The Daily Shot: 01-Dec-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

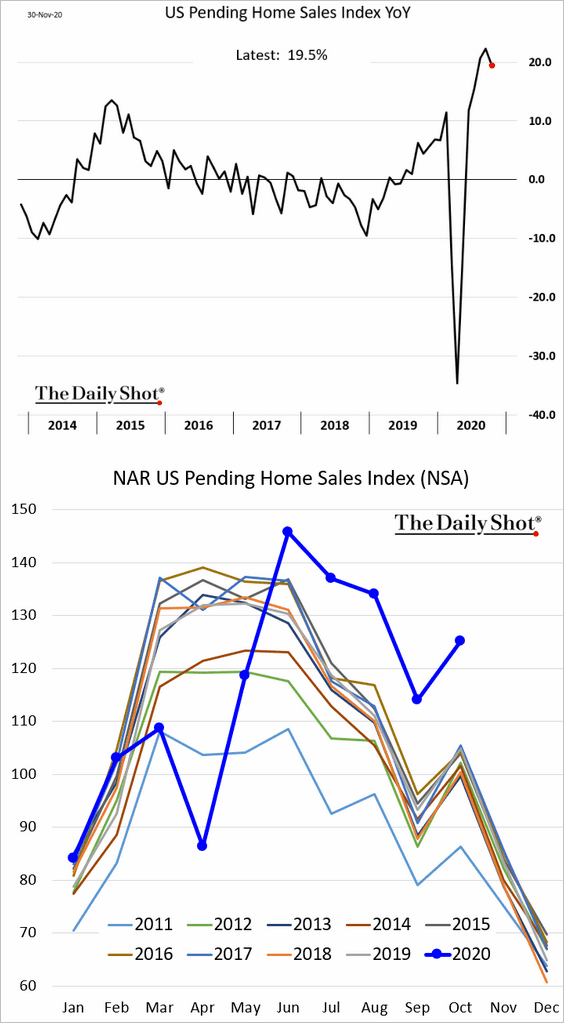

1. Let’s begin with the housing market.

• Pending home sales came off the highs but are still nearly 20% above last year’s levels.

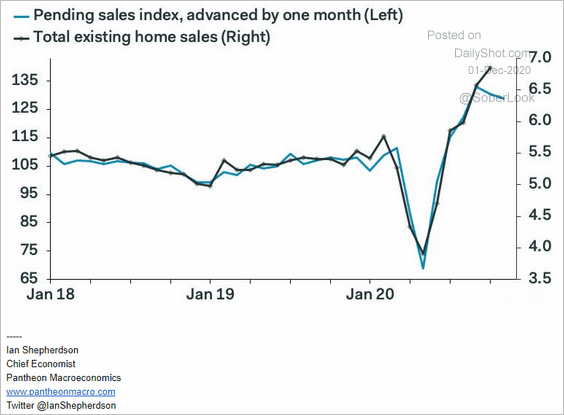

Total existing-home sales will probably moderate as well.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

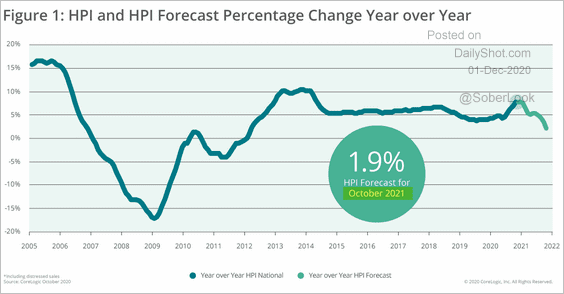

• CoreLogic still expects home price appreciation to slow next year.

Source: CoreLogic

Source: CoreLogic

——————–

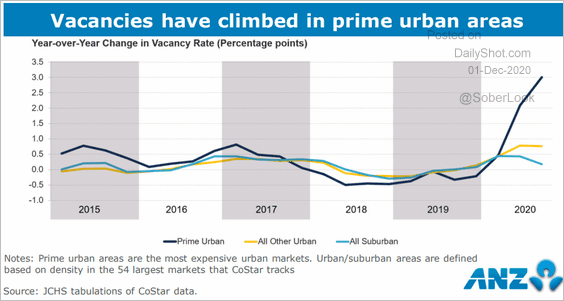

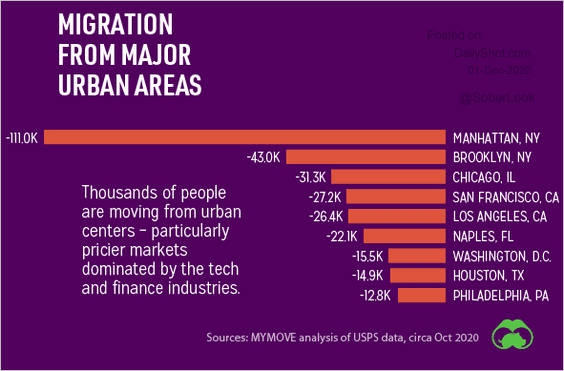

2. Residential vacancies climbed sharply across large cities as demand dwindles (2nd chart).

Source: ANZ Research

Source: ANZ Research

Source: @VisualCap Read full article

Source: @VisualCap Read full article

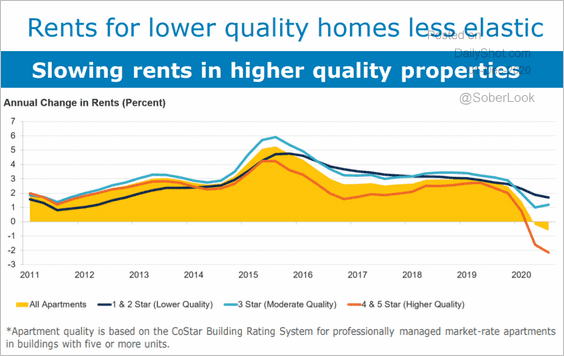

Rental weakness has been more pronounced for higher-end residential properties.

Source: ANZ Research

Source: ANZ Research

——————–

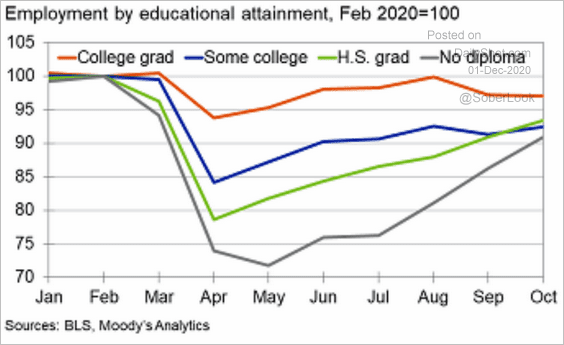

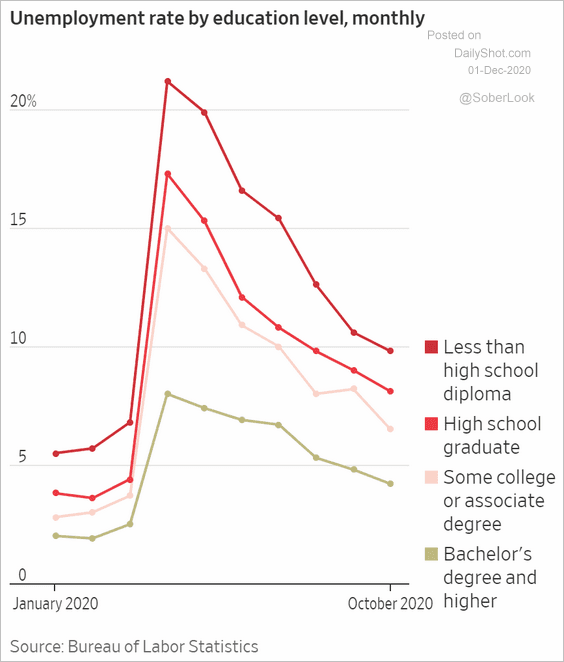

3. Here are some updates on the labor market.

• Employment recovery by educational attainment (2 charts):

Source: Moody’s Analytics

Source: Moody’s Analytics

Source: @WSJ Read full article

Source: @WSJ Read full article

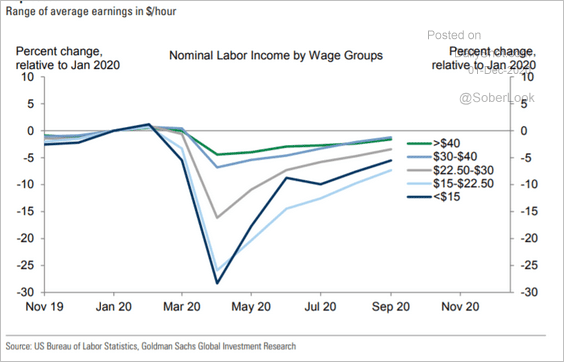

• Recovery in labor income by wage category:

Source: Goldman Sachs

Source: Goldman Sachs

• Oops …

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

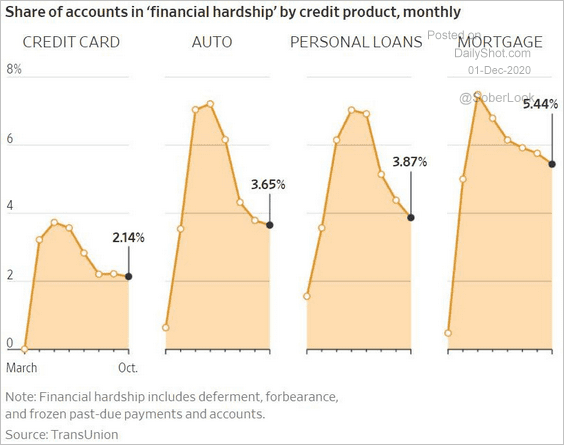

4. This chart shows the percentage of borrowers in each credit product who are experiencing “financial hardship.”

Source: @WSJ Read full article

Source: @WSJ Read full article

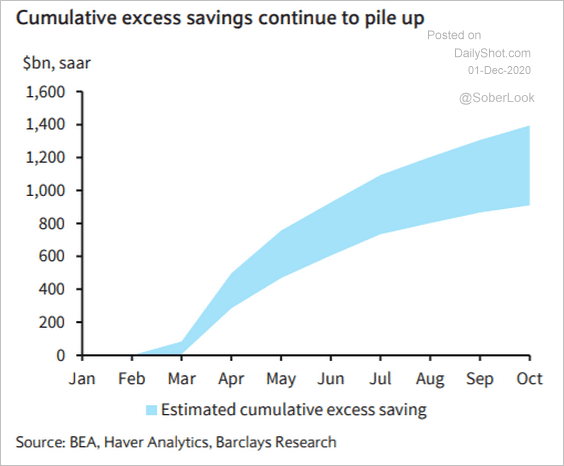

5. Elevated excess savings have been supporting consumer spending.

Source: Barclays Research

Source: Barclays Research

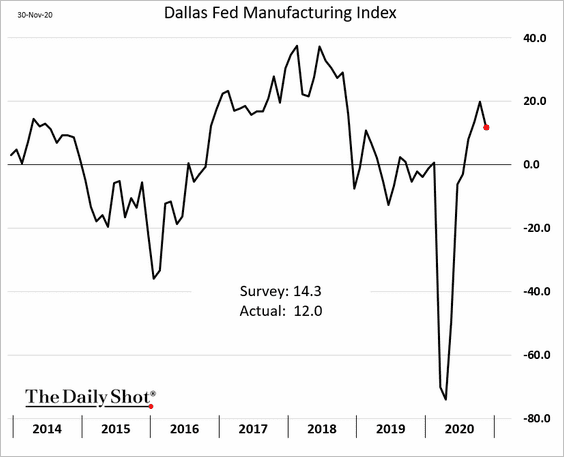

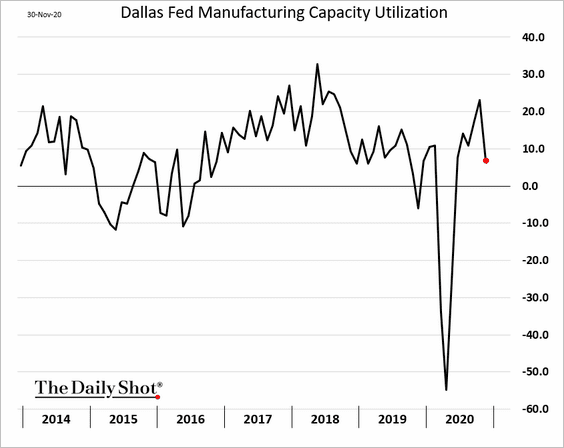

6. The Dallas Fed manufacturing index pulled back in November, but activity remains robust.

——————–

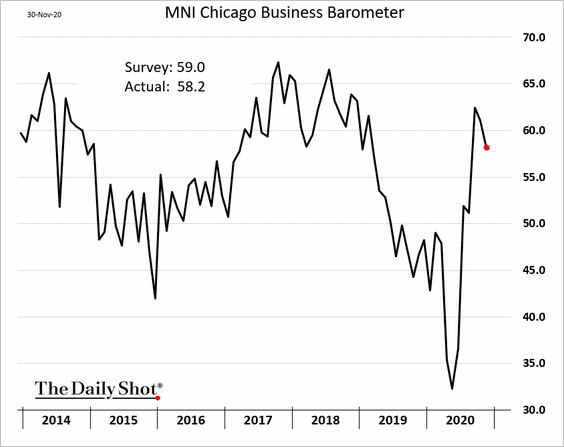

7. The Chicago PMI index (regional business activity) also retreated from the highs.

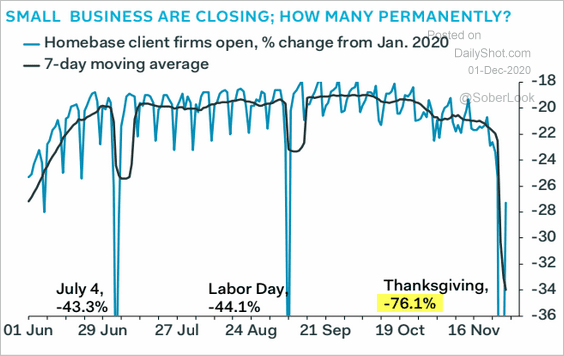

8. Small businesses remain under pressure due to the pandemic.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

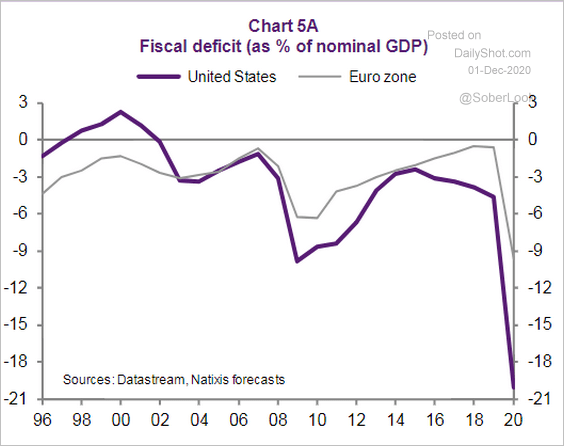

9. This year’s US budget gap far exceeded the levels we see in the Eurozone, which in part explains the US economic outperformance (much larger fiscal stimulus).

