The Daily Shot: 20-Nov-20

• The United States

• The United Kingdom

• Europe

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Food for Thought

The United States

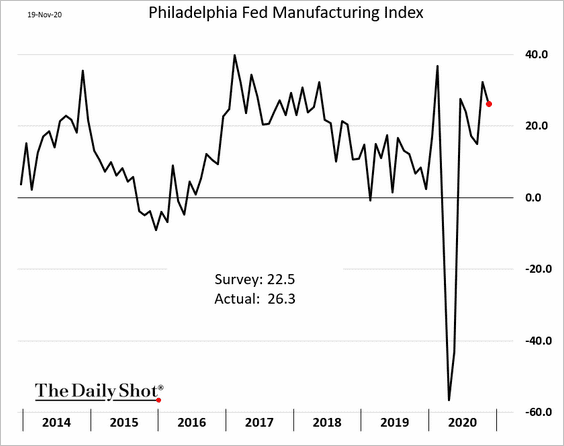

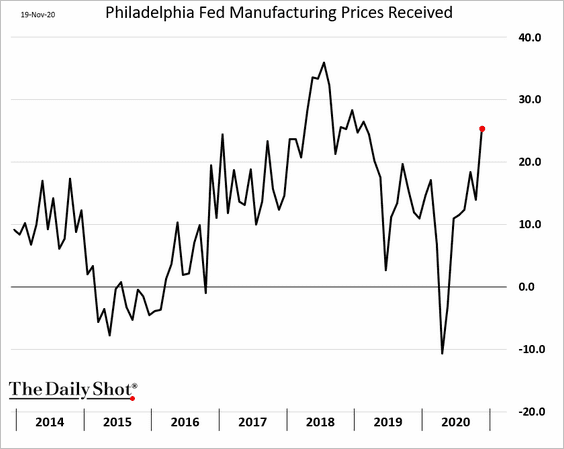

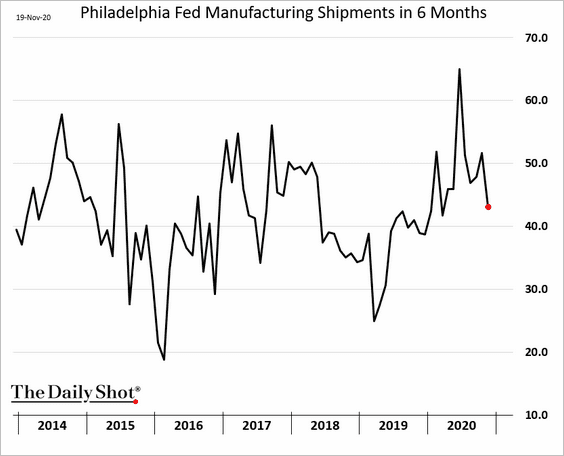

1. The Philly Fed’s manufacturing report showed continued strength in the region’s factory activity this month.

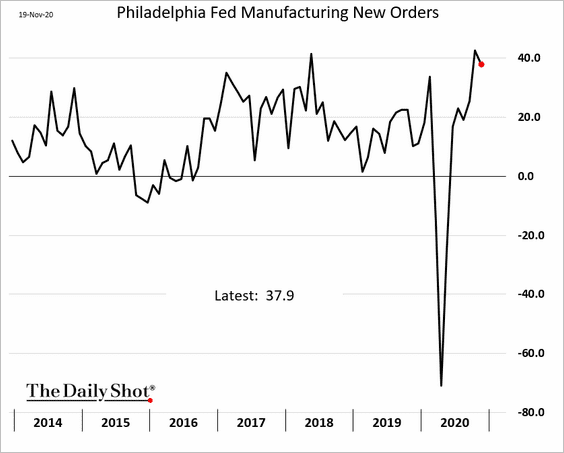

• New orders remain robust.

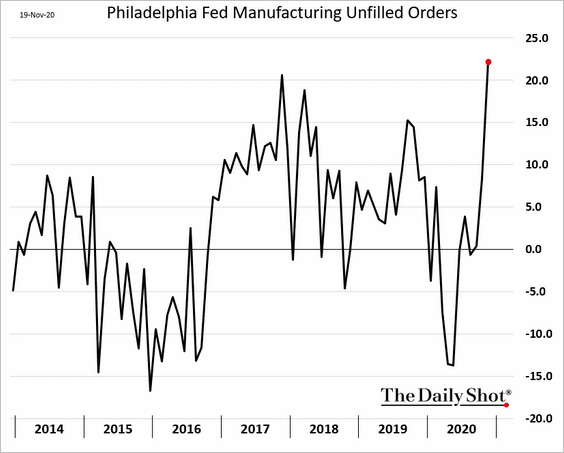

• And there is a substantial backlog of work.

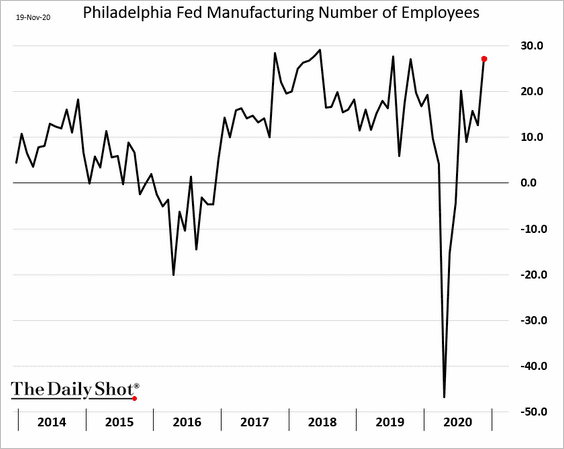

• Hiring is back at 2019 highs.

• More manufacturers have been raising prices.

Facing the pandemic headwinds, manufacturers were less upbeat about the future.

——————–

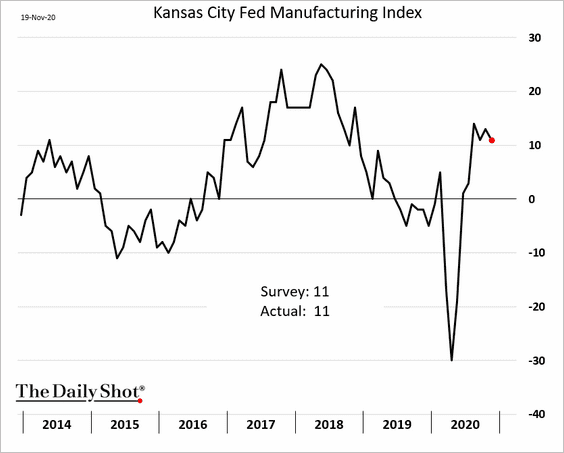

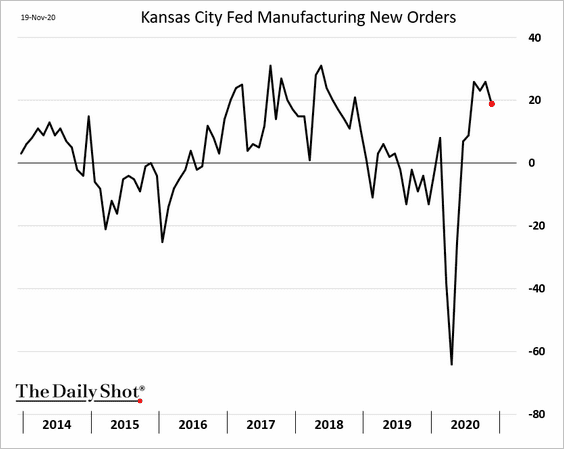

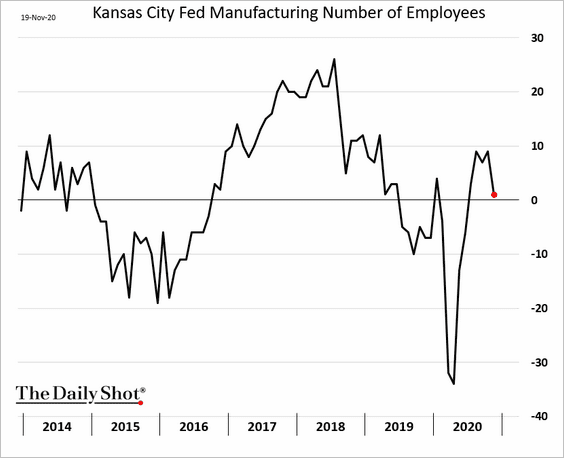

2. The Kansas City Fed’s manufacturing report was also relatively strong.

However, hiring has slowed.

