The Daily Shot: 05-Nov-20

• Equities

• Credit

• Rates

• Commodities

• Cryptocurrency

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• The United kIngdom

• The United States

• Food for Thought

Equities

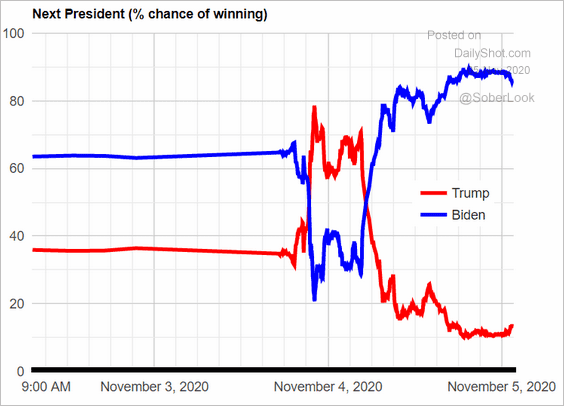

1. While ballot counts are still ongoing in the US, the betting markets now show Joe Biden winning the presidency. The sharp reversal took place as more mail-in ballots came in.

Source: ElectionBettingOdds.com

Source: ElectionBettingOdds.com

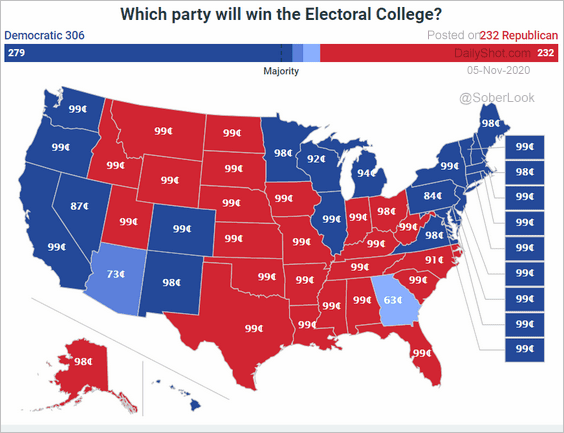

Here is the latest electoral map (based on betting markets’ odds).

Source: @PredictIt

Source: @PredictIt

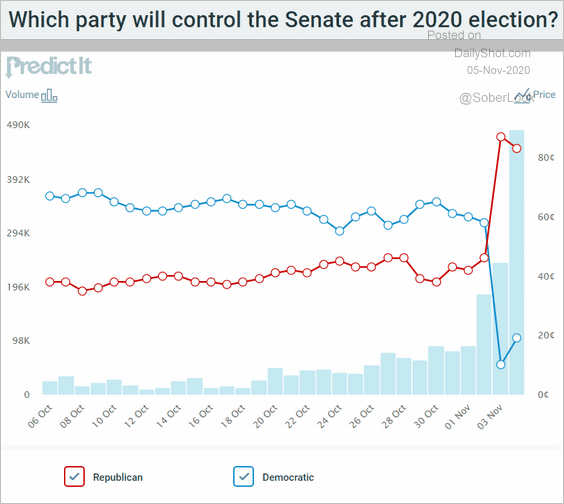

However, a “blue wave” is not likely as Republicans seem to retain Senate control.

Source: @PredictIt

Source: @PredictIt

——————–

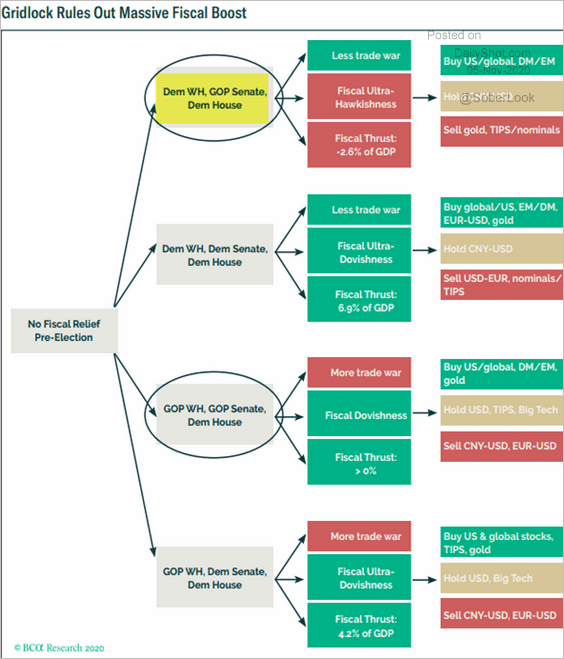

2. Here is what this means for the markets.

• Republicans in the Senate have no appetite for a massive stimulus bill.

Source: BCA Research

Source: BCA Research

• With the year-end income cliff approaching (see this chart/comment from Oxford Economics), the Fed is now more likely to step in with a larger QE package.

Source: @markets Read full article

Source: @markets Read full article

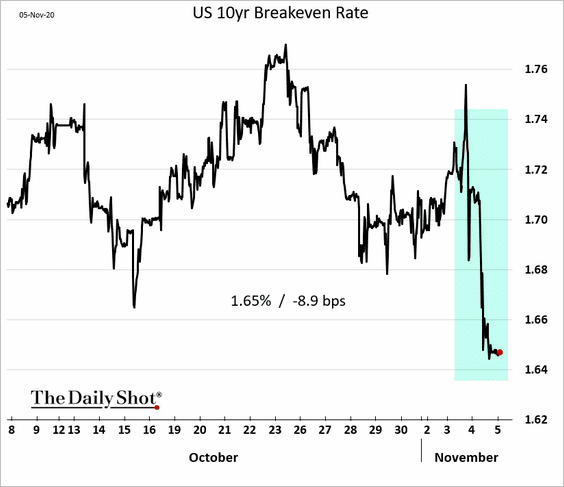

Moreover, a fiscal stimulus-driven inflation spike becomes less likely. This chart shows market-based long-term inflation expectations.

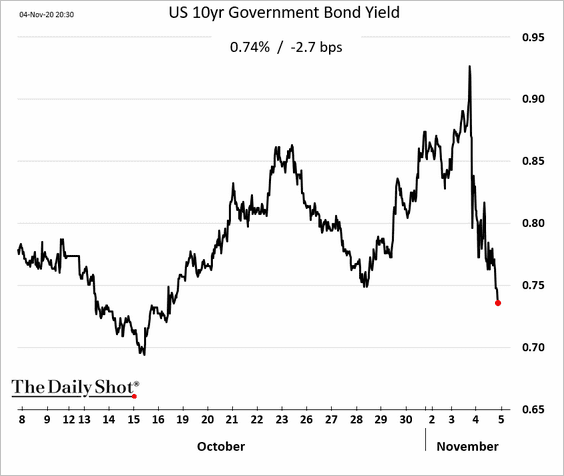

With the Fed potentially in play and inflation expectations declining, Treasury yields tumbled.

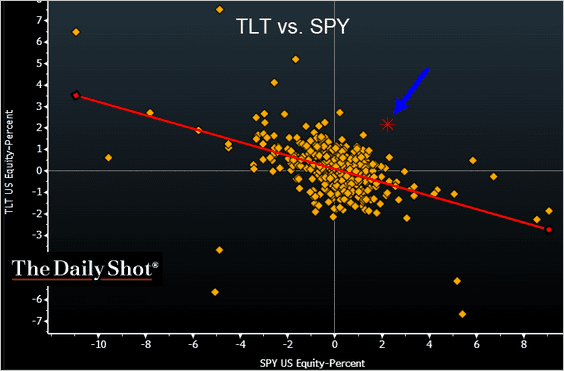

The simultaneous sharp rally in stocks and bonds (which is quite unusual) is an indication that the market expects the Fed to step in.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

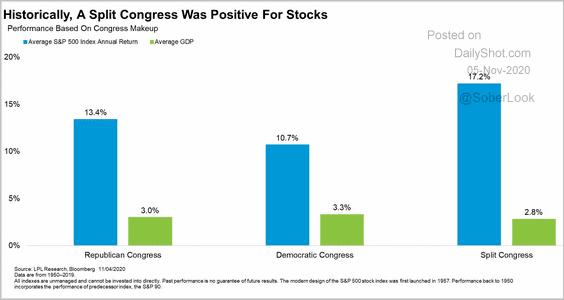

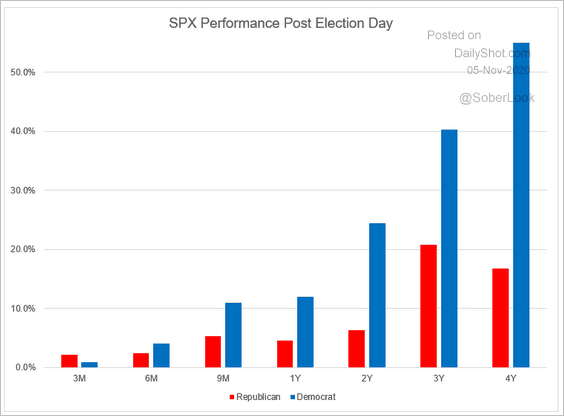

• A split government is generally good for stocks.

Source: LPL Research

Source: LPL Research

A Democrat in the White House has also been historically positive for stocks.