Source: Natixis

Source: Natixis

Canada

1. Small and medium-size business activity ticked higher. The recovery has been uneven, with the second wave pressuring some sectors.

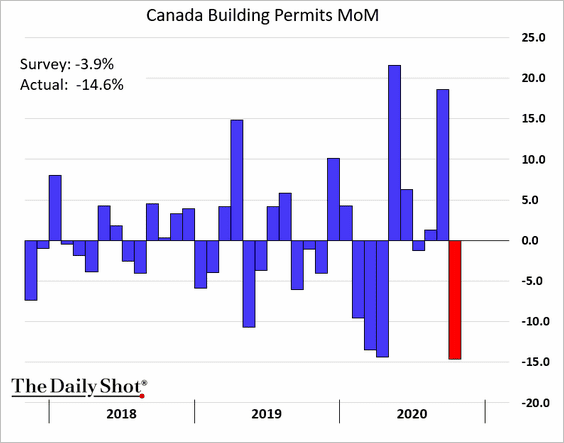

2. Building permits tumbled last month.

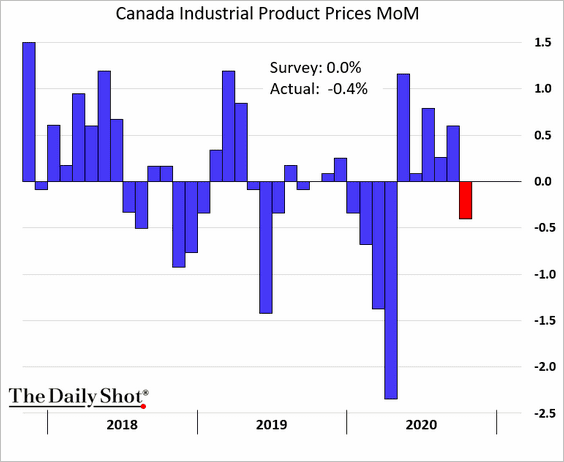

3. Industrial producer prices unexpectedly declined.

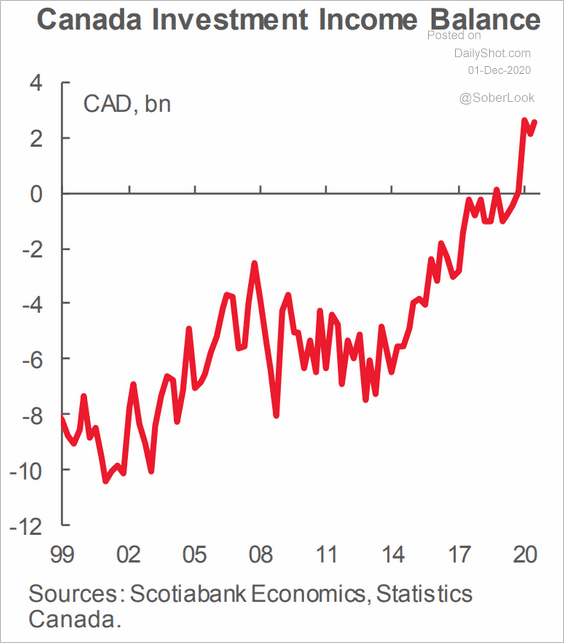

4. Here is Canada’s investment income balance. Canadians are generating more income abroad than foreigners are making in Canada.

Source: Scotiabank Economics

Source: Scotiabank Economics

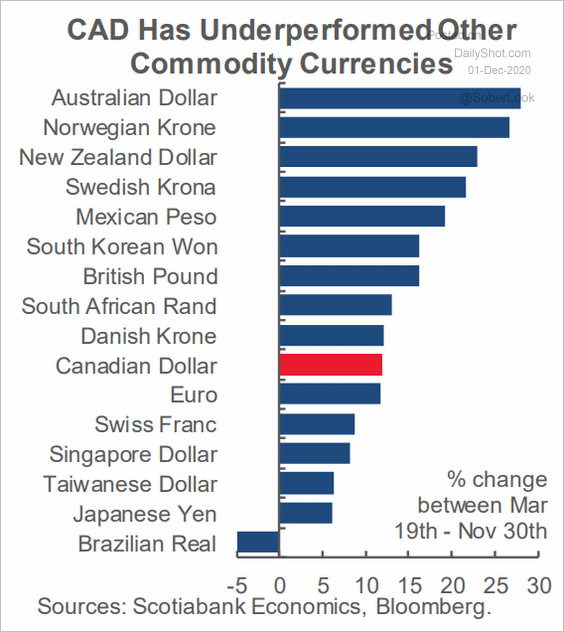

5. The loonie underperformed other commodity currencies in November.

Source: Scotiabank Economics

Source: Scotiabank Economics

The United Kingdom

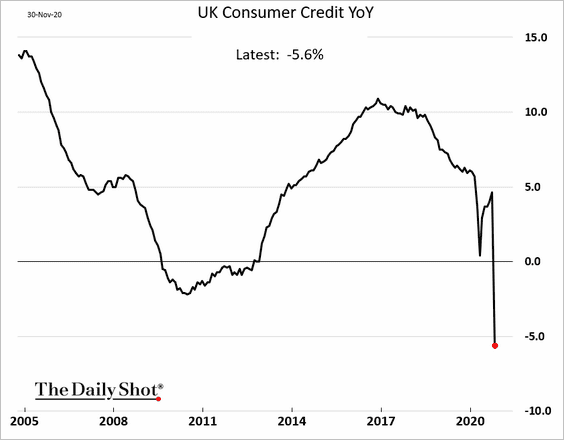

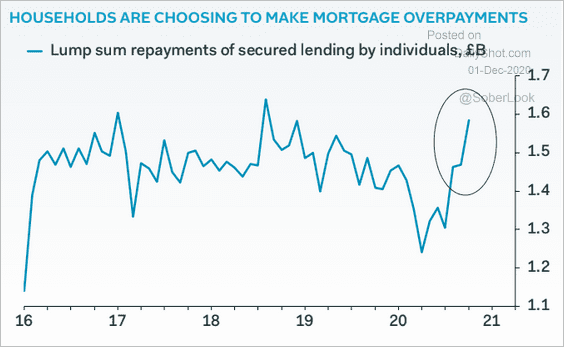

1. Mortgage approvals hit a multi-year high, easily exceeding forecasts.

The overall consumer credit has been declining rapidly as households pull back on borrowing and pay down their loans.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

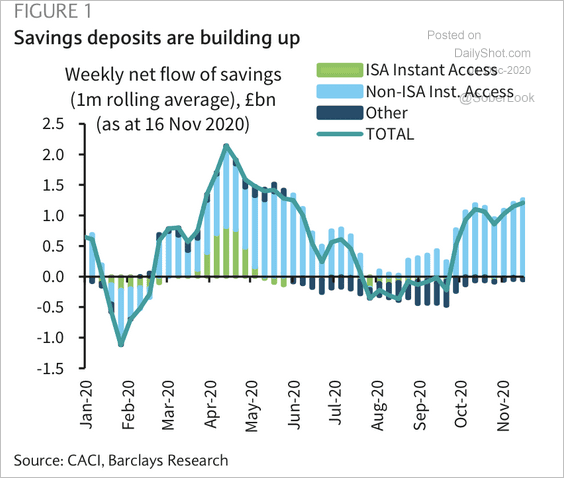

2. Savings deposits have risen over the past two months.

Source: Barclays Research

Source: Barclays Research

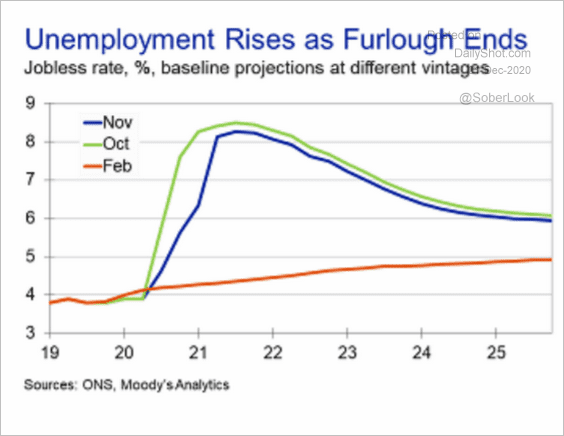

3. The unemployment rate is expected to climb further next year.

Source: Moody’s Analytics

Source: Moody’s Analytics

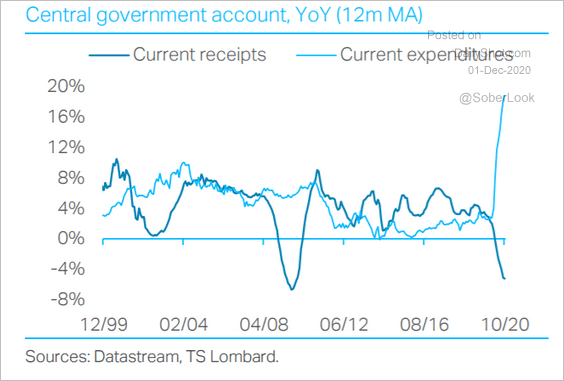

4. This chart shows the government’s receipts and expenditures.

Source: TS Lombard

Source: TS Lombard

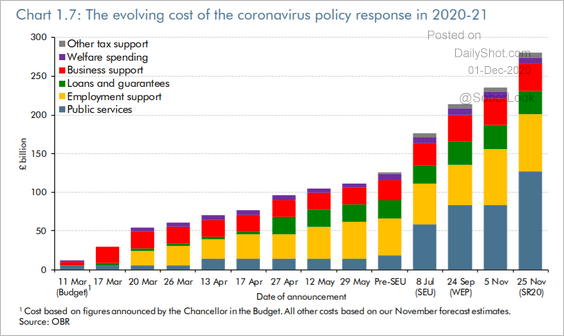

The crisis has been expensive.

Source: OBR

Source: OBR

——————–

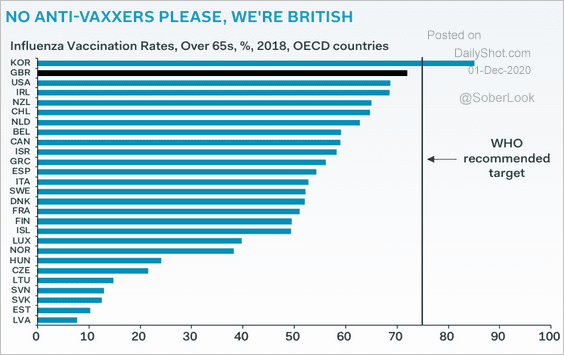

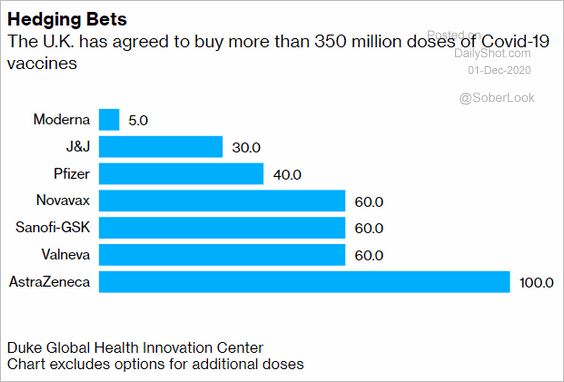

5. Flu vaccination rates suggest that the UK will be successful in rolling out the COVID vaccine.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: @bpolitics Read full article