——————–

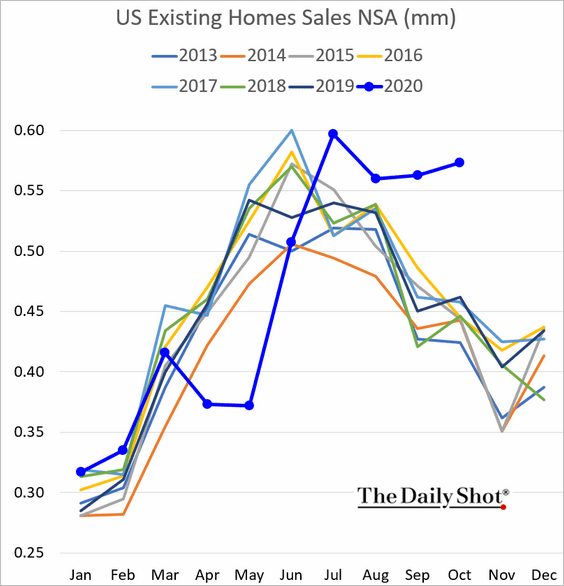

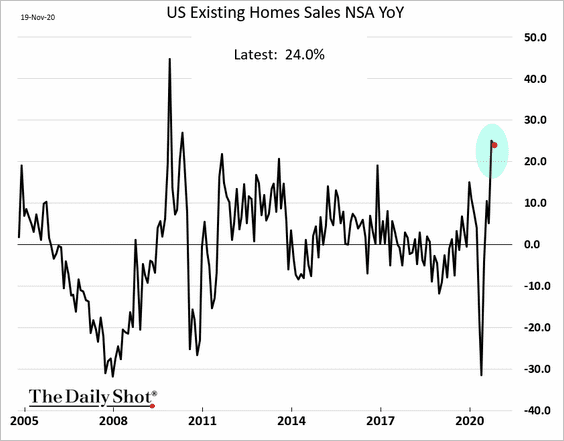

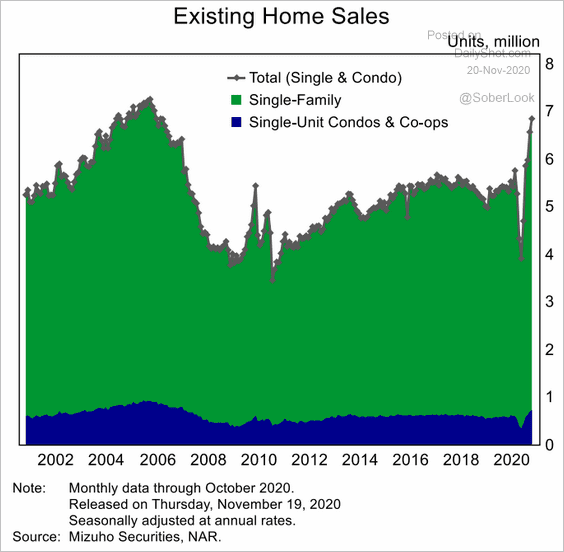

3. US sales of previously owned homes hit a multi-year high for this time of the year – up 24% vs. 2019 (3 charts).

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

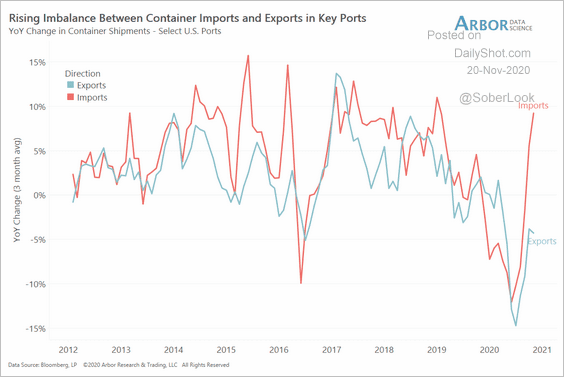

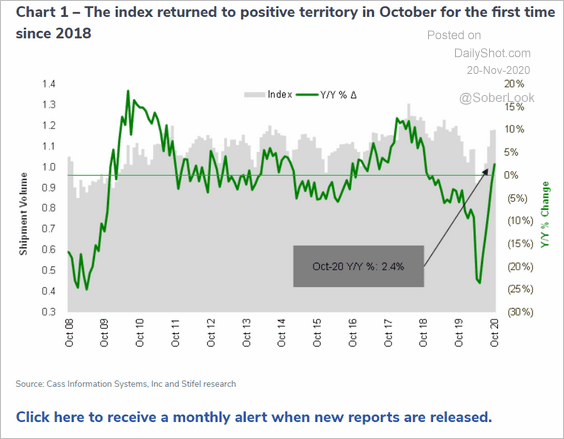

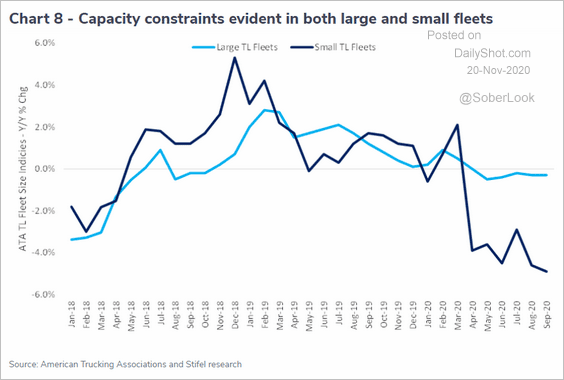

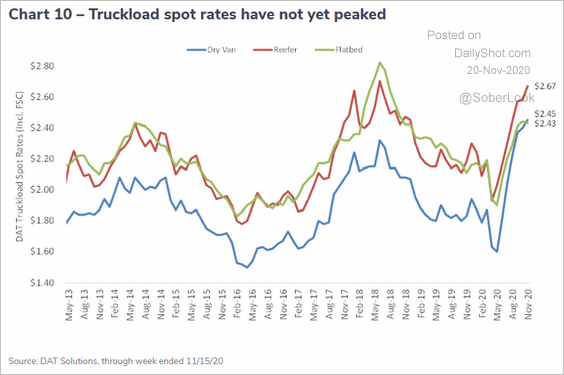

4. Next, we have some updates on freight activity.

• Based on container shipments at US ports, imports are far outpacing exports.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

• Domestic shipping volumes are now up year-over-year.

Source: Cass Information Systems

Source: Cass Information Systems

• US trucking fleets have shrunk this year.

Source: Cass Information Systems

Source: Cass Information Systems

Rising demand for freight transport and tight capacity sent truckload rates sharply higher.

Source: Cass Information Systems

Source: Cass Information Systems

• Intermodal shipping rates are still soft.

Source: Cass Information Systems

Source: Cass Information Systems

——————–

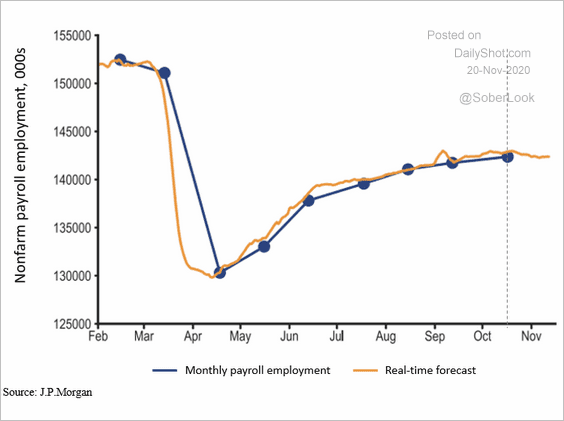

4. Here are some updates on the labor market.

• The recovery is stalling.

Source: JP Morgan, @SteveRattner

Source: JP Morgan, @SteveRattner

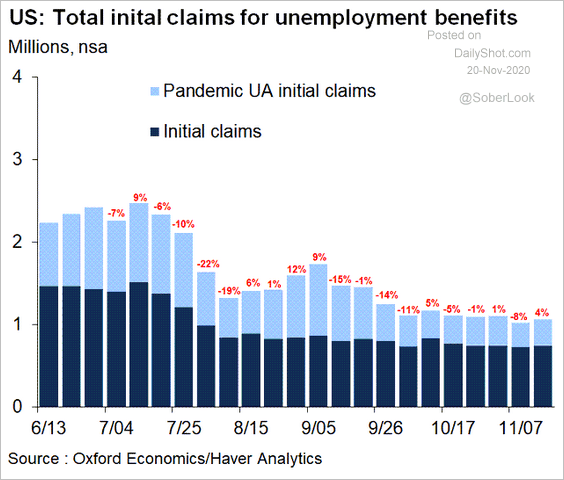

• Initial unemployment claims rose last week as the pandemic takes its toll.

Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

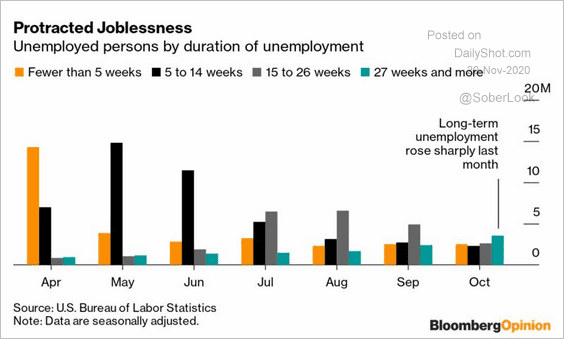

– Long-term unemployment has been climbing.

Source: @bopinion Read full article

Source: @bopinion Read full article

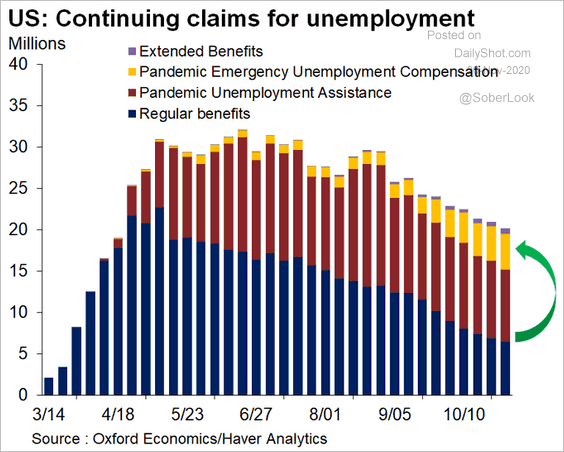

– As regular state unemployment benefits run out, emergency programs kick in.

Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

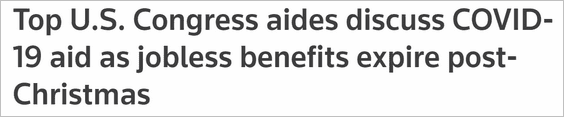

– But these emergency programs are about to end. Will Congress act?

Source: Reuters Read full article

Source: Reuters Read full article

Source: Oxford Economics

Source: Oxford Economics

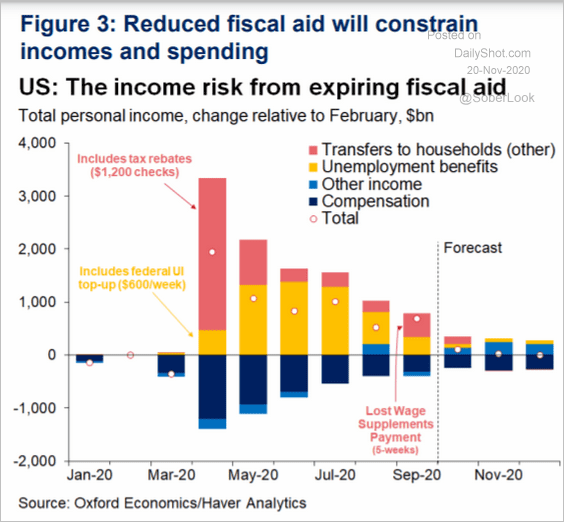

• This chart shows the unemployment rate in the lowest- vs. highest-earning industries.

Source: Leuthold Group, @axios Read full article

Source: Leuthold Group, @axios Read full article

——————–

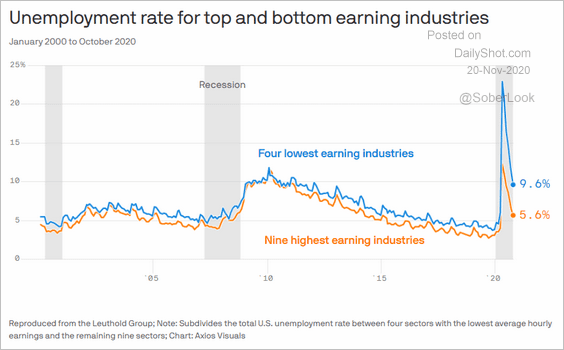

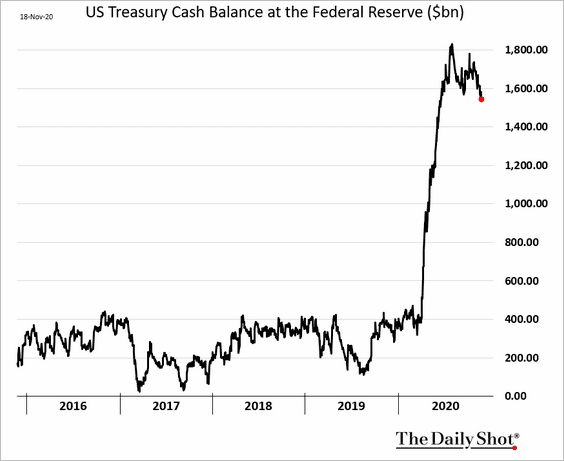

5. The US Treasury is pulling the plug on some of the emergency programs it put in place with the Fed (red arrows below).

