The Daily Shot: 04-Nov-20

• The United States

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

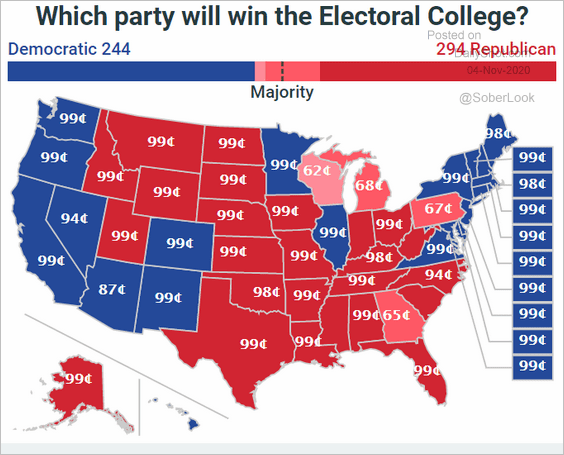

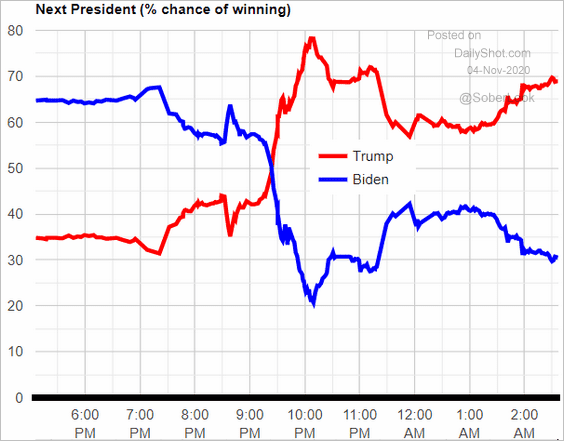

1. While the US election is still too close to call, as of 3:00 AM EST, the betting markets were projecting a victory for President Trump.

• The electoral map:

Source: @PredictIt

Source: @PredictIt

• Probability of victory based on the betting markets (2 charts):

Source: ElectionBettingOdds.com

Source: ElectionBettingOdds.com

Source: FTX

Source: FTX

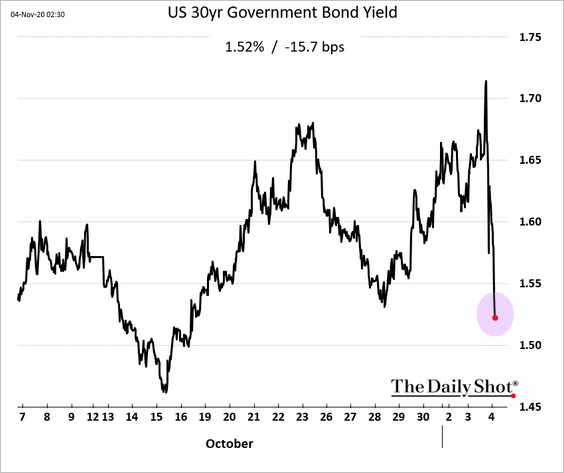

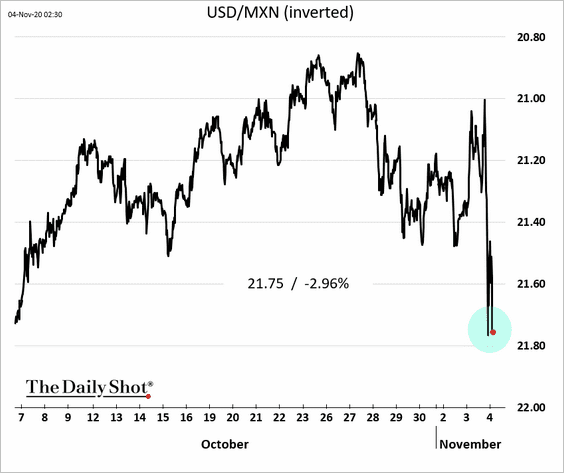

That is not the outcome global markets have been expecting.

• Treasury yields tumbled due to lower chances of a massive fiscal stimulus package.

• Stock futures first rallied but later reversed course. This is also due to lower chances of stimulus as well as a possibility of contested election results.

• The Mexican peso tumbled 3%.

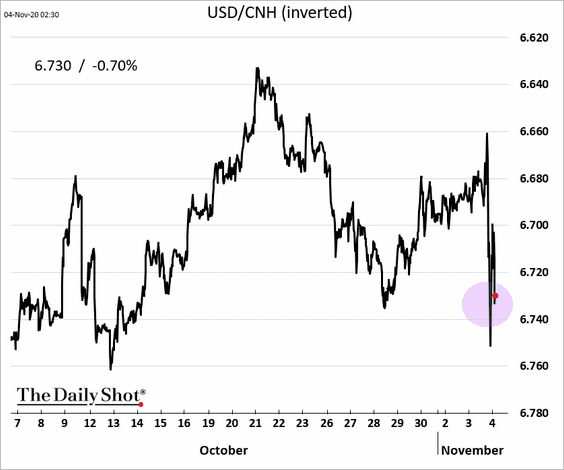

• The yuan is also under pressure.

——————–

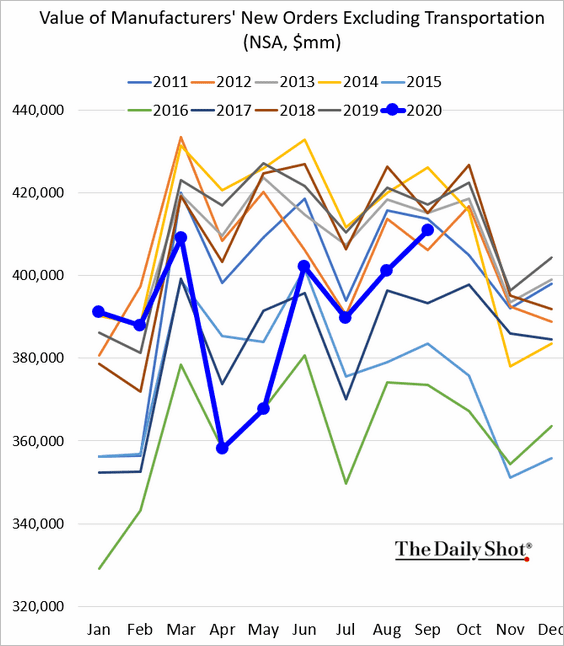

2. US manufacturing orders continue to recover but remain below last year’s levels.

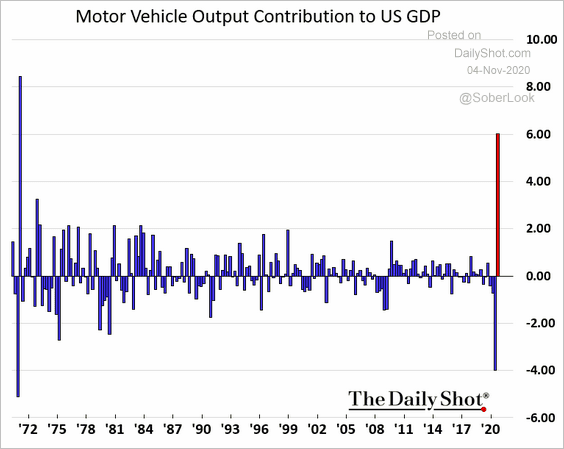

• Will motor vehicles continue to power the nation’s manufacturing recovery? Here is the sector’s contribution to the GDP (%, through Q3).

h/t Melinda Grenier

h/t Melinda Grenier

——————–

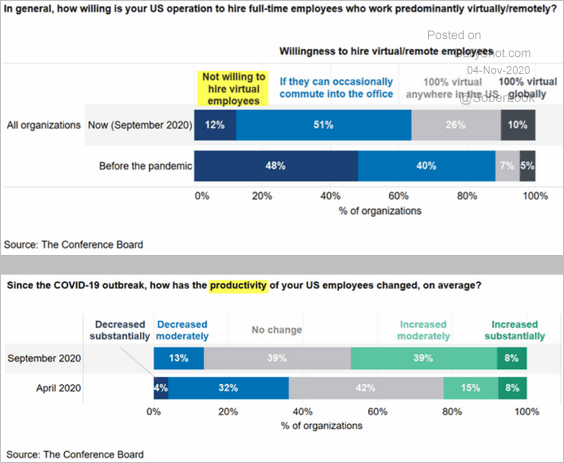

3. Companies are becoming more comfortable with remote workers and increasingly see this shift improving productivity.

Source: The Conference Board

Source: The Conference Board

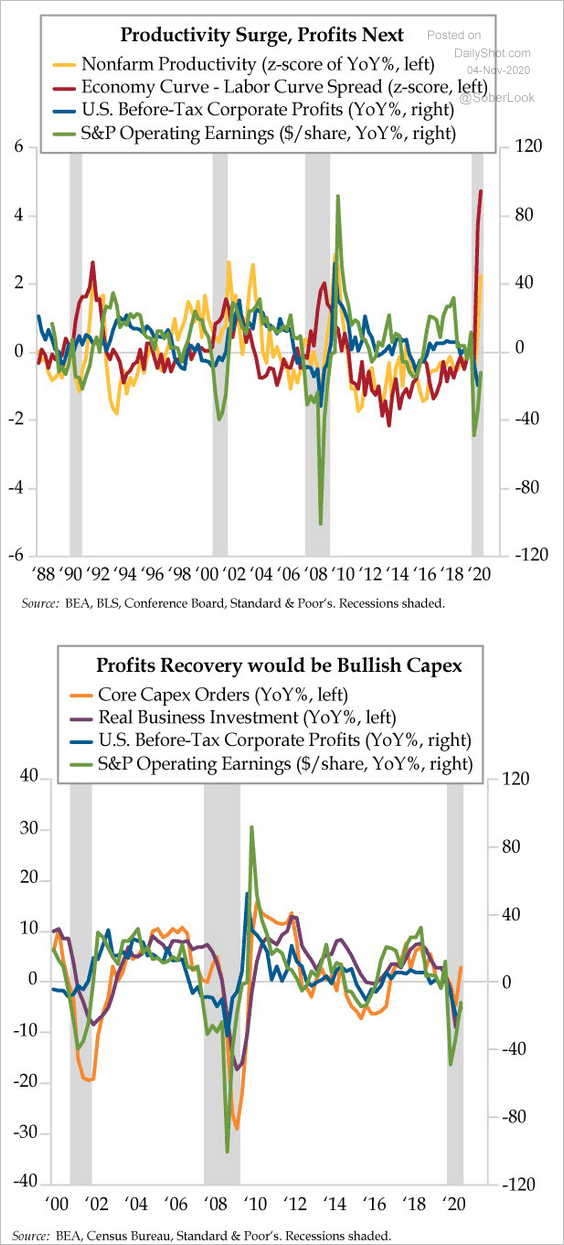

US businesses have been able to operate with a smaller workforce, which is also boosting productivity. Will we see higher profits and CapEx as a result of these trends?

