The Daily Shot: 03-Nov-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

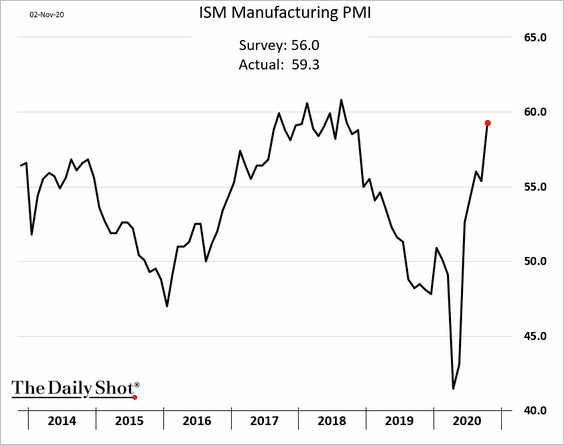

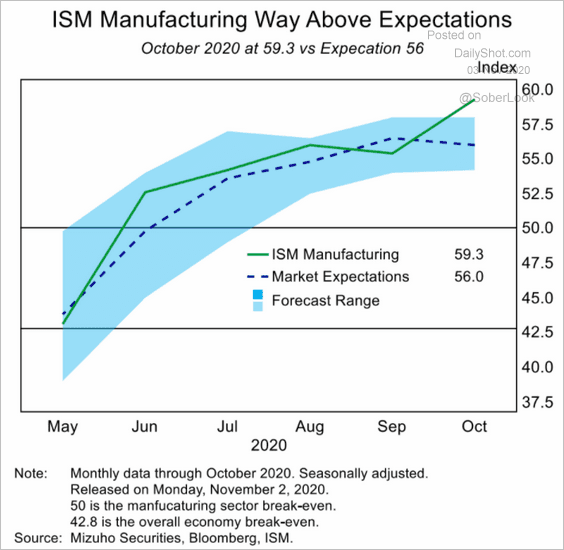

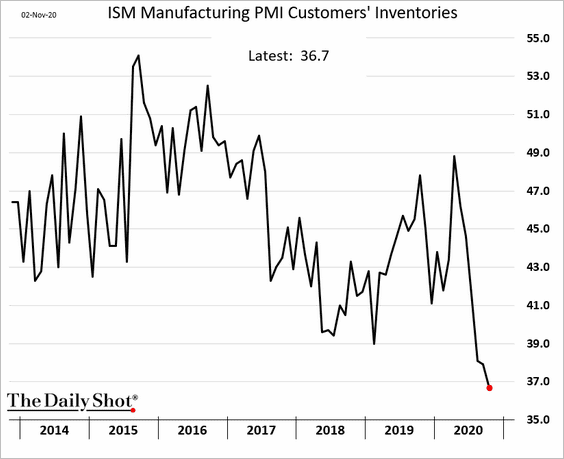

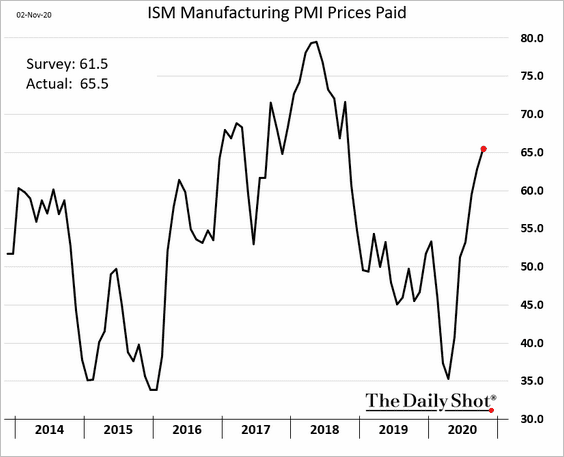

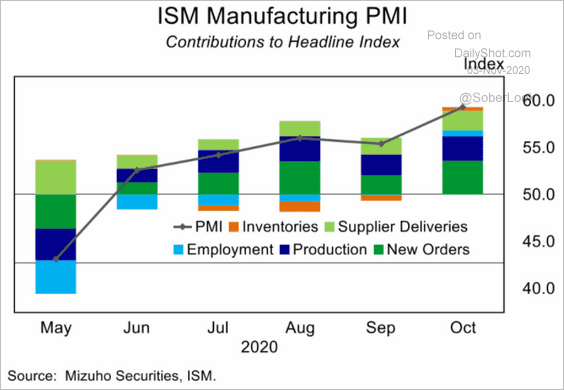

1. US factory activity quickened last month, with the ISM PMI report exceeding forecasts (2 charts).

Source: Mizuho Securities USA

Source: Mizuho Securities USA

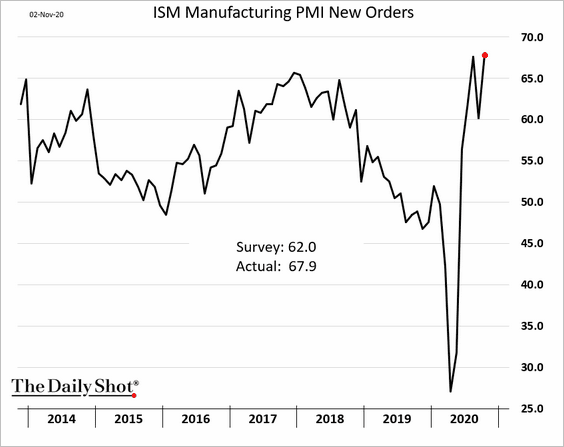

• The index of new orders hit a multi-year high.

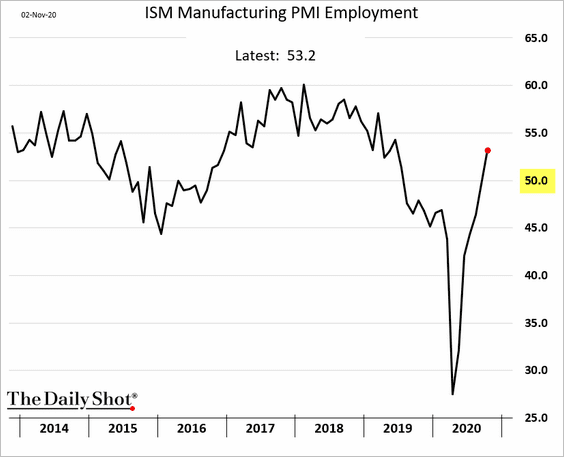

• Employment is back in growth mode.

• Manufacturers see their customers’ inventories as being too low.

• Input price gains accelerated.

• Here are the contributions to the ISM index.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

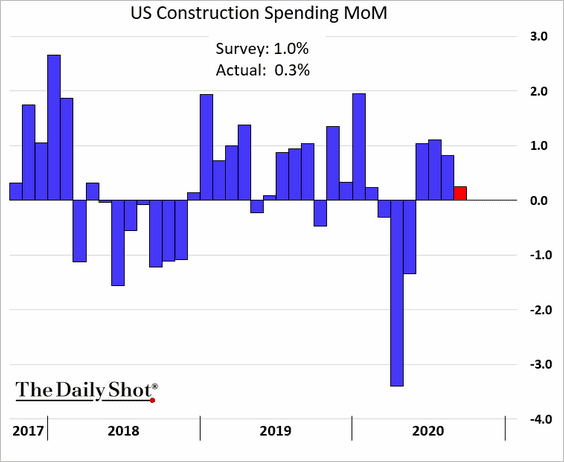

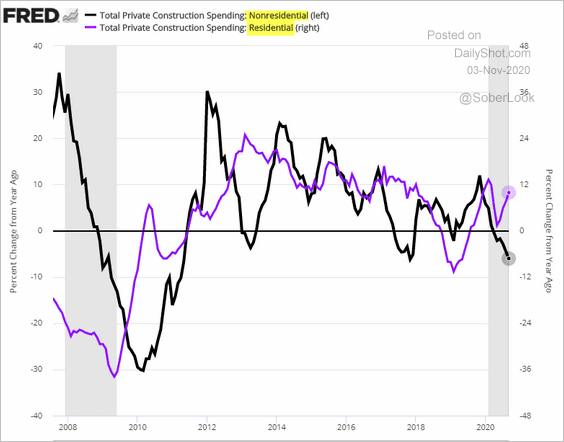

2. Growth in construction spending slowed.

The recent weakness was driven by nonresidential construction.

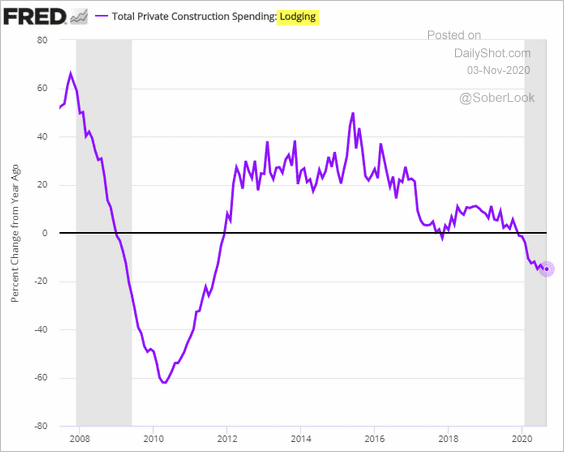

Who would want to invest in a new hotel in this environment?

——————–

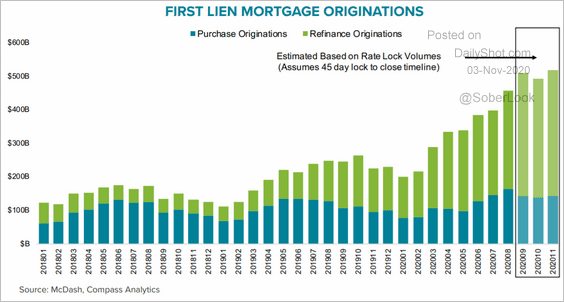

3. Now, let’s take a look at the nation’s housing and rental markets.

• Mortgage originations hit a multi-year high.

Source: Black Knight

Source: Black Knight

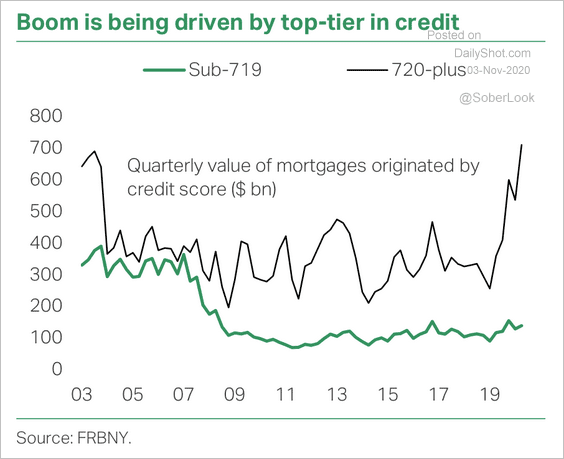

• The housing boom has been powered by borrowers with credit scores of 750 and above.

Source: TS Lombard

Source: TS Lombard

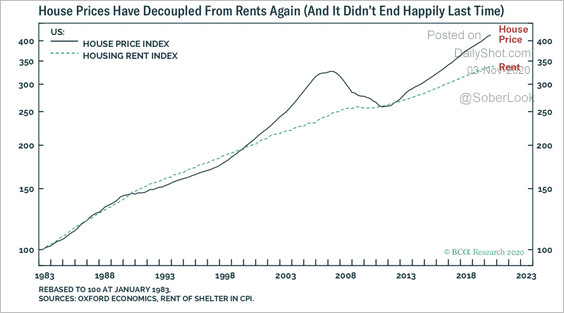

• Earlier, we saw the divergence between home prices and wages. Here is a similar comparison with rents.

Source: BCA Research

Source: BCA Research

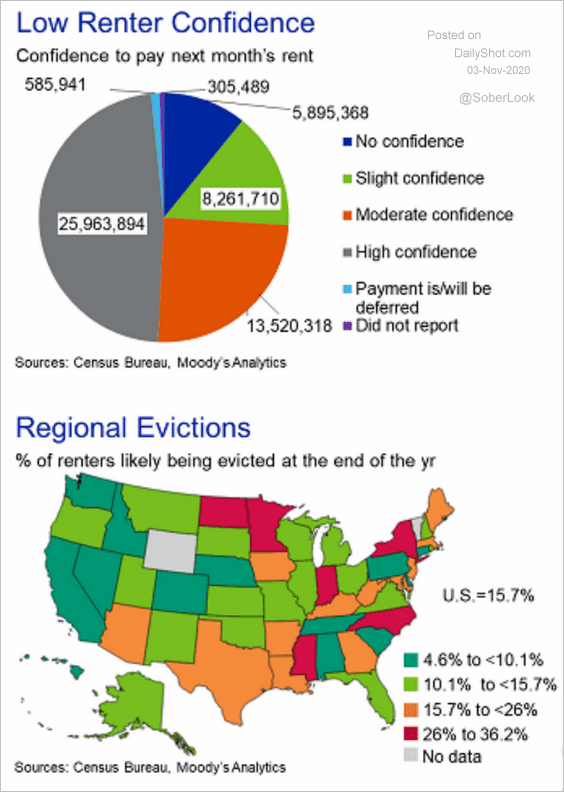

• Evictions could climb as some renters struggle to make payments.

Source: Moody’s Analytics

Source: Moody’s Analytics

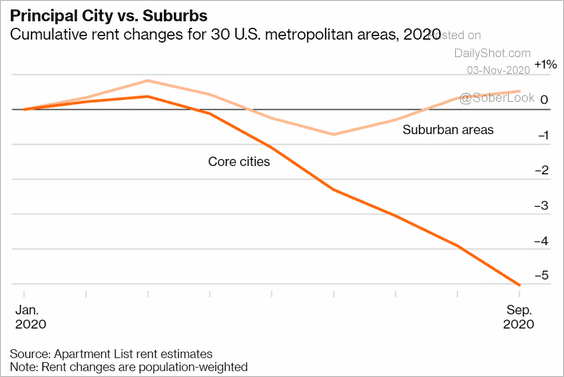

• Migration out of urban areas is on full display in this year’s rent changes.