Source: @colbyLsmith, @JamesPoliti, @FT Read full article

Source: @colbyLsmith, @JamesPoliti, @FT Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

The Treasury wants some of its liquidity back.

Source: @BloombergQuint Read full article

Source: @BloombergQuint Read full article

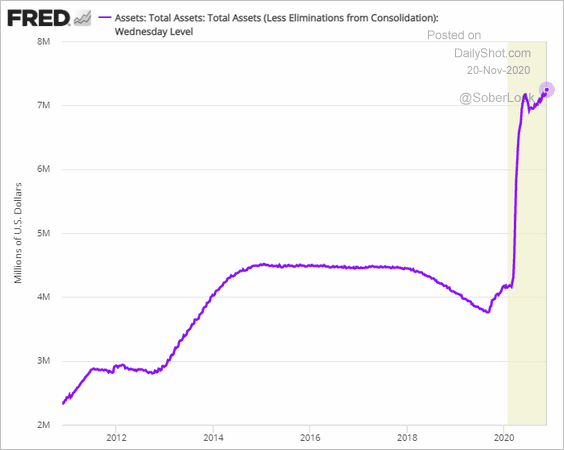

By the way, the Fed’s balance sheet hit another record high this week.

——————–

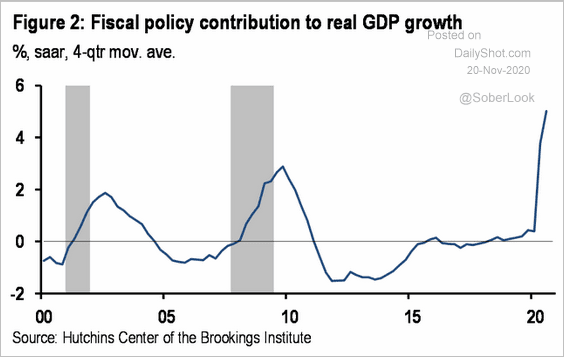

6. The economy has been dependent on federal aid this year.

Source: @BrookingsInst, @dlacalle_IA

Source: @BrookingsInst, @dlacalle_IA

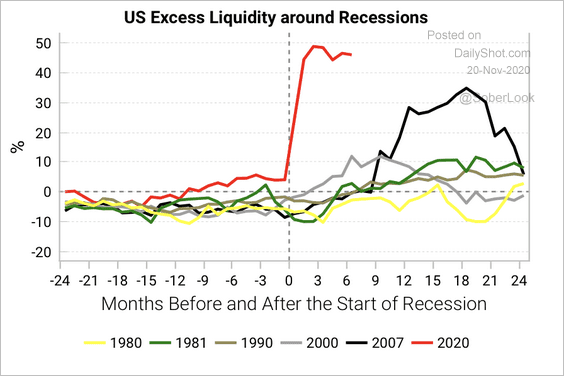

Is all the excess liquidity sufficient to keep the rebound going?

Source: Variant Perception

Source: Variant Perception

——————–

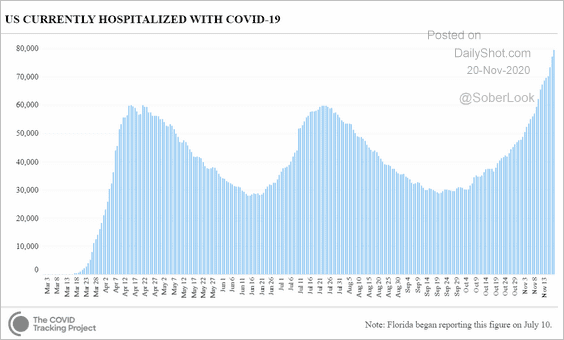

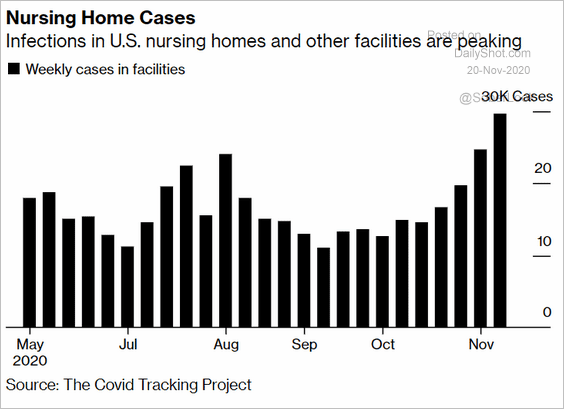

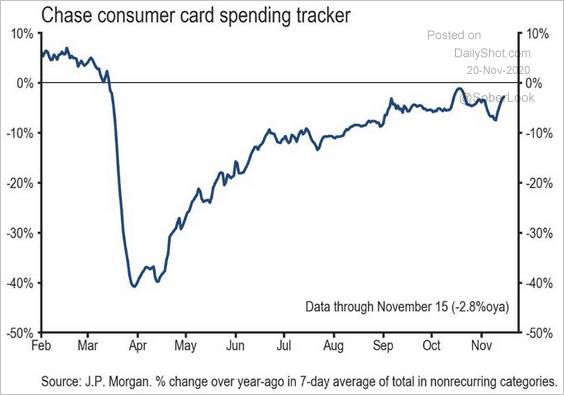

7. Here are some updates on the pandemic.

• COVID-related hospitalizations hit another record high.

Source: CovidTracking.com

Source: CovidTracking.com

• Infections at nursing homes are soaring.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

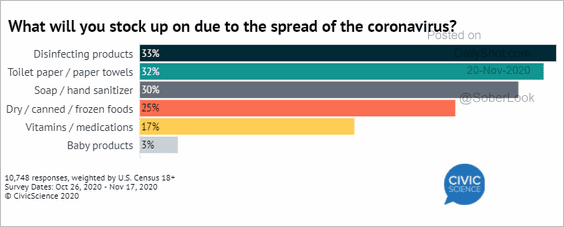

• Chase credit card spending ticked higher. JP Morgan suspects the increase was driven “by a jump in spending in supermarkets and wholesale clubs …” Hoarding is back, although not to the extent we saw in March.

