The Daily Shot: 13-Nov-20

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Food for Thought

The United States

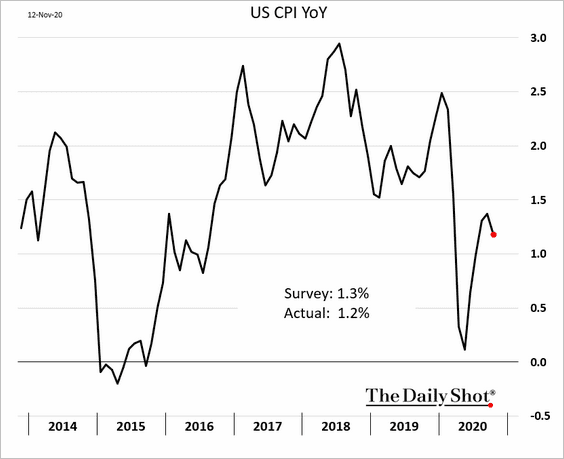

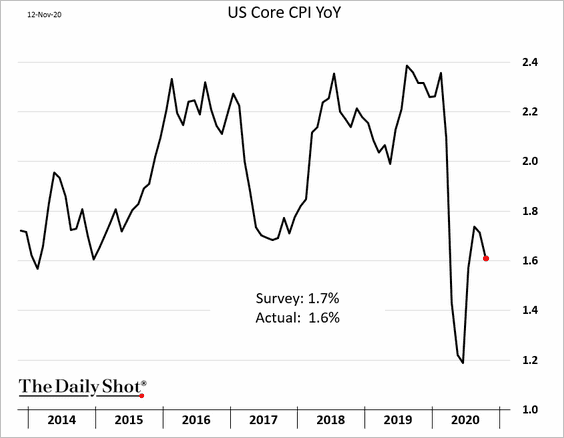

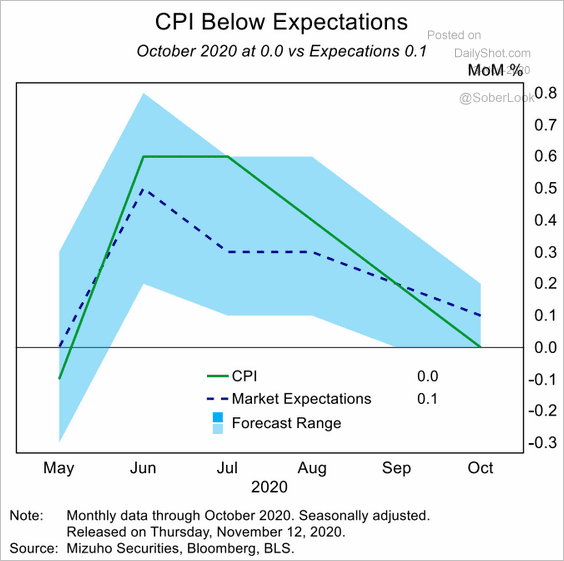

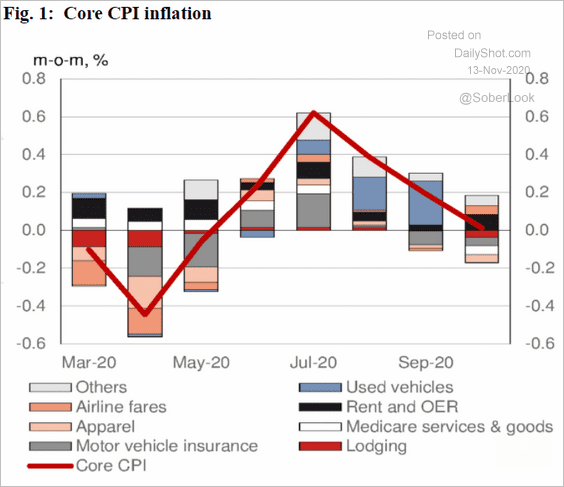

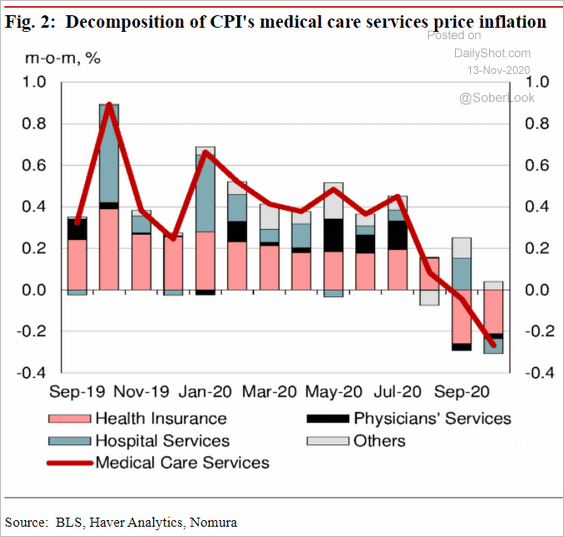

1. The October CPI report showed a slowdown in price increases, with both the headline and the core inflation figures coming in below consensus.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

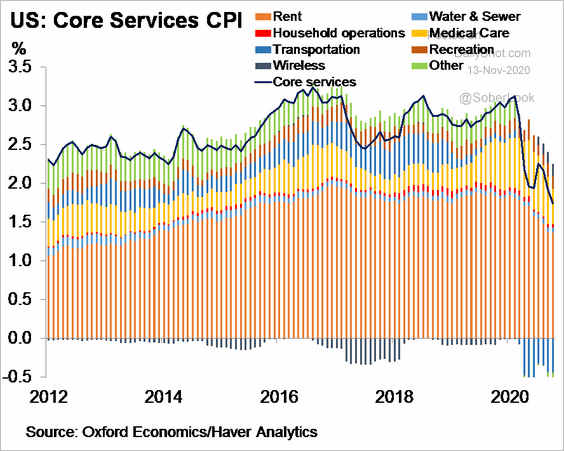

This chart shows the core services CPI and its components.

Source: Oxford Economics

Source: Oxford Economics

And these are the month-over-month changes.

Source: Nomura Securities

Source: Nomura Securities

Over the years, many Americans have become skeptical about the official CPI figures. That mistrust of inflation data became more pronounced this year after the lockdowns. We decided to ask a number of people across the US about their experience with inflation and why they don’t believe the CPI figures. Below are some responses and the corresponding data from the latest CPI report.

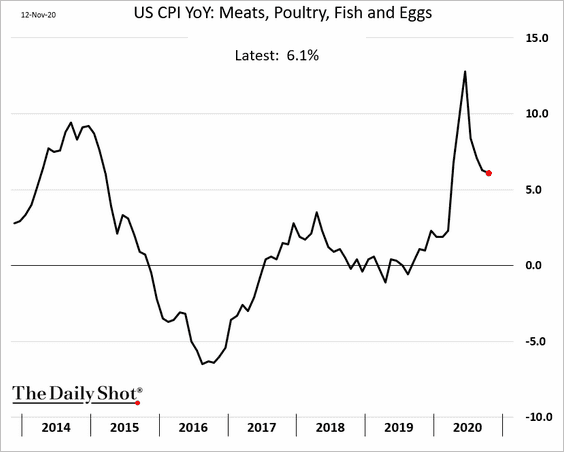

– “When I walk into a grocery store, these inflation numbers you report make me laugh.”

– “Have you gone food shopping? It’s hyperinflation out there. ”

While meat inflation (which spiked earlier this year due to supply bottlenecks) is off the highs, prices are still well above last year’s levels.

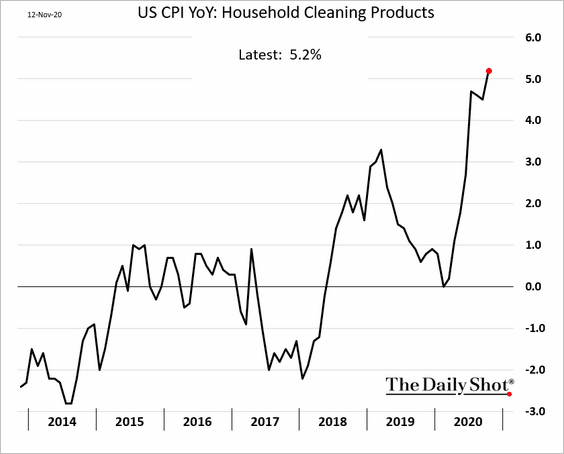

And here we have the CPI for cleaning products.

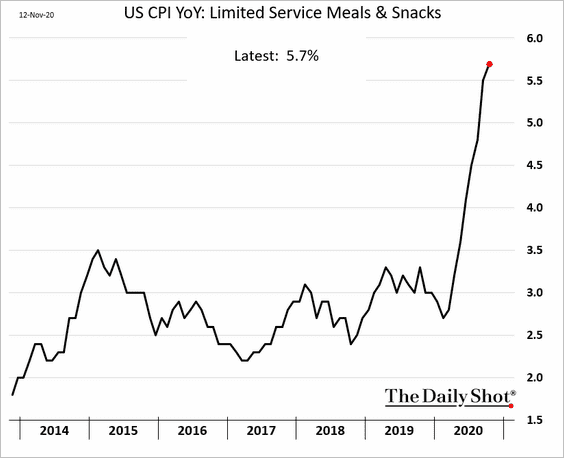

– “I am paying much more these days when I eat out.”

Indeed. Fast-food restaurant prices are up sharply.

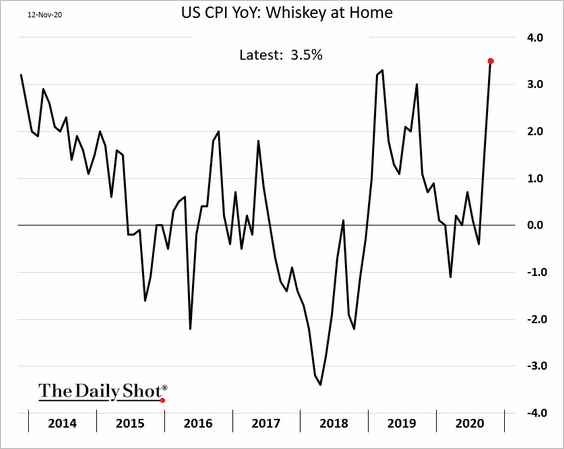

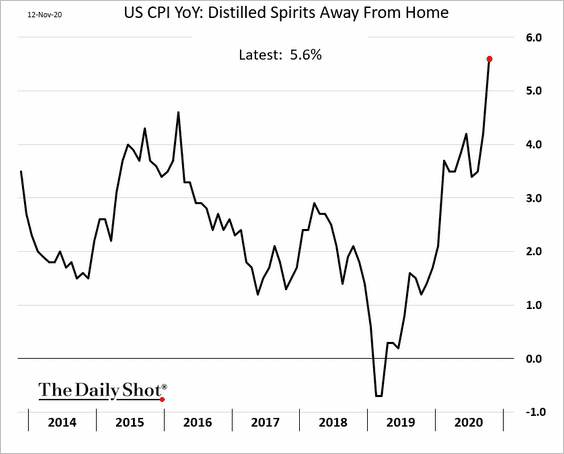

– “It’s costing me way more to get a drink these days.”

Definitely.

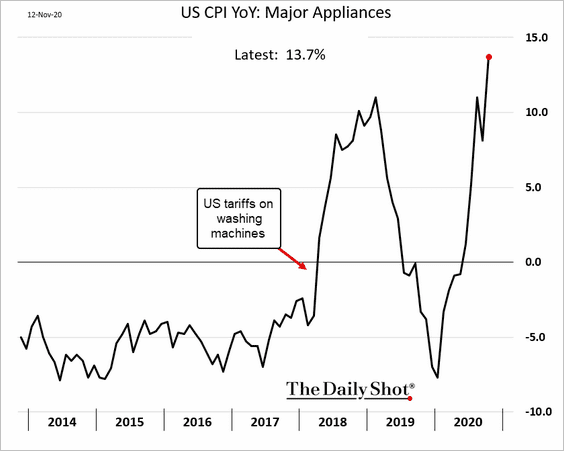

– “I had to pay more for a washer and dryer than the prices I saw last year. It’s a ripoff.”

That’s correct.

