The Daily Shot: 25-Nov-20

• Equities

• Rates

• Commodities

• Energy

• Emerging Markets

• China

• Asia – Pacific

• Japan

• The Eurozone

• The United Kingdom

• The United States

• Global Developments

• Food for Thought

Equities

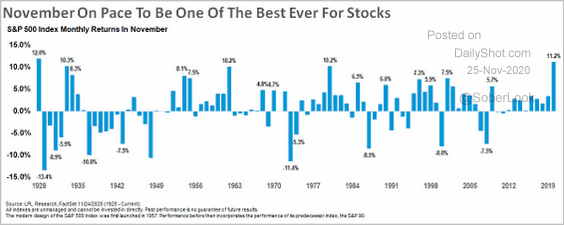

1. The Dow broke above 30k as investors bought value and cyclical shares. The vaccine-driven rotation continues.

It’s been a good month for stocks.

Source: @RyanDetrick

Source: @RyanDetrick

——————–

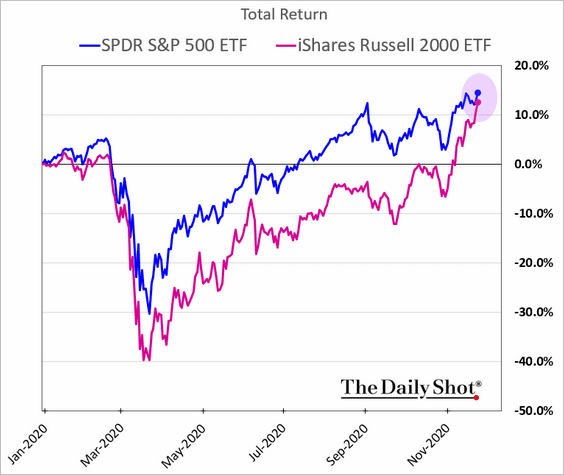

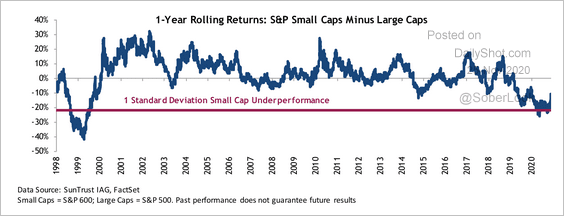

2. Small caps are catching up to the S&P 500 on a year-to-date basis.

The underperformance of small-caps reached an extreme, …

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

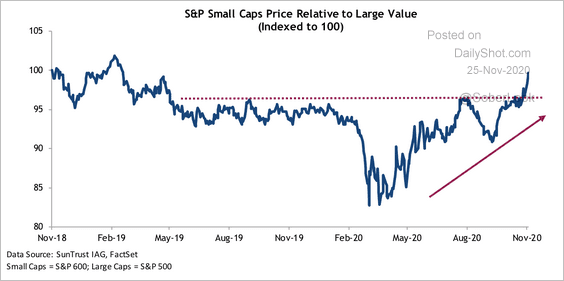

… triggering a breakout relative to the broader market, …

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

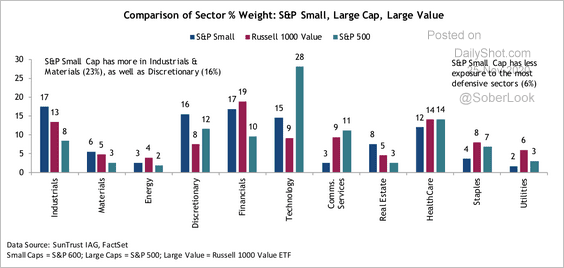

… as investors seek more cyclical exposure in sectors such as industrials and consumer discretionary.

Source: SunTrust Private Wealth Management

Source: SunTrust Private Wealth Management

——————–

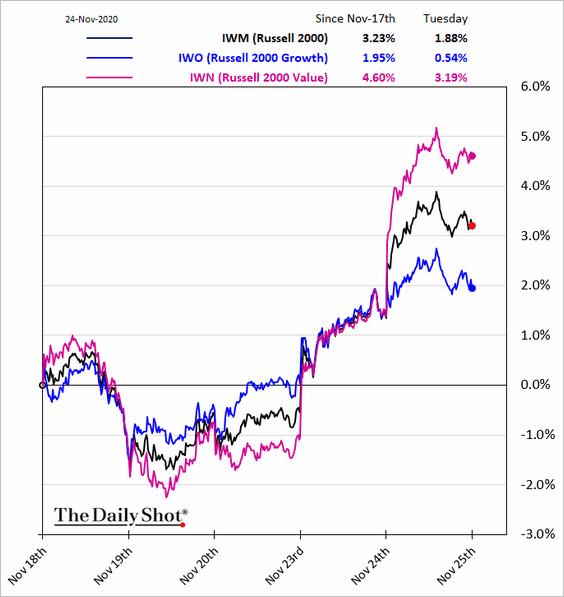

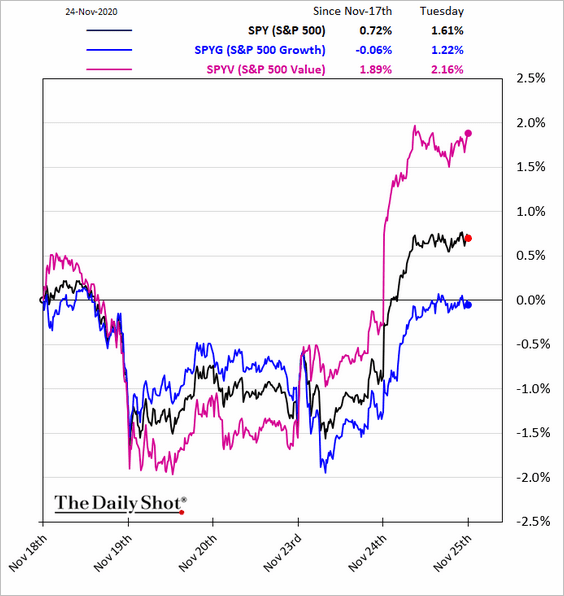

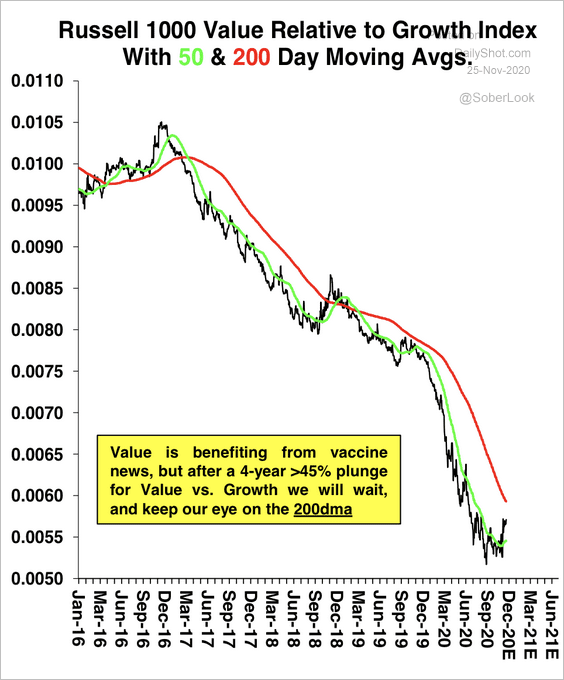

3. Both small- and large-cap value stocks outperformed on Tuesday.

Value has been down some 45% vs. growth over the past four years.