Source: JP Morgan, @carlquintanilla

Source: JP Morgan, @carlquintanilla

Source: The Washington Post Read full article

Source: The Washington Post Read full article

Source: @CivicScience

Source: @CivicScience

The United Kingdom

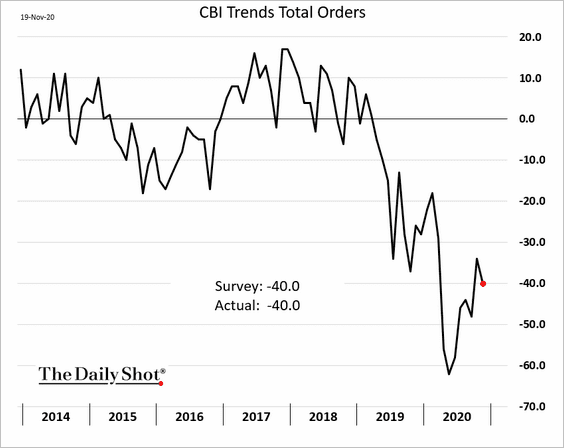

1. The recovery in industrial orders is slowing.

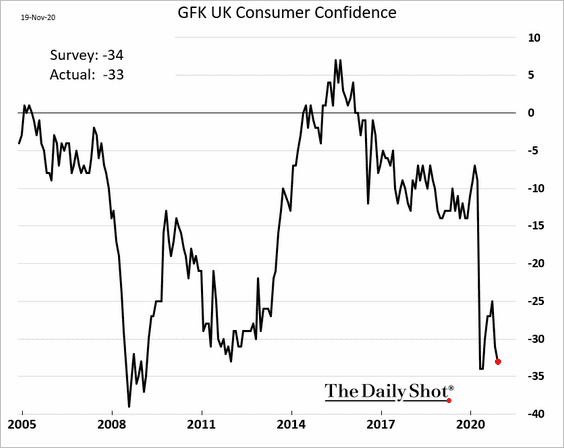

2. Consumer confidence is back near the 2020 lows.

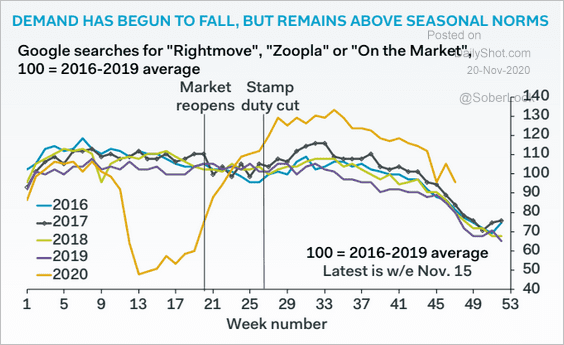

3. Housing demand is moderating.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

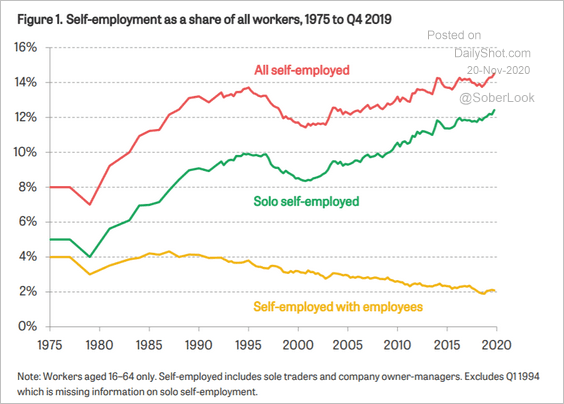

4. This chart shows the trend in self-employment.

Source: IFS Read full article

Source: IFS Read full article

Europe

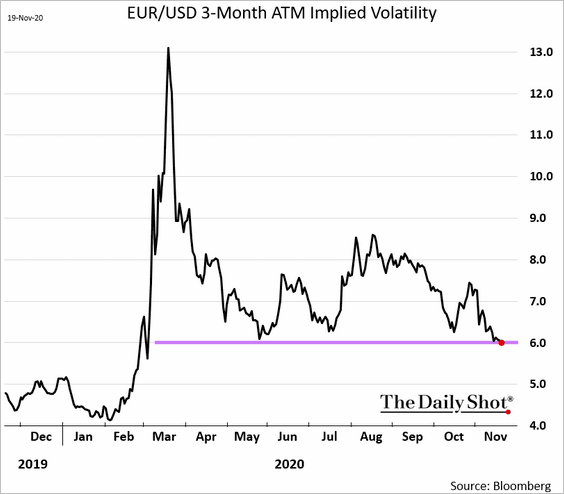

1. Euro implied volatility hit the lowest level since March after the US elections.

h/t @vkaramanis_fx

h/t @vkaramanis_fx

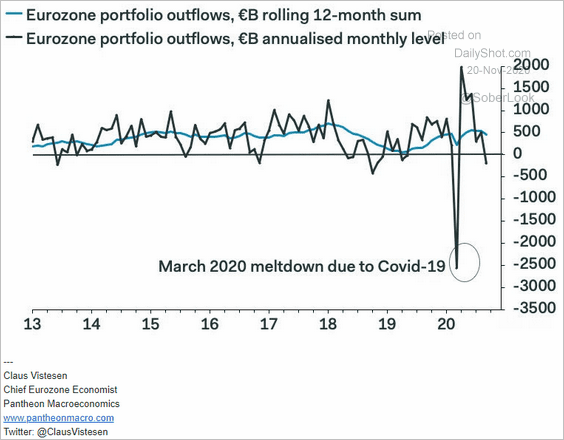

2. Eurozone portfolio flows turned negative.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

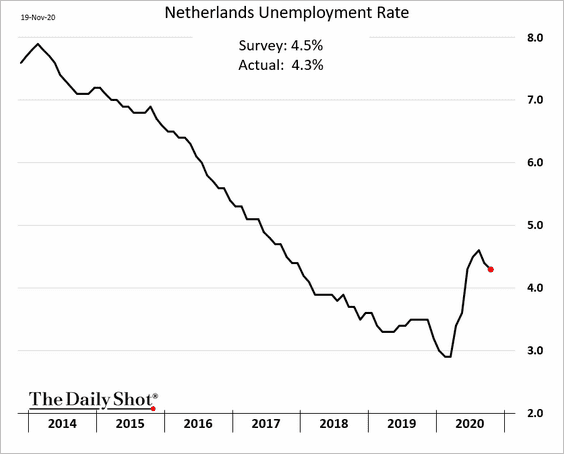

3. The Netherlands unemployment rate is gradually declining.

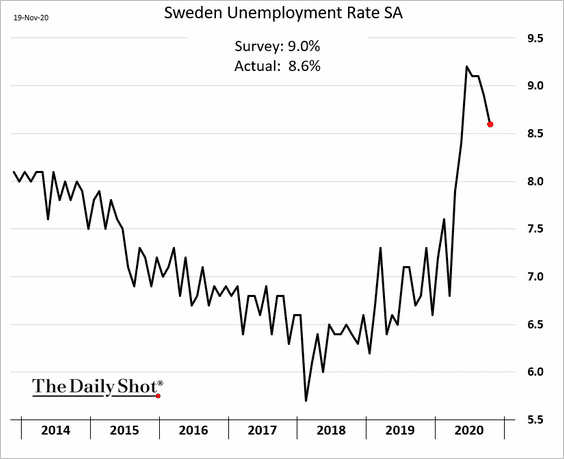

4. Sweden’s unemployment rate fell more than expected.

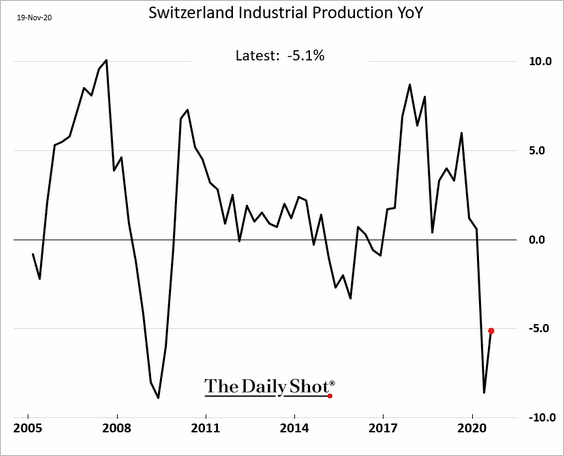

5. Swiss industrial production remains soft.

Japan

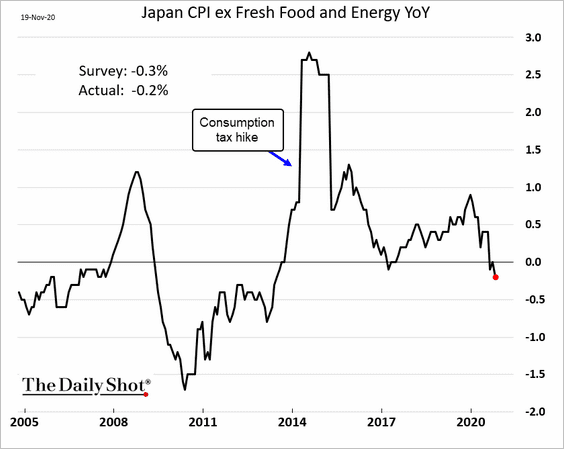

1. The core CPI is in negative territory, although the decline wasn’t as large as expected.

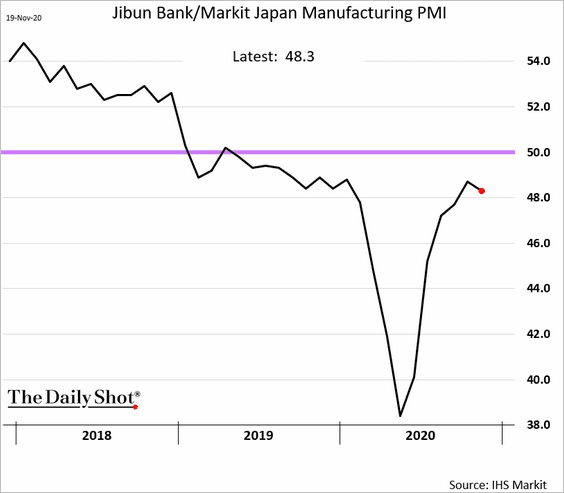

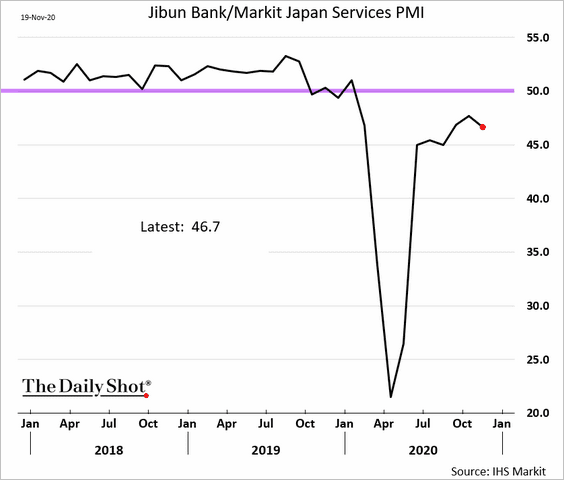

2. Manufacturing recovery stalled this month.

And services continue to struggle (PMI < 50).

China

1. China’s large-cap index is at resistance.

Source: CNBC, h/t Charlie Zhu

Source: CNBC, h/t Charlie Zhu

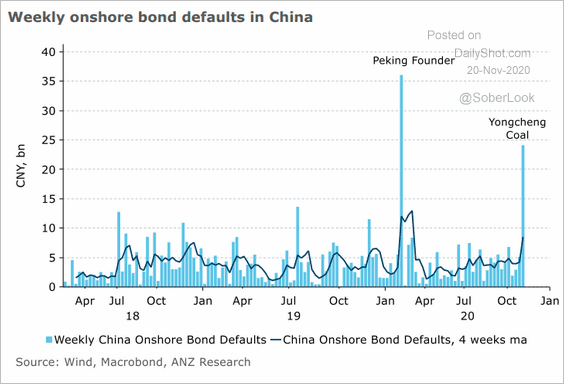

2. Will we see more corporate bond defaults ahead?

Source: ANZ Research

Source: ANZ Research

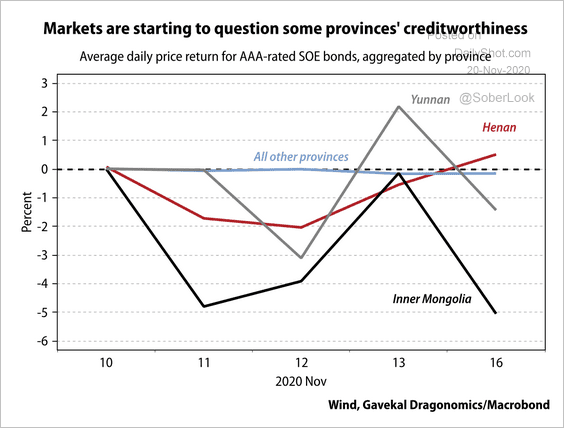

3. Investors have been selling high-rated state-owned-enterprise (SOE) bonds in provinces where local governments have poor reputations, according to Gavekal.

Source: Gavekal

Source: Gavekal

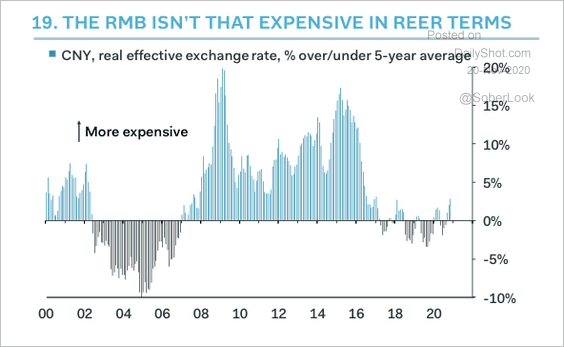

4. The renminbi still looks cheap, based on its real effective exchange rate.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