Source: @citylab Read full article

Source: @citylab Read full article

——————–

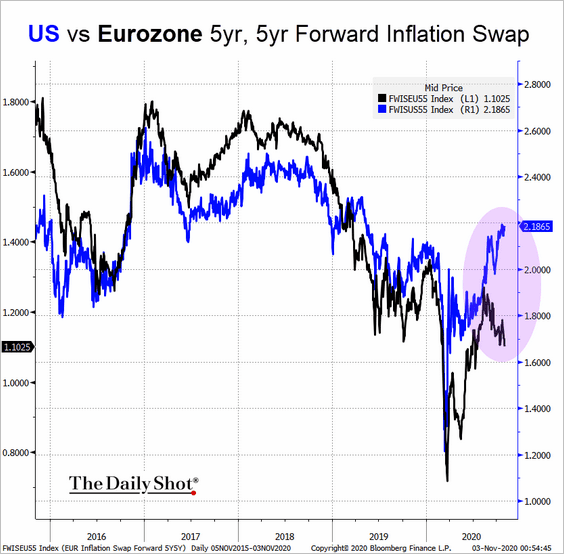

4. Next, let’s take a look at some inflation trends.

• US and Eurozone long-term inflation expectations have diverged sharply. The market sees the fiscal stimulus in the US significantly outpacing that of the euro area.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

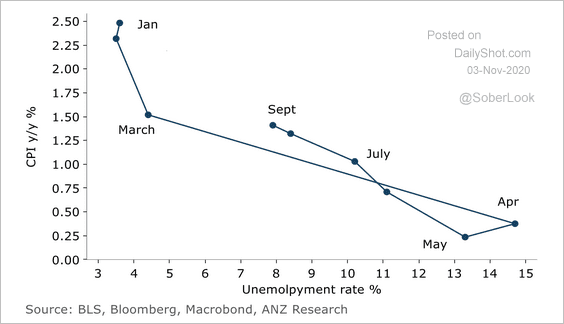

• The Phillips Curve illustrates a steady recovery in inflation and employment since May.

Source: ANZ Research

Source: ANZ Research

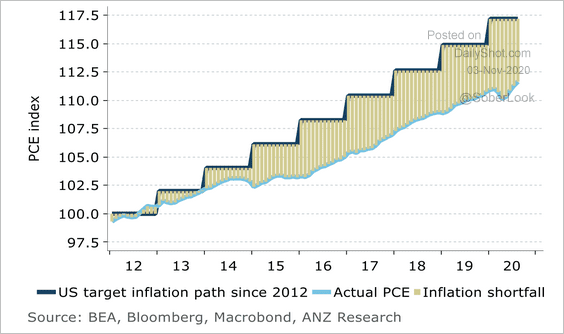

• The Fed has a troubled history with inflation targeting.

Source: ANZ Research

Source: ANZ Research

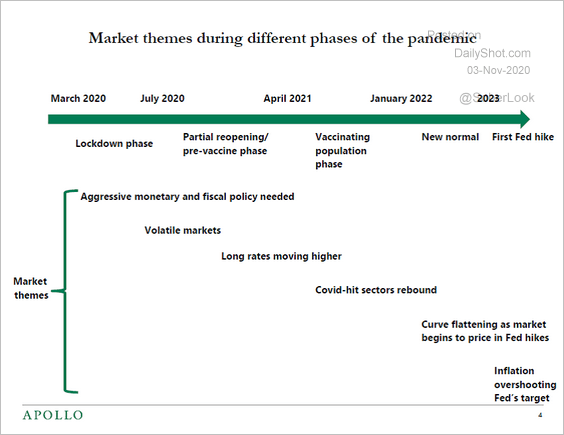

• When will inflation overshoot the Fed’s target?

Source: Torsten Slok; Apollo Global Management

Source: Torsten Slok; Apollo Global Management

——————–

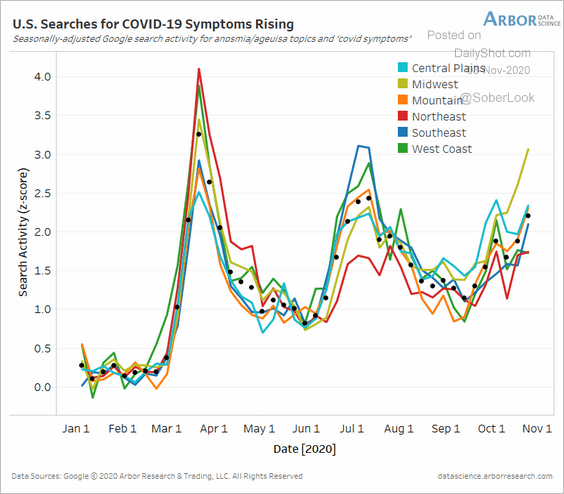

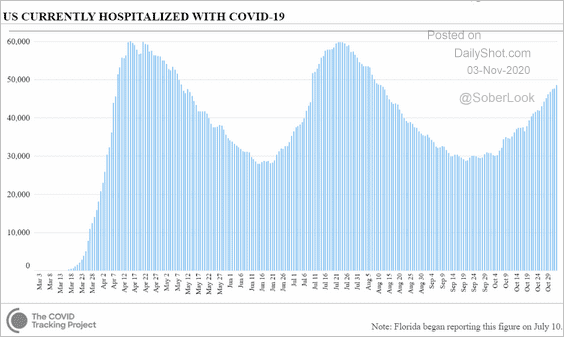

5. Below are a couple of COVID trends in the US.

• Google searches for COVID symptoms:

Source: Arbor Research & Trading

Source: Arbor Research & Trading

• Hospitalizations:

Source: CovidTracking.com

Source: CovidTracking.com

——————–

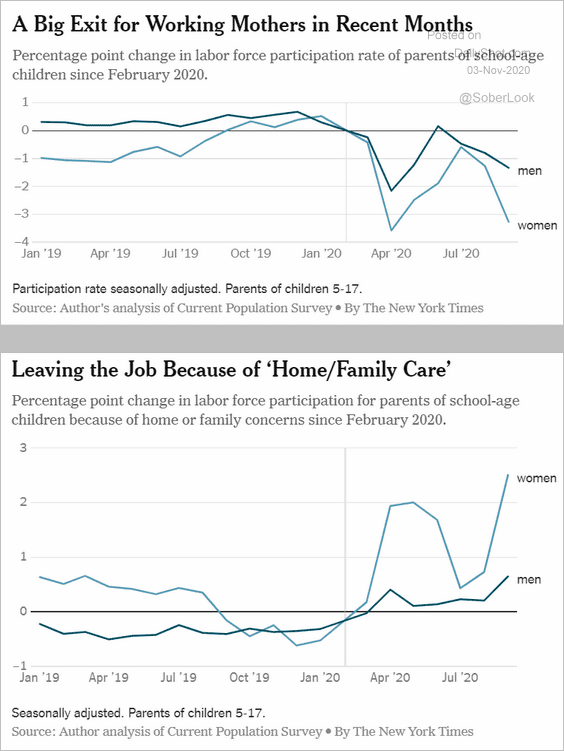

6. School closures and childcare challenges have forced many women out of the labor force.

Source: The New York Times Read full article

Source: The New York Times Read full article

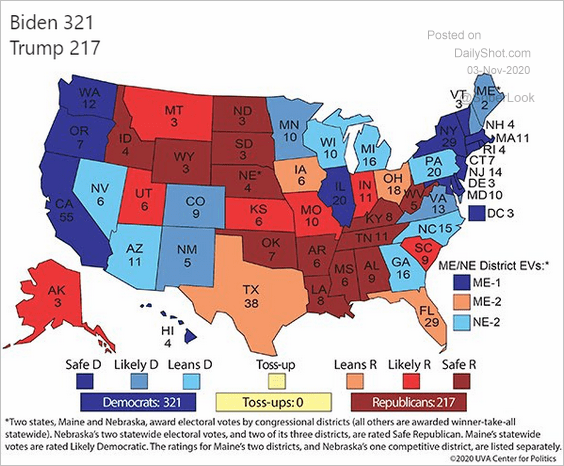

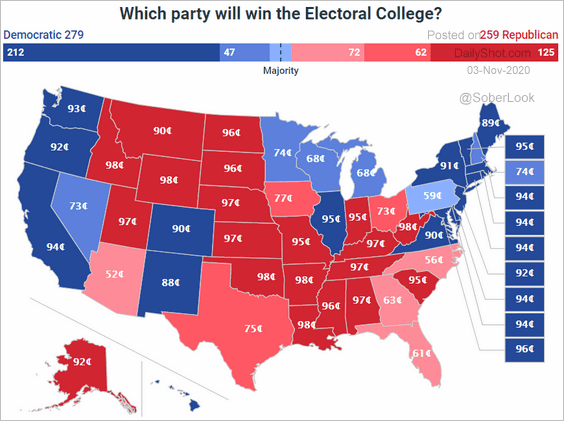

7. Finally, here is a section on the US elections.

• The electoral map based on Larry Sabato’s Crystal Ball:

Source: @Politics_Polls, @LarrySabato

Source: @Politics_Polls, @LarrySabato

• The electoral map based on the betting markets (Predictit):

Source: @PredictIt

Source: @PredictIt

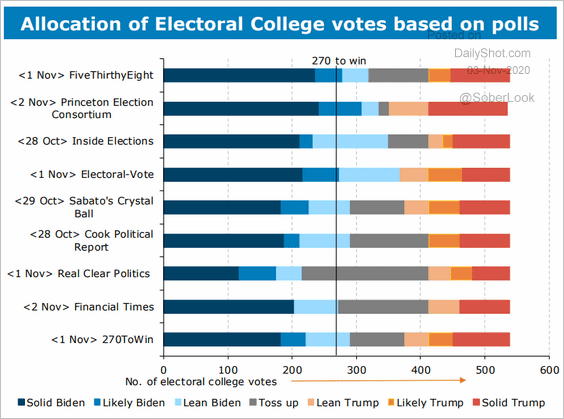

• Polling analysis by different groups:

Source: ANZ Research

Source: ANZ Research

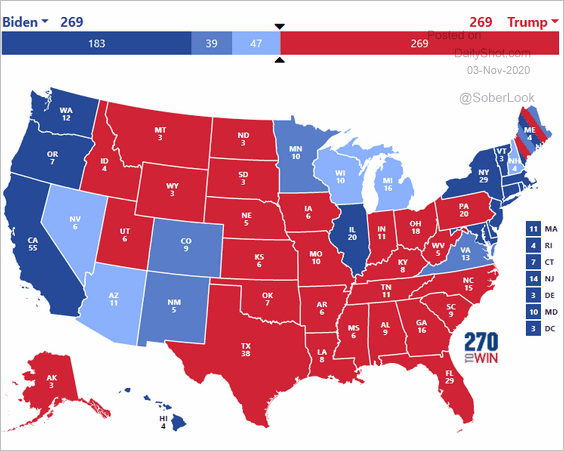

• What would a tie in the Electoral College look like?

Source: Independent Advisor Alliance

Source: Independent Advisor Alliance

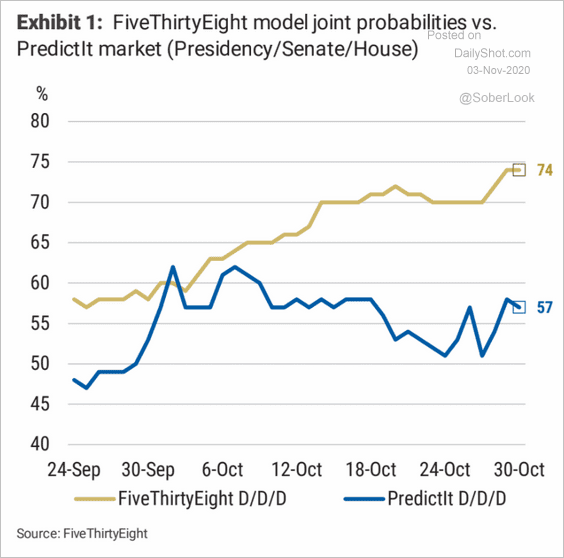

• “Blue wave” probability estimates (538 vs. PredictIt):

Source: Morgan Stanley Research

Source: Morgan Stanley Research

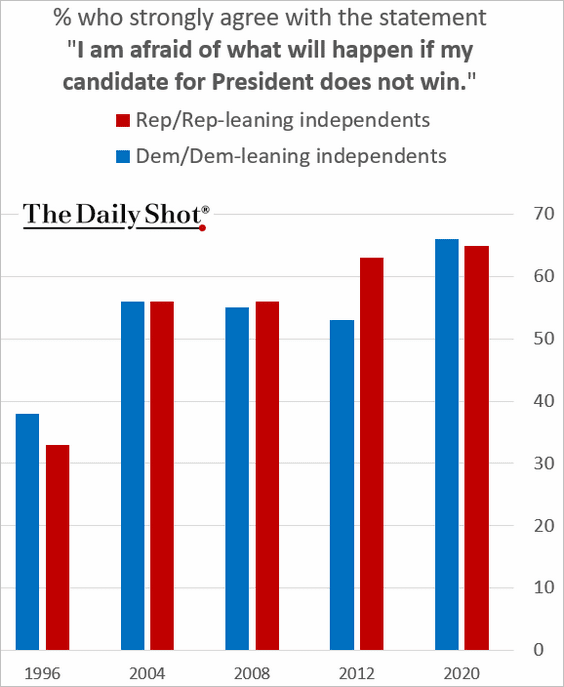

• What if my candidate doesn’t win?

