The Daily Shot: 09-Nov-20

• Equities

• Rates

• Commodities

• Emerging Markets

• China

• Japan

• The Eurozone

• Canada

• The United States

• Global Developments

• Food for Thought

Equities

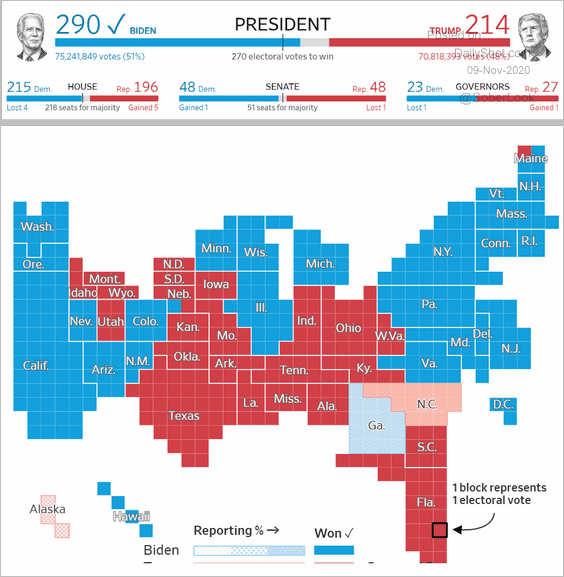

1. The US election is finally over, with political uncertainty quickly dissipating. While there still may be some ballot-counting adjustments at the margin, the key results are in.

Source: @WSJ Read full article

Source: @WSJ Read full article

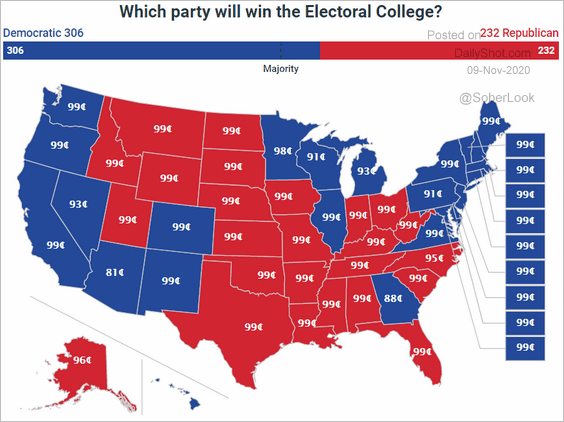

Here are the betting market odds for the Electoral College.

Source: @PredictIt

Source: @PredictIt

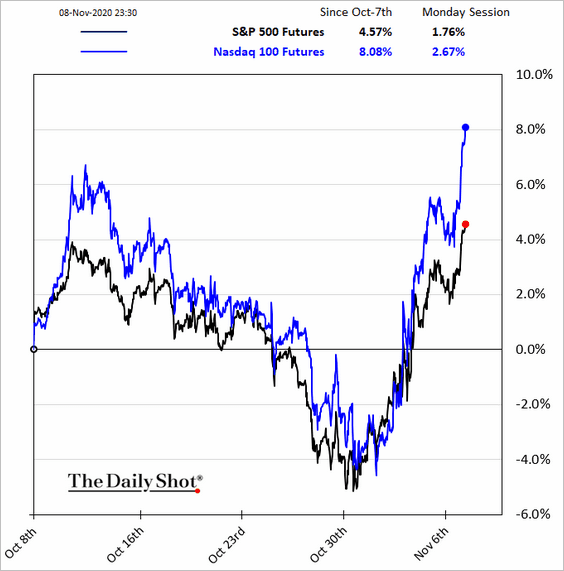

The market is pleased with the election outcome and reduced uncertainty (for now). Stock futures are up sharply in early trading.

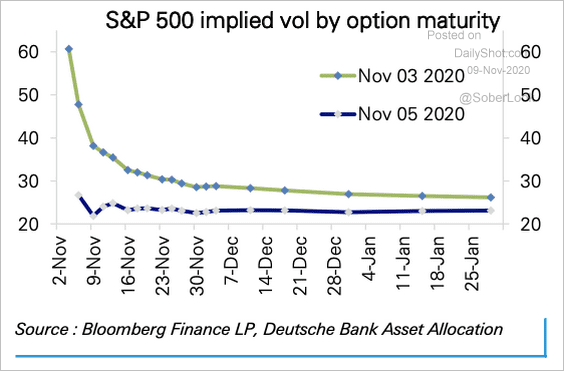

The collapse in vol (less uncertainty) has been supporting the post-election bounce, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

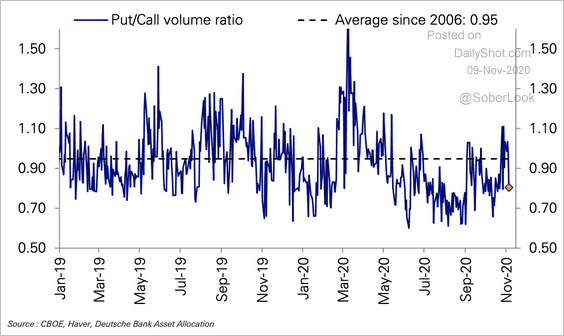

The put-call ratio declined last week.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

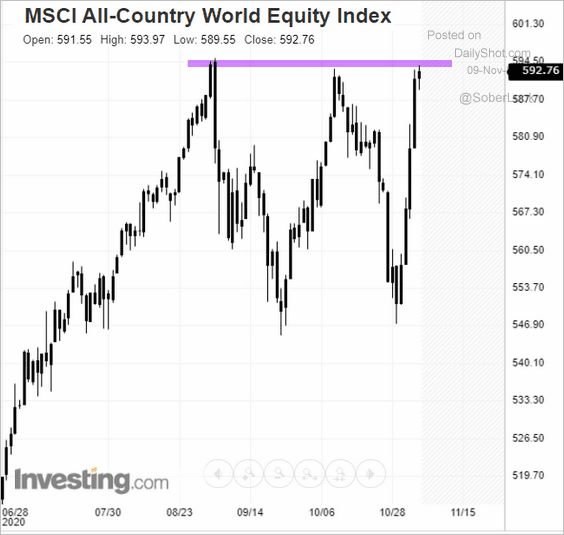

2. The MSCI World Index is testing all-time highs.

h/t @toddwhitebloomb

h/t @toddwhitebloomb

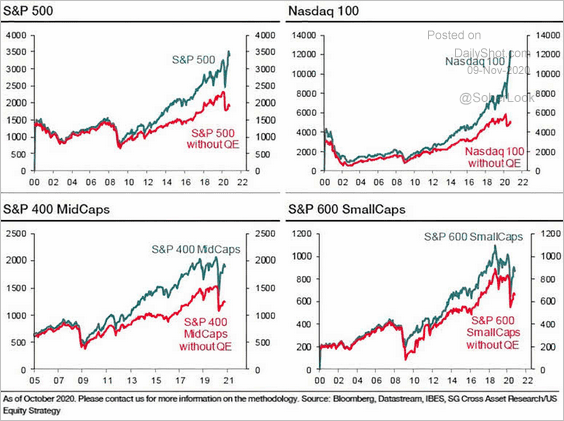

3. How would the US market have performed without the Fed’s QE?

Source: @ISABELNET_SA, @SocieteGenerale

Source: @ISABELNET_SA, @SocieteGenerale

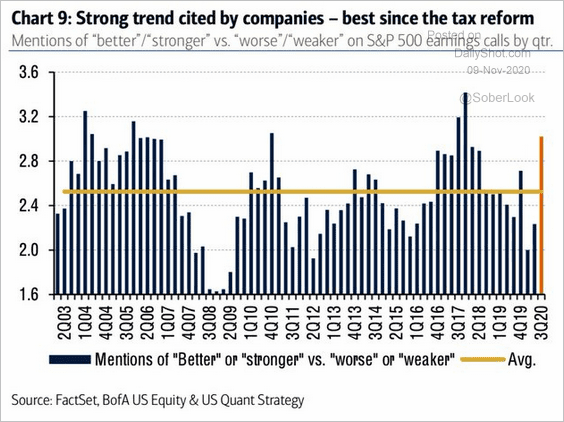

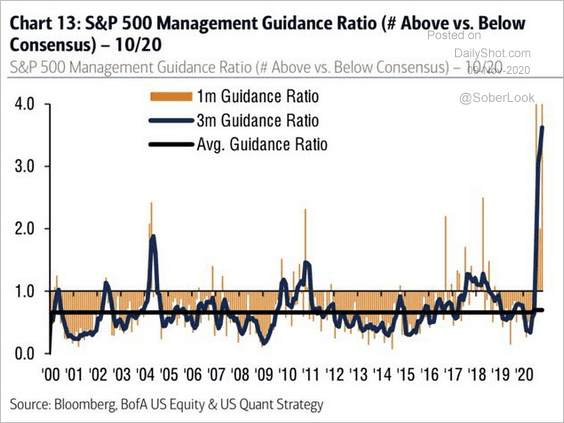

4. S&P 500 CEOs are most upbeat in years.

Source: BofA Global Research, @WallStJesus

Source: BofA Global Research, @WallStJesus

Guidance is at extremes relative to expectations.