Source: Mizuho Americas Trading Desk

Source: Mizuho Americas Trading Desk

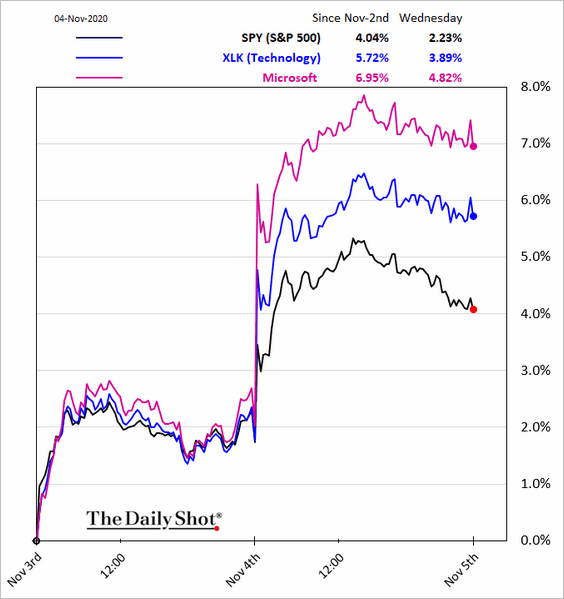

• Additionally, the gridlock in Congress makes any significant new antitrust legislation against the tech industry less likely. Tech shares soared.

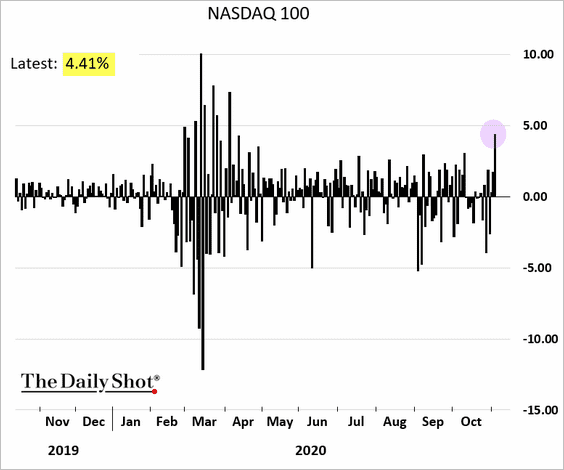

Here are the daily percent changes in the Nasdaq 100 index.

• The sharp decline in bond yields put substantial pressure on bank shares.

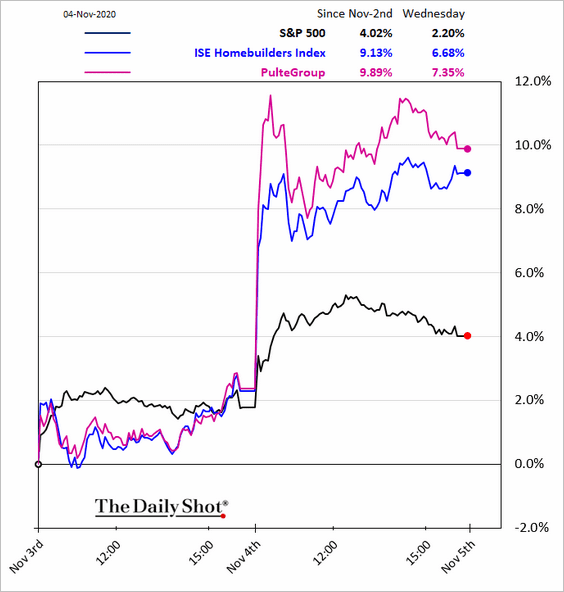

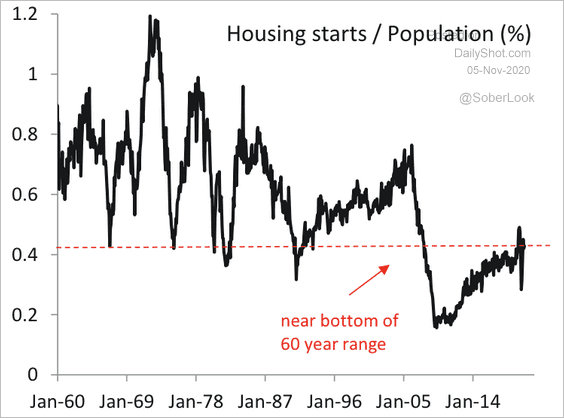

On the other hand, lower yields boosted homebuilder stocks.

There may be more upside for the housing market as mortgage rates decline further.

Source: Piper Sandler

Source: Piper Sandler

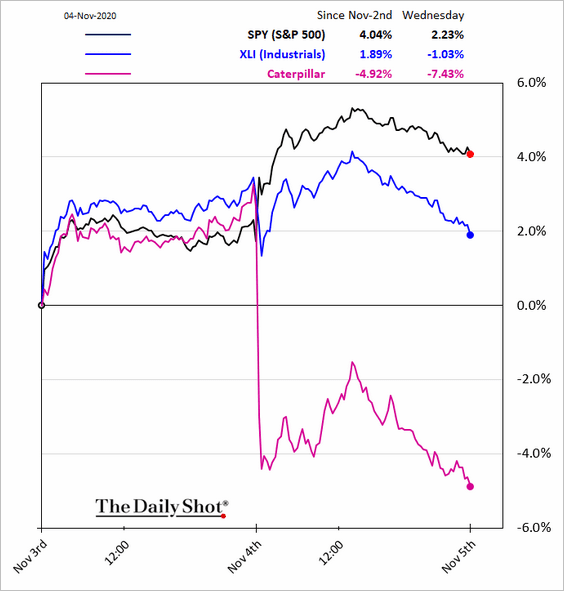

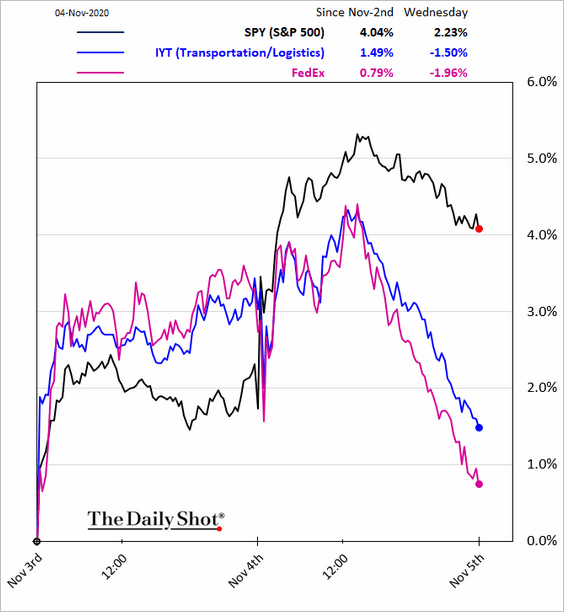

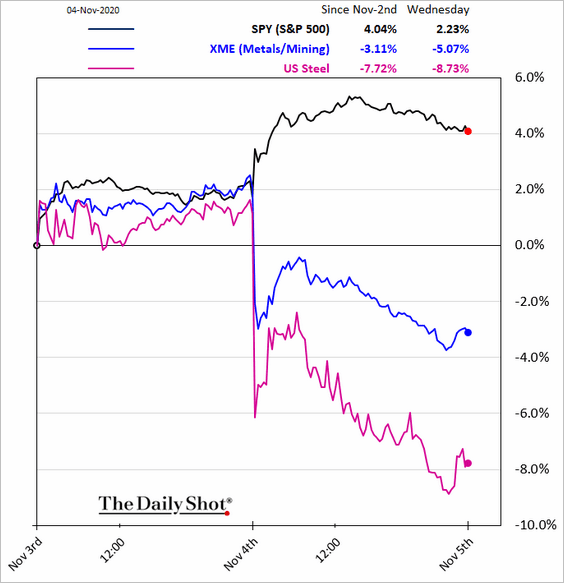

• With no massive fiscal spending on the horizon, several sectors underperformed.

– Industrials:

– Transportation:

– Metals & Mining (will steel tariffs be lifted?):