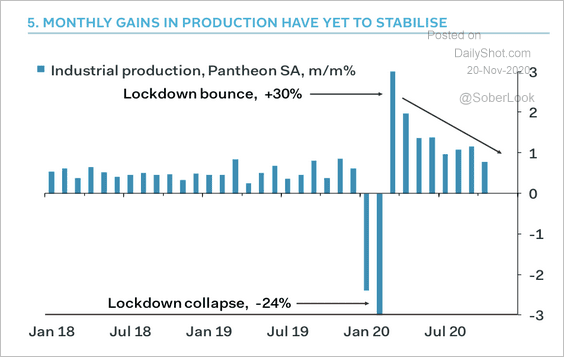

5. Gains in industrial production have been moderating.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

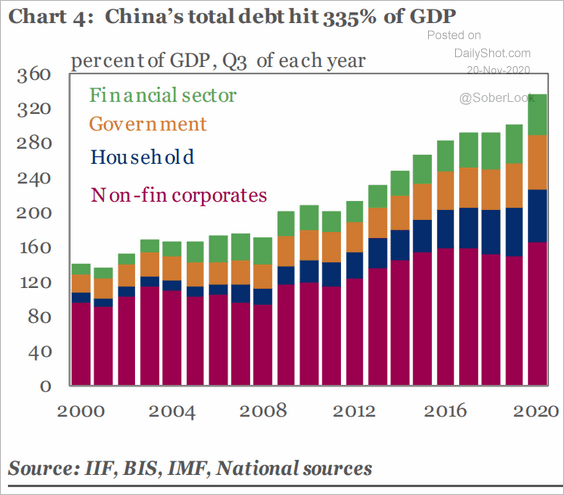

6. Here is China’s total debt-to-GDP ratio over time.

Source: IIF

Source: IIF

Emerging Markets

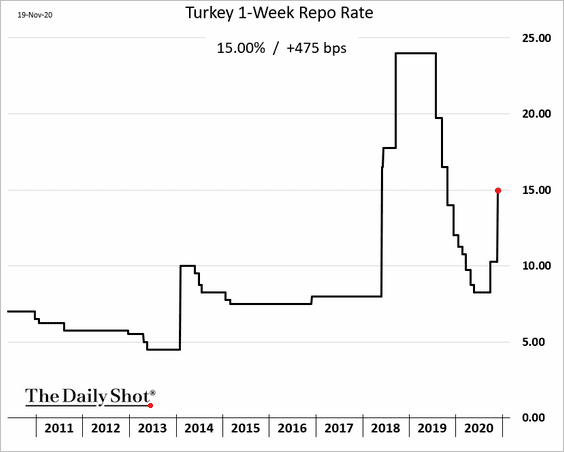

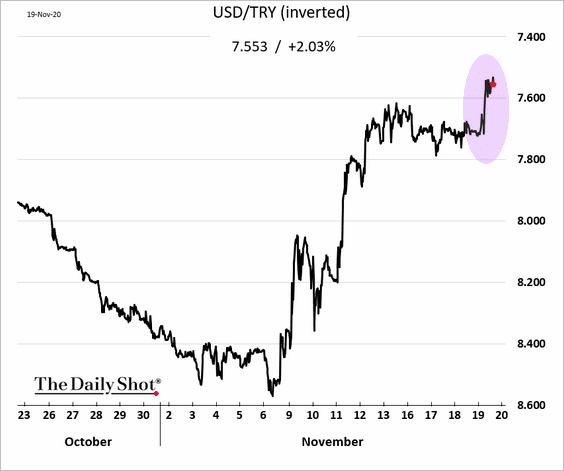

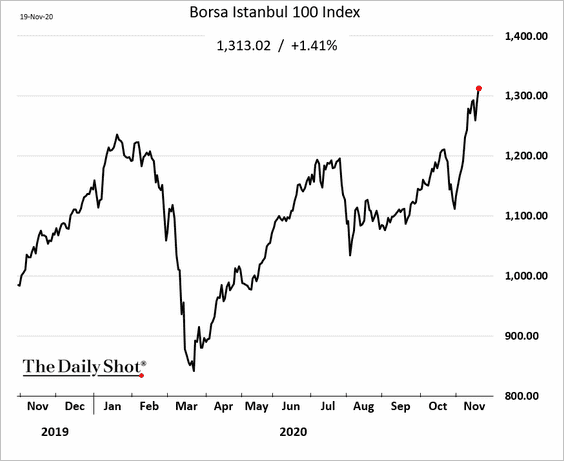

1. In a bold move, the Turkish central bank delivered a 475 bps hike to support the currency.

The lira climbed further.

Stocks continue to rally.

——————–

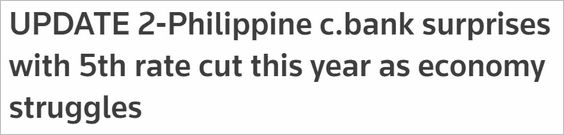

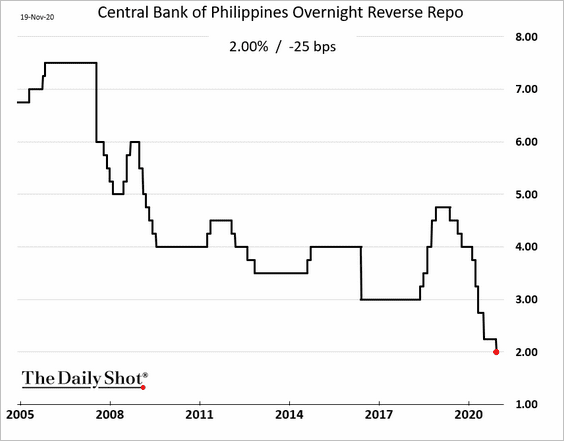

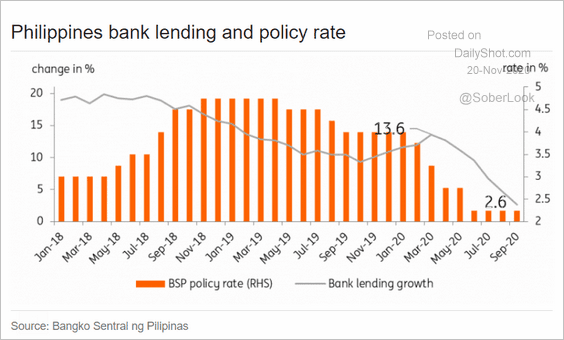

2. The Philippine central bank cut rates again as credit expansion slows.

Source: Reuters Read full article

Source: Reuters Read full article

Source: ING

Source: ING

——————–

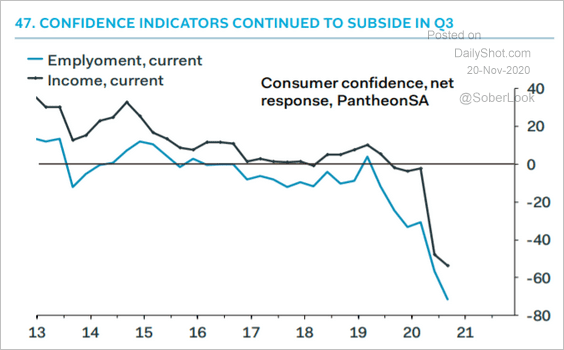

3. Confidence indicators in India remain depressed.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

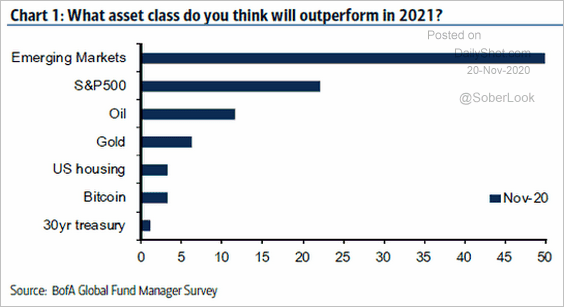

4. Fund managers think that EM stocks will outperform next year.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

Cryptocurrency

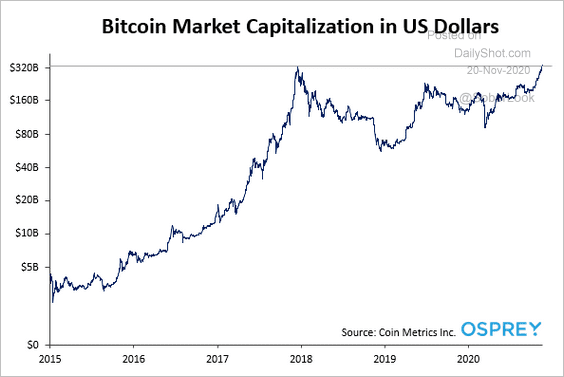

1. Bitcoin continues to soar.

2. Bitcoin’s market cap made an all-time high at $334 billion.

Source: @OspreyFunds

Source: @OspreyFunds

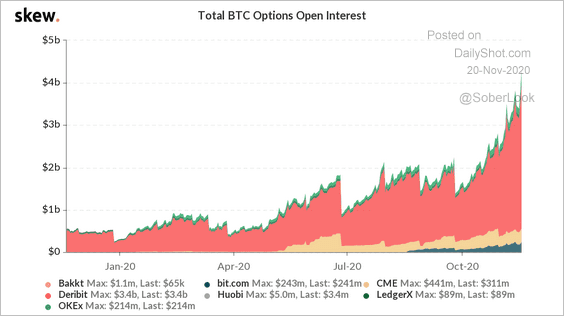

3. Open interest in bitcoin options has shot up to a record high.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

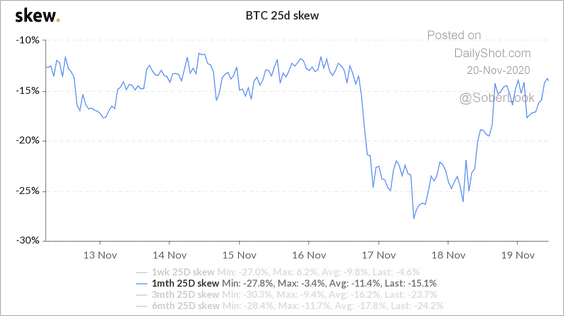

4. The spread between the cost of bitcoin puts and calls has eased, suggesting that investors are starting to hedge against a price pullback.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