Source: The Daily Feather

Source: The Daily Feather

——————–

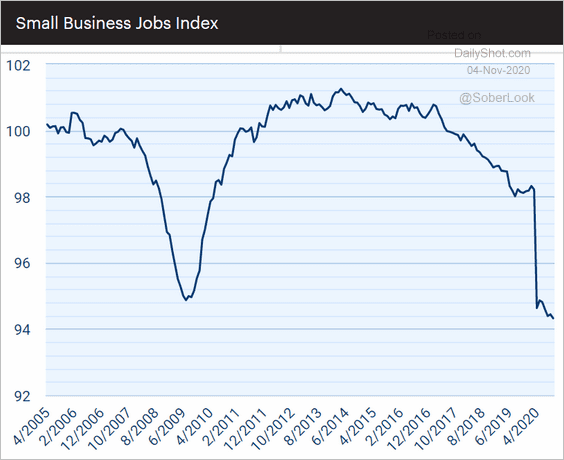

4. Small Business employment remains depressed, according to Paychex/IHS Markit Small Business Employment Watch.

Source: Paychex/IHS Markit Small Business Employment Watch Read full article

Source: Paychex/IHS Markit Small Business Employment Watch Read full article

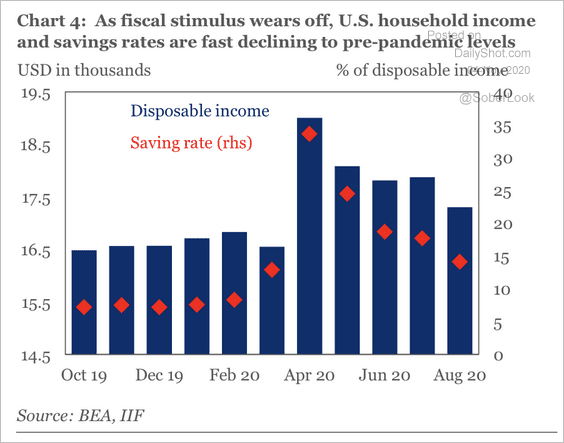

5. Household income and savings rates are heading toward pre-pandemic levels.

Source: IIF

Source: IIF

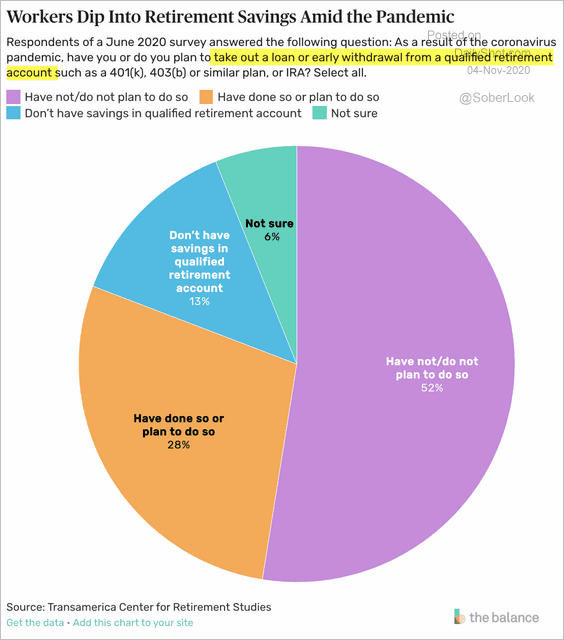

6. A substantial percentage of US households are tapping their retirement savings this year.

Source: Investopedia, The Balance

Source: Investopedia, The Balance

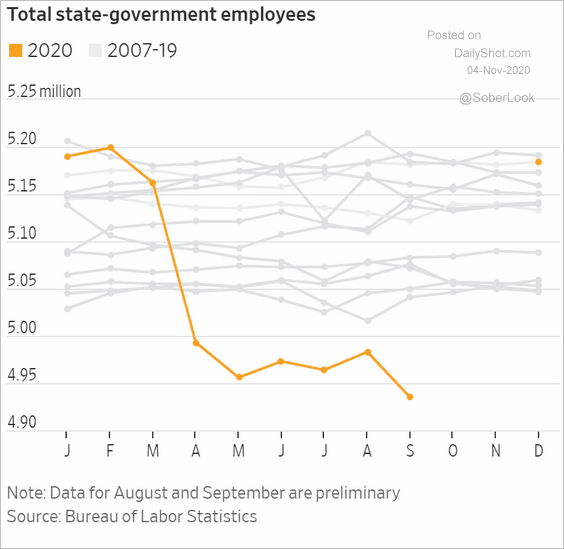

7. Finally, this chart shows the 2020 state-government employment vs. previous years.

Source: @WSJ Read full article

Source: @WSJ Read full article

The Eurozone

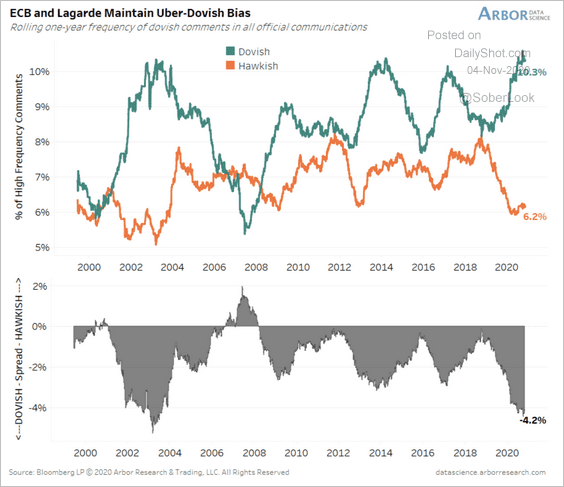

1. Based on the ECB’s official communications, the central bank has been increasingly dovish as it gears up for further bond buying in December.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

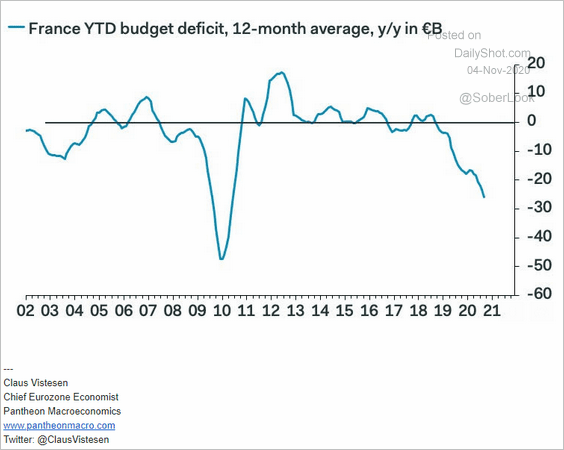

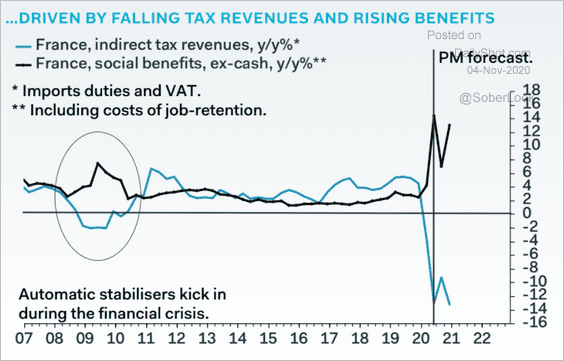

2. The fiscal situation in France has deteriorated sharply (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

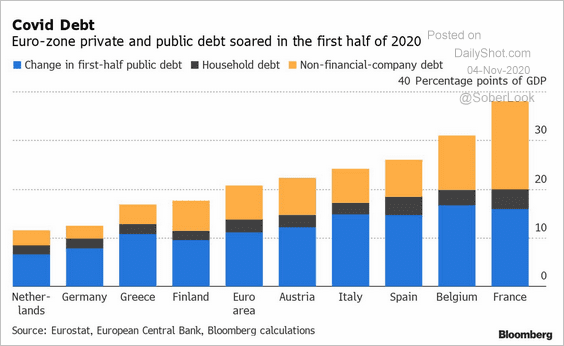

3. Here is the total debt growth in the first half of 2020, by country.

Source: @markets Read full article

Source: @markets Read full article

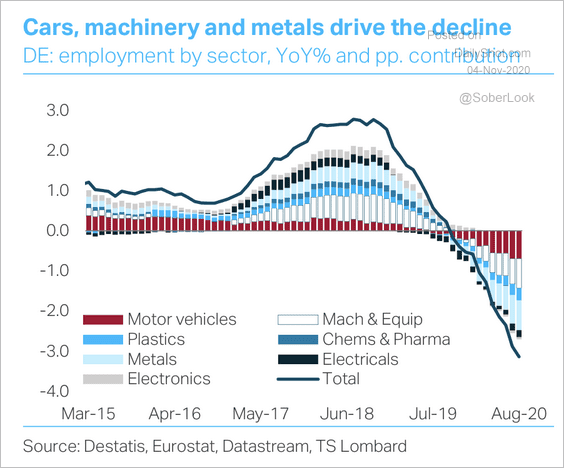

4. Below are a couple of updates on Germany.

• German industrial employment by sector:

Source: TS Lombard

Source: TS Lombard

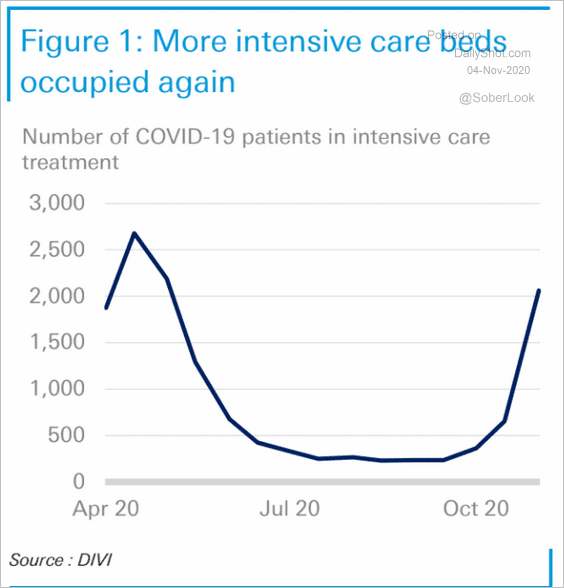

• Occupied intensive care beds:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