Source: Gallup Read full article

Source: Gallup Read full article

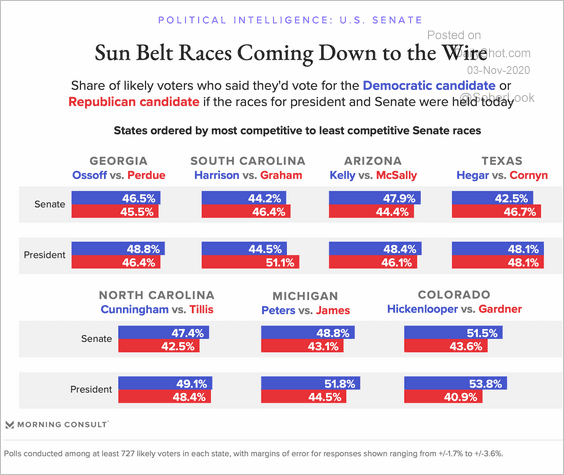

• Senate races:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

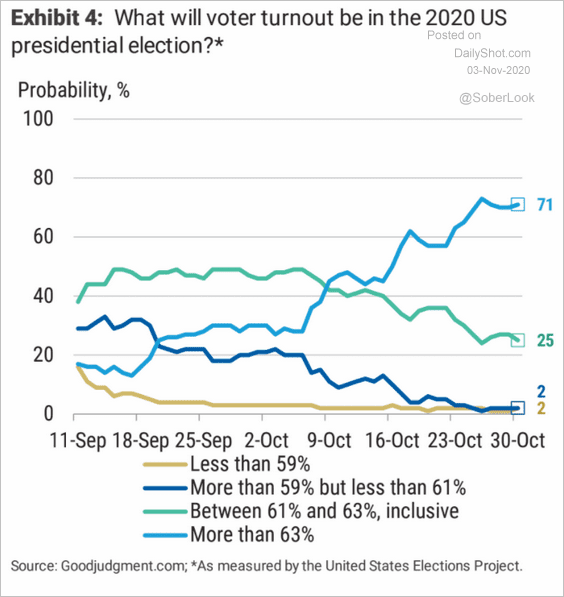

• Turnout expectations:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

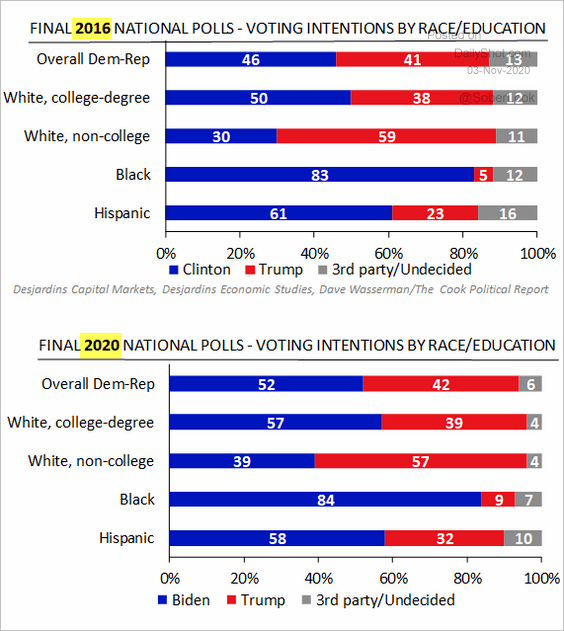

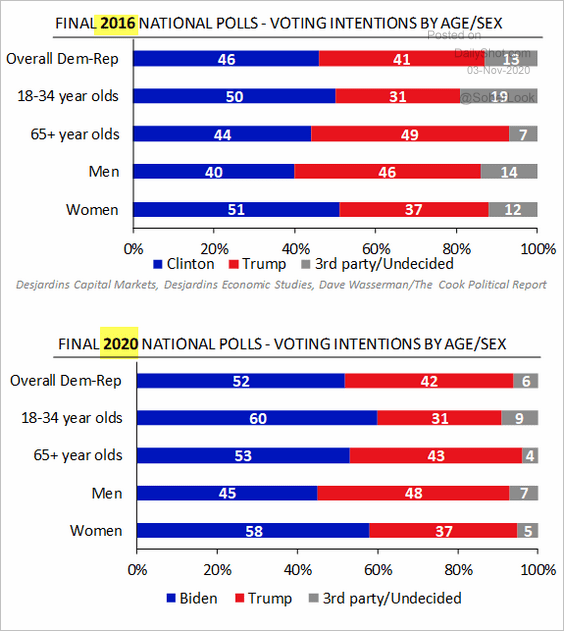

• 2016 vs. 2020 demographics (2 charts):

Source: Desjardins

Source: Desjardins

Source: Desjardins

Source: Desjardins

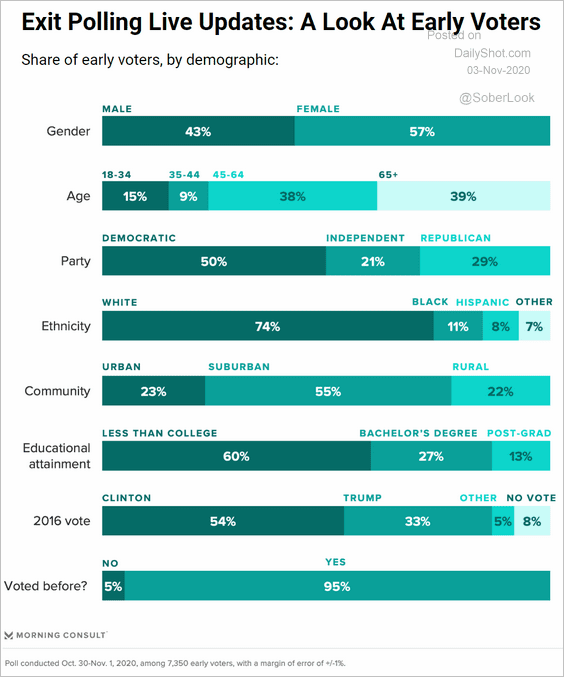

• Early voter demographics:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

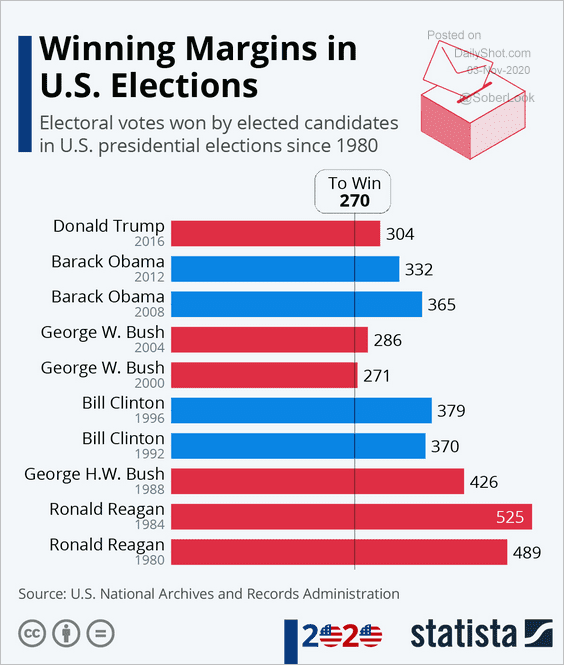

• Historical winning margins:

Source: Statista

Source: Statista

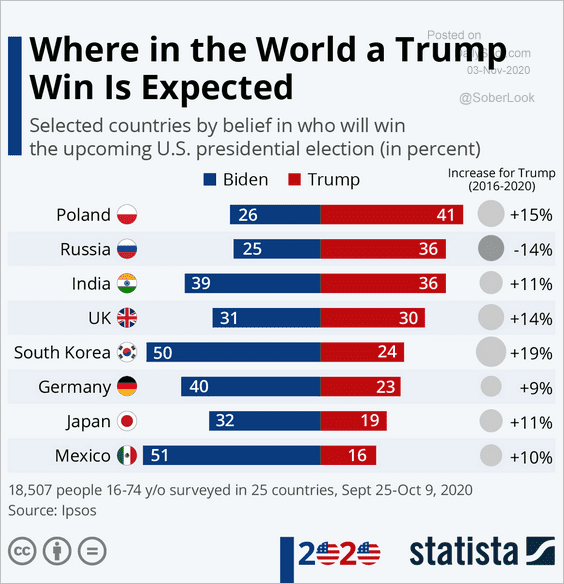

• What outcome do other countries expect?

Source: Statista

Source: Statista

Canada

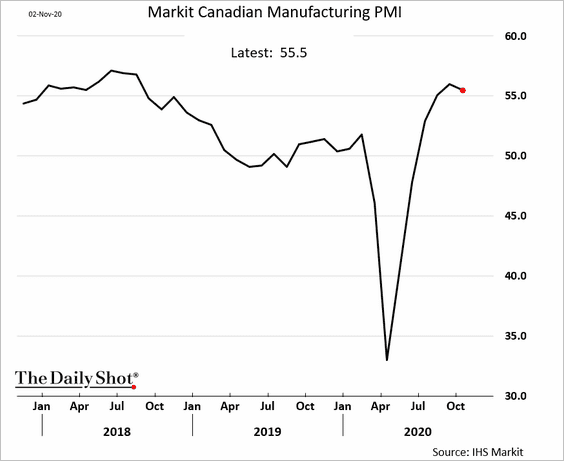

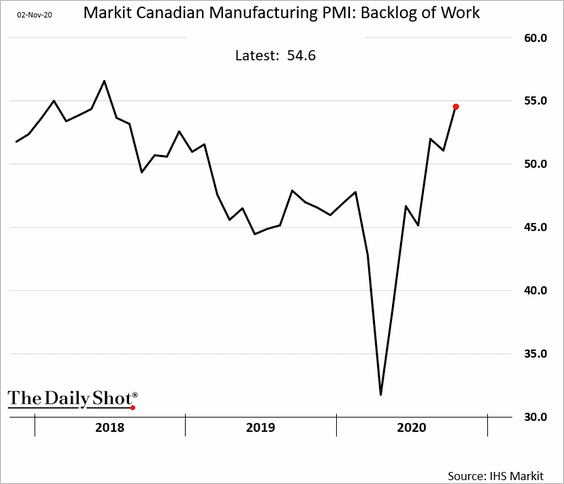

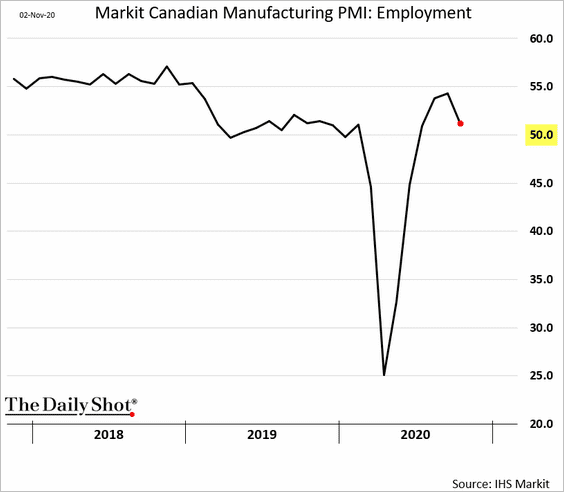

1. Manufacturing growth continued in October.

• The backlog of work accelerated.

• Factory hiring slowed.

——————–

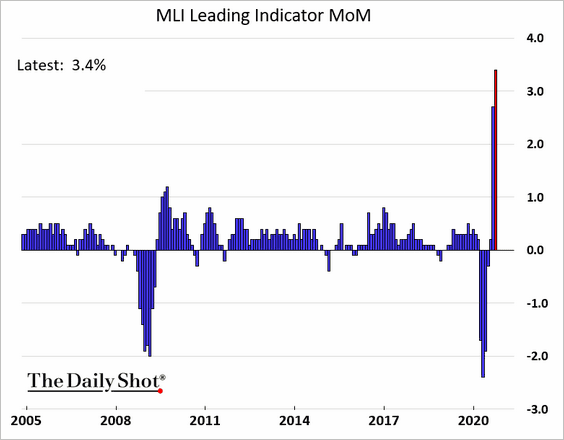

2. The MLI Leading Indicator monthly change hit a record high in September. Will we see a substantial pullback in October?

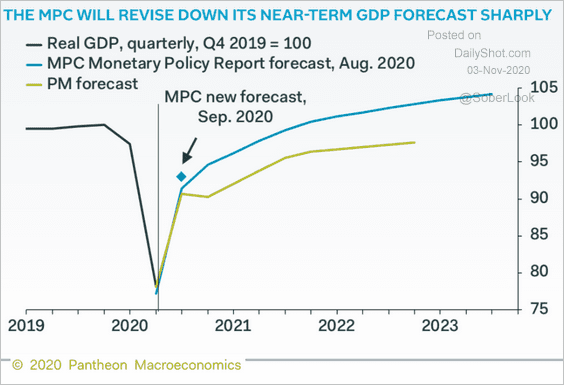

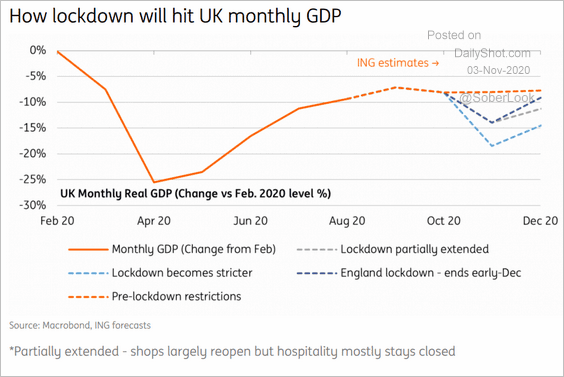

The United Kingdom

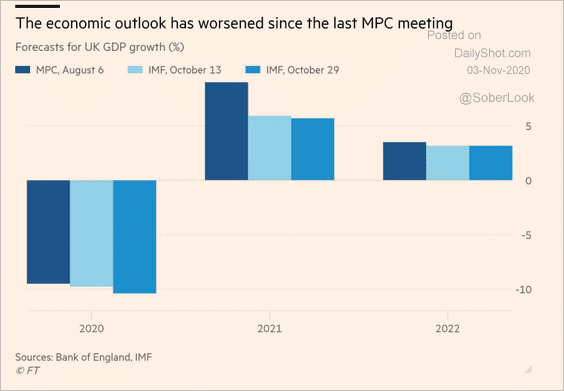

The UK economic outlook has worsened since the last MPC meeting.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Here are some scenarios of the lockdown impact on the GDP.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: ING

Source: ING

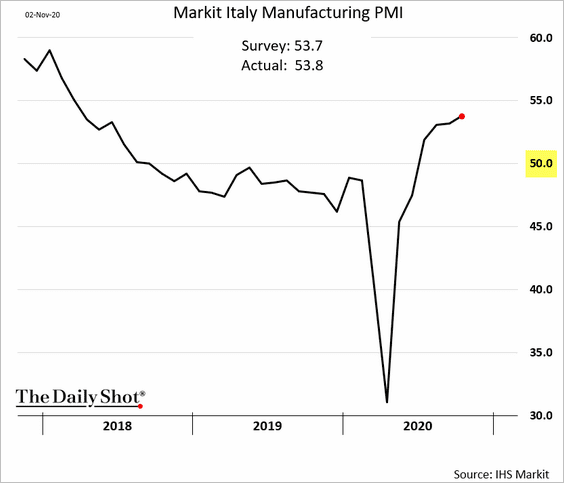

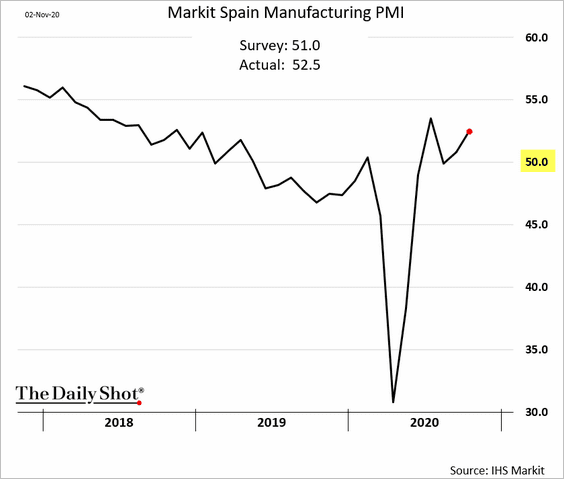

The Eurozone

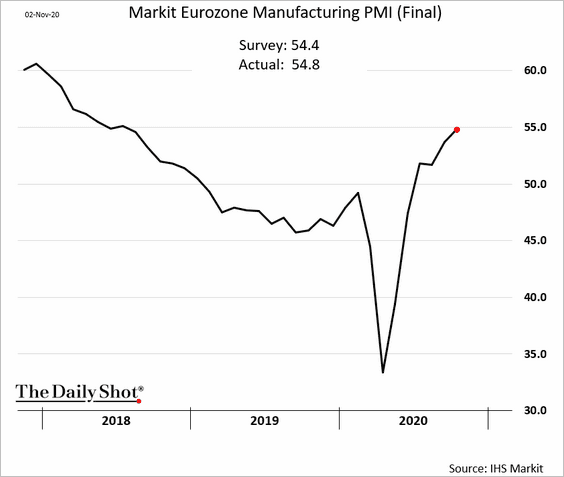

1. October factory activity surprised to the upside.

• Italy:

• Spain:

• Eurozone (better than the earlier report):

——————–

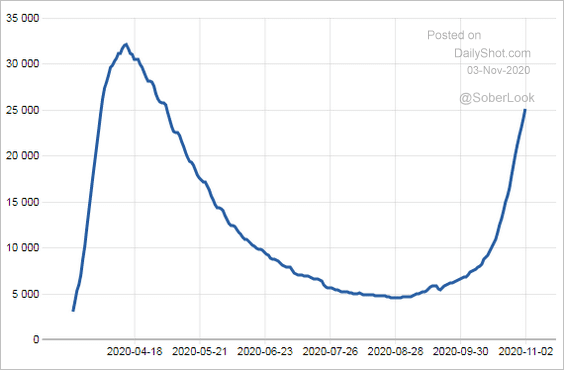

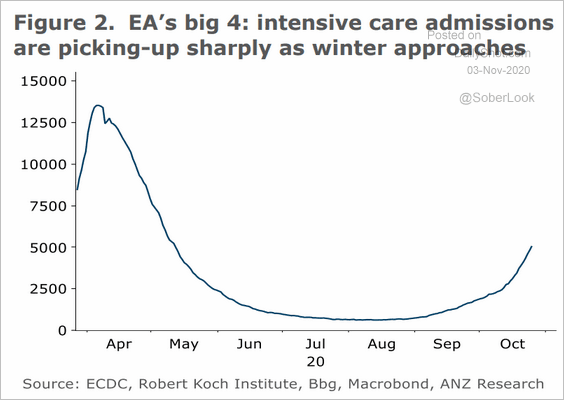

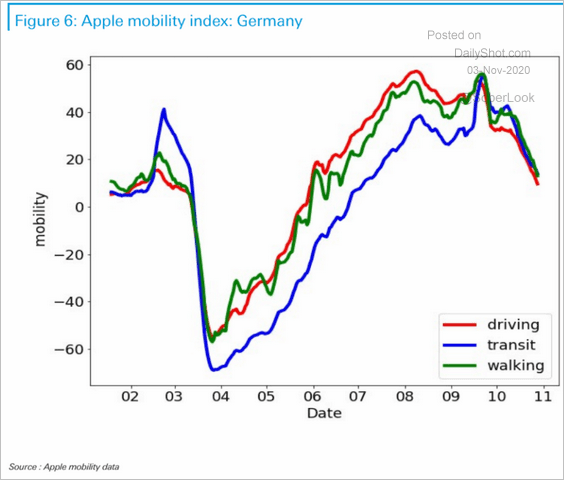

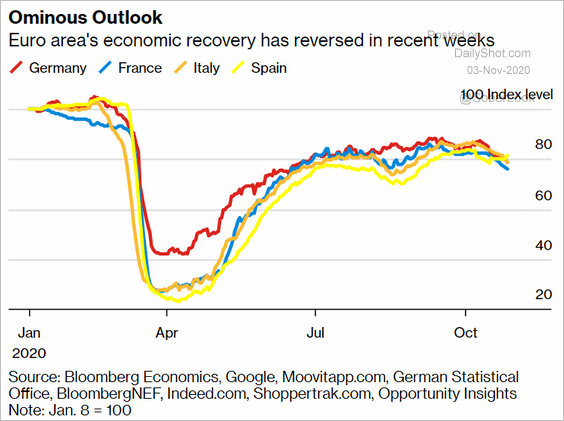

2. The pandemic is pressuring economic activity.

• Hospitalizations in France:

Source: @BNODesk

Source: @BNODesk

• Intensive care admissions in the Eurozone:

Source: ANZ Research

Source: ANZ Research

• Germany’s mobility indicators:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Bloomberg’s recovery indices:

Source: @business Read full article

Source: @business Read full article

——————–

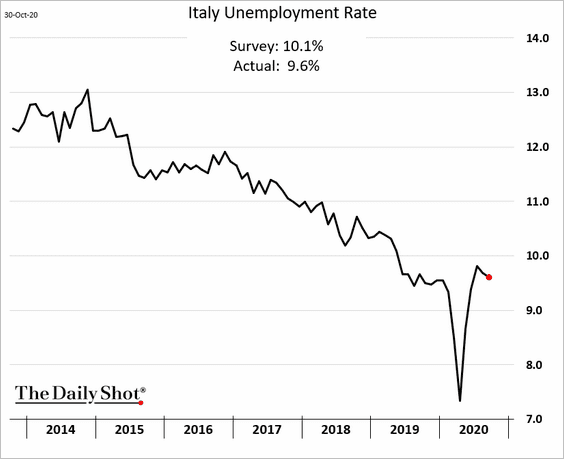

3. The Italian unemployment rate held below 10%.

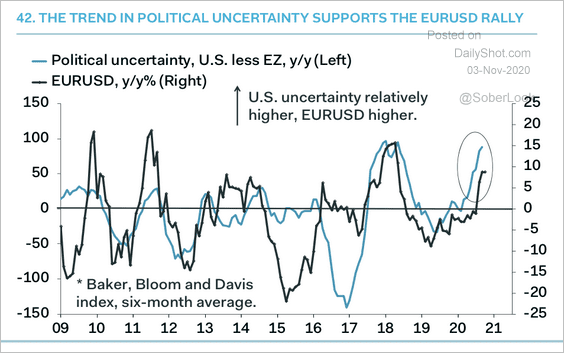

4. Rising US political uncertainty has been supportive of EUR/USD.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Europe

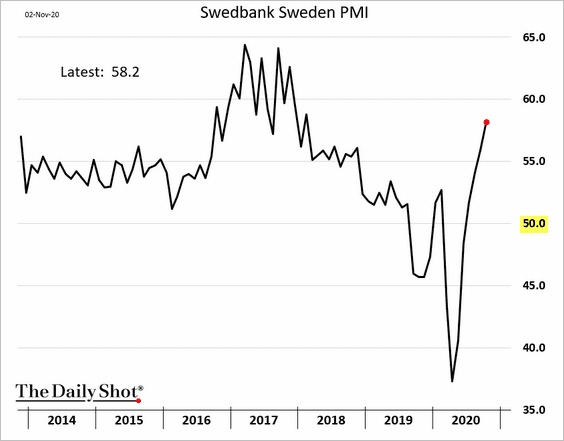

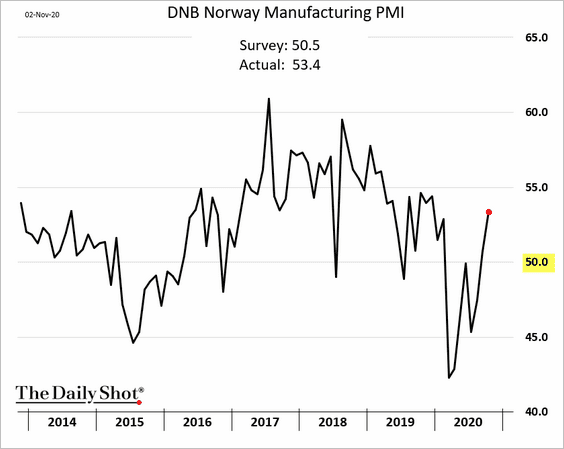

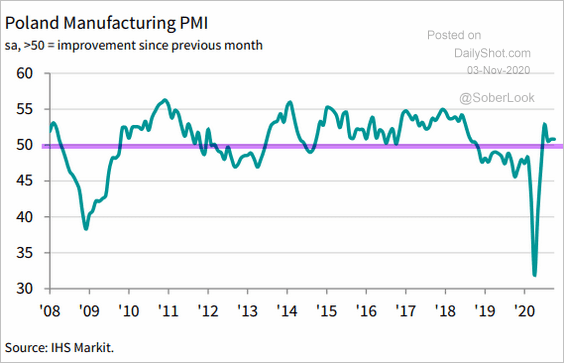

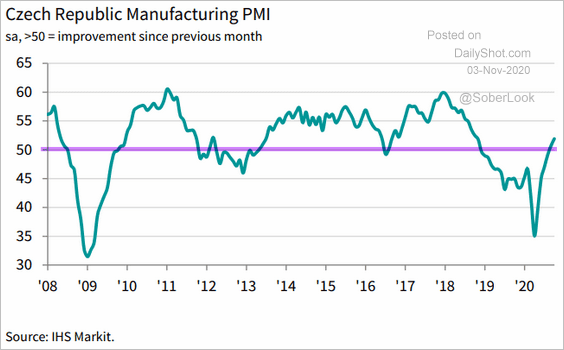

1. Let’s run through some PMI trends, which show improving manufacturing growth.

• Sweden:

• Norway:

• Central Europe:

Source: IHS Markit Read full article

Source: IHS Markit Read full article

Source: IHS Markit Read full article

Source: IHS Markit Read full article

——————–

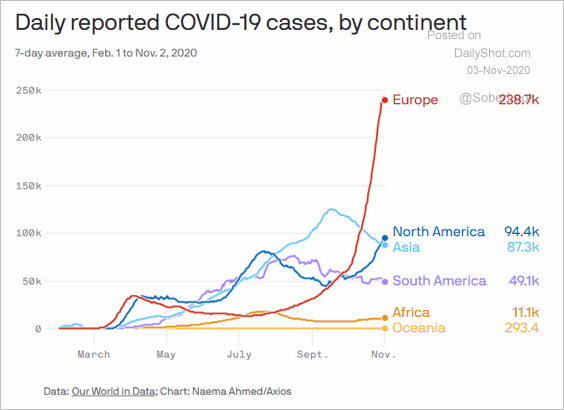

2. Europe is outpacing the rest of the world in new COVID cases.

Source: @axios Read full article

Source: @axios Read full article

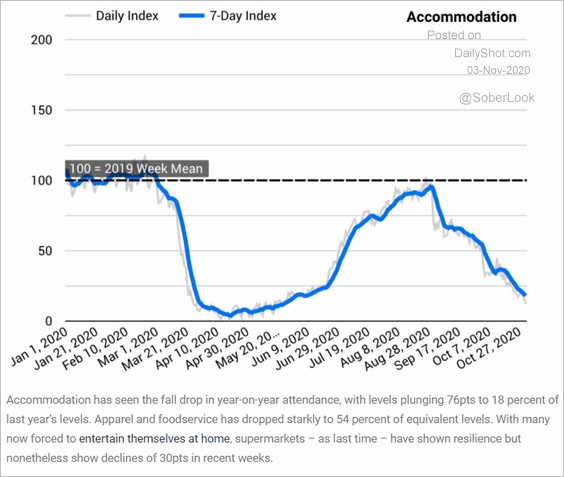

And it’s putting a strain on the economy (see comment below).

Source: huq Read full article

Source: huq Read full article

——————–

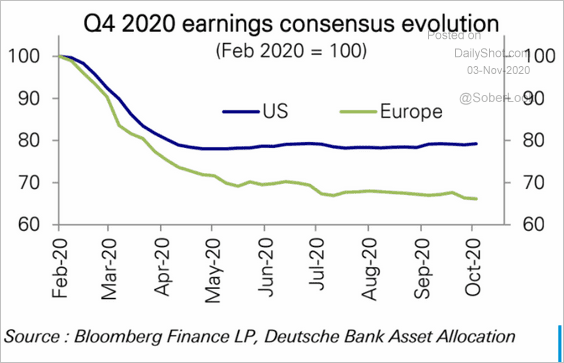

3. European corporate earnings projections are lagging those in the US.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Asia – Pacific

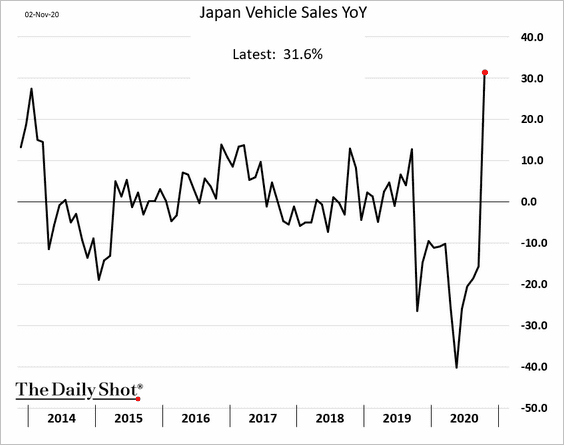

1. Japan’s vehicle sales rebounded sharply.

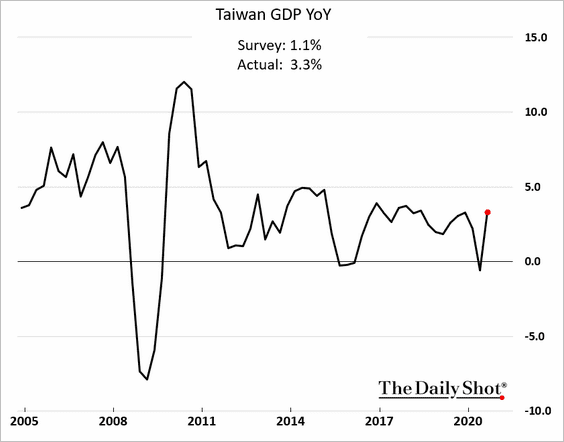

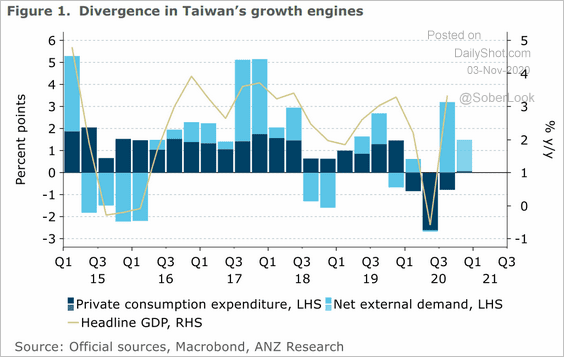

2. Taiwan’s GDP surprised to the upside, driven by external demand (2nd chart). The economy held up remarkably well this year.