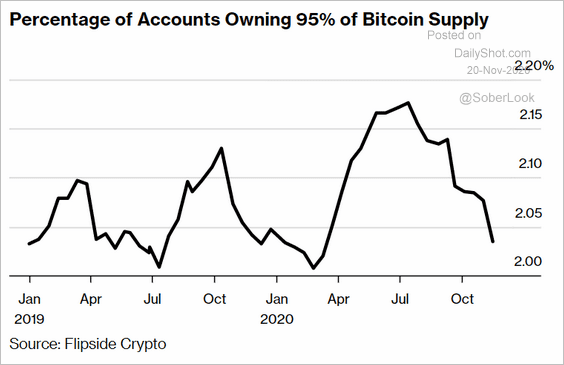

5. Bitcoin ownership is becoming more concentrated again.

Source: @markets Read full article

Source: @markets Read full article

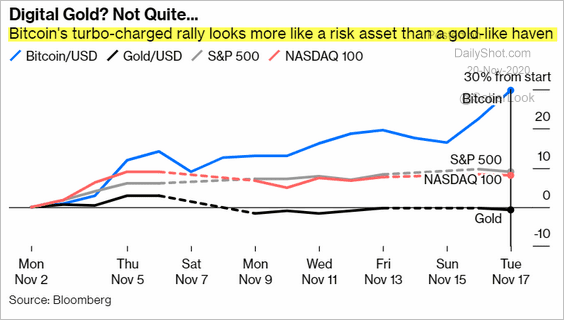

6. Bitcoin trades more like a risk asset rather than a safe-haven product.

Source: @bopinion Read full article

Source: @bopinion Read full article

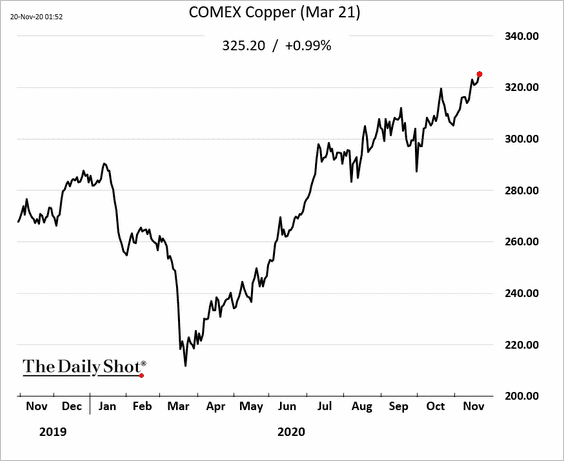

Commodities

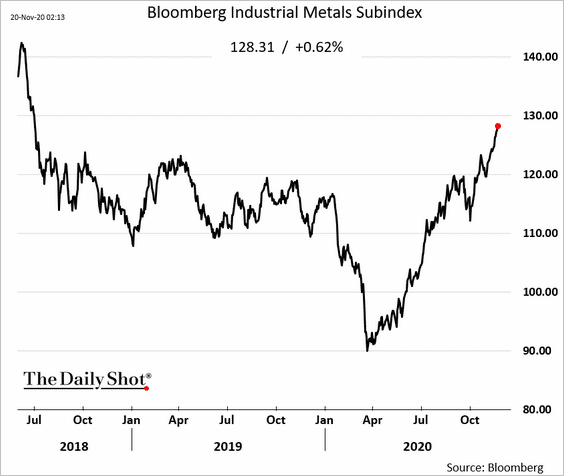

1. Industrial metals keep climbing.

——————–

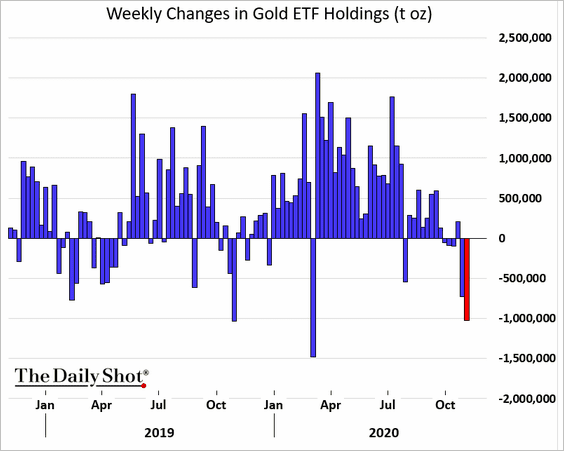

2. This chart shows the weekly changes in gold ETFs’ holdings.

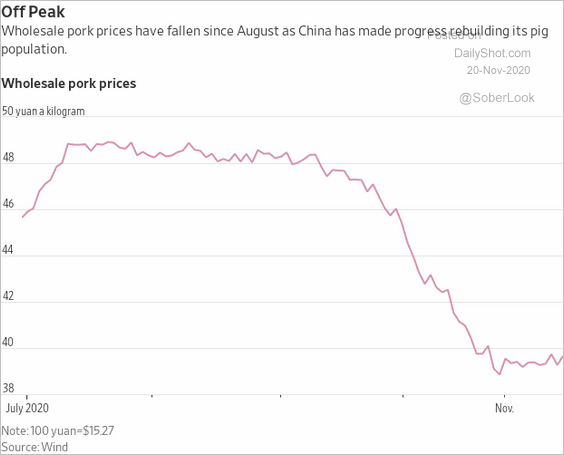

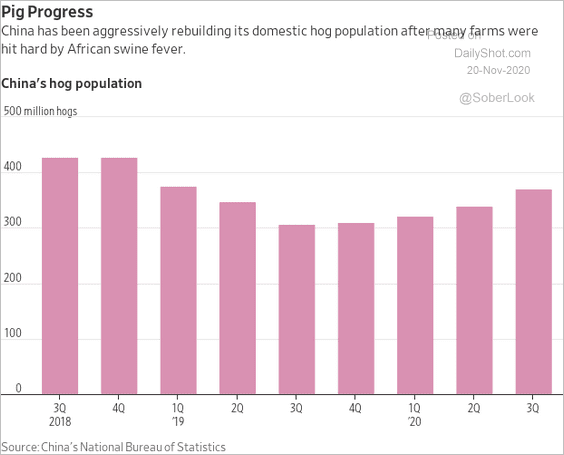

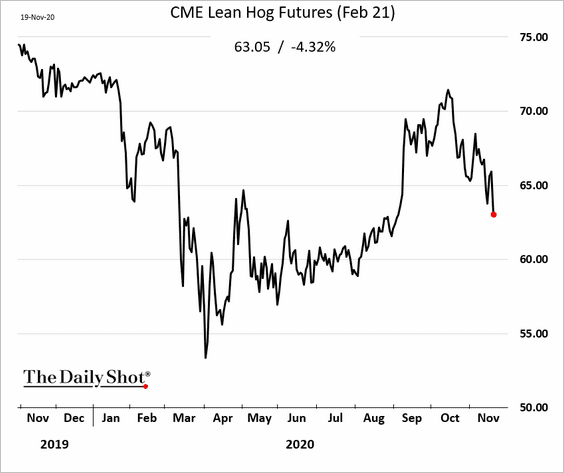

3. China’s pork prices have declined sharply as the herd recovers.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

US hog futures are lower.

——————–

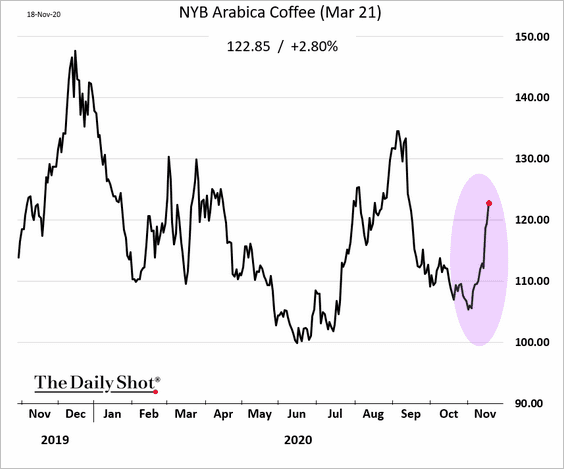

4. Coffee futures are rallying after Nicaragua and Honduras were hit by Hurricane Iota.

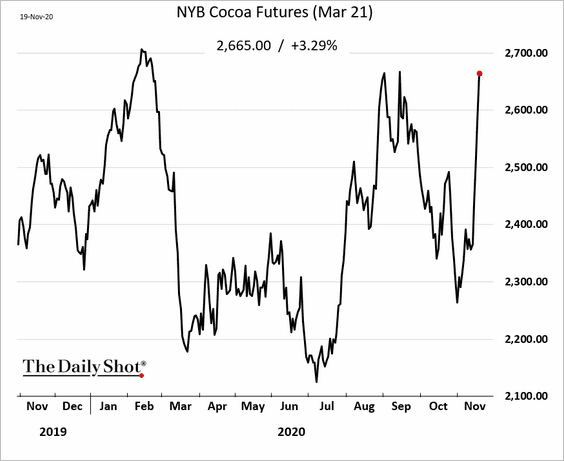

5. Hershey has been sourcing cocoa in the US futures market, perhaps trying to circumvent the West African cocoa premium. Cocoa futures are up sharply.