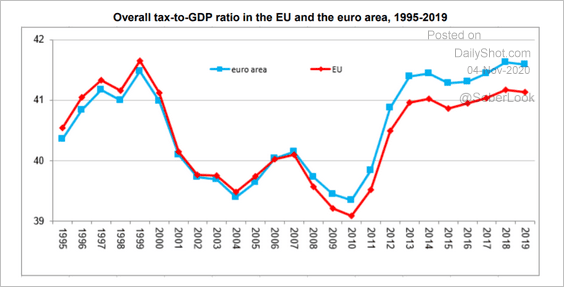

5. Finally, we have the Eurozone’s (and EU’s) overall tax-to-GDP ratio.

Source: Eurostat Read full article

Source: Eurostat Read full article

Europe

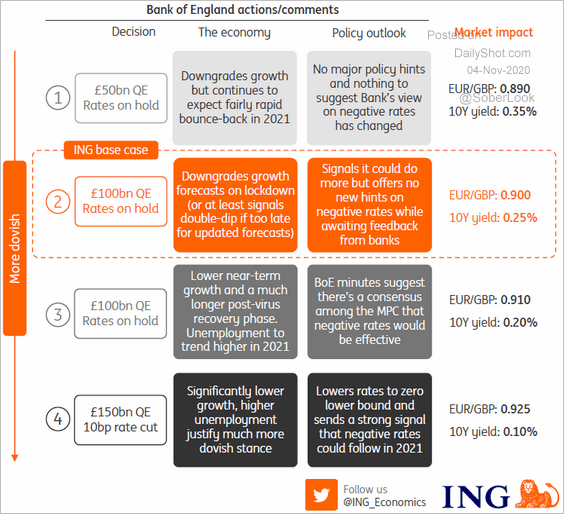

1. What should we expect from the Bank of England on Thursday, and what will be the impact on the markets?

Source: ING

Source: ING

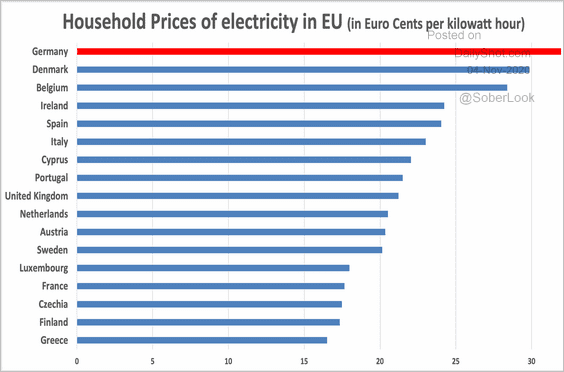

2. This chart compares electricity prices across the EU.

Source: @Schuldensuehner

Source: @Schuldensuehner

Asia – Pacific

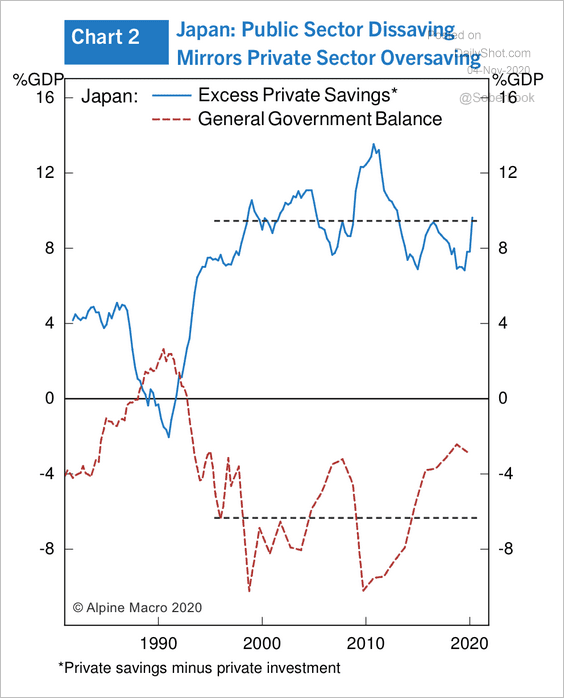

1. Japan’s private sector has run a large savings surplus over the past 30 years.

Source: Alpine Macro

Source: Alpine Macro

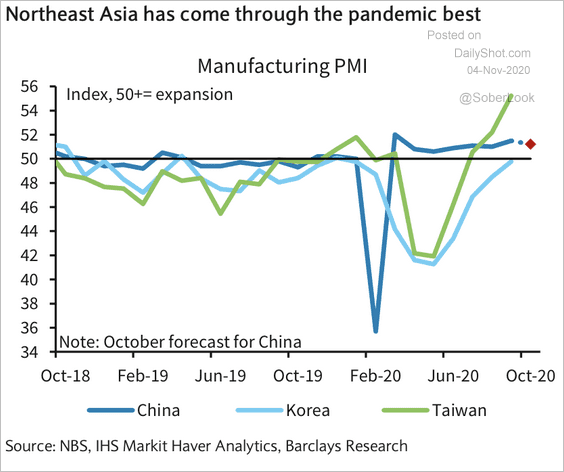

2. Taiwan’s manufacturing recovery has outpaced China and Korea.

Source: Barclays Research

Source: Barclays Research

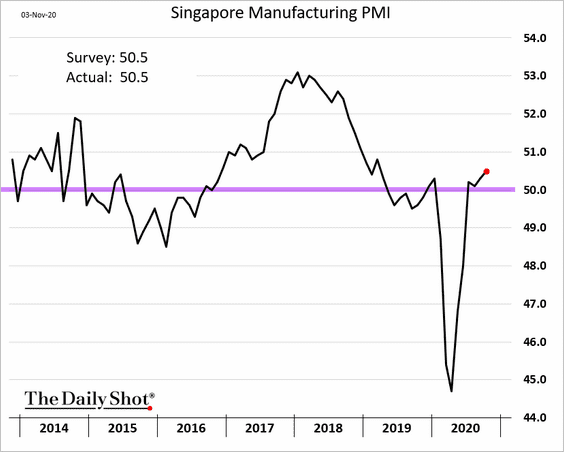

3. Singapore’s factory activity strengthened in October.

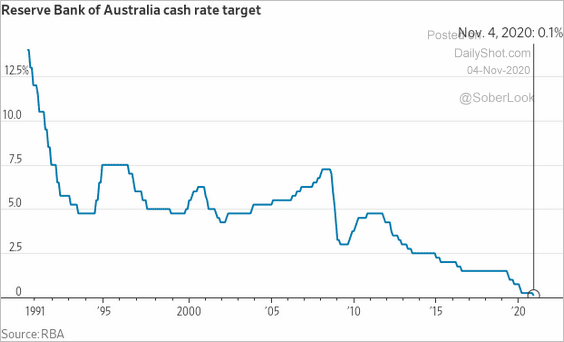

4. The RBA cut rates (as expected) and announced a A$ 100 bond-buying program.

Source: @WSJ Read full article

Source: @WSJ Read full article

China

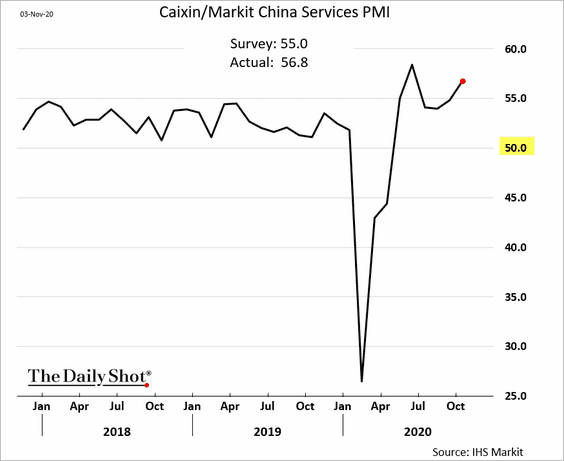

1. Service sector growth accelerated last month, as China’s economy continues its impressive rebound.

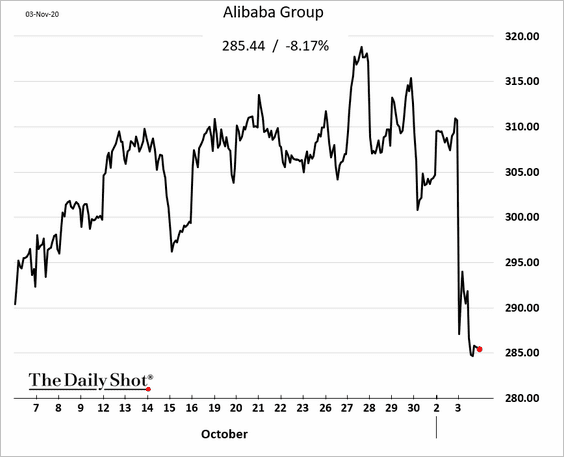

2. Beijing halted the Ant Group IPO, with regulators now planning to discourage banks from working with the firm. There seems to be some concern about Ant’s size posing risks for the financial system.

Source: @technology Read full article

Source: @technology Read full article

——————–

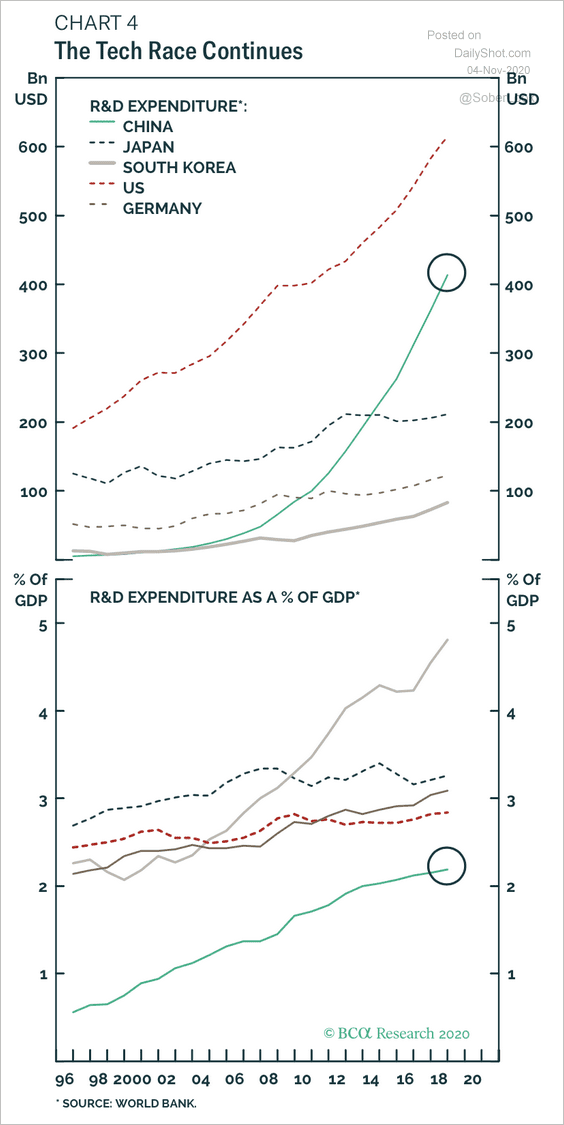

3. China’s spending on research and development has accelerated in recent years (although R&D is flattening out as a percent of GDP).

Source: BCA Research

Source: BCA Research

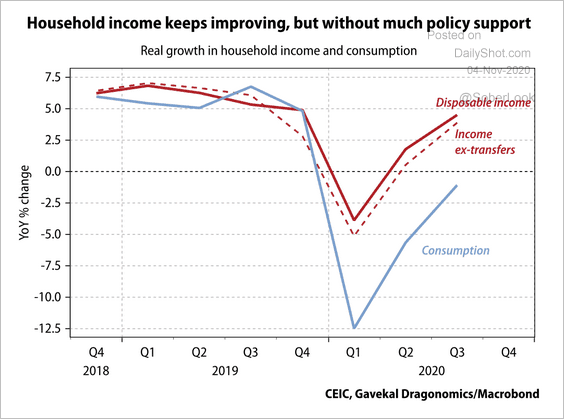

4. Disposable income is improving but may require additional government support to encourage spending.

Source: Gavekal

Source: Gavekal

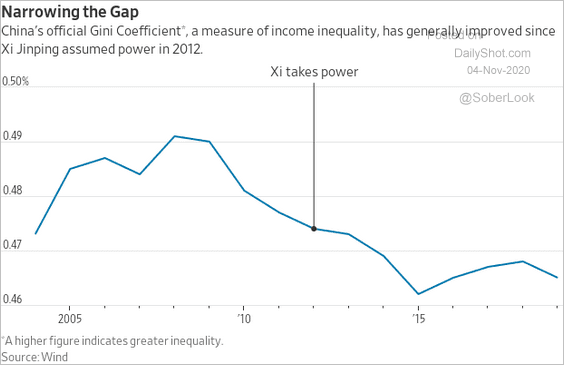

5. Here is China’s Gini Coefficient.

Source: @jeffsparshott, @WSJ

Source: @jeffsparshott, @WSJ

Emerging Markets

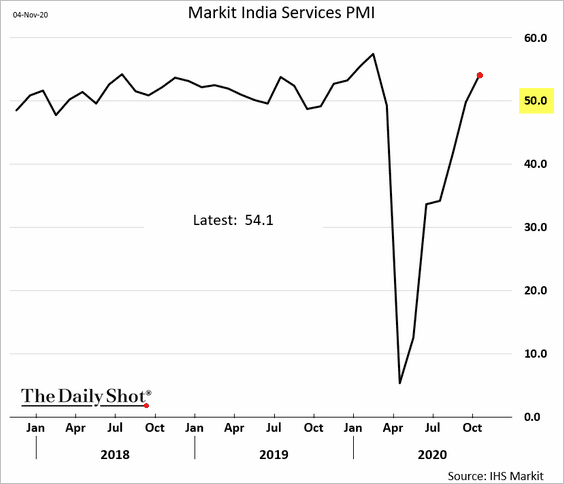

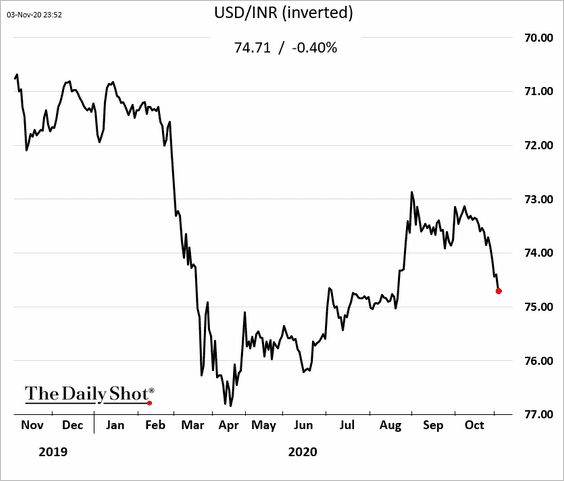

1. India’s service sector is now firmly in growth mode.

The rupee continues to slide.