Source: BofA Global Research, @WallStJesus

Source: BofA Global Research, @WallStJesus

——————–

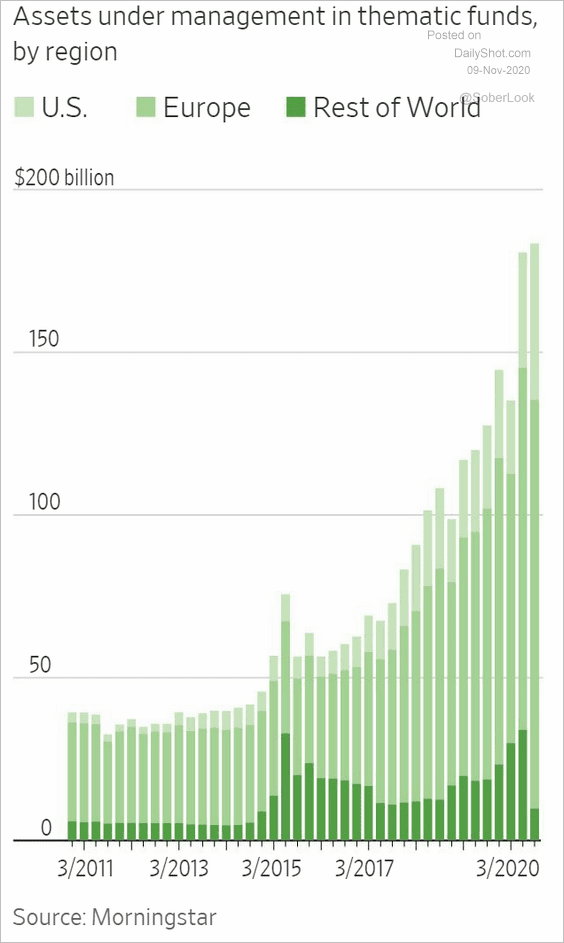

5. Thematic funds have been popular this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

Rates

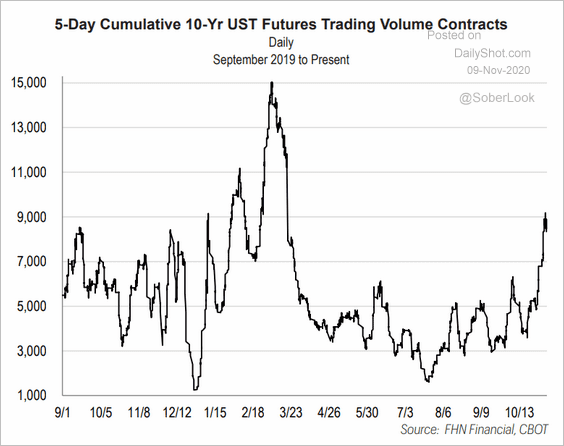

1. The 10-year Treasury futures volume spiked in recent days.

Source: FHN Financial

Source: FHN Financial

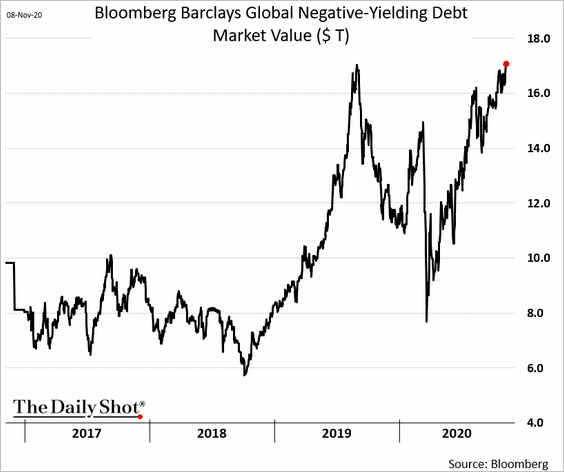

2. The amount of negative-yielding debt globally is now above $17 trillion (a record).

Commodities

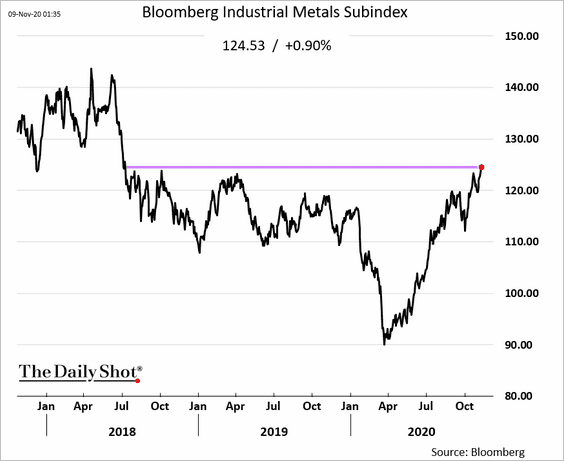

1. Bloomberg’s industrial metals index hit the highest level since 2018.

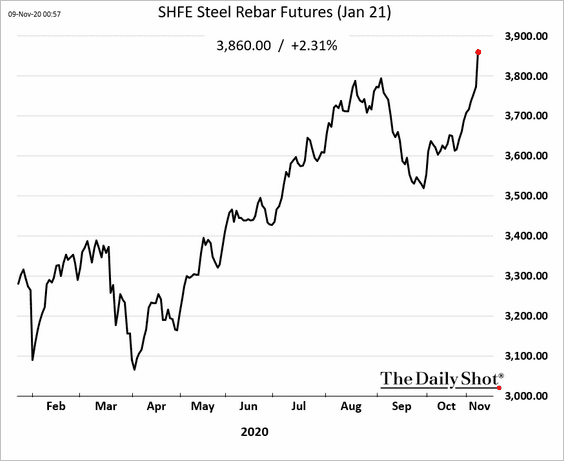

Steel futures in China are soaring.

——————–

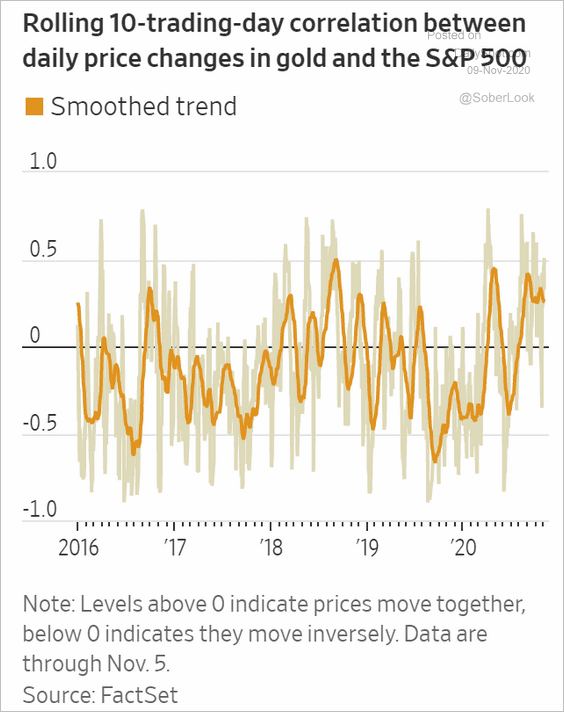

2. Gold has been correlated with stocks recently, which makes it less effective as a hedge.

Source: @WSJ Read full article

Source: @WSJ Read full article

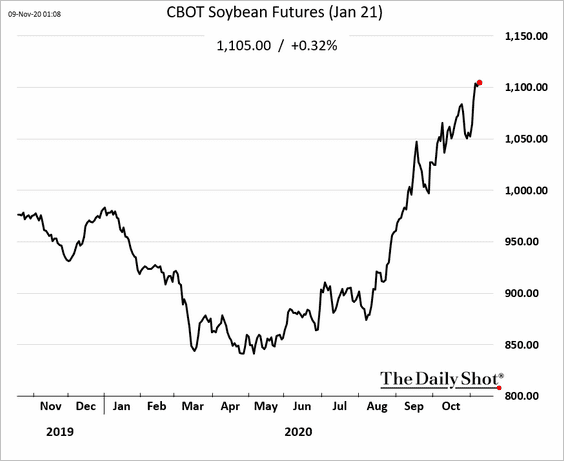

3. US soybean futures continue to climb.

Emerging Markets

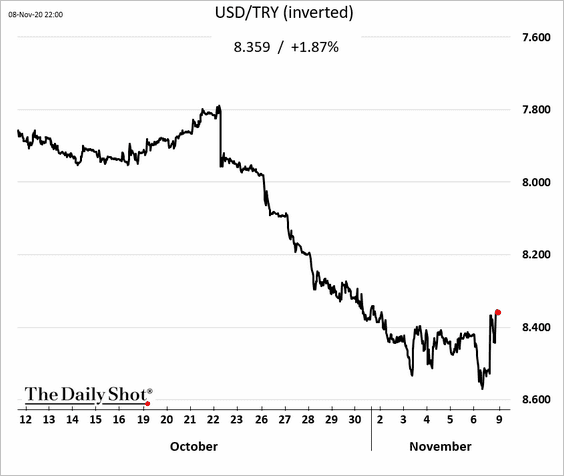

1. Erdogan fired Turkey’s central bank governor.

Source: @WSJ Read full article

Source: @WSJ Read full article

And Tukey’s finance minister, Murat Uysal (Erdogan’s son-in-law), resigned.

Source: ABC News Read full article

Source: ABC News Read full article

The market was happy with Uysal’s resignation, sending the lira higher. Let’s see how long that lasts.

——————–

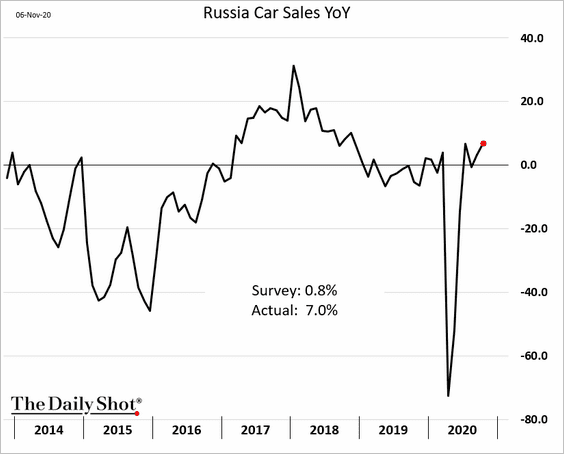

2. Russia’s car sales surprised to the upside.

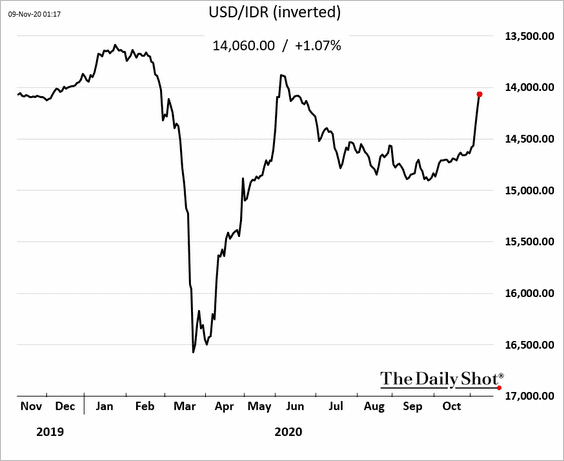

3. The Indonesian rupiah continues to climb as investment funds flow into the country.

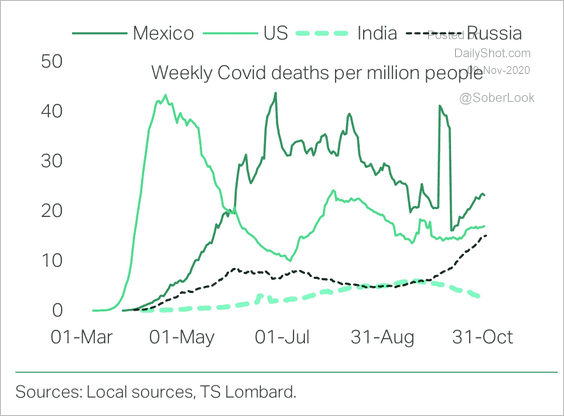

4. India’s weekly deaths from COVID-19 are falling.

Source: TS Lombard

Source: TS Lombard

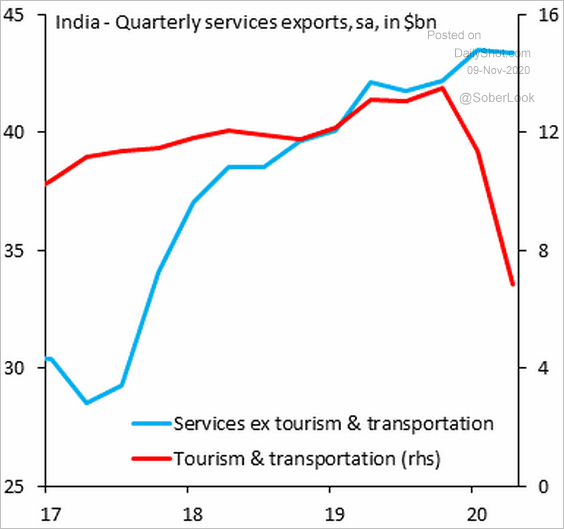

India’s service exports have been dragged lower by the tourism and transportation sectors.