Source: Stifel

Source: Stifel

——————–

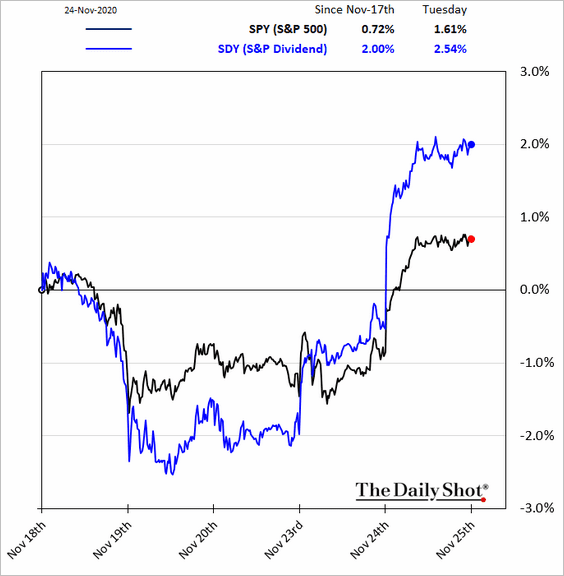

4. High-dividend stocks rose sharply on Tuesday.

——————–

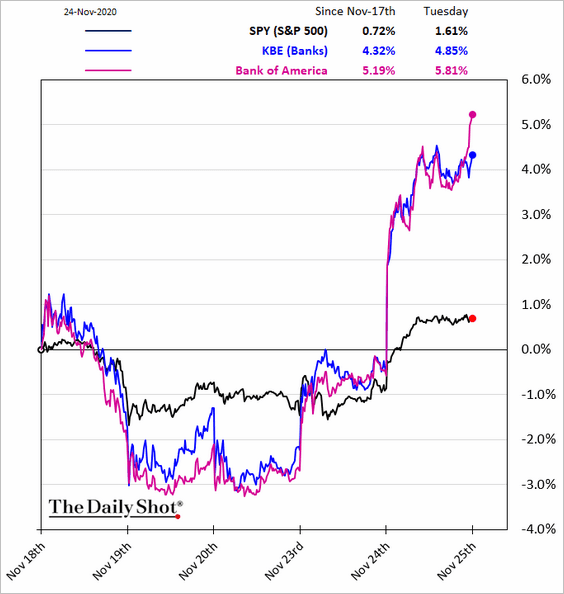

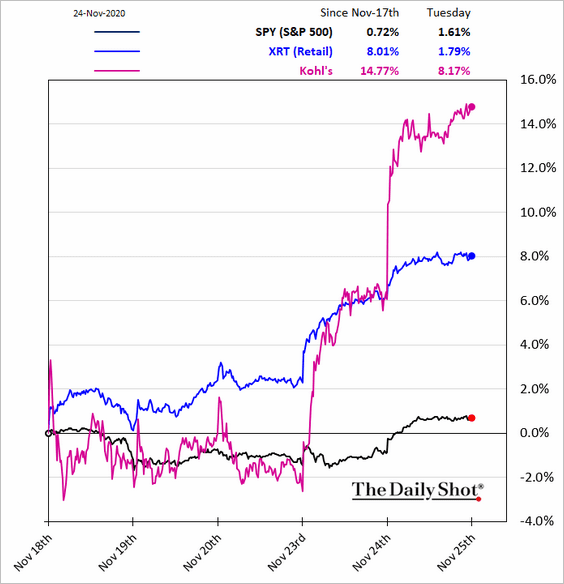

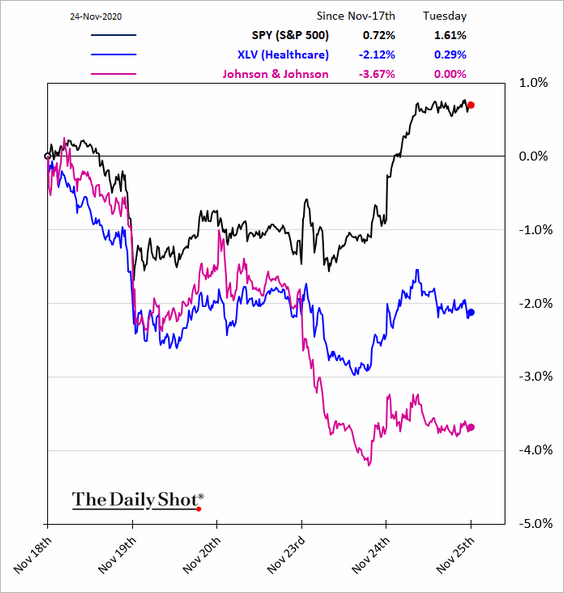

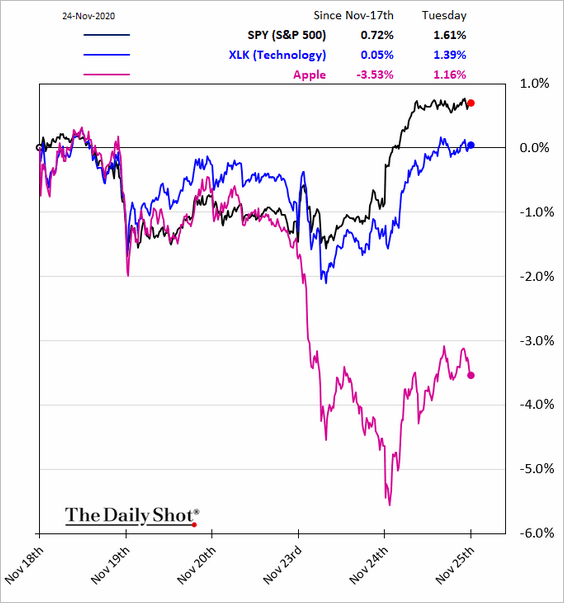

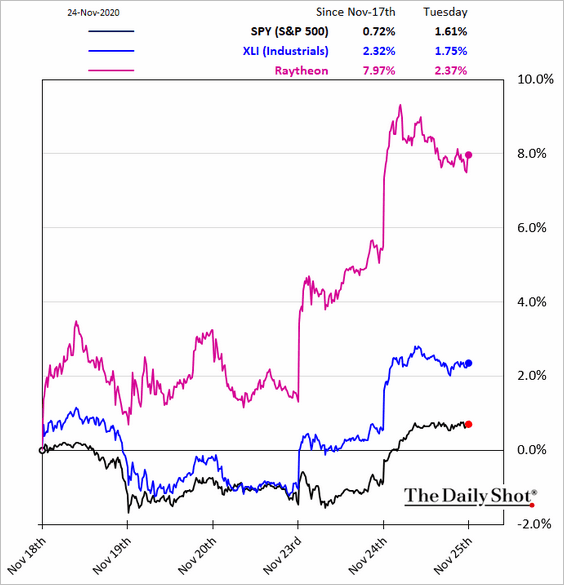

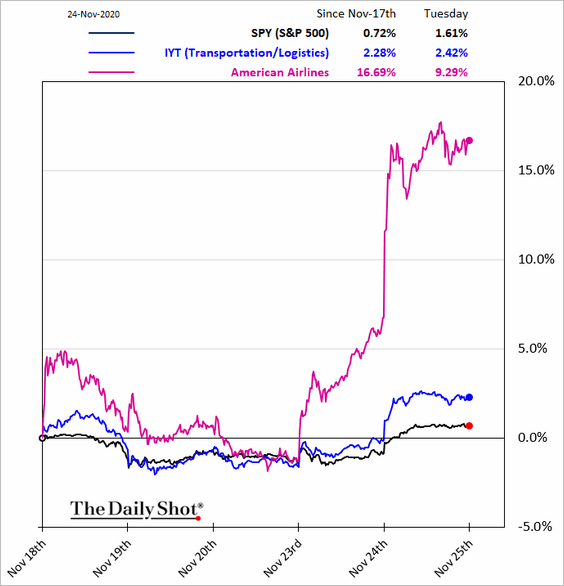

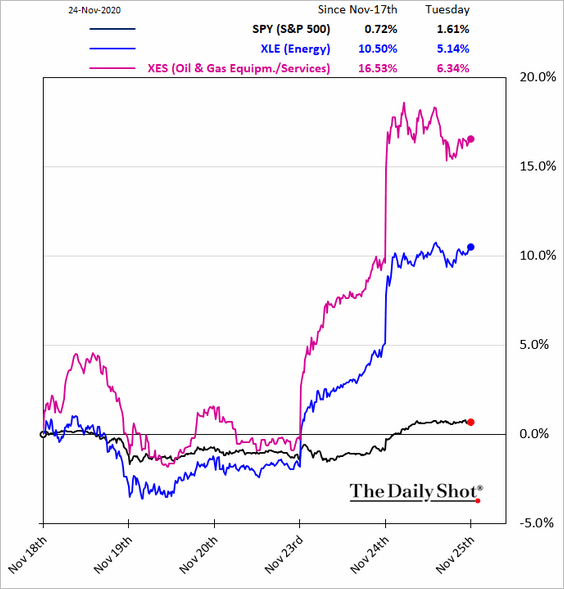

5. Here are some sector performance charts (last five business days).

• Banks:

• Retail:

• Healthcare:

• Tech:

• Industrials:

• Transportation:

• Energy:

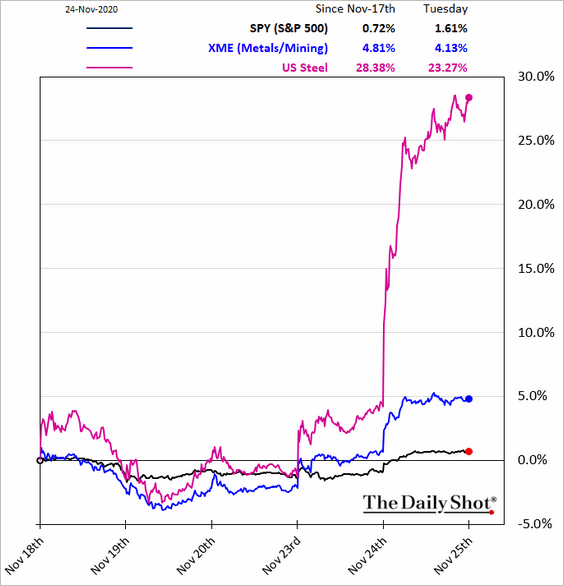

• Metals & Mining:

——————–

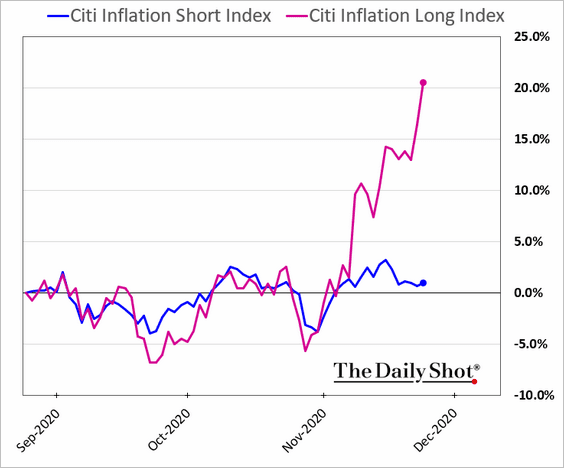

6. The stock market is pricing in higher inflation ahead. Here is the relative performance of stocks that benefit from increased inflation vs. those that underperform when prices climb.

7. Stocks favored by retail investors are up almost 80% year-to-date.

Source: @markets Read full article

Source: @markets Read full article

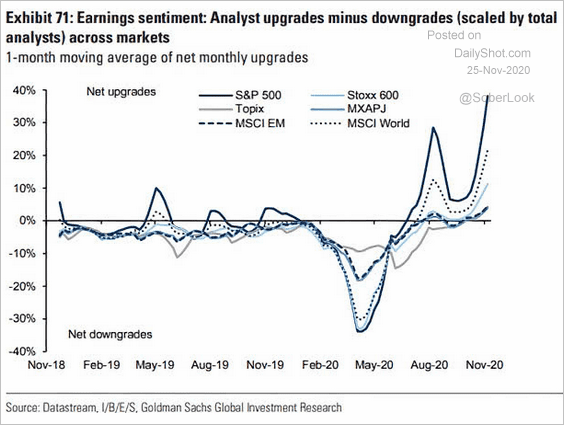

8. Earnings sentiment continues to improve.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

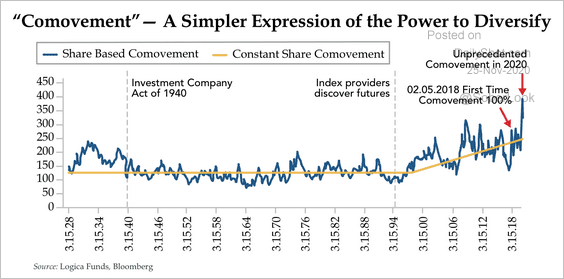

9. There has been an unprecedented rise in stock “comovement” (absolute number of stocks moving up or down in a given day).

Source: Quill Intelligence

Source: Quill Intelligence

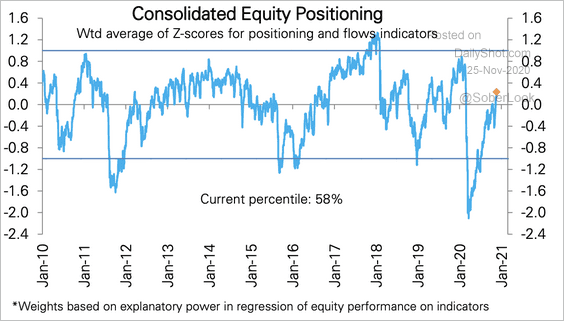

11. Equity positioning is bullish but not extreme.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

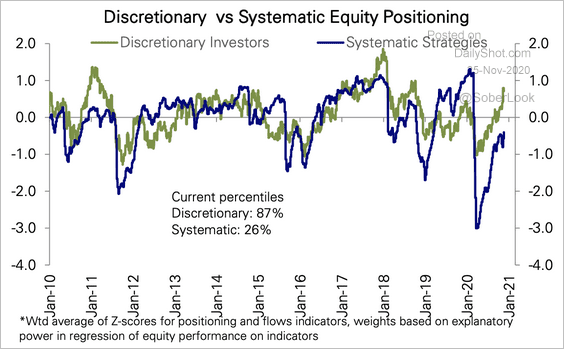

Discretionary funds drove the recent tilt toward bullish positioning, while systematic strategy exposure remains low.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

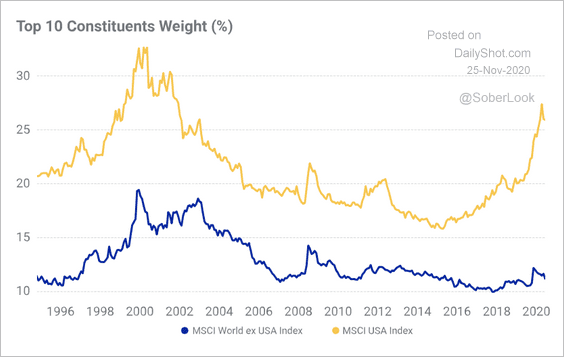

12. The US market is more concentrated than the rest of the world.

Source: MSCI Read full article

Source: MSCI Read full article

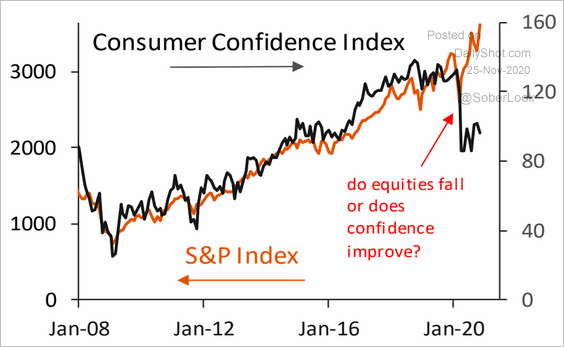

13. The gap between stocks and consumer confidence keeps widening.

Source: Piper Sandler

Source: Piper Sandler

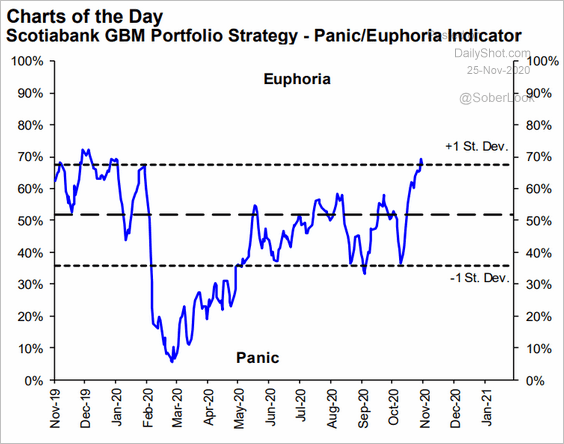

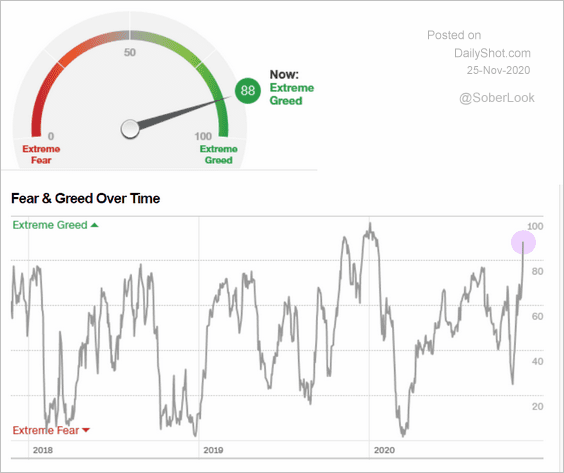

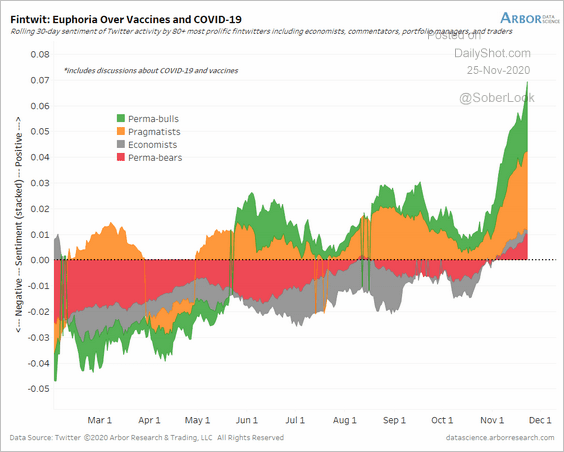

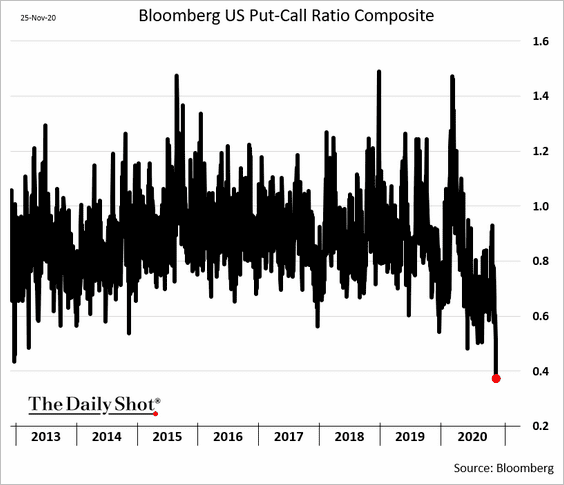

14. Numerous indicators continue to signal investor euphoria.

• Scotiabank’s Panic/Euphoria Indicator:

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

• The CNN Fear & Greed Index:

Source: CNN Business

Source: CNN Business

• Financial Twitter sentiment:

Source: Arbor Research & Trading

Source: Arbor Research & Trading

• The put-call ratio:

Rates

1. The market expects the Fed to boost its duration-weighted purchases, keeping yields artificially low.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

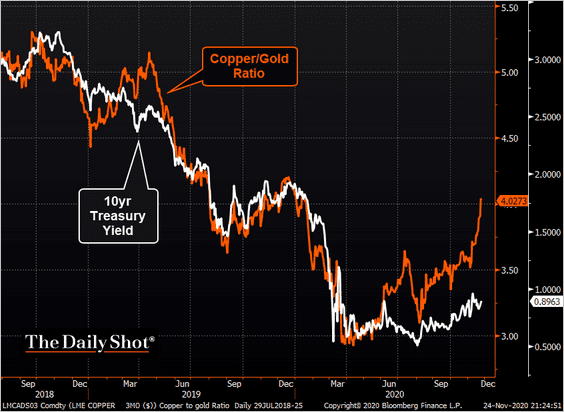

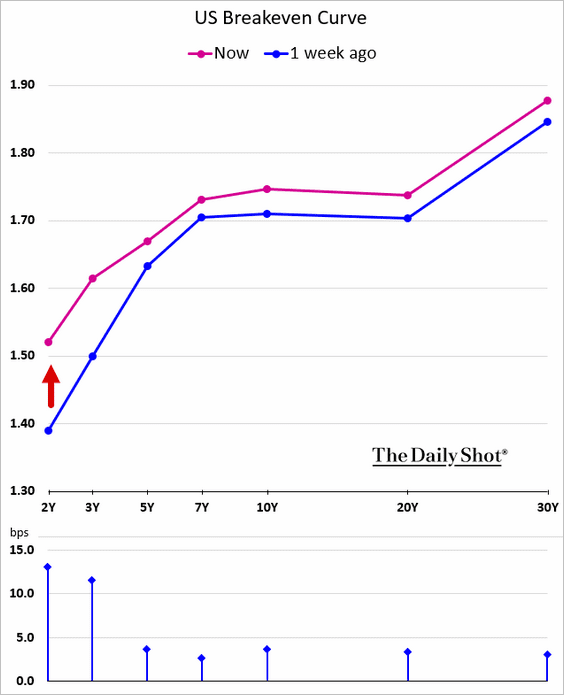

2. Short-term inflation expectations have been rising faster than the rest of the breakeven curve.

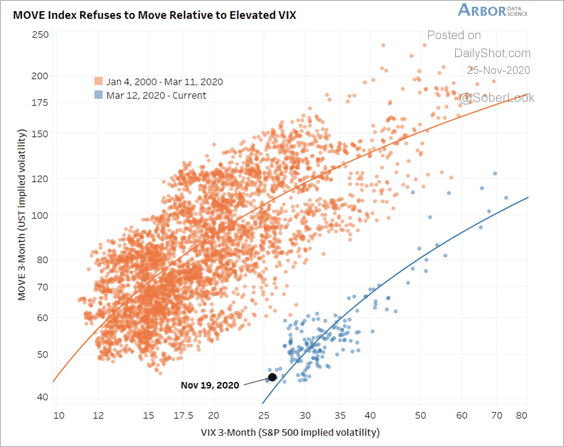

3. US Treasury implied volatility (MOVE Index) has diverged from VIX, which remains elevated.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Commodities

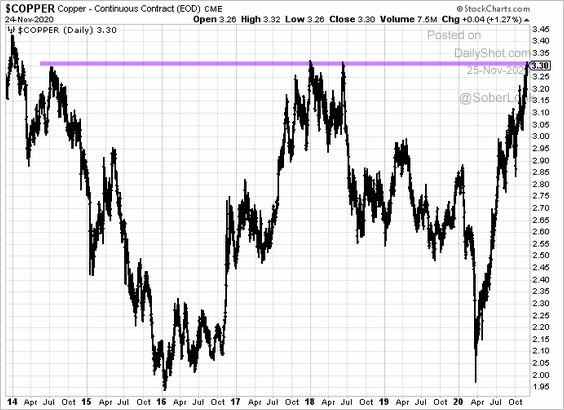

1. Copper keeps grinding higher.

2. Next, we have some updates on gold.

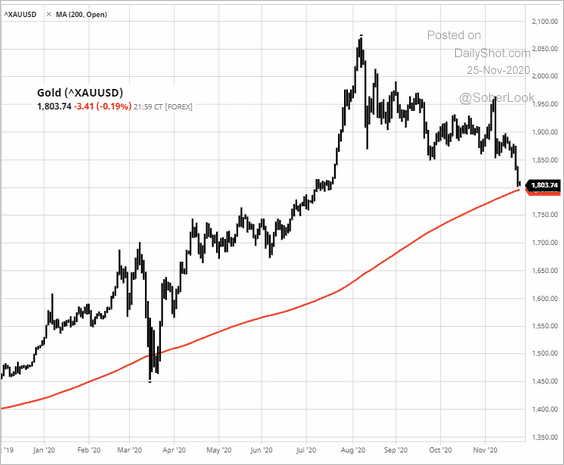

• Gold is testing support at the 200-day moving average.

Source: barchart.com

Source: barchart.com

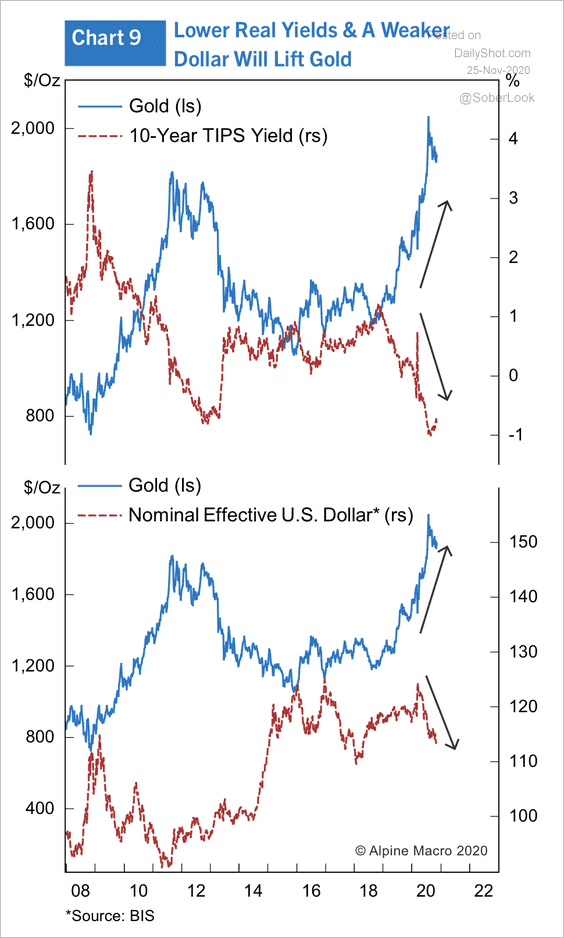

• Will low real-yields and a weak dollar remain supportive of gold?

Source: Alpine Macro

Source: Alpine Macro

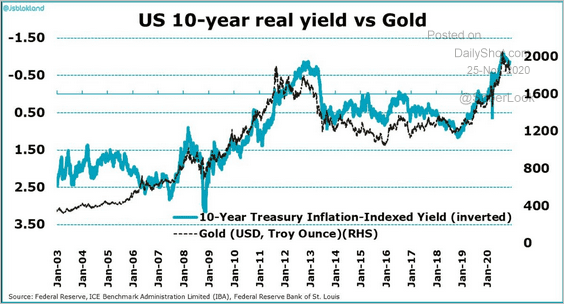

Source: @jsblokland

Source: @jsblokland

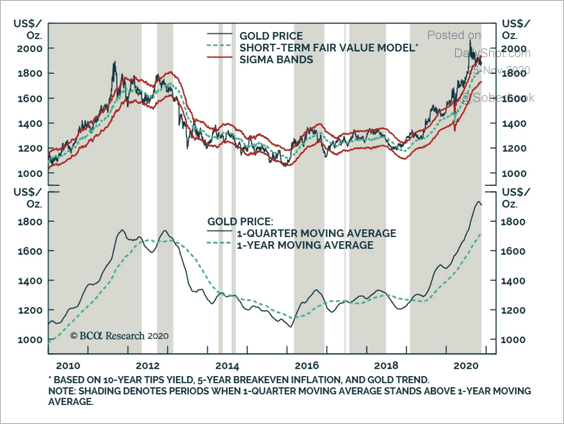

• Gold traded 20% above fair value in early-August and is now correcting back into its “normal” range, according to BCA Research.

Source: BCA Research

Source: BCA Research

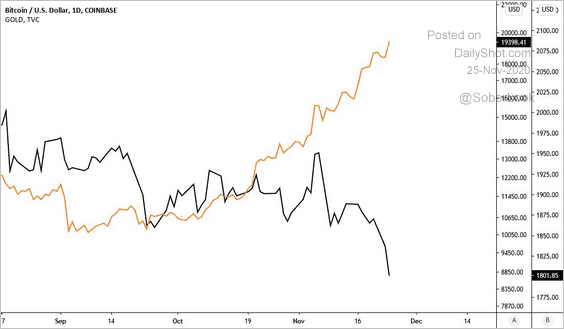

• Gold (black line) has diverged from Bitcoin.

Source: @zackvoell

Source: @zackvoell

——————–

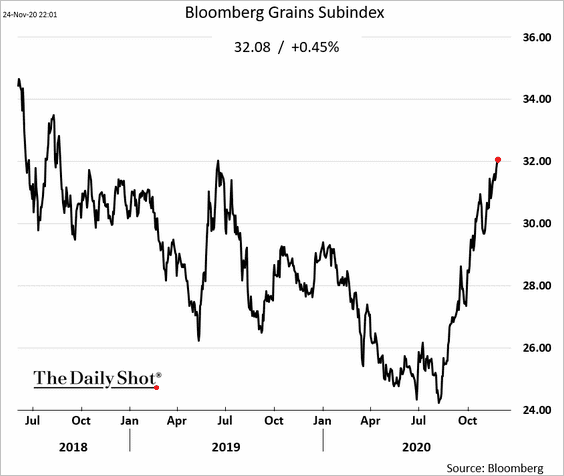

3. US grain prices continue to climb amid drought conditions in parts of the country.

Energy

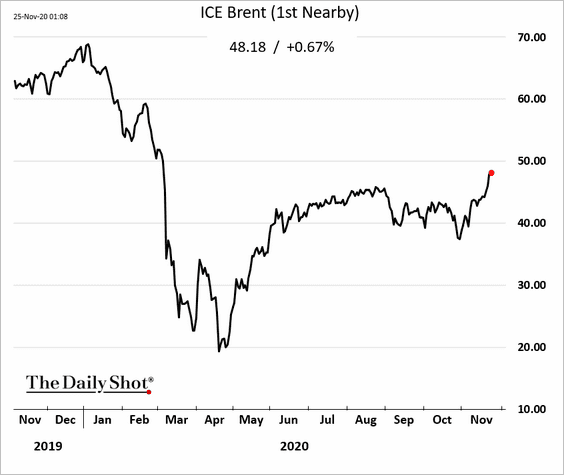

1. Brent futures are above $48/bbl.

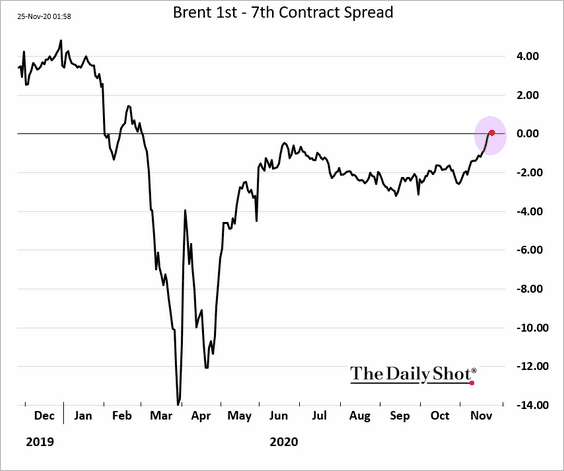

The curve is in backwardation (negative-sloping).