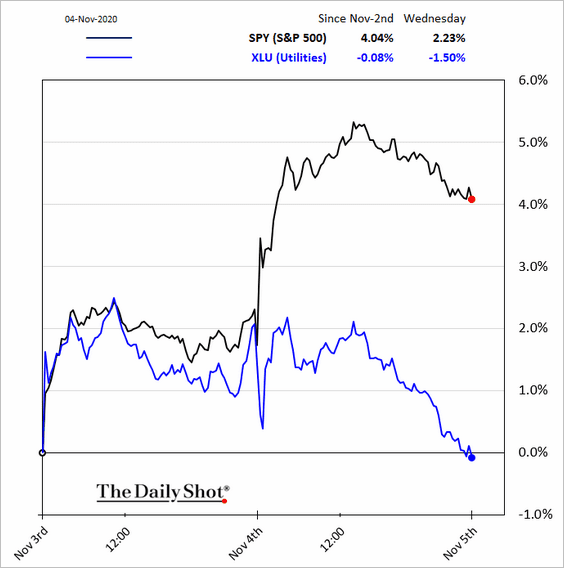

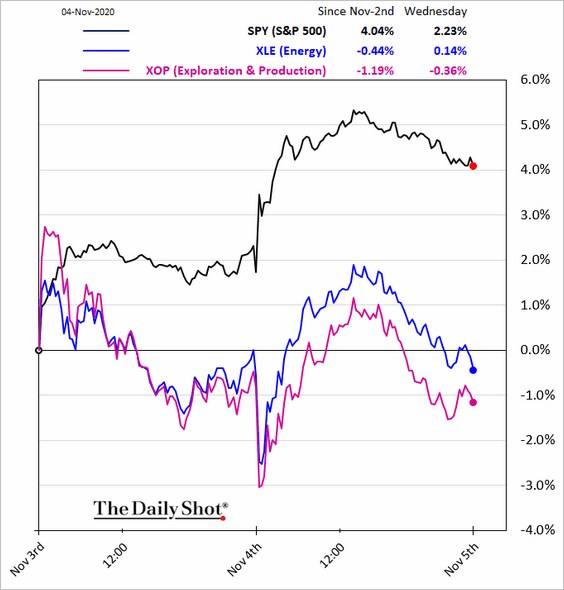

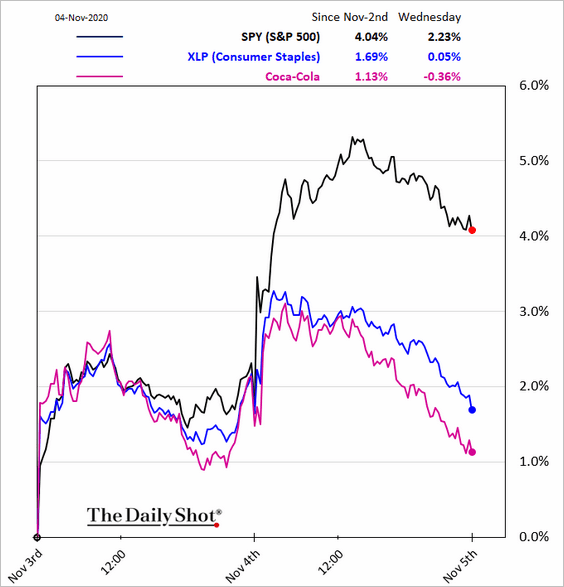

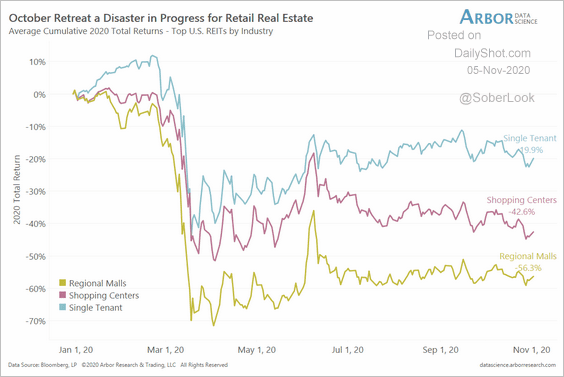

3. Here are some additional sector updates.

• Utilities (less demand for defensive stocks):

• Energy:

– Consumer staples:

• REITs:

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

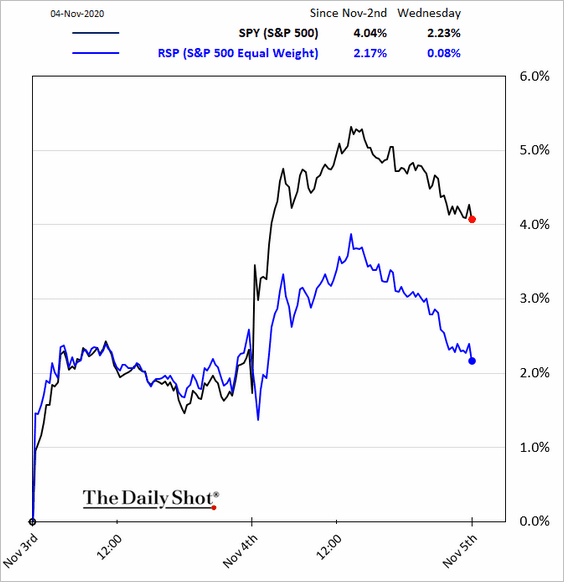

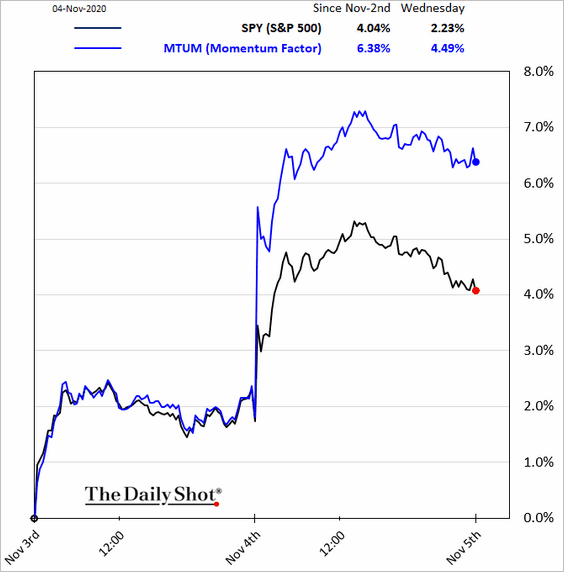

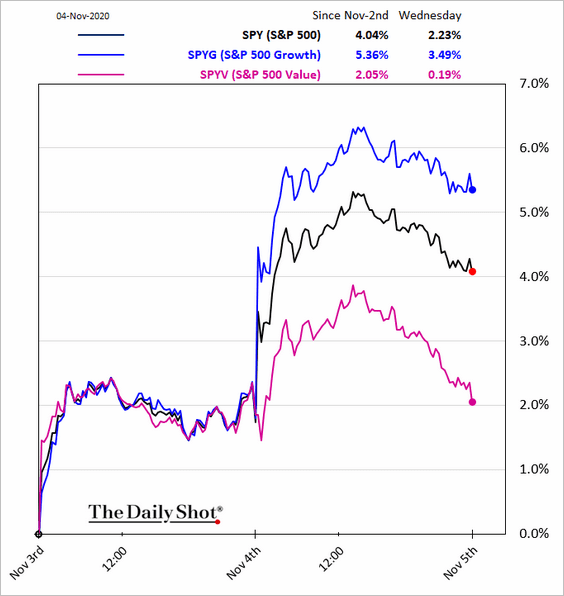

4. The equal-weight S&P 500 underperformed sharply as the tech mega-caps fell back in favor.

Below are a couple of other equity factor charts.

• Momentum:

• Growth vs. value:

——————–

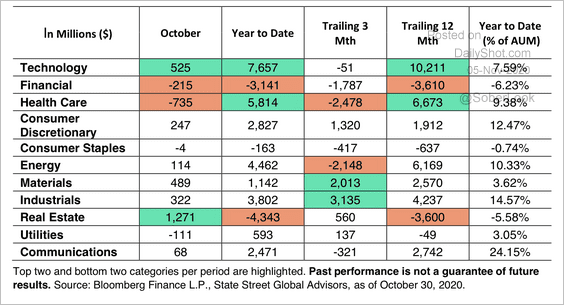

5. Investors shifted away from healthcare ETFs toward real estate in October.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

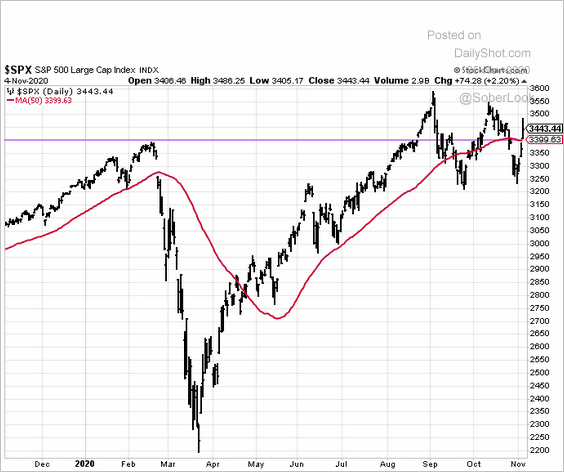

6. The S&P 500 is back above the 50-day moving average.

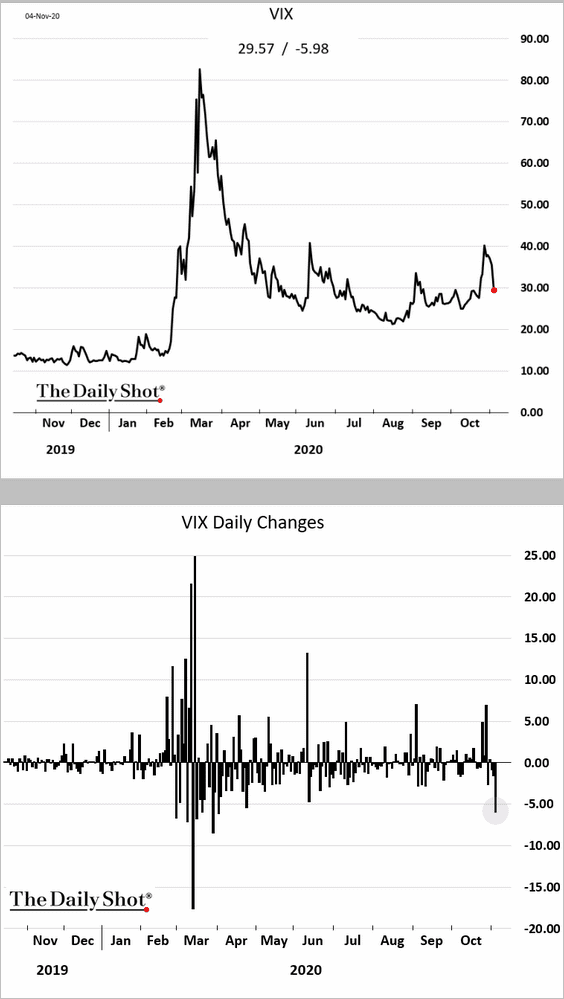

VIX declined sharply.