Source: @SergiLanauIIF

Source: @SergiLanauIIF

——————–

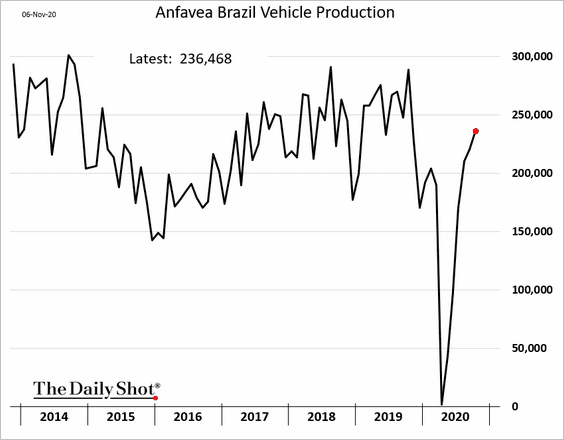

5. Brazil’s vehicle production keeps climbing.

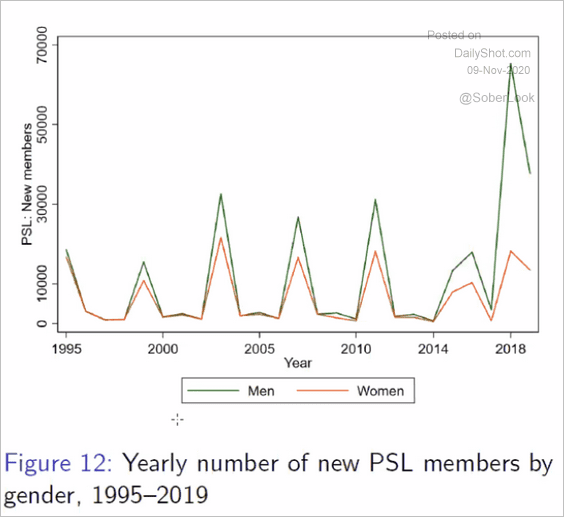

Separately, new membership in Bolsonaro’s party didn’t have a large gender divide until Bolsonaro became President.

Source: Barros and Silva (2020)

Source: Barros and Silva (2020)

——————–

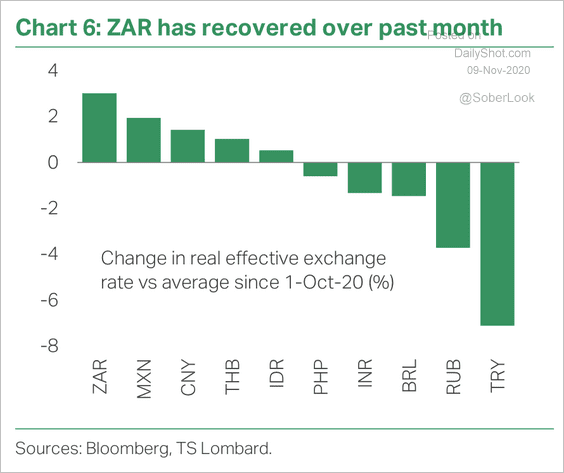

6. Here is a look at EM currency performance over the past month.

Source: TS Lombard

Source: TS Lombard

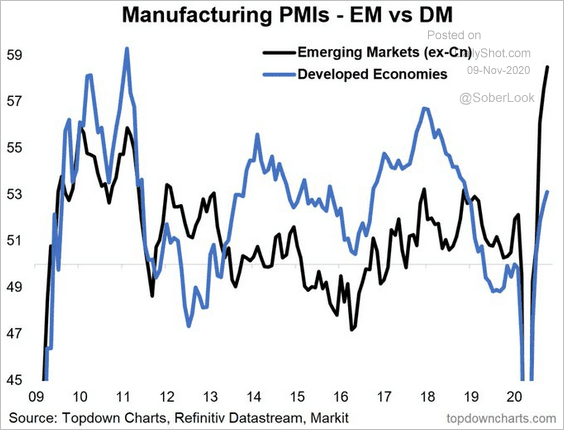

7. EM manufacturing growth has been outperforming advanced economies.

Source: @topdowncharts Read full article

Source: @topdowncharts Read full article

China

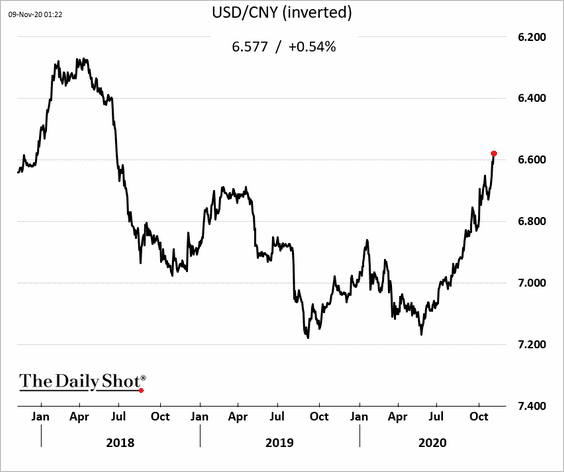

1. The renminbi is up sharply on US election outcome.

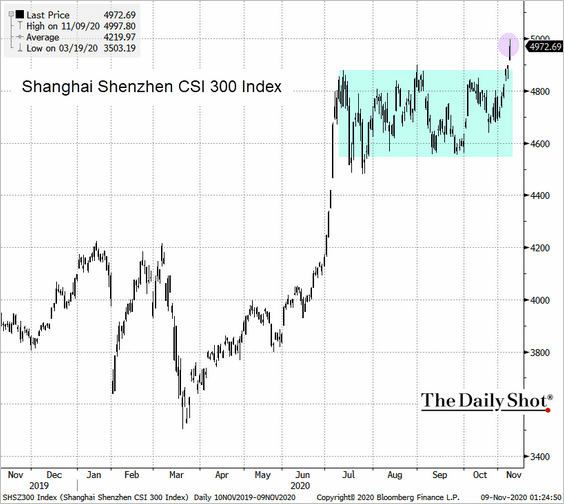

2. The stock market broke above the recent trading range.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

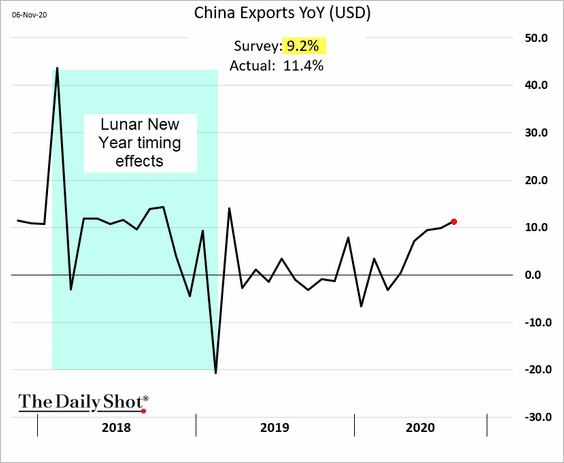

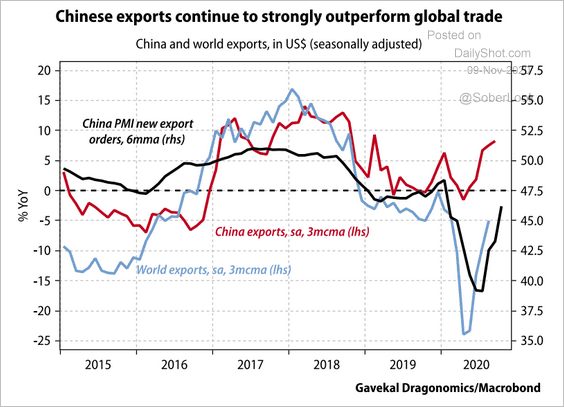

3. China’s exports are 11% above last year’s levels, …

… outperforming global trade.

Source: Gavekal

Source: Gavekal

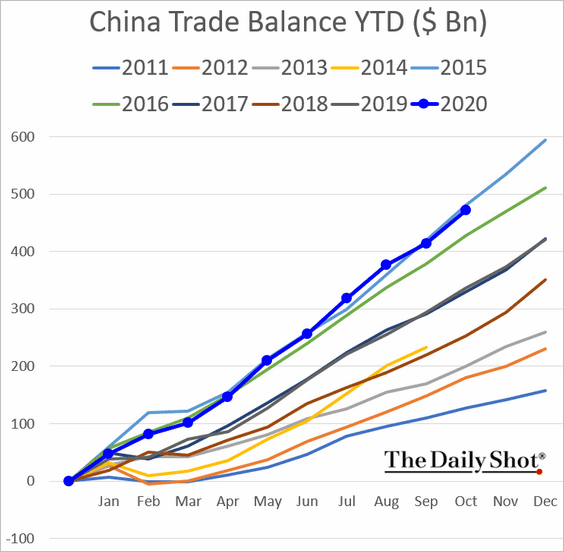

Here is the trade balance vs. previous years (year-to-date).

——————–

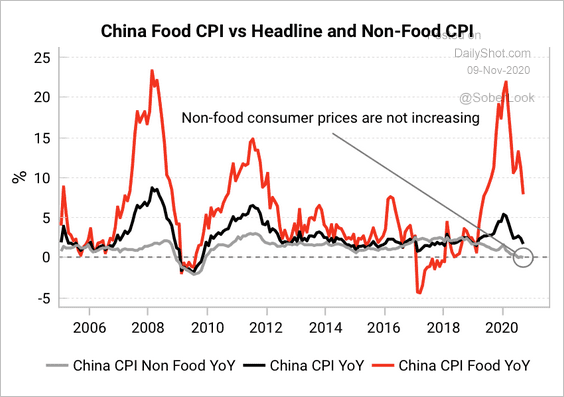

4. Inflation data remains weak for now, and real yields will climb higher as food prices ease, according to Variant Perception.