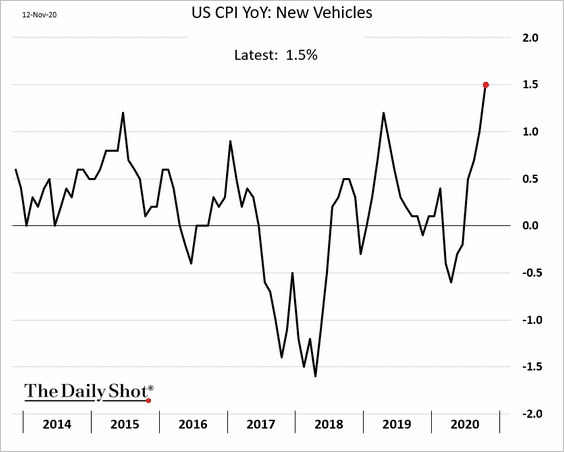

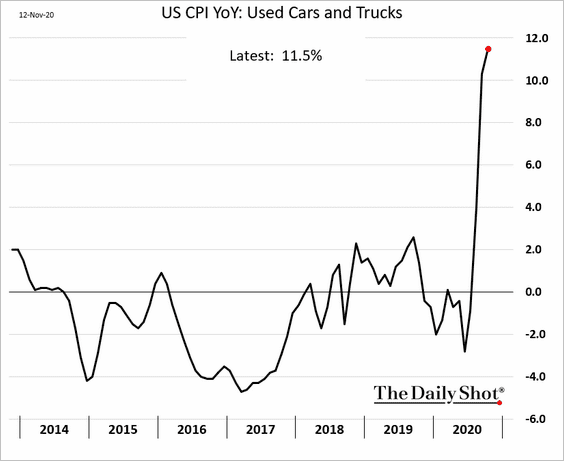

– “Car prices are up. Your inflation numbers are a joke.”

No question about that. Especially used cars.

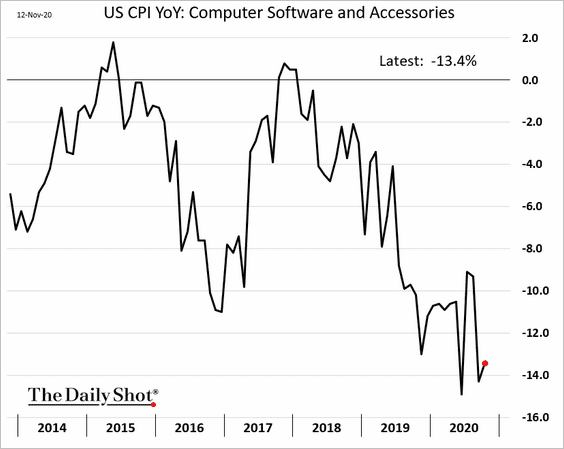

OK, but there are other products and services where prices are rising much slower or even falling. How about technology?

– “I don’t need a new computer – mine works just fine.”

– “I bought a laptop for $1,300. I paid less than that five years ago.”

Yes, but the computer can do much more than it did five years ago.

– “That’s just a bunch of … . A computer with much less capability is just not usable – so you are forced to buy the more powerful stuff.”

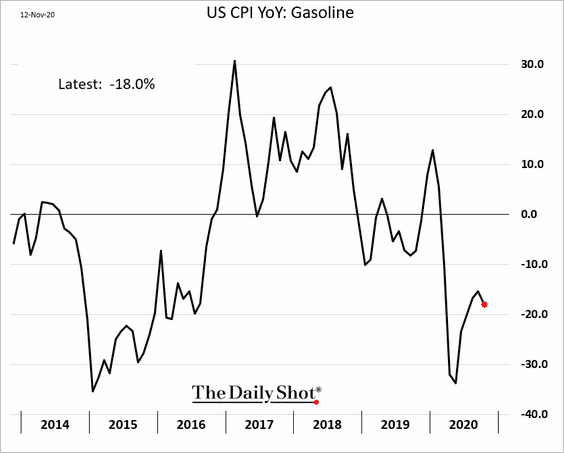

Gasoline prices are lower.

– “Doesn’t matter much – my car does 33 miles/gallon.”

– “I don’t take long trips anymore.”

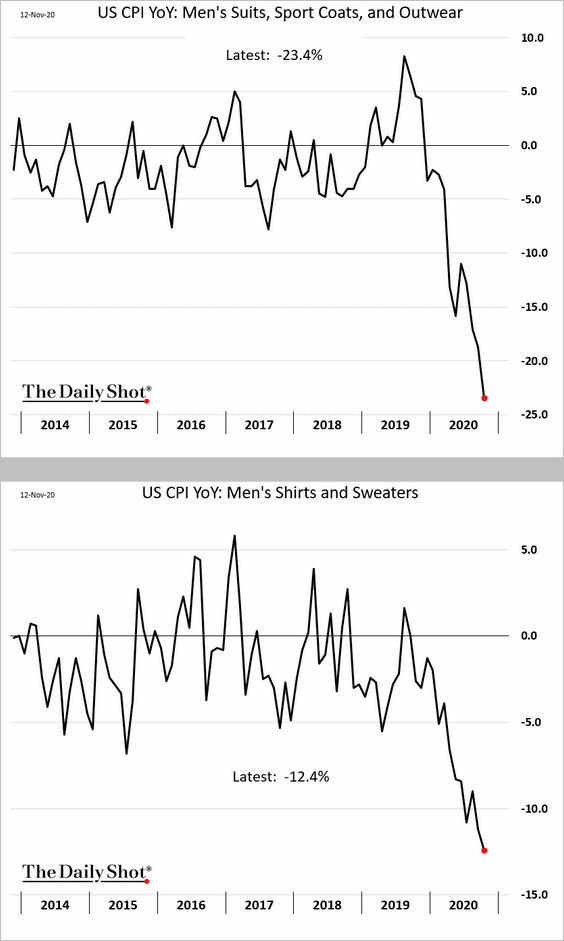

You can buy men’s suits at a much lower price than last year.

– “I don’t wear suits.”

– “I work from home. I just need a shirt for the video call.”

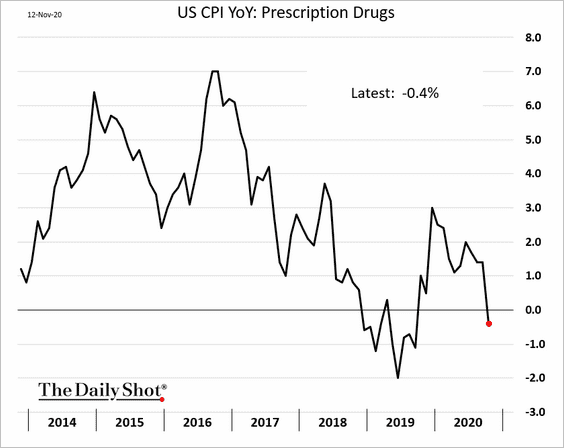

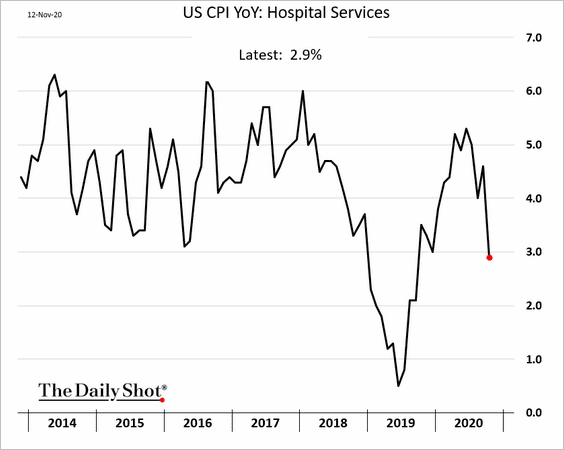

Healthcare inflation is slowing (3 charts).

Source: Nomura Securities

Source: Nomura Securities

– “Have you tried going to a doctor out of network?”

– “Yeah, they jacked up prices a couple of years ago – so them not raising prices now doesn’t help.”

– “Doesn’t help me – my insurance pays for it anyway.”

– “Try buying health insurance for your family when you have your own company. It’s $1,400/month.”

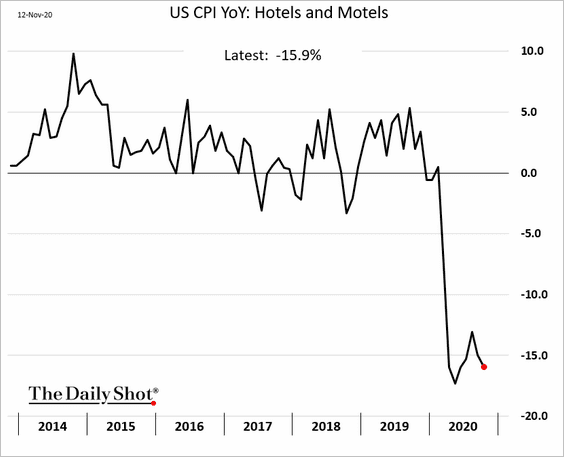

Hotels and airline fares are cheaper.

– “There is no way I am staying at a hotel these days.”

– “I have no plans to travel – so how does that help me.”

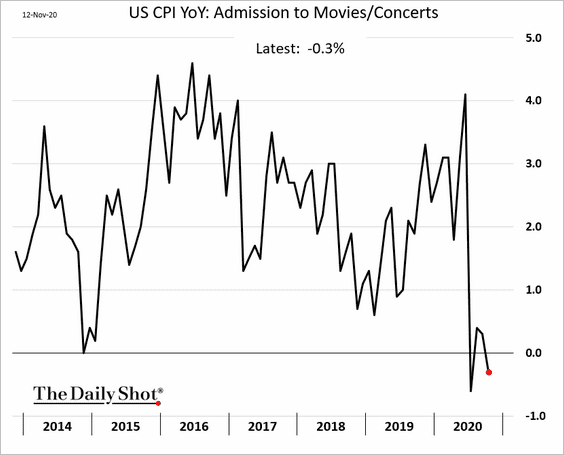

Movie tickets aren’t rising.

– “Is this a joke?”

– “I am not going until there is a vaccine.”

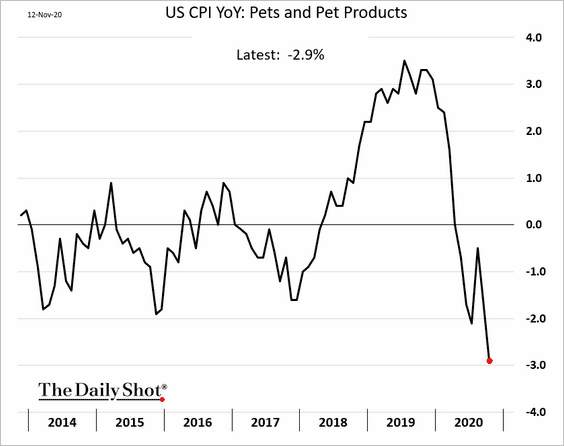

Pets and pet products are cheaper.

– “Seriously?”

——————–

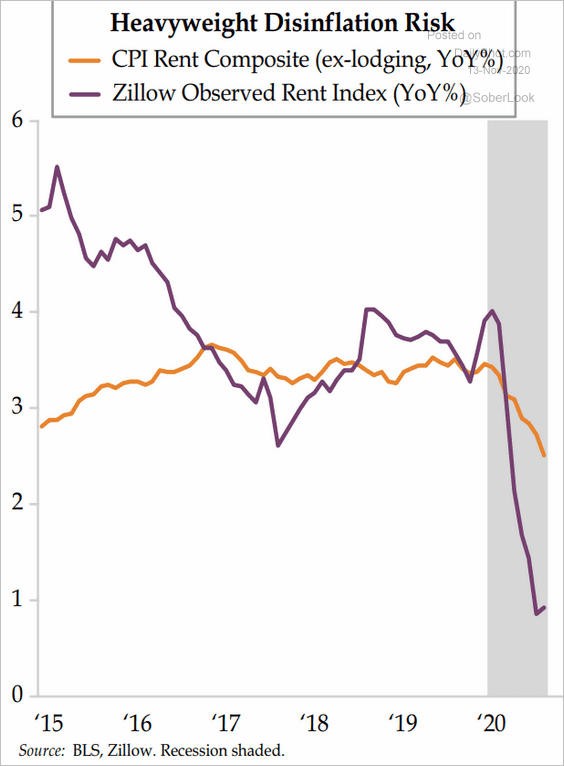

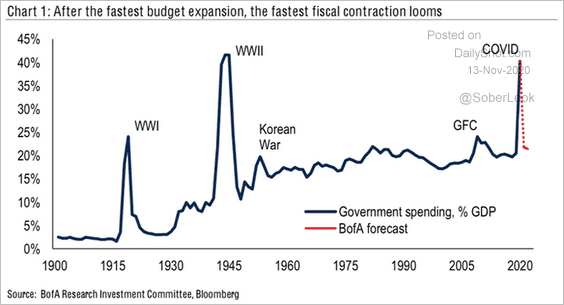

2. Here are a couple of other updates on inflation.

• Zillow data point to more downside for rent inflation.

Source: The Daily Feather

Source: The Daily Feather

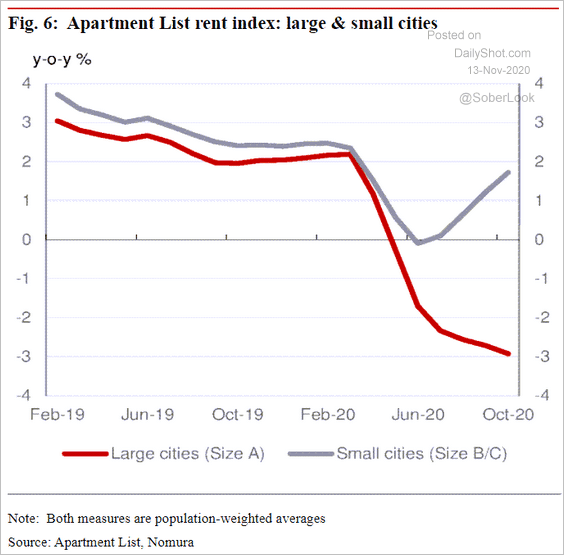

• Here is another illustration of migration out of large metro areas.