——————–

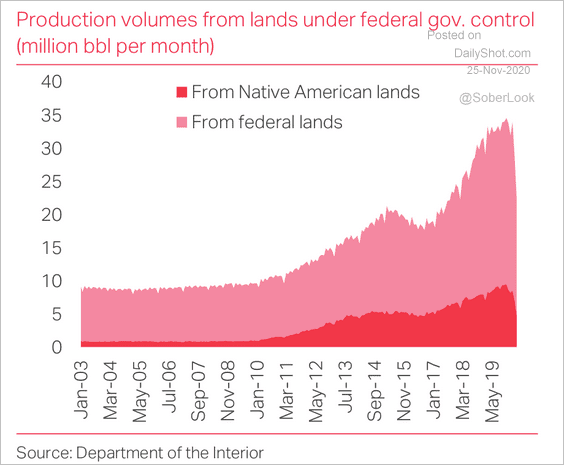

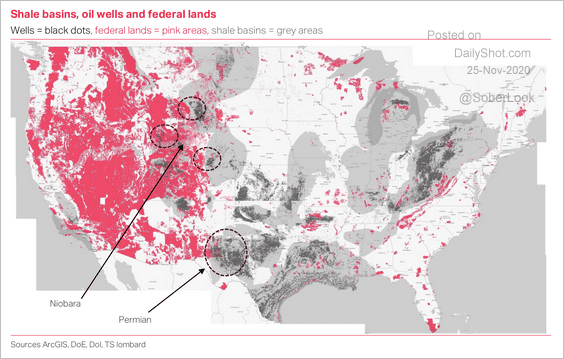

2. US oil production on federal land remains robust.

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

——————–

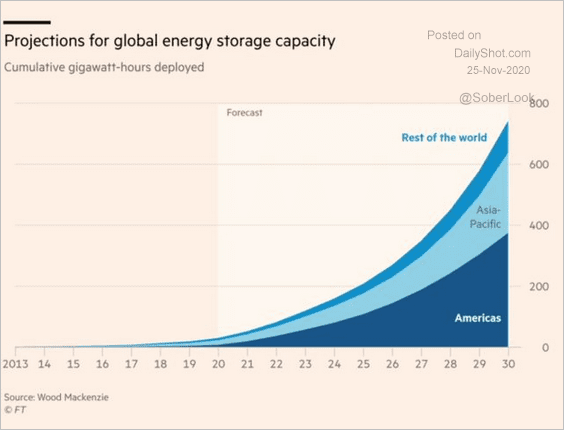

3. This chart shows a global forecast for battery storage capacity over the next decade.

Source: @adam_tooze, @financialtimes Read full article

Source: @adam_tooze, @financialtimes Read full article

Emerging Markets

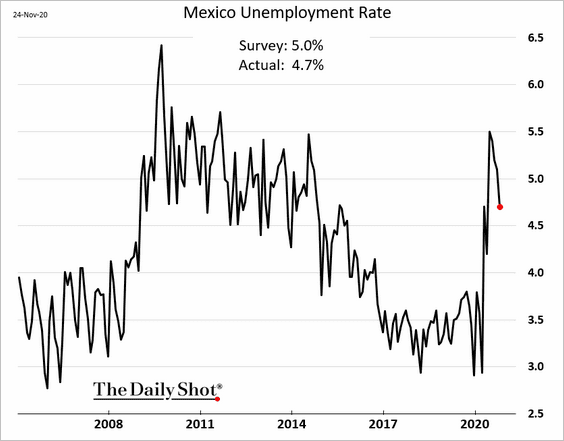

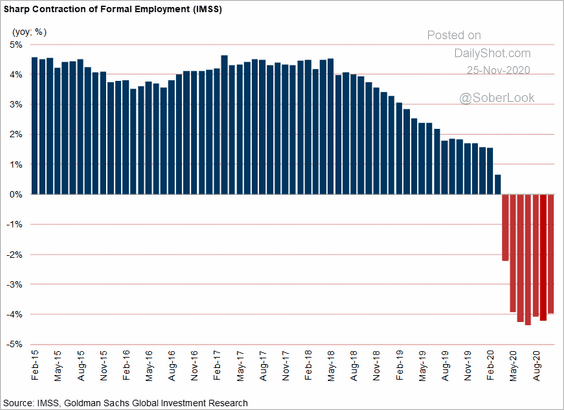

1. Mexican unemployment rate declined in recent months, but formal employment remains depressed.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