——————–

7. The AAII investor sentiment index continues to move into bullish territory.

Credit

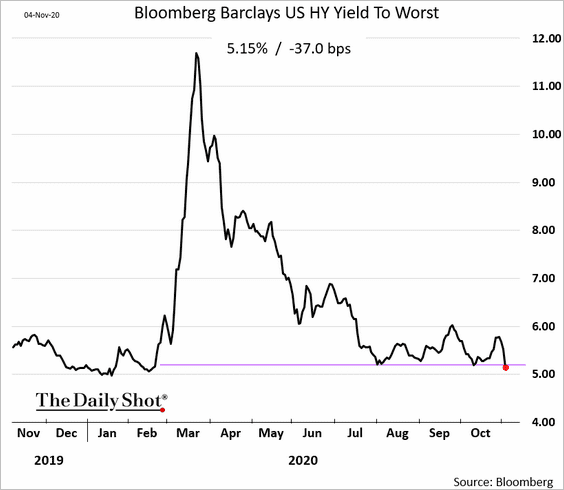

1. The yield on US high-yield bonds hit the lowest level since February.

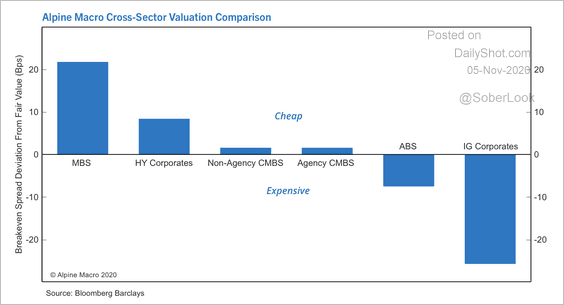

2. Here is a look at credit valuations, according to Alpine Macro.

Source: Alpine Macro

Source: Alpine Macro

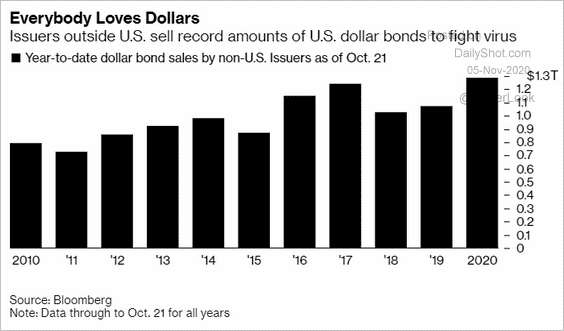

3. Non-US issuers sold a record amount of USD-denominated bonds this year.

Source: @markets Read full article

Source: @markets Read full article

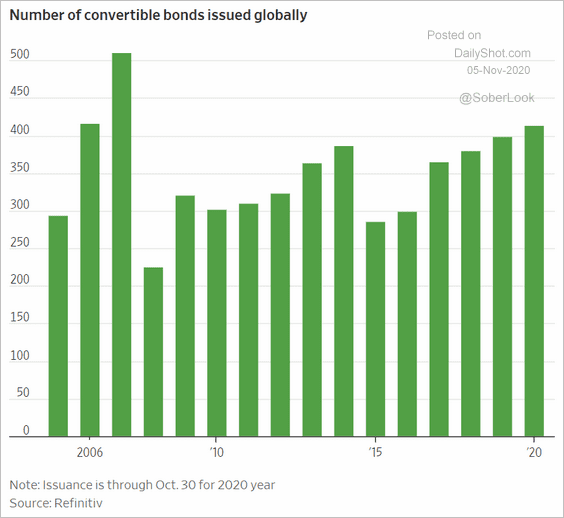

4. Convertible bonds have been increasingly popular.

Source: @WSJ Read full article

Source: @WSJ Read full article

Rates

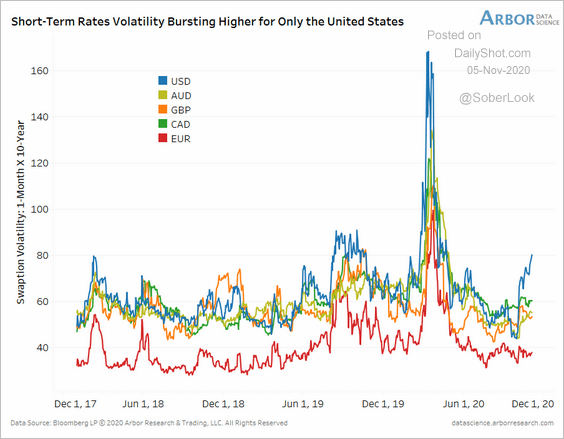

1. US implied volatility stands out.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

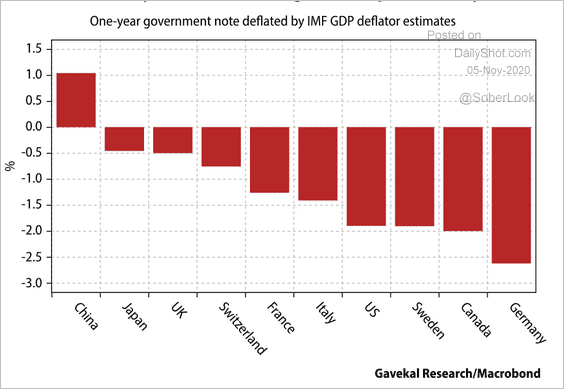

2. China is the only large economy offering investors positive real yields.

Source: Gavekal

Source: Gavekal

Commodities

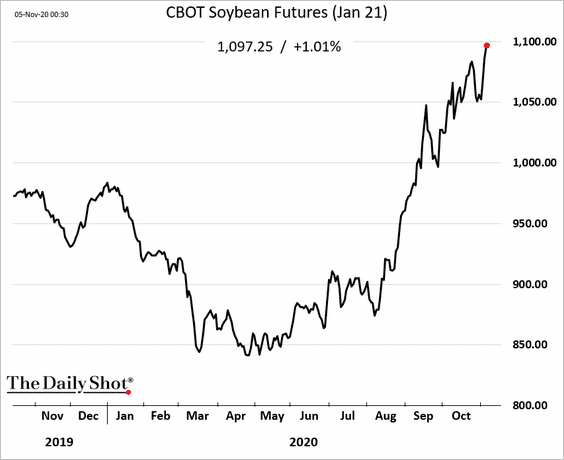

1. US soybean futures are soaring, boosted by dry weather damaging crops in Latin America. A stronger Chinese yuan also helps.

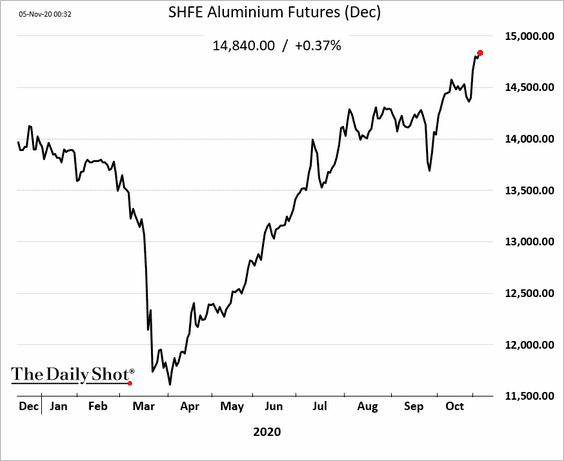

2. Aluminum prices in China keep climbing.

Cryptocurrency

Bitcoin hit the highest level since early 2018 (holding above $14k).

Emerging Markets

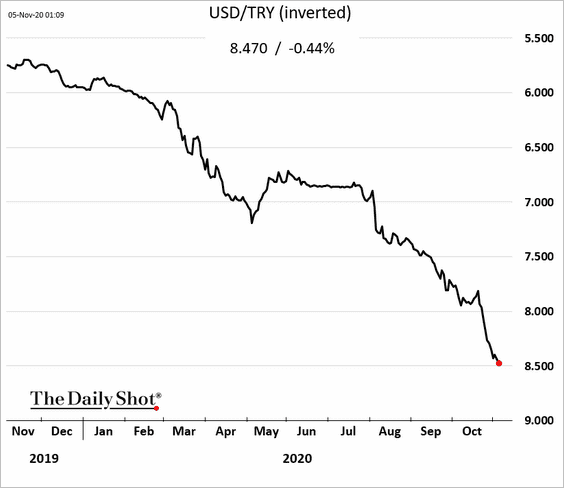

1. The Turkish lira resumed its decline. A Biden White House is not the best outcome for Erdogan.

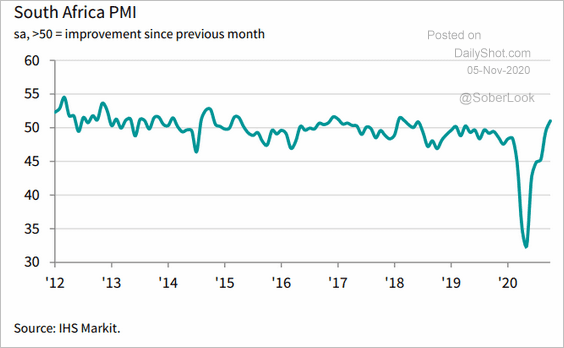

2. South Africa’s business activity has accelerated.

Source: IHS Markit Read full article

Source: IHS Markit Read full article

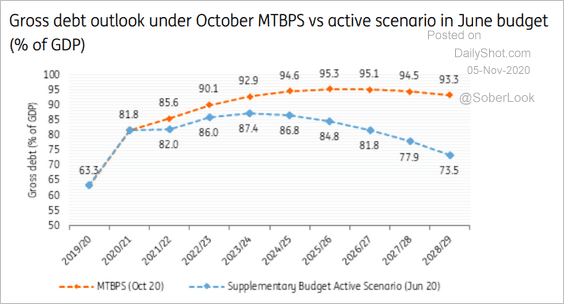

South Africa’s debt-to-GDP projections have been too optimistic.