Source: Nomura Securities

Source: Nomura Securities

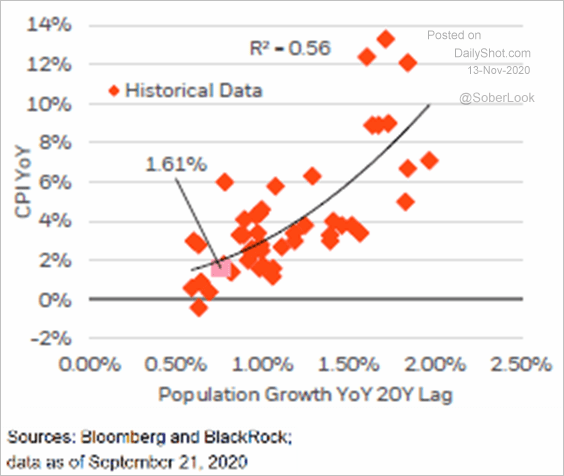

• Slower population growth tends to correspond to lower inflation.

Source: BlackRock

Source: BlackRock

——————–

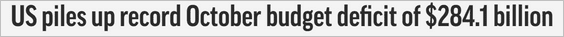

3. The federal budget started the new fiscal year with a record deficit for the month.

Source: AP Read full article

Source: AP Read full article

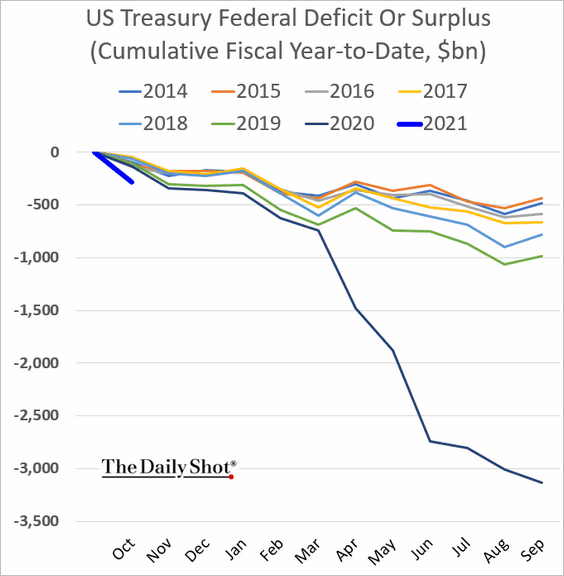

But spending is expected to slow, resulting in a “fiscal cliff.”

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

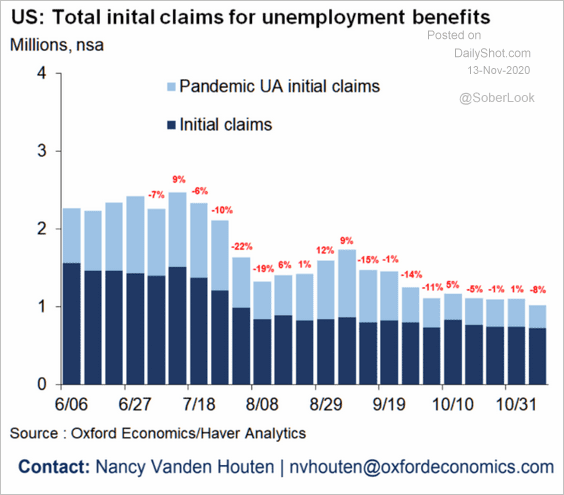

4. Initial jobless claims declined last week, but there are risks ahead for the labor market.

Source: Oxford Economics

Source: Oxford Economics

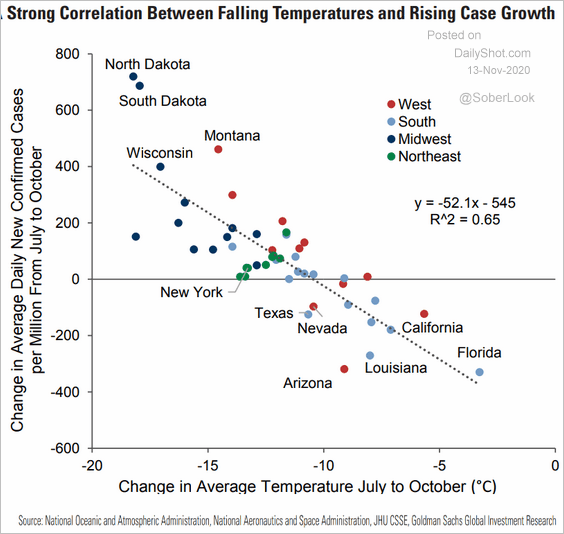

5. Winter is coming.

Source: Goldman Sachs

Source: Goldman Sachs

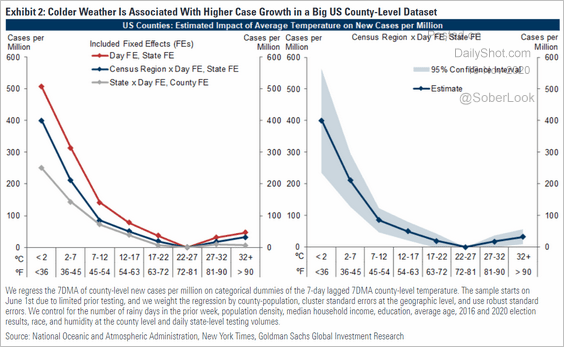

Colder weather means more cases, according to Goldman.

Source: Goldman Sachs

Source: Goldman Sachs

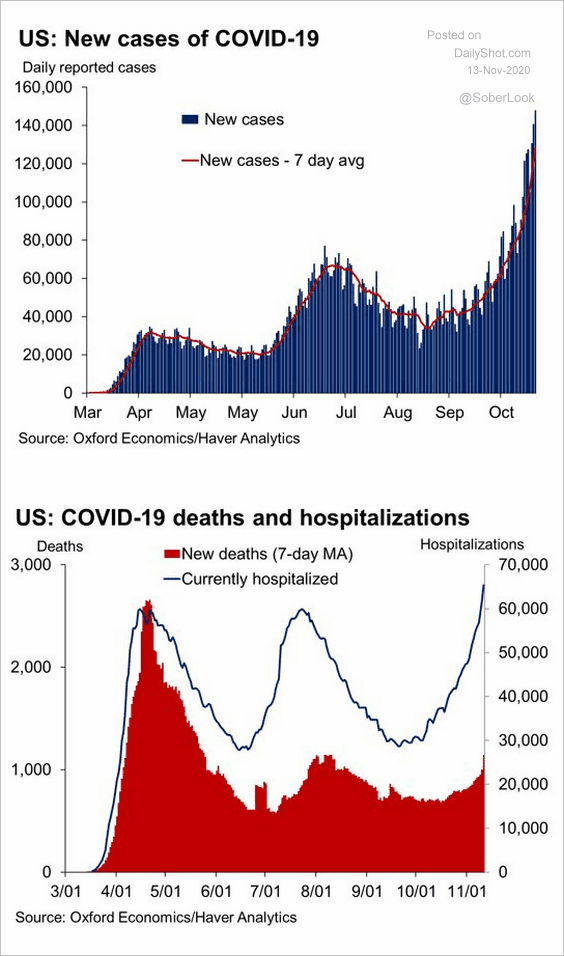

The COVID situation continues to get worse.

Source: @GregDaco

Source: @GregDaco

——————–

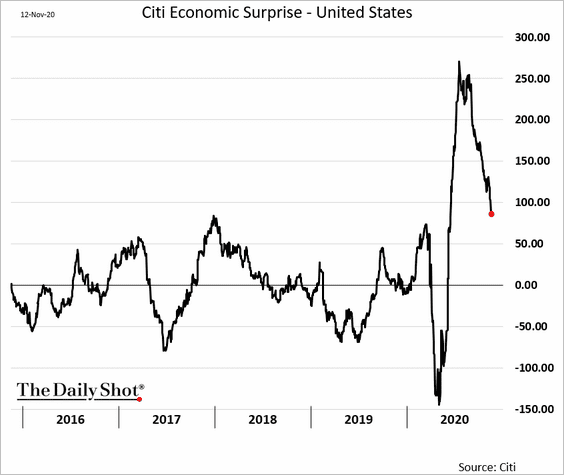

6. The Citi Economic Surprise Index shows some loss of momentum in the recovery.

The United Kingdom

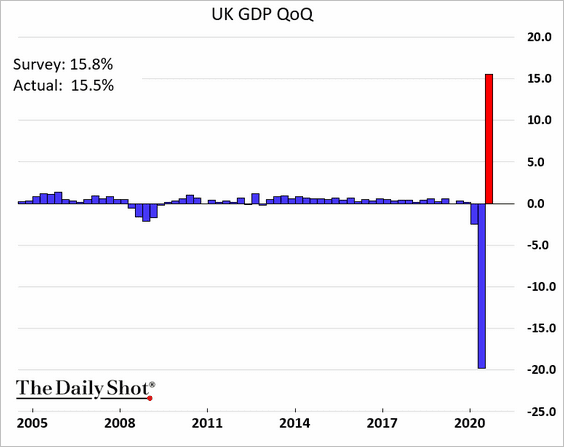

1. The Q3 GDP rebound was in line with expectations.

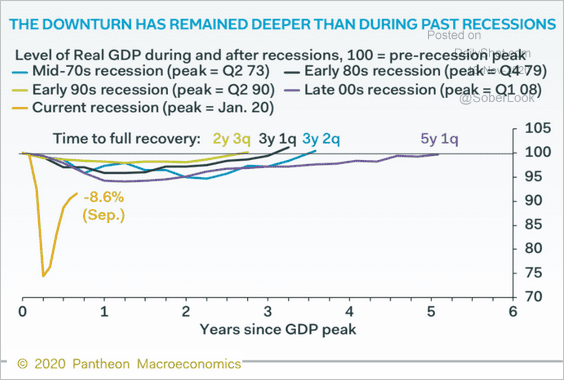

Here is the trajectory vs. previous recessions.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

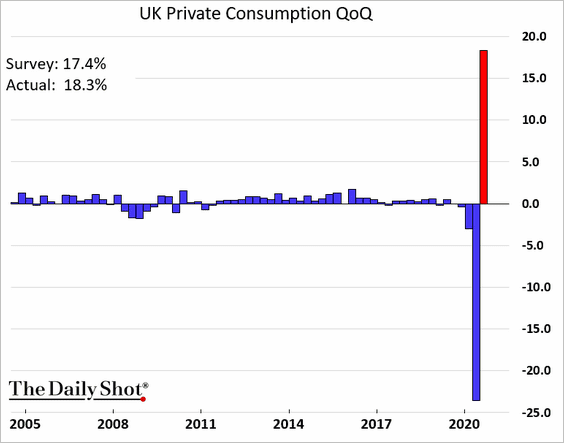

Private consumption was relatively strong.

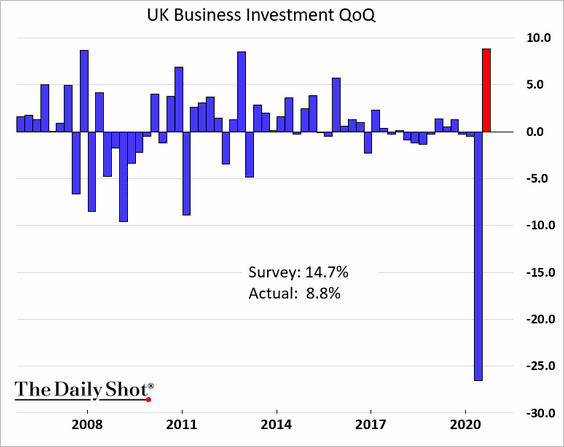

But business investment remains soft.

——————–

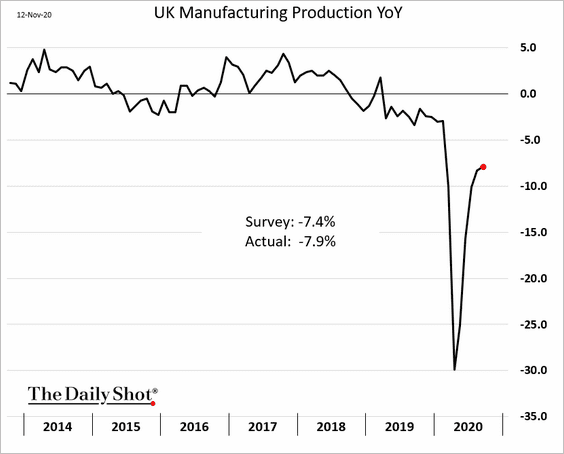

2. The rebound in factory production is slowing.

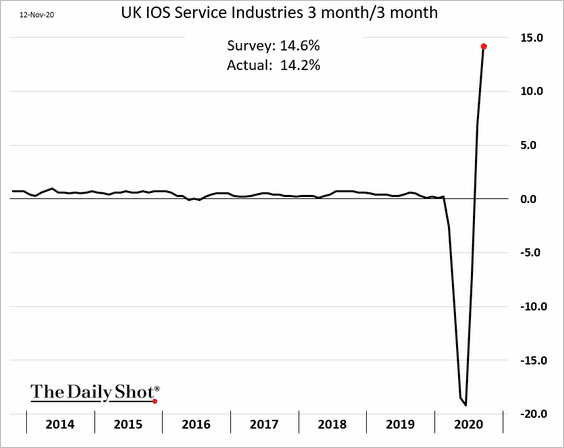

This chart shows the 3-month change in service-sector output.