——————–

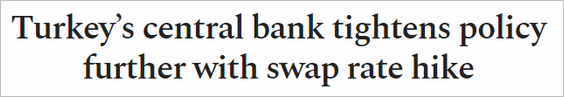

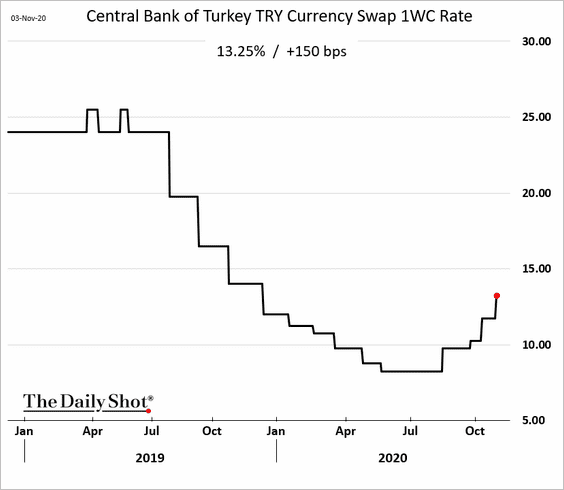

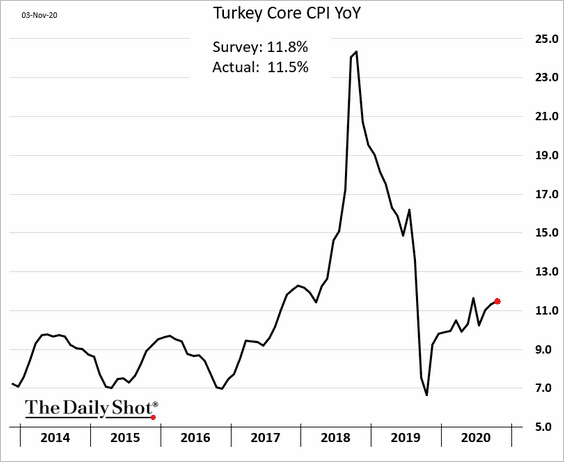

2. Worried about the lira’s persistent decline, the Turkish central bank tightened liquidity (by raising the currency swap rate).

Source: Daily Sabah Read full article

Source: Daily Sabah Read full article

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

The currency bounced from the lows.

• The lira’s extreme weakness will keep putting upward pressure on inflation.

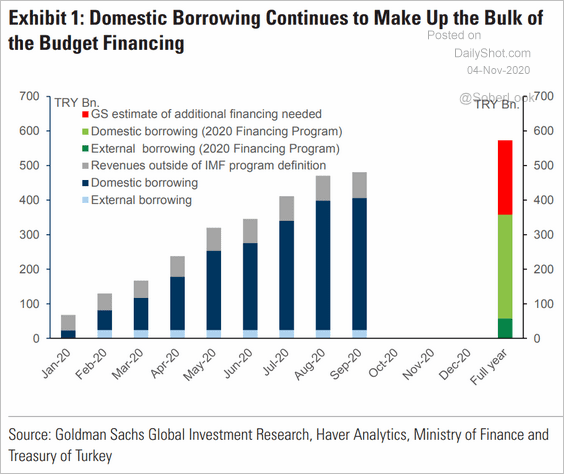

• The government continues to rely on domestic funding for the bulk of its budget financing.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

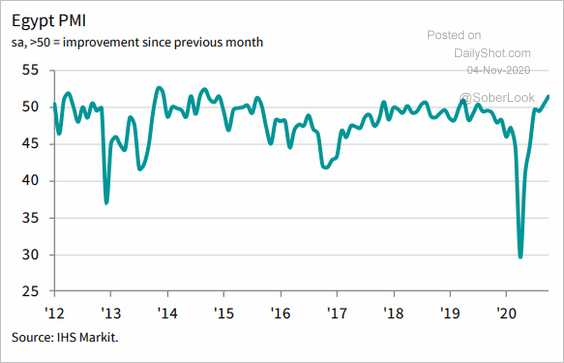

3. Egypt’s business activity is expanding at the fastest pace in years.

Source: IHS Markit Read full article

Source: IHS Markit Read full article

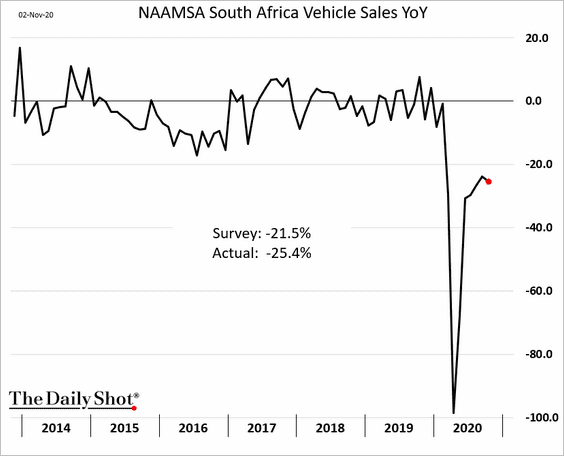

4. South Africa’s vehicle sales recovery has stalled.

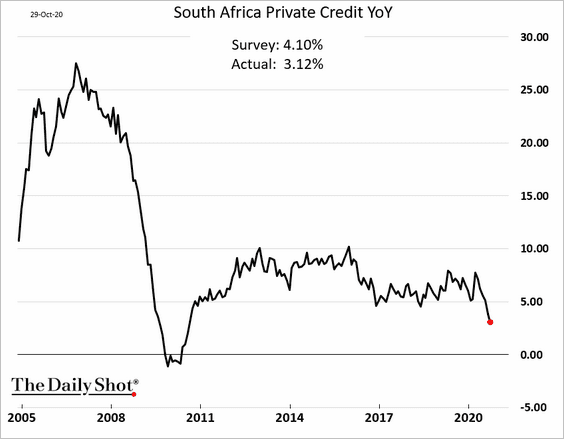

And credit growth continues to slow.

——————–

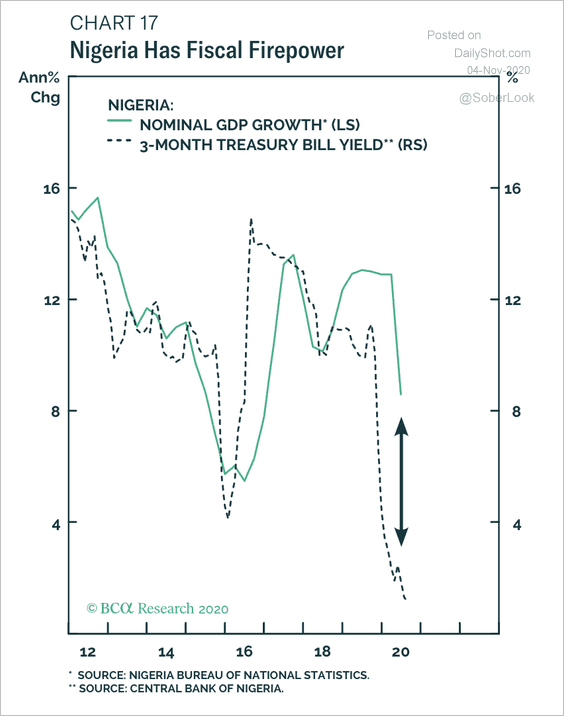

5. In Nigeria, nominal GDP growth is above short-term rates. This leaves room for the currency to fall and government spending to rise, according to BCA Research.

Source: BCA Research

Source: BCA Research

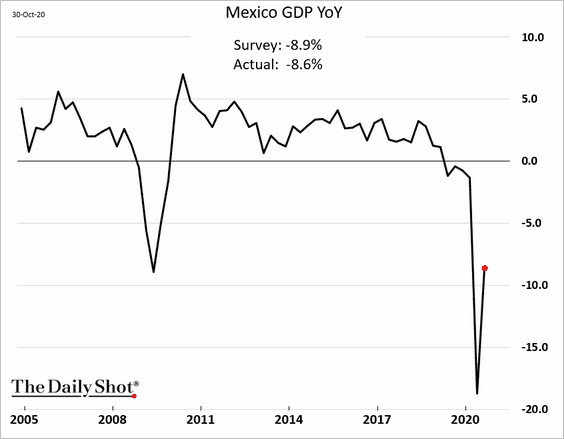

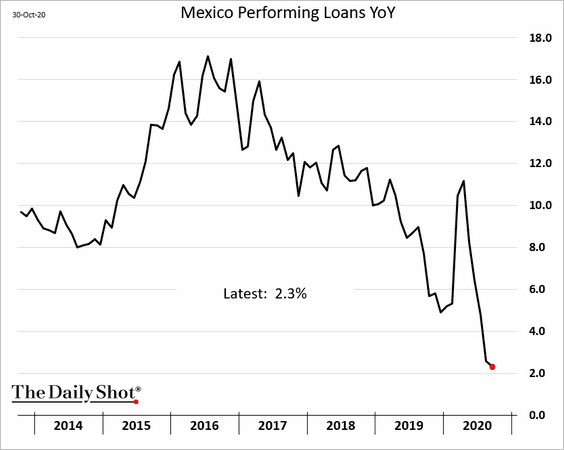

6. Mexico’s recovery has a long way to go.

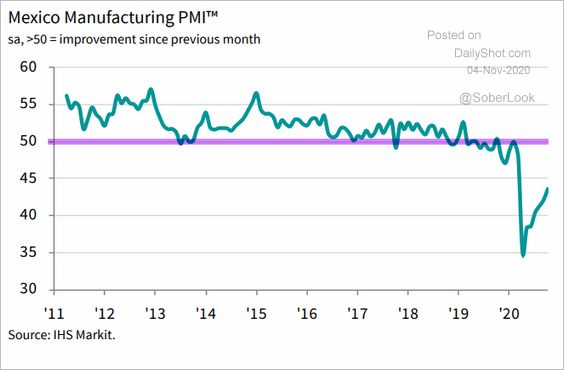

• Markit’s manufacturing PMI report suggests that Mexican factory activity is still in contraction mode (PMI < 50).

Source: IHS Markit Read full article

Source: IHS Markit Read full article

• Loan growth has been slowing.