Source: ING

Source: ING

——————–

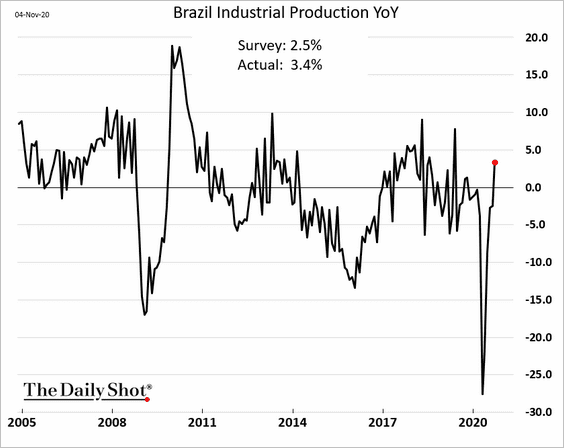

3. Brazil’s industrial production (for September) surprised to the upside.

China

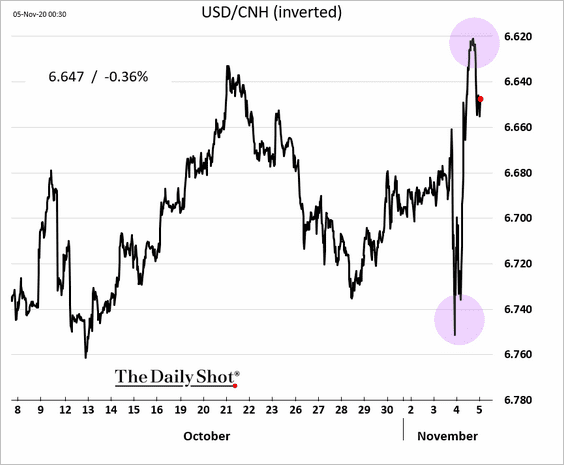

1. The renminbi got whipsawed by the US election uncertainty (see the equities section)

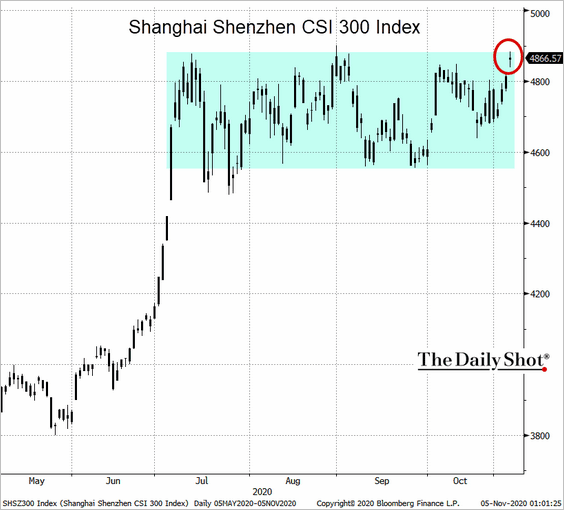

2. China’s stock benchmark is in the upper end of the trading range again. Will we see a breakout (perhaps based on better trade relations with the US under the Biden administration)?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Asia – Pacific

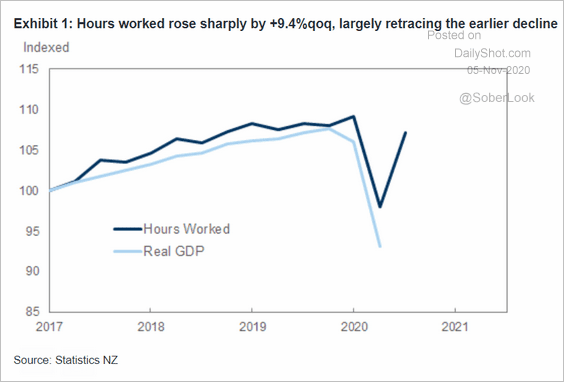

1. New Zealand’s hours worked rebounded sharply last quarter.

Source: Goldman Sachs

Source: Goldman Sachs

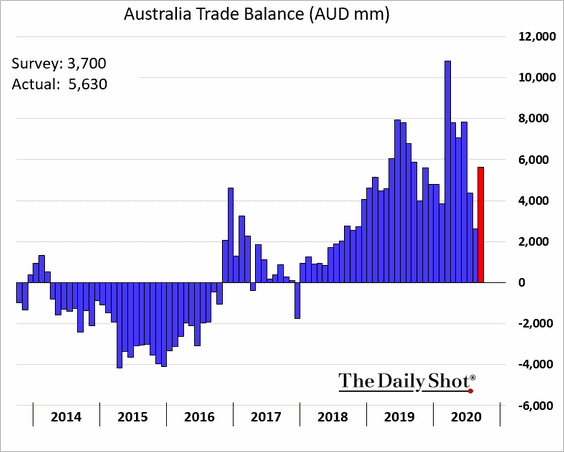

2. Australia’s trade surplus surprised to the upside.

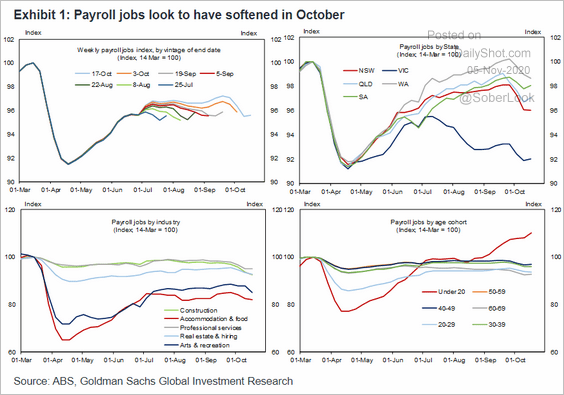

Separately, this chart shows payroll trends in Australia.