Source: @BloombergQuint Read full article

Source: @BloombergQuint Read full article

Energy

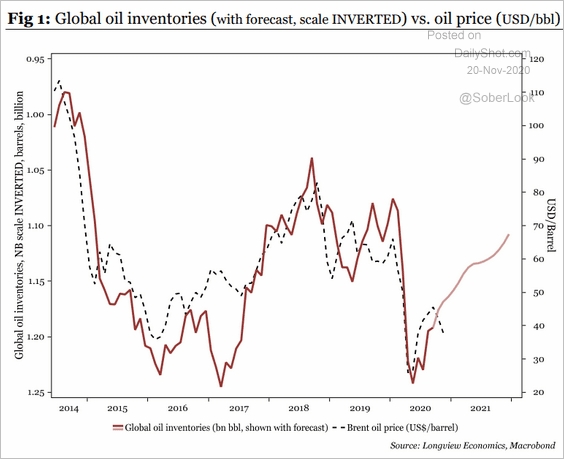

1. Global oil inventories are expected to keep falling next year, supporting Brent prices.

Source: Longview Economics

Source: Longview Economics

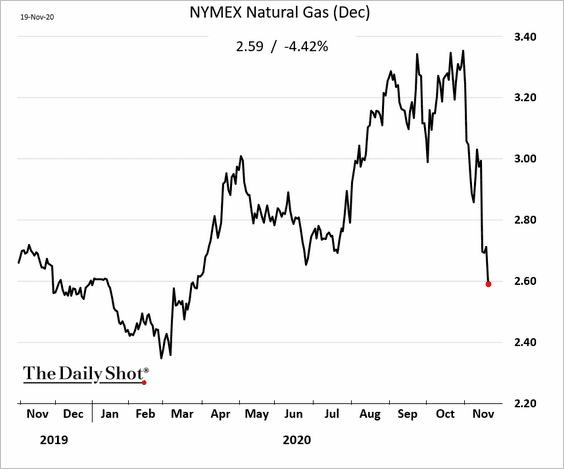

2. US natural gas futures continue to slump amid warmer weather.

Equities

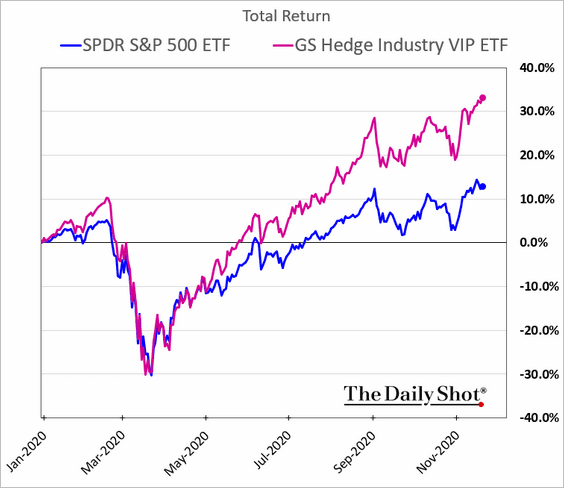

1. Hedge funds’ stock picks have been widening their outperformance.

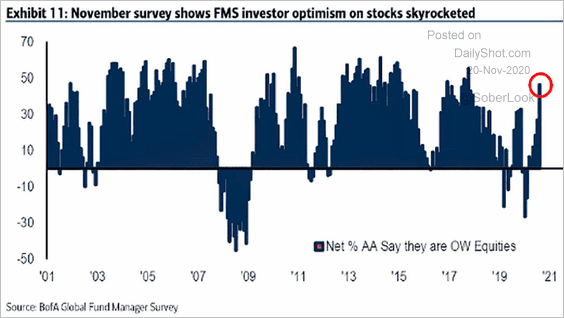

2. Fund managers are upbeat.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

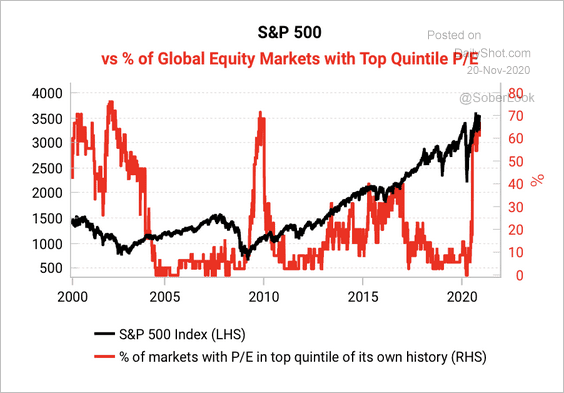

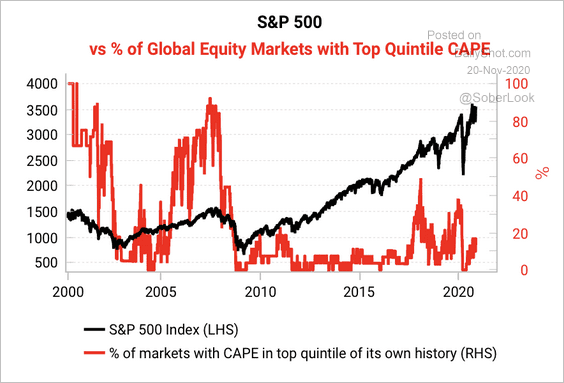

3. Global equity valuations appear stretched relative to history.

Source: Variant Perception

Source: Variant Perception

However, valuations based on the CAPE ratio are not as excessive.

Source: Variant Perception

Source: Variant Perception

——————–

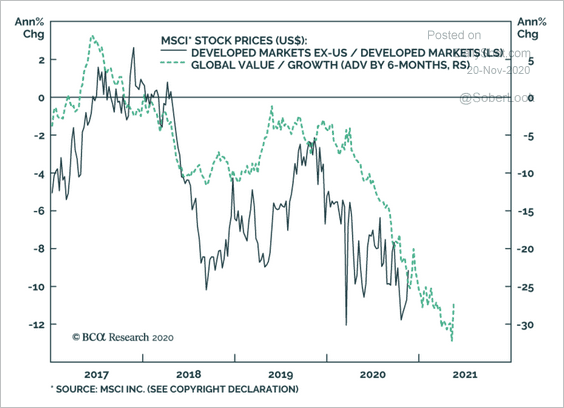

4. International stocks (ex. US) have been correlated with the trend in value versus growth over the past few years. Will we see a rotation out of US stocks?

Source: BCA Research

Source: BCA Research

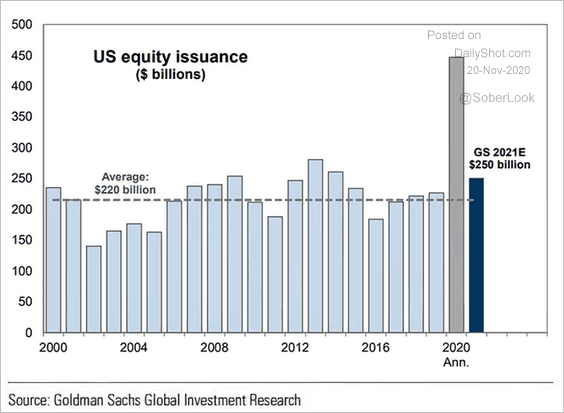

5. After a massive spike, US equity issuance is expected to return to a more normal pace next year.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

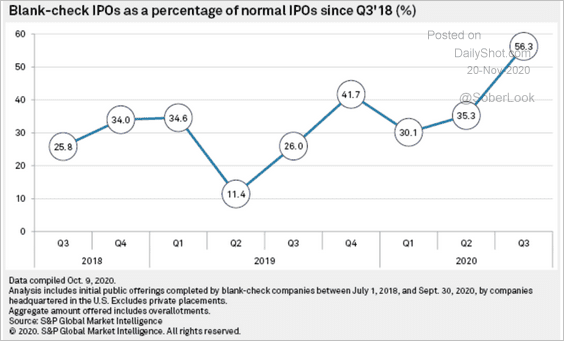

6. US SPAC activity skyrocketed in Q3, accounting for 56.3% of the total US IPO proceeds raised during the quarter.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

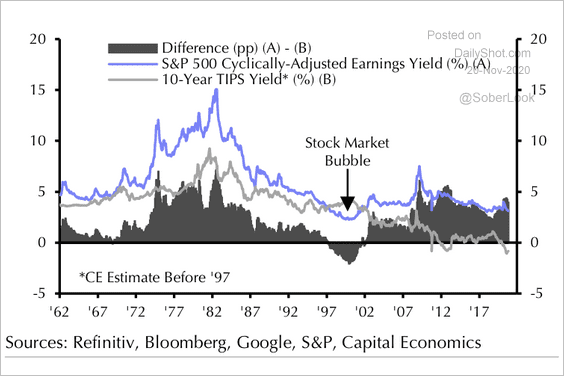

7. Real yields of safe assets, like TIPS, will likely remain low, encouraging investors to hunt for yield elsewhere – perhaps in equities (according to Capital Economics).

Source: Capital Economics

Source: Capital Economics

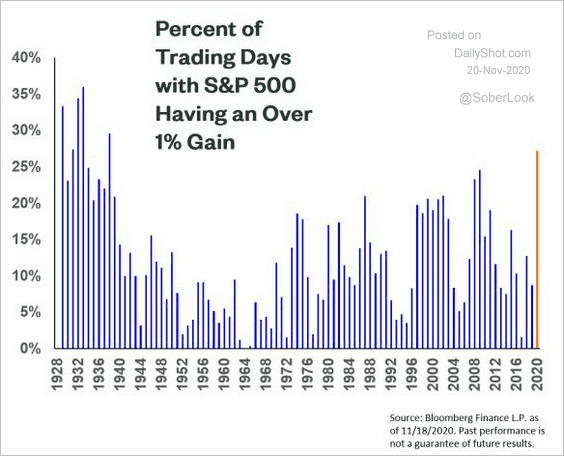

8. It’s been a volatile year – especially to the upside.

Source: SPDR Americas Research, @mattbartolini Read full article

Source: SPDR Americas Research, @mattbartolini Read full article

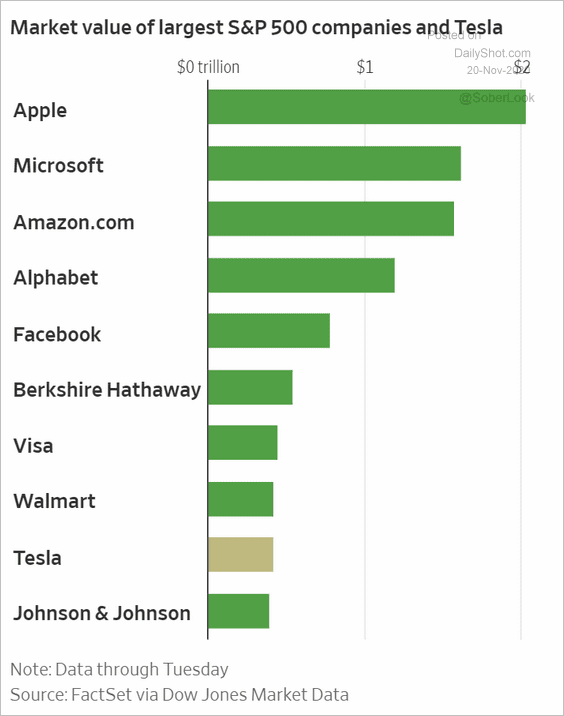

9. Here are the largest members of the S&P 500 by market value.

Source: @WSJ Read full article

Source: @WSJ Read full article

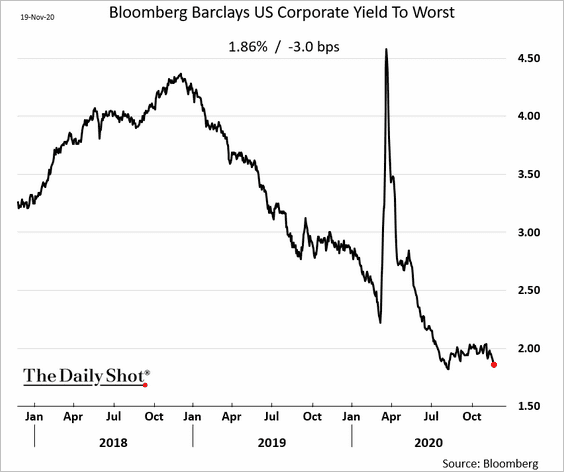

Credit

1. US investment-grade bond yields are near the lows again.

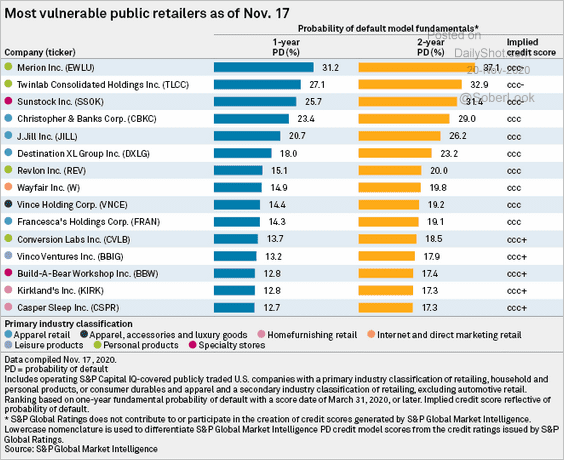

2. Here are the most vulnerable retailers.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

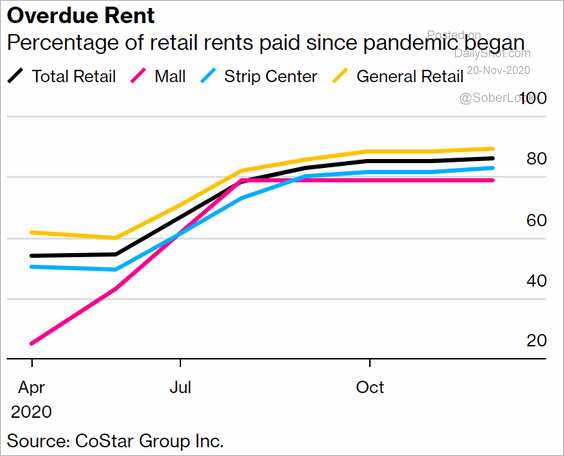

Many retailers are still not paying rent (or making partial payments).