Source: Variant Perception

Source: Variant Perception

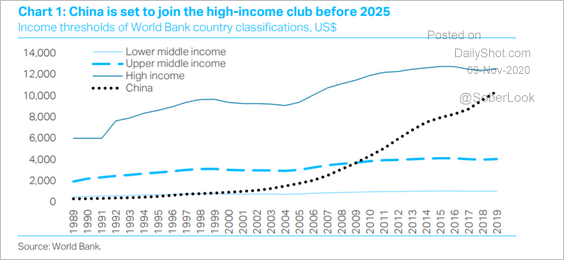

6. China will soon join the ranks of high-income countries.

Source: TS Lombard

Source: TS Lombard

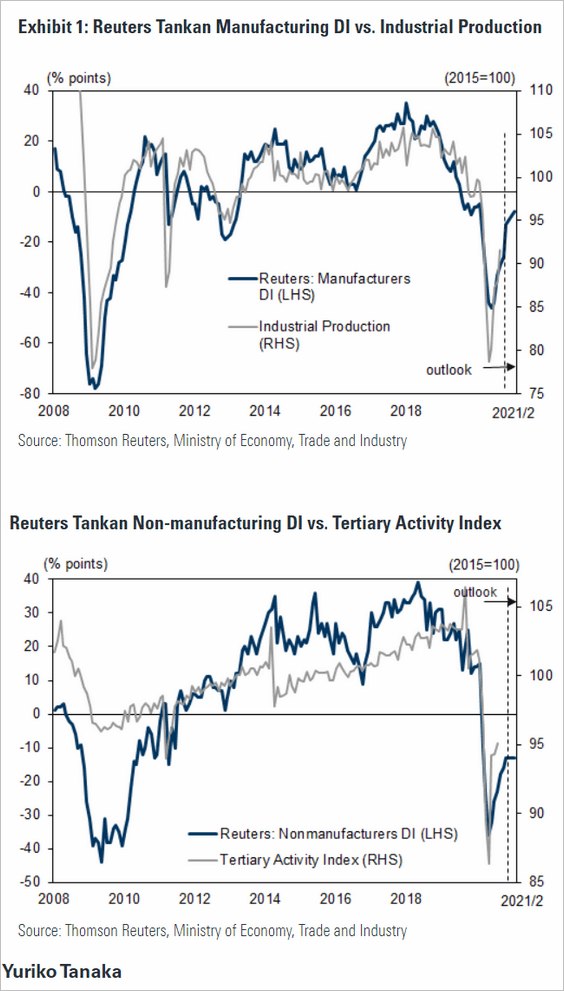

Japan

1. Service-sector recovery continues to lag manufacturing.

Source: Goldman Sachs

Source: Goldman Sachs

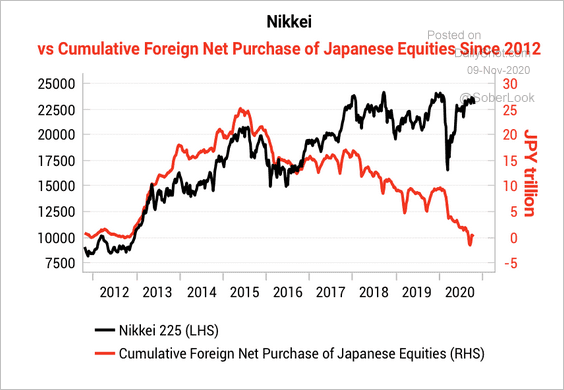

2. Japanese equities have been shunned by international investors for the past five years.

Source: Variant Perception

Source: Variant Perception

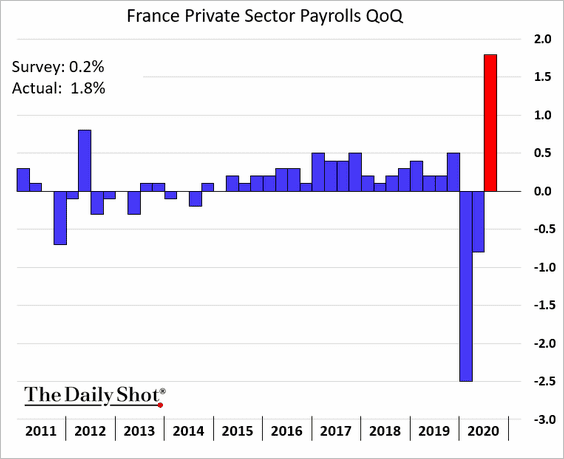

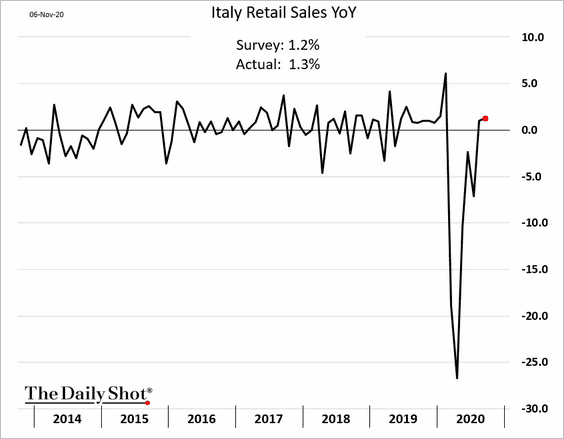

The Eurozone

1. French payrolls rebounded more than expected in Q3.

2. Italian retail sales held up well in September.

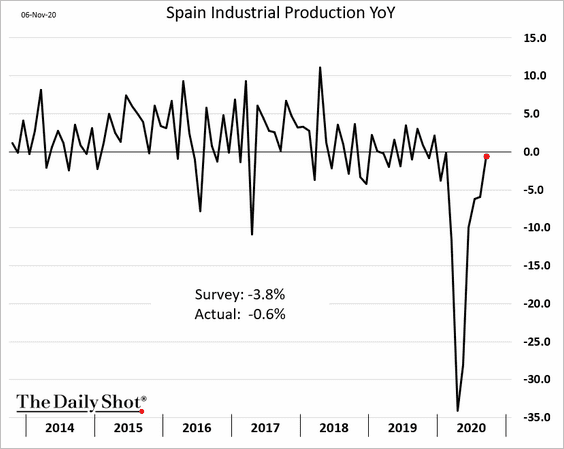

3. Spain’s manufacturing output is almost back to last year’s levels.

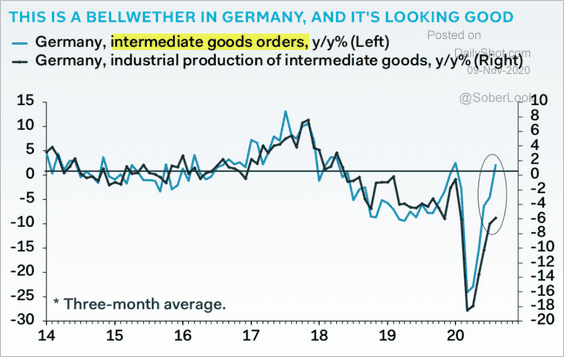

4. Germany’s intermediate goods orders point to further gains in industrial production.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

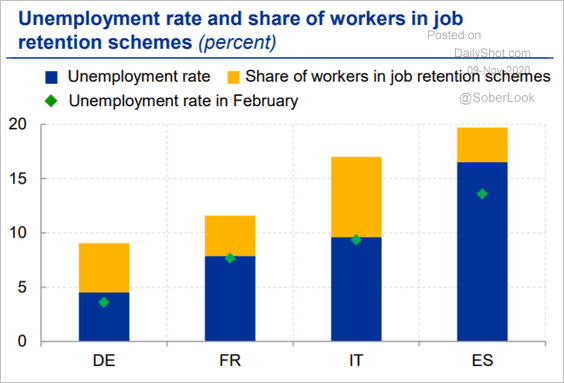

5. This chart shows the unemployment rate plus the share of workers in job retention schemes.

Source: ECB Read full article

Source: ECB Read full article

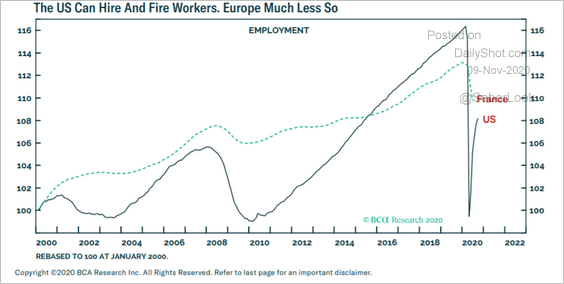

6. The ease of laying off and rehiring workers in the US makes US employment more volatile than what we see in the Eurozone.

Source: BCA Research

Source: BCA Research

Canada

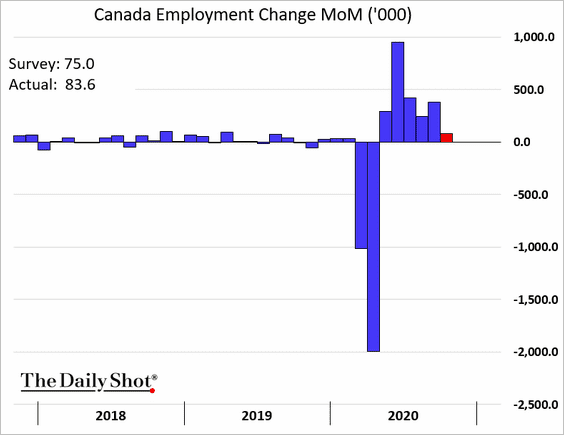

1. The October jobs report was a bit stronger than expected.

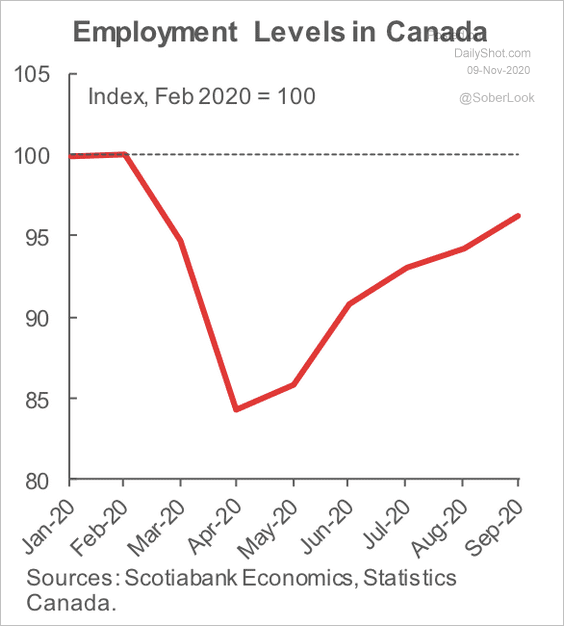

• Here is Canada’s employment vs. pre-COVID levels.

Source: Scotiabank Economics

Source: Scotiabank Economics

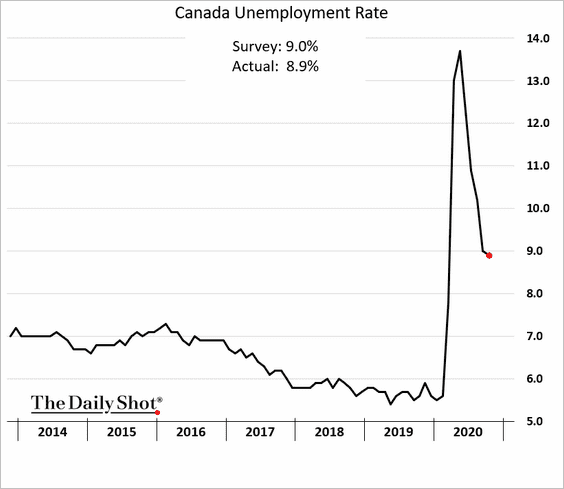

• The unemployment rate dipped below 9%.

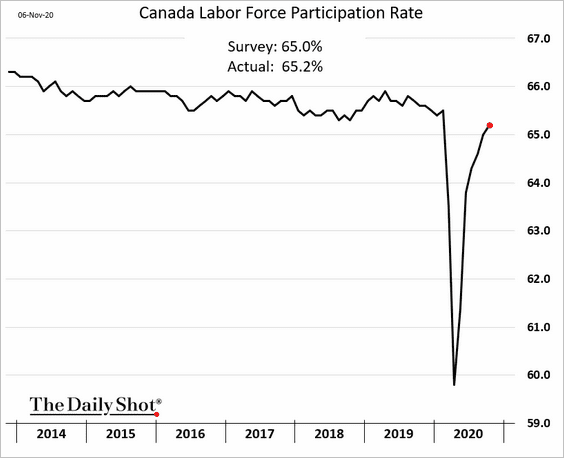

• The participation rate continues to recover.