——————–

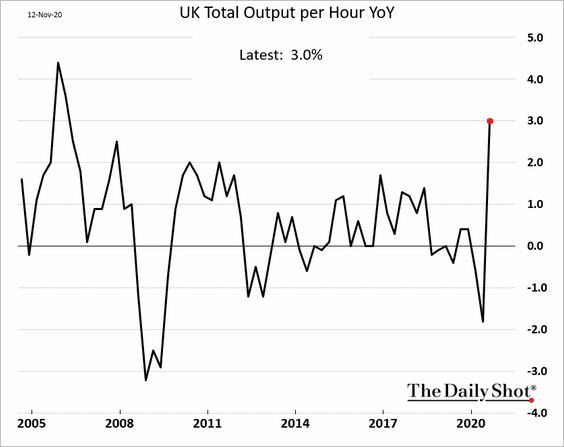

3. Productivity improved last quarter.

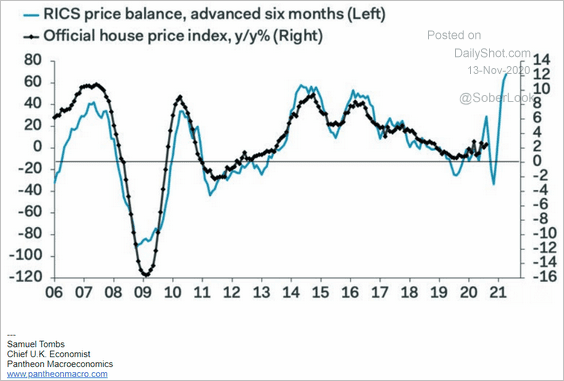

4. The RICS index shows further gains for home prices.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

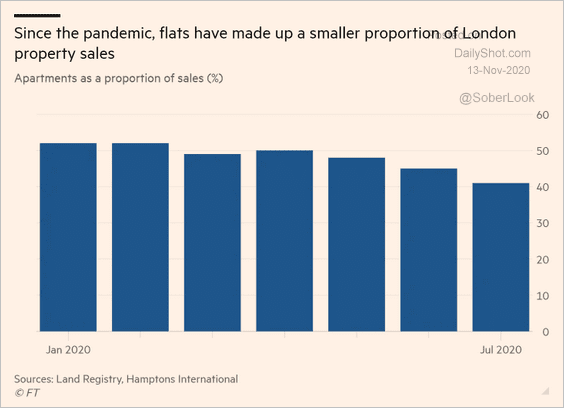

While there is an increased demand for detached housing, apartment sales in London have slowed.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

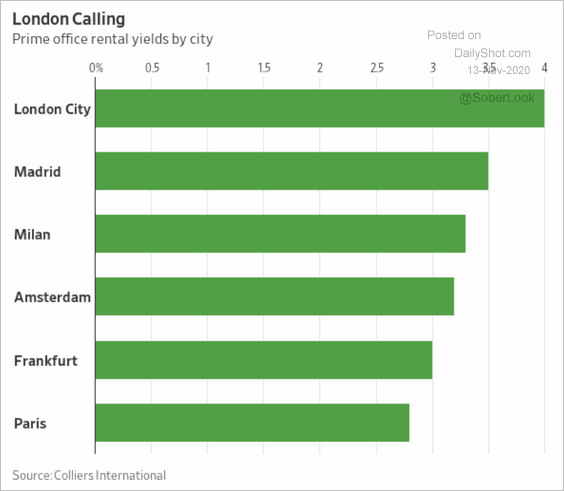

5. London office properties look attractive as an investment relative to other major European cities (assuming tenants will return).

Source: @WSJ Read full article

Source: @WSJ Read full article

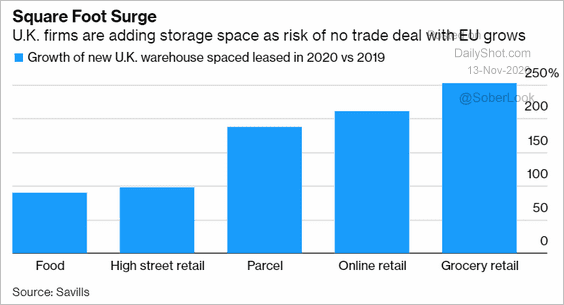

6. UK companies have been adding more storage as they try to address the EU deal uncertainty.

Source: @business Read full article

Source: @business Read full article

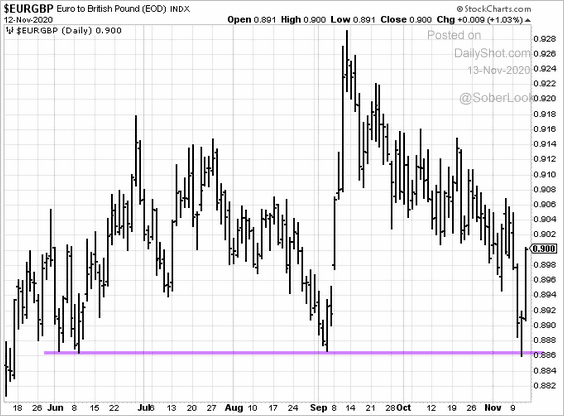

7. The euro once again held support relative to the pound.

h/t @vkaramanis_fx

h/t @vkaramanis_fx

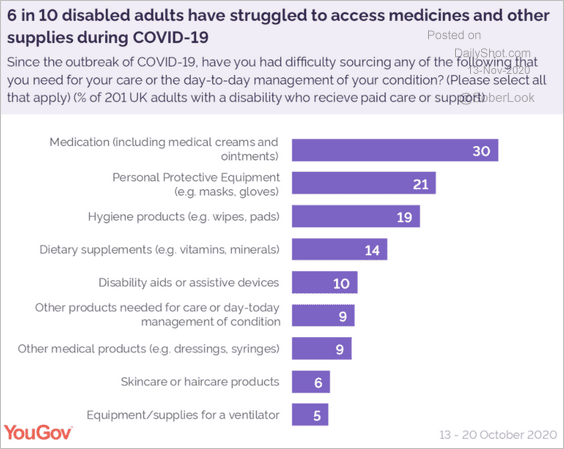

8. Many disabled adults struggled to access medications and medical supplies during the pandemic.

Source: YouGov Read full article

Source: YouGov Read full article

The Eurozone

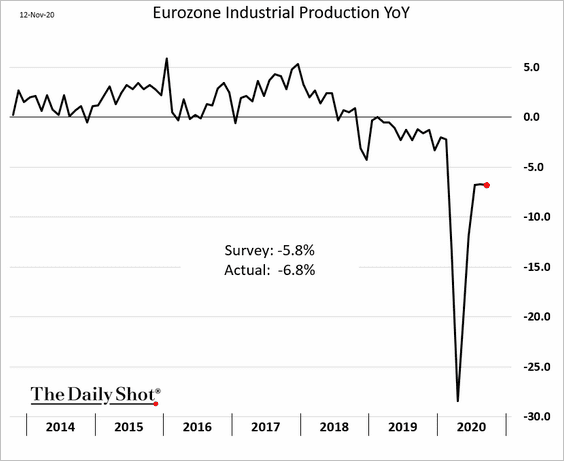

1. As we saw previously (#3 here), the rebound in industrial production has stalled.

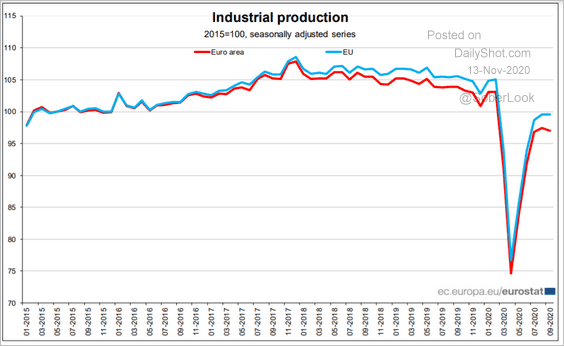

The Eurozone is trailing the overall EU output.

Source: Eurostat Read full article

Source: Eurostat Read full article

——————–

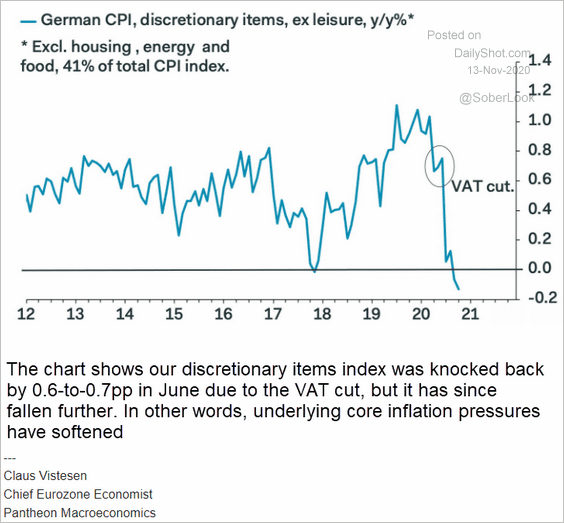

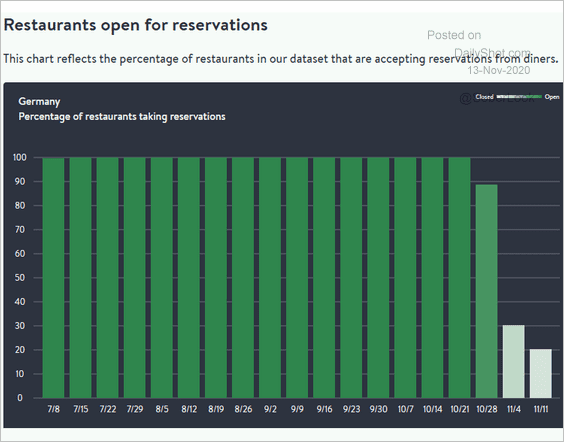

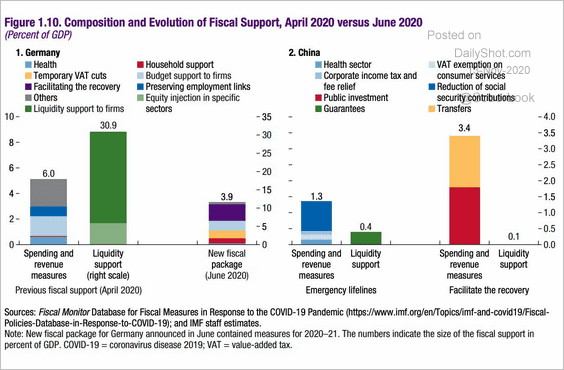

2. Here are some updates on Germany.

• Discretionary items CPI (see comment from Pantheon Macroeconomics):

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Restaurants open for reservations:

Source: OpenTable

Source: OpenTable

• Fiscal stimulus (Germany vs. China):