Source: Goldman Sachs

Source: Goldman Sachs

The Eurozone

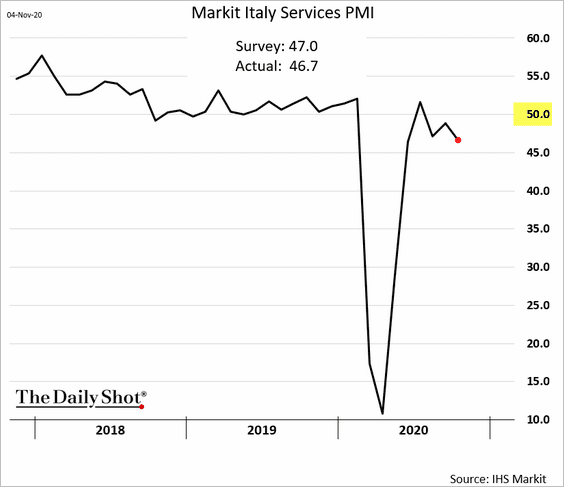

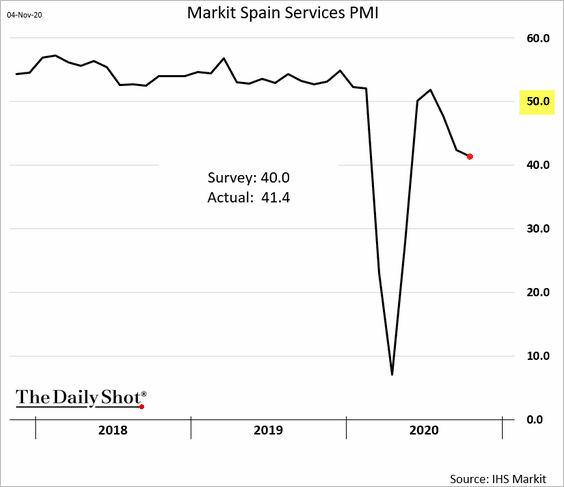

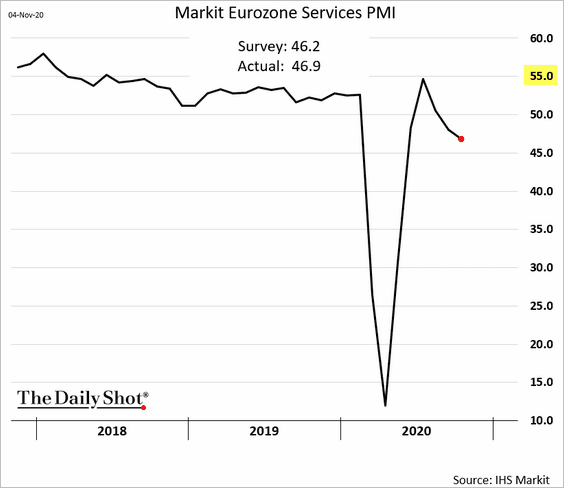

1. Service-sector PMIs showed further contraction in business activity as the pandemic takes a toll.

——————–

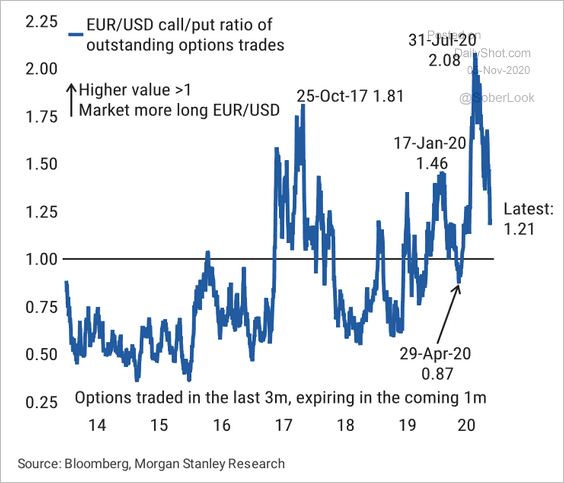

2. The options market’s sentiment on the euro has soured.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

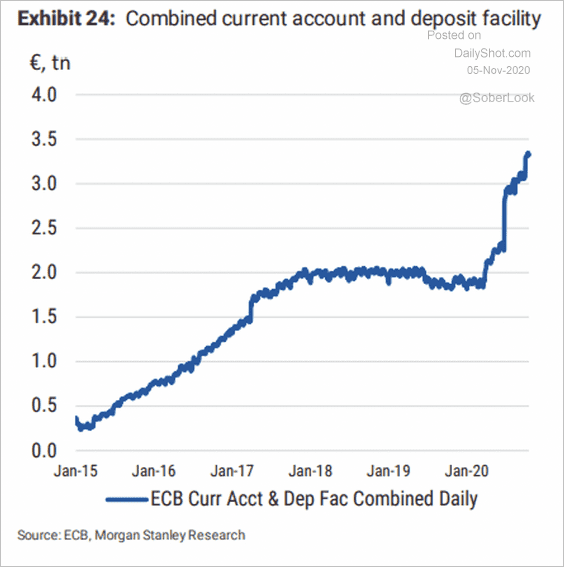

3. Excess reserves continue to rise as the ECB’s combined current account and deposit facility reach all-time highs, according to Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

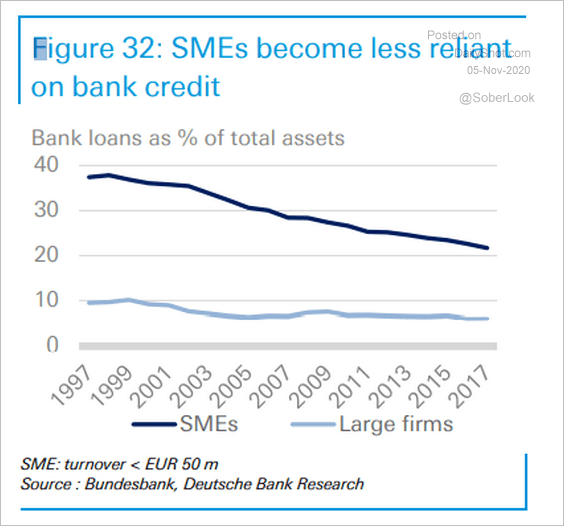

4. German small and medium-sized firms are becoming less dependent on credit.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

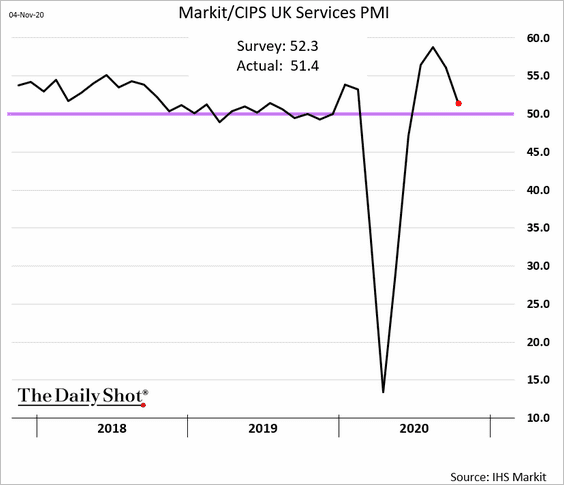

The United kIngdom

1. Service sector growth is stalling.

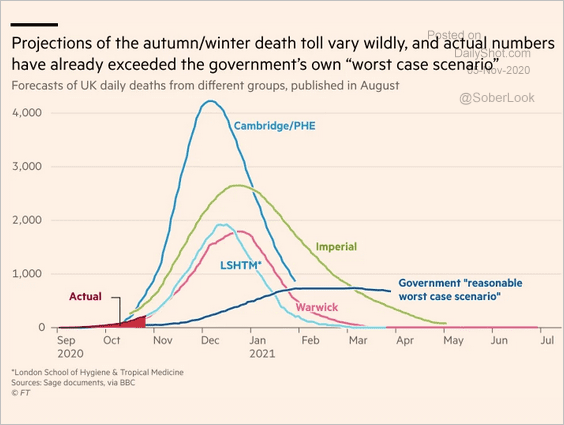

2. How bad will the pandemic get in the UK?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

The United States

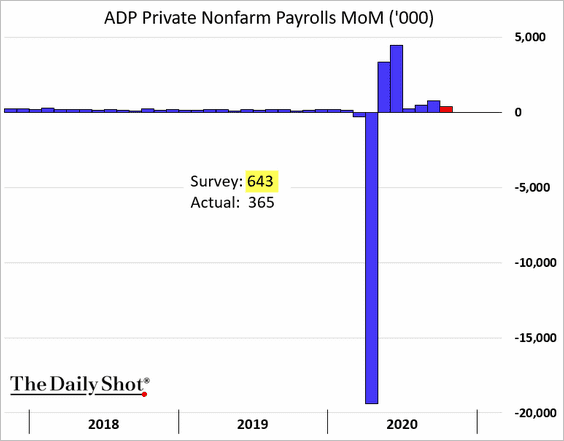

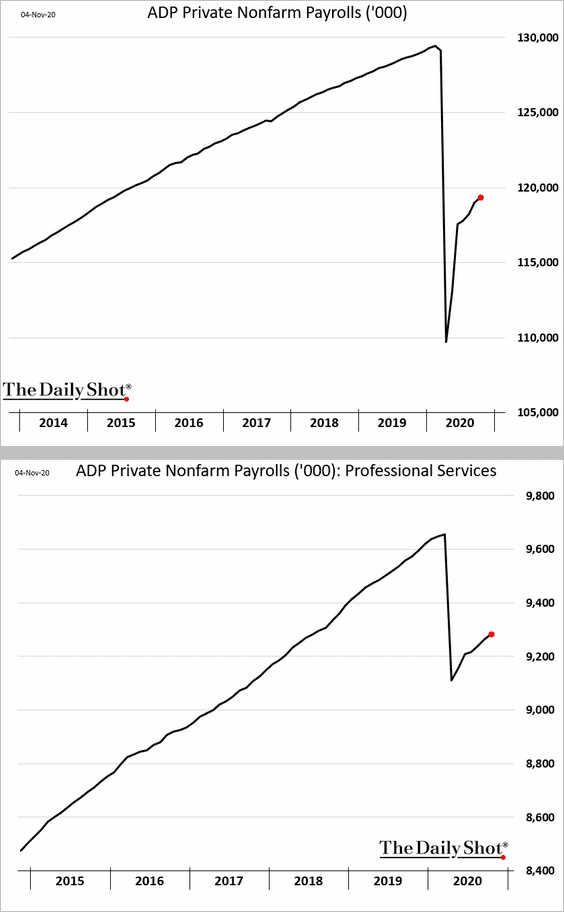

1. Last month’s ADP private payrolls report was considerably weaker than expected.

The labor market recovery is losing steam.

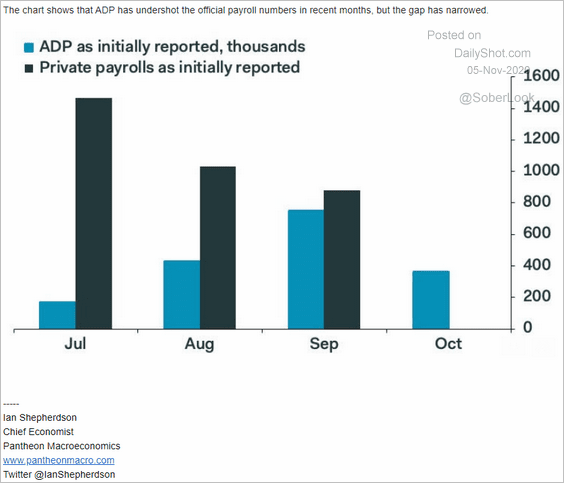

However, the recent ADP figures have been consistently below the official payrolls data.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

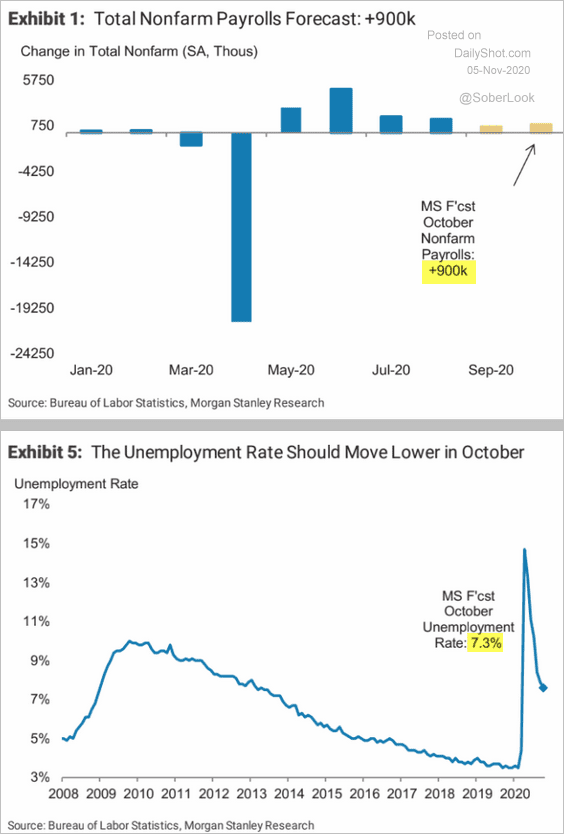

Morgan Stanley expects to see substantial gains in the October jobs report on Friday.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