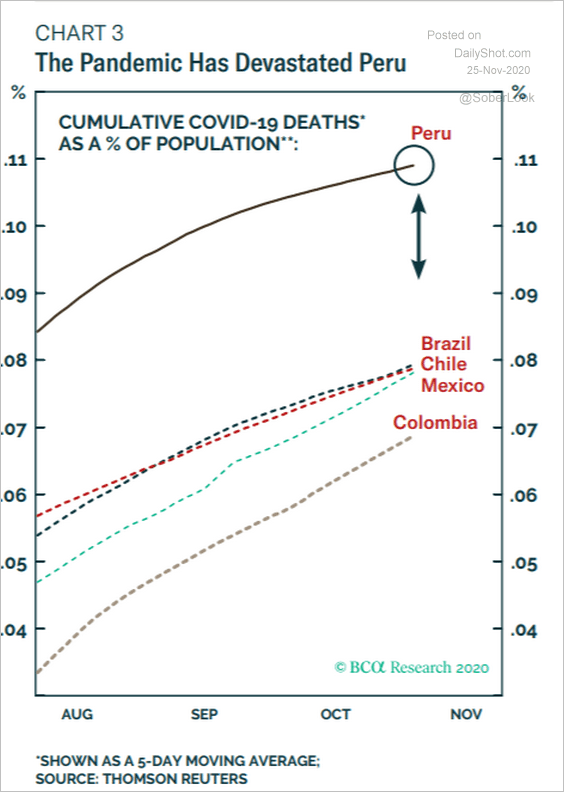

2. The pandemic has devastated Peru.

Source: BCA Research

Source: BCA Research

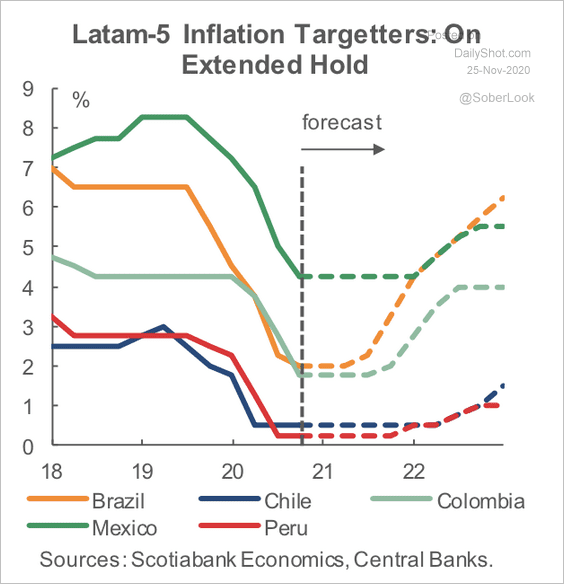

3. Scotiabank expects central banks in Latin America to remain on hold into mid-2021.

Source: Scotiabank Economics

Source: Scotiabank Economics

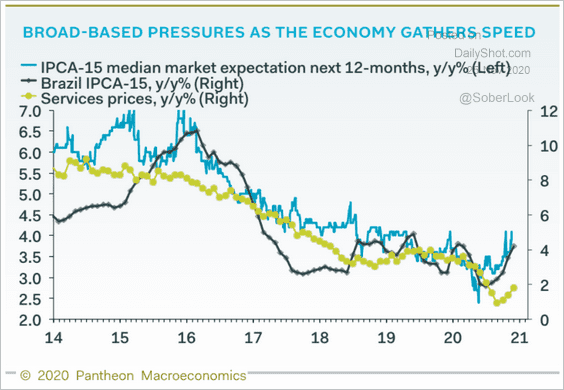

4. Inflation is on the rise in Brazil.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

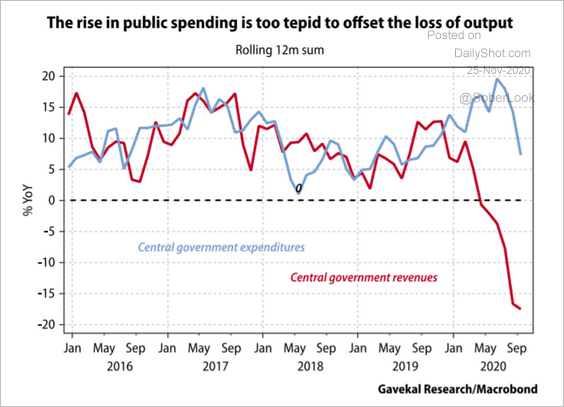

5. This chart shows India’s government expenditures and revenues.

Source: Gavekal

Source: Gavekal

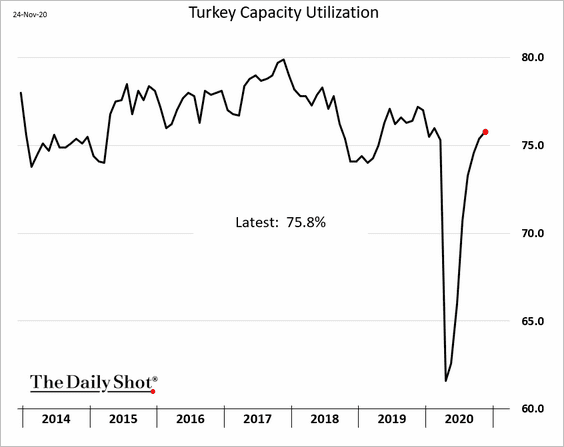

6. Turkey’s capacity utilization has recovered.

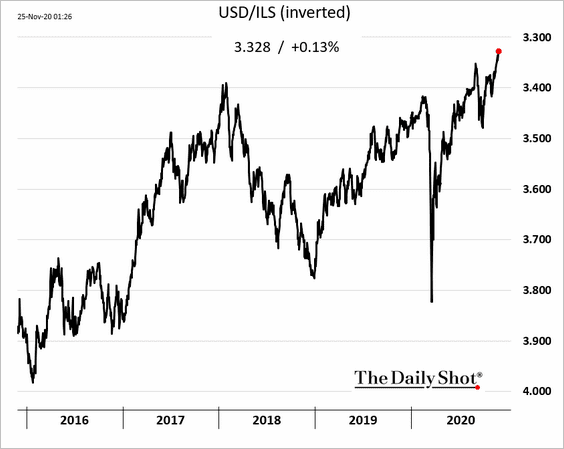

7. The Israeli shekel hit a multi-year high, boosting disinflationary pressures.

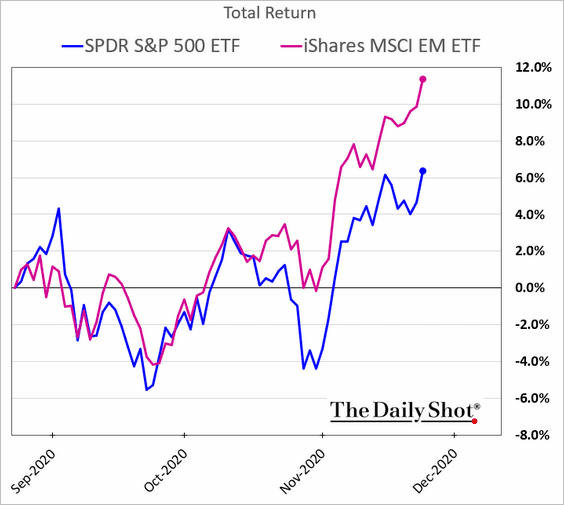

8. EM stocks have outperformed the S&P 500 in dollar terms.

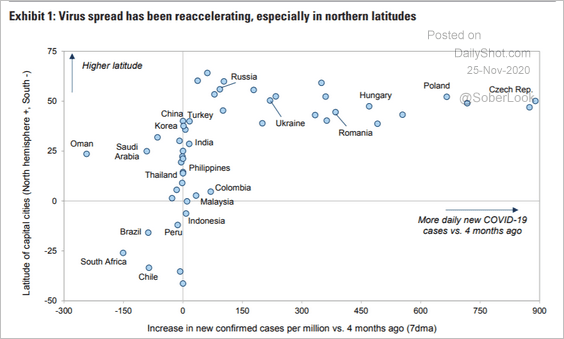

9. This chart shows the latitude of each country vs. the increase in new COVID cases.

Source: Goldman Sachs

Source: Goldman Sachs

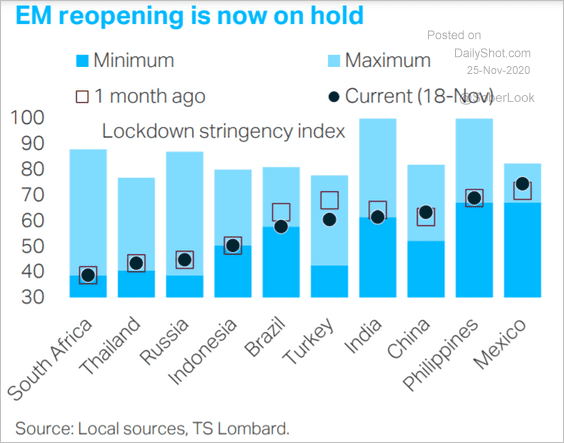

10. Reopening is on hold.

Source: TS Lombard

Source: TS Lombard

China

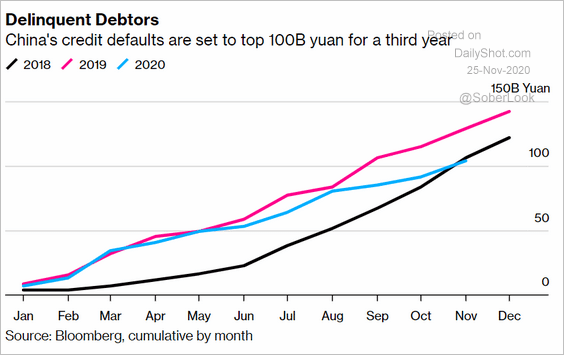

1. Credit defaults continue to climb, although the pace has been slower than last year.

Source: @markets Read full article

Source: @markets Read full article

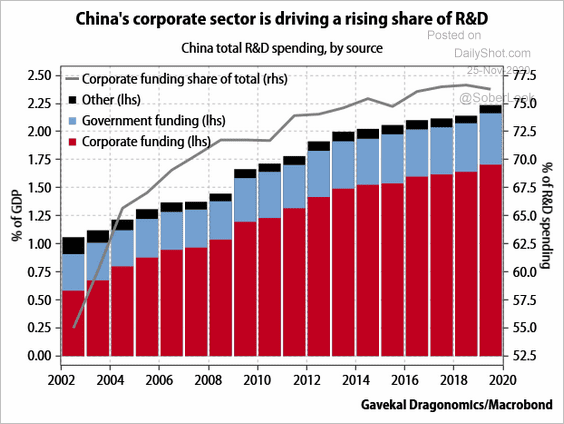

2. The private sector is increasingly dominating China’s R&D.

Source: Gavekal

Source: Gavekal

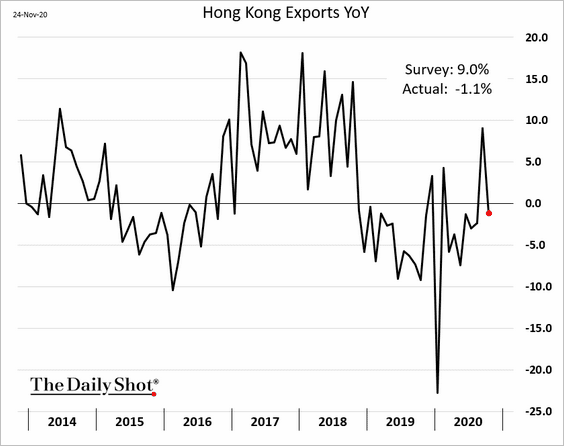

3. Hong Kong’s exports unexpectedly slumped.

Asia – Pacific

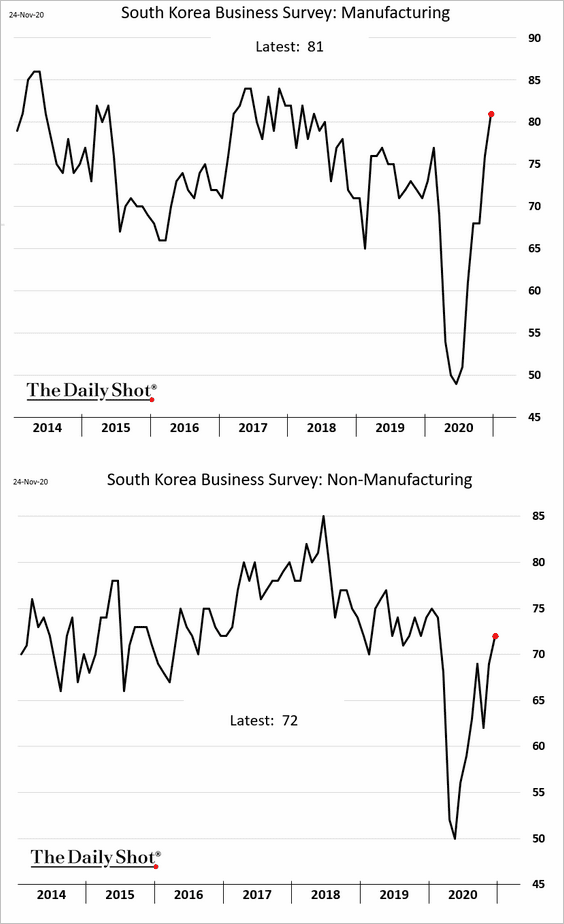

1. South Korea’s business surveys show a marked improvement.

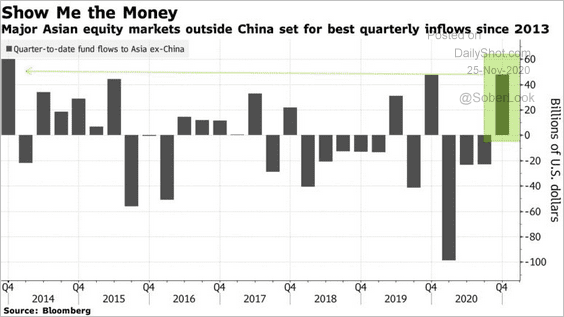

2. Fund flows into Asian equities have been robust this quarter.

Source: @markets Read full article

Source: @markets Read full article

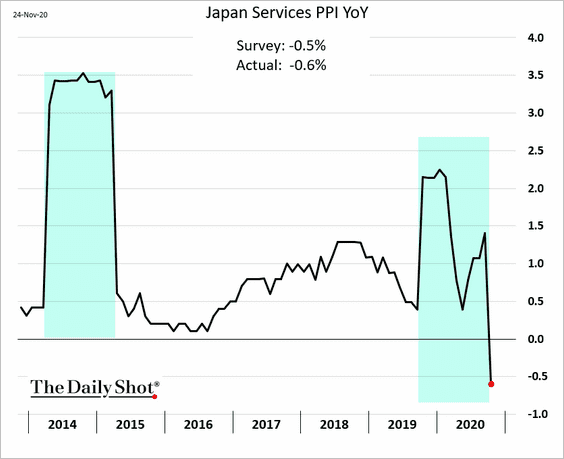

Japan

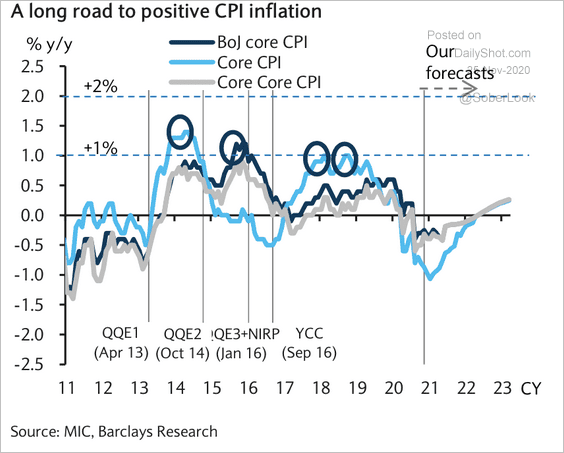

1. Barclays expects core CPI to trend below zero next year before finally turning positive in 2021.

Source: Barclays Research

Source: Barclays Research

The sharp decline in the services PPI was due to base effects from the consumption tax hike.

——————–

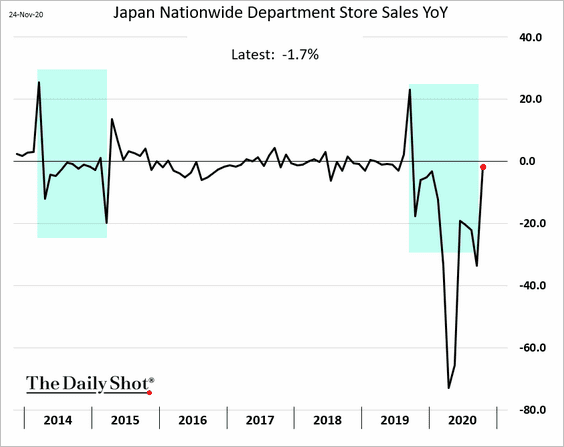

2. Department store sales rebounded, but this index is also distorted by the base effect.

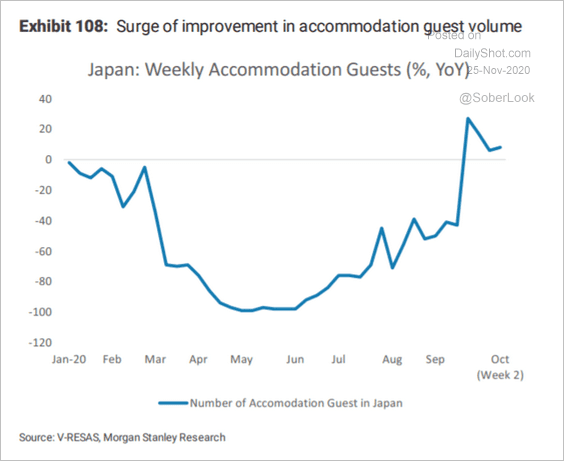

3. Accommodation guest volumes have rebounded.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

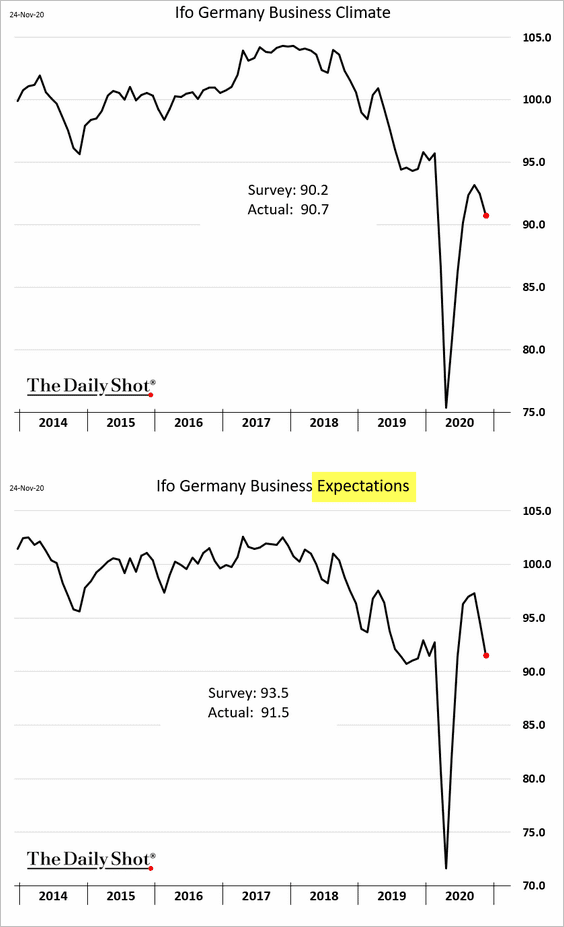

The Eurozone

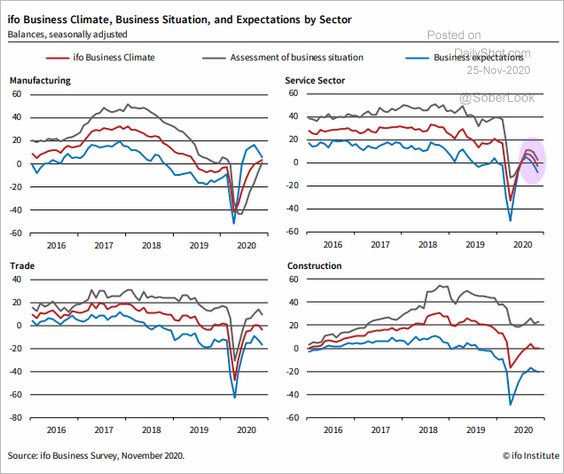

1. Germany’s Ifo business expectations index surprised to the downside.

The weakness has been more pronounced in services.