——————–

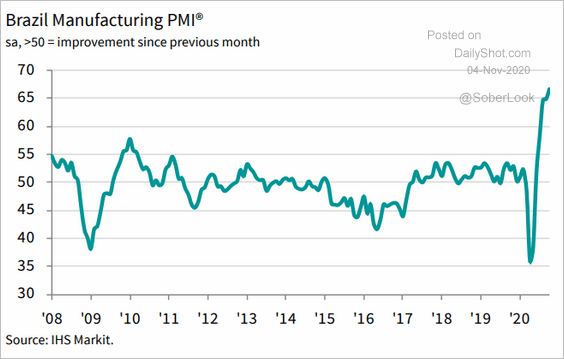

7. Brazil’s manufacturing PMI hit a record high, with the Markit report showing some price pressures.

Source: IHS Markit Read full article

Source: IHS Markit Read full article

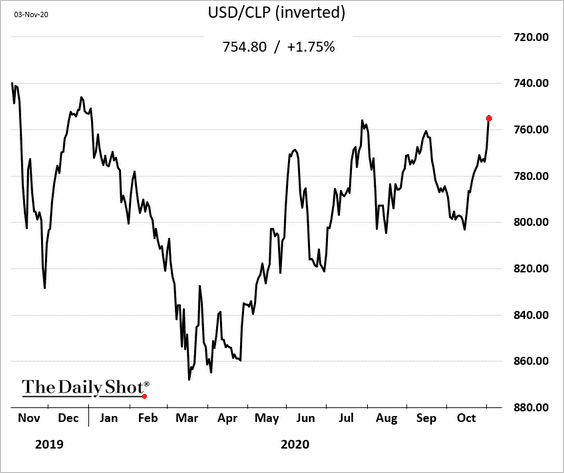

8. The Chilean peso hit the highest level since early January.

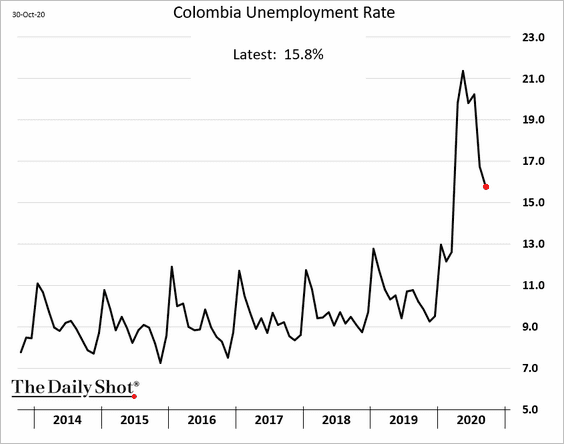

9. Colombia’s labor market continues to recover.

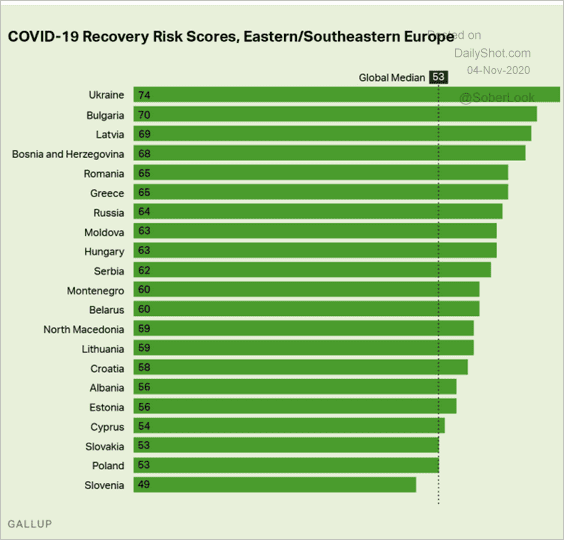

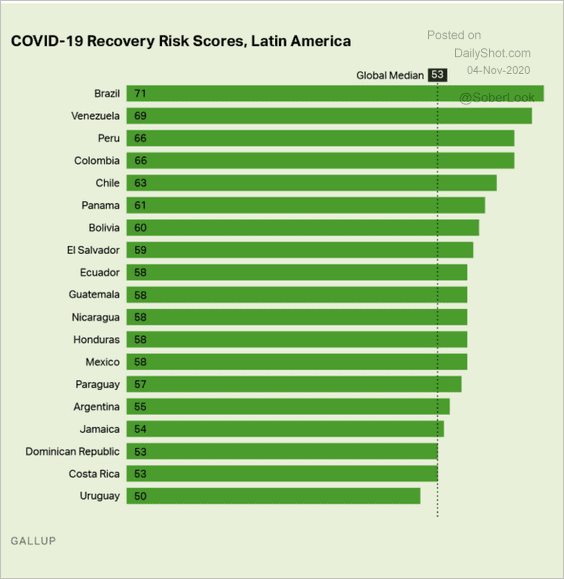

10. These charts from Gallup show which countries “are most likely to struggle with long-term efforts to deal with COVID-19 outbreaks and setbacks, according to a new measure that combines Gallup World Poll and Wellcome Global Monitor.”

Source: Gallup Read full article

Source: Gallup Read full article

Source: Gallup Read full article

Source: Gallup Read full article

Cryptocurrency

1. Bitcoin continues to test the $14k resistance.

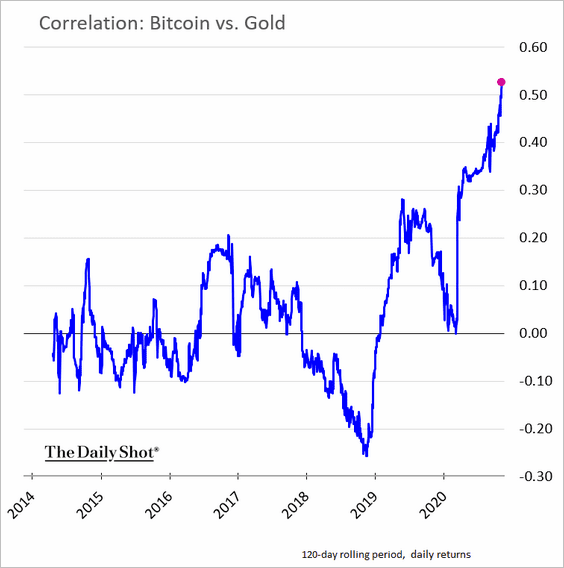

2. The correlation between Bitcoin in gold is at a multi-year high.

Commodities

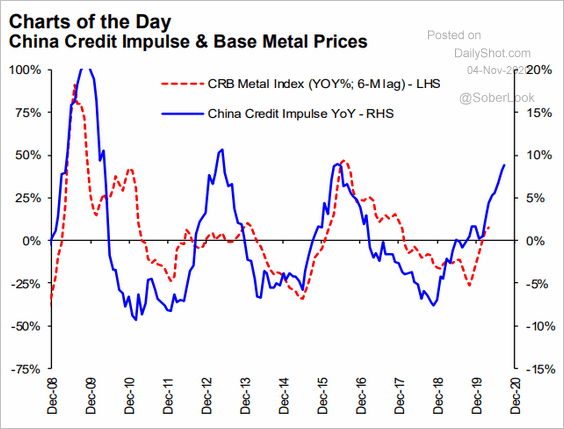

1. China’s credit impulse points to further upside for industrial metals.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

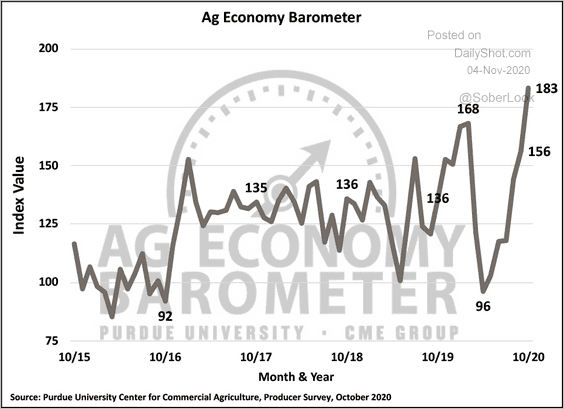

2. US farmers’ sentiment continues to climb as agricultural commodity prices rebound.

Source: Purdue University/CME Group Ag Economy Barometer

Source: Purdue University/CME Group Ag Economy Barometer

Energy

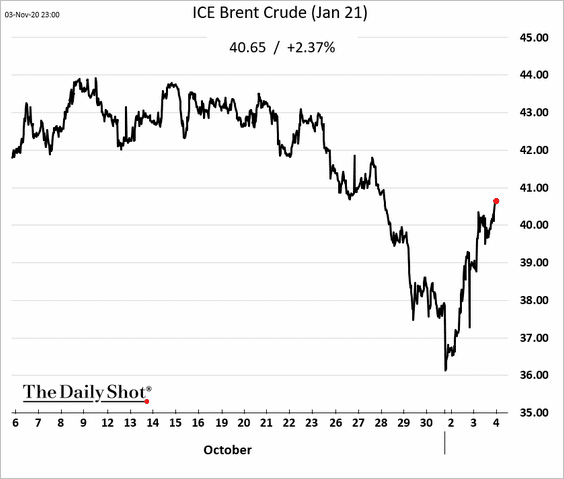

1. The active Brent crude contract is back above $40/bbl (there has been some talk of additional OPEC+ production cuts).

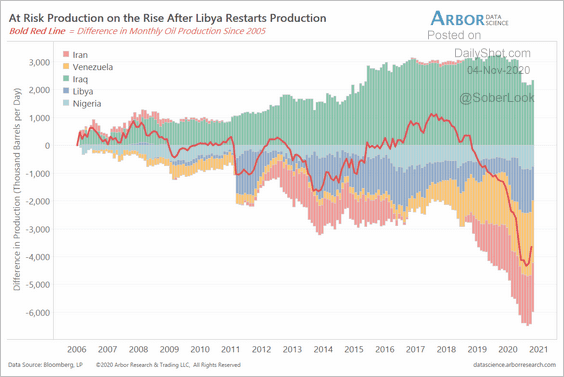

2. Global “at-risk” crude oil production has bottomed as Libya restarts output.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