Source: ANZ Research

Source: ANZ Research

——————–

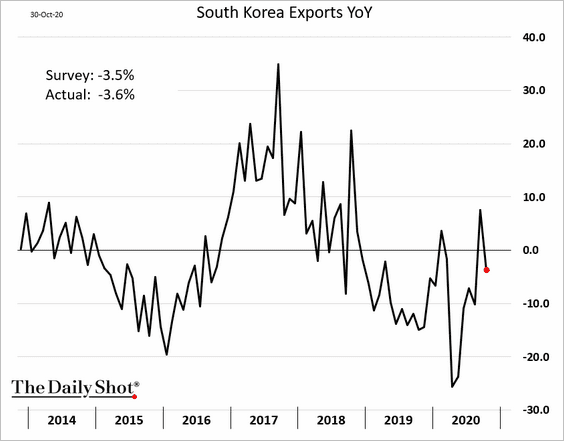

3. South Korea’s exports slowed in October.

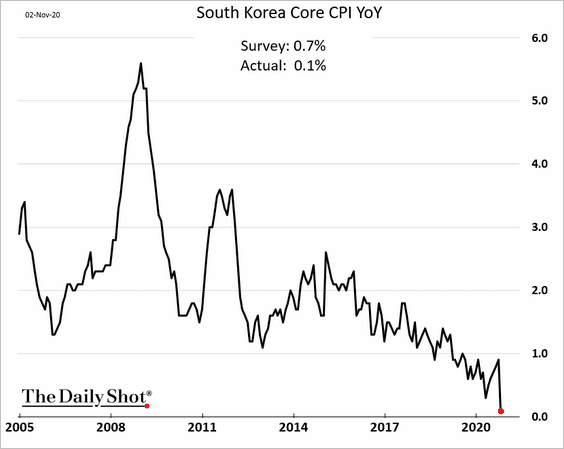

The nation’s core CPI hit a new low. Here is a comment from ANZ:

… the pullback is not a cause for serious concern as it was driven mainly by a sharp fall in communication prices following government subsidies for mobile phone bills.

——————–

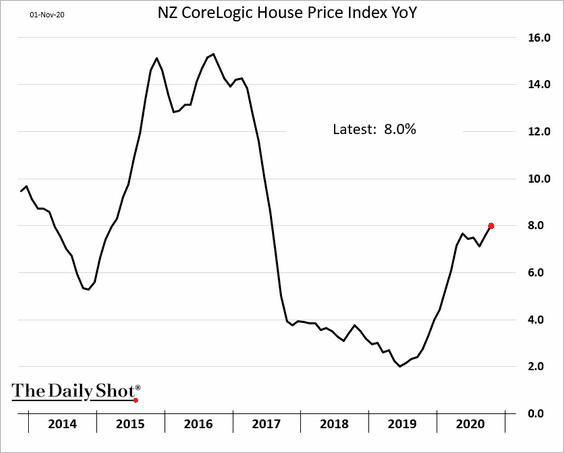

4. New Zealand’s home prices are now 8% above last year’s levels.

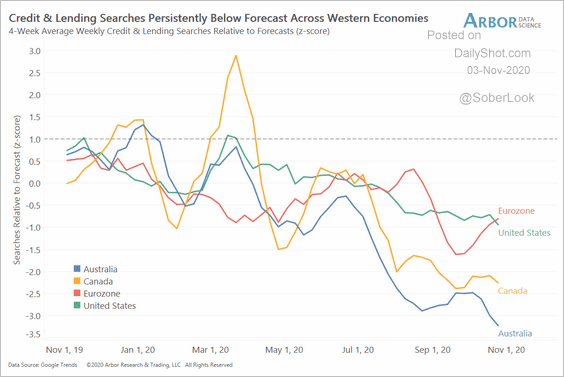

5. Search activity for loan/credit-related items in Australia tumbled in recent months.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

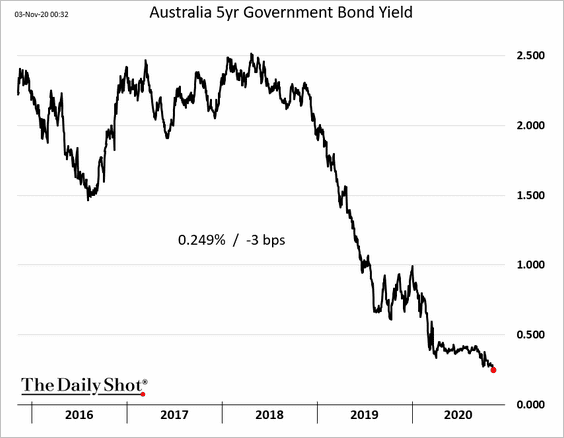

The 5yr Aussie government bond yield hit a new low.

China

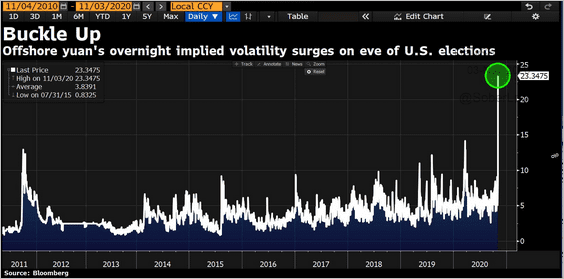

1. The renminbi implied volatility spiked ahead of the US elections.

Source: @DavidInglesTV

Source: @DavidInglesTV

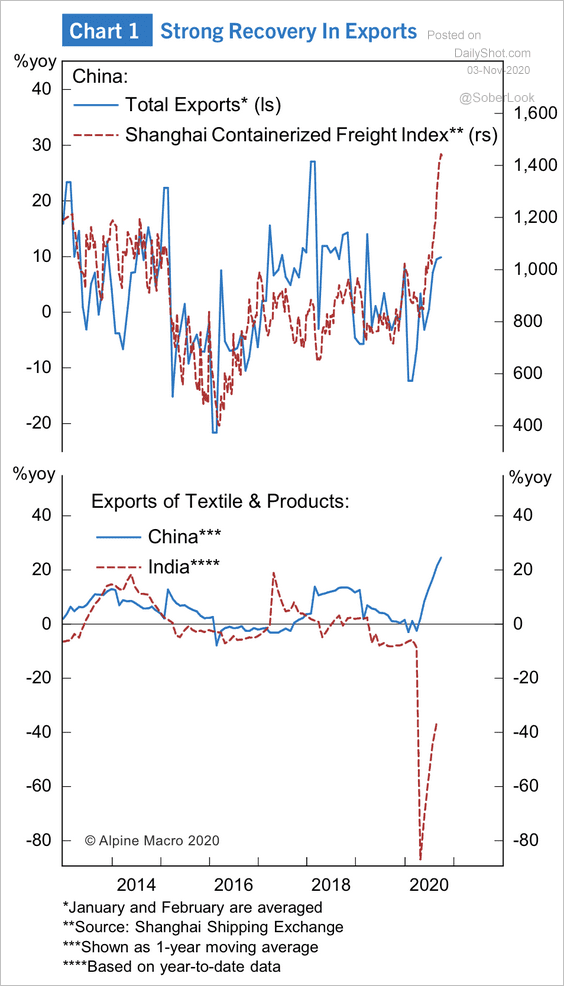

2. Container shipping activity has surged to multi-year highs, with exports of textiles far outpacing India.

Source: Alpine Macro

Source: Alpine Macro

3. China is allowing greater access to its onshore futures market. This makes it easier for foreign investors to hedge or speculate on stock positions.

Source: @FT Read full article

Source: @FT Read full article

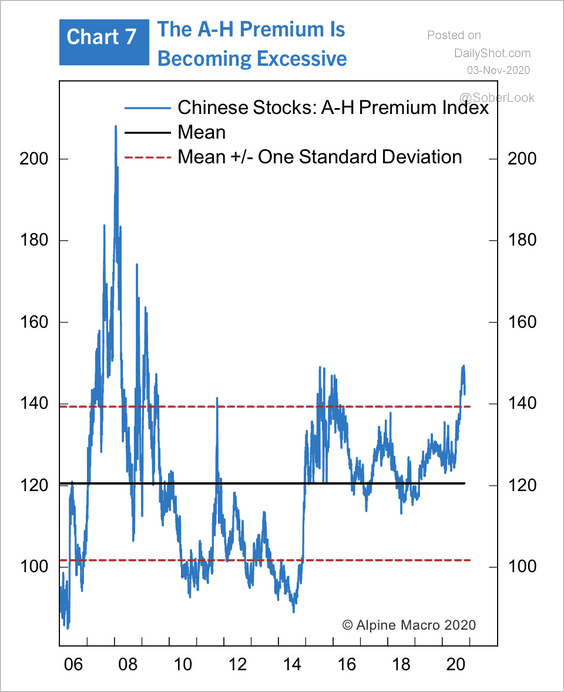

4. A-shares with dual listings are currently trading at a 40% premium to their Hong-Kong listed counterparts, according to Alpine Macro.