Source: ifo Institute

Source: ifo Institute

——————–

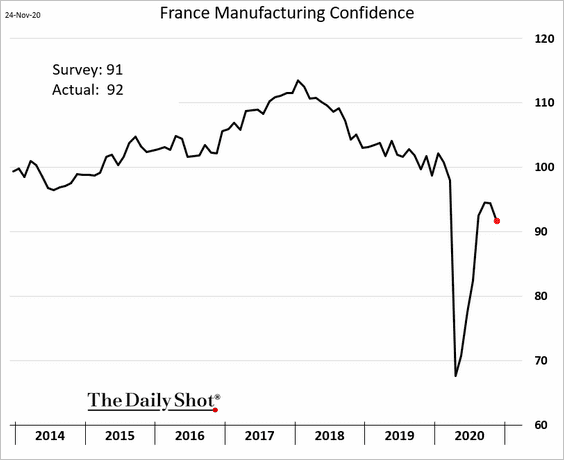

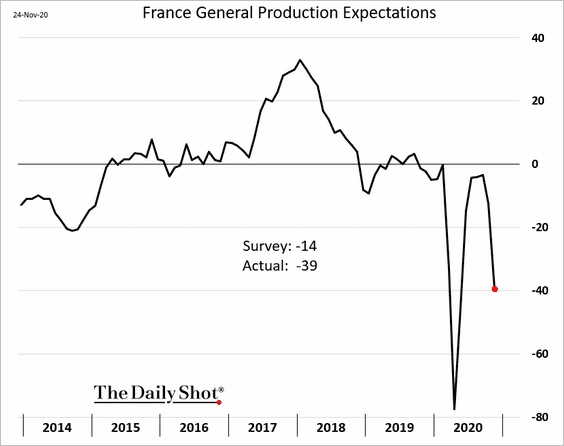

2. French manufacturing confidence deteriorated this month.

Here is the index of production expectations.

——————–

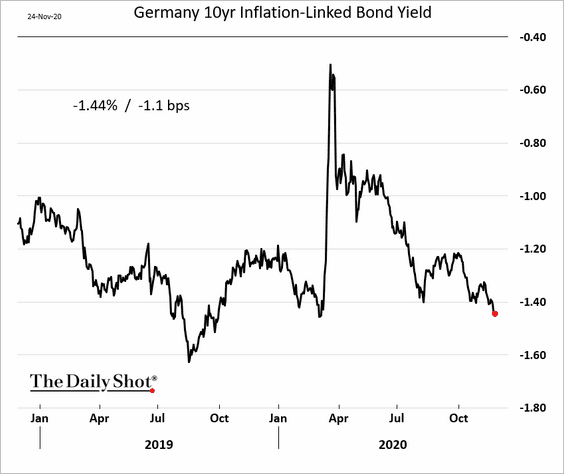

3. Germany’s real rates (implied by inflation-linked Bunds) continue to drift lower.

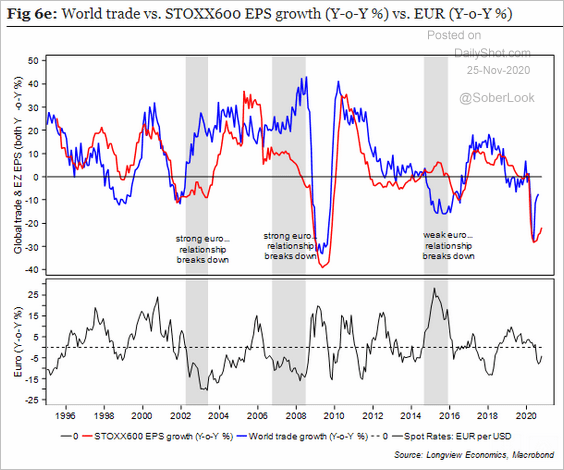

4. Global trade improvements should boost European corporate earnings.

Source: Longview Economics

Source: Longview Economics

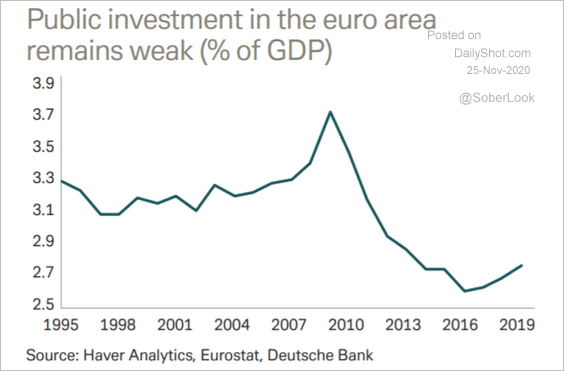

5. Public investment has been soft in recent years (austerity).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

The United Kingdom

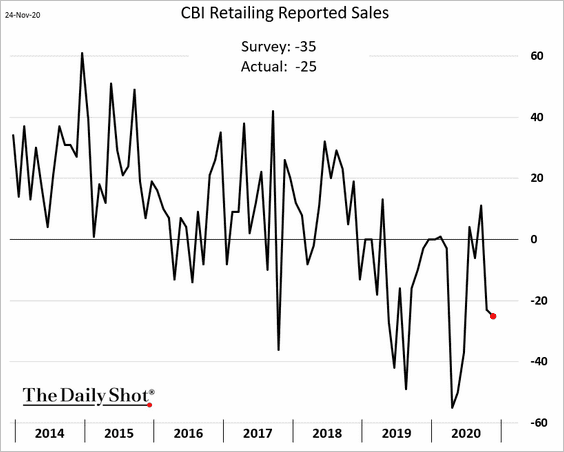

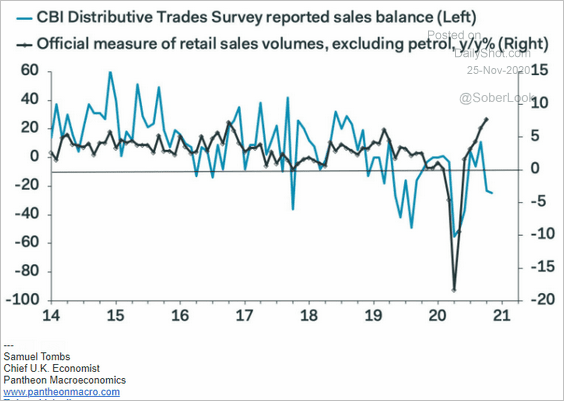

1. The CBI index points to softer retail sales.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

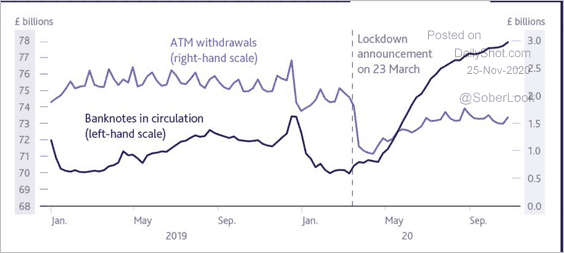

2. Cash hoarding accelerated this year.

Source: BoE Read full article

Source: BoE Read full article

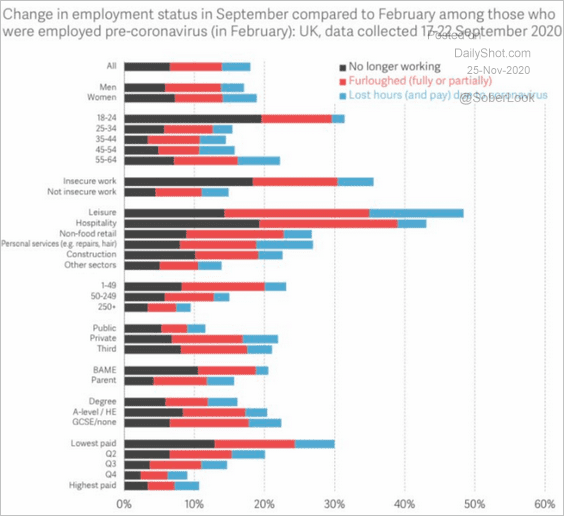

3. Low-paid workers have faced the greatest health risks and the biggest economic hit from this crisis.

Source: @TorstenBell

Source: @TorstenBell

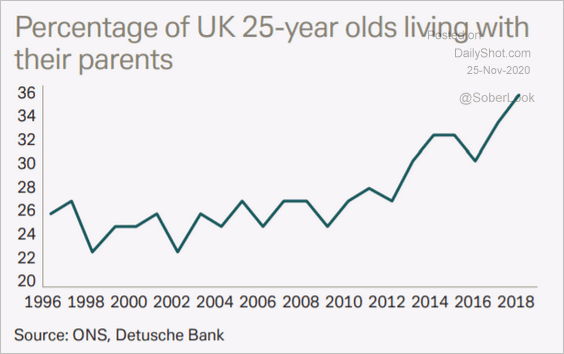

4. Just like in the US, more young people have been living with their parents.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

The United States

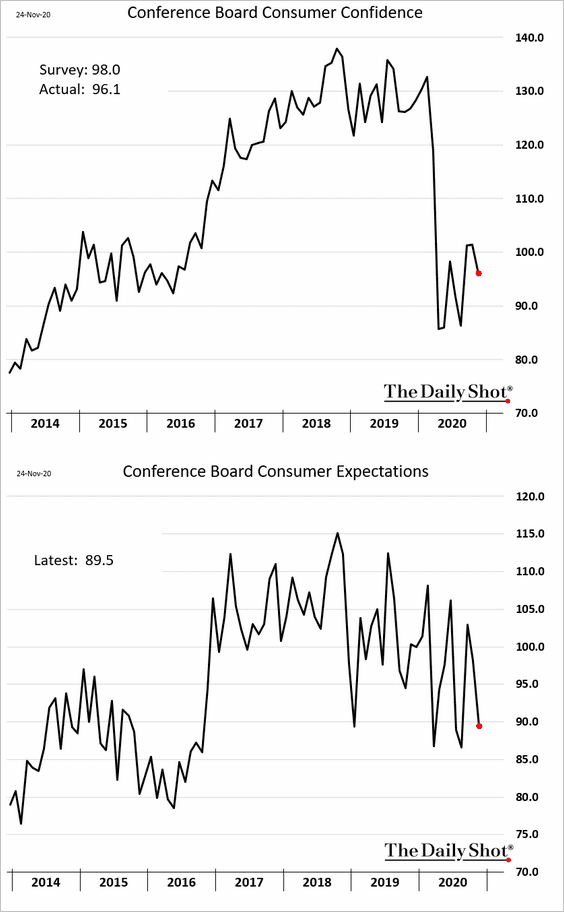

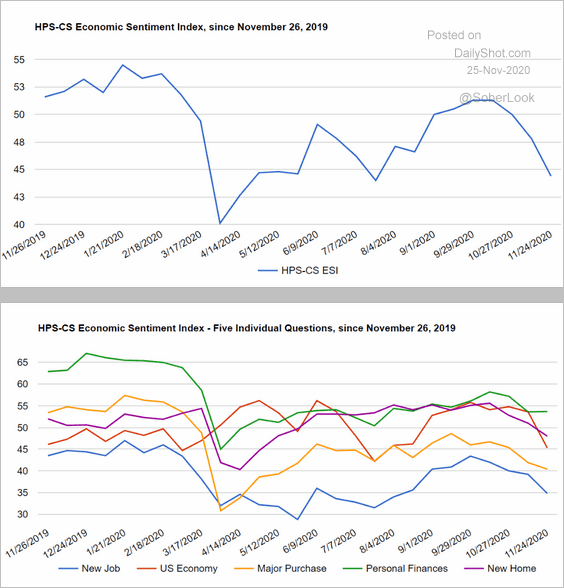

1. As we saw earlier, consumer confidence softened this month. Here is the Conference Board’s index.

And this is the HPS-CS sentiment index.