——————–

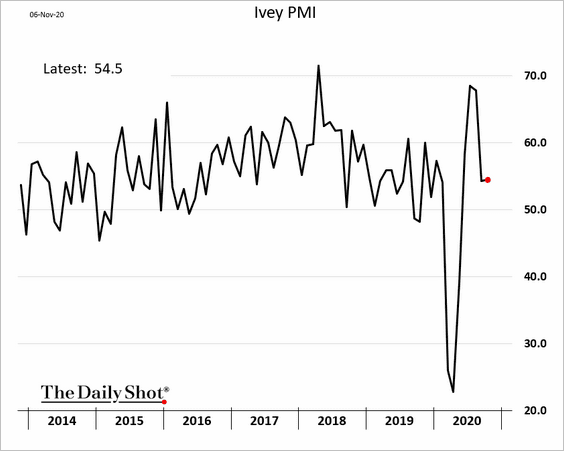

2. The Ivey PMI measure of business activity remained stable last month.

3. Here is the Oxford Economics Recovery Tracker.

![]() Source: Oxford Economics

Source: Oxford Economics

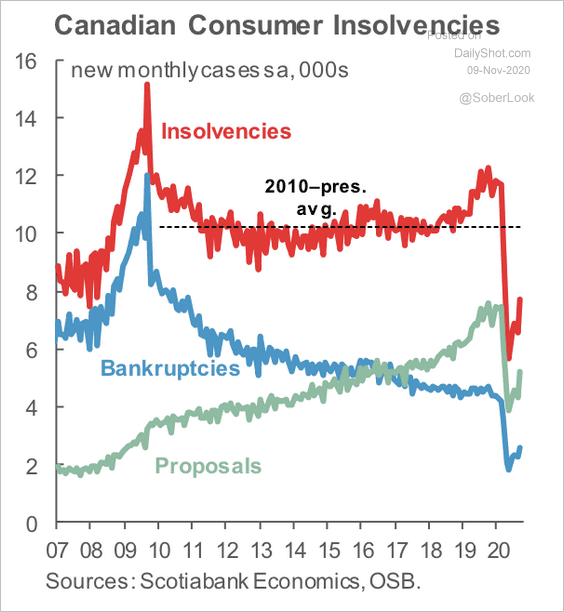

4. Consumer insolvency filings continued to climb in September. Note that debt payment deferrals kept insolvencies at all-time lows during the height of the pandemic.

Source: Scotiabank Economics

Source: Scotiabank Economics

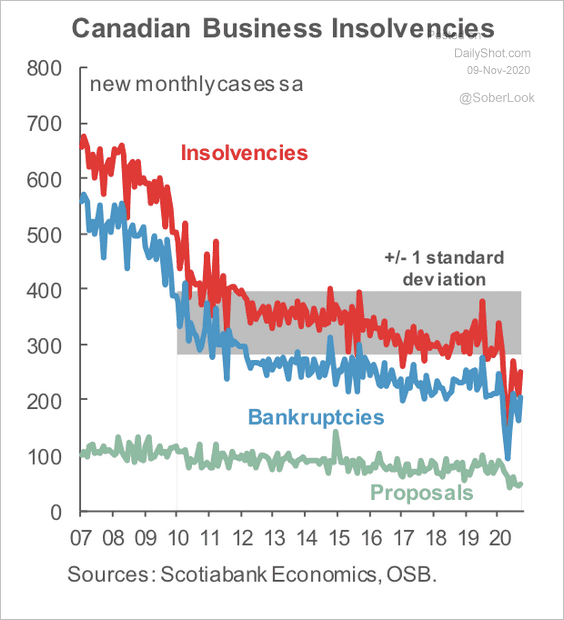

Business insolvencies picked up in September but remained below the long-term average.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

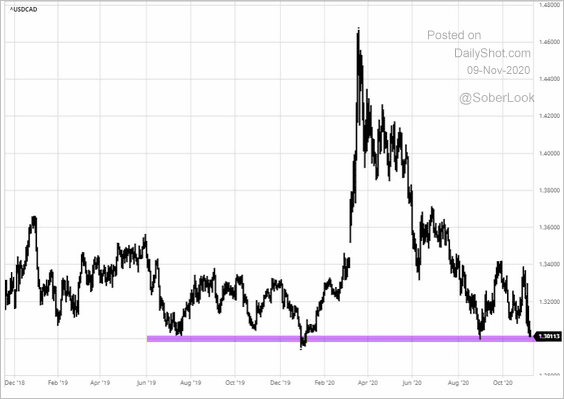

5. USD/CAD is at support (1.30).

The United States

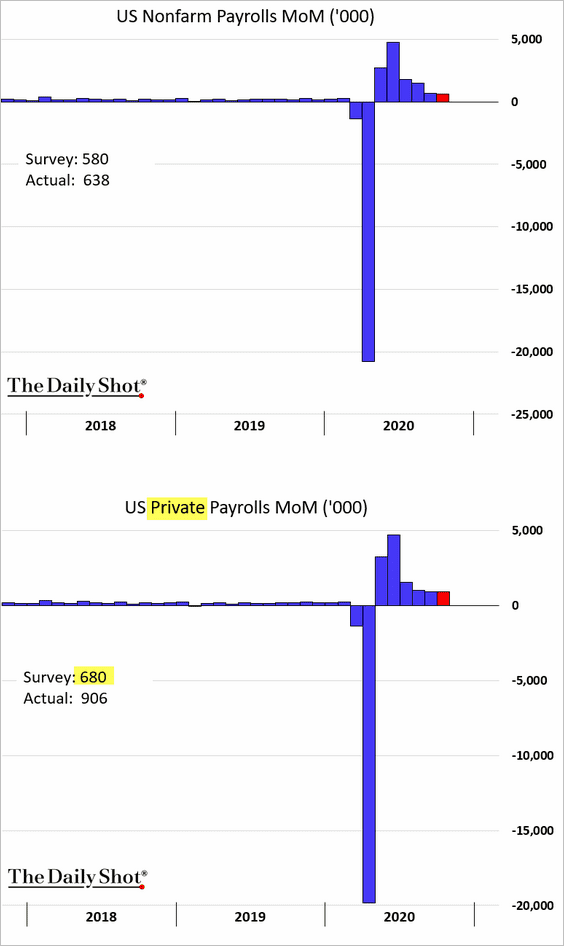

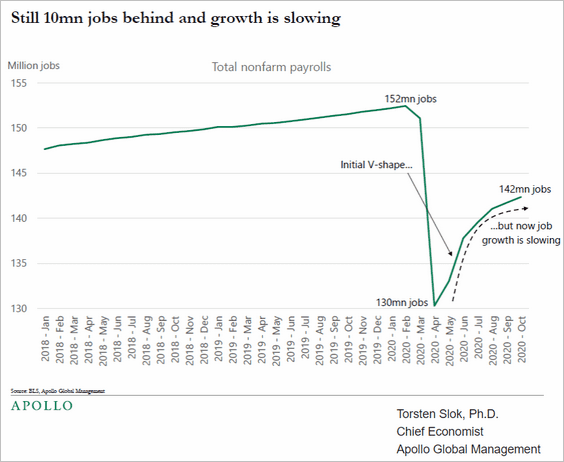

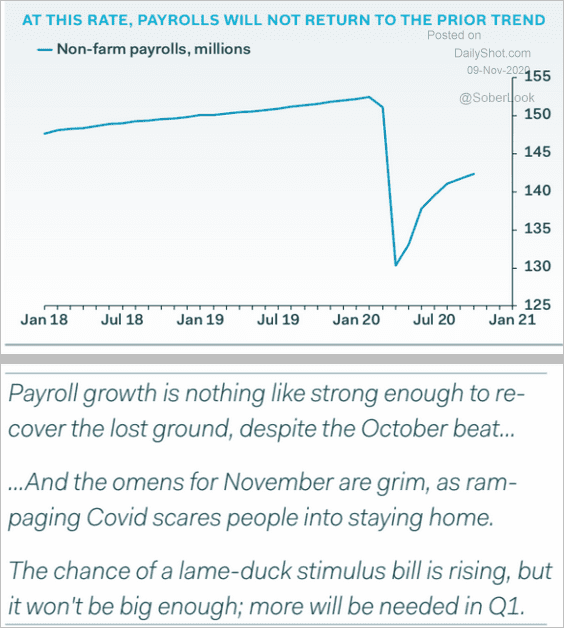

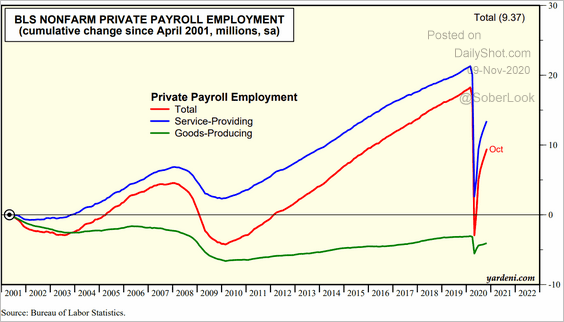

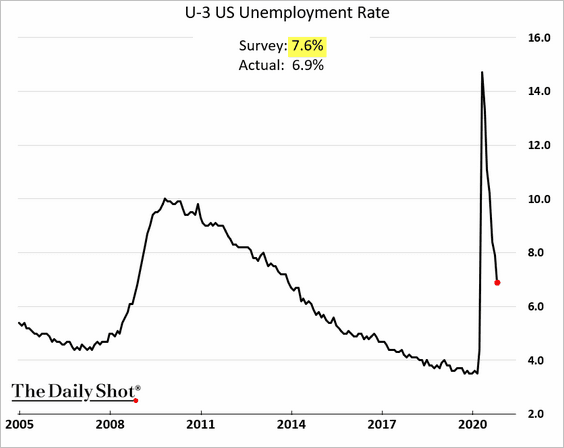

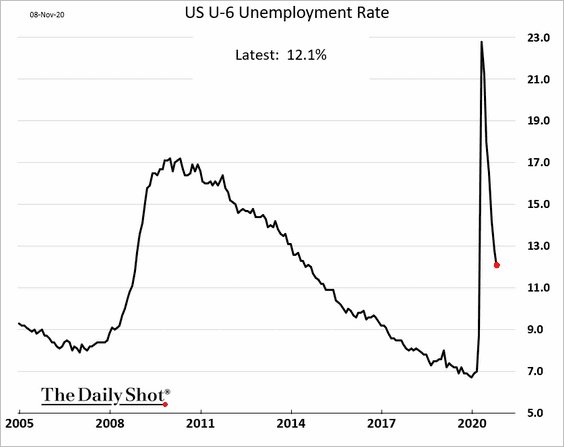

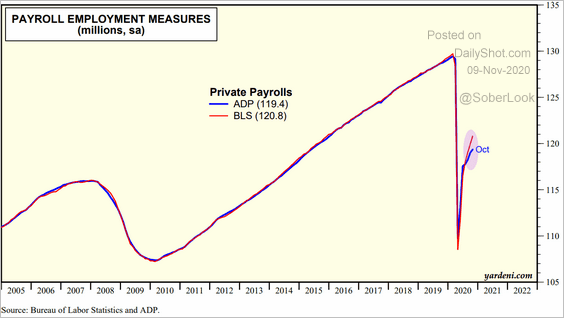

1. The October employment report was stronger than the market was expecting, particularly in private payrolls (second chart).