Source: @markets, h/t @DiMartinoBooth Read full article

Source: @markets, h/t @DiMartinoBooth Read full article

——————–

Food for Thought

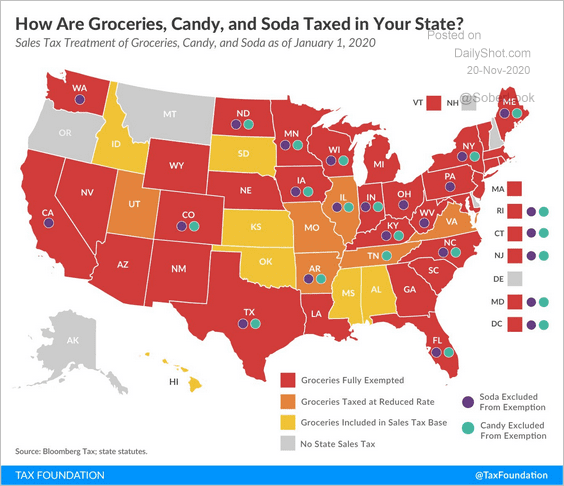

1. Taxes on groceries, candy, and soda:

Source: @TaxFoundation Read full article

Source: @TaxFoundation Read full article

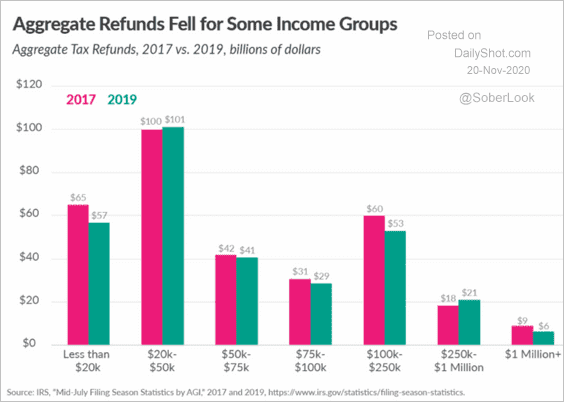

2. Tax refunds in 2017 and 2019:

Source: @TaxFoundation Read full article

Source: @TaxFoundation Read full article

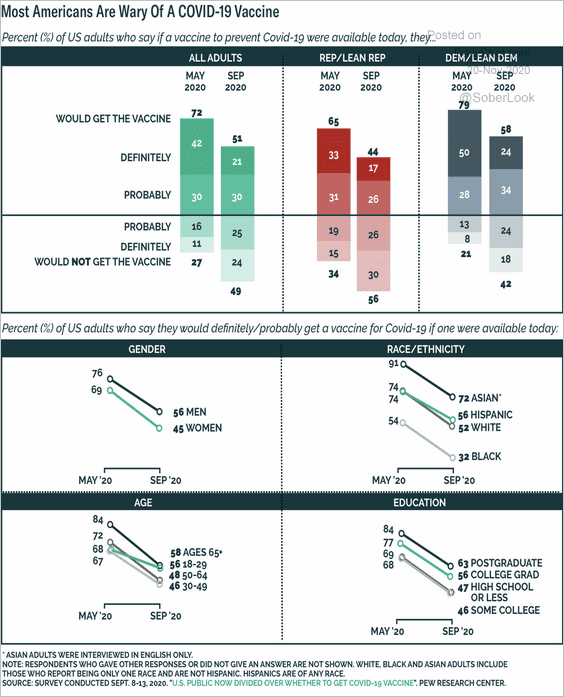

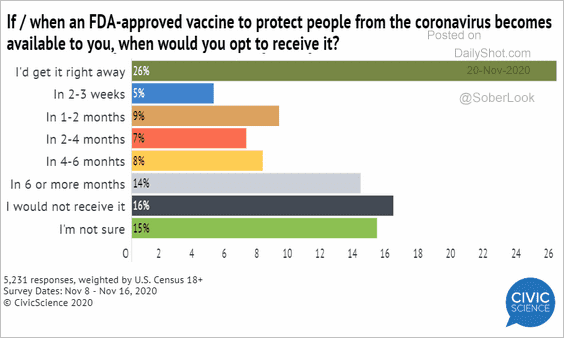

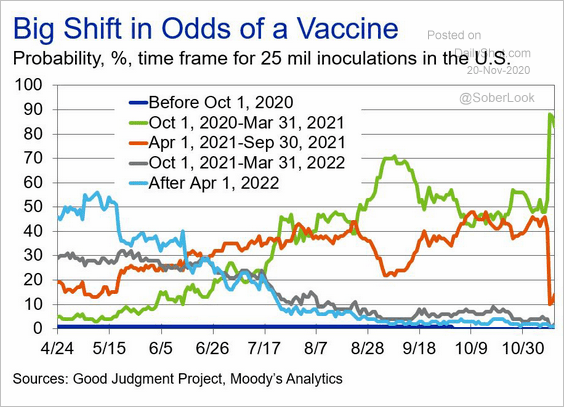

3. Here are a couple of updates on the vaccine.

• Americans’ comfort level with getting vaccinated (2 charts):

Source: BCA Research

Source: BCA Research

Source: @CivicScience Read full article

Source: @CivicScience Read full article

• Vaccine delivery timing (odds):

Source: Moody’s Analytics

Source: Moody’s Analytics

——————–

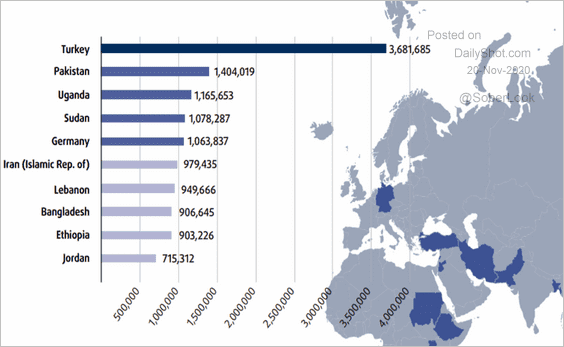

4. Countries with the largest number of refugees:

Source: European Union Agency for Fundamental Rights Read full article

Source: European Union Agency for Fundamental Rights Read full article

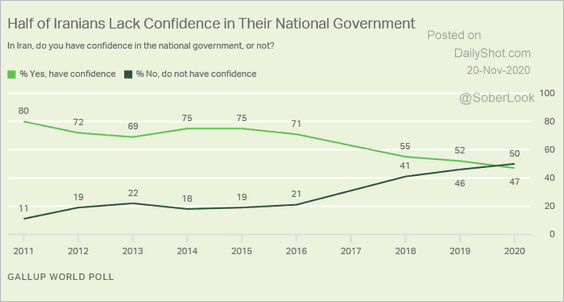

5. Iranians don’t have much confidence in their government.

Source: Gallup Read full article

Source: Gallup Read full article

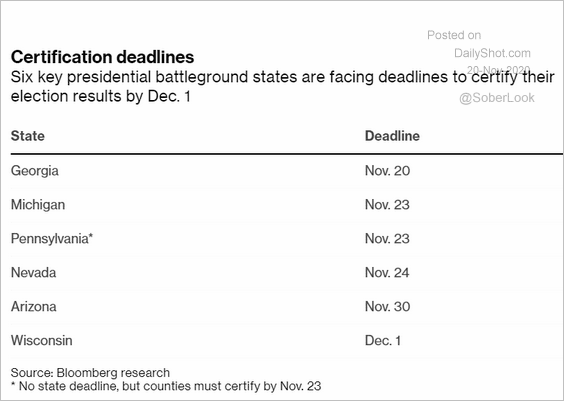

6. Election results certification deadlines in select US states:

Source: @bpolitics Read full article

Source: @bpolitics Read full article

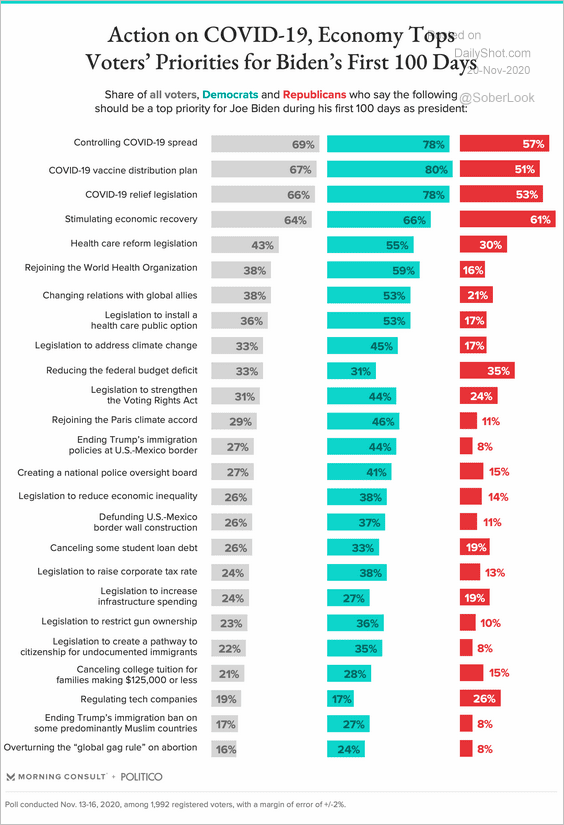

7. Priorities for Biden’s first 100 days:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

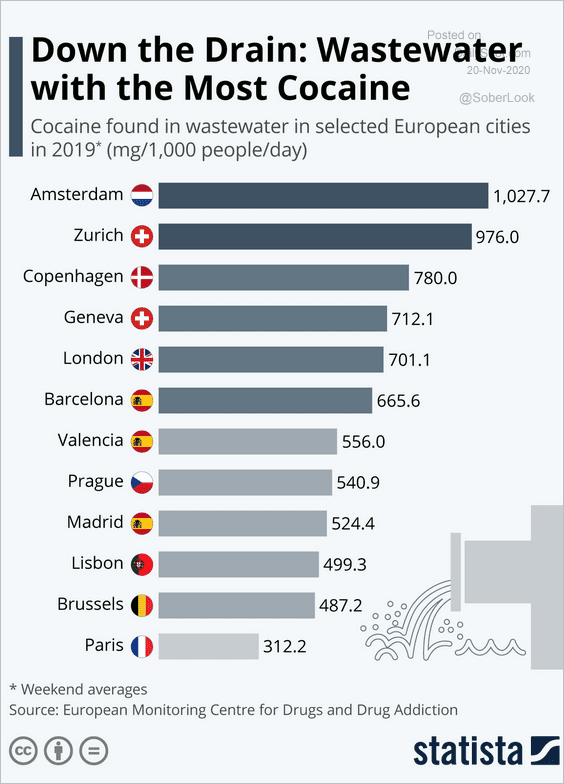

8. Cocaine levels in wastewater across Europe:

Source: Statista

Source: Statista

——————–

Have a great weekend!