Source: @HPSInsight, @CivicScience

Source: @HPSInsight, @CivicScience

——————–

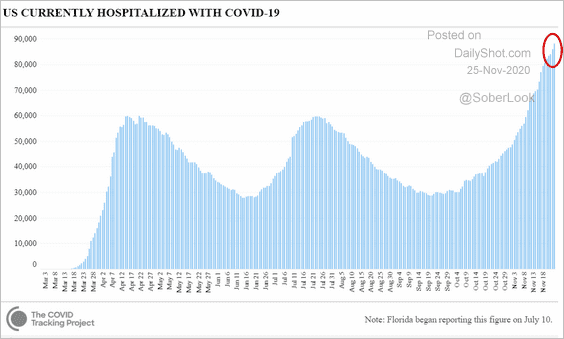

2. COVID-related hospitalizations hit a new record.

Source: CovidTracking.com

Source: CovidTracking.com

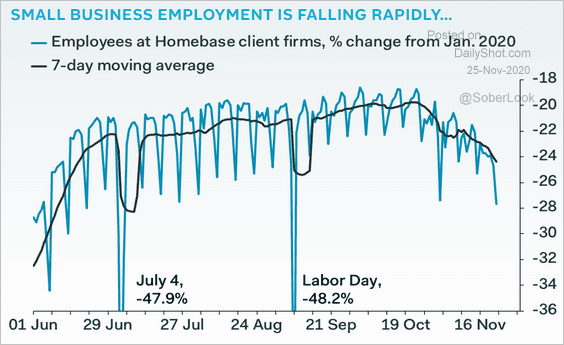

3. Small business employment is deteriorating.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

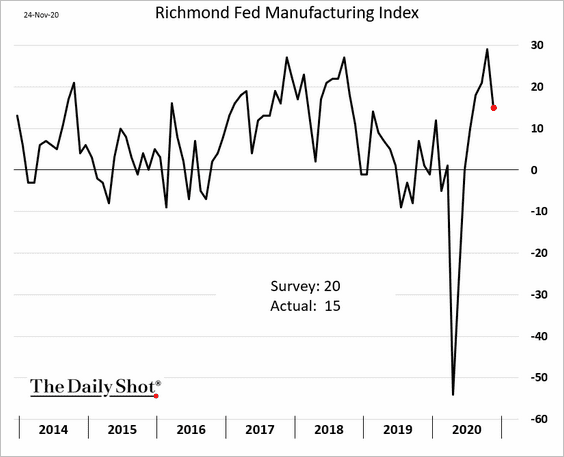

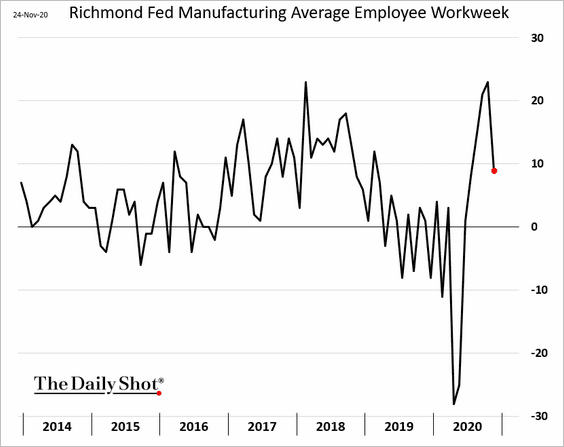

4. The Richmond Fed’s regional manufacturing index pulled back from the highs.

——————–

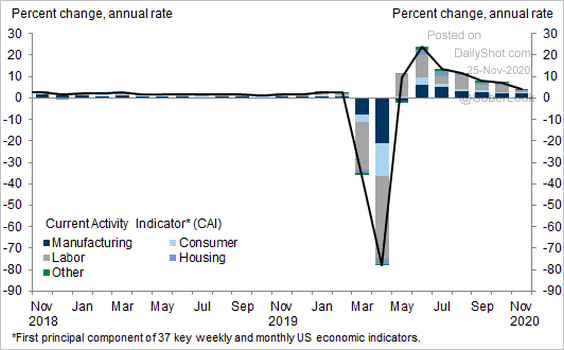

5. Here is Goldman’s Current Activity Indicator (CAI).

Source: Goldman Sachs

Source: Goldman Sachs

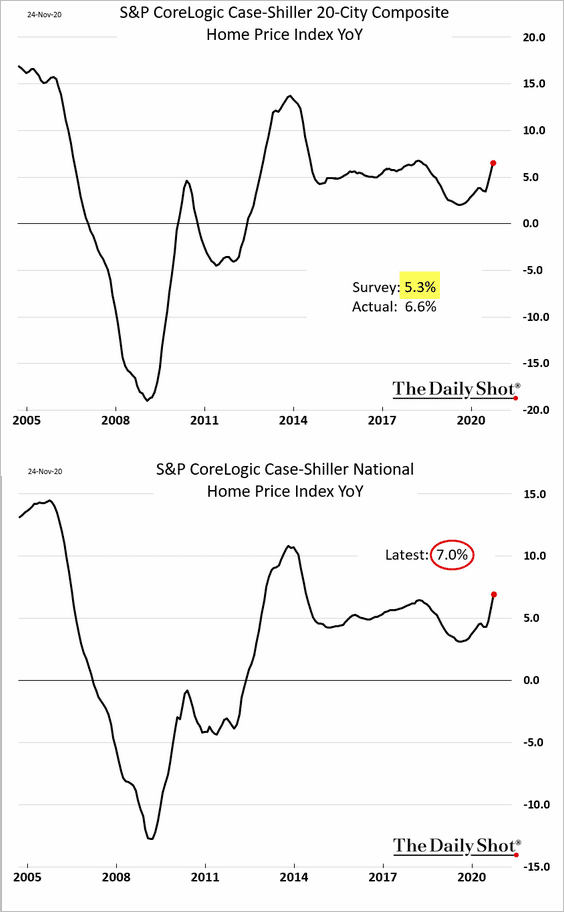

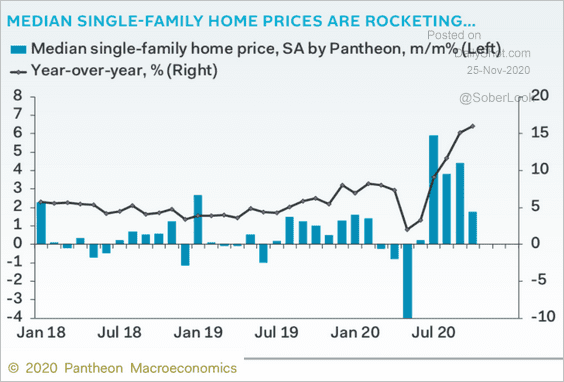

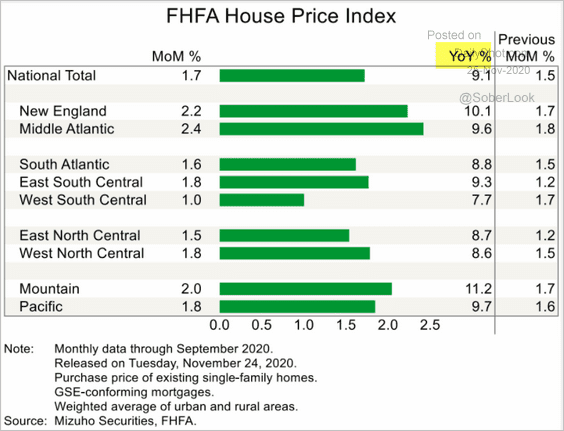

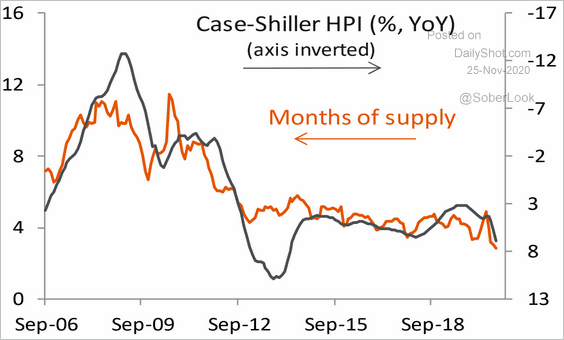

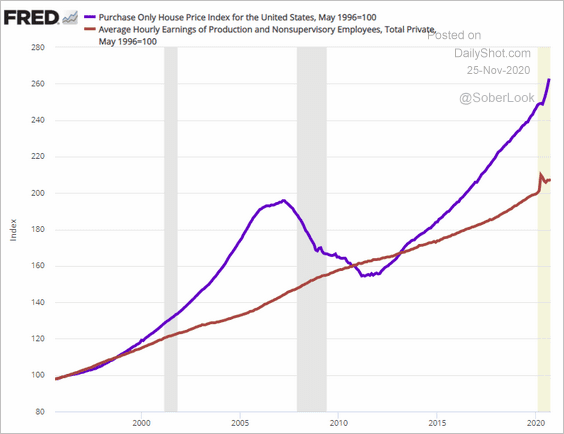

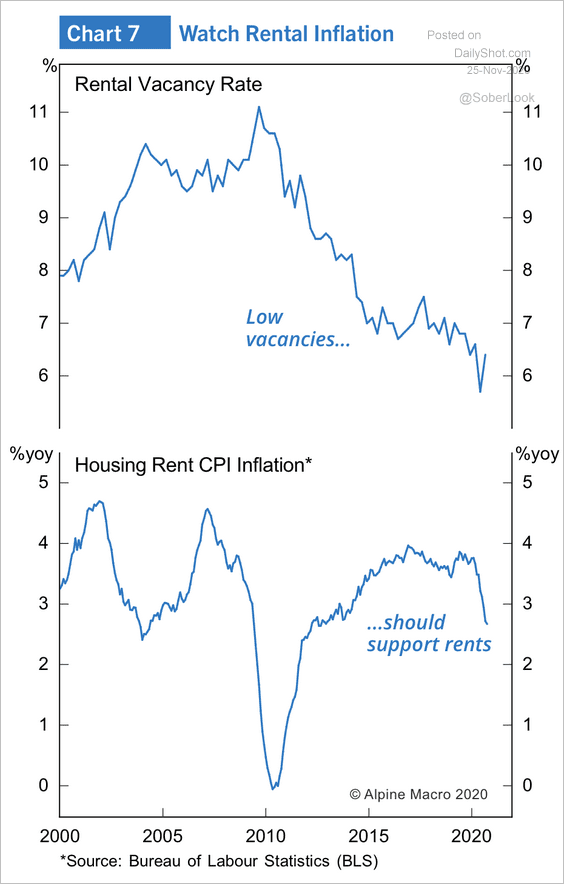

6. Next, we have some updates on housing.

• Home price gains accelerated in September, exceeding expectations.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Here is the FHFA housing price index by region.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

• Tight supplies are expected to boost prices further.

Source: Piper Sandler

Source: Piper Sandler

• The market is highly dependent on record-low mortgage rates. Wages are just not keeping up with home price increases.

• Eroding housing affordability will gradually tilt towards renting, which should support rent inflation.

Source: Alpine Macro

Source: Alpine Macro

Global Developments

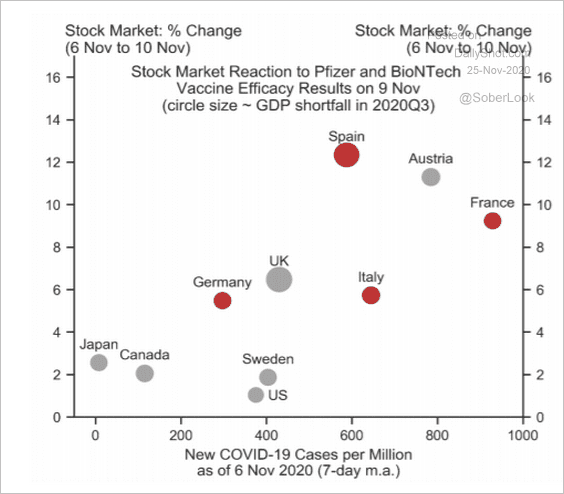

1. The vaccine-related boost to stocks was the highest in countries with ongoing outbreaks.

Source: Goldman Sachs

Source: Goldman Sachs

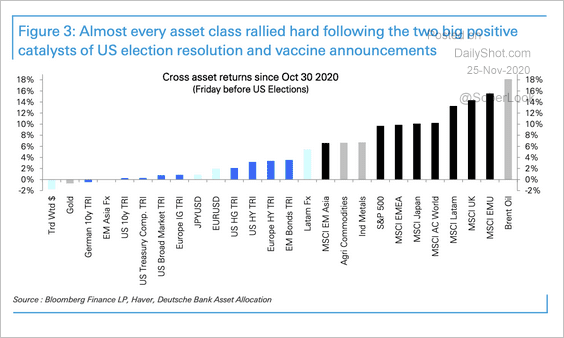

2. Here is a look at cross-asset returns since the Friday before the US elections.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

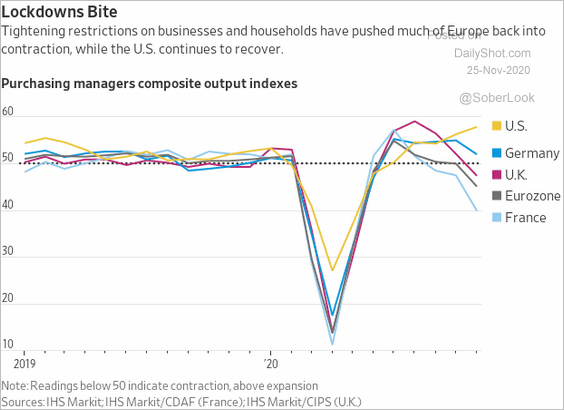

3. US business activity has been outperforming Europe.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Food for Thought