But the recovery is slowing, …

Source: Apollo

Source: Apollo

… and there are substantial risks ahead – see comments below from Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

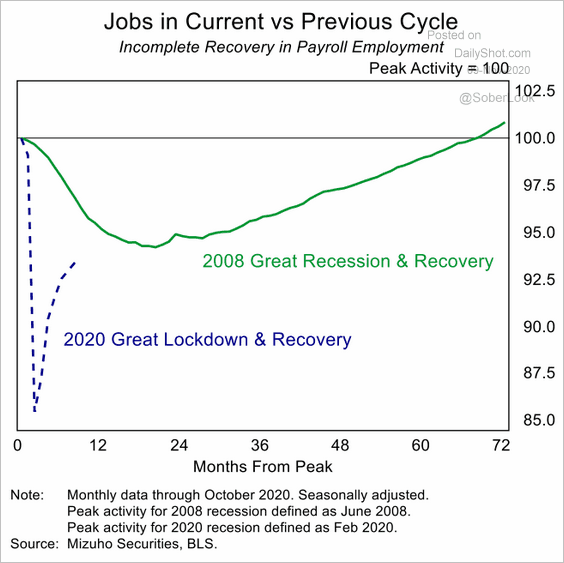

Let’s take a look at some labor market trends.

• Current recovery vs. 2008:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

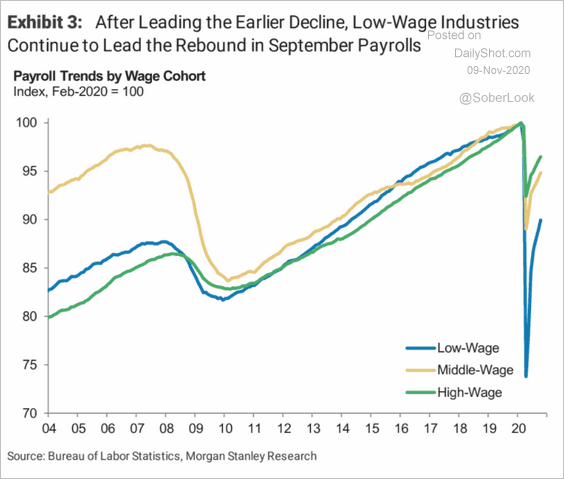

• Employment level by wage category:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Services vs. goods:

Source: Apollo

Source: Apollo

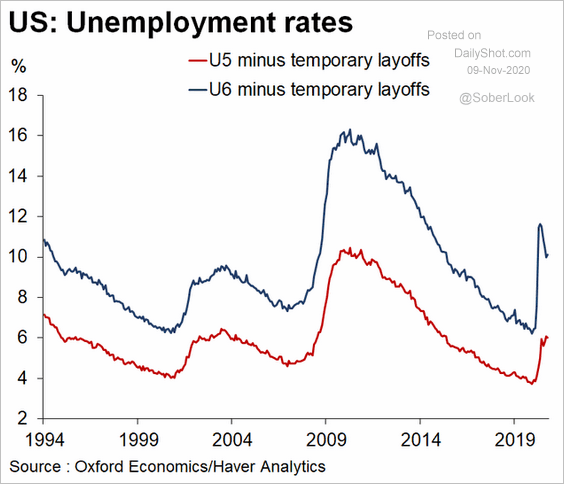

• The unemployment rate (chart below) and underemployment (2nd chart):

• Underemployment excluding temporary layoffs (this is a key indicator to watch going forward):

Source: @GregDaco, @JedKolko

Source: @GregDaco, @JedKolko

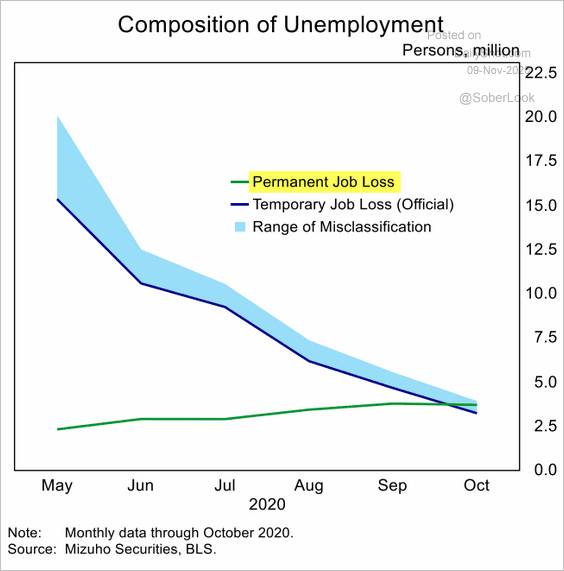

• Permanent job losses:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

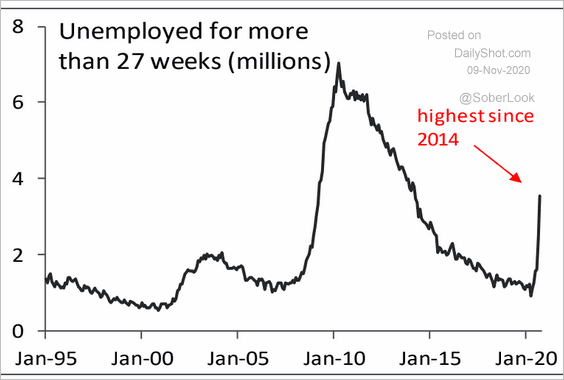

• Long-term unemployment:

Source: Piper Sandler

Source: Piper Sandler

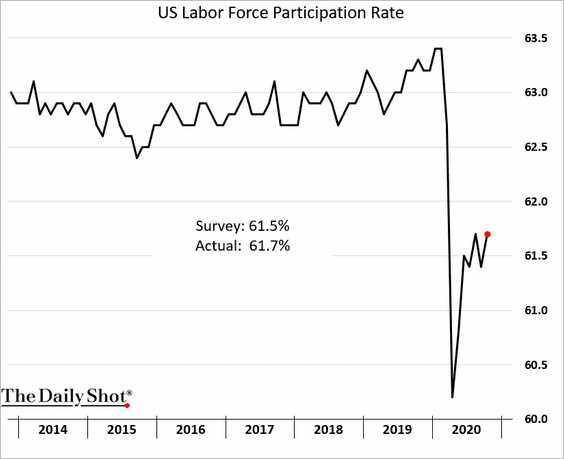

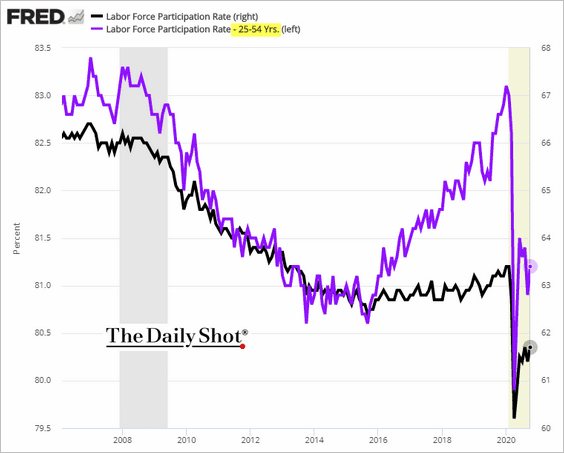

• Labor force participation rate:

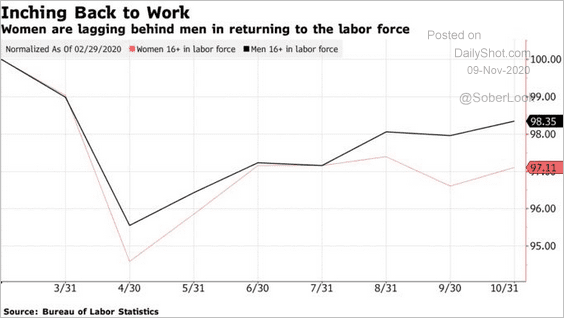

– Men vs. women:

Source: @markets Read full article

Source: @markets Read full article

– Prime-age participation:

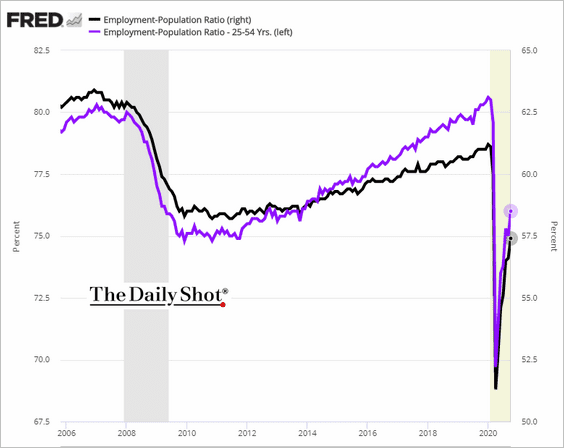

– Employment-to-population ratio:

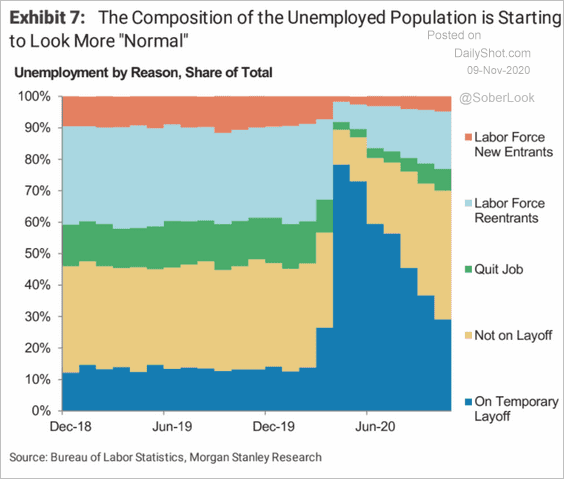

• Unemployment by reason:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

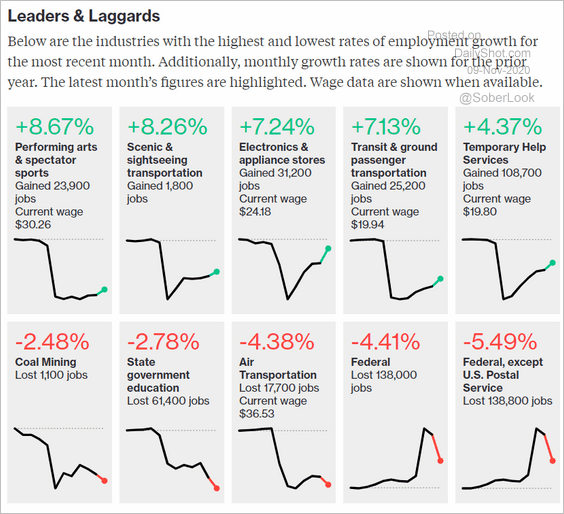

• Best- and worst-performing sectors last month:

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

• A widening divergence between ADP private payrolls and the government’s employment data:

Source: Yardeni Research

Source: Yardeni Research

——————–

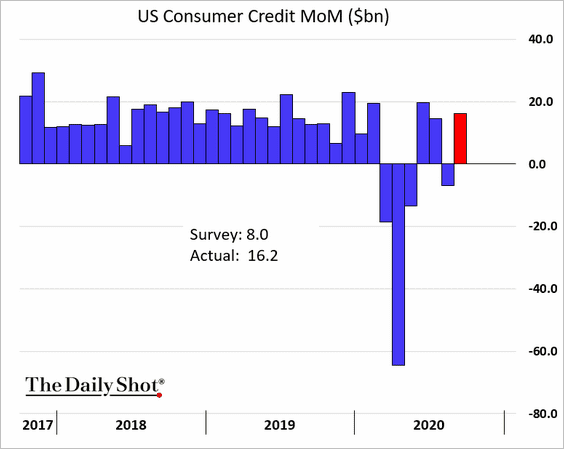

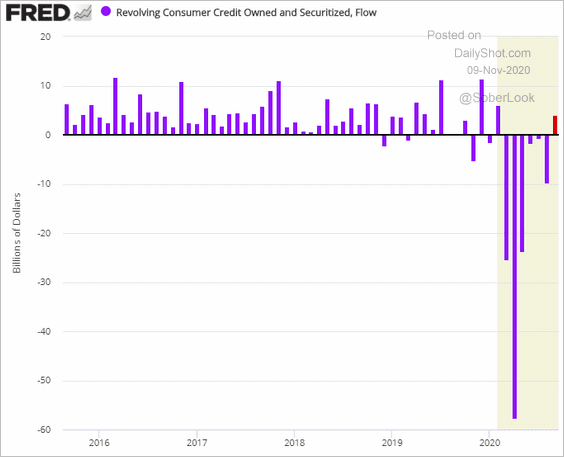

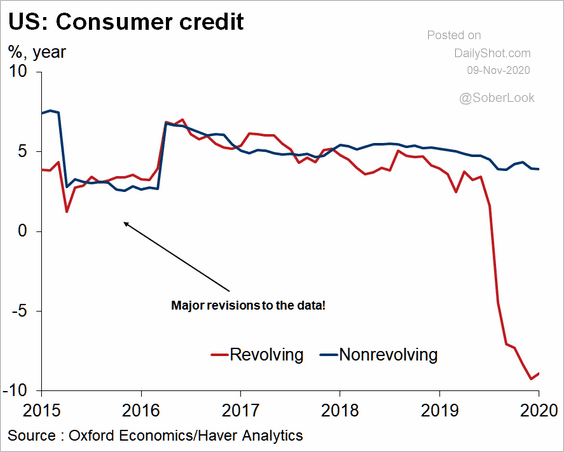

2. Consumer credit bounced in September, …

… driven by higher credit card usage (revolving credit).

But credit card balances remain depressed relative to pre-pandemic levels.

Source: Oxford Economics

Source: Oxford Economics

——————–

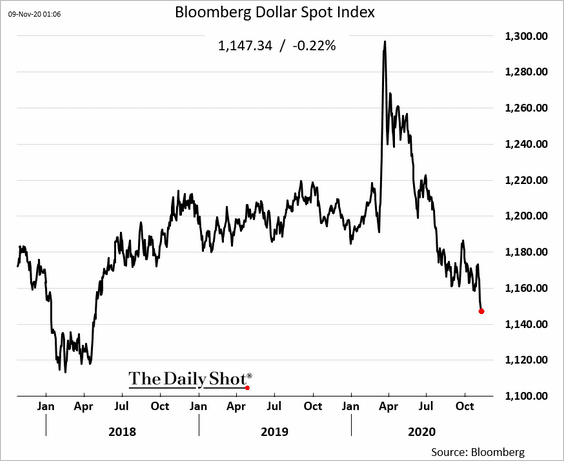

3. The US dollar continues to weaken. With the election uncertainty mostly behind us, rising risk appetite is pressuring the greenback.

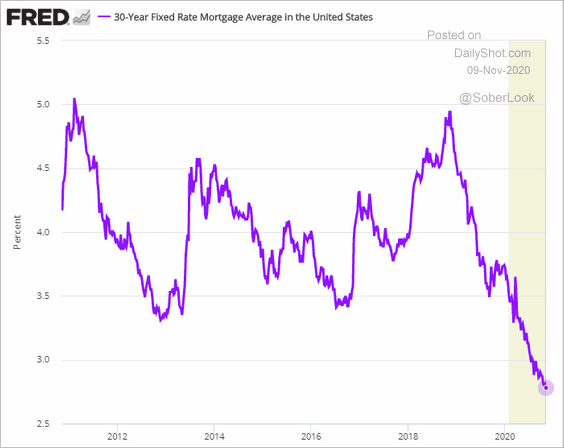

4. The 30yr mortgage rate hit another record low after Treasury yields tumbled last week.

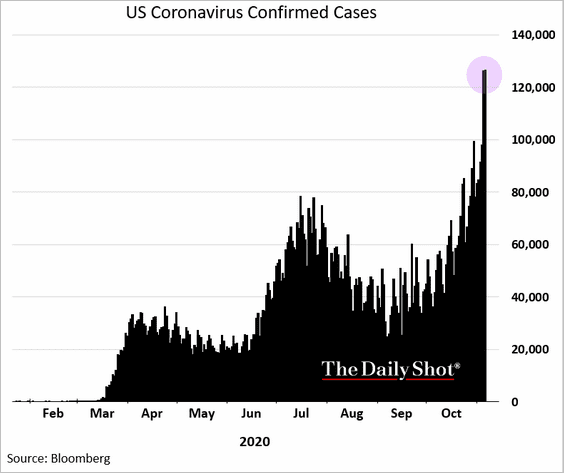

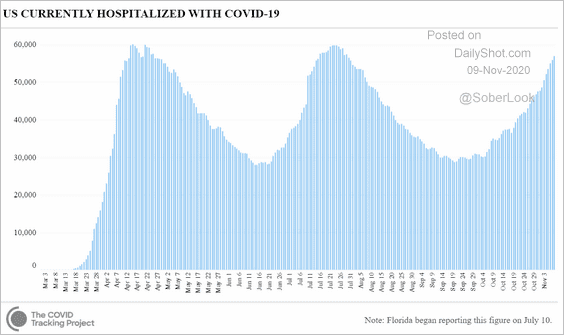

5. US daily COVID cases spiked to a new record, …

… with hospitalization rates continuing to climb.

Source: CovidTracking.com

Source: CovidTracking.com

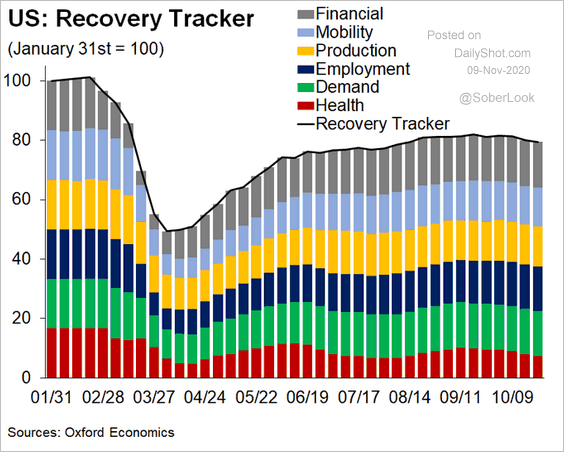

The pandemic is increasingly becoming a drag on growth.

Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

Global Developments

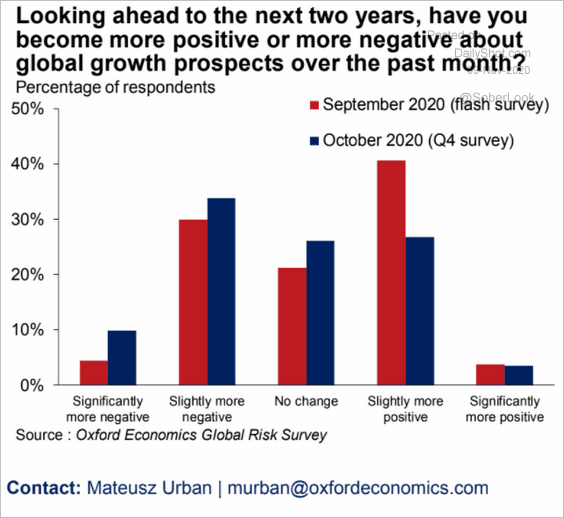

1. Businesses curbed their economic growth expectations last month.

Source: Oxford Economics

Source: Oxford Economics

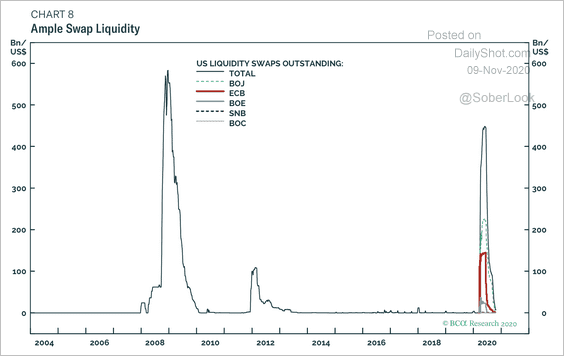

2. For now, there remains ample room for central banks to draw on the Fed’s dollar liquidity facility. This suggests that a potential dollar bounce could be short-lived, according to BCA Research.

Source: BCA Research

Source: BCA Research

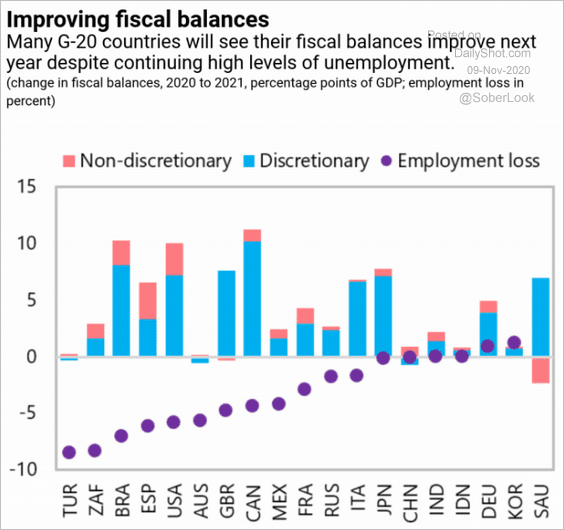

3. Fiscal balances should improve next year.

Source: IMF Read full article

Source: IMF Read full article

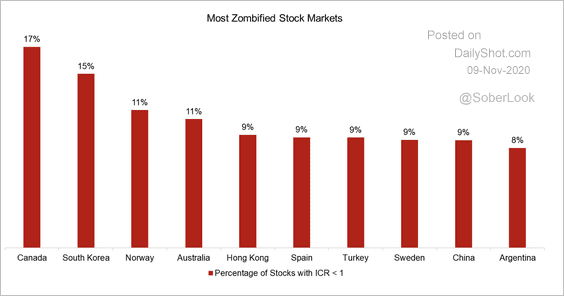

4. Here are the most “zombified” equity markets (stocks with interest coverage ratios below one), according to Factor Research.