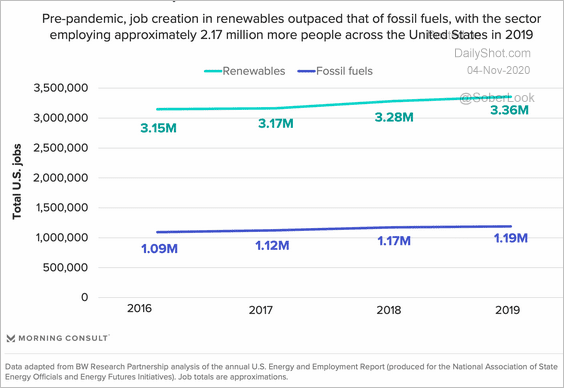

3. This chart shows US employment in renewables and fossil-fuel sectors.

Source: Morning Consult

Source: Morning Consult

Equities

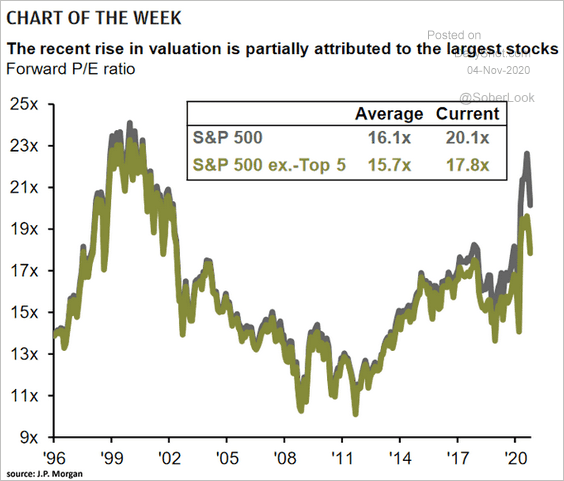

1. The tech mega-caps drove a great deal of the recent valuation spike in the S&P 500.

Source: @ISABELNET_SA, @JPMorganAM

Source: @ISABELNET_SA, @JPMorganAM

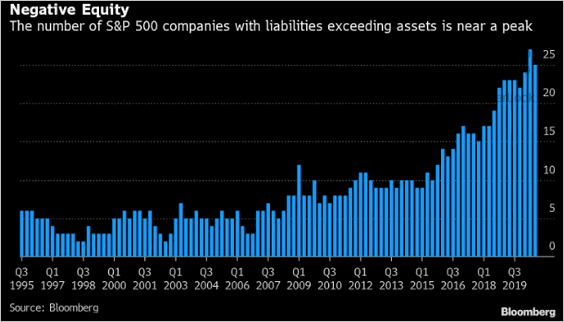

2. More of the S&P 500 firms now have negative equity.

Source: @TheOneDave

Source: @TheOneDave

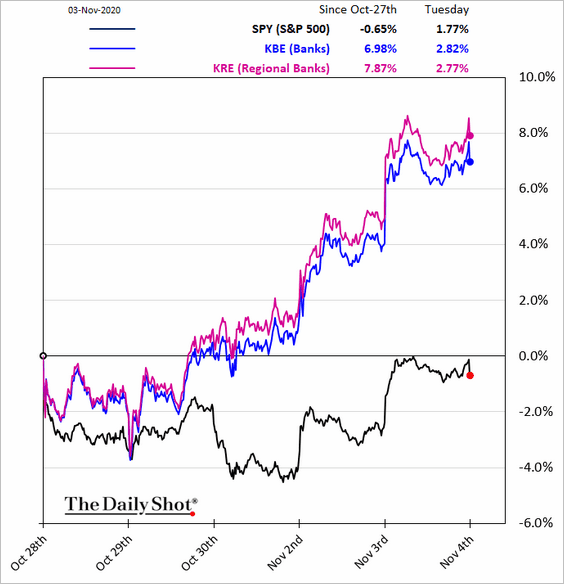

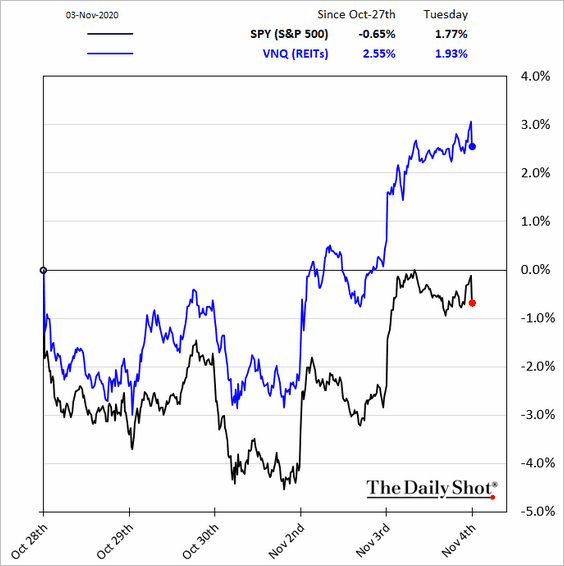

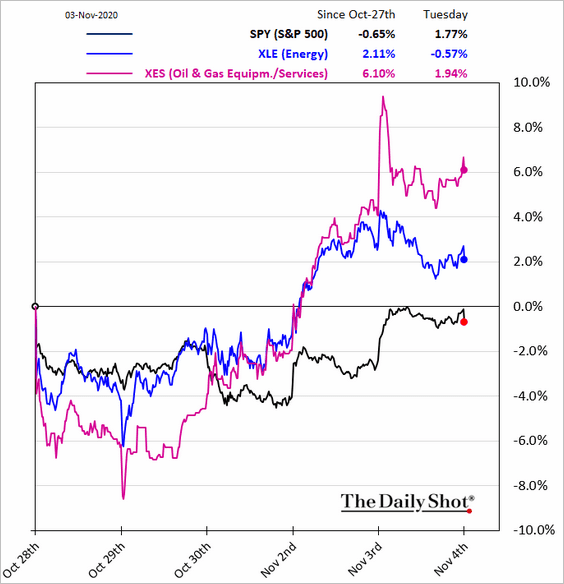

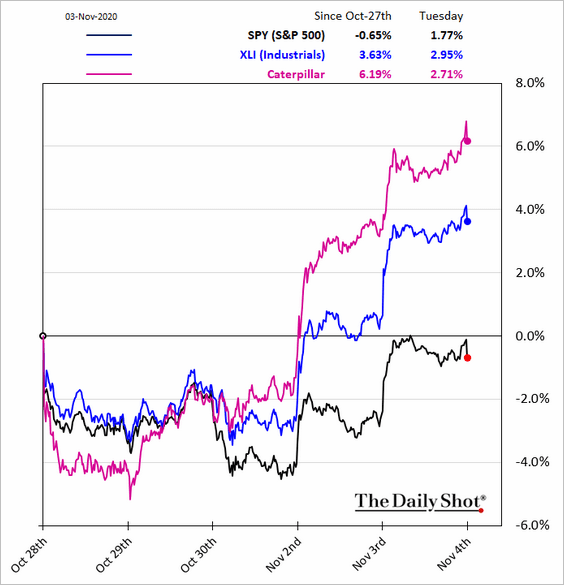

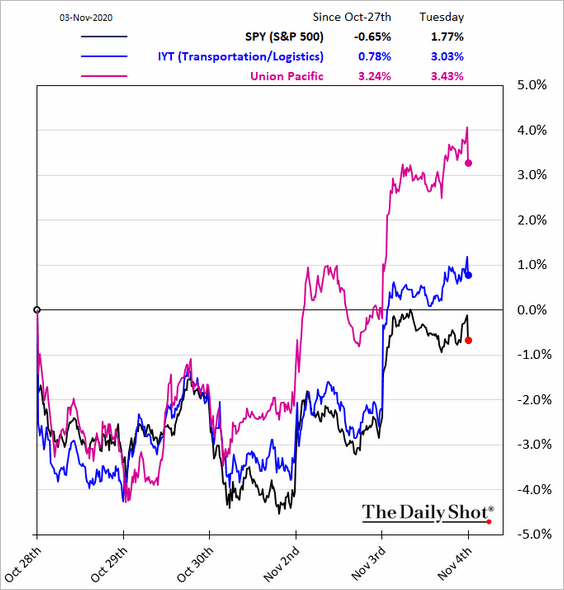

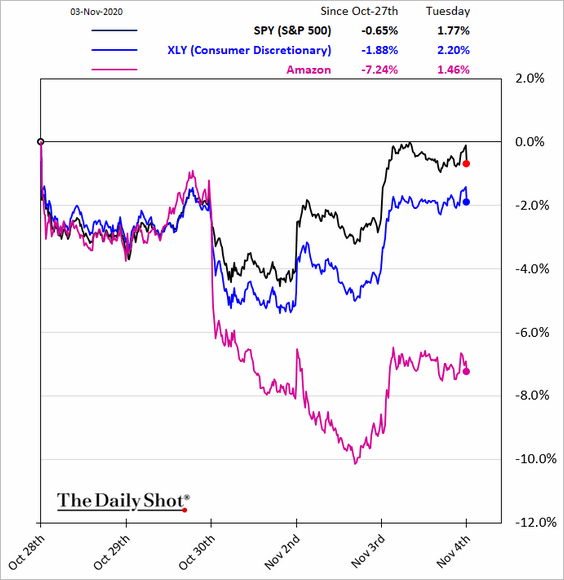

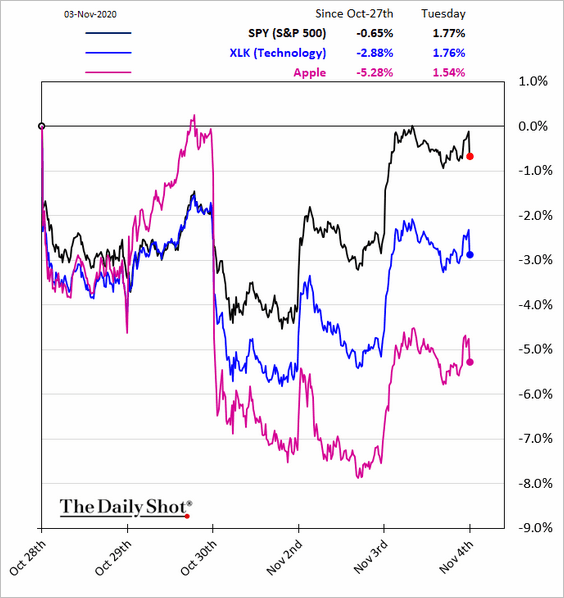

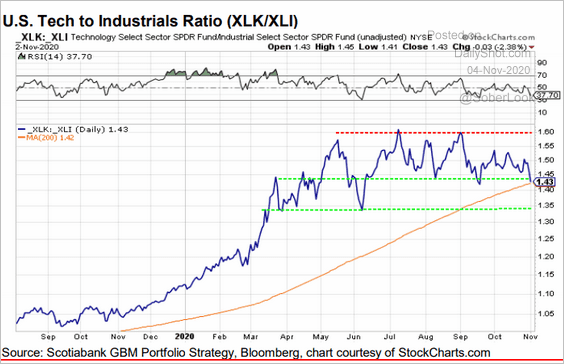

3. Next, we have some sector trends.

• Banks:

• REITs:

• Energy:

• Industrials:

• Transportation:

• Consumer Discretionary:

• Tech:

• The ratio of tech to industrials (last 12 months):

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Credit

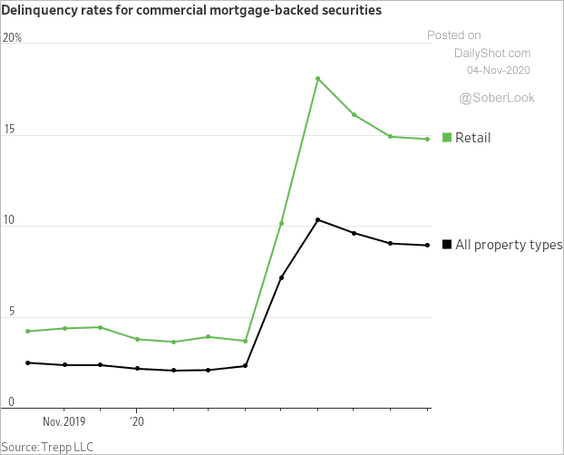

1. Delinquency rates on commercial mortgages (loans held by CMBS) remain elevated.

Source: @WSJ Read full article

Source: @WSJ Read full article

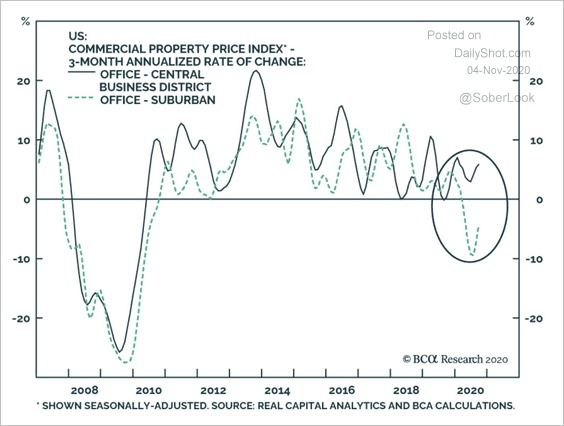

By the way, at least for now, commercial property deflation is considerably less intense than in 2008.

Source: BCA Research

Source: BCA Research

——————–

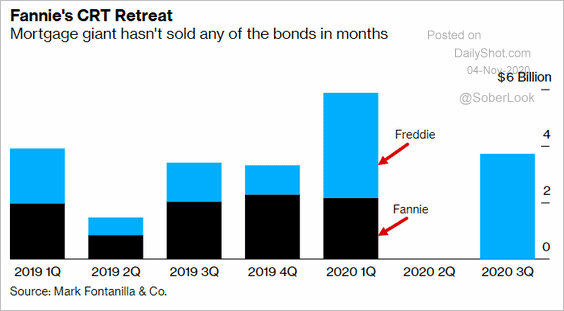

2. Credit risk transfer (CRT) deals by Fannie and Freddie have slowed amid uncertainty around regulatory capital relief. CRT investors take on mortgage borrowers’ credit risk (which is not the case for traditional agency MBS bonds).