Source: Alpine Macro

Source: Alpine Macro

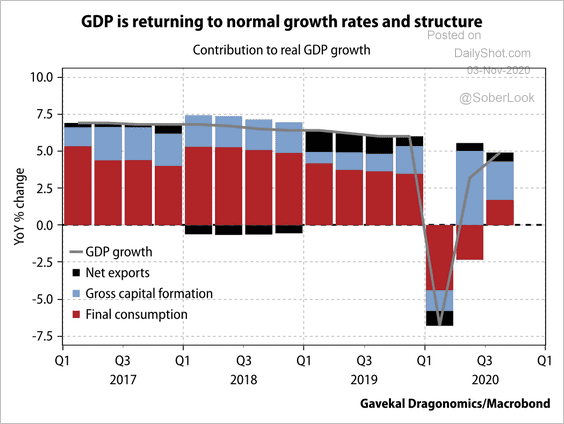

5. Here are the contributions to real GDP. While growth is normalizing, household consumption remains a weak spot.

Source: Gavekal

Source: Gavekal

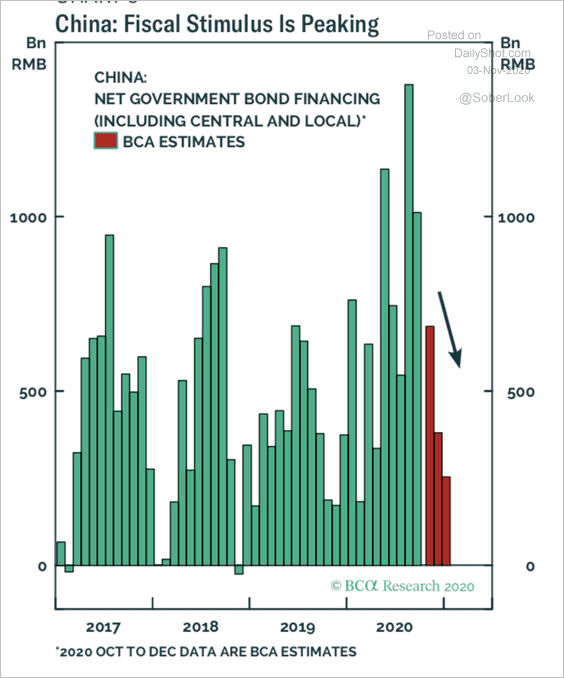

6. Fiscal stimulus has peaked.

Source: BCA Research

Source: BCA Research

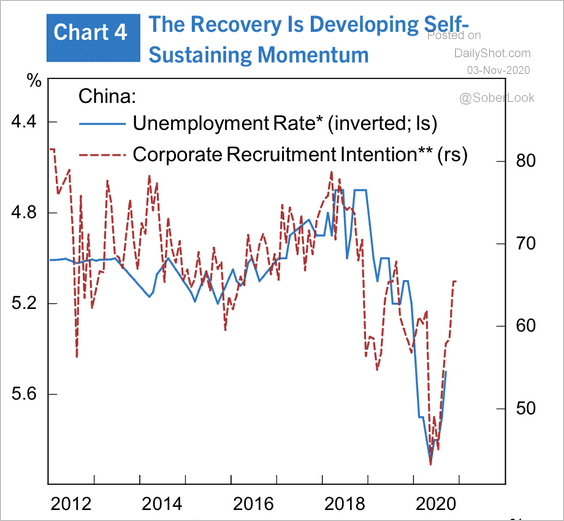

7. The economic rebound has boosted corporate hiring intentions.

Source: Alpine Macro

Source: Alpine Macro

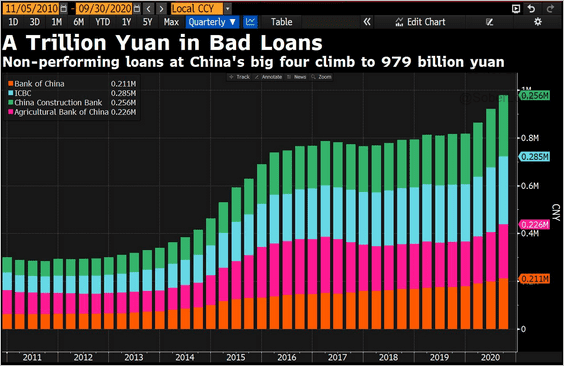

8. Nonperforming loan balances rose this year.

Source: @DavidInglesTV

Source: @DavidInglesTV

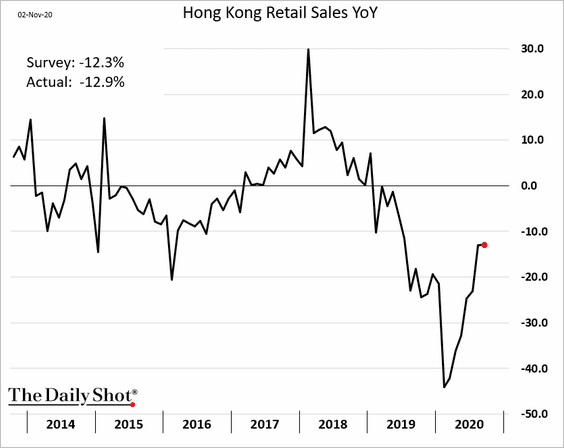

9. The recovery in Hong Kong’s retail sales has stalled.

Emerging Markets

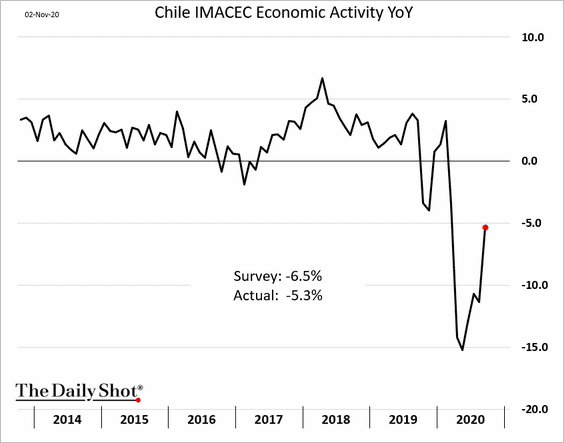

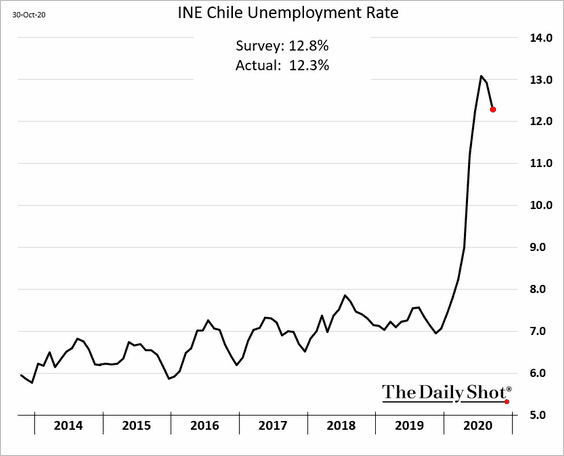

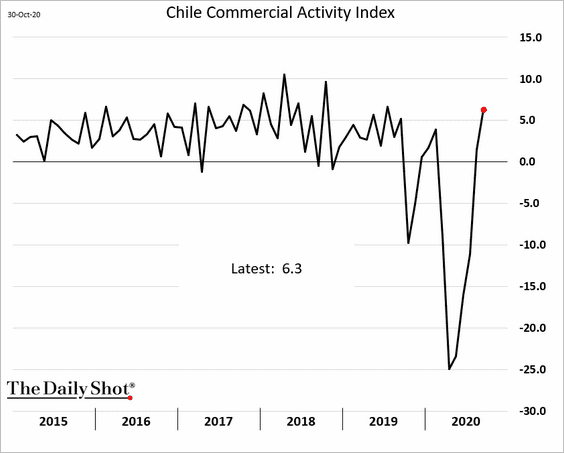

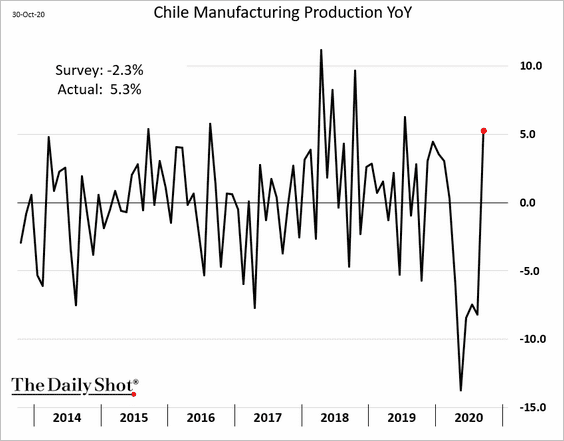

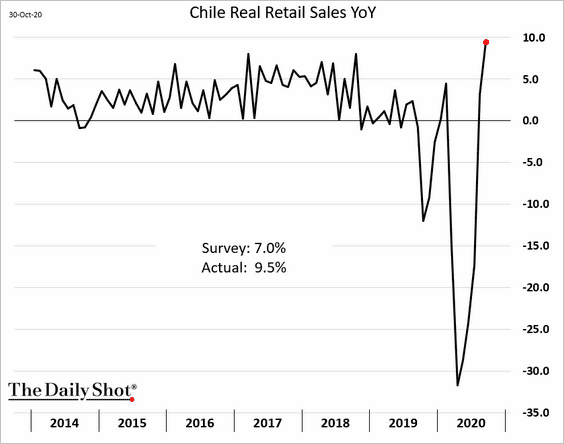

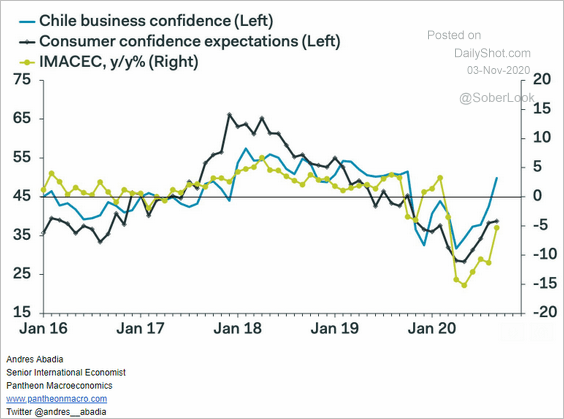

1. Let’s begin with Chile, where the recovery has picked up momentum.

• Economic activity:

• The unemployment rate (off the highs):

• Commercial activity index:

• Industrial production:

• Retail sales:

• Consumer and business sentiment:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

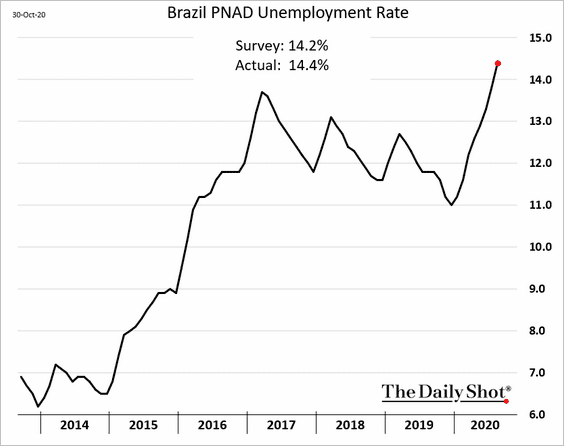

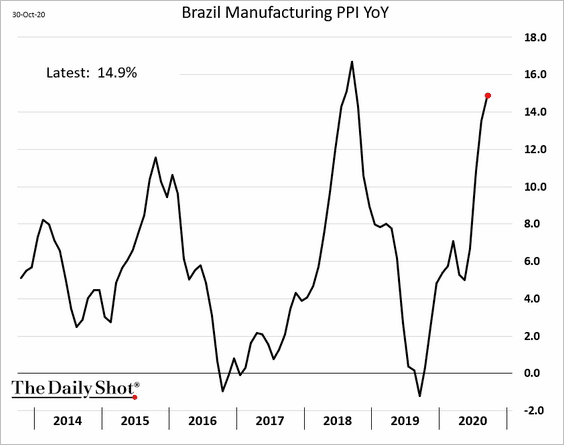

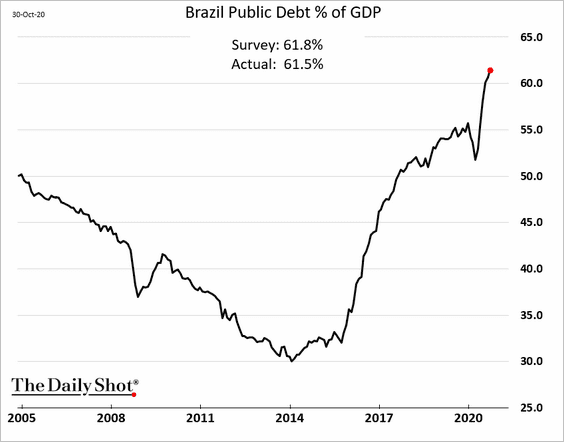

2. Here are some updates on Brazil.

• Unemployment:

• Manufacturing output prices:

• Debt-to-GDP ratio:

——————–

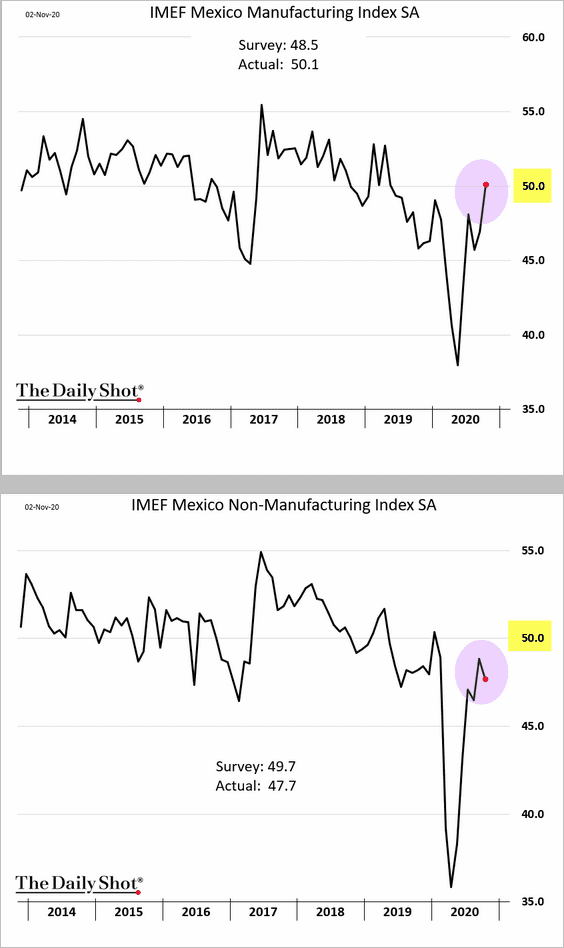

3. Next, let’s look at some manufacturing PMI trends.

• Mexico (manufacturing and services diverge):

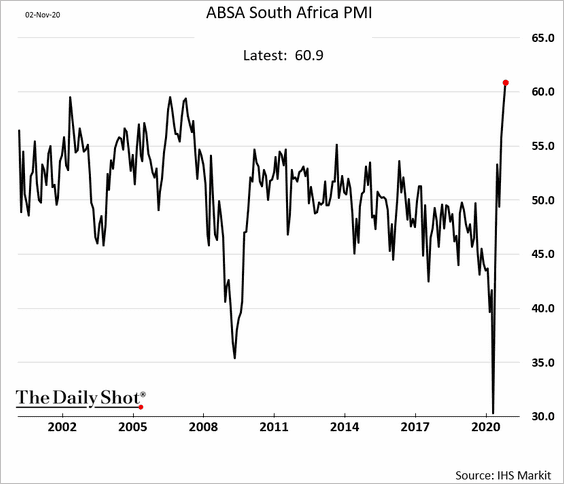

• Sout Africa PMI (record high):

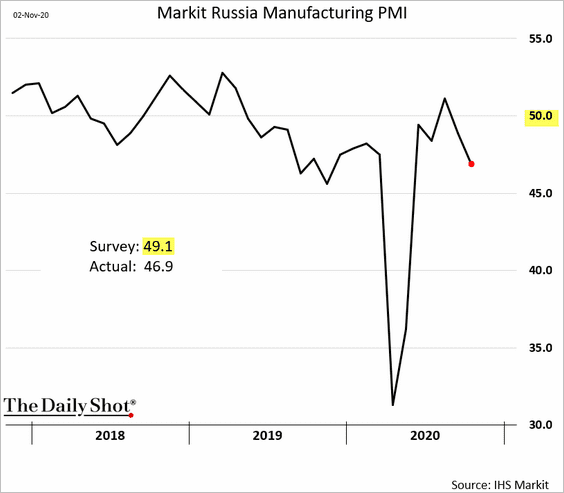

• Russia (back in contraction mode):

Energy

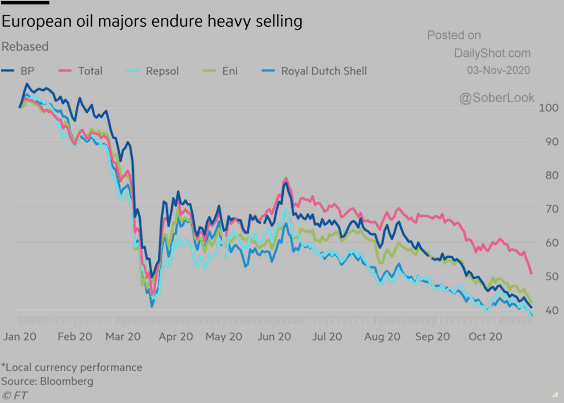

1. European oil and gas stocks have been under significant pressure this year.

Source: @FT Read full article

Source: @FT Read full article

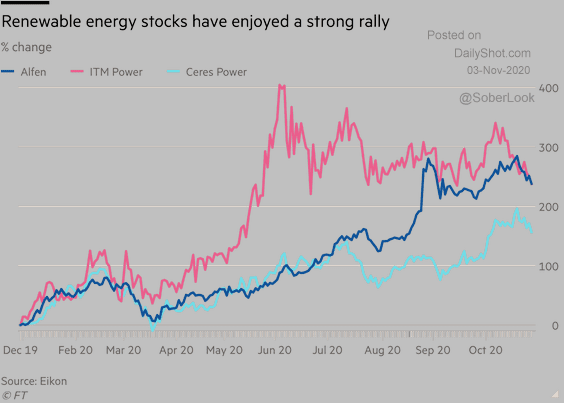

Meanwhile, European renewable stocks have rallied.

Source: @FT Read full article

Source: @FT Read full article

——————–

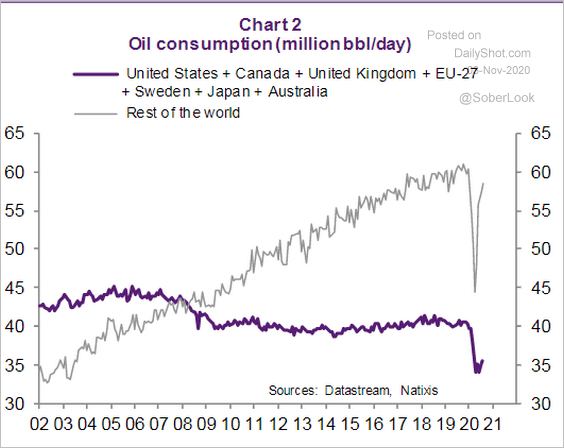

2. Natixis expects a “relatively stable demand for oil, mainly from consumption in emerging countries, and a fairly rapid increase in natural gas consumption.”

Source: Natixis

Source: Natixis

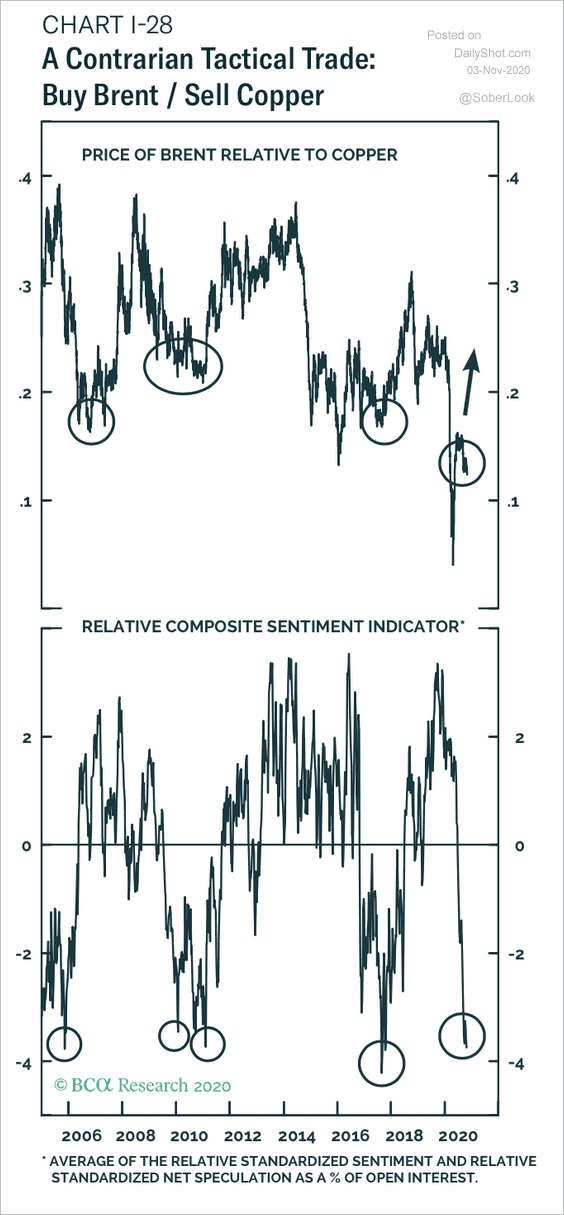

3. Negative sentiment in crude oil has reached an extreme versus copper.

Source: BCA Research

Source: BCA Research

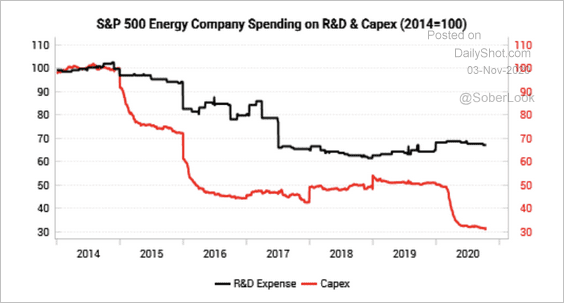

4. Low oil prices have reduced the incentive to invest in R&D and new projects. Have we reached the bottom?

Source: Variant Perception

Source: Variant Perception

Equities

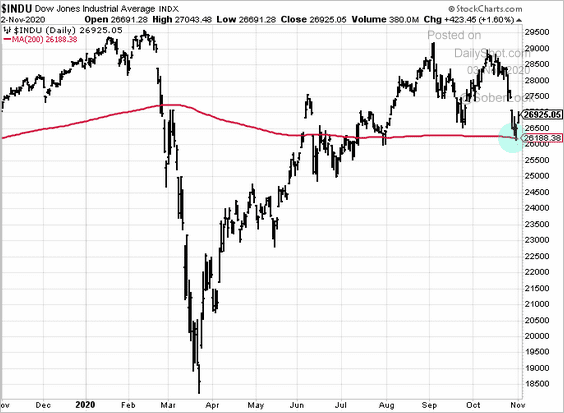

1. The Dow held support at the 200-day moving average.

h/t Nancy Moran

h/t Nancy Moran

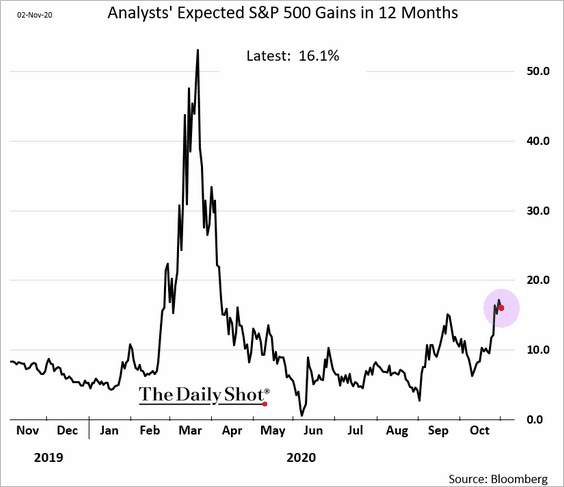

2. Analysts expect the S&P 500 to be up about 16% a year from now.

h/t Nancy Moran

h/t Nancy Moran

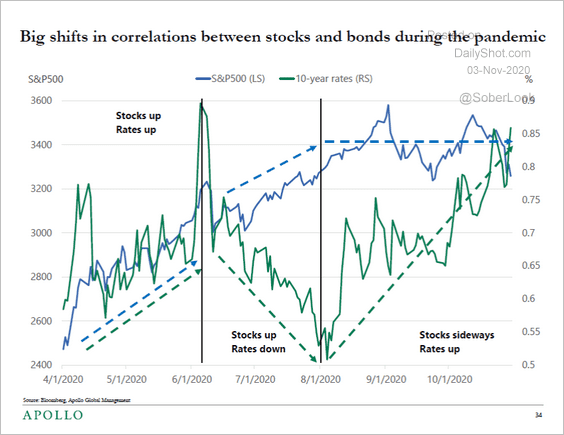

3. We’ve had significant shifts in correlations between stocks and bonds this year.

Source: Torsten Slok; Apollo Global Management

Source: Torsten Slok; Apollo Global Management

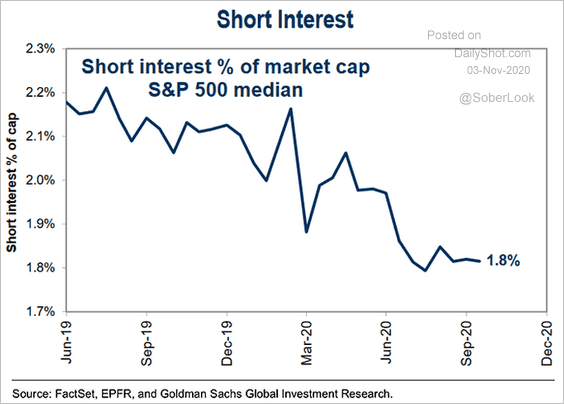

4. Short interest in S&P 500 shares remains depressed.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

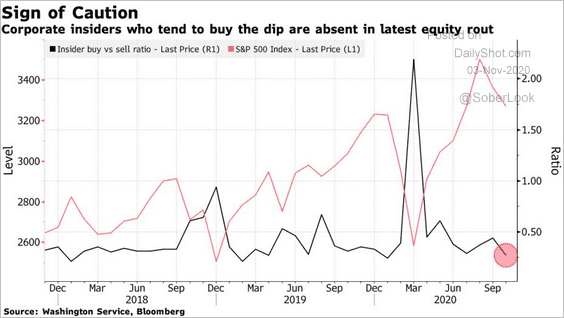

5. Insiders have been staying put ahead of the elections.

Source: @markets Read full article

Source: @markets Read full article

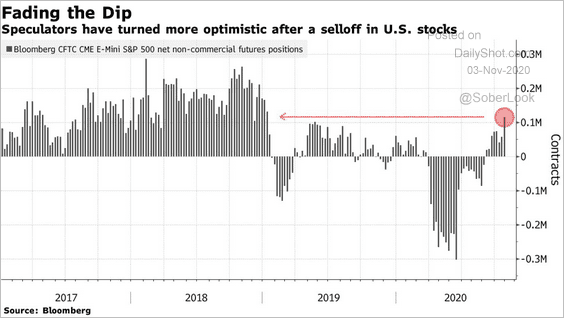

6. Speculative accounts have boosted their bets on S&P 500 futures.

Source: @jessefelder, @markets Read full article

Source: @jessefelder, @markets Read full article

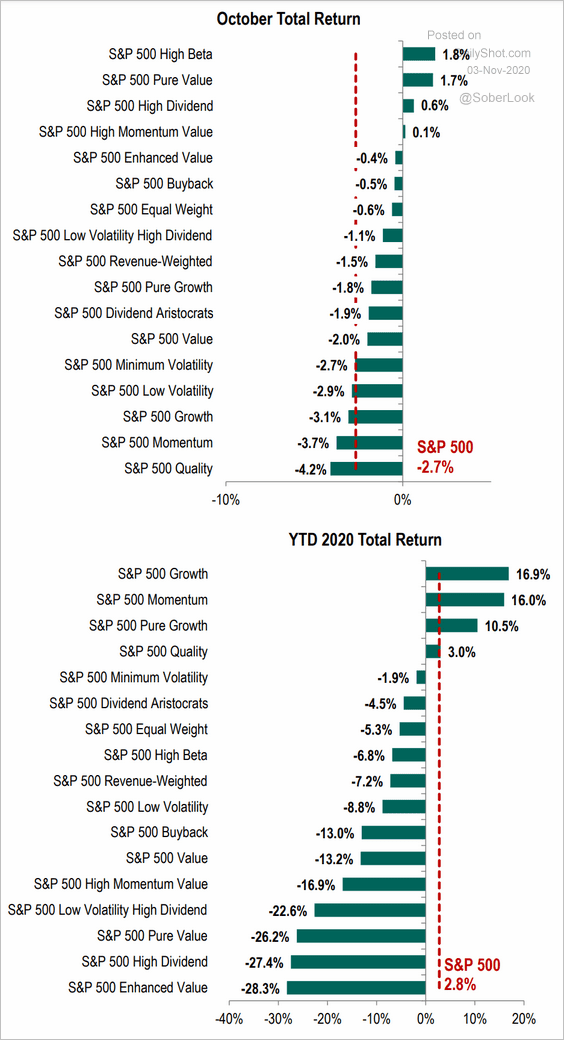

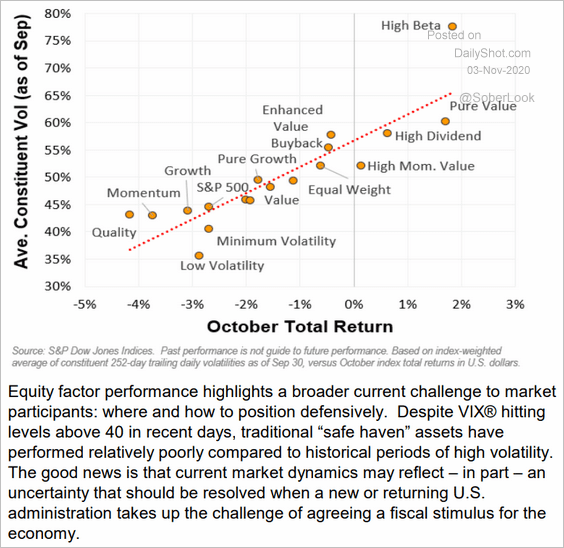

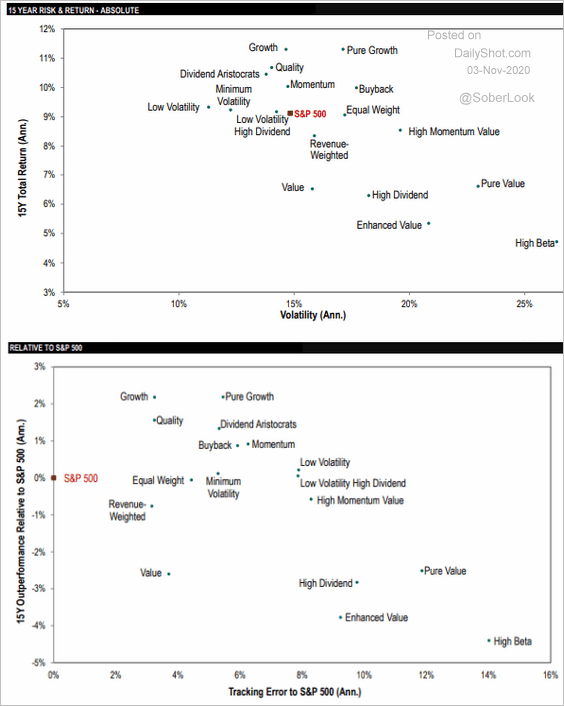

7. Finally, we have some updates on equity factor performance (from S&P Global).

• October and year-to-date returns:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

• Average constituent volatility vs. October returns:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

• Long-term returns vs. vol:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Rates

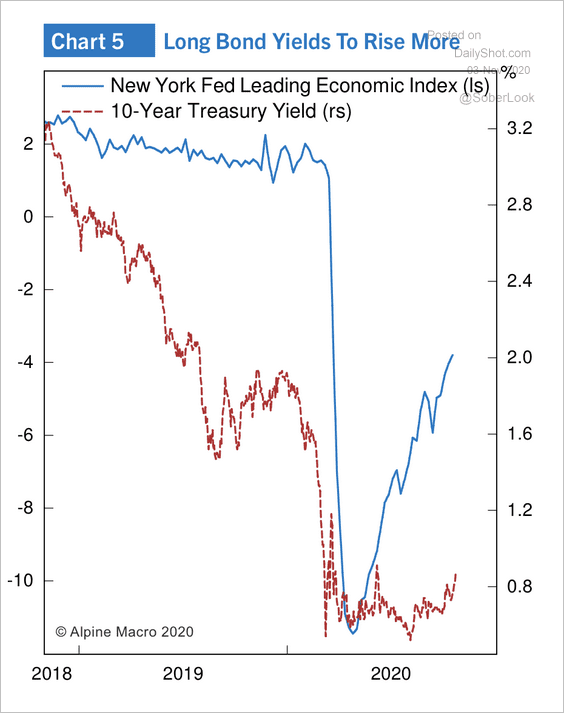

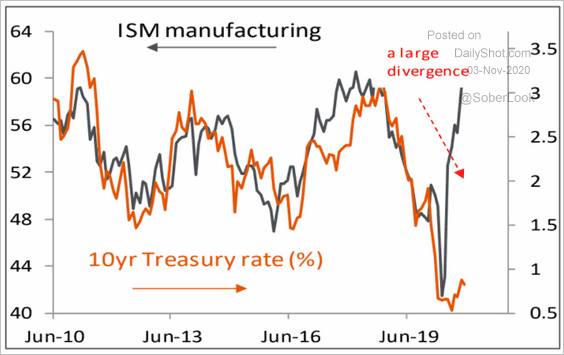

1. Fundamentals continue to signal higher Treasury yields (2 charts).

Source: Gavekal

Source: Gavekal

Source: Piper Sandler

Source: Piper Sandler

——————–

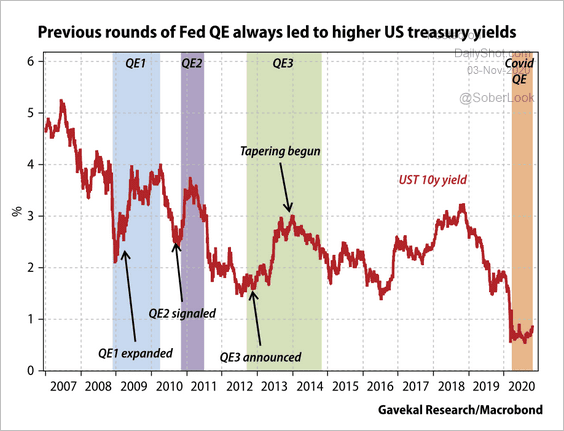

2. QE typically results in higher Treasury yields.

Source: Gavekal

Source: Gavekal

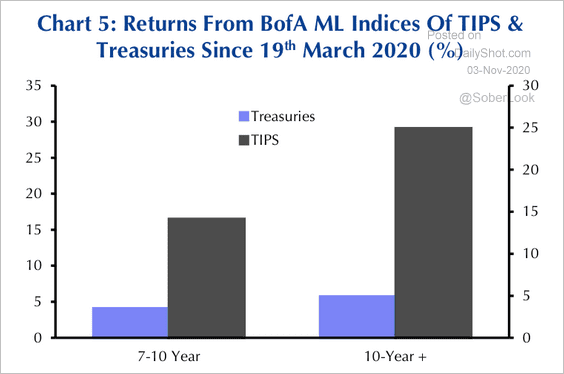

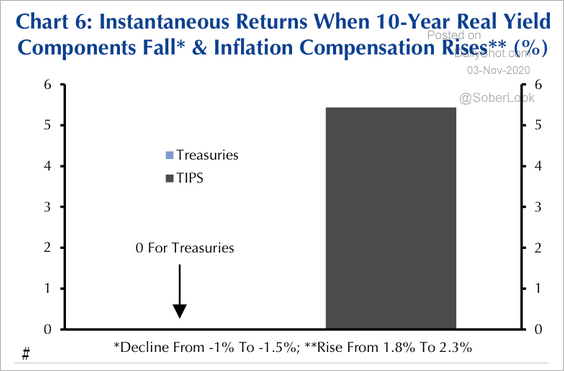

3. The gap in returns for TIPs and Treasuries has been larger for longer-dated maturities this year.

Source: Capital Economics

Source: Capital Economics

TIPs significantly outperform Treasuries when real yields fall and inflation expectations rise, according to Capital Economics.

Source: Capital Economics

Source: Capital Economics

Global Developments

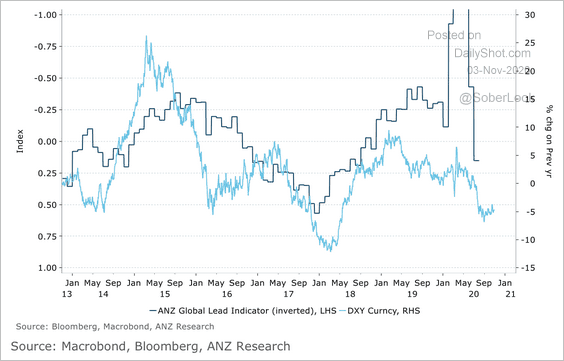

1. The global growth outlook will have a significant influence on the dollar over the next 12 months, according to ANZ.

Source: ANZ Research

Source: ANZ Research

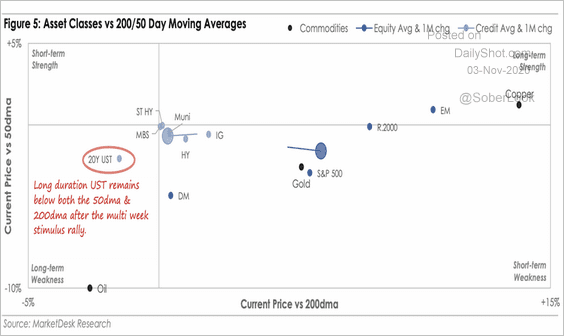

2. This chart shows asset classes relative to their 50 and 200-day moving averages.

Source: MarketDesk Research

Source: MarketDesk Research

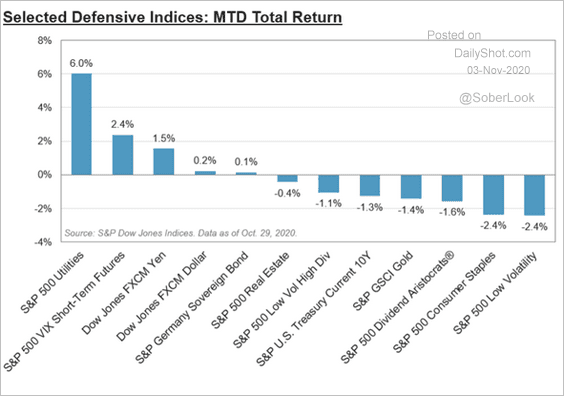

3. How did defensive indices perform last month?

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

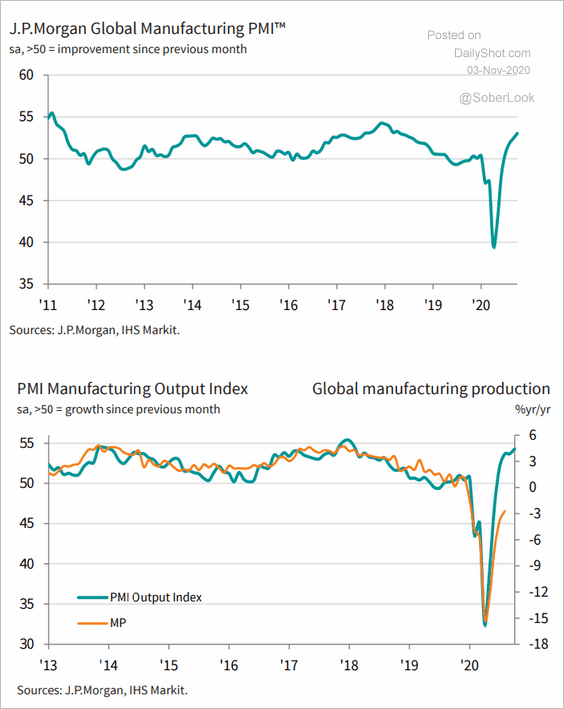

4. Global manufacturing growth strengthened in October.

Source: @WilliamsonChris, @IHSMarkit Read full article

Source: @WilliamsonChris, @IHSMarkit Read full article

——————–

Food for Thought

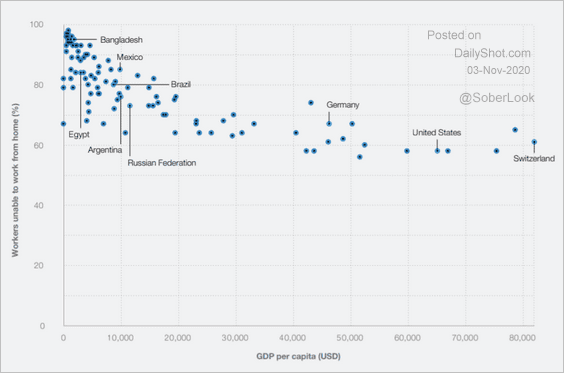

1. Ability to work from home vs. GDP per capita:

Source: WEF Read full article

Source: WEF Read full article

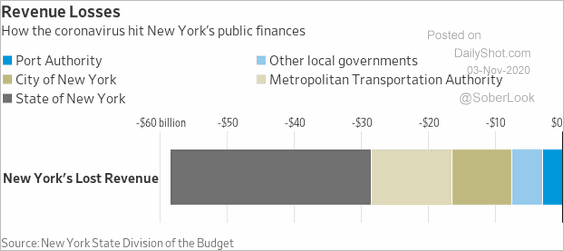

2. New York City’s revenue losses:

Source: @WSJ Read full article

Source: @WSJ Read full article

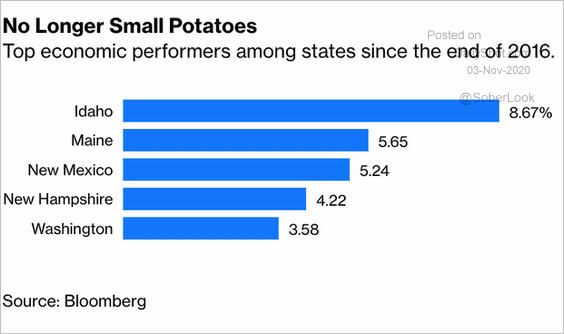

3. States with best economic performance:

Source: @bopinion Read full article

Source: @bopinion Read full article

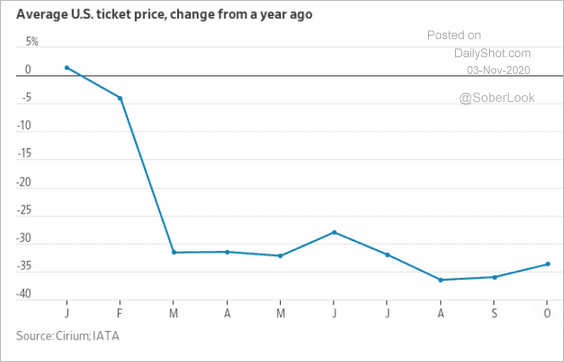

4. US airline ticket prices:

Source: @WSJ Read full article

Source: @WSJ Read full article

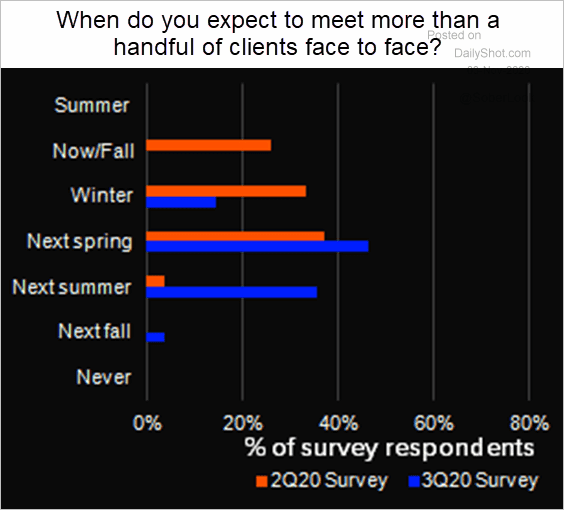

5. When do you expect to meet more than a handful of clients face to face?

Source: @LPCLoans

Source: @LPCLoans

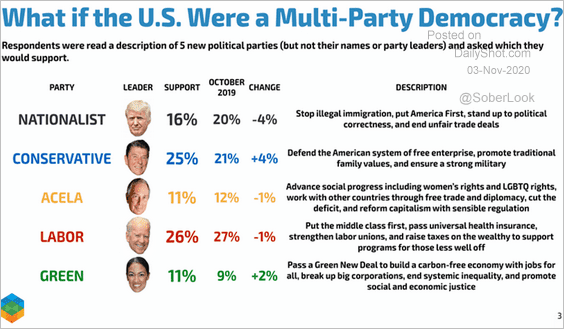

6. What if the US were a multi-party Democracy?

Source: Echelon Insights

Source: Echelon Insights

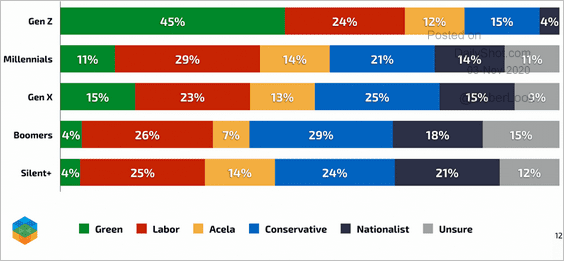

Who would support these parties?

Source: Echelon Insights

Source: Echelon Insights

——————–

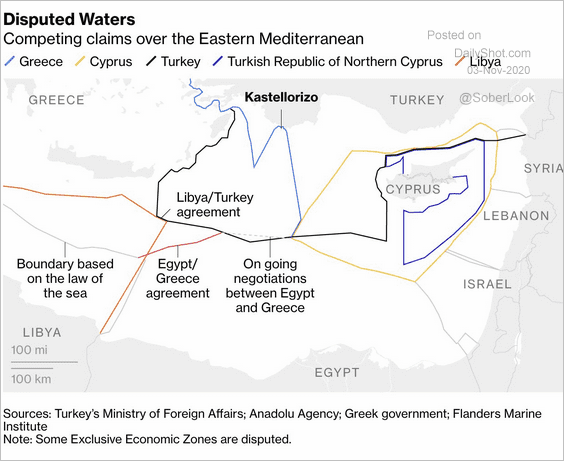

7. Competing claims over the Eastern Mediterranean:

Source: @bopinion Read full article

Source: @bopinion Read full article

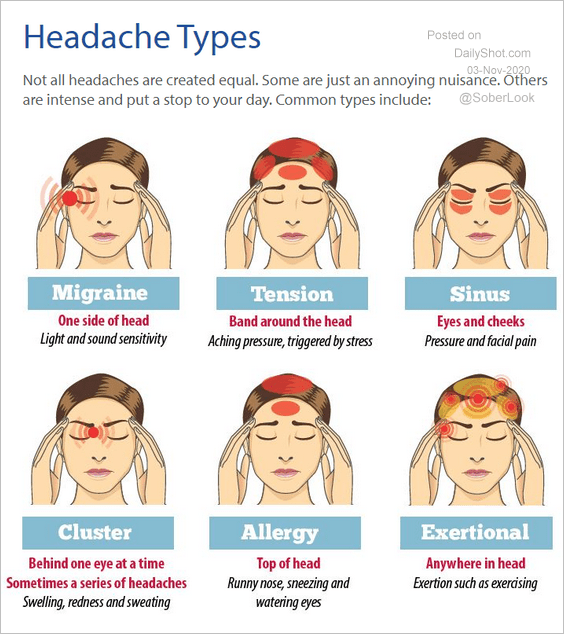

8. Headache types:

Source: CHI Health Read full article

Source: CHI Health Read full article

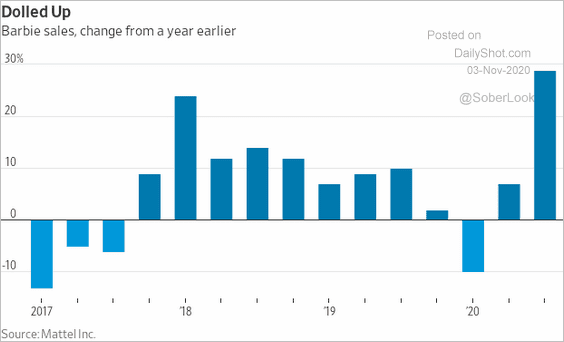

9. Barbie doll sales:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–