Source: Factor Research

Source: Factor Research

——————–

Food for Thought

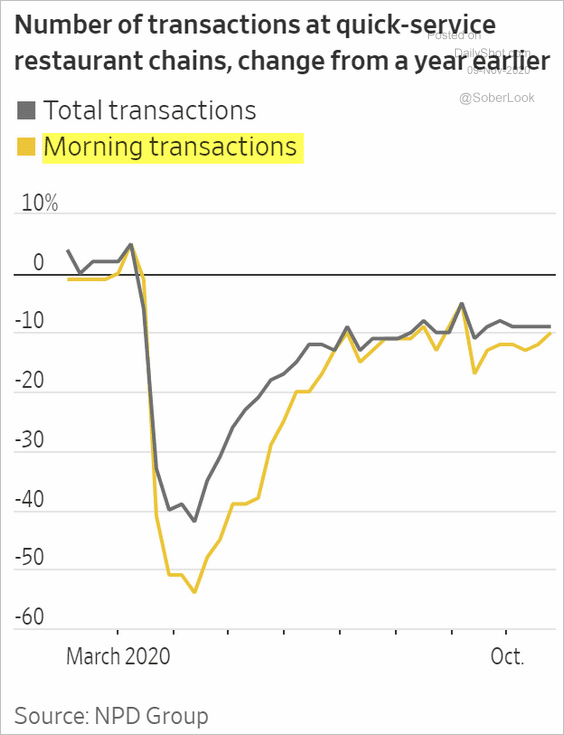

1. Fast food restaurants’ breakfast sales:

Source: @WSJ Read full article

Source: @WSJ Read full article

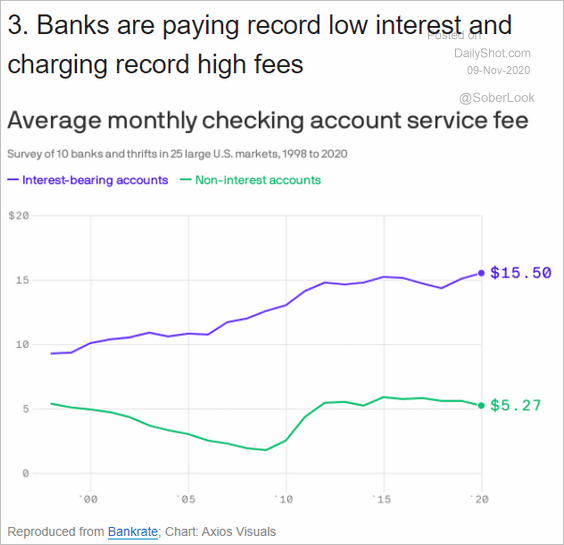

2. Bank account fees:

Source: @axios Read full article

Source: @axios Read full article

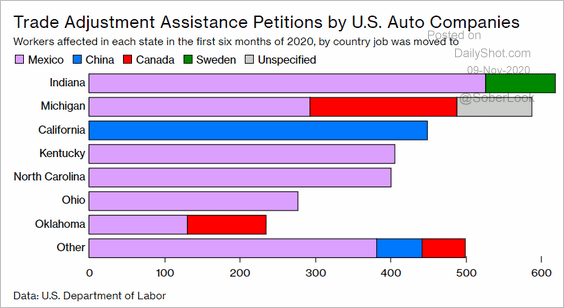

3. US auto manufacturing jobs moving abroad:

Source: @BW Read full article

Source: @BW Read full article

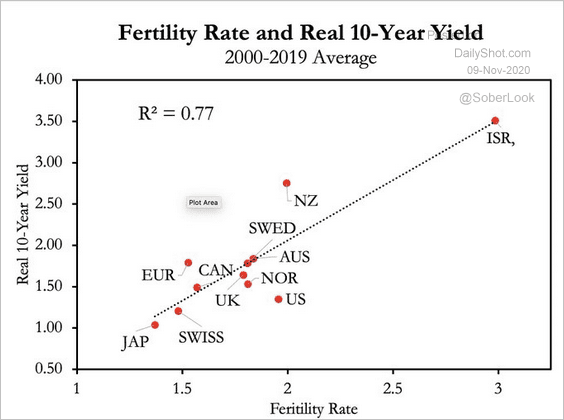

4. Interest rates and fertility rates:

Source: @DavidBeckworth

Source: @DavidBeckworth

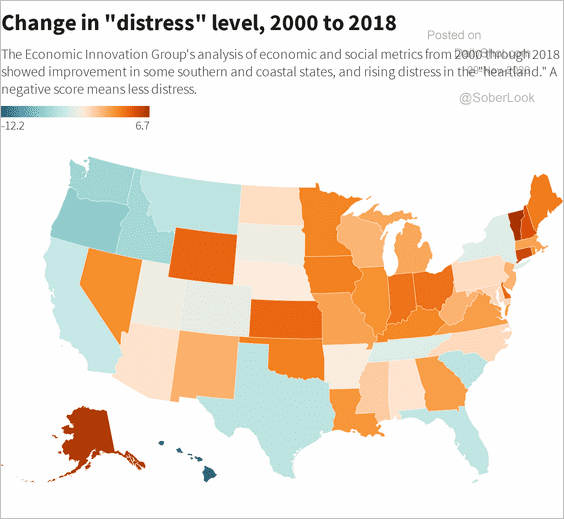

5. “Distress” levels across the US:

Source: Reuters Read full article

Source: Reuters Read full article

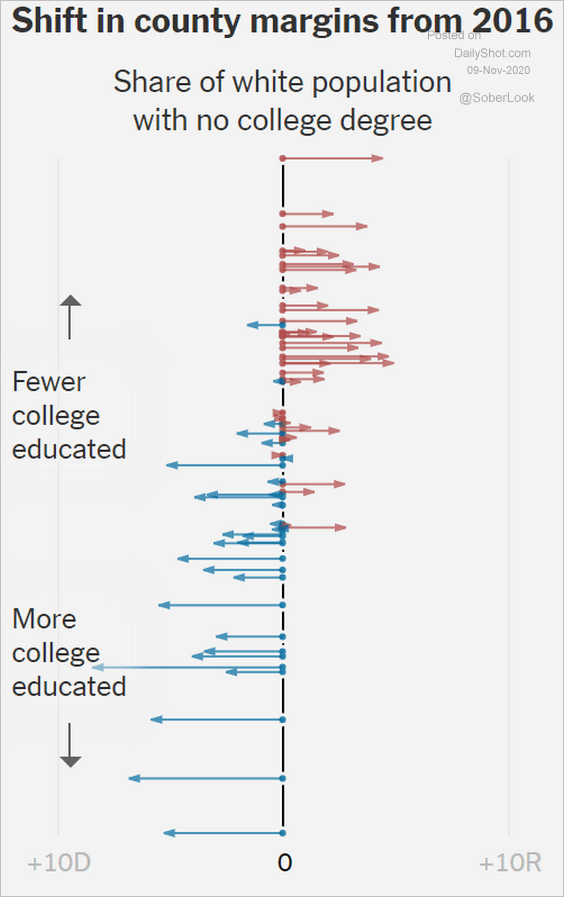

6. The shift in voter margins (Republican vs. Democrat) from 2016, by education:

Source: The New York Times Read full article

Source: The New York Times Read full article

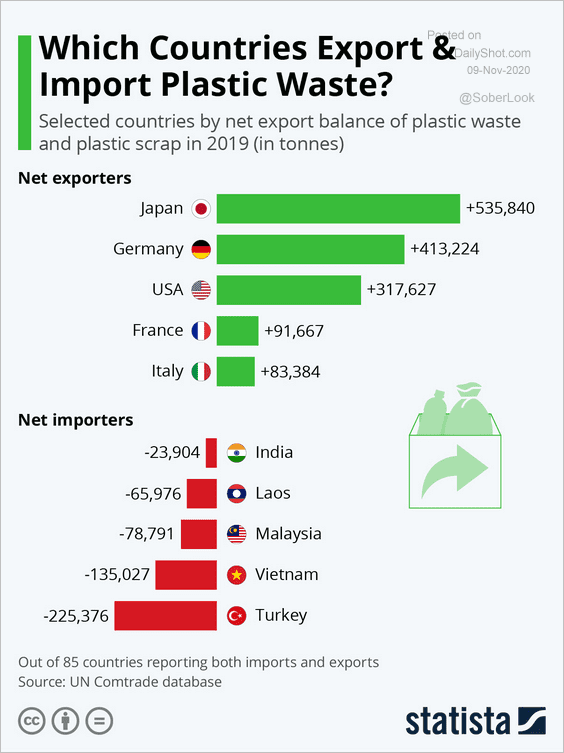

7. Plastic importers and exporters:

Source: Statista

Source: Statista

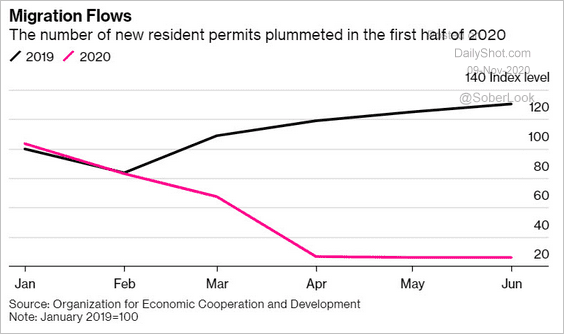

8. Migration in OECD countries:

Source: @business Read full article

Source: @business Read full article

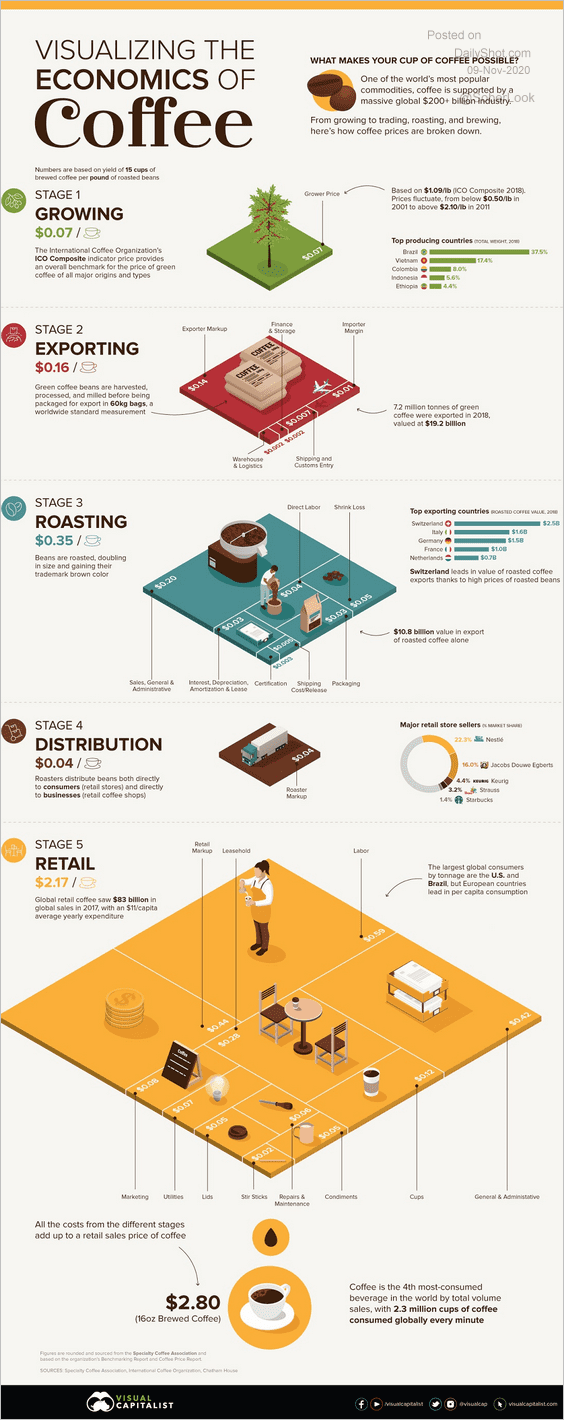

9. The economics of a cup of coffee:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–