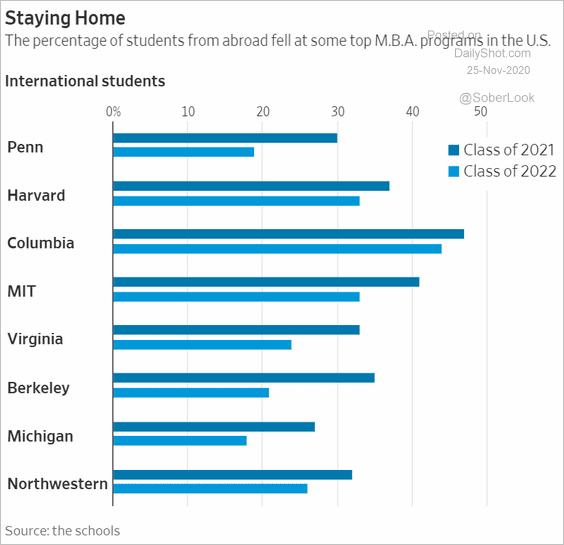

1. Foreign students in US MBA programs:

Source: @WSJ Read full article

Source: @WSJ Read full article

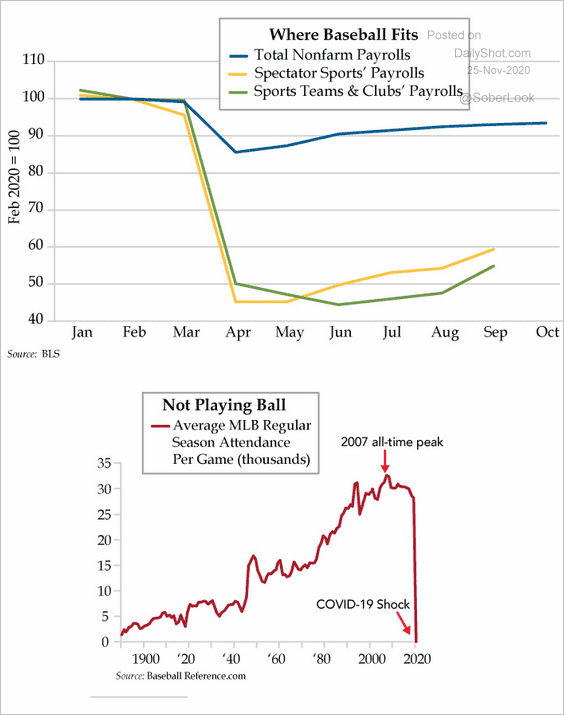

2. Spectator sports’ employment:

Source: The Daily Feather

Source: The Daily Feather

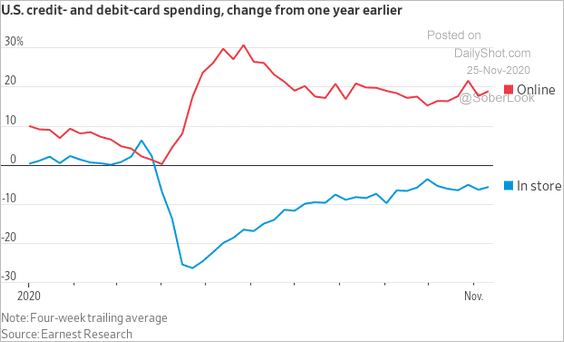

3. US credit/debit-card spending:

Source: @jeffsparshott

Source: @jeffsparshott

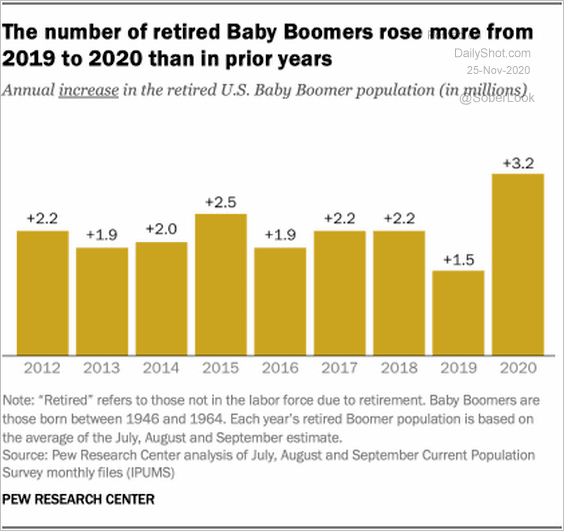

4. Baby Boomer retirements:

Source: @pewresearch Read full article

Source: @pewresearch Read full article

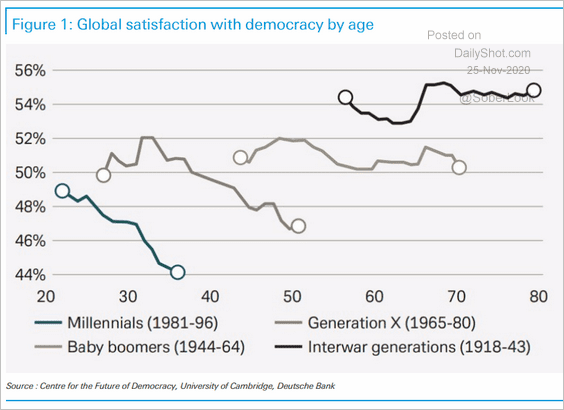

5. Satisfaction with democracy:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

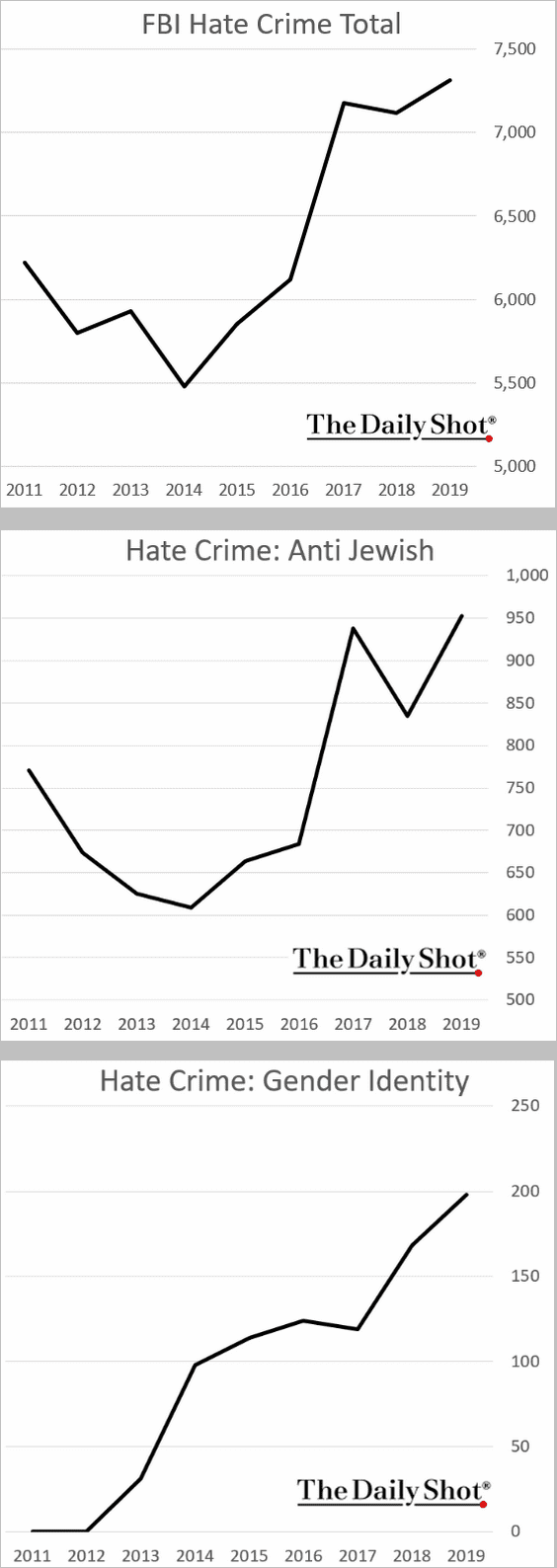

6. Hate crime in the US (number of cases each year):

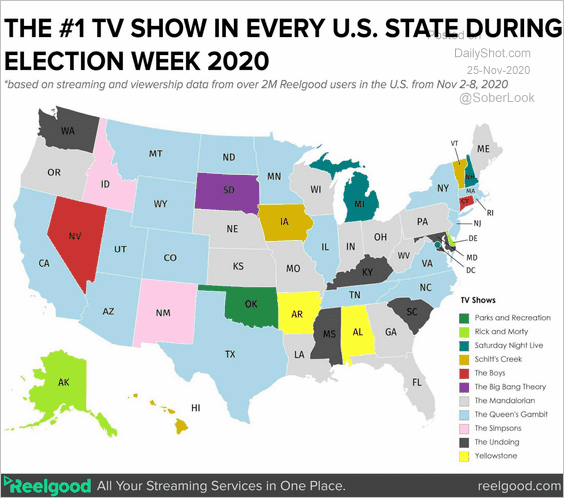

7. TV shows watched during the election week:

Source: Reelgood

Source: Reelgood

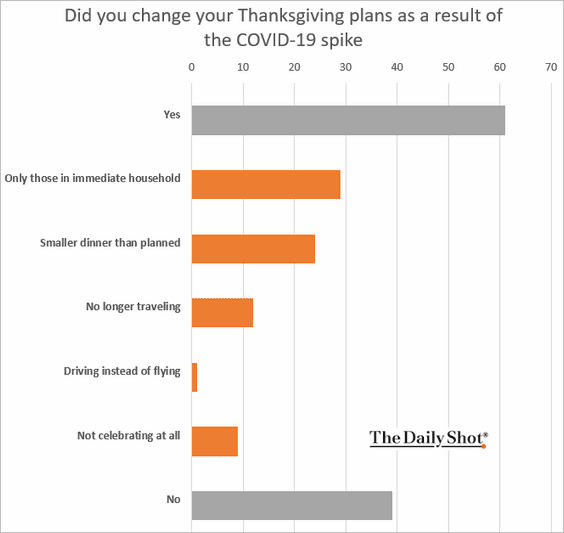

8. Thanksgiving plans:

Source: @axios Read full article

Source: @axios Read full article

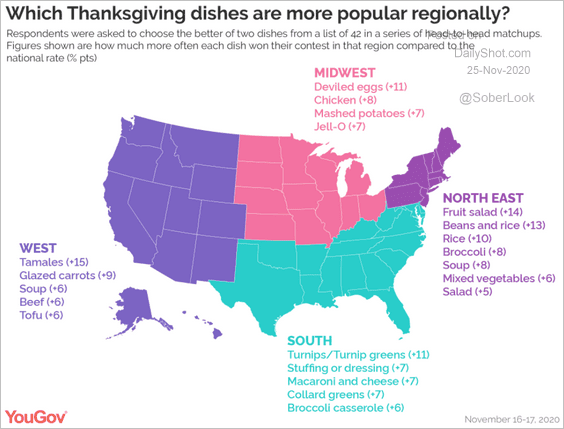

9. Thanksgiving dishes:

Source: @YouGovAmerica Read full article

Source: @YouGovAmerica Read full article

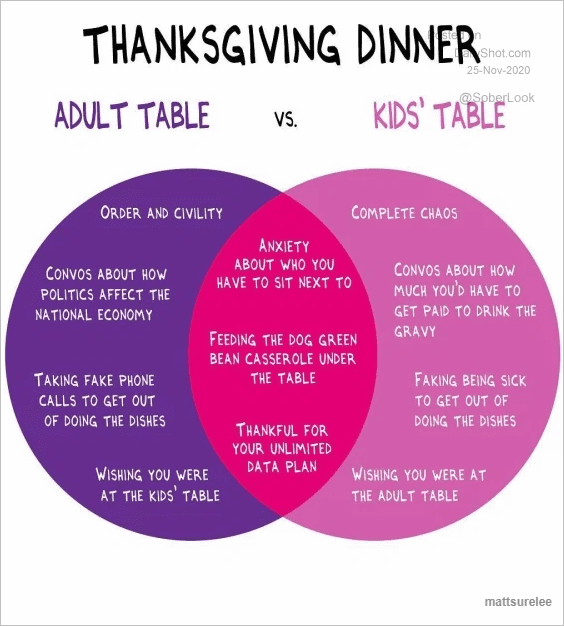

10. Adult table vs. kids’ table:

Source: The Chive

Source: The Chive

——————–

Happy Thanksgiving to our readers in the United States!