Source: @markets Read full article

Source: @markets Read full article

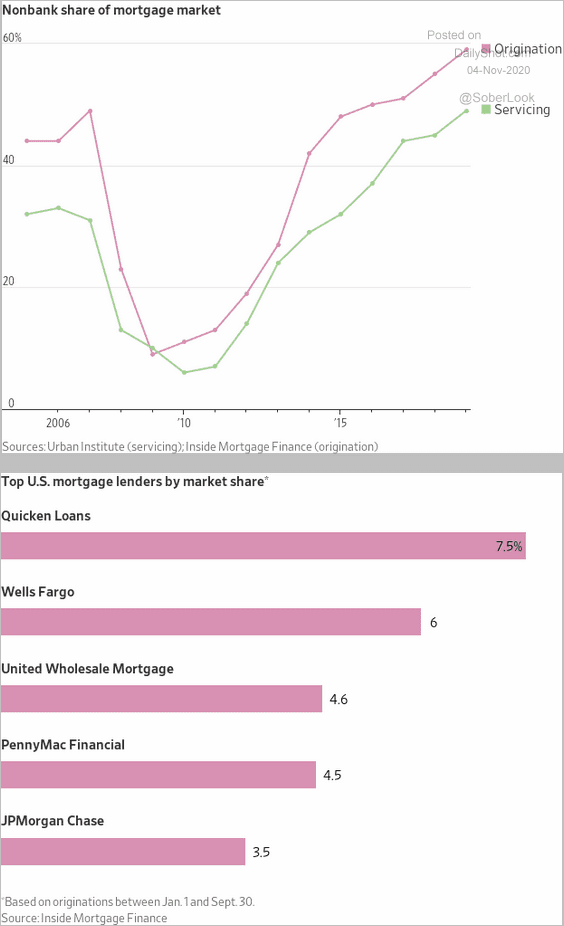

3. Non-bank lenders increasingly dominate the mortgage market.

Source: @WSJ Read full article

Source: @WSJ Read full article

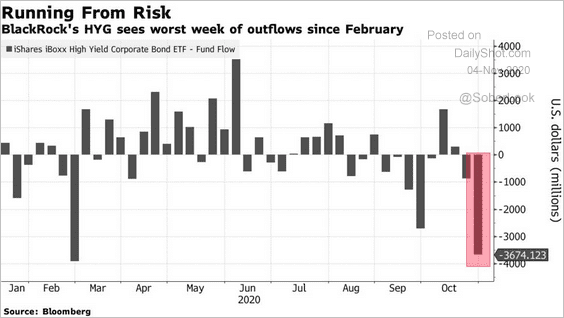

4. The largest US high-yield bond ETF saw some outflows recently.

Source: @markets Read full article

Source: @markets Read full article

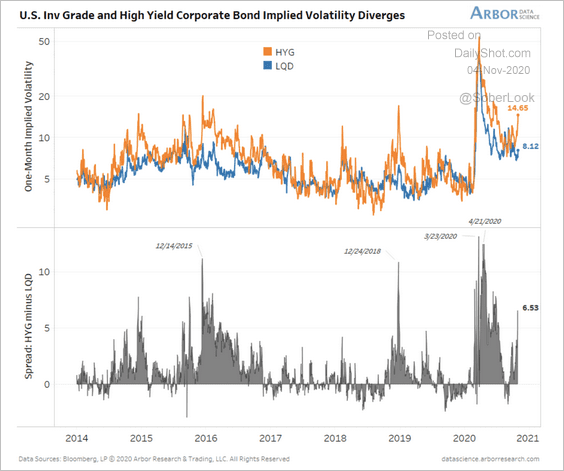

5. The gap between US high-yield and investment-grade corporate bond volatility has widened the most since June.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

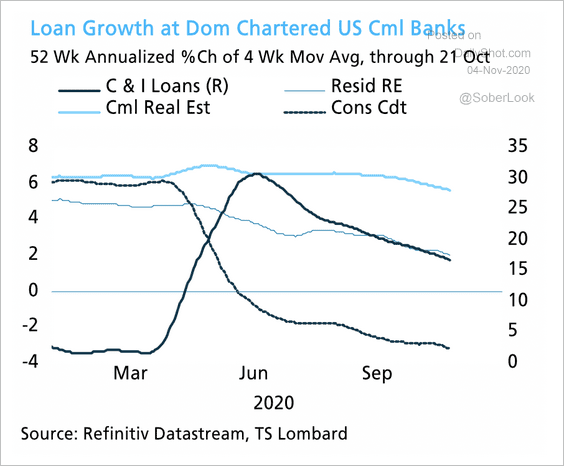

6. This chart shows the changes in US loan growth by sector in 2020 (C&I = business loans, Cml = commercial real estate).

Source: TS Lombard

Source: TS Lombard

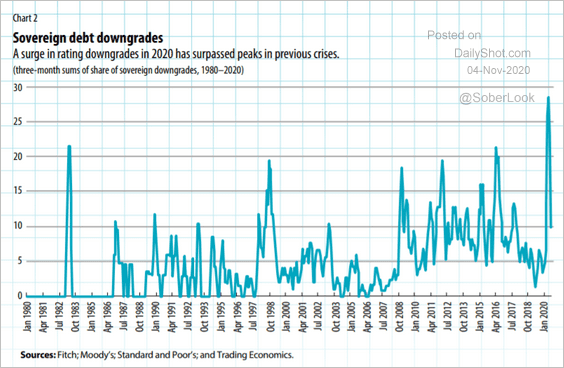

7. Sovereign debt downgrades spiked this year.

Source: IMF Read full article

Source: IMF Read full article

Rates

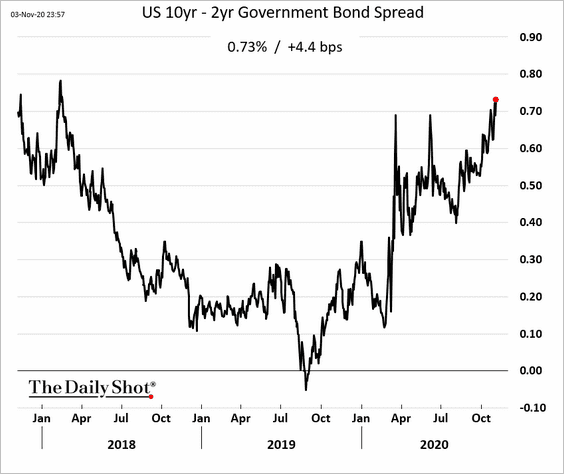

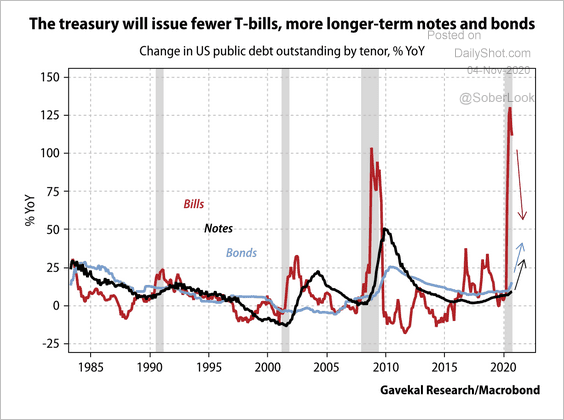

1. The Treasury curve continues to steepen.

And the coming shift in relative issuance from the Treasury will continue to favor further steepening of the curve, according to Gavekal.

Source: Gavekal

Source: Gavekal

——————–

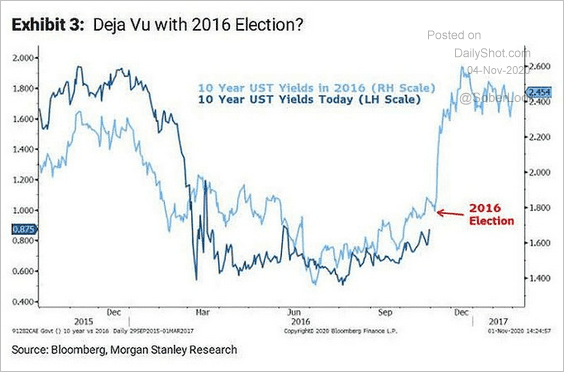

2. Will Treasury yields follow the 2016 pattern?

Source: @ISABELNET_SA, @MorganStanley

Source: @ISABELNET_SA, @MorganStanley

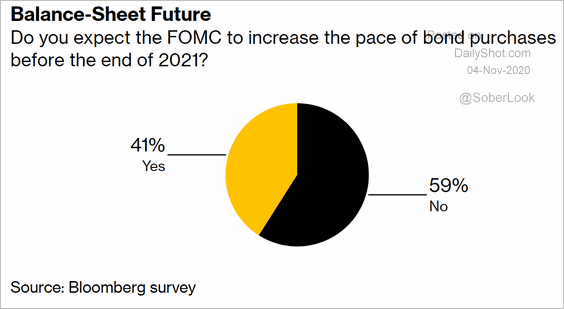

3. According to a Bloomberg survey, the Fed is unlikely to boost bond purchases this year.

Source: @markets Read full article

Source: @markets Read full article

Global Developments

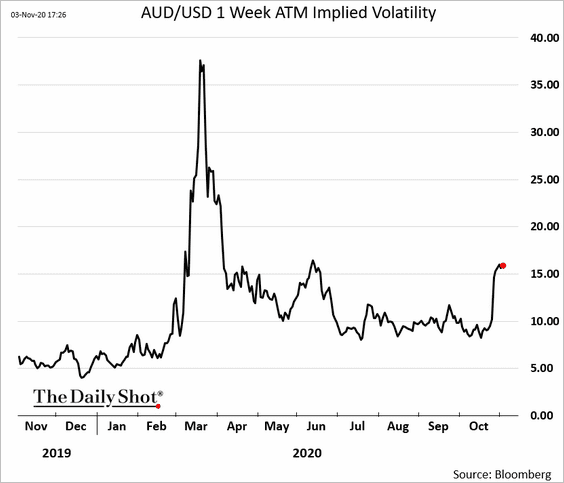

1. Short-term implied volatility in the currency markets remains elevated.

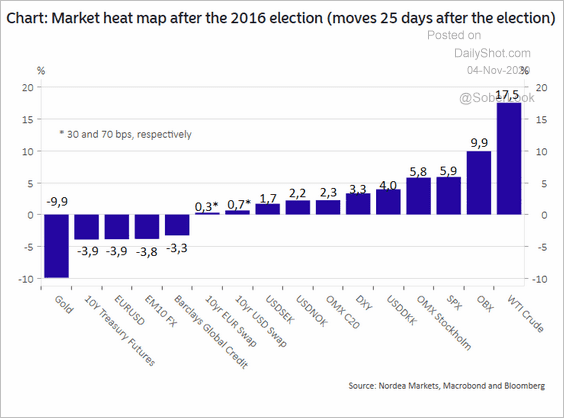

2. How did assets perform after the 2016 US elections?

Source: Nordea Markets

Source: Nordea Markets

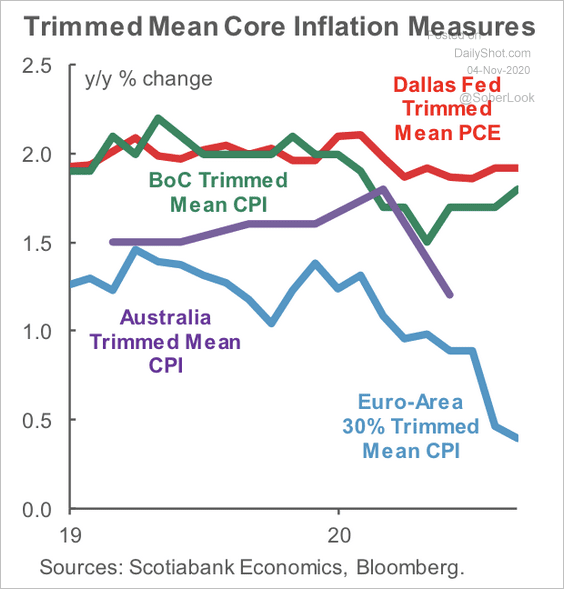

3. This chart shows the recent changes in core CPI measures in select economies.

Source: Scotiabank Economics

Source: Scotiabank Economics

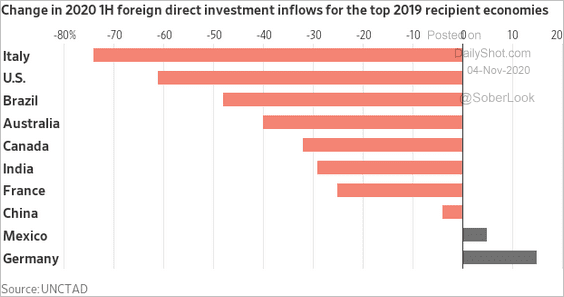

4. Foreign direct investment flows declined sharply in most countries.

Source: @WSJ Read full article

Source: @WSJ Read full article

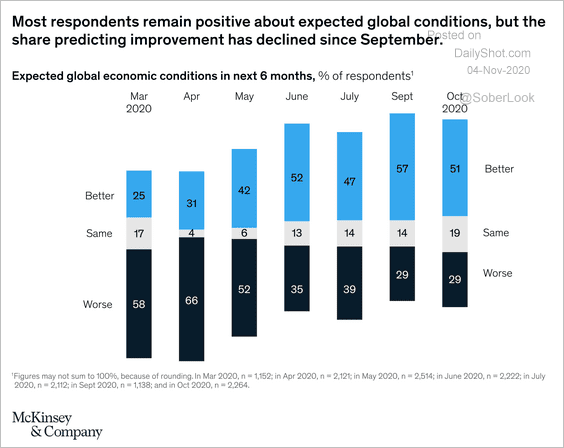

5. Business executives surveyed by McKinsey maintain a positive outlook for the world economy.

Source: McKinsey Read full article

Source: McKinsey Read full article

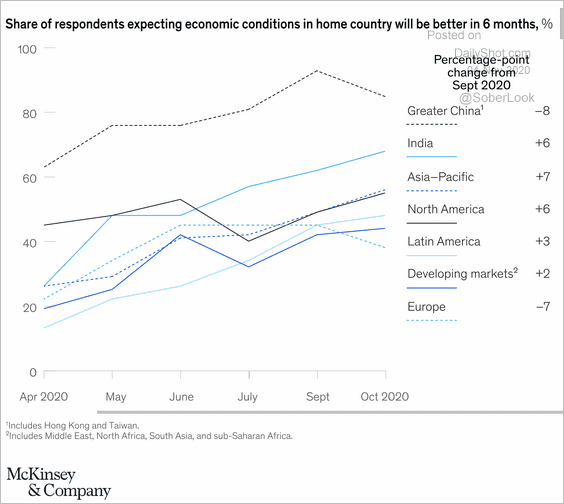

However, according to McKinsey, the economic outlook for business executives in Greater China (incl. HK and Taiwan) and Europe have tempered.