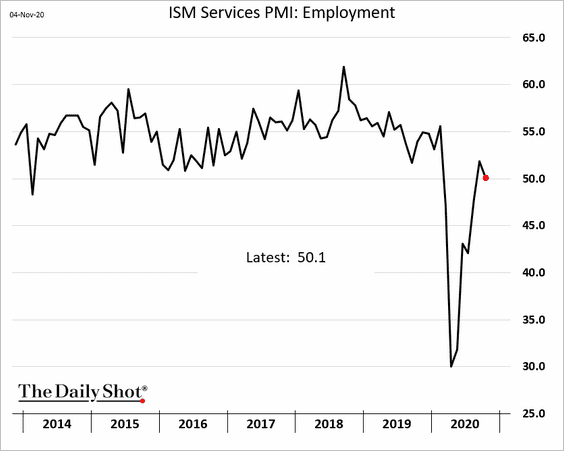

2. The nation’s service sector growth is losing momentum.

• ISM Services PMI:

• Employment

——————–

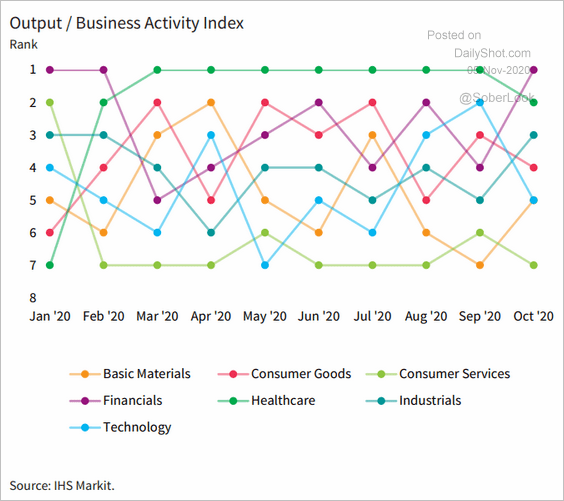

3. Below is a ranking of service-sector performance by industry (from Markit).

Source: IHS Markit

Source: IHS Markit

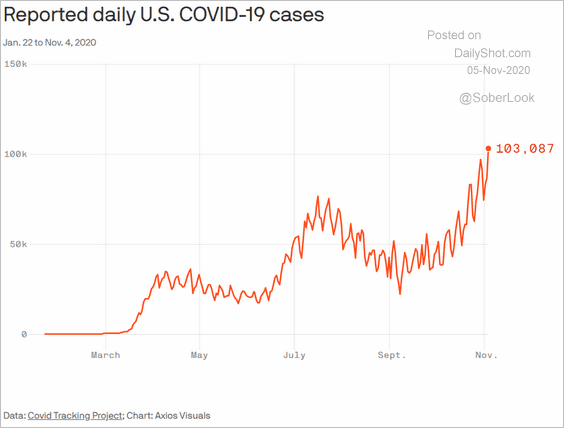

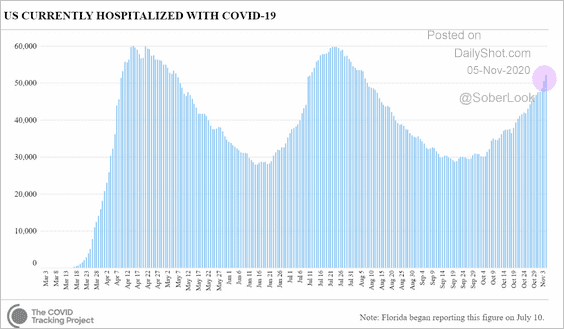

4. Here is an update on the pandemic.

• New cases:

Source: @axios Read full article

Source: @axios Read full article

• Hospitalizations:

Source: CovidTracking.com

Source: CovidTracking.com

——————–

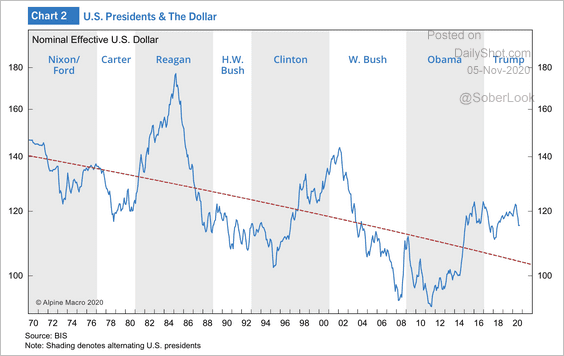

5. How did the dollar perform during previous US presidential cycles?

Source: Alpine Macro

Source: Alpine Macro

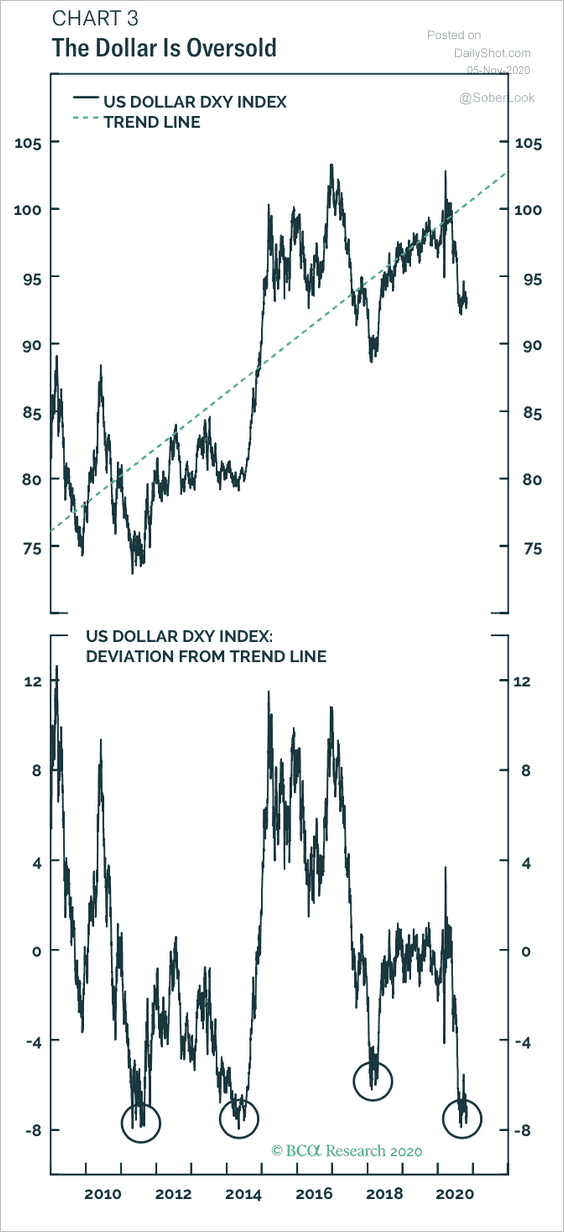

By the way, is the dollar oversold?