Source: @adam_tooze, @IMFNews

Source: @adam_tooze, @IMFNews

——————–

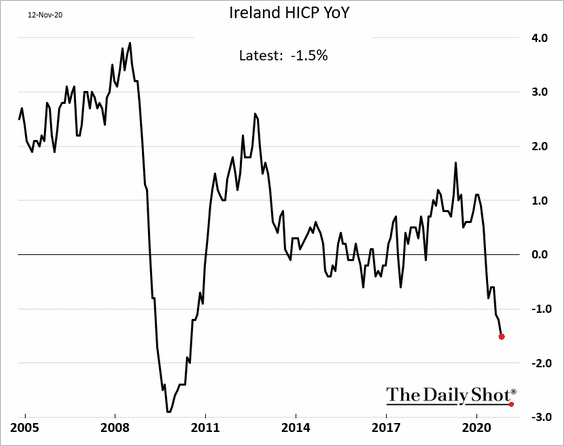

3. Ireland is deep in deflation.

Europe

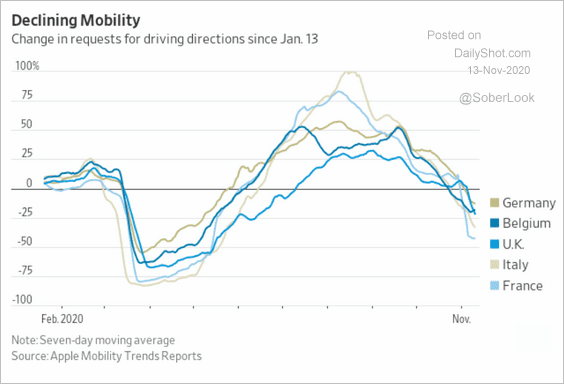

1. Mobility across Europe has deteriorated.

Source: @jeffsparshott

Source: @jeffsparshott

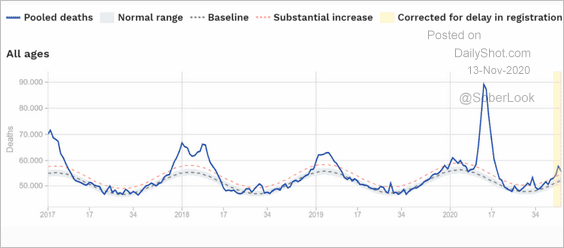

2. This chart shows European death rates vs. historical averages.

Source: EuroMOMO

Source: EuroMOMO

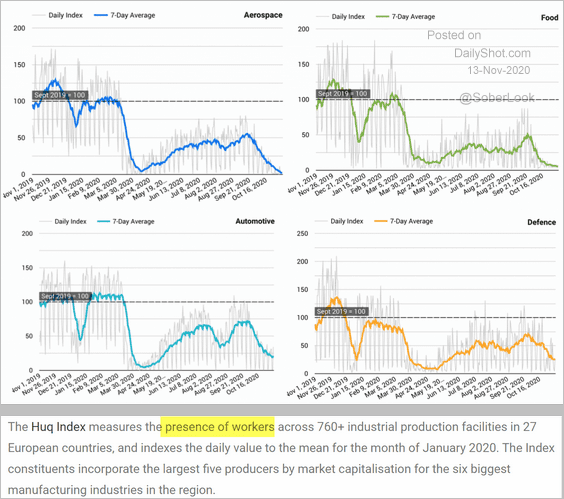

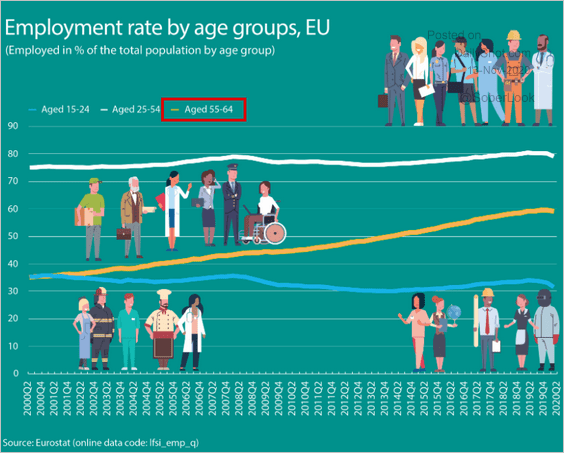

3. Next, we have some updates on employment.

• Factory workers that are at work:

Source: Huq

Source: Huq

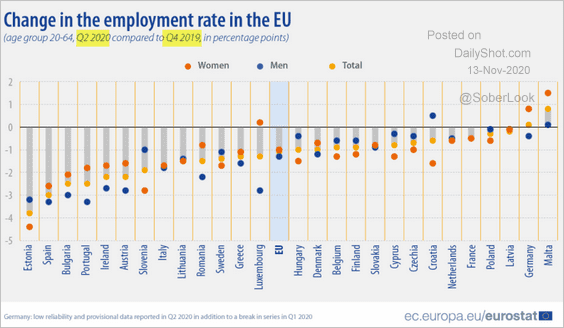

• Employment rate changes (Q4 2019 to Q2 2020):

Source: Eurostat Read full article

Source: Eurostat Read full article

• More older Europeans are working:

Source: Eurostat Read full article

Source: Eurostat Read full article

Asia – Pacific

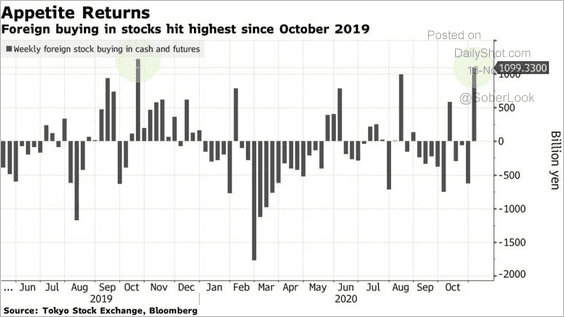

1. Foreigners are buying Japanese stocks.

Source: @markets Read full article

Source: @markets Read full article

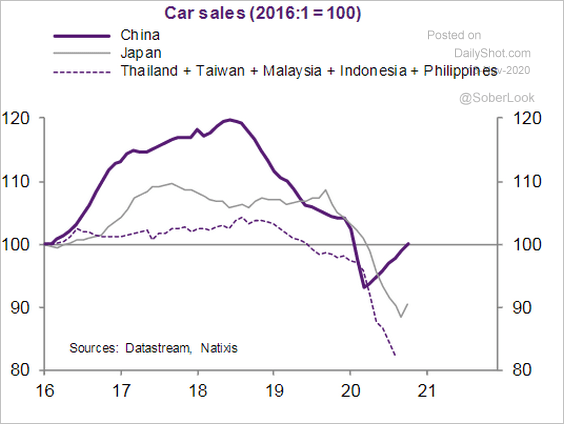

2. This chart shows car sales in select Asian countries:

Source: Natixis

Source: Natixis

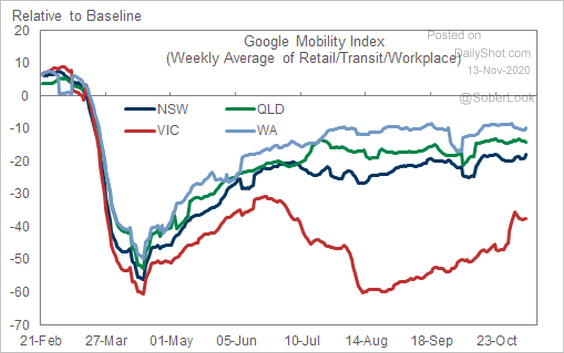

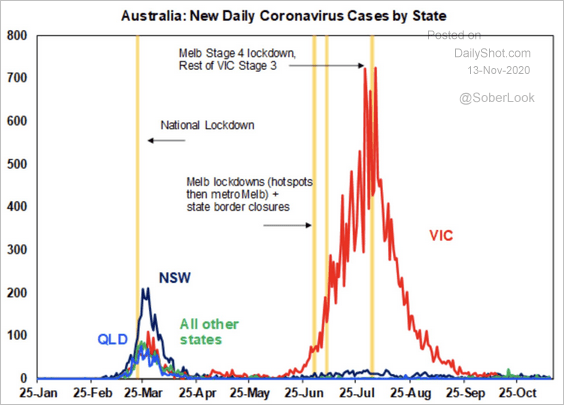

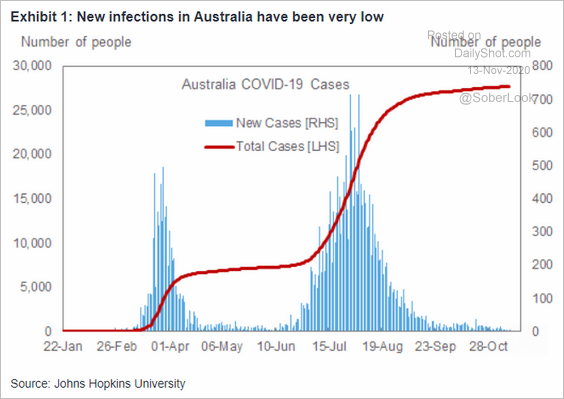

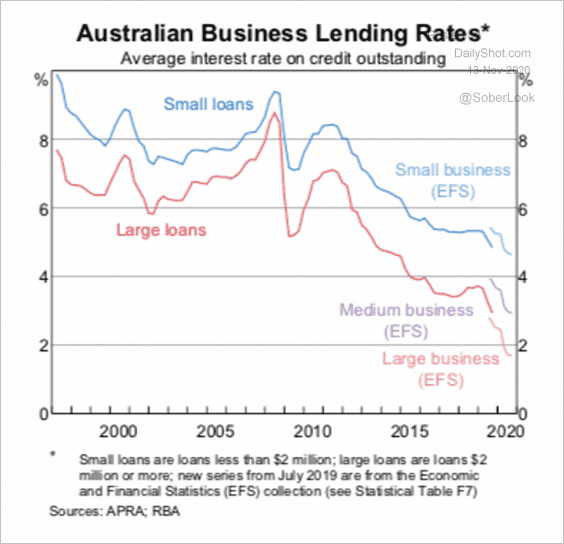

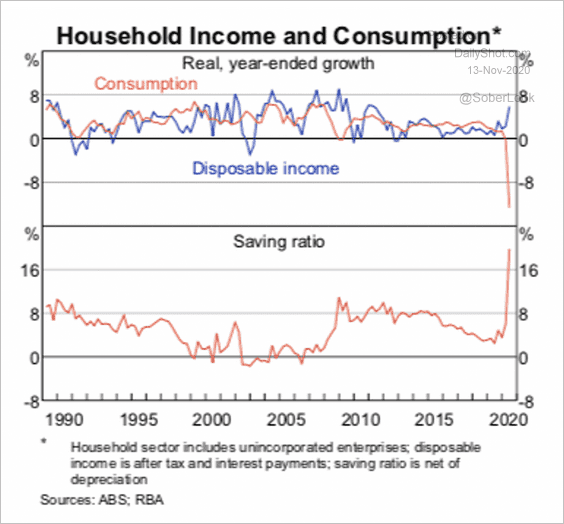

3. Next, we have some updates on Australia.

• Mobility:

Source: Goldman Sachs

Source: Goldman Sachs

• Infection rates (2 charts):

Source: @ShaneOliverAMP

Source: @ShaneOliverAMP

Source: Goldman Sachs

Source: Goldman Sachs

• Business lending:

Source: RBA

Source: RBA

• Consumption, disposable income, and the savings ratio:

Source: RBA

Source: RBA

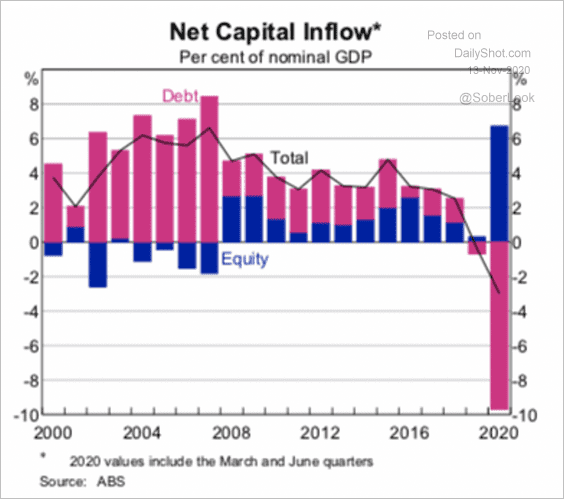

• A 20-year high in equity inflows has been mirrored by a 20-year high in debt outflows.