Source: @bpolitics Read full article

——————–

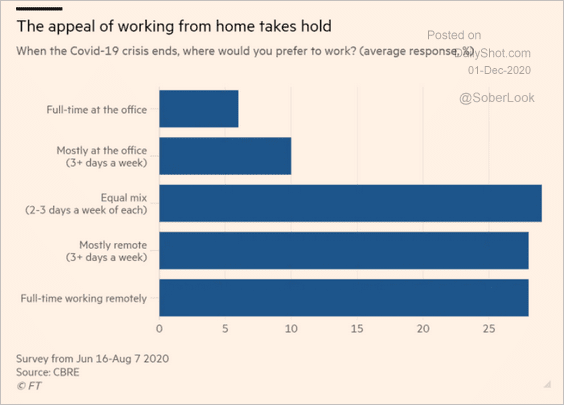

6. Working from home is not a temporary change.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

The Eurozone

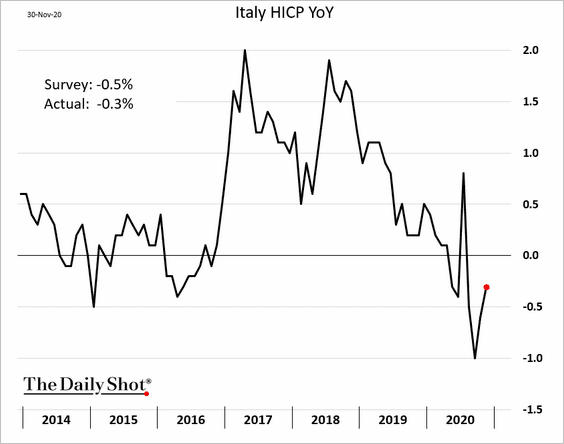

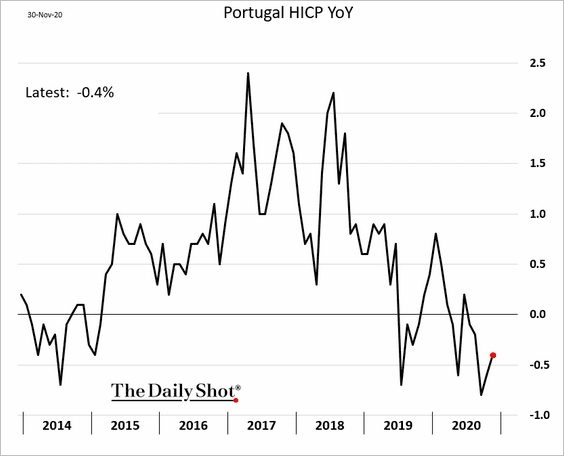

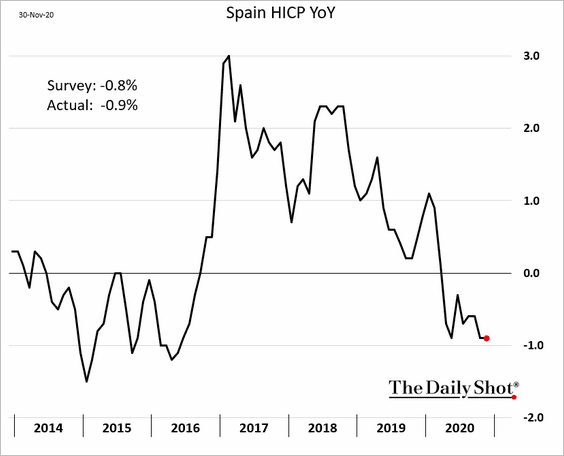

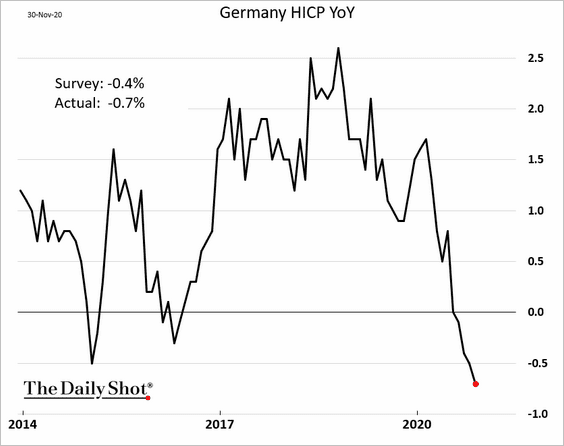

1. Let’s begin with the CPI report.

• Italy and Portugal saw an uptick in inflation.

• Consumer prices were lower in Spain and Germany (below consensus). Germany’s CPI is the lowest in recent years.

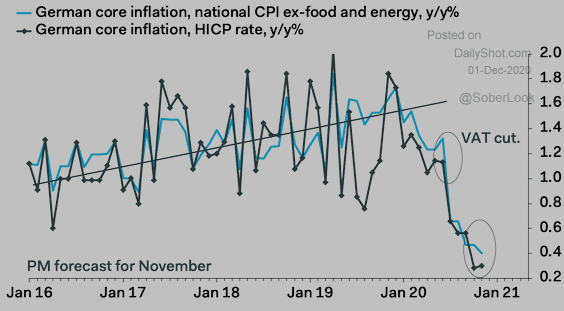

Germany’s core CPI is also soft.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

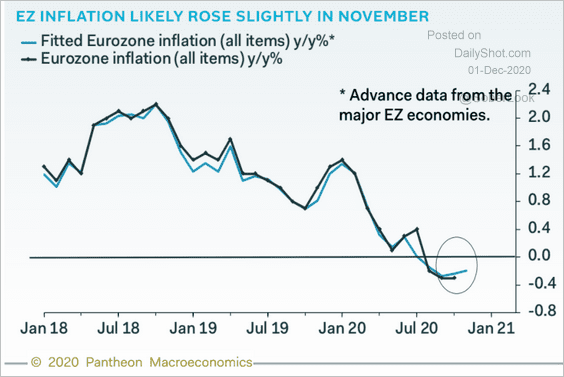

• Inflation probably ticked higher at the Eurozone level.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

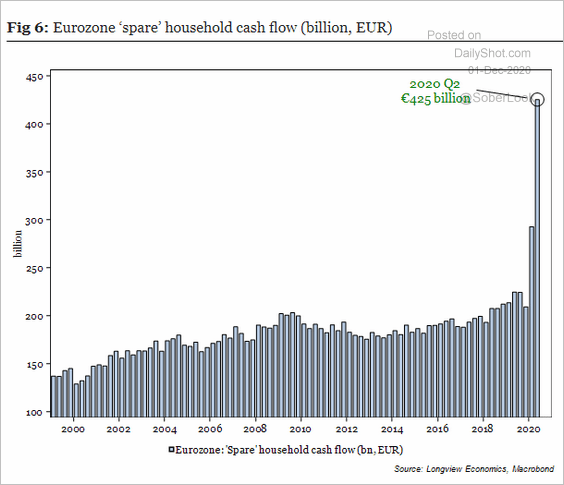

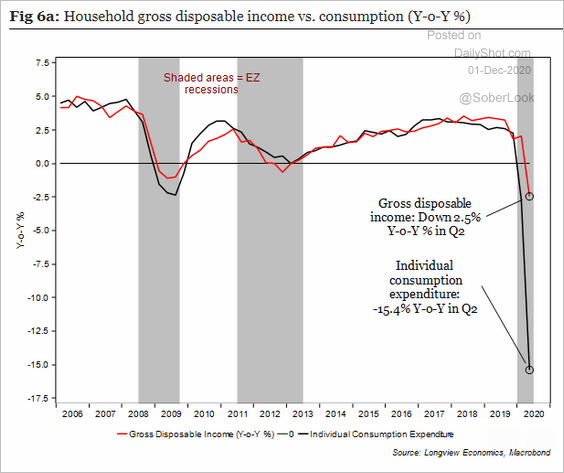

2. “Spare” household cash flow has been unprecedented, …

Source: Longview Economics

Source: Longview Economics

… driven by the massive gap between disposable income and consumption.

Source: Longview Economics

Source: Longview Economics

——————–

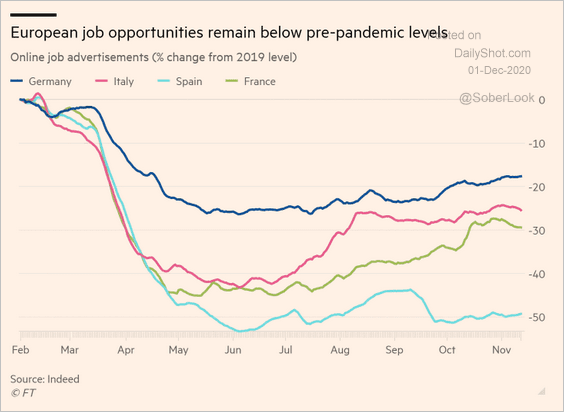

3. Job opportunities remain depressed.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

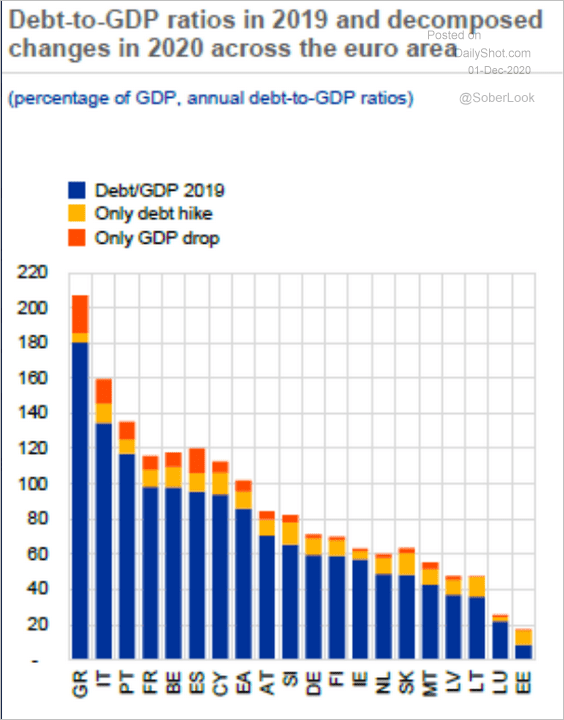

4. This chart shows the attribution of gains in debt-to-GDP ratios.

Source: ECB Read full article

Source: ECB Read full article

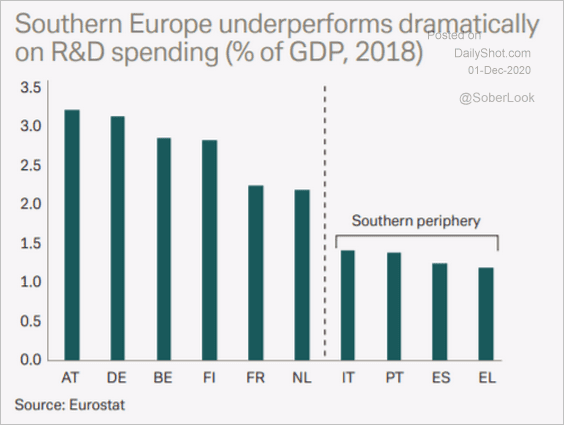

5. R&D Spending has been weak in southern Europe.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

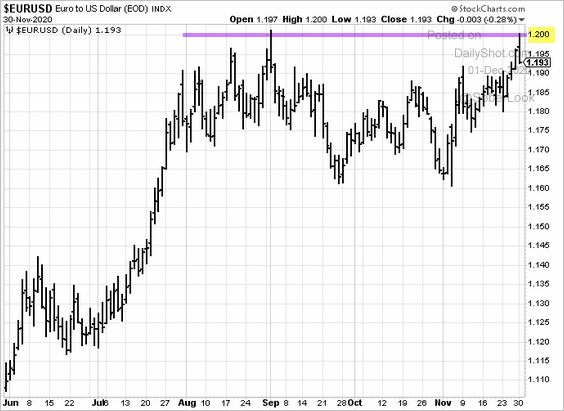

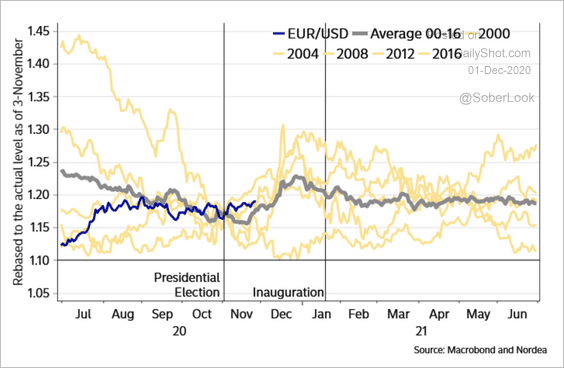

6. The euro is testing resistance at 1.20.

Will it sustain a break above 1.20 before New Year’s?

Source: Nordea Markets

Source: Nordea Markets

Source: Nordea Markets

Source: Nordea Markets

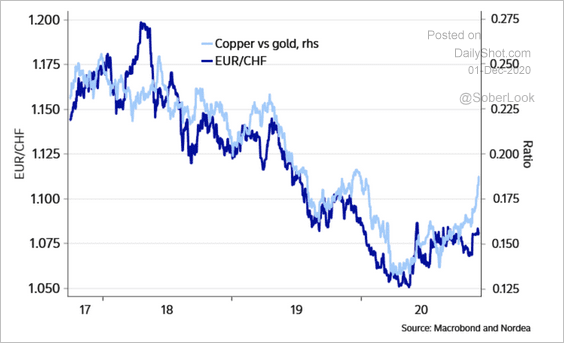

Separately, EUR/CHF has been correlated with the copper/gold ratio over the past few years.