Source: McKinsey Read full article

Source: McKinsey Read full article

——————–

Food for Thought

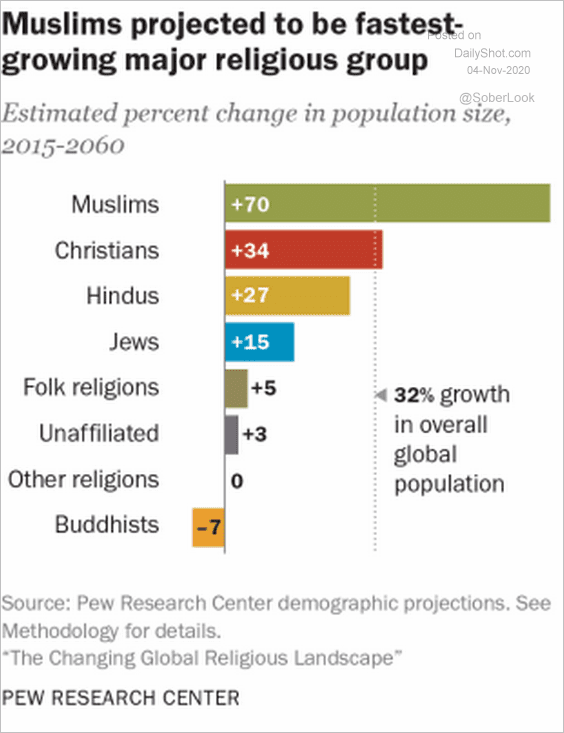

1. Projected growth of major religious groups globally:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

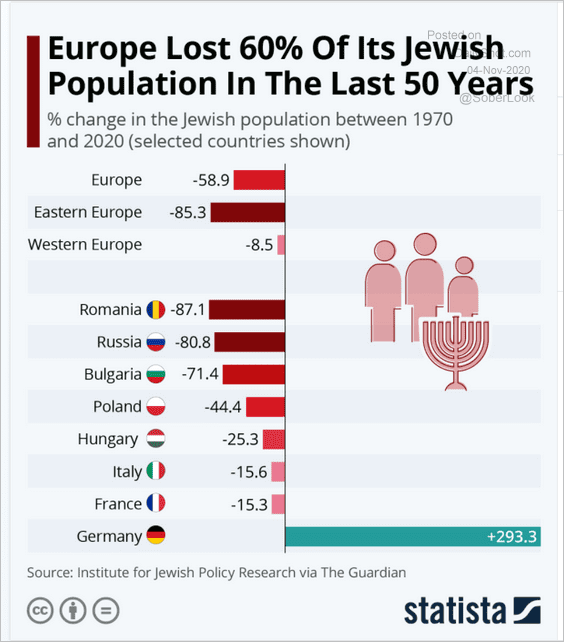

2. Europe’s Jewish population:

Source: Statista

Source: Statista

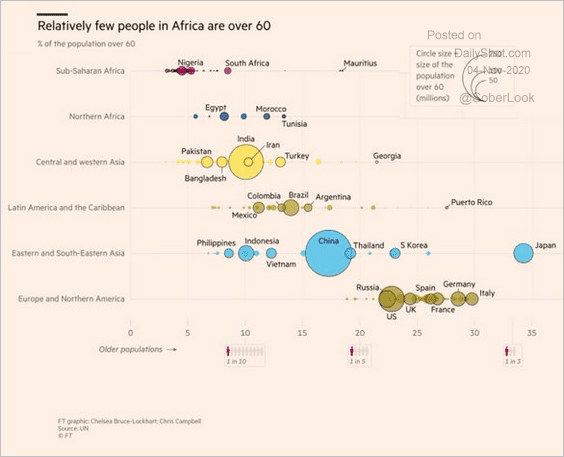

3. Share of the population aged 60 and older:

Source: @adam_tooze, @OurWorldInData, @MaxCRoser Read full article

Source: @adam_tooze, @OurWorldInData, @MaxCRoser Read full article

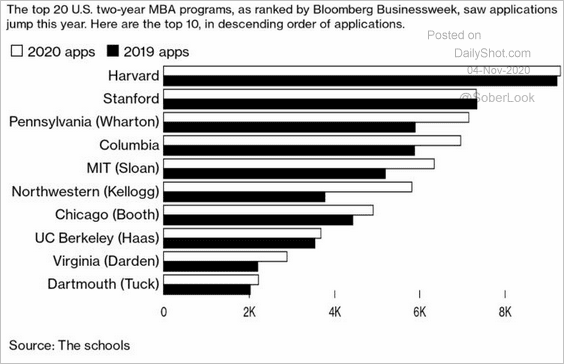

4. Applications to US MBA programs:

Source: @BW Read full article

Source: @BW Read full article

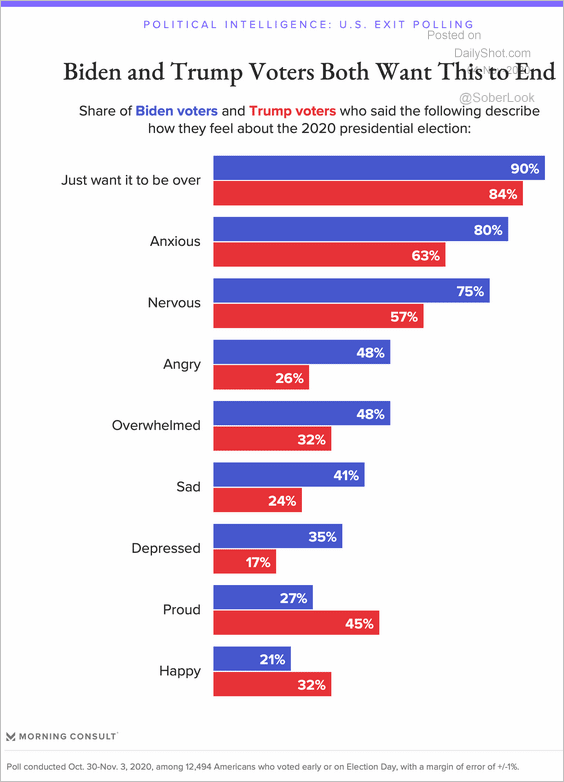

5. How US voters feel about the elections:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

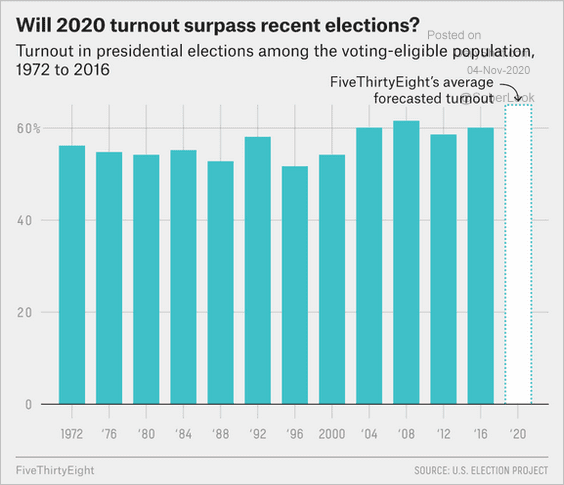

6. US election turnout estimate:

Source: @geoffreyvs

Source: @geoffreyvs

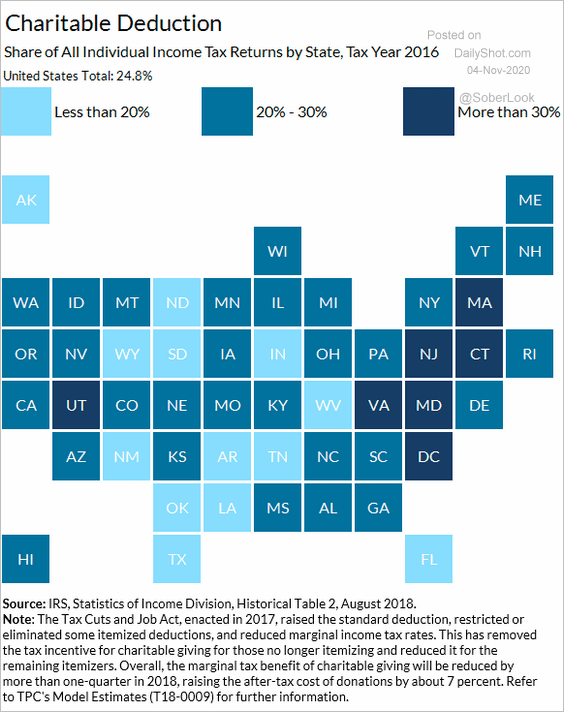

7. Charitable donations (tax deductions) by state:

Source: Urban Institute, Brookings Institution Read full article

Source: Urban Institute, Brookings Institution Read full article

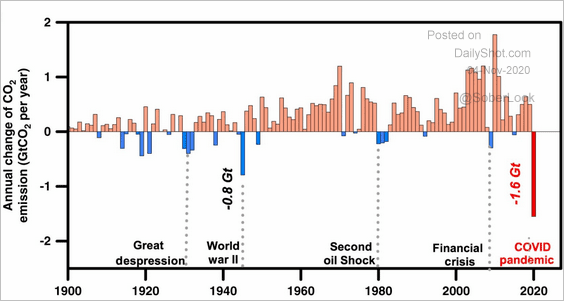

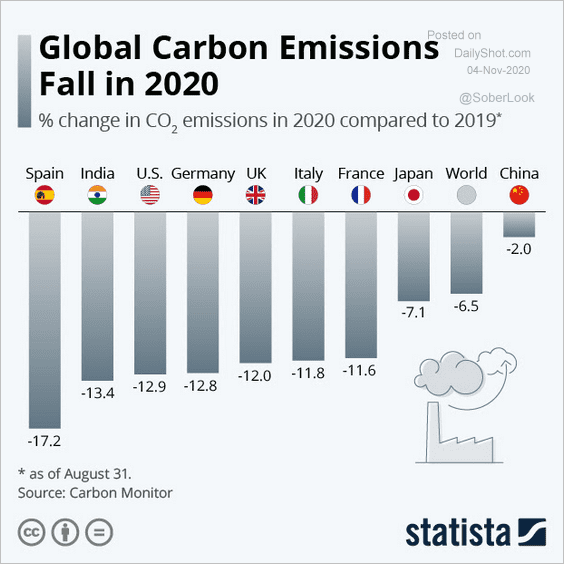

8. COVID impact on CO2 emissions (2 charts):

Source: @adam_tooze, @LiuzhuLiu Read full article

Source: @adam_tooze, @LiuzhuLiu Read full article

Source: Statista

Source: Statista

——————–

9. This is a black and white photograph, and only the lines have color (creating an optical illusion).

Source: @page_eco

Source: @page_eco

——————–