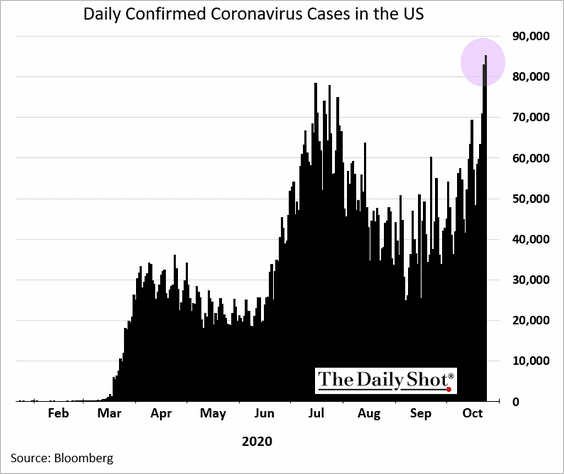

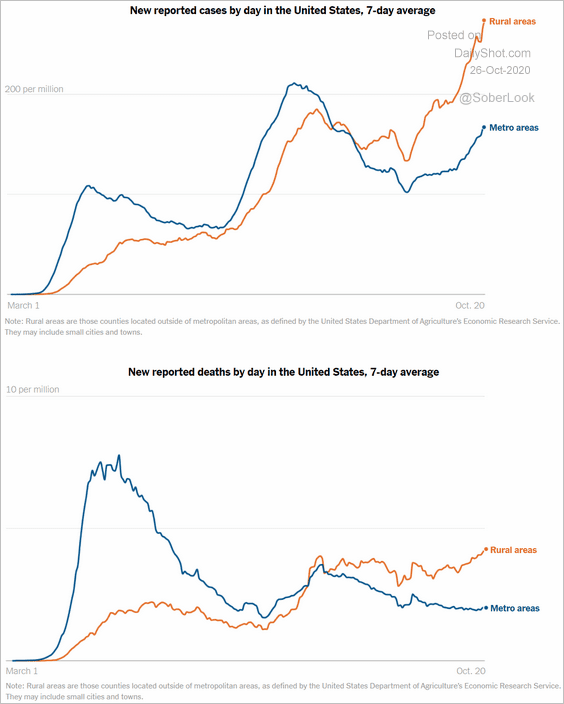

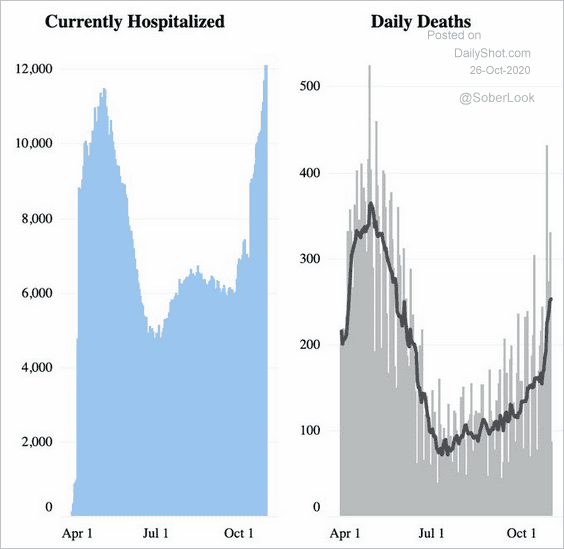

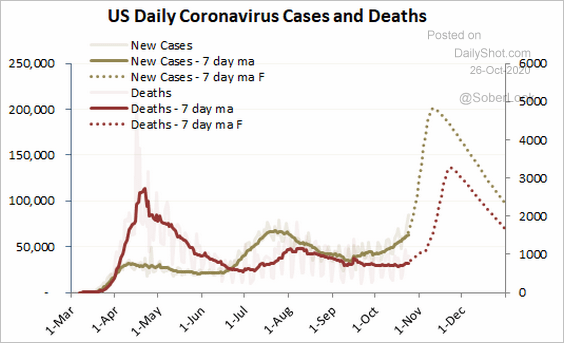

2. The pandemic is posing risks for the nation’s economic recovery.

• Daily new cases (record high):

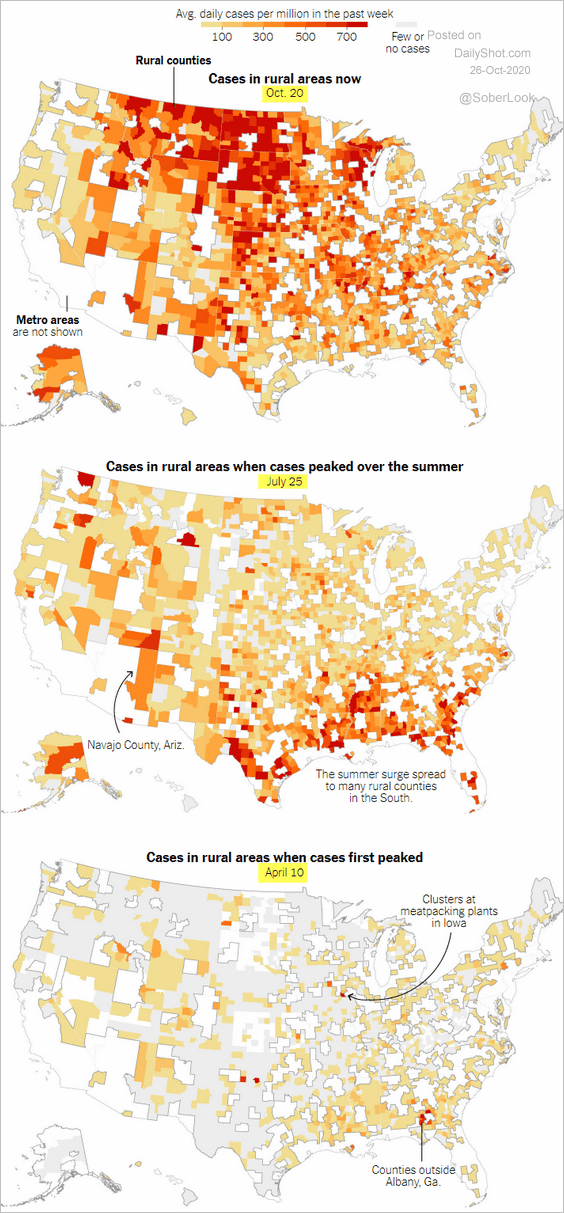

• Rural-areas’ new cases and deaths:

Source: The New York Times, h/t @carlquintanilla Read full article

Source: The New York Times, h/t @carlquintanilla Read full article

• US Midwest hospitalizations and deaths:

Source: @jnordvig, @COVID19Tracking Further reading

Source: @jnordvig, @COVID19Tracking Further reading

• Model projections from Princeton Energy Advisors:

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

——————–

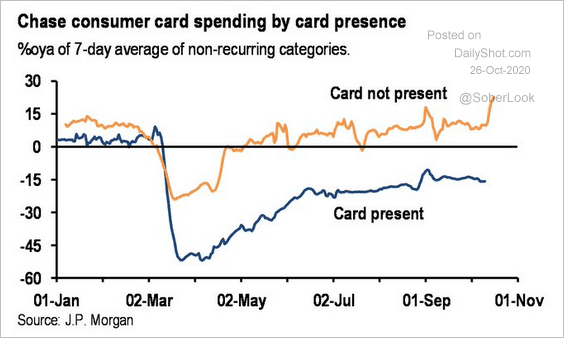

3. Online purchasing activity remains above last year’s levels. In-store purchases (“card present”) continue to lag.

Source: JPMorgan, @carlquintanilla

Source: JPMorgan, @carlquintanilla

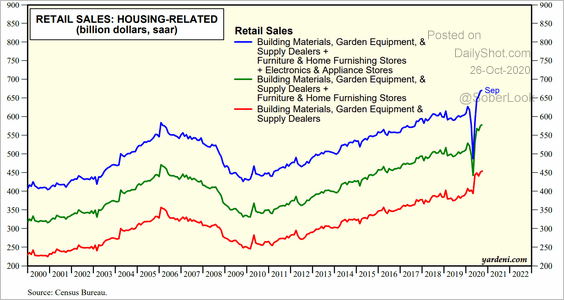

4. Housing-related retail sales have been exceptionally strong.

Source: Yardeni Research

Source: Yardeni Research

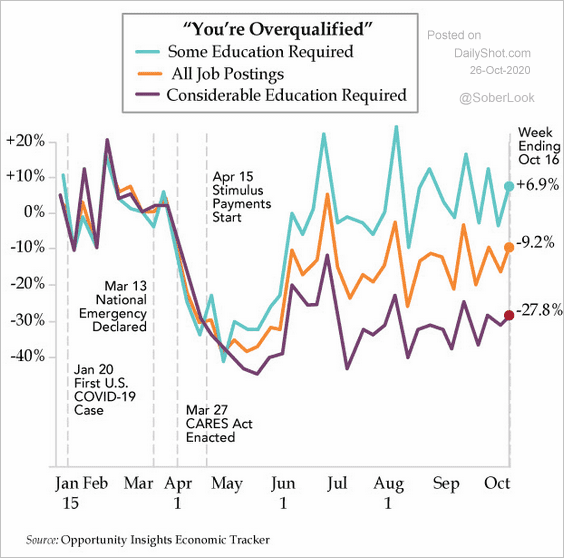

5. Next, we have a couple of updates on the labor market.

• Job openings by education requirement (vs. last year):

Source: The Daily Feather

Source: The Daily Feather

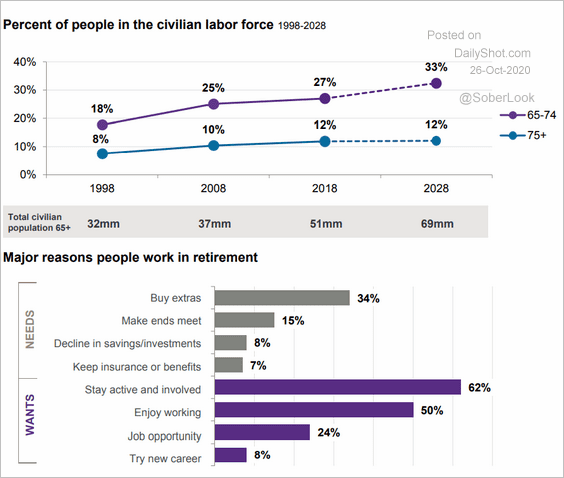

• Older Americans in the workforce (a forecast) and the reasons people work during retirement (2nd chart):