Source: Nordea Markets

Source: Nordea Markets

——————–

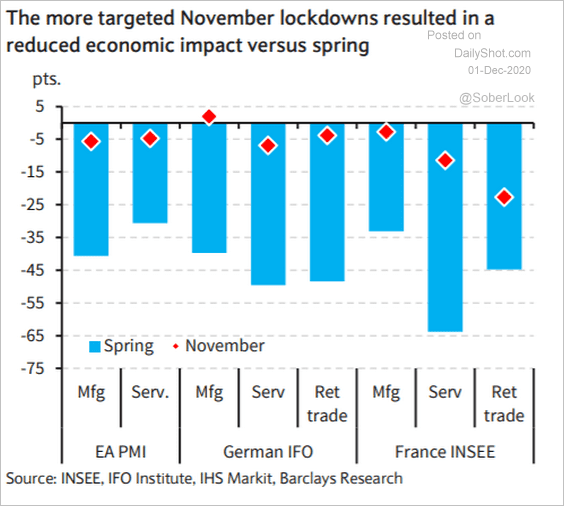

8. The second-wave lockdowns haven’t been nearly as severe as the first wave.

Source: Barclays Research

Source: Barclays Research

Europe

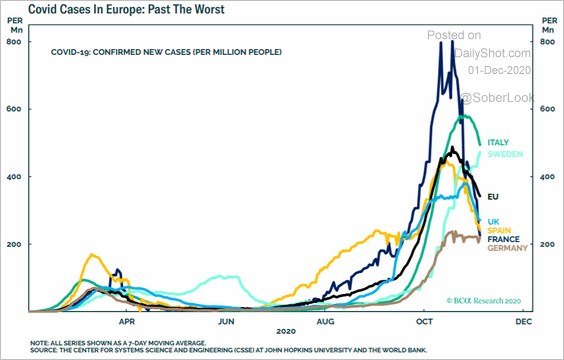

1. New COVID cases have peaked.

Source: BCA Research

Source: BCA Research

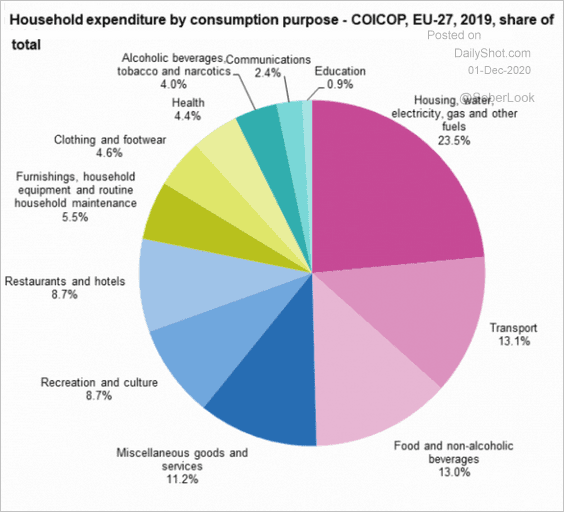

2. How do EU households spend their money?

Source: Eurostat Read full article

Source: Eurostat Read full article

3. What percentage of small and medium-sized firms are late on their payments?

Source: ECB Read full article

Source: ECB Read full article

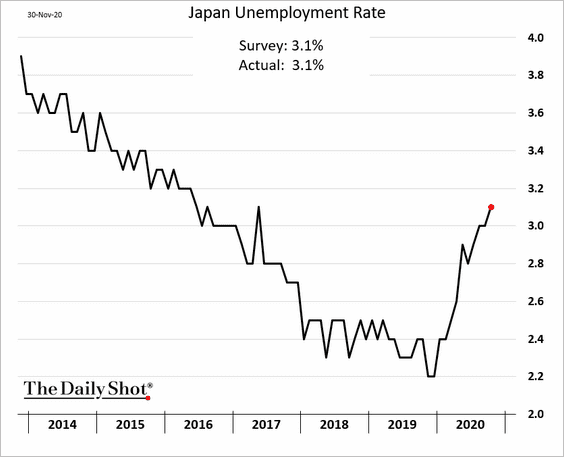

Japan

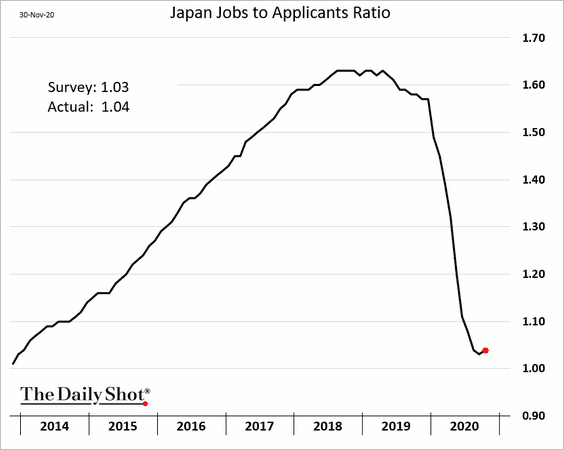

1. The unemployment rate keeps grinding higher.

But the jobs-to-applicants ratio appears to have bottomed.

——————–

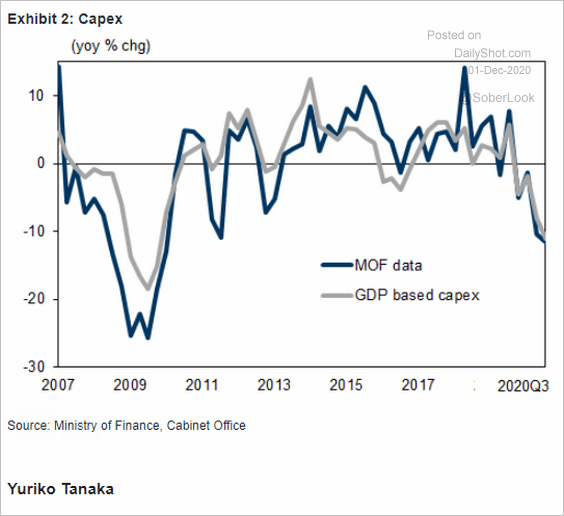

2. Business investment has slowed sharply this year.

Source: Goldman Sachs

Source: Goldman Sachs

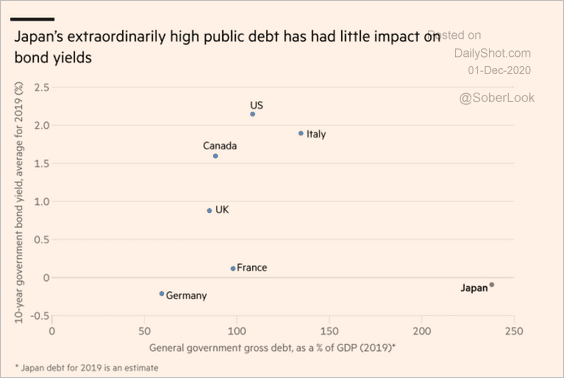

3. Massive public debt has not resulted in higher bond yields (thanks to the BoJ).

Source: @financialtimes Read full article

Source: @financialtimes Read full article

4. Rate differentials suggest a lower USD/JPY. Will we see a break below 100?

Source: Nordea Markets

Source: Nordea Markets

Asia – Pacific

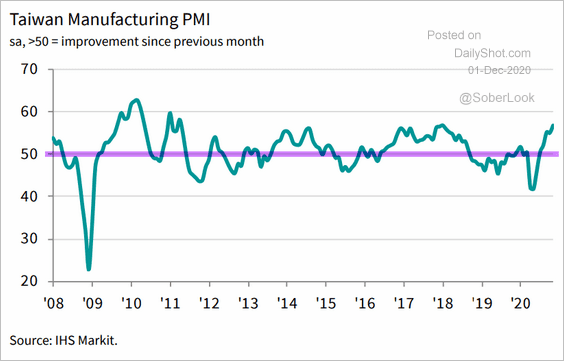

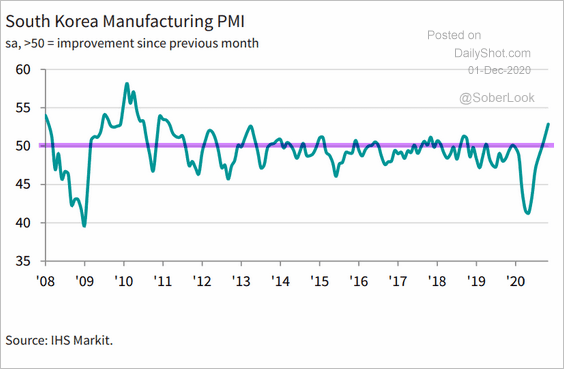

1. Taiwan’s and South Korea’s manufacturing PMI reports show accelerating factory activity.

Source: IHS Markit

Source: IHS Markit

Source: IHS Markit

Source: IHS Markit

——————–

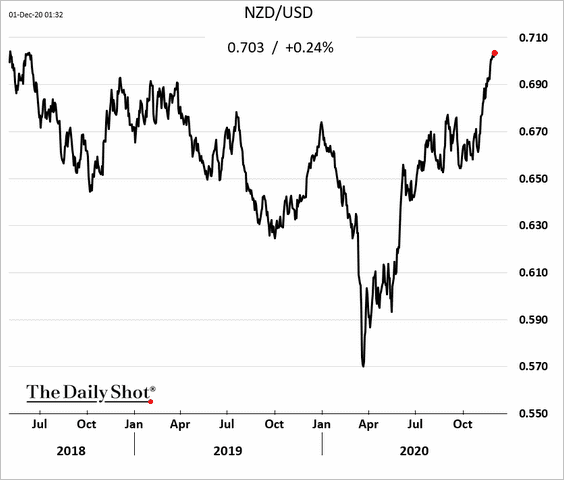

2. The Kiwi dollar hit a multi-year high.

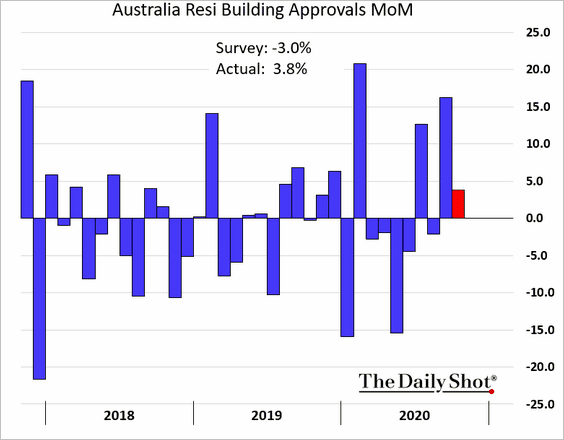

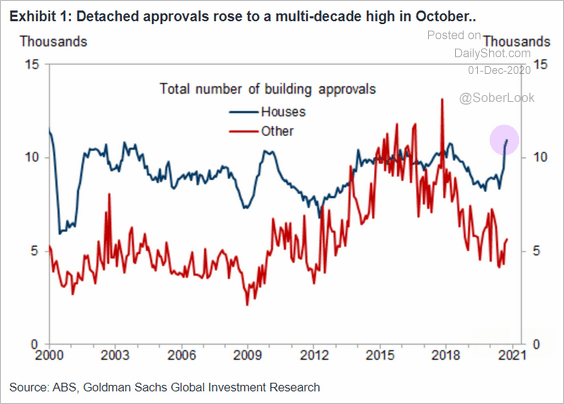

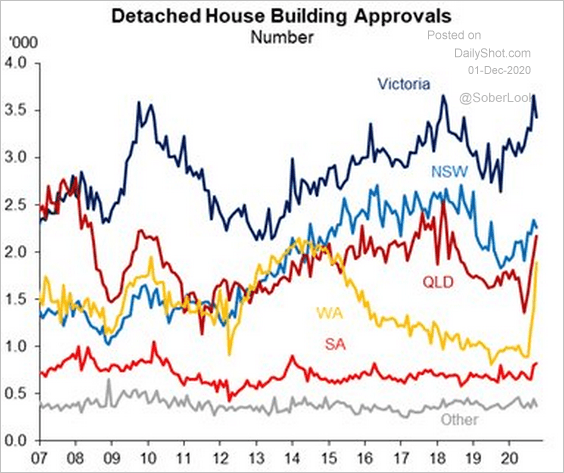

3. Next, we have some updates on Australia.

• Building approvals surprised to the upside, driven by single-family homes.

Source: Goldman Sachs

Source: Goldman Sachs

Here is the regional breakdown.

Source: @justinfabo

Source: @justinfabo

——————–

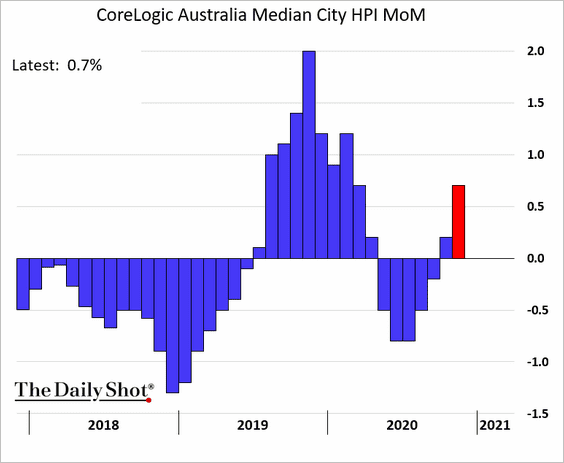

• Home prices are climbing again.

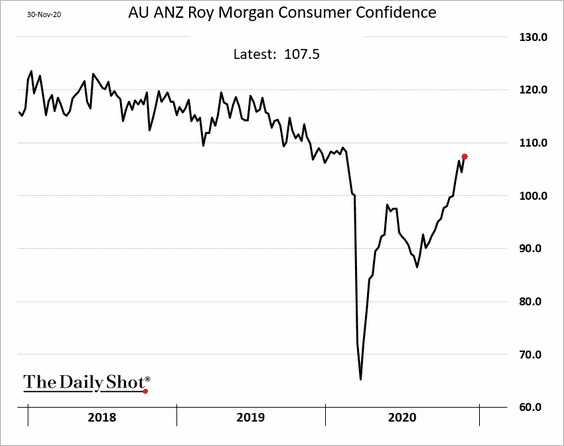

• Consumer confidence has nearly fully recovered.

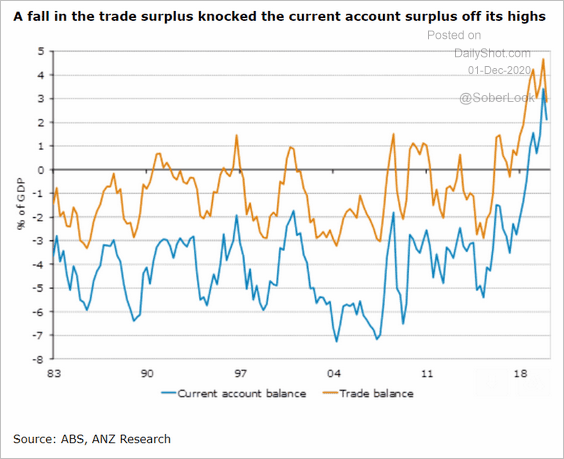

• Trade surplus came off the highs.