Source: BCA Research

Source: BCA Research

——————–

Food for Thought

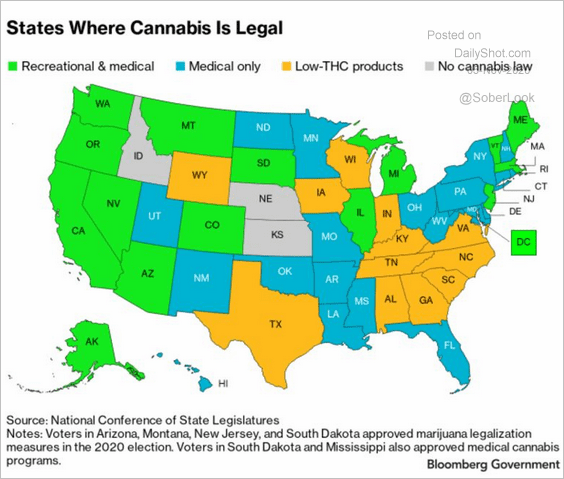

1. States where cannabis is now legal:

Source: @bpolitics Read full article

Source: @bpolitics Read full article

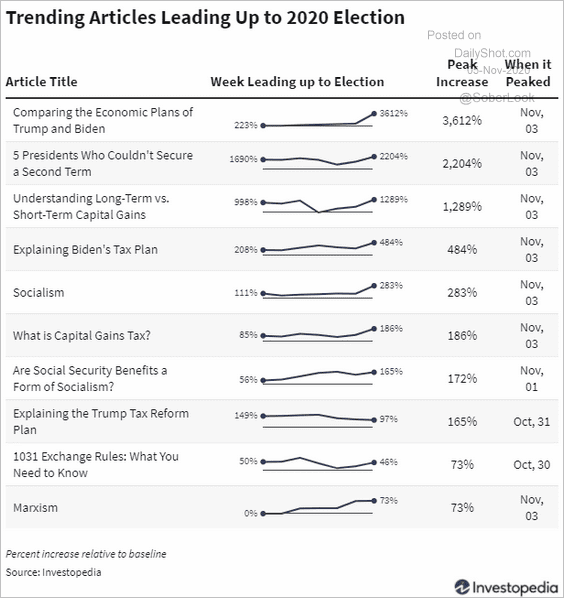

2. Trending Investopedia articles leading up to the elections:

Source: Investopedia Read full article

Source: Investopedia Read full article

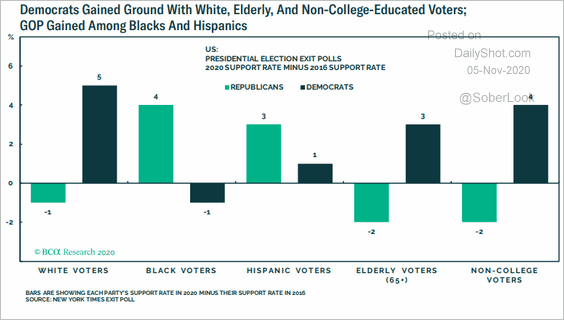

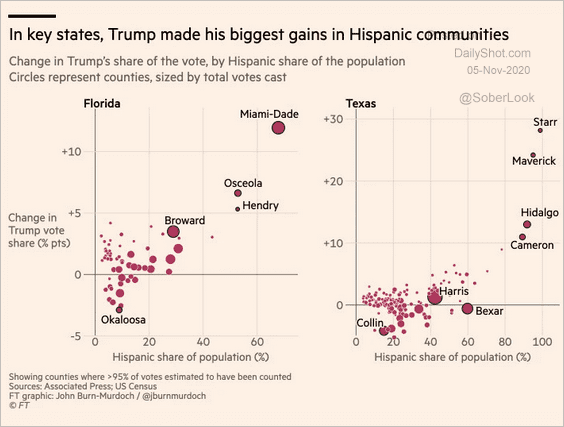

3. Demographic data from the 2020 elections (2 charts):

Source: BCA Research

Source: BCA Research

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

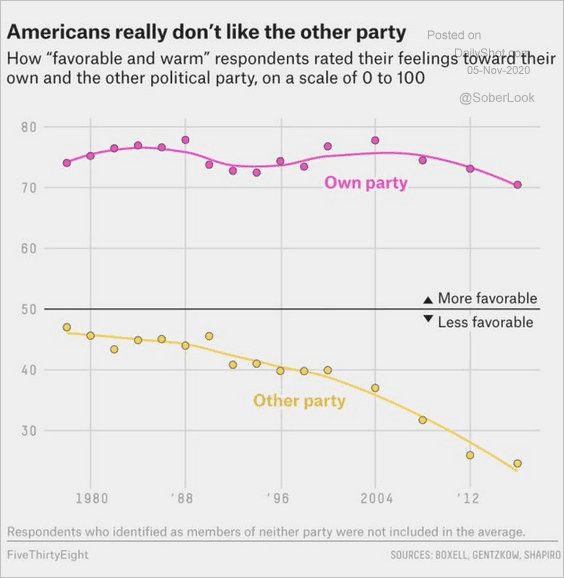

4. Political polarization in the US:

Source: @adam_tooze, @leedrutman, @FiveThirtyEight Read full article

Source: @adam_tooze, @leedrutman, @FiveThirtyEight Read full article

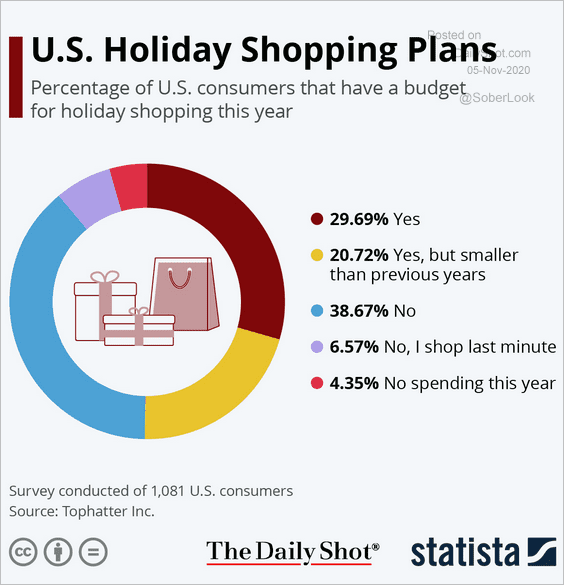

5. Holiday shopping budgets:

Source: Statista

Source: Statista

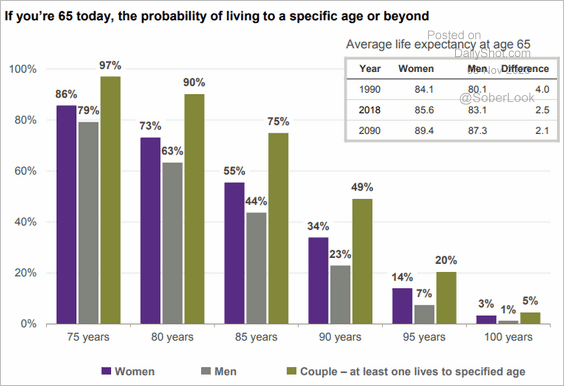

6. Life expectancy at 65:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

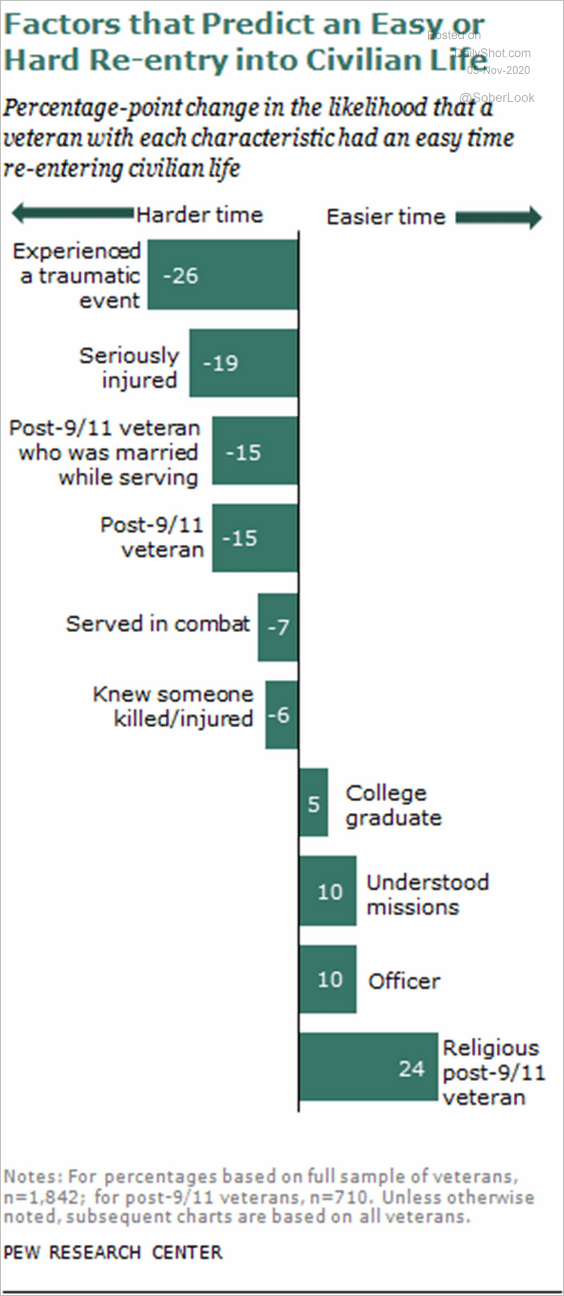

7. Veterans re-entering civilian life:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

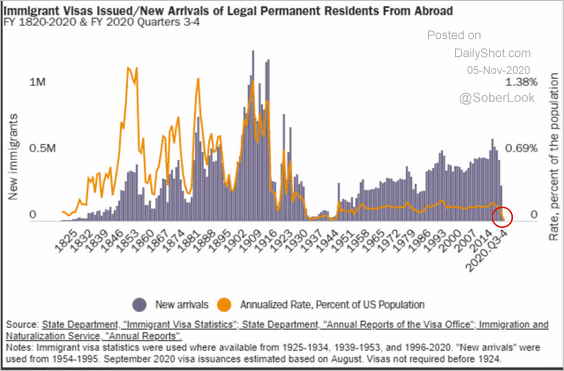

8. US legal permanent residents from abroad:

Source: Cato Institute Read full article

Source: Cato Institute Read full article

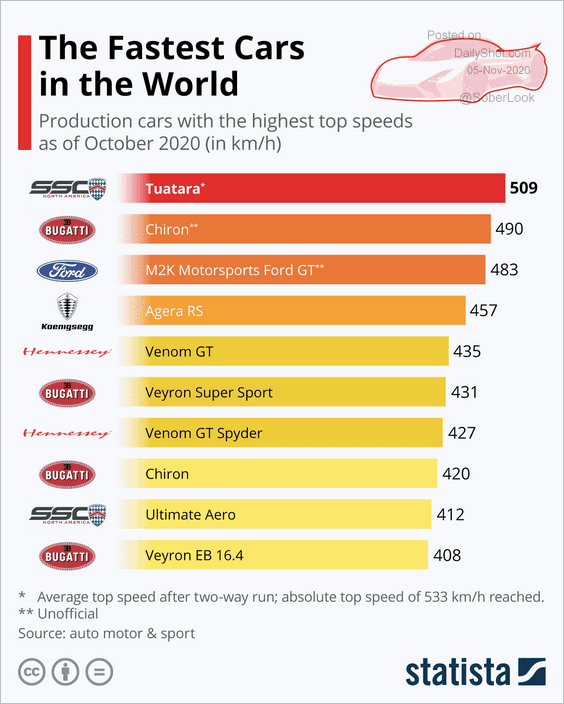

9. The world’s fastest cars:

Source: Statista

Source: Statista

——————–