Source: RBA

Source: RBA

China

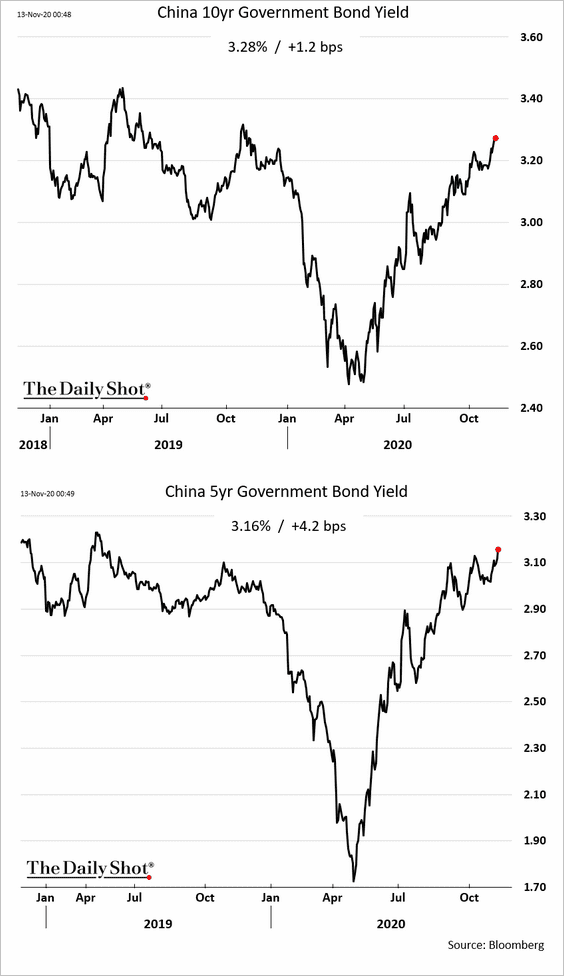

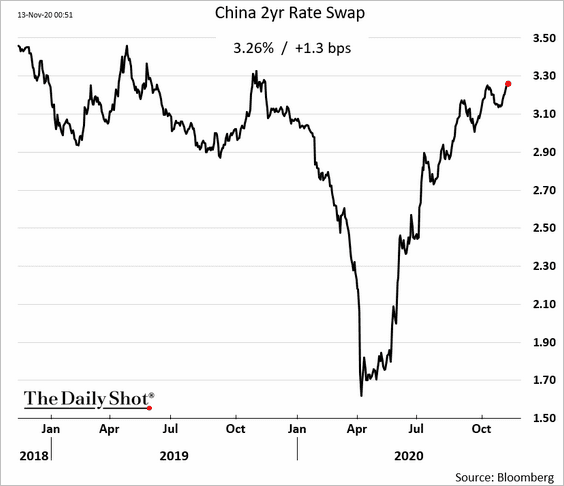

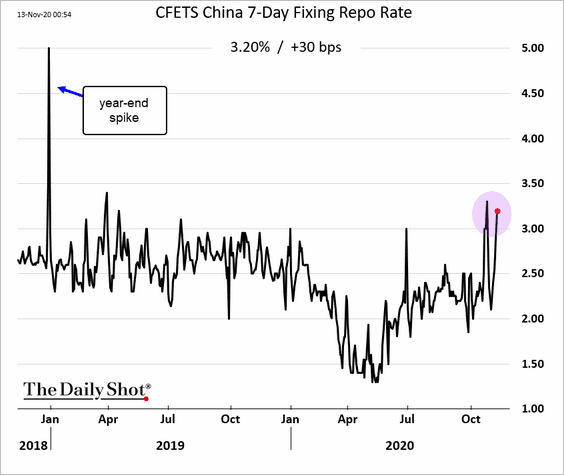

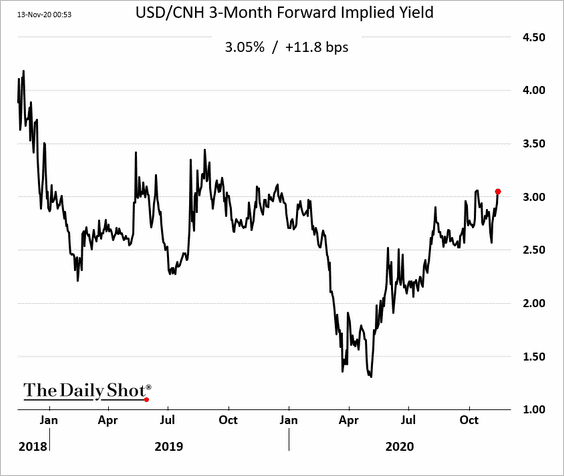

1. Rates are rising across the board.

• The 10yr and 5yr bond yields:

• The 2-year interest rate swap:

• The 7-day repo rate (points to tight monetary conditions):

• The 3-month rate implied by the offshore yuan F/X forwards (points to tighter liquidity in the offshore currency):

——————–

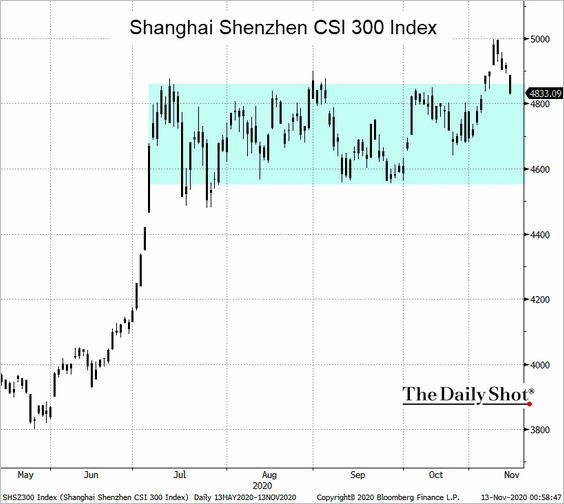

2. The stock market is back within the recent trading range.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

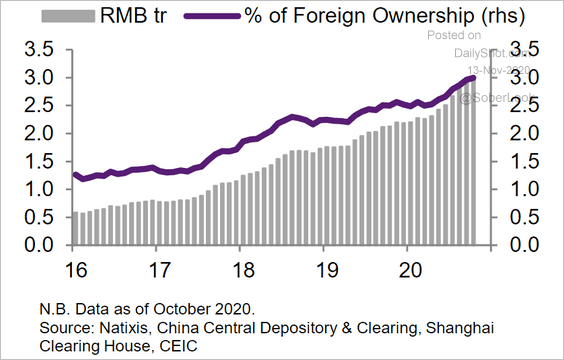

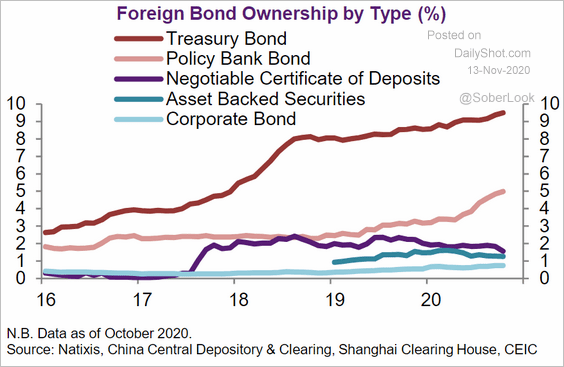

2. Foreign ownership of bonds hit a record high.

Source: Natixis

Source: Natixis

Source: Natixis

Source: Natixis

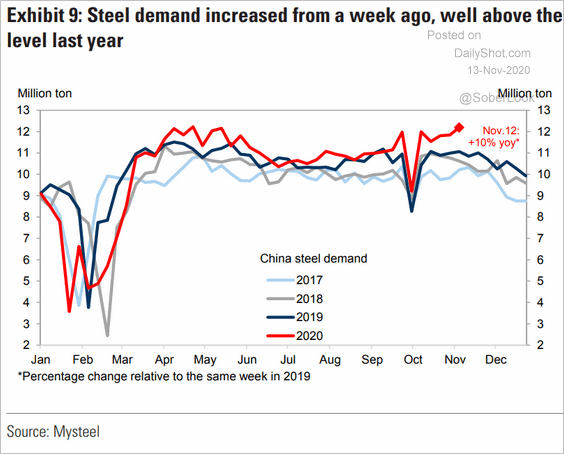

3. Steel demand keeps climbing.

Source: Goldman Sachs

Source: Goldman Sachs

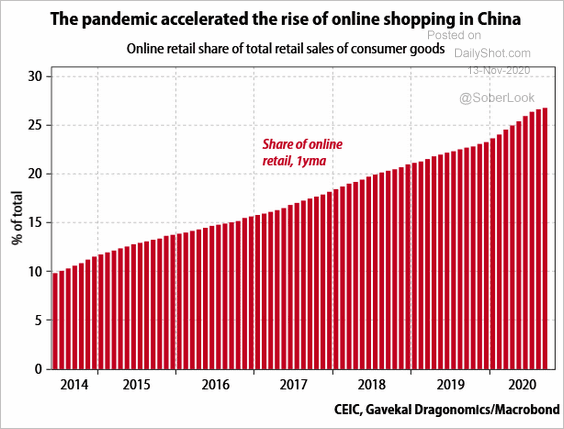

4. Online retail market share increased sharply during the pandemic.

Source: Gavekal

Source: Gavekal

Emerging Markets

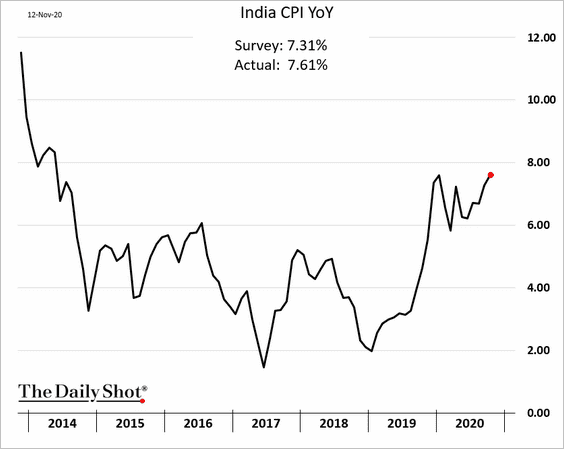

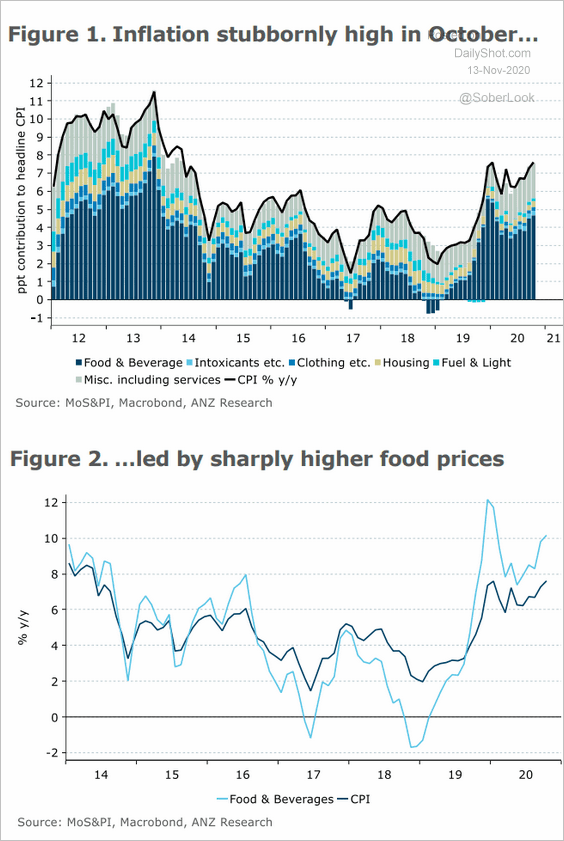

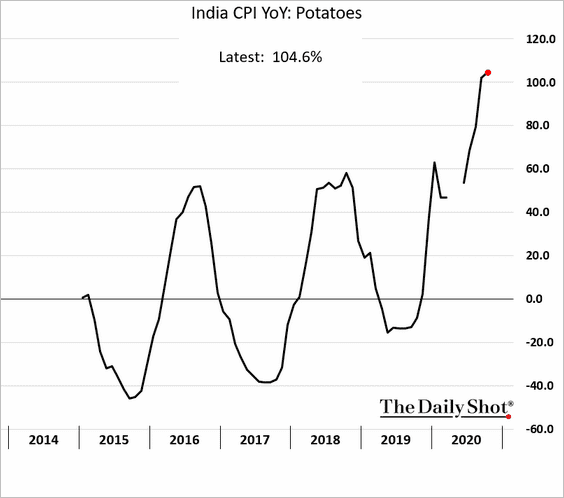

1. India’s CPI surprised to the upside, driven by food prices.

Source: ANZ Research

Source: ANZ Research

——————–

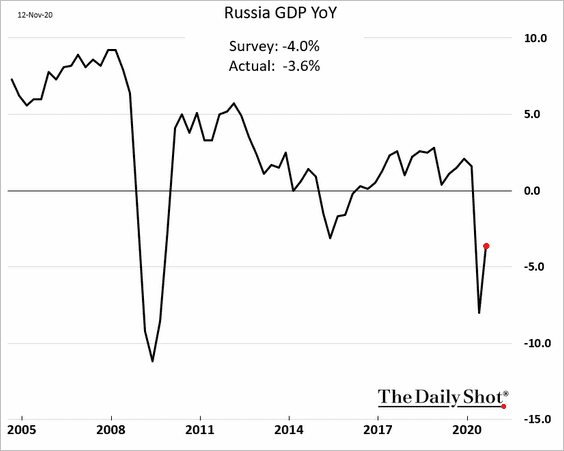

2. Russia’s GDP bounced from the lows, but the recovery will take time.

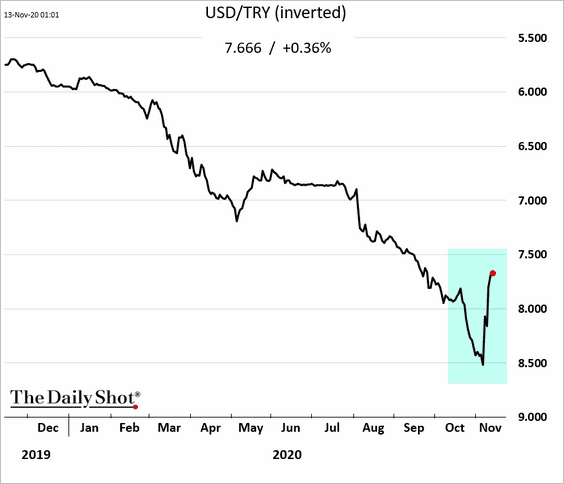

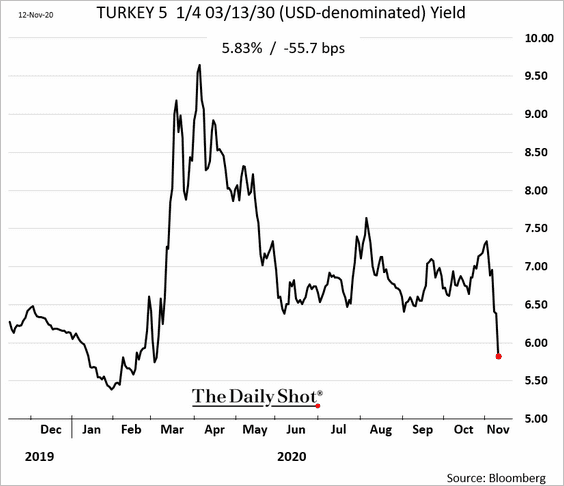

3. Turkish assets continue to climb in response to Erdogan’s supposed policy shift.

• The lira:

• The 10yr USD-denominated bond yield:

——————–

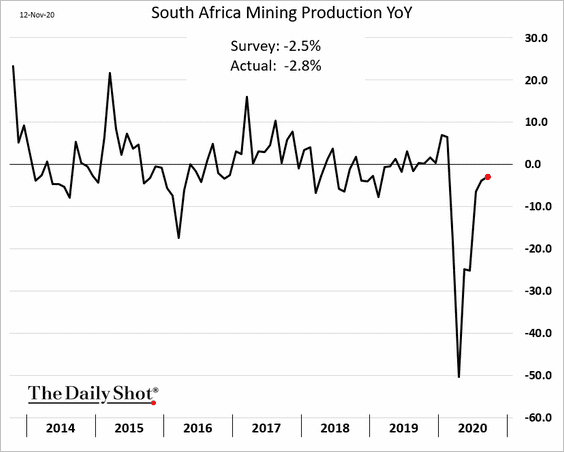

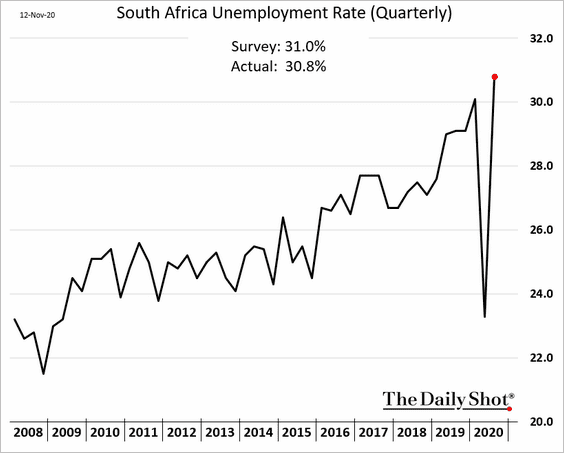

4. Here are a couple of updates on South Africa:

• Mining output:

• The quarterly unemployment rate:

——————–

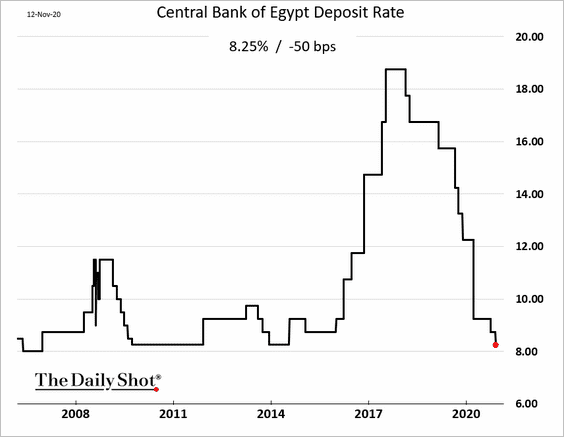

5. Egypt’s central bank cut rates again. The big rate spike in 2016 was after the nation’s massive currency devaluation.

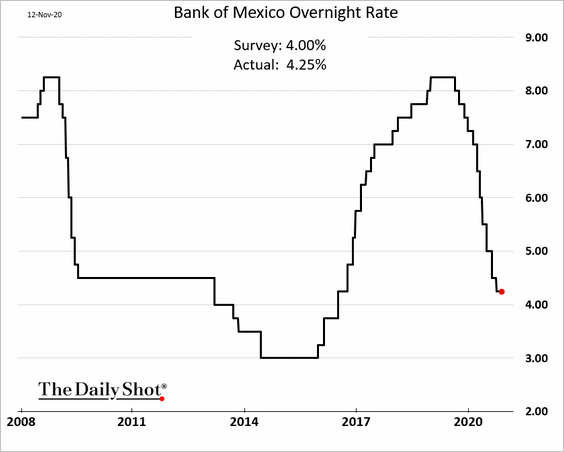

6. Banxico kept rates on hold due to inflation concerns. The market was hoping for a cut.

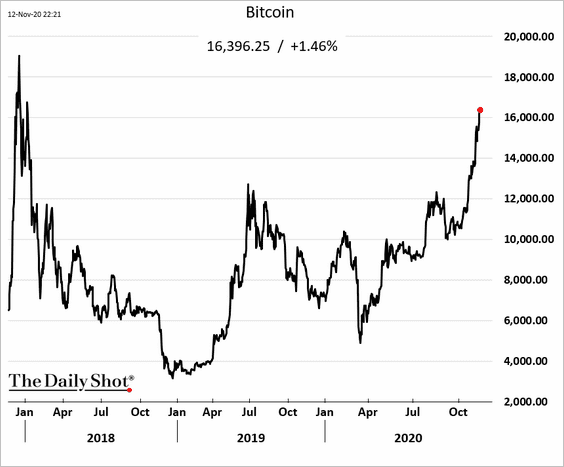

Cryptocurrency

Bitcoin blasted past $16k for the first time since early 2018.

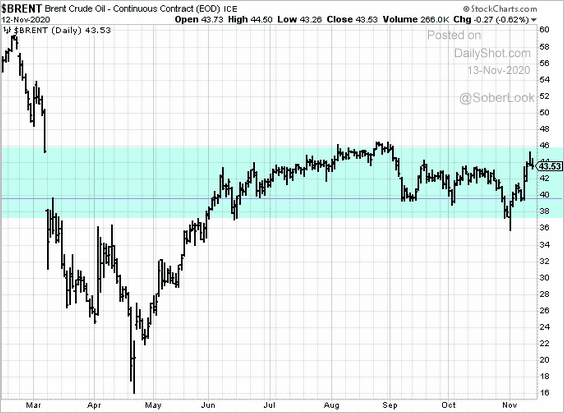

Energy

1. Crude oil remains stuck in a trading range.

• WTI:

Source: @KritiGuptaNews

Source: @KritiGuptaNews

• Brent:

——————–

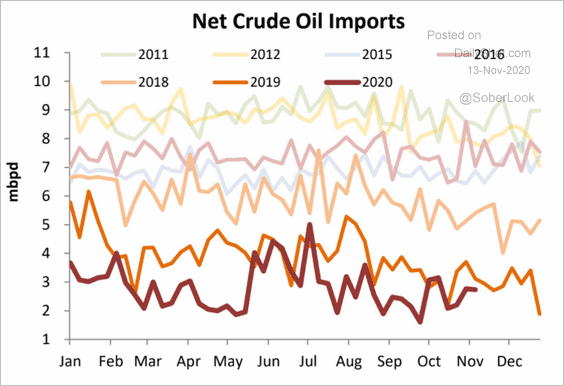

2. This chart shows net US oil imports:

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

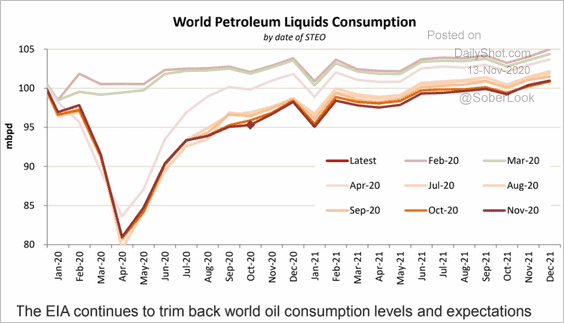

3. The EIA’s (US Department of Energy) continues to downgrade its global petroleum liquids consumption forecasts.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

Equities

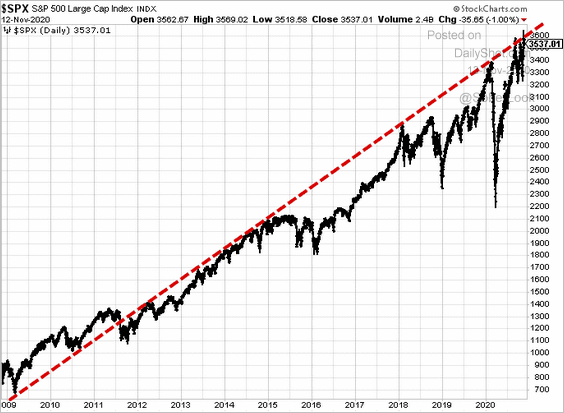

1. The S&P 500 is at long-term resistance.

h/t Cormac Mullen

h/t Cormac Mullen

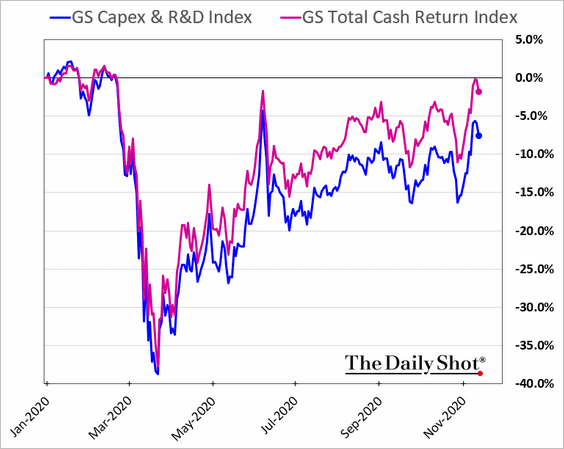

2. Companies known for share buybacks and dividend payouts (total cash return) have outperformed those focused on CapEx and R&D.