Source: ANZ Research

Source: ANZ Research

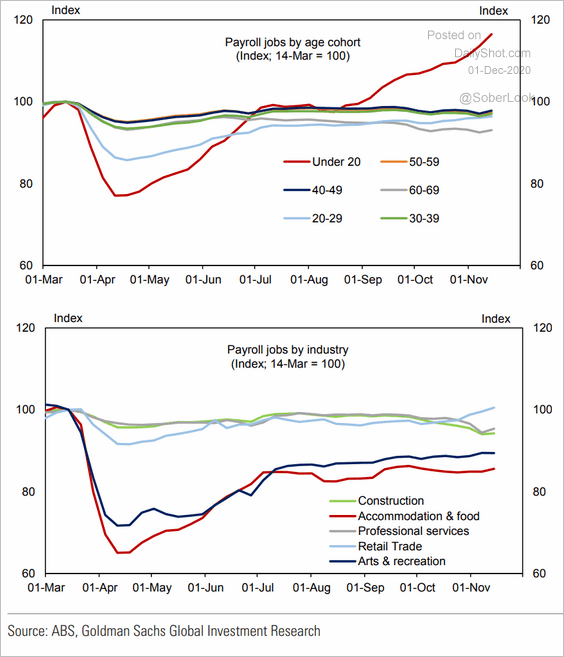

• Here are the trends in Australia’s payrolls.

Source: Goldman Sachs

Source: Goldman Sachs

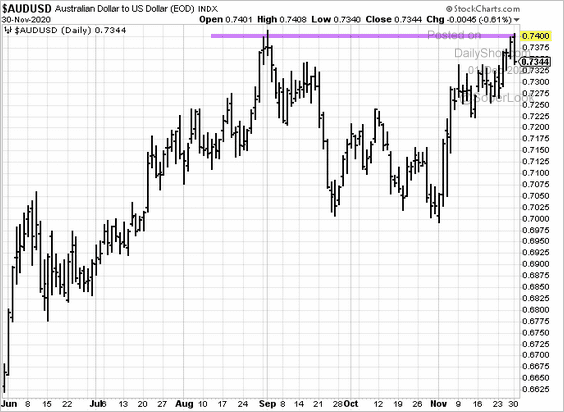

• The Aussie dollar is testing resistance at USD 0.74.

China

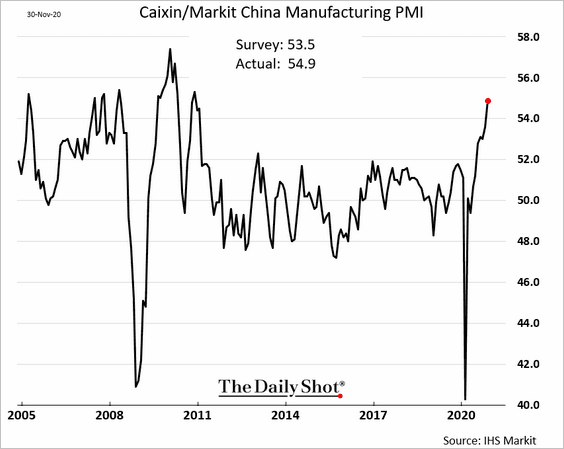

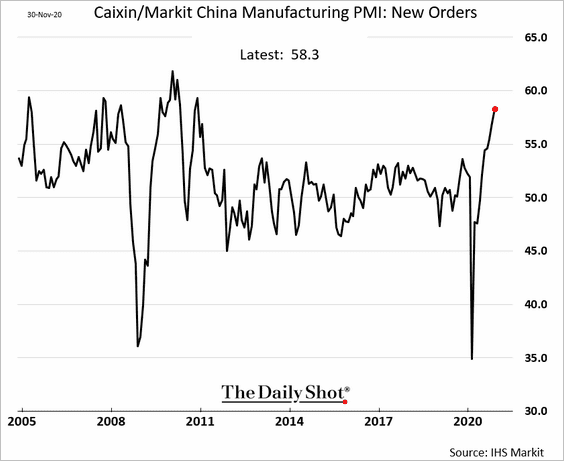

1. The Markit PMI result surprised to the upside, with factory growth accelerating.

——————–

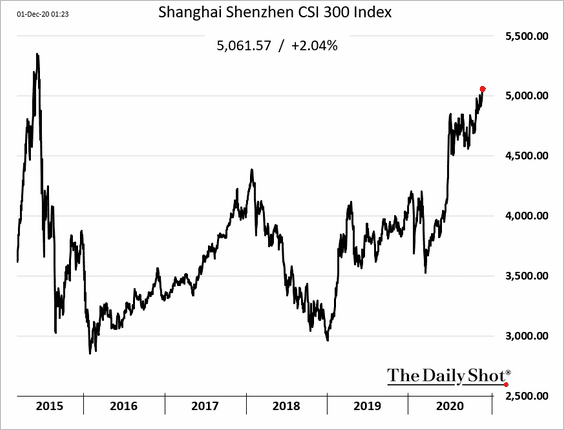

2. The stock market benchmark index hit the highest level since the 2015 bubble.

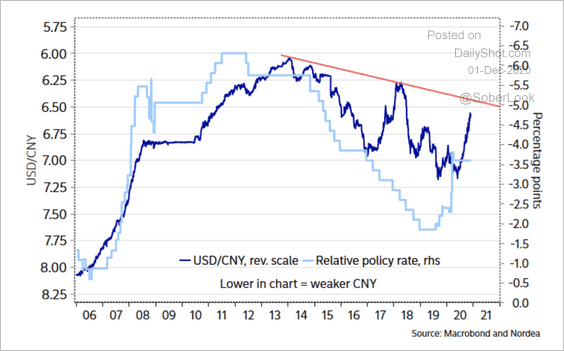

3. USD/CNY is facing resistance.

Source: Nordea Markets

Source: Nordea Markets

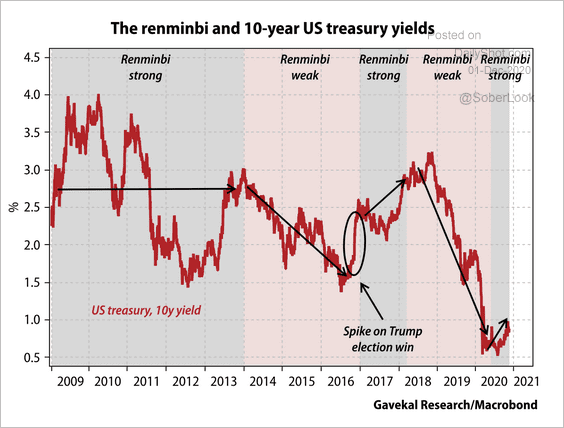

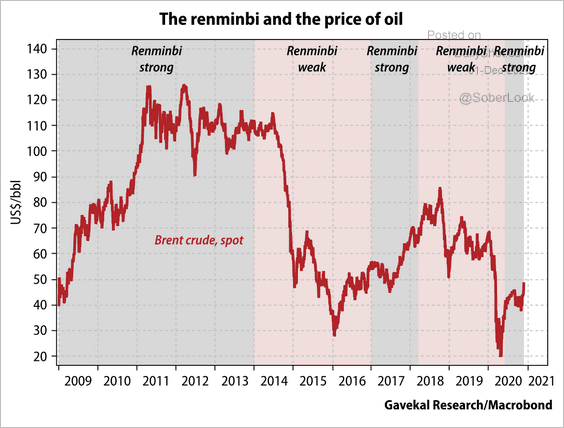

Generally, a weaker renminbi has coincided with falling Treasury yields and lower oil prices.

Source: Gavekal

Source: Gavekal

Source: Gavekal

Source: Gavekal

——————–

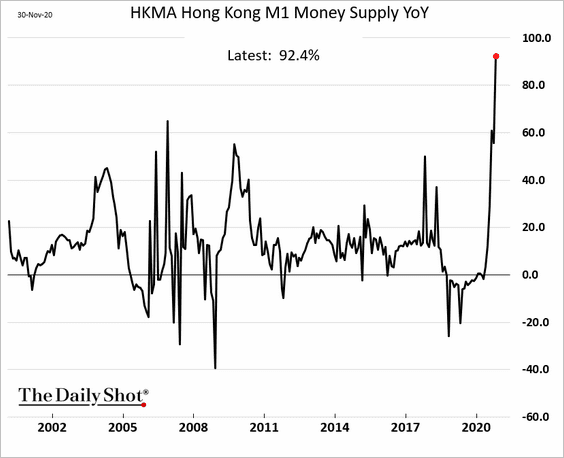

4. Hong Kong’s financial system is awash with liquidity.

Emerging Markets

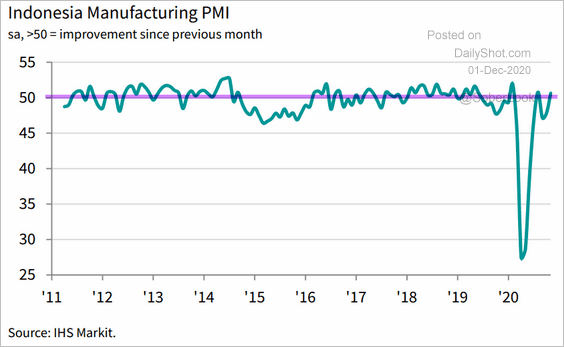

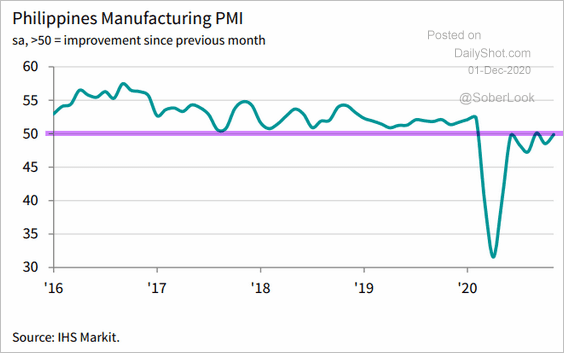

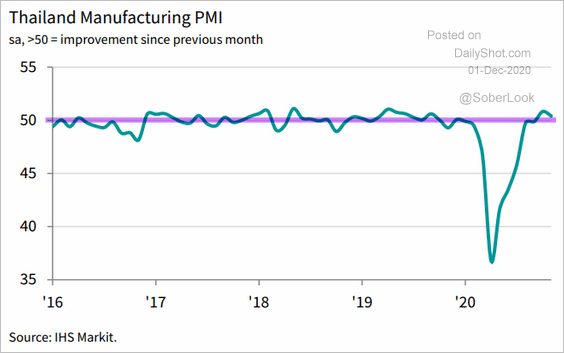

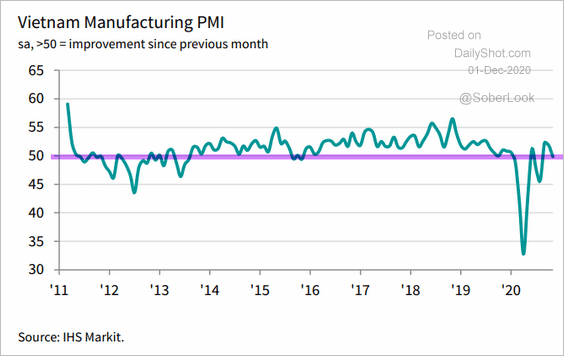

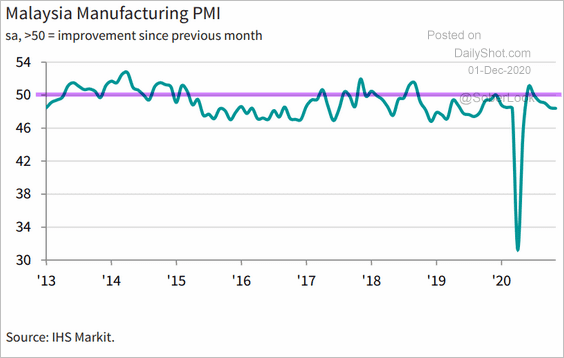

1. While China, Taiwan, and South Korea all saw substantial expansion in factory activity in November, that hasn’t been the case for other Asian economies. The manufacturing PMI indices show most countries treading water (PMI close to 50).

• Indonesia:

Source: IHS Markit

Source: IHS Markit

• The Philippines:

Source: IHS Markit

Source: IHS Markit

• Thailand:

Source: IHS Markit

Source: IHS Markit

• Vietnam:

Source: IHS Markit

Source: IHS Markit

• Malaysia (contraction):

Source: IHS Markit

Source: IHS Markit

——————–

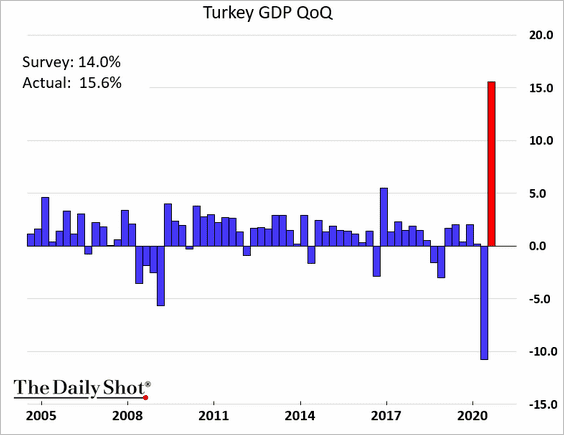

2. Turkey’s Q3 GDP rebound was stronger than expected.

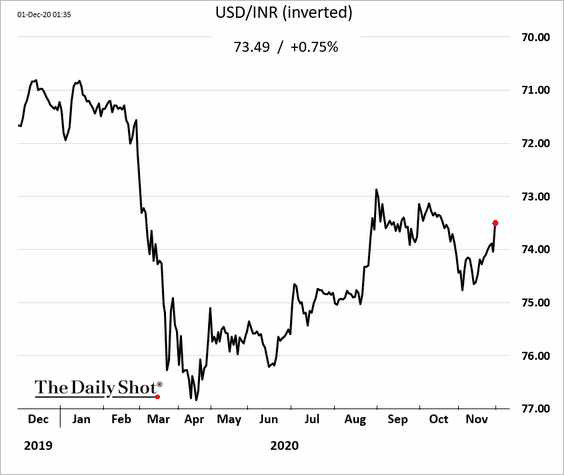

3. The rupee is climbing, driven by capital inflows.

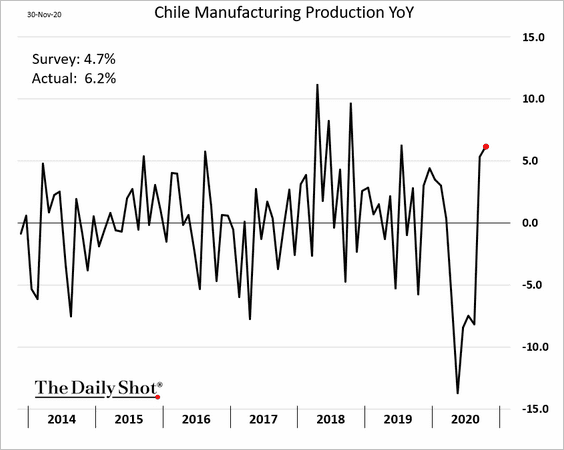

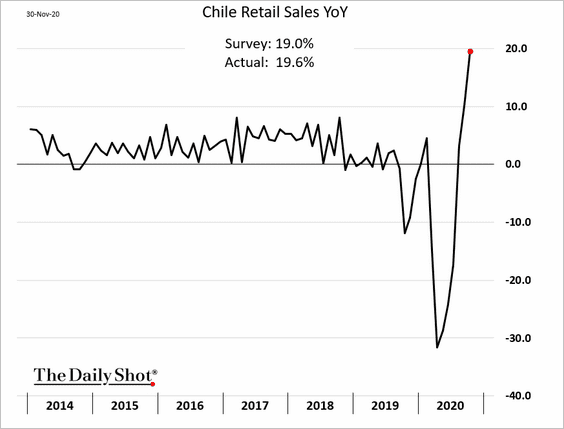

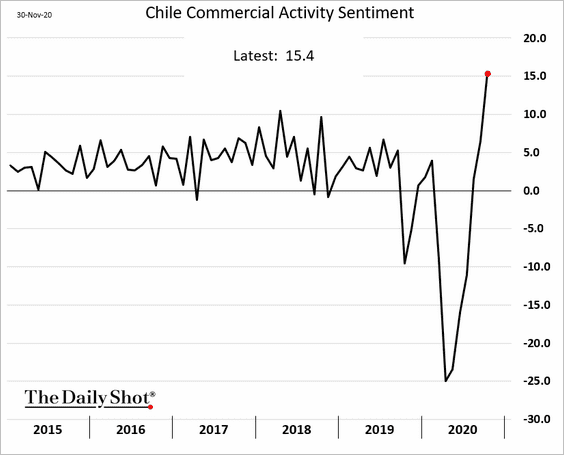

4. Chile’s economy continues to recover.

• Industrial production:

• Retail sales:

• Commercial activity:

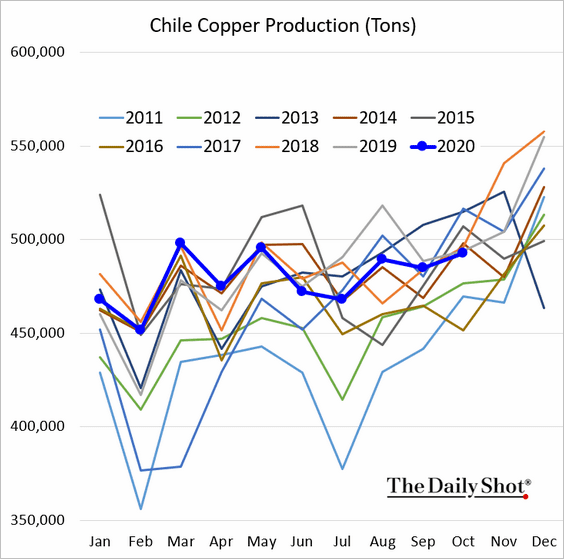

Chile’s copper output is in line with 2019 and 2018 levels.

——————–

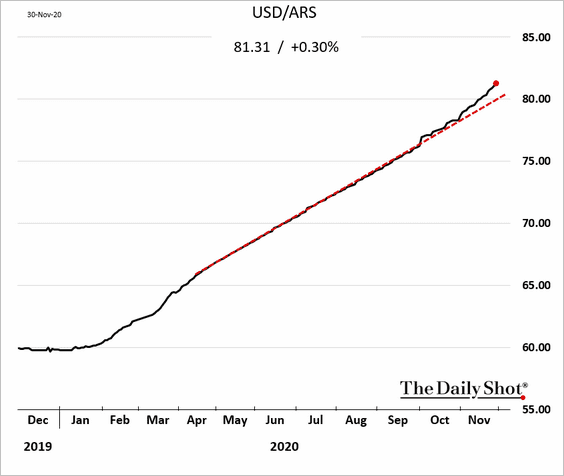

5. Argentina is accelerating the peso’s devaluation.

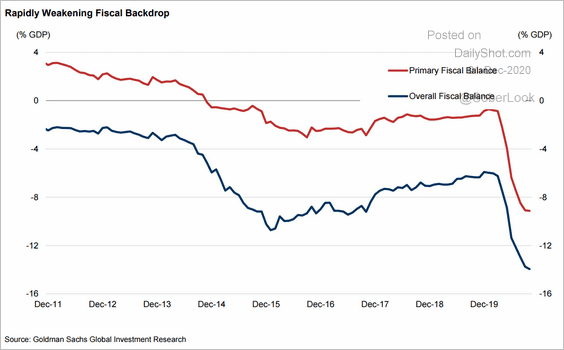

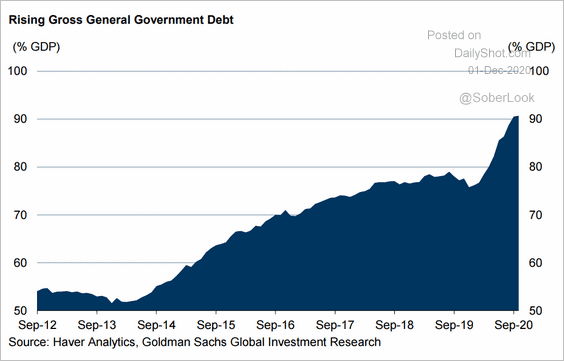

6. Brazil’s fiscal situation continues to deteriorate (2 charts):

Source: Goldman Sachs

Source: Goldman Sachs

Source: Goldman Sachs

Source: Goldman Sachs

Cryptocurrency

Bitcoin hit a record high, pushing toward $20k.

Commodities

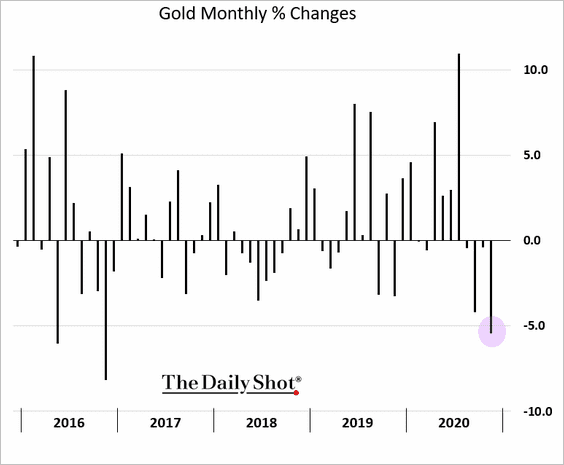

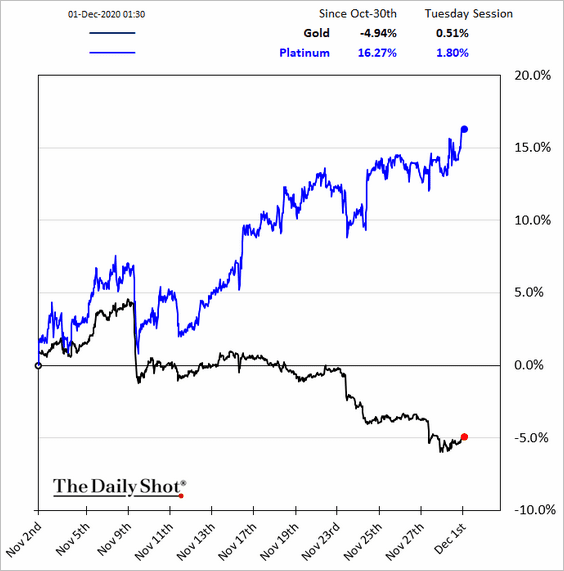

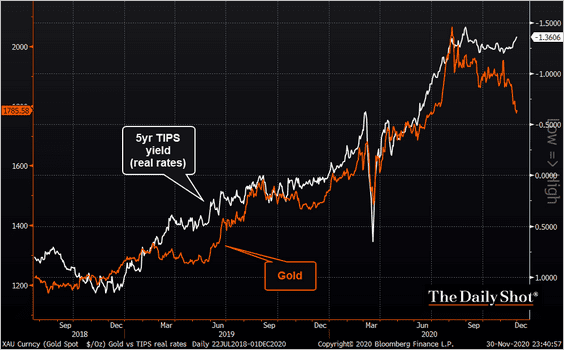

1. Let’s start with gold.

• It’s been a rough month.

• Here is gold vs. platinum.

• Gold has diverged from real rates (TIPS yields), pointing to potential gains ahead for the precious metal.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

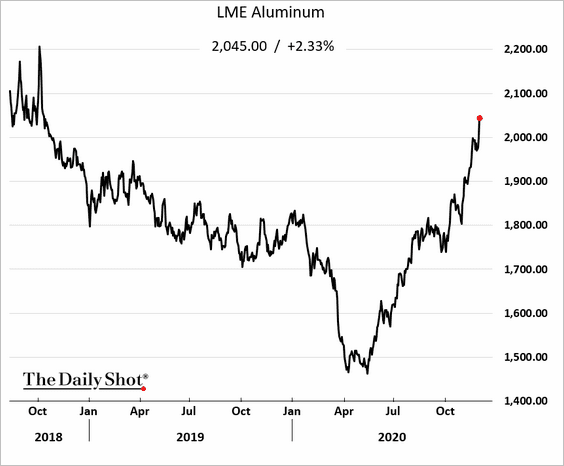

2. The rally in aluminum continues.

Energy

1. Here is a look at the November performance for energy products and energy equity indices.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

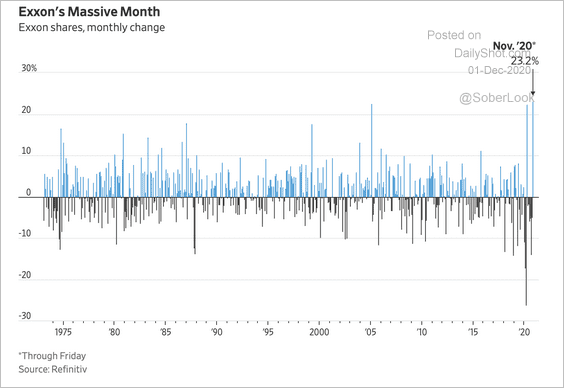

Exxon Mobil’s stock just had its best month since at least 1972.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