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

——————–

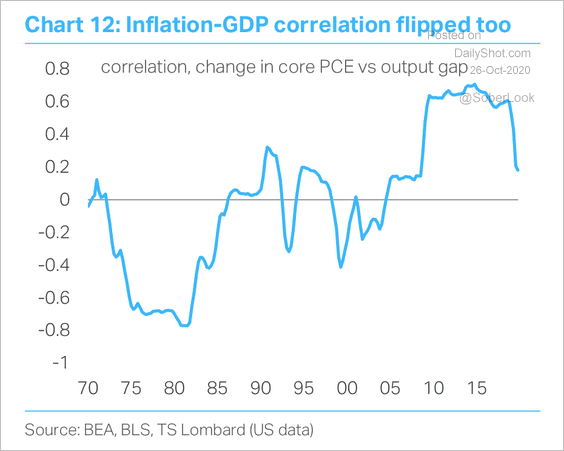

6. Inflation has been less correlated with GDP over the past few years.

Source: TS Lombard

Source: TS Lombard

——————–

Canada

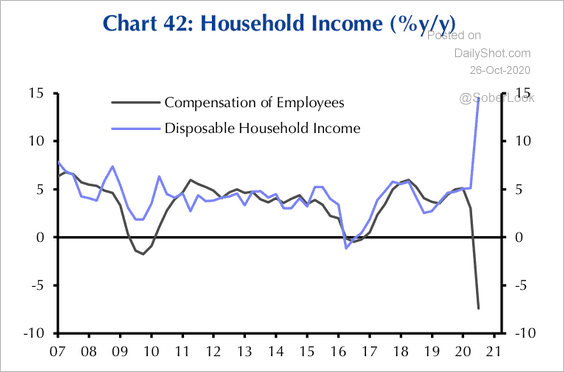

1. Disposable income has sharply diverged from employee compensation due to this year’s spike in government support.

Source: Capital Economics

Source: Capital Economics

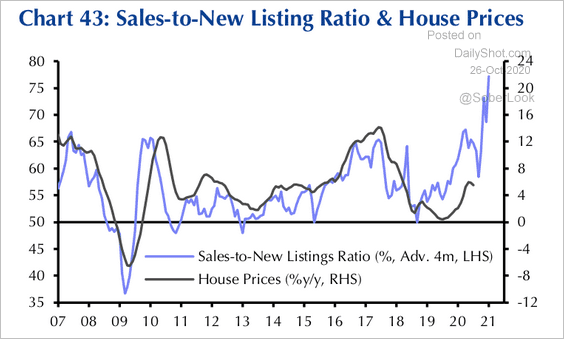

2. The sales-to-new listings ratio points to higher housing prices ahead.

Source: Capital Economics

Source: Capital Economics

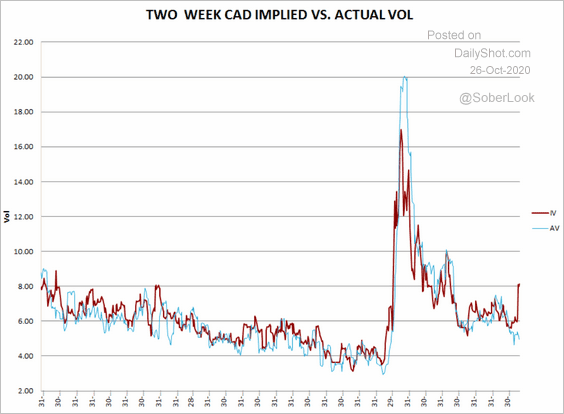

3. Currency markets expect higher volatility in USD/CAD. The loonie’s sensitivity to global growth and US elections will be closely watched over the next two weeks.

Source: @FXVolResearch

Source: @FXVolResearch

The United Kingdom

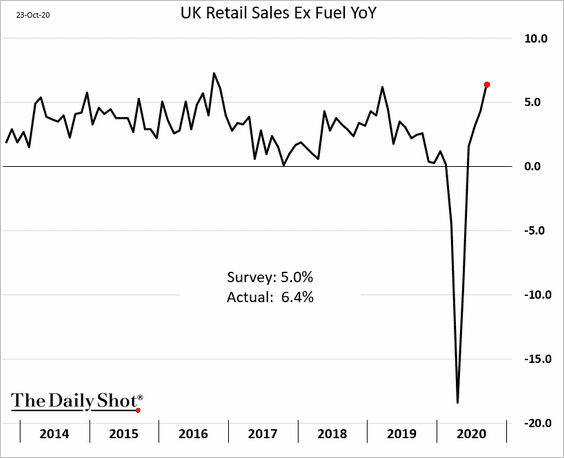

1. Retail sales surprised to the upside.

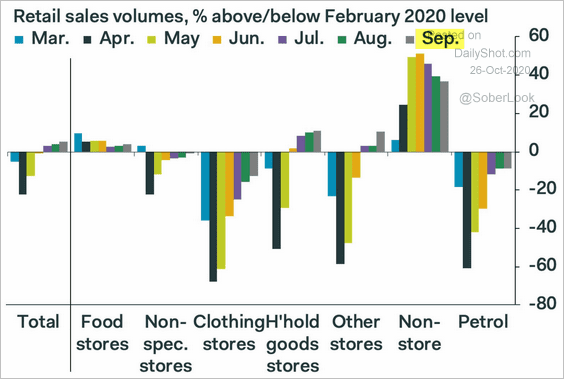

Here is the breakdown by sector.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

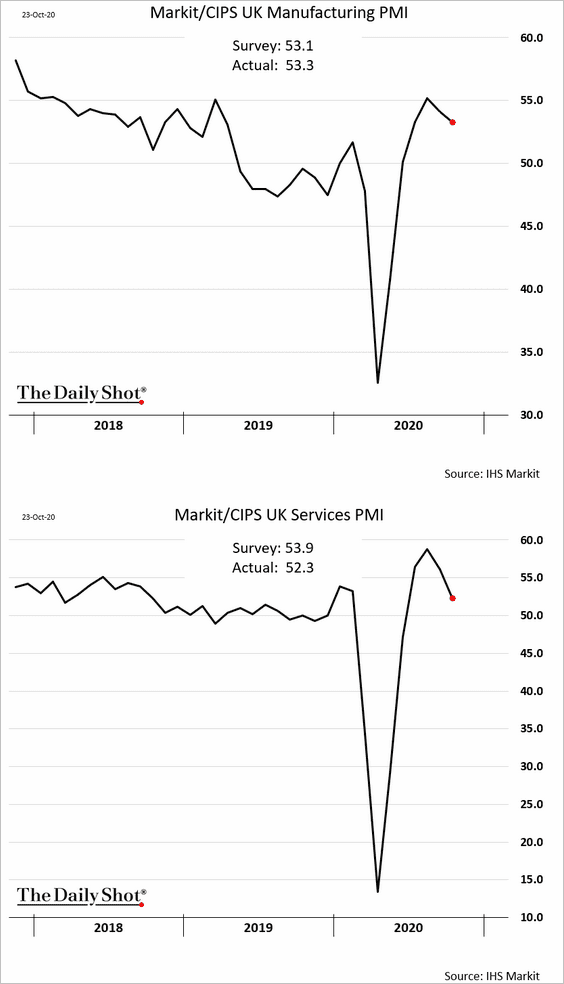

2. Business activity continued to expand this month, but the pace of growth has slowed. The UK services PMI was below market expectations.

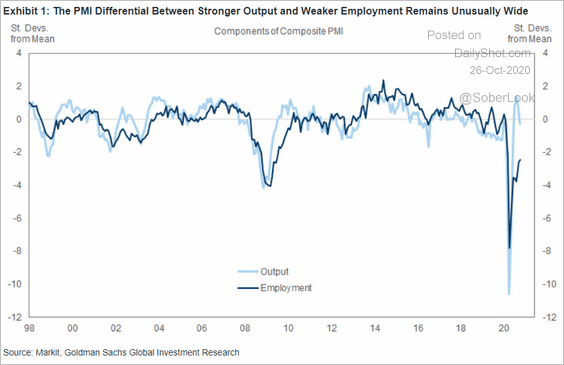

Economists are concerned about the divergence between PMI output and employment.

Source: Goldman Sachs

Source: Goldman Sachs

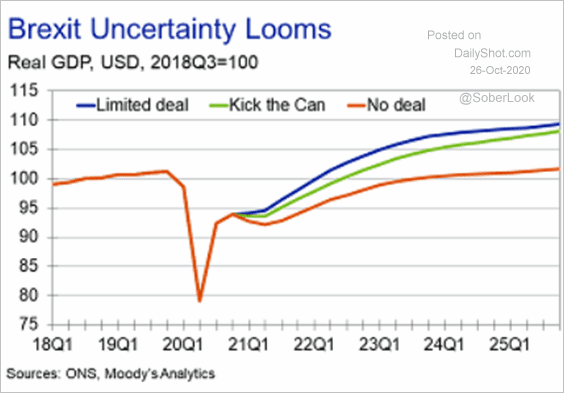

3. The GDP trajectory is heavily dependent on the UK-EU trade deal.

Source: Moody’s Analytics

Source: Moody’s Analytics

The Eurozone

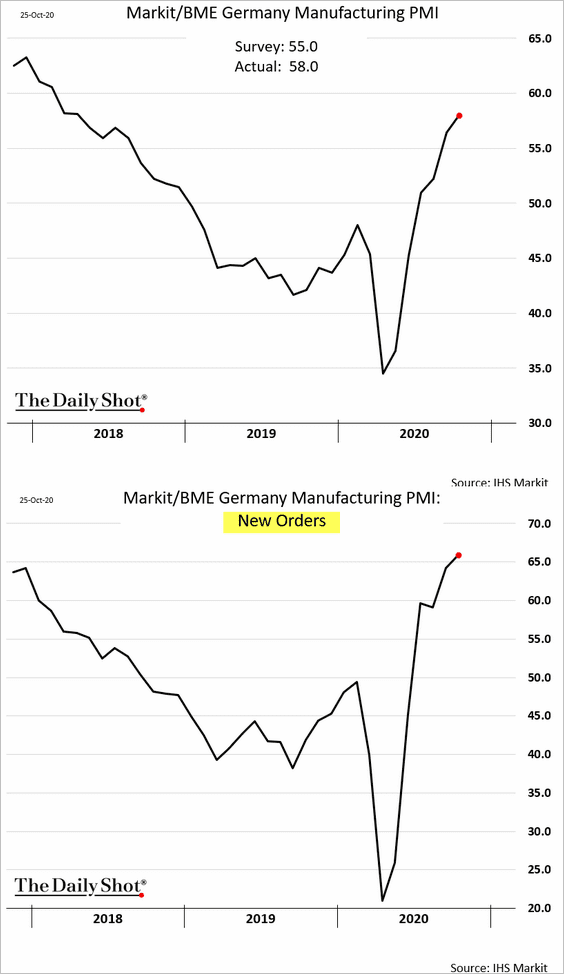

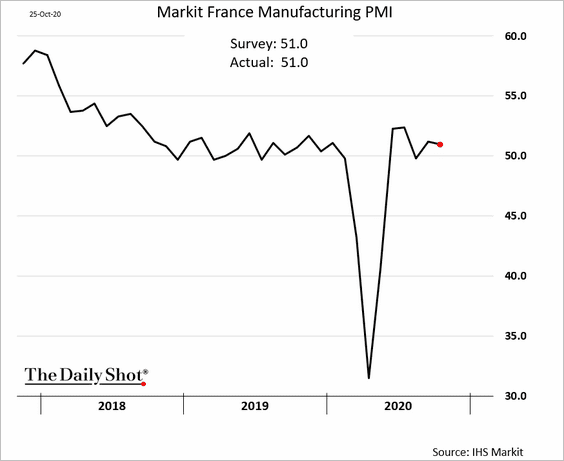

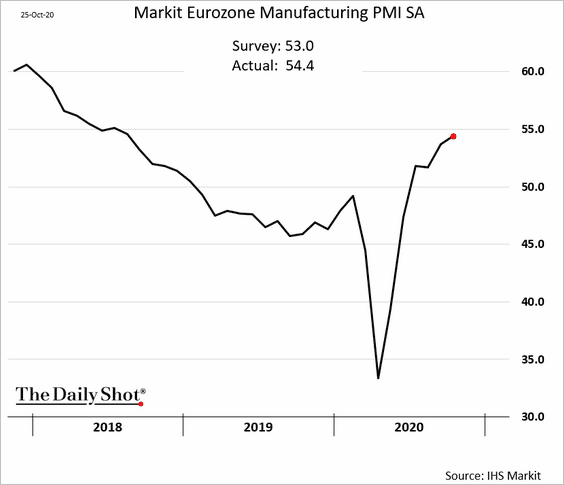

1. Manufacturing held up well this month, according to the preliminary Markit PMI report.

• Germany:

• France:

• The Eurozone:

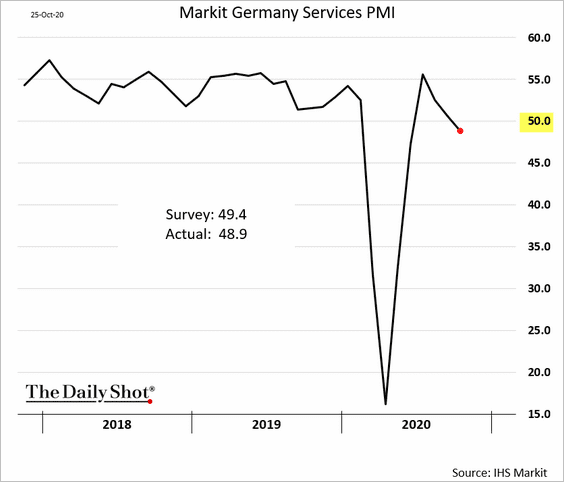

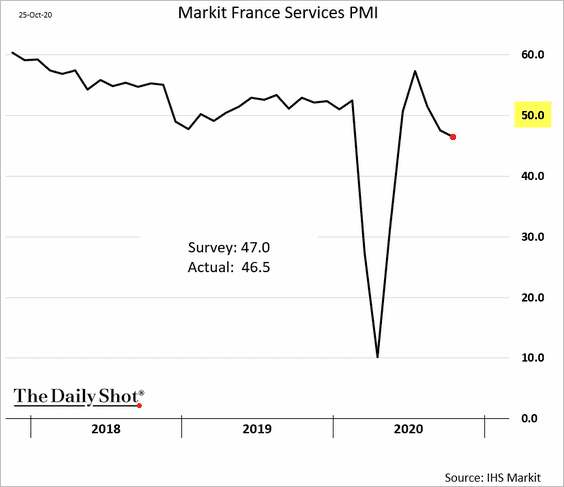

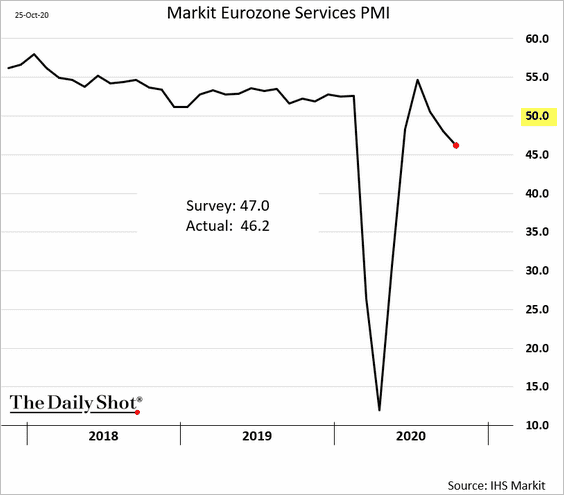

On the other hand, the pandemic’s second wave has been pressuring service companies (PMIs dipped below 50, indicating contraction).

• Germany:

• France:

• The Eurozone:

——————–

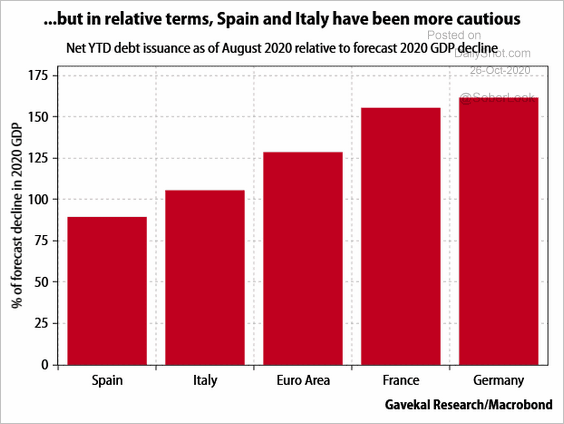

2. This year’s debt increase in Italy and Spain was lower than what we saw in Germany and France (as % of GDP).

Source: Gavekal

Source: Gavekal

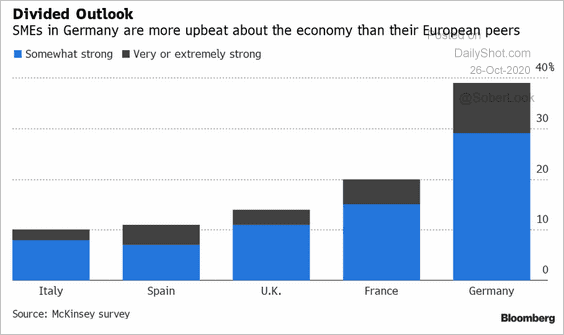

3. Germany’s small and medium-sized firms are more upbeat about the economy.

Source: @lucy_meakin, Bloomberg Finance L.P.

Source: @lucy_meakin, Bloomberg Finance L.P.

Japan

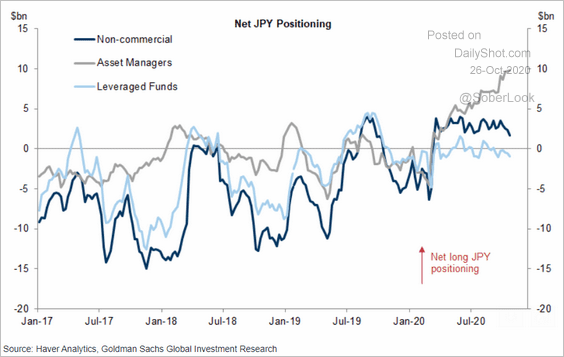

1. Asset managers are increasingly long the yen (which is often used as a macro hedge).

Source: Goldman Sachs

Source: Goldman Sachs

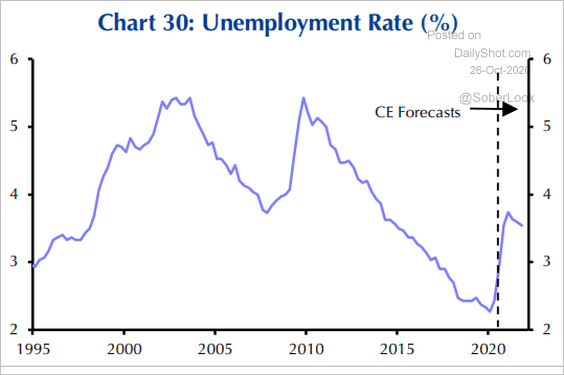

2. Will Japan’s unemployment rate climb further before peaking?

Source: Capital Economics

Source: Capital Economics

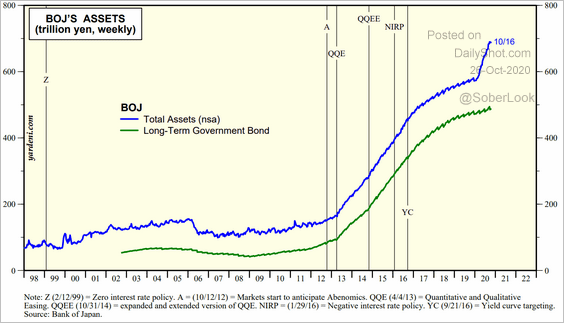

3. This chart shows the BoJ’s balance sheet over time.

Source: Yardeni Research

Source: Yardeni Research

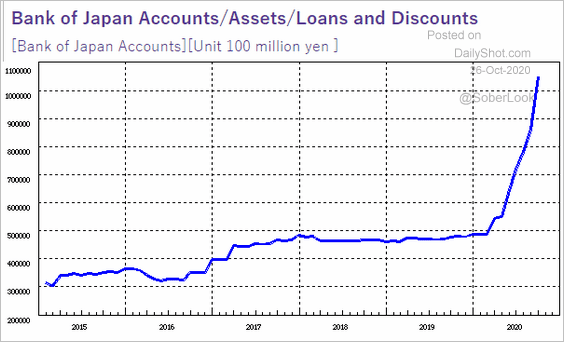

The BoJ’s loan scheme (chart below) caused this year’s asset spike (above).

Source: BoJ

Source: BoJ

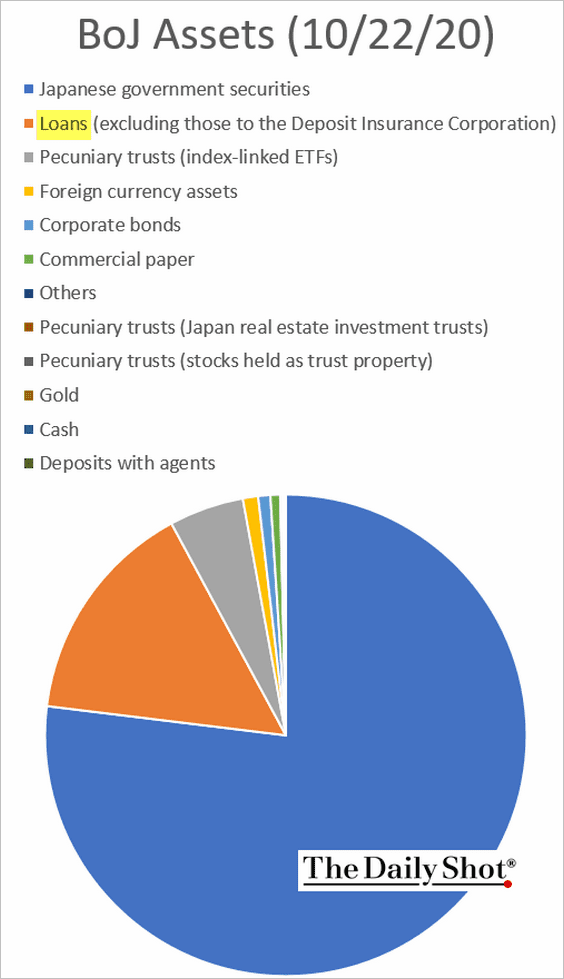

Here is the current breakdown of the central bank’s assets.

Asia – Pacific

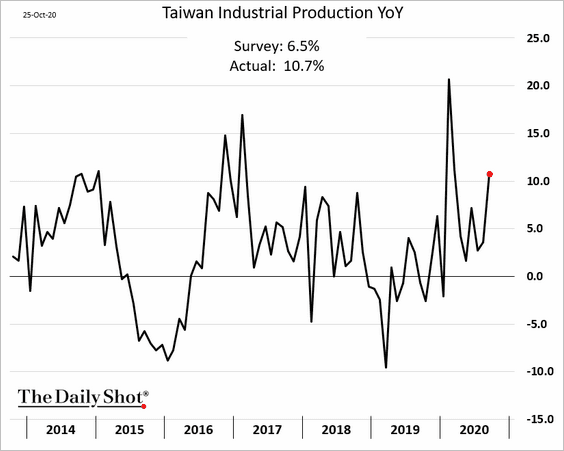

1. Taiwan’s industrial production continues to top economists’ forecasts.

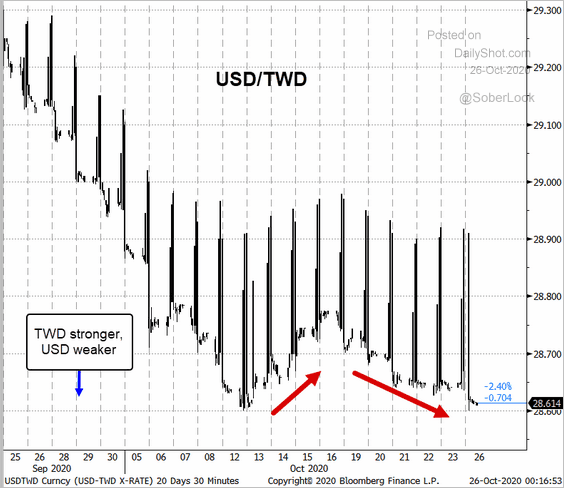

Capital inflows are pushing the Taiwan dollar higher despite increased interventions from the central bank.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

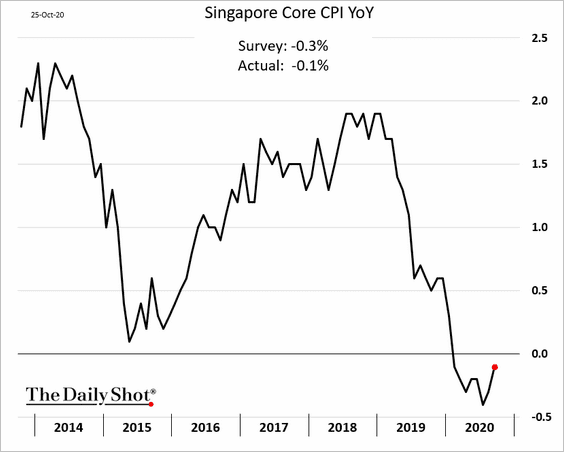

2. Singapore’s inflation appears to be recovering.

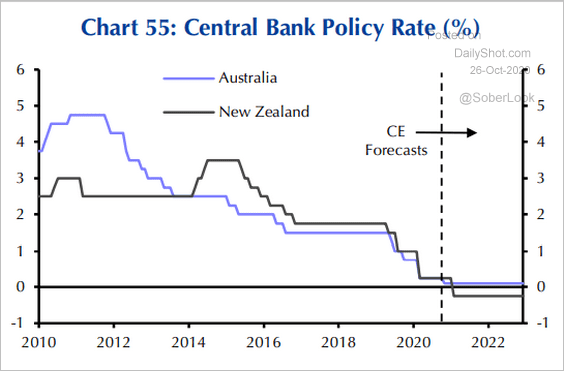

3. According to Capital Economics, the RBNZ will take rates below zero.

Source: Capital Economics

Source: Capital Economics

China

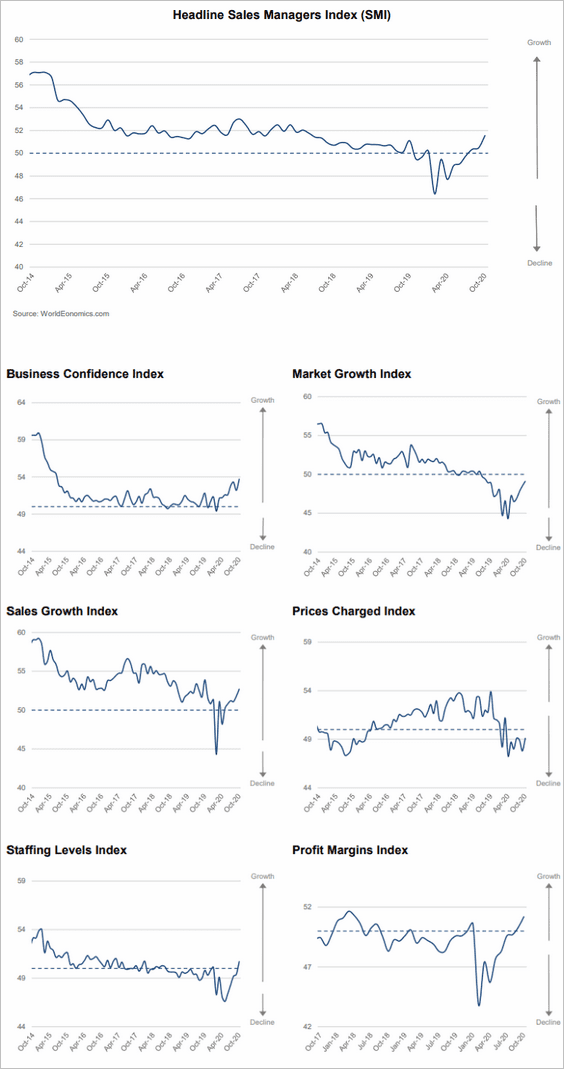

1. The World Economics SMI report showed business activity accelerating this month.

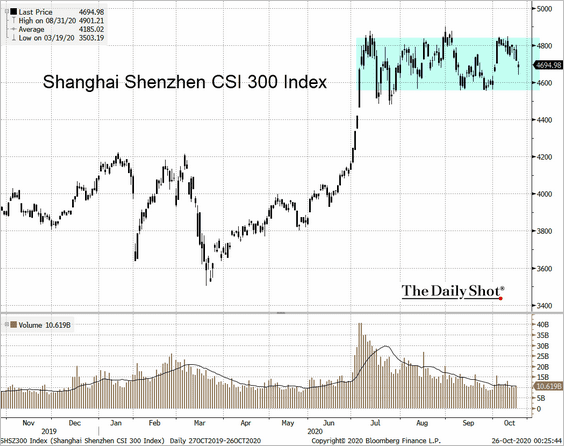

2. The stock market remains within the trading range.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

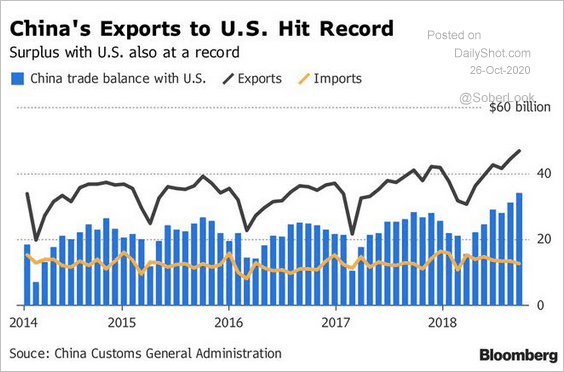

3. China’s exports to the US and the trade surplus are at record highs.

Source: @bpolitics

Source: @bpolitics

Emerging Markets

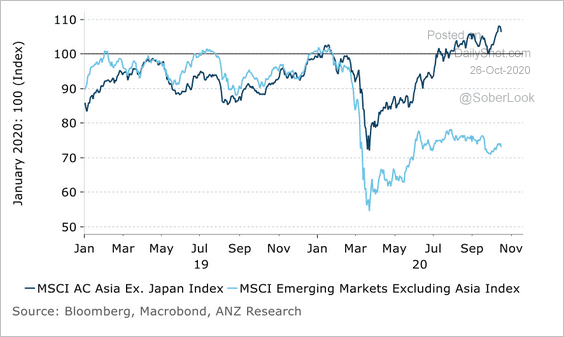

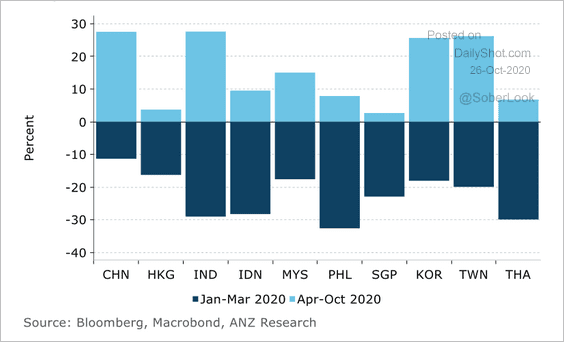

1. Asian equities have outperformed broader emerging markets since the March low, …

Source: ANZ Research

Source: ANZ Research

…but returns have varied across countries.

Source: ANZ Research

Source: ANZ Research

——————–

2. Equity fund flows are boosting the Philippine peso. USD/PHP is at support.

Source: barchart.com

Source: barchart.com

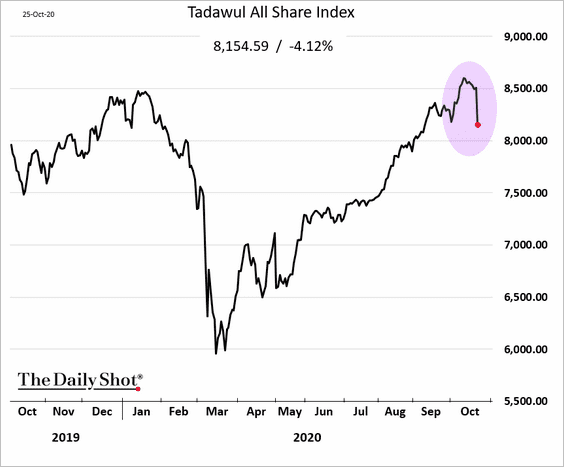

3. Saudi stocks sold off amid concerns about new COVID-related government restrictions.

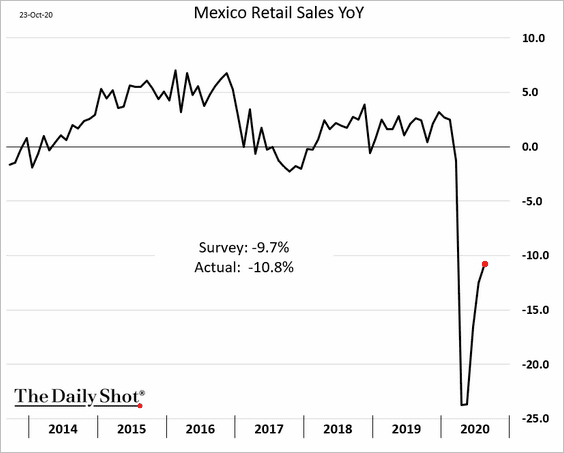

4. Mexico’s retail sales recovery has a long way to go (data through August).

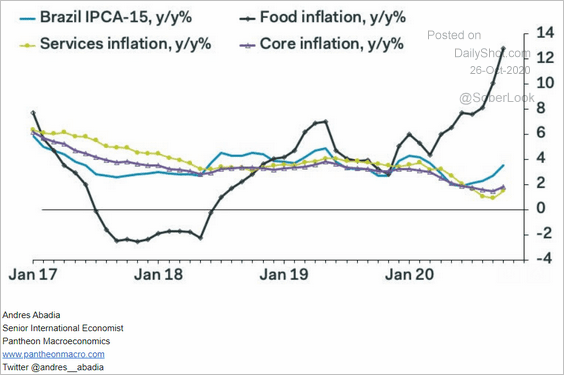

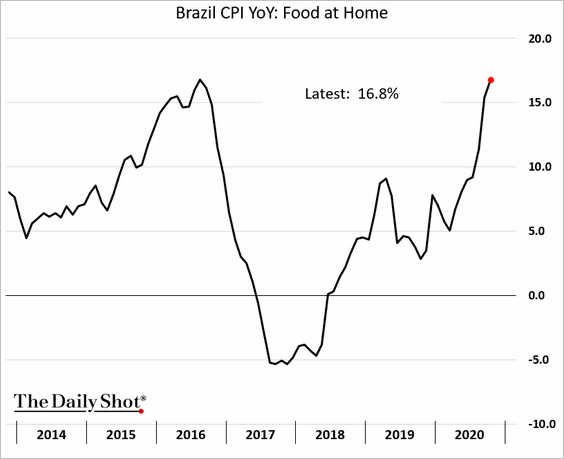

5. Brazil’s CPI has been climbing, boosted by food prices. Core inflation remains subdued.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

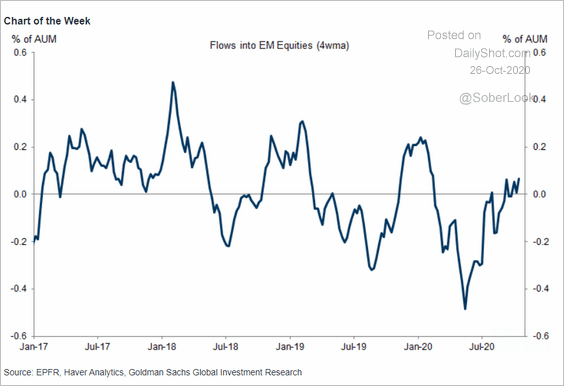

6. EM equity flows are in positive territory.

Source: Goldman Sachs

Source: Goldman Sachs

Cryptocurrency

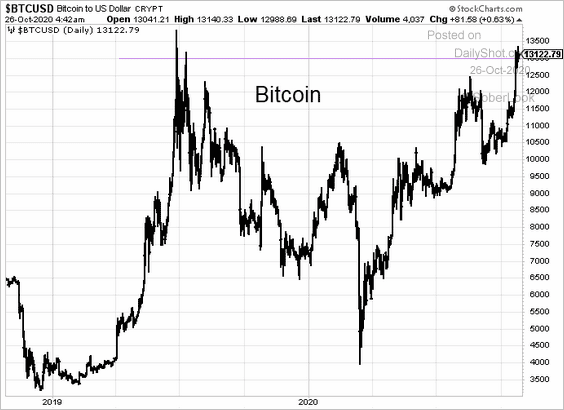

1. Bitcoin is holding above $13k, boosted by PayPal’s move into the crypto space.

Source: Forbes Read full article

Source: Forbes Read full article

——————–

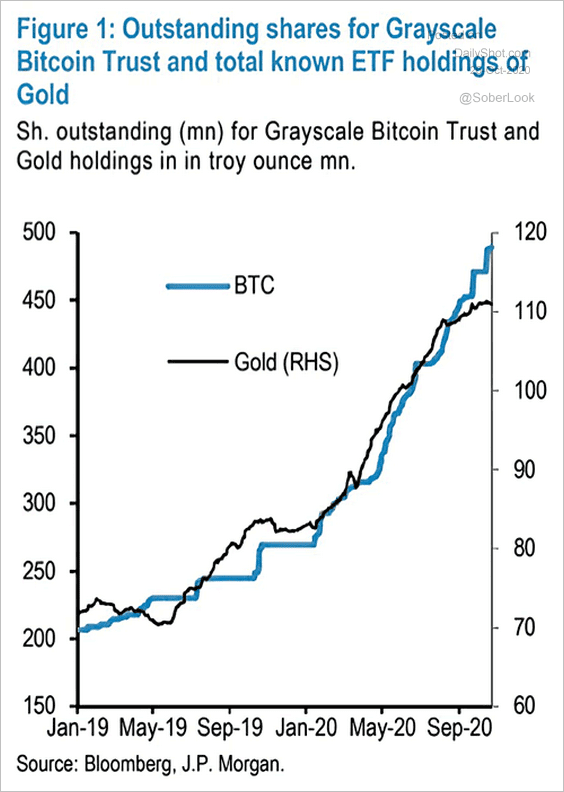

2. The Grayscale Bitcoin Trust growth in shares outstanding has been following ETF gold holdings. It’s an indication of investor demand to shift some capital away from currencies controlled by central banks (amid massive easing efforts).

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @jpmorgan

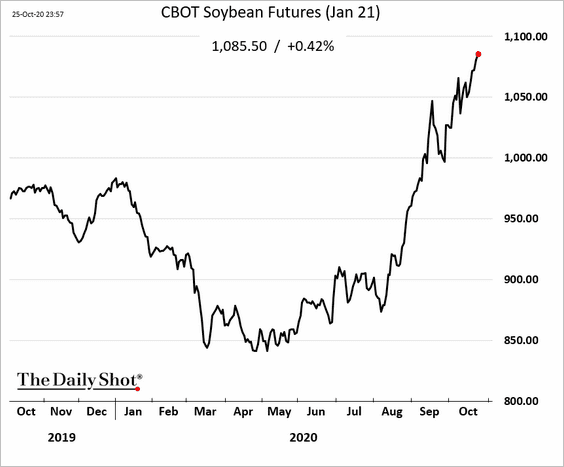

Commodities

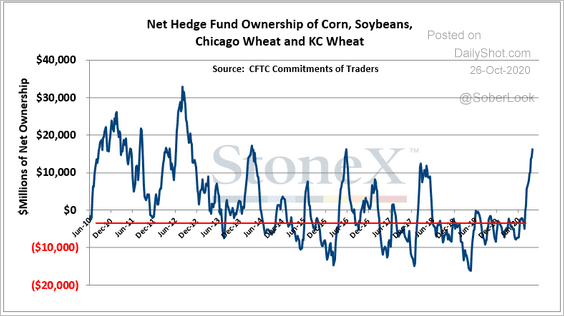

1. Net hedge-fund ownership of key grain futures hit a new 4-year high after being net-short over the past few years.

Source: @ArlanFF101

Source: @ArlanFF101

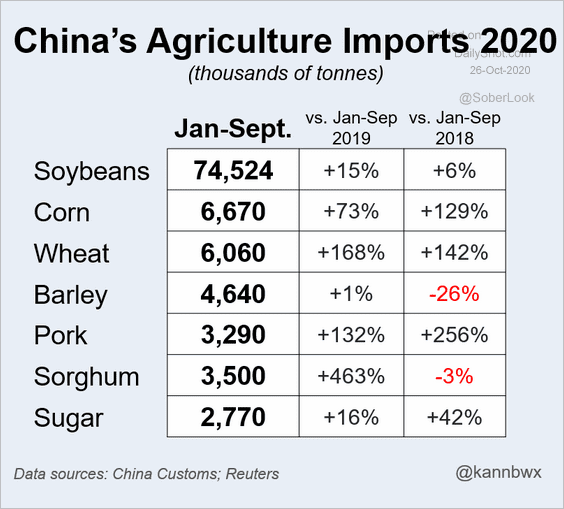

2. China’s agricultural imports from the US are substantially higher than the past two years, with the exception of barley and sorghum.

Source: @kannbwx

Source: @kannbwx

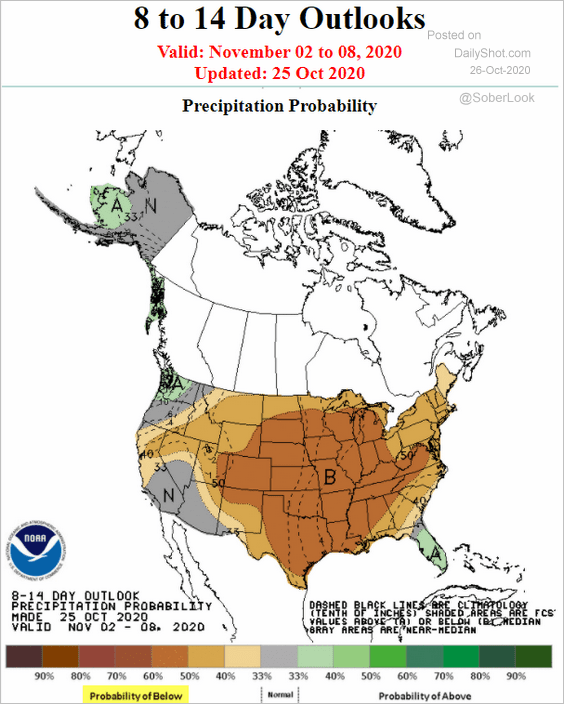

The combination of export demand and dry weather in the US has been supporting grain prices.

Source: NOAA

Source: NOAA

——————–

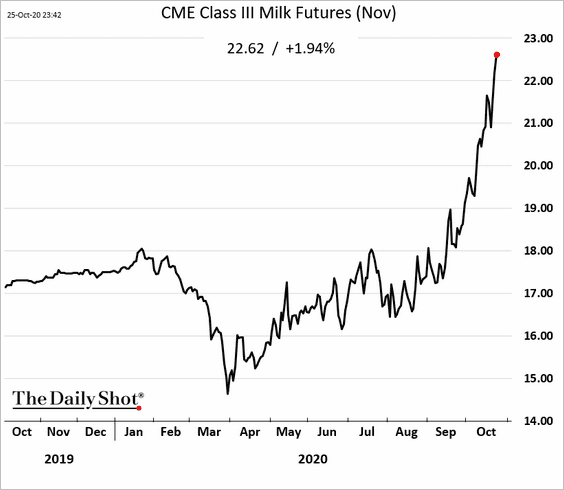

3. US milk futures keep climbing (Class III milk is used to make cheese).

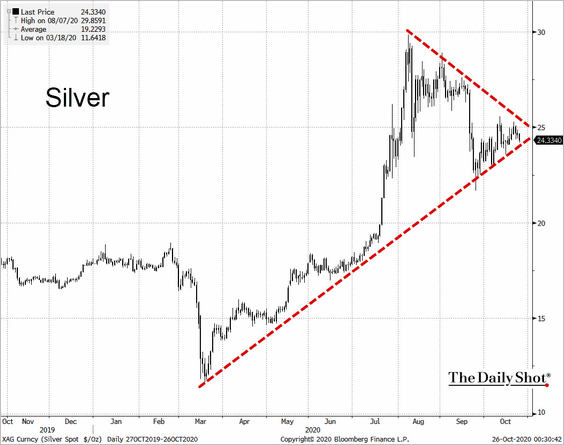

4. Silver has been consolidating.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Energy

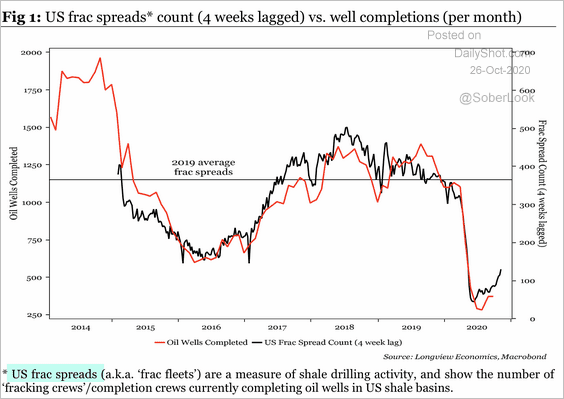

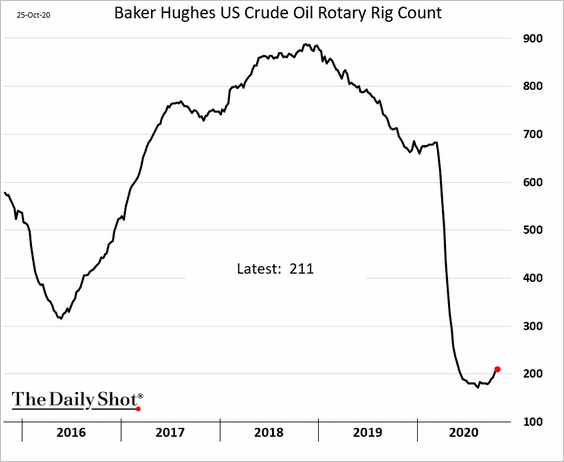

1. US shale drilling activity has bottomed (see definition below for “frac spreads”).

Source: Longview Economics

Source: Longview Economics

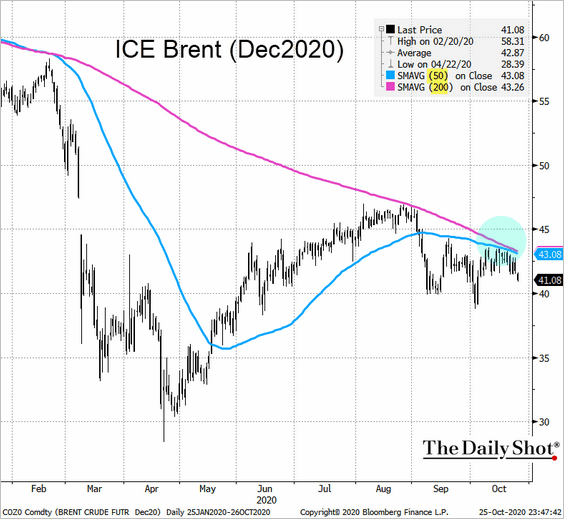

2. The December Brent contract held resistance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Equities

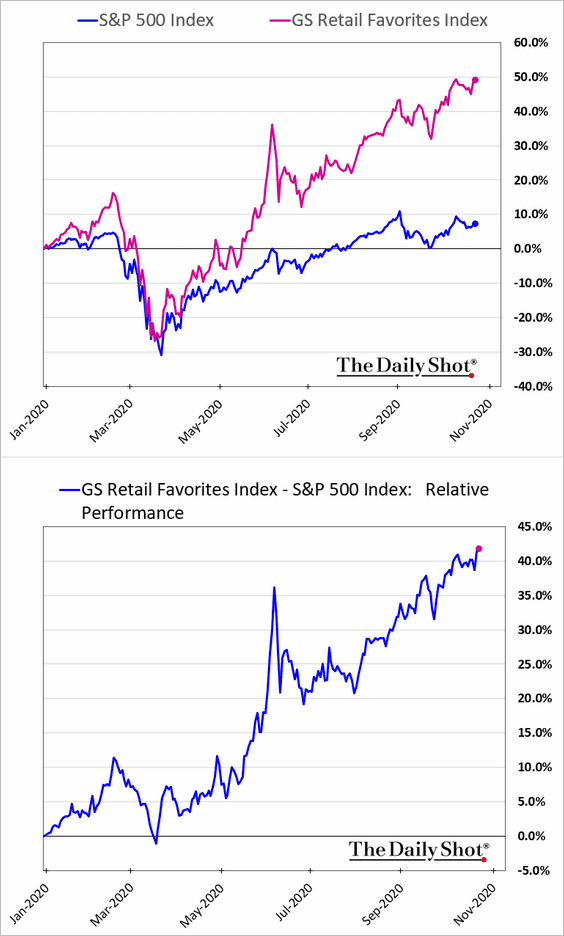

1. Retail investors continue to push their favorite stocks higher.

Anecdotal evidence suggests that retail investor enthusiasm may be similar to what we saw in the late 1990s.

Source: @WSJ Read full article

Source: @WSJ Read full article

There are even stories of delayed student loan payments used for stock speculation. And millions have stopped paying their student debt.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

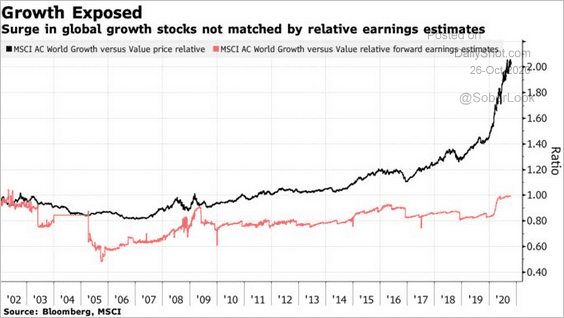

2. Global growth stocks’ outperformance has diverged from relative earnings expectations.

Source: @markets Read full article

Source: @markets Read full article

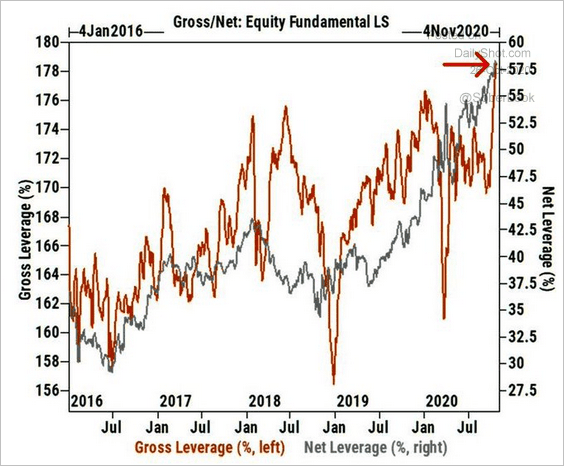

3. Long/short equity funds have been boosting leverage.

Source: @MacroCharts

Source: @MacroCharts

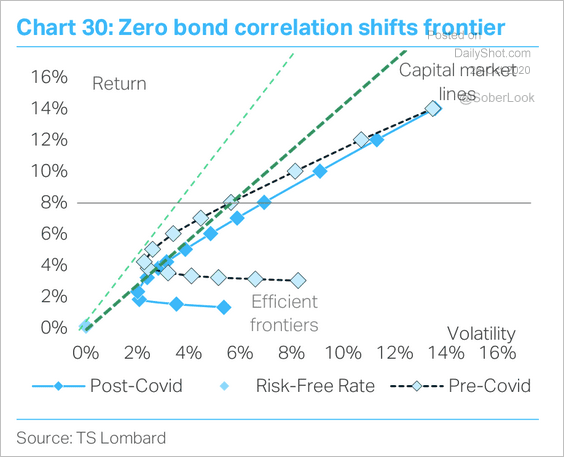

4. A rising stock-bond correlation in a zero interest rate environment could result in investors assuming higher portfolio risk, according to TS Lombard. This is due to the “flatter” efficient frontier.

Source: TS Lombard

Source: TS Lombard

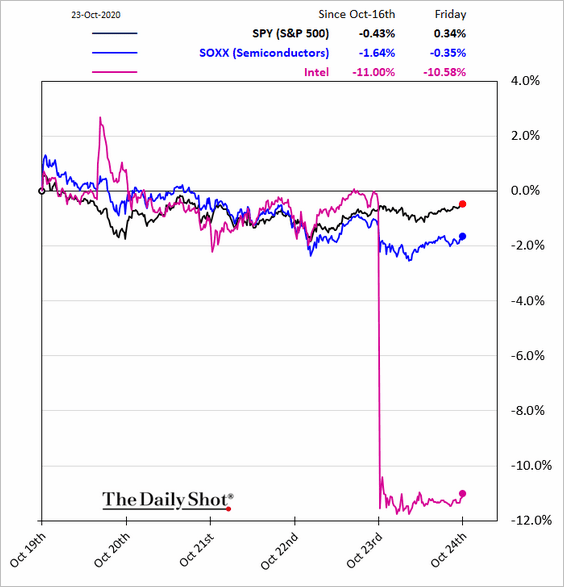

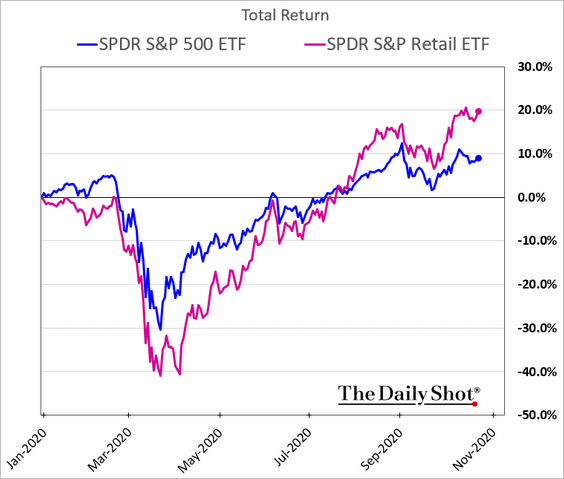

5. Here are a couple of sector updates.

• Semiconductors:

• Retail companies (YTD):

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

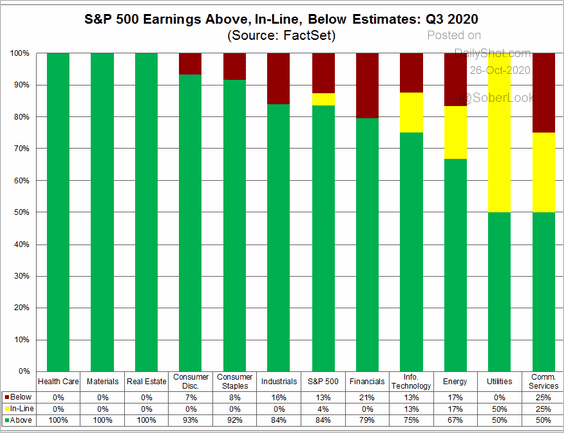

6. Q3 earnings have generally been surprising to the upside.

Source: @FactSet Read full article

Source: @FactSet Read full article

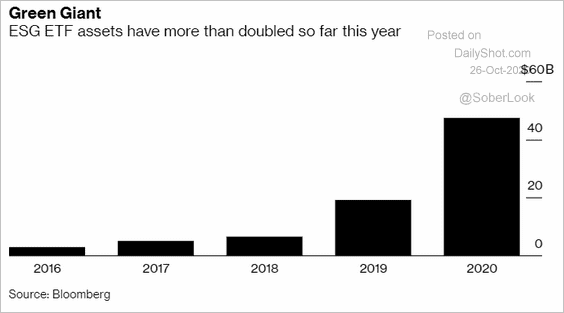

7. ESG ETF assets more than doubled this year.

Source: @markets Read full article

Source: @markets Read full article

Credit

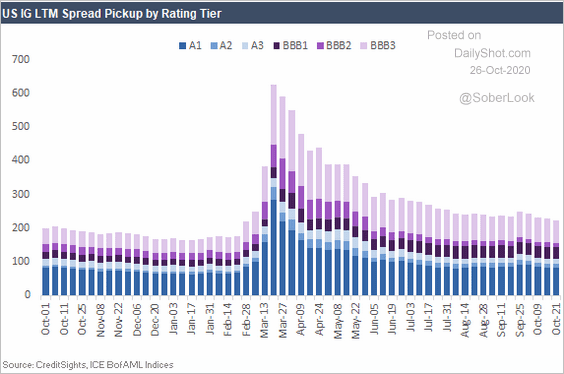

1. How much spread does one pick up by moving to lower rating tiers (for investment-grade bonds)?

Source: CreditSights

Source: CreditSights

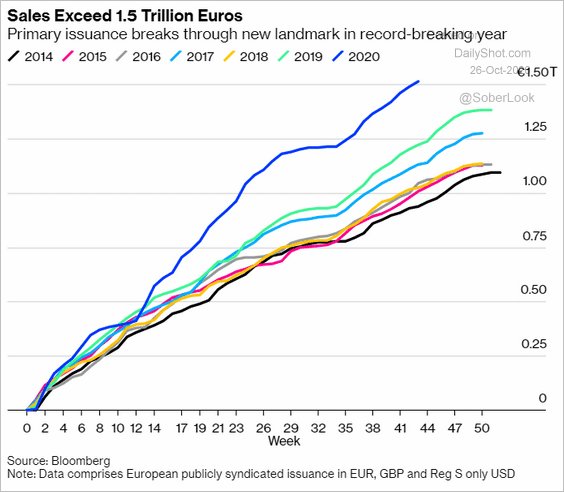

2. European bond sales have been breaking records.

Source: @markets Read full article

Source: @markets Read full article

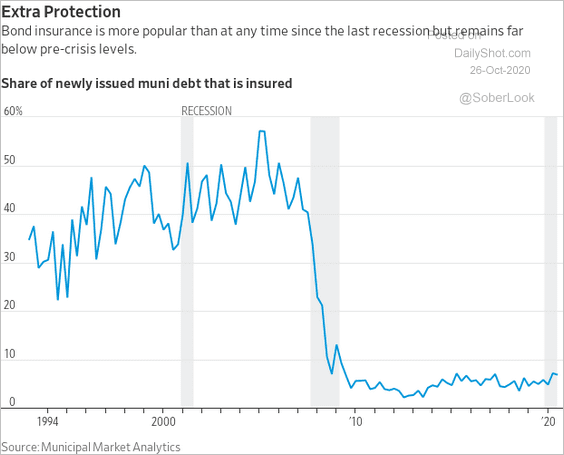

3. Insured muni debt is rising but remains small relative to pre-2008 levels.

Source: @WSJ Read full article

Source: @WSJ Read full article

Rates

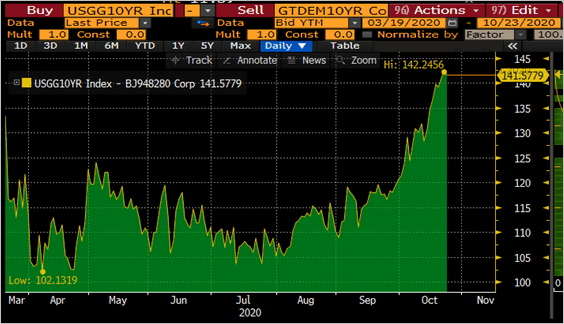

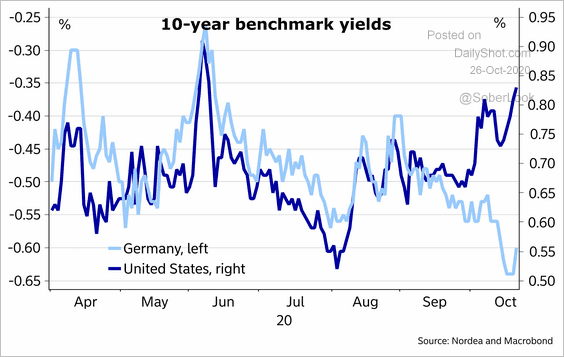

1. The 10-year Treasury yield is at its highest level relative to the 10-year Bund yield since March.

Source: @lisaabramowicz1

Source: @lisaabramowicz1

Source: Nordea Markets

Source: Nordea Markets

——————–

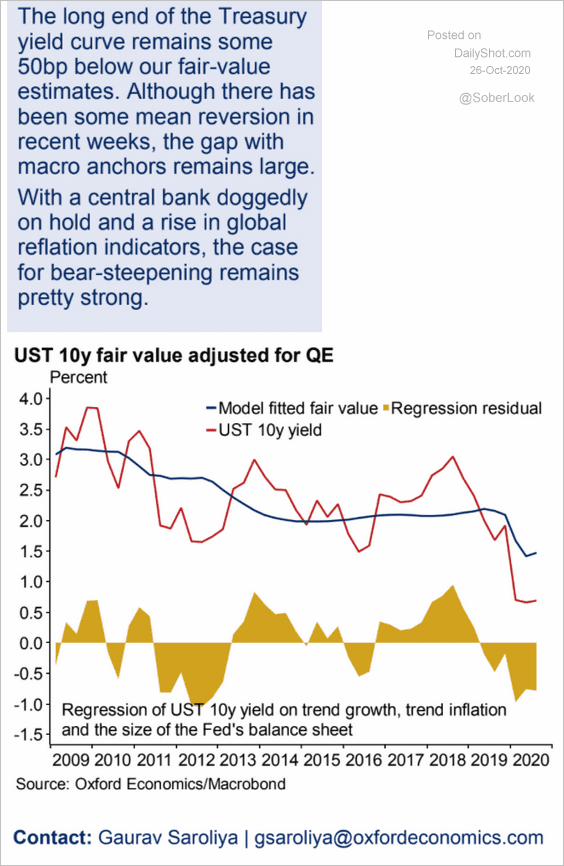

2. Economic models continue to signal upside risk for Treasury yields.

Source: Oxford Economics

Source: Oxford Economics

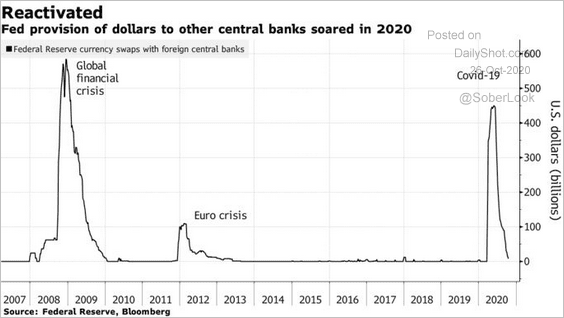

3. This chart shows the Fed’s liquidity swap utilization (providing dollars to other central banks).

Source: @markets Read full article

Source: @markets Read full article

——————–

Food for Thought

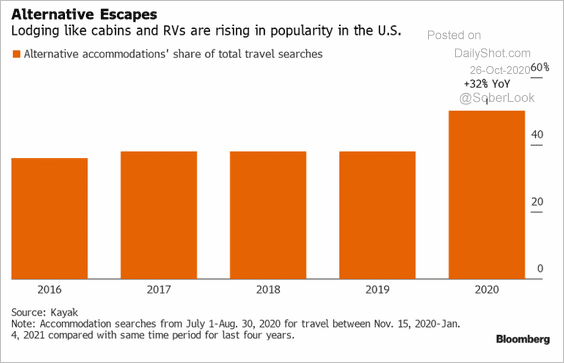

1. Alternative accommodations (cabins and RVs):

Source: Sophie Caronello

Source: Sophie Caronello

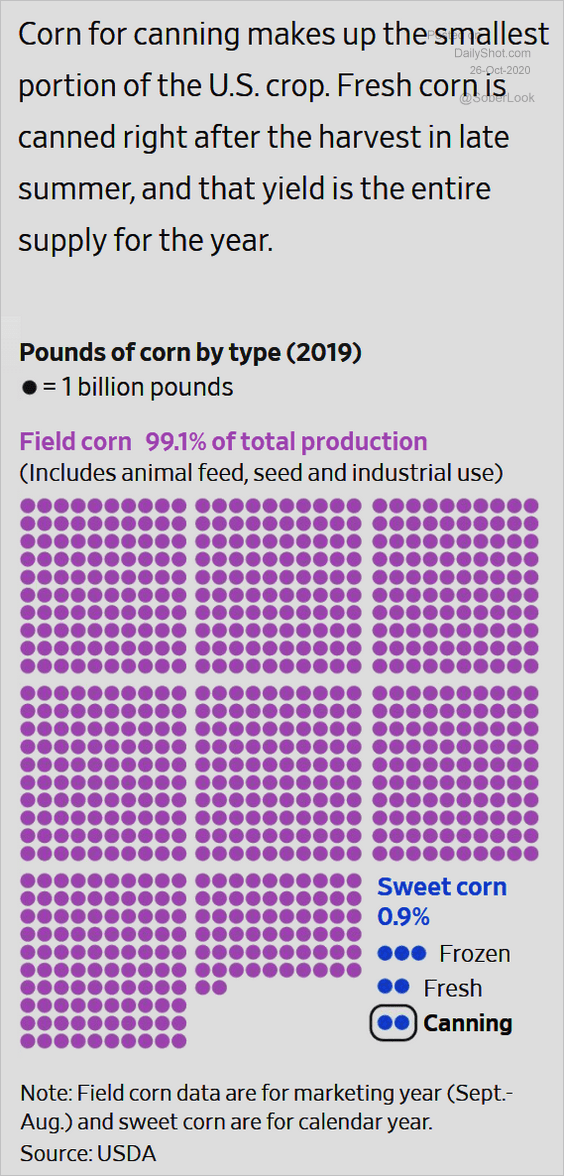

2. Canned corn:

Source: @WSJ Read full article

Source: @WSJ Read full article

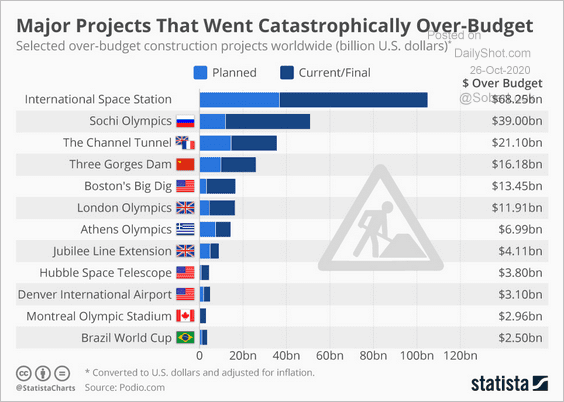

3. Most over-budget projects:

Source: Statista

Source: Statista

4. COVID cases in rural areas:

Source: The New York Times, h/t @carlquintanilla Read full article

Source: The New York Times, h/t @carlquintanilla Read full article

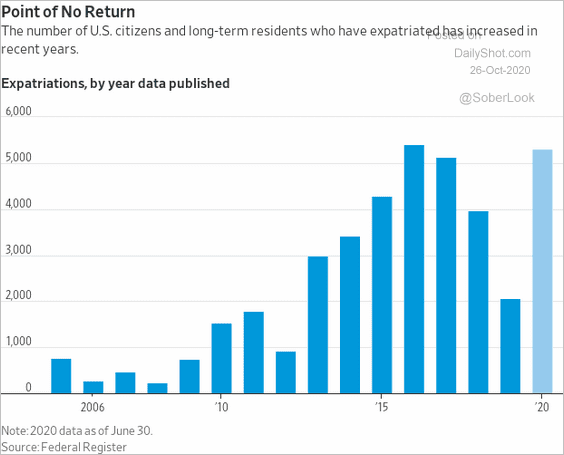

5. Americans renouncing their citizenship:

Source: @WSJ Read full article

Source: @WSJ Read full article

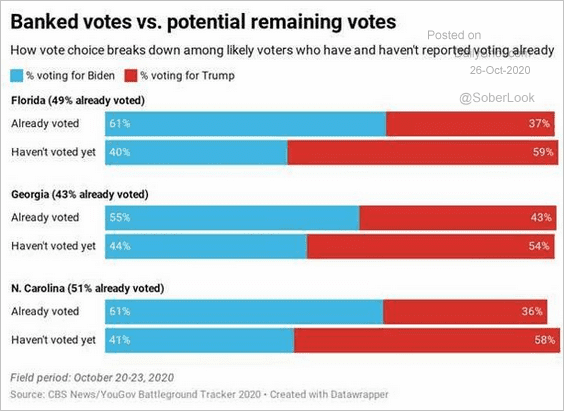

6. Early voting vs. remaining votes (US elections):

Source: CBS News Read full article

Source: CBS News Read full article

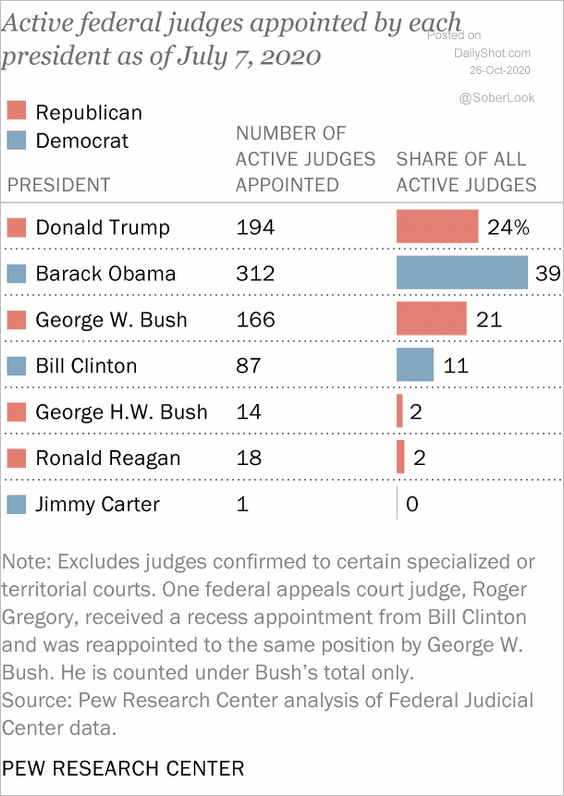

7. Active federal judges:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

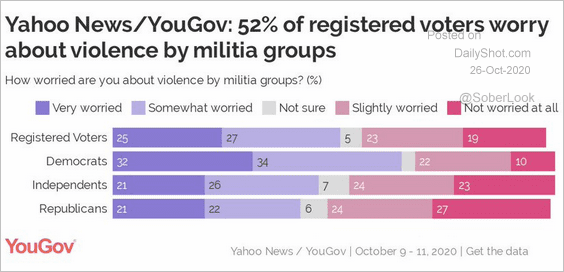

8. Concerns about militia groups:

Source: @YouGovAmerica Read full article

Source: @YouGovAmerica Read full article

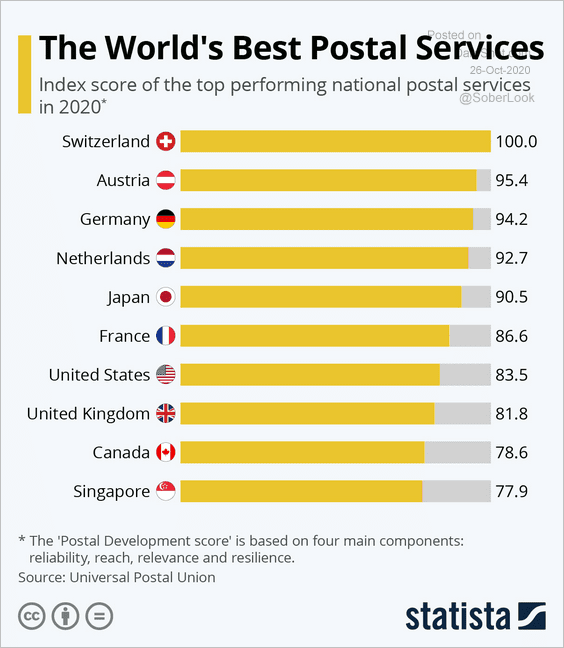

9. Best postal services:

Source: Statista

Source: Statista

——————–