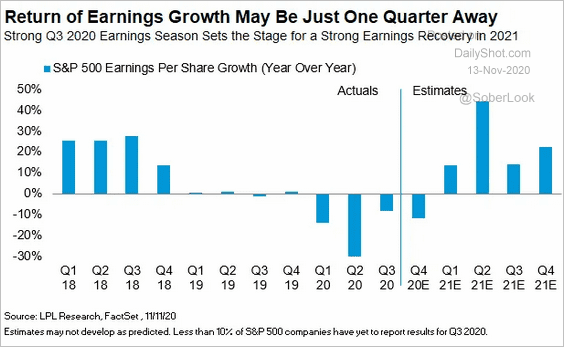

3. Year-over-year earnings growth is expected to turn positive next year.

Source: LPL Research

Source: LPL Research

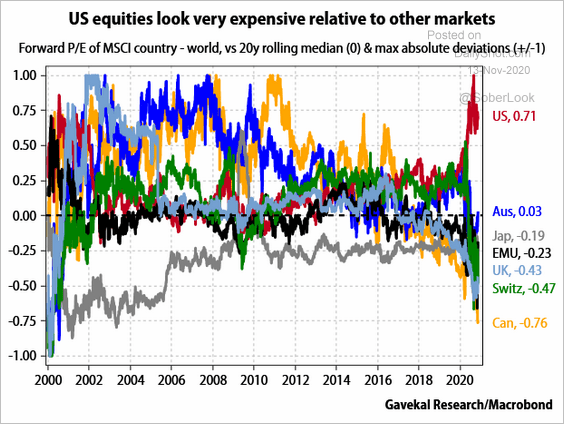

4. US stocks are expensive relative to the rest of the world.

Source: Gavekal

Source: Gavekal

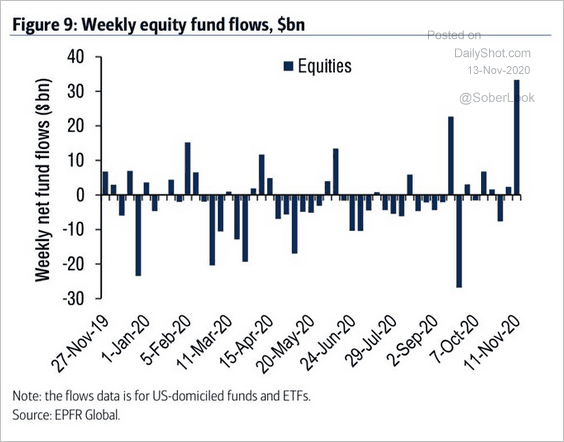

6. Stock funds saw massive inflows this week.

Source: BofA, @WallStJesus

Source: BofA, @WallStJesus

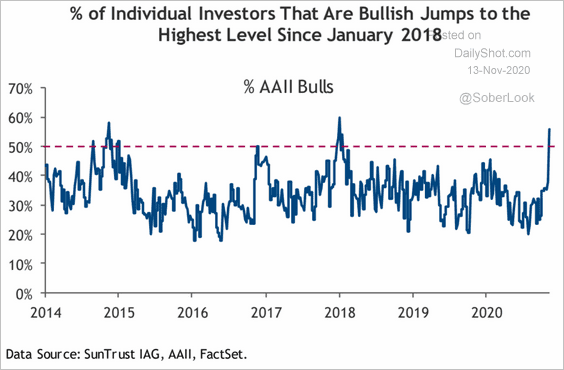

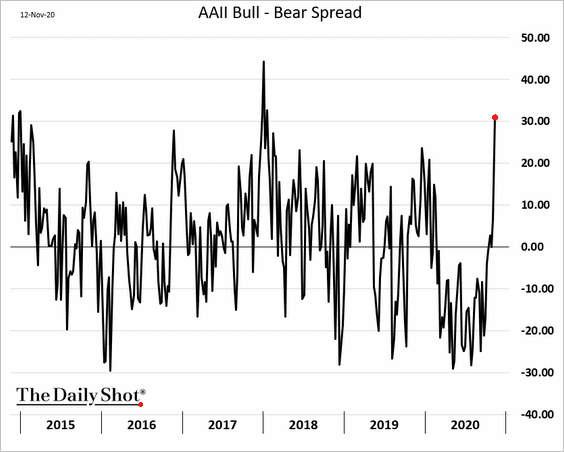

7. US investors haven’t been this bullish since early 2018 (right after the US tax cuts).

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

——————–

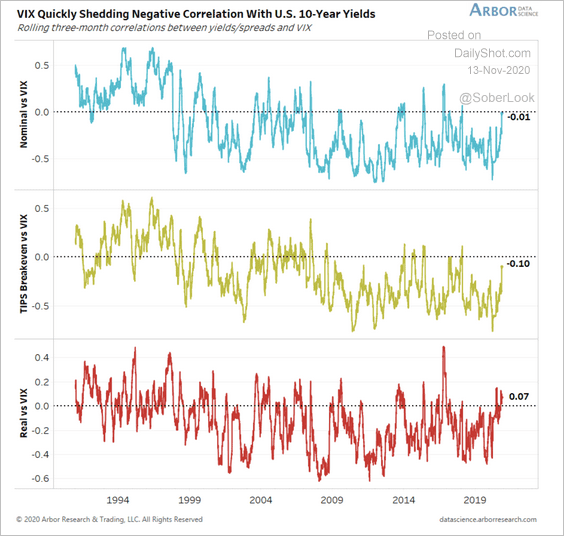

8. Higher yields are no longer coinciding with lower equity volatility.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

Food for Thought

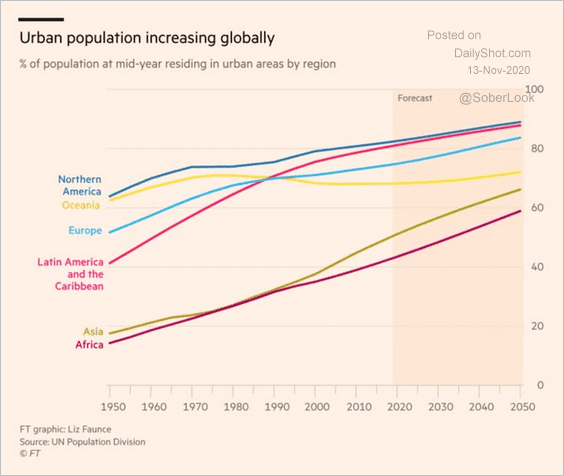

1. Urban population growth:

Source: @adam_tooze Read full article

Source: @adam_tooze Read full article

Source: Statista

Source: Statista

——————–

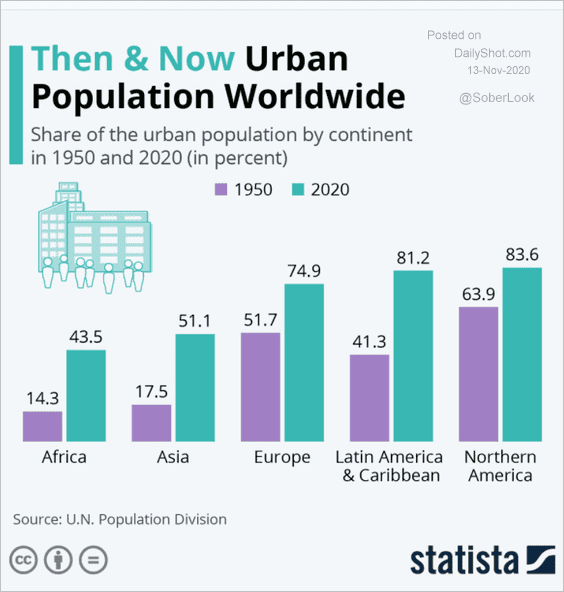

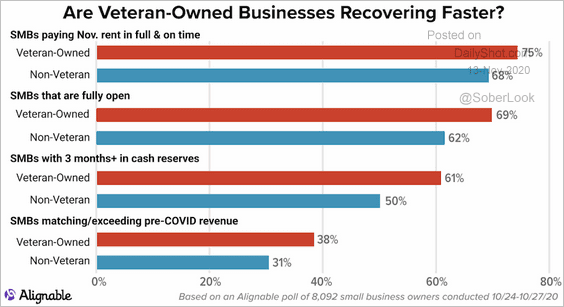

2. The history of US bank mergers:

Source: Martineau, Knox, Combs; American Journal of Industrial and Business Management

Source: Martineau, Knox, Combs; American Journal of Industrial and Business Management

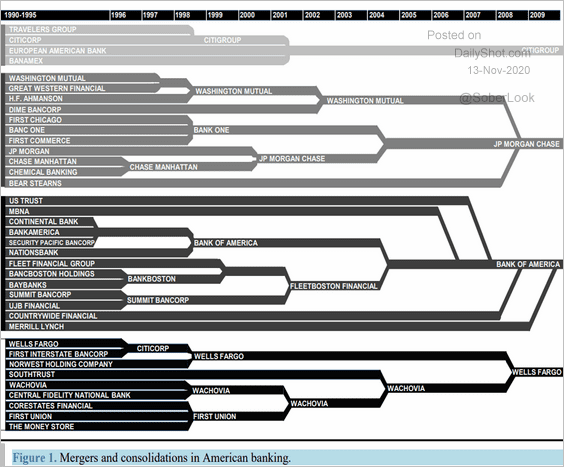

3. Veteran-owned small businesses:

Source: Alignable Read full article

Source: Alignable Read full article

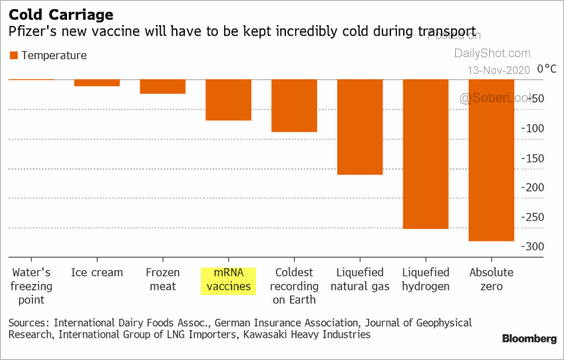

4. How much refrigeration does Pfizer’s vaccine require?

Source: @danmurtaugh, @TheTerminal, Bloomberg Finance L.P.

Source: @danmurtaugh, @TheTerminal, Bloomberg Finance L.P.

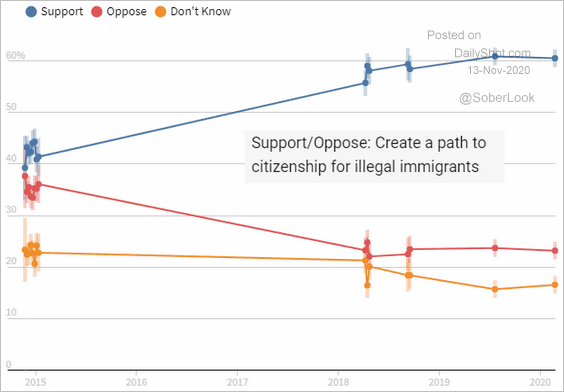

5. Path to citizenship for illegal immigrants:

Source: Reuters Read full article

Source: Reuters Read full article

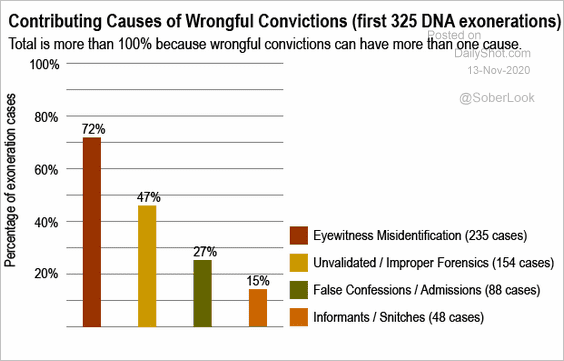

6. DNA-based exonerations:

Source: Innocence Project Read full article

Source: Innocence Project Read full article

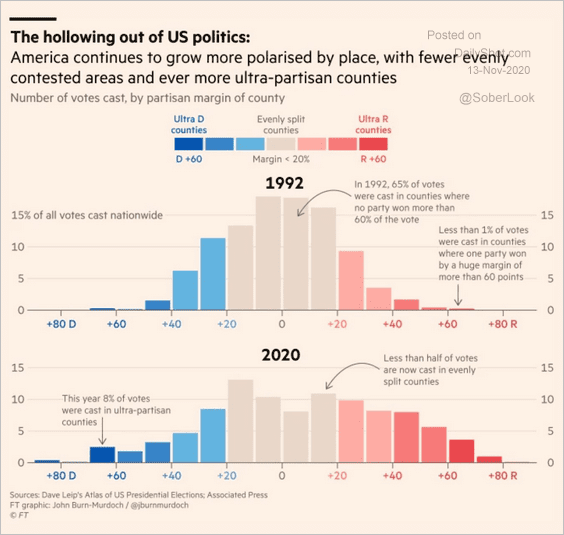

7. US political polarization:

Source: @adam_tooze, @financialtimes Read full article

Source: @adam_tooze, @financialtimes Read full article

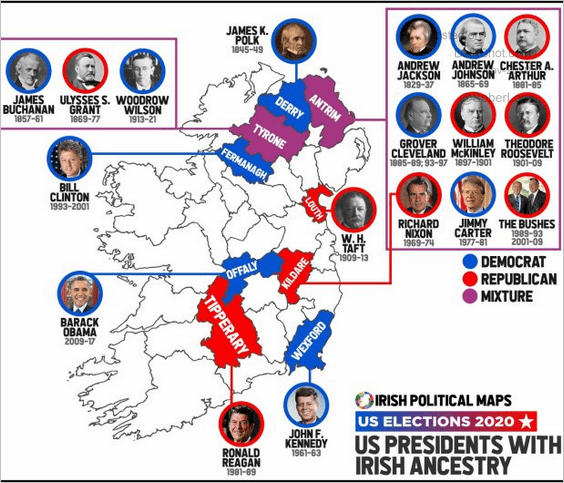

8. US presidents with Irish ancestry:

Source: @onlmaps Read full article

Source: @onlmaps Read full article

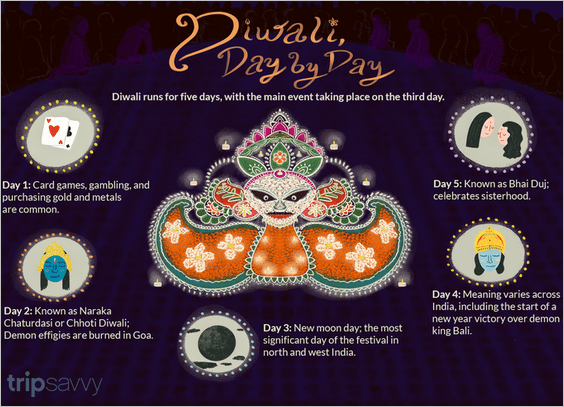

9. Diwali – India’s festival of lights:

Source: Tripsavvy Read full article

Source: Tripsavvy Read full article

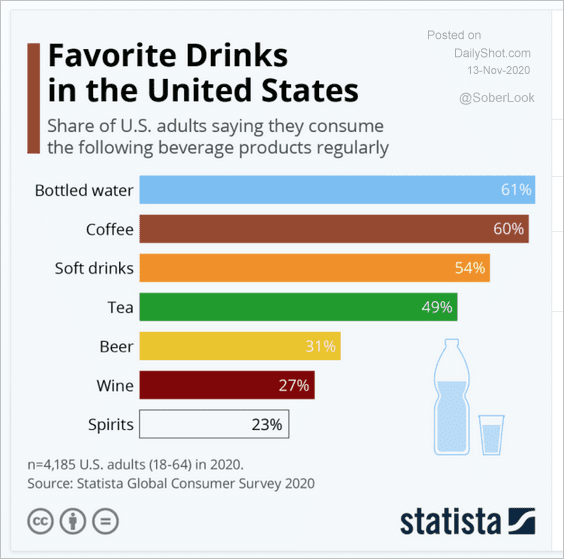

10. Favorite drinks in the US:

Source: Statista

Source: Statista

——————–

Have a great weekend!