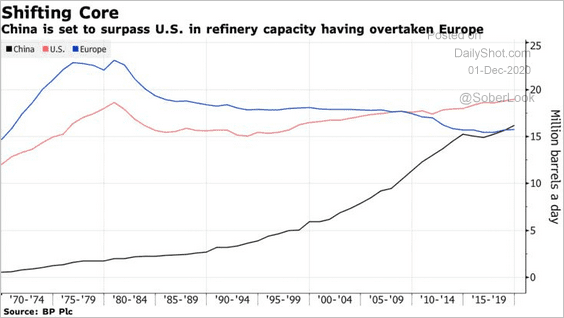

2. China’s refining capacity has overtaken Europe.

Source: @markets Read full article

Source: @markets Read full article

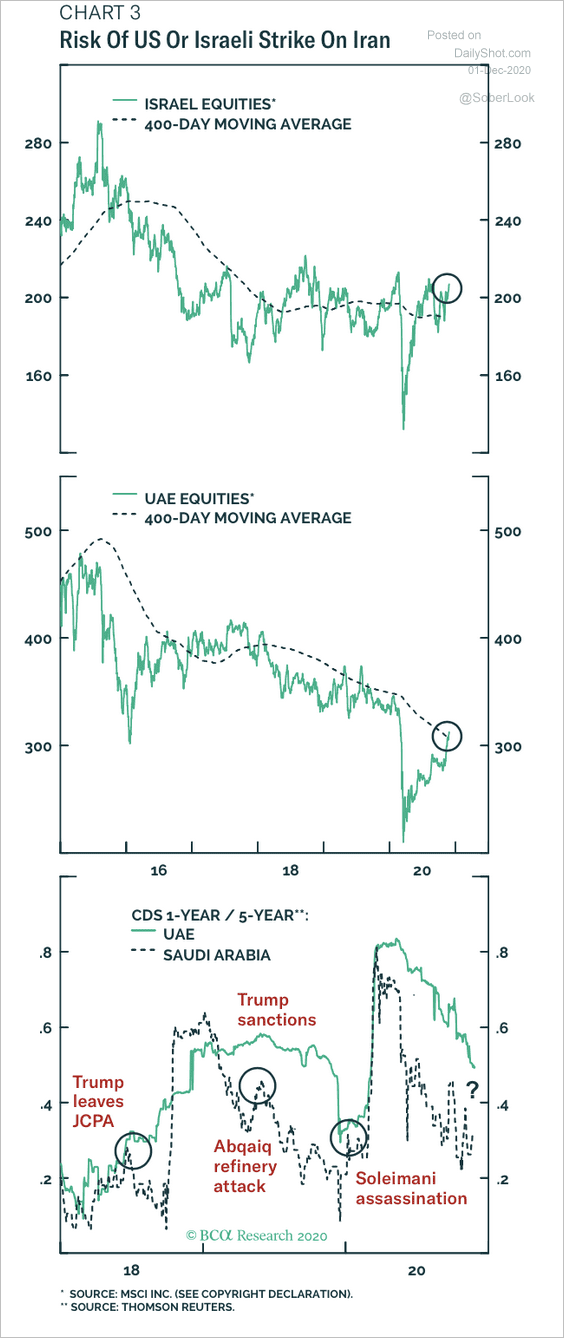

3. Financial markets are not prepared for geopolitical risk in the Middle East, according to BCA Research (see article).

Source: BCA Research

Source: BCA Research

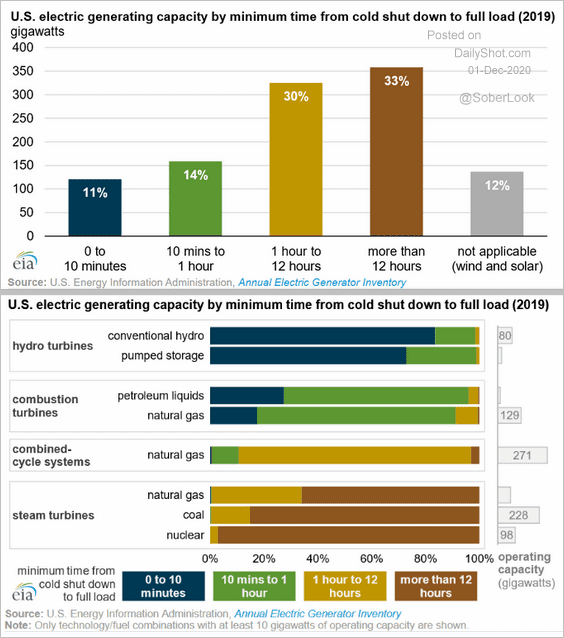

4. According to EIA, “about 25% of U.S. power plants can start up within an hour.”

Source: @EIAgov Read full article

Source: @EIAgov Read full article

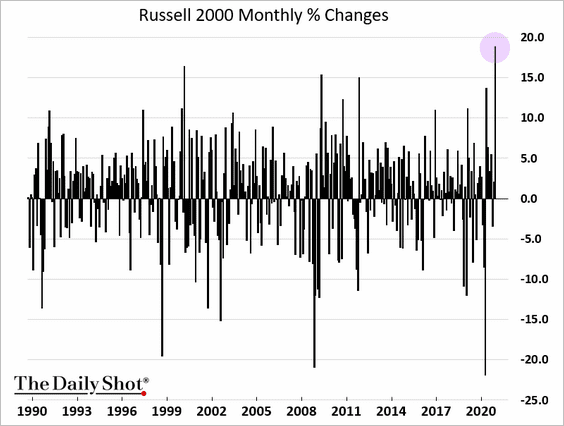

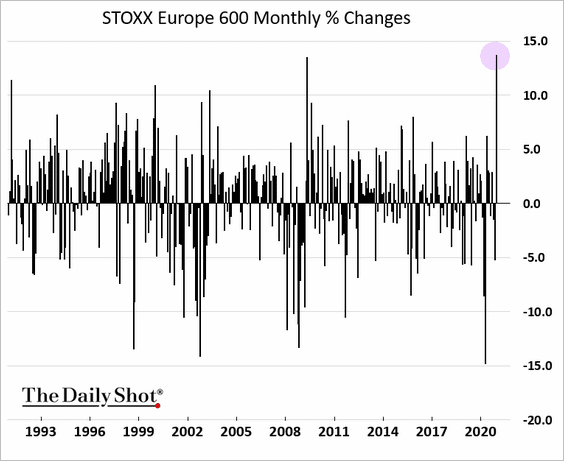

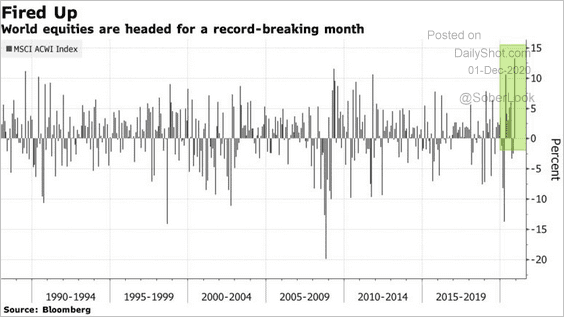

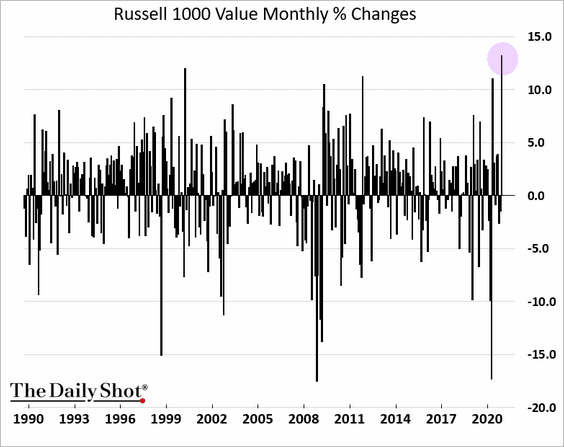

Equities

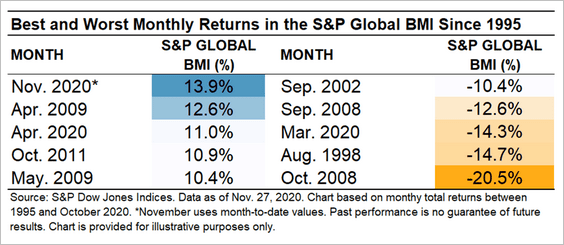

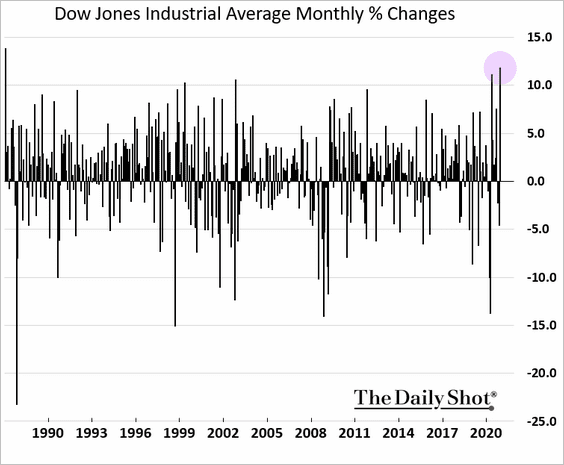

1. It’s been a good month for stocks.

• The S&P 500:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

• The Dow:

• Small caps:

• European stocks:

• Global equities:

Source: @markets Read full article

Source: @markets Read full article

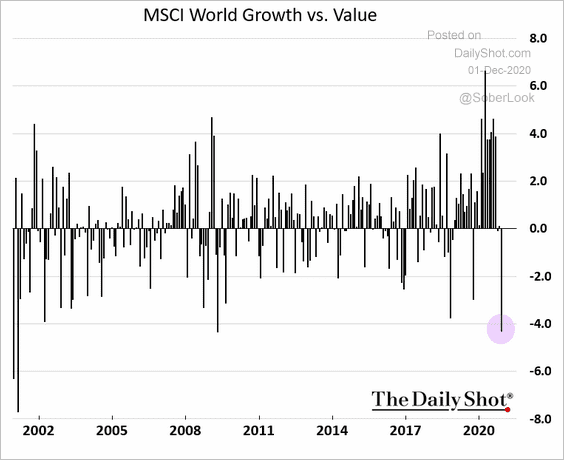

• Value stocks did particularly well, …

… while growth underperformed by most in two decades.

h/t @IshikaMookerjee

h/t @IshikaMookerjee

——————–

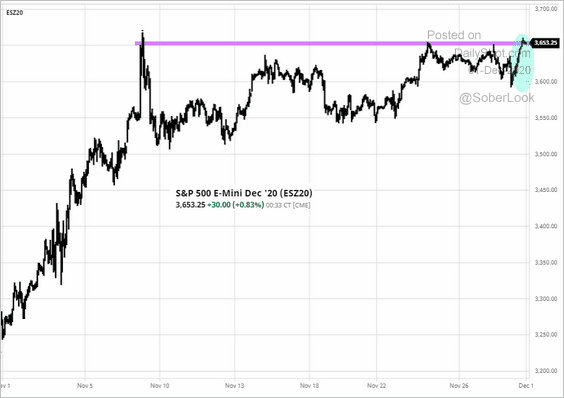

2. S&P 500 futures are up again this morning.

Source: barchart.com

Source: barchart.com

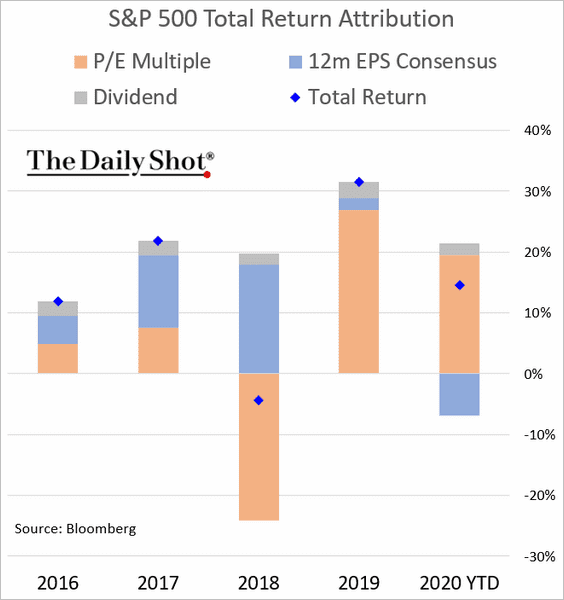

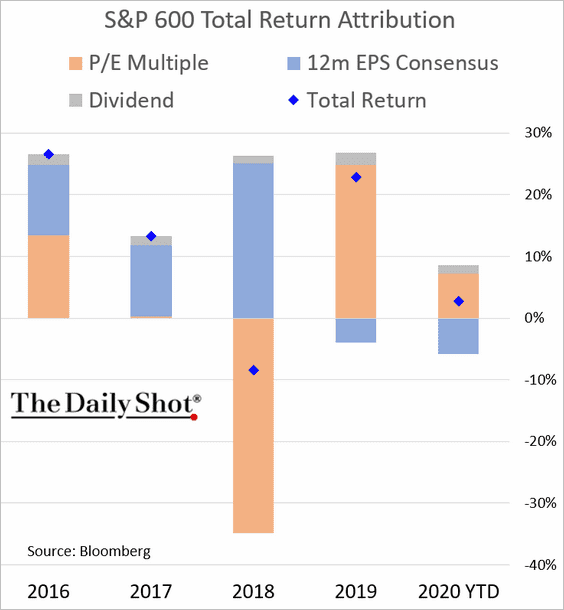

3. Here is the year-to-date performance attribution.

• S&P 500:

• S&P 600 (small caps):

——————–

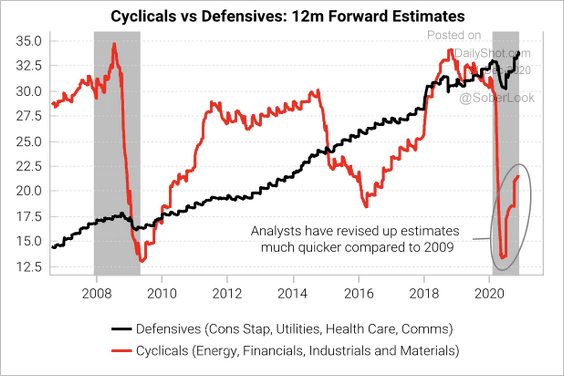

4. Analysts continue to revise up their earnings estimates for cyclical companies.

Source: Variant Perception

Source: Variant Perception

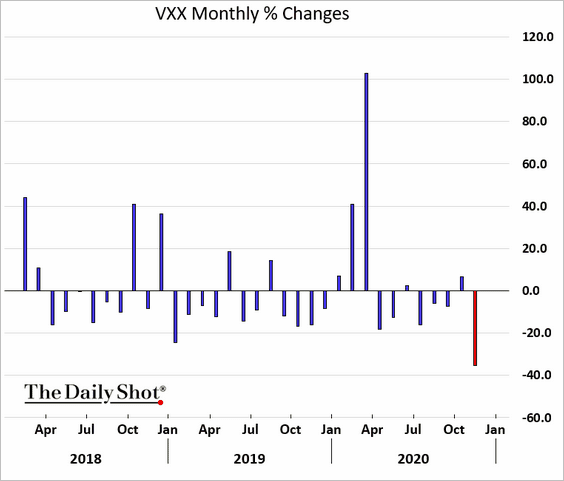

5. Shorting vol paid off handsomely in November (VXX is a VIX ETN).

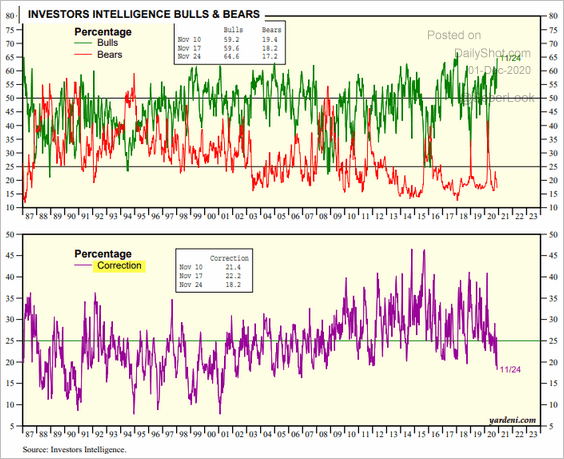

6. The percentage of investors expecting a correction hit the lowest level in years.

Source: Yardeni Research

Source: Yardeni Research

Credit

1. US investment-grade bond yields hit a new low.

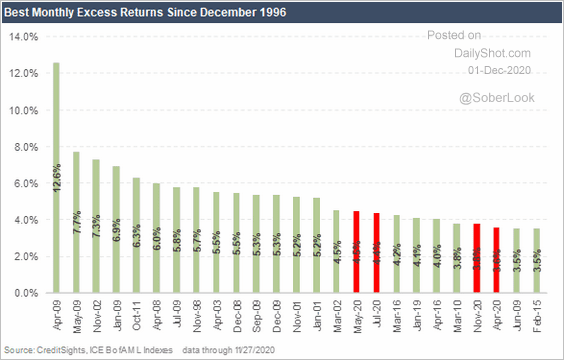

2. November was a good month for credit.

Source: CreditSights

Source: CreditSights

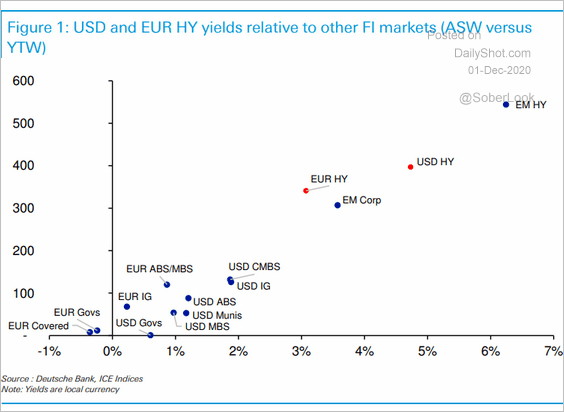

3. This chart shows how US and European junk bond yields compare to other fixed-income products.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Global Developments

1. Asset managers are boosting their bets against the US dollar.

Source: ANZ Research

Source: ANZ Research

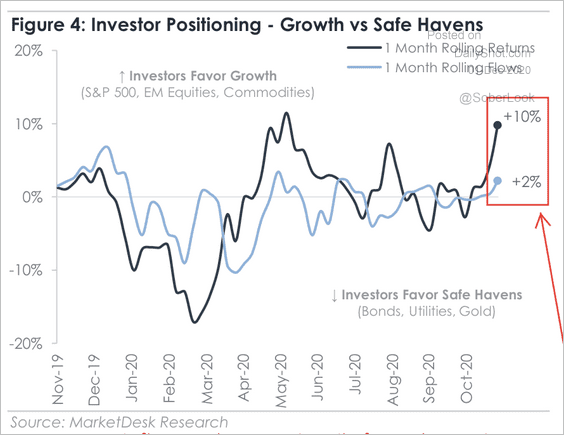

2. Investors favored growth over safe-havens over the past month.

Source: MarketDesk Research

Source: MarketDesk Research

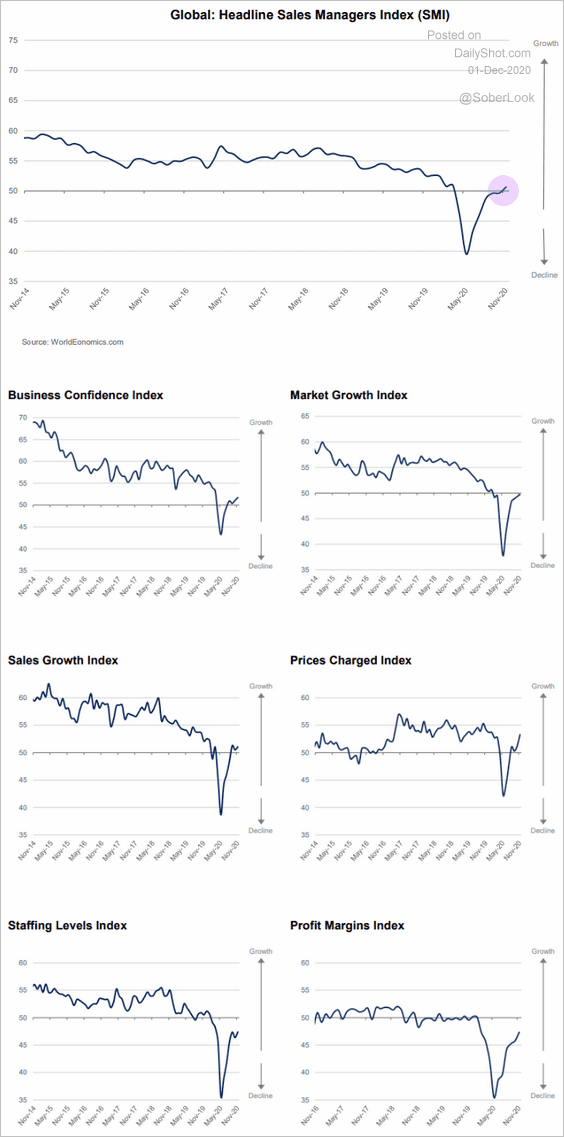

3. Global business activity is back in growth mode, according to the World Economics SMI report.

Source: World Economics

Source: World Economics

——————–

Food for Thought

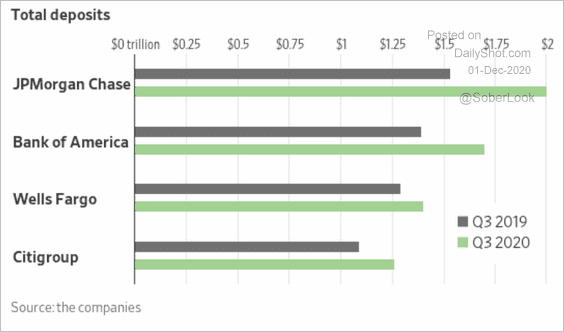

1. Growth in bank deposits:

Source: @WSJ Read full article

Source: @WSJ Read full article

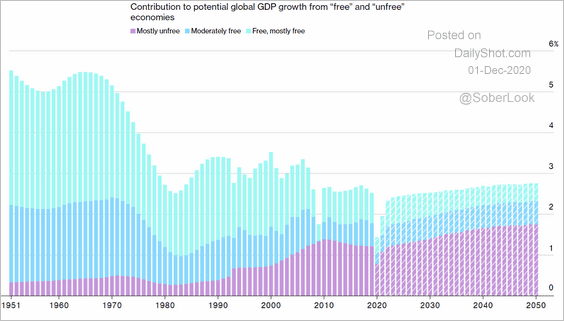

2. Contribution to the global GDP from “free” and “unfree” economies:

Source: @bw Read full article

Source: @bw Read full article

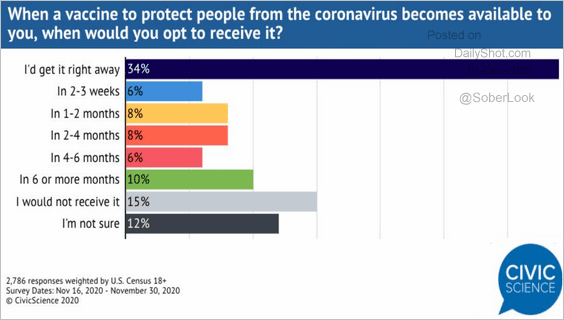

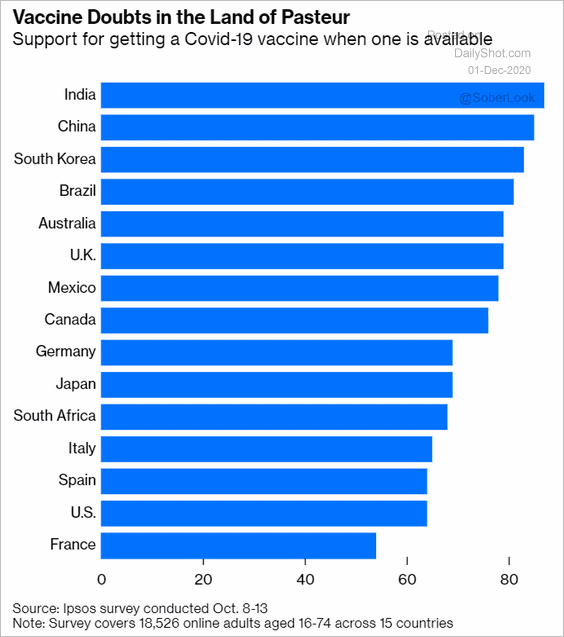

3. Support for getting vaccinated against COVID:

Source: @CivicScience

Source: @CivicScience

Source: @bopinion Read full article

Source: @bopinion Read full article

——————–

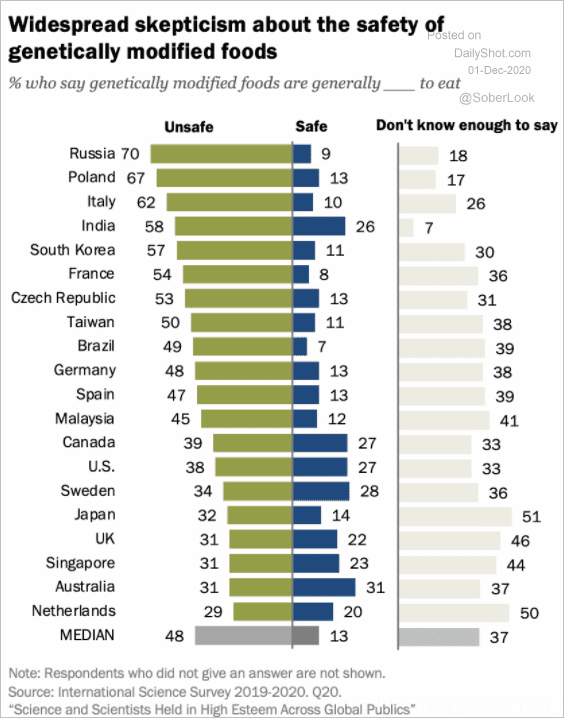

4. Views on genetically modified foods:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

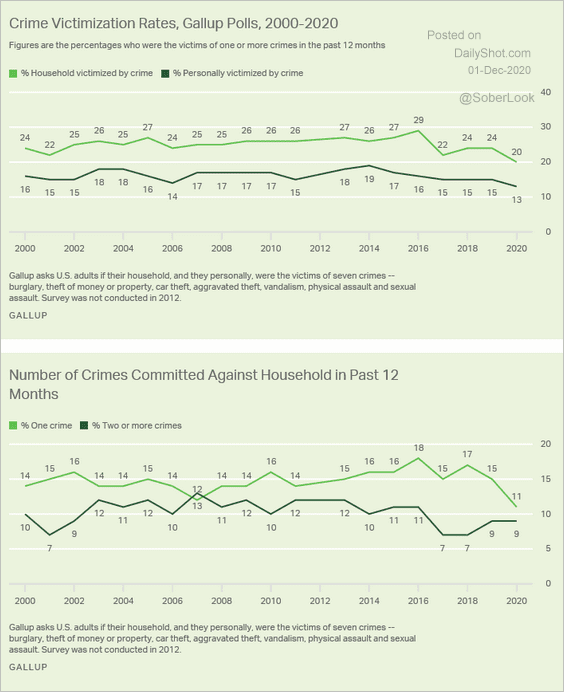

5. Households victimized by crime in the US:

Source: Gallup Read full article

Source: Gallup Read full article

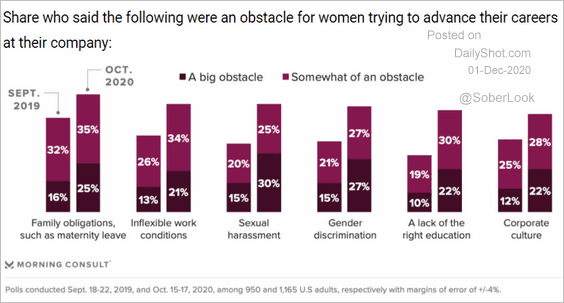

6. Obstacles faced by women trying to advance their career:

Source: Morning Consult

Source: Morning Consult

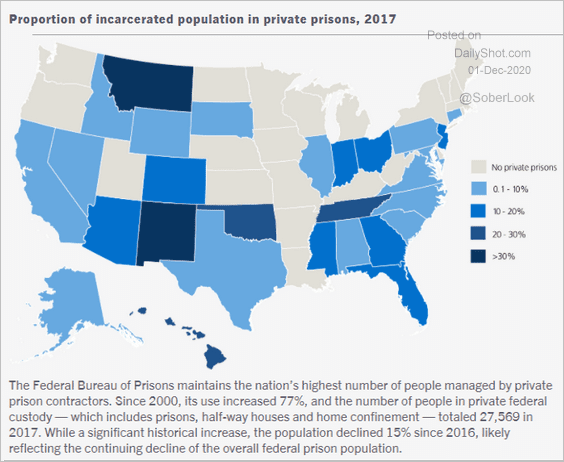

7. Private prisons in the US:

Source: The Sentencing Project Read full article

Source: The Sentencing Project Read full article

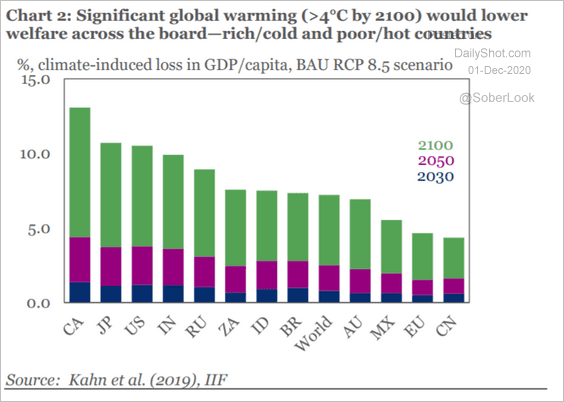

8. Global warming’s potential impact on economic growth:

Source: IIF

Source: IIF

9. Online search activity for “chess”:

Source: @chartrdaily

Source: @chartrdaily

——————–