The Daily Shot: 02-Dec-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

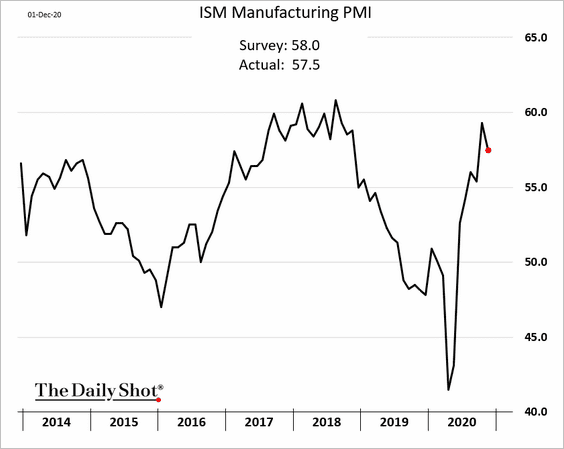

1. Growth in the nation’s factory activity eased a bit in November.

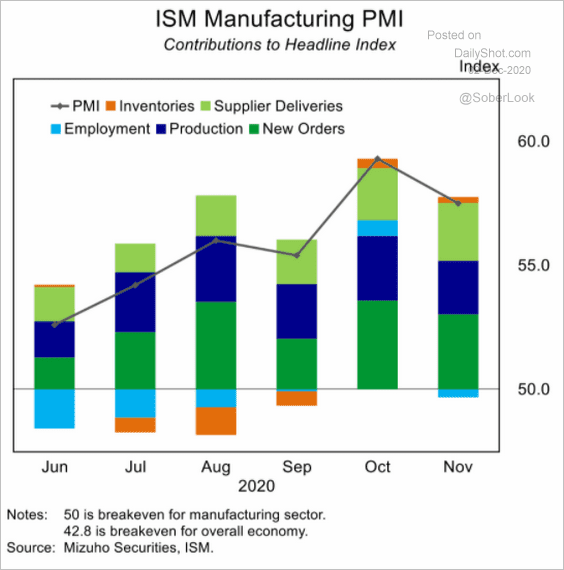

• Here is the breakdown.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

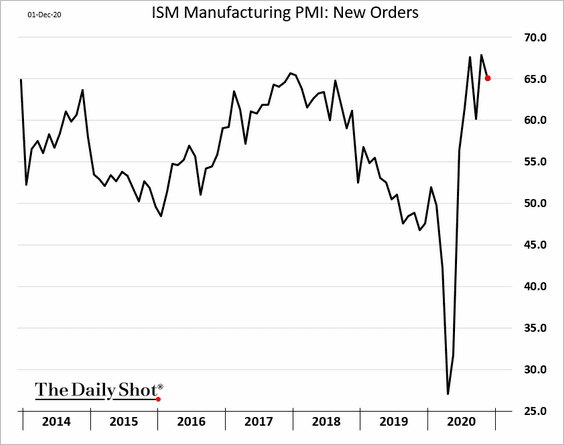

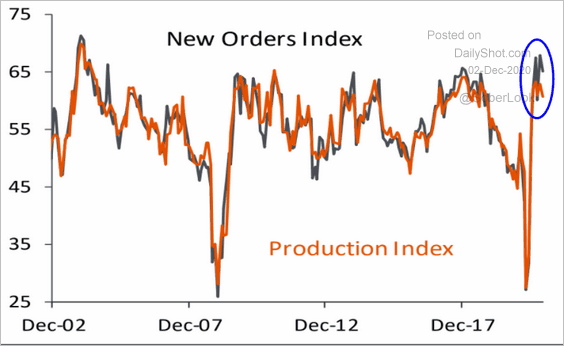

• The ISM new orders index remains near multi-year highs.

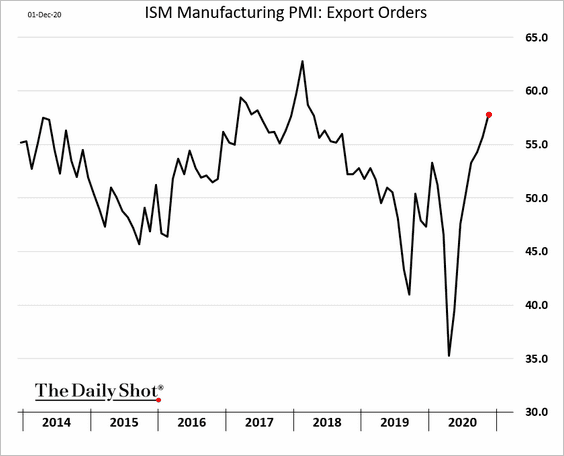

And export orders accelerated.

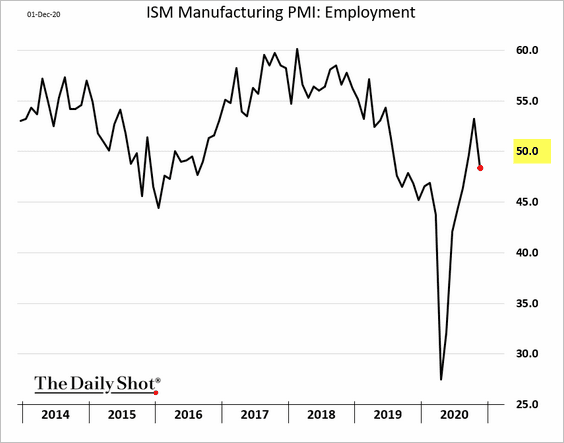

• One area of concern is a pullback in hiring. The employment PMI index has moved below 50 (contraction).

Source: Reuters Read full article

Source: Reuters Read full article

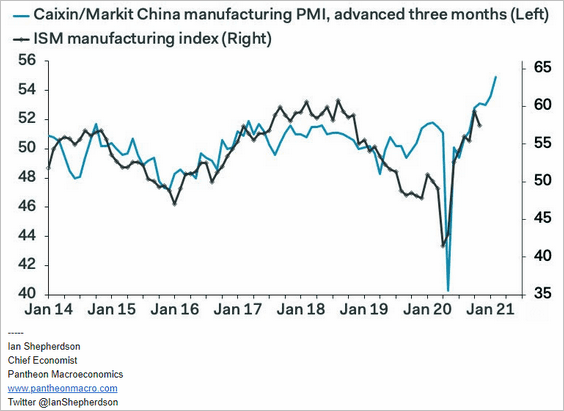

• Going forward, factory activity is expected to strengthen further.

– Orders vs. production:

Source: Piper Sandler

Source: Piper Sandler

– US ISM vs. China’s manufacturing PMI:

——————–

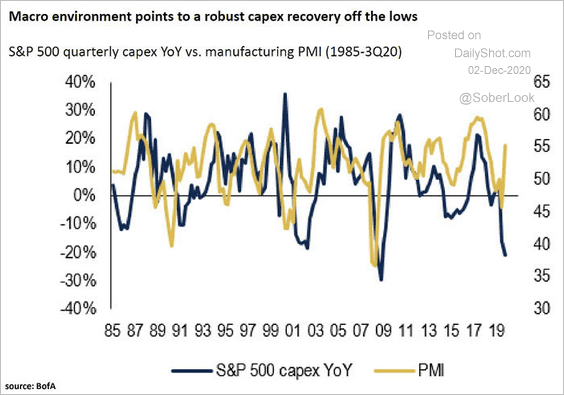

2. Survey data, such as the ISM index above, point to improvements in business investment.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

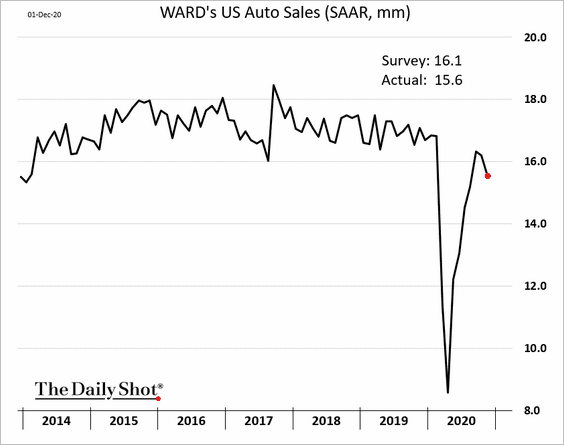

3. US automobile sales lost some momentum in November.

Source: CNA Read full article

Source: CNA Read full article

——————–

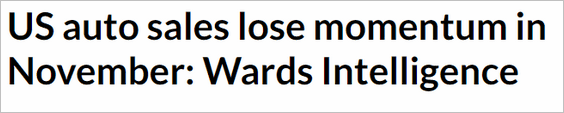

4. Online sales have been robust.

Source: @technology Read full article

Source: @technology Read full article

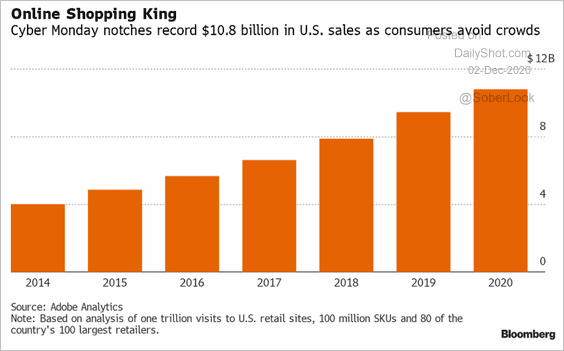

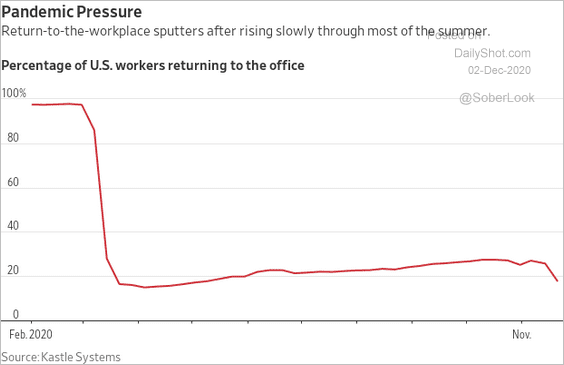

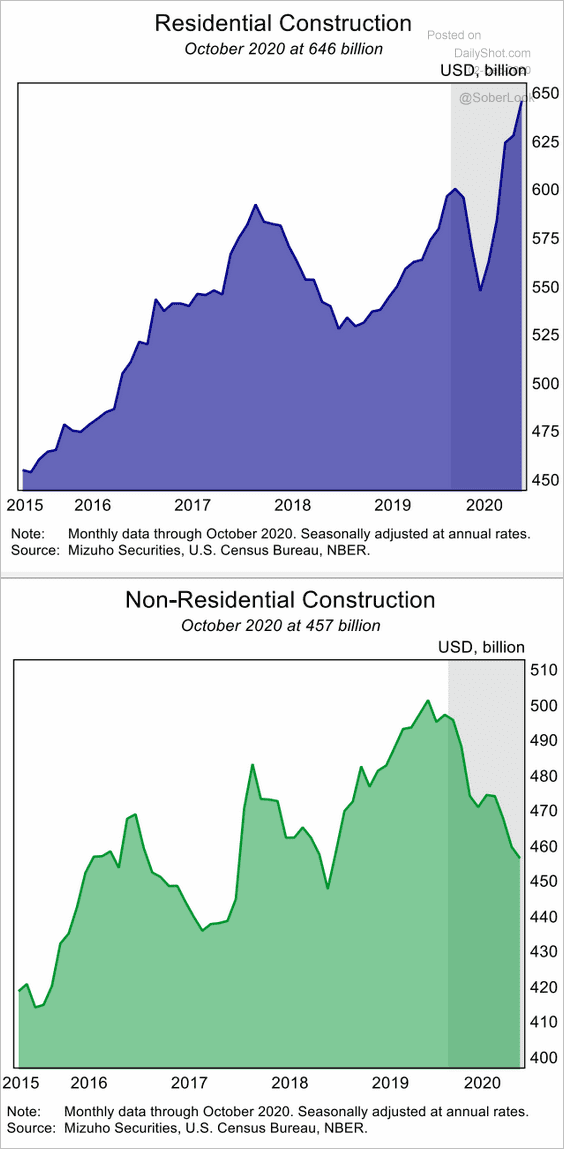

5. The divergence between residential and nonresidential construction spending continues to widen. It’s partially a reflection of the pandemic shift to a “home office” (2nd chart).

Source: @WSJ Read full article

Source: @WSJ Read full article

Here is the divergence in dollar terms.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

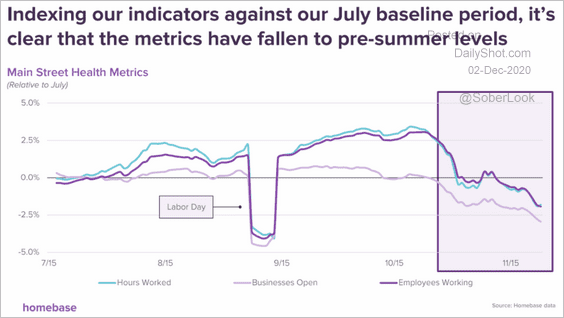

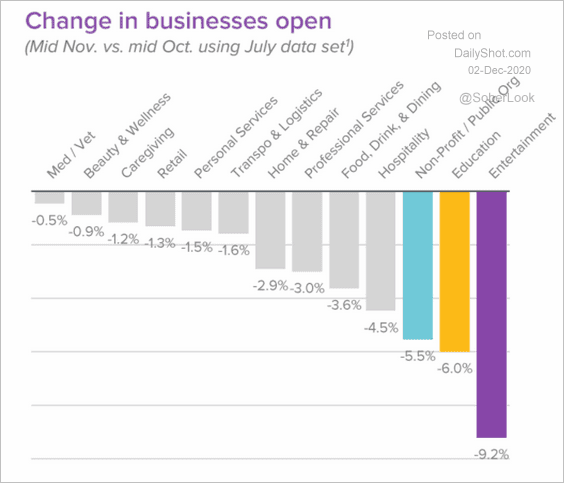

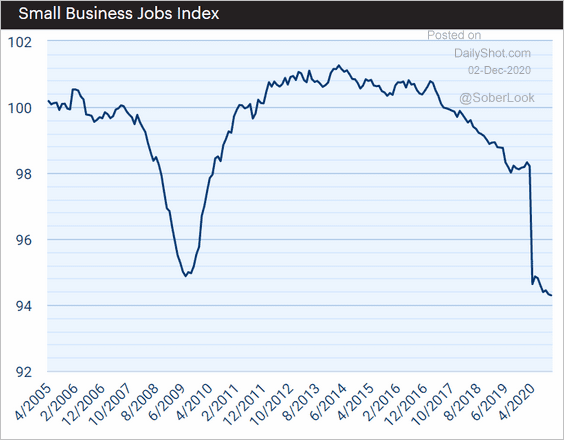

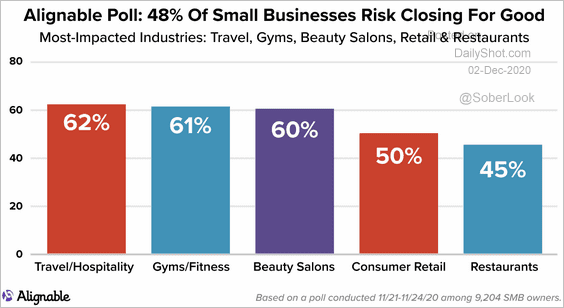

6. As discussed previously, many small businesses are struggling.

• The Homebase index of businesses open and employees working:

Source: Homebase

Source: Homebase

• Business closures in November:

Source: Homebase

Source: Homebase

• The Paychex/IHS Markit Small Business Employment Index:

Source: Paychex/IHS Markit Small Business Employment Watch

Source: Paychex/IHS Markit Small Business Employment Watch

• Risks of closing for good:

Source: Alignable

Source: Alignable

——————–

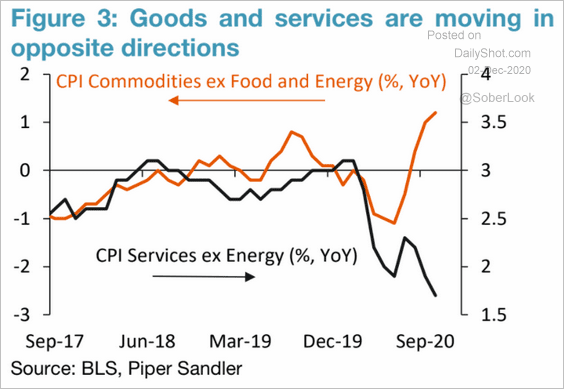

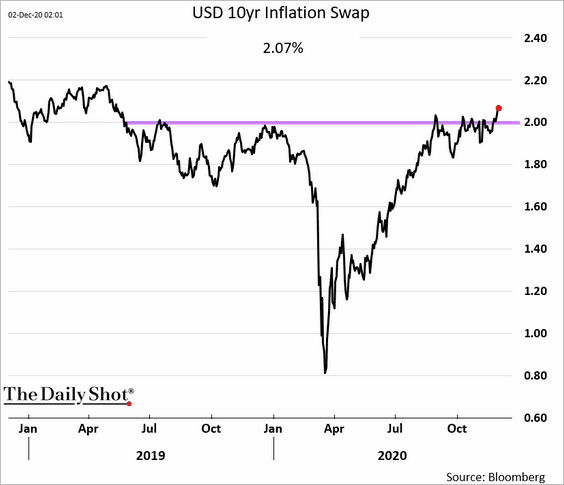

7. Here are a couple of updates on inflation.

• US goods vs. services CPI:

Source: Piper Sandler

Source: Piper Sandler

• Long-term market-based inflation expectations (now above 2%):

——————–

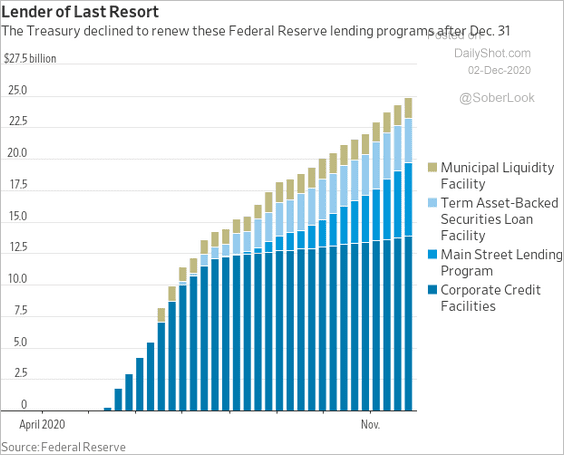

8. Finally, we have the evolution of the Fed/Treasury emergency programs that Mnuchin is terminating (see story).

Source: @WSJ Read full article

Source: @WSJ Read full article

Canada

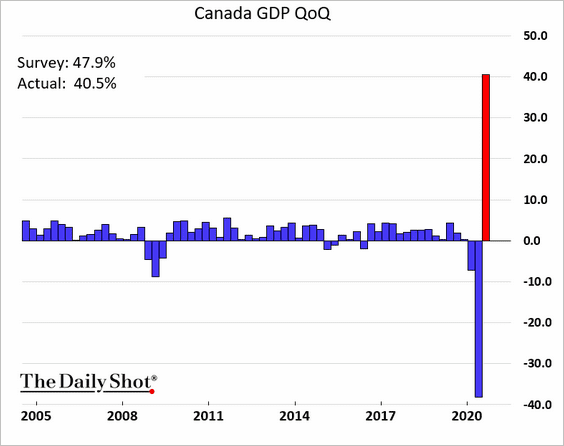

1. The Q3 GDP rebound was a bit below estimates (chart shows annualized quarterly GDP changes).

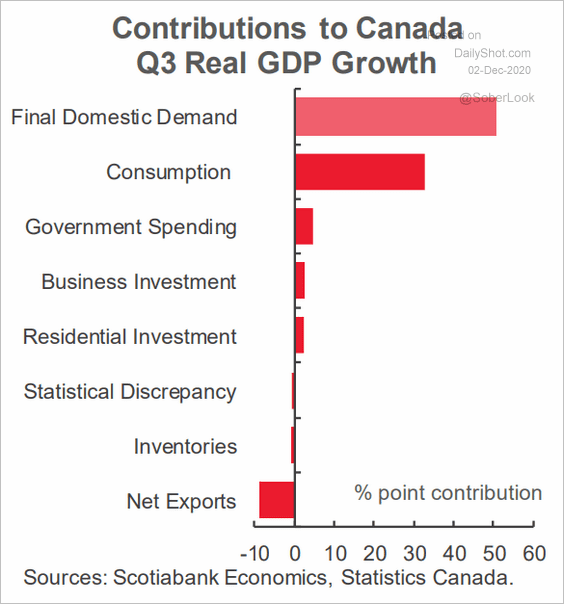

Here are the contributions.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

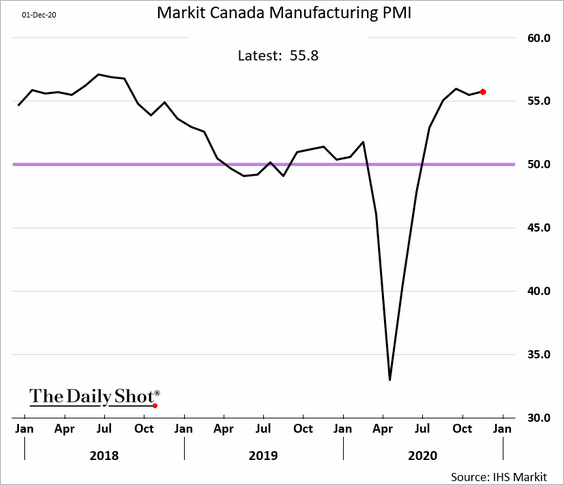

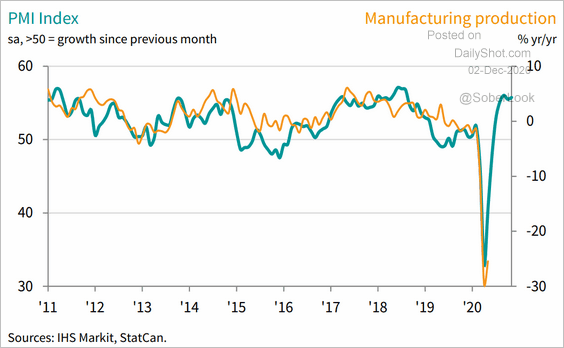

2. The Markit PMI report showed stable manufacturing growth last month.

We should see a sharp rebound in industrial production.

Source: IHS Markit

Source: IHS Markit

The United Kingdom

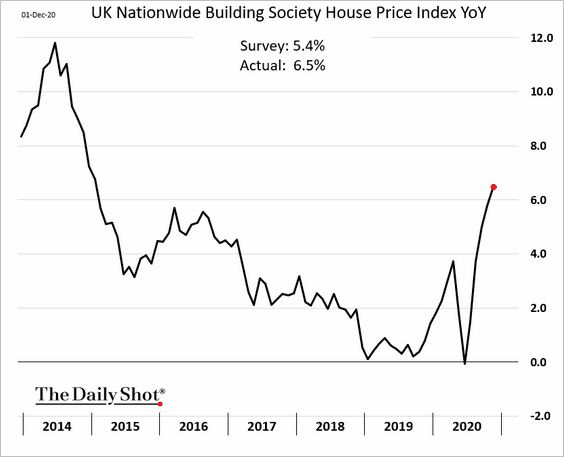

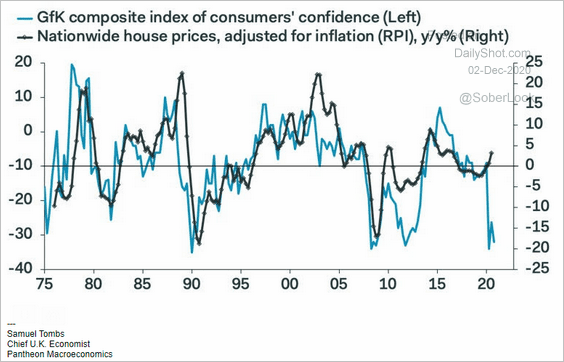

1. Home price gains have been accelerating, with the latest report exceeding forecasts.

But soft consumer confidence could pressure the housing market.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

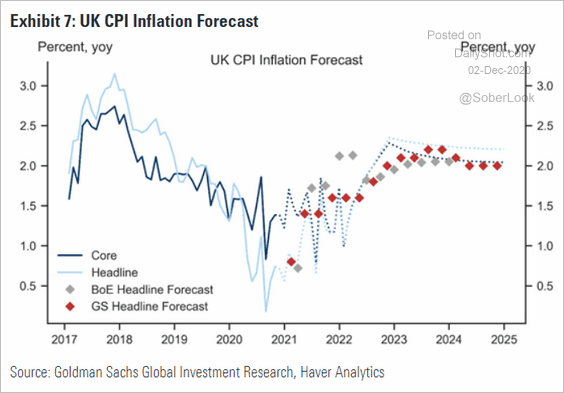

2. Below is Goldman’s forecast for the UK CPI.

Source: Goldman Sachs

Source: Goldman Sachs

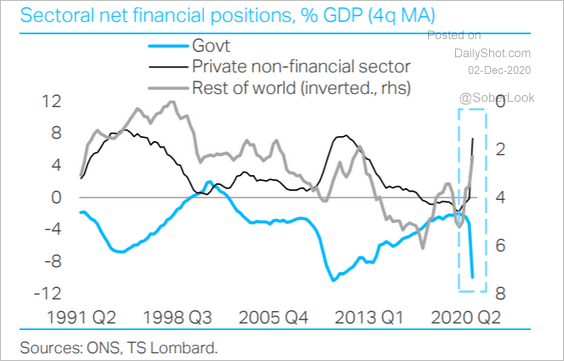

3. Here is how the pandemic changed the sectoral financial positions (see overview).

Source: TS Lombard

Source: TS Lombard

The Eurozone

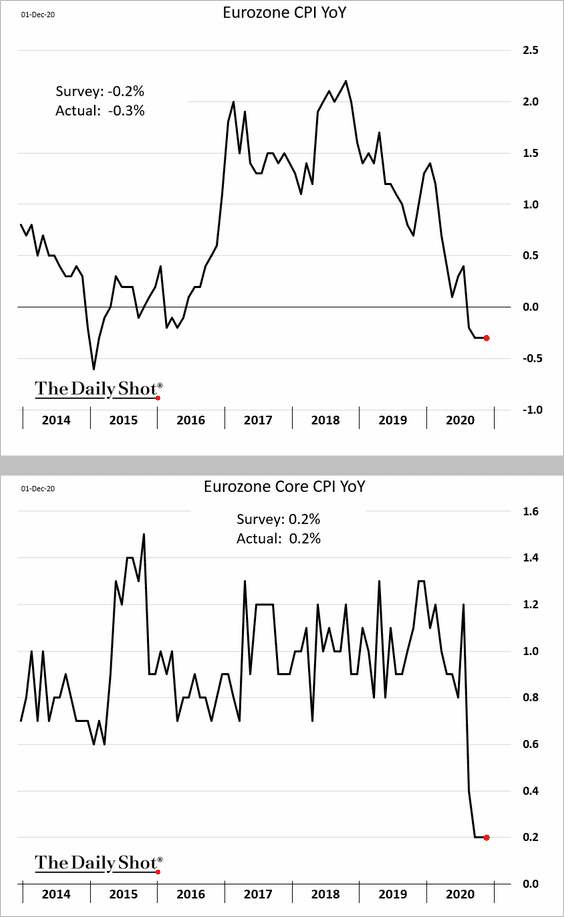

1. There was no uptick in the November CPI, as some had expected.

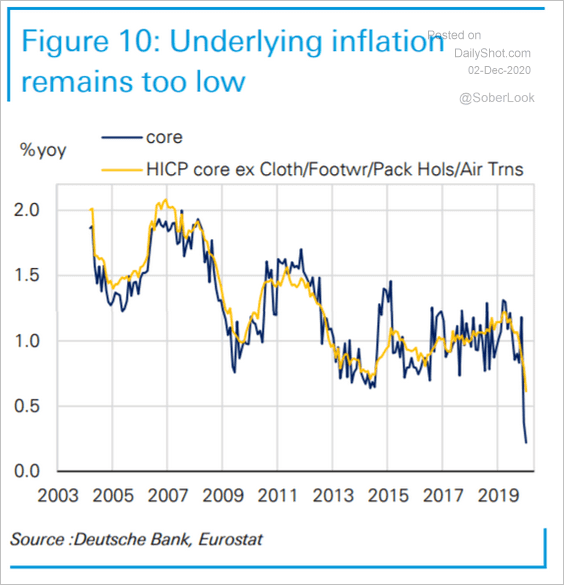

The “underlying” inflation has also been soft.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

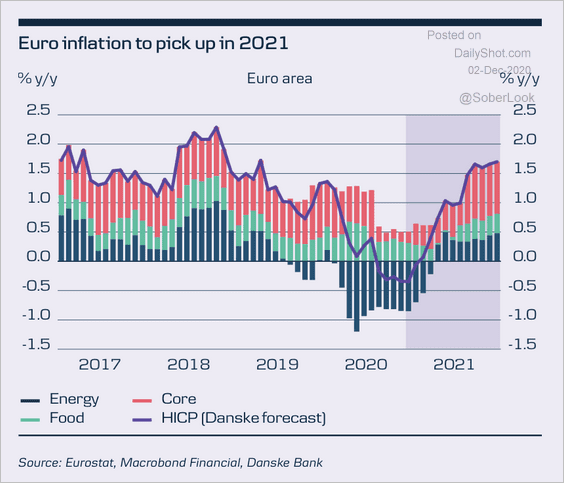

But Danske Bank expects euro area inflation to pick up next year.

Source: Danske Bank

Source: Danske Bank

——————–

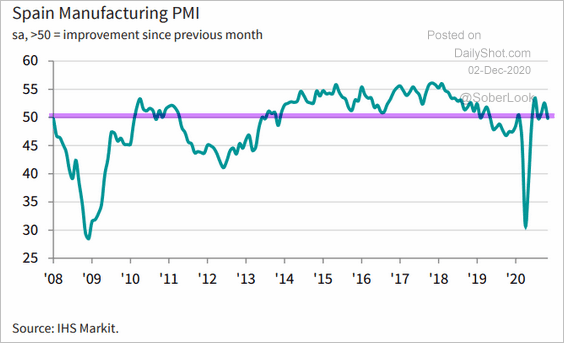

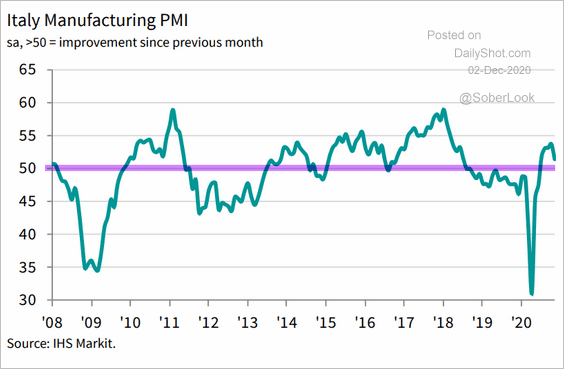

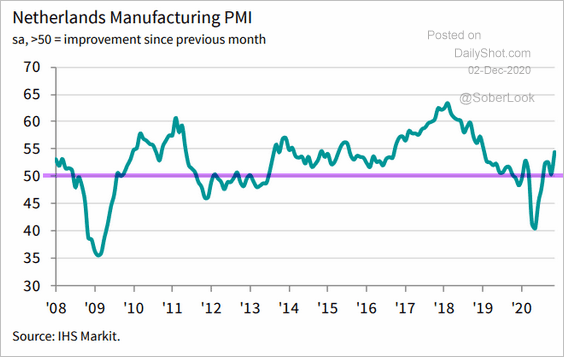

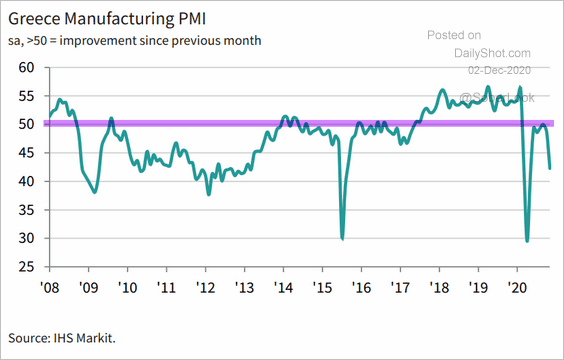

2. Here are some of the manufacturing indices that weren’t in the flash PMI report.

• Spain (treading water):

Source: IHS Markit

Source: IHS Markit

• Italy (slower growth):

Source: IHS Markit

Source: IHS Markit

• The Netherlands (accelerating growth):

Source: IHS Markit

Source: IHS Markit

• Greece (back in contraction):

Source: IHS Markit

Source: IHS Markit

——————–

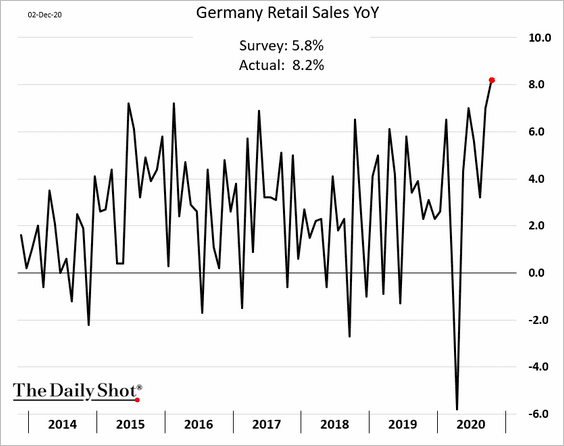

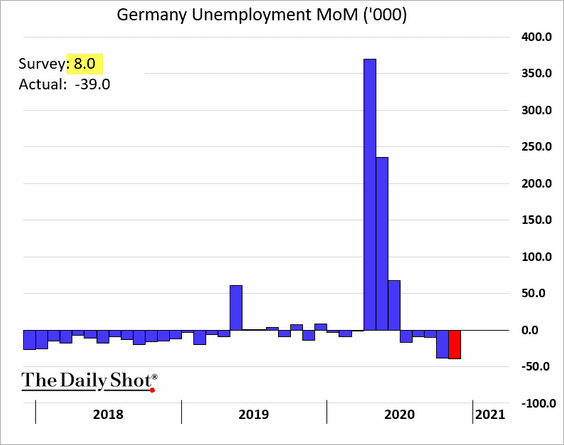

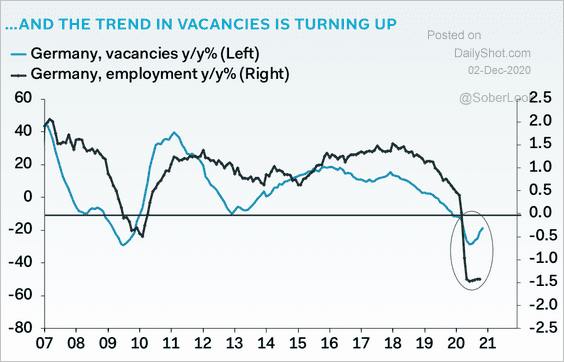

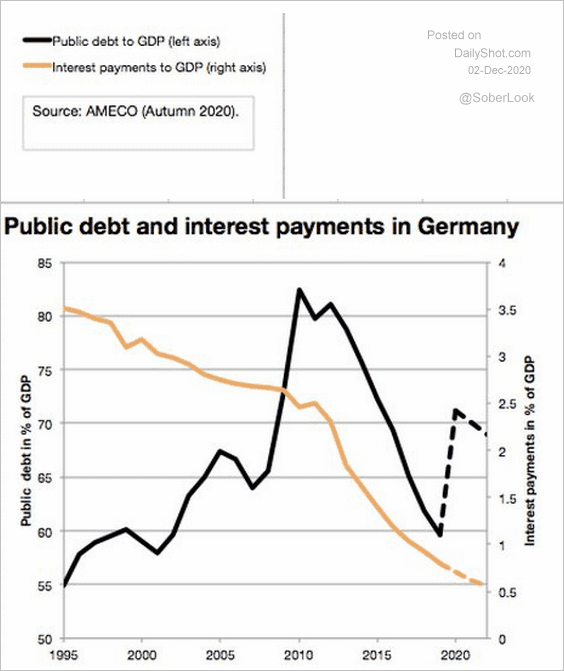

3. Next, we have some updates on Germany.

• The October retail sales report surprised to the upside.

• The labor market continues to strengthen.

• Job vacancies are turning higher.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Projected government debt and interest expenses:

Source: @heimbergecon

Source: @heimbergecon

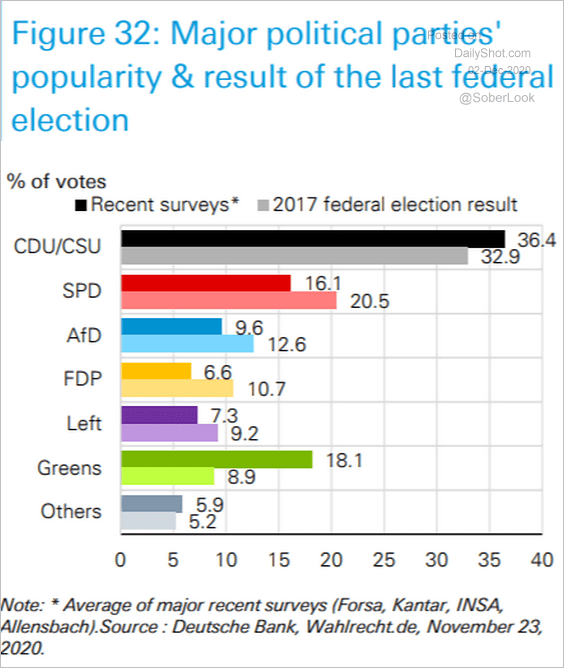

• The latest political polls:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

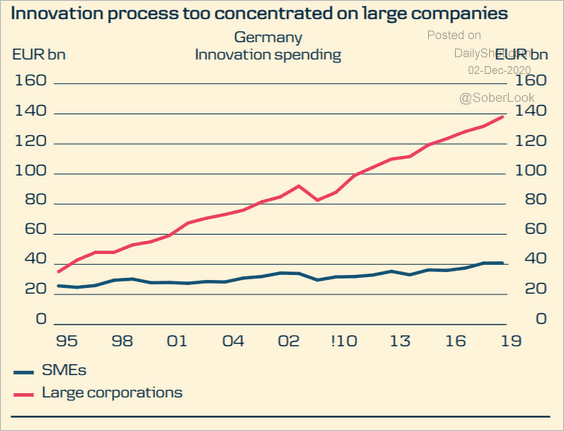

• Germany’s concentrated innovation process:

Source: Danske Bank

Source: Danske Bank

——————–

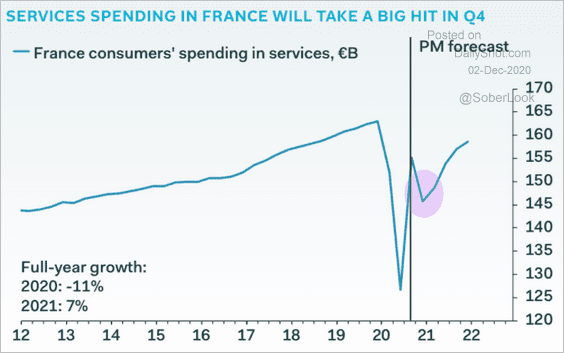

4. French consumer spending in services is under pressure.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

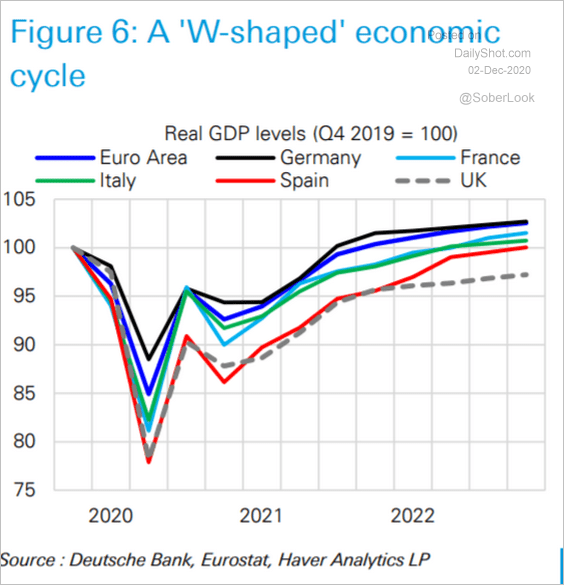

5. It’s a “W-shaped” economic cycle.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

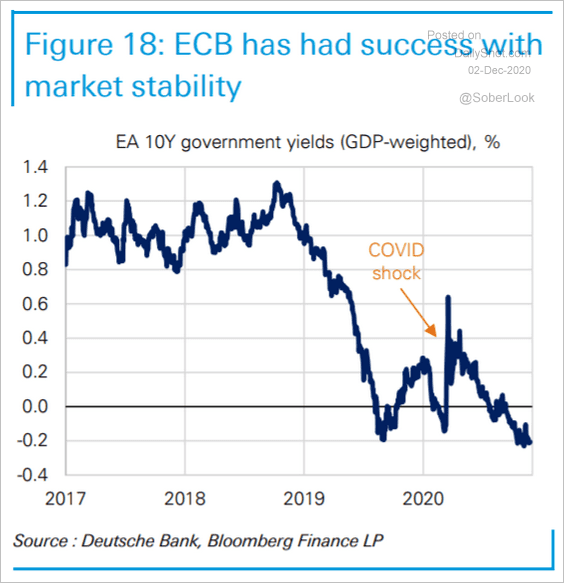

6. Eurozone bond yields remain near record lows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

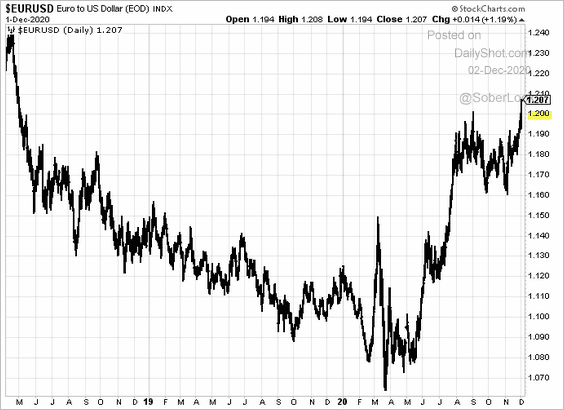

7. The euro broke above 1.20.

Europe

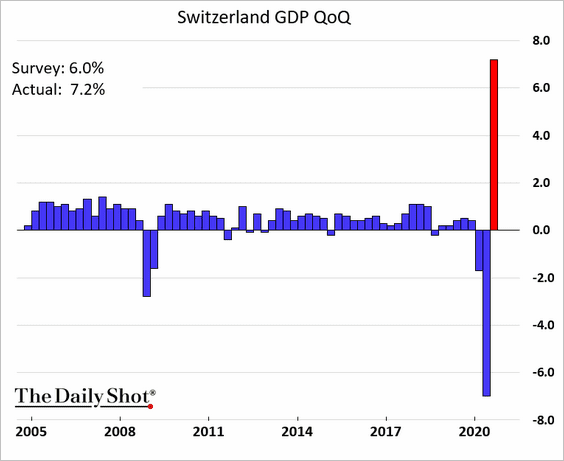

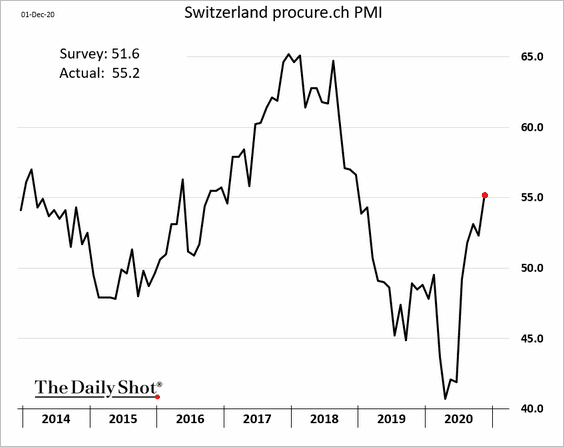

Let’s begin with Switzerland.

• The GDP rebound was firmer than expected.

• Manufacturing activity is picking up momentum.

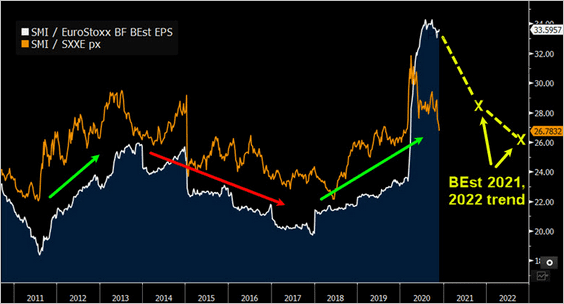

• Swiss equities have been underperforming. A growing focus on cyclicals could look past the SMI’s safe-haven status.

Source: @timcraighead

Source: @timcraighead

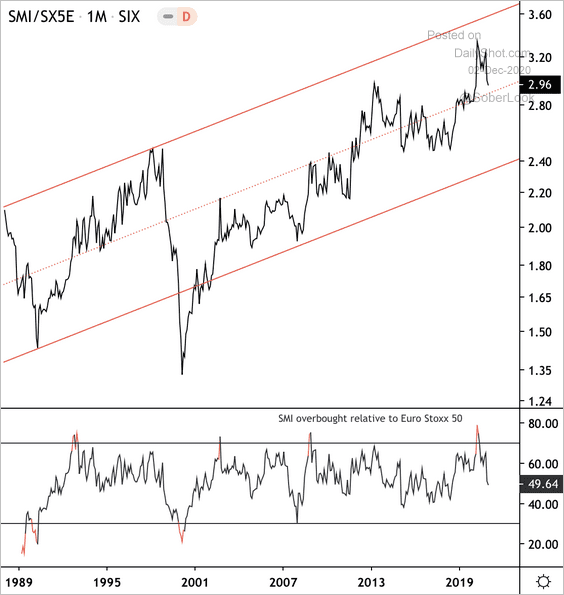

Here is a long-term chart showing SMI overbought relative to the Euro Stoxx 50 Index.

Source: @dsassower, @DantesOutlook

Source: @dsassower, @DantesOutlook

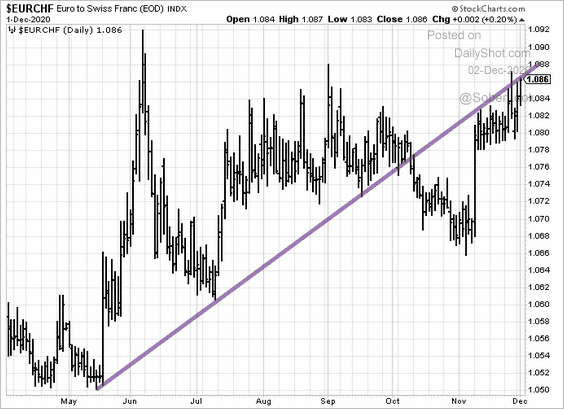

• EUR/CHF is at resistance.

——————–

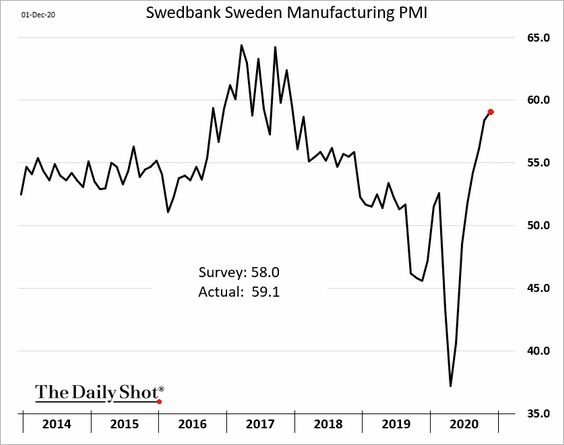

2. Below are some manufacturing PMI trends.

• Sweden (very strong):

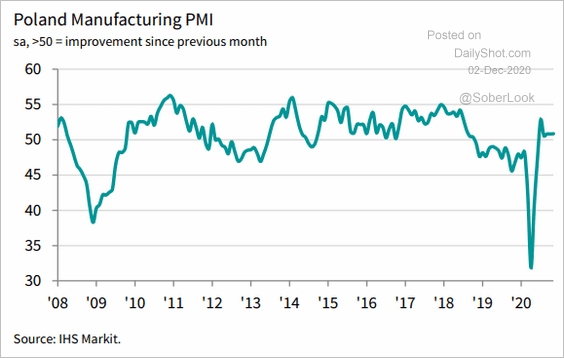

• Poland (treading water):

Source: IHS Markit

Source: IHS Markit

• The Czech Republic (gaining momentum):

Source: IHS Markit

Source: IHS Markit

——————–

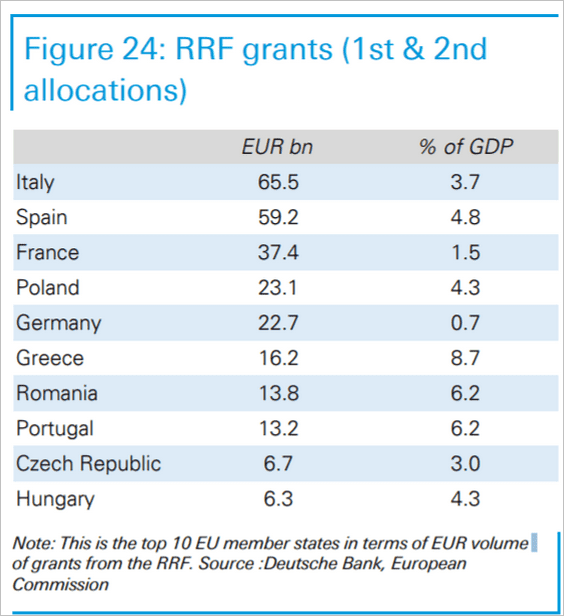

3. Here is a look at the RRF grants (Next Generation EU stimulus package).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Asia – Pacific

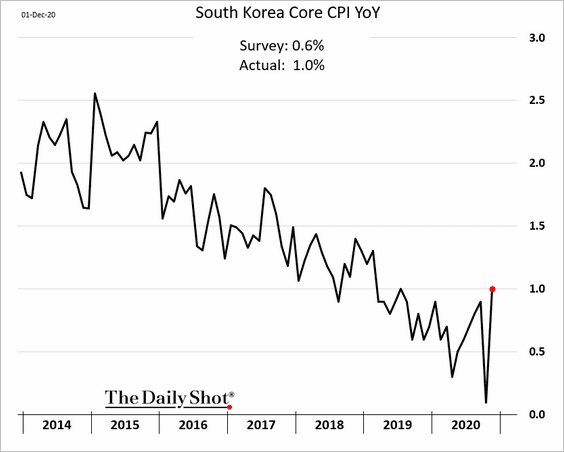

1. South Korea’s CPI bounced from the lows as the impact of the government’s mobile phone bill subsidies wanes.

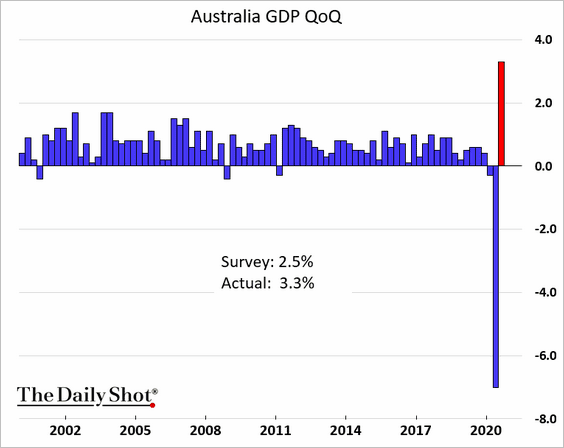

2. Australia’s GDP bounced more than expected last quarter as the nation pulls out of its first recession in decades.

China

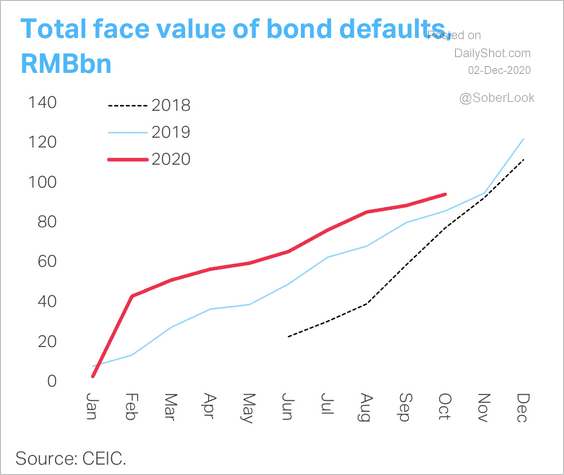

1. Increased defaults will lead to tighter liquidity for non-bank financial institutions, according to TS Lombard.

Source: TS Lombard

Source: TS Lombard

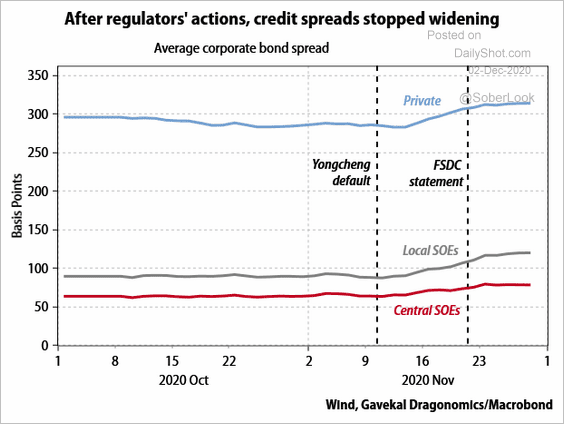

For now, Beijing has stabilized the situation, with spreads no longer climbing.

Source: Gavekal

Source: Gavekal

——————–

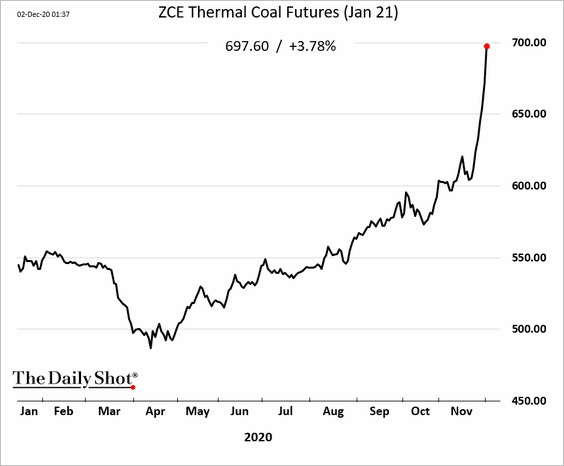

2. China’s coal prices spiked as the dispute with Australia dampens imports.

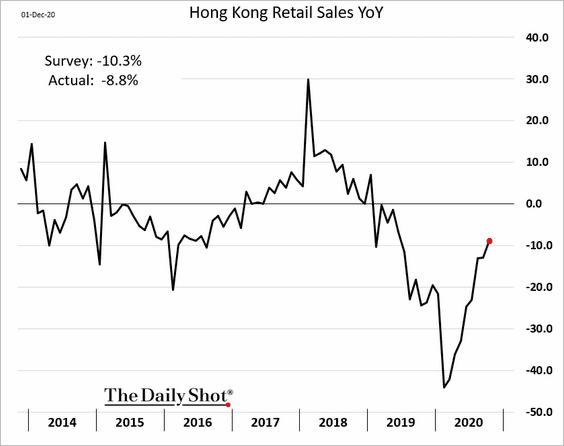

3. Hong Kong’s retail sales are rebounding.

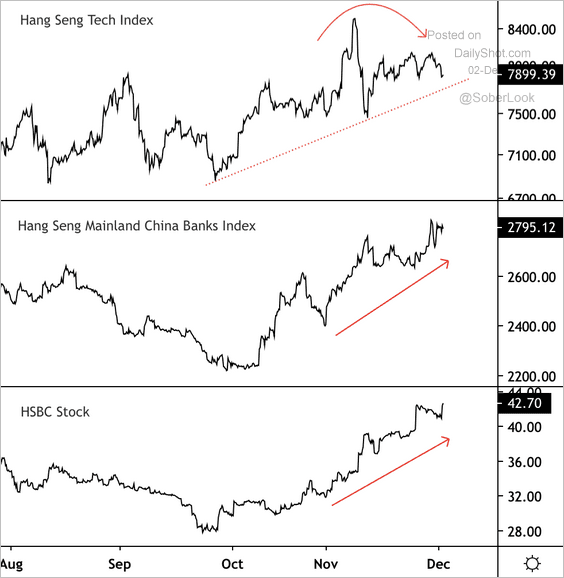

4. Hong Kong tech stocks have lagged banking stocks over the past few months.

Source: @DantesOutlook

Source: @DantesOutlook

Emerging Markets

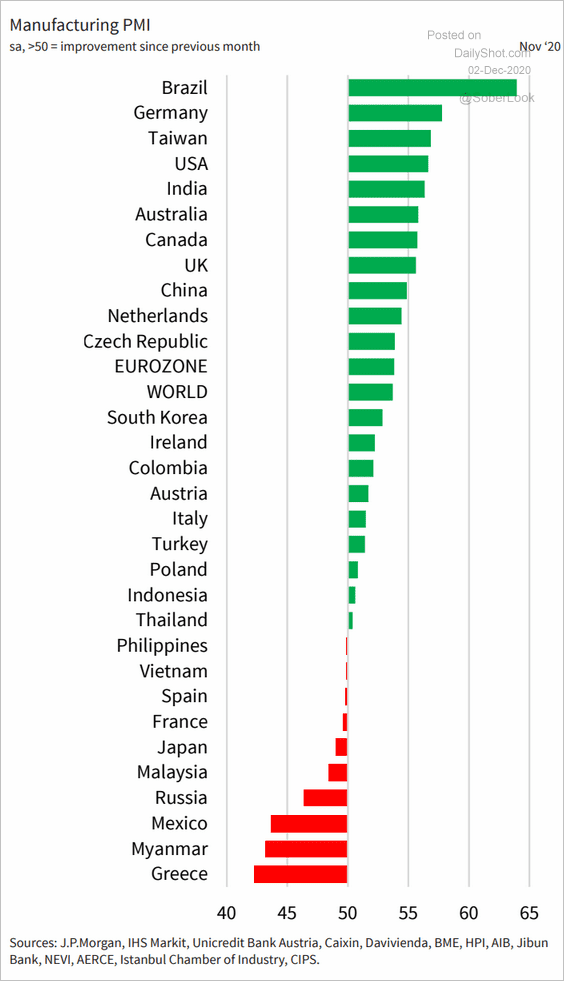

1. Let’s start with the November manufacturing PMI rundown.

• Russia (worsening contraction):

Source: IHS Markit

Source: IHS Markit

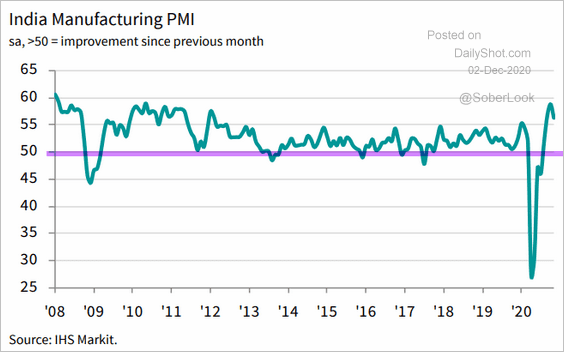

• India (very strong):

Source: IHS Markit

Source: IHS Markit

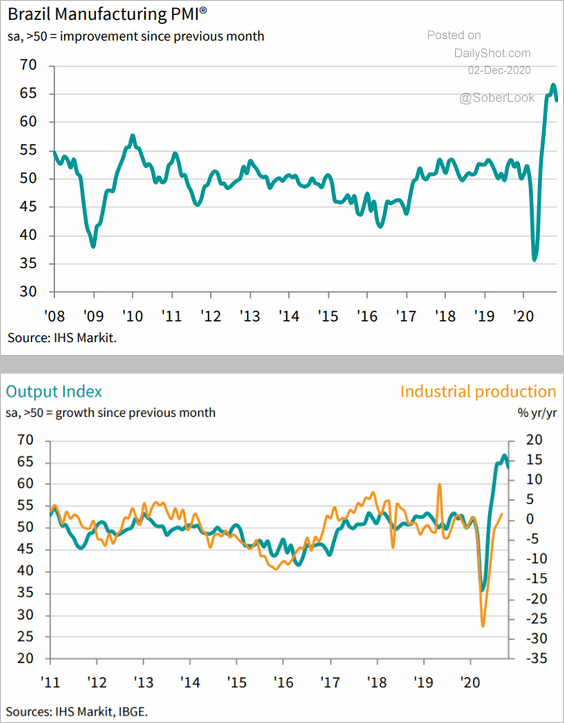

• Brazil (rapid expansion):

Source: IHS Markit

Source: IHS Markit

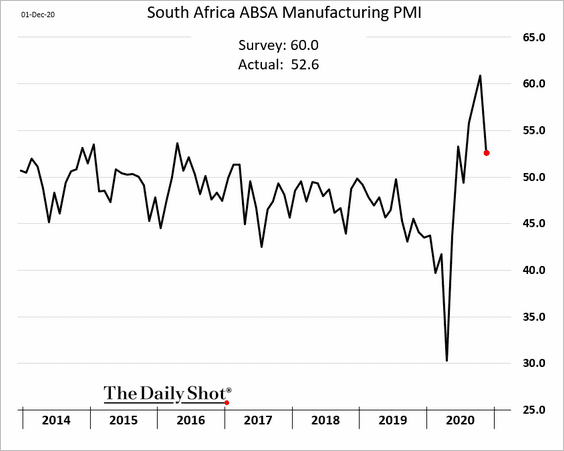

• South Africa (loss of momentum):

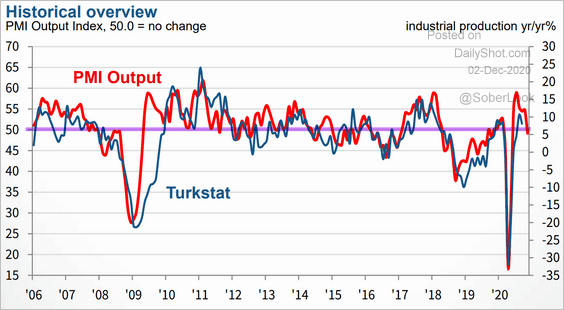

• Turkey (stalling):

Source: IHS Markit

Source: IHS Markit

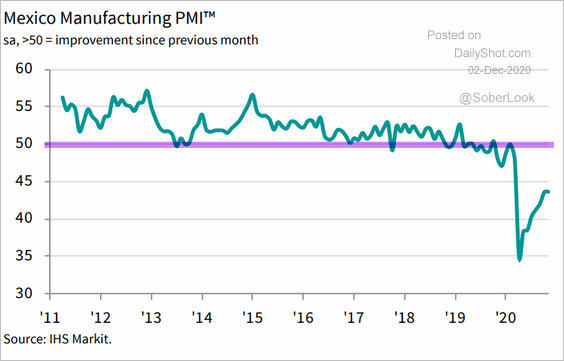

• Mexico (extreme weakness):

Source: IHS Markit

Source: IHS Markit

——————–

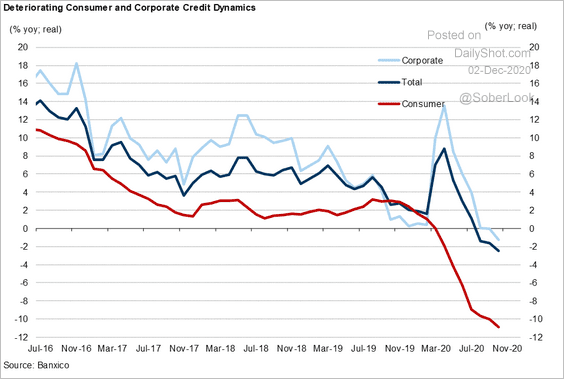

2. Mexico’s private credit continues to worsen.

Source: Goldman Sachs

Source: Goldman Sachs

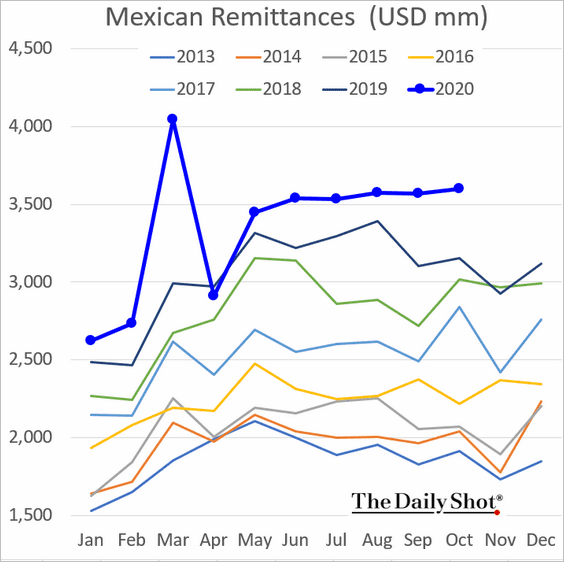

Separately, remittances remain robust.

——————–

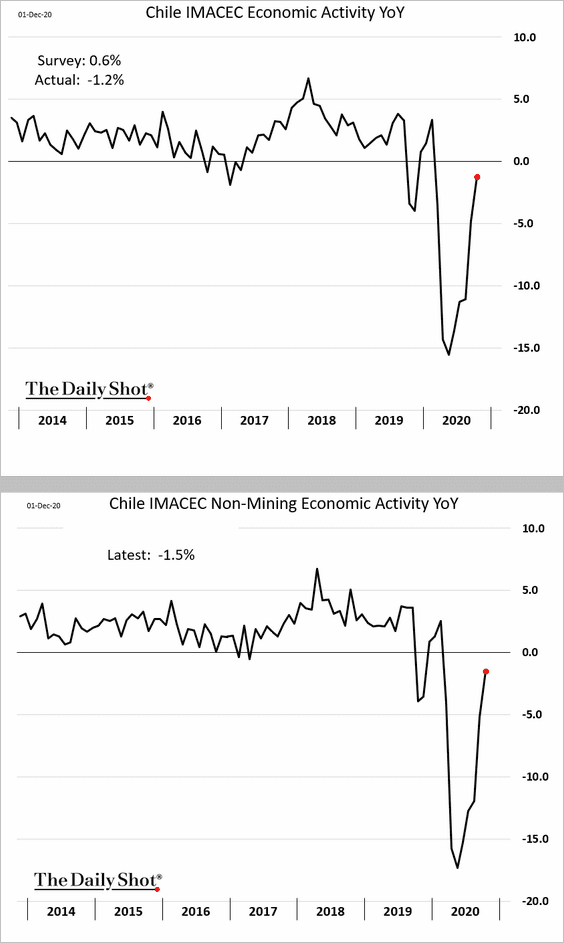

3. Chile’s economic activity rebounded slower than expected in October.

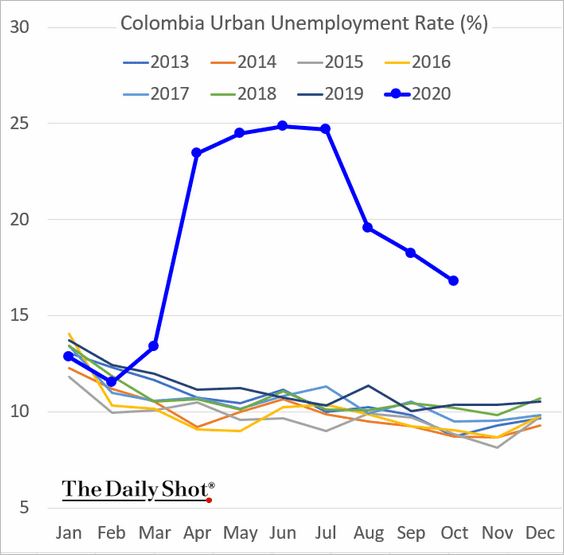

4. Colombia’s unemployment rate is moderating (but is still massive).

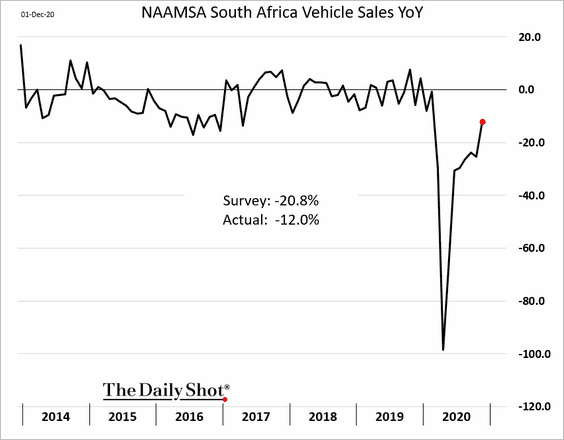

5. South Africa’s car sales are rebounding.

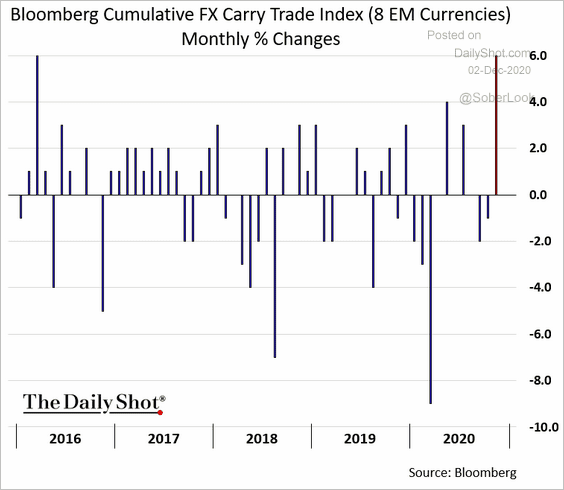

6. November was a good month for FX carry trades.

h/t @liviayap11

h/t @liviayap11

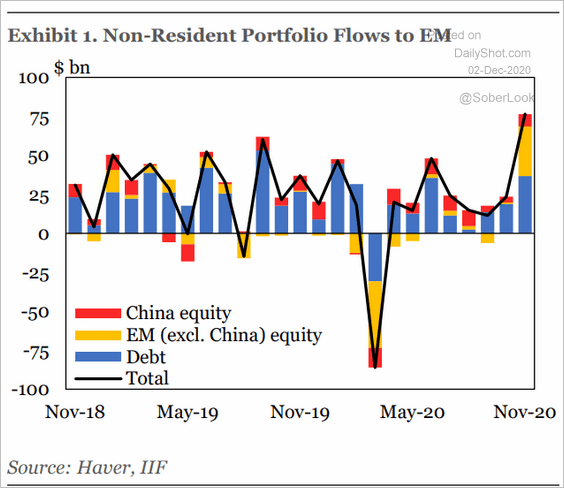

7. Portfolio inflows hit a multi-year high.

Source: IIF

Source: IIF

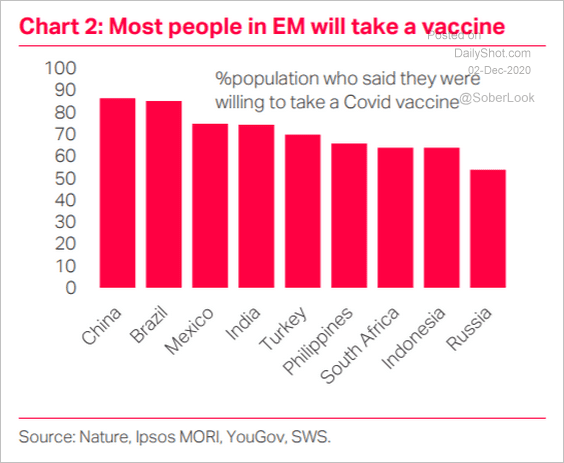

8. The population in EM countries is receptive to a COVID vaccine.

Source: TS Lombard

Source: TS Lombard

Cryptocurrency

Bitcoin held resistance at $20k.

Commodities

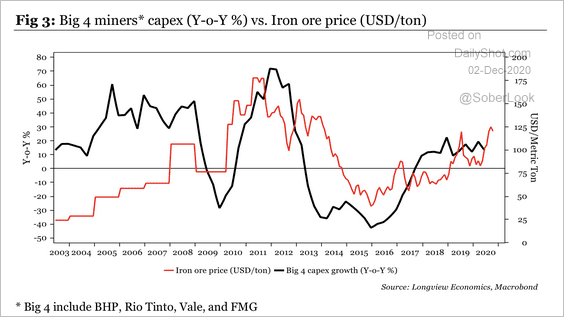

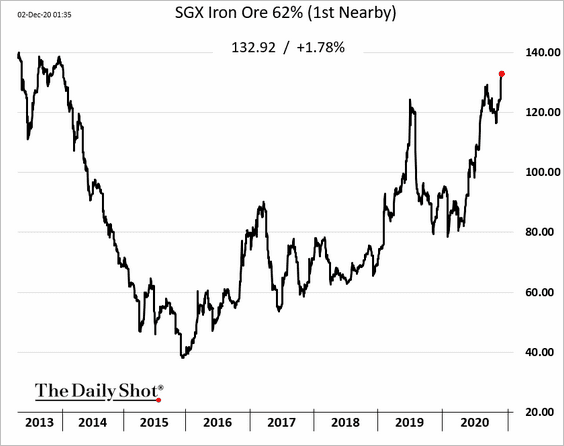

1. Miners are adding new projects as iron ore prices rise.

Source: Longview Economics

Source: Longview Economics

——————–

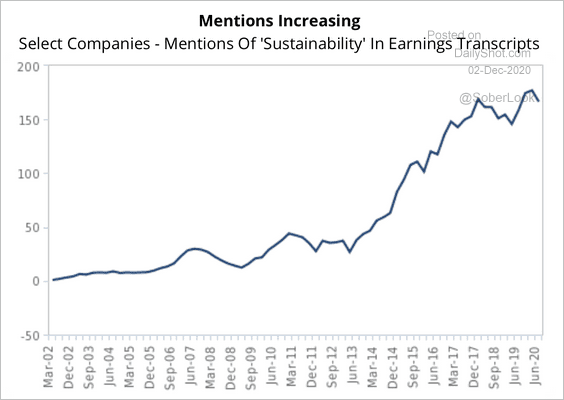

2. Agricultural companies are increasingly mentioning sustainability in earnings transcripts.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

3. Rhodium price gains have been impressive.

Source: @WSJ Read full article

Source: @WSJ Read full article

Energy

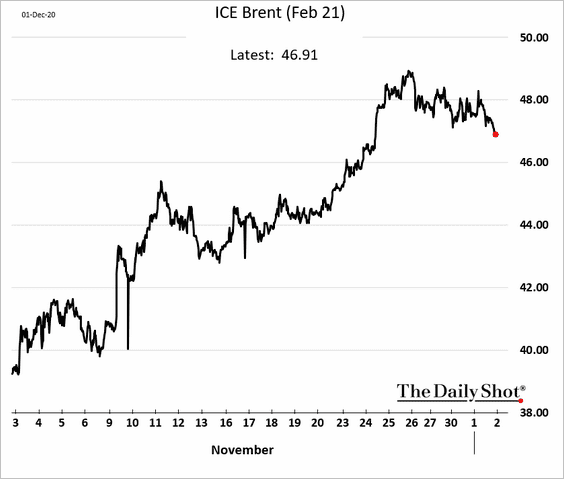

1. Brent crude dipped below $47/bbl on OPEC+ uncertainty.

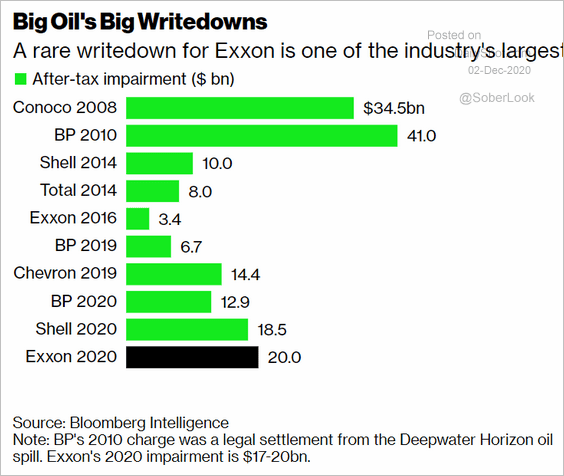

2. Here are some of the largest oil company writedowns.

Source: @business Read full article

Source: @business Read full article

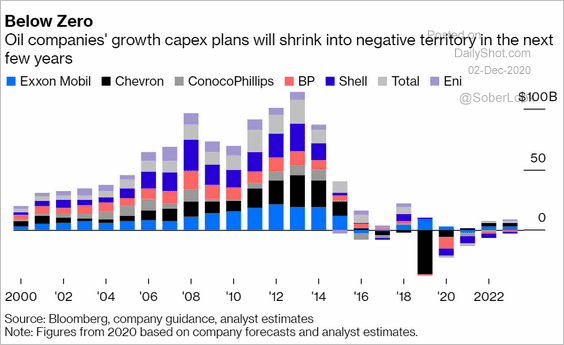

3. CapEx will remain soft.

Source: @davidfickling, @bopinion Read full article

Source: @davidfickling, @bopinion Read full article

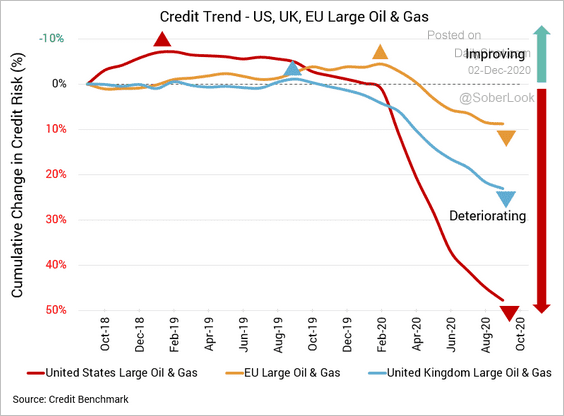

4. The US energy sector’s default risk is much higher than in the UK and EU.

Source: Credit Benchmark Read full article

Source: Credit Benchmark Read full article

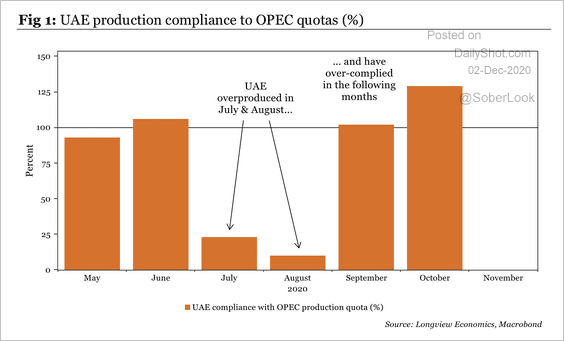

5. The UAE has over-complied with OPEC quotas since September.

Source: Longview Economics

Source: Longview Economics

Will the UAE leave OPEC?

Source: Arab News

Source: Arab News

——————–

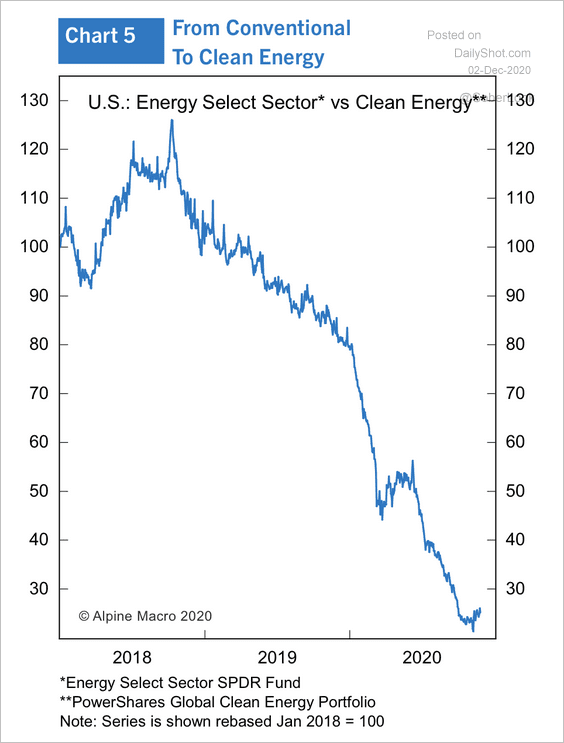

6. Traditional energy stocks have massively underperformed clean energy stocks over the past two years.

Source: Alpine Macro

Source: Alpine Macro

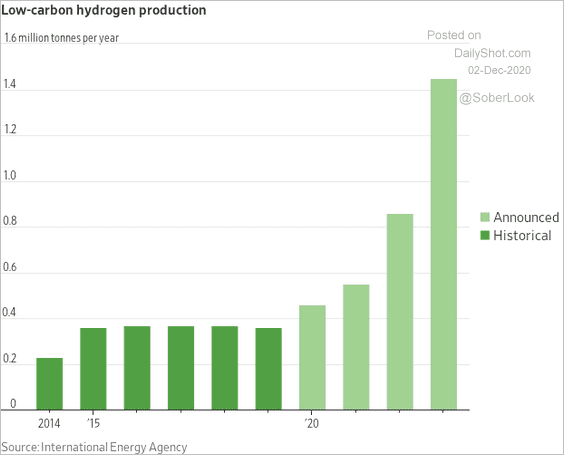

7. Demand for hydrogen has picked up.

Source: @WSJ Read full article

Source: @WSJ Read full article

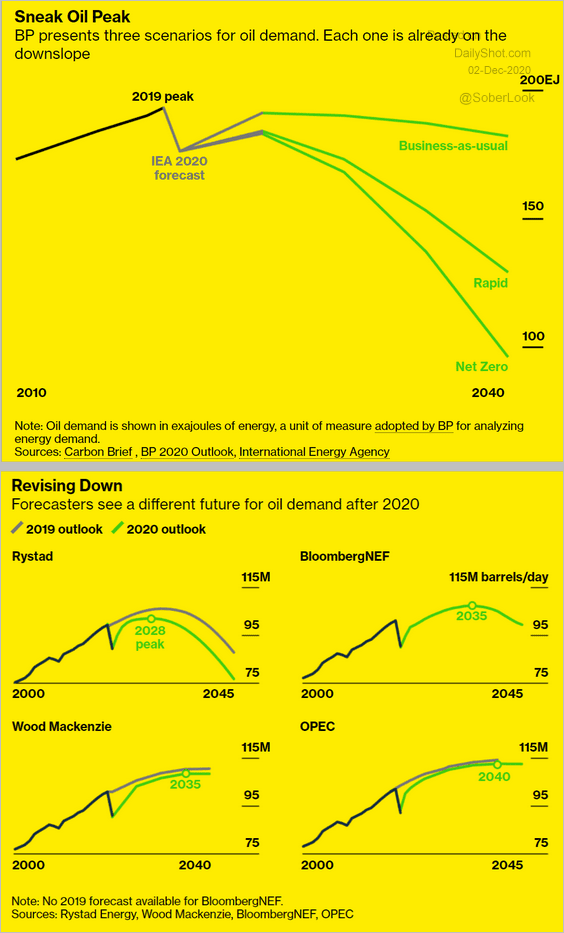

8. Peak oil?

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

Equities

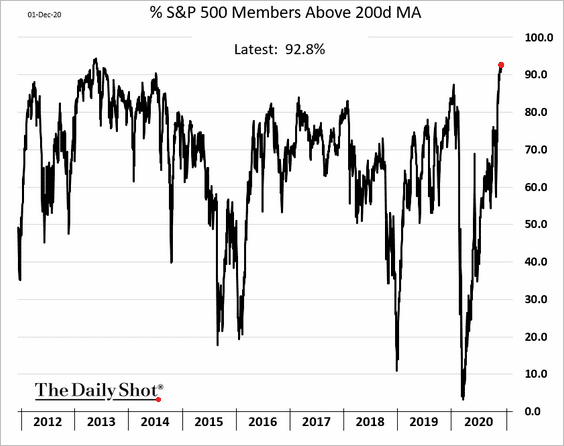

1. Almost 93% of S&P 500 members are above their 200-day moving average.

2. Short sellers have been punished. Here is Goldman’s index of the most heavily shorted stocks.

Source: @LizAnnSonders, @GoldmanSachs, @Bloomberg

Source: @LizAnnSonders, @GoldmanSachs, @Bloomberg

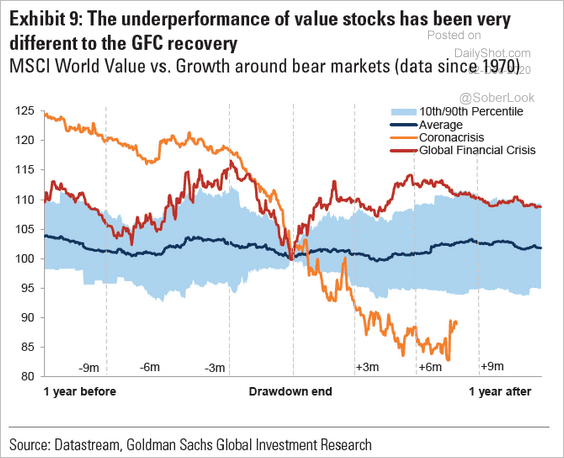

3. The value vs. growth trajectory has been quite different from what we saw in 2008.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

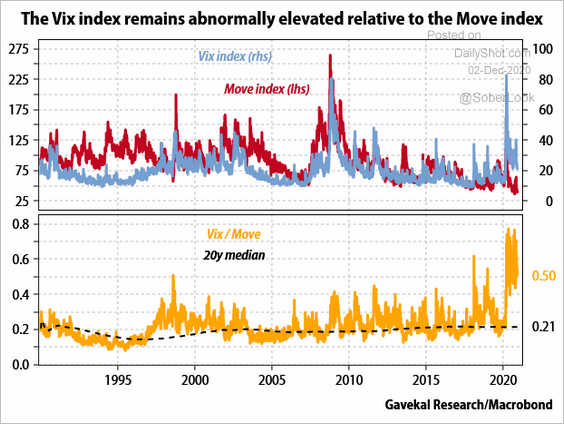

4. VIX remains elevated vs. the equivalent measure in the Treasury market (MOVE).

Source: Gavekal

Source: Gavekal

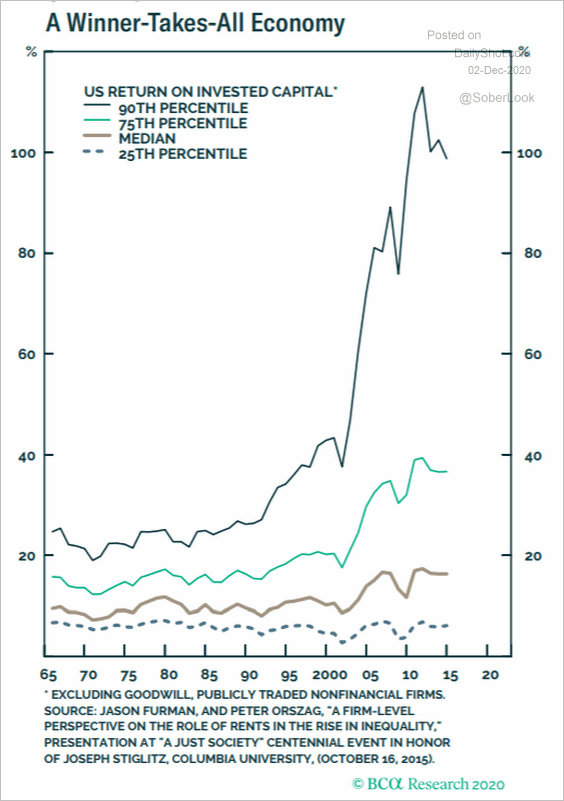

5. The largest companies have the best returns on capital.

Source: BCA Research

Source: BCA Research

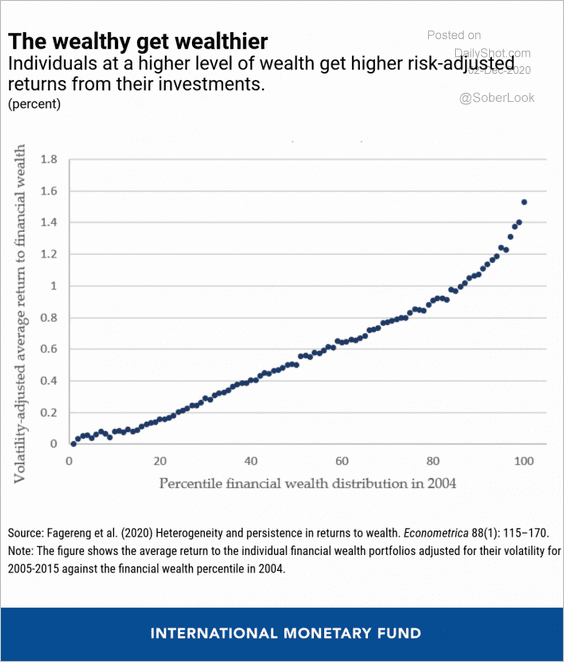

6. Wealthier investors get the best risk-adjusted returns.

Source: IMF

Source: IMF

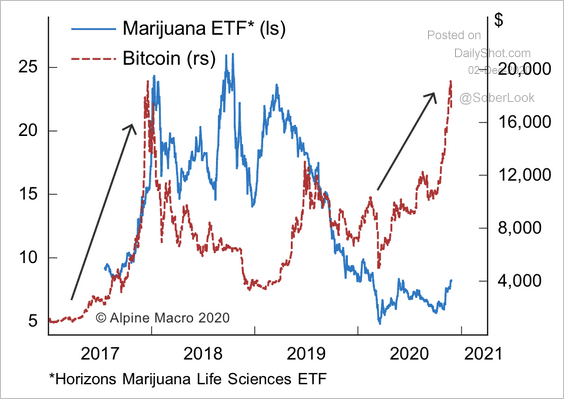

7. Will marijuana stocks follow the rally in bitcoin?

Source: Alpine Macro

Source: Alpine Macro

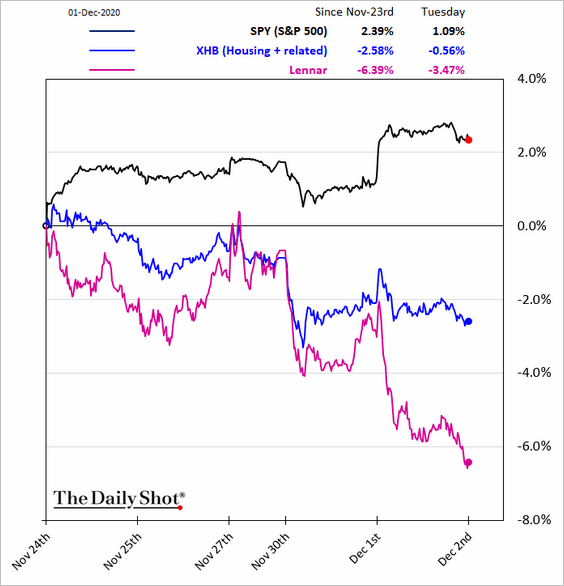

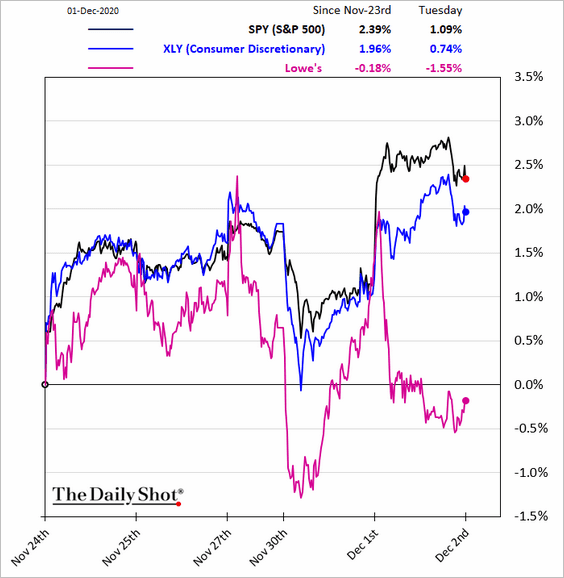

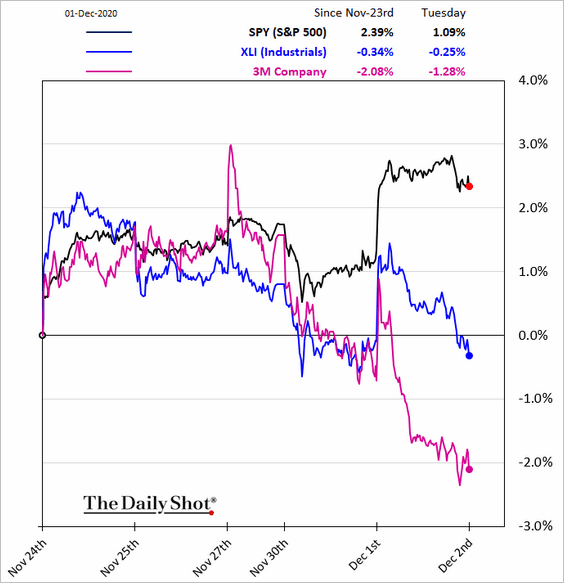

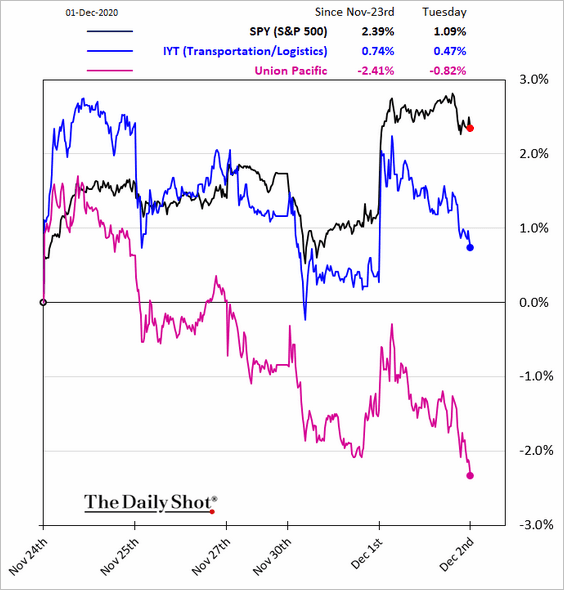

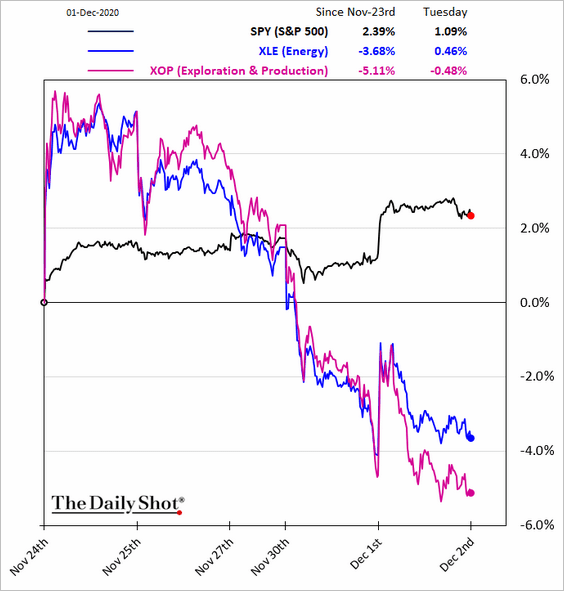

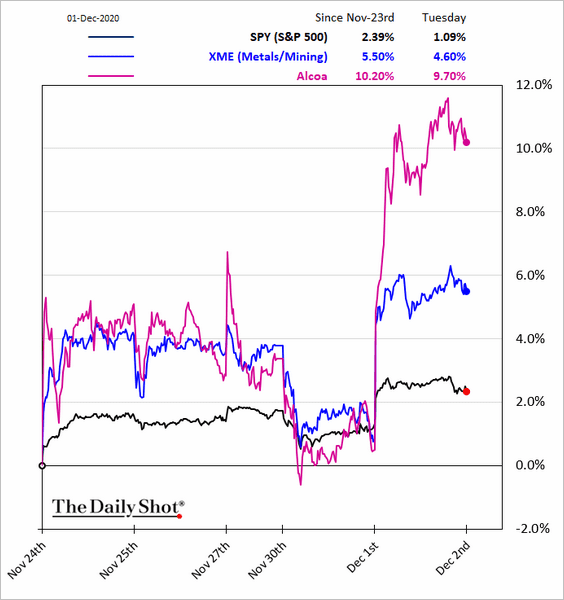

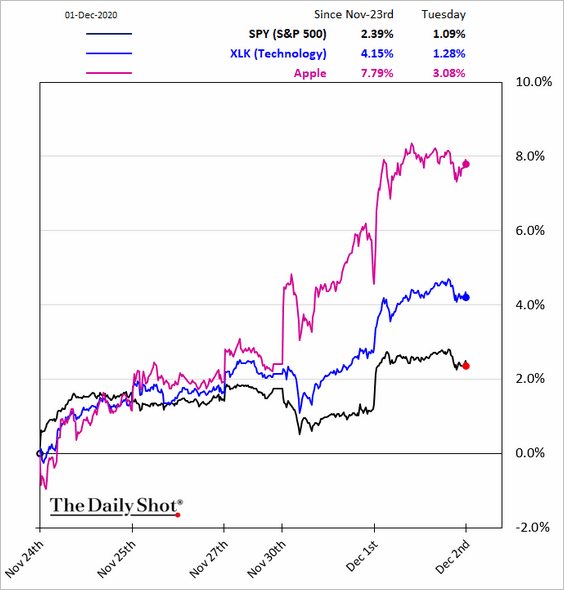

8. Here are some sector performance updates (last five business days).

• Housing:

• Consumer Discretionary:

• Industrials:

• Transportation:

• Energy:

• Metals & Mining (see the commodities section):

• Tech:

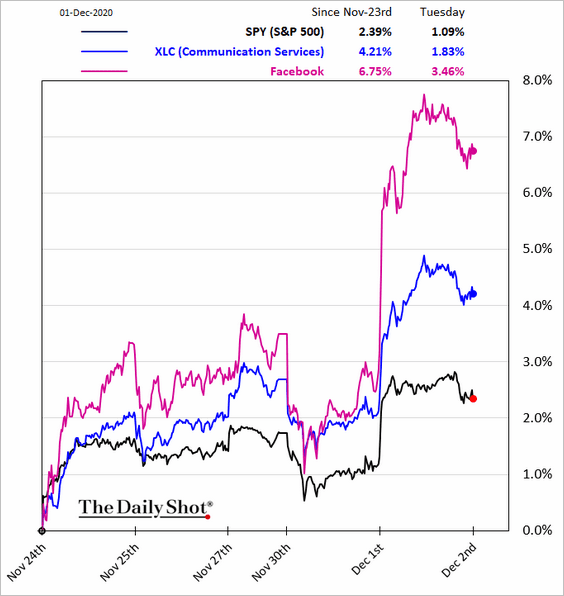

• Communication Services:

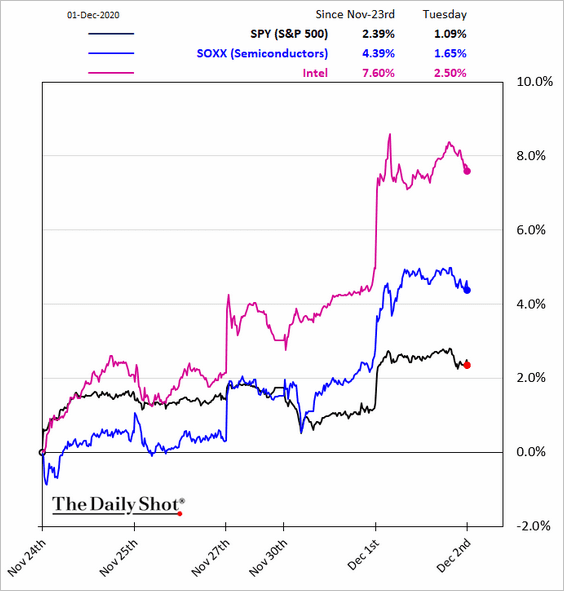

• Semiconductors:

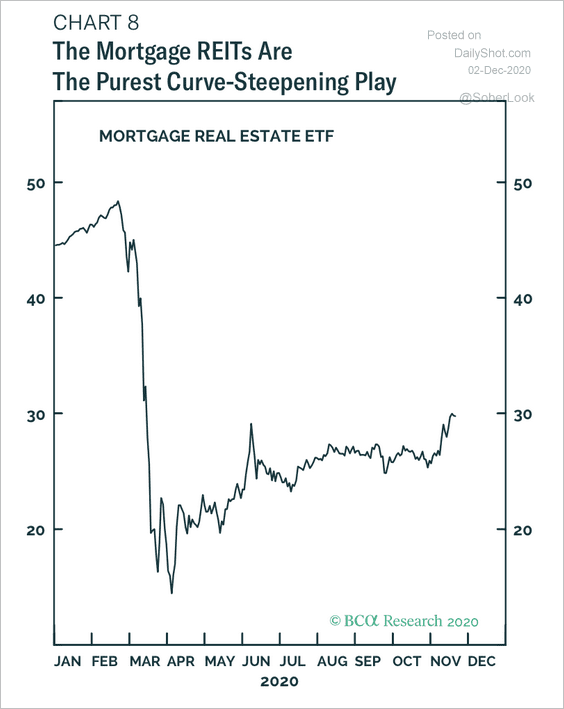

• US mortgage REITs are gradually recovering from March lows. The sector benefits from a steeper yield curve, according to BCA Research.

Source: BCA Research

Source: BCA Research

Credit

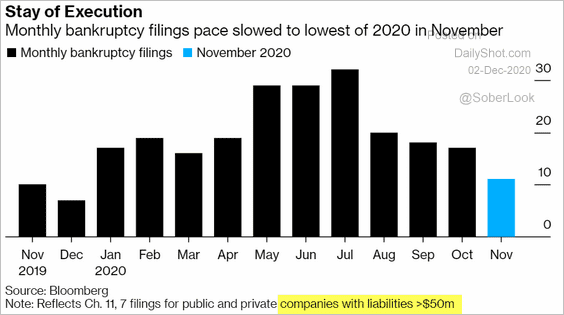

1. Bankruptcy filings slowed again.

Source: @markets Read full article

Source: @markets Read full article

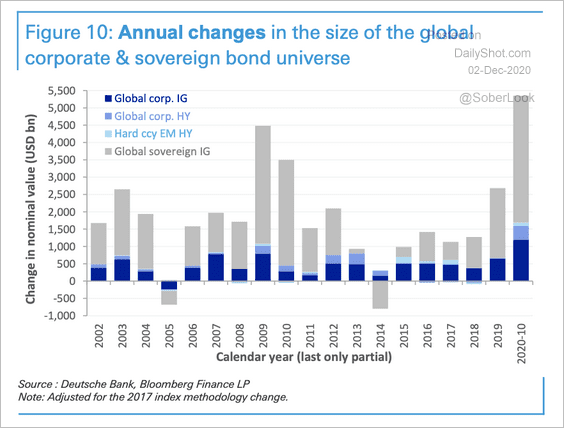

2. Record global supply of credit has meaningfully expanded the global fixed income market this year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

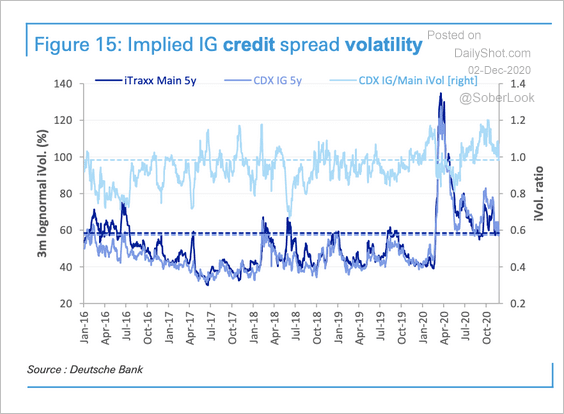

3. Volatility remains elevated in investment-grade credit.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

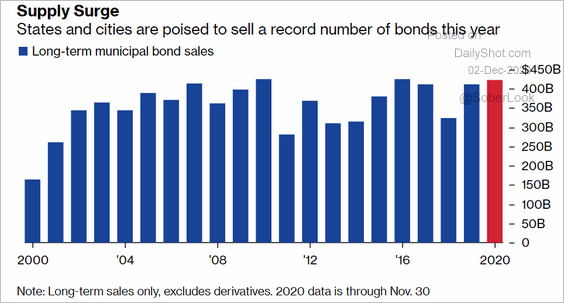

4. Muni bond sales have been robust.

Source: @markets Read full article

Source: @markets Read full article

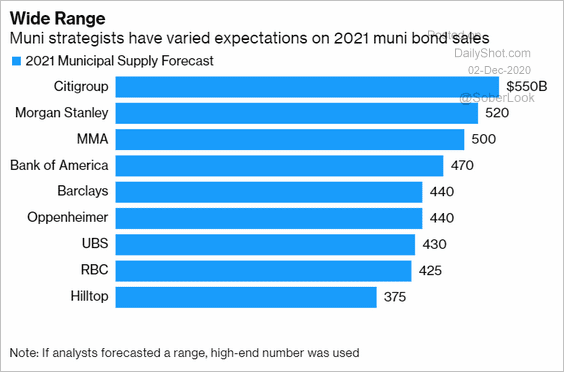

Below are some forecasts for next year.

Source: @markets Read full article

Source: @markets Read full article

Rates

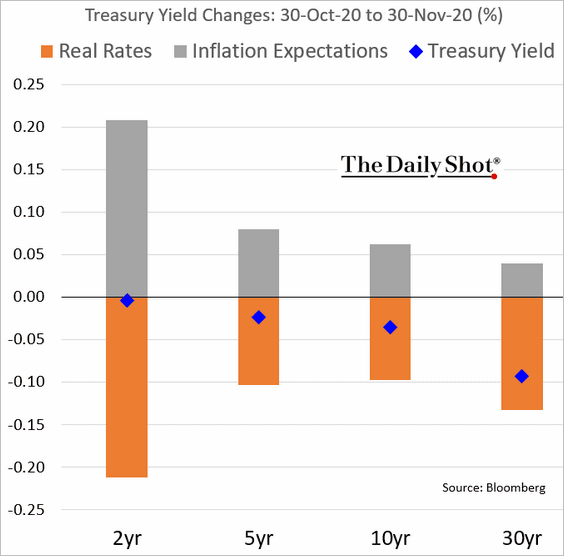

1. Here is the attribution of Treasury yield changes last month.

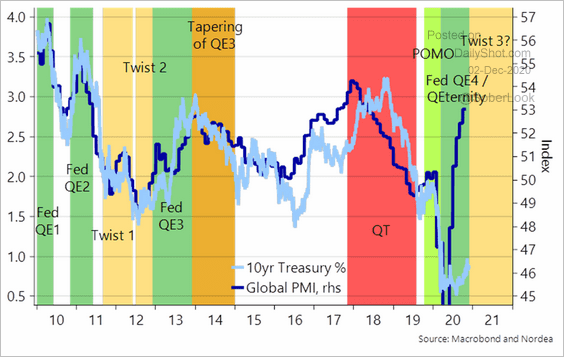

2. The 10yr Treasury yield continues to grind higher.

And PMI indicators suggest that the trend should continue.

Source: Nordea Markets

Source: Nordea Markets

——————–

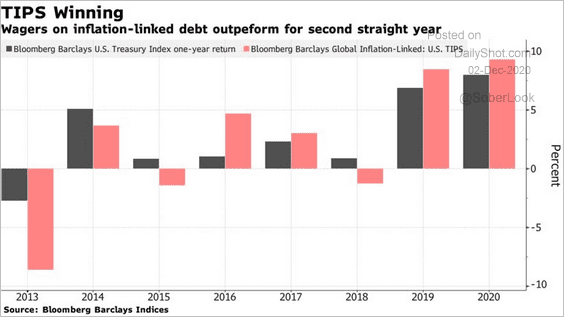

3. TIPS are outperforming regular Treasuries again.

Source: @business Read full article

Source: @business Read full article

Global Developments

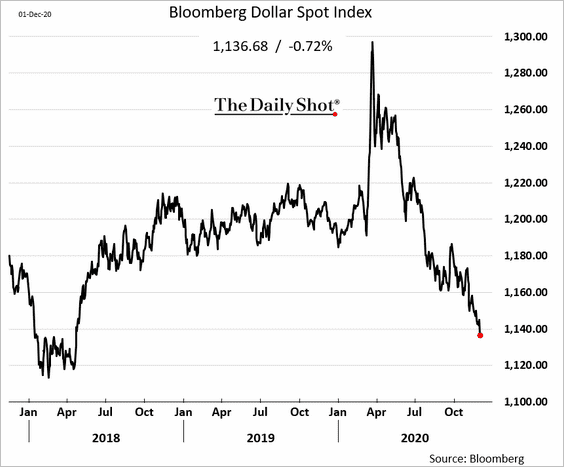

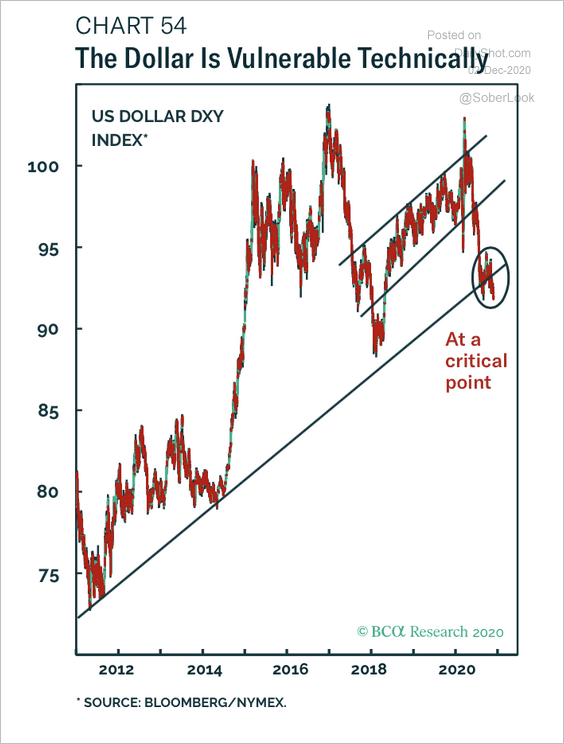

1. The US dollar decline has accelerated, …

… as the greenback broke its long-term uptrend.

Source: BCA Research

Source: BCA Research

——————–

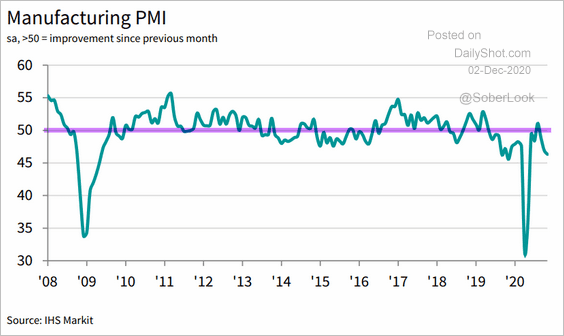

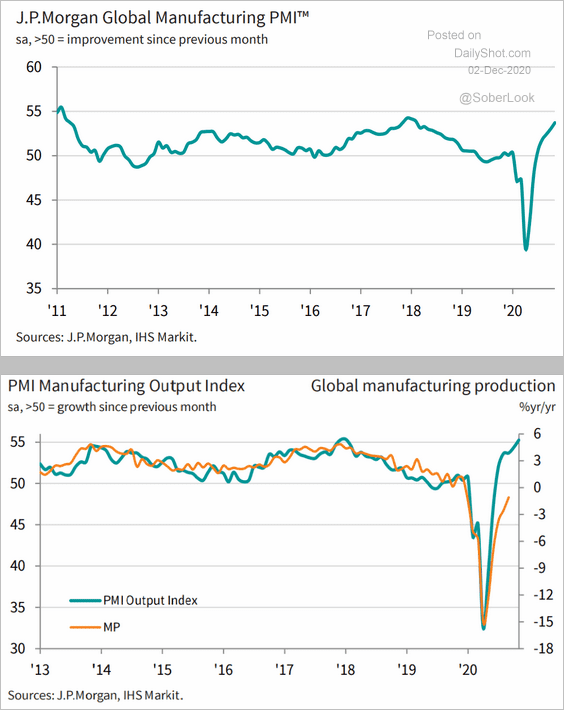

2. Here is a look at the manufacturing PMI report, which bodes well for global industrial production.

Source: IHS Markit

Source: IHS Markit

Source: IHS Markit

Source: IHS Markit

——————–

Food for Thought

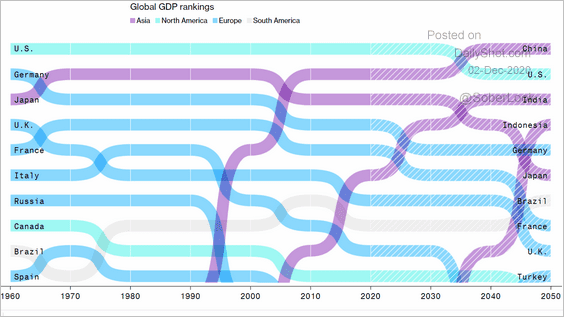

1. Global GDP rankings (projection):

Source: @bw Read full article

Source: @bw Read full article

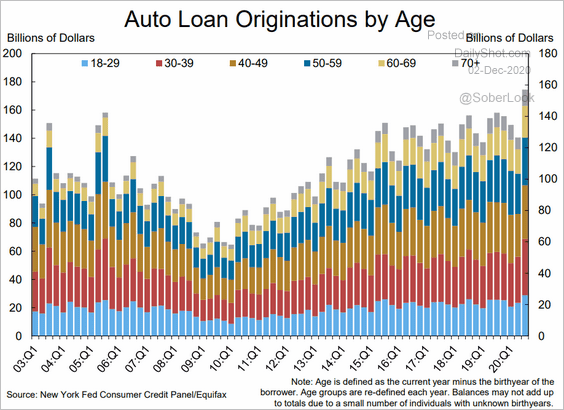

2. US car loan originations by age:

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

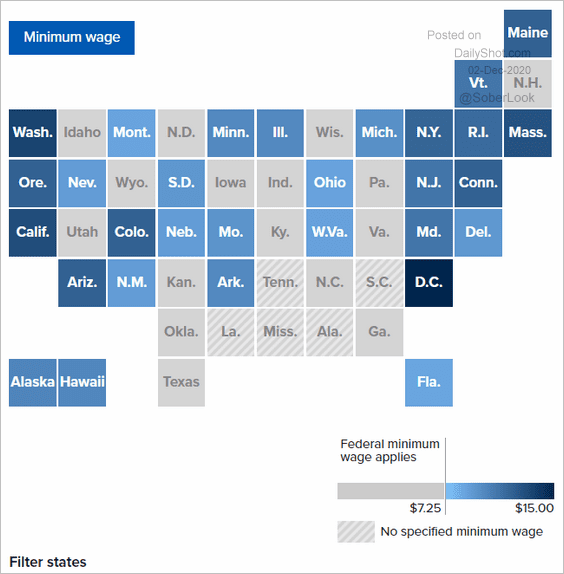

3. US minimum wage map:

Source: Economic Policy Institute, h/t Hightower Las Vegas, RCG Economics

Source: Economic Policy Institute, h/t Hightower Las Vegas, RCG Economics

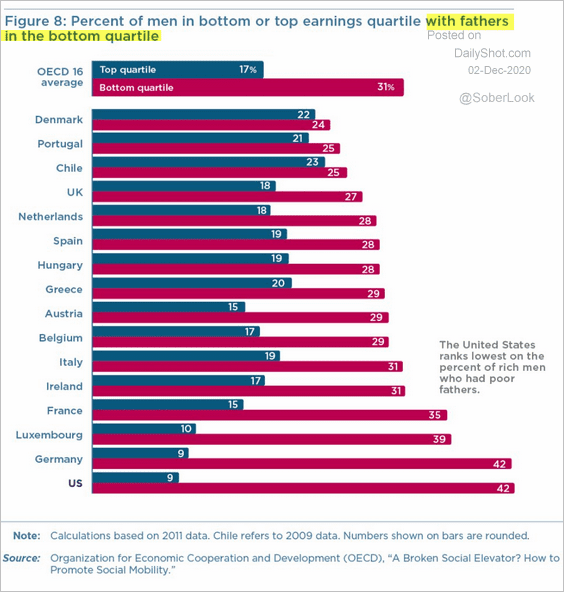

4. Upward mobility by country:

Source: @adam_tooze, @OECDeconomy, @PIIE Read full article

Source: @adam_tooze, @OECDeconomy, @PIIE Read full article

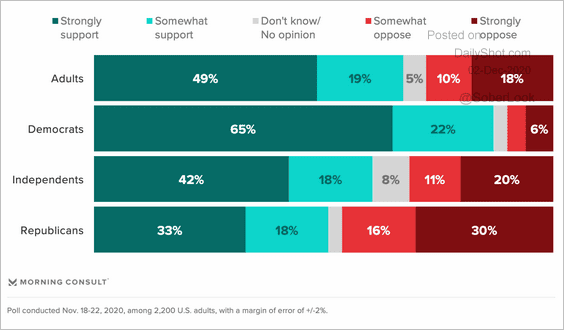

5. More TV time:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

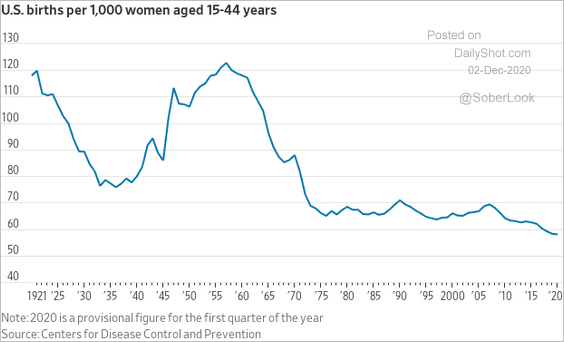

6. The US fertility rate:

Source: @WSJ Read full article

Source: @WSJ Read full article

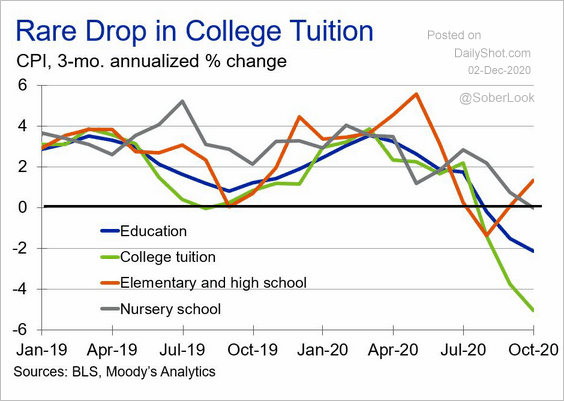

7. US education CPI:

Source: Moody’s Analytics

Source: Moody’s Analytics

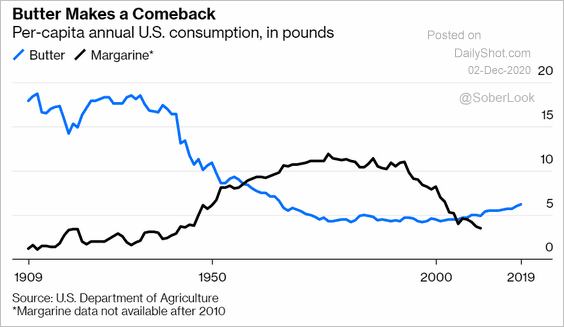

8. Butter vs. margarine:

Source: @bopinion Read full article

Source: @bopinion Read full article

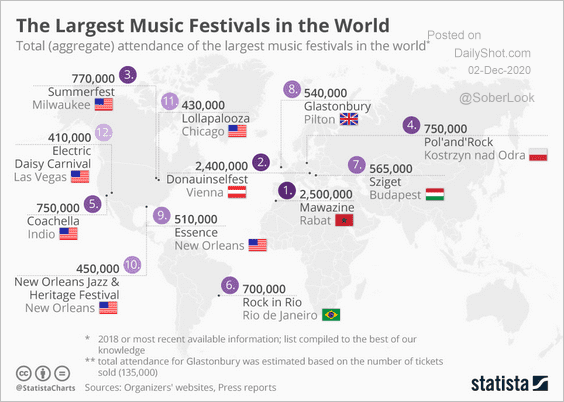

9. Largest music festivals:

Source: Statista

Source: